RETAIL PROPERTIES OF AMERICA, INC. REPORTS

FOURTH QUARTER AND FULL YEAR 2016 RESULTS

Oak Brook, IL – February 14, 2017 – Retail Properties of America, Inc. (NYSE: RPAI) (the “Company”) today reported financial and operating results for the quarter and year ended December 31, 2016.

FINANCIAL RESULTS

For the quarter ended December 31, 2016, the Company reported:

| |

| ▪ | Net income attributable to common shareholders of $15.9 million, or $0.07 per share, compared to $0.6 million, or $0.00 per share, for the same period in 2015; |

| |

| ▪ | Funds from operations (FFO) attributable to common shareholders of $52.9 million, or $0.22 per share, compared to $59.5 million, or $0.25 per share, for the same period in 2015; and |

| |

| ▪ | Operating funds from operations (Operating FFO) attributable to common shareholders of $59.9 million, or $0.25 per share, compared to $62.6 million, or $0.26 per share, for the same period in 2015. |

For the year ended December 31, 2016, the Company reported:

| |

| ▪ | Net income attributable to common shareholders of $157.4 million, or $0.66 per share, compared to $115.6 million, or $0.49 per share, for 2015; |

| |

| ▪ | FFO attributable to common shareholders of $268.0 million, or $1.13 per share, compared to $227.9 million, or $0.96 per share, for 2015; and |

| |

| ▪ | Operating FFO attributable to common shareholders of $257.2 million, or $1.09 per share, compared to $251.3 million, or $1.06 per share, for 2015. |

OPERATING RESULTS

For the quarter ended December 31, 2016, the Company’s portfolio results were as follows:

| |

| ▪ | 1.9% increase in same store net operating income (NOI) over the comparable period in 2015; |

| |

| ▪ | Total same store portfolio percent leased, including leases signed but not commenced: 95.7% at December 31, 2016, up 30 basis points from 95.4% at September 30, 2016 and up 10 basis points from 95.6% at December 31, 2015; |

| |

| ▪ | Retail portfolio percent leased, including leases signed but not commenced: 95.0% at December 31, 2016, up 50 basis points from 94.5% at September 30, 2016 and up 10 basis points from 94.9% at December 31, 2015; |

| |

| ▪ | Retail portfolio annualized base rent (ABR) per occupied square foot of $17.11 at December 31, 2016, up 5.2% from $16.27 ABR per occupied square foot at December 31, 2015; |

| |

| ▪ | 502,000 square feet of retail leasing transactions comprised of 136 new and renewal leases; and |

| |

| ▪ | Positive comparable cash leasing spreads of 27.4% on new leases and 4.5% on renewal leases for a blended spread of 6.8%. |

n Retail Properties of America, Inc.

T: 800.541.7661

www.rpai.com 2021 Spring Road, Suite 200

Oak Brook, IL 60523

For the year ended December 31, 2016, the Company’s portfolio results were as follows:

| |

| ▪ | 3.5% increase in same store NOI over the comparable period in 2015; |

| |

| ▪ | 3,332,000 square feet of retail leasing transactions comprised of 540 new and renewal leases; and |

| |

| ▪ | Positive comparable cash blended leasing spreads of 7.5%, consisting of 6.6% on renewal leases and 13.8% on new leases. Excluding the impact from eight Rite Aid leases within the Company’s single-user retail portfolio that were extended to effectuate the planned 2016 disposition of these assets, all of which were sold during the second and third quarters, comparable cash blended leasing spreads were 7.8%. |

“Our tremendous team here at RPAI delivered strong results in 2016,” stated Steve Grimes, president and chief executive officer. “With same store NOI growth of 3.5%, nearly $1.0 billion in portfolio transaction volume, a compelling Investor Day, and recently the defeasance of the IW JV portfolio of mortgages payable, 2016 by all measures was an outperformance year and our foundation is healthier than ever going into 2017.”

INVESTMENT ACTIVITY

Acquisitions

In 2016, the Company completed $408.3 million of acquisitions, primarily on an unencumbered basis, with a weighted average ABR per occupied square foot of $22.20. These acquisitions included seven high quality, multi-tenant retail assets, the fee interest in an existing multi-tenant retail property and the anchor space improvements, which were previously subject to a ground lease with the Company, at an existing multi-tenant retail property. The acquisitions are located in the Chicago, New York, Dallas and Seattle Metropolitan Statistical Areas (MSA) and the greater Washington, D.C. area, expanding the Company’s multi-tenant retail footprint in its target markets by 1.0 million square feet. These properties possess strong demographic profiles, with weighted average household income of $109,000 and weighted average population of 84,000 within a three-mile radius.

During the quarter, the Company closed on the first phase of the previously announced acquisition of One Loudoun Downtown, located in the Washington, D.C. MSA, for a gross purchase price of $125.0 million. The Company remains under contract for the remaining phases at One Loudoun Downtown, representing an aggregate gross purchase price of up to $35.5 million. These transactions are expected to close throughout the first three quarters of 2017 as the seller completes construction on stand-alone buildings at the property.

Subsequent to year end, the Company completed the previously announced acquisition of Main Street Promenade, located in the heart of Downtown Naperville, Illinois in the Chicago MSA, for a gross purchase price of $88.0 million. Main Street Promenade is a 182,000 square foot mixed-use project that includes approximately 103,000 square feet of retail and approximately 79,000 square feet of office, as well as an adjacent vacant parcel identified for future redevelopment that is entitled for up to 80,000 square feet of mixed-use space. Downtown Naperville is located just 30 miles from Chicago and is the destination of choice for shopping, dining and relaxation with over 100 national and boutique stores, 40 national and local restaurants and 300 businesses, epitomizing the work, shop, play lifestyle. The property is currently 93.1% occupied and is located within a “super-zip”, one of the most affluent and well-educated zip codes in the country, and boasts average household income of $130,000 and population of 215,000 within a five-mile radius.

Dispositions

In 2016, the Company completed $543.0 million of dispositions, which included the sales of 10 non-target multi-tenant retail assets for $386.6 million, 35 single-user retail assets for $151.5 million, one single-user outparcel for $2.6 million and one development property, which was not under active development, for $2.3 million.

During the quarter, the Company completed $149.7 million of dispositions, which included the sales of 14 single-user retail assets for $54.8 million, three non-target multi-tenant retail assets for $92.6 million and one development property, which was not under active development, for $2.3 million.

Subsequent to year end, the Company disposed of a single-user retail asset for $0.5 million. Additionally, the Company is under contract to sell $166.9 million of dispositions, including seven non-target multi-tenant retail assets for $158.9 million and two single-user retail assets for $8.0 million. These transactions are expected to close in the first quarter of 2017, subject to satisfaction of customary closing conditions.

SCHAUMBURG TOWERS

On January 19, 2017, the Company announced that the office property formerly known as Zurich Towers has been renamed Schaumburg Towers. Additionally, the Company signed two new leases with Great American Insurance Group and Swiss Re for approximately 78,000 square feet. Schaumburg Towers is an office building with twin 20-story towers totaling approximately 895,000 square feet. The property is located in Schaumburg, Illinois and situated adjacent to Woodfield Mall, a Class A shopping mall easily accessible from two major highways. To date, the Company has re-leased approximately 397,000 square feet of the available 895,000 square feet.

BALANCE SHEET AND CAPITAL MARKETS ACTIVITY

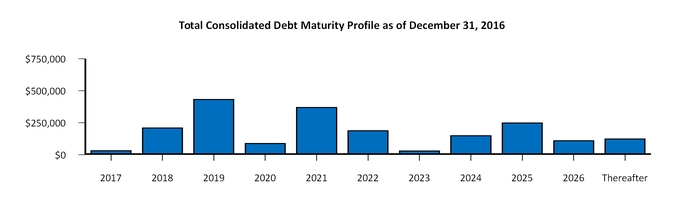

As of December 31, 2016, the Company had approximately $2.0 billion of consolidated indebtedness, which resulted in a net debt to adjusted EBITDA ratio of 5.6x, or a net debt and preferred stock to adjusted EBITDA ratio of 6.0x. Consolidated indebtedness had a weighted average contractual interest rate of 4.44% and a weighted average maturity of 5.3 years.

