SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| (Mark One) | |

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | or |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | or |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

Commission file number:

MITCHELLS & BUTLERS PLC

(Exact name of Registrant as specified in its charter)

England and Wales

(Jurisdiction of incorporation or organization)

20 North Audley Street,

London W1K 6WN

England

(Address of principal executive offices)

Copies to:

Richard C Morrissey, Esq.

Sullivan & Cromwell LLP

1 New Fetter Lane, London EC4A 1AN

Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class | Name of each exchange

on which registered |

| | |

| American Depositary Shares | New York Stock Exchange |

| | |

| Ordinary Shares | New York Stock Exchange* |

| * Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Not Applicable

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days:

Yes  No

No

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17  Item 18

Item 18

As used in this document, except as the context otherwise requires, the terms:

| | • | “Company” and “M and B” refer to Mitchells & Butlers PLC or, where appropriate, the Company’s board of directors; |

| | | |

| | • | “M and B Group” or “Group” are used for convenience to refer to the Company and those companies which will become its subsidiaries or its subsidiary undertakings upon completion of the Separation; |

| | | |

| | • | “directors” or “board” refers to members of the board of directors of the Company after Separation either individually or collectively, as the context may require; |

| | | |

| | • | “ordinary share” or “M and B share” refers to the ordinary shares of 1p each of the Company the nominal value of which will be changed in connection with the Separation as described in “Item 9. The Offer and Listing”, except as the context otherwise requires; |

| | | |

| | • | “Six Continents” refers to Six Continents PLC (formerly known as Bass PLC or “Bass”); |

| | | |

| | • | “Six Continents Group” refers to Six Continents and its subsidiaries; |

| | | |

| | • | “Britvic” refers to Britannia Soft Drinks Limited; |

| | | |

| | • | “Beer Orders” refers to the Supply of Beer (Tied Estate) Order 1989 and the Supply of Beer (Loan Ties, Licensed Brewers and Wholesale Prices) Order 1989; |

| | | |

| | • | “VAT” refers to UK Value Added Tax levied by HM Customs & Excise on certain goods and services; and |

| | | |

| | • | “Senior Management Team” refers to the board and the other senior management listed in “Item 1. Identity of Directors, Senior Management and Advisors – Directors and Senior Management”. |

| | | |

| | • | “Separation Transaction” or “Separation” refers to the completion of the proposed transaction announced by Six Continents on October 1, 2002: (i) to separate Six Continents’ hotels business and soft drinks business (which it has through its controlling interest in Britvic) from its retail business (herein referred to as “Retail”) and (ii) to return approximately £700 million of capital, or 81p per existing share in cash, to its shareholders, absent a material change in circumstances in the trading environment or capital markets (herein referred to as the “Return of Capital”). The Separation will result in two separately listed holding companies, (i) Mitchells & Butler PLC, which will be the holding company for Retail and Six Continents’ property development business, Standard Commercial Property Developments Limited (herein referred to as “SCPD”), and (ii) InterContinental Hotels Group PLC (“InterContinental PLC”), which will be the holding company for the hotels business and soft drinks business of the Six Continents Group. |

| | | |

| | • | “InterContinental Group” refers to InterContinental Hotels Group PLC and those companies which will become its subsidiaries or its subsidiary undertakings upon completion of the Separation, and “InterContinental” refers to the specific registered brand. |

References in this document to the “Companies Act” mean the Companies Act 1985, as amended, of Great Britain; references to the “EU” mean the European Union. References in this document to “UK” refer to the United Kingdom of Great Britain and Northern Ireland.

Except as otherwise noted or unless the context otherwise requires, the information in this registration statement is presented as of completion of the proposed Separation Transaction described below.

Six Continents Retail Limited was formerly known as Bass Inns & Taverns Limited until 1991, when its name changed to Bass Taverns Limited. Subsequently, it used the trading name Bass Leisure Retail. On July 27, 2001, Bass Taverns Limited changed its name to Six Continents Retail Limited, following the sale of the Bass brewing business and name to Interbrew UK Holdings Limited.

The Company’s combined financial statements appearing in this registration statement are expressed in UK pounds sterling. In this document, references to “US dollars”, “US$”, “$” or “¢” are to United States (US)

4

Back to Contents

currency, references to “euro” or “€” are to the euro, the currency of the European Economic and Monetary Union, and references to “pounds sterling”, “sterling”, “£”, “pence” or “p” are to United Kingdom currency. Solely for convenience, this registration statement contains translations of certain pound sterling amounts into US dollars at specified rates. These translations should not be construed as representations that the pound sterling amounts actually represent such US dollar amounts or could be converted into US dollars at the rates indicated. Unless otherwise indicated, the translations of pounds sterling into US dollars have been made at the rate of £1.00 = $1.57, the noon buying rate in The City of New York for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York on September 30, 2002. On March 19, 2003, the noon buying rate was £1.00 = $1.56. For information regarding rates of exchange between pounds sterling and US dollars from fiscal 1998 to the present, see “Item 3. Key Information – Selected Combined Financial Information – Exchange Rates”.

The Company’s fiscal year will end on September 30 of each year. References in this document to a particular year are to the fiscal year unless otherwise indicated. For example, the Company refers to the fiscal year ended September 30, 2002 as 2002, and other fiscal years in a similar manner.

The Company’s combined financial statements are prepared on the basis of accounting principles generally accepted in the United Kingdom (“UK GAAP”) which differ from those generally accepted in the United States (“US GAAP”). The significant differences applicable to the M and B Group are explained in Note 32 of Notes to the Financial Statements.

The Company will furnish The Bank of New York, as Depositary, with annual reports containing Consolidated Financial Statements and an independent auditors’ opinion thereon. These Financial Statements will be prepared on the basis of UK GAAP. The annual reports will contain reconciliations to US GAAP of net income and shareholders’ equity. The Company will also furnish the Depositary with semi-annual reports, prepared in conformity with UK GAAP, which will contain unaudited interim consolidated financial information. Upon receipt thereof, the Depositary will mail all such reports to recorded holders of American Depositary Receipts (“ADRs”) evidencing American Depositary Shares (“ADSs”). The Company will also furnish to the Depositary all notices of shareholders’ meetings and other reports and communications that will be made generally availabl e to shareholders of the Company. The Depositary will make such notices, reports and communications available for inspection by recorded holders of ADRs and will mail to recorded holders of ADRs notices of shareholders’ meetings received by the Depositary. The Company will not be required to report quarterly financial information.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the board of directors with respect thereto. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often use such words as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe” or other words of similar meaning. Such statements in the Form 20-F include, but are not limited to, statements under the following headings: (i) “Item 4. Information on the Company”; (ii) “Item 5. Operating and Financial Review and Prospects”; (iii) “Item 8. Financial Information”; and (iv) “Item 11. Quantitative and Qualitative Disclosures About Market Risk”. Specific risks faced by the Company are described under “Item 3. Key Information – Risk Factors”. These statements are based on assumptions and assessments made by the Group’s management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. By their nature, forward-looking statements involve risk and uncertainty, and the factors described in the context of such forward-looking statements in this document could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking statements. These factors include, among others, the future balance between supply and demand for the Group’s sites, the effect of economic conditions and unforeseen external events on the Group’s business, the availability of suitable properties and necessary licenses, possible regulatory changes or actions, the Group’s ability to purchase adequate insurance, or its ability to access the capital markets for future capital needs.

