CNO Financial (CNO) 8-KRegulation FD Disclosure

Filed: 21 May 09, 12:00am

Summary

Our goal is stable and predictable investment performance

We invest predominantly in liquid fixed income securities

Our portfolio is actively managed

Our portfolio reflects credit migration and mark-to-market trends consistent

with the credit cycle and market conditions

Our risk controls include intensive fundamental research, credit policy,

diversification, asset liability management, hedging, and compliance

We have experienced investment professionals (including 13 CFA

Charterholders, 2 CPAs, 11 MBAs, and 2 JDs)

Our current priority is the preservation of capital in the context of satisfactory

investment income

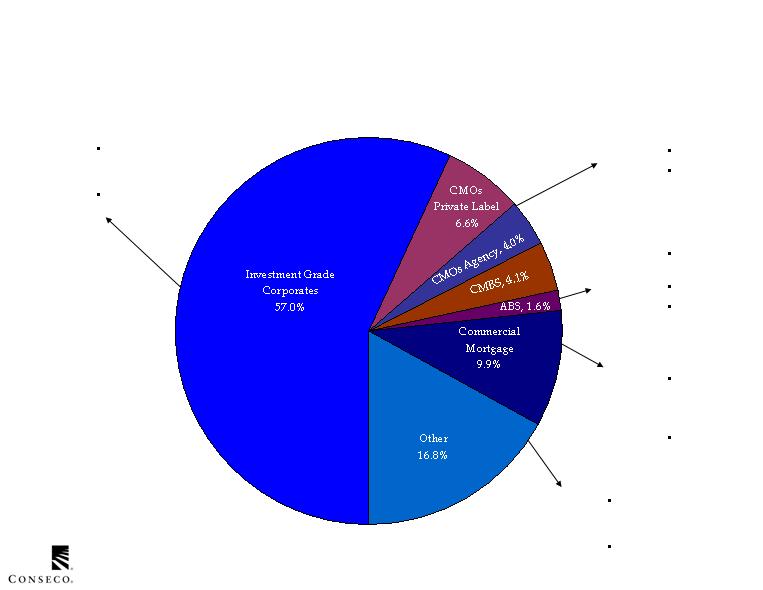

Asset Allocation

*Excludes the assets of a variable interest entity we are required to consolidate for GAAP purposes. The carrying value of our investment

in the subordinated debt of the entity was $78 million at March 31, 2009. The entity holds assets primarily consisting of below-investment

grade loans with a book value of $386 million.

As of 3/31/2009

(Allocations based on book values)

Our diversified investment portfolio is built around

traditional liquid fixed income products*

Asset Allocation

As of 3/31/2009

$Millions

Our mark-to-market is consistent with widened credit spreads

and increased volatility

*Excludes variable interest entity

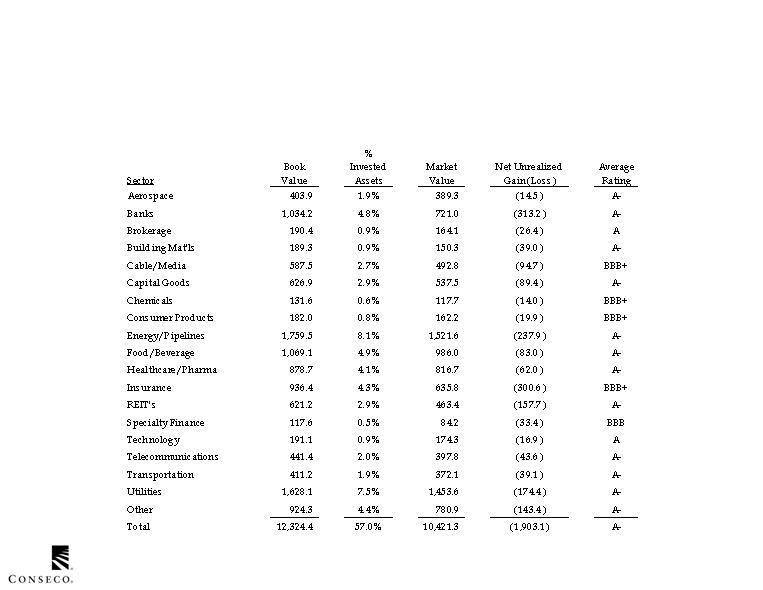

Our diversified IG Corporate allocation (57.0% of portfolio)

emphasizes traditionally non-cyclical sectors

Asset Allocation - Investment Grade Corporates

As of 3/31/2009

(Allocations based on book values)

Asset Allocation - Investment Grade Corporates

As of 3/31/2009

$Millions

In certain IG Corporate sectors, our mark-to-market reflects

significant market illiquidity and event risk (e.g. financials)

