Pioneer Municipal High Income Fund, Inc.

Annual Report | April 30, 2021

Ticker Symbol: MHI

On April 21, 2021, the Fund redomiciled from a Delaware statutory trust to a Maryland corporation and was renamed Pioneer Municipal High Income Fund, Inc.

Paper copies of the Fund’s shareholder reports are no longer sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports are available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundi.com/us

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 1

President’s LetterDear Shareholders,

With the first half of 2021 nearly over, we have seen some better news on the COVID-19 pandemic front. In the US, widespread distribution of the COVID-19 vaccines approved for emergency use late last year, and a general decline in both virus cases and related hospitalizations, have had a positive effect on overall market sentiment.

While there may finally be a light visible at the end of the pandemic tunnel, the long-term impact on the global economy from COVID-19, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others, and the markets, which do not thrive on uncertainty, have been volatile.

With that said, so far during 2021, we have seen investments typically associated with a higher degree of risk, such as equities and high-yield bonds, outperform investments regarded as less risky, such as government debt. In addition, cyclical stocks, or stocks of companies with greater exposure to the ebbs and flows of the economic cycle, have rallied this year after slumping during the height of the pandemic, as investors have appeared to embrace the potential for a more widespread reopening of the economy in the coming months. Additional fiscal stimulus from the US government in recent months has also helped provide some market momentum.

Despite the strong rebound from the March 2020 lows and positive market performance so far this year, several factors that could lead to increased volatility and weaker performance bear watching. These include: public-health issues such as potential surges in COVID-19 cases, particularly as “variants” of the virus have continued to arise; macroeconomic concerns (inflation, energy prices, sluggish employment figures); and changes to the US government’s fiscal policies, particularly the possibility of higher income tax rates on both individuals and businesses.

After leaving our offices in March of 2020 due to COVID-19, we have re-opened our US locations and have invited our employees to slowly return to the office. I am proud of the careful planning that has taken place. Our business has continued to operate without any disruption and we all look forward to regaining a bit of normalcy after 15 months of remote working.

Since 1928, Amundi US’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the risks during periods of market volatility.

2 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress.

As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

June 2021

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 3

Portfolio Management Discussion |

4/30/21 Note to Shareholders: On April 21, 2021, Pioneer Municipal High Income Trust redomiciled from a Delaware statutory trust to a Maryland corporation and was renamed Pioneer Municipal High Income Fund, Inc. The redomiciling did not result in any change to the investment adviser, investment objective and strategies, portfolio management team, policies and procedures or the members of the Board overseeing the Fund. Please see Note 7, “Redomiciling,” for more information regarding the redomiciling.

During the 12-month period ended April 30, 2021, the municipal bond market continued its steady recovery from the disruptions and volatility that had beset global financial markets with the onset of the COVID-19 pandemic and the resulting economic downturn. In the following interview, Jonathan Chirunga and David Eurkus discuss the factors that influenced the performance of Pioneer Municipal High Income Fund, Inc. during the 12-month period. Mr. Chirunga, Managing Director, Director of High-Yield Municipals, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), and Mr. Eurkus, Managing Director, Director of Municipals, and a portfolio manager at Amundi US, are responsible for the day-to-day management of the Fund.

Q How did the Fund perform during the 12-month period ended April 30, 2021?

A Pioneer Municipal High Income Fund, Inc. returned 12.04% at net asset value (NAV) and 22.33% at market price during the 12-month period ended April 30, 2021. During the same 12-month period, the Fund’s benchmarks, the Bloomberg Barclays U.S. Municipal High Yield Bond Index and the Bloomberg Barclays Municipal Bond Index, returned 20.78% and 7.75% at NAV, respectively. The Bloomberg Barclays U.S. Municipal High Yield Bond Index is an unmanaged measure of the performance of lower-rated municipal bonds, while the Bloomberg Barclays Municipal Bond Index is an unmanaged measure of the performance of investment-grade municipal bonds. Unlike the Fund, the two indices do not use leverage. While use of leverage increases investment opportunity, it also increases investment risk.

During the same 12-month period, the average return at NAV of the 18 closed-end funds in Morningstar’s Closed-End High Yield Municipal category (which may or may not be leveraged) was 19.04%, and the average return at market price of the closed-end funds within the same Morningstar category was 26.42%.

4 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

The shares of the Fund were selling at a 4.0% discount to NAV on April 30, 2021. Comparatively, the shares of the Fund were selling at a 12.1% discount to NAV on April 30, 2020.

On April 30, 2021, the standardized 30-day SEC yield of the Fund’s shares was 1.48%*.

Q How would you describe the investment environment in the municipal bond market during the 12-month period ended April 30, 2021?

A For the overall period, the investment environment for municipal bonds was largely favorable, driven in part by the accommodative stance on monetary policy by the US Federal Reserve System (Fed), healthy demand for tax-free bonds, with limited supply, and the continued longer-term effects on the municipal market from the federal tax overhaul legislation passed in late-2017, which contributed to a decrease in the aforementioned municipal supply. The 2017 tax legislation included key provisions that led to the significant reduction in the issuance of advance-refunding bonds, thus restricting supply, while placing limits on state and local tax deductions. The latter provision helped to increase demand for municipal bonds among high-net-worth individuals in search of tax-exempt income. (An advance-refunding bond is issued to retire, or pre-refund, another outstanding bond more than 90 days in advance of the original bond’s maturity date.)

Like most financial markets, the tax-exempt market had come under significant stress created by the onset of the COVID-19 pandemic in the first quarter of 2020, as virus-mitigation efforts put into place by state and local governments caused many segments of the US economy to shut down and drove unemployment rates into territory rarely seen in recent decades. To combat the very serious economic effects from COVID-19 on individuals, states, municipalities, and the United States overall, the Fed as well as Congress and the Trump administration undertook a large number of monetary and fiscal measures. In early 2020, the Fed reduced the target range of the federal funds rate to near zero, reintroduced lending facilities from the 2008 financial crisis era, instituted new lending facilities, and re-started quantitative easing (that is, injecting massive liquidity into the economy by purchasing Treasury, agency, mortgage, and corporate bonds).

* The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 5

In addition, US lawmakers approved two large fiscal aid packages during the spring and early summer of 2020, in the form of loans and grants to individuals, small businesses, medical systems, and higher education institutions, in light of the sudden freeze-up in economic activity and continuously rising unemployment. Taken together, those measures helped to calm financial markets, including the municipal bond market.

As the 12-month period progressed, the tax-exempt bond market gradually recovered, as domestic and global investors became aggressive purchasers of these bonds, and earlier yield increases reversed themselves as municipal bond prices rose. At the same time, the stunning contraction in economic activity across the country due to COVID-19 containment measures – especially within the tourism, transportation, retail, and service industries – as well as dramatic reductions in federal, state, and local tax revenues, continued to overshadow the municipal bond market. In September and October of 2020, amid robust demand from buyers, the market saw a rush of tax-exempt and taxable municipal issuance in advance of the November US presidential election. Near the end of the calendar year, the conclusion of the presidential and Congressional elections and investor optimism regarding the direction of the US economy in the wake of rollouts of the first approved COVID-19 vaccines helped to reinforce a strong technical (supply/demand) environment for investing in longer-term municipal bonds.

Lastly, toward the end of the 12-month period, municipal investors began focusing on the ongoing COVID-19 vaccination efforts, the $1.9 trillion stimulus package passed by US lawmakers during the first quarter of 2021, and the continued, albeit gradual, reopening of the US economy.

Throughout the 12-month period, the high-yield municipal bond market received support from strong demand not only from traditional municipal investors, but also from non-traditional investors and foreign purchasers in search of relative safety, lower default rates, and attractive tax-equivalent yields as compared with taxable investments.

Q What factors affected the Fund’s performance relative to the Bloomberg Barclays municipal bond indices during the 12-month period ended April 30, 2021?

A We maintained a well-diversified** portfolio during the 12-month period, with exposures to both investment-grade and high-yield municipal bonds.