During 2016, the Company executed on numerous significant capital markets initiatives, including the following:

| |

| ▪ | In January 2016, closed on a $1.2 billion amended and restated unsecured credit facility, which increased total capacity by $200.0 million, extended the weighted average term by 2.2 years and lowered the weighted average interest rate by 13 basis points; |

| |

| ▪ | In September 2016, entered into an agreement to issue $200.0 million of senior unsecured notes, consisting of $100.0 million of 10-year 4.08% senior unsecured notes (Notes Due 2026) and $100.0 million of 12-year 4.24% senior unsecured notes (Notes Due 2028), resulting in a weighted average fixed interest rate of 4.16%. The issuance of the Notes Due 2026 occurred on September 30, 2016 and the issuance of the Notes Due 2028 occurred on December 28, 2016; |

| |

| ▪ | In November 2016, entered into an agreement for a seven-year $200.0 million senior unsecured term loan (Term Loan Due 2023) with an interest rate of London Interbank Offered Rate (LIBOR) plus a credit spread of between 1.70% and 2.55%, based on the Company’s leverage ratio. In January 2017, the Company drew the full balance of the Term Loan Due 2023. In addition, in January 2017, the Company entered into two interest rate swap agreements to effectively fix the interest rate on the Term Loan Due 2023 at 1.2628% plus a credit spread through November 22, 2018; |

| |

| ▪ | Throughout 2016, repaid or extinguished $321.5 million of mortgage debt without prepayment penalties, excluding amortization, with a weighted average interest rate of |

5.47%, of which $191.8 million was repaid during the fourth quarter with a weighted average interest rate of 5.14%;

| |

| ▪ | During the fourth quarter, defeased or incurred prepayment penalties related to the extinguishment of $36.4 million of mortgage debt with a weighted average interest rate of 5.55%; and |

| |

| ▪ | During the fourth quarter, repurchased 591,488 shares of common stock under the Company’s stock repurchase program at an average price per share of $14.93 for a total of approximately $8.8 million. |

Subsequent to year end, the Company defeased the $379.4 million IW JV cross-collateralized portfolio of mortgages payable that were scheduled to mature in 2019 and had an interest rate of 7.50%. In connection with this transaction, the Company incurred approximately $60.2 million in defeasance costs. The fair value of these mortgages was approximately $45.1 million higher than the outstanding principal balance as of December 31, 2016.

2017 GUIDANCE

The Company expects to generate net income attributable to common shareholders of $1.15 to $1.20 per share in 2017. The Company expects to generate Operating FFO of $1.00 to $1.05 per share in 2017, based, in part, on the following assumptions:

| |

| ▪ | Generate same store NOI growth of 2.0% to 3.0%; |

| |

| ▪ | Acquire approximately $375 to $475 million of strategic acquisitions in the Company’s target markets; |

| |

| ▪ | Dispose of approximately $800 to $900 million of assets, including the sale of Schaumburg Towers; and |

| |

| ▪ | Incur approximately $42 to $44 million of general and administrative expenses. |

The following table reconciles the Company’s reported 2016 Operating FFO to the Company’s 2017 Operating FFO guidance range.

|

| | | | | | | |

| | Low | | High |

| 2016 Operating FFO per common share outstanding | $ | 1.09 |

| | $ | 1.09 |

|

| | | | |

| 2016 net retail investment activity | (0.04 | ) | | (0.04 | ) |

2017 net retail investment activity(1) | (0.12 | ) | | (0.08 | ) |

| Schaumburg Towers (expected sale in the fourth quarter of 2017) | (0.07 | ) | | (0.07 | ) |

| Subtotal | 0.86 |

| | 0.90 |

|

| | | | |

| Same store NOI growth | 0.025 |

| | 0.035 |

|

Interest expense(1) | 0.14 |

| | 0.13 |

|

| General and administrative expenses | 0.00 |

| | 0.01 |

|

Redevelopment assets(2) | (0.01 | ) | | (0.01 | ) |

Non-cash items(3) | (0.01 | ) | | (0.01 | ) |

Lease termination fee income(4) | (0.005 | ) | | (0.005 | ) |

| 2017 estimated Operating FFO per common share outstanding | $ | 1.00 |

| | $ | 1.05 |

|

| |

| (1) | Reflects the relative timing of acquisitions and dispositions during the year |

| |

| (2) | Represents three properties where the Company has begun redevelopment and/or activities in anticipation of future redevelopment: Reisterstown Road Plaza, Towson Circle and Boulevard at the Capital Centre |

| |

| (3) | Non-cash items include straight-line rental income, amortization of above and below market lease intangibles and lease inducements, and non-cash ground rent expense |

| |

| (4) | The Company has not forecasted speculative lease termination fee income for 2017 |

DIVIDEND

On February 13, 2017, the Company declared the first quarter 2017 Series A preferred stock cash dividend of $0.4375 per preferred share, for the period beginning January 1, 2017, which will be paid on March 31, 2017 to preferred shareholders of record on March 20, 2017.

On February 13, 2017, the Company also declared the first quarter 2017 quarterly cash dividend of $0.165625 per share on its outstanding Class A common stock, which will be paid on April 10, 2017 to Class A common shareholders of record on March 27, 2017.

WEBCAST AND SUPPLEMENTAL INFORMATION

The Company’s management team will hold a webcast on Wednesday, February 15, 2017 at 11:00 AM (ET), to discuss its quarterly and full year financial results and operating performance, as well as business highlights and outlook. In addition, the Company may discuss business and financial developments and trends and other matters affecting the Company, some of which may not have been previously disclosed.

A live webcast will be available online on the Company’s website at www.rpai.com in the INVEST section. The conference call can be accessed by dialing (877) 705-6003 or (201) 493-6725 for international participants. Please dial in at least ten minutes prior to the start of the call to register.

A replay of the webcast will be available. To listen to the replay, please go to www.rpai.com in the INVEST section of the website and follow the instructions. A replay of the call will be available from 2:00 PM (ET) on February 15, 2017 until midnight (ET) on March 1, 2017. The replay can be accessed by dialing (844) 512-2921 or (412) 317-6671 for international callers and entering pin number 13650424.

The Company has also posted supplemental financial and operating information and other data in the INVEST section of its website.

ABOUT RPAI

Retail Properties of America, Inc. is a REIT that owns and operates high quality, strategically located shopping centers in the United States. As of December 31, 2016, the Company owned 156 retail operating properties representing 25.8 million square feet. The Company is publicly traded on the New York Stock Exchange under the ticker symbol RPAI. Additional information about the Company is available at www.rpai.com.

SAFE HARBOR LANGUAGE

The statements and certain other information contained in this press release, which can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “should”, “intends”, “plans”, “estimates”, “continue” or “anticipates” and variations of such words or similar expressions or the negative of such words, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These forward-looking statements reflect the Company’s current views about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to the Company and on assumptions it has made. Although the Company believes that its plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, the Company can give no assurance that such plans, intentions, expectations or strategies will be attained or achieved. Furthermore, these forward-looking statements should be considered as subject to the many risks and uncertainties that exist in the Company’s operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to, economic, business and financial conditions, and changes in the Company’s industry and changes in the real estate markets in particular, rental rates and/or vacancy rates, frequency and magnitude of defaults on, early terminations of or non-renewal of leases by tenants, bankruptcy or insolvency of a major tenant or a significant number of smaller tenants, interest rates or operating costs, real estate valuations, the availability, terms and deployment of capital, general volatility of the capital and credit markets and the market price of the Company’s Class A common stock, risks generally associated with real estate acquisitions and dispositions, including the Company’s ability to identify and pursue acquisition and disposition opportunities, risks generally associated with redevelopment, including the impact of

construction delays and cost overruns, the Company’s ability to lease redeveloped space and the Company’s ability to identify and pursue redevelopment opportunities, competitive and cost factors, the Company’s ability to enter into new leases or renew leases on favorable terms, the Company’s ability to create long-term shareholder value, satisfaction of closing conditions to the pending transactions described herein, the Company’s failure to successfully execute its non-target disposition program and capital recycling efforts, regulatory changes and other risk factors, including those detailed in the sections of the Company’s most recent Forms 10-K and 10-Q filed with the SEC titled “Risk Factors”. The Company assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

NON-GAAP FINANCIAL MEASURES

As defined by the National Association of Real Estate Investment Trusts (NAREIT), an industry trade group, Funds From Operations (FFO) means net income (loss) computed in accordance with generally accepted accounting principles (GAAP), excluding gains (or losses) from sales of depreciable real estate, plus depreciation and amortization and impairment charges on depreciable real estate. The Company has adopted the NAREIT definition in its computation of FFO attributable to common shareholders. The Company believes that, subject to the following limitations, FFO attributable to common shareholders provides a basis for comparing its performance and operations to those of other real estate investment trusts (REITs). The Company believes that FFO attributable to common shareholders, which is a supplemental non-GAAP financial measure, provides an additional and useful means to assess the operating performance of REITs. FFO attributable to common shareholders does not represent an alternative to (i) “Net income” or “Net income attributable to common shareholders” as an indicator of the Company’s financial performance, or (ii) “Cash flows from operating activities” in accordance with GAAP as a measure of the Company’s capacity to fund cash needs, including the payment of dividends.

The Company also reports Operating FFO attributable to common shareholders, which is defined as FFO attributable to common shareholders excluding the impact of discrete non-operating transactions and other events which the Company does not consider representative of the comparable operating results of its real estate operating portfolio, which is its core business platform. Specific examples of discrete non-operating transactions and other events include, but are not limited to, the financial statement impact of gains or losses associated with the early extinguishment of debt or other liabilities, impairment charges to write down the carrying value of assets other than depreciable real estate, actual or anticipated settlement of litigation involving the Company and executive and realignment separation charges, which are otherwise excluded from the Company’s calculation of FFO attributable to common shareholders. The Company believes that Operating FFO attributable to common shareholders, which is a supplemental non-GAAP financial measure, provides an additional and useful means to assess the operating performance of REITs. Operating FFO attributable to common shareholders does not represent an alternative to (i) “Net income” or “Net income attributable to common shareholders” as an indicator of the Company’s financial performance, or (ii) “Cash flows from operating activities” in accordance with GAAP as a measure of the Company’s capacity to fund cash needs, including the payment of dividends. Comparison of the Company’s presentation of Operating FFO attributable to common shareholders to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs.

