UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21323

Eaton Vance Limited Duration Income Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

March 31

Date of Fiscal Year End

September 30, 2012

Date of Reporting Period

Item 1. Reports to Stockholders

| | |

Eaton Vance Limited Duration Income Fund (EVV) Semiannual Report September 30, 2012 | |

|

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Semiannual Report September 30, 2012

Eaton Vance

Limited Duration Income Fund

Table of Contents

| | | | |

Performance | | | 2 | |

| |

Fund Profile | | | 2 | |

| |

Endnotes and Additional Disclosures | | | 3 | |

| |

Financial Statements | | | 4 | |

| |

Board of Trustees’ Contract Approval | | | 49 | |

| |

Officers and Trustees | | | 52 | |

| |

Important Notices | | | 53 | |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Performance1

Portfolio Managers Scott H. Page, CFA, Payson F. Swaffield, CFA, Mark S. Venezia, CFA, Michael W. Weilheimer, CFA, Catherine C. McDermott and Andrew Szczurowski, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | Six Months | | | One Year | | | Five Years | | | Since Inception | |

Fund at NAV | | | 5/30/2003 | | | | 5.01 | % | | | 14.15 | % | | | 8.72 | % | | | 7.74 | % |

Fund at Market Price | | | — | | | | 9.90 | | | | 25.26 | | | | 10.47 | | | | 7.91 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 1.49 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Distributions2 | | | | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | | | | | $ | 0.625 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 7.47 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 7.36 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Leverage3 | | | | | | | | | | | | | | | |

Auction Preferred Shares (APS) | | | | | | | | | | | | | | | | | | | 9.85 | % |

Borrowings | | | | | | | | | | | | | | | | | | | 17.51 | |

Fund Profile

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Endnotes and Additional Disclosures

| 1 | Performance results reflect the effects of leverage. |

| 2 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be composed of ordinary income, tax-exempt income, net realized capital gains and return of capital. |

| 3 | Leverage represents the liquidation value of the Fund’s APS and borrowings outstanding as a percentage of Fund net assets applicable to common shares plus APS and borrowings outstanding. Use of leverage creates an opportunity for income, but creates risks including greater price volatility. The cost of leverage rises and falls with changes in short-term interest rates. The Fund is required to maintain prescribed asset coverage for its APS and borrowings, which could be reduced if Fund asset values decline. |

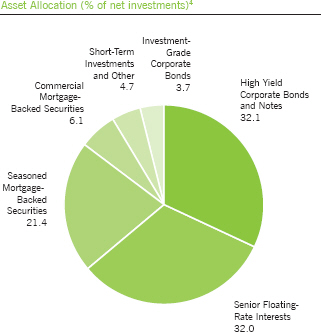

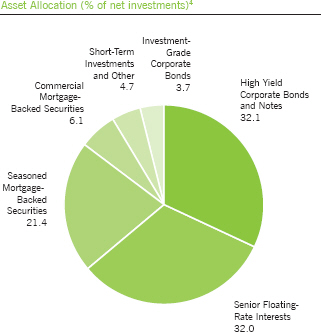

| 4 | Asset allocation as a percentage of the Fund’s net assets amounted to 137.7%. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited)

| | | | | | | | | | |

| Senior Floating-Rate Interests — 44.1%(1) | |

| | | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Aerospace and Defense — 0.7% | | | | | | | | | | |

AVIO S.p.A. | | | | | | | | | | |

Term Loan, 3.09%, Maturing June 14, 2017 | | | | | 650 | | | $ | 633,209 | |

Term Loan, 3.87%, Maturing December 14, 2017 | | EUR | | | 575 | | | | 738,904 | |

Term Loan, 3.97%, Maturing December 14, 2017 | | | | | 700 | | | | 681,917 | |

Booz Allen Hamilton Inc. | | | | | | | | | | |

Term Loan, 4.50%, Maturing July 31, 2019 | | | | | 900 | | | | 906,281 | |

DAE Aviation Holdings, Inc. | | | | | | | | | | |

Term Loan, 5.45%, Maturing July 31, 2014 | | | | | 1,366 | | | | 1,365,651 | |

Term Loan, 5.45%, Maturing July 31, 2014 | | | | | 1,438 | | | | 1,438,037 | |

Ducommun Incorporated | | | | | | | | | | |

Term Loan, 5.50%, Maturing June 28, 2017 | | | | | 538 | | | | 543,597 | |

IAP Worldwide Services, Inc. | | | | | | | | | | |

Term Loan, 9.25%, Maturing December 28, 2012 | | | | | 971 | | | | 823,257 | |

Sequa Corporation | | | | | | | | | | |

Term Loan, 3.72%, Maturing December 3, 2014 | | | | | 2,191 | | | | 2,190,070 | |

Term Loan, 6.25%, Maturing December 3, 2014 | | | | | 273 | | | | 274,984 | |

TASC, Inc. | | | | | | | | | | |

Term Loan, 4.50%, Maturing December 18, 2015 | | | | | 1,528 | | | | 1,531,734 | |

Transdigm, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing February 14, 2017 | | | | | 819 | | | | 825,465 | |

Wesco Aircraft Hardware Corp. | | | | | | | | | | |

Term Loan, 4.25%, Maturing April 7, 2017 | | | | | 367 | | | | 368,480 | |

Wyle Services Corporation | | | | | | | | | | |

Term Loan, 5.00%, Maturing March 27, 2017 | | | | | 879 | | | | 879,090 | |

| | | | | | | | | | | |

| | | | | | | | $ | 13,200,676 | |

| | | | | | | | | | | |

| | | |

Air Transport — 0.1% | | | | | | | | | | |

Evergreen International Aviation, Inc. | | | | | | | | | | |

Term Loan, 11.50%, Maturing June 30, 2015 | | | | | 907 | | | $ | 852,920 | |

Orbitz Worldwide Inc. | | | | | | | | | | |

Term Loan, 3.22%, Maturing July 25, 2014 | | | | | 1,654 | | | | 1,608,803 | |

| | | | | | | | | | | |

| | | | | | | | $ | 2,461,723 | |

| | | | | | | | | | | |

| | | |

Automotive — 2.6% | | | | | | | | | | |

Allison Transmission, Inc. | | | | | | | | | | |

Term Loan, 2.72%, Maturing August 7, 2014 | | | | | 2,965 | | | $ | 2,975,192 | |

Term Loan, 4.25%, Maturing August 23, 2019 | | | | | 3,367 | | | | 3,382,345 | |

Autoparts Holdings Limited | | | | | | | | | | |

Term Loan, 6.50%, Maturing July 28, 2017 | | | | | 992 | | | | 992,481 | |

Chrysler Group LLC | | | | | | | | | | |

Term Loan, 6.00%, Maturing May 24, 2017 | | | | | 7,907 | | | | 8,078,202 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Automotive (continued) | | | | | | | | | | |

Delphi Corporation | | | | | | | | | | |

Term Loan, 3.50%, Maturing March 31, 2017 | | | | | 1,994 | | | $ | 2,003,235 | |

Federal-Mogul Corporation | | | | | | | | | | |

Term Loan, 2.17%, Maturing December 29, 2014 | | | | | 3,999 | | | | 3,910,735 | |

Term Loan, 2.16%, Maturing December 28, 2015 | | | | | 3,553 | | | | 3,474,704 | |

Goodyear Tire & Rubber Company (The) | | | | | | | | | | |

Term Loan - Second Lien, 4.75%, Maturing April 30, 2019 | | | | | 6,775 | | | | 6,845,575 | |

HHI Holdings LLC | | | | | | | | | | |

Term Loan, 7.00%, Maturing March 21, 2017 | | | | | 1,663 | | | | 1,663,076 | |

Metaldyne Company LLC | | | | | | | | | | |

Term Loan, 5.25%, Maturing May 18, 2017 | | | | | 3,082 | | | | 3,131,908 | |

SRAM, LLC | | | | | | | | | | |

Term Loan, 4.77%, Maturing June 7, 2018 | | | | | 2,736 | | | | 2,770,497 | |

Tomkins LLC | | | | | | | | | | |

Term Loan, 4.25%, Maturing September 29, 2016 | | | | | 5,124 | | | | 5,161,493 | |

TriMas Corporation | | | | | | | | | | |

Term Loan, 4.25%, Maturing June 21, 2017 | | | | | 1,086 | | | | 1,088,652 | |

Veyance Technologies, Inc. | | | | | | | | | | |

Term Loan, 2.47%, Maturing July 31, 2014 | | | | | 291 | | | | 288,329 | |

Term Loan, 2.47%, Maturing July 31, 2014 | | | | | 2,034 | | | | 2,013,007 | |

Term Loan, 5.50%, Maturing July 31, 2014 | | | | | 348 | | | | 348,685 | |

Term Loan - Second Lien, 5.98%, Maturing July 31, 2015 | | | | | 4,100 | | | | 3,936,000 | |

| | | | | | | | | | | |

| | | | | | | | $ | 52,064,116 | |

| | | | | | | | | | | |

| | | |

Beverage and Tobacco — 0.0%(2) | | | | | | | | | | |

Maine Beverage Company | | | | | | | | | | |

Term Loan, 2.21%, Maturing March 31, 2013 | | | | | 73 | | | $ | 71,966 | |

| | | | | | | | | | | |

| | | | | | | | $ | 71,966 | |

| | | | | | | | | | | |

| | | |

Building and Development — 0.2% | | | | | | | | | | |

Preferred Proppants, LLC | | | | | | | | | | |

Term Loan, 7.50%, Maturing December 15, 2016 | | | | | 720 | | | $ | 685,383 | |

RE/MAX International, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing April 15, 2016 | | | | | 2,090 | | | | 2,105,319 | |

Realogy Corporation | | | | | | | | | | |

Term Loan, 3.25%, Maturing October 10, 2013 | | | | | 97 | | | | 93,465 | |

Summit Materials Companies I, LLC | | | | | | | | | | |

Term Loan, 6.00%, Maturing January 30, 2019 | | | | | 498 | | | | 502,351 | |

| | | | | | | | | | | |

| | | | | | | | $ | 3,386,518 | |

| | | | | | | | | | | |

| | | | |

| | 4 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Business Equipment and Services — 4.0% | | | | | | | | | | |

ACCO Brands Corporation | | | | | | | | | | |

Term Loan, 4.25%, Maturing April 30, 2019 | | | | | 1,493 | | | $ | 1,505,094 | |

Acosta, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing March 1, 2018 | | | | | 3,884 | | | | 3,908,093 | |

Advantage Sales & Marketing, Inc. | | | | | | | | | | |

Term Loan, 5.25%, Maturing December 18, 2017 | | | | | 3,107 | | | | 3,115,825 | |