5

Back to Contents

BACKGROUND TO THE SEPARATION TRANSACTION

The Separation Transaction |

| | |

| On October 1, 2002, Six Continents announced its intention to: |

| | | |

| | • | separate Six Continents’ hotels business and soft drinks business from the retail business; and |

| | | |

| | • | return approximately £700 million of capital, or 81p per existing share, in cash, to its shareholders, absent a material change in circumstances in the trading environment or capital markets. |

| | |

| The Separation will be implemented in several steps as follows: |

| | |

| • | First, a scheme of arrangement (the “Scheme of Arrangement”), subject to sanction by the High Court of Justice in England and Wales (the “Court”), will result in a new holding company (M and B) being placed on top of Six Continents. Six Continents shareholders will receive one M and B share and 81 pence in cash in respect of each Six Continents share held by them at the record time of the Scheme of Arrangement. |

| | |

| • | Next, Six Continents will transfer the Retail business of Six Continents and SCPD to M and B (the “M and B Group Transfer”). The effect of this part of the Separation is that the Retail business of Six Continents and SCPD will become owned by M and B directly rather than by Six Continents. The terms of this transfer are governed by the M and B Group Transfer Share Purchase Agreement referred to in “Item 7. Major Shareholders and Related Party Transactions – Related Party Transactions”. |

| | |

| • | This will be followed by a consolidation of the M and B shares, i.e. a reduction in the number of M and B shares on a 50 for 59 basis (the “M and B Share Consolidation”). |

| | |

| • | Finally, the last step of the Separation will take place. This will be effected by a reduction in the capital of M and B, which is also a Court approved process. The M and B reduction of capital will take place as follows: |

| | | |

| | • | the capital of M and B will be reduced by a reduction in the nominal value of each M and B share by an amount which, in aggregate, is expected to be equal to at least the market value (after the M and B Group Transfer) of all the shares of Six Continents held by M and B; |

| | | |

| | • | M and B will transfer Six Continents to InterContinental PLC so that InterContinental PLC becomes the holding company of Six Continents’ hotels business and its controlling interest in Britvic; and |

| | | |

| | • | Six Continents shareholders at the Separation record time will be allotted and issued one InterContinental PLC share, credited as fully paid, for each M and B share held (after the M and B Share Consolidation). |

As a result of the foregoing, former Six Continents shareholders will hold 50 M and B shares and 50 InterContinental PLC shares for every 59 Six Continents shares held at the record time for the Scheme of Arrangement and will also have been paid 81 pence in cash for each Six Continents share held at that time. It will only be after all the steps have taken place that Six Continents shareholders will receive their new share certificates and cash (or their CREST accounts will be credited if they hold their Six Continents shares in uncertificated form through CREST).

| A more detailed description of the Separation agreements is set out in “Item 7. Major Shareholders and Related Party Transactions – Related Party Transactions”. |

6

Back to Contents

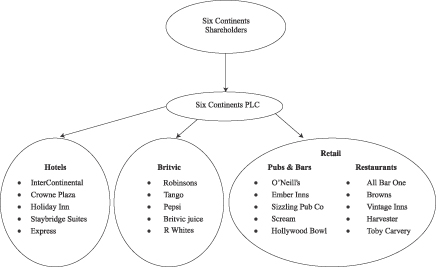

Prior to the Separation, the structure of Six Continents (together with examples of its brands) is broadly as follows:

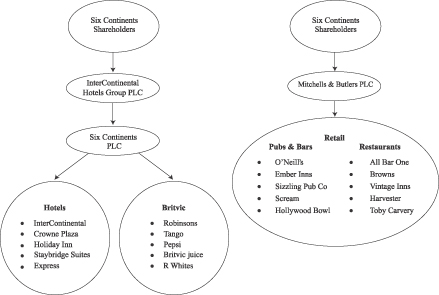

The new structure after the Separation will be:

7

Back to Contents

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

| The Separation is conditional upon, among other things, Court approval. At an extraordinary general meeting of Six Continents’ shareholders and a shareholders’ meeting convened by order of the Court, both held on March 12, 2003, Six Continents’ shareholders approved the various steps necessary to implement the Separation. |

| | |

The following is the expected timetable of the further principal events connected with the Separation. All times shown in this document are London times unless otherwise stated. The dates and times given are based on Six Continents’ current expectations and may be changed. |

| |

| Conditional dealings commence in M and B shares and InterContinental PLC shares on the London Stock Exchange and in M and B ADSs and InterContinental PLC ADSs on the New York Stock Exchange | | | March 31, 2003 | |

| Payment date for interim dividend | | | April 9, 2003 | |

| Court hearing of petition to sanction the Scheme of Arrangement | | | April 10, 2003 | |

| Last day of dealings in Six Continents shares1 | | | April 11, 2003 | |

| Record time and date in order to participate in the Scheme of Arrangement | | | 4.30pm on April 11, 2003 | |

| Scheme of Arrangement becomes effective and M and B becomes the ultimate holding company of the Six Continents Group | | | after close of business on April 11, 2003 | |

| Court hearing of the petition to confirm the M and B reduction of capital to effect the Separation | | | April 14, 2003 | |

| M and B reduction of capital occurs and the Separation is completed | | | 8.00am on April 15, 2003 | |

| Trading in M and B shares and InterContinental PLC shares commences on the London Stock Exchange | | | 8.00am on April 15, 2003 | |

| Trading of M and B ADSs and InterContinental PLC ADSs commences on the New York Stock Exchange | | | 9.30am (New York time) on April 15, 2003 | |

| Crediting of M and B shares and InterContinental PLC shares to accounts in CREST, the system of paperless settlement of trades in listed securities in the United Kingdom | | | April 15, 2003 | |

| Dispatch of certificates for M and B shares and InterContinental PLC shares and checks in respect of the Return of Capital and fractional entitlements (as appropriate)2 | | | by April 23, 2003 | |

| Payments in respect of the Return of Capital and fractional entitlements (as appropriate) credited to CREST accounts | | | April 23, 2003 | |

| 1 | Trading in Six Continents ADSs is expected to cease at 11.30am New York time. |

| | |

| 2 | All fractions of ordinary shares following the M and B share consolidation will be aggregated and consolidated into whole ordinary shares (together with corresponding fractional entitlements to InterContinental PLC ordinary shares). Those shares will be sold and the net proceeds of such sale will be sent to ordinary shareholders. |

8

Back to Contents

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

| | |

| DIRECTORS AND SENIOR MANAGEMENT |

The board of directors, comprising executive and non-executive directors, and the other senior management upon completion of the Separation will be:

Directors | |

| Roger Carr | Non-executive Chairman |

| Tim Clarke | Chief Executive |

| Karim Naffah | Finance Director |

| Mike Bramley | Managing Director, Pubs & Bars |

| Tony Hughes | Managing Director, Restaurants |

| George Fairweather | Non-executive Director |

| Sara Weller | Non-executive Director |

| John Butterfield | Strategy Director |

| Bronagh Kennedy | Company Secretary |

| Adam Martin | Marketing Director |

| Richard Pratt | Commercial Director |

| Bill Scobie | Deputy Finance Director |

| Alison Wheaton | Portfolio Director |

Registered office and

business address of directors | 20 North Audley Street

London

W1K 6WN

England |

During the period of time between the effectiveness of the Scheme of Arrangement, now scheduled to be shortly after 4.30 pm (London time) on April 11, 2003, and completion of the Separation, which is expected to be several days later, M and B will be the holding company of Retail and Six Continents. During that period, Sir Ian Prosser, Tim Clarke, Richard North, Roger Carr, Bryan K. Sanderson, Robert C. Larson and Sir Howard Stringer will be the directors of M and B. During that period, Richard Winter will be the company secretary of M and B. Upon completion of the Separation, all the existing directors of M and B will retire from the Board, save for Tim Clarke and Roger Carr. Mike Bramley, Tony Hughes and Karim Naffah will become executive directors and George Fairweather and Sara Weller will become non-executive directors of M and B from completion of the Separation. Richard Winter will be replaced by Bronagh Kennedy as company secretary. M and B is seeking to appoint one additional non-executive director to take office following Separation. Subsequent to completion of the Separation, M and B’s registered office will become 27 Fleet Street, Birmingham B3 1JP, England.

9

Back to Contents

| | |

| Financial Advisor | Schroder Salomon Smith Barney

Citigroup Centre

Canada Square

Canary Wharf

London E14 5LB |

| | |

| Joint Brokers | Cazenove & Co. Ltd

12 Tokenhouse Yard

London EC2R 7AN |

| | |

| | Merrill Lynch International

2 King Edward Street

London EC1A 1HQ |

Legal Advisors to Six Continents Retail Limited and the Company

(as to English law) | Linklaters

One Silk Street

London EC2Y 8HQ |

Legal Advisors to Six Continents Retail Limited and the Company

(as to English law) | Allen & Overy

One New Change

London EC4M 9QQ |

Legal Advisors to Six Continents Retail Limited and the Company

(as to US securities law) | Sullivan & Cromwell LLP

1 New Fetter Lane

London EC4A 1AN |

| | |

| Independent Auditors | Ernst & Young LLP

Becket House

1 Lambeth Palace Road

London SE1 7EU |

| | |

| Registrars | Lloyds TSB Registrars

The Causeway

Worthing

West Sussex BN99 6DA |

| | |

| ADS Depositary | The Bank of New York

One Wall Street

New York, NY 10286 |

| | |

| Bankers | Barclays Capital

5 The North Colonnade

Canary Wharf

London E14 4BB |

| | |

| | HSBC Bank plc

8 Canada Square

London E14 5HQ |

| | |

| | J.P. Morgan plc

125 London Wall

London EC2Y 5AJ |

| | |

| | Salomon Brothers International Limited

Citigroup Centre

33 Canada Square

Canary Wharf

London E14 5LB |

| | |

| | The Royal Bank of Scotland plc

135 Bishopsgate

London EC2M 3UR |

10

Back to Contents

The Combined Financial Statements as at September 30, 2002 and 2001 and for each of the three years ended September 30, 2002, 2001 and 2000 included in this registration statement have been audited by the Group’s independent auditors, Ernst & Young LLP.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

| SELECTED COMBINED FINANCIAL INFORMATION |

| |

The selected combined financial information set forth below at September 30, 2002 and 2001 and for the years ended September 30, 2002, 2001 and 2000 is derived from the Combined Financial Statements of the Group, which have been audited by its independent auditors, Ernst & Young LLP, included elsewhere in this registration statement. The selected combined financial information set forth below at September 30, 2000, 1999 and 1998 and for the years ended September 30, 1999 and 1998 is unaudited but has been derived from the audited financial statements of Six Continents PLC and, in the opinion of management, has been prepared on a basis consistent with that for subsequent years. The selected combined financial information set forth below should be read in conjunction with, and is qualified in its entirety by reference to, the Combined Financial Statements and Notes thereto included elsewhere in this registration statement.

Significant changes will be made to M and B’s capital structure as a result of the Separation as described in the Unaudited Condensed Pro Forma Combined Financial Information included elsewhere in this registration statement. The selected combined financial information below reflects the capital structure in place prior to the Separation, which was appropriate historically to Six Continents, and the capital position, interest charges and tax liabilities may not reflect M and B’s capital position, interest charges and tax liabilities had M and B been an independently financed and managed group during such periods, or for any future period.

The Combined Financial Statements have been prepared in accordance with UK GAAP which differ in certain respects from US GAAP. A description of the significant differences and reconciliations of net income for the years ended September 30, 2002, 2001 and 2000 and invested capital at September 30, 2002 and 2001 are set forth in Note 32 of Notes to the Financial Statements.

Back to Contents

Combined Profit and Loss Account |

| | | Year ended September 30 (i) | |

| | |

| |

| | | 2002 (ii) (iii) | | 2002 (iii) | | 2001 (iii) | | 2000 (iii) | | 1999 | | 1998 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | $ | | £ | | £ | | £ | | £ | | £ | |

| | | (In millions, except per ordinary share and ADS amounts) | |

Amounts in accordance with UK GAAP | | | | | | | | | | | | | | | | | | | |

| Turnover: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | – Pubs & Bars | | | 1,360 | | | 866 | | | 832 | | | 818 | | | 672 | | | 655 | |

| | – Restaurants | | | 956 | | | 609 | | | 564 | | | 520 | | | 412 | | | 380 | |

| | – Inns and other | | | — | | | — | | | 161 | | | 336 | | | 344 | | | 333 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 2,316 | | | 1,475 | | | 1,557 | | | 1,674 | | | 1,428 | | | 1,368 | |

| | – SCPD | | | 9 | | | 6 | | | 5 | | | 9 | | | 7 | | | 10 | |

| Discontinued operations (iv) | | | — | | | — | | | — | | | 79 | | | 75 | | | 115 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 2,325 | | | 1,481 | | | 1,562 | | | 1,762 | | | 1,510 | | | 1,493 | |

| | |

| |

| |

| |

| |

| |

| |

| Total operating profit: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | – Pubs & Bars | | | 298 | | | 190 | | | 187 | | | 186 | | | 161 | | | 137 | |

| �� | – Restaurants | | | 154 | | | 98 | | | 87 | | | 85 | | | 58 | | | 54 | |

| | – Inns and other | | | — | | | — | | | 31 | | | 75 | | | 79 | | | 78 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 452 | | | 288 | | | 305 | | | 346 | | | 298 | | | 269 | |

| – SCPD | | | 2 | | | 1 | | | 1 | | | 2 | | | 1 | | | 1 | |

| Discontinued operations (iv) | | | — | | | — | | | — | | | 18 | | | 7 | | | 16 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 454 | | | 289 | | | 306 | | | 366 | | | 306 | | | 286 | |

| | |

| |

| |

| |

| |

| |

| |

| Non-operating exceptional items: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | | (3 | ) | | (2 | ) | | (36 | ) | | — | | | — | | | (32 | ) |

| Discontinued operations (iv) | | | — | | | — | | | — | | | 33 | | | (1) | | | 77 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | (3 | ) | | (2 | ) | | (36 | ) | | 33 | | | (1 | ) | | 45 | |

| | |

| |

| |

| |

| |

| |

| |

| Profit on ordinary activities before interest | | | 451 | | | 287 | | | 270 | | | 399 | | | 305 | | | 331 | |

| Interest receivable | | | 3 | | | 2 | | | 6 | | | 3 | | | 2 | | | 13 | |

| Interest payable and similar charges | | | (71 | ) | | (45 | ) | | (64 | ) | | (86 | ) | | (79 | ) | | (123 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Profit on ordinary activities before taxation | | | 383 | | | 244 | | | 212 | | | 316 | | | 228 | | | 221 | |

| Taxation | | | (126 | ) | | (80 | ) | | (82 | ) | | (111 | ) | | (46 | ) | | (34 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Profit for the financial year | | | 257 | | | 164 | | | 130 | | | 205 | | | 182 | | | 187 | |

| | |

| |

| |

| |

| |

| |

| |

| Per ordinary share: (v) | | | | | | | | | | | | | | | | | | | |

| Basic | | | 35.0 | ¢ | | 22.3 | p | | 17.7 | p | | 27.9 | p | | 24.8 | p | | 25.5 | p |

| Adjusted: (vi) | | | 35.0 | ¢ | | 22.3 | p | | 23.6 | p | | 23.4 | p | | 24.9 | p | | 19.4 | p |

| Diluted | | | 35.0 | ¢ | | 22.3 | p | | 17.7 | p | | 27.9 | p | | 24.8 | p | | 25.5 | p |

| | |

| |

| |

| |

| |

| |

| |

Amounts in accordance with US GAAP | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 279 | | | 178 | | | 495 | | | 184 | | | 205 | | | 121 | |

| Discontinued operations: (iv) | | | | | | | | | | | | | | | | | | | |

| Profit/(loss) from operations | | | — | | | — | | | — | | | 11 | | | 4 | | | (1 | ) |

| Surplus on disposal | | | — | | | — | | | — | | | 33 | | | — | | | 437 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | | 279 | | | 178 | | | 495 | | | 228 | | | 209 | | | 557 | |

| | |

| |

| |

| |

| |

| |

| |

Per ordinary share and American Depositary

Share (v)(vii) | | | | | | | | | | | | | | | | | | | |

| Basic – Continuing operations | | | 38.0 | ¢ | | 24.2 | p | | 67.4 | p | | 25.1 | p | | 27.9 | p | | 16.5 | p |

| – Discontinued operations (iv) | | | — | | | — | | | — | | | 6.0 | p | | 0.5 | p | | 59.4 | p |

