3Q12 Financial and operating results for the period ended September 30, 2012 October 30, 2012 Unless otherwise specified, comparisons in this presentation are between 3Q12 and 3Q11. Exhibit 99.1

CNO Financial Group 2 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on October 29, 2012, our Quarterly Reports on Form 10-Q, our 2011 Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date.

CNO Financial Group 3 Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; book value, excluding accumulated other comprehensive income (loss) per share; operating return measures; earnings before net realized investment gains (losses) and corporate interest and taxes; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group 4

CNO Financial Group 5 Summary 3Q results reflect significant management actions – Successfully completed recapitalization; lowering cost of capital while maintaining strong capital ratios – Significant progress on OCB litigation – Review of actuarial assumptions Businesses continue to perform well with core earnings building Continue to invest in business strategy CNO

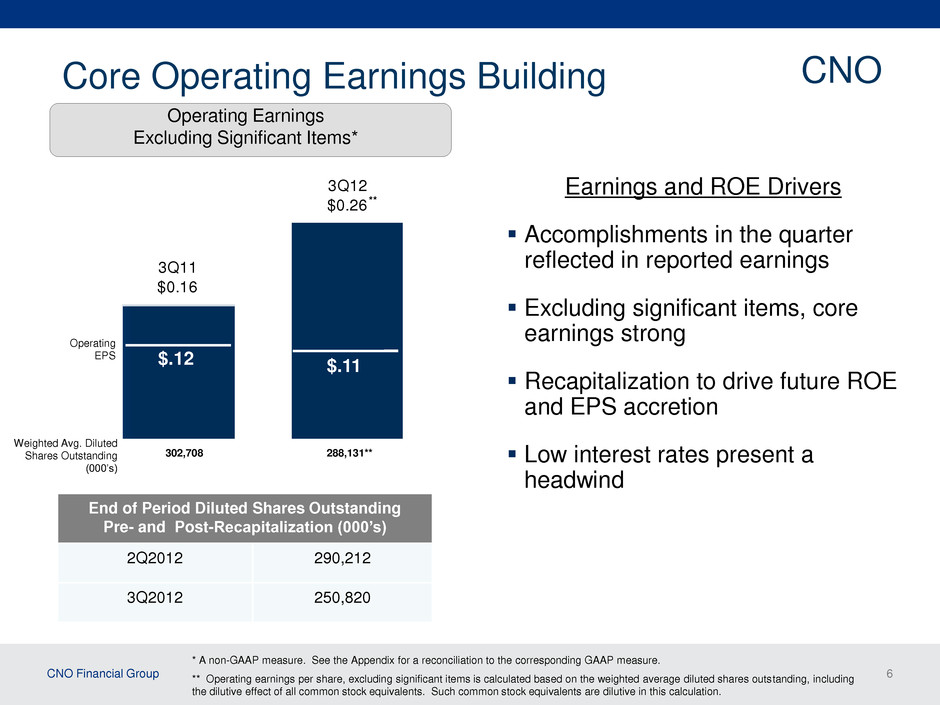

CNO Financial Group 6 Core Operating Earnings Building * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. ** Operating earnings per share, excluding significant items is calculated based on the weighted average diluted shares outstanding, including the dilutive effect of all common stock equivalents. Such common stock equivalents are dilutive in this calculation. 3Q12 $0.26 3Q11 $0.16 Operating Earnings Excluding Significant Items* Earnings and ROE Drivers Accomplishments in the quarter reflected in reported earnings Excluding significant items, core earnings strong Recapitalization to drive future ROE and EPS accretion Low interest rates present a headwind CNO Operating EPS $.12 $.11 End of Period Diluted Shares Outstanding Pre- and Post-Recapitalization (000’s) 2Q2012 290,212 3Q2012 250,820 302,708 Weighted Avg. Diluted Shares Outstanding (000’s) 288,131** **

CNO Financial Group 7 Recapitalization Summary CNO New debt structure reflects strong performance and improved credit ratings Lower weighted average cost of capital Improved financial flexibility and debt maturity profile Significantly reduced convertible overhang Raised $950 million to pay off senior secured debt and repurchase majority of the convertible debentures Meaningful stair step in go forward EPS and ROE

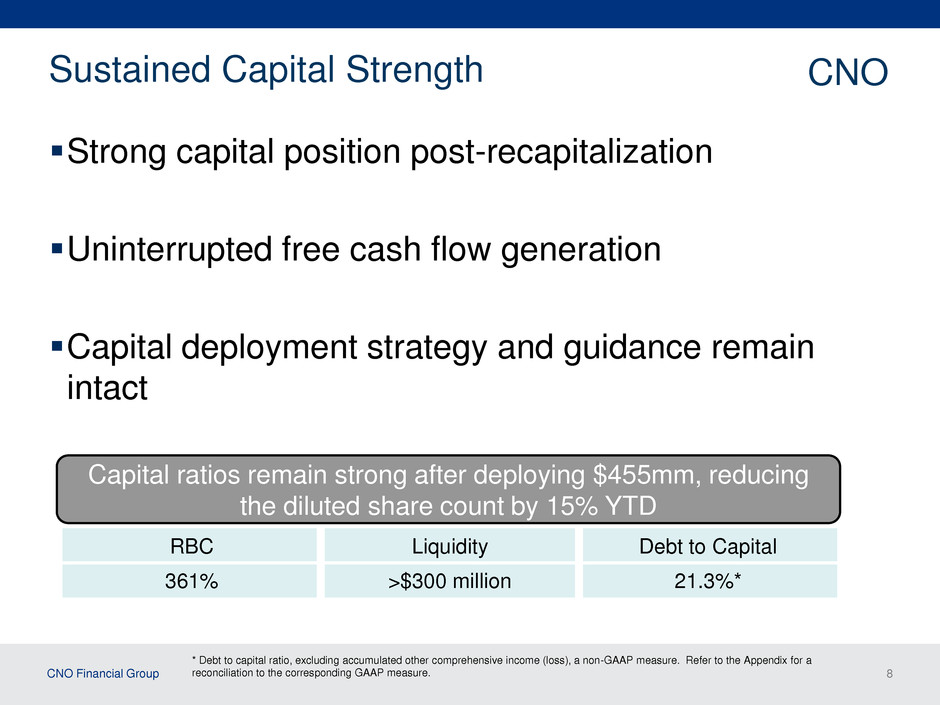

CNO Financial Group 8 Sustained Capital Strength CNO Strong capital position post-recapitalization Uninterrupted free cash flow generation Capital deployment strategy and guidance remain intact Capital ratios remain strong after deploying $455mm, reducing the diluted share count by 15% YTD RBC Liquidity Debt to Capital 361% >$300 million 21.3%* * Debt to capital ratio, excluding accumulated other comprehensive income (loss), a non-GAAP measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure.

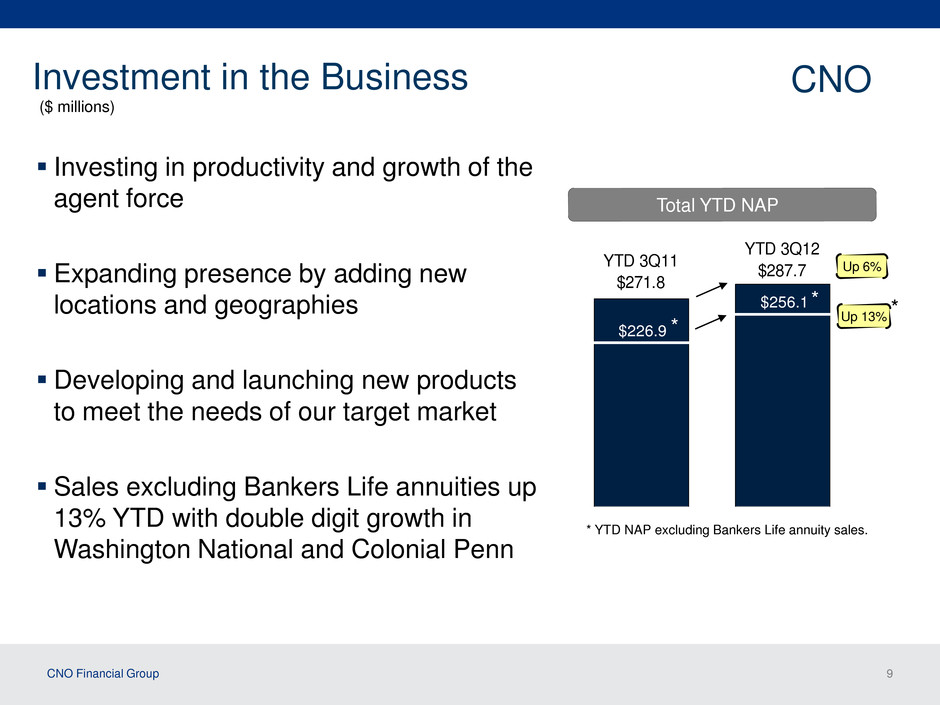

CNO Financial Group 9 Investment in the Business CNO Investing in productivity and growth of the agent force Expanding presence by adding new locations and geographies Developing and launching new products to meet the needs of our target market Sales excluding Bankers Life annuities up 13% YTD with double digit growth in Washington National and Colonial Penn YTD 3Q11 $271.8 YTD 3Q12 $287.7 Total YTD NAP $226.9 $256.1 * * YTD NAP excluding Bankers Life annuity sales. Up 6% Up 13% * * ($ millions)

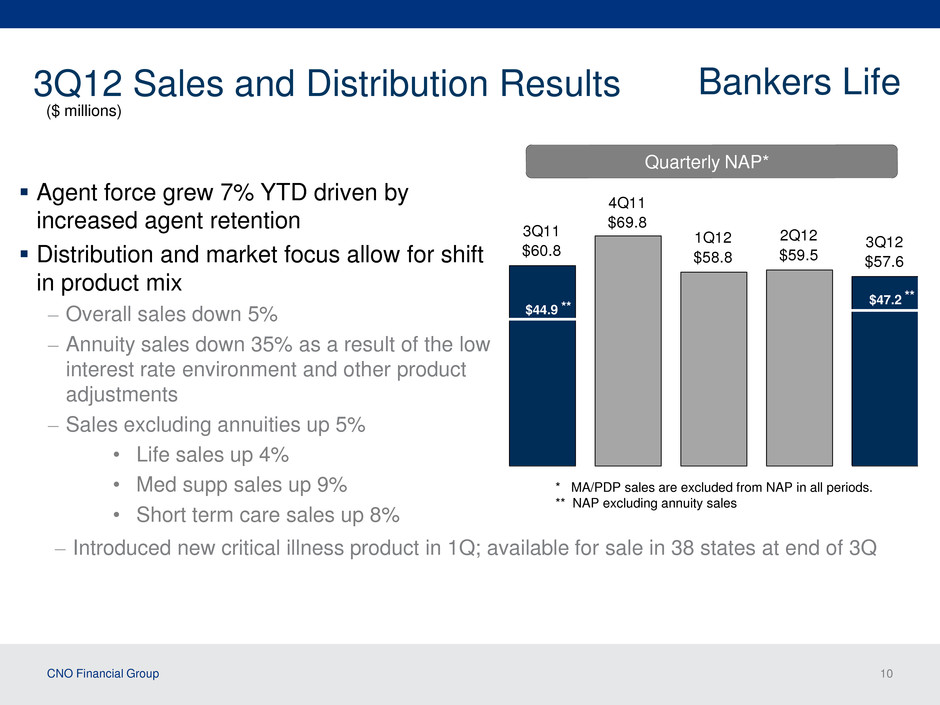

CNO Financial Group 10 3Q12 Sales and Distribution Results Bankers Life * MA/PDP sales are excluded from NAP in all periods. ** NAP excluding annuity sales ($ millions) – Introduced new critical illness product in 1Q; available for sale in 38 states at end of 3Q 3Q11 $60.8 4Q11 $69.8 1Q12 $58.8 2Q12 $59.5 3Q12 $57.6 Agent force grew 7% YTD driven by increased agent retention Distribution and market focus allow for shift in product mix – Overall sales down 5% – Annuity sales down 35% as a result of the low interest rate environment and other product adjustments – Sales excluding annuities up 5% • Life sales up 4% • Med supp sales up 9% • Short term care sales up 8% Quarterly NAP* $44.9 $47.2 ** **

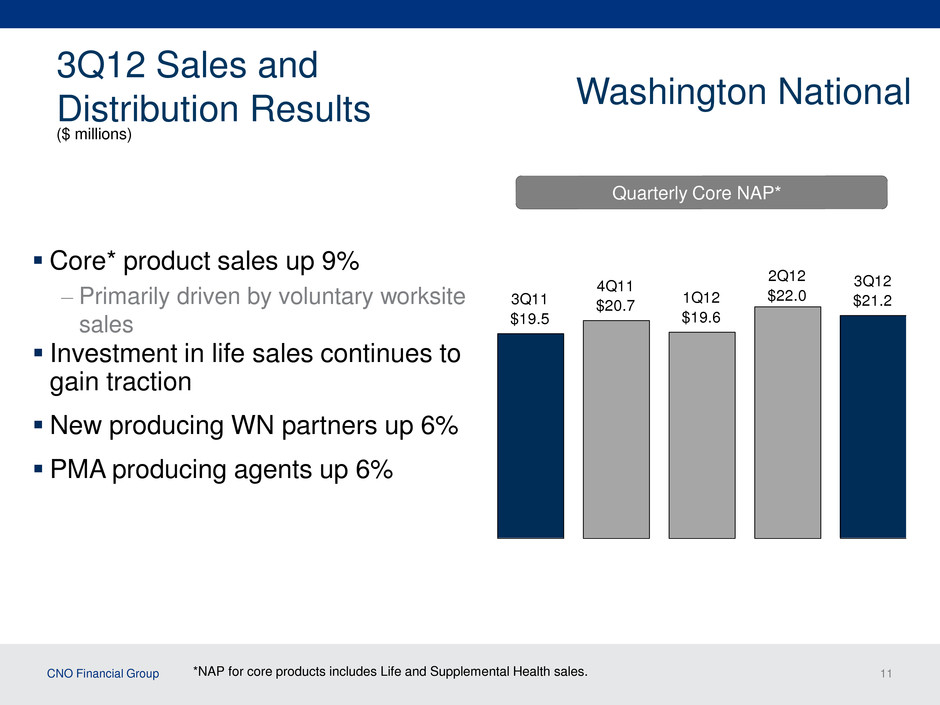

CNO Financial Group 11 Washington National 3Q12 Sales and Distribution Results ($ millions) Investment in life sales continues to gain traction New producing WN partners up 6% PMA producing agents up 6% 3Q11 $19.5 4Q11 $20.7 1Q12 $19.6 2Q12 $22.0 3Q12 $21.2 Core* product sales up 9% – Primarily driven by voluntary worksite sales *NAP for core products includes Life and Supplemental Health sales. Quarterly Core NAP*

