Fourth Quarter 2021 Financial and operating results for the period ended December 31, 2021 February 8, 2022 Unless otherwise specified, comparisons in this presentation are between 4Q20 and 4Q21. Exhibit 99.3

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 2 Important Legal Information Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on February 8, 2022, our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date. Forward-Looking Statements This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes the measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, CNOinc.com. Non-GAAP Measures

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 3

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 4 2021 Year in Review Strong Operational Performance • Operating EPS1 of $2.79 vs. $2.53 in 2020, up 10% • Continued execution of Transformation objectives • Deepened integration between D2C / field agents • Enhanced attractiveness of Worksite product / service offering • Prudently managed expenses • Invested in associate programs; DE&I and ESG progress • Generated $380 million in free cash flow • Returned $468 million to shareholders • Record $402 million in share repurchases • Book value per diluted share excluding AOCI1 up 12% • Operating ROE1, as adjusted, of 12.1% • Investment portfolio remains conservatively positioned 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Building on Track Record of Execution Strong earnings; solid operational execution; record buybacks

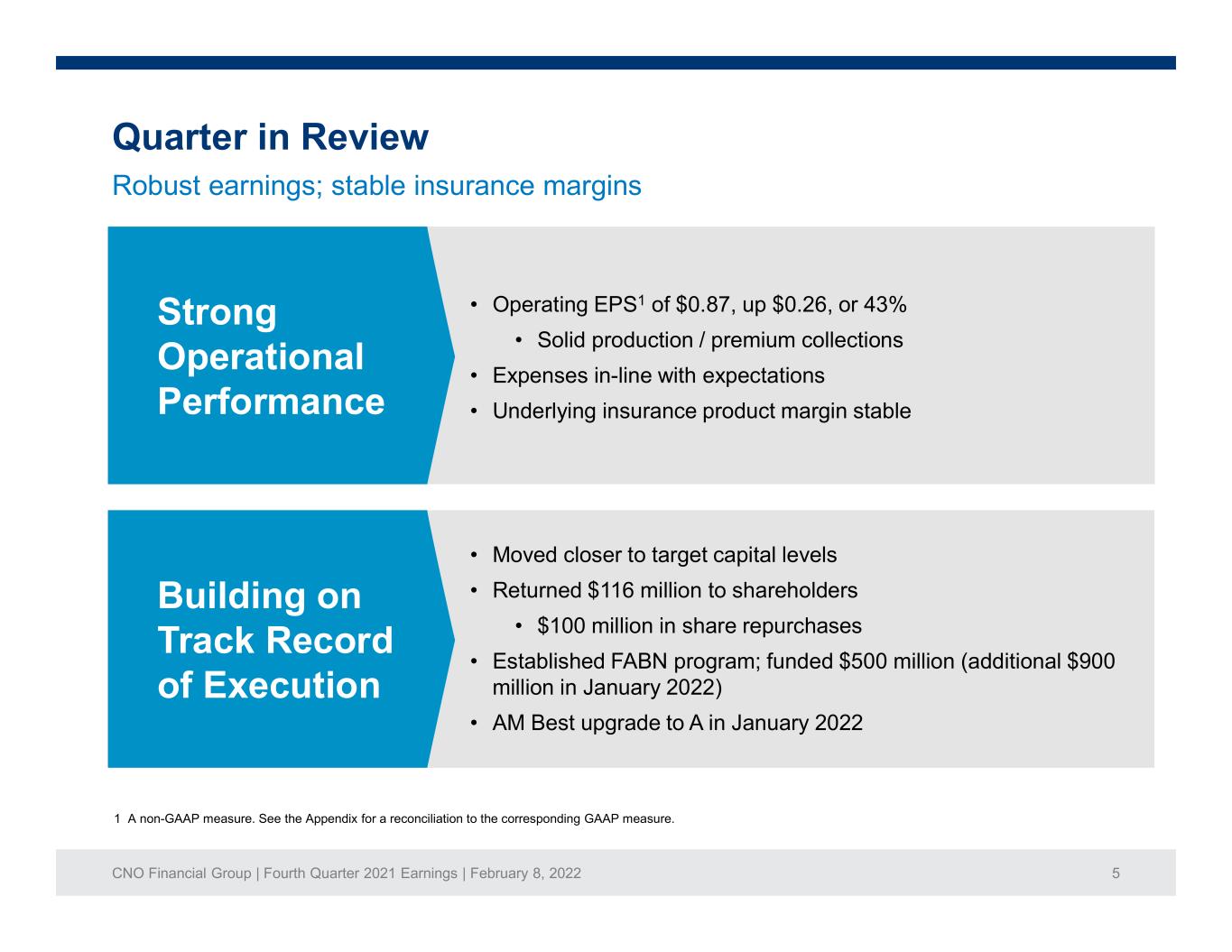

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 5 Quarter in Review Strong Operational Performance • Moved closer to target capital levels • Returned $116 million to shareholders • $100 million in share repurchases • Established FABN program; funded $500 million (additional $900 million in January 2022) • AM Best upgrade to A in January 2022 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. Building on Track Record of Execution • Operating EPS1 of $0.87, up $0.26, or 43% • Solid production / premium collections • Expenses in-line with expectations • Underlying insurance product margin stable Robust earnings; stable insurance margins

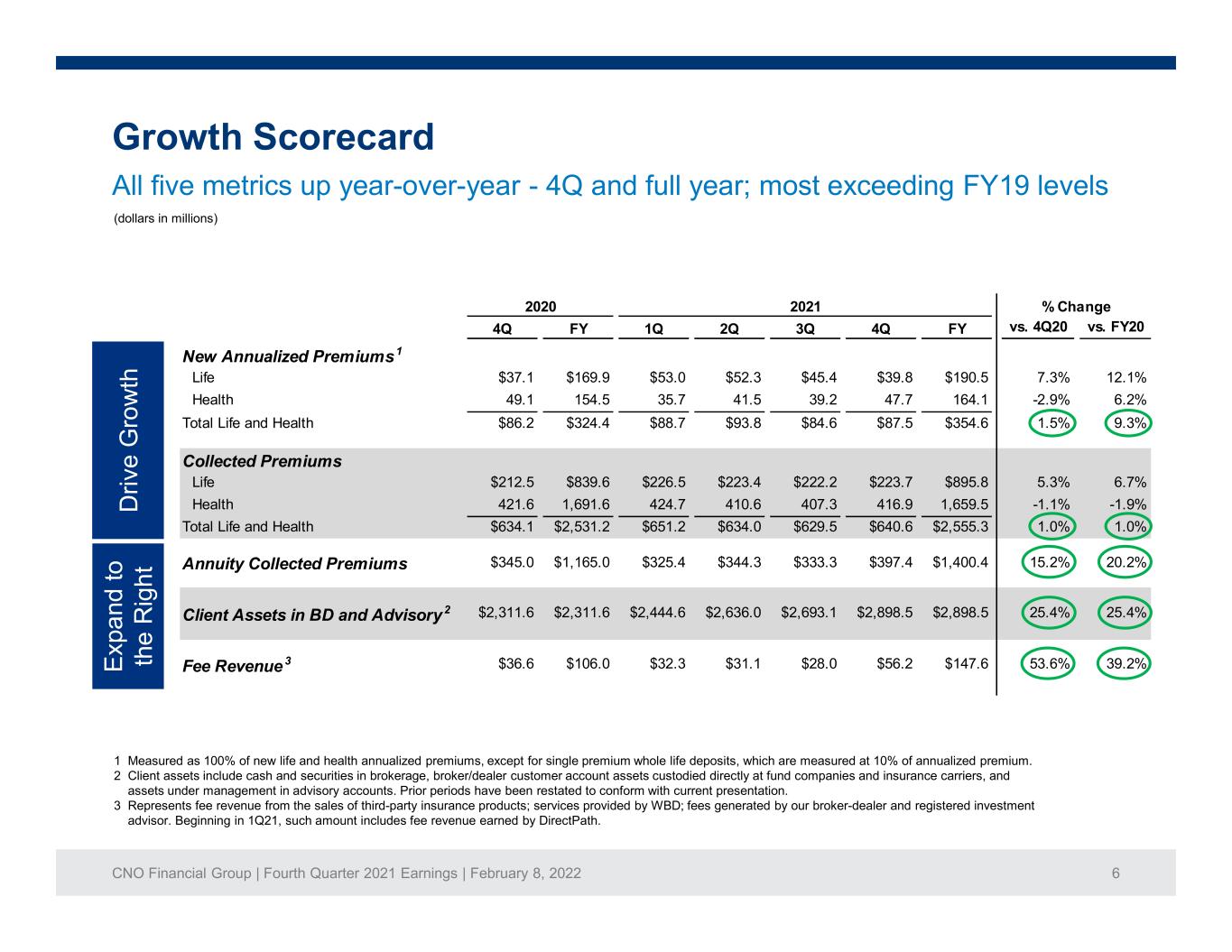

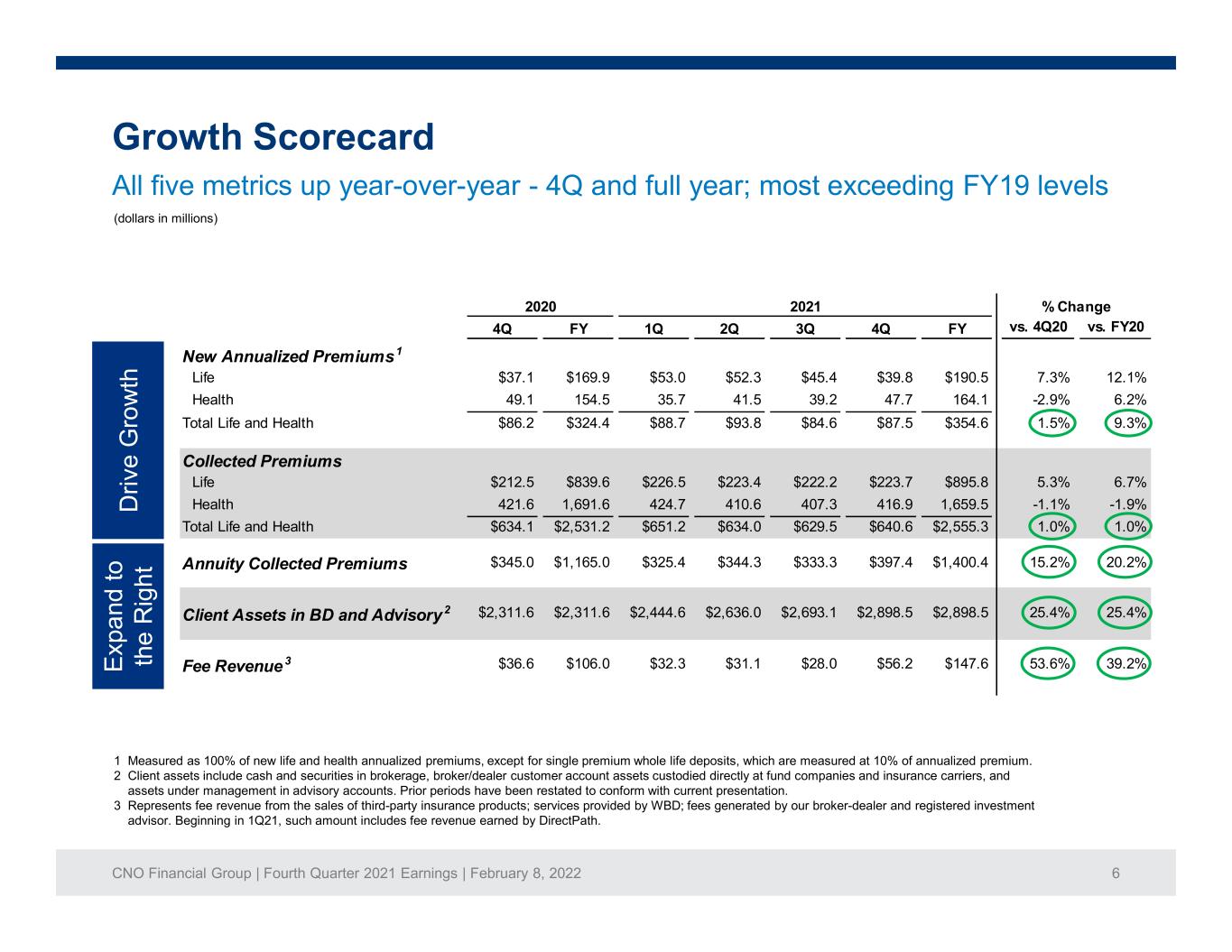

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 6 4Q FY 1Q 2Q 3Q 4Q FY vs. 4Q20 vs. FY20 New Annualized Premiums1 Life $37.1 $169.9 $53.0 $52.3 $45.4 $39.8 $190.5 7.3% 12.1% Health 49.1 154.5 35.7 41.5 39.2 47.7 164.1 -2.9% 6.2% Total Life and Health $86.2 $324.4 $88.7 $93.8 $84.6 $87.5 $354.6 1.5% 9.3% Collected Premiums Life $212.5 $839.6 $226.5 $223.4 $222.2 $223.7 $895.8 5.3% 6.7% Health 421.6 1,691.6 424.7 410.6 407.3 416.9 1,659.5 -1.1% -1.9% Total Life and Health $634.1 $2,531.2 $651.2 $634.0 $629.5 $640.6 $2,555.3 1.0% 1.0% Annuity Collected Premiums $345.0 $1,165.0 $325.4 $344.3 $333.3 $397.4 $1,400.4 15.2% 20.2% Client Assets in BD and Advisory2 $2,311.6 $2,311.6 $2,444.6 $2,636.0 $2,693.1 $2,898.5 $2,898.5 25.4% 25.4% Fee Revenue 3 $36.6 $106.0 $32.3 $31.1 $28.0 $56.2 $147.6 53.6% 39.2% % Change2020 2021 Growth Scorecard E xp a nd t o th e R ig h t D ri ve G ro w th 1 Measured as 100% of new life and health annualized premiums, except for single premium whole life deposits, which are measured at 10% of annualized premium. 2 Client assets include cash and securities in brokerage, broker/dealer customer account assets custodied directly at fund companies and insurance carriers, and assets under management in advisory accounts. Prior periods have been restated to conform with current presentation. 3 Represents fee revenue from the sales of third-party insurance products; services provided by WBD; fees generated by our broker-dealer and registered investment advisor. Beginning in 1Q21, such amount includes fee revenue earned by DirectPath. (dollars in millions) All five metrics up year-over-year - 4Q and full year; most exceeding FY19 levels

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 7 Consumer Division Update Fourth Quarter HighlightsKey Initiatives Transformation continues to drive sales momentum Expand reach Maintain growth momentum Optimize distribution • Total Life sales up 4% YoY; up 22% vs. 4Q19 • D2C Life sales up 21% YoY; up 33% vs. 4Q19 • Annuity collected premiums up 15% YoY; up 23% vs. 4Q19 • Third-party sales up 24% YoY; up 31% vs. 4Q19 • Cross-channel collaboration extended to Health • Agent productivity strength; recruiting headwinds • Registered agent1 count up 2% • Successful Medicare Advantage selling season • 50% of Life and Health NAP sold virtually • Steady growth in client assets in brokerage and advisory 1 Registered agents are dually licensed as insurance agents and financial representatives who can buy and sell securities for clients, and/or investment advisors who can provide ongoing investment advice for clients.

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 8 Worksite Division Update Fourth Quarter Highlights • Life and Health sales up 16% YoY; up 31% sequentially • Fee revenue up 125%, driven by the addition of DirectPath • Stable employer base and premium collection • Continued DirectPath / WBD cross sale success • Average client size increasing • Rising Per Employee Per Month (PEPM) metrics Key Initiatives Expand reach • Productivity gains across all cohorts • Early success with incentive programs for new agents • Strong veteran agent retention Restore growth Optimize distribution Sales rebuilding; COVID continues to slow pace of recovery

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 9 Excess Capital Allocation Strategy Disciplined and opportunistic approach to maximize shareholder value Organic investments to sustain and grow the core businesses • Agent pilots, technology-driven customer experience enhancements • Hybrid distribution • Worksite B2B marketing, lead generation Return capital to shareholders • Share repurchases: $100 million in 4Q21, record $402 million in 2021 • Dividends: $16 million in 4Q21, $66 million in 2021 Opportunistic transactions • Highly selective M&A • CNO Ventures; strategic minority investments largely in InsurTech • LTC reinsurance (2018), Web Benefits Design (2019), DirectPath (2021)

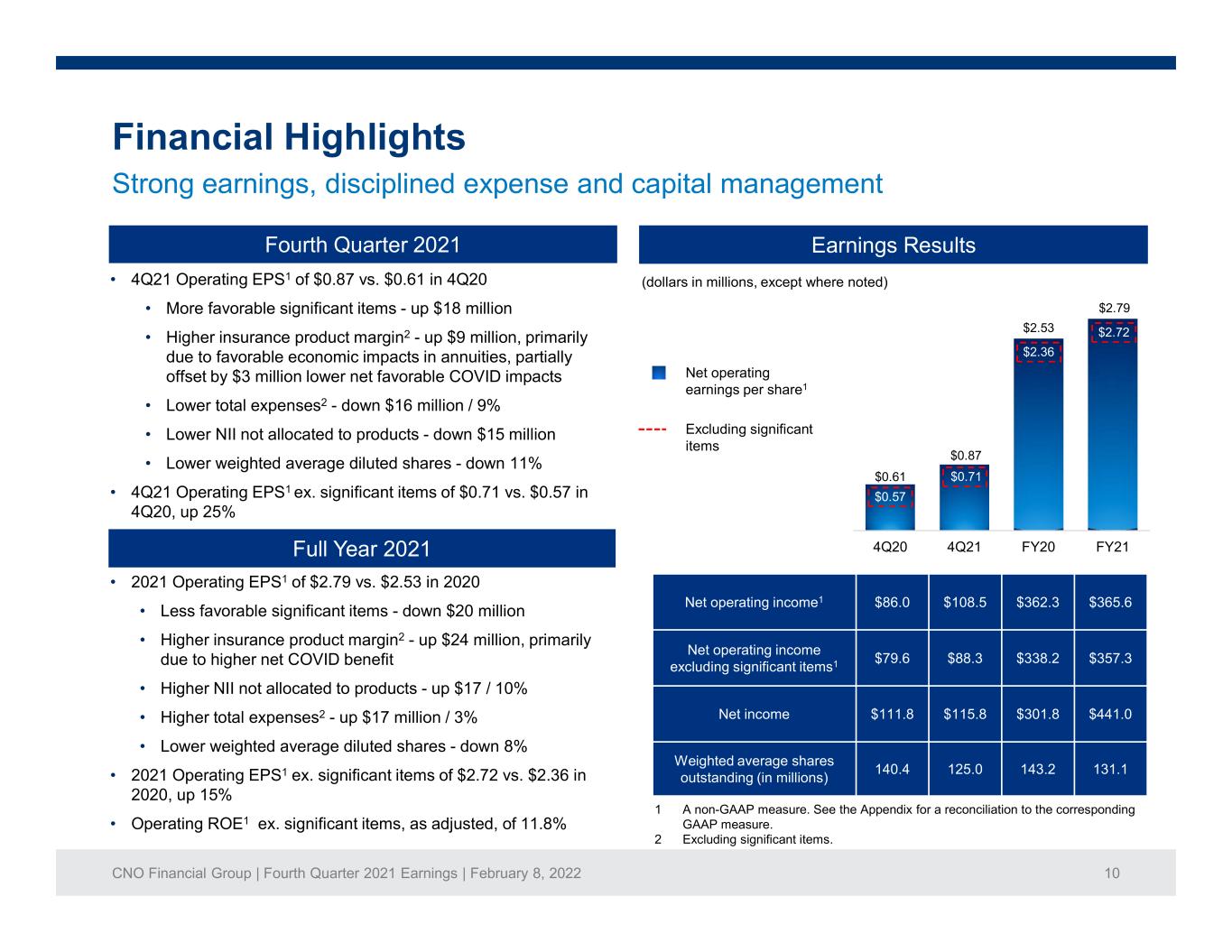

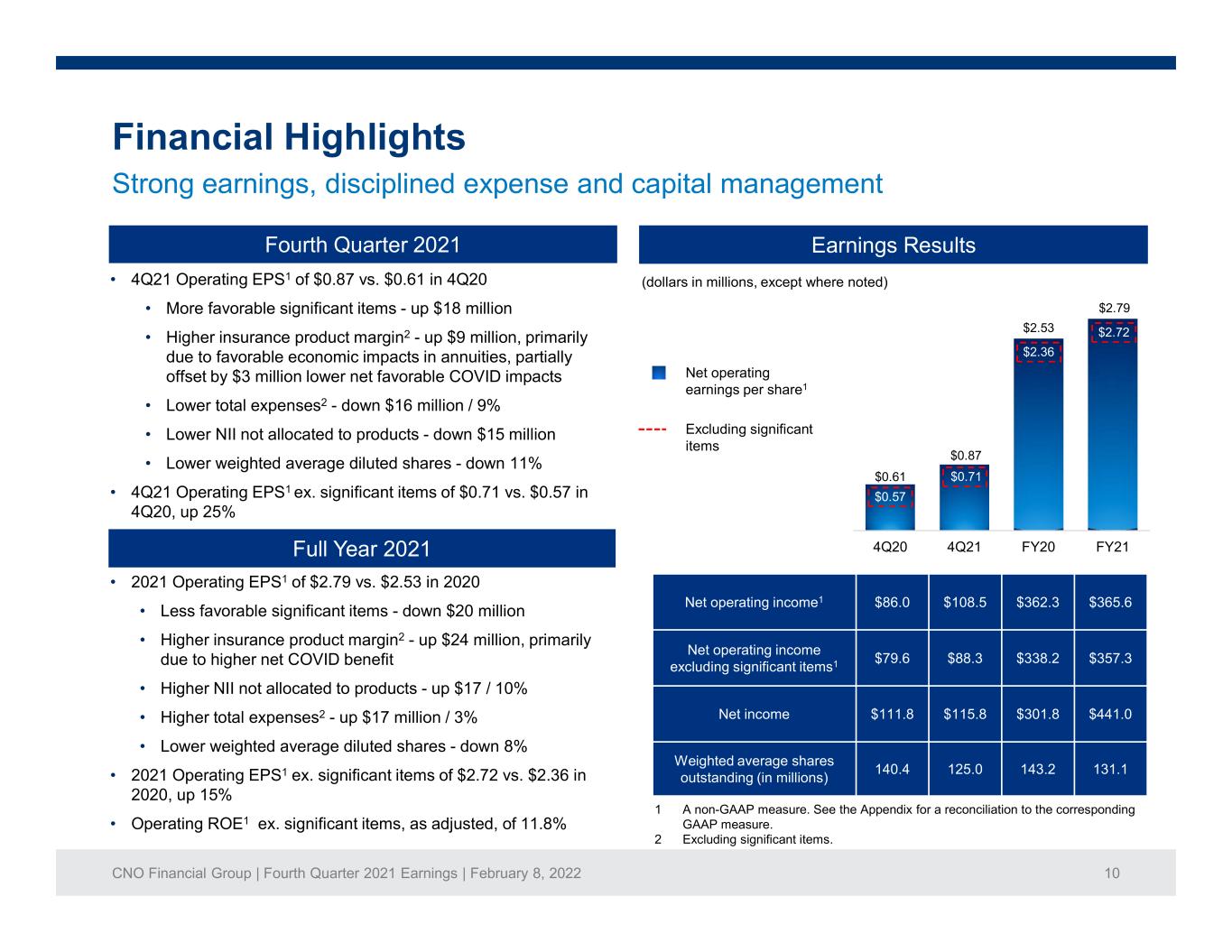

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 10 Financial Highlights Strong earnings, disciplined expense and capital management Earnings ResultsFourth Quarter 2021 Net operating income1 $86.0 $108.5 $362.3 $365.6 Net operating income excluding significant items1 $79.6 $88.3 $338.2 $357.3 Net income $111.8 $115.8 $301.8 $441.0 Weighted average shares outstanding (in millions) 140.4 125.0 143.2 131.1 (dollars in millions, except where noted) Net operating earnings per share1 • 4Q21 Operating EPS1 of $0.87 vs. $0.61 in 4Q20 • More favorable significant items - up $18 million • Higher insurance product margin2 - up $9 million, primarily due to favorable economic impacts in annuities, partially offset by $3 million lower net favorable COVID impacts • Lower total expenses2 - down $16 million / 9% • Lower NII not allocated to products - down $15 million • Lower weighted average diluted shares - down 11% • 4Q21 Operating EPS1 ex. significant items of $0.71 vs. $0.57 in 4Q20, up 25% 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. 2 Excluding significant items. Excluding significant items $0.61 $0.87 $2.53 $2.79 4Q20 4Q21 FY20 FY21 $0.57 $2.36 $0.71 $2.72 Full Year 2021 • 2021 Operating EPS1 of $2.79 vs. $2.53 in 2020 • Less favorable significant items - down $20 million • Higher insurance product margin2 - up $24 million, primarily due to higher net COVID benefit • Higher NII not allocated to products - up $17 / 10% • Higher total expenses2 - up $17 million / 3% • Lower weighted average diluted shares - down 8% • 2021 Operating EPS1 ex. significant items of $2.72 vs. $2.36 in 2020, up 15% • Operating ROE1 ex. significant items, as adjusted, of 11.8%

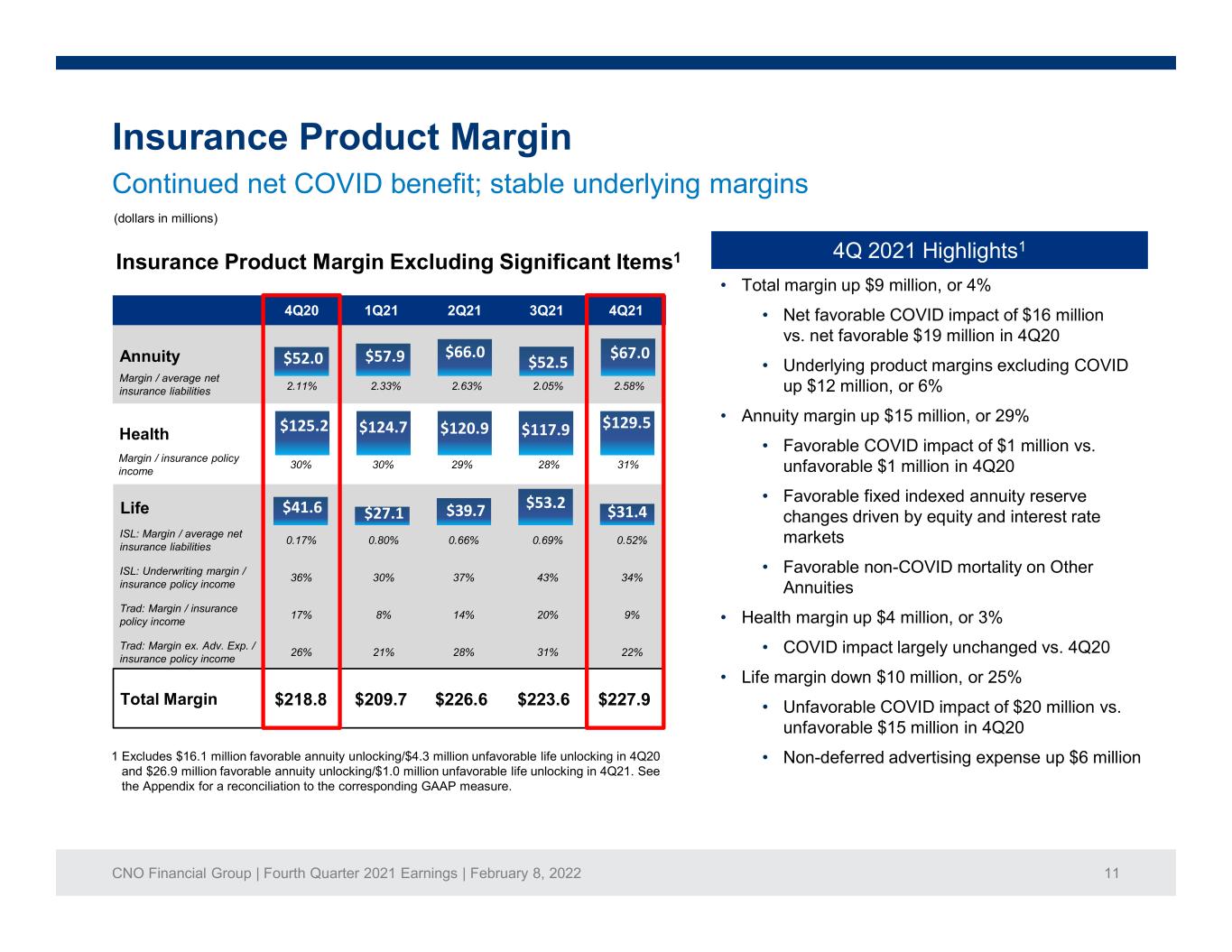

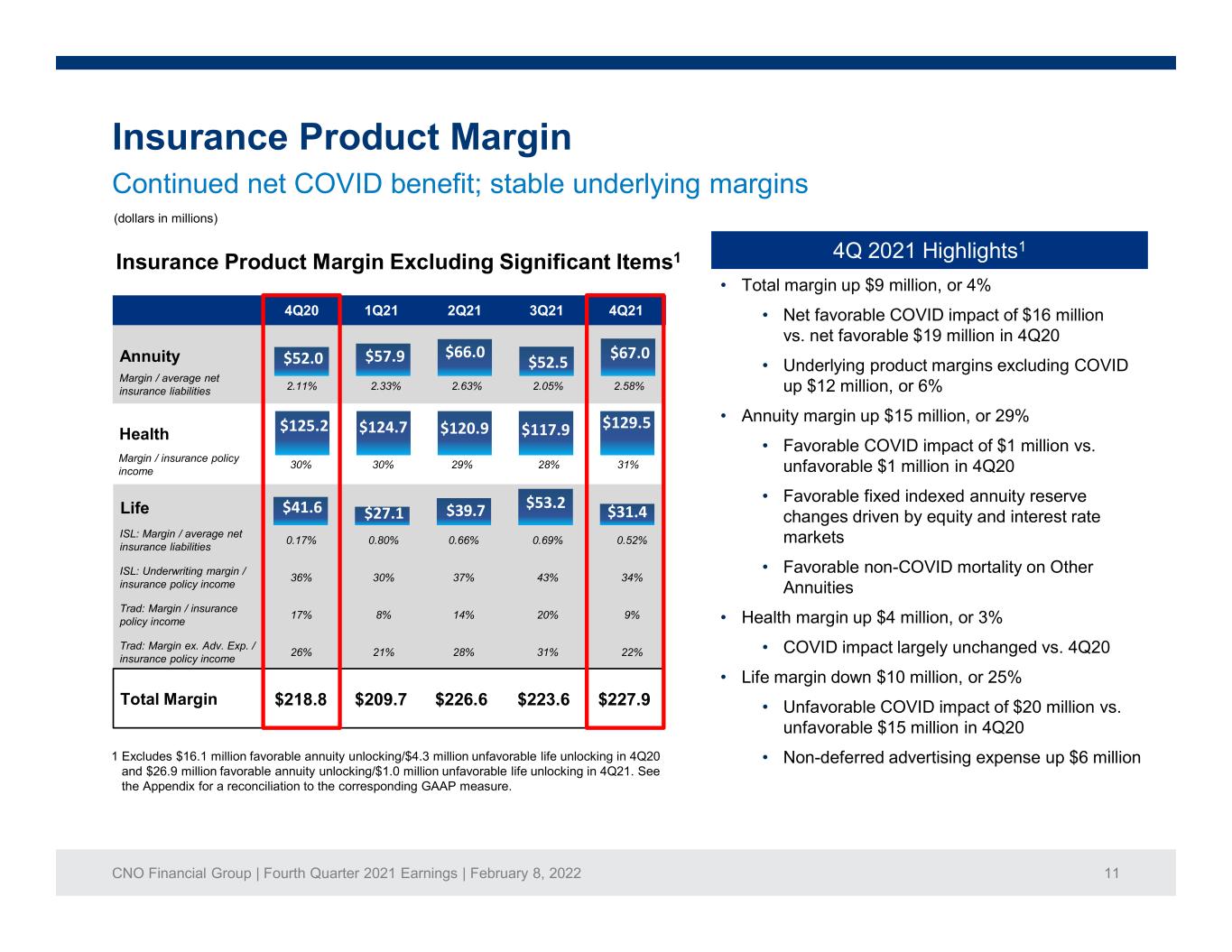

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 11 4Q 2021 Highlights1 $52.0 $57.9 $66.0 $52.5 $67.0 $41.6 $27.1 $39.7 $53.2 $31.4 $125.2 $124.7 $120.9 $117.9 $129.5 Insurance Product Margin (dollars in millions) Continued net COVID benefit; stable underlying margins Insurance Product Margin Excluding Significant Items1 4Q20 1Q21 2Q21 3Q21 4Q21 Annuity Health Life Total Margin $218.8 $209.7 $226.6 $223.6 $227.9 2.11% 2.33% 2.63% 2.05% 2.58% Margin / average net insurance liabilities Margin / insurance policy income 30% 30% 29% 28% 31% ISL: Margin / average net insurance liabilities 0.17% 0.80% 0.66% 0.69% 0.52% ISL: Underwriting margin / insurance policy income 36% 30% 37% 43% 34% Trad: Margin / insurance policy income 17% 8% 14% 20% 9% Trad: Margin ex. Adv. Exp. / insurance policy income 26% 21% 28% 31% 22% • Total margin up $9 million, or 4% • Net favorable COVID impact of $16 million vs. net favorable $19 million in 4Q20 • Underlying product margins excluding COVID up $12 million, or 6% • Annuity margin up $15 million, or 29% • Favorable COVID impact of $1 million vs. unfavorable $1 million in 4Q20 • Favorable fixed indexed annuity reserve changes driven by equity and interest rate markets • Favorable non-COVID mortality on Other Annuities • Health margin up $4 million, or 3% • COVID impact largely unchanged vs. 4Q20 • Life margin down $10 million, or 25% • Unfavorable COVID impact of $20 million vs. unfavorable $15 million in 4Q20 • Non-deferred advertising expense up $6 million1 Excludes $16.1 million favorable annuity unlocking/$4.3 million unfavorable life unlocking in 4Q20 and $26.9 million favorable annuity unlocking/$1.0 million unfavorable life unlocking in 4Q21. See the Appendix for a reconciliation to the corresponding GAAP measure.

