CNO Financial (CNO) 8-KRegulation FD Disclosure

Filed: 5 Sep 07, 12:00am

A Primer on Conseco’s Long-term Care Business

August 2007

A refresher on the typical features of

long-term care policies

Provide benefits for either care provided in a long-term care facility or care received in one’s

home (“home health care”) or both during the contract term.

Premiums are generally determined based on the age of the insured at issuance and are not

scheduled to increase as insured ages.

Cannot be canceled, but are subject to certain conditions (regulatory approval and adverse

morbidity experience), premium rates may be increased (guaranteed renewable).

Provide benefits while the insured is confined in a nursing home, assisted living facility, (but not

a hospital) or receiving home health care services or both.

Policies that include coverage for long-term care facilities provide benefits for confinement to

licensed nursing facilities, and in some cases, assisted living facilities.

May be subject to a waiting period (such as 90 days) and a limit of covered benefits (for a

specified period, such as 2 years, or amount, such as $200,000).

2

Some more details on benefits provided

under these policies

Eligibility for benefits generally require that the insured need assistance with at least two activities of daily living

or have cognitive impairment that makes it unsafe for the insured to live unsupervised. Alternatively, eligibility

under many older policies may be based on a physician’s determination that care is medically necessary.

Benefits are generally paid on an expensed-incurred basis, subject to a daily maximum.

Benefits are paid for as long as insured remains eligible, or until the policy’s maximum period or dollar amount

has been exhausted.

Most policies include a waiver of premium benefits that waive the premium payable for the duration of the claim

once the insured has received benefits.

Many policies include restoration of benefit feature that permit benefits of the policy to be replenished after the

insured has recovered and has been independent for a specified period of time.

Some policies include an inflation feature, purchased as a rider to the base policy, which is intended to allow the

benefit amounts purchased to keep pace with the rising cost of care.

3

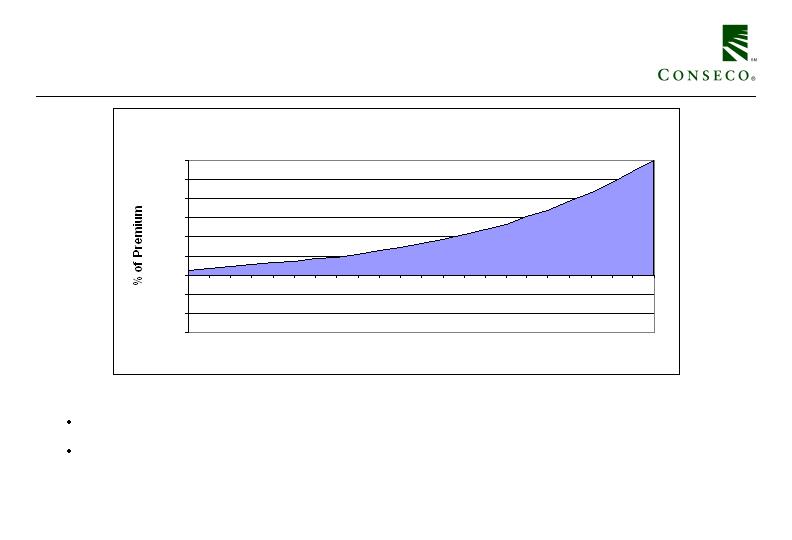

The life cycle of a block of long-term care

business

Premiums are recognized as revenue when due.

Incurred claims are expected to be small in the early policy years and grow as policies age.

A substantial part of premiums collected are required to fund benefits payable in future periods and

become part of the active life reserves.

Active life reserves essentially hold back a portion of premiums that would otherwise be reported as

profits.

Active life reserves grow over the early years of a block of policies, when morbidity is low; and are

released in the later years when morbidity is high.

The interest income earned on the assets supporting the reserves is an important factor in measuring

the profitability of long duration products.

If the assumptions used to determine active life reserves are correct, the increase in claim cost will

be offset by a comparable reduction in active life reserves plus investment income on the reserves.

4

Long-term care business life cycle -

Incurred claim ratios

Incurred Claim Ratio (incurred claims / premium)

-150.0%

-100.0%

-50.0%

0.0%

50.0%

100.0%

150.0%

200.0%

250.0%

300.0%

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Policy Year

Incurred claims are very low in the early years of a policy.

As the policies age, the incurred claims ratio will increase, eventually exceeding 100%.