** | Diversification does not assure a profit nor protect against loss. |

6 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

A key detractor from the Fund’s performance relative to the overall high-yield municipal market during the 12-month period was a continued portfolio underweight to Puerto Rico. The Fund’s allocation to Puerto Rico’s debt has remained at less than 3% of the total investment portfolio, compared to an approximately 13% weighting in the Bloomberg Barclays US High Yield Municipal Index. The Commonwealth’s bonds have been benefiting from increased investor demand for high-yield municipal bonds. Due to the volume of bonds issued by Puerto Rico, they have managed to retain liquidity. That said, we anticipate keeping the Fund’s portfolio underweight to Puerto Rico, as we have had ongoing concerns about its debt, given the effects the COVID-19 pandemic has had on international tourism, an industry upon which the Commonwealth’s economy has been heavily reliant.

The top-performing municipal bond issues for the Fund relative to the benchmarks during the 12-month period were two series of Tarrant County (Texas) Continuing Care Retirement Facility bonds, which were pre-refunded by the issuer at a premium price. Holdings of California Tobacco Settlement bonds and Arlington (Texas) education bonds also contributed positively to the Fund’s relative performance.

Conversely, the Fund’s position in University of Texas non-callable bonds detracted from relative returns, as a number of high-quality bond issues such as the University of Texas position, felt the negative effects of interest-rate increases over the 12-month period (as did US Treasuries). Holdings of Two Rivers (Montana) Correctional Facility bonds and Clare Oaks (Illinois) Continuing Care Retirement Facility bonds also weighed on the Fund’s relative performance for the period.

Q Did the Fund’s distributions*** to shareholders change during the 12-month period ended April 30, 2021?

A Yes, the Fund’s dividend rose during the period. An increase in the dividend from $0.0450 cents per share to $0.0525 cents per share was announced on November 5, 2020, and paid on November 30, 2020. The distribution then remained unchanged, at $0.0525 per share/per month, for the rest of the Fund’s fiscal year ended April 30, 2021.

Q Did the level of leverage in the Fund change during the 12-month period ended April 30, 2021?

A At the end of the 12-month period ended April 30, 2021, 32.6% of the Fund’s total managed assets were financed by leverage obtained through the issuance of preferred shares, compared with 30.8% of the Fund’s total

*** Distributions are not guaranteed.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 7

managed assets financed by leverage at the start of the period on May 1, 2020. During the 12-month period, the Fund increased the absolute amount of leverage by a total of $20 million, to $145 million as of April 30, 2021. The percentage of the Fund’s total managed assets financed by leverage increased during the 12-month period due to the increase in the amount of preferred shares issued by the Fund.

Q Did the Fund have any exposure to derivative securities during the 12-month period ended April 30, 2021?

A No, the Fund’s portfolio held no derivative securities during the period.

Q What is your investment outlook?

A Because of an apparent lack of a sustained resurgence in US inflation, as well as the frequently repeated pronouncements from the Fed that it will continue to hold the federal funds target range at or near zero for the next several years, we are optimistic regarding the path of interest rates going forward. Additionally, in light of the continued low default rate for the municipal bond asset class and a favorable supply/demand environment, given continually shrinking supply and persistently strong demand from various categories of investors, we believe that the prospects for the tax-exempt bond market are favorable.

Also, if the recently proposed, major federal infrastructure initiative is eventually passed into law by Congress, we believe we might see an increased number of attractive tax-exempt investment opportunities arise from the variety of new construction projects that could be created by the legislation. Lastly, given the enormous and continuing need for federal economic assistance of all sorts in order to cope with the ongoing economic effects of COVID-19, the US government may be forced to deal with its rising debt levels in part by raising taxes on corporations and high-income individuals, which may further increase demand for municipal bonds. In fact, both capital gains and other tax increases had already been proposed by the Biden administration prior to the end of the 12-month period.

Consistent with our investment discipline in managing the Fund’s portfolio, we intend to continue to focus on intensive, fundamental research into individual bond issues, while maintaining a close watch on any economic factors that could influence the high-yield and investment-grade municipal markets. Based on those factors, we do not anticipate making any significant changes to the portfolio’s positioning and structure in the near future.

8 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Please refer to the Schedule of Investments on pages 15–24 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

Investments in high-yield or lower-rated securities are subject to greater-than-average risk.

The Fund may invest in securities of issuers that are in default or that are in bankruptcy.

A portion of income may be subject to state, federal, and/or alternative minimum tax. Capital gains, if any, are subject to a capital gains tax.

When interest rates rise, the prices of debt securities held by the Fund will generally fall. Conversely, when interest rates fall the prices of debt securities held by the Fund generally will rise.

A general rise in interest rates could adversely affect the price and liquidity of fixed income securities.

By concentrating in municipal securities, the Fund is more susceptible to adverse economic, political or regulatory developments than is a portfolio that invests more broadly.

Investments in the Fund are subject to possible loss due to the financial failure of the issuers of the underlying securities and the issuers’ inability to meet their debt obligations.

The Fund may invest up to 20% of its total assets in illiquid securities. Illiquid securities may be difficult to dispose of at a price reflective of their value at the times when the Fund believes it is desirable to do so, and the market price of illiquid securities is generally more volatile than that of more liquid securities. Illiquid securities are also more difficult to value and investment of the Fund’s assets in illiquid securities may restrict the Fund’s ability to take advantage of market opportunities.

The Fund uses leverage through the issuance of preferred shares. Leverage creates significant risks, including the risk that the Fund’s incremental income or capital appreciation for investments purchased with the proceeds of leverage will not be sufficient to cover the cost of the leverage, which may adversely affect the return for the holders of common shares.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 9

The Fund is required to maintain certain regulatory, rating agency and other asset coverage requirements in connection with its outstanding preferred shares. In order to maintain required asset coverage levels, the Fund may be required to alter the composition of its investment portfolio or take other actions, such as redeeming preferred shares with the proceeds from portfolio transactions, at what might be inopportune times in the market. Such actions could reduce the net earnings or returns to holders of the Fund’s common shares over time, which is likely to result in a decrease in the market value of the Fund’s shares.

These risks may increase share price volatility.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

10 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Portfolio Summary |

4/30/21 Portfolio Diversification

(As a percentage of total investments)*

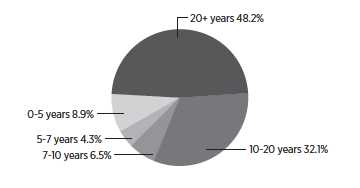

Portfolio Maturity

(As a percentage of total investments)*

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 11

Portfolio Summary | 4/30/21 (continued)

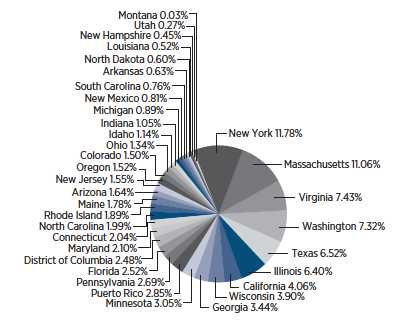

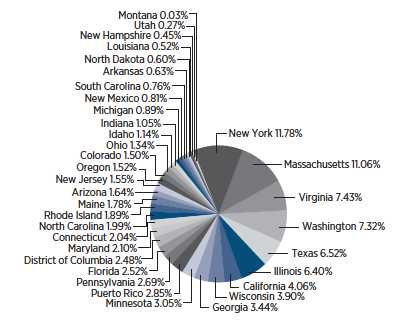

State Diversification

(As a percentage of total investments)*

| 10 Largest Holdings | |

(As a percentage of total investments)*

| |

| 1. | Metropolitan Pier & Exposition Authority, McCormick Place, 5.65%, | |

| 6/15/22 (NATL-RE Insured) | 3.68% |

| 2. | State of Washington, Motor Vehicle Sales Tax, Series C, 6/1/22 | |

| (NATL Insured) | 3.24 |

| 3. | Massachusetts Development Finance Agency, WGBH Foundation, | |

| Series A, 5.75%, 1/1/42 (AMBAC Insured) | 2.58 |

| 4. | New York State Dormitory Authority, Series A, 4.0%, 7/1/41 | 2.14 |

| 5. | New York State Dormitory Authority, Series C, 5.0%, 3/15/39 | 1.91 |

| 6. | Brookhaven Development Authority, 4.0%, 7/1/49 | 1.86 |

| 7. | New York State Dormitory Authority, 5.0%, 10/1/50 | 1.77 |

| 8. | University of Texas System, Financing System, Series A, 5.0%, 8/15/49 | 1.75 |

| 9. | Massachusetts Development Finance Agency, Harvard University, | |

| Series A, 5.0%, 7/15/40 | 1.72 |

| 10. | University System of Maryland, 4.0%, 4/1/43 | 1.46 |

* Excludes temporary cash investments and all derivative contracts except for options purchased. |

| The Fund is actively managed, and current holdings may be different. The holdings listed should not |

| be considered recommendations to buy or sell any securities. | |

12 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Prices and Distributions |

