UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21326

Cohen & Steers REIT and Preferred and Income Fund, Inc.

(Exact name of registrant as specified in charter)

280 Park Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)832-3232

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

Item 1. Reports to Stockholders.

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

To Our Shareholders:

We would like to share with you our report for the six months ended June 30, 2019. The total returns for Cohen & Steers REIT and Preferred and Income Fund, Inc. (the Fund) and its comparative benchmarks were:

| | | | |

| | | Six Months Ended

June 30, 2019 | |

Cohen & Steers REIT and Preferred and Income Fund at Net Asset Valuea | | | 20.63 | % |

Cohen & Steers REIT and Preferred and Income Fund at Market Valuea | | | 25.91 | % |

Linked Benchmarkb | | | 18.41 | % |

ICE BofAML Fixed Rate Preferred Securities Indexb | | | 11.98 | % |

Linked Blended Benchmark—50% FTSE Nareit All Equity REITs Index/50% ICE BofAML Fixed Rate Preferred Securities Indexb | | | 15.21 | % |

S&P 500 Indexb | | | 18.54 | % |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance results reflect the effects of leverage, resulting from borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Managed Distribution Policy

The Fund, acting in accordance with an exemptive order received from the U.S. Securities and Exchange Commission (SEC) and with approval of its Board of Directors (the Board), adopted a

| a | As a closed-end investment company, the price of the Fund’s exchange-traded shares will be set by market forces and can deviate from the net asset value (NAV) per share of the Fund. |

| b | The Linked Benchmark is represented by the performance of the FTSE Nareit Equity REITs Index through March 31, 2019 and the FTSE Nareit All Equity REITs Index thereafter. The Linked Blended Benchmark is represented by the performance of the blended benchmark consisting of—50% FTSE Nareit Equity REITs Index/50% ICE BofAML Fixed Rate Preferred Securities Index through March 31, 2019 and the blended benchmark consisting of 50% FTSE Nareit All Equity REITs Index/50% ICE BofAML Fixed Rate Preferred Securities Index thereafter. The FTSE Nareit Equity REITs Index contains all tax-qualified real estate investment trusts (REITs) except timber and infrastructure REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. The FTSE Nareit All Equity REITs Index contains all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. ICE BofAML Fixed Rate Preferred Securities Index tracks the performance of fixed-rate U.S. dollar-denominated preferred securities issued in the U.S. domestic market. The S&P 500 Index is an unmanaged index of 500 large capitalization stocks that is frequently used as a general measure of U.S. stock market performance. |

1

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

managed distribution policy under which the Fund intends to include long-term capital gains, where applicable, as part of the regular monthly cash distributions to its shareholders (the Plan). The Plan gives the Fund greater flexibility to realize long-term capital gains and to distribute those gains on a regular monthly basis. In accordance with the Plan, the Fund currently distributes $ 0.124 per share on a monthly basis.

The Fund may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Fund’s Plan. The Fund’s total return based on NAV is presented in the table above as well as in the Financial Highlights table.

The Plan provides that the Board of Directors may amend or terminate the Plan at any time without prior notice to Fund shareholders; however, at this time, there are no reasonably foreseeable circumstances that might cause the termination. The termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above NAV) or widening an existing trading discount.

Market Review

U.S. real estate stocks had a solid gain in the first half of 2019, with most sectors posting double-digit returns, following the downturn late in 2018. Stocks broadly benefited as the U.S. Federal Reserve and other central banks indicated they would pursue accommodative monetary policies amid slowing global economic growth and generally low inflation. Late in the period, signs of progress in U.S.-China trade negotiations contributed to investors’ willingness to take risk, driving equity markets higher. Meanwhile, real estate fundamentals remained healthy in most property types, with firm, lease-based demand and relatively limited new supply.

Preferred securities also had a significant advance, amid a global trend of lower interest rates in response to weaker economic forecasts. The yield on the10-year U.S. Treasury fell to 2.0% from a high of 2.6% at the start of the year, and the entire yield curve inverted relative to overnight lending rates. Yields on10-year German and Japanese sovereign bonds both fell below zero for the first time since 2016, while the French equivalent dropped to zero for the first time. U.K.10-year government bond yields also ended lower, showing volatility in response to shifting sentiment toward Brexit.

With economies slowing but still relatively healthy, credit markets responded positively to a supportive mix of declining yields and anticipated monetary stimulus. In this environment, preferred securities were among thetop-performing fixed income categories in the period, outperforming long-term U.S. Treasury paper and investment-grade corporate bonds.

Fund Performance

The Fund had a positive total return in the period and outperformed its linked blended benchmark on both a NAV and market price basis.

2

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

Within the real estate stock market, regional malls declined, the only sector in the index to post a negative return in the period, hindered by ongoing store closings related to competition frome-commerce. Even owners of high-quality properties such as Simon Property Group struggled. The Fund’s significant underweight in malls helped its relative performance.

Technology-related REITs had generally strong gains, benefiting from rapid growth in data usage and anticipated capital spending on 5G infrastructure. The Fund’s overweights in data center company Equinix and cell tower owner Crown Castle International contributed to performance with sizable returns. Stock selection in the single family homes sector further helped performance.

Industrial REITs were top performers in the period, lifted in part by merger & acquisition activity that highlighted potential opportunites in these stocks. Private real estate firm Blackstone announced the purchase of $18.7 billion worth of assets from listed industrial company GLP at a premium to prevailing valuations in the sector. The Fund’s underweight in industrial companies as a group detracted from relative performance. Stock selection in the hotel sector hindered performance as well.

The Fund’s investment in preferred securities modestly detracted from relative return in the period. Favorable security selection in the insurance sector was more than countered by underperformance in the banking, utilities and telecommunications services sectors.

Impact of Leverage on Fund Performance

The Fund employs leverage as part of a yield-enhancement strategy. Leverage, which can increase total return in rising markets (just as it can have the opposite effect in declining markets), significantly contributed to the Fund’s performance for thesix-month period ended June 30, 2019.

Impact of Derivatives on Fund Performance

The Fund used derivatives in the form of options for hedging purposes, as well as forward foreign currency exchange contracts for managing currency risk on certain Fund positions denominated in foreign currencies. These contracts did not have a material effect on the Fund’s total return for thesix-month period ended June 30, 2019.

3

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

Sincerely,

| | |

| |

|

| |

THOMAS N. BOHJALIAN | | WILLIAM F. SCAPELL |

Portfolio Manager | | Portfolio Manager |

JASON YABLON

Portfolio Manager

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions.

4

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

Our Leverage Strategy

(Unaudited)

Our current leverage strategy utilizes borrowings up to the maximum permitted by the Investment Company Act of 1940 to provide additional capital for the Fund, with an objective of increasing net income available for shareholders. As of June 30, 2019, leverage represented 24% of the Fund’s managed assets.

Through a combination of variable and fixed rate financing, the Fund has locked in interest rates on a significant portion of this additional capital for periods expiring in 2020, 2021 and 2022a(where we effectively reduce our variable rate obligation and lock in our fixed rate obligation over various terms). Locking in a significant portion of our leveraging costs is designed to protect the dividend-paying ability of the Fund. The use of leverage increases the volatility of the Fund’s NAV in both up and down markets. However, we believe that locking in portions of the Fund’s leveraging costs for the various terms partially protects the Fund’s expenses from an increase in short-term interest rates.

Leverage Factsb,c

| | |

Leverage (as a % of managed assets) | | 24% |

% Fixed Rate | | 85% |

% Variable Rate | | 15% |

Weighted Average Rate on Financing | | 3.0%a |

Weighted Average Term on Financing | | 2.3 yearsa |

The Fund seeks to enhance its dividend yield through leverage. The use of leverage is a speculative technique and there are special risks and costs associated with leverage. The NAV of the Fund’s shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for shareholders. On the other hand, to the extent that the total cost of leverage exceeds the incremental income gained from employing such leverage, shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may need to liquidate investments, including under adverse economic conditions which may result in capital losses potentially reducing returns to shareholders. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

| a | On February 24, 2015, the Fund amended its credit agreement to extend the fixed rate financing terms, originally expiring in 2017, 2018 and 2019, by three years, now expiring in 2020, 2021 and 2022, respectively. The weighted average rate on financing does not include the three year extension for the 2022 fixed-rate tranche and will increase as the extended fixed-rate tranche becomes effective in 2019. The weighted average term on financing includes the three year extension. |

| b | Data as of June 30, 2019. Information is subject to change. |

| c | See Note 7 in Notes to Financial Statements. |

5

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

June 30, 2019

Top Ten Holdingsa

(Unaudited)

| | | | | | | | |

Security | | Value | | | % of

Managed

Assets | |

| | |

American Tower Corp. | | $ | 59,905,690 | | | | 4.1 | |

Equinix, Inc. | | | 50,836,466 | | | | 3.5 | |

Prologis, Inc. | | | 47,520,046 | | | | 3.3 | |

Crown Castle International Corp. | | | 42,734,205 | | | | 2.9 | |

Extra Space Storage, Inc. | | | 36,883,012 | | | | 2.5 | |

Welltower, Inc. | | | 36,735,380 | | | | 2.5 | |

Essex Property Trust, Inc. | | | 35,388,922 | | | | 2.4 | |

UDR, Inc. | | | 27,919,560 | | | | 1.9 | |

Invitation Homes, Inc. | | | 27,677,365 | | | | 1.9 | |

Sun Communities, Inc. | | | 27,385,614 | | | | 1.9 | |

| a | Top ten holdings are determined on the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Schedule of Investments for additional details on such other positions. |