| | |

| |

| |

| |

| |

| |

| |

| | | | 38.0 | ¢ | | 24.2 | p | | 67.4 | p | | 31.1 | p | | 28.4 | p | | 75.9 | p |

| | |

| |

| |

| |

| |

| |

| |

| Diluted – Continuing operations | | | 38.0 | ¢ | | 24.2 | p | | 67.4 | p | | 25.1 | p | | 27.9 | p | | 16.5 | p |

| – Discontinued operations | | | — | | | — | | | — | | | 6.0 | p | | 0.5 | p | | 59.4 | p |

| | |

| |

| |

| |

| |

| |

| |

| | | | 38.0 | ¢ | | 24.2 | p | | 67.4 | p | | 31.1 | p | | 28.4 | p | | 75.9 | p |

| | |

| |

| |

| |

| |

| |

| |

Footnotes on following page. |

12

Back to Contents

Combined Balance Sheet Data |

| | | September 30 (i) | |

| | |

| |

| | | 2002 (ii)(iii) | | 2002 (iii) | | 2001 (iii) | | 2000 (iii) | | 1999 | | 1998 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | $ | | £ | | £ | | £ | | £ | | £ | |

| | | (In millions) | |

Amounts in accordance with UK GAAP | | | | | | | | | | | | | | | | | | | |

| Intangible assets | | | 17 | | | 11 | | | 11 | | | 11 | | | 13 | | | — | |

| Tangible assets | | | 5,536 | | | 3,526 | | | 3,381 | | | 3,815 | | | 2,742 | | | 2,339 | |

| Investments | | | — | | | — | | | — | | | 1 | | | 16 | | | 15 | |

| Current assets | | | 228 | | | 145 | | | 157 | | | 168 | | | 141 | | | 117 | |

| Total assets | | | 5,781 | | | 3,682 | | | 3,549 | | | 3,995 | | | 2,912 | | | 2,471 | |

| | |

| |

| |

| |

| |

| |

| |

| Amounts due to Six Continents Group companies | | | (1,304 | ) | | (831 | ) | | (825 | ) | | (1,197 | ) | | (1,267 | ) | | (1,332 | ) |

| Other current liabilities | | | (344 | ) | | (219 | ) | | (250 | ) | | (276 | ) | | (240 | ) | | (217 | ) |

| Non-current liabilities | | | (305 | ) | | (194 | ) | | (173 | ) | | (151 | ) | | (104 | ) | | (119 | ) |

| Invested capital | | | (3,828 | ) | | (2,438 | ) | | (2,301 | ) | | (2,371 | ) | | (1,301 | ) | | (803 | ) |

| | |

| |

| |

| |

| |

| |

| |

Amounts in accordance with US GAAP | | | | | | | | | | | | | | | | | | | |

| Intangible assets | | | 85 | | | 54 | | | 55 | | | 56 | | | 59 | | | 47 | |

| Tangible assets | | | 4,027 | | | 2,565 | | | 2,414 | | | 2,551 | | | 1,467 | | | 1,348 | |

| Investments | | | — | | | — | | | — | | | 1 | | | 16 | | | 15 | |

| Current assets | | | 228 | | | 145 | | | 157 | | | 168 | | | 141 | | | 117 | |

| Total assets | | | 4,340 | | | 2,764 | | | 2,626 | | | 2,776 | | | 1,683 | | | 1,527 | |

| | |

| |

| |

| |

| |

| |

| |

| Current liabilities | | | (1,649 | ) | | (1,050 | ) | | (1,075 | ) | | (1,473 | ) | | (1,507 | ) | | (1,549 | ) |

| Non-current liabilities | | | (218 | ) | | (139 | ) | | (127 | ) | | (173 | ) | | (148 | ) | | (159 | ) |

| Invested capital | | | (2,473 | ) | | (1,575 | ) | | (1,424 | ) | | (1,130 | ) | | (28 | ) | | (181 | ) |

| | |

| |

| |

| |

| |

| |

| |

| (i) | The results for fiscal 1999 include 53 weeks’ trading; all other fiscal years include 52 weeks’ trading. |

| | |

| (ii) | US dollar amounts have been translated at the noon buying rate on September 30, 2002 of £1.00 = $1.57 solely for convenience. |

| | |

| (iii) | Amounts for 2002, 2001 and 2000 include the results of operations and assets and liabilities relating to 550 pubs formerly owned by Allied Domecq Retailing Limited, acquired in October 1999. See Note 24 of Notes to the Financial Statements. |

| | |

| (iv) | Under UK GAAP, discontinued operations comprise the results of operations of Lastbrew Limited, which were part of the disposal of Bass Brewers by Six Continents, and of the leased pub business sold in 1998. For the purposes of US GAAP, discontinued operations comprise only the results of operations of Lastbrew Limited. |

| | |

| (v) | Basic and adjusted per ordinary share amounts for each year presented are based on 734 million shares, being the estimated number of M and B ordinary shares to be outstanding on Separation, assuming that the M and B Share Consolidation has been effected and no options are exercised under the Six Continents share schemes prior to the completion of the Separation. Diluted per ordinary share amounts take account of the number of options estimated to be outstanding on Separation. The resulting number of shares is 734 million. |

| | |

| (vi) | Adjusted earnings per share are disclosed in order to show performance undistorted by abnormal items and, in respect of Financial Reporting Standard 15, the impact of adopting this Standard. |

| | |

| (vii) | Each American Depositary Share represents one ordinary share. |

| | |

M and B intends to recommend a final 2003 dividend of 5.65p and to pay a 2004 interim dividend of 2.85p, making the 8.5p per ordinary share announced on October 1, 2002. M and B intends to recommend a 2004 final dividend of 6.65p, an increase of 18% over the 2003 final (which would equal a total dividend of 9.5p in respect

13

Back to Contents

of the Company’s first full financial year to September 2004). Thereafter, M and B intends to adopt a progressive dividend policy to deliver real growth in dividends from the level established in 2004. This would be enabled through a combination of the M and B Group’s lower capital expenditure requirement (as the conversion of the former Allied Domecq estate comes to an end), the beneficial impact of actions taken on overhead costs and increases in retail staff productivity, and an increased level of value-enhancing individual site disposals.

Cash dividend payments by the Company will be made in pounds sterling and exchange rate fluctuations will affect the US dollar amount received by holders of ADRs on conversion of such dividends. Moreover, fluctuations in the exchange rates between pounds sterling and the US dollar will affect the dollar equivalent of the pounds sterling price of the ordinary shares on the London Stock Exchange and, as a result, are likely to affect the market price of the ADSs which are represented by ADRs in the United States.

The following tables show, for the periods and dates indicated, certain information regarding the exchange rate for pounds sterling, based on the noon buying rate for pounds sterling expressed in US dollars per £1.00. The exchange rate on March 19, 2003 was £1.00 = US$1.56.