4/30/21 Market Value per Common Share^

| | | | | | | |

| | 4/30/21 | | | 4/30/20 | |

Market Value | | $ | 12.61 | | | $ | 10.82 | |

Discount | | | (4.03 | )% | | | (12.10 | )% |

| | | |

| Net Asset Value per Common Share^ | |

|

| 4/30/21 | 4/30/20 |

Net Asset Value | $13.14 | $12.31 |

| | | | |

| Distributions per Common Share*: | |

|

|

| Net | | |

| Investment | Short-Term | Long-Term |

| Income | Capital Gains | Capital Gains |

5/1/20 – 4/30/21 | $0.585 | $— | $ — |

| | | |

| Yields | | |

|

| 4/30/21 | 4/30/20 |

30-Day SEC Yield | 1.48% | 2.67% |

The data shown above represents past performance, which is no guarantee of future results. |

^ | Net asset value and market value are published in Barron’s on Saturday, The Wall Street Journal on |

| Monday and The New York Times on Monday and Saturday. Net asset value and market value are |

| published daily on the Fund’s website at www.amundi.com/us. |

* | The amount of distributions made to shareholders during the period was in excess of the net |

| investment income earned by the Fund during the period. The Fund has accumulated undistributed |

| net investment income which is part of the Fund’s NAV. A portion of this accumulated net |

| investment income was distributed to shareowners during the period. A decrease in distributions |

| may have a negative effect on the market value of the Fund’s shares. |

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 13

Performance Update |

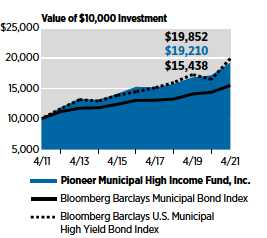

4/30/21 Investment Returns

The mountain chart on the right shows the change in market value, including reinvestment of dividends and distributions, of a $10,000 investment made in common shares of Pioneer Municipal High Income Fund, Inc. during the periods shown, compared to that of the Bloomberg Barclays Municipal Bond Index and Bloomberg Barclays U.S. Municipal High Yield Bond Index.

| | | | | | | | | | | | | |

| Average Annual Total Returns | | | | |

(As of April 30, 2021) | | | | | | | |

| | |

| | | | | | | | | | | BBG | |

| | | | | | | | BBG | | | Barclays | |

| | Net | | | | | | Barclays | | | U.S. | |

| | Asset | | | | | | Municipal | | | Municipal | |

| | Value | | | Market | | | Bond | | | High Yield | |

| Period | | (NAV)

| | | Price | | | Index | | | Bond Index | |

10 years | | | 6.75 | % | | | 5.99 | % | | | 4.44 | % | | | 7.10 | % |

5 years | | | 4.72 | | | | 2.99 | | | | 3.51 | | | | 6.61 | |

1 year | | | 12.04 | | | | 22.33 | | | | 7.75 | | | | 20.78 | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and your shares may trade below NAV due to such factors as interest rate changes and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions. All performance is for common shares of the Fund.

Shares of closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and, once issued, shares of closed-end funds are bought and sold in the open market through a stock exchange and frequently trade at prices lower than their NAV. NAV per common share is total assets less total liabilities, which include preferred shares or borrowings, as applicable, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at the greater of NAV or 95% of the market price. When NAV is higher, dividends are assumed to be reinvested at prices obtained through open-market purchases under the Fund’s dividend reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the sale of Fund shares. Had these fees and taxes been reflected, performance would have been lower.

The Bloomberg Barclays Municipal Bond Index is an unmanaged, broad measure of the municipal bond market. The Bloomberg Barclays U.S. Municipal High Yield Bond Index is unmanaged, totals over $26 billion in market value and maintains over 1,300 securities. Municipal bonds in this index have the following requirements: maturities of one year or greater, sub investment grade (below Baa or non-rated), fixed coupon rate, issued after 12/31/90, deal size over $20 million, and maturity size of at least $3 million. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. The indices do not use leverage. It is not possible to invest directly in the indices.

Please refer to the financial highlights for a more current total return ratio.

14 Pioneer Municipal High Income Fund, Inc. | Annual Report

| 4/30/21

Schedule of Investments |

4/30/21 | | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | UNAFFILIATED ISSUERS — 146.8% | |

| | | MUNICIPAL BONDS — 146.8% of Net Assets(a) | |

| | | Arizona — 2.4% | |

| 4,000,000(b) | | City of Phoenix, 5.0%, 7/1/27 | $ 4,883,720 |

| 2,230,000 | | City of Phoenix, Industrial Development Authority, | |

| | 3rd & Indian School Assisted Living Project,

| |

| | | 5.4%, 10/1/36 | 2,302,542 |

| 24,000 | | County of Pima, Industrial Development Authority, | |

| | | Arizona Charter Schools Project, Series C, 6.75%, 7/1/31 | 24,447 |

| | | Total Arizona | $ 7,210,709 |

| | | Arkansas — 0.9% | |

| 2,500,000 | | Arkansas Development Finance Authority, Big River | |

| | | Steel Project, 4.5%, 9/1/49 (144A) | $ 2,752,825 |

| | | Total Arkansas | $ 2,752,825 |

| | | California — 6.0% | |

| 1,000,000 | | California County Tobacco Securitization Agency, 5.0%, | |

| | | 6/1/49 | $ 1,243,630 |

| 10,000,000(c) | | California County Tobacco Securitization Agency, | |

| | | Capital Appreciation, Stanislaus County, Subordinated, | |

| | | Series A, 6/1/46 | 2,426,300 |

| 2,000,000 | | California Educational Facilities Authority, Stanford | |

| | | University, Series U-7, 5.0%, 6/1/46 | 3,053,580 |

| 530,000 | | California Municipal Finance Authority, Santa Rosa | |

| | | Academy Project, Series A, 5.75%, 7/1/30 | 546,022 |

| 1,590,000(d) | | California School Finance Authority, Classical Academies | |

| | | Project, Series A, 7.375%, 10/1/43 | 1,746,090 |

| 1,400,000 | | California Statewide Communities Development | |

| | | Authority, Lancer Plaza Project, 5.625%, 11/1/33 | 1,420,342 |

| 1,250,000 | | City of Oroville, Oroville Hospital, 5.25%, 4/1/54 | 1,430,575 |

| 2,000,000(b)(d) | | Los Angeles Community College District, Series G, | |

| | | 4.0%, 8/1/39 | 2,241,980 |

| 1,605,000 | | Los Angeles County Metropolitan Transportation | |

| | | Authority, Series A, 5.0%, 7/1/30 | 2,024,676 |

| 1,500,000(b) | | State of California, 3.0%, 10/1/33 | 1,711,455 |

| | | Total California | $ 17,844,650 |

| | | Colorado — 2.2% | |

| 2,180,000 | | Board of Water Commissioners City & County of | |

| | | Denver, 4.0%, 9/15/42 | $ 2,479,772 |

| 1,500,000(d) | | Colorado Educational & Cultural Facilities Authority, | |

| | Rocky Mountain Classical Academy Project, |

| | | 8.0%, 9/1/43 | 1,763,535 |

| 1,665,000(e) | | Tender Option Bond Trust Receipts/Certificates, RIB, | |

| | | 0.0%, 6/1/39 (144A) | 2,363,001 |

| | Total Colorado | $ 6,606,308 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 15

