CNO Overview August 12, 2013 Exhibit 99.1

CNO Financial Group | CNO Overview | August 12, 2013 2

CNO Financial Group | CNO Overview | August 12, 2013 3 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of the date on the cover page of this presentation.

CNO Financial Group | CNO Overview | August 12, 2013 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group | CNO Overview | August 12, 2013 5 Track record of strong execution Well positioned in the growing and underserved retirement and middle-income market Building core value drivers Well capitalized and generating significant excess capital CNO Fundamentals

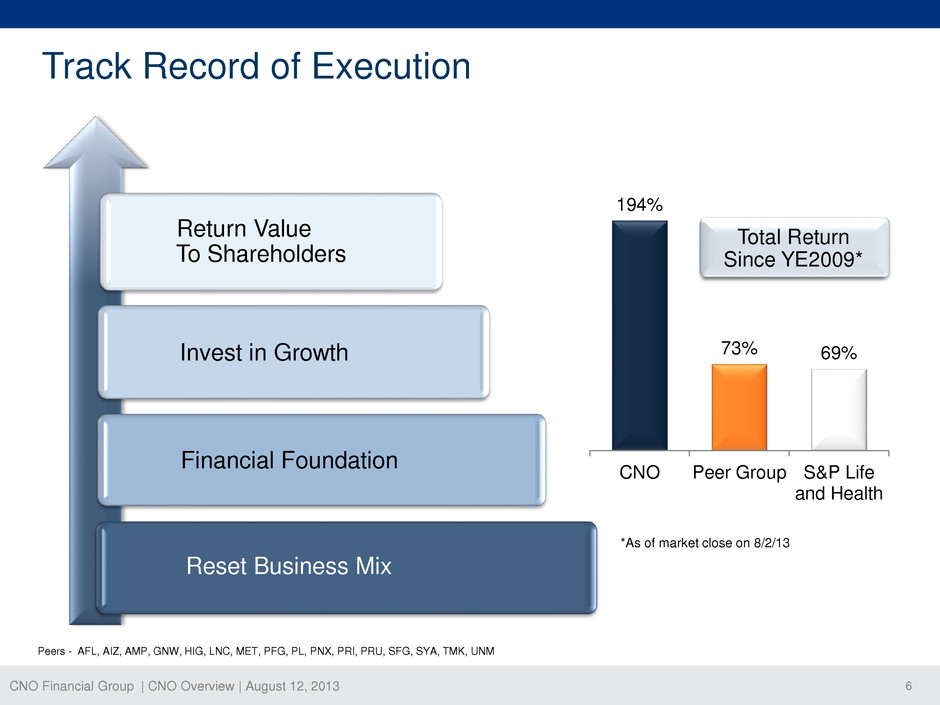

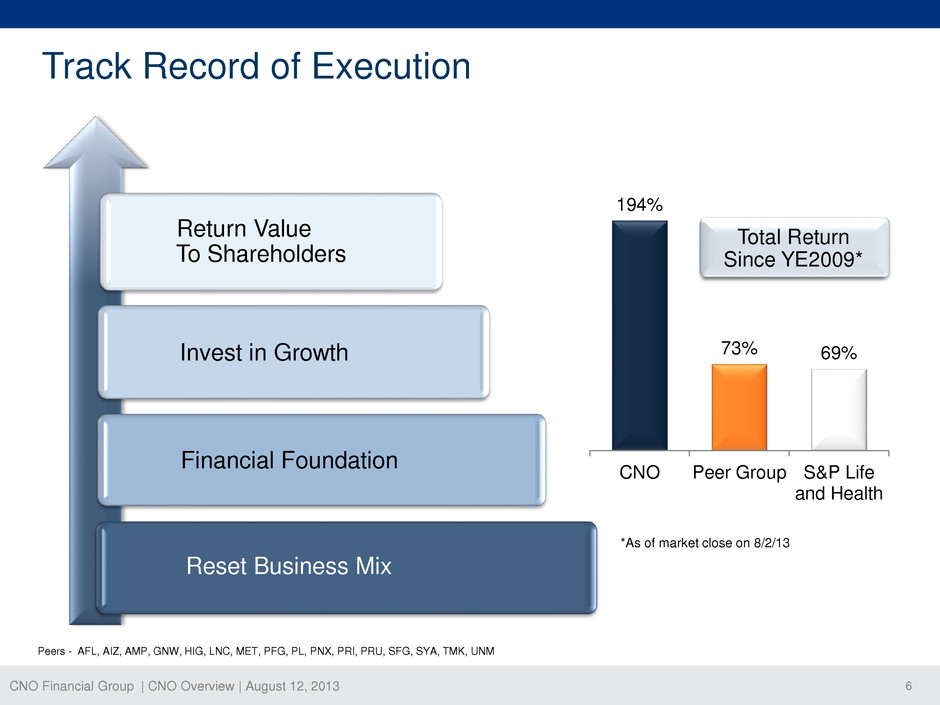

CNO Financial Group | CNO Overview | August 12, 2013 6 194% 73% 69% CNO Peer Group S&P Life and Health Track Record of Execution Total Return Since YE2009* *As of market close on 8/2/13 Reset Business Mix Financial Foundation Return Value To Shareholders Invest in Growth Peers - AFL, AIZ, AMP, GNW, HIG, LNC, MET, PFG, PL, PNX, PRI, PRU, SFG, SYA, TMK, UNM

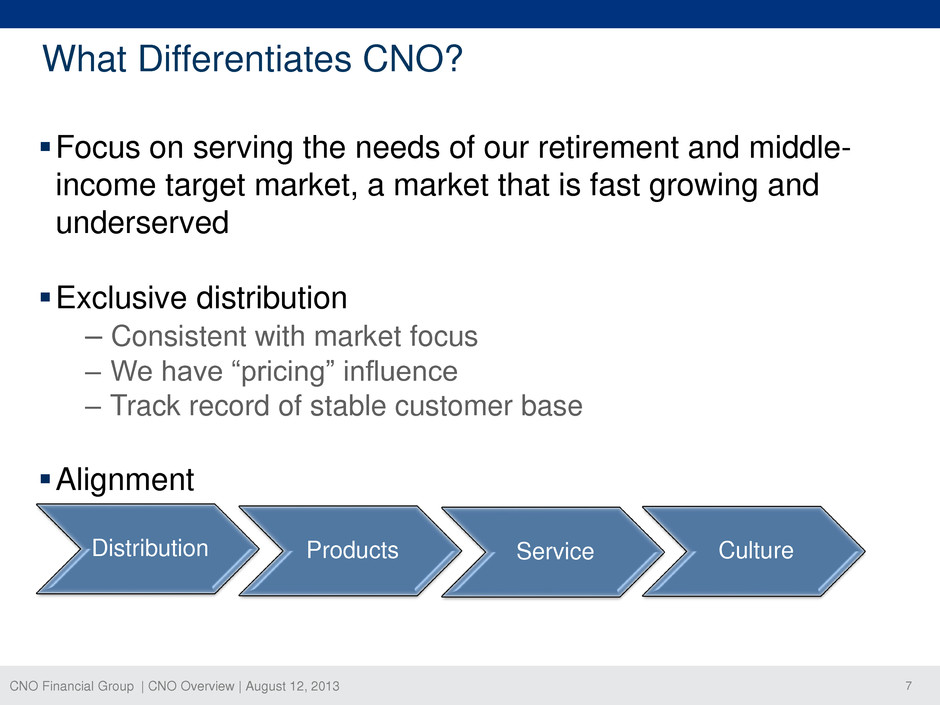

CNO Financial Group | CNO Overview | August 12, 2013 7 What Differentiates CNO? Focus on serving the needs of our retirement and middle- income target market, a market that is fast growing and underserved Exclusive distribution ‒ Consistent with market focus ‒ We have “pricing” influence ‒ Track record of stable customer base Alignment Distribution Products Culture Service

CNO Financial Group | CNO Overview | August 12, 2013 8 0 20 40 60 80 100 120 140 160 180 200 2010 2020 2030 2040 2050 M il li on s Age 45 - 54 Age 55 - 64 Age 65+ CNO’s Target Market Source: Census Data Population Growth in Our Market The Opportunity Fast Growing, Underserved and Unprepared “Over the past five years, the missed opportunity in the middle market for life insurers has grown significantly… In addition, the rising cost of healthcare, may be an emerging, largely unrecognized need for life insurance planning “– Conning Research 2012 “Middle market consumers comprise approximately 57% of the U.S. population, and many of them are underinsured” – LIMRA 2011 “Middle-market consumers are underinsured… penetration has declined by 14 percentage points since 2004… Simply returning penetration to 2004 levels could raise annual premiums by $20 billion” – McKinsey&Company 2012 “Almost two in three (63%) middle-income Americans age 55 to 75 are unsure if they have saved enough to live comfortably in retirement” - Center for a Secure Retirement 2011 “54% of middle-income Americans do not receive professional retirement guidance of any kind and half (51%) have not been contacted by any type of professional in the last 12 months”– Center for a Secure Retirement 2011 “72% of middle-market consumers want to speak with professionals about at least one financial product or service” – LIMRA 2011

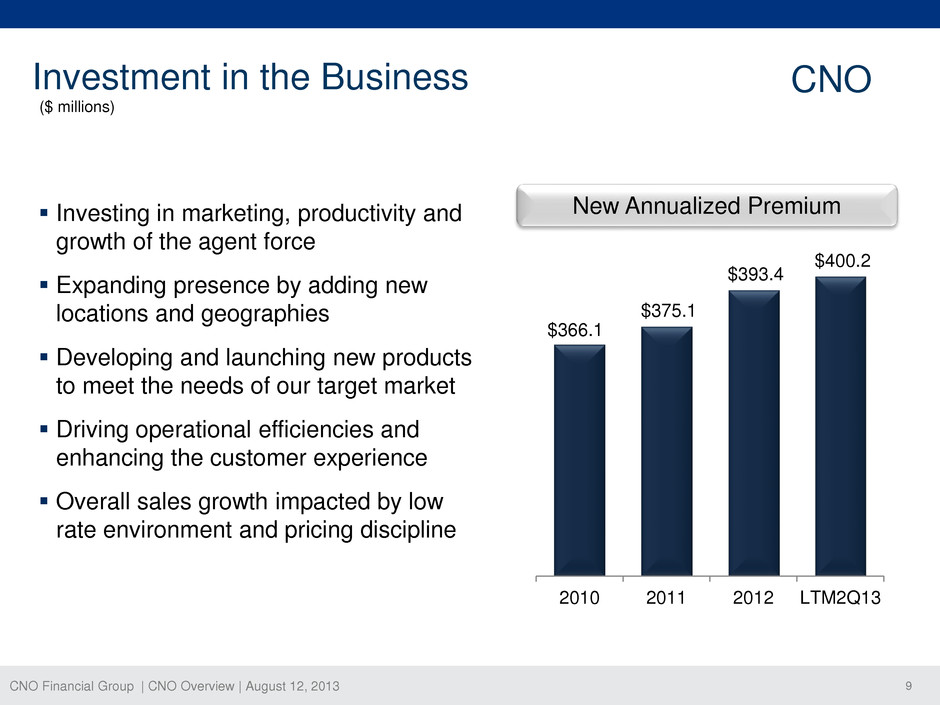

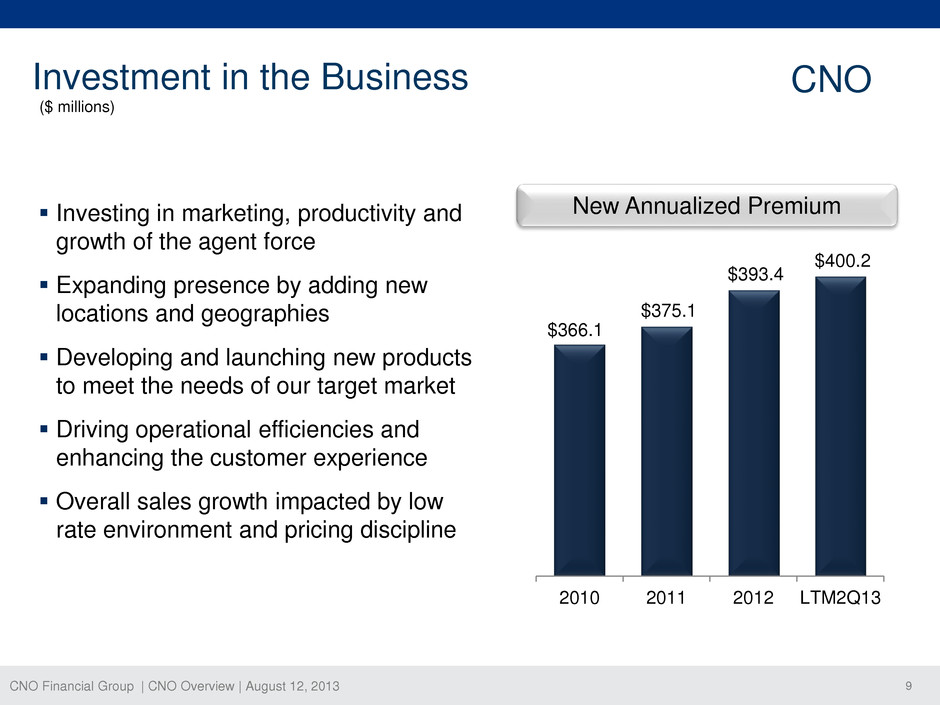

CNO Financial Group | CNO Overview | August 12, 2013 9 Investment in the Business CNO Investing in marketing, productivity and growth of the agent force Expanding presence by adding new locations and geographies Developing and launching new products to meet the needs of our target market Driving operational efficiencies and enhancing the customer experience Overall sales growth impacted by low rate environment and pricing discipline ($ millions) New Annualized Premium $366.1 $375.1 $393.4 $400.2 2010 2011 2012 LTM2Q13

