Exhibit 99.1

Exhibit 99.1

DURING THESE DARK DAYS, ONE STAR HAS SHINED BRIGHT.

NUSTAR

GP HOLDINGS, LLC

2008 Summary Annual Report

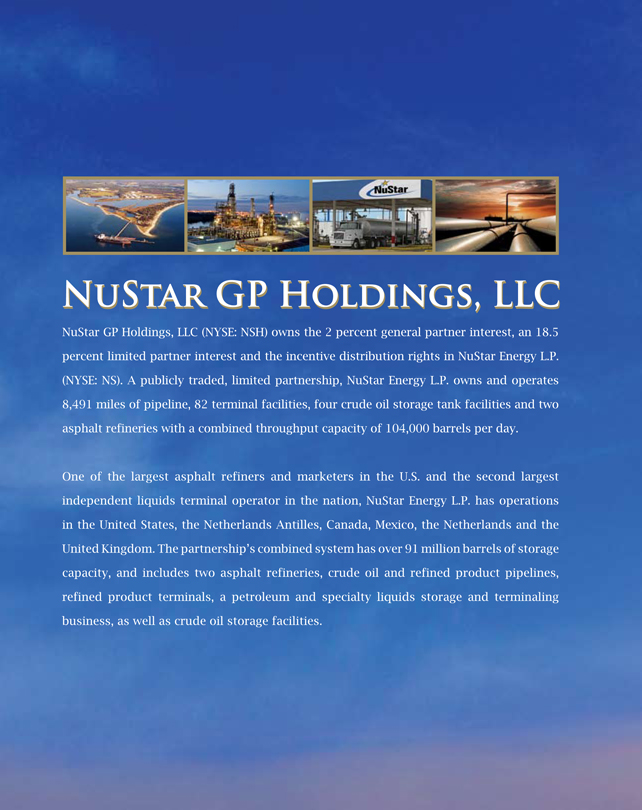

NUSTAR GP HOLDINGS, LLC

NuStar GP Holdings, LLC (NYSE: NSH) owns the 2 percent general partner interest, an 18.5 percent limited partner interest and the incentive distribution rights in NuStar Energy L.P. (NYSE: NS). A publicly traded, limited partnership, NuStar Energy L.P. owns and operates 8,491 miles of pipeline, 82 terminal facilities, four crude oil storage tank facilities and two asphalt refineries with a combined throughput capacity of 104,000 barrels per day.

One of the largest asphalt refiners and marketers in the U.S. and the second largest independent liquids terminal operator in the nation, NuStar Energy L.P. has operations in the United States, the Netherlands Antilles, Canada, Mexico, the Netherlands and the United Kingdom. The partnership’s combined system has over 91 million barrels of storage capacity, and includes two asphalt refineries, crude oil and refined product pipelines, refined product terminals, a petroleum and specialty liquids storage and terminaling business, as well as crude oil storage facilities.

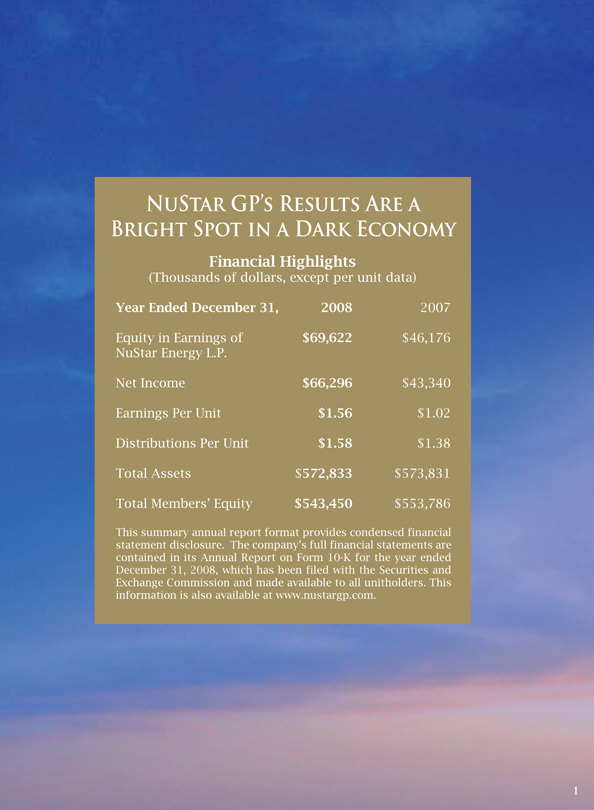

NUSTAR GP’S RESULTS ARE A BRIGHT SPOT IN A DARK ECONOMY

Financial Highlights

(Thousands of dollars, except per unit data)

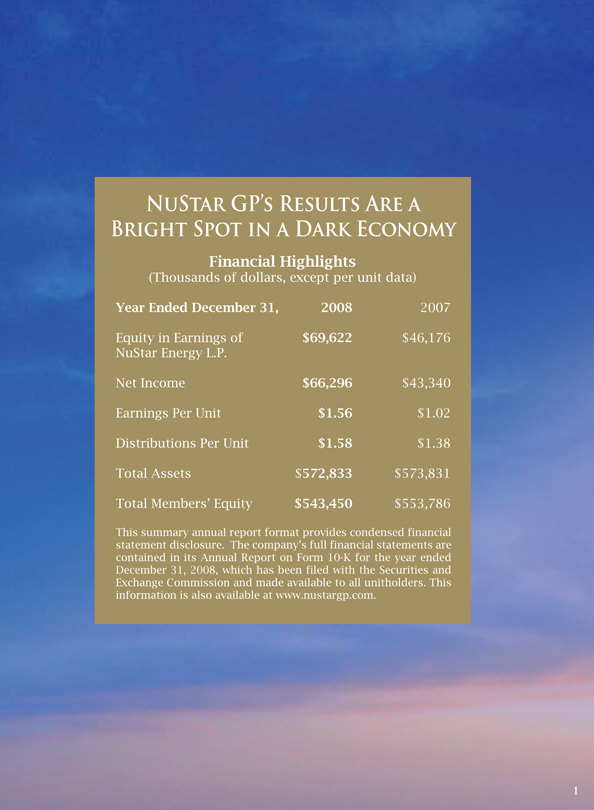

Year Ended December 31, 2008 2007

Equity in Earnings of $69,622 $46,176 NuStar Energy L.P.

Net Income $66,296 $43,340 Earnings Per Unit $1.56 $1.02 Distributions Per Unit $1.58 $1.38 Total Assets $572,833 $573,831 Total Members’ Equity $543,450 $553,786

This summary annual report format provides condensed financial statement disclosure. The company’s full financial statements are contained in its Annual Report on Form 10-K for the year ended December 31, 2008, which has been filed with the Securities and Exchange Commission and made available to all unitholders. This information is also available at www.nustargp.com.