Schedule of Investments | 4/30/21 (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Connecticut — 3.0% | |

| 3,465,000 | | Mohegan Tribal Finance Authority, 7.0%, 2/1/45 (144A) | $ 3,543,690 |

| 5,000,000(b) | | State of Connecticut, Series E, 4.0%, 9/1/30 | 5,406,750 |

| | | Total Connecticut | $ 8,950,440 |

| | | District of Columbia — 3.6% | |

| 2,380,000 | | District of Columbia Tobacco Settlement Financing | |

| | | Corp., Asset-Backed, 6.5%, 5/15/33 | $ 2,597,889 |

| 6,000,000 | | District of Columbia Tobacco Settlement Financing | |

| | | Corp., Asset-Backed, 6.75%, 5/15/40 | 6,128,400 |

| 10,000,000(c) | | District of Columbia Tobacco Settlement Financing | |

| | Corp., Capital Appreciation, Asset-Backed,

|

| | | Series A, 6/15/46 | 2,193,100 |

| | | Total District of Columbia | $ 10,919,389 |

| | | Florida — 3.7% | |

| 5,000,000 | | County of Miami-Dade, Water & Sewer System | |

| | | Revenue, Series A, 4.0%, 10/1/44 | $ 5,721,500 |

| 5,000,000 | | Florida’s Turnpike Enterprise, Department of | |

| | | Transportation, Series A, 4.0%, 7/1/34 | 5,343,800 |

| | | Total Florida | $ 11,065,300 |

| | | Georgia — 5.0% | |

| 7,010,000 | | Brookhaven Development Authority, 4.0%, 7/1/49 | $ 8,152,069 |

| 2,500,000 | | County of Fulton GA Water & Sewerage Revenue, | |

| | | 2.25%, 1/1/42 | 2,550,625 |

| 4,000,000 | | Private Colleges & Universities Authority, Emory | |

| | | University, Series A, 5.0%, 10/1/43 | 4,394,840 |

| | | Total Georgia | $ 15,097,534 |

| | | Idaho — 1.7% | |

| 5,000,000 | | Power County Industrial Development Corp., FMC Corp. | |

| | | Project, 6.45%, 8/1/32 | $ 5,032,550 |

| | | Total Idaho | $ 5,032,550 |

| | | Illinois — 9.4% | |

| 704,519(c) | | Illinois Finance Authority, 11/15/52 | $ 56,277 |

| 1,116,010(e) | | Illinois Finance Authority, 4.0%, 11/15/52 | 1,134,971 |

| 3,500,000 | | Illinois Finance Authority, The Admiral at the Lake | |

| | | Project, 5.25%, 5/15/42 | 3,493,315 |

| 4,000,000 | | Illinois Finance Authority, The Admiral at the Lake | |

| | | Project, 5.5%, 5/15/54 | 4,026,400 |

| 1,610,000(f) | | Metropolitan Pier & Exposition Authority, McCormick | |

| | | Place, 5.65%, 6/15/22 (NATL-RE Insured) | 1,705,232 |

| 13,785,000 | | Metropolitan Pier & Exposition Authority, McCormick | |

| | | Place, 5.65%, 6/15/22 (NATL-RE Insured) | 14,457,708 |

| 1,000,000 | | Metropolitan Pier & Exposition Authority, McCormick | |

| | | Place, Series B, 5.0%, 6/15/52 (ST APPROP Insured) | 1,034,520 |

The accompanying notes are an integral part of these financial statements.

16 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Illinois — (continued) | |

| 1,485,000(f) | | Metropolitan Pier & Exposition Authority, McCormick | |

| | | Place, Series B, 5.65%, 6/15/22 (NATL-RE Insured) | $ 1,575,644 |

| 695,000 | | Southwestern Illinois Development Authority, Village of | |

| | | Sauget Project, 5.625%, 11/1/26 | 660,264 |

| | | Total Illinois | $ 28,144,331 |

| | | Indiana — 1.5% | |

| 2,000,000 | | City of Evansville, Silver Birch Evansville Project, | |

| | | 5.45%, 1/1/38 | $ 2,016,500 |

| 1,500,000 | | City of Mishawaka, Silver Birch Mishawaka Project, | |

| | | 5.375%, 1/1/38 (144A) | 1,508,640 |

| 1,000,000 | | Indiana Finance Authority, Multipurpose Educational | |

| | | Facilities, Avondale Meadows Academy Project, | |

| | | 5.375%, 7/1/47 | 1,105,060 |

| | | Total Indiana | $ 4,630,200 |

| | | Louisiana — 0.8% | |

| 2,260,000(d) | | Jefferson Parish Hospital Service District No. 2, East | |

| | | Jefferson General Hospital, 6.375%, 7/1/41 | $ 2,281,606 |

| | | Total Louisiana | $ 2,281,606 |

| | | Maine — 2.6% | |

| 1,400,000 | | City of Portland ME General Airport Revenue, | |

| | | 4.0%, 1/1/40 | $ 1,603,714 |

| 1,500,000(d) | | Maine Health & Higher Educational Facilities Authority, | |

| | | Maine General Medical Center, 7.5%, 7/1/32 | 1,518,450 |

| 4,480,000 | | Maine Turnpike Authority, Series A, 5.0%, 7/1/42 | 4,678,778 |

| | | Total Maine | $ 7,800,942 |

| | | Maryland — 3.1% | |

| 1,350,000 | | Maryland Health & Higher Educational Facilities | |

| | | Authority, City Neighbors, Series A, 6.75%, 7/1/44 | $ 1,455,111 |

| 5,365,000 | | University System of Maryland, 4.0%, 4/1/43 | 6,436,337 |

| 1,250,000 | | Washington Suburban Sanitary Commission, 3.0%, | |

| | | 6/1/47 (CNTY GTD Insured) | 1,345,775 |

| | | Total Maryland | $ 9,237,223 |

| | | Massachusetts — 16.2% | |

| 2,000,000(b) | | City of Boston, Series A, 5.0%, 3/1/39 | $ 2,531,660 |

| 4,000,000(b) | | Commonwealth of Massachusetts, 3.0%, 3/1/49 | 4,268,600 |

| 7,000,000(c) | | Massachusetts Bay Transportation Authority, | |

| | | Series A, 7/1/28 | 6,245,190 |

| 1,550,000 | | Massachusetts Development Finance Agency, Harvard | |

| | | University, Series A, 5.0%, 7/15/36 | 2,267,061 |

| 5,000,000 | | Massachusetts Development Finance Agency, Harvard | |

| | | University, Series A, 5.0%, 7/15/40 | 7,567,050 |

| 1,000,000 | | Massachusetts Development Finance Agency, Partners | |

| | | Healthcare System, 4.0%, 7/1/41 | 1,124,690 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 17

Schedule of Investments | 4/30/21 (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Massachusetts — (continued) | |

| 5,000,000 | | Massachusetts Development Finance Agency, Partner’s | |

| | | Healthcare System, Series S-1, 4.0%, 7/1/41 | $ 5,825,700 |

| 7,100,000 | | Massachusetts Development Finance Agency, WGBH | |

| | | Foundation, Series A, 5.75%, 1/1/42 (AMBAC Insured) | 11,346,794 |

| 70,000 | | Massachusetts Educational Financing Authority, Series I, | |

| | | 6.0%, 1/1/28 | 70,343 |

| 3,100,000 | | Massachusetts Health & Educational Facilities Authority, | |

| | | Massachusetts Institute of Technology, Series K, | |

| | | 5.5%, 7/1/32 | 4,508,330 |

| 2,800,000(b) | | Town of Arlington MA, 2.0%, 9/15/41 | 2,832,032 |

| | | Total Massachusetts | $ 48,587,450 |

| | | Michigan — 1.3% | |

| 1,000,000 | | David Ellis Academy, 5.25%, 6/1/45 | $ 1,047,070 |

| 2,640,000 | | Michigan State University, Series A, 5.0%, 8/15/41 | 2,874,353 |

| | | Total Michigan | $ 3,921,423 |

| | | Minnesota — 4.5% | |

| 1,840,000 | | Bloomington Port Authority, Radisson Blu Mall of | |

| | | America, 9.0%, 12/1/35 | $ 1,840,258 |

| 1,000,000 | | City of Ham Lake, DaVinci Academy, Series A, | |

| | | 5.0%, 7/1/47 | 1,020,240 |

| 1,000,000 | | City of Rochester, Health Care Facilities, Mayo Clinic, | |

| | | 4.0%, 11/15/48 | 1,154,670 |

| 2,300,000 | | City of Rochester, Mayo Clinic, Series B, 5.0%, 11/15/35 | 3,521,346 |

| 5,000,000(b) | | State of Minnesota, Series B, 4.0%, 8/1/27 | 5,877,300 |

| | | Total Minnesota | $ 13,413,814 |

| | | Montana — 0.0%† | |

| 1,600,000(g) | | Two Rivers Authority, Inc., 7.375%, 11/1/27 | $ 122,560 |

| | | Total Montana | $ 122,560 |

| | | New Hampshire — 0.7% | |

| 1,000,000 | | New Hampshire Health & Education Facilities | |

| | | Authority Act, 5.0%, 8/1/59 | $ 1,573,680 |

| 375,000 | | New Hampshire Health & Education Facilities | |

| | | Authority Act, Catholic Medical Centre, 3.75%, 7/1/40 | 413,066 |

| | | Total New Hampshire | $ 1,986,746 |

| | | New Jersey — 2.3% | |

| 1,000,000 | | New Jersey Economic Development Authority, | |

| | | Charter Marion P Thomas, 5.375%, 10/1/50 (144A) | $ 1,098,390 |

| 3,000,000 | | New Jersey Economic Development Authority, | |

| | | Continental Airlines, 5.25%, 9/15/29 | 3,116,670 |

| 2,500,000 | | New Jersey Economic Development Authority, | |

| | | Continental Airlines, 5.75%, 9/15/27 | 2,599,795 |

| | | Total New Jersey | $ 6,814,855 |

The accompanying notes are an integral part of these financial statements.