Affinion Group, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing July 16, 2015 | | | | | 5,491 | | | | 5,058,911 | |

Allied Security Holdings, LLC | | | | | | | | | | |

Term Loan, 5.25%, Maturing February 3, 2017 | | | | | 542 | | | | 543,782 | |

Altegrity, Inc. | | | | | | | | | | |

Term Loan, 2.97%, Maturing February 21, 2015 | | | | | 2,556 | | | | 2,383,683 | |

BAR/BRI Review Courses, Inc. | | | | | | | | | | |

Term Loan, 6.00%, Maturing June 16, 2017 | | | | | 675 | | | | 676,907 | |

Brand Energy & Infrastructure Services, Inc. | | | | | | | | | | |

Term Loan, 2.50%, Maturing February 7, 2014 | | | | | 910 | | | | 899,186 | |

Term Loan, 3.68%, Maturing February 7, 2014 | | | | | 983 | | | | 975,090 | |

Brickman Group Holdings Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing October 14, 2016 | | | | | 1,569 | | | | 1,584,469 | |

Brock Holdings III, Inc. | | | | | | | | | | |

Term Loan, 6.01%, Maturing March 16, 2017 | | | | | 1,027 | | | | 1,040,098 | |

Catalina Marketing Corporation | | | | | | | | | | |

Term Loan, 2.97%, Maturing October 1, 2014 | | | | | 1,958 | | | | 1,950,651 | |

ClientLogic Corporation | | | | | | | | | | |

Term Loan, 7.21%, Maturing January 30, 2017 | | | | | 1,171 | | | | 1,077,408 | |

Corporate Executive Board Company, The | | | | | | | | | | |

Term Loan, 5.00%, Maturing July 2, 2019 | | | | | 550 | | | | 553,094 | |

CPM Acquisition Corp. | | | | | | | | | | |

Term Loan, 6.25%, Maturing August 29, 2017 | | | | | 525 | | | | 527,625 | |

Education Management LLC | | | | | | | | | | |

Term Loan, 8.25%, Maturing March 29, 2018 | | | | | 2,113 | | | | 1,874,669 | |

EIG Investors Corp. | | | | | | | | | | |

Term Loan, 7.75%, Maturing April 20, 2018 | | | | | 2,469 | | | | 2,488,101 | |

Expert Global Solutions, Inc. | | | | | | | | | | |

Term Loan, 8.00%, Maturing April 3, 2018 | | | | | 1,990 | | | | 2,008,242 | |

Genesys Telecom Holdings, U.S., Inc. | | | | | | | | | | |

Term Loan, 6.75%, Maturing January 31, 2019 | | | | | 647 | | | | 654,296 | |

Genpact International, Inc. | | | | | | | | | | |

Term Loan, 4.25%, Maturing August 30, 2019 | | | | | 1,700 | | | | 1,707,438 | |

Go Daddy Operating Company, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing December 17, 2018 | | | | | 3,798 | | | | 3,787,248 | |

KAR Auction Services, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing May 19, 2017 | | | | | 3,061 | | | | 3,081,020 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Business Equipment and Services (continued) | | | | | | | | | | |

Kronos, Inc. | | | | | | | | | | |

Term Loan, 5.11%, Maturing June 9, 2017 | | | | | 1,445 | | | $ | 1,456,608 | |

Term Loan, 6.25%, Maturing December 28, 2017 | | | | | 868 | | | | 881,464 | |

Meritas LLC | | | | | | | | | | |

Term Loan, 7.50%, Maturing July 28, 2017 | | | | | 766 | | | | 765,625 | |

Mitchell International, Inc. | | | | | | | | | | |

Term Loan - Second Lien, 5.63%, Maturing March 30, 2015 | | | | | 2,500 | | | | 2,462,500 | |

Monitronics International Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing March 16, 2018 | | | | | 896 | | | | 907,253 | |

Quintiles Transnational Corp. | | | | | | | | | | |

Term Loan, 5.00%, Maturing June 8, 2018 | | | | | 4,518 | | | | 4,550,567 | |

Sabre, Inc. | | | | | | | | | | |

Term Loan, 2.22%, Maturing September 30, 2014 | | | | | 1,755 | | | | 1,752,202 | |

Sensus USA Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing May 9, 2017 | | | | | 714 | | | | 716,803 | |

SunGard Data Systems, Inc. | | | | | | | | | | |

Term Loan, 3.91%, Maturing February 26, 2016 | | | | | 9,552 | | | | 9,587,691 | |

Term Loan, 3.98%, Maturing February 28, 2017 | | | | | 314 | | | | 315,127 | |

SymphonyIRI Group, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing December 1, 2017 | | | | | 891 | | | | 891,000 | |

Trans Union, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing February 12, 2018 | | | | | 1,977 | | | | 1,998,206 | |

Travelport LLC | | | | | | | | | | |

Term Loan, 4.86%, Maturing August 21, 2015 | | | | | 446 | | | | 426,221 | |

Term Loan, 4.96%, Maturing August 21, 2015 | | | | | 1,563 | | | | 1,493,458 | |

Term Loan, 4.96%, Maturing August 21, 2015 | | | | | 1,649 | | | | 1,575,689 | |

Term Loan, 5.06%, Maturing August 21, 2015 | | EUR | | | 739 | | | | 889,524 | |

U.S. Security Holdings, Inc. | | | | | | | | | | |

Term Loan, 6.00%, Maturing July 28, 2017 | | | | | 130 | | | | 130,883 | |

Term Loan, 6.00%, Maturing July 28, 2017 | | | | | 663 | | | | 668,706 | |

West Corporation | | | | | | | | | | |

Term Loan, 5.50%, Maturing July 15, 2016 | | | | | 1,331 | | | | 1,343,602 | |

Term Loan, 5.50%, Maturing July 15, 2016 | | | | | 3,786 | | | | 3,822,655 | |

Term Loan, 5.75%, Maturing June 29, 2018 | | | | | 1,222 | | | | 1,234,921 | |

| | | | | | | | | | | |

| | | | | | | | $ | 79,271,635 | |

| | | | | | | | | | | |

| | | |

Cable and Satellite Television — 2.1% | | | | | | | | | | |

Atlantic Broadband Finance, LLC | | | | | | | | | | |

Term Loan, 5.25%, Maturing April 4, 2019 | | | | | 1,347 | | | $ | 1,355,282 | |

Term Loan - Second Lien, 9.75%, Maturing October 4, 2019 | | | | | 775 | | | | 812,781 | |

Bragg Communications Incorporated | | | | | | | | | | |

Term Loan, 4.00%, Maturing February 28, 2018 | | | | | 398 | | | | 399,990 | |

| | | | |

| | 5 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Cable and Satellite Television (continued) | | | | | | | | | | |

Cequel Communications, LLC | | | | | | | | | | |

Term Loan, 4.00%, Maturing February 14, 2019 | | | | | 5,497 | | | $ | 5,526,582 | |

Charter Communications Operating, LLC | | | | | | | | | | |

Term Loan, 4.00%, Maturing May 15, 2019 | | | | | 995 | | | | 1,001,592 | |

Crown Media Holdings, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing July 14, 2018 | | | | | 497 | | | | 499,778 | |

CSC Holdings, Inc. | | | | | | | | | | |

Term Loan, 1.97%, Maturing March 29, 2016 | | | | | 2,604 | | | | 2,602,710 | |

Kabel Deutschland GMBH | | | | | | | | | | |

Term Loan, 4.25%, Maturing February 1, 2019 | | | | | 1,100 | | | | 1,103,241 | |

Lavena Holdings 4 GmbH | | | | | | | | | | |

Term Loan, 2.95%, Maturing March 6, 2015 | | EUR | | | 2,045 | | | | 2,446,952 | |

Term Loan, 3.32%, Maturing March 4, 2016 | | EUR | | | 2,045 | | | | 2,446,952 | |

Term Loan, 7.70%, Maturing March 6, 2017(3) | | EUR | | | 540 | | | | 558,115 | |

Term Loan - Second Lien, 4.45%, Maturing September 2, 2016 | | EUR | | | 452 | | | | 518,761 | |

MCC Iowa LLC | | | | | | | | | | |

Term Loan, 1.94%, Maturing January 30, 2015 | | | | | 2,311 | | | | 2,270,116 | |

Mediacom Broadband LLC | | | | | | | | | | |

Term Loan, 4.50%, Maturing October 23, 2017 | | | | | 1,808 | | | | 1,799,333 | |

Mediacom Illinois, LLC | | | | | | | | | | |

Term Loan, 1.69%, Maturing January 30, 2015 | | | | | 4,561 | | | | 4,427,505 | |

Mediacom LLC | | | | | | | | | | |

Term Loan, 4.50%, Maturing October 23, 2017 | | | | | 1,002 | | | | 991,167 | |

P7S1 Broadcasting Holding II B.V. | | | | | | | | | | |

Term Loan, 2.81%, Maturing July 1, 2016 | | EUR | | | 1,235 | | | | 1,539,676 | |

UPC Broadband Holding B.V. | | | | | | | | | | |

Term Loan, 3.87%, Maturing December 31, 2016 | | EUR | | | 4,531 | | | | 5,780,145 | |

Term Loan, 4.12%, Maturing December 29, 2017 | | EUR | | | 1,962 | | | | 2,505,960 | |

UPC Financing Partnership | | | | | | | | | | |

Term Loan, 3.73%, Maturing December 30, 2016 | | | | | 239 | | | | 238,121 | |

Term Loan, 3.73%, Maturing December 29, 2017 | | | | | 1,815 | | | | 1,810,102 | |

Term Loan, 4.75%, Maturing December 29, 2017 | | | | | 400 | | | | 403,000 | |

WaveDivision Holdings, LLC | | | | | | | | | | |

Term Loan, Maturing August 9, 2019(4) | | | | | 350 | | | | 353,062 | |

| | | | | | | | | | | |

| | | | | | | | $ | 41,390,923 | |

| | | | | | | | | | | |

| | | |

Chemicals and Plastics — 1.8% | | | | | | | | | | |

Ashland, Inc. | | | | | | | | | | |

Term Loan, 3.75%, Maturing August 23, 2018 | | | | | 1,665 | | | $ | 1,679,379 | |

AZ Chem US Inc. | | | | | | | | | | |

Term Loan, 7.25%, Maturing December 22, 2017 | | | | | 1,083 | | | | 1,106,405 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Chemicals and Plastics (continued) | | | | | | | | | | |

Celanese U.S. Holdings LLC | | | | | | | | | | |

Term Loan, 2.87%, Maturing October 31, 2016 | | EUR | | | 1,338 | | | $ | 1,724,226 | |

