KBW 2008 Insurance Conference

September 4, 2008

Forward Looking Statements

Cautionary Statement Regarding Forward-Looking Statements. Our statements, trend analyses and other information contained in these materials relative to markets for

Conseco’s products and trends in Conseco’s operations or financial results, as well as other statements, contain forward-looking statements within the meaning of the federal

securities laws and the Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,”

“plan,” “estimate,” “expect,” “project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable with,”

“optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that contain these words carefully

because they describe our expectations, plans, strategies and goals and our beliefs concerning future business conditions, our results of operations, financial position, and our

business outlook or they state other ‘‘forward-looking’’ information based on currently available information. Assumptions and other important factors that could cause our

actual results to differ materially from those anticipated in our forward-looking statements include, among other things: (i) general economic, market and political conditions,

including the performance and fluctuations of the financial markets which may affect our ability to raise capital or refinance our existing indebtedness; (ii) our ability to obtain

adequate and timely rate increases on our supplemental health products including our long-term care business; (iii) mortality, morbidity, the increased cost and usage of health

care services, persistency, the adequacy of our previous reserve estimates and other factors which may affect the profitability of our insurance products; (iv) changes in our

assumptions related to the cost of policies produced or the value of policies inforce at the Effective Date; (v) the recoverability of our deferred tax asset and the effect of

potential tax rate changes on its value; (vi) changes in accounting principles and the interpretation thereof; (vii) our ability to achieve anticipated expense reductions and levels

of operational efficiencies including improvements in claims adjudication and continued automation and rationalization of operating systems; (viii) performance and valuation of

our investments, including the impact of realized losses (including other-than-temporary impairment charges); (ix) our ability to identify products and markets in which we can

compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand recognition; (x) the ultimate outcome of

lawsuits filed against us and other legal and regulatory proceedings to which we are subject; (xi) our ability to remediate the material weakness in internal controls over the

actuarial reporting process that we identified at year-end 2006 and to maintain effective controls over financial reporting; (xii) our ability to continue to recruit and retain

productive agents and distribution partners and customer response to new products, distribution channels and marketing initiatives; (xiii) our ability to achieve eventual

upgrades of the financial strength ratings of Conseco and our insurance company subsidiaries as well as the potential impact of rating downgrades on our business; (xiv) the

risk factors or uncertainties listed from time to time in our filings with the Securities and Exchange Commission; (xv) our ability to continue to satisfy the financial ratio and

balance requirements and other covenants of our debt agreements; (xvi) regulatory changes or actions, including those relating to regulation of the financial affairs of our

insurance companies, such as the payment of dividends to us, regulation of financial services affecting (among other things) bank sales and underwriting of insurance

products, regulation of the sale, underwriting and pricing of products, and health care regulation affecting health insurance products; (xvii) changes in the Federal income tax

laws and regulations which may affect or eliminate the relative tax advantages of some of our products; and (xviii) the receipt of regulatory approval and consummation of the

plan to transfer Conseco Senior Health Insurance Company to an independent trust. Other factors and assumptions not identified above are also relevant to the forward-

looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All written or oral forward-looking statements

attributable to us are expressly qualified in their entirety by the foregoing cautionary statement. Our forward-looking statements speak only as of the date made. We assume

no obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments,

changes in assumptions or changes in other factors affecting the forward-looking statements.

Non-GAAP Measures

This presentation contains certain financial measures that differ from the comparable measures under

Generally Accepted Accounting Principles (GAAP). Reconciliations between such non-GAAP measures and

the comparable GAAP measures are included in the Appendix.

While management believes these measures are useful to enhance understanding and comparability of our

financial results, these non-GAAP measures should not be considered substitutes for the most directly

comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the Securities

and Exchange Commision that are available in the “Investor – SEC Filings” section of Conseco’s website,

www.conseco.com.

Conseco Today

Pursued roll-up strategy of insurance

companies in the 1990s

Twelve acquisitions for a combined

consideration of $5.4Bn between 1990 and

1997

Seven acquisitions prior to 1990

Made “diversifying” acquisition of

manufactured housing lender Green Tree for

$6.0Bn in 1998

Problems with Green Tree forced Conseco

into bankruptcy in 2002 (insurance

companies continued operating)

Emerged from bankruptcy in 2003

Focused provider of supplemental health,

protection and accumulation products to the

underserved senior middle market with over

4 million policyholders

Operates through three active segments

Bankers Life: strong career agent franchise

Colonial Penn: direct distribution platform with

solid growth potential

Conseco Insurance Group: independent agents

Run-off segment

Primarily old acquired blocks of long term care

(LTC) policies

Old Conseco

New Conseco

Creating Value at Conseco:

Fix, Focus, Grow

Stabilize, then substantially

eliminate run-off LTC

exposure

Improve CIG profitability

Enhance control and data

quality environment

Use “Value of New

Business” metric to guide

marketing and sales efforts

Realign Management

Consolidate back office

Align long-term incentive

compensation with

shareholder interests

Fix

Focus

Grow

Focus on fast growing

market segments where

Conseco has the

appropriate capabilities

and competencies

Achieve run-rate adjusted ROE of 11% by 2009

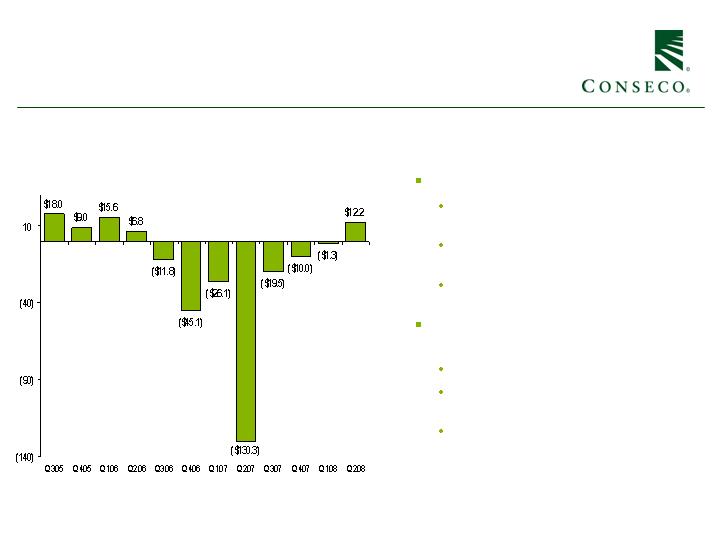

Fixing LTC Run-off:

The Separation of CSHI

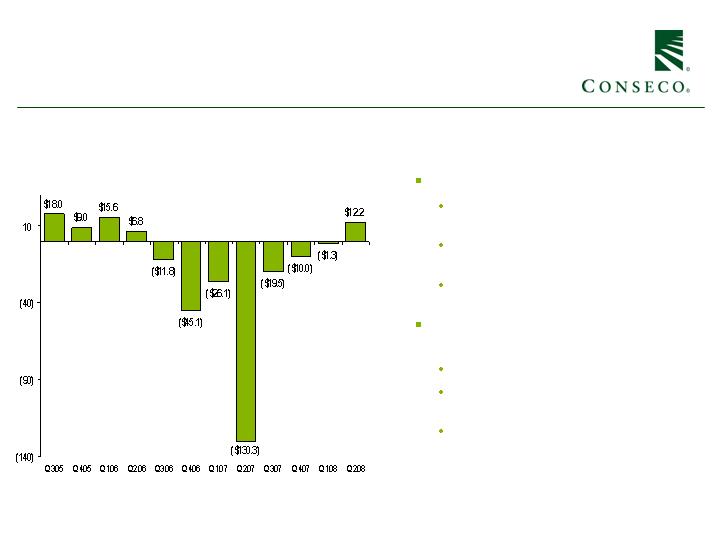

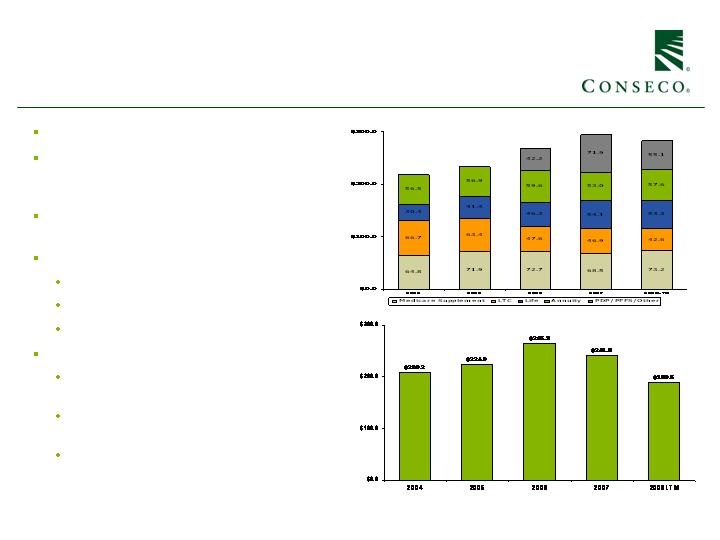

Run-off Segment Pre-Tax Operating Earnings ($MM) (a)

Stabilized LTC business

Strengthened reserves by $200MM over

the last 18 months

Installed experienced management team

focused exclusively on LTC

Pursued premium rate increases where

justified

Improved customer service to LTC

policy holders

Enhanced claims management

Outsourced most admin operations to

the Long Term Care Group

Concluded multi-state insurance

regulatory examination and started

remediation

Management Actions Taken Prior to Separation

(a) A non-GAAP financial measure which excludes net realized investment gains (losses), net of related amortization. See the Appendix for a reconciliation to the

corresponding GAAP measure.

CSHI Separation Transaction Overview

Key Transaction Terms

CSHI (which houses 87% of run-off LTC business) to be transferred for no consideration to not-for-profit

business trust set up to own and operate the business for the benefit of its LTC policyholders

Pre-separation capital contribution of $175MM to CSHI to raise total adjusted statutory capital to $300MM

Subject to approval by Pennsylvania Insurance Department

Expected closing in Q4 2008

Conseco Rationale

A balanced solution, considering the various stakeholders, to definitively separate CSHI from Conseco

Separation eliminates potential source of earnings volatility and perceived call on Conseco’s capital

Allows capital to be applied to profitable, high growth businesses

Improves rating profile, positioning Conseco for an upgrade over time

Allows Conseco’s management to focus exclusively on core businesses

Aggressively Pursuing Expense

Reduction Opportunities

Back-office consolidation and elimination of excess office space completed; expected to

produce run-rate savings of $25 million annually by year-end 2008

Approximately $11 million in savings realized in 2007

Additional $9 million expected in 2008

Remaining $5 million expected in 2009

Additional $6 million annual impact from CIG reductions in sales and marketing expenses as

a result of improved focus

$2 million realized in 2007, full amount beginning in 2008

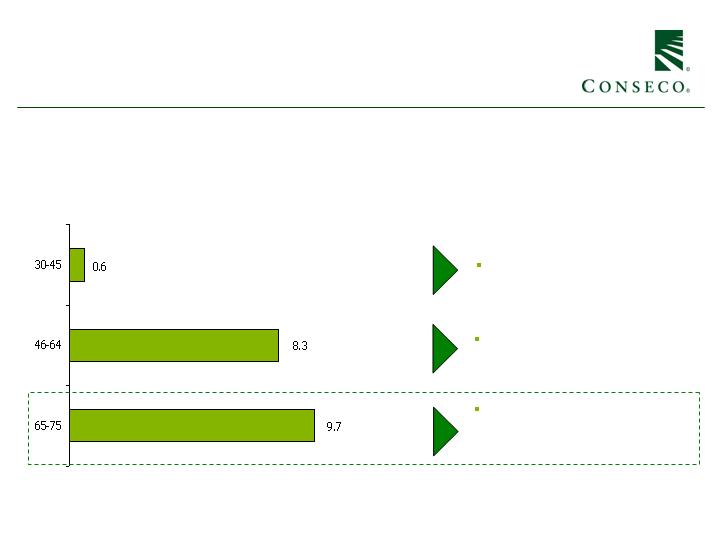

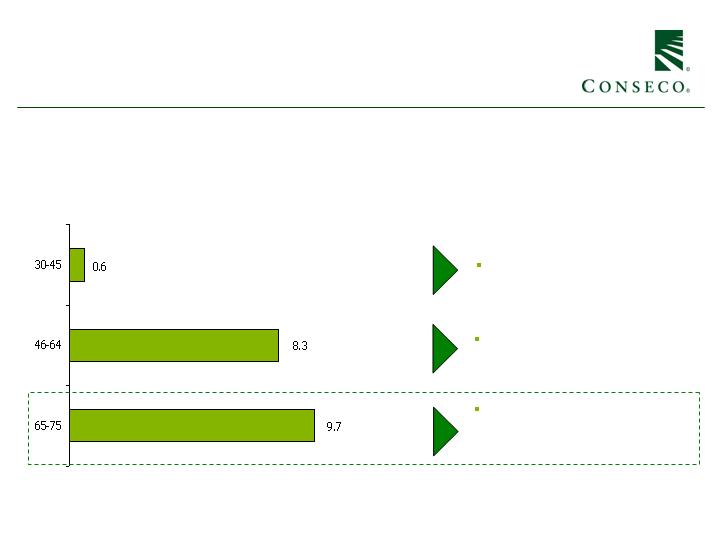

0.1%

1.1%

3.9%

Source U.S. Census Bureau

Life, disability

Annuities, 401(k), mutual funds

Senior health, critical illness, final

need, long term care, annuities

with lifetime income

Focusing on the Fast Growing, Underserved

Middle Income Senior Market

Growth of Population 2007-2017E (Million people)

Age Cohort CAGR

Primary Insurance Product Needs

Source: KBW Research

AFL

AIG

Aviva

USA

Banner

GFR

GNW

Guardian

HIG

KCLI

LNC

Mass

Mutual

MET

NFS

NW

NY Life

PFG

PL

PLFE

PNX

PRU

TMK

SFG

UNM

Products

More

Affluent

Less

Affluent

Protection

Product

Asset

Accumulation

(Relative company size based on total assets)

CNO

CIG

BLC

CPL

MOO

UHCO

State Farm

Allstate

Combined

Mutual

Stock Life

P&C

Legend

Few Competitors in Our Target Space

Conseco Has Expertise

Across Important Middle

Market Products

Specified Disease

Equity-Indexed Life and

Annuity Products

(Longevity Solutions)

Long-Term Care

Medicare Supplement

Whole life products

Final expense / Term

insurance for protection

Able to Access Consumers

Across Multiple Channels

With an Agent (Retail)

Bankers

CIG - Independents

Without an Agent: (Direct)

Colonial Penn

At Work: (Worksite Marketing)

PMA Worksite Division

(CIG-owned)

CIG - Independents

Strong Trends Are Impacting

Middle Market Consumers

Rising medical costs

Decline of societal safety nets

(government & employer)

Increased longevity

Greater awareness of need for

retirement planning

The Right Products and The Right Channels for

Today’s Middle Market Consumer

We Offer a Unique Value Proposition

that is Closely Aligned to Important

Trends in Our Target Market

Exceptional Customer Reach

Over 4 million Conseco policyholders

Powerful Bankers career agent force

Over 5,000 contracted agents spread across 230 locations

70 million Americans in broad target market; 2/3 live within 25 miles of a Bankers branch

3 million annual home visits to prospects and 18 million phone calls

Successful direct response effort

28 million pieces of direct mail sent annually

3% response rate

“Touch” virtually every American turning 65

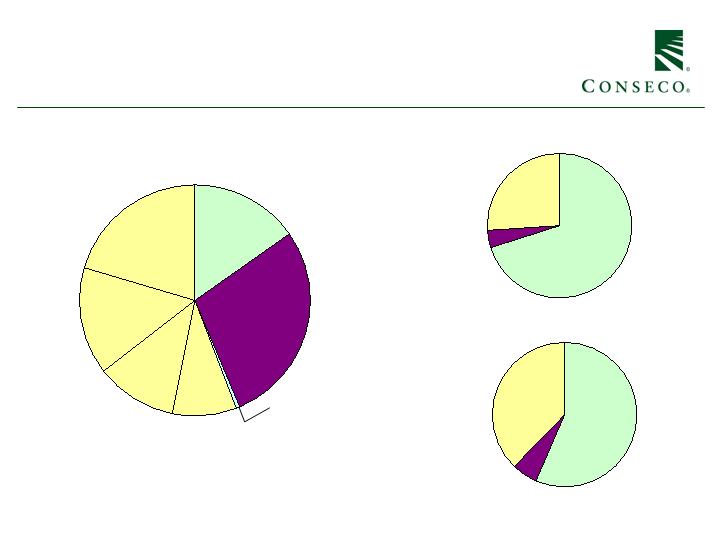

Conseco at a Glance:

Collected Premiums and Pre-tax Income

6/30/08 Last Twelve Months (“LTM”)

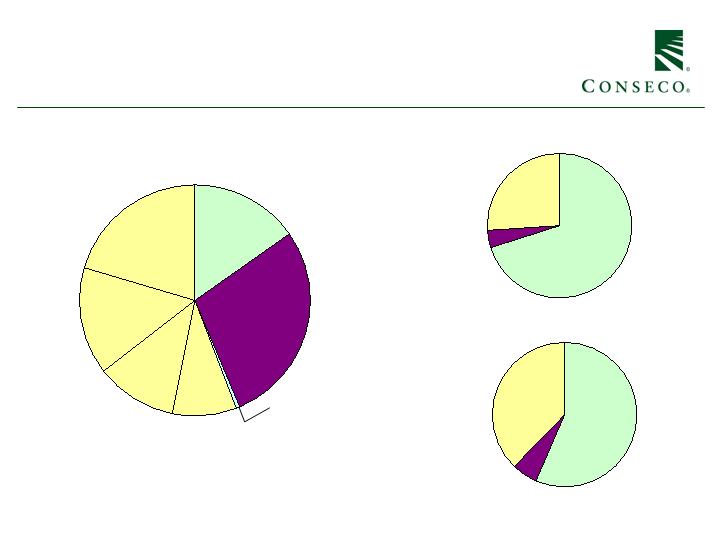

Collected Premiums by Product (a)

6/30/08 LTM Pre-Tax Operating

Earnings by Distribution Channel (a) (b)

6/30/08 LTM Collected Premiums by

Distribution Channel (a)

Annuities

28.4%

LTC

15.0%

Life

15.2%

Bankers

65.9%

Bankers

70.0%

CIG

26.2%

Colonial Penn

3.8%

CIG

27.6%

Colonial Penn

6.5%

Other

0.6%

PDP & PFFS

11.5%

Specified Disease

8.8%

Medicare

Supplement

20.5%

(a) Excludes LTC run-off

(b) A non-GAAP financial measure which excludes: (i) net realized investment gains (losses), net of related amortization; (ii) costs related to a

litigation settlement; and (iii) the loss related to a coinsurance transaction. See the Appendix for a reconciliation to the corresponding GAAP measure.

Total: $4.1Bn

Total: $287.5MM

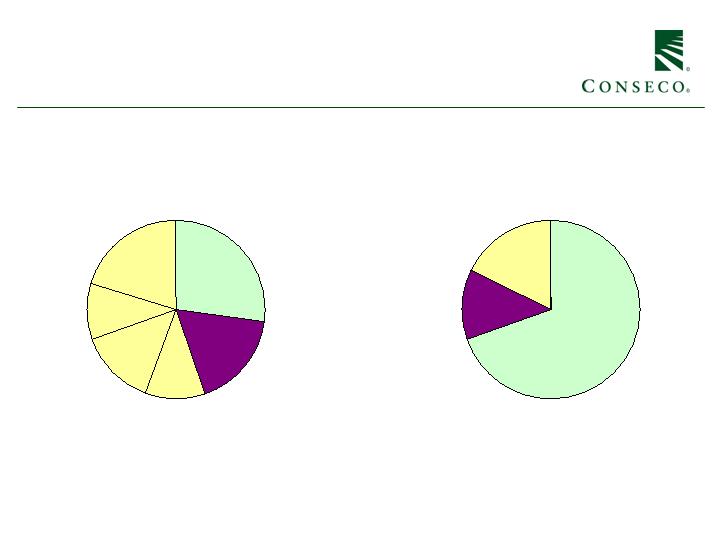

Conseco at a Glance:

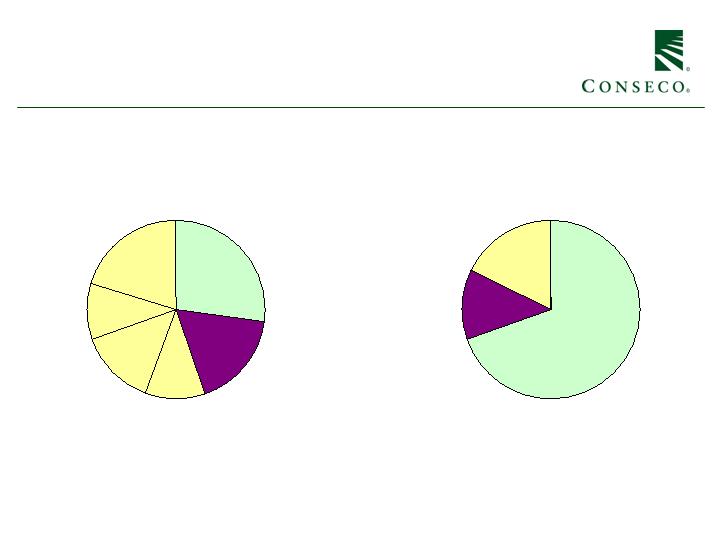

New Annualized Premiums (“NAP”)

6/30/08 LTM NAP by Product

6/30/08 LTM NAP by Distribution

Channel

Bankers

70.1%

CIG

18.0%

Colonial Penn

11.9%

Annuities

17.9%

LTC

10.6%

Life

26.3%

PDP & PFFS

14.0%

Specified

Disease

10.8%

Medicare

Supplement

20.4%

Total NAP: $403.2MM

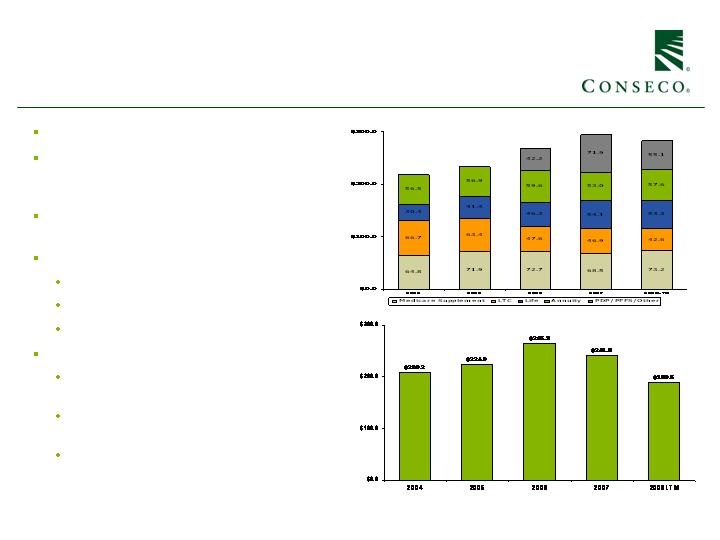

Bankers Life Overview

Solid business with expanding low cost distribution

Focused on the middle-class senior market with

Medicare supplement, life, annuity, LTC, Medicare

Part D and Medicare Advantage products

“Kitchen-table” sales model through over 5,000

career agents and sales mangers

Strong momentum in recruitment

Agent count up 5% since 6/30/07

8% YTD growth in new agents

8% YTD growth in productive agents (a)

Key initiatives

Continue growth in agents and improve agent

productivity

Fix weakened profitability of LTC business

thorough re-rates and claims management

Develop new products

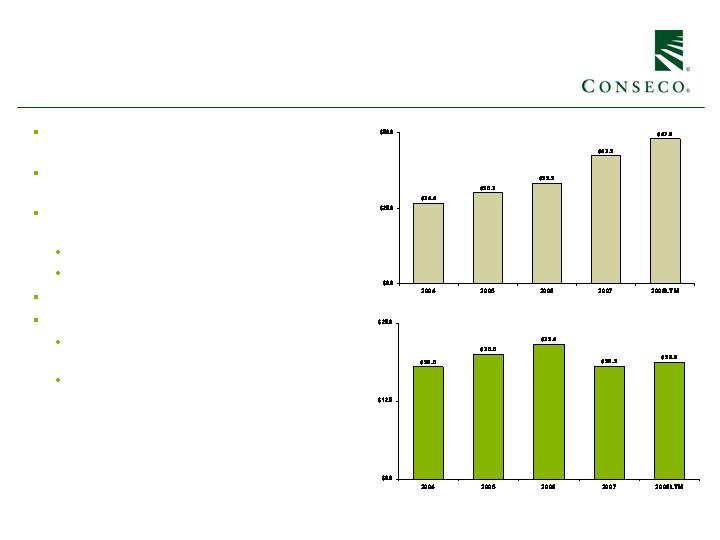

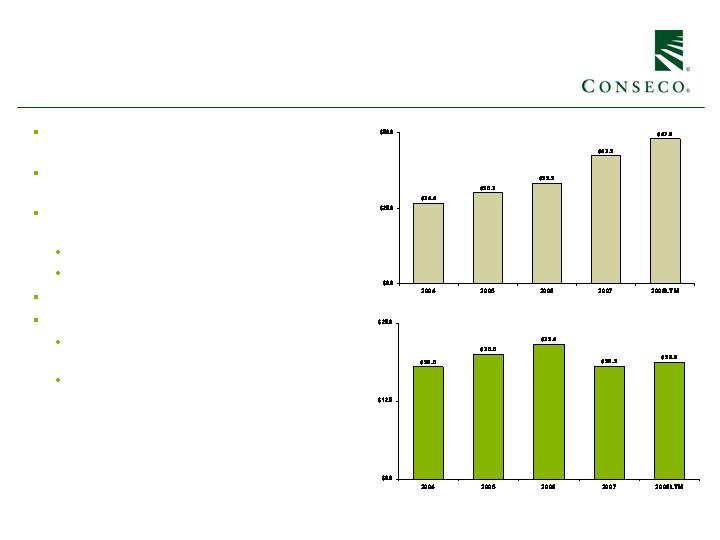

Pre -Tax Operating Earnings ($MM) (b)

New Annualized Premiums ($MM)

$218.4

$233.6

$ 268.4

$ 294.4

$ 282.8

(a) Productive agents defined as agent who sold 4+ policies or earned $2,000+ in commissions per month during the most recent 12 months

(b) A non-GAAP financial measure which excludes net realized investment gains (losses), net of related amortization. See the Appendix for a reconciliation to the

corresponding GAAP measure.

Colonial Penn Overview

Focuses on lower middle-income retirees with

simple, low cost life insurance products

Direct response model with media and mail based

lead generation with robust telemarketing support

Well positioned in unique market niche with strong

growth potential

30% sales growth in 2007

Sustainable growth of 20% per year

Low cost administrative platform

Recent Accomplishments

Recaptured block of business ceded to Swiss Re in

2002

Launched mid-face life product

New Annualized Life Premiums ($MM)

(a) A non-GAAP financial measure which excludes net realized investment gains (losses), net of related amortization. See the Appendix for a reconciliation to the

corresponding GAAP measure.

Pre -Tax Operating Earnings ($MM) (a)

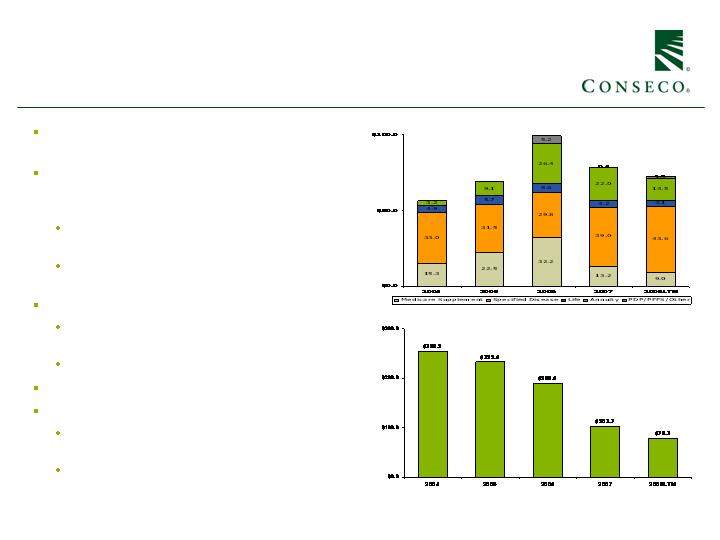

CIG Overview

Focused on middle income working Americans and

retirees with suppl. health and protection products

Distribution through 2,600 independent producers,

including 590 from Performance Matters Associates

(“PMA”), a wholly-owned marketing company

PMA currently generates 50% of new business

focusing on profitable supplemental health products

Building new relationships, broadening supplemental

health and life distribution

Key markets

Worksite – small business, education, government,

healthcare and credit unions

Individual – farm/rural and seniors

Strategic goal of 10-15% profitable annual growth

Achievements

Positive new business value for all products with

optimization of business mix

Sales/marketing expenses realigned with market focus

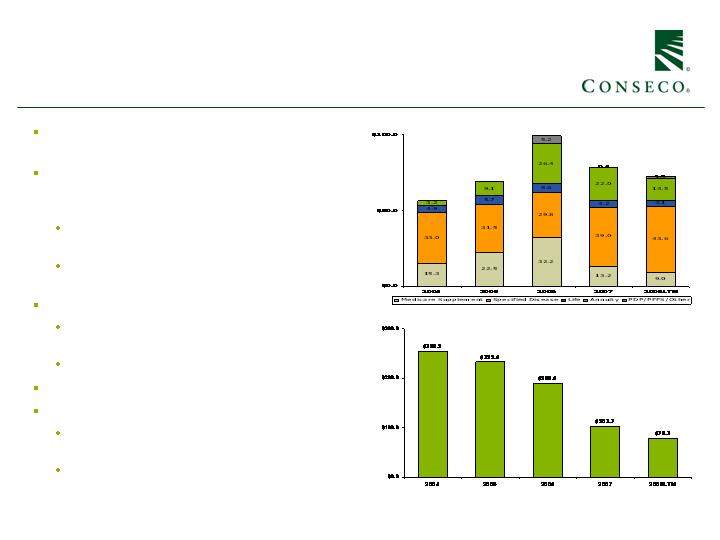

New Annualized Premiums ($MM)

$ 56.4

$ 68.8

$ 99.2

$ 78.8

$ 72.5

Pre -Tax Earnings ($MM) (a)

(a) A non-GAAP financial measure which excludes: (i) net realized investment gains (losses), net of related amortization; (ii) costs related to a litigation settlement; and

(iii) the loss related to a coinsurance transaction. See the Appendix for a reconciliation to the corresponding GAAP measure.

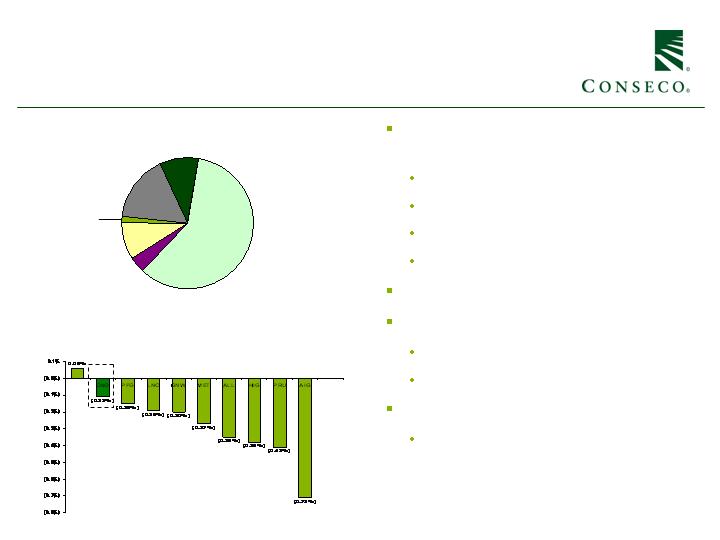

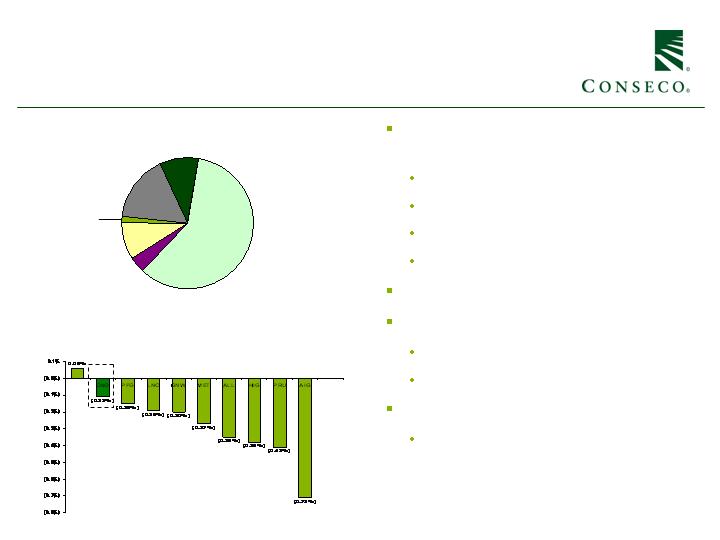

Limited Exposure to Troubled Asset Classes

Structured securities represent 24% of total

actively managed fixed maturity securities

Over 89% AAA rated

Over 40% agency CMOs

11% Alt-A Assets (99% AAA rated)