The Company also reports Net Operating Income (NOI), which it defines as all revenues other than straight-line rental income, amortization of lease inducements, amortization of acquired above and below market lease intangibles and lease termination fee income, less real estate taxes and all operating expenses other than straight-line ground rent expense and amortization of acquired ground lease intangibles, which are non-cash items. NOI consists of Same Store NOI and NOI from Other Investment Properties. Same Store NOI for the year ended December 31, 2016 represents NOI from the Company’s same store portfolio consisting of 140 retail operating properties acquired or placed in service and stabilized prior to January 1, 2015. NOI from Other Investment Properties for the year ended December 31, 2016 represents NOI primarily from properties acquired during 2015 and 2016, the Company’s one remaining office property, three properties where the Company has begun redevelopment and/or activities in anticipation of future redevelopment, the properties that were sold or held for sale in 2015 and 2016, the net income from the Company’s wholly-owned captive insurance company and the historical ground rent expense related to an existing same store investment property that was subject to a ground lease with a third party prior to the Company’s acquisition of the fee interest on April 29, 2016. For the three months ended December 31, 2016, the Company’s same store portfolio consists of 147 retail operating properties inclusive of the same store portfolio for the year ended December 31, 2016 and seven additional retail operating properties that were acquired during the nine months ended September 30, 2015. The financial results reported in Other Investment Properties for the three months ended December 31, 2016 are inclusive of the topics described above for the year ended December 31, 2016 excluding the seven investment properties that were acquired during the nine months ended September 30, 2015. The Company believes that NOI, Same Store NOI and NOI from Other Investment Properties, which are supplemental non-GAAP financial measures, provide an additional and useful operating perspective not immediately apparent from “Operating income” or “Net income attributable to common shareholders” in accordance with GAAP. The Company uses these measures to evaluate its performance on a property-by-property basis because they allow management to evaluate the impact that factors such as lease structure, lease rates and tenant base have on the

Company’s operating results. NOI, Same Store NOI and NOI from Other Investment Properties do not represent alternatives to “Net income” or “Net income attributable to common shareholders” in accordance with GAAP as indicators of the Company’s financial performance. Comparison of the Company’s presentation of NOI, Same Store NOI and NOI from Other Investment Properties to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs.

Adjusted EBITDA is a supplemental non-GAAP financial measure and represents net income attributable to common shareholders before interest, income taxes, depreciation and amortization, as further adjusted to eliminate the impact of certain items that the Company does not consider indicative of its ongoing performance. The Company believes that Adjusted EBITDA is useful because it allows investors and management to evaluate and compare the Company’s performance from period to period in a meaningful and consistent manner in addition to standard financial measurements under GAAP. Adjusted EBITDA should not be considered an alternative to “Net income attributable to common shareholders” as an indicator of the Company’s financial performance. Comparison of the Company’s presentation of Adjusted EBITDA to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs.

Net Debt to Adjusted EBITDA is a supplemental non-GAAP financial measure and represents (i) the Company’s total notional debt, excluding unamortized premium, discount and capitalized loan fees, less cash and cash equivalents divided by (ii) Adjusted EBITDA for the prior three months, annualized. The Company believes that this ratio is useful because it provides investors with information regarding its total notional debt net of cash and cash equivalents, which could be used to repay debt, compared to its performance as measured using Adjusted EBITDA. Comparison of the Company’s presentation of Net Debt to Adjusted EBITDA to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs.

Net Debt and Preferred Stock to Adjusted EBITDA is a supplemental non-GAAP financial measure and represents (i) the Company’s total notional debt, excluding unamortized premium, discount and capitalized loan fees, plus preferred stock, less cash and cash equivalents divided by (ii) Adjusted EBITDA for the prior three months, annualized. The Company believes that this ratio is useful because it provides investors with information regarding its total notional debt and preferred stock, net of cash and cash equivalents, which could be used to repay debt, compared to its performance as measured using Adjusted EBITDA. Comparison of the Company’s presentation of Net Debt and Preferred Stock to Adjusted EBITDA to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs.

CONTACT INFORMATION

For Investors:

Michael Fitzmaurice

VP – Capital Markets & Investor Relations

Retail Properties of America, Inc.

(630) 634-4233

For Media Inquiries:

Kimberly Freely

AVP – Director of Public Relations & Communications

Retail Properties of America, Inc.

(630) 634-4319

Retail Properties of America, Inc.

FFO Attributable to Common Shareholders and

Operating FFO Attributable to Common Shareholders Guidance

|

| | | | | | | | |

| | | Per Share Guidance Range Full Year 2017 |

| | | Low | | High |

| | | | | |

| Net income attributable to common shareholders | | $ | 1.15 |

| | $ | 1.20 |

|

| Depreciation and amortization of depreciable real estate | | 0.88 |

| | 0.88 |

|

| Provision for impairment of investment properties | | — |

| | — |

|

| Gain on sales of depreciable investment properties | | (1.35 | ) | | (1.35 | ) |

| FFO attributable to common shareholders | | $ | 0.68 |

| | $ | 0.73 |

|

| | | | | |

| Impact on earnings from the early extinguishment of debt, net | | 0.30 |

| | 0.30 |

|

| Provision for hedge ineffectiveness | | — |

| | — |

|

| Preferred stock redemption in excess of carrying value | | 0.02 |

| | 0.02 |

|

| Other | | — |

| | — |

|

| Operating FFO attributable to common shareholders | | $ | 1.00 |

| | $ | 1.05 |

|

Retail Properties of America, Inc.

Consolidated Balance Sheets

(amounts in thousands, except par value amounts)

(unaudited)

|

| | | | | | | | |

| | | December 31,

2016 | | December 31,

2015 |

| Assets | | |

| | |

|

| Investment properties: | | |

| | |

|

| Land | | $ | 1,191,403 |

| | $ | 1,254,131 |

|

| Building and other improvements | | 4,284,664 |

| | 4,428,554 |

|

| Developments in progress | | 23,439 |

| | 5,157 |

|

| | | 5,499,506 |

| | 5,687,842 |

|

| Less accumulated depreciation | | (1,443,333 | ) | | (1,433,195 | ) |

| Net investment properties | | 4,056,173 |

| | 4,254,647 |

|

| | | | | |

| Cash and cash equivalents | | 53,119 |

| | 51,424 |

|

| Accounts and notes receivable (net of allowances of $6,886 and $7,910, respectively) | | 78,941 |

| | 82,804 |

|

| Acquired lease intangible assets, net | | 142,015 |

| | 138,766 |

|

| Assets associated with investment properties held for sale | | 30,827 |

| | — |

|

| Other assets, net | | 91,898 |

| | 93,610 |

|

| Total assets | | $ | 4,452,973 |

| | $ | 4,621,251 |

|

| | | | | |

| Liabilities and Equity | | |

| | |

|

| Liabilities: | | |

| | |

|

Mortgages payable, net (includes unamortized premium of $1,437 and $1,865, respectively, unamortized discount of $(622) and $(1), respectively, and unamortized capitalized loan fees of $(5,026) and $(7,233), respectively) | | $ | 769,184 |

| | $ | 1,123,136 |

|

Unsecured notes payable, net (includes unamortized discount of $(971) and $(1,090), respectively, and unamortized capitalized loan fees of $(3,886) and $(3,334), respectively) | | 695,143 |

| | 495,576 |

|

Unsecured term loans, net (includes unamortized capitalized loan fees of $(2,402) and $(2,474), respectively) | | 447,598 |

| | 447,526 |

|

| Unsecured revolving line of credit | | 86,000 |

| | 100,000 |

|

| Accounts payable and accrued expenses | | 83,085 |

| | 69,800 |

|

| Distributions payable | | 39,222 |

| | 39,297 |

|

| Acquired lease intangible liabilities, net | | 105,290 |

| | 114,834 |

|

| Liabilities associated with investment properties held for sale | | 864 |

| | — |

|

| Other liabilities | | 74,501 |

| | 75,745 |

|

| Total liabilities | | 2,300,887 |

| | 2,465,914 |

|

| | | | | |

| Commitments and contingencies | | |

| | |

|

| | | | | |

| Equity: | | |

| | |

|

Preferred stock, $0.001 par value, 10,000 shares authorized, 7.00% Series A cumulative redeemable preferred stock, 5,400 shares issued and outstanding as of December 31, 2016 and 2015; liquidation preference $135,000 | | 5 |

| | 5 |

|

Class A common stock, $0.001 par value, 475,000 shares authorized, 236,770 and 237,267 shares issued and outstanding as of December 31, 2016 and 2015, respectively | | 237 |

| | 237 |

|

| Additional paid-in capital | | 4,927,155 |

| | 4,931,395 |

|

| Accumulated distributions in excess of earnings | | (2,776,033 | ) | | (2,776,215 | ) |

| Accumulated other comprehensive income (loss) | | 722 |

| | (85 | ) |

| Total equity | | 2,152,086 |

| | 2,155,337 |

|

| Total liabilities and equity | | $ | 4,452,973 |

| | $ | 4,621,251 |

|

|

| | |

| 4th Quarter 2016 Supplemental Information | | 1 |

Retail Properties of America, Inc.

