UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material under §240.14a-12 |

NeoPhotonics Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of NeoPhotonics Corporation, a Delaware corporation (“NeoPhotonics”) by Lumentum Holdings Inc., a Delaware corporation (“Lumentum”), pursuant to the terms of an Agreement and Plan of Merger, dated November 3, 2021, by and among NeoPhotonics, Lumentum and Neptune Merger Sub, Inc., a Delaware corporation and direct wholly owned subsidiary of Lumentum:

Each item above was first used or made available on November 4, 2021.

Lumentum to Acquire NeoPhotonics Accelerating optical network speed and scalability November 4, 2021 (i)

Cautionary note regarding forward looking statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change. The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional information and where to find it This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com or by contacting NeoPhotonics’ Investor Relations at ir@neophotonics.com. Participants in the solicitation The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

Call Participants Alan Lowe President & Chief Executive Officer, Lumentum Tim Jenks President, Chief Executive Officer & Chairman, NeoPhotonics Wajid Ali Executive Vice President and Chief Financial Officer, Lumentum Chris Coldren Senior Vice President, Strategy and Corporate Development, Lumentum

+

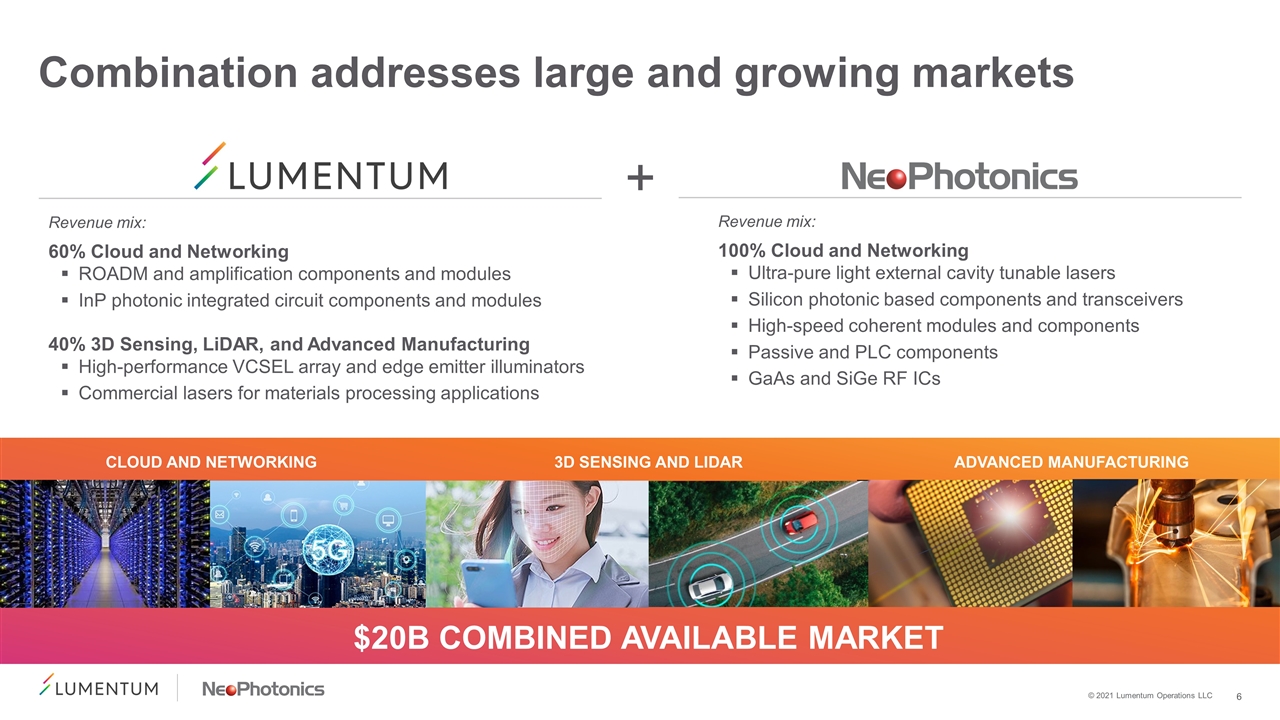

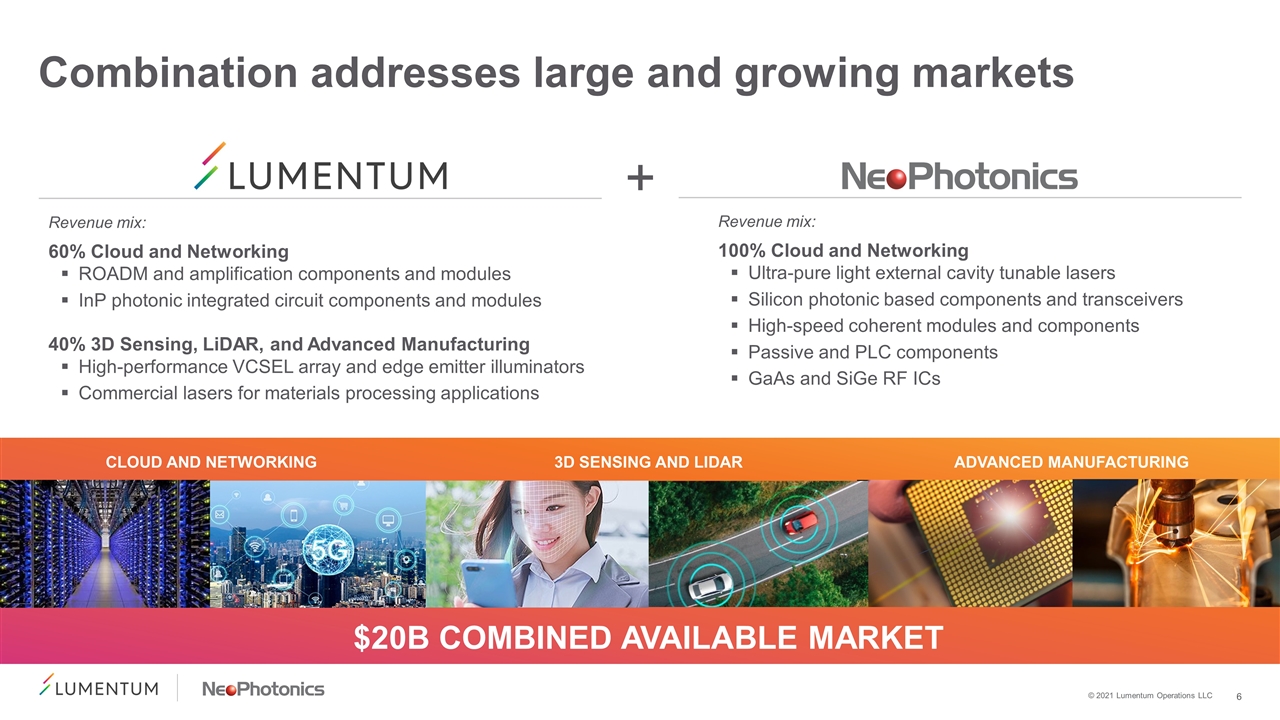

Combination addresses large and growing markets $20B combined available market Cloud and Networking 3D Sensing and LiDAR Advanced Manufacturing Revenue mix: 100% Cloud and Networking Ultra-pure light external cavity tunable lasers Silicon photonic based components and transceivers High-speed coherent modules and components Passive and PLC components GaAs and SiGe RF ICs Revenue mix: 60% Cloud and Networking ROADM and amplification components and modules InP photonic integrated circuit components and modules 40% 3D Sensing, LiDAR, and Advanced Manufacturing High-performance VCSEL array and edge emitter illuminators Commercial lasers for materials processing applications +

