U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SB-2

Amendment No. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Colombia Goldfields Ltd.

(Exact name of Registrant as specified in its charter)

| Delaware | 1400 | 76-0730088 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

#208-8 King Street East Toronto, Ontario, Canada | M5C 1B5 | |

| (Name and address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code: 416-203-3856 | |

| Approximate date of commencement of proposed sale to the public: | As soon as practicable after the effective date of this Registration Statement. |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box |X|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. |__|

CALCULATION OF REGISTRATION FEE | ||||

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER SHARE (1) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE (1) | AMOUNT OF REGISTRATION FEE (4) |

| Common Stock (2) | 17,686,849 shares | $1.01 | $17,863,717 | $2,263.33 |

| Common Stock Underlying Warrants (3) | 6,890,706 shares | $1.72 | $11,852,014 | $1,501.65 |

| (1) | Pursuant to Rule 457(c) under the Securities Act, the proposed maximum offering price per share and the proposed maximum aggregate offering price have been determined on the basis of the average of the bid and asked price as of a specified date within five business days prior to the date of filing this registration statement. |

| (2) | These shares of common stock refer to those issued in exempt offerings to accredited investors. |

| (3) | These shares of common stock underlie the warrants to purchase shares of common stock that were issued in exempt offerings to accredited investors and issued as a commission in connection with an exempt offering. |

| (4) | Previously paid. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

COPIES OF COMMUNICATIONS TO:

Cane Clark LLP, 3273 East Warm Springs Rd., Las Vegas, NV 89120, (702) 312-6255 Fax: (702) 944-7100

Agent for service of process

SUBJECT TO COMPLETION, Dated October 27, 2006

PROSPECTUS

COLOMBIA GOLDFIELDS LTD.

24,577,555 SHARES OF COMMON STOCK

We completed three different exempt offerings to accredited investors. The first exempt offering closed on October 14, 2005 and consisted of a Unit that was priced at $0.25 which included one share of common stock and a warrant to purchase one share of common stock. We are registering in this prospectus 4,221,000 shares of common stock and 3,471,000 shares issued upon exercise of the warrants issued in this offering. In connection with this offering, we issued as a commission 368,100 shares of our common stock and we are registering these shares in this prospectus. In a second exempt offering that closed on January 10, 2006, we offered shares of our common stock at the offering price of $0.60 per share. We are registering in this prospectus 3,126,083 shares of common stock issued in this offering. Our third exempt offering closed on April 26, 2006 and consisted of a Unit that was priced at $1.50 which included one share of common stock and a warrant to purchase one share of common stock. We are registering in this prospectus 6,500,666 shares of common stock and the 6,500,666 shares of common stock underlying the warrants issued in this offering. In connection with this offering, we paid a commission which included the issuance of warrants to purchase 390,040 shares of our common stock. We are also registering in this prospectus the 390,040 shares of common stock underlying the warrants issued as a commission. The selling shareholders named in this prospectus are offering all of the shares of common stock being registered by this prospectus. We will not receive any proceeds from the sale of shares in this offering, although we will receive proceeds from the exercise of the stock warrants. We have not made any arrangements for the sale of these securities.

Our common stock is presently quoted on the over-the-counter bulletin board (the “OTCBB”) administered by the National Association of Securities Dealers (“NASD”) and our stock trading symbol is GCDF. As a result, the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders. On October 24, 2006 the last sale price of our common stock as reported by the OTCBB was $1.45 per share.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" on page 8-15.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: October 27, 2006

Page | |

Colombia Goldfields Ltd.

We were incorporated in the state of Nevada on March 25, 2003 under the name Secure Automated Filing Enterprises Inc. and reincorporated in the state of Delaware on July 31, 2006. From the date of our incorporation until March 2005, we provided electronic filing services to companies that are required to electronically file reports with the Securities and Exchange Commission (‘SEC”). After this time, we reorganized our operations and our current focus is on the acquisition and development of our interests in mining properties located in western Colombia. We are an exploration stage company and there is no assurance that commercially exploitable reserves of gold exists on any of our property interests. In the event that commercially exploitable reserves of gold exist on any of our property interests, we cannot guarantee that we will make a profit. If we cannot acquire or locate gold deposits, or if it is not economical to recover the gold deposits, our business and operations will be materially and adversely affected. The disclosure that follows is a summary of each of the property interests.

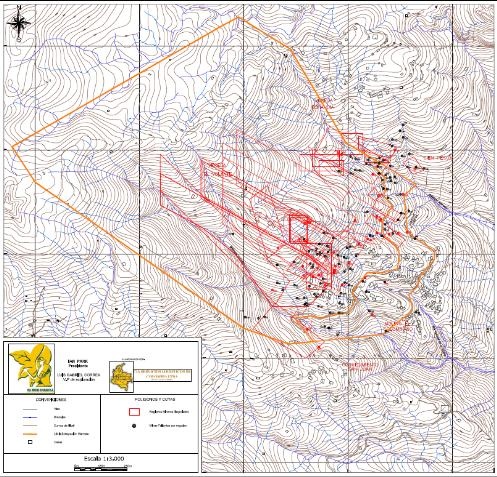

On September 22, 2005, we entered into an Assignment Agreement with Investcol Limited ("Investcol"), a corporation organized and existing under the laws of Belize, where Investcol assigned, transferred, and conveyed to us all of its rights under a Contract for Purchase Option of Mining Concessions (“Original Option Contract”) entered into with CIA Servicios Logisticos de Colombia Ltda., a corporation organized and existing under the laws of Colombia. As a result of this Assignment Agreement with Investcol, we acquired an option to purchase certain mining and mineral rights on property known as Concession 6602, 1343, and 6329 located in Caramanta Municipality, Antioquia Department, Medellin, Colombia. In consideration for the assignment of this interest, we paid to Investcol $500,000 and issued Investcol 1,000,000 shares of our common stock. In order to keep the underlying option in the Original Option Contract in good standing, we must incur exploration expenditures in the amount of $750,000 during the 12 month period commencing June 25, 2006 together with the issuance of 1,000,000 shares of our common stock and incur additional exploration expenditures of $1,740,000 for the 12 month period commencing June 25, 2007. On September 25, 2006, we entered into a Master Agreement to acquire all of the issued and outstanding shares of Gavilan Minerales S.A. (“Gavilan”), a Colombia corporation, for the purchase price of $300,000 and the issuance of 1,150,000 shares of our common stock. Cia Servicios Logisticos de Colombia Ltda. is the primary shareholder of Gavilan. Gavilan holds proper legal title to Concessions 6602, 1343, and 6329. As a result of our acquisition of Gavilan, we became the title holder of these Concessions and no longer have to satisfy any minimum exploratory work obligations on these Concessions.