Consolidated Statements of Operations

(amounts in thousands, except per share amounts)

(unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

| Revenues | | | | | | |

| | |

|

| Rental income | | $ | 111,577 |

| | $ | 116,819 |

| | $ | 455,658 |

| | $ | 472,344 |

|

| Tenant recovery income | | 29,429 |

| | 29,919 |

| | 118,569 |

| | 119,536 |

|

| Other property income | | 1,746 |

| | 2,182 |

| | 8,916 |

| | 12,080 |

|

| Total revenues | | 142,752 |

| | 148,920 |

| | 583,143 |

| | 603,960 |

|

| | | | | | | | | |

| Expenses | | | | | | |

| | |

|

| Operating expenses | | 22,457 |

| | 23,191 |

| | 85,895 |

| | 94,780 |

|

| Real estate taxes | | 20,808 |

| | 20,853 |

| | 81,774 |

| | 82,810 |

|

| Depreciation and amortization | | 60,828 |

| | 51,361 |

| | 224,430 |

| | 214,706 |

|

| Provision for impairment of investment properties | | 9,328 |

| | 15,824 |

| | 20,376 |

| | 19,937 |

|

| General and administrative expenses | | 11,233 |

| | 14,708 |

| | 44,522 |

| | 50,657 |

|

| Total expenses | | 124,654 |

| | 125,937 |

| | 456,997 |

| | 462,890 |

|

| | | | | | | | | |

| Operating income | | 18,098 |

| | 22,983 |

| | 126,146 |

| | 141,070 |

|

| | | | | | | | | |

| Gain on extinguishment of debt | | — |

| | — |

| | 13,653 |

| | — |

|

| Gain on extinguishment of other liabilities | | — |

| | — |

| | 6,978 |

| | — |

|

| Interest expense | | (31,387 | ) | | (28,328 | ) | | (109,730 | ) | | (138,938 | ) |

| Other (expense) income, net | | (386 | ) | | 302 |

| | 63 |

| | 1,700 |

|

| (Loss) income from continuing operations | | (13,675 | ) | | (5,043 | ) | | 37,110 |

| | 3,832 |

|

| Gain on sales of investment properties | | 31,970 |

| | 8,578 |

| | 129,707 |

| | 121,792 |

|

| Net income | | 18,295 |

| | 3,535 |

| | 166,817 |

| | 125,624 |

|

| Net income attributable to noncontrolling interest | | — |

| | (528 | ) | | — |

| | (528 | ) |

| Net income attributable to the Company | | 18,295 |

| | 3,007 |

| | 166,817 |

| | 125,096 |

|

| Preferred stock dividends | | (2,363 | ) | | (2,363 | ) | | (9,450 | ) | | (9,450 | ) |

| Net income attributable to common shareholders | | $ | 15,932 |

| | $ | 644 |

| | $ | 157,367 |

| | $ | 115,646 |

|

| | | | | | | | | |

| Earnings per common share – basic and diluted | | | | | | |

| | |

|

| Net income per common share attributable to common shareholders | | $ | 0.07 |

| | $ | — |

| | $ | 0.66 |

| | $ | 0.49 |

|

| | | | | | | | | |

| Weighted average number of common shares outstanding – basic | | 236,528 |

| | 236,477 |

| | 236,651 |

| | 236,380 |

|

| | | | | | | | | |

| Weighted average number of common shares outstanding – diluted | | 236,852 |

| | 236,479 |

| | 236,951 |

| | 236,382 |

|

|

| | |

| 4th Quarter 2016 Supplemental Information | | 2 |

Retail Properties of America, Inc.

Funds From Operations (FFO) Attributable to Common Shareholders,

Operating FFO Attributable to Common Shareholders and Additional Information

(dollar amounts in thousands, except per share amounts)

(unaudited)

|

| | | | | | | | | | | | | | | | |

| FFO attributable to common shareholders and Operating FFO attributable to common shareholders (a) | | |

| | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

| | | | | | | | | |

| Net income attributable to common shareholders | | $ | 15,932 |

| | $ | 644 |

| | $ | 157,367 |

| | $ | 115,646 |

|

| Depreciation and amortization of depreciable real estate | | 60,441 |

| | 51,082 |

| | 223,018 |

| | 213,602 |

|

| Provision for impairment of investment properties | | 8,485 |

| | 15,824 |

| | 17,369 |

| | 19,937 |

|

Gain on sales of depreciable investment properties, net of noncontrolling interest | | (31,970 | ) | | (8,050 | ) | | (129,707 | ) | | (121,264 | ) |

| FFO attributable to common shareholders | | $ | 52,888 |

| | $ | 59,500 |

| | $ | 268,047 |

| | $ | 227,921 |

|

| | | | | | | | | |

FFO attributable to common shareholders per common share outstanding | | $ | 0.22 |

| | $ | 0.25 |

| | $ | 1.13 |

| | $ | 0.96 |

|

| | | | | | | | | |

| FFO attributable to common shareholders | | $ | 52,888 |

| | $ | 59,500 |

| | $ | 268,047 |

| | $ | 227,921 |

|

| Impact on earnings from the early extinguishment of debt, net | | 5,814 |

| | 1,229 |

| | (7,028 | ) | | 18,864 |

|

| Provision for hedge ineffectiveness | | 14 |

| | — |

| | (21 | ) | | (25 | ) |

| Provision for impairment of non-depreciable investment property | | 843 |

| | — |

| | 3,007 |

| | — |

|

| Gain on extinguishment of other liabilities | | — |

| | — |

| | (6,978 | ) | | — |

|

| Executive and realignment separation charges (b) | | — |

| | 1,193 |

| | — |

| | 4,730 |

|

| Other (c) | | 321 |

| | 685 |

| | 132 |

| | (224 | ) |

| Operating FFO attributable to common shareholders | | $ | 59,880 |

| | $ | 62,607 |

| | $ | 257,159 |

| | $ | 251,266 |

|

| | | | | | | | | |

Operating FFO attributable to common shareholders per common share outstanding | | $ | 0.25 |

| | $ | 0.26 |

| | $ | 1.09 |

| | $ | 1.06 |

|

| | | | | | | | | |

| Weighted average number of common shares outstanding – basic | | 236,528 |

| | 236,477 |

| | 236,651 |

| | 236,380 |

|

| Dividends declared per common share | | $ | 0.165625 |

| | $ | 0.165625 |

| | $ | 0.6625 |

| | $ | 0.6625 |

|

| | | | | | | | | |

| Additional Information (d) | | | | | | |

| | |

|

| Lease-related expenditures (e) | | | | | | | | |

| Same store | | $ | 3,891 |

| | $ | 8,552 |

| | $ | 27,350 |

| | $ | 23,371 |

|

| Other investment properties | | $ | 758 |

| | $ | 622 |

| | $ | 7,243 |

| | $ | 10,785 |

|

| | | | | | | | | |

| Capital expenditures (f) | | | | | | | | |

| Same store | | $ | 4,364 |

| | $ | 2,528 |

| | $ | 17,785 |

| | $ | 14,709 |

|

| Other investment properties | | $ | 1,458 |

| | $ | 415 |

| | $ | 9,030 |

| | $ | 4,968 |

|

| | | | | | | | | |

| Straight-line rental income, net | | $ | 1,547 |

| | $ | 1,201 |

| | $ | 4,601 |

| | $ | 3,498 |

|

Amortization of above and below market lease intangibles and lease inducements | | $ | 363 |

| | $ | 2,064 |

| | $ | 1,958 |

| | $ | 2,774 |

|

| Non-cash ground rent expense (g) | | $ | 741 |

| | $ | 785 |

| | $ | 2,693 |

| | $ | 3,162 |

|

| |

| (a) | Refer to page 19 for definitions of FFO attributable to common shareholders and Operating FFO attributable to common shareholders. |

| |

| (b) | Included in "General and administrative expenses" in the consolidated statements of operations. |

| |

| (c) | Consists of the impact on earnings from net settlements and easement proceeds, which are included in "Other (expense) income, net" in the consolidated statements of operations. |

| |

| (d) | The same store portfolio for the year ended ended December 31, 2016 consists of 140 retail operating properties. The same store portfolio for the three months ended December 31, 2016 consists of 147 retail operating properties. Refer to pages 19 – 22 for definitions and reconciliations of non-GAAP financial measures. |

| |

| (e) | Consists of payments for tenant improvements, lease commissions and lease inducements and excludes developments in progress. |

| |

| (f) | Consists of payments for building, site and other improvements, net of anticipated recoveries, and excludes developments in progress. |

| |

| (g) | Includes amortization of acquired ground lease intangibles and straight-line ground rent expense. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 3 |

Retail Properties of America, Inc.