Term Loan, 3.21%, Maturing October 31, 2016 | | | | | 2,081 | | | | 2,096,481 | |

Chemtura Corp | | | | | | | | | | |

Term Loan, Maturing August 27, 2016(4) | | | | | 275 | | | | 278,008 | |

Emerald Performance Materials, LLC | | | | | | | | | | |

Term Loan, 6.75%, Maturing May 18, 2018 | | | | | 748 | | | | 755,606 | |

General Chemical Corporation | | | | | | | | | | |

Term Loan, 5.00%, Maturing October 6, 2015 | | | | | 592 | | | | 594,620 | |

Harko C.V. | | | | | | | | | | |

Term Loan, 5.75%, Maturing August 2, 2017 | | | | | 545 | | | | 548,244 | |

Houghton International, Inc. | | | | | | | | | | |

Term Loan, 6.75%, Maturing January 29, 2016 | | | | | 1,787 | | | | 1,804,116 | |

Huntsman International, LLC | | | | | | | | | | |

Term Loan, 2.79%, Maturing April 19, 2017 | | | | | 2,123 | | | | 2,118,730 | |

Ineos US Finance LLC | | | | | | | | | | |

Term Loan, 6.50%, Maturing May 4, 2018 | | | | | 6,622 | | | | 6,698,596 | |

MacDermid, Inc. | | | | | | | | | | |

Term Loan, 2.32%, Maturing April 11, 2014 | | EUR | | | 729 | | | | 930,044 | |

Momentive Performance Materials Inc. | | | | | | | | | | |

Term Loan, 3.75%, Maturing May 29, 2015 | | | | | 672 | | | | 651,476 | |

Momentive Performance Materials USA Inc. | | | | | | | | | | |

Term Loan, 3.75%, Maturing May 5, 2015 | | | | | 1,258 | | | | 1,218,678 | |

Momentive Specialty Chemicals Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing May 5, 2015 | | | | | 848 | | | | 843,136 | |

Term Loan, 4.13%, Maturing May 5, 2015 | | | | | 383 | | | | 381,013 | |

Term Loan, 4.25%, Maturing May 5, 2015 | | | | | 2,245 | | | | 2,188,657 | |

OEP Pearl Dutch Acquisition B.V. | | | | | | | | | | |

Term Loan, 6.50%, Maturing March 30, 2018 | | | | | 101 | | | | 101,751 | |

Schoeller Arca Systems Holding B.V. | | | | | | | | | | |

Term Loan, 4.78%, Maturing November 16, 2015 | | EUR | | | 289 | | | | 260,006 | |

Term Loan, 4.78%, Maturing November 16, 2015 | | EUR | | | 824 | | | | 741,325 | |

Term Loan, 4.78%, Maturing November 16, 2015 | | EUR | | | 887 | | | | 797,738 | |

Sonneborn LLC | | | | | | | | | | |

Term Loan, 6.50%, Maturing March 30, 2018 | | | | | 571 | | | | 576,590 | |

Styron S.A.R.L., LLC | | | | | | | | | | |

Term Loan, 8.00%, Maturing August 2, 2017 | | | | | 1,659 | | | | 1,595,222 | |

Taminco Global Chemical Corporation | | | | | | | | | | |

Term Loan, 5.25%, Maturing February 15, 2019 | | | | | 398 | | | | 402,975 | |

Tronox Pigments (Netherlands) B.V. | | | | | | | | | | |

Term Loan, 4.25%, Maturing February 8, 2018 | | | | | 182 | | | | 183,504 | |

Term Loan, 4.25%, Maturing February 8, 2018 | | | | | 666 | | | | 672,849 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Chemicals and Plastics (continued) | | | | | | | | | | |

Univar Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing June 30, 2017 | | | | | 3,968 | | | $ | 3,959,189 | |

| | | | | | | | | | | |

| | | | | | | | $ | 34,908,564 | |

| | | | | | | | | | | |

| | | |

Clothing / Textiles — 0.1% | | | | | | | | | | |

Ascena Retail Group, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing June 14, 2018 | | | | | 948 | | | $ | 956,312 | |

Phillips-Van Heusen Corporation | | | | | | | | | | |

Term Loan, 3.50%, Maturing May 6, 2016 | | | | | 677 | | | | 680,415 | |

Wolverine Worldwide, Inc. | | | | | | | | | | |

Term Loan, Maturing July 31, 2019(4) | | | | | 575 | | | | 582,547 | |

| | | | | | | | | | | |

| | | | | | | | $ | 2,219,274 | |

| | | | | | | | | | | |

| | | |

Conglomerates — 0.7% | | | | | | | | | | |

Jarden Corporation | | | | | | | | | | |

Term Loan, 3.22%, Maturing March 30, 2018 | | | | | 842 | | | $ | 844,860 | |

Jason Incorporated | | | | | | | | | | |

Term Loan, 8.25%, Maturing September 21, 2014 | | | | | 245 | | | | 245,360 | |

Term Loan, 7.75%, Maturing September 22, 2014 | | | | | 223 | | | | 223,333 | |

Term Loan, 8.25%, Maturing September 22, 2014 | | | | | 99 | | | | 98,837 | |

Rexnord Corporation | | | | | | | | | | |

Term Loan, 5.00%, Maturing April 2, 2018 | | | | | 4,392 | | | | 4,417,891 | |

RGIS Services, LLC | | | | | | | | | | |

Term Loan, 4.61%, Maturing October 18, 2016 | | | | | 1,984 | | | | 1,964,478 | |

Term Loan, 5.50%, Maturing October 18, 2017 | | | | | 1,468 | | | | 1,465,790 | |

Rocket Software, Inc. | | | | | | | | | | |

Term Loan, 7.00%, Maturing February 8, 2018 | | | | | 447 | | | | 447,742 | |

Spectrum Brands, Inc. | | | | | | | | | | |

Term Loan, 5.02%, Maturing June 17, 2016 | | | | | 546 | | | | 549,297 | |

Walter Energy, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing April 2, 2018 | | | | | 2,956 | | | | 2,949,283 | |

| | | | | | | | | | | |

| | | | | | | | $ | 13,206,871 | |

| | | | | | | | | | | |

| | | |

Containers and Glass Products — 0.8% | | | | | | | | | | |

Berry Plastics Holding Corporation | | | | | | | | | | |

Term Loan, 2.22%, Maturing April 3, 2015 | | | | | 5,429 | | | $ | 5,407,227 | |

BWAY Corporation | | | | | | | | | | |

Term Loan, 4.25%, Maturing February 23, 2018 | | | | | 278 | | | | 279,173 | |

Term Loan, 4.25%, Maturing February 23, 2018 | | | | | 2,757 | | | | 2,770,093 | |

Pelican Products, Inc. | | | | | | | | | | |

Term Loan, 7.00%, Maturing July 11, 2018 | | | | | 499 | | | | 498,750 | |

Reynolds Group Holdings Inc. | | | | | | | | | | |

Term Loan, Maturing September 20, 2018(4) | | | | | 5,175 | | | | 5,202,474 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Containers and Glass Products (continued) | | | | | | | | | | |

Sealed Air Corporation | | | | | | | | | | |

Term Loan, 4.75%, Maturing October 3, 2018 | | | | | 686 | | | $ | 691,451 | |

TricorBraun, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing May 3, 2018 | | | | | 675 | | | | 680,063 | |

| | | | | | | | | | | |

| | | | | | | | $ | 15,529,231 | |

| | | | | | | | | | | |

| | | |

Cosmetics / Toiletries — 0.3% | | | | | | | | | | |

Bausch & Lomb, Inc. | | | | | | | | | | |

Term Loan, 5.25%, Maturing May 17, 2019 | | | | | 3,167 | | | $ | 3,205,859 | |

Huish Detergents, Inc. | | | | | | | | | | |

Term Loan, 2.22%, Maturing April 25, 2014 | | | | | 1,208 | | | | 1,155,210 | |

KIK Custom Products, Inc. | | | | | | | | | | |

Term Loan - Second Lien, 5.23%, Maturing November 28, 2014 | | | | | 1,900 | | | | 1,464,900 | |

Prestige Brands, Inc. | | | | | | | | | | |

Term Loan, 5.27%, Maturing January 31, 2019 | | | | | 449 | | | | 454,648 | |

| | | | | | | | | | | |

| | | | | | | | $ | 6,280,617 | |

| | | | | | | | | | | |

| | | |

Drugs — 0.5% | | | | | | | | | | |

Aptalis Pharma, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing February 10, 2017 | | | | | 995 | | | $ | 998,109 | |

Term Loan, 5.50%, Maturing February 10, 2017 | | | | | 1,742 | | | | 1,741,780 | |

Endo Pharmaceuticals Holdings Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing June 18, 2018 | | | | | 373 | | | | 374,383 | |

Warner Chilcott Company, LLC | | | | | | | | | | |

Term Loan, 3.75%, Maturing March 17, 2016 | | | | | 700 | | | | 703,282 | |

Term Loan, 4.25%, Maturing March 15, 2018 | | | | | 983 | | | | 986,137 | |

Warner Chilcott Corporation | | | | | | | | | | |

Term Loan, 4.25%, Maturing March 15, 2018 | | | | | 747 | | | | 748,982 | |

Term Loan, 4.25%, Maturing March 15, 2018 | | | | | 1,967 | | | | 1,972,274 | |

WC Luxco S.a.r.l. | | | | | | | | | | |

Term Loan, 4.25%, Maturing March 15, 2018 | | | | | 1,352 | | | | 1,355,938 | |

| | | | | | | | | | | |

| | | | | | | | $ | 8,880,885 | |

| | | | | | | | | | | |

| | | |

Ecological Services and Equipment — 0.1% | | | | | | | | | | |

ADS Waste Holdings | | | | | | | | | | |

Term Loan, Maturing September 11, 2019(4) | | | | | 2,125 | | | $ | 2,142,708 | |

Envirotest Systems Holding Corp. | | | | | | | | | | |

Term Loan - Second Lien, 15.50%, Maturing March 31, 2017(5) | | | | | 95 | | | | 97,681 | |

Viking Consortium Borrower Limited | | | | | | | | | | |

Term Loan - Second Lien, 7.31%, Maturing March 31, 2016(3) (5) | | GBP | | | 523 | | | | 232,330 | |

| | | | | | | | | | | |

| | | | | | | | $ | 2,472,719 | |

| | | | | | | | | | | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Electronics / Electrical — 3.1% | | | | | | | | | | |

Aeroflex Incorporated | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 9, 2018 | | | | | 1,469 | | | $ | 1,467,760 | |