18 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | New Mexico — 1.2% | |

| 650,000 | | County of Otero, Otero County Jail Project, 9.0%, 4/1/23 | $ 641,881 |

| 2,960,000(e) | | County of Otero, Otero County Jail Project, 9.0%, 4/1/28 | 2,923,000 |

| | | Total New Mexico | $ 3,564,881 |

| | | New York — 17.3% | |

| 3,000,000 | | Metropolitan Transportation Authority, 4.0%, 11/15/45 | $ 3,401,250 |

| 2,000,000 | | Metropolitan Transportation Authority, 4.0%, 11/15/48 | 2,262,060 |

| 2,500,000 | | Metropolitan Transportation Authority, 5.0%, 11/15/33 | 3,202,775 |

| 2,000,000 | | Metropolitan Transportation Authority, 5.25%, 11/15/55 | 2,473,100 |

| 2,500,000 | | New York State Dormitory Authority, 3.0%, 3/15/41 | 2,664,025 |

| 4,865,000 | | New York State Dormitory Authority, 5.0%, 10/1/50 | 7,760,064 |

| 8,000,000 | | New York State Dormitory Authority, Series A, | |

| | | 4.0%, 7/1/41 | 9,400,000 |

| 2,500,000 | | New York State Dormitory Authority, Series A, | |

| | | 5.0%, 3/15/41 | 3,105,450 |

| 7,500,000 | | New York State Dormitory Authority, Series C, | |

| | | 5.0%, 3/15/39 | 8,403,675 |

| 1,500,000 | | New York State Dormitory Authority, Trustees of | |

| | | Columbia University, 5.0%, 10/1/45 | 2,345,670 |

| 3,000,000 | | New York State Urban Development Corp., 3.0%, 3/15/49 | 3,121,290 |

| 1,000,000 | | Troy Capital Resource Corp., 4.0%, 9/1/40 | 1,152,800 |

| 2,312,177 | | Westchester County Healthcare Corp., Series A, | |

| | | 5.0%, 11/1/44 | 2,458,052 |

| | | Total New York | $ 51,750,211 |

| | | North Carolina — 2.9% | |

| 2,500,000(b) | | County of Mecklenburg NC, 2.0%, 3/1/41 | $ 2,524,425 |

| 4,225,000(e) | | Tender Option Bond Trust Receipts/Certificates, | |

| | | RIB, 0.0%, 1/1/38 (144A) | 6,218,566 |

| | | Total North Carolina | $ 8,742,991 |

| | | North Dakota — 0.9% | |

| 2,525,000(d) | | County of Burleigh, St. Alexius Medical Center, | |

| | | 5.0%, 7/1/38 | $ 2,653,245 |

| | | Total North Dakota | $ 2,653,245 |

| | | Ohio — 2.0% | |

| 1,000,000 | | Buckeye Tobacco Settlement Financing Authority, | |

| | | 4.0%, 6/1/48 | $ 1,104,180 |

| 1,000,000 | | Buckeye Tobacco Settlement Financing Authority, | |

| | | 5.0%, 6/1/55 | 1,123,750 |

| 1,000,000 | | Ohio Housing Finance Agency, Sanctuary Springboro | |

| | | Project, 5.45%, 1/1/38 (144A) | 1,013,480 |

| 2,500,000(b)(d) | | State of Ohio, Common Schools, Series B, | |

| | | 5.0%, 6/15/29 | 2,638,375 |

| | Total Ohio | $ 5,879,785 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 19

Schedule of Investments | 4/30/21 (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Oregon — 2.2% | |

| 1,000,000 | | Oregon Health & Science University, Series A, | |

| | | 5.0%, 7/1/42 | $ 1,209,580 |

| 5,190,000(d) | | Oregon Health & Science University, Series E, | |

| | | 5.0%, 7/1/32 | 5,456,974 |

| | | Total Oregon | $ 6,666,554 |

| | | Pennsylvania — 4.0% | |

| 3,000,000 | | Geisinger Authority, Geisinger Health System, | |

| | | series A-1, 5.0%, 2/15/45 | $ 3,590,280 |

| 2,000,000 | | Pennsylvania Housing Finance Agency, 2.05%, 4/1/41 | 1,995,920 |

| 1,500,000 | | Pennsylvania Turnpike Commission, 5.25%, 12/1/44 | 1,933,590 |

| 1,000,000 | | Philadelphia Authority for Industrial Development, | |

| | | 5.0%, 11/15/50 | 1,023,030 |

| 500,000 | | Philadelphia Authority for Industrial Development, | |

| | | 5.5%, 6/1/49 (144A) | 533,010 |

| 460,000 | | Philadelphia Authority for Industrial Development, | |

| | | Greater Philadelphia Health Action, Inc., Project, | |

| | | Series A, 6.625%, 6/1/50 | 490,190 |

| 2,000,000(d) | | Philadelphia Authority for Industrial Development, | |

| | | Nueva Esperanze, Inc., 8.2%, 12/1/43 | 2,260,080 |

| | | Total Pennsylvania | $ 11,826,100 |

| | | Puerto Rico — 4.2% | |

| 6,255,000(b)(g) | | Commonwealth of Puerto Rico, 8.0%, 7/1/35 | $ 5,019,638 |

| 1,000,000 | | Puerto Rico Electric Power Authority, 5.25%, 7/1/21 | 922,500 |

| 1,386,000 | | Puerto Rico Sales Tax Financing Corp. Sales Tax | |

| | | Revenue, 4.536%, 7/1/53 | 1,518,751 |

| 2,000,000 | | Puerto Rico Sales Tax Financing Corp. Sales Tax | |

| | | Revenue, 4.784%, 7/1/58 | 2,226,220 |

| 2,500,000 | | Puerto Rico Sales Tax Financing Corp. Sales Tax | |

| | | Revenue, 5.0%, 7/1/58 | 2,816,400 |

| | | Total Puerto Rico | $ 12,503,509 |

| | | Rhode Island — 2.8% | |

| 5,900,000(g) | | Central Falls Detention Facility Corp., 7.25%, 7/15/35 | $ 1,062,000 |

| 2,000,000 | | Rhode Island Health & Educational Building Corp., | |

| | | Brown University, Series A, 4.0%, 9/1/37 | 2,336,500 |

| 1,000,000 | | Rhode Island Turnpike & Bridge Authority, 4.0%, 10/1/44 | 1,162,050 |

| 2,500,000(e) | | Tender Option Bond Trust Receipts/Certificates, | |

| | | RIB, 0.0%, 9/1/47 (144A) | 3,745,800 |

| | | Total Rhode Island | $ 8,306,350 |

| | | South Carolina — 1.1% | |

| 2,850,000 | | City of Charleston SC Waterworks & Sewer System | |

| | | Revenue, 4.0%, 1/1/49 | $ 3,323,470 |

| | | Total South Carolina | $ 3,323,470 |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Texas — 9.6% | |