Also on September 22, 2005, we entered into an agreement with Investcol to manage the exploration operations on these interests. We paid Investcol an office fee of $7,500 on a monthly basis through July 31, 2006.

We acquired an interest in certain mining rights and options to acquire mining rights in the Zona Alta portion of the Marmato deposit located in western Colombia as a result of our acquisition of an equity interest in RNC (Colombia) Limited ("RNC"), a Belize corporation and a wholly-owned subsidiary of Investcol Limited. Pursuant to a Stock Purchase Agreement we entered into on January 12, 2006 with Investcol and RNC, we acquired 25% of RNC’s issued and outstanding

stock in consideration for the issuance of 1,000,000 shares of our common stock to Investcol and a $1,200,000 non-interest bearing demand loan to RNC. Thereafter on April 28, 2006, we acquired an additional 25% of RNC’s issued and outstanding common stock, resulting in us owning 50% of RNC’s issued and outstanding common stock, in consideration for the issuance of 2,000,000 shares of our common stock to Investcol and a $4,000,000 non-interest bearing demand loan to RNC. Thereafter, we acquired an additional 25% of RNC’s issued and outstanding common stock, resulting in our owning 75% of RNC’s issued and outstanding common stock, in consideration for the issuance of 4,200,000 shares of our common stock to Investcol, payment of $200,000 to Investcol, a commitment to provide a $5,000,000 non-interest bearing loan to RNC by December 31, 2006, and commitment to provide sufficient funds to RNC to complete the feasibility study on the Marmato Mountain Project pursuant to the First Amendment to the Stock Purchase Agreement (the “First Amendment”) of the Stock Purchase Agreement executed on August 22, 2006. Subject to the revised terms of the First Amendment to the Stock Purchase Agreement, we have the option to acquire the final 25% interest in RNC until May 1, 2009 resulting in our owning 100% of RNC, in consideration for the lesser of 25% of the value of Caldas as determined by a bankable feasibility study or $15,000,000 plus the issuance of 4,000,000 shares of our common stock to Investcol. The purchase price could be payable in either in cash, shares of our common stock or any combination thereof.

RNC is the beneficial holder of 94.99% of the issued and outstanding stock of Compania Minera de Caldas S.A. ("Caldas"), a Colombia corporation that (i) owns certain mining rights, (ii) has options to acquire mining rights and (iii) has exclusive rights to evaluate certain property, all located in the Zona Alta portion of the Marmato deposit located in western Colombia.

On April 10, 2006, we acquired from Investcol its rights to acquire certain mining contracts to exclusively engage in mining activities on Concessions 6993, 7039, 6821, and 6770 (the “Contracts”) and options to acquire the exclusive rights to engage in mining activities on Concessions HET-31, 32, 26, 27, and HETG-01 (the “Options”) all located within an area referred to as the Caramanta location in western Colombia. In consideration for this acquisition, we issued to Investcol one million restricted shares of our common stock and paid to Investcol $350,000. As a result of our acquisition of Gavilan on September 25, 2006 pursuant to the terms of the Master Agreement described above, we also became the title holder to Concessions 6993, 7039, 6821, 6770, HET-31, 32, 26, 27, and HETG-01 and no longer have to satisfy any minimum exploratory work obligations on these Concessions.

On August 30, 2006, Caldas entered into a Transfer of Properties and Sale Agreement with Sociedad KEDAHDA S.A (“KEDAHDA”), a Colombia corporation, and acquired the Mining Title, Mining Application, and Mining Data for property located in the Marmato Mountain Gold District located in Colombia identified Title 5956, Applications 6455, 6455-B, 6418, 6418-B, 6418-C, 6170, D15-151, 622-17, 623-17, 615-17, 616-17 and 628-17. Pursuant to an Agreement with Caldas, we paid the purchase price of $500,000 for these entire property interests and Caldas agreed to hold the title for these property interests in their name for our benefit. Title to these property interests are being held by Caldas in order to secure the approval for the transfer of title by Colombian mining authorities in accordance with the applicable laws of the Republic of Colombia.

Our principal office is located at #208-8 King Street East, Toronto, Ontario, Canada M5C 1B5.

Our fiscal year end is December 31.

The Offering

Securities Being Offered | Up to 24,577,555 shares of our common stock of which17,686,849 are currently issued and outstanding and 6,890,706 represent common shares underlying warrants we have issued. |

Offering Price and Alternative Plan of Distribution | All shares being offered are being sold by existing shareholders without our involvement, so the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders. |

Minimum Number of Shares To Be Sold in This Offering | None |

Securities Issued and to be Issued | 52,036,849 shares of our common stock are issued and outstanding as of October 27, 2006. All of the common stock to be sold under this prospectus will be sold by existing shareholders. Our issued and outstanding shares will increase if warrants issued to the selling shareholders are exercised into common stock. If all of the warrants issued are exercised into common stock, we will have 58,927,555 shares of common stock issued and outstanding. |

Summary Financial Information

Balance Sheet Data | As of December 31, 2005 (audited) | As of June 30, 2006 (unaudited) |

Cash and cash equivalents Total Assets Liabilities Total Stockholder’s Equity | $ 1,565,640 1,765,341 83,004 1,682,337 | $ 6,728,353 7,101,802 2,402,678 4,699,124 |

Statement of Operations | Fiscal Year Ended December 31, 2005 (audited) | Three Months Ended June 30, 2006 (unaudited) | Six Months Ended June 30, 2006 (unaudited) | |||||

Revenue Net Loss for Reporting Period | $ $ | 0 1,491,470 | $ $ | 0 13,394,106 | $ $ | 0 16,881,742 | ||

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Due to any of these risks, you may lose all or part of your investment.

We have incurred a net loss of $18,432,705 for the period from our inception on March 25, 2003 to June 30, 2006. As of June 30, 2006, we had cash and cash equivalents in the amount of $6,728,353. We presently are not generating any revenue and do not anticipate that we will generate any revenue from operations in the near future. Our business plan includes completing the acquisition of the remaining 25% equity interest in RNC (Colombia) Limited, which may require additional funds of as much as $15,000,000 on or before May 1, 2009. As a result, we will require at least $15,000,000 to implement our business plan over the twelve to thirty-six months. We currently do not have any arrangements for financing and we may not be able to obtain financing. If we are unable to obtain additional financing when sought, we will be required to curtail our business plan. Any additional equity financing may involve substantial dilution to our then existing shareholders. There is a significant risk to investors who purchase shares of our common stock because there is a risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time.