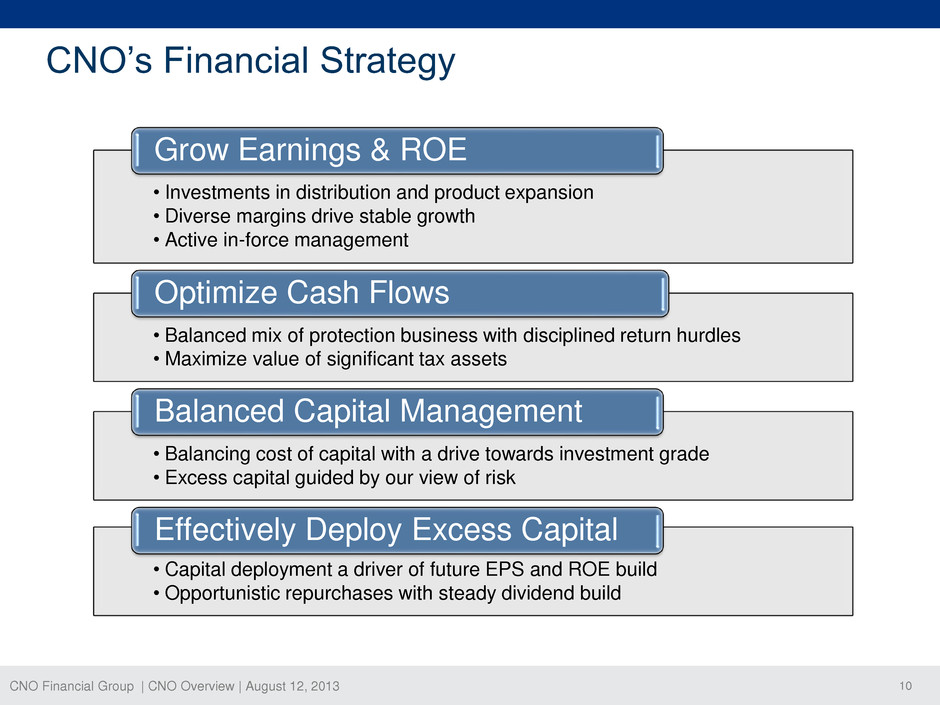

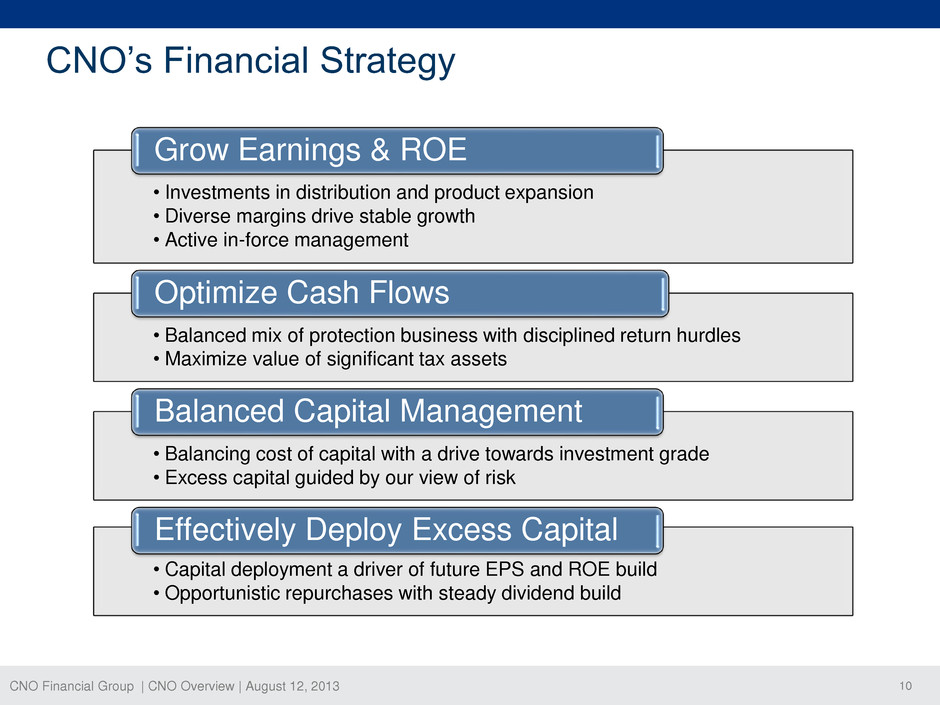

CNO Financial Group | CNO Overview | August 12, 2013 10 CNO’s Financial Strategy • Investments in distribution and product expansion • Diverse margins drive stable growth • Active in-force management Grow Earnings & ROE • Balanced mix of protection business with disciplined return hurdles • Maximize value of significant tax assets Optimize Cash Flows • Balancing cost of capital with a drive towards investment grade • Excess capital guided by our view of risk Balanced Capital Management • Capital deployment a driver of future EPS and ROE build • Opportunistic repurchases with steady dividend build Effectively Deploy Excess Capital

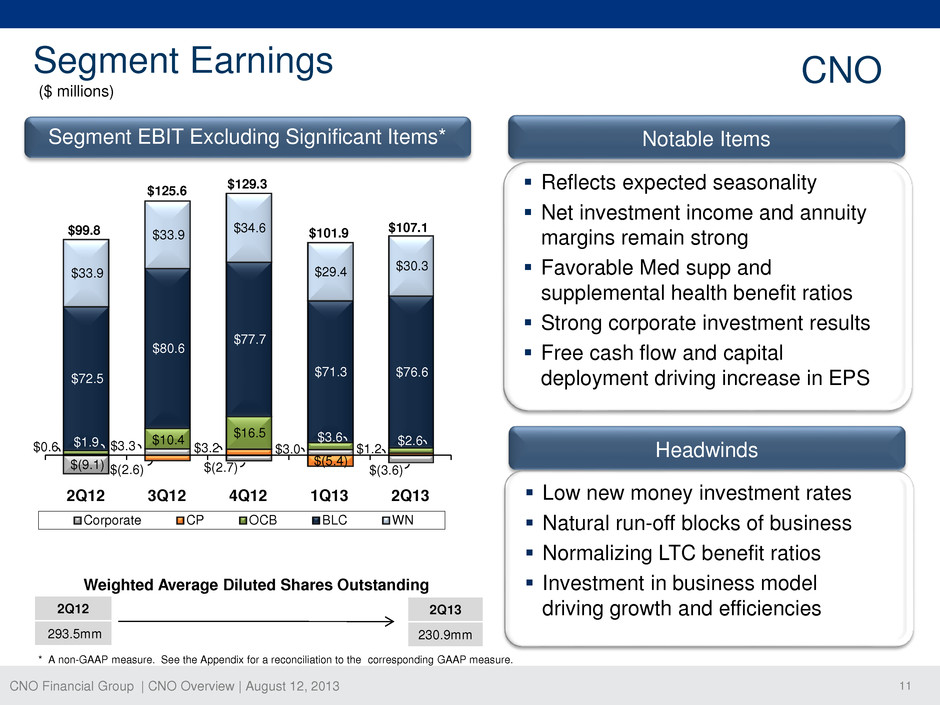

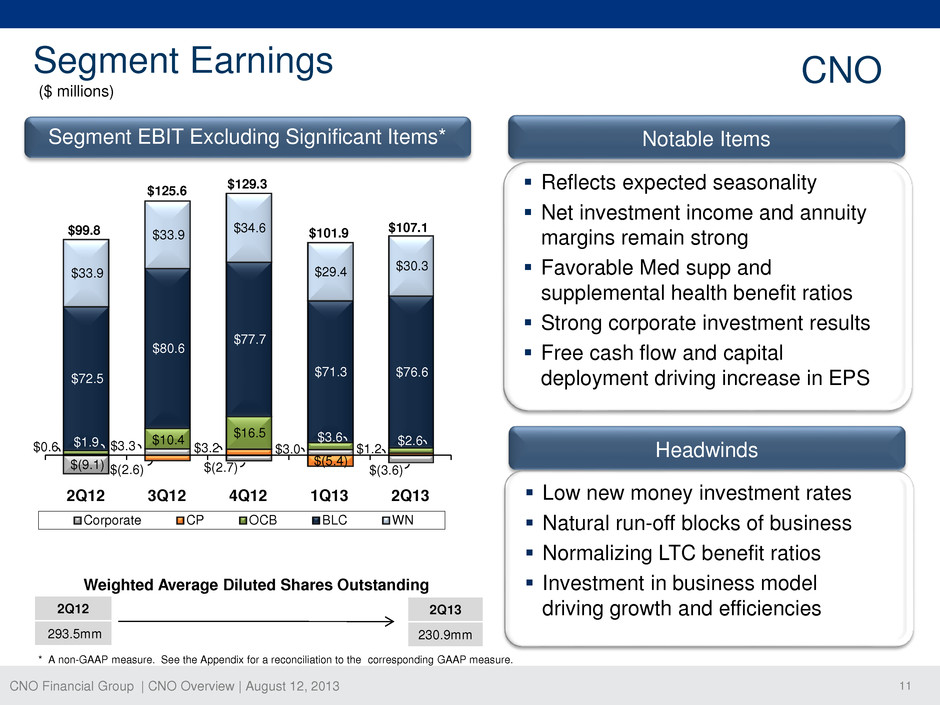

CNO Financial Group | CNO Overview | August 12, 2013 11 $(9.1) $3.3 $(2.7) $3.0 $(3.6) $0.6 $(2.6) $3.2 $(5.4) $1.2 $1.9 $10.4 $16.5 $3.6 $2.6 $72.5 $80.6 $77.7 $71.3 $76.6 $33.9 $33.9 $34.6 $29.4 $30.3 2Q12 3Q12 4Q12 1Q13 2Q13 Corporate CP OCB BLC WN ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Segment Earnings Notable Items $99.8 $125.6 $129.3 Segment EBIT Excluding Significant Items* CNO $101.9 2Q12 293.5mm Weighted Average Diluted Shares Outstanding 2Q13 230.9mm $107.1 Reflects expected seasonality Net investment income and annuity margins remain strong Favorable Med supp and supplemental health benefit ratios Strong corporate investment results Free cash flow and capital deployment driving increase in EPS Headwinds Low new money investment rates Natural run-off blocks of business Normalizing LTC benefit ratios Investment in business model driving growth and efficiencies

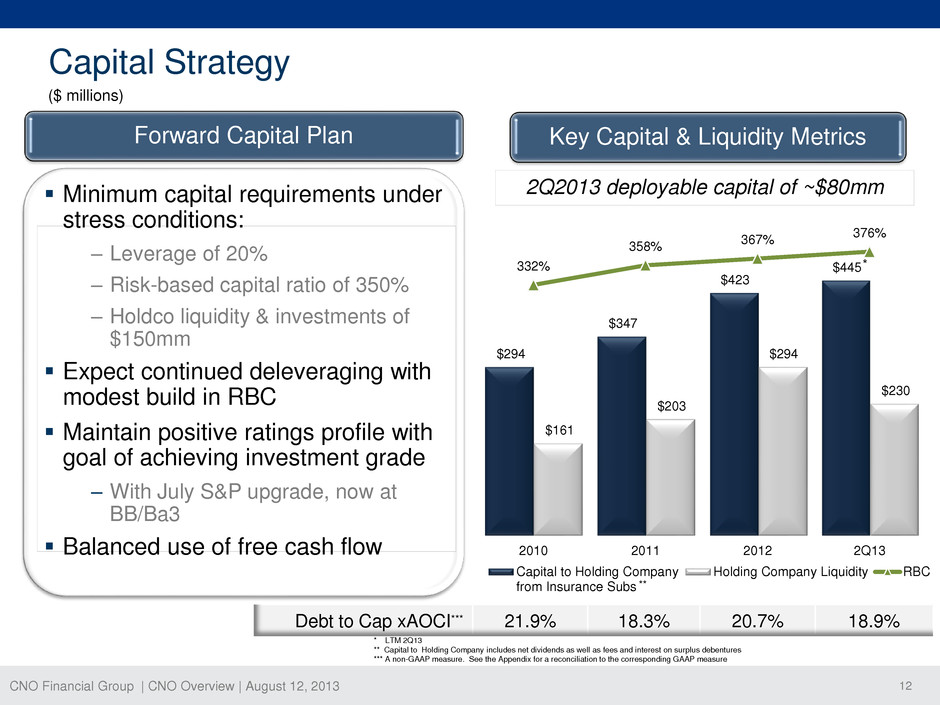

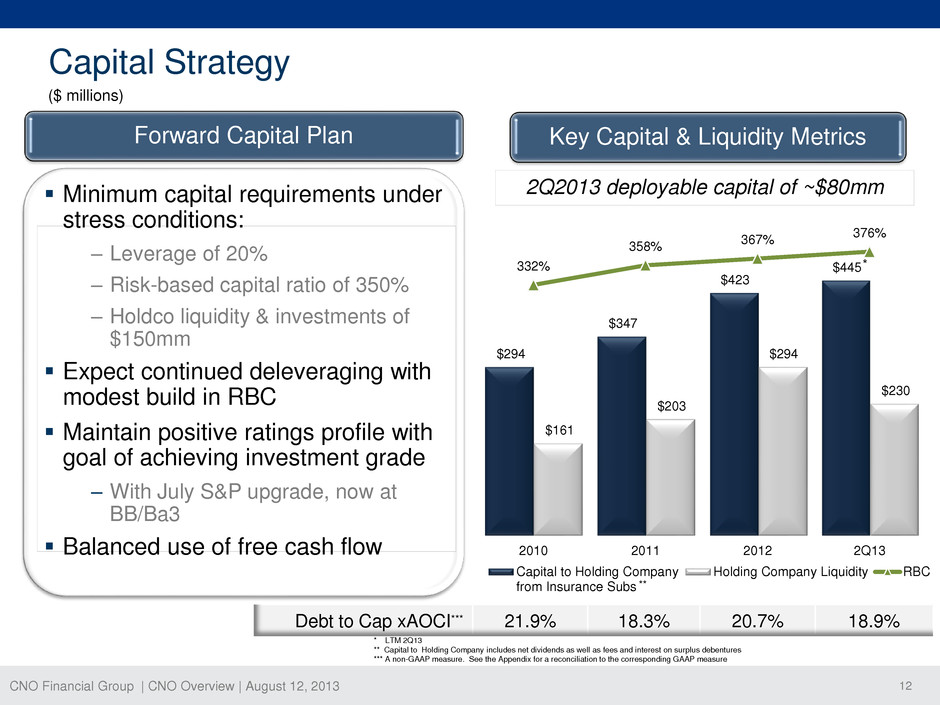

CNO Financial Group | CNO Overview | August 12, 2013 12 $294 $347 $423 $445 $161 $203 $294 $230 332% 358% 367% 376% 2010 2011 2012 2Q13 Capital to Holding Company from Insurance Subs Holding Company Liquidity RBC Debt to Cap xAOCI*** 21.9% 18.3% 20.7% 18.9% ($ millions) Capital Strategy Forward Capital Plan Key Capital & Liquidity Metrics 2Q2013 deployable capital of ~$80mm * LTM 2Q13 ** Capital to Holding Company includes net dividends as well as fees and interest on surplus debentures *** A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure ** * Minimum capital requirements under stress conditions: ‒ Leverage of 20% ‒ Risk-based capital ratio of 350% ‒ Holdco liquidity & investments of $150mm Expect continued deleveraging with modest build in RBC Maintain positive ratings profile with goal of achieving investment grade ‒ With July S&P upgrade, now at BB/Ba3 Balanced use of free cash flow