A LETTER TO OUR UNITHOLDERS

While many companies struggled during the dark days of 2008, NuStar shined brightly – finishing the year with record results in virtually every aspect of our business!

Both NuStar Energy L.P. and NuStar GP Holdings, LLC reported record earnings, distributable cash flow and EBITDA for 2008 – all significantly higher than 2007!

With the L.P.’s revenues over 225 percent higher, at $4.8 billion, the L.P. earned a place on the FORTUNE 500 list for the first time ever! This accomplishment is indicative of the significant scale that NuStar has achieved in record time through its successful growth strategy.

Certainly, the acquisition of CIT-GO Asphalt Refining Company in 2008 was one of the primary drivers of the L.P.’s many record achievements. It added two asphalt refineries with a combined throughput capacity of 104,000 barrels per day and three asphalt terminals on the East Coast.

This acquisition literally transformed the L.P. overnight into the No. 1 asphalt producer on the U.S. East Coast and the No. 3 asphalt producer in the nation. Not only does this acquisition provide exposure in one of the nation’s best

asphalt markets, it complements the L.P.’s existing business, further diversifies its customer base and expands its geographic diversity.

And, it’s already proven to be a great acquisition as it has exceeded even our very bullish outlook. As we predicted, the tight supply/demand balance resulted in historic profit margins for the L.P.’s asphalt operations in 2008. In fact, these operations proved to be the single largest contributor to the increase in both companies’ earnings last year.

Also contributing to the earnings increase was the timely completion of several storage expansion projects that were part of the L.P.’s historic $400 million construction program. The vast majority of these projects, which were completed on time and on budget, are backed by long-term contracts. And, they are expected to be accretive to distributable cash flow with internal rates of return in the range of 15-20 percent.

As a result of these acquisitions and expansion projects, the L.P. is now one of the largest and most geographically diverse master limited partnerships (MLPs) and the second largest independent terminal operator in the nation.

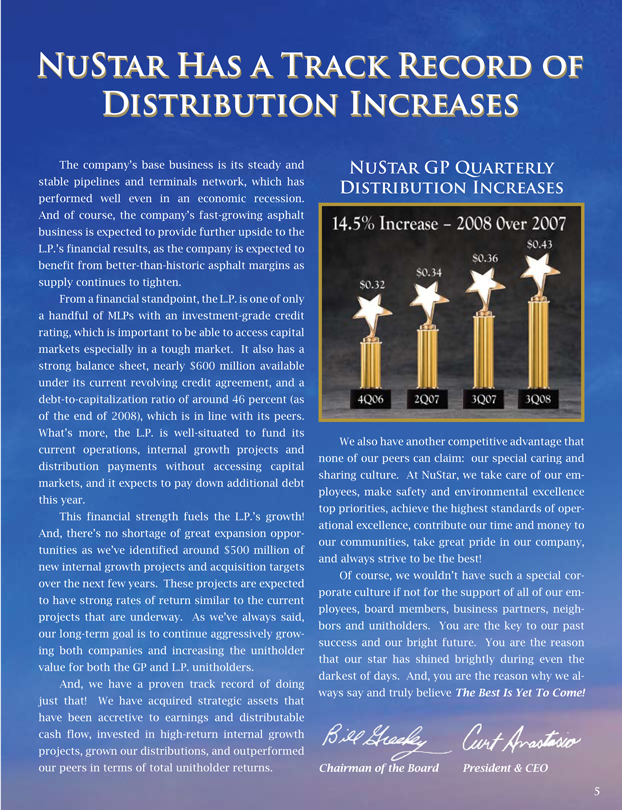

Largely because of the L.P.’s growth, the GP earned net income of $66 million, or $1.56 per unit, which is 53 percent higher than the net income of $43 million, or $1.02 per unit earned in 2007. The really great news is that we exceeded our distribution growth target for the GP by increasing it nearly 15 percent! So it currently stands at $0.43 per unit, or $1.72 annually.

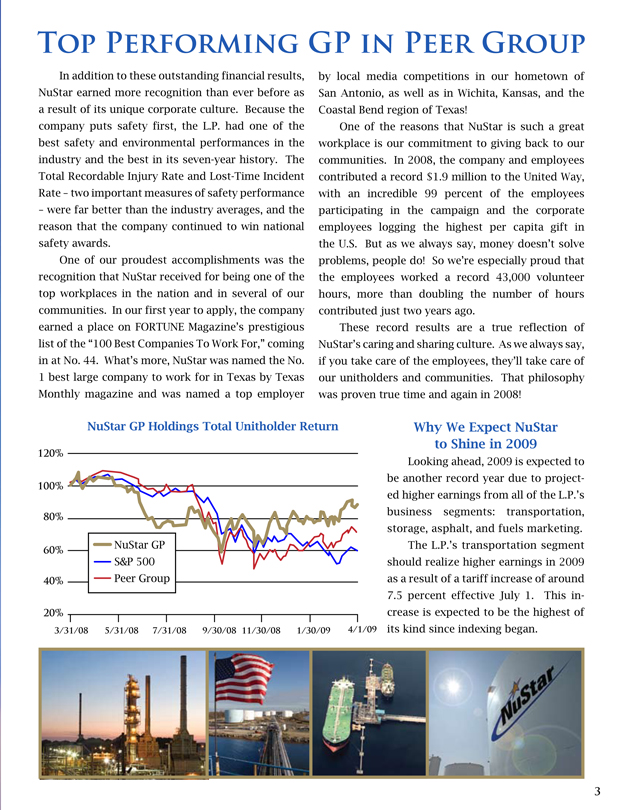

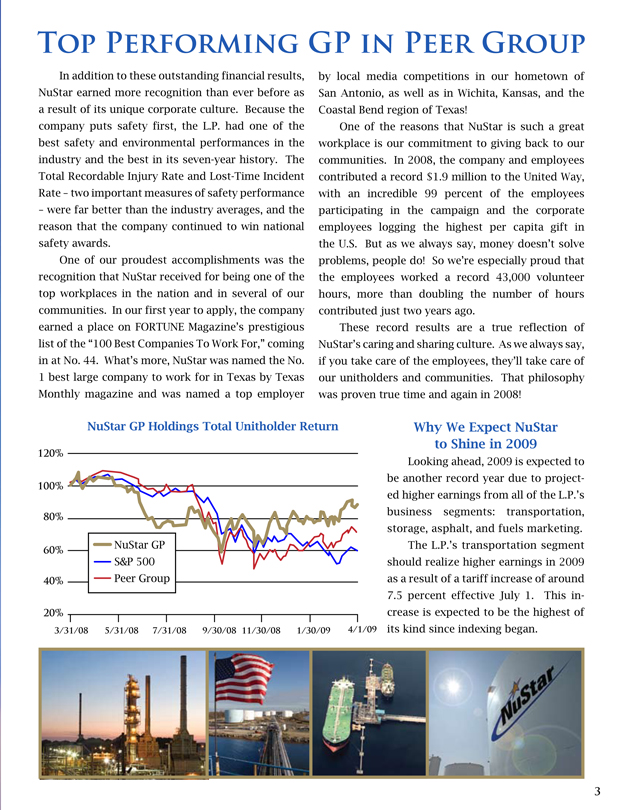

And, while the nation entered the worst economic crisis since the Great Depression, we are pleased to report that the GP not only outperformed the S&P 500 and the Alerian MLP Index, but was also the No. 1 best performing publicly traded general partner in its peer group for 2008 based on total return!