Supplemental Financial Statement Detail

(amounts in thousands)

(unaudited)

|

| | | | | | | | |

| Supplemental Balance Sheet Detail | | December 31,

2016 | | December 31,

2015 |

| Accounts and Notes Receivable | | |

| | |

|

| Accounts and notes receivable (net of allowances of $6,200 and $7,052, respectively) | | $ | 27,948 |

| | $ | 30,143 |

|

| Straight-line receivables (net of allowances of $686 and $858, respectively) | | 50,993 |

| | 52,661 |

|

| Total | | $ | 78,941 |

| | $ | 82,804 |

|

| | | | | |

| Other Assets, Net | | |

| | |

|

| Deferred costs, net | | $ | 30,657 |

| | $ | 27,132 |

|

| Restricted cash and escrows | | 29,230 |

| | 35,804 |

|

| Fair value of derivatives | | 743 |

| | — |

|

| Other assets, net | | 31,268 |

| | 30,674 |

|

| Total | | $ | 91,898 |

| | $ | 93,610 |

|

| | | | | |

| Other Liabilities | | |

| | |

|

| Unearned income | | $ | 16,883 |

| | $ | 22,216 |

|

| Straight-line ground rent liability | | 31,516 |

| | 35,241 |

|

| Fair value of derivatives | | — |

| | 85 |

|

| Other liabilities | | 26,102 |

| | 18,203 |

|

| Total | | $ | 74,501 |

| | $ | 75,745 |

|

| | | | | |

| Developments in Progress | | |

| | |

|

| Active developments/redevelopments (a) | | $ | 23,439 |

| | $ | — |

|

| Property available for future development | | — |

| | 5,157 |

|

| Total | | $ | 23,439 |

| | $ | 5,157 |

|

|

| | | | | | | | | | | | | | | | |

| Supplemental Statements of Operations Detail | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

| Rental Income | | |

| | |

| | |

| | |

|

| Base rent | | $ | 108,310 |

| | $ | 112,269 |

| | $ | 443,941 |

| | $ | 460,265 |

|

| Percentage and specialty rent | | 1,357 |

| | 1,285 |

| | 5,158 |

| | 5,807 |

|

| Straight-line rent | | 1,547 |

| | 1,201 |

| | 4,601 |

| | 3,498 |

|

| Amortization of above and below market lease intangibles and lease inducements | | 363 |

| | 2,064 |

| | 1,958 |

| | 2,774 |

|

| Total | | $ | 111,577 |

| | $ | 116,819 |

| | $ | 455,658 |

| | $ | 472,344 |

|

| | | | | | | | | |

| Other Property Income | | |

| | |

| | |

| | |

|

| Lease termination income | | $ | 269 |

| | $ | 45 |

| | $ | 3,339 |

| | $ | 3,757 |

|

| Other property income | | 1,477 |

| | 2,137 |

| | 5,577 |

| | 8,323 |

|

| Total | | $ | 1,746 |

| | $ | 2,182 |

| | $ | 8,916 |

| | $ | 12,080 |

|

| | | | | | | | | |

| Property Operating Expense Supplemental Information | | | | | | | | |

| Bad Debt Expense | | $ | 989 |

| | $ | 367 |

| | $ | 1,763 |

| | $ | 1,472 |

|

| Non-Cash Ground Rent Expense (b) | | $ | 741 |

| | $ | 785 |

| | $ | 2,693 |

| | $ | 3,162 |

|

| | | | | | | | | |

| General and Administrative Expense Supplemental Information | | | | | | | | |

| Acquisition Costs (c) | | $ | — |

| | $ | 294 |

| | $ | 913 |

| | $ | 1,591 |

|

| Non-Cash Amortization of Stock-Based Compensation | | $ | 1,913 |

| | $ | 2,528 |

| | $ | 7,206 |

| | $ | 10,644 |

|

| | | | | | | | | |

| Additional Supplemental Information | | | | | | | | |

| Capitalized Compensation Costs – Development and Capital Projects | | $ | 430 |

| | $ | — |

| | $ | 1,196 |

| | $ | — |

|

| Capitalized Internal Leasing Incentives | | $ | 99 |

| | $ | 134 |

| | $ | 423 |

| | $ | 474 |

|

| Capitalized Interest | | $ | 68 |

| | $ | — |

| | $ | 69 |

| | $ | — |

|

| |

| (a) | Represents Reisterstown Road Plaza and Towson Circle. See page 10 for further details. |

| |

| (b) | Includes amortization of acquired ground lease intangibles and straight-line ground rent expense. |

| |

| (c) | The Company early adopted ASU 2017-01, Business Combinations, on a prospective basis as of October 1, 2016. As a result, $725 of acquisition costs incurred during the three months ended December 31, 2016 were capitalized. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 4 |

Retail Properties of America, Inc.

Same Store Net Operating Income (NOI)

(dollar amounts in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | | | | |

| Same store portfolio (a) | | | | | | | | | | | | |

| | | As of December 31 based on Same store portfolio for the Three Months Ended December 31, 2016 | | As of December 31 based on Same store portfolio for the Year Ended December 31, 2016 |

| | | 2016 | | 2015 | | Change | | 2016 | | 2015 | | Change |

| | | | | | | | | | | | | |

Number of retail operating properties in same store portfolio | | 147 |

| | 147 |

| | — |

| | 140 |

| | 140 |

| | — |

|

| | | | | | | | | | | | | |

| Occupancy | | 95.1 | % | | 94.9 | % | | 0.2 | % | | 95.1 | % | | 95.0 | % | | 0.1 | % |

| | | | | | | | | | | | | |

| Percent leased (b) | | 95.7 | % | | 95.6 | % | | 0.1 | % | | 95.7 | % | | 95.6 | % | | 0.1 | % |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Same store NOI (c) | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2016 | | 2015 | | Change | | 2016 | | 2015 | | Change |

| | | | | | | | | | | | | |

| Base rent | | $ | 95,065 |

| | $ | 93,009 |

| | | | $ | 355,077 |

| | $ | 347,806 |

| | |

| Percentage and specialty rent | | 1,074 |

| | 682 |

| | | | 3,626 |

| | 3,095 |

| | |

| Tenant recovery income | | 26,665 |

| | 26,058 |

| | | | 96,208 |

| | 94,354 |

| | |

| Other property operating income (d) | | 1,037 |

| | 946 |

| | | | 3,405 |

| | 3,527 |

| | |

| | | 123,841 |

| | 120,695 |

| | | | 458,316 |

| | 448,782 |

| | |

| | | | | | | | | | | | | |

| Property operating expenses (e) | | 18,246 |

| | 17,650 |

| | | | 64,355 |

| | 65,722 |

| | |

| Bad debt expense | | 883 |

| | 300 |

| | | | 31 |

| | 1,179 |

| | |

| Real estate taxes | | 18,485 |

| | 18,105 |

| | | | 67,144 |

| | 66,210 |

| | |

| | | 37,614 |

| | 36,055 |

| | | | 131,530 |

| | 133,111 |

| | |

| | | | | | | | | | | | | |

| Same Store NOI (c) | | $ | 86,227 |

| | $ | 84,640 |

| | 1.9 | % | | $ | 326,786 |

| | $ | 315,671 |

| | 3.5 | % |

| |

| (a) | For the year ended December 31, 2016, the Company's same store portfolio consists of 140 retail operating properties and excludes properties acquired or placed in service and stabilized during 2015 and 2016, the Company's one remaining office property, three properties where the Company has begun redevelopment and/or activities in anticipation of future redevelopment and investment properties sold or classified as held for sale during 2015 and 2016. For the three months ended December 31, 2016, the Company's same store portfolio consists of 147 retail operating properties inclusive of the same store portfolio for the year ended December 31, 2016 and seven additional properties that were acquired during the nine months ended September 30, 2015. |

| |

| (b) | Includes leases signed but not commenced. |

| |

| (c) | Refer to pages 19 – 22 for definitions and reconciliations of non-GAAP financial measures. Comparison of the Company's presentation of Same Store NOI to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in definition and application by such REITs. |

| |

| (d) | Consists of all operating items included in "Other property income" in the consolidated statements of operations, which include all items other than lease termination fee income. |

| |

| (e) | Consists of all property operating items included in "Operating expenses" in the consolidated statements of operations, which include all items other than straight-line ground rent expense and amortization of acquired ground lease intangibles, which are non-cash items. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 5 |

Retail Properties of America, Inc.

