Prospectus Supplement to Prospectus dated October 1, 2012

GE Capital Credit Card Master Note Trust

Issuing Entity

RFS Holding, L.L.C. Depositor | GE Capital Retail Bank Sponsor |

$563,091,483 Series 2012-7 Asset Backed Notes(1)

| | | Class A Notes | | Class B Notes |

| Principal amount | | $500,000,000 | | $63,091,483 |

| | | | | |

| Interest rate | | 1.76% per year | | 2.21% per year |

| | | | | |

| Interest payment dates | | monthly on the 15th, beginning November 15, 2012 | | monthly on the 15th, beginning November 15, 2012 |

| Expected principal payment date | | September 2019 payment date | | September 2019 payment date |

| Final maturity date | | September 2022 payment date | | September 2022 payment date |

| Price to public | | $499,724,650 (or 99.94493%) | | $63,072,278 (or 99.96956%) |

| Underwriting discount | | $1,875,000 (or 0.375%) | | $347,003 (or 0.550%) |

| Proceeds to issuing entity | | $497,849,650 (or 99.56993%) | | $62,725,275 (or 99.41956%) |

| (1) | The issuing entity is also issuing Class C notes in the amount of $42,586,750. The Class C notes are not offered by this prospectus supplement and the accompanying prospectus and will initially be purchased by an affiliate of the depositor. |

The Class A notes benefit from credit enhancement in the form of subordination of the Class B notes and the Class C notes and a specified amount of excess collateral. The Class B notes benefit from credit enhancement in the form of subordination of the Class C notes and a specified amount of excess collateral.

The notes will be paid from the issuing entity’s assets consisting primarily of receivables in a portfolio of private label and co-branded revolving credit card accounts owned by GE Capital Retail Bank.

We expect to issue your series of notes in book-entry form on or about October 17, 2012.

You should consider carefully the risk factors beginning on page S-12 in this prospectus supplement and page 1 in the prospectus. A note is not a deposit and neither the notes nor the underlying accounts or receivables are insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The notes are obligations of GE Capital Credit Card Master Note Trust only and are not obligations of RFS Holding, L.L.C., GE Capital Retail Bank, General Electric Capital Corporation, their respective affiliates or any other person. This prospectus supplement may be used to offer and sell the notes only if accompanied by the prospectus. |

Neither the Securities and Exchange Commission nor any state securities commission has approved these notes or determined that this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Underwriters of the Class A notes and the Class B notes

| Citigroup | J.P. Morgan |

| | |

| Loop Capital Markets |

| Mitsubishi UFJ Securities |

| Scotiabank |

October 10, 2012

TABLE OF CONTENTS

| | | Page |

| | | |

| Summary of Terms | | S-1 |

| Series 2012-7 | | S-1 |

| Offered Notes | | S-2 |

| Structural Summary | | S-3 |

| Issuing Entity | | S-3 |

| Collateral for the Notes | | S-3 |

| Addition of Assets to the Trust | | S-3 |

| Removal of Assets from the Trust | | S-4 |

| Other Series of Notes | | S-4 |

| Equity Amount | | S-4 |

| Allocations of Collections and Losses | | S-5 |

| Application of Finance Charge Collections | | S-6 |

| Application of Principal Collections | | S-7 |

| Interest on the Notes | | S-8 |

| Credit Enhancement | | S-8 |

| Early Amortization Events | | S-9 |

| Events of Default | | S-9 |

| Optional Redemption | | S-10 |

| Servicing and Servicer’s Fee | | S-10 |

| Tax Status | | S-10 |

| State Tax Consequences | | S-10 |

| ERISA Considerations | | S-11 |

| Risk Factors | | S-11 |

| Ratings | | S-11 |

| RFS Holding, L.L.C. | | S-11 |

| Risk Factors | | S-12 |

| Receivables Performance | | S-14 |

| Delinquency and Loss Experience | | S-14 |

| Balance Reductions | | S-17 |

| Revenue Experience | | S-17 |

| Composition of the Trust Portfolio | | S-18 |

| Review of Pool Asset Disclosure | | S-21 |

| Compliance with Underwriting Criteria | | S-22 |

| Static Pool Information | | S-23 |

| Repurchase of Receivables | | S-23 |

| Maturity Considerations | | S-24 |

| Controlled Accumulation Period | | S-24 |

| Early Amortization Period | | S-24 |

| Payment Rates | | S-24 |

| Use of Proceeds | | S-25 |

| Description of Series Provisions | | S-25 |

| General | | S-25 |

| Collateral Amount | | S-26 |

| Allocation Percentages | | S-26 |

| Interest Payments | | S-27 |

| Revolving Period; Source of Principal Payments | | S-27 |

| Controlled Accumulation Period | | S-28 |

| Early Amortization Period | | S-29 |

| Subordination | | S-29 |

| Application of Finance Charge Collections | | S-29 |

| Reallocation of Principal Collections | | S-31 |

| Investor Charge-Offs | | S-31 |

| Sharing Provisions | | S-32 |

| Principal Accumulation Account | | S-32 |

| Excess Collateral Amount | | S-33 |

| Reserve Account | | S-33 |

| Spread Account | | S-34 |

| Spread Account Distributions | | S-35 |

| Early Amortization Events | | S-35 |

| Events of Default | | S-37 |

| Servicing Compensation and Payment of Expenses | | S-37 |

| Reports to Noteholders | | S-37 |

| Legal Proceedings | | S-37 |

| Underwriting | | S-38 |

| European Investment Restrictions | | S-40 |

| Legal Matters | | S-40 |

| Glossary of Terms for Prospectus Supplement | | S-41 |

| | | |

| ANNEX I - OTHER SERIES OF NOTES ISSUED AND OUTSTANDING | | A-1-1 |

| | | |

| ANNEX II - MONTHLY NOTEHOLDER’S STATEMENT GE CAPITAL CREDIT CARD MASTER NOTE TRUST | | A-2-1 |

| | | |

| ANNEX III – STATIC POOL DATA | | A-3-1 |

Important Notice about Information Presented in this

Prospectus Supplement and the Accompanying Prospectus

We (RFS Holding, L.L.C.) provide information to you about the notes in two separate documents: (a) the accompanying prospectus, which provides general information, some of which may not apply to your series of notes, and (b) this prospectus supplement, which describes the specific terms of your series of notes.

Whenever the information in this prospectus supplement is more specific than the information in the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information provided in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference. We have not authorized anyone to provide you with different information. We are not offering the notes in any state where the offer is not permitted.

We include cross references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find further related discussions. The preceding Table of Contents and the Table of Contents in the accompanying prospectus provide the pages on which these captions are located.

Summary of Terms

| Issuing Entity: | | GE Capital Credit Card Master Note Trust |

| | | |

| Depositor: | | RFS Holding, L.L.C. |

| | | |

| Sponsor: | | GE Capital Retail Bank |

| | | |

| Servicer and Administrator: | | General Electric Capital Corporation |

| | | |

| Indenture Trustee: | | Deutsche Bank Trust Company Americas |

| | | |

| Owner Trustee: | | BNY Mellon Trust of Delaware |

| | | |

| Expected Closing Date: | | On or about October 17, 2012 |

| | |

| Commencement of Accumulation Period | | |

| (subject to adjustment): | | June 22, 2019 |

| | | |

| Expected Principal Payment Date: | | September 2019 payment date |

| | | |

| Final Maturity Date: | | September 2022 payment date |

| | | |

| Clearance and Settlement: | | DTC/Clearstream/Euroclear |

| | | |

| Denominations: | | The Class A notes will be issued in minimum denominations of $100,000 and in integral multiples of $1,000 and the Class B notes will be issued in minimum denominations of $100,000 and in integral multiples of $1. |

| | | |

| Servicing Fee Rate: | | 2% per year |

| | | |

| Initial Collateral Amount: | | $630,914,827 |

| | | |

| Primary Assets of the Issuing Entity: | | Receivables generated by a portfolio of private label and co-branded revolving credit card accounts owned by GE Capital Retail Bank |

| | | |

| Offered Notes: | | The Class A notes and the Class B notes are offered by this prospectus supplement and the accompanying prospectus. The Class C notes will be purchased by an affiliate of the depositor and are not offered hereby. |