| 500,000 | | Arlington Higher Education Finance Corp., 5.45%, | |

| | | 3/1/49 (144A) | $ 554,100 |

| 1,000,000 | | Arlington Higher Education Finance Corp., Universal | |

| | | Academy, Series A, 7.0%, 3/1/34 | 1,106,080 |

| 1,000,000 | | City of Houston TX Combined Utility System Revenue, | |

| | | 4.0%, 11/15/35 | 1,220,550 |

| 1,490,000(b) | | County of Harris, Series A, 5.0%, 10/1/26 | 1,790,637 |

| 5,000,000(b)(d) | | Goose Creek Consolidated Independent School | |

| | | District, Series C, 4.0%, 2/15/26 (PSF-GTD Insured) | 5,517,750 |

| 3,785,000 | | North Texas Tollway Authority, Series A, 5.0%, 1/1/35 | 4,331,895 |

| 1,500,000(d) | | Red River Health Facilities Development Corp., MRC | |

| | | Crestview, Series A, 8.0%, 11/15/41 | 1,560,990 |

| 3,960,000(g) | | Sanger Industrial Development Corp., Texas Pellets | |

| | | Project, Series B, 8.0%, 7/1/38 | 975,150 |

| 990,082 | | Texas Department of Housing & Community Affairs, | |

| | | 2.3%, 7/1/37 (FNMA HUD SECT 8 Insured) | 1,016,828 |

| 350,000 | | Texas Municipal Gas Acquisition & Supply Corp. III, | |

| | | 5.0%, 12/15/31 | 464,940 |

| 2,000,000 | | Texas Water Development Board, 4.0%, 10/15/44 | 2,388,300 |

| 4,990,000 | | University of Texas System, Financing System, Series A, | |

| | | 5.0%, 8/15/49 | 7,709,899 |

| | | Total Texas | $ 28,637,119 |

| | | Utah — 0.4% | |

| 1,000,000 | | Salt Lake City Corp., Airport Revenue, Series B, | |

| | | 5.0%, 7/1/35 | $ 1,198,880 |

| | | Total Utah | $ 1,198,880 |

| | | Virginia — 10.9% | |

| 5,000,000(b) | | City of Alexandria VA, 3.0%, 7/15/46 (ST AID | |

| | | WITHHLDG Insured) | $ 5,448,800 |

| 1,000,000 | | City of Richmond VA Public Utility Revenue, | |

| | | 3.0%, 1/15/45 | 1,083,670 |

| 2,200,000(b) | | County of Arlington, 4.0%, 8/15/35 | 2,524,610 |

| 1,415,000(b) | | County of Fairfax, Series A, 4.0%, 10/1/33 (ST AID | |

| | | WITHHLDG Insured) | 1,665,059 |

| 5,000,000 | | University of Virginia, Series A, 5.0%, 4/1/42 | 6,118,900 |

| 4,000,000(d) | | Upper Occoquan Sewage Authority, 4.0%, 7/1/41 | 4,607,560 |

| 5,000,000 | | Virginia College Building Authority, Series A, | |

| | | 3.0%, 2/1/36 | 5,572,100 |

| 4,000,000 | | Virginia Commonwealth Transportation Board, Capital | |

| | | Projects, 3.0%, 5/15/37 | 4,443,480 |

| 1,000,000 | | Virginia Public Building Authority, 4.0%, 8/1/39 | 1,204,730 |

| | | Total Virginia | $ 32,668,909 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 21

Schedule of Investments | 4/30/21 (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | Washington — 10.7% | |

| 3,745,000 | | City of Seattle, Water System Revenue, 4.0%, 8/1/32 | $ 4,367,606 |

| 2,500,000(b) | | King County, Issaquah School District No. 411, 4.0%, | |

| | | 12/1/31 (SCH BD GTY Insured) | 2,871,425 |

| 1,000,000(b) | | State of Washington, 4.0%, 7/1/39 | 1,229,830 |

| 14,315,000(b)(c) | | State of Washington, Motor Vehicle Sales Tax, Series C, | |

| | | 6/1/22 (NATL Insured) | 14,235,122 |

| 3,285,000(e) | | Tender Option Bond Trust Receipts/Certificates, | |

| | | RIB, 0.0%, 1/1/45 (144A) | 5,231,034 |

| 2,500,000 | | University of Washington, Series B, 5.0%, 6/1/29 | 2,956,550 |

| 1,150,000(d) | | Washington State Housing Finance Commission, | |

| | | Mirabella Project, Series A, 6.75%, 10/1/47 (144A) | 1,254,926 |

| | | Total Washington | $ 32,146,493 |

| | | Wisconsin — 5.7% | |

| 1,500,000 | | Public Finance Authority, Gardner Webb University, | |

| | | 5.0%, 7/1/31 (144A) | $ 1,659,525 |

| 5,000,000 | | Public Finance Authority, Glenridge Palmer Ranch, | |

| | | Series A, 8.25%, 6/1/46 (144A) | 5,119,450 |

| 750,000 | | Public Finance Authority, Roseman University Health | |

| | | Sciences Project, 5.875%, 4/1/45 | 785,152 |

| 1,000,000 | | Public Finance Authority, SearStone CCRC Project, | |

| | | Series A, 5.3%, 6/1/47 | 1,005,120 |

| 1,465,000(d) | | Public Finance Authority, SearStone CCRC Project, | |

| | | Series A, 8.625%, 6/1/47 | 1,588,778 |

| 5,000,000 | | Wisconsin Department of Transportation, Series A, | |

| | | 5.0%, 7/1/28 | 5,697,350 |

| 1,220,000 | | Wisconsin Housing & Economic Development | |

| | | Authority, 2.95%, 3/1/42 (FNMA COLL Insured) | 1,269,727 |

| | | Total Wisconsin | $ 17,125,102 |

| | | TOTAL MUNICIPAL BONDS | |

| | | (Cost $414,016,481) | $ 439,414,454 |

| | | TOTAL INVESTMENTS IN UNAFFILIATED | |

| | | ISSUERS — 146.8% | |

| | | (Cost $414,016,481) | $ 439,414,454 |

| | | OTHER ASSETS AND LIABILITIES — (46.8)% | $ (140,134,679) |

| | | NET ASSETS APPLICABLE TO COMMON | |

| | | SHAREOWNERS — 100.0% | $ 299,279,775 |

| | |

RIB | Residual Interest Bond is purchased in a secondary market. The interest rate is |

| subject to change periodically and inversely based upon prevailing market rates. |

| The interest rate shown is the rate at April 30, 2021. |

(144A) | Security is exempt from registration under Rule 144A of the Securities Act of |

| 1933. Such securities may be resold normally to qualified institutional buyers in a |

| transaction exempt from registration. At April 30, 2021, the value of these |

| securities amounted to $36,596,437, or 12.2% of net assets applicable to |

| common shareowners. |

The accompanying notes are an integral part of these financial statements.

22 Pioneer Municipal High Income Fund, Inc. | Annual Report

| 4/30/21

AMBAC CNTY-GTD FNMA COLL FNMA HUD SECT 8 | Ambac Assurance Corp. County Guaranteed. Federal National Mortgage Association Collateral. Federal National Mortgage Association U.S. Department of Housing and Urban Development Section 8. |

NATL PSF-GTD SCH BD GTY | National Public Finance Guarantee Corp. Permanent School Fund Guaranteed. School Board Guaranty. |

ST AID WITHHLDG

| State Aid Withholding. |

ST APPROP

| State Appropriations. |

†

| Amount rounds to less than 0.1%. |

(a)

| Consists of Revenue Bonds unless otherwise indicated.

|

(b)

| Represents a General Obligation Bond.

|

(c)

| Security issued with a zero coupon. Income is recognized through accretion of discount.

|

(d) | Pre-refunded bonds have been collateralized by U.S. Treasury or U.S. Government Agency securities which are held in escrow to pay interest and principal on the tax exempt issue and to retire the bonds in full at the earliest refunding date. |

(e) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at April 30, 2021. |

(f)

| Escrow to maturity.

|

| (g) | Security is in default. |

Purchases and sales of securities (excluding temporary cash investments) for the year ended April 30, 2021, aggregated $68,117,850 and $43,426,372, respectively.

The Fund is permitted to engage in purchase and sale transactions (“cross trades”) with certain funds and accounts for which the Amundi Asset Management US, Inc. (the “Adviser”) serves as the Fund’s investment adviser, as set forth in Rule 17a-7 under the Investment Company Act of 1940, pursuant to procedures adopted by the Board of Directors. Under these procedures, cross trades are effected at current market prices. During the year ended April 30, 2021, the Fund did not engage in any cross trade activity.