Aspect Software, Inc. | | | | | | | | | | |

Term Loan, 6.25%, Maturing May 6, 2016 | | | | | 2,806 | | | | 2,770,629 | |

Attachmate Corporation | | | | | | | | | | |

Term Loan, 7.25%, Maturing November 22, 2017 | | | | | 3,238 | | | | 3,268,482 | |

Cinedigm Digital Funding I, LLC | | | | | | | | | | |

Term Loan, 5.25%, Maturing April 29, 2016 | | | | | 549 | | | | 553,590 | |

CommScope, Inc. | | | | | | | | | | |

Term Loan, 4.25%, Maturing January 12, 2018 | | | | | 3,266 | | | | 3,287,612 | |

Dealer Computer Services, Inc. | | | | | | | | | | |

Term Loan, 3.75%, Maturing April 20, 2018 | | | | | 1,553 | | | | 1,561,736 | |

DG FastChannel, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing July 26, 2018 | | | | | 1,639 | | | | 1,597,868 | |

Eagle Parent, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing May 16, 2018 | | | | | 2,765 | | | | 2,786,429 | |

Edwards (Cayman Islands II) Limited | | | | | | | | | | |

Term Loan, 5.50%, Maturing May 31, 2016 | | | | | 2,029 | | | | 2,043,989 | |

Freescale Semiconductor, Inc. | | | | | | | | | | |

Term Loan, 4.48%, Maturing December 1, 2016 | | | | | 4,321 | | | | 4,232,479 | |

InfoGroup Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 25, 2018 | | | | | 972 | | | | 875,247 | |

Infor (US), Inc. | | | | | | | | | | |

Term Loan, 5.25%, Maturing April 5, 2018 | | | | | 5,212 | | | | 5,239,081 | |

Magic Newco LLC | | | | | | | | | | |

Term Loan, 7.25%, Maturing December 12, 2018 | | | | | 1,500 | | | | 1,508,907 | |

Microsemi Corporation | | | | | | | | | | |

Term Loan, 4.00%, Maturing February 2, 2018 | | | | | 1,601 | | | | 1,612,633 | |

NeuStar, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing November 8, 2018 | | | | | 1,015 | | | | 1,024,898 | |

Nxp B.V. | | | | | | | | | | |

Term Loan, 4.50%, Maturing March 3, 2017 | | | | | 2,536 | | | | 2,564,909 | |

Term Loan, 5.50%, Maturing March 3, 2017 | | | | | 1,089 | | | | 1,110,326 | |

Term Loan, 5.25%, Maturing March 19, 2019 | | | | | 1,667 | | | | 1,688,846 | |

Open Solutions, Inc. | | | | | | | | | | |

Term Loan, 2.58%, Maturing January 23, 2014 | | | | | 2,316 | | | | 2,239,939 | |

Rovi Solutions Corporation | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 29, 2019 | | | | | 846 | | | | 818,263 | |

SafeNet Inc. | | | | | | | | | | |

Term Loan, 2.72%, Maturing April 12, 2014 | | | | | 888 | | | | 885,372 | |

Semtech Corp. | | | | | | | | | | |

Term Loan, 4.25%, Maturing March 20, 2017 | | | | | 424 | | | | 427,382 | |

Sensata Technologies Finance Company, LLC | | | | | | | | | | |

Term Loan, 4.00%, Maturing May 11, 2018 | | | | | 3,728 | | | | 3,753,184 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Electronics / Electrical (continued) | | | | | | | | | | |

Serena Software, Inc. | | | | | | | | | | |

Term Loan, 4.23%, Maturing March 10, 2016 | | | | | 3,206 | | | $ | 3,174,040 | |

Term Loan, 5.00%, Maturing March 10, 2016 | | | | | 350 | | | | 348,250 | |

Shield Finance Co. S.A.R.L. | | | | | | | | | | |

Term Loan, 6.50%, Maturing May 10, 2019 | | | | | 1,047 | | | | 1,053,921 | |

SkillSoft Corporation | | | | | | | | | | |

Term Loan, Maturing May 26, 2017(4) | | | | | 1,247 | | | | 1,247,280 | |

Sophia, L.P. | | | | | | | | | | |

Term Loan, 6.25%, Maturing July 19, 2018 | | | | | 1,423 | | | | 1,442,788 | |

SS&C Technologies Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing June 7, 2019 | | | | | 142 | | | | 144,294 | |

Term Loan, 5.00%, Maturing June 7, 2019 | | | | | 1,374 | | | | 1,389,046 | |

VeriFone Inc. | | | | | | | | | | |

Term Loan, 4.25%, Maturing December 28, 2018 | | | | | 294 | | | | 295,200 | |

Vertafore, Inc. | | | | | | | | | | |

Term Loan, 5.25%, Maturing July 29, 2016 | | | | | 2,041 | | | | 2,049,719 | |

Web.com Group, Inc. | | | | | | | | | | |

Term Loan, 7.00%, Maturing October 27, 2017 | | | | | 3,116 | | | | 3,144,742 | |

| | | | | | | | | | | |

| | | $ | 61,608,841 | |

| | | | | | | | | | | |

| | | |

Equipment Leasing — 0.3% | | | | | | | | | | |

BakerCorp International, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing June 1, 2018 | | | | | 891 | | | $ | 895,010 | |

Delos Aircraft Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing April 12, 2016 | | | | | 1,300 | | | | 1,314,625 | |

Flying Fortress Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing June 30, 2017 | | | | | 3,475 | | | | 3,522,781 | |

| | | | | | | | | | | |

| | | $ | 5,732,416 | |

| | | | | | | | | | | |

| | | |

Financial Intermediaries — 1.6% | | | | | | | | | | |

American Capital Holdings, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing July 19, 2016 | | | | | 875 | | | $ | 883,750 | |

Asset Acceptance Capital Corp. | | | | | | | | | | |

Term Loan, 8.75%, Maturing November 14, 2017 | | | | | 1,323 | | | | 1,339,980 | |

CB Richard Ellis Services, Inc. | | | | | | | | | | |

Term Loan, 3.47%, Maturing March 5, 2018 | | | | | 648 | | | | 648,597 | |

Term Loan, 3.72%, Maturing September 4, 2019 | | | | | 612 | | | | 612,564 | |

Citco III Limited | | | | | | | | | | |

Term Loan, 5.50%, Maturing June 29, 2018 | | | | | 2,767 | | | | 2,788,231 | |

First Data Corp. | | | | | | | | | | |

Term Loan, 2.97%, Maturing September 24, 2014 | | | | | 44 | | | | 44,222 | |

Term Loan, 2.97%, Maturing September 24, 2014 | | | | | 104 | | | | 103,614 | |

Term Loan, 2.97%, Maturing September 24, 2014 | | | | | 118 | | | | 117,271 | |

Term Loan, Maturing September 30, 2018(4) | | | | | 1,350 | | | | 1,328,625 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Financial Intermediaries (continued) | | | | | | | | | | |

Grosvenor Capital Management Holdings, LLP | | | | | | | | | | |

Term Loan, 4.25%, Maturing December 5, 2016 | | | | | 605 | | | $ | 595,506 | |

Hamilton Lane Advisors, LLC | | | | | | | | | | |

Term Loan, 6.50%, Maturing February 23, 2018 | | | | | 756 | | | | 755,625 | |

iPayment, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 8, 2017 | | | | | 987 | | | | 982,065 | |

LPL Holdings, Inc. | | | | | | | | | | |

Term Loan, 2.72%, Maturing March 29, 2017 | | | | | 804 | | | | 794,320 | |

Term Loan, 4.00%, Maturing March 29, 2019 | | | | | 3,109 | | | | 3,122,979 | |

Mercury Payment Systems Canada, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing July 3, 2017 | | | | | 716 | | | | 723,097 | |

MIP Delaware, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing July 12, 2018 | | | | | 728 | | | | 731,494 | |

Nuveen Investments, Inc. | |

Term Loan, 5.90%, Maturing May 12, 2017 | | | | | 3,653 | | | | 3,652,036 | |

Term Loan, 5.90%, Maturing May 13, 2017 | | | | | 2,542 | | | | 2,543,241 | |

Term Loan, 7.25%, Maturing May 13, 2017 | | | | | 550 | | | | 552,200 | |

Oz Management LP | |

Term Loan, 1.72%, Maturing November 15, 2016 | | | | | 1,368 | | | | 1,210,338 | |

RJO Holdings Corp. | |

Term Loan, 6.22%, Maturing December 10, 2015(5) | | | | | 32 | | | | 26,494 | |

Term Loan, 6.97%, Maturing December 10, 2015(5) | | | | | 1,022 | | | | 797,141 | |

RPI Finance Trust | |

Term Loan, 4.00%, Maturing May 9, 2018 | | | | | 3,722 | | | | 3,735,782 | |

Term Loan, 4.00%, Maturing November 9, 2018 | | | | | 1,991 | | | | 2,006,561 | |

Vantiv, LLC | |

Term Loan, 3.75%, Maturing March 27, 2019 | | | | | 498 | | | | 499,677 | |

| | | | | | | | | | | |

| | | $ | 30,595,410 | |

| | | | | | | | | | | |

| | | |

Food Products — 1.9% | | | | | | | | | | |

Blue Buffalo Company, Ltd. | | | | | | | | | | |

Term Loan, 6.50%, Maturing August 8, 2019 | | | | | 1,225 | | | $ | 1,227,297 | |

Clearwater Seafoods Limited Partnership | |

Term Loan, 6.75%, Maturing June 6, 2018 | | | | | 1,150 | | | | 1,152,875 | |

Dean Foods Company | |

Term Loan, 1.60%, Maturing April 2, 2014 | | | | | 3,628 | | | | 3,615,558 | |

Del Monte Foods Company | |

Term Loan, 4.50%, Maturing March 8, 2018 | | | | | 5,848 | | | | 5,850,870 | |

Dole Food Company Inc. | |

Term Loan, 5.04%, Maturing July 6, 2018 | | | | | 1,054 | | | | 1,059,208 | |

Hearthside Food Solutions, LLC | |

Term Loan, 6.50%, Maturing June 5, 2018 | | | | | 1,275 | | | | 1,278,187 | |

High Liner Foods Incorporated | |

Term Loan, 7.00%, Maturing December 19, 2017 | | | | | 670 | | | | 676,637 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Food Products (continued) | | | | | | | | | | |

JBS USA Holdings Inc. | |

Term Loan, 4.25%, Maturing May 25, 2018 | | | | | 3,049 | | | $ | 3,041,172 | |

Michael Foods Group, Inc. | |

Term Loan, 4.25%, Maturing February 23, 2018 | | | | | 1,437 | | | | 1,448,371 | |