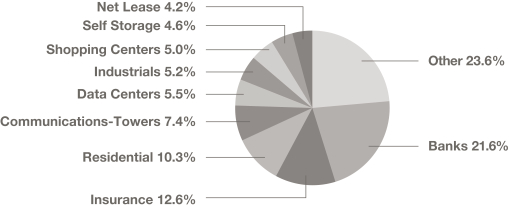

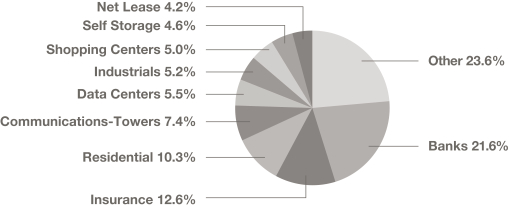

Sector Breakdown

(Based on Managed Assets)

(Unaudited)

6

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

COMMON STOCK | | | 65.3% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | | 9.3% | | | | | | | | | |

American Tower Corp.a,b | | | | 293,009 | | | $ | 59,905,690 | |

Crown Castle International Corp.a | | | | 327,842 | | | | 42,734,205 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 102,639,895 | |

| | | | | | | | | | | | |

REAL ESTATE | | | 56.0% | | | | | | | | | |

DATA CENTERS | | | 7.2% | | | | | | | | | |

CyrusOne, Inc.a | | | | 320,925 | | | | 18,523,791 | |

Digital Realty Trust, Inc.a,b | | | | 91,941 | | | | 10,829,731 | |

Equinix, Inc.a,b | | | | 100,808 | | | | 50,836,466 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 80,189,988 | |

| | | | | | | | | | | | |

HEALTH CARE | | | 4.7% | | | | | | | | | |

Sabra Health Care REIT, Inc.a,b | | | | 758,736 | | | | 14,939,512 | |

Welltower, Inc.a,b | | | | 450,575 | | | | 36,735,380 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 51,674,892 | |

| | | | | | | | | | | | |

HOTEL | | | 2.5% | | | | | | | | | |

Host Hotels & Resorts, Inc.a,b | | | | 510,751 | | | | 9,305,883 | |

Pebblebrook Hotel Trusta,b | | | | 340,152 | | | | 9,585,483 | |

Sunstone Hotel Investors, Inc.a,b | | | | 620,774 | | | | 8,510,812 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 27,402,178 | |

| | | | | | | | | | | | |

INDUSTRIALS | | | 4.3% | | | | | | | | | |

Prologis, Inc.a,b | | | | 593,259 | | | | 47,520,046 | |

| | | | | | | | | | | | |

NET LEASE | | | 5.2% | | | | | | | | | |

Four Corners Property Trust, Inc. | | | | 214,456 | | | | 5,861,082 | |

Spirit Realty Capital, Inc.a,b | | | | 366,430 | | | | 15,631,904 | |

VEREIT, Inc. | | | | 1,677,454 | | | | 15,113,861 | |

VICI Properties, Inc.a,b | | | | 942,450 | | | | 20,771,598 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 57,378,445 | |

| | | | | | | | | | | | |

OFFICE | | | 5.0% | | | | | | | | | |

Boston Properties, Inc.a | | | | 71,406 | | | | 9,211,374 | |

Douglas Emmett, Inc.a,b | | | | 231,178 | | | | 9,210,131 | |

Hudson Pacific Properties, Inc.a | | | | 278,968 | | | | 9,281,265 | |

Kilroy Realty Corp.a | | | | 276,411 | | | | 20,401,896 | |

See accompanying notes to financial statements.

7

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

Vornado Realty Trusta,b | | | | 104,537 | | | $ | 6,700,822 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 54,805,488 | |

| | | | | | | | | | | | |

RESIDENTIAL | | | 13.5% | | | | | | | | | |

APARTMENT | | | 8.5% | | | | | | | | | |

Apartment Investment & Management Co., Class Aa,b | | | | 231,434 | | | | 11,599,472 | |

Equity Residentiala,b | | | | 258,968 | | | | 19,660,851 | |

Essex Property Trust, Inc.a,b | | | | 121,224 | | | | 35,388,922 | |

UDR, Inc.a,b | | | | 621,955 | | | | 27,919,560 | |

| | | | | | | | | |

| | | | | | | | | | | 94,568,805 | |

| | | | | | | | | | | | |

MANUFACTURED HOME | | | 2.5% | | | | | | | | | |

Sun Communities, Inc.a,b | | | | 213,633 | | | | 27,385,614 | |

| | | | | | | | | | | | |

SINGLE FAMILY | | | 2.5% | | | | | | | | | |

Invitation Homes, Inc.a,b | | | | 1,035,442 | | | | 27,677,365 | |

| | | | | | | | | | | | |

TOTAL RESIDENTIAL | | | | | | | | 149,631,784 | |

| | | | | |

SELF STORAGE | | | 5.7% | | | | | | | | | |

Extra Space Storage, Inc.a,b | | | | 347,625 | | | | 36,883,012 | |

Public Storage | | | | 111,112 | | | | 26,463,545 | |

| | | | | | | | | |

| | | | 63,346,557 | |

| | | | | |

SHOPPING CENTERS | | | 6.6% | | | | | | | | | |

COMMUNITY CENTER | | | 2.8% | | | | | | | | | |

Acadia Realty Trust | | | | 256,861 | | | | 7,030,286 | |

Regency Centers Corp.a,b | | | | 151,522 | | | | 10,112,578 | |

Urban Edge Properties | | | | 799,487 | | | | 13,855,110 | |

| | | | | | | | | |

| | | | | | | | | | | 30,997,974 | |

| | | | | | | | | | | | |

FREE STANDING | | | 2.1% | | | | | | | | | |

Realty Income Corp.a,b | | | | 338,797 | | | | 23,366,829 | |

| | | | | | | | | | | | |

REGIONAL MALL | | | 1.7% | | | | | | | | | |

Macerich Co. (The)a | | | | 139,533 | | | | 4,672,960 | |

Simon Property Group, Inc.a,b | | | | 90,224 | | | | 14,414,186 | |

| | | | | | | | | |

| | | | | | | | | | | 19,087,146 | |

| | | | | | | | | | | | |

TOTAL SHOPPING CENTERS | | | | | | | | 73,451,949 | |

| | | | | |

See accompanying notes to financial statements.

8

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

SPECIALTY | | | 1.3% | | | | | | | | | |

Iron Mountain, Inc. | | | | 116,869 | | | $ | 3,658,000 | |

Lamar Advertising Co., Class Aa,b | | | | 133,077 | | | | 10,740,644 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 14,398,644 | |

| | | | | | | | | | | | |

TOTAL REAL ESTATE | | | | | | | | 619,799,971 | |

| | | | | | | | | | | | |

TOTAL COMMON STOCK

(Identified cost—$512,781,338) | | | | | | | | 722,439,866 | |

| | | | | | | | |

PREFERRED SECURITIES—$25 PAR VALUE | | | 18.8% | | | | | | | | | |

BANKS | | | 5.8% | | | | | | | | | |

Bank of America Corp., 6.20%, Series CCa,c | | | | 127,981 | | | | 3,358,221 | |

Bank of America Corp., 6.00%, Series GGa,c | | | | 104,775 | | | | 2,801,683 | |

Bank of America Corp., 5.875%, Series HHc | | | | 179,000 | | | | 4,673,690 | |

Bank of America Corp., 5.375%, Series KKc | | | | 65,250 | | | | 1,627,988 | |

Bank of America Corp., 6.50%, Series Ya,c | | | | 58,856 | | | | 1,502,005 | |

BB&T Corp., 5.625%, Series Ec | | | | 64,591 | | | | 1,624,464 | |

Citigroup, Inc., 6.875% to 11/15/23, Series Kc,d | | | | 159,391 | | | | 4,368,907 | |

Citigroup, Inc., 6.30%, Series Sa,b,c | | | | 189,006 | | | | 4,940,617 | |

Citizens Financial Group, Inc., 6.35% to 4/6/24, Series Dc,d | | | | 64,000 | | | | 1,715,200 | |