Capitalization

(dollar amounts in thousands, except share price and ratios)

|

| | | | | | | | |

| Capitalization Data | | | | |

| | | December 31,

2016 | | December 31,

2015 |

| Equity Capitalization | | |

| | |

|

| Common stock shares outstanding (a) | | 236,770 |

| | 237,267 |

|

| Common share price | | $ | 15.33 |

| | $ | 14.77 |

|

| | | 3,629,684 |

| | 3,504,434 |

|

| Series A preferred stock | | 135,000 |

| | 135,000 |

|

| Total equity capitalization | | $ | 3,764,684 |

| | $ | 3,639,434 |

|

| | | | | |

| Debt Capitalization | | |

| | |

|

| Mortgages payable (b) | | $ | 773,395 |

| | $ | 1,128,505 |

|

| Unsecured notes payable (c) | | 700,000 |

| | 500,000 |

|

| Unsecured term loans (d) | | 450,000 |

| | 450,000 |

|

| Unsecured revolving line of credit | | 86,000 |

| | 100,000 |

|

| Total debt capitalization | | $ | 2,009,395 |

| | $ | 2,178,505 |

|

| | | | | |

| Total capitalization at end of period | | $ | 5,774,079 |

| | $ | 5,817,939 |

|

|

| | | | | | | | |

| Calculation of Net Debt to Adjusted EBITDA Ratios (e) |

| | | | | |

| | | December 31,

2016 | | December 31,

2015 |

| | | | | |

| Total notional debt | | $ | 2,009,395 |

| | $ | 2,178,505 |

|

| Less: consolidated cash and cash equivalents | | (53,119 | ) | | (51,424 | ) |

| Total net debt | | $ | 1,956,276 |

| | $ | 2,127,081 |

|

| Total net debt and preferred stock | | $ | 2,091,276 |

| | $ | 2,262,081 |

|

| Adjusted EBITDA (f) | | $ | 351,472 |

| | $ | 366,652 |

|

| Net Debt to Adjusted EBITDA | | 5.6x |

| | 5.8x |

|

| Net Debt and Preferred Stock to Adjusted EBITDA | | 6.0x |

| | 6.2x |

|

| |

| (a) | Excludes performance restricted stock units and options outstanding, which could potentially convert to common stock in the future. |

| |

| (b) | Mortgages payable excludes mortgage premium of $1,437 and $1,865, discount of $(622) and $(1), and capitalized loan fees of $(5,026) and $(7,233), net of accumulated amortization, as of December 31, 2016 and 2015, respectively. |

| |

| (c) | Unsecured notes payable exclude discount of $(971) and $(1,090) and capitalized loan fees of $(3,886) and $(3,334), net of accumulated amortization, as of December 31, 2016 and 2015, respectively. |

| |

| (d) | Unsecured term loans excludes capitalized loan fees of $(2,402) and $(2,474), net of accumulated amortization, as of December 31, 2016 and 2015, respectively. |

| |

| (e) | Refer to pages 19 – 22 for definitions and reconciliations of non-GAAP financial measures. |

| |

| (f) | For purposes of these ratio calculations, annualized three months ended figures were used. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 6 |

Retail Properties of America, Inc.

Covenants

|

| | | | | |

| Unsecured Credit Facility, Term Loan Due 2023 and Notes Due 2021, 2024, 2026 and 2028 (a) |

| | | Covenant | | December 31, 2016 |

| | | | | |

|

| Leverage ratio (b) | | < 60.0% | (b) | 33.3 | % |

| | | | | |

|

| Secured leverage ratio (b) | Unsecured Credit Facility and Term Loan Due 2023: Notes Due 2021, 2024, 2026 and 2028: | < 45.0% < 40.0% | (b) | 12.8 | % |

| | | | | |

| Fixed charge coverage ratio (c) | | > 1.50x | | 2.9x |

|

| | | | | |

|

| Interest coverage ratio (d) | | > 1.50x | | 3.5x |

|

| | | | | |

| Unencumbered leverage ratio (b) | | < 60.0% | (b) | 31.4 | % |

| | | | | |

|

| Unencumbered interest coverage ratio | | > 1.75x | | 6.3x |

|

|

| | | | |

| Notes Due 2025 (e) | | | |

| | Covenant | | December 31, 2016 |

| | | | |

|

| Leverage ratio (f) | < 60.0% | | 34.5 | % |

| | | | |

|

| Secured leverage ratio (f) | < 40.0% | | 13.3 | % |

| | | | |

| Debt service coverage ratio (g) | > 1.50x | | 3.8x |

|

| | | | |

| Unencumbered assets to unsecured debt ratio | > 150% | | 320 | % |

| |

| (a) | For a complete listing of all covenants related to the Company's Unsecured Credit Facility (comprised of the unsecured term loans and unsecured revolving line of credit) as well as covenant definitions, refer to the Fourth Amended and Restated Credit Agreement filed as Exhibit 10.8 to the Company's Annual Report on Form 10-K for the year ended December 31, 2015, filed on February 17, 2016. For a complete listing of all covenants as well as covenant definitions related to the Company's Term Loan Due 2023, refer to the credit agreement filed as Exhibit 10.1 to the Company's Current Report on Form 8-K, dated November 29, 2016. The Term Loan Due 2023 closed during the year ended December 31, 2016 and funded on January 3, 2017. For a complete listing of all covenants related to the Company's 4.12% senior unsecured notes due 2021 and 4.58% senior unsecured notes due 2024 (Notes Due 2021 and 2024) as well as covenant definitions, refer to the Note Purchase Agreement filed as Exhibit 10.1 to the Company's Current Report on Form 8-K, dated May 22, 2014. For a complete listing of all covenants related to the Company's 4.08% senior unsecured notes due 2026 and 4.24% senior unsecured notes due 2028 (Notes Due 2026 and 2028) as well as covenant definitions, refer to the Note Purchase Agreement filed as Exhibit 10.1 to the Company's Current Report on Form 8-K, dated October 5, 2016. |

| |

| (b) | Based upon a capitalization rate of 6.75%. |

| |

| (c) | Applies only to the Company's Unsecured Credit Facility, Term Loan Due 2023 and Notes Due 2026 and 2028. This ratio is based upon consolidated debt service, including interest expense, principal amortization and preferred dividends declared, excluding interest expense related to defeasance costs and prepayment premiums. |

| |

| (d) | Applies only to the Company's Notes Due 2021, 2024, 2026 and 2028. |

| |

| (e) | For a complete listing of all covenants related to the Company's 4.00% senior unsecured notes due 2025 (Notes Due 2025) as well as covenant definitions, refer to the First Supplemental Indenture filed as Exhibit 4.2 to the Company's Current Report on Form 8-K, dated March 12, 2015. |

| |

| (f) | Based upon the book value of Total Assets as defined in the First Supplemental Indenture. |

| |

| (g) | Based upon interest expense and excludes principal amortization and preferred dividends declared. This ratio is calculated on a pro forma basis with the assumption that debt and property transactions occurred on the first day of the preceding four-quarter period. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 7 |

Retail Properties of America, Inc.

Consolidated Debt Summary as of December 31, 2016

(dollar amounts in thousands)

|

| | | | | | | | | |

| | | Balance | | Weighted Average (WA) Interest Rate (a) | | WA Years to Maturity |

| | | | | | | |

| Fixed rate mortgages payable (b) | | $ | 773,395 |

| | 6.31 | % | | 4.2 years |

| | | | | | | |

| Unsecured notes payable: | | | | | | |

| Senior notes – 4.12% due 2021 | | 100,000 |

| | 4.12 | % | | 4.5 years |

| Senior notes – 4.58% due 2024 | | 150,000 |

| | 4.58 | % | | 7.5 years |

| Senior notes – 4.00% due 2025 | | 250,000 |

| | 4.00 | % | | 8.2 years |

| Senior notes – 4.08% due 2026 | | 100,000 |

| | 4.08 | % | | 9.8 years |

| Senior notes – 4.24% due 2028 | | 100,000 |

| | 4.24 | % | | 12.0 years |

| Total unsecured notes payable (b) | | 700,000 |

| | 4.19 | % | | 8.3 years |

| | | | | | | |

| Unsecured credit facility: | | |

| | |

| | |

| Term loan – fixed rate (c) | | 250,000 |

| | 1.97 | % | | 4.0 years |

| Term loan – variable rate | | 200,000 |

| | 2.22 | % | | 1.4 years |

| Revolving line of credit – variable rate | | 86,000 |

| | 2.12 | % | | 3.0 years |

| Total unsecured credit facility (b) | | 536,000 |

| | 2.09 | % | | 2.9 years |

| | | | | | | |

| Total consolidated indebtedness | | $ | 2,009,395 |

| | 4.44 | % | | 5.3 years |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Debt Maturity Schedule as of December 31, 2016 |

| | | | | | | | | | | | | | | |

| Year | | Fixed Rate (b) | | WA Rates on Fixed Debt | | Variable Rate (b) | | WA Rates on Variable Debt (d) | | Total | | % of Total | | WA Rates on Total Debt (a) |

