Exhibit 10.4

EXECUTION COPY

SERVICING AGREEMENT

among

CONN’S RECEIVABLES FUNDING 2016-A, LLC,

AS ISSUER,

CONN’S RECEIVABLES 2016-A TRUST,

AS RECEIVABLES TRUST,

CONN APPLIANCES, INC.,

AS SERVICER,

and

WELLS FARGO BANK, NATIONAL ASSOCIATION,

AS TRUSTEE

DATED AS OF MARCH 17, 2016

TABLE OF CONTENTS

| | | | |

| | | | | Page |

ARTICLE I | | DEFINITIONS | | |

Section 1.01 | | Defined Terms | | 1 |

Section 1.02 | | Definitions | | 4 |

Section 1.03 | | Other Definitional Provisions | | 5 |

ARTICLE II | | ADMINISTRATION AND SERVICING OF RECEIVABLES AND RELATED SECURITY | | |

Section 2.01 | | Appointment of Servicer | | 5 |

Section 2.02 | | Duties of Servicer | | 6 |

Section 2.03 | | Purchase of Ineligible Receivables | | 13 |

Section 2.04 | | Purchase of Returned and Refinanced Receivables | | 13 |

Section 2.05 | | Rights After Designation of New Servicer | | 14 |

Section 2.06 | | Servicer Default | | 17 |

Section 2.07 | | Servicer Indemnification of Indemnified Parties | | 18 |

Section 2.08 | | Grant of License | | 18 |

Section 2.09 | | Servicing Compensation | | 19 |

Section 2.10 | | Representations and Warranties of the Servicer | | 19 |

Section 2.11 | | Reports and Records for the Trustee | | 22 |

Section 2.12 | | Reports to the Commission | | 23 |

Section 2.13 | | Affirmative Covenants of the Servicer | | 23 |

Section 2.14 | | Negative Covenants of the Servicer | | 24 |

Section 2.15 | | Sale of Defaulted Receivables | | 25 |

ARTICLE III | | RIGHTS OF NOTEHOLDERS AND ALLOCATION AND APPLICATION OF COLLECTIONS | | |

Section 3.01 | | Establishment of Accounts | | 26 |

Section 3.02 | | Collections and Allocations | | 26 |

ARTICLE IV | | OTHER SERVICER POWERS | | |

Section 4.01 | | Appointment of Paying Agent | | 27 |

Section 4.02 | | [Reserved.] | | 27 |

ARTICLE V | | OTHER MATTERS RELATING TO THE SERVICER | | |

Section 5.01 | | Liability of the Servicer | | 27 |

Section 5.02 | | Limitation on Liability of the Servicer and Others | | 27 |

Section 5.03 | | Servicer Not to Resign | | 28 |

Section 5.04 | | Waiver of Defaults | | 28 |

i

TABLE OF CONTENTS

| | | | | | |

| | | | | Page | |

ARTICLE VI | | ADDITIONAL OBLIGATION OF THE SERVICER WITH RESPECT TO THE TRUSTEE | | | | |

Section 6.01 | | Successor Trustee | | | 28 | |

Section 6.02 | | Tax Returns | | | 28 | |

Section 6.03 | | Final Payment with Respect to Any Series | | | 29 | |

Section 6.04 | | Optional Purchase of Receivables Trust Estate | | | 29 | |

ARTICLE VII | | MISCELLANEOUS PROVISIONS | | | | |

Section 7.01 | | Amendment | | | 30 | |

Section 7.02 | | Protection of Right, Title and Interest to Receivables and Related Security | | | 31 | |