Month | | | | Month’s highest

exchange rate | | | | Month’s lowest

exchange rate | |

| March 2003 (through March 19, 2003) | | | | | | 1.61 | | | | | | 1.56 | |

| February 2003 | | | | | | 1.65 | | | | | | 1.57 | |

| January 2003 | | | | | | 1.65 | | | | | | 1.60 | |

| December 2002 | | | | | | 1.61 | | | | | | 1.55 | |

| November 2002 | | | | | | 1.59 | | | | | | 1.54 | |

| October 2002 | | | | | | 1.57 | | | | | | 1.54 | |

| September 2002 | | | | | | 1.57 | | | | | | 1.53 | |

| | | | | | | | | | | | | | |

Year ended September 30 | | | Period

end | | | Average

rate (1) | | |

High

| | |

Low

| |

| 1998 | | | 1.70 | | | 1.66 | | | 1.71 | | | 1.61 | |

| 1999 | | | 1.65 | | | 1.63 | | | 1.72 | | | 1.55 | |

| 2000 | | | 1.48 | | | 1.55 | | | 1.68 | | | 1.40 | |

| 2001 | | | 1.47 | | | 1.44 | | | 1.50 | | | 1.37 | |

| 2002 | | | 1.57 | | | 1.48 | | | 1.58 | | | 1.41 | |

| (1) | The average of the noon buying rates on the last day of each full month during the period. |

14

Back to Contents

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth the Company’s actual and pro forma capitalization and indebtedness as of September 30, 2002. The pro forma amounts reflect the anticipated capitalization and indebtedness of the Company on Separation. There has been no material change to the actual capitalization and indebtedness since September 30, 2002. This table should be read in conjunction with the Combined Financial Statements of the Group and the Unaudited Condensed Pro Forma Combined Financial Information appearing elsewhere in this registration statement and with “Item 5. Operating and Financial Review and Prospects”.

| | | As at September 30, 2002 | |

| | |

| |

| | | Actual | | Pro forma(i) | |

| | |

|

| |

|

| |

| | | (£ million) | |

| Amounts owed to Six Continents Group companies falling due within one year | | | 831 | | | — | |

Short-term borrowings:

Bank loans and other borrowings

(secured : actual £2 million; pro forma to £2 million) | | | 3 | | | 387 | |

| | |

|

| |

|

| |

| | | | 834 | | | 387 | |

| | |

|

| |

|

| |

| Long-term borrowings: | | | | | | | |

| Bank loans and other borrowings | | | 1 | | | 1,001 | |

| Invested capital | | | 2,438 | | | — | |

| | |

|

| |

|

| |

| Shareholders’ funds | | | | | | | |

| Share capital | | | — | | | 37 | |

| Revaluation reserve | | | — | | | 342 | |

| Other reserves(ii) | | | — | | | 983 | |

| Merger reserve(ii) | | | — | | | 65 | |

| Profit and loss account(ii) | | | — | | | 458 | |

| | |

|

| |

|

| |

| Total shareholders’ funds | | | — | | | 1,885 | |

| | |

|

| |

|

| |

| Total capitalization(iii) | | | 3,273 | | | 3,273 | |

| | |

|

| |

|

| |

| (i) | Details of the assumptions underlying the pro forma capitalization and indebtedness are set out in the Unaudited Condensed Pro Forma Combined Financial Information. |

| | |

| | The structure of the Separation is such that it is not possible to determine the nominal value of M and B shares until just before Separation. The total nominal value of ordinary shares in M and B is to be calculated by reference to a formula so that M and B has sufficient share capital in order to effect the Separation by way of a reduction of share capital and to ensure that the capital reduction is at least equal to the market value (after the M and B Group Transfer) of all shares of Six Continents held by M and B. In order to give pro forma effect to the Separation and illustrate the estimated analysis of shareholders’ funds, the amounts for share capital, other reserves and profit and loss reserve, these have been calculated by reference to this formula and certain assumptions. The key assumptions for illustrative purposes are based on the following amounts as of March 19, 2003: |

| | | |

| | • | the market price of Six Continents ordinary shares was 607p per share; |

| | | |

| | • | book value of investment by Six Continents in M and B was £1,720 million; |

| | | |

| | • | estimated market capitalization of InterContinental Group was £3,000 million; |

| | | |

| | • | amount of capital reduction in excess of market capitalization of InterContinental Group was £983 million; |

| | | |

| | • | amount to be drawn under M and B new facilities was £1,385 million; and |

| | | |

| | • | amount of inter-company indebtedness to be capitalized was £228 million. |

| | |

| | The actual nominal value will be calculated by reference to the information at the time of Separation. |

| | |

| (ii) | These amounts are estimates, the actual values will depend on the estimated market value at the time of Separation. |

| | |

| (iii) | Total capitalization under US GAAP would be: actual £2,410 million; pro forma £2,410 million. |

REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

15

Back to Contents

RISK FACTORS

This section describes some of the risks that could materially affect the Group’s businesses. The risks below are not the only ones that the Group faces – some risks are not yet known to the Group and some that the Group does not currently believe to be material could later turn out to be material. All of these risks could materially affect the Group, its turnover, operating profit, earnings, net assets and liquidity and capital resources.

The Group is exposed to the risks of economic recession |

The Group is exposed to the risks of a recession in the United Kingdom and to a lesser extent in Germany. A recession in either market could result in lower consumer expenditure and therefore lower revenues and reduced net income, particularly in the Group’s restaurant business. The Group’s Alex sites in Germany have already experienced lower revenues as a result of the current economic climate in Germany. The Group’s sites in London have experienced lower revenues as a result of economic downturn, from decreased activity in the financial markets and from reduced tourist visits as a result of the terrorist attacks on September 11, 2001 and the conflict in the Middle East.

Changes to regulation may affect the cost base of the Group |

Both in the United Kingdom and in Germany, the Group’s operations are subject to regulation, and changes in regulation could adversely affect results of operations, including through higher costs. More restrictive regulations could also lead to increasing prices to consumers, which in turn may adversely affect demand and therefore revenues and profitability. See “Item 4. Information on the Company – Regulatory Environment” for additional information on the regulation to which the Group is subject. In particular, some examples of the regulatory changes which could affect the Group’s cost base include:

| | • | additional EU or UK employment legislation (in particular, the level of the national minimum wage which is under annual review by the UK Low Pay Commission (which has just recommended an increase to £4.50 per hour which will come into effect from 1 October 2003, followed by an increase to £4.85 per hour from October 2004) and which the Trades Union Congress in the United Kingdom is seeking to raise to between £5.00 and £5.30 in 2004, and the maximum number of hours an employee may be permitted to work and the extent to which they may voluntarily opt-out) which could further increase labor costs; |

| | | |

| | • | competition law, consumer protection and environmental law changes which could adversely affect the Group’s operations; and |

| | | |

| | • | implementation of the Disability Discrimination Act 1998, which will require changes to certain of the Group’s sites. |

| | | |

The Group’s sites must compete with other pubs and restaurants and consumption at home |

The Group’s pubs and restaurants compete for consumers with a wide variety of other branded and non-branded pubs and restaurants as well as off-licenses, supermarkets and takeaways, some of which may offer higher amenity levels or lower prices and be backed by greater financial and operational resources. The Group’s pubs and restaurants may not be successful in competing against any or all of these alternatives and a sustained loss of customers and/or skilled employees to other pubs or leisure activities or increased consumption at home could have a material adverse effect on the Group’s business operations and prospects.

The Group’s activities are affected by a number of fiscal-related matters |

The Group’s activities are affected by a number of fiscal-related matters. These matters include duty on alcoholic beverages, value added tax, other business taxes and the availability of duty harmonization to travelers between EU countries. Changes in legislation which affect all or any of these matters may adversely affect the financial performance of the Group.

16

Back to Contents

The Group is exposed to funding risks in relation to the defined benefits under its pension schemes |

The Group is obliged by law to maintain a minimum funding level in relation to its ongoing obligation to provide current and future pensions for the members of its schemes who are entitled to defined benefits. In addition to this, if any scheme of the Group is wound up, the Group could become statutorily liable to make an immediate payment to the trustees to bring the funding of these defined benefits to a level which is higher than this minimum. Also, the trustees of the Group’s schemes have wide discretion under the scheme rules to decide the contributions payable by the Group, and these must be set with a view to making prudent provision for the benefits accruing under the schemes of the Group.

Some of the issues which could adversely affect the funding of these defined benefits (and materially affect the Group’s funding obligations) are:

| • | poor investment performance of pension fund investments; |

| | |

| • | long life expectancy (which will make pensions payable for longer and therefore more expensive to provide, whether paid directly from the schemes or secured by the purchase of annuities); |

| | |

| • | adverse annuity rates (which tend in particular to depend on prevailing interest rates and life expectancy) as these will make it more expensive to secure pensions with an insurance company; |

| | |

| • | clarification of the law that might require guaranteed minimum pensions relating to service prior to April 6, 1997 to be equalized as between men and women; and |

| | |

| • | other events occurring which make past service benefits more expensive than predicted in the actuarial assumptions by reference to which the Group’s past contributions were assessed. |

An additional uncertainty is that changes to the statutory requirement regarding funding are expected, and these could in some cases prove to be more onerous for employers than those described above. It should be noted (particularly in view of disappointing stock market performance since the beginning of 2003) that the schemes’ funding positions may well prove to be weaker now than as at December 31, 2002, and further adverse changes are possible in the future. The financial impact for the Group of a poor pensions funding position will be worsened by the fact that the schemes are to retain all past service liabilities of Six Continents not transferred to the InterContinental PLC schemes (rather than merely retaining only those liabilities which arise from past service with companies in the M and B Group).

