UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[ X ] Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2010 or

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _________ to _________

Commission file number: 001-31792

CNO Financial Group, Inc.

| Delaware | | 75-3108137 |

| State of Incorporation | | IRS Employer Identification No. |

| | | |

| 11825 N. Pennsylvania Street | | |

| Carmel, Indiana 46032 | | (317) 817-6100 |

| Address of principal executive offices | | Telephone |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of Each Exchange on which Registered |

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

| Rights to purchase Series A Junior Participating Preferred Stock | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ X ] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [ X ]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer [ X ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ] No [ X ]

At June 30, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the Registrant’s common equity held by nonaffiliates was approximately $1,225 million.

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

Shares of common stock outstanding as of February 11, 2011: 251,084,174

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Registrant’s definitive proxy statement for the 2011 annual meeting of shareholders are incorporated by reference into Part III of this report.

| TABLE OF CONTENTS |

| | | |

| | | Page |

| PART I | | |

| | | |

| Item 1. | Business of CNO | 3 |

| | | |

| Item 1A. | Risk Factors | 24 |

| | | |

| Item 1B. | Unresolved Staff Comments | 42 |

| | | |

| Item 2. | Properties | 42 |

| | | |

| Item 3. | Legal Proceedings | 42 |

| | | |

| | Executive Officers of the Registrant | 43 |

| | | |

| PART II | | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 44 |

| | | |

| Item 6. | Selected Consolidated Financial Data | 47 |

| | | |

| Item 7. | Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations | 48 |

| | | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 117 |

| | | |

| Item 8. | Consolidated Financial Statements and Supplementary Data | 117 |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 202 |

| | | |

| Item 9A. | Controls and Procedures | 202 |

| | | |

| Item 9B. | Other Information | 203 |

| | | |

| PART III | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 203 |

| | | |

| Item 11. | Executive Compensation | 203 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 203 |

| | | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 204 |

| | | |

| Item 14. | Principal Accountant Fees and Services | 204 |

| | | |

| PART IV | | |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules | 204 |

PART I

ITEM 1. BUSINESS OF CNO.

CNO Financial Group, Inc., a Delaware corporation (“CNO”), (formerly known as Conseco, Inc. prior to its name change in May 2010) is a holding company for a group of insurance companies operating throughout the United States that develop, market and administer health insurance, annuity, individual life insurance and other insurance products. CNO became the successor to Conseco, Inc., an Indiana corporation (our “Predecessor”), in connection with our bankruptcy reorganization which became effective on September 10, 2003 (the “Effective Date”). The terms “CNO Financial Group, Inc.”, the “Company”, “we”, “us”, and “our” as used in this report refer to CNO and its subsidiaries or, when the context requires otherwise, our Predecessor and its subsidiaries. Such terms, when used to describe insurance business and products, refer to the insurance business and products of CNO’s insurance subsidiaries.

We focus on serving the senior and middle-income markets, which we believe are attractive, underserved, high growth markets. We sell our products through three distribution channels: career agents, independent producers (some of whom sell one or more of our product lines exclusively) and direct marketing. As of December 31, 2010, we had shareholders’ equity of $4.3 billion and assets of $31.9 billion. For the year ended December 31, 2010, we had revenues of $4.1 billion and net income of $284.6 million. See our consolidated financial statements and accompanying footnotes for additional financial information about the Company and its segments.

Beginning July 1, 2010, management changed the manner in which it disaggregates the Company’s operations for making operating decisions and assessing performance. As a result, the Company manages its business through the following operating segments: Bankers Life, Washington National and Colonial Penn, which are defined on the basis of product distribution; Other CNO Business, comprised primarily of products we no longer sell actively; and corporate operations, comprised of holding company activities and certain noninsurance company businesses. Our segments are described below.

| | • | Bankers Life, which markets and distributes Medicare supplement insurance, interest-sensitive life insurance, traditional life insurance, fixed annuities and long-term care insurance products to the middle-income senior market through a dedicated field force of career agents and sales managers supported by a network of community-based branch offices. The Bankers Life segment includes primarily the business of Bankers Life and Casualty Company (“Bankers Life”). Bankers Life also markets and distributes Medicare Advantage plans primarily through a distribution arrangement with Humana, Inc. (“Humana”) and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry Health Care (“Coventry”). |

| | • | Washington National, which markets and distributes supplemental health (including specified disease, accident and hospital indemnity insurance products) and life insurance to middle-income consumers at home and at the worksite. These products are marketed through Performance Matters Associates, Inc. (“PMA”), a wholly owned subsidiary, and through independent marketing organizations and insurance agencies, including worksite marketing. The products being marketed are underwritten by Washington National Insurance Company (“Washington National”). |

| | • | Colonial Penn, which markets primarily graded benefit and simplified issue life insurance directly to customers through television advertising, direct mail, the internet and telemarketing. The Colonial Penn segment includes primarily the business of Colonial Penn Life Insurance Company (“Colonial Penn”). |

| | • | Other CNO Business, which consists of blocks of interest-sensitive life insurance, traditional life insurance, annuities, long-term care insurance and other supplemental health products. These blocks of business are not being actively marketed and were primarily issued or acquired by Conseco Life Insurance Company (“Conseco Life”) and Washington National. |

On November 12, 2008, CNO and CDOC, Inc. (“CDOC”), a wholly owned subsidiary of CNO, completed the transfer (the “Transfer”) of the stock of Senior Health Insurance Company of Pennsylvania (“Senior Health”) to Senior Health Care Oversight Trust, an independent trust (the “Independent Trust”) for the exclusive benefit of Senior Health’s long-term care policyholders. The Transfer was approved by the Pennsylvania Insurance Department.

In connection with the Transfer, the Company entered into a $125.0 million Senior Note due November 12, 2013 (the “Senior Health Note”), payable to Senior Health. The note has a five-year maturity date; a 6 percent interest rate; and requires annual principal payments of $25.0 million. As of December 31, 2010, the principal amount outstanding under the

Senior Health Note was $75.0 million. As a condition of the order from the Pennsylvania Insurance Department approving the Transfer, CNO agreed that it would not pay cash dividends on its common stock while any portion of the $125.0 million note remained outstanding.

OUR STRATEGIC DIRECTION

Our mission is to be a premier provider of life insurance, supplemental health products and annuities to America’s middle-income consumers with a focus on seniors, while providing value to our shareholders. We believe we can accomplish this mission through the effective execution of the following strategies:

| | • | Remain Focused on the Needs of Our Senior and Middle Income Market Customers. We define our business by our target markets and not by our products. We continue to adapt our distribution, product offerings and product features to the evolving needs of our middle income and senior customers. We provide a broad range of middle market products to meet the protection needs of our customers and to provide them with longevity solutions. We are able to reach our customers through our career agents and independent agent relationships, directly, through our Colonial Penn direct distribution platform, and at work, through our worksite marketing channel. |

| | • | Expand and Improve the Efficiency of our Distribution Channels. The continued development and maintenance of our distribution channels is critical to our continued sales growth. We dedicate substantial resources to the recruitment, development and retention of our Bankers Life career agents and seek to maximize their productivity by providing them with high quality leads for new business opportunities. In addition, investments in both our direct distribution platform, Colonial Penn and in PMA, have enabled us to achieve significant sales growth since 2004. |

| | • | Seek Profitable Growth. We continue to pursue profitable growth opportunities in the middle income market. We focus on marketing and selling products that meet the needs of our customers, and we believe it will enable us to provide long-term value for our shareholders. As part of this strategy, we have eliminated or de-emphasized products with return characteristics that we consider to be inadequate. |