Section 7.03 | | Governing Law | | | 32 | |

Section 7.04 | | Notices | | | 32 | |

Section 7.05 | | Severability of Provisions | | | 32 | |

Section 7.06 | | Delegation | | | 32 | |

Section 7.07 | | Waiver of Trial by Jury | | | 33 | |

Section 7.08 | | Further Assurances | | | 33 | |

Section 7.09 | | No Waiver; Cumulative Remedies | | | 33 | |

Section 7.10 | | Counterparts | | | 33 | |

Section 7.11 | | Third-Party Beneficiaries | | | 33 | |

Section 7.12 | | Actions by Noteholders | | | 33 | |

Section 7.13 | | Rule 144A Information | | | 33 | |

Section 7.14 | | Merger and Integration | | | 34 | |

Section 7.15 | | Headings | | | 34 | |

Section 7.16 | | Rights of the Trustee | | | 34 | |

Section 7.17 | | Sales Tax Proceeds | | | 34 | |

Section 7.18 | | Limitation of Liability | | | 34 | |

EXHIBITS | | | | | | |

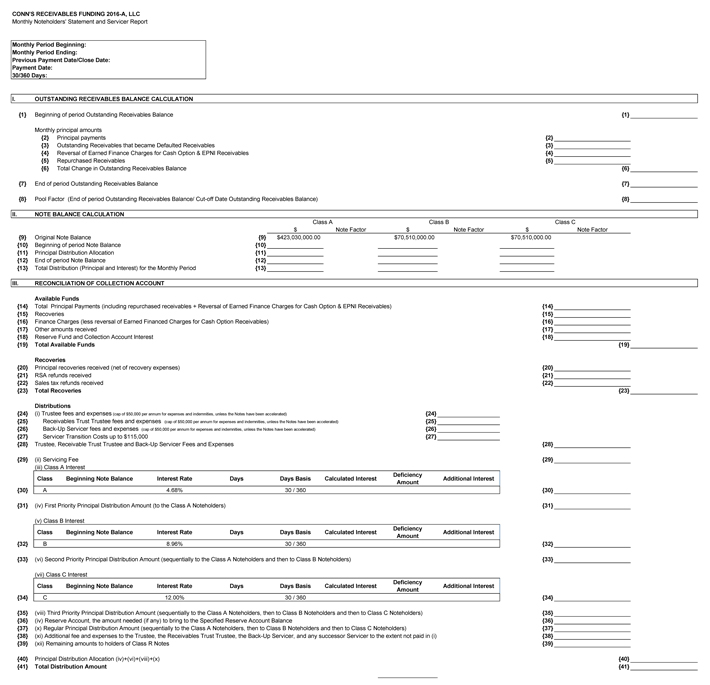

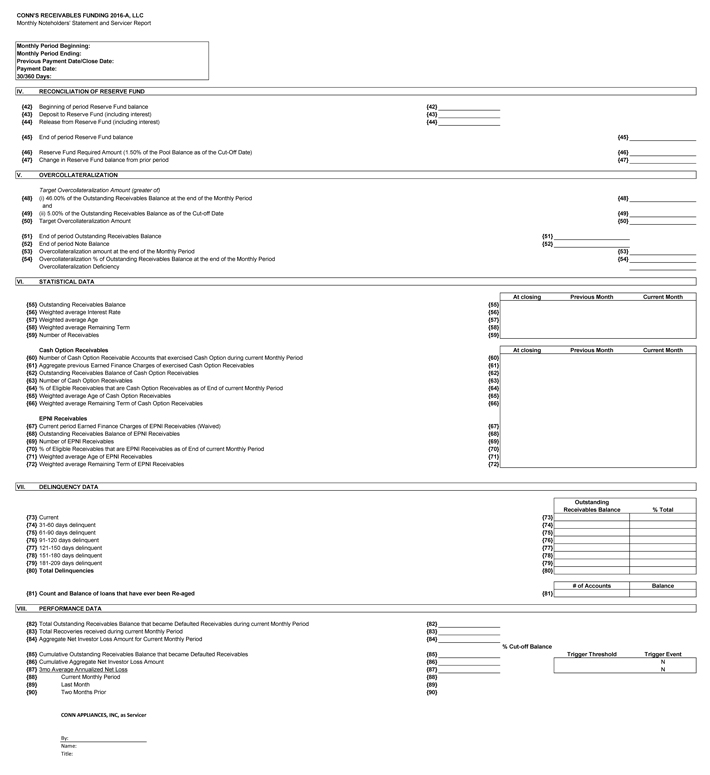

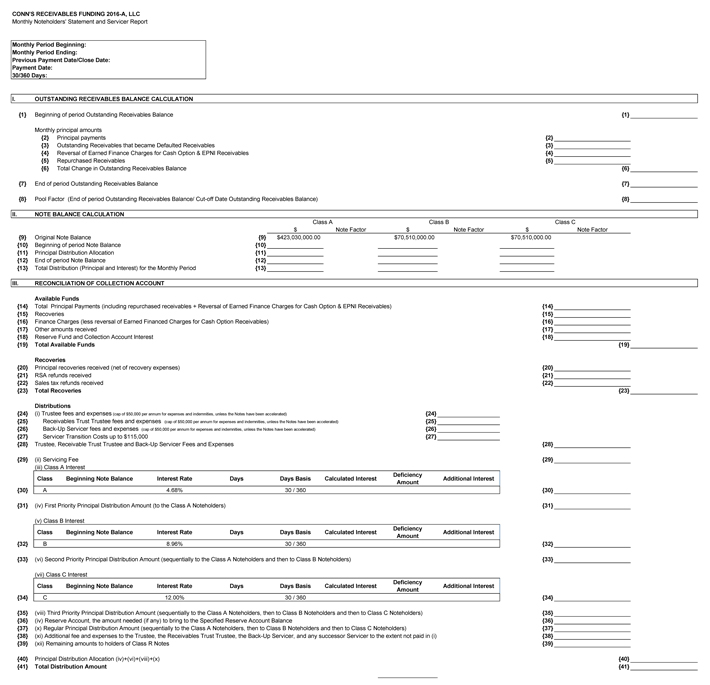

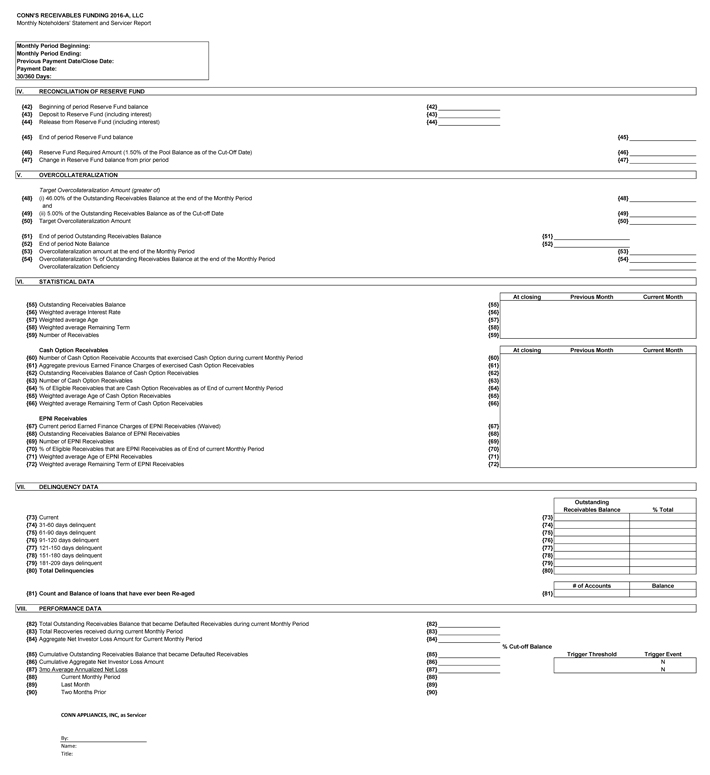

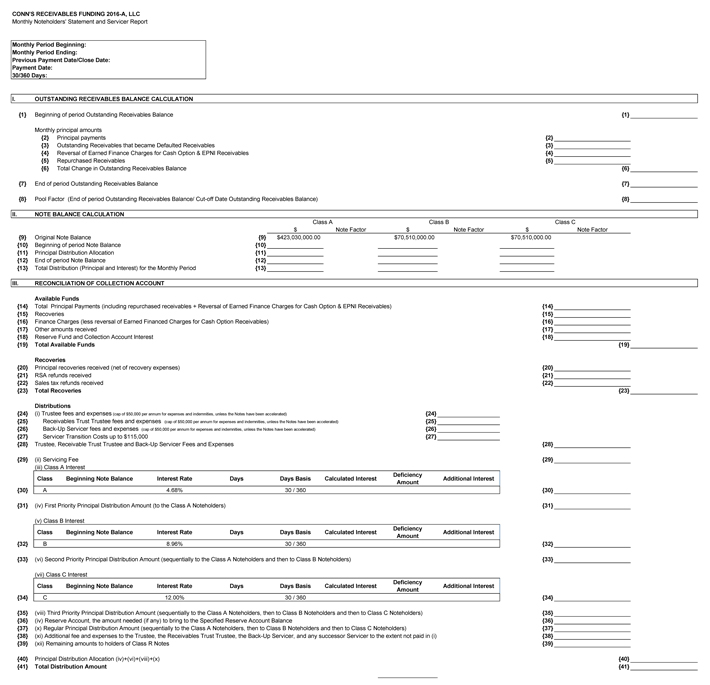

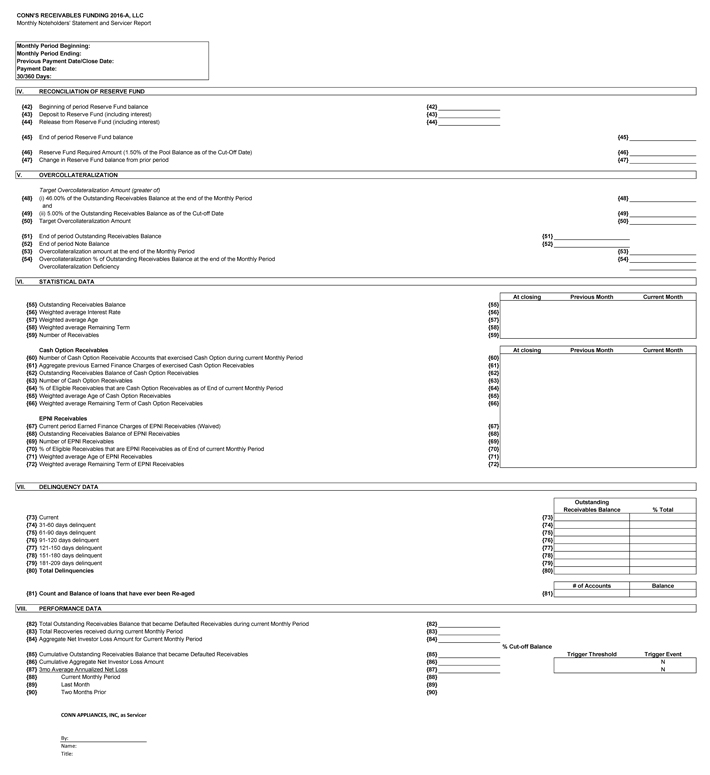

Exhibit A | | Form of Monthly Servicer Report | | | | |

Exhibit B | | Form of Annual Servicer’s Certificate | | | | |

SCHEDULES | | | | | | |

Schedule 2.08 (i) | | Litigation | | | | |

ii

SERVICING AGREEMENT dated as of March 17, 2016 (the “Agreement”) by and amongCONN’S RECEIVABLES FUNDING 2016-A, LLC, a Delaware limited liability company, as issuer (the “Issuer”),CONN’S RECEIVABLES 2016-A TRUST, a Delaware statutory trust, as receivables trust (the “Receivables Trust”), CONN APPLIANCES, INC., a Texas corporation (“Conn Appliances”), as initial Servicer, andWELLS FARGO BANK, NATIONAL ASSOCIATION, a national banking association, as trustee under the Indenture (defined below) (in such capacity, together with its successors and assigns in such capacity, the “Trustee”).

WHEREAS, the Receivables Trust has purchased from Conn Appliances Receivables Funding, LLC (the “Depositor”), and the Depositor purchased from Conn Credit I L.P. Contracts, Receivables and other Related Security relating to such Receivables pursuant to the terms of and subject to the conditions set forth in the Second Receivables Purchase Agreement, dated as of March 17, 2016 between the Depositor and the Receivables Trust.

WHEREAS, the Issuer is entering into a Base Indenture and a supplement thereto, each dated as of March 17, 2016 (the Base Indenture, as amended, supplemented or otherwise modified from time to time, the “Indenture”), between the Issuer and the Trustee, and each of the other Transaction Documents to which it is a party, pursuant to which the Issuer plans to issue Notes in order to finance its purchase of the Receivables Trust Certificate which represents the ownership of the Receivables Trust which owns the Contracts, Receivables and other Related Security relating to such Receivables.

WHEREAS, the Servicer is willing to service all Receivables and other Related Security acquired by the Receivables Trust, pursuant to the terms and subject to the conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

Section 1.01Defined Terms. As used in this Agreement, the following terms have the following meanings:

“Back-Up Servicer” means Systems & Services Technologies, Inc., together with its permitted successors and assigns, in such capacity.

“Back-Up Servicing Agreement” is defined in Section 2.01(b).

“Conn Appliances” is defined in the preamble.

“Consolidated Net Worth” means at any date, with respect to any Person, the consolidated stockholders’ equity of such Person and its consolidated Subsidiaries, minus (to the extent reflected in determining such consolidated stockholders’ equity) all intangible assets (in each case, as determined in accordance with GAAP, applied on a basis consistent with the most recent audited financial statements of such Person before the Closing Date).

“Custodian” is defined inSection 2.02(a)(ii).

“Depositor” is defined in the first recital.

“Field Collections” is defined inSection 2.02(c).

“Indemnified Parties” is defined inSection 2.07.

“Indenture” is defined in thesecond recital.

“In-Store Payments” is defined inSection 2.02(c).

“Issuer” is defined in thepreamble.

“Mail Payments” is defined in Section 2.02(c).

“Optional Purchase” is defined in Section 6.04.

“Optional Purchase Price” means an amount equal to the fair market value of the Receivables on the date on which the Optional Purchase will occur, provided, however, that the Optional Purchase Price shall not be less than accrued and unpaid interest, if applicable, then due on the Series 2016-A Notes and the aggregate unpaid principal, if any, of all of the outstanding Series 2016-A Notes plus an amount sufficient to pay (A) the Servicing Fee (including to any successor servicer) for such Payment Date and all unpaid Servicing Fees with respect to prior Payment Dates and (B) the Trustee, Receivables Trust Trustee and Back-Up Servicer Fees and Expenses for such Payment Date and all unpaid Trustee, Receivables Trust Trustee and Back-Up Servicer Fees and Expenses with respect to prior Payment Dates, after giving effect to the Available Funds for such Payment Date).

