Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant: x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |||

x |

Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to Rule 14a-12 | |||||

Conn’s, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

CONN’S, INC.

3295 College Street

Beaumont, Texas 77701

(409) 832-1696

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 3, 2004

To the Stockholders of Conn’s, Inc.:

NOTICE IS HEREBY GIVEN that the 2004 annual meeting of stockholders of Conn’s, Inc. will be held on Thursday, June 3, 2004, at 3295 College Street, Beaumont, Texas 77701, commencing at 10:00 a.m. local time, for the following purposes:

| 1. | to elect two directors; |

| 2. | to consider a proposal to approve an amendment to our certificate of incorporation to allow our board of directors to determine the size of the board of directors and to remove the provisions providing for a classified board of directors; |

| 3. | to consider a proposal to approve an amendment to the Conn’s, Inc. Amended and Restated 2003 Incentive Stock Option Plan to provide for a maximum number of shares with respect to which options may be granted during a specified period to any single employee and to grant the chief executive officer the authority to grant options to non-executive officers; and |

| 4. | to transact such other business as may properly come before the meeting. |

A copy of the proxy statement relating to the 2004 annual meeting of stockholders, in which the foregoing matters are described in more detail, and our Annual Report on Form 10-K outlining our operations for the fiscal year ended January 31, 2004, accompanies this notice of 2004 annual meeting of stockholders.

Only stockholders of record at the close of business on April 15, 2004 are entitled to notice of and to vote at the 2004 annual meeting of stockholders or any adjournment thereof. A list of such stockholders, arranged in alphabetical order and showing the address of and the number of shares registered in the name of each such stockholder, will be available for examination by any stockholder for any purpose relating to the meeting during ordinary business hours for a period of at least ten days prior to the meeting at the principal offices of the company located at 3295 College Street, Beaumont, Texas 77701.

Your vote is important. Whether or not you expect to be present at the meeting, please complete, sign, date and return promptly the enclosed form of proxy in the enclosed pre-addressed, postage-paid return envelope.

By Order of the Board of Directors, |

/s/ David R. Atnip |

DAVID R. ATNIP |

Secretary |

April 30, 2004

Beaumont, Texas

This proxy statement is first being mailed to our stockholders on or about April 30, 2004.

Table of Contents

[GRAPHIC APPEARS HERE]

PROXY STATEMENT

2004 ANNUAL MEETING OF STOCKHOLDERS

| Date: | June 3, 2004 | |||

| Time: | 10:00 a.m. local time | |||

| Location: | Conn’s, Inc., 3295 College Street, Beaumont, Texas 77701 | |||

| Record Date and Number of Votes: | April 15, 2004. Holders of our common stock are entitled to one vote for each share of common stock they owned as of the close of business on April 15, 2004. You may not cumulate votes. | |||

| Agenda: | 1. | to elect two directors; | ||

| 2. | to consider a proposal to approve an amendment to our certificate of incorporation to allow our board of directors to determine the size of the board of directors and to remove the provision providing for a classified board of directors; | |||

| 3. | to consider a proposal to approve an amendment to the Conn’s, Inc. Amended and Restated 2003 Incentive Stock Option Plan to provide for a maximum number of shares with respect to which options may be granted during a specified period to any single employee and to grant the chief executive officer the authority to grant options to non-executive officers; and | |||

| 4. | to transact such other business as may properly come before the meeting. | |||

| Proxies: | Unless you tell us on the enclosed form of proxy to vote differently, we will vote signed returned proxies “FOR” the board’s nominees, “FOR” approval of the amendment to our certificate of incorporation and “FOR” approval of the amendment to our incentive stock option plan. The proxy holders will use their discretion on other matters. If a nominee cannot or will not serve as a director, the proxy holders will vote for a person whom they believe will carry on our present policies. | |||

| Proxies Solicited By: | The Board of Directors | |||

| First Mailing Date: | We are first mailing this Proxy Statement and the form of proxy on or about April 30, 2004. | |||

| Revoking Your Proxy: | You may revoke your proxy before it is voted at the meeting. To revoke your proxy, follow the procedures listed on page 2 under “General Information Regarding the 2004 Annual Meeting of Stockholders; Revocation of Proxies.” | |||

PLEASE VOTE BY RETURNING YOUR PROXY. YOUR VOTE IS IMPORTANT.

Prompt return of your proxy will help reduce the costs of resolicitation.

Table of Contents

| Page | ||

GENERAL INFORMATION REGARDING THE 2004 ANNUAL MEETING OF STOCKHOLDERS | 1 | |

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 4 | ||

PROPOSAL ONE: APPROVAL OF THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION | 4 | |

| 4 | ||

| 4 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

Options Granted Under the Amended and Restated 2003 Incentive Stock Option Plan | 9 | |

Equity Compensation Plan Information Prior to Stockholder Approval of the Amendment to the Plan | 10 | |

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 12 | ||

Policy Regarding Director Attendance at the Annual Meeting of Stockholders | 12 | |

| 12 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 21 | ||

| 21 | ||

| 22 | ||

| 22 | ||

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 22 | |

| 22 | ||

STOCK OWNERSHIP OF DIRECTORS, EXECUTIVE OFFICERS AND PRINCIPAL STOCKHOLDERS | 23 | |

| 26 | ||

| 28 | ||

| 28 | ||

i

Table of Contents

GENERAL INFORMATION REGARDING THE 2004 ANNUAL MEETING OF STOCKHOLDERS

The holders of a majority of the outstanding shares of common stock entitled to vote at the 2004 annual meeting of stockholders, represented in person or by proxy, will constitute a quorum at the meeting. However, if a quorum is not present or represented at the meeting, the stockholders entitled to vote at the meeting, present in person or represented by proxy, have the power to adjourn the meeting, without notice, other than by announcement at the meeting, until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the original meeting.

Votes Required to Approve Proposals

To be elected, directors must receive a plurality of the shares voting in person or by proxy, provided a quorum exists. A plurality means receiving the largest number of votes, regardless of whether that is a majority. The amendment to our certificate of incorporation requires the affirmative vote of the holders of at least 75% of the outstanding shares entitled to vote. The amendment to our incentive stock option plan requires the affirmative vote of a majority of the shares entitled to vote that are present in person or represented by proxy at the meeting.

Record Date, Shares Outstanding and Number of Votes

Only stockholders of record as of the close of business on April 15, 2004, the record date set for the meeting by our board, are entitled to notice of and to vote at the meeting or any adjournments of the meeting. On the record date, there were 23,151,799 shares of our common stock issued and outstanding and entitled to vote. Each share of common stock entitles the holder to one vote per share.

Method of Counting Votes, Abstentions and Broker Non-Votes

Votes cast by proxy or in person will be counted by the inspector of election appointed by the company.

Those who fail to return a proxy or who do not attend the meeting will not count towards determining any required quorum, plurality or majority of votes cast. Stockholders and brokers returning proxies or attending the meeting who abstain from voting on the election of our directors, approval of the amendment to our certificate of incorporation or approval of the amendment to our incentive stock option plan will count towards determining a quorum. Such abstentions will have no effect on the election of our directors or the approval of the amendment to our incentive stock option plan, but will have the same effect as a no vote on the approval of the amendment to our certificate of incorporation.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. Brokers are permitted to vote on routine, non-controversial proposals in instances where they have not received voting instructions from the beneficial owner of the stock but are not permitted to vote on non-routine matters. In the event that a broker does not receive voting instructions for non-routine matters, a broker may notify us that it lacks voting authority to vote those shares. These “broker non-votes” refer to votes that could have been cast on the matter in question by brokers with respect to uninstructed shares if the brokers had received their customers’ instructions. The inspector of election will treat broker non-votes as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. However, for the purpose of determining the outcome of any matter as to which the broker has indicated on the proxy that it does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters). These broker non-votes will have no effect on the outcome of the election of our directors or the amendment to our incentive stock option plan, but will have the same effect as a no vote on the approval of the amendment to our certificate of incorporation.