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 12 $- $100.0 $200.0 $300.0 $400.0 4Q 2020 4Q 2021 Investment Income Not Allocated to Product Lines $- $100.0 $200.0 $300.0 $400.0 4Q 2020 4Q 2021 Total Net Investment Income1 Annuity Health Life Not Allocated $- $100.0 $200.0 $300.0 $400.0 4Q 2020 4Q 2021 Investment Income Allocated to Product Lines Annuity Health Life Investment Results • Average yield on allocated investments of 4.68% vs. 4.72% in 3Q21 and 4.83% in 4Q20 • New money rate of 3.67%, up from 3.55% in 3Q21 • $683 million in new money investments with average rating of A- and average duration of 11.4 years 1 Reflects sum of allocated and non-allocated investment income. Refer to pages 16-19 of the financial supplement for more information on the components of net investment income. $221.8 $225.1 $267.9$279.6 $42.8$57.8 • Invested assets up 5% YoY • 460 bps reduction in BBB/HY since 12/31/2020 • Earned yield of 4.83% vs. 5.03% in 3Q21 and 5.22% in 4Q20 • Investment Income Not Allocated to Product Lines down $15 million YoY • Moderating alternatives performance • $3 billion FABN program • October 2021 - $500 million inaugural issuance • January 2022 - $900 million issuance (dollars in millions) Solid investment income performance; strong but moderating variable results

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 13 IG Corporates, 51.1% Non-Agency RMBS, 7.4% Mortgage Loans, 4.5% HY Corporates, 3.0% CMBS, 8.3% Municipals, 10.5% ABS, 4.1% Govts/Agency, 1.3% CLO, 2.1% Equities, 0.5% Other Invested Assets, 2.1% Alternatives, 2.1% Policy Loans, 0.4% Cash, 2.6% Portfolio Composition $29 billion of Invested Assets Highlights (Fair Value as of 12/31/2021) General Approach • Positioned for stable performance across credit cycles • Focus on quality • Lower than average allocation to most higher risk categories • Low impairments through multiple cycles • $25.3 billion of assets with high degree of liquidity • 65% of portfolio in corporate and government bonds • Strong credit risk profile • 95.4% rated NAIC 1 / 2 • Portfolio average rating A • Significant credit enhancement in structured products • Diversified commercial and residential mortgages with favorable performance metrics and strong operating characteristics. No commercial delinquencies, immaterial residential delinquencies. • Alternative investments emphasizing current cash flows and comparatively predictable results High quality, balanced earnings and risks

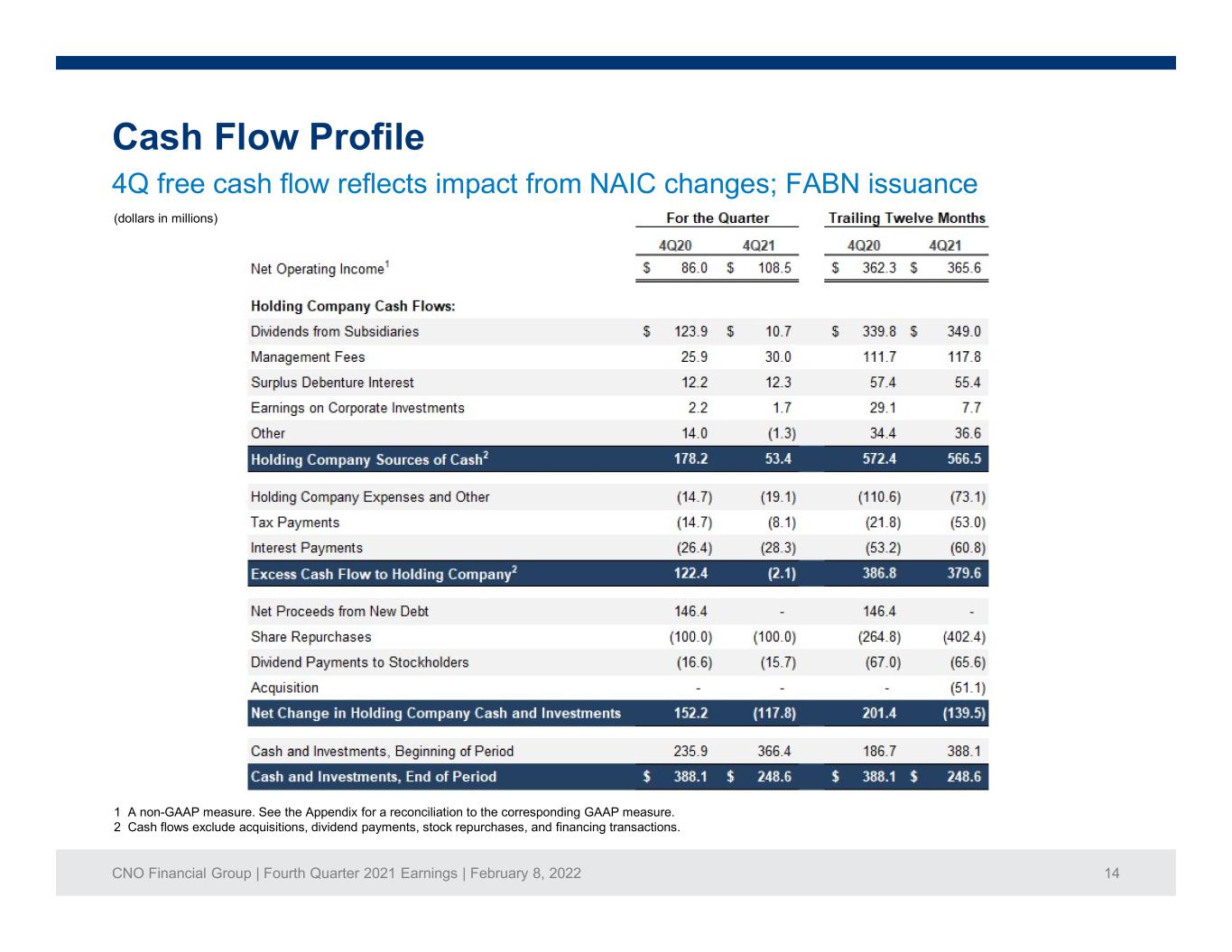

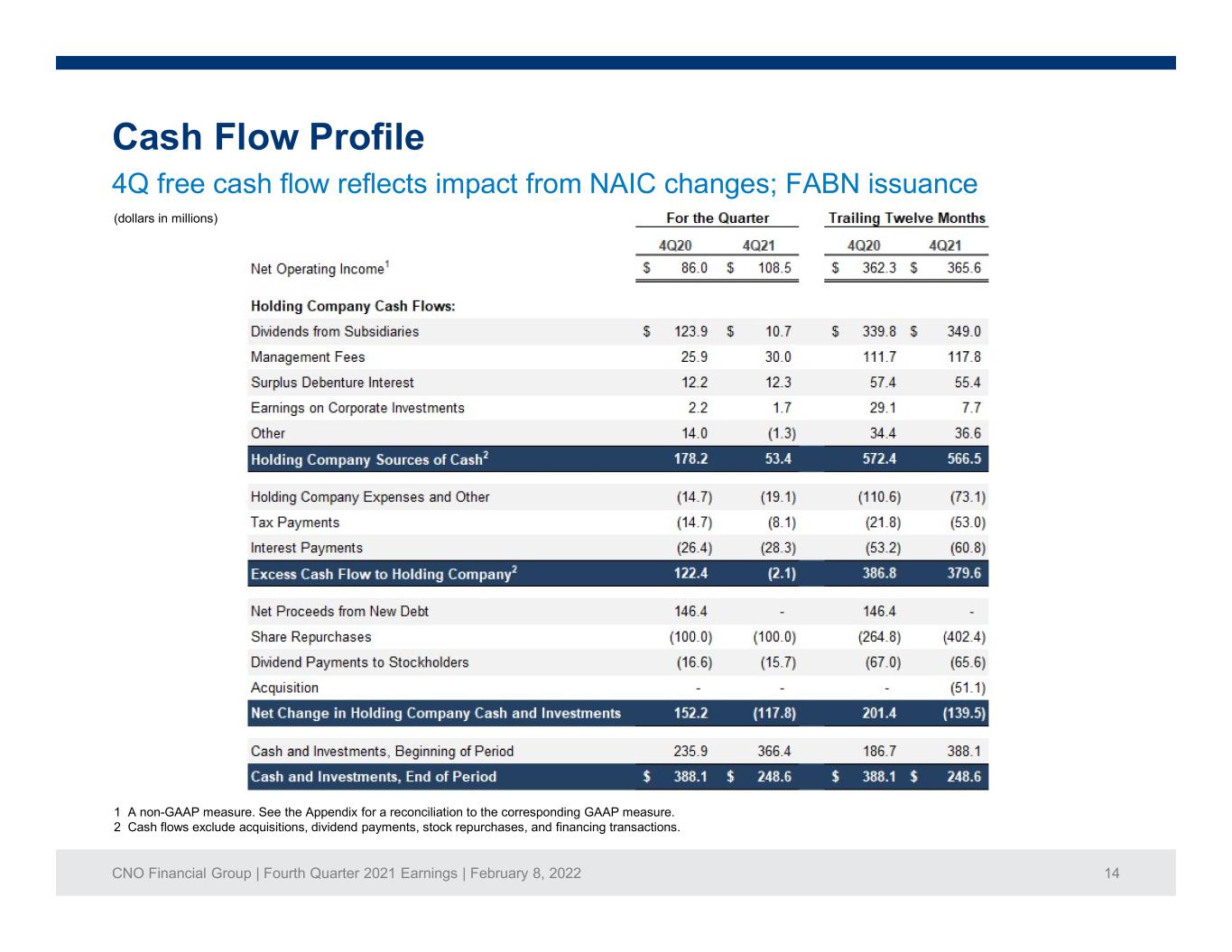

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 14 Cash Flow Profile 4Q free cash flow reflects impact from NAIC changes; FABN issuance (dollars in millions) 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. 2 Cash flows exclude acquisitions, dividend payments, stock repurchases, and financing transactions.

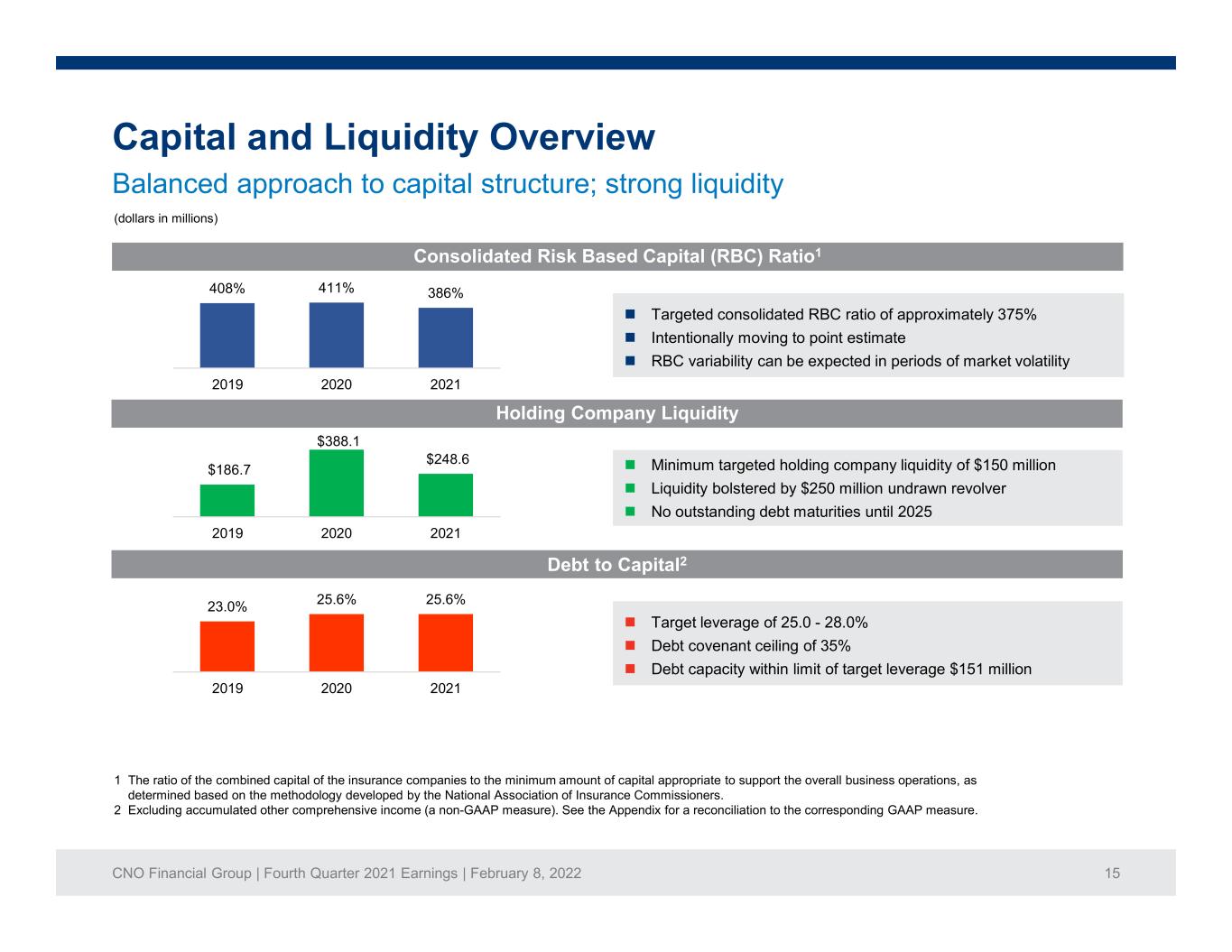

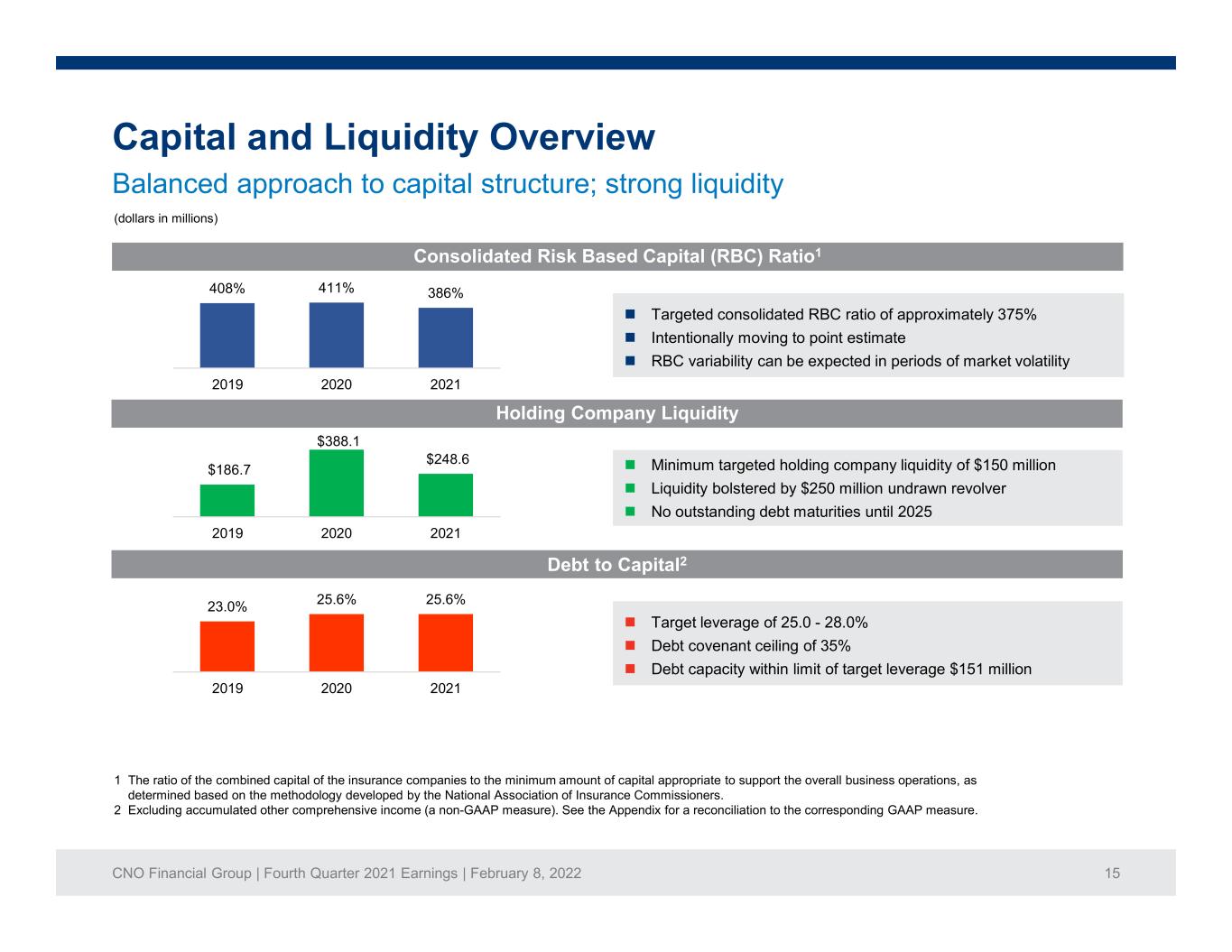

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 15 Capital and Liquidity Overview 1 The ratio of the combined capital of the insurance companies to the minimum amount of capital appropriate to support the overall business operations, as determined based on the methodology developed by the National Association of Insurance Commissioners. 2 Excluding accumulated other comprehensive income (a non-GAAP measure). See the Appendix for a reconciliation to the corresponding GAAP measure. Debt to Capital2 Consolidated Risk Based Capital (RBC) Ratio1 Target leverage of 25.0 - 28.0% Debt covenant ceiling of 35% Debt capacity within limit of target leverage $151 million Targeted consolidated RBC ratio of approximately 375% Intentionally moving to point estimate RBC variability can be expected in periods of market volatility Holding Company Liquidity Minimum targeted holding company liquidity of $150 million Liquidity bolstered by $250 million undrawn revolver No outstanding debt maturities until 2025 Balanced approach to capital structure; strong liquidity (dollars in millions) 408% 411% 386% 2019 2020 2021 $186.7 $388.1 $248.6 2019 2020 2021 23.0% 25.6% 25.6% 2019 2020 2021

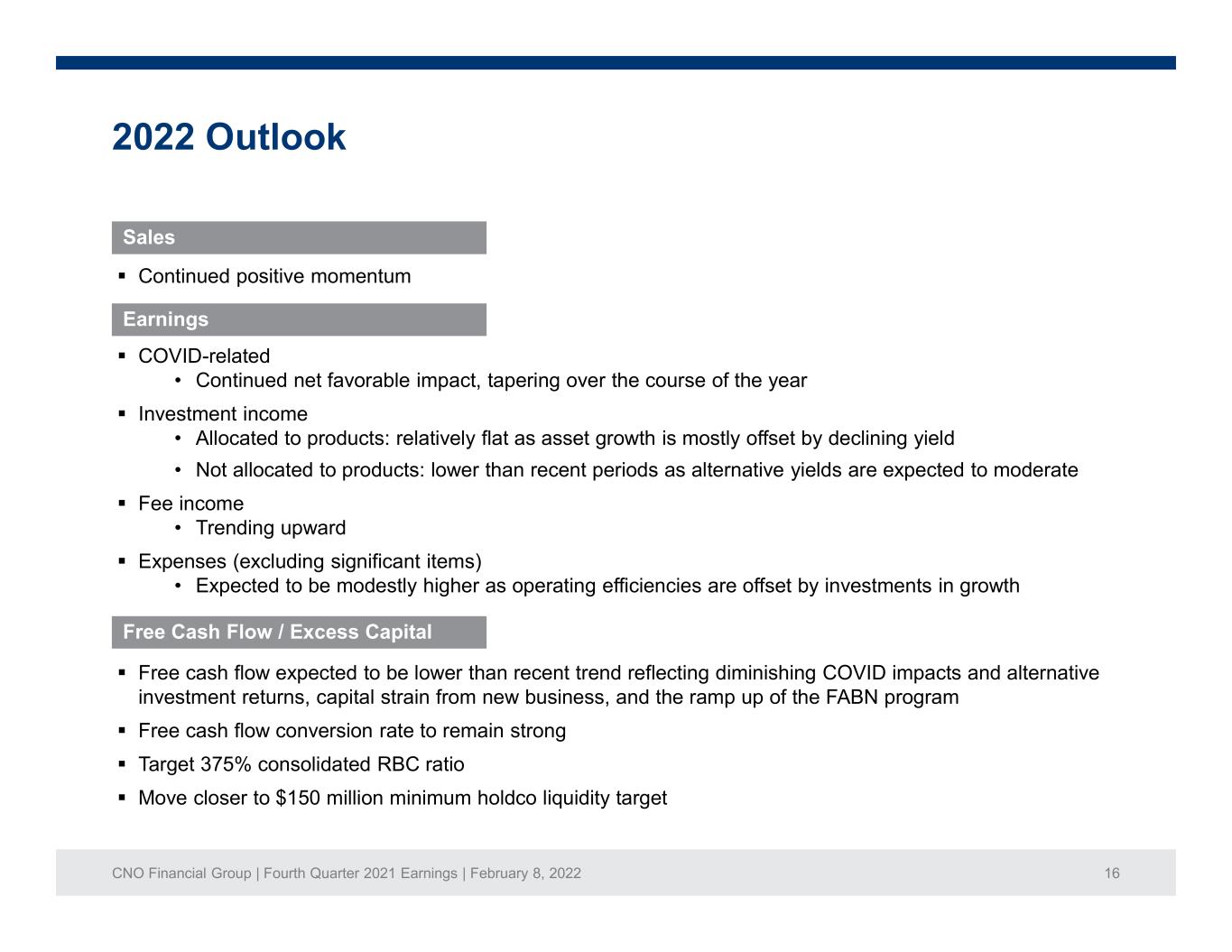

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 16 2022 Outlook Sales Continued positive momentum Earnings Free Cash Flow / Excess Capital Free cash flow expected to be lower than recent trend reflecting diminishing COVID impacts and alternative investment returns, capital strain from new business, and the ramp up of the FABN program Free cash flow conversion rate to remain strong Target 375% consolidated RBC ratio Move closer to $150 million minimum holdco liquidity target COVID-related • Continued net favorable impact, tapering over the course of the year Investment income • Allocated to products: relatively flat as asset growth is mostly offset by declining yield • Not allocated to products: lower than recent periods as alternative yields are expected to moderate Fee income • Trending upward Expenses (excluding significant items) • Expected to be modestly higher as operating efficiencies are offset by investments in growth

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 17 Delivering on our Commitments Turnaround / De-risking Pivot to Growth Optimize Long-term Value Pre 2017 2017 – 2019 2020 – ? Ongoing • Reinsured life block (2009) • Recapitalized company (2012) • Initiated dividend (2012) • Sold Legacy Life Insurance Block (2014) • Migrated ratings upwards–within non-investment grade ratings classes • Completed Senior Leadership additions • Reinsured LTC block • Achieved investment grade credit ratings • Up-in-quality portfolio repositioning • Sustainable momentum in recruiting and sales • Benefiting from diverse business model and strong retention • Balancing capital return with investments in growth • Conservative capital structure • Up-in-quality investment positioning • Successfully pivoting to new sales approaches • Accelerating integration of D2C and exclusive agents • Expanding D2C offerings • Reimagining future workplace • Optimize customer-centric business alignment • Expand omnichannel delivery model • Extract potential from Worksite business • Enhance growth, margin and ROE profile • Maximize distributable cash flow • Accelerate pace of capital deployment • Leverage technology COVID-19

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 18 Well-positioned in underserved senior middle-income market Highly differentiated business model Favorable demographic tailwinds Sustainable growth initiatives in place Strong balance sheet; robust free cash flow generation Investment Highlights

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 19 Questions and Answers

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 20 Appendix 1: Quarter in Review Strong Operational Performance • Broker-Dealer/Registered Investment Advisor Slide 21 • Exclusive Agent Counts Slide 22 Building on Strong Track Record of Execution • New Money Rate Walk Slide 23 • New Money Summary Slide 24 • Long-Term Care Insurance Slide 25 • Tax Asset Summary Slide 26