| | | |

Series 2012-7

| Class | | Amount | | | % of Initial

Collateral Amount | |

| Class A notes | | $ | 500,000,000 | | | | 79.25 | % |

| Class B notes | | $ | 63,091,483 | | | | 10.00 | % |

| Class C notes(1) | | $ | 42,586,750 | | | | 6.75 | % |

| Excess collateral amount | | $ | 25,236,594 | | | | 4.00 | % |

| Initial collateral amount | | $ | 630,914,827 | | | | 100.00 | % |

| (1) | The Class C notes are not offered hereby. |

Offered Notes

| | | Class A | | Class B |

| | | | | |

| Principal Amount: | | $500,000,000 | | $63,091,483 |

| | | | | |

| Anticipated Ratings(1): | | We expect that the Class A notes will receive credit ratings from two nationally recognized statistical rating organizations hired by the sponsor to rate the notes (the “Hired Agencies”). | | We expect that the Class B notes will receive credit ratings from the Hired Agencies. |

| | | | | |

| Credit Enhancement: | | Subordination of Class B and Class C and excess collateral amount | | Subordination of Class C and excess collateral amount |

| | | | | |

| Interest Rate: | | 1.76% per year | | 2.21% per year |

| | | | | |

| Interest Accrual Method: | | 30/360 | | 30/360 |

| | | | | |

| Interest Payment Dates: | | Monthly (15th), beginning November 15, 2012 | | Monthly (15th), beginning November 15, 2012 |

| | | | | |

| ERISA Eligibility: | | Yes, subject to important considerations described under “ERISA Considerations” in the accompanying prospectus. | | Yes, subject to important considerations described under “ERISA Considerations” in the accompanying prospectus. |

| | | | | |

| Debt for United States Federal Income Tax Purposes: | | Yes, subject to important considerations described under “Federal Income Tax Consequences” in the accompanying prospectus. | | Yes, subject to important considerations described under “Federal Income Tax Consequences” in the accompanying prospectus. |

| (1) | Ratings on the notes are expected to be monitored by the Hired Agencies while the notes are outstanding. |

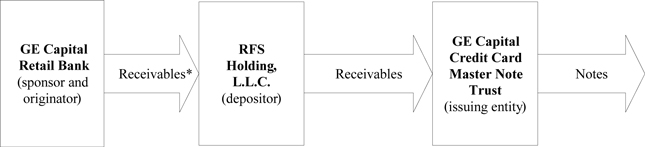

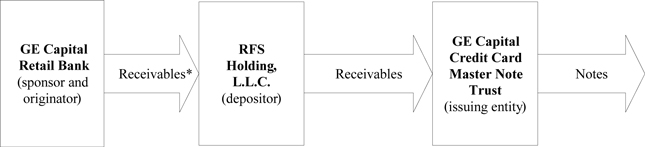

Structural Summary

This summary is a simplified presentation of the major structural components of Series 2012-7. It does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire document and the accompanying prospectus before you purchase any notes.

*Certain receivables were transferred by GE Capital Retail Bank to PLT Holding, L.L.C. which in turn transferred those receivables to RFS Holding, L.L.C.

Issuing Entity

The notes will be issued by GE Capital Credit Card Master Note Trust, a Delaware statutory trust, which is referred to in this prospectus supplement as the issuing entity or the trust. The notes will be issued under an indenture supplement to an indenture, each between the trust and the indenture trustee. The trust’s principal offices are at the following address: c/o General Electric Capital Corporation, as administrator, 777 Long Ridge Rd., Building B, 3rd Floor, Stamford, CT 06927. The contact phone number is (877) 441-5094.

The indenture trustee is Deutsche Bank Trust Company Americas.

Collateral for the Notes

The notes are secured by a pool of receivables that arise under certain of GE Capital Retail Bank’s private label and co-branded revolving credit card accounts. We refer to the receivables securing the notes as the transferred receivables, and we refer to the accounts that have been designated as trust accounts as the trust portfolio.

The following information regarding the trust portfolio is as of August 21, 2012:

| • | total transferred receivables: |

$18,134,366,350

$ 17,147,615,909

| • | finance charge receivables: |

$986,750,441

| • | total number of accounts designated to the trust portfolio: 34,411,282 |

As of August 31, 2012:

| • | The accounts designated for the trust portfolio had an average total receivable balance of approximately $518 and an average credit limit of approximately $2,803. |

| • | For accounts designated for the trust portfolio, the percentage of the aggregate total receivable balance to the aggregate total credit limit was 18.5%. |

| • | The average age of the accounts designated for the trust portfolio was approximately 111 months. |

Addition of Assets to the Trust

When an account has been designated as a trust account, GE Capital Retail Bank continues to own the account, but we buy all receivables existing at the time of designation or created later and transfer them to the trust. GE Capital Retail Bank has the option to designate additional accounts, which must meet the criteria for eligible accounts described under “The Trust Portfolio—Representations and Warranties of the Depositor” in the accompanying prospectus, as trust accounts from time to time. If the volume of

additional accounts designated exceeds specified periodic limitations, then additional new accounts can only be designated if the rating agency condition is satisfied. Satisfaction of the rating agency condition is also required if GE Capital Retail Bank wishes to designate any accounts that it acquired from third-party financial institutions or accounts in a new retailer program.

See “The Trust Portfolio—Additions of Trust Assets” in the accompanying prospectus for a more detailed description of the limitations on our ability to designate additional accounts. In addition, GE Capital Retail Bank is required to designate additional accounts as trust accounts if the amount of principal receivables held by the trust falls below a specified minimum, as more fully described in “The Trust Portfolio—Addition of Trust Assets” in the accompanying prospectus.

Removal of Assets from the Trust

Optional Removals

We have the right to remove accounts from the list of designated accounts and to repurchase the related receivables from the trust in two circumstances. First, when the trust holds excess receivables, we may remove accounts and repurchase the related receivables on a random basis, subject to the satisfaction of the rating agency condition. Second, some retailers have the right to purchase or to designate a third party to purchase receivables relating to their credit card program if the program is terminated. If a retailer exercises this right, we will remove and repurchase the related accounts and receivables and are not required to satisfy the rating agency condition. The conditions that must be satisfied when we remove accounts from the list of designated accounts are more fully described under “The Trust Portfolio—Removal of Accounts” in the accompanying prospectus.

Required Removals

We are required to repurchase receivables from the trust if it is discovered that they did not satisfy eligibility requirements in some material respect at the time that we transferred them to the trust, and the ineligibility results in a charge-off or an impairment of the trust’s rights in the transferred receivables or their proceeds. Similarly, the servicer is required to purchase receivables from the trust if the servicer fails to satisfy any of its obligations in connection with the transferred receivables or trust accounts, and the failure results in a material impairment of the transferred receivables or subjects their proceeds to a conflicting lien. These repurchase and purchase obligations are subject to cure periods and are more fully described in “The Trust Portfolio—Representations and Warranties of the Depositor” and “The Servicers—Servicer’s Representations, Warranties and Covenants” in the accompanying prospectus.

Other Series of Notes

The trust has issued other series of notes and may issue additional series of notes from time to time in the future. A summary of the series of notes expected to be outstanding as of the closing date is in “Annex I: Other Series of Notes Issued and Outstanding,” which is included at the end of this prospectus supplement and is incorporated into this prospectus supplement. Neither you nor any other noteholder will have the right to receive notice of, or consent to, the issuance of future series of notes.

No new series of notes may be issued unless the conditions described in “Description of the Notes—New Issuances of Notes” in the accompanying prospectus are satisfied, including:

| • | the rating agency condition is satisfied; |

| • | we certify, based on facts known to the certifying officer, that the new issuance will not cause an early amortization event or an event of default or materially or adversely affect the amount or timing of distributions to be made to any class of noteholders; |

| • | after giving effect to the new issuance, the free equity amount would not be less than the minimum free equity amount and the amount of principal receivables held by the trust and the principal amount of any participation interests held by the trust, together with any amount on deposit in the excess funding account, would at least equal the required minimum amount for the trust; and |

| • | an opinion with respect to certain tax matters is delivered. |

Equity Amount

We refer to the excess of the sum of the total amount of principal receivables and the principal amount of any participation interests held by the trust,

plus any balance in the excess funding account and the amount of principal collections on deposit in other trust accounts, over the aggregate outstanding principal amount of all of the trust’s notes as the equity amount. To provide support for your notes, we are required to maintain an equity amount in the trust of not less than the excess collateral amount for your notes. The excess collateral amount for your series provides credit enhancement by absorbing losses and uncovered dilution on the transferred receivables allocated to your series to the extent not covered by finance charge collections available to your series.