Table of Contents

The enclosed proxies will be voted in accordance with the instructions you place on the form of proxy. Unless you tell us on the form of proxy to vote differently, we will vote signed returned proxies “FOR” the board’s nominees, “FOR” approval of the amendment to our certificate of incorporation and “FOR” approval of the amendment to our incentive stock option plan. The proxy holders will use their discretion on other matters. If a nominee cannot or will not serve as a director, the proxy holders will vote for a person whom they believe will carry on our present policies.

Pursuant to the terms of a voting trust agreement entered into by Stephens Group, Inc., Stephens Inc. and certain affiliates of Stephens Inc., which collectively own approximately 58.7% of our common stock, unless the voting trust is revoked, the trustee of the voting trust must vote the shares of common stock held by the voting trust “FOR” and/or “AGAINST” any proposal or other matter submitted to the stockholders of the company for approval in the same proportion as the votes cast “FOR” and “AGAINST” such proposal or other matter by all other stockholders, not counting abstentions. Therefore, each proxy received voting “FOR” or “AGAINST” any of the three proposals will result in a proportionate number of shares held in the voting trust to be voted “FOR” or “AGAINST” a proposal. However, abstentions and broker non-votes will not impact how the shares in the voting trust are counted.

You may revoke your proxy before it is voted. Any stockholder returning the enclosed form of proxy may revoke such proxy at any time prior to its exercise by:

| • | delivering a signed proxy, dated later than the original proxy, to our transfer agent, EquiServe Trust Company, N.A., at 150 Royall Street, Canton, Massachusetts 02021, Attention: Therese Collins (please make sure our transfer agent receives your proxy at least two business days prior to the date of the meeting); |

| • | delivering a signed, written revocation letter, dated later than the proxy, to our transfer agent, EquiServe Trust Company, N.A., at 150 Royall Street, Canton, Massachusetts 02021, Attention: Therese Collins (please make sure our transfer agent receives your revocation letter at least two business days prior to the date of the meeting); or |

| • | attending the meeting and voting in person (attending the meeting alone will not revoke your proxy). |

Your last vote is the vote that will be counted.

Stockholder Proposals and Other Business

From time to time, stockholders seek to nominate directors or present proposals for inclusion in our proxy statement and form of proxy for consideration at an annual meeting of stockholders. To be included in our proxy statement and form of proxy or considered at our next annual meeting, you must timely submit nominations of directors or proposals, in addition to meeting other legal requirements. We must receive your nominations and/or proposals for the 2005 annual meeting no later than January 4, 2004 for possible inclusion in the proxy statement or prior to March 4, 2004 for possible consideration at the meeting. However, if the date of the 2005 annual meeting changes by more than 30 days from the date of this year’s meeting, then we must receive your nominations and/or proposals within a reasonable time before we begin to print and mail our proxy materials.

We do not intend to bring any business before the 2004 annual stockholders meeting other than the matters described in this proxy statement nor have we been informed of any matters that may be presented at the meeting by others. If however, any other business should properly arise, the persons appointed in the enclosed proxy have discretionary authority to vote in accordance with their best judgment.

2

Table of Contents

The cost of soliciting proxies will be borne by the company. In addition to the solicitation of proxies by mail, solicitation may be made by our directors, officers and employees by other means, including telephone, email or in person. No special compensation will be paid to directors, officers or employees for the solicitation of proxies. To solicit proxies, we also will request the assistance of banks, brokerage houses and other custodians, nominees or fiduciaries, and, upon request, will reimburse such organizations or individuals for their reasonable expenses in forwarding soliciting materials to beneficial owners and in obtaining authorization for the execution of proxies.

The booklet containing this proxy statement also contains our annual report to stockholders and Form 10-K including audited consolidated financial statements for the year ended January 31, 2004. The booklet has been mailed to all stockholders of record as of the close of business on April 15, 2004. Any stockholder that has not received a copy of our annual report may obtain a copy, without charge, by writing to us at 3295 College Street, Beaumont, Texas 77701, Attention: C. William Frank. You may also obtain our SEC filings through the SEC’s website at www.sec.gov.

3

Table of Contents

PROPOSALS FOR STOCKHOLDER ACTION

APPROVAL OF THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

Currently, our certificate of incorporation authorizes the number of directors to be no more than seven and divides our board into three classes of directors who serve three year terms. In April 2004, our board adopted a proposal to amend our certificate of incorporation to allow the board of directors to determine the size of our board of directors and to remove the provisions providing for a classified board, subject to stockholder approval of the amendment. Our board has declared the proposed amendment to be advisable and in the best interests of the company and the stockholders.

We propose to amend our certificate of incorporation as follows:

Current Article Ten, Sections B and E of the Company’s Certificate of Incorporation will be amended and restated to read as follows:

“B. Except as otherwise provided for or fixed pursuant to the provisions of Article FOUR of this Certificate of Incorporation relating to the rights of holders of any series of Preferred Stock to elect additional directors, the total number of directors which shall constitute the entire Board of Directors of the Corporation shall be no less than three (3) directors. The number of directors which shall constitute the entire Board of Directors shall be determined as set forth in the Bylaws of the Corporation. Except with respect to the current terms of directors elected prior to the effective time of the amendment eliminating the classified Board of Directors, who shall serve the remainder of their term, each director shall hold office until the next annual meeting of the stockholders of the Corporation following such director’s election or appointment and, the foregoing notwithstanding, shall serve until his successor shall have been duly elected and qualified, unless he shall resign, become disqualified, disabled or shall otherwise be removed.”

“C. Subject to the rights of the holders of any one or more series of Preferred Stock then outstanding, newly created directorships resulting from any increase in the authorized number of directors or any vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office or other cause shall be filled solely by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors. Any director so chosen shall hold office until the next election of directors and until his successor shall be elected and qualified. No decrease in the number of directors shall shorten the term of any incumbent director.”

Article Ten, Sections C and D of the Company’s Certificate of Incorporation, which were provisions that only applied to a classified board, will be removed. Accordingly, Article Ten, Sections F, G and H will become Sections D, E and F, respectively.

The remaining provisions of our certificate of incorporation will remain the same and in full force and effect.

4

Table of Contents

Declassification of Board

Our primary purpose in originally adopting a certificate of incorporation with a classified board structure was to help assure continuity and stability in the management of the business and affairs of the company and thereby enhance the ability of the company to carry out long-range plans and goals for its benefit and the benefit of its stockholders. However, a classified board structure may discourage hostile attempts to acquire control of our company without first negotiating the acquisition with our board of directors because the extended and staggered terms of directors in a classified board generally operates to delay the acquisition of control of the board by a would-be acquirer for at least a year. During that time, the would-be acquirer would bear the risk of a large investment in a company that it did not control. A classified board may encourage a person seeking control of a corporation to negotiate with the board of directors of that corporation, which negotiations may result in a higher price or more favorable terms for stockholders or may give the board an opportunity to prevent a takeover that it believes is not in the best interests of the stockholders.

