UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________

Form 10-K

_____________________________________________________

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

001-35061

(Commission File No.)

__________________________________________________

NeoPhotonics Corporation

(Exact name of Registrant as specified in its charter)

_______________________________________________________________

| | | | | | | | |

| Delaware | | 94-3253730 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

3081 Zanker Road

San Jose, California 95134

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code:

+1 (408) 232-9200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading symbol: | Name of Exchange on Which Registered |

| Common Stock, par value $0.0025 per share | NPTN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

___________________________________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| Non-accelerated filer | | ☐ | | Small reporting company | | ☐ |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [Yes ☒ No ☐]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2021, the approximate aggregate market value of voting stock held by non-affiliates of the Registrant, based upon the last sale price of the Registrant’s common stock on the last business day of the Registrant’s most recently completed second fiscal quarter, June 30, 2021 (based upon the closing sale price of the Registrant’s common stock on the New York Stock Exchange), was approximately $516,380,000. This calculation excludes 1,504,525 shares held by directors, executive officers and stockholders affiliated with our directors and executive officers.

As of February 18, 2022, the Registrant had 53,128,218 outstanding shares of Common Stock.

__________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant has incorporated by reference into Part III of this Annual Report on Form 10-K portions of its Proxy Statement for its 2022 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A. The Proxy Statement will be filed within 120 days of Registrant’s fiscal year ended December 31, 2021.

NEOPHOTONICS CORPORATION

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2020

Table of Contents

PART I

ITEM 1. BUSINESS

FORWARD-LOOKING STATEMENTS

You should read the following discussion in conjunction with our Consolidated Financial Statements and the related “Notes to Consolidated Financial Statements” and “Financial Statements and Supplementary Data” included in this Annual Report on Form 10-K. This discussion contains forward-looking statements including statements concerning our possible or assumed future results of operations, proposed merger with Lumentum Holdings Inc., business strategies, competitive position, industry environment, potential growth opportunities and the effects of competition. Such statements are based upon our management’s beliefs and assumptions and on information currently available to us. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors in this Annual Report on Form 10-K are discussed in greater detail under the heading “Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Annual Report on Form 10-K. You should read this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

CONVENTIONS THAT APPLY IN THIS ANNUAL REPORT ON FORM 10-K

The conventions and terms used in this Report relate to the following categories in our industry:

| | | | | | | | | | | | | | | | | | | | | | | |

| Communications Technologies | Optical Materials

Platforms | Lasers,

Coherent Components and Modules | Speed | Transmission Reach or Distance | Data Center | Modulations | Transport and Switching |

• 5G • CDC • CPO • Coherent • Contentionless • Disaggregation • DWDM • IP over DWDM • Long Haul • Metro • PIC • PLC | • III-V • GaAs • InP • SiGe • Silicon Photonics | • CDM • CFPx • COSA • DCO • DFB • ECL • EML • ICR • MCS • NLW • OSFP • QSFP-DD

| • 100G • 400G • 400ZR • 400ZR+ • 600G • 800G • 1T • Gbaud • Gbps • Tbps | • DR (500 m) • FR (2 km) • LR (10 km) • ZR (≤120 km) • ZR+ (>120 km) • Metro reach • Regional reach • Long haul | • Cloud • DCI • IP | • Modulation Order • PAM • QAM • QPSK | • AAWG • Drop Module • ROADM |

Unless otherwise indicated, references in this Annual Report on Form 10-K to:

• “5G” refers to fifth-generation wireless architecture;

•“100G products” collectively refers to all products sold by us designed for use at 100Gbps (“100G”), and in coherent transmission systems, designed for use at 100Gbps or higher data rates. Some customers may use components designed for use at 100G at lower speeds. Our 100G products include both coherent transmission products and 100G network products that are not coherent;

•“400G products” collectively refers to all products sold by us designed for use at 400Gbps (“400G”), and in coherent transmission systems, designed for use at 400Gbps or higher data rates;