5

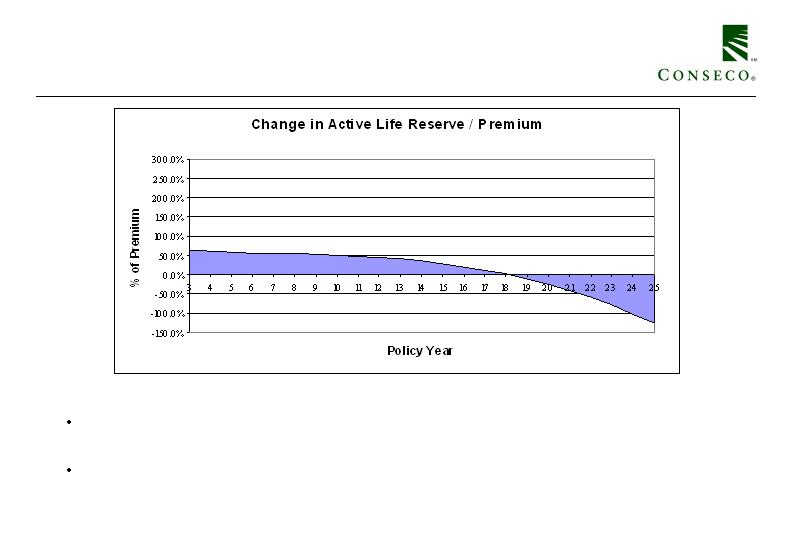

Long-term care business life cycle -

Change in active life reserve

A substantial part of the premium collected in early years is held back as active life reserves to

fund the claims that will be incurred in the future.

Eventually, active life reserves begin to be released (year 18 in this example). Such release will

offset a portion of the claims incurred as shown in the next slide.

6

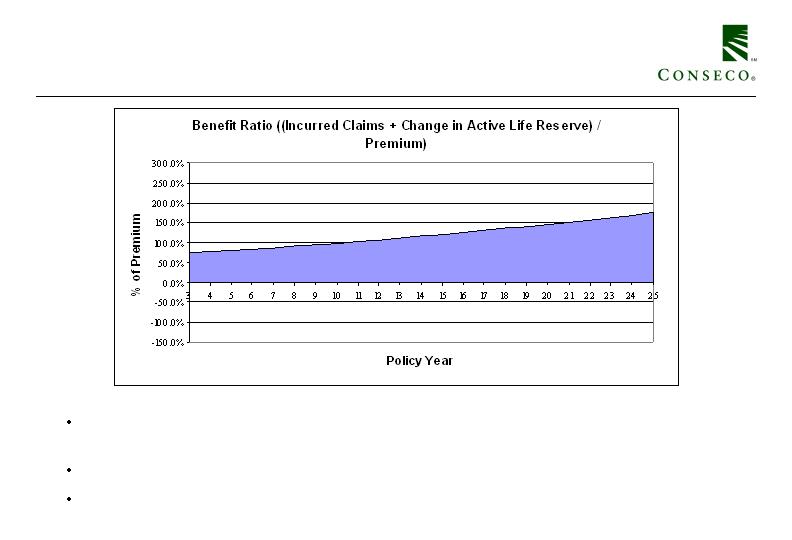

Long-term care business life cycle -

Total benefits incurred

When incurred claims and the change in active life reserves are combined, the increase over time

is less severe.

However, the benefit ratio will increase over time, eventually exceeding 100%.

This increase is substantially offset by investment income, as shown in the next slide.

7

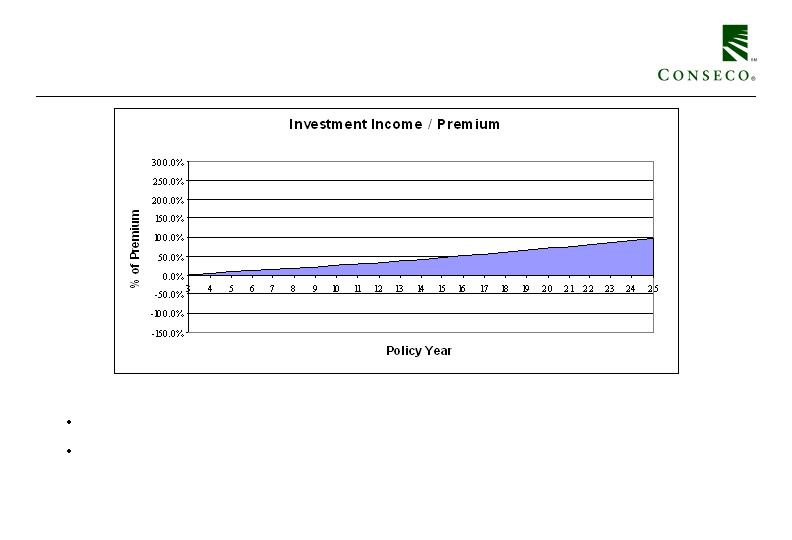

Long-term care business life cycle -

Investment income

Investment income is earned on the assets supporting the reserves.