The classification of directors does have the effect of making it more difficult for stockholders to change the composition of the board of directors of the company. Some investors have come to view classified boards as having the effect of insulating directors from being accountable to a corporation’s stockholders. For example, a classified board of directors limits the ability of stockholders to elect all directors on an annual basis rather than waiting up to two additional years to replace some directors. It may also discourage proxy contests in which stockholders have an opportunity to vote for a competing slate of nominees. The election of directors is the primary means for stockholders to influence corporate governance policies and to hold management accountable for its implementation of those policies. A number of major corporations have determined that, regardless of the merits of a classified board in promoting continuity of management and experience and in deterring coercive takeover attempts, principles of good corporate governance dictate that all directors of a corporation be elected annually.

After due consideration of the various issues concerning the declassification of our board, the board of directors unanimously determined to propose to the stockholders the declassification of the board so that each director would stand for re-election on an annual basis. This determination by our board of directors is in furtherance of its goal of ensuring that our corporate governance policies comply with applicable rules and regulations and maximize our accountability to our stockholders.

Increase in Number of Directors

One of the purposes of the amendment to our certificate of incorporation is to enable us to take timely advantage of the availability of well-qualified candidates for our board of directors and to increase our ability to attract high-quality individuals to serve as directors. Our board of directors has deemed the amendment to be in the best interests of our stockholders because it believes that the presence of additional talented individuals with industry experience will enhance our ability to meet the challenges we face in an increasingly competitive market.

If the proposed amendment is adopted, we intend to immediately file it with the Secretary of State of the State of Delaware, at which time it will become effective. The amendment will be filed prior to the election of directors so that the directors to be elected at the annual meeting will serve one year terms which will expire at the 2005 annual meeting of stockholders. However, the amendment will not impact the current term of the directors which are not expiring at the 2004 annual meeting. After the amendment is filed, the board of directors will have the authority to increase or decrease the size of our board of directors, subject to the provisions of our certificate of incorporation and bylaws.

We Recommend That You Vote For Approval Of The Amendment To Our Certificate Of Incorporation.

5

Table of Contents

ELECTION OF DIRECTORS

Number of Directors To Be Elected

Our board is currently constituted with seven director positions. Two directors are to be elected at the 2004 annual meeting of stockholders. If the amendment to our certificate of incorporation is approved at the annual meeting, the two directors elected at the annual meeting will hold office until the 2005 annual meeting of stockholders or until their respective successors have been elected and qualified. If the amendment to our certificate of incorporation is not approved at the annual meeting, the newly elected directors will hold office until the 2007 annual meeting of stockholders or until their respective successors have been elected and qualified.

You may not vote for a greater number of directors than those nominated.

Our board of directors met in April 2004 and considered the candidates for election to the board at the 2004 annual meeting, and a majority of our independent directors recommended that the board nominate Marvin D. Brailsford and William T. Trawick for re-election at the 2004 annual meeting. In making these recommendations, the independent directors considered the requirements and qualifications discussed under “Board of Directors; Nominating Policies” on page 13 of this proxy statement. Based on this recommendation, our board has nominated Marvin D. Brailsford and William T. Trawick to be elected by the stockholders at the 2004 annual meeting. Both nominees have consented to serve as directors. The board has no reason to believe that either of the nominees will be unable or unwilling to act as a director. In the event either director is unable to stand for election, the board of directors may either reduce the size of the board or designate a substitute.

For biographical information regarding each of the board’s nominees for director, please refer to “General Information Regarding the Company; Board of Directors; Board Nominees” on page 11 of this proxy statement.

We Recommend That You Vote For Each Of The Board Nominees.

6

Table of Contents

APPROVAL OF THE AMENDMENT TO THE AMENDED AND RESTATED 2003 INCENTIVE STOCK OPTION PLAN

Effective January 2003, our board of directors adopted the Conn’s, Inc. Amended and Restated 2003 Incentive Stock Option Plan. The plan was approved by our stockholders at the January 17, 2003 special meeting of the stockholders of Conn Appliances, Inc., our predecessor corporation. The purpose of the plan is to secure for Conn’s and our stockholders the benefits of the incentives inherent in the ownership of our common stock by our present and future employees.

General Description of the Plan

Under the plan, officers and employees are eligible to receive awards in the form of stock options. At January 31, 2004, a total of 1,531,440 shares of common stock were issued and outstanding under the plan, 47,450 outstanding options had been exercised and 980,877 shares are currently available for issuance under the plan. All of the shares authorized for issuance under the plan have been approved by the stockholders and are registered on a Form S-8 filed with the SEC. Copies of the full text of the plan are available for review at our principal offices and we will furnish copies to our stockholders without charge upon written request directed to Conn’s, Inc., 3295 College Street, Beaumont, Texas 77701, Attention: Chief Financial Officer.

The plan is administered by our board of directors and the compensation committee of our board. Except as provided in the NASD exemptions, the members of the compensation committee must be “non-employee directors” as defined in Rule 16b-3 under the Securities Exchange Act of 1934 and “outside directors” as required under Section 162(m) of the Internal Revenue Code of 1986, as amended. Our compensation committee currently consists of Jon E.M. Jacoby, Theodore M. Wright and William T. Trawick. Mr. Jacoby is serving on the committee in accordance with the applicable NASD exemptions, and Messrs. Wright and Trawick are independent directors.

The board or the compensation committee has discretion in determining the terms, restrictions and conditions of each award granted under the plan. The board or the compensation committee is permitted, in its discretion, to change and/or rescind the terms of any award granted under the plan as long as such change or rescission does not adversely affect the rights of the award recipient as stated in the applicable award agreement.

The plan may be amended or terminated by the board or the compensation committee at any time. However, an amendment that would impair the rights of a recipient of any outstanding award will not be valid with respect to such award without the recipient’s consent. In addition, our stockholders must approve any amendment to increase the number of authorized shares under the plan, to change employees eligible to participate in the plan, to change the manner in which options are issued or exercised, to extend the term of the plan or to adopt any amendment which requires stockholder approval under NASD rules.

Proposed Amendment to the Plan

We proposed to amend the plan as follows:

Section 5(a) of the plan will be amended and restated to read as follows:

“(a) This Plan shall be administered by the Board or a Committee appointed by the Board, which Committee shall be constituted to comply with Applicable Laws. Notwithstanding the foregoing, the Chief Executive Officer of the Company shall have the ability to grant Options to non-executive officers of the Company under guidelines or formulae approved or adopted by the Committee.”

7

Table of Contents

Section 6(a) of the plan will be amended and restated to read as follows:

“(a) Options may be granted only to Employees. The maximum number of Shares with respect to which Options may be granted during a specified period to any single Employee is 2,559,767.”

The remaining provisions of the plan will remain the same and in full force and effect.

One of the purposes of the proposed amendment to the plan is to ensure that compensation related to stock options granted under the plan is considered performance-based compensation that is excluded from the $1 million deduction limit of Section 162(m) of the Internal Revenue Code and therefore remains fully deductible. Section 162(m) requires that (i) the grant must be made by the compensation committee; (ii) the plan under which the option is granted states the maximum number of shares with respect to which options may be granted during a specified period (usually a fiscal year or a calendar year) to any employee; and (iii) under the terms of the option, the amount of compensation the employee could receive is based solely on an increase in the value of the stock after the date of grant.

The other purpose of the amendment to the plan is to make the administration of the plan more efficient, which will further promote our ability to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to our employees and to promote the success of the Company’s business. Accordingly, the board of directors unanimously determined to propose to the stockholders the inclusion of a maximum number of shares with respect to which options may be granted during a specified period to any single employee, and to grant authority to the chief executive officer to grant options to non-executive officers.

