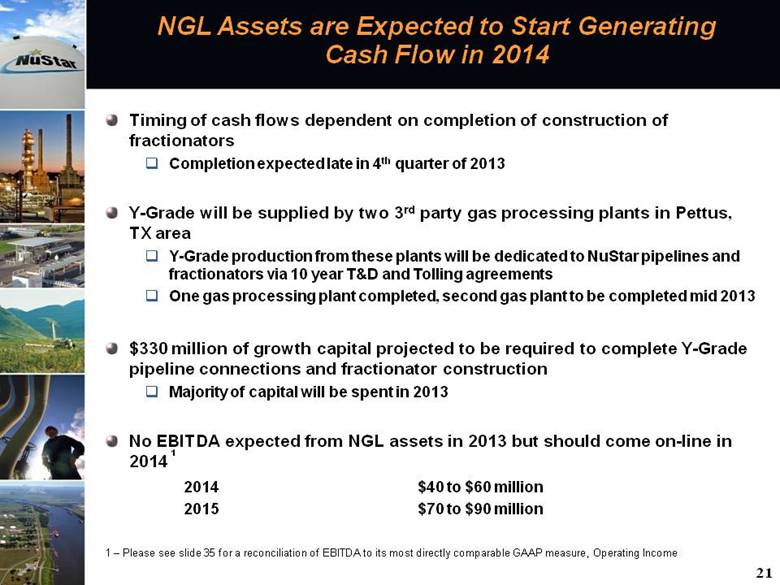

| Reconciliation of Non-GAAP Financial Information: Storage Segment 32 (Unaudited, Dollars in Thousands) The following is a reconciliation of operating income to EBITDA for the Storage Segment: 2006 2007 2008 2009 2010 2011 Operating income 108,486 $ 114,635 $ 141,079 $ 171,245 $ 178,947 $ 193,395 $ Plus depreciation and amortization expense 53,121 62,317 66,706 70,888 77,071 87,737 EBITDA 161,607 $ 176,952 $ 207,785 $ 242,133 $ 256,018 $ 281,132 $ 2012 2013 (1) 2014 Projected operating income range $ 211,000 - 216,000 $ 203,000 - 223,000 $ 213,000 - 236,000 Plus projected depreciation and amortization expense range 90,000 - 95,000 98,000 - 105,000 98,000 - 105,000 Projected EBITDA range $ 301,000 - 311,000 $ 301,000 - 328,000 $ 311,000 - 341,000 (1) The year ended December 31, 2013 includes $17 million of EBITDA and operating income related to the impact from an LLS to WTI spread. St. Eustatius Distillate Project St. James, LA Terminal Expansion Project Phase 2 St. James, LA 2nd Unit Train Unloading Facility Project Projected annual operating income range $ 8,000 - 7,000 $ 7,000 - 6,000 $ 14,000 - 17,000 Plus projected annual depreciation and amortization expense range 2,000 - 3,000 1,000 - 2,000 1,000 - 3,000 Projected annual EBITDA 10,000 $ 8,000 $ $ 15,000 - 20,000 The following are reconciliations of projected annual operating income to projected annual EBITDA for certain projects in our storage segment related to our internal growth program: Year Ended December 31, NuStar Energy L.P. utilizes a financial measure, EBITDA, that is not defined in United States generally accepted accounting principles. Management uses this financial measure because it is a widely accepted financial indicator used by investors to compare partnership performance. In addition, management believes that this measure provides investors an enhanced perspective of the operating performance of the partnership's assets. EBITDA is not intended nor presented as an alternative to net income. EBITDA should not be considered in isolation or as a substitute for a measure of performance prepared in accordance with United States generally accepted accounting principles. EBITDA in the following reconciliations relate to our operating segments. For purposes of segment reporting we do not allocate general and administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the following reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure. Year Ended December 31, The following is a reconciliation of projected operating income to projected EBITDA for the Storage Segment: |