“Permitted Modification” means any change to or modification (for the avoidance of doubt, any modification made solely as required by applicable law shall be deemed to be a “Permitted Modification”) of the terms of a Receivable, including the timing or amount of payments on the Receivable, so long as one of the following conditions has been satisfied:

| | a. | any change or modification, individually and collectively with any other change or modification proposed to be made with respect to the Receivable, is ministerial in nature; |

| | b. | any change or modification is (i) granted to an Obligor in accordance with the Servicer’s Credit and Collection Policies and (ii) such change or modification (including when taken together with any other prior change or modification) does not result in a Significant Modification; |

2

| | c. | any change or modification where (i) the Obligor is in payment default or (ii) in the judgment of the Servicer, in accordance with the Servicer’s Credit and Collection Policies, it is reasonably foreseeable that the Obligor will default (it being understood that the Servicer may proactively contact any Obligor whom the Servicer believes may be at higher risk of a payment default under the related Receivable); or |

| | d. | any extension, deferral, amendment, modification, alteration or adjustment, including a “payment holiday” or “skip-a-pay” extension granted to an Obligor that is made (I) in accordance with the Servicer’s Credit and Collection Policies and (II) with respect to which the Servicer has delivered an Opinion of Counsel to the Issuer, the Receivables Trust, the Trustee and the Receivables Trust Trustee to the effect that such extension, deferral, amendment, modification, alteration or adjustment, including a “payment holiday” or “skip-a-pay” extension will not result in or not cause the Receivables Trust (or any part thereof) to be classified, for United States federal income tax purposes, as an association (or a publicly traded partnership) taxable as a corporation or as other than a fixed investment trust described in Treasury Regulation section 301.7701-4(c) that is treated as a grantor trust under subpart E, Part I of subchapter J of the Code. |

“Post Office Box” means, collectively, post office box 815867 and post office box 815868, each in Dallas, Texas 75234, and, upon notice to Trustee, each other post office box opened and maintained by the Receivables Trust or the Servicer for the receipt of Collections from Obligors and governed by a Post Office Box Agreement reflecting that such post office box is in the name of the Receivables Trust, as any such post office boxes may be closed from time to time by the Servicer with prior written notice to the Trustee (provided that (i) there shall at all times be at least one post office box open to receive Collections, (ii) the Servicer takes customary and prudent procedures to notify Obligors to make payments to such post office box and (iii) the closing or opening of any post office box is consistent with the servicing standard set forth in Section 2.02(b)(ii)).

“Post Office Box Agreement” means an agreement by and among the Servicer and the United States Postal Service, which is a standard post office box agreement, specifying the rights of the parties in the Post Office Box.

“Purchase Amount” shall have the meaning assigned to such term inSection 2.03.

“Purchase Event” has the meaning assigned to that term inSection 2.03.

“Purchase Payment” has the meaning assigned to that term inSection 2.03.

3

“Refinanced Receivable” has the meaning assigned to that term inSection 2.04.

“Returned/Refinanced Receivables” has the meaning assigned to that term inSection 2.04.

“Returned Receivable” has the meaning assigned to that term inSection 2.04.

“Servicer” is defined inSection 2.01(a).

“Servicer Default” is defined inSection 2.06.

“Servicing Fee” is defined inSection 2.09.

“Significant Modification” means any of the following changes (taking changes that occurred prior to acquisition of the Receivables by the Receivables Trust into account) to a Receivable:

| | a. | lowering the principal amount of a Receivable if the reduction lowers the yield of the Receivable by more than the greater of (x) 25 basis points or (y) 5 percent of the annual yield of the unmodified Receivable; |

| | b. | making any change in interest rate of a Receivable or other payments which results in the change in the annual yield of more than the greater of (x) 25 basis points or (y) 5 percent of the annual yield of the unmodified Receivable; and |

| | c. | deferral of any payment on the Receivable beyond the due date for that payment that would result in a deferral of payments for a period of more than the lesser of 5 years or 50% of the original term of the Receivable taking into account, in the aggregate, all deferments and deferrals. |

“Specified Servicer Default” means any Servicer Default of the type specified inparagraph (d) ofSection 2.06.

“SST” means Systems & Services Technologies, Inc.

“Successor Servicer” is defined inSection 2.01(b)(i).

“Trustee” is defined in thepreamble.

Section 1.02Definitions. Capitalized terms used but not defined herein shall have the respective meanings given to such terms in the Indenture and, to the extent applicable, the Series Supplement.

4

Section 1.03Other Definitional Provisions.

(a) All terms defined in this Agreement shall have the defined meanings when used in any certificate or other document made or delivered pursuant hereto unless otherwise defined therein.

(b) Where the character or amount of any asset or liability or item of income or expense is required to be determined, or any accounting computation is required to be made, for the purpose of this Agreement, such determination or calculation shall be made in accordance with GAAP. When used herein, the term “financial statement” shall include the notes and schedules thereto. All accounting determinations and computations hereunder or under any other Transaction Documents shall be made without duplication.

(c) [Reserved.]

(d) The words “hereof,” “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement; and Section, subsection, Schedule and Exhibit references contained in this Agreement are references to Sections, subsections, Schedules and Exhibits in or to this Agreement unless otherwise specified.

ARTICLE II

ADMINISTRATION AND SERVICING

OF RECEIVABLES AND RELATED SECURITY

Section 2.01Appointment of Servicer.

(a) The servicing, administering and collection of the Receivables shall be conducted by such Person (the “Servicer”) so designated from time to time in accordance with thisSection 2.01. Until the Trustee gives notice to Conn Appliances of the designation of a new Servicer pursuant to thisSection 2.01, Conn Appliances is hereby designated as, and hereby agrees to perform the duties and obligations of, the Servicer pursuant to the terms hereof. The Servicer may not delegate any of its rights, duties or obligations hereunder, or designate a substitute Servicer, without the prior written consent of the Trustee and the Receivables Trust;provided,however, that the Servicer shall be permitted to delegate its duties hereunder to any of its Affiliates and may use subservicers, contractors or agents but will remain obligated and liable for the performance of any such delegated duties as if it were performing such duties itself.

(b) (i) After the occurrence of a Servicer Default, the Trustee may, and upon the direction of the Required Noteholders or in the case of a Specified Servicer Default shall, in accordance with the provisions set forth inclause (ii) below, appoint the Back-Up Servicer pursuant to the Back-Up Servicing Agreement dated as of the date hereof (as amended, supplemented or otherwise

5

modified from time to time, the “Back-Up Servicing Agreement”), among the Back-Up Servicer and the various other parties thereto or any other successor servicer (SST, or any other successor servicer so appointed in accordance with the terms of Section 2.01(b)(ii) below, in such capacity, the “Successor Servicer”) to succeed to Conn Appliances as Servicer hereunder.

(ii) If (x) the Back-Up Servicer, on the date of its appointment as Successor Servicer or at any time following such appointment, fails or is unable to perform the duties of the Servicer hereunder or has previously resigned or otherwise been terminated as Back-Up Servicer, or (y) any other Person designated Successor Servicer in accordance with thisSection 2.01 resigns, fails or is unable to perform the duties of the Servicer hereunder following its appointment as Successor Servicer, the Trustee may with the consent of the Required Noteholders, and upon the direction of the Required Noteholders shall, appoint as Servicer any Person to succeed the then-current Servicer on the condition in each case that any such Person so appointed shall agree to perform the duties and obligations of the Servicer pursuant to the terms hereof. Until such time as the Person so appointed becomes obligated to begin acting as Servicer hereunder, the then current Servicer will continue to perform all servicing functions under this Agreement and the other Servicer Transaction Documents. If the Trustee is not able to appoint a new Servicer to succeed Conn Appliances, the Back-Up Servicer or any other Person then acting as Servicer, within a reasonable time following the date upon which it is required to so appoint a successor to the Servicer pursuant to thisSection 2.01 (but in any event not later than 30 days following such date), the Trustee shall at the expense of the Issuer (as Certificateholder of the Receivables Trust) petition a court of competent jurisdiction to appoint as the Servicer hereunder any established financial institution having, a net worth of not less than $25,000,000 and whose regular business includes the servicing of receivables comparable to the Receivables which are the subject of this Agreement. Following any appointment of a Successor Servicer pursuant to thisSection 2.01, the Trustee will provide notice thereof to the Issuer, the Receivables Trust, the Depository, the Depositor and the Noteholders.

(c) The Trustee shall not be responsible for any differential between the Servicing Fee and any compensation paid to a Successor Servicer hereunder.

Section 2.02Duties of Servicer.