Such income becomes an increasingly important component of revenue over time.

8

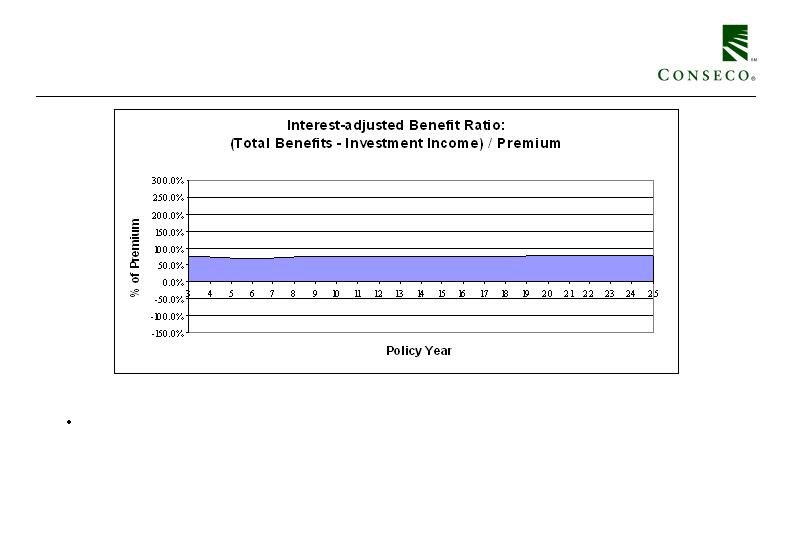

Long-term care business life cycle -

Interest-adjusted benefit ratio

The interest-adjusted benefit ratio, which includes the change in active life reserves and

investment income, is expected to be level over time.

9

Long-term care policies are subject to

changing experience

Benefits are expected to increase over time with the aging of the insured, and actual profitability is sensitive to

experience relating to several assumptions made in pricing. Our business, along with other blocks in the industry,

has experienced unfavorable development related to some of the following assumptions:

Incidence of claim – In some cases, more policyholders have received benefits than assumed in pricing, in

part due to people living longer.

Duration of claim – In some cases, benefits are being provided for longer periods of time than assumed in

pricing, often because policyholders are living longer while receiving care.

Persistency – In some cases, policyholders are not allowing their policies to lapse as frequently as assumed in

pricing. This results in higher than expected claims in later policy years.

Medical inflation – the cost of care has risen faster than expected.

As experience deteriorates, original expected profit margins decrease.

Rate increases are necessary to return the business to profitability (or in some cases, break even).

This change in experience has most materially affected the performance of the Other Business in Run-off segment,

as shown in the next slide.

Change in interest rates can also have an impact on earnings. However, interest rate changes have not been a

significant factor for our block in recent periods.