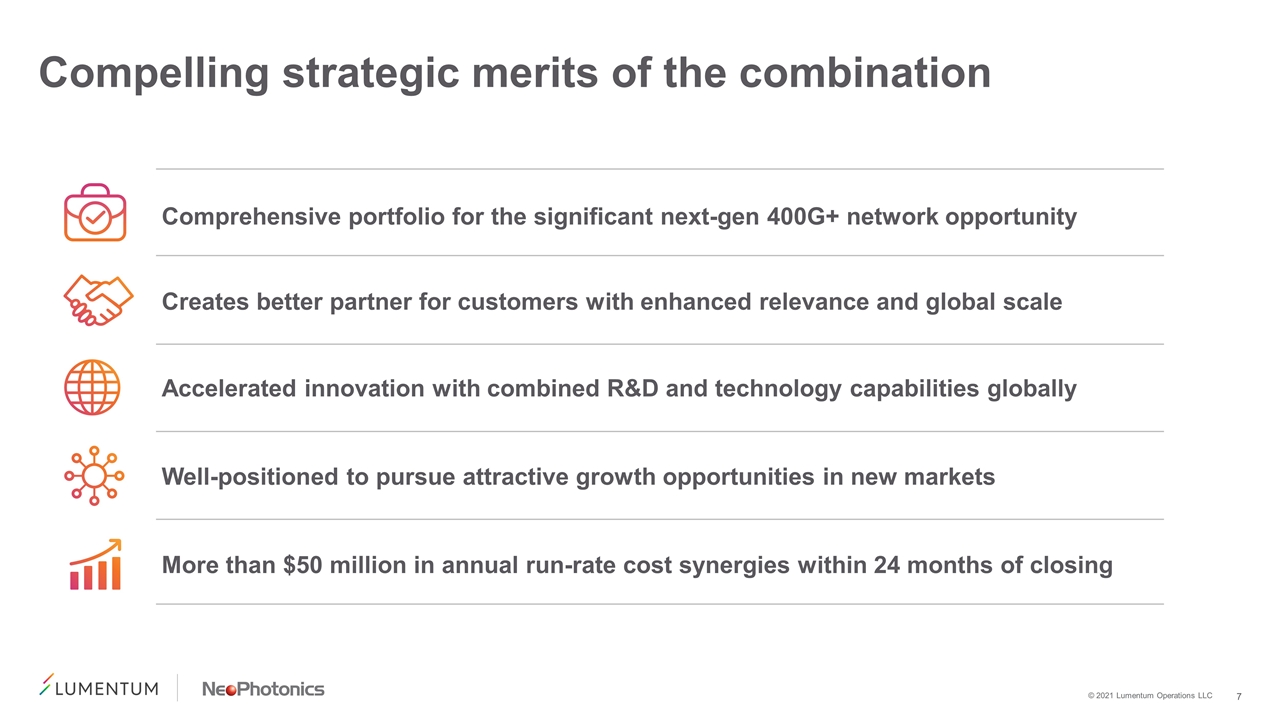

Compelling strategic merits of the combination More than $50 million in annual run-rate cost synergies within 24 months of closing Accelerated innovation with combined R&D and technology capabilities globally Well-positioned to pursue attractive growth opportunities in new markets Comprehensive portfolio for the significant next-gen 400G+ network opportunity Creates better partner for customers with enhanced relevance and global scale

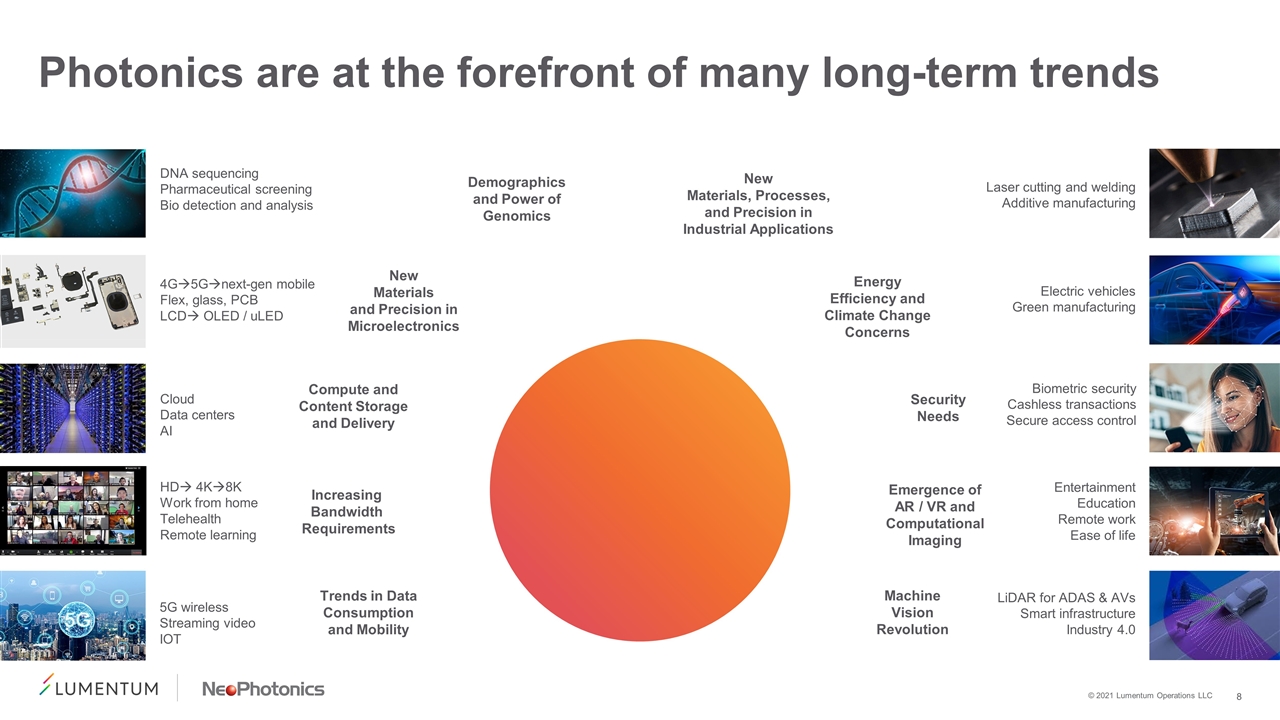

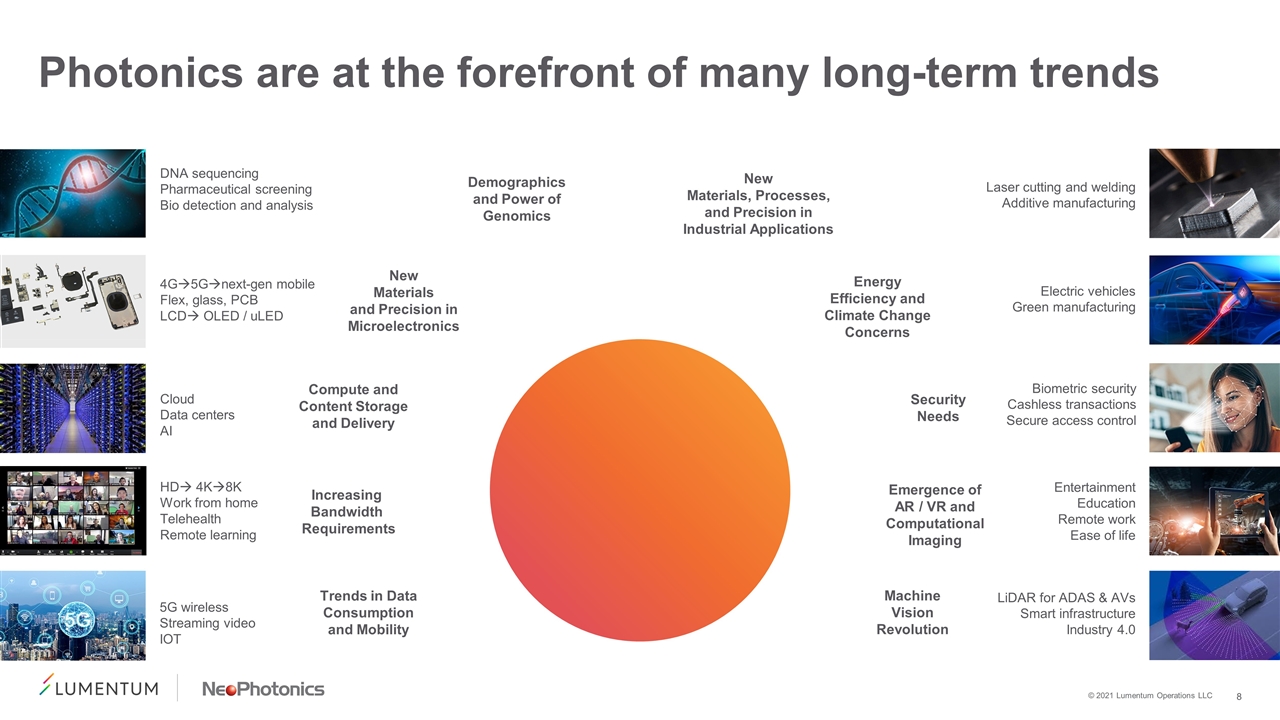

Photonics are at the forefront of many long-term trends New Materials and Precision in Microelectronics Energy Efficiency and Climate Change Concerns Compute and Content Storage and Delivery Increasing Bandwidth Requirements Emergence of AR / VR and Computational Imaging Machine Vision Revolution LiDAR for ADAS & AVs Smart infrastructure Industry 4.0 Entertainment Education Remote work Ease of life Security Needs Cloud Data centers AI Trends in Data Consumption and Mobility 5G wireless Streaming video IOT HDà 4Kà8K Work from home Telehealth Remote learning Electric vehicles Green manufacturing 4Gà5Gànext-gen mobile Flex, glass, PCB LCDà OLED / uLED Biometric security Cashless transactions Secure access control New Materials, Processes, and Precision in Industrial Applications Demographics and Power of Genomics DNA sequencing Pharmaceutical screening Bio detection and analysis Laser cutting and welding Additive manufacturing

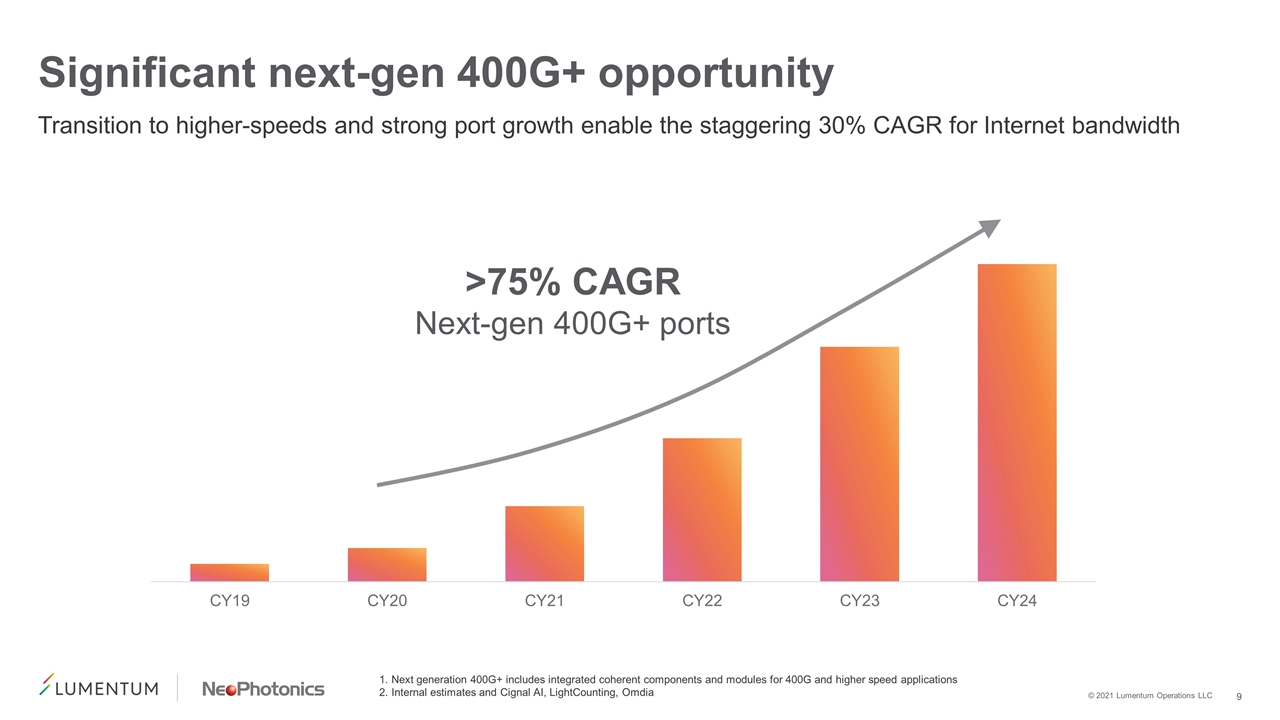

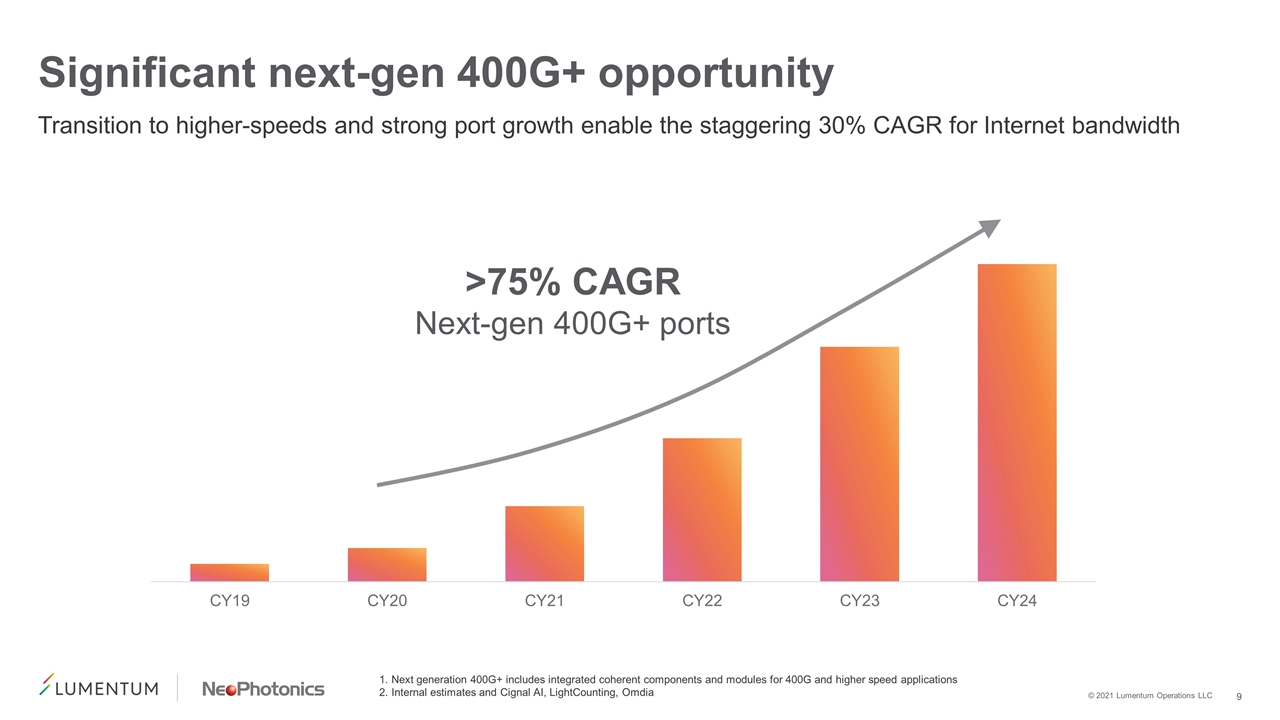

Significant next-gen 400G+ opportunity Transition to higher-speeds and strong port growth enable the staggering 30% CAGR for Internet bandwidth Next generation 400G+ includes integrated coherent components and modules for 400G and higher speed applications Internal estimates and Cignal AI, LightCounting, Omdia >75% CAGR Next-gen 400G+ ports

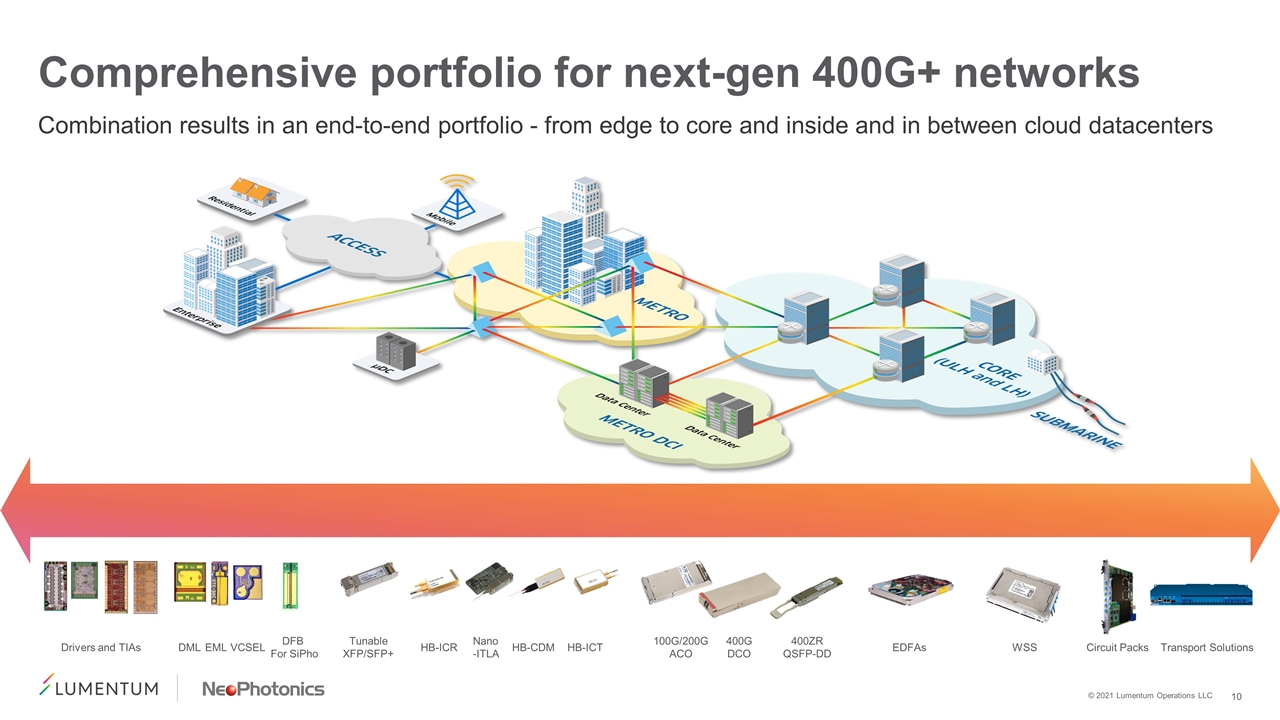

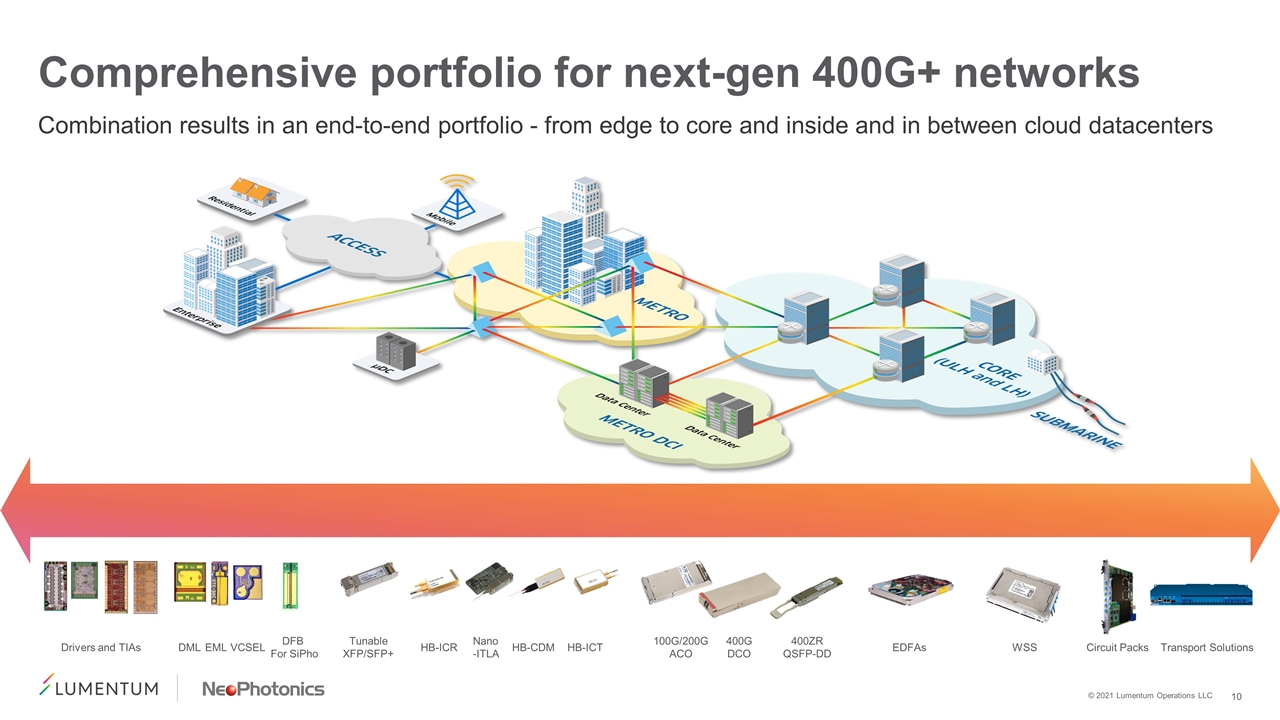

Comprehensive portfolio for next-gen 400G+ networks Combination results in an end-to-end portfolio - from edge to core and inside and in between cloud datacenters EML VCSEL DML 100G/200G ACO 400G DCO Nano-ITLA HB-CDM HB-ICR HB-ICT Tunable XFP/SFP+ Drivers and TIAs EDFAs WSS Circuit Packs Transport Solutions 400ZR QSFP-DD DFB For SiPho

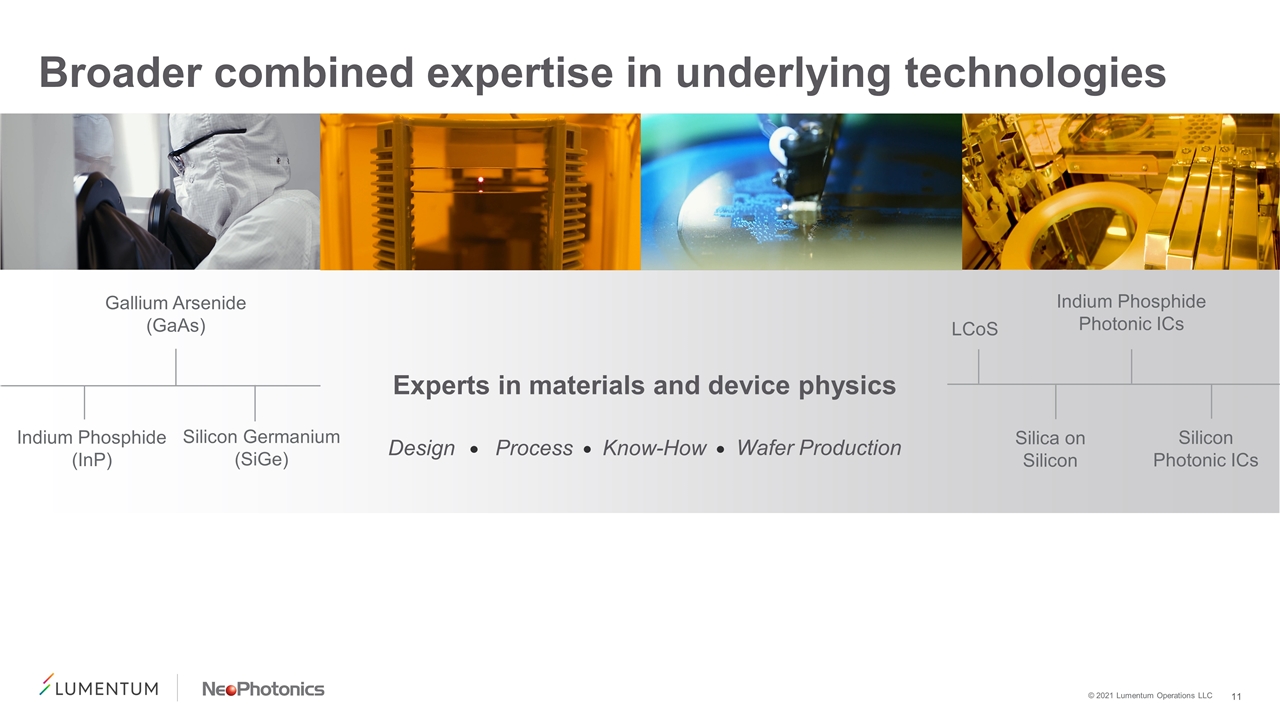

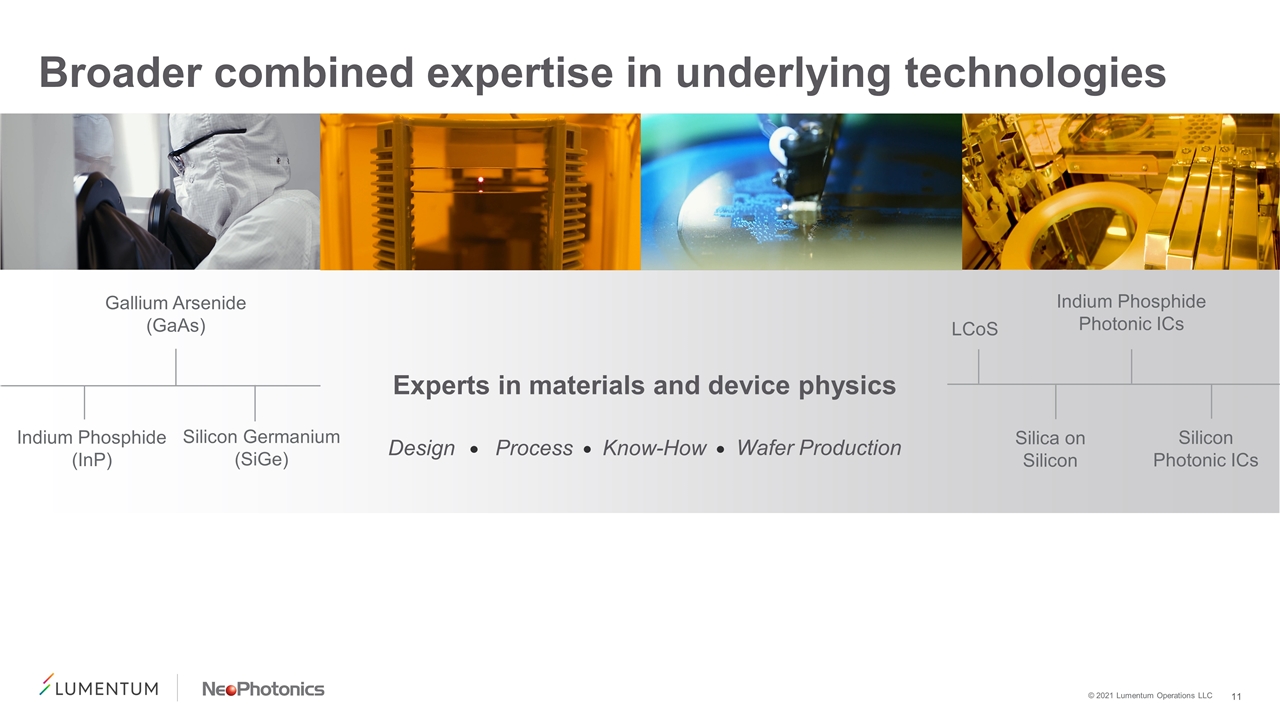

Broader combined expertise in underlying technologies Experts in materials and device physics Indium Phosphide (InP) Gallium Arsenide (GaAs) Indium Phosphide Photonic ICs Silica on Silicon LCoS Design Process Know-How Wafer Production Silicon Germanium (SiGe) Silicon Photonic ICs

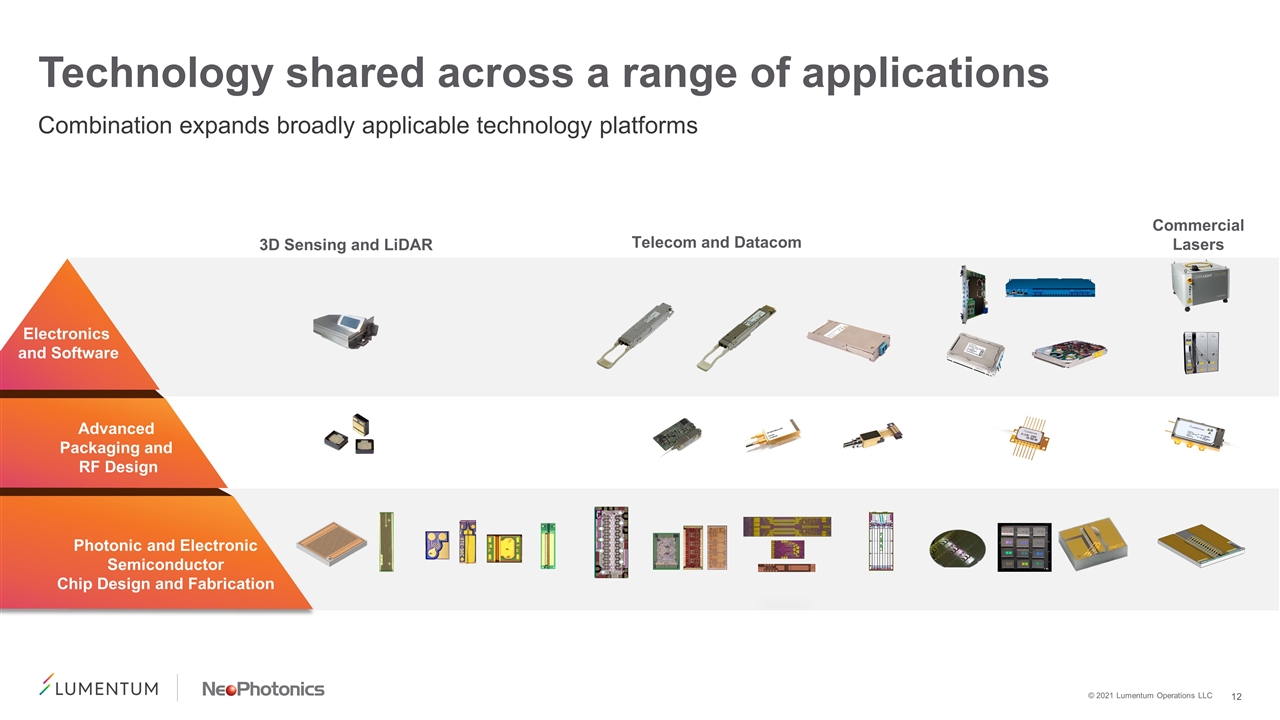

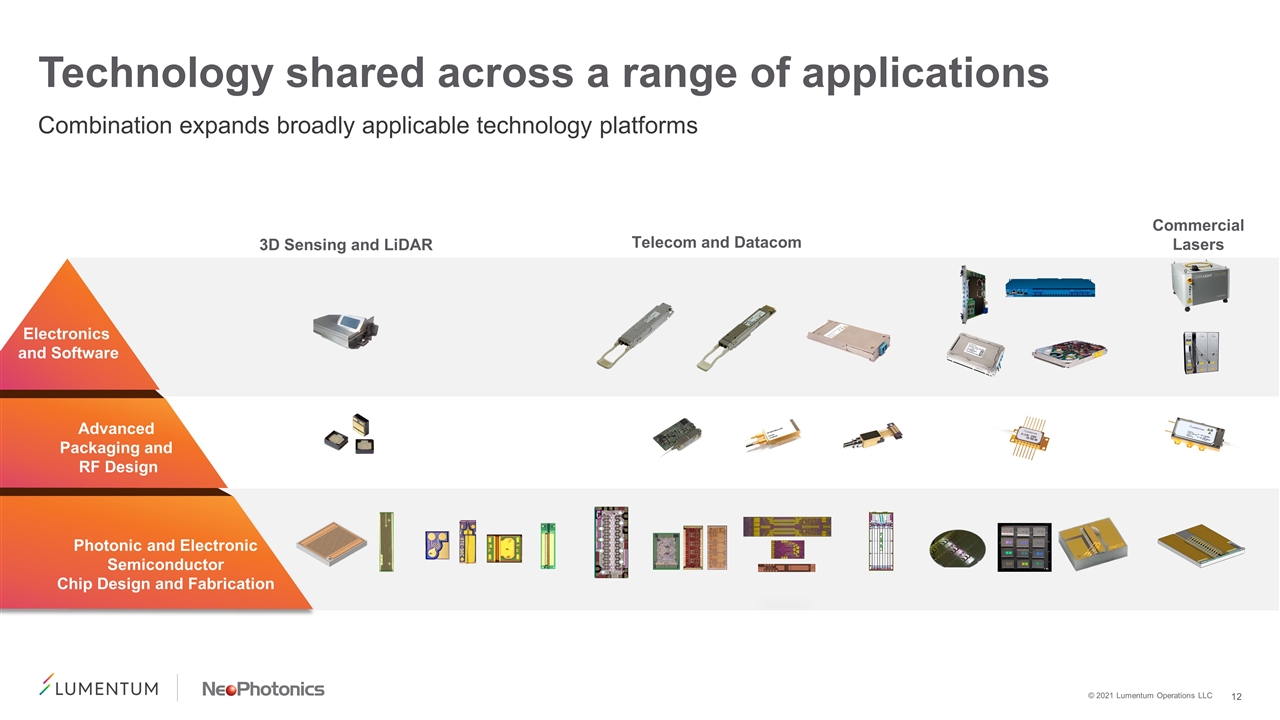

Technology shared across a range of applications Combination expands broadly applicable technology platforms Photonic and Electronic Semiconductor Chip Design and Fabrication Advanced Packaging and RF Design Electronics and Software 3D Sensing and LiDAR Telecom and Datacom Commercial Lasers

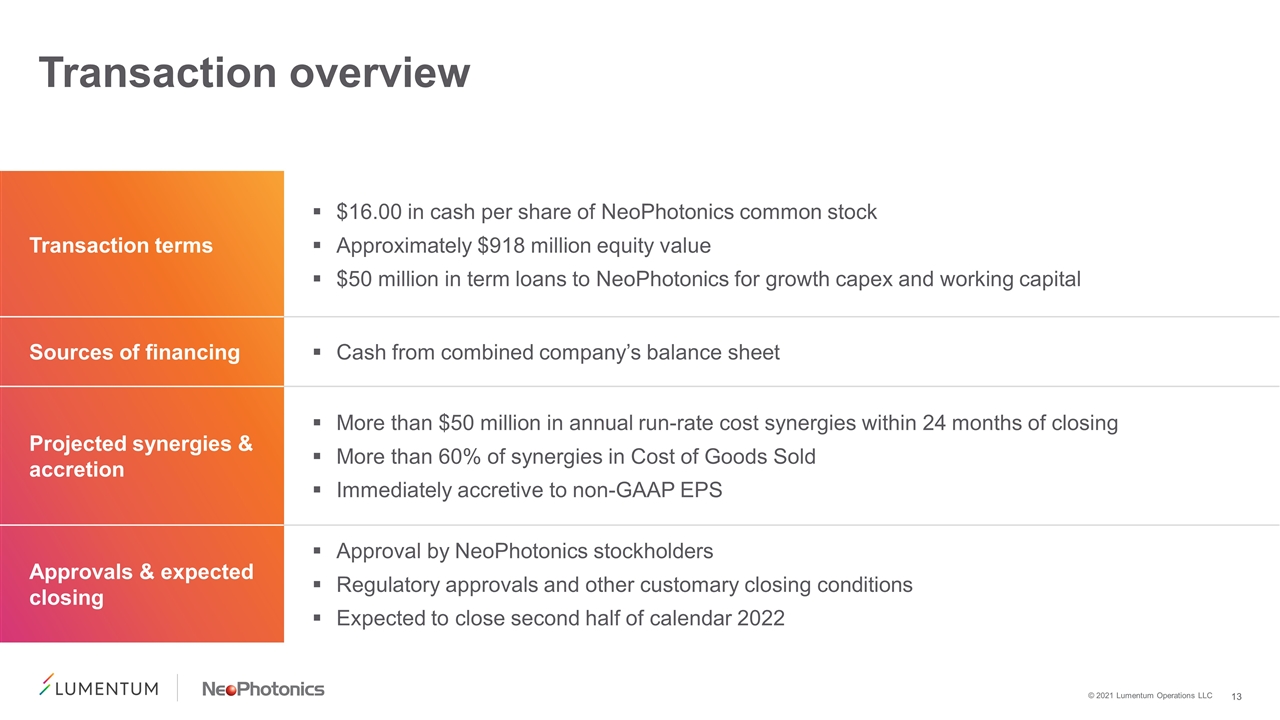

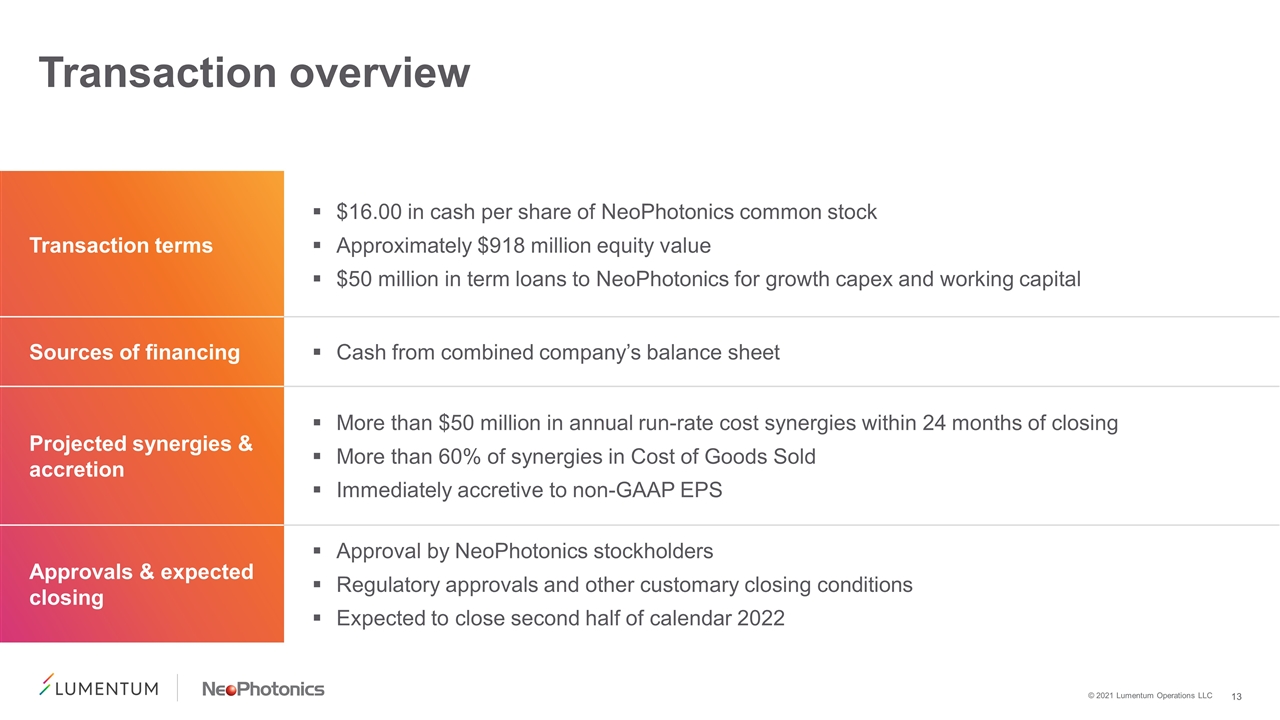

Transaction overview Transaction terms $16.00 in cash per share of NeoPhotonics common stock Approximately $918 million equity value $50 million in term loans to NeoPhotonics for growth capex and working capital Sources of financing Cash from combined company’s balance sheet Projected synergies & accretion More than $50 million in annual run-rate cost synergies within 24 months of closing More than 60% of synergies in Cost of Goods Sold Immediately accretive to non-GAAP EPS Approvals & expected closing Approval by NeoPhotonics stockholders Regulatory approvals and other customary closing conditions Expected to close second half of calendar 2022

Combination creates benefits for stakeholders Customers Best-in-class capabilities with expanded technology and product portfolio Financial strength with intention to invest strongly in innovation and manufacturing capacity Combined global R&D innovation engine focused on accelerating customer roadmaps and fundamental technology innovation Customer-centric culture with track record of operational excellence Employees Strong cultural alignment, with a focus on engineering, innovation, and customer experience Broader market scope, larger global footprint, and increased scale New and exciting opportunities for career growth, including in new roles and in new markets Investors High exposure to long-term growth trends Best-in-class financial model with strong operating leverage Solid balance sheet and strong cash flows Financial flexibility to continue to invest in growth initiatives and expanding addressable markets

Thank you

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

(ii)

From: Tim Jenks

Sent: Thursday, November 4, 2021 4:51 AM

Subject: An Announcement on the Future of NeoPhotonics | Q3 FY 2021 Results

NeoPhotonics Colleagues -

Today we announced that we have reached an agreement to be acquired by Lumentum for $16 per share in cash, valuing the company at approximately $918 million. This is an exciting milestone in NeoPhotonics’ history and one that will help us to advance our products and technology to their full potential, enabling us to better serve our customers in today’s fast-growing market for high-speed optical components and modules for cloud and telecom optical network infrastructure. The press release we issued can be found on our investor relations website at https://ir.neophotonics.com/.

This is an important development for our company, for you and for all of our colleagues. We have reached this milestone because of your dedication, your technical and operating skills, and the many contributions you make every day. Now we are counting on your continuing efforts to maximize the value of what we have already created. Today’s announcement is just the first step in the process, and we anticipate that the transaction will close in the second half of 2022.

Many of you already know Lumentum as a leader and innovator in our industry. Lumentum’s optical networking product and technology portfolio are highly complementary to ours, including ROADMS, optical amplifiers, and pump lasers. Lumentum has leadership positions in the industrial and consumer markets which are complementary to our focused Cloud and Telecom markets.

With the pace of innovation of our industry, driven by the Cloud and moving faster than ever, Lumentum is an ideal partner to extend our reach and help us serve our customers on a larger scale, especially as we witness continuously rising global demand for our ultra-pure light tunable lasers, plus components and modules for speed over distance applications, including 400ZR. By combining Lumentum and NeoPhotonics’ complementary product portfolios and R&D capabilities, we will be best positioned to accelerate our innovation efforts and capture attractive growth opportunities that will benefit our employees and all NeoPhotonics stakeholders.

Q3 Fiscal Year 2021 Results

In addition to today’s transaction announcement, we also reported our third quarter fiscal year 2021 results, which can be found on our investor relations website at https://ir.neophotonics.com. We reported revenue of $83.7 million for the quarter. This was up 29% sequentially, and I am proud to say that we fulfilled our pledge, made a year ago after the Department of Commerce actions, such that we successfully returned to non-GAAP profitability in this third quarter of 2021.

Moving Forward

As we move forward, please keep in mind that today is just the first step. Until the expected close next year, Lumentum and NeoPhotonics remain separate and independent companies. In short, it is business as usual.

We have been successful as a technology innovator for the last 25 years. Now I am counting on you and each of our colleagues to stay focused on your day-to-day responsibilities and in providing the same level of dedication to our innovation, our business growth and our service to customers as we have thus far. As we move forward, there are many details to be worked through regarding how we will bring our two companies together. I expect to update you regularly along the way.

We will be sharing more details around the combination and our recent quarterly results during Town Hall meetings to be held at 3:30 pm Pacific Time (Thursday) for North America and Europe, 9:30 am Japan Time (Friday) for Japan and 9:30 am China Time (Friday) for China. We encourage all of you to attend your local session via Teams.

To address questions about this transaction, please refer to the attached FAQ / an FAQ

Our announcement today may generate increased interest on our company from the media and other external parties. Per our company policy, should you receive any media or external inquiries, please direct them to:

| • | | Tim Jenks at tim.jenks@neophotonics.com, Beth Eby at beth.eby@neophotonics.com or Ferris Lipscomb at ferris.lipscomb@neophotonics.com in North America or EMEA |

| • | | Takeshi Nakamura at takeshi.nakamura@neophotonics.com in Japan |

| • | | Raymond Cheung at raymond.cheung@neophotonics.com in China |

I want to thank each of you for your hard work and continued commitment to our company and the customers we serve, as well as to the suppliers and service providers with whom we do business. The chapter ahead can be exciting and potentially rewarding. And it will continue to be my privilege to lead the NeoPhotonics team as we begin this next chapter.

With sincere thanks and best regards,

Tim

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

(iii)

Employee FAQ

| 1. | What are the contents of today’s announcement? |

| | • | | We have reached an agreement to be acquired by Lumentum Holdings. |

| | • | | Lumentum is a leading provider of complementary photonic solutions for optical networking and lasers for the industrial and consumer markets, and this transaction will broaden the available product and technology portfolio we are able to offer to our customers. |

| | • | | Combining with Lumentum will place us in position to better serve the needs of our customers by enhancing our product offerings while creating even stronger relationships with our suppliers. |

| | • | | The combined company will be several times larger than NeoPhotonics alone, with a broad range of product, technology and business growth opportunities. |

| | • | | This announcement is an agreement. The transaction will require regulatory approval in the United States and China before the transaction can close. It is expected that regulatory approval will take several quarters to obtain. |

| | • | | During this time period until the transaction closes with Lumentum, NeoPhotonics remains an independent company and will operate independently. |

| 2. | Why is Lumentum acquiring NeoPhotonics? |

| | • | | Lumentum’s optical components and subsystems are part of virtually every type of telecom, enterprise, and data center network, and they also offer lasers that enable advanced manufacturing techniques and other diverse applications. |

| | • | | NeoPhotonics brings our leading portfolio of complementary high-speed coherent solutions for optical communications, including our industry leading external cavity ultra-pure light tunable lasers, high baud rate coherent receivers and modulators, silicon photonics, complete 400ZR module solutions, lasers and optical ICs, plus passives and switches. |

| | • | | Combining with Lumentum will place us in position to better serve our customers with an expanded technology and product portfolio.. |

| 3. | What does this mean for my job? Should I expect any changes to my compensation or title? |

| | • | | The continuity of our business for all of our stakeholders, including our employees, is absolutely crucial. Until the close of the transaction, we will continue to run our business independently and execute our growth path going forward. |

| | • | | It will be business as usual and we will continue ramping our growth products while the transaction approval process moves toward completion. |

| | • | | As such, we will all continue in our respective roles as we do today. |

| | • | | Lumentum tells us that they have a large number of open roles – people matter. |

| | • | | As NeoPhotonics will continue to operate independently, we will not transition into Lychee or take new roles. Such actions would not occur until the transaction closes. |

| 4. | What does it mean to “operate independently”? |

| | • | | It is essential that NeoPhotonics continue to operate separately and independently as it did before agreeing to the transaction. This is a legal and regulatory requirement. |

| | • | | You should not share competitively sensitive information with Lumentum unless you are part of the ongoing diligence or integration planning. |

| | • | | Until the transaction closes, we cannot do any of the following with Lumentum: |

| | • | | Agree on prices or other terms for customers |

| | • | | Allocate customers or refer customers to Lumentum |

| | • | | Make joint sales calls, joint proposals or jointly negotiate terms |

| | • | | Have NeoPhotonics undertake new projects for Lumentum, or discontinue or change planned projects or R&D at the direction of Lumentum |

| | • | | Work on projects for Lumentum or allow Lumentum employees work on projects for us |

| | • | | Implement any post-acquisition plans |

| | • | | If there are circumstances that require you to communicate with Lumentum about topics that you would not have prior to the acquisition, please work with your supervisor, Ferris, or anyone on the Legal team to ensure compliance. |

| 5. | When or what changes will take place with regards to benefit and stock plans: |

| | • | | NeoPhotonics will continue to operate independently until the close. Therefore, NeoPhotonics benefits plan will continue in each geography. |

| | • | | As we continue to operate independently, the NeoPhotonics pay and bonus programs and practices continue. |

| | • | | For programs including RSUs, and SARs, we will publish separate notices on each of these as details are worked out. However, these programs are continuing without change through the close of the acquisition. |

| | • | | Similarly, treatment of NeoPhotonics stock in the transaction will be a topic of separate notices as these details are worked out. |

| | • | | For our ESPP program, if you are currently participating in the ESPP program, your participation will continue as before through the end of the current purchase period which ends November 15, 2021. You will not be able to make any changes to your ESPP elections. After the November 15, 2021 purchase period, there will not be any further purchase periods and your participation will automatically end. |

| 6. | When will this take place? |

| | • | | We anticipate that this transaction will close in the second half of 2022 as regulatory approvals can take an extensive period of time. Until the transaction is closed, NeoPhotonics remains an independent company. |

| 7. | What has to be done before the transaction closes? |

| | • | | The transaction is subject to receipt of antitrust regulatory approval in the US and China, as well as other customary closing conditions, including the approval of NeoPhotonics shareholders. |

| 8. | What other changes should I expect? |

| | • | | While we have reached this agreement, it will not close for several quarters and there are still many factors that we are not yet in a position to address. We are committed to being transparent as more details are developed and we will maintain an open line of communication with our team. |

| 9. | Is Tim staying onboard? |

| | • | | Tim will continue to lead the company as CEO and the exec staff will continue in their current roles as we continue to operate with business as usual. |

| | • | | Continuity of our business for all of our stakeholders, including our employees, is absolutely crucial. |

| | • | | We will plan integration in the months and quarters ahead. Our business is highly complementary to theirs. |

| 10. | Will our office locations change? |

| | • | | NeoPhotonics and Lumentum have complementary locations in the US, Canada, Japan and China. |

| | • | | In the months ahead plans will be made on locations and will be the subject of future notices and plans are made. |

| 11. | When will I find out more information? |

| | • | | Tim will hold town hall meetings on November 4 (US/Can) / November 5 (JP/China). |

| | • | | Additionally, if you have any immediate questions, please reach out to your manager or to HR. |

| 12. | What should I tell our customers? |

| | • | | We are notifying external parties with whom we do business and will be in communication with them as this process progresses. |

| | • | | If you are customer- or supplier-facing, you will be receiving a set of helpful talking points to utilize when speaking with your contacts. |

| | • | | If you need such input, please contact Ferris Lipscomb. |

| | • | | Tim and Lumentum’s CEO will be talking with top customers, as will Brad Wright and our sales managers. If you need input, please contact Brad Wright. |

| | • | | Outside of this coordinated communication, do not coordinate with Lumentum on sales (or any other) activities. Please contact anyone on the legal team if you have any questions about what activities are allowed. |

| 13. | What should I tell our service providers? |

| | • | | We are notifying external parties with whom we do business and will be in communication with them as this process progresses. |

| | • | | If you are in regular communications with service providers, you will be in receipt of a set of helpful talking points to utilize when speaking with your contacts. |

| | • | | If you need such input, please contact Ferris Lipscomb or your site executive. |

| 14. | What should we tell our suppliers? |

| | • | | We are notifying external parties with whom we do business and will be in communication with them as this process progresses. |

| | • | | If you interface with our suppliers, you will be in receipt of talking points to utilize when speaking with your contacts. |

| | • | | If you need such input, please contact Ferris Lipscomb or your site executive.. |

| 15. | What kind of information can be shared with Lumentum employees? |

| | • | | Do not contact your counterpart at Lumentum or begin cooperation on any aspect of the business with Lumentum. If there are any questions on this point or if someone from Lumentum reaches out to you, please contact Barbara Rogan in USA or Luqian Hu in China immediately. |

| | • | | The two companies will continue to operate independently for the next several quarters. Until the acquisition is completed, our relationship with Lumentum doesn’t change. |

| | • | | As is always the case, you may not share any confidential information. As the announcement and press release are public information, you may discuss this public information. However, you may not discuss any specifics about our business, operations or financial performance. |

| | • | | Until the transaction is completed, we will continue to operate as separate companies, and you should maintain the confidentiality of all NeoPhotonics’ proprietary information. In particular, Non-disclosure Agreements between NeoPhotonics and other companies remain in force and protect such confidential information. These may not be shared with Lumentum employees. |

| 16. | What do I do if the press, analysts or external lawyers contact me? |

| | • | | Please do not discuss anything with any of these constituents. Refer them to the appropriate contacts below. Please do not comment about the transaction on social media. |

| | • | | Until the close of the acquisition, contact: Tim Jenks, Beth Eby, Ferris Lipscomb, Barbara Rogan, Raymond Cheung or Takeshi Nakamura. |

| 17. | Whom should I contact for investor related questions? |

| | • | | Until the close, contact: Tim Jenks, Beth Eby or Ferris Lipscomb. |

| | • | | In China, questions should be referred to Raymond Cheung . |

| | • | | In Japan, questions should be referred to Takeshi Nakamura. |

| 18. | Have any changes been made to the stock trading window? Can I buy or sell Lumentum or NeoPhotonics stock at the present time? |

| | • | | Our trading window is currently closed. We will announce when the next trading window will open – we are targeting late November. |

| | • | | Until the transaction is complete, trading NeoPhotonics stock you own will continue to be subject to the NeoPhotonics insider trading policy. If you are currently designated as an “insider” you will continue to be subject to the additional legal requirements of the NeoPhotonics insider trading policy. |

| | • | | Note that while waiting for the transaction to close, the stock price usually reflects both the transaction price and the probability of the deal closing. |

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

(iv)

From: Tim Jenks

To: Valued Customer

Subject: An Announcement about the Future of NeoPhotonics

Dear Valued Customer,

I have exciting news to share regarding NeoPhotonics. This morning, we announced an agreement to be acquired by Lumentum, a leading provider of complementary photonic solutions for optical networking and lasers for industrial and consumer markets. The press release we issued can be found on our investor relations website at https://ir.neophotonics.com .

This is an important development for our NeoPhotonics and one that will enhance your experience and provide access to a deeper set of optical products and solutions. We’ve long respected Lumentum as a leader and innovator in our industry, and believe they are the ideal partner to help us serve our customers on an even larger scale. Lumentum’s optical components and subsystems are part of virtually every type of telecom, enterprise, and data center network, and they also offer lasers that enable advanced manufacturing techniques and other diverse applications. As a combined company, we are confident in our ability to accelerate innovation as well as meet the growing need for high-speed optical transmission solutions.

Today is just the first step in this process. Until the transaction closes, which we expect to occur in the second half of calendar year 2022, Lumentum and NeoPhotonics will continue to operate as separate and independent companies. During that time you should not expect any changes to our relationship or how you do business with NeoPhotonics.

As always, we greatly appreciate your support and look forward to continuing to grow our relationship with you. We will keep you informed as the acquisition progresses and with the plan for NeoPhotonics to integrate into Lychee. Please don’t hesitate to reach out to NeoPhotonics, to Brad Wright or to me personally with any questions.

Thank you and best regards,

Tim Jenks

CEO

NEOPHOTONICS Corporation

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

(v)

Customer FAQ

| 1. | What are you announcing today? |

| | • | | We have reached an agreement to be acquired by Lumentum Holdings. |

| | • | | Lumentum is a leading provider of complementary photonic solutions for optical networking and lasers for the industrial and consumer markets, and this transaction will strengthen the company’s ability to serve customers and broaden our available product and technology portfolio. |

| | • | | Combining with Lumentum will place us in position serve our customers with a larger portfolio of product offerings and a larger combined global R&D innovation team focusing on innovation. |

| | • | | The transaction will require regulatory approval in the United States and China before the transaction can close. It is expected that regulatory approval will take several quarters to obtain. |

| | • | | During this time period until the transaction closes with Lumentum, NeoPhotonics remains an independent company and will operate independently. |

| 2. | Why is NeoPhotonics being sold to Lumentum? |

| | • | | Lumentum’s optical components and subsystems are part of virtually every type of telecom, enterprise, and data center network, and they also offer lasers that enable advanced manufacturing techniques and other diverse applications. |

| | • | | NeoPhotonics brings our leading portfolio of complementary high-speed coherent solutions for optical communications, including our industry leading external cavity ultra-pure light tunable lasers, high baud rate coherent receivers and modulators, silicon photonics, complete 400ZR module solutions, lasers and optical ICs, plus passives and switches. |

| | • | | Combining with Lumentum will place us in position to better serve our customers with an expanded technology and product portfolio. |

| 3. | What are the details or terms of the sale? |

| | • | | Lumentum will acquire all outstanding NeoPhotonics shares in an all cash transaction at $16.00 per share |

| | • | | While we have reached this agreement, it will not close for several quarters while various approvals are pending. |

| | • | | The companies will continue to operate independently until such time as the transaction closes. |

| 4. | When will the sale become effective? |

| | • | | We anticipate that this transaction will close in the second half of 2022. Until the transaction is closed, NeoPhotonics remains an independent company. |

| 5. | What are the increased capabilities deriving from this sale? |

| | • | | By combining with Lumentum, we will broaden and enhance our product and technology portfolio, positioning us to better serve the needs of our customers. |

| | • | | This combination will provide you with greater access to complementary industry leading high-speed coherent solutions for optical communications. In addition to our external cavity ultra-pure light linewidth tunable lasers, high baud rate coherent receivers and modulators, you we have access to an expanded portfolio of ROADMs, pump lasers, fiber lasers, industrial lasers, VCSEL arrays, Indium Phosphide-based high-speed coherent components, and coherent transceiver modules. |

| 6. | Will there be changes made to NeoPhotonics management? |

| | • | | We are committed to preserving the continuity of our business and to providing you with the same level of service you have come to expect from our company. |

| | • | | Continuity of our business for all of our stakeholders, including our employees, is absolutely crucial. |

| | • | | Tim will continue to lead the company as CEO. He and the executive team will continue to operate with business as usual through the regulatory approval process required for this kind of multi-national transaction. |

| 7. | How will the sale affect my relationship with NeoPhotonics? |

| | • | | You will continue to work directly with the same NeoPhotonics team and receive the level of service you have grown accustomed to. |

| | • | | As we work through the various regulatory approvals required for this transaction, NeoPhotonics remains a separate and independent company. |

| 8. | Will I still be working with the same client relationship manager? |

| | • | | Throughout the regulatory approval process, you will continue to work with the same teams and relationship managers you are familiar with at NeoPhotonics. |

| | • | | We will plan integration in the months and quarters ahead. Our businesses are highly complementary, which bodes well for our future ability to meet your needs. |

| 9. | What immediate changes can we expect from this announcement? |

| | • | | We do not anticipate any immediate changes as result of this announcement. As we work through the various regulatory approvals required for this transaction, NeoPhotonics remains a separate and independent company and business will continue as usual. |

| | • | | Over time, we anticipate this partnership will result in a deeper set of optical products and solutions that will allow us to better support you. |

| 10. | Will the transaction disrupt any ongoing operations or service? |

| | • | | No, it will be business as usual for our clients in all aspects and facets in how they utilize our services and products and engage with our team. |

| | • | | You will continue to work directly with the same NeoPhotonics team and receive the level of service you have grown accustomed to. |

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.

(vi)

From: Tim Jenks

To: Valued Partner

Subject: An Announcement about the Future of NeoPhotonics

Dear Valued Partner,

We recently announced the exciting news that we have entered into an agreement to be acquired by Lumentum Holdings, a leading provider of complementary photonic solutions for optical networking and lasers for industrial and consumer markets. The press release we issued can be found on our investor relations website at https://ir.neophotonics.com.

We’ve long respected Lumentum as a leader and innovator in our industry, and believe they are the ideal partner to help us serve our customers on an even larger scale. Lumentum’s optical components and subsystems are part of virtually every type of telecom, enterprise, and data center network. Further, they also offer complementary lasers that enable advanced manufacturing techniques and other diverse applications. As a combined company, we are confident in our ability to accelerate innovation as well as meet the growing need for high-speed optical transmission solutions.

Today is just the first step in this process. We expect the transaction to close in the second half of calendar year 2022. Importantly, until then it is business as usual, and NeoPhotonics and Lumentum will continue to operate as separate, independent companies. We will continue to work with you as we always have, and you should not expect any changes in our relationship or how we do business together.

We greatly appreciate your support and look forward to continuing to work with you. As always, if you have any questions, please feel free to reach out to your usual contact.

Thank you and best regards,

Tim Jenks

CEO

NeoPhotonics Corporation

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events, including the timing of the proposed transaction and other information related to the proposed transaction. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the proposed transaction and our expectations, strategy, plans or intentions regarding it. Forward-looking statements in this communication include, but are not limited to, (i) expectations regarding the timing, completion and expected benefits of the proposed transaction, (ii) plans, objectives and intentions with respect to future operations, customers and the market, and (iii) the expected impact of the proposed transaction on the business of the parties. Expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include the risk that the transaction may not be completed in a timely manner or at all; the ability to secure regulatory approvals on the terms expected in a timely manner or at all; the effect of the announcement or pendency of the transaction on our business relationships, results of operations and business generally; risks that the proposed transaction disrupts current plans and operations; the risk of litigation and/or regulatory actions related to the proposed transaction; potential impacts of the Covid-19 pandemic; changing supply and demand conditions in the industry; and general market, political, economic and business conditions. The forward-looking statements contained in this communication are also subject to other risks and uncertainties, including those more fully described in filings with the Securities and Exchange Commission, including reports filed on Form 10-K, 10-Q and 8-K and in other filings made by NeoPhotonics and Lumentum with the SEC from time to time and available at www.sec.gov. These forward looking statements are based on current expectations, and with regard to the proposed transaction, are based on Lumentum’s and NeoPhotonics’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by NeoPhotonics and Lumentum, all of which are subject to change.

The parties undertake no obligation to update the information contained in this communication or any other forward-looking statement.

Additional Information and Where to Find It

This communication is being made in respect of a proposed business combination involving Lumentum and NeoPhotonics. NeoPhotonics will file relevant materials with the Securities and Exchange Commission (the “SEC”) in connection with the proposed transaction, including a proxy statement on Schedule 14A. Under the proposed terms, promptly after filing its proxy statement with the SEC, NeoPhotonics will mail or otherwise make available the proxy statement and a proxy card to each stockholder entitled to vote at the annual meeting relating to the proposed transaction. NEOPHOTONICS STOCKHOLDERS AND OTHER INVESTORS ARE ADVISED TO CAREFULLY READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN RESPECT OF THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

LUMENTUM AND NEOPHOTONICS URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain these materials (when they are available and filed) free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by contacting Lumentum’s Investor Relations Department at investor.relations@lumentum.com. Copies of documents filed with the SEC by NeoPhotonics (when they become available) may be obtained free of charge on NeoPhotonics’ website at https://ir.NeoPhotonics.com/ by contacting NeoPhotonics’ Investor Relations at ir@NeoPhotonics.com.

Participants in the Solicitation

The directors and executive officers of NeoPhotonics may be deemed to be participants in the solicitation of proxies from the stockholders of NeoPhotonics in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding NeoPhotonics’ directors and executive officers is also included in NeoPhotonics’ proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2021. These documents are available free of charge as described in the preceding paragraph.