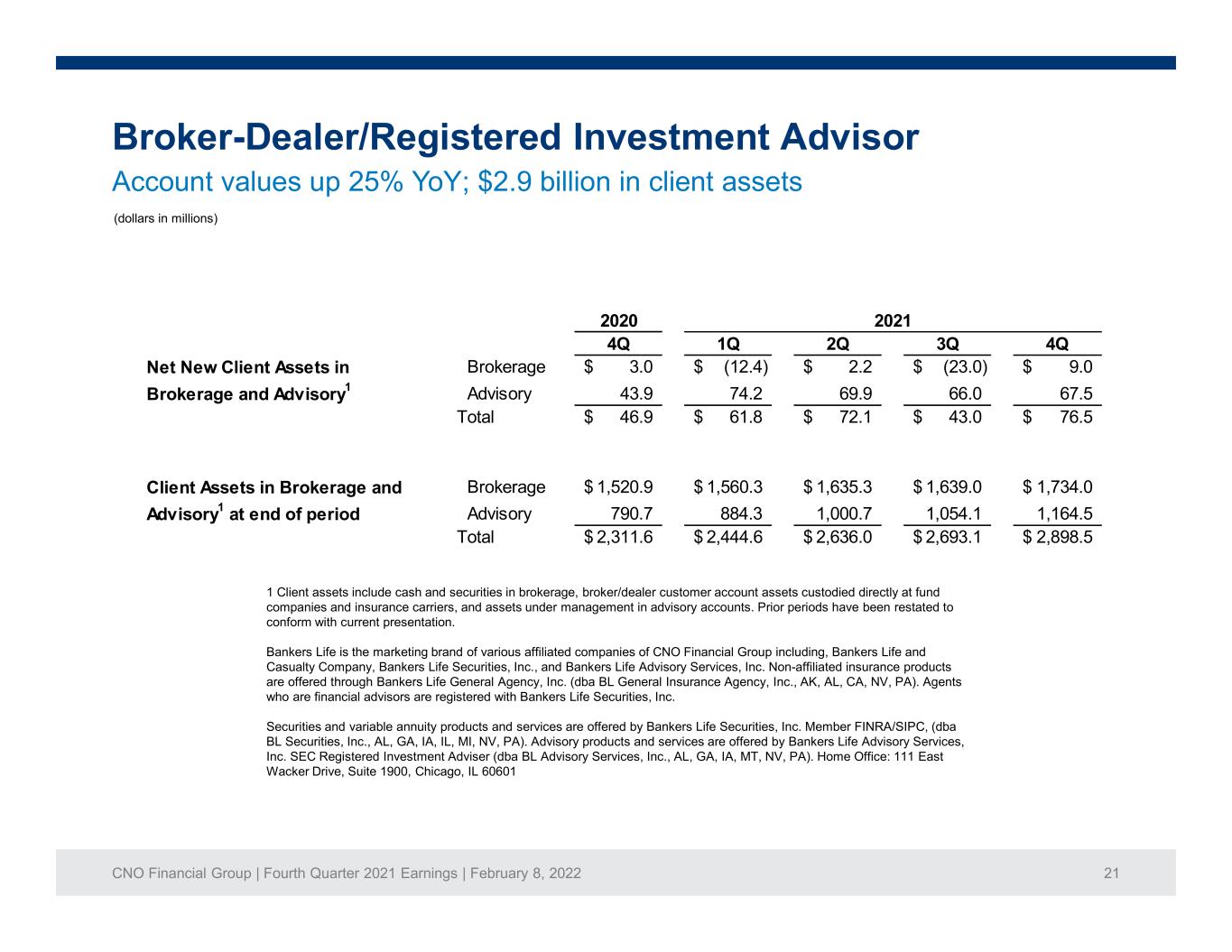

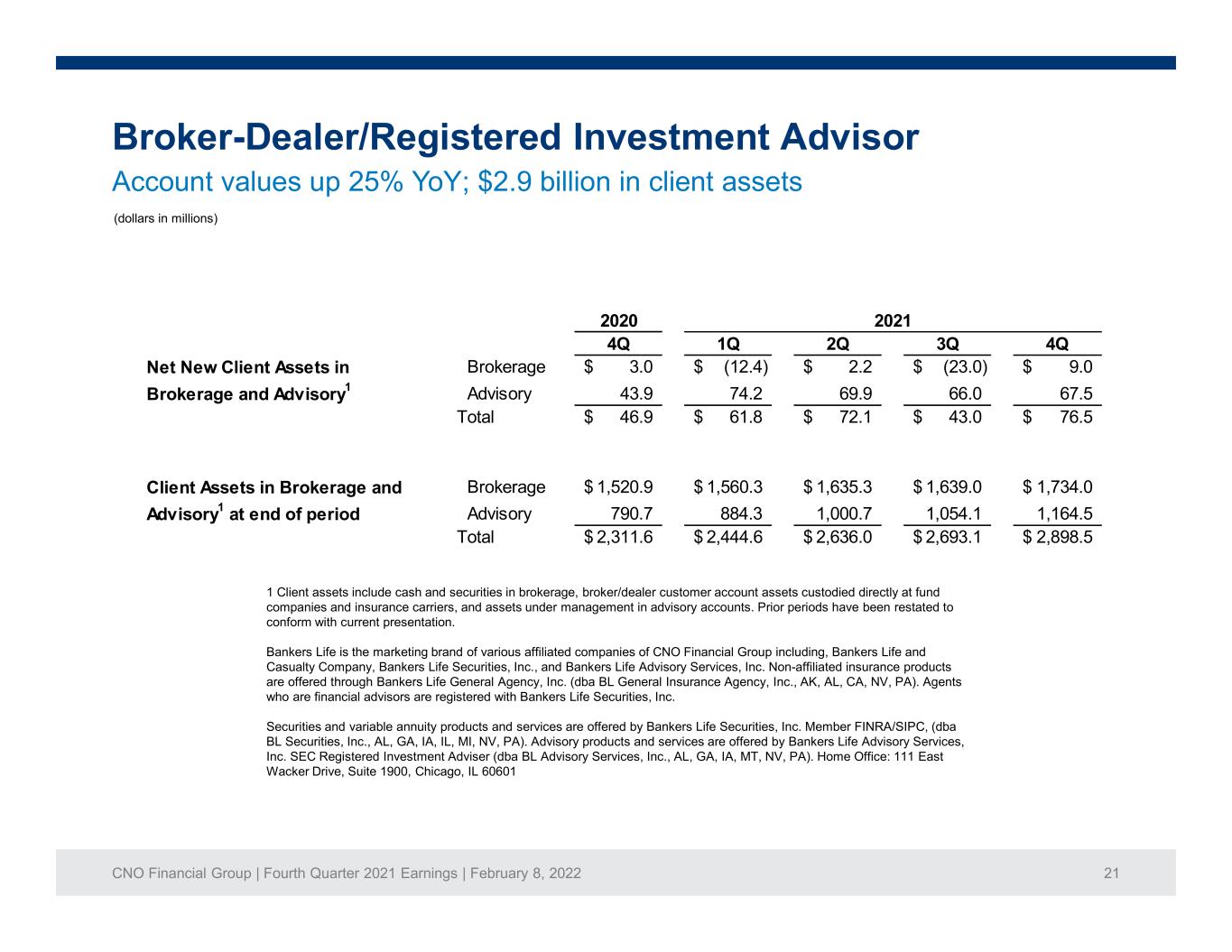

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 21 Broker-Dealer/Registered Investment Advisor 1 Client assets include cash and securities in brokerage, broker/dealer customer account assets custodied directly at fund companies and insurance carriers, and assets under management in advisory accounts. Prior periods have been restated to conform with current presentation. Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life General Agency, Inc. (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA). Agents who are financial advisors are registered with Bankers Life Securities, Inc. Securities and variable annuity products and services are offered by Bankers Life Securities, Inc. Member FINRA/SIPC, (dba BL Securities, Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services are offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA). Home Office: 111 East Wacker Drive, Suite 1900, Chicago, IL 60601 (dollars in millions) Account values up 25% YoY; $2.9 billion in client assets 2020 4Q 1Q 2Q 3Q 4Q Net New Client Assets in Brokerage 3.0$ (12.4)$ 2.2$ (23.0)$ 9.0$ Brokerage and Advisory1 Advisory 43.9 74.2 69.9 66.0 67.5 Total 46.9$ 61.8$ 72.1$ 43.0$ 76.5$ Client Assets in Brokerage and Brokerage 1,520.9$ 1,560.3$ 1,635.3$ 1,639.0$ 1,734.0$ Advisory1 at end of period Advisory 790.7 884.3 1,000.7 1,054.1 1,164.5 Total 2,311.6$ 2,444.6$ 2,636.0$ 2,693.1$ 2,898.5$ 2021

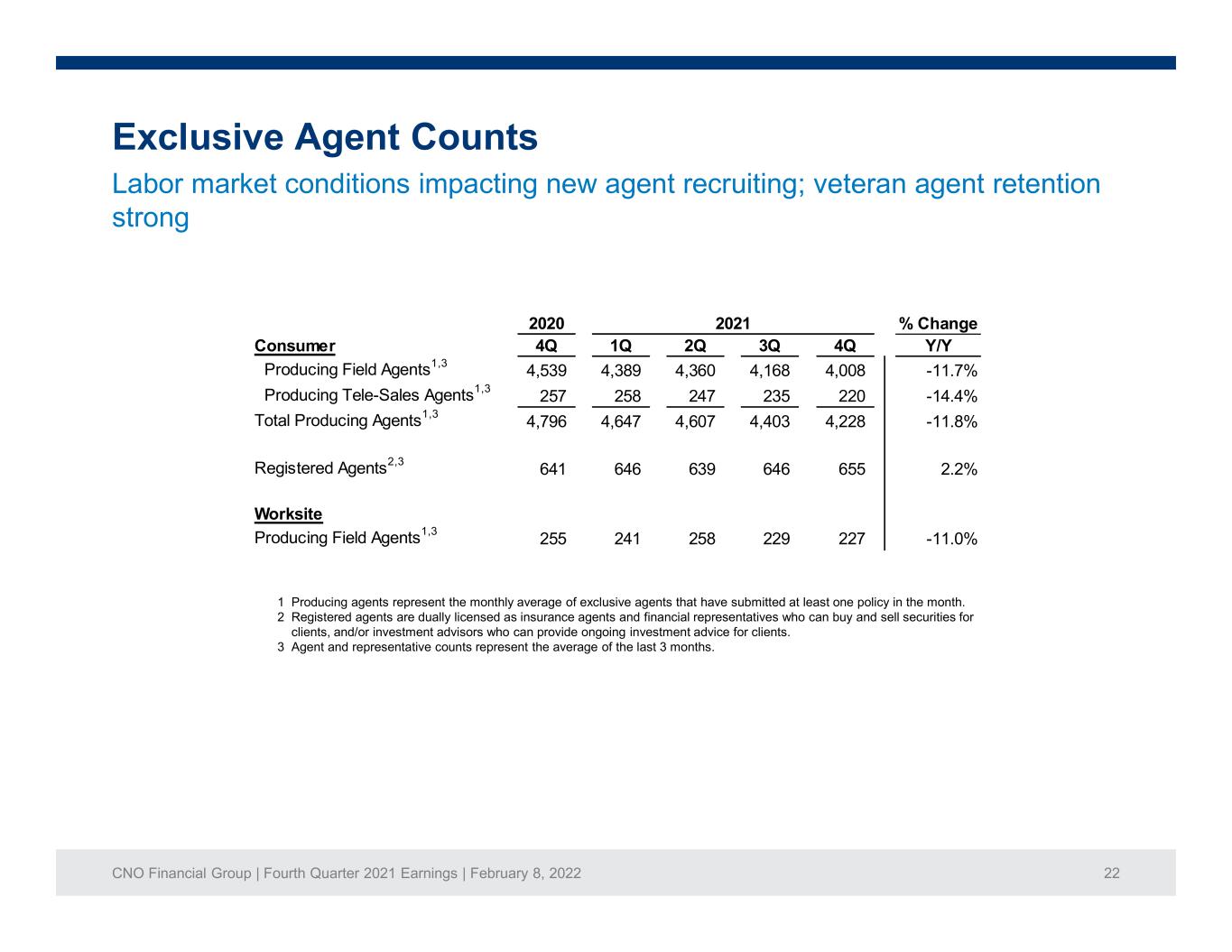

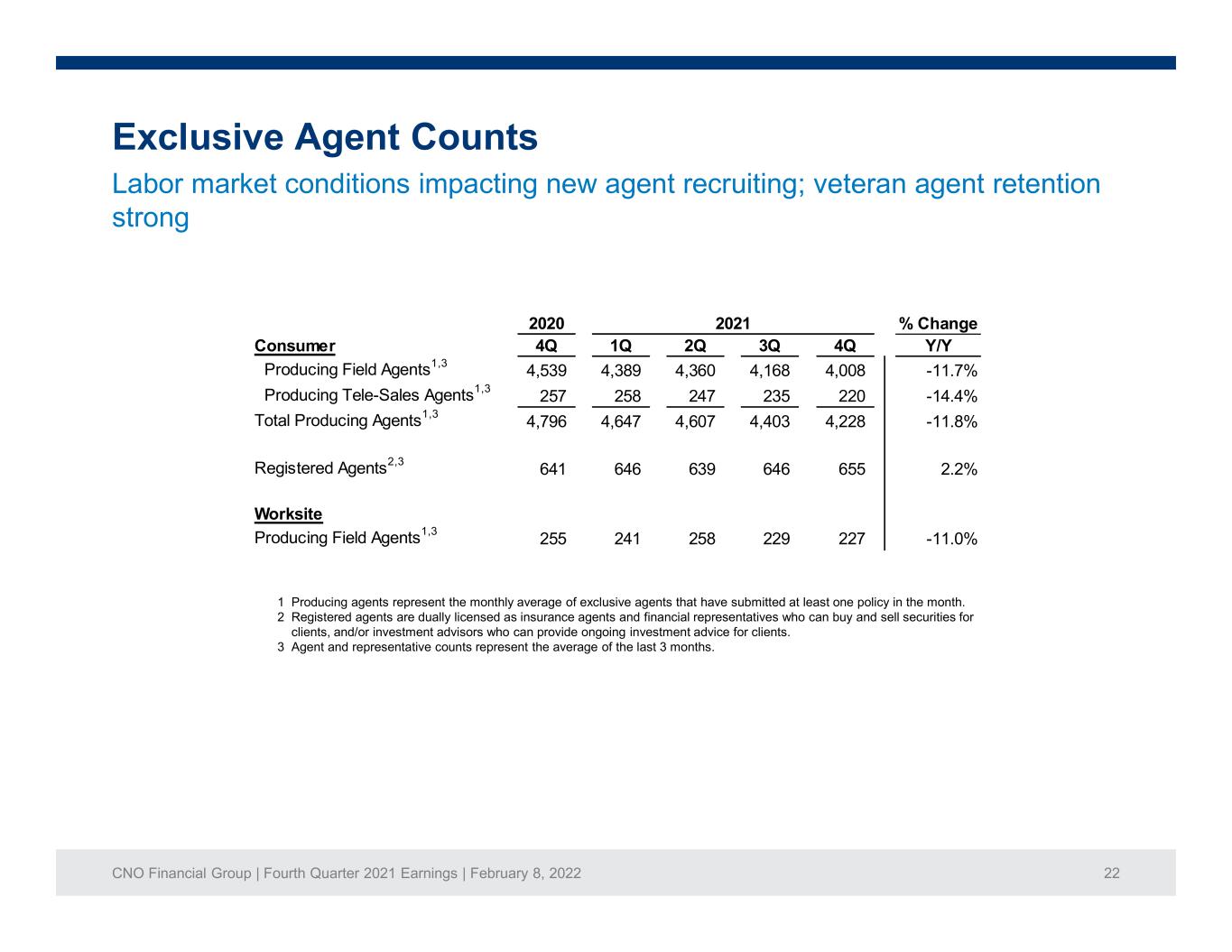

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 22 2020 % Change Consumer 4Q 1Q 2Q 3Q 4Q Y/Y Producing Field Agents1,3 4,539 4,389 4,360 4,168 4,008 -11.7% Producing Tele-Sales Agents1,3 257 258 247 235 220 -14.4% Total Producing Agents1,3 4,796 4,647 4,607 4,403 4,228 -11.8% Registered Agents2,3 641 646 639 646 655 2.2% Worksite Producing Field Agents1,3 255 241 258 229 227 -11.0% 2021 Exclusive Agent Counts 1 Producing agents represent the monthly average of exclusive agents that have submitted at least one policy in the month. 2 Registered agents are dually licensed as insurance agents and financial representatives who can buy and sell securities for clients, and/or investment advisors who can provide ongoing investment advice for clients. 3 Agent and representative counts represent the average of the last 3 months. Labor market conditions impacting new agent recruiting; veteran agent retention strong

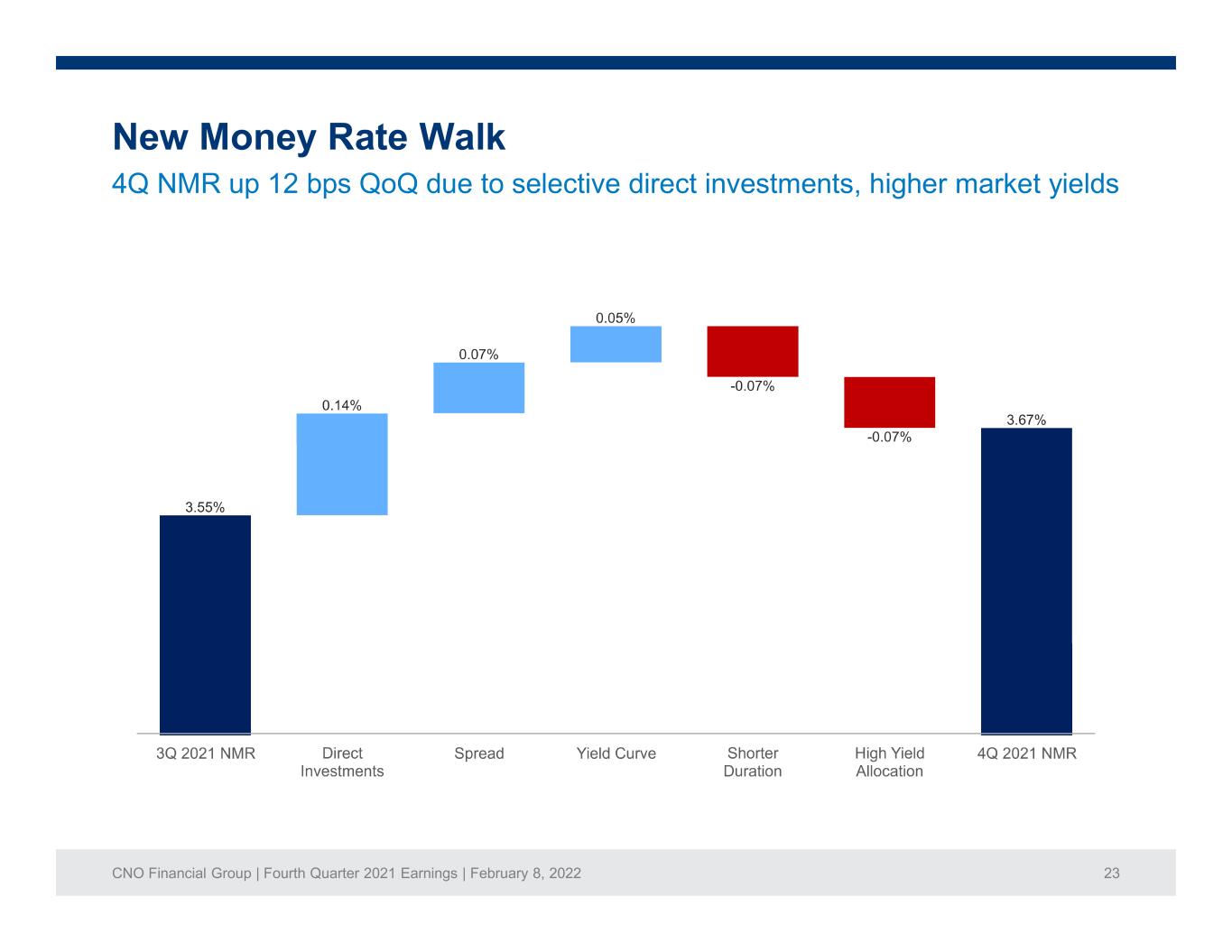

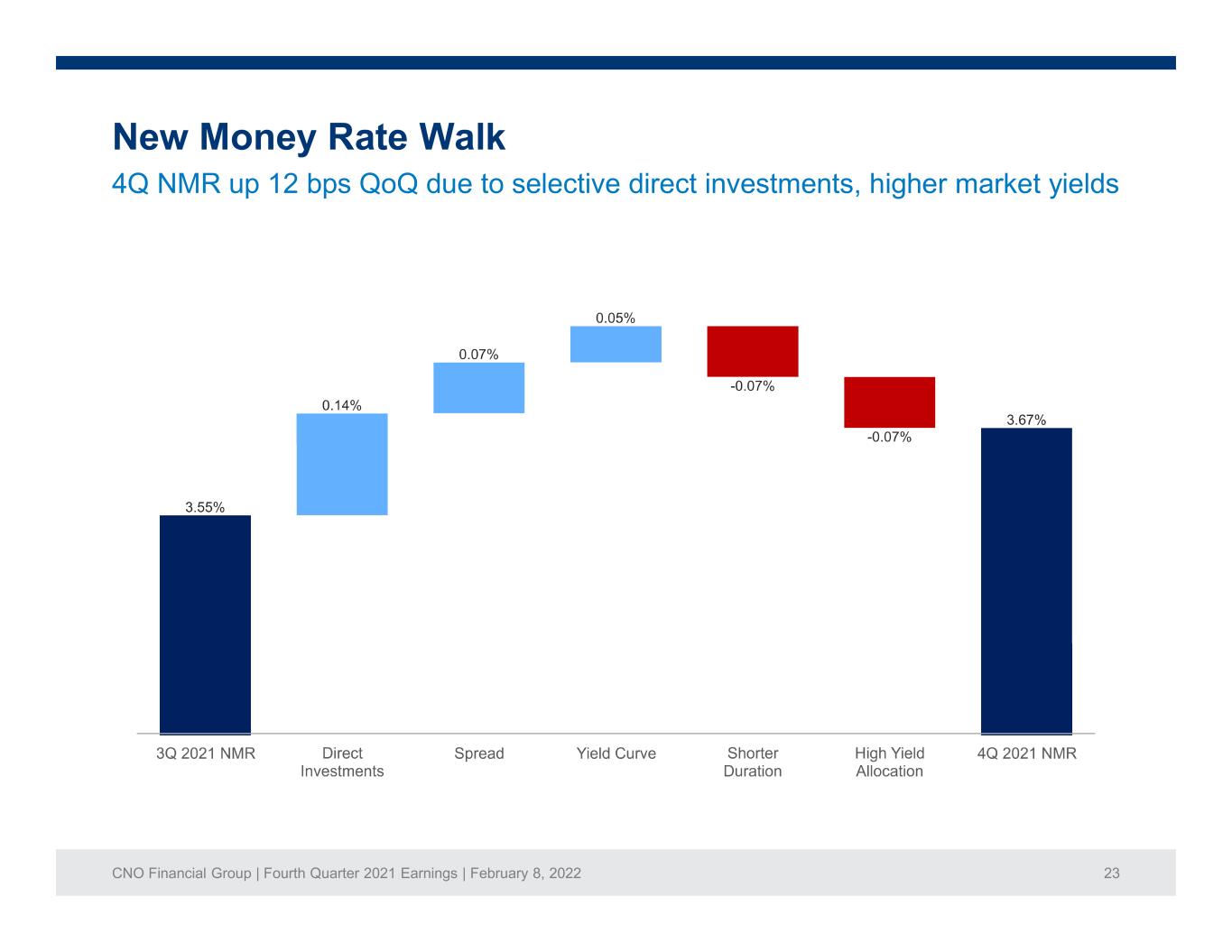

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 23 New Money Rate Walk 4Q NMR up 12 bps QoQ due to selective direct investments, higher market yields

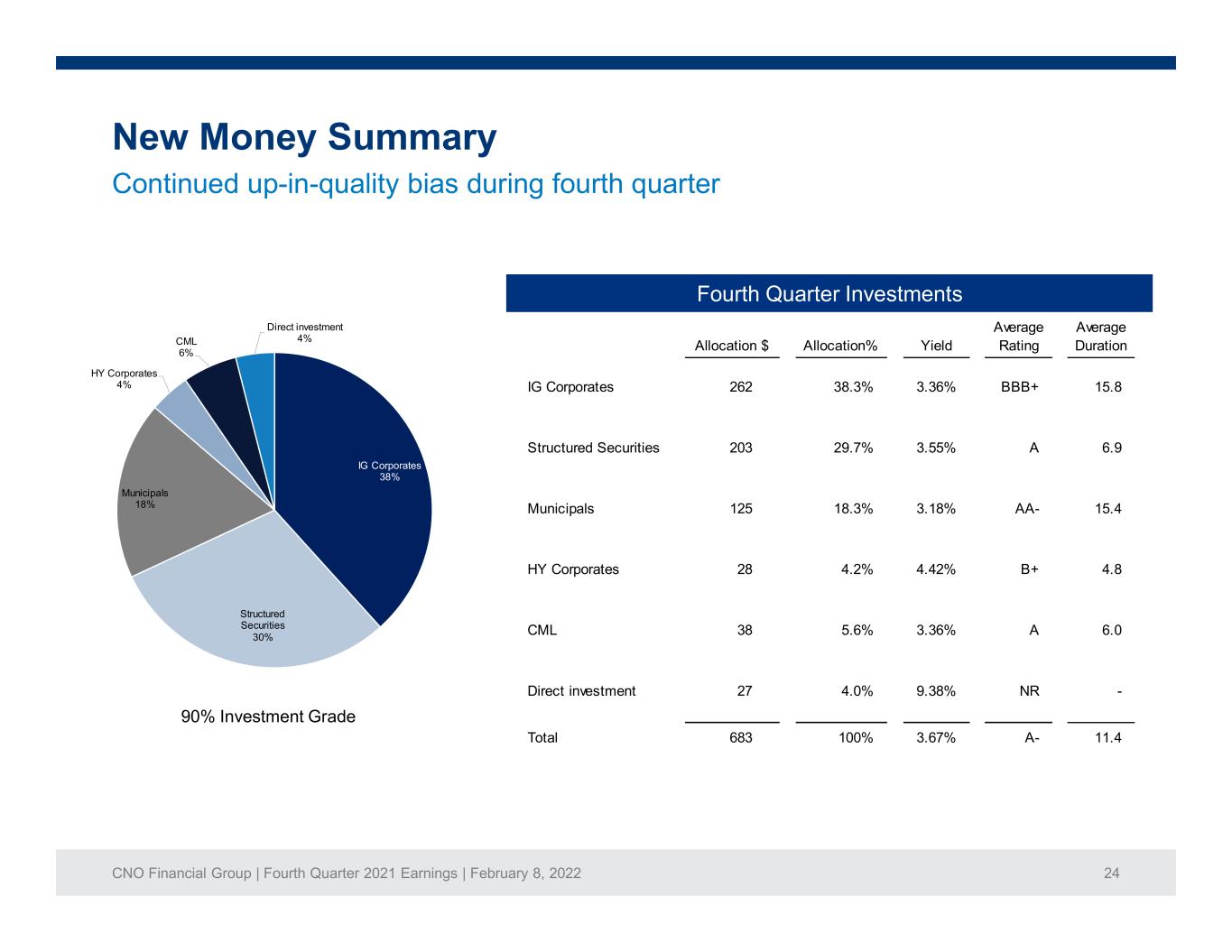

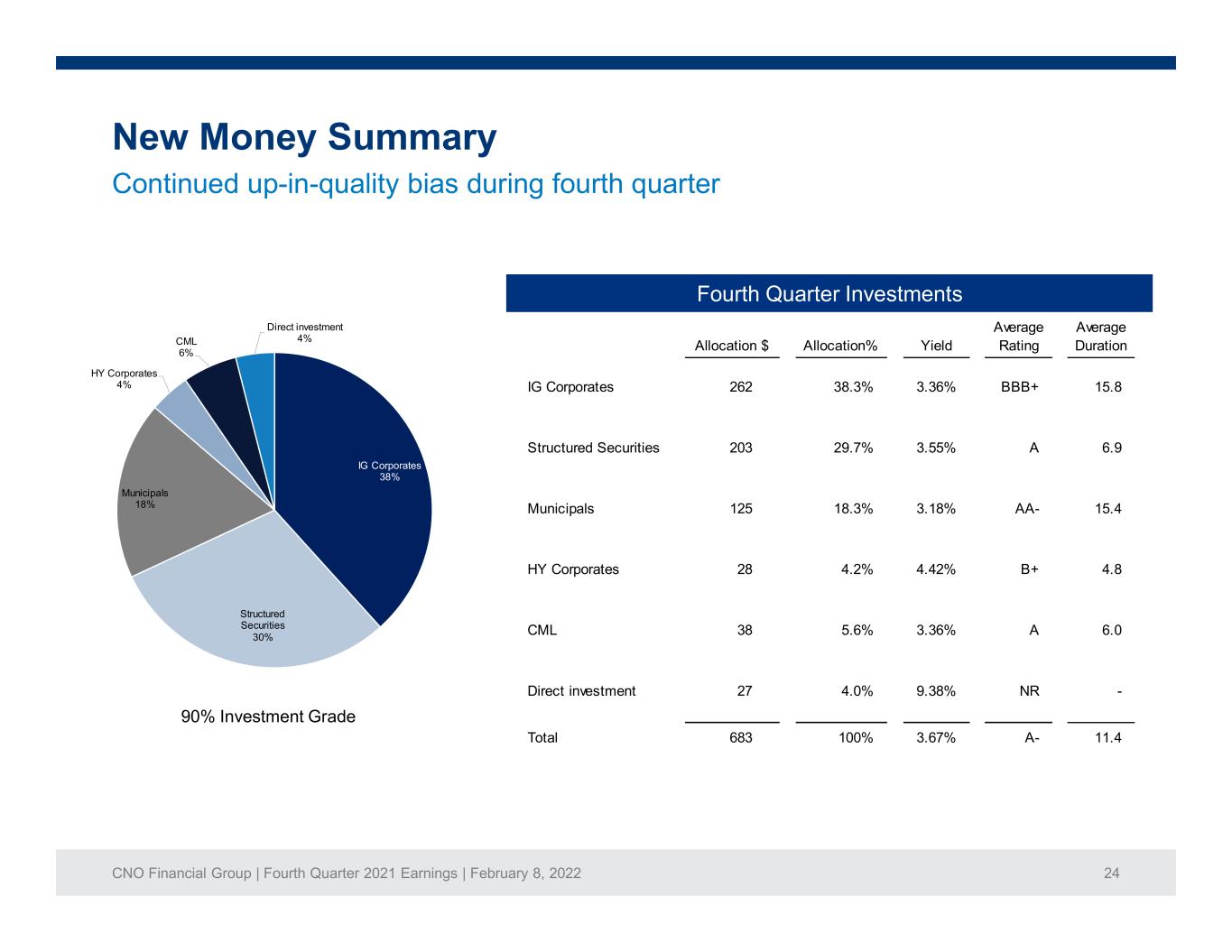

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 24 IG Corporates 38% Structured Securities 30% Municipals 18% HY Corporates 4% CML 6% Direct investment 4% Allocation $ Allocation% Yield Average Rating Average Duration IG Corporates 262 38.3% 3.36% BBB+ 15.8 Structured Securities 203 29.7% 3.55% A 6.9 Municipals 125 18.3% 3.18% AA- 15.4 HY Corporates 28 4.2% 4.42% B+ 4.8 CML 38 5.6% 3.36% A 6.0 Direct investment 27 4.0% 9.38% NR - Total 683 100% 3.67% A- 11.4 New Money Summary Continued up-in-quality bias during fourth quarter 90% Investment Grade Fourth Quarter Investments