We have a very limited operating history upon which an evaluation of our future success or failure can be made. It was only recently that we took steps in a plan to engage in the acquisition of interests in exploration and development properties in western Colombia, and it is too early to determine whether such steps will lead to success. It is premature to evaluate the likelihood that we will be able to operate our business successfully. To date, we have been involved primarily in the acquisition of property interests and mining rights in western Colombia and have not commenced any exploration activities. We have not earned any revenues from our current operations as of the date of this prospectus.

We do not maintain insurance against title. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. Currently, we are in the process of investigating the title of mineral concessions for which we hold the options to acquire either directly or through our equity interest in RNC (Colombia) Limited. We cannot give any assurance that title to such properties will not be challenged or impugned and cannot be certain that we will have or acquire valid title to these mining properties. The possibility also exists that title to existing properties or future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we will not be able to afford resulting in the failure of our business.

Our property interests and proposed exploration activities in western Colombia are subject to political, economic and other uncertainties, including the risk of expropriation, nationalization, renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, changes in laws or taxation policies, currency exchange restrictions, changing political conditions and international monetary fluctuations. Future government actions concerning the economy, taxation, or the operation and regulation of nationally important facilities such as mines could have a significant effect on us. No assurances can be given that our plans and operations will not be adversely affected by future developments in Colombia

Our operations are subject to Colombian and local laws and regulations regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials. Any changes in these laws could affect our operations and economics. Environmental laws and regulations change frequently, and the implementation of new, or the modification of existing, laws or regulations could harm us. We cannot predict how agencies or courts in Colombia will interpret existing laws and regulations or the effect of these adoptions and interpretations may have on our business or financial condition. We may be required to make significant expenditures to comply with governmental laws and regulations.

Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not have a material adverse effect on our operations in the future. Exploration activities may give rise to significant liabilities on our part to the government and third parties and may require us to incur substantial costs of remediation.

Additionally, we do not maintain insurance against environmental risks. As a result, any claims against us may result in liabilities we will not be able to afford resulting in the failure of our business.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Weather conditions can increase delays resulting in additional costs and expenses. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards for which we cannot insure or for which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of commercially exploitable mineral deposits. We may be forced to revise our exploration program at an increased cost if we encounter unusual or unexpected formations. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

We have and will in the future engage consultants to assist it with respect to our operations in Colombia. We are beginning to deal with the various regulatory and governmental agencies, and the rules and regulations of such agencies, in connection with the Marmato and Caramanta transactions. No assurances can be given that it will be successful in our efforts. Further, in order for us to operate and grow our business in Colombia, we need to continually conform to the laws, rules and regulations of such country and local jurisdiction. It is possible that the legal and regulatory environment pertaining to the exploration and development of gold mining properties will change. Uncertainty and new regulations and rules could increase our cost of doing business, or prevent us from conducting our business.

Our due diligence activities have been limited, and to a great extent, we have relied upon information provided to us by Investcol Limited. Accordingly, no assurances can be given that the properties or mining rights we possess will contain adequate amounts of gold for commercialization. Further, even if we recover gold from such mining properties, we cannot

guarantee that we will make a profit. If we cannot acquire or locate commercially exploitable gold deposits, or if it is not economical to recover the gold deposits, our business and operations will be materially adversely affected.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and many competitors dominate this industry. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities or in the retention of qualified personnel. No assurances can be given that we will be able to compete effectively.

The availability of markets and the volatility of market prices are beyond our control and represent a significant risk. Even if commercially viable deposits of gold are found to exist on our property interests, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell gold in the event that commercial viable deposits are found to exist.

The search for gold as a business is extremely risky. We cannot provide any assurances that the gold mining interests that we have acquired will contain commercially exploitable reserves of gold. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures made and to be made by us in connection with the our interests in the Marmato Mountain Gold District and Caramanta Municipality, as well as the further exploration of the properties, will be substantial and may not result in the discovery of commercially exploitable reserves of gold.

With the exception of Mr. Martin who is our President and Chief Executive Officer, all of our officers and directors are not residents of the United States. Furthermore, all or a substantial portion of the assets of our current executive officers and directors are located outside the United States. All of our operations are also located outside of the United States. As a result, it may not be possible for you to:

| § | effect service of process within the United States upon us or our executive officers and directors; or |

| § | enforce judgments obtained in U.S. courts based on civil liability provisions of the U.S. federal securities laws against us or our executive officers and directors; |

| § | enforce judgments of U.S. courts based on civil liability provisions of the U.S. federal securities laws in the courts of foreign jurisdictions against judgments obtained against us or our executive officers and directors; or |

| § | bring an action in a court of a foreign jurisdiction to enforce liabilities based on the U.S. federal securities laws against us or our executive officers and directors. |

Mr. Martin, our President and Chief Executive Officer, is also an officer and director of Investcol Limited (“Investcol”), the party from which we acquired our equity interest in RNC (Colombia) Limited and other interests, applications and options in mining rights in western Colombia. Investcol has been retained to direct and supervise our mining operations in Colombia. Although the terms of each of these agreements with Investcol were negotiated and agreed to prior to Mr. Martin's appointment as President and Chief Executive Officer, future situations may develop where Mr. Martin's interest as a principal of Investcol conflicts with his fiduciary duties as an officer and director of our company. Although, we will attempt to minimize or eliminate Mr. Martin's ability to influence any of our decisions affecting Investcol, should a conflict occur it is possible that any such conflict could be resolved in the interests of Investcol instead of our shareholders.

Our Chief Executive Officer, Mr. Martin, is also an officer and director of Investcol and he may become affiliated with other mining companies. We do not maintain a key man life insurance policy for Mr. Martin. Our executive officers do not devote their full time to our operations. If the demands of our business require the full business time of Mr. Martin or our other executive officers and directors, it is possible that they may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

The ability to identify, negotiate and consummate transactions that will benefit us are dependent upon the efforts of our management team and Investcol. We have engaged Investcol to provide support for our management and supervise exploration and development activities in Colombia. The loss of the services of any member of management or the principals of Investcol could have a material adverse effect on us.