| | • | Pursue Operational Efficiencies and Cost Reduction Opportunities. We seek to strengthen our competitive position with a focus on cost control and enhanced operational efficiency. Our efforts include: |

| | • | improvements to our policy administration processes and procedures to reduce costs and improve customer service; |

| | • | continued consolidation of policy processing systems, including conversions and elimination of systems; |

| | • | streamlining administrative procedures and consolidating processes across the enterprise to reduce costs; and |

| | • | eliminating expenses associated with the marketing of those products that do not meet our return objectives. |

| | • | Continue to Manage and Where Possible Reduce the Risk Profile of Our Business . We actively manage the risks associated with our business and have taken several steps to reduce the risk profile of our business. In the fourth quarter of 2007, we completed a transaction to coinsure 100 percent of a block of inforce fixed index annuity and fixed annuity business sold through independent distribution. Such business was largely out of the surrender charge periods and had policyholder and other reserves of $2.8 billion. This transaction significantly reduced the asset and liability risks associated with this business. In the fourth quarter of 2008, we transferred the stock of Senior Health to the Independent Trust, eliminating our exposure to a substantial block of long-term care business previously included in our run-off segment. In 2009, we began coinsuring a significant portion of the new long-term care business written through our Bankers Life segment. These transactions have reduced our exposure to long-term care business that has led to volatile earnings in the past. |

We have purposefully avoided products like variable life and variable annuity contracts that we believe would expose us to risks that are not commensurate with potential profits. We plan to continue to emphasize products that are straightforward and have a lower risk profile. We believe such products meet various needs of the middle income markets we serve.

We will continue to manage the investment risks associated with our insurance business by:

• maintaining a largely investment-grade, diversified fixed-income portfolio;

| | • | maximizing the spread between the investment income we earn and the yields we pay on investment products within acceptable levels of risk; and |

| | • | continually tailoring our investment portfolio to consider expected liability durations, cash flows and other requirements. |

We believe that our focus on middle-income families and seniors will position us favorably to capitalize on the future growth in these markets.

OTHER INFORMATION

Our Predecessor was organized in 1979 as an Indiana corporation and commenced operations in 1982. Our executive offices are located at 11825 N. Pennsylvania Street, Carmel, Indiana 46032, and our telephone number is (317) 817-6100. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act are available free of charge on our website at www.CNOinc.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). These filings are also available on the SEC’s website at www.sec.gov. In addition, the public may read and copy any document we file at the SEC’s Public Reference Room located at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Copies of these filings are also available, without charge, from CNO Investor Relations, 11825 N. Pennsylvania Street, Carmel, IN 46032.

Our website also includes the charters of our Audit and Enterprise Risk Committee, Executive Committee, Governance and Strategy Committee, Human Resources and Compensation Committee and Investment Committee, as well as our Corporate Governance Operating Principles and our Code of Business Conduct and Ethics that applies to all officers, directors and employees. Copies of these documents are available free of charge on our website at www.CNOinc.com or from CNO Investor Relations at the address shown above. Within the time period specified by the SEC and the New York Stock Exchange, we will post on our website any amendment to our Code of Business Conduct and Ethics and any waiver applicable to our principal executive officer, principal financial officer or principal accounting officer.

In May 2010, we filed with the New York Stock Exchange the Annual CEO Certification regarding the Company’s compliance with their Corporate Governance listing standards as required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual. In addition, we have filed as exhibits to this 2010 Form 10-K the applicable certifications of the Company’s Chief Executive Officer and Chief Financial Officer required under Section 302 of the Sarbanes-Oxley Act of 2002 regarding the Company’s public disclosures.

Data in Item 1 are provided as of or for the year ended December 31, 2010 (as the context implies), unless otherwise indicated.

MARKETING AND DISTRIBUTION

Insurance

Our insurance subsidiaries develop, market and administer health insurance, annuity, individual life insurance and other insurance products. We sell these products through three primary distribution channels: career agents, independent producers (some of whom sell one or more of our product lines exclusively) and direct marketing. We had premium collections of $3.6 billion, $4.1 billion and $4.5 billion in 2010, 2009 and 2008, respectively.

Our insurance subsidiaries collectively hold licenses to market our insurance products in all fifty states, the District of Columbia, and certain protectorates of the United States. Sales to residents of the following states accounted for at least five percent of our 2010 collected premiums: Florida (7.8 percent), California (7.2 percent), Texas (6.1 percent) and Pennsylvania (6.1 percent).

We believe that most purchases of life insurance, accident and health insurance and annuity products occur only after individuals are contacted and solicited by an insurance agent. Accordingly, the success of our distribution system is largely dependent on our ability to attract and retain experienced and highly motivated agents. A description of our primary distribution channels is as follows:

Career Agents. This agency force of over 5,100 agents and sales managers working from 145 branch offices establishes one-on-one contact with potential policyholders and promotes strong personal relationships with existing policyholders. The career agents sell primarily supplemental health and long-term care insurance policies, life insurance and annuities. In 2010, this distribution channel accounted for $2,575.2 million, or 72 percent, of our total collected premiums. These agents sell Bankers Life policies, as well as Medicare Advantage plans primarily through a distribution arrangement with Humana and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry, and typically visit the prospe ctive policyholder’s home to conduct personalized “kitchen-table” sales presentations. After the sale of an insurance policy, the agent serves as a contact person for policyholder questions, claims assistance and additional insurance needs.

Independent Producers. Independent producers are a diverse network of independent agents, insurance brokers and marketing organizations. The general agency and insurance brokerage distribution system is comprised of independent licensed agents doing business in all fifty states, the District of Columbia, and certain protectorates of the United States. In 2010, this distribution channel collected $820.8 million, or 23 percent, of our total premiums.

Marketing organizations typically recruit agents by advertising our products and commission structure through direct mail advertising or through seminars for agents and brokers. These organizations bear most of the costs incurred in marketing our products. We compensate the marketing organizations by paying them a percentage of the commissions earned on new sales generated by agents recruited by such organizations. Certain of these marketing organizations are specialty organizations that have a marketing expertise or a distribution system related to a particular product or market, such as worksite and individual health products. During 1999 and 2000, we purchased three organizations that specialize in marketing and distributing health products and combined them under the name PMA. In 2010, the PMA distribution channel accounted for $228.8 million, or 6 percent, of our total collected premiums.

Direct Marketing. This distribution channel is engaged primarily in the sale of graded benefit life insurance policies through Colonial Penn. In 2010, this channel accounted for $194.1 million, or 5 percent, of our total collected premiums.

Products

The following table summarizes premium collections by major category and segment for the years ended December 31, 2010, 2009 and 2008 (dollars in millions):

Total premium collections

| | | 2010 | | | 2009 | | | 2008 | |

| Health: | | | | | | | | | |

| Bankers Life | | $ | 1,360.1 | | | $ | 1,711.7 | | | $ | 1,887.0 | |

| Washington National | | | 564.9 | | | | 566.3 | | | | 584.9 | |

| Colonial Penn | | | 6.4 | | | | 7.5 | | | | 8.9 | |

| Other CNO Business | | | 31.7 | | | | 34.1 | | | | 36.9 | |

| | | | | | | | | | | | | |

| Total health | | | 1,963.1 | | | | 2,319.6 | | | | 2,517.7 | |

| | | | | | | | | | | | | |

| Annuities: | | | | | | | | | | | | |

| Bankers Life | | | 1,005.5 | | | | 1,060.4 | | | | 1,224.1 | |

| Other CNO Business | | | 16.4 | | | | 78.4 | | | | 129.8 | |

| | | | | | | | | | | | | |

| Total annuities | | | 1,021.9 | | | | 1,138.8 | | | | 1,353.9 | |

| | | | | | | | | | | | | |

| Life: | | | | | | | | | | | | |

| Bankers Life | | | 209.6 | | | | 228.8 | | | | 209.4 | |

| Washington National | | | 16.2 | | | | 30.1 | | | | 35.7 | |

| Colonial Penn | | | 187.7 | | | | 187.3 | | | | 174.1 | |

| Other CNO Business | | | 191.6 | | | | 210.2 | | | | 234.1 | |

| | | | | | | | | | | | | |

| Total life | | | 605.1 | | | | 656.4 | | | | 653.3 | |

| | | | | | | | | | | | | |

| Total premium collections | | $ | 3,590.1 | | | $ | 4,114.8 | | | $ | 4,524.9 | |

| | | | | | | | | | | | | |

In addition, the long-term care business included in our discontinued operations had collected premiums of $225.9 million in 2008.

Our insurance companies collected premiums from the following products:

Health

Health Premium Collections (dollars in millions)

| | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | |

| Medicare supplement: | | | | | | | | | |

| Bankers Life | | $ | 697.8 | | | $ | 653.7 | | | $ | 636.6 | |

| Washington National | | | 154.8 | | | | 177.8 | | | | 203.8 | |

| Colonial Penn | | | 6.0 | | | | 7.0 | | | | 8.1 | |

| | | | | | | | | | | | | |

| Total | | | 858.6 | | | | 838.5 | | | | 848.5 | |

| | | | | | | | | | | | | |

| Long-term care: | | | | | | | | | | | | |

| Bankers Life | | | 584.6 | | | | 601.6 | | | | 625.7 | |

| Other CNO Business | | | 29.2 | | | | 31.4 | | | | 33.7 | |

| | | | | | | | | | | | | |

| Total | | | 613.8 | | | | 633.0 | | | | 659.4 | |

| | | | | | | | | | | | | |

| Prescription Drug Plan and Medicare Advantage products included in Bankers Life | | | 66.4 | | | | 444.4 | | | | 614.0 | |

| | | | | | | | | | | | | |

| Health products included in Washington National | | | 405.5 | | | | 383.3 | | | | 374.6 | |

| | | | | | | | | | | | | |

| Other: | | | | | | | | | | | | |

| Bankers Life | | | 11.3 | | | | 12.0 | | | | 10.7 | |

| Washington National | | | 4.6 | | | | 5.2 | | | | 6.5 | |

| Colonial Penn | | | .4 | | | | .5 | | | | .8 | |

| Other CNO Business | | | 2.5 | | | | 2.7 | | | | 3.2 | |

| | | | | | | | | | | | | |

| Total | | | 18.8 | | | | 20.4 | | | | 21.2 | |

| | | | | | | | | | | | | |

| Total health premium collections | | $ | 1,963.1 | | | $ | 2,319.6 | | | $ | 2,517.7 | |

The following describes our major supplemental health products:

Medicare Supplement. Medicare supplement collected premiums were $858.6 million during 2010 or 24 percent of our total collected premiums. Medicare is a federal health insurance program for disabled persons and seniors (age 65 and older). Part A of the program provides protection against the costs of hospitalization and related hospital and skilled nursing facility care, subject to an initial deductible, related coinsurance amounts and specified maximum benefit levels. The deductible and coinsurance amounts are subject to change each year by the federal government. Part B of Medicare covers doctor’s bills and a number of other medical costs not covered by Part A, subject to deductible and coinsurance am ounts for charges approved by Medicare. The deductible amount is subject to change each year by the federal government.

Medicare supplement policies provide coverage for many of the hospital and medical expenses which the Medicare program does not cover, such as deductibles, coinsurance costs (in which the insured and Medicare share the costs of medical expenses) and specified losses which exceed the federal program’s maximum benefits. Our Medicare supplement plans automatically adjust coverage to reflect changes in Medicare benefits. In marketing these products, we currently concentrate on individuals who have recently become eligible for Medicare by reaching the age of 65. Approximately 42 percent of new sales of Medicare supplement policies in 2010 were to individuals who had recently reached the age of 65.

Both Bankers Life and Washington National sell Medicare supplement insurance.

Long-Term Care. Long-term care collected premiums were $613.8 million during 2010, or 17 percent of our total collected premiums. Long-term care products provide coverage, within prescribed limits, for nursing homes, home

healthcare, or a combination of both. We sell the long-term care plans primarily to retirees and, to a lesser degree, to older self-employed individuals in the middle-income market.

Current nursing home care policies cover incurred charges up to a daily fixed-dollar limit with an elimination period (which, similar to a deductible, requires the insured to pay for a certain number of days of nursing home care before the insurance coverage begins), subject to a maximum benefit. Home healthcare policies cover incurred charges after a deductible or elimination period and are subject to a weekly or monthly maximum dollar amount, and an overall benefit maximum. Comprehensive policies cover both nursing home care and home healthcare. We monitor the loss experience on our long-term care products and, when necessary, apply for rate increases in the jurisdictions in which we sell such products. Regulatory filings are made before we increase our premiums on these products.

A small portion of our long-term care business resides in the Other CNO Business segment. This business was sold through independent producers and was largely underwritten by certain of our subsidiaries prior to their acquisitions by our Predecessor in 1996 and 1997. The performance of these blocks of business did not meet the expectations we had when the blocks were acquired. As a result, we ceased selling new long-term care policies through independent distribution in 2003.

We continue to sell long-term care insurance through the Bankers Life career agent distribution channel. This business is underwritten using stricter underwriting and pricing standards than had previously been used on our acquired blocks of long-term care business included in the Other CNO Business segment.

Prescription Drug Plan and Medicare Advantage. The Medicare Prescription Drug, Improvement and Modernization Act of 2003 provided for the introduction of a prescription drug program under Medicare Part D. Persons eligible for Medicare can receive their Part D coverage through a stand-alone Prescription Drug Plan (“PDP”). In order to offer a PDP product to our current and potential future policyholders without investment in management and infrastructure, we entered into a national distribution agreement with Coventry to use our career and independent agents to distribute Coventry’s PDP product, Advantra Rx. We receive a fee based on the number of PDP plans sold through our distribution channels. &# 160;In addition, CNO has a quota-share reinsurance agreement with Coventry for CNO enrollees that provides CNO with a specified percentage of net premiums and related profits subject to a risk corridor. The Part D program was effective January 1, 2006. PDP collected premiums were $65.3 million during 2010 or 2 percent of our total collected premiums.

CNO expanded its strategic alliance with Coventry by entering into national distribution agreements under which our career agents began distributing Coventry’s Private-Fee-For-Service (“PFFS”) plan, with coverage beginning January 1, 2007. Under the agreement, we received a fee based on the number of PFFS plans sold through our distribution channels. In addition, CNO had a quota-share reinsurance agreement with Coventry for CNO enrollees that provided CNO with a specified percentage of the net premiums and related profits. Coventry decided to cease selling PFFS plans effective January 1, 2010. On July 22, 2009, Bankers Life announced a strategic alliance under which it offers Humana’s Medicare Advantage plans to its policyholders and consumers nationwide throug h its career agency force and receives marketing fees based on sales. Effective January 1, 2010, the Company no longer assumes the underwriting risk related to PFFS business.

Supplemental Health Products. Supplemental health collected premiums were $405.5 million during 2010, or 11 percent of our total collected premiums. These policies generally provide fixed or limited benefits. Cancer insurance and heart/stroke products are guaranteed renewable individual accident and health insurance policies. Payments under cancer insurance policies are generally made directly to, or at the direction of, the policyholder following diagnosis of, or treatment for, a covered type of cancer. Heart/stroke policies provide for payments directly to the policyholder for treatment of a covered heart disease, heart attack or stroke. Accident products combine insurance for accidental death wi th limited benefit disability income insurance. Hospital indemnity products provide a fixed dollar amount per day of confinement in a hospital. The benefits provided under the supplemental health policies do not necessarily reflect the actual cost incurred by the insured as a result of the illness, or accident, and benefits are not reduced by any other medical insurance payments made to or on behalf of the insured.

Approximately 75 percent of the total number of our supplemental health policies inforce was sold with return of premium or cash value riders. The return of premium rider generally provides that, after a policy has been inforce for a specified number of years or upon the policyholder reaching a specified age, we will pay to the policyholder, or in some cases, a beneficiary under the policy, the aggregate amount of all premiums paid under the policy, without interest, less the aggregate amount of all claims incurred under the policy. For some policies, the return of premium rider does not have any claim offset. The cash value rider is similar to the return of premium rider, but also provides for payment of a graded portion of the return of premium benefit if the policy terminates before the return of premi um benefit is earned.

Other Health Products. Other supplemental health product collected premiums were $18.8 million during 2010. This category includes various other health products such as major medical health insurance, senior hospital indemnity and disability income products which are sold in small amounts or other products which are no longer actively marketed.

Annuities

Annuity premium collections (dollars in millions)

| | | 2010 | | | 2009 | | | 2008 | |

| Fixed index annuity: | | | | | | | | | |

Bankers Life | | $ | 577.7 | | | $ | 350.1 | | | $ | 522.8 | |

Other CNO Business | | | 14.9 | | | | 76.6 | | | | 123.7 | |

| | | | | | | | | | | | | |

| Total fixed index annuity premium collections | | | 592.6 | | | | 426.7 | | | | 646.5 | |

| | | | | | | | | | | | | |

| Other fixed annuity: | | | | | | | | | | | | |

Bankers Life | | | 427.8 | | | | 710.3 | | | | 701.3 | |

Other CNO Business | | | 1.5 | | | | 1.8 | | | | 6.1 | |

| | | | | | | | | | | | | |

Total fixed annuity premium collections | | | 429.3 | | | | 712.1 | | | | 707.4 | |

| | | | | | | | | | | | | |

Total annuity premium collections | | $ | 1,021.9 | | | $ | 1,138.8 | | | $ | 1,353.9 | |

During 2010, we collected annuity premiums of $1,021.9 million or 28 percent of our total premiums collected. Annuity products include fixed index annuity, traditional fixed rate annuity and single premium immediate annuity products sold through both Bankers Life and Other CNO Business. Annuities offer a tax-deferred means of accumulating savings for retirement needs, and provide a tax-efficient source of income in the payout period. Our major source of income from fixed rate annuities is the spread between the investment income earned on the underlying general account assets and the interest credited to contractholders’ accounts. For fixed index annuities, our major source of income is the spread between the investment income earned on the underlying general account assets and the cost o f the index options purchased to provide index-based credits to the contractholders’ accounts.

The change in mix of premium collections between Bankers Life’s fixed index products and fixed annuity products has fluctuated due to volatility in the financial markets in recent periods. In addition, premium collections from Bankers Life’s fixed annuity products decreased in 2010 as low new money interest rates negatively impacted our sales and the overall sales in the fixed annuity market.

The following describes the major annuity products:

Fixed Index Annuities. These products accounted for $592.6 million, or 16 percent, of our total premium collections during 2010. The account value (or “accumulation value”) of these annuities is credited in an amount that is based on changes in a particular index during a specified period of time. Within each contract issued, each fixed index annuity specifies:

| | • | The time period during which the change in the index is measured. At the end of the time period, the change in the index is applied to the account value. The time period of the contract ranges from 1 to 4 years. |

| | • | The method used to measure the change in the index. |

| | • | The measured change in the index is multiplied by a “participation rate” (percentage of change in the index) before the credit is applied. Some policies guarantee the initial participation rate for the life of the contract, and some vary the rate for each period. |

| | • | The measured change in the index may also be limited to a “cap” before the credit is applied. Some policies guarantee the initial cap for the life of the contract, and some vary the cap for each period. |

| | • | The measured change in the index may also be limited to the excess in the measured change over a “margin” before the credit is applied. Some policies guarantee the initial margin for the life of the contract, and some vary the margin for each period. |

These products have guaranteed minimum cash surrender values, regardless of actual index performance and the resulting indexed-based interest credits applied.

We generally buy call options and similar investments on the applicable indices in an effort to hedge potential increases to policyholder benefits resulting from increases in the indices to which the product’s return is linked.

Other Fixed Rate Annuities. These products include fixed rate single-premium deferred annuities (“SPDAs”), flexible premium deferred annuities (“FPDAs”) and single-premium immediate annuities (“SPIAs”). These products accounted for $429.3 million, or 12 percent, of our total premium collections during 2010. Our fixed rate SPDAs and FPDAs typically have an interest rate (the “crediting rate”) that is guaranteed by the Company for the first policy year, after which we have the discretionary ability to change the crediting rate to any rate not below a guaranteed minimum rate. The guaranteed rates on annuities written recently range from 1.5 percent to 3.0 percent, and the rat es, on all policies inforce range from 1.5 percent to 6.0 percent. The initial crediting rate is largely a function of:

• the interest rate we can earn on invested assets acquired with the new annuity fund deposits;

• the costs related to marketing and maintaining the annuity products; and

• the rates offered on similar products by our competitors.

For subsequent adjustments to crediting rates, we take into account current and prospective yields on investments, annuity surrender assumptions, competitive industry pricing and the crediting rate history for particular groups of annuity policies with similar characteristics.

In 2010, a significant portion of our new annuity sales have been “bonus interest” products. The initial crediting rate on these products specifies a bonus crediting rate of 1.0 to 3.0 percent of the annuity deposit for the first policy year only. After the first year, the bonus interest portion of the initial crediting rate is automatically discontinued, and the renewal crediting rate is established. As of December 31, 2010, the average crediting rate, excluding bonuses, on our outstanding traditional annuities was 3.6 percent.

Withdrawals from deferred annuities are generally subject to a surrender charge of 3 percent to 19 percent in the first year, declining to zero over a 5 to 12 year period, depending on issue age and product. Surrender charges are set at levels intended to protect the Company from loss on early terminations and to reduce the likelihood that policyholders will terminate their policies during periods of increasing interest rates. This practice is intended to lengthen the duration of policy liabilities and to enable us to maintain profitability on such policies.

Penalty-free withdrawals from deferred annuities of up to 10 percent of either premiums or account value are available in most plans after the first year of the annuity’s term.

Some deferred annuity products apply a market value adjustment during the surrender charge period. This adjustment is determined by a formula specified in the annuity contract, and may increase or decrease the cash surrender value depending on changes in the amount and direction of market interest rates or credited interest rates at the time of withdrawal. The resulting cash surrender values will be at least equal to the guaranteed minimum values.

SPIAs accounted for $12.0 million, or .3 percent, of our total premiums collected in 2010. SPIAs are designed to provide a series of periodic payments for a fixed period of time or for life, according to the policyholder’s choice at the time of issuance. Once the payments begin, the amount, frequency and length of time over which they are payable are fixed. SPIAs often are purchased by persons at or near retirement age who desire a steady stream of payments over a future period of years. The single premium is often the payout from a deferred annuity contract. The implicit interest rate on SPIAs is based on market conditions when the policy is issued. The implicit interest rate on our outstanding SPIAs averaged 7.0 percent at December 31, 2010.

Life Insurance

Life insurance premium collections (dollars in millions)

| | | 2010 | | | 2009 | | | 2008 | |

| Interest-sensitive life products: | | | | | | | | | |

| Bankers Life | | $ | 65.5 | | | $ | 63.2 | | | $ | 63.7 | |

| Colonial Penn | | | .5 | | | | .5 | | | | .5 | |

| Other CNO Business | | | 162.7 | | | | 180.6 | | | | 202.5 | |

| | | | | | | | | | | | | |

| Total interest-sensitive life premium collections | | | 228.7 | | | | 244.3 | | | | 266.7 | |

| | | | | | | | | | | | | |

| Traditional life: | | | | | | | | | | | | |

| Bankers Life | | | 144.1 | | | | 165.6 | | | | 145.7 | |

| Washington National | | | 16.4 | | | | 30.1 | | | | 35.7 | |

| Colonial Penn | | | 187.2 | | | | 186.8 | | | | 173.6 | |

| Other CNO Business | | | 28.7 | | | | 29.6 | | | | 31.6 | |

| | | | | | | | | | | | | |

| Total traditional life premium collections | | | 376.4 | | | | 412.1 | | | | 386.6 | |

| | | | | | | | | | | | | |

| Total life insurance premium collections | | $ | 605.1 | | | $ | 656.4 | | | $ | 653.3 | |

Life products include traditional and interest-sensitive life insurance products. These products are currently sold through the Bankers Life, Washington National and Colonial Penn segments. During 2010, we collected life insurance premiums of $605.1 million, or 17 percent, of our total collected premiums. Sales of life products are affected by the financial strength ratings assigned to our insurance subsidiaries by independent rating agencies. See “—Competition” below.

Interest-Sensitive Life Products. These products include universal life and other interest-sensitive life products that provide life insurance with adjustable rates of return related to current interest rates. They accounted for $228.7 million, or 6.4 percent, of our total collected premiums in 2010. These products are marketed by independent producers and, to a lesser extent, career agents (including independent producers and career agents specializing in worksite sales). The principal differences between universal life products and other interest-sensitive life products are policy provisions affecting the amount and timing of premium payments. Universal life policyholders may vary the frequency and size of their premium payments, and policy benefits may also fluctuate according to such payments. Premium payments under other interest-sensitive policies may not be varied by the policyholders. Universal life products include fixed index universal life products. The account value of these policies is credited with interest at a guaranteed rate, plus additional interest credits based on changes in a particular stock index during a specified time period.

Traditional Life. These products accounted for $376.4 million, or 10 percent, of our total collected premiums in 2010. Traditional life policies, including whole life, graded benefit life, term life and single premium whole life products, are marketed through independent producers, career agents and direct response marketing. Under whole life policies, the policyholder generally pays a level premium over an agreed period or the policyholder’s lifetime. The annual premium in a whole life policy is generally higher than the premium for comparable term insurance coverage in the early years of the policy’s life, but is generally lower than the premium for comparable term insurance coverage in the later years of the policy& #8217;s life. These policies combine insurance protection with a savings component that gradually increases in amount over the life of the policy. The policyholder may borrow against the savings component generally at a rate of interest lower than that available from other lending sources. The policyholder may also choose to surrender the policy and receive the accumulated cash value rather than continuing the insurance protection. Term life products offer pure insurance protection for life with a guaranteed level premium for a specified period of time—typically 5, 10, 15 or 20 years. In some instances, these products offer an option to return the premium at the end of the guaranteed period.

Traditional life products also include graded benefit life insurance products. Graded benefit life products accounted for $184.1 million, or 5.1 percent, of our total collected premiums in 2010. Graded benefit life insurance products are offered on an individual basis primarily to persons age 50 to 85, principally in face amounts of $400 to $25,000, without medical examination or evidence of insurability. Premiums are paid as frequently as monthly. Benefits paid are less than the face amount of the policy during the first two years, except in cases of accidental death. Our Colonial Penn segment markets graded benefit life policies under its own brand name using direct response marketing techniques. New policyholder leads are generated primarily from television, print adver tisements and direct response mailings.

Traditional life products also include single premium whole life insurance. This product requires one initial lump sum payment in return for providing life insurance protection for the insured’s entire lifetime. Single premium whole life products accounted for $46.2 million, or 1.3 percent, of our total collected premiums in 2010.

INVESTMENTS

40|86 Advisors, Inc. (“40|86 Advisors”, a registered investment advisor and wholly owned subsidiary of CNO) manages the investment portfolios of our insurance subsidiaries. 40|86 Advisors had approximately $24.0 billion of assets (at fair value) under management at December 31, 2010, of which $23.7 billion were assets of our subsidiaries and $.3 billion were assets managed for third parties. Our general account investment strategies are to:

| | • | maintain a largely investment-grade, diversified fixed-income portfolio; |

| | • | maximize the spread between the investment income we earn and the yields we pay on investment products within acceptable levels of risk; |

| | • | provide adequate liquidity; |

| | • | construct our investment portfolio considering expected liability durations, cash flows and other requirements; and |

| | • | maximize total return through active investment management. |

During 2010, 2009 and 2008, we recognized net realized investment gains (losses) of $30.2 million, $(60.5) million and $(262.4) million, respectively, excluding any such amounts included in discontinued operations. During 2010, net realized investment gains were comprised of: (i) $180.0 million of net gains from the sale of investments (primarily fixed maturities); and (ii) $149.8 million of writedowns of investments for other-than-temporary declines in fair value recognized through net income ($146.8 million, prior to the $(3.0) million of impairment losses recognized through accumulated other comprehensive income (loss)). During 2009, net realized investment losses were comprised of: (i) $134.9 million of net gains from the sales of investments (primarily fixed maturities); and (ii) $195.4 mil lion of writedowns of investments for other than temporary declines in fair value recognized through net income ($385.0 million, prior to the $189.6 million of impairment losses recognized through accumulated other comprehensive loss). During 2008, net realized investment losses were comprised of: (i) $100.1 million of net losses from the sales of investments (primarily fixed maturities); and (ii) $162.3 million of writedowns of investments for other than temporary declines in fair value.

Investment activities are an integral part of our business because investment income is a significant component of our revenues. The profitability of many of our insurance products is significantly affected by spreads between interest yields on investments and rates credited on insurance liabilities. Although substantially all credited rates on SPDAs, FPDAs and interest sensitive life products may be changed annually (subject to minimum guaranteed rates), changes in crediting rates may not be sufficient to maintain targeted investment spreads in all economic and market environments. In addition, competition, minimum guaranteed rates and other factors, including the impact of surrenders and withdrawals, may limit our ability to adjust or to maintain crediting rates at levels necessary to avoid narrowing of spreads under certain market conditions. As of December 31, 2010, the average yield, computed on the cost basis of our fixed maturity portfolio, was 5.9 percent, and the average interest rate credited or accruing to our total insurance liabilities was 4.5 percent.

We manage the equity-based risk component of our fixed index annuity products by:

• purchasing equity-based options with similar payoff characteristics; and

| | • | adjusting the participation rate to reflect the change in the cost of such options (such cost varies based on market conditions). |

The price of the options we purchase to manage the equity-based risk component of our fixed index annuities varies based on market conditions. The price of the options generally increases with increases in the volatility of the applicable indices, which may either reduce the profitability of the fixed index products or cause us to lower participation rates. Accordingly, volatility of the indices is one factor in the uncertainty regarding the profitability of our fixed index products. We attempt to mitigate this risk by adjusting the participation rates to reflect the change in the cost of such options.

Our invested assets are predominately fixed rate in nature and their value fluctuates with changes in market rates. We seek to manage the interest rate risk inherent in our business by managing the durations and cash flows of our fixed maturity investments along with those of our insurance liabilities. For example, duration measures the expected change in the fair value of assets and liabilities for a given change in interest rates. If interest rates increase by 1 percent, the fair value of a fixed maturity security with a duration of 5 years is typically expected to decrease in value by approximately 5 percent. When the estimated durations of assets and liabilities are similar, a change in the value of assets should be largely offset by a change in the value of liabilities.

We calculate asset and liability durations using our estimates of future asset and liability cash flows. At December 31, 2010, the duration of our fixed income securities (as modified to reflect prepayments and potential calls) was approximately 8.8 years and the duration of our insurance liabilities was approximately 8.7 years. These durations indicate that while our investment portfolio had a longer duration and, consequently, was more sensitive to interest rate fluctuations than our liabilities at that date, this sensitivity was within corporate guidelines. We generally seek to minimize the gap between asset and liability durations.

For information regarding the composition and diversification of the investment portfolio of our subsidiaries, see “Investments”.

COMPETITION

The markets in which we operate are competitive. Compared to CNO, many companies in the financial services industry are larger, have greater capital, technological and marketing resources, have better access to capital and other sources of liquidity at a lower cost, offer broader and more diversified product lines, have larger staffs and higher ratings. An expanding number of banks, securities brokerage firms and other financial intermediaries also market insurance products or offer competing products, such as mutual fund products, traditional bank investments and other investment and retirement funding alternatives. We also compete with many of these companies and others in providing services for fees. In most areas, competition is based on a number of factors including pricing, service provid ed to distributors and policyholders and ratings. CNO’s subsidiaries must also compete to attract and retain the allegiance of agents, insurance brokers and marketing companies.

In the individual health insurance business, companies compete primarily on the bases of marketing, service and price. Pursuant to federal regulations, the Medicare supplement products offered by all companies have standardized policy features. This increases the comparability of such policies and intensifies competition based on other factors. See “—Insurance Underwriting” and “Governmental Regulation” for additional information. In addition to competing with the products of other insurance companies, commercial banks, thrifts, mutual funds and broker dealers, our insurance products compete with health maintenance organizations, preferred provider organizations and other health care-related institutions which provide medical benefits based on contractual agreements.

We believe that the volatility experienced in the financial markets in recent periods, its impact on the capital position of many competitors, and subsequent actions by regulators and rating agencies have altered the competitive environment. In particular, these factors have emphasized financial strength as a significant differentiator from the perspective of consumers. The effects of the current market conditions may also lead to consolidation in the insurance industry. Although we can not predict the ultimate impact of these conditions, we believe that the strongest companies will have a competitive advantage as a result of the current circumstances.

An important competitive factor for life insurance companies is the ratings they receive from nationally recognized rating organizations. Agents, insurance brokers and marketing companies who market our products and prospective purchasers of our products use the ratings of our insurance subsidiaries as one factor in determining which insurer’s products to market or purchase. Ratings have the most impact on our annuity, interest-sensitive life insurance and long-term care products. Insurance financial strength ratings are opinions regarding an insurance company’s financial capacity to meet the obligations of its insurance policies in accordance with their terms. They are not directed toward the protection of investors, and such ratings are not recommendations to buy, sell or hold sec urities.

On December 22, 2010, A.M. Best Company (“A.M. Best”) upgraded the financial strength ratings of our primary insurance subsidiaries, except Conseco Life, to “B+” from “B”. A.M. Best also affirmed the financial strength rating of “B-” of Conseco Life and revised the outlook for the rating of Conseco Life to stable from negative. On March 23, 2010, A.M. Best affirmed the financial strength rating of “B” of our primary insurance subsidiaries, except Conseco Life, whose “B”

rating was downgraded to “B-”. A.M. Best also revised the outlook for the ratings of our primary insurance subsidiaries to stable from negative, except for Conseco Life, whose outlook of negative was affirmed. A “stable” designation means that there is a low likelihood of a rating change due to stable financial market trends. The “B+” rating is assigned to companies that have a good ability, in A.M. Best’s opinion, to meet their ongoing obligations to policyholders. A “B-“ rating is assigned to companies that have a fair ability, in A.M. Best’s opinion, to meet their current obligations to policyholders, but are financially vulnerable to adverse changes in underwriting and economic conditions. A.M. Best ratings for the indust ry currently range from “A++ (Superior)” to “F (In Liquidation)” and some companies are not rated. An “A++” rating indicates a superior ability to meet ongoing obligations to policyholders. A.M. Best has sixteen possible ratings. There are five ratings above the “B+” rating of our primary insurance subsidiaries, other than Conseco Life, and ten ratings that are below that rating. There are seven ratings above the “B-” rating of Conseco Life and eight ratings that are below that rating.

On December 21, 2010, Standard & Poor’s Corporation (“S&P”) upgraded the financial strength ratings of our primary insurance subsidiaries to “BB” from “BB-” and the outlook for such ratings is stable. A “stable” designation means that a rating is not likely to change. S&P financial strength ratings range from “AAA” to “R” and some companies are not rated. An insurer rated “BB” or lower is regarded as having vulnerable characteristics that may outweigh its strengths. A “BB” rating indicates the least degree of vulnerability within the range; a “CC” rating indicates the highest degree of vulnerability. Pluses and minuses show the relative standing within a categ ory. In S&P’s view, an insurer rated “BB” has marginal financial security characteristics and although positive attributes exist, adverse business conditions could lead to an insufficient ability to meet financial commitments. S&P has twenty-one possible ratings. There are eleven ratings above our “BB” rating and nine ratings that are below our rating.

On November 30, 2010, Moody’s Investor Services, Inc. (“Moody’s”) affirmed the financial strength rating of “Ba1” of our primary insurance subsidiaries with a stable outlook. On May 26, 2010, Moody’s upgraded the financial strength ratings of our primary insurance subsidiaries to “Ba1” from “Ba2”. Moody’s also revised the outlook for the ratings of our primary insurance subsidiaries to stable from positive. A “stable” designation means that a rating is not likely to change. Moody’s financial strength ratings range from “Aaa” to “C”. Rating categories from “Aaa” to “Baa” are classified as “secure” by Moody’s and rating categor ies from “Ba” to “C” are considered “vulnerable” and these ratings may be supplemented with numbers “1”, “2”, or “3” to show relative standing within a category. In Moody’s view, an insurer rated “Ba1” offers questionable financial security and, often, the ability of these companies to meet policyholders’ obligations may be very moderate and thereby not well safeguarded in the future. Moody’s has twenty-one possible ratings. There are ten ratings above our “Ba1” rating and ten ratings that are below our rating.

In light of the difficulties experienced recently by many financial institutions, including insurance companies, rating agencies have increased the frequency and scope of their credit reviews and requested additional information from the companies that they rate, including us. They may also adjust upward the capital and other requirements employed in the rating agency models for maintenance of certain ratings levels. We cannot predict what actions rating agencies may take, or what actions we may take in response. Accordingly, downgrades and outlook revisions related to us or the life insurance industry may occur in the future at any time and without notice by any rating agency. These could increase policy surrenders and withdrawals, adversely affect relationships with our distribution channels, reduce new sales, reduce our ability to borrow and increase our future borrowing costs.

INSURANCE UNDERWRITING

Under regulations developed by the National Association of Insurance Commissioners (“NAIC”) (an association of state regulators and their staffs) and adopted by the states, we are prohibited from underwriting our Medicare supplement policies for certain first-time purchasers. If a person applies for insurance within six months after becoming eligible by reason of age, or disability in certain limited circumstances, the application may not be rejected due to medical conditions. Some states prohibit underwriting of all Medicare supplement policies. For other prospective Medicare supplement policyholders, such as senior citizens who are transferring to our products, the underwriting procedures are relatively limited, except for policies providing prescription drug coverage.

Before issuing long-term care products, we generally apply detailed underwriting procedures to assess and quantify the insurance risks. We require medical examinations of applicants (including blood and urine tests, where permitted) for certain health insurance products and for life insurance products which exceed prescribed policy amounts. These requirements vary according to the applicant’s age and may vary by type of policy or product. We also rely on medical records and the potential policyholder’s written application. In recent years, there have been significant regulatory changes with respect to underwriting certain types of health insurance. An increasing number of states prohibit underwriting and/or charging higher

premiums for substandard risks. We monitor changes in state regulation that affect our products, and consider these regulatory developments in determining the products we market and where we market them.

Our supplemental health policies are individually underwritten using a simplified issue application. Based on an applicant’s responses on the application, the underwriter either: (i) approves the policy as applied for; (ii) approves the policy with reduced benefits; or (iii) rejects the application.

Most of our life insurance policies are underwritten individually, although standardized underwriting procedures have been adopted for certain low face-amount life insurance coverages. After initial processing, insurance underwriters obtain the information needed to make an underwriting decision (such as medical examinations, doctors’ statements and special medical tests). After collecting and reviewing the information, the underwriter either: (i) approves the policy as applied for; (ii) approves the policy with an extra premium charge because of unfavorable factors; or (iii) rejects the application.

We underwrite group insurance policies based on the characteristics of the group and its past claim experience. Graded benefit life insurance policies are issued without medical examination or evidence of insurability. There is minimal underwriting on annuities.

LIABILITIES FOR INSURANCE PRODUCTS

At December 31, 2010, the total balance of our liabilities for insurance products was $24.5 billion. These liabilities are generally payable over an extended period of time. The profitability of our insurance products depends on pricing and other factors. Differences between our expectations when we sold these products and our actual experience could result in future losses.

Liabilities for insurance products are calculated using management’s best judgments, based on our past experience and standard actuarial tables, of mortality, morbidity, lapse rates, investment experience and expense levels. For all of our insurance products, we establish an active life reserve, a liability for due and unpaid claims, claims in the course of settlement and incurred but not reported claims. In addition, for our health insurance business, we establish a reserve for the present value of amounts not yet due on incurred claims. Many factors can affect these reserves and liabilities, such as economic and social conditions, inflation, hospital and pharmaceutical costs, changes in doctrines of legal liability and extra-contractual damage awards. Therefore, our reserves and liabili ties are necessarily based on extensive estimates, assumptions and historical experience. Establishing reserves is an uncertain process, and it is possible that actual claims will materially exceed our reserves and have a material adverse effect on our results of operations and financial condition. Our financial results depend significantly upon the extent to which our actual claims experience is consistent with the assumptions we used in determining our reserves and pricing our products. If our assumptions with respect to future claims are incorrect, or our reserves are insufficient to cover our actual losses and expenses, we would be required to increase our liabilities, which would negatively affect our operating results.

REINSURANCE

Consistent with the general practice of the life insurance industry, our subsidiaries enter into both facultative and treaty agreements of indemnity reinsurance with other insurance companies in order to reinsure portions of the coverage provided by our insurance products. Indemnity reinsurance agreements are intended to limit a life insurer’s maximum loss on a large or unusually hazardous risk or to diversify its risk. Indemnity reinsurance does not discharge the original insurer’s primary liability to the insured. Our reinsured business is ceded to numerous reinsurers. Based on our periodic review of their financial statements, insurance industry reports and reports filed with state insurance departments, we believe the assuming companies are able to honor all contractual commitments.

As of December 31, 2010, the policy risk retention limit of our insurance subsidiaries was generally $.8 million or less. Reinsurance ceded by CNO represented 25 percent of gross combined life insurance inforce and reinsurance assumed represented .8 percent of net combined life insurance inforce. Our principal reinsurers at December 31, 2010 were as follows (dollars in millions):

| | | Ceded life | | | A.M. Best | |

| Name of Reinsurer | | insurance inforce | | | rating | |

| | | | | | | |

| Wilton Reassurance Company (“Wilton Re”) | | $ | 3,389.0 | | | | A | - |

| Swiss Re Life and Health America Inc. | | | 3,086.3 | | | | A | |

| Security Life of Denver Insurance Company | | | 2,523.4 | | | | A | |

Reassure America Life Insurance Company (“REALIC”) (a) | | | 1,247.0 | | | | A | |

| RGA Reinsurance Company | | | 827.9 | | | | A | + |

| Munich American Reassurance Company | | | 814.7 | | | | A | + |

| Lincoln National Life Insurance Company | | | 519.3 | | | | A | + |

| Scor Global Life Re Insurance Co of Texas | | | 473.8 | | | | A | |

| Hannover Life Reassurance Company | | | 340.9 | | | | A | |

| General Re Life Corporation | | | 331.6 | | | | A | ++ |

| All others (b) | | | 1,247.0 | | | | | |

| | | | | | | | | |

| | | $ | 14,800.9 | | | | | |

____________________

| (a) | In addition to the life insurance business summarized above, REALIC has assumed certain annuity business from our insurance subsidiaries through a coinsurance agreement. Such business had total insurance policy liabilities of $1.7 billion at December 31, 2010. |

| (b) | No other single reinsurer assumed greater than 2 percent of the total ceded business inforce. |

EMPLOYEES

At December 31, 2010, we had approximately 3,680 full time employees, including 1,400 employees supporting our Bankers Life segment, 370 employees supporting our Colonial Penn segment and 1,910 employees supporting our shared services and our Washington National, Other CNO Business and corporate segments. None of our employees are covered by a collective bargaining agreement. We believe that we have good relations with our employees.

GOVERNMENTAL REGULATION

Our insurance businesses are subject to extensive regulation and supervision by the insurance regulatory agencies of the jurisdictions in which they operate. This regulation and supervision is primarily for the benefit and protection of customers, and not for the benefit of investors or creditors. State laws generally establish supervisory agencies that have broad regulatory authority, including the power to:

• grant and revoke business licenses;

• regulate and supervise sales practices and market conduct;

• establish guaranty associations;

• license agents;

• approve policy forms;

| | • | approve premium rates and premium rate increases for some lines of business such as long-term care and Medicare supplement; |

• establish reserve requirements;

• prescribe the form and content of required financial statements and reports;

• determine the reasonableness and adequacy of statutory capital and surplus;

• perform financial, market conduct and other examinations;

• define acceptable accounting principles; and

• regulate the types and amounts of permitted investments.

In addition, the NAIC issues model laws and regulations, many of which have been adopted by state insurance regulators, relating to:

• reserve requirements;

• risk-based capital (“RBC”) standards;

• codification of insurance accounting principles;

• investment restrictions;

• restrictions on an insurance company’s ability to pay dividends;

• credit for reinsurance; and

• product illustrations.

In addition to the regulations described above, most states have also enacted laws or regulations regarding the activities of insurance holding company systems, including acquisitions, the terms of surplus debentures, the terms of transactions between insurance companies and their affiliates and other related matters. Various notice and reporting requirements generally apply to transactions between insurance companies and their affiliates within an insurance holding company system, depending on the size and nature of the transactions. These requirements may include prior regulatory approval or prior notice for certain material transactions. Currently, the Company and its insurance subsidiaries are registered as a holding company system pursuant to such laws and regulations in the domiciliary states of the insurance subsidiaries. In addition, the Company’s insurance subsidiaries routinely report to other jurisdictions.

Insurance regulators may prohibit the payment of dividends or other payments by our insurance subsidiaries to parent companies if they determine that such payment could be adverse to our policyholders or contract holders. Otherwise, the ability of our insurance subsidiaries to pay dividends is subject to state insurance department regulations and is based on the financial statements of our insurance subsidiaries prepared in accordance with statutory accounting practices prescribed or permitted by regulatory authorities, which differ from financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). These regulations generally permit dividends to be paid by the insurance company if such dividends are not in excess of unassigned surplus and, for any 12-month period, are in amounts less than the greater of, or in a few states, the lesser of:

• statutory net gain from operations or statutory net income for the prior year; or

• 10 percent of statutory capital and surplus at the end of the preceding year.

Any dividends in excess of these levels require the approval of the director or commissioner of the applicable state insurance department.

In accordance with an order from the Florida Office of Insurance Regulation, Washington National may not distribute funds to any affiliate or shareholder without prior notice to the Florida Office of Insurance Regulation. In addition, the RBC and other capital requirements described below can also limit, in certain circumstances, the ability of our insurance subsidiaries to pay dividends.

Our insurance subsidiaries that have long-term care business have made insurance regulatory filings seeking actuarially justified rate increases on our long-term care policies. Most of our long-term care business is guaranteed renewable, and, if necessary rate increases are not approved, we may be required to write off all or a portion of the insurance acquisition costs and establish a premium deficiency reserve. If we are unable to raise our premium rates because we fail to obtain approval for actuarially justified rate increases in one or more states, our financial condition and results of operations could be adversely affected.

During 2006, the Florida legislature enacted a statute, known as House Bill 947, intended to provide new protections to long-term care insurance policyholders. Among other requirements, this statute requires: (i) claim experience of affiliated long-term care insurers to be pooled in determining justification for rate increases for Florida policyholders; and (ii) insurers with closed blocks of long-term care insurance to not raise rates above the comparable new business premium rates offered by affiliated insurers. The manner in which the requirements of this statute are applied to our long-term care policies in Florida (including policies subject to the order from the Florida Office of Insurance Regulation as described in “Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations”) may affect our ability to achieve our anticipated rate increases on this business.

Most states have also enacted legislation or adopted administrative regulations that affect the acquisition (or sale) of control of insurance companies. The nature and extent of such legislation and regulations vary from state to state. Generally, these regulations require an acquirer of control to file detailed information and the plan of acquisition, and to obtain administrative approval prior to the acquisition of control. “Control” is generally defined as the direct or indirect power to direct or cause the direction of the management and policies of a person and is rebuttably presumed to exist if a person or group of affiliated persons directly or indirectly owns or controls 10 percent or more of the voting securities of another person.

Using statutory statements filed with state regulators annually, the NAIC calculates certain financial ratios to assist state regulators in monitoring the financial condition of insurance companies. A “usual range” of results for each ratio is used as a benchmark. An insurance company may fall out of the usual range for one or more ratios because of specific transactions that are in themselves immaterial or eliminated at the consolidated level. Generally, an insurance company will become subject to regulatory scrutiny if it falls outside the usual ranges of four or more of the ratios, and regulators may then act, if the company has insufficient capital, to constrain the company’s underwriting capacity. In the past, variances in certain ratios of our insurance subsidiaries have resulted in inquiries from insurance departments, to which we have responded. These inquiries have not led to any restrictions affecting our operations.

The NAIC’s RBC requirements provide a tool for insurance regulators to determine the levels of statutory capital and surplus an insurer must maintain in relation to its insurance and investment risks and the need for possible regulatory attention. The RBC requirements provide four levels of regulatory attention, varying with the ratio of the insurance company’s total adjusted capital (defined as the total of its statutory capital and surplus, asset valuation reserve and certain other adjustments) to its RBC (as measured on December 31 of each year), as follows:

| | • | if a company’s total adjusted capital is less than 100 percent but greater than or equal to 75 percent of its RBC (the “Company Action Level”), the company must submit a comprehensive plan to the regulatory authority proposing corrective actions aimed at improving its capital position; |

| | • | if a company’s total adjusted capital is less than 75 percent but greater than or equal to 50 percent of its RBC, the regulatory authority will perform a special examination of the company and issue an order specifying the corrective actions that must be taken; |

| | • | if a company’s total adjusted capital is less than 50 percent but greater than or equal to 35 percent of its RBC (the “Authorized Control Level”), the regulatory authority may take any action it deems necessary, including placing the company under regulatory control; and |

| | • | if a company’s total adjusted capital is less than 35 percent of its RBC (the “Mandatory Control Level”), the regulatory authority must place the company under its control. |

In addition, the RBC requirements provide for a trend test if a company’s total adjusted capital is between 100 percent and 125 percent of its RBC at the end of the year. The trend test calculates the greater of the decrease in the margin of total adjusted capital over RBC:

• between the current year and the prior year; and

• for the average of the last 3 years.

It assumes that such decrease could occur again in the coming year. Any company whose trended total adjusted capital is less than 95 percent of its RBC would trigger a requirement to submit a comprehensive plan as described above for the Company Action Level.

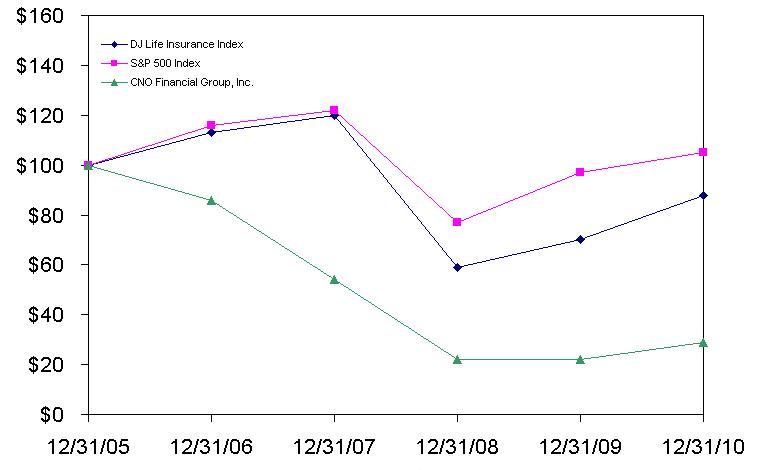

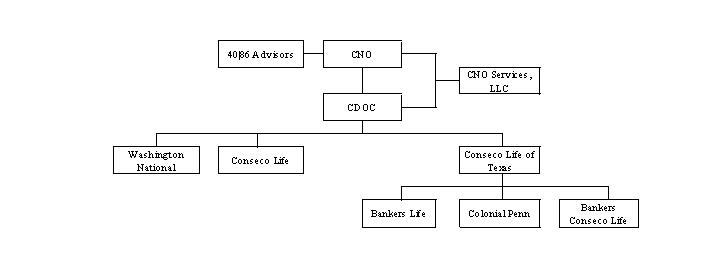

The 2010 statutory annual statements to be filed with the state insurance regulators of each of our insurance subsidiaries are expected to reflect total adjusted capital in excess of the levels subjecting the subsidiaries to any regulatory action. No assurances can be given that we will make future contributions or otherwise make capital available to our insurance subsidiaries.