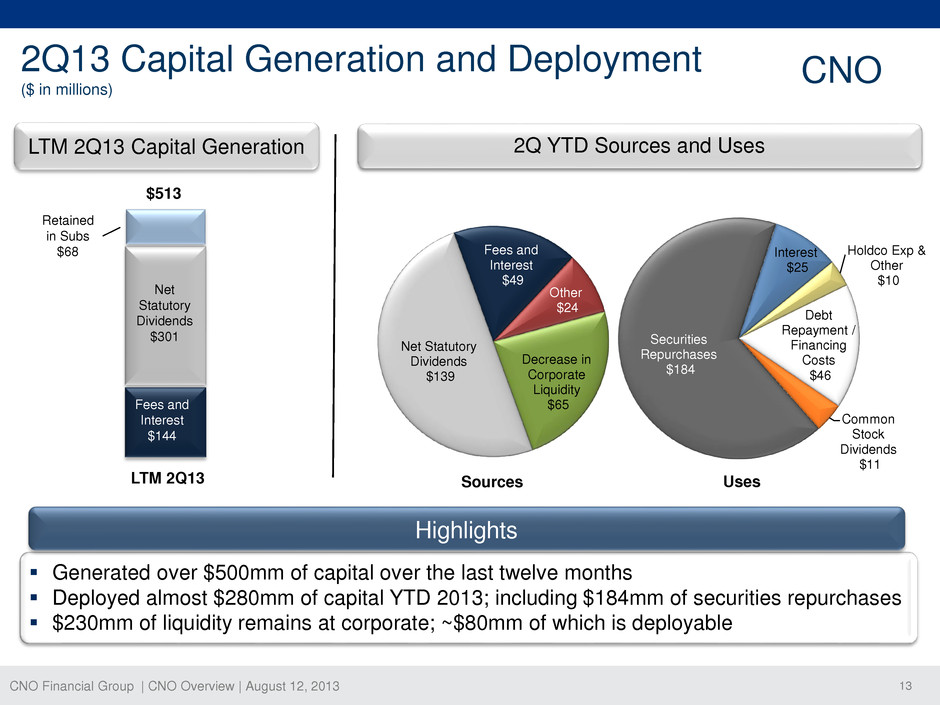

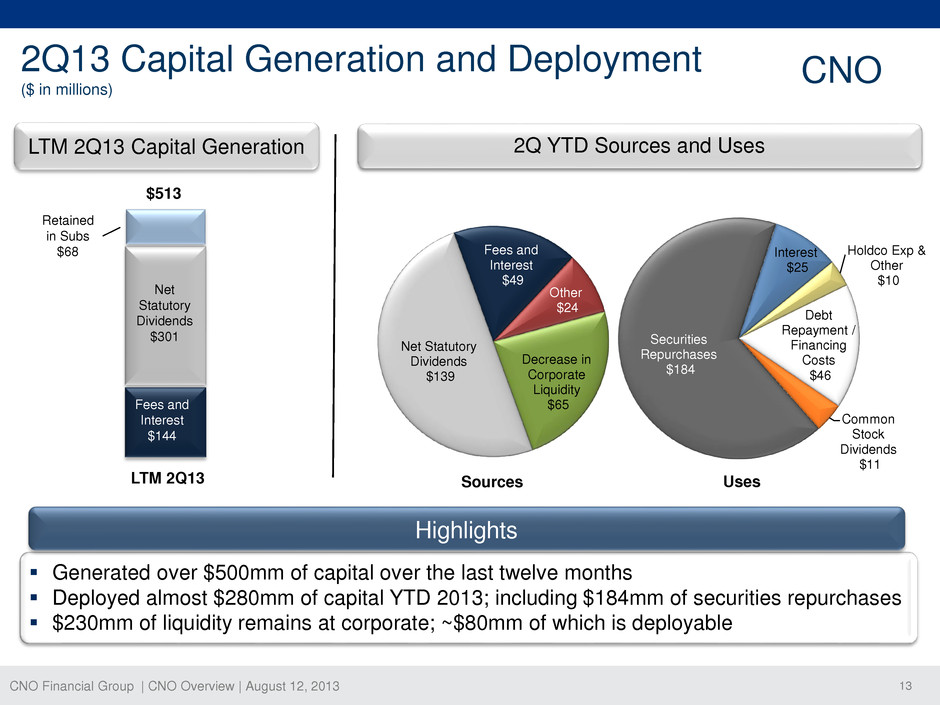

CNO Financial Group | CNO Overview | August 12, 2013 13 Interest $25 Holdco Exp & Other $10 Debt Repayment / Financing Costs $46 Common Stock Dividends $11 Securities Repurchases $184 2Q13 Capital Generation and Deployment ($ in millions) 2Q YTD Sources and Uses Highlights Generated over $500mm of capital over the last twelve months Deployed almost $280mm of capital YTD 2013; including $184mm of securities repurchases $230mm of liquidity remains at corporate; ~$80mm of which is deployable CNO LTM 2Q13 Capital Generation $513 LTM 2Q13 Sources Uses Retained in Subs $68 Fees and Interest $144 Net Statutory Dividends $301 Net Statutory Dividends $139 Fees and Interest $49 Other $24 Decrease in Corporate Liquidity $65

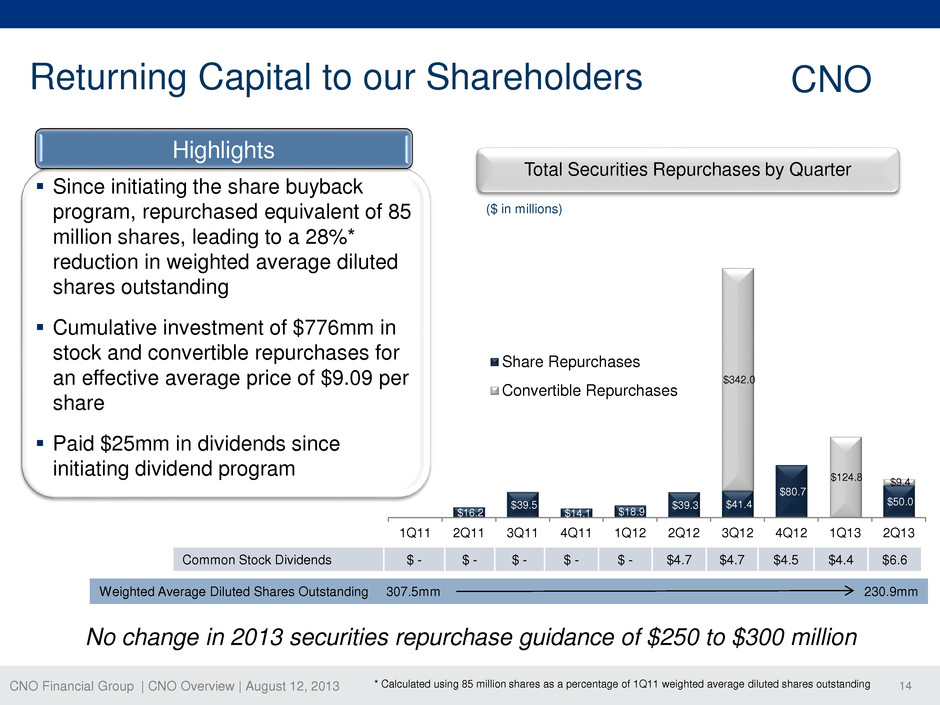

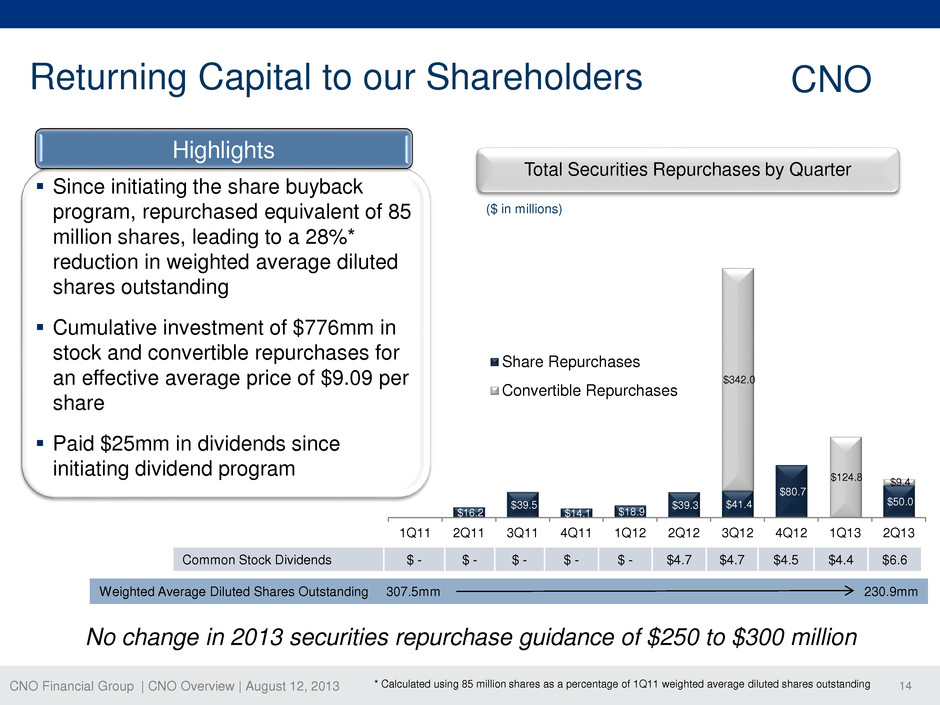

CNO Financial Group | CNO Overview | August 12, 2013 14 Returning Capital to our Shareholders CNO Since initiating the share buyback program, repurchased equivalent of 85 million shares, leading to a 28%* reduction in weighted average diluted shares outstanding Cumulative investment of $776mm in stock and convertible repurchases for an effective average price of $9.09 per share Paid $25mm in dividends since initiating dividend program Total Securities Repurchases by Quarter * Calculated using 85 million shares as a percentage of 1Q11 weighted average diluted shares outstanding Common Stock Dividends $ - $ - $ - $ - $ - $4.7 $4.7 $4.5 $4.4 $6.6 Highlights Weighted Average Diluted Shares Outstanding 307.5mm 230.9mm ($ in millions) $16.2 $39.5 $14.1 $18.9 $39.3 $41.4 $80.7 $50.0 $342.0 $124.8 $9.4 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 Share Repurchases Convertible Repurchases No change in 2013 securities repurchase guidance of $250 to $300 million

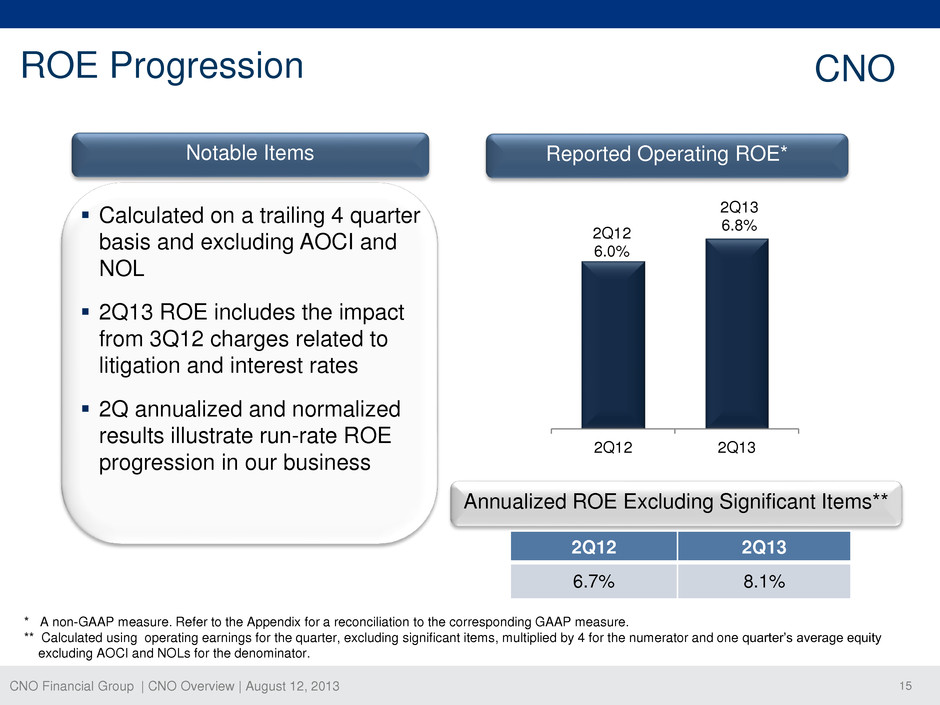

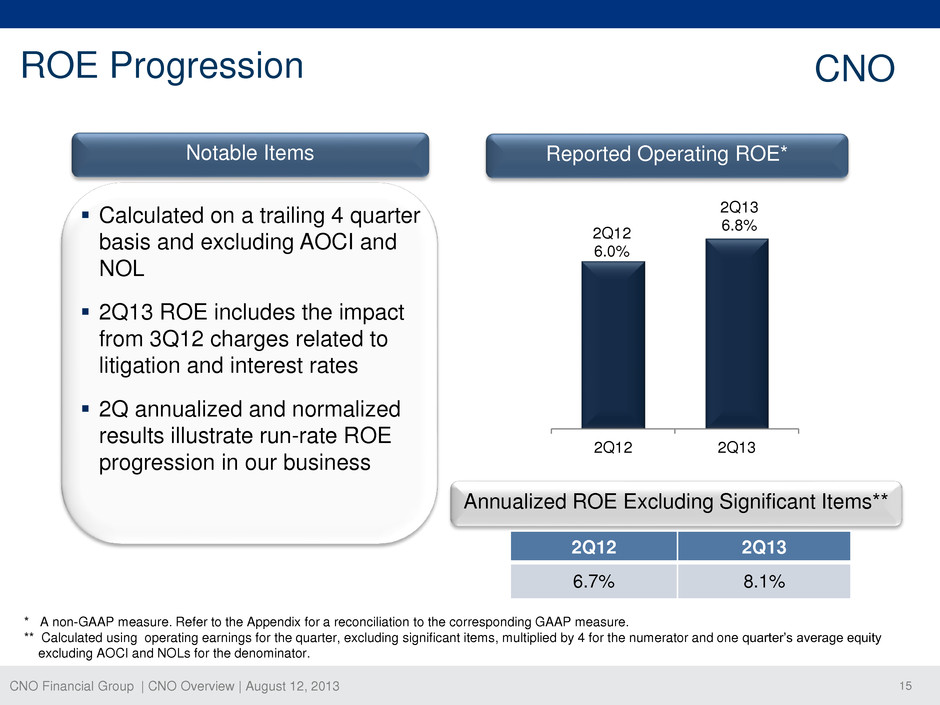

CNO Financial Group | CNO Overview | August 12, 2013 15 ROE Progression CNO Calculated on a trailing 4 quarter basis and excluding AOCI and NOL 2Q13 ROE includes the impact from 3Q12 charges related to litigation and interest rates 2Q annualized and normalized results illustrate run-rate ROE progression in our business Notable Items Reported Operating ROE* 2Q12 6.0% 2Q13 6.8% 2Q12 2Q13 Annualized ROE Excluding Significant Items** 2Q12 2Q13 6.7% 8.1% * A non-GAAP measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure. ** Calculated using operating earnings for the quarter, excluding significant items, multiplied by 4 for the numerator and one quarter’s average equity excluding AOCI and NOLs for the denominator.