Effective internal controls are necessary for us to provide reliable financials reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. We have in the past discovered, and may in the future discover, areas of our internal controls that need improvement. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. As a public company, we are required to comply with the Sarbanes-Oxley Act. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers. We continue to evaluate and monitor developments with respect to these rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Short selling occurs when a person sells shares of stock which the person does not yet own and promises to buy stock in the future to cover the sale. The general objective of the person selling the shares short is to make a profit by buying the shares later, at a lower price, to cover the sale. Significant amounts of short selling, or the perception that a significant amount of short sales could occur, could depress the market price of our common stock. In contrast, purchases to cover a short position may have the effect of preventing or retarding a decline in the market price of our common stock, and together with the imposition of the penalty bid, may stabilize, maintain or otherwise affect the market price of our common stock. As a result, the price of our common stock may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued at any time. These transactions may be effected on over-the-counter bulletin board or any other available markets or exchanges. Such short selling if it were to occur could impact the value of our stock in an extreme and volatile manner to the detriment of our shareholders.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

Stock prices in general, and stock prices of mineral exploration companies in particular, have experienced extreme volatility that often have been unrelated to the operating performance or any specifics of the company. Factors that may influence the market price of our common stock include:

| (i) | actual or anticipated changes or milestones in our operations; |

| (ii) | our ability or inability to acquire gold mining properties or interests in such properties in Colombia; |

| (iii) | our ability or inability to generate revenues; |

| (iv) | increased competition within Colombia and elsewhere; |

| (v) | government regulations, including mineral exploration regulations that affect our operations; |

| (vi) | predictions and trends in the gold mining exploration industry; |

| (vii) | volatility of gold market prices; |

| (viii) | sales of common stock by "insiders"; and |

| (ix) | announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors. |

Our stock price may also be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuation, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations, may adversely affect the market price of our common stock.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on the over-the-counter bulletin board administered by the NASD). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

Our shares are quoted on the over-the-counter bulletin board and we are required to remain current in our filings with the SEC in order for shares of our common stock to remain eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are not statements of historical fact but rather reflect our current expectations, estimates and predictions about future results and events. These statements may use words such as “anticipate,” “believe,” “estimate,”“expect,”“intend,”“predict,”“project” and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our beliefs and assumptions, using information currently available to us. These forward-looking statements are subject to risks, uncertainties and assumptions, including but not limited to, risks, uncertainties and assumptions discussed in this prospectus. Factors that can cause or contribute to these differences include those described under the headings “Risk Factors” and “Management Discussion and Analysis.”

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual result may vary materially from what we projected. Any forward-looking statements you read in this prospectus reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this paragraph. You should specifically consider the factors identified in this prospectus that would cause actual results to differ before making an investment decision.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

All shares being offered will be sold by existing shareholders without our involvement, consequently the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders.

The selling shareholders named in this prospectus are offering all of the shares of common stock being registered by this prospectus. The shares include the following:

| § | 4,221,000 common shares and the 3,471,000 common shares issued upon the exercise of the warrants that the selling shareholders acquired from us by the selling shareholders in an offering that was exempt from registration under Rule 506 of Regulation D of the Securities Act of 1933 and completed on October 14, 2005; |

| § | 368,100 shares of common stock issued as a commission in connection with the exempt offering from registration under Rule 506 of Regulation D of the Securities Act of 1933 and completed on October 14, 2005; |

| § | 3,126,083 shares of common stock that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933 and completed on January 10, 2006; |

| § | 6,500,666 common shares and the right to purchase 6,500,666 common shares that are underlying each warrant that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933 and completed on April 26, 2006; |

| § | 390,040 shares of common stock that are underlying warrants issued as a commission in connection with the exempt offering from registration under Regulation S of the Securities Act of 1933 and completed on April 26, 2006; |

At the time of the purchase, no selling shareholder had any agreements or understandings to distribute the securities.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of April 26, 2006, including:

| 1. | The number of shares owned by each prior to this offering; |

| 2. | The number of shares to be received upon the exercise of warrants; |

| 3. | The total number of shares that are to be offered by each; |

| 4. | The total number of shares that will be owned by each upon completion of the offering; |

| 5. | The percentage owned by each upon completion of the offering; and |

| 6. | The identity of the beneficial holder of any entity that owns the shares. |

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 52,036,849 shares of common stock outstanding on October 27, 2006.

Name and Address of Selling Shareholder | Shares Owned Prior to This Offering | Shares To Be Received Upon The Exercise of Warrants | Total Number Of Shares To Be Offered For Selling Shareholder Account | Total Shares To Be Owned Upon Completion of This Offering | Percent Owned Upon Completion Of This Offering |

Absolute Octane Fund One Cayman House 215 North Church St. P.O. Box 10630 APO Grand Cayman, Cayman Islands | 1,800,000 | 1,800,000 | 3,600,000 | 0 | 0% |

Absolute East West Fund One Cayman House 215 North Church St. P.O. Box 10630 APO Grand Cayman, Cayman Islands | 2,000,000 | 2,000,000 | 4,000,000 | 0 | 0% |

Wendy Caledon Flat 14 26 Lowndes Street London, England, UK, SW1 X95D | 12,000 | 12,000 | 24,000 | 0 | 0% |

Mexana Limited Akara Building. 24 De Castro Street Wickhams Cay I Road Town, Tortola, BVI | 166,666 | 166,666 | 333,332 | 0 | 0% |

Timeless Precious Metal Fund 123 Melita Street Valletta, Malta, VLT 16 | 200,000 | 200,000 | 400,000 | 0 | 0% |

Georges Berberat Chemin Rieu, Nr 10, CH-1208 Geneva, Switzerland | 60,000 | 10,000 | 70,000 | 0 | 0% |

Anima S.G.R.p.A. Rubrica Anima Fondo Trading Via Brera 18 20121 Milan, Italy | 500,000 | 500,000 | 1,000,000 | 0 | 0% |

Anima S.G.R.p.A Rubrica- Fondattivo Via Brera 18 20121 Milan, Italy | 150,000 | 150,000 | 300,000 | 0 | 0% |

Anima S.G.R.p.A. Rubrica - Anima America Via Brera 18 20121 Milan, Italy | 350,000 | 350,000 | 700,000 | 0 | 0% |

Monique Steinbruchel 9 Route De Covery Meinier 1252, Switzerland | 12,000 | 12,000 | 24,000 | 0 | 0% |

Standard Bank Jersey Ltd. As Custodian of Belgravia Gold & Resource Fund LP 47-49 La Motte Street St Helier, Jersey Channel Islands, JE4 8XR | 150,000 | 150,000 | 300,000 | 0 | 0% |

Gesico International S.A. P.O. Box 7412 Panama 5, Republic of Panama | 335,000 | 335,000 | 670,000 | 0 | 0% |

Amerfin SA C/O CapitalPro International Inc., 2 Rue Robert De Traz Geneva 1206, Switzerland | 70,000 | 70,000 | 140,000 | 0 | 0% |

Finaline Business P. Moncheur-Finaline 10 Rue De La Corraterie Geneva 1204, Switzerland | 50,000 | 50,000 | 100,000 | 0 | 0% |

Petrus FD P. Moncheur-Finaline 10 Rue De La Corraterie Geneva 1204, Switzerland | 100,000 | 100,000 | 200,000 | 0 | 0% |

Mel Craw Route De La Florettaz 71 Cheserex 1275, Switzerland | 27,000 | 27,000 | 54,000 | 0 | 0% |