NBTY, Inc. | |

Term Loan, 4.25%, Maturing October 2, 2017 | | | | | 6,321 | | | | 6,354,120 | |

Pierre Foods, Inc. | |

Term Loan, 7.00%, Maturing September 30, 2016 | | | | | 2,338 | | | | 2,351,771 | |

Pinnacle Foods Finance LLC | |

Term Loan, 4.75%, Maturing October 17, 2018 | | | | | 299 | | | | 299,495 | |

Term Loan, 4.75%, Maturing October 17, 2018 | | | | | 6,608 | | | | 6,629,089 | |

Solvest Ltd. | |

Term Loan, 5.02%, Maturing July 6, 2018 | | | | | 1,886 | | | | 1,895,427 | |

| | | | | | | | | | | |

| | | $ | 36,880,077 | |

| | | | | | | | | | | |

| | | |

Food Service — 1.8% | | | | | | | | | | |

Aramark Corporation | | | | | | | | | | |

Term Loan, 3.46%, Maturing July 26, 2016 | | | | | 246 | | | $ | 246,311 | |

Term Loan, 3.46%, Maturing July 26, 2016 | | | | | 137 | | | | 137,099 | |

Term Loan, 3.47%, Maturing July 26, 2016 | | | | | 3,742 | | | | 3,745,318 | |

Term Loan, 3.57%, Maturing July 26, 2016 | | | | | 1,696 | | | | 1,697,040 | |

Term Loan, 3.97%, Maturing July 26, 2016 | | GBP | | | 950 | | | | 1,510,409 | |

Brasa Holdings, Inc. | |

Term Loan, 7.50%, Maturing July 19, 2019 | | | | | 475 | | | | 473,812 | |

Buffets, Inc. | |

Term Loan, 0.24%, Maturing April 22, 2015 | | | | | 137 | | | | 137,036 | |

Burger King Corporation | |

Term Loan, Maturing September 27, 2019(4) | | | | | 2,650 | | | | 2,658,281 | |

DineEquity, Inc. | |

Term Loan, 4.30%, Maturing October 19, 2017 | | | | | 1,787 | | | | 1,802,219 | |

Dunkin’ Brands, Inc. | |

Term Loan, 4.00%, Maturing November 23, 2017 | | | | | 2,262 | | | | 2,262,529 | |

Landry’s, Inc. | |

Term Loan, 6.50%, Maturing April 24, 2018 | | | | | 1,368 | | | | 1,388,989 | |

NPC International, Inc. | |

Term Loan, 5.25%, Maturing December 28, 2018 | | | | | 697 | | | | 705,206 | |

OSI Restaurant Partners, LLC | |

Revolving Loan, 2.50%, Maturing June 14, 2013 | | | | | 547 | | | | 545,771 | |

Term Loan, 2.50%, Maturing June 14, 2014 | | | | | 5,999 | | | | 5,980,505 | |

P.F. Chang’s China Bistro Inc. | |

Term Loan, 6.25%, Maturing July 2, 2019 | | | | | 450 | | | | 455,062 | |

Sagittarius Restaurants, LLC | |

Term Loan, 7.50%, Maturing May 18, 2015 | | | | | 471 | | | | 471,544 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Food Service (continued) | | | | | | | | | | |

US Foods, Inc. | |

Term Loan, 2.72%, Maturing July 3, 2014 | | | | | 673 | | | $ | 667,116 | |

Term Loan, 5.75%, Maturing March 31, 2017 | | | | | 4,283 | | | | 4,236,779 | |

Weight Watchers International, Inc. | |

Term Loan, 4.00%, Maturing March 15, 2019 | | | | | 3,367 | | | | 3,370,771 | |

Wendy’s International, Inc. | |

Term Loan, 4.75%, Maturing May 15, 2019 | | | | | 2,050 | | | | 2,070,820 | |

| | | | | | | | | | | |

| | | $ | 34,562,617 | |

| | | | | | | | | | | |

| | | |

Food / Drug Retailers — 1.5% | | | | | | | | | | |

Alliance Boots Holdings Limited | | | | | | | | | | |

Term Loan, 3.09%, Maturing July 9, 2015 | | EUR | | | 1,000 | | | $ | 1,243,942 | |

Term Loan, 3.51%, Maturing July 9, 2015 | | GBP | | | 5,950 | | | | 9,200,915 | |

General Nutrition Centers, Inc. | |

Term Loan, 5.25%, Maturing March 2, 2018 | | | | | 4,898 | | | | 4,906,520 | |

Pantry, Inc. (The) | |

Term Loan, 5.75%, Maturing August 2, 2019 | | | | | 475 | | | | 478,364 | |

Rite Aid Corporation | |

Term Loan, 1.97%, Maturing June 4, 2014 | | | | | 5,681 | | | | 5,643,070 | |

Term Loan, 4.50%, Maturing March 2, 2018 | | | | | 5,040 | | | | 5,033,440 | |

Sprouts Farmers Markets Holdings, LLC | |

Term Loan, 6.00%, Maturing April 18, 2018 | | | | | 746 | | | | 747,145 | |

Term Loan, 6.00%, Maturing April 18, 2018 | | | | | 1,347 | | | | 1,356,725 | |

| | | | | | | | | | | |

| | | $ | 28,610,121 | |

| | | | | | | | | | | |

| | | |

Health Care — 5.4% | | | | | | | | | | |

Alere, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing June 30, 2017 | | | | | 473 | | | $ | 474,496 | |

Term Loan, 4.75%, Maturing June 30, 2017 | | | | | 596 | | | | 598,943 | |

Term Loan, 4.75%, Maturing June 30, 2017 | | | | | 3,270 | | | | 3,289,389 | |

Alkermes, Inc. | |

Term Loan, Maturing September 18, 2019(4) | | | | | 750 | | | | 754,688 | |

Alliance Healthcare Services, Inc. | |

Term Loan, 7.25%, Maturing June 1, 2016 | | | | | 1,906 | | | | 1,858,648 | |

Ardent Medical Services, Inc. | |

Term Loan, 6.50%, Maturing September 15, 2015 | | | | | 710 | | | | 713,287 | |

Aveta, Inc. | |

Term Loan, 8.50%, Maturing April 4, 2017 | | | | | 1,275 | | | | 1,291,254 | |

Term Loan, 8.50%, Maturing April 4, 2017 | | | | | 1,275 | | | | 1,291,254 | |

Biomet Inc. | |

Term Loan, 3.31%, Maturing March 25, 2015 | | | | | 3,002 | | | | 3,007,402 | |

BSN Medical Acquisition Holding GmbH | |

Term Loan, 6.00%, Maturing July 27, 2019 | | | | | 625 | | | | 629,948 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Health Care (continued) | | | | | | | | | | |

Catalent Pharma Solutions Inc. | |

Term Loan, 4.12%, Maturing September 15, 2016 | | EUR | | | 1,895 | | | $ | 2,444,301 | |

Term Loan, 4.22%, Maturing September 15, 2016 | | | | | 1,086 | | | | 1,089,860 | |

Term Loan, 5.25%, Maturing September 15, 2017 | | | | | 645 | | | | 651,584 | |

CDRL MS, Inc. | |

Term Loan, 6.75%, Maturing October 3, 2016 | | | | | 783 | | | | 785,499 | |

Community Health Systems, Inc. | |

Term Loan, 3.92%, Maturing January 25, 2017 | | | | | 7,104 | | | | 7,146,144 | |

Convatec Inc. | |

Term Loan, 5.75%, Maturing December 22, 2016 | | | | | 1,495 | | | | 1,502,151 | |

CRC Health Corporation | |

Term Loan, 4.86%, Maturing November 16, 2015 | | | | | 1,160 | | | | 1,103,084 | |

DaVita, Inc. | |

Term Loan, Maturing September 2, 2019(4) | | | | | 3,325 | | | | 3,337,469 | |

DJO Finance LLC | |

Term Loan, 5.22%, Maturing November 1, 2016 | | | | | 1,494 | | | | 1,496,633 | |

Term Loan, 6.25%, Maturing September 15, 2017 | | | | | 423 | | | | 424,989 | |

Drumm Investors LLC | |

Term Loan, 5.00%, Maturing May 4, 2018 | | | | | 1,974 | | | | 1,910,235 | |

Emdeon, Inc. | |

Term Loan, 5.00%, Maturing November 2, 2018 | | | | | 846 | | | | 853,150 | |

Emergency Medical Services Corporation | |

Term Loan, 5.25%, Maturing May 25, 2018 | | | | | 3,473 | | | | 3,495,176 | |

Fenwal, Inc. | |

Term Loan, 2.67%, Maturing February 28, 2014 | | | | | 136 | | | | 135,996 | |

Term Loan, 2.67%, Maturing February 28, 2014 | | | | | 795 | | | | 793,016 | |

Fresenius US Finance I Inc. | |

Term Loan, 3.50%, Maturing September 10, 2014 | | | | | 353 | | | | 354,119 | |

Term Loan, 3.50%, Maturing September 10, 2014 | | | | | 617 | | | | 619,608 | |

Grifols Inc. | |

Term Loan, 4.50%, Maturing June 1, 2017 | | | | | 3,207 | | | | 3,239,440 | |

HCA, Inc. | |

Term Loan, 3.61%, Maturing March 31, 2017 | | | | | 5,961 | | | | 5,980,741 | |

Term Loan, 3.47%, Maturing May 1, 2018 | | | | | 2,152 | | | | 2,158,399 | |

Health Management Associates, Inc. | |

Term Loan, 4.50%, Maturing November 16, 2018 | | | | | 4,249 | | | | 4,286,300 | |

Hologic Inc. | |

Term Loan, 4.50%, Maturing August 1, 2019 | | | | | 2,025 | | | | 2,051,325 | |

Iasis Healthcare LLC | |

Term Loan, 5.00%, Maturing May 3, 2018 | | | | | 1,773 | | | | 1,780,757 | |

inVentiv Health, Inc. | |

Term Loan, 6.50%, Maturing August 4, 2016 | | | | | 3,455 | | | | 3,351,398 | |

Term Loan, 6.75%, Maturing May 15, 2018 | | | | | 2,333 | | | | 2,268,964 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Health Care (continued) | | | | | | | | | | |