At April 30, 2021, the net unrealized appreciation on investments based on cost for federal tax purposes of $411,832,479 was as follows:

| | |

Aggregate gross unrealized appreciation for all investments in which | |

there is an excess of value over tax cost | $ 38,847,614 |

Aggregate gross unrealized depreciation for all investments in which | |

there is an excess of tax cost over value | (11,265,639) |

Net unrealized appreciation | $ 27,581,975 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 23

Schedule of Investments | 4/30/21 (continued)

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| |

| Level 1 – unadjusted quoted prices in active markets for identical securities. |

| Level 2 – other significant observable inputs (including quoted prices for similar securities, |

| interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial |

| Statements — Note 1A. |

| Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining |

| fair value of investments). See Notes to Financial Statements — Note 1A. |

The following is a summary of the inputs used as of April 30, 2021, in valuing the Fund’s investments:

| | | | | |

| Level 1 | Level 2 | Level 3 | Total |

Municipal Bonds | $ — | $ 439,414,454 | — | $ 439,414,454 |

| Total Investments in Securities | $ — | $ 439,414,454 | $ — | $ 439,414,454 |

| Other Financial Instruments | | | | |

Variable Rate MuniFund Term | | | | |

Preferred Shares(a) | $ — | $(145,000,000) | $ — | $(145,000,000) |

| Total Other Financial Instruments | $ — | $(145,000,000) | $ — | $(145,000,000) |

(a) The Fund may hold liabilities in which the fair value approximates the carrying amount for financial |

| statement purposes. |

During the year ended April 30, 2021, there were no transfers in or out of Level 3. |

The accompanying notes are an integral part of these financial statements.

24 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Statement of Assets and Liabilities |

4/30/21

| ASSETS: | | | |

| Investments in unaffiliated issuers, at value (cost $414,016,481) | | $ | 439,414,454 | |

| Cash | | | 2,525,065 | |

| Receivables — | | | | |

| Interest | | | 5,190,669 | |

| Other assets | | | 1,020 | |

| Total assets | | $ | 447,131,208 | |

| LIABILITIES: | | | | |

| Variable Rate MuniFund Term Preferred Shares* | | | 145,000,000 | |

| Payables — | | | | |

| Investment securities purchased | | | 2,776,619 | |

| Distributions | | | 25 | |

| Directors’ fees | | | 629 | |

| Due to affiliates | | | 26,013 | |

| Accrued expenses | | | 48,147 | |

| Total liabilities | | $ | 147,851,433 | |

| NET ASSETS APPLICABLE TO COMMON SHAREOWNERS: | | | | |

| Paid-in capital | | $ | 300,996,046 | |

| Distributable earnings (loss) | | | (1,716,271 | ) |

| Net assets applicable to common shareowners | | $ | 299,279,775 | |

| NET ASSET VALUE PER COMMON SHARE: | | | | |

| No par value | | | | |

| Based on $299,279,775/22,771,349 common shares | | $ | 13.14 | |

* $100,000 liquidation value per share applicable to 1,450 shares.

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 25

FOR THE YEAR ENDED 4/30/21

| | | | | | | |

| INVESTMENT INCOME: | | | | | | |

| Interest from unaffiliated issuers | | $ | 17,334,023 | | | | |

| Total investment income | | | | | | $ | 17,334,023 | |

| EXPENSES: | | | | | | | | |

| Management fees | | $ | 2,554,454 | | | | | |

| Administrative expense | | | 200,779 | | | | | |

| Transfer agent fees | | | 10,655 | | | | | |

| Shareowner communications expense | | | 23,900 | | | | | |

| Custodian fees | | | 5,074 | | | | | |

| Registration fees | | | 19,600 | | | | | |

| Professional fees | | | 473,786 | | | | | |

| Printing expense | | | 18,352 | | | | | |

| Pricing fees | | | 6,388 | | | | | |

| Directors’ fees | | | 17,002 | | | | | |

| Insurance expense | | | 733 | | | | | |

| Interest expense | | | 1,392,200 | | | | | |

| Miscellaneous | | | 84,441 | | | | | |

| Total expenses | | | | | | $ | 4,807,364 | |

| Net investment income | | | | | | $ | 12,526,659 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | $ | (262,256 | ) | | | | |

| Change in net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | 20,078,824 | | | | | |

| Net realized and unrealized gain (loss) on investments | | | | | | $ | 19,816,568 | |

| Net increase in net assets resulting from operations | | | | | | $ | 32,343,227 | |

The accompanying notes are an integral part of these financial statements.

26 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Statements of Changes in Net Assets

| | Year | | | Year | |

| | Ended | | | Ended | |

| | 4/30/21 | | | 4/30/20 | |

| FROM OPERATIONS: | | | | | | |

Net investment income (loss) | | $ | 12,526,659 | | | $ | 12,469,533 | |

Net realized gain (loss) on investments | | | (262,256 | ) | | | 1,931,953 | |

Change in net unrealized appreciation (depreciation) | | | | | | | | |

| on investments | | | 20,078,824 | | | | (9,109,466 | ) |

| Net increase in net assets resulting from operations | | $ | 32,343,227 | | | $ | 5,292,020 | |

| DISTRIBUTIONS TO COMMON SHAREOWNERS: | | | | | | | | |

($0.59 and $0.57 per share, respectively) | | $ | (13,321,239 | ) | | $ | (12,979,669 | ) |

| Total distributions to common shareowners | | $ | (13,321,239 | ) | | $ | (12,979,669 | ) |

| Net increase (decrease) in net assets applicable to | | | | | | | | |

| common shareowners | | $ | 19,021,988 | | | $ | (7,687,649 | ) |

| NET ASSETS APPLICABLE TO COMMON SHAREOWNERS: | | | | | | | | |

Beginning of year | | $ | 280,257,787 | | | $ | 287,945,436 | |

End of year | | $ | 299,279,775 | | | $ | 280,257,787 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 27

FOR THE YEAR ENDED 4/30/21

| Cash Flows From Operating Activities: | | | |

| Net Increase in net assets resulting from operations | | $ | 32,343,227 | |

| Adjustments to reconcile net increase in net assets resulting | | | | |

| from operations to net cash, restricted cash and foreign | | | | |

| currencies used in operating activities: | | | | |

| Purchases of investment securities | | $ | (69,349,720 | ) |

| Proceeds from disposition and maturity of investment securities | | | 44,426,391 | |

| Net (accretion) and amortization of discount/premium on investment securities | | | 564,089 | |

| Change in unrealized appreciation on investments in unaffiliated issuers | | | (20,078,824 | ) |

| Net realized loss on investments in unaffiliated issuers | | | 262,256 | |

| Decrease in interest receivable | | | 340,725 | |

| Decrease in other assets | | | 107,151 | |

| Decrease in due from advisor | | | 166,532 | |

| Increase in due to affiliates | | | 23,272 | |

| Increase in Directors’ fees payable | | | 583 | |

| Decrease in interest expense payable | | | (28,550 | ) |

| Decrease in accrued expenses payable | | | (40,712 | ) |

| Net cash, restricted cash and foreign currencies used in operating activities | | $ | (11,263,580 | ) |

| Cash Flows Provided by Financing Activities: | | | | |

| Payments on borrowings | | $ | 20,000,000 | |

| Distributions to shareowners | | | (13,321,239 | ) |

| Net cash, restricted cash and foreign currencies provided by | | | | |

| financing activities | | $ | 6,678,761 | |

| Cash, Restricted Cash and Foreign Currencies: | | | | |

| Beginning of year* | | $ | 7,109,884 | |

| End of year* | | $ | 2,525,065 | |

| Cash Flow Information: | | | | |

| Cash paid for interest | | $ | 1,421,627 | |

* The following table provides a reconciliation of cash, restricted cash and foreign currencies reported within Statement of Assets and Liabilities that sum to the total of the same such amounts shown in the Statement of Cash Flows:

| Year | Year |

| Ended | Ended |

| 4/30/21 | 4/30/20 |

Cash | $2,525,065 | $7,109,884 |

| Total cash, restricted cash and foreign currencies | | |

| shown in the Statement of Cash Flows | $2,525,065 | $7,109,884 |

The accompanying notes are an integral part of these financial statements.