| | | | | | | | | | | | | | | |

| 2017 | | $ | 35,023 |

| | 4.83 | % | | $ | — |

| | — |

| | $ | 35,023 |

| | 1.7 | % | | 4.83 | % |

| 2018 | | 11,463 |

| | 6.51 | % | | 200,000 |

| | 2.22 | % | | 211,463 |

| | 10.5 | % | | 2.45 | % |

| 2019 | | 433,982 |

| | 7.49 | % | | — |

| | — |

| | 433,982 |

| | 21.6 | % | | 7.49 | % |

| 2020 | | 4,334 |

| | 4.58 | % | | 86,000 |

| | 2.12 | % | | 90,334 |

| | 4.5 | % | | 2.24 | % |

| 2021 | | 373,249 |

| | 2.73 | % | | — |

| | — |

| | 373,249 |

| | 18.6 | % | | 2.73 | % |

| 2022 | | 191,488 |

| | 4.89 | % | | — |

| | — |

| | 191,488 |

| | 9.5 | % | | 4.89 | % |

| 2023 | | 31,758 |

| | 4.13 | % | | — |

| | — |

| | 31,758 |

| | 1.6 | % | | 4.13 | % |

| 2024 | | 151,737 |

| | 4.57 | % | | — |

| | — |

| | 151,737 |

| | 7.6 | % | | 4.57 | % |

| 2025 | | 251,809 |

| | 4.00 | % | | — |

| | — |

| | 251,809 |

| | 12.5 | % | | 4.00 | % |

| 2026 | | 112,634 |

| | 4.15 | % | | — |

| | — |

| | 112,634 |

| | 5.6 | % | | 4.15 | % |

| Thereafter | | 125,918 |

| | 4.26 | % | | — |

| | — |

| | 125,918 |

| | 6.3 | % | | 4.26 | % |

| Total | | $ | 1,723,395 |

| | 4.82 | % | | $ | 286,000 |

| | 2.19 | % | | $ | 2,009,395 |

| | 100.0 | % | | 4.44 | % |

| |

| (a) | Interest rates presented exclude the impact of premium, discount and capitalized loan fee amortization. As of December 31, 2016, the Company's overall weighted average interest rate for consolidated debt including the impact of premium, discount and capitalized loan fee amortization was 4.67%. |

| |

| (b) | Fixed rate mortgages payable excludes mortgage premium of $1,437, discount of $(622) and capitalized loan fees of $(5,026), net of accumulated amortization, as of December 31, 2016. Unsecured notes payable excludes discount of $(971) and capitalized loan fees of $(3,886), net of accumulated amortization, as of December 31, 2016. Term loans exclude capitalized loan fees of $(2,402), net of accumulated amortization, as of December 31, 2016. In the consolidated debt maturity schedule, maturity amounts for each year include scheduled principal amortization payments. |

| |

| (c) | Reflects $250,000 of LIBOR-based variable rate debt that has been swapped to a weighted average fixed rate of 0.6677% plus a credit spread based on a leverage grid ranging from 1.30% to 2.20% through December 31, 2017. The applicable credit spread was 1.30% as of December 31, 2016. |

| |

| (d) | Represents interest rates as of December 31, 2016. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 8 |

Retail Properties of America, Inc.

Summary of Indebtedness as of December 31, 2016

(dollar amounts in thousands)

|

| | | | | | | | | | | | | |

| Description | | Maturity Date | | Interest Rate (a) | | Interest Rate Type | | Secured or Unsecured | | Balance as of 12/31/2016 | |

| Consolidated Indebtedness | | | | | | | | | | | |

| Lincoln Park | | 12/01/17 | | 4.05% | | Fixed | | Secured | | $ | 25,054 |

| |

| Corwest Plaza | | 04/01/19 | | 7.25% | | Fixed | | Secured | | 14,018 |

| |

| Dorman Center | | 04/01/19 | | 7.70% | | Fixed | | Secured | | 19,951 |

| |

| Shops at Park Place | | 05/01/19 | | 7.48% | | Fixed | | Secured | | 7,535 |

| |

| Shoppes of New Hope | | 06/01/19 | | 7.75% | | Fixed | | Secured | | 3,381 |

| |

| Village Shoppes at Simonton | | 06/01/19 | | 7.75% | | Fixed | | Secured | | 3,121 |

| |

| Plaza at Marysville | | 09/01/19 | | 8.00% | | Fixed | | Secured | | 8,590 |

| |

| Forks Town Center | | 10/01/19 | | 7.70% | | Fixed | | Secured | | 7,838 |

| |

| IW JV 2009 portfolio (45 properties) (b) | | 12/01/19 | | 7.50% | | Fixed | | Secured | | 379,435 |

| (b) |

| Sawyer Heights Village | | 07/01/21 | | 5.00% | | Fixed | | Secured | | 18,700 |

| |

| Ashland & Roosevelt (bank pad) | | 02/25/22 | | 7.48% | | Fixed | | Secured | | 973 |

| |

| Gardiner Manor Mall | | 03/01/22 | | 4.95% | | Fixed | | Secured | | 34,747 |

| |

| Peoria Crossings | | 04/01/22 | | 4.82% | | Fixed | | Secured | | 24,131 |

| |

| Southlake Corners | | 04/01/22 | | 4.89% | | Fixed | | Secured | | 20,945 |

| |

| Tollgate Marketplace | | 04/01/22 | | 4.84% | | Fixed | | Secured | | 35,000 |

| |

| Town Square Plaza | | 04/01/22 | | 4.82% | | Fixed | | Secured | | 16,815 |

| |

| Village Shoppes at Gainesville | | 04/01/22 | | 4.25% | | Fixed | | Secured | | 19,430 |

| |

| Reisterstown Road Plaza | | 06/01/22 | | 5.25% | | Fixed | | Secured | | 46,250 |

| |

| Gateway Village | | 01/01/23 | | 4.14% | | Fixed | | Secured | | 34,999 |

| |

| Home Depot Plaza | | 12/01/26 | | 4.82% | | Fixed | | Secured | | 10,750 |

| |

| Northgate North | | 06/01/27 | | 4.50% | | Fixed | | Secured | | 26,352 |

| |

| The Shoppes at Union Hill (c) | | 06/01/31 | | 3.75% | | Fixed | | Secured | | 15,380 |

| |

| Mortgages payable (d) | | | | | | | | | | 773,395 |

| |

| | | | | | | | | | | | |

| Senior notes – 4.12% due 2021 | | 06/30/21 | | 4.12% | | Fixed | | Unsecured | | 100,000 |

| |

| Senior notes – 4.58% due 2024 | | 06/30/24 | | 4.58% | | Fixed | | Unsecured | | 150,000 |

| |

| Senior notes – 4.00% due 2025 | | 03/15/25 | | 4.00% | | Fixed | | Unsecured | | 250,000 |

| |

| Senior notes – 4.08% due 2026 | | 09/30/26 | | 4.08% | | Fixed | | Unsecured | | 100,000 |

| |

| Senior notes – 4.24% due 2028 | | 12/28/28 | | 4.24% | | Fixed | | Unsecured | | 100,000 |

| |

| Unsecured notes payable (d) | | | | | | | | | | 700,000 |

| |

| | | | | | | | | | | | |

| Term loan | | 01/05/21 | | 1.97% | (e) | Fixed | | Unsecured | | 250,000 |

| |

| Term loan | | 05/11/18 | | 2.22% | | Variable | | Unsecured | | 200,000 |

| |

| Revolving line of credit | | 01/05/20 | | 2.12% | | Variable | | Unsecured | | 86,000 |

| |

| Unsecured credit facility (d) | | | | | | | | | | 536,000 |

| |

| | | | | | | | | | | | |

| Total consolidated indebtedness (f) | | 04/03/22 | | 4.44% | | | | | | $ | 2,009,395 |

| |

| |

| (a) | Interest rates presented exclude the impact of premium, discount and capitalized loan fee amortization. As of December 31, 2016, the Company's overall weighted average interest rate for consolidated debt including the impact of premium, discount and capitalized loan fee amortization was 4.67%. |

| |

| (b) | Subsequent to December 31, 2016, the Company defeased the IW JV 2009 cross-collateralized portfolio of mortgages payable and incurred a defeasance premium of $60,198. As a result, the 45 properties that secured the mortgages payable as of December 31, 2016 are no longer encumbered by mortgages. |

| |

| (c) | The mortgage debt was assumed in conjunction with the acquisition of the property on April 1, 2016. |

| |

| (d) | Mortgages payable excludes mortgage premium of $1,437, discount of $(622) and capitalized loan fees of $(5,026), net of accumulated amortization, as of December 31, 2016. Unsecured notes payable excludes discount of $(971) and capitalized loan fees of $(3,886), net of accumulated amortization, as of December 31, 2016. Term loans exclude capitalized loan fees of $(2,402), net of accumulated amortization, as of December 31, 2016. |

| |

| (e) | Reflects $250,000 of LIBOR-based variable rate debt that has been swapped to a weighted average fixed rate of 0.6677% plus a credit spread based on a leverage grid ranging from 1.30% to 2.20% through December 31, 2017. The applicable credit spread was 1.30% as of December 31, 2016. |

| |

| (f) | Subsequent to December 31, 2016, the Company received funding on a seven-year $200,000 unsecured term loan that is priced on a leverage grid at a rate of LIBOR plus a credit spread ranging from 1.70% to 2.55% and matures on November 22, 2023. Also subsequent to December 31, 2016, the Company entered into two agreements to swap a total of $200,000 of LIBOR-based variable rate debt to a fixed interest rate of 1.2628% plus the relevant credit spread through November 22, 2018. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 9 |

Retail Properties of America, Inc.