Kindred Healthcare, Inc. | |

Term Loan, 5.25%, Maturing June 1, 2018 | | | | | 1,728 | | | $ | 1,707,042 | |

Term Loan, Maturing June 1, 2018(4) | | | | | 850 | | | | 839,630 | |

Kinetic Concepts, Inc. | |

Term Loan, 7.00%, Maturing May 4, 2018 | | | | | 3,722 | | | | 3,780,029 | |

LHP Hospital Group, Inc. | |

Term Loan, 9.00%, Maturing July 3, 2018 | | | | | 599 | | | | 605,981 | |

MedAssets, Inc. | |

Term Loan, 5.25%, Maturing November 16, 2016 | | | | | 795 | | | | 802,619 | |

Medpace, Inc. | |

Term Loan, 6.51%, Maturing June 16, 2017 | | | | | 853 | | | | 821,157 | |

Multiplan, Inc. | |

Term Loan, 4.75%, Maturing August 26, 2017 | | | | | 3,333 | | | | 3,348,899 | |

MX USA, Inc. | |

Term Loan, 6.50%, Maturing April 28, 2017 | | | | | 597 | | | | 594,015 | |

One Call Medical, Inc. | |

Term Loan, 7.00%, Maturing August 16, 2019 | | | | | 950 | | | | 950,000 | |

Onex Carestream Finance LP | |

Term Loan, 5.00%, Maturing February 25, 2017 | | | | | 2,437 | | | | 2,415,466 | |

Par Pharmaceutical Companies, Inc. | |

Term Loan, 5.00%, Maturing September 30, 2019 | | | | | 1,275 | | | | 1,274,203 | |

Pharmaceutical Product Development, Inc. | |

Term Loan, 6.25%, Maturing December 5, 2018 | | | | | 2,059 | | | | 2,080,891 | |

Physiotherapy Associates Holdings, Inc. | |

Term Loan, 6.01%, Maturing April 30, 2018 | | | | | 324 | | | | 324,188 | |

Radnet Management, Inc. | |

Term Loan, 5.75%, Maturing April 6, 2016 | | | | | 2,328 | | | | 2,323,602 | |

Select Medical Corporation | |

Term Loan, 5.50%, Maturing June 1, 2018 | | | | | 3,209 | | | | 3,231,439 | |

Sheridan Holdings, Inc. | |

Term Loan, 6.00%, Maturing June 29, 2018 | | | | | 623 | | | | 630,062 | |

Sunrise Medical Holdings B.V. | |

Term Loan, 6.75%, Maturing May 13, 2014 | | EUR | | | 706 | | | | 891,304 | |

TriZetto Group, Inc. (The) | |

Term Loan, 4.75%, Maturing May 2, 2018 | | | | | 1,555 | | | | 1,550,939 | |

Truven Health Analytics Inc. | |

Term Loan, 6.75%, Maturing June 6, 2019 | | | | | 2,993 | | | | 3,018,684 | |

Universal Health Services, Inc. | |

Term Loan, 3.75%, Maturing November 15, 2016 | | | | | 507 | | | | 508,439 | |

Valeant Pharmaceuticals International, Inc. | |

Term Loan, 4.75%, Maturing February 13, 2019 | | | | | 873 | | | | 879,904 | |

Term Loan, 4.75%, Maturing February 13, 2019 | | | | | 1,020 | | | | 1,027,949 | |

Term Loan, Maturing September 27, 2019(4) | | | | | 2,150 | | | | 2,153,584 | |

Vanguard Health Holding Co. II, LLC | |

Term Loan, 5.00%, Maturing January 29, 2016 | | | | | 1,225 | | | | 1,233,947 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Health Care (continued) | | | | | | | | | | |

VWR Funding, Inc. | |

Term Loan, 2.72%, Maturing June 30, 2014 | | | | | 1,125 | | | $ | 1,126,125 | |

Term Loan, 4.47%, Maturing April 3, 2017 | | | | | 1,125 | | | | 1,131,045 | |

| | | | | | | | | | | |

| | | $ | 106,420,790 | |

| | | | | | | | | | | |

| | | |

Home Furnishings — 0.5% | | | | | | | | | | |

Hunter Fan Company | | | | | | | | | | |

Term Loan, 2.72%, Maturing April 16, 2014 | | | | | 467 | | | $ | 446,457 | |

Term Loan - Second Lien, 6.97%, Maturing October 16, 2014 | | | | | 500 | | | | 425,000 | |

National Bedding Company LLC | |

Term Loan, 6.00%, Maturing November 28, 2013 | | | | | 3,214 | | | | 3,212,247 | |

Term Loan - Second Lien, 7.25%, Maturing February 28, 2014 | | | | | 2,550 | | | | 2,543,625 | |

Oreck Corporation | |

Term Loan - Second Lien, 3.88%, Maturing March 19, 2016(5) | | | | | 527 | | | | 475,649 | |

Serta Simmons Holdings, LLC | |

Term Loan, Maturing September 19, 2019(4) | | | | | 1,775 | | | | 1,770,405 | |

Sofia III S.a.r.l. | |

Term Loan, 2.62%, Maturing June 24, 2016 | | EUR | | | 374 | | | | 424,488 | |

| | | | | | | | | | | |

| | | $ | 9,297,871 | |

| | | | | | | | | | | |

| | | |

Industrial Equipment — 0.6% | | | | | | | | | | |

Colfax Corporation | | | | | | | | | | |

Term Loan, 4.50%, Maturing January 11, 2019 | | | | | 1,340 | | | $ | 1,350,343 | |

Generac Power Systems, Inc. | | | | | | | | | | |

Term Loan, 6.25%, Maturing February 8, 2019 | | | | | 1,650 | | | | 1,685,062 | |

Grede LLC | | | | | | | | | | |

Term Loan, 7.00%, Maturing April 3, 2017 | | | | | 833 | | | | 834,562 | |

Husky Injection Molding Systems Ltd. | | | | | | | | | | |

Term Loan, 5.75%, Maturing June 29, 2018 | | | | | 1,931 | | | | 1,949,771 | |

Kion Group GMBH | | | | | | | | | | |

Term Loan, 3.37%, Maturing December 23, 2014(3) | | EUR | | | 1,311 | | | | 1,642,285 | |

Term Loan, 3.47%, Maturing December 23, 2014(3) | | | | | 260 | | | | 253,477 | |

Term Loan, 3.97%, Maturing December 23, 2015(3) | | | | | 260 | | | | 253,477 | |

Term Loan, 3.87%, Maturing December 29, 2015(3) | | EUR | | | 1,311 | | | | 1,642,285 | |

Manitowoc Company, Inc. (The) | | | | | | | | | | |

Term Loan, 4.25%, Maturing November 13, 2017 | | | | | 602 | | | | 606,414 | |

Tank Holding Corp. | | | | | | | | | | |

Term Loan, 6.75%, Maturing July 9, 2019 | | | | | 1,059 | | | | 1,061,295 | |

Unifrax Corporation | | | | | | | | | | |

Term Loan, 6.50%, Maturing November 28, 2018 | | | | | 1,095 | | | | 1,107,057 | |

| | | | | | | | | | | |

| | | $ | 12,386,028 | |

| | | | | | | | | | | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Insurance — 1.2% | | | | | | | | | | |

Alliant Holdings I, Inc. | | | | | | | | | | |

Term Loan, 3.36%, Maturing August 21, 2014 | | | | | 2,632 | | | $ | 2,641,411 | |

AmWINS Group, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing June 6, 2019 | | | | | 1,047 | | | | 1,051,303 | |

Term Loan - Second Lien, 9.25%, Maturing December 6, 2019 | | | | | 3,475 | | | | 3,485,137 | |

Applied Systems, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing December 8, 2016 | | | | | 622 | | | | 623,430 | |

Term Loan, 5.50%, Maturing December 8, 2016 | | | | | 950 | | | | 952,287 | |

Asurion LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing May 24, 2018 | | | | | 8,474 | | | | 8,530,647 | |

Term Loan - Second Lien, 9.00%, Maturing

May 24, 2019 | | | | | 524 | | | | 542,876 | |

CNO Financial Group, Inc. | | | | | | | | | | |

Term Loan, Maturing September 20, 2016(4) | | | | | 1,125 | | | | 1,133,437 | |

Hub International Limited | | | | | | | | | | |

Term Loan, 4.72%, Maturing June 13, 2017 | | | | | 1,138 | | | | 1,149,403 | |

Sedgwick CMS Holdings, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing December 30, 2016 | | | | | 658 | | | | 655,959 | |

USI Holdings Corporation | |

Term Loan, 2.72%, Maturing May 5, 2014 | | | | | 2,588 | | | | 2,592,775 | |

Term Loan, 7.00%, Maturing May 5, 2014 | | | | | 970 | | | | 975,658 | |

| | | | | | | | | | | |

| | | $ | 24,334,323 | |

| | | | | | | | | | | |

| | | |

Leisure Goods / Activities / Movies — 2.0% | | | | | | | | | | |

Alpha D2 Limited | | | | | | | | | | |

Term Loan, 5.75%, Maturing April 28, 2017 | | | | | 2,090 | | | $ | 2,112,790 | |

AMC Entertainment, Inc. | | | | | | | | | | |

Term Loan, 4.25%, Maturing December 15, 2016 | | | | | 1,646 | | | | 1,655,811 | |

Term Loan, 4.75%, Maturing February 22, 2018 | | | | | 1,017 | | | | 1,025,044 | |

AMC Networks Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing December 31, 2018 | | | | | 1,457 | | | | 1,457,776 | |

Bombardier Recreational Products, Inc. | | | | | | | | | | |

Term Loan, 4.47%, Maturing June 28, 2016 | | | | | 2,825 | | | | 2,845,964 | |

Bright Horizons Family Solutions, Inc. | | | | | | | | | | |

Term Loan, 4.22%, Maturing May 28, 2015 | | | | | 237 | | | | 237,803 | |

Cedar Fair, L.P. | | | | | | | | | | |

Term Loan, 4.00%, Maturing December 15, 2017 | | | | | 2,360 | | | | 2,377,809 | |

Cinemark USA, Inc. | | | | | | | | | | |

Term Loan, 3.48%, Maturing April 29, 2016 | | | | | 3,615 | | | | 3,638,405 | |

Clubcorp Club Operations, Inc. | | | | | | | | | | |

Term Loan, 6.00%, Maturing November 30, 2016 | | | | | 1,980 | | | | 1,997,172 | |

Live Nation Entertainment, Inc. | | | | | | | | | | |

Term Loan, 4.50%, Maturing November 7, 2016 | | | | | 5,623 | | | | 5,646,134 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Leisure Goods / Activities / Movies (continued) | | | | | | | | | | |

Regal Cinemas, Inc. | | | | | | | | | | |

Term Loan, 3.25%, Maturing August 23, 2017 | | | | | 3,930 | | | $ | 3,945,791 | |