As with many other pension schemes throughout the United Kingdom, there is the possibility of future claims being brought against the Group alleging unlawful indirect sex discrimination contrary to Article 141 of the European Treaty, on the grounds of a scheme’s former exclusion of part-time employees. Any further such claim would have to be brought within six months of leaving employment. The chances of success for such claims are uncertain owing to issues of law that are presently unresolved.

The Group is reliant on the reputation of its brands |

Failure to protect the Group’s brands or an event which materially damaged the reputation of one or more of the Group’s brands and/or failure to sustain their appeal to its customers could have an adverse impact on subsequent revenues from that brand or to the Group’s brands as a whole.

Certain changes in regulation may affect the Group’s revenue |

Some examples of regulatory changes which could affect the Group’s revenue base include:

| | | |

| | | Licensing reform which would result in additional expense and process delays or require re-licensing of existing license holders or permit objections to a new site after planning consent has been granted, and any delays and failures to obtain required licenses or permits could negatively affect the Group’s operations and in particular its ability to obtain licenses for new sites in residential areas. |

| | | |

| | • | Changes to drink-driving and smoking laws |

| | | |

| | | The UK Government has carried out consultation exercises concerning the legal blood alcohol limit for drivers and smoking in public places to decide whether to introduce regulations controlling smoking in public, including in pubs and restaurants. If the UK Government introduces regulations which further |

17

Back to Contents

| | | discourage customers from driving to pubs or discourage smokers from frequenting pubs and restaurants, the Group’s pubs and restaurants could suffer a reduction in turnover which could have a negative effect on its business. |

| | | | |

| | • | Changes to gaming legislation |

| | | |

| | | Changes to the gaming legislation are under consideration by the UK Government, including the operation of amusement machines with prizes (or fruit machines) (“AWPs”) in pubs. The main areas of the current legislation that would change is that play by those under 18 years old would be illegal (although Retail already complies with a voluntary code to this effect) and the control of numbers of AWPs would pass from licensing magistrates to local authorities. The other areas of change relate to categories of machines permitted in casinos, licensed betting offices, bingo, amusement arcades, family entertainment centers and motorway service stations which may increase the competitive threat to the Group in respect of gaming. These new gaming laws could impede the Group’s ability to increase income from AWPs. |

| | | |

The Group may be adversely affected by changes in supplier dynamics and interruptions in supply or by circumstances adversely affecting business continuity |

In recent years, there has been a consolidation in the brewing and distribution industry in the United Kingdom. This consolidation could have the effect of exposing the Group to reliance on a limited number of suppliers, and those suppliers may be able to exert pressures on the Group that could have the effect of raising the prices paid by the Group for goods bought or delivered, reducing margins and adversely affecting results of operations.

The Group has entered into agreements with all of its key suppliers. Termination of these agreements, variation of their terms or the failure of a party to comply with its obligations under these agreements could have a material adverse effect on the operations and financial performance of the Group.

The interruption or contamination of the supply of food and drink to the Group’s sites or loss of a key office or part of the Group’s IT infrastructure may affect the Group’s ability to trade.

Weather may adversely affect the Group’s business |

Attendance levels at the Group’s pubs and restaurants may also be adversely affected by persistent rain or other inclement weather, especially during the summer months or over the Christmas period (which are peak trading times). This could have a negative effect on turnover generated by the Group’s pubs and restaurants and, in turn, could have a negative effect on the results of the Group’s operations.

The pub industry is subject to varying consumer perceptions and public attitudes |

In the United Kingdom, consumption of alcoholic beverages has become the subject of considerable social and political attention in recent years due to increasing public concern over alcohol-related social problems including drink driving, underage drinking and adverse health consequences associated with the misuse of alcohol, including alcoholism. For example, from 1995 to 2000, sales of all beer (by volume) in the United Kingdom decreased by 3.6%. Changes in consumer tastes in both food and drink and demographic trends over time may affect the appeal of the Group’s pubs and restaurants to consumers. The Group’s success will depend in part on its ability to anticipate, identify and respond to these changing conditions in the context of the life-cycle economics of the leisure industry.

Complaints or litigation from pub customers, employees and third parties may adversely affect the Group |

The Group, or the licensed retailing industry, could be the subject of complaints or litigation from individuals or groups of pub customers and/or employees and/or class actions alleging illness or injury (such as passive smoking or alcohol abuse) or raising other food quality, health or operational concerns, and from other third parties in nuisance and negligence. It may also incur additional liabilities as a freehold property owner (including environmental liability). These claims may also divert the Group’s financial and management resources from more beneficial uses. If the Group were to be found liable in respect of any complaint or litigation,

18

Back to Contents

this could adversely affect the Group’s results of operations, and also adversely affect the reputation of the Group or its brands.

| The Group is exposed to fluctuations in the property market |

Around 16% of the Group’s property is short leasehold which is subject to periodic rent reviews and renegotiation of rents when leases are renewed. The property market may develop so that rentals may increase such that they affect the economic viability of one or more of such properties. Equally, a downturn in the UK property market may lead to a reduction in the Group’s freehold property values over time.

Lack of acquisition opportunities for the Group |

As there is a finite number of existing or potential sites in good locations, the Group’s strategy of acquiring suitable sites for development of new pubs and restaurants, particularly in residential areas, may be negatively impacted.

Debt, Liquidity and Revenue Risks |

| |

The Group’s indebtedness could adversely affect its financial health |

The Group has a significant amount of debt and may incur additional debt from time to time. The Group’s indebtedness could:

| | • | require the Group to dedicate much of its cash flow from operations to payments on indebtedness, and so reduce the availability of cash flow to fund its working capital, capital expenditures, product and service development and other general corporate purposes; |

| | | |

| | • | limit the Group’s ability to obtain additional financing to fund future working capital, capital expenditures, product and service development and other general corporate purposes; |

| | | |

| | • | increase the Group’s vulnerability to adverse economic and industry conditions; or |

| | | |

| | • | limit the Group’s flexibility in planning for, or reacting to, changes in its business and industry as well as the economy generally. |

Also, since the Group’s debt upon Separation will accrue interest at rates that fluctuate with prevailing interest rates, any increases in prevailing interest rates may increase the Group’s interest payment obligations. The Group may enter into hedging transactions in order to manage its floating interest-rate exposure.

The Group is exposed to refinancing risk in relation to its credit facilities |

The Group has put in place borrowing facilities to meet its expected capital resource requirements, an element of which will require refinancing within the next 24 months. If the Group’s operating and financial covenants in these facilities are not met, the Group may lose its ability to utilize its existing facilities or to borrow money in the future or to do so on terms it considers to be favorable. Conditions in the capital markets also will affect the Group’s ability to borrow funds or to raise equity financing, as well as the terms it may obtain. All of these factors could make it difficult or impossible for the Group otherwise to raise capital needed to pursue its growth strategies. The Company cannot assure investors that the Group will be able to arrange any additional financing or refinancing needed to fund its capital resource requirements on acceptable terms, or at all. As the Group’s levels of debt increase, its business may not be able to generate sufficient cash flow to service its debt and/or continue its investment program.

The Group has a high proportion of fixed overheads and variable revenues |

A high proportion of the Group’s operating overheads and certain other costs remain constant even if its revenues drop. The expenses of owning and operating a managed pub or pub-restaurant are not significantly reduced when circumstances such as market and economic factors and competition cause a reduction in revenues. Owners of leased and tenanted estates generally have a lower risk to revenue exposure compared with the Group because the tenant is obliged to pay the negotiated rent. In addition, owners of leased and tenanted estates typically have lower fixed costs at operating level and at a head office level than the Group.