Development Projects as of December 31, 2016

(dollar amounts in thousands)

|

| | | | | | | | | | | | | | | | | | | | | |

| Property Name | | Metropolitan Statistical Area (MSA) | | Included in Same store portfolio (a) | | Total Estimated Net Costs (b) | | Net Costs Inception to Date | | Incremental Gross Leasable Area (GLA) | | Targeted

Completion (c) | | Projected Incremental Return on Cost (d) | | Project Description |

| | | | | | | | | | | | | | | | | |

| Redevelopments | | | | | | | | | | | | | | | | |

| Reisterstown Road Plaza | | Baltimore | | No | | $12,000-$13,000 | | $ | 1,417 |

| | (52,500 | ) | | Q4 2017 | | 9.5%-11.5% | | Reconfigure existing space with a facade renovation and the addition of a multi-tenant retail pad |

| Towson Circle (e) | | Baltimore | | No | | $33,000-$35,000 | | $ | 10,053 |

| | (40,000 | ) | | Q3 2019 | | 8.0%-10.0% | | Mixed-use redevelopment that will include double-sided street level retail with approximately 390 residential units above |

| | | | | | | | | | | | | | | | | |

| Expansions and Pad Developments | | | | | | | | | | | | | | |

| Pavilion at King's Grant | | Charlotte | | Yes | | $ | 2,300 |

| | $ | 383 |

| | 32,400 |

| | Q2 2017 | | 15.0%-16.0% | | 32,400 sq. ft. expansion |

| Shops at Park Place | | Dallas | | Yes | | $ | 3,900 |

| | $ | 390 |

| | 25,040 |

| | Q2 2017 | | 8.75%-9.75% | | 25,040 sq. ft. pad development |

| Lakewood Towne Center | | Seattle | | Yes | | $ | 1,900 |

| | $ | 114 |

| | 4,500 |

| | Q3 2017 | | 7.0%-8.0% | | 4,500 sq. ft. pad development |

|

| | | | | | | | |

| Property Name | | MSA | | Included in Same store portfolio (a) | | Targeted Commencement | | Project Description |

| | | | | | | | | |

| Redevelopment Pipeline | | | | | | | | |

| Boulevard at the Capital Centre | | Washington, D.C. | | No | | 2018 | | Dimensions Healthcare/University of Maryland Regional Medical Center phased redevelopment; Certificate of Need approved in October 2016 |

| Merrifield Town Center II | | Washington, D.C. | | No (f) | | 2019 | | Mixed-use redevelopment and monetization of air rights |

| Tysons Corner | | Washington, D.C. | | No (f) | | 2021 | | Redevelopment with increased density |

| |

| (a) | The Company's same store portfolio consists of retail operating properties acquired or placed in service and stabilized prior to January 1, 2015. A property is removed from the Company's same store portfolio if the project is considered to significantly impact the existing property's NOI and activities have begun in anticipation of the project. Expansions and Pad Developments are not considered to significantly impact the existing property's NOI, and therefore, have not been removed from the Company's same store portfolio if they have otherwise met the criteria to be included in the Company's same store portfolio for the year ended December 31, 2016. |

| |

| (b) | Net costs represent the Company's estimated share of the project costs, net of proceeds from land sales, reimbursement from third parties and contributions from project partners, as applicable. |

| |

| (c) | A redevelopment is considered complete and its classification changed from development to operating when it is substantially completed and held available for occupancy, but no later than one year from the completion of major construction activity. |

| |

| (d) | Projected Incremental Return on Cost (ROC) generally reflects only the unleveraged incremental NOI generated by the project upon stabilization and is calculated as incremental NOI divided by incremental cost. A property is considered stabilized upon reaching 90% occupancy, but no later than one year from the date it was classified as operating. Incremental NOI is the difference between NOI expected to be generated by the stabilized project and the NOI generated prior to the commencement of active redevelopment, development or expansion of the space. ROC does not include peripheral impacts, such as the impact on future lease rollover at the property or the impact on the long-term value of the property. |

| |

| (e) | The Company expects to begin demolition activities in Q3 2017. |

| |

| (f) | Property was acquired subsequent to December 31, 2014, and as such, does not meet the criteria to be included in the Company's same store portfolio for the year ended December 31, 2016. |

The Company cannot guarantee that (i) ROC will be generated at the percentage listed or at all, (ii) total net costs associated with these projects will be equal to the total estimated net costs, (iii) project completion or stabilization will occur when anticipated or (iv) that the Company will ultimately complete any or all of these projects. The ROC and total estimated net costs reflect the Company's best estimate based upon current information, may change over time and are subject to certain conditions which are beyond the Company's control, including, without limitation, general economic conditions, market conditions and other business factors.

|

| | |

| 4th Quarter 2016 Supplemental Information | | 10 |

Retail Properties of America, Inc.

Development Projects as of December 31, 2016 (continued)

(dollar amounts in thousands)

The Company has identified the following potential expansion and pad development opportunities to add stand-alone buildings, convert previously under-utilized space or develop additional retail GLA at existing properties. Executing on these opportunities may be subject to certain conditions which are beyond the Company's control, including, without limitation, government approvals, tenant consents as well as general economic, market and other conditions and, therefore, the Company can provide no assurances that any of the expansion and pad development opportunities (i) will be executed on, (ii) will commence when anticipated or (iii) will ultimately be realized.

|

| | | | | | | | |

| Property Name | | MSA | | Included in Same store portfolio (a) | | Potential Additional Square Feet | |

| | | | | | | | |

| Expansions and Pad Development Opportunities | | | | | |

| Southlake Town Square | | Dallas | | Yes | | 275,000 |

| |

| One Loudoun Downtown | | Washington, D.C. | | No (b) | | 182,000 |

| (c) |

| Governor's Marketplace | | Tallahassee | | Yes | | 20,600 |

| |

| Lakewood Towne Center | | Seattle | | Yes | | 10,500 |

| |

| Gateway Plaza | | Dallas | | Yes | | 8,000 |

| |

| High Ridge Crossing | | St. Louis | | Yes | | 7,500 |

| |

| Fox Creek Village | | Boulder | | Yes | | 6,000 |

| |

| Century III Plaza | | Pittsburgh | | Yes | | 6,000 |

| |

| Humblewood Shopping Center | | Houston | | Yes | | 5,000 |

| |

| Watauga Pavilion | | Dallas | | Yes | | 5,000 |

| |

| Page Field Commons | | Cape Coral-Fort Myers, FL | | Yes | | 4,700 |

| |

| Downtown Crown | | Washington, D.C. | | No (b) | | 3,000 - 9,000 |

| |

| |

| (a) | The Company's same store portfolio consists of retail operating properties acquired or placed in service and stabilized prior to January 1, 2015. A property is removed from the Company's same store portfolio if the project is considered to significantly impact the existing property's NOI and activities have begun in anticipation of the project. Expansions and Pad Development Opportunities are not considered to significantly impact the existing property's NOI, and therefore, have not been removed from the Company's same store portfolio if they have otherwise met the criteria to be included in the Company's same store portfolio for the year ended December 31, 2016. |

| |

| (b) | Property was acquired subsequent to December 31, 2014, and as such, does not meet the criteria to be included in the Company's same store portfolio for the year ended December 31, 2016. |

| |

| (c) | The acquisition of One Loudoun Downtown – Phase I included vacant parcels that have been approved for future development of up to 182,000 square feet of GLA and rights to develop 285 multi-family units at the property. |

|

| | | | | | | | | | | | | | | | | | | | | |

| Property Name | | MSA | | Included in Same store portfolio (d) | | Total Estimated Net Costs (d) | | Net Costs Inception to Date | | Incremental GLA | | Completion | | Projected Incremental Return on Cost (d) | | Project Description |

| | | | | | | | | | | | | | | | | |

| Completed Expansions and Pad Developments | | | | | | | | | | | | | | |

| Lake Worth Towne Crossing – Parcel | | Dallas | | No (e) | | $ | 2,872 |

| | $ | 2,872 |

| | 15,030 |

| | Q4 2015 | | 11.3% | | 15,030 sq. ft. multi-tenant retail |

| Parkway Towne Crossing | | Dallas | | Yes | | $ | 3,500 |

| | $ | 3,073 |

| | 21,000 |

| | Q3 2016 | | 9.9% | | 21,000 sq. ft. multi-tenant retail |

| Heritage Square | | Seattle | | Yes | | $ | 1,500 |

| | $ | 1,279 |

| | (360 | ) | | Q3 2016 | | 11.2% | | 4,200 sq. ft. redevelopment of outparcel for new tenant, Corner Bakery |

| |

| (d) | See footnotes on page 10. |

| |

| (e) | The expansion was completed on a land parcel acquired on March 24, 2015, and as such, does not meet the criteria to be included in the Company's same store portfolio for the year ended December 31, 2016. |

|

| | |

| 4th Quarter 2016 Supplemental Information | | 11 |

Retail Properties of America, Inc.