28 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

| | Year | Year | Year | Year | Year |

| | Ended | Ended | Ended | Ended | Ended |

| | 4/30/21 | 4/30/20 | 4/30/19 | 4/30/18 | 4/30/17* |

| Per Share Operating Performance | | |

Net asset value, beginning of period | $ 12.31 | $ 12.65 | $ 12.50 | $ 12.72 | $ 13.49 |

Increase (decrease) from investment operations: (a) | |

| Net investment income (b) | $ 0.55 | $ 0.55 | $ 0.74 | $ 0.78 | $ 0.73 |

| Net realized and unrealized gain (loss) on investments | 0.87 | (0.32) | 0.19 | (0.29) | (0.76) |

Distributions to preferred shareowners from: | | |

| Net investment income (b) | $ — | $ — | $ (0.15) | $ (0.09) | $ (0.05) |

| Net increase (decrease) from investment operations | $ 1.42 | $ 0.23 | $ 0.78 | $ 0.40 | $ (0.08) |

Distributions to common shareowners from: | | |

| Net investment income and previously undistributed net |

| investment income | $ (0.59)** | $ (0.57)** | $ (0.63) | $ (0.62) | $ (0.69) |

| Net increase (decrease) in net asset value | $ 0.83 | $ (0.34) | $ 0.15 | $ (0.22) | $ (0.77) |

Net asset value, end of period | $ 13.14 | $ 12.31 | $ 12.65 | $ 12.50 | $ 12.72 |

Market value, end of period | $ 12.61 | $ 10.82 | $ 11.91 | $ 11.25 | $ 11.75 |

| Total return at net asset value (c) | 12.04% | 2.00%(d) | 6.93% | 3.53% | (0.45)% |

| Total return at market value (c) | 22.33% | (4.77)% | 11.86% | 0.87% | (11.83)% |

Ratios to average net assets of common shareowners: | |

| Total expenses plus interest expense (e) (f) | 1.62% | 2.13% | 1.03% | 1.01% | 1.00% |

| Net investment income before preferred share distributions (b) | 4.22% | 4.24% | 5.92% | 6.14% | 5.54% |

| Net investment income (f) | 4.22% | 4.24% | 4.69% | 5.44% | 5.16% |

| Preferred share distributions (b) | —% | —% | (1.23)% | 0.71% | 0.38% |

Portfolio turnover rate | 10% | 17% | 16% | 20% | 19% |

Net assets of common shareowners, end of period (in thousands) | $299,280 | $280,258 | $287,945 | $284,596 | $289,741 |

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 29

Financial Highlights (continued)

| | | | | | |

| Year | Year | Year | Year | Year |

| Ended | Ended | Ended | Ended | Ended |

| 4/30/21 | 4/30/20 | 4/30/19 | 4/30/18 | 4/30/17* |

Preferred shares outstanding (in thousands) (g) (h) (i) | $145,000 | $125,000 | $125,000 | $125,000 | $101,000 |

Asset coverage per preferred share, end of period | $306,399 | $324,229 | $330,370 | $327,672 | $ 96,723 |

Average market value per preferred share (j) | $100,000 | $100,000 | $100,000 | $100,000 | $ 25,000 |

Liquidation value, including interest expense payable, per preferred share | $ 99,999 | $100,023 | $100,014 | $ 99,996 | $ 25,006 |

* | The Fund was audited by an independent registered public accounting firm other than Ernst & Young LLP. |

** | The amount of distributions made to shareowners during the year were in excess of the net investment income earned by the Fund during the year. The Fund has accumulated undistributed net investment income which is part of the Fund’s NAV. A portion of the accumulated net investment income was distributed to shareowners during the year.

|

(a) | The per common share data presented above is based upon the average common shares outstanding for the periods presented. |

(b) | Beginning April 30, 2020, distribution payments to preferred shareowners are included as a component of net investment income. |

(c) | Total investment return is calculated assuming a purchase of common shares at the current net asset value or market value on the first day and a sale at the current net asset value or market value on the last day of the periods reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. Past performance is not a guarantee of future results.

|

(d) | If the Fund had not recognized gains in settlement of class action lawsuits during the year ended April 30, 2020, the total return would have been 1.73%. |

(e) | Prior to April 30, 2020, the expense ratios do not reflect the effect of distribution payments to preferred shareowners. |

(f) | Includes interest expense of 0.47%, 1.10%, —%, —% and —%, respectively. |

(g) | Prior to February 9, 2018 there were 4,040 Auction Preferred Shares (“APS”) outstanding with a liquidation preference of $25,000 per share. The Fund redeemed all 2,000 outstanding Series A APS on February 14, 2018 and all 2,040 outstanding Series B APS on February 15, 2018.

|

(h) | The Fund issued 1,250 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 9, 2018. |

(i) | The Fund issued 200 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 16, 2021. |

(j) | Market value is redemption value without an active market. |

The accompanying notes are an integral part of these financial statements.

30 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

Notes to Financial Statements |

4/30/21

1. Organization and Significant Accounting Policies

Pioneer Municipal High Income Fund, Inc. (the “Fund”) is organized as a Maryland corporation. Prior to April 21, 2021, the Fund was organized as a Delaware statutory trust. On April 21, 2021, the Fund redomiciled to a Maryland corporation through a statutory merger of the predecessor Delaware statutory trust with and into a newly-established Maryland corporation formed for the purpose of effecting the redomiciling. The Fund was originally organized on March 13, 2003. Prior to commencing operations on July 21, 2003, the Fund had no operations other than matters relating to its organization and registration as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The investment objective of the Fund is to seek a high level of current income exempt from regular federal income tax, and the Fund may, as a secondary objective, also seek capital appreciation to the extent that it is consistent with its primary investment objective.

Amundi Asset Management US, Inc., an indirect, wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”). Prior to January 1, 2021, the Adviser was named Amundi Pioneer Asset Management, Inc.

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2018-13 “Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”) which modifies disclosure requirements for fair value measurements, principally for Level 3 securities and transfers between levels of the fair value hierarchy. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. The Fund has adopted ASU 2018-13 for the year ended April 30, 2021. The impact to the Fund’s adoption was limited to changes in the Fund’s disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy and disclosure of the range and weighted average used to develop significant unobservable inputs for Level 3 fair value investments, when applicable.

In March 2020, FASB issued an Accounting Standard Update, ASU 2020-04, Reference Rate Reform (Topic 848) — Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other LIBOR-based reference rates at the end of 2021. The temporary relief provided by ASU 2020-04 is effective for certain reference rate-related

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 31

contract modifications that occur during the period from March 12, 2020 through December 31, 2022. Management is evaluating the impact of ASU 2020-04 on the Fund’s investments, derivatives, debt and other contracts, if applicable, that will undergo reference rate-related modifications as a result of the reference rate reform.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

A. Security Valuation

The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE.

Fixed-income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed-income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers.

Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser pursuant to procedures adopted by the Fund’s Board of Directors. The Adviser’s fair valuation team uses fair value methods approved by the Valuation Committee of the Board of Directors. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued

32 Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21

securities and for discussing and assessing fair values on an ongoing basis, and at least quarterly, with the Valuation Committee of the Board of Directors.

Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Fund may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material.

At April 30, 2021, no securities were valued using fair value methods (other than securities valued using prices supplied by independent pricing services, broker-dealers or using a third party insurance industry pricing model).

B. Investment Income and Transactions

Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities.

Discounts and premiums on purchase prices of debt securities are accreted or amortized, respectively, daily, into interest income on an effective yield to maturity basis with a corresponding increase or decrease in the cost basis of the security. Premiums and discounts related to certain mortgage-backed securities are amortized or accreted in proportion to the monthly paydowns.

Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively.

Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes.

C. Federal Income Taxes

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its shareowners. Therefore, no provision for federal income taxes is

Pioneer Municipal High Income Fund, Inc. | Annual Report | 4/30/21 33

required. As of April 30, 2021, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities.

The amount and character of income and capital gain distributions to shareowners are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences.

At April 30, 2021, the Fund was permitted to carry forward indefinitely $888,961 of short-term losses $28,414,581 of long-term losses.

The tax character of distributions paid during the years ended April 30, 2021 and April 30, 2020, were as follows:

| 2021 | 2020 |

| Distributions paid from: | | |

Tax-exempt distributions | $13,892,324 | $15,198,352 |

Ordinary income | 821,115 | 1,011,767 |

| Total | $14,713,439 | $16,210,119 |