First Republic Bank/CA, 5.50%, Series Ic | | | | 28,277 | | | | 715,974 | |

GMAC Capital Trust I, 8.303% (3 Month US LIBOR + 5.785%), due 2/15/40, Series 2 (TruPS) (FRN)a,e | | | | 286,420 | | | | 7,484,155 | |

Huntington Bancshares, Inc., 6.25%, Series Da,c | | | | 110,273 | | | | 2,854,968 | |

JPMorgan Chase & Co., 6.15%, Series BBc | | | | 100,000 | | | | 2,620,000 | |

JPMorgan Chase & Co., 6.00%, Series EEc | | | | 101,903 | | | | 2,766,666 | |

JPMorgan Chase & Co., 6.125%, Series Ya,c | | | | 223,861 | | | | 5,766,659 | |

New York Community Bancorp, Inc., 6.375% to 3/17/27, Series Ac,d | | | | 73,450 | | | | 1,878,851 | |

Regions Financial Corp., 6.375% to 9/15/24, Series Bc,d | | | | 76,426 | | | | 2,091,780 | |

Regions Financial Corp., 5.70% to 5/15/29, Series Cc,d | | | | 174,000 | | | | 4,497,900 | |

Synovus Financial Corp., 5.875% to 7/1/24, Series Ec,d | | | | 80,000 | | | | 2,072,000 | |

TCF Financial Corp., 5.70%, Series Cc | | | | 73,000 | | | | 1,827,920 | |

Wells Fargo & Co., 5.85% to 9/15/23, Series Qc,d | | | | 122,748 | | | | 3,223,362 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 64,413,010 | |

| | | | | | | | | | | | |

CONSUMER CYCLICAL—AUTOMOBILES | | | 0.2% | | | | | | | | | |

Ford Motor Co., 6.200%, due 6/1/59 | | | | 68,925 | | | | 1,818,931 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

9

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

ELECTRIC | | | 1.7% | | | | | | | | | |

INTEGRATED ELECTRIC | | | 0.3% | | | | | | | | | |

Integrys Holding, Inc., 6.00% to 8/1/23, due 8/1/73d | | | | 122,977 | | | $ | 3,258,891 | |

| | | | | | | | | | | | |

REGULATED ELECTRIC | | | 1.4% | | | | | | | | | |

CMS Energy Corp., 5.875%, due 3/1/79 | | | | 139,950 | | | | 3,712,874 | |

Duke Energy Corp., 5.625%, due 9/15/78 | | | | 40,000 | | | | 1,068,800 | |

Duke Energy Corp., 5.750%, Series Ac | | | | 163,625 | | | | 4,322,972 | |

Southern Co./The, 6.25%, due 10/15/75 | | | | 105,356 | | | | 2,799,309 | |

Southern Co./The, 5.25%, due 12/1/77 | | | | 129,435 | | | | 3,325,185 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,229,140 | |

| | | | | | | | | | | | |

TOTAL ELECTRIC | | | | | | | | 18,488,031 | |

| | | | | | | | |

FINANCIAL | | | 2.2% | | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES | | | 0.7% | | | | | | | | | |

Apollo Global Management LLC, 6.375%, Series Ac | | | | 29,288 | | | | 750,065 | |

Apollo Global Management LLC, 6.375%, Series Bc | | | | 59,970 | | | | 1,550,824 | |

KKR & Co., Inc., 6.75%, Series Ac | | | | 58,578 | | | | 1,560,518 | |

National Rural Utilities Cooperative Finance Corp., 5.50%, due 5/15/64, Series US | | | | 120,265 | | | | 3,209,873 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,071,280 | |

| | | | | | | | | | | | |

INVESTMENT ADVISORY SERVICES | | | 0.2% | | | | | | | | | |

Ares Management Corp., 7.00%, Series Ac | | | | 94,506 | | | | 2,500,629 | |

| | | | | | | | | | | | |

INVESTMENT BANKER/BROKER | | | 1.3% | | | | | | | | | |

Carlyle Group LP/The, 5.875%, Series Ac | | | | 76,675 | | | | 1,853,235 | |

Morgan Stanley, 6.875% to 1/15/24, Series Fa,c,d | | | | 194,296 | | | | 5,331,482 | |

Morgan Stanley, 6.375% to 10/15/24, Series Ia,b,c,d | | | | 164,338 | | | | 4,407,545 | |

Morgan Stanley, 5.85% to 4/15/27, Series Kc,d | | | | 121,056 | | | | 3,186,194 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 14,778,456 | |

| | | | | | | | | | | | |

TOTAL FINANCIAL | | | | | | | | 24,350,365 | |

| | | | | | | | | | | | |

INDUSTRIALS—CHEMICALS | | | 0.8% | | | | | | | | | |

CHS, Inc., 7.10% to 3/31/24, Series 2a,c,d | | | | 190,229 | | | | 4,993,511 | |

CHS, Inc., 6.75% to 9/30/24, Series 3c,d | | | | 90,453 | | | | 2,336,401 | |

CHS, Inc., 7.50%, Series 4c | | | | 74,495 | | | | 2,027,009 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,356,921 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

10

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

INSURANCE | | | 3.6% | | | | | | | | | |

LIFE/HEALTH INSURANCE | | | 1.4% | | | | | | | | | |

Athene Holding Ltd., 6.35% to 6/30/29, Series Ac,d | | | | 199,925 | | | $ | 5,278,020 | |

MetLife, Inc., 5.625%, Series Ec | | | | 55,000 | | | | 1,424,500 | |

Prudential Financial, Inc., 5.625%, due 8/15/58 | | | | 56,000 | | | | 1,484,000 | |

Unum Group, 6.25%, due 6/15/58 | | | | 139,900 | | | | 3,679,370 | |

Voya Financial, Inc., 5.35% to 9/15/29, Series Bc,d | | | | 140,275 | | | | 3,546,152 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,412,042 | |

| | | | | | | | | | | | |

MULTI-LINE | | | 0.9% | | | | | | | | | |

American Financial Group, Inc., 5.875%, due 3/30/59 | | | | 75,000 | | | | 1,983,750 | |

American Financial Group, Inc., 6.00%, due 11/15/55 | | | | 38,556 | | | | 1,021,348 | |

American International Group, Inc., 5.85% to 3/15/24, Series Ac | | | | 73,969 | | | | 1,941,686 | |

WR Berkley Corp., 5.70%, due 3/30/58 | | | | 56,505 | | | | 1,500,773 | |

WR Berkley Corp., 5.75%, due 6/1/56 | | | | 137,102 | | | | 3,534,490 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,982,047 | |

| | | | | | | | | | | | |

MULTI-LINE—FOREIGN | | | 0.2% | | | | | |

PartnerRe Ltd., 6.50%, Series G (Bermuda)c | | | | 74,903 | | | | 1,984,930 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY—FOREIGN | | | 0.3% | | | | | |

Enstar Group Ltd., 7.00% to 9/1/28, Series D (Bermuda)c,d | | | | 132,981 | | | | 3,420,271 | |

| | | | | | | | | | | | |

REINSURANCE | | | 0.5% | | | | | |

Arch Capital Group Ltd., 5.25%, Series Ec | | | | 37,337 | | | | 894,221 | |

Arch Capital Group Ltd., 5.45%, Series Fc | | | | 82,593 | | | | 2,046,655 | |

Reinsurance Group of America, Inc., 5.75% to 6/15/26, due 6/15/56d | | | | 106,345 | | | | 2,903,218 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,844,094 | |

| | | | | | | | | | | | |

REINSURANCE—FOREIGN | | | 0.3% | | | | | |

RenaissanceRe Holdings Ltd., 5.75%, Series F (Bermuda)c | | | | 144,600 | | | | 3,742,248 | |

| | | | | | | | | | | | |

TOTAL INSURANCE | | | | | | | | 40,385,632 | |

| | | | | | | | |

INTEGRATED TELECOMMUNICATIONS SERVICES | | | 0.2% | | | | | |

AT&T, Inc., 5.625%, due 8/1/67 | | | | 70,000 | | | | 1,870,400 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

11

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

PIPELINES | | | 0.6% | | | | | | | | | |

Energy Transfer Operating LP, 7.625% to 8/15/23, Series Dc,d | | | | 135,000 | | | $ | 3,296,700 | |

Energy Transfer Operating LP, 7.60% to 5/15/24, Series Ec,d | | | | 100,000 | | | | 2,493,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,789,700 | |

| | | | | | | | | | | | |

PIPELINES—FOREIGN | | | 0.4% | | | | | |

Enbridge, Inc., 6.375% to 4/15/23, due 4/15/78, Series B (Canada)d | | | | 184,825 | | | | 4,823,933 | |

| | | | | | | | | | | | |

REAL ESTATE | | | 2.3% | | | | | |

DIVERSIFIED | | | 0.4% | | | | | |

Lexington Realty Trust, 6.50%, Series C ($50 Par Value)a,c | | | | 76,536 | | | | 4,114,575 | |

| | | | | | | | | | | | |

HOTEL | | | 0.2% | | | | | | | | | |

Hersha Hospitality Trust, 6.875%, Series Ca,c | | | | 69,345 | | | | 1,747,147 | |