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 25 New sales (~$30 million annually) focused on short duration products – 99% of new sales for policies with 2 years or less in benefits – Average benefit period of 12 months – New business 25% reinsured since 2008 Reserve assumptions informed by historical experience – No morbidity improvement – No mortality improvement – Minimal future rate increases – New money rates reflect a low for long environment Favorable economic profile – 2021 Loss Recognition Testing margin increased to $376 million or ~15% of Net GAAP Liabilities driven by margin from new business – Statutory reserves ~$210 million higher than LTC Net GAAP Liabilities, which are currently ~$2.51 billion – Total LTC is just 12% of overall CNO insurance liabilities – Potential adverse impact from severe stress scenarios is significantly reduced – Average maximum benefit at issuance is $143 per day for inforce block Long-Term Care Insurance Highly differentiated inforce block; prudently managed

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 26 Non-Life NOLs $242 DTAs related to tax strategy $158 Value of NOLs and deferred tax assets (DTAs) related to tax strategy Details • Total estimated economic value of tax assets related to our NOLs and tax strategy of approximately $263 million @ 10% discount rate ($2.13 on a per share basis). • Life NOLs have been fully utilized. Non- life NOLs are expected to offset 100% of non-life taxable income and 35% of life taxable income through 2023. $400 (dollars in millions) Tax Asset Summary as of December 31, 2021 $400 million/$3.24 per diluted share value of NOLs and DTAs related to tax strategy

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 27 Appendix 2: Financial Exhibits • Non-GAAP Financial Measures Slides 28-46

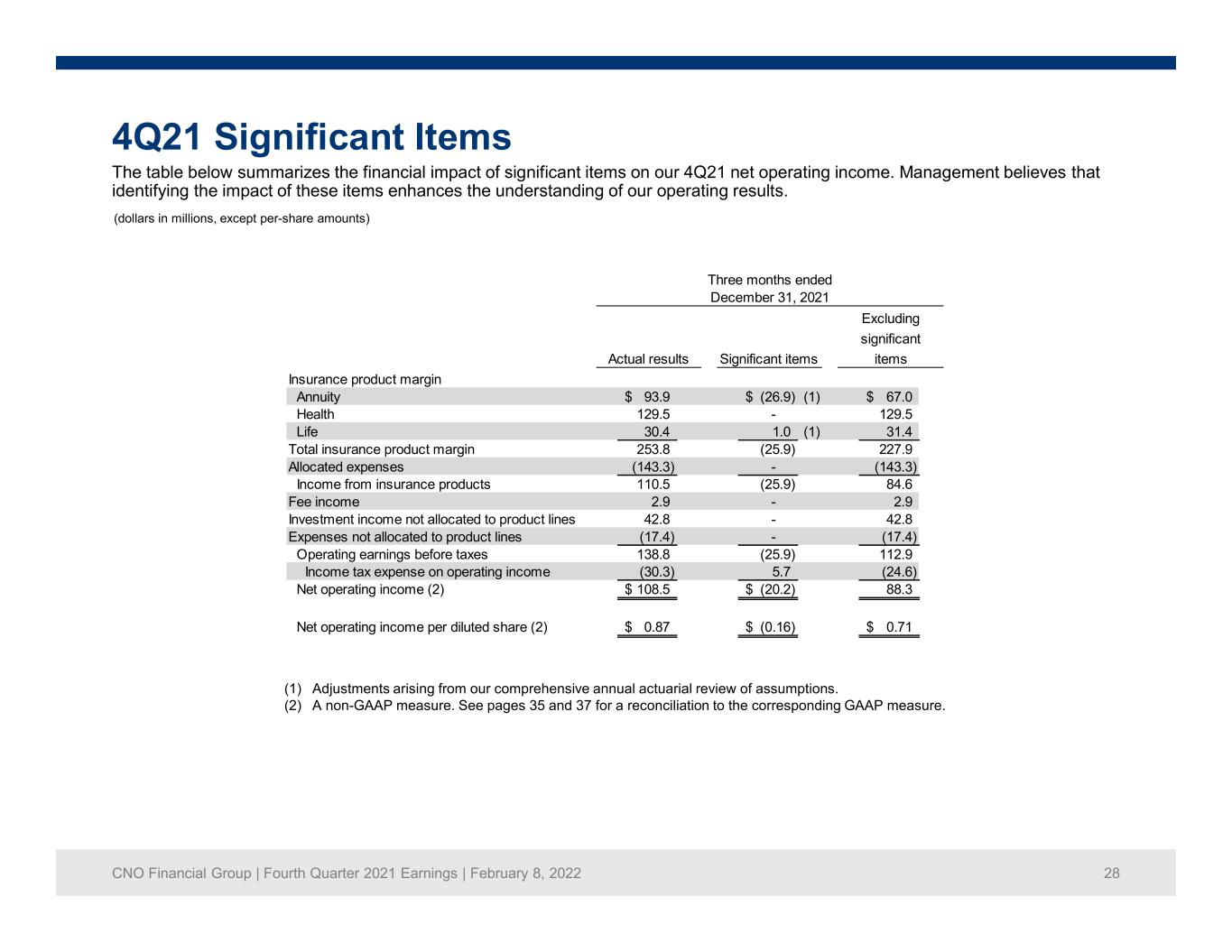

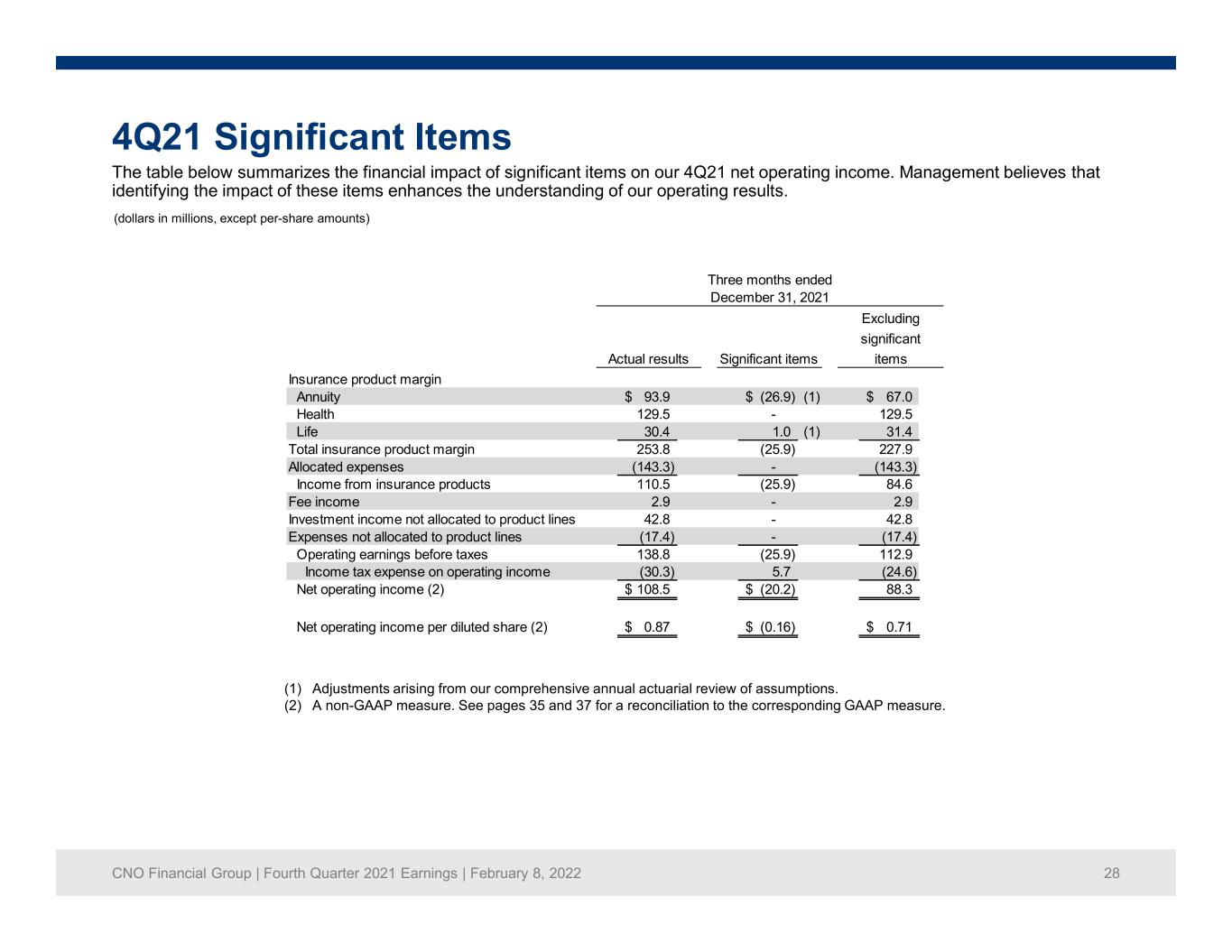

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 28 The table below summarizes the financial impact of significant items on our 4Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 4Q21 Significant Items (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 93.9$ (26.9)$ (1) 67.0$ Health 129.5 - 129.5 Life 30.4 1.0 (1) 31.4 Total insurance product margin 253.8 (25.9) 227.9 Allocated expenses (143.3) - (143.3) Income from insurance products 110.5 (25.9) 84.6 Fee income 2.9 - 2.9 Investment income not allocated to product lines 42.8 - 42.8 Expenses not allocated to product lines (17.4) - (17.4) Operating earnings before taxes 138.8 (25.9) 112.9 Income tax expense on operating income (30.3) 5.7 (24.6) Net operating income (2) 108.5$ (20.2)$ 88.3 Net operating income per diluted share (2) 0.87$ (0.16)$ 0.71$ Three months ended December 31, 2021 Actual results Significant items Excluding significant items

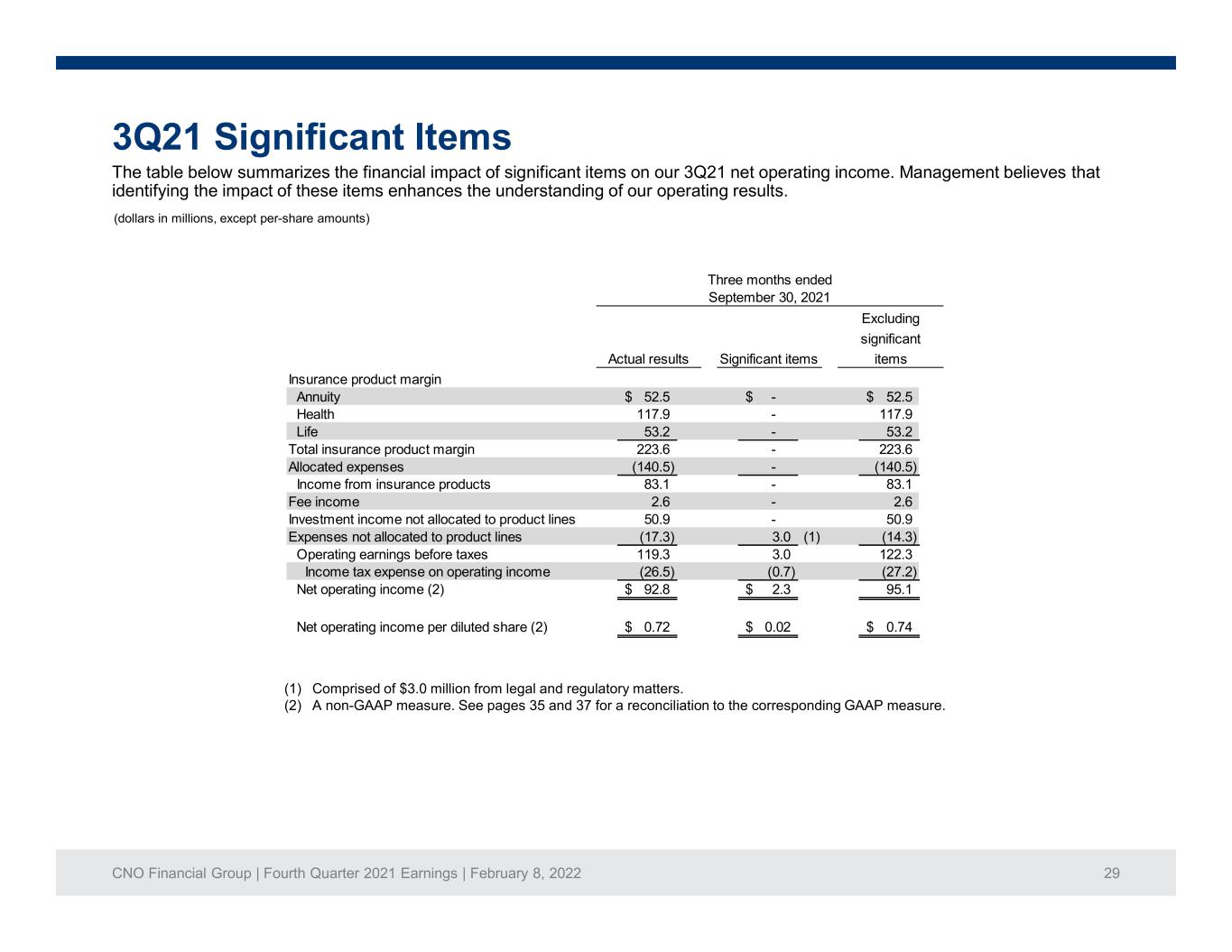

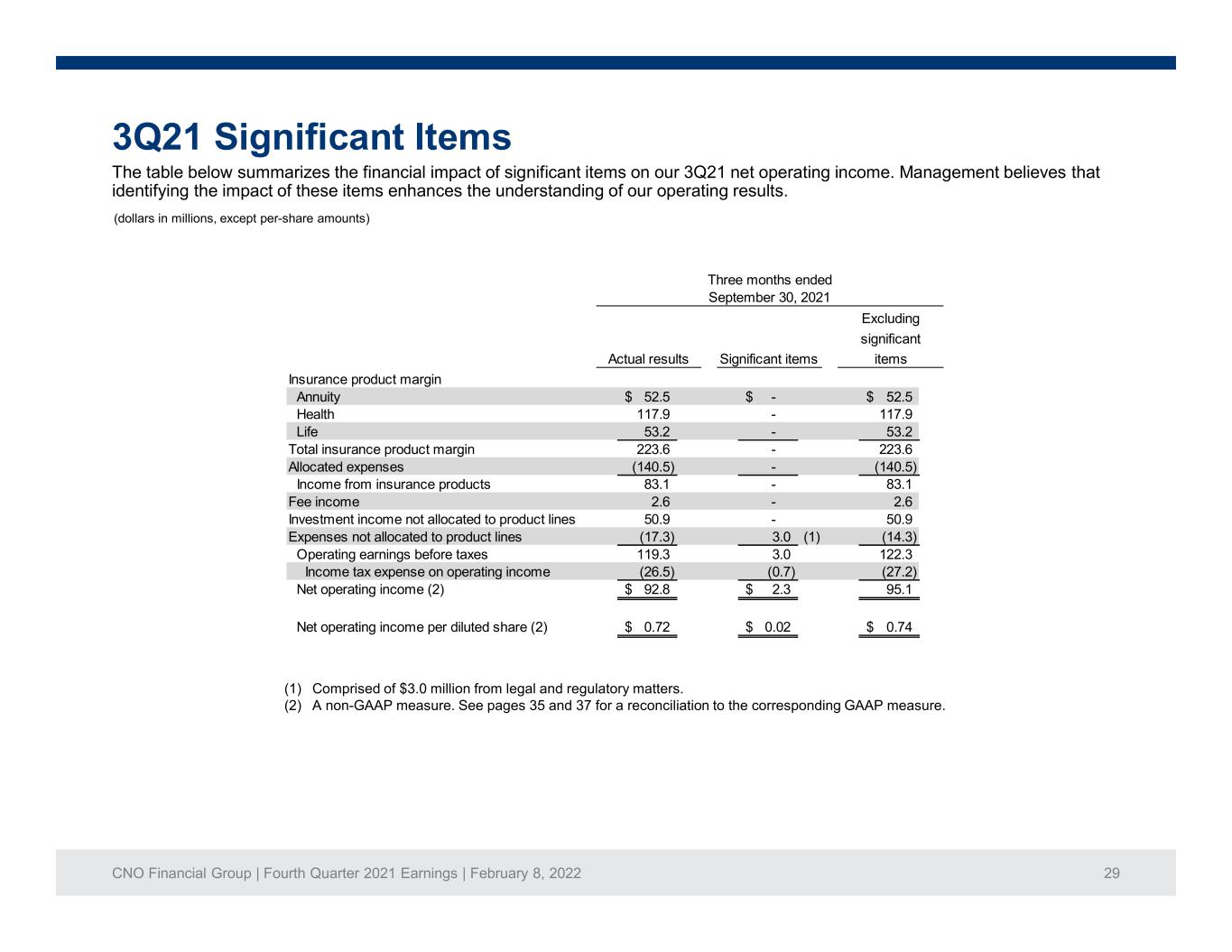

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 29 The table below summarizes the financial impact of significant items on our 3Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 3Q21 Significant Items (dollars in millions, except per-share amounts) (1) Comprised of $3.0 million from legal and regulatory matters. (2) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 52.5$ -$ 52.5$ Health 117.9 - 117.9 Life 53.2 - 53.2 Total insurance product margin 223.6 - 223.6 Allocated expenses (140.5) - (140.5) Income from insurance products 83.1 - 83.1 Fee income 2.6 - 2.6 Investment income not allocated to product lines 50.9 - 50.9 Expenses not allocated to product lines (17.3) 3.0 (1) (14.3) Operating earnings before taxes 119.3 3.0 122.3 Income tax expense on operating income (26.5) (0.7) (27.2) Net operating income (2) 92.8$ 2.3$ 95.1 Net operating income per diluted share (2) 0.72$ 0.02$ 0.74$ Three months ended September 30, 2021 Actual results Significant items Excluding significant items

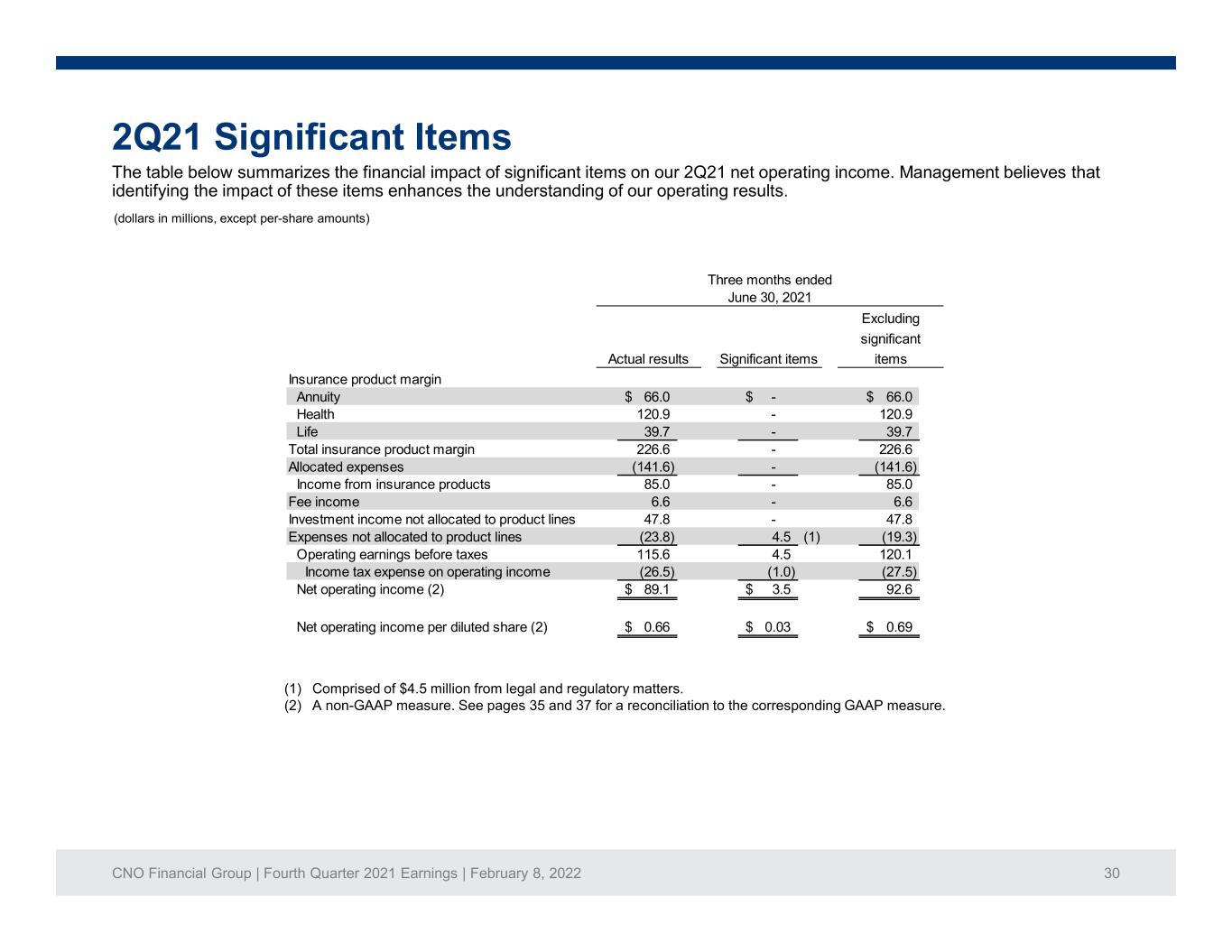

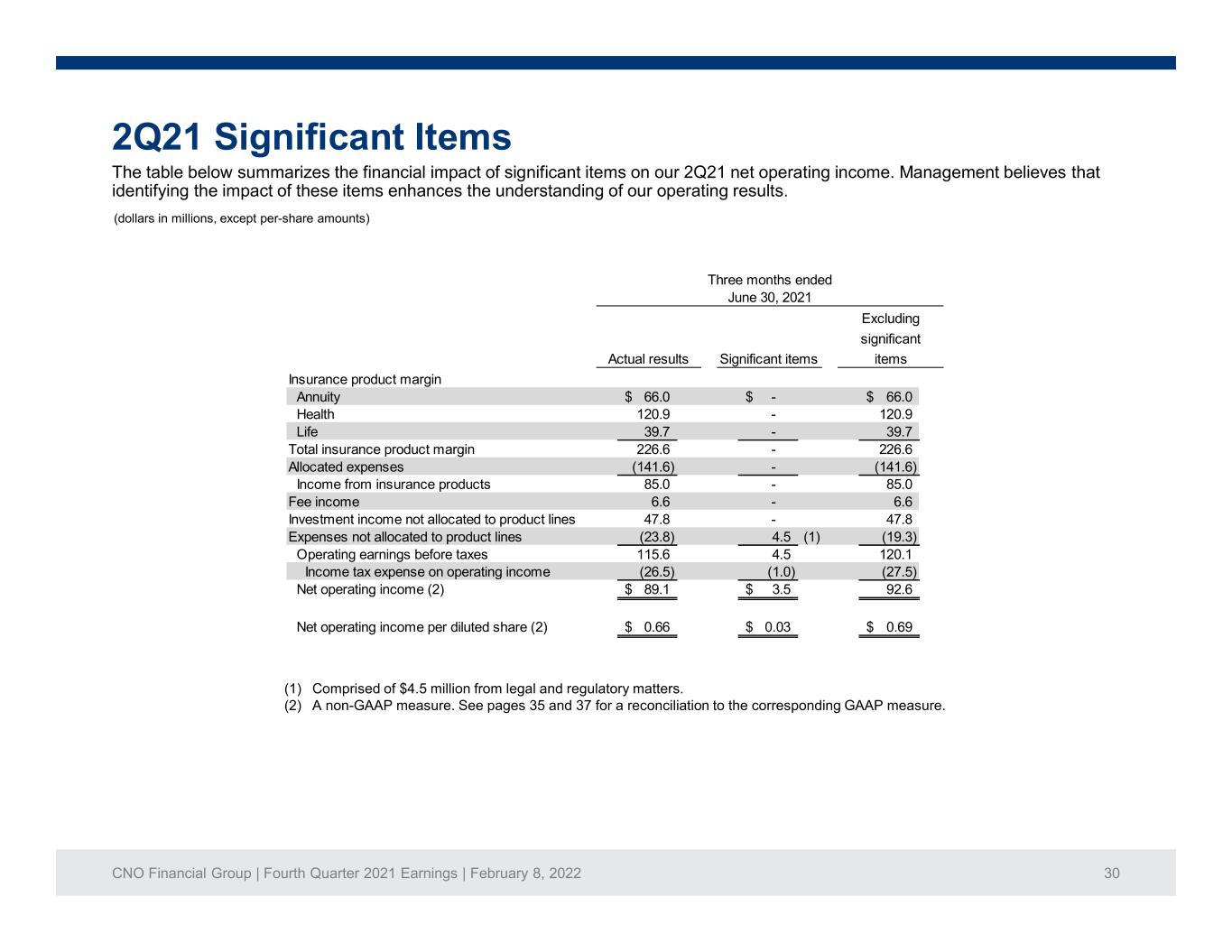

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 30 The table below summarizes the financial impact of significant items on our 2Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 2Q21 Significant Items (dollars in millions, except per-share amounts) (1) Comprised of $4.5 million from legal and regulatory matters. (2) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 66.0$ -$ 66.0$ Health 120.9 - 120.9 Life 39.7 - 39.7 Total insurance product margin 226.6 - 226.6 Allocated expenses (141.6) - (141.6) Income from insurance products 85.0 - 85.0 Fee income 6.6 - 6.6 Investment income not allocated to product lines 47.8 - 47.8 Expenses not allocated to product lines (23.8) 4.5 (1) (19.3) Operating earnings before taxes 115.6 4.5 120.1 Income tax expense on operating income (26.5) (1.0) (27.5) Net operating income (2) 89.1$ 3.5$ 92.6 Net operating income per diluted share (2) 0.66$ 0.03$ 0.69$ Three months ended June 30, 2021 Actual results Significant items Excluding significant items