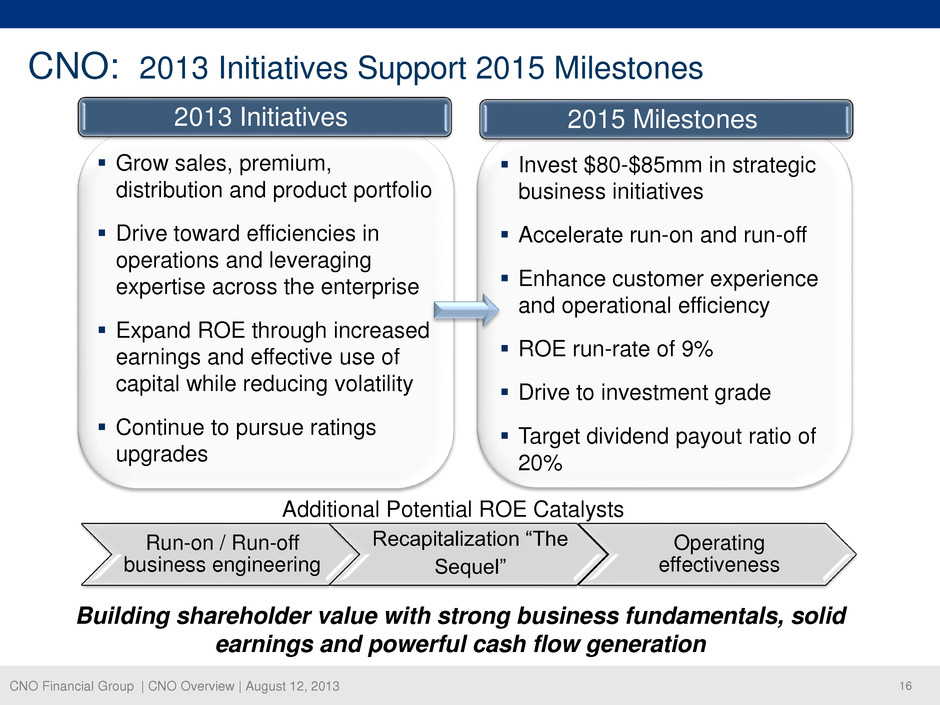

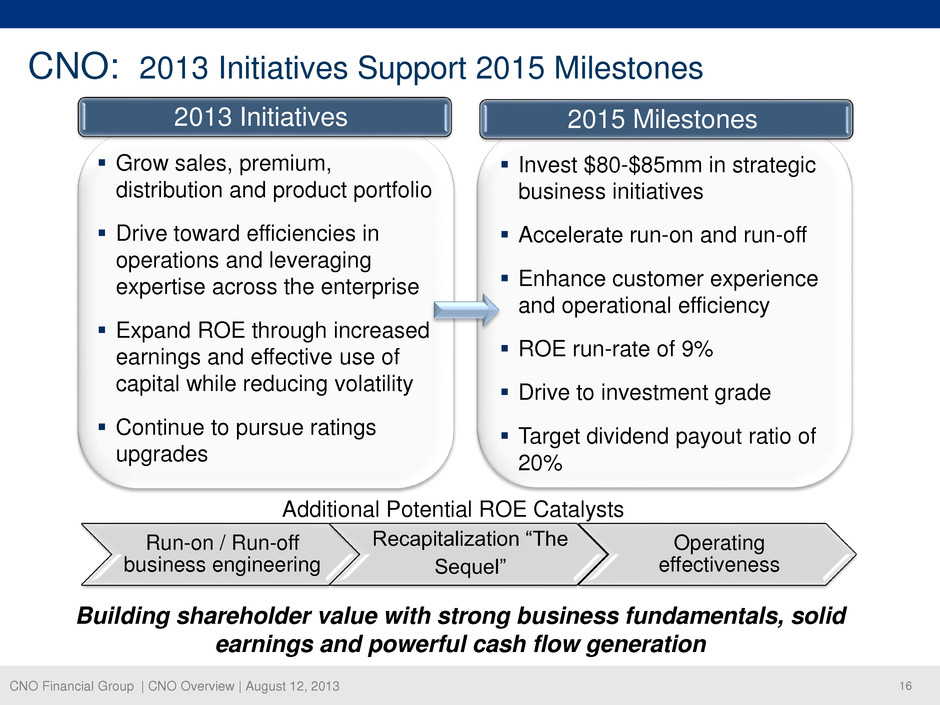

CNO Financial Group | CNO Overview | August 12, 2013 16 Grow sales, premium, distribution and product portfolio Drive toward efficiencies in operations and leveraging expertise across the enterprise Expand ROE through increased earnings and effective use of capital while reducing volatility Continue to pursue ratings upgrades Invest $80-$85mm in strategic business initiatives Accelerate run-on and run-off Enhance customer experience and operational efficiency ROE run-rate of 9% Drive to investment grade Target dividend payout ratio of 20% CNO: 2013 Initiatives Support 2015 Milestones 2013 Initiatives Additional Potential ROE Catalysts Run-on / Run-off business engineering Recapitalization “The Sequel” Operating effectiveness 2015 Milestones Building shareholder value with strong business fundamentals, solid earnings and powerful cash flow generation

CNO Financial Group | CNO Overview | August 12, 2013 17 Q&A

CNO Financial Group | CNO Overview | August 12, 2013 18 Appendix

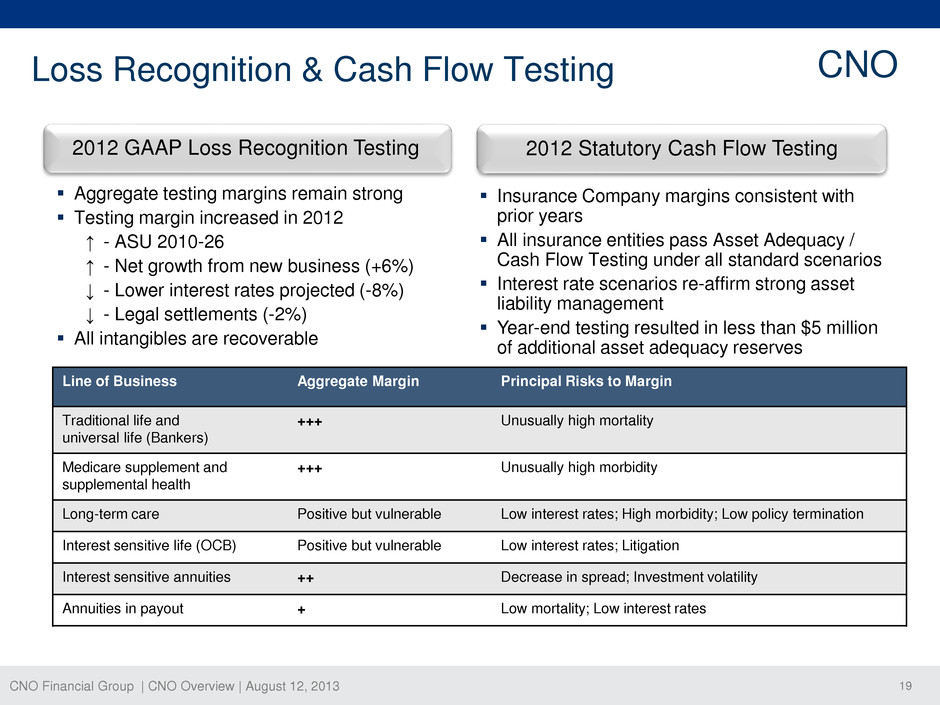

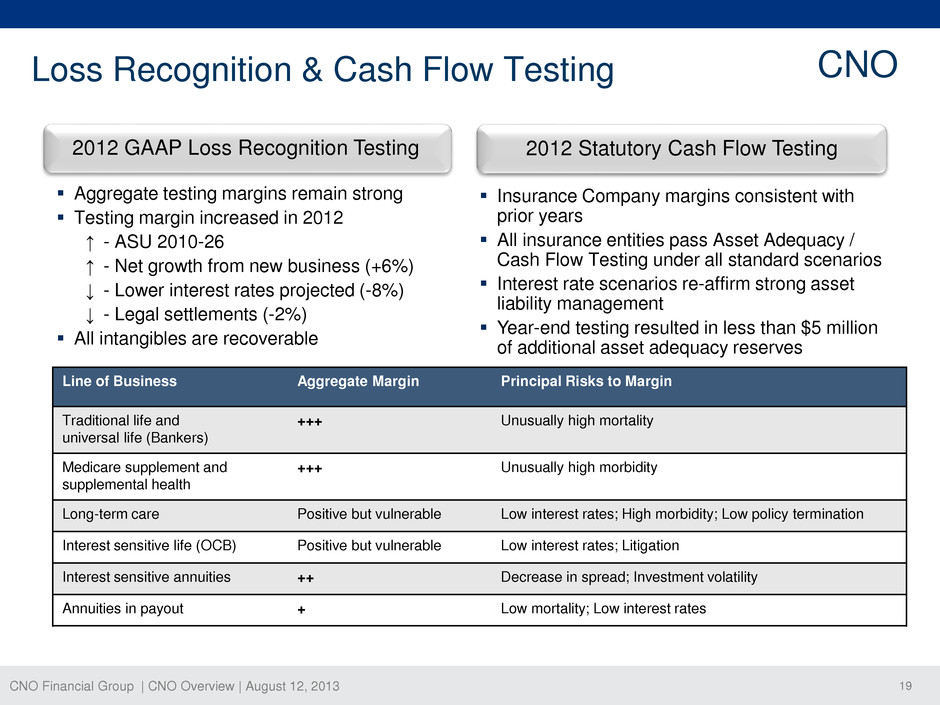

CNO Financial Group | CNO Overview | August 12, 2013 19 Loss Recognition & Cash Flow Testing 2012 Statutory Cash Flow Testing 2012 GAAP Loss Recognition Testing Aggregate testing margins remain strong Testing margin increased in 2012 ↑ - ASU 2010-26 ↑ - Net growth from new business (+6%) ↓ - Lower interest rates projected (-8%) ↓ - Legal settlements (-2%) All intangibles are recoverable Insurance Company margins consistent with prior years All insurance entities pass Asset Adequacy / Cash Flow Testing under all standard scenarios Interest rate scenarios re-affirm strong asset liability management Year-end testing resulted in less than $5 million of additional asset adequacy reserves Line of Business Aggregate Margin Principal Risks to Margin Traditional life and universal life (Bankers) +++ Unusually high mortality Medicare supplement and supplemental health +++ Unusually high morbidity Long-term care Positive but vulnerable Low interest rates; High morbidity; Low policy termination Interest sensitive life (OCB) Positive but vulnerable Low interest rates; Litigation Interest sensitive annuities ++ Decrease in spread; Investment volatility Annuities in payout + Low mortality; Low interest rates CNO

CNO Financial Group | CNO Overview | August 12, 2013 20 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

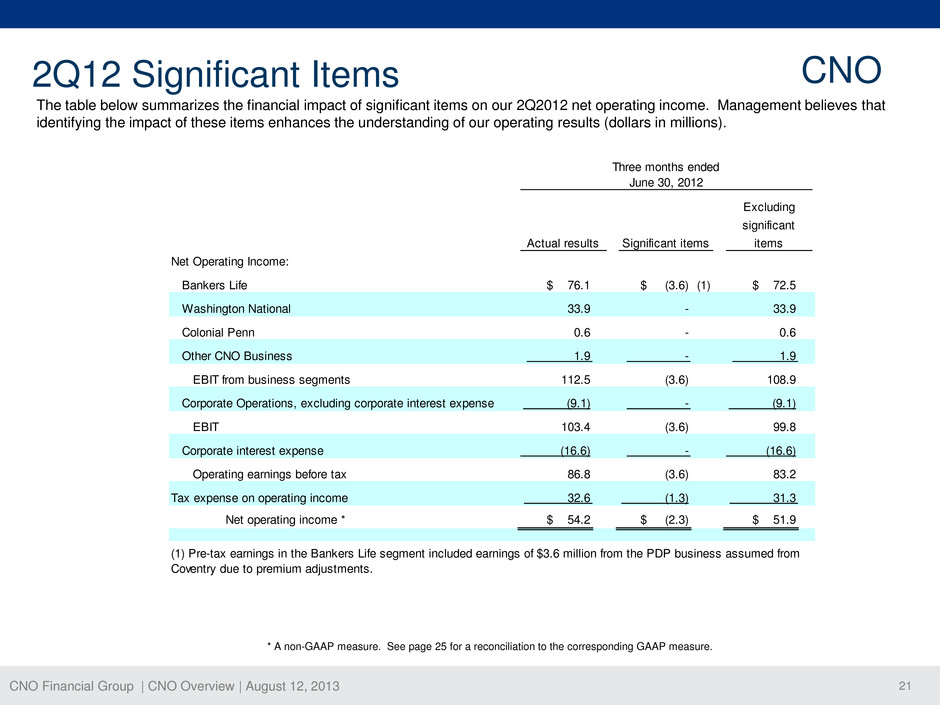

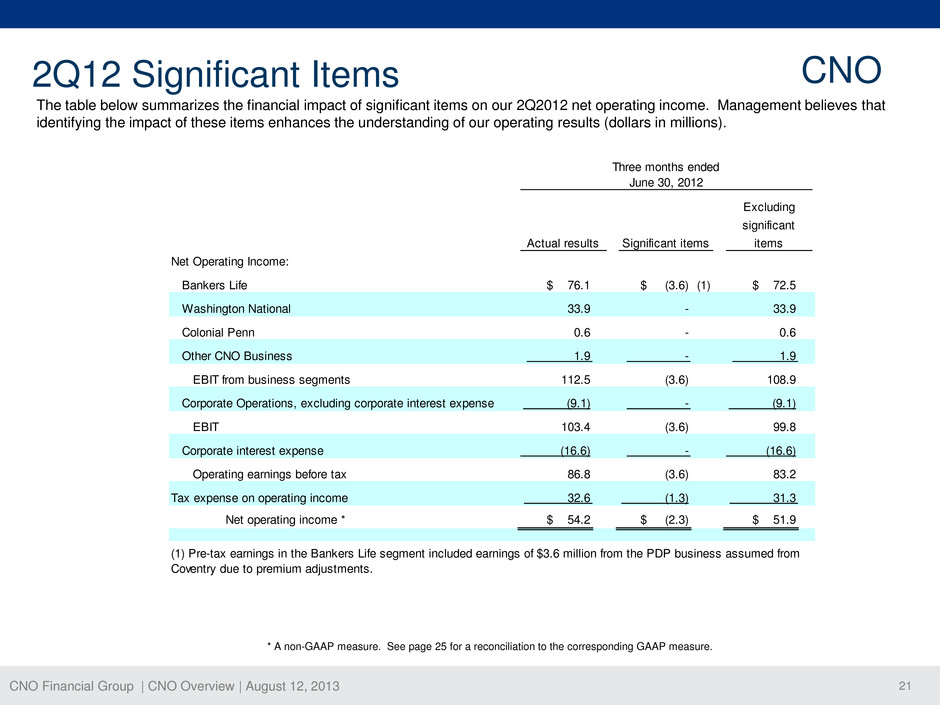

CNO Financial Group | CNO Overview | August 12, 2013 21 The table below summarizes the financial impact of significant items on our 2Q2012 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 76.1 $ (3.6) (1) $ 72.5 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 54.2 $ (2.3) $ 51.9 (1) Pre-tax earnings in the Bankers Life segment included earnings of $3.6 million from the PDP business assumed from Coventry due to premium adjustments. 86.8 (3.6) 83.2 32.6 (1.3) 31.3 103.4 (3.6) 99.8 (16.6) - (16.6) 112.5 (3.6) 108.9 (9.1) - (9.1) 0.6 - 0.6 1.9 - 1.9 33.9 - 33.9 Three months ended June 30, 2012 Actual results Significant items Excluding significant items 2Q12 Significant Items CNO * A non-GAAP measure. See page 25 for a reconciliation to the corresponding GAAP measure.

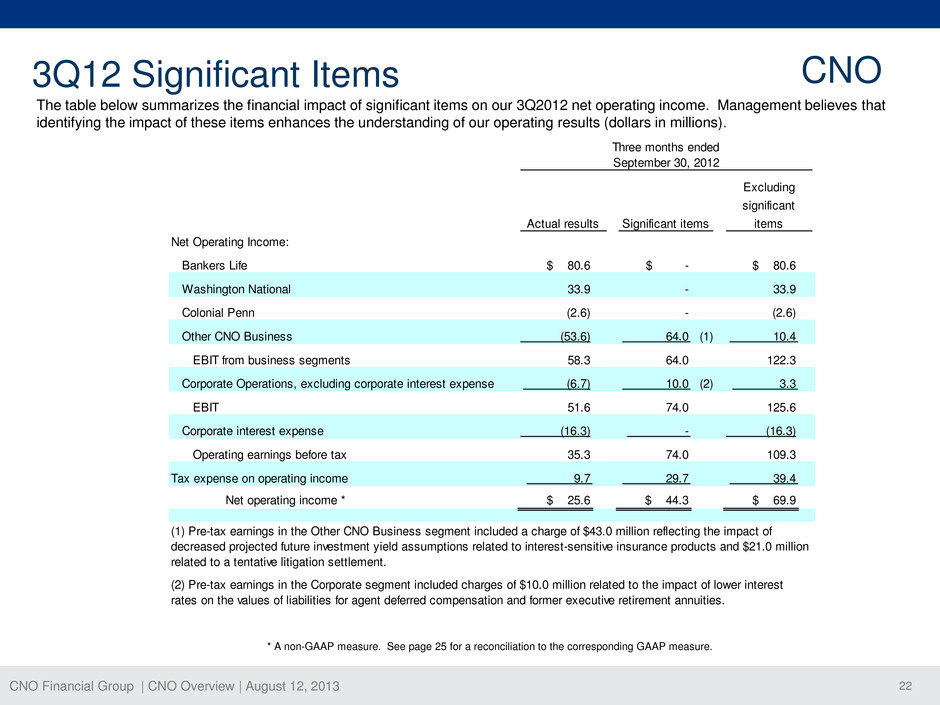

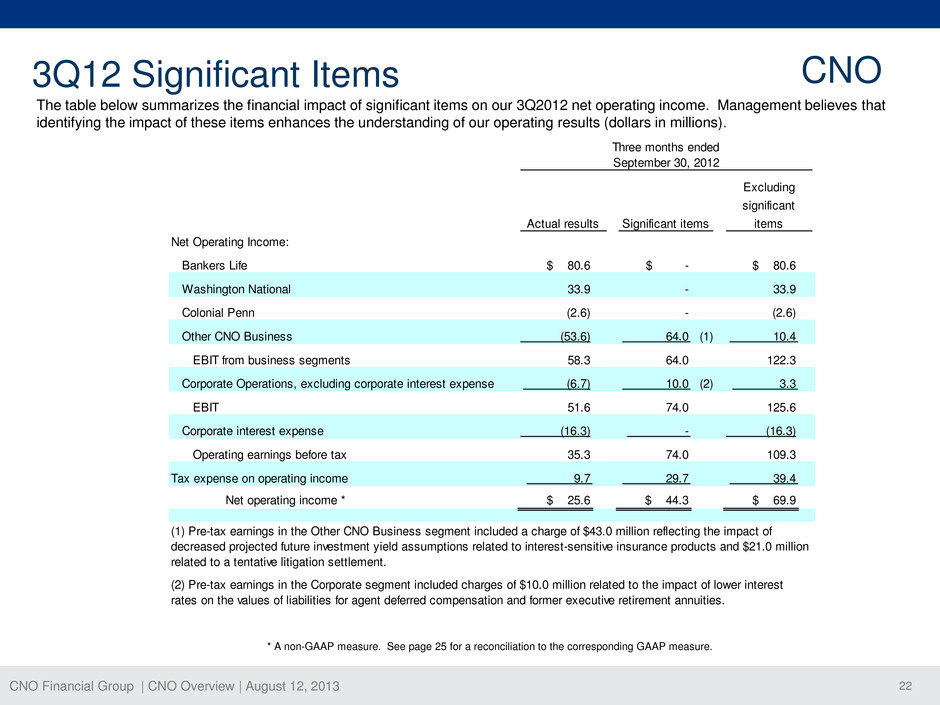

CNO Financial Group | CNO Overview | August 12, 2013 22 The table below summarizes the financial impact of significant items on our 3Q2012 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 80.6 $ - $ 80.6 Washington National Colonial Penn Other CNO Business (1) EBIT from business segments Corporate Operations, excluding corporate interest expense (2) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 25.6 $ 44.3 $ 69.9 Three months ended September 30, 2012 Actual results Significant items Excluding significant items 33.9 - 33.9 (2.6) - (2.6) (53.6) 64.0 10.4 58.3 64.0 122.3 (6.7) 10.0 3.3 39.4 51.6 74.0 125.6 (16.3) - (16.3) (2) Pre-tax earnings in the Corporate segment included charges of $10.0 million related to the impact of lower interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities. (1) Pre-tax earnings in the Other CNO Business segment included a charge of $43.0 million reflecting the impact of decreased projected future investment yield assumptions related to interest-sensitive insurance products and $21.0 million related to a tentative litigation settlement. 35.3 74.0 109.3 9.7 29.7 3Q12 Significant Items CNO * A non-GAAP measure. See page 25 for a reconciliation to the corresponding GAAP measure.

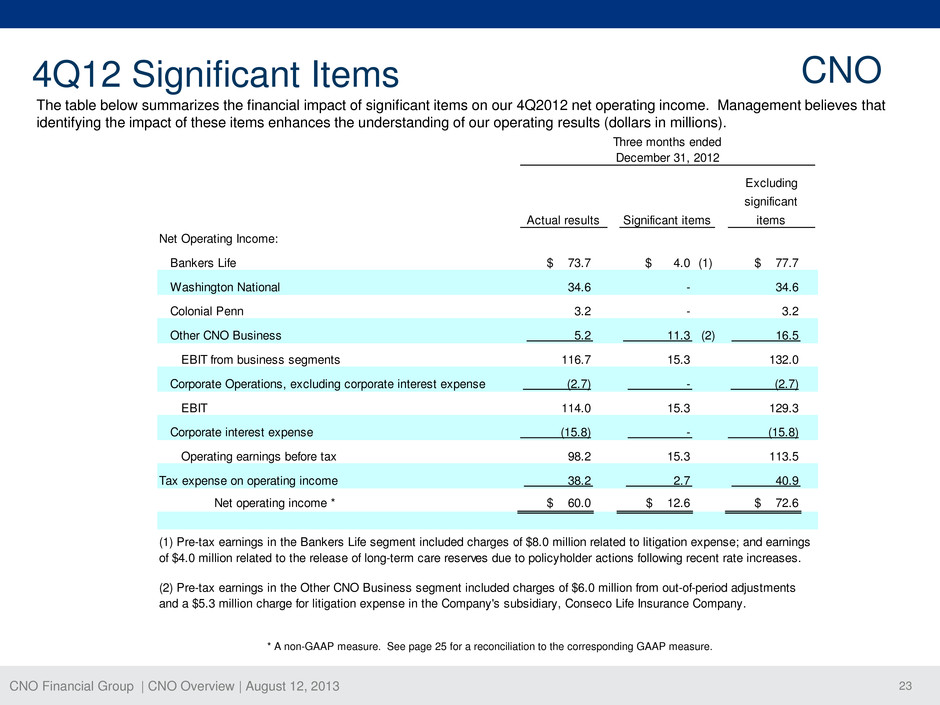

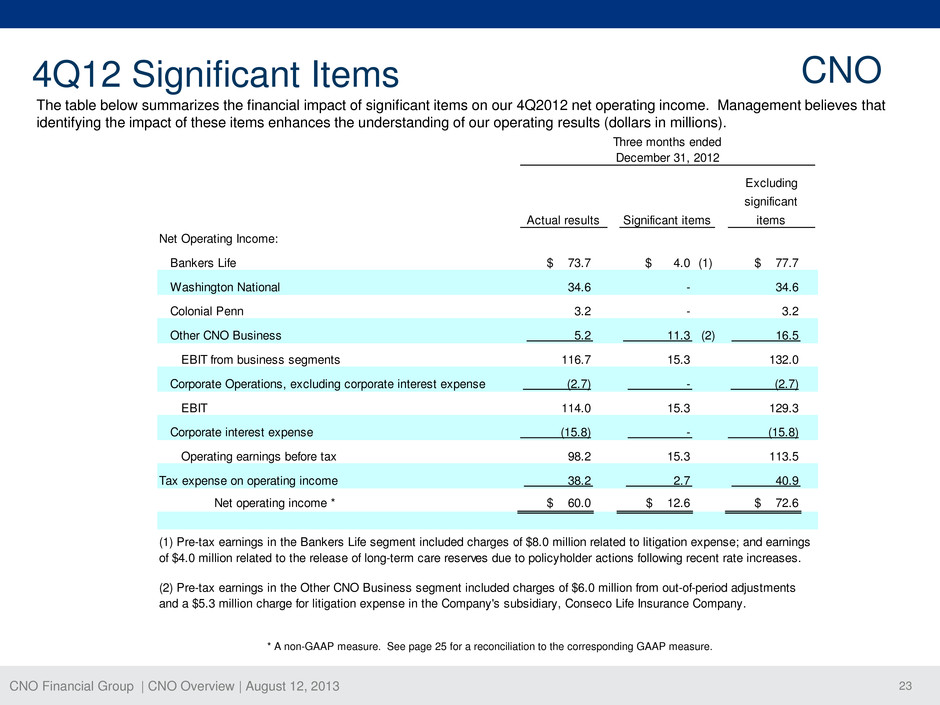

CNO Financial Group | CNO Overview | August 12, 2013 23 The table below summarizes the financial impact of significant items on our 4Q2012 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 73.7 $ 4.0 (1) $ 77.7 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 60.0 $ 12.6 $ 72.6 (2) Pre-tax earnings in the Other CNO Business segment included charges of $6.0 million from out-of-period adjustments and a $5.3 million charge for litigation expense in the Company's subsidiary, Conseco Life Insurance Company. (1) Pre-tax earnings in the Bankers Life segment included charges of $8.0 million related to litigation expense; and earnings of $4.0 million related to the release of long-term care reserves due to policyholder actions following recent rate increases. 98.2 15.3 113.5 38.2 2.7 40.9 114.0 15.3 129.3 (15.8) - (15.8) 116.7 15.3 132.0 (2.7) - (2.7) 3.2 - 3.2 5.2 11.3 16.5 34.6 - 34.6 Three months ended December 31, 2012 Actual results Significant items Excluding significant items 4Q12 Significant Items CNO * A non-GAAP measure. See page 25 for a reconciliation to the corresponding GAAP measure.

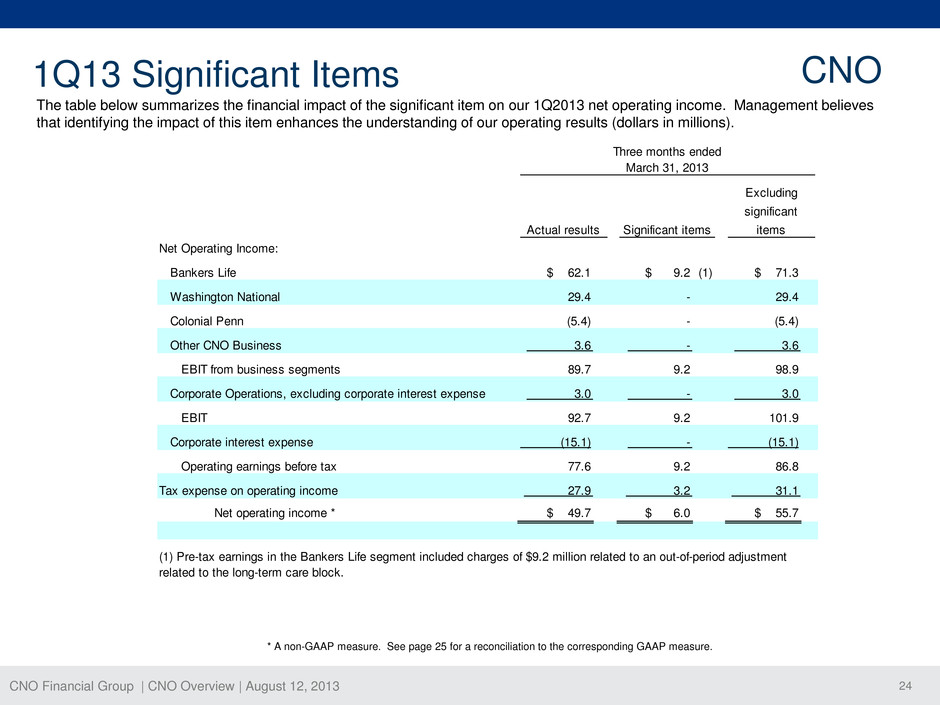

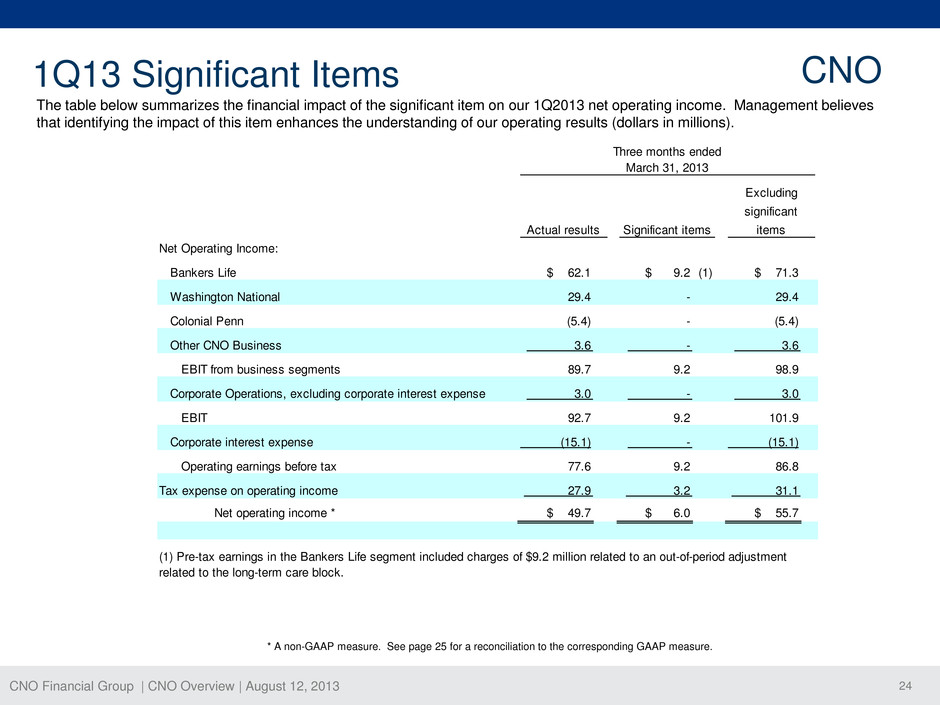

CNO Financial Group | CNO Overview | August 12, 2013 24 The table below summarizes the financial impact of the significant item on our 1Q2013 net operating income. Management believes that identifying the impact of this item enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 62.1 $ 9.2 (1) $ 71.3 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 49.7 $ 6.0 $ 55.7 (1) Pre-tax earnings in the Bankers Life segment included charges of $9.2 million related to an out-of-period adjustment related to the long-term care block. 77.6 9.2 86.8 27.9 3.2 31.1 92.7 9.2 101.9 (15.1) - (15.1) 89.7 9.2 98.9 3.0 - 3.0 (5.4) - (5.4) 3.6 - 3.6 29.4 - 29.4 Three months ended March 31, 2013 Actual results Significant items Excluding significant items 1Q13 Significant Items CNO * A non-GAAP measure. See page 25 for a reconciliation to the corresponding GAAP measure.

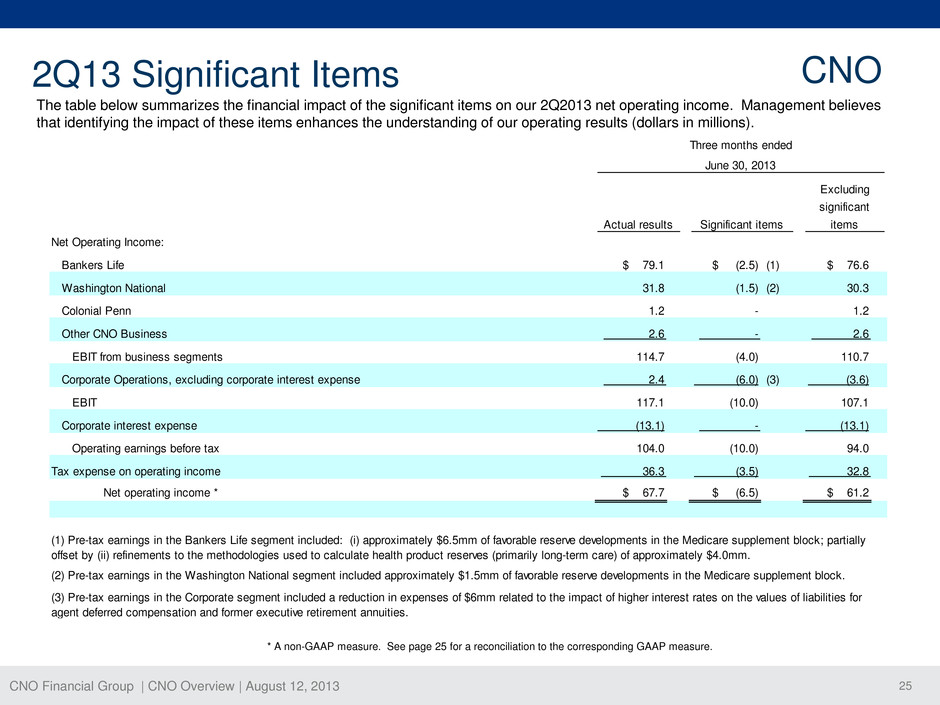

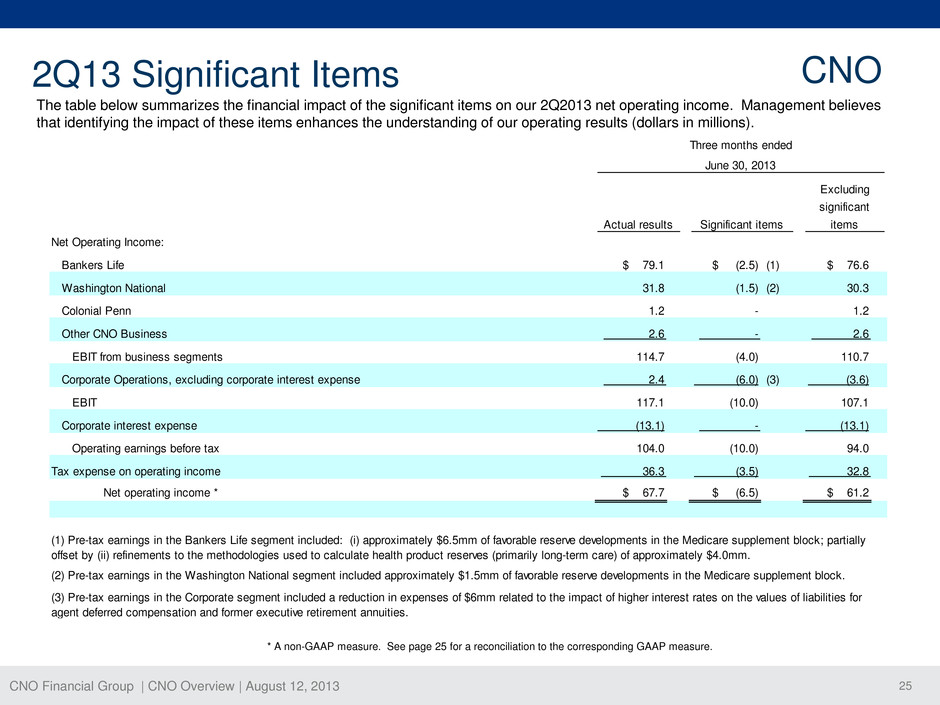

CNO Financial Group | CNO Overview | August 12, 2013 25 The table below summarizes the financial impact of the significant items on our 2Q2013 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 79.1 $ (2.5) (1) $ 76.6 Washington National (2) Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense (3) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 67.7 $ (6.5) $ 61.2 Three months ended June 30, 2013 Actual results Significant items Excluding significant items 31.8 (1.5) 30.3 1.2 - 1.2 2.6 - 2.6 114.7 (4.0) 110.7 2.4 (6.0) (3.6) 117.1 (10.0) 107.1 (13.1) - (13.1) 104.0 (10.0) 94.0 36.3 (3.5) 32.8 (2) Pre-tax earnings in the Washington National segment included approximately $1.5mm of favorable reserve developments in the Medicare supplement block. (3) Pre-tax earnings in the Corporate segment included a reduction in expenses of $6mm related to the impact of higher interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities. (1) Pre-tax earnings in the Bankers Life segment included: (i) approximately $6.5mm of favorable reserve developments in the Medicare supplement block; partially offs t by (ii) refinements to the methodologies used to calculate health product reserves (primarily long-term care) of approximately $4.0mm. 2Q13 Significant Items CNO * A non-GAAP measure. See page 25 for a reconciliation to the corresponding GAAP measure.

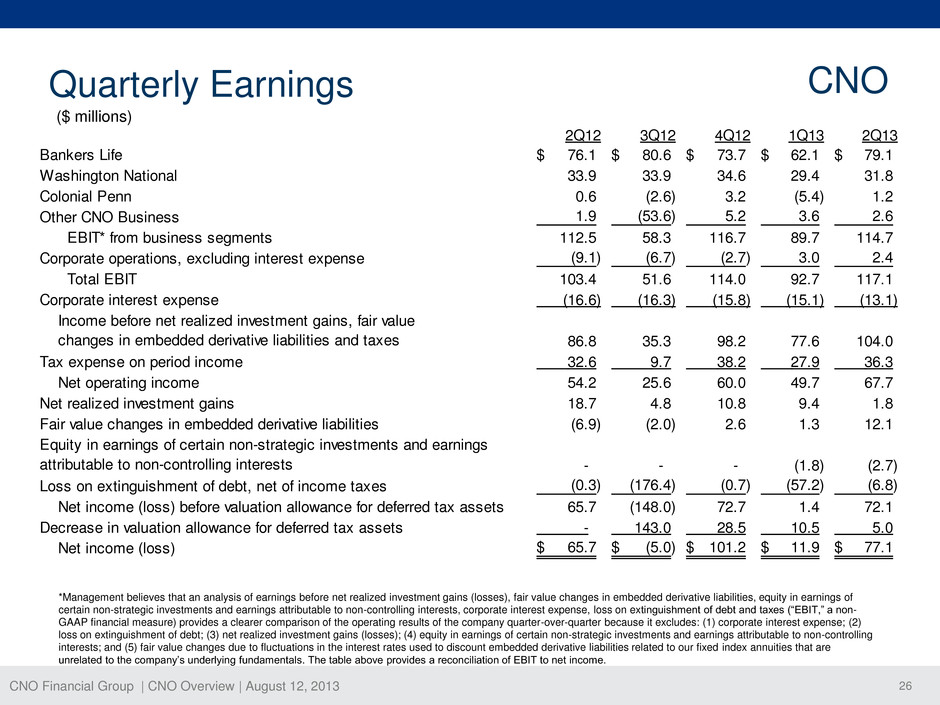

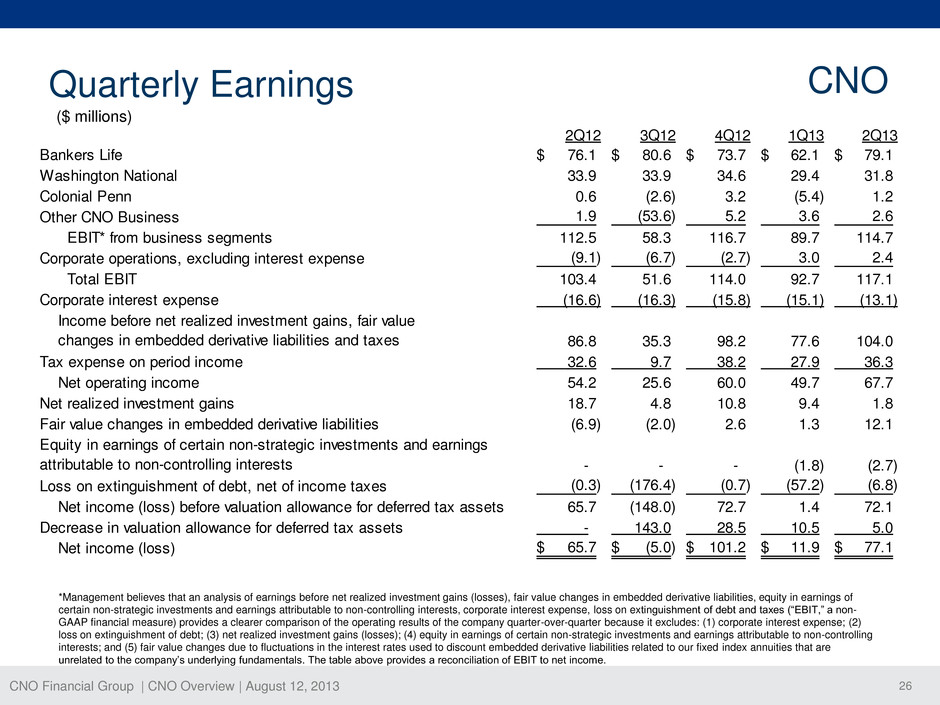

CNO Financial Group | CNO Overview | August 12, 2013 26 Quarterly Earnings CNO *Management believes that an analysis of earnings before net realized investment gains (losses), fair value changes in embedded derivative liabilities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, corporate interest expense, loss on extinguishment of debt and taxes (“EBIT,” a non- GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment of debt; (3) net realized investment gains (losses); (4) equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests; and (5) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation of EBIT to net income. 2Q12 3Q12 4Q12 1Q13 2Q13 Bankers Life 76.1$ 80.6$ 73.7$ 62.1$ 79.1$ Washington National 33.9 33.9 34.6 29.4 31.8 Colonial Penn 0.6 (2.6) 3.2 (5.4) 1.2 Other CNO Business 1.9 (53.6) 5.2 3.6 2.6 EBIT* from business segments 112.5 58.3 116.7 89.7 114.7 Corporate operations, excluding interest expense (9.1) (6.7) (2.7) 3.0 2.4 Total EBIT 103.4 51.6 114.0 92.7 117.1 Corporate interest expense (16.6) (16.3) (15.8) (15.1) (13.1) 86.8 35.3 98.2 77.6 104.0 Tax expense on period income 32.6 9.7 38.2 27.9 36.3 Net operating income 54.2 25.6 60.0 49.7 67.7 Net realized investment gains 18.7 4.8 10.8 9.4 1.8 Fair value changes in embedded derivative liabilities (6.9) (2.0) 2.6 1.3 12.1 - - - (1.8) (2.7) Loss on extinguishment of debt, net of income taxes (0.3) (176.4) (0.7) (57.2) (6.8) Net income (loss) before valuation allowance for deferred tax assets 65.7 (148.0) 72.7 1.4 72.1 Decrease in valuation allowance for deferred tax assets - 143.0 28.5 10.5 5.0 Net income (loss) 65.7$ (5.0)$ 101.2$ 11.9$ 77.1$ Income before net realized investment gains, fair value changes in embedded derivative liabilities and taxes Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests ($ millions)

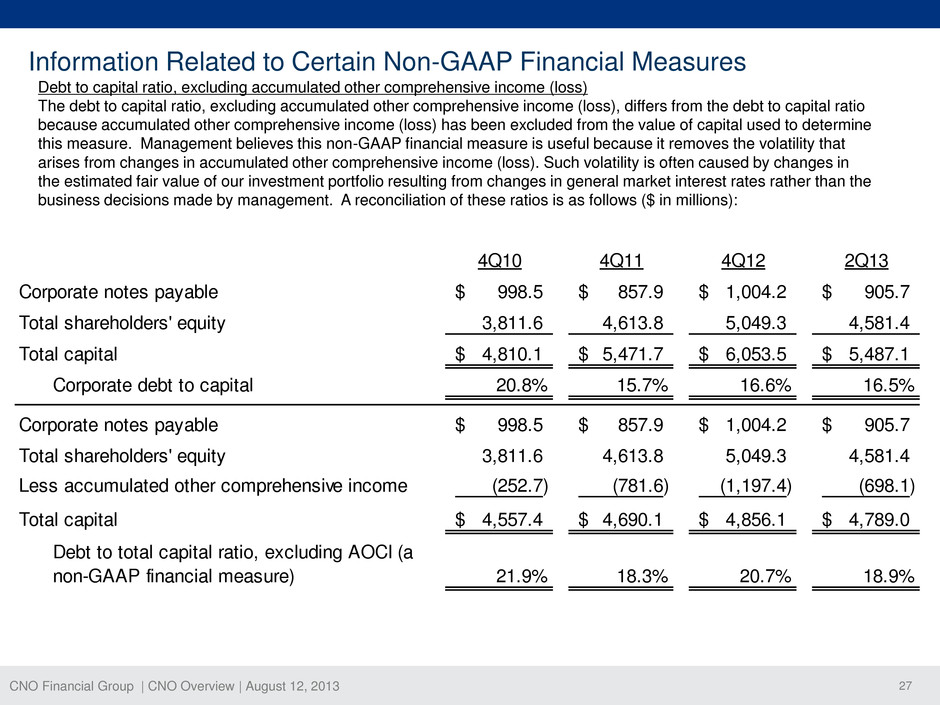

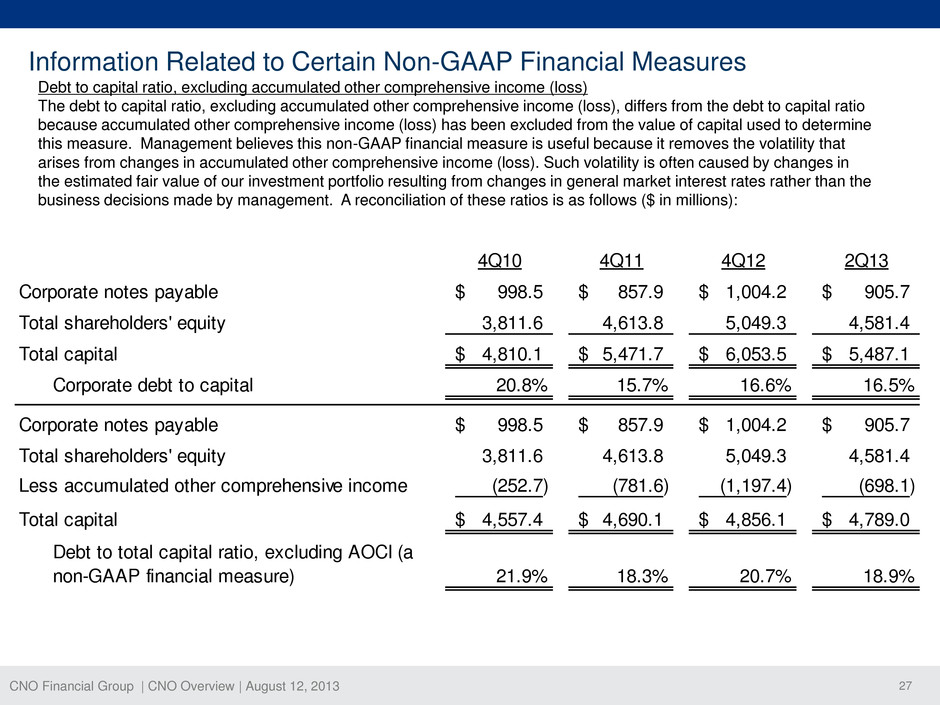

CNO Financial Group | CNO Overview | August 12, 2013 27 Information Related to Certain Non-GAAP Financial Measures 4Q10 4Q11 4Q12 2Q13 Corporate notes payable 998.5$ 857.9$ 1,004.2$ 905.7$ Total shareholders' equity 3,811.6 4,613.8 5,049.3 4,581.4 Total capital 4,810.1$ 5,471.7$ 6,053.5$ 5,487.1$ Corporate debt to capital 20.8% 15.7% 16.6% 16.5% Corporate notes payable 998.5$ 857.9$ 1,004.2$ 905.7$ Total shareholders' equity 3,811.6 4,613.8 5,049.3 4,581.4 Less accumulated other comprehensive income (252.7) (781.6) (1,197.4) (698.1) Total capital 4,557.4$ 4,690.1$ 4,856.1$ 4,789.0$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 21.9% 18.3% 20.7% 18.9% Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions):

CNO Financial Group | CNO Overview | August 12, 2013 28 Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of return before loss on extinguishment of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non- GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continued operations. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation. All references to return on allocated capital measures assume a capital allocation based on a 275% targeted risk-based capital at the segment level. Additionally, corporate debt has been allocated to the segments.

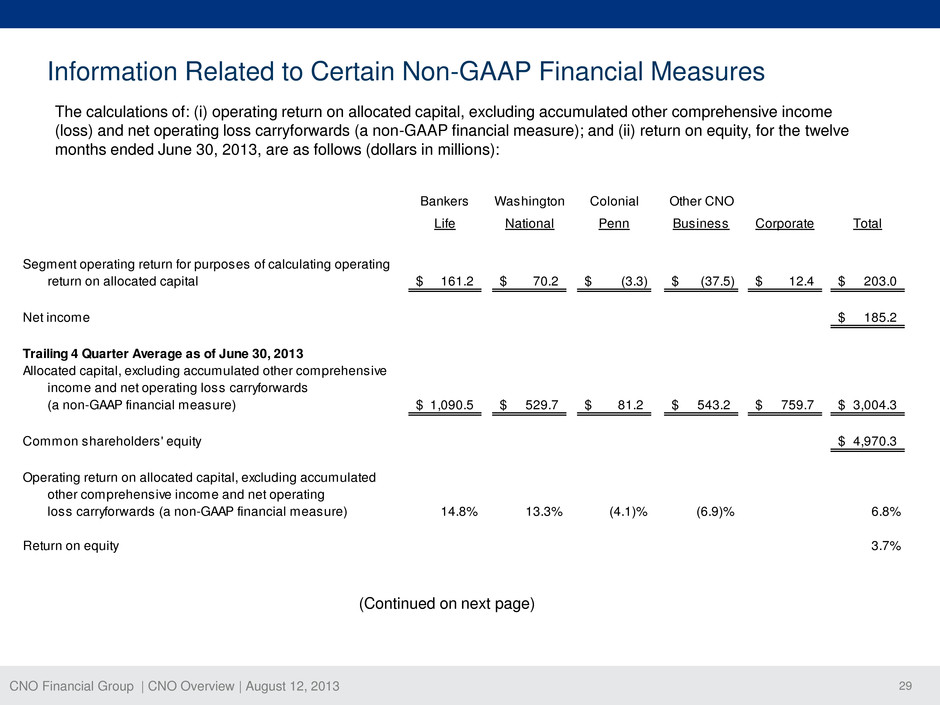

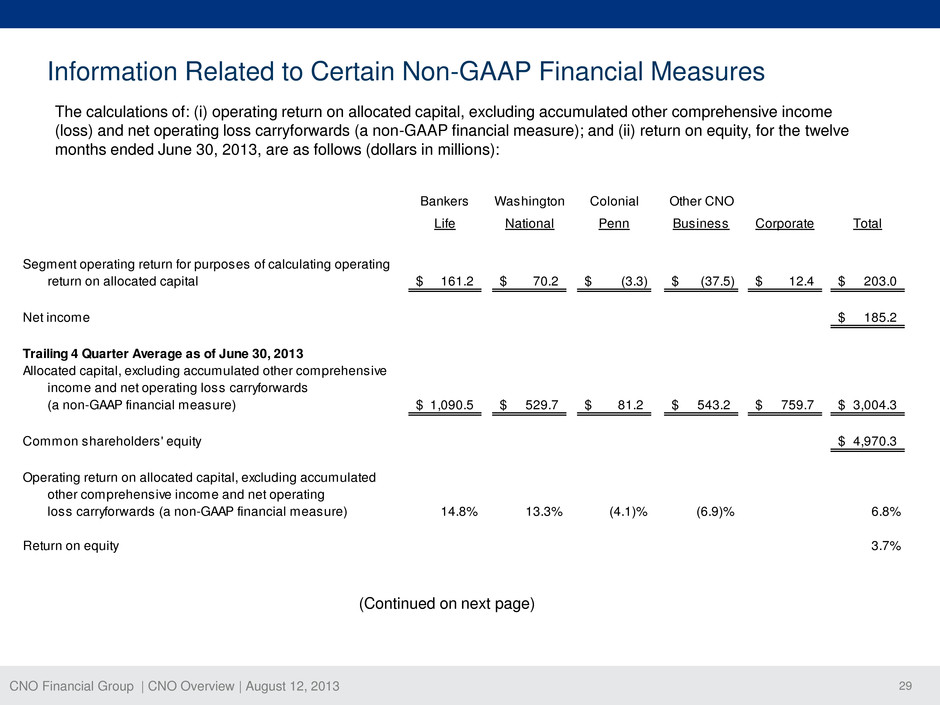

CNO Financial Group | CNO Overview | August 12, 2013 29 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on allocated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (ii) return on equity, for the twelve months ended June 30, 2013, are as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Segment operating return for purposes of calculating operating return on allocated capital 161.2$ 70.2$ (3.3)$ (37.5)$ 12.4$ 203.0$ Net income 185.2$ Trailing 4 Quarter Average as of June 30, 2013 Allocated capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 1,090.5$ 529.7$ 81.2$ 543.2$ 759.7$ 3,004.3$ Commo shareholders' equity 4,970.3$ Operating return on allocated capital, excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 14.8% 13.3% (4.1)% (6.9)% 6.8% Return on equity 3.7% (Continued on next page)

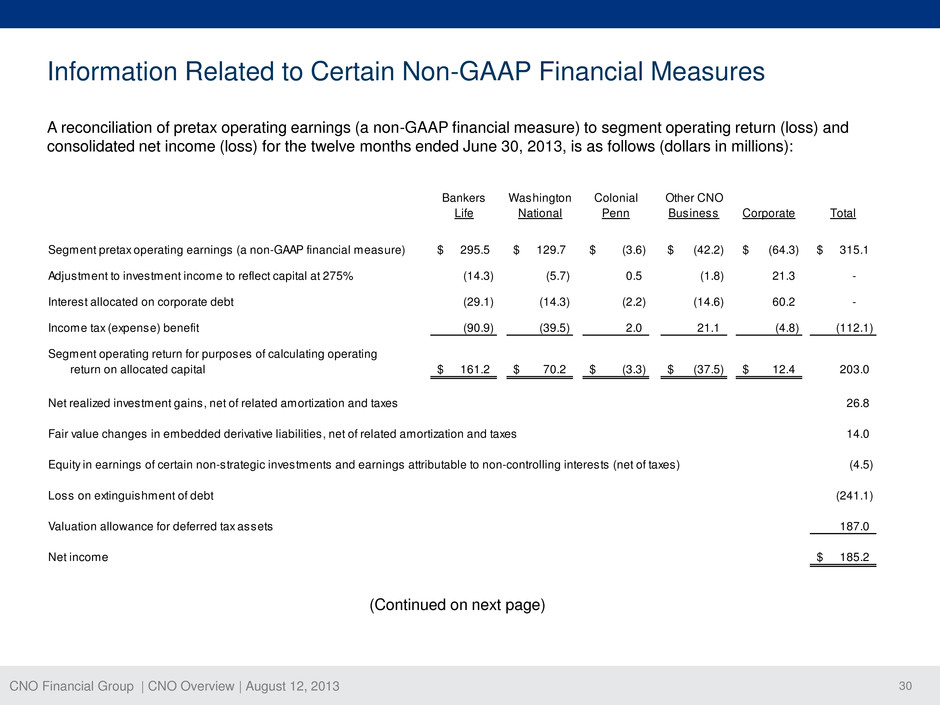

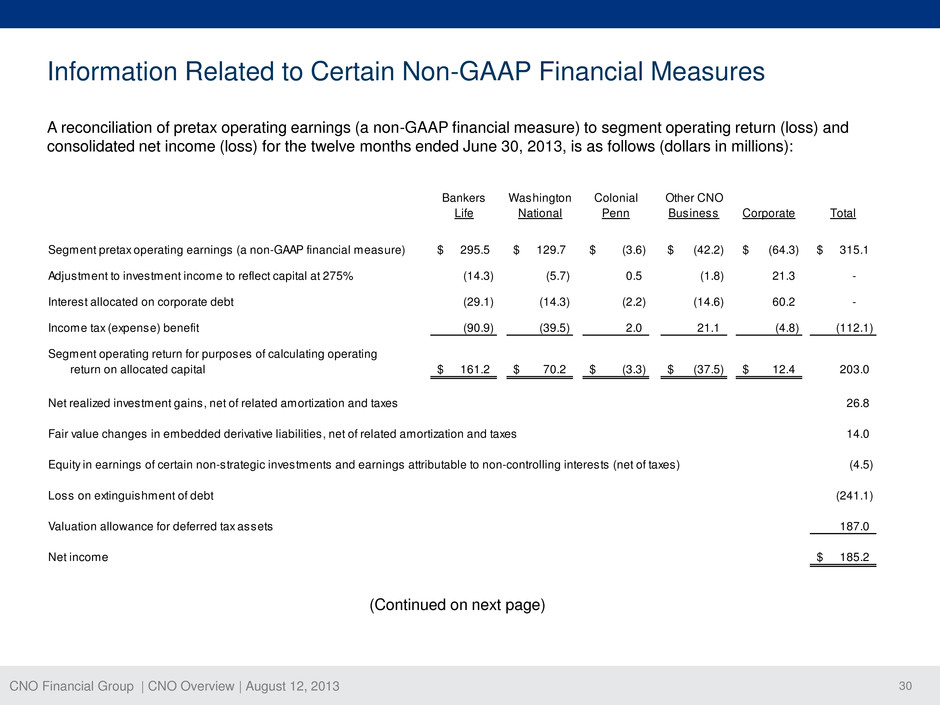

CNO Financial Group | CNO Overview | August 12, 2013 30 Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to segment operating return (loss) and consolidated net income (loss) for the twelve months ended June 30, 2013, is as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Segment pretax operating earnings (a non-GAAP financial measure) 295.5$ 129.7$ (3.6)$ (42.2)$ (64.3)$ 315.1$ Adjustment to investment income to reflect capital at 275% (14.3) (5.7) 0.5 (1.8) 21.3 - Interest allocated on corporate debt (29.1) (14.3) (2.2) (14.6) 60.2 - Income tax (expense) benefit (90.9) (39.5) 2.0 21.1 (4.8) (112.1) Segment operating return for purposes of calculating operating return on allocated capital 161.2$ 70.2$ (3.3)$ (37.5)$ 12.4$ 203.0 Net realized investment gains, net of related amortization and taxes 26.8 Fair value changes in embedded derivative liabilities, net of related amortization and taxes 14.0 Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests (net of taxes) (4.5) Loss on extinguishment of debt (241.1) Valuation allowance for deferred tax assets 187.0 Net income 185.2$ (Continued on next page)

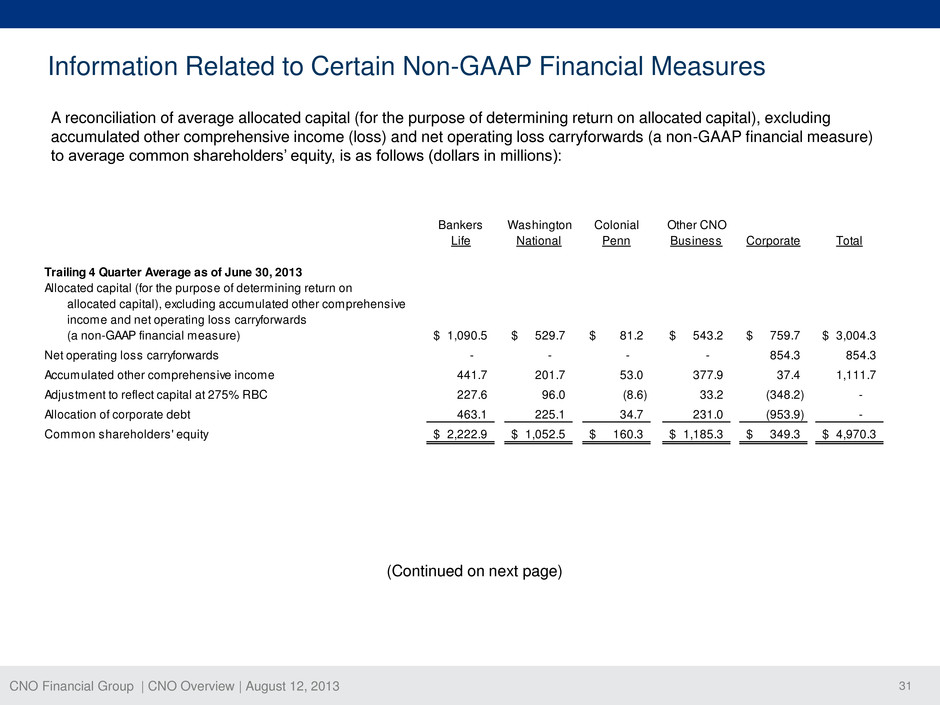

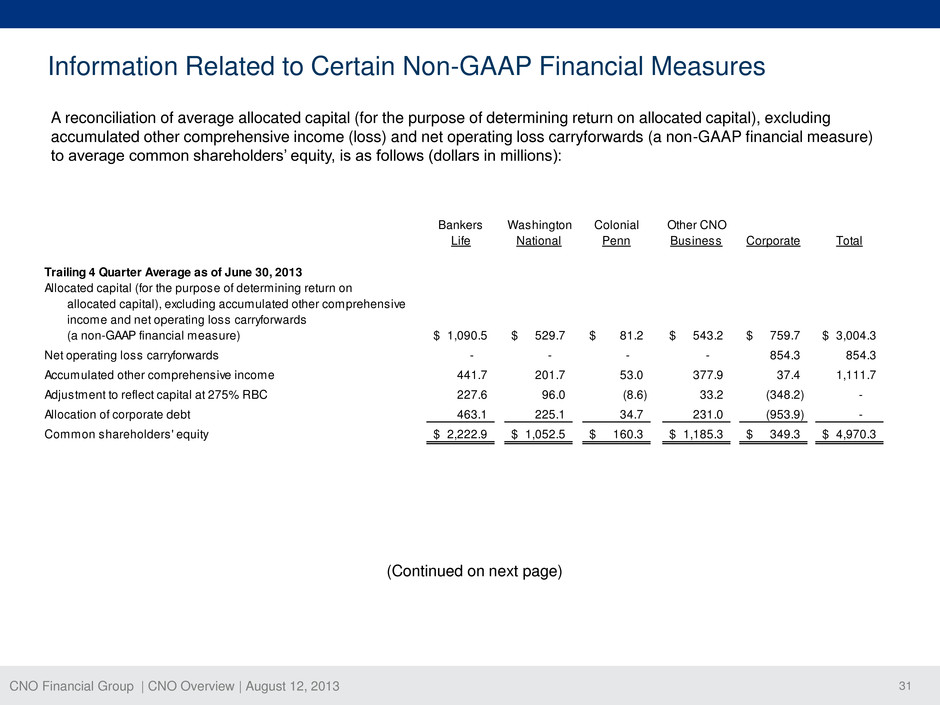

CNO Financial Group | CNO Overview | August 12, 2013 31 Information Related to Certain Non-GAAP Financial Measures A reconciliation of average allocated capital (for the purpose of determining return on allocated capital), excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to average common shareholders’ equity, is as follows (dollars in millions): Bankers Washington Colonial Other CNO Life National Penn Business Corporate Total Trailing 4 Quarter Average as of June 30, 2013 Allocated capital (for the purpose of determining return on allocated capital), excluding accumulated other comprehensive income and net operating loss carryforwards (a non-GAAP financial measure) 1,090.5$ 529.7$ 81.2$ 543.2$ 759.7$ 3,004.3$ Net operating loss carryforwards - - - - 854.3 854.3 Accumulated other comprehensive income 441.7 201.7 53.0 377.9 37.4 1,111.7 Adjustment to reflect capital at 275% RBC 227.6 96.0 (8.6) 33.2 (348.2) - Allocation of corporate debt 463.1 225.1 34.7 231.0 (953.9) - Common shareholders' equity 2,222.9$ 1,052.5$ 160.3$ 1,185.3$ 349.3$ 4,970.3$ (Continued on next page)

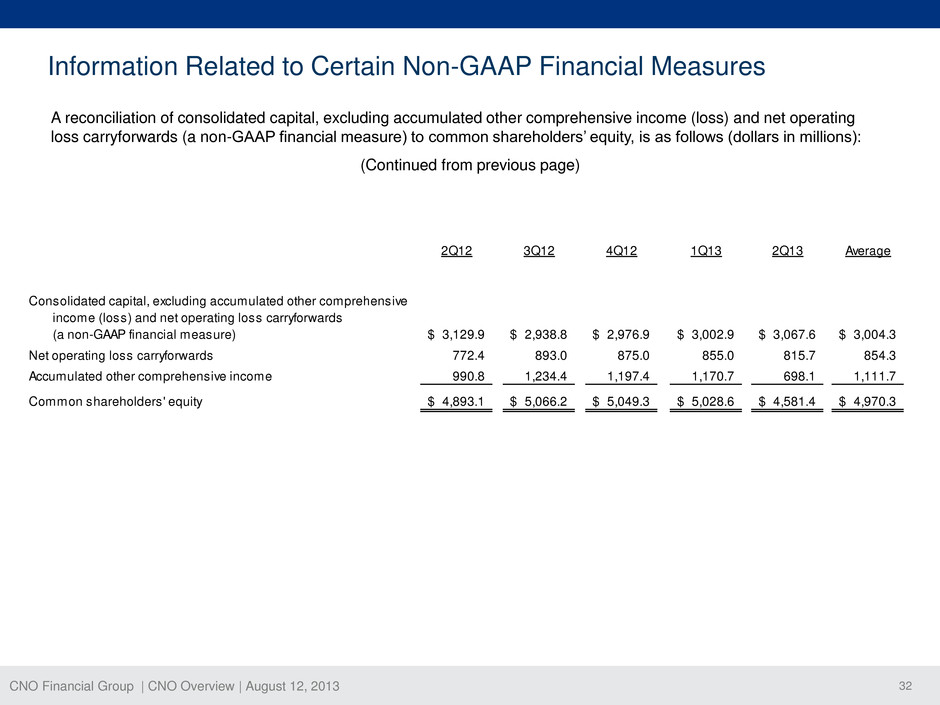

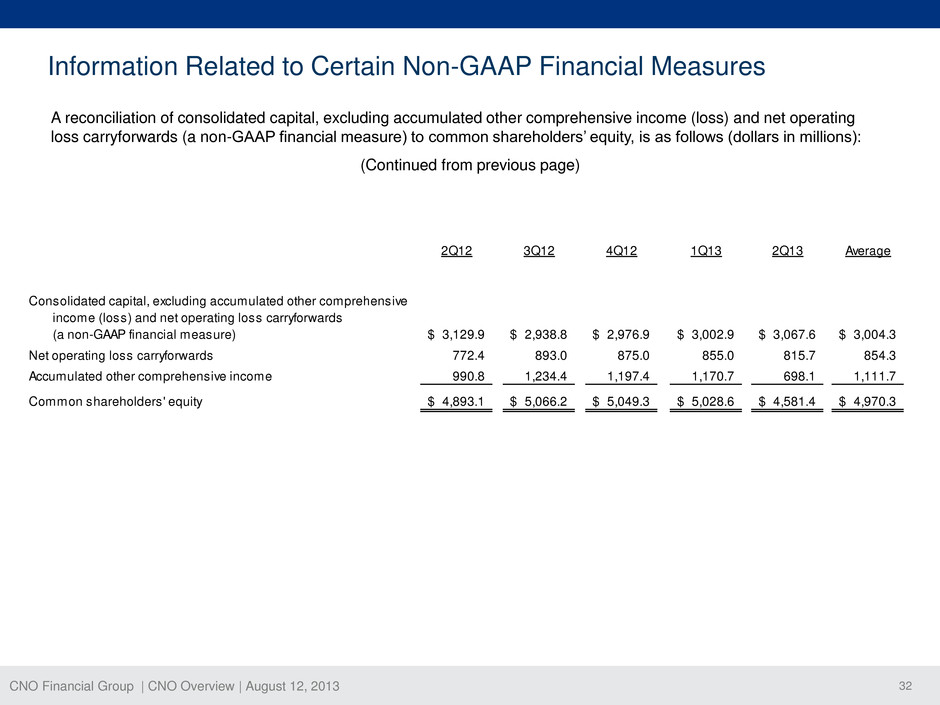

CNO Financial Group | CNO Overview | August 12, 2013 32 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 2Q12 3Q12 4Q12 1Q13 2Q13 Average C solid t d capital, excluding accumulated other comprehensive inco e (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,129.9$ 2,938.8$ 2,976.9$ 3,002.9$ 3,067.6$ 3,004.3$ Net operating loss carryforwards 772.4 893.0 875.0 855.0 815.7 854.3 Accumulated other comprehensive income 990.8 1,234.4 1,197.4 1,170.7 698.1 1,111.7 Common shareholders' equity 4,893.1$ 5,066.2$ 5,049.3$ 5,028.6$ 4,581.4$ 4,970.3$ (Continued from previous page)