The equity amount at any time may exceed the excess collateral amount for your series and any excess collateral amounts required to be maintained for other series of notes. We refer to this excess amount, if any, as the free equity amount. We are required to maintain a minimum free equity amount equal to the product of the highest required retained transferor percentage for any series of outstanding notes and the aggregate principal receivables securing the notes. The required retained transferor percentage for Series 2012-7 and each other outstanding series of notes is 5.5%.

The excess collateral amount for your series and a portion of the free equity amount also enhance the likelihood of timely payment of principal on your notes through cash flow subordination because of two features of your series.

| • | The first feature is that the numerator for your series’ allocation percentage for principal collections includes the excess collateral amount. This results in the share of principal collections corresponding to the excess collateral amount being available for required principal payments on the notes or deposits to the principal accumulation account before any such collections are applied to reduce the excess collateral amount. |

| • | The second feature is that the numerator for your series’ allocation percentage for principal collections does not reduce as principal payments are made to your series or collections are accumulated to repay your notes. Since the collateral amount for your series does reduce as a result of principal payments and principal accumulation, effectively a portion of your principal allocation during an accumulation or amortization period comes from principal collections corresponding to the free equity amount. |

Allocations of Collections and Losses

Your notes represent the right to receive principal and interest, which is secured in part by the right to payments from a portion of the collections on the transferred receivables. The servicer, on behalf of the trust, will allocate to the collateral amount for your series a portion of defaulted principal receivables and will also allocate a portion of the dilution on the transferred receivables to the collateral amount for your series if the dilution is not offset by the free equity amount and we fail to comply with our obligation to reimburse the trust for the dilution. Dilution means any reduction to the principal balances of the transferred receivables because of merchandise returns or any other reason except losses or payments.

The portion of collections and defaulted principal receivables allocated to the collateral amount for your series will be based mainly upon the ratio of the collateral amount for your series to the aggregate amount of principal receivables securing the notes. The way this ratio is calculated for purposes of allocating principal collections will vary during each of three periods that will or may apply to your notes:

| • | Therevolving period,which will begin on the closing date and end when either of the other two periods begins. |

| • | Thecontrolled accumulation period,which is scheduled to begin on June 22, 2019, but which may begin earlier or later, and end when the notes have been paid in full. However, if an early amortization event occurs before the controlled accumulation period begins, there will be no controlled accumulation period and an early amortization period will begin. If an early amortization event occurs during the controlled accumulation period, the controlled accumulation period will end, and an early amortization period will begin. |

| • | Theearly amortization period,which will only occur if one or more adverse events, known as early amortization events, occurs. |

For most purposes, the collateral amount used in determining these ratios will be reset no less frequently than at the end of each monthly period. References in this prospectus supplement to the monthly period related to any payment date refer to the period beginning on the 22nd day of the second preceding calendar month and ending on the 21st day of the immediately preceding calendar month.

The first monthly period for your series will begin on the closing date and end on October 21, 2012. However, for allocations of principal collections during the controlled accumulation period or the early amortization period, the collateral amount as of the end of the revolving period will be used.

The initial collateral amount for your series will equal the sum of the initial outstanding principal amount of the Series 2012-7 notes plus an initial excess collateral amount described in “Summary of Terms” above. The collateral amount will thereafter be reduced by:

| • | principal collections to the extent applied to make principal payments on the notes (other than principal payments made from funds on deposit in the spread account) or to fund the principal accumulation account; |

| • | reductions in the excess collateral amount that result from reductions in the required excess collateral amount; |

| • | the amount of any principal collections to the extent reallocated to cover interest, payments to the indenture trustee, the owner trustee and the administrator for the trust and monthly servicing fee payments for your series; and |

| • | your series’ share of defaults and uncovered dilution to the extent not funded from finance charge collections and investment earnings allocated to your series. |

Any reduction in the collateral amount because of reallocated principal collections, defaults or uncovered dilution will be reimbursed to the extent that your series has finance charge collections and other amounts treated as finance charge collections available for this purpose in future periods.

As described under “—Credit Enhancement—Subordination” below in this summary and in “Risk Factors—Payments on the Class B notes are subordinate to payments on the Class A notes” and in “Description of Series Provisions—Subordination,” the excess collateral amount provides credit enhancement by absorbing reductions in the collateral amount because of reallocated principal collections, defaults and uncovered dilution. If the total amount of these types of reductions exceeds the sum of the excess collateral amount and the principal amount of the Class C notes, then the Class B notes may not be repaid in full. If the total amount of these types of reductions exceeds the sum of the excess collateral amount and the principal amounts of the Class C and Class B notes, then the Class A notes may not be repaid in full.

Application of Finance Charge Collections

The trust will apply your series’ share of collections of finance charge receivables, recoveries and investment earnings each month in the following order of priority:

| • | to pay,pro rata,the following amounts allocated to your series: accrued and unpaid fees and other amounts owed to the indenture trustee up to a maximum amount of $25,000 for each calendar year, the accrued and unpaid fees and other amounts owed to the owner trustee up to a maximum amount of $25,000 for each calendar year and the accrued and unpaid fees and other amounts owed to the administrator for the trust up to a maximum amount of $25,000 for each calendar year; |

| • | to pay the servicing fee for your series (to the extent not directly paid by the trust to the servicer during the month); |

| • | to pay interest on the Class A notes; |

| • | to pay interest on the Class B notes; |

| • | to pay interest on the Class C notes; |

| • | to cover your series’ share of defaults and uncovered dilution; |

| • | to increase the collateral amount to the extent of reductions in your series’ collateral amount resulting from defaults and uncovered dilution allocated to your series and from reallocated principal collections, in each case that have not been previously reimbursed; |

| • | to fund, in limited circumstances, a reserve account to cover interest payment shortfalls for the Series 2012-7 notes during the controlled accumulation period; |

| • | to make a deposit, if needed, to the spread account for the Class C notes up to the required spread account amount; |

| • | without duplication of the amount specified in the sixth bullet point above in respect of uncovered dilution, to cover your series’ share of the excess, if any, of the minimum free equity amount over the free equity amount, which will be calculated as described under “Description of Series Provisions—Application of Finance Charge Collections”; |

| • | unless an early amortization event has occurred, to pay,pro rata,remaining amounts owed to the indenture trustee, the owner trustee and the administrator for the trust that are allocated to your series; |

| • | to other series that share excess finance charge collections with Series 2012-7; |

| • | if an early amortization event has occurred,first,to make principal payments on the Class A notes, the Class B notes and the Class C notes, in that order of priority, andsecond,to pay,pro rata,remaining amounts owed to the indenture trustee, the owner trustee and the administrator for the trust that are allocated to your series; and |

Collections of finance charge receivables, recoveries, investment earnings and certain other amounts that are initially allocated to another series will be used to cover any shortfalls to the extent those amounts are not needed by those other series and the excess funds are allocated to your series as described in “Description of the Notes—Shared Excess Finance Charge Collections” in the accompanying prospectus.

Application of Principal Collections

The trust will apply your series’ share of collections of principal receivables each month as follows:

Revolving Period

During the revolving period, no principal will be paid to, or accumulated for, your series.

Controlled Accumulation Period

During the controlled accumulation period, your series’ share of principal collections will be deposited in a principal accumulation account, up to a specified deposit amount on each payment date. Unless an early amortization event occurs, amounts on deposit in that account will be paid on the expected principal payment date first to the Class A noteholders, then to the Class B noteholders and then to the Class C noteholders, in each case until the specified class of notes is paid in full or the amounts available are depleted.

Early Amortization Period

An early amortization period for your series will start if an early amortization event occurs. The early amortization events for your series are described below in this summary and under “Description of Series Provisions—Early Amortization Events” in this prospectus supplement and under “Description of the Notes—Early Amortization Events” in the accompanying prospectus. During the early amortization period, your series’ share of principal collections will be paid monthly first to the Class A noteholders, then to the Class B noteholders and then to the Class C noteholders, in each case until the specified class of notes is paid in full.

Reallocation of Principal Collections

During any of the above periods, principal collections allocated to your series may be reallocated, if necessary, to make required payments of interest on the Class A notes, the Class B notes and the Class C notes, payments to the indenture trustee, the owner trustee and the administrator for the trust and monthly servicing fee payments not made from your series’ share of finance charge collections and other amounts treated as finance charge collections and excess finance charge collections available from other series that share with your series. This reallocation is one of the ways that the notes obtain the benefit of subordination, as described under “Credit Enhancement—Subordination” in this summary. The amount of reallocated principal collections available to each class is limited by the amount of subordination available to that class.

