SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to (S)240.14a-11(c) or (S)240.14a-12 |

Digital Theater Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

Digital Theater Systems, Inc.

5171 Clareton Drive

Agoura Hills, California 91301

Notice of Annual Meeting of Stockholders

To Be Held May 19, 2004

To Our Stockholders:

The annual meeting of stockholders of Digital Theater Systems, Inc., a Delaware corporation, will be held on May 19, 2004 at 10:00 a.m., local time, at the Warner Center Marriott located at 21850 Oxnard Street, Woodland Hills, California 91367, for the following purposes:

| | 1. | To elect two members of the Board of Directors, whose terms are described in the proxy statement. |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP to serve as our independent auditors for the 2004 fiscal year; and |

| | 3. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Holders of record of Digital Theater Systems, Inc. common stock at the close of business on April 1, 2004, are entitled to vote at the meeting.

In addition to the proxy statement, proxy card and voting instructions, a copy of Digital Theater Systems, Inc.’s annual report on Form 10-K, which is not part of the proxy soliciting material, is enclosed.

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning a proxy card in the enclosed, postage-prepaid envelope. Many stockholders may also vote over the Internet or by telephone. If Internet and telephone voting are available to you, you can find voting instructions in the materials accompanying the proxy statement. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the enclosed proxy statement.

By Order of the Board of Directors,

Blake Welcher, Executive Vice President, Legal, General Counsel, and Corporate Secretary

Agoura Hills, California

April 19, 2004

Digital Theater Systems, Inc.

5171 Clareton Drive

Agoura Hills, California 91301

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2004

This proxy statement is furnished on behalf of the board of directors of Digital Theater Systems, Inc., a Delaware corporation, for use at the annual meeting of stockholders to be held on May 19, 2004 at 10:00 a.m., local time, and at any postponement or adjournment thereof. The annual meeting will be held at the Warner Center Marriott located at 21850 Oxnard Street, Woodland Hills, California 91367.

These proxy solicitation materials were first mailed on or about April 19, 2004 to all stockholders entitled to vote at the annual meeting.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will vote on the election of two Class I directors and the ratification of PricewaterhouseCoopers LLP to serve as the Company’s independent auditors for the 2004 fiscal year and any other business that may properly come before the meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, April 1, 2004, are entitled to vote at the annual meeting or any postponement or adjournment of the meeting.

What are the board of directors’ recommendations on the proposals?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote FOR each of the nominees for director and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company.

With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, according to their own best judgment. At the date this proxy statement went to press, we did not know of any other matters that are to be presented at the annual meeting.

How do I vote my shares at the Annual Meeting?

Sign and date each proxy card you receive and return it in the postage-prepaid envelope enclosed with your proxy materials. If you are a registered stockholder and attend the annual meeting, then you may deliver your completed proxy card in person or you may vote in person at the annual meeting.

If your shares are held in “street name” by your broker or bank, you will receive a form from your broker or bank seeking instructions as to how your shares should be voted. If you do not instruct your broker or bank how to vote, your broker or bank will vote your shares if it has discretionary power to vote on a particular matter.

1

Can I change my vote after I return my proxy card?

Yes, you may revoke or change your proxy at any time before the annual meeting by filing with Blake Welcher, our Executive Vice President, Legal and General Counsel and Corporate Secretary, at 5171 Clareton Drive, Agoura Hills, California, 91301, a notice of revocation or another signed proxy with a later date. You may also revoke your proxy by attending the annual meeting and voting in person.

Who will count the votes?

EquiServe Trust Company, N.A. will count the votes and act as the inspector of election.

What does it mean if I get more than one proxy card?

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, EquiServe Trust Company, N.A. (781) 575-3224, or, if your shares are held in street name, by contacting the broker or bank that holds your shares.

How many shares can vote?

As of the record date, April 1, 2004, 16,681,393 shares of our common stock were issued and outstanding. Every stockholder is entitled to one vote for each share of common stock held.

What is a quorum?

The presence at the meeting in person or by proxy of the holders of a majority of the shares of stock entitled to vote at the meeting will constitute a quorum for the transaction of business. Proxies marked as abstaining on any matter to be acted upon by stockholders and “broker non-votes” will be treated as present for purposes of determining a quorum. A broker non-vote occurs when you fail to provide voting instructions for shares you hold in street name. Under those circumstances, your broker may be authorized to vote for you on some routine items but is prohibited from voting on other items. Those items for which your broker cannot vote result in broker non-votes.

What is required to approve each proposal?

The nominees for director who receive a plurality of the affirmative votes cast will become Class I directors.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to ratify the appointment of PricewaterhouseCoopers LLP as independent auditors.

If a broker indicates on its proxy that it does not have discretionary authority to vote on a particular matter, the affected shares will be counted as shares present for the purpose of determining the presence of a quorum. Broker non-votes will not be counted for purposes of determining whether a proposal has been approved.

What happens if I abstain?

Proxies marked “abstain” will be counted as shares present for the purpose of determining the presence of a quorum, but for purposes of determining the outcome of a proposal shares represented by these proxies will not be treated as affirmative votes. For proposals requiring an affirmative vote of a majority of the shares present, an abstention is equivalent to a “no” vote.

2

How will Digital Theater Systems solicit proxies?

We have retained EquiServe Trust Company, N.A. and The Altman Group, Inc. to assist in the distribution of proxy materials. The costs and expenses of preparing and mailing proxy solicitation materials for the annual meeting and reimbursements paid to brokerage firms and others for their reasonable out-of-pocket expenses for forwarding proxy solicitation materials to stockholders will be borne by us. We have retained a proxy solicitation service to assist in soliciting proxies and we will bear these costs, which we expect will be approximately $10,000. Proxies may also be solicited in person, by telephone, or by facsimile by our directors, officers, and employees without additional compensation being paid to these persons.

ITEM 1 — ELECTION OF DIRECTORS

The Board of Directors is divided into three classes of directors with staggered three-year terms, with each class consisting, as nearly possible, of one-third of the total number of directors. The Board currently consists of eight persons.

Two Class I Directors will be elected at the annual meeting to serve for a three-year term expiring at our annual meeting in 2007. The Nominating/Corporate Governance Committee of the Board has nominated Daniel E. Slusser and Joseph A. Fischer for re-election to fill these positions. You can find information about Messrs. Slusser and Fischer below.

The persons named in the proxy card will vote such proxy for the election of Messrs. Slusser and Fischer, unless you indicate that your vote should be withheld. You cannot vote for a greater number of directors than two. If elected, Messrs. Slusser and Fischer will each continue in office until his successor has been duly elected and qualified, or until the earlier of his death, resignation or retirement. Messrs. Slusser and Fischer have each indicated to the company that he will serve if elected. We do not anticipate that either nominee will be unable to stand for election, but, if that happens, your proxy will be voted in favor of another person nominated by the Board.

The Board of Directors recommends a vote FOR the election of Messrs. Slusser and Fischer as Directors.

NOMINEES FOR TERMS EXPIRING AT THE ANNUAL MEETING OF STOCKHOLDERS IN 2007

Daniel E. Slusser, 65,has served as the Chairman of our Board of Directors since October 2001, and served as our Chief Executive Officer and Vice Chairman of our Board of Directors from April 1997 to September 2001. Prior to joining us, from 1974 to April 1997, Mr. Slusser served as Senior Vice President and General Manager at Universal Studios, Inc., an entertainment company. He also held various positions at 20th Century Fox Film Corporation, an entertainment company. Mr. Slusser is the past chairman of the Permanent Charities Committee, and has been involved in many industry organizations, including the Society of Motion Picture and Television Engineers (SMPTE), the Academy of Motion Picture Arts and Sciences, and the Academy of Television Arts and Sciences. Mr. Slusser is a member and past two-term President of the Los Angeles Film Development Committee, a two-term Chairman of the L.A. County Filming Advisory Board and past Vice Chairman of the California State Film Commission. Mr. Slusser is the recipient of the 1986 Presidential Proclamation Award from SMPTE and was named 1986 Man of the Year by the Israel Histadrut organization.