2008 WAS A

RECORD YEAR IN VIRTUALLY

EVERY RESPECT!

TOP PERFORMING GP IN PEER GROUP

In addition to these outstanding financial results, NuStar earned more recognition than ever before as a result of its unique corporate culture. Because the company puts safety first, the L.P. had one of the best safety and environmental performances in the industry and the best in its seven-year history. The Total Recordable Injury Rate and Lost-Time Incident Rate – two important measures of safety performance – were far better than the industry averages, and the reason that the company continued to win national safety awards.

One of our proudest accomplishments was the recognition that NuStar received for being one of the top workplaces in the nation and in several of our communities. In our first year to apply, the company earned a place on FORTUNE Magazine’s prestigious list of the “100 Best Companies To Work For,” coming in at No. 44. What’s more, NuStar was named the No. 1 best large company to work for in Texas by Texas Monthly magazine and was named a top employer by local media competitions in our hometown of San Antonio, as well as in Wichita, Kansas, and the Coastal Bend region of Texas!

One of the reasons that NuStar is such a great workplace is our commitment to giving back to our communities. In 2008, the company and employees contributed a record $1.9 million to the United Way, with an incredible 99 percent of the employees participating in the campaign and the corporate employees logging the highest per capita gift in the U.S. But as we always say, money doesn’t solve problems, people do! So we’re especially proud that the employees worked a record 43,000 volunteer hours, more than doubling the number of hours contributed just two years ago.

These record results are a true reflection of NuStar’s caring and sharing culture. As we always say, if you take care of the employees, they’ll take care of our unitholders and communities. That philosophy was proven true time and again in 2008!

NuStar GP Holdings Total Unitholder Return

Why We Expect NuStar to Shine in 2009

Looking ahead, 2009 is expected to be another record year due to projected higher earnings from all of the L.P.’s business segments: transportation, storage, asphalt, and fuels marketing.

The L.P.’s transportation segment should realize higher earnings in 2009 as a result of a tariff increase of around 7.5 percent effective July 1. This increase is expected to be the highest of its kind since indexing began.

Turning to the L.P.’s storage segment, it should benefit from a full year’s contribution from the projects completed under the company’s $400 million construction program. And to the extent that certain storage contracts are up for renewal, the L.P. expects to profit from contango markets as customers have an incentive to continue to store products since the price of commodities for future delivery is higher than the spot price.

What’s really exciting about our outlook is the great potential for record results from the L.P.’s asphalt operations. We have already started off the year with asphalt inventories below the five-year historical average. The tight supply has been primarily driven by a lack of asphalt imports since early last year. Looking at the remainder of the year, a reduction in U.S. refinery utilization rates should result in less asphalt being produced, as refiners continue to run at lower throughput rates because of weak margins for gasoline and distillates. Also limiting asphalt production has been OPEC’s decision to cut production of heavier, sour crude oil barrels, which results in less asphalt being produced. As a result, asphalt supply is expected to be tighter in 2009 than 2008, and tighter supplies typically translate into higher profit margins.

On the demand side, the picture is also bullish! The American Recovery and Revitalization Act provides for $29 billion in transportation infrastructure investments. This stimulus spending alone is expected to increase asphalt demand by more than 10 percent between 2009 and 2011 over 2008 levels. And, more than 25 percent of the $29 billion is expected to be allocated to the markets that the L.P. serves.

It’s also important to note that the U.S. Congress is already considering the reauthorization of SAF-ETEA-LU, which is the legislation that authorizes the federal surface transportation programs for highways, highway safety and transit. According to news reports, some Congressional leaders are advocating for this new funding to be significantly higher than the current appropriation.

In addition to the increased asphalt demand the U.S., foreign stimulus efforts are expected increase global asphalt demand – further tightening supply and driving up margins.

The long-term outlook is just as bright! There are still a lot of U.S. coker units coming online over the next few years. This should continue to cause the supply of asphalt to tighten and asphalt margins to increase, as these coker units process more of the byproducts of heavy, sour crude oil that are used to produce asphalt. So in essence, the L.P. should be able to take advantage of coker margins without having to invest in a coker.

Because the L.P. is expected to have its best year ever, the GP is anticipating another record year and targeting a distribution increase again in 2009! Even better, we remain very bullish on the long-term fundamentals of our business and expect strong earnings in the years to come!

Why our Star Shines Brighter

The future should be even brighter for both companies because of several strategic advantages that set us apart from our peers. The L.P. benefits from being the most geographically diverse MLP with a high-quality, large and diverse asset footprint that covers eight different countries.

NUSTAR HAS A TRACK RECORD OF DISTRIBUTION INCREASES

The company’s base business is its steady and stable pipelines and terminals network, which has performed well even in an economic recession. And of course, the company’s fast-growing asphalt business is expected to provide further upside to the L.P.’s financial results, as the company is expected to benefit from better-than-historic asphalt margins as supply continues to tighten.

From a financial standpoint, the L.P. is one of only a handful of MLPs with an investment-grade credit rating, which is important to be able to access capital markets especially in a tough market. It also has a strong balance sheet, nearly $600 million available under its current revolving credit agreement, and a debt-to-capitalization ratio of around 46 percent (as of the end of 2008), which is in line with its peers. What’s more, the L.P. is well-situated to fund its current operations, internal growth projects and distribution payments without accessing capital markets, and it expects to pay down additional debt this year.

This financial strength fuels the L.P.’s growth! And, there’s no shortage of great expansion opportunities as we’ve identified around $500 million of new internal growth projects and acquisition targets over the next few years. These projects are expected to have strong rates of return similar to the current projects that are underway. As we’ve always said, our long-term goal is to continue aggressively growing both companies and increasing the unitholder value for both the GP and L.P. unitholders.

And, we have a proven track record of doing just that! We have acquired strategic assets that have been accretive to earnings and distributable cash flow, invested in high-return internal growth projects, grown our distributions, and outperformed our peers in terms of total unitholder returns.

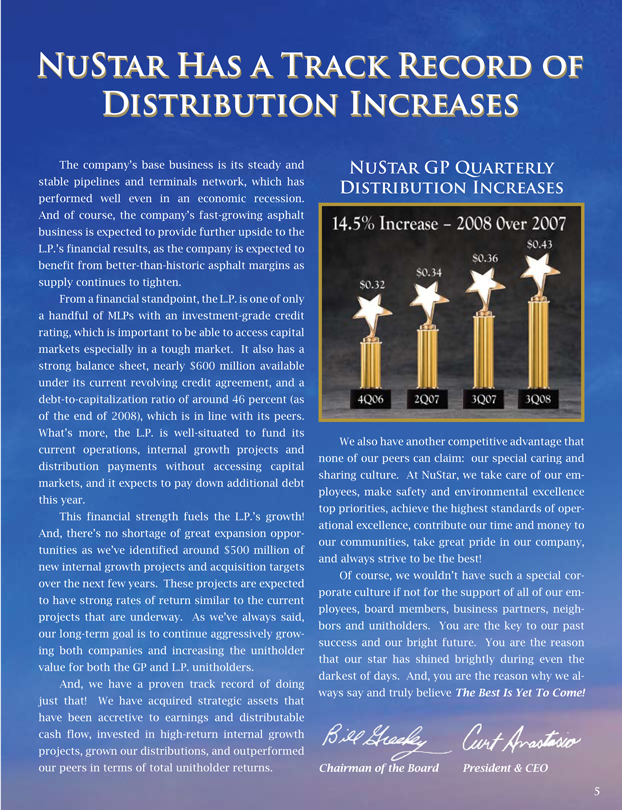

NUSTAR GP QUARTERLY DISTRIBUTION INCREASES

14.5% Increase – 2008 Over 2007

$0.32 $0.34 $0.36 $0.43

4Q06 2Q07 3Q07 3Q08

We also have another competitive advantage that none of our peers can claim: our special caring and sharing culture. At NuStar, we take care of our employees, make safety and environmental excellence top priorities, achieve the highest standards of operational excellence, contribute our time and money our communities, take great pride in our company, and always strive to be the best!

Of course, we wouldn’t have such a special corporate culture if not for the support of all of our employees, board members, business partners, neighbors and unitholders. You are the key to our past success and our bright future. You are the reason that our star has shined brightly during even darkest of days. And, you are the reason why we always say and truly believe The Best Is Yet To Come!

Chairman of the Board President & CEO

A SHINING STAR AROUND THE GLOBE

LEGEND

Headquarters/International Office NuStar Energy L.P. Refined Product Terminals

Third-Party Asphalt Terminal

Nustar Asphalt Terminal Crude Oil Storage Facilities Crude Oil Storage Tanks Asphalt Refinery

Origin/Termination Points

Central West Crude Oil Pipelines System Central West Refined Products Pipelines System

Single-Use Refined Product Pipelines Single-Use Crude Oil Pipeline North Refined Products Pipelines System

East Refined Products Pipelines System Ammonia Pipelines System

Since 2001, NuStar Energy L.P. has grown from a regional operator to a global player with world-class operations in eight different countries. Today, NuStar is the third largest independent liquids terminal operator in the world and one of the largest asphalt producers and suppliers. Its operations have grown from 3,600 miles of pipeline to 8,491 miles, from 11 terminal facilities to 82 terminals, and from 6.1 million barrels

of storage capacity to a staggering 91 million barrels. In addition, the company has added two asphalt refineries with a combined throughput capacity of 104,000 barrels per day. With its experience acquiring assets,

expertise in upgrading and expanding its operations and solid financial strength,

NuStar clearly has the tools necessary to continue growing in the years to come. Most importantly,

the company is committed to acquiring assets and investing in projects that build on its base business and support its new asphalt strategy. That’s why even in these turbulent times, the company’s star has never shined more brightly!

SAFETY AND

ENVIRONMENTAL

EXCELLENCE

MAKE

NUSTAR SHINE

Most companies are fortunate to receive one award in a single year. But in 2008, NuStar employees were honored with several safety awards from the Independent Liquids Terminals Association, National Safety Council, American Petroleum Institute and CSX Transportation. Because safety comes first, the L.P.’s Total Recordable Injury Rate and Lost-Time Incident Rate – two important measures of safety performance – were far better than the industry averages in 2008. What’s more, the company realized a marked improvement in its environmental performance last year. As a result of these improvements, NuStar has one of the best health, safety and environmental track records in the industry. At NuStar, safety and environmental excellence are core values so they always take top priority. And that is without a doubt the most important way the company can protect its employees, contract workers, communities, assets and unitholders!

NUSTAR’S SPIRIT OF GIVING SHINES THROUGH

On any given day, you might find NuStar employees cleaning up parks, mentoring at-risk youth, feeding the hungry, comforting the elderly or raising money for a worthy cause. The company’s employees give generously of their time and money to charities stretching from the Carolinas to California, and from Canada to the UK. In 2008, they gave a record 43,000 volunteer hours, more than doubling the number of hours contributed just two years ago. They also gave a record $1.9 million with company match to the United Way, and they achieved an incredible 99 percent participation rate companywide.

To help the homeless, the employees have organized a charity golf tournament that has raised approximately $5 million over the past three years. And, these are just a few of the ways that the employees have given back to their communities. They are the reason why the company’s star has shined so bright in all of its communities!

EMPLOYEES

ARE SHINING

EXAMPLES

OF SUCCESS

It takes great employees to make a great company. And NuStar has the best employees, as they are talented, hard-working and dedicated. The company has recruited and retained such an outstanding workforce by making the company a great place to work. In fact, the company earned a rank of No. 44 on FORTUNE Magazine’s prestigious list of the “100 Best Companies To Work For” in 2008. In addition to that honor, NuStar was named the No. 1 best large company to work for in Texas by Texas Monthly magazine, and recognized as one of the top places to work through media competitions in its hometown of San Antonio, as well as Wichita, Kansas, and the Coastal Bend area of Texas. This recognition is particularly noteworthy considering that the L.P. earned such high rankings on all of these lists in its first year of participation and that these rankings are predominantly based on confidential employee surveys.

FORTUNE THE 100 BEST NuStar VOTED #44 BEST COMPANIES TO WORK FOR

CONDENSED FINANCIAL INFORMATION

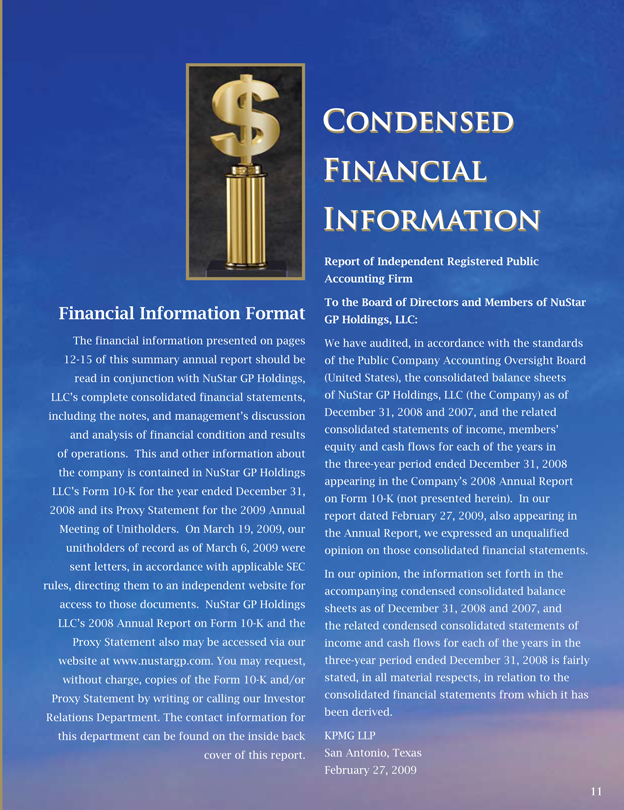

Financial Information Format

The financial information presented on pages 12-15 of this summary annual report should be read in conjunction with NuStar GP Holdings, LLC’s complete consolidated financial statements, including the notes, and management’s discussion and analysis of financial condition and results of operations. This and other information about the company is contained in NuStar GP Holdings LLC’s Form 10-K for the year ended December 31, 2008 and its Proxy Statement for the 2009 Annual Meeting of Unitholders. On March 19, 2009, our unitholders of record as of March 6, 2009 were sent letters, in accordance with applicable SEC rules, directing them to an independent website for access to those documents. NuStar GP Holdings LLC’s 2008 Annual Report on Form 10-K and the Proxy Statement also may be accessed via our website at www.nustargp.com. You may request, without charge, copies of the Form 10-K and/or Proxy Statement by writing or calling our Investor Relations Department. The contact information for this department can be found on the inside back cover of this report.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Members of NuStar GP Holdings, LLC:

We have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of NuStar GP Holdings, LLC (the Company) as of December 31, 2008 and 2007, and the related consolidated statements of income, members’ equity and cash flows for each of the years in the three-year period ended December 31, 2008 appearing in the Company’s 2008 Annual Report on Form 10-K (not presented herein). In our report dated February 27, 2009, also appearing in the Annual Report, we expressed an unqualified opinion on those consolidated financial statements.

In our opinion, the information set forth in the accompanying condensed consolidated balance sheets as of December 31, 2008 and 2007, and the related condensed consolidated statements of income and cash flows for each of the years in the three-year period ended December 31, 2008 is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived.

KPMG LLP

San Antonio, Texas February 27, 2009

CONDENSED

CONSOLIDATED

BALANCE

SHEETS

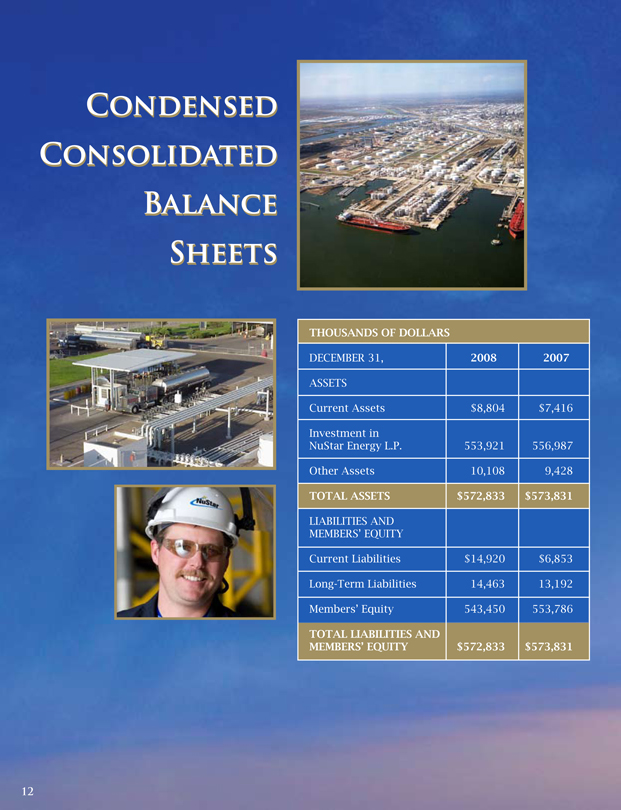

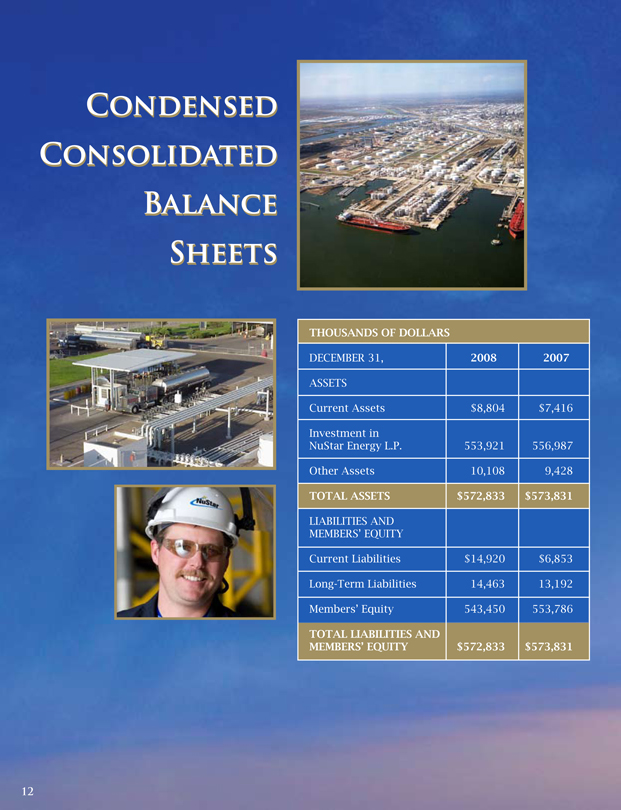

THOUSANDS OF DOLLARS

DECEMBER 31, 2008 2007

ASSETS

Current Assets $8,804 $7,416

Investment in

NuStar Energy L.P. 553,921 556,987

Other Assets 10,108 9,428

TOTAL ASSETS $572,833 $573,831

LIABILITIES AND

MEMBERS’ EQUITY

Current Liabilities $14,920 $6,853 Long-Term Liabilities 14,463 13,192 Members’ Equity 543,450 553,786

TOTAL LIABILITIES AND

MEMBERS’ EQUITY $572,833 $573,831

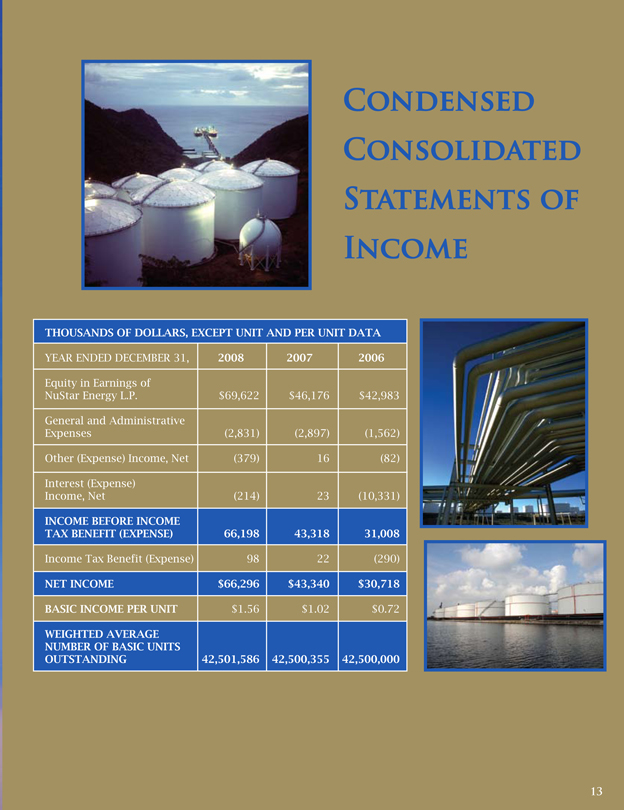

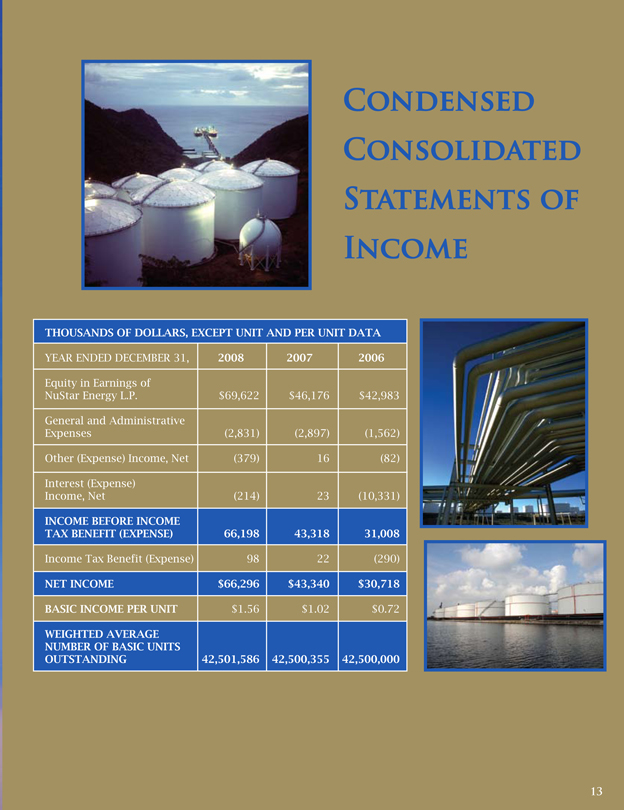

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

THOUSANDS OF DOLLARS, EXCEPT UNIT AND PER UNIT DATA

YEAR ENDED DECEMBER 31, 2008 2007 2006

Equity in Earnings of

NuStar Energy L.P. $69,622 $46,176 $42,983

General and Administrative

Expenses (2,831) (2,897) (1,562)

Other (Expense) Income, Net (379) 16 (82)

Interest (Expense)

Income, Net (214) 23 (10,331)

INCOME BEFORE INCOME

TAX BENEFIT (EXPENSE) 66,198 43,318 31,008

Income Tax Benefit (Expense) 98 22 (290)

NET INCOME $66,296 $43,340 $30,718

BASIC INCOME PER UNIT $1.56 $1.02 $0.72

WEIGHTED AVERAGE NUMBER OF BASIC UNITS

OUTSTANDING 42,501,586 42,500,355 42,500,000

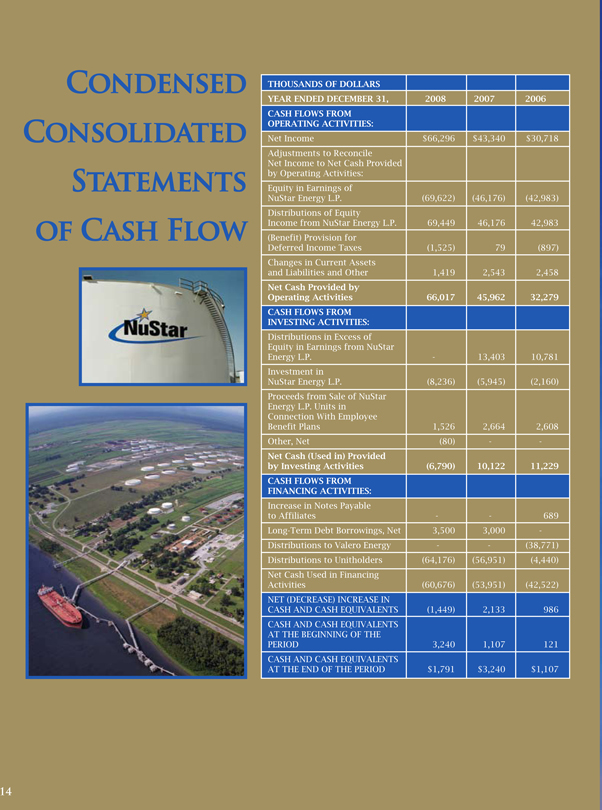

CONDENSED

CONSOLIDATED

STATEMENTS

OF CASH FLOW

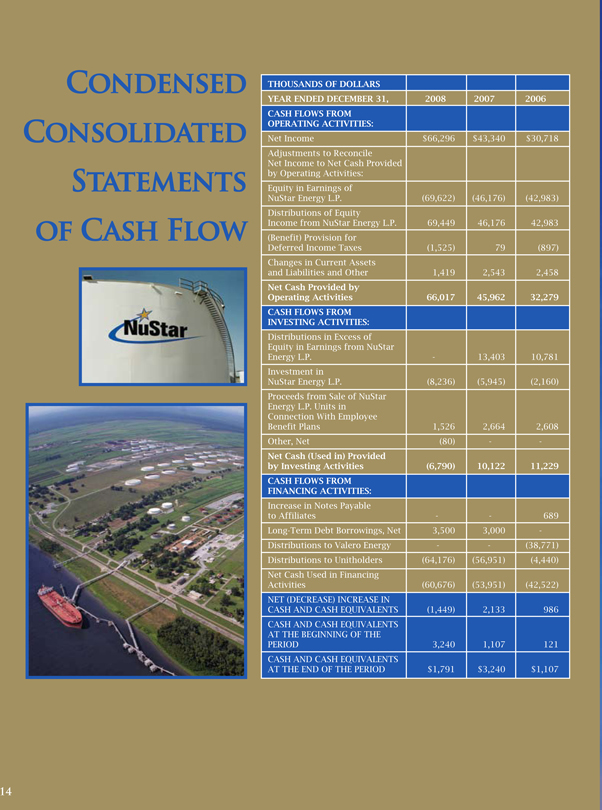

THOUSANDS OF DOLLARS

YEAR ENDED DECEMBER 31, 2008 2007 2006 CASH FLOWS FROM

OPERATING ACTIVITIES:

Net Income $66,296 $43,340 $30,718

Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities:

Equity in Earnings of NuStar Energy L.P. (69,622) (46,176) (42,983)

Distributions of Equity Income from NuStar Energy L.P. 69,449 46,176 42,983

(Benefit) Provision for Deferred Income Taxes (1,525) 79 (897)

Changes in Current Assets and Liabilities and Other 1,419 2,543 2,458

Net Cash Provided by Operating Activities 66,017 45,962 32,279

CASH FLOWS FROM

INVESTING ACTIVITIES:

Distributions in Excess of Equity in Earnings from NuStar Energy L.P. -13,403 10,781

Investment in NuStar Energy L.P. (8,236) (5,945)(2,160)

Proceeds from Sale of NuStar Energy L.P. Units in Connection With Employee Benefit Plans 1,526 2,664 2,608

Other, Net (80) - -

Net Cash (Used in) Provided by Investing Activities (6,790) 10,122 11,229

CASH FLOWS FROM

FINANCING ACTIVITIES:

Increase in Notes Payable to Affiliates - - 689

Long-Term Debt Borrowings, Net 3,500 3,000 -

Distributions to Valero Energy - - (38,771)

Distributions to Unitholders (64,176) (56,951) (4,440)

Net Cash Used in Financing Activities (60,676) (53,951) (42,522)

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (1,449) 2,133 986

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD 3,240 1,107 121

CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD $1,791 $3,240 $1,107

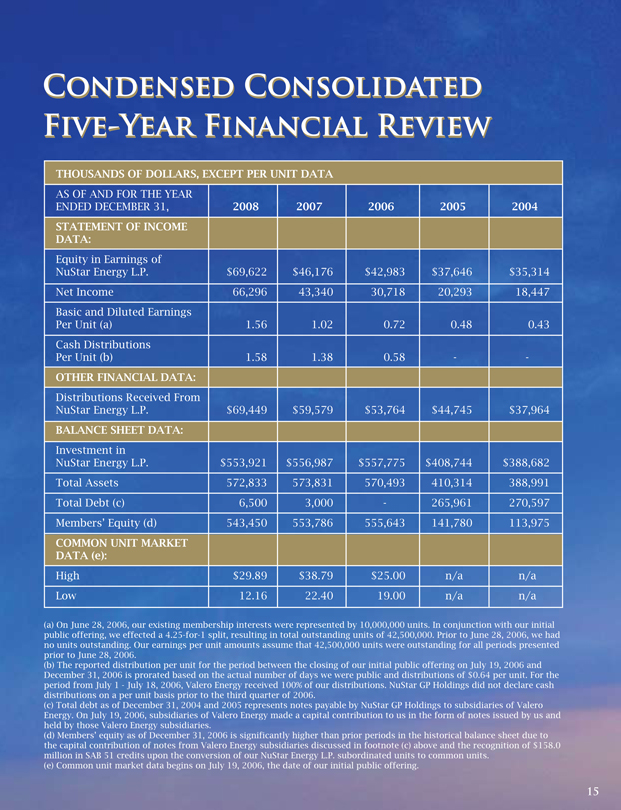

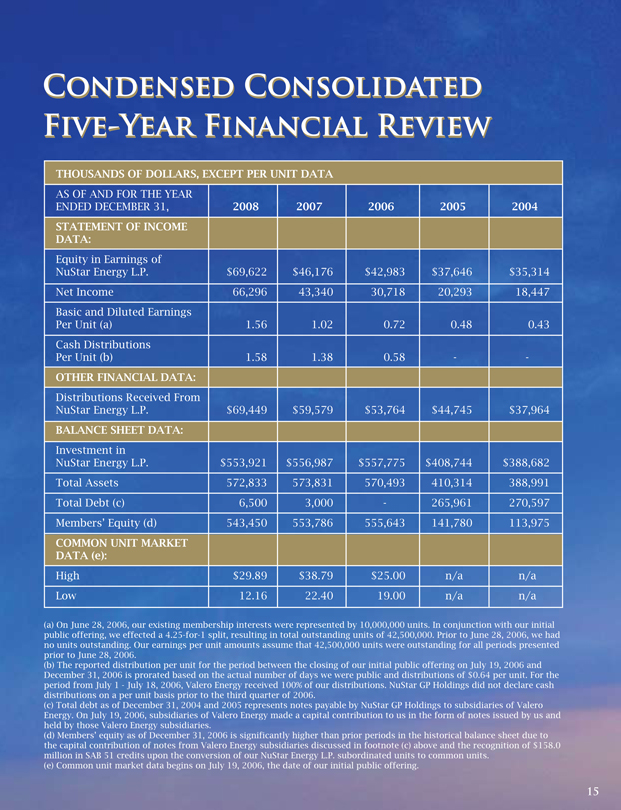

CONDENSED CONSOLIDATED FIVE-YEAR FINANCIAL REVIEW

THOUSANDS OF DOLLARS, EXCEPT PER UNIT DATA

AS OF AND FOR THE YEAR

ENDED DECEMBER 31, 2008 2007 2006 2005 2004

STATEMENT OF INCOME DATA:

Equity in Earnings of NuStar Energy L.P. $69,622 $46,176 $42,983 $37,646 $35,314

Net Income 66,296 43,340 30,718 20,293 18,447

Basic and Diluted Earnings Per Unit (a) 1.56 1.02 0.72 0.48 0.43

Cash Distributions Per Unit (b) 1.58 1.38 0.58 - -

OTHER FINANCIAL DATA:

Distributions Received From NuStar Energy L.P. $69,449 $59,579 $53,764 $44,745 $37,964

BALANCE SHEET DATA:

Investment in NuStar Energy L.P. $553,921 $556,987 $557,775 $408,744 $388,682

Total Assets 572,833 573,831 570,493 410,314 388,991

Total Debt (c) 6,500 3,000 - 265,961 270,597

Members’ Equity (d) 543,450 553,786 555,643 141,780 113,975

COMMON UNIT MARKET DATA (e):

High $29.89 $38.79 $25.00 n/a n/a

Low 12.16 22.40 19.00 n/a n/a

(a) On June 28, 2006, our existing membership interests were represented by 10,000,000 units. In conjunction with our initial public offering, we effected a 4.25-for-1 split, resulting in total outstanding units of 42,500,000. Prior to June 28, 2006, we had no units outstanding. Our earnings per unit amounts assume that 42,500,000 units were outstanding for all periods presented prior to June 28, 2006.

(b) The reported distribution per unit for the period between the closing of our initial public offering on July 19, 2006 and December 31, 2006 is prorated based on the actual number of days we were public and distributions of $0.64 per unit. For the period from July 1 - July 18, 2006, Valero Energy received 100% of our distributions. NuStar GP Holdings did not declare cash distributions on a per unit basis prior to the third quarter of 2006.

(c) Total debt as of December 31, 2004 and 2005 represents notes payable by NuStar GP Holdings to subsidiaries of Valero Energy. On July 19, 2006, subsidiaries of Valero Energy made a capital contribution to us in the form of notes issued by us and held by those Valero Energy subsidiaries.

(d) Members’ equity as of December 31, 2006 is significantly higher than prior periods in the historical balance sheet due to the capital contribution of notes from Valero Energy subsidiaries discussed in footnote (c) above and the recognition of $158.0 million in SAB 51 credits upon the conversion of our NuStar Energy L.P. subordinated units to common units.

(e) Common unit market data begins on July 19, 2006, the date of our initial public offering.

SHINING THE

SPOTLIGHT

ON OUR

BOARD OF

DIRECTORS

[Left to Right]

Bill Burnett is a board member and the former Chief Financial Officer of Lucifer Lighting Company, a San Antonio-based manufacturer of architectural lighting products. Mr. Burnett, who is a C.P.A., served as a partner with Arthur Andersen LLP until his retirement in 2001 after 29 years of service.

Stan McLelland is a director of two privately held companies, Patton Surgical Corp. and the general partner of Yorktown Technologies, LP. Between 1997 and 2001, he served as U.S. Ambassador to Jamaica. Prior to that appointment, Mr. McLelland was Executive Vice President and General Counsel of Valero Energy Corporation.

Curt Anastasio is President and Chief Executive Officer of NuStar GP Holdings, LLC and NuStar Energy L.P. Prior to becoming President of the L.P. in 1999, Mr. Anastasio held various positions in supply, trading, transportation, marketing, development and legal with a predecessor of Valero Energy Corporation.

Fully Clingman served as the President and Chief Operating Officer of HEB Grocery Company in San Antonio from 1984 through 2003, and served on that company’s board through 2008. Currently, Mr. Clingman is a board member of CarMax, a publicly held NYSE-listed company, and is Chairman of the Board of three privately held food manufacturing companies owned by Silver Ventures.

Bill Greehey is Chairman of the Board of NuStar GP Holdings, LLC and NuStar Energy L.P. Previously, he served as Chairman of the Board of Valero Energy Corporation from 1979 through January 2007, and as Chief Executive Officer of Valero from 1979 until his retirement in 2005.

UNITHOLDER INFORMATION

PHYSICAL ADDRESS

2330 North Loop 1604 West San Antonio, TX 78248

MAILING ADDRESS

P.O. Box 781609 San Antonio, TX 78278

PHONE NUMBER

(800) 866-9060

COMMON UNITS

NuStar GP Holdings, LLC’s common units are listed on the New York Stock Exchange under the ticker symbol “NSH.”

TRANSFER AGENT AND REGISTRAR

Computershare Investor Services, LLC has been appointed transfer agent, registrar and distribution disbursing agent for the company’s units.

Inquiries with respect to unit accounts and distributions and all requests to transfer certificates should be addressed to:

Computershare Investor Services, LLC 250 Royall Street, Mail Stop 1A Canton, MA 02021 United States of America Phone: (877) 239-9457 www.computershare.com/contactus

COMPANY DISTRIBUTION WITHHOLDING

Under federal income tax law, individual unitholders are subject to certain penalties and withholdings on company distributions, if they have not provided the company with a correct social security number or other taxpayer identification number. For this reason, any unitholder who has not provided a taxpayer identification number should obtain a Form W-9 (Payer’s Request for Taxpayer Identification Number).

To request a Form W-9, please contact the company’s transfer agent and registrar at the address shown in the first column below.

INVESTOR INQUIRIES

NuStar GP Holdings, LLC Investor Relations Department P.O. Box 781609 San Antonio, TX 78278 Phone: (210) 918-2895 investorrelations@nustargp.com

MEDIA INQUIRIES

NuStar GP Holdings, LLC Corporate Communications Department P.O. Box 781609 San Antonio, TX 78278 Phone: (210) 918-2314 corporatecommunications@ nustargp.com

WEBSITE

Please visit www.nustargp.com for earnings and other financial results, filings with the Securities and Exchange Commission and background information on the company.

DIRECTORS

Bill Greehey Curt Anastasio Bill Burnett Fully Clingman Stan McLelland

PRINCIPAL OFFICERS

Curt Anastasio President & Chief Executive Officer Brad Barron Senior Vice President & General Counsel Steve Blank Senior Vice President, Chief Financial Officer & Treasurer Mark Meador Vice President - Investor Relations Amy Perry Corporate Secretary Tom Shoaf Vice President & Controller

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements regarding future events and the future financial performance of NuStar GP Holdings, LLC. All forward-looking statements are based on the company’s beliefs as well as assumptions made by and information currently available to the company. These statements reflect the company’s current views with respect to future events and are subject to various risks, uncertainties and assumptions. These risks, uncertainties and assumptions are discussed in NuStar GP Holdings, LLC’s 2008 annual report on Form 10-K, which can be accessed at www.nustargp.com, and subsequent filings with the Securities and Exchange Commission.

NON-GAAP MEASURES

NuStar Energy L.P. and NuStar G.P. Holdings, LLC utilize certain financial measures, EBITDA and distributable cash flow, as applicable, which are not defined in U.S. generally accepted accounting principles (GAAP). NuStar Energy L.P. and NuStar G.P. Holdings, LLC use these financial measures because they are widely accepted financial indicators used by investors to compare partnership and LLC performance. Neither EBITDA nor distributable cash flow should be considered in isolation or as substitutes for net income or cash flows prepared in accordance with GAAP. C Mixed Sources Product group from well-managed forests, controlled sources and recycled wood or fiber www.fsc.org Cert no. SCS-COC-00648 C 1996 Forest Stewardship Council FSC 10%

NuStar GP Holdings, LLC

2330 North Loop 1604 West H San Antonio, Texas 78248 210-918-2000 H www.nustargp.com