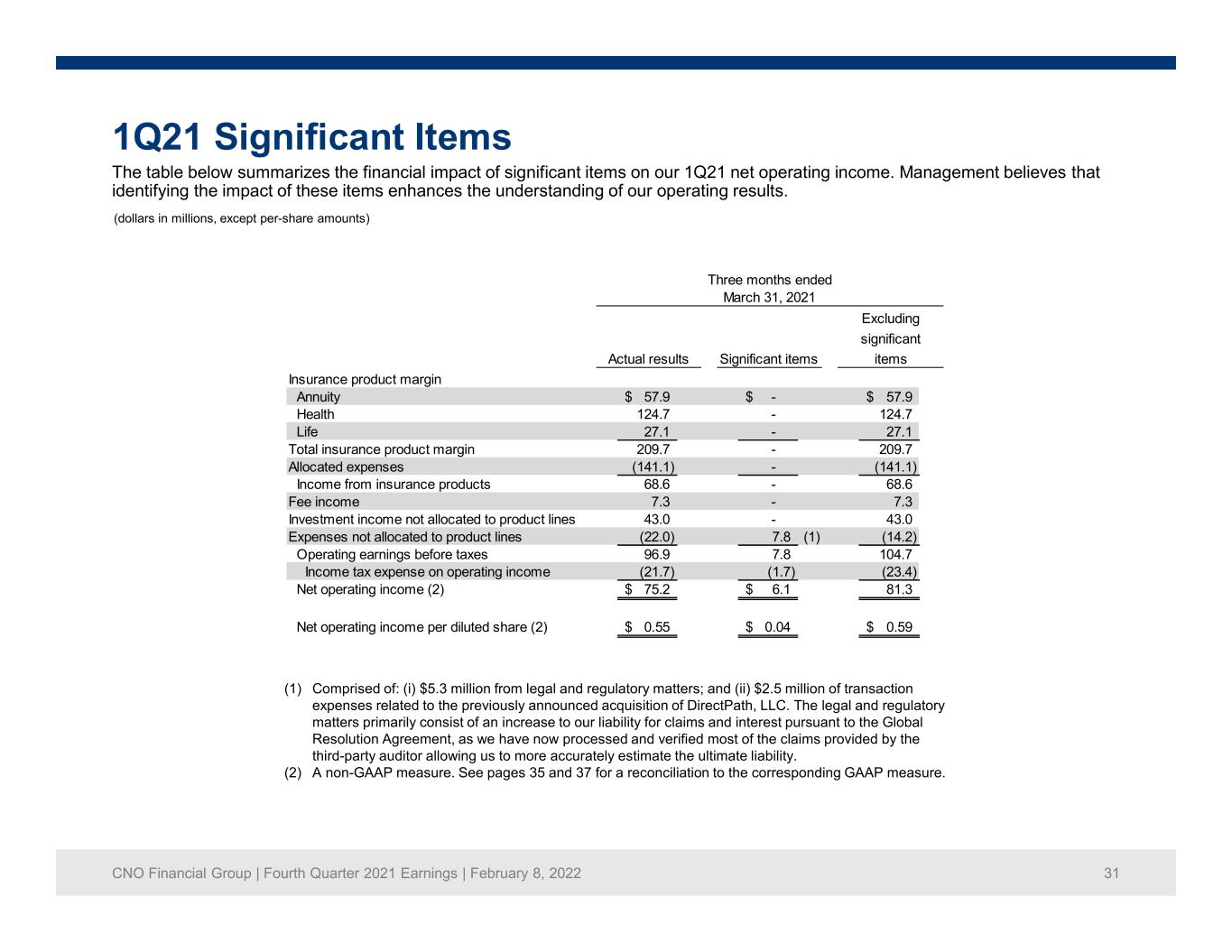

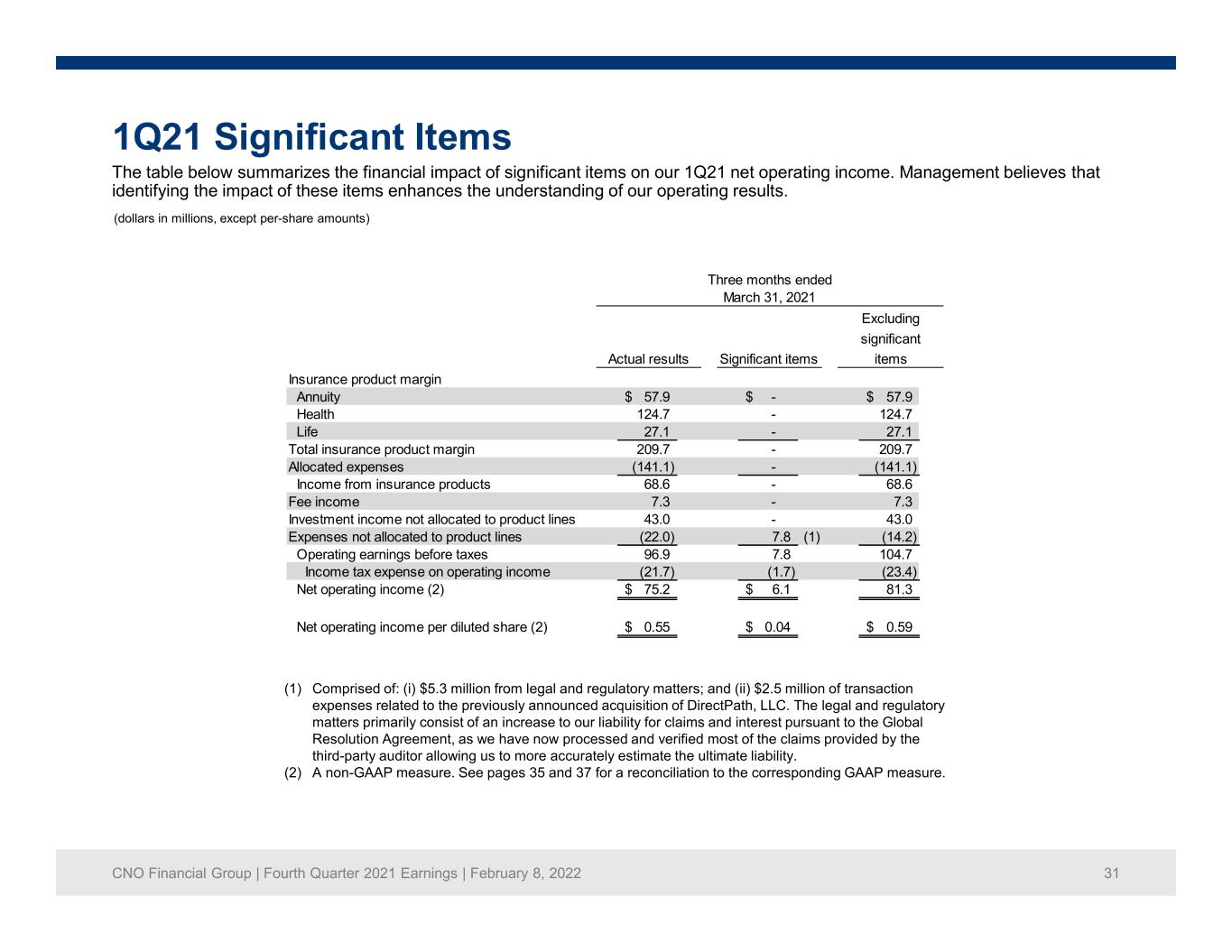

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 31 The table below summarizes the financial impact of significant items on our 1Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 1Q21 Significant Items (dollars in millions, except per-share amounts) (1) Comprised of: (i) $5.3 million from legal and regulatory matters; and (ii) $2.5 million of transaction expenses related to the previously announced acquisition of DirectPath, LLC. The legal and regulatory matters primarily consist of an increase to our liability for claims and interest pursuant to the Global Resolution Agreement, as we have now processed and verified most of the claims provided by the third-party auditor allowing us to more accurately estimate the ultimate liability. (2) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 57.9$ -$ 57.9$ Health 124.7 - 124.7 Life 27.1 - 27.1 Total insurance product margin 209.7 - 209.7 Allocated expenses (141.1) - (141.1) Income from insurance products 68.6 - 68.6 Fee income 7.3 - 7.3 Investment income not allocated to product lines 43.0 - 43.0 Expenses not allocated to product lines (22.0) 7.8 (1) (14.2) Operating earnings before taxes 96.9 7.8 104.7 Income tax expense on operating income (21.7) (1.7) (23.4) Net operating income (2) 75.2$ 6.1$ 81.3 Net operating income per diluted share (2) 0.55$ 0.04$ 0.59$ Three months ended March 31, 2021 Actual results Significant items Excluding significant items

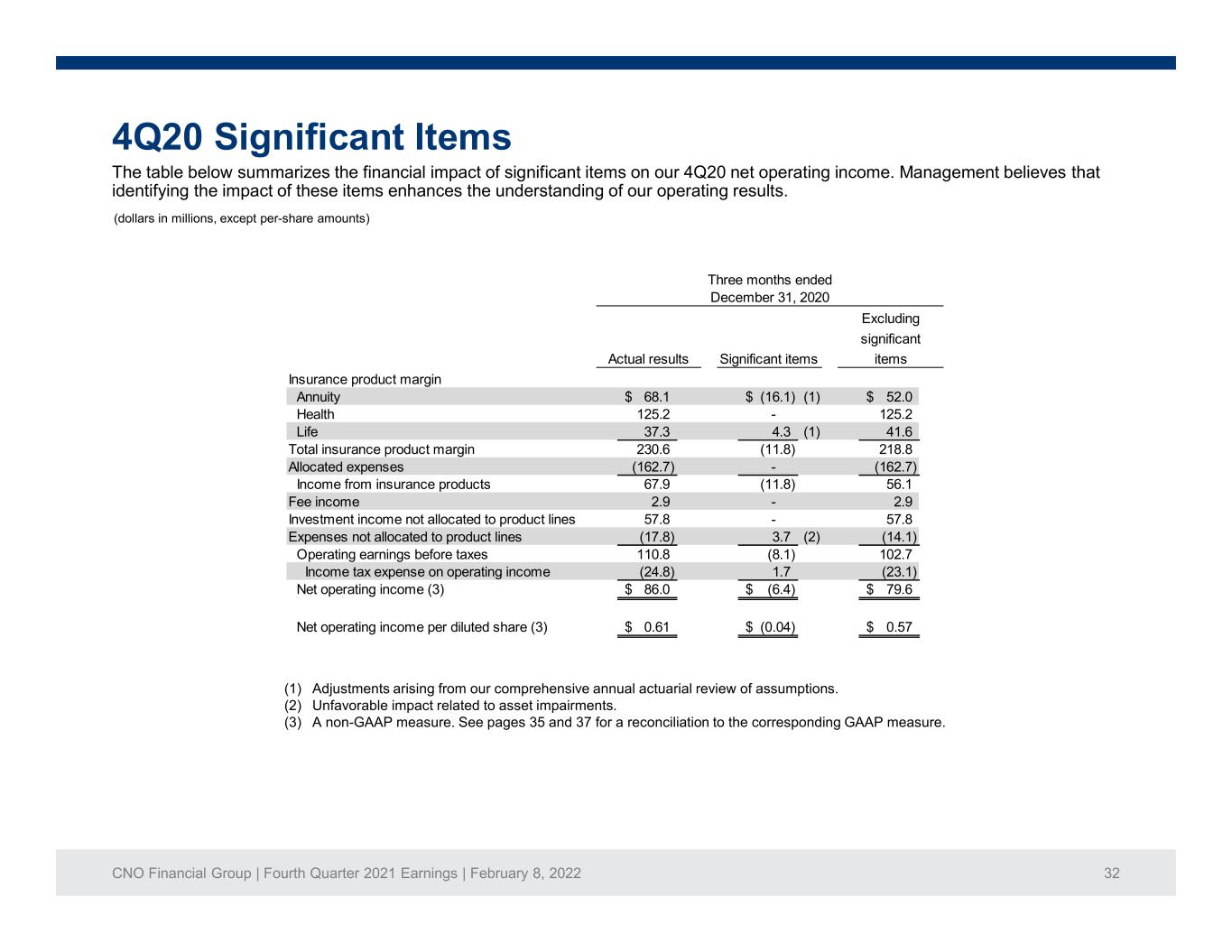

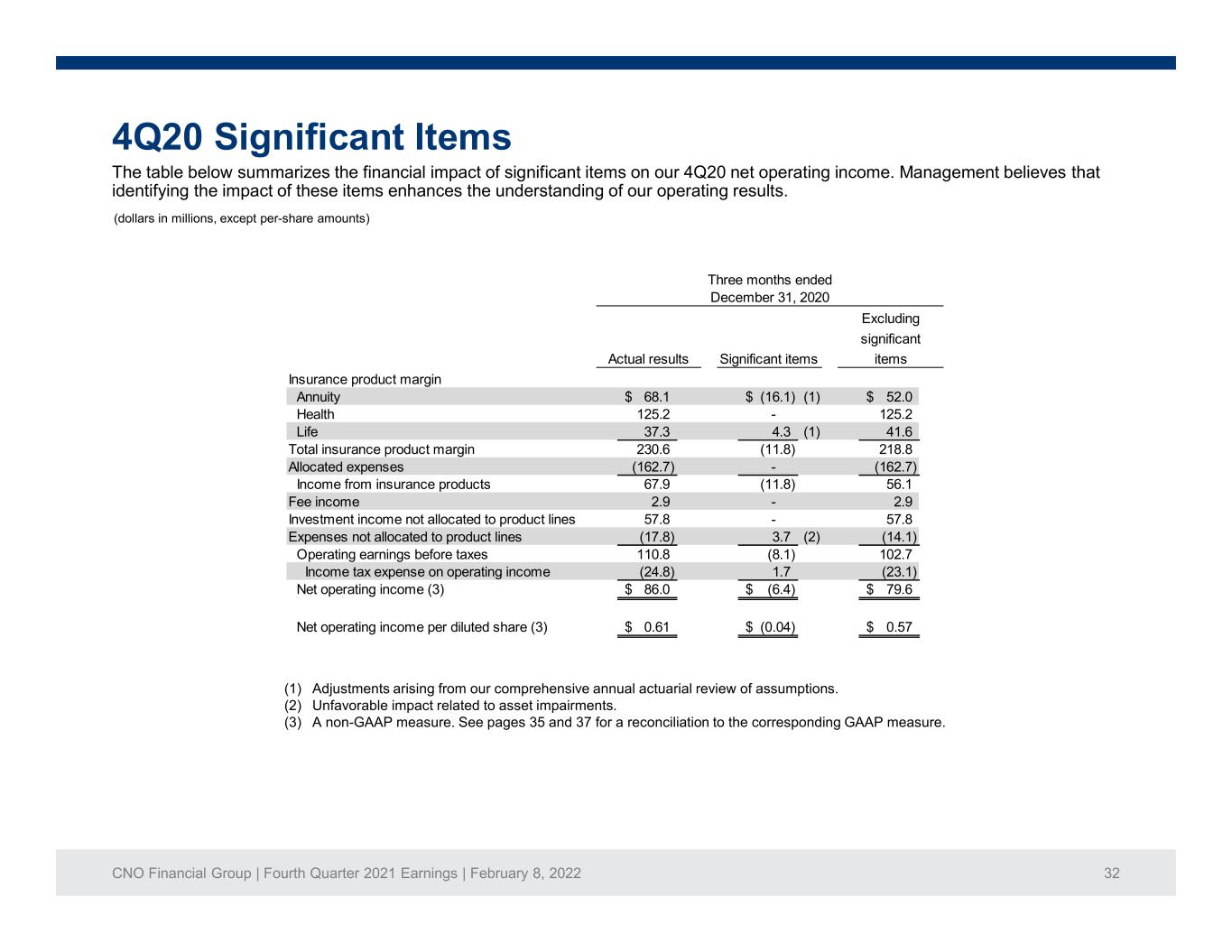

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 32 The table below summarizes the financial impact of significant items on our 4Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 4Q20 Significant Items (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) Unfavorable impact related to asset impairments. (3) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 68.1$ (16.1)$ (1) 52.0$ Health 125.2 - 125.2 Life 37.3 4.3 (1) 41.6 Total insurance product margin 230.6 (11.8) 218.8 Allocated expenses (162.7) - (162.7) Income from insurance products 67.9 (11.8) 56.1 Fee income 2.9 - 2.9 Investment income not allocated to product lines 57.8 - 57.8 Expenses not allocated to product lines (17.8) 3.7 (2) (14.1) Operating earnings before taxes 110.8 (8.1) 102.7 Income tax expense on operating income (24.8) 1.7 (23.1) Net operating income (3) 86.0$ (6.4)$ 79.6$ Net operating income per diluted share (3) 0.61$ (0.04)$ 0.57$ Three months ended December 31, 2020 Actual results Significant items Excluding significant items

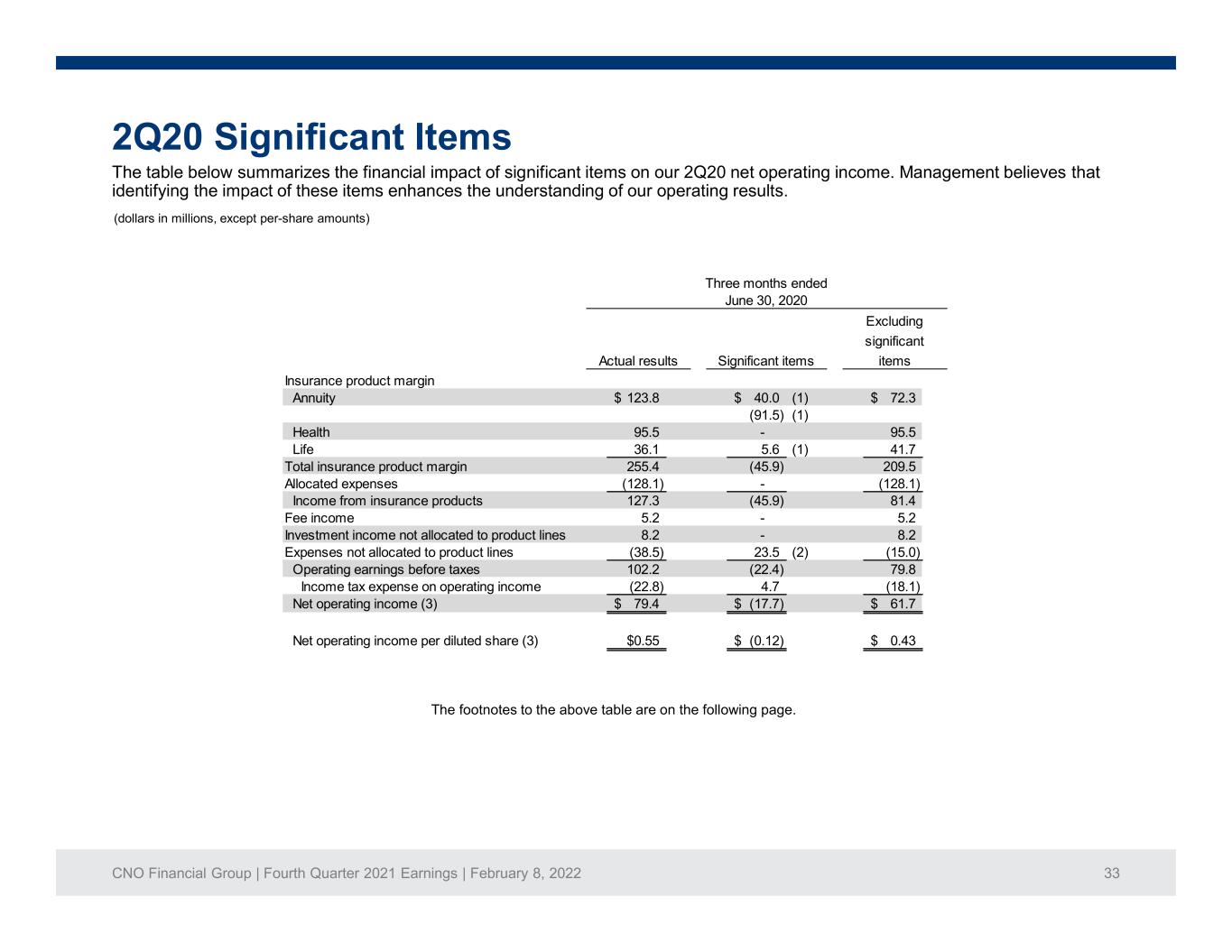

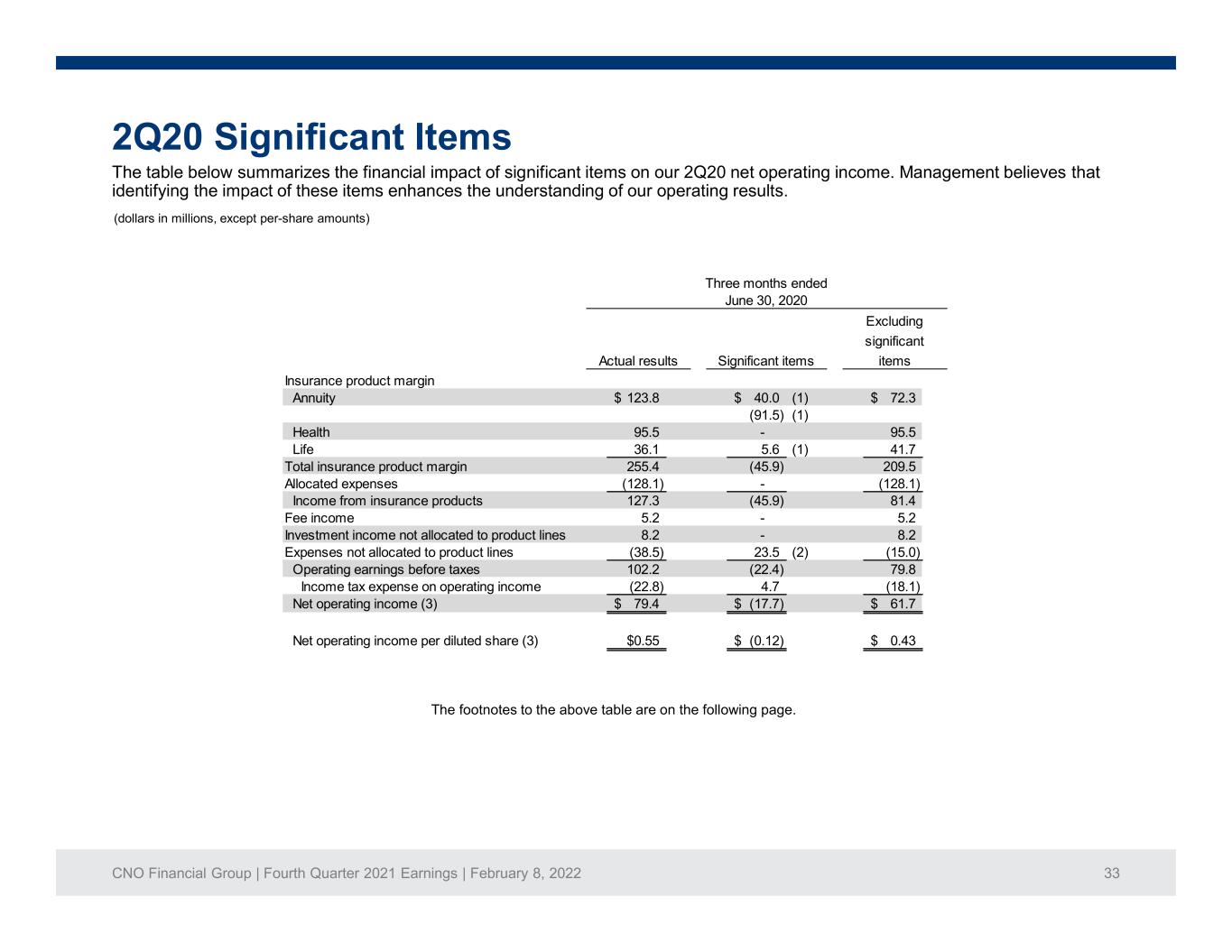

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 33 The table below summarizes the financial impact of significant items on our 2Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 2Q20 Significant Items (dollars in millions, except per-share amounts) Insurance product margin Annuity 123.8$ 40.0$ (1) 72.3$ (91.5) (1) Health 95.5 - 95.5 Life 36.1 5.6 (1) 41.7 Total insurance product margin 255.4 (45.9) 209.5 Allocated expenses (128.1) - (128.1) Income from insurance products 127.3 (45.9) 81.4 Fee income 5.2 - 5.2 Investment income not allocated to product lines 8.2 - 8.2 Expenses not allocated to product lines (38.5) 23.5 (2) (15.0) Operating earnings before taxes 102.2 (22.4) 79.8 Income tax expense on operating income (22.8) 4.7 (18.1) Net operating income (3) 79.4$ (17.7)$ 61.7$ Net operating income per diluted share (3) $0.55 (0.12)$ 0.43$ Three months ended June 30, 2020 Actual results Significant items Excluding significant items The footnotes to the above table are on the following page.

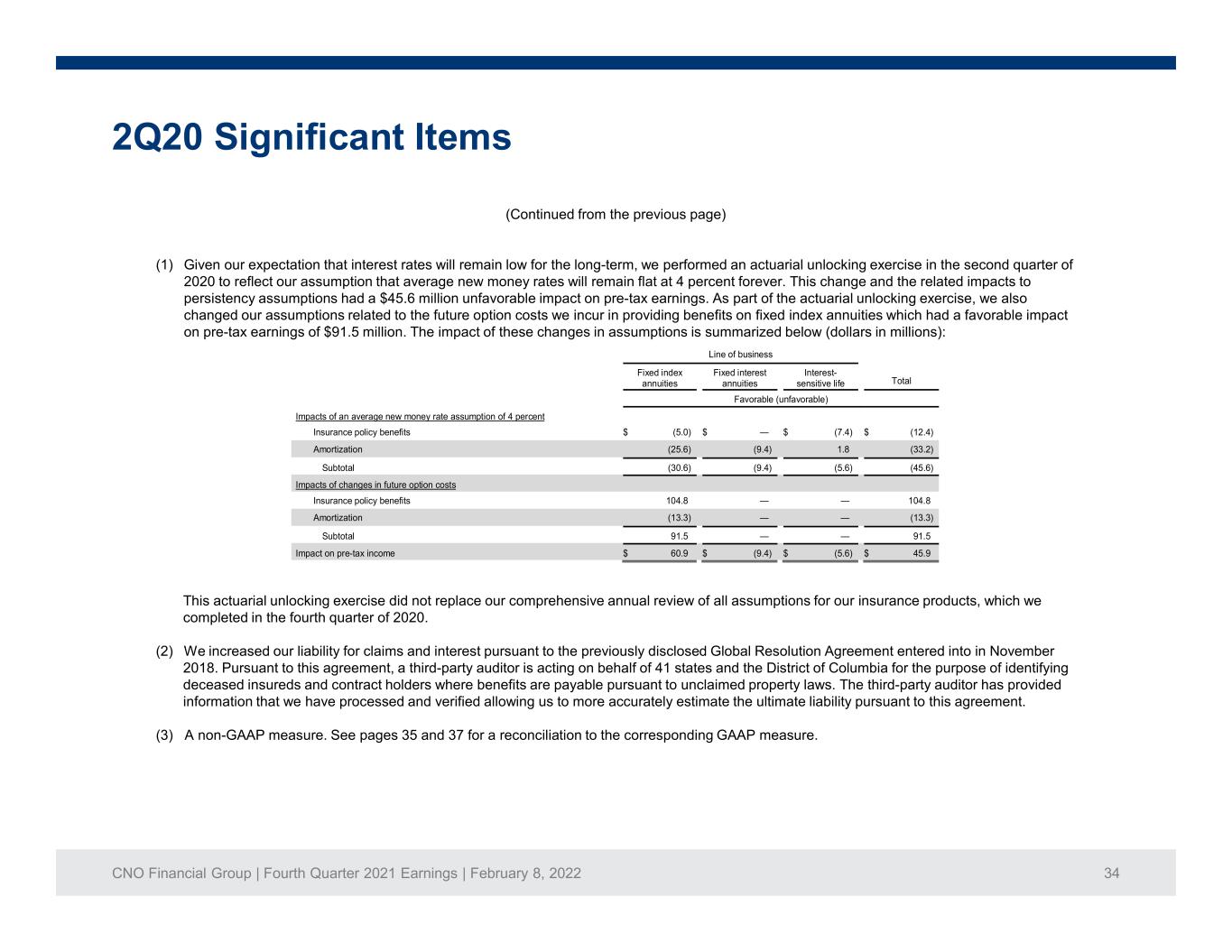

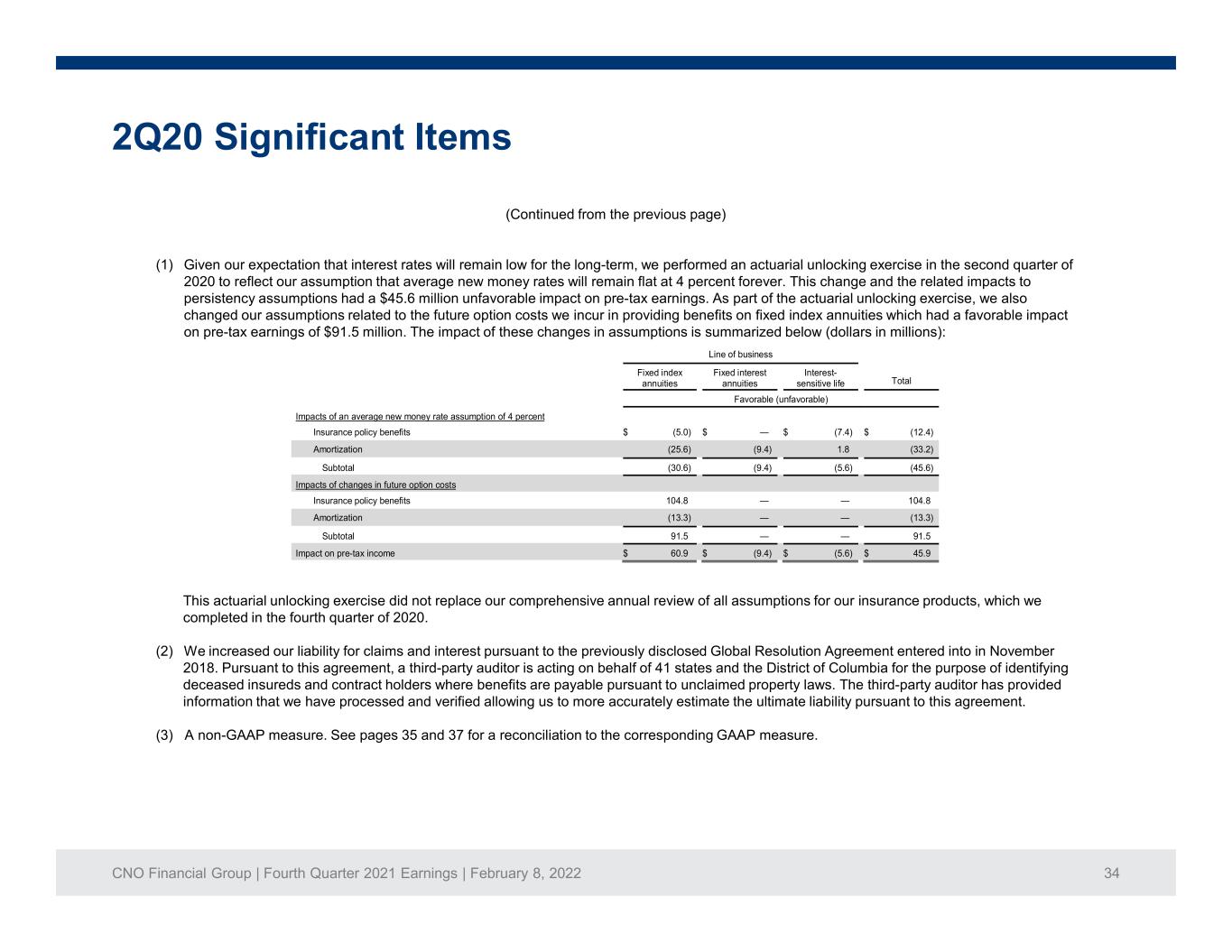

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 34 2Q20 Significant Items (Continued from the previous page) (1) Given our expectation that interest rates will remain low for the long-term, we performed an actuarial unlocking exercise in the second quarter of 2020 to reflect our assumption that average new money rates will remain flat at 4 percent forever. This change and the related impacts to persistency assumptions had a $45.6 million unfavorable impact on pre-tax earnings. As part of the actuarial unlocking exercise, we also changed our assumptions related to the future option costs we incur in providing benefits on fixed index annuities which had a favorable impact on pre-tax earnings of $91.5 million. The impact of these changes in assumptions is summarized below (dollars in millions): This actuarial unlocking exercise did not replace our comprehensive annual review of all assumptions for our insurance products, which we completed in the fourth quarter of 2020. (2) We increased our liability for claims and interest pursuant to the previously disclosed Global Resolution Agreement entered into in November 2018. Pursuant to this agreement, a third-party auditor is acting on behalf of 41 states and the District of Columbia for the purpose of identifying deceased insureds and contract holders where benefits are payable pursuant to unclaimed property laws. The third-party auditor has provided information that we have processed and verified allowing us to more accurately estimate the ultimate liability pursuant to this agreement. (3) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Line of business Fixed index annuities Fixed interest annuities Interest- sensitive life Total Favorable (unfavorable) Impacts of an average new money rate assumption of 4 percent Insurance policy benefits $ (5.0) $ — $ (7.4) $ (12.4) Amortization (25.6) (9.4) 1.8 (33.2) Subtotal (30.6) (9.4) (5.6) (45.6) Impacts of changes in future option costs Insurance policy benefits 104.8 — — 104.8 Amortization (13.3) — — (13.3) Subtotal 91.5 — — 91.5 Impact on pre-tax income $ 60.9 $ (9.4) $ (5.6) $ 45.9

