UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary proxy statement

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

Definitive proxy statement

Definitive additional materials

Soliciting material pursuant to §240.14a-12

Conseco, Inc.

(Name of Registrant as Specified in Its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

No fee required

Fee computed on table below per Exchange Act Rules 14a-(6)(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

______________________________________________________________

(2) Aggregate number of securities to which transaction applies:

______________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth

the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________

(4) Proposed maximum aggregate value of transaction:

______________________________________________________________

(5) Total fee paid:

______________________________________________________________

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

______________________________________________________________

(2) Form, schedule or registration statement no.:

______________________________________________________________

(3) Filing party:

______________________________________________________________

(4) Date filed:

______________________________________________________________

The following materials were prepared for use in a presentation given to RiskMetrics Group on April 30,

2009 and may be provided to certain shareholders of Conseco, Inc. after April 30, 2009.

Conseco, Inc.

11825 North Pennsylvania Street

Carmel, IN 46032

April 30, 2009

RiskMetrics Presentation

April 30, 2009

Agenda

Business Overview

Recent Financial Performance

Investment Portfolio Review

Board of Directors

Summary

Q&A

Conseco Highlights

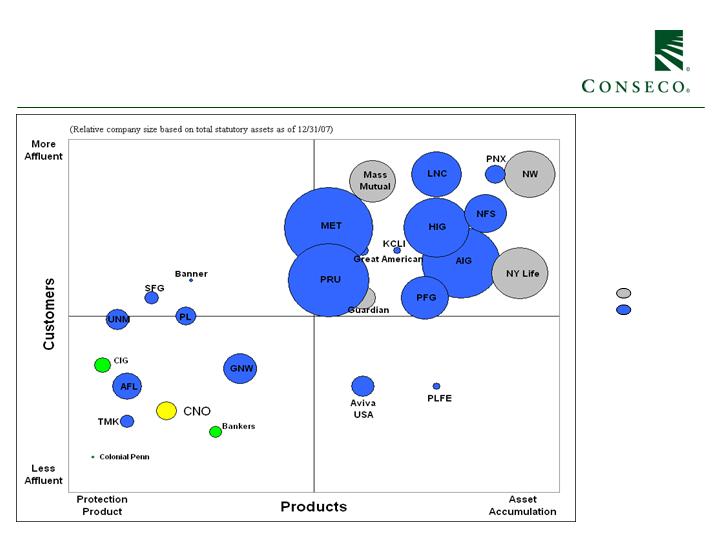

Defined and differentiated by focus on senior middle income market

Target Market

Products

Distribution

Small face amount protection products (4 million policies in force)

Not ratings dependent

Virtually no variable business (no sales since 2002)

Bankers: “kitchen table” sales model through 4,800+ career agents

Colonial Penn: direct sales

CIG: Independent producers; PMA (wholly owned marketing company) now

57% of sales

High agent recruitment and retention

Operating Performance

Capital Management

Investments

Capital preservation through multiple reinsurance transactions

Improving product mix, reducing risk

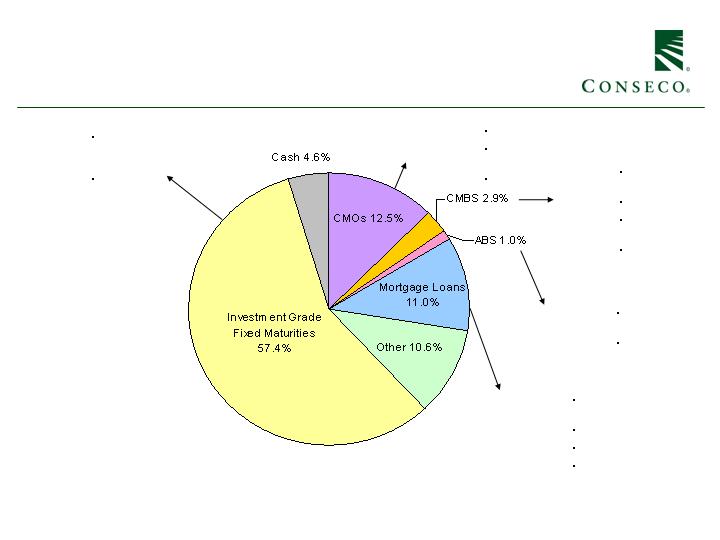

92% Investment Grade

Highly diversified portfolio

No significant investment in exotic securities

Solid growth in Sales and VNB

Strong core operating performance

Volatility substantially reduced through separation of LTC run-off business

Conseco Has Expertise

Across Important Middle

Market Products

Specified Disease

Equity-Indexed Life and

Annuity products

(longevity solutions)

Long-Term Care

Medicare Supplement

Whole Life products

Final Expense / Term

insurance for protection

Able to Access Consumers

Across Multiple Channels

With an Agent (Retail)

Bankers

CIG

Independents

PMA (CIG-owned)

Without an Agent: (Direct)

Colonial Penn

At Work: (Worksite Marketing)

PMA Worksite Division

CIG - Independents

Strong Trends Are Impacting

Middle Market Consumers

Rising medical costs

Decline of societal safety nets

(government & employer)

Increased longevity

Greater awareness of need for

retirement planning

The Right Products and The Right Channels for

Today’s Middle Market Consumer

Unique Value Proposition that is Closely

Aligned to Important Target Market Trends

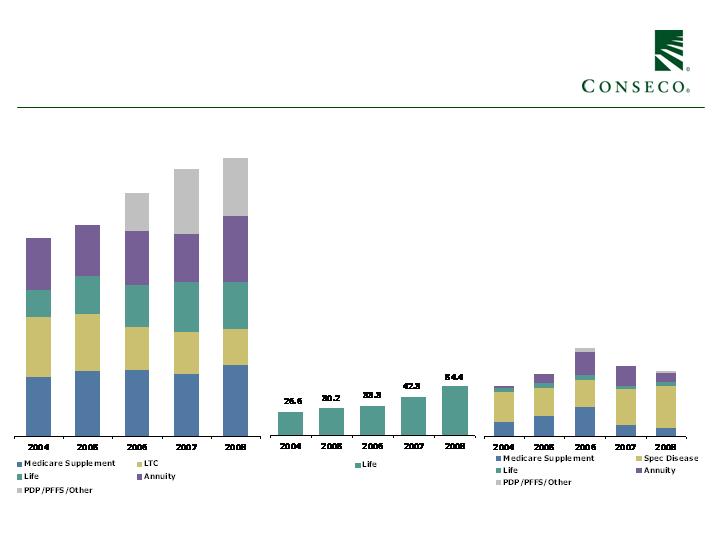

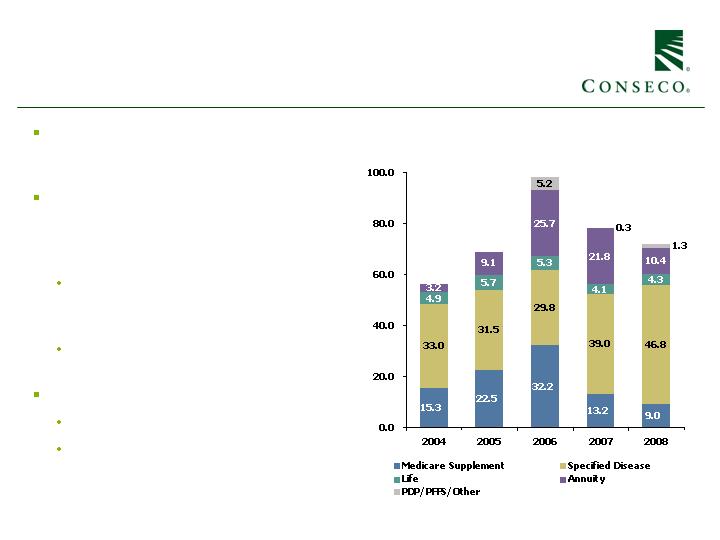

Product Shift aligned with profitability –

New Sales Across Business Units

(NAP $ in millions) (a)

Bankers

Colonial Penn

CIG

218.4

233.6

268.4

294.4

306.5

56.4

68.8

98.2

78.4

71.8

(a) Measured by new annualized premium, which includes 6% of annuity and 10% of single premium whole life deposits and 100% of all other

premiums, PDP sales equal $200 per enrolled policy in 2008, $310 in 2007 and $315 in 2006, PFFS sales equal $2,250 per enrolled policy

($2,100 in 2007)

Fix, Focus, Grow

Key Accomplishments

9/06

Jim Prieur

hired

10/08

Buy back of

Convertible

Securities

12/06

VNB

introduced

4/07

Ed Bonach

hired

6/07

Expanded credit facility to

$870 million at LIBOR +

200

2007/2008

CIG sales &

marketing rightsizing

- $6 million annual

expense reduction

2008

Excess Chicago space

vacated - $5 million

annual expense save

Q4 2007

Recapture of

Colonial Penn

Life Block

Q3 2007

Sale of $3 billion

annuity block

12/06

LTC brought under

one management team

Q3 2007

Completed consolidation of

shared services in Carmel,

Sale of excess space in

Carmel

12/08

Reinsured Bankers

LTC New Business

11/08

Separation of Closed

Block LTC business

12/08

Improved capital

efficiency through use

of reinsurance and

other means

3/09

Renegotiated credit facility

to loosen covenants; cost

increased to LIBOR (2.5%

floor) + 500

Q1/08

Engaged Morgan

Stanley to

evaluate strategic

alternatives

Analyst Commentary

FBR Analyst – Indianapolis Business Journal Article 3/14/09

Conseco has reported better numbers in the past, said Binner, the Friedman Billings analyst. But they were

pumped up due to problems that have been uncovered since the 2006 arrival of CEO Jim Prieur and Chief

Financial Officer Ed Bonach.

“Jim and Ed have created a better-functioning Conseco than ever really existed,” Binner said. “They are

real, and they’re really fixing the company. But the economic backdrop is just so terrible right now.

”

KBW Analyst Report 1/5/09

Nevertheless, we still believe current management has been upfront with all stakeholders in trying to

address and do the heavy lifting to fix Conseco's many problems.

Dowling Analyst Report 11/12/08

CNO had a major win today by receiving approval of the transfer of the Senior Health Insurance Co.

(formally American Travelers) to an independent trust in PA.

CNO management, its bankers and shareholders do not now have the future unknown obligations of this

company. We view this as a major positive for CNO. Precious capital can now be used to deal with

portfolio issues and other emerging issues, not this run-off LTC block of business.

KBW Analyst Report 3/18/08

In our opinion, the turnaround remains on track despite negative reaction in the stock following the reported

net loss and additional charges (though expected).

Bankers Overview

Solid business with expanding low cost

distribution

9% compounded annual sales growth (versus

low single digit growth rate for industry)

Focused on the middle-class senior market

with Medicare supplement, life, annuity,

LTC, Medicare Part D and Medicare

Advantage products

“Kitchen-table” sales model through over

4,800 agents

Strong momentum in recruitment

12% YTD growth in new agents

5% YTD growth in productive agents in

2008 over 2007 (a)

New Annualized Premiums ($ millions)

218.4

233.6

268.4

294.4

306.5

(a) Productive agents defined as agent who averages 4+ policies sold per month or averages $2,000+ in commissions earned per month

during the most recent 12 months

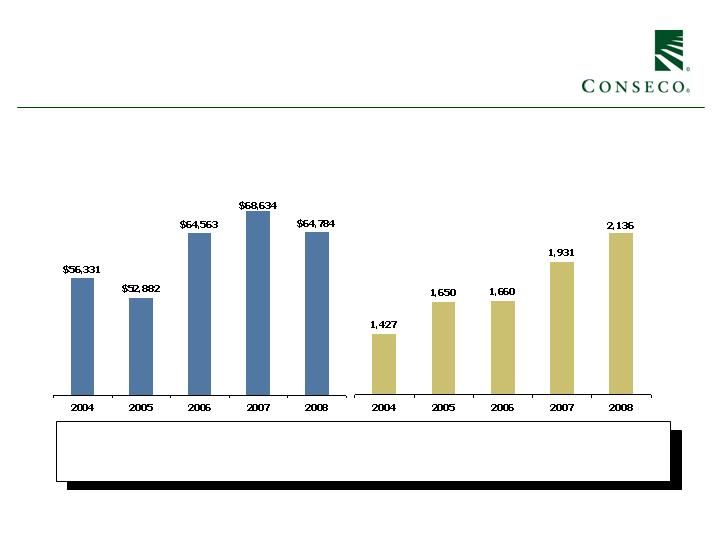

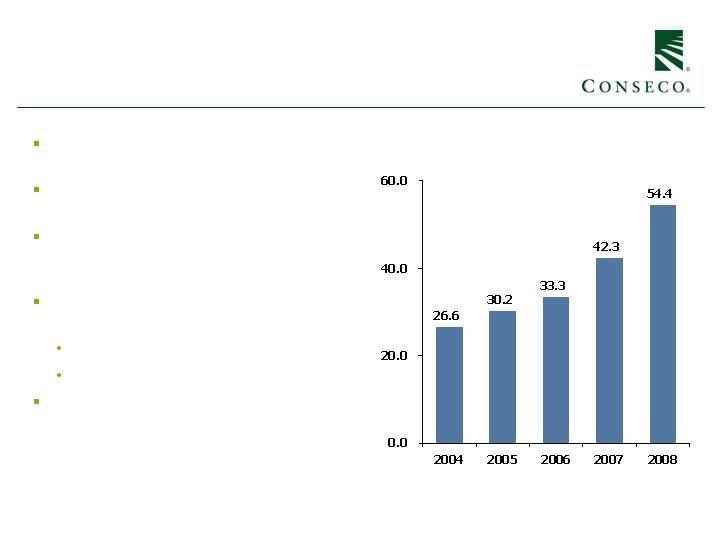

Bankers Agent Force Growth and

Productivity Improvements

Number of Productive Agents (a)

Monthly Average 2004 – 2008

NAP per Agent (productivity)

Yearly Average 2004 – 2008

These improvements are enabling Bankers to grow total NAP to a target of 10% growth

per year while the life insurance industry grows in the low single digits per year

(a) Productive agents defined as agent who averages 4+ policies sold per month or averages $2,000+ in commissions earned per month

during the most recent 12 months

Colonial Penn Overview

Focus on lower middle-income retirees with

simple, low cost life insurance products

Approximately 17% compound annual sales

growth since 2004

Direct response model with media and mail

based lead generation with robust

telemarketing support

Well positioned in unique market niche with

strong growth potential

19% sales growth in 2008

Sustainable growth of 20% per year

Low cost administrative platform

New Annualized Life Premiums ($ millions)

CIG Overview

Focus on middle income working Americans

and retirees with supplemental health and

protection products

Distribution through approximately 2,400

independent producers, including 565 from

Performance Matters Associates (“PMA”), a

wholly-owned marketing company

PMA currently generates 57% of new

business focusing on profitable

supplemental health products

Building new relationships, broadening

supplemental health and life distribution

Key markets

Individual – farm/rural and seniors

Worksite – small business, education,

government, healthcare and credit unions

New Annualized Premiums ($ millions)

56.4

68.8

98.2

78.4

71.8

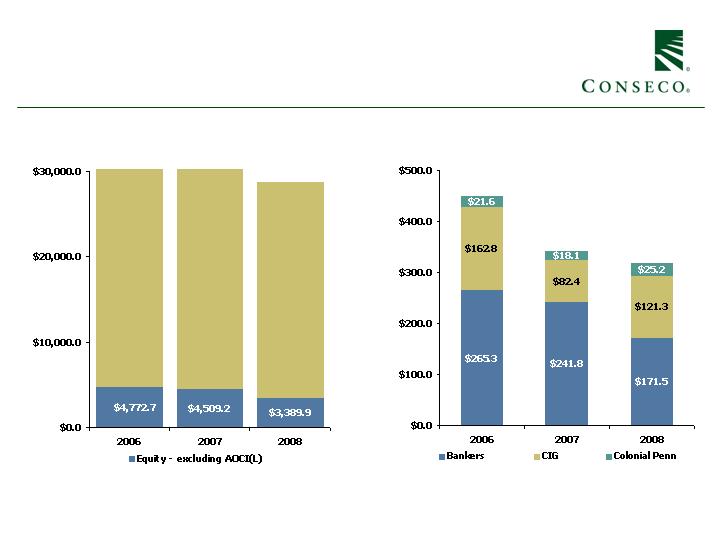

Historical Financial Performance

($ in millions)

Total Assets / Equity ex AOCI(L) (a)

(a) Amounts do not reflect changes for the adoption of any Accounting Pronouncements in 2009 which require retrospective application.

(b) A non-GAAP financial measure which excludes: (i) net realized investment gains (losses), net of related amortization; (ii) a litigation settlement

in 2006 and refinements to such estimates in subsequent periods; (iii) a 2007 charge related to an annuity coinsurance transaction; and (iv)

corporate operations. See the Appendix for a reconciliation to the corresponding GAAP measure.

$449.7

$342.3

$318.0

Pre – Tax Operating Income (b)

$33,593.1

$33,971.2

$28,769.7

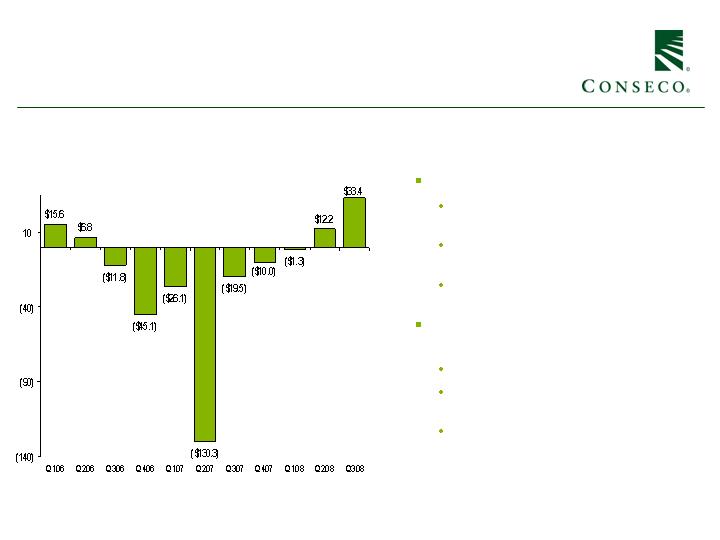

Fixing LTC Run-off:

The Separation of Senior Health

Run-off Segment Pre-Tax Operating Earnings ($MM) (a)

Stabilized LTC business

Strengthened reserves by $200MM in

2007 - 2008

Installed experienced management team

focused exclusively on LTC

Pursued premium rate increases where

justified

Improved customer service to LTC

policy holders

Enhanced claims management

Outsourced most admin operations to

the Long Term Care Group

Concluded multi-state insurance

regulatory examination and started

remediation

Management Actions Taken Prior to Separation

(a) A non-GAAP financial measure which excludes net realized investment gains (losses), net of related amortization. Q3 2008 results include $30.5

million gain on reinsurance recapture.

Senior Health Separation Transaction

Overview

Key Transaction Terms

Senior Health* (which housed 87% of run-off LTC business) was transferred for no consideration to a

not-for-profit business trust set up to own and operate the business for the benefit of its LTC

policyholders

Pre-separation capital contribution of $175MM to Senior Health to raise total adjusted statutory capital to

approximately $300MM

Closed in Q4 2008

Conseco Rationale

A balanced solution, considering the various stakeholders, to definitively separate Senior Health from

Conseco

Separation eliminates potential source of earnings volatility and perceived call on Conseco’s capital

Allows capital to be applied to profitable, high growth businesses

Improves risk profile

Allows Conseco’s management to focus on core businesses

*Senior Health Insurance Company of Pennsylvania, formerly known as Conseco Senior Health Insurance Company prior to its name change in

October 2008.

Senior Health Separation Transaction

and Related Charges

(a) Amount is before the potential tax benefit. A deferred tax valuation allowance was established for all future

potential tax benefits generated by these charges since management has concluded that it is more likely than

not that such tax benefits will not be utilized to offset future taxable income.

($ in millions)

During 2008, Conseco recorded accounting charges totaling $1.0 billion related to the transaction,

comprised of Senior Health's equity (as calculated in accordance with generally accepted accounting

principles), an additional valuation allowance for deferred tax assets, the capital contribution to Senior

Health and the Independent Trust and transaction expenses.

The accounting charges are summarized as follows:

$1,022.8

Total charges

204.4

Additional capital contribution and transaction expenses

159.2

Write-off of remaining shareholder's equity of Senior Health

298.0

Increase to deferred tax valuation allowance based on recent results which have

had a significant impact on taxable income and the effects of the transaction

(19.3)

Gain on reinsurance recapture, net of tax

$380.5

Recognition of unrealized losses on investments transferred to the Independent

Trust

(a)

(a)

(a)

Impact of Credit Facility Amendment

on Key Debt Covenants

*Excludes Accumulated Other Comprehensive Income (Loss)

** Changes in covenant levels from Q3 2008 primarily driven by the transfer of Senior Health to an independent trust

***Reflects impact of modifications to the covenants which are applicable from March 31, 2009 through June 30, 2010

NOTE: Amounts do not reflect changes for the adoption of any Accounting Pronouncements in 2009 which require retrospective application.

($ millions)

Q3 2008

Q4 2007

30.0%

21.0%

2.00X

3.34X

$1,270

$1,497

250%

296%

125%

30.0%

23.6%

2.00X

2.64X

$1,270

$1,433

250%

257%

125%

Debt/Capital Ratio*

Covenant Maximum

Actual

Interest Coverage

Covenant Minimum

Actual

Statutory Capital

Covenant Minimum

Actual

RBC Ratio

Covenant Minimum

Actual

Company Action Level Trigger

Q4 2008**

30.0%

28.3%

2.00X

2.35X

$1,270

$1,366

250%

255%

125%

Modified

Covenant Levels***

32.5%

1.50X

$1,100

200%

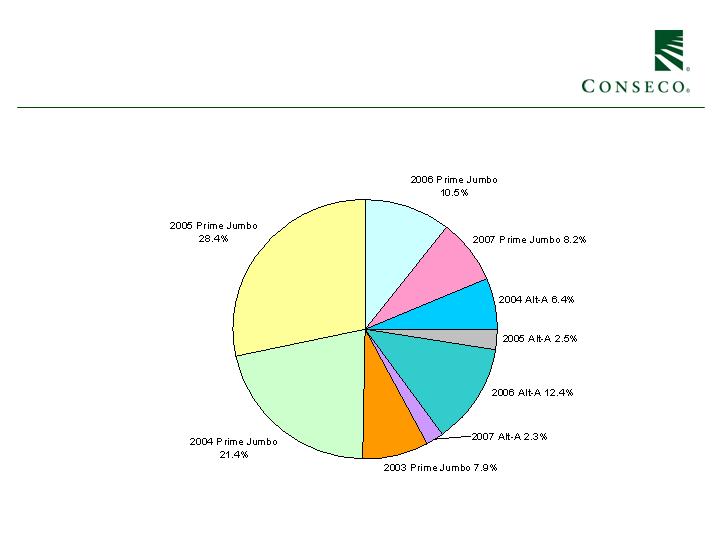

Subprime allocation substantially

reduced

HEL allocation reflects market

stresses

Overall mark-to-market and

credit migration consistent with

credit cycle

Pressure on financials and

cyclicals

Overall highly rated

Pressure on ALT-A delinquency

trends

Some Alt-A downgrades

Low, but rising delinquency

trends

Seasoned portfolio

BBB market pricing pressure

severe

Nominal downgrades to date,

but rating activity likely

Slowing economy and lack of financing availability

likely to lead to higher delinquencies

Active surveillance and portfolio management

Nominal new investment activity

Liquidated $45 million in problematic exposures in

Q4 2008

Managing through the credit cycle by emphasizing long-term

assessments of value and quality

Asset Allocation

at 12/31/08

Rating Agency Commentary on

Investment Portfolio

AM BEST- Report Revision Date - 03/04/2009

The overall credit quality of the portfolio is solid.

The corporate bond portfolio is also well diversified by industry sector.

A.M. Best notes that CNO's credit risk on BIG securities is partially mitigated by its lower

exposure to structured securities relative to the industry.

Structured securities are reasonably well diversified, consisting mainly of CMOs, asset-backed

and commercial mortgage-backed securities. These securities are typically invested in

sequential and planned amortization classes with modest amounts invested in riskier tranches.

In general, A.M. Best notes that the group's investment risk credit risk profile has improved

due to a reduction in high yield bonds, structured securities, affiliated investments and limited

partnerships.

MOODY’S – 3/03/2009 Rating Update

Over the past several years, the company has reduced the amount of alternative investments

and affiliated investments.

Overall, we believe the company's investment portfolio is representative of an A-rated

company.

$13,532

340

440

11

134

76

2,920

838

292

2,159

1,809

$22,551

($ millions)

Corporates

US Treasuries

States and Political

Unrealized Losses

at 12/31/08

Foreign Governments

CDOs

Mortgage Pass-throughs

CMOs

CMBS

ABS

Mortgage Loans

Equity, Cash & Other

Total

Book Value

Market Value

Net Unrealized

Gain/(Loss)

2008

Impairments

$11,436

371

386

9

97

77

2,443

572

204

2,122

1,793

$19,510

$(2,096)

31

(54)

(2)

(37)

1

(477)

(266)

(88)

(37)

(16)

$(3,041)

$98

-

-

-

-

-

35

-

19

6

4

$162

Board Structure and Governance

Nine members being elected

Eight members are independent, including Chairman

Two independent directors added in 2007 following extensive search

Hired new CEO (September 2006) and CFO (April 2007)

Active Board

14 Board Meetings in 2008

More than 30 Board Committee Meetings in 2008 including 18 Audit

Committee meetings

Active role in establishing strategy – engaged Morgan Stanley to review strategic

alternatives beginning in January 2008

Adopted majority voting for directors and declassified Board in 2008

Board of Directors Biographies

R. Glenn Hilliard, 66, has served as chairman of our board of directors since September 2003. During the period from

August 2004 until September 2005, he served as executive chairman and at all other times since September 2003 he has

served as non-executive Chairman. Mr. Hilliard has been chairman and chief executive officer of Hilliard Group, LLC, an

investment and consulting firm, since 2003. From 1999 until his retirement in 2003, Mr. Hilliard served as chairman, chief

executive officer and a member of the executive committee for ING Americas. From 1994 to 1999 he was chairman and

CEO of ING North America. Mr. Hilliard is a Trustee of Columbia Funds Series Trust, Columbia Funds Master Investment

Trust, Columbia Funds Variable Insurance Trust I (formerly Nations Separate Account Trust) and Banc of America Funds

T

rust.

Donna A. James, 51, has been a director of Conseco since May 2007. Since 2006 Ms. James has been President and

managing director of Lardon & Associates, a business and executive advisory services firm. Before retiring in 2006, Ms.

James worked in various capacities with Nationwide Mutual Insurance Company and its public company subsidiary,

Nationwide Financial Services, Inc., beginning in 1981, including President, Nationwide Strategic Investments (2003-2006),

Executive Vice President and Chief Administrative Officer (2000-2003) and Senior Vice President and Chief Human

Resources Officer (1998-2000). She is also a director of Coca-Cola Enterprises, Inc., Limited Brands, Inc. and Time Warner

Cable Inc.

Debra J. Perry, 58, has served as a director of Conseco since June 2004. Since 2008 Ms. Perry has been the managing

member of Perry Consulting LLC. From 1992-2004, she was a senior executive at Moody’s Investors Service and Moody’s

Corporation. During her career there, she served as Chief Administrative Officer and Chief Credit Officer, and had

responsibility for several ratings groups, including Americas Corporate Finance, Leverage Finance, Public Finance, and

Finance, Securities and Insurance. Until recently, Ms. Perry served on the board of MBIA Inc., the largest financial guaranty

insurance company. At the request of the MBIA board, she became a consultant to its Credit Risk Committee to refine and

implement the company’s risk strategy as part of a five-year transformation plan. Ms. Perry is also a director of Korn/Ferry

International.

Board of Directors Biographies

C. James Prieur, 57, has been chief executive officer and a director since September 2006. Before joining Conseco,

Mr. Prieur had been with Sun Life Financial since 1979. He began his career in private placements, then equity and

fixed income portfolio management, rising to vice president of investments for Canada in 1988, and then vice

president of investments for the U.S. in 1992. In 1997 he was named senior vice president and general manager for

all U.S. operations, and became corporate president and chief operating officer in 1999.

Philip R. Roberts, 67, joined our board of directors in September 2003. Mr. Roberts is retired. From 2000 until

2007, Mr. Roberts was principal of Roberts Ventures L.L.C., consultant for merger and acquisition and product

development for investment management firms. From 1996 until 2000, Mr. Roberts served as chief investment

officer of trust business for Mellon Financial Corporation and headed its institutional asset management businesses

from 1990 to 1996.

Neal C. Schneider, 64, joined our board of directors in September 2003. Between 2002 and 2003, Mr. Schneider

was a partner of Smart and Associates, LLP, a business advisory and accounting firm. Between 2000 and 2002, he

was an independent consultant. Until his retirement in 2000, Mr. Schneider spent 34 years with Arthur Andersen &

Co., including service as partner in charge of the Worldwide Insurance Industry Practice and the North American

Financial Service Practice. Mr. Schneider has been chairman of the board of PMA Capital Corporation since 2003.

Board of Directors Biographies

Michael T. Tokarz, 59, joined our board of directors in September 2003. Mr. Tokarz is the chairman of MVC

Capital, Inc. (a registered investment company). In addition, he has been a managing member of the Tokarz Group,

LLC (venture capital investments) since 2002. He was a general partner with Kohlberg Kravis Roberts & Co. from

1985 until he retired in 2002. Mr. Tokarz is chairman of Walter Industries, Inc. and is also a director of Idex Corp.

and Dakota Growers Pasta Companies, Inc

John G. Turner, 69, joined our board of directors in September 2003. Mr. Turner has been chairman of Hillcrest

Capital Partners, a private equity investment firm since 2002. Mr. Turner served as chairman and CEO of ReliaStar

Financial Corp. from 1991 until it was acquired by ING in 2000. After the acquisition he became vice chairman and

a member of the executive committee for ING Americas until his retirement in 2002. Mr. Turner is a director of

Hormel Foods Corporation.

Doreen A. Wright, 52, joined our board of directors in May 2007. Ms. Wright was Senior Vice President and Chief

Information Officer of Campbell Soup Company from 2001 until her retirement in 2008. Prior to joining Campbell

Soup Company, she was Executive Vice President and Chief Information Officer at Nabisco, Inc. from 1999-2001.

From 1995 through 1998, Ms. Wright was Senior Vice President, Operations and Systems for Prudential Insurance

Company’s Prudential Investment Group. From 1984 until 1994, she held various leadership positions at Bankers

Trust Company as a Managing Director and Senior Vice President of numerous large-scale institutional customer

service and technology groups. Ms. Wright serves on the boards of directors of The Oriental Trading Company and

The Riverside Symphonia, and she previously served on the board of directors of The Yankee Candle Company.

Qualifications of Mr. Roberts

Mr. Roberts has worked in the insurance and securities industry since 1964

Joined Conseco's board of directors in September of 2003.

From 2000 to 2007, Mr. Roberts served as principal of Roberts Ventures L.L.C., consultant for

merger & acquisition and product development for investment management firms.

From 1996 until 2000, Mr. Roberts served as chief investment officer of trust business for Mellon

Financial Corporation and headed Mellon's institutional asset management businesses from 1990

to 1996, in addition to chairing the Trust Committee. (Institutional Assets at Mellon were about

$130 billion and Personal Assets were about $60 billion during his tenure). Company grew

organically about 7% after adjusting for market movements. Also started a company to run

dynamic currency hedging and built AUM to $30 billion in five year

s.

Prior to joining Mellon, Mr. Roberts enjoyed a 26-year career with Aetna Life & Casualty

Company. During his tenure he served in a variety of management positions, culminating in

service as senior vice president and chief investment officer. (Aetna's assets were approximately

$45 billion including P&C assets as well as the life assets).

Mr. Roberts graduated from Harvard University with a bachelor of arts degree in economics. He

also holds an MBA from the University of Connecticut.

Progress on Conseco’s Turnaround

Emerged from bankruptcy in September 2003 with new Board of Directors

Jim Prieur hired in September 2006 – “Fix Focus and Grow” Strategy

Sold $3 billion annuity block

Recaptured life block ($50 million of traditional life insurance premium in force

that had been ceded)

Reduced expenses, consolidated and right-sized operations (annual savings in

excess of $25 million)

Retained investment banker to advise on strategic alternatives to build shareholder

value

Separated LTC Closed-Block to reduce earnings volatility and free up capital

(Strengthened reserves by $200MM in 2007 – 2008)

Improved Capital Efficiency

Renegotiated Credit Facility to increase flexibility

All business segments returned to profitability

Board has been actively engaged throughout

Appendix

Amended and Restated Long-Term

Incentive Plan

Amendment and restatement of the Plan incorporates the provisions of the Plan as

currently in effect and includes the following key modifications:

Limits on Full-Value Awards.

Eliminating Liberal Share Counting Provisions.

Shareholders’ Re-Approval of Performance Goals.

Clarifying and Conforming Amendments.

Increase in the number of shares authorized to be issued under the Plan by

15,846,268 shares, for a total number of authorized shares under the Plan of

25,846,268. First increase in Plan shares since Plan was adopted in 2003.

2009 annual award is based upon a higher price than current market share price

(was developed on a 12 month trailing basis)

Additional shares needed to attract and retain management

Plan conforms to RiskMetrics Group guidelines

Information Related to Certain Non-

GAAP Financial Measures

The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP

measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts

that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with

GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial

results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures.

Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange

Commission that are available in the “Investor – SEC Filings” section of Conseco’s website, www.conseco.com.

Operating earnings measures

Management believes that an analysis of net income applicable to common stock before net realized gains or losses, losses

related to the transfer of Senior Health to an independent trust and income taxes (a non-GAAP financial measure) is important to

evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses

this measure to evaluate performance because realized investment gains or losses, losses related to the transfer of Senior Health

to an independent trust and increases to our valuation allowance for deferred tax assets are unrelated to the Company’s

continuing operations.

In addition, our results were affected by unusual and significant charges related to: (i) a litigation settlement in Q2 2006 and

refinements to such estimates recognized in subsequent periods; and (ii) a Q3 2007 charge related to an annuity coinsurance

transaction. Management believes an analysis of operating earnings before these charges is important to evaluate the

performance of the Company prior to the effect of these unusual and significant charges.

Information Related to Certain Non-

GAAP Financial Measures

A reconciliation of EBIT to net income (loss) applicable to common stock is as follows (dollars in millions):

NOTE: Amounts do not reflect changes for the adoption of any Accounting Pronouncements in 2009 which require retrospective application.

2006

2007

2008

EBIT, excluding costs related to a litigation settlement and loss

related to a coninsurance transaction:

Bankers Life

265.3

$

241.8

$

171.5

$

Colonial Penn

21.6

18.1

25.2

Conseco Insurance Group

162.8

82.4

121.3

Corporate Operations, excluding corporate interest expense

(18.2)

(16.8)

(26.7)

EBIT, excluding costs related to a litigation settlement and a loss

related to an annuity coinsurance transaction

431.5

325.5

291.3

Costs related to a litigation settlement

(174.7)

(64.4)

-

Loss related to an annuity coinsurance transaction

-

(76.5)

-

Total EBIT

256.8

184.6

291.3

Corporate interest expense

(52.9)

(72.3)

(59.2)

Gain (loss) on extinguishment of debt

(0.7)

-

21.2

Income (loss) before net realized investment losses, taxes

203.2

112.3

253.3

and discontinuted operations

Tax expense (benefit) on period income

73.7

38.8

96.9

Income (loss) before net realized investment losses, valuation

allowance for deferred tax assets and discontinued operations

129.5

73.5

156.4

Preferred stock dividends

(38.0)

(14.1)

-

Net income (loss) before net realized investment gains (losses),

valuation allowance for deferred tax assets and discontinued

operations

91.5

59.4

156.4

Net realized investment losses (excluding the increase in unrealized

losses on those investmentes transferred to an independent trust

and net of related amortization and taxes and the establishment of

a valuation allowance for deferred tax assets related to such losses)

(23.8)

(79.5)

(217.4)

Net income (loss) applicable to common stock before valuation

allowance for deferred tax assets and discontinued operations

67.7

(20.1)

(61.0)

Valuation allowance for deferred tax assets (excluding the establishment

of a valuation allowance for realized investment losses and

discontinued operations)

-

(68.0)

(343.0)

Discontinued Operations

0.3

(105.9)

(722.7)

Net income (loss) applicable to common stock

68.0

$

(194.0)

$

(1,126.7)

$