19

Back to Contents

Accordingly, a significant decline in the Group’s revenues would have a disproportionately adverse effect on its cash flow and ability to make interest and principal payments on its debt.

The Group may face increased costs in insuring its businesses |

The Group intends to be covered under Six Continents’ existing policies until September 30, 2003. This insurance has historically been maintained at levels determined by Six Continents to be appropriate in light of the cost of cover and the risk profiles of all of its businesses. From October 2003, the Group will need to put its own insurance arrangements in place. Following the effects of the September 11, 2001 terrorist attacks on the World Trade Center in New York, companies generally are facing increased premiums for reduced cover as the insurance market hardens. Generally, the Group will have to pay higher premiums or in some cases take out less, or a lower quality of, cover. This could adversely affect the Group by increasing costs or increasing its exposure to certain risks.

Sales of a substantial number of M and B shares or ADSs after the Separation, or the prospect of such sales, could materially and adversely affect the price of these securities

As a result of the Separation, there may be substantial trading activity in M and B shares and ADSs in the public markets. This may occur because, for example, shareholders who receive the Group’s securities as a result of the Separation do not wish to hold securities in the Company or may not be able to hold the securities as a result of their own portfolio requirements and preferences, such as those relating to indexed membership or geographic or industry exposures. A high level of trading activity may lead to volatility in the price of the Company’s securities, and significant selling pressure may adversely affect the price of the Company’s securities. Declines in the market price of M and B shares or ADSs may impair the Group’s ability to raise capital through an offering of securities in the future.

Risks for US Shareholders |

| |

The price of the Company’s ADSs and the US dollar value of any dividends will be affected by fluctuations in the US dollar/UK pound sterling exchange rate |

Fluctuations in the exchange rates between the US dollar and the UK pound sterling will affect the US dollar conversion by the Depositary of any cash dividends paid in pounds sterling on the ordinary shares represented by the ADSs, and the US dollar equivalent of the pound sterling price of the ordinary shares on the London Stock Exchange, which may consequently affect the market price of the ADSs. These fluctuations would also affect the US dollar value of the proceeds a holder of an ADR would receive upon the sale in the United Kingdom of any of the Group’s equity shares withdrawn from the Depositary.

Shareholders and ADR holders may not be able to effect service of process in the United States upon the Group and certain individuals or enforce United States court judgments against the Group or some of the Group’s directors and officers |

The Group is organized under the laws of England and Wales and all of its directors and executive officers are resident outside the United States. Additionally, substantially all of the Group’s assets and assets of its directors and executive officers are located outside the United States and it has no place of business in the United States. As a result, shareholders may not be able to effect service of process in the United States against the Group or the Group’s directors or executive officers or enforce the judgment of a US court against the Group’s directors or executive officers in any action, including those predicated upon civil liability provisions of the federal securities law of the United States, either inside or outside the United States, notwithstanding that The Bank of New York will be authorized to accept service from ADR holders on the Group’s behalf. Further, it may not be possible for shareholders to bring original actions based upon US federal securities laws in the courts of England and Wales, and there may be doubt as to the enforceability against the Group, its directors or its executive officers in the United Kingdom, whether in original actions or in actions for the enforcement of judgments of US courts, of civil liabilities predicated solely upon the laws of the United States, including federal securities laws.

20

Back to Contents

ITEM 4. INFORMATION ON THE COMPANY |

| |

The Group is the United Kingdom’s leading operator of managed pubs, bars and restaurants (in terms of sales and number of sites), with a particular focus on high-take sites. The Group’s high quality, predominantly freehold estate comprises over 2,000 sites spread throughout the United Kingdom and over 40 sites in Germany. As at September 30, 2002, the Group had tangible fixed assets with a net book value of approximately £3.5 billion, including £0.7 billion of revaluation.

Mitchells & Butlers PLC is a public limited company. It was incorporated in Great Britain on October 2, 2002 and is registered in, and operates under, the laws of England and Wales. Operations undertaken in countries other than England and Wales are under the laws of those countries in which they reside. M and B’s headquarters are in the United Kingdom and its registered address following the Separation will be:

27 Fleet Street

Birmingham

B3 1JP

England

Tel: + 44(0) 870 609 3000

Internet address: www.mbplc.com

The Group has a wide brand portfolio, with a number of segment-leading and well established brands providing targeted offers for a variety of consumer groups, locations and occasions.

The following chart depicts how the Group’s UK brands are targeted by location or by primary occasion (drinks or food), together with the number of sites at September 30, 2002 for each:

| | | | Drinks-led | | | | Food-led |

|

|

Residential | | | Ember Inns (137)

Sizzling Pub Co. (96)

Scream (90)

Arena (53)

Unbranded (466) |

| | | Vintage Inns (196)

Harvester (150)

Toby Carvery (70)

Innkeeper’s Fayre (24)

Unbranded (97) |

|

|

City Center | | | O’Neill’s (91)

Goose (44)

Edward’s (40)

Flares (22)

Unbranded (353) | | | | All Bar One (53)

Browns (15)

Unbranded (0) |

|

| The Group’s accommodation brands (Express by Holiday Inn and Innkeeper’s Lodge), the ten pin bowling operation (Hollywood Bowl) and the branded bar and brasserie chain in Germany (Alex) are not shown in the chart above. |

Within each quadrant, the relevant brands target different consumer groups or occasions. For example, within residential, drinks-led sites, Ember Inns is for the quiet drink occasion; Sizzling Pub Co. is focused on local drinking with ‘value for money’ pub food; Scream is aimed at students; and Arena targets sports and entertainment occasions. In total, over 1,100 of the Group’s sites are branded, of which over 800 are in residential areas.

In addition, the Group has a large estate of over 900 unbranded pubs and restaurants including those forming the conversion pipeline to the Group’s brands and formats.

The Group generated operating profits of £288 million (excluding £1 million of operating profit generated by SCPD) on revenues of £1.475 billion (excluding £6 million of revenues of SCPD) in 2002, delivering a post-tax cash return on cash capital employed of over 10%.

21

Back to Contents

The Senior Management Team has built and developed the Group’s business by:

| | • | re-aligning its property portfolio through carefully chosen disposals and targeted acquisitions; |

| | | |

| | • | developing, rolling out and sustaining high quality and distinctive brands (such as Vintage Inns, Toby Carvery, All Bar One, O’Neill’s and Ember Inns) which cater to modern eating and drinking trends and which have broad demographic appeal, targeting the wider audience that now frequents pubs and restaurants; |

| | | |

| | • | acquiring selected brands to complement the Group’s existing portfolio (Harvester, Browns and Alex) and rolling them out; |

| | | |

| | • | developing its expertise and infrastructure in purchasing and logistics management, particularly focusing on realizing economies of scale across all categories of the supply chain (especially food) to obtain better quality products on better terms; and |

| | | |

| | • | introducing reward packages for its licensed house managers to encourage their participation in growing the profits of the business. |

The growth in the Group’s turnover and profits stems primarily from brand roll-out to new sites and from sales and profits uplifts on conversion of existing sites to brands and formats. Thereafter, site sales tend to be broadly flat (or marginally declining), with pubs and bars tending to show slight declines after year one and restaurants and accommodation showing slight growth after year one. Longer-term profit growth is also driven by scale efficiencies, through, for example, increasing staff productivity, supply chain gains and reducing central costs.

Prior to 1989, the involvement of Six Continents (then known as Bass) in pubs was as a vertically integrated brewing and retailing company with regional operations covering both brewing and pubs. In 1989, Six Continents was reorganized and, in the process, created a drinks-led retail business with a managed and leased estate of over 7,000 sites. As a result of the Beer Orders, which restricted the number of pubs which brewers could tie to their products, Six Continents disposed of over 2,700 pubs and bars by November 1, 1992.

In the ten years since then, the Group has undergone a major transformation in its operations, with a number of significant acquisitions and disposals during this period and focused investment to reposition its estate in terms of geography, sales mix and branding.