10

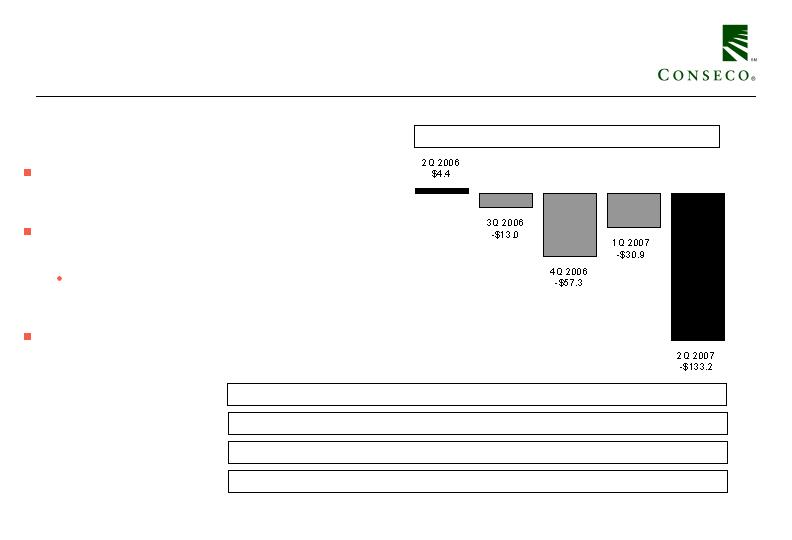

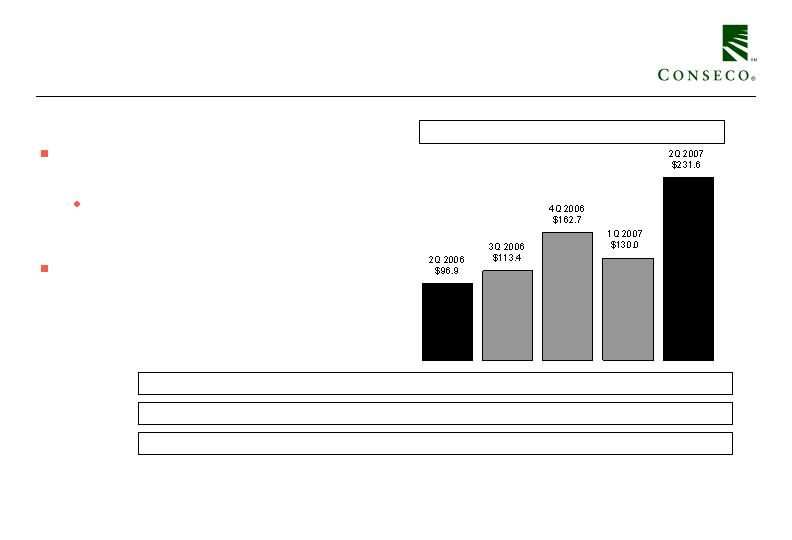

Other Business in Run-off –

Segment Performance

The recent experience from this block reflects

significant increases to reserves related to prior

period claim development.

For example, the experience in 2Q2007 reflects $118

million of increases to prior-period incurred claim

estimates.

Such amount includes $110 million of

strengthening adjustments to claim reserve

methods and assumptions.

The next several slides will summarize how long-term

care reserves are determined.

PTOI-Trailing 4 Quarters: $62.7 $33.3 ($41.9) ($96.8) ($234.4)

Revenues-Quarterly: $126.8 $128.1 $127.9 $126.6 $125.8

Pre-Tax Operating Income

Revenues -Tr. 4 Quarters: $528.1 $519.6 $516.5 $509.4 $508.4

($ millions)

Collected Premiums-Quarterly: $82.4 $80.4 $76.6 $81.2 $76.2

11

A refresher on how long-term care reserves

are determined

There are two components of policyholder liabilities.

Active life reserves – reserve for future policyholder benefits not yet incurred (calculated

as the present value of future benefits less future net premiums).

Claim reserves – liability for all future payments for any claim incurred as of the

valuation date, as well as payments due on valuation date (calculated as the present value

of future payments on known claims, plus a provision for amounts due, plus a provision

for unknown claims, referred to as incurred but not reported claims or “IBNR”).

12

Other Business in Run-off –

Balance Sheet Detail

Active life reserves account for the largest component of total reserves, but have not

been responsible for the recent volatility

Reserve increases in the last four quarters have related to claim reserves

2Q2007 claim reserve reflects expectation of continued adverse claim development

The claim reserve increase in 2Q2007 reflects $110 million of strengthening adjustments

to claim reserve methods and assumptions

Insurance acquisition cost balance is 5% of net liability and is declining rapidly

Balance remains recoverable under best estimate assumptions

($ millions)

Insurance Liabilities and Intangible Assets, Net of Reinsurance

Active Life Reserve

Claim Reserve

Insurance Acquisition Costs

Net Liability

Percent Change

2Q 2006

$2,413.3

731.4

(181.8)

$2,962.9

-

3Q 2006

$2,413.6

734.8

(176.2)

$2,972.2

0.3%

4Q 2006

$2,412.7

801.2

(170.9)

$3,043.0

2.4%

1Q 2007

$2,412.3

816.5

(165.2)

$3,063.6

0.7%

2Q 2007

$2,409.1

940.4

(159.5)

$3,190.0

4.1%

13

Active life reserves

These reserves are calculated utilizing assumptions estimated in the year a policy is issued (or for

business in force as of August 31, 2003, (the “fresh-start date”) the assumptions developed on that

date).