Sunstone Hotel Investors, Inc., 6.95%, Series Ec | | | | 41,866 | | | | 1,140,849 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,887,996 | |

| | | | | | | | | | | | |

INDUSTRIALS | | | 0.4% | | | | | | | | | |

Monmouth Real Estate Investment Corp., 6.125%, Series Cc | | | | 140,000 | | | | 3,347,400 | |

STAG Industrial, Inc., 6.875%, Series Cc | | | | 44,881 | | | | 1,196,079 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,543,479 | |

| | | | | | | | | | | | |

NET LEASE | | | 0.4% | | | | | | | | | |

VEREIT, Inc., 6.70%, Series Fa,c | | | | 159,902 | | | | 4,031,129 | |

| | | | | | | | | | | | |

SELF STORAGE | | | 0.3% | | | | | | | | | |

National Storage Affiliates Trust, 6.00%, Series Ac | | | | 127,000 | † | | | 3,282,950 | |

| | | | | | | | | | | | |

SHOPPING CENTERS—COMMUNITY CENTER | | | 0.3% | | | | | | | | | |

Saul Centers, Inc., 6.875%, Series Ca,c | | | | 49,082 | | | | 1,315,398 | |

SITE Centers Corp., 6.50%, Series Jc | | | | 102,152 | | | | 2,596,704 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,912,102 | |

| | | | | | | | | | | | |

SPECIALTY | | | 0.3% | | | | | | | | | |

Digital Realty Trust, Inc., 6.35%, Series Ic | | | | 120,113 | | | | 3,136,150 | |

| | | | | | | | | | | | |

TOTAL REAL ESTATE | | | | | | | | 25,908,381 | |

| | | | | | | | |

See accompanying notes to financial statements.

12

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

UTILITIES | | | 1.0% | | | | | | | | | |

MULTI—UTILITIES | | | 0.2% | | | | | | | | | |

NiSource, Inc., 6.50% to 3/15/24, Series Bc,d | | | | 64,445 | | | $ | 1,691,681 | |

| | | | | | | | | | | | |

MULTI-UTILITIES—FOREIGN | | | 0.3% | | | | | | | | | |

Algonquin Power & Utilities Corp., 6.875% to 10/17/23, due 10/17/78 (Canada)d | | | | 31,625 | | | | 851,029 | |

Algonquin Power & Utilities Corp., 6.20% to 7/1/24, due 7/1/79, Series19-A (Canada)d | | | | 102,550 | | | | 2,643,739 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,494,768 | |

| | | | | | | | | | | | |

ELECTRIC UTILITIES | | | 0.3% | | | | | | | | | |

NextEra Energy Capital Holdings, Inc., 5.65%, due 3/1/79, Series N | | | | 124,537 | | | | 3,254,152 | |

| | | | | | | | | | | | |

GAS UTILITIES | | | 0.2% | | | | | | | | | |

Spire, Inc., 5.90%, Series Ac | | | | 80,475 | | | | 2,110,054 | |

| | | | | | | | | | | | |

TOTAL UTILITIES | | | | | | | | 10,550,655 | |

| | | | | | | | |

TOTAL PREFERRED SECURITIES—$25 PAR VALUE

(Identified cost—$196,079,181) | | | | | | | | 207,755,959 | |

| | | | | | | | |

| | | |

| | | | | | Principal

Amount | | | | |

PREFERRED SECURITIES—CAPITAL SECURITIES | | | 44.8% | | | | | | | | | |

BANKS | | | 9.1% | | | | | | | | | |

Bank of America Corp., 5.875% to 3/15/28, Series FFc,d | | | $ | 5,706,000 | | | | 5,961,058 | |

Bank of America Corp., 6.25% to 9/5/24, Series Xc,d | | | | 5,800,000 | | | | 6,323,073 | |

Bank of America Corp., 6.50% to 10/23/24, Series Za,c,d | | | | 5,713,000 | | | | 6,336,203 | |

Citigroup Capital III, 7.625%, due 12/1/36a | | | | 4,700,000 | | | | 6,115,075 | |

Citigroup, Inc., 5.90% to 2/15/23c,d | | | | 2,000,000 | | | | 2,074,308 | |

Citigroup, Inc., 5.95% to 1/30/23c,d | | | | 1,661,000 | | | | 1,734,225 | |

Citigroup, Inc., 6.125% to 11/15/20, Series Rc,d | | | | 1,936,000 | | | | 1,989,918 | |

Citigroup, Inc., 6.25% to 8/15/26, Series Ta,b,c,d | | | | 4,825,000 | | | | 5,303,375 | |

Citizens Financial Group, Inc., 6.375% to 4/6/24, Series Cc,d | | | | 1,800,000 | | | | 1,856,736 | |

CoBank ACB, 6.25% to 10/1/22, Series Fa,c,d | | | | 33,000 | † | | | 3,446,438 | |

CoBank ACB, 6.125%, Series Ga,c | | | | 46,500 | † | | | 4,801,125 | |

CoBank ACB, 6.25% to 10/1/26, Series Ia,c,d | | | | 4,334,000 | | | | 4,566,952 | |

Dresdner Funding Trust I, 8.151%, due 6/30/31, 144Aa,g | | | | 3,035,906 | | | | 4,100,750 | |

See accompanying notes to financial statements.

13

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

Farm Credit Bank of Texas, 6.75% to 9/15/23, 144Aa,b,c,d,g | | | $ | 63,000 | † | | $ | 6,709,500 | |

Farm Credit Bank of Texas, 10.00%, Series 1a,c | | | | 6,000 | † | | | 6,630,000 | |

Goldman Sachs Group, Inc./The, 5.50% to 8/10/24, Series Qc,d | | | | 2,390,000 | | | | 2,449,750 | |

JPMorgan Chase & Co., 6.75% to 2/1/24, Series Sa,c,d | | | | 6,650,000 | | | | 7,354,534 | |

SunTrust Banks, Inc., 5.125% to 12/15/27, Series Hc,d | | | | 1,500,000 | | | | 1,473,300 | |

Wells Fargo & Co., 6.180% (3 Month US LIBOR + 3.77%), Series K (FRN)a,c,e | | | | 12,274,000 | | | | 12,355,622 | |

Wells Fargo & Co., 5.875% to 6/15/25, Series Uc,d | | | | 4,330,000 | | | | 4,710,585 | |

Wells Fargo Capital X, 5.95%, due 12/15/36, (TruPS)a | | | | 3,700,000 | | | | 4,362,978 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 100,655,505 | |

| | | | | | | | | | | | |

BANKS—FOREIGN | | | 13.5% | | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA, 6.125% to 11/16/27 (Spain)c,d,h | | | | 1,600,000 | | | | 1,507,440 | |

Banco Mercantil del Norte SA/Grand Cayman, 7.50% to 6/27/29, 144A (Mexico)c,d,g,h | | | | 1,800,000 | | | | 1,821,600 | |

Bank of China Hong Kong Ltd., 5.90% to 9/14/23, 144A (Hong Kong)c,d,g | | | | 5,800,000 | | | | 6,188,396 | |

Barclays PLC, 7.125% to 6/15/25 (United Kingdom)c,d,h | | | | 1,800,000 | | | | 2,391,632 | |

Barclays PLC, 7.875% to 3/15/22 (United Kingdom)c,d,f,h | | | | 3,400,000 | | | | 3,565,750 | |

Barclays PLC, 8.00% to 6/15/24 (United Kingdom)c,d,h | | | | 4,200,000 | | | | 4,407,753 | |

BNP Paribas SA, 6.625% to 3/25/24, 144A (France)c,d,g,h | | | | 2,000,000 | | | | 2,083,930 | |

BNP Paribas SA, 7.00% to 8/16/28, 144A (France)c,d,g,h | | | | 1,000,000 | | | | 1,068,400 | |

BNP Paribas SA, 7.195% to 6/25/37, 144A (France)a,c,d,g | | | | 3,400,000 | | | | 3,683,815 | |

BNP Paribas SA, 7.375% to 8/19/25, 144A (France)c,d,g,h | | | | 4,500,000 | | | | 5,004,472 | |

BNP Paribas SA, 7.625% to 3/30/21, 144A (France)a,c,d,g,h | | | | 3,400,000 | | | | 3,600,940 | |

Credit Agricole SA, 6.875% to 9/23/24, 144A (France)c,d,g,h | | | | 2,400,000 | | | | 2,521,716 | |

Credit Agricole SA, 7.875% to 1/23/24, 144A (France)c,d,g,h | | | | 3,200,000 | | | | 3,531,744 | |

Credit Agricole SA, 8.125% to 12/23/25, 144A (France)a,c,d,g,h | | | | 7,300,000 | | | | 8,464,292 | |

Credit Suisse Group AG, 7.125% to 7/29/22 (Switzerland)c,d,f,h | | | | 3,400,000 | | | | 3,609,593 | |

See accompanying notes to financial statements.