Tax Effects of Participation in the Plan

The following is a brief summary of certain federal income tax consequences arising with respect to options granted under the plan. This summary is not intended to be exhaustive and the exact tax consequences to the participant will depend on various factors and his or her particular circumstances. This summary is based on present laws, regulations and interpretations and does not purport to be a complete description of federal tax consequences. This summary of federal tax consequences may change in the event of a change in the Internal Revenue Code or regulations thereunder or interpretations thereof. We urge participants to consult with a tax advisor with respect to any state, local and foreign tax considerations or particular federal tax implications of options granted under the plan prior to taking action with respect to an option. The plan is not intended to be a “qualified plan” under Section 401(a) of the Internal Revenue Code.

Withholding

We may deduct from all amounts paid by us to the participants in cash or other form, any federal, state, or local taxes required by law to be withheld with respect to such payments. The participant receiving shares of common stock issued under the plan upon the exercise of options will be required to pay us the amount of any taxes which we are required to withhold with respect to such shares of common stock.

Incentive Stock Options

The grant or exercise of an incentive stock option will not result in ordinary taxable income to the participant or a tax deduction for us. However, when the option is exercised, the difference between the exercise price and the fair market value of the stock on the date of exercise will be considered income for the purposes of the alternative minimum tax. Accordingly, the exercise of an incentive stock option may result in an alternative minimum tax liability.

Shares acquired pursuant to the exercise of an incentive stock option ordinarily receive capital gain or loss treatment on their sale or other disposition. However, if the holder disposes of the shares acquired upon the exercise of an incentive stock option within two years after the date of grant or one

8

Table of Contents

year after the date of exercise (a “disqualifying disposition”), the holder will generally recognize ordinary income in the amount of the excess of the fair market value of the shares on the date the option was exercised over the exercise price, and we will be entitled to a corresponding tax deduction, provided we comply with applicable income tax reporting requirements. Any excess of the amount realized by the holder on the disqualifying disposition over the fair market value of the shares on the date of exercise of the option will generally be a capital gain.

If an option is exercised through the use of shares previously owned by the holder, such exercise generally will not be considered a taxable disposition of the previously owned shares and thus no gain or loss will be recognized with respect to those shares upon such exercise.

Non-qualified Stock Options

Some of the options granted under the plan may be non-qualified stock options, that is, options not intended to be incentive stock options within the meaning of Section 422 of the Internal Revenue Code.

There are no tax consequences to the participant or us by reason of the grant of a non-qualified stock option. Upon exercise of a non-qualified stock option, the participant normally will recognize taxable ordinary income equal to the excess, if any, of the stock’s fair market value on the date the non-qualified stock option is exercised over the exercise price of the option. Upon disposition of the stock, the participant will recognize a gain or loss equal to the difference between the amount realized as a result of the sale and the sum of the exercise price plus any amount recognized as ordinary income when the non-qualified stock option was exercised or, if later, when the shares subject to the non-qualified stock option are no longer subject to a substantial risk of forfeiture. Such gain or loss will be long-term or short-term depending on whether the stock was held for more than the applicable capital gains holding period.

If we comply with applicable income reporting requirements, we will be entitled to a federal income tax deduction in the same amount and at the same time as the participant recognizes ordinary income, subject to any deduction limitation under Section 162(m) of the Internal Revenue Code, which is discussed below.

Section 162(m)

Section 162(m) of the Internal Revenue Code generally disallows a public company’s tax deduction for compensation paid in excess of $1 million in any tax year to its chief executive officer, or the individual acting in that capacity, and the four most highly compensated executives. However, compensation that qualifies as “performance-based compensation” is excluded from this $1 million deduction limit and therefore remains fully deductible by the company that pays it. We intend that options granted (i) with an exercise price at least equal to 100% of the fair market value of the underlying shares of common stock at the date of grant and (ii) to employees the compensation committee expects to be named executive officers at the time a deduction arises in connection with these options, qualify as “performance-based compensation” so these options will not be subject to the Section 162(m) deduction limitations.

Options Granted Under the Amended and Restated 2003 Incentive Stock Option Plan

As of January 31, 2004, the closing sale price of our common stock was $16.00 per share, as reported by Nasdaq. The following table sets forth information with respect to options granted to the listed persons and groups under the plan through January 31, 2004.

9

Table of Contents

Name and Principal Position | Number Of Shares Underlying Options | Grant Date | Exercise Price | Expiration Date | |||||

Thomas J. Frank, Sr., Chairman of the Board and Chief Executive Officer | 56,500 | 11/25/03 | $ | 14.00 | 11/24/13 | ||||

William C. Nylin, Jr., President and Chief Operating Officer | 56,500 28,070 | 11/25/03 7/15/01 | $ | 14.00 8.21 | 11/24/03 7/14/11 | ||||

C. William Frank, Executive Vice President and Chief Financial Officer | 48,500 29,680 70,000 | 11/25/03 7/15/01 7/28/00 | $ | 14.00 8.21 8.21 | 11/24/13 7/14/11 7/27/10 | ||||

David W. Trahan, Senior Vice President-Merchandising | 8,000 | 11/25/03 | $ | 14.00 | 11/24/13 | ||||

Walter M. Broussard, Senior Vice President-Store Operations | 8,000 45,500 | 11/25/03 1/25/01 | $ | 14.00 8.21 | 11/24/03 1/24/11 | ||||

All Current Executive Officers, as a Group (8 persons) | 220,000 204,750 94,500 119,000 | 11/25/03 7/15/01 1/25/01 7/28/00 | $ | 14.00 8.21 8.21 8.21 | 11/24/13 7/14/11 1/27/10 7/27/10 | ||||

All Current Directors Who Are Not Executive Officers, as a Group (6 persons) | 240,000 | 11/25/03 | $ | 14.00 | 11/24/13 | ||||

All Employees, Including All Current Officers Who Are Not Executive Officers, as a Group (52 persons) | 149,000 244,140 297,500 199,500 | 11/25/03 7/15/01 1/25/01 7/28/00 | $ | 14.00 8.21 8.21 8.21 | 11/24/13 7/14/11 1/27/10 7/27/10 | ||||

Equity Compensation Plan Information Prior to Stockholder Approval of the Amendment to the Plan

The following table provides information about our common stock that may be issued upon the exercise of options under all of our existing equity compensation plans as of January 31, 2004.

| (A) | (B) | (C) | |||||

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted- Average Exercise Price of Outstanding Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (A)) | ||||

Equity Compensation Plans Approved by Stockholders | 1,771,440 | $ | 10.26 | 1,040,877 | |||

Equity Compensation Plans Not Approved by Stockholders | — | — | — | ||||

Total | 1,771,440 | $ | 10.26 | 1,040,877 | |||

We Recommend That You Vote For Approval Of

The Amendment To The Conn’s, Inc. Amended and Restated 2003 Incentive Stock Option Plan.

10

Table of Contents

Our board of directors met in April 2004 and considered the candidates for election to the board at the 2004 annual meeting, and a majority of our independent directors recommended that the board nominate Marvin D. Brailsford and William T. Trawick for re-election at the 2004 annual meeting. Based on this recommendation, our board has nominated Marvin D. Brailsford and William T. Trawick to be elected by all of our stockholders.

Marvin D. Brailsford has served as a director since September 2003. From 1996 until 2002, General Brailsford served as Vice President-Material Stewardship Project Manager for the U.S. government’s Rocky Flats Environmental Technology Site where he was responsible for managing engineered systems and commodities purchasing. From 1992 to 1996, General Brailsford was president of the Brailsford Group, Inc., a management consulting company, and served as president of Metters Industries, Inc., an information technology and systems engineering company, during this time period. In 1992, he retired from the U.S. Army as a Lieutenant General, after 33 years of service, most recently where he served as Deputy Commanding General Materiel Readiness/Executive Director for Conventional Ammunition at the U.S. Materiel Command in Alexandria, Virginia. Since 1996, General Brailsford has served on the board of directors of Illinois Tool Works, Inc. and has been a member of its audit committee and chairman of its corporate governance committee. He also serves or has served on the boards of directors of various private and governmental entities. General Brailsford earned a B.S. degree in biology from Prairie View A & M University and a M.S. degree in bacteriology from Iowa State University. He is also a graduate of the Executive Program at the Graduate School of Business Administration, University of California at Berkley; Harvard University’s John F. Kennedy School of Government; the U.S. Army Command and General Staff College; and the Army War College. General Brailsford is 65 years old.

William T. Trawickhas served as a director since September 2003. Since August 2000, he has served as Executive Director of NATM Buying Corporation where he oversees the administrative activities of the multi-billion dollar regional group purchasing program of which we are a member. He also functions as a consultant to our merchandising department on an ongoing basis. From September 1996 to July 1999, Mr. Trawick served as our Vice President of Merchandising and was responsible for all product purchasing, merchandising and store operations. Mr. Trawick is 57 years old.

If the amendment to our certificate of incorporation is approved at the annual meeting, these directors will serve one year terms which expire at the 2005 annual meeting of stockholders. If the amendment is not approved, these directors will serve three year terms which expires at the 2007 annual meeting of stockholders.

Terms to Expire at 2005 Annual Meeting

Jon E. M. Jacobyhas served as a director since April 2003. Mr. Jacoby is a director of Stephens Group, Inc. and its wholly-owned subsidiary Stephens Inc. In September 2003, he retired as a Senior Executive Vice President of Stephens Inc., where he had been employed since 1963. His positions included Investment Analyst, Assistant to the President and Manager of the Corporate Finance Department and the Special Investments Department for Stephens Group, Inc. Mr. Jacoby serves on the board of directors of Delta and Pine Land Company, Power-One, Inc., Sangamo BioSciences, Inc. and Eden Bioscience Corporation. He received his B.S. from the University of Notre Dame and his M.B.A. from Harvard Business School. Mr. Jacoby is 66 years old.

Bob L. Martinhas served as a director since September 2003. Mr. Martin has over 31 years of retailing and merchandising experience. Prior to retiring from the retail industry in 1999, he headed the international operations of Wal-Mart International, Inc. for 15 years. From 1968 to 1983, Mr. Martin was responsible for technology services for Dillard’s, Inc. He currently serves on the board of directors of Dillard’s, Inc., Gap, Inc., Sabre Holdings Corporation and Edgewater Technology, Inc. He has experience as chairman of the corporate governance committee and compensation committee, and has been a member of the audit committee of publicly held companies. Mr. Martin attended South Texas University and holds an honorary doctorate degree from Southwest Baptist University. Mr. Martin is 55 years old.

11

Table of Contents

Terms to Expire at 2006 Annual Meeting

Thomas J. Frank, Sr. was appointed as our Chairman of the Board and Chief Executive Officer in 1994. He has been employed by us for 44 years, has been a member of our board of directors since 1980 and has held every key management position within the organization, including responsibilities for distribution, service, credit, information technology, accounting and general operations. Mr. Frank and C. William Frank are brothers. Mr. Frank holds a B.A. degree in industrial arts from Sam Houston State University and attended graduate courses at Harvard University and Texas A&M University. Mr. Frank is 64 years old.

Douglas H. Martinhas served as a director since 1998. Mr. Martin is an Executive Vice President of Stephens Group, Inc. and Stephens Inc., a wholly-owned subsidiary of Stephens Group, Inc., where he has been employed since 1981. He is responsible for the investment of the firm’s capital in private companies. Mr. Martin serves as a member of the board of directors of numerous privately held companies. He received his B.A. in physics and economics from Vanderbilt University and his M.B.A. from Stanford University. Mr. Martin is 50 years old.

Theodore M. Wrighthas served as a director since September 2003. Mr. Wright has served as the President of Sonic Automotive, Inc., a New York Stock Exchange listed and Fortune 300 automotive retailer, since October 2002 and has served as one of its directors since 1997. Previously Mr. Wright served as its chief financial officer from April 1997 to April 2003. From 1995 to 1997, Mr. Wright was a Senior Manager in Deloitte & Touche LLP’s Columbia, South Carolina office. From 1994 to 1995, he was a Senior Manager in Deloitte & Touche LLP’s National Office of Accounting Research and SEC Services Department. Mr. Wright received a B.A. from Davidson College. Mr. Wright is 41 years old.

During fiscal 2004, our board was constituted with seven director positions held by Thomas J. Frank, Sr., Marvin D. Brailsford, Jon E.M. Jacoby, Bob L. Martin, Douglas H. Martin, William T. Trawick and Theodore M. Wright.

The board has determined that the following directors are independent as defined by NASD listing standards: Marvin D. Brailsford, Bob L. Martin, William T. Trawick and Theodore M. Wright. The independent directors of the board have executive sessions scheduled for June 3, 2004 and November 30, 2004.

During fiscal 2004, the board held three regularly scheduled meetings. Each person serving as a director during fiscal 2004 attended all of the board meetings, except Messrs. Trawick and Bob Martin, both of whom missed one meeting.

Policy Regarding Director Attendance at the Annual Meeting of Stockholders

It is our policy that each member of the board of directors is encouraged to attend our annual meeting of stockholders.

Audit Committee

The Audit Committee recommends the appointment of our independent auditors. It also approves audit reports and plans, accounting policies, audit fees and certain other expenses. In connection with the rules adopted by the SEC and NASD, we adopted a revised written charter for the Audit Committee, which is attached to this proxy statement as Appendix A and is posted on our website atwww.conns.com under “Investor Relations”. The Audit Committee reviews and reassesses the adequacy of the written charter on an annual basis.

12

Table of Contents

Messrs. Wright, Douglas Martin and Brailsford serve on the Audit Committee. The Audit Committee held four meetings in fiscal 2004, which were attended by all of the members. The board has determined that Mr. Wright is an “audit committee financial expert” as defined by SEC rules. In addition, each of the members of the Audit Committee is “independent” as defined by the NASD listing standards and the Sarbanes-Oxley Act of 2002, except Mr. Douglas Martin who is serving on the Audit Committee until November 24, 2004, the first anniversary of the company’s listing on Nasdaq, in accordance with NASD regulations.

Compensation Committee

The Compensation Committee determines executive officer compensation and administers our compensation and incentive plans. The Compensation Committee also evaluates the competitiveness of our compensation and the performance of our executive officers, including our Chief Executive Officer. In connection with the rules adopted by the SEC and NASD, we adopted a revised written charter, which is posted on our website at www.conns.com under “Investor Relations.”

Messrs. Jacoby, Trawick and Wright serve on the Compensation Committee. The Compensation Committee held two regular meetings in fiscal 2004, which were attended by all the members. All members of the Compensation Committee are independent directors as defined by NASD regulations, except Mr. Jacoby who is serving on the Compensation Committee in accordance with exemptions pursuant to NASD regulations.

In preparation of our initial public offering, we conducted a thorough process of selecting qualified directors for our board. Both directors whose terms expire at this annual meeting were appointed in September 2003 in preparation for that offering. Given this fact, the size of our company and our board of directors, the fact that we have only one director that is employed by us, as well as the limited amount of time we, as a newly listed public company, have had to comply with new Nasdaq regulations and the Sarbanes-Oxley Act of 2002, we do not currently have a standing nominating committee. Our board believes that at this time it would not be a prudent use of our board’s resources to have a separate nominating committee and those resources are better utilized on our other committees and board functions. Thus, in accordance with Nasdaq rules, a majority of our independent directors will recommend director nominees for the board’s selection.

The goal of our board has been, and continues to be, to identify nominees for service on the board of directors who will bring a variety of perspectives and skills from their professional and business experience. In furtherance of this goal, our board had adopted nominating policies and procedures which are available on our website at www.conns.com under “Investor Relations.” The independent directors will consider candidates for nomination proposed by stockholders so long as they are made in accordance with the provisions of Section 2.14 of our Bylaws.

For the independent directors to consider candidates recommended by stockholders, Section 2.14 of our Bylaws requires that the stockholder provide notice to our Secretary not less than 90 days prior to the anniversary date of the immediately preceding annual meeting of the stockholders. The notice to our Secretary must set forth (a) as to each person whom the stockholder proposes to nominate for election or re-election as a director, information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected); (b) as to any other business that the stockholder proposes to bring before the meeting, a brief description of such business, the reasons for conducting such business at the meeting and any material interest of such stockholder in the business; and (c) as to the stockholder giving the notice (i) the name and address, as they appear on the company’s books, of such stockholder and (ii) the class and number of shares of voting stock of the company which are beneficially owned by such stockholder.

13

Table of Contents

The independent directors believe that the minimum requirements for a person to be qualified to be a member of the board of directors, are that a person must (i) be an individual of the highest character and integrity and have an inquiring mind, vision, a willingness to ask hard questions and the ability to work well with others; (ii) be free of any conflict of interest that would violate any applicable law or regulation or interfere with the proper and reasonable performance of the responsibilities of a director; (iii) be willing and able to devote sufficient time to the affairs of the company and be diligent in fulfilling the responsibilities of a director and board committee member (including developing and maintaining sufficient knowledge of the company and its industry; reviewing and analyzing reports and other information important to the board and committee responsibilities; preparing for, attending and participating in board and committee meetings; and satisfying appropriate orientation and continuing education guidelines); and (iv) have the capacity and desire to represent the balanced, best interest of the stockholders as a whole and not primarily a special interest group or constituency. The independent directors evaluate whether certain individuals possess the foregoing qualities and recommends to the board for nomination candidates for election or re-election as directors at the annual meeting of stockholders, or if applicable, at a special meeting of stockholders. This process is the same regardless of whether the nominee is recommended by our board or one of our stockholders.

In fiscal 2004, non-employee directors received an annual retainer of $5,000. Additionally, non-employee directors received $1,000 for each board meeting and $750 for each committee meeting attended and were reimbursed for their expenses in attending such meetings.

We adopted the 2003 Non-Employee Director Stock Option Plan in February 2003 in connection with our initial public offering. The plan is administered by the board of directors. Only non-employee directors are eligible grantees. Upon the closing of the initial public offering, we granted each of our then-current non-employee directors an option to purchase 40,000 shares of our common stock, and we will grant an option to purchase 40,000 shares of our common stock to any new board member. We will also grant our non-employee directors an option to purchase an additional 10,000 shares following each annual stockholders meeting on and after the fourth anniversary of each non-employee director’s initial election or appointment to the board of directors. All options issued to non-employee directors vest equally over a three year period. The board of directors has reserved 300,000 shares for issuance upon the exercise of options granted under the plan, subject to adjustment. The exercise price of each option is equal to the fair market value of our common stock at the time the option is granted. The options have a term of up to ten years. Upon a change in control or sale of the company, optionees have special vesting and exercise rights.

As permitted by the Delaware General Corporation Law, we have adopted provisions in our certificate of incorporation and bylaws that provide for the indemnification of our directors and officers to the fullest extent permitted by applicable law. These provisions, among other things, indemnify each of our directors and officers for certain expenses, including judgments, fines and amounts paid in settling or otherwise disposing of actions or threatened actions, incurred by reason of the fact that such person was a director or officer of Conn’s or of any other corporation which such person served in any capacity at the request of Conn’s.

In addition, we have entered into indemnification agreements with each of our directors pursuant to which we will indemnify them against judgments, claims, damages, losses and expenses incurred as a result of the fact that any director, in his capacity as a director, is made or threatened to be made a party to any suit or proceeding. The indemnification agreements also provide for the advancement of certain expenses (such as attorney’s fees, witness fees, damages, judgments, fines and settlement costs) to our directors in connection with any such suit or proceeding.

We maintain a directors’ and officers’ liability insurance policy to insure our directors and officers against certain losses resulting from acts committed by them in their capacities as our directors and officers, including liabilities arising under the Securities Act of 1933.

14

Table of Contents

Stockholder Communications with the Board

We have adopted a policy which allows stockholders to communicate directly with the board of directors. Stockholders may contact the board or any committee of the board by any one of the following methods:

| By telephone: | By mail: | By e-mail: | ||

| (409) 832-1696 Ext. 3218 | Board of Directors 3295 College Street Beaumont, Texas 77701 | Conns1890tf@aol.com | ||

All communications submitted under this policy will be compiled by the Compliance Officer of the company and submitted to the board or the requisite board committee on a periodic basis. Complaints or concerns relating to accounting, internal accounting controls or auditing matters will be referred to the Audit Committee under the policy adopted by the Audit Committee. This policy and procedure is posted on our website at www.conns.com under “Investor Relations”.

15

Table of Contents

The Committee

Our board of directors established the Audit Committee to recommend the appointment of our independent auditors and to oversee the company’s (i) financial reporting process; (ii) internal audits, control and authorities; (iii) treasury function and cash management policies; (iv) compliance with and performance against debt and other third party financing requirements; and (v) financial, tax, environmental and other risk management policies. The Audit Committee is composed of three members and operates under a written charter, a copy of which will be filed with this year’s proxy statement relating to our 2004 annual meeting of stockholders. The Audit Committee has prepared the following report on its activities with respect to the company’s financial statements for the fiscal year ended January 31, 2004.

Review and Discussion

Management is responsible for Conn’s financial reporting process including its system of internal controls, and for the preparation of Conn’s consolidated financial statements in accordance with generally accepted accounting principles. Ernst & Young LLP, the company’s independent auditors, is responsible for auditing those financial statements. It is the Audit Committee’s responsibility to monitor and review these processes. The members of the Audit Committee are not employees of Conn’s and do not represent themselves to be or to serve as, accountants or auditors by profession or experts in the field of accounting or auditing.

In connection with the preparation of the company’s audited financial statements for the fiscal year ended January 31, 2004, the Audit Committee:

| • | reviewed and discussed the audited financial statements with management; |

| • | discussed with Ernst & Young the matters required to be discussed by Statement on Auditing Standards No. 61; and |

| • | received the written disclosures and the letter from Ernst & Young required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with Ernst & Young its independence from Conn’s, including whether Ernst & Young’s provision of non-audit services to the company is compatible with the auditors’ independence. |

The Audit Committee meets with the company’s independent auditors to discuss the results of their examinations, their evaluations of the company’s internal controls and the overall quality of the company’s financial reporting. The Audit Committee held four meetings during the fiscal year ended January 31, 2004.

Recommendation

Based on the review and discussion referred to above, the Audit Committee recommended to the board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended January 31, 2004, for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE: |

Theodore M. Wright, Chairman |

Marvin D. Brailsford Douglas H. Martin |

16

Table of Contents

The Committee

The Compensation Committee determines the compensation of the company’s Chief Executive Officer and other executive officers of the company, evaluates the compensation plans, policies and programs applicable to executive officers of the company and makes recommendations to the board concerning such plans, policies and programs, advises the board regarding compensation plans, policies and programs applicable to non-employee directors for their services as a director and administers the company’s stock option, stock purchase and other plans, which under their terms are to be administered by the Compensation Committee.

Overall Philosophy and Objectives

We have developed a compensation program for executives and key employees designed to: (i) reward performance that increases the value of our common stock; (ii) attract, retain and motivate executives and key employees with competitive compensation opportunities; (iii) build and encourage ownership of our shares; and (iv) address the concerns of our stockholders, employees, the financial community and the general public.

To meet these objectives, we reviewed competitive compensation data and implemented the base salary and incentive programs discussed below.

Executive Compensation

The available forms of executive compensation include base salary, cash bonus awards and incentive stock options. Our performance is a key consideration in determining executive compensation. However, our compensation policy recognizes that stock price performance is only one measure of performance and, given industry business conditions and our long-term strategic direction and goals, it may not necessarily be the best current measure of executive performance. Therefore, our compensation policy also gives consideration to the achievement of specified business objectives when determining executive officer compensation. The Compensation Committee, in certain cases, offers employees and executive officers equity compensation in addition to salary in keeping with our overall compensation philosophy, which attempts to place equity in the hands of our employees in an effort to further instill stockholder considerations and values in the actions of all our employees and executive officers.

Compensation paid to executive officers is based upon a company-wide compensation structure that emphasizes incentive bonus compensation based upon individual and company performance and is consistent for each position relative to its authority and responsibility. Stock option awards in fiscal 2004 were used to reward certain officers and to retain them through the potential of capital gains and equity buildup in Conn’s. The number of stock options granted is determined by the subjective evaluation of the officer’s ability to influence our long-term growth and profitability. Stock options granted to our senior management have been granted only pursuant to our Amended and Restated 2003 Incentive Stock Option Plan. The board believes the award of options represents an effective incentive to create value for our stockholders.

CEO Compensation

The Compensation Committee established a base salary for Mr. Thomas Frank of $480,000 for fiscal year 2004. The Compensation Committee also awarded Mr. Thomas Frank a bonus of $900,000 for services rendered in fiscal year 2004. For the 2005 fiscal year, the Compensation Committee established a base salary for Mr. Thomas Frank of $480,000. The Compensation Committee deemed the 2004 bonus and the salary level for 2005 to be generally commensurate with the Chief Executive Officer’s position at comparable publicly owned companies and in recognition of the increased responsibilities associated with our growth, performance and public company status. In determining Mr. Thomas Frank’s salary and bonus, the Compensation Committee considered his industry experience, past performance and other subjective factors.

17

Table of Contents

The Compensation Committee believes that the Chief Executive Officer’s 2004 and 2005 compensation levels were and are justified by Conn’s financial progress and performance against the goals set by the Compensation Committee.

| COMPENSATION COMMITTEE: |

Jon E.M. Jacoby, Chairman William T. Trawick Theodore M. Wright |

18

Table of Contents

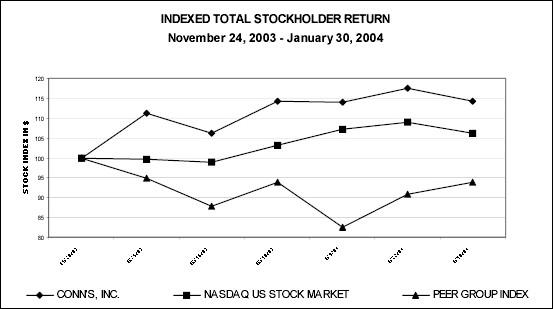

The following graph provides a comparison of the cumulative total stockholder return on our common stock against the Nasdaq U.S. Stock Market Index and the average of a peer group index comprised of five publicly traded consumer electronic and/or appliance retailers(1) since our initial public offering on November 24, 2003. Since we have not been publicly traded long enough to provide information on an annual basis, we have selected seven different measurement dates that are approximately equal periods of time between November 24, 2003 and January 30, 2004 (the last trading day of our fiscal year) for comparison purposes. The graph reflects the value of a $100 investment as of November 24, 2003 in either our stock or the indices presented at the dates of measurement, including reinvestment of dividends. The corresponding index values and common stock price values are summarized in the table below by measurement date.

TRADE DATE | CONN’S INDEX | NASDAQ U.S. STOCK MARKET INDEX | PEER GROUP STOCK INDEX1 | CONN’S CLOSING STOCK PRICE | ||||||||

November 24, 2003 | $ | 100.00 | $ | 100.00 | $ | 100.00 | $ | 14.00 | ||||

December 5, 2003 | 111.29 | 99.52 | 94.93 | 15.58 | ||||||||

December 16, 2003 | 106.07 | 98.83 | 87.70 | 14.85 | ||||||||

December 30, 2003 | 114.29 | 103.22 | 93.88 | 16.00 | ||||||||

January 9, 2004 | 113.86 | 107.18 | 82.58 | 15.94 | ||||||||

January 22, 2004 | 117.50 | 108.83 | 90.81 | 16.45 | ||||||||

January 30, 2004 | 114.29 | 106.11 | 93.87 | 16.00 | ||||||||

| (1) | The peer group index consists of the simple average of the indices of Sears, Roebuck & Co., Best Buy Co., Inc., Circuit City Stores, Inc., Ultimate Electronics, Inc. and Tweeter Home Entertainment Group, Inc. |

19

Table of Contents

The board appoints our executive officers at the first board meeting following our annual meeting of stockholders and updates the executive officer positions as necessary. Our executive officers serve at the discretion of the board and until their successors are elected and qualified or until the earlier of their death, resignation or removal.

The following sets forth certain biographical information regarding our executive officers, including service with Conn Appliances, Inc., our predecessor company:

Name | Age | Positions | Years of Service with Conn’s | |||

Thomas J. Frank, Sr. | 64 | Chairman of the Board and Chief Executive Officer | 44 | |||

William C. Nylin, Jr. | 61 | President and Chief Operating Officer | 11 | |||

C. William Frank | 57 | Executive Vice President and Chief Financial Officer | 6 | |||

David R. Atnip | 56 | Senior Vice President and Secretary/Treasurer | 11 | |||

Walter M. Broussard | 44 | Senior Vice President – Store Operations | 18 | |||

Robert B. Lee, Jr. | 57 | Senior Vice President – Advertising | 4 | |||

David W. Trahan | 43 | Senior Vice President – Merchandising | 16 | |||

Reymundo de la Fuente, Jr. | 43 | Senior Vice President – Credit | 5 |

Thomas J. Frank, Sr. was appointed as our Chairman of the Board and Chief Executive Officer in 1994. He has been employed by us for 44 years, has been a member of our board of directors since 1980 and has held every key management position within the organization, including responsibilities for distribution, service, credit, information technology, accounting and general operations. Mr. Frank and C. William Frank are brothers. Mr. Frank holds a B.A. degree in industrial arts from Sam Houston State University and attended graduate courses at Harvard University and Texas A&M University.

William C. Nylin, Jr. has served as our President and Chief Operating Officer since 1995. He became a member of our board of directors in 1993 and served in that capacity until September 2003. In addition to performing responsibilities as Chief Operating Officer, he has direct responsibility for credit granting and collections, information technology, human resources, distribution, service and training. From 1984 to 1995, Dr. Nylin held several executive management positions, including Deputy Chancellor and Executive Vice President of Finance and Operations at Lamar University. Dr. Nylin obtained his B.S. degree in mathematics from Lamar University and holds both a masters degree and a doctorate degree in computer sciences from Purdue University. He has also completed a post-graduate program at Harvard University.

C. William Frank has served as our Executive Vice President since October 2001 and as our Chief Financial Officer since joining us in 1997. He joined our board of directors in October 1997 and served in that capacity until September 2003. From 1992 to 1996, Mr. Frank served as Vice President and Chief Accounting Officer of Living Centers of America, a publicly held provider of long term healthcare facilities. Mr. Frank and Thomas J. Frank, Sr. are brothers. Mr. Frank obtained his undergraduate degree in accounting from Lamar University and his M.B.A. from Pepperdine University.

David R. Atnip has served as our Senior Vice President since October 2001 and as our Secretary/Treasurer since 1997. He joined us in 1992 and served as Chief Financial Officer from 1994 to 1997. In 1995, he joined our board of directors and served in that capacity until September 2003. Mr. Atnip holds a B.B.A. in accounting from The University of Texas at Arlington and has over 20 years of financial experience in the savings and loan industry.

Walter M. Broussard has served as our Senior Vice President - Store Operations since October 2001. Mr. Broussard has served us in numerous retail capacities since 1985, including working on the sales floor as a sales consultant, store manager and district manager. He has over 24 years of retail sales experience. He attended Lamar University and has completed special study programs at Harvard University, Rice University and the University of Notre Dame.

20

Table of Contents

Robert B. Lee, Jr. has served as our Senior Vice President - Advertising since October 2001. He joined us in 1999 as our Vice President - Advertising. His responsibilities include planning and implementing our $25 million advertising budget and our consumer research activities and validating geographical data for the site selection process. From 1990 until 1998, he was a partner in Ann Lee & Associates, a Beaumont-based advertising agency and public relations firm where he served as Chief Operating Officer. Mr. Lee obtained a B.B.A. from The University of Texas at Austin and completed a post-graduate program at the University of Notre Dame.

David W. Trahan has served as our Senior Vice President - Merchandising since October 2001. He has been employed by us since 1986 in various capacities, including sales, store operations and merchandising. He has been directly responsible for our merchandising and product purchasing functions, as well as product display and pricing operations, for the last three years. Mr. Trahan has completed special study programs at Harvard University, Rice University and Lamar University.

Reymundo de la Fuente, Jr. has served as our Senior Vice President - Credit since October 2001. Since joining us in 1998, he has served in positions that involve direct responsibility for credit underwriting, customer service inbound operations, collections, recovery of charge-offs and legal activities. Mr. de-la-Fuente has worked in the credit receivables industry since 1986 with national credit organizations. His responsibilities included the strategic direction and development of large credit portfolios. Mr. de la Fuente obtained his B.B.A. in finance from The University of Texas at San Antonio and holds an M.B.A. from Our Lady of the Lake in San Antonio.

Our board has adopted a code of business conduct and ethics for our employees, a code of ethics for our chief executive officer and senior financial professionals and a code of business conduct and ethics for our board of directors. A copy of these codes are published on our website at www.conns.com under “Investor Relations.” We intend to make all required disclosures concerning any amendments to, or waivers from, these codes on our website.

Summary Compensation Table

The following table sets forth the total compensation paid or accrued by us for the fiscal years ended January 31, 2003 and 2004 on behalf of each of our named executive officers.

Name and Position | Fiscal Year | All Other Compensation | ||||||||||

| Annual Compensation | Company to 401(k) Plan | |||||||||||

| Salary | Bonus | |||||||||||

Thomas J. Frank, Sr. Chairman of the Board and Chief Executive Officer | 2003 2004 | $ | 480,000 465,000 | $ | 825,000 900,000 | $ | 11,198 9,600 | (1) | ||||

William C. Nylin, Jr. President and Chief Operating Officer | 2003 2004 | $ | 250,000 290,000 | $ | 266,000 300,000 | $ | 11,243 9,804 | (1) | ||||

C. William Frank Executive Vice President and Chief Financial Officer | 2003 2004 | $ | 250,000 250,000 | $ | 230,000 250,000 | $ | 12,258 8,973 | (1) | ||||

David W. Trahan Senior Vice President-Merchandising | 2003 2004 | $ | 180,000 180,000 | $ | 168,500 180,000 | $ | 9,730 7,884 | | ||||

Walter M. Broussard Senior Vice President-Store Operations | 2003 2004 | $ | 144,000 144,000 | $ | 153,000 170,000 | $ | 8,388 7,752 | | ||||

| (1) | Includes $1,500 in fees paid to these officers for service as a director during fiscal 2004. |

21

Table of Contents

We have employment agreements with Thomas J. Frank, Sr., our Chairman of the Board and Chief Executive Officer, William C. Nylin, Jr., our President and Chief Operating Officer, C. William Frank, our Executive Vice President and Chief Financial Officer, and David R. Atnip, our Senior Vice President and Secretary/Treasurer. Under the terms of these employment agreements, each of our executive officers is entitled to payment of an annual salary plus a bonus based upon attainment of performance goals determined by our Compensation Committee, to participate in our employee benefit plans and to receive options to purchase shares of our common stock. In the event that we terminate the executive officer’s employment other than for cause or we do not renew the employment agreement when it expires, we are obligated to pay the executive officer severance in an amount equal to the executive officer’s annual base salary. All of our executive officers’ employment agreements with us contain confidentiality and other customary provisions.

Option Grants in Last Fiscal Year

Name | Number of Securities Underlying Options Granted | % of Total Granted in Fiscal 2003 | Exercise Price | Expiration Date | Potential Realizable Value at Assumed Annual Stock Price Appreciation for Option Term | |||||||||||

| 5% | 10% | |||||||||||||||

Thomas J. Frank, Sr. | 56,500 | 15.3 | % | $ | 14.00 | 11/24/13 | $ | 497,450 | $ | 1,260,650 | ||||||

William C. Nylin, Jr. | 56,500 | 15.3 | 14.00 | 11/24/13 | 497,456 | 1,260,650 | ||||||||||

C. William Frank | 48,500 | 13.1 | 14.00 | 11/24/13 | 427,019 | 1,082,151 | ||||||||||

Walter M. Broussard | 8,000 | 2.2 | 14.00 | 11/24/13 | 70,436 | 178,499 | ||||||||||

David W. Trahan | 8,000 | 2.2 | 14.00 | 11/24/13 | 70,436 | 178,499 | ||||||||||

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides certain information with respect to options to purchase common stock held by our named executive officers as of January 31, 2004.

Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-the-Money Options at Fiscal Year End | ||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Thomas J. Frank, Sr. | — | — | — | 56,500 | $ | — | $ | 113,000 | ||||||

William C. Nylin, Jr. | — | — | 11,228 | 73,342 | 87,474 | 244,211 | ||||||||

C. William Frank | — | — | 53,872 | 94,308 | 419,701 | 453,877 | ||||||||

Walter M. Broussard | — | — | 27,300 | 26,200 | 212,687 | 143,791 | ||||||||

David W. Trahan | — | — | — | 8,000 | — | 16,000 | ||||||||

Employee Equity Incentive Plans

Amended and Restated 2003 Incentive Stock Option Plan