RBSI Custody Bank Ltd. REF Samaria a/c No. 306734 St. Andres House Le Bordage St. Guernsey Channel Islands GX1 1BR | 75,000 | 75,000 | 150,000 | 0 | 0% |

Stephan Chayto 12, Vent Blanc Geneva 1223, Switzerland | 110,000 | 10,000 | 120,000 | 0 | 0% |

Miguel Rivera 8 Chemin Tivoli, Petit-Lancy, 1213 Geneva, Switzerland | 3,000 | 3,000 | 6,000 | 0 | 0% |

John A. Marden Rte de Malaguou, 10, CH 1208, Geneva, Switzerland | 15,000 | 15,000 | 30,000 | 0 | 0% |

Peter Gheysens 36A Chemin Armand Dufaux, 1245 Geneva, Switzerland | 10,000 | 10,000 | 20,000 | 0 | 0% |

Pierre Arbour 1434 Sherbrooke West Montreal, Quebec Canada H3G 1K4 | 25,000 | 25,000 | 50,000 | 0 | 0% |

Credit Agricole (Suisse) SA Administration titres 46-48 chemin de Beree, 10 Lausanne, Switzerland | 2,630,000 | 75,000 | 2,705,000 | 0 | 0% |

Julius Baer & Co. Ltd Rue Pierre - Fatio 7 P.O. Box 3142 1211 Geneva 3 Switzerland. Attention: Mr. Cedric Follonier | 415,000 | 255,000 | 670,000 | 0 | 0% |

Olivier Turrettini Chemin du Nantet 36 CH-1245 Collonge Bellerive, Switzerland. | 20,000 | 20,000 | 40,000 | 0 | 0% |

Northcove Holdings SA 19 Blvd. Georges-Favon 1204 Geneva, Switzerland | 56,500 | 0 | 56,500 | 0 | 0% |

Parkdale Investments SA 1, rue du Cendrier, 1201 Geneva, Switzerland | 0 | 72,220 | 72,220 | 0 | 0% |

Evergreen Investment Corp. 22 rue Henri-Mussard, 1207 Geneva, Switzerland | 0 | 236,620 | 236,620 | 0 | 0% |

Westmount Capital 17, rue du Cendrier, 1201 Geneva, Switzerland | 0 | 73,000 | 73,000 | 0 | 0% |

RAM Partners SA 19 blvd Georges-Favon, CH-1204 Geneva, Switzerland | 0 | 8,200 | 8,200 | 0 | 0% |

Heritage Bank & Trust 12, cours des Bastions, P.O. Box 3341, 1211 Geneva 3, Switzerland | 100,000 | 0 | 100,000 | 0 | 0% |

Francis G. O'Hara C/O RAMP Partners, 19 Blvd Georges-Favon, CH 1204 Geneva, Switzerland | 70,000 | 0 | 70,000 | 0 | 0% |

Francis G. O'Hara C/O RAMP Partners, 19 Blvd Georges-Favon, CH 1204 Geneva, Switzerland | 50,000 | 0 | 50,000 | 0 | 0% |

Bank Julius Baer & Co. Ltd Bahnhofstrasse 36, 8010 Zurich, Switzerland | 721,600 | 80,000 | 801,600 | 0 | 0% |

FPFS CS Ireland Ltd. Custom House Plaza 5th Fl. Plaz IFSC Dublin 1 Ireland | 835,000 | 0 | 835,000 | 0 | 0% |

Pierre-Eric BOSSI Rue Du Leman 18, 1201 Geneve, Switzerland | 10,000 | 0 | 10,000 | 0 | 0% |

Pierre-Eric BOSSI Rue Du Leman 18, 1201 Geneve, Switzerland | 50,000 | 0 | 50,000 | 0 | 0% |

George S. Palfi 8 rue, Pedro-Meylan, 1208 Geneva, Switzerland | 100,000 | 0 | 100,000 | 0 | 0% |

BMO Nesbitt Burns in Trust for A/C 402-20141-22 36th Floor, 1 First Canadian Place, Toronto, ON, Canada, M5X 1H3, Attn Paulette Palumbo | 350,000 | 0 | 350,000 | 0 | 0% |

Laurent MARTIN-ROUAIX 17 rue des Maraichers, 1205 Geneva, Switzerland | 9,000 | 0 | 9,000 | 0 | 0% |

Morrie Tobin 40 Bassano Road, Toronto, Ontario,Canada, M2N 2K1 | 100,000 | 0 | 100,000 | 0 | 0% |

Morrie Tobin 40 Bassano Road, Toronto, Ontario,Canada, M2N 2K1 | 83,333 | 0 | 83,333 | 0 | 0% |

Evergreen Investment Corporation c/o Executive Relocation, 54 rue de Lausanne, 1202 Geneva, Switzerland | 65,000 | 0 | 65,000 | 0 | 0% |

Evergreen Investment Corporation c/o Executive Relocation, 54 rue de Lausanne, 1202 Geneva, Switzerland | 60,000 | 0 | 60,000 | 0 | 0% |

Henry Galvin 45C8 Dalhart road. NW., Calgary, Alberta, Canada, T3A1B7 | 30,000 | 0 | 30,000 | 0 | 0% |

Martino Vergata 2020 Sinclair Street, Winnipeg, Manitoba, Canada, R2V 4G5 | 15,000 | 0 | 15,000 | 0 | 0% |

Portal Standards Inc. Main Street, Charlestown, Nevis, West Indies | 500,000 | 0 | 500,000 | 0 | 0% |

Mr. Yuri Baybazarov Crown Capital Group Ltd., C/O Dimitry Spivak, 12 Ch.De laTour De Champel, 1206 Geneva, Switzerland | 55,750 | 0 | 55,750 | 0 | 0% |

Christian Weyer Primaco S.A., Rue A Saladin, P.O. Box 6, 1299 Crans-Pres-Celigny, Switzerland | 50,000 | 0 | 50,000 | 0 | 0% |

Behzad Shayanfar 31 Bickenhall Mansions, Bickenhall Street, London, W1U 6BR, UK | 25,000 | 0 | 25,000 | 0 | 0% |

George Gut Le Majestic, 1936 Verbier 1S, Switzerland | 15,000 | 0 | 15,000 | 0 | 0% |

Richard Hunter 3828 West Broadway Vancouver, B.C., Canada V6R 2C3 | 80,000 | 0 | 80,000 | 0 | 0% |

Gilmore Advisors Ltd. (BVI) C/O Leon Afanassiev Rue de la Vallee 3, 1204 Geneva-Switzerland | 40,000 | 0 | 40,000 | 0 | 0% |

