CNO Financial (CNO) 8-KQuarterly Financial Supplement - 2Q09

Filed: 5 Aug 09, 12:00am

Quarterly Financial Supplement - 2Q09

Table of Contents

Page

Consolidated balance sheet

2

Consolidated statement of operations

3

Earnings per share analysis

4

Computation of weighted average shares outstanding

5

Analyses of income before taxes and selected data:

Bankers Life

6-7

Colonial Penn

8

Conseco Insurance Group

9-10

Premiums collected on insurance products:

Bankers Life

11

Colonial Penn

12

Conseco Insurance Group

13

Statutory information

14

Notes

15

Conseco, Inc.

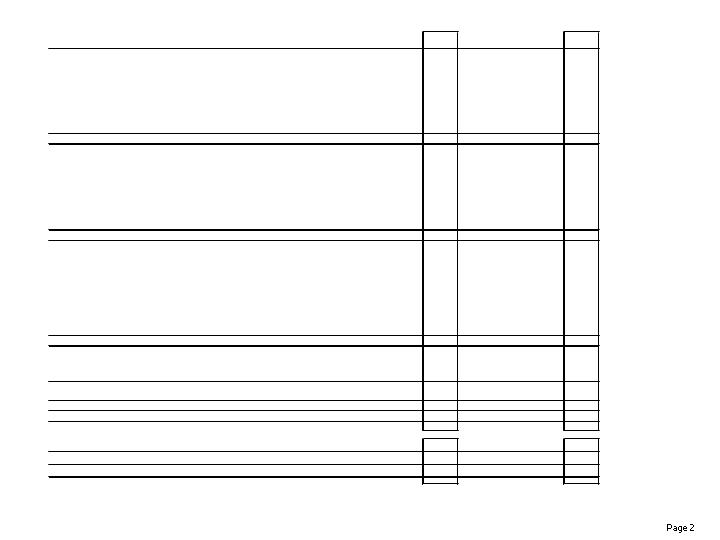

Consolidated balance sheet (in millions)

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Assets

Investments:

Actively managed fixed maturities at fair value

$17,531.1

$17,552.1

$16,641.7

$15,277.0

$15,396.8

$16,876.2

Equity securities at fair value

34.4

34.3

34.2

32.4

32.5

32.3

Mortgage loans

1,908.1

1,976.3

2,047.3

2,159.4

2,140.5

2,094.1

Policy loans

367.0

364.3

362.0

363.5

361.3

361.9

Trading securities

361.2

266.5

280.5

326.5

280.3

258.9

Securities lending collateral

387.7

295.9

282.0

393.7

243.9

259.9

Other invested assets

86.6

86.6

90.8

95.0

101.6

131.6

Total investments

20,676.1

20,576.0

19,738.5

18,647.5

18,556.9

20,014.9

Cash and cash equivalents - unrestricted

505.4

297.7

307.9

894.5

769.6

881.3

Cash and cash equivalents - restricted

36.5

21.5

12.0

4.8

4.5

3.7

Accrued investment income

304.4

288.4

306.7

298.7

312.5

302.9

Value of policies inforce at the Effective Date

1,529.5

1,492.8

1,493.7

1,477.8

1,425.5

1,335.1

Cost of policies produced

1,549.4

1,658.7

1,859.0

1,812.6

1,874.5

1,874.9

Reinsurance receivables

3,432.9

3,366.6

3,303.9

3,284.8

3,155.3

3,049.8

Income tax assets, net

1,732.0

1,532.9

1,772.8

2,047.7

2,068.6

1,607.3

Assets held in separate accounts

25.0

24.6

22.0

18.2

17.0

18.5

Other assets

337.1

329.7

326.1

276.7

322.9

345.1

Assets of discontinued operations

3,556.6

3,412.6

3,225.1

0.0

0.0

0.0

Total assets

33,684.9

33,001.5

32,367.7

28,763.3

28,507.3

29,433.5

Liabilities

Liabilities for insurance products:

Interest-sensitive products

13,119.5

13,105.0

13,175.6

13,332.8

13,215.3

13,124.1

Traditional products

9,638.0

9,713.9

9,841.3

9,828.7

9,864.3

9,913.4

Claims payable and other policyholder funds

926.1

953.2

873.1

1,008.4

987.8

972.4

Liabilities related to separate accounts

25.0

24.6

22.0

18.2

17.0

18.5

Other liabilities

531.6

478.1

422.8

457.4

506.5

715.9

Investment borrowings

848.3

824.2

823.9

767.5

758.3

747.6

Securities lending payable

394.0

300.2

290.7

408.8

256.4

267.3

Notes payable - direct corporate obligations

1,167.7

1,167.9

1,168.0

1,311.5

1,310.5

1,259.3

Liabilities of discontinued operations

3,080.0

3,038.7

3,034.0

0.0

0.0

0.0

Total liabilities

29,730.2

29,605.8

29,651.4

27,133.3

26,916.1

27,018.5

Shareholders' equity

Common stock

1.9

1.9

1.9

1.9

1.9

1.9

Additional paid-in capital

4,098.5

4,101.6

4,104.0

4,104.0

4,105.6

4,108.2

Retained earnings (accumulated deficit)

419.9

(68.6)

(251.9)

(705.2)

(675.8)

(648.2)

Total shareholders' equity before accumulated other comprehensive loss

4,520.3

4,034.9

3,854.0

3,400.7

3,431.7

3,461.9

Accumulated other comprehensive loss

(565.6)

(639.2)

(1,137.7)

(1,770.7)

(1,840.5)

(1,046.9)

Total shareholders' equity

3,954.7

3,395.7

2,716.3

1,630.0

1,591.2

2,415.0

Total liabilities and shareholders' equity

$33,684.9

$33,001.5

$32,367.7

$28,763.3

$28,507.3

$29,433.5

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

Book value per share at period-end (1) (2)

$24.48

$21.84

$20.86

$18.41

$18.57

$18.72

Book value per share assuming conversion of convertible securities (1) (3)

$24.48

$21.84

$20.86

$18.41

$18.57

$18.68

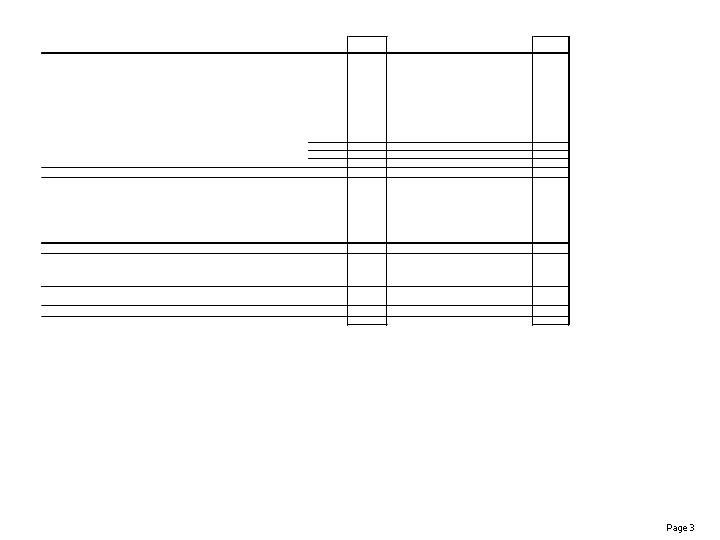

Conseco, Inc.

Consolidated statement of operations (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Revenues

Insurance policy income

$785.1

$830.0

$821.8

$816.7

$3,253.6

$782.8

$791.3

Net investment income (loss):

General account assets

310.0

311.9

312.8

319.8

1,254.5

308.6

308.0

Policyholder and reinsurer accounts and other special-purpose portfolios

(26.0)

(21.6)

(24.3)

(3.8)

(75.7)

(18.0)

9.5

Realized investment gains (losses):

Net realized investment gains (losses), excluding impairment losses

(4.3)

(4.5)

(43.2)

(48.1)

(100.1)

85.1

20.3

Other-than-temporary impairment losses:

Total other-than-temporary impairment losses

(41.3)

(26.0)

(50.1)

(44.9)

(162.3)

(108.1)

(53.7)

Other-than-temporary impairment losses recognized in other comprehensive loss

0.0

0.0

0.0

0.0

0.0

16.1

17.1

Net impairment losses recognized

(41.3)

(26.0)

(50.1)

(44.9)

(162.3)

(92.0)

(36.6)

Total realized gains (losses)

(45.6)

(30.5)

(93.3)

(93.0)

(262.4)

(6.9)

(16.3)

Fee revenue and other income

4.0

4.9

4.9

5.9

19.7

3.0

3.1

Total revenues

1,027.5

1,094.7

1,021.9

1,045.6

4,189.7

1,069.5

1,095.6

Benefits and expenses

Insurance policy benefits

767.7

815.9

797.0

831.9

3,212.5

753.5

781.1

Interest expense

30.8

25.1

24.6

26.0

106.5

23.2

32.7

Amortization

109.8

101.5

77.6

79.0

367.9

120.8

101.8

Gain on extinguishment of debt

0.0

0.0

0.0

(21.2)

(21.2)

0.0

0.0

Expenses related to debt modification

0.0

0.0

0.0

0.0

0.0

9.5

0.0

Other operating costs and expenses

131.1

136.1

117.0

136.1

520.3

120.3

130.4

Total benefits and expenses

1,039.4

1,078.6

1,016.2

1,051.8

4,186.0

1,027.3

1,046.0

Income (loss) before income taxes and discontinued operations

(11.9)

16.1

5.7

(6.2)

3.7

42.2

49.6

Income tax expense (benefit) on period income

(4.2)

8.3

1.6

3.7

9.4

15.3

17.4

Valuation allowance for deferred tax assets

0.0

298.0

30.0

75.9

403.9

2.4

4.6

Income (loss) before discontinued operations

(7.7)

(290.2)

(25.9)

(85.8)

(409.6)

24.5

27.6

Discontinued operations, net of income taxes

0.5

(198.3)

(157.4)

(367.5)

(722.7)

0.0

0.0

Net income (loss)

($7.2)

($488.5)

($183.3)

($453.3)

($1,132.3)

$24.5

$27.6

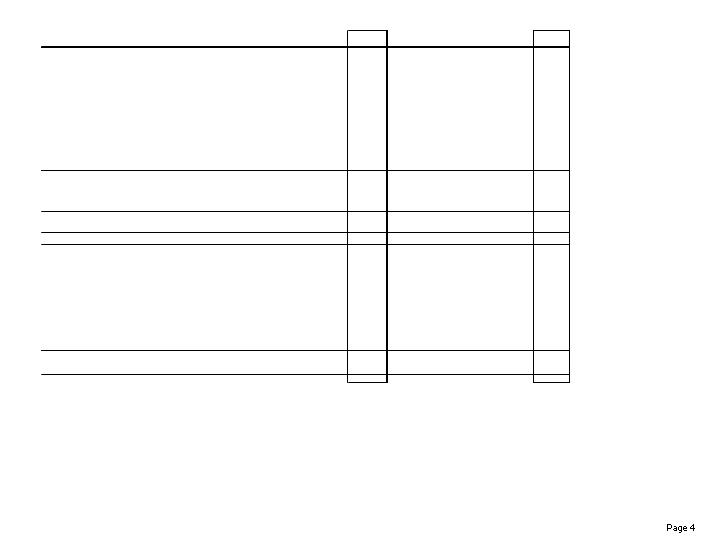

Conseco, Inc.

Earnings per share analysis ($ in millions, except per share amounts)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Income (loss) before net realized investment losses,

net of related amortization and income taxes:

Bankers Life

$29.1

$34.6

$67.8

$40.0

$171.5

$44.7

$63.3

Colonial Penn

3.7

8.3

6.5

6.7

25.2

5.1

11.0

Conseco Insurance Group

23.3

32.3

34.2

31.5

121.3

31.2

21.2

Corporate operations:

Interest expense on debt

(18.5)

(16.1)

(15.8)

(17.5)

(67.9)

(13.7)

(23.9)

Gain on extinguishment of debt

0.0

0.0

0.0

21.2

21.2

0.0

0.0

Expenses related to debt modification

0.0

0.0

0.0

0.0

0.0

(9.5)

0.0

Other corporate expenses, net

(6.7)

(16.2)

(3.7)

(0.1)

(26.7)

(8.7)

(8.8)

Net realized investment losses, net of related amortization

(42.8)

(26.8)

(83.3)

(88.0)

(240.9)

(6.9)

(13.2)

Income (loss) before taxes and discontinued operations

(11.9)

16.1

5.7

(6.2)

3.7

42.2

49.6

Taxes

(4.2)

8.3

1.6

3.7

9.4

15.3

17.4

Valuation allowance for deferred tax assets

0.0

298.0

30.0

75.9

403.9

2.4

4.6

Income (loss) before discontinued operations

(7.7)

(290.2)

(25.9)

(85.8)

(409.6)

24.5

27.6

Discontinued operations, net of income taxes

0.5

(198.3)

(157.4)

(367.5)

(722.7)

0.0

0.0

Net income (loss)

($7.2)

($488.5)

($183.3)

($453.3)

($1,132.3)

$24.5

$27.6

Diluted earnings (loss) per share

($0.04)

($2.65)

($0.99)

($2.45)

($6.13)

$0.13

$0.15

Net realized investment losses, net of related amortization and taxes, per share

($0.15)

($0.09)

($0.45)

($0.48)

($1.18)

($0.04)

($0.07)

Valuation allowance for deferred tax assets

$0.00

($1.61)

$0.00

($0.24)

($1.86)

$0.00

$0.00

Discontinued operations

$0.00

($1.08)

($0.85)

($1.99)

($3.91)

$0.00

$0.00

Diluted earnings (loss) per share, excluding net realized investment losses,

valuation allowance for deferred tax assets and discontinued operations

$0.11

$0.13

$0.31

$0.26

$0.82

$0.17

$0.22

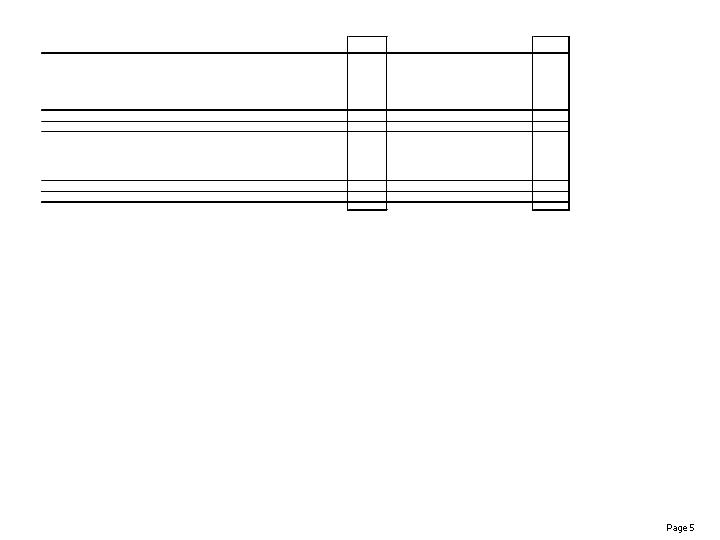

Conseco, Inc.

Computation of weighted average shares outstanding

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

(000s)

Basic

Shares outstanding, beginning of period

184,652.0

184,655.5

184,725.9

184,725.9

184,652.0

184,753.8

184,758.8

Weighted average shares issued during the period:

Shares issued under stock option and restricted stock plans

1.4

29.5

0.0

36.5

57.3

0.3

60.8

Shares withheld for the payment of the exercise price of stock options and taxes

(0.4)

(0.6)

0.0

(10.7)

(5.5)

0.0

0.0

Weighted average basic shares outstanding during the period

184,653.0

184,684.4

184,725.9

184,751.7

184,703.8

184,754.1

184,819.6

Basic shares outstanding, end of period

184,655.5

184,725.9

184,725.9

184,753.8

184,753.8

184,758.8

184,886.2

Diluted

Weighted average basic shares outstanding

184,653.0

184,684.4

184,725.9

184,751.7

184,703.8

184,754.1

184,819.6

Common stock equivalent shares related to:

Stock option and restricted stock plans

0.0

0.0

0.0

0.0

0.0

2.1

409.3

Weighted average diluted shares outstanding during the period

184,653.0

184,684.4

184,725.9

184,751.7

184,703.8

184,756.2

185,228.9

Diluted shares outstanding, end of period

184,681.2

184,792.3

184,761.1

184,755.7

184,755.7

184,760.9

185,295.5

Conseco, Inc.

Bankers Life

Analysis of income before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Insurance policy income

$497.0

$543.4

$537.7

$531.8

$2,109.9

$491.5

$497.6

Net investment income (loss):

General account invested assets

149.4

153.5

155.2

159.0

617.1

155.4

160.2

Equity-indexed products

(17.3)

(17.5)

(14.0)

(0.6)

(49.4)

(13.5)

(2.5)

Other special-purpose portfolios

(2.8)

(0.8)

(2.9)

(3.0)

(9.5)

0.3

5.9

Net realized investment losses

(19.3)

(12.1)

(48.4)

(36.9)

(116.7)

(1.9)

(14.9)

Fee revenue and other income

1.6

2.1

3.1

4.2

11.0

1.4

1.6

Total revenues

608.6

668.6

630.7

654.5

2,562.4

633.2

647.9

Insurance policy benefits

434.9

497.2

470.3

477.5

1,879.9

429.6

422.9

Amounts added to policyholder account balances:

Annuity products and interest-sensitive life products other than equity-indexed products

44.2

43.5

43.1

44.9

175.7

45.9

48.2

Equity-indexed products

0.6

(6.3)

3.1

37.4

34.8

(8.3)

16.0

Amortization related to operations

75.0

66.6

53.5

39.7

234.8

75.6

63.1

Amortization related to net realized investment losses

(2.5)

(1.9)

(8.0)

(3.4)

(15.8)

0.5

(1.6)

Other operating costs and expenses

44.1

45.1

41.3

51.9

182.4

47.6

49.3

Total benefits and expenses

596.3

644.2

603.3

648.0

2,491.8

590.9

597.9

Income before income taxes

$12.3

$24.4

$27.4

$6.5

$70.6

$42.3

$50.0

Supplemental health product underwriting margins (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Medicare supplement:

Earned premium

$161.4

$157.8

$159.9

$159.9

$639.0

$165.3

$165.6

Benefit ratio

64.6%

71.3%

72.5%

74.7%

70.8%

70.2%

68.6%

Underwriting margin (earned premium less policy benefits)

$57.1

$45.4

$43.9

$40.3

$186.7

$49.3

$52.0

PDP and PFFS:

Earned premium

$118.7

$171.5

$165.6

$153.7

$609.5

$122.6

$118.9

Benefit ratio

93.9%

94.0%

95.1%

100.8%

96.0%

94.4%

94.3%

Underwriting margin (earned premium less policy benefits)

$7.2

$10.2

$8.2

$(1.2)

$24.4

$6.9

$6.7

Long-term care:

Earned premium

$156.2

$156.3

$156.2

$155.6

$624.3

$150.7

$152.0

Benefit ratio before interest income on reserves

111.6%

114.7%

102.1%

102.2%

107.6%

105.1%

103.2%

Interest-adjusted benefit ratio

79.0%

81.4%

68.1%

67.4%

74.0%

68.6%

66.4%

Underwriting margin (earned premium plus interest income

on reserves less policy benefits)

$32.8

$29.1

$49.8

$50.7

$162.4

$47.3

$51.0

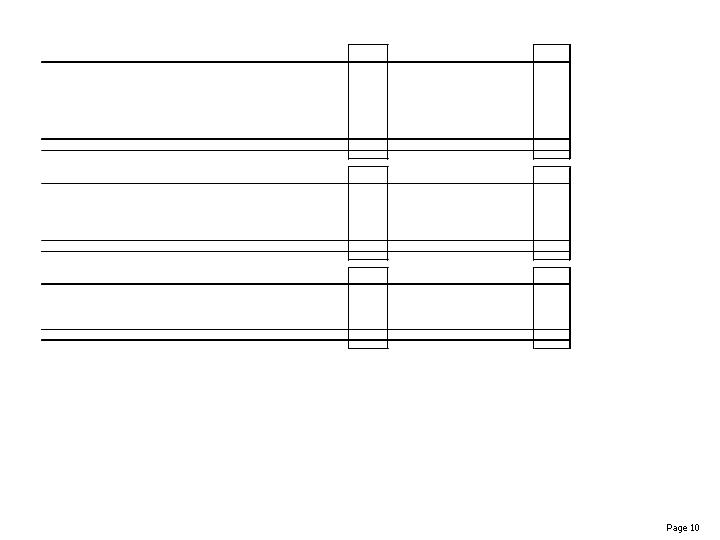

Conseco, Inc.

Bankers Life

Average liabilities for insurance products (in millions) (continued)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Annuities:

Mortality based

$250.3

$253.2

$254.2

$253.8

$252.9

$252.9

$250.7

Equity-indexed

1,043.6

1,147.1

1,255.8

1,365.7

1,203.0

1,426.4

1,464.4

Deposit based

4,445.9

4,419.8

4,442.8

4,548.8

4,464.3

4,678.2

4,754.7

Health

3,768.1

3,848.8

3,921.2

3,983.8

3,880.5

4,050.4

4,090.0

Life:

Interest sensitive

380.1

382.8

387.5

393.4

385.9

397.6

399.4

Non-interest sensitive

335.9

351.0

365.7

378.3

357.8

396.5

415.0

Total average liabilities for insurance products, net of reinsurance ceded

$10,223.9

$10,402.7

$10,627.2

$10,923.8

$10,544.4

$11,202.0

$11,374.2

Analysis of income before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Value of policies in force at the effective date

Balance, beginning of period

$781.6

$761.7

$745.3

$759.6

$781.6

$761.7

$727.6

Amortization related to operations

(36.2)

(29.4)

(16.7)

(19.3)

(101.6)

(31.8)

(26.7)

Amortization related to net realized investment (gains) losses

0.4

0.3

1.0

0.6

2.3

(0.1)

0.1

Adjustment related to unrealized (gain) or loss on actively

managed fixed maturities

15.9

12.7

30.0

20.8

79.4

(2.2)

(44.5)

Balance, end of period

$761.7

$745.3

$759.6

$761.7

$761.7

$727.6

$656.5

Cost of policies produced

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Balance, beginning of period

$941.6

$1,025.9

$1,103.9

$1,264.3

$941.6

$1,216.2

$1,259.8

Deferred acquisition expenses

80.5

74.8

85.7

65.2

306.2

76.7

72.4

Amortization related to operations

(38.8)

(37.2)

(36.8)

(20.4)

(133.2)

(43.8)

(36.4)

Amortization related to net realized investment (gains) losses

2.1

1.6

7.0

2.8

13.5

(0.4)

1.5

Adjustment related to unrealized (gain) or loss on actively

managed fixed maturities

40.5

38.8

104.5

(95.7)

88.1

11.1

(39.7)

Balance, end of period

$1,025.9

$1,103.9

$1,264.3

$1,216.2

$1,216.2

$1,259.8

$1,257.6

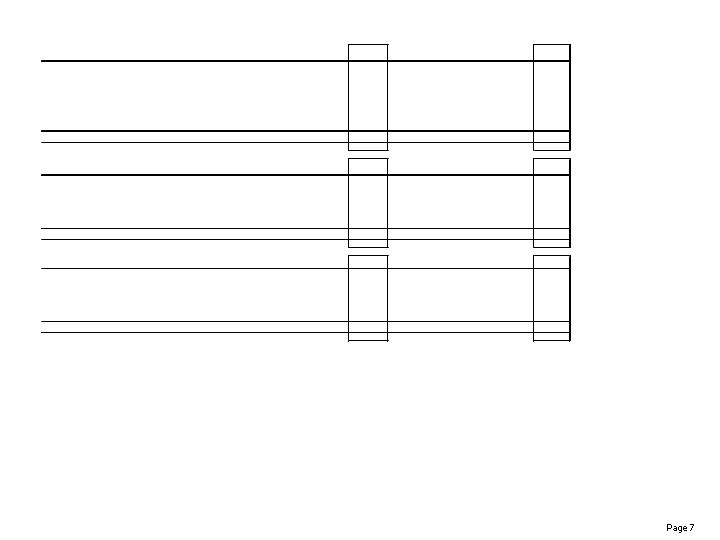

Conseco, Inc.

Colonial Penn

Analysis of income before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Insurance policy income

$44.4

$47.5

$46.4

$46.5

$184.8

$47.1

$52.7

Net investment income (loss):

General account invested assets

9.7

10.1

10.1

10.2

40.1

9.8

9.8

Trading account income related to reinsurer accounts

(0.5)

0.0

0.0

0.0

(0.5)

0.0

0.0

Net realized investment gains (losses)

(0.6)

0.7

(1.5)

(0.2)

(1.6)

0.1

1.1

Fee revenue and other income

0.3

0.5

0.5

0.5

1.8

0.2

0.2

Total revenues

53.3

58.8

55.5

57.0

224.6

57.2

63.8

Insurance policy benefits

35.0

35.5

33.9

33.8

138.2

36.1

36.0

Amounts added to annuity and interest-sensitive life product account balances

0.3

0.3

0.3

0.3

1.2

0.3

0.2

Amortization related to operations

7.4

7.4

9.2

8.0

32.0

8.4

8.0

Other operating costs and expenses

7.5

6.6

7.1

8.4

29.6

7.2

7.5

Total benefits and expenses

50.2

49.8

50.5

50.5

201.0

52.0

51.7

Income (loss) before income taxes

$3.1

$9.0

$5.0

$6.5

$23.6

$5.2

$12.1

Average liabilities for insurance products (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Annuities - mortality based

$87.2

$86.5

$85.6

$84.4

$85.9

$83.4

$82.1

Health

21.5

20.9

20.5

20.2

20.7

19.7

19.2

Life:

Interest sensitive

25.0

25.1

25.0

24.7

25.0

24.1

23.3

Non-interest sensitive

561.4

561.9

562.8

565.4

562.9

568.6

569.1

Total average liabilities for insurance products, net of reinsurance ceded

$695.1

$694.4

$693.9

$694.7

$694.5

$695.8

$693.7

Analysis of income before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Value of policies in force at the effective date

Balance, beginning of period

$119.4

$115.5

$112.1

$108.7

$119.4

$105.3

$101.6

Amortization related to operations

(3.9)

(3.4)

(3.4)

(3.4)

(14.1)

(3.7)

(3.2)

Balance, end of period

$115.5

$112.1

$108.7

$105.3

$105.3

$101.6

$98.4

Cost of policies produced

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Balance, beginning of period

$130.4

$147.8

$159.7

$169.8

$130.4

$174.8

$183.9

Deferred acquisition expenses

20.9

15.9

15.9

9.6

62.3

13.8

10.9

Amortization related to operations

(3.5)

(4.0)

(5.8)

(4.6)

(17.9)

(4.7)

(4.8)

Balance, end of period

$147.8

$159.7

$169.8

$174.8

$174.8

$183.9

$190.0

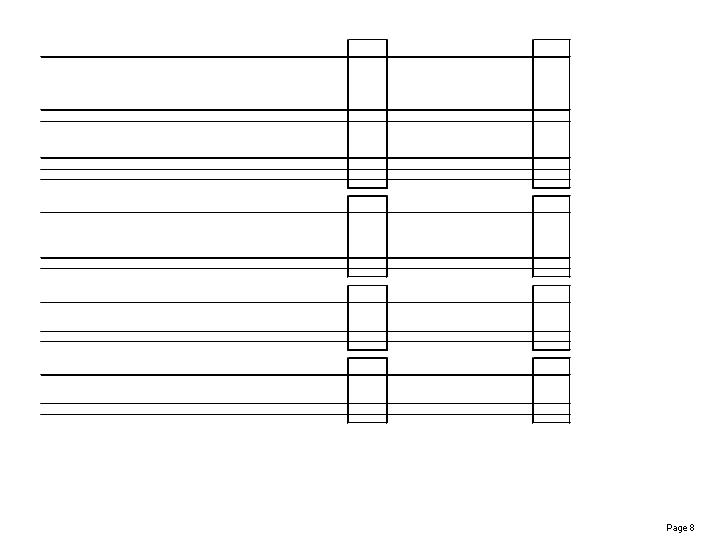

Conseco, Inc.

Conseco Insurance Group

Analysis of income (loss) before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Insurance policy income

$243.7

$239.1

$237.7

$238.4

$958.9

$244.2

$241.0

Net investment income (loss):

General account invested assets

149.4

147.3

146.4

149.6

592.7

143.4

138.5

Equity-indexed products

(10.5)

(10.0)

(6.8)

(1.1)

(28.4)

(7.0)

(0.4)

Trading account income related to policyholder and reinsurer accounts

(4.2)

(0.1)

(8.3)

(5.9)

(18.5)

(2.3)

5.7

Change in value of embedded derivatives related to modified coinsurance agreements

1.4

1.5

2.7

1.1

6.7

0.2

(2.7)

Net realized investment gains (losses)

(9.1)

(15.2)

(38.8)

(30.2)

(93.3)

2.7

(4.7)

Fee revenue and other income

0.8

0.5

0.1

0.3

1.7

0.7

0.4

Total revenues

371.5

363.1

333.0

352.2

1,419.8

381.9

377.8

Insurance policy benefits

209.1

208.6

203.6

199.6

820.9

214.1

215.1

Amounts added to policyholder account balances:

Annuity products and interest-sensitive life products other than equity-indexed products

40.5

37.9

38.4

36.8

153.6

36.0

35.8

Equity-indexed products

3.1

(0.8)

4.3

1.6

8.2

(0.2)

6.9

Amortization related to operations

30.2

31.2

24.9

36.3

122.6

36.8

33.8

Amortization related to net realized investment losses

(0.3)

(1.8)

(2.0)

(1.6)

(5.7)

(0.5)

(1.5)

Interest expense on investment borrowings

5.8

5.5

5.6

5.5

22.4

5.2

5.2

Other operating costs and expenses

68.6

63.6

60.8

71.1

264.1

56.1

64.5

Total benefits and expenses

357.0

344.2

335.6

349.3

1,386.1

347.5

359.8

Income (loss) before income taxes

$14.5

$18.9

($2.6)

$2.9

$33.7

$34.4

$18.0

Supplemental health product underwriting margins (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Medicare supplement:

Earned premium

$53.7

$51.2

$50.3

$49.2

$204.4

$47.3

$45.9

Benefit ratio

65.8%

71.9%

73.0%

62.8%

68.4%

67.3%

71.2%

Underwriting margin (earned premium less policy benefits)

$18.4

$14.3

$13.6

$18.3

$64.6

$15.4

$13.2

Specified disease:

Earned premium

$92.0

$92.0

$92.4

$94.0

$370.4

$93.8

$94.7

Benefit ratio before interest income on reserves

81.7%

80.4%

82.6%

63.8%

77.1%

76.0%

83.3%

Interest-adjusted benefit ratio

48.1%

46.7%

48.5%

30.1%

43.3%

42.2%

49.7%

Underwriting margin (earned premium plus interest income

on reserves less policy benefits)

$47.7

$49.1

$47.6

$65.8

$210.2

$54.2

$47.7

Long-term care:

Earned premium

$8.8

$8.7

$8.6

$8.5

$34.6

$8.3

$8.1

Benefit ratio before interest income on reserves

136.4%

133.8%

193.5%

216.9%

169.6%

210.1%

182.2%

Interest-adjusted benefit ratio

66.4%

57.0%

115.2%

137.4%

93.5%

132.0%

103.1%

Underwriting margin (earned premium plus interest income

on reserves less policy benefits)

$3.0

$3.7

$(1.3)

$(3.2)

$2.2

$(2.7)

$(0.2)

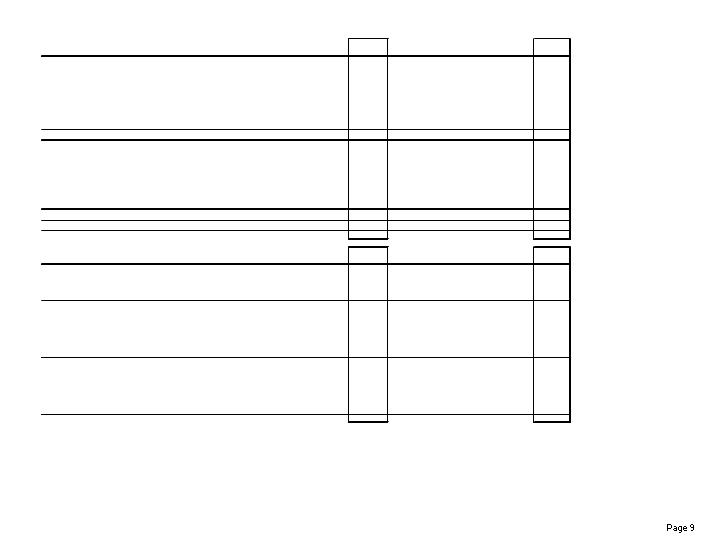

Conseco, Inc.

Conseco Insurance Group

Average liabilities for insurance products (in millions) (continued)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Annuities:

Mortality based

$223.5

$221.1

$219.8

$218.3

$220.7

$217.2

$215.8

Equity-indexed

889.9

895.9

893.9

884.4

891.0

836.5

773.6

Deposit based

788.4

767.5

741.3

713.0

752.6

688.8

669.6

Separate accounts

26.2

24.8

23.3

20.1

23.6

17.6

17.7

Health

2,978.0

2,989.6

3,000.4

3,004.5

2,993.1

2,991.9

3,003.5

Life:

Interest sensitive

2,963.0

2,954.3

2,937.5

2,927.2

2,945.5

2,906.2

2,860.8

Non-interest sensitive

1,420.7

1,402.7

1,381.8

1,369.8

1,393.8

1,360.2

1,344.9

Total average liabilities for insurance products, net of reinsurance ceded

$9,289.7

$9,255.9

$9,198.0

$9,137.3

$9,220.3

$9,018.4

$8,885.9

Analysis of income (loss) before taxes (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Value of policies in force at the effective date

Balance, beginning of period

$672.6

$652.3

$635.4

$625.4

$672.6

$610.8

$596.3

Amortization related to operations

(22.7)

(19.6)

(15.1)

(16.8)

(74.2)

(15.4)

(10.8)

Amortization related to net realized investment (gains) losses

(0.1)

0.1

0.1

0.2

0.3

(0.8)

0.4

Adjustment related to unrealized (gain) or loss on actively managed fixed maturities

2.5

2.6

5.0

3.2

13.3

1.7

(5.7)

Other

0.0

0.0

0.0

(1.2)

(1.2)

0.0

0.0

Balance, end of period

$652.3

$635.4

$625.4

$610.8

$610.8

$596.3

$580.2

Cost of policies produced

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Balance, beginning of period

$351.0

$375.7

$395.1

$424.9

$351.0

$421.6

$430.8

Deferred acquisition expenses

21.9

21.1

20.4

27.2

90.6

15.3

15.9

Amortization related to operations

(7.5)

(11.6)

(9.8)

(19.5)

(48.4)

(21.4)

(23.0)

Amortization related to net realized investment (gains) losses

0.4

1.7

1.9

1.4

5.4

1.3

1.1

Adjustment related to unrealized (gain) or loss on actively managed fixed maturities

9.9

8.2

17.3

(12.4)

23.0

14.0

2.5

Balance, end of period

$375.7

$395.1

$424.9

$421.6

$421.6

$430.8

$427.3

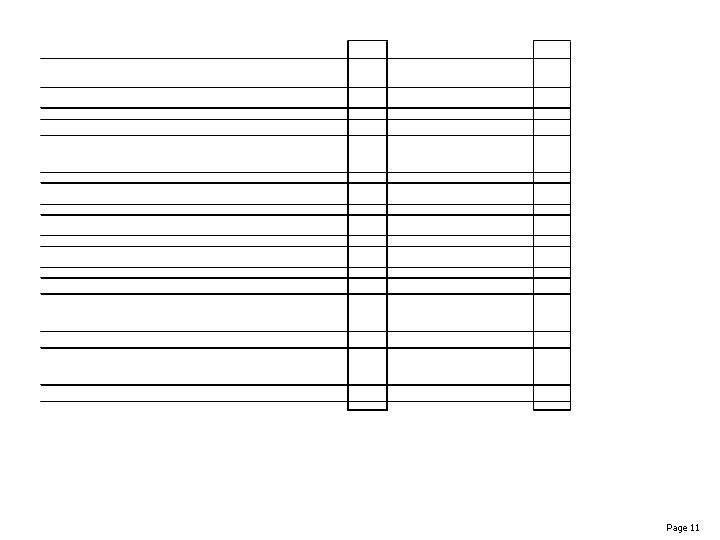

Conseco, Inc.

Bankers Life

Premiums collected on insurance products (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Annuities

Equity-indexed (first-year)

$132.3

$132.8

$150.1

$107.6

$522.8

$73.1

$90.8

Other fixed (first-year)

95.3

127.3

172.3

302.9

697.8

228.0

183.9

Other fixed (renewal)

1.1

1.0

0.7

0.7

3.5

1.0

0.7

Subtotal - other fixed annuities

96.4

128.3

173.0

303.6

701.3

229.0

184.6

Total annuities

228.7

261.1

323.1

411.2

1,224.1

302.1

275.4

Supplemental health

Medicare supplement (first-year)

19.1

19.4

19.8

23.0

81.3

19.7

21.1

Medicare supplement (renewal)

140.8

131.2

134.0

149.3

555.3

136.1

134.1

Subtotal - Medicare supplement

159.9

150.6

153.8

172.3

636.6

155.8

155.2

Long-term care (first-year)

11.0

10.6

10.8

10.3

42.7

4.2

4.7

Long-term care (renewal)

145.6

144.6

144.0

148.8

583.0

141.7

147.2

Subtotal - long-term care

156.6

155.2

154.8

159.1

625.7

145.9

151.9

PDP and PFFS (first-year)

70.4

116.1

86.2

80.6

353.3

16.2

22.2

PDP and PFFS (renewal)

46.0

46.3

81.2

87.2

260.7

103.0

89.7

Subtotal - PDP and PFFS

116.4

162.4

167.4

167.8

614.0

119.2

111.9

Other health (first-year)

0.4

0.5

0.6

0.6

2.1

0.6

0.7

Other health (renewal)

2.2

2.1

2.1

2.2

8.6

2.3

2.3

Subtotal - other health

2.6

2.6

2.7

2.8

10.7

2.9

3.0

Total supplemental health

435.5

470.8

478.7

502.0

1,887.0

423.8

422.0

Life insurance

First-year

18.5

22.5

19.5

20.2

80.7

16.8

19.4

Renewal

29.5

31.3

32.4

35.5

128.7

32.1

35.9

Total life insurance

48.0

53.8

51.9

55.7

209.4

48.9

55.3

Collections on insurance products

Total first-year premium collections on insurance products

347.0

429.2

459.3

545.2

1,780.7

358.6

342.8

Total renewal premium collections on insurance products

365.2

356.5

394.4

423.7

1,539.8

416.2

409.9

Total collections on insurance products

$712.2

$785.7

$853.7

$968.9

$3,320.5

$774.8

$752.7

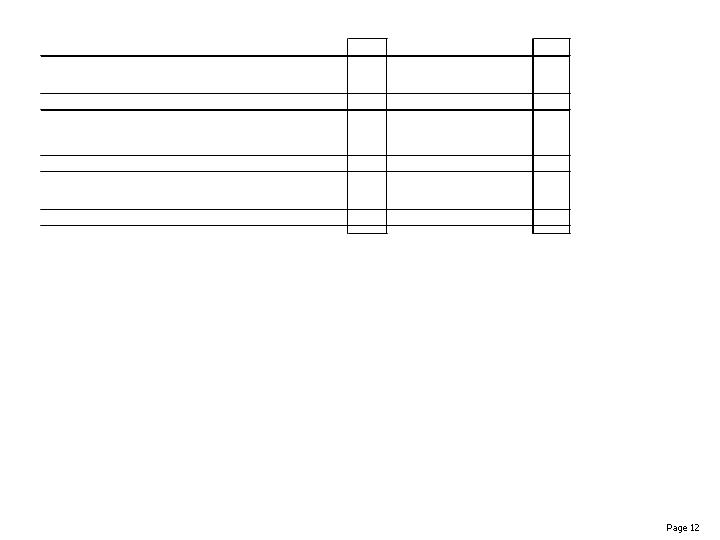

Conseco, Inc.

Colonial Penn

Premiums collected on insurance products (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Life insurance

First-year

$8.4

$8.9

$8.8

$8.9

$35.0

$9.2

$8.4

Renewal

34.5

34.9

34.8

34.9

139.1

37.8

37.4

Total life insurance

42.9

43.8

43.6

43.8

174.1

47.0

45.8

Supplemental health (all of which are renewal premiums)

Medicare supplement

2.1

2.1

2.0

1.9

8.1

1.7

1.9

Other health

0.2

0.2

0.2

0.2

0.8

0.2

0.2

Total supplemental health

2.3

2.3

2.2

2.1

8.9

1.9

2.1

Collections on insurance products

Total first-year premium collections on insurance products

8.4

8.9

8.8

8.9

35.0

9.2

8.4

Total renewal premium collections on insurance products

36.8

37.2

37.0

37.0

148.0

39.7

39.5

Total collections on insurance products

$45.2

$46.1

$45.8

$45.9

$183.0

$48.9

$47.9

Conseco, Inc.

Conseco Insurance Group

Premiums collected on insurance products (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09

Annuities

Equity-indexed (first-year)

$38.2

$33.4

$23.7

$20.8

$116.1

$17.7

$20.5

Equity-indexed (renewal)

1.8

2.1

1.8

1.9

7.6

1.4

1.4

Subtotal - equity-indexed annuities

40.0

35.5

25.5

22.7

123.7

19.1

21.9

Other fixed (first-year)

1.0

1.0

1.4

0.4

3.8

0.1

0.1

Other fixed (renewal)

0.6

0.6

0.5

0.6

2.3

0.3

0.3

Subtotal - other fixed annuities

1.6

1.6

1.9

1.0

6.1

0.4

0.4

Total annuities

41.6

37.1

27.4

23.7

129.8

19.5

22.3

Supplemental health

Medicare supplement (first-year)

2.8

2.3

2.1

2.4

9.6

1.5

1.9

Medicare supplement (renewal)

50.3

47.3

46.4

50.2

194.2

41.3

42.5

Subtotal - Medicare supplement

53.1

49.6

48.5

52.6

203.8

42.8

44.4

Specified disease (first-year)

9.4

9.8

9.7

10.5

39.4

10.2

11.1

Specified disease (renewal)

84.8

82.7

82.6

85.1

335.2

82.8

84.0

Subtotal - specified disease

94.2

92.5

92.3

95.6

374.6

93.0

95.1

Long-term care (all of which are renewal)

8.8

8.8

8.1

8.0

33.7

8.4

8.0

Other health (first-year)

0.0

0.0

0.1

0.0

0.1

0.0

0.0

Other health (renewal)

2.4

2.3

2.5

2.4

9.6

2.0

1.8

Subtotal - other health

2.4

2.3

2.6

2.4

9.7

2.0

1.8

Total supplemental health

158.5

153.2

151.5

158.6

621.8

146.2

149.3

Life insurance

First-year

0.7

1.2

2.0

0.4

4.3

0.5

0.5

Renewal

71.2

65.7

65.8

62.8

265.5

63.9

61.9

Total life insurance

71.9

66.9

67.8

63.2

269.8

64.4

62.4

Collections on insurance products

Total first-year premium collections on insurance products

52.1

47.7

39.0

34.5

173.3

30.0

34.1

Total renewal premium collections on insurance products

219.9

209.5

207.7

211.0

848.1

200.1

199.9

Total collections on insurance products

$272.0

$257.2

$246.7

$245.5

$1,021.4

$230.1

$234.0

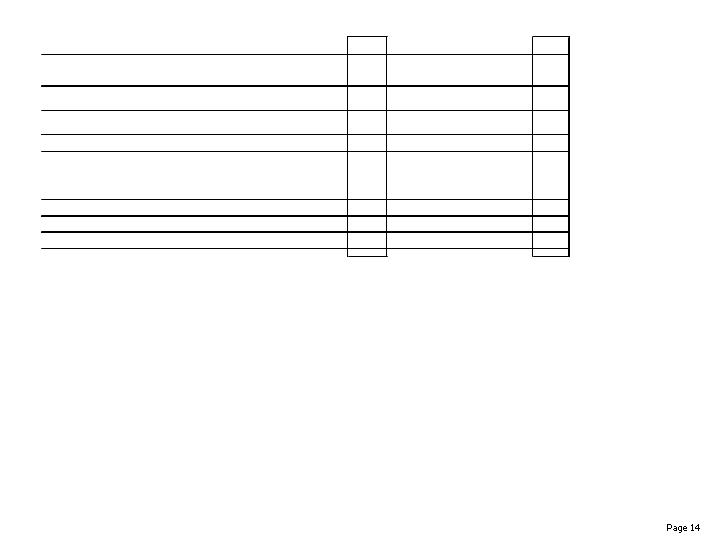

Conseco, Inc.

Statutory information - consolidated basis (4) (in millions)

1Q08

2Q08

3Q08

4Q08

2008

1Q09

2Q09 (*)

Net gain (loss) from operations before interest expense

and federal income taxes

$12.8

$20.8

$69.8

$60.0

$163.4

$53.1

$84.0

Interest expense on surplus debentures held by parent company

16.3

12.4

12.8

14.9

56.4

10.1

9.7

Net gain (loss) from operations before federal income taxes

(3.5)

8.4

57.0

45.1

107.0

43.0

74.3

Federal income tax expense (benefit)

(1.3)

1.4

(0.2)

(13.1)

(13.2)

(0.7)

0.1

Net gain (loss) from operations before net realized capital gains (losses)

(2.2)

7.0

57.2

58.2

120.2

43.7

74.2

Net realized capital losses

(7.2)

(21.1)

(87.5)

(101.3)

(217.1)

(69.0)

(80.2)

Net loss

($9.4)

($14.1)

($30.3)

($43.1)

($96.9)

($25.3)

($6.0)

Capital and surplus

$1,326.6

$1,310.2

$1,330.8

$1,311.5

$1,311.5

$1,268.1

$1,254.0

Asset valuation reserve (AVR)

162.2

155.7

99.3

55.0

55.0

32.9

24.9

Capital, surplus and AVR

1,488.8

1,465.9

1,430.1

1,366.5

1,366.5

1,301.0

1,278.9

Interest maintenance reserve (IMR)

208.5

194.9

179.1

147.7

147.7

215.8

274.0

Total statutory capital, surplus, AVR & IMR

$1,697.3

$1,660.8

$1,609.2

$1,514.2

$1,514.2

$1,516.8

$1,552.9

* Such amounts are preliminary as the statutory basis financials statements of our insurance subsidiaries for 2Q09 will be filed with the respective insurance

regulators on or about August 14, 2009.

Notes

(3) Assumes conversion of all convertible securities.

(4) Based on statutory accounting practices prescribed or permitted by regulatory authorities for Conseco's insurance subsidiaries after appropriate elimination of

intercompany accounts among such subsidiaries. Such accounting practices differ from GAAP.

(1) Excludes accumulated other comprehensive loss.

(2) Shareholders' equity (excluding preferred stock) divided by common shares outstanding.