In realigning its estate portfolio, Retail retained the strongest sites from its former Bass estate (approximately 1,100 sites from around 7,400). In 1995, Retail acquired the Harvester chain from Forte plc. In 1997, Retail acquired the Browns chain of seven restaurants. Following the disposal of most of the Six Continents Group’s entertainment businesses in 1997 and 1998, Hollywood Bowl was transferred to Retail. In 1998, Retail largely disposed of its leased pub business and acquired the Alex brand in Germany.

Retail also increased the size of its estate by acquiring 550 high-potential former Allied Domecq sites, out of approximately 3,500 sites, from Punch (ADR Joint Venture Company) Limited in 1999. In addition, during this ten year period, Retail acquired over 400 carefully selected new sites and new builds. In 2001, Retail sold to Nomura International PLC (“Nomura”) an estate consisting of 988 smaller unbranded pubs with limited growth potential as managed pubs.

Over the ten year period up to September 30, 2002, the Group has realized cash proceeds of £1.6 billion through disposals and has achieved a profit of £158 million on disposals against book value.

Further details of the activities of the Group, including geographic and brand segmentation, are set out below.

22

Back to Contents

The Group operates primarily in the UK pub sector, which is itself part of the wider drinking out and eating out market, which also includes restaurants, social clubs, nightclubs and fast food outlets. Going to pubs, clubs and bars continues to be one of the most popular leisure activities in the United Kingdom, with over 80% of adults participating, with an average of three visits per month. The Company estimates that in calendar year 2002, the annual sales of the UK pub sector were of the order of £18 billion, including VAT, and that the Group represented around 9% of this sector in terms of sales with only 3% by number of sites.

The UK pub sector consists of some 60,000 pubs in total, which can be broadly categorized into three distinct business models: managed pubs (around 20% of sites), leased/tenanted pubs (around 50% of sites) and individual, independently owned pubs (around 30% of sites).

99% of the Group’s sites are managed. Managed pubs are generally owned by a pub company, such as the Group, or brewer and operated by a salaried manager and staff employed by the owning company, which prescribes the entire product range and detail of service style. They tend to be larger than leased/tenanted pubs and individual, independently owned pubs and have a higher average weekly take, or AWT, which the Company estimates is around £11,000. The Group’s sites have an AWT of over £14,000, significantly ahead of the typical managed pub AWT.

Leased/tenanted pubs tend to be smaller and are owned by a pub company or brewer but leased to, and therefore operated by, a third party tenant or lessee, who pays rent to the owner, is generally responsible for the maintenance of the pub, and is normally contracted to purchase the majority of drink products (in particular, beer) for resale from the owner. The Company estimates that these pubs have an AWT of around £3,000 to £4,000 and are typically more dependent than managed pubs on the sale of draught beer.

Individual pubs (sometimes known as freehouses) are independently owned and operated by a private individual, who is responsible for the maintenance of the pub and retains any profits after the expenses of running the pub. The owner is free to decide which products to sell.

The UK pub sector is influenced by trends for both eating out and drinking out. The value of annual sales in the drinking out sector is currently estimated at £26 billion, including VAT. Expenditure on drinking out has been growing steadily in line with inflation for the last 20 years, at an average rate of 6.0% per annum. The Company estimates that drink sales in pubs account for almost half of the overall drinking out sector, the balance being made up of drink sales in nightclubs, social clubs, hotels and restaurants.

Expenditure on eating out in the United Kingdom has been growing steadily ahead of inflation, at a rate of 9.8% per annum over the past 20 years. The annual sales value of the eating out sector is now estimated at £30 billion, including VAT.

Eating out in pubs has become increasingly popular. Pubs have increased their share of the restaurant sector (in terms of food sales) by approximately three percentage points in the past five years. In 2001, total food sales by pubs accounted for approximately £5 billion and Mintel Pub Catering estimates that total food sales by pubs will grow to around £7 billion by 2006.

Historical market trends suggest that drinking out is less responsive to changes in the overall economy than eating out, being more resilient in economic downturns than the eating out market, but with eating out showing greater growth during periods of high economic growth. However, the Company believes that during economic downturns, lower priced restaurants (including the Group’s pub-restaurants, where average food expenditure per head is under £8) tend to be more resilient than higher priced restaurants, as customers trade down.

The Company expects that over the long term the drinking out and eating out market as a whole will continue to develop in line with past trends, although it is clearly not immune to shorter-term economic

23

Back to Contents

conditions. There are a number of key market drivers shaping the future of the UK drinking out and eating out market:

| | • | economic climate – overall economic growth or decline and, in particular, overall changes in the level of consumer expenditure; |

| | | |

| | • | changes in demographics – for example, over the next five years, the number of 18–24 year olds (who are a key consumer group for the drinking out market) is forecast to grow by 8% and the number of persons aged 45 and above (who are a key consumer group for the pub-restaurant market) is forecast to grow by 6%; |

| | | |

| | • | broadened consumer appeal – an increase in the number of people visiting pubs from a wider selection of social and demographic groups (including women, families and older people) mitigating against a decrease in the frequency of visits by traditional blue collar male pub users; |

| | | |

| | • | growth in food sales in pubs – in 2001, food sales were estimated to account for approximately 25% of industry sales, approximately double the level of 15 years earlier; this is partly due to consumers’ increasing propensity to eat out, a preference for informal dining and an improvement in the breadth and quality of the pub food offering; |

| | | |

| | • | product trends – sales of alcohol in pubs are rising (broadly in line with inflation) and there are continued shifts in demand in the beverages sector, with declining sales of draught beer in pubs being offset by sales growth in wine, premium packaged spirits, bottled lagers and soft drinks; |

| | | |

| | • | branding – the growth in branded and formatted sites aiming to provide consistency of standards and customer service, with a view to attracting new customers, driving customer loyalty and increasing frequency of visits; |

| | | |

| | • | competition – the increased number of sites and higher levels of investment on the high street (main street) over the last six to seven years has led to supply outgrowing demand. This, together with the increased price sensitivity of consumers, as well as the rising levels of home consumption (partly due to the widening gap between the on-trade and off-trade price of alcohol) has resulted in an overall increase in competition; |

| | | |

| | • | shift in pub ownership – the Company estimates that around 30% of pubs are now owned by financially leveraged companies, compared with 2% in 1997, contributing to a reduction in the overall levels of expansionary and maintenance capital expenditure in the industry; and |

| | | |

| | • | regulation – the licensing reform proposed by the UK Government in November 2002, which may result in longer opening hours for existing pubs and restrict the granting of new licenses, particularly in residential areas, and changes in employment legislation, including the level of the UK national minimum wage, and in property taxation. |

| | | |

The Group’s strategy is to capitalize and build on its position as the leader in the managed pub and pub-restaurant sector, to drive returns, cash generation and long-term earnings growth to create value for shareholders.

The Group intends to implement its strategy by:

| | • | owning and developing licensed properties with high AWT, maintaining high levels of amenity, service and value; |

| | | |

| | • | evolving its retail brands and formats to gain market share and, as appropriate, creating new consumer offers; |

| | | |

| | • | delivering high returns on incremental capital invested by developing prime sites into these brands and formats; and |

| | | |

| | • | generating additional cost, margin and revenue benefits from unit, brand and corporate scale, to consolidate its leading position in the market. |

24

Back to Contents

The Company expects that successful implementation of this operational strategy would enable management to drive longer-term earnings growth and freehold capital appreciation through the ongoing development of the Group’s estate and, by taking advantage of specific value-enhancing disposal opportunities (for instance due to the higher valuations being achieved through unlicensed use), to realize value for the Company’s shareholders through dividends and, where appropriate, returns of capital.

This strategy highlights the importance of M and B Group’s unique, high quality estate in enabling the M and B Group to drive value from its portfolio of both branded and unbranded sites, without over-exposure to any particular segment of the market.

Further detail on the strategy for the Group can be found in this “Item 4. Information on the Company – Segmental Information”.

Owning and developing licensed properties with high AWT |