Danaya Limited (BVI) C/O Leon Afanassiev Rue de la Vallee 3, 1204 Geneva-Switzerland | 40,000 | 0 | 40,000 | 0 | 0% |

Vilman Enterprises Ltd. (BVI) C/O Leon Afanassiev Rue de la Vallee 3, 1204 Geneva-Switzerland | 50,000 | 0 | 50,000 | 0 | 0% |

Pierre-Eric Bossi Rue Du Leman 18, 1701 Geneva, Switzerland | 160,000 | 0 | 160,000 | 0 | 0% |

EFG Eurofinanciere D’Investissement Villa Des Aigles 15 Avenue D’Ostende MC 98000, Monaco | 80,000 | 0 | 80,000 | 0 | 0% |

Laurent Martin-Rouaix 17 Rue de Maraichers, 1205 Geneva, Switzerland | 30,000 | 0 | 30,000 | 0 | 0% |

Aldford Group Ltd. Loyalist Plaza Don Mackay Blvd. Marsh Harbour, Abaco, Bahamas | 400,000 | 0 | 400,000 | 0 | 0% |

James T. Braha 680 Fox St. Longboat Key, Florida, 34228 | 100,000 | 0 | 100,000 | 0 | 0% |

Morrie Tobin 40 Bassano Road Toronto, Ontario, M2N 2K1 | 400,000 | 0 | 400,000 | 0 | 0% |

Behzad Shayanfar Flat 612, 159 Great Dover St. London, SE14WW, UK | 150,000 | 0 | 150,000 | 0 | 0% |

Thierry Moret Chemin de la Dauphine, 9, 1291 Commugny - Switzerland | 220,000 | 0 | 220,000 | 0 | 0% |

Ruone International Consulting LLC PO Box 1071 Portsmouth, NH 03802 | 200,000 | 0 | 200,000 | 0 | 0% |

Jemaa M’Rad 8, Chemin Gilbert Trolliet, 1209 Geneva, Switzerland | 40,000 | 0 | 40,000 | 0 | 0% |

Chris A. Pederson Rue Beau Sejour 18, 1209 Geneva, Switzerland | 80,000 | 0 | 80,000 | 0 | 0% |

Affaires Financieres SA Lowenstrasse 11, 8001 Zurich, Switzerland | 200,000 | 0 | 200,000 | 0 | 0% |

Mac & Co. P.O. Box 3196 Pittsburgh, PA 15230-3196 | 100,000 | 0 | 100,000 | 0 | 0% |

Heritage Bank & Trust SA 12 Cours Des Bastions PO Box 3341, 1211 Geneva 3 - Switzerland | 1,580,000 | 0 | 1,580,000 | 0 | 0% |

Roytor & Co for Bank Sal. Oppenheim Jr. & Cie (Switzerland) Ltd. Uraniastr. 28, CH-8022 Zurich, Switzerland | 800,000 | 0 | 800,000 | 0 | 0% |

Banque Bonhote & Cie SA 16 Rue Du Bassim, 2001 Neuchatel, Switzerland | 200,000 | 0 | 200,000 | 0 | 0% |

Bank Insinger de Beaufort Safe Custody NV Herebracht 537, 1017 BV Amsterdam, Netherlands | 100,000 | 0 | 100,000 | 0 | 0% |

None of the selling shareholders;

| (1) | has had a material relationship with us other than as a shareholder at any time within the past three years; or |

| (2) | has been one of our officers or directors. |

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | on such public markets or exchanges as the common stock may from time to time be trading; |

| 2. | in privately negotiated transactions; |

| 3. | through the writing of options on the common stock; |

| 4. | in short sales, |

| 5. | in any combination of these methods of distribution; or |

| 6. | any other method permitted by applicable law. |

Our common stock is quoted on the over-the-counter bulletin board administered by the NASD, so the offering price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will

thus be determined by market factors and the independent decisions of the selling shareholders. The sales price to the public may be:

| 1. | the market price of our common stock prevailing at the time of sale; |

| 2. | a price related to such prevailing market price of our common stock, or; |

| 3. | such other price as the selling shareholders determine from time to time. |

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

In general, under Rule 144 of the Securities Act as currently in effect, a person who has beneficially owned restricted securities for at least one year would be entitled to sell within any three-month period a number of shares that does not exceed the greater of the following:

| § | one percent of the number of shares of common stock then outstanding, or |

| § | the average weekly trading volume of the common stock during the four calendar weeks preceding the sale. However, pursuant to the rules and regulations promulgated under the Securities Act, the OTC Bulletin Board, where our common stock is quoted, is not an “automated quotation system” referred to in Rule 144(e). As a consequence, this market-based volume limitation allowed for securities listed on an exchange or quoted on NASDAQ is unavailable for our common stock. |

Sales under Rule 144 are also subject to requirements with respect to manner-of-sales requirements, notice requirements and the availability of current public information about us. Under Rule 144(k), a person who is not deemed to have been our affiliate at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least two years, is entitled to sell his or her shares without complying with the manner-of-sale, public information, volume limitation or notice provisions of Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders, or if they act as agent for the purchaser of such common stock, from such purchaser. The selling shareholders will likely pay the usual and customary brokerage fees for such services. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. Under such circumstance, all unidentified security holders will be identified in pre-effective or post-effective amendment(s) or prospectus supplement(s), as applicable.

We can provide no assurance that all or any of the common stock offered being registered hereby will be sold by the selling shareholders.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. In particular, during such times as the

selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| 1. | not engage in any stabilization activities in connection with our common stock; |

| 2. | furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and; |

| 3. | not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Delaware is Corporation Service Company, 2711 Centerville Rd., Wilmington, Delaware 19808.

Our executive officers and directors and their respective ages as of October 27, 2006 are as follows:

Name | Age | Office(s) Held |

| J. Randall Martin | 49 | President, Chief Executive Officer and Director |

| Daniel Hunter | 47 | Chief Operating Officer and Director |

| Kenneth Phillippe | 54 | Chief Financial Officer |

| Luis Gabriel Correa Ocampo | 31 | Vice President of Exploration |

| Harry Hopmeyer | 50 | Chairman of the Board of Directors |

| Thomas Ernest McGrail | 56 | Director |

| Robert E. Van Tassell | 71 | Director |

| David Bikerman | 47 | Director |

Set forth below is a brief description of the background and business experience of executive officers and directors.