14

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | |

| | | | | Principal

Amount | | | Value | |

Credit Suisse Group AG, 7.50% to 7/17/23, 144A (Switzerland)c,d,g,h | | $ | 4,200,000 | | | $ | 4,511,997 | |

DNB Bank ASA, 6.50% to 3/26/22 (Norway)c,d,f,h | | | 3,300,000 | | | | 3,489,486 | |

HSBC Capital Funding Dollar 1 LP, 10.176% to 6/30/30, 144A (United Kingdom)a,c,d,g | | | 5,192,000 | | | | 8,075,014 | |

HSBC Holdings PLC, 6.375% to 3/30/25 (United Kingdom)a,b,c,d,h | | | 4,600,000 | | | | 4,840,189 | |

HSBC Holdings PLC, 6.50% to 3/23/28 (United Kingdom)c,d,h | | | 2,200,000 | | | | 2,308,196 | |

HSBC Holdings PLC, 6.875% to 6/1/21 (United Kingdom)c,d,h | | | 3,400,000 | | | | 3,588,190 | |

ING Groep N.V., 6.875% to 4/16/22 (Netherlands)c,d,f,h | | | 2,200,000 | | | | 2,321,574 | |

Lloyds Banking Group PLC, 7.50% to 6/27/24 (United Kingdom)a,c,d,h | | | 3,266,000 | | | | 3,441,548 | |

Lloyds Banking Group PLC, 7.50% to 9/27/25 (United Kingdom)c,d,h | | | 5,085,000 | | | | 5,349,954 | |

Nationwide Building Society, 10.25% () (United Kingdom)c,f | | | 1,715,000 | | | | 3,296,892 | |

Nordea Bank Abp, 6.625% to 3/26/26, 144A (Finland)c,d,g,h | | | 2,400,000 | | | | 2,534,052 | |

RBS Capital Trust II, 6.425% to 1/3/34 (United Kingdom)c,d | | | 800,000 | | | | 1,022,000 | |

Royal Bank of Scotland Group PLC, 7.648% to 9/30/31 (United Kingdom)a,c,d | | | 4,141,000 | | | | 5,414,357 | |

Royal Bank of Scotland Group PLC, 8.00% to 8/10/25 (United Kingdom)c,d,h | | | 4,300,000 | | | | 4,660,125 | |

Royal Bank of Scotland Group PLC, 8.625% to 8/15/21 (United Kingdom)a,c,d,h | | | 6,800,000 | | | | 7,345,700 | |

Societe Generale SA, 7.375% to 9/13/21, 144A (France)c,d,g,h | | | 4,600,000 | | | | 4,847,480 | |

Societe Generale SA, 8.00% to 9/29/25, 144A (France)c,d,g,h | | | 2,400,000 | | | | 2,648,052 | |

Standard Chartered PLC, 7.50% to 4/2/22, 144A (United Kingdom)c,d,g,h | | | 2,400,000 | | | | 2,544,000 | |

Standard Chartered PLC, 7.75% to 4/2/23, 144A (United Kingdom)c,d,g,h | | | 1,500,000 | | | | 1,594,823 | |

Stichting AK Rabobank Certificaten, 6.50% (Netherlands)c,f | | | 4,900,000 | | | | 6,833,913 | |

See accompanying notes to financial statements.

15

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

Svenska Handelsbanken AB, 6.25% to 3/1/24, Series EMTN (Sweden)c,d,f,h | | | $ | 3,000,000 | | | $ | 3,180,825 | |

UBS Group Funding Switzerland AG, 7.00% to 2/19/25 (Switzerland)c,d,f,h | | | | 2,200,000 | | | | 2,414,500 | |

UBS Group Funding Switzerland AG, 7.125% to 8/10/21 (Switzerland)c,d,f,h | | | | 3,200,000 | | | | 3,368,000 | |

UBS Group Funding Switzerland AG, 7.00% to 1/31/24, 144A (Switzerland)c,d,g,h | | | | 4,200,000 | | | | 4,460,253 | |

UniCredit SpA, 7.50% to 6/3/26 () (Italy)c,d,f,h | | | | 1,600,000 | | | | 1,923,584 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 149,466,177 | |

| | | | | | | | | | | | |

COMMUNICATIONS—TOWERS | | | 0.4% | | | | | | | | | |

Crown Castle International Corp., 6.875%, due 8/1/20, Series A (Convertible) | | | | 3,900 | † | | | 4,668,401 | |

| | | | | | | | | | | | |

ELECTRIC | | | 1.0% | | | | | | | | | |

INTEGRATED ELECTRIC—FOREIGN | | | 0.4% | | | | | | | | | |

Electricite de France SA, 4.00% to 7/4/24 (France)c,d,f | | | | 3,000,000 | | | | 3,690,942 | |

| | | | | | | | | | | | |

REGULATED ELECTRIC | | | 0.6% | | | | | | | | | |

CenterPoint Energy, Inc., 6.125% to 9/01/23, Series Ac,d | | | | 3,790,000 | | | | 3,929,415 | |

Southern Co./The, 5.50% to 3/15/22, due 3/15/57, Series Bd | | | | 2,850,000 | | | | 2,921,159 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,850,574 | |

| | | | | | | | | | | | |

TOTAL ELECTRIC | | | | | | | | 10,541,516 | |

| | | | | | | | |

FOOD | | | 1.4% | | | | | | | | | |

Dairy Farmers of America, Inc., 7.875%, 144Ac,g,i | | | | 52,100 | † | | | 5,236,050 | |

Dairy Farmers of America, Inc., 7.875%, Series B, 144Ac,g | | | | 82,000 | † | | | 8,241,000 | |

Land O’ Lakes, Inc., 7.00%, 144Ac,g | | | | 1,650,000 | | | | 1,567,500 | |

Land O’ Lakes, Inc., 7.25%, 144Ac,g | | | | 945,000 | | | | 926,100 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,970,650 | |

| | | | | | | | | | | | |

INDUSTRIALS—DIVERSIFIED MANUFACTURING | | | 1.1% | | | | | | | | | |

General Electric Co., 5.00% to 1/21/21, Series Da,b,c,d | | | | 12,366,000 | | | | 11,881,005 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

16

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

INSURANCE | | | 12.7% | | | | | | | | | |

LIFE/HEALTH INSURANCE | | | 4.6% | | | | | | | | | |

MetLife Capital Trust IV, 7.875%, due 12/15/37, 144A (TruPS)g | | | $ | 4,381,000 | | | $ | 5,527,048 | |

MetLife, Inc., 6.40%, due 12/15/36 | | | | 669,000 | | | | 765,995 | |

MetLife, Inc., 10.75%, due 8/1/39a | | | | 3,592,000 | | | | 5,700,019 | |

MetLife, Inc., 9.25%, due 4/8/38, 144Aa,g | | | | 9,265,000 | | | | 12,985,778 | |

MetLife, Inc., 5.875% to 3/15/28, Series Dc,d | | | | 1,671,000 | | | | 1,765,445 | |

Prudential Financial, Inc., 5.20% to 3/15/24, due 3/15/44d | | | | 2,000,000 | | | | 2,083,757 | |

Prudential Financial, Inc., 5.625% to 6/15/23, due 6/15/43a,d | | | | 11,464,000 | | | | 12,144,102 | |

Prudential Financial, Inc., 5.70% to 9/15/28, due 9/15/48d | | | | 1,040,000 | | | | 1,119,019 | |

Prudential Financial, Inc., 5.875% to 9/15/22, due 9/15/42d | | | | 1,300,000 | | | | 1,378,461 | |

Voya Financial, Inc., 5.65% to 5/15/23, due 5/15/53a,d | | | | 5,550,000 | | | | 5,763,564 | |

Voya Financial, Inc., 6.125% to 9/15/23, Series Ac,d | | | | 1,550,000 | | | | 1,636,358 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 50,869,546 | |

| | | | | | | | | | | | |

LIFE/HEALTH INSURANCE—FOREIGN | | | 4.4% | | | | | | | | | |

Aegon NV, 5.625% to 4/15/29 (Netherlands)c,d,f,h | | | | 3,200,000 | | | | 4,043,481 | |

Dai-ichi Life Insurance Co., Ltd., 4.00% to 7/24/26, 144A (Japan)c,d,g | | | | 3,900,000 | | | | 3,947,209 | |

Dai-ichi Life Insurance Co., Ltd., 5.10% to 10/28/24, 144A (Japan)a,c,d,g | | | | 4,400,000 | | | | 4,733,146 | |

Fukoku Mutual Life Insurance Co., 6.50% to 9/19/23 (Japan)c,d,f | | | | 3,064,000 | | | | 3,404,564 | |

Hanwha Life Insurance Co., Ltd., 4.70% to 4/23/23, 144A (South Korea)c,d,g | | | | 2,400,000 | | | | 2,379,796 | |

La Mondiale SAM, 4.80% to 1/18/28, due 1/18/48 (France)d,f | | | | 1,400,000 | | | | 1,324,190 | |

Meiji Yasuda Life Insurance Co., 5.10% to 4/26/28, due 4/26/48, 144A (Japan)d,g | | | | 2,000,000 | | | | 2,183,040 | |

Meiji Yasuda Life Insurance Co., 5.20% to 10/20/25, due 10/20/45, 144A (Japan)a,d,g | | | | 7,350,000 | | | | 7,967,547 | |

Nippon Life Insurance Co., 4.70% to 1/20/26, due 1/20/46, 144A (Japan)a,d,g | | | | 5,600,000 | | | | 5,951,512 | |

See accompanying notes to financial statements.

17

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

Nippon Life Insurance Co., 5.10% to 10/16/24, due 10/16/44, 144A (Japan)d,g | | | $ | 2,000,000 | | | $ | 2,148,040 | |

NN Group NV, 4.50% to 1/15/26 (Netherlands)c,d,f | | | | 200,000 | | | | 251,698 | |

Phoenix Group Holdings, 5.375%, due 7/6/27, Series EMTN (United Kingdom)f | | | | 3,600,000 | | | | 3,601,800 | |

Sumitomo Life Insurance Co., 6.50% to 9/20/23, due 9/20/73, 144A

(Japan)d,g | | | | 6,200,000 | | | | 6,899,174 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 48,835,197 | |

| | | | | | | | | | | | |

MULTI-LINE | | | 0.7% | | | | | |

American International Group, Inc., 8.175% to 5/15/38, due 5/15/58d | | | | 2,700,000 | | | | 3,460,104 | |

American International Group, Inc., 5.75% to 4/1/28, due 4/1/48, SeriesA-9d | | | | 2,930,000 | | | | 3,017,138 | |

Hartford Financial Services Group, Inc./The, 4.643% (3 Month US LIBOR + 2.125%), due 2/12/47, 144A, Series ICON (FRN)e,g | | | | 1,000,000 | | | | 851,520 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,328,762 | |

| | | | | | | | | | | | |

MULTI-LINE—FOREIGN | | | 0.2% | | | | | |

AXA SA, 6.379% to 12/14/36, 144A (France)c,d,g | | | | 2,299,000 | | | | 2,608,710 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY | | | 0.7% | | | | | |

Assurant, Inc., 7.00% to 3/27/28, due 3/27/48d | | | | 3,550,000 | | | | 3,790,584 | |

Liberty Mutual Group Inc, 3.625% to 5/23/24, due 5/23/59, 144Ad,g | | | | 3,200,000 | | | | 3,728,324 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,518,908 | |

| | | | | | | | | | | | |

PROPERTY CASUALTY—FOREIGN | | | 2.1% | | | | | |

Mitsui Sumitomo Insurance Co., Ltd., 4.95% to 3/6/29, 144A (Japan)c,d,g | | | | 5,200,000 | | | | 5,601,180 | |

QBE Insurance Group Ltd., 6.75% to 12/2/24, due 12/2/44 (Australia)d,f | | | | 4,603,000 | | | | 5,012,759 | |

QBE Insurance Group Ltd., 5.875% to 6/17/26, due 6/17/46, Series EMTN (Australia)d,f | | | | 2,200,000 | | | | 2,314,017 | |

Sompo Japan Nipponkoa Insurance, Inc., 5.325% to 3/28/23, due 3/28/73, 144A (Japan)d,g | | | | 3,200,000 | | | | 3,404,864 | |

Swiss Re Finance Luxembourg SA, 5.00% to 4/2/29, due 4/2/49, 144A (Switzerland)d,g | | | | 3,400,000 | | | | 3,649,900 | |

See accompanying notes to financial statements.

18

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

VIVAT NV, 6.25% to 11/16/22 (Netherlands)c,d,f | | | $ | 3,200,000 | | | $ | 3,228,848 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 23,211,568 | |

| | | | | | | | | | | | |

TOTAL INSURANCE | | | | | | | | 140,372,691 | |

| | | | | | | | |

INTEGRATED TELECOMMUNICATIONS SERVICES | | | 0.3% | | | | | |

Centaur Funding Corp., 9.08%, due 4/21/20, 144Aa,g | | | | 3,254 | † | | | 3,432,970 | |

| | | | | | | | | | | | |

INTEGRATED TELECOMMUNICATIONS SERVICES—FOREIGN | | | 0.7% | | | | | |

Vodafone Group PLC, 7.00% to 4/4/29, due 4/4/79 (United Kingdom)d | | | | 6,650,000 | | | | 7,182,665 | |

| | | | | | | | | | | | |

MATERIAL—METALS & MINING | | | 0.9% | | | | | |

BHP Billiton Finance USA Ltd., 6.75% to 10/20/25, due 10/19/75, 144A (Australia)a,d,g | | | | 9,000,000 | | | | 10,282,680 | |

| | | | | | | | | | | | |

PIPELINES—FOREIGN | | | 1.7% | | | | | |

Enbridge, Inc., 6.25% to 3/1/28, due 3/1/78 (Canada)d | | | | 5,330,000 | | | | 5,401,849 | |

Enbridge, Inc., 6.00% to 1/15/27, due 1/15/77,

Series16-A (Canada)d | | | | 4,012,000 | | | | 4,038,158 | |

Transcanada Trust, 5.625% to 5/20/25, due 5/20/75 (Canada)d | | | | 2,733,000 | | | | 2,708,348 | |

Transcanada Trust, 5.875% to 8/15/26, due 8/15/76,Series 16-A

(Canada)a,d | | | | 7,002,000 | | | | 7,197,496 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,345,851 | |

| | | | | | | | | | | | |

UTILITIES | | | 2.0% | | | | | |

ELECTRIC UTILITIES | | | 0.4% | | | | | |

NextEra Energy Capital Holdings, Inc.,

5.65% to 5/1/29, due 5/1/79d | | | | 3,850,000 | | | | 3,971,646 | |

| | | | | | | | | | | | |

ELECTRIC UTILITIES—FOREIGN | | | 1.6% | | | | | |

Emera, Inc., 6.75% to 6/15/26, due 6/15/76,

Series16-A (Canada)a,d | | | | 8,320,000 | | | | 8,931,353 | |

Enel SpA, 8.75% to 9/24/23, due 9/24/73, 144A (Italy)a,d,g | | | | 8,110,000 | | | | 9,387,325 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 18,318,678 | |

| | | | | | | | | | | | |

TOTAL UTILITIES | | | | | | | | 22,290,324 | |

| | | | | | | | | | | | |

TOTAL PREFERRED SECURITIES—CAPITAL SECURITIES

(Identified cost—$461,318,914) | | | | | | | | 496,090,435 | |

| | | | | | | | |

See accompanying notes to financial statements.

19

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount | | | Value | |

CORPORATE BONDS | | | 0.5% | | | | | | | | | |

INDUSTRIALS | | | 0.2% | | | | | | | | | |

General Electric Co., 5.875%, due 1/14/38, Series MTN | | | $ | 1,893,000 | | | $ | 2,146,636 | |

| | | | | | | | | | | | |

INSURANCE | | | 0.3% | | | | | | | | | |

Brighthouse Financial, Inc., 4.70%, due 6/22/47 | | | | 3,500,000 | | | | 2,927,049 | |

| | | | | | | | | | | | |

TOTAL CORPORATE BONDS

(Identified cost—$4,620,471) | | | | | | | | 5,073,685 | |

| | | | | | | | |

| | | |

| | | | | | Shares | | | | |

SHORT-TERM INVESTMENTS | | | 1.9% | | | | | | | | | |

MONEY MARKET FUNDS | | | | | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 2.17%j | | | | 21,323,444 | | | | 21,323,444 | |

| | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$21,323,444) | | | | | | | | 21,323,444 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTSIN SECURITIES

(Identified cost—$1,196,123,348) | | | 131.3% | | | | | | | | 1,452,683,389 | |

WRITTEN OPTION CONTRACTS | | | (0.0) | | | | | | | | (226,833 | ) |

LIABILITIESIN EXCESSOF OTHER ASSETS | | | (31.3) | | | | | | | | (346,364,193 | ) |

| | | | | | | | | | | | |

NET ASSETS (Equivalent to $23.25 per share based on 47,566,736 shares of common stock outstanding) | | | 100.0% | | | | | | | $ | 1,106,092,363 | |

| | | | | | | | | | | | |

Over-the-Counter Option Contracts

Written Options

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Description | | Counterparty | | Exercise

Price | | | Expiration

Date | | | Number of

Contracts | | | Notional

Amountk | | | Premiums

Received | | | Value | |

Call—American Tower Corp | | Goldman Sachs International | | | $207.00 | | | | 7/19/2019 | | | | (314 | ) | | | $(6,419,730 | ) | | | $(79,128 | ) | | | $(86,162 | ) |

Put—Macerich

Co. (The) | | Goldman Sachs International | | | 32.50 | | | | 7/19/2019 | | | | (2,154 | ) | | | (7,213,746 | ) | | | (101,238 | ) | | | (113,532 | ) |

Put—Macerich

Co. (The) | | BNP Paribas SA | | | 30.00 | | | | 8/16/2019 | | | | (557 | ) | | | (1,865,393 | ) | | | (35,570 | ) | | | (27,139 | ) |

| | | | | | | | | | | | | (3,025 | ) | | | $(15,498,869 | ) | | | $(215,936 | ) | | | $(226,833 | ) |

| |

See accompanying notes to financial statements.

20

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

Forward Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Counterparty | | Contracts to

Deliver | | | In Exchange

For | | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

Brown Brothers Harriman | | EUR | | | 14,030,758 | | | USD | | | 15,671,655 | | | | 7/2/19 | | | $ | (282,722 | ) |

Brown Brothers Harriman | | EUR | | | 1,033,539 | | | USD | | | 1,159,956 | | | | 7/2/19 | | | | (15,281 | ) |

Brown Brothers Harriman | | EUR | | | 994,487 | | | USD | | | 1,116,710 | | | | 7/2/19 | | | | (14,121 | ) |

Brown Brothers Harriman | | EUR | | | 1,288,788 | | | USD | | | 1,459,728 | | | | 7/2/19 | | | | (5,753 | ) |

Brown Brothers Harriman | | EUR | | | 917,325 | | | USD | | | 1,039,613 | | | | 7/2/19 | | | | (3,477 | ) |

Brown Brothers Harriman | | GBP | | | 2,629,298 | | | USD | | | 3,318,779 | | | | 7/2/19 | | | | (20,296 | ) |

Brown Brothers Harriman | | GBP | | | 290,664 | | | USD | | | 369,284 | | | | 7/2/19 | | | | 155 | |

Brown Brothers Harriman | | GBP | | | 853,348 | | | USD | | | 1,083,896 | | | | 7/2/19 | | | | 187 | |

Brown Brothers Harriman | | GBP | | | 1,800,000 | | | USD | | | 2,295,088 | | | | 7/2/19 | | | | 9,179 | |

Brown Brothers Harriman | | USD | | | 20,798,056 | | | EUR | | | 18,264,897 | | | | 7/2/19 | | | | (29,038 | ) |

Brown Brothers Harriman | | USD | | | 5,671,311 | | | GBP | | | 4,456,581 | | | | 7/2/19 | | | | (11,679 | ) |

Brown Brothers Harriman | | USD | | | 1,415,841 | | | GBP | | | 1,116,729 | | | | 7/2/19 | | | | 2,348 | |

Brown Brothers Harriman | | EUR | | | 18,173,847 | | | USD | | | 20,746,264 | | | | 8/2/19 | | | | 27,712 | |

Brown Brothers Harriman | | GBP | | | 4,469,822 | | | USD | | | 5,696,654 | | | | 8/2/19 | | | | 11,356 | |

| | | | | | | | | | | | | | | | | | $ | (331,430 | ) |

| |

Glossary of Portfolio Abbreviations

| | |

EMTN | | Euro Medium Term Note |

EUR | | Euro Currency |

FRN | | Floating Rate Note |

GBP | | Great British Pound |

LIBOR | | London Interbank Offered Rate |

MTN | | Medium Term Note |

REIT | | Real Estate Investment Trust |

TruPS | | Trust Preferred Securities |

USD | | United States Dollar |

See accompanying notes to financial statements.

21

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2019 (Unaudited)

| a | All or a portion of the security is pledged as collateral in connection with the Fund’s credit agreement. $706,345,061 in aggregate has been pledged as collateral. |

| b | A portion of the security has been rehypothecated in connection with the Fund’s credit agreement. $324,006,494 in aggregate has been rehypothecated. |

| c | Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. |

| d | Security converts to floating rate after the indicated fixed-rate coupon period. |

| e | Variable rate. Rate shown is in effect at June 30, 2019. |

| f | Securities exempt from registration under Regulation S of the Securities Act of 1933. These securities are subject to resale restrictions. Aggregate holdings amounted to $60,876,416 which represents 5.5% of the net assets of the Fund, of which 0.0% are illiquid. |

| g | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. Aggregate holdings amounted to $193,635,639 which represents 17.5% of the net assets of the Fund, of which 0.0% are illiquid. |

| h | Contingent Capital security (CoCo). CoCos are debt or preferred securities with loss absorption characteristics built into the terms of the security for the benefit of the issuer. Aggregate holdings amounted to $118,995,271 which represents 10.8% of the net assets of the Fund (8.2% of the managed assets of the Fund). |

i Security value is determined based on significant unobservable inputs (Level 3).

| j | Rate quoted represents the annualizedseven-day yield. |

| k | Amount represents number of contracts multiplied by notional contract size multiplied by the underlying price. |

See accompanying notes to financial statements.

22

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2019 (Unaudited)

| | | | |

ASSETS: | |

Investments in securities, at valuea (Identified cost—$1,196,123,348) | | $ | 1,452,683,389 | |

Cash | | | 61,274 | |

Cash collateral pledged forover-the-counter option contracts | | | 280,000 | |

Foreign currency, at value (Identified cost—$139,878) | | | 140,062 | |

Receivable for: | | | | |

Dividends and interest | | | 9,766,343 | |

Investment securities sold | | | 6,142,848 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | 50,937 | |

Other assets | | | 34,527 | |

| | | | |

Total Assets | | | 1,469,159,380 | |

| | | | |

LIABILITIES: | |

Unrealized depreciation on forward foreign currency exchange contracts | | | 382,367 | |

Written option contracts, at value (Premiums received—$215,936) | | | 226,833 | |

Payable for: | | | | |

Credit agreement | | | 350,000,000 | |

Investment securities purchased | | | 10,376,154 | |

Interest expense | | | 867,372 | |

Investment management fees | | | 780,138 | |

Dividends declared | | | 241,176 | |

Administration fees | | | 72,013 | |

Directors’ fees | | | 1,133 | |

Other liabilities | | | 119,831 | |

| | | | |

Total Liabilities | | | 363,067,017 | |

| | | | |

NET ASSETS | | $ | 1,106,092,363 | |

| | | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 804,849,914 | |

Total distributable earnings/(accumulated loss) | | | 301,242,449 | |

| | | | |

| | | $1,106,092,363 | |

| | | | |

NET ASSET VALUE PER SHARE: | |

($1,106,092,363 ÷ 47,566,736 shares outstanding) | | $ | 23.25 | |

| | | | |

MARKET PRICE PER SHARE | | $ | 21.62 | |

| | | | |

MARKET PRICE PREMIUM (DISCOUNT) TO NET ASSET VALUE PER SHARE | | | (7.01 | )% |

| | | | |

| a | Includes $706,345,061 pledged, of which $324,006,494 has been rehypothecated, in connection with the Fund’s credit agreement, as described in Note 7. |

See accompanying notes to financial statements.

23

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2019 (Unaudited)

| | | | |

Investment Income: | |

Dividend income (net of $295 of foreign withholding tax) | | $ | 17,747,021 | |

Interest income | | | 13,286,987 | |

Rehypothecation income | | | 30,983 | |

| | | | |

Total Investment Income | | | 31,064,991 | |

| | | | |

Expenses: | |

Interest expense | | | 5,250,655 | |

Investment management fees | | | 4,551,276 | |

Administration fees | | | 495,737 | |

Shareholder reporting expenses | | | 211,156 | |

Custodian fees and expenses | | | 49,615 | |

Professional fees | | | 43,500 | |

Directors’ fees and expenses | | | 27,400 | |

Transfer agent fees and expenses | | | 10,859 | |

Miscellaneous | | | 45,979 | |

| | | | |

Total Expenses | | | 10,686,177 | |

| | | | |

Net Investment Income (Loss) | | | 20,378,814 | |

| | | | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | |

Investments in securities | | | 29,525,038 | |

Written option contracts | | | 599,257 | |

Forward foreign currency exchange contracts | | | 454,968 | |

Foreign currency transactions | | | (19,656 | ) |

| | | | |

Net realized gain (loss) | | | 30,559,607 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments in securities | | | 140,745,790 | |

Written option contracts | | | (247,970 | ) |

Forward foreign currency exchange contracts | | | (276,578 | ) |

Foreign currency translations | | | 2,313 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 140,223,555 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | 170,783,162 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 191,161,976 | |

| | | | |

See accompanying notes to financial statements.

24

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| | | | | | | | |

| | | For the

Six Months Ended

June 30, 2019 | | | For the

Year Ended

December 31, 2018 | |

Change in Net Assets: | |

From Operations: | | | | | | | | |

Net investment income (loss) | | $ | 20,378,814 | | | $ | 41,643,913 | |

Net realized gain (loss) | | | 30,559,607 | | | | 49,573,158 | |

Net change in unrealized appreciation (depreciation) | | | 140,223,555 | | | | (154,822,184 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 191,161,976 | | | | (63,605,113 | ) |

| | | | | | | | |

Distributions to Shareholders | | | (35,389,652 | ) | | | (70,779,303 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 155,772,324 | | | | (134,384,416 | ) |

Net Assets: | | | | | | | | |

Beginning of period | | | 950,320,039 | | | | 1,084,704,455 | |

| | | | | | | | |

End of period | | $ | 1,106,092,363 | | | $ | 950,320,039 | |

| | | | | | | | |

See accompanying notes to financial statements.

25

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

STATEMENT OF CASH FLOWS

For the Six Months Ended June 30, 2019 (Unaudited)

| | | | |

Increase (Decrease) in Cash: | | | | |

Cash Flows from Operating Activities: | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 191,161,976 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investments | | | (448,000,312 | ) |

Proceeds from sales and maturities of long-term investments | | | 472,203,103 | |

Net purchases, sales and maturities of short-term investments | | | (11,332,670 | ) |

Net amortization of premium on investments in securities | | | 620,480 | |

Net increase in dividends and interest receivable and other assets | | | (295,115 | ) |

Net decrease in cash collateral received forover-the-counter options contracts | | | (410,000 | ) |

Net increase in interest expense payable, accrued expenses and other liabilities | | | 742,226 | |

Decrease in premiums received from written option contracts | | | (319,972 | ) |

Net change in unrealized depreciation on written option contracts | | | 247,970 | |

Net change in unrealized appreciation on investments in securities | | | (140,745,790 | ) |

Net change in unrealized depreciation on forward foreign currency exchange contracts | | | 276,578 | |

Net realized gain on investments in securities | | | (29,525,038 | ) |

| | | | |

Cash provided by operating activities | | | 34,623,436 | |

| | | | |

Cash Flows from Financing Activities: | | | | |

Dividends and distributions paid | | | (35,401,618 | ) |

| | | | |

Increase (decrease) in cash and restricted cash | | | (778,182 | ) |

Cash and restricted cash at beginning of period | | | 1,259,518 | |

| | | | |

Cash and restricted cash at end of period (including foreign currency) | | $ | 481,336 | |

| | | | |

Supplemental Disclosure of Cash Flow Information andNon-Cash Activities:

During the six months ended June 30, 2019, interest paid was $4,499,584.

The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sums to the total of such amounts shown on the Statement of Cash Flows.

| | | | |

Cash | | $ | 61,274 | |

Restricted cash | | | 280,000 | |

Foreign currency | | | 140,062 | |

| | | | |

Total cash and restricted cash shown on the Statement of Cash Flows | | $ | 481,336 | |

| | | | |

Restricted cash consists of cash that has been deposited with a broker and pledged to cover the Fund’s collateral or margin obligations under derivative contracts. It is reported on the Statement of Assets and Liabilities as cash collateral pledged forover-the-counter option contracts.

See accompanying notes to financial statements.

26

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

June 30, 2019 | | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of period | | | $19.98 | | | | $22.80 | | | | $21.75 | | | | $21.63 | | | | $21.62 | | | | $17.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)a | | | 0.43 | | | | 0.88 | | | | 0.94 | | | | 1.03 | | | | 0.91 | | | | 0.96 | |

Net realized and unrealized gain (loss) | | | 3.58 | | | | (2.21 | )b | | | 1.60 | | | | 0.57 | | | | 0.57 | | | | 4.07 | c |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 4.01 | | | | (1.33 | ) | | | 2.54 | | | | 1.60 | | | | 1.48 | | | | 5.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.74 | ) | | | (0.92 | ) | | | (0.92 | ) | | | (0.97 | ) | | | (1.48 | ) | | | (1.29 | ) |

Net realized gain | | | — | | | | (0.57 | ) | | | (0.57 | ) | | | (0.51 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions to shareholders | | | (0.74 | ) | | | (1.49 | ) | | | (1.49 | ) | | | (1.48 | ) | | | (1.48 | ) | | | (1.29 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Anti-dilutive effect from the repurchase of shares | | | — | | | | — | | | | — | | | | — | | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net increase (decrease) in net asset value | | | 3.27 | | | | (2.82 | ) | | | 1.05 | | | | 0.12 | | | | 0.01 | | | | 3.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, end of period | | | $23.25 | | | | $19.98 | | | | $22.80 | | | | $21.75 | | | | $21.63 | | | | $21.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Market value, end of period | | | $21.62 | | | | $17.80 | | | | $21.27 | | | | $19.12 | | | | $18.44 | | | | $18.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

| | |

Total net asset value returnd | | | 20.63 | %e | | | –5.20 | %b | | | 12.65 | % | | | 8.43 | % | | | 8.45 | % | | | 29.87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total market value returnd | | | 25.91 | %e | | | –9.47 | % | | | 19.58 | % | | | 11.79 | % | | | 5.26 | % | | | 29.91 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

| | |

See accompanying notes to financial statements.

27

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

June 30, 2019 | | | For the Year Ended December 31, | |

Ratios/Supplemental Data: | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net assets, end of period (in millions) | | | $1,106.1 | | | | $950.3 | | | | $1,084.7 | | | | $1,034.6 | | | | $1,029.0 | | | | $1,032.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average daily net assets: | |

| | | | | | |

Expenses | | | 2.03 | %f | | | 1.93 | %b | | | 1.67 | % | | | 1.65 | % | | | 1.67 | % | | | 1.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses (excluding interest expense) | | | 1.03 | %f | | | 1.05 | % | | | 1.01 | % | | | 1.01 | % | | | 1.03 | % | | | 1.03 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 3.87 | %f | | | 4.10 | % | | | 4.19 | % | | | 4.64 | % | | | 4.18 | % | | | 4.76 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average daily managed assetsg | | | 1.53 | %f | | | 1.43 | % | | | 1.26 | % | | | 1.24 | % | | | 1.25 | % | | | 1.26 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 33 | %e | | | 39 | % | | | 26 | % | | | 46 | % | | | 42 | % | | | 54 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Credit Agreement | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Asset coverage ratio for credit agreement | | | 416 | % | | | 372 | % | | | 410 | % | | | 396 | % | | | 394 | % | | | 395 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Asset coverage per $1,000 for credit agreement | | | $4,160 | | | | $3,715 | | | | $4,099 | | | | $3,956 | | | | $3,940 | | | | $3,951 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| a | Calculation based on average shares outstanding. |

| b | During the reporting period the Fund settled legal claims against one issuer of securities previously held by the Fund. As a result, the net realized and unrealized gain (loss) on investments per share includes proceeds received from the settlement. Without these proceeds the net realized and unrealized gain (loss) on investments per share would have been $(2.22). Additionally, the expense ratio includes extraordinary expenses related to the direct action. Without these expenses, the ratio of expenses to average daily net assets would have been 1.92%. Excluding the proceeds from and expenses relating to the settlements, the total return on a NAV basis would have been-5.24%. |

| c | Includes gains resulting from class action litigation payments on securities owned in prior years. Without these gains, the net realized and unrealized gains (losses) on investments per share would have been $3.99 and the total return on an NAV basis would have been 29.58%. |

| d | Total net asset value return measures the change in net asset value per share over the period indicated. Total market value return is computed based upon the Fund’s market price per share and excludes the effects of brokerage commissions. Dividends and distributions are assumed, for purposes of these calculations, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| g | Average daily managed assets represent net assets plus the outstanding balance of the credit agreement. |

See accompanying notes to financial statements.

28

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Organization and Significant Accounting Policies

Cohen & Steers REIT and Preferred and Income Fund, Inc. (the Fund) was incorporated under the laws of the State of Maryland on March 25, 2003 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified,closed-end management investment company. The Fund’s primary investment objective is high current income. The Fund’s secondary investment objective is capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation:Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price. Exchange-traded options are valued at their last sale price as of the close of options trading on applicable exchanges on the valuation date. In the absence of a last sale price on such day, options are valued at the average of the quoted bid and ask prices as of the close of business.Over-the-counter (OTC) options are valued based upon prices provided by a third-party pricing service or counterparty. Forward contracts are valued daily at the prevailing forward exchange rate.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certainnon-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the OTC market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment manager) to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Fixed-income securities are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Directors, to reflect the fair market value of such securities. The pricing services or broker-dealers use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services or broker-dealers may utilize a market-based

29

COHEN & STEERS REITAND PREFERREDAND INCOME FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services or broker-dealers also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features which are then used to calculate the fair values.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments inopen-end mutual funds are valued at net asset value (NAV).