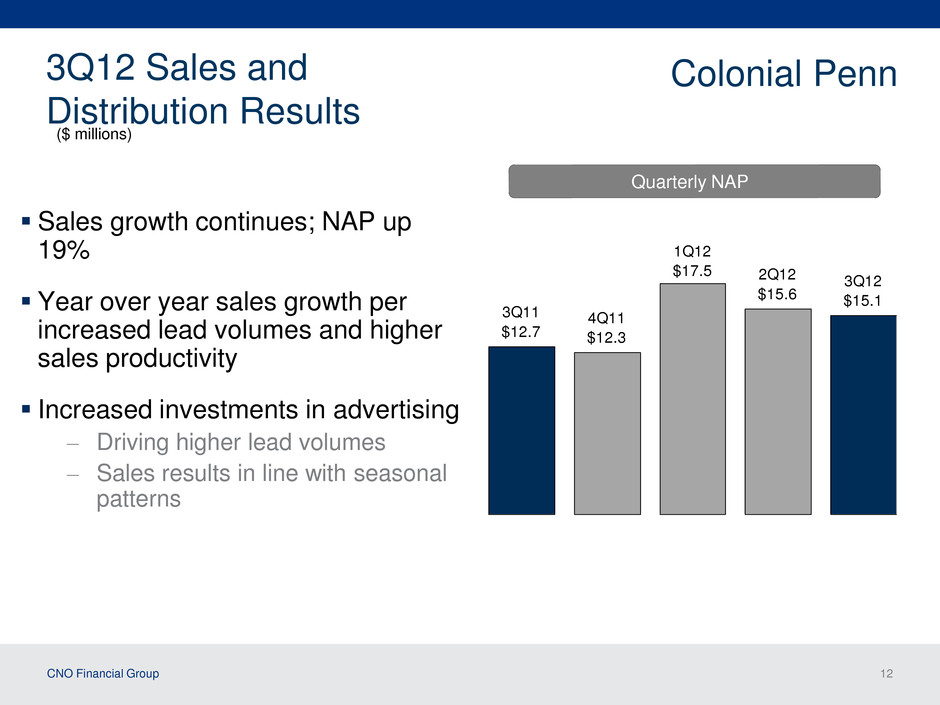

CNO Financial Group 12 Sales growth continues; NAP up 19% Year over year sales growth per increased lead volumes and higher sales productivity Increased investments in advertising – Driving higher lead volumes – Sales results in line with seasonal patterns 3Q12 Sales and Distribution Results Colonial Penn 3Q11 $12.7 4Q11 $12.3 1Q12 $17.5 2Q12 $15.6 3Q12 $15.1 Quarterly NAP ($ millions)

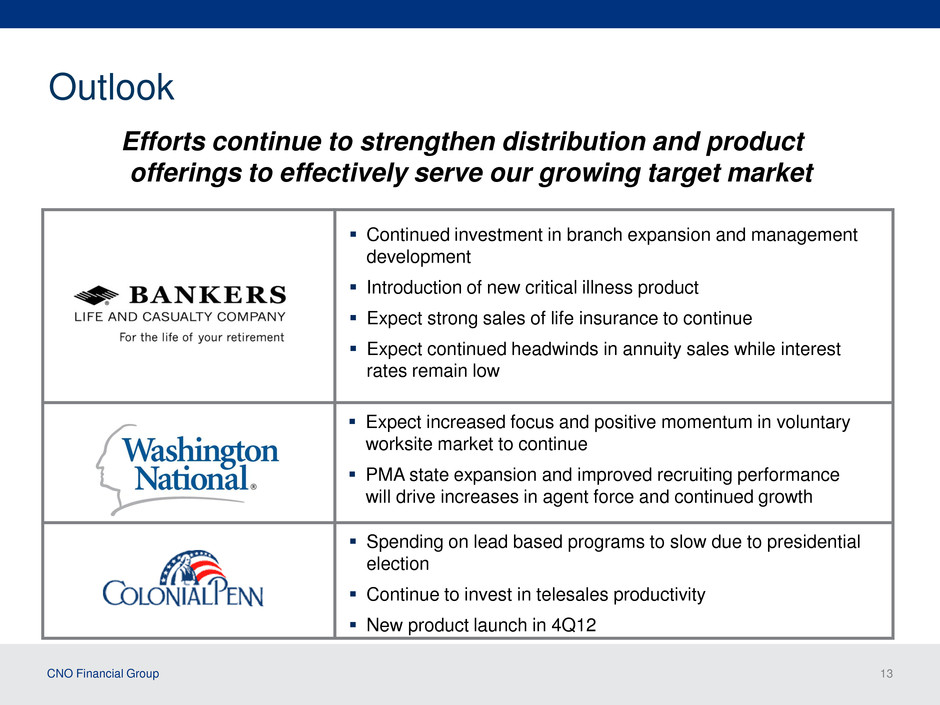

CNO Financial Group 13 Outlook Efforts continue to strengthen distribution and product offerings to effectively serve our growing target market Continued investment in branch expansion and management development Introduction of new critical illness product Expect strong sales of life insurance to continue Expect continued headwinds in annuity sales while interest rates remain low Expect increased focus and positive momentum in voluntary worksite market to continue PMA state expansion and improved recruiting performance will drive increases in agent force and continued growth Spending on lead based programs to slow due to presidential election Continue to invest in telesales productivity New product launch in 4Q12

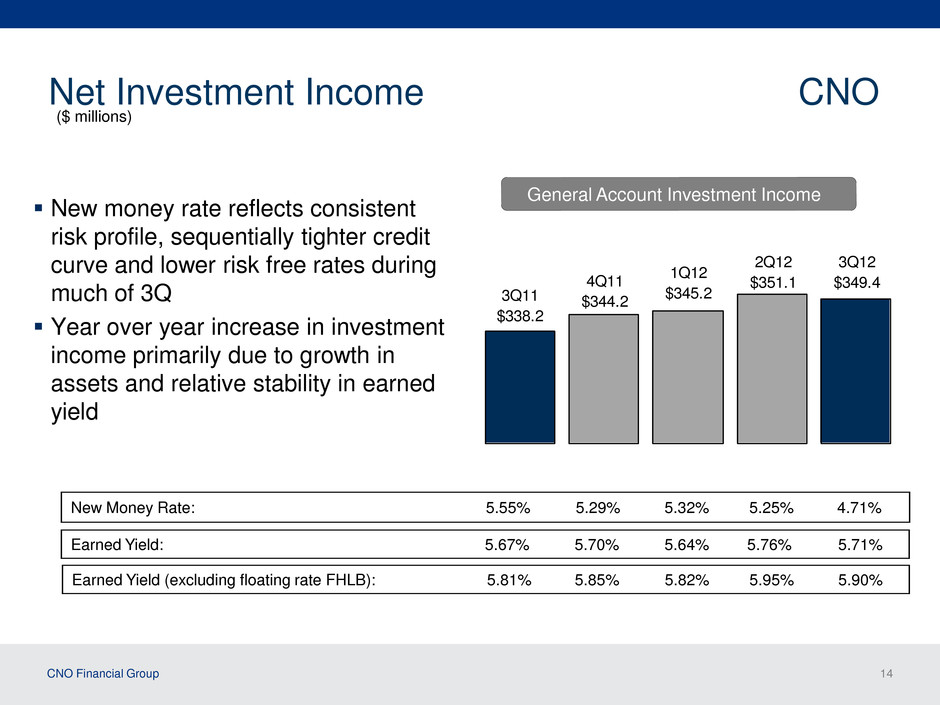

CNO Financial Group 14 Net Investment Income CNO New money rate reflects consistent risk profile, sequentially tighter credit curve and lower risk free rates during much of 3Q Year over year increase in investment income primarily due to growth in assets and relative stability in earned yield 3Q12 $349.4 1Q12 $345.2 4Q11 $344.23Q11 $338.2 2Q12 $351.1 Earned Yield: 5.67% 5.70% 5.64% 5.76% 5.71% ($ millions) Earned Yield (excluding floating rate FHLB): 5.81% 5.85% 5.82% 5.95% 5.90% New Money Rate: 5.55% 5.29% 5.32% 5.25% 4.71% General Account Investment Income

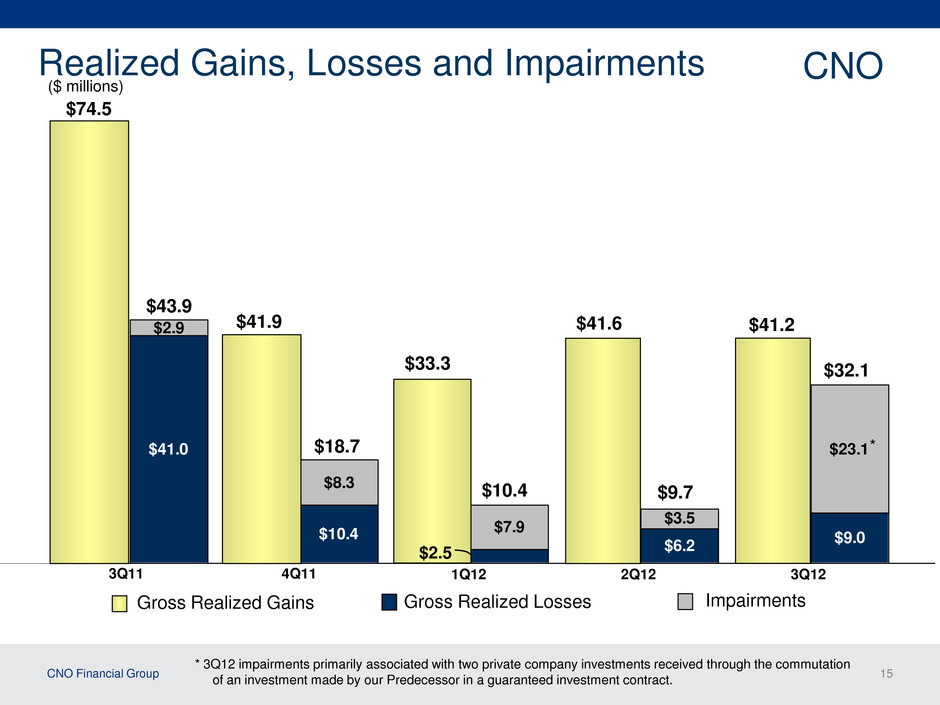

CNO Financial Group 15 $41.0 $10.4 $6.2 $9.0 $2.9 $8.3 $7.9 $2.5 $3.5 $23.1 Realized Gains, Losses and Impairments ($ millions) CNO 3Q11 2Q12 3Q12 4Q11 1Q12 Gross Realized Gains Gross Realized Losses Impairments $74.5 $43.9 $41.9 $18.7 $33.3 $41.6 $41.2 $10.4 $9.7 $32.1 * 3Q12 impairments primarily associated with two private company investments received through the commutation of an investment made by our Predecessor in a guaranteed investment contract. * $2.5

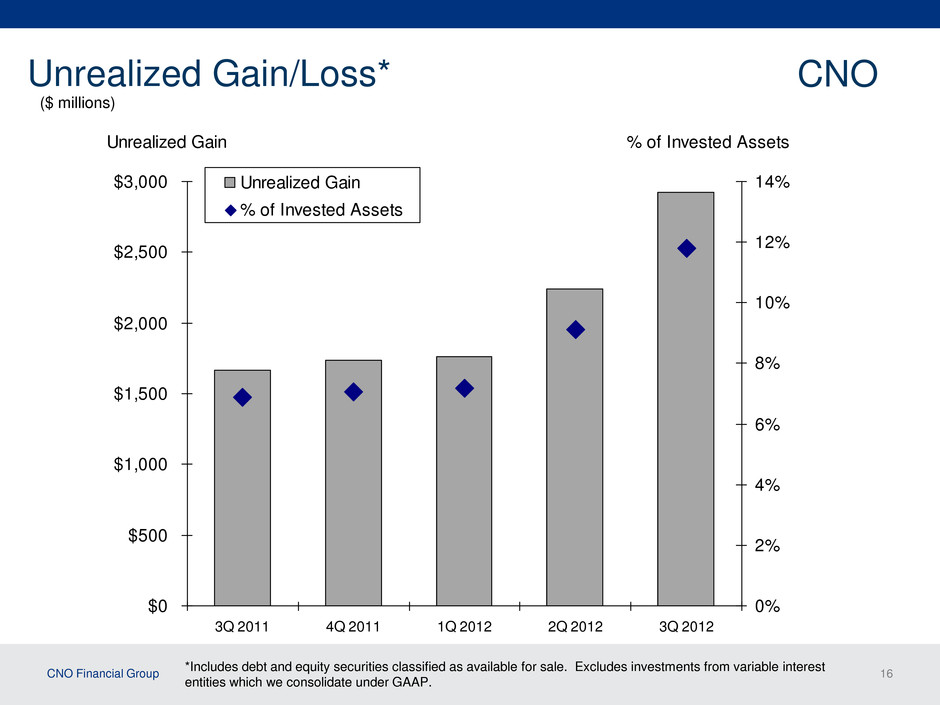

CNO Financial Group 16 Unrealized Gain/Loss* CNO ($ millions) *Includes debt and equity securities classified as available for sale. Excludes investments from variable interest entities which we consolidate under GAAP. $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 Unrealized Gain 0% 2% 4% 6% 8% 10% 12% 14% % of Invested Assets Unrealized Gain % of Invested Assets

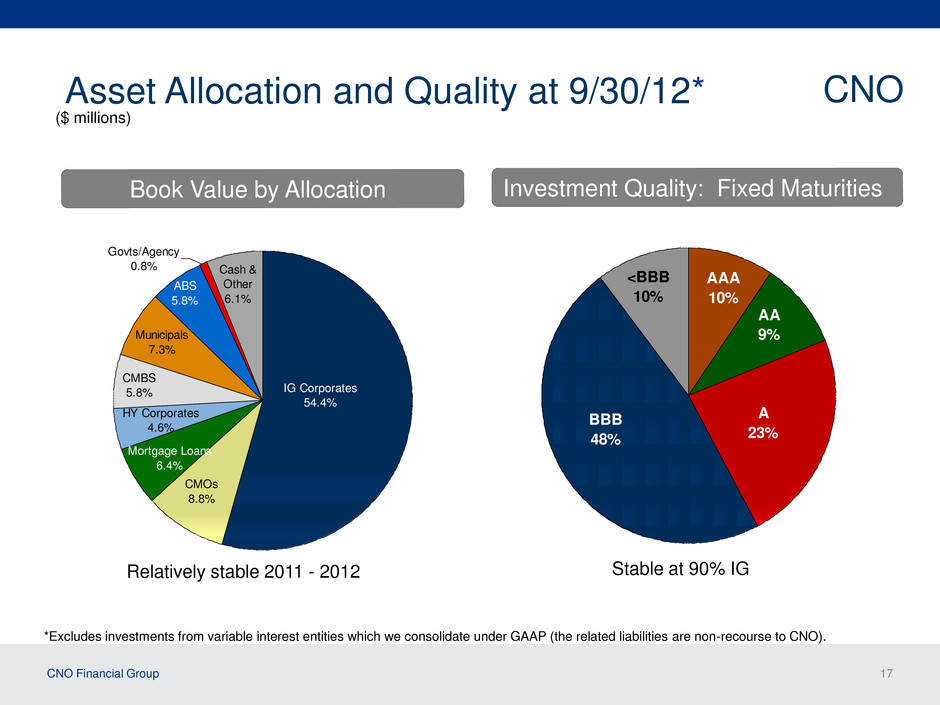

CNO Financial Group 17 Asset Allocation and Quality at 9/30/12* Govts/Agency 0.8% Cash & Other 6.1% ABS 5.8% Municipals 7.3% CMBS 5.8% HY Corporates 4.6% Mortgage Loans 6.4% CMOs 8.8% IG Corporates 54.4% *Excludes investments from variable interest entities which we consolidate under GAAP (the related liabilities are non-recourse to CNO). ($ millions) CNO <BBB 10% AAA 10% AA 9% A 23% BBB 48% Relatively stable 2011 - 2012 Stable at 90% IG Book Value by Allocation Investment Quality: Fixed Maturities

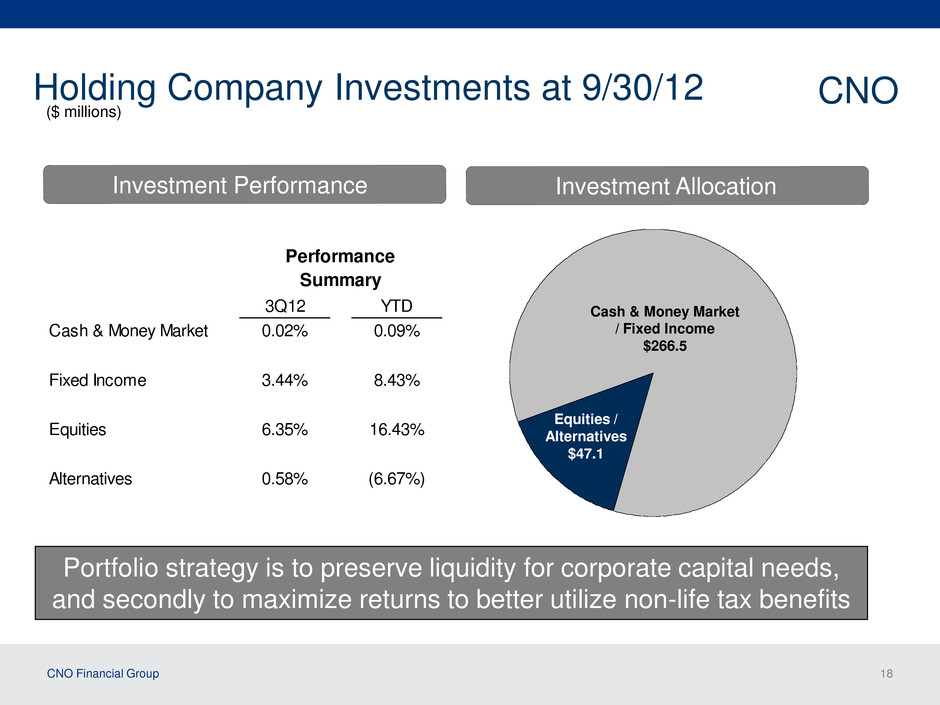

CNO Financial Group 18 Holding Company Investments at 9/30/12 CNO ($ millions) Cash & Money Market / Fixed Income $266.5 Equities / Alternatives $47.1 Portfolio strategy is to preserve liquidity for corporate capital needs, and secondly to maximize returns to better utilize non-life tax benefits Investment Performance Investment Allocation Cash & Money Market Fixed Income Equities Alternatives 16.43% (6.67%) 3.44% 6.35% 0.58% 8.43% Performance Summary 3Q12 YTD 0.02% 0.09%

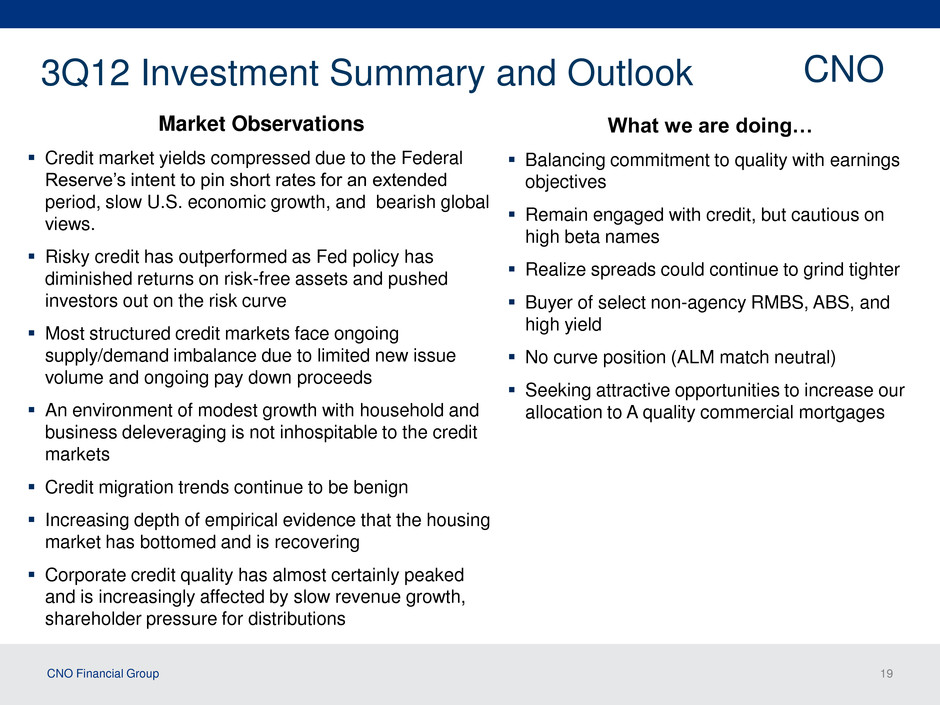

CNO Financial Group 19 3Q12 Investment Summary and Outlook CNO Market Observations Credit market yields compressed due to the Federal Reserve’s intent to pin short rates for an extended period, slow U.S. economic growth, and bearish global views. Risky credit has outperformed as Fed policy has diminished returns on risk-free assets and pushed investors out on the risk curve Most structured credit markets face ongoing supply/demand imbalance due to limited new issue volume and ongoing pay down proceeds An environment of modest growth with household and business deleveraging is not inhospitable to the credit markets Credit migration trends continue to be benign Increasing depth of empirical evidence that the housing market has bottomed and is recovering Corporate credit quality has almost certainly peaked and is increasingly affected by slow revenue growth, shareholder pressure for distributions What we are doing… Balancing commitment to quality with earnings objectives Remain engaged with credit, but cautious on high beta names Realize spreads could continue to grind tighter Buyer of select non-agency RMBS, ABS, and high yield No curve position (ALM match neutral) Seeking attractive opportunities to increase our allocation to A quality commercial mortgages

CNO Financial Group 20 3Q12 Consolidated Financial Highlights CNO Results Reflect Significant Management Actions - Lower-for-longer rates prudently reflected in core assumptions - OCB litigation reserves set the stage for less volatility - Stable core earnings supports tax valuation allowance reduction - Recapitalization lowers cost of capital and builds financial flexibility Capital & Liquidity Uninterrupted - RBC ratio, leverage and holding company liquidity remain strong - 2012 YTD cash flow to the holding company in excess of $300mm - Capital deployment on pace after significant convertible repurchase - Excess and deployable capital of $150mm at the holding company

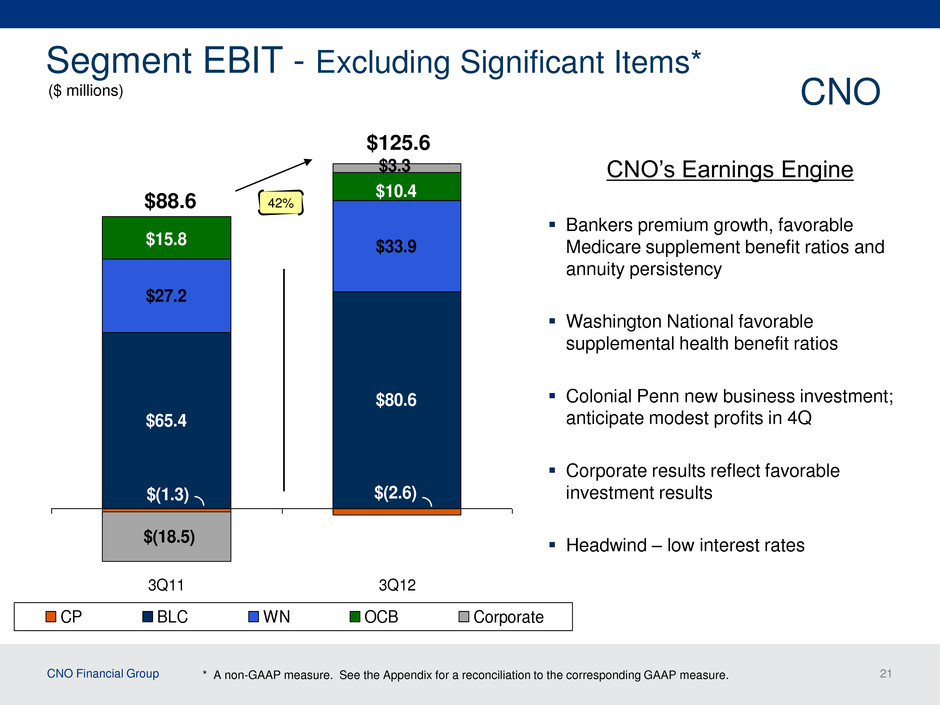

CNO Financial Group 21 $65.4 $80.6 $27.2 $33.9 $(18.5) $(2.6)$(1.3) $10.4 $15.8 $3.3 3Q11 3Q12 CP BLC WN OCB Corporate CNO ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. $125.6 $88.6 42% Segment EBIT - Excluding Significant Items* CNO’s Earnings Engine Bankers premium growth, favorable Medicare supplement benefit ratios and annuity persistency Washington National favorable supplemental health benefit ratios Colonial Penn new business investment; anticipate modest profits in 4Q Corporate results reflect favorable investment results ��� Headwind – low interest rates

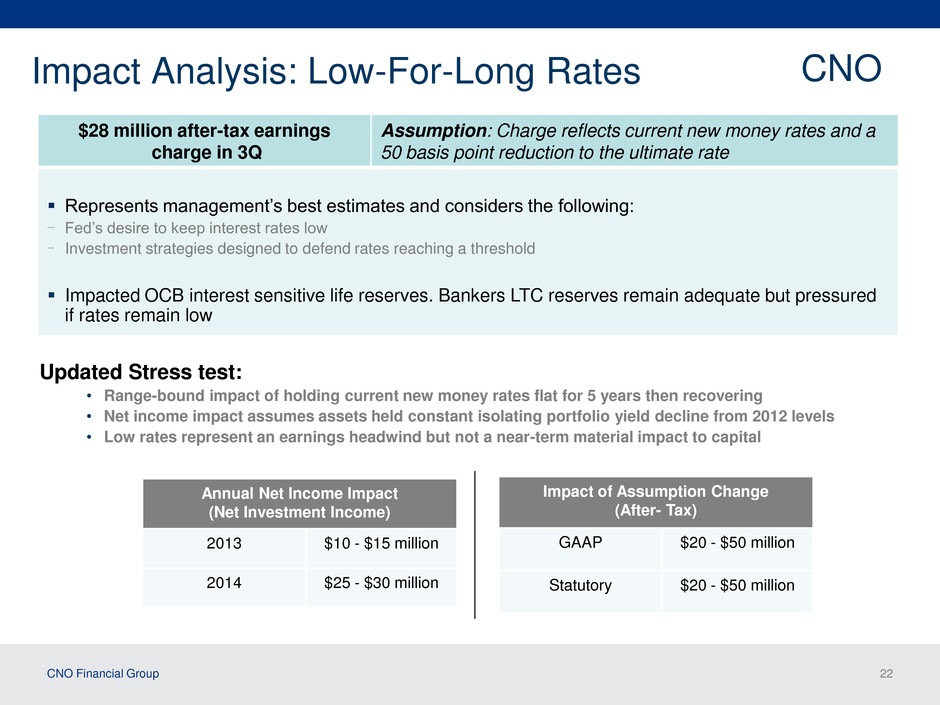

CNO Financial Group 22 Impact Analysis: Low-For-Long Rates Updated Stress test: • Range-bound impact of holding current new money rates flat for 5 years then recovering • Net income impact assumes assets held constant isolating portfolio yield decline from 2012 levels • Low rates represent an earnings headwind but not a near-term material impact to capital Annual Net Income Impact (Net Investment Income) 2013 $10 - $15 million 2014 $25 - $30 million CNO $28 million after-tax earnings charge in 3Q Assumption: Charge reflects current new money rates and a 50 basis point reduction to the ultimate rate Represents management’s best estimates and considers the following: - Fed’s desire to keep interest rates low - Investment strategies designed to defend rates reaching a threshold Impacted OCB interest sensitive life reserves. Bankers LTC reserves remain adequate but pressured if rates remain low Impact of Assumption Change (After- Tax) GAAP $20 - $50 million Statutory $20 - $50 million

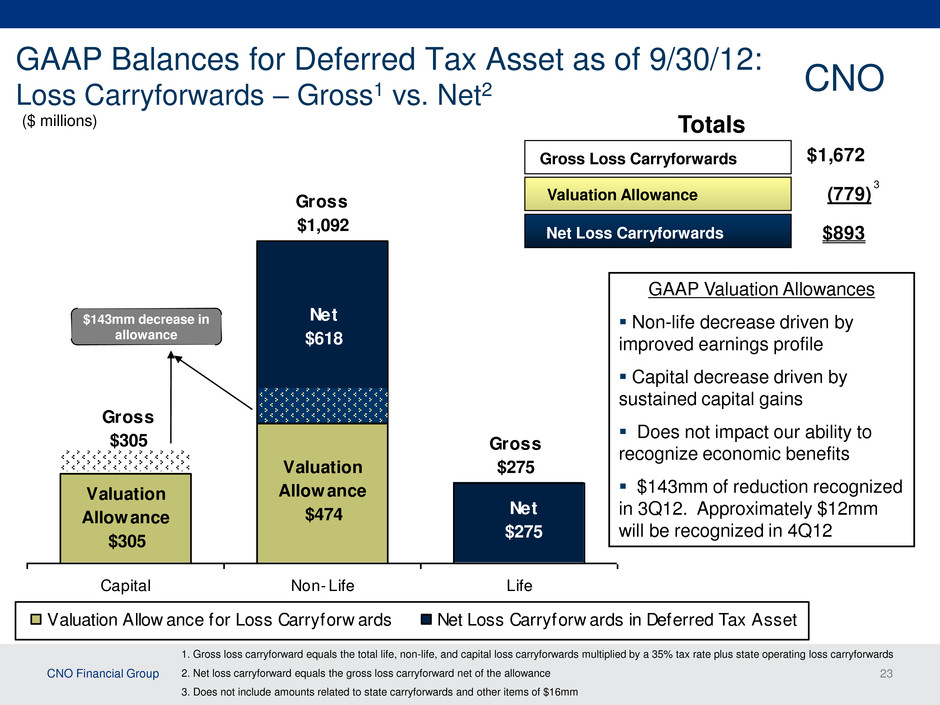

CNO Financial Group 23 Valuation Allowance $474 Valuation Allowance $305 Net $275 Net $618 Capital Non- Life Life Valuation Allow ance for Loss Carryforw ards Net Loss Carryforw ards in Deferred Tax Asset Gross $275 Gross $305 Gross $1,092 GAAP Balances for Deferred Tax Asset as of 9/30/12: Loss Carryforwards – Gross1 vs. Net2 ($ millions) 1. Gross loss carryforward equals the total life, non-life, and capital loss carryforwards multiplied by a 35% tax rate plus state operating loss carryforwards 2. Net loss carryforward equals the gross loss carryforward net of the allowance 3. Does not include amounts related to state carryforwards and other items of $16mm Totals Gross Loss Carryforwards Net Loss Carryforwards Valuation Allowance GAAP Valuation Allowances Non-life decrease driven by improved earnings profile Capital decrease driven by sustained capital gains Does not impact our ability to recognize economic benefits $143mm of reduction recognized in 3Q12. Approximately $12mm will be recognized in 4Q12 $1,672 (779) $893 3 $143mm decrease in allowance CNO

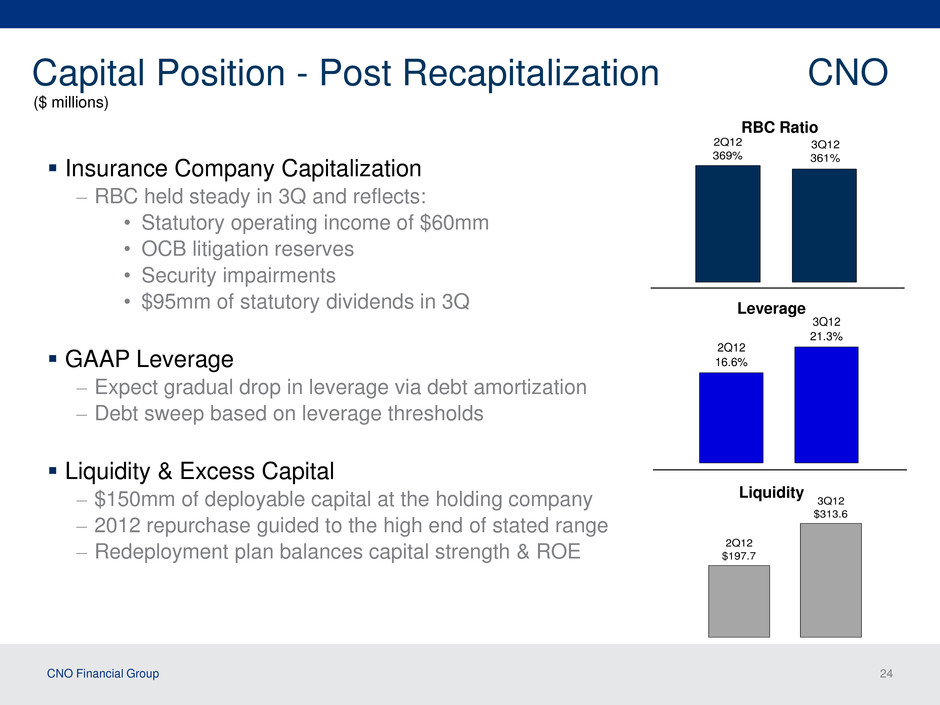

CNO Financial Group 24 Capital Position - Post Recapitalization CNO 2Q12 369% 3Q12 361% 2Q12 16.6% 3Q12 21.3% 3Q12 $313.6 2Q12 $197.7 Leverage RBC Ratio Liquidity Insurance Company Capitalization – RBC held steady in 3Q and reflects: • Statutory operating income of $60mm • OCB litigation reserves • Security impairments • $95mm of statutory dividends in 3Q GAAP Leverage – Expect gradual drop in leverage via debt amortization – Debt sweep based on leverage thresholds Liquidity & Excess Capital – $150mm of deployable capital at the holding company – 2012 repurchase guided to the high end of stated range – Redeployment plan balances capital strength & ROE ($ millions)

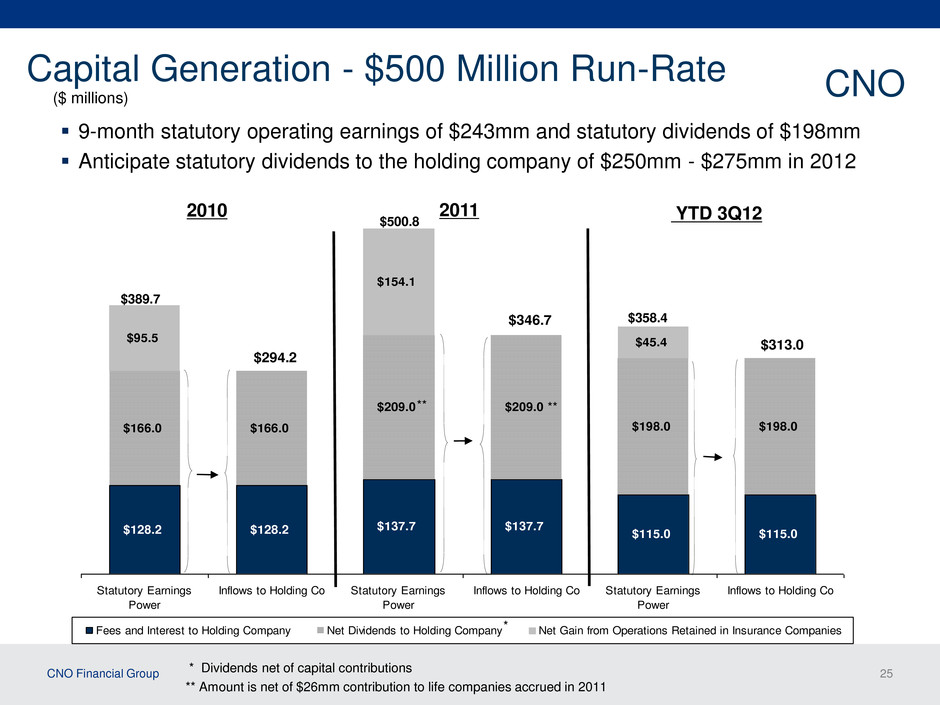

CNO Financial Group 25 $128.2 $137.7 $115.0 $166.0 $209.0 $198.0 $95.5 $154.1 $45.4 $128.2 $137.7 $115.0 $166.0 $209.0 $198.0 $313.0 $346.7 $294.2 Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Fees and Interest to Holding Company Net Dividends to Holding Company Net Gain from Operations Retained in Insurance Companies ($ millions) 2010 YTD 3Q12 Capital Generation - $500 Million Run-Rate CNO * Dividends net of capital contributions * ** ** Amount is net of $26mm contribution to life companies accrued in 2011 2011 9-month statutory operating earnings of $243mm and statutory dividends of $198mm Anticipate statutory dividends to the holding company of $250mm - $275mm in 2012 $389.7 $500.8 $358.4 **

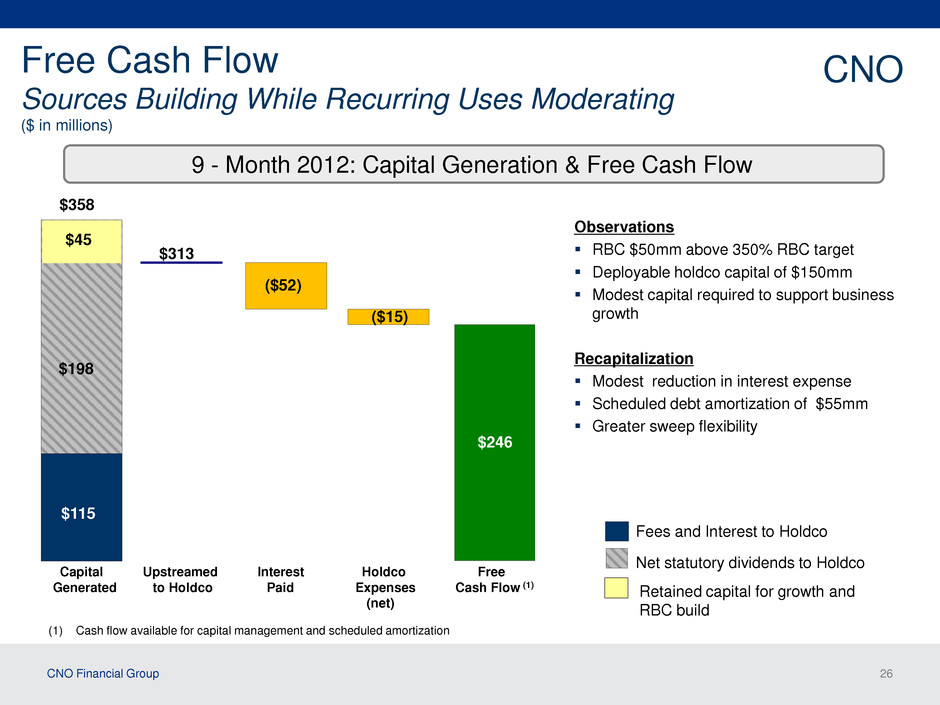

CNO Financial Group 26 Free Cash Flow Sources Building While Recurring Uses Moderating ($ in millions) CNO Fees and Interest to Holdco Net statutory dividends to Holdco Retained capital for growth and RBC build $358 ($52) ($15) Capital Upstreamed Interest Holdco Free Generated to Holdco Paid Expenses Cash Flow (1) (net) $246 $198 $45 $313 $115 Observations RBC $50mm above 350% RBC target Deployable holdco capital of $150mm Modest capital required to support business growth Recapitalization Modest reduction in interest expense Scheduled debt amortization of $55mm Greater sweep flexibility 9 - Month 2012: Capital Generation & Free Cash Flow (1) Cash flow available for capital management and scheduled amortization

CNO Financial Group 27 CNO: Well Positioned in Growing & Underserved Markets The middle-income, pre-retiree and retirement markets are growing as the Baby Boomers age These markets need straightforward products that help address healthcare expenditures, retirement, and leaving a legacy for loved ones We are well positioned in all 3 segments to serve these needs Sales of these products convert quickly to cash Gear shift to increased capital deployment Refreshed capital structure Alignment of target market, product mix, distribution, and home office

CNO Financial Group 28 2012 CNO Investor Day in NYC CNO will be hosting an Investor Day on Thursday, December 13, 2012 in NYC Invitations will be sent and additional details posted to our website in the coming weeks The event will be available via webcast

CNO Financial Group 29 Questions and Answers

CNO Financial Group 30 Appendix

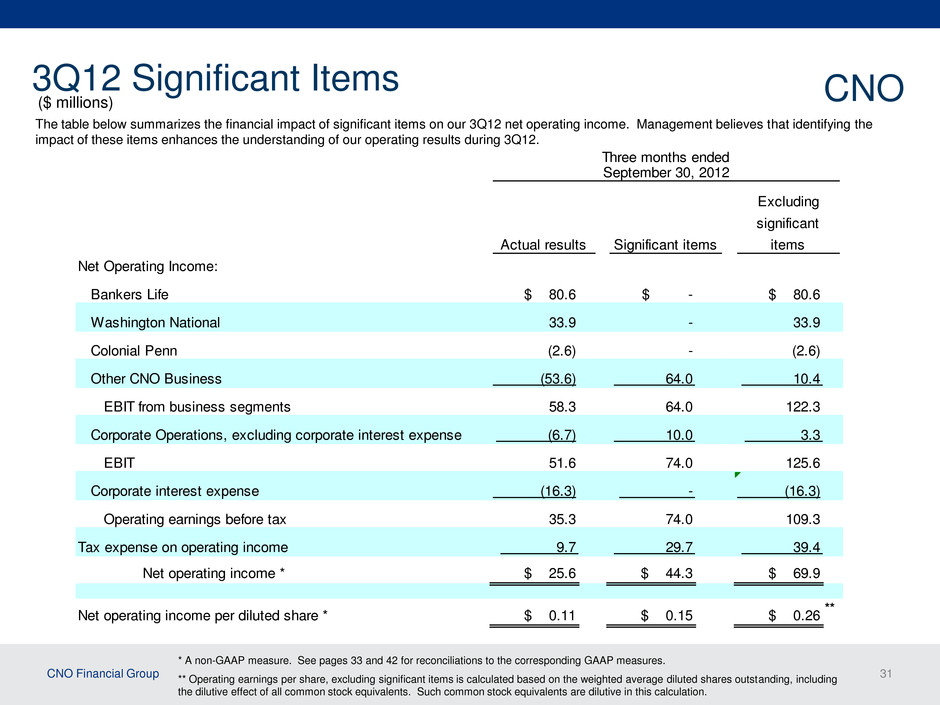

CNO Financial Group 31 3Q12 Significant Items CNO ($ millions) The table below summarizes the financial impact of significant items on our 3Q12 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 3Q12. Net Operating Income: Bankers Life $ 80.6 $ - $ 80.6 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 25.6 $ 44.3 $ 69.9 Net operating income per diluted share * $ 0.11 $ 0.15 $ 0.26 Three months ended September 30, 2012 Actual results Significant items Excluding significant items 33.9 - 33.9 (2.6) - (2.6) (53.6) 64.0 10.4 58.3 64.0 122.3 (6.7) 10.0 3.3 51.6 74.0 125.6 (16.3) - (16.3) 35.3 74.0 109.3 9.7 29.7 39.4 * A non-GAAP measure. See pages 33 and 42 for reconciliations to the corresponding GAAP measures. ** Operating earnings per share, excluding significant items is calculated based on the weighted average diluted shares outstanding, including the dilutive effect of all common stock equivalents. Such common stock equivalents are dilutive in this calculation. **

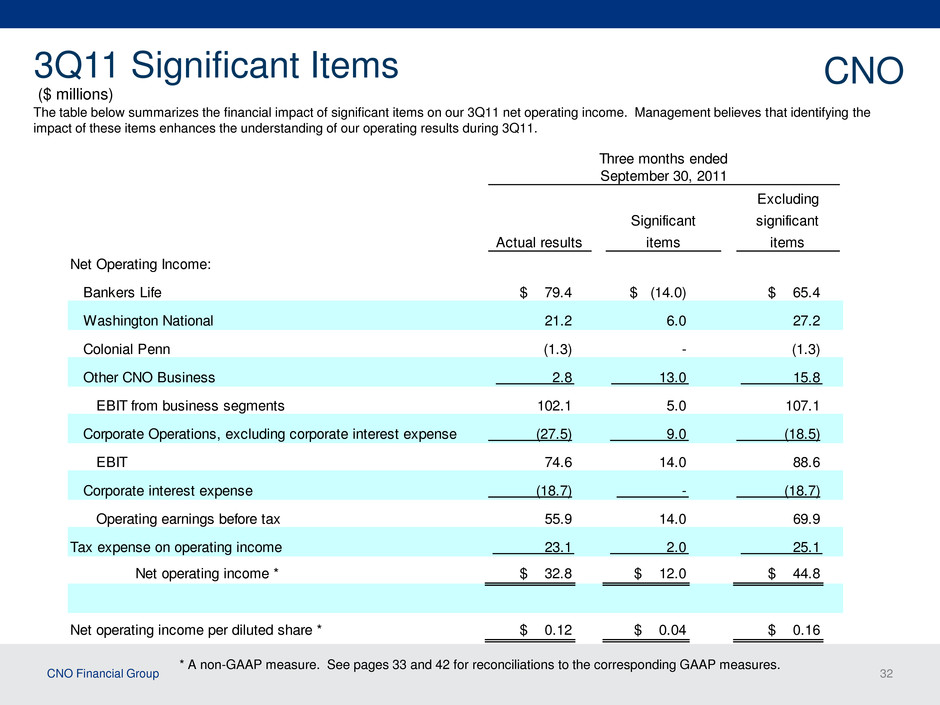

CNO Financial Group 32 3Q11 Significant Items CNO ($ millions) The table below summarizes the financial impact of significant items on our 3Q11 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results during 3Q11. Net Operating Income: Bankers Life $ 79.4 $ (14.0) $ 65.4 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 32.8 $ 12.0 $ 44.8 Net operating income per diluted share * $ 0.12 $ 0.04 $ 0.16 55.9 14.0 69.9 23.1 2.0 25.1 74.6 14.0 88.6 (18.7) - (18.7) 102.1 5.0 107.1 (27.5) 9.0 (18.5) (1.3) - (1.3) 2.8 13.0 15.8 21.2 6.0 27.2 Three months ended September 30, 2011 Actual results Significant items Excluding significant items * A non-GAAP measure. See pages 33 and 42 for reconciliations to the corresponding GAAP measures.

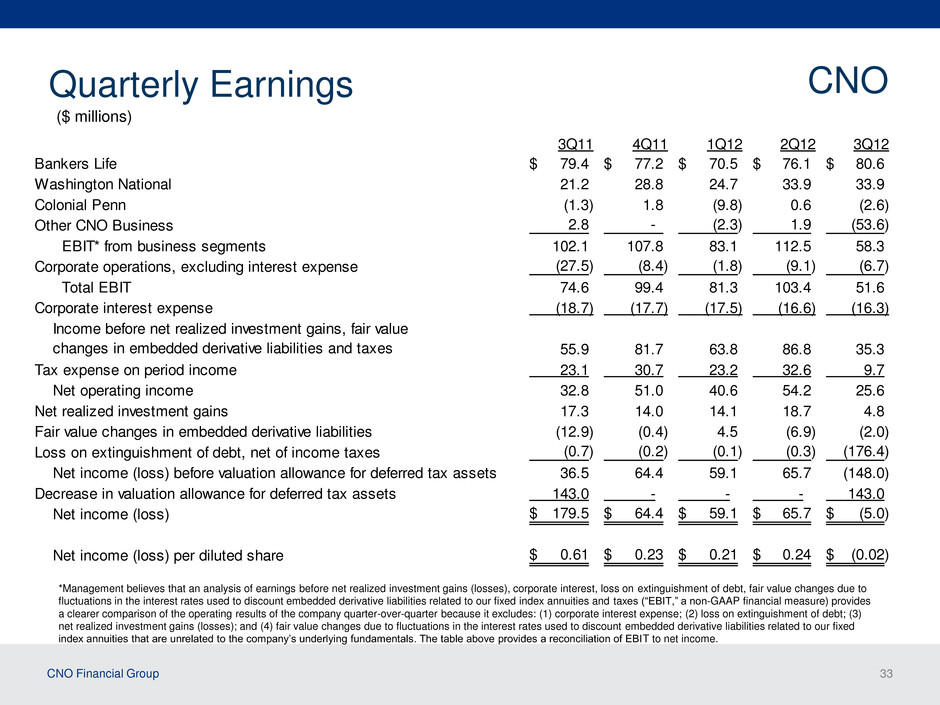

CNO Financial Group 33 Quarterly Earnings CNO *Management believes that an analysis of earnings before net realized investment gains (losses), corporate interest, loss on extinguishment of debt, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment of debt; (3) net realized investment gains (losses); and (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation of EBIT to net income. 3Q11 4Q11 1Q12 2Q12 3Q12 Bankers Life 79.4$ 77.2$ 70.5$ 76.1$ 80.6$ Washington National 21.2 28.8 24.7 33.9 33.9 Colonial Penn (1.3) 1.8 (9.8) 0.6 (2.6) Other CNO Business 2.8 - (2.3) 1.9 (53.6) EBIT* from business segments 102.1 107.8 83.1 112.5 58.3 Corporate operations, excluding interest expense (27.5) (8.4) (1.8) (9.1) (6.7) Total EBIT 74.6 99.4 81.3 103.4 51.6 Corporate interest expense (18.7) (17.7) (17.5) (16.6) (16.3) 55.9 81.7 63.8 86.8 35.3 Tax expense on period income 23.1 30.7 23.2 32.6 9.7 Net operating income 32.8 51.0 40.6 54.2 25.6 Net realized investment gains 17.3 14.0 14.1 18.7 4.8 Fair value changes in embedded derivative liabilities (12.9) (0.4) 4.5 (6.9) (2.0) Loss on extinguishment of debt, net of income taxes (0.7) (0.2) (0.1) (0.3) (176.4) Net income (loss) before valuation allowance for deferred tax assets 36.5 64.4 59.1 65.7 (148.0) Decrease in valuation allowance for deferred tax assets 143.0 - - - 143.0 Net income (loss) 179.5$ 64.4$ 59.1$ 65.7$ (5.0)$ Net income (loss) per diluted share 0.61$ 0.23$ 0.21$ 0.24$ (0.02)$ Income before net realized investment gains, fair value changes in embedded derivative liabilities and taxes ($ millions)

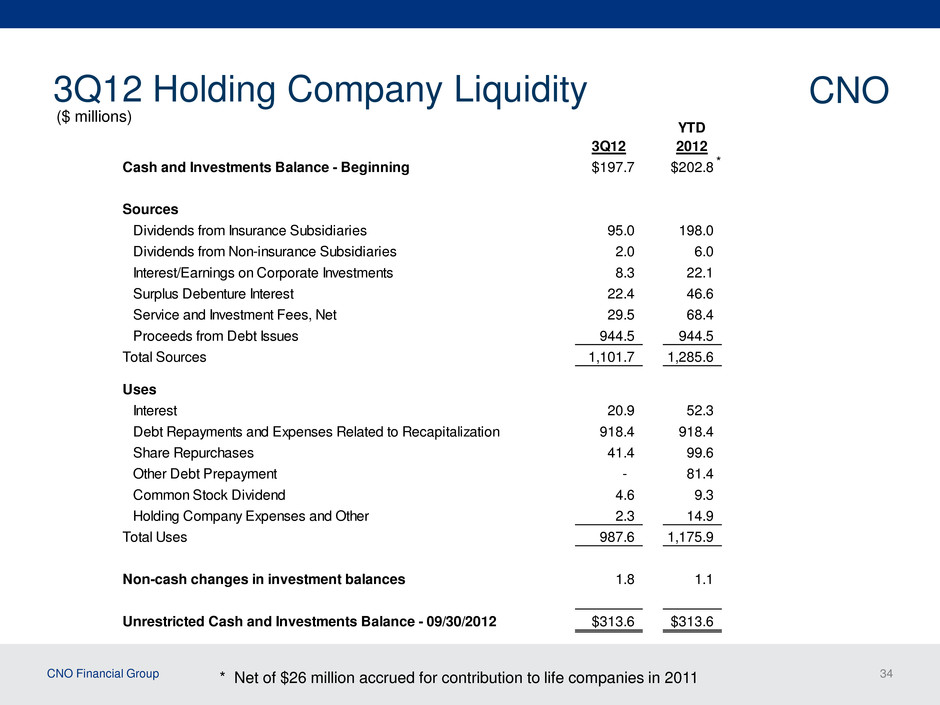

CNO Financial Group 34 3Q12 Holding Company Liquidity CNO ($ millions) 3Q12 YTD 2012 Cash and Investments Balance - Beginning $197.7 $202.8 Sources Dividends from Insurance Subsidiaries 95.0 198.0 Dividends from Non-insurance Subsidiaries 2.0 6.0 Interest/Earnings on Corporate Investments 8.3 22.1 Surplus Debenture Interest 22.4 46.6 Service and Investment Fees, Net 29.5 68.4 Proceeds from Debt Issues 944.5 944.5 Total Sources 1,101.7 1,285.6 Uses Interest 20.9 52.3 Debt Repayments and Expenses Related to Recapitalization 918.4 918.4 Share Repurchases 41.4 99.6 Other Debt Prepayment - 81.4 Common Stock Dividend 4.6 9.3 Holding Company Expenses and Other 2.3 14.9 Total Uses 987.6 1,175.9 Non-cash changes in investment balances 1.8 1.1 Unrestricted Cash and Investments Balance - 09/30/2012 $313.6 $313.6 * * Net of $26 million accrued for contribution to life companies in 2011

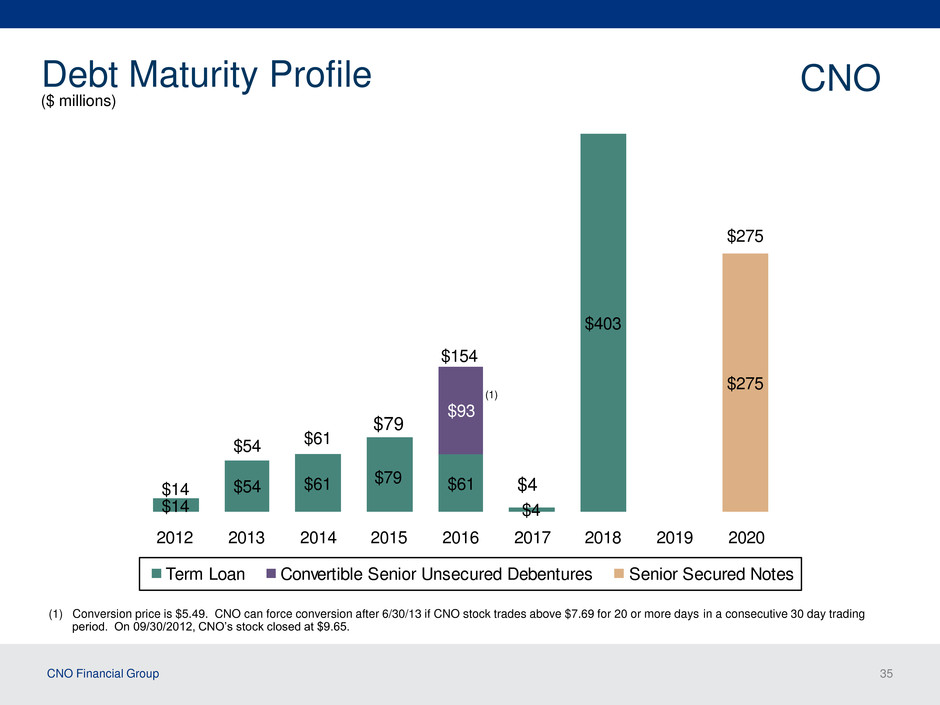

CNO Financial Group 35 $14 $275 $275 $403 $61 $4 $79$61$54 $93 $403 $14 $54 $74 $154 $61 2012 2013 2014 2015 2016 2017 2018 2019 2020 Term Loan Convertible Senior Unsecured Debentures Senior Secured Notes Debt Maturity Profile (1) Conversion price is $5.49. CNO can force conversion after 6/30/13 if CNO stock trades above $7.69 for 20 or more days in a consecutive 30 day trading period. On 09/30/2012, CNO’s stock closed at $9.65. (1) ($ millions) CNO $79 $4

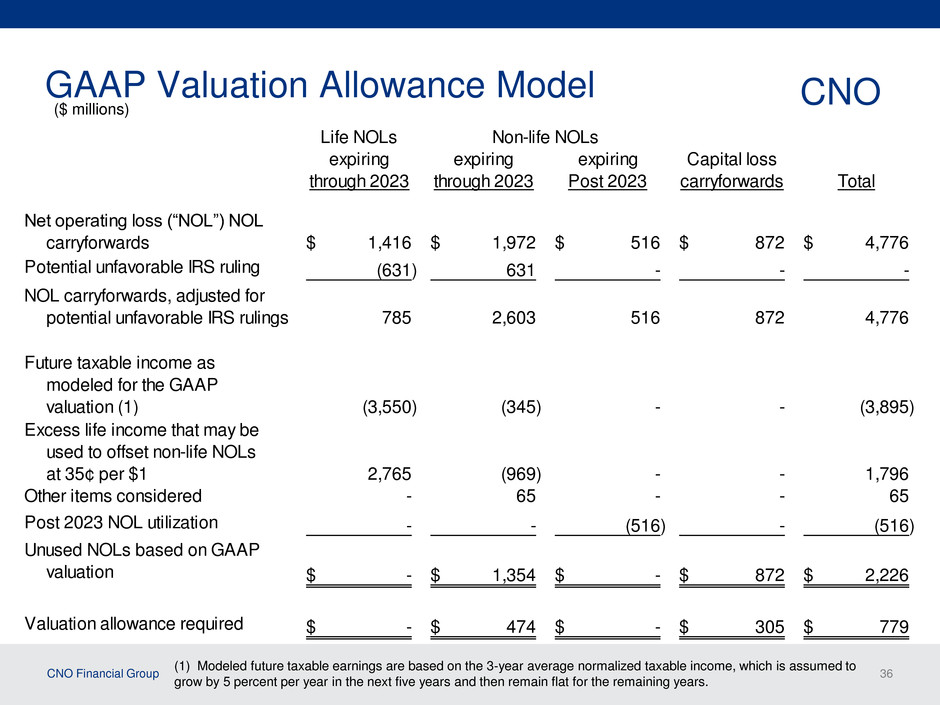

CNO Financial Group 36 GAAP Valuation Allowance Model ($ millions) CNO (1) Modeled future taxable earnings are based on the 3-year average normalized taxable income, which is assumed to grow by 5 percent per year in the next five years and then remain flat for the remaining years. Life NOLs Non-life NOLs expiring expiring expiring Capital loss through 2023 through 2023 Post 2023 carryforwards Total Net operating loss (“NOL”) NOL carryforwards 1,416$ 1,972$ 516$ 872$ 4,776$ Potential unfavorable IRS ruling (631) 631 - - - NOL carryforwards, adjusted for potential unfavorable IRS rulings 785 2,603 516 872 4,776 Future taxable income as modeled for the GAAP valuation (1) (3,550) (345) - - (3,895) Excess life income that may be used to offset non-life NOLs at 35¢ per $1 2,765 (969) - - 1,796 Other items considered - 65 - - 65 Post 2023 NOL utilization - - (516) - (516) Un sed NOLs based on GAAP valuation -$ 1,354$ -$ 872$ 2,226$ Valuation allowance required -$ 474$ -$ 305$ 779$

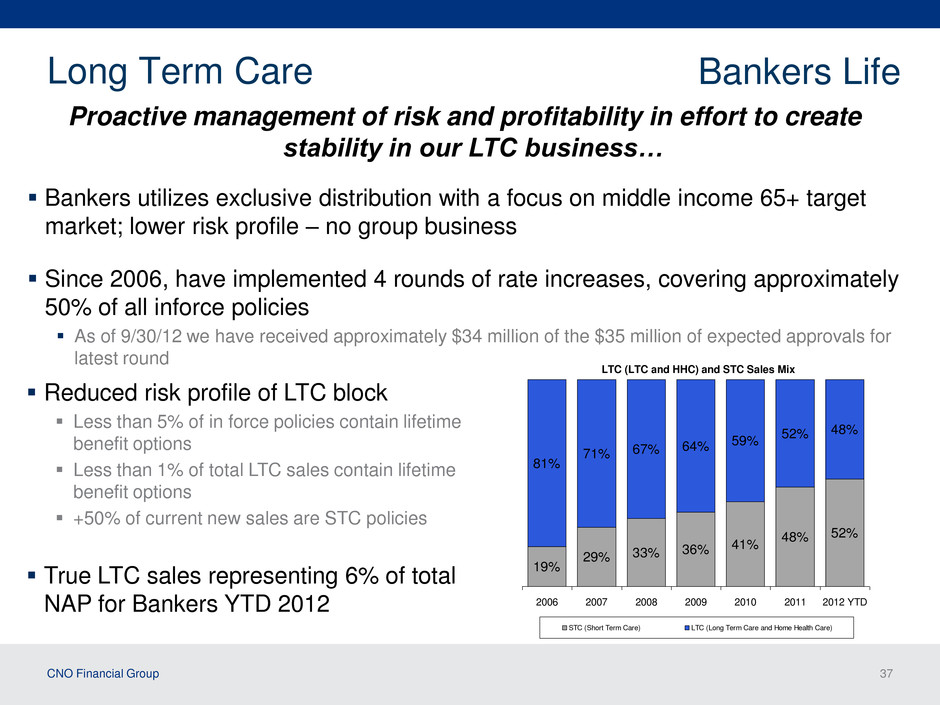

CNO Financial Group 37 LTC (LTC and HHC) and STC Sales Mix 19% 29% 33% 36% 41% 48% 52% 81% 71% 67% 64% 59% 52% 48% 2006 2007 2008 2009 2010 2011 2012 YTD STC (Short Term Care) LTC (Long Term Care and Home Health Care) Long Term Care Bankers utilizes exclusive distribution with a focus on middle income 65+ target market; lower risk profile – no group business Since 2006, have implemented 4 rounds of rate increases, covering approximately 50% of all inforce policies As of 9/30/12 we have received approximately $34 million of the $35 million of expected approvals for latest round Reduced risk profile of LTC block Less than 5% of in force policies contain lifetime benefit options Less than 1% of total LTC sales contain lifetime benefit options +50% of current new sales are STC policies True LTC sales representing 6% of total NAP for Bankers YTD 2012 Proactive management of risk and profitability in effort to create stability in our LTC business… Bankers Life

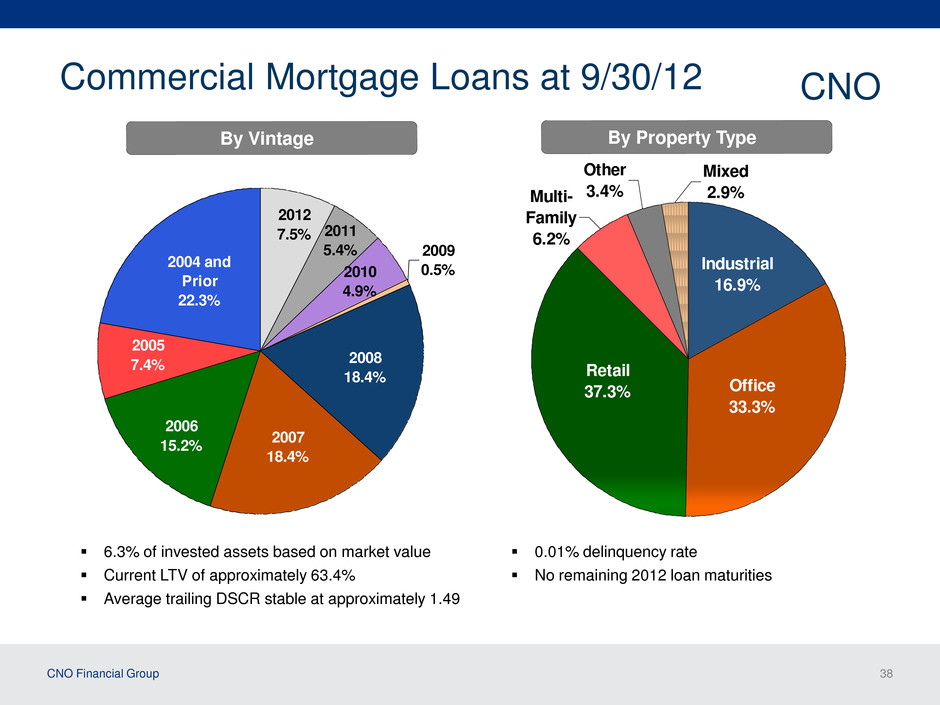

CNO Financial Group 38 Commercial Mortgage Loans at 9/30/12 6.3% of invested assets based on market value Current LTV of approximately 63.4% Average trailing DSCR stable at approximately 1.49 By Property Type By Vintage 0.01% delinquency rate ��� No remaining 2012 loan maturities CNO 2004 and Prior 22.3% 2011 5.4% 2012 7.5% 2010 4.9% 2009 0.5% 2008 18.4% 2007 18.4% 2006 15.2% 2005 7.4% Office 33.3% Industrial 16.9% Retail 37.3% Multi- Family 6.2% Other 3.4% Mixed 2.9%

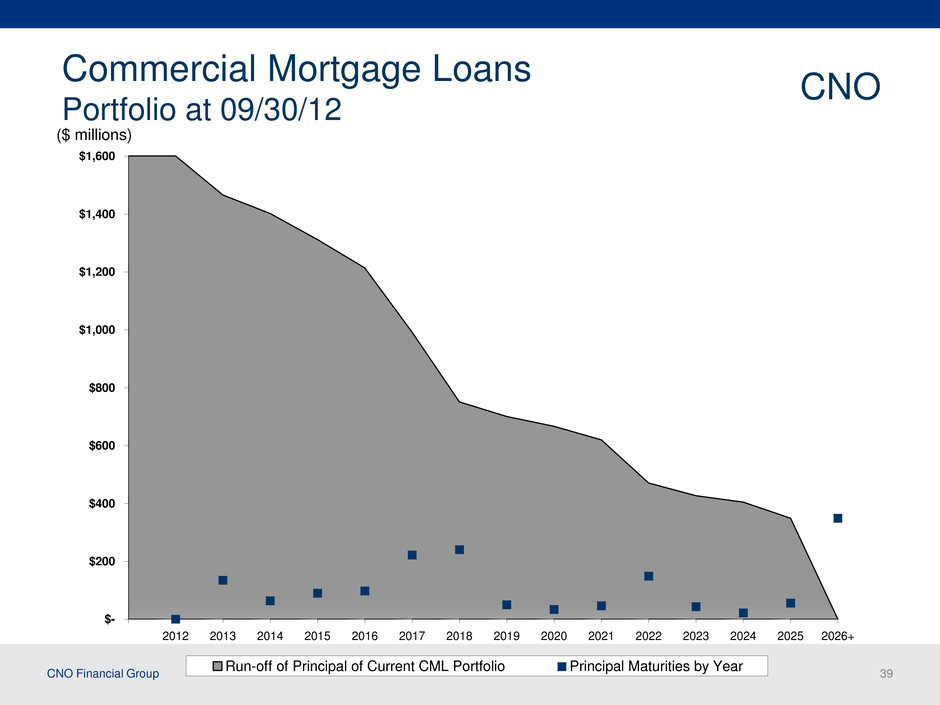

CNO Financial Group 39 Commercial Mortgage Loans Portfolio at 09/30/12 CNO ($ millions) $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026+ Run-off of Principal of Current CML Portfolio Principal Maturities by Year

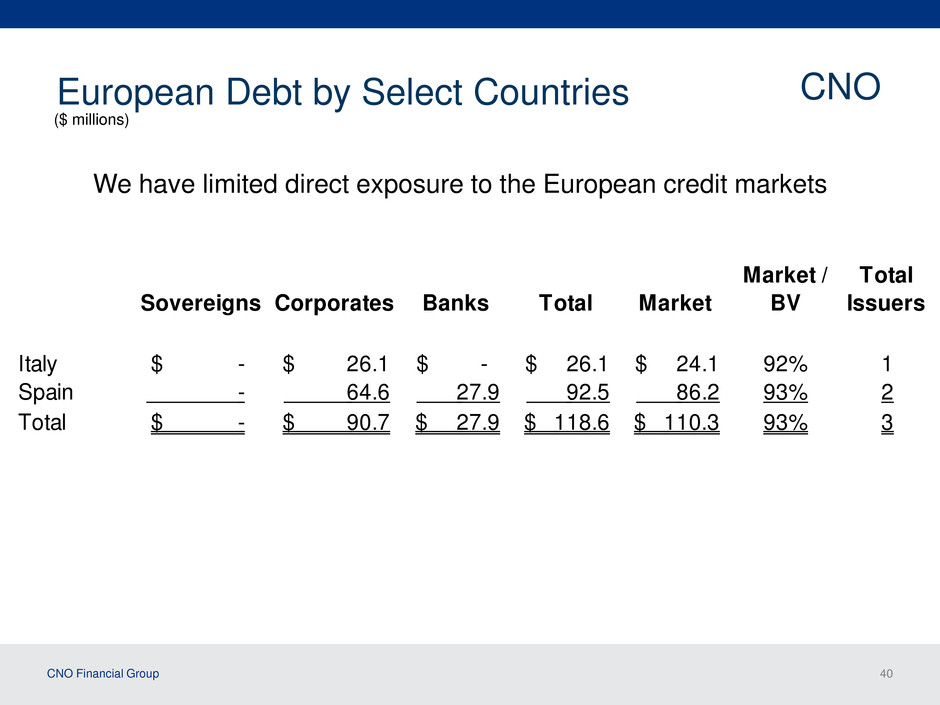

CNO Financial Group 40 European Debt by Select Countries Sovereigns Corporates Banks Total Market Market / BV Total Issuers Italy -$ 26.1$ -$ 26.1$ 24.1$ 92% 1 Spain - 64.6 27.9 92.5 86.2 93% 2 Total -$ 90.7$ 27.9$ 118.6$ 110.3$ 93% 3 ($ millions) We have limited direct exposure to the European credit markets CNO

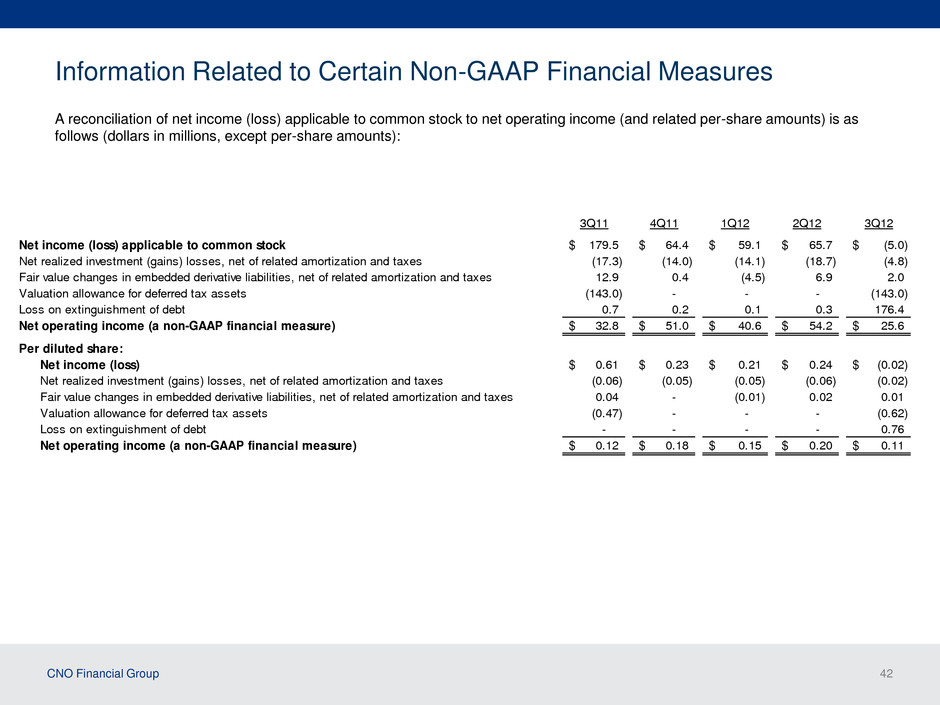

CNO Financial Group 41 Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before loss on extinguishment of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations.

CNO Financial Group 42 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income (loss) applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 3Q11 4Q11 1Q12 2Q12 3Q12 Net income (loss) applicable to common stock 179.5$ 64.4$ 59.1$ 65.7$ (5.0)$ Net realized investment (gains) losses, net of related amortization and taxes (17.3) (14.0) (14.1) (18.7) (4.8) Fair value changes in embedded derivative liabilities, net of related amortization and taxes 12.9 0.4 (4.5) 6.9 2.0 Valuation allowance for deferred tax assets (143.0) - - - (143.0) Loss on extinguishment of debt 0.7 0.2 0.1 0.3 176.4 Net operating income (a non-GAAP financial measure) 32.8$ 51.0$ 40.6$ 54.2$ 25.6$ Per diluted share: Net income (loss) 0.61$ 0.23$ 0.21$ 0.24$ (0.02)$ N t realiz d investment (gains) losses, net of related amortization and taxes (0.06) (0.05) (0.05) (0.06) (0.02) F ir value changes in embedded derivative liabilities, net of related amortization and taxes 0.04 - (0.01) 0.02 0.01 Valuation allowance for deferred tax assets (0.47) - - - (0.62) Loss on extinguishment of debt - - - - 0.76 Net operating income (a non-GAAP financial measure) 0.12$ 0.18$ 0.15$ 0.20$ 0.11$

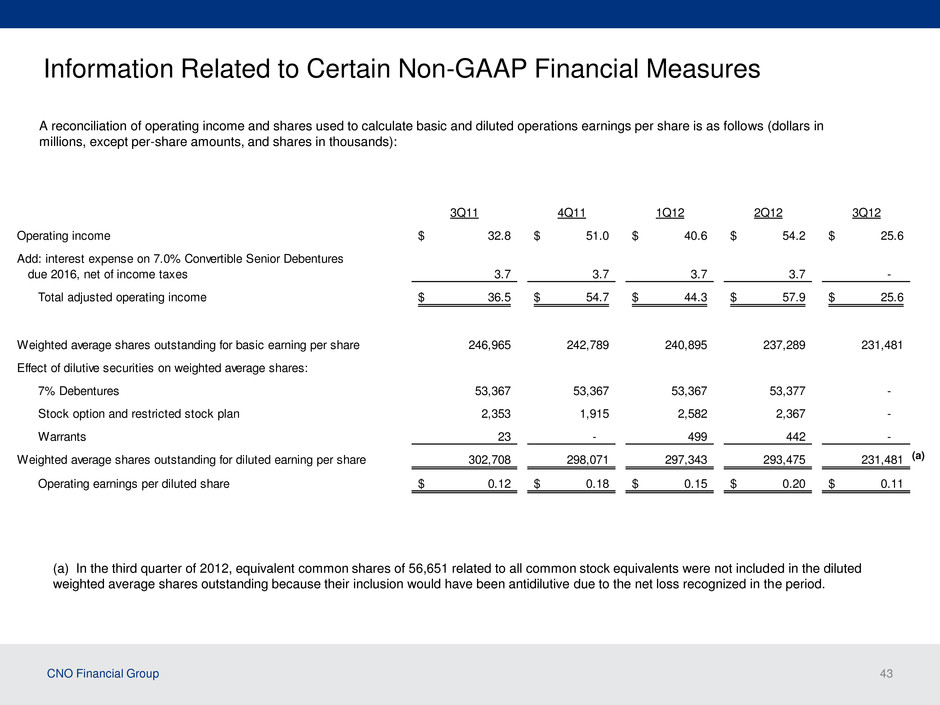

CNO Financial Group 43 3Q11 4Q11 1Q12 2Q12 3Q12 Operating income 32.8$ 51.0$ 40.6$ 54.2$ 25.6$ Add: interest expense on 7.0% Convertible Senior Debentures due 2016, net of income taxes 3.7 3.7 3.7 3.7 - Total adjusted operating income 36.5$ 54.7$ 44.3$ 57.9$ 25.6$ Weighted average shares outstanding for basic earning per share 246,965 242,789 240,895 237,289 231,481 Effect of dilutive securities on weighted average shares: 7% Debentures 53,367 53,367 53,367 53,377 - Stock option and restricted stock plan 2,353 1,915 2,582 2,367 - Warrants 23 - 499 442 - Weighted average shares outstanding for diluted earning per share 302,708 298,071 297,343 293,475 231,481 Operating earnings per diluted share 0.12$ 0.18$ 0.15$ 0.20$ 0.11$ A reconciliation of operating income and shares used to calculate basic and diluted operations earnings per share is as follows (dollars in millions, except per-share amounts, and shares in thousands): Information Related to Certain Non-GAAP Financial Measures (a) (a) In the third quarter of 2012, equivalent common shares of 56,651 related to all common stock equivalents were not included in the diluted weighted average shares outstanding because their inclusion would have been antidilutive due to the net loss recognized in the period.

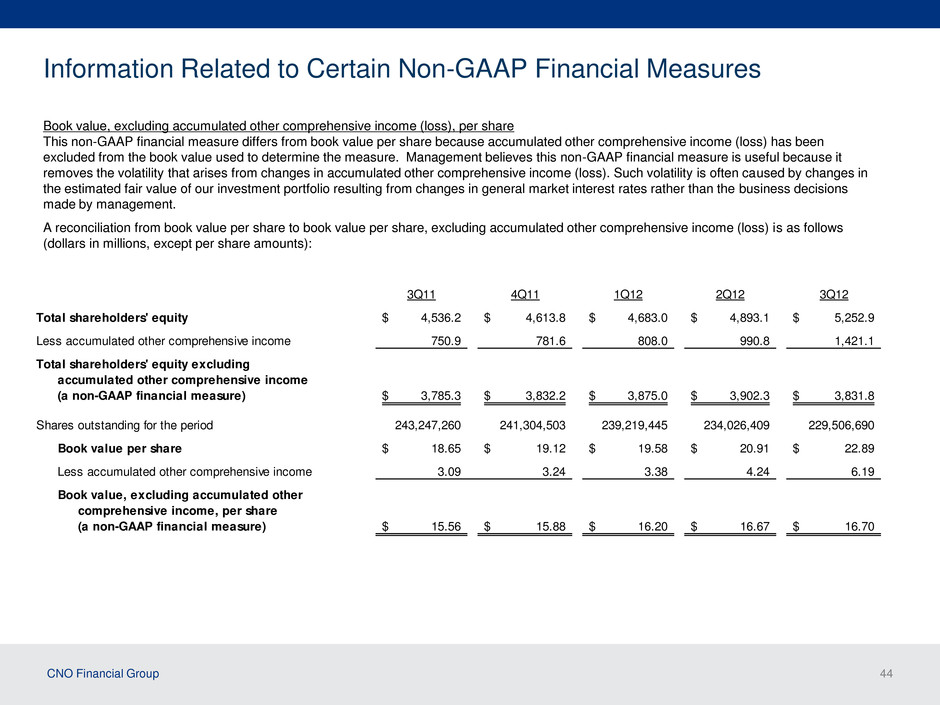

CNO Financial Group 44 Information Related to Certain Non-GAAP Financial Measures Book value, excluding accumulated other comprehensive income (loss), per share This non-GAAP financial measure differs from book value per share because accumulated other comprehensive income (loss) has been excluded from the book value used to determine the measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. 3Q11 4Q11 1Q12 2Q12 3Q12 Total shareholders' equity 4,536.2$ 4,613.8$ 4,683.0$ 4,893.1$ 5,252.9$ Less accumulated other comprehensive income 750.9 781.6 808.0 990.8 1,421.1 Total shareholders' equity excluding accumulated other comprehensive income (a non-GAAP financial measure) 3,785.3$ 3,832.2$ 3,875.0$ 3,902.3$ 3,831.8$ Shares outstanding for the period 243,247,260 241,304,503 239,219,445 234,026,409 229,506,690 Book value per share 18.65$ 19.12$ 19.58$ 20.91$ 22.89$ Less accumulated other comprehensive income 3.09 3.24 3.38 4.24 6.19 Book value, excluding accumulated other comprehensive income, per share (a non-GAAP financial measure) 15.56$ 15.88$ 16.20$ 16.67$ 16.70$ A reconciliation from book value per share to book value per share, excluding accumulated other comprehensive income (loss) is as follows (dollars in millions, except per share amounts):

CNO Financial Group 45 Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of return before loss on extinguishment of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continued operations. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to- period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation. All references to return on allocated capital measures assume a capital allocation based on a 275% targeted risk-based capital at the segment level. Additionally, corporate debt has been allocated to the segments.

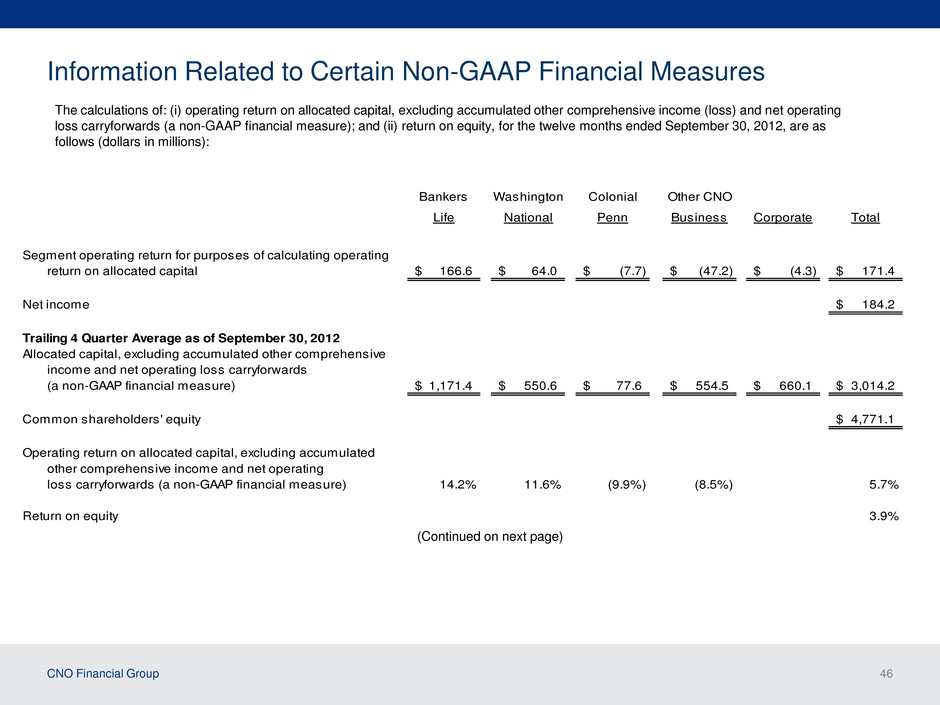

CNO Financial Group 46 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on allocated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (ii) return on equity, for the twelve months ended September 30, 2012, are as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Segment operating return for purposes of calculating operating return on allocated capital 166.6$ 64.0$ (7.7)$ (47.2)$ (4.3)$ 171.4$ Net income 184.2$ Trailing 4 Quarter Average as of September 30, 2012 Allocated capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 1,171.4$ 550.6$ 77.6$ 554.5$ 660.1$ 3,014.2$ Common shareholders' equity 4,771.1$ Operating return on allocated capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 14.2% 11.6% (9.9%) (8.5%) 5.7% Return on equity 3.9% (Continued on next page)

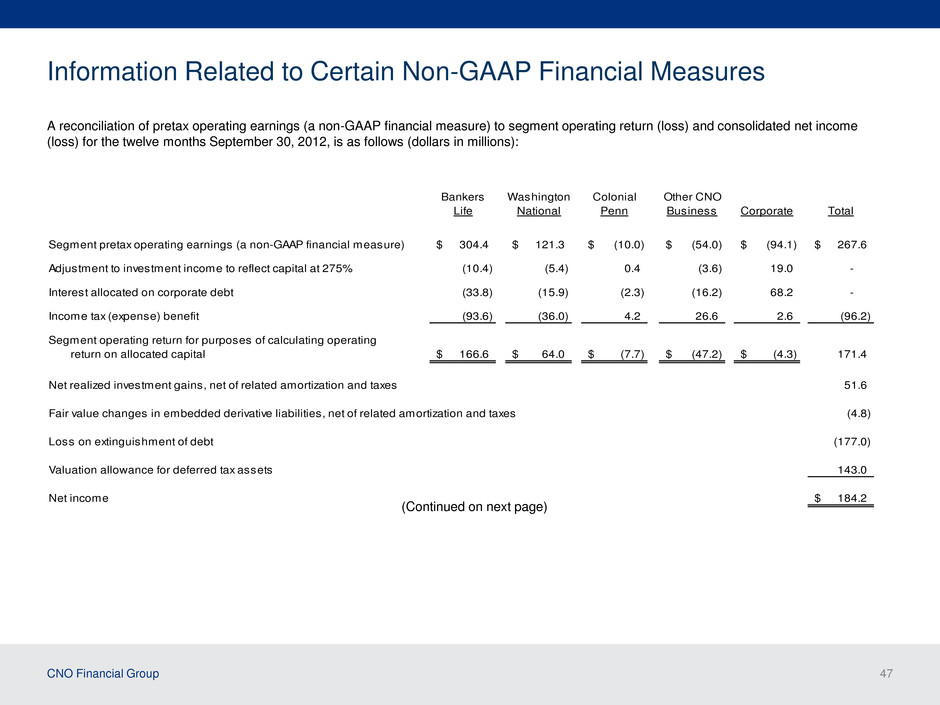

CNO Financial Group 47 Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to segment operating return (loss) and consolidated net income (loss) for the twelve months September 30, 2012, is as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Segment pretax operating earnings (a non-GAAP financial measure) 304.4$ 121.3$ (10.0)$ (54.0)$ (94.1)$ 267.6$ Adjustment to investment income to reflect capital at 275% (10.4) (5.4) 0.4 (3.6) 19.0 - Interest allocated on corporate debt (33.8) (15.9) (2.3) (16.2) 68.2 - Income tax (expense) benefit (93.6) (36.0) 4.2 26.6 2.6 (96.2) Segment operating return for purposes of calculating operating return on allocated capital 166.6$ 64.0$ (7.7)$ (47.2)$ (4.3)$ 171.4 Net realized investment gains, net of related amortization and taxes 51.6 Fair value changes in embedded derivative liabilities, net of related amortization and taxes (4.8) Loss on extinguishment of debt (177.0) Valuation allowance for deferred tax assets 143.0 Net income 184.2$ (Continued on next page)

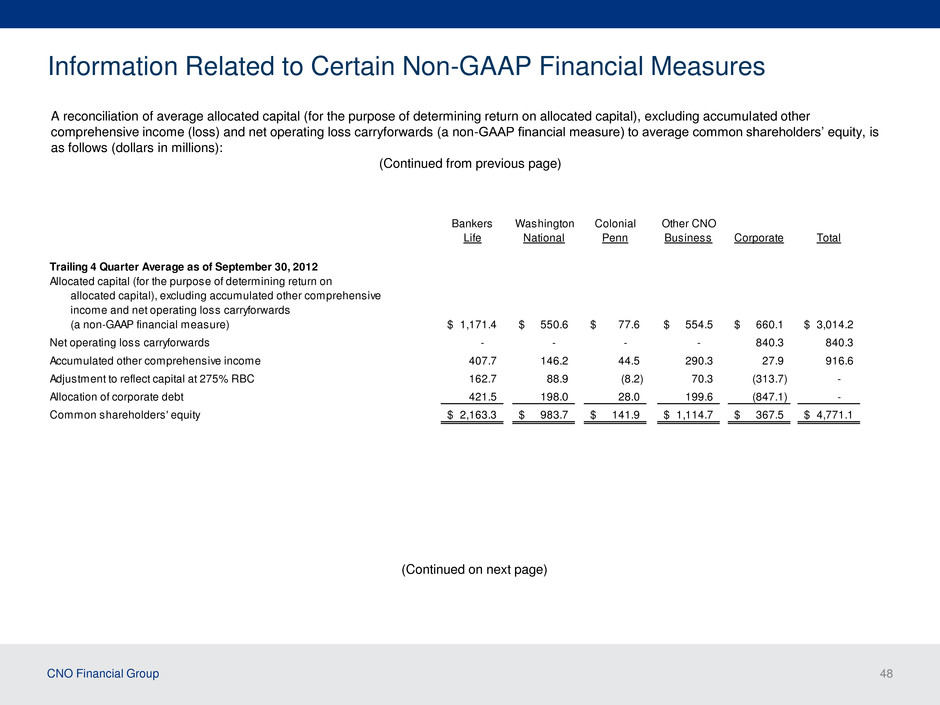

CNO Financial Group 48 Information Related to Certain Non-GAAP Financial Measures A reconciliation of average allocated capital (for the purpose of determining return on allocated capital), excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to average common shareholders’ equity, is as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Trailing 4 Quarter Average as of September 30, 2012 Allocated capital (for the purpose of determining return on allocated capital), excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 1,171.4$ 550.6$ 77.6$ 554.5$ 660.1$ 3,014.2$ Net operating loss carryforwards - - - - 840.3 840.3 Accumulated other comprehensive income 407.7 146.2 44.5 290.3 27.9 916.6 Adjustment to reflect capital at 275% RBC 162.7 88.9 (8.2) 70.3 (313.7) - Allocation of corporate debt 421.5 198.0 28.0 199.6 (847.1) - Common shareholders' equity 2,163.3$ 983.7$ 141.9$ 1,114.7$ 367.5$ 4,771.1$ (Continued on next page) (Continued from previous page)

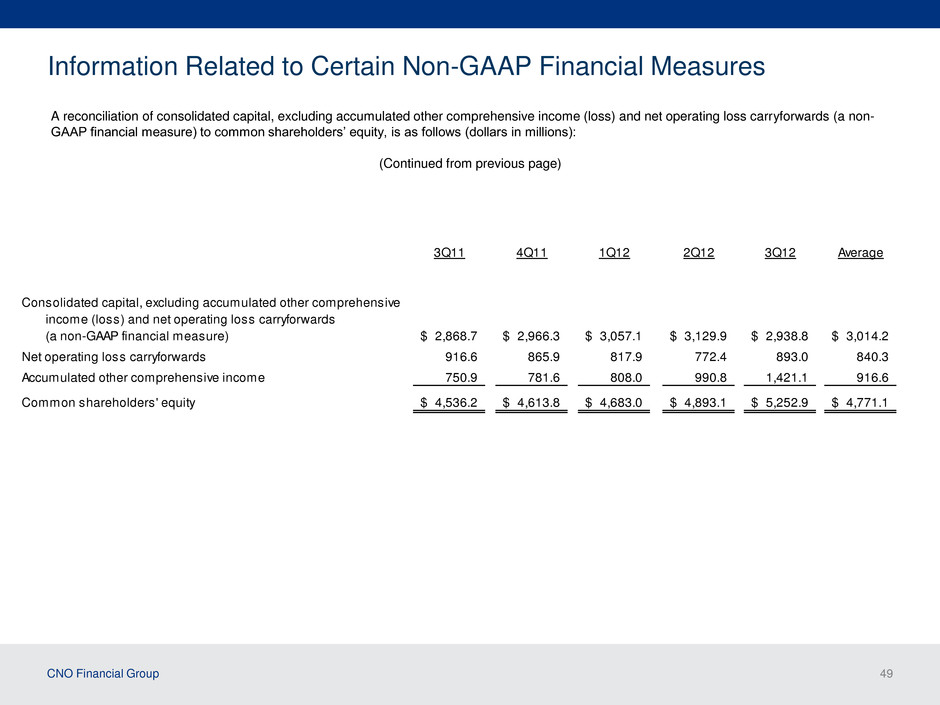

CNO Financial Group 49 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 3Q11 4Q11 1Q12 2Q12 3Q12 Average Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,868.7$ 2,966.3$ 3,057.1$ 3,129.9$ 2,938.8$ 3,014.2$ Net operating loss carryforwards 916.6 865.9 817.9 772.4 893.0 840.3 Accumulated other comprehensive income 750.9 781.6 808.0 990.8 1,421.1 916.6 Common shareholders' equity 4,536.2$ 4,613.8$ 4,683.0$ 4,893.1$ 5,252.9$ 4,771.1$ (Continued from previous page)

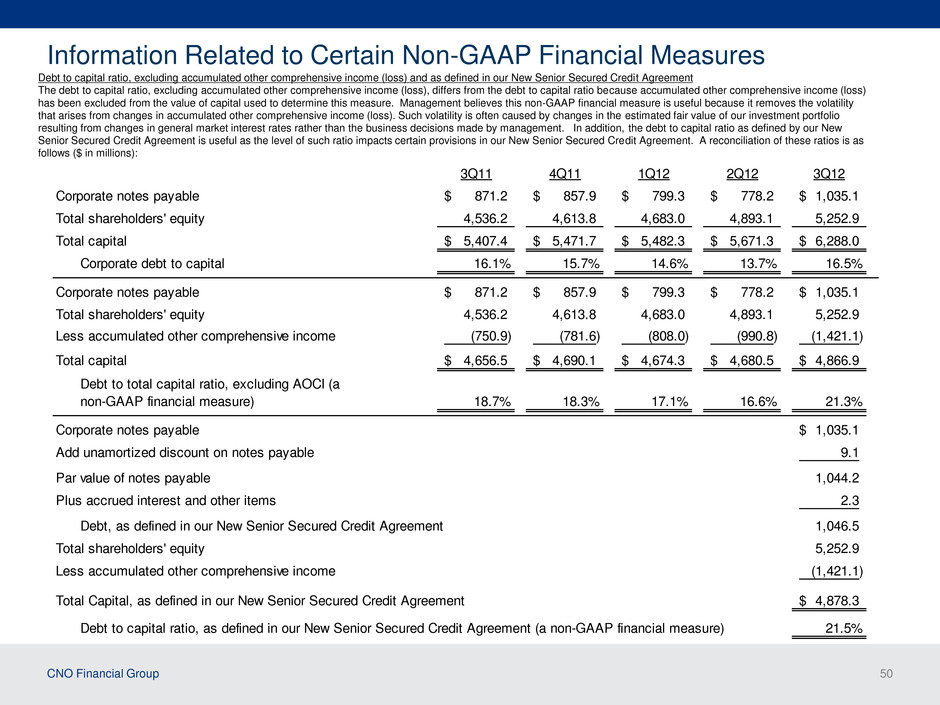

CNO Financial Group 50 Information Related to Certain Non-GAAP Financial Measures 3Q11 4Q11 1Q12 2Q12 3Q12 Corporate notes payable 871.2$ 857.9$ 799.3$ 778.2$ 1,035.1$ Total shareholders' equity 4,536.2 4,613.8 4,683.0 4,893.1 5,252.9 Total capital 5,407.4$ 5,471.7$ 5,482.3$ 5,671.3$ 6,288.0$ Corporate debt to capital 16.1% 15.7% 14.6% 13.7% 16.5% Corporate notes payable 871.2$ 857.9$ 799.3$ 778.2$ 1,035.1$ Total shareholders' equity 4,536.2 4,613.8 4,683.0 4,893.1 5,252.9 Less accumulated other comprehensive income (750.9) (781.6) (808.0) (990.8) (1,421.1) Total capital 4,656.5$ 4,690.1$ 4,674.3$ 4,680.5$ 4,866.9$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 18.7% 18.3% 17.1% 16.6% 21.3% Corporate notes payable 1,035.1$ Add unamortized discount on notes payable 9.1 Par value of notes payable 1,044.2 Plus accrued interest and other items 2.3 Debt, as defined in our New Senior Secured Credit Agreement 1,046.5 Total shareholders' equity 5,252.9 Less accumulated other comprehensive income (1,421.1) Total Capital, as defined in our New Senior Secured Credit Agreement 4,878.3$ Debt to capital ratio, as defined in our New Senior Secured Credit Agreement (a non-GAAP financial measure) 21.5% Debt to capital ratio, excluding accumulated other comprehensive income (loss) and as defined in our New Senior Secured Credit Agreement The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, the debt to capital ratio as defined by our New Senior Secured Credit Agreement is useful as the level of such ratio impacts certain provisions in our New Senior Secured Credit Agreement. A reconciliation of these ratios is as follows ($ in millions):