(a) (i) The Servicer shall take or cause to be taken all such action as may be reasonably necessary or advisable to collect each Receivable from time to time, all in accordance with applicable Laws, with reasonable care and diligence, and in accordance with the Credit and Collection Policies and otherwise in accordance with the Servicer Transaction Documents. Each of the Receivables Trust, Issuer (as Certificateholder of the Receivables Trust), each Noteholder by

6

its acceptance of the related Notes and each of the other Secured Parties, hereby appoints as its agent the Servicer, from time to time designated pursuant toSection 2.01 hereof, to enforce its respective rights and interests in and under the Contracts, Receivables and Related Security, Collections and proceeds with respect thereto. To the extent permitted by applicable law, each of the Receivables Trust and Conn Appliances (to the extent not then acting as Servicer hereunder) hereby grants to any Servicer appointed hereunder all rights and powers of the Receivables Trust and/or Conn Appliances, as the case may be, under the Contracts and with respect to the Related Security, and hereby grants an irrevocable power of attorney to take in the Receivables Trust’s and/or Conn Appliances’ name and on behalf of the Receivables Trust or Conn Appliances any and all steps necessary or desirable, in the reasonable determination of the Servicer, to collect all amounts due under any and all Receivables, including, without limitation, to cancel any policy of insurance, make demands for unearned premiums, commence enforcement proceedings, exercise other powers under a Contract, execute and deliver instruments of satisfaction or cancellation, or full or partial discharge, with respect to Receivables, endorse the Receivables Trust’s, the Issuer’s and/or Conn Appliances’ name on checks and other instruments representing Collections and enforce such Receivables and the related Contracts. The Servicer shall, as soon as practicable following receipt thereof, turn over to Conn Appliances any collections of any Indebtedness of any Person which is not on account of a Receivable. The Servicer shall not voluntarily make the Receivables Trust, the Issuer, the Trustee, any Noteholder or any of their respective agents a party to any litigation without the prior written consent of such Person other than any litigation adverse to such person. Without limiting the generality of the foregoing and subject toSection 2.04, the Servicer is hereby authorized and empowered unless such power and authority is revoked in writing by the Trustee (as designee of the Receivables Trust) pursuant to the terms of the Servicer Transaction Documents (A) to make deposits into the Collection Account as set forth in this Agreement and the Indenture; provided, however, that with respect to any Successor Servicer, nothing contained in any Servicer Transaction Document shall impose an obligation on such Successor Servicer to make any withdrawals or payments from the Collection Account or any other Trust Account, (B) to instruct the Trustee in writing, substantially in the form of the Monthly Servicer Report, to make deposits or withdrawals and payments from the Collection Account, the Payment Account and any Series Account, in accordance with such instructions as set forth in the Indenture, (C) to instruct or notify the Trustee in writing as set forth in this Agreement and, the Indenture, (D) to make all calculations, allocations and determinations required of the Servicer under the Indenture and as required herein or to establish Series Accounts, (E) to execute and deliver, on behalf of the Receivables Trust for the benefit of the Issuer and the Noteholders, any and all instruments of satisfaction or cancellation, or of partial or full release or discharge, and all other comparable instruments, with respect to the Receivables and the other Contracts and Related Security and, after any delinquency in payment relating to any Receivable, to the extent permitted under and in compliance with applicable law and regulations, to

7

commence enforcement proceedings with respect thereto (including cancellation of the related insurance policy) and (F) in the case of the initial Servicer only, to make any filings, reports, notices, applications, registrations with, and to seek any consents or authorizations from, the Securities and Exchange Commission and any state securities authority on behalf of the Issuer as may be necessary or advisable to comply with any federal or state securities or reporting requirements.

(ii) Subject to the terms and conditions of thisSection 2.02(a)(ii), the Servicer shall maintain custody and possession of the Receivable Files on behalf of, and as bailee for, the Receivables Trust (for the benefit of the Trustee, the Issuer, the Noteholders and the other Secured Parties) (in such capacity, together with its successors and assigns, the “Custodian”).

(A) Custodian agrees to maintain possession of the related Receivable Files at its offices where they are presently maintained, at the offices of the related subcustodians or at such other offices of Custodian as shall from time to time be identified to Trustee by written notice. Custodian shall segregate physical Receivable Files from other files maintained by Custodian and shall, to the extent a Receivable File is stored in electronic format, maintain an authoritative electronic copy of each Receivable File on a data tape or other electronic media in a fire-resistant safe or room. The Receivables Trust hereby appoints Conn Appliances, and Conn Appliances hereby agrees to act, as initial Custodian hereunder. Custodian may, at the Servicer’s request, temporarily deliver individual Receivable Files or any portion thereof to Servicer without notice as necessary to conduct collection and other servicing activities in accordance with the Credit and Collection Policies.

(B) As custodian and bailee, Custodian shall hold the Receivable Files (by itself and/or through subcustodians) on behalf of the Receivables Trust (for the benefit of the Trustee, the Issuer, the Noteholders and the other Secured Parties) and, by agreeing to act as Custodian, is deemed to have received notice of the security interests of the Secured Parties in the Contracts and related Receivables. As custodian and bailee, Custodian shall maintain accurate records pertaining to each Receivable to enable it to comply with the terms and conditions of this Agreement, maintain a current inventory thereof and conduct periodic physical inspections of Receivable Files held by it under this Agreement and attend to all other details in connection with maintaining custody of the Receivable Files.

(C) In performing its duties under thisSection 2.02(a)(ii), Custodian agrees to act with reasonable care, using that degree of skill and care that it exercises with respect to similar contracts owned and/or serviced by it. Custodian shall promptly report to the Receivables Trust and the Trustee any material failure by it to hold the Receivable Files as herein provided and shall promptly take appropriate action to remedy such failure. In acting as custodian of the Receivable Files, Custodian agrees further not to assert, and shall cause each

8

related subcustodian not to assert any beneficial ownership interests in the Receivables. Custodian agrees to indemnify the Receivables Trust, Trustee, the Secured Parties and Issuer, and their respective officers, directors, employees, partners and agents for any and all liabilities, obligations, losses, damages, payments, costs, or expenses of any kind whatsoever which may be imposed on or incurred by any such Person arising from the negligence or willful misconduct of Custodian in maintaining custody of the Receivable Files pursuant to thisSection 2.02(a)(ii);provided,however, that Custodian will not be liable to the extent that any such amount resulted from the negligence or willful misconduct of such Person.

(D) The appointment of Custodian shall terminate upon acceptance of the appointment of a Successor Servicer in accordance with this Agreement. The Successor Servicer, by acceptance of its appointment, shall become the successor Custodian. Promptly following the appointment of a successor Custodian, and in any event within five days of such appointment, the then-existing Custodian shall (at such Custodian’s sole cost and expense if a Servicer Default shall have occurred or if such Custodian shall have been removed for cause) deliver all of the Receivable Files in its possession, and all records maintained by it with respect thereto, to such successor Custodian.

(b) (i) Servicer shall service and administer the Receivables on behalf of the Receivables Trust (for the benefit of the Issuer, the Trustee and the other Secured Parties) and shall have full power and authority, acting alone and/or through subservicers, contractors or agents as provided inSection 2.02(b)(iii), to do any and all things which it may deem reasonably necessary or desirable in connection with such servicing and administration and which are consistent with this Agreement and the other Servicer Transaction Documents. Consistent with the terms of this Agreement and the other Servicer Transaction Documents, Servicer (or any agent on Servicer’s behalf) may waive, modify or vary any term of any Receivable or consent to the postponement of strict compliance with any such term or in any manner, grant indulgence to any Obligor if, in Servicer’s sole discretion, such waiver, modification, postponement or indulgence will maximize collections on such Receivable;provided,however, that Servicer (or any agent on Servicer’s behalf) may not permit any modification with respect to any Receivable unless such modification is a Permitted Modification, is in accordance with the Credit and Collection Policies and, in the case of any extension of the final maturity date of a Receivable, such extension does not extend beyond the Legal Final Payment Date and the total amount of extensions of such Receivables is not in excess of twenty-four months unless such extension is as a result of or required by applicable law or judicial order. Without limiting the generality of the foregoing, Servicer in its own name or in the name of the Receivables Trust is hereby authorized and empowered by the Receivables Trust when Servicer believes it appropriate in its reasonable judgment to execute and deliver, on behalf of the Receivables Trust, any and all instruments of satisfaction or cancellation, or of partial or full release or discharge and all other comparable instruments, with respect to the Receivable.

9

(ii) Servicer shall service and administer the Receivables by employing such procedures (including collection procedures) and degree of care, in each case consistent with industry standards, as are customarily employed by Servicer in servicing and administering contracts and notes owned or serviced by Servicer comparable to the Receivables.

(iii) Servicer may perform any of its duties pursuant to this Agreement, including those delegated to it pursuant to this Agreement, through subservicers, contractors or agents appointed by Servicer. Such subservicers may include Affiliates of Servicer. Notwithstanding any such delegation of a duty, Servicer shall remain obligated and liable for the performance of such duty as if Servicer were performing such duty.

(iv) Servicer may take such actions as are necessary to discharge its duties as Servicer in accordance with this Agreement, including the power to execute and deliver on behalf of Issuer such instruments and documents as may be customary, necessary or desirable in connection with the performance of Servicer’s duties under this Agreement (including consents, waivers and discharges relating to the Receivable).

(v) Servicer shall keep separate records covering the transactions contemplated by this Agreement including the identity and collection status of each Receivable.

(c)Collections. (i) On or prior to the Closing Date, initial Servicer shall have established and shall maintain thereafter the following system of collecting and processing Collections of Receivables. Servicer shall direct the Obligors to make payments of Receivables only (A) by check mailed to the Post Office Box (such payments, upon receipt in such Post Office Box being referred to herein as “Mail Payments”), (B) by cash, credit card or check delivered in person or by phone at retail stores or other business locations of initial Servicer (such payments, upon receipt by such stores, being referred to herein as “In-Store Payments”), (C) by third party money wire transfer, ACH or other bill pay service that provides for the electronic deposit of funds into an account of the Servicer on behalf of Obligors, (D) by utilizing the Servicer’s Webpay portal; or (E) by cash, credit card or check delivered in person or by phone or by an agent of Conn Appliances at a service center of Conn Appliances or, in the case of certain delinquent accounts, to employees of Conn Appliances operating out of a service center of Conn Appliances or Servicer (such payments, upon receipt by the service center, being referred to herein as “Field Collections”). Notwithstanding anything to the contrary in thisSection 2.02(c), any Successor Servicer shall collect and process Collections of Receivables in any manner that is in accordance with the servicing standard set forth herein.