Shared Principal Collections

Your series is a principal sharing series; however, your series will not be entitled to share excess principal collections from other series on any payment date during an early amortization period that is prior to the expected principal payment date unless all outstanding series of notes are in early amortization periods. See “Description of the Notes—Shared Principal Collections” in the accompanying prospectus.

At all times, collections of principal receivables allocated to your series that are not needed to make deposits or payments for your series will be:first,made available to other series,second,deposited in the excess funding account if needed to maintain the minimum free equity amount for the trust, andthird,distributed to us or our assigns.

Interest on the Notes

Each class of notes will accrue interest from and including the closing date to but excluding November 15, 2012, and for each following interest period at the applicable rate per annum specified below:

| Class A: | 1.76% |

| Class B: | 2.21% |

| Class C: | 3.00% |

Interest on the Series 2012-7 notes will be calculated based on a 360 day year of twelve 30-day months (and in the case of the initial interest period, for a period of 28 days).

Credit Enhancement

Credit enhancement for your series includes subordination of junior classes of notes and the excess collateral amount. A spread account also provides credit enhancement primarily for the benefit of the Class C notes.

Credit enhancement for your series is for your series’ benefit only, and you are not entitled to the benefits of credit enhancement available to other series.

Subordination

Credit enhancement for the Class A notes includes the subordination of the Class B notes, the Class C notes and the excess collateral amount. Credit enhancement for the Class B notes includes the subordination of the Class C notes and the excess collateral amount.

Subordination serves as credit enhancement in the following way. The more subordinated, or junior, classes of notes will not receive payments of interest or principal until required payments have been made to the more senior classes. As a result, subordinated classes will absorb any shortfalls in collections or deterioration in the collateral for the notes prior to senior classes. The excess collateral amount for your series is subordinated to all of the classes of notes, so it will absorb shortfalls and collateral deterioration before any class of notes.

Spread Account

A spread account will provide additional credit enhancement for your series, primarily for the benefit of the Class C notes. The spread account initially will not be funded. After the Series 2012-7 notes are issued, deposits into the spread account will be made each month from finance charge collections allocated to your series, other amounts treated as finance charge collections and excess finance charge collections available from other series up to the required spread account amount. The required spread account amount is described under “Description of Series Provisions—Spread Account.”

The spread account will be used to make interest payments on the Class C notes if finance charge collections allocated to your series, other amounts treated as finance charge collections and excess finance charge collections available from other series are insufficient to make those payments.

Unless an early amortization event occurs, the amount, if any, remaining on deposit in the spread account on the expected principal payment date for the Class C notes, after making the payments described in the preceding paragraph, will be applied to pay principal on the Class C notes, to the extent that the Class C notes have not been paid in full after application of all principal collections on that date. Except as provided in the following paragraph, if an early amortization event occurs, the amount, if any, remaining on deposit in the spread account, after making the payments described in the preceding paragraph, will be applied to pay principal on the Class C notes on the earlier of the final maturity date and the first payment date on which the outstanding principal amount of the Class A notes and Class B notes has been paid in full.

In addition, on any day after the occurrence of an event of default with respect to Series 2012-7 and the acceleration of the maturity date, the indenture trustee will withdraw from the spread account the outstanding amount on deposit in the spread account and deposit that amount in the distribution account for distribution to the Class C noteholders, Class A noteholders and Class B noteholders, in that order of priority, to fund any shortfalls in amounts owed to those noteholders.

Early Amortization Events

The trust will begin to repay the principal of the notes before the expected principal payment date if an early amortization event occurs. An early amortization event will occur if the finance charge collections on the receivables are too low or if defaults on the receivables are too high. The minimum amount that must be available for payments to your series in any monthly period, referred to as the base rate, is the result, expressed as a percentage, of the sum of the interest payable on the Series 2012-7 notes for the related interest period, plus your series’ share of the servicing fee for the related monthly period and, subject to certain limitations, your series’ share of fees, expenses and other amounts owing to the indenture trustee, the owner trustee and the administrator for the trust,divided by the sum of the collateral amount and amounts on deposit in the principal accumulation account, each as of the last day of that monthly period. If the average net portfolio yield for your series, calculated as described in the following sentence, for the two monthly periods preceding the January 2013 payment date or, thereafter, any three consecutive monthly periods is less than the average base rate for the same two or three consecutive monthly periods, an early amortization event will occur. The net portfolio yield for your series for any monthly period will be the result, expressed as a percentage, of the amount of finance charge collections and other amounts treated as finance charge collections allocated to your series for that monthly period, other than excess finance charge collections, net of the amount of defaulted principal receivables and uncovered dilution allocated to your series for that monthly period,dividedby the sum of the collateral amount and amounts on deposit in the principal accumulation account, each as of the last day of that monthly period.

The other early amortization events are:

| • | Our failure to make required payments or deposits or material failure by us to perform other obligations, subject to applicable grace periods; |

| • | Material inaccuracies in our representations and warranties, subject to applicable grace periods; |

| • | The Series 2012-7 notes are not paid in full on the expected principal payment date; |

| • | Bankruptcy, insolvency or similar events relating to us or any originator of accounts designated under the receivables sale agreement in the future; |

| • | We are unable to transfer additional receivables to the trust or GE Capital Retail Bank is unable to transfer additional receivables to us; |

| • | We do not transfer receivables in additional accounts or participations to the trust when required; |

| • | Servicer defaults described in the accompanying prospectus under the caption “The Servicers—Servicer Default; Successor Servicer” and other specified material defaults of the servicer, subject to applicable grace periods; |

| • | The trust becomes subject to regulation as an “investment company” under the Investment Company Act of 1940; or |

| • | An event of default occurs for the Series 2012-7 notes and their maturity date is accelerated. |

The early amortization events for Series 2012-7 are more fully described under “Description of Series Provisions—Early Amortization Events” in this prospectus supplement and under “Description of the Notes—Early Amortization Events” in the accompanying prospectus.

Events of Default

The Series 2012-7 notes are subject to events of default described under “Description of the Notes—Events of Default; Rights upon Event of Default” in the accompanying prospectus. These include:

| • | Failure to pay interest on the Series 2012-7 notes for 35 days after it is due; |

| • | Failure to pay principal on the Series 2012-7 notes when it becomes due and payable on the final maturity date for the Series 2012-7 notes; |

| • | Bankruptcy, insolvency or similar events relating to the trust; and |

| • | Material failure by the trust to perform its obligations under the indenture, subject to applicable grace periods. |

In the case of an event of default involving bankruptcy, insolvency or similar events relating to the trust, the principal amount of the Series 2012-7 notes automatically will become immediately due and payable. If any other event of default occurs and continues with respect to the Series 2012-7 notes, the indenture trustee or holders of not less than a majority of the then-outstanding principal amount of the Series 2012-7 notes may declare the principal amount of the Series 2012-7 notes to be immediately due and payable. These declarations may be rescinded by holders of not less than a majority of the then-outstanding principal amount of the Series 2012-7 notes if the related event of default has been cured, subject to the conditions described under “Description of the Notes—Events of Default; Rights upon Event of Default” in the accompanying prospectus.

After an event of default and the acceleration of the Series 2012-7 notes, funds allocated to the Series 2012-7 notes and on deposit in the collection account, the excess funding account and the other trust accounts will be applied to pay principal of and interest on the Series 2012-7 notes to the extent permitted by law. Principal collections and finance charge collections allocated to Series 2012-7 will be applied to make monthly principal and interest payments on the Series 2012-7 notes until the earlier of the date those notes are paid in full or the final maturity date.

If the Series 2012-7 notes are accelerated or the trust fails to pay the principal of the Series 2012-7 notes on the final maturity date, subject to the conditions described in the prospectus under “Description of the Notes—Events of Default; Rights upon Event of Default”, the indenture trustee may, if legally permitted, cause the trust to sell principal receivables in an amount equal to the collateral amount for Series 2012-7 and the related finance charge receivables.

Optional Redemption

We have the option to purchase the collateral amount for your series when the outstanding principal amount for your series has been reduced to 10% or less of the initial principal amount, but only if the purchase price paid to the trust is sufficient to pay in full all amounts owing to the noteholders. The purchase price for your series will equal the collateral amount for your series plus the applicable allocation percentage of finance charge receivables. See “Description of the Notes—Final Payment of Principal” in the accompanying prospectus.

Servicing and Servicer’s Fee

Prior to May 22, 2008, the servicer for the trust was GE Money Bank (now known as GE Capital Retail Bank). On May 22, 2008, GE Money Bank (now known as GE Capital Retail Bank) transferred the servicing role to GE Capital. GE Capital has entered into sub-servicing arrangements with certain affiliated sub-servicers, including GE Consumer Finance, Inc., and may from time to time enter into additional sub-servicing arrangements with other affiliated companies. See “The Servicers” in the accompanying prospectus.

GE Capital, as servicer, receives a fee for its servicing activities. The share of the servicing fee allocable to Series 2012-7 for each payment date will be equal to one-twelfth of the product of (a) 2% and (b) the collateral amount for Series 2012-7 on the last day of the prior monthly period. However, the servicing fee for the first monthly period will be based on the number of days in the first monthly period. The servicing fee allocable to Series 2012-7 for each payment date will be paid from your series share of collections of finance charge receivables, recoveries and investment earnings each month as described in “—Application of Finance Charge Collections” above and in “Description of Series Provisions—Application of Finance Charge Collections.”

Tax Status

Subject to important considerations described under “Federal Income Tax Consequences” in the accompanying prospectus, Mayer Brown LLP as tax counsel to the trust, is of the opinion that under existing law the Class A notes and the Class B notes (other than Class B notes purchased by a person which for federal income tax purposes is considered the same person as the issuer) will be characterized as debt for federal income tax purposes and that the trust will not be classified as an association or constitute a publicly traded partnership taxable as a corporation for U.S. federal income tax purposes. By your acceptance of a Series 2012-7 note, you will agree to treat your Series 2012-7 notes as debt for federal, state and local income and franchise tax purposes. See “Federal Income Tax Consequences” in the accompanying prospectus for additional information concerning the application of federal income tax laws.

State Tax Consequences

The tax discussion in the attached prospectus does not address the tax treatment of the issuing entity, the notes or noteholders under any state or

local tax laws, which may differ materially from the federal income tax treatment of such persons and instruments. The jurisdictions in which these state and local tax issues may arise include those in which the holder is taxable, the bank and servicer carry on their activities, and the obligors on the accounts and receivables are located. You are urged to consult with your own tax advisors regarding the state tax treatment of the issuing entity as well as any state tax consequences to you of purchasing, holding and disposing of your notes.

ERISA Considerations

Subject to important considerations described under “ERISA Considerations” in the accompanying prospectus, the Class A notes and the Class B notes are eligible for purchase by persons investing assets of employee benefit plans or individual retirement accounts. Each purchaser will be deemed to represent and warrant that either it is not acquiring the note with assets of (or on behalf of) a benefit plan or any other plan that is subject to Title I of ERISA or Section 4975 of the Internal Revenue Code or to a law that is substantially similar to the fiduciary responsibility or prohibited transaction provisions of Title I of ERISA or Section 4975 of the Internal Revenue Code or its purchase, holding and disposition of the notes will not result in a non-exempt prohibited transaction under ERISA or Section 4975 of the Internal Revenue Code or a violation of any substantially similar applicable law. If you are contemplating purchasing the Class A notes or the Class B notes on behalf of or with plan assets of any plan or account, we suggest that you consult with counsel regarding whether the purchase or holding of the Class A notes or the Class B notes could give rise to a prohibited transaction under ERISA or Section 4975 of the Internal Revenue Code or a violation of any substantially similar applicable law. Benefit plans that are subject to Title I of ERISA or Section 4975 of the Internal Revenue Code may not acquire Class A notes or Class B notes at any time that such notes do not have a current investment grade rating from a nationally recognized statistical rating organization. See “ERISA Considerations” in the accompanying prospectus for additional information.

Risk Factors

There are material risks associated with an investment in the Class A notes and the Class B notes, and you should consider the matters set forth under “Risk Factors” beginning on page S-12 and on page 1 of the accompanying prospectus.

Ratings

We expect that the notes will receive credit ratings from two Hired Agencies.

Any rating assigned to the Class A notes or the Class B notes by a Hired Agency will reflect the rating agency’s assessment solely of the likelihood that noteholders will receive timely payments of interest and the ultimate repayment of principal on the final maturity date for the Class A notes and the Class B notes, and will be based primarily on the value of the transferred receivables and the credit enhancement provided. The rating is not a recommendation to purchase, hold or sell any notes. The rating does not constitute a comment as to the marketability of any notes, any market price or suitability for a particular investor. Ratings on the notes are expected to be monitored by the Hired Agencies while the notes are outstanding. Any rating can be changed or withdrawn by a Hired Agency at any time. In addition, a rating agency not hired by the sponsor to rate the transaction may provide an unsolicited rating that differs from (or is lower than) the ratings provided by the Hired Agencies.

RFS Holding, L.L.C.

Our address is 777 Long Ridge Road, Stamford, Connecticut 06927. Our phone number is (877) 441-5094.

This prospectus supplement uses defined terms. You can find a glossary of terms under the caption “Glossary of Terms for Prospectus Supplement” beginning on page S-41 in this prospectus supplement and under the caption “Glossary of Terms for Prospectus” beginning on page 75 in the accompanying prospectus.

Risk Factors

In addition to the risk factors described in the prospectus, you should consider the following:

It may not be possible to find a purchaser for your securities.

There is currently no secondary market for the notes and we cannot assure you that one will develop. As a result, you may not be able to resell your notes at all, or may be able to do so only at a substantial loss. The underwriters may assist in resales of the notes, but they are not required to do so. We do not intend to apply for the inclusion of the notes on any exchange or automated quotation system. A trading market for the notes may not develop. If a trading market does develop, it might not continue or it might not be sufficiently liquid to allow you to resell any of your notes. The secondary market for asset-backed securities is currently experiencing significant reduced liquidity. This period of illiquidity may continue and may adversely affect the market value of your notes.

The ratings for the offered notes are limited in scope, may be lowered or withdrawn, or the offered notes may receive an unsolicited rating, which may have an adverse effect on the liquidity or the market price of the offered notes.

Security ratings are not a recommendation to purchase, hold or sell the offered notes, inasmuch as the rating does not comment as to market price or suitability for a particular investor. A rating of the offered notes addresses the likelihood of the timely payment of interest and the ultimate repayment of principal of the offered notes on the final maturity date pursuant to their respective terms. There is no assurance that a rating will remain for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if in its judgment circumstances in the future so warrant. Neither the depositor nor the sponsor nor any of their affiliates will have any obligation to replace or supplement the credit enhancement, or to take any other action to maintain any ratings of the offered notes. A rating agency may revise or withdraw the ratings at any time in its sole discretion, including as a result of a failure by the sponsor to comply with its obligation to post information provided to the Hired Agencies on a website that is accessible by a rating agency that is not a Hired Agency.

The Hired Agencies have been hired by the sponsor to provide their ratings on the offered notes. We note that a rating agency may have a conflict of interest where, as is the case with the ratings of the offered notes by the Hired Agencies, the sponsor or the issuer of a security pays the fee charged by the rating agency for its rating services.

It is possible that other rating agencies not hired by the sponsor may provide an unsolicited rating that differs from (or is lower than) the rating provided by the Hired Agencies. As of the date of this prospectus supplement, we are not aware of the existence of any unsolicited rating provided (or to be provided at a future time) by any rating agency not hired to rate the transaction. However, there can be no assurance that an unsolicited rating will not be issued prior to or after the closing date, and none of the sponsor, the depositor nor any underwriter is obligated to inform investors (or potential investors) in the offered notes if an unsolicited rating is issued after the date of this prospectus supplement. Consequently, if you intend to purchase offered notes, you should monitor whether an unsolicited rating of the offered notes has been issued by a non-hired rating agency and should consult with your financial and legal advisors regarding the impact of an unsolicited rating on a class of offered notes. If any non-hired rating agency provides an unsolicited rating that differs from (or is lower than) the rating provided by the Hired Agencies, the liquidity or the market value of your offered note may be adversely affected.

Payments on the Class B notes are subordinate to payments on the Class A notes.

If you buy Class B notes, your interest payments will be subordinate to interest payments on the Class A notes, and your principal payments will be subordinate to principal payments on the Class A Notes as follows:

| • | You will not receive any interest payments on your Class B notes on any payment date until the full amount of interest then payable on the Class A notes has been paid in full. |

| • | In addition, you will not receive any principal payments on your Class B notes on any payment date until the entire principal amount of the Class A notes has been paid in full. |

As a result of these features, any reduction in the collateral amount for your series due to charge-offs, dilution or reallocation of principal will reduce payments on the Class B notes before reducing payments on the Class A notes. If the total amount of these reductions exceeds the excess collateral amount and the principal amount of the Class C notes, then the Class B notes may not be repaid in full. If receivables are sold after an event of default, the net proceeds of that sale would be paid first to the Class A noteholders until the outstanding principal amount of the Class A notes and all accrued and unpaid interest payable to the Class A noteholders have been paid in full before any payments would be made to the Class B noteholders.

Termination of certain credit card programs could lead to a reduction of receivables in the trust.

GE Capital Retail Bank operates its private label and co-branded credit card programs with various retailers under agreements, some of which, if not extended, are scheduled to expire while your notes are outstanding. The program agreements generally have original contract terms ranging from approximately two to ten years and remaining terms ranging from approximately one year and four months to five years and two months. Some of those program agreements provide that, upon expiration or termination, the retailer may purchase or designate a third party to purchase the receivables generated with respect to its program, including the receivables in the trust. Approximately 100% of the accounts would be subject to removal from the trust and approximately 100% of the total receivables in the trust as of August 31, 2012 would be subject to purchase prior to the expected principal payment date for your series if the related program agreements were not extended.

In addition, the program agreements generally permit the retailers or GE Capital Retail Bank to terminate the program agreements prior to the respective termination dates for the programs if the other party materially breaches its obligations under the related program agreements, subject to any cure rights under the related program agreements. Certain program agreements are also subject to early termination in the event the related retailer becomes insolvent, becomes subject to a bankruptcy proceeding or has a material change in financial condition, upon the occurrence of a significant change in law or upon the occurrence of other specified portfolio-related performance triggers or other events of default. The program agreements generally may be terminated prior to scheduled expiration upon mutual agreement between GE Capital Retail Bank and the related retailers.

If a program agreement were terminated as described above and the related retailer were to exercise its right to purchase the related accounts and receivables and GE Capital Retail Bank were unable to provide receivables arising under newly designated additional accounts to replace those purchased by the retailers, an early amortization period could begin. If an early amortization period commences as a result of a termination of one or more program agreements, you could be paid sooner than expected and may not be able to reinvest the amount paid to you at the same rate you would have been able to earn on your notes.

Geographic concentration may result in more risk to you.

As of August 31, 2012, the servicer’s records indicate that based on billing addresses, obligors on the accounts were concentrated in Texas, California, Florida, North Carolina and New York. No other state accounted for more than 5% of the number of accounts or 5% of the total receivables balances as of that date. Economic conditions or other factors affecting these states in particular could adversely impact the delinquency or credit loss experience of the trust portfolio and could result in delays in payments or losses on the notes. See “Composition of the Trust Portfolio—Composition by Billing Address” in this prospectus supplement.

Charge-offs may increase which could reduce payments to you.

The global financial and economic crisis has had an adverse effect on the financial condition of many consumers in the United States, which was also reflected in the performance of the trust portfolio in recent years.

Despite certain signs of improvement, including recent declines in the domestic unemployment rate, the global economic environment remains volatile and could continue to present challenges having an adverse effect on the trust portfolio for the foreseeable future. More specifically, increases in delinquencies and charge-offs could occur, particularly if conditions in the general economy deteriorate.

If the amount of charged-off receivables and any uncovered dilution allocated to your series exceeds the amount of funds available to reimburse those amounts, you may not receive the full amount of principal and interest due to you. See “Description of Series Provisions—Investor Charge-Offs” in this prospectus supplement and “The Servicers—Defaulted Receivables; Dilution; Investor Charge-Offs” in the accompanying prospectus.

Receivables Performance

The trust portfolio includes a subset of the accounts arising in GE Capital Retail Bank’s (the “bank”) private label and co-branded credit card programs for specified retailers. We refer to these specified retailers as the “approved retailers.” The approved retailers are listed in the table “Composition by Retailer” under “Composition of the Trust Portfolio” below.

The tables below contain performance information for the receivables in the trust portfolio for each of the periods shown. The composition of the trust portfolio is expected to change over time and accounts arising in the private label and co-branded card programs for additional retailers may be added to the trust portfolio in the future.

On February 26, 2009, accounts having an aggregate outstanding total receivables balance, including principal receivables and finance charge receivables, of approximately $1.5 billion, determined as of the close of business on February 21, 2009, were removed from the trust portfolio and the related receivables were reassigned to us. The removed accounts were selected from the four largest retailers in the trust portfolio at that time, JCPenney, Lowe’s, Sam’s Club and Wal-Mart, and had proprietary credit scores determined by the bank that fell below a specified level as of the cut-off date for the removal. A subset of these accounts having an aggregate principal receivables balance equal to $182,195,470, were re-designated to the trust portfolio on March 21, 2012.

For purposes of the tables in this section:

| • | Each Securitization Reporting Year is the period of twelve Monthly Periods ending on December 21st of the related calendar year. |

| • | Receivables Outstanding is the sum of total receivables included in the trust portfolio as of the date or in the period indicated. |

| • | Principal Receivables Outstanding is the sum of principal receivables included in the trust portfolio as of the date or in the period indicated. |

| • | Average Principal Receivables Outstanding is the average of the balance of the Principal Receivables Outstanding as of the first day of each monthly period in the period indicated. |

| • | Accounts Outstanding is the sum of the number of accounts included in the trust portfolio as of the date or in the period indicated. |

| • | Average Accounts Outstanding is the average of the number of accounts in each monthly period in the period indicated. |

Delinquency and Loss Experience

The following tables set forth the aggregate delinquency and loss experience for cardholder payments on the credit card accounts in the trust portfolio for each of the dates or periods shown. Please note that numbers and percentages presented in the tables in this section may not sum to the totals presented due to rounding.

The global financial and economic crisis has had and could continue to have an adverse effect on the trust portfolio. The recent recession and increased rates of unemployment contributed to significant increases in net losses and delinquencies for 2008, 2009 and 2010, compared to 2007. As described above, on February 26, 2009, low-credit score accounts having an aggregate outstanding total receivables balance, including principal receivables and finance charge receivables, of approximately $1.5 billion, determined as of the close of business on February 21, 2009, were removed from the trust portfolio. Although the effect of the removal was to cause a reduction in the amount of delinquent receivables and charge-offs for the twelve months ended December 21, 2009, increases in delinquencies and charge-offs could again occur, particularly if conditions in the general economy further deteriorate. Gross charge-offs as a percentage of Average Principal Receivables Outstanding (annualized) and Net Principal Charge-Offs as a percentage of Average Principal Receivables Outstanding (annualized) were 10.77% and 9.41%, respectively, for the two months ended February 21, 2009 (before giving effect to the removal of accounts on February 26, 2009), as compared to 9.08% and 8.15%, respectively, for the twelve months ended December 21, 2009. The amount of delinquent receivables as a percentage of Receivables Outstanding was 6.88% as of January 21, 2009, as compared to 5.35% as of December 21, 2009. There can be no assurance that the delinquency and charge-off rates will not increase to pre-removal levels or higher levels over time.

We cannot assure you that the future delinquency and loss experience for the trust portfolio will be similar to historical experience set forth below.

Receivables Delinquency Experience

(Dollars in Thousands)

| | | As of August 21, | | | As of December 21, | |

| | | 2012 | | | 2011 | |

| | | Receivables | | | Percentage of

Receivables

Outstanding | | | Receivables | | | Percentage of

Receivables

Outstanding | |

| Receivables Outstanding | | $ | 18,134,366 | | | | | | | $ | 19,636,126 | | | | | |

| Receivables Delinquent: | | | | | | | | | | | | | | | | |

| 30-59 Days | | | 225,927 | | | | 1.25 | % | | | 230,328 | | | | 1.17 | % |

| 60-89 Days | | | 157,658 | | | | 0.87 | % | | | 171,955 | | | | 0.88 | % |

| 90-119 Days | | | 119,238 | | | | 0.66 | % | | | 141,543 | | | | 0.72 | % |

| 120-149 Days | | | 98,552 | | | | 0.54 | % | | | 117,589 | | | | 0.60 | % |

| 150-179 Days | | | 76,543 | | | | 0.42 | % | | | 95,273 | | | | 0.49 | % |

| 180 or more Days | | | 4 | | | | 0.00 | % | | | 15 | | | | 0.00 | % |

| Total | | $ | 677,923 | | | | 3.74 | % | | $ | 756,702 | | | | 3.85 | % |

| | | As of December 21, | |

| | | 2010 | | | 2009 | |

| | | Receivables | | | Percentage of

Receivables

Outstanding | | | Receivables | | | Percentage of

Receivables

Outstanding | |

| Receivables Outstanding | | $ | 18,165,466 | | | | | | | $ | 19,772,387 | | | | | |

| Receivables Delinquent: | | | | | | | | | | | | | | | | |

| 30-59 Days | | | 239,331 | | | | 1.32 | % | | | 306,064 | | | | 1.55 | % |

| 60-89 Days | | | 182,981 | | | | 1.01 | % | | | 240,634 | | | | 1.22 | % |

| 90-119 Days | | | 156,931 | | | | 0.86 | % | | | 200,383 | | | | 1.01 | % |

| 120-149 Days | | | 141,554 | | | | 0.78 | % | | | 170,865 | | | | 0.86 | % |

| 150-179 Days | | | 110,458 | | | | 0.61 | % | | | 139,642 | | | | 0.71 | % |

| 180 or more Days | | | 4 | | | | 0.00 | % | | | 5 | | | | 0.00 | % |

| Total | | $ | 831,259 | | | | 4.58 | % | | $ | 1,057,593 | | | | 5.35 | % |

Account Delinquency Experience

| | | As of August 21, | | | As of December 21, | |

| | | 2012 | | | 2011 | |

| | | Accounts | | | Percentage of Total

Accounts

Outstanding | | | Accounts | | | Percentage of Total

Accounts

Outstanding | |

| Accounts Outstanding | | | 34,411,282 | | | | | | | | 38,362,612 | | | | | |

| Accounts Delinquent: | | | | | | | | | | | | | | | | |

| 30-59 Days | | | 175,867 | | | | 0.51 | % | | | 176,207 | | | | 0.46 | % |

| 60-89 Days | | | 111,213 | | | | 0.32 | % | | | 117,955 | | | | 0.31 | % |

| 90-119 Days | | | 81,149 | | | | 0.24 | % | | | 93,716 | | | | 0.24 | % |

| 120-149 Days | | | 65,866 | | | | 0.19 | % | | | 76,267 | | | | 0.20 | % |

| 150-179 Days | | | 47,413 | | | | 0.14 | % | | | 62,484 | | | | 0.16 | % |

| 180 or more Days | | | 2 | | | | 0.00 | % | | | 6 | | | | 0.00 | % |

| Total | | | 481,510 | | | | 1.40 | % | | | 526,635 | | | | 1.37 | % |

| | | As of December 21, | |

| | | 2010 | | | 2009 | |

| | | Accounts | | | Percentage of Total

Accounts

Outstanding | | | Accounts | | | Percentage of Total

Accounts

Outstanding | |

| Accounts Outstanding | | | 36,768,070 | | | | | | | | 42,944,125 | | | | | |

| Accounts Delinquent: | | | | | | | | | | | | | | | | |

| 30-59 Days | | | 185,246 | | | | 0.50 | % | | | 249,590 | | | | 0.58 | % |

| 60-89 Days | | | 124,760 | | | | 0.34 | % | | | 177,159 | | | | 0.41 | % |

| 90-119 Days | | | 103,634 | | | | 0.28 | % | | | 141,317 | | | | 0.33 | % |

| 120-149 Days | | | 90,730 | | | | 0.25 | % | | | 118,525 | | | | 0.28 | % |

| 150-179 Days | | | 70,391 | | | | 0.19 | % | | | 96,242 | | | | 0.22 | % |

| 180 or more Days | | | 4 | | | | 0.00 | % | | | 2 | | | | 0.00 | % |

| Total | | | 574,765 | | | | 1.56 | % | | | 782,835 | | | | 1.82 | % |

Loss Experience

(Dollars in Thousands)

| | | Eight Months Ended

August 21, | | | Securitization Reporting Year | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Average Principal Receivables Outstanding | | $ | 17,586,135 | | | $ | 17,155,868 | | | $ | 17,547,629 | | | $ | 17,645,181 | |

| Gross Principal Charge-Offs | | $ | 835,554 | | | $ | 1,350,808 | | | $ | 1,764,794 | | | $ | 1,603,030 | |

| Gross Principal Charge-Offs as a percentage of Average Principal Receivables Outstanding (annualized) | | | 7.13 | % | | | 7.87 | % | | | 10.06 | % | | | 9.08 | % |

| Less: Recoveries | | $ | 129,433 | | | $ | 170,904 | | | $ | 147,598 | | | $ | 164,903 | |

| Net Principal Charge-Offs | | $ | 706,121 | | | $ | 1,179,904 | | | $ | 1,617,195 | | | $ | 1,438,128 | |

| Net Principal Charge-Offs as a percentage of Average Principal Receivables Outstanding (annualized) | | | 6.02 | % | | | 6.88 | % | | | 9.22 | % | | | 8.15 | % |

| Gross Charge-Off Accounts | | | 702,951 | | | | 1,131,247 | | | | 1,506,814 | | | | 1,553,564 | |

| Average Accounts Outstanding | | | 36,694,524 | | | | 37,973,033 | | | | 40,139,347 | | | | 43,200,788 | |

| Gross Charge-Offs as a Percentage of Average Accounts Outstanding (annualized) | | | 2.87 | % | | | 2.98 | % | | | 3.75 | % | | | 3.60 | % |

Balance Reductions

The accounts in the trust portfolio may have balance reductions granted for a number of reasons, including merchandise refunds, returns, and fraudulent charges. As of the twelve months ended August 21, 2012, the average monthly balance reduction rate for the approved portfolio of accounts attributable to such returns and fraud was 0.95%.

Revenue Experience

The net revenues collected from finance charges and fees related to accounts in the trust portfolio for each of the periods shown are set forth in the following table. Fees include late fees, pay by phone fees, over limit fees, balance transfer fees, cash advance fees and returned check fees.

We cannot assure you that the future revenue experience for the receivables in the trust portfolio will remain similar to the historical experience set forth below.

Revenue Experience

(Dollars in Thousands)

| | | Eight Months Ended

August 21, | | | Securitization Reporting Year | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Average Principal Receivables Outstanding | | $ | 17,586,135 | | | $ | 17,155,868 | | | $ | 17,547,629 | | | $ | 17,645,181 | |

| Collected Finance Charges and Fees | | $ | 2,850,852 | | | $ | 3,972,184 | | | $ | 4,275,252 | | | $ | 4,241,337 | |

| Collected Finance Charges and Fees as a percentage of Average Principal Receivables Outstanding (annualized) | | | 24.32 | % | | | 23.15 | % | | | 24.36 | % | | | 24.04 | % |

Composition of the Trust Portfolio

The receivables to be conveyed to the trust have been or will be generated from transactions made by holders of credit card accounts included in the trust portfolio. A description of the bank’s credit card business is contained in the prospectus under the caption “The Sponsor—Credit Card Activities.”

The following tables summarize the trust portfolio by various criteria as of August 31, 2012 for each of the retailers included in the trust portfolio, except for the “Composition by FICO® Score” table, which reflects receivables balances as of August 31, 2012, and the composition of accounts by FICO® score as most recently refreshed.

Please note that numbers and percentages presented in the tables in this section may not sum to the totals presented due to rounding.

For purposes of the tables in this section:

| • | Total Receivables Outstanding is the sum of principal receivables and finance charge receivables (which includes fee receivables) included in the trust portfolio in the period indicated. |

| • | Accounts is the number of accounts included in the trust portfolio as of the date or in the period indicated. |

Composition by Retailer

| Retailer | | Total Receivables

Outstanding | | | Percentage of

Total Receivables

Outstanding | | | Number

of Accounts | | | Percentage

of Number

of Accounts | |

| JCPenney | | $ | 4,157,730,128 | | | | 21.9 | % | | | 12,508,479 | | | | 34.1 | % |

| Lowe’s | | | 3,349,190,822 | | | | 17.6 | % | | | 3,577,200 | | | | 9.7 | % |

| Wal-Mart (1) | | | 2,312,987,014 | | | | 12.2 | % | | | 2,953,756 | | | | 8.0 | % |

| Sam’s Club(1) | | | 2,113,941,190 | | | | 11.1 | % | | | 3,624,606 | | | | 9.9 | % |

| Sam’s Club Dual Card | | | 2,005,165,596 | | | | 10.5 | % | | | 1,770,792 | | | | 4.8 | % |

| Gap Family Dual Card(2) | | | 1,475,310,839 | | | | 7.8 | % | | | 2,414,163 | | | | 6.6 | % |

| Belk | | | 802,450,132 | | | | 4.2 | % | | | 2,620,163 | | | | 7.1 | % |

| Gap(3) | | | 653,248,280 | | | | 3.4 | % | | | 3,374,126 | | | | 9.2 | % |

| Dillard’s | | | 605,582,778 | | | | 3.2 | % | | | 990,109 | | | | 2.7 | % |

| Chevron | | | 564,126,983 | | | | 3.0 | % | | | 1,711,715 | | | | 4.7 | % |

| JCPenney Dual Card | | | 259,269,083 | | | | 1.4 | % | | | 196,085 | | | | 0.5 | % |

| Other | | | 711,666,157 | | | | 3.7 | % | | | 954,810 | | | | 2.6 | % |

| Total | | $ | 19,010,669,002 | | | | 100.0 | % | | | 36,696,004 | | | | 100.0 | % |

| (1) | Sam’s Club and Wal-Mart are affiliated retailers. Sam’s Club cards may also be used at Wal-Mart locations, and Wal-Mart cards may be used at Sam’s Club locations if the cardholder belongs to the club. Figures shown here are based on which retailer is identified on the card, not where the purchase was made. |

| (2) | Figures presented for Gap Family Dual Card include Old Navy Dual Card, Gap Dual Card and Banana Republic Dual Card, which are affiliated retailers. Each of these retailers’ cards may be used at the locations of the other two. |

| (3) | Figures presented for Gap include Old Navy, Gap and Banana Republic, which are affiliated retailers. Each of these retailers’ cards may be used at the locations of the other two. |

Composition by Account Balance

| Account Balance Range | | Total Receivables

Outstanding | | | Percentage of

Total Receivables

Outstanding | | | Number

of Accounts | | | Percentage

of Number

of Accounts | |

| Credit Balance | | $ | (20,984,101 | ) | | | -0.1 | % | | | 453,603 | | | | 1.2 | % |

| No Balance | | | - | | | | 0.0 | % | | | 14,936,223 | | | | 40.7 | % |

| $0.01-$500.00 | | | 2,055,532,751 | | | | 10.8 | % | | | 11,600,931 | | | | 31.6 | % |

| $500.01-$1,000.00 | | | 2,756,352,398 | | | | 14.5 | % | | | 3,799,731 | | | | 10.4 | % |

| $1,000.01-$2,000.00 | | | 4,571,518,882 | | | | 24.0 | % | | | 3,217,933 | | | | 8.8 | % |

| $2,000.01-$3,000.00 | | | 3,132,859,154 | | | | 16.5 | % | | | 1,289,155 | | | | 3.5 | % |

| $3,000.01-$4,000.00 | | | 2,083,215,982 | | | | 11.0 | % | | | 603,476 | | | | 1.6 | % |

| $4,000.01-$5,000.00 | | | 1,660,118,336 | | | | 8.7 | % | | | 370,319 | | | | 1.0 | % |

| $5,000.01-$6,000.00 | | | 1,132,097,381 | | | | 6.0 | % | | | 208,028 | | | | 0.6 | % |

| $6,000.01-$7,000.00 | | | 643,050,985 | | | | 3.4 | % | | | 99,725 | | | | 0.3 | % |

| $7,000.01-$8,000.00 | | | 392,497,207 | | | | 2.1 | % | | | 52,710 | | | | 0.1 | % |

| $8,000.01-$9,000.00 | | | 259,254,704 | | | | 1.4 | % | | | 30,640 | | | | 0.1 | % |

| $9,000.01-$10,000.00 | | | 194,670,011 | | | | 1.0 | % | | | 20,547 | | | | 0.1 | % |

| $10,000.01-$15,000.00 | | | 136,751,471 | | | | 0.7 | % | | | 12,233 | | | | 0.0 | % |

| $15,000.01-$20,000.00 | | | 9,764,812 | | | | 0.1 | % | | | 581 | | | | 0.0 | % |

| $20,000.01 or more | | | 3,969,029 | | | | 0.0 | % | | | 169 | | | | 0.0 | % |

| Total | | $ | 19,010,669,002 | | | | 100.0 | % | | | 36,696,004 | | | | 100.0 | % |

Composition by Credit Limit

| Credit Limit Range | | Total Receivables

Outstanding | | | Percentage of

Total Receivables

Outstanding | | | Number

of Accounts | | | Percentage

of Number

of Accounts | |

| $0.01-$500.00 | | $ | 412,406,075 | | | | 2.2 | % | | | 3,987,175 | | | | 10.9 | % |

| $500.01-$1,000.00 | | | 1,150,833,611 | | | | 6.1 | % | | | 4,583,197 | | | | 12.5 | % |

| $1,000.01-$2,000.00 | | | 2,737,280,405 | | | | 14.4 | % | | | 10,284,272 | | | | 28.0 | % |

| $2,000.01-$3,000.00 | | | 2,832,759,294 | | | | 14.9 | % | | | 6,535,613 | | | | 17.8 | % |

| $3,000.01-$4,000.00 | | | 2,125,370,953 | | | | 11.2 | % | | | 3,442,114 | | | | 9.4 | % |

| $4,000.01-$5,000.00 | | | 2,326,054,067 | | | | 12.2 | % | | | 2,628,191 | | | | 7.2 | % |

| $5,000.01-$6,000.00 | | | 1,978,712,963 | | | | 10.4 | % | | | 1,486,822 | | | | 4.1 | % |

| $6,000.01-$7,000.00 | | | 1,470,357,639 | | | | 7.7 | % | | | 1,050,141 | | | | 2.9 | % |

| $7,000.01-$8,000.00 | | | 1,311,832,235 | | | | 6.9 | % | | | 969,640 | | | | 2.6 | % |

| $8,000.01-$9,000.00 | | | 850,810,811 | | | | 4.5 | % | | | 475,548 | | | | 1.3 | % |

| $9,000.01-$10,000.00 | | | 1,459,138,773 | | | | 7.7 | % | | | 1,067,541 | | | | 2.9 | % |

| $10,000.01 or more | | | 355,112,176 | | | | 1.9 | % | | | 185,750 | | | | 0.5 | % |

| Total | | $ | 19,010,669,002 | | | | 100.0 | % | | | 36,696,004 | | | | 100.0 | % |

Composition by Account Age

| Age | | Total Receivables

Outstanding | | | Percentage of

Total Receivables

Outstanding | | | Number

of Accounts | | | Percentage

of Number

of Accounts | |

| Up to 6 Months | | $ | 317,846,612 | | | | 1.7 | % | | | 1,084,429 | | | | 3.0 | % |

| 6 Months to 12 Months | | | 521,335,975 | | | | 2.7 | % | | | 1,411,593 | | | | 3.8 | % |

| Over 12 Months to 24 Months | | | 1,188,385,257 | | | | 6.3 | % | | | 2,985,523 | | | | 8.1 | % |

| Over 24 Months to 36 Months | | | 1,515,216,511 | | | | 8.0 | % | | | 2,943,849 | | | | 8.0 | % |

| Over 36 Months to 48 Months | | | 1,570,815,887 | | | | 8.3 | % | | | 2,866,571 | | | | 7.8 | % |

| Over 48 Months to 60 Months | | | 1,696,362,791 | | | | 8.9 | % | | | 2,776,002 | | | | 7.6 | % |

| Over 60 Months to 72 Months | | | 1,734,780,318 | | | | 9.1 | % | | | 2,841,086 | | | | 7.7 | % |

| Over 72 Months to 84 Months | | | 1,656,153,051 | | | | 8.7 | % | | | 2,482,600 | | | | 6.8 | % |

| Over 84 Months to 96 Months | | | 1,428,470,709 | | | | 7.5 | % | | | 2,138,998 | | | | 5.8 | % |

| Over 96 Months to 108 Months | | | 923,798,672 | | | | 4.9 | % | | | 1,765,865 | | | | 4.8 | % |

| Over 108 Months to 120 Months | | | 755,919,304 | | | | 4.0 | % | | | 1,459,264 | | | | 4.0 | % |

| Over 120 Months | | | 5,701,583,917 | | | | 30.0 | % | | | 11,940,224 | | | | 32.5 | % |

| Total | | $ | 19,010,669,002 | | | | 100.0 | % | | | 36,696,004 | | | | 100.0 | % |