No exposure to Agency preferred or common

Below investment grade only 6% of portfolio

$102MM sub-prime home equity ABS

90% pre-2006 vintage

Only $22MM in A category or lower

$923MM CMBS exposure

Only $273MM in A category or lower

Composition of Investments as of 6/30/08

CMBS

3.9%

Investment

Grade

Corporates

59.1%

Other

9.8%

Commercial

Mortgages

9.4%

ABS

1.7%

CMOs

16.2%

2Q’08 Net Investments G/L as a % of Assets

UNUM

Conseco Today

A turnaround story

Strategic separation of most of LTC run-off nearing completion

Progress on improving profitability

Strategic focus on senior middle market

Defined by our markets, not our products

Little competition in target segment

Above average growth and profit potential

Demographics are favorable

Broad reach across the market

Appendix

Information Related to Certain Non-

GAAP Financial Measures

The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP

measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts

that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with

GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial

results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange

Commision that are available in the “Investor – SEC Filings” section of Conseco’s website, www.conseco.com.

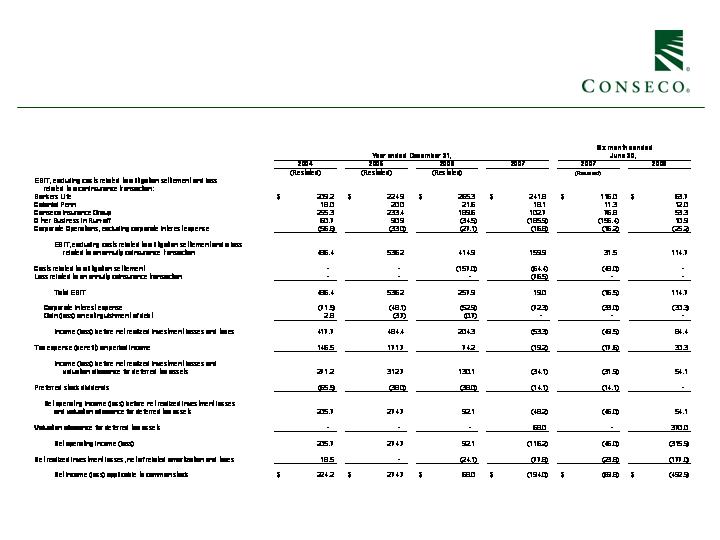

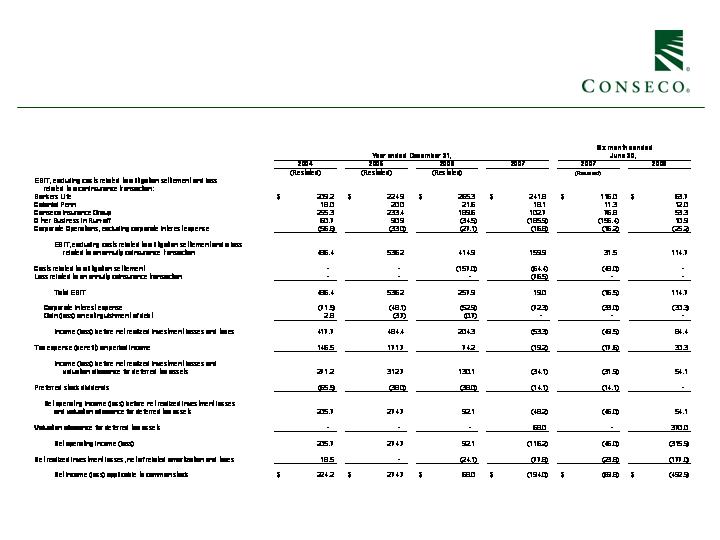

Operating earnings measures

Management believes that an analysis of earnings before net realized gains or losses and corporate interest and taxes (“EBIT”, a

non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in

the life insurance industry. Management uses this measure to evaluate performance because realized investment gains or losses

can be affected by events that are unrelated to the Company’s underlying fundamentals.

In addition, our results were affected by unusual and significant charges related to: (i) a litigation settlement in Q2 2006 and

refinements to such estimates recognized in subsequent periods; (ii) a Q3 2007 charge related to a coinsurance transaction; and

(iii) a Q4 2007 and Q2 2008 valuation allowance for deferred tax assets. Management believes an analysis of operating earnings

before these charges is important to evaluate the performance of the Company prior to the effect of these unusual and significant

charges.

Information Related to Certain Non-

GAAP Financial Measures

A reconciliation of EBIT to net income applicable to common stock is as follows (dollars in millions):