Joseph A. Fischer, 72,has served as a member of our Board of Directors since July 2003. Retired since 1996, Mr. Fischer was a senior financial and operating executive in the entertainment industry for almost 30 years. From 1987 until his retirement, Mr. Fischer served as Executive Vice President of the motion picture group at MCA, Inc. Prior to that, he was Chairman and CEO of Four Star International, a producer and distributor of television programs, and was President of MGM/UA Entertainment, where he was also a member of the Board of Directors and Executive Committee. During the course of his career, he has also held executive positions at Columbia Pictures Industries and Price Waterhouse & Co.

3

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE ANNUAL MEETING OF STOCKHOLDERS IN 2005

Joerg D. Agin, 61,has served as a member of our Board of Directors since July 2003. Since September 2001, he has been the President of Agin Consulting, a consulting business engaged for specific project work associated with hybrid and digital motion imaging systems. Mr. Agin retired in September 2001 from the Eastman Kodak Company, a manufacturer and marketer of imaging products, after more than 30 years with the company. He first joined Kodak in 1967 as an electrical engineer, but, most recently, from 1995 through August 2001, he served as Senior Vice President and President of the company’s Entertainment Imaging division. Mr. Agin also worked at MCA/Universal Studios, a motion picture studio, as Senior Vice President, New Technology and Business Development from 1992 through 1995. Mr. Agin is a Fellow of the Society of Motion Pictures & Television Engineers (SMPTE) and the recipient of the Technicolor Herbert T. Kalmus Gold Medal Award for outstanding achievement in color motion pictures. Mr. Agin attended MIT Sloane School of Management for Senior Executives, holds a B.S. in Electrical Engineering from the University of Delaware, and an M.B.A. from Pepperdine University.

Steven M. Friedman, 49,has served as a member of our Board of Directors since October 1997. He is a general partner of Eos Partners, L.P., an investment firm which he co-founded in 1994. Prior to Eos, Mr. Friedman was a general partner at Odyssey Partners, L.P., an investment partnership, where he was responsible for its private investment business. Before joining Odyssey in 1983, he was a vice president in leveraged finance at Citibank, N.A., a global financial services company. Mr. Friedman has a B.A. and an M.B.A. from the University of Chicago and a J.D. from Brooklyn Law School.

Warren N. Lieberfarb, 60,has served as a member of our Board of Directors since October 2003. Prior to his retirement in December 2002, Mr. Lieberfarb served for more than 20 years as an executive officer of Warner Home Video, the home entertainment arm of Warner Bros. Entertainment, a broad-based entertainment company. From 1984 until retirement, Mr. Lieberfarb was President of Warner Home Video, and prior to that he served as its Senior Vice President, Sales and Marketing. Mr. Lieberfarb first joined Warner Bros. in 1975 as Vice President of Marketing, and subsequently served as head of International Advertising and Publicity for the motion pictures division. Prior to Warner Bros., Mr. Lieberfarb served as Vice President of Telecommunications at Twentieth Century Fox and as Executive Assistant to the President at Paramount Pictures. He currently, serves on the Board of Trustees of the University of Pennsylvania, and is a member of the Board’s Nominating and Development Committees, and on the University of Pennsylvania Library Board of Overseers and the Undergraduate Advisory Board of The Wharton School. Mr. Lieberfarb also serves on the Board of Directors and Board of Trustees of the American Film Institute, and chairs its Entrepreneurial Committee, and on the Board of Directors of Sirius Satellite Radio, a satellite radio provider. Mr. Lieberfarb is the recipient of a 1999 Emmy Award from the Academy of Television Arts and Sciences and the 2002 Wharton/Infosys “Technology Change Agent” award. In 2003, he received the Décoration des Arts et Lettres from the French Ministry of Culture and Communications, the Medal du Festival from the Cannes Film Festival, and the MIPCOM DVD Lifetime Achievement Award. Mr. Lieberfarb holds a B.S. in Economics from The Wharton School at the University of Pennsylvania and an M.B.A. from the University of Michigan.

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE ANNUAL MEETING OF STOCKHOLDERS IN 2006

Jon E. Kirchner, 36,has served as our President and Chief Executive Officer since September 2001, and as a member of our Board of Directors since August 2002. Since joining us in 1993, Mr. Kirchner has served in a number of capacities. From April 2000 to September 2001, he was our President and Chief Operating Officer. From September 1998 to April 2000, he served as our Executive Vice President of Operations, and from March 1996 to September 1998, he was our Vice President of Finance and Business Development. Mr. Kirchner has

4

also served as our Director of International Operations and Controller. Prior to joining us, Mr. Kirchner worked for the Dispute Analysis and Corporate Recovery and Audit Groups of Price Waterhouse LLP (now PricewaterhouseCoopers, LLP), an international accounting firm. During his tenure at Price Waterhouse LLP, he advised clients on financial and operational restructuring, business turnaround, market positioning, and valuation issues. Mr. Kirchner has experience in a variety of industries including entertainment, high technology, manufacturing, distribution, and transportation. He is a Certified Public Accountant and received a B.A. in Economics, Cum Laude, from Claremont McKenna College.

James B. McElwee, 52,has served as a member of our Board of Directors since October 1997. Since 1992, he has been a general partner of Weston Presidio Capital, a private equity firm and has been active in the private equity industry, investing in a broad range of growth companies, since 1979. Prior to Weston Presidio, Mr. McElwee served as Senior Vice President of the Security Pacific Venture Capital Group, a private equity firm, and was the founding Managing Director of its Menlo Park, California office. Previously, he served as Senior Consultant with Accenture, an international consulting firm, where he advised a variety of clients in the healthcare, retailing, and technology industries. Mr. McElwee has a B.A. from Claremont McKenna College where he serves on the Board of Trustees and an M.B.A. from the Wharton Graduate School of Business where he currently serves as a member of the Wharton Entrepreneurial Advisory Board.

Ronald N. Stone, 60, was elected to our Board of Directors in April 2004. Mr. Stone is currently an advisor to Pioneer Electronics (USA) Inc., a global consumer electronics company, a role he has held since he retired from Pioneer in May 2003. At the time of his retirement, Mr. Stone served as president of Pioneer’s Customer Support Division, a position he had held since March 2000. The Customer Support Division is responsible for product services, accessories, and after-sales operations for several Pioneer entities. Prior to his position as president of the Customer Support Division, Mr. Stone served as executive vice president and Chief Financial Officer of Pioneer Electronics (USA) Inc. since 1985. Mr. Stone also served on the board of directors of Pioneer and several of its North American subsidiaries. Mr. Stone began his career with Pioneer Electronics in 1975. Formerly chairman of the executive committee, Mr. Stone now serves on the executive board of the Consumer Electronics Association (CEA), owner of the International Consumer Electronics Show®. He also serves on the UCLA Medical Center board of advisors and on its Information Technology and Finance committees. Mr. Stone received his bachelor’s degree in accounting from the University of Southern California. He is a Certified Public Accountant.

ITEM 2 — RATIFICATION OF INDEPENDENT AUDITORS

The Audit Committee has appointed PricewaterhouseCoopers LLP as independent auditors for the Company and its subsidiaries during the year ended December 31, 2003, to serve in the same capacity for the 2004 fiscal year, and is asking the stockholders to ratify this appointment. The affirmative vote of a majority of the shares represented and voting at the Annual Meeting is required to ratify the selection of PricewaterhouseCoopers LLP.

In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its stockholders.

A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if the representative so desires. The representative is expected to be available to respond to appropriate questions.

The Board of Directors recommends that the stockholders vote FOR the ratification of PricewaterhouseCoopers LLP as independent auditors of the Company.

5

The following table presents fees for professional audit services rendered by PricewaterhouseCoopers LLP for the audit of the Company’s annual financial statements for fiscal years 2003 and 2002, and fees billed for other services rendered by PricewaterhouseCoopers for fiscal years 2003 and 2002.

| | | | | | |

| | | Fiscal Year

2003

| | Fiscal Year

2002

|

(1) Audit Fees | | $ | 554,312 | | $ | 147,000 |

(2) Audit-Related Fees | | | 47,653 | | | — |

(3) Tax-Related Fees | | | 47,316 | | | 23,911 |

(4) All Other Fees | | | — | | | — |

| | |

|

| |

|

|

| | | $ | 649,281 | | $ | 170,911 |

| | |

|

| |

|

|

| (1) | Audit fees for fiscal year 2003 include the audit of our financial statements for fiscal 2003, review of the financial statements included in Forms 10-Q for fiscal year 2003 and fees related to our initial and follow-on public offerings. For 2003, the amount excludes fees billed in 2003 related to the audit for fiscal 2002. Audit fees for fiscal year 2002 relate to the audit of our financial statements for fiscal year 2002. |

| (2) | Audit-related fees include consultation services related to technical accounting issues. |

| (3) | Tax-related fees include services related to tax compliance (including U.S. federal and state returns), tax consulting, tax planning and assistance with transfer pricing. |

All non-audit services occurring after our initial public offering were reviewed with the Audit Committee, which concluded that the provision of such services by PricewaterhouseCoopers was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

Our Audit Committee has adopted a Pre-Approval Policy whereby all engagements of our independent auditor must be pre-approved by the Audit Committee. The committee has delegated to the Chairman of the committee the authority to evaluate and approve engagements on behalf of the committee in the event that a need arises for pre-approval between committee meetings. If the Chairman approves any such engagements, he will report that approval to the full committee at the next committee meeting.

GOVERNANCE OF THE COMPANY

Pursuant to the Delaware General Corporation Law and the company’s by-laws, Digital Theater System, Inc.’s business, property and affairs are managed by or under the direction of the Board of Directors. Members of the Board are kept informed of the company’s business through discussions with the Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. We currently have eight members of the Board — Messrs. Agin, Fischer, Friedman, Kirchner, Lieberfarb, McElwee, Slusser, and Stone.

The Board has three standing committees:

| | • | The Audit Committee, the members of which are Joerg Agin, Joseph Fischer and Steven Friedman; |

| | • | The Compensation Committee, the members of which are Joerg Agin, Steven Friedman and James McElwee; and |

| | • | The Nominating/Corporate Governance Committee, the members of which are Joerg Agin, Joseph Fischer and James McElwee. |

Messrs. Agin, Fischer, Friedman, Lieberfarb, McElwee and Stone are not, and have never been, employees of our company or any of our subsidiaries and the Board has determined that each of these directors is independent according to the requirements regarding director independence set forth under applicable NASD rules (each, an “Independent Director”).

6

The Board has adopted a charter for each of the three standing committees. The Board has also adopted a code of ethics that applies to our principal executive officer, principal financial officer and controller and a code of conduct that applies to all of our employees, officers and directors. You can find links to these materials on our website atwww.dtsonline.com under investor relations. The information on our website is not incorporated by reference in this Proxy Statement.

During fiscal 2003, the Board held 18 meetings and the three standing committees held a total of 10 meetings. Except for Mr. Lieberfarb, each director attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he was a director, and (ii) the total number of meetings of all committees of the Board on which he served during the period that he served. Mr. Lieberfarb attended 60% of the total number of meetings of the Board of Directors and the Board committees of which he was a member during fiscal 2003 during the period that he served. Although the Company has no formal policy regarding director attendance at annual meetings, it does expect all members of the Board to attend the 2004 Annual Meeting.

Audit Committee

The audit committee consists of Independent Directors. The audit committee is a standing committee of, and operates under a written charter adopted by, our Board of Directors. The audit committee charter is attached as Appendix A to this Proxy Statement. The audit committee reviews and monitors our financial statements and accounting practices, appoints, determines funding for, and oversees our independent auditors, reviews the results and scope of the audit and other services provided by our independent auditors, and reviews and evaluates our audit and control functions. Mr. Fischer chairs the Audit Committee. The audit committee met five times during fiscal 2003.

Audit Committee Financial Expert. The Board has determined that the Chairman of the committee, Mr. Fischer, is an “audit committee financial expert,” as that term is defined in Item 401(h) of Regulation S-K and “independent” under applicable NASD rules.

Compensation Committee

The compensation committee consists of Independent Directors. The compensation committee makes decisions and recommendations regarding salaries, benefits, and incentive compensation for our directors and executive officers and administers our incentive compensation and benefit plans, including our 2003 Equity Incentive Plan. Mr. McElwee is chairman of the Compensation Committee. The compensation committee met three times during fiscal 2003.

Nominating/Corporate Governance Committee

Our nominating/corporate governance committee consists of Independent Directors. Mr. Agin chairs the nominating/corporate governance committee. The nominating/corporate governance committee met two times during fiscal 2003. The nominating/corporate governance committee assists the board of directors in fulfilling its responsibilities by:

| | • | identifying and approving individuals qualified to serve as members of our board of directors; |

| | • | selecting director nominees for our annual meetings of stockholders; |

| | • | evaluating our board’s performance; and |

| | • | developing and recommending to our board corporate governance guidelines and oversight with respect to corporate governance and ethical conduct. |

7

The Board believes that directors should possess the highest personal and professional ethics and should be willing and able to devote the required amount of time to company business. When considering candidates for director, the nominating/corporate governance committee takes into account a number of factors, including the following:

| | • | Independence from management |

| | • | Age, gender and ethnic background |

| | • | Whether the candidate has relevant business experience |

| | • | Judgment, skill, integrity and reputation |

| | • | Existing commitments to other businesses |

| | • | Potential conflicts of interest with other pursuits |

| | • | Legal considerations such as antitrust issues |

| | • | Corporate governance background |

| | • | Financial and accounting background, to enable the committee to determine whether the candidate would be suitable for audit committee membership |

| | • | Executive compensation background, to enable the committee to determine whether the candidate would be suitable for compensation committee membership |

| | • | The size and composition of the existing Board |

Before nominating a sitting director for re-election at an annual meeting, the committee will consider:

| | • | The director’s performance on the Board; and |

| | • | Whether the director’s re-election would be consistent with the company’s governance guidelines. |

The nominating/corporate governance committee will also consider candidates for director suggested by stockholders applying the criteria for candidates described above and considering the additional information referred to below. Stockholders wishing to suggest a candidate for director should write to the Company’s corporate Secretary and include the following information:

| | • | A statement that the writer is a stockholder and is proposing a candidate for consideration by the committee; |

| | • | The name of and contact information for the candidate; |

| | • | A statement of the candidate’s business and educational experience; |

| | • | Information regarding each of the director evaluation criteria established from time to time by the nominating/corporate governance committee and disclosed in the company’s annual proxy statements sufficient to enable the committee to evaluate the candidate; |

| | • | A statement detailing any relationship between the candidate and any customer, supplier or competitor of DTS; |

| | • | Detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

| | • | A statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

Other Committees

Our Board of Directors may establish other committees as it deems necessary or appropriate from time to time.