Assumptions include estimates for persistency, claim costs, morbidity, interest rates, expenses

and premium rate increases.

Once these assumptions are established, we are required under SFAS 60 to continue to use them

unless our assessment of premium adequacy indicates that future premiums are not adequate to cover

future benefits and expenses; or when our premium rate increases exceed original assumptions.

Our assessment of premium adequacy is based on our most recent assumptions for persistency,

morbidity, interest rates, expenses and premium rate increases, all or any of which may be different

than the assumptions utilized in establishing our active life reserves. If premiums plus net liabilities

(active life reserves plus claim reserves less insurance intangibles) were determined to be inadequate

to fund future benefits and expenses, we would be required to write off all or a portion of our

insurance acquisition costs.

When premium rate increases exceed original assumptions, reserve assumptions are updated using a

prospective method whereby the impact is graded in over time.

14

Claim reserves

These reserves are for benefits to be paid in the future for our current claims (both reported and

incurred but not reported claims). These reserves are determined using assumptions based on our

current best estimate.

The significant assumptions utilized in establishing claim reserves include expectations about the

duration, cost of care being reimbursed, the interest rate utilized to discount the claim reserves,

claims that have been incurred but not yet reported, claims that have been closed but are expected to

reopen and assumptions about which claims that are currently in their eligibility review stage will

eventually become claims that have payments associated with them.

We review “verified claim reserves” to determine the accuracy of past estimates, as described on the

following page.

15

Validation of claims incurred

during a period

Verified basis normalizes all periods for the impact of claim reserve deficiencies.

Expected incurred losses are paid out over subsequent periods.

At each reporting date, the incurred claims estimate for a particular period is restated or

“verified” as the total payments to date plus the current estimate of the claim reserve for

future payments (for claims incurred in that period).

16

Other Business in Run-off –

Verified Incurred Development

Developed

Deficiencies

in Periods

Prior to

2Q07

1Q07

2006

2005

2004

2003

Total Closed Block LTC

Reported Claims

221.5

119.7

433.4

396.0

370.8

Prior Period Development

(108.5)

(34.9)

(71.9)

(58.7)

(44.1)

Verified Claims as of Reporting Date

113.0

84.8

361.5

337.3

326.7

Developed through:

12/31/2004

326.7

44.1

12/31/2005

337.3

326.1

103.5

12/31/2006

361.5

365.0

337.6

136.1

3/31/2007

84.8

375.5

368.8

344.1

146.7

6/30/2007

113.0

104.2

418.1

388.9

356.2

160.9

Reporting Periods

Verified Claims

17

The experience related to the run-off block has been very volatile. Most of this

business was written by certain subsidiaries prior to their acquisition by Conseco in

1996 and 1997.

Bankers Life long-term care block –

Verified Incurred Development

Developed

Deficiencies

in Periods

Prior to

2Q07

1Q07

2006

2005

2004

2003

Total Bankers Life Block LTC

Reported Claims

108.0

104.2

398.3

341.2

294.1

Prior Period Development

-

3.3

(0.5)

(4.3)

(1.0)

Verified Claims as of Reporting Date

108.0

107.5

397.8

336.9

293.1

Developed through:

12/31/2004

293.1

1.0

12/31/2005

336.9

296.6

1.8

12/31/2006

397.8

334.0

295.3

6.5

3/31/2007

107.5

394.8

333.0

295.8

6.7

6/30/2007

108.0

107.7

389.7

334.9

297.5

8.0

Reporting Periods

Verified Claims

18

The experience related to the Banker Life long-term care block has not been as volatile

as the run-off block. This business was written through our career agency distribution

channel.

Other Business in Run-off –

2Q 2007 Earnings

($ millions)

As

Verified

2Q 2006

Reported

Basis

Insurance policy income

82.1

$

78.1

$

78.1

$

Net investment income

44.6

47.6

47.6

Fee revenue and other income

0.1

0.1

0.1

Total revenues

126.8

125.8

125.8

Insurance policy benefits

96.9

231.6

113.3

Amortization related to operations

3.5

5.8

5.8

Other operating costs and expenses

22.0

21.6

21.6

Total benefits and expenses

122.4

259.0

140.7

Income (loss) before net realized investment gains (losses) and income taxes

4.4

$

(133.2)

$

(14.9)

$

2Q 2007

19

Our 2Q2007 reported earnings were affected by prior period claim reserve development.