*This table excludes non investment grade securities

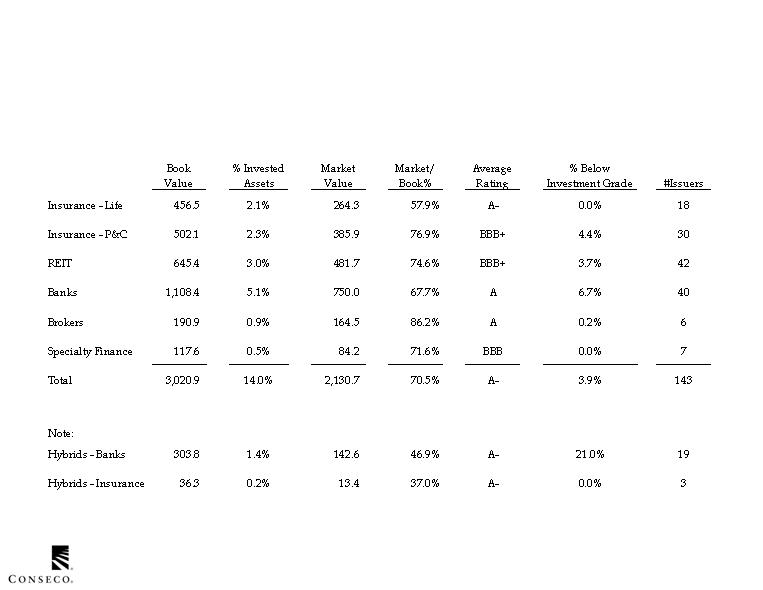

As of 3/31/2009

$Millions

Our exposure to financials (14% of invested assets) is diversified*

* This table includes financial below-investment grade securities

Asset Allocation - Investment Grade Corporates

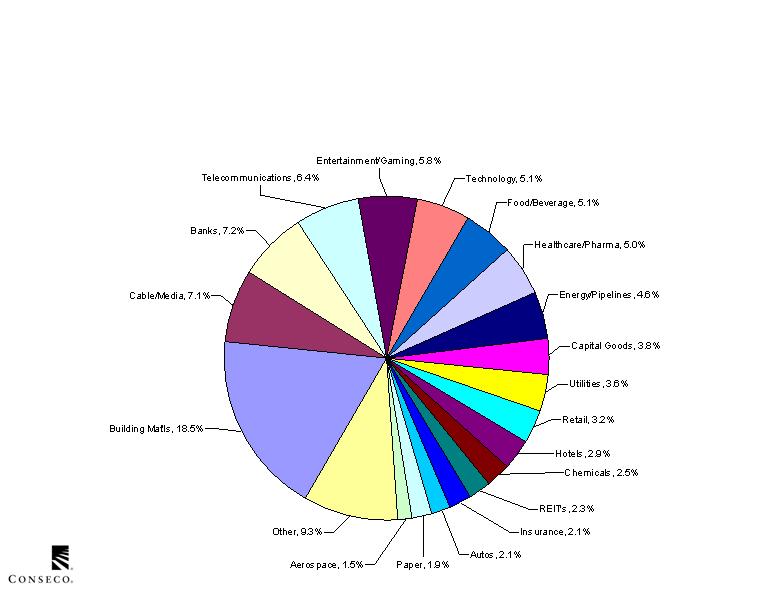

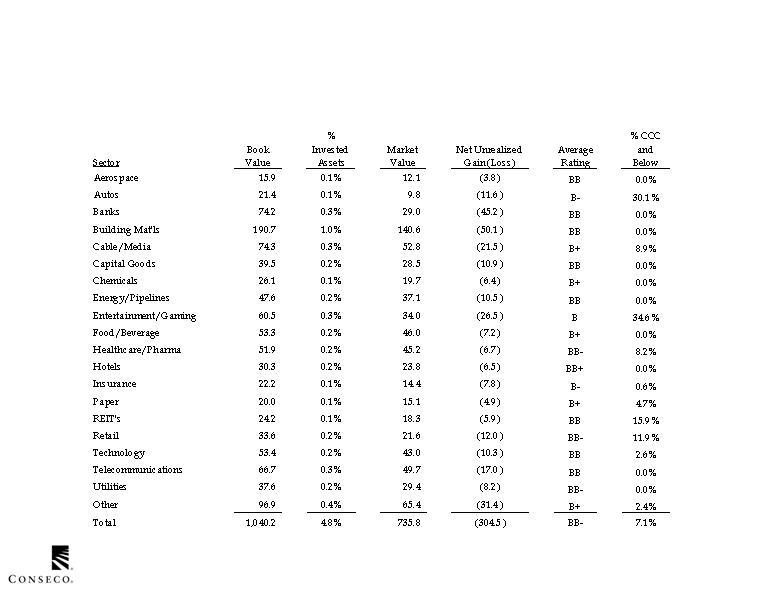

Our BIG Corporate allocation (5.0% of portfolio) is diversified

and weighted away from cyclicals

Asset Allocation – Below-Investment Grade Corporates

As of 3/31/2009

(Allocations based on book values)

As of 3/31/2009

$Millions

Our BIG Corporates are heavily oriented toward

BB credits: we have limited below B credits

Asset Allocation – Below-Investment Grade Corporates

Asset Allocation – Below-Investment Grade Corporates

We are investing very little new money in below-investment grade;

experiencing ratings migration trends consistent with the credit cycle

From 1/1/2009 to 3/31/2009

$Millions

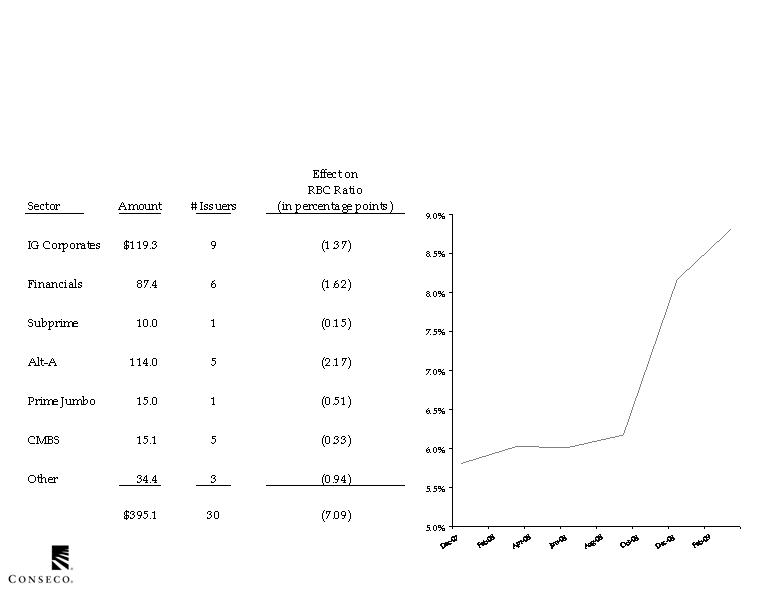

BIG Ratio

Downgrades in 1Q 2009

As of 3/31/2009

$Millions

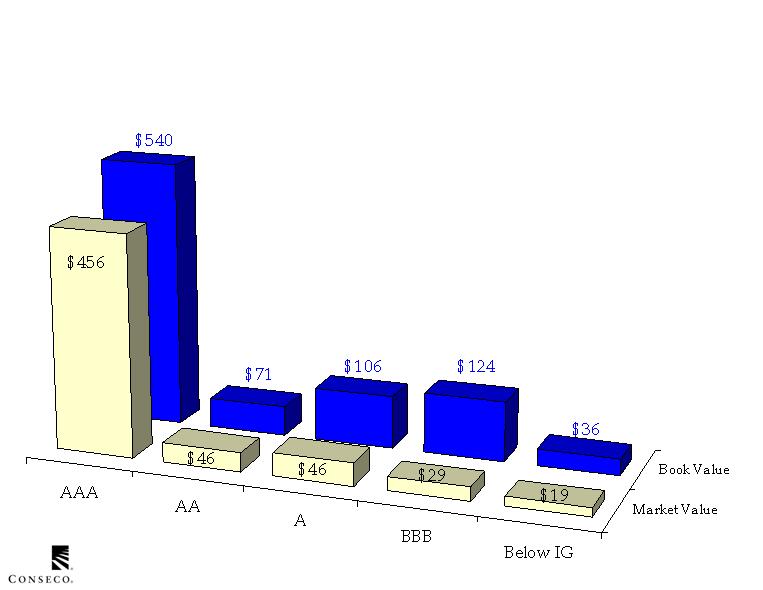

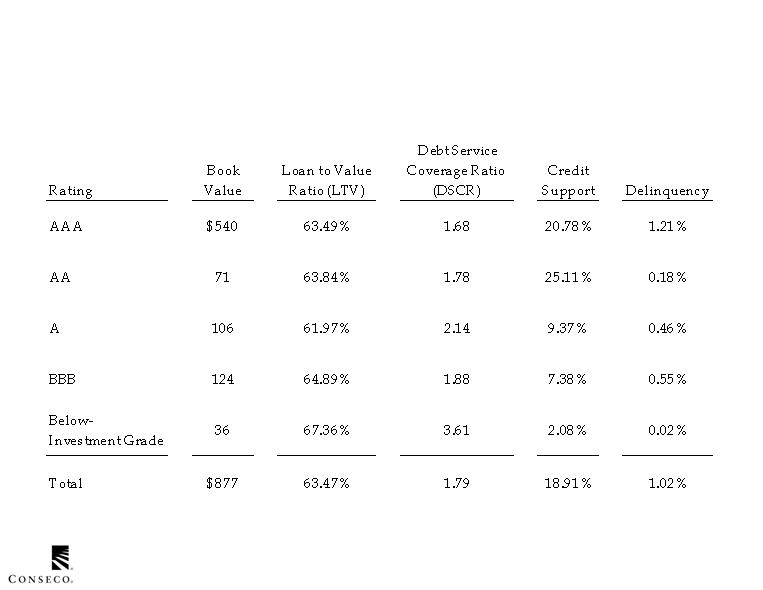

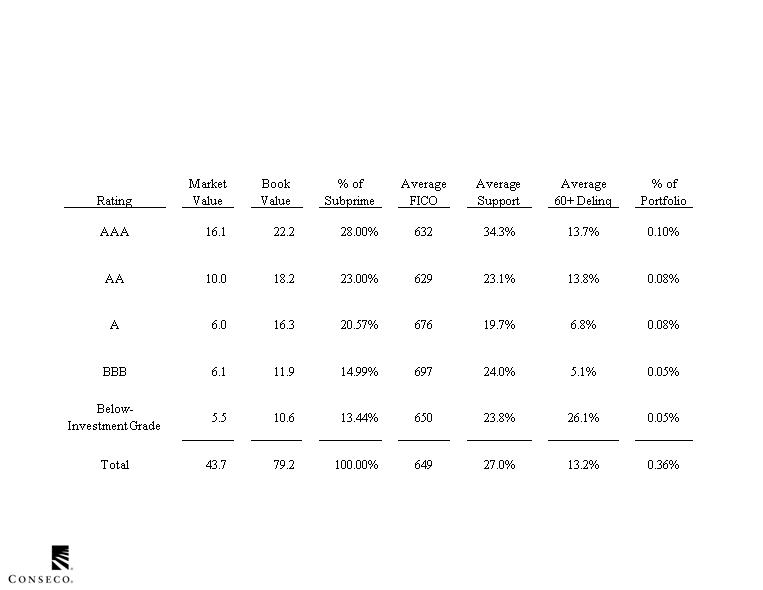

Our CMBS portfolio (4.1% of invested assets) is primarily

comprised of AAA and AA rated securities (70%)

Asset Allocation - CMBS

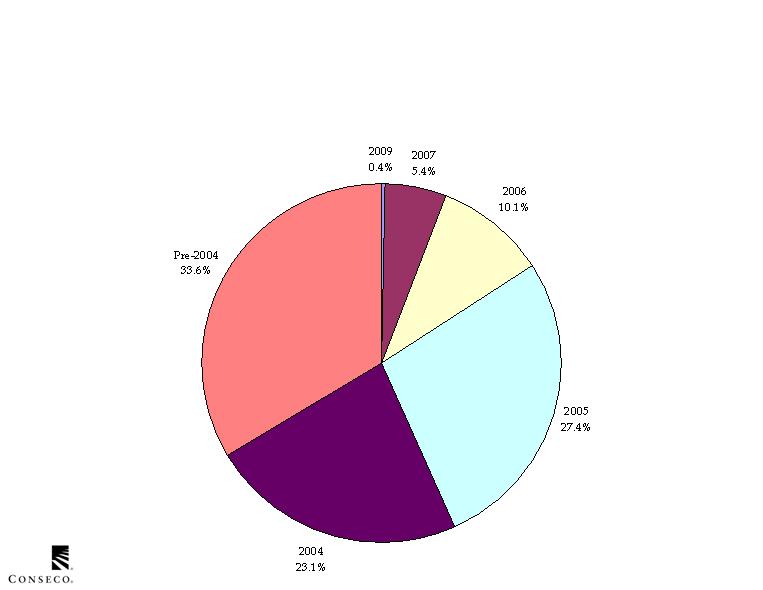

Our CMBS exposure is heavily weighted toward older vintages with stronger qualitative

characteristics and seasoning. We have limited exposure to the 2006 and 2007 vintages.

Asset Allocation - CMBS

As of 3/31/2009

(Allocations based on book values)

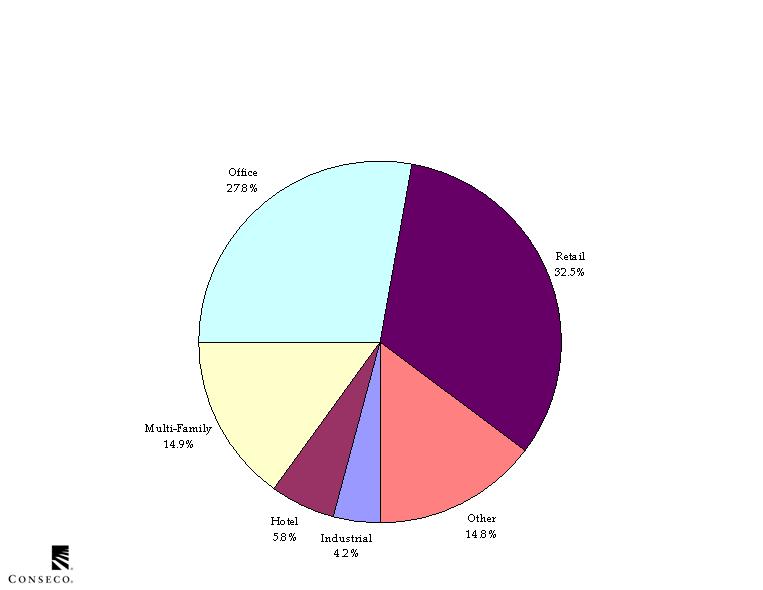

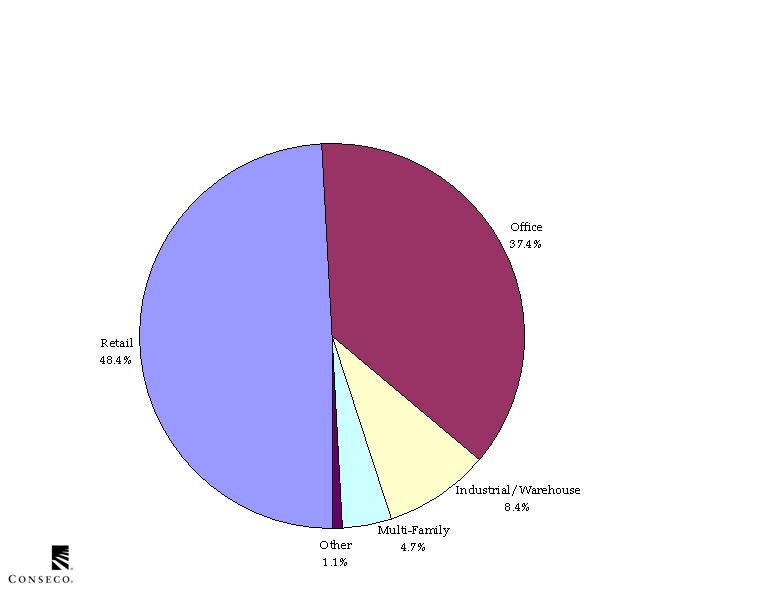

Our CMBS investments are backed by a diverse pool of underlying collateral –

more than 7,905 commercial mortgage loans with a face value exceeding $90 billion

Asset Allocation - CMBS

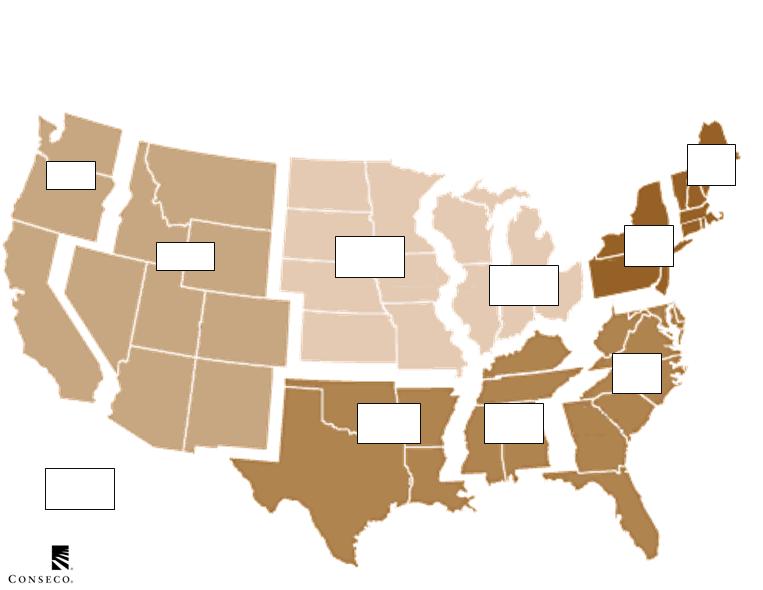

As of 3/31/2009

(Allocations based on book values)

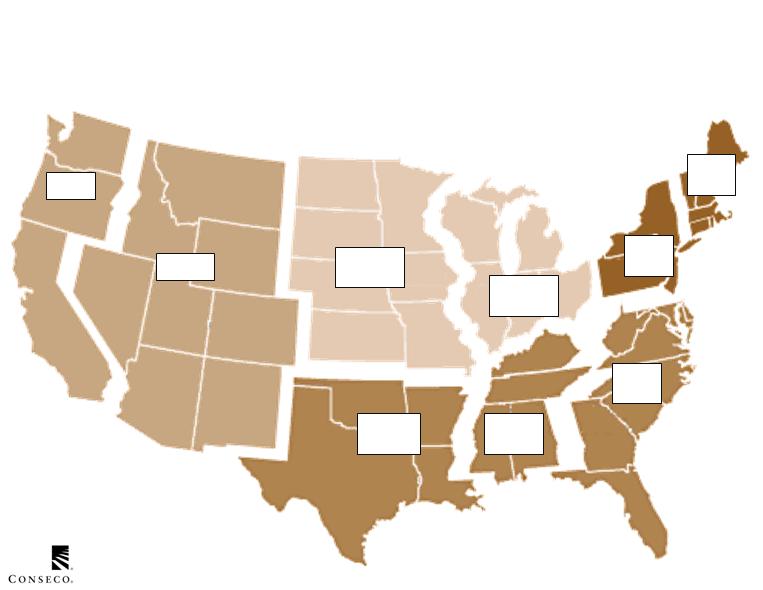

South

Atlantic

17.9%

New

England

4.5%

East South

Central

2.0%

West South

Central

7.6%

Pacific

18.0%

Middle

Atlantic

20.5%

Mountain

7.1%

West North

Central

2.7%

East North

Central

8.2%

The collateral underlying our CMBS investments is geographically diverse

Multiple

Regions

11.5%

Asset Allocation - CMBS

As of 3/31/2009

(Allocations based on book values)

Delinquencies in the collateral underlying our CMBS are increasing but

are lower than comparable statistics for the entire CMBS market

1.

Source: Intex. Data as of March 31, 2009.

Asset Allocation - CMBS

The following summarizes the credit characteristics of our CMBS portfolio

As of 3/31/2009

$Millions

Asset Allocation - CMBS

Asset Allocation - CMBS

Collateral

DSCR

LTV

Occupancy

Cap rate

Rent rolls

Geographic distribution

Industry distribution

Collateral rating/credit grade

distribution

IO loans

NOI trends

TI/LC reserves

Sponsor

Structure

Surveillance

Property/company and

management overview

Origination practices

Underwriting standards

Monitoring and collection

process

Quality control

Special Servicer

rating/strength

Trust structure

Cash flow allocation

Mechanics of credit

enhancement/protection

Stress tests

Rating

Term/Yield/Duration vs.

portfolio

Prepayment projections

Intex Platform

Monitor rating versus

performance

Identify underperforming

assets/transactions which could

lead to rating change

Projections on defaults

delinquencies, and recoveries

Projected cash flows and credit

support levels

Stress tests

Real Point

We actively track CMBS using a robust underwriting and surveillance process

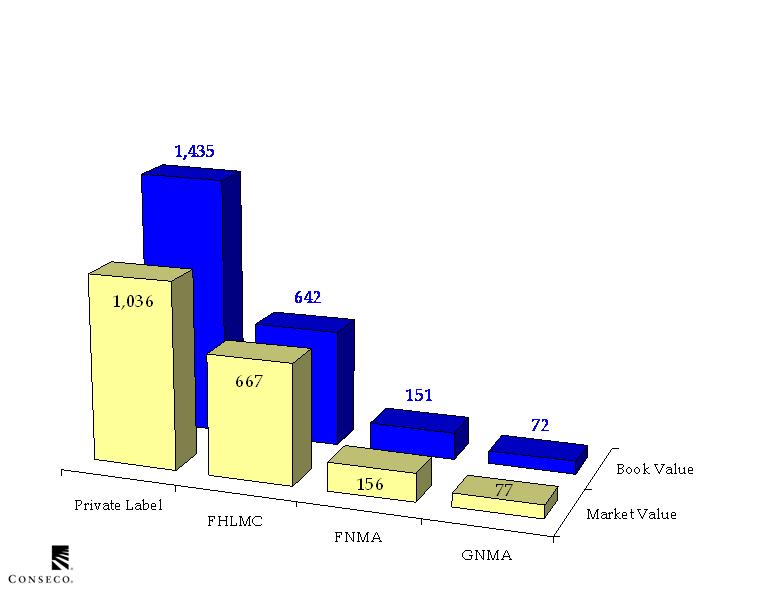

Our CMO investments (10.6% of the portfolio) are 80% AAA rated

and approximately 40% GSE guaranteed

As of 3/31/2009

$Millions

Asset Allocation - CMO

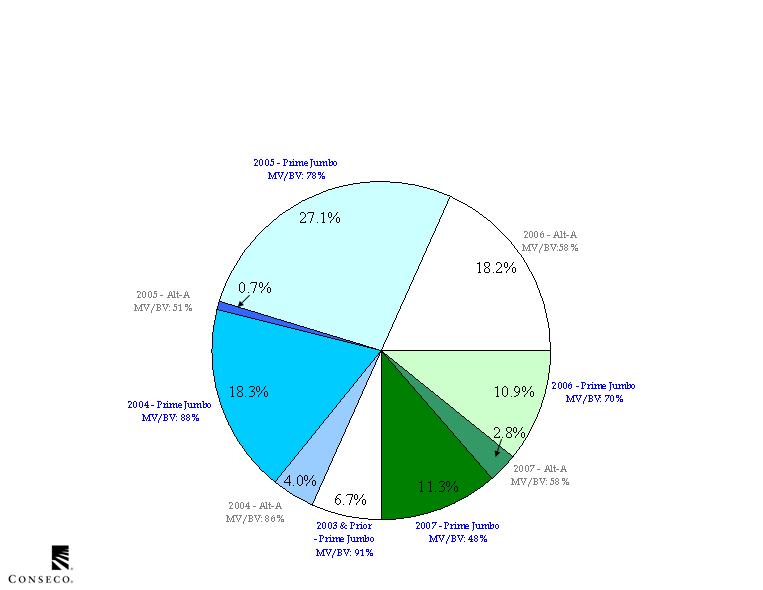

Our private label CMO investments (6.6% of the portfolio)

are 66% AAA rated and diversified by vintage

Asset Allocation - CMO

As of 3/31/2009

(Allocations based on book values)

As of 3/31/2009

$Millions

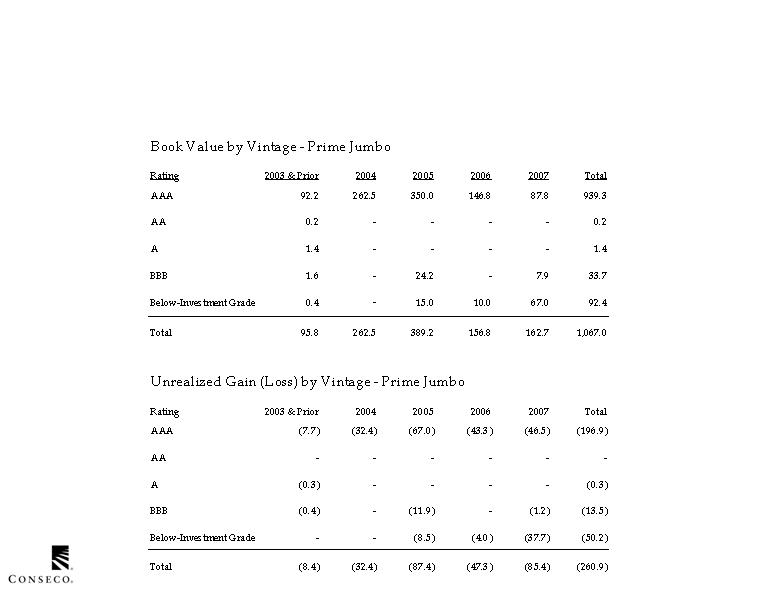

MBS collateralized by prime jumbo loans

comprise 74% of our private label CMO’s

Asset Allocation - CMO

As of 3/31/2009

$Millions

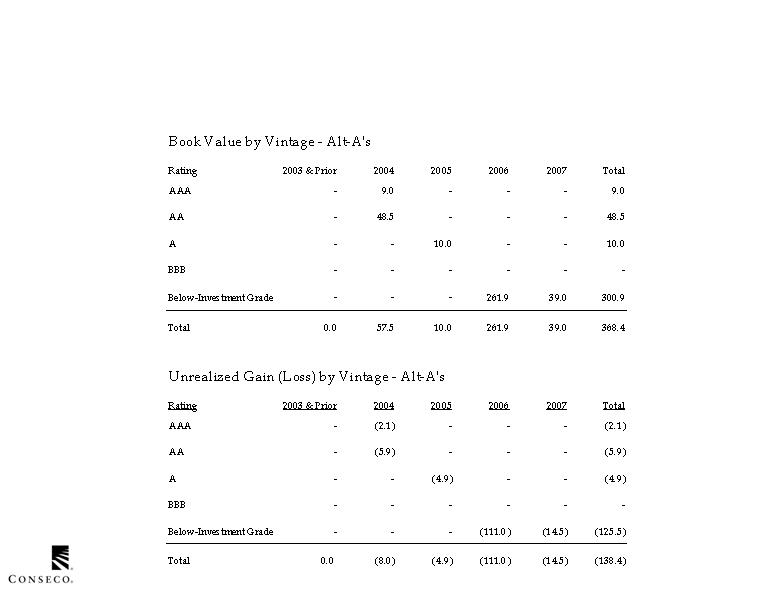

MBS collateralized by Alt-A mortgage loans

comprise 26% of our private label CMO’s

Asset Allocation - CMO

As of 3/31/2009

$Millions

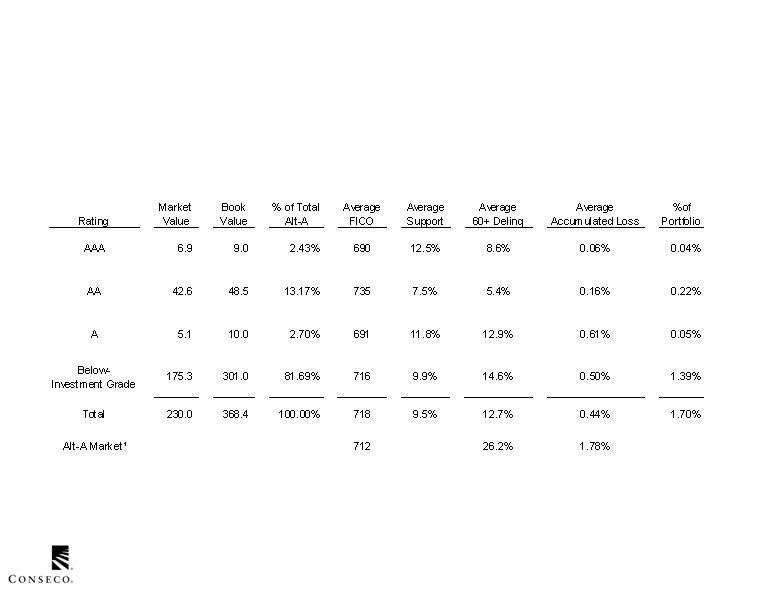

The following summaries the qualitative and credit support characteristics

of our Alt-A securities compared to the general Alt-A market

Asset Allocation - CMO

1.

Source: True Standings. Data as of March 31, 2009

Asset Allocation - CMO

Collateral

Loan-Level analysis

Debt-to-Income

Loan-to-Value

Occupancy type

Geographic distribution

Property value trends

Credit score

IO loans

Documentation

Historical performance

Loan Performance Platform

Sponsor

Structure

Surveillance

Origination practices

Underwriting practices

Servicer quality

Monitoring and collection

process

Quality control

Trust structure

Cash flow allocation

Mechanics of credit

enhancement/protection

Stepdowns

Rating

Intex Platform

Stochastics on defaults,

delinquencies, recoveries,

prepayments, and cash flows

Trends in credit support relative to

delinquencies and losses

Projected cash coverages

Principal payment windows

Projected collateral writedowns

Term/Yield/Duration vs. portfolio

Yield Book Platform

We have a robust analytical process for all residential mortgage securities

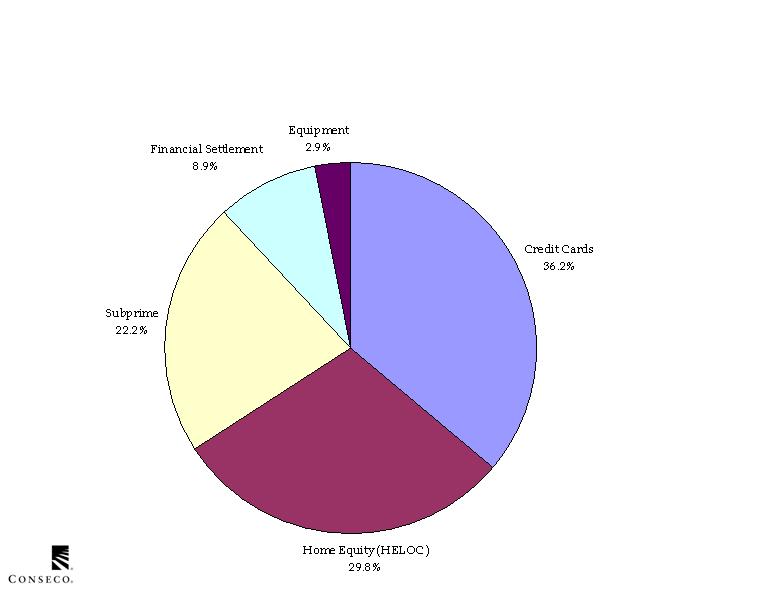

Our ABS allocation represents 1.6% of our portfolio

Asset Allocation - Asset Backed Securities

As of 3/31/2009

(Allocations based on book values)

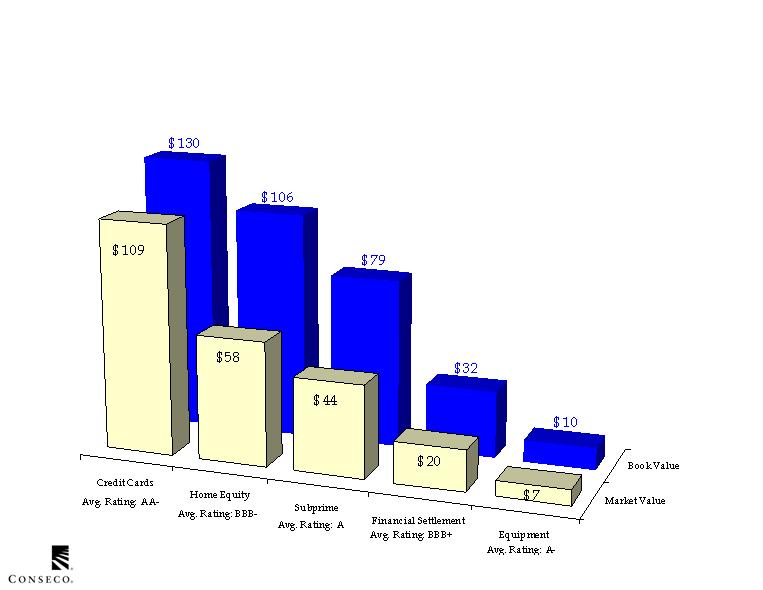

As of 3/31/2009

$Millions

Subprime and home equity valuations reflect the challenging market environment

Asset Allocation - Asset Backed Securities

As of 3/31/2009

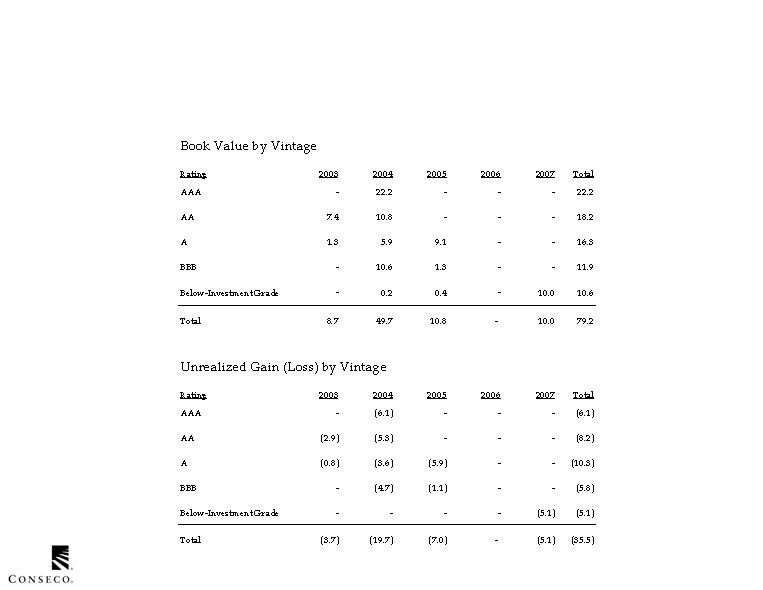

Subprime represents only 0.4% of our portfolio and

originates mostly in highly seasoned pre-2006 vintages

Asset Allocation - Asset Backed Securities

As of 3/31/2009

Asset Allocation - Asset Backed Securities

The following summarizes the credit support and other characteristics

of our Subprime Asset backed securities

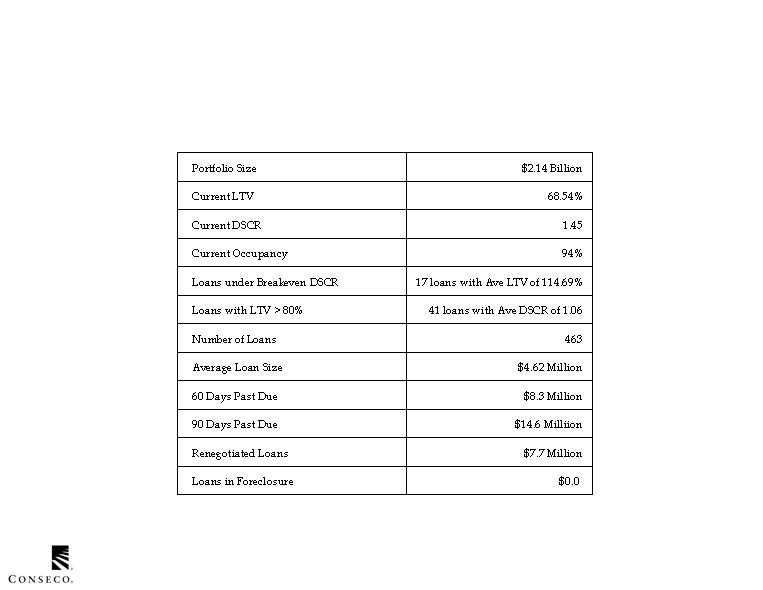

Asset Allocation - Commercial Mortgages

Commercial mortgage loans represent 9.9% of our portfolio

As of 3/31/2009

(Allocations based on book values)

South

Atlantic

21.4%

New

England

8.5%

East South

Central

5.2%

West South

Central

5.9%

Pacific

8.5%

Middle

Atlantic

6.8%

Mountain

10.0%

West North

Central

12.3%

East North

Central

21.4%

Our portfolio of commercial mortgage loans is geographically diversified

Asset Allocation - Commercial Mortgages

As of 3/31/2009

(Allocations based on book values)

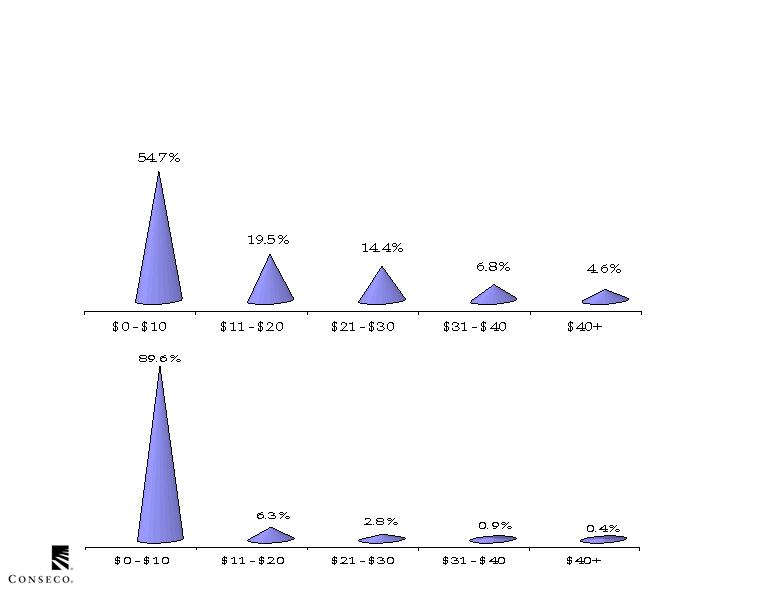

Loan Balance

Number of Loans

Our commercial mortgage portfolio tends toward a large number of

medium sized loans with few large exposures

Asset Allocation - Commercial Mortgages

As of 3/31/2009

(Allocations based on book values)

Characteristics of our commercial mortgage loans

Asset Allocation - Commercial Mortgages

As of 3/31/2009

(Dollar amounts are book values)

We take a proactive approach to controlling key investment risks

Risk Management

Measuring quantifiable risks using proven methodologies/market-consistent

values

Documented guidelines for risk policies and risk capacity

Monitoring and enforcing adherence to our risk policies

Extensive use of third parties to value invested assets - independent data

integrity function

Ongoing fundamental credit surveillance at individual credit level

Senior oversight of illiquid capital commitments

Dedicated hedging and asset liability management functions with clear

performance goals

Subprime allocation reflects

severe market discount and

high delinquencies in 2006

and 2007 vintages

HEL allocation reflects market

stresses

Risk Management

Overall mark-to-market and

credit migration consistent

with credit cycle

Pressure on financials

Highly rated, highly liquid

Pressure on ALT-A’s and

prime jumbos

Low, but rising delinquency

trends

Seasoned portfolio

Pricing pressure on BBB

exposure bears careful

surveillance

Increases in delinquencies

could result from slowing

economy

Active surveillance and

portfolio management

We are managing through the credit cycle by emphasizing

long-term assessments of value and quality

As of 3/31/2009

(Allocations based on book values)

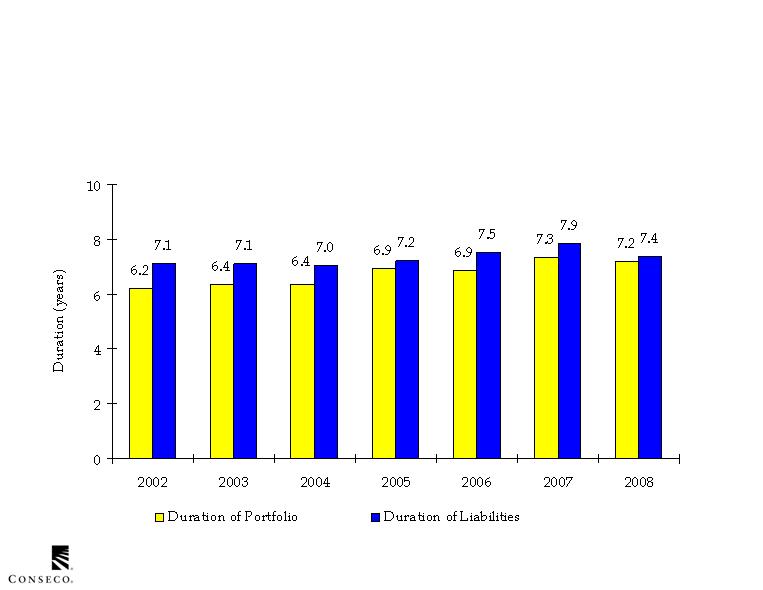

We continue to manage our asset portfolio to

align with our insurance liabilities

As of 12/31/2009

(In years)

Risk Management

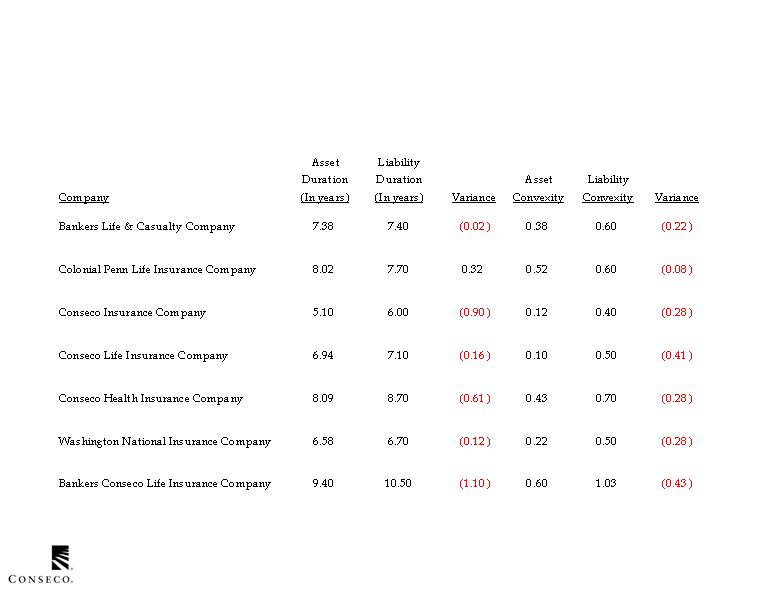

The following summarizes the duration of our assets and liabilities by legal entity

As of 3/31/09

Risk Management