CNO Overview March 26, 2014 Exhibit 99.1

CNO Financial Group | CNO Overview | March 26, 2014 2

CNO Financial Group | CNO Overview | March 26, 2014 3 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of the date on the cover page of this presentation.

CNO Financial Group | CNO Overview | March 26, 2014 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

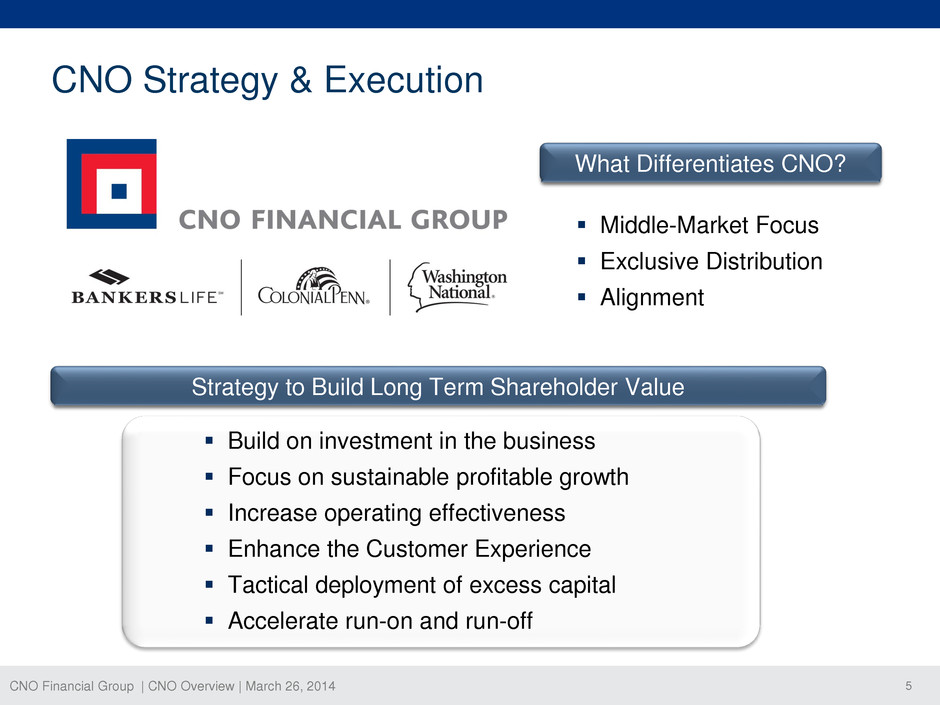

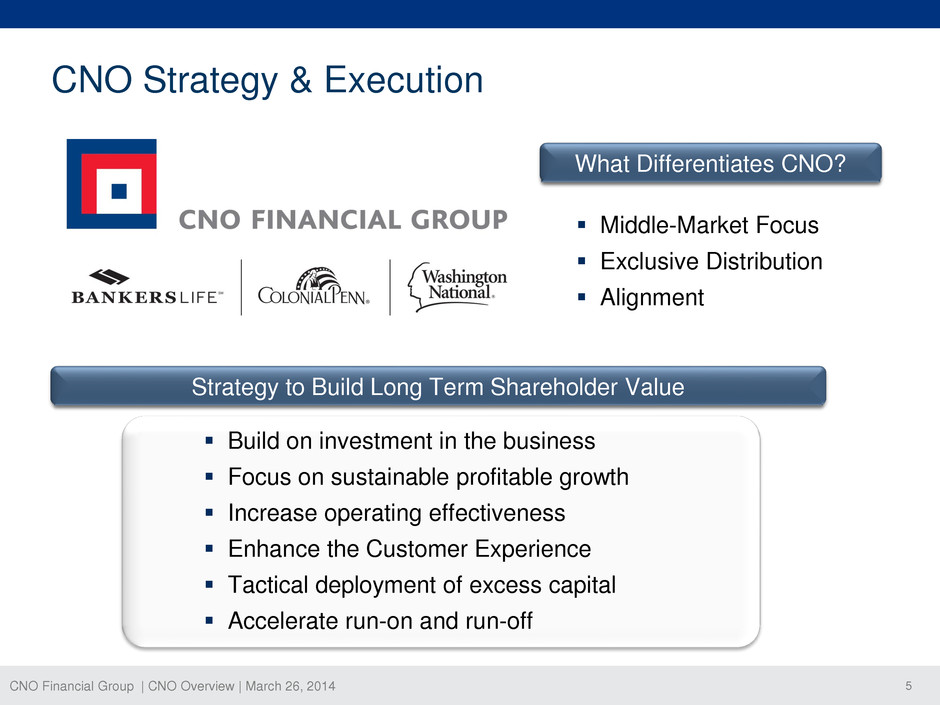

CNO Financial Group | CNO Overview | March 26, 2014 5 CNO Strategy & Execution Strategy to Build Long Term Shareholder Value Build on investment in the business Focus on sustainable profitable growth Increase operating effectiveness Enhance the Customer Experience Tactical deployment of excess capital Accelerate run-on and run-off Middle-Market Focus Exclusive Distribution Alignment What Differentiates CNO?

CNO Financial Group | CNO Overview | March 26, 2014 6 Agent productivity Branch and geographic expansion New product development Worksite platform Operating efficiencies Customer Experience Key Initiatives Leveraging Middle Market Focus & Business Model Investment Breakdown Plan to Invest $45 - $55 million in Key Initiatives in 2014 to Drive Above Industry Growth Rates Key Initiatives Back Office Efficiencies & Capabilities Agent Growth and Expansion Customer Experience / Brand Awareness New Products and Market Reach ($ millions) 2013 2011 NAP $416 $375 Collected Premium* $2,527 $2,369 Bankers Annuities Average Liabilities $7,323 $6,970 * Bankers Life (excluding annuities), Washington National and Colonial Penn segments

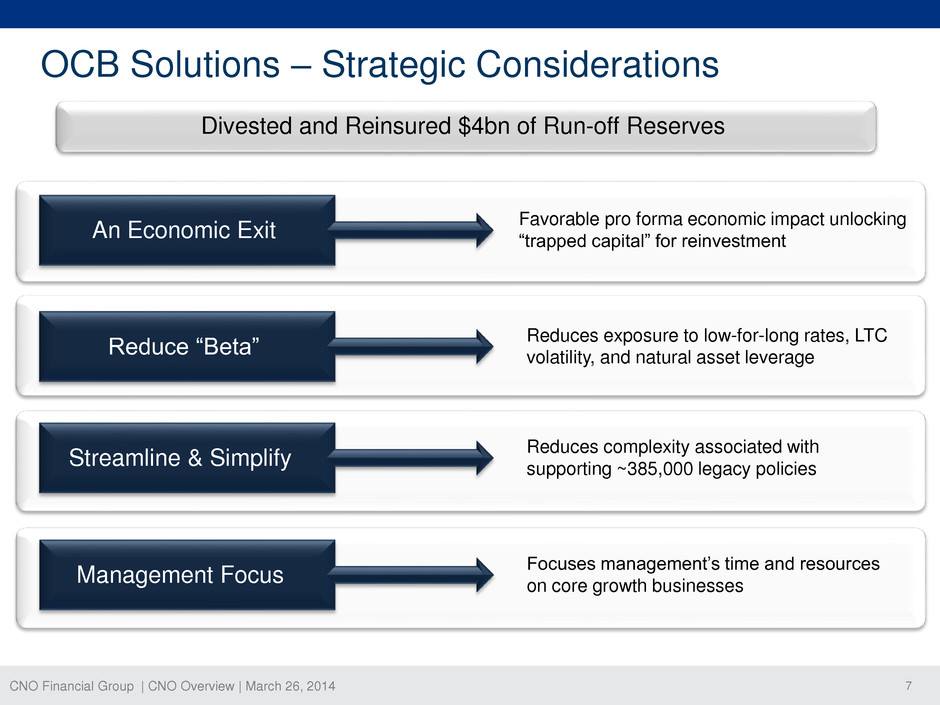

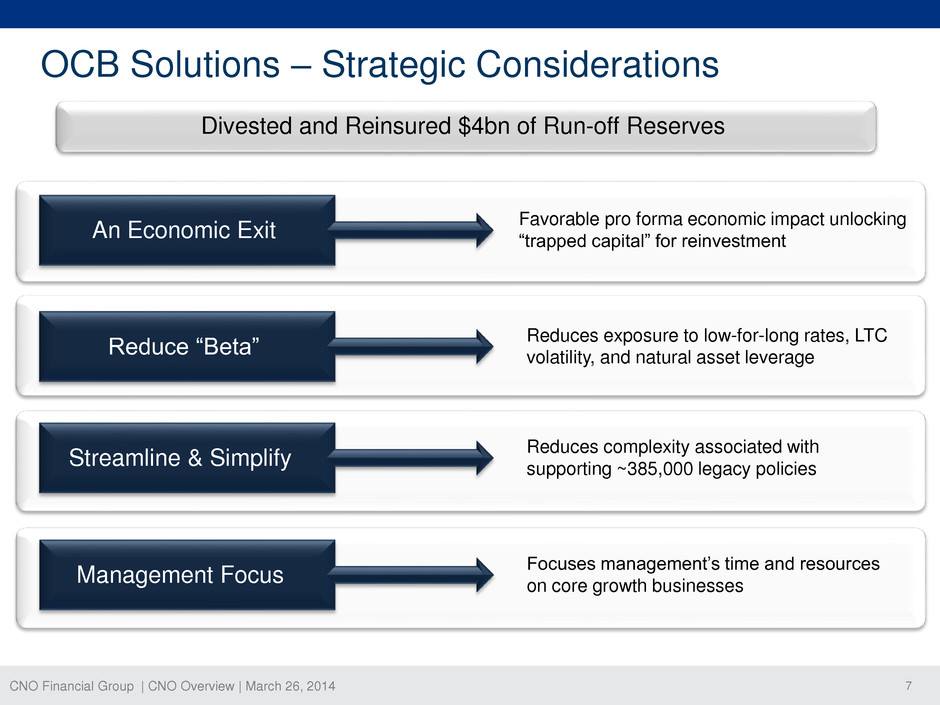

CNO Financial Group | CNO Overview | March 26, 2014 7 An Economic Exit Favorable pro forma economic impact unlocking “trapped capital” for reinvestment Reduce “Beta” Reduces exposure to low-for-long rates, LTC volatility, and natural asset leverage Streamline & Simplify Reduces complexity associated with supporting ~385,000 legacy policies Divested and Reinsured $4bn of Run-off Reserves Management Focus Focuses management’s time and resources on core growth businesses OCB Solutions – Strategic Considerations

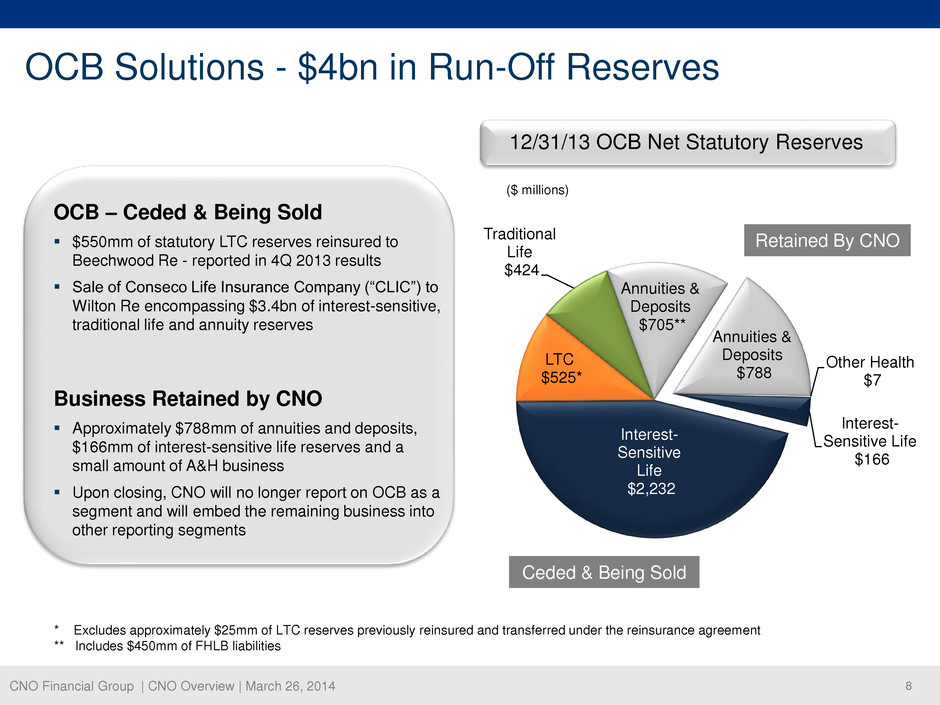

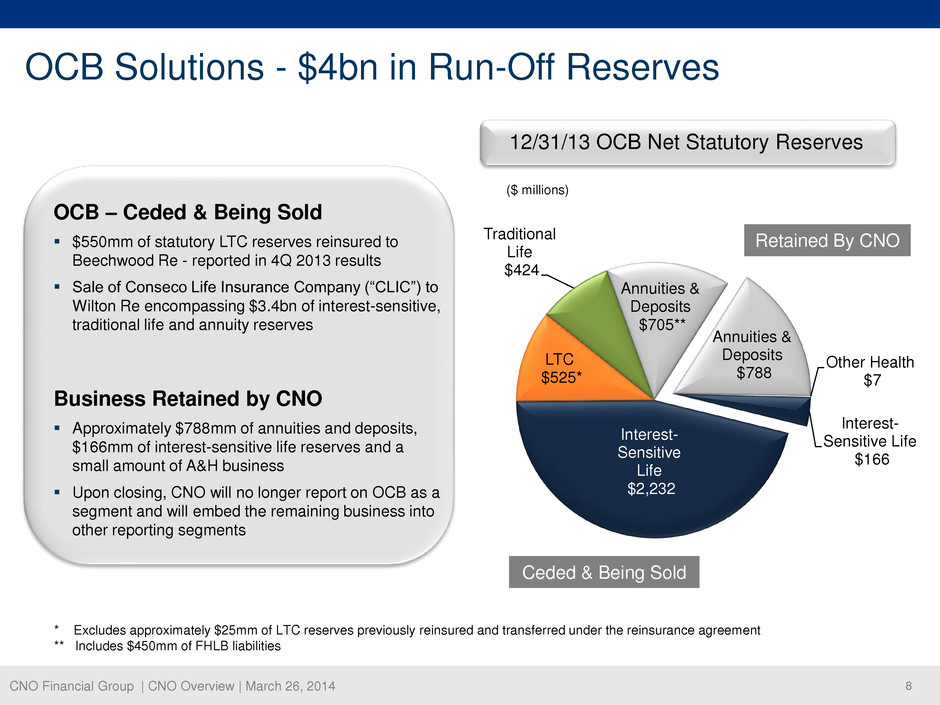

CNO Financial Group | CNO Overview | March 26, 2014 8 Annuities & Deposits $705** Interest- Sensitive Life $2,232 LTC $525* Traditional Life $424 Annuities & Deposits $788 Other Health $7 Interest- Sensitive Life $166 OCB Solutions - $4bn in Run-Off Reserves 12/31/13 OCB Net Statutory Reserves Retained By CNO Ceded & Being Sold OCB – Ceded & Being Sold $550mm of statutory LTC reserves reinsured to Beechwood Re - reported in 4Q 2013 results Sale of Conseco Life Insurance Company (“CLIC”) to Wilton Re encompassing $3.4bn of interest-sensitive, traditional life and annuity reserves Business Retained by CNO Approximately $788mm of annuities and deposits, $166mm of interest-sensitive life reserves and a small amount of A&H business Upon closing, CNO will no longer report on OCB as a segment and will embed the remaining business into other reporting segments * Excludes approximately $25mm of LTC reserves previously reinsured and transferred under the reinsurance agreement ** Includes $450mm of FHLB liabilities ($ millions)

CNO Financial Group | CNO Overview | March 26, 2014 9 • Stepped-up investment in growth and platform initiatives with an incremental impact on expenses in 2014 of ~$10 million Investing to Drive Long-Term Growth • Value of new business governs the run-on of profitable business while recent transactions accelerate OCB run-off and support reshaping LTC Reshaping In-Force & Building Economic Value • Investment-grade ratings provide a path to unlocking future shareholder value through increased financial flexibility and lowering our cost of capital Capital Strength & Financial Flexibility • Build quality ROE on book value growth through investment and a tactical approach to capital deployment Drive Valuation & Tactical Capital Deployment Financial Plan Underpinnings

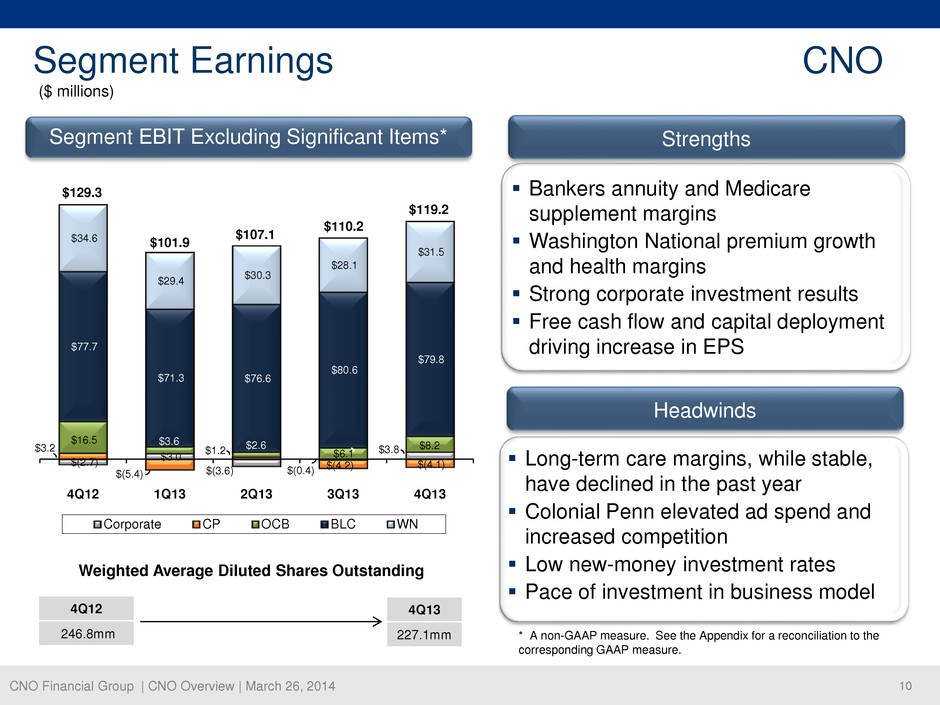

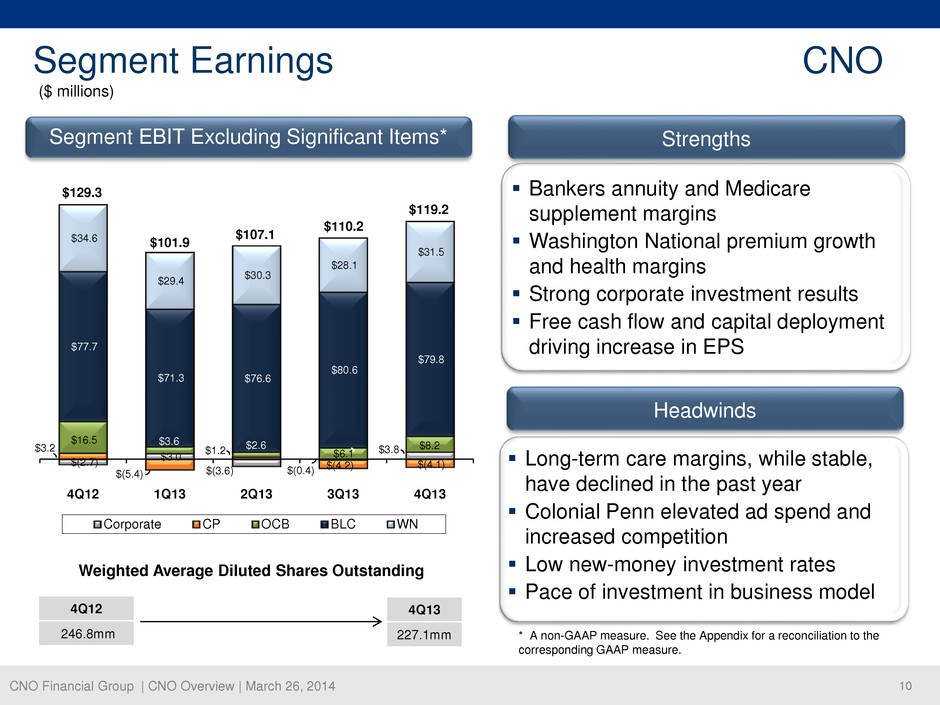

CNO Financial Group | CNO Overview | March 26, 2014 10 $(2.7) $3.0 $(3.6) $(0.4) $3.8 $3.2 $(5.4) $1.2 $(4.2) $(4.1) $16.5 $3.6 $2.6 $6.1 $8.2 $77.7 $71.3 $76.6 $80.6 $79.8 $34.6 $29.4 $30.3 $28.1 $31.5 4Q12 1Q13 2Q13 3Q13 4Q13 Corporate CP OCB BLC WN ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Segment Earnings Strengths $129.3 Segment EBIT Excluding Significant Items* Bankers annuity and Medicare supplement margins Washington National premium growth and health margins Strong corporate investment results Free cash flow and capital deployment driving increase in EPS CNO $101.9 4Q12 246.8mm Weighted Average Diluted Shares Outstanding 4Q13 227.1mm $107.1 $110.2 $119.2 Headwinds Long-term care margins, while stable, have declined in the past year Colonial Penn elevated ad spend and increased competition Low new-money investment rates Pace of investment in business model

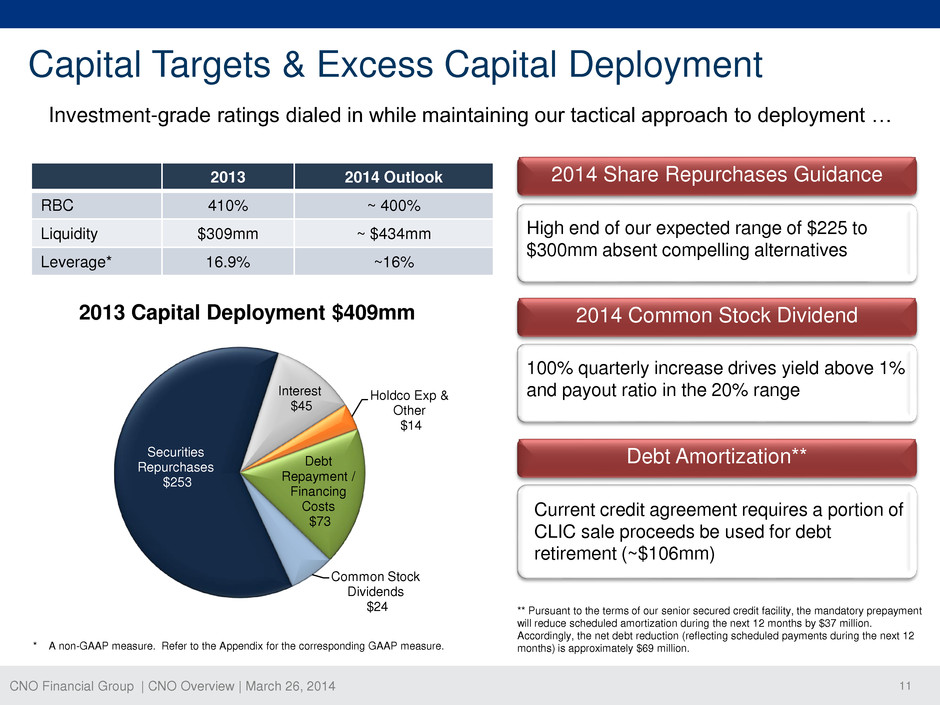

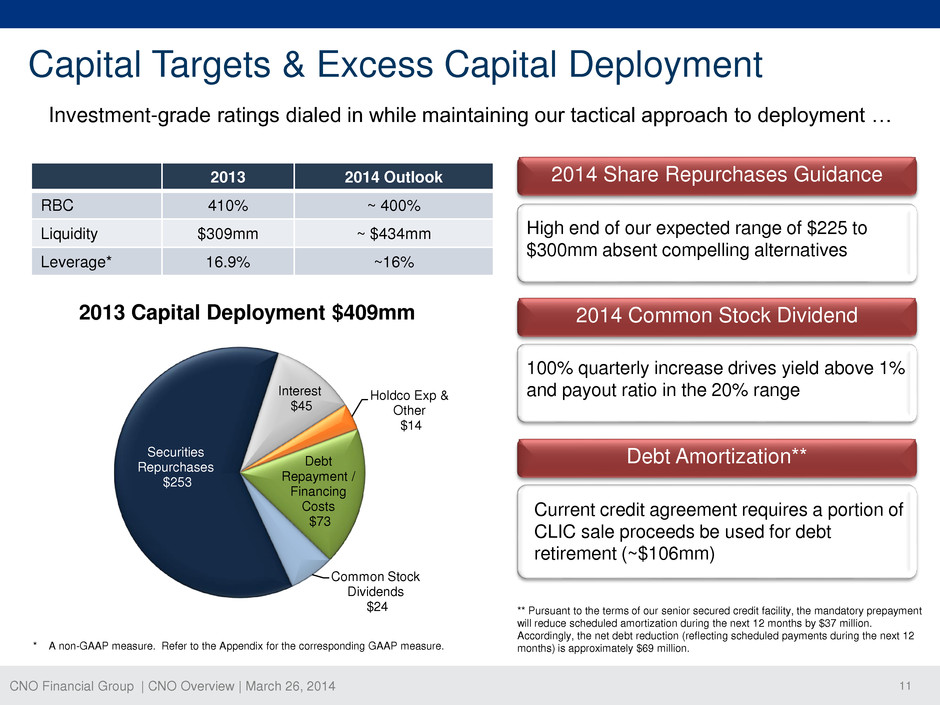

CNO Financial Group | CNO Overview | March 26, 2014 11 Capital Targets & Excess Capital Deployment 2013 2014 Outlook RBC 410% ~ 400% Liquidity $309mm ~ $434mm Leverage* 16.9% ~16% Investment-grade ratings dialed in while maintaining our tactical approach to deployment … 2014 Share Repurchases Guidance v High end of our expected range of $225 to $300mm absent compelling alternatives 2014 Common Stock Dividend v Debt Amortization** v Current credit agreement requires a portion of CLIC sale proceeds be used for debt retirement (~$106mm) 100% quarterly increase drives yield above 1% and payout ratio in the 20% range * A non-GAAP measure. Refer to the Appendix for the corresponding GAAP measure. Interest $45 Holdco Exp & Other $14 Debt Repayment / Financing Costs $73 Common Stock Dividends $24 Securities Repurchases $253 2013 Capital Deployment $409mm ** Pursuant to the terms of our senior secured credit facility, the mandatory prepayment will reduce scheduled amortization during the next 12 months by $37 million. Accordingly, the net debt reduction (reflecting scheduled payments during the next 12 months) is approximately $69 million.

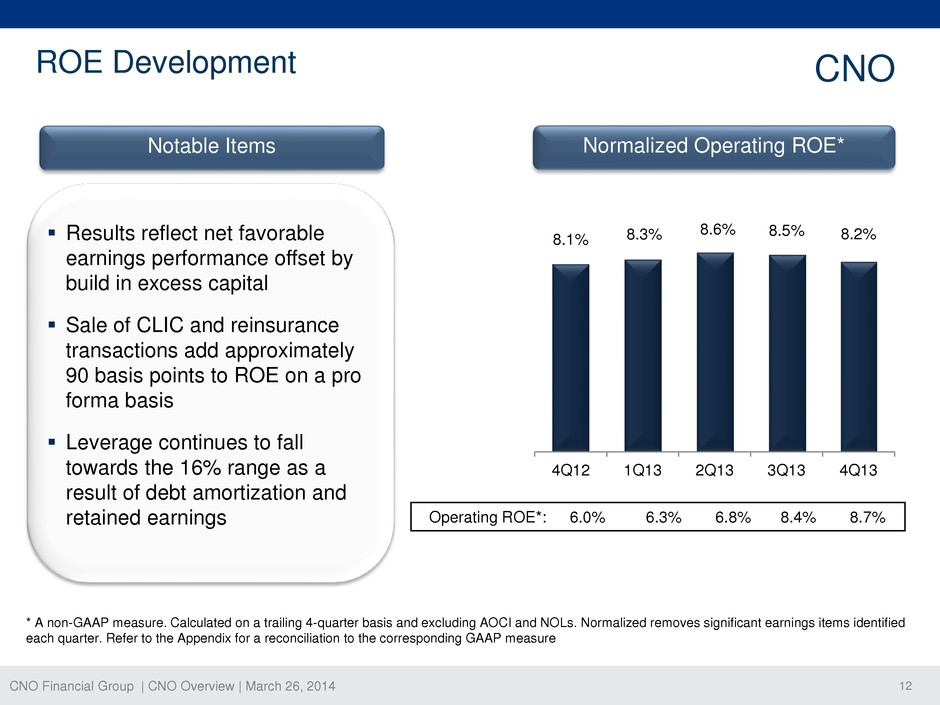

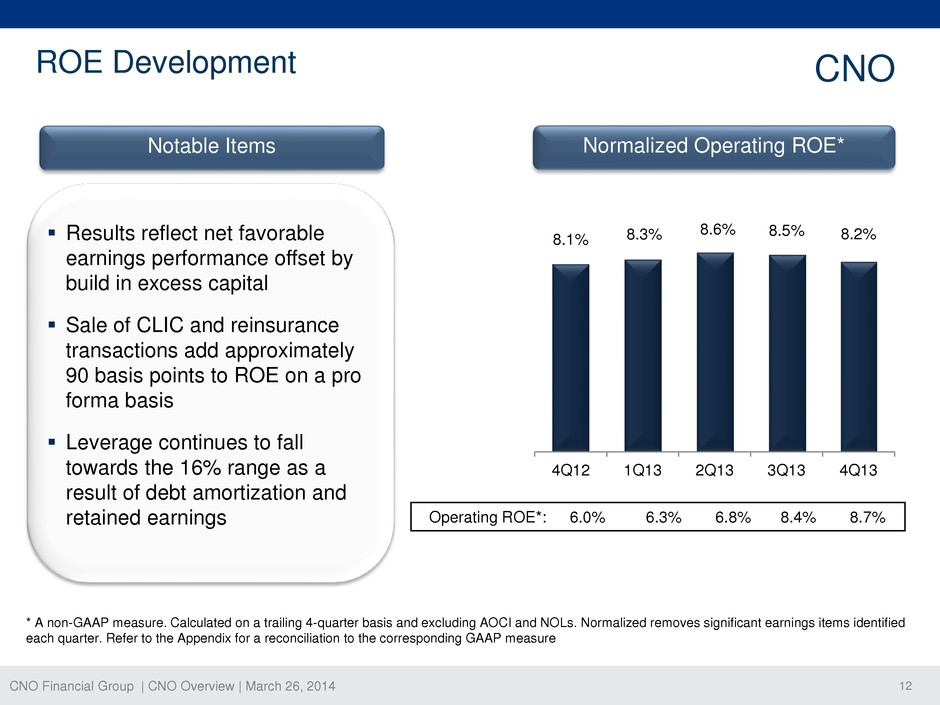

CNO Financial Group | CNO Overview | March 26, 2014 12 ROE Development CNO Results reflect net favorable earnings performance offset by build in excess capital Sale of CLIC and reinsurance transactions add approximately 90 basis points to ROE on a pro forma basis Leverage continues to fall towards the 16% range as a result of debt amortization and retained earnings Notable Items Normalized Operating ROE* * A non-GAAP measure. Calculated on a trailing 4-quarter basis and excluding AOCI and NOLs. Normalized removes significant earnings items identified each quarter. Refer to the Appendix for a reconciliation to the corresponding GAAP measure Operating ROE*: 6.0% 6.3% 6.8% 8.4% 8.7% 8.1% 8.3% 8.6% 8.5% 8.2% 4Q12 1Q13 2Q13 3Q13 4Q13

CNO Financial Group | CNO Overview | March 26, 2014 13 CNO Moving Forward Financial Strength – Focus on sustainable, profitable growth while reshaping in-force driving a higher quality ROE Focused on Core Franchise Growth – Investments in distribution productivity and growth yielding top-tier industry growth rates Tactical Deployment of Excess Capital – Balanced capital deployment producing investment grade financial ratios while returning capital to shareholders Building shareholder value with strong business fundamentals, solid earnings and powerful cash flow generation

CNO Financial Group | CNO Overview | March 26, 2014 14 Q&A

CNO Financial Group | CNO Overview | March 26, 2014 15 Appendix

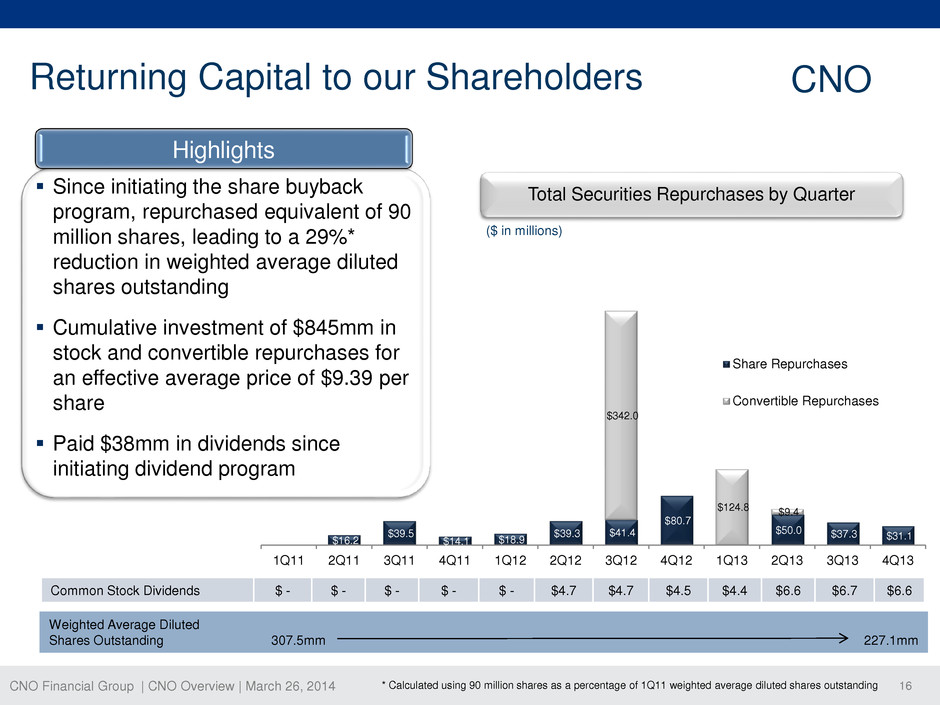

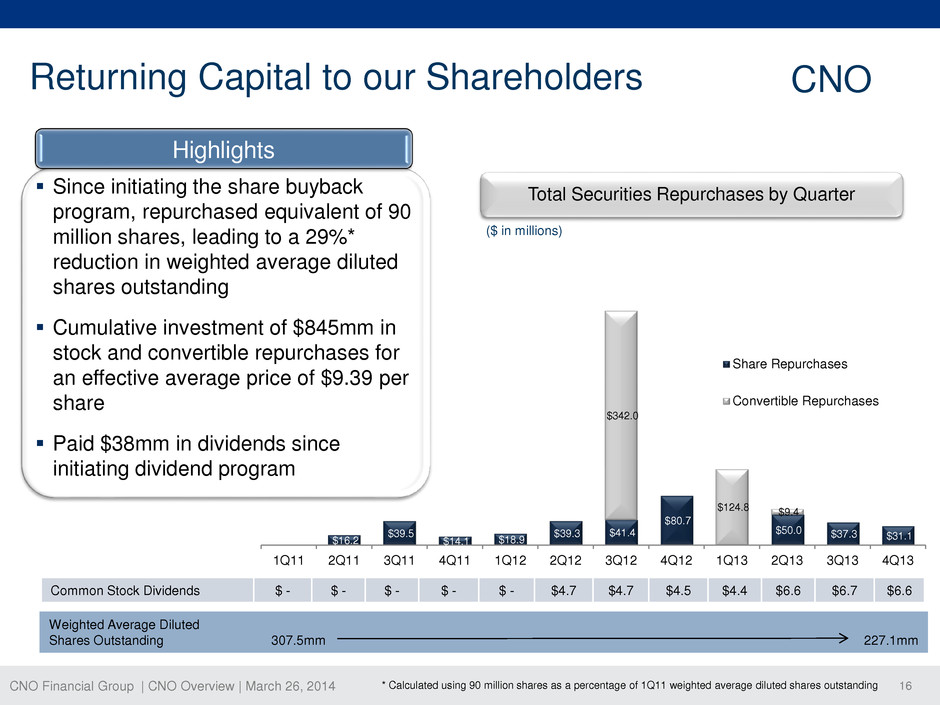

CNO Financial Group | CNO Overview | March 26, 2014 16 $16.2 $39.5 $14.1 $18.9 $39.3 $41.4 $80.7 $50.0 $37.3 $31.1 $342.0 $124.8 $9.4 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 Share Repurchases Convertible Repurchases Returning Capital to our Shareholders CNO Since initiating the share buyback program, repurchased equivalent of 90 million shares, leading to a 29%* reduction in weighted average diluted shares outstanding Cumulative investment of $845mm in stock and convertible repurchases for an effective average price of $9.39 per share Paid $38mm in dividends since initiating dividend program Total Securities Repurchases by Quarter * Calculated using 90 million shares as a percentage of 1Q11 weighted average diluted shares outstanding Common Stock Dividends $ - $ - $ - $ - $ - $4.7 $4.7 $4.5 $4.4 $6.6 $6.7 $6.6 Highlights Weighted Average Diluted Shares Outstanding 307.5mm 227.1mm ($ in millions)

CNO Financial Group | CNO Overview | March 26, 2014 17 Loss Recognition & Cash Flow Testing 2013 Statutory Cash Flow Testing 2013 GAAP Loss Recognition Testing Aggregate margins remain strong at 14% of $25 billion in tested liabilities* Testing margin increased modestly in 2013 ↑ - Net growth in In-force (+5%) ↑ - Improved experience and expenses (+5%) Earned rates in-line with best estimates All intangibles are recoverable Aggregate insurance company margins improved at 12% of statutory reserves Margins benefited from recovery in interest rates and overall experience All insurance entities pass Asset Adequacy / Cash Flow Testing under all standard scenarios Year-end testing resulted in a modest net increase in asset adequacy reserves ($10 million) Key Lines of Business Tested Liabilities* ($ in billions) Key Risks to Margin Aggregate Margins Traditional life and Universal life $2.0 Mortality Aggregate margins of approximately 45% Medicare supplement and supplemental health $7.2 Morbidity Aggregate margins of approximately 25% Bankers Long-Term Care $4.2 Interest Rates; Morbidity; Persistency LRT margins of 5%, CFT margin positive and benefits from health aggregation Interest sensitive life (OCB) $2.4 Interest Rates; Mortality LRT margins of 1% with potential for future earnings and capital volatility Annuities $8.7 Spreads; Persistency Aggregate margins of approximately 7% CNO * Tested liabilities defined as the Net GAAP Liability (liabilities less intangibles) with exception of Medicare Supplement and Supplemental Health which measures margin against the present value of policy benefits

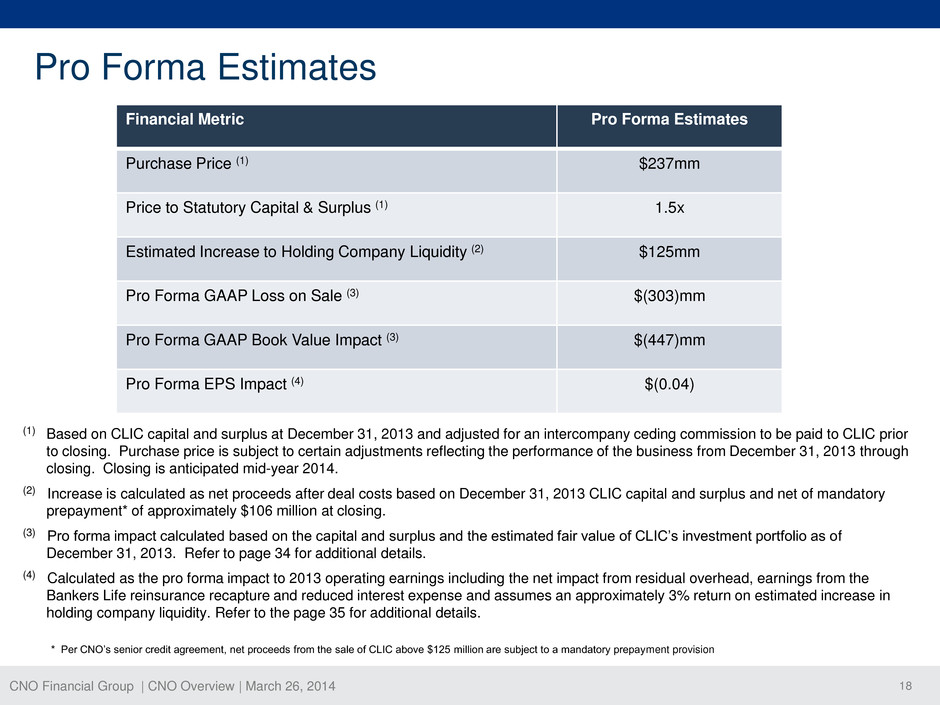

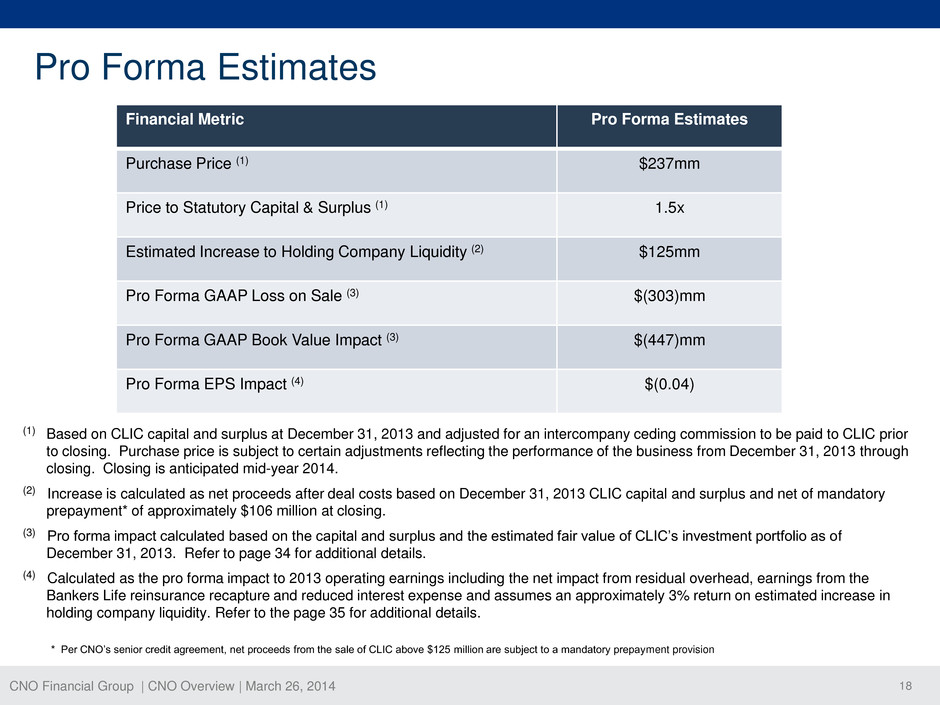

CNO Financial Group | CNO Overview | March 26, 2014 18 Pro Forma Estimates Financial Metric Pro Forma Estimates Purchase Price (1) $237mm Price to Statutory Capital & Surplus (1) 1.5x Estimated Increase to Holding Company Liquidity (2) $125mm Pro Forma GAAP Loss on Sale (3) $(303)mm Pro Forma GAAP Book Value Impact (3) $(447)mm Pro Forma EPS Impact (4) $(0.04) (1) Based on CLIC capital and surplus at December 31, 2013 and adjusted for an intercompany ceding commission to be paid to CLIC prior to closing. Purchase price is subject to certain adjustments reflecting the performance of the business from December 31, 2013 through closing. Closing is anticipated mid-year 2014. (2) Increase is calculated as net proceeds after deal costs based on December 31, 2013 CLIC capital and surplus and net of mandatory prepayment* of approximately $106 million at closing. (3) Pro forma impact calculated based on the capital and surplus and the estimated fair value of CLIC’s investment portfolio as of December 31, 2013. Refer to page 34 for additional details. (4) Calculated as the pro forma impact to 2013 operating earnings including the net impact from residual overhead, earnings from the Bankers Life reinsurance recapture and reduced interest expense and assumes an approximately 3% return on estimated increase in holding company liquidity. Refer to the page 35 for additional details. * Per CNO’s senior credit agreement, net proceeds from the sale of CLIC above $125 million are subject to a mandatory prepayment provision

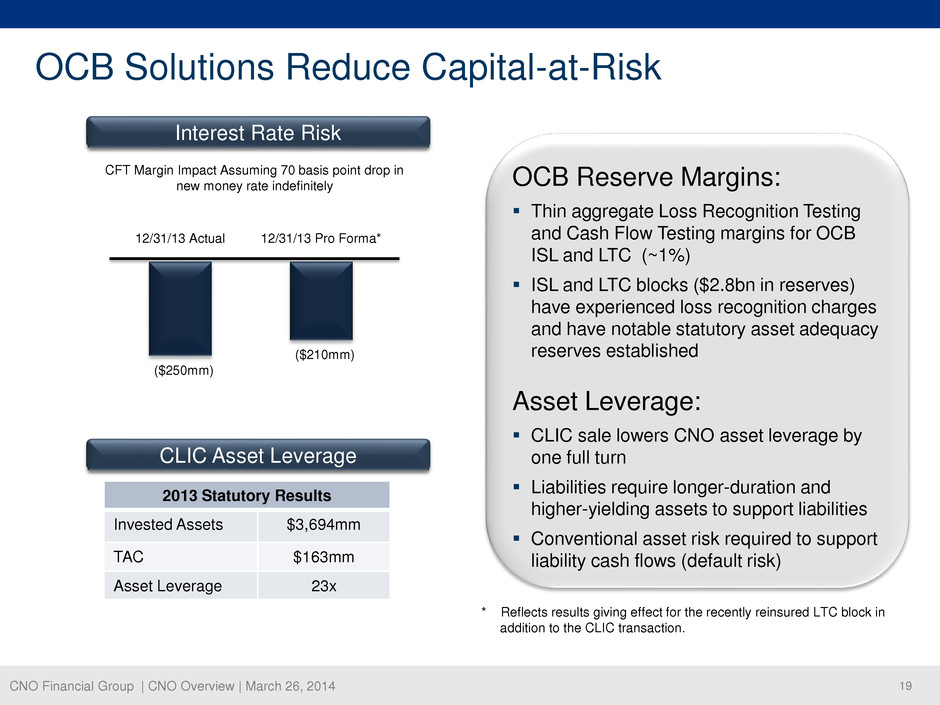

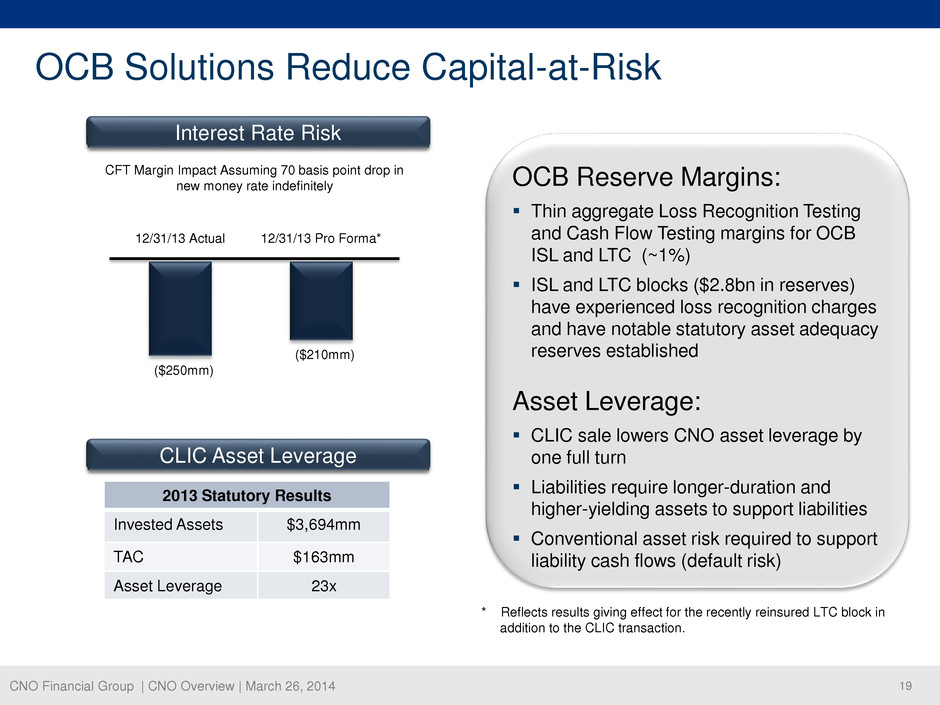

CNO Financial Group | CNO Overview | March 26, 2014 19 OCB Solutions Reduce Capital-at-Risk OCB Reserve Margins: Thin aggregate Loss Recognition Testing and Cash Flow Testing margins for OCB ISL and LTC (~1%) ISL and LTC blocks ($2.8bn in reserves) have experienced loss recognition charges and have notable statutory asset adequacy reserves established Asset Leverage: CLIC sale lowers CNO asset leverage by one full turn Liabilities require longer-duration and higher-yielding assets to support liabilities Conventional asset risk required to support liability cash flows (default risk) Interest Rate Risk CLIC Asset Leverage CFT Margin Impact Assuming 70 basis point drop in new money rate indefinitely 12/31/13 Actual 12/31/13 Pro Forma* ($250mm) ($210mm) * Reflects results giving effect for the recently reinsured LTC block in addition to the CLIC transaction. 2013 Statutory Results Invested Assets $3,694mm TAC $163mm Asset Leverage 23x

CNO Financial Group | CNO Overview | March 26, 2014 20 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

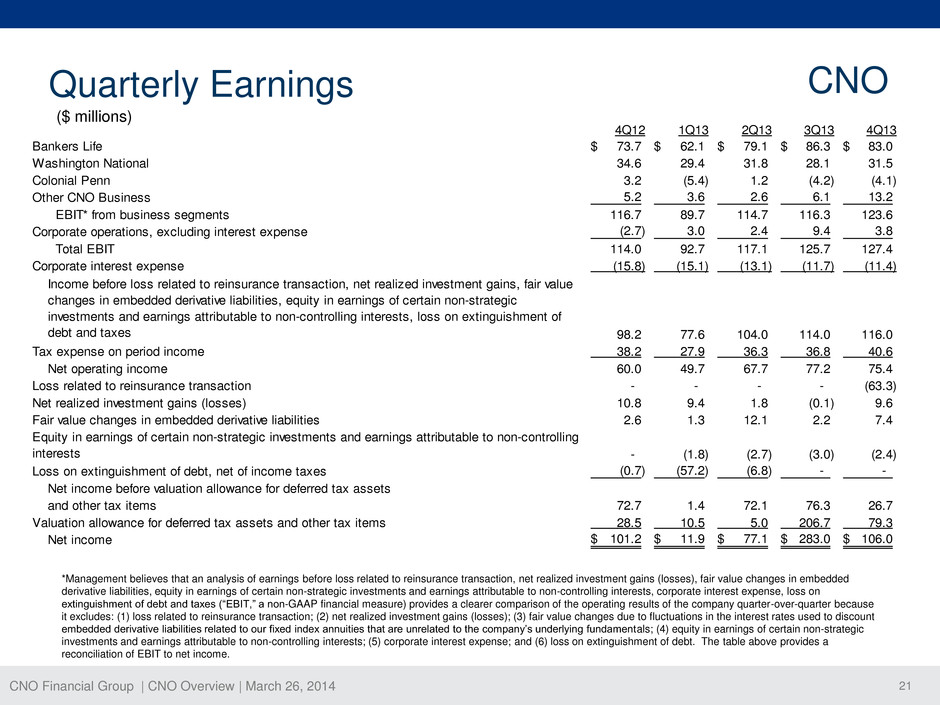

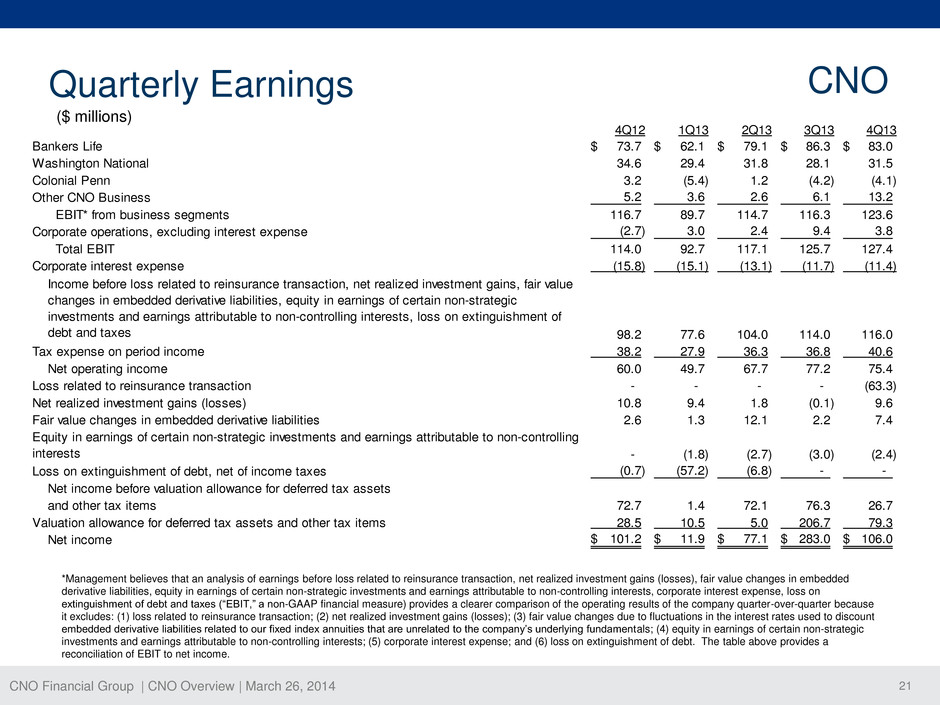

CNO Financial Group | CNO Overview | March 26, 2014 21 Quarterly Earnings CNO *Management believes that an analysis of earnings before loss related to reinsurance transaction, net realized investment gains (losses), fair value changes in embedded derivative liabilities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, corporate interest expense, loss on extinguishment of debt and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) loss related to reinsurance transaction; (2) net realized investment gains (losses); (3) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals; (4) equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests; (5) corporate interest expense; and (6) loss on extinguishment of debt. The table above provides a reconciliation of EBIT to net income. 4Q12 1Q13 2Q13 3Q13 4Q13 Bankers Life 73.7$ 62.1$ 79.1$ 86.3$ 83.0$ Washington National 34.6 29.4 31.8 28.1 31.5 Colonial Penn 3.2 (5.4) 1.2 (4.2) (4.1) Other CNO Business 5.2 3.6 2.6 6.1 13.2 EBIT* from business segments 116.7 89.7 114.7 116.3 123.6 Corporate operations, excluding interest expense (2.7) 3.0 2.4 9.4 3.8 Total EBIT 114.0 92.7 117.1 125.7 127.4 Corporate interest expense (15.8) (15.1) (13.1) (11.7) (11.4) 98.2 77.6 104.0 114.0 116.0 Tax expense on period income 38.2 27.9 36.3 36.8 40.6 Net operating income 60.0 49.7 67.7 77.2 75.4 Loss related to reinsurance transaction - - - - (63.3) Net realized investment gains (losses) 10.8 9.4 1.8 (0.1) 9.6 Fair value changes in embedded derivative liabilities 2.6 1.3 12.1 2.2 7.4 - (1.8) (2.7) (3.0) (2.4) Loss on extinguishment of debt, net of income taxes (0.7) (57.2) (6.8) - - Net income before valuation allowance for deferred tax assets and other tax items 72.7 1.4 72.1 76.3 26.7 Valuation allowance for deferred tax assets and other tax items 28.5 10.5 5.0 206.7 79.3 Net income 101.2$ 11.9$ 77.1$ 283.0$ 106.0$ Income before loss related to reinsurance transaction, net realized investment gains, fair value changes in embedded derivative liabilities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, loss on extinguishment of debt and taxes Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests ($ millions)

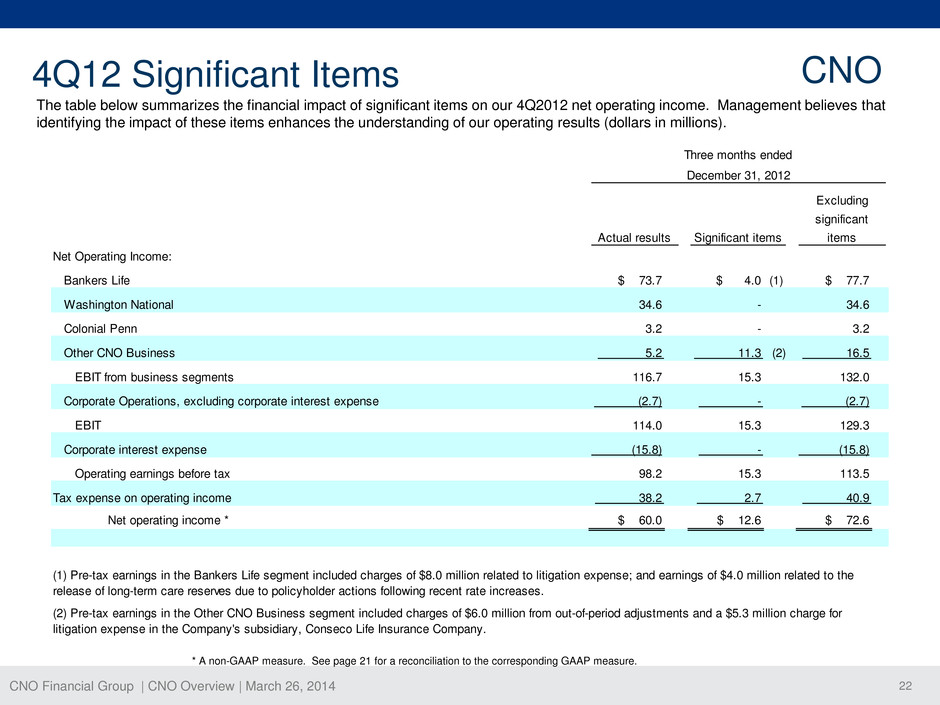

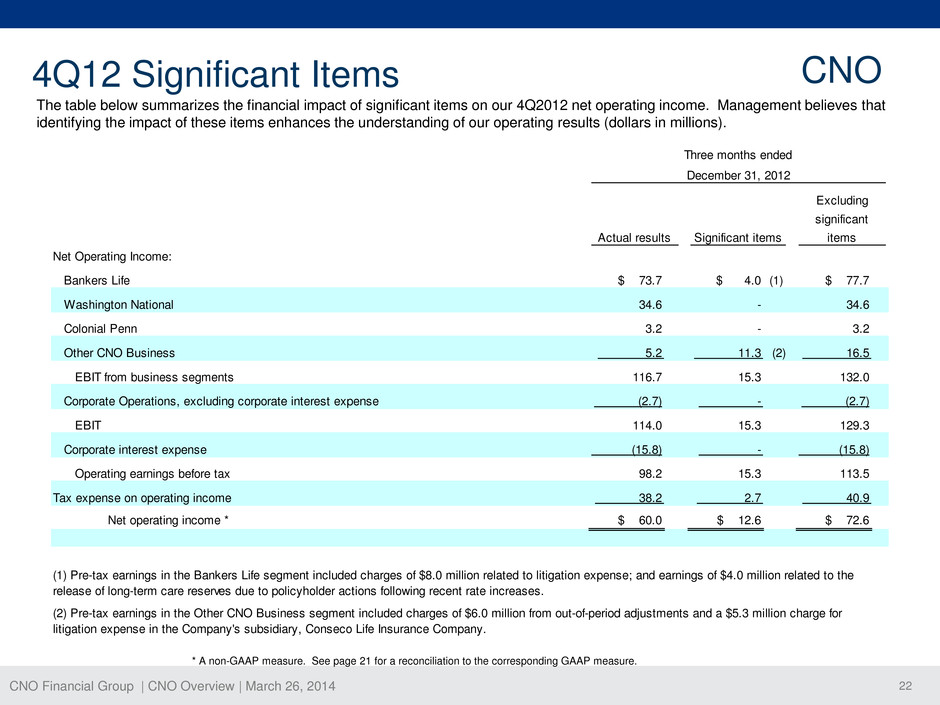

CNO Financial Group | CNO Overview | March 26, 2014 22 The table below summarizes the financial impact of significant items on our 4Q2012 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 73.7 $ 4.0 (1) $ 77.7 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 60.0 $ 12.6 $ 72.6 Three months ended December 31, 2012 Actual results Significant items Excluding significant items 34.6 - 34.6 3.2 - 3.2 5.2 11.3 16.5 116.7 15.3 132.0 (2.7) - (2.7) 40.9 114.0 15.3 129.3 (15.8) - (15.8) (2) Pre-tax earnings in the Other CNO Business segment included charges of $6.0 million from out-of-period adjustments and a $5.3 million charge for litigation expense in the Company's subsidiary, Conseco Life Insurance Company. (1) Pre-tax earnings in the Bankers Life segment included charges of $8.0 million related to litigation expense; and earnings of $4.0 million related to the release of long-term care reserves due to policyholder actions following recent rate increases. 98.2 15.3 113.5 38.2 2.7 4Q12 Significant Items CNO * A non-GAAP measure. See page 21 for a reconciliation to the corresponding GAAP measure.

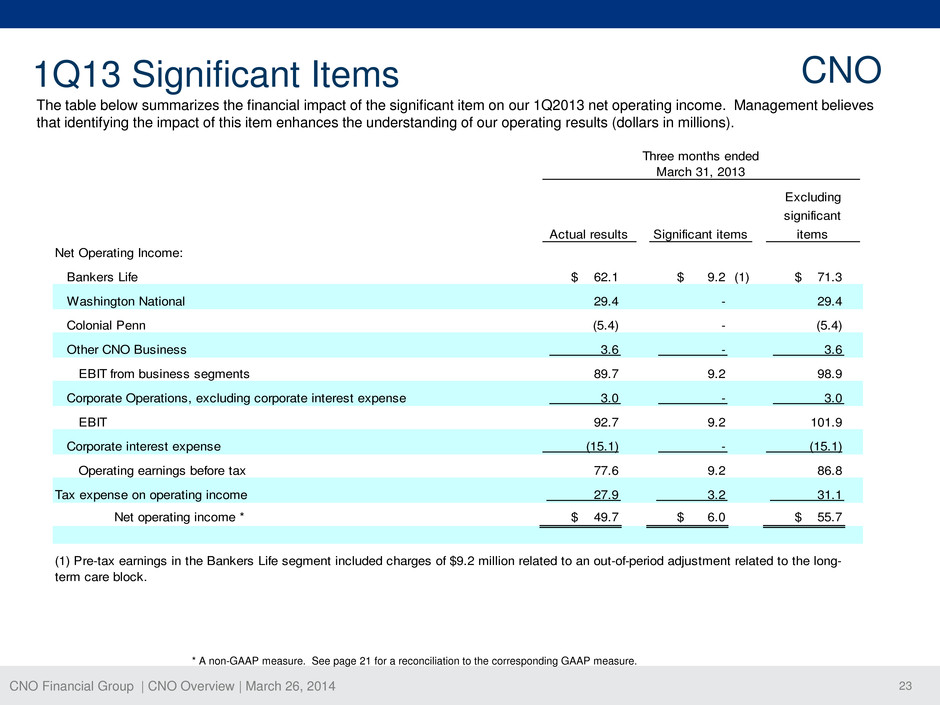

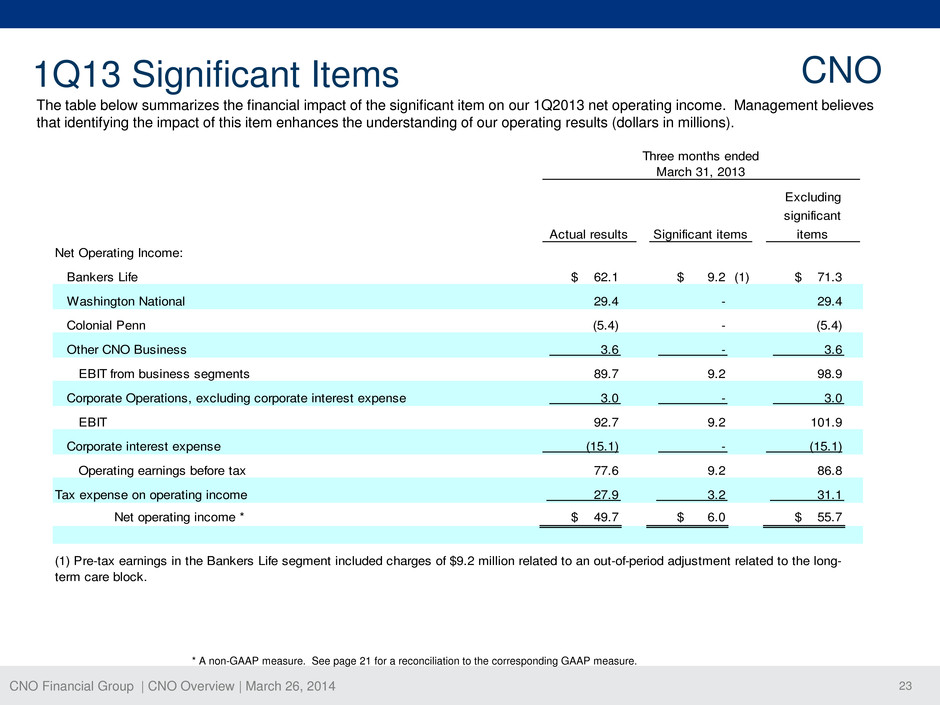

CNO Financial Group | CNO Overview | March 26, 2014 23 The table below summarizes the financial impact of the significant item on our 1Q2013 net operating income. Management believes that identifying the impact of this item enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 62.1 $ 9.2 (1) $ 71.3 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 49.7 $ 6.0 $ 55.7 (1) Pre-tax earnings in the Bankers Life segment included charges of $9.2 million related to an out-of-period adjustment related to the long- term care block. 77.6 9.2 86.8 27.9 3.2 31.1 92.7 9.2 101.9 (15.1) - (15.1) 89.7 9.2 98.9 3.0 - 3.0 (5.4) - (5.4) 3.6 - 3.6 29.4 - 29.4 Three months ended March 31, 2013 Actual results Significant items Excluding significant items 1Q13 Significant Items CNO * A non-GAAP measure. See page 21 for a reconciliation to the corresponding GAAP measure.

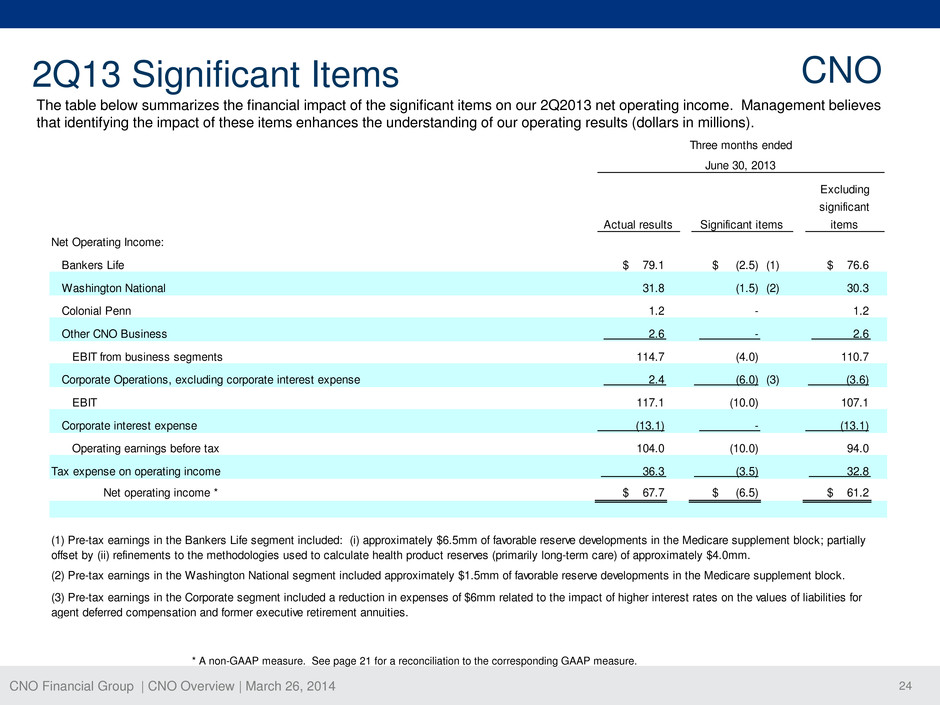

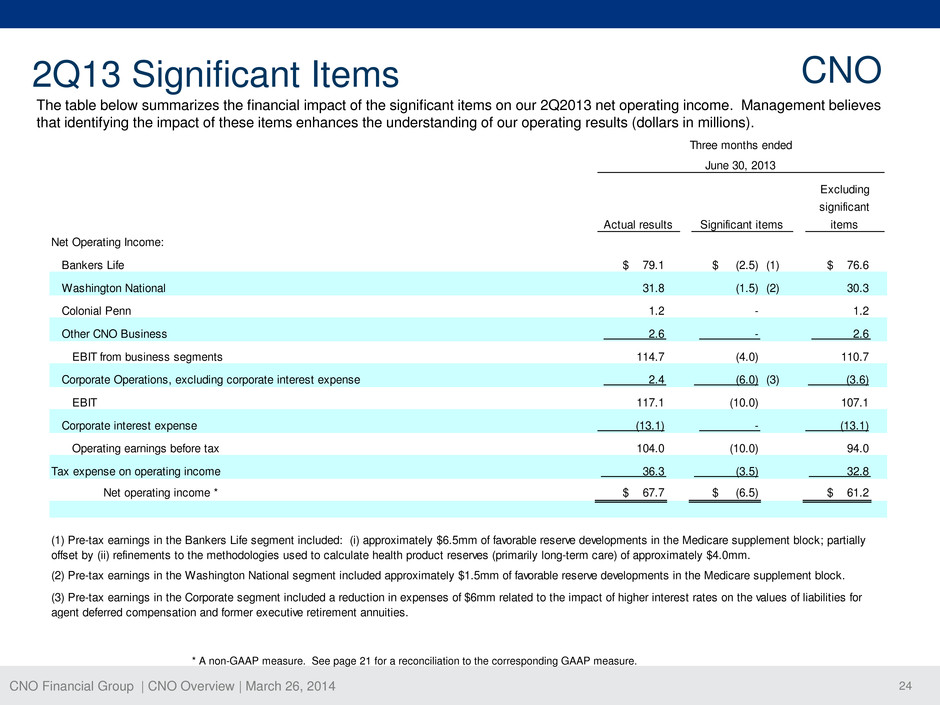

CNO Financial Group | CNO Overview | March 26, 2014 24 The table below summarizes the financial impact of the significant items on our 2Q2013 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 79.1 $ (2.5) (1) $ 76.6 Washington National (2) Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense (3) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 67.7 $ (6.5) $ 61.2 Three months ended June 30, 2013 Actual results Significant items Excluding significant items 31.8 (1.5) 30.3 1.2 - 1.2 2.6 - 2.6 114.7 (4.0) 110.7 2.4 (6.0) (3.6) 117.1 (10.0) 107.1 (13.1) - (13.1) 104.0 (10.0) 94.0 36.3 (3.5) 32.8 (2) Pre-tax earnings in the Washington National segment included approximately $1.5mm of favorable reserve developments in the Medicare supplement block. (3) Pre-tax earnings in the Corporate segment included a reduction in expenses of $6mm related to the impact of higher interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities. (1) Pre-tax earnings in the Bankers Life segment included: (i) approximately $6.5mm of favorable reserve developments in the Medicare supplement block; partially offs t by (ii) refinements to the methodologies used to calculate health product reserves (primarily long-term care) of approximately $4.0mm. 2Q13 Significant Items CNO * A non-GAAP measure. See page 21 for a reconciliation to the corresponding GAAP measure.

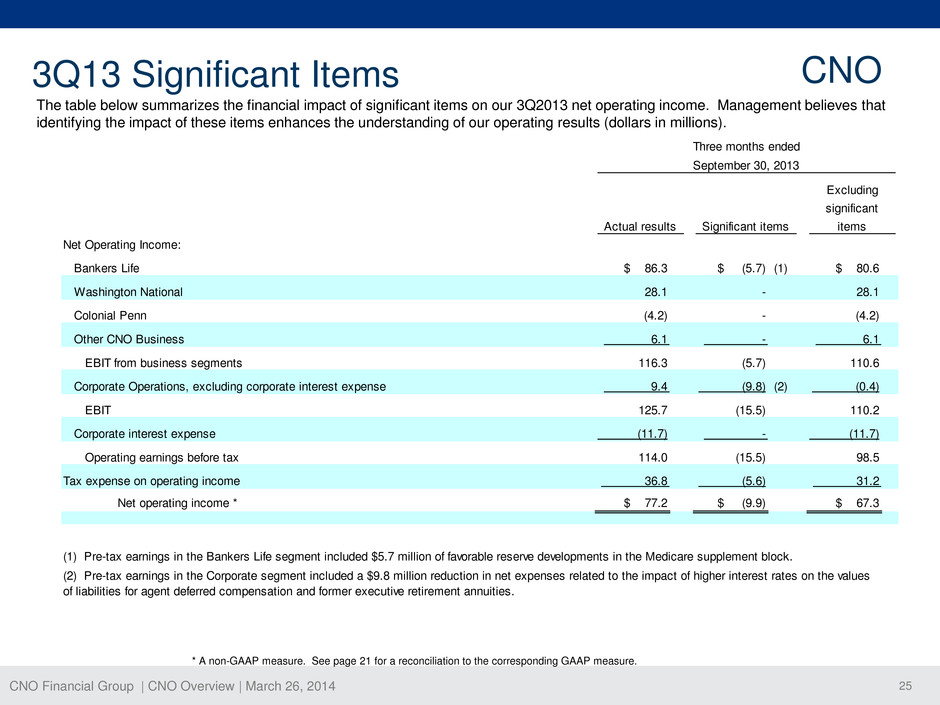

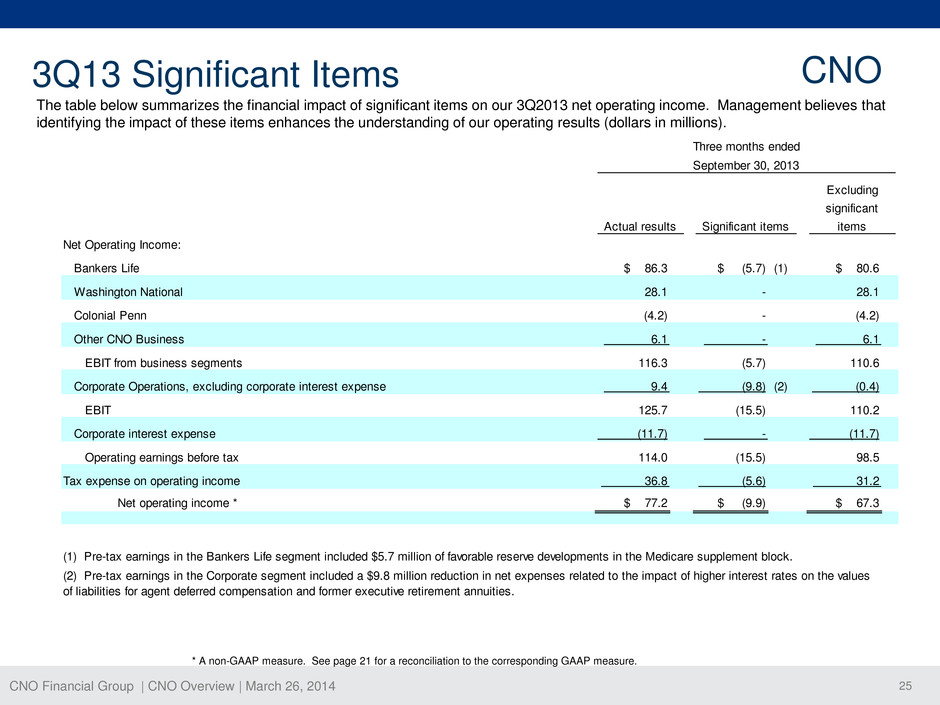

CNO Financial Group | CNO Overview | March 26, 2014 25 The table below summarizes the financial impact of significant items on our 3Q2013 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 86.3 $ (5.7) (1) $ 80.6 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense (2) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 77.2 $ (9.9) $ 67.3 (2) Pre-tax earnings in the Corporate segment included a $9.8 million reduction in net expenses related to the impact of higher interest rates on the values of liabilities for agent deferred compensation and former executive retirement annuities. Three months ended September 30, 2013 Actual results Significant items Excluding significant items 28.1 - 28.1 (4.2) - (4.2) 6.1 - 6.1 116.3 (5.7) 110.6 36.8 (5.6) 31.2 9.4 (9.8) (0.4) 125.7 (15.5) 110.2 (11.7) - (11.7) (1) Pre-tax earnings in the Bankers Life segment included $5.7 million of favorable reserve developments in the Medicare supplement block. 114.0 (15.5) 98.5 3Q13 Significant Items CNO * A non-GAAP measure. See page 21 for a reconciliation to the corresponding GAAP measure.

CNO Financial Group | CNO Overview | March 26, 2014 26 The table below summarizes the financial impact of significant items on our 4Q2013 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 83.0 $ (3.2) (1) $ 79.8 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 75.4 $ (5.2) $ 70.2 (2) Pre-tax earnings in the Other CNO Business segment included a $5 million favorable impact from the settlement of a reinsurance matter. (1) Pr -tax e rnings in the Bankers Life segment included: (i) $5.8 million of favorable reserve developments in the Medicare supplement block; net of (ii) $2.6 million of net unfavorable adjustments primarily related to reserves established for remediation efforts. 116.0 (8.2) 107.8 40.6 (3.0) 37.6 127.4 (8.2) 119.2 (11.4) - (11.4) 123.6 (8.2) 115.4 3.8 - 3.8 (4.1) - (4.1) 13.2 (5.0) 8.2 31.5 - 31.5 Three months ended December 31, 2013 Actual results Significant items Excluding significant items 4Q13 Significant Items CNO * A non-GAAP measure. See page 21 for a reconciliation to the corresponding GAAP measure.

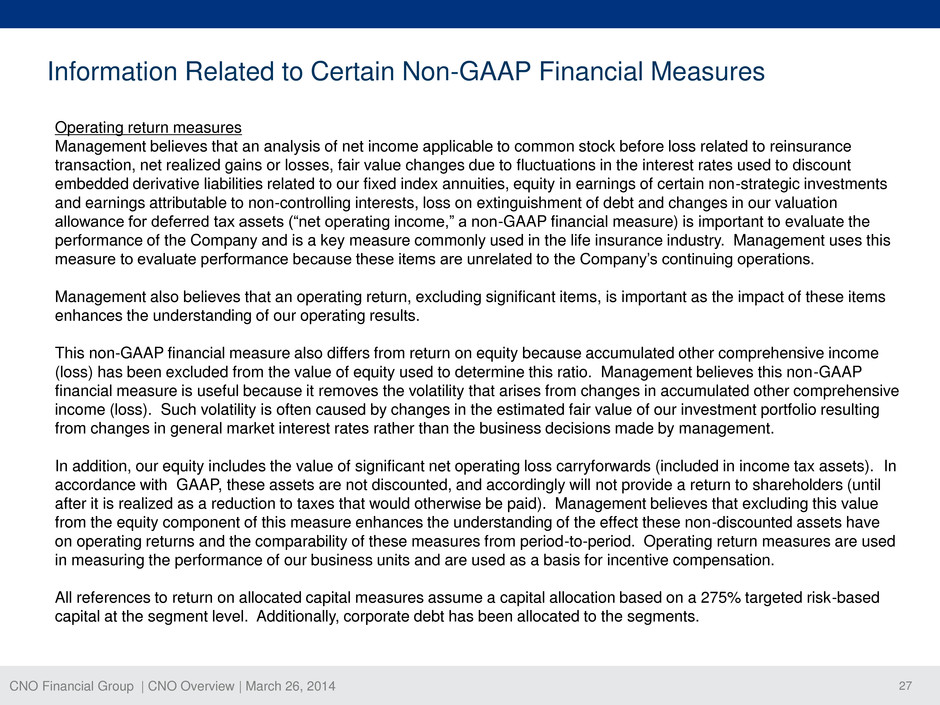

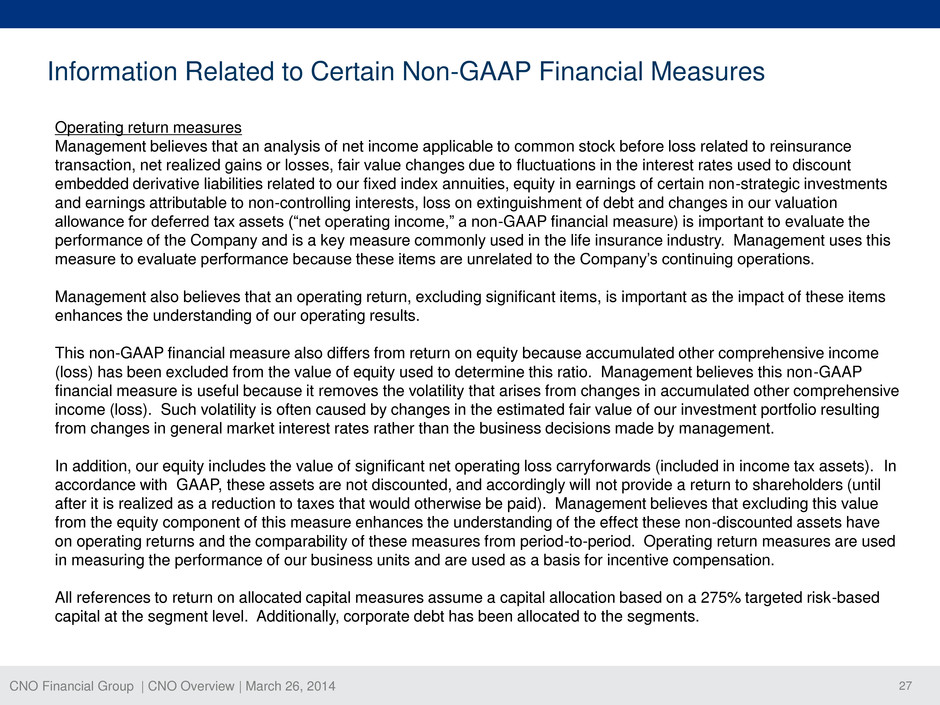

CNO Financial Group | CNO Overview | March 26, 2014 27 Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of net income applicable to common stock before loss related to reinsurance transaction, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, loss on extinguishment of debt and changes in our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation. All references to return on allocated capital measures assume a capital allocation based on a 275% targeted risk-based capital at the segment level. Additionally, corporate debt has been allocated to the segments.

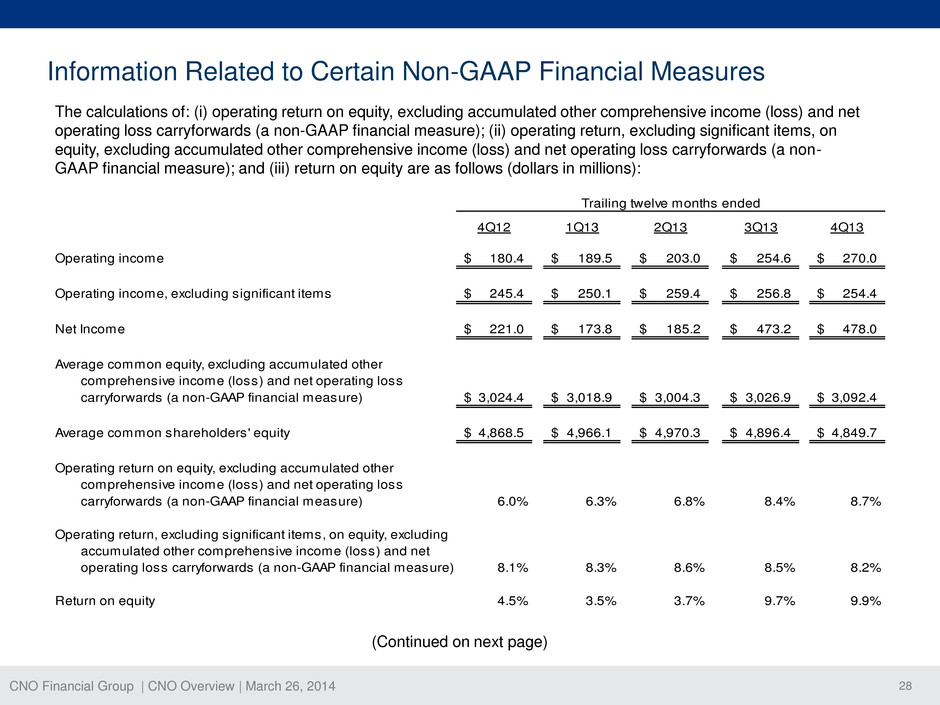

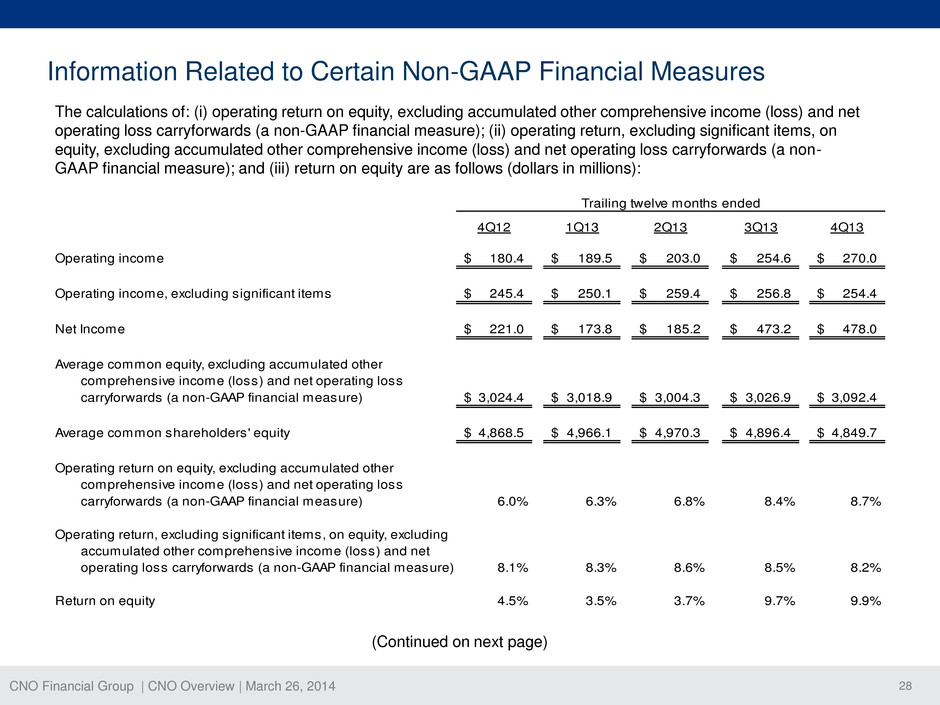

CNO Financial Group | CNO Overview | March 26, 2014 28 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure); and (iii) return on equity are as follows (dollars in millions): 4Q12 1Q13 2Q13 3Q13 4Q13 Operating income 180.4$ 189.5$ 203.0$ 254.6$ 270.0$ Operating income, excluding significant items 245.4$ 250.1$ 259.4$ 256.8$ 254.4$ Net Income 221.0$ 173.8$ 185.2$ 473.2$ 478.0$ Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,024.4$ 3,018.9$ 3,004.3$ 3,026.9$ 3,092.4$ Average common shareholders' equity 4,868.5$ 4,966.1$ 4,970.3$ 4,896.4$ 4,849.7$ Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwar s (a non-GAAP financial measure) 6.0% 6.3% 6.8% 8.4% 8.7% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 8.1% 8.3% 8.6% 8.5% 8.2% Return on equity 4.5% 3.5% 3.7% 9.7% 9.9% Trailing twelve months ended (Continued on next page)

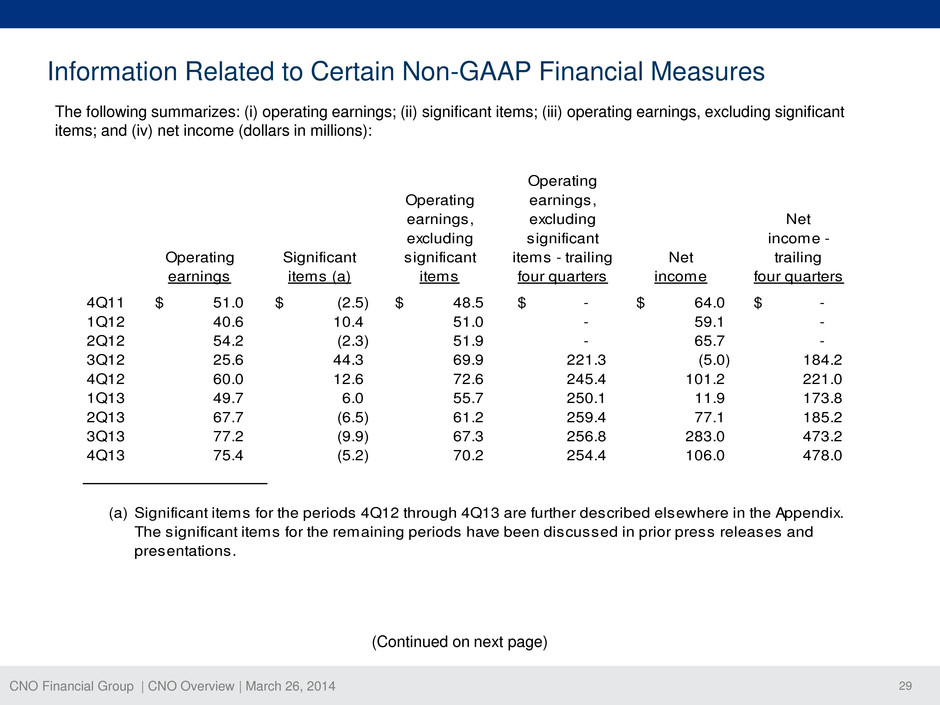

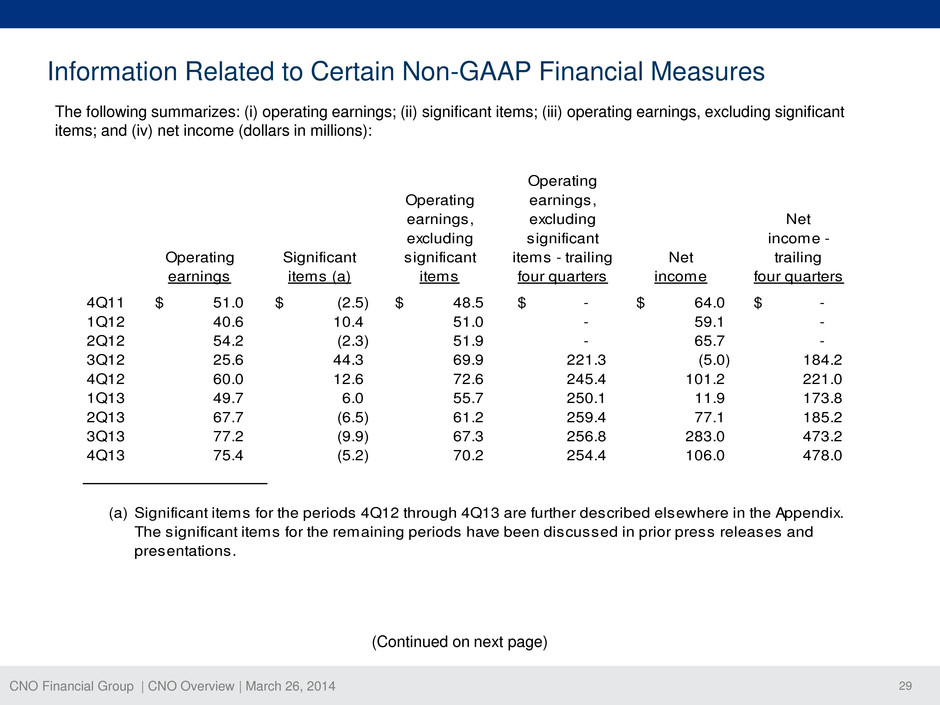

CNO Financial Group | CNO Overview | March 26, 2014 29 Information Related to Certain Non-GAAP Financial Measures The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income (dollars in millions): Operating Operating earnings, earnings, excluding Net excluding significant income - Operating Significant significant items - trailing Net trailing earnings items (a) items four quarters income four quarters 4Q11 51.0$ (2.5)$ 48.5$ -$ 64.0$ -$ 1Q12 40.6 10.4 51.0 - 59.1 - 2Q12 54.2 (2.3) 51.9 - 65.7 - 3Q12 25.6 44.3 69.9 221.3 (5.0) 184.2 4Q12 60.0 12.6 72.6 245.4 101.2 221.0 1Q13 49.7 6.0 55.7 250.1 11.9 173.8 2Q13 67.7 (6.5) 61.2 259.4 77.1 185.2 3Q13 77.2 (9.9) 67.3 256.8 283.0 473.2 4Q13 75.4 (5.2) 70.2 254.4 106.0 478.0 (a) Significant items for the periods 4Q12 through 4Q13 are further described elsewhere in the Appendix. The significant items for the remaining periods have been discussed in prior press releases and presentations. (Continued on next page)

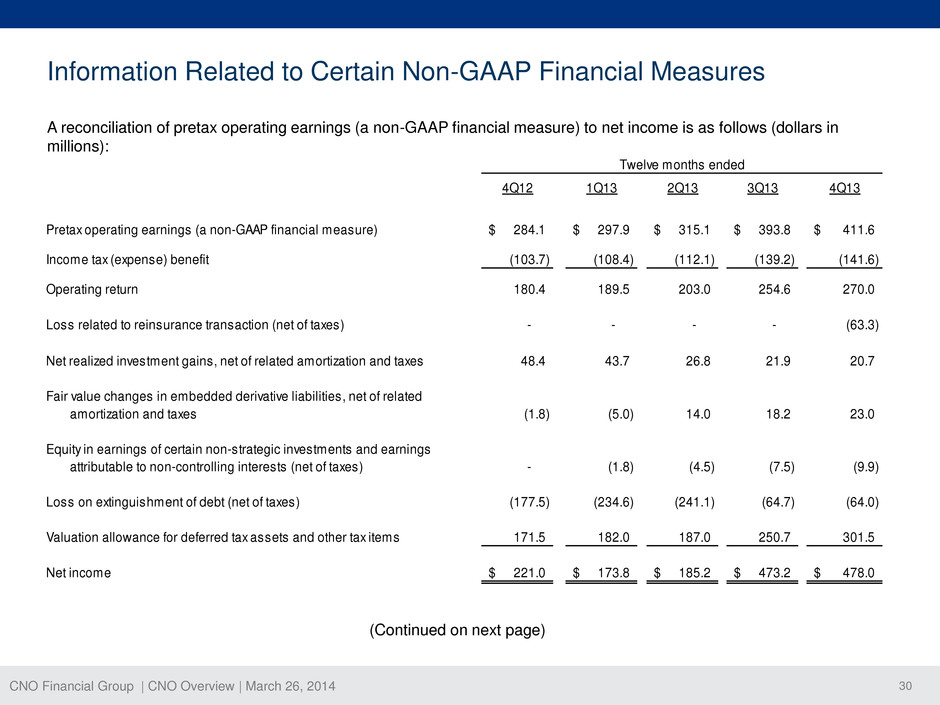

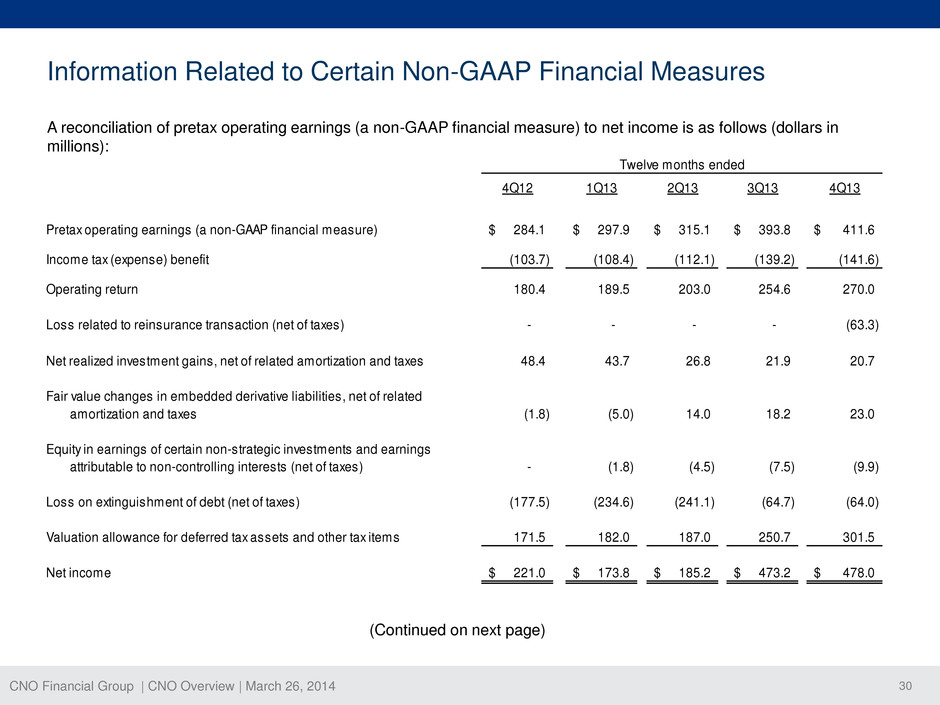

CNO Financial Group | CNO Overview | March 26, 2014 30 Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to net income is as follows (dollars in millions): 4Q12 1Q13 2Q13 3Q13 4Q13 Pretax operating earnings (a non-GAAP financial measure) 284.1$ 297.9$ 315.1$ 393.8$ 411.6$ Income tax (expense) benefit (103.7) (108.4) (112.1) (139.2) (141.6) Operating return 180.4 189.5 203.0 254.6 270.0 Loss related to reinsurance transaction (net of taxes) - - - - (63.3) Net realized investment gains, net of related amortization and taxes 48.4 43.7 26.8 21.9 20.7 Fair value changes in embedded derivative liabilities, net of related amortization and taxes (1.8) (5.0) 14.0 18.2 23.0 Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests (net of taxes) - (1.8) (4.5) (7.5) (9.9) Loss on extinguishment of debt (net of taxes) (177.5) (234.6) (241.1) (64.7) (64.0) Valuation allowance for deferred tax assets and other tax items 171.5 182.0 187.0 250.7 301.5 Net income 221.0$ 173.8$ 185.2$ 473.2$ 478.0$ Twelve months ended (Continued on next page)

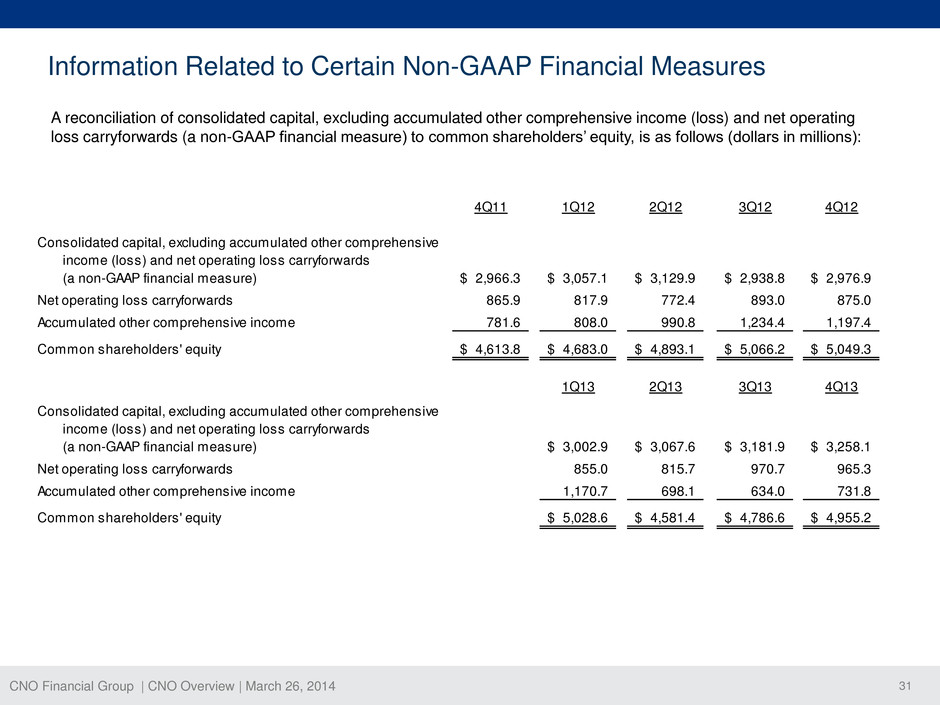

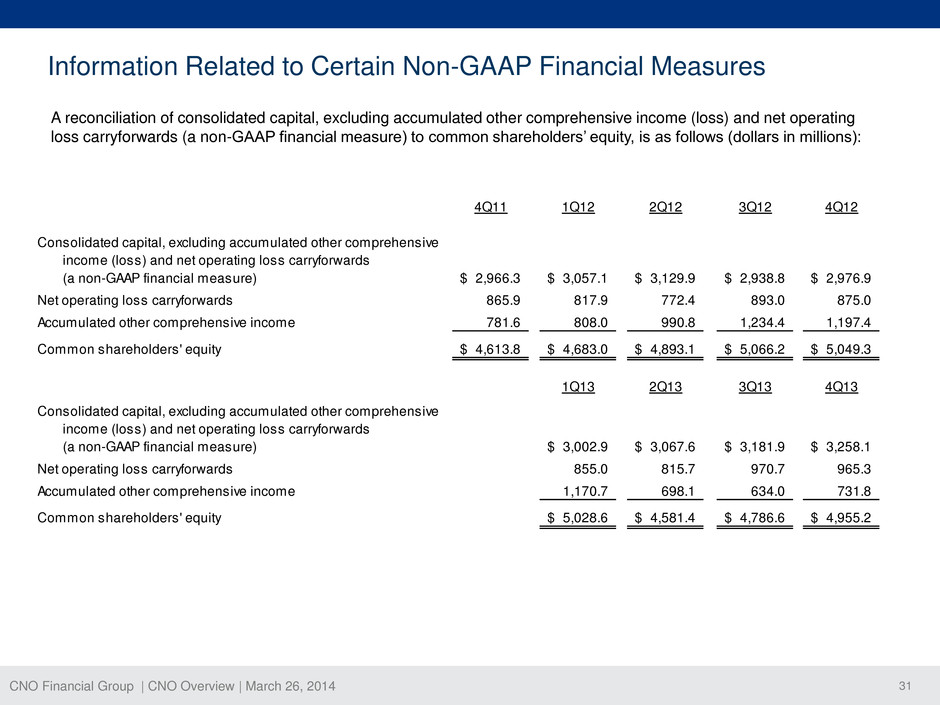

CNO Financial Group | CNO Overview | March 26, 2014 31 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 4Q11 1Q12 2Q12 3Q12 4Q12 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,966.3$ 3,057.1$ 3,129.9$ 2,938.8$ 2,976.9$ Net operating loss carryforwards 865.9 817.9 772.4 893.0 875.0 Accumulated other comprehensive income 781.6 808.0 990.8 1,234.4 1,197.4 Common shareholders' equity 4,613.8$ 4,683.0$ 4,893.1$ 5,066.2$ 5,049.3$ 1Q13 2Q13 3Q13 4Q13 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,002.9$ 3,067.6$ 3,181.9$ 3,258.1$ Net operating loss carryforwards 855.0 815.7 970.7 965.3 Accumulated other comprehensive income 1,170.7 698.1 634.0 731.8 Common shareholders' equity 5,028.6$ 4,581.4$ 4,786.6$ 4,955.2$

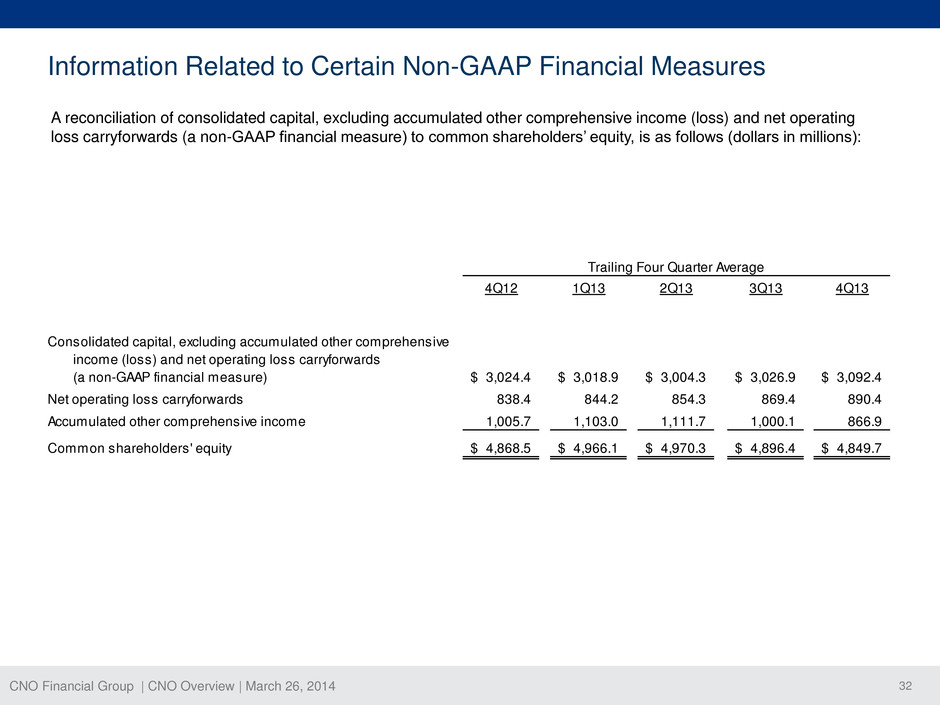

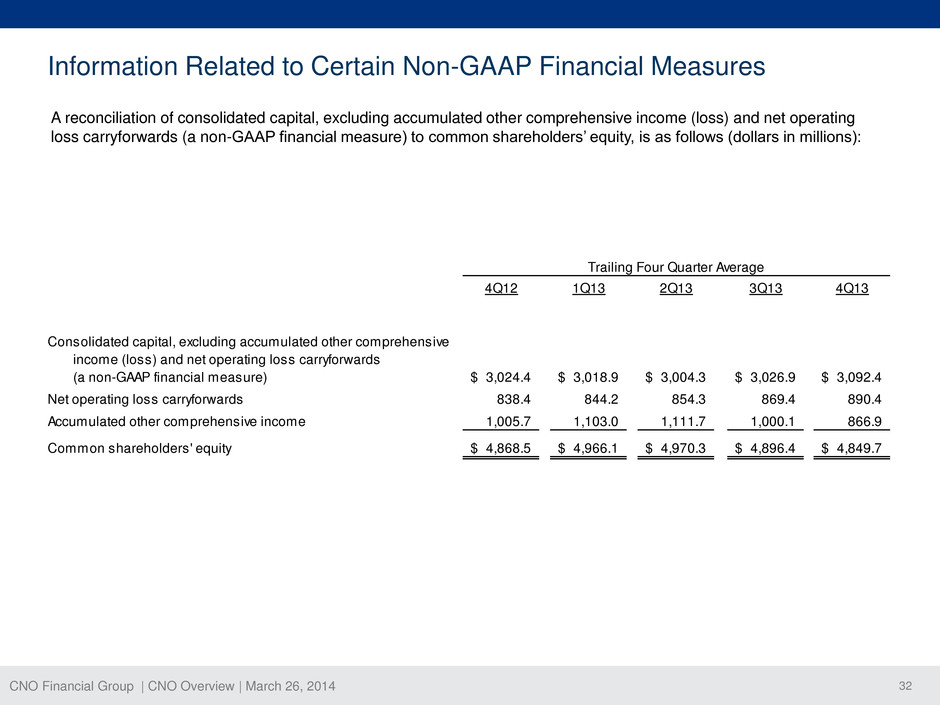

CNO Financial Group | CNO Overview | March 26, 2014 32 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 4Q12 1Q13 2Q13 3Q13 4Q13 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,024.4$ 3,018.9$ 3,004.3$ 3,026.9$ 3,092.4$ Net operating loss carryforwards 838.4 844.2 854.3 869.4 890.4 Accumulated other comprehensive income 1,005.7 1,103.0 1,111.7 1,000.1 866.9 Common shareholders' equity 4,868.5$ 4,966.1$ 4,970.3$ 4,896.4$ 4,849.7$ Trailing Four Quarter Average

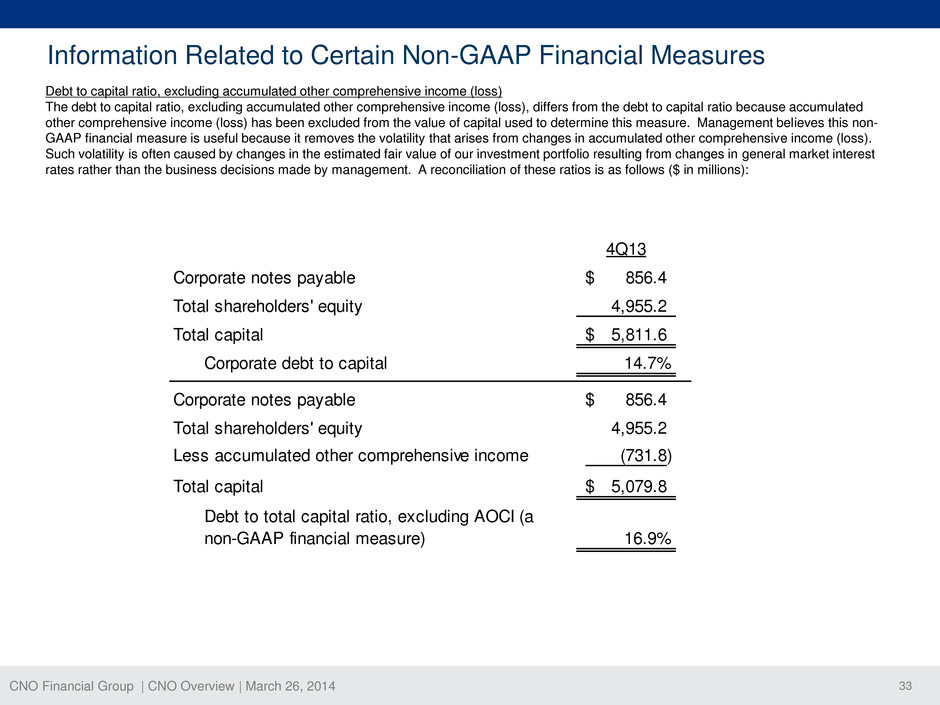

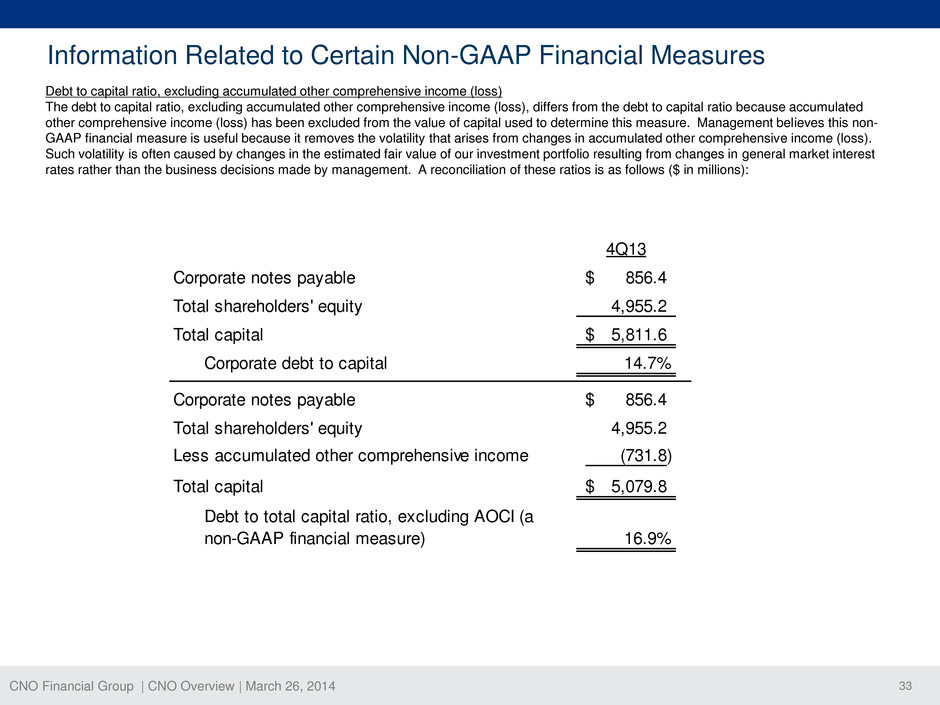

CNO Financial Group | CNO Overview | March 26, 2014 33 Information Related to Certain Non-GAAP Financial Measures 4Q13 Corporate notes payable 856.4$ Total shareholders' equity 4,955.2 Total capital 5,811.6$ orporate debt to capital 14.7% Corporate notes payable 856.4$ Total shareholders' equity 4,955.2 Less accumulated other comprehensive income (731.8) Total capital 5,079.8$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 16.9% Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non- GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions):

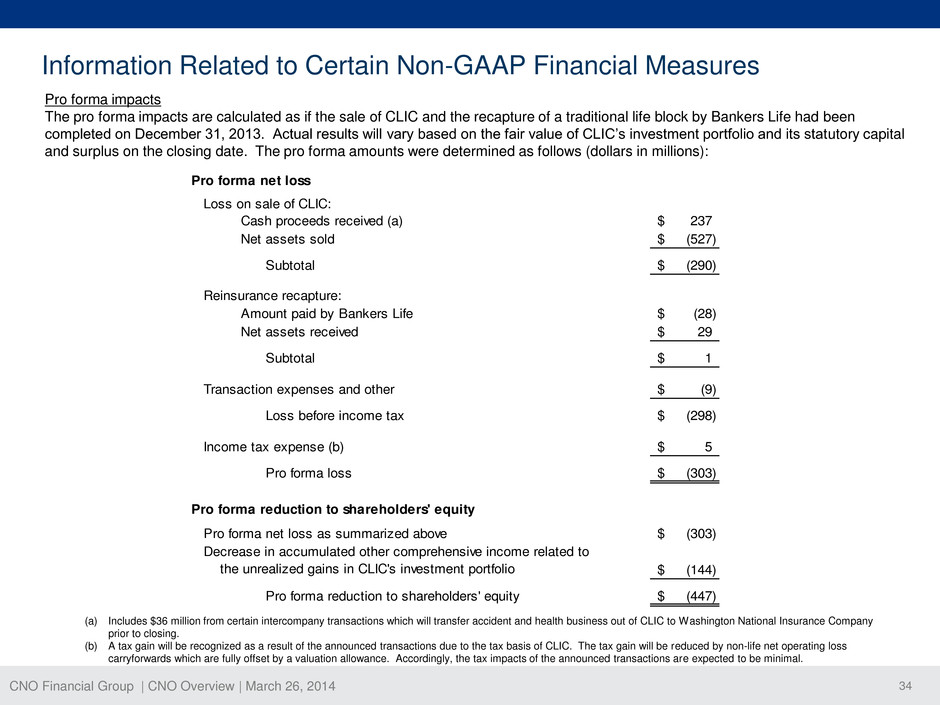

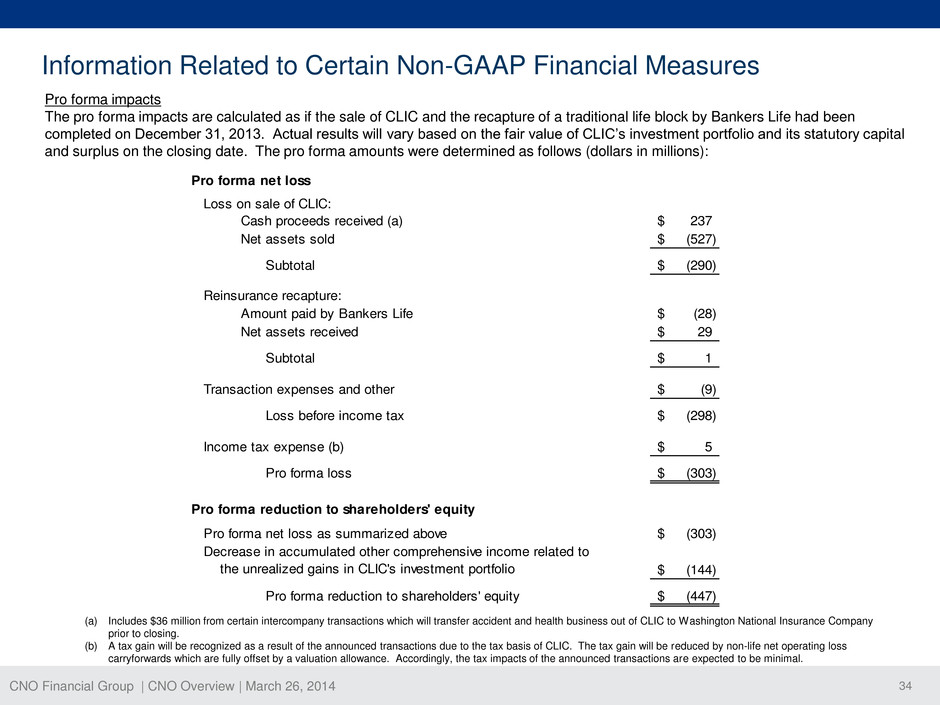

CNO Financial Group | CNO Overview | March 26, 2014 34 Pro forma net loss Loss on sale of CLIC: Cash proceeds received (a) 237$ Net assets sold (527)$ Subtotal (290)$ Reinsurance recapture: Amount paid by Bankers Life (28)$ Net assets received 29$ Subtotal 1$ Transaction expenses and other (9)$ Loss before income tax (298)$ Income tax expense (b) 5$ Pro forma loss (303)$ Pro forma reduction to shareholders' equity Pro forma net loss as summarized above (303)$ (144)$ Pro forma reduction to shareholders' equity (447)$ Decrease in accumulated other comprehensive income related to the unrealized gains in CLIC's investment portfolio Pro forma impacts The pro forma impacts are calculated as if the sale of CLIC and the recapture of a traditional life block by Bankers Life had been completed on December 31, 2013. Actual results will vary based on the fair value of CLIC’s investment portfolio and its statutory capital and surplus on the closing date. The pro forma amounts were determined as follows (dollars in millions): Information Related to Certain Non-GAAP Financial Measures (a) Includes $36 million from certain intercompany transactions which will transfer accident and health business out of CLIC to Washington National Insurance Company prior to closing. (b) A tax gain will be recognized as a result of the announced transactions due to the tax basis of CLIC. The tax gain will be reduced by non-life net operating loss carryforwards which are fully offset by a valuation allowance. Accordingly, the tax impacts of the announced transactions are expected to be minimal.

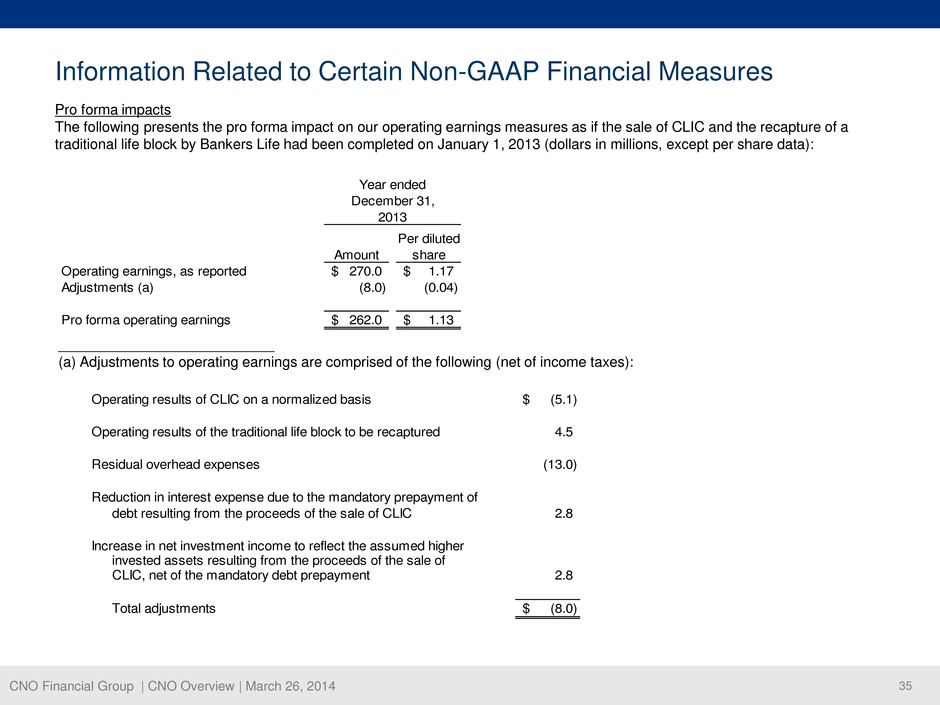

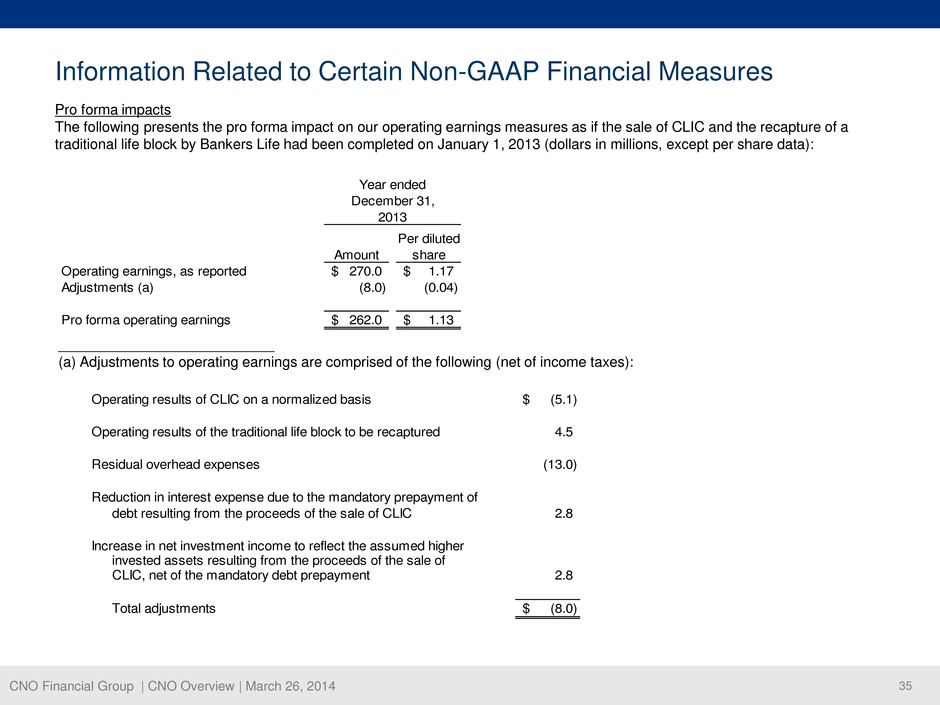

CNO Financial Group | CNO Overview | March 26, 2014 35 Information Related to Certain Non-GAAP Financial Measures Pro forma impacts The following presents the pro forma impact on our operating earnings measures as if the sale of CLIC and the recapture of a traditional life block by Bankers Life had been completed on January 1, 2013 (dollars in millions, except per share data): Per diluted Amount share Operating earnings, as reported 270.0$ 1.17$ Adjustments (a) (8.0) (0.04) Pro forma operating earnings 262.0$ 1.13$ Year ended December 31, 2013 ___________________________ (a) Adjustments to operating earnings are comprised of the following (net of income taxes): Operating results of CLIC on a normalized basis (5.1)$ Operating results of the traditional life block to b recaptured 4.5 R sid al overh d expenses (13.0) Reduction in interest expense due to the mandatory prepayment of debt resulting from the proceeds of the sale of CLIC 2.8 I cr as i net investment income to reflect the assumed higher invested assets resulting from the proceeds of the sale of CLIC, net of the mandatory debt prepayment 2.8 Total adjustments (8.0)$