Verified basis earnings normalizes the impact of prior period deficiencies.

Other Business in Run-off –

Benefit Detail

Incurred claims in all periods reflect

volatility due to development of out-

of-period incurred claim estimates

Includes reserve strengthening

adjustments of $110 million in 2Q

2007

Increase (decrease) in active life

reserves varies with persistency; 2Q

2006 included $9.4 million release of

redundant reserves

Total benefits equal incurred claims plus increase in reserve for future benefits. Verified basis incurred claims adjust all

periods for claim reserve redundancies and deficiencies.

Total Benefits

($ millions)

$234.9

$126.7

$164.0

$113.5

$117.3

Incurred Claims

$(3.3)

$3.3

$(1.3)

$(0.1)

$(20.4)

Increase (decrease) in Active Life Reserve

$116.6

$114.4

$124.5

$119.6

$116.5

Verified Basis Incurred Claims

20

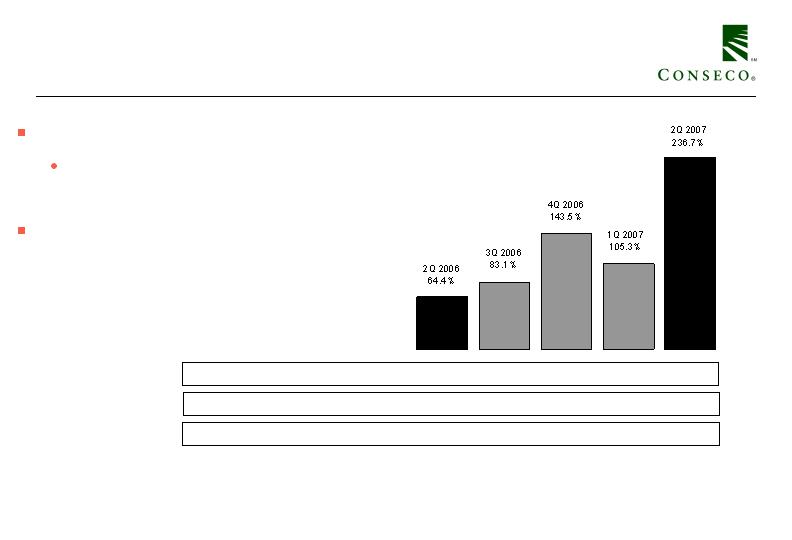

Other Business in Run-off –

Interest-Adjusted Benefit Ratio*

Verified basis normalizes all periods for

impact of claim reserve deficiencies

Prior period deficiencies increased

benefit ratio by 152 percentage points in

2Q 2007

2Q 2006 benefit reserve adjustment reduced

benefit ratio by 11 percentage points

Trailing 4 Quarter Avg.: 52.1% 60.1% 83.2% 99.0% 141.0%

Qtrly. non-int. adjusted: 118.0% 136.0% 198.2% 163.5% 296.7%

*We calculate interest-adjusted benefit ratios by dividing insurance policy benefits less interest income on the

accumulated assets backing the insurance liabilities by insurance policy income.

Qtrly. Verified Basis non-int. adjusted: 116.9% 143.5% 147.6% 148.1% 145.1%

21

Other Business in Run-off –

Claim Counts and Claims Paid

2Q05

3Q05

4Q05

1Q06

2Q06

3Q06

4Q06

1Q07

2Q07

Claims Paid

95.4

$

107.4

$

83.1

$

90.4

$

101.2

$

96.1

$

81.6

$

102.0

$

96.8

$

Claimant Counts

12,240

12,449

12,290

11,805

12,536

12,288

12,048

11,870

12,424

22

Claimant count estimates remain around 12,000 with paid claims near $100m (before inventory adjustments)

Other Business in Run-off –

LTC Persistency

3Q 05

4Q 05

1Q 06

2Q 06

3Q 06

4Q 06

1Q 07

2Q 07

Policy counts

202,804

201,649

197,585

194,080

190,134

187,123

183,655

179,952

Annualized termination rates

10.7%

2.3%

7.8%

6.9%

7.9%

6.2%

7.2%

7.8%

23

Our termination rates have exceeded expectations in recent periods due to rate increases.

However, we expect lower termination rates in future periods due to the large level of non-

forfeiture elections that will be applicable.