Financial and operating results for the period ended March 31, 2021 April 28, 2021 Unless otherwise specified, comparisons in this presentation are between 1Q20 and 1Q21. Exhibit 99.3

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 2 Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on April 28, 2021, our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date. Forward-Looking Statements This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes the measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, CNOinc.com. Non-GAAP Measures

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 3

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 4 Strong earnings; sales metrics approaching or exceeding pre-pandemic levels • COVID demonstrated value of diversified model • Operating income per share1 up 2% excl. significant items • Insurance product margin up 10%; favorably impacted by deferral of care • Continued improvement in growth metrics; persistency consistent with pre-pandemic levels • Capital and liquidity remain strong • Book value per diluted share excl. AOCI1 up 13% • Returned $116 million to shareholders • $100 million in share repurchases • Completed acquisition of DirectPath • A.M. Best outlook revised to Positive from Stable 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure.

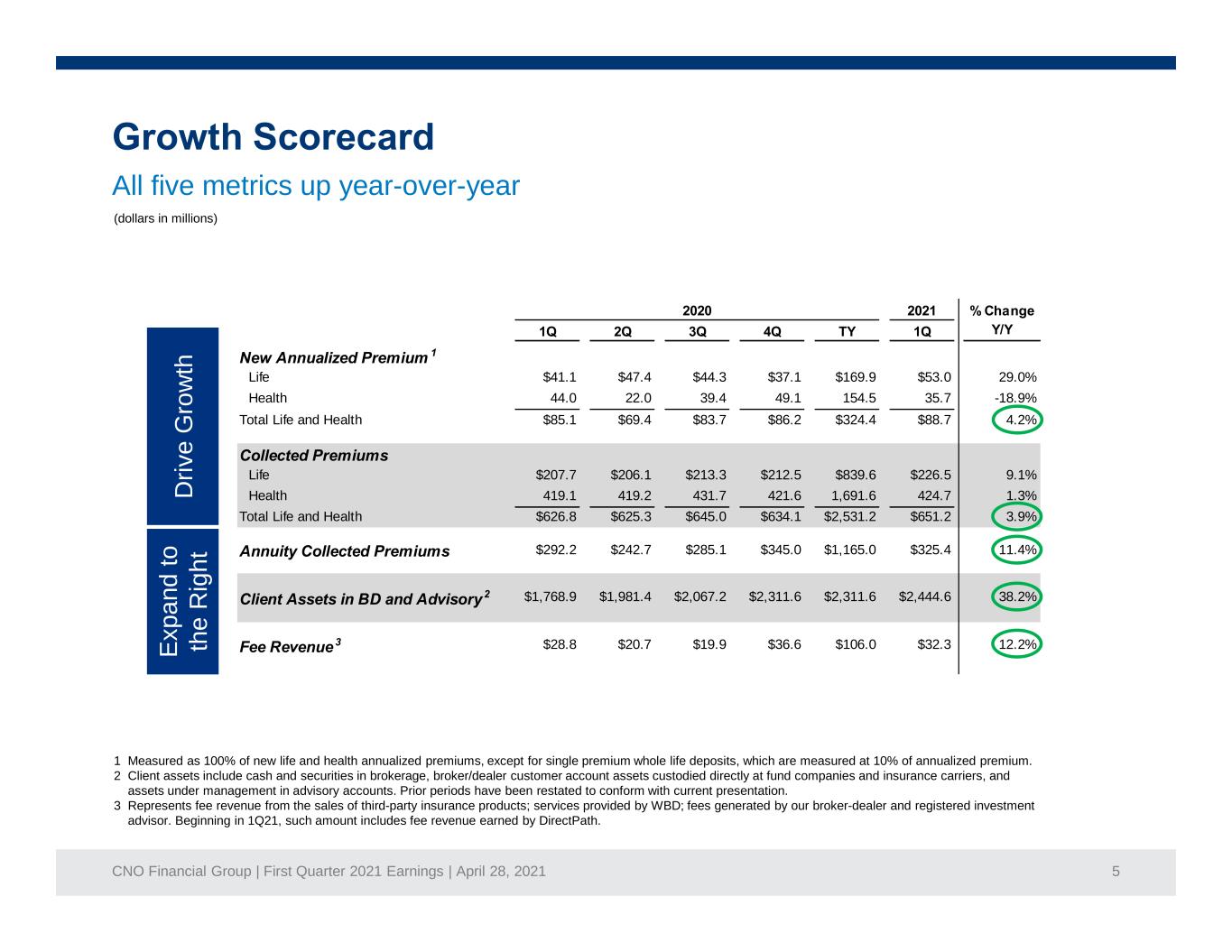

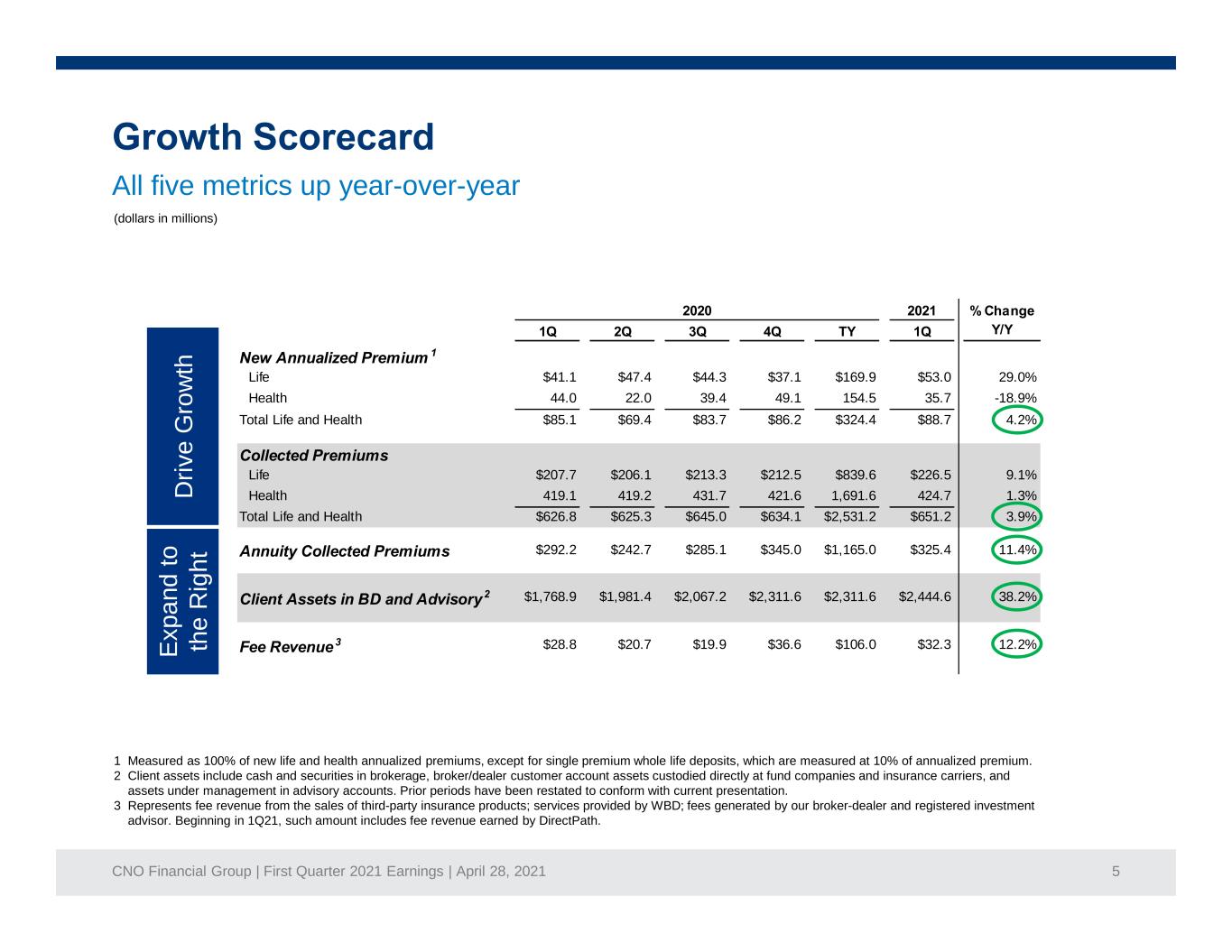

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 5 New Annualized Premium 1 Life $41.1 $47.4 $44.3 $37.1 $169.9 $53.0 29.0% Health 44.0 22.0 39.4 49.1 154.5 35.7 -18.9% Total Life and Health $85.1 $69.4 $83.7 $86.2 $324.4 $88.7 4.2% Collected Premiums Life $207.7 $206.1 $213.3 $212.5 $839.6 $226.5 9.1% Health 419.1 419.2 431.7 421.6 1,691.6 424.7 1.3% Total Life and Health $626.8 $625.3 $645.0 $634.1 $2,531.2 $651.2 3.9% Annuity Collected Premiums $292.2 $242.7 $285.1 $345.0 $1,165.0 $325.4 11.4% Client Assets in BD and Advisory2 $1,768.9 $1,981.4 $2,067.2 $2,311.6 $2,311.6 $2,444.6 38.2% Fee Revenue3 $28.8 $20.7 $19.9 $36.6 $106.0 $32.3 12.2%E xp a n d t o th e R ig h t D ri ve G ro w th 1 Measured as 100% of new life and health annualized premiums, except for single premium whole life deposits, which are measured at 10% of annualized premium. 2 Client assets include cash and securities in brokerage, broker/dealer customer account assets custodied directly at fund companies and insurance carriers, and assets under management in advisory accounts. Prior periods have been restated to conform with current presentation. 3 Represents fee revenue from the sales of third-party insurance products; services provided by WBD; fees generated by our broker-dealer and registered investment advisor. Beginning in 1Q21, such amount includes fee revenue earned by DirectPath. (dollars in millions) All five metrics up year-over-year

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 6 Transformation driving record Life sales and improved productivity Maintain growth momentum Optimize distribution Expand reach • Life sales up record 34%, driven by D2C sales up 38% and exclusive field agent Life sales up 29% • Annuity collected premiums up 11% • Exclusive agent force stable • Cross-channel collaboration driving productivity • Registered Agent1 count up 6% • Approximately 50% of Life and Health NAP sold virtually • Steady growth in client assets in brokerage and advisory 1 Registered agents are dually licensed as insurance agents and financial representatives who can buy and sell securities for clients, and/or investment advisors who can provide ongoing investment advice for clients.

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 7 Workplaces re-opening; momentum building Restore growth Evolve digital capabilities & tools Enhance portfolio • Continued sequential improvement in sales growth • Employer base stable • Steady premium collection • Solid veteran agent retention • Leveraging WBD technology to access new groups • Piloting online lead generation / B2B marketing • Combination of DirectPath and WBD offerings creates unique bundle; cross-sell pipeline growing • New monthly income protection group term life product available nationwide • Continued rollout of group critical illness product

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 8 Disciplined and opportunistic approach to maximize shareholder value Organic investments to sustain and grow the core businesses • Agent pilots, technology-driven customer experience enhancements • Hybrid distribution • Worksite B2B marketing, lead generation Return capital to shareholders • $100 million in share repurchases in 1Q21 • Continued capacity to repurchase shares Opportunistic transactions • Highly selective M&A • LTC reinsurance (2018), Web Benefits Design (2019), DirectPath (2021)

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 9 Significant progress • Performed GHG emissions inventory • Established GHG emissions reduction target • Earmarked $100 million for new impact investments • Advanced DE&I programs • Linked DE&I progress to executive compensation • Augmented associate benefits • Developed responsible investment policy • Enhanced policies that promote ethical and responsible business practices • Formed CNO Council on Sustainability

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 10 $0.59 Solid start to the year, emerging from pandemic Earnings ResultsFirst Quarter 2021 Net operating income1 $84.3 $75.2 Net income (loss) $(21.2) $147.4 Weighted average shares outstanding (in millions) 145.8 136.7 (dollars in millions, except where noted) Net operating earnings per share1 • Operating EPS1 of $0.55, down 5% from $0.58 in 1Q20 • $0.59 / up 2% excl. significant items • $0.13 / $22 million net favorable COVID impact • $0.08 lower variable net investment income • Operating ROE1, as adjusted, of 12.3%; 11.7% excl. significant items • $100 million in share repurchases • Weighted average share count reduced by 6% YoY • Consolidated RBC ratio of 407% • Holdco liquidity of $324 million • Statutory operating income estimated to be $40 million • Statutory capital and surplus of $1.8 billion 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Net income (loss) per share 1Q20 1Q21 Excluding significant items

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 11 $59.5 $72.3 $45.3 $52.0 $57.9 $44.3 $41.7 $47.3 $41.6 $27.1 $86.9 $95.5 $152.2 $125.2 $124.7 (dollars in millions) Ongoing favorable net COVID impact; stable underlying margins 2.47% 2.99% 1.86% 2.11% 2.33% Margin / average net insurance liabilities Margin / insurance policy income 20% 22% 36% 30% 30% ISL: Margin / average net insurance liabilities 0.67% 0.44% 0.30% 0.17% 0.80% ISL: Underwriting margin / insurance policy income 42% 42% 43% 36% 30% Trad: Margin / insurance policy income 17% 16% 18% 17% 8% Trad: Margin ex. Adv. Exp. / insurance policy income 30% 26% 27% 26% 21% Highlights1 • Total margin up $19 million, or 10% • Favorable COVID impact of $22 million • Annuity margin down $2 million, or 3% • Favorable COVID impact of $1 million • Health margin up $38 million, or 43% • Favorable COVID impact of $40 million from deferral of care • Medicare Supplement: $9 million • Supplemental health: $6 million • Long-term care: $25 million • Life margin down $17 million, or 39% • Unfavorable COVID mortality impact of $19 million • Underlying business performing as expected excluding COVID 1 Excludes $16.1 million favorable annuity unlocking/$4.3 million unfavorable life unlocking in 4Q20; $51.5 million favorable annuity unlocking/$5.6 million unfavorable life unlocking in 2Q20. See the Appendix for a reconciliation to the corresponding GAAP measure.

