Preliminary View of

Fourth Quarter 2008

Financial and Operating Results

Conseco, Inc.

Forward-Looking Statements

Cautionary Statement Regarding Forward-Looking Statements. Our statements, trend analyses and other information contained in these

materials relative to markets for Conseco’s products and trends in Conseco’s operations or financial results, as well as other statements, contain

forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. Forward-

looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “project,” “intend,” “may,”

“will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable with,” “optimistic” and similar

words, although some forward-looking statements are expressed differently. You should consider statements that contain these words carefully

because they describe our expectations, plans, strategies and goals and our beliefs concerning future business conditions, our results of operations,

financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on currently available information. Assumptions

and other important factors that could cause our actual results to differ materially from those anticipated in our forward-looking statements include,

among other things: (i) general economic, market and political conditions, including the performance and fluctuations of the financial markets which

may affect our ability to raise capital or refinance our existing indebtedness and the cost of doing so; (ii) our ability to generate sufficient liquidity to

meet our debt service obligations and other cash needs; (iii) our ability to obtain adequate and timely rate increases on our supplemental health

products including our long-term care business; (iv) the receipt of required regulatory approvals for dividend and surplus debenture interest

payments from our insurance subsidiaries; (v) mortality, morbidity, the increased cost and usage of health care services, persistency, the adequacy

of our previous reserve estimates and other factors which may affect the profitability of our insurance products; (vi) changes in our assumptions

related to the cost of policies produced or the value of policies inforce at the Effective Date; (vii) the recoverability of our deferred tax asset and the

effect of potential tax rate changes on its value; (viii) changes in accounting principles and the interpretation thereof; (ix) our ability to achieve

anticipated expense reductions and levels of operational efficiencies including improvements in claims adjudication and continued automation and

rationalization of operating systems; (x) performance and valuation of our investments, including the impact of realized losses (including other-than-

temporary impairment charges); (xi) our ability to identify products and markets in which we can compete effectively against competitors with greater

market share, higher ratings, greater financial resources and stronger brand recognition; (xii) the ultimate outcome of lawsuits filed against us and

other legal and regulatory proceedings to which we are subject; (xiii) our ability to remediate the material weakness in internal controls over the

actuarial reporting process that we identified at year-end 2006 and to maintain effective controls over financial reporting; (xiv) our ability to continue

to recruit and retain productive agents and distribution partners and customer response to new products, distribution channels and marketing

initiatives; (xv) our ability to achieve eventual upgrades of the financial strength ratings of Conseco and our insurance company subsidiaries as well

as the potential impact of rating downgrades on our business; (xvi) the risk factors or uncertainties listed from time to time in our filings with the

Securities and Exchange Commission; (xvii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our

debt agreements; (xviii) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance companies, such

as the payment of dividends to us, regulation of financial services affecting (among other things) bank sales and underwriting of insurance products,

regulation of the sale, underwriting and pricing of products, and health care regulation affecting health insurance products; and (xix) changes in the

Federal income tax laws and regulations which may affect or eliminate the relative tax advantages of some of our products. Other factors and

assumptions not identified above are also relevant to the forward-looking statements, and if they prove incorrect, could also cause actual results to

differ materially from those projected. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by the

foregoing cautionary statement. Our forward-looking statements speak only as of the date made. We assume no obligation to update or to publicly

announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in

assumptions or changes in other factors affecting the forward-looking statements.

Non-GAAP Measures

This presentation contains the following financial measures that differ from the comparable measures

under Generally Accepted Accounting Principles (GAAP): operating earnings measures; book value

excluding accumulated other comprehensive income (loss) per diluted share; operating return measures;

earnings before net realized investment gains (losses) and corporate interest and taxes; debt to capital

ratios, excluding accumulated other comprehensive income (loss); and interest-adjusted benefit ratios.

Reconciliations between those non-GAAP measures and the comparable GAAP measures are included

in the Appendix, or on the page such measure is presented.

While management believes these measures are useful to enhance understanding and comparability of

our financial results, these non-GAAP measures should not be considered substitutes for the most

directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the

Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of

Conseco’s website, www.conseco.com.

Preliminary Results

All financial results described herein should be considered preliminary and are subject to change to

reflect any necessary adjustments that are identified before the Company completes its financial

statements and files its Annual Report on Form 10-K for the year ended December 31, 2008.

CNO

Going Concern Discussion

Form 10-K filing delayed until on or before March 17, 2009.

Finalizing the analysis and disclosure related to investment portfolio

Auditors’ concerns regarding liquidity and debt covenant margins

(primarily those that could be impacted by a significant amount of

additional realized losses in the Company’s investment portfolio). Unless

auditors are satisfied with additional information being provided by the

Company, the audit opinion will include an explanatory paragraph

regarding the Company’s ability to continue as a going concern.

Material Control Weakness

Q4 2008

Preliminary Financial Summary

CNO

Continued profitability in all three insurance segments, with

total Q4 2008 EBIT of $78.1 million

$101.6 million quarterly sales for CNO, up 16% over Q4 2007

Bankers sales up 25%

Colonial Penn sales up 16%

CIG sales down 9%

Separation of Senior Health* occurred in Q4 2008

Capital management initiatives

Section 382 shareholder rights plan announced in January

2009

*Senior Health Insurance Company of Pennsylvania, formerly known as Conseco Senior Health Insurance

Company prior to its name change in October 2008.

Q4 2008

Preliminary Financial Summary

CNO

Investment portfolio earned yields meeting expectations

Net realized investment losses of $88.0 million (including

impairment losses of $44.8 million), consistent with Q3 2008

results, industry trends and market conditions

Accumulated other comprehensive loss increased from $1.1

billion at 9/30/08 to $1.8 billion at 12/31/08, primarily driven by

wider credit spreads, consistent with market conditions

Company expects final audited financial statements to show

compliance, as of 12/31/08, with all financial ratio and balance

covenants of bank facility

Why CNO is Different

Not ratings-sensitive

Virtually no variable business

Focus on protection products

Small average policy sizes

No significant investments in exotic securities

No dynamic hedging

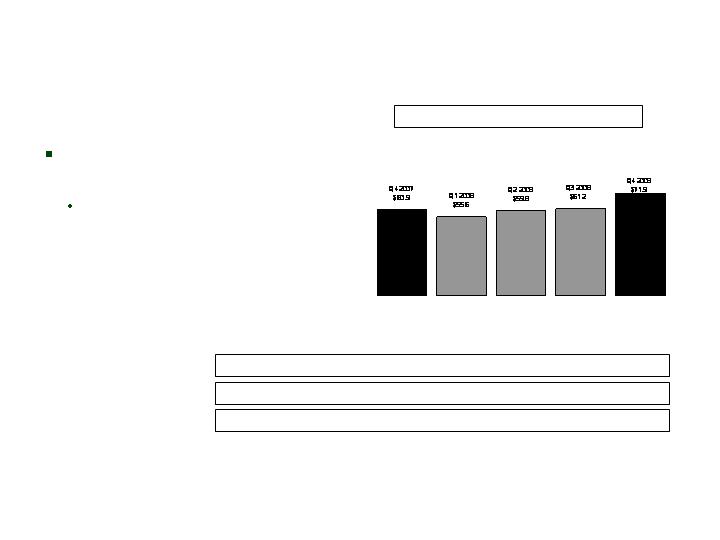

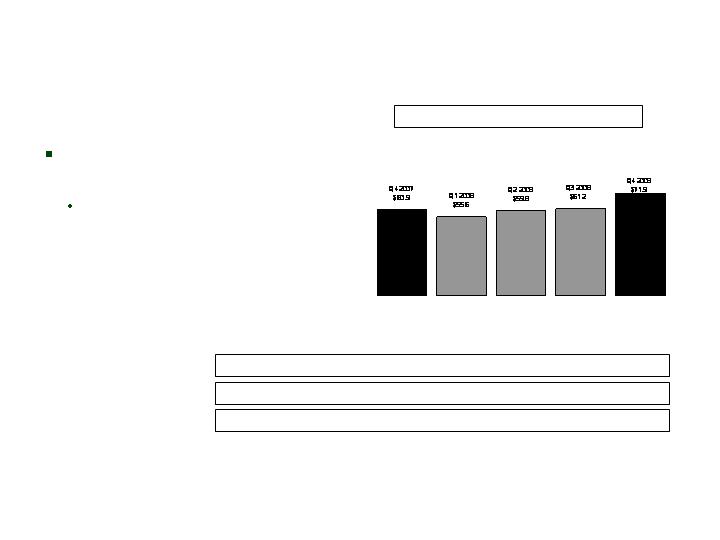

Collected Premiums

CNO

Strong, consistent

growth in Bankers

and Colonial Penn

Slight decline in CIG

due to focus on

more profitable

business

BLC

Q4 2007

$4,045.0

Q1 2008

$4,056.4

($ millions)

CP

CIG

Collected Premiums-Trailing 4 Quarters

Q2 2008

$4,167.3

Q3 2008

$4,275.1

Q4 2008

$4,524.9

Bankers Life

Colonial Penn

Conseco Insurance Group

Corporate operations, interest expense

and gain on extinguishment of debt

Income before net realized investment losses*

Net realized investment losses

Discontinued operations

Total

Q4 2008

Preliminary Summary of Results

CNO

$40.0

6.7

31.5

5.9

84.1

(88.0)

(369.6)

$(373.5)

Pre-Tax

After Tax

EPS

($ millions, except per share amounts)

$48.7

(88.0)

(367.5)

$(406.8)

$0.26

(0.47)

(1.99)

$(2.20)

*Management believes that an analysis of earnings before net realized investment gains (losses) (including losses

related to the transfer of Senior Health to an independent trust – now included in Discontinued Operations) and taxes (a

non-GAAP financial measure) provides an alternative measure of the operating results of the company because it

excludes net realized gains (losses) that are unrelated to the company’s underlying fundamentals. The table above

provides a reconciliation to the corresponding GAAP measure.

**See Appendix for a reconciliation to the corresponding GAAP measure.

**

Q4 Preliminary Earnings

CNO Consolidated

*Management believes that an analysis of earnings before net realized investment gains (losses) (including losses

related to the transfer of Senior Health to an independent trust – now included in discontinued Operations) and

corporate interest and taxes (“EBIT,” a non-GAAP financial measure) provides an alternative measure to compare

the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; and

(2) net realized gains (losses) that are unrelated to the company’s underlying fundamentals. The table above

provides a reconciliation of EBIT to net income applicable to common stock.

($ millions)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Bankers Life

$58.3

$29.1

$34.6

$67.8

$40.0

Colonial Penn

(0.2)

3.7

8.3

6.5

6.7

Conseco Insurance Group

9.6

23.3

32.3

34.2

31.5

Corporate operations, excluding interest expense

(2.9)

(6.7)

(16.2)

(3.7)

(0.1)

Total EBIT*

64.8

49.4

59.0

104.8

78.1

Corporate interest expense

(19.1)

(16.4)

(13.9)

(13.7)

(15.2)

Gain on extinguishment of debt

0.0

0.0

0.0

0.0

21.2

Income (loss) before net realized investment losses, taxes

and discontinued operations

45.7

33.0

45.1

91.1

84.1

Tax expense on period income

18.5

11.5

18.5

31.5

35.4

Net operating income (loss)

27.2

21.5

26.6

59.6

48.7

Net realized investment losses (excluding the increase in unrealized

losses on those investments transferred to an independent

trust and net of related amortization and taxes and the establish-

ment of a valuation allowance for deferred tax assets related to

such losses)

(23.8)

(27.8)

(17.4)

(84.2)

(88.0)

Net income (loss) applicable to common stock before valuation

allowance for deferred tax assets and discontinued operations

3.4

(6.3)

9.2

(24.6)

(39.3)

Valuation allowance for deferred tax assets

(68.0)

0.0

(298.0)

0.0

0.0

Discontinued operations

(6.9)

0.5

(198.3)

(157.4)

(367.5)

Net loss applicable to common stock

($71.5)

($5.8)

($487.1)

($182.0)

($406.8)

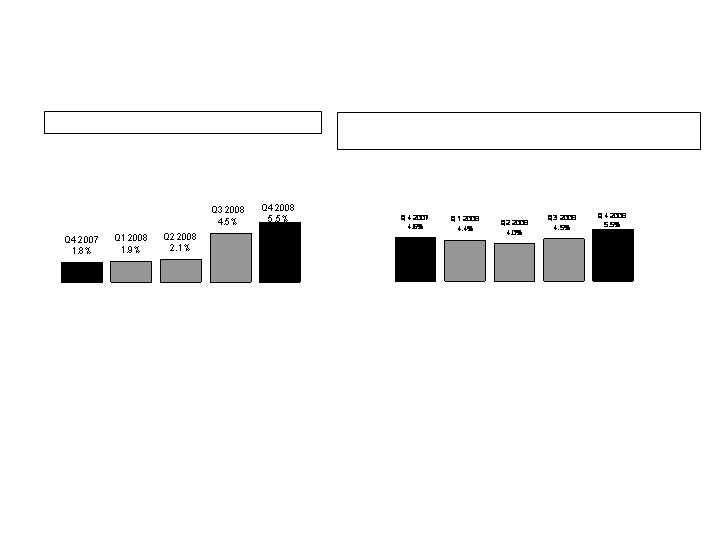

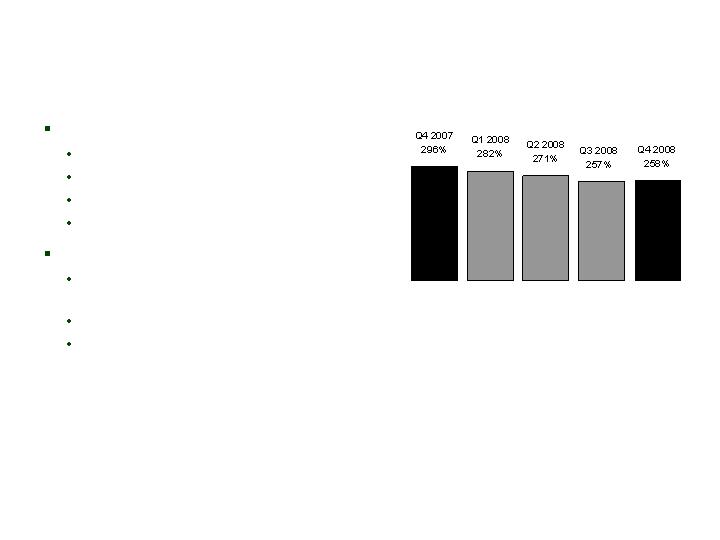

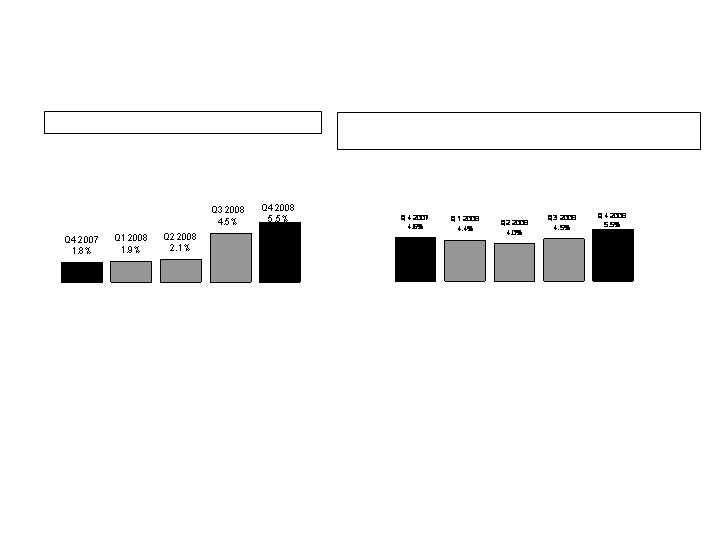

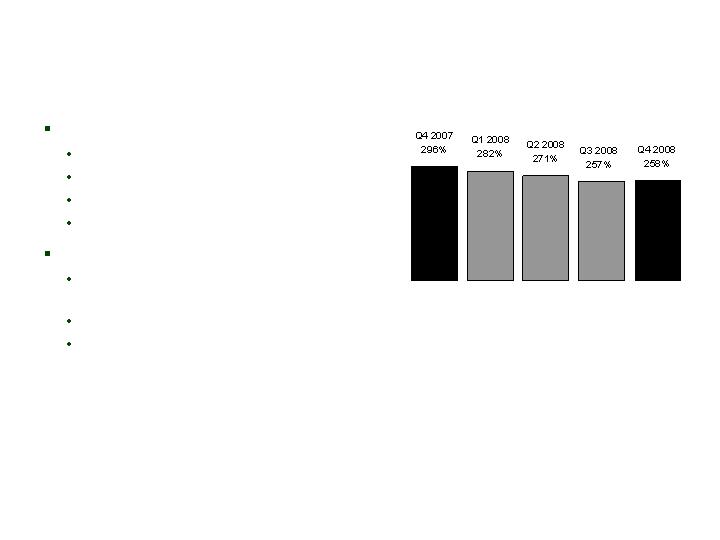

Preliminary Operating ROE

CNO

Operating ROE*, Trailing 4 Quarters

Operating ROE (Before Annuity Coinsurance Transaction)**,

Trailing 4 Quarters

*Operating return excludes net realized

investment gains (losses), valuation allowance

related to deferred tax assets and losses related

to the transfer of Senior Health to an

independent trust. Equity excludes

accumulated other comprehensive income

(loss) and the value of net operating loss

carryforwards, and assumes conversion of

preferred stock. See Appendix for

corresponding GAAP measure.

**Operating return, as calculated and defined on the left side

of this page, but before a Q3 2007 charge related to an

annuity coinsurance transaction. See Appendix for

corresponding GAAP measure.

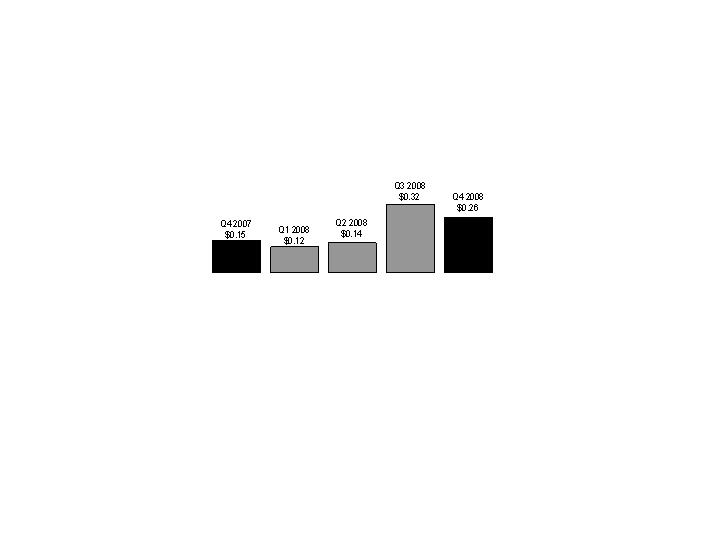

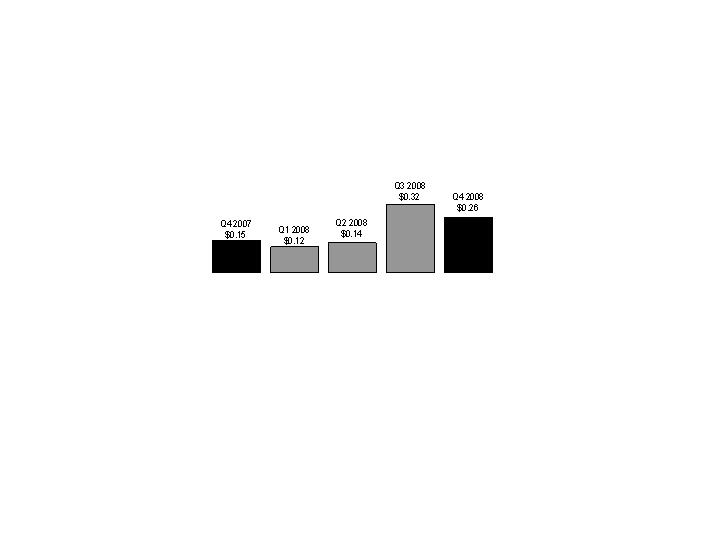

Preliminary Operating EPS* (Diluted)

CNO

*Operating earnings per share exclude net realized investment gains (losses), valuation allowance related to

deferred tax assets and losses related to the transfer of Senior Health to an independent trust. See Appendix

for corresponding GAAP measure.

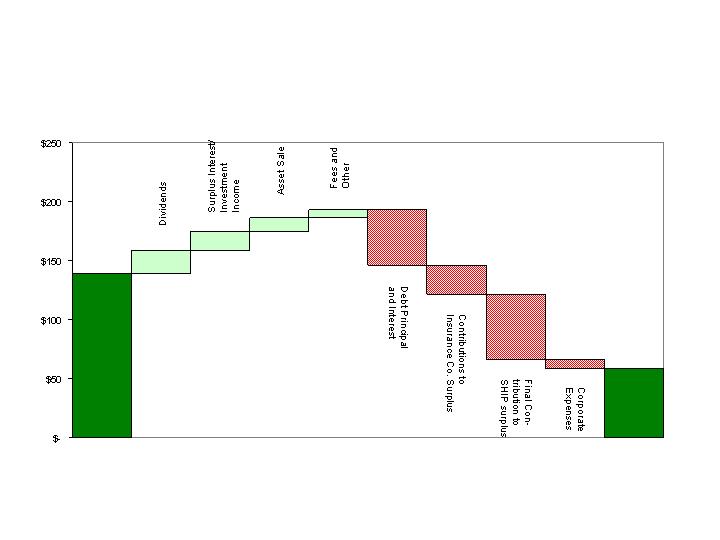

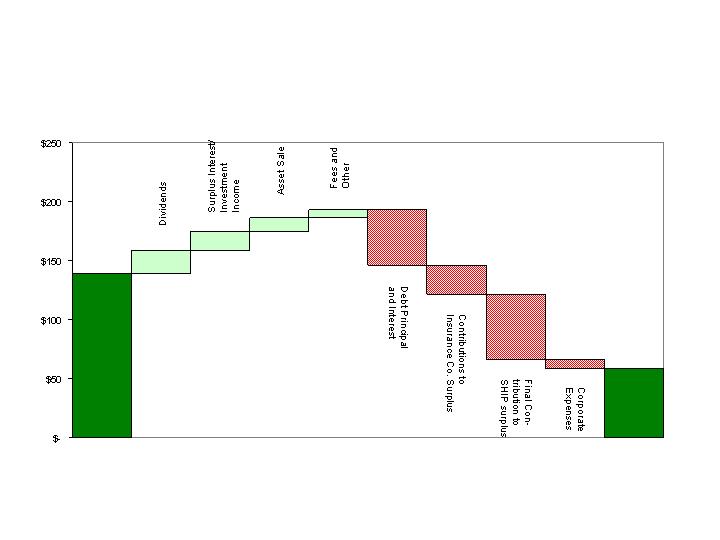

Corporate liquidity

Available holding and non-life company liquidity of $59 million at 12/31/08

$108 million of liquidity at 2/27/09

Repurchased $37 million of our convertible debentures during October

2008 for $16 million, resulting in $21 million gain

Drew down $75 million on revolver during October 2008, which confirmed

the availability of these funds; repaid $20 million in December 2008

Sources of and uses of funds, excluding insurance subsidiary dividends

Liquidity

CNO

($ millions)

Sources:

Interest on Surplus Debentures

Net Fees for Services Provided Under Intercompany Agreements

Uses:

Interest Expense on Corporate Debt

Operating Expenses

Net Impact

2007

$69.9

92.9

(72.3)

(42.4)

$48.1

2008

$56.4

83.2

(59.2)

(43.5)

$36.9

CNO

($ millions)

Liquidity: Q4 2008 Actual

$138

$20

$15

$12

$7

$46

$25

$50

$12

$59

Beginning

Liquidity

Balance

Ending

Liquidity

Balance

2009 Liquidity Projection

CNO

*Subject to regulatory approval. Dividend payments of $25 million and Surplus Debenture Interest of $21

million are pending regulatory approval.

($ millions)

$59.0

60.0

44.9

53.0

37.4

195.3

54.6

55.0

10.2

25.0

34.1

178.9

$75.4

Cash Balance 12/31/08

Sources

Dividends*

Surplus Debenture Interest*

Management and Investment Fees

Intercompany Loans and Other

Total Sources

Uses

Interest

Debt Repayments:

Revolver

Senior Credit Facility

Senior Health Notes

Holding Company Expenses

Total Uses

Cash Balance 12/31/09

Company expects final

audited statements to

show compliance, as of

12/31/08, with all

financial ratio and

balance covenants of

bank facility

Key Debt Covenants

CNO

Q4 2008

($ millions)

Q4 2007

30.0%

21.0%

2.00X

3.34X

$1,270

$1,497

250%

296%

30.0%

27.9%

2.00X

2.34X

$1,270

$1,381

250%

258%

Debt/Capital Ratio*

Covenant Maximum

Actual

Interest Coverage

Covenant Minimum

Actual

Statutory Capital

Covenant Minimum

Actual

RBC Ratio

Covenant Minimum

Actual

*Excludes Accumulated Other Comprehensive Income

Q3 2008

30.0%

23.6%

2.00X

2.64X

$1,270

$1,433

250%

257%

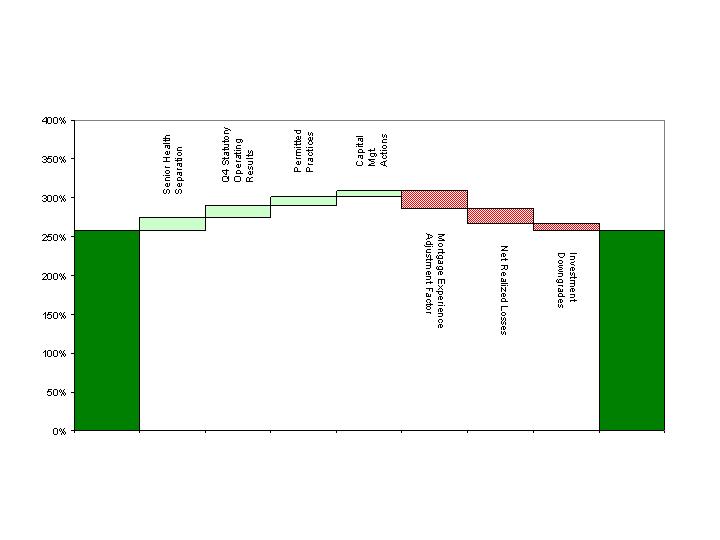

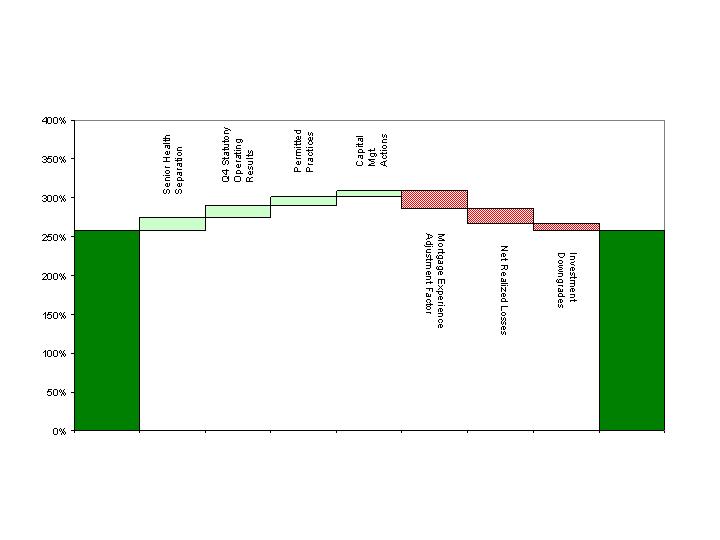

Consolidated RBC Ratio*

CNO

Q4 2008 positive impacts:

Senior Health separation

Q4 statutory operating results

Permitted practices

Capital management actions

Q4 2008 negative impacts:

Mortgage Experience Adjustment

Factor

Net realized losses

Investment downgrades

*Risk-Based Capital (“RBC”) requirements provide a tool for insurance regulators to determine the levels of

statutory capital and surplus an insurer must maintain in relation to its insurance and investment risks. The

RBC ratio is the ratio of the statutory consolidated adjusted capital of our insurance subsidiaries to RBC.

Consolidated RBC Ratio –

Q4 2008 Changes

CNO

Beginning

RBC

Ending

RBC

257%

258%

18%

15%

11%

8%

23%

19%

9%

Capital Management Actions

Bankers LTC New Business Reinsurance

Benefits

Improve capital and product risk mix

Develop partnership with reinsurer

Transaction Terms

Reinsurer: Reinsurance Group of America (RGA)

Reinsure 2008, 2009 and future new business

Traditional coinsurance; quota share is 70% for 2008 and 50% for 2009+

Coventry Agreement

Exited reinsurance of Coventry group contracts – non-core business

Improves RBC going forward

Other Reinsurance

Series of small external and internal arrangements – effects on following

page

Permitted Practice Approvals

CNO

Capital Management Actions:

Statutory Financial Impact

CNO

($ millions)

$6.8

N/A

$24.4

$61.9

Bankers - LTC Reinsurance

Bankers – Coventry Group Exit

Other Reinsurance and Capital Actions

Permitted Practices

+1.5%

N/A

+10.8%

+11.0%

$6.8

$(0.3)

$(20.7)

N/A

Consolidated

RBC Impact

+1.5%

+7.8%

+3.2%

N/A

2008

Consolidated

TAC Impact

Consolidated

RBC Impact

Consolidated

TAC Impact

2009

Capital Management Actions:

2009 GAAP Impact

CNO

($ millions, except per share amounts)

Pre-Tax

$(3.0)

$(7.5)

$(3.7)

Bankers - LTC Reinsurance

Bankers – Coventry Group Exit

Other Reinsurance and Capital Actions

After Tax

$(2.0)

$(4.9)

$(2.4)

Per Share

$(0.01)

$(0.03)

$(0.01)

GAAP Operating Income

Earnings were $40.0 million, vs. $67.8 million in Q3 2008

Q4 2008 earnings affected by:

Lower than expected PFFS/PDP margins

Lower margins in Med Supp

FAS 133 and COLI volatility

Med Supp and LTC reinsurance transaction

Continued stabilization in LTC margins

Strong Q4 2008 sales

Q4 Summary

Bankers

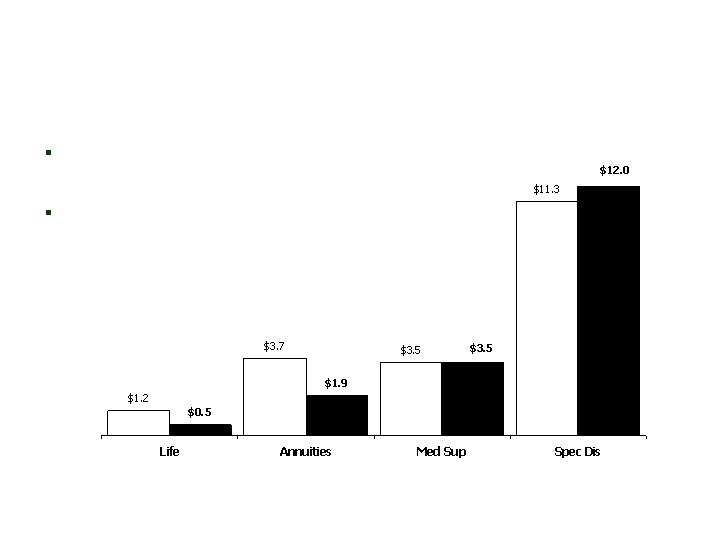

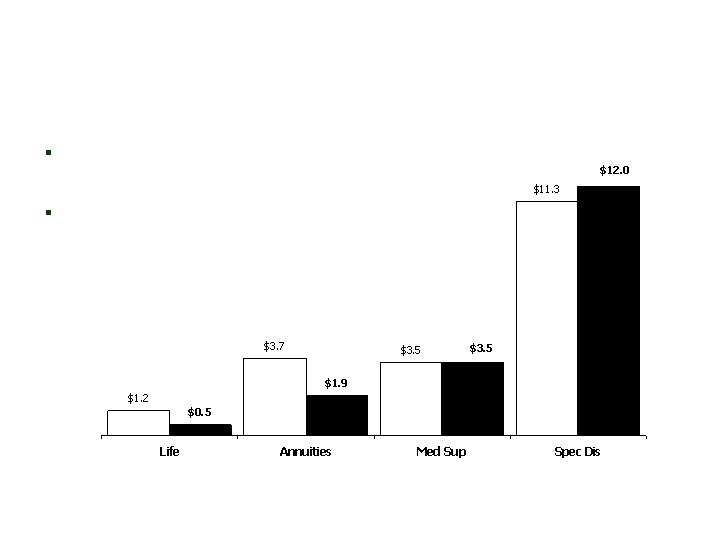

NAP Results

Quarterly NAP up 18% vs Q4

2007 (up 25% including PFFS)

Strong sales of annuities (+84%)

and Med Supp (+21%), partially

offset by lower life (-13%) and

LTC (-27%) sales

Bankers

($ millions)

Quarterly NAP-Excluding PFFS

NAP-Quarterly*: $58.3 $114.6 $53.4 $65.8 $72.8

PFFS NAP-Quarterly*: $(2.6) $59.0 $(6.4) $4.6 $0.9

Non-PFFS NAP-Quarterly: $60.9 $55.6 $59.8 $61.2 $71.9

*Excludes group business not sold by Bankers agents.

Q4 Earnings

Bankers

Management believes that an analysis of income (loss) before net realized investment gains (losses), net of

related amortization (a non-GAAP financial measure), is important to evaluate the financial performance of our

business, and is a measure commonly used in the life insurance industry. Management uses this measure to

evaluate performance because realized gains or losses can be affected by events that are unrelated to a

company’s underlying fundamentals. The table on Page 10 reconciles the non-GAAP measure to the

corresponding GAAP measure. See Appendix for a reconciliation of the return on equity measure to the

corresponding GAAP measure.

Trailing 4 Quarter Operating Return on Equity: 7.1%

($ millions)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Insurance policy income

$470.4

$497.0

$543.4

$537.7

$531.8

Net investment income

132.1

129.3

135.2

138.3

155.4

Fee revenue and other income

4.3

1.6

2.1

3.1

4.2

Total revenues

606.8

627.9

680.7

679.1

691.4

Insurance policy benefits

394.9

434.9

497.2

470.3

477.5

Amounts added to policyholder account balances

43.5

44.8

37.2

46.2

82.3

Amortization related to operations

65.0

75.0

66.6

53.5

39.7

Other operating costs and expenses

45.1

44.1

45.1

41.3

51.9

Total benefits and expenses

548.5

598.8

646.1

611.3

651.4

Income before net realized investment gains (losses),

net of related amortization and income taxes

$58.3

$29.1

$34.6

$67.8

$40.0

Q4 2008 NAP of $11 million, 16% above Q4 2007

2008 YTD NAP of $54.4 million, up 28% over prior year

Q4 2008 earnings were $6.7 million, compared to $(0.2)

million in Q4 2007

Lower expenses from discontinued PFFS pilot program

Q4 2007 recapture of reinsurance treaty

Organic growth from sales initiatives

Q4 Summary

Colonial Penn

Q4 Earnings

Colonial Penn

Management believes that an analysis of income (loss) before net realized investment gains (losses), net of

related amortization (a non-GAAP financial measure), is important to evaluate the financial performance of our

business, and is a measure commonly used in the life insurance industry. Management uses this measure to

evaluate performance because realized gains or losses can be affected by events that are unrelated to a

company’s underlying fundamentals. The table on Page 10 reconciles the non-GAAP measure to the

corresponding GAAP measure. See Appendix for a reconciliation of the return on equity measure to the

corresponding GAAP measure.

Trailing 4 Quarter Operating Return on Equity: 12.4%

($ millions)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Insurance policy income

$34.6

$44.4

$47.5

$46.4

$46.5

Net investment income

9.5

9.2

10.1

10.1

10.2

Fee revenue and other income

0.2

0.3

0.5

0.5

0.5

Total revenues

44.3

53.9

58.1

57.0

57.2

Insurance policy benefits

25.2

35.0

35.5

33.9

33.8

Amounts added to policyholder account balances

0.3

0.3

0.3

0.3

0.3

Amortization related to operations

5.5

7.4

7.4

9.2

8.0

Other operating costs and expenses

13.5

7.5

6.6

7.1

8.4

Total benefits and expenses

44.5

50.2

49.8

50.5

50.5

Income (loss) before net realized investment

gains (losses) and income taxes, net of

related amortization

($0.2)

$3.7

$8.3

$6.5

$6.7

Q4 2008 NAP $18 million,

9% below Q4 2007

CIG

($ millions)

Sales gains in specified disease, up 6%

from Q4 2007

Decreases in high face-amount life and

annuity products, consistent with CIG’s

re-focus

Q4 2008 earnings down 8% vs Q3 2008:

Unlocking adjustment of $7.0 million on the interest-sensitive life block

Lower LTC closed block margins ($4.4 million)

Partially offset by:

Higher specified disease margins due to a deferred ROP adjustment

Higher Medicare supplement margins

Q4 2008 earnings up 228% vs Q4 2007:

Higher specified disease margins and lower amortization

The unlocking adjustment was significantly less in Q4 2008

Partially offset by lower LTC closed block margins

Continuing to make changes to non-guaranteed elements of older life

insurance policies issued by Conseco’s predecessor companies

Q4 Summary

CIG

Q4 Earnings

CIG

Management believes that an analysis of income (loss) before net realized investment gains (losses), net of

related amortization (a non-GAAP financial measure), is important to evaluate the financial performance of our

business, and is a measure commonly used in the life insurance industry. Management uses this measure to

evaluate performance because realized gains or losses can be affected by events that are unrelated to a

company’s underlying fundamentals. The table on Page 10 reconciles the non-GAAP measure to the

corresponding GAAP measure. See Appendix for a reconciliation of the return on equity measure to the

corresponding GAAP measure.

Trailing 4 Quarter Operating Return on Equity: 3.7%

($ millions)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Insurance policy income

$242.6

$243.7

$239.1

$237.7

$238.4

Net investment income

137.7

136.1

138.7

134.0

143.7

Fee revenue and other income

0.3

0.8

0.5

0.1

0.3

Total revenues

380.6

380.6

378.3

371.8

382.4

Insurance policy benefits

195.1

209.1

208.6

203.6

199.6

Amounts added to policyholder account balances

47.7

43.6

37.1

42.7

38.4

Amortization related to operations

51.2

30.2

31.2

24.9

36.3

Interest expense on investment borrowings

6.1

5.8

5.5

5.6

5.5

Gain on reinsurance recapture

0.0

0.0

0.0

(0.8)

0.0

Other operating costs and expenses

70.9

68.6

63.6

61.6

71.1

Total benefits and expenses

371.0

357.3

346.0

337.6

350.9

Income before net realized investment gains (losses),

net of related amortization and income taxes, excluding

costs related to the litigation settlement and the loss

related to an annuity coinsurance transaction

$9.6

$23.3

$32.3

$34.2

$31.5

Q4 2008

Net Realized Losses

CNO

Net losses on sales

Losses due to recognition of other-than-temporary impairments

Subtotal before amortization adjustment

Amortization adjustment to DAC and PVP

Net realized investment losses

$(48.1)

(44.9)

(93.0)

5.0

$(88.0)

($ millions)

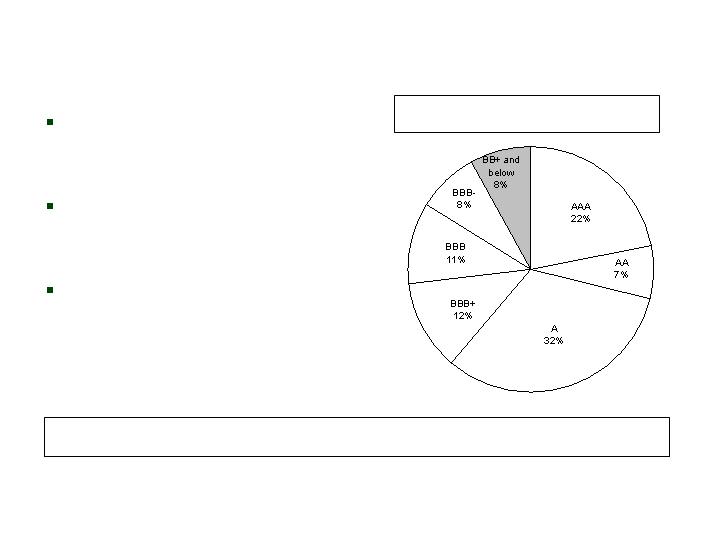

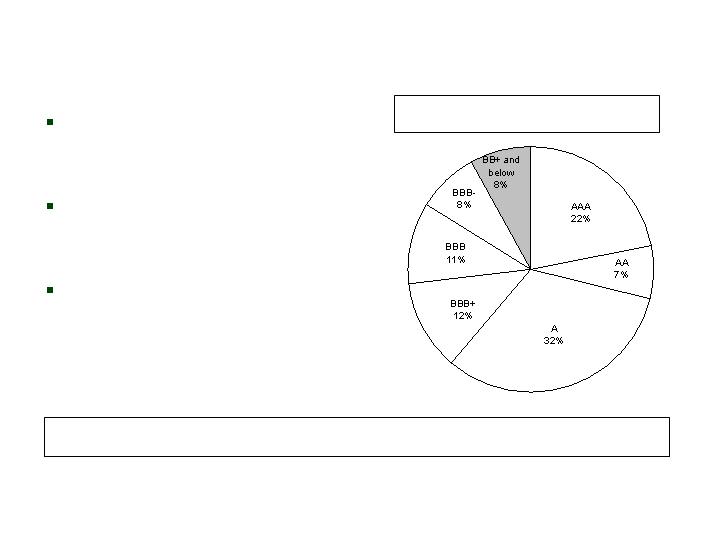

Investment Quality:

Fixed Maturities*

CNO

Investment grade securities

represent 92% of total

portfolio*

Limited new money allocation

to below-investment grade

securities

Increase in below-investment

grade ratio driven by credit

cycle/ratings migration

Actively Managed Fixed Maturities by Rating at

12/31/08 (Market Value)

12/31/08

92%

9/30/08

93%

6/30/08

93%

3/31/07

93%

12/31/07

92%

% of Bonds which are Investment Grade:

*Includes investments from a variable interest entity which we consolidate under GAAP (though the related

liabilities are non-recourse to Conseco).

Subprime allocation substantially

reduced

HEL allocation reflects market

stresses

Overall mark-to-market and

credit migration consistent with

credit cycle

Pressure on financials and

cyclicals

Overall highly rated

Pressure on ALT-A delinquency

trends

Some Alt-A downgrades

Low, but rising delinquency

trends

Seasoned portfolio

BBB market pricing pressure

severe

Nominal downgrades to date,

but rating activity likely

Slowing economy and lack of financing availability

likely to lead to higher delinquencies

Active surveillance and portfolio management

Nominal new investment activity

Liquidated $45 million in problematic exposures in

Q4 2008

Managing through the credit cycle by emphasizing long-term

assessments of value and quality

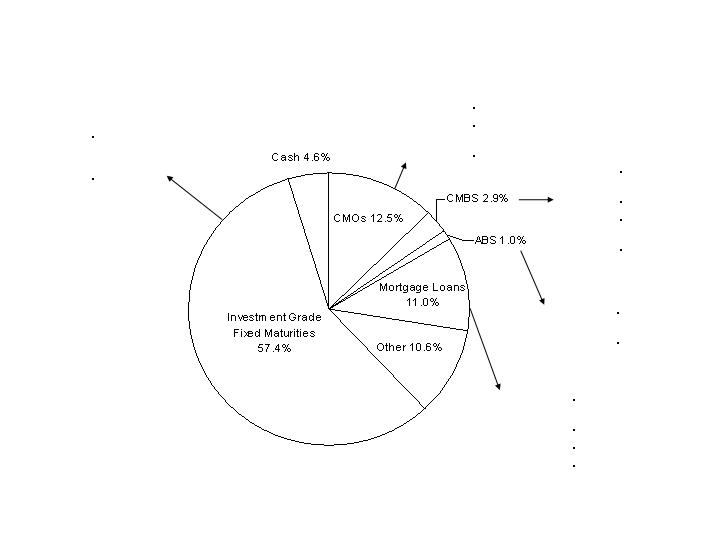

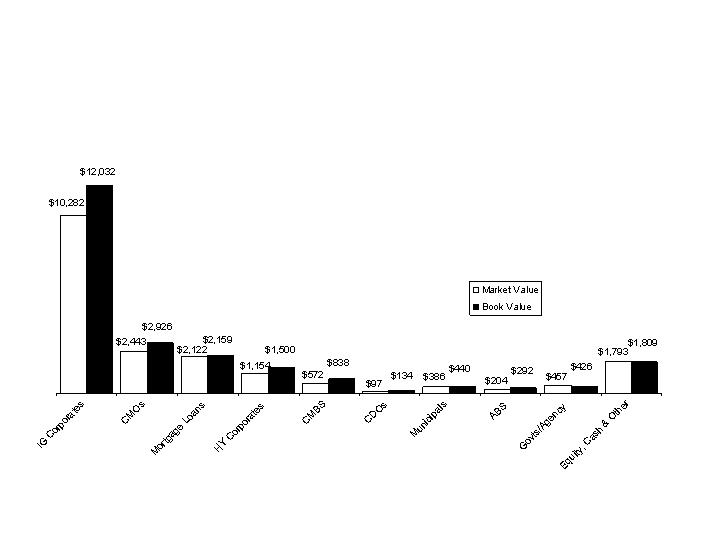

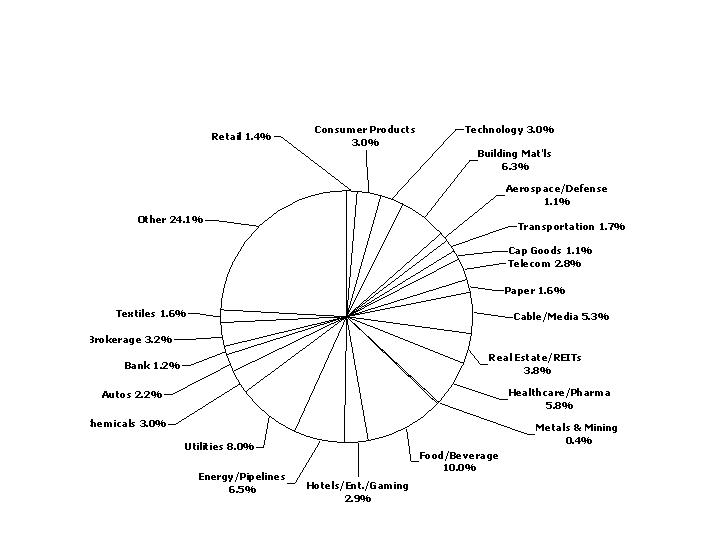

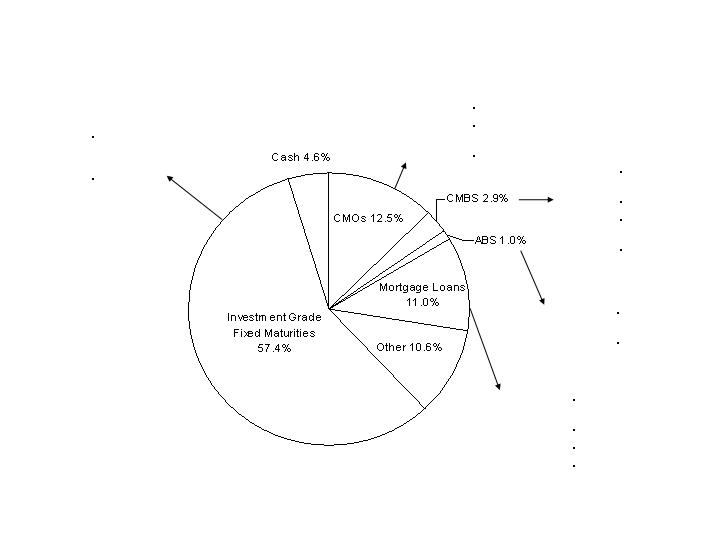

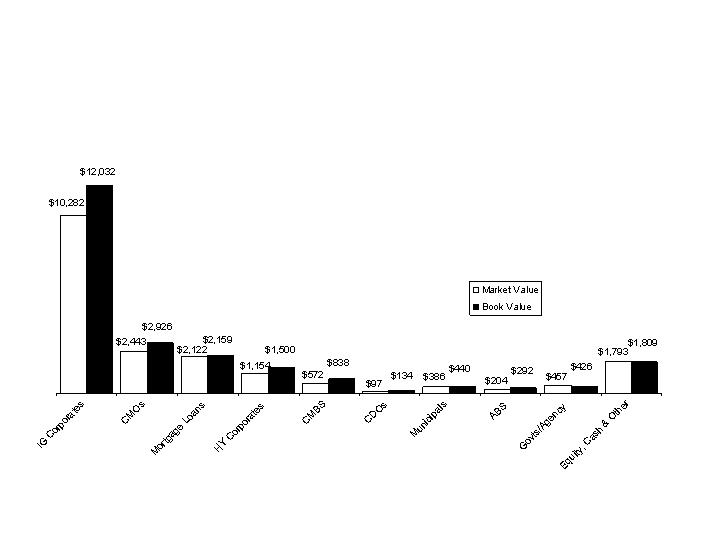

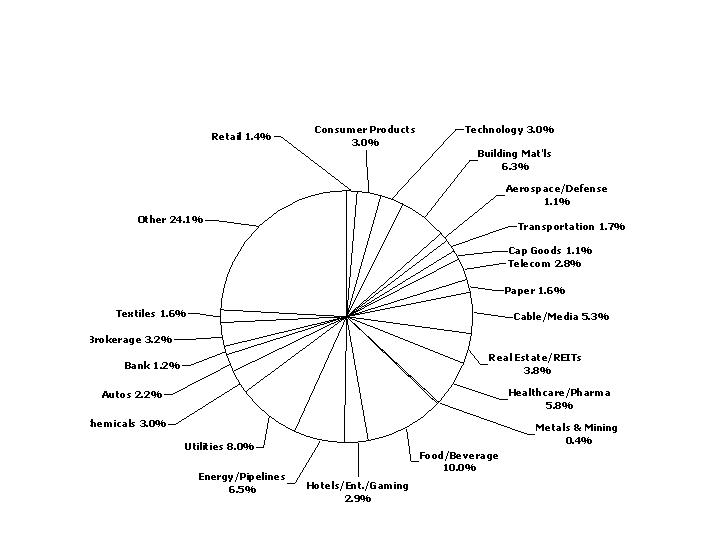

Asset Allocation at 12/31/08

CNO

Asset Allocation at 12/31/08

MTM in line with market trends, reflecting

wider spreads in corporates and mortgages

CNO

($ millions)

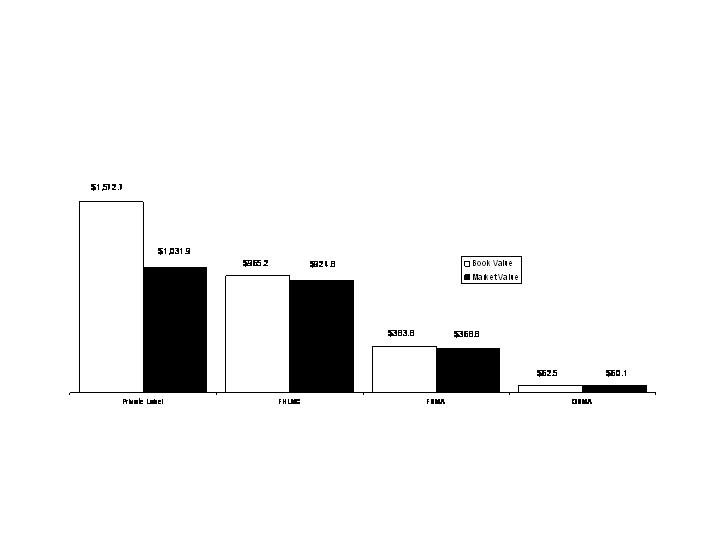

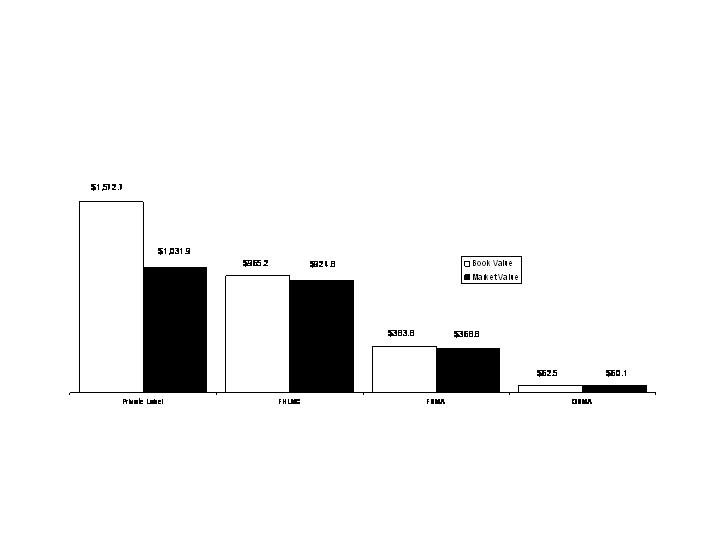

CMOs by Agency at 12/31/08

Our CMO portfolio is almost evenly divided

between agencies and non-agencies

CNO

($ millions)

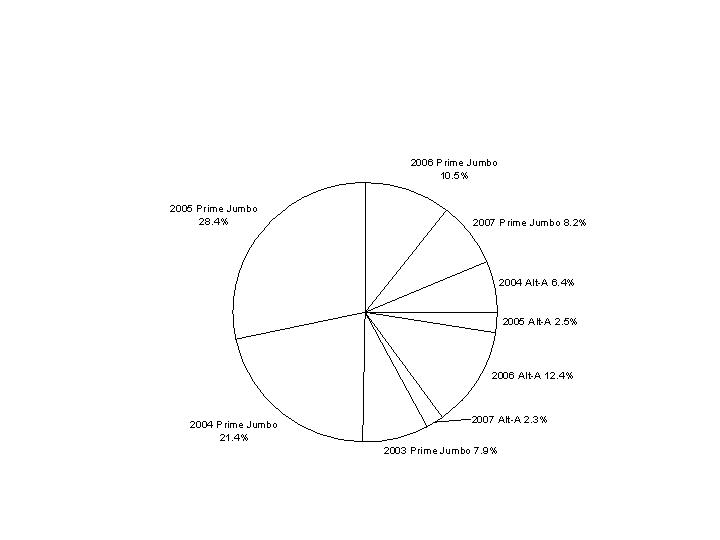

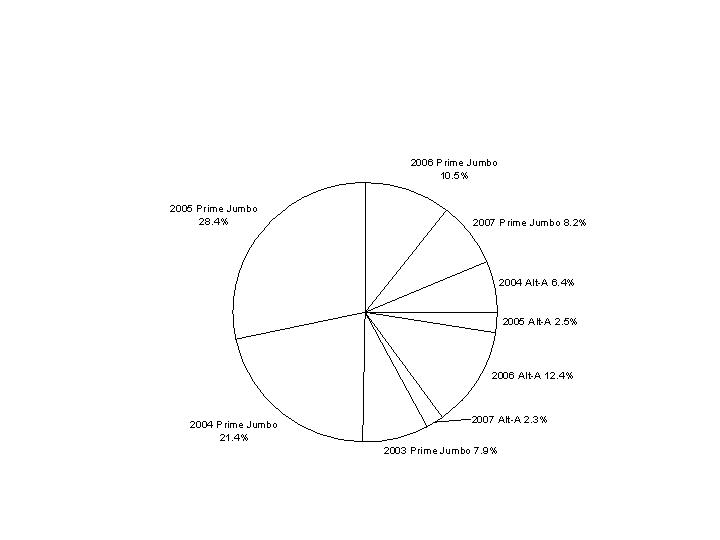

Non-Agency CMOs at 12/31/08

Our non-agency CMOs are diversified by type and vintage

CNO

Alt-A at 12/31/08

CNO

AAA

AA

A

BB

Total

$227.1

$0.9

$3.9

$10.8

$242.7

$466.5

$4.0

$3.9

$10.8

$485.2

93.6%

0.4%

1.6%

4.4%

100.0%

1.22%

0.00%

0.02%

0.06%

1.30%

Market

Value (mil.)

Book

Value (mil.)

% of

Alt-A*

% of

Portfolio*

Rating

$14.7 million (market value) A category or lower (0.08% of invested assets)

Substantial credit support inherent in structures relative to expected losses, even at

rising delinquency rates

No exposure to “affordability products” – option ARMs, hybrid, neg-ams

716

695

708

704

715

Avg.

FICO

9.2%

18.2%

6.8%

12.0%

9.3%

Avg.

Support

9.7%

6.5%

12.5%

16.2%

9.9%

Avg. 60+

Delinq.

*% of market value

($ millions)

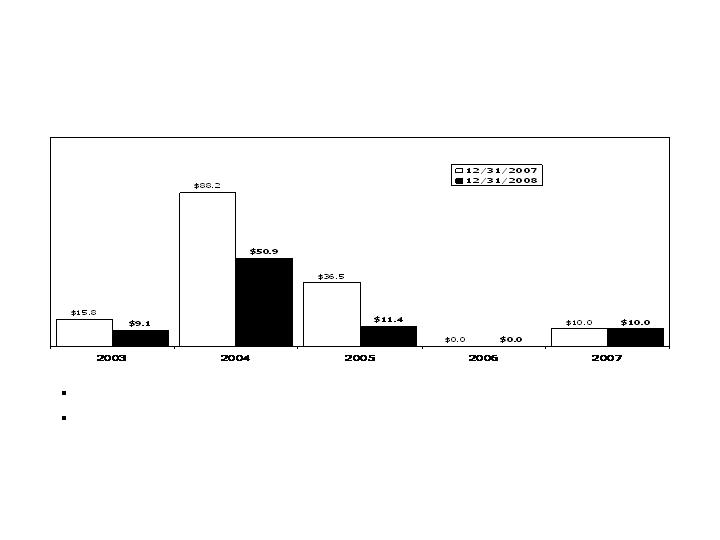

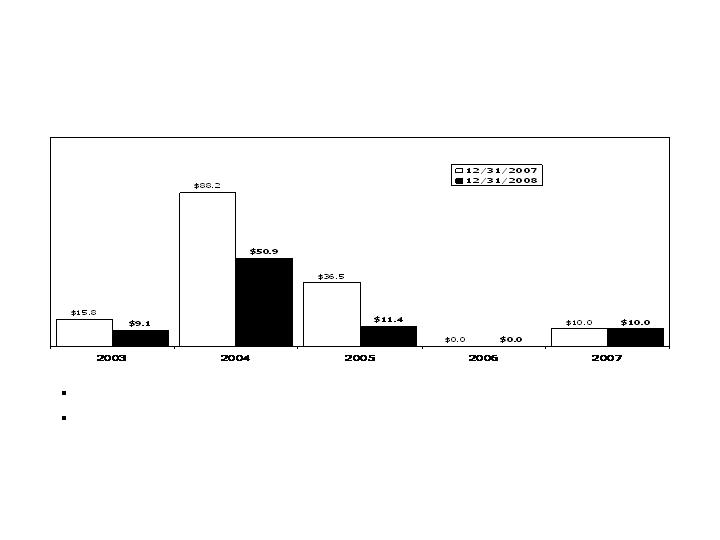

Sub-Prime Home Equity ABS

By Vintage

CNO

Exposure reduced by 46% in 2008

Market value represents 0.32% of invested assets at 12/31/08, compared to 0.52% at 12/31/07

(GAAP book value - $ millions)

$150.5

$81.4

Sub-Prime Home Equity ABS

CNO

AAA

AA

A

Total

$24.1

$21.6

$12.5

$58.2

$32.3

$31.7

$17.4

$81.4

39.7%

38.9%

21.4%

100.0%

0.13%

0.12%

0.07%

0.32%

Market

Value (mil.)

Book

Value (mil.)

% of

Subprime*

% of

Portfolio*

Rating

Only $12.5 million (market value) A category or lower (0.07% of invested assets)

No exposure to “affordability products” – negative amortization, option ARM

collateral, etc.

Rising delinquencies, consistent with market conditions

Remaining portfolio generally reflects satisfactory margin for adverse collateral

performance

639

648

665

648

Avg.

FICO

30.3%

23.4%

22.8%

26.1%

Avg.

Support

15.8%

9.5%

8.4%

11.9%

Avg. 60+

Delinq.

*% of market value

($ millions)

CMBS by Vintage at 12/31/08

Our CMBS exposure is heavily weighted toward higher ratings and

older vintages with stronger qualitative characteristics and seasoning

CNO

---

$93.3

$38.1

$15.6

$31.9

$15.6

$30.2

A

$23.2

$30.7

$21.4

---

2006

---

$23.2

$20.6

---

$122.7

$27.5

---

$61.2

$34.9

$47.0

$537.7

$450.8

2007

Total BV

Total MV

---

$76.9

$2.3

$111.7

2005

---

$9.1

$7.4

$153.7

2004

---

$6.0

$30.1

$225.3

Pre-2004

<BBB

BBB

AA

AAA

(GAAP book value - $ millions)

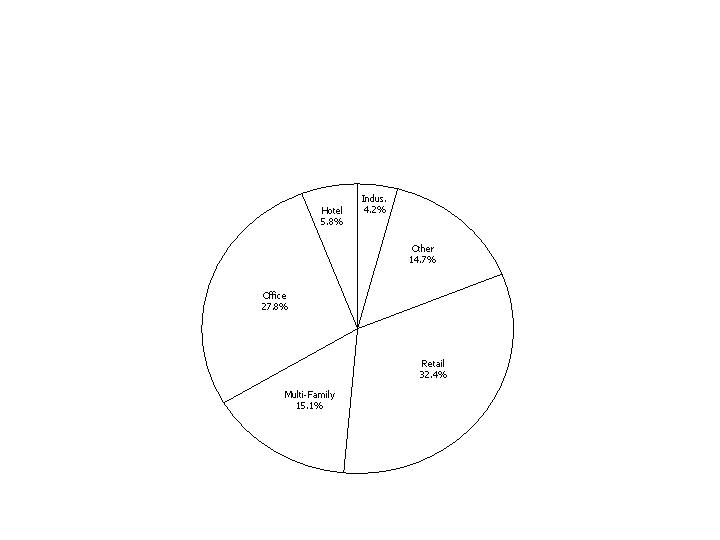

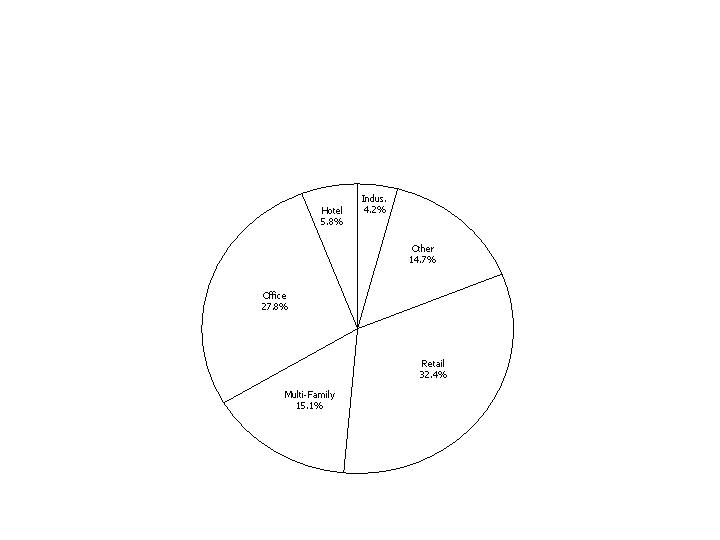

CMBS by Collateral Type at 12/31/08

Our CMBS are backed by a diverse pool of underlying collateral –

$90 billion, from more than 7,800 commercial mortgage loans

CNO

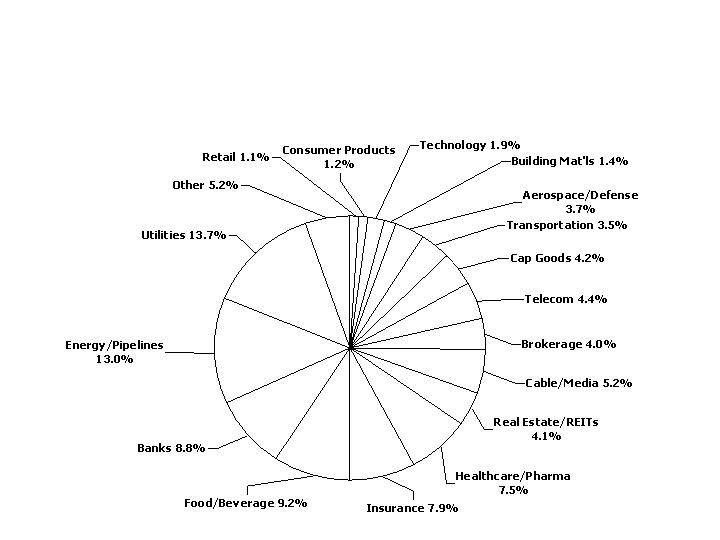

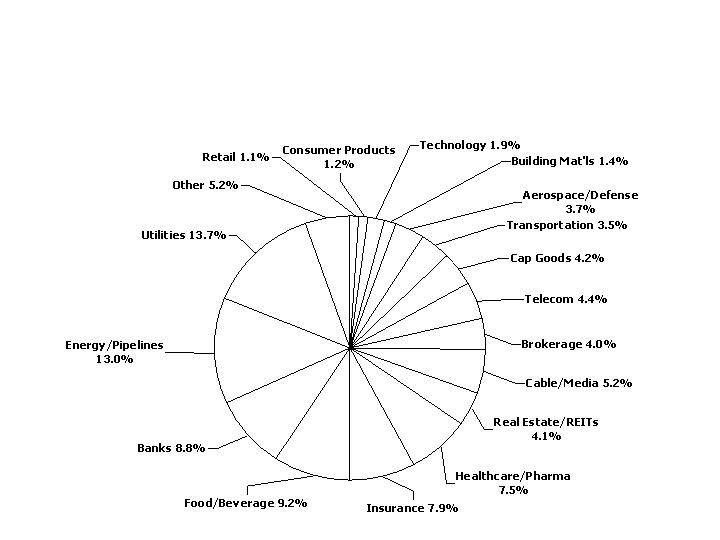

Investment Grade Corporates

at 12/31/08

Our IG Corporate allocation is highly diversified

CNO

High Yield Corporates

at 12/31/08

Our HY Corporate allocation is diversified and is weighted away from cyclicals

CNO

CNO Summary

Key differences between Conseco and the rest of the industry:

Our sales are continuing to grow and, indeed, are growing strongly

Our products are simple and straightforward, and entail less risk than

products designed for higher-net-worth customers

Our market is sufficiently different from most insurers

Capital management initiatives implemented

Strong franchise in the consumer senior middle market

Less stock market exposure than some of our highly rated competitors

have

We will be:

Continuing to work on sales growth

Continuing to make the business more efficient

Continuing to work on projects to improve our capital position going forward

Questions and Answers

Appendix

Information Related to Certain Non-GAAP Financial Measures

The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a

numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or

included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these

measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as

substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic

filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of Conseco’s website,

www.conseco.com.

Operating earnings measures

Management believes that an analysis of net income applicable to common stock before net realized gains or losses and losses related to the

transfer of Senior Health to an independent trust (“net operating income”, a non-GAAP financial measure) is important to evaluate the performance

of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance

because realized investment gains or losses can be affected by events that are unrelated to the Company’s underlying fundamentals.

In addition, our results were affected by a significant charge related to a Q4 2007 valuation allowance for deferred tax assets. Management does

not believe that similar charges are likely to recur within two years, and there were no similar charges recognized within the prior two years.

Management believes an analysis of operating earnings before these charges is important to evaluate the performance of the Company prior to

the effect of these unusual and significant charges.

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of net income applicable to common stock to the net operating income, excluding a Q4 2007 and Q2 2008 valuation allowance for

deferred tax assets (and related per share amounts) is as follows (dollars in millions, except per share amounts):

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Net income (loss) applicable to common stock

(71.5)

$

(5.8)

$

(487.1)

$

(182.0)

$

(406.8)

$

Net realized investment losses, net of related amortization and taxes

23.8

27.8

17.4

84.2

88.0

Discontinued operations

6.9

(0.5)

198.3

157.4

367.5

Net operating income (loss) (a non-GAAP financial measure)

(40.8)

21.5

(271.4)

59.6

48.7

Valuation allowance for deferred tax assets

68.0

-

298.0

-

-

Net operating income before a Q4 2007 valuation allowance for deferred

tax assets (a non-GAAP financial measure)

27.2

$

21.5

$

26.6

$

59.6

$

48.7

$

Per diluted share:

Net income (loss)

(0.38)

$

(0.03)

$

(2.64)

$

(0.98)

$

(2.20)

$

Net realized investment losses, net of related amortization and taxes

0.13

0.15

0.09

0.45

0.47

Discontinued operations

0.03

-

1.08

0.85

1.99

Net operating income (loss) (a non-GAAP financial measure)

(0.22)

0.12

(1.47)

0.32

0.26

Valuation allowance for deferred tax assets

0.37

-

1.61

-

-

Net operating income before a Q4 2007 valuation allowance for

deferred tax assets (a non-GAAP financial measure)

0.15

$

0.12

$

0.14

$

0.32

$

0.26

$

Information Related to Certain Non-GAAP Financial Measures

Book value, excluding accumulated other comprehensive income, per diluted share

This non-GAAP financial measure differs from book value per diluted share because accumulated other comprehensive income has been

excluded from the book value used to determine the measure. Management believes this non-GAAP financial measure is useful because it

removes the volatility that arises from changes in accumulated other comprehensive income. Such volatility is often caused by changes in the

estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made

by management.

Information Related to Certain Non-GAAP Financial Measures

A reconciliation from book value per diluted share to book value per diluted share, excluding accumulated other comprehensive income (loss) is

as follows (dollars in millions, except per share amounts):

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Total shareholders' equity

4,235.9

$

3,939.7

$

3,382.1

$

2,704.0

$

1,664.2

$

Less accumulated other comprehensive income (loss)

(273.3)

(565.6)

(639.2)

(1,137.7)

(1,770.7)

Total shareholders' equity excluding

accumulated other comprehensive income (loss)

(a non-GAAP financial measure)

4,509.2

$

4,505.3

$

4,021.3

$

3,841.7

$

3,434.9

$

Diluted shares outstanding for the period

184,708,727

184,681,243

184,792,300

184,761,138

184,755,680

Book value per diluted share

22.93

$

21.33

$

18.30

$

14.64

$

9.01

$

Less accumulated other comprehensive income (loss)

(1.48)

(3.07)

(3.46)

(6.15)

(9.58)

Book value, excluding accumulated other

comprehensive income (loss), per diluted share

(a non-GAAP financial measure)

24.41

$

24.40

$

21.76

$

20.79

$

18.59

$

Information Related to Certain Non-GAAP Financial Measures

Operating return measures

Management believes that an analysis of return before net realized gains or losses and losses related to the transfer of Senior Health to an

independent trust (“net operating income”, a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key

measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because realized investment

gains or losses can be affected by events that are unrelated to the Company’s underlying fundamentals.

In addition, our returns were affected by a significant charge related to a Q4 2007 and Q2 2008 valuation allowance for deferred tax assets.

Management does not believe that similar charges are likely to recur within two years, and there were no similar charges recognized within the

prior two years. Management believes an analysis of return before these charges and subsequent refinements is important to evaluate the

performance of the Company prior to the effect of these unusual and significant charges.

This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded

from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the

volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the

estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made

by management.

In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with

GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes

that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the

understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-

period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive

compensation.

All references to segment operating return measures assume a 25% debt to total capital ratio at the segment level. Additionally, corporate

expenses have been allocated to the segments.

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of return on common equity to operating return less a Q4 2007 and Q2 2008 valuation allowance for deferred tax assets on

common equity (excluding accumulated other comprehensive income (loss) and net operating loss carryforwards) is as follows (dollars in millions,

except per share amounts):

(continued on next page)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Net income (loss) applicable to common stock

(71.5)

$

(5.8)

$

(487.1)

$

(182.0)

$

(406.8)

$

Net realized investment (gains) losses, net of related amortization and taxes

23.8

27.8

17.4

84.2

88.0

Discontinued operations

6.9

(0.5)

198.3

157.4

367.5

Net operating income (loss) (a non-GAAP financial measure)

(40.8)

21.5

(271.4)

59.6

48.7

Valuation allowance for deferred tax assets

68.0

-

298.0

-

-

Net operating income before a Q4 2007 valuation allowance for

deferred tax assets (a non-GAAP financial measure)

27.2

$

21.5

$

26.6

$

59.6

$

48.7

$

Common shareholders' equity

4,235.9

$

3,939.7

$

3,382.1

$

2,704.0

$

1,664.2

$

Less accumulated other comprehensive income (loss)

(273.3)

(565.6)

(639.2)

(1,137.7)

(1,770.7)

Common shareholder's equity, excluding accumulated other comprehensive

income (loss) (a non-GAAP financial measure)

4,509.2

4,505.3

4,021.3

3,841.7

3,434.9

Less net operating loss carryforwards

1,426.7

1,435.1

1,137.2

1,121.7

1,048.4

Common shareholders' equity, excluding accumulated other comprehensive income

(loss) and net operating loss carryforwards (a non-GAAP financial measure)

3,082.5

$

3,070.2

$

2,884.1

$

2,720.0

$

2,386.5

$

Information Related to Certain Non-GAAP Financial Measures

(continued from previous page)

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Average common shareholders' equity

$4,260.7

$4,087.8

$3,660.9

$3,043.1

$2,184.1

Average common shareholders' equity, excluding accumulated other

comprehensive income (loss) and net operating loss carryforwards (a

non-GAAP financial measure)

$3,148.7

$3,076.4

$2,977.2

$2,802.1

$2,553.3

Return on equity ratios:

Return on common equity

-6.7%

-0.6%

-53.2%

-23.9%

-74.5%

Operating return less the valuation allowance for deferred

tax assets on common equity, excluding accumulated

other comprehensive income (loss) and net operating loss carry-

forwards (a non-GAAP financial measure)

3.5%

2.8%

3.6%

8.5%

7.6%

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of pretax operating earnings (a non-GAAP financial measure) to segment operating income (loss) and consolidated net income

(loss) for the nine months ended December 31, 2008, is as follows (dollars in millions):

(Continued on next page)

Corporate and

Discontinued

CIG

Bankers

Colonial Penn

Operations

Total

Pretax operating earnings (a non-GAAP financial measure)

121.3

$

171.5

$

25.2

$

(64.7)

$

253.3

$

Allocation of interest expense, excess capital and corporate

expenses

(37.3)

(27.3)

(2.3)

66.9

-

Income tax (expense) benefit

(32.1)

(55.1)

(8.8)

(0.9)

(96.9)

Segment operating income (loss)

51.9

$

89.1

$

14.1

$

1.3

$

156.4

Net realized investment losses, net of related amortization and taxes

(217.4)

Discontinued operations

(722.7)

Valuation allowance for deferred tax assets

(298.0)

Net income

(1,081.7)

$

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of common shareholders’ equity, excluding accumulated other comprehensive income (loss) and net operating loss

carryforwards (a non-GAAP financial measure) to common shareholders’ equity is as follows (dollars in millions):

(Continued from previous page)

(Continued on next page)

Corporate and

Discontinued

CIG

Bankers

Colonial Penn

Operations

Total

December 31, 2007

Common shareholders' equity, excluding accumulated other

comprehensive income (loss) and net operating loss carryforwards

(a non-GAAP financial measure)

1,192.4

$

1,299.8

$

109.7

$

480.6

$

3,082.5

$

Net operating loss carryforwards

1,426.7

-

-

-

1,426.7

Accumulated other comprehensive income (loss)

(106.7)

(106.7)

(4.1)

(55.8)

(273.3)

Allocation of capital

464.7

433.3

36.5

(934.5)

-

Common shareholders' equity

2,977.1

$

1,626.4

$

142.1

$

(509.7)

$

4,235.9

$

December 31, 2008

Common shareholders' equity, excluding accumulated other

comprehensive income (loss) and net operating loss carryforwards

(a non-GAAP financial measure)

1,582.4

$

1,232.1

$

111.9

$

(539.9)

$

2,386.5

$

Net operating loss carryforwards

1,048.4

-

-

-

1,048.4

Accumulated other comprehensive income (loss)

(824.7)

(817.9)

(41.4)

(86.7)

(1,770.7)

Allocation of capital

526.9

410.7

37.3

(974.9)

-

Common shareholders' equity

2,333.0

$

824.9

$

107.8

$

(1,601.5)

$

1,664.2

$

Information Related to Certain Non-GAAP Financial Measures

(Continued from previous page)

A reconciliation of average common shareholders’ equity, excluding accumulated other comprehensive income (loss) and net operating loss

carryforwards (a non-GAAP financial measure) to average common shareholders’ equity at December 31, 2008, is as follows (dollars in millions):

Corporate and

Discontinued

CIG

Bankers

Colonial Penn

Operations

Total

Average common shareholders' equity, excluding accumulated

other comprehensive income (loss) and net operating loss

carryforwards (a non-GAAP financial measure)

1,416.3

$

1,247.3

$

113.3

$

75.3

$

2,852.2

$

Average net operating loss carryforwards

1,232.9

Average accumulated other comprehensive income (loss)

(841.1)

Average common shareholders' equity

3,244.0

$

Return on equity ratios:

Return on equity

-33.3%

Operating return (less the Q4 2007 and Q2 2008 valuation

allowance for deferred tax assets) on common equity,

excluding accumulated other comprehensive income

(loss) and net operating loss carryforwards (a

non-GAAP financial measure)

3.7%

7.1%

12.4%

NM

5.5%

Information Related to Certain Non-GAAP Financial Measures

Debt to capital ratio, excluding accumulated other comprehensive income (loss)

This non-GAAP financial measure differs from the debt to capital ratio because accumulated other comprehensive income has been excluded

from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes

the volatility that arises from changes in accumulated other comprehensive income. Such volatility is often caused by changes in the estimated

fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by

management.

Information Related to Certain Non-GAAP Financial Measures

A reconciliation of the debt to capital ratio to debt to capital, excluding accumulated other comprehensive loss is as follows (dollars in millions):

Q4 2007

Q1 2008

Q2 2008

Q3 2008

Q4 2008

Corporate notes payable

1,193.7

$

1,191.7

$

1,189.7

$

1,187.6

$

1,328.7

$

Total shareholders' equity

4,235.9

3,939.7

3,382.1

2,704.0

1,664.2

Total capital

5,429.6

5,131.4

4,571.8

3,891.6

2,992.9

Less accumulated other comprehensive loss

273.3

565.6

639.2

1,137.7

1,770.7

Total capital, excluding accumulated other

comprehensive loss

(a non-GAAP financial measure)

5,702.9

$

5,697.0

$

5,211.0

$

5,029.3

$

4,763.6

$

Corporate notes payable

1,193.7

$

1,191.7

$

1,189.7

$

1,187.6

$

1,328.7

$

Corporate notes payable to capital ratios:

Corporate debt to total capital

22.0%

23.2%

26.0%

30.5%

44.4%

Corporate debt to total capital, excluding

accumulated other comprehensive loss

(a non-GAAP financial measure)

20.9%

20.9%

22.8%

23.6%

27.9%