8

Stockholder Communications with Directors and Management

Any stockholder who desires to contact any member of our Board of Directors or management can write to:

Digital Theater Systems, Inc.

Attn: Stockholder Relations

5171 Clareton Drive

Agoura Hills, CA 91301

Your letter should indicate that you are a DTS stockholder. Depending on the subject matter, our stockholder relations personnel will:

| | • | forward the communications to the director or directors to whom it is addressed; |

| | • | forward the communications to the appropriate management personnel; |

| | • | attempt to handle the inquiry directly, for example where it is a request for information about the company, or it is a stock-related matter; or |

| | • | not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

Compensation of Directors

Except that our audit committee chair receives an annual retainer of $20,000, we currently pay our non-employee directors the following fees related to their service on our board of directors:

| | | |

• annual retainer | | $ | 10,000 |

• per board meeting | | $ | 2,000 |

• per committee meeting | | $ | 1,000 |

We intend to promptly reimburse all Independent Directors for reasonable expenses incurred to attend meetings of our Board of Directors or its committees. In addition, our 2003 Equity Incentive Plan (the “2003 Plan”) provides for automatic grants of stock options to our non-employee directors in order to provide them with additional incentives and, thereby promote the success of our business. The 2003 Plan provides for an initial, automatic grant of an option to purchase 7,500 shares of our common stock to each newly elected or appointed non-employee director. The 2003 Plan also provides for an annual grant of an option to purchase 3,750 shares of our common stock to each non-employee director within 30 days after the date of each annual meeting of the stockholders. However, a non-employee director granted an initial option on, or within a period of six months prior to, the date of an annual meeting of stockholders will not be granted an annual option with respect to that annual stockholders’ meeting. Each initial and annual option will have an exercise price equal to the fair market value of a share of our common stock on the date of grant and will have a term of ten years. The initial options granted to newly elected or appointed non-employee directors will vest and become exercisable in 24 equal installments on each monthly anniversary of the date of grant of the option for so long as the non-employee director continuously remains a director of, or a consultant to, our company. The 3,750 share option grants made on an annual basis will vest and become exercisable in 12 equal installments on each monthly anniversary of the date of the grant of the option for so long as the non-employee director continuously remains a director of, or a consultant to, our company. All automatic non-employee director options granted under the 2003 Plan will be non-statutory stock options. Options must be exercised, if at all, within three months after a non-employee director’s termination of service, except in the case of death in which event the director’s estate shall have one year from the date of death to exercise the option. However, in no event shall any option granted to a director be exercisable later than the expiration of the option’s term. In the event of our merger with another corporation or another change of control, all automatic non-employee director options will become fully vested and exercisable.

9

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Unless otherwise set forth, below are the name, age, position, and a brief account of the business experience of each of our executive officers and significant employees.

| | | | |

Name

| | Age

| | Position(s)

|

Jon E. Kirchner | | 36 | | President and Chief Executive Officer, Director |

Melvin L. Flanigan | | 45 | | Executive Vice President, Finance and Chief Financial Officer |

Andrea M. Nee | | 45 | | Executive Vice President, Operations |

Blake A. Welcher | | 42 | | Executive Vice President, Legal and General Counsel |

W. Paul Smith | | 40 | | Senior Vice President, Research and Development |

Patrick J. Watson | | 43 | | Senior Vice President, Strategy and Business Development |

Jan C. Wissmuller | | 55 | | Senior Vice President, Engineering and Product Development |

Jeffrey A. Skillen | | 34 | | Vice President, DTS Entertainment |

Brian D. Towne | | 39 | | Vice President, Consumer/Pro Audio |

Jon E. Kirchnerhas served as our President and Chief Executive Officer since September 2001, and as a member of our Board of Directors since August 2002. Since joining us in 1993, Mr. Kirchner has served in a number of capacities. From April 2000 to September 2001, he was our President and Chief Operating Officer. From September 1998 to April 2000, he served as our Executive Vice President of Operations, and from March 1996 to September 1998, he was our Vice President of Finance and Business Development. Mr. Kirchner has also served as our Director of International Operations and Controller. Prior to joining us, Mr. Kirchner worked for the Dispute Analysis and Corporate Recovery and Audit Groups of Price Waterhouse LLP (now PricewaterhouseCoopers, LLP), an international accounting firm. During his tenure at Price Waterhouse LLP, he advised clients on financial and operational restructuring, business turnaround, market positioning, and valuation issues. Mr. Kirchner has experience in a variety of industries including entertainment, high technology, manufacturing, distribution, and transportation. He is a Certified Public Accountant and received a B.A. in Economics, Cum Laude, from Claremont McKenna College.

Melvin L. Flaniganhas served as our Executive Vice President, Finance and Chief Financial Officer since September 2003. Prior to that, he served as our Vice President and Chief Financial Officer since joining us in July 1999. From March 1996 to July 1999, he served as Chief Financial Officer and Vice President, Operations at SensArray Corporation, a supplier of thermal measurement products for semiconductor, LCD, and memory-disk fabrication processes. Mr. Flanigan led SensArray’s manufacturing and finance efforts. He has served as a director of SensArray since January 1997. Prior to joining SensArray, Mr. Flanigan was Corporate Controller for Megatest Corporation, a manufacturer of automatic test equipment for memory chips, where he was involved in international mergers and acquisitions activities. Mr. Flanigan has also previously held positions at Cooperative Solutions, Inc., a software developer in the client server transaction processing market, Hewlett-Packard Company, a provider of ITinfrastructure, personal computing and access devices, global services, and imaging and printing, and Price Waterhouse LLP. He is a Certified Public Accountant and holds an M.B.A. and B.S. in Accounting from Santa Clara University.

Andrea M. Neehas served as our Executive Vice President, Operations since September 2003. From October 2001 to September 2003, Ms. Nee served as our Vice President of Operations and, from October 1997 to October 2001, as our Vice President and General Manager of our Theatrical business, where she oversaw the day-to-day operations of that business. Ms. Nee first joined us in 1993 as Director of Operations and Post Production. Before joining us, Ms. Nee worked as Senior Financial Analyst with PTI Technologies, a provider of filtration products and services. She also previously held positions with Northrop Grumman, a provider of defense and warfighting systems, and Litton Data Systems, a global defense electronics company. Ms. Nee has a B.A. in Public Administration from San Diego State University.

Blake A. Welcherhas served as our Executive Vice President, Legal and General Counsel since September 2003 and, prior to that, as our Vice President and General Counsel since February 2000. From April 1999 to

10

February 2000, Mr. Welcher served as our General Counsel, Intellectual Property, where he was responsible for the Company’s intellectual property assets and licensing. Prior to joining us, from April 1997 to April 1999, Mr. Welcher served as an intellectual property attorney for Koppel & Jacobs, where he provided intellectual property support and counsel for clients in the electrical, mechanical, and entertainment industries. Previously, he served in the same capacity for the Cabot Corporation, a global specialty chemicals company. Mr. Welcher holds a J.D. and Masters of Intellectual Property from the Franklin Pierce Law Center and a B.S. in Aeronautical Engineering from California Polytechnic State University.

W. Paul Smithhas served as our Senior Vice President, Research and Development since September 2003 and, prior to that, as our Vice President of Research and Development since October 2000. From 1995 through October 2000, Mr. Smith served as our Director of Research and Development. Prior to joining us in 1995, Mr. Smith worked for AlgoRhythmic Technology, Ltd. (ART), a start-up venture formed to develop a range of coding and transmission products for the professional audio industry. Prior to ART, Mr. Smith served as Manager of Research and Development for Audio Processing Technology Ltd., a provider of digital audio compression technology. He holds three U.S. patents and several foreign counterparts in audio coding and has published several papers on the subject. Mr. Smith graduated with a First Class Honours degree in Electronic Engineering from Queen’s University in Belfast, Northern Ireland. Thereafter, he was involved in post-graduate collaborative research with General Electric Corporation, a diversified technology and services company, on the simulation and analysis of quaternary alloy semiconductors.

Patrick J. Watsonhas served as our Senior Vice President, Strategy and Business Development since September 2003. From February 2000 to September 2003, Mr. Watson served as our Vice President of Business Development and, from February 1997 to January 2000, as our Director of Technical Sales, where he led the penetration of our technology in the consumer electronics home theater market, as well as the proliferation of our technology in new markets such as cars, personal computers, video games, and broadcast. Prior to joining us, Mr. Watson worked in technical sales for a number of firms focused on audio coding technology including Audio Processing Technology Ltd. and AlgoRhythmic Technology, Ltd. in Northern Ireland. He graduated from Ulster University in Northern Ireland with a degree in engineering and from Queens University in Belfast, Northern Ireland with a Masters in Electronics.

Jan C. Wissmullerhas served as our Senior Vice President, Engineering and Product Development since September 2003. From July 2002 through September 2003, Mr. Wissmuller served as our Vice President of Engineering. Prior to joining us, from 1988 to July 2002, he had various roles at Lexicon, Inc., a digital audio processing equipment company, and he last served as its Vice President of Engineering. At Lexicon, he oversaw all aspects of engineering activities, including resource management, policy and process development, strategic planning, and technical consultation. Before joining Lexicon, Mr. Wissmuller held engineering and project management positions at Atex, Inc., an electronic pre-press company, and Analogic, Inc., a provider of medical imaging products and services. Mr. Wissmuller holds B.S. degrees in Physics and Humanities (Music) from Massachusetts Institute of Technology, a Masters in Music Composition from the University of Toronto, and a Ph.D. in Music Theory and Composition from Harvard University.

Jeffrey A. Skillenhas served as our Vice President, DTS Entertainment business since he joined us in January 2002. From December 1998 to December 2001, he served as Executive Vice President for Valley Entertainment, Inc., a music label, where he had general management and administrative responsibilities. Prior to that, he served from 1991 to December 1998, as General Manager for ‘Roundtown Productions, L.P., a music label and publishing management company, where he had management responsibilities for all company activities. Mr. Skillen holds a Bachelor of Music from East Carolina University.

Brian D. Townehas served as our Vice President, Consumer/Pro Audio since he joined us in August 2003. From April 2002 to August 2003, he served as Director of Product Management at Kenwood USA Corporation, a manufacturer of mobile electronics, home entertainment, and communications equipment, where he led all home and mobile entertainment product planning and development for the North American market. From August 1995

11

to April 2002, Mr. Towne held various product planning, development and marketing positions at Kenwood USA. Prior to Kenwood USA, he held various research and development and marketing positions at Pioneer Electronics (USA) Inc., the sales and marketing arm of Pioneer Corporation, a manufacturer of consumer and commercial electronics. Fluent in Japanese, Mr. Towne spent part of his tenure at Pioneer living and working in Japan. He also previously served as an Electronics Specialist in the United States Marine Corps. Mr. Towne holds a B.S. in Engineering Technology, with honors, from California Polytechnic University, Pomona.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and holders of more than 10% of our common stock (the “Reporting Persons”), to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Reporting Persons are required by SEC regulation to furnish us with copies of all Section 16(a) reports they file. We have identified and described the business experience of each of our directors and executive officers who are subject to Section 16(a) of the Exchange Act elsewhere in this proxy statement.

Based solely on our review of the copies of Section 16(a) reports received or written representations from certain Reporting Persons, we believe that all reporting requirements under Section 16(a) for the fiscal year ended December 31, 2003 have been complied with in a timely manner except that Dan Slusser filed a Form 4 on December 23, 2003 reporting an option exercise of 200 shares, which was due on December 19, 2003.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information with respect to the beneficial ownership of our common stock as of March 1, 2004 (or such other date as provided below), by:

| | • | each person, or group of affiliated persons, known by us to own beneficially 5% or more of our common stock; |

| | • | each of our named executive officers; and |

| | • | all of our directors and executive officers as a group. |

| | | | | |

Name of Beneficial Owner(1)

| | Number of

Shares (2)

| | Percentage

Ownership (2)

| |

Five Percent Stockholders | | | | | |

Nordea Investment Management North America, Inc. on behalf of Nordea Investment Management Bank Denmark A/S (3) | | 1,240,859 | | 7.46 | % |

Universal City Studios LLLP (4) | | 1,154,715 | | 6.71 | |

Baron Capital Group, Inc. (5) | | 1,054,300 | | 6.34 | |

Federated Investors, Inc. (6) | | 1,045,000 | | 6.29 | |

| | |

Directors and Executive Officers | | | | | |

Steven M. Friedman (7) | | 434,126 | | 2.61 | |

Jon E. Kirchner (8) | | 420,964 | | 2.47 | |

Dan E. Slusser (9) | | 200,475 | | 1.19 | |

Melvin L. Flanigan (10) | | 117,180 | | * | |

Andrea M. Nee (11) | | 111,519 | | * | |

Blake A. Welcher (12) | | 95,958 | | * | |

James B. McElwee (13) | | 31,326 | | * | |

Joseph A. Fischer (14) | | 2,912 | | * | |

Joerg D. Agin (15) | | 2,812 | | * | |

Warren N. Lieberfarb (16) | | 1,875 | | * | |

Ronald N. Stone | | — | | * | |

All directors and executive officers as a group (16 persons)(17) | | 1,705,428 | | 9.56 | % |

12

| * | Represents beneficial ownership of less than 1% of the outstanding shares of common stock. |

| (1) | Unless otherwise indicated, the address for each individual listed below is: c/o Digital Theater Systems, Inc., 5171 Clareton Drive, Agoura Hills, California 91301. |

| (2) | Beneficial ownership is based on information furnished by the individuals or entities. Unless otherwise indicated and subject to community property laws where applicable, the individuals and entities named in the table above have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them. Beneficial ownership and percentage ownership are determined in accordance with the rules of the Securities and Exchange Commission. In calculating the number of shares beneficially owned by an individual or entity and the percentage ownership of that individual or entity, shares underlying options and warrants held by that individual or entity that are either currently exercisable or exercisable within 60 days from March 1, 2004 are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other individual or entity. Percentage ownership for each stockholder is based on 16,624,367 shares of our common stock outstanding as of March 1, 2004, together with the applicable option(s) and warrant(s) for that stockholder or group of stockholders. |

| (3) | Based upon a Schedule 13G filed by Nordea Investment Management North America, Inc., on behalf of Nordea Investment Management Bank Denmark A/S, or Nordea, March 5, 2004 containing information as of February 15, 2004. Nordea beneficially owned 1,240,859 shares, with shared voting power over 1,240,859 shares and sole dispositive power over 1,240,859 shares. The address for Nordea is 437 Madison Avenue, 22nd Floor, New York, New York 10022. |

| (4) | Based upon a Schedule 13G filed February 13, 2004, containing information as of December 31, 2003, the following entities and persons beneficially owned in the aggregate 1,154,715 shares: |

| | | | | | | | | | |

Entity or Person

| | Shares

Beneficially

Owned

| | Sole

Voting

Power

| | Shared

Voting

Power

| | Sole

Dispositive

Power

| | Shared

Dispositive

Power

|

Universal City Studios LLLP | | 1,154,715 | | — | | 1,154,715 | | — | | 1,154,715 |

Vivendi Universal Entertainment LLLP | | 1,154,715 | | — | | 1,154,715 | | — | | 1,154,715 |

Vivendi Universal S.A. | | 1,154,715 | | — | | 1,154,715 | | — | | 1,154,715 |

Includes a warrant to purchase 574,825 shares of common stock that is currently exercisable. The address for Universal City Studios LLLP and Vivendi Universal Entertainment LLLP is 100 Universal City Plaza, Universal City, California 91608. The address for Vivendi Universal S.A. is 42 avenue de Friedland, 75380 Paris, Cedex 08, France.

| (5) | Based upon a Schedule 13G filed February 13, 2004, containing information as of December 31, 2003, the following entities and persons beneficially owned in the aggregate 1,054,300 shares: |

| | | | | | | | | | |

Entity or Person

| | Shares

Beneficially

Owned

| | Sole

Voting

Power

| | Shared

Voting

Power

| | Sole

Dispositive

Power

| | Shared

Dispositive

Power

|

Baron Capital Group, Inc. | | 1,054,300 | | — | | 1,029,300 | | — | | 1,054,300 |

BAMCO, Inc. | | 1,031,000 | | — | | 1,006,000 | | — | | 1,031,000 |

Baron Capital Management, Inc. | | 23,300 | | — | | 23,300 | | — | | 23,300 |

Baron Small Cap Fund | | 1,000,000 | | — | | 1,000,000 | | — | | 1,000,000 |

Ronald Baron | | 1,054,300 | | — | | 1,029,300 | | — | | 1,054,300 |

The address for Baron Capital Group, Inc. is 767 Fifth Avenue, 49th Floor, New York, New York 10153.

13

| (6) | Based upon a Schedule 13G filed February 13, 2004, containing information as of December 31, 2003, the following entities and persons beneficially owned in the aggregate 1,045,000 shares: |

| | | | | | | | | | |

Entity or Person

| | Shares

Beneficially

Owned

| | Sole Voting

Power

| | Shared

Voting

Power

| | Sole

Dispositive

Power

| | Shared

Dispositive

Power

|

Federated Investors, Inc. | | 1,045,000 | | 1,045,000 | | — | | 1,045,000 | | — |

Voting Shares Irrevocable Trust | | 1,045,000 | | 1,045,000 | | — | | 1,045,000 | | — |

John F. Donahue | | 1,045,000 | | — | | 1,045,000 | | — | | 1,045,000 |

Rhodora J. Donahue | | 1,045,000 | | — | | 1,045,000 | | — | | 1,045,000 |

J. Christopher Donahue | | 1,045,000 | | — | | 1,045,000 | | — | | 1,045,000 |

The address for Federated Investors, Inc. is Federated Investors Tower, Pittsburg, PA 15222-3779.

| (7) | Includes 431,314 shares of common stock held by Eos Partners SBIC, L.P. and 2,812 shares of common stock issuable upon exercise of a stock option held by Eos Management, Inc., an affiliated entity, which is currently exercisable or exercisable within 60 days of March 1, 2004. Steven Friedman, a member of our board of directors, is a general partner of Eos Partners SBIC, L.P. Mr. Friedman does not have voting or investment power with respect to the shares held by Eos Partners SBIC, L.P., and disclaims beneficial ownership of these shares except to the extent of his proportionate interest in the shares. The address for Eos Partners SBIC, L.P. and Mr. Friedman is 320 Park Avenue, Suite 220, New York, New York 10022. |

| (8) | Includes a warrant to purchase 7,018 shares of common stock that is currently exercisable and 397,087 shares of common stock issuable upon exercise of stock options that are currently exercisable. |

| (9) | Includes 200,073 shares of common stock issuable upon exercise of stock options that are currently exercisable. |

| (10) | Includes 116,441 shares of common stock issuable upon exercise of stock options that are currently exercisable. |

| (11) | Includes 110,921 shares of common stock issuable upon exercise of stock options that are currently exercisable. |

| (12) | Includes 95,515 shares of common stock issuable upon exercise of stock options that are currently exercisable. |

| (13) | Includes 2,812 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of March 1, 2004. |

| (14) | Includes 2,812 shares of common stock issuable upon exercise of a stock option that is currently exercisable or exercisable within 60 days of March 1, 2004. |

| (15) | Consists of 2,812 shares of common stock issuable upon exercise of a stock option that is currently exercisable or exercisable within 60 days of March 1, 2004. |

| (16) | Consists of 1,875 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of March 1, 2004. |

| (17) | Includes a warrant to purchase 7,018 shares of common stock that is currently exercisable and 1,213,031 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of March 1, 2004. |

14

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes information as of December 31, 2003 about our equity compensation plans, including our 1997 Stock Option Plan, 2002 Stock Option Plan, 2003 Equity Incentive Plan and 2003 Employee Stock Purchase Plan.

| | | | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)

| |

| | | (a) | | (b) | | (c) | |

Equity compensation plans approved by security holders | | 1,709,322 | | $ | 3.32 | | 1,399,218 | (1) |

Equity compensation plans not approved by security holders | | — | | | — | | — | |

| | |

| |

|

| |

|

|

Totals | | 1,709,322 | | $ | 3.32 | | 1,399,218 | |

| | |

| |

|

| |

|

|

| (1) | Consists of shares available for future issuance under our 2003 Equity Incentive Plan and 2003 Employee Stock Purchase Plan. As of December 31, 2003, an aggregate of 917,545 shares of common stock were available for issuance under the 2003 Equity Incentive Plan and 481,673 shares of common stock were available for issuance under the 2003 Employee Stock Purchase Plan. The 2003 Equity Incentive Plan contains a provision for an automatic increase in the number of shares available for grant each January until and including January 1, 2013, subject to certain limitations, by a number of shares equal to the least of: 1) four percent of the number of shares issued and outstanding on the immediately preceding December 31, 2) 1,500,000 shares, or 3) a number of shares set by the Board of Directors. The 2003 Employee Stock Purchase Plan contains a provision for an automatic increase in the number of shares available for grant each January until and including January 1, 2013, subject to certain limitations, by a number of shares equal to the least of: 1) 500,000 shares, 2) one percent of the number of shares of all classes of common stock of the Company outstanding on that date, or 3) a lesser amount determined by the Board of Directors. |

15

EXECUTIVE COMPENSATION

The following table sets forth all compensation earned during the years ended December 31, 2002 and 2003 by our Chief Executive Officer and our four other most highly compensated executives whose total compensation exceeded $100,000 in the year ended December 31, 2003. These five officers are referred to as the named executive officers in this proxy statement. The compensation described in this table does not include medical, group life insurance, or other benefits which are available generally to all of our salaried employees.

Summary Compensation Table

| | | | | | | | | | | | | | | |

| | | Year

| | Annual Compensation

| | | Long-Term

Compensation

| | | All Other

Compensation

($)

| |

Name and Principal Position(s)

| | | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($) (1)

| | | Securities

Underlying

Options

| | |

Jon E. Kirchner | | 2003 | | 286,539 | | 160,000 | | — | | | — | | | 6,102 | (2) |

President and Chief Executive Officer | | 2002 | | 236,538 | | 115,000 | | 13,054 | (3) | | 465,000 | (4) | | 5,602 | (2) |

| | | | | | |

Melvin L. Flanigan | | 2003 | | 203,461 | | 80,000 | | — | | | — | | | 5,371 | (2) |

Executive Vice President, Finance and Chief Financial Officer | | 2002 | | 180,769 | | 60,000 | | — | | | 115,500 | (5) | | 5,602 | (2) |

| | | | | | |

Blake A. Welcher | | 2003 | | 183,462 | | 80,000 | | — | | | — | | | 4,671 | (2) |

Executive Vice President, Legal and General Counsel | | 2002 | | 156,923 | | 45,000 | | — | | | 87,500 | (6) | | 5,352 | (2) |

| | | | | | |

Daniel E. Slusser | | 2003 | | 112,693 | | 100,000 | | — | | | — | | | 4,356 | (2) |

Chairman of the Board of Directors | | 2002 | | 192,308 | | 100,000 | | — | | | 232,500 | (7) | | 6,102 | (2) |

| | | | | | |

Andrea M. Nee | | 2003 | | 163,616 | | 25,000 | | — | | | — | | | 3,574 | (2) |

Executive Vice President, Operations | | 2002 | | 150,000 | | 10,000 | | — | | | 87,500 | (8) | | 4,872 | (2) |

| (1) | Does not include perquisites paid to any of the listed executives that did not exceed the lesser of $50,000 or 10% of the executives’ annual salary and bonus. |

| (2) | Includes a $102 premium paid by us for a term life insurance policy for the benefit of the officer. There is no cash surrender value under the policy. The remainder, if any, consists of a 401(k) plan matching contribution. |

| (3) | Represents payment made for reimbursement of taxes of $13,054. |

| (4) | Includes options to purchase an aggregate of 110,000 shares of our common stock that were issued on September 30, 2002 in replacement of options to purchase the same number of shares that were cancelled on March 15, 2002. |

| (5) | Includes options to purchase an aggregate of 30,000 shares of our common stock that were issued on September 30, 2002 in replacement of options to purchase the same number of shares that were cancelled on March 15, 2002. |

| (6) | Includes options to purchase an aggregate of 12,500 shares of our common stock that were issued on September 30, 2002 in replacement of options to purchase the same number of shares that were cancelled on March 15, 2002. |

| (7) | Includes options to purchase an aggregate of 162,500 shares of our common stock that were issued on September 30, 2002 in replacement of options to purchase the same number of shares that were cancelled on March 15, 2002. |

| (8) | Includes options to purchase an aggregate of 87,500 shares of our common stock that were issued on September 30, 2002 in replacement of options to purchase the same number of shares that were cancelled on March 15, 2002. |

16

AGGREGATED OPTION EXERCISES IN 2003 AND FISCAL YEAR-END OPTION VALUES

The following table shows information concerning options to purchase shares of our common stock that were exercised by the named executive officers during fiscal year 2003 and the number and value of unexercised in-the-money options held by each of the named executive officers at December 31, 2003. The fiscal year-end value of unexercised in-the-money options listed below has been calculated on the basis of the closing sale price of our common stock as of December 31, 2003, less the applicable exercise price per share, multiplied by the number of shares underlying such options. The closing price of our common stock on December 31, 2003 was $24.69 per share. An option is in-the-money if the fair market value of the underlying shares exceeds the exercise price of the option.

| | | | | | | | | | | | |

| | | Shares

Acquired on

Exercise

| | Value

Realized ($)

| | Number of Securities

Underlying Unexercised

Options at

December 31, 2003

| | Value of Unexercised In-

The-Money Options at

December 31, 2003

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable ($)

| | Unexercisable ($)

|

Jon E. Kirchner | | 117,913 | | 2,764,176 | | 347,087 | | — | | 8,215,549 | | — |

Melvin L. Flanigan | | 29,059 | | 681,216 | | 86,411 | | — | | 2,046,058 | | — |

Blake A. Welcher | | 21,985 | | 515,383 | | 65,515 | | — | | 1,550,740 | | — |

Daniel E. Slusser | | 52,227 | | 1,224,331 | | 200,073 | | — | | 4,735,728 | | — |

Andrea M. Nee | | 6,579 | | 154,228 | | 110,921 | | — | | 2,625,500 | | — |

Employment and Change of Control Arrangements

We entered into an employment agreement with Jon E. Kirchner to serve as our President and Chief Executive Officer and a member of our Board of Directors. This agreement provides for a term of 18 months, which automatically renews on a daily basis until terminated in accordance with its provisions. Under this agreement, if Mr. Kirchner’s employment is terminated without cause, or is constructively terminated, we are required to pay his salary for a period of 18 months and all of his options will immediately vest in full. Mr. Kirchner’s current annual salary is $325,000. In addition, in the event of a change of control or sale of our company, all of Mr. Kirchner’s stock options will immediately vest in full. A constructive termination includes Mr. Kirchner’s removal from his position as President and Chief Executive Officer and a member of our Board of Directors or any material change by us in his functions, duties, or responsibilities, without his consent or other than for cause; a material non-voluntary reduction in his base salary and eligibility for bonus amounts; or a change of control or sale of our company.

We entered into an employment agreement with Melvin L. Flanigan to serve as Executive Vice President, Finance and Chief Financial Officer. This agreement provides for a term of 12 months, which automatically renews on a daily basis until terminated in accordance with its provisions. Under the agreement, if Mr. Flanigan’s employment is terminated without cause, or is constructively terminated, we are required to pay his salary and continue his benefits for a period of 12 months following the termination. Mr. Flanigan’s current annual salary is $215,000. In addition, in such event, all of his stock options will immediately vest in full. A constructive termination includes: Mr. Flanigan’s removal from his position as Vice President and Chief Financial Officer or any material change by us in his functions, duties, or responsibilities, without his consent; or a material non-voluntary reduction in his base salary and eligibility for bonus amounts. Under the terms of Mr. Flanigan’s option grants, in the event of a change of control or sale of our company, options to purchase 64,125 shares of our common stock will immediately vest in full.

We entered into an employment agreement with Blake A. Welcher to serve as Executive Vice President, Legal and General Counsel. This agreement provides for a term of 12 months, which automatically renews on a daily basis until terminated in accordance with its provisions. Under the agreement, if Mr. Welcher’s employment is terminated without cause, or is constructively terminated, we are required to pay his salary and continue his benefits for a period of 12 months following the termination. In addition, in such event, all of his

17

stock options shall immediately vest in full. A constructive termination includes Mr. Welcher’s removal from his position as Vice President and General Counsel or any material change by us in his functions, duties or responsibilities, without his consent, or a material non-voluntary reduction in his base salary and eligibility for bonus amounts. Under the terms of Mr. Welcher’s option grants, in the event of a change of control or sale of our company, options to purchase 56,250 shares of our common stock will immediately vest in full.

We entered into an employment agreement with Daniel E. Slusser to serve as the Chairman of our Board of Directors. This agreement provides for a term that expired in January 2004, however the parties are in the process of extending this agreement to expire in January 2005. Under the agreement that expired in January 2004, if Mr. Slusser’s employment was terminated without cause, or was constructively terminated, we were required to pay a lump-sum severance to him, with his benefits continuing through the end of the term of the agreement, and all of his stock options would have immediately vested in full. In addition, in the event of a change of control or sale of our company, all of Mr. Slusser stock options will immediately vest in full. A constructive termination includes: Mr. Slusser’s removal from his position as Chairman of our Board of Directors or any material change by us in his functions, duties, or responsibilities, without his consent or other than for cause; a material non-voluntary reduction in his base salary and eligibility for bonus amounts; or a change of control or sale of our company.

We entered into an employment agreement with Andrea M. Nee to serve as Executive Vice President, Operations. This agreement provides for a term of 12 months, which automatically renews on a daily basis until terminated in accordance with its provisions. Under the agreement, if Mrs. Nee’s employment is terminated without cause, or is constructively terminated, we are required to pay her salary and continue her benefits for a period of 12 months following the termination. In addition, in such event, all of her stock options shall immediately vest in full. A constructive termination includes Mrs. Nee’s removal from her position as Executive Vice President, Operations or any material change by us in her functions, duties or responsibilities, without her consent, or a material non-voluntary reduction in her base salary and eligibility for bonus amounts.

The compensation committee, as plan administrator of our 2003 Equity Incentive Plan (“2003 Plan”), has the authority to grant options, stock appreciation rights (“SARs”), and stock awards and to structure repurchase rights under that plan so that the shares subject to those options, SARs, and stock awards will immediately vest, or the repurchase rights will terminate, in the event that they are not assumed or substituted in connection with a change in control, whether by merger, asset sale, successful tender offer for more than 50% of our outstanding voting stock, or by a change in the majority of the board by reason of one or more contested elections for board membership. Vesting or the termination of repurchase rights will occur either at the time of the change in control or, if the options, SARs, or stock awards are assumed or substituted, then vesting or the termination of repurchase rights may occur upon the subsequent involuntary termination of the individual’s service within a designated period not to exceed 18 months following the change in control.

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Proxy Statement or future filings made by the Company under those statues, the Compensation Committee Report, the Audit Committee Report, Audit Committee Charter, reference to the independence of the Audit Committee members and Stock Performance Graph are not deemed filed with the Securities and Exchange Commission and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by the Company under those statutes.

18

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Compensation Committee Interlocks and Insider Participation

The members of the compensation committee are Joerg Agin, Steven Friedman and James McElwee. None of these individuals has at any time been an officer or employee of ours or any of our subsidiaries. In addition, prior to our initial public offering in 2003, Dan Slusser served on the compensation committee. Mr. Slusser is Chairman of the Board and served as Chief Executive Officer and Vice Chairman of the Board from April 1997 to September 2001. There are no interlocking relationships between any our executive officers and compensation committee, on the one hand, and the executive officers and compensation committee of any other companies, on the other hand, nor has any such interlocking relationships existed in the past.

Relationship with Universal City Studios LLLP

During 2003, we sold equipment and provided services to Universal City Studios for approximately $615,000. Universal City Studios LLLP owns in excess of 5% of our common stock. The consideration paid by Universal City Studios for technology and trademarks licensed, equipment sold, and services rendered by us is comparable to amounts that would be paid in an arms-length transaction. We expect to continue to sell equipment and provide services to Universal City Studios in the normal course of our business.

19

STOCK PERFORMANCE GRAPH

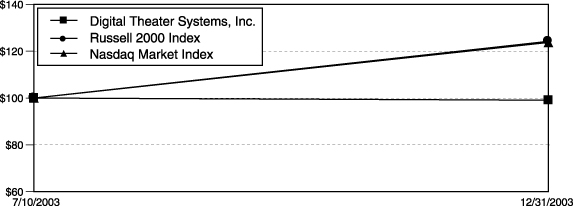

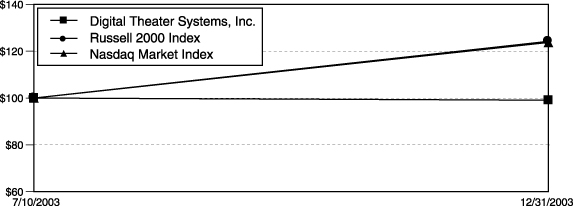

The following graph compares the cumulative total stockholder return on our common stock to that of the Nasdaq Market Index and the Russell 2000® Index from July 10, 2003 (the date our common stock began to trade publicly) through December 31, 2003, the date of our fiscal year end. The graph assumes that a $100 investment was made at the close of trading on July 10, 2003 in our common stock and in each index, and that dividends, if any, were reinvested. The stock price performance shown on the graph below should not be considered indicative of future price performance.

| | | | | | |

| | | July 10, 2003

| | December 31, 2003

|

Digital Theater Systems, Inc. | | $ | 100.00 | | $ | 99.08 |

Russell 2000 Index | | $ | 100.00 | | $ | 124.21 |

Nasdaq Market Index | | $ | 100.00 | | $ | 123.75 |

20

REPORT OF THE AUDIT COMMITTEE

We have reviewed Digital Theater Systems’ audited financial statements as of and for the fiscal year ended December 31, 2003, and met with both management and PricewaterhouseCoopers LLP, Digital Theater Systems’ independent auditors, to discuss those financial statements.

Management has primary responsibility for the company’s financial statements and the overall reporting process, including the company’s system of internal controls. Management has represented to us that the financial statements were prepared in accordance with accounting principles generally accepted in the United States.

We discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). We have also received from and discussed with PricewaterhouseCoopers LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). These items relate to that firm’s independence from the company. We have also discussed with the independent auditors the auditors’ independence from Digital Theater Systems and its management.

Based on the review and discussions referred to above in this report, we recommended to the Board of Directors that the audited financial statements be included in Digital Theater Systems’ Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the Securities and Exchange Commission.

Joseph A. Fischer (Chair)

Joerg D. Agin

Steven M. Friedman

21

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

One of the functions of the Compensation Committee of the Board is to develop and periodically review compensation policies and practices applicable to our executive officers, including the criteria upon which executive compensation is determined and the components of compensation. In this capacity, the Committee reviews and approves corporate goals and objectives relevant to the Chief Executive Officer’s (CEO) compensation, evaluates the CEO’s performance in light of these goals and objectives, and fixes the CEO’s compensation based on this evaluation. The Committee also determines the compensation for the other executive officers. The Committee oversees the employment agreements for the CEO and other executive officers and the administration of the Company’s stock option and equity incentive plans. The Committee may seek the advice of independent consultants and counsel in carrying out its responsibilities.

Compensation Philosophy

Our philosophy in setting compensation policies for executive officers is closely aligned with the long-term interest of stockholders and with the Company’s corporate goals and strategies. The Committee sets compensation policies applicable to our executive officers, including the CEO, and evaluates the performance of such officers. The Committee believes that executive compensation should be directly linked to corporate performance and accomplishments that increase stockholder value. To emphasize our philosophy, the Committee adopted the following guidelines as a foundation for decisions that affect the levels of executive compensation:

| | • | provide a competitive total compensation package that enables us to attract, motivate and retain key executive talent; |

| | • | align all pay programs with our annual goals and long-term business strategies and objectives; |

| | • | provide variable compensation opportunities that are directly linked to the performance of the officers and their impact on improving stockholder value; and |

| | • | provide significant performance-based criteria related to long-term stockholder value balancing superior performance and risk. |

Components of Executive Compensation

The Committee focuses primarily on the following three components in forming the total compensation package for our executive officers: base salary, annual incentive bonus, and long-term incentives. The Committee believes that cash compensation in the form of salary and bonus provides our executives with short-term rewards for operational success, and that long-term compensation through the award of stock options aligns the objectives of management with those of our stockholders with respect to long-term performance and success.

Base Salary and Variable Compensation

The Committee intends to compensate our executive officers, including the CEO, competitively within our industry and with respect to other companies with whom we compete for executive talent. In determining compensation levels for executive officers, the Committee formally and informally gathers relevant market data on industry compensation, inflation data and survey data from independent sources and the Company’s management. Our goal has been to provide cash compensation to our executive officers around median compensation levels for similar positions in related industries.