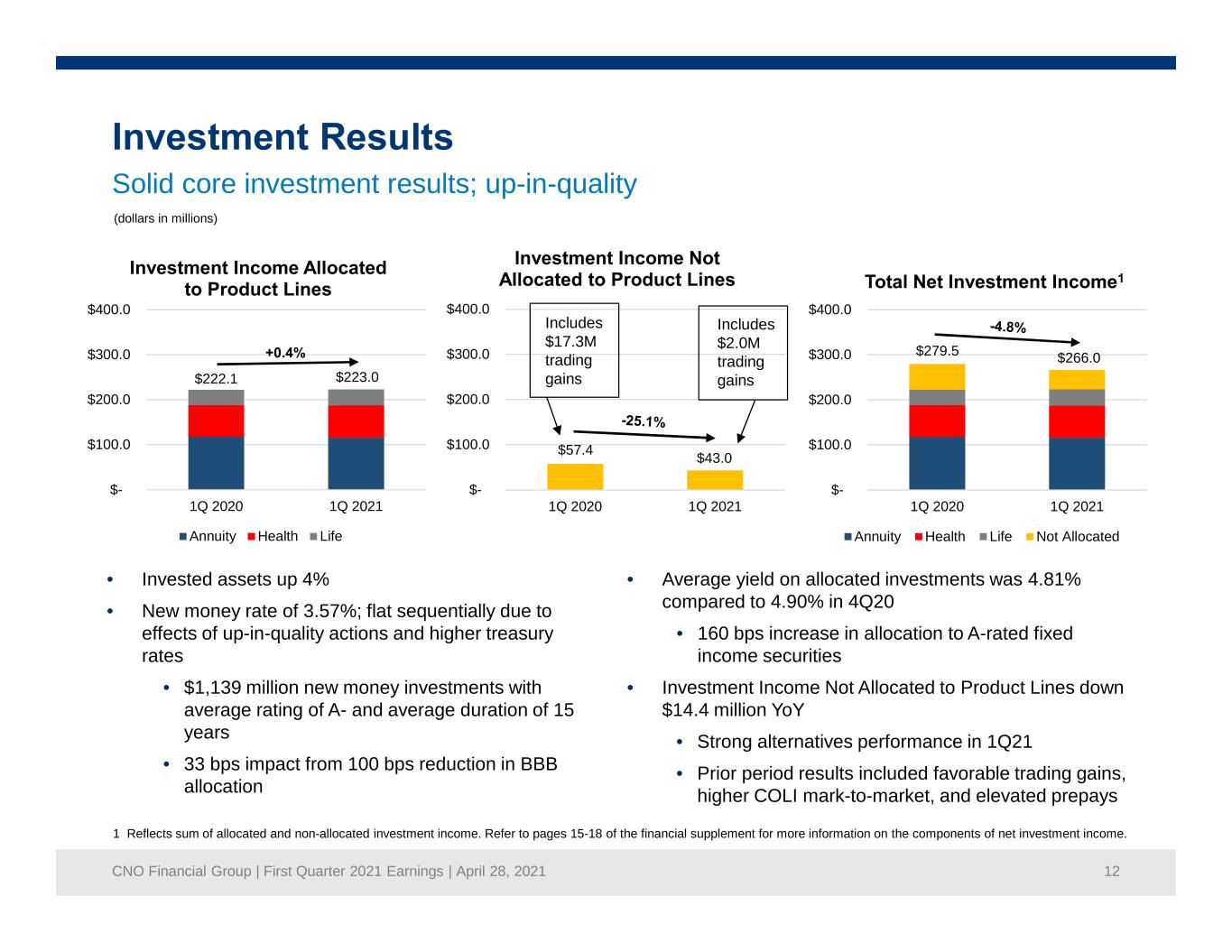

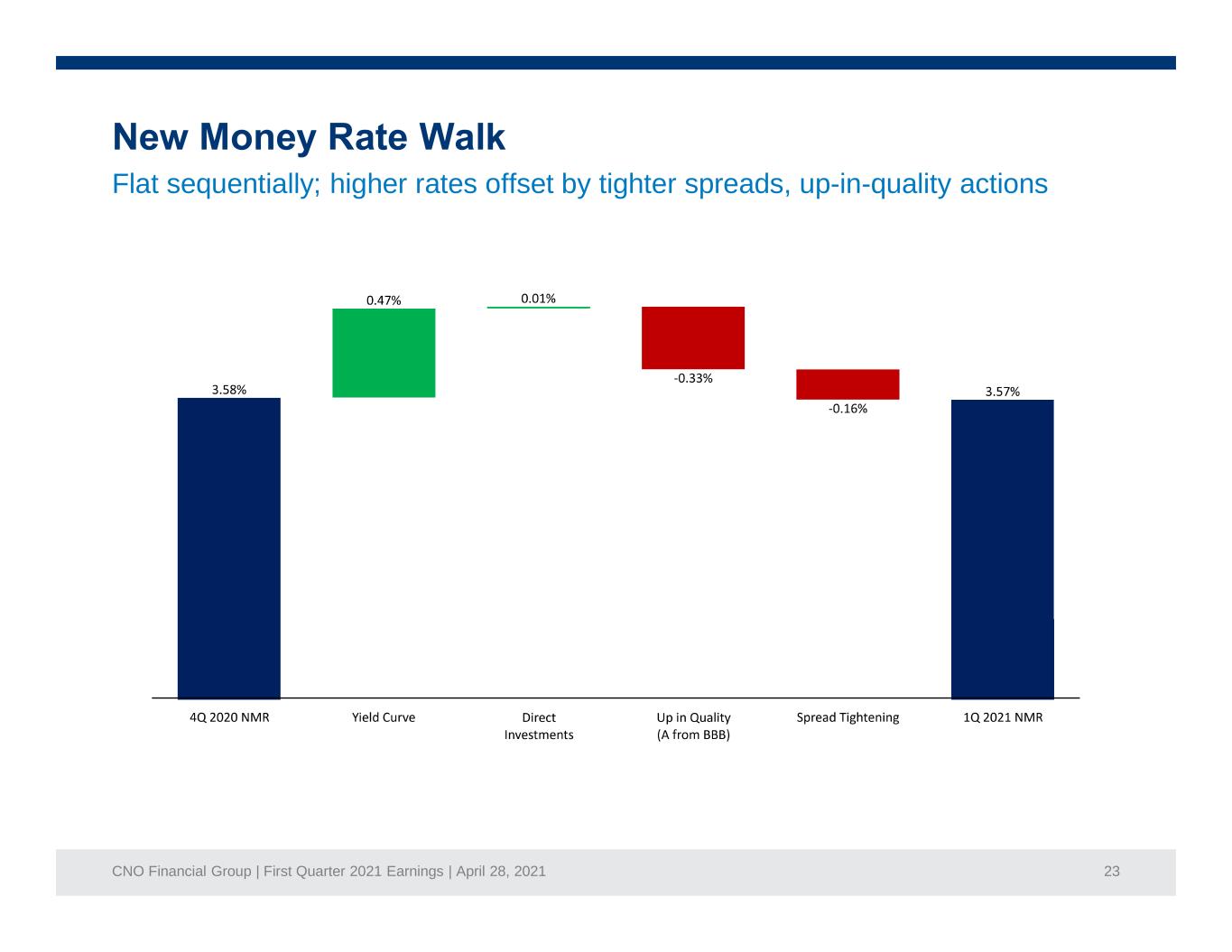

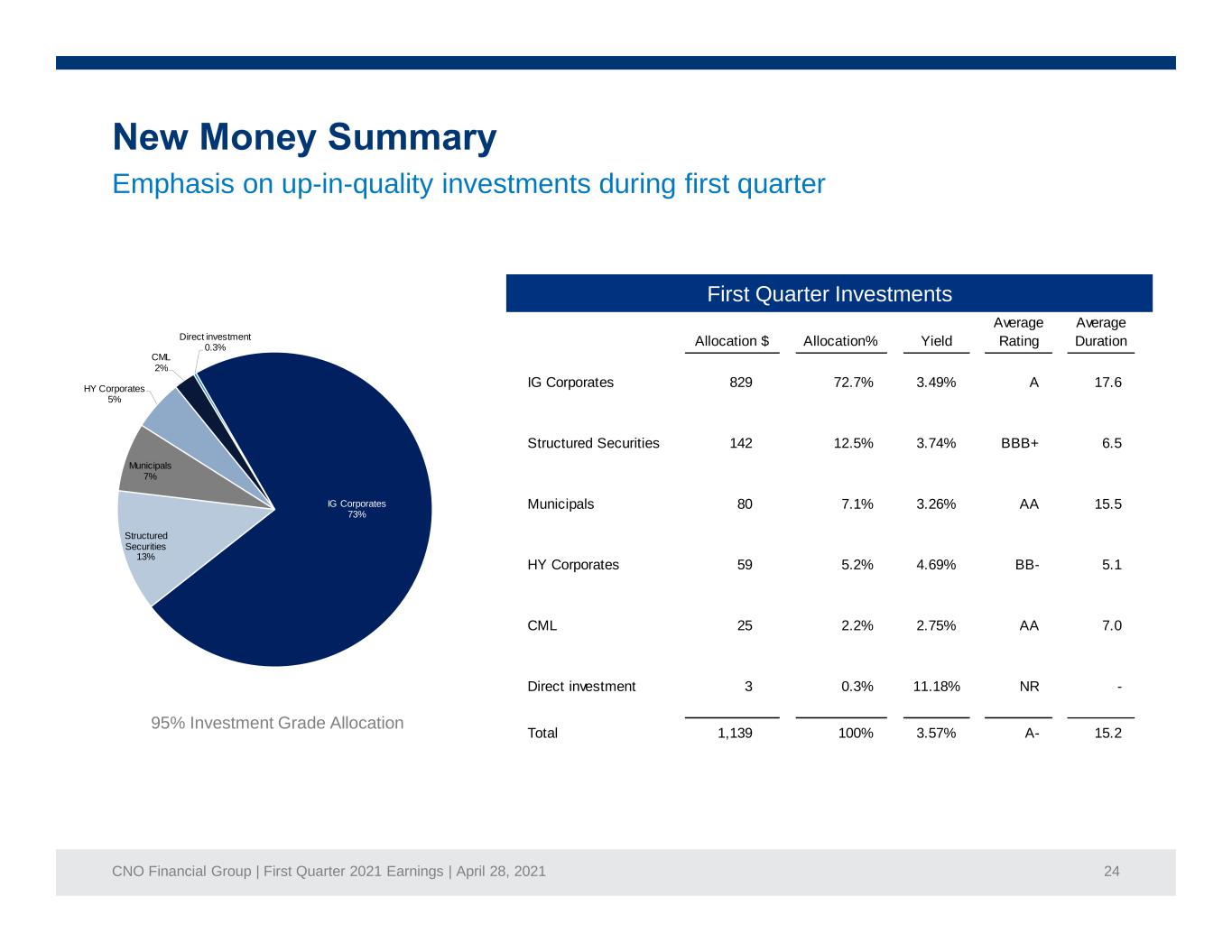

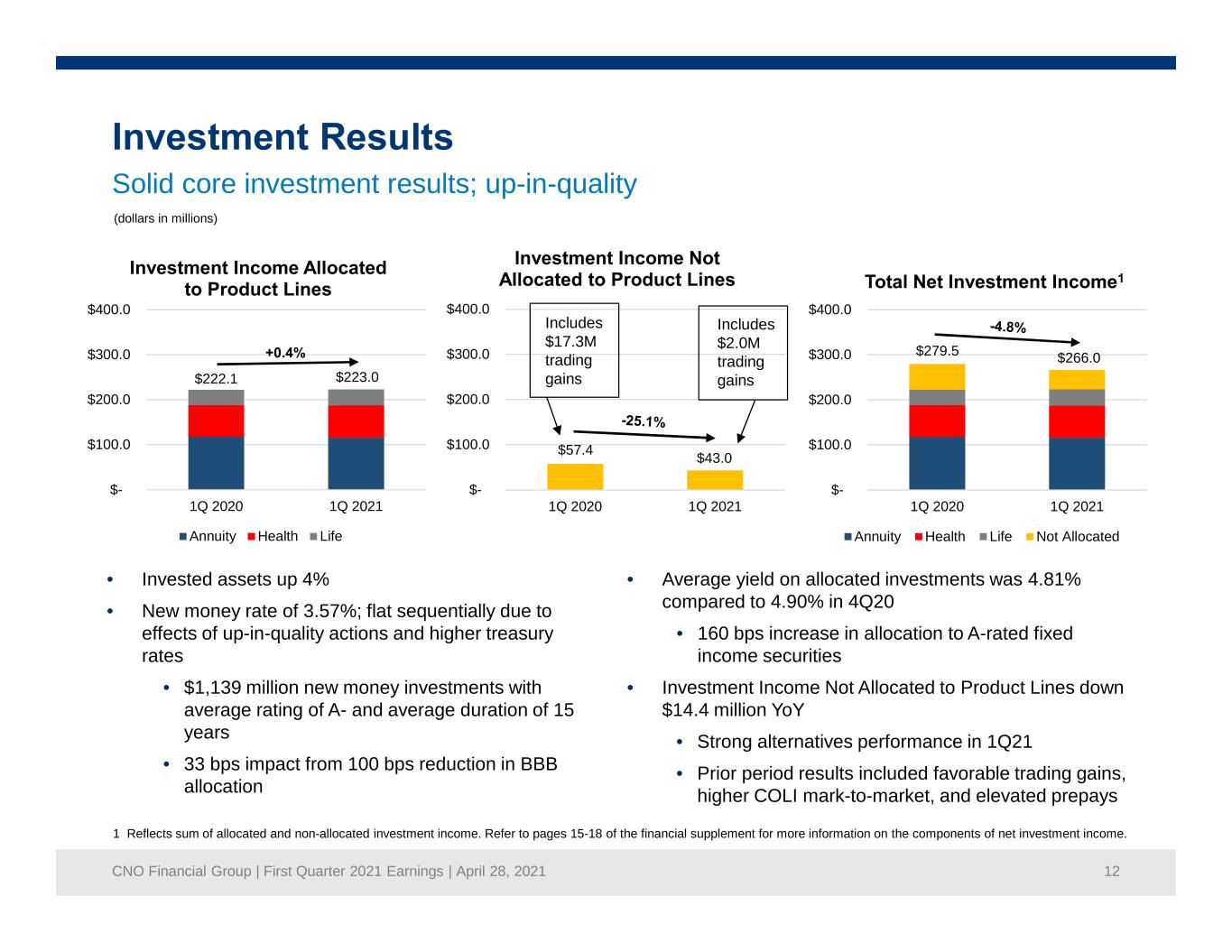

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 12 $- $100.0 $200.0 $300.0 $400.0 1Q 2020 1Q 2021 Includes $2.0M trading gains $- $100.0 $200.0 $300.0 $400.0 1Q 2020 1Q 2021 Annuity Health Life Not Allocated $- $100.0 $200.0 $300.0 $400.0 1Q 2020 1Q 2021 Annuity Health Life • Invested assets up 4% • New money rate of 3.57%; flat sequentially due to effects of up-in-quality actions and higher treasury rates • $1,139 million new money investments with average rating of A- and average duration of 15 years • 33 bps impact from 100 bps reduction in BBB allocation (dollars in millions) 1 Reflects sum of allocated and non-allocated investment income. Refer to pages 15-18 of the financial supplement for more information on the components of net investment income. Solid core investment results; up-in-quality $222.1 $223.0 $266.0 $279.5 $43.0 $57.4 • Average yield on allocated investments was 4.81% compared to 4.90% in 4Q20 • 160 bps increase in allocation to A-rated fixed income securities • Investment Income Not Allocated to Product Lines down $14.4 million YoY • Strong alternatives performance in 1Q21 • Prior period results included favorable trading gains, higher COLI mark-to-market, and elevated prepays Includes $17.3M trading gains

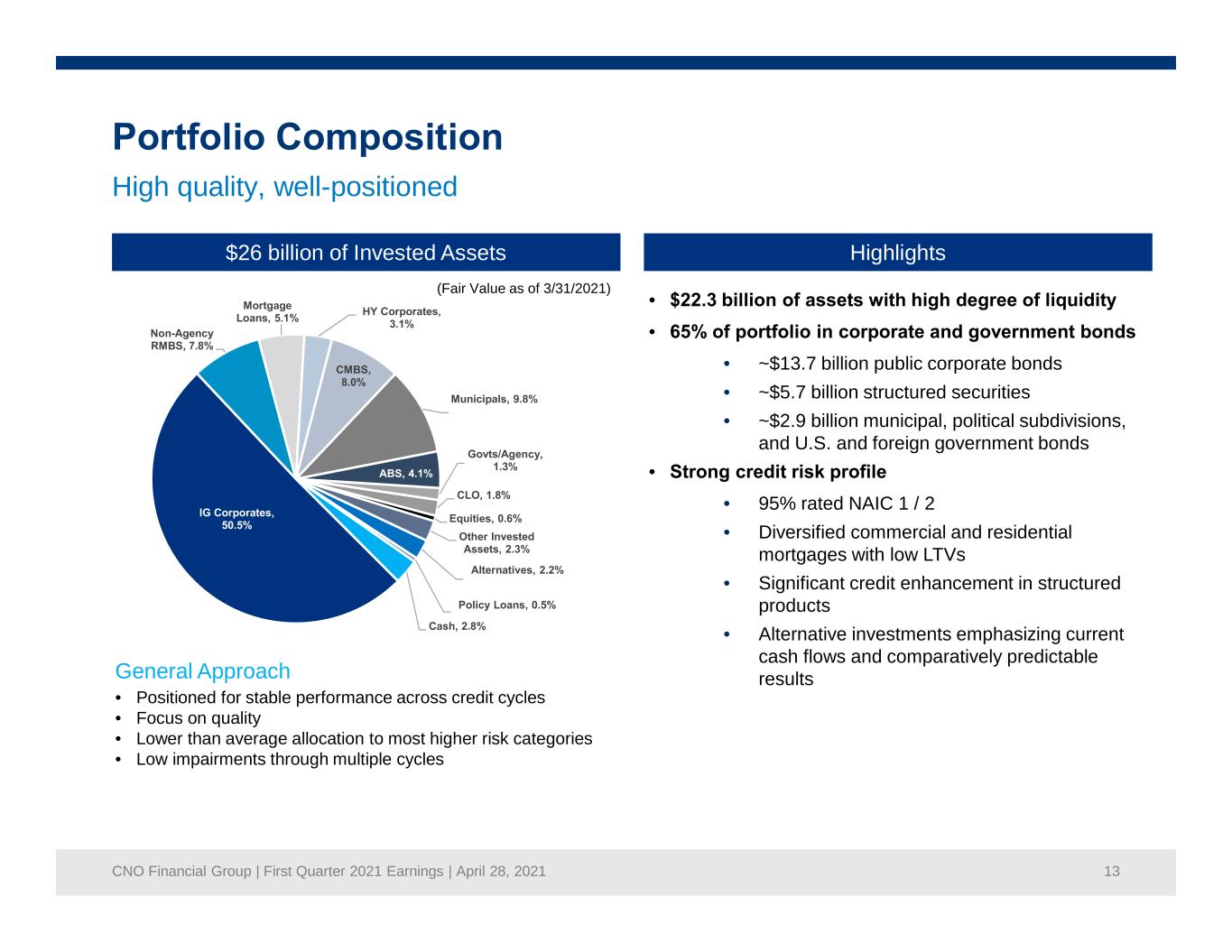

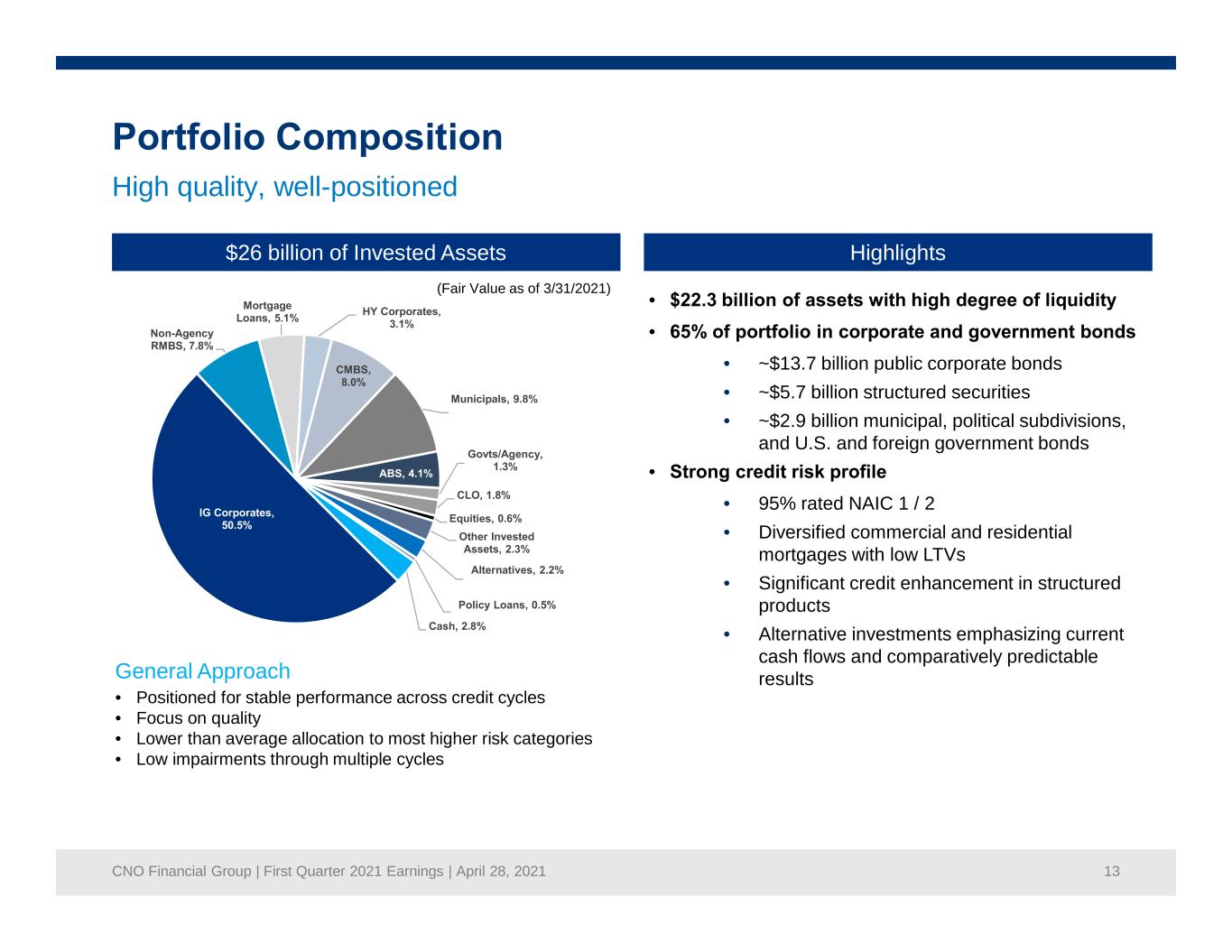

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 13 High quality, well-positioned $26 billion of Invested Assets Highlights (Fair Value as of 3/31/2021) General Approach • Positioned for stable performance across credit cycles • Focus on quality • Lower than average allocation to most higher risk categories • Low impairments through multiple cycles • • • ~$13.7 billion public corporate bonds • ~$5.7 billion structured securities • ~$2.9 billion municipal, political subdivisions, and U.S. and foreign government bonds • • 95% rated NAIC 1 / 2 • Diversified commercial and residential mortgages with low LTVs • Significant credit enhancement in structured products • Alternative investments emphasizing current cash flows and comparatively predictable results

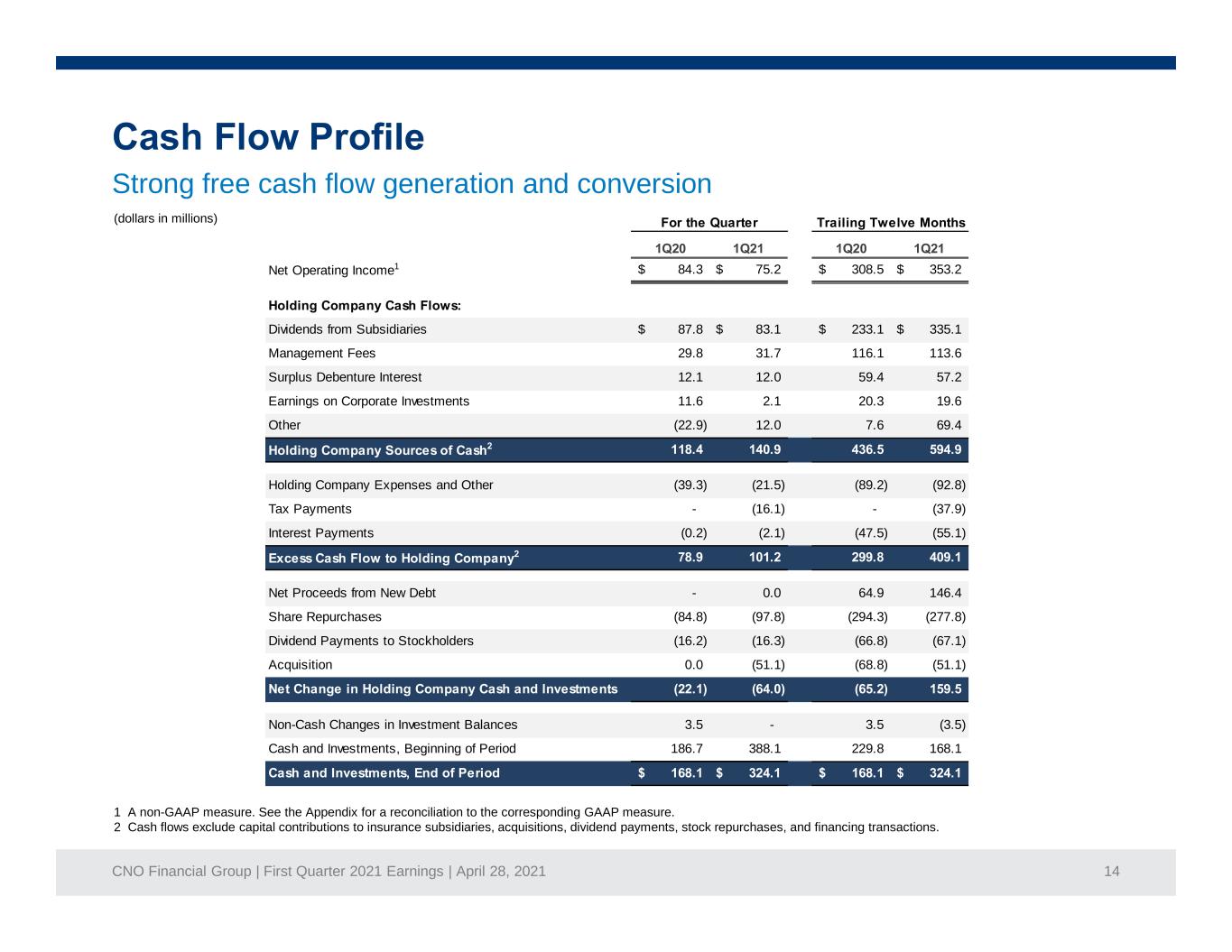

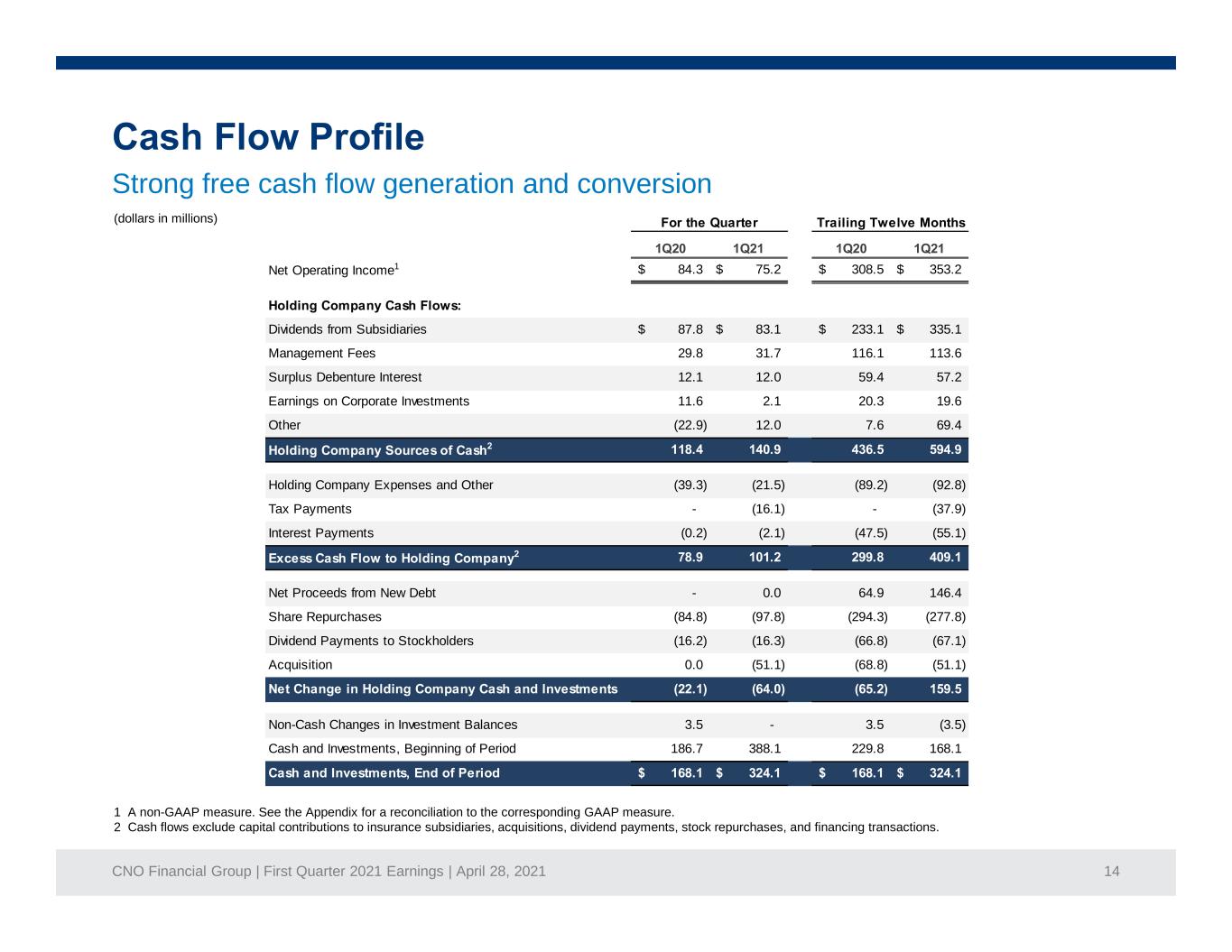

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 14 Strong free cash flow generation and conversion (dollars in millions) 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. 2 Cash flows exclude capital contributions to insurance subsidiaries, acquisitions, dividend payments, stock repurchases, and financing transactions. Net Operating Income1 84.3$ 75.2$ 308.5$ 353.2$ Dividends from Subsidiaries 87.8$ 83.1$ 233.1$ 335.1$ Management Fees 29.8 31.7 116.1 113.6 Surplus Debenture Interest 12.1 12.0 59.4 57.2 Earnings on Corporate Investments 11.6 2.1 20.3 19.6 Other (22.9) 12.0 7.6 69.4 Holding Company Expenses and Other (39.3) (21.5) (89.2) (92.8) Tax Payments - (16.1) - (37.9) Interest Payments (0.2) (2.1) (47.5) (55.1) Net Proceeds from New Debt - 0.0 64.9 146.4 Share Repurchases (84.8) (97.8) (294.3) (277.8) Dividend Payments to Stockholders (16.2) (16.3) (66.8) (67.1) Acquisition 0.0 (51.1) (68.8) (51.1) Non-Cash Changes in Investment Balances 3.5 - 3.5 (3.5) Cash and Investments, Beginning of Period 186.7 388.1 229.8 168.1

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 15 1 The ratio of the combined capital of the insurance companies to the minimum amount of capital appropriate to support the overall business operations, as determined based on the methodology developed by the National Association of Insurance Commissioners. 2 Excluding accumulated other comprehensive income (a non-GAAP measure). See the Appendix for a reconciliation to the corresponding GAAP measure. Target leverage of 25.0 – 28.0% Debt covenant ceiling of 35% Debt capacity within limit of target leverage $163 million Targeted consolidated RBC ratio of 375-400% Excess due to intentional conservative positioning RBC variability can be expected in periods of market volatility Minimum targeted holding company liquidity of $150 million Liquidity bolstered by $250 million undrawn revolver No outstanding debt maturities until 2025 Conservative approach to capital structure; strong liquidity (dollars in millions) 408% 411% 407% 2019 2020 1Q 2021 23.0% 25.6% 25.4% 2019 2020 1Q 2021 $186.7 $388.1 $324.1 2019 2020 1Q 2021

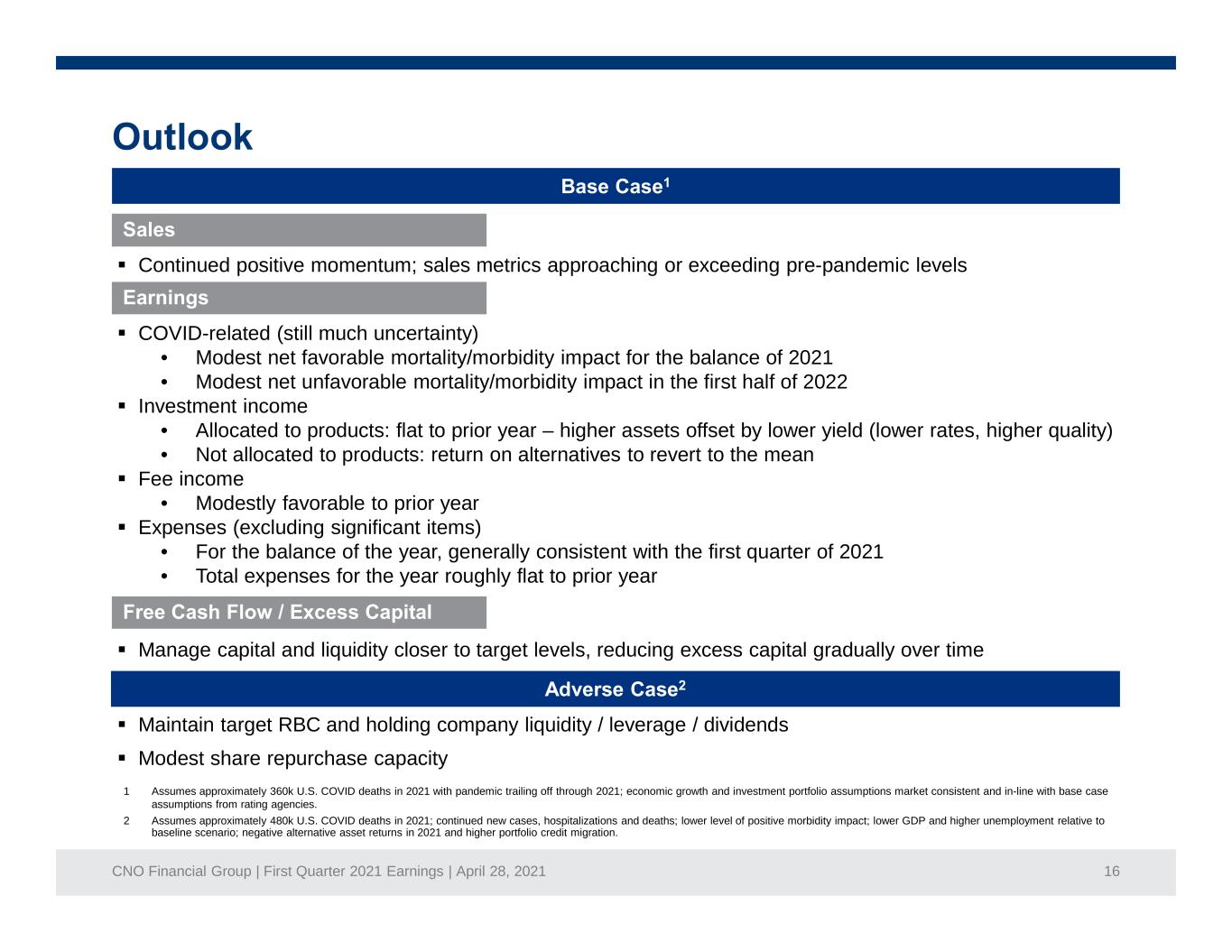

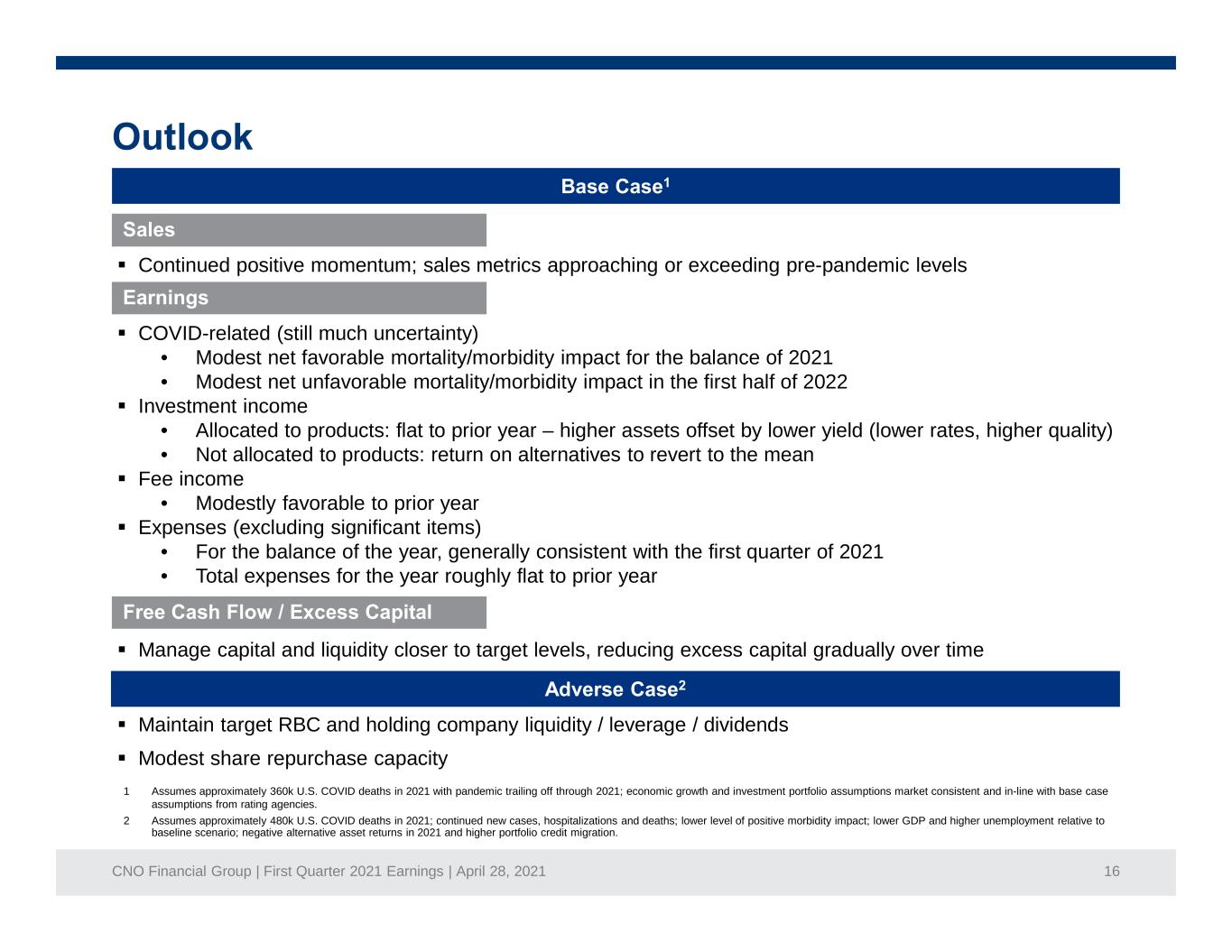

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 16 1 Assumes approximately 360k U.S. COVID deaths in 2021 with pandemic trailing off through 2021; economic growth and investment portfolio assumptions market consistent and in-line with base case assumptions from rating agencies. 2 Assumes approximately 480k U.S. COVID deaths in 2021; continued new cases, hospitalizations and deaths; lower level of positive morbidity impact; lower GDP and higher unemployment relative to baseline scenario; negative alternative asset returns in 2021 and higher portfolio credit migration. Continued positive momentum; sales metrics approaching or exceeding pre-pandemic levels Maintain target RBC and holding company liquidity / leverage / dividends Modest share repurchase capacity Manage capital and liquidity closer to target levels, reducing excess capital gradually over time COVID-related (still much uncertainty) • Modest net favorable mortality/morbidity impact for the balance of 2021 • Modest net unfavorable mortality/morbidity impact in the first half of 2022 Investment income • Allocated to products: flat to prior year – higher assets offset by lower yield (lower rates, higher quality) • Not allocated to products: return on alternatives to revert to the mean Fee income • Modestly favorable to prior year Expenses (excluding significant items) • For the balance of the year, generally consistent with the first quarter of 2021 • Total expenses for the year roughly flat to prior year

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 17 • Reinsured life block (2009) • Recapitalized company (2012) • Initiated dividend (2012) • Sold Legacy Life Insurance Block (2014) • Migrated ratings upwards–within non-investment grade ratings classes • Completed Senior Leadership additions • Reinsured LTC block • Achieved investment grade credit ratings • Up-in-quality portfolio repositioning • Sustainable momentum in recruiting and sales • Benefiting from diverse business model and strong retention • Balancing capital return with investments in growth • Conservative capital structure • Up-in-quality investment positioning • Successfully pivoting to new sales approaches • Accelerating integration of D2C and exclusive agents • Expanding D2C offerings • Reimagining future workplace • Optimize customer-centric business alignment • Expand omnichannel delivery model • Extract potential from Worksite business • Enhance growth, margin and ROE profile • Maximize distributable cash flow • Accelerate pace of capital deployment • Leverage technology Pivoting to post COVID strategic priorities

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 18 Well-positioned in underserved senior middle-income market Highly differentiated business model Favorable demographic tailwinds Sustainable growth initiatives in place Strong balance sheet; robust free cash flow generation

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 19

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 20 • Broker-Dealer/Registered Investment Advisor Slide 21 • Exclusive Agent Counts Slide 22 • New Money Rate Walk Slide 23 • New Money Summary Slide 24 • Investment Overview Slides 25-27 • Long-Term Care Insurance Slide 28 • Tax Asset Summary Slide 29

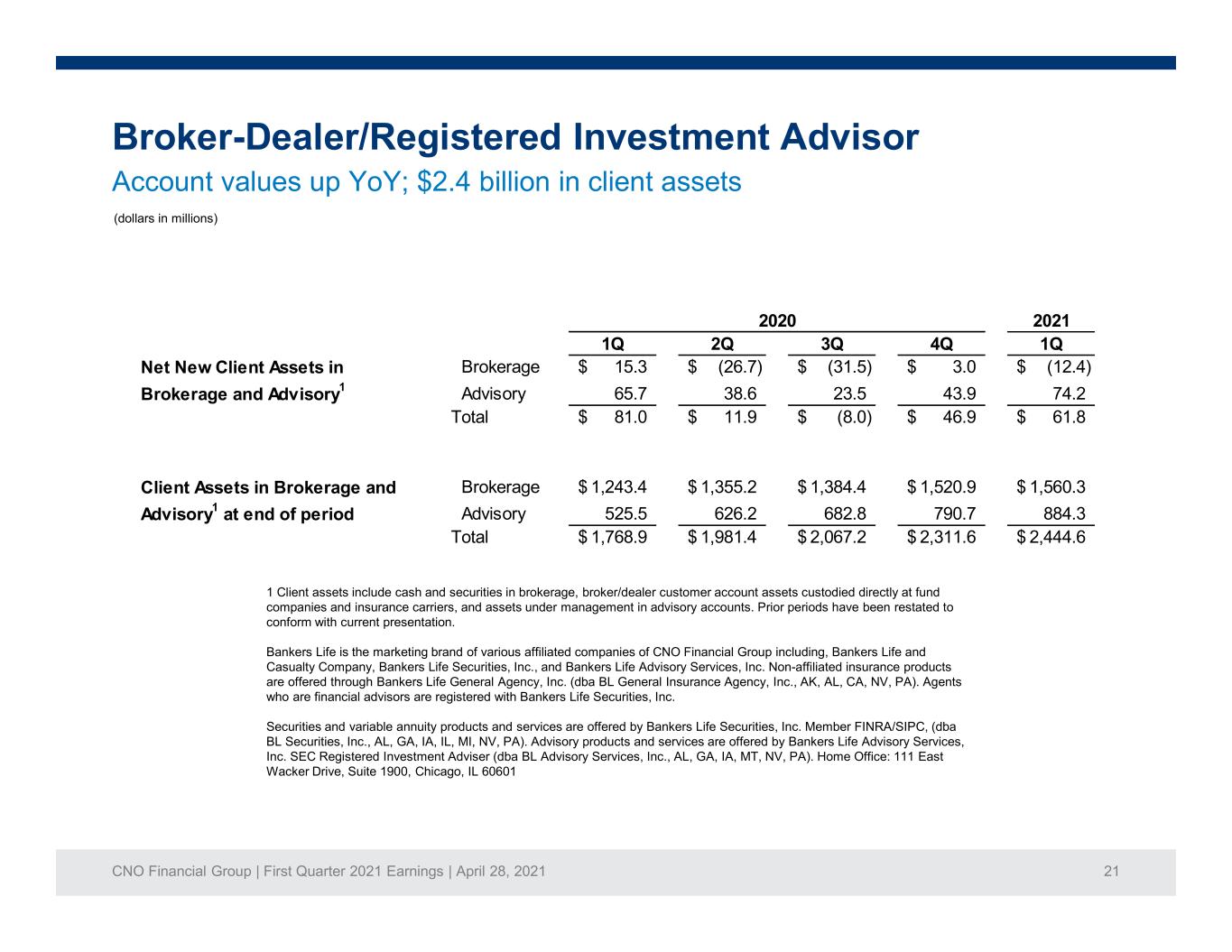

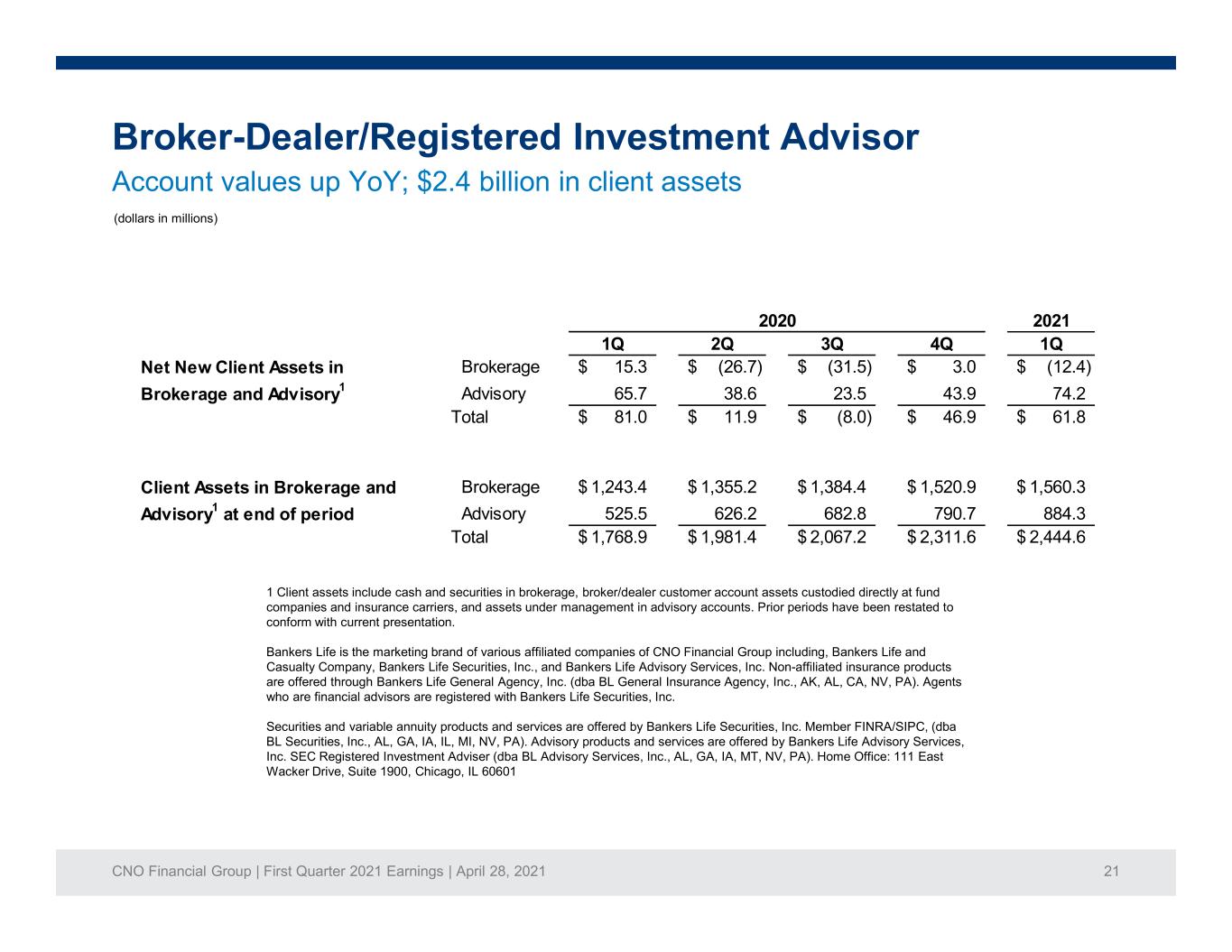

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 21 1 Client assets include cash and securities in brokerage, broker/dealer customer account assets custodied directly at fund companies and insurance carriers, and assets under management in advisory accounts. Prior periods have been restated to conform with current presentation. Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life General Agency, Inc. (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA). Agents who are financial advisors are registered with Bankers Life Securities, Inc. Securities and variable annuity products and services are offered by Bankers Life Securities, Inc. Member FINRA/SIPC, (dba BL Securities, Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services are offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA). Home Office: 111 East Wacker Drive, Suite 1900, Chicago, IL 60601 (dollars in millions) Account values up YoY; $2.4 billion in client assets Brokerage 15.3$ (26.7)$ (31.5)$ 3.0$ (12.4)$ Advisory 65.7 38.6 23.5 43.9 74.2 Total 81.0$ 11.9$ (8.0)$ 46.9$ 61.8$ Brokerage 1,243.4$ 1,355.2$ 1,384.4$ 1,520.9$ 1,560.3$ Advisory 525.5 626.2 682.8 790.7 884.3 Total 1,768.9$ 1,981.4$ 2,067.2$ 2,311.6$ 2,444.6$

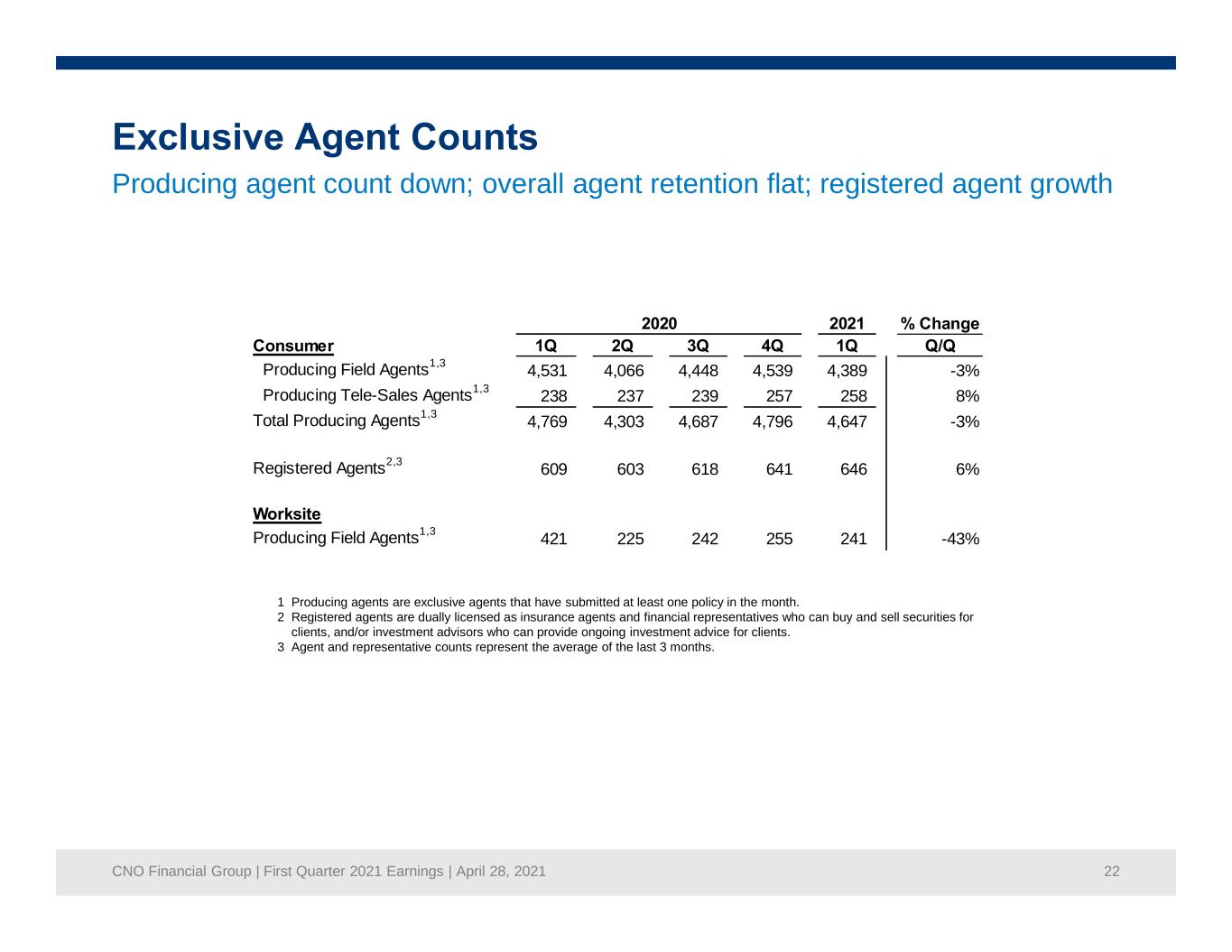

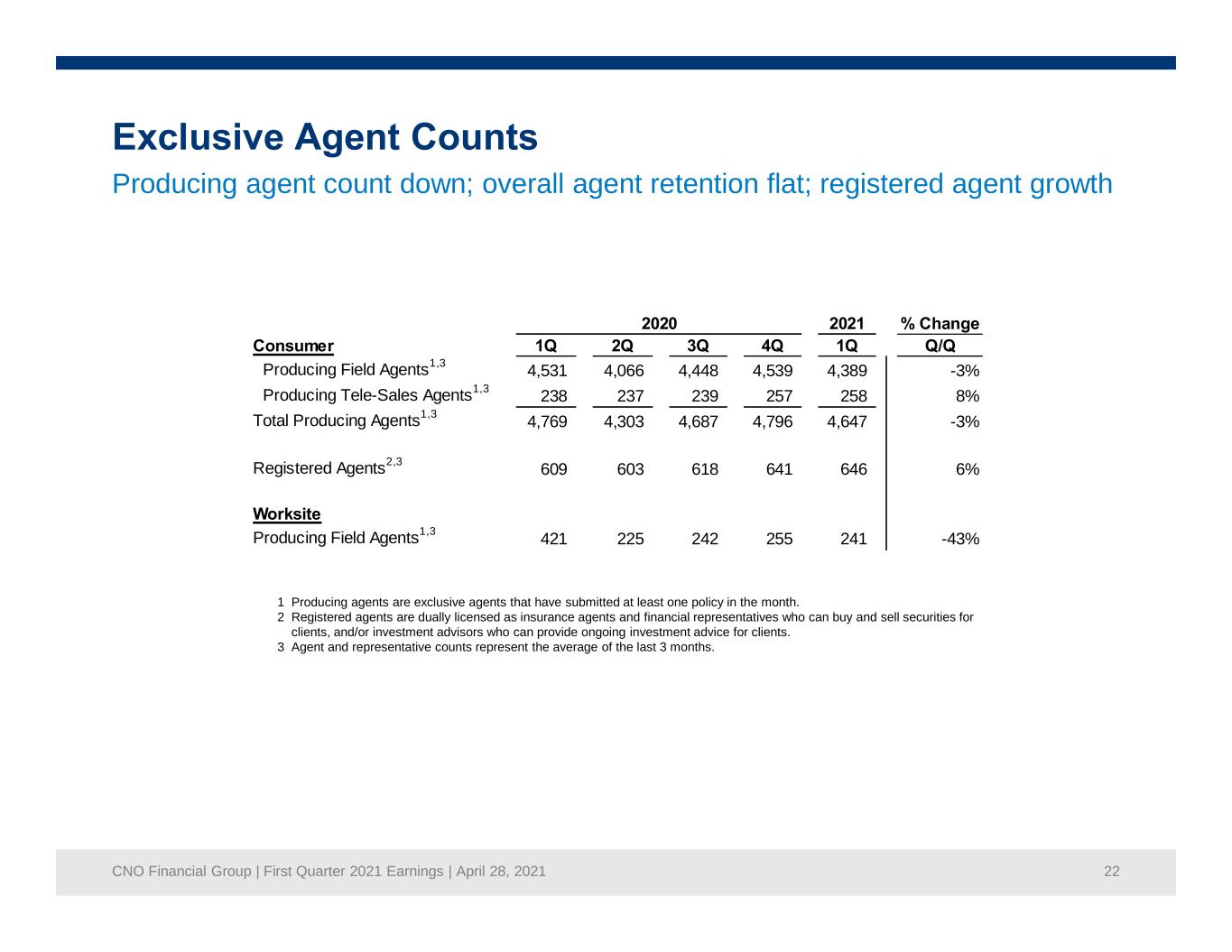

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 22 Producing Field Agents 1,3 4,531 4,066 4,448 4,539 4,389 -3% Producing Tele-Sales Agents 1,3 238 237 239 257 258 8% Total Producing Agents 1,3 4,769 4,303 4,687 4,796 4,647 -3% Registered Agents 2,3 609 603 618 641 646 6% Producing Field Agents 1,3 421 225 242 255 241 -43% 1 Producing agents are exclusive agents that have submitted at least one policy in the month. 2 Registered agents are dually licensed as insurance agents and financial representatives who can buy and sell securities for clients, and/or investment advisors who can provide ongoing investment advice for clients. 3 Agent and representative counts represent the average of the last 3 months. Producing agent count down; overall agent retention flat; registered agent growth

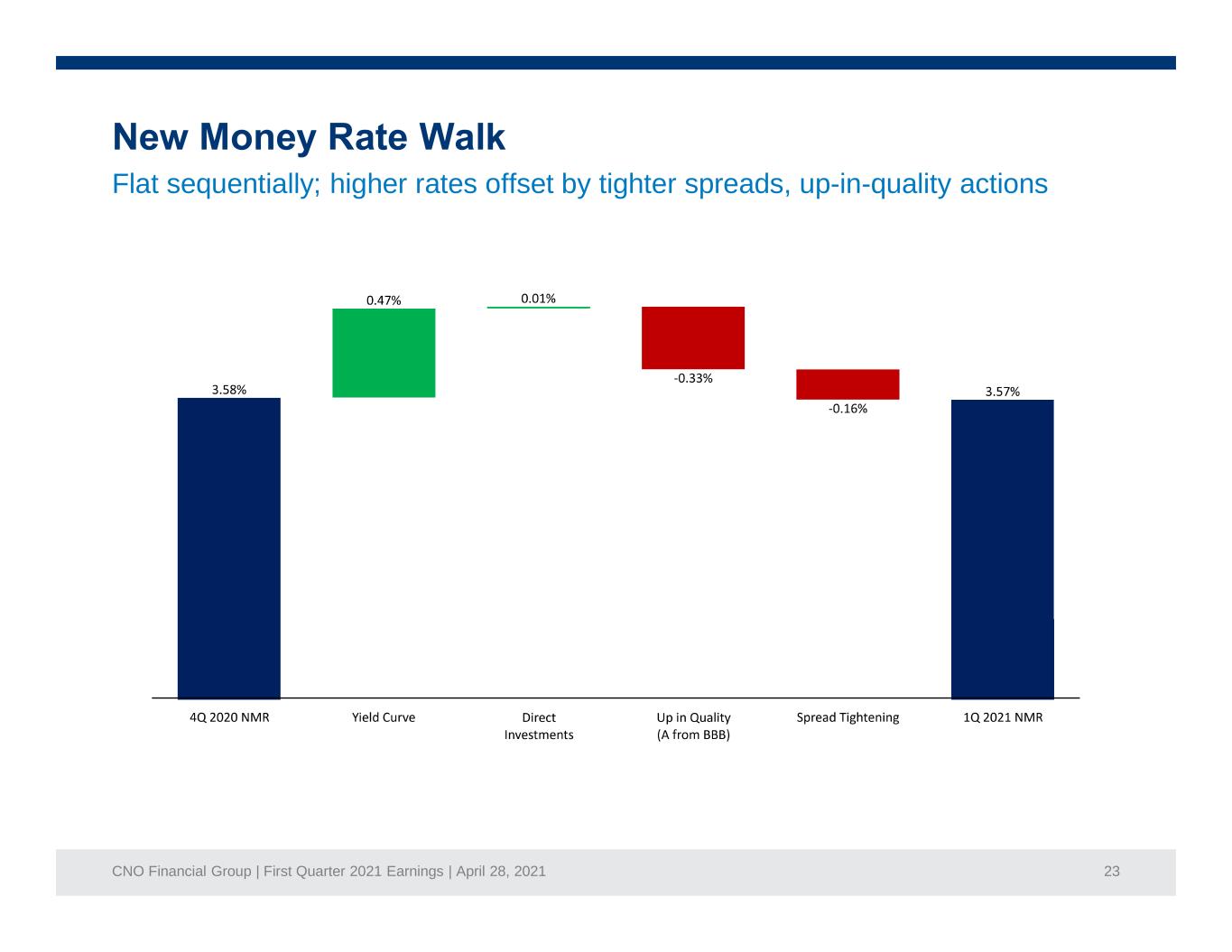

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 23 Flat sequentially; higher rates offset by tighter spreads, up-in-quality actions

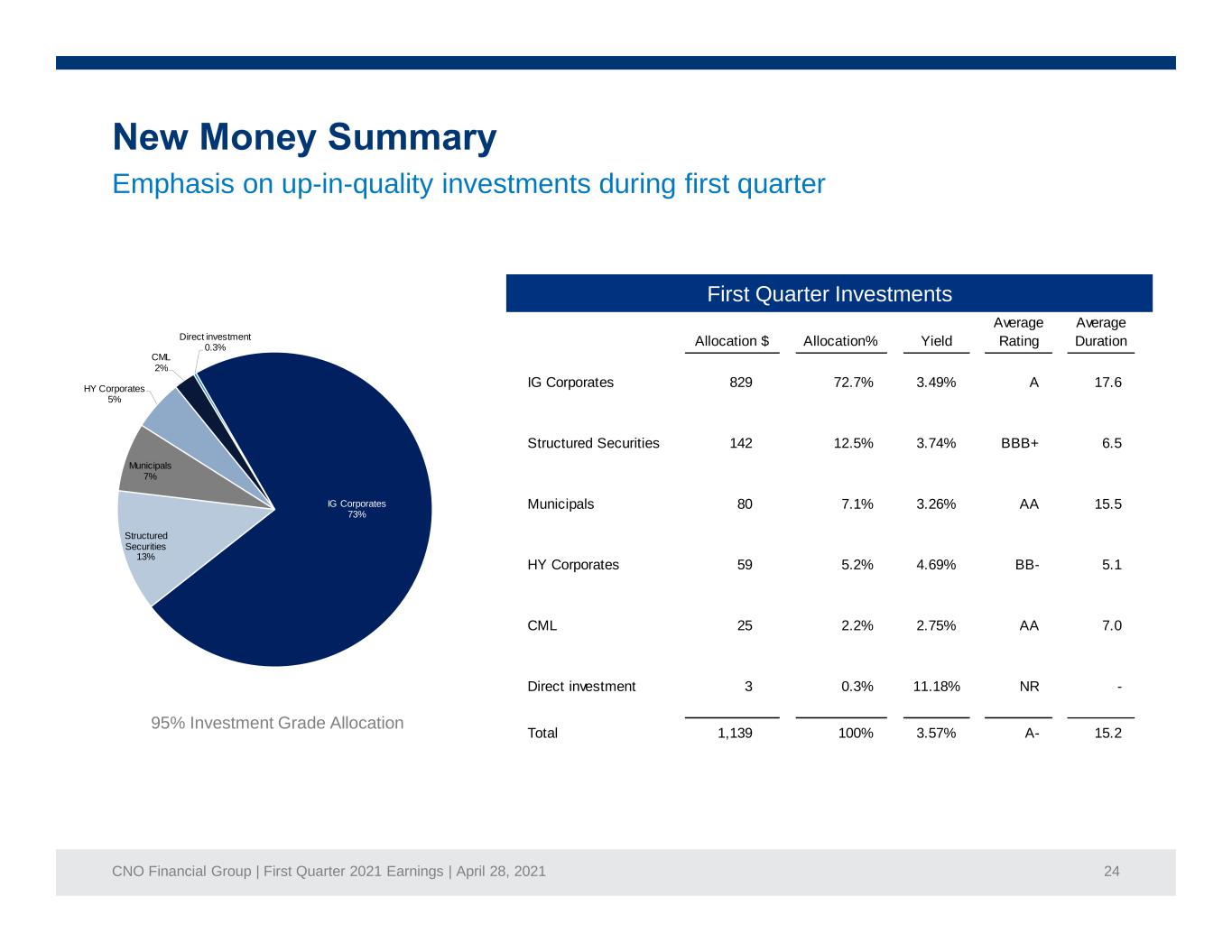

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 24 IG Corporates 73% Structured Securities 13% Municipals 7% HY Corporates 5% CML 2% Direct investment 0.3% Emphasis on up-in-quality investments during first quarter 95% Investment Grade Allocation First Quarter Investments Allocation $ Allocation% Yield Average Rating Average Duration IG Corporates 829 72.7% 3.49% A 17.6 Structured Securities 142 12.5% 3.74% BBB+ 6.5 Municipals 80 7.1% 3.26% AA 15.5 HY Corporates 59 5.2% 4.69% BB- 5.1 CML 25 2.2% 2.75% AA 7.0 Direct investment 3 0.3% 11.18% NR - Total 1,139 100% 3.57% A- 15.2

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 25 AAA 11.6%AA+ 3.7% AA 50.1% A 30.2% A- 2.2% Key Portfolio Metrics Cumulative loss scenarios versus Break Points 100% AAA-A Ratings Composition Portfolio Portfolio Index AAA 11.6% - - AA 53.8% - - A 34.6% - - BBB - N/A 5.0% BB - N/A 3.0% % of Rating Downgrade Watch 11.7% 11.3% 10.9% 13.7% 13.5% 14.1%14.1% 15.1% 13.1% 33.7% 26.4% 21.9% AAA AA A Base Case NAIC Stress GFC Break Point AAA AA A Credit Support Portfolio 38% 25% 17% Market 37% 25% 19% WARF Portfolio 3,031 3,092 3,067 Market 3,062 3,071 3,106 Diversity Score Portfolio 81 82 82 Market 78 76 76 WAPx Portfolio 97.3 97.5 98.0 Market 97.5 97.5 97.3 (As of 3/31/2021) Significant cushion against stress scenarios

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 26 Eas t 25.6% South 34.5% Centra l 13.7% Mounta in 8.2% Pacific 17.9% CM1 78.3% CM2 21.7% Apartment 29.0% Industrial 20.0% Offi ce Building 18.5% Other commercial 12.0% Reta il 20.5% Key Portfolio Facts Portfolio Geography Underlying Property Type Ratings Composition $1.2 billion of net invested assets 100% First Mortgage 100% Rated CM1-2 49% Weighted Avg LTV¹ 2.06x Weighted DSCR¹ 1 LTV and DSCR as of year 2020 operating statements (As of 3/31/2021) Very conservatively underwritten; loss resistant, no delinquencies or forbearances

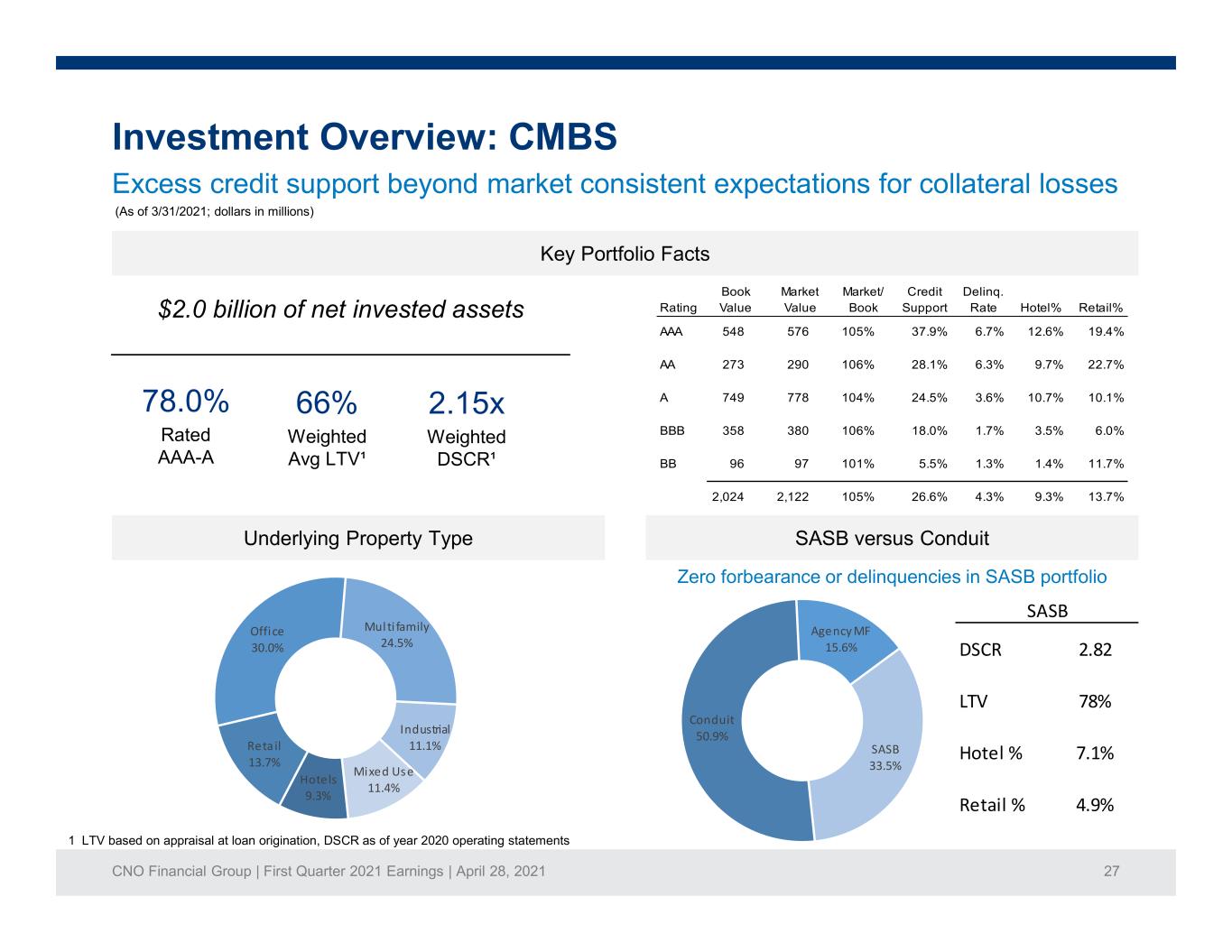

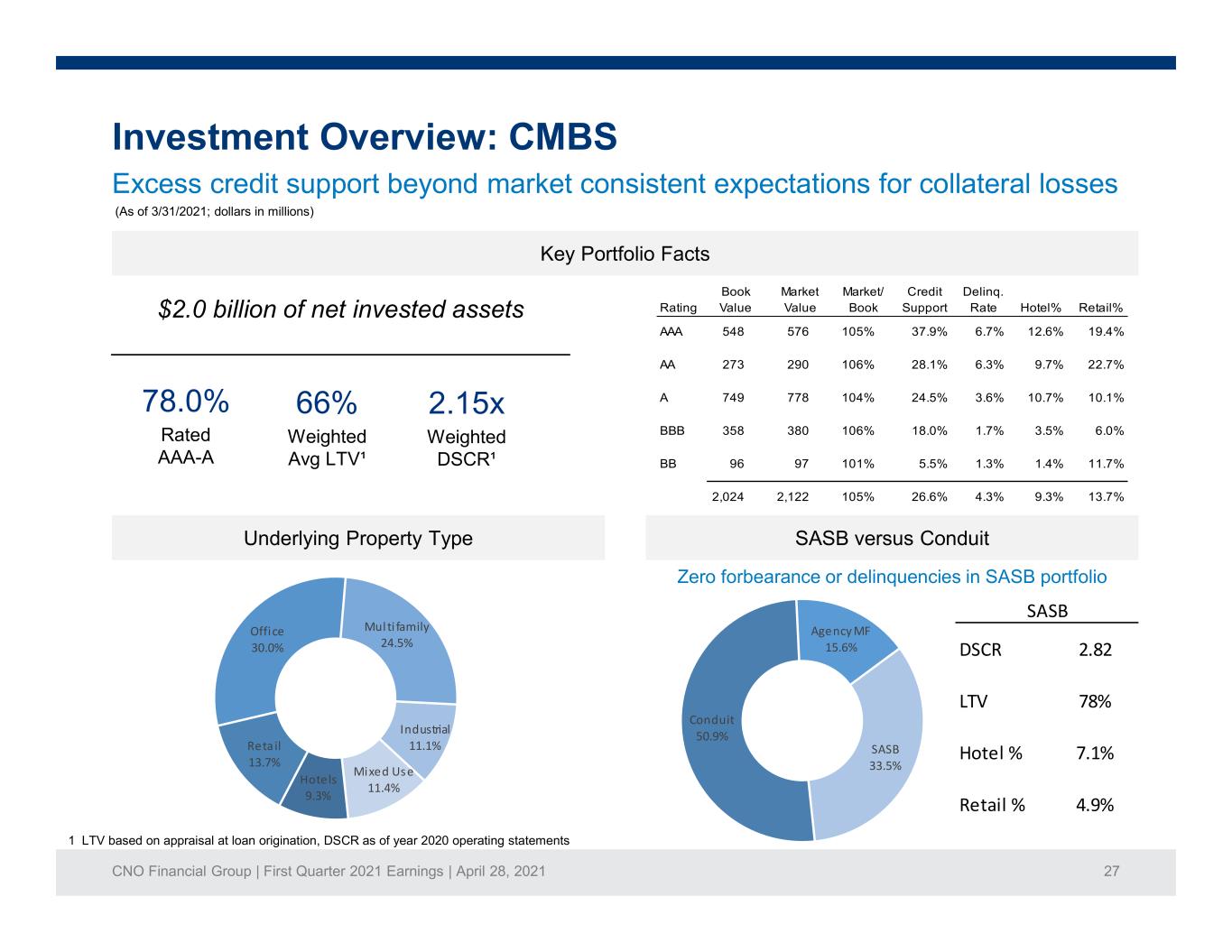

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 27 Conduit 50.9% Agency MF 15.6% SASB 33.5% Hotels 9.3% Retail 13.7% Office 30.0% Multi family 24.5% Industrial 11.1% Mixed Use 11.4% Key Portfolio Facts Underlying Property Type SASB versus Conduit $2.0 billion of net invested assets 78.0% Rated AAA-A 66% Weighted Avg LTV¹ 2.15x Weighted DSCR¹ Zero forbearance or delinquencies in SASB portfolio Rating Book Value Market Value Market/ Book Credit Support Delinq. Rate Hotel% Retail% AAA 548 576 105% 37.9% 6.7% 12.6% 19.4% AA 273 290 106% 28.1% 6.3% 9.7% 22.7% A 749 778 104% 24.5% 3.6% 10.7% 10.1% BBB 358 380 106% 18.0% 1.7% 3.5% 6.0% BB 96 97 101% 5.5% 1.3% 1.4% 11.7% 2,024 2,122 105% 26.6% 4.3% 9.3% 13.7% DSCR 2.82 LTV 78% Hotel % 7.1% Retail % 4.9% SASB (As of 3/31/2021; dollars in millions) Excess credit support beyond market consistent expectations for collateral losses 1 LTV based on appraisal at loan origination, DSCR as of year 2020 operating statements

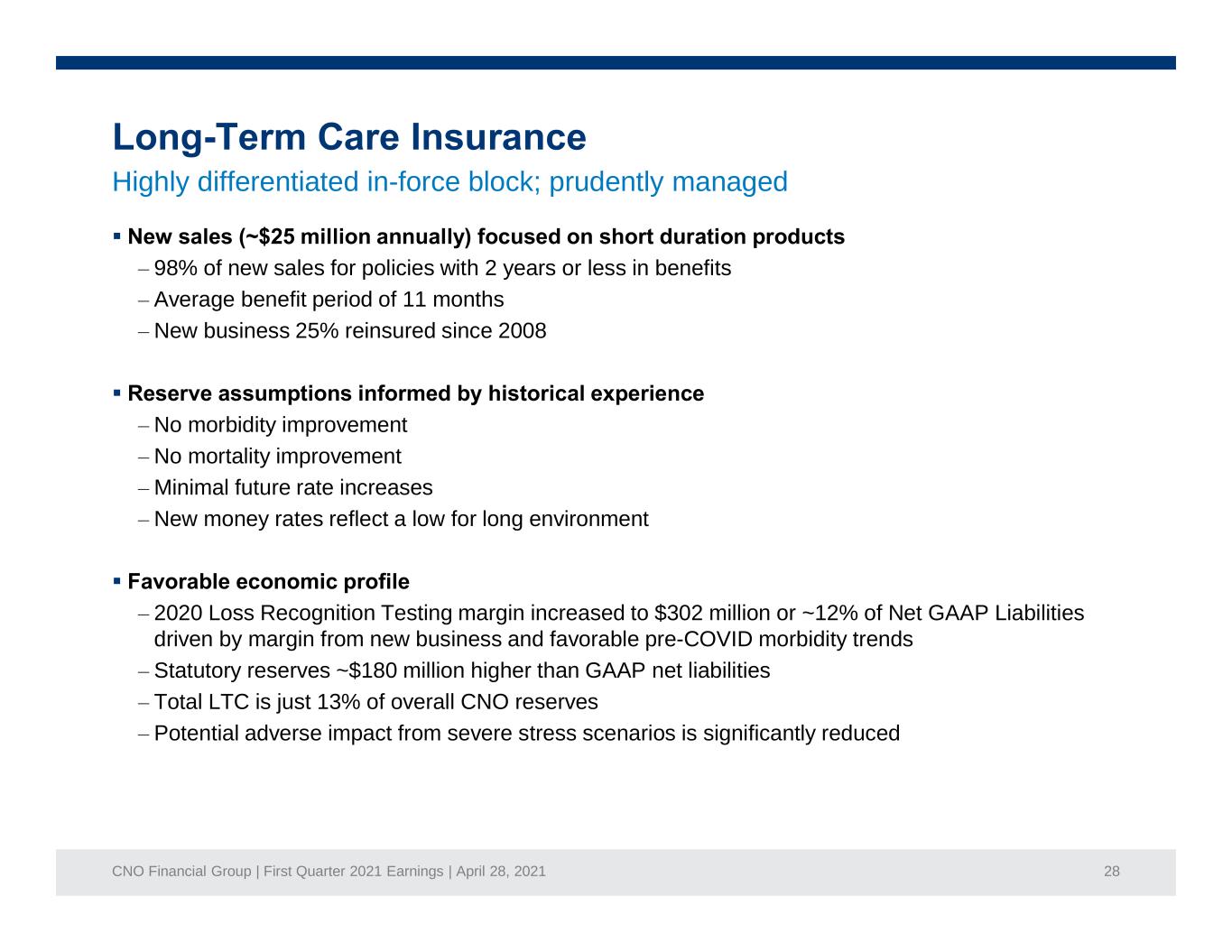

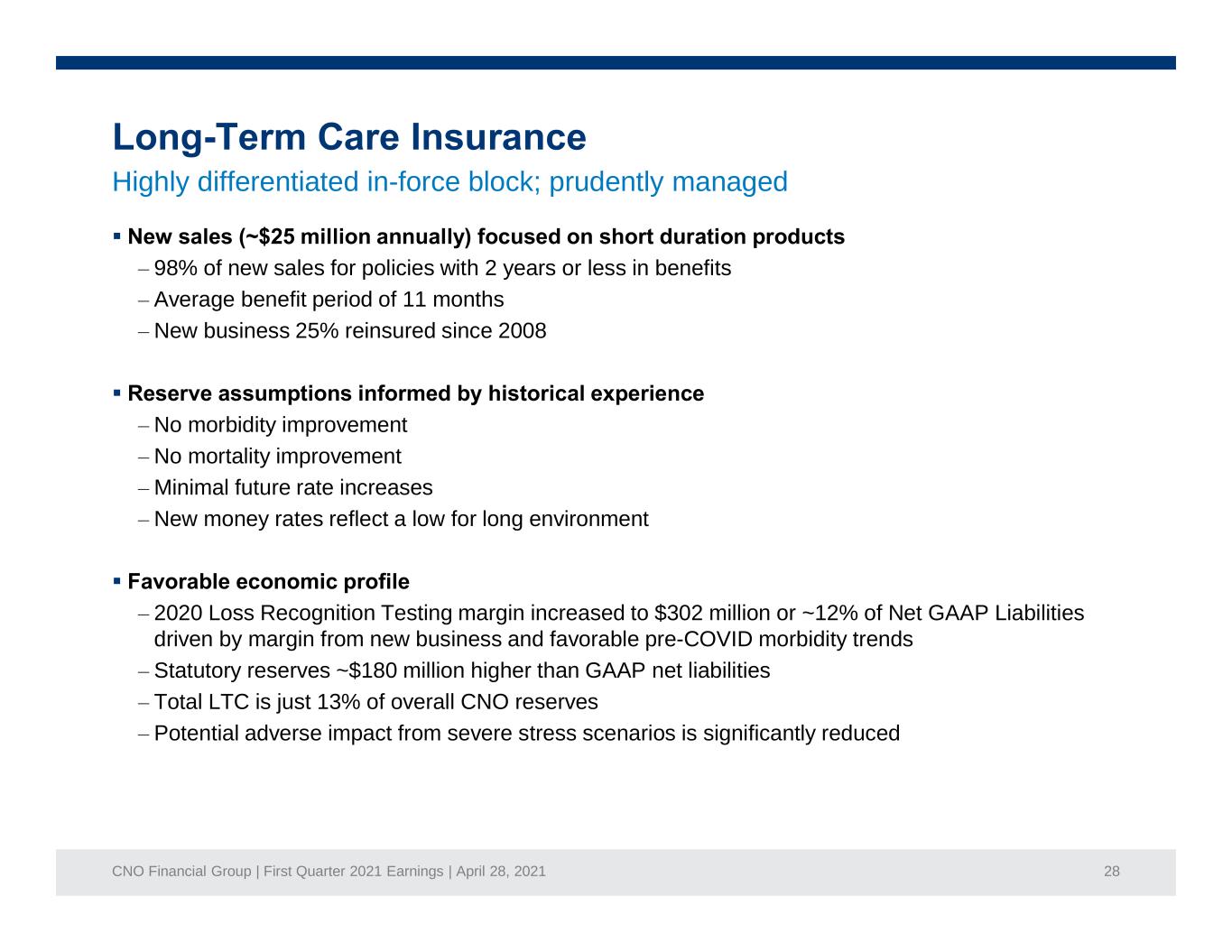

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 28 – 98% of new sales for policies with 2 years or less in benefits – Average benefit period of 11 months – New business 25% reinsured since 2008 – No morbidity improvement – No mortality improvement – Minimal future rate increases – New money rates reflect a low for long environment – 2020 Loss Recognition Testing margin increased to $302 million or ~12% of Net GAAP Liabilities driven by margin from new business and favorable pre-COVID morbidity trends – Statutory reserves ~$180 million higher than GAAP net liabilities – Total LTC is just 13% of overall CNO reserves – Potential adverse impact from severe stress scenarios is significantly reduced Highly differentiated in-force block; prudently managed

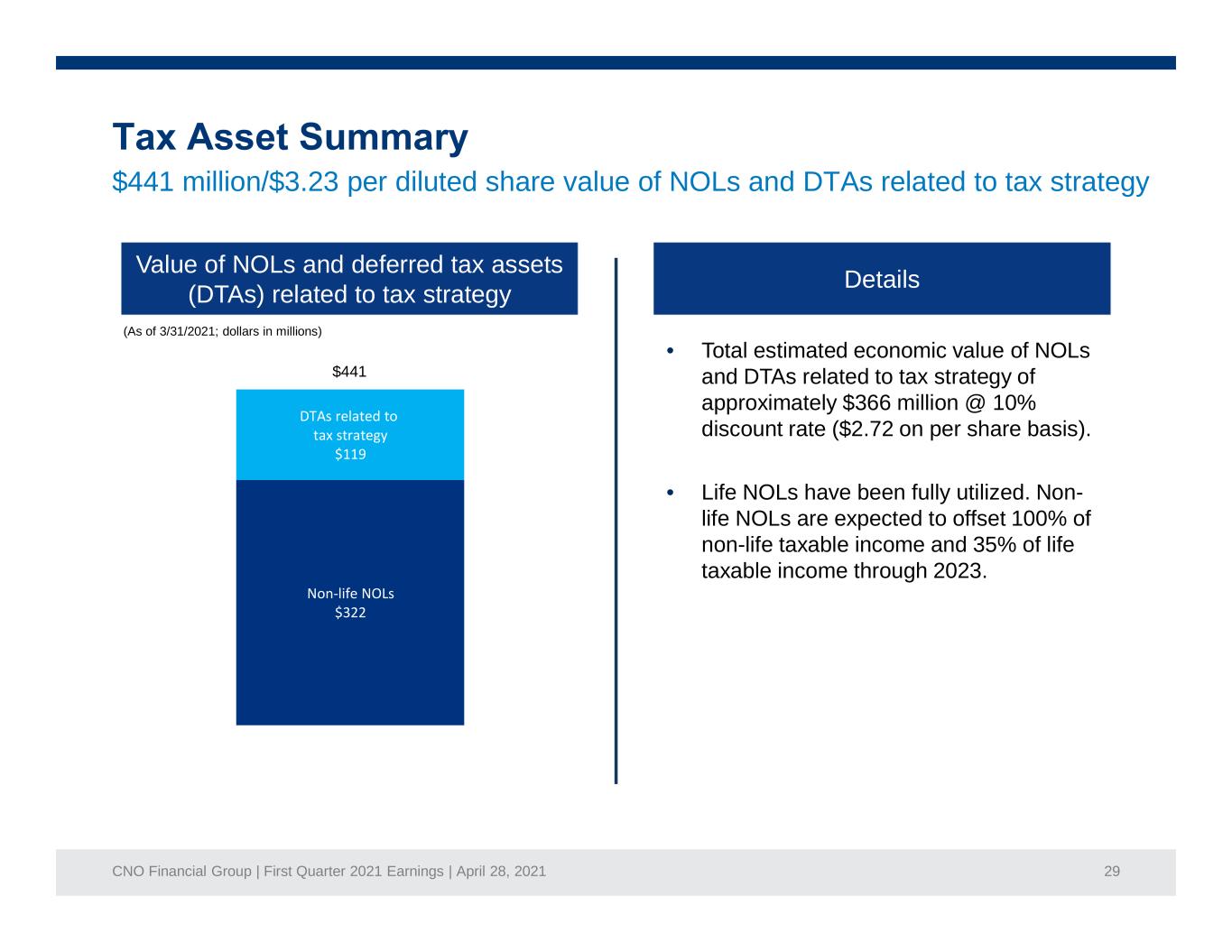

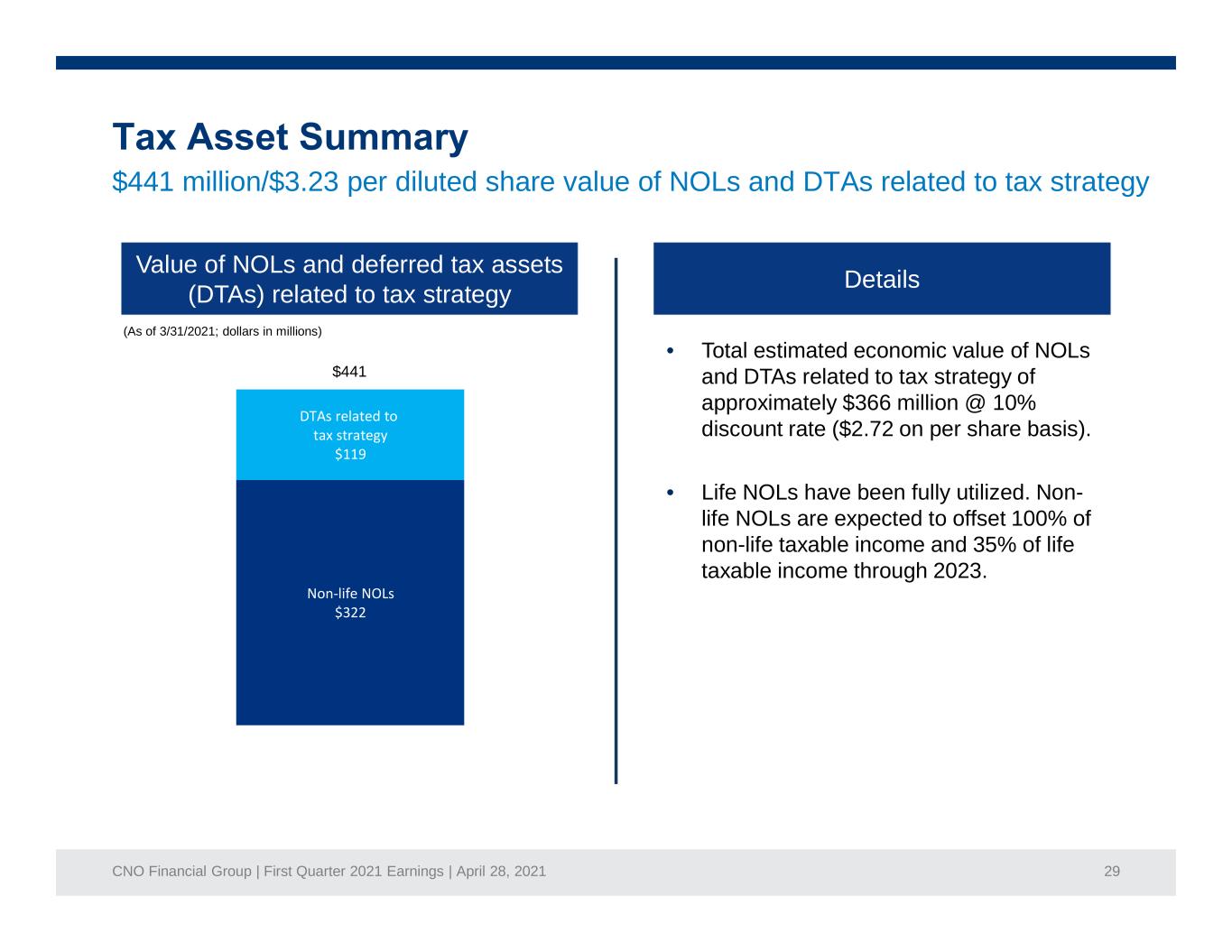

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 29 Non-life NOLs $322 DTAs related to tax strategy $119 Value of NOLs and deferred tax assets (DTAs) related to tax strategy Details • Total estimated economic value of NOLs and DTAs related to tax strategy of approximately $366 million @ 10% discount rate ($2.72 on per share basis). • Life NOLs have been fully utilized. Non- life NOLs are expected to offset 100% of non-life taxable income and 35% of life taxable income through 2023. $441 (As of 3/31/2021; dollars in millions) $441 million/$3.23 per diluted share value of NOLs and DTAs related to tax strategy

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 30 • Non-GAAP Financial Measures Slides 31-47

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 31 The table below summarizes the financial impact of significant items on our 1Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. (dollars in millions, except per-share amounts) (1) Comprised of: (i) $5.3 million from legal and regulatory matters; and (ii) $2.5 million of transaction expenses related to the previously announced acquisition of DirectPath, LLC. The legal and regulatory matters primarily consist of an increase to our liability for claims and interest pursuant to the Global Resolution Agreement, as we have now processed and verified most of the claims provided by the third party auditor allowing us to more accurately estimate the ultimate liability. (2) A non-GAAP measure. See pages 36 and 38 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 57.9$ -$ 57.9$ Health 124.7 - 124.7 Life 27.1 - 27.1 Total insurance product margin 209.7 - 209.7 Allocated expenses (141.1) - (141.1) Income from insurance products 68.6 - 68.6 Fee income 7.3 - 7.3 Investment income not allocated to product lines 43.0 - 43.0 Expenses not allocated to product lines (22.0) 7.8 (1) (14.2) Operating earnings before taxes 96.9 7.8 104.7 Income tax expense on operating income (21.7) (1.7) (23.4) Net operating income (2) 75.2$ 6.1$ 81.3 Net operating income per diluted share (2) 0.55$ 0.04$ 0.59$ Three months ended March 31, 2021 Actual results Significant items Excluding significant items

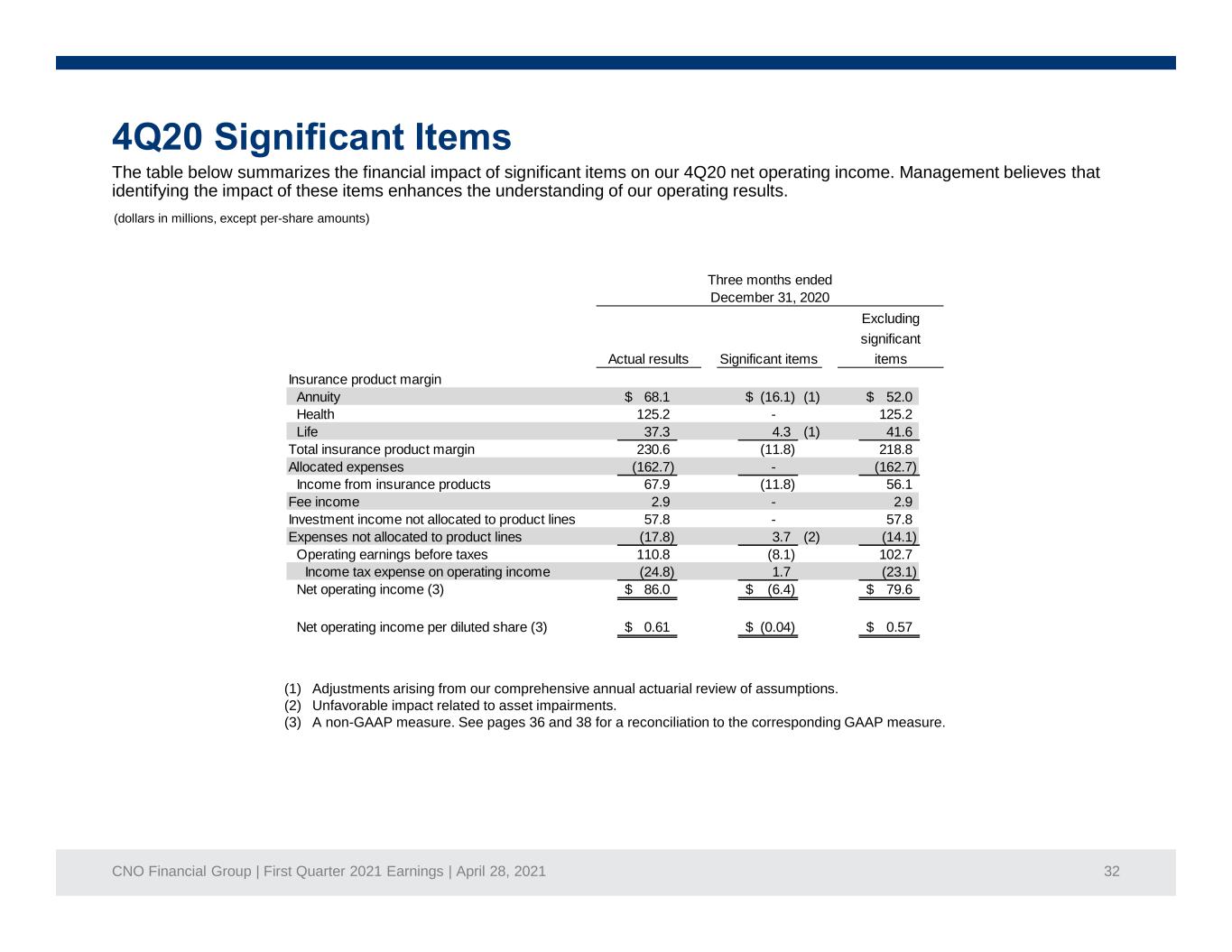

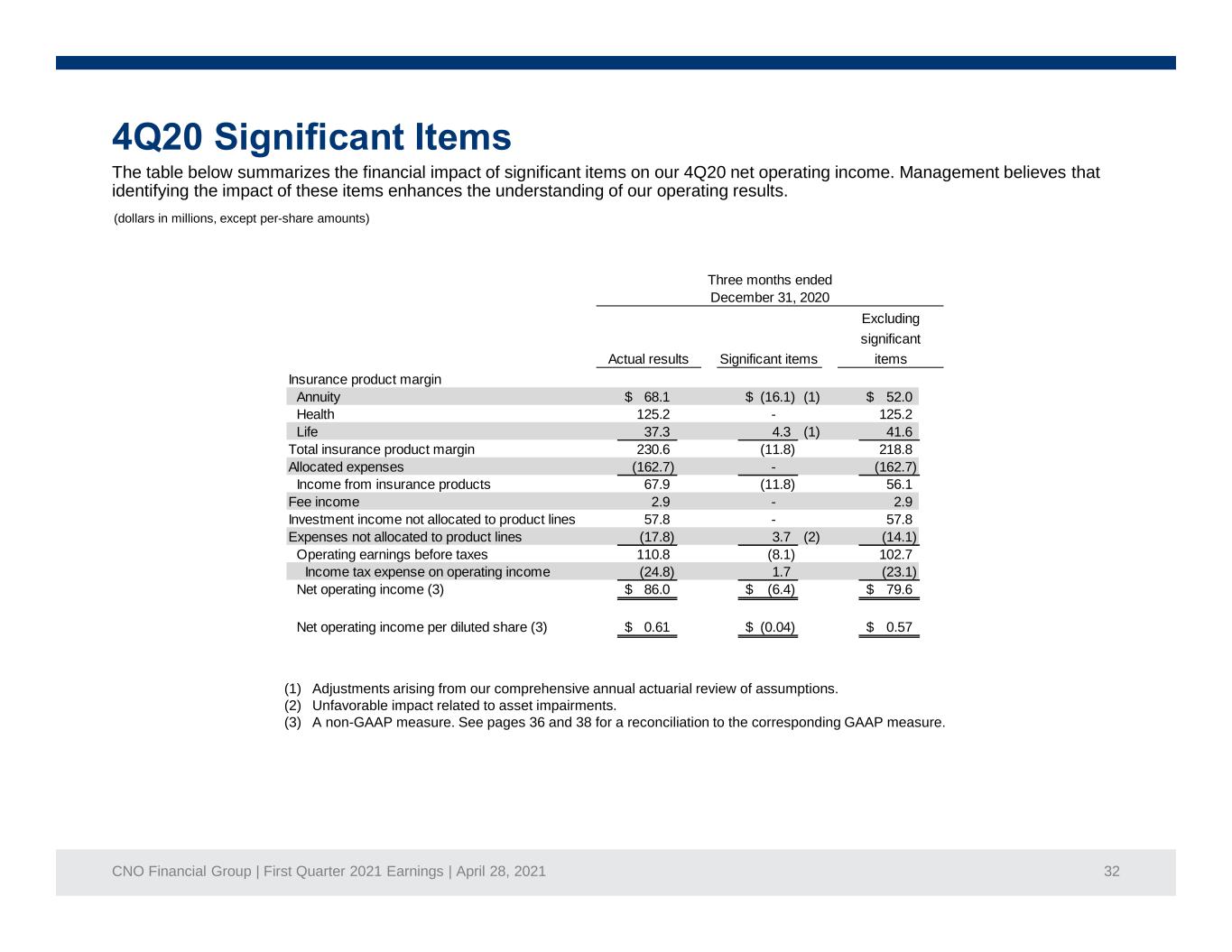

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 32 The table below summarizes the financial impact of significant items on our 4Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) Unfavorable impact related to asset impairments. (3) A non-GAAP measure. See pages 36 and 38 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 68.1$ (16.1)$ (1) 52.0$ Health 125.2 - 125.2 Life 37.3 4.3 (1) 41.6 Total insurance product margin 230.6 (11.8) 218.8 Allocated expenses (162.7) - (162.7) Income from insurance products 67.9 (11.8) 56.1 Fee income 2.9 - 2.9 Investment income not allocated to product lines 57.8 - 57.8 Expenses not allocated to product lines (17.8) 3.7 (2) (14.1) Operating earnings before taxes 110.8 (8.1) 102.7 Income tax expense on operating income (24.8) 1.7 (23.1) Net operating income (3) 86.0$ (6.4)$ 79.6$ Net operating income per diluted share (3) 0.61$ (0.04)$ 0.57$ Three months ended December 31, 2020 Actual results Significant items Excluding significant items

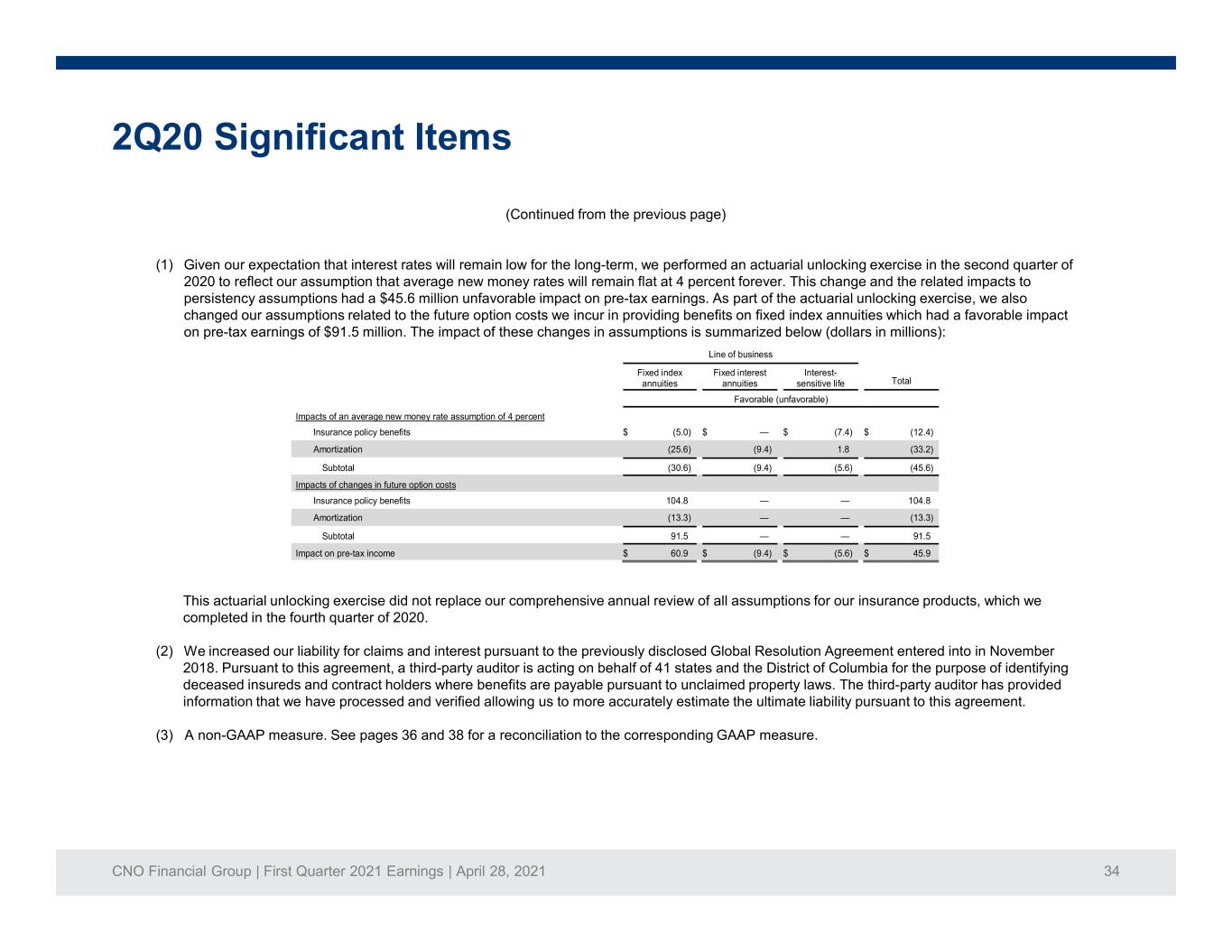

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 33 The table below summarizes the financial impact of significant items on our 2Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. (dollars in millions, except per-share amounts) Insurance product margin Annuity 123.8$ 40.0$ (1) 72.3$ (91.5) (1) Health 95.5 - 95.5 Life 36.1 5.6 (1) 41.7 Total insurance product margin 255.4 (45.9) 209.5 Allocated expenses (128.1) - (128.1) Income from insurance products 127.3 (45.9) 81.4 Fee income 5.2 - 5.2 Investment income not allocated to product lines 8.2 - 8.2 Expenses not allocated to product lines (38.5) 23.5 (2) (15.0) Operating earnings before taxes 102.2 (22.4) 79.8 Income tax expense on operating income (22.8) 4.7 (18.1) Net operating income (3) 79.4$ (17.7)$ 61.7$ Net operating income per diluted share (3) $0.55 (0.12)$ 0.43$ Three months ended June 30, 2020 Actual results Significant items Excluding significant items The footnotes to the above table are on the following page.

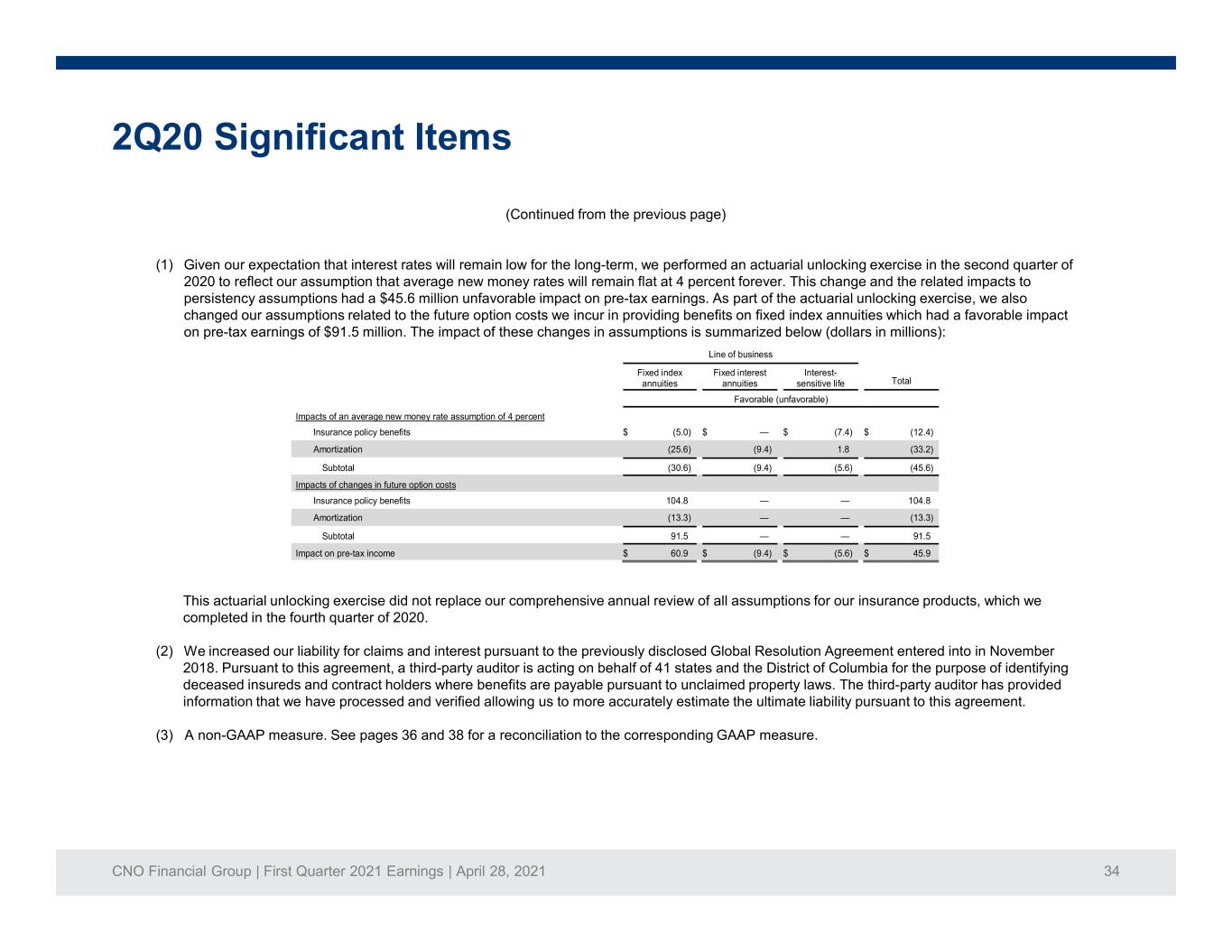

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 34 (Continued from the previous page) (1) Given our expectation that interest rates will remain low for the long-term, we performed an actuarial unlocking exercise in the second quarter of 2020 to reflect our assumption that average new money rates will remain flat at 4 percent forever. This change and the related impacts to persistency assumptions had a $45.6 million unfavorable impact on pre-tax earnings. As part of the actuarial unlocking exercise, we also changed our assumptions related to the future option costs we incur in providing benefits on fixed index annuities which had a favorable impact on pre-tax earnings of $91.5 million. The impact of these changes in assumptions is summarized below (dollars in millions): This actuarial unlocking exercise did not replace our comprehensive annual review of all assumptions for our insurance products, which we completed in the fourth quarter of 2020. (2) We increased our liability for claims and interest pursuant to the previously disclosed Global Resolution Agreement entered into in November 2018. Pursuant to this agreement, a third-party auditor is acting on behalf of 41 states and the District of Columbia for the purpose of identifying deceased insureds and contract holders where benefits are payable pursuant to unclaimed property laws. The third-party auditor has provided information that we have processed and verified allowing us to more accurately estimate the ultimate liability pursuant to this agreement. (3) A non-GAAP measure. See pages 36 and 38 for a reconciliation to the corresponding GAAP measure. Line of business Fixed index annuities Fixed interest annuities Interest- sensitive life Total Favorable (unfavorable) Impacts of an average new money rate assumption of 4 percent Insurance policy benefits $ (5.0) $ — $ (7.4) $ (12.4) Amortization (25.6) (9.4) 1.8 (33.2) Subtotal (30.6) (9.4) (5.6) (45.6) Impacts of changes in future option costs Insurance policy benefits 104.8 — — 104.8 Amortization (13.3) — — (13.3) Subtotal 91.5 — — 91.5 Impact on pre-tax income $ 60.9 $ (9.4) $ (5.6) $ 45.9

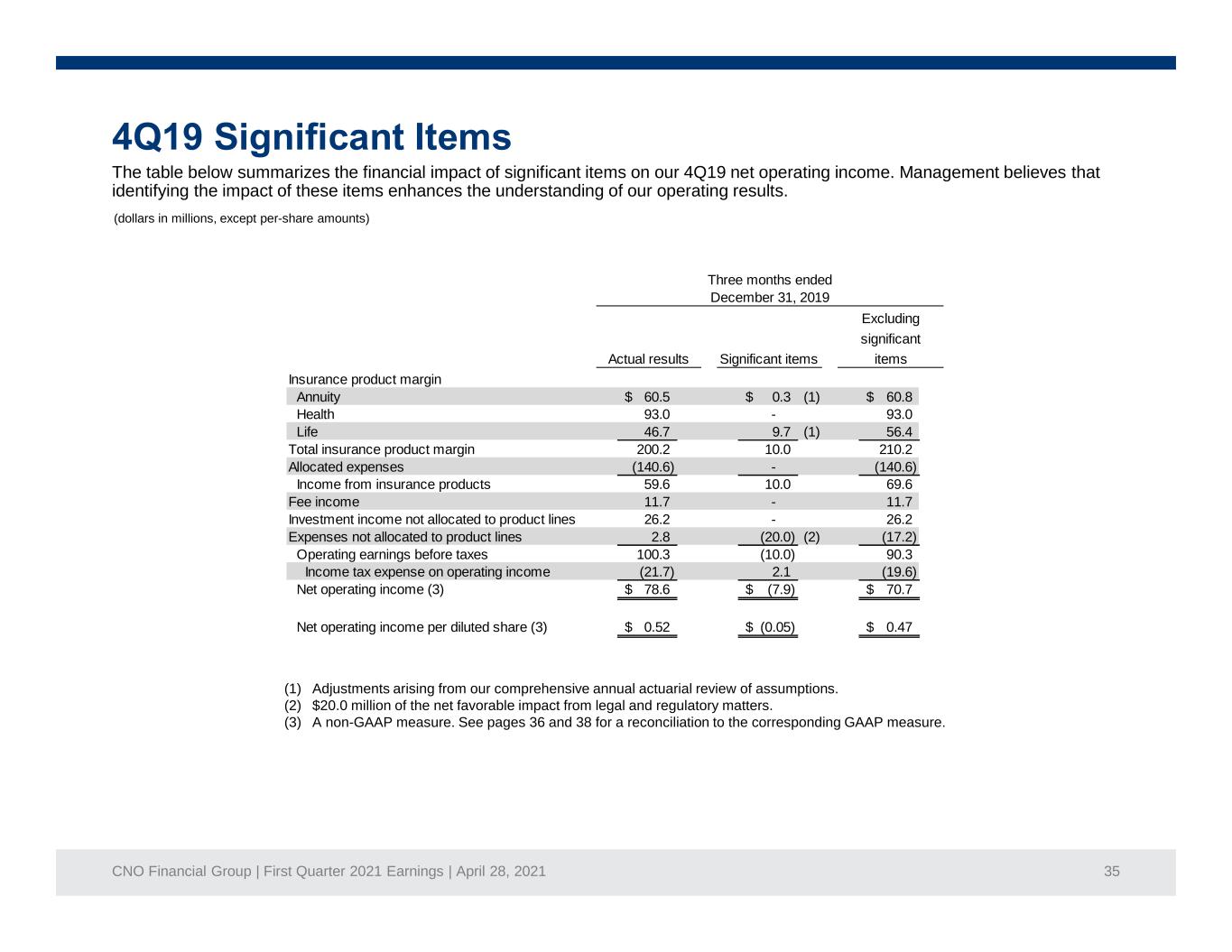

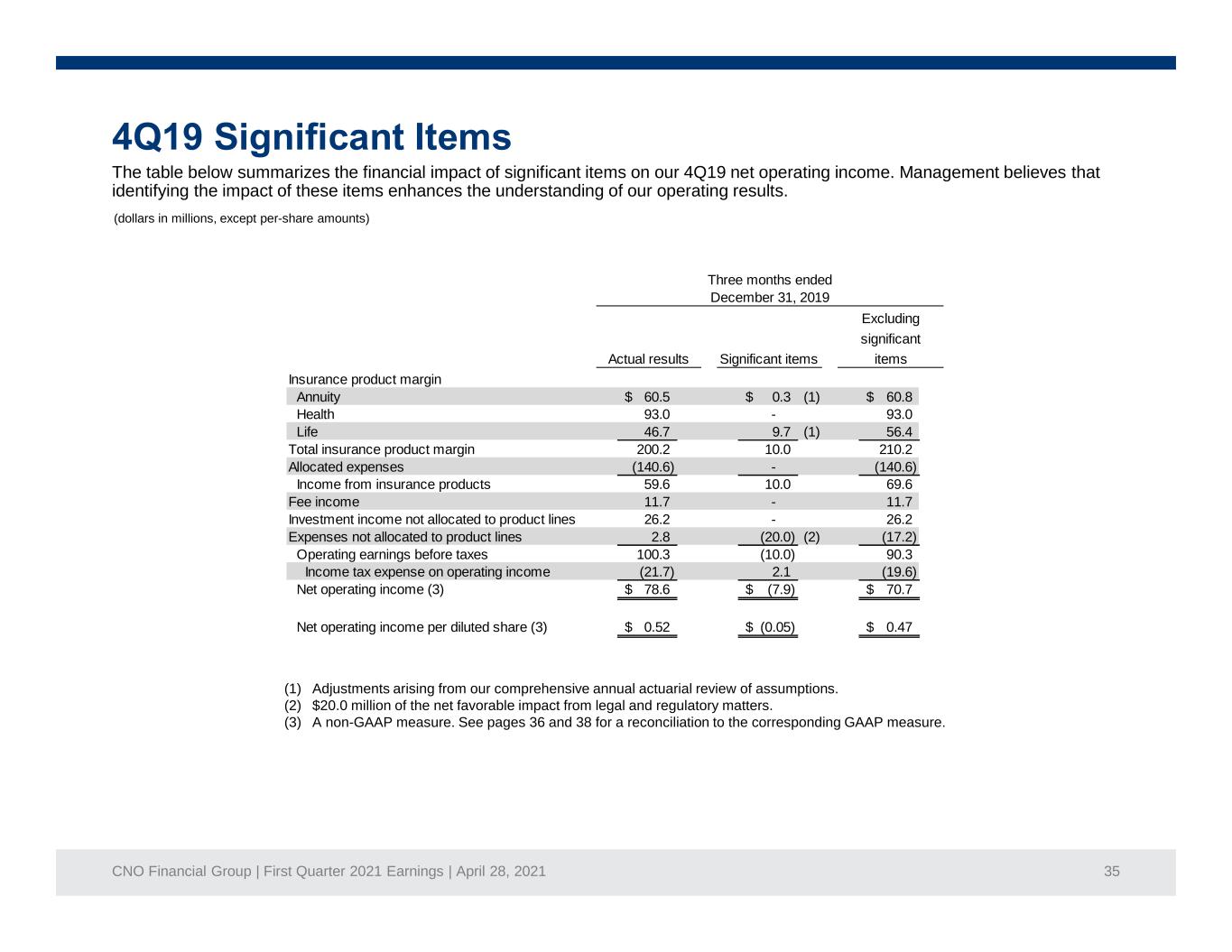

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 35 The table below summarizes the financial impact of significant items on our 4Q19 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) $20.0 million of the net favorable impact from legal and regulatory matters. (3) A non-GAAP measure. See pages 36 and 38 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 60.5$ 0.3$ (1) 60.8$ Health 93.0 - 93.0 Life 46.7 9.7 (1) 56.4 Total insurance product margin 200.2 10.0 210.2 Allocated expenses (140.6) - (140.6) Income from insurance products 59.6 10.0 69.6 Fee income 11.7 - 11.7 Investment income not allocated to product lines 26.2 - 26.2 Expenses not allocated to product lines 2.8 (20.0) (2) (17.2) Operating earnings before taxes 100.3 (10.0) 90.3 Income tax expense on operating income (21.7) 2.1 (19.6) Net operating income (3) 78.6$ (7.9)$ 70.7$ Net operating income per diluted share (3) 0.52$ (0.05)$ 0.47$ Three months ended December 31, 2019 Actual results Significant items Excluding significant items

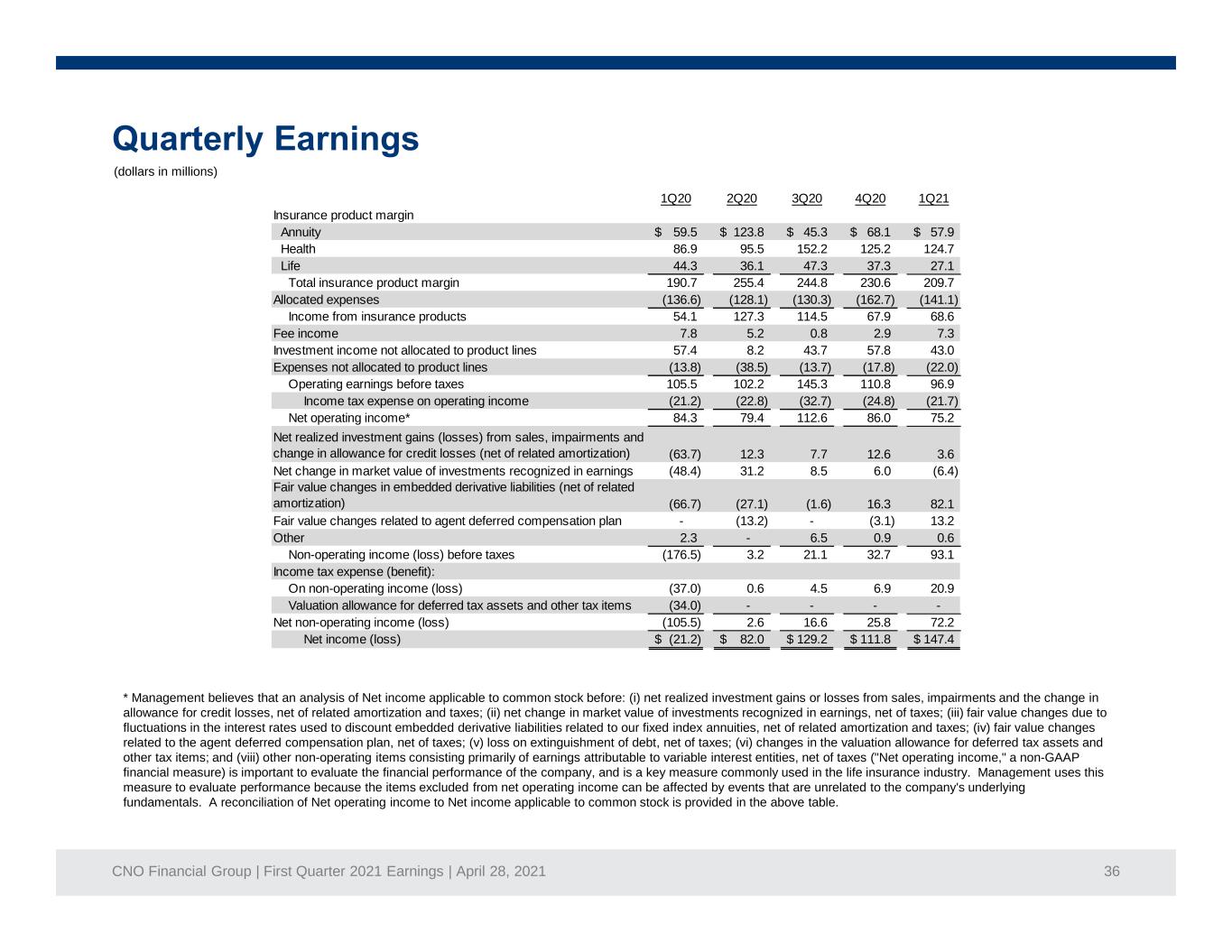

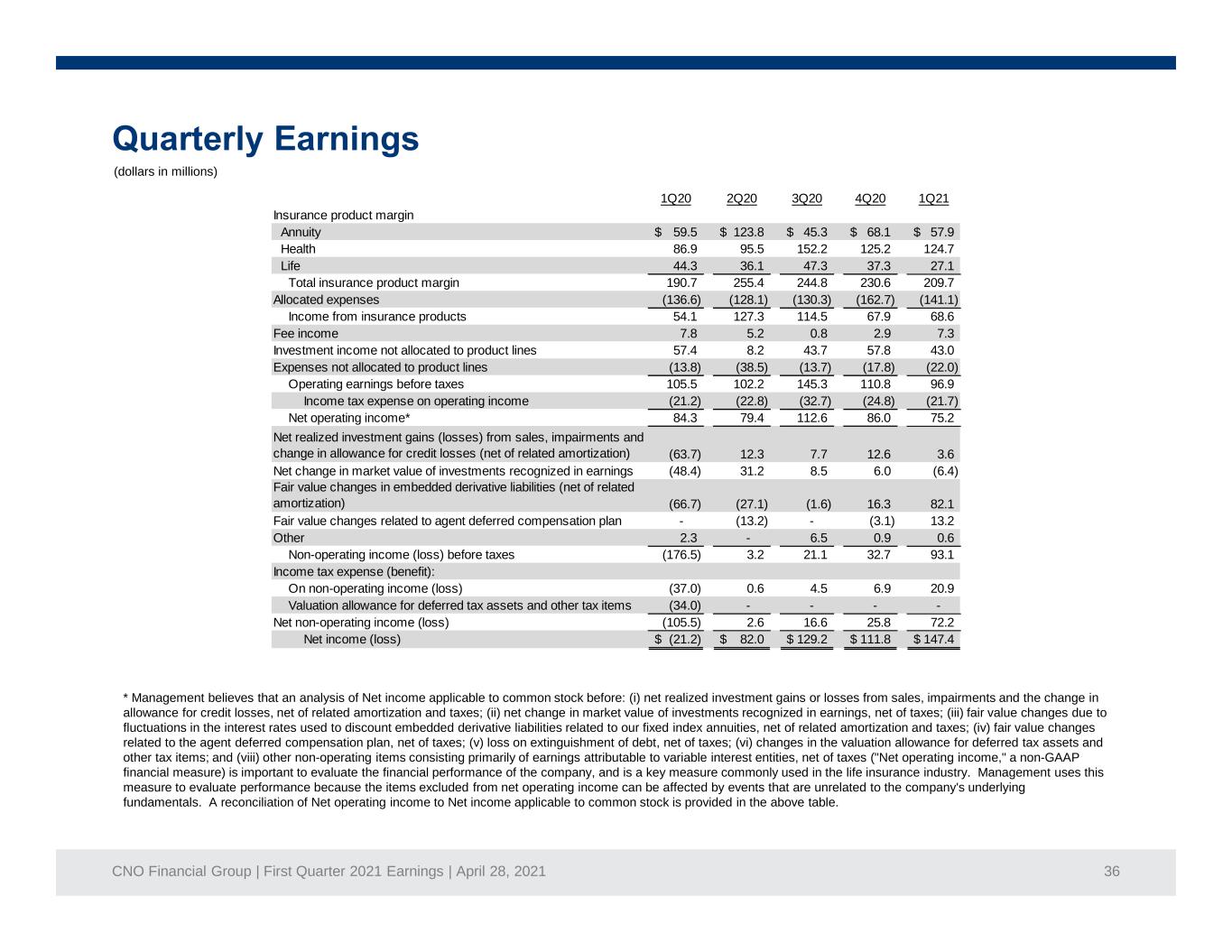

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 36 (dollars in millions) * Management believes that an analysis of Net income applicable to common stock before: (i) net realized investment gains or losses from sales, impairments and the change in allowance for credit losses, net of related amortization and taxes; (ii) net change in market value of investments recognized in earnings, net of taxes; (iii) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, net of related amortization and taxes; (iv) fair value changes related to the agent deferred compensation plan, net of taxes; (v) loss on extinguishment of debt, net of taxes; (vi) changes in the valuation allowance for deferred tax assets and other tax items; and (viii) other non-operating items consisting primarily of earnings attributable to variable interest entities, net of taxes ("Net operating income," a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the company's underlying fundamentals. A reconciliation of Net operating income to Net income applicable to common stock is provided in the above table. 1Q20 2Q20 3Q20 4Q20 1Q21 Insurance product margin Annuity 59.5$ 123.8$ 45.3$ 68.1$ 57.9$ Health 86.9 95.5 152.2 125.2 124.7 Life 44.3 36.1 47.3 37.3 27.1 Total insurance product margin 190.7 255.4 244.8 230.6 209.7 Allocated expenses (136.6) (128.1) (130.3) (162.7) (141.1) Income from insurance products 54.1 127.3 114.5 67.9 68.6 Fee income 7.8 5.2 0.8 2.9 7.3 Investment income not allocated to product lines 57.4 8.2 43.7 57.8 43.0 Expenses not allocated to product lines (13.8) (38.5) (13.7) (17.8) (22.0) Operating earnings before taxes 105.5 102.2 145.3 110.8 96.9 Income tax expense on operating income (21.2) (22.8) (32.7) (24.8) (21.7) Net operating income* 84.3 79.4 112.6 86.0 75.2 Net realized investment gains (losses) from sales, impairments and change in allowance for credit losses (net of related amortization) (63.7) 12.3 7.7 12.6 3.6 Net change in market value of investments recognized in earnings (48.4) 31.2 8.5 6.0 (6.4) Fair value changes in embedded derivative liabilities (net of related amortization) (66.7) (27.1) (1.6) 16.3 82.1 Fair value changes related to agent deferred compensation plan - (13.2) - (3.1) 13.2 Other 2.3 - 6.5 0.9 0.6 Non-operating income (loss) before taxes (176.5) 3.2 21.1 32.7 93.1 Income tax expense (benefit): On non-operating income (loss) (37.0) 0.6 4.5 6.9 20.9 Valuation allowance for deferred tax assets and other tax items (34.0) - - - - Net non-operating income (loss) (105.5) 2.6 16.6 25.8 72.2 Net income (loss) (21.2)$ 82.0$ 129.2$ 111.8$ 147.4$

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 37 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales, impairments and change in allowance for credit losses, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, changes in the valuation allowance for deferred tax assets and other tax items and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non- GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals.

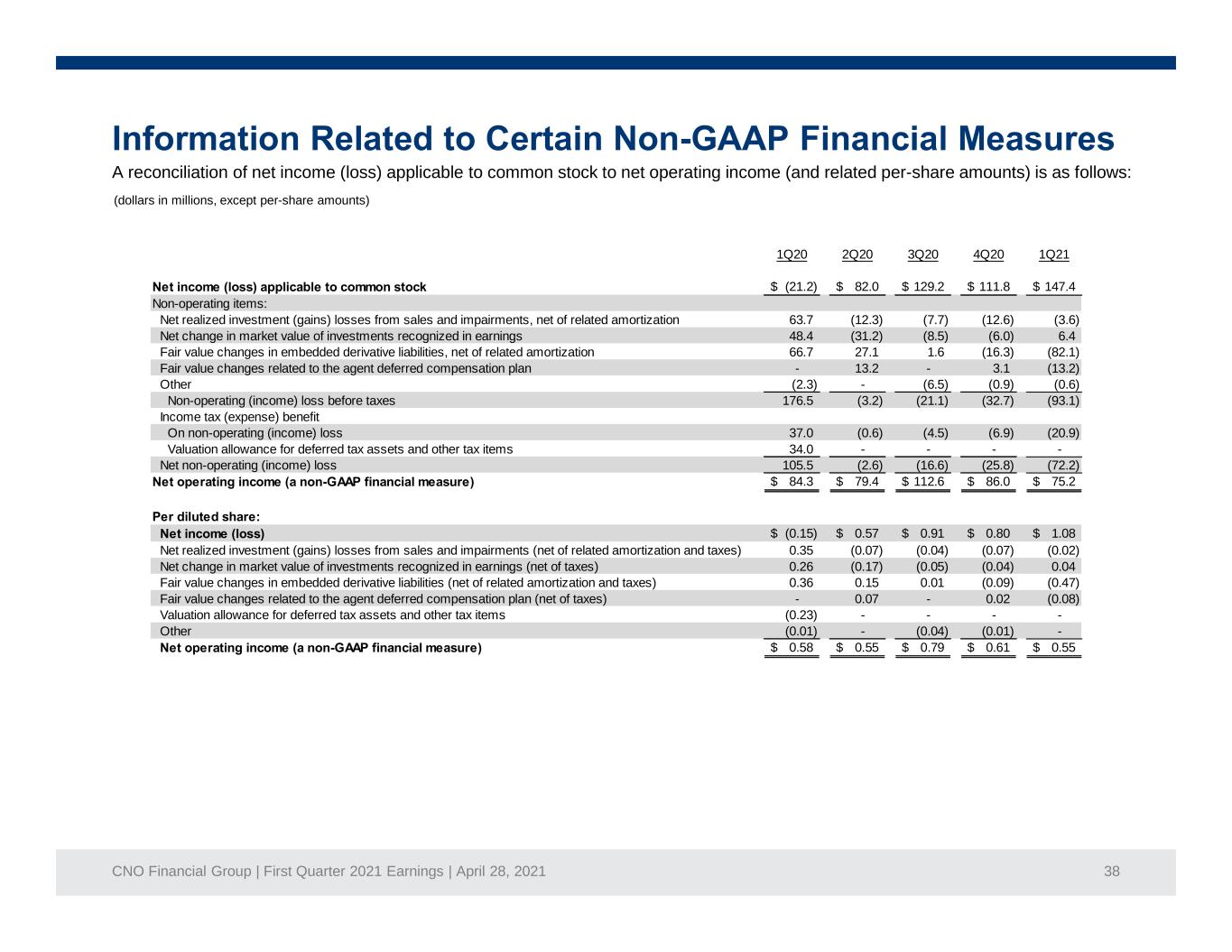

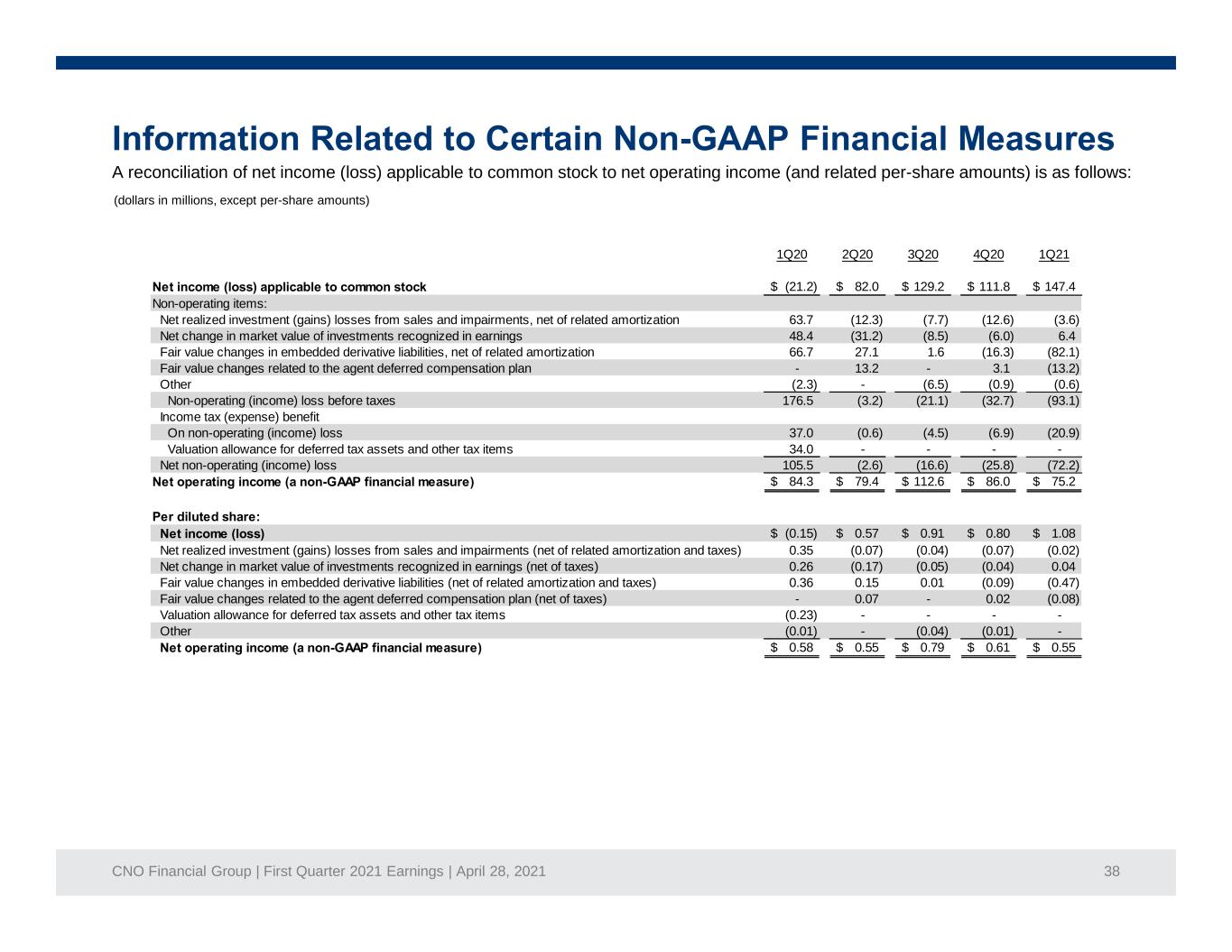

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 38 A reconciliation of net income (loss) applicable to common stock to net operating income (and related per-share amounts) is as follows: (dollars in millions, except per-share amounts) 1Q20 2Q20 3Q20 4Q20 1Q21 (21.2)$ 82.0$ 129.2$ 111.8$ 147.4$ Non-operating items: Net realized investment (gains) losses from sales and impairments, net of related amortization 63.7 (12.3) (7.7) (12.6) (3.6) Net change in market value of investments recognized in earnings 48.4 (31.2) (8.5) (6.0) 6.4 Fair value changes in embedded derivative liabilities, net of related amortization 66.7 27.1 1.6 (16.3) (82.1) Fair value changes related to the agent deferred compensation plan - 13.2 - 3.1 (13.2) Other (2.3) - (6.5) (0.9) (0.6) Non-operating (income) loss before taxes 176.5 (3.2) (21.1) (32.7) (93.1) Income tax (expense) benefit On non-operating (income) loss 37.0 (0.6) (4.5) (6.9) (20.9) Valuation allowance for deferred tax assets and other tax items 34.0 - - - - Net non-operating (income) loss 105.5 (2.6) (16.6) (25.8) (72.2) 84.3$ 79.4$ 112.6$ 86.0$ 75.2$ (0.15)$ 0.57$ 0.91$ 0.80$ 1.08$ Net realized investment (gains) losses from sales and impairments (net of related amortization and taxes) 0.35 (0.07) (0.04) (0.07) (0.02) Net change in market value of investments recognized in earnings (net of taxes) 0.26 (0.17) (0.05) (0.04) 0.04 Fair value changes in embedded derivative liabilities (net of related amortization and taxes) 0.36 0.15 0.01 (0.09) (0.47) Fair value changes related to the agent deferred compensation plan (net of taxes) - 0.07 - 0.02 (0.08) Valuation allowance for deferred tax assets and other tax items (0.23) - - - - Other (0.01) - (0.04) (0.01) - 0.58$ 0.55$ 0.79$ 0.61$ 0.55$

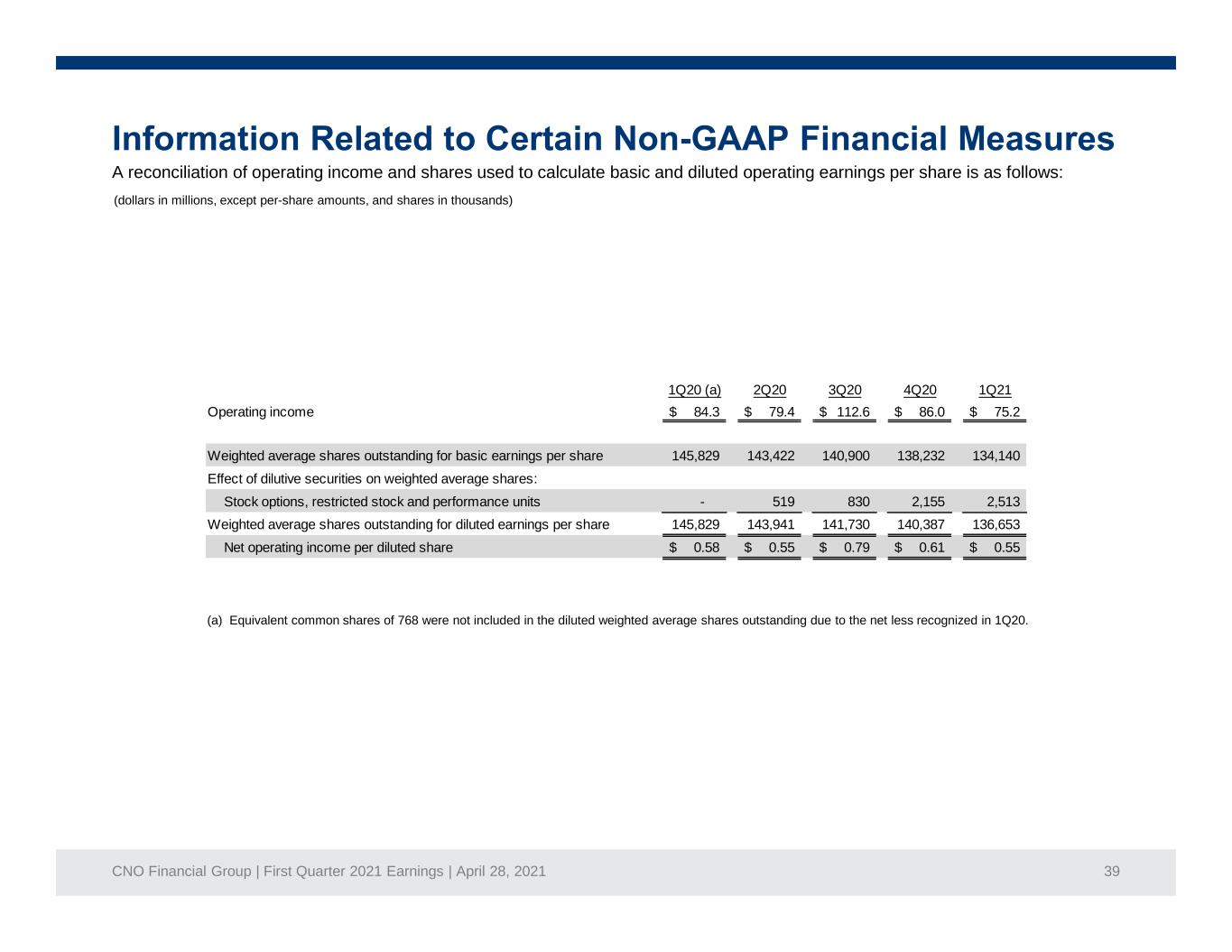

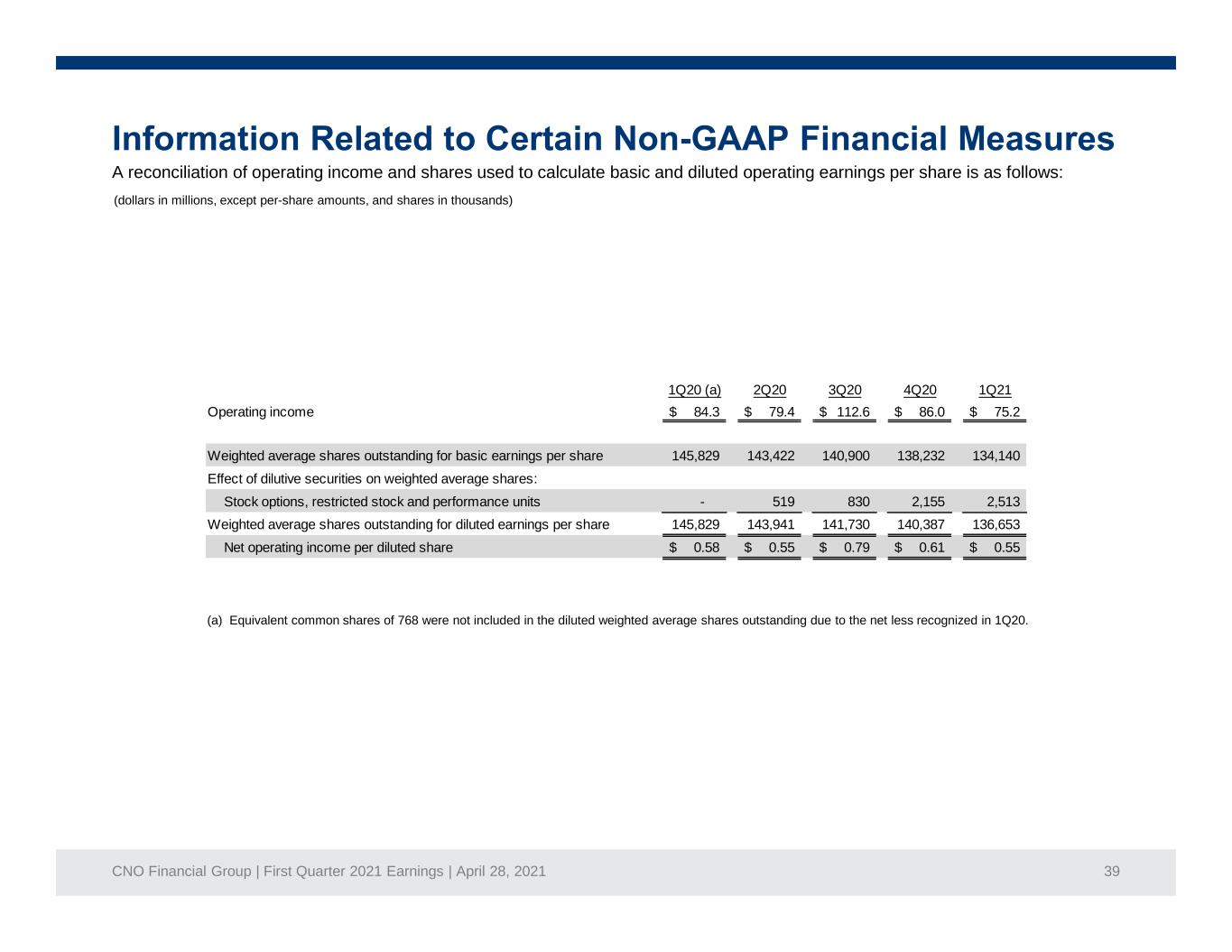

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 39 A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows: (dollars in millions, except per-share amounts, and shares in thousands) (a) Equivalent common shares of 768 were not included in the diluted weighted average shares outstanding due to the net less recognized in 1Q20. 1Q20 (a) 2Q20 3Q20 4Q20 1Q21 Operating income 84.3$ 79.4$ 112.6$ 86.0$ 75.2$ Weighted average shares outstanding for basic earnings per share 145,829 143,422 140,900 138,232 134,140 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units - 519 830 2,155 2,513 Weighted average shares outstanding for diluted earnings per share 145,829 143,941 141,730 140,387 136,653 Net operating income per diluted share 0.58$ 0.55$ 0.79$ 0.61$ 0.55$

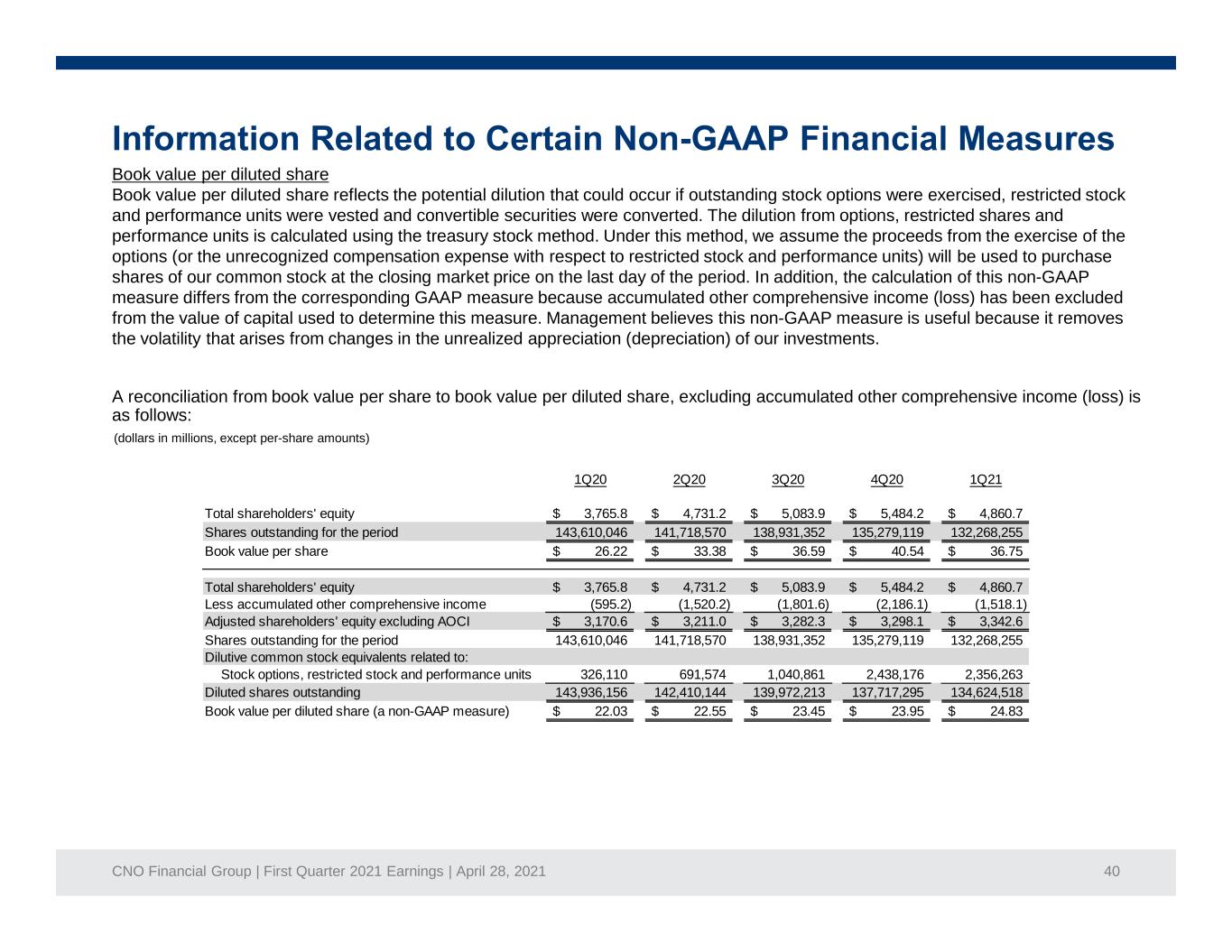

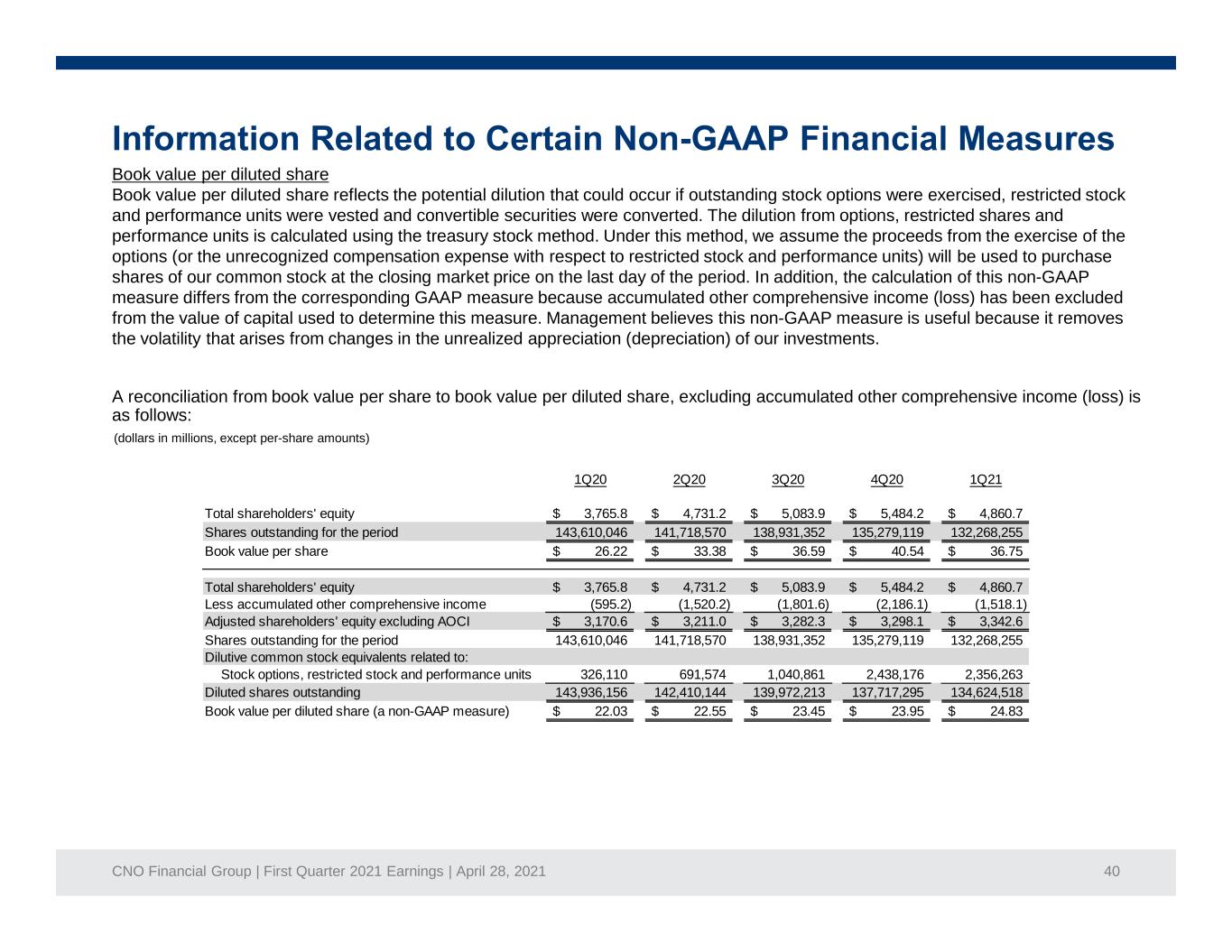

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 40 Book value per diluted share Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised, restricted stock and performance units were vested and convertible securities were converted. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments. A reconciliation from book value per share to book value per diluted share, excluding accumulated other comprehensive income (loss) is as follows: (dollars in millions, except per-share amounts) 1Q20 2Q20 3Q20 4Q20 1Q21 Total shareholders' equity 3,765.8$ 4,731.2$ 5,083.9$ 5,484.2$ 4,860.7$ Shares outstanding for the period 143,610,046 141,718,570 138,931,352 135,279,119 132,268,255 Book value per share 26.22$ 33.38$ 36.59$ 40.54$ 36.75$ Total shareholders' equity 3,765.8$ 4,731.2$ 5,083.9$ 5,484.2$ 4,860.7$ Less accumulated other comprehensive income (595.2) (1,520.2) (1,801.6) (2,186.1) (1,518.1) Adjusted shareholders' equity excluding AOCI 3,170.6$ 3,211.0$ 3,282.3$ 3,298.1$ 3,342.6$ Shares outstanding for the period 143,610,046 141,718,570 138,931,352 135,279,119 132,268,255 Dilutive common stock equivalents related to: Stock options, restricted stock and performance units 326,110 691,574 1,040,861 2,438,176 2,356,263 Diluted shares outstanding 143,936,156 142,410,144 139,972,213 137,717,295 134,624,518 Book value per diluted share (a non-GAAP measure) 22.03$ 22.55$ 23.45$ 23.95$ 24.83$

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 41 Operating return measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales, impairments and change in allowance for credit losses, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, changes in the valuation allowance for deferred tax assets and other tax items, loss on extinguishment of debt and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation.

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 42 The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant item, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows: (dollars in millions) (Continued on next page) 1Q20 2Q20 3Q20 4Q20 1Q21 Operating income 308.5$ 311.5$ 354.9$ 362.3$ 353.2$ Operating income, excluding significant items 300.6$ 285.9$ 329.3$ 338.2$ 335.2$ Net income 336.4$ 380.8$ 468.0$ 301.8$ 470.4$ Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,713.0$ 2,722.9$ 2,760.6$ 2,812.4$ 2,876.5$ Average common shareholders' equity 4,321.1$ 4,372.0$ 4,498.2$ 4,665.4$ 4,903.1$ Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 11.4% 11.4% 12.9% 12.9% 12.3% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 11.1% 10.5% 11.9% 12.0% 11.7% Return on equity 7.8% 8.7% 10.4% 6.5% 9.6% Trailing Twelve Months Ended

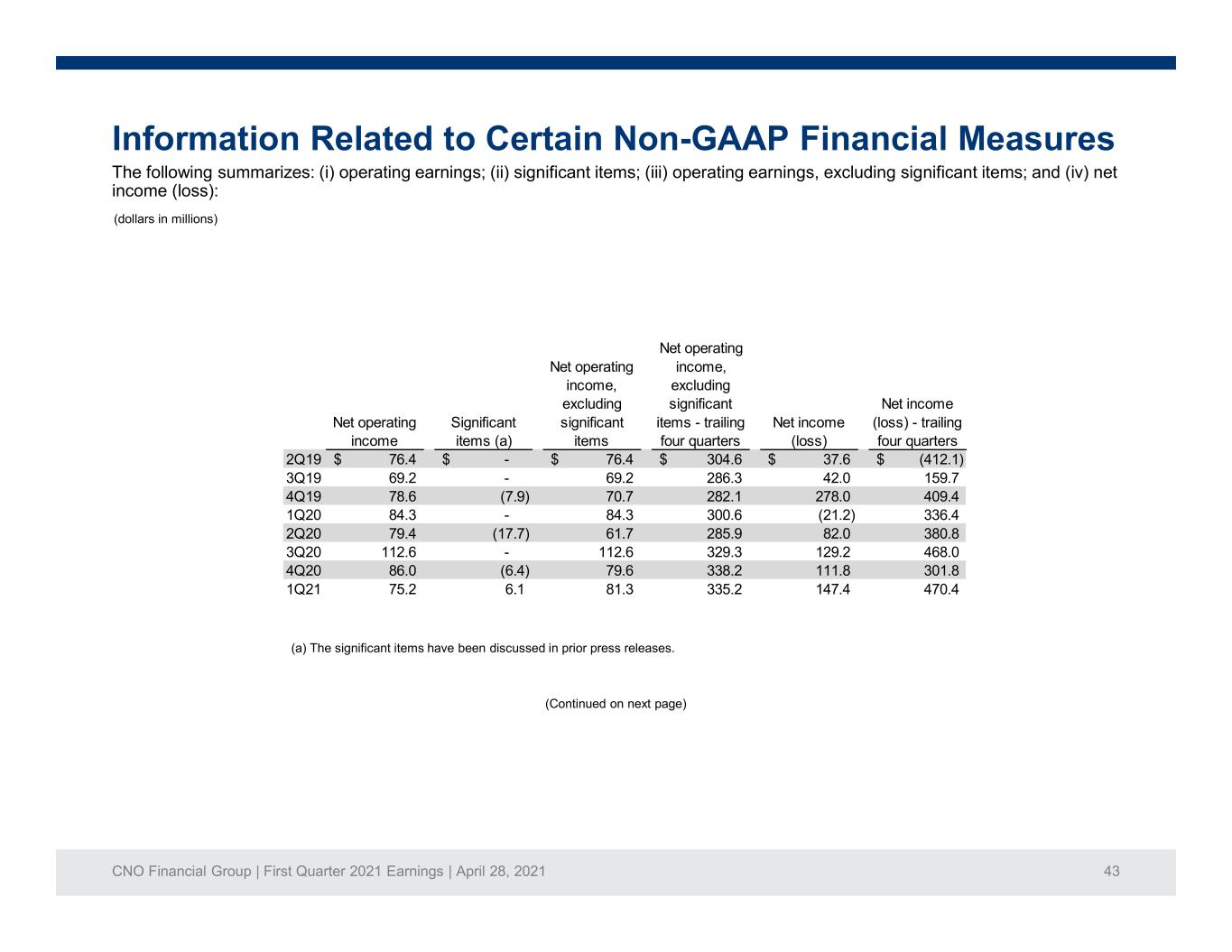

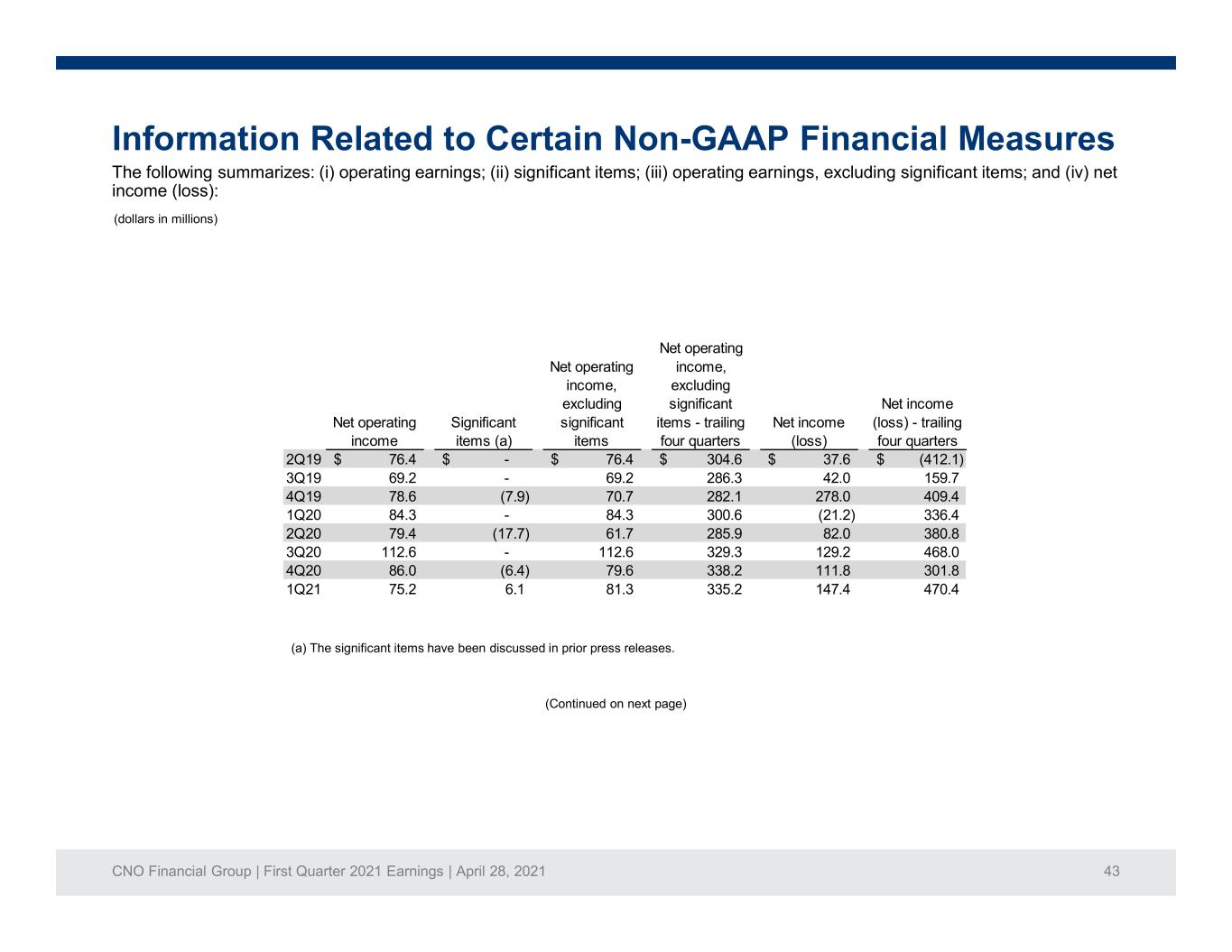

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 43 The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income (loss): (dollars in millions) Net operating income Significant items (a) Net operating income, excluding significant items Net operating income, excluding significant items - trailing four quarters Net income (loss) Net income (loss) - trailing four quarters 2Q19 76.4$ -$ 76.4$ 304.6$ 37.6$ (412.1)$ 3Q19 69.2 - 69.2 286.3 42.0 159.7 4Q19 78.6 (7.9) 70.7 282.1 278.0 409.4 1Q20 84.3 - 84.3 300.6 (21.2) 336.4 2Q20 79.4 (17.7) 61.7 285.9 82.0 380.8 3Q20 112.6 - 112.6 329.3 129.2 468.0 4Q20 86.0 (6.4) 79.6 338.2 111.8 301.8 1Q21 75.2 6.1 81.3 335.2 147.4 470.4 (a) The significant items have been discussed in prior press releases. (Continued on next page)

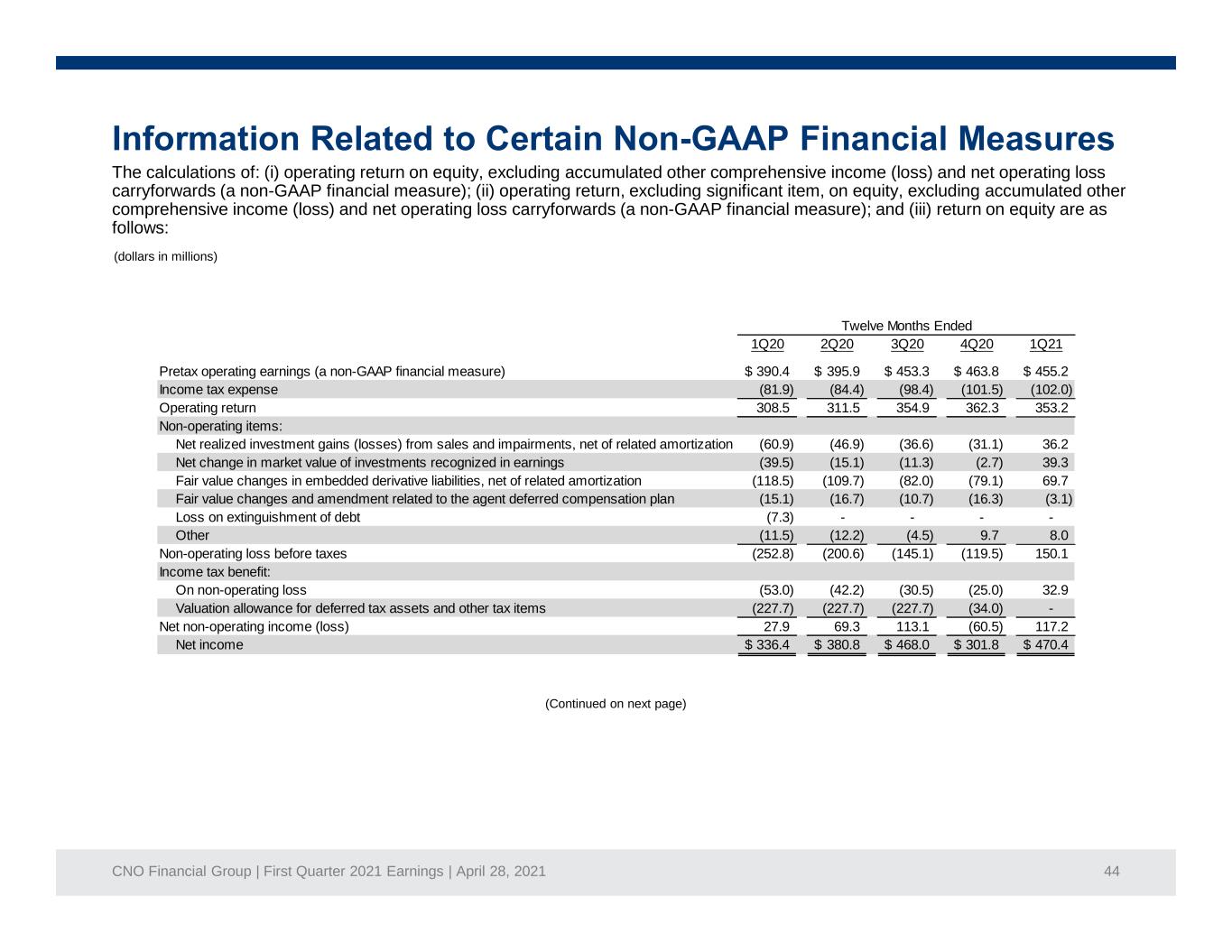

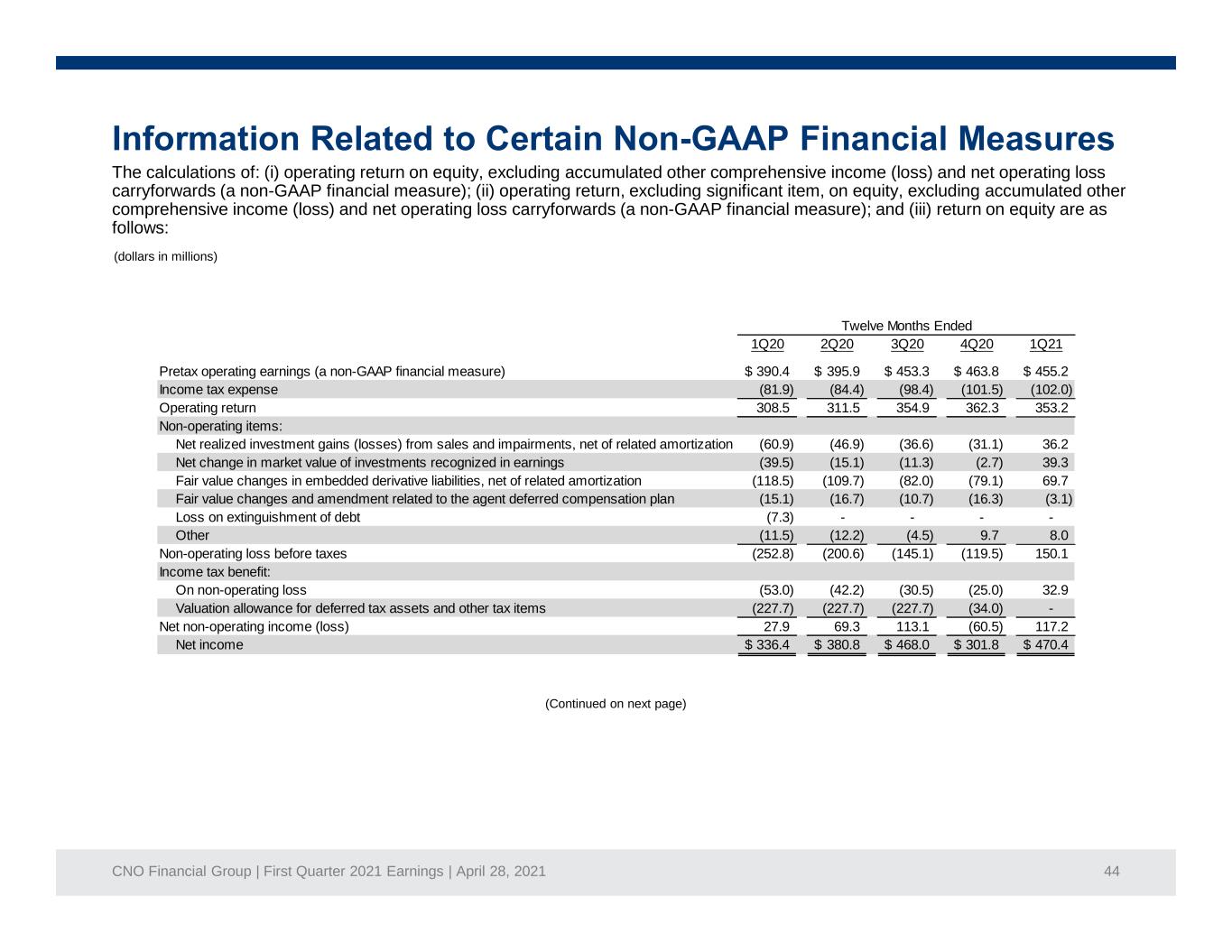

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 44 The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant item, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows: (dollars in millions) (Continued on next page) 1Q20 2Q20 3Q20 4Q20 1Q21 Pretax operating earnings (a non-GAAP financial measure) 390.4$ 395.9$ 453.3$ 463.8$ 455.2$ Income tax expense (81.9) (84.4) (98.4) (101.5) (102.0) Operating return 308.5 311.5 354.9 362.3 353.2 Non-operating items: Net realized investment gains (losses) from sales and impairments, net of related amortization (60.9) (46.9) (36.6) (31.1) 36.2 Net change in market value of investments recognized in earnings (39.5) (15.1) (11.3) (2.7) 39.3 Fair value changes in embedded derivative liabilities, net of related amortization (118.5) (109.7) (82.0) (79.1) 69.7 Fair value changes and amendment related to the agent deferred compensation plan (15.1) (16.7) (10.7) (16.3) (3.1) Loss on extinguishment of debt (7.3) - - - - Other (11.5) (12.2) (4.5) 9.7 8.0 Non-operating loss before taxes (252.8) (200.6) (145.1) (119.5) 150.1 Income tax benefit: On non-operating loss (53.0) (42.2) (30.5) (25.0) 32.9 Valuation allowance for deferred tax assets and other tax items (227.7) (227.7) (227.7) (34.0) - Net non-operating income (loss) 27.9 69.3 113.1 (60.5) 117.2 Net income 336.4$ 380.8$ 468.0$ 301.8$ 470.4$ Twelve Months Ended

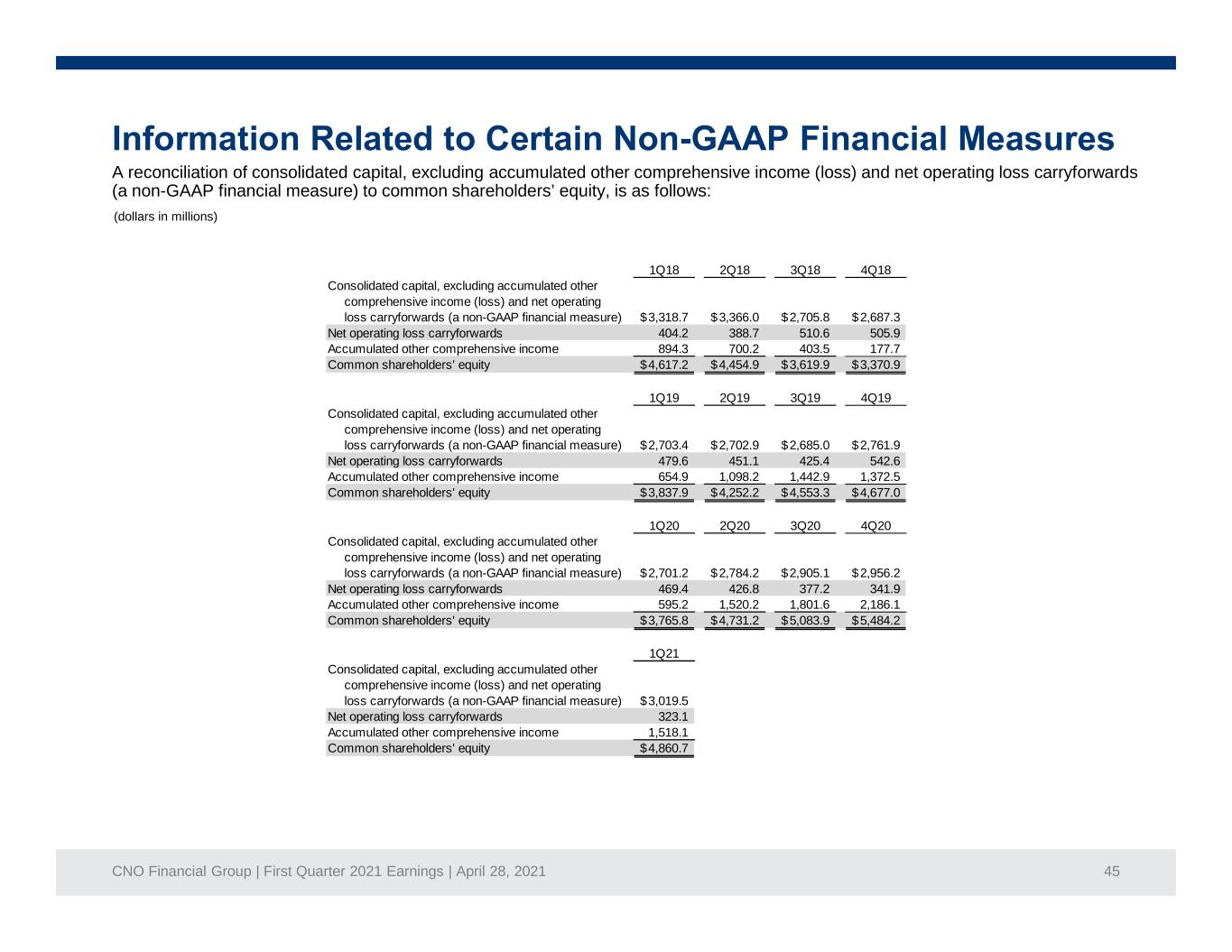

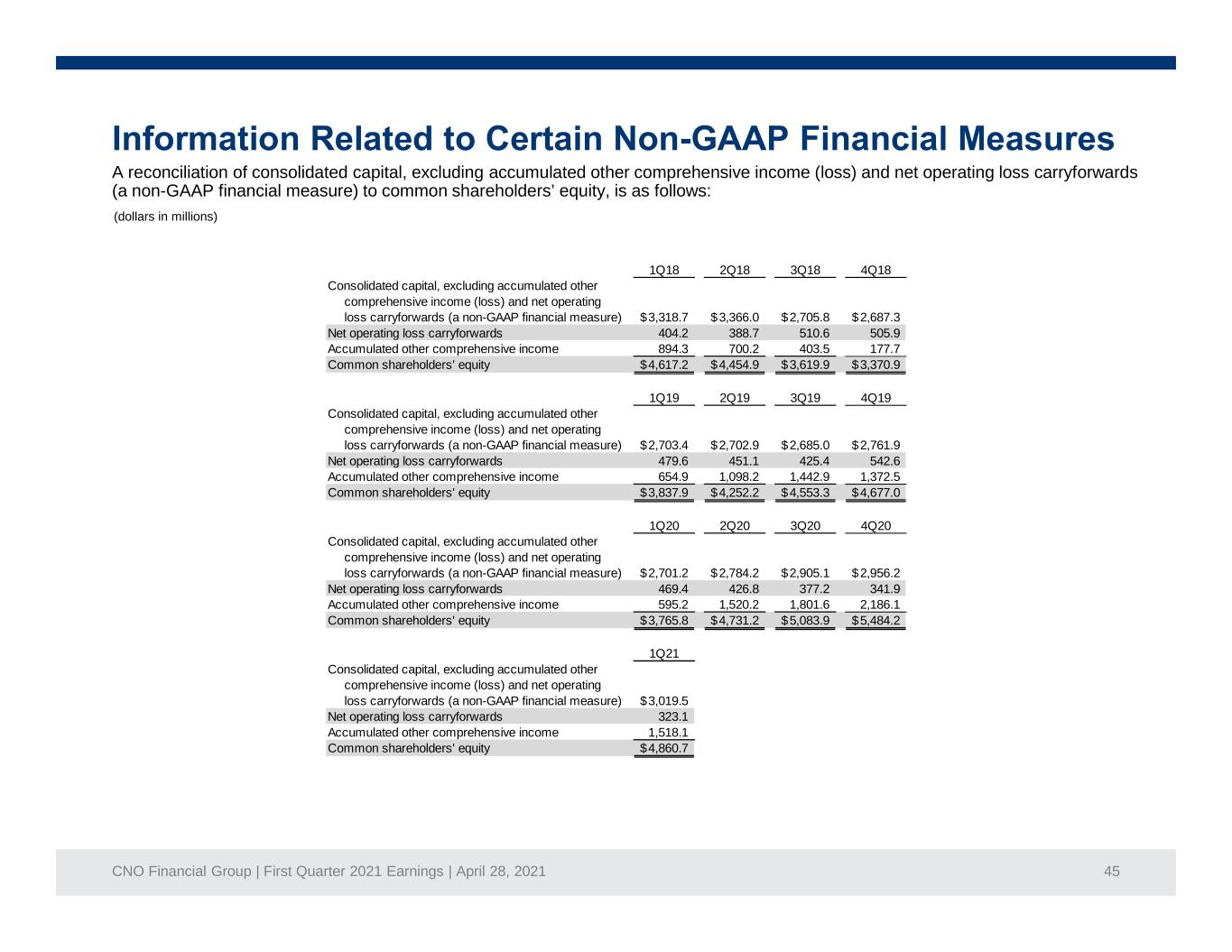

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 45 A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows: (dollars in millions) 1Q18 2Q18 3Q18 4Q18 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,318.7$ 3,366.0$ 2,705.8$ 2,687.3$ Net operating loss carryforwards 404.2 388.7 510.6 505.9 Accumulated other comprehensive income 894.3 700.2 403.5 177.7 Common shareholders' equity 4,617.2$ 4,454.9$ 3,619.9$ 3,370.9$ 1Q19 2Q19 3Q19 4Q19 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,703.4$ 2,702.9$ 2,685.0$ 2,761.9$ Net operating loss carryforwards 479.6 451.1 425.4 542.6 Accumulated other comprehensive income 654.9 1,098.2 1,442.9 1,372.5 Common shareholders' equity 3,837.9$ 4,252.2$ 4,553.3$ 4,677.0$ 1Q20 2Q20 3Q20 4Q20 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,701.2$ 2,784.2$ 2,905.1$ 2,956.2$ Net operating loss carryforwards 469.4 426.8 377.2 341.9 Accumulated other comprehensive income 595.2 1,520.2 1,801.6 2,186.1 Common shareholders' equity 3,765.8$ 4,731.2$ 5,083.9$ 5,484.2$ 1Q21 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,019.5$ Net operating loss carryforwards 323.1 Accumulated other comprehensive income 1,518.1 Common shareholders' equity 4,860.7$

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 46 A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows: (dollars in millions) 1Q20 2Q20 3Q20 4Q20 1Q21 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,713.0$ 2,722.9$ 2,760.6$ 2,812.4$ 2,876.5$ Net operating loss carryforwards 473.4 469.1 460.0 428.9 385.5 Accumulated other comprehensive income 1,134.7 1,180.0 1,277.6 1,424.1 1,641.1 Common shareholders' equity 4,321.1$ 4,372.0$ 4,498.2$ 4,665.4$ 4,903.1$ Trailing Four Quarter Average

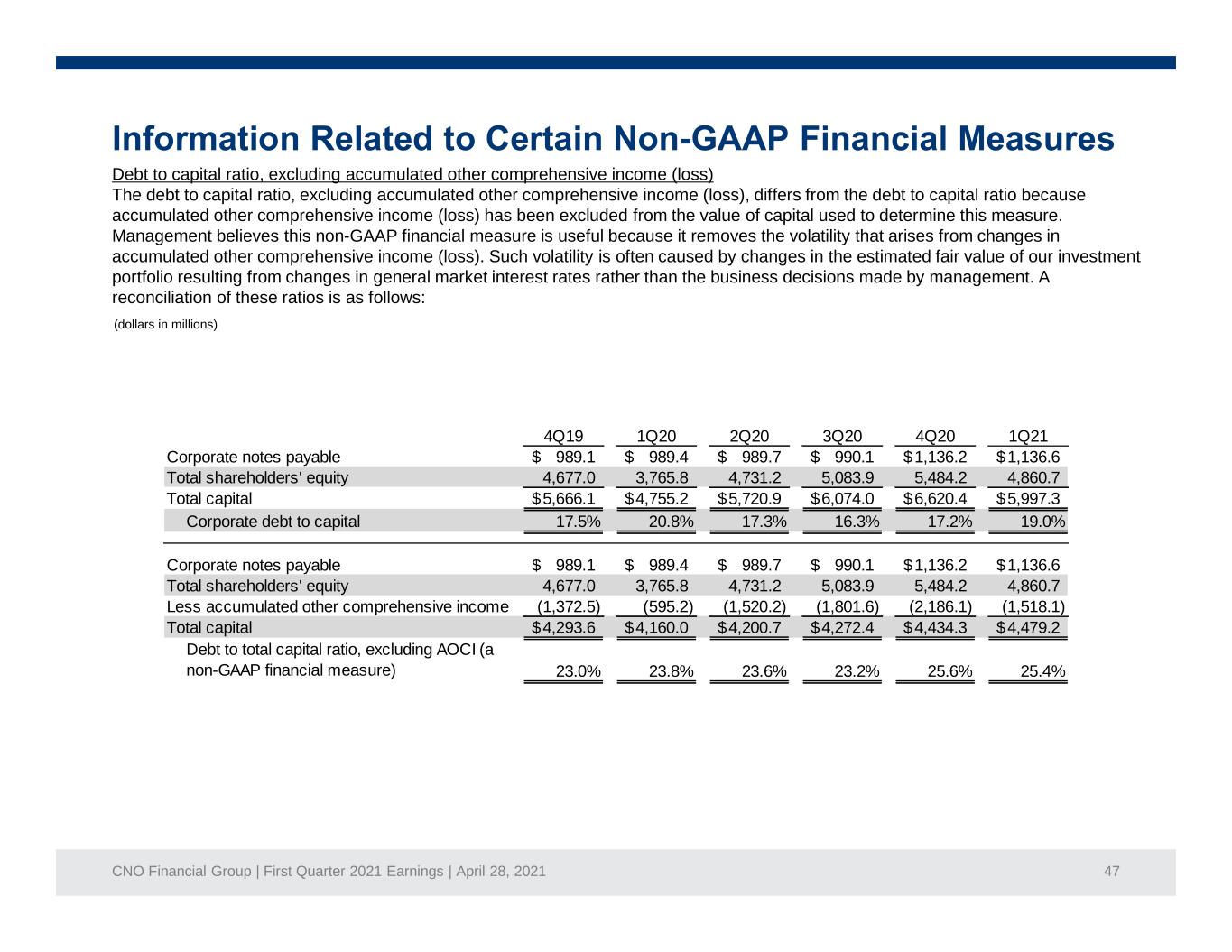

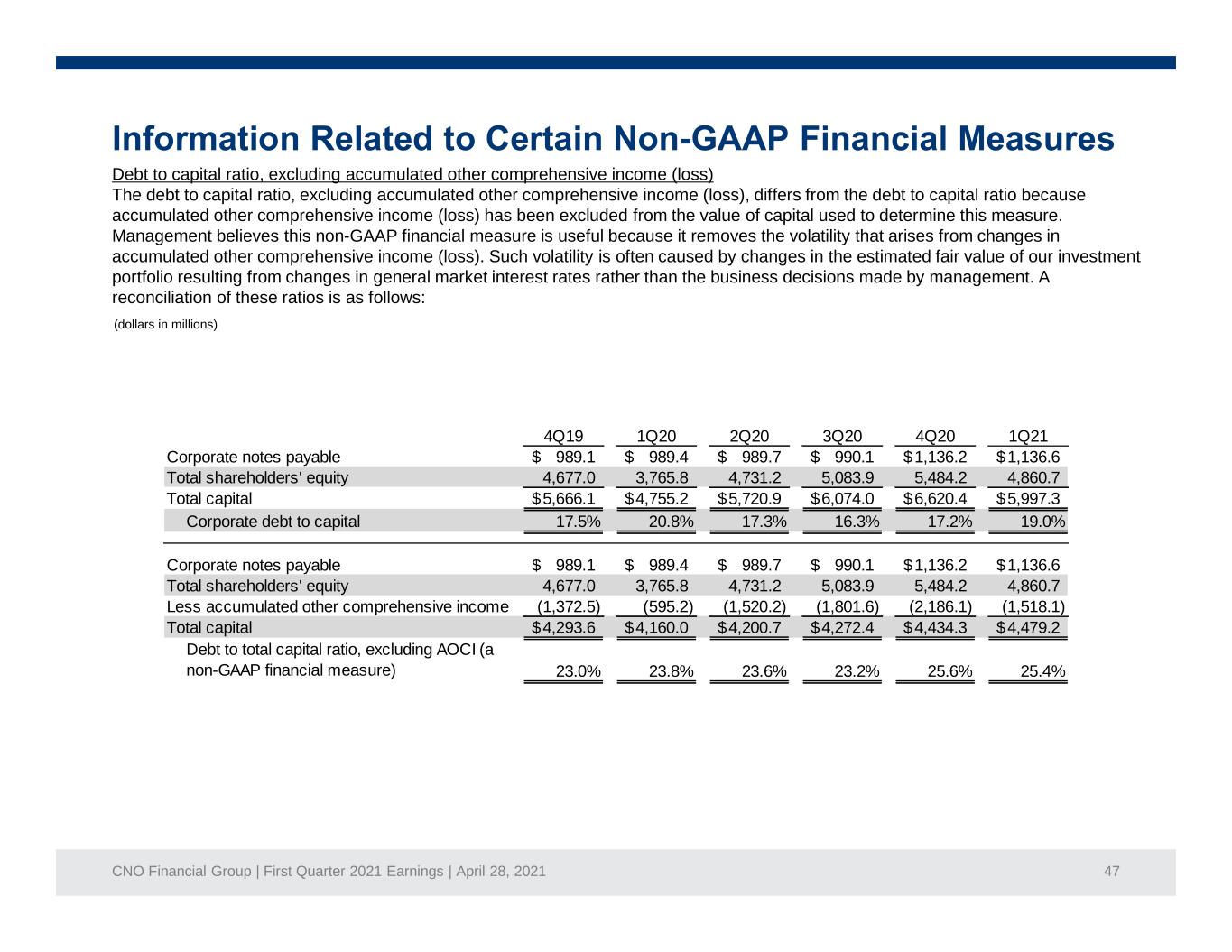

CNO Financial Group | First Quarter 2021 Earnings | April 28, 2021 47 Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows: (dollars in millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 Total capital 5,666.1$ 4,755.2$ 5,720.9$ 6,074.0$ 6,620.4$ 5,997.3$ Corporate debt to capital 17.5% 20.8% 17.3% 16.3% 17.2% 19.0% Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 Less accumulated other comprehensive income (1,372.5) (595.2) (1,520.2) (1,801.6) (2,186.1) (1,518.1) Total capital 4,293.6$ 4,160.0$ 4,200.7$ 4,272.4$ 4,434.3$ 4,479.2$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 23.0% 23.8% 23.6% 23.2% 25.6% 25.4%