Harry Hopmeyer. On November 2, 2005, our Board of Directors appointed Mr. Hopmeyer to serve as a member of and Chairman of the Board. Mr. Hopmeyer has served as a director, principal, and advisor to numerous private and public sector entities. Mr. Hopmeyer is a Director of Faircourt Asset Management Inc., which currently manages in excess of $850 million, and invests in a diversified portfolio of business and industrial trusts, commodity trusts, REITS, and pipeline generation funds. Mr. Hopmeyer is also a Senior Canadian advisor to BLC-Edmond de Rothschild Bank in Paris, France, and is Chairman of CSP Security Group and was appointed to the Canadian Centre of Security and Intelligence based in Ottawa, Canada. Mr. Hopmeyer co-founded Fast Company Media Enterprises, Cambridge, Massachusetts, and along with the former editors of the Harvard Business Review, played an instrumental role in its sale to

the Bertelsman Group in 2001. He co-founded and was a director of Prime Restaurant Group with Claridge Investments and built Prime into the second largest casual dining chain in Canada. Mr. Hopmeyer has been a director of both Sino Silver Corp. and RNC Gold Inc. since January 2005. He was also instrumental in the expansion of Greenstone Resources business into Latin America. Mr. Hopmeyer is also past director of the Montreal Children’s Hospital; he is also National Chairman of “Leave Out Violence,” a leading national Canadian organization that offers various training programs to help young people adapt to real-life stresses of the modern world. Additionally, he is a council member of the Historica Foundation.

J. Randall Martin. On March 1, 2006, our Board of Directors appointed J. Randall Martin to act as our Chief Executive Officer, President, and as a member of our Board. Most recently, Mr. Martin served as Chairman and CEO of RNC Gold from May 13, 2005 to February 28, 2006 and served as CEO from December 2003 to May 13, 2005. Following its inception as a private company in 2000, he proceeded to list RNC Gold on the Toronto TSX in December of 2003. At the end of February 2006, RNC Gold completed a successful amalgamation with Yamana Resources, a Toronto-based intermediate gold producer. RNC Gold operated three gold mines located in Nicaragua and Honduras with combined annual gold production capacity of over 150,000 ounces. RNC Gold also completed a feasibility study on a gold project in Panama and conducted extensive exploration programs in Mexico, Honduras, and Nicaragua. Mr. Martin previously worked with AMAX Inc. (a worldwide base metals mining company), DRX, Inc. (a junior exploration company), Martin Marrietta, Behre Dolbear (an international mining consulting company) and Greenstone Resources Limited (a Central American gold producer). He has a B.Sc. in mining engineering from the Krumb School of Mines at Columbia University where he completed graduate work in mining and mineral economics.

Daniel W. Hunter. Mr. Hunter was appointed as our Chief Executive Officer and a member of our Board of Directors in March 2005. On March 1, 2006, Mr. Hunter resigned as our Chief Executive Officer and was appointed to serve as our Chief Operating Officer. Mr. Hunter has been actively involved in all operations of the Company including investor relations and all aspects of audit, finance, and regulatory matters. Since 1998, Mr. Hunter has been a director and CEO of Encore Clean Energy, Inc Encore is actively developing various devices in the renewable clean energy field. Mr. Hunter has been actively involved in all operations of Encore including investor relations, sourcing and evaluating technologies, liaison with inventors and all aspects of audit, finance, and regulatory matters. Prior to 1998, Mr. Hunter was active for 20 years as an investment advisor specializing in financing junior and intermediate mining and technology companies. He was a founding partner and securities broker with Canaccord Capital, Canada's largest independent brokerage firm.

Kenneth Phillippe. On December 23, 2005, the Board of Directors appointed Mr. Kenneth Phillippe to act as our Chief Financial Officer. Mr. Kenneth Phillippe is a self-employed Chartered Accountant with over 20 years of experience working with public companies in the capacities of Director, Officer, Financial Advisor, or Consultant. Between February 2000 and August 2005 he served in various corporate positions including director, officer and chair of the audit committee of MDX Medical Inc., a Vancouver based medical device company.

Luis Gabriel Correa Ocampo. On June 14, 2005, our Board of Directors appointed Mr. Ocampo to act as Vice President of Exploration. Mr. Ocampo graduated from EAFIT University in 1999. Mr. Ocampo has six years of experience in surface exploration and drilling, reserve

calculations, mining management, and design. Mr. Ocampo’s prior experience includes research with the Sedimentology and Stratigraphy group of EAFIT University (1999 - 2000). Mr. Ocampo has conducted exploration and exploitation of marble deposits (2000 - 2003) as well as coal exploration drilling at Cerrrejon S.A, a large coal deposit (2003 - 2004). Until August 2006, Mr. Ocampo was employed by Cia Servicios Logísticos de Colombia Ltda. as its Chief Geologist.

Thomas Ernest McGrail. On June 14, 2005, our Board of Directors appointed Mr. McGrail to serve as a member of the Board. Mr. McGrail has an extensive background in mining development and operation. From January 2002 to the present, Mr. McGrail has served as construction manager for Minero Cerro Quema. Mr. McGrail’s responsibilities include obtaining all appropriate government approvals prior to commencing mining operations and participating in the feasibility study. Also from January 2002 to the present, Mr. McGrail has acted as a consultant to Minerales de Copan for a project located in Honduras. From April 2001 to July 2002, Mr. McGrail served as general manager for Desarrollo Minera de Nicaragua, S.A. and also acted as the interim general manager for this company on a mining project from August 2004 to October 2004. Mr. McGrail served as president and general manager of HEMCO de Nicaragua, S.A. from June 1999 to April 2001.

Robert E. Van Tassell. On November 29, 2005, our Board of Directors appointed Mr. Van Tassell to serve as a member of our Board. Prior to his retirement in 1998, Mr. Van Tassell was involved in the Canadian mining industry for 42 years, the last 16 of which was spent as Vice President of Exploration for Dickenson Mines/Goldcorp Inc. Mr. Van Tassell is a life member of the CIM, a member of the Association of Applied Geochemists and the Geological Association of Canada. Mr. Van Tassell currently is a member of the Board of Directors for the following companies: Lexam Explorations Inc., Plato Gold Corp., Red Lake Resources, Rupert Resources, and Yukon Gold Corporation.

David Bikerman. On July 31, 2006, Mr. Bikerman was elected to serve as a member of our Board. Mr. Bikerman has been in the mining field for over twenty years and is experienced in all aspects of mining enterprises from exploration through operations. He is the founder of Bikerman Engineering & Technology Associates, Inc. where he offers expert services to the mining industry in financial modeling, exploration and geologic model preparation, geo-statistical and reserve analyses, environmental plans, project feasibility, and project design and management.

Mr. Bikerman is President of China Operations and advisor to the Board for East Delta Resources Corp. and is President and CEO of Sino Silver Corp. Most recently, Mr. Bikerman served as the Manager of Mining for RNC Resources Ltd. until it was sold in 2006. He was Vice President and Chief Engineer for Greenstone Resources Ltd. from 1993 to 1996 and was responsible for technical analysis, project design, and engineering for a Central American gold project. He was Vice President and Manager of Mining of Minas Santa Rosa, S.A. (Panama) and was a member of the Board of Minera Nicaraguense, S. A. (Nicaragua). He worked for five years as an Associate at Behre Dolbear & Co., an international minerals industry consultant based in New York, N.Y.