10

(ii) Servicer’s right of access to the Post Office Box and the Collection Account shall be revocable at the option of Trustee as designee of the Receivables Trust (acting in its own discretion or at the direction of the Required Noteholders) upon the occurrence of any Default, Event of Default or Servicer Default. In addition, after the occurrence of any Default, Event of Default or Servicer Default, Servicer agrees that it shall, upon the written request of Trustee, notify all Obligors under Receivables to make payment thereof to (i) one or more bank accounts and/or post-office boxes designated by Trustee and specified in such notice or (ii) any Successor Servicer appointed hereunder. The Trustee may, and shall at the request of the Required Noteholders, if any Default, Event of Default or Servicer Default has occurred, require the Servicer to establish a lockbox account pursuant to a lockbox agreement acceptable to the Trustee, and with notice to the Notice Person, to direct all Obligors under Receivables to make payments to such lockbox account.

(iii) Servicer shall remove or cause all Mail Payments to be removed from the Post Office Box by the close of business on each Business Day. Servicer shall process all such Mail Payments and all Field Collections on the date received by recording the amount of the payment received from the Obligor and the applicable account number. Subject to Section 5.4(a) of the Indenture, no later than the close of business on the second Business Day following the date on which Mail Payments are received in the Post Office Box or Field Collections are received by Servicer, Servicer shall deposit or cause such Mail Payments and such Field Collections to be deposited in the Collection Account. Subject to Section 5.4(a) of the Indenture, the Originator and Servicer shall cause all In-Store Payments to be (i) processed as soon as possible after such payments are received by the Originator or Servicer but in no event later than the Business Day after such receipt, and (ii) deposited in the Collection Account no later than two Business Days following the date of such receipt. Subject to Section 5.4(a) of the Indenture, Servicer shall deposit all Recoveries into the Collection Account within two Business Days after the date of its receipt of such Recoveries.

(iv) [Reserved].

(v) All Collections received by Servicer in respect of Receivables will, pending remittance to the Collection Account as provided herein, be held by Servicer in trust for the exclusive benefit of Trustee (on behalf of the Receivables Trust) and shall not, unless otherwise permitted by the Servicer Transaction Documents, be commingled with any other funds or property of the Originator, Depositor or Servicer except as otherwise permitted in accordance with Section 5.4 of the Indenture. Only Collections shall be deposited in the Collection Account. The Servicer may cause to be withdrawn from the Collection Account such amounts that have been deposited into the Collection Account in error not representing Collections or other proceeds of the

11

Trust Estate and any amounts that are deposited by Servicer that relate to checks rejected by the Obligor’s bank for insufficient funds.

(vi) Each of Depositor, the Receivables Trust, Issuer and Servicer hereby irrevocably waive any right to set off against, or otherwise deduct from, any Collections.

(vii) The Receivables Trust, Issuer and initial Servicer hereby transfer, assign, pledge, set over and convey to Trustee all of their right, title and interest in and to the Collection Account and the other Trust Accounts.

(viii) All payments or other amounts collected or received by Servicer in respect of a Receivable shall be applied to the Outstanding Receivables Balance of such Receivable.

(d) [Reserved.]

(e) (i) (A) [Reserved.]

(B) If SST is then acting as Successor Servicer, it shall cause a firm of independent certified public accountants, which may also render other services to SST or its affiliates, to deliver to the Issuer, the Receivables Trust, and the Trustee, within 120 days after the end of each fiscal year thereafter, commencing in the year after SST becomes Successor Servicer, (i) an opinion by a firm of nationally recognized independent certified public accountants on the financial position of SST at the end of the relevant fiscal year and the results of operations and changes in financial position of SST for such year then ended on the basis of an examination conducted in accordance with generally accepted auditing standards, and (ii) a report from such independent certified public accountants to the effect that based on an examination of certain specified documents and records relating to the servicing of SST’s loan portfolio conducted substantially in compliance with SSAE 16 (the “Applicable Accounting Standards”), such firm is of the opinion that such servicing has been conducted in compliance with the Applicable Accounting Standards except for (a) such exceptions as such firm shall believe to be immaterial and (b) such other exceptions as shall be set forth in such statement.

(ii) The Servicer will deliver to the Trustee and each Notice Person on or before the one year anniversary of the Closing Date and on each anniversary thereof, a certificate in substantially the form ofExhibit B of an authorized officer of the Servicer stating that (a) a review of the activities of the Servicer during the preceding year and of its performance under this Agreement was made under the supervision of the officer signing such certificate and (b) to the best of such officer’s knowledge, based on such review, the Servicer has fully performed in all material respects all of its obligations under this Agreement and each other applicable Servicer Transaction Document to which it is a party

12

throughout such period, or, if there has been a default in the performance of any such obligation, specifying such default known to such officer and the nature and status thereof.

(f) Notwithstanding anything to the contrary contained in this Article II, the Servicer, if not Conn Appliances or any Affiliate of Conn Appliances, shall have no obligation to collect, enforce or take any other action described in this Article II with respect to any Indebtedness that is not included in the Trust Estate other than to deliver to the Issuer the collections and documents with respect to any such Indebtedness as described inSection 2.02(a) hereof.

Section 2.03Purchase of Ineligible Receivables.

(a) If the representation and warranty of the initial Servicer contained inSection 2.10(d) was not true and correct with respect to any Contract and related Receivable as of the Cut-Off Date in any material respect that materially and adversely impacts such Contract and the related Receivable (a “Purchase Event” and any such Receivable, an “Ineligible Receivable”), the initial Servicer shall, at the request of the Trustee, purchase such Ineligible Receivable with ten (10) Business Days after demand thereof from the Receivables Trust for an amount (the “Purchase Amount”) equal to the then Outstanding Receivables Balance of such Ineligible Receivable at the time of such purchase (any such payment a “Purchase Payment”).

(b) The initial Servicer and the Receivables Trust agree that after payment of the Purchase Amount for an Ineligible Receivable as provided inclause (a) above, such Ineligible Receivable shall no longer constitute a Receivable for purposes of the Transaction Documents.

(c) Except as expressly set forth herein, the initial Servicer shall not have any right under this Agreement, by implication or otherwise, to purchase from the Receivables Trust any Receivables.

(d) The obligation of the initial Servicer to purchase an Ineligible Receivable pursuant to thisSection 2.03 will survive the termination of this Agreement or the earlier resignation or removal of the initial Servicer.

Section 2.04Purchase of Returned and Refinanced Receivables

(a) Notwithstanding anything to the contrary herein, the initial Servicer shall purchase any Receivable from the Receivables Trust to the extent that (i) the Merchandise related to such Receivable is returned by an Obligor (a “Returned Receivable”), or (ii) the Receivable is fully refinanced in connection with the purchase after the Cut-Off Date by the related Obligor of additional Merchandise using the initial Servicer’s in-house credit (a “Refinanced Receivable,” and, together with Returned Receivables, the “Returned/Refinanced Receivables”).

13

(b) The initial Servicer shall purchase any Returned/Refinanced Receivables pursuant toclause (a) for an amount equal to the Purchase Amount for the applicable Returned/Refinanced Receivable.

(c) The initial Servicer and the Receivables Trust agree that after payment of the Purchase Amount for a Returned/Refinanced Receivables as provided inclause (a) above, such Returned/Refinanced Receivable shall no longer constitute a Receivable for purposes of the Transaction Documents

Section 2.05Rights After Designation of New Servicer. (a) At any time following the designation of a Successor Servicer (other than Conn Appliances or an Affiliate thereof) pursuant toSection 2.01 hereof:

(i) The Trustee may, at its option, or shall, at the direction of the Required Noteholders, direct that payment of all amounts payable under any Receivable be made directly to the Trustee or its designee.

(ii) The Receivables Trust shall, at the Trustee’s request, (A) assemble all of the records relating to the Receivables and other Related Security, and shall make the same available to the Trustee or its designee at a place selected by the Trustee or its designee, and (B) segregate all cash, checks and other instruments received by it from time to time constituting Collections of Receivables in a manner acceptable to the Trustee and shall, promptly upon receipt, remit all such cash, checks and instruments, duly endorsed or with duly executed instruments of transfer, to the Trustee or its designee.

(iii) The Receivables Trust hereby authorizes the Trustee and the Issuer (as Certificateholder of the Receivables Trust) to take any and all steps in the Receivables Trust’s name and on behalf of the Receivables Trust necessary or desirable, in the reasonable determination of the Trustee, to collect all amounts due under any and all Receivables, including, without limitation, endorsing the Receivables Trust’s name on checks and other instruments representing Collections and enforcing such Receivables and the related Contracts.

(iv) Upon delivery of a Notice of Appointment (as defined in the Back-Up Servicing Agreement) to the Back-Up Servicer, Conn Appliances shall designate one or more employees acceptable to the Successor Servicer to assist the Successor Servicer with respect to In-Store Payments so long as Conn Appliances continues to accept, or the Successor Servicer permits, In-Store Payments to be made as described herein; provided, however, such employee of Conn Appliances shall in no event be deemed an employee, agent, custodian or nominee of the Successor Servicer and the Successor Servicer shall have no responsibility or liability for any negligence or willful misconduct of such employee or for such employee’s failure to assist the Successor Servicer (including

14

without limitation any acts or omissions unrelated to the transactions contemplated hereby). Upon the request of the Successor Servicer to the Trustee, 100% of the Noteholders may direct the Successor Servicer to designate an employee of Successor Servicer to be assigned to any or all Conn Appliances stores to oversee the collection of In-Store Payments at such stores. Each such employee shall be placed at such store at the expense of the Issuer (as Certificateholder of the Receivables Trust) at the monthly rate reflected in the SST Fee Schedule.