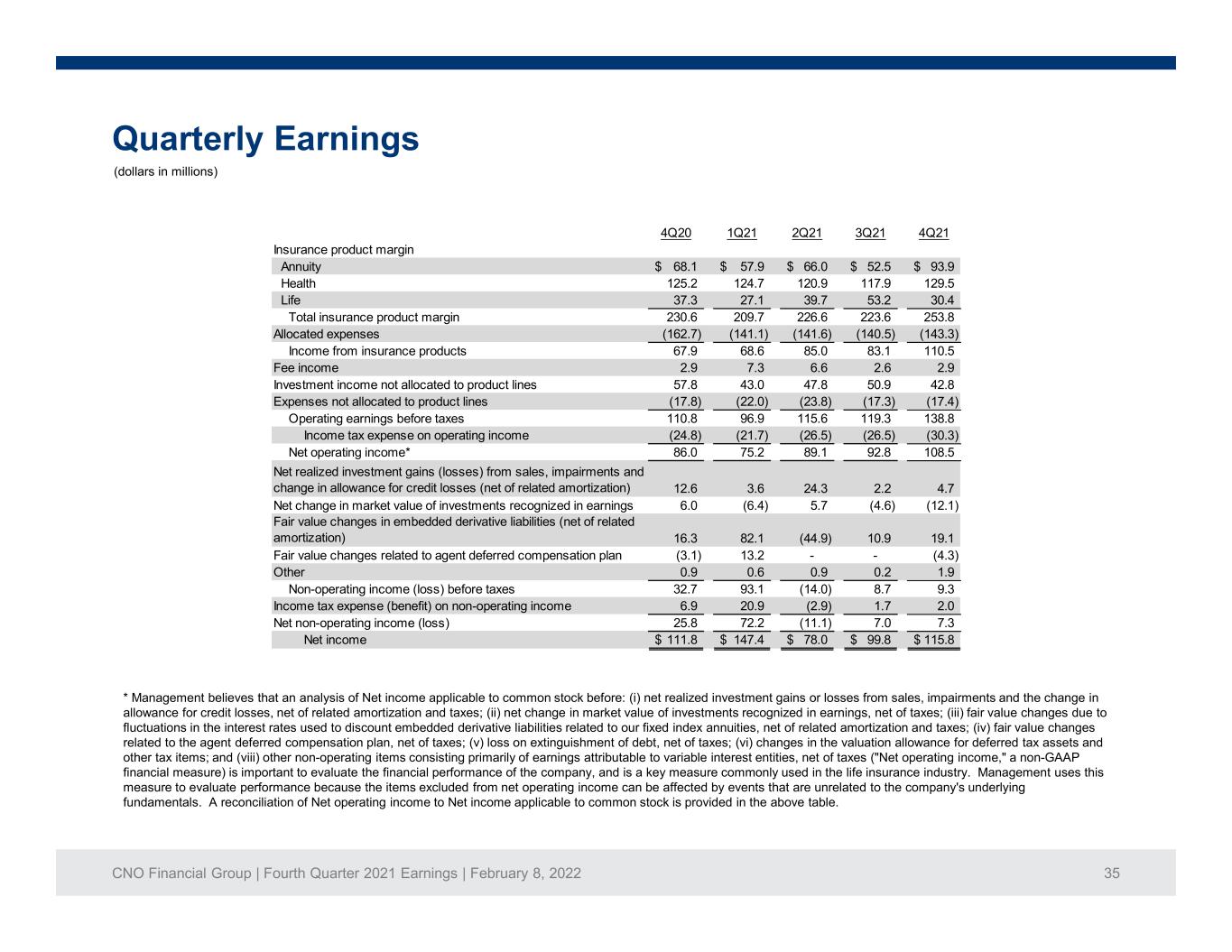

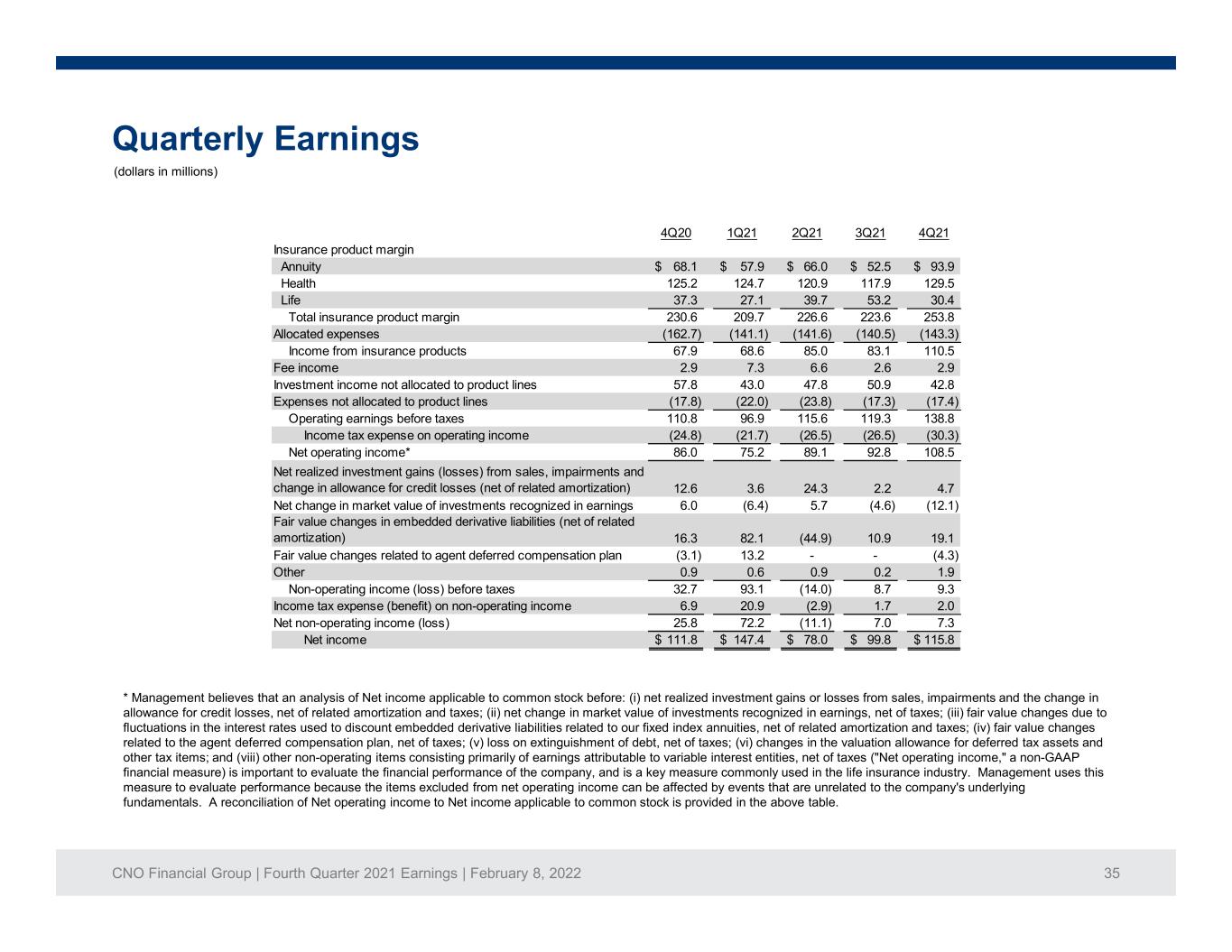

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 35 4Q20 1Q21 2Q21 3Q21 4Q21 Insurance product margin Annuity 68.1$ 57.9$ 66.0$ 52.5$ 93.9$ Health 125.2 124.7 120.9 117.9 129.5 Life 37.3 27.1 39.7 53.2 30.4 Total insurance product margin 230.6 209.7 226.6 223.6 253.8 Allocated expenses (162.7) (141.1) (141.6) (140.5) (143.3) Income from insurance products 67.9 68.6 85.0 83.1 110.5 Fee income 2.9 7.3 6.6 2.6 2.9 Investment income not allocated to product lines 57.8 43.0 47.8 50.9 42.8 Expenses not allocated to product lines (17.8) (22.0) (23.8) (17.3) (17.4) Operating earnings before taxes 110.8 96.9 115.6 119.3 138.8 Income tax expense on operating income (24.8) (21.7) (26.5) (26.5) (30.3) Net operating income* 86.0 75.2 89.1 92.8 108.5 Net realized investment gains (losses) from sales, impairments and change in allowance for credit losses (net of related amortization) 12.6 3.6 24.3 2.2 4.7 Net change in market value of investments recognized in earnings 6.0 (6.4) 5.7 (4.6) (12.1) Fair value changes in embedded derivative liabilities (net of related amortization) 16.3 82.1 (44.9) 10.9 19.1 Fair value changes related to agent deferred compensation plan (3.1) 13.2 - - (4.3) Other 0.9 0.6 0.9 0.2 1.9 Non-operating income (loss) before taxes 32.7 93.1 (14.0) 8.7 9.3 Income tax expense (benefit) on non-operating income 6.9 20.9 (2.9) 1.7 2.0 Net non-operating income (loss) 25.8 72.2 (11.1) 7.0 7.3 Net income 111.8$ 147.4$ 78.0$ 99.8$ 115.8$ Quarterly Earnings (dollars in millions) * Management believes that an analysis of Net income applicable to common stock before: (i) net realized investment gains or losses from sales, impairments and the change in allowance for credit losses, net of related amortization and taxes; (ii) net change in market value of investments recognized in earnings, net of taxes; (iii) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, net of related amortization and taxes; (iv) fair value changes related to the agent deferred compensation plan, net of taxes; (v) loss on extinguishment of debt, net of taxes; (vi) changes in the valuation allowance for deferred tax assets and other tax items; and (viii) other non-operating items consisting primarily of earnings attributable to variable interest entities, net of taxes ("Net operating income," a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the company's underlying fundamentals. A reconciliation of Net operating income to Net income applicable to common stock is provided in the above table.

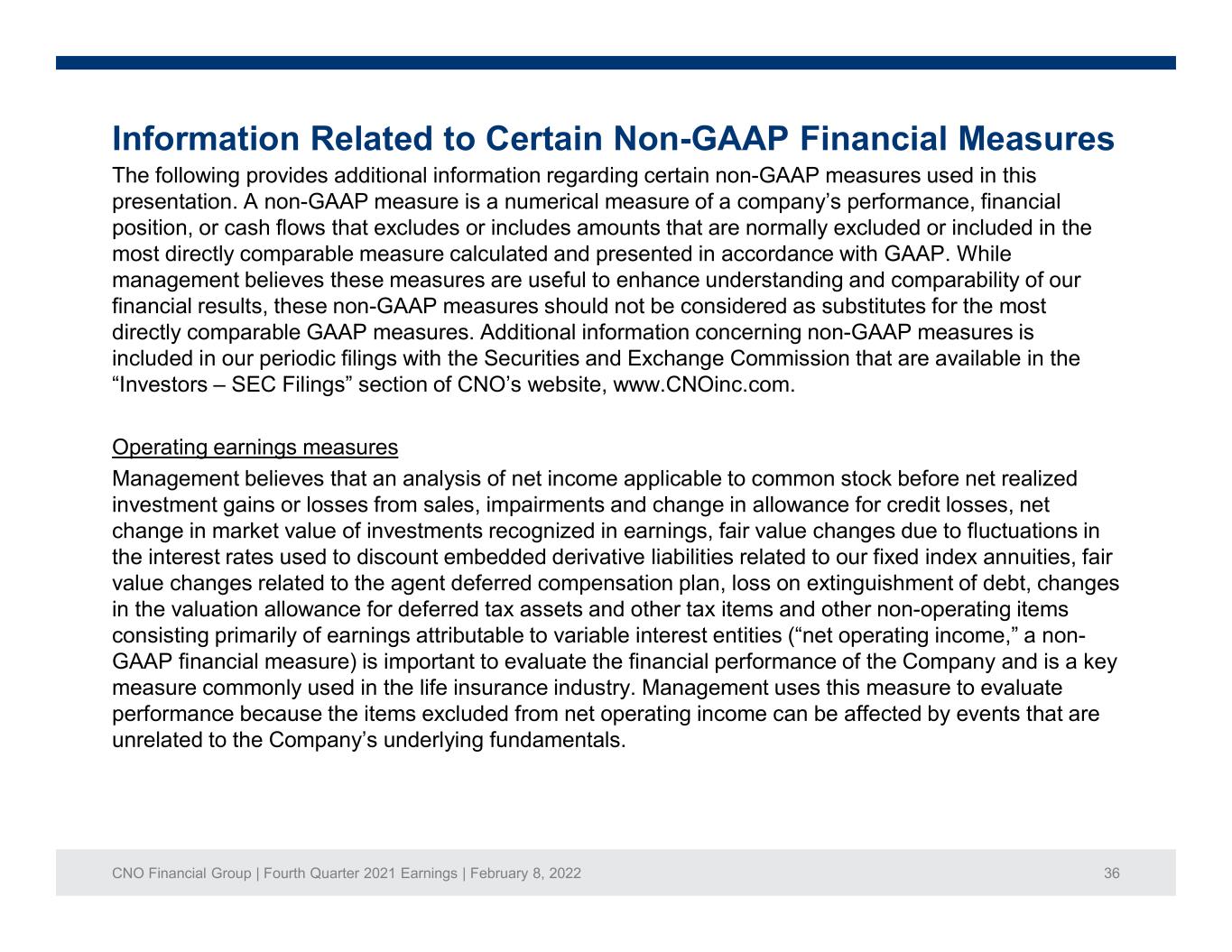

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 36 Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales, impairments and change in allowance for credit losses, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, changes in the valuation allowance for deferred tax assets and other tax items and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non- GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals.

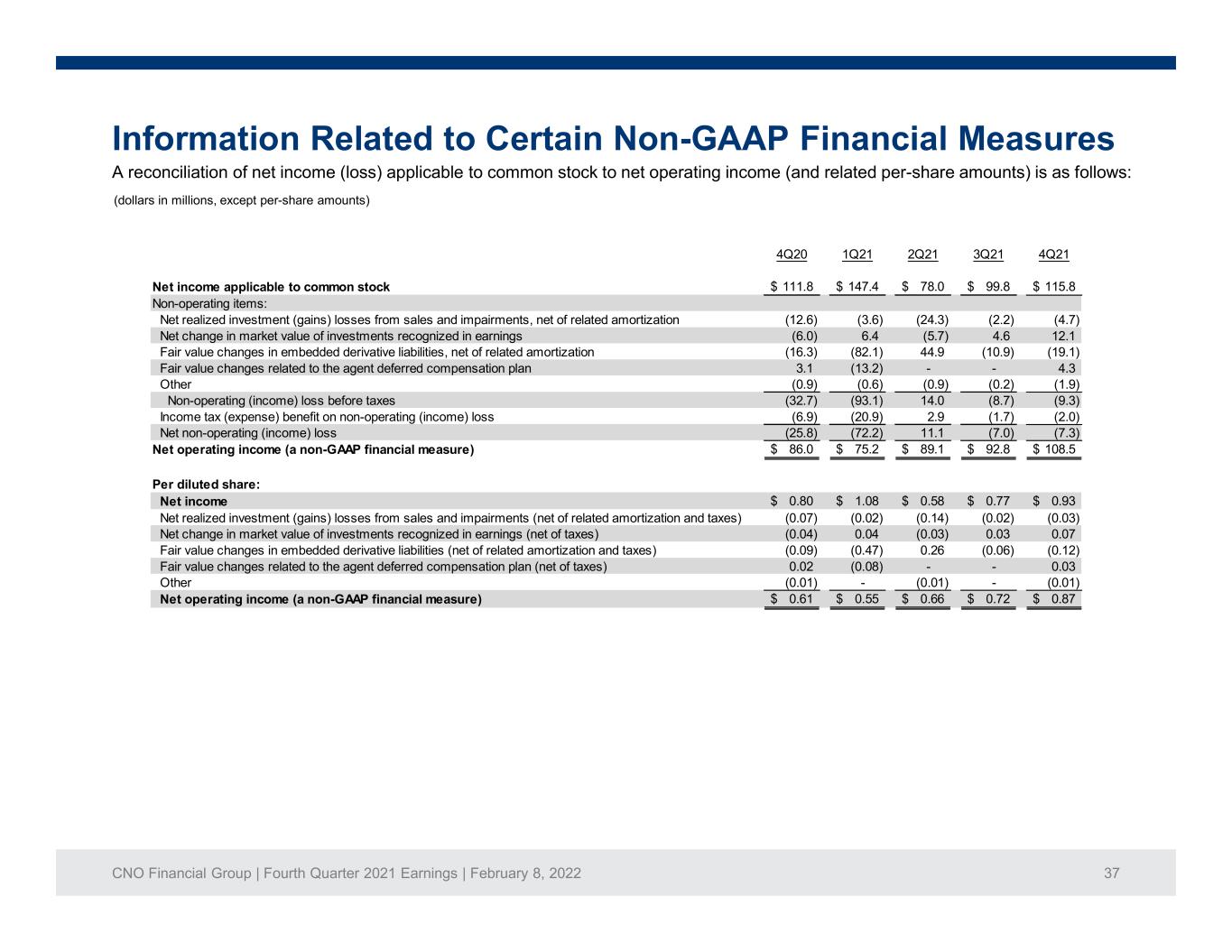

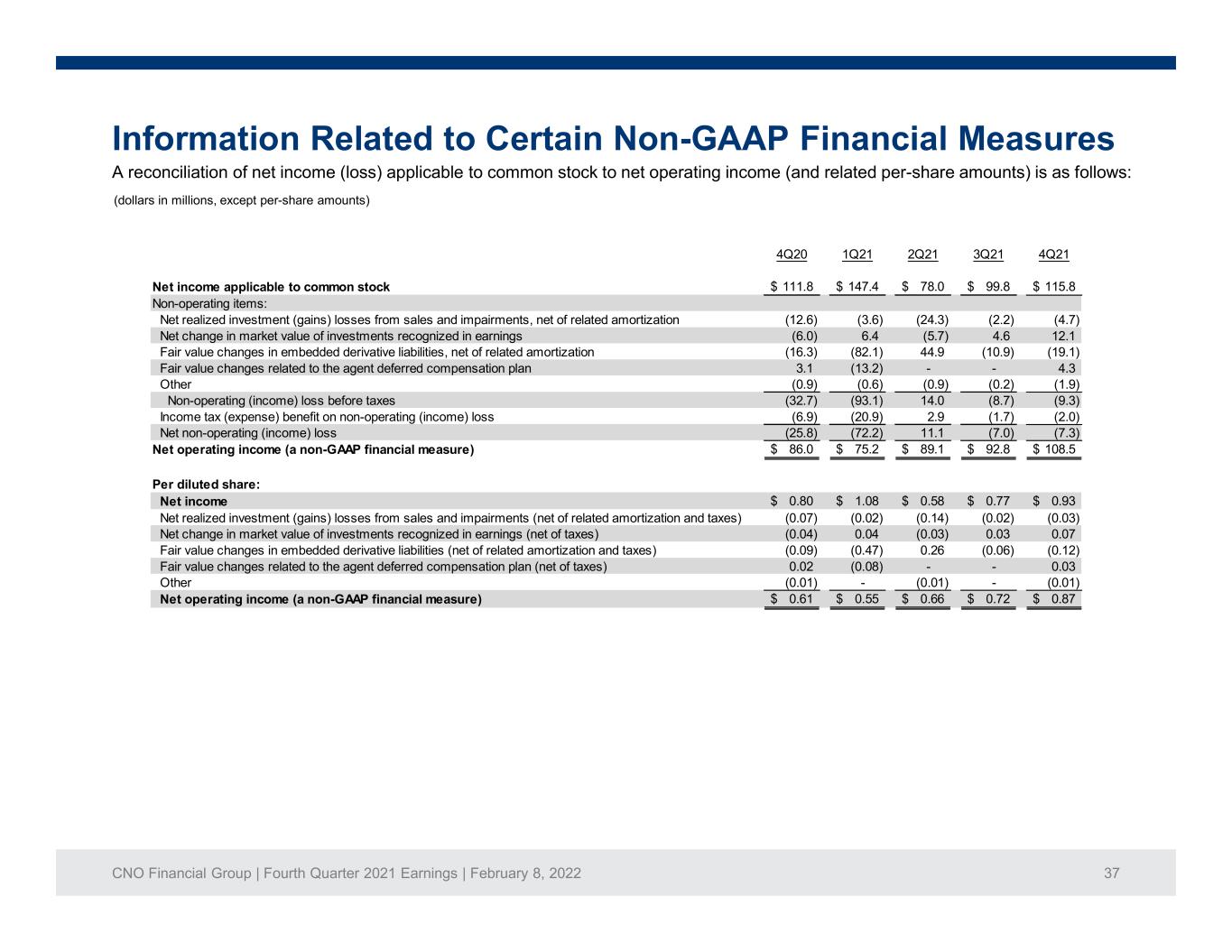

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 37 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income (loss) applicable to common stock to net operating income (and related per-share amounts) is as follows: (dollars in millions, except per-share amounts) 4Q20 1Q21 2Q21 3Q21 4Q21 Net income applicable to common stock 111.8$ 147.4$ 78.0$ 99.8$ 115.8$ Non-operating items: Net realized investment (gains) losses from sales and impairments, net of related amortization (12.6) (3.6) (24.3) (2.2) (4.7) Net change in market value of investments recognized in earnings (6.0) 6.4 (5.7) 4.6 12.1 Fair value changes in embedded derivative liabilities, net of related amortization (16.3) (82.1) 44.9 (10.9) (19.1) Fair value changes related to the agent deferred compensation plan 3.1 (13.2) - - 4.3 Other (0.9) (0.6) (0.9) (0.2) (1.9) Non-operating (income) loss before taxes (32.7) (93.1) 14.0 (8.7) (9.3) Income tax (expense) benefit on non-operating (income) loss (6.9) (20.9) 2.9 (1.7) (2.0) Net non-operating (income) loss (25.8) (72.2) 11.1 (7.0) (7.3) Net operating income (a non-GAAP financial measure) 86.0$ 75.2$ 89.1$ 92.8$ 108.5$ Per diluted share: Net income 0.80$ 1.08$ 0.58$ 0.77$ 0.93$ Net realized investment (gains) losses from sales and impairments (net of related amortization and taxes) (0.07) (0.02) (0.14) (0.02) (0.03) Net change in market value of investments recognized in earnings (net of taxes) (0.04) 0.04 (0.03) 0.03 0.07 Fair value changes in embedded derivative liabilities (net of related amortization and taxes) (0.09) (0.47) 0.26 (0.06) (0.12) Fair value changes related to the agent deferred compensation plan (net of taxes) 0.02 (0.08) - - 0.03 Other (0.01) - (0.01) - (0.01) Net operating income (a non-GAAP financial measure) 0.61$ 0.55$ 0.66$ 0.72$ 0.87$

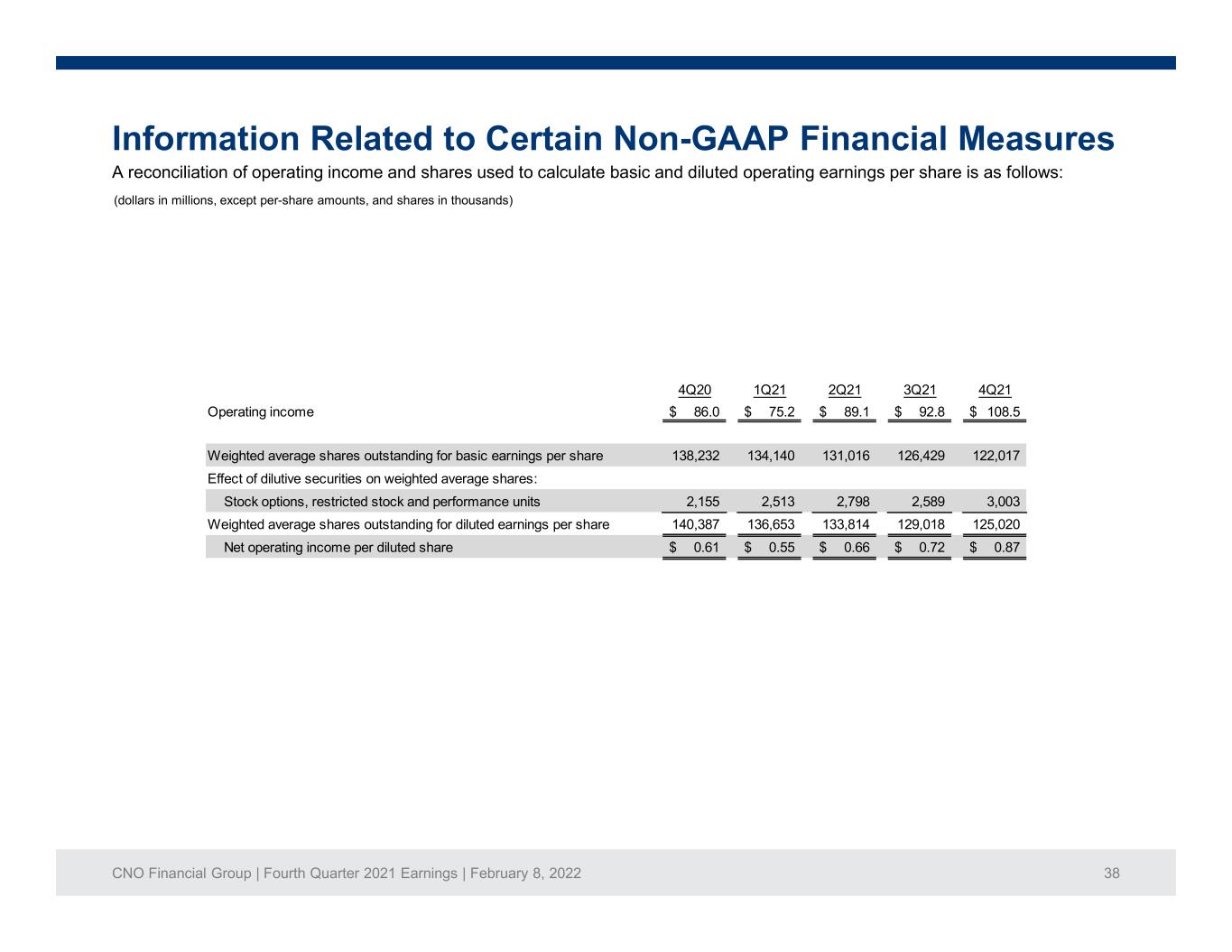

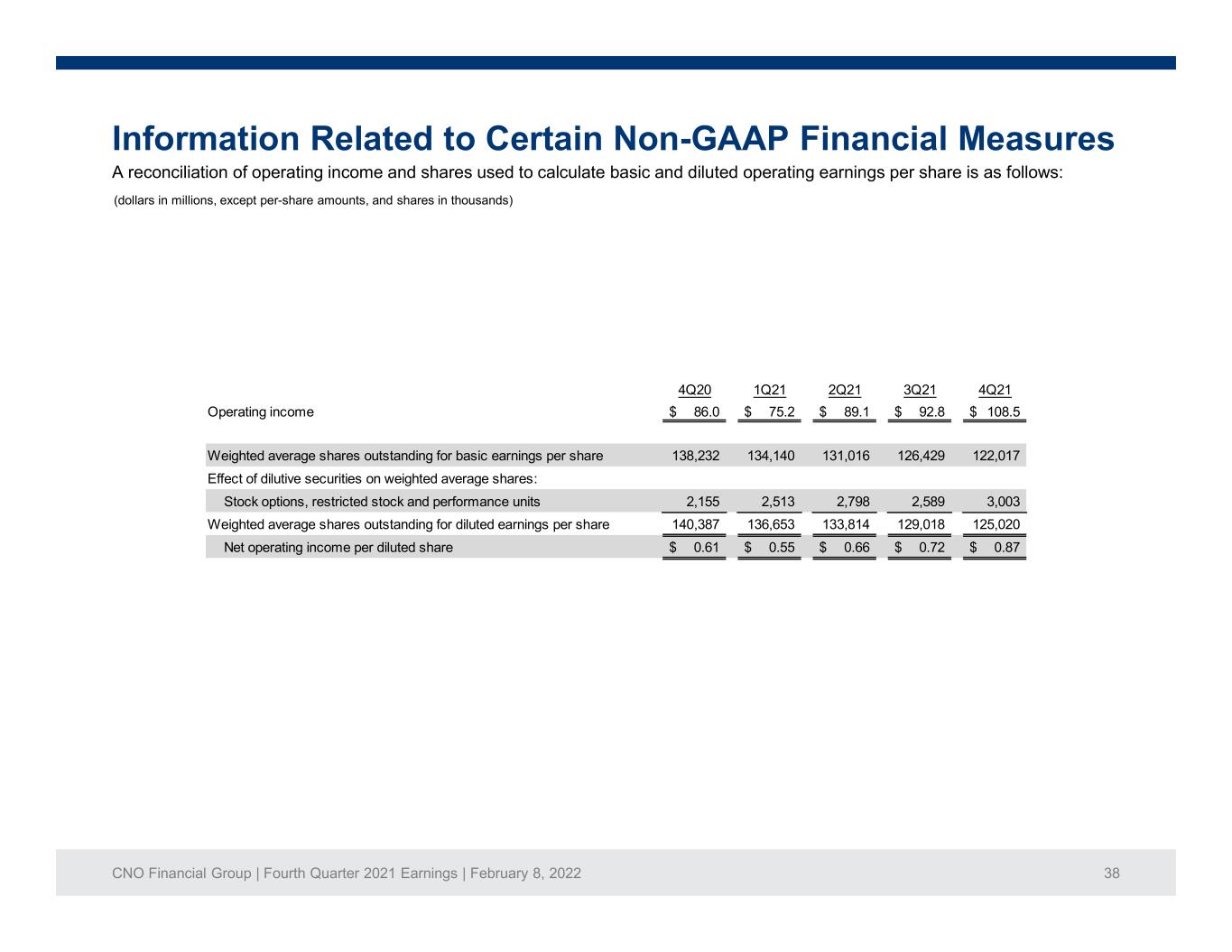

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 38 Information Related to Certain Non-GAAP Financial Measures A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows: (dollars in millions, except per-share amounts, and shares in thousands) 4Q20 1Q21 2Q21 3Q21 4Q21 Operating income 86.0$ 75.2$ 89.1$ 92.8$ 108.5$ Weighted average shares outstanding for basic earnings per share 138,232 134,140 131,016 126,429 122,017 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units 2,155 2,513 2,798 2,589 3,003 Weighted average shares outstanding for diluted earnings per share 140,387 136,653 133,814 129,018 125,020 Net operating income per diluted share 0.61$ 0.55$ 0.66$ 0.72$ 0.87$