•“400G”, “600G”, “800G” or “1 T” refers to data rates at 400Gbps (“400G”) to 800Gbps or 1 Tbps transmission;

•“III-V compound semiconductors” refers to compound semiconductor materials made from group III and group V elements of the periodic table, such as Indium Phosphide and Gallium Arsenide;

•“AAWG” refers to Athermal Arrayed Waveguide Grating, a device which can separate or combine signals that have different wavelengths;

•“Advanced Hybrid Photonic Integration” refers to state-of-the-art integration of multi-platform materials and devices;

• “Baud”, “baud rate” or "Gbaud” refers to a unit of the symbol rate of a transmission system and is equal to the number of times a signal changes state per second. One baud is equivalent to one symbol per second. Similarly, Gbaud is equivalent to one billion symbols per second. The data rate of a transmission symbol is determined by multiplying the baud rate times a factor determined by the modulation order.

•“CDC” refers to Colorless, Directionless, and Contentionless;

•"CDM" refers to a Coherent Driver Modulator which integrates a coherent in-phase and quadrature modulator and drivers;

•“CFP” or “CFPx” refers to CFP Multi-Source Agreement, or CFP MSA, industry standard for hundred Gigabits per second and higher (C), form factor (F), pluggable (P) modules;

•"Cloud" refers to the vast constellation of servers that are located in data centers around the world and which are accessed through the internet, along with the associated software and data bases that run on them and the communications links that interconnect them.

•“Coherent” refers to a mode of optical data transmission that encodes and decodes information in the phase, polarization and amplitude characteristics of an optical signal;

•“Contentionless” refers to the ability to switch two or more channels of the same wavelength or color from different directions through the same switch, such as a Multi-Cast Switch (MCS);

•“COSA” refers to a Coherent Optical Sub-assembly that combines multiple discrete devices such as a modulator and a receiver;

•“CPO” refers to co-packaged optoelectronics;

•“DCI” refers to Data Center Interconnect;

•“DCO” refers to a Digital Coherent Optical module;

•“DFB” refers to Distributed Feedback laser;

•“Disaggregation” refers to the trend in optical communications to separate software and hardware platforms so that different parts of a system can be supplied by different vendors;

•“DR” refers to transmission over a reach of 500 meters;

•“DSP” refers to the use of a specialized digital signal processor to perform a wide variety of signal processing operations to recover transmitted data from an optical signal, including recovery of such signals impaired through transmission.

•“Drop Module” refers to a wavelength multiplexer module;

•“DWDM” refers to Dense Wavelength Division Multiplexing, which combines multiple channels onto a single fiber using many different wavelengths, or colors, of light;

•“ECL” refers to External Cavity Laser;

•“EML” refers to Electro-absorptively Modulated Laser;

• “FR” refers to transmission over a reach of 2 kilometers;

•“GaAs” refers to Gallium Arsenide, a III-V component semiconductor material;

•“Gbaud” refers to symbol rate measure in billions of baud;

•“Gbps” refers to gigabits per second;

•“High Speed Products” refers to transmitter and receiver products as well as switching and other component products for 100G and beyond optical transmission applications. Our high speed 100G and beyond products are based on our Advanced Hybrid Photonic Integration technologies, which support 100 gigabits or more per second of information transmitted over a single channel. Our 400G and above products are a subset of our High Speed Products.

•“ICR” refers to Integrated Coherent Receiver;

•“InP” refers to Indium Phosphide, a III-V component semiconductor material;

•“IP over DWDM” or 'Internet Protocol (IP) over DWDM' is the concept of sending data packets directly over an optical layer using DWDM for its capacity and other operations.

•“I/Q” refers to In-Phase and Quadrature Modulator;

•“ITLA” refers to Integrable Tunable Laser Assembly;

•“LR” refers to transmission over a reach of 10 kilometers;

•“MCS” refers to Multi-Cast Switch;

•“Modulation Order” refers to modulation schemes which can transmit more than one bit per symbol (baud), such as QPSK, PAM and QAM.