(b) The Successor Servicer may accept and reasonably rely on all accounting and servicing records and other documentation provided to the Successor Servicer by or at the direction of the predecessor Servicer, including documents prepared or maintained by the Originator, or previous servicer, or any party providing services related to the Contracts, the Receivables and other Related Security (collectively, “third party”). The predecessor Servicer agrees to indemnify and hold harmless the related Successor Servicer, its respective officers, employees and agents against any and all claims, losses, penalties, fines, forfeitures, legal fees and related costs, judgments, and any other costs, fees and expenses that the Successor Servicer may sustain in any way related to the negligence or willful misconduct of any third party hired by or at the direction of such predecessor Servicer, any Affiliate of such predecessor Servicer or any of their respective agents with respect to the Contracts, the Receivables and other Related Security. The Successor Servicer shall have no duty, responsibility, obligation or liability (collectively, “liability”) for the acts or omissions of any such third party. If any error, inaccuracy or omission (collectively, “error”) exists in any information provided to the Successor Servicer and such errors cause or materially contribute to the Successor Servicer making or continuing any error (collectively, “continuing errors”), the Successor Servicer shall have no liability for such continuing errors; provided, however, that this provision shall not protect the Successor Servicer against any liability which would otherwise be imposed by reason of willful misconduct or negligence in discovering or correcting any error or in the performance of its duties contemplated herein.

In the event the Successor Servicer becomes aware of errors and/or continuing errors that, in the opinion of the Successor Servicer, impair its ability to perform its obligations hereunder, the Successor Servicer shall promptly notify the other parties hereto of such errors and/or continuing errors. The Successor Servicer may undertake to reconstruct any data or records appropriate to correct such errors and/or continuing errors and to prevent future continuing errors. The Successor Servicer shall be entitled to recover its costs thereby expended from the predecessor Servicer.

Neither the Successor Servicer nor any of the directors or officers or employees or agents of the Successor Servicer shall be under any liability to the other parties hereto except as provided in this Agreement for any action taken or for refraining from the taking of any action in good faith pursuant to this Agreement;provided, however, that this provision shall not protect the Successor Servicer or any such Person against any liability that would otherwise be imposed by reason of willful misconduct, bad faith or negligence in the performance of duties, by reason of reckless disregard of obligations and duties under this Agreement or any violation of law by the Successor Servicer or such Person, as the case may be. The Successor Servicer and any director, officer, employee or agent of the Successor Servicer may rely in good faith on the advice of counsel or on any document of any kindprima facie properly executed and submitted by any Person respecting any matters arising under this Agreement.

15

The Successor Servicer will not be responsible for delays attributable to the predecessor Servicer’s failure to deliver information, defects in the information supplied by such predecessor Servicer or other circumstances beyond the reasonable control of the Successor Servicer. In addition, the Successor Servicer (and in the case of clauses (A) and (C) below, if a Servicing Officer of the Successor Servicer has actual knowledge of errors, which in the reasonable opinion of the Successor Servicer impair its ability to perform its services hereunder, after reasonable inquiry), shall have no responsibility and shall not be in default hereunder or incur any liability for any act or omission, failure, error, malfunction or any delay in carrying out any of its duties under this Agreement for: (A) any such failure or delay that results from the Successor Servicer acting in accordance with information prepared or supplied by a Person other than any Person hired by the Successor Servicer, the Successor Servicer or the failure of any such other Person (including without limitation the predecessor Servicer, but excluding any Person hired by the Successor Servicer) to prepare or provide such information or other circumstances beyond the control of the Successor Servicer; (B) any act or failure to act by any third party (other than those hired by the Successor Servicer), including without limitation the predecessor Servicer, the Receivables Trust, the Issuer and the Trustee; (C) any inaccuracy or omission in a notice or communication received by the Successor Servicer from any third parties (other than those hired by the Successor Servicer); (D) the invalidity or unenforceability of any Contracts, the Receivables and Related Security under applicable law; (E) the breach or inaccuracy of any representation or warranty made with respect to the Contracts, the Receivables and Related Security; or (F) the acts or omissions of any predecessor or successor Servicer.

The Servicer, the Issuer and the Receivables Trust agree to reasonably cooperate with the Successor Servicer in effecting the assumption of its responsibilities and rights under this Agreement. The Servicer shall provide to the Successor Servicer all necessary servicing files and records relating to the Contracts, the Receivables and Related Security (as deemed necessary by the Successor Servicer at such time on a reasonable basis) and the initial Servicer shall use all commercially reasonable efforts to provide to the Successor Servicer access to and transfer of records and use by the Successor Servicer of all licenses, servicing system, software, hardware, equipment, telephony, personnel, employees, facilities or other accommodations necessary or desirable to collect the Contracts, in all cases, subject to the terms of the Intercreditor Agreement, if applicable. The departing Servicer (if SST, only upon termination for cause) shall be obligated to pay the costs associated with the transfer of servicing files and records to the Successor Servicer. The Receivables Trust, the Issuer and the Trustee, and the Successor Servicer shall take such action, consistent with this Agreement, as shall be necessary to effectuate any such succession.

Indemnification by the Servicer under this Article shall be paid solely by the Servicer and not from the Trust Estate, and shall include, without limitation, reasonable fees and expenses of counsel and expenses of litigation. If the indemnifying party has made any indemnity payments pursuant to thisSection 2.03(b) and the recipient thereafter collects any of such amounts from others, the recipient shall promptly repay such amounts collected to the indemnifying party, without interest.

16

Section 2.06Servicer Default. The occurrence of any one or more of the following events shall constitute a Servicer default (each, a “Servicer Default”):

(a) failure by the Servicer (or, for so long as Conn Appliances is the Servicer, Conn Appliances) to make any payment, transfer or deposit under this Agreement or any other Servicer Transaction Document or to provide the Monthly Servicer Report to the Trustee to make such payment, transfer or deposit or any withdrawal on or before the date occurring five (5) days after the date such payment, transfer or deposit is required to be made or given, as the case may be, under the terms of this Agreement or any other Servicer Transaction Document (or in the case of a payment, transfer, deposit, instruction or notice to be made or given with respect to any Interest Period, by the related Payment Date);

(b) failure on the part of the Servicer (or, for so long as the Servicer is Conn Appliances, Conn Appliances) to duly observe or perform any other covenants or agreements of the Servicer set forth in this Agreement or any other Servicer Transaction Document, which failure continues unremedied for a period of thirty (30) days after the earlier of discovery by the Servicer or the date on which written notice of such failure, requiring the same to be remedied, shall have been given to the Servicer by the Trustee, the Receivables Trust, the Receivables Trust Trustee or the Issuer; or the Servicer shall assign its duties under this Agreement, except as permitted by Article II;

(c) any representation, warranty or certification made by the Servicer in this Agreement or any other Servicer Transaction Document or in any certificate delivered pursuant to this Agreement or any other Servicer Transaction Document shall prove to have been incorrect when made and which continues unremedied for a period of thirty (30) days after the date on which the Servicer has actual knowledge thereof or on which written notice thereof, requiring the same to be remedied, shall have been given to the Servicer by the Trustee, the Issuer or the Receivables Trust Trustee;

(d) the Servicer shall become the subject of any Event of Bankruptcy or shall voluntarily suspend payment of its obligations;

(e) for so long as Conn Appliances is the Servicer, the failure of Consolidated Parent to maintain Consolidated Net Worth of at least the sum of $250,000,000; or

(f) at any time that Conn Appliances is Servicer, a final judgment or judgments for the payment of money in excess of $5,000,000 in the aggregate shall have been rendered against the Issuer or Conn Appliances and the same shall have remained unsatisfied and in effect, without stay of execution, for a period of thirty (30) consecutive days after the period for appellate review shall have elapsed.

17

Section 2.07Servicer Indemnification of Indemnified Parties. (A) The Servicer (if other than SST as successor Servicer) will indemnify, defend and hold harmless the Trustee, the Receivables Trust Trustee, the Issuer, the Receivables Trust, the Back-Up Servicer, the successor Servicer and the Noteholders, and (B) SST as successor Servicer will indemnify and hold harmless the Trustee, on behalf of the Noteholders, the Receivables Trust Trustee, on behalf of the holder of the Receivables Trust Certificate, the Issuer and the Receivables Trust (in each case, together with their respective successors and permitted assigns) and each of their respective agents, officers, members and employees (each, a “Servicer Indemnified Party” and, collectively, the “Servicer Indemnified Parties”), from and against any claim, loss, liability, expense, damage or injury suffered or sustained by reason of such Servicer’s negligence in the performance of or failure to perform its duties or obligations under the Servicer Transaction Documents or Servicer’s willful misconduct or breach by the Servicer of any of its representations or warranties contained in this Agreement, including any judgment, award, settlement, reasonable attorneys’ fees and other costs or expenses reasonably incurred in connection with the defense of any actual action, proceeding or claim;provided,however, that the Servicer shall not indemnify any Servicer Indemnified Party for any such acts or omissions attributable to the negligence or willful misconduct of such Servicer Indemnified Party. Any indemnification pursuant to this Section shall be had only from the assets of the Servicer and shall not be payable from Collections except to the extent such Collections are released to the Servicer in accordance withSection 5.15 of the Indenture in respect of the Servicing Fee. The provisions of such indemnity shall run directly to and be enforceable by such Servicer Indemnified Parties.