Revolution Studios Distribution Company, LLC | | | | | | | | | | |

Term Loan, 3.97%, Maturing December 21, 2014(5) | | | | | 1,246 | | | | 1,014,616 | |

Term Loan - Second Lien, 7.22%, Maturing June 21, 2015(5) | | | | | 2,050 | | | | 873,505 | |

SeaWorld Parks & Entertainment, Inc. | | | | | | | | | | |

Term Loan, 2.93%, Maturing February 17, 2016 | | | | | 948 | | | | 945,932 | |

Term Loan, 4.00%, Maturing August 17, 2017 | | | | | 1,529 | | | | 1,536,981 | |

Six Flags Theme Parks, Inc. | | | | | | | | | | |

Term Loan, 4.25%, Maturing December 20, 2018 | | | | | 4,700 | | | | 4,735,231 | |

Town Sports International Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 11, 2018 | | | | | 916 | | | | 929,013 | |

Zuffa LLC | | | | | | | | | | |

Term Loan, 2.25%, Maturing June 19, 2015 | | | | | 1,443 | | | | 1,417,643 | |

Term Loan, 7.50%, Maturing June 19, 2015 | | | | | 1,492 | | | | 1,503,574 | |

| | | | | | | | | | | |

| | | $ | 39,896,994 | |

| | | | | | | | | | | |

| | | |

Lodging and Casinos — 0.7% | | | | | | | | | | |

Affinity Gaming, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing November 9, 2017 | | | | | 1,692 | | | $ | 1,716,872 | |

Ameristar Casinos, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing April 16, 2018 | | | | | 980 | | | | 986,914 | |

Caesars Entertainment Operating Company | | | | | | | | | | |

Term Loan, 5.47%, Maturing January 26, 2018 | | | | | 3,683 | | | | 3,357,188 | |

Gala Group LTD | | | | | | | | | | |

Term Loan, 5.52%, Maturing May 30, 2018 | | GBP | | | 1,775 | | | | 2,640,949 | |

Isle of Capri Casinos, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing March 24, 2017 | | | | | 862 | | | | 869,237 | |

Las Vegas Sands LLC | | | | | | | | | | |

Term Loan, 2.72%, Maturing November 23, 2016 | | | | | 613 | | | | 611,015 | |

Term Loan, 2.72%, Maturing November 23, 2016 | | | | | 2,249 | | | | 2,243,925 | |

LodgeNet Entertainment Corporation | | | | | | | | | | |

Term Loan, 6.50%, Maturing April 4, 2014 | | | | | 529 | | | | 401,528 | |

Penn National Gaming, Inc. | | | | | | | | | | |

Term Loan, 3.75%, Maturing July 16, 2018 | | | | | 711 | | | | 714,894 | |

Pinnacle Entertainment, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 19, 2019 | | | | | 597 | | | | 601,104 | |

Tropicana Entertainment Inc. | | | | | | | | | | |

Term Loan, 7.50%, Maturing March 16, 2018 | | | | | 149 | | | | 150,929 | |

| | | | | | | | | | | |

| | | $ | 14,294,555 | |

| | | | | | | | | | | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Nonferrous Metals / Minerals — 0.6% | | | | | | | | | | |

Arch Coal Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 16, 2018 | | | | | 2,519 | | | $ | 2,542,293 | |

Fairmount Minerals LTD | | | | | | | | | | |

Term Loan, 5.25%, Maturing March 15, 2017 | | | | | 3,611 | | | | 3,607,829 | |

Noranda Aluminum Acquisition Corporation | | | | | | | | | | |

Term Loan, 5.75%, Maturing February 24, 2019 | | | | | 1,045 | | | | 1,058,136 | |

Novelis, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 10, 2017 | | | | | 693 | | | | 695,235 | |

Term Loan, 4.00%, Maturing March 10, 2017 | | | | | 2,063 | | | | 2,069,904 | |

Oxbow Carbon and Mineral Holdings LLC | | | | | | | | | | |

Term Loan, 3.72%, Maturing May 8, 2016 | | | | | 1,380 | | | | 1,386,423 | |

| | | | | | | | | | | |

| | | $ | 11,359,820 | |

| | | | | | | | | | | |

| | | |

Oil and Gas — 1.1% | | | | | | | | | | |

Buffalo Gulf Coast Terminals LLC | | | | | | | | | | |

Term Loan, 7.50%, Maturing October 31, 2017 | | | | | 594 | | | $ | 605,880 | |

Citgo Petroleum Corporation | | | | | | | | | | |

Term Loan, 8.00%, Maturing June 24, 2015 | | | | | 474 | | | | 481,219 | |

Term Loan, 9.00%, Maturing June 23, 2017 | | | | | 489 | | | | 498,525 | |

Crestwood Holdings LLC | | | | | | | | | | |

Term Loan, 9.75%, Maturing March 26, 2018 | | | | | 1,145 | | | | 1,163,346 | |

Energy Transfer Equity, L.P. | | | | | | | | | | |

Term Loan, 3.75%, Maturing March 24, 2017 | | | | | 2,725 | | | | 2,727,461 | |

Frac Tech International LLC | | | | | | | | | | |

Term Loan, 8.50%, Maturing May 6, 2016 | | | | | 1,380 | | | | 1,332,268 | |

Gibson Energy ULC | | | | | | | | | | |

Term Loan, 4.75%, Maturing June 15, 2018 | | | | | 2,463 | | | | 2,485,712 | |

MEG Energy Corp. | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 16, 2018 | | | | | 1,139 | | | | 1,145,221 | |

Obsidian Holdings LLC | | | | | | | | | | |

Term Loan, 6.75%, Maturing November 2, 2015 | | | | | 1,932 | | | | 1,932,253 | |

Obsidian Natural Gas Trust | | | | | | | | | | |

Term Loan, 7.00%, Maturing November 2, 2015 | | | | | 912 | | | | 916,834 | |

Samson Investment Company | | | | | | | | | | |

Term Loan - Second Lien, 6.00%, Maturing September 13, 2018 | | | | | 900 | | | | 906,937 | |

Sheridan Production Partners I, LLC | | | | | | | | | | |

Term Loan, 6.50%, Maturing April 20, 2017 | | | | | 133 | | | | 133,529 | |

Term Loan, 6.50%, Maturing April 20, 2017 | | | | | 218 | | | | 218,611 | |

Term Loan, 6.50%, Maturing April 20, 2017 | | | | | 2,184 | | | | 2,192,965 | |

Term Loan, Maturing September 14, 2019(4) | | | | | 541 | | | | 535,509 | |

Term Loan, Maturing September 25, 2019(4) | | | | | 44 | | | | 43,944 | |

Term Loan, Maturing September 25, 2019(4) | | | | | 72 | | | | 71,945 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Oil and Gas (continued) | | | | | | | | | | |

Tervita Corporation | | | | | | | | | | |

Term Loan, 6.50%, Maturing October 17, 2014 | | | | | 546 | | | $ | 547,694 | |

Term Loan, 3.22%, Maturing November 14, 2014 | | | | | 3,071 | | | | 3,043,977 | |

| | | | | | | | | | | |

| | | $ | 20,983,830 | |

| | | | | | | | | | | |

| | | |

Publishing — 1.5% | | | | | | | | | | |

Ascend Learning, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing May 23, 2017 | | | | | 2,045 | | | $ | 2,049,961 | |

Aster Zweite Beteiligungs GmbH | | | | | | | | | | |

Term Loan, 5.95%, Maturing December 31, 2014 | | EUR | | | 429 | | | | 533,921 | |

Term Loan, 5.95%, Maturing December 31, 2014 | | EUR | | | 479 | | | | 596,776 | |

Term Loan, 5.97%, Maturing December 31, 2014 | | | | | 243 | | | | 233,553 | |

Term Loan, 5.97%, Maturing December 31, 2014 | | | | | 655 | | | | 629,395 | |

Term Loan, 8.20%, Maturing June 30, 2016 | | EUR | | | 1,503 | | | | 1,612,431 | |

Cengage Learning Acquisitions, Inc. | | | | | | | | | | |

Term Loan, 2.47%, Maturing July 3, 2014 | | | | | 1,646 | | | | 1,569,600 | |

GateHouse Media Operating, Inc. | | | | | | | | | | |

Term Loan, 2.22%, Maturing August 28, 2014 | | | | | 2,909 | | | | 946,168 | |

Term Loan, 2.22%, Maturing August 28, 2014 | | | | | 4,131 | | | | 1,343,340 | |

Term Loan, 2.47%, Maturing August 28, 2014 | | | | | 960 | | | | 312,206 | |

Getty Images, Inc. | | | | | | | | | | |

Term Loan, 3.97%, Maturing November 2, 2015 | | | | | 563 | | | | 564,586 | |

Term Loan, 5.25%, Maturing November 7, 2016 | | | | | 1,806 | | | | 1,810,626 | |

Interactive Data Corp. | | | | | | | | | | |

Term Loan, 4.50%, Maturing February 12, 2018 | | | | | 3,097 | | | | 3,118,241 | |

Laureate Education, Inc. | | | | | | | | | | |

Term Loan, 5.25%, Maturing June 18, 2018 | | | | | 6,285 | | | | 6,213,948 | |

Medianews Group | | | | | | | | | | |

Term Loan, 8.50%, Maturing March 19, 2014 | | | | | 128 | | | | 124,359 | |

Merrill Communications, LLC | | | | | | | | | | |

Term Loan, 9.75%, Maturing December 24, 2012 | | | | | 1,382 | | | | 1,356,016 | |

Nelson Education Ltd. | | | | | | | | | | |

Term Loan, 2.86%, Maturing July 3, 2014 | | | | | 624 | | | | 524,141 | |

Nielsen Finance LLC | | | | | | | | | | |

Term Loan, 3.48%, Maturing May 2, 2016 | | | | | 1,970 | | | | 1,980,444 | |

Penton Media, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing August 1, 2014(3) | | | | | 968 | | | | 788,665 | |

SGS International, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing September 30, 2013 | | | | | 569 | | | | 569,806 | |

Source Interlink Companies, Inc. | | | | | | | | | | |

Term Loan, 15.00%, Maturing March 18, 2014(3)(5) | | | | | 924 | | | | 554,391 | |

Term Loan - Second Lien, 10.75%, Maturing June 18, 2013 | | | | | 1,111 | | | | 1,066,178 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Publishing (continued) | | | | | | | | | | |