•"Network Products and Solutions” collectively refers to all products sold by us for use in optical communications networks and a variety of other applications that are designed for use at data rates that are less than 100Gbps, including 40G, 10G and lower data rates. These products include certain passive products that do not explicitly have a data rate specification, but that are most commonly used in networks at these data rates;

•“NLW” refers to Narrow Line Width;

•“OSFP” refers to Octal Small Form Factor Pluggable;

•“PAM” or “PAM4” refers to Pulse Amplitude Modulation or PAM with four amplitude levels;

•“PIC” refers to Photonic Integrated Circuit;

•“PLC” refers to Planar Lightwave Circuit;

•“QAM” refers to Quaternary Amplitude Modulation; a means to code digital data on a coherent light signal;

•“QPSK” refers to Quadrature Phase Shift Keying;

•“QSFP” refers to 40G and 100G Quad Small Form-factor modules that are Pluggable into standard industry interfaces for switches, routers and other telecommunications equipment;

•“ROADM” refers to Reconfigurable Optical Add Drop Multiplexer;

•“SiGe” refers to Silicon Germanium, a III-V compound semiconductor material;

•“Silicon Photonics” or “SiPho” or “Sipho” refers to Photonic Integrated Circuits manufactured using Silicon waveguides on Silicon wafers;

•“Tbps” or “T” refers to terabits per second. One terabit is one trillion bits;

•“ZR” refers to a transmission reach of 80 to 120 kilometers;

•“ZR+” refers to transmission at distances over a reach greater than 120 kilometers using a small form factor coherent pluggable transceiver module.

Unless the context indicates otherwise, we use the terms “NeoPhotonics,” “we,” “us,” “our” and “the Company” in this Annual Report on Form 10-K to refer to NeoPhotonics Corporation and, where appropriate, its subsidiaries.

Overview: Our Position in Advanced Communications

We develop, manufacture and sell optoelectronic products that transmit and receive high-speed digital optical signals for Cloud and hyperscale data center internet content provider and telecom networks. We are the world's leading supplier of tunable lasers that emit the ultra-pure light that is required for the highest speed over distance fiber optic communications links.

Cloud and hyperscale data center networks are operated by companies such as Amazon, Google, Meta, Microsoft and Tencent, while telecom networks are operated by telecommunications carriers such as AT&T, China Mobile, Deutsche Telekom, NTT Communications, Telefonica and Verizon. As operators of large-scale high-speed communications networks, many of these companies are end-users of NeoPhotonics products. Our direct customers can be these companies, their contract manufacturers or their network equipment suppliers, including companies such as Arista Networks, Ciena Corporation, Cisco Systems, Huawei Technologies, Infinera, Nokia and ZTE. These network equipment manufacturers and their engineering and manufacturing suppliers ("EMS") have historically been our primary customers. However, as we integrate our products into more complete solutions, we expect rising revenues directly from operators of high-speed communications networks.

Most of all the world’s leading suppliers of network equipment and coherent transceiver products directly or indirectly use NeoPhotonics ultra-pure light tunable lasers for their highest speed coherent solutions, and most of them use our integrated modulator and receiver components.

Our high-speed products support the explosive growth of data traffic in Cloud and hyperscale data center networks. Our laser market penetration has increased substantially over the last five years, and our ultra-pure light lasers have been adopted by nearly all leading network equipment and coherent transceiver manufacturers for their 400G and above systems. In addition to our leadership in ultra-pure light tunable lasers, we have been increasing our sales with these companies in modulator and receiver components. Over the recent years, many of these network equipment manufacturers have adopted our 64 Gbaud and 96 Gbaud receiver and modulator components, together with our tunable laser, for their highest speed systems.

Our products operate at the highest speed over distance, at speeds of 400 Gigabits per Second ("G"), 600G and 800G and beyond data rates in a single wavelength. Versions of these products have the speed, size, output power and low power consumption that enable interoperable pluggable transceivers in standard form factors which directly transmit data using industry standard Internet Protocol coding, or IP over DWDM wavelengths, greatly simplifying data networks, thereby lowering costs and reducing the total electrical power required.