The Issuer (as Certificateholder of the Receivables Trust) will indemnify and hold harmless the Servicer and its officers, directors, employees, representatives and agents (each, an “Issuer Indemnified Party”), from and against and reimburse the Servicer for any and all claims, expenses, obligations, liabilities, losses, damages, injuries (to person, property, or natural resources), penalties, stamp or other similar taxes, actions, suits, judgments, reasonable costs and expenses (including reasonable attorney’s and agent’s fees and expenses) of whatever kind or nature regardless of their merit, demanded, asserted or claimed against the Servicer directly or indirectly relating to, or arising from, claims against the Servicer by reason of its participation in the transactions contemplated hereby, including without limitation all reasonable costs required to be associated with claims for damages to persons or property, and reasonable attorneys’ and consultants’ fees and expenses and court costs; provided, however, that the Issuer shall not indemnify any Issuer Indemnified Party for any such acts or omissions attributable directly or indirectly to the negligence or willful misconduct of such Issuer Indemnified Party or, other than with respect to SST as successor Servicer, for any breach by the Servicer of any of the Servicer Transaction Documents. The provisions of this section shall survive the termination of this Agreement or the earlier resignation or removal of the Servicer.

Section 2.08Grant of License. For the purpose of enabling the Back-Up Servicer or any other Successor Servicer to perform the functions of servicing and collecting the Receivables upon a Servicer Default, Conn Appliances hereby (i) assigns, to the extent not prohibited by law or the terms of any agreement to which Conn Appliances is a party or by which it is deemed bound (by the terms thereof or by acceptance of a license), to the Trustee for the benefit of the Secured Parties and shall be deemed to assign to the Trustee for the benefit of the Secured Parties, the Back-Up Servicer or any other Successor Servicer all rights owned or hereinafter acquired by Conn Appliances (by license, sublicense, lease, easement or otherwise)

18

in and to any equipment used for servicing (or reasonable access thereto) together with a copy of any software used in connection with the performance of its duties as Servicer and relating to the Servicing and collecting of Receivables, (ii) agrees to use all reasonable efforts to assist the Trustee for the benefit of the Secured Parties, the Back-Up Servicer or any other Successor Servicer to arrange licensing agreements with all software vendors and other applicable persons in a manner and to the extent reasonably appropriate to effectuate the servicing of the Receivables, (iii) agrees to deliver to the Trustee, the Back-Up Servicer or any Successor Servicer executed copies of any landlord waivers that may be necessary to grant to the Trustee, the Back–Up Servicer or any other Successor Servicer access to any leased premises of Conn Appliances for which the Trustee, the Back-Up Servicer or any other Successor Servicer may require access to perform the collection and administrative functions to be performed by the Trustee, the Back-Up Servicer or any Successor Servicer under the Servicer Transaction Documents and (iv) agrees that it will terminate its activities as Servicer hereunder in a manner which the Trustee the Back-Up Servicer or any Successor Servicer reasonably believes will facilitate the transition of the performance of such activities to the Back-Up Servicer or any other designated Successor Servicer, as applicable, and shall use commercially reasonable efforts to assist the Trustee, the Back-Up Servicer or any Successor Servicer in such transition. The terms of this Section 2.08 shall all be subject to the limitations on the Servicer’s rights as set forth in the Intercreditor Agreement.

Section 2.09Servicing Compensation. As compensation for its servicing and custodial activities hereunder and reimbursement for its expenses (in the case of Conn Appliances only) as set forth in the immediately following paragraph, the Servicer shall be entitled to receive a servicing fee (the “Servicing Fee”) as set forth in the Transaction Documents (including, with regards to SST as Successor Servicer, as set forth on the SST Fee Schedule) prior to the Indenture Termination Date as described in Section 12.1 of the Indenture. The Servicing Fee shall be payable, with respect to each Series, at the times and subject to the limitations set forth in the Indenture.

The initial Servicer’s expenses include expenses incurred by the initial Servicer in connection with its activities hereunder;provided, that the initial Servicer in its capacity as such shall not be liable for any liabilities, costs or expenses of the Receivables Trust, the Issuer, the Noteholders or the Note Owners arising under any tax law, including without limitation any federal, state or local income or franchise taxes or any other tax imposed on or measured by income or gross receipts (or any interest or penalties with respect thereto or arising from a failure to comply therewith) except to the extent that such liabilities, taxes or expenses arose as a result of the breach by the initial Servicer of its obligations underSection 6.02 hereof. In such case, the initial Servicer shall be required to pay such expenses for its own account and shall not be entitled to any payment therefor other than the Servicing Fee. The payment of the expenses of SST, as Successor Servicer, which with respect to SST are set forth in the SST Fee Schedule attached to the Back-Up Servicing Agreement, shall be distributed on each Payment Date to the extent of funds available therefor in accordance with Section 5.15 of the Indenture and the SST Fee Schedule. The provisions of thisSection 2.09 shall survive the termination of this Agreement and the earlier resignation or removal of the Servicer.

19

Section 2.10Representations and Warranties of the Servicer. The Servicer hereby represents, warrants and covenants to and for the benefit of the Receivables Trust, the Issuer, the Trustee, the Back-Up Servicer, the Successor Servicer and the Noteholders as of the date of this Agreement and, in the case of the initial Servicer, as of the Closing Date and, in the case of any Successor Servicer, as of the date of its appointment as Servicer:

(a)Organization and Good Standing, etc. Servicer has been duly organized and is validly existing and in good standing under the laws of its state of organization, with power and authority to own its properties and to conduct its business as such properties are presently owned and such business are presently conducted. Servicer is duly licensed or qualified to do business as a foreign entity in good standing in the jurisdiction where its principal place of business and chief executive office are located and in each other jurisdiction in which the failure to be so licensed or qualified would be reasonably likely to have a Material Adverse Effect.

(b)Power and Authority; Due Authorization. Servicer has (i) all necessary power, authority and legal right to execute, deliver and perform, as applicable, its obligations under this Agreement and each of the other Servicer Transaction Documents, and (ii) duly authorized, by all necessary action, the execution, delivery and performance, as applicable, of this Agreement and the other Servicer Transaction Documents. Servicer has and in the case of the initial Servicer only, had at all relevant times, and now has, all necessary power, authority and legal right to perform its duties as Servicer.

(c)No Violation. The consummation of the transactions contemplated by this Agreement and the other Servicer Transaction Documents and the fulfillment of the terms hereof will not (i) conflict with, result in any breach of any of the terms and provisions of, or constitute (with or without notice or lapse of time or both) a default under, (A) the organizational documents of Servicer, or (B) (in the case of SST as successor Servicer, without investigation or inquiry) any material indenture, loan agreement, pooling and servicing agreement, receivables purchase and sale agreement, mortgage, deed of trust, or other agreement or instrument to which Servicer is a party or by which any of them or any of their respective properties is bound, (ii) in the case of the initial Servicer only, result in or require the creation or imposition of any Adverse Claim upon any of its properties pursuant to the terms of any such indenture, loan agreement, pooling and servicing agreement, receivables purchase and sale agreement, mortgage, deed of trust, or other agreement or instrument, other than pursuant to the terms of the Servicer Transaction Documents, or (iii) violate any law or any order, rule, or regulation applicable to Servicer or of any court or of any federal, state or foreign regulatory body, administrative agency, or other governmental instrumentality having jurisdiction over Servicer or any of its properties.

(d)Eligible Receivable. Solely in the case of the initial Servicer, all Receivables in the Trust Estate are Eligible Receivables as of the Cut-Off Date.

20

(e)Validity and Binding Nature. This Agreement is, and the other Servicer Transaction Documents when duly executed and delivered, as applicable, by Servicer and the other parties thereto will be, the legal, valid and binding obligation of Servicer enforceable in accordance with their respective terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar law affecting creditors’ rights generally and by general principles of equity.

(f)Government Approvals. No authorization or approval or other action by, and no notice to or filing with, any governmental authority or regulatory body required for the due execution, delivery or performance by Servicer of any Servicer Transaction Document to which it is a party remains unobtained or unfiled, except in the case of the initial Servicer for the filing of the UCC financing statements referred to inSection 3.11(iii) and Schedule I to the Indenture.

(g)Margin Regulations. Initial Servicer is not engaged in the business of extending credit for the purpose of purchasing or carrying margin stock, and no proceeds of any Class A Notes, directly or indirectly, will be used for a purpose that violates, or would be inconsistent with, Regulations T, U and X promulgated by the Federal Reserve Board from time to time.

(h)Compliance with Applicable Laws. Servicer is in compliance with the requirements of all applicable laws, rules, regulations, and orders of all governmental authorities, a breach of any of which, individually or in the aggregate, would be reasonably likely to have a Material Adverse Effect.