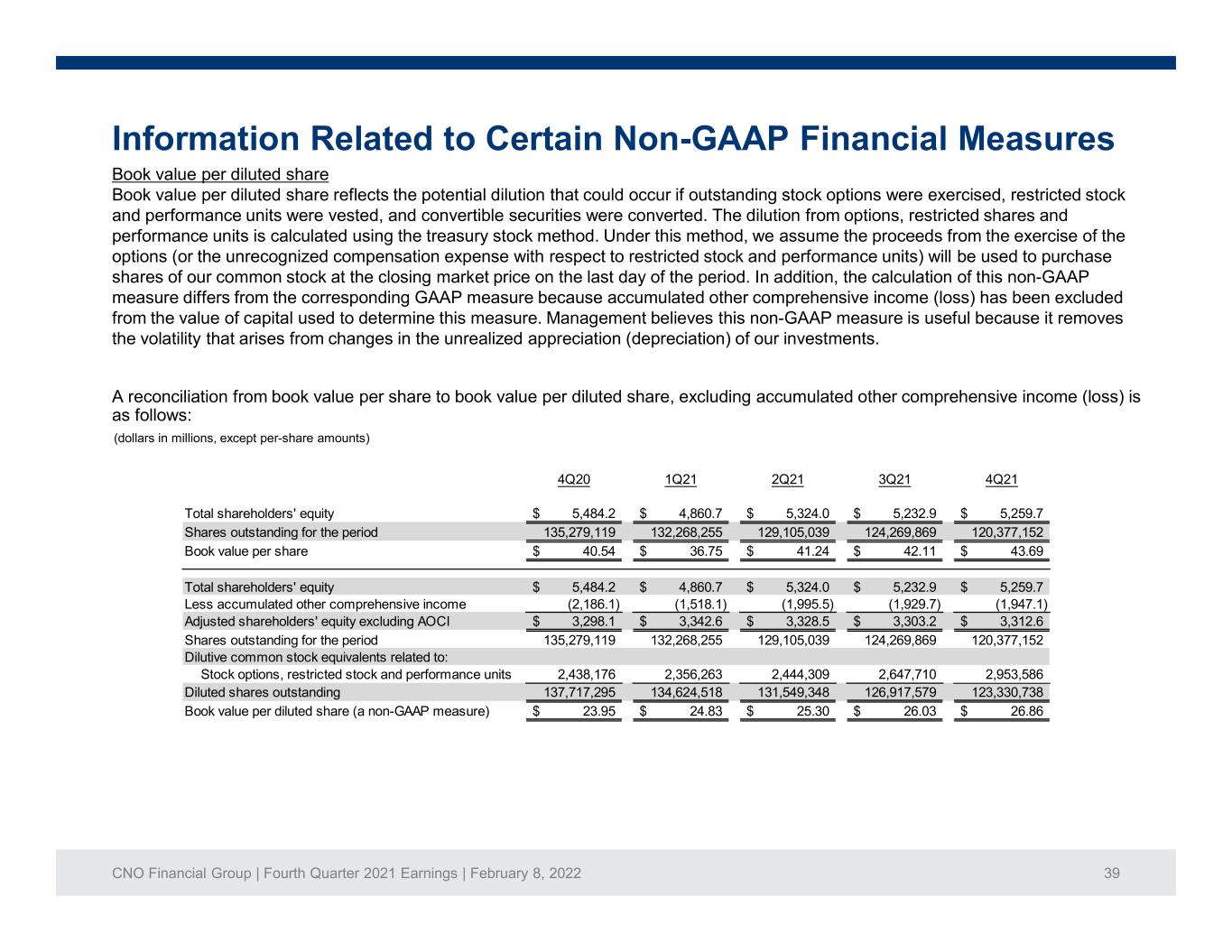

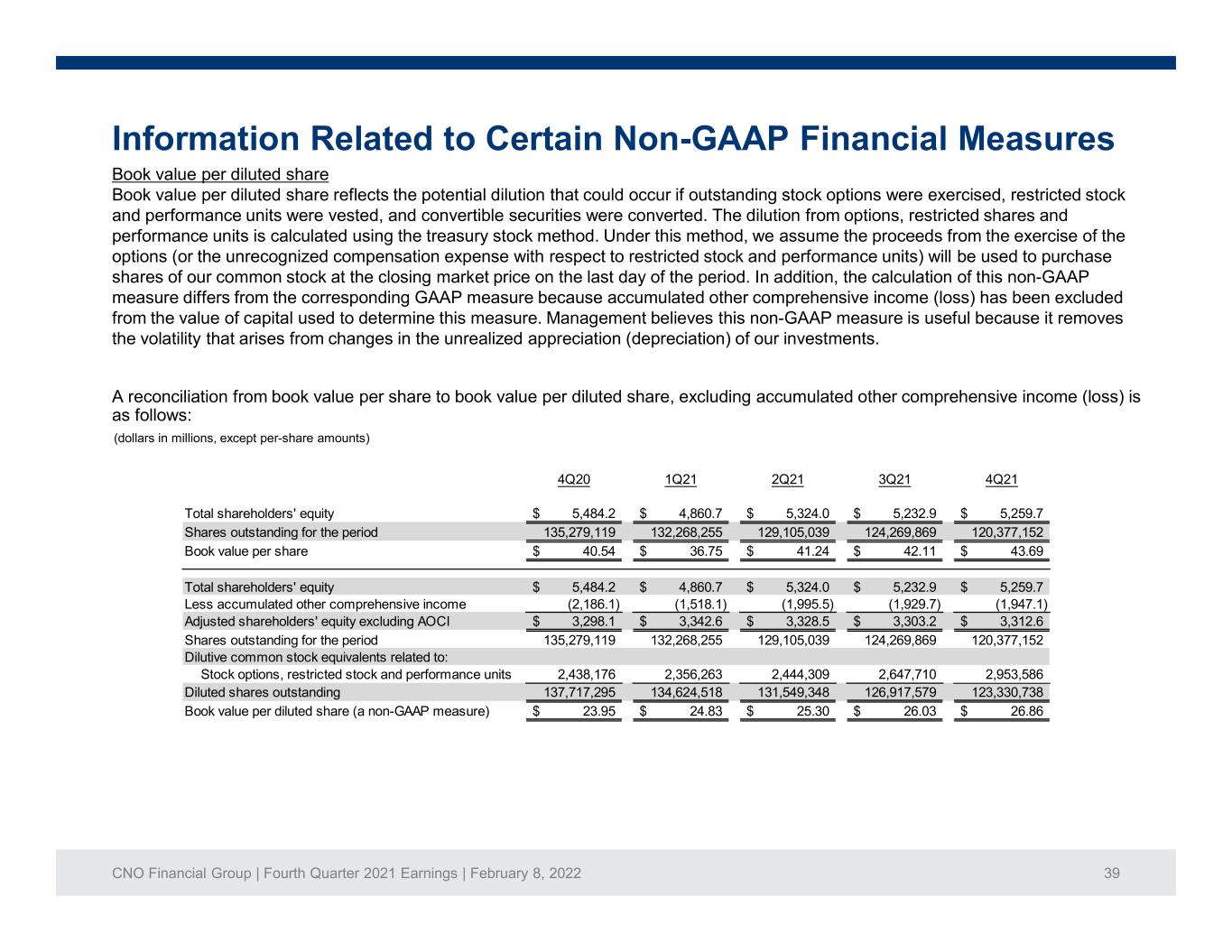

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 39 Information Related to Certain Non-GAAP Financial Measures Book value per diluted share Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised, restricted stock and performance units were vested, and convertible securities were converted. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments. A reconciliation from book value per share to book value per diluted share, excluding accumulated other comprehensive income (loss) is as follows: (dollars in millions, except per-share amounts) 4Q20 1Q21 2Q21 3Q21 4Q21 Total shareholders' equity 5,484.2$ 4,860.7$ 5,324.0$ 5,232.9$ 5,259.7$ Shares outstanding for the period 135,279,119 132,268,255 129,105,039 124,269,869 120,377,152 Book value per share 40.54$ 36.75$ 41.24$ 42.11$ 43.69$ Total shareholders' equity 5,484.2$ 4,860.7$ 5,324.0$ 5,232.9$ 5,259.7$ Less accumulated other comprehensive income (2,186.1) (1,518.1) (1,995.5) (1,929.7) (1,947.1) Adjusted shareholders' equity excluding AOCI 3,298.1$ 3,342.6$ 3,328.5$ 3,303.2$ 3,312.6$ Shares outstanding for the period 135,279,119 132,268,255 129,105,039 124,269,869 120,377,152 Dilutive common stock equivalents related to: Stock options, restricted stock and performance units 2,438,176 2,356,263 2,444,309 2,647,710 2,953,586 Diluted shares outstanding 137,717,295 134,624,518 131,549,348 126,917,579 123,330,738 Book value per diluted share (a non-GAAP measure) 23.95$ 24.83$ 25.30$ 26.03$ 26.86$

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 40 Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales, impairments and change in allowance for credit losses, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, changes in the valuation allowance for deferred tax assets and other tax items, loss on extinguishment of debt and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition, our equity includes the value of significant net operating loss carryforwards (included in income tax assets). In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive compensation.

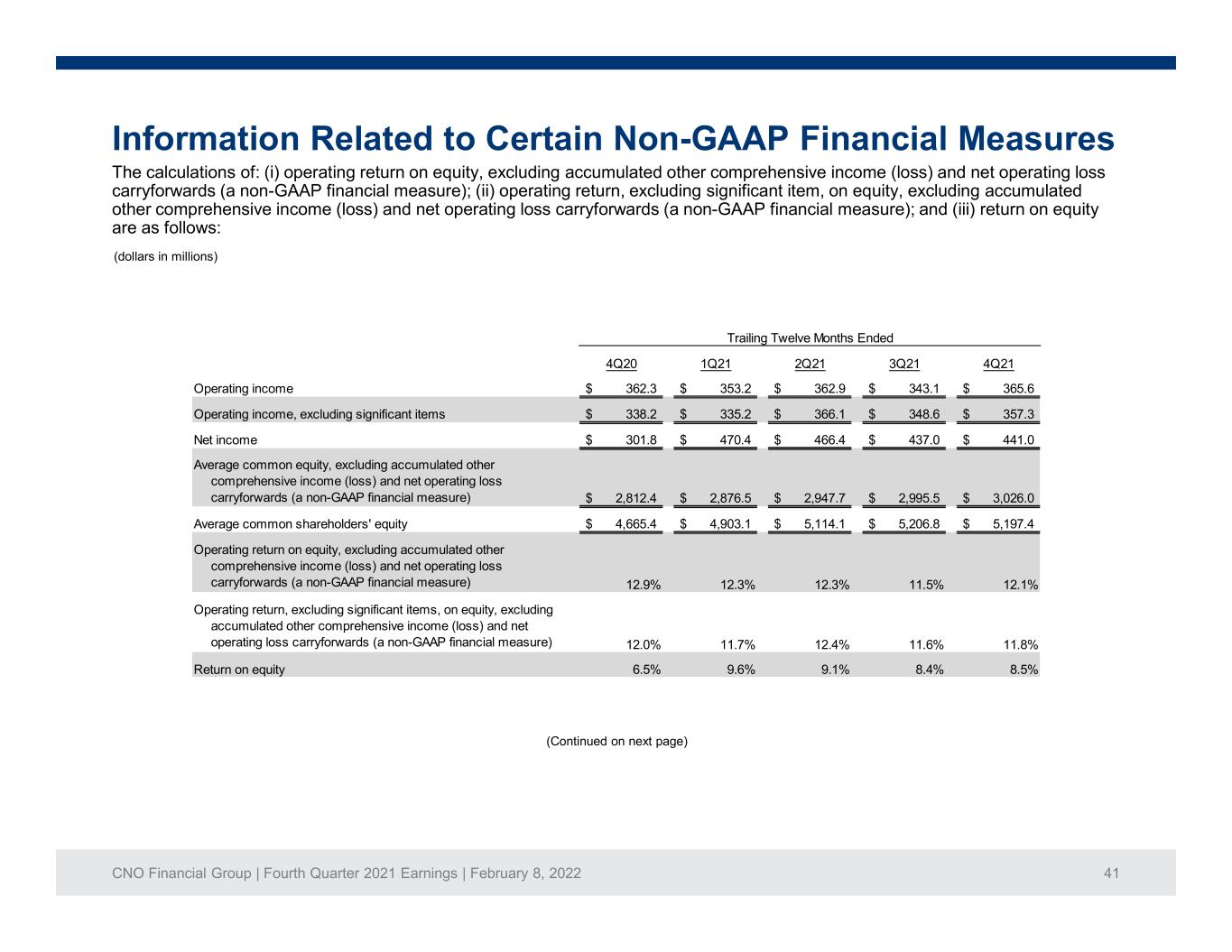

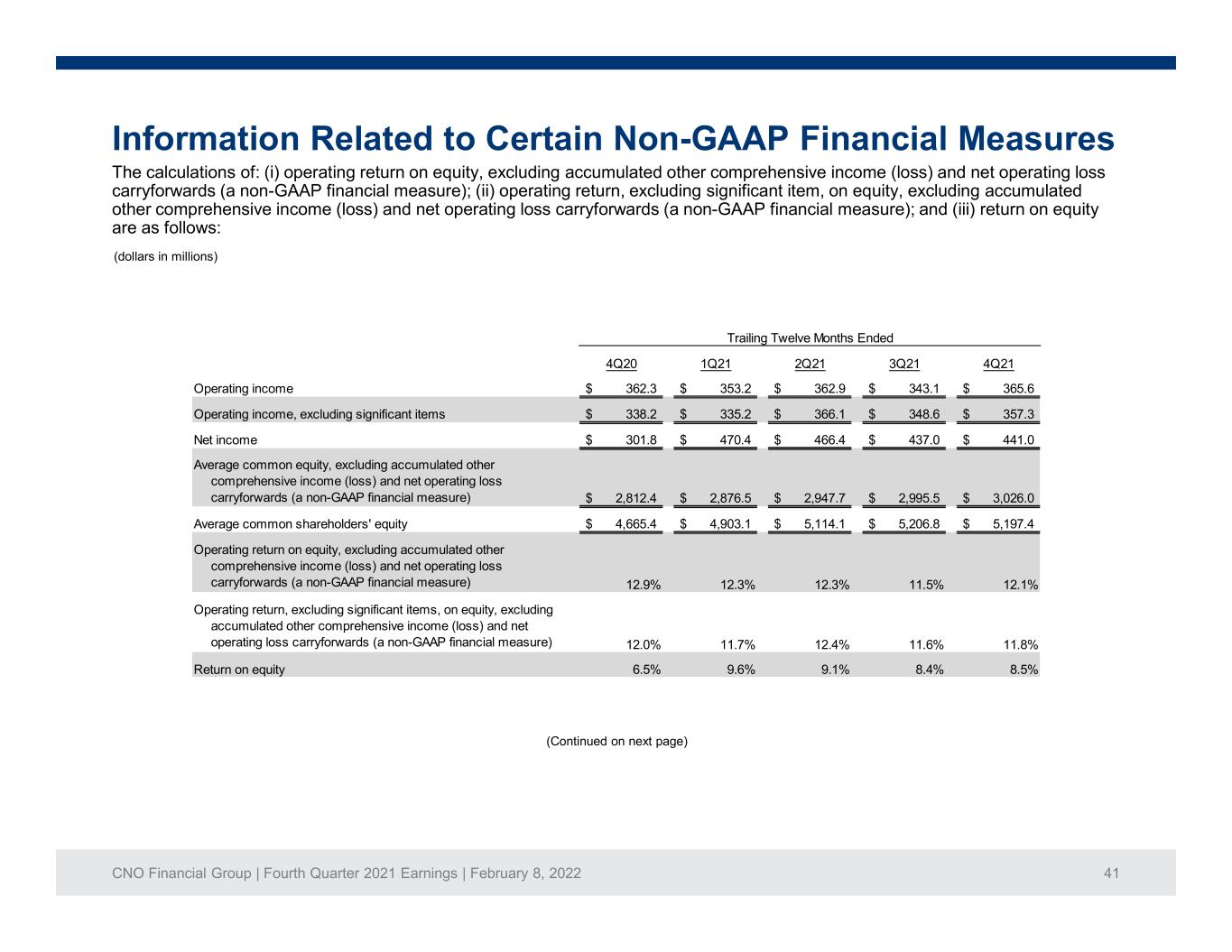

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 41 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant item, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows: (dollars in millions) (Continued on next page) 4Q20 1Q21 2Q21 3Q21 4Q21 Operating income 362.3$ 353.2$ 362.9$ 343.1$ 365.6$ Operating income, excluding significant items 338.2$ 335.2$ 366.1$ 348.6$ 357.3$ Net income 301.8$ 470.4$ 466.4$ 437.0$ 441.0$ Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,812.4$ 2,876.5$ 2,947.7$ 2,995.5$ 3,026.0$ Average common shareholders' equity 4,665.4$ 4,903.1$ 5,114.1$ 5,206.8$ 5,197.4$ Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 12.9% 12.3% 12.3% 11.5% 12.1% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 12.0% 11.7% 12.4% 11.6% 11.8% Return on equity 6.5% 9.6% 9.1% 8.4% 8.5% Trailing Twelve Months Ended

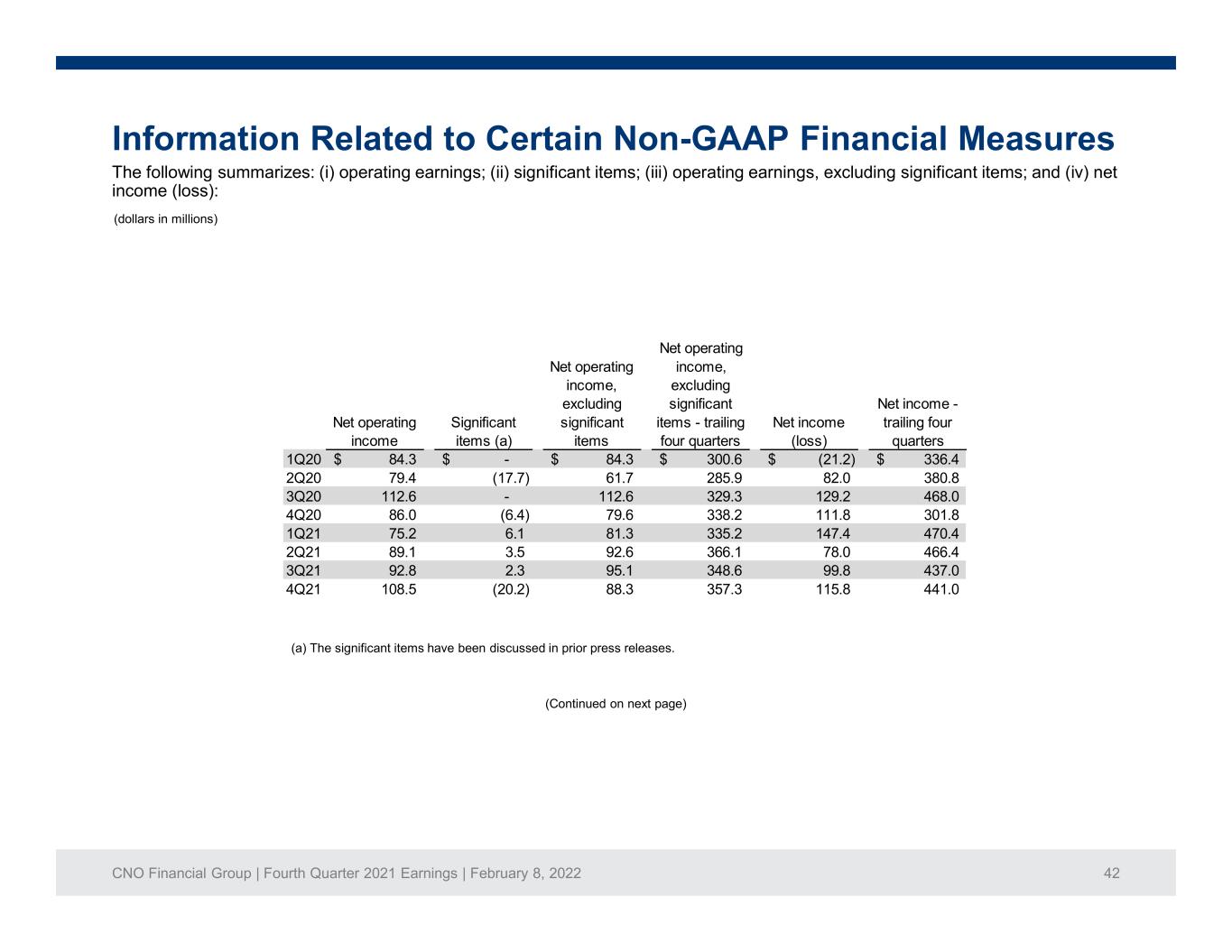

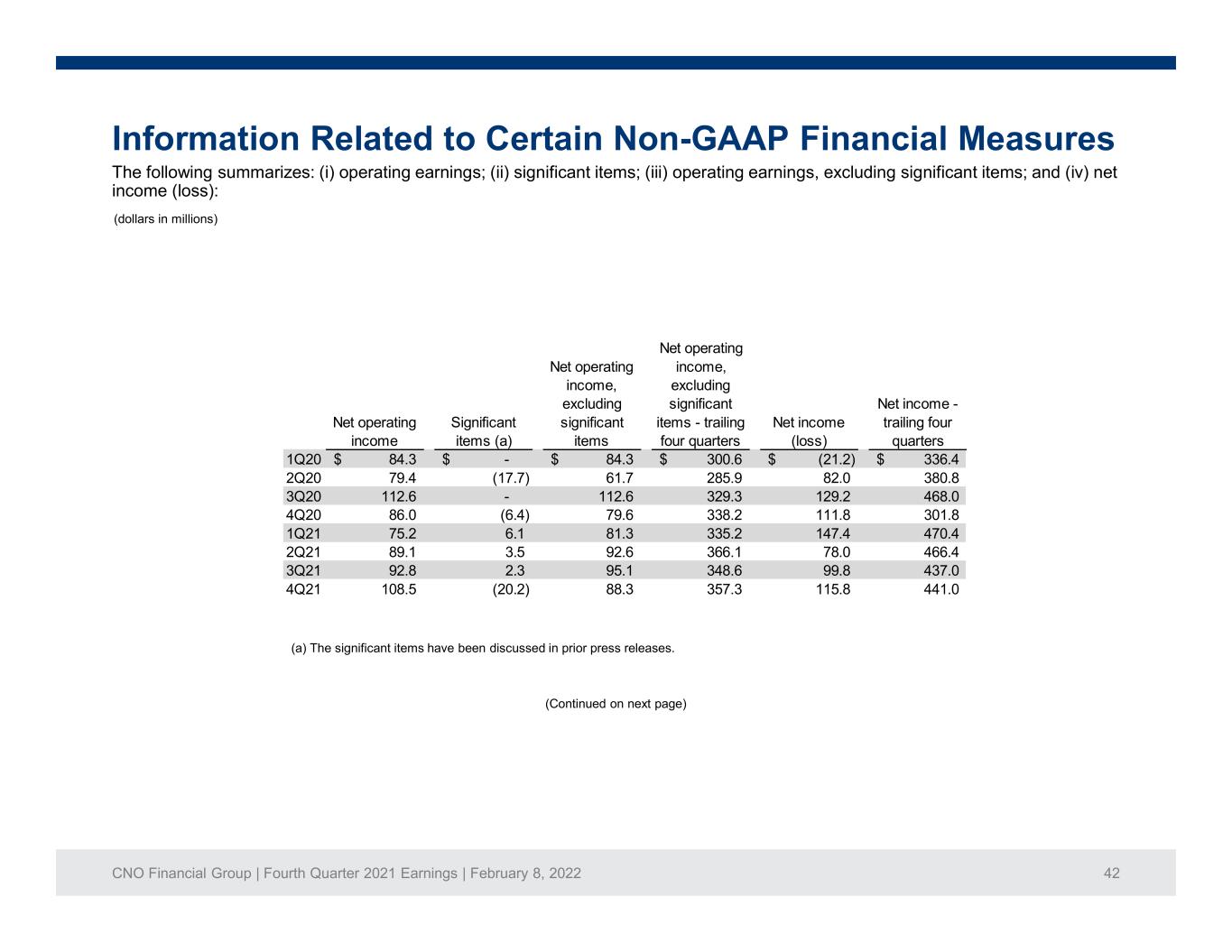

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 42 Information Related to Certain Non-GAAP Financial Measures The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income (loss): (dollars in millions) Net operating income Significant items (a) Net operating income, excluding significant items Net operating income, excluding significant items - trailing four quarters Net income (loss) Net income - trailing four quarters 1Q20 84.3$ -$ 84.3$ 300.6$ (21.2)$ 336.4$ 2Q20 79.4 (17.7) 61.7 285.9 82.0 380.8 3Q20 112.6 - 112.6 329.3 129.2 468.0 4Q20 86.0 (6.4) 79.6 338.2 111.8 301.8 1Q21 75.2 6.1 81.3 335.2 147.4 470.4 2Q21 89.1 3.5 92.6 366.1 78.0 466.4 3Q21 92.8 2.3 95.1 348.6 99.8 437.0 4Q21 108.5 (20.2) 88.3 357.3 115.8 441.0 (a) The significant items have been discussed in prior press releases. (Continued on next page)