Our revenue from products capable of maximum data rates of 400G and above grew by 70% in 2021 over 2020, up from $86 million in 2020 to $148 million in 2021. Similarly, 400G and above revenue doubled in 2020 over 2019, from $44 million in 2019 to $86 million in 2020. Revenue from products for 400G and above applications has been increasing steadily and is now approximately 56% of fourth quarter revenues. 400G capable products are defined as products capable of 50 Gbaud and above operation plus lasers purchased specifically for systems with a maximum data rate of 400G or higher. Customers often use products capable of a maximum data rate of 400G and above at lower speeds, in order to achieve longer transmission distances by employing lower order modulation schemes. We believe that the market for products with a maximum data rate of 400G and above will grow at a 5-year compound annual growth rate of approximately 60 percent through 2025. We therefore expect our 400G and above revenues will continue to grow at an accelerated rate over the intermediate and longer term.

Over the past decade we have been first to deliver commercial mass production volumes for each of the highest speed advances in coherent optical components and lasers, as maximum speeds have advanced for each wavelength, or color, from 100G to 200G, 400G and 800G. We are a specialist in developing and producing products for the highest speed over distance applications, where high baud rate, laser single clarity and high sensitivity are keys to achieving longer distances for a given speed.

We believe we are well positioned to attain and maintain industry leadership in these laser, component and module solutions based on our leadership in the ultra-pure light lasers which power them and our comprehensive Silicon Photonics and compound semiconductor technologies for optical ICs.

Proposed Merger with Lumentum Holdings, Inc.

On November 3, 2021, we entered into an Agreement and Plan of Merger with Lumentum Holdings Inc., a Delaware corporation (“Lumentum”) and Neptune Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Lumentum (“Merger Sub”), (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, we will be acquired by Lumentum through a merger of Merger Sub and into us (the “Merger”), with NeoPhotonics Corporation surviving the Merger as a wholly owned subsidiary of Lumentum.

Pursuant to the terms of the Merger Agreement, and subject to the terms and conditions set forth therein, our stockholders will receive $16.00 per share in cash, without interest thereon and after giving effect to any required tax withholdings, for each NeoPhotonics share they own. As of December 23, 2021, the date of our Definitive Proxy Statement filed in connection with the Merger, we anticipate that the total amount of funds necessary to complete the Merger and the related transactions, and to pay the fees and expenses required to be paid at the Closing of the Merger by Parent and Merger Sub under the Merger Agreement, will be approximately $913 million. Lumentum will provide up to $50 million in interim debt financing to us, which would provide us financing that may be necessary to operate our business during the pendency of the Merger on terms that are, taken as a whole, likely better than those that could otherwise be obtained from an unrelated third party. The cash consideration will be funded from the combined company’s balance sheet.

The Merger Agreement contains certain termination rights for both Lumentum and us and provides that if the Merger Agreement is terminated for failure to obtain antitrust approval, Lumentum may be required to pay us a termination fee of $55.1 million; and if Lumentum or any of its affiliates enters into any agreement, letter of intent or other similar agreement for an acquisition of any ownership interest or assets of any person that cause a material delay in, or results in the failure of, the consummation of the Merger, Lumentum may be required to pay us an additional termination fee of $36.7 million.

Consummation of the Merger is subject to customary closing conditions, including the absence of certain legal impediments, the expiration or termination of the required waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (“HSR Act”), and approval by the holders of a majority of the outstanding shares of our common stock. The waiting period under the HSR Act expired as of January 21, 2022 and the required approval from our stockholders was obtained on February 1, 2022.

The remaining requirements for closure of the Merger are customary closing conditions set forth in the Merger Agreement and approval from the State Administration for Market Regulation ("SAMR") of the People’s Republic of China. The Merger is expected to close in the second half of calendar year 2022.

For additional information related to the Merger Agreement and the Merger, we refer you to our Definitive Proxy Statement filed with the Securities and Exchange Commission on December 23, 2021, which includes the full text of the Merger Agreement as Annex A, our Current Report on Form 8-K filed with the Securities and Exchange Commission filed on January 20, 2022, our Current Report on Form 8-K filed with the Securities and Exchange Commission filed on January 21, 2022, our Current Report on Form 8-K filed with the Securities and Exchange Commission filed on January 24, 2022, and our Current Report on Form 8-K filed with the Securities and Exchange Commission filed on February 1, 2022.

During the year ended December 31, 2021, we recorded acquisition-related costs of $3.7 million in operating expenses within our consolidated statement of operations.

Our Technology and Product Position

Our high-speed optical communications technologies encode information onto optical signals from electronic signals for transmitting and decode it for receiving. We achieve ultra-high speed data transmission using coherent technology that encodes phase, amplitude and polarization on an optical wavelength, packing in orders of magnitude more information than is possible with simple on/off encoding. With the inherent characteristics in our ultra-pure light tunable lasers, we achieve longer distance transmission as well as higher speed.

Coherent is the technology of choice for high speed over distance data transmission in Cloud infrastructure and data center interconnection, in addition to telecom networks. The move to 400G and above transmission has been a fulcrum for the industry as it marked a major step-up in speed as well as enabling new network architecture alternatives to dramatically lower costs by deploying 400ZR architectures in networks. 400G is now the basic building block for network deployments for all reaches from 40km to long haul distances of 2000kms or more, all of which require coherent transmission technology.

We believe we are a global leader in coherent transmission technology, based on our leadership in ultra-pure light lasers, silicon photonics and optical integration for miniaturization and low power consumption. We sell to virtually all of the leading telecom network equipment companies such as ADVA, Arista Networks, Ciena, Cisco Systems, Fiberhome, Fujitsu, Huawei, Infinera, NEC, Nokia and ZTE. As the primary producer of ultra-pure light lasers, we have delivered more than 2 million lasers into the market of approximately more than 3.2 million coherent ports deployed by the industry over the past 10 years (each port may use either one or two lasers).

Our High Speed Products, including our 400G and above capable products, use our Silicon Photonics integration, compound semiconductor integration and our Advanced Hybrid Photonic Integration technologies to optimize performance by combining different materials platforms. We believe that our use of all of these technologies together is an important competitive differentiator to provide solutions with optimized cost and performance.

The development of the market and the expanding range or uses of 400G and above solutions has two key paths. First is the use of 400G, 600G, 800G and beyond products in chassis-based systems, including systems that support long distance transmission. This is the path for continuing expansion of carrier deployments for the highest speed over a given distance. Second is the use of 400G coherent pluggable modules as the basic building block for communications infrastructure providing direct connection of routers and switches within and between data centers, eliminating the need for proprietary DWDM interfaces. These DCI interconnects, using 400ZR and 400ZR+ pluggable modules, enable new, lower cost network architectures using IP over DWDM protocols. Both of these paths portend accelerating growth.

The emergence of 400ZR and 400ZR+ coherent pluggable modules extends our capabilities to a new, rapidly expanding market segment. Such modules put full coherent transmission capabilities of a line card into the same form factor as a pluggable client side transceiver, enabling interconnects between data centers to be nearly as simple as interconnects within a data center, thereby substantially reducing costs.

Such modules are causing a sea change in the market structure. Signal processors and optics have both progressed to the extent that they are small enough, and their power consumption is low enough, to enable architectures that fully leverage new,

much smaller form factors to deliver a major increase in data rates and scale while minimizing for macro power demands. As a result, for the first time, hyperscaler data center operators and telecom carriers can re-architect their networks with much greater capability to manage the exploding demand for data transmission.

Use cases for 400ZR and 400ZR+ system level modules extend across data center interconnect, backhaul for 5G wireless networks and metro networks. Key attributes of power and power density, and interoperability of pluggable solutions, drive this forecast. These architectures are now being deployed by hyperscale operators and will be adopted in metro telecom networks using 400ZR+ pluggable modules in areas where reach and density make it the clear economic winner with much lower total costs. Furthermore, we believe that our high performance optics combined with next generation digital signal processor ("DSP") will enable 800ZR and 800ZR+ coherent pluggable modules with the next few years, followed by 1.6T implementations.

We believe that Cloud and hyperscale data center operators, such as Alibaba, Amazon, Apple, Google, Meta, Microsoft and Tencent, have the potential to become significant customers as they increasingly link hyperscale data centers regionally. These operators need the highest speeds at reaches to 120 kilometers and farther, defining the ZR+ market sector where we excel and have fundamental technology advantages. We believe the Cloud and hyperscale data center markets will become more important in our sales mix, from our further penetration of this market sector and the higher potential revenue growth rate it portends.

Furthermore, extension of coherent pluggable modules to the metro network is a use case driven by substantially lower costs achieved through elimination of network equipment proprietary chassis, and a reduction in the number of ROADMs required, compared to current network architectures.

With 400G as a fulcrum in the path of growth in the market at the highest speeds, we believe we are well positioned to take advantage of this rapidly developing, high growth market.

Continuing Rapid Growth of Data Traffic in the Information Age

Previously unimaginable amounts of data are being generated with new cloud-based applications that drive massive data manipulation and continue to emerge and expand, impacting almost every realm of knowledge and economic and social life. Examples include applications such as cloud computing, autonomous vehicles, virtual reality, smart homes, tele-medicine, genomics, artificial intelligence and machine learning.

The massive infrastructure of hyperscale data centers necessitates extremely high capacity optical interconnections. There are well over 700 hyperscale data centers around the world, each housing well over 100,000 micro-processors. Each hyperscale data center is surrounded by many more enterprise-level data centers, representing new and growing public cloud, private cloud and hybrid cloud networks. This vast proliferation of data applications will continue to drive growth in hyperscale and enterprise data centers for decades to come.

The ability to generate and process data requires that the data be transported to where it is needed. Thus, the second major element of the Cloud is the communications interconnections between data centers and consumers and between the data centers themselves.

Total annual IP data traffic will reach approximately five zettabytes in the next year, or five trillion billion bytes, according to the Cisco Visual Networking Index. Total data traffic is forecast to nearly double over the next few years, with nearly all of this data being carried over fiber optic communication links.

Networks operating at 400G, 600G, 800G and beyond data rates have adopted coherent transmission technology because of its ability to increase data rates and lower costs. With the explosion of data traffic, these high speed optical networks are very high growth segments of the optical communications market. They support the continuing rapid expansion of hyperscale data center and content provider networks, as well as the expansion of telecom backbone, metro and mobile networks to accommodate increased traffic for the foreseeable future.

Speed over Distance Matters

Our solutions are often unique in their ability to service the need for this explosive growth in data traffic by providing high integrity signals across longer distances. It is more challenging and expensive to transmit a signal a thousand kilometers or across a continent than it is to send the same information a few hundred meters across a data center or campus network.

For speed over distance, state of the art and best of breed optics are essential, and increasingly so as distances extend and data rates increase. For distances of 80 kilometers to a few hundred kilometers, i.e. ZR and ZR+ distances, then further to 2,000 kilometers, or long haul reaches, specialized technologies are needed for each. The benefits of coherent transmission have made it the preferred technology for these state-of-the-art high speed over distance networks. We believe that our Silicon Photonics integration and our ultra-pure light tunable lasers are enabling technologies.

Our Advanced Hybrid Photonic Integration technologies effectively address the challenges inherent in precision and high volume manufacturing of optical components for coherent transmission when distances extend to the longest reaches. For example, we demonstrated our Multi-Rate CFP2-DCO coherent pluggable module transmitting at a 400 Gbps data rate over a distance of 1,500 km in a 75GHz-spaced DWDM channel and we have achieved 400G over 800 km with our QSFP-DD coherent pluggable module.

Emerging Change in Network Architