UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant¨ Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| x | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Hooper Holmes, Inc.

(Name of Registrant as Specified In Its Charter)

Ronald V. Aprahamian

Larry Ferguson

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Mr. Ronald Aprahamian provided the attached slide presentation to certain corporate governance organizations today.

Ronald V. Aprahamian and Larry Ferguson, have filed a definitive proxy statement and accompanying BLUE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of Mr. Aprahamian’s nominees at the 2009 annual meeting of shareholders of Hooper Holmes, Inc.

Item I. Slide Presentation to Risk Metrics

1 Risk Metrics Presentation May 8, 2009 Ronald V. Aprahamian Larry Ferguson Shareholder Advocacy and Proxy Contest at Hooper Holmes, Inc. |

2 Change is needed now at Hooper Holmes, Inc. ________________________________________________________ • The stock price has fallen over 90% over the past four years • The Company has experienced substantial declines in revenue and has posted losses for the past four years • Board/management has failed to provide guidance on revenue, costs or profits, and there is a loss of confidence among investors • The Board is entrenched, not responsive to requests for new Board members, and has reduced the number of Board seats from 9 in 2007 to 7 in 2009 • The Board rejected Mr. Aprahamian’s proposals to add the Aprahamian nominees, who have CEO-level experience and were not even interviewed |

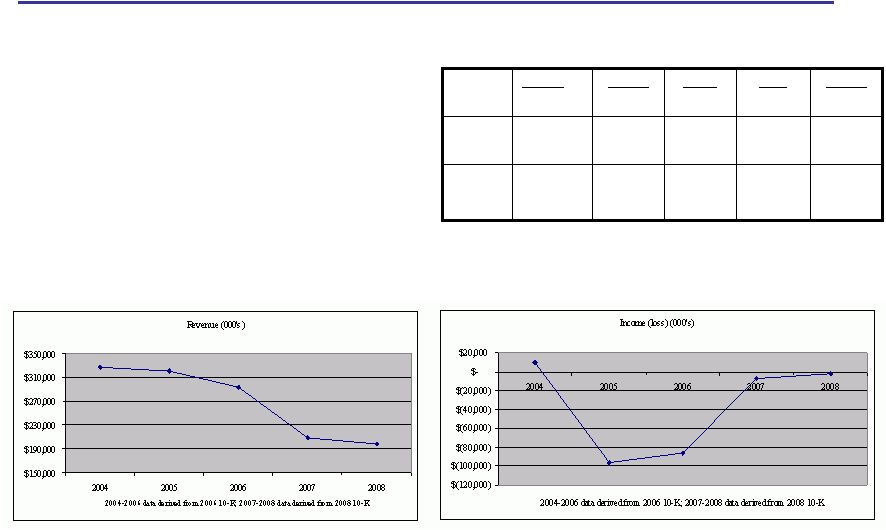

3 Hooper Holmes underperformed during the past four years • Board and management have failed to: – halt the decline of revenue – reduce costs to offset the declining revenues – implement a plan to keep costs at a maximum of 95% of revenue $(7,307) $208,632 2007 $(86,091) $293,862 _2006 $(1,885) $(96,623) $10,015 Income (loss) $198,223 $320,346 $326,651 Revenue _2008_ _2005_ _2004_ Hooper Holmes 10-K for the years ended December 31, 2006 and December 31, 2008 |

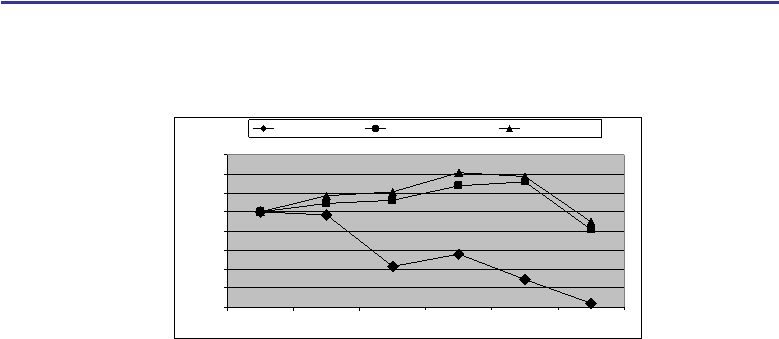

4 Hooper Holmes’ stock price performance $- $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 2003 2004 2005 2006 2007 2008 Hooper Holmes, Inc. S&P 500 Composite Index Russell 2000 Index $ 89.68 $137.55 $141.43 $120.89 $117.00 $100.00 Russell 2000 Index $ 81.23 $132.06 $127.55 $112.26 $108.99 $100.00 S&P 500 Composite Index $ 4.18 $ 28.78 $ 55.38 $ 42.66 $ 96.76 $100.00 Hooper Holmes, Inc. 12/31/08 12/31/07 12/31/06 12/31/05 12/31/04 12/31/03 Source: Hooper Holmes 10-K for the year ended December 31, 2008 • Hooper Holmes’ stock performance has significantly underperformed the broader market |

5 What are we trying to accomplish at Hooper Holmes, Inc. • Cause management to be held accountable for performance and place emphasis on achieving shareholder value • Enumeration of specific steps to improve financial performance and communication of revenue, cost and profit goals to shareholders • A greater sense of Board responsiveness to shareholders • Incorporate new members with CEO-level experience in turnarounds who will bring fresh ideas to the Board • Eliminate Board entrenchment by: – Declassifying the Board, and – Removing the poison pill |

6 Who We Are – Ronald Aprahamian • Independent investor who owns 3,061,000 shares (4.4%) of common stock of Hooper Holmes • Significant experience in the healthcare, healthcare services, and software industry • Former CEO of a $50 million public company (1975 – 1986) and of a $100 million private company (1988 – 1996) • Director experience with 5 public companies with revenues ranging from $50 million to $1.5 billion and 5 private companies • Experienced in corporate turnarounds: – Superior Consultants Holding, Inc., from 20 million market cap to $111 million. Resulting in the cash-sale of the company – First Consulting Group, Inc. from 140 million market cap to $365 million. Resulting in the cash-sale of the Company |

7 Who We Are - Larry Ferguson • Nearly 30 years of experience in the healthcare and technology industry • Current Director of Accelrys, Inc. (ACCL) • Served as President of Systems Associates, Inc. (public company acquired by American Express, later a division of First Data Corporation) from 1986 to 1992 • Served as CEO of First Consulting Group from 2006 to 2008, publicly trader provider of information technology services and products to health and life sciences organizations. Contributed to its turnaround, resulting in a $365 million cash-sale of the company • Extensive managerial experience, served as CEO of both domestic and international companies, as well as public and private companies ranging in size from business with hundreds of employees to approximately 3000 • Served as Chairman of the Board of Daou Systems, Inc., publicly traded provider of consulting and management services to healthcare organizations • Served as director of Sunquest Information Systems, publicly traded healthcare information systems company |

8 Timeline of events leading up to the Proxy Contest • Mr. Aprahamian became a Hooper Holmes’ shareholder in early 2008. He currently owns 3,061,000 shares, more than the entire Board combined • In July 2008, Ron Aprahamian contacted the Board, expressing interest to become a Board member to help improve the Company’s deteriorating economic performance • In 2008, Heartland Advisors, with 18.8% holdings, provided the Board with a positive reference for Mr. Aprahamian • In November of 2008 the Company reported another poor quarterly performance. Hooper Holmes’ market cap fell to just $10 million. • In November 2008, Ron Aprahamian asked Mr. Bubbs (CEO) and Mr. Lowrance (Chairman of the Board) to report their planned actions to counteract further losses • Hooper Holmes stated no such report would be issued until March 2009 • In January 2009, Mr. Lowrance informed Ron Aprahamian that his candidacy had been rejected • Ron Aprahamian sent further communications to Mr. Lowrance to re-consider his candidacy to which he responded that the Board would not review further the “merits” of his candidacy |

9 Timeline of events leading up to the Proxy Contest (contd.) • In the Company’s analyst call of March 13, 2009, Mr. Bubbs stated: “the Governance Committee realizes that as we enter the healthcare sector, we’re going to want to have more expertise on the health side with a good dash of business knowledge, and so they’re aggressively recruiting in that particular area.” However, instead of opening the Board to new members when Mr. Kennedy resigned, the Board chose to reduce the Board seats continuing to ignore our nominees • We tried to avoid a costly proxy contest by personally contacting the Company’s CEO and Chairman of the Board. We suggested the expansion of the Board to accommodate our nominees • On April 13, 2009, Mr. Aprahamian sent another letter to Mr. Bubbs and Mr. Lowrance asking to reconsider their position and communicating his intention to start a proxy contest on April 15, 2009 • After the Board and management ignored Ron Aprahamian’s requests, he filed a preliminary proxy on April 15, 2009 |

10 Mr. Aprahamian Responses to the Company’s Letter to Shareholders of April 20, 2-009 • “Mr. Aprahamian’s prior SEC and Sunrise experiences make him unqualified to serve the Hooper Holmes Board.” – In 1985 an SEC Consent Agreement was signed. This fact has been fully disclosed and was not a factor in 4 subsequent public company directorships on which Mr. Aprahamian served – With respect to the Sunrise Litigation: • A Special Independent Investigation was completed. • The Case settled for $13 million. • Findings of no fault of independent directors • Mr. Aprahamian served as director of Metrocall, Inc., which filed for bankruptcy in 2002. – This experience will serve the Company well, particularly in this economic environment • Mr. Aprahamian, with the shareholding greater than that of the entire Board has interests strongly aligned with those of the shareholders • Mr. Aprahamian is well qualified to serve as a director of Hooper Holmes |

11 Mr. Aprahamian’s Nominees’ Plan for Hooper Holmes • Add directors with CEO experience at public companies to contribute to developing a successful turnaround plan for the Company • Develop a sound plan and define revenue, cost and profit targets for shareholders who can hold the Board/Management accountable • Develop a compensation system for Management and Staff tied to accomplishment of targeted profit and revenue goals • Review and evaluate the strategic initiatives of the Company, including for each business unit • Hold Management accountable for the achievement of planned targets • Declassify the Board to have every Director up for election or re-election on an annual basis rather than every three years • Eliminate the poison pill currently in place |

12 Cautionary Statement Regarding Forward-Looking Statements This document contains forward-looking statements. These statements may be identified by the use of forward-looking terminology such as the words “expects,” “intends,” “believes,” “anticipates” and other terms with similar meaning indicating possible future events or actions or potential impact on the business or shareholders of the Company. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, the ability to successfully solicit sufficient proxies to elect Mr. Aprahamian’s Nominees to the Company’s board of directors, the ability of Mr. Aprahamian’s Nominees to influence Hooper Holmes’ Board of Directors and the management of the Company and to improve the strategic direction of the Company, and risk factors associated with the business of the Company, as described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008, and in other periodic reports of the Company, which are available at no charge at the website of the Securities and Exchange Commission at http://www.sec.gov. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results. |

ADDITIONAL INFORMATION

On May 08, 2009, Ronald V. Aprahamian and Larry Ferguson, made a definitive filing with the Securities and Exchange Commission of a definitive proxy statement and an accompanying BLUE proxy card to be used to solicit votes for the election of Mr. Aprahamian’s nominees at the 2009 annual meeting of shareholders of Hooper Holmes, Inc. (the “Company”)

RONALD V. APRAHAMIAN AND LARRY FERGUSON ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ MR. APRAHAMIAN’S AND FERGUSON’S DEFINITIVE PROXY STATEMENT AND ANY OTHER PROXY MATERIALS RELATED TO THE SOLICITATION OF PROXIES FROM SHAREHOLDERS OF THE COMPANY FOR USE AT THE 2009 ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PROPOSED DIRECTOR NOMINEES OF MR. APRAHAMIAN AND PARTICIPANTS IN SUCH PROXY SOLICITATION. THE PROXY STATEMENT AND A FORM OF PROXY WILL BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE ATHTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE PROXY SOLICITATION WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR. GEORGESON INC., AT ITS TOLL-FREE NUMBER: 1-866-828-4295.