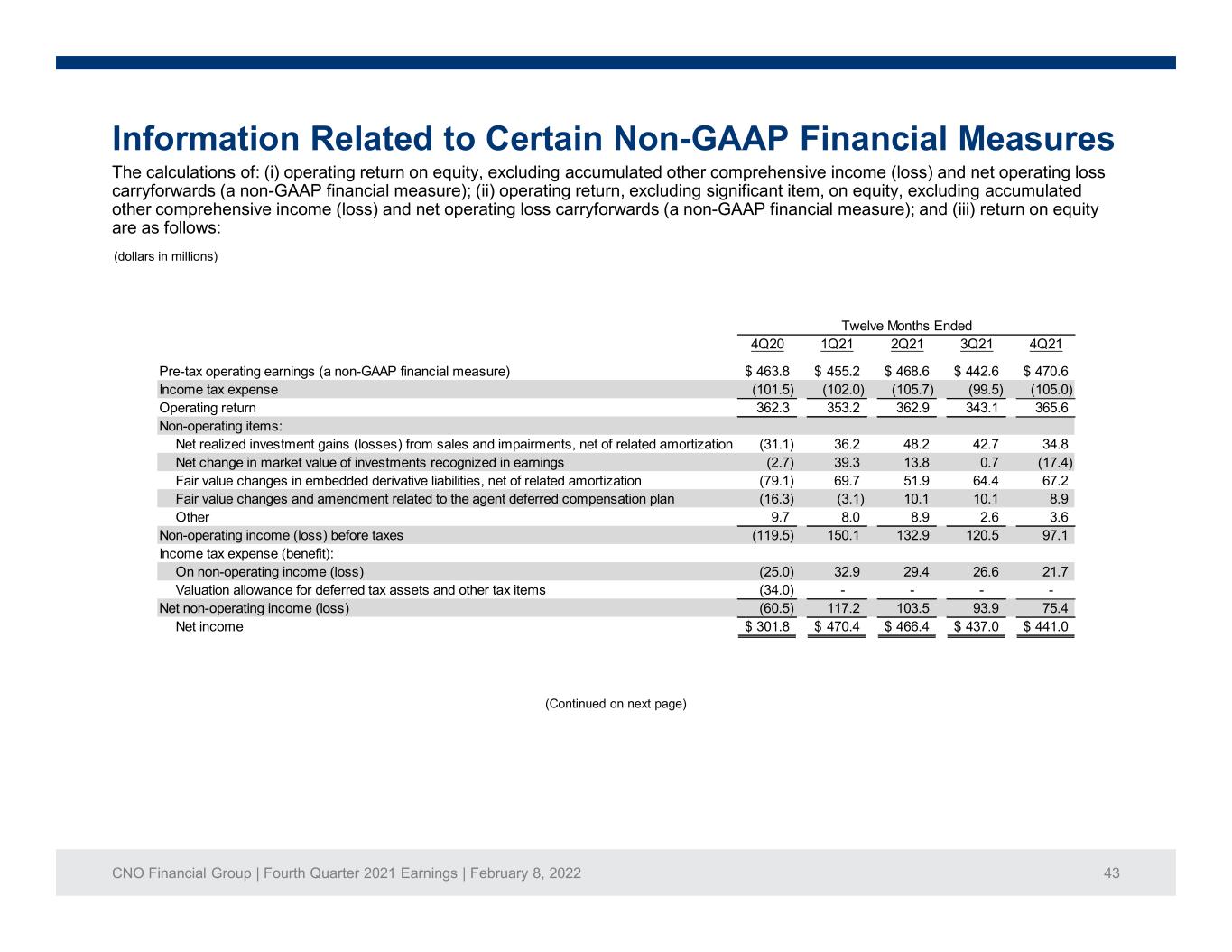

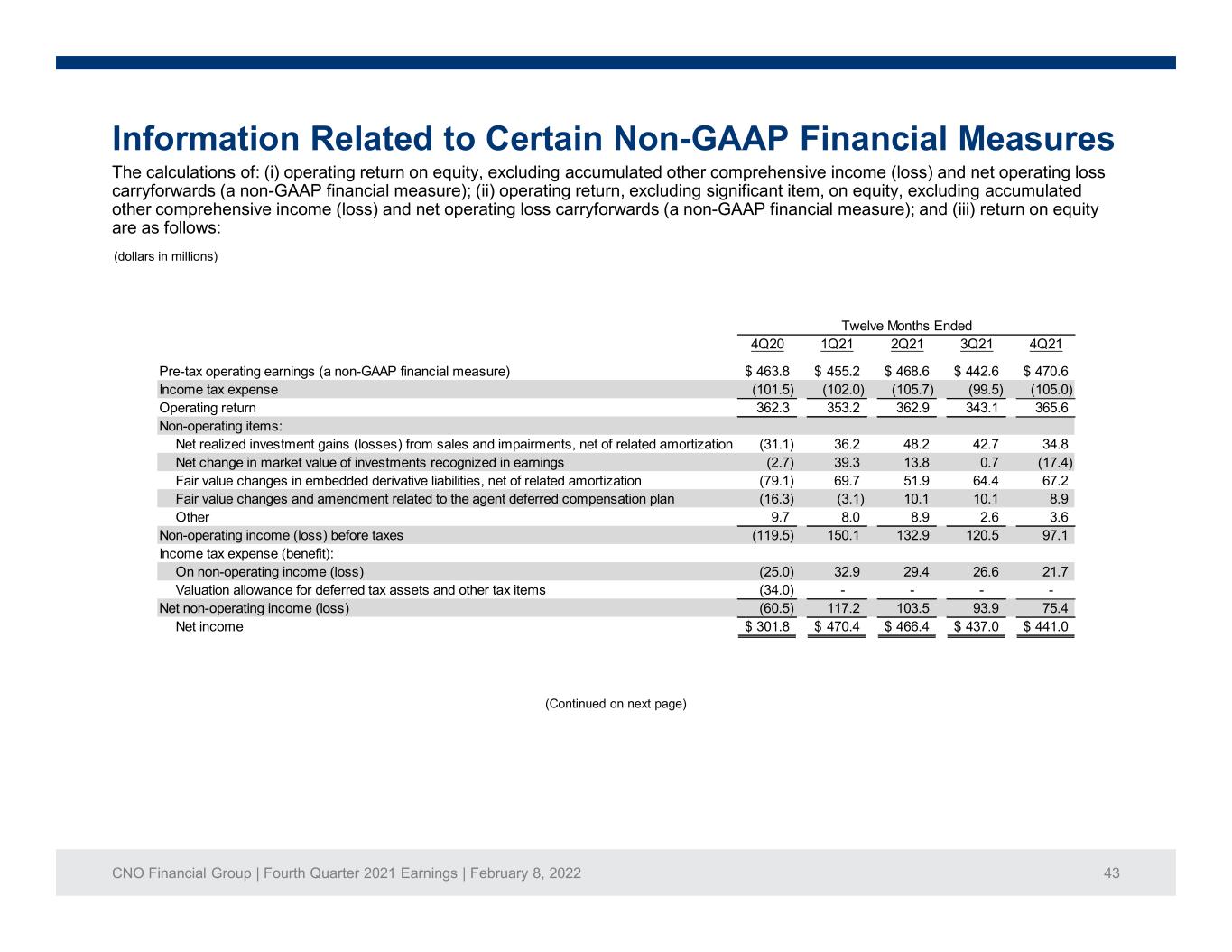

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 43 Information Related to Certain Non-GAAP Financial Measures The calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant item, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows: (dollars in millions) (Continued on next page) 4Q20 1Q21 2Q21 3Q21 4Q21 Pre-tax operating earnings (a non-GAAP financial measure) 463.8$ 455.2$ 468.6$ 442.6$ 470.6$ Income tax expense (101.5) (102.0) (105.7) (99.5) (105.0) Operating return 362.3 353.2 362.9 343.1 365.6 Non-operating items: Net realized investment gains (losses) from sales and impairments, net of related amortization (31.1) 36.2 48.2 42.7 34.8 Net change in market value of investments recognized in earnings (2.7) 39.3 13.8 0.7 (17.4) Fair value changes in embedded derivative liabilities, net of related amortization (79.1) 69.7 51.9 64.4 67.2 Fair value changes and amendment related to the agent deferred compensation plan (16.3) (3.1) 10.1 10.1 8.9 Other 9.7 8.0 8.9 2.6 3.6 Non-operating income (loss) before taxes (119.5) 150.1 132.9 120.5 97.1 Income tax expense (benefit): On non-operating income (loss) (25.0) 32.9 29.4 26.6 21.7 Valuation allowance for deferred tax assets and other tax items (34.0) - - - - Net non-operating income (loss) (60.5) 117.2 103.5 93.9 75.4 Net income 301.8$ 470.4$ 466.4$ 437.0$ 441.0$ Twelve Months Ended

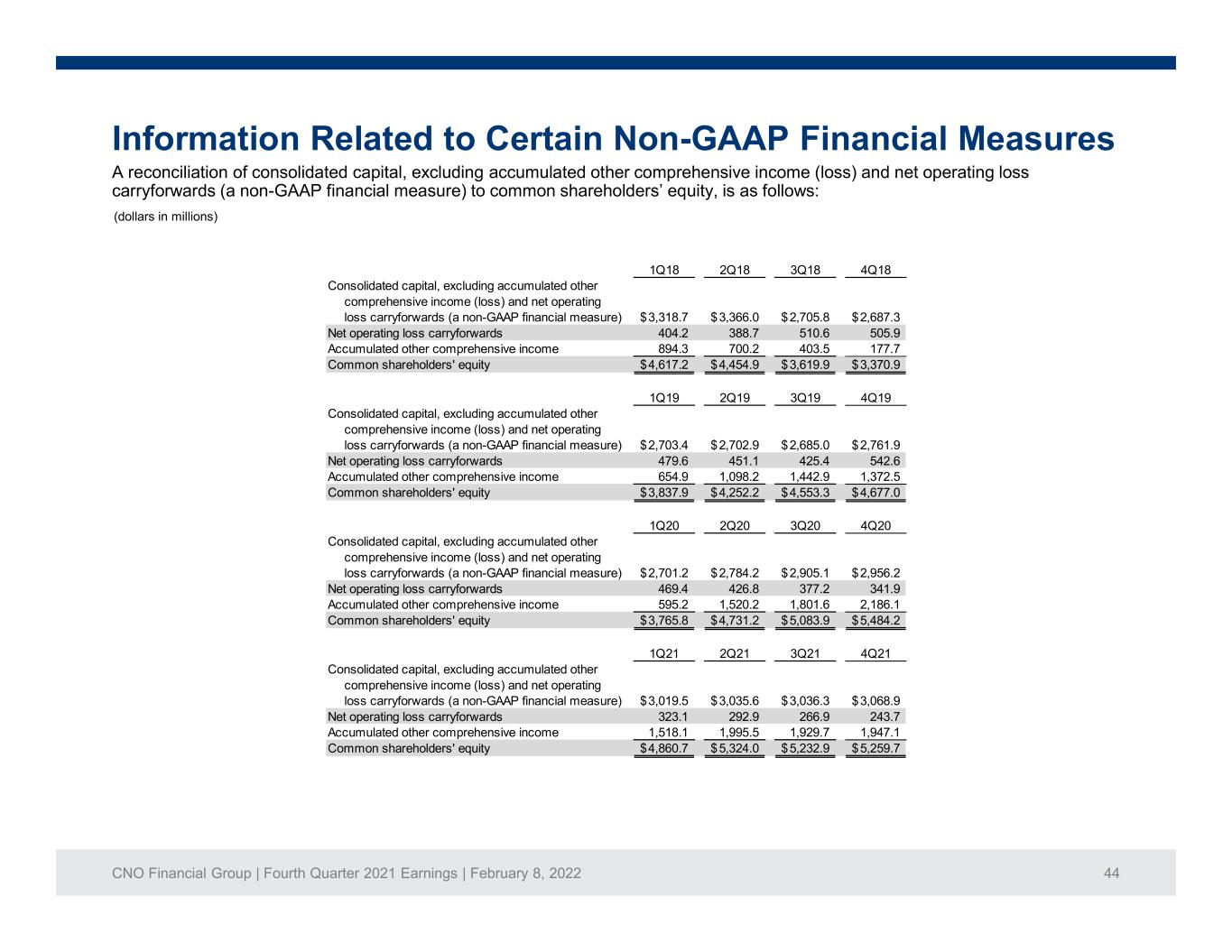

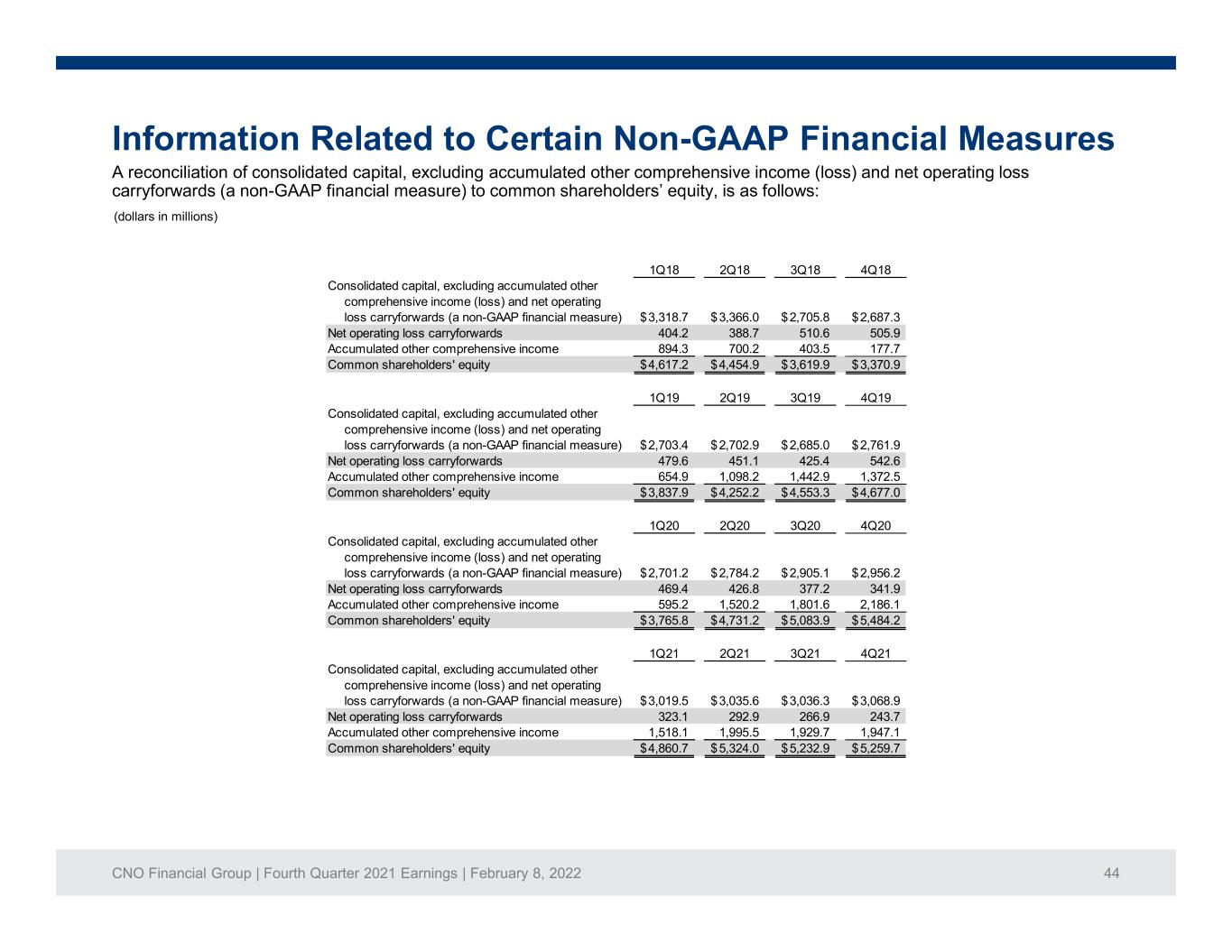

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 44 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows: (dollars in millions) 1Q18 2Q18 3Q18 4Q18 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,318.7$ 3,366.0$ 2,705.8$ 2,687.3$ Net operating loss carryforwards 404.2 388.7 510.6 505.9 Accumulated other comprehensive income 894.3 700.2 403.5 177.7 Common shareholders' equity 4,617.2$ 4,454.9$ 3,619.9$ 3,370.9$ 1Q19 2Q19 3Q19 4Q19 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,703.4$ 2,702.9$ 2,685.0$ 2,761.9$ Net operating loss carryforwards 479.6 451.1 425.4 542.6 Accumulated other comprehensive income 654.9 1,098.2 1,442.9 1,372.5 Common shareholders' equity 3,837.9$ 4,252.2$ 4,553.3$ 4,677.0$ 1Q20 2Q20 3Q20 4Q20 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,701.2$ 2,784.2$ 2,905.1$ 2,956.2$ Net operating loss carryforwards 469.4 426.8 377.2 341.9 Accumulated other comprehensive income 595.2 1,520.2 1,801.6 2,186.1 Common shareholders' equity 3,765.8$ 4,731.2$ 5,083.9$ 5,484.2$ 1Q21 2Q21 3Q21 4Q21 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,019.5$ 3,035.6$ 3,036.3$ 3,068.9$ Net operating loss carryforwards 323.1 292.9 266.9 243.7 Accumulated other comprehensive income 1,518.1 1,995.5 1,929.7 1,947.1 Common shareholders' equity 4,860.7$ 5,324.0$ 5,232.9$ 5,259.7$

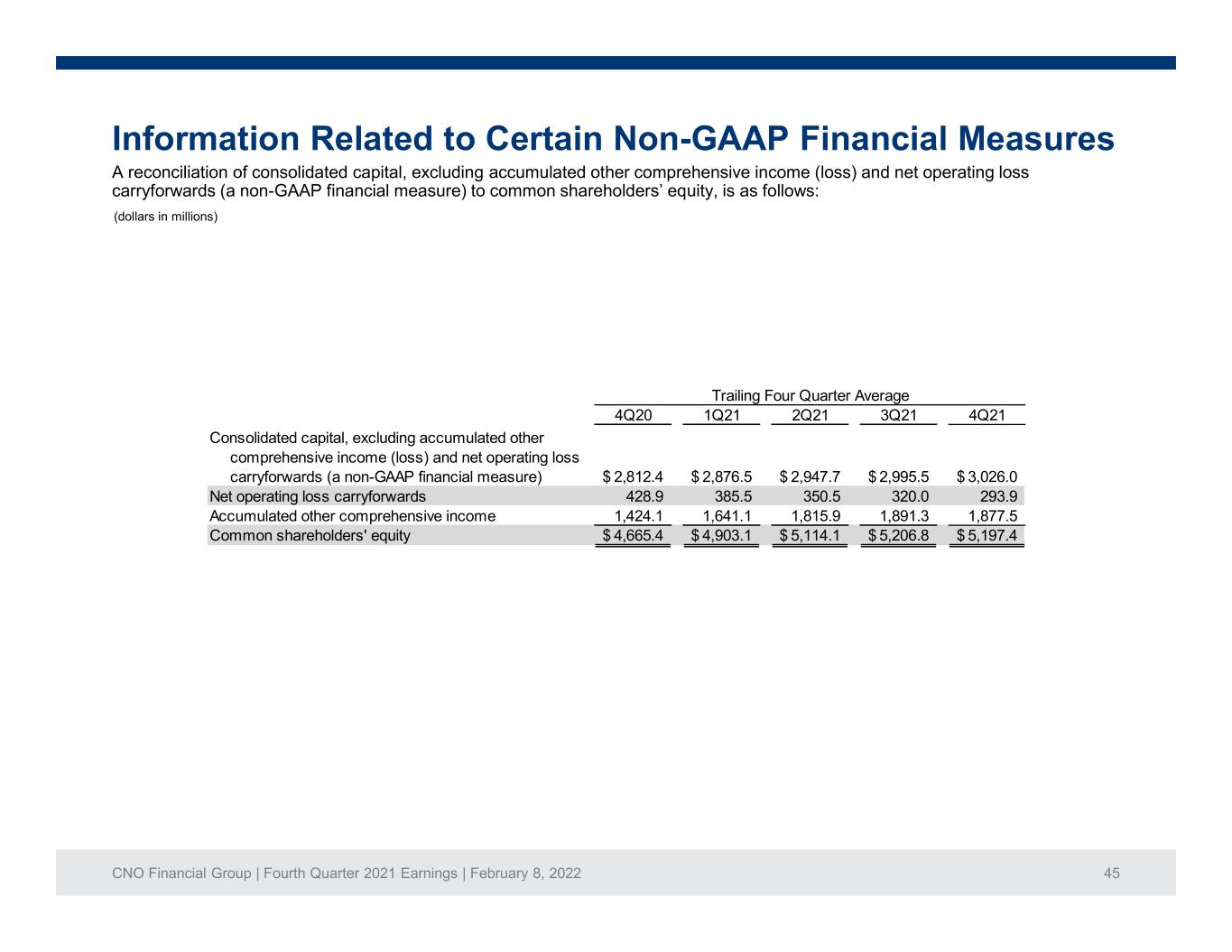

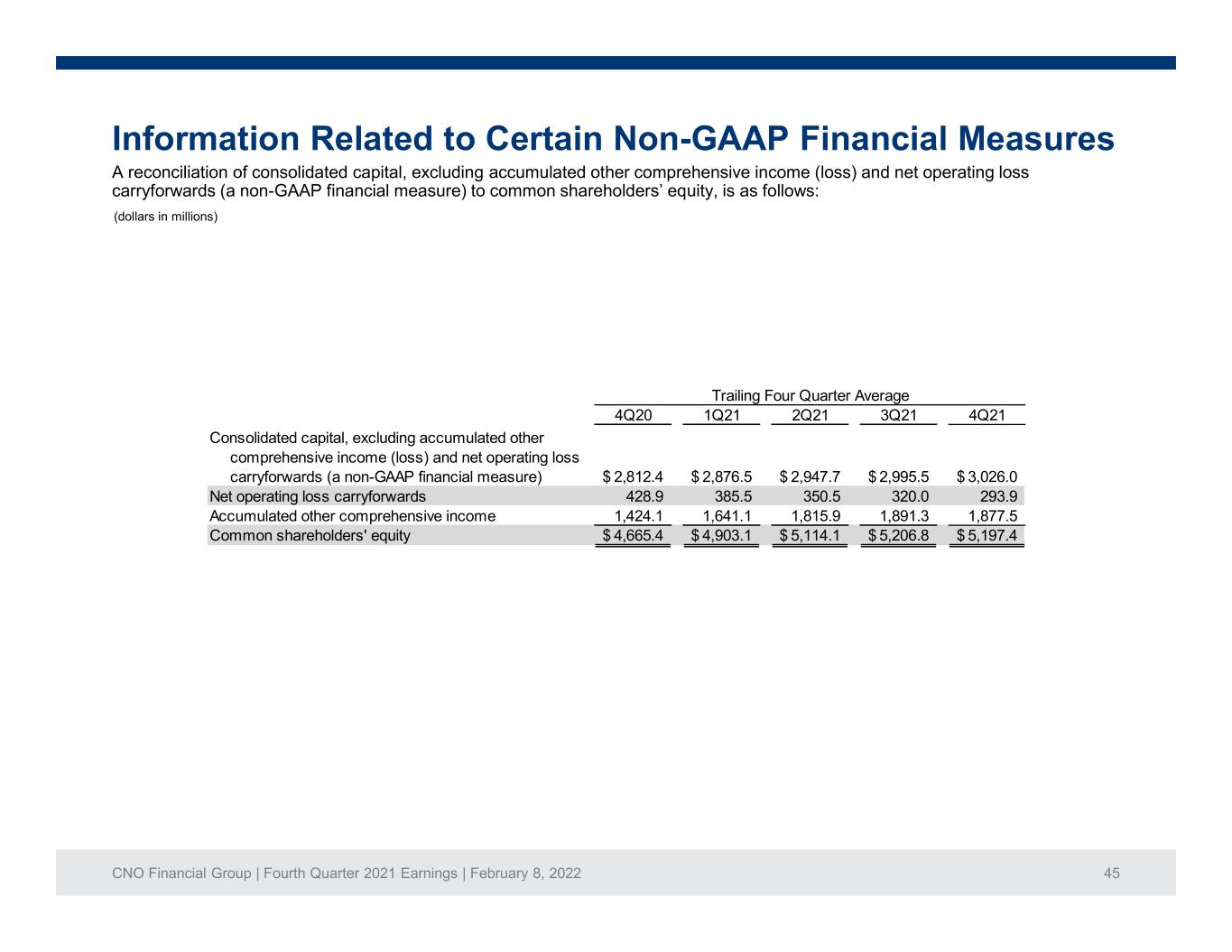

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 45 Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows: (dollars in millions) 4Q20 1Q21 2Q21 3Q21 4Q21 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 2,812.4$ 2,876.5$ 2,947.7$ 2,995.5$ 3,026.0$ Net operating loss carryforwards 428.9 385.5 350.5 320.0 293.9 Accumulated other comprehensive income 1,424.1 1,641.1 1,815.9 1,891.3 1,877.5 Common shareholders' equity 4,665.4$ 4,903.1$ 5,114.1$ 5,206.8$ 5,197.4$ Trailing Four Quarter Average

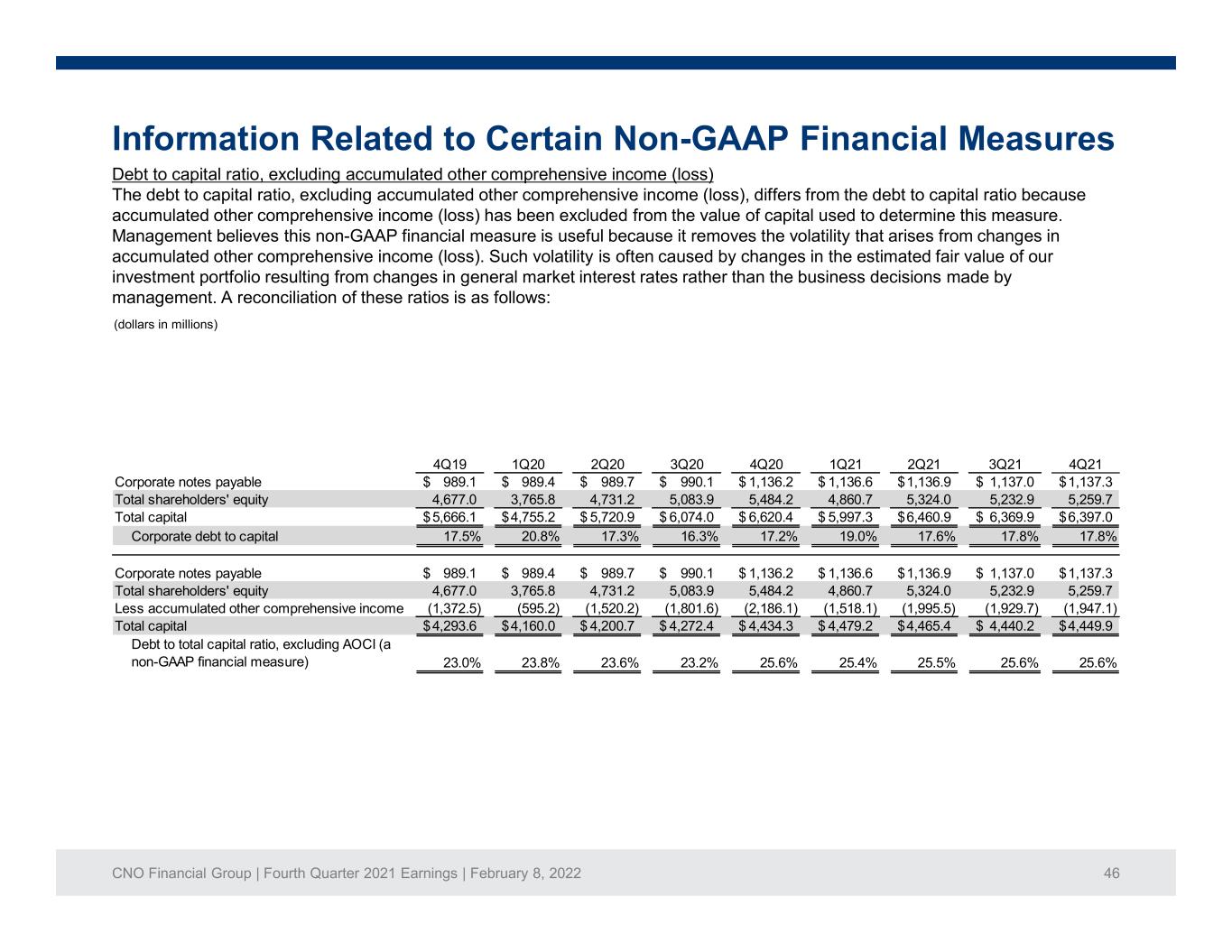

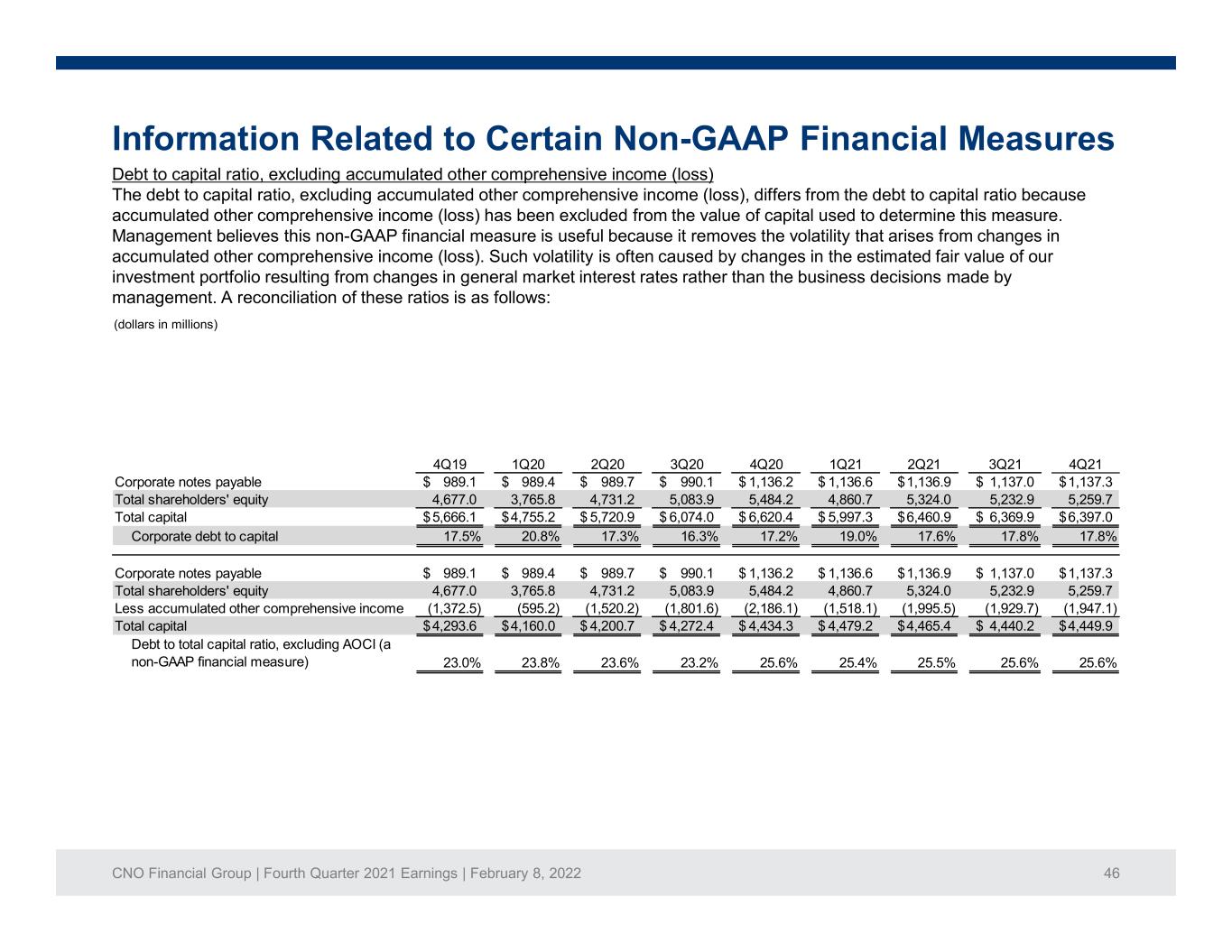

CNO Financial Group | Fourth Quarter 2021 Earnings | February 8, 2022 46 Information Related to Certain Non-GAAP Financial Measures Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows: (dollars in millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ 1,136.9$ 1,137.0$ 1,137.3$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 5,324.0 5,232.9 5,259.7 Total capital 5,666.1$ 4,755.2$ 5,720.9$ 6,074.0$ 6,620.4$ 5,997.3$ 6,460.9$ 6,369.9$ 6,397.0$ Corporate debt to capital 17.5% 20.8% 17.3% 16.3% 17.2% 19.0% 17.6% 17.8% 17.8% Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ 1,136.9$ 1,137.0$ 1,137.3$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 5,324.0 5,232.9 5,259.7 Less accumulated other comprehensive income (1,372.5) (595.2) (1,520.2) (1,801.6) (2,186.1) (1,518.1) (1,995.5) (1,929.7) (1,947.1) Total capital 4,293.6$ 4,160.0$ 4,200.7$ 4,272.4$ 4,434.3$ 4,479.2$ 4,465.4$ 4,440.2$ 4,449.9$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 23.0% 23.8% 23.6% 23.2% 25.6% 25.4% 25.5% 25.6% 25.6%