(i)No Proceedings. Except as described inSchedule 2.10(i), provided that such schedule shall only apply to the initial Servicer,

(i) there is no order, judgment, decree, injunction, stipulation or consent order of or with any court or other government authority to which Servicer is subject, and there is no action, suit, arbitration, regulatory proceeding or investigation pending, or, to the actual knowledge of Servicer, threatened, before or by any court, regulatory body, administrative agency or other tribunal or governmental instrumentality, against Servicer that, individually or in the aggregate, is reasonably likely to have a Material Adverse Effect; and

(ii) there is no action, suit, proceeding, arbitration, regulatory or governmental investigation, pending or, to the actual knowledge of Servicer, threatened, before or by any court, regulatory body, administrative agency, or other tribunal or governmental instrumentality (A) asserting the invalidity of this Agreement or any other Servicer Transaction Document, or (B) seeking to prevent the consummation of any of the other transactions contemplated by this Agreement or any other Servicer Transaction Document.

21

(j)Accuracy of Information. All information heretofore furnished by, or on behalf of, Servicer to the Receivables Trust, the Issuer, the Trustee or any Noteholder in connection with any Servicer Transaction Document, or any transaction contemplated thereby, is true and accurate in every material respect.

If SST is acting as Successor Servicer, with respect to the representations set forth in Sections 2.10(a), 2.10(i) and 2.10(j), when determining whether any Material Adverse Effect has occurred with respect to any matter described in such sections, clauses (ii) and (iii) of the definition of “Material Adverse Effect” shall apply without reference to the effect of such matter on Depositor or on any Servicer (other than SST as Successor Servicer).

In the event that there is any breach of any of the representations, warranties or covenants of the initial Servicer contained inSections 2.13(a)and(e) and2.14(a) with respect to any Receivable, and such Receivable becomes a Defaulted Receivable or the rights of the Secured Parties in, to or under such Receivable or its proceeds are impaired or the proceeds of such Receivable are not available to the Trustee for the benefit of the Secured Parties or the initial Servicer has released any Merchandise securing a Receivable from the lien created by such Receivable (except as specifically provided in the Servicer Transaction Documents), then the initial Servicer shall be deemed to have received on such day a collection of such Receivable in full, and the initial Servicer shall, on the Distribution Date, deposit into the Collection Account, subject toSection 5.4(a) of the Indenture, an amount equal to the Outstanding Receivables Balance of such Receivable, and such amount shall be allocated and applied by the initial Servicer as a Collection allocable to the Receivables or Related Security in accordance withSection 5.11 (or the applicable section relating to allocation of Collections) in the Indenture. In the event that the initial Servicer has paid to or for the benefit of the Noteholders or any other applicable Secured Party the full Outstanding Receivables Balance of any Receivable pursuant to this paragraph, the Receivables Trust shall release and convey all of such Person’s right, title and interest in and to the related Receivable to the initial Servicer, without representation or warranty, but free and clear of all liens created by such Person, as applicable.

Section 2.11Reports and Records for the Trustee. In addition to each of the reports required to be prepared and delivered by the Servicer pursuant toSection 2.02(e) hereof, the Servicer shall prepare and deliver in accordance with thisSection 2.11 each of the following reports and notices:

(a)Periodic Reports. The Servicer shall prepare and forward to the Receivables Trust, the Issuer, the Back-Up Servicer and the Trustee (i) on or prior to the Series Transfer Date with respect to each calendar month, a Monthly Servicer Report in substantially the form set forth onExhibit A-1 attached hereto as of the last Business Day of the immediately preceding calendar month, and (ii) as soon as reasonably practicable, from time to time, such other information in its possession as the Receivables Trust, the Trustee or the Back-Up Servicer may reasonably request.

(b)Monthly Noteholders’ Statement. Unless otherwise stated in the Series Supplement, on each Determination Date the Servicer shall forward to the Receivables Trust, the Trustee and the Back-Up Servicer a Monthly Noteholders’ Statement substantially in the form set forth on Exhibit A-2 attached hereto prepared by the Servicer.

22

(c)Issuer Reports. The Servicer shall prepare and deliver the reports applicable to it and comply with all the provisions applicable to it under Section 4.3 of the Indenture.

(d)Series Reports. The initial Servicer shall prepare and deliver any reports required to be prepared and delivered by the Servicer by the terms of any agreements of the Issuer or the Servicer relating to the issuance or purchase of any of the Notes.

Section 2.12Reports to the Commission. The Issuer, the Receivables Trust and/or Conn Appliances, if the Issuer, the Receivables Trust and/or Conn Appliances or any Affiliate of either of them is not acting as Servicer, shall, at the expense of the Issuer or Conn Appliances, as applicable, cooperate in any reasonable request of the Trustee in connection with any filings required to be filed by the Trustee under the provisions of the Securities Exchange Act of 1934 or pursuant to Section 4.3 of the Indenture.

Section 2.13Affirmative Covenants of the Servicer. At all times from the date hereof to the date on which the outstanding principal balance of all Notes shall be equal to zero, unless the Required Noteholders shall otherwise consent in writing:

(a)Credit and Collection Policies. The Servicer will comply in all material respects with the Credit and Collection Policies in regard to each Receivable and the related Contract.

(b)Collections Received. Subject toSection 5.4(a) of the Indenture, the Servicer shall set aside and deposit as soon as reasonably practicable (but in any event no later than two (2) Business Days following its receipt thereof) into the Collection Account all Collections received from time to time by the Servicer.

(c)Notice of Defaults, Events of Default, Potential Pay Out Event or Servicer Defaults. Within five (5) Business Days after the Servicer obtains actual knowledge or receives written notice of the occurrence of each Default, Event of Default or Servicer Default, the Servicer will furnish to the Trustee and the Rating Agency a statement of a Responsible Officer of the Servicer, setting forth to the extent actually known by the Servicer, details of such Default, Event of Default or Servicer Default, and the action which the Servicer, the Issuer or a Depositor proposes to take with respect thereto.

(d)Conduct of Business. The Servicer will do all things necessary to remain duly incorporated, validly existing and in good standing in its jurisdiction of organization and maintain all requisite authority to conduct its business in each jurisdiction in which its business is conducted to the extent that the failure to maintain such would have a Material Adverse Effect.

23

(e)Compliance with Laws. The Servicer will comply in all respects with all laws with respect to the Receivables to the extent that anynon-compliance would have a Material Adverse Effect.

(f)Further Information. The Servicer shall furnish or cause to be furnished to the Receivables Trust, the Trustee such other information relating to the Receivables and readily available public information regarding the financial condition of the Servicer, as soon as reasonably practicable, and in such form and detail, as the Trustee or the Receivables Trust may reasonably request.

(g)Furnishing of Information and Inspection of Records. The Servicer will furnish to the Receivables Trust, the Trustee and the Issuer from time to time such information in its possession with respect to the Receivables as such Person may reasonably request, including, without limitation, listings identifying the Outstanding Receivables Balance for each Receivable, together with an aging of Receivables. The Servicer will, at any time and from time to time during regular business hours and, upon reasonable notice, permit the Trustee, the Issuer, or its agents or representatives, (i) to examine and make copies of and abstracts from all Records relating to the Receivables and (ii) to visit the offices and properties of the Servicer for the purpose of examining such Records, and to discuss matters relating to Receivables or the Servicer’s performance hereunder and under the other Servicer Transaction Documents with any Servicing Officer of the Servicer having knowledge of such matters. Upon a Default, Event of Default or Servicer Default, the Trustee and the Issuer may have, without notice, reasonable access to all records and the offices and properties of the Servicer.

If SST is acting as Successor Servicer, with respect to the covenants set forth in Sections 2.13(d), 2.13(e) and 2.14(c), when determining whether any Material Adverse Effect has occurred with respect to any matter described in such sections, clauses (ii) and (iii) of the definition of “Material Adverse Effect” shall apply without reference to the effect of such matter on Depositor or on any Servicer (other than SST as Successor Servicer).

Section 2.14Negative Covenants of the Servicer. At all times from the date hereof to the date on which the outstanding principal balance of all Notes shall be equal to zero, unless the Required Noteholders shall otherwise consent in writing:

(a)Modifications of Receivables or Contracts. The Servicer shall not extend, amend, forgive, discharge, compromise, waive, cancel or otherwise modify the terms of any Receivable or amend, modify or waive any term or condition of any Contract related thereto; except in accordance with Section 2.02(b).

(b)Merger or Consolidation of, or Assumption of the Obligations of, the Servicer. (I) The Servicer shall not consolidate with or merge into any other corporation or convey or transfer its properties and assets substantially as an entirety to any Person, unless:

24

(i) the entity formed by such consolidation or into which the Servicer is merged or the Person which acquires by conveyance or transfer the properties and assets of the Servicer substantially as an entirety shall be an entity organized and existing under the laws of the United States of America or any State or the District of Columbia and, if the Servicer is not the surviving entity, such corporation shall expressly assume, by an agreement supplemental hereto executed and delivered to the Trustee, and with the satisfaction of the Rating Agency Condition, the performance of every covenant and obligation of the Servicer under the Servicer Transaction Documents; and

(ii) the Servicer has delivered to the Trustee, each Notice Person and the Receivables Trust (if requested by such Person) an Opinion of Counsel stating that such consolidation, merger, conveyance or transfer comply with this paragraph (b) and that all conditions precedent herein provided for relating to such transaction have been complied with (and if an agreement supplemental hereto has been executed as contemplated by clause (i) above, such opinion of counsel shall state that such supplemental agreement is a legal, valid and standing obligation of the Servicer enforceable against the Servicer in accordance with its terms, subject to bankruptcy, insolvency, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles).