Exhibit 99.3 Second Quarter 2019 Financial and operating results for the period ended June 30, 2019 July 30, 2019 Unless otherwise specified, comparisons in this presentation are between 2Q18 and 2Q19. CNO Financial Group | 2017 Investor Day | June 5, 2017 1

Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on July 30, 2019, our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 2

Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; book value, excluding accumulated other comprehensive income (loss) per share; operating return measures; earnings before net realized investment gains (losses) from sales and impairments, net change in market value of investments recognized in earnings, fair value changes in embedded derivative liabilities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, loss related to reinsurance transaction, other non-operating items, corporate interest expense and taxes; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 3

CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 4

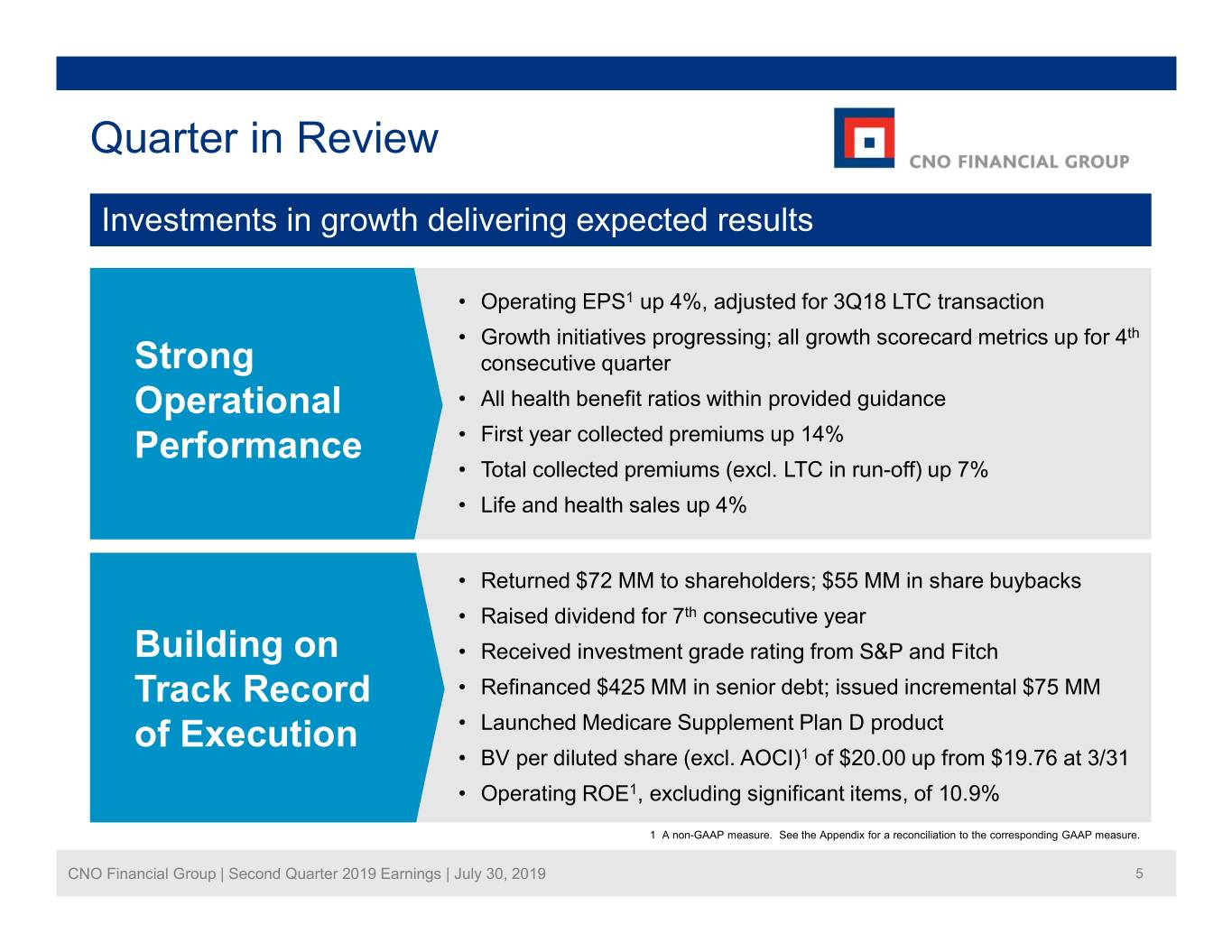

Quarter in Review Investments in growth delivering expected results • Operating EPS1 up 4%, adjusted for 3Q18 LTC transaction • Growth initiatives progressing; all growth scorecard metrics up for 4th Strong consecutive quarter Operational • All health benefit ratios within provided guidance Performance • First year collected premiums up 14% • Total collected premiums (excl. LTC in run-off) up 7% • Life and health sales up 4% • Returned $72 MM to shareholders; $55 MM in share buybacks • Raised dividend for 7th consecutive year Building on • Received investment grade rating from S&P and Fitch Track Record • Refinanced $425 MM in senior debt; issued incremental $75 MM of Execution • Launched Medicare Supplement Plan D product • BV per diluted share (excl. AOCI)1 of $20.00 up from $19.76 at 3/31 • Operating ROE1, excluding significant items, of 10.9% 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 5

Growth Scorecard All 5 metrics up for 4th consecutive quarter 2018 2019 % Change ($ millions) 2Q 3Q 4Q TY 1Q 2Q Q/Q New Annualized Premium 1 Life Insurance $36.9 $37.4 $36.3 $147.5 $39.7 $39.4 6.8% Health Insurance 44.9 44.3 53.3 183.7 40.1 45.8 2.0% Total Life & Health Insurance $81.8 $81.7 $89.6 $331.2 $79.8 $85.2 4.2% Collected Premiums Bankers Life $653.4 $635.7 $732.1 $2,648.2 $683.9 $705.2 7.9% Washington National 172.8 167.5 176.3 692.8 176.8 176.9 2.4% Colonial Penn 73.8 74.0 75.2 298.3 77.2 76.7 3.9% DriveGrowth Sub-total 900.0 877.2 983.6 3,639.3 937.9 958.8 6.5% LTC in run-off 47.6 44.9 3.7 145.8 3.6 3.4 -92.9% Total CNO $947.6 $922.1 $987.3 $3,785.1 $941.5 $962.2 1.5% Annuity Collected Premiums Bankers Life $287.0 $270.5 $354.3 $1,163.2 $315.3 $341.0 18.8% Client Assets in Brokerage and Advisory 2 Bankers Life $1,081.7 $1,178.2 $1,104.9 $1,104.9 $1,234.4 $1,303.0 20.5% the the Right 3 Expand to to Expand Fee Revenue $10.2 $10.4 $10.6 $49.8 $25.4 $15.6 52.9% 1 Measured as 100% of new term life and health annualized premiums and 10% of single premium whole life deposits. 2 Client assets include cash and securities in brokerage and managed advisory accounts. 3 Prior period fee revenue on the Growth Scorecard (which only included the fee revenue of Bankers Life) has been restated to include fee revenue from Washington National (including the fee revenue of Web Benefits Design acquired in 2Q19). CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 6

Segment Update Solid execution fueling continued growth momentum Key Initiatives Second Quarter Highlights • First year collected premiums up 15%; total collected premiums up 8% Reinvigorate • Health NAP up 6%; Life NAP down 4% growth • Launched Medicare Supplement Plan D • Med Advantage issued policies up 13%; third party fee revenue up 25% • Total client assets up 20% at BD/RIA to $1.3 billion Expand • FA count up 17%; 14% of agent force dually licensed to the right • Annuity collected premiums up 19%; average collected premium per policy up 5% Reshape the agent • Quarterly average producing agent count up 3% force and optimize • Continued positive impact from agent force initiatives productivity • Ongoing agent productivity improvement CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 7

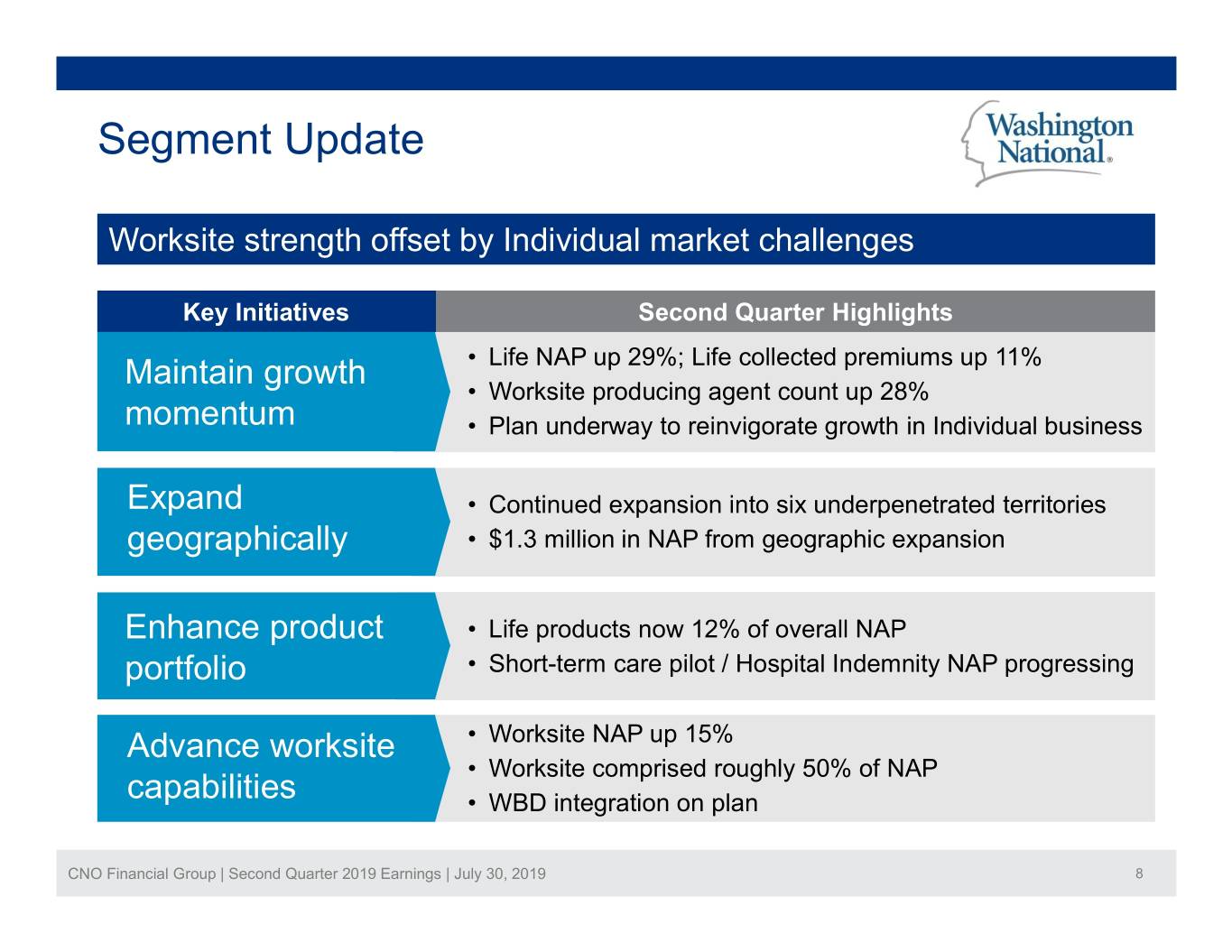

Segment Update Worksite strength offset by Individual market challenges Key Initiatives Second Quarter Highlights Maintain growth • Life NAP up 29%; Life collected premiums up 11% • Worksite producing agent count up 28% momentum • Plan underway to reinvigorate growth in Individual business Expand • Continued expansion into six underpenetrated territories geographically • $1.3 million in NAP from geographic expansion Enhance product • Life products now 12% of overall NAP portfolio • Short-term care pilot / Hospital Indemnity NAP progressing Advance worksite • Worksite NAP up 15% • Worksite comprised roughly 50% of NAP capabilities • WBD integration on plan CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 8

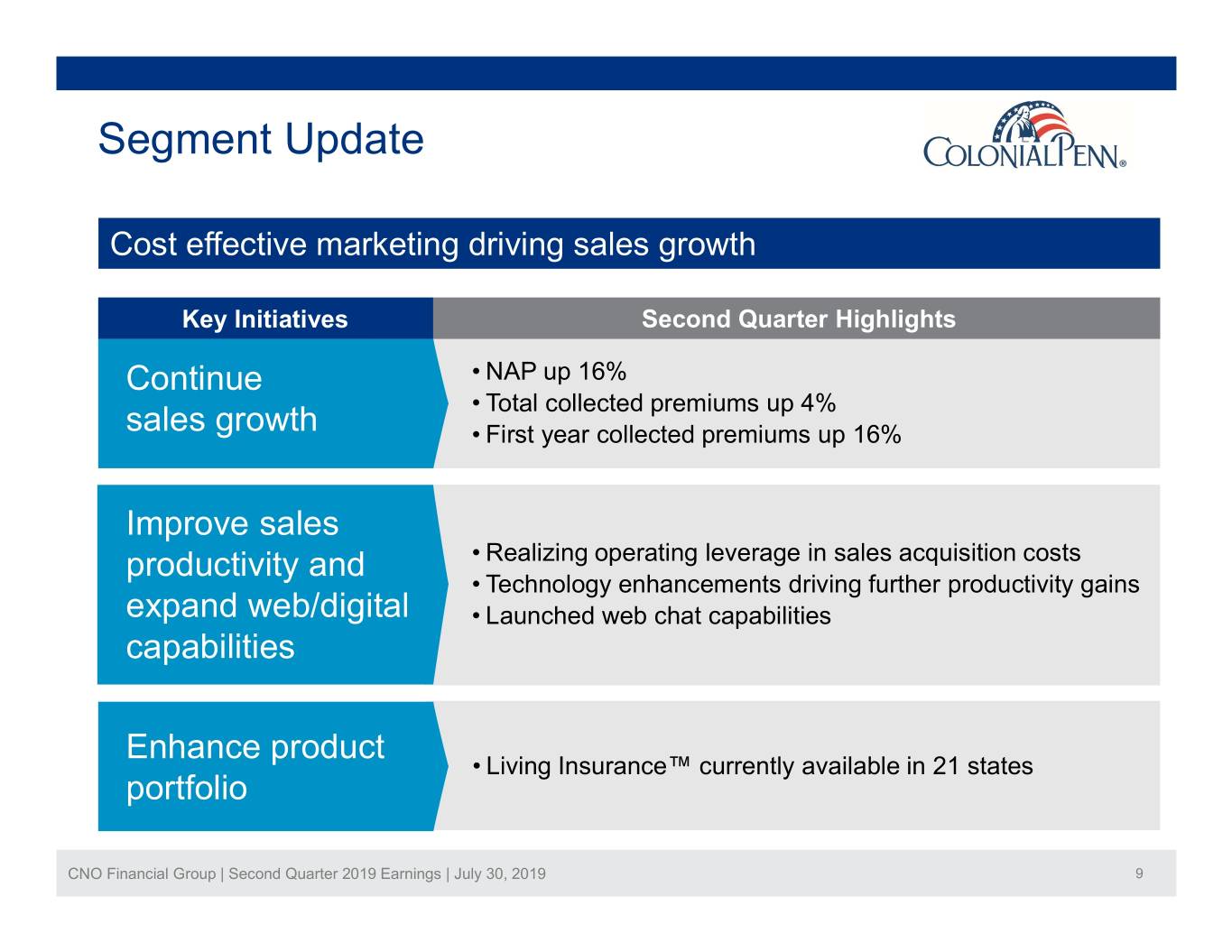

Segment Update Cost effective marketing driving sales growth Key Initiatives Second Quarter Highlights Continue • NAP up 16% • Total collected premiums up 4% sales growth • First year collected premiums up 16% Improve sales productivity and • Realizing operating leverage in sales acquisition costs • Technology enhancements driving further productivity gains expand web/digital • Launched web chat capabilities capabilities Enhance product • Living Insurance™ currently available in 21 states portfolio CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 9

Excess Capital Allocation Strategy Disciplined and opportunistic approach Organic investments to sustain and grow the core businesses Return capital to shareholders - $55 million in share repurchases in 2Q; $102 million YTD - Increased dividend 10% in 2Q; 7th consecutive annual increase - Dividend payout ratio targeted at 20-25% Opportunistic transactions - Highly selective M&A to expand product offerings or enhance distribution CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 10

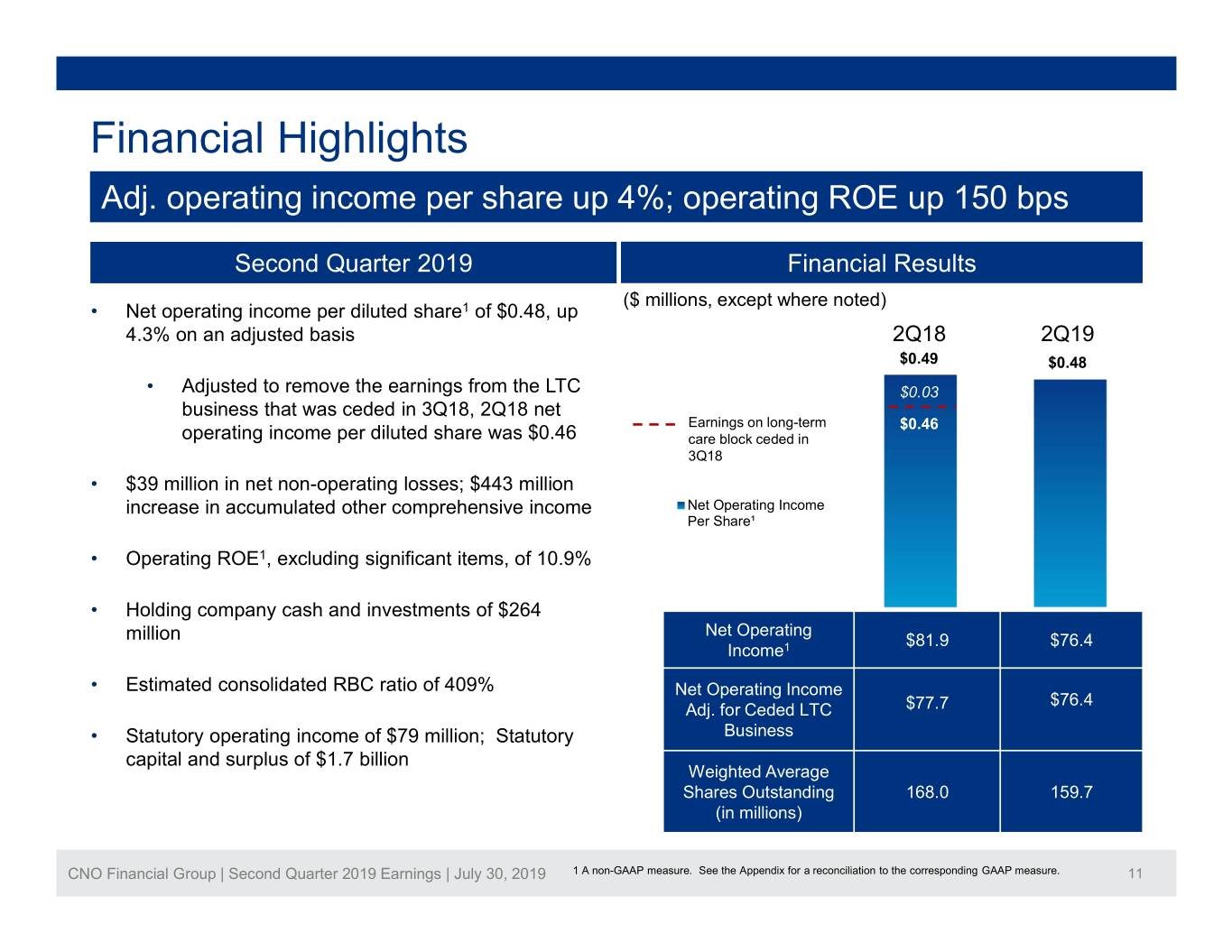

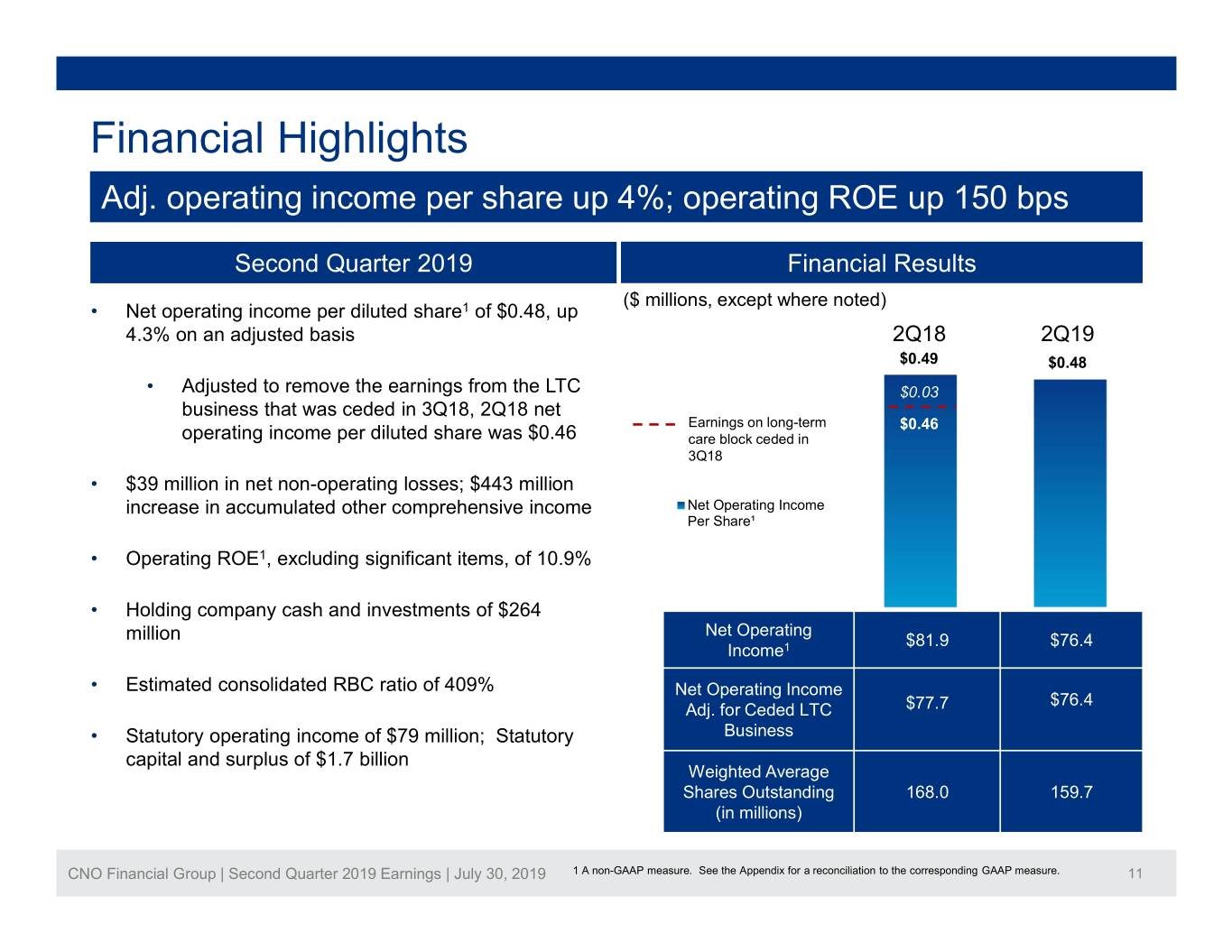

Financial Highlights Adj. operating income per share up 4%; operating ROE up 150 bps Second Quarter 2019 Financial Results ($ millions, except where noted) • Net operating income per diluted share1 of $0.48, up 4.3% on an adjusted basis 2Q18 2Q19 $0.49 $0.48 • Adjusted to remove the earnings from the LTC $0.03 business that was ceded in 3Q18, 2Q18 net Earnings on long-term $0.46 operating income per diluted share was $0.46 care block ceded in 3Q18 • $39 million in net non-operating losses; $443 million increase in accumulated other comprehensive income Net Operating Income Per Share¹ • Operating ROE1, excluding significant items, of 10.9% • Holding company cash and investments of $264 Net Operating million $81.9 $76.4 Income1 • Estimated consolidated RBC ratio of 409% Net Operating Income $76.4 Adj. for Ceded LTC $77.7 • Statutory operating income of $79 million; Statutory Business capital and surplus of $1.7 billion Weighted Average Shares Outstanding 168.0 159.7 (in millions) CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. 11

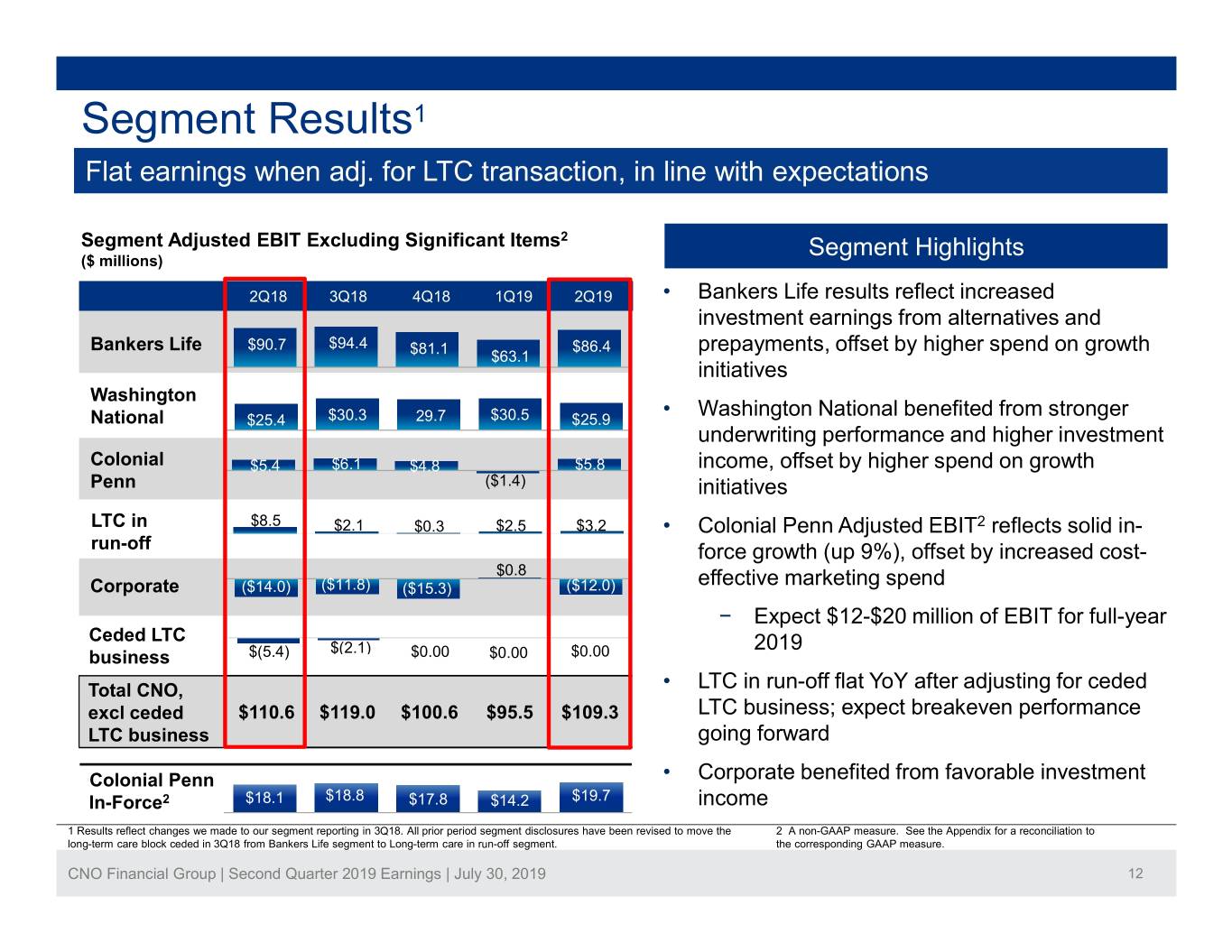

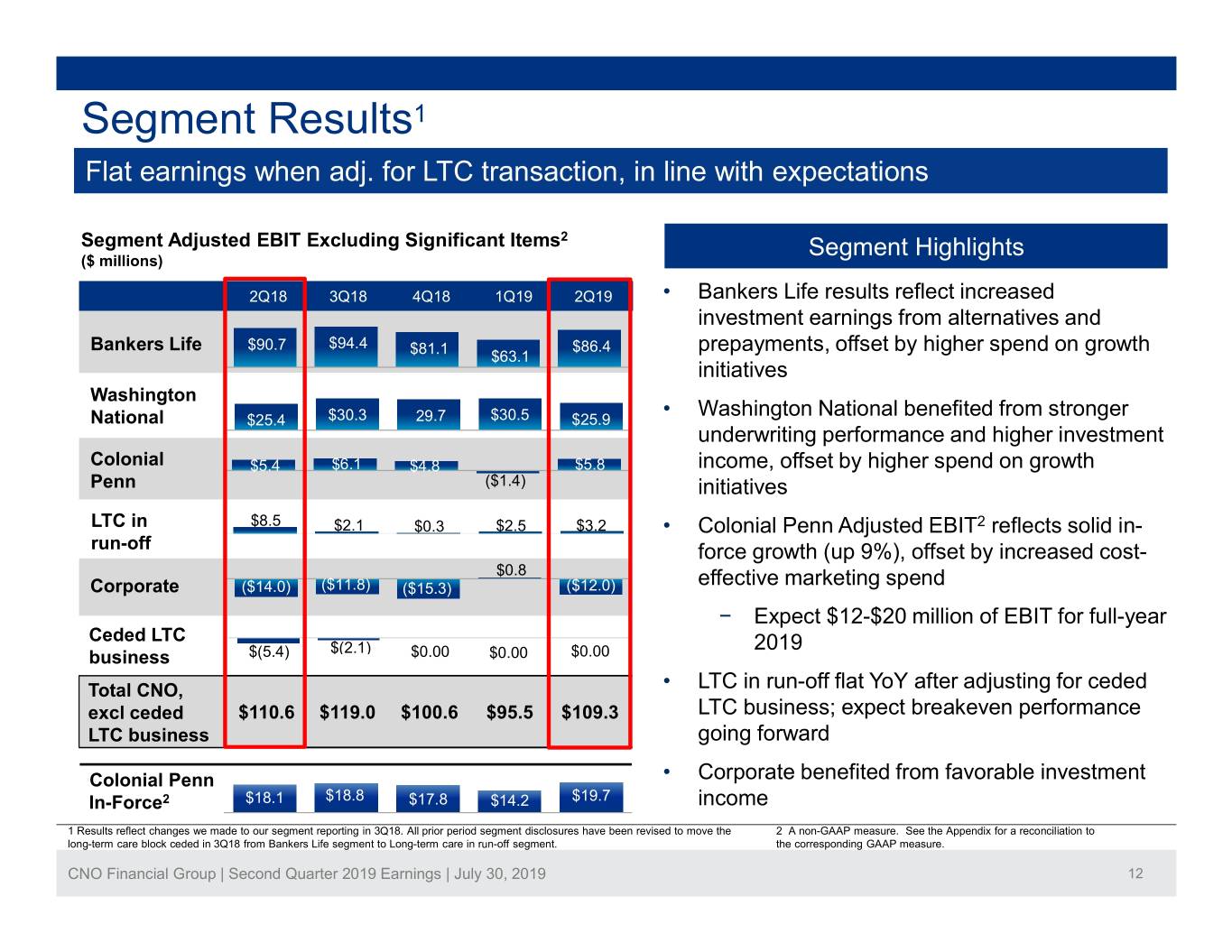

Segment Results1 Flat earnings when adj. for LTC transaction, in line with expectations Segment Adjusted EBIT Excluding Significant Items2 Segment Highlights ($ millions) 2Q18 3Q18 4Q18 1Q19 2Q19 • Bankers Life results reflect increased investment earnings from alternatives and Bankers Life $90.7 $94.4 $81.1 $86.4 prepayments, offset by higher spend on growth $63.1 initiatives Washington • Washington National benefited from stronger National $25.4 $30.3 29.7 $30.5 $25.9 underwriting performance and higher investment Colonial $5.4 $6.1 $4.8 $5.8 income, offset by higher spend on growth Penn ($1.4) initiatives LTC in $8.5 $2.1 $0.3 $2.5 $3.2 • Colonial Penn Adjusted EBIT2 reflects solid in- run-off force growth (up 9%), offset by increased cost- $0.8 Corporate ($14.0) ($11.8) ($15.3) ($12.0) effective marketing spend − Expect $12-$20 million of EBIT for full-year Ceded LTC $(2.1) 2019 business $(5.4) $0.00 $0.00 $0.00 Total CNO, • LTC in run-off flat YoY after adjusting for ceded excl ceded $110.6 $119.0 $100.6 $95.5 $109.3 LTC business; expect breakeven performance LTC business going forward Colonial Penn • Corporate benefited from favorable investment In-Force2 $18.1 $18.8 $17.8 $14.2 $19.7 income 1 Results reflect changes we made to our segment reporting in 3Q18. All prior period segment disclosures have been revised to move the 2 A non-GAAP measure. See the Appendix for a reconciliation to long-term care block ceded in 3Q18 from Bankers Life segment to Long-term care in run-off segment. the corresponding GAAP measure. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 12

Health Margins All benefit ratios within guidance Bankers Life Medicare Bankers Life Long-term Care Washington National Supplement Benefit Ratio IABR1,2 Supplemental Health IABR1 $192 $192 $190 $191 $191 $152 $152 $156 $156 $157 75.6% 76.0% 73.1% 72.3% 74.0% $64 $64 $64 $64 $64 56.6% 56.9% 56.2% 76.3% 79.0% 74.7% 77.2% 77.5% 53.8% 53.4% 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Earned Premium ($ millions) Earned Premium ($ millions) Earned Premium ($ millions) Reported Benefit Ratio Reported IABR Reported IABR . Benefit ratio of 74.0% . IABR1,2 of 77.5% . IABR1 of 56.2% . 1% (+/-) = $1.9 million pre-tax . 1% (+/-) = $0.6 million pre-tax . 1% (+/-) = $1.6 million pre-tax . Maintaining benefit ratio guidance . Maintaining IABR1,2 guidance of . Maintaining IABR1 guidance of 55- of 73-77% for 2019 74-79% for 2019 58% for 2019 1 Interest-adjusted benefit ratio (IABR); a non-GAAP measure. Refer to the Appendix for the corresponding GAAP measure. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 2 Retained LTC business only. 13

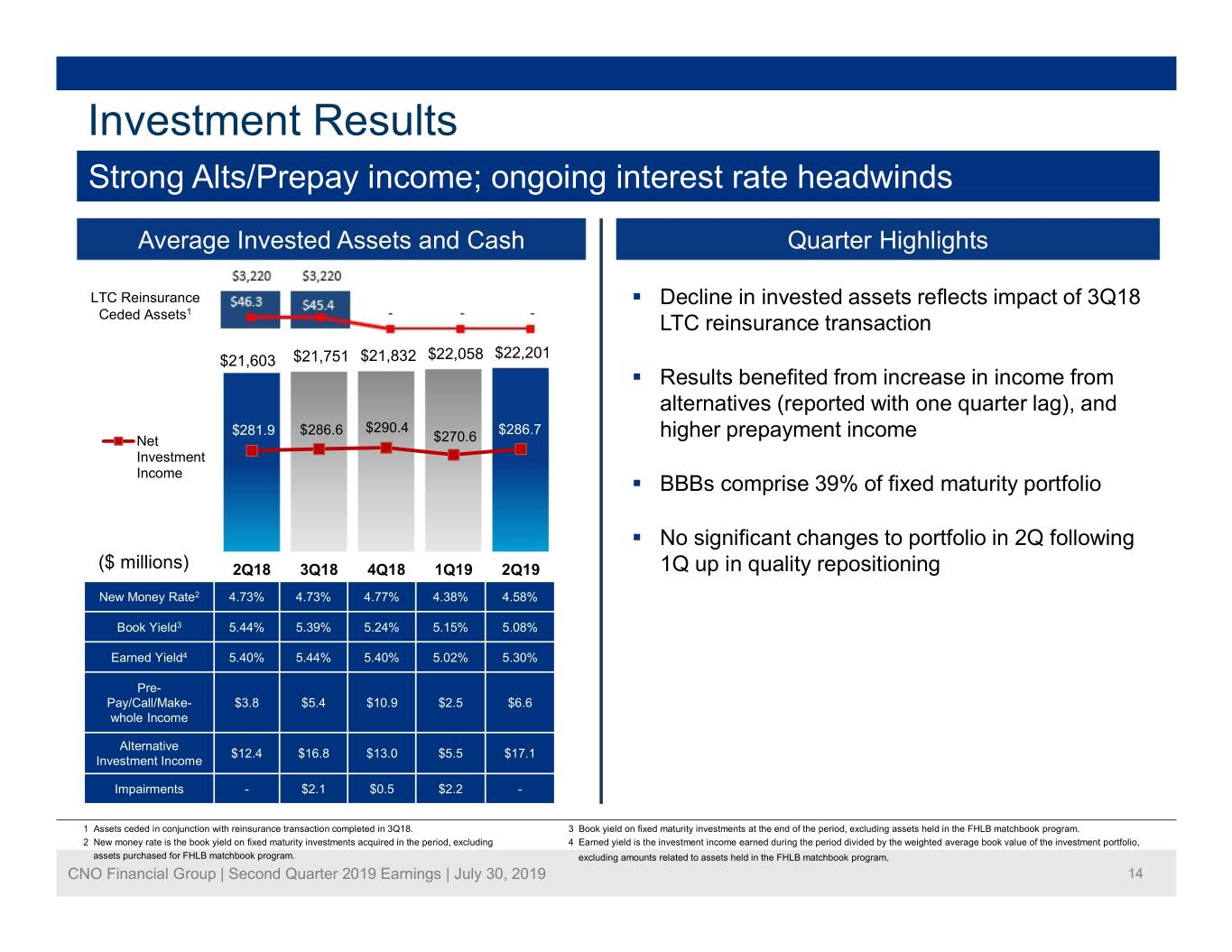

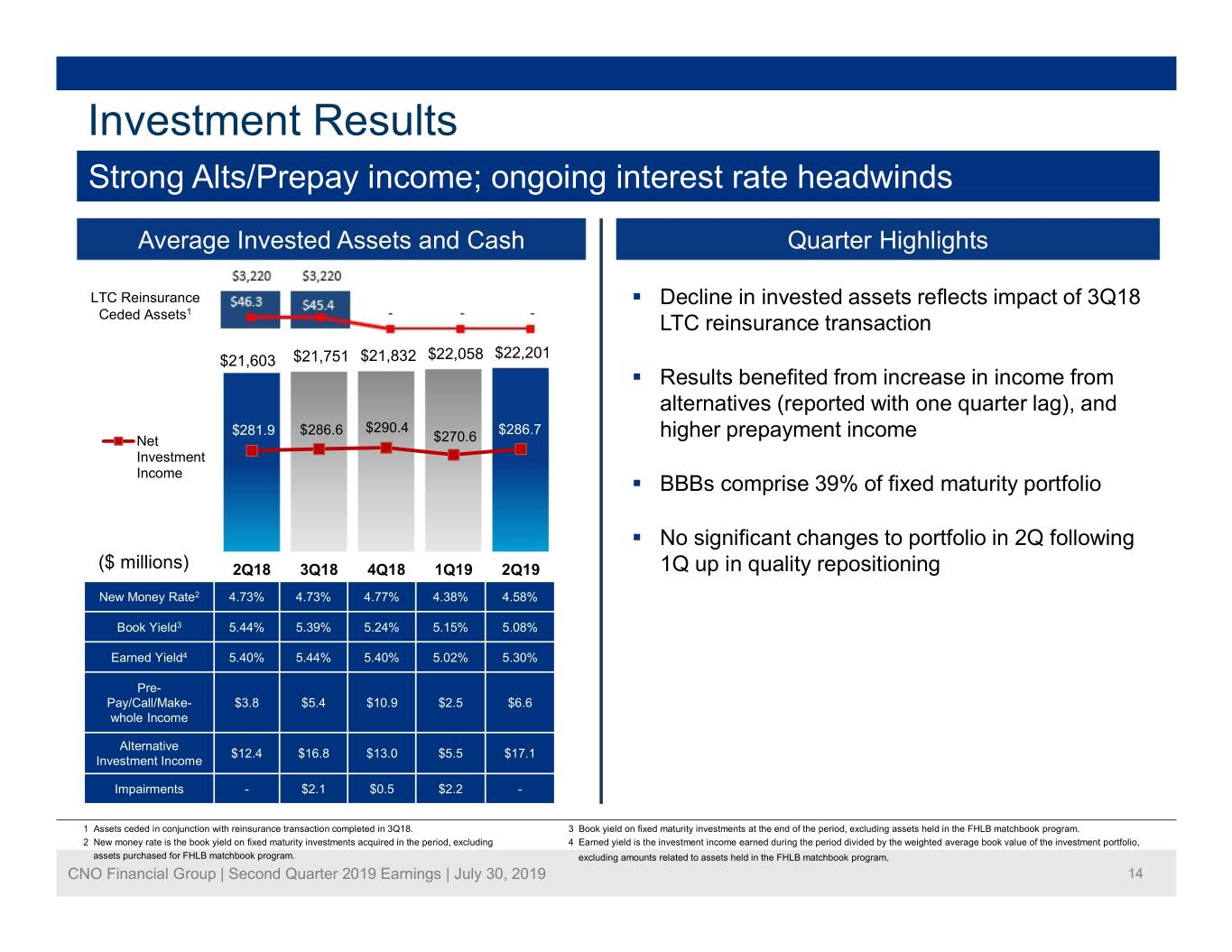

Investment Results Strong Alts/Prepay income; ongoing interest rate headwinds Average Invested Assets and Cash Quarter Highlights LTC Reinsurance . Decline in invested assets reflects impact of 3Q18 1 Ceded Assets LTC reinsurance transaction $22,201 $21,603 $21,751 $21,832 $22,058 . Results benefited from increase in income from alternatives (reported with one quarter lag), and $281.9 $286.6 $290.4 $286.7 higher prepayment income Net $270.6 Investment Income . BBBs comprise 39% of fixed maturity portfolio . No significant changes to portfolio in 2Q following ($ millions) 2Q18 3Q18 4Q18 1Q19 2Q19 1Q up in quality repositioning New Money Rate2 4.73% 4.73% 4.77% 4.38% 4.58% Book Yield3 5.44% 5.39% 5.24% 5.15% 5.08% Earned Yield4 5.40% 5.44% 5.40% 5.02% 5.30% Pre- Pay/Call/Make- $3.8 $5.4 $10.9 $2.5 $6.6 whole Income Alternative $12.4 $16.8 $13.0 $5.5 $17.1 Investment Income Impairments - $2.1 $0.5 $2.2 - 1 Assets ceded in conjunction with reinsurance transaction completed in 3Q18. 3 Book yield on fixed maturity investments at the end of the period, excluding assets held in the FHLB matchbook program. 2 New money rate is the book yield on fixed maturity investments acquired in the period, excluding 4 Earned yield is the investment income earned during the period divided by the weighted average book value of the investment portfolio, assets purchased for FHLB matchbook program. excluding amounts related to assets held in the FHLB matchbook program. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 14

Committed to Long-Term Shareholder Value Creation Continued progress on strategic initiatives Effectively deploy excess capital Extend depth and breadth of product offerings Leverage diverse distribution channels and unique product combination Expand to the right Enhance customer experience Growth in sales, earnings, FCF, and ROE CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 15

Questions and Answers CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 16

Appendix 1: Quarter in Review Strong Operational Performance • Broker-Dealer/Registered Investment Advisor Slide 18 • Agent Count Slide 19 Building on Strong Track Record of Execution • Bankers Life Retained LTC Insurance Slides 20-21 • Portfolio Composition Slide 22 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 17

Broker-Dealer/Registered Investment Advisor Account value tops $1.3 billion; up 20% YoY ($ millions) 2018 2019 2Q 3Q 4Q 1Q 2Q Net New Client Assets in Brokerage $3.1 $26.3 -$1.1 -$3.0 $5.1 Brokerage and Advisory1 Advisory 49.1 44.2 13.2 35.7 33.2 Total $52.2 $70.5 $12.1 $32.7 $38.3 Client Assets in Brokerage and Brokerage $813.6 $860.4 $794.1 $861.6 $886.0 Advisory1 at end of period Advisory 268.1 317.8 310.8 372.8 417.0 Total $1,081.7 $1,178.2 $1,104.9 $1,234.4 $1,303.0 1 Client assets include cash and securities in brokerage and managed advisory accounts. Net new client assets includes total inflows of cash and securities into brokerage and managed advisory accounts less outflows. Inflows include interest and dividends and exclude changes due to market fluctuations. Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life General Agency, Inc. (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA). Agents who are financial advisors are registered with Bankers Life Securities, Inc. Securities and variable annuity products and services are offered by Bankers Life Securities, Inc. Member FINRA/SIPC, (dba BL Securities, Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services are offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA). Home Office: 111 East Wacker Drive, Suite 1900, Chicago, IL 60601 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 18

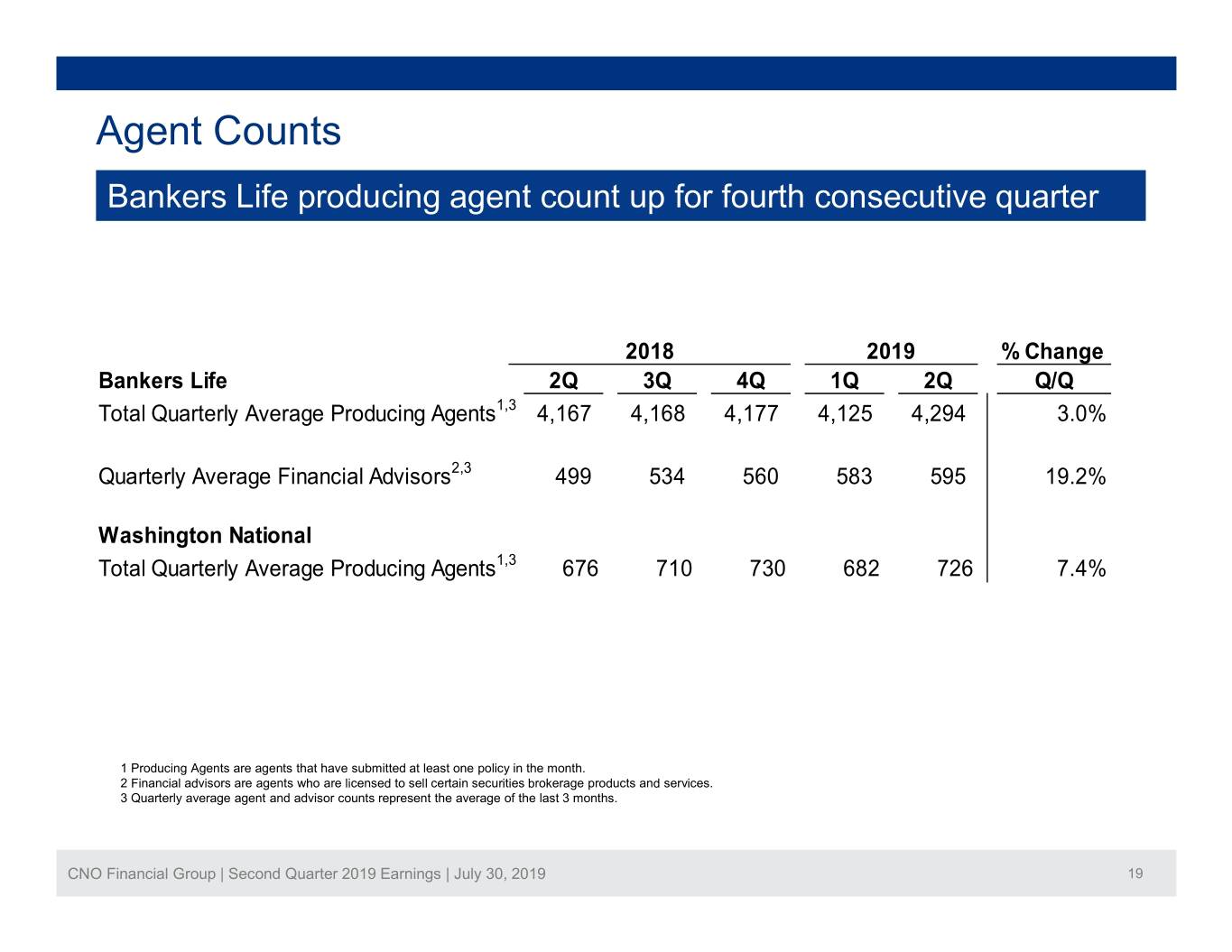

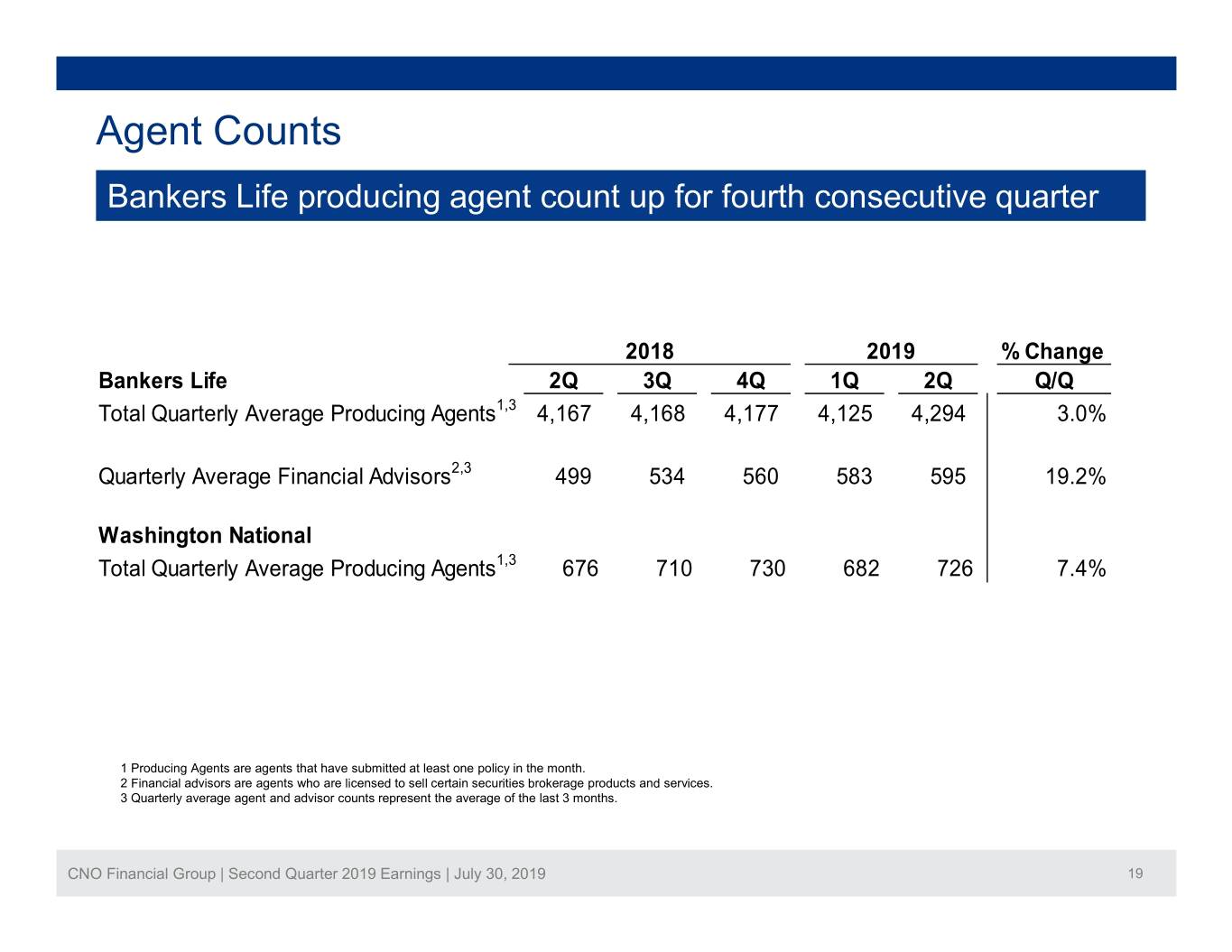

Agent Counts Bankers Life producing agent count up for fourth consecutive quarter 2018 2019 % Change Bankers Life 2Q 3Q 4Q 1Q 2Q Q/Q Total Quarterly Average Producing Agents1,3 4,167 4,168 4,177 4,125 4,294 3.0% Quarterly Average Financial Advisors2,3 499 534 560 583 595 19.2% Washington National Total Quarterly Average Producing Agents1,3 676 710 730 682 726 7.4% 1 Producing Agents are agents that have submitted at least one policy in the month. 2 Financial advisors are agents who are licensed to sell certain securities brokerage products and services. 3 Quarterly average agent and advisor counts represent the average of the last 3 months. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 19

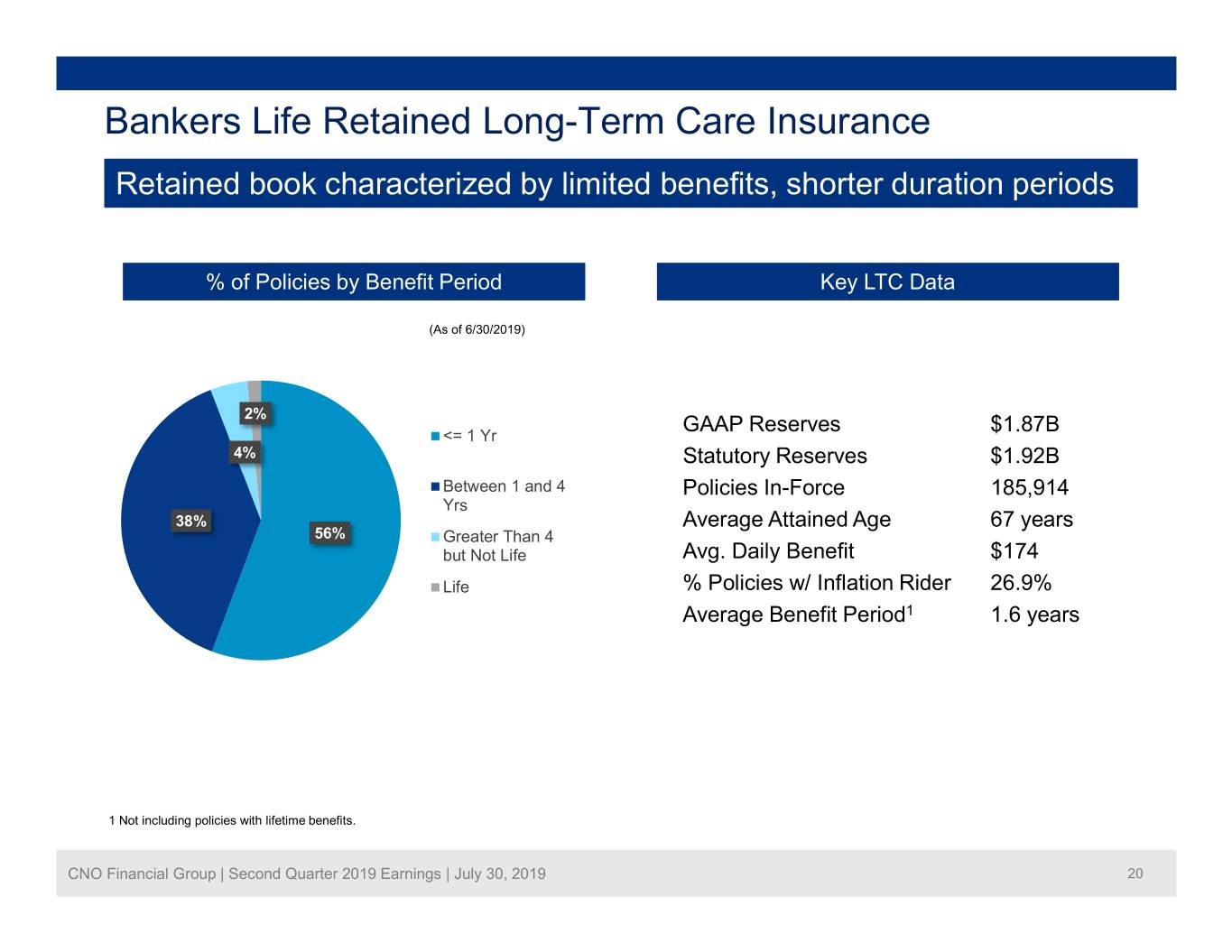

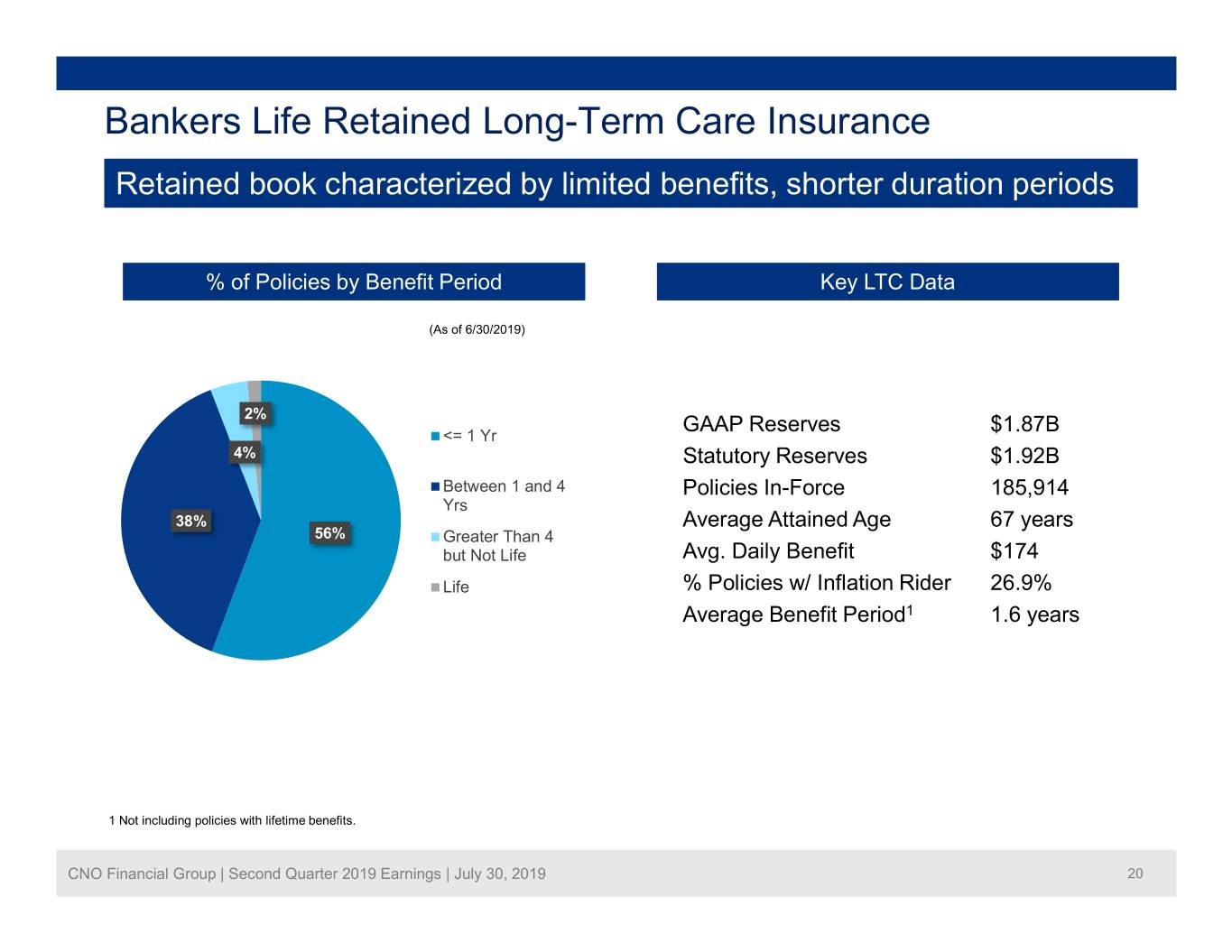

Bankers Life Retained Long-Term Care Insurance Retained book characterized by limited benefits, shorter duration periods % of Policies by Benefit Period Key LTC Data (As of 6/30/2019) 2% GAAP Reserves $1.87B <= 1 Yr 4% Statutory Reserves $1.92B Between 1 and 4 Policies In-Force 185,914 Yrs 38% Average Attained Age 67 years 56% Greater Than 4 but Not Life Avg. Daily Benefit $174 Life % Policies w/ Inflation Rider 26.9% Average Benefit Period1 1.6 years 1 Not including policies with lifetime benefits. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 20

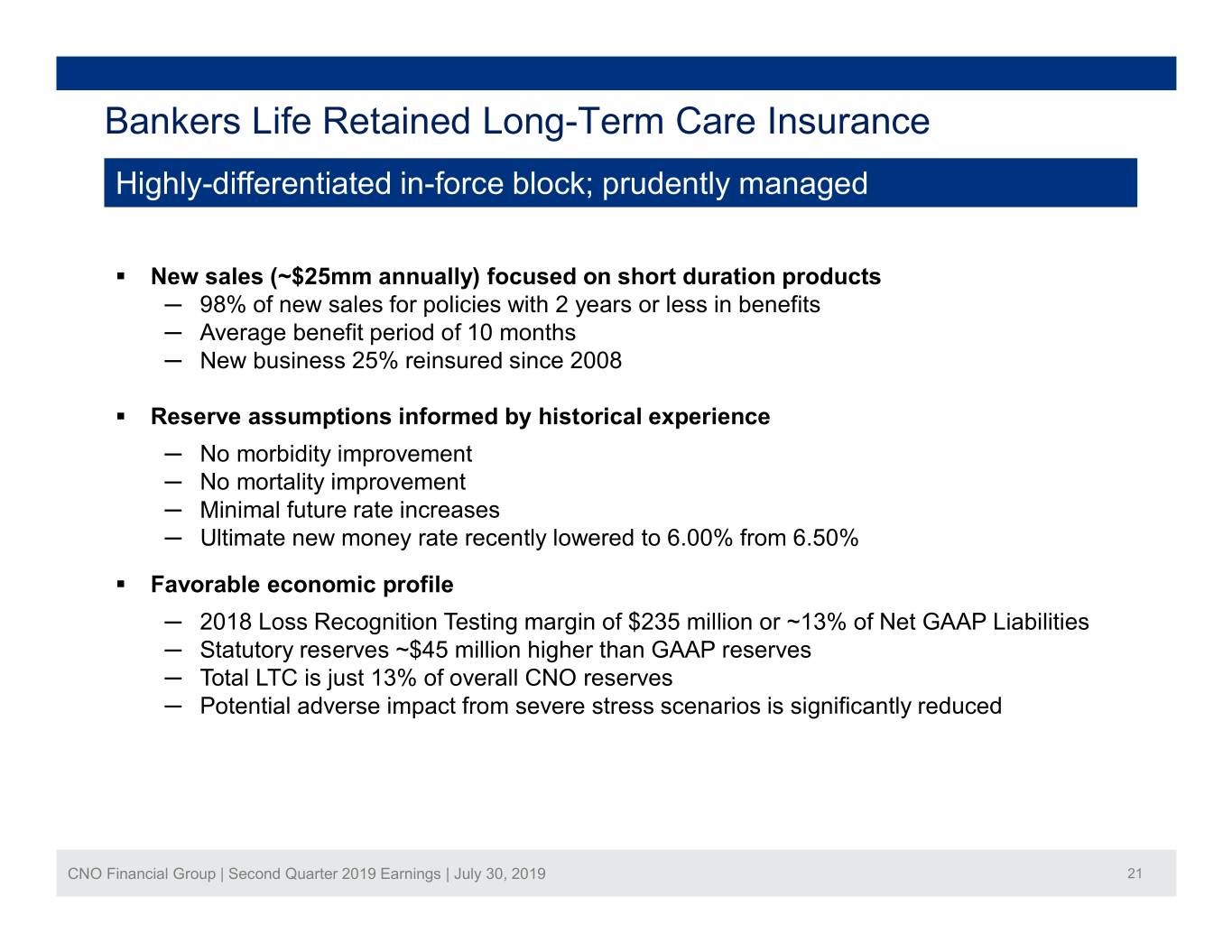

Bankers Life Retained Long-Term Care Insurance Highly-differentiated in-force block; prudently managed . New sales (~$25mm annually) focused on short duration products ─ 98% of new sales for policies with 2 years or less in benefits ─ Average benefit period of 10 months ─ New business 25% reinsured since 2008 . Reserve assumptions informed by historical experience ─ No morbidity improvement ─ No mortality improvement ─ Minimal future rate increases ─ Ultimate new money rate recently lowered to 6.00% from 6.50% . Favorable economic profile ─ 2018 Loss Recognition Testing margin of $235 million or ~13% of Net GAAP Liabilities ─ Statutory reserves ~$45 million higher than GAAP reserves ─ Total LTC is just 13% of overall CNO reserves ─ Potential adverse impact from severe stress scenarios is significantly reduced CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 21

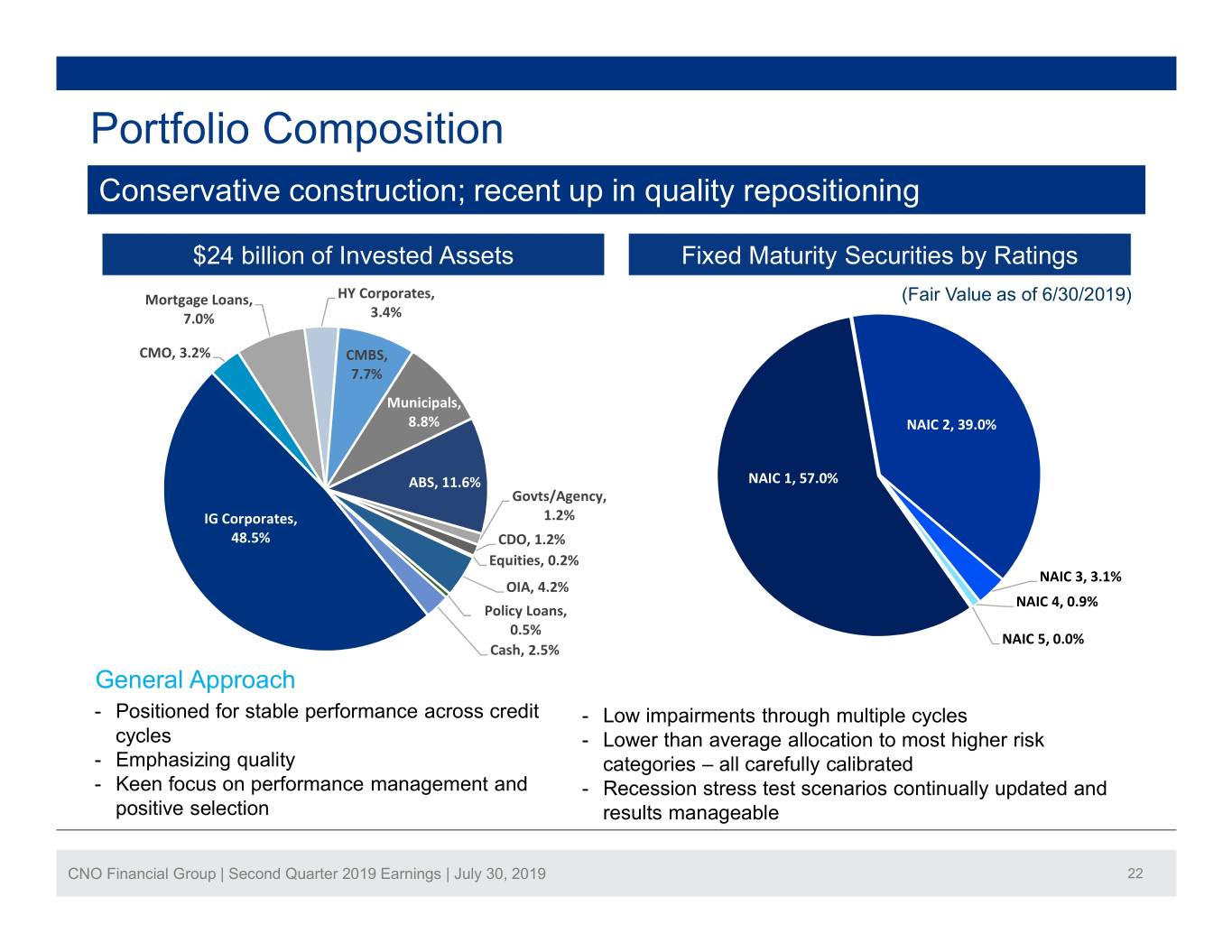

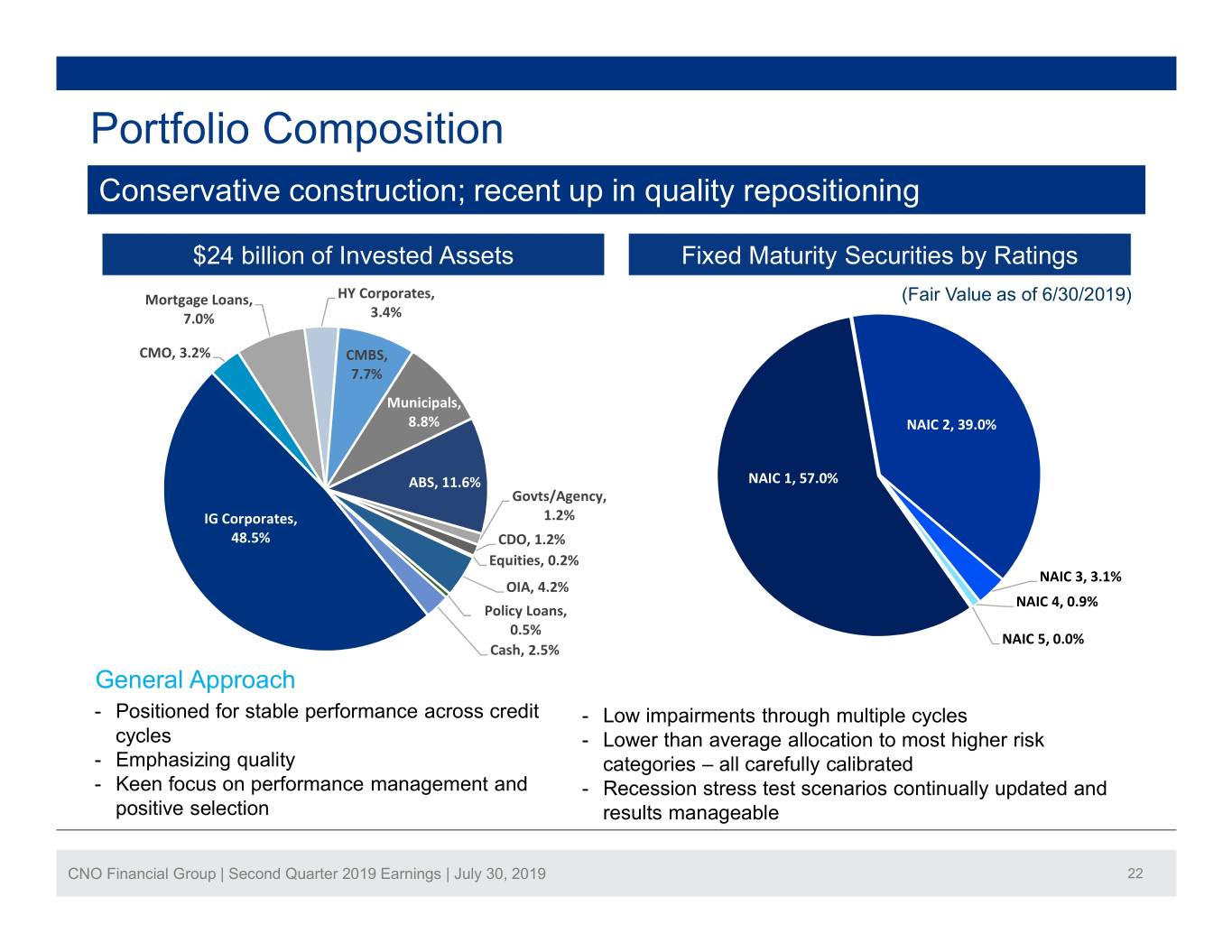

Portfolio Composition Conservative construction; recent up in quality repositioning $24 billion of Invested Assets Fixed Maturity Securities by Ratings Mortgage Loans, HY Corporates, (Fair Value as of 6/30/2019) 7.0% 3.4% CMO, 3.2% CMBS, 7.7% Municipals, 8.8% NAIC 2, 39.0% ABS, 11.6% NAIC 1, 57.0% Govts/Agency, IG Corporates, 1.2% 48.5% CDO, 1.2% Equities, 0.2% NAIC 3, 3.1% OIA, 4.2% NAIC 4, 0.9% Policy Loans, 0.5% NAIC 5, 0.0% Cash, 2.5% General Approach - Positioned for stable performance across credit - Low impairments through multiple cycles cycles - Lower than average allocation to most higher risk - Emphasizing quality categories – all carefully calibrated - Keen focus on performance management and - Recession stress test scenarios continually updated and positive selection results manageable CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 22

Appendix 2: Financial Exhibits • Holding Company Liquidity Slide 24 • Tax Asset Summary Slide 25 • Non-GAAP Financial Measures Slides 26-41 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 23

2019 Holding Company Liquidity ($ millions) 2Q19 Cash and Investments Balance - Beginning $229.8 Sources Dividends from Insurance Subsidiaries 89.9 Management Fees 28.3 Surplus Debenture Interest 12.3 Earnings on Corporate Investments 3.7 Gross Proceeds from New Debt 500.0 Net Intercompany Settlements and Other 16.4 Total Sources 650.6 Uses Share Repurchases 59.0 Interest Expense 21.8 Common Stock Dividends 17.4 Debt Repayments 425.0 Acquisition 66.7 General Expenses & Other 26.4 Total Uses 616.3 Cash and Investments Balance - June 30, 2019 $264.1 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 24

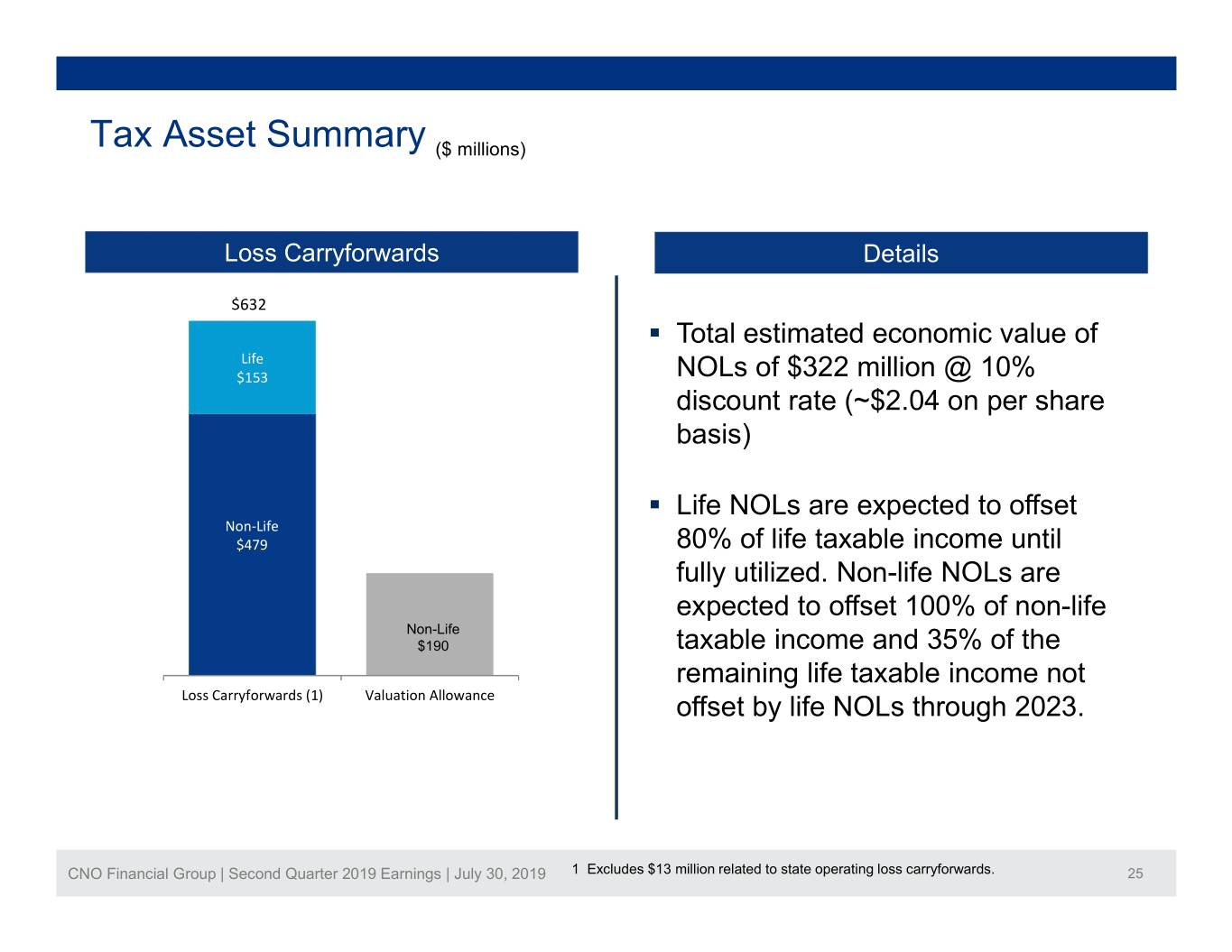

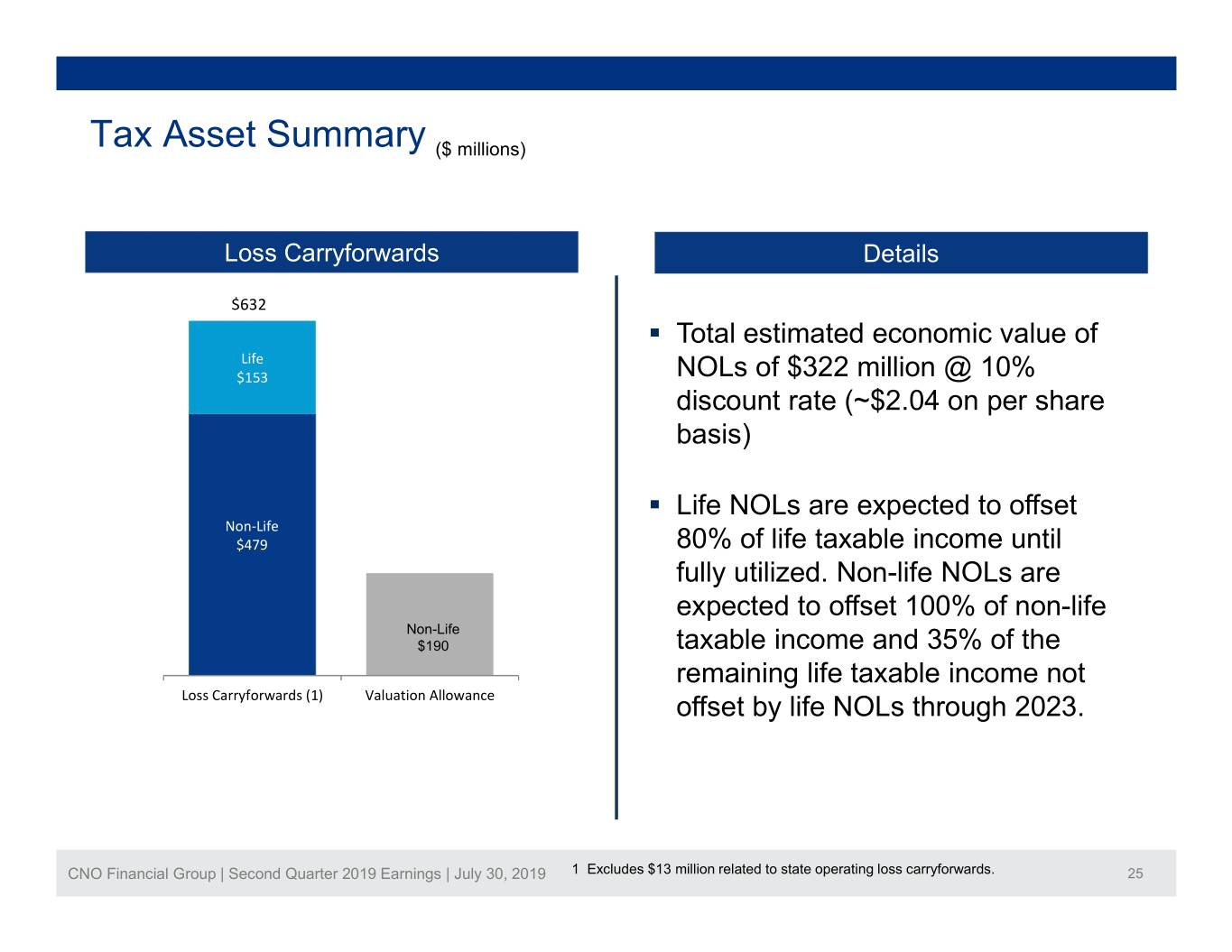

Tax Asset Summary ($ millions) Loss Carryforwards Details $632 . Total estimated economic value of Life $153 NOLs of $322 million @ 10% discount rate (~$2.04 on per share basis) . Life NOLs are expected to offset Non-Life $479 80% of life taxable income until fully utilized. Non-life NOLs are expected to offset 100% of non-life Non-Life $190 taxable income and 35% of the remaining life taxable income not Loss Carryforwards (1) Valuation Allowance offset by life NOLs through 2023. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 1 Excludes $13 million related to state operating loss carryforwards. 25

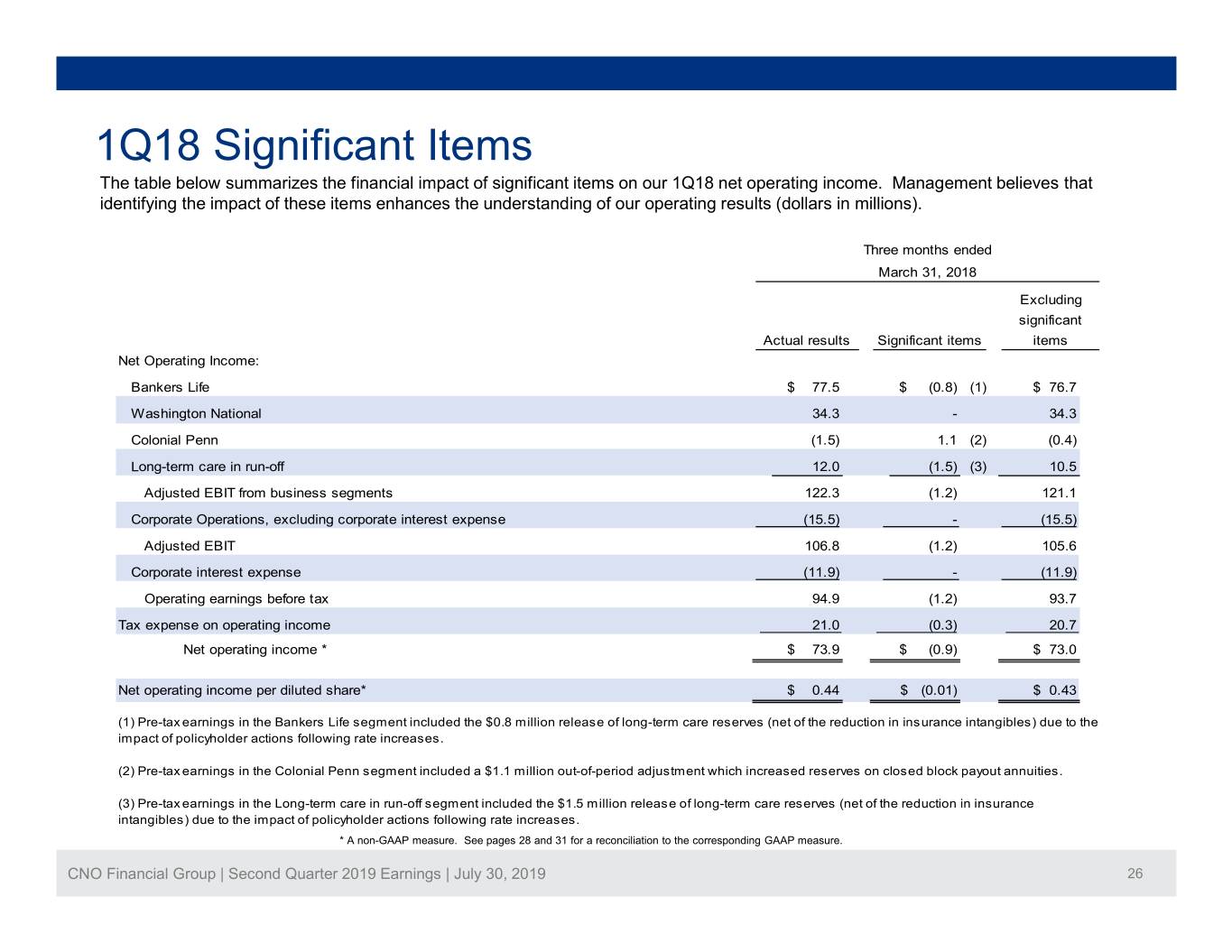

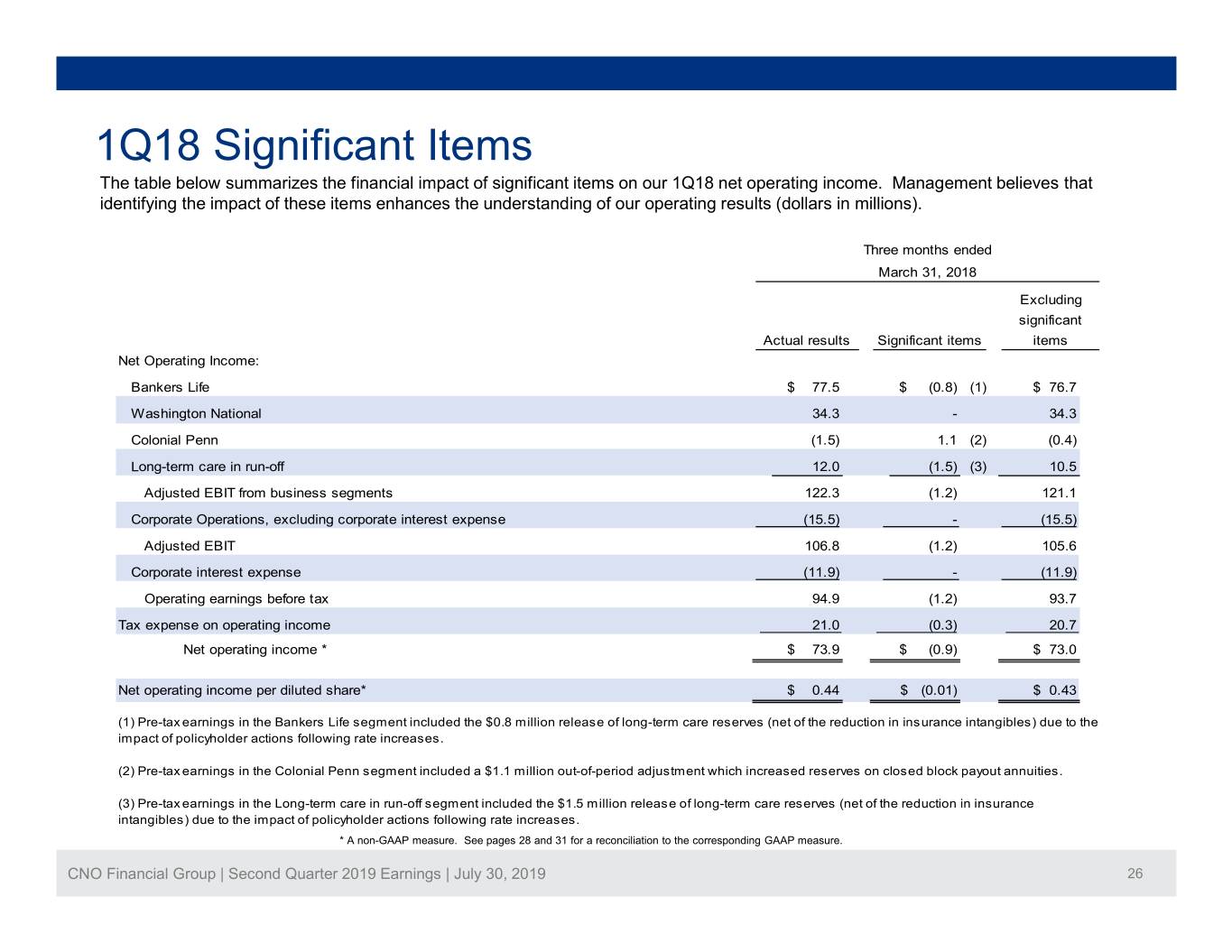

1Q18 Significant Items The table below summarizes the financial impact of significant items on our 1Q18 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended March 31, 2018 Excluding significant Actual results Significant items items Net Operating Income: Bankers Life $ 77.5 $ (0.8) (1) $ 76.7 Washington National 34.3 - 34.3 Colonial Penn (1.5) 1.1 (2) (0.4) Long-term care in run-off 12.0 (1.5) (3) 10.5 Adjusted EBIT from business segments 122.3 (1.2) 121.1 Corporate Operations, excluding corporate interest expense (15.5) - (15.5) Adjusted EBIT 106.8 (1.2) 105.6 Corporate interest expense (11.9) - (11.9) Operating earnings before tax 94.9 (1.2) 93.7 Tax expense on operating income 21.0 (0.3) 20.7 Net operating income * $ 73.9 $ (0.9) $ 73.0 Net operating income per diluted share* $ 0.44 $ (0.01) $ 0.43 (1) Pre-tax earnings in the Bankers Life segment included the $0.8 million release of long-term care reserves (net of the reduction in insurance intangibles) due to the impact of policyholder actions following rate increases. (2) Pre-tax earnings in the Colonial Penn segment included a $1.1 million out-of-period adjustment which increased reserves on closed block payout annuities. (3) Pre-tax earnings in the Long-term care in run-off segment included the $1.5 million release of long-term care reserves (net of the reduction in insurance intangibles) due to the impact of policyholder actions following rate increases. * A non-GAAP measure. See pages 28 and 31 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 26

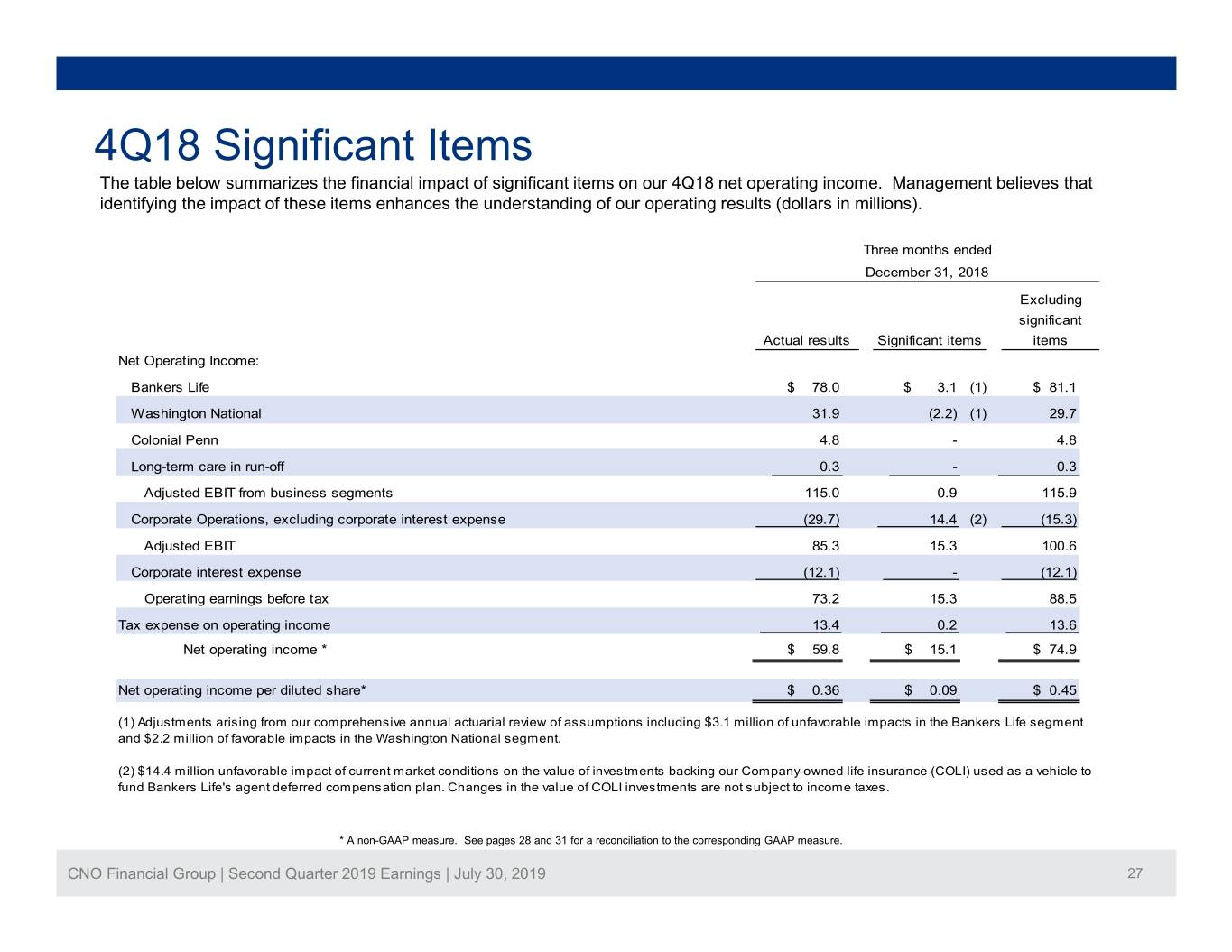

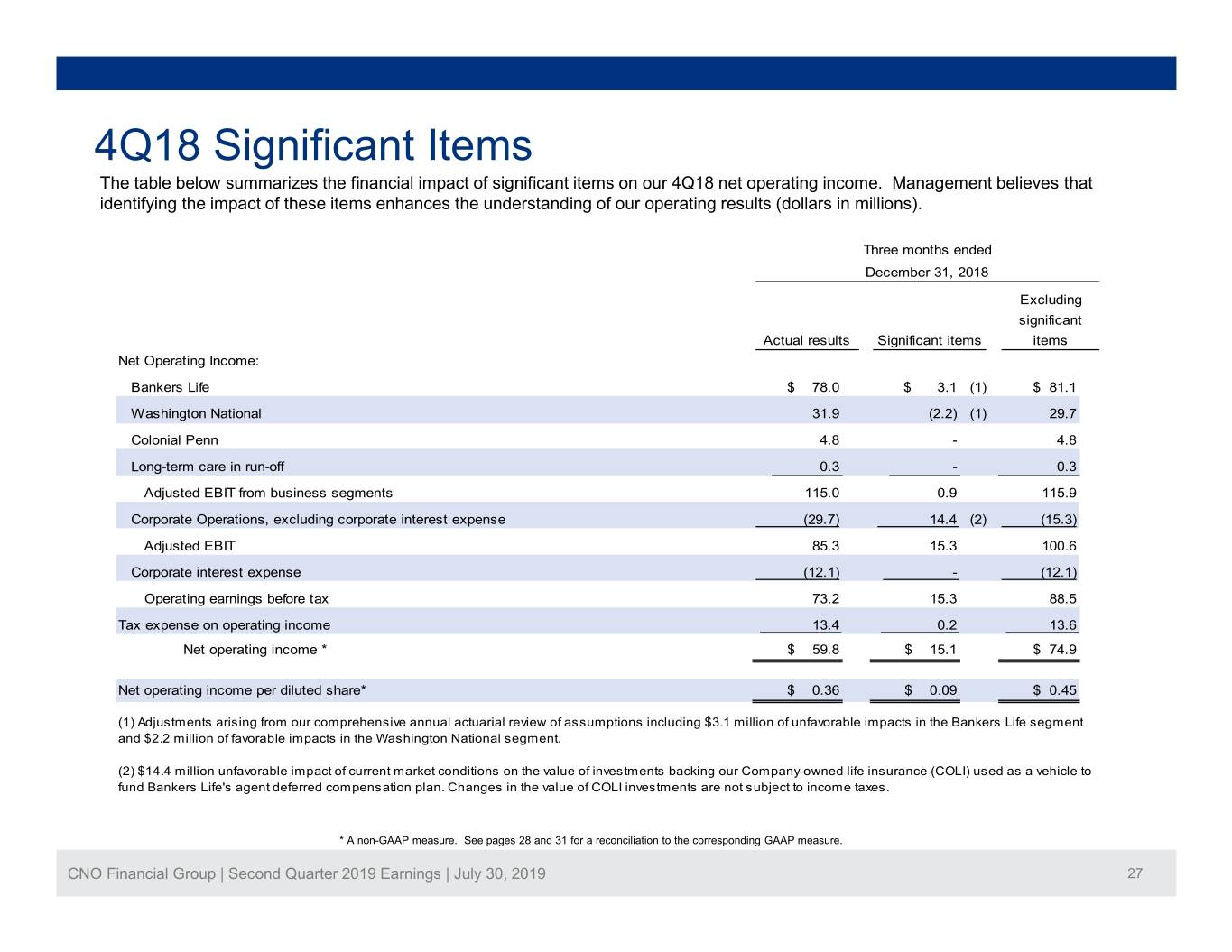

4Q18 Significant Items The table below summarizes the financial impact of significant items on our 4Q18 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended December 31, 2018 Excluding significant Actual results Significant items items Net Operating Income: Bankers Life $ 78.0 $ 3.1 (1) $ 81.1 Washington National 31.9 (2.2) (1) 29.7 Colonial Penn 4.8 - 4.8 Long-term care in run-off 0.3 - 0.3 Adjusted EBIT from business segments 115.0 0.9 115.9 Corporate Operations, excluding corporate interest expense (29.7) 14.4 (2) (15.3) Adjusted EBIT 85.3 15.3 100.6 Corporate interest expense (12.1) - (12.1) Operating earnings before tax 73.2 15.3 88.5 Tax expense on operating income 13.4 0.2 13.6 Net operating income * $ 59.8 $ 15.1 $ 74.9 Net operating income per diluted share* $ 0.36 $ 0.09 $ 0.45 (1) Adjustments arising from our comprehensive annual actuarial review of assumptions including $3.1 million of unfavorable impacts in the Bankers Life segment and $2.2 million of favorable impacts in the Washington National segment. (2) $14.4 million unfavorable impact of current market conditions on the value of investments backing our Company-owned life insurance (COLI) used as a vehicle to fund Bankers Life's agent deferred compensation plan. Changes in the value of COLI investments are not subject to income taxes. * A non-GAAP measure. See pages 28 and 31 for a reconciliation to the corresponding GAAP measure. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 27

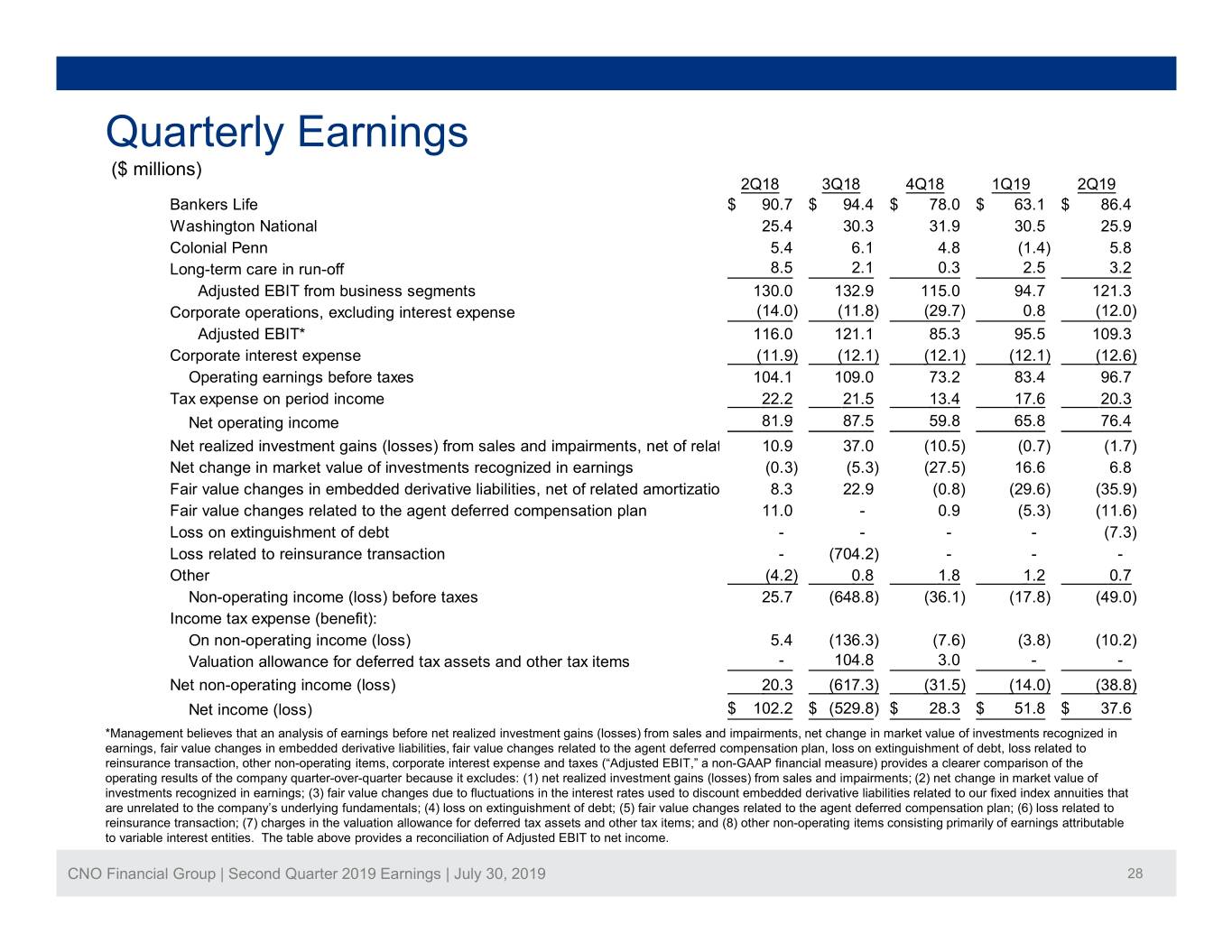

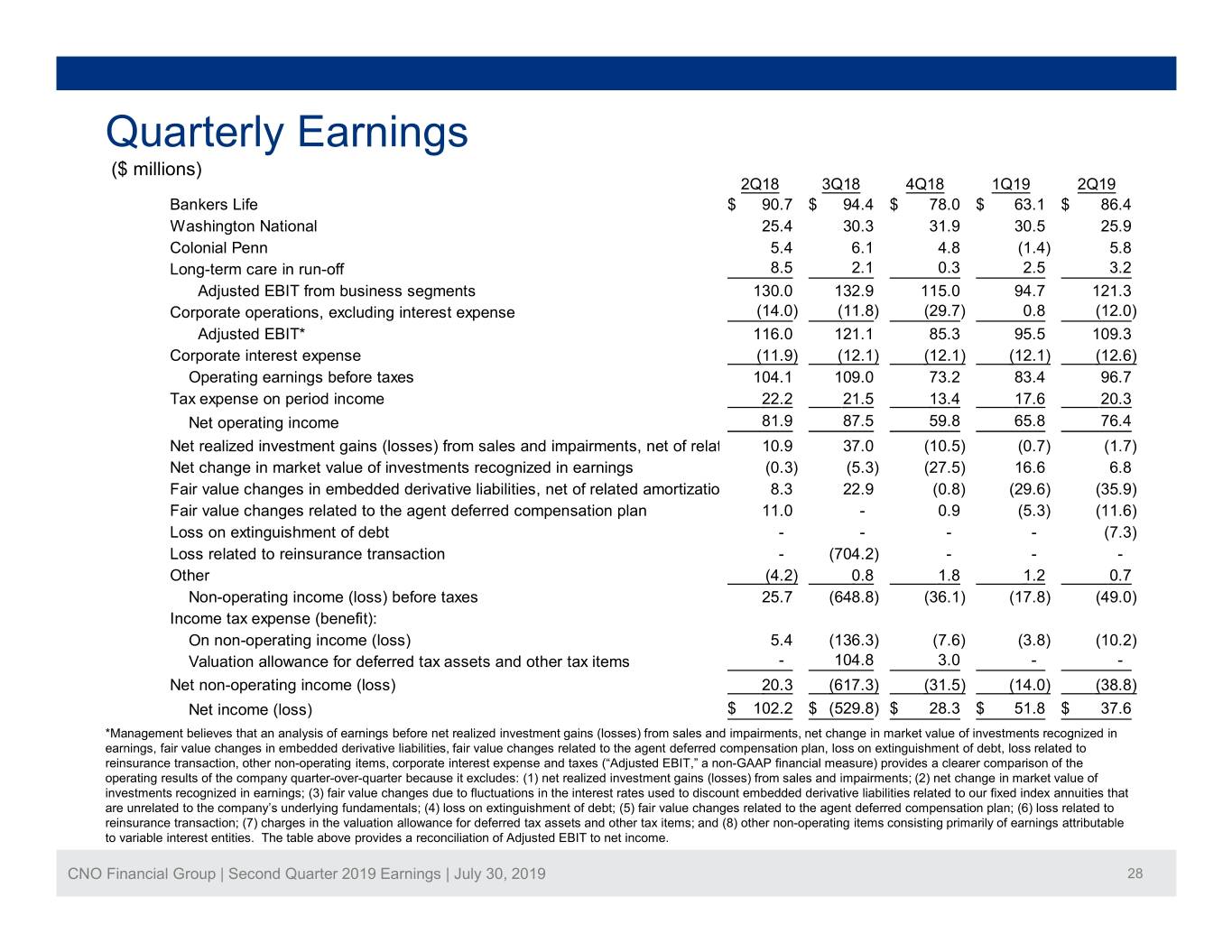

Quarterly Earnings ($ millions) 2Q18 3Q18 4Q18 1Q19 2Q19 Bankers Life$ 90.7 $ 94.4 $ 78.0 $ 63.1 $ 86.4 Washington National 25.4 30.3 31.9 30.5 25.9 Colonial Penn 5.4 6.1 4.8 (1.4) 5.8 Long-term care in run-off 8.5 2.1 0.3 2.5 3.2 Adjusted EBIT from business segments 130.0 132.9 115.0 94.7 121.3 Corporate operations, excluding interest expense (14.0) (11.8) (29.7) 0.8 (12.0) Adjusted EBIT* 116.0 121.1 85.3 95.5 109.3 Corporate interest expense (11.9) (12.1) (12.1) (12.1) (12.6) Operating earnings before taxes 104.1 109.0 73.2 83.4 96.7 Tax expense on period income 22.2 21.5 13.4 17.6 20.3 Net operating income 81.9 87.5 59.8 65.8 76.4 Net realized investment gains (losses) from sales and impairments, net of related amortization 10.9 37.0 (10.5) (0.7) (1.7) Net change in market value of investments recognized in earnings (0.3) (5.3) (27.5) 16.6 6.8 Fair value changes in embedded derivative liabilities, net of related amortization 8.3 22.9 (0.8) (29.6) (35.9) Fair value changes related to the agent deferred compensation plan 11.0 - 0.9 (5.3) (11.6) Loss on extinguishment of debt - - - - (7.3) Loss related to reinsurance transaction - (704.2) - - - Other (4.2) 0.8 1.8 1.2 0.7 Non-operating income (loss) before taxes 25.7 (648.8) (36.1) (17.8) (49.0) Income tax expense (benefit): On non-operating income (loss) 5.4 (136.3) (7.6) (3.8) (10.2) Valuation allowance for deferred tax assets and other tax items - 104.8 3.0 - - Net non-operating income (loss) 20.3 (617.3) (31.5) (14.0) (38.8) Net income (loss) $ 102.2 $ (529.8) $ 28.3 $ 51.8 $ 37.6 *Management believes that an analysis of earnings before net realized investment gains (losses) from sales and impairments, net change in market value of investments recognized in earnings, fair value changes in embedded derivative liabilities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, loss related to reinsurance transaction, other non-operating items, corporate interest expense and taxes (“Adjusted EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) net realized investment gains (losses) from sales and impairments; (2) net change in market value of investments recognized in earnings; (3) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals; (4) loss on extinguishment of debt; (5) fair value changes related to the agent deferred compensation plan; (6) loss related to reinsurance transaction; (7) charges in the valuation allowance for deferred tax assets and other tax items; and (8) other non-operating items consisting primarily of earnings attributable to variable interest entities. The table above provides a reconciliation of Adjusted EBIT to net income. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 28

Colonial Penn Segment Adjusted EBIT Summarized by In-Force and New Business An analysis of Adjusted EBIT for Colonial Penn, separated between in-force and new business, provides increased clarity for this segment as the vast majority of the costs to generate new business in this segment are not deferrable and Adjusted EBIT will fluctuate based on management's decisions on how much marketing costs to incur in each period. Adjusted EBIT from new business includes pre-tax revenues and expenses associated with new sales of our insurance products during the first year after the sale is completed. Adjusted EBIT from in-force business includes all pre-tax revenues and expenses associated with sales of insurance products that were completed more than one year before the end of the reporting period. The allocation of certain revenues and expenses between new and in-force business is based on estimates, which we believe are reasonable (dollars in millions): Adjusted EBIT from Inforce Business Adjusted EBIT from New Business Adjusted EBIT from Inforce and New Business 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Revenues Insurance policy income$ 62.9 $ 63.3 $ 62.9 $ 64.0 $ 64.3 $ 11.6 $ 11.8 $ 12.0 $ 12.7 $ 13.3 $ 74.5 $ 75.1 $ 74.9 $ 76.7 $ 77.6 Net investment income 11.3 11.1 11.2 10.7 10.8 - - - - - 11.3 11.1 11.2 10.7 10.8 Fee revenue and other income 0.4 0.5 0.4 0.5 0.4 - - - - - 0.4 0.5 0.4 0.5 0.4 Total revenues 74.6 74.9 74.5 75.2 75.5 11.6 11.8 12.0 12.7 13.3 86.2 86.7 86.5 87.9 88.8 Benefits and expenses Insurance policy benefits 43.5 42.6 42.8 48.2 44.1 7.1 7.2 7.3 8.0 8.4 50.6 49.8 50.1 56.2 52.5 Interest expense 0.4 0.3 0.4 0.4 0.4 - - - - - 0.4 0.3 0.4 0.4 0.4 Amortization 4.0 4.0 4.8 4.1 3.2 0.1 0.2 0.1 0.4 0.4 4.1 4.2 4.9 4.5 3.6 Other operating costs and expenses 8.6 9.2 8.7 8.3 8.1 17.1 17.1 17.6 19.9 18.4 25.7 26.3 26.3 28.2 26.5 Total benefits and expenses 56.5 56.1 56.7 61.0 55.8 24.3 24.5 25.0 28.3 27.2 80.8 80.6 81.7 89.3 83.0 Adjusted EBIT from Inforce Business$ 18.1 $ 18.8 $ 17.8 $ 14.2 $ 19.7 $ (12.7) $ (12.7) $ (13.0) $ (15.6) $ (13.9) $ 5.4 $ 6.1 $ 4.8 $ (1.4) $ 5.8 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 29

Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales and impairments, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, loss related to reinsurance transaction, changes in the valuation allowance for deferred tax assets and other tax items and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 30

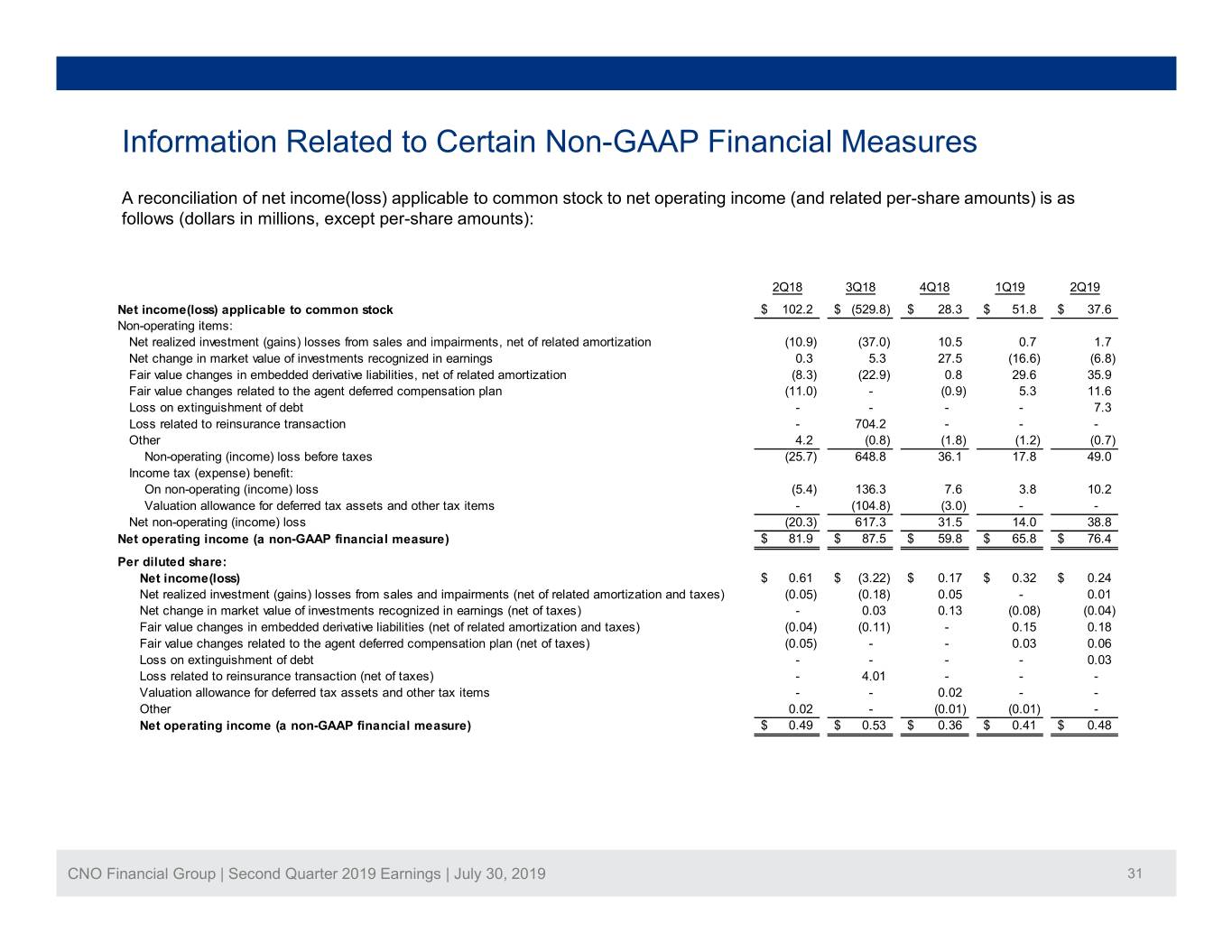

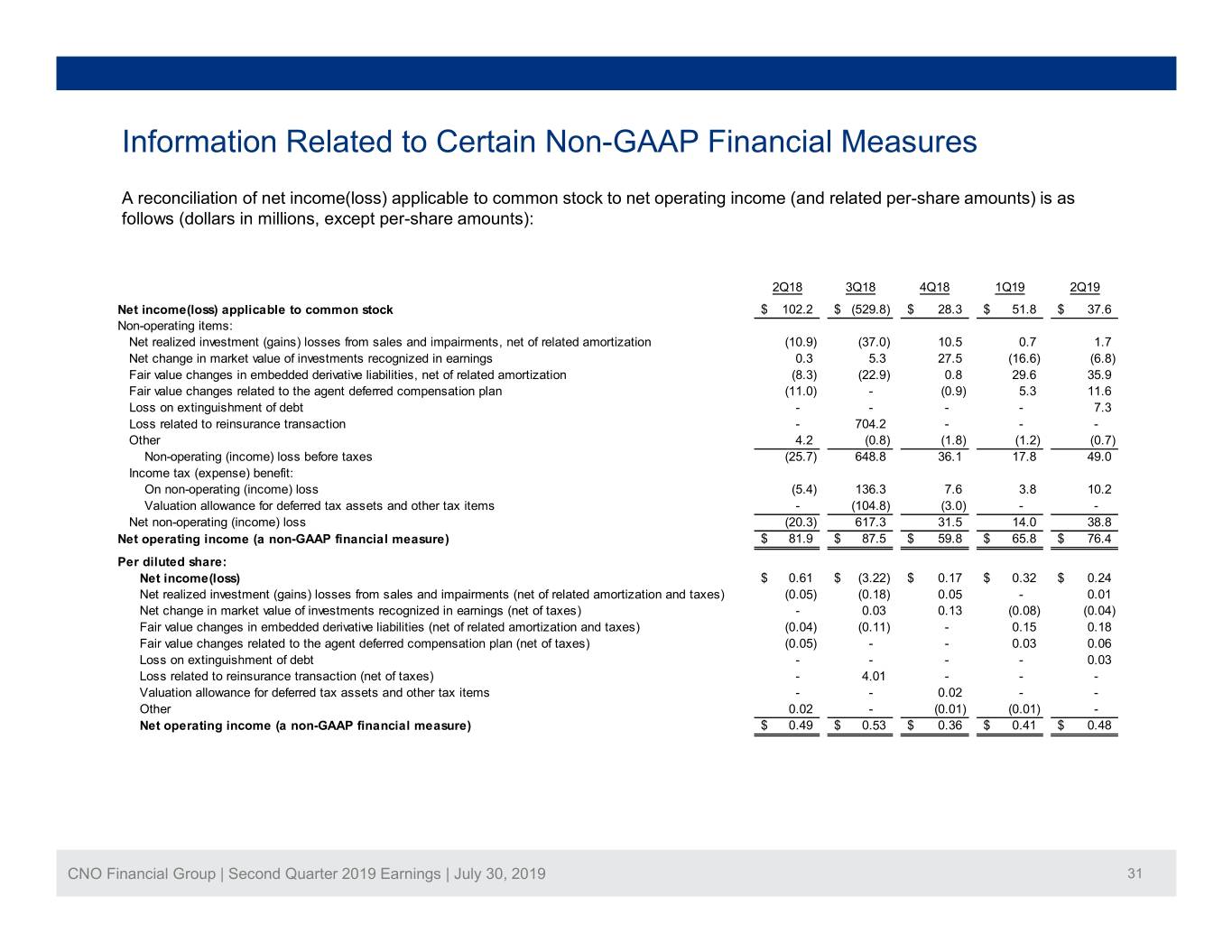

Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income(loss) applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 2Q18 3Q18 4Q18 1Q19 2Q19 Net income(loss) applicable to common stock $ 102.2 $ (529.8) $ 28.3 $ 51.8 $ 37.6 Non-operating items: Net realized investment (gains) losses from sales and impairments, net of related amortization (10.9) (37.0) 10.5 0.7 1.7 Net change in market value of investments recognized in earnings 0.3 5.3 27.5 (16.6) (6.8) Fair value changes in embedded derivative liabilities, net of related amortization (8.3) (22.9) 0.8 29.6 35.9 Fair value changes related to the agent deferred compensation plan (11.0) - (0.9) 5.3 11.6 Loss on extinguishment of debt - - - - 7.3 Loss related to reinsurance transaction - 704.2 - - - Other 4.2 (0.8) (1.8) (1.2) (0.7) Non-operating (income) loss before taxes (25.7) 648.8 36.1 17.8 49.0 Income tax (expense) benefit: On non-operating (income) loss (5.4) 136.3 7.6 3.8 10.2 Valuation allowance for deferred tax assets and other tax items - (104.8) (3.0) - - Net non-operating (income) loss (20.3) 617.3 31.5 14.0 38.8 Net operating income (a non-GAAP financial measure) $ 81.9 $ 87.5 $ 59.8 $ 65.8 $ 76.4 Per diluted share: Net income(loss) $ 0.61 $ (3.22) $ 0.17 $ 0.32 $ 0.24 Net realized investment (gains) losses from sales and impairments (net of related amortization and taxes) (0.05) (0.18) 0.05 - 0.01 Net change in market value of investments recognized in earnings (net of taxes) - 0.03 0.13 (0.08) (0.04) Fair value changes in embedded derivative liabilities (net of related amortization and taxes) (0.04) (0.11) - 0.15 0.18 Fair value changes related to the agent deferred compensation plan (net of taxes) (0.05) - - 0.03 0.06 Loss on extinguishment of debt - - - - 0.03 Loss related to reinsurance transaction (net of taxes) - 4.01 - - - Valuation allowance for deferred tax assets and other tax items - - 0.02 - - Other 0.02 - (0.01) (0.01) - Net operating income (a non-GAAP financial measure) $ 0.49 $ 0.53 $ 0.36 $ 0.41 $ 0.48 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 31

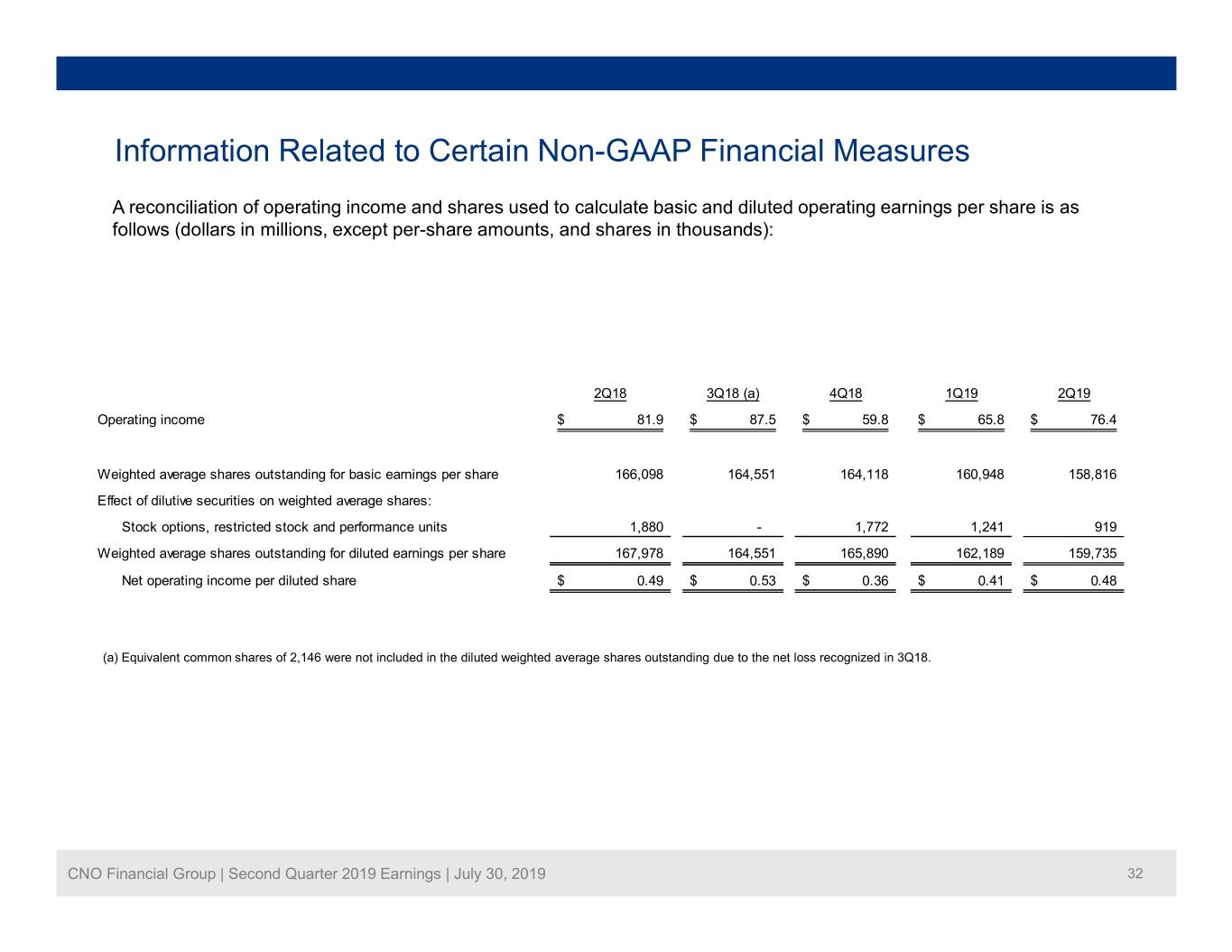

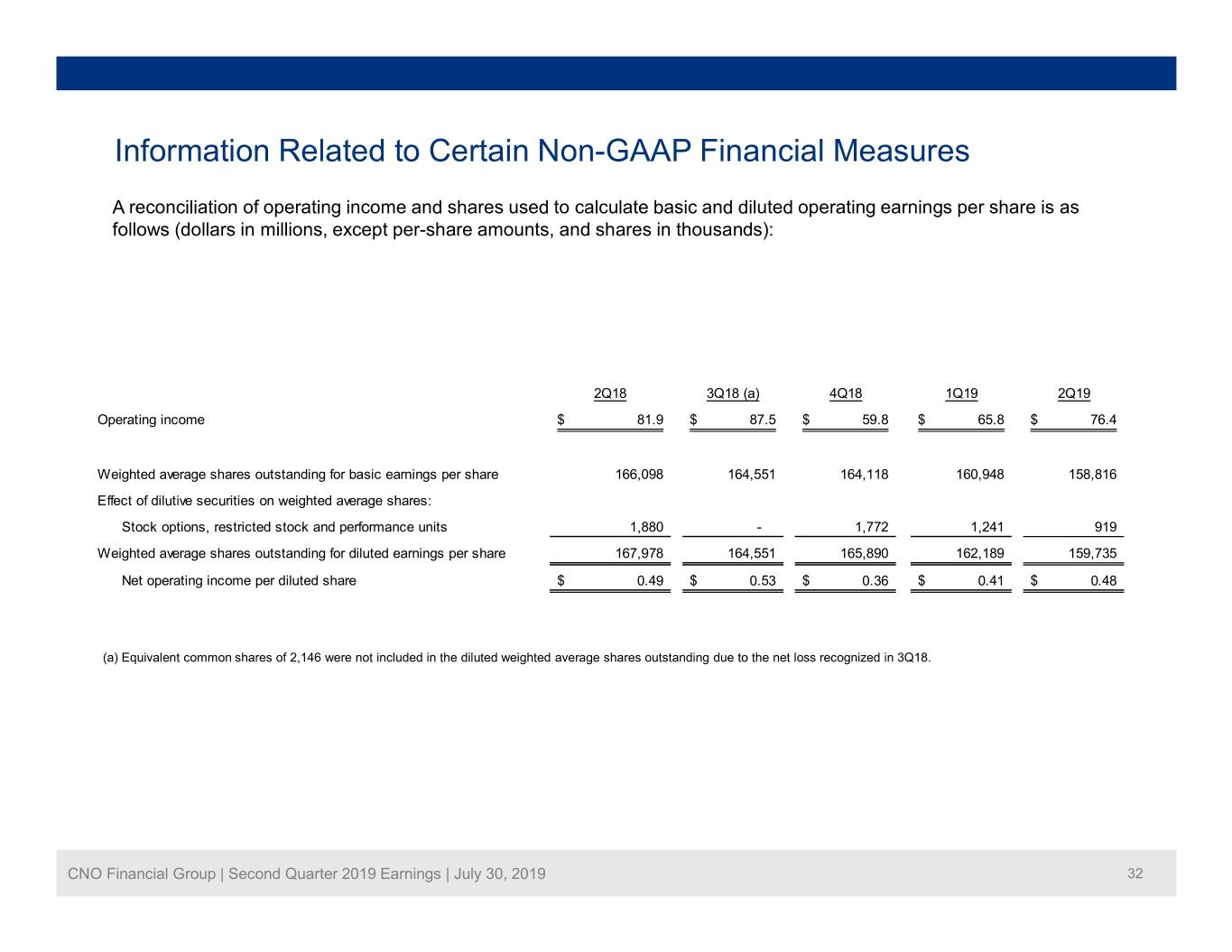

Information Related to Certain Non-GAAP Financial Measures A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows (dollars in millions, except per-share amounts, and shares in thousands): 2Q18 3Q18 (a) 4Q18 1Q19 2Q19 Operating income$ 81.9 $ 87.5 $ 59.8 $ 65.8 $ 76.4 Weighted average shares outstanding for basic earnings per share 166,098 164,551 164,118 160,948 158,816 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units 1,880 - 1,772 1,241 919 Weighted average shares outstanding for diluted earnings per share 167,978 164,551 165,890 162,189 159,735 Net operating income per diluted share$ 0.49 $ 0.53 $ 0.36 $ 0.41 $ 0.48 (a) Equivalent common shares of 2,146 were not included in the diluted weighted average shares outstanding due to the net loss recognized in 3Q18. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 32

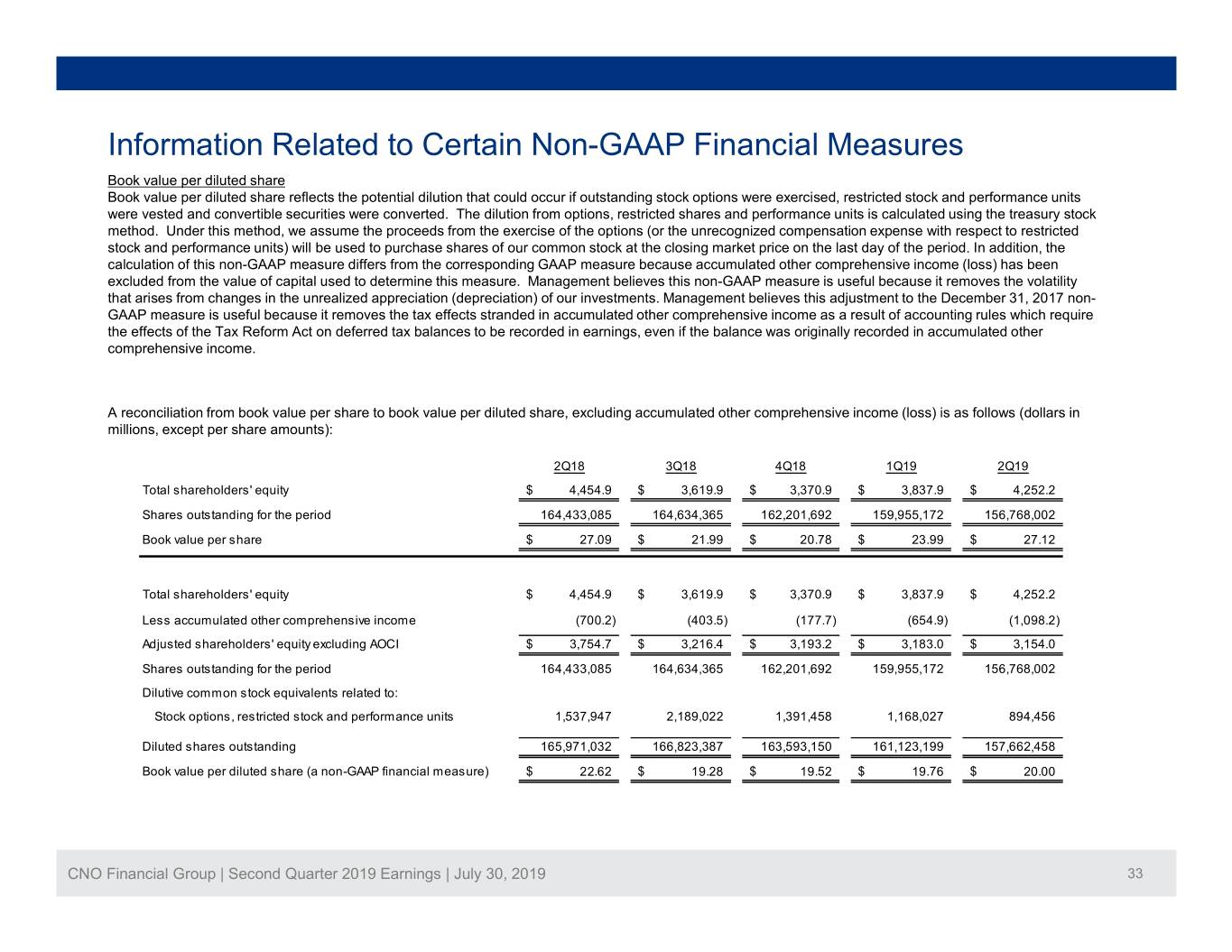

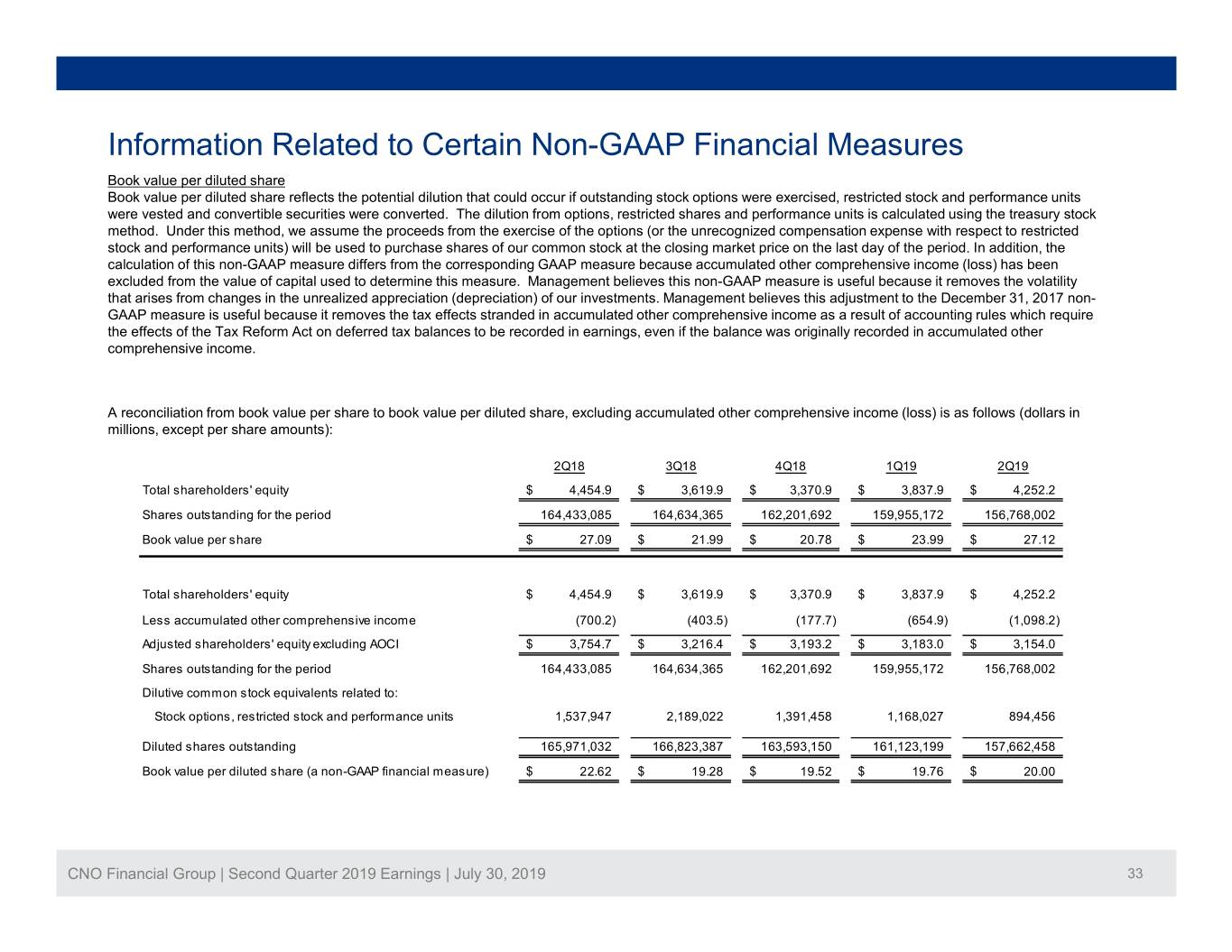

Information Related to Certain Non-GAAP Financial Measures Book value per diluted share Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised, restricted stock and performance units were vested and convertible securities were converted. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments. Management believes this adjustment to the December 31, 2017 non- GAAP measure is useful because it removes the tax effects stranded in accumulated other comprehensive income as a result of accounting rules which require the effects of the Tax Reform Act on deferred tax balances to be recorded in earnings, even if the balance was originally recorded in accumulated other comprehensive income. A reconciliation from book value per share to book value per diluted share, excluding accumulated other comprehensive income (loss) is as follows (dollars in millions, except per share amounts): 2Q18 3Q18 4Q18 1Q19 2Q19 Total shareholders' equity$ 4,454.9 $ 3,619.9 $ 3,370.9 $ 3,837.9 $ 4,252.2 Shares outstanding for the period 164,433,085 164,634,365 162,201,692 159,955,172 156,768,002 Book value per share$ 27.09 $ 21.99 $ 20.78 $ 23.99 $ 27.12 Total shareholders' equity$ 4,454.9 $ 3,619.9 $ 3,370.9 $ 3,837.9 $ 4,252.2 Less accumulated other comprehensive income (700.2) (403.5) (177.7) (654.9) (1,098.2) Adjusted shareholders' equity excluding AOCI$ 3,754.7 $ 3,216.4 $ 3,193.2 $ 3,183.0 $ 3,154.0 Shares outstanding for the period 164,433,085 164,634,365 162,201,692 159,955,172 156,768,002 Dilutive common stock equivalents related to: Stock options, restricted stock and performance units 1,537,947 2,189,022 1,391,458 1,168,027 894,456 Diluted shares outstanding 165,971,032 166,823,387 163,593,150 161,123,199 157,662,458 Book value per diluted share (a non-GAAP financial measure)$ 22.62 $ 19.28 $ 19.52 $ 19.76 $ 20.00 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 33

Information Related to Certain Non-GAAP Financial Measures Interest-adjusted benefit ratios The interest-adjusted benefit ratio (a non-GAAP measure) is calculated by dividing the product's insurance policy benefits less imputed interest income on the accumulated assets backing the insurance liabilities by insurance policy income. Interest income is an important factor in measuring the performance of longer duration health products. The net cash flows generally cause an accumulation of amounts in the early years of a policy (accounted for as reserve increases), which will be paid out as benefits in later policy years (accounted for as reserve decreases). Accordingly, as the policies age, the benefit ratio will typically increase, but the increase in the change in reserve will be partially offset by the imputed interest income earned on the accumulated assets. The interest-adjusted benefit ratio reflects the effects of such interest income offset. Since interest income is an important factor in measuring the performance of these products, management believes a benefit ratio, which includes the effect of interest income, is useful in analyzing product performance. (Dollars in millions) 2Q18 3Q18 4Q18 1Q19 2Q19 Bankers Life Long-term care benefit ratios Earned premium$ 64.0 $ 63.7 $ 63.8 $ 63.7 $ 63.5 Benefit ratio before imputed interest income on reserves 119.3% 122.5% 117.9% 120.6% 122.1% Interest-adjusted benefit ratio 76.3% 79.0% 74.7% 77.2% 77.5% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits)$ 15.1 $ 13.4 $ 16.2 $ 14.5 $ 14.3 Washington National Supplemental health benefit ratios Earned premium$ 151.8 $ 152.2 $ 156.0 $ 155.6 $ 156.7 Benefit ratio before imputed interest income on reserves 80.7% 81.3% 77.7% 77.6% 80.2% Interest-adjusted benefit ratio 56.6% 56.9% 53.8% 53.4% 56.2% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits)$ 65.8 $ 65.6 $ 72.1 $ 72.4 $ 68.7 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 34

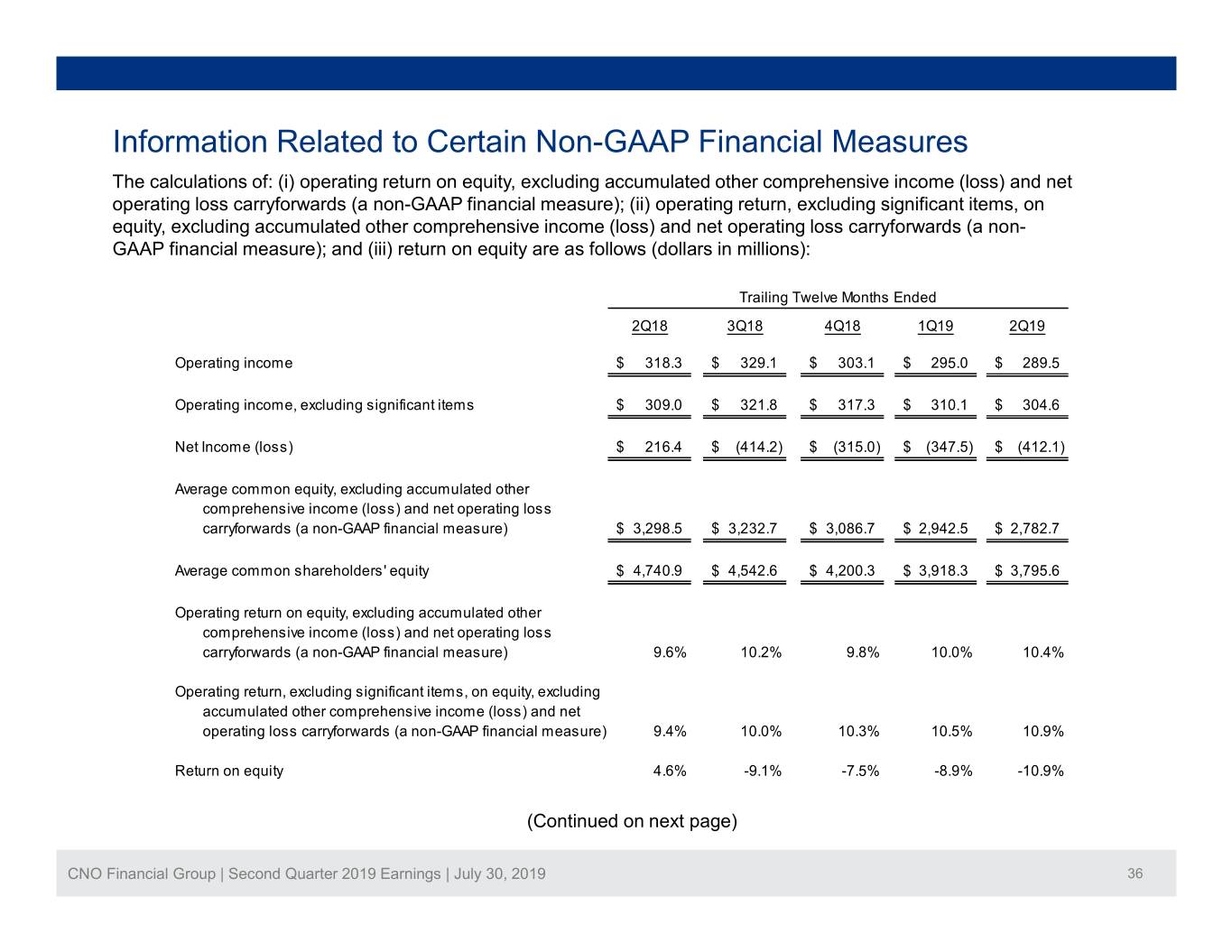

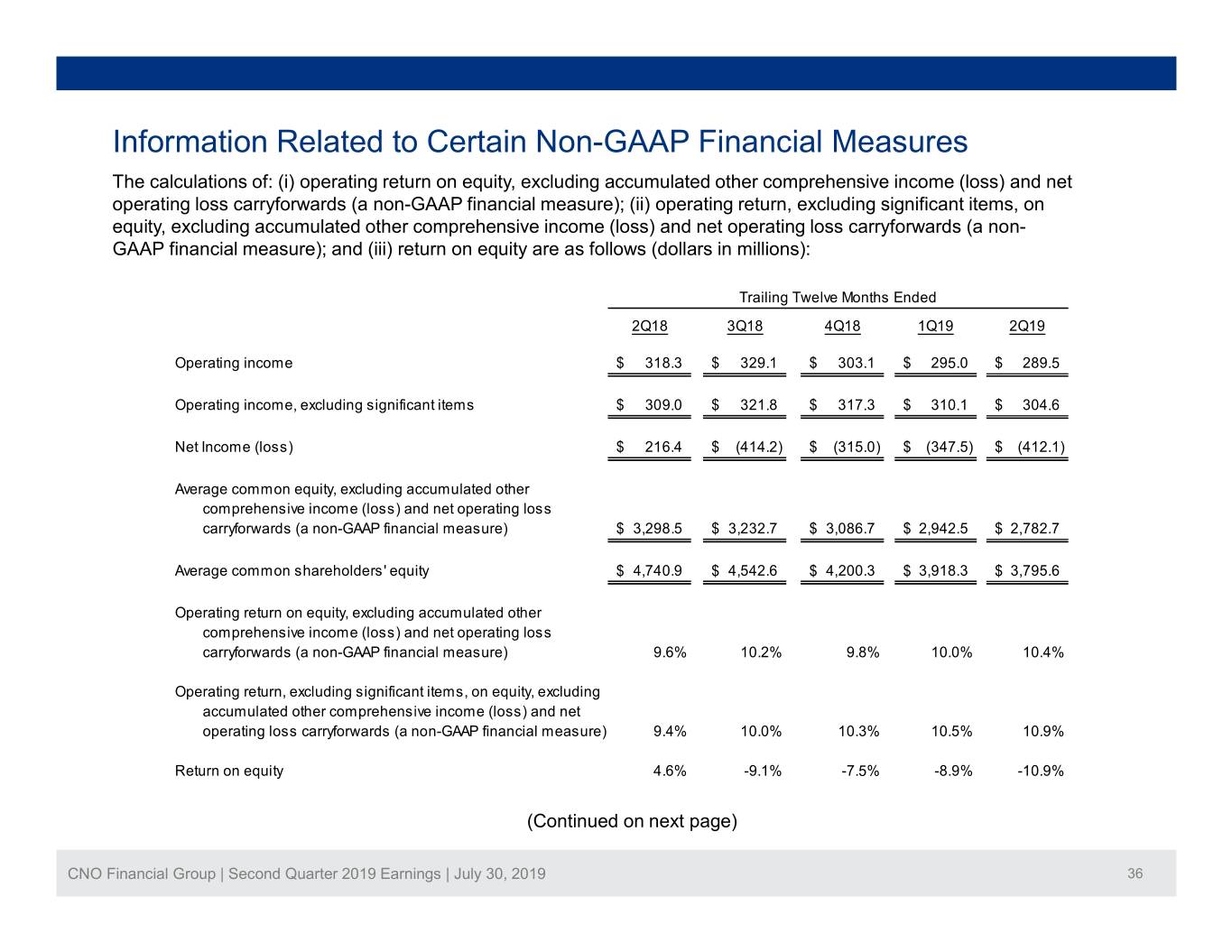

Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales and impairments, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, loss on reinsurance transaction, changes in the valuation allowance for deferred tax assets and other tax items, loss on extinguishment of debt and other non- operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation. CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 35

Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure); and (iii) return on equity are as follows (dollars in millions): Trailing Twelve Months Ended 2Q18 3Q18 4Q18 1Q19 2Q19 Operating income$ 318.3 $ 329.1 $ 303.1 $ 295.0 $ 289.5 Operating income, excluding significant items$ 309.0 $ 321.8 $ 317.3 $ 310.1 $ 304.6 Net Income (loss)$ 216.4 $ (414.2) $ (315.0) $ (347.5) $ (412.1) Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,298.5 $ 3,232.7 $ 3,086.7 $ 2,942.5 $ 2,782.7 Average common shareholders' equity$ 4,740.9 $ 4,542.6 $ 4,200.3 $ 3,918.3 $ 3,795.6 Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 9.6% 10.2% 9.8% 10.0% 10.4% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 9.4% 10.0% 10.3% 10.5% 10.9% Return on equity 4.6% -9.1% -7.5% -8.9% -10.9% (Continued on next page) CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 36

Information Related to Certain Non-GAAP Financial Measures The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income(loss) (dollars in millions): Net Operating Net Operating Income, income, excluding Net excluding significant income (loss) - Net Operating Significant significant items - trailing Net trailing income items (a) items four quarters income (loss) four quarters 3Q17$ 76.7 $ (2.0) $ 74.7 $ 269.7 $ 100.8 $ 480.7 4Q17 85.8 (6.4) 79.4 288.3 (70.9) 175.6 1Q18 73.9 (0.9) 73.0 299.6 84.3 197.6 2Q18 81.9 - 81.9 309.0 102.2 216.4 3Q18 87.5 - 87.5 321.8 (529.8) (414.2) 4Q18 59.8 15.1 74.9 317.3 28.3 (315.0) 1Q19 65.8 - 65.8 310.1 51.8 (347.5) 2Q19 76.4 - 76.4 304.6 37.6 (412.1) (a) The significant items have been discussed in prior press releases. (Continued on next page) CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 37

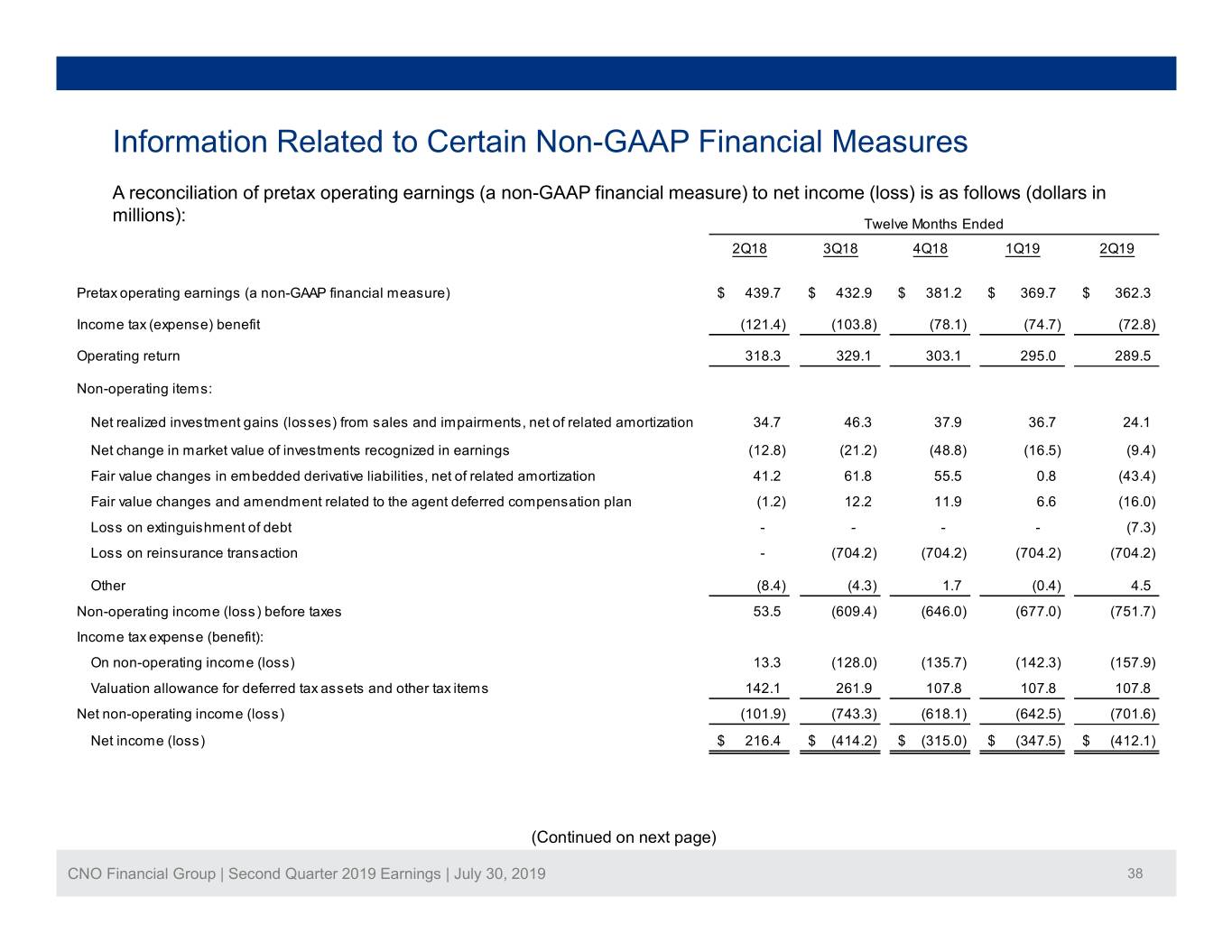

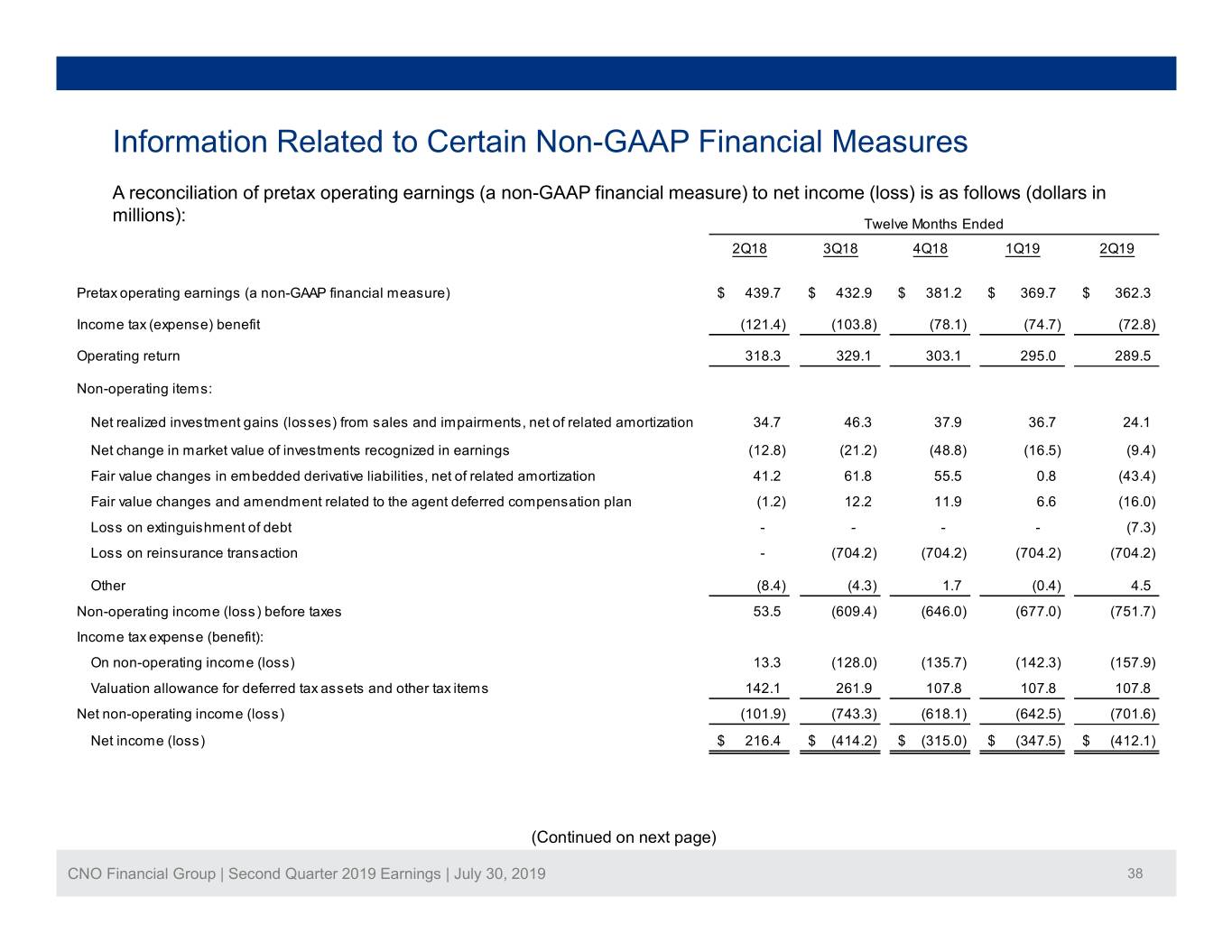

Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to net income (loss) is as follows (dollars in millions): Twelve Months Ended 2Q18 3Q18 4Q18 1Q19 2Q19 Pretax operating earnings (a non-GAAP financial measure)$ 439.7 $ 432.9 $ 381.2 $ 369.7 $ 362.3 Income tax (expense) benefit (121.4) (103.8) (78.1) (74.7) (72.8) Operating return 318.3 329.1 303.1 295.0 289.5 Non-operating items: Net realized investment gains (losses) from sales and impairments, net of related amortization 34.7 46.3 37.9 36.7 24.1 Net change in market value of investments recognized in earnings (12.8) (21.2) (48.8) (16.5) (9.4) Fair value changes in embedded derivative liabilities, net of related amortization 41.2 61.8 55.5 0.8 (43.4) Fair value changes and amendment related to the agent deferred compensation plan (1.2) 12.2 11.9 6.6 (16.0) Loss on extinguishment of debt - - - - (7.3) Loss on reinsurance transaction - (704.2) (704.2) (704.2) (704.2) Other (8.4) (4.3) 1.7 (0.4) 4.5 Non-operating income (loss) before taxes 53.5 (609.4) (646.0) (677.0) (751.7) Income tax expense (benefit): On non-operating income (loss) 13.3 (128.0) (135.7) (142.3) (157.9) Valuation allowance for deferred tax assets and other tax items 142.1 261.9 107.8 107.8 107.8 Net non-operating income (loss) (101.9) (743.3) (618.1) (642.5) (701.6) Net income (loss)$ 216.4 $ (414.2) $ (315.0) $ (347.5) $ (412.1) (Continued on next page) CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 38

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 1Q17 2Q17 3Q17 4Q17 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,236.6 $ 3,263.2 $ 3,335.0 $ 3,225.6 Net operating loss carryforwards 640.6 621.6 613.1 409.8 Accumulated other comprehensive income 729.6 894.5 933.6 1,212.1 Common shareholders' equity$ 4,606.8 $ 4,779.3 $ 4,881.7 $ 4,847.5 1Q18 2Q18 3Q18 4Q18 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,318.7 $ 3,366.0 $ 2,705.8 $ 2,687.3 Net operating loss carryforwards 404.2 388.7 510.6 505.9 Accumulated other comprehensive income 894.3 700.2 403.5 177.7 Common shareholders' equity$ 4,617.2 $ 4,454.9 $ 3,619.9 $ 3,370.9 1Q19 2Q19 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 2,703.4 $ 2,702.9 Net operating loss carryforwards 479.6 451.1 Accumulated other comprehensive income 654.9 1,098.2 Common shareholders' equity$ 3,837.9 $ 4,252.2 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 39

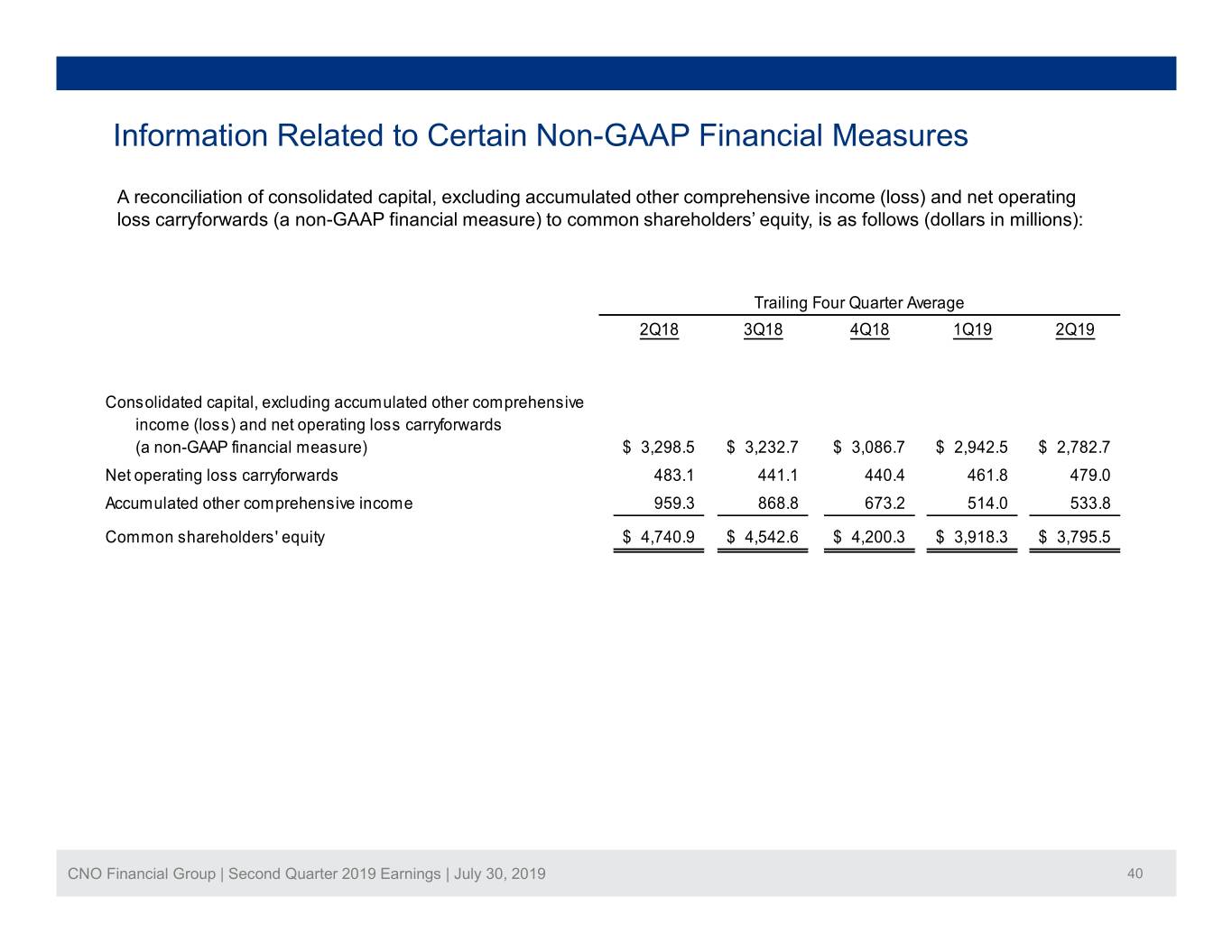

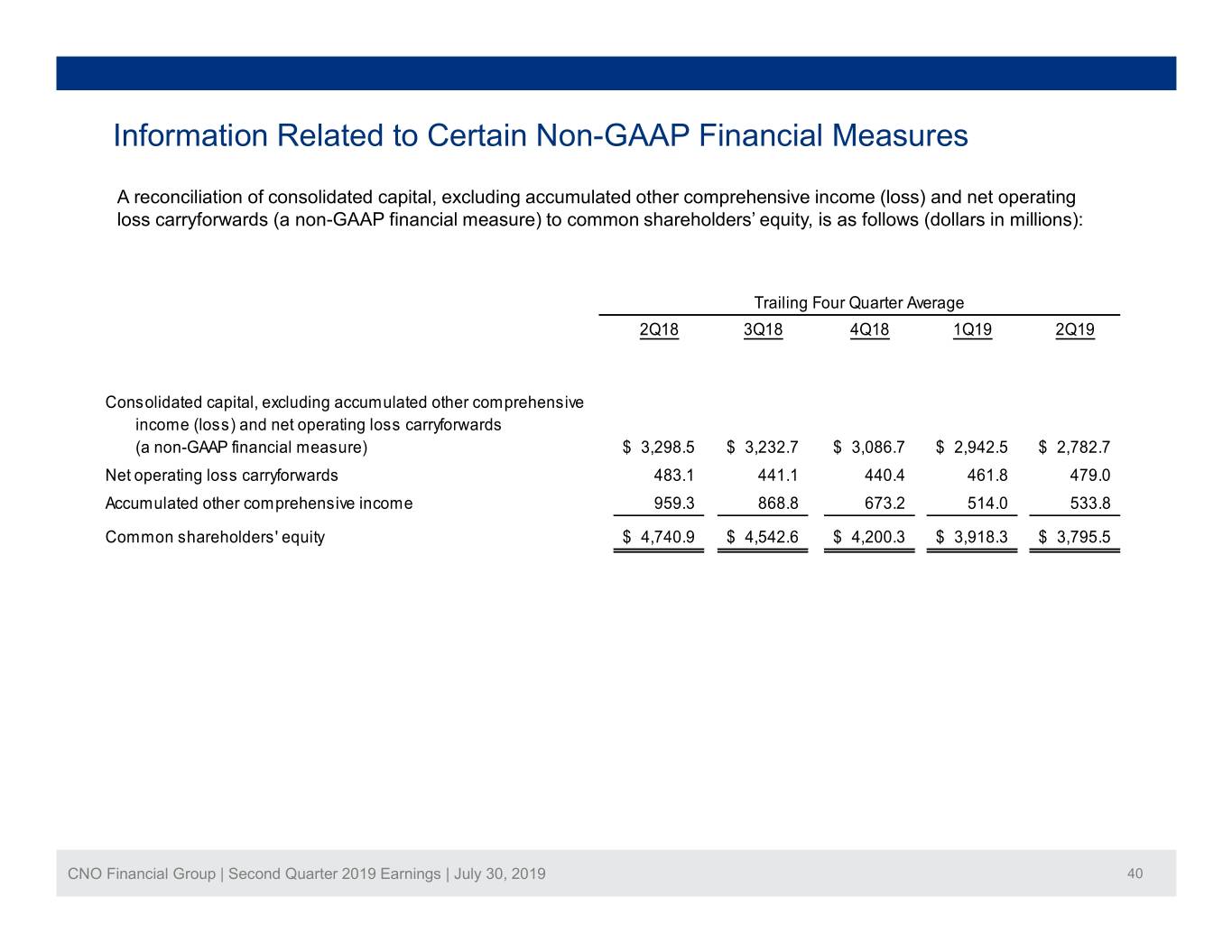

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): Trailing Four Quarter Average 2Q18 3Q18 4Q18 1Q19 2Q19 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure)$ 3,298.5 $ 3,232.7 $ 3,086.7 $ 2,942.5 $ 2,782.7 Net operating loss carryforwards 483.1 441.1 440.4 461.8 479.0 Accumulated other comprehensive income 959.3 868.8 673.2 514.0 533.8 Common shareholders' equity$ 4,740.9 $ 4,542.6 $ 4,200.3 $ 3,918.3 $ 3,795.5 CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 40

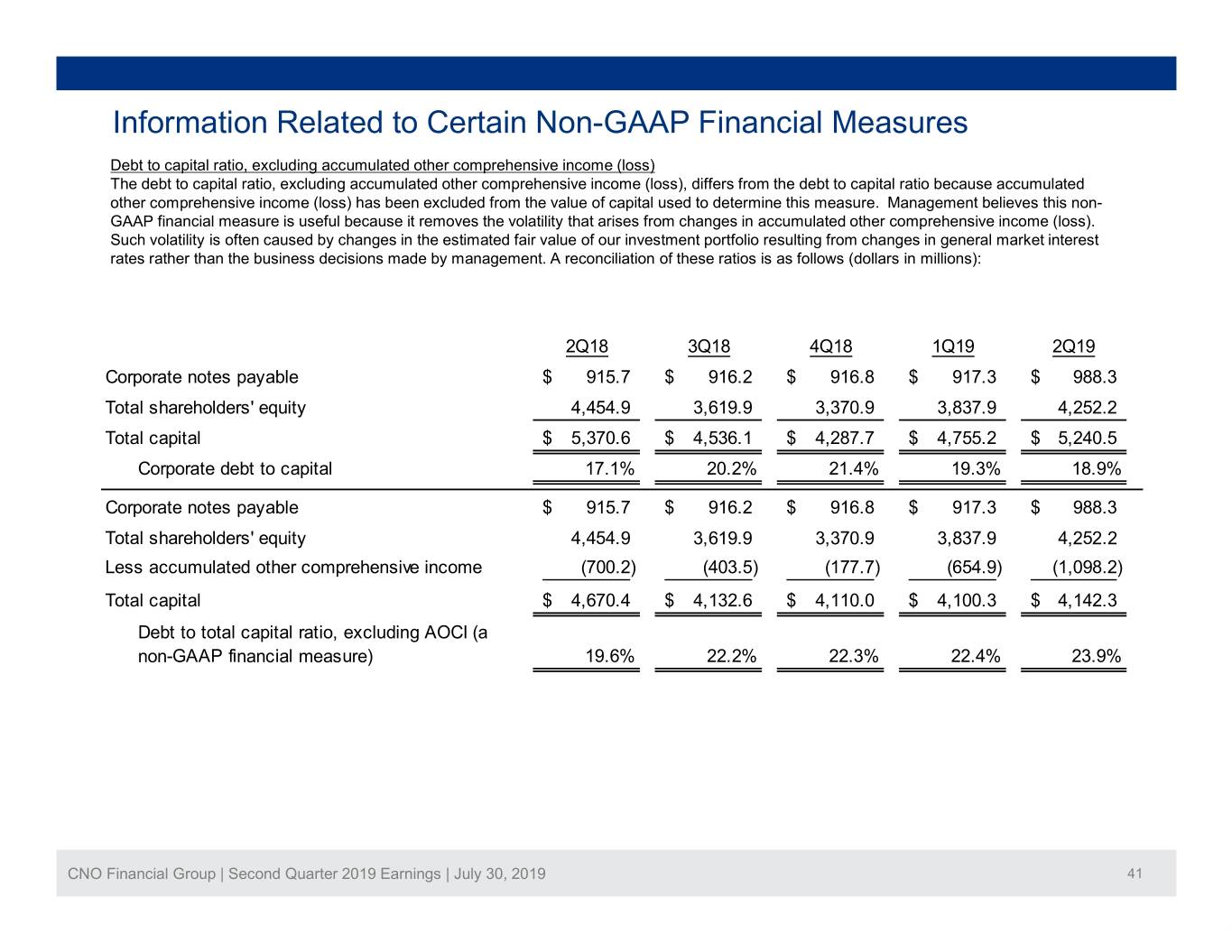

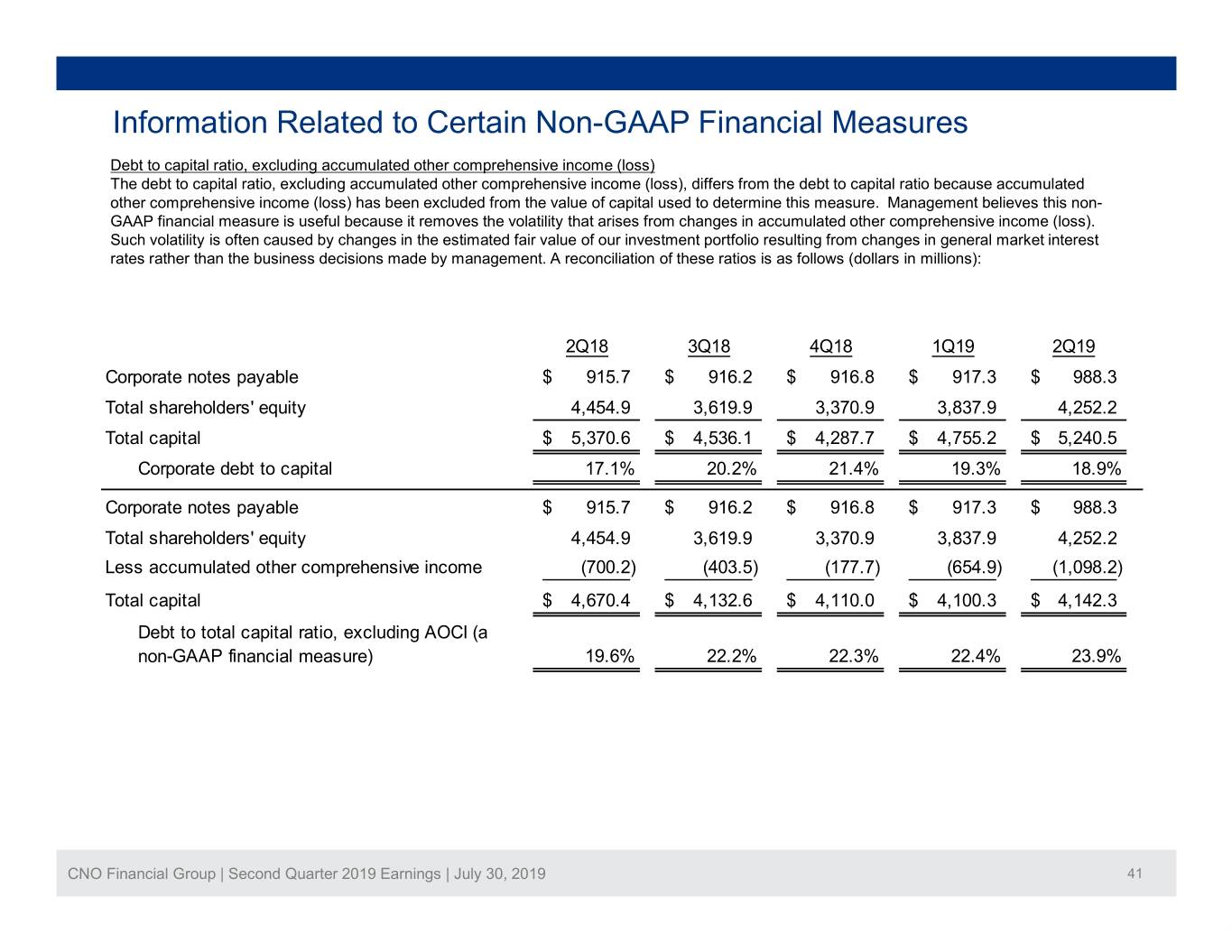

Information Related to Certain Non-GAAP Financial Measures Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non- GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows (dollars in millions): 2Q18 3Q18 4Q18 1Q19 2Q19 Corporate notes payable$ 915.7 $ 916.2 $ 916.8 $ 917.3 $ 988.3 Total shareholders' equity 4,454.9 3,619.9 3,370.9 3,837.9 4,252.2 Total capital$ 5,370.6 $ 4,536.1 $ 4,287.7 $ 4,755.2 $ 5,240.5 Corporate debt to capital 17.1% 20.2% 21.4% 19.3% 18.9% Corporate notes payable$ 915.7 $ 916.2 $ 916.8 $ 917.3 $ 988.3 Total shareholders' equity 4,454.9 3,619.9 3,370.9 3,837.9 4,252.2 Less accumulated other comprehensive income (700.2) (403.5) (177.7) (654.9) (1,098.2) Total capital $ 4,670.4 $ 4,132.6 $ 4,110.0 $ 4,100.3 $ 4,142.3 Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 19.6% 22.2% 22.3% 22.4% 23.9% CNO Financial Group | Second Quarter 2019 Earnings | July 30, 2019 41