Star Tribune Company (The) | | | | | | | | | | |

Term Loan, 8.00%, Maturing September 28, 2014 | | | | | 19 | | | $ | 17,916 | |

Term Loan, 8.00%, Maturing September 29, 2014 | | | | | 25 | | | | 23,889 | |

| | | | | | | | | | | |

| | | | | | | | $ | 28,540,557 | |

| | | | | | | | | | | |

| | | |

Radio and Television — 1.3% | | | | | | | | | | |

Clear Channel Communications, Inc. | | | | | | | | | | |

Term Loan, 3.87%, Maturing January 28, 2016 | | | | | 984 | | | $ | 807,098 | |

Cumulus Media Holdings Inc. | | | | | | | | | | |

Term Loan - Second Lien, Maturing

September 16, 2019(4) | | | | | 1,000 | | | | 1,012,500 | |

Cumulus Media, Inc. | | | | | | | | | | |

Term Loan, 5.75%, Maturing September 17, 2018 | | | | | 4,512 | | | | 4,543,650 | |

Entercom Radio, LLC | | | | | | | | | | |

Term Loan, 6.25%, Maturing November 23, 2018 | | | | | 566 | | | | 569,913 | |

Foxco Acquisition Sub, LLC | | | | | | | | | | |

Term Loan, 5.50%, Maturing July 31, 2017 | | | | | 1,500 | | | | 1,515,000 | |

Gray Television, Inc. | | | | | | | | | | |

Term Loan, 3.74%, Maturing December 31, 2014 | | | | | 1,726 | | | | 1,724,841 | |

LIN Television Corp. | | | | | | | | | | |

Term Loan, 5.00%, Maturing December 21, 2018 | | | | | 596 | | | | 602,944 | |

Local TV Finance, LLC | | | | | | | | | | |

Term Loan, 4.22%, Maturing May 7, 2015 | | | | | 1,712 | | | | 1,727,003 | |

Mission Broadcasting, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing September 30, 2016 | | | | | 648 | | | | 649,703 | |

Nexstar Broadcasting, Inc. | | | | | | | | | | |

Term Loan, 5.00%, Maturing September 30, 2016 | | | | | 2,984 | | | | 2,991,055 | |

Raycom TV Broadcasting, Inc. | | | | | | | | | | |

Term Loan, 4.50%, Maturing May 31, 2017 | | | | | 913 | | | | 908,870 | |

Sinclair Television Group Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing October 28, 2016 | | | | | 757 | | | | 762,116 | |

Tyrol Acquisitions 2 SAS | | | | | | | | | | |

Term Loan, 4.12%, Maturing January 29, 2016 | | EUR | | | 758 | | | | 885,292 | |

Term Loan, 4.12%, Maturing January 29, 2016 | | EUR | | | 758 | | | | 885,292 | |

Univision Communications Inc. | | | | | | | | | | |

Term Loan, 4.47%, Maturing March 31, 2017 | | | | | 5,725 | | | | 5,681,517 | |

Weather Channel | | | | | | | | | | |

Term Loan, 4.25%, Maturing February 13, 2017 | | | | | 1,249 | | | | 1,258,653 | |

| | | | | | | | | | | |

| | | | | | | | $ | 26,525,447 | |

| | | | | | | | | | | |

| | | |

Rail Industries — 0.0%(2) | | | | | | | | | | |

RailAmerica, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 1, 2019 | | | | | 796 | | | $ | 796,498 | |

| | | | | | | | | | | |

| | | | | | | | $ | 796,498 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Retailers (Except Food and Drug) — 1.4% | | | | | | | | | | |

99 Cents Only Stores | | | | | | | | | | |

Term Loan, 5.25%, Maturing January 11, 2019 | | | | | 521 | | | $ | 527,582 | |

Evergreen Acqco 1 LP | | | | | | | | | | |

Term Loan, 6.25%, Maturing July 9, 2019 | | | | | 723 | | | | 733,131 | |

FTD, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing June 11, 2018 | | | | | 1,300 | | | | 1,306,187 | |

Harbor Freight Tools USA, Inc. | | | | | | | | | | |

Term Loan, 5.50%, Maturing November 14, 2017 | | | | | 1,050 | | | | 1,055,906 | |

J Crew Group, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing March 7, 2018 | | | | | 2,666 | | | | 2,670,535 | |

Jo-Ann Stores, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing March 16, 2018 | | | | | 2,613 | | | | 2,623,674 | |

Michaels Stores, Inc. | | | | | | | | | | |

Term Loan, 4.91%, Maturing July 29, 2016 | | | | | 926 | | | | 934,692 | |

National Vision, Inc. | | | | | | | | | | |

Term Loan, 7.00%, Maturing August 2, 2018 | | | | | 848 | | | | 852,114 | |

Neiman Marcus Group, Inc. (The) | | | | | | | | | | |

Term Loan, 4.75%, Maturing May 16, 2018 | | | | | 3,250 | | | | 3,273,452 | |

Ollie’s Bargain Outlet, Inc. | | | | | | | | | | |

Term Loan, Maturing September 27, 2019(4) | | | | | 525 | | | | 522,375 | |

Pep Boys-Manny, Moe & Jack (The) | | | | | | | | | | |

Term Loan, Maturing October 17, 2018(4) | | | | | 500 | | | | 496,250 | |

Petco Animal Supplies, Inc. | | | | | | | | | | |

Term Loan, 4.50%, Maturing November 24, 2017 | | | | | 2,440 | | | | 2,455,504 | |

Pilot Travel Centers LLC | | | | | | | | | | |

Term Loan, 4.25%, Maturing March 30, 2018 | | | | | 1,676 | | | | 1,683,989 | |

Term Loan, 4.25%, Maturing August 7, 2019 | | | | | 575 | | | | 578,594 | |

ServiceMaster Company | | | | | | | | | | |

Term Loan, 4.48%, Maturing January 31, 2017 | | | | | 3,179 | | | | 3,195,209 | |

Visant Holding Corp. | | | | | | | | | | |

Term Loan, 5.25%, Maturing December 22, 2016 | | | | | 1,295 | | | | 1,254,151 | |

Vivarte SA | | | | | | | | | | |

Term Loan, 3.07%, Maturing March 9, 2015 | | EUR | | | 31 | | | | 33,406 | |

Term Loan, 3.07%, Maturing March 9, 2015 | | EUR | | | 122 | | | | 129,913 | |

Term Loan, 3.07%, Maturing March 9, 2015 | | EUR | | | 781 | | | | 834,410 | |

Term Loan, 3.57%, Maturing March 8, 2016 | | EUR | | | 31 | | | | 33,406 | |

Term Loan, 3.57%, Maturing March 8, 2016 | | EUR | | | 122 | | | | 129,913 | |

Term Loan, 3.57%, Maturing March 8, 2016 | | EUR | | | 781 | | | | 834,410 | |

Wilton Brands LLC | | | | | | | | | | |

Term Loan, 7.50%, Maturing August 30, 2018 | | | | | 675 | | | | 682,594 | |

| | | | | | | | | | | |

| | | | | | | | $ | 26,841,397 | |

| | | | | | | | | | | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Limited Duration Income Fund

September 30, 2012

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |

Steel — 0.3% | | | | | | | | | | |

Essar Steel Algoma, Inc. | | | | | | | | | | |

Term Loan, 8.75%, Maturing September 19, 2014 | | | | | 1,850 | | | $ | 1,868,500 | |

JMC Steel Group, Inc. | | | | | | | | | | |

Term Loan, 4.75%, Maturing April 3, 2017 | | | | | 640 | | | | 644,659 | |

Patriot Coal Corporation | | | | | | | | | | |

Term Loan, 9.25%, Maturing October 4, 2013 | | | | | 875 | | | | 882,656 | |

SunCoke Energy, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing July 26, 2018 | | | | | 543 | | | | 545,842 | |

Waupaca Foundry, Inc. | | | | | | | | | | |

Term Loan, 8.50%, Maturing June 29, 2017 | | | | | 1,200 | | | | 1,212,000 | |

WireCo WorldGroup, Inc. | | | | | | | | | | |

Term Loan, 6.00%, Maturing February 15, 2017 | | | | | 700 | | | | 707,875 | |

| | | | | | | | | | | |

| | | | | | | | $ | 5,861,532 | |

| | | | | | | | | | | |

| | | |

Surface Transport — 0.3% | | | | | | | | | | |

Hertz Corporation, (The) | | | | | | | | | | |

Term Loan, 3.75%, Maturing March 9, 2018 | | | | | 3,300 | | | $ | 3,297,394 | |

Swift Transportation Co. Inc. | | | | | | | | | | |

Term Loan, 3.98%, Maturing December 21, 2016 | | | | | 1,270 | | | | 1,275,991 | |

Term Loan, 5.00%, Maturing December 21, 2017 | | | | | 1,858 | | | | 1,870,294 | |

| | | | | | | | | | | |

| | | | | | | | $ | 6,443,679 | |

| | | | | | | | | | | |

| | | |

Telecommunications — 2.1% | | | | | | | | | | |

Cellular South, Inc. | | | | | | | | | | |

Revolving Loan, 4.50%, Maturing July 27, 2017 | | | | | 916 | | | $ | 923,763 | |

Crown Castle International Corporation | | | | | | | | | | |

Term Loan, 4.00%, Maturing January 31, 2019 | | | | | 1,911 | | | | 1,919,997 | |

Eircom Finco S.a.r.l | | | | | | | | | | |

Term Loan, 4.27%, Maturing September 30, 2017 | | EUR | | | 3,069 | | | | 2,770,640 | |

Intelsat Jackson Holdings S.A. | | | | | | | | | | |

Term Loan, 5.25%, Maturing April 2, 2018 | | | | | 10,418 | | | | 10,469,570 | |

IPC Systems, Inc. | | | | | | | | | | |

Term Loan, 2.85%, Maturing May 31, 2014 | | GBP | | | 1,326 | | | | 2,116,836 | |

Macquarie UK Broadcast Limited | | | | | | | | | | |

Term Loan, 3.02%, Maturing December 1, 2014 | | GBP | | | 1,071 | | | | 1,611,246 | |

MetroPCS Wireless, Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing March 16, 2018 | | | | | 7,097 | | | | 7,117,466 | |

NTELOS Inc. | | | | | | | | | | |

Term Loan, 4.00%, Maturing August 7, 2015 | | | | | 1,208 | | | | 1,212,904 | |

Oberthur Technologies Holding SAS | | | | | | | | | | |

Term Loan, 6.25%, Maturing March 30, 2019 | | | | | 575 | | | | 568,531 | |

SBA Finance | | | | | | | | | | |

Term Loan, 3.75%, Maturing June 29, 2018 | | | | | 1,012 | | | | 1,014,402 | |

Term Loan, Maturing September 20, 2019(4) | | | | | 475 | | | | 477,672 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | Principal

Amount*

(000’s omitted) | | | Value | |

| | | | | | | | | | |

| | | |