Mr. Bikerman holds three degrees in mining engineering. In 1981, he earned his Bachelor of Science in Mining Engineering from the University of Pittsburgh. In 1985, he earned his Master

of Science in mining engineering from the Henry Krumb School of Mines at Columbia University in New York. In 1995, he earned his Engineer of Mines, also from the Henry Krumb School of Mines at Columbia University.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We have no significant employees other than our officers and directors. We do retain consultants to assist in our operations on an as-needed basis.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past five years, none of the following occurred with any director, person nominated to become a director, executive officer, or control person of our company: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

The following table sets forth, as of October 27, 2006, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly and the percentage shown is based on 52,036,849 shares of common stock issued and outstanding on October 27, 2006.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Except as described in the footnotes to this table, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock held by them. Except as otherwise indicated, the

address of each person named in this table is c/o Colombia Goldfields Ltd., #208-8 King Street East, Toronto, Ontario Canada M5C 1B5.

Title of class | Name and address of beneficial owner (1) | Amount of beneficial ownership | Percent of class |

Executive Officers and Directors | |||

| Common | Daniel Hunter | 4,268,400 | 8.2% (2) |

| Common | J. Randall Martin | 1,000,000 | 1.9% (3) |

| Common | Luis Gabriel Correa Ocampo | 0 | 0% (4) |

| Common | Thomas Ernest McGrail | 200,000 | 0.4% (5) |

| Common | David Bikerman | 0 | 0% |

| Common | Harry Hopmeyer | 1,000,000 | 1.9% (6) |

| Common | Kenneth Phillippe | 0 | 0% (7) |

| Common | Robert E. Van Tassell | 0 | 0% (8) |

Total of all Directors and Executive Officers | 6,468,400 | 12.4% | |

More than 5% Beneficial Owners | |||

| Common | Investcol Limited (9) #208-8 King Street East Toronto, Ontario Canada M5C 1B5 | 9,200,000 | 17.7% |

| (1) | As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date. |

| (2) | Mr. Hunter was granted options to purchase 450,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (3) | Mr. Martin was granted options to purchase 500,000 shares of common stock at an exercise price of $1.65 per share, but none of these options are exercisable within 60 days. |

| (4) | Mr. Ocampo was granted options to purchase 50,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (5) | Mr. Mc Grail was granted options to purchase 200,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (6) | Mr. Hopmeyer was granted options to purchase 500,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (7) | Mr. Phillippe was granted options to purchase 150,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (8) | Mr. Van Tassell was granted options to purchase 200,000 shares of common stock at an exercise price of $0.75 per share, but none of these options are exercisable within 60 days. |

| (9) | Mr. Martin is an officer and director of Investcol Limited. Pursuant to Rule 13d-4 of the Securities and Exchange Act of 1934, Mr. Martin disclaims beneficial ownership over the shares held by Investcol Limited. The shares held by Investcol Limited have not been included in the calculation of beneficial ownership for Mr. Martin. |

Our authorized capital stock consists of 200,000,000 shares of common stock and 10,000,000 shares of preferred stock, with a par value of $0.00001 per share. As of October 27, 2006, there were 52,036,849 shares of our common stock and 0 shares of our preferred stock issued and outstanding.

Common Stock

Our common stock is entitled to one vote for each outstanding share held by him, her, or it on each matter voted at a stockholders' meeting, including the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present, in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing five percent (5%) of our capital stock issued, outstanding, and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger, or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities, or property (including cash) all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our common stock have no pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our Board of Directors is authorized to issue all or any of the shares of the preferred stock in one or more series, fix the number of shares, determine or alter for each such series voting powers or other rights, qualifications, limitations, or restrictions thereof. The Board of Directors is also expressly authorized to increase or decrease the number of shares of any series subsequent to the issuance of shares of that series, but not below the number of shares of such series then outstanding. In case the number of shares of any series shall be decreased in accordance with the foregoing sentence, the shares constituting such decrease shall resume the status that they had prior to the adoption of the resolution originally fixing the number of shares of such series.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

In the event that a dividend is declared, common stockholders on the record date are entitled to share ratably in any dividends that may be declared from time to time on the common stock by our board of directors from funds legally available.

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The DGCL provides that a corporation may pay dividends out of surplus, out the corporation's net profits for the preceding fiscal year, or both provided that there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation's stock raving a distribution preference.

Share Purchase Warrants

We are registering the common stock underlying the warrants that are a component of the units offered in an exempt offering from registration pursuant to Rule 506 of Regulation D of the Securities Act that was completed on October 14, 2005. The holder(s) of the 4,221,000 warrants issued in the exempt offering that closed on October 14, 2005 have the option to convert the warrant into our common stock on a one-to-one basis for a 12-month period or until October 12, 2006 at an exercise price of $0.50 per share.

We are registering the common stock underlying the warrants that are a component of the units offered in an exempt offering from registration pursuant to Regulation S of the Securities Act that was completed on April 26, 2006. The holder(s) of the 6,500,666 warrants issued in the exempt offering that closed on April 26, 2006 have the option to convert the warrant into our common stock on a one-to-one basis for a 24-month period or until April 26, 2008 at an exercise price of $2.50 per share.

We are registering the common stock underlying the warrants that were issued as a commission in connection with the exempt offering from registration under Regulation S of the Securities Act of 1933 and completed on April 26, 2006. The holder of the 390,040 warrants has the option to convert the warrant into our common stock on a one-to-one basis for a 36-month period or until April 26, 2009 at an exercise price of $2.00 per share.

Holders of all warrants have no voting rights unless and until the warrants are converted into common stock. As a result of owning these warrants, warrant holders have no right to participate in any shareholder decisions.

We have no other stock purchase warrants outstanding other than those described above.

Delaware Anti-Takeover Laws

Delaware General Corporation Law (“DGCL”) Section 203 provides state regulation over the acquisition of a controlling interest in certain Delaware corporations unless our Articles of Incorporation or Bylaws provide that the provisions of these sections do not apply. Our Articles of Incorporation and Bylaws do not state that these provisions do not apply. The DGCL creates a number of restrictions on the ability of a person or entity to acquire control of a Delaware corporation by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Cane Clark, LLP our independent legal counsel, has provided legal advice in connection with this registration statement and the offer and sale of our securities. Akerman Senterfitt has provided an opinion with respect to the validity of the issuance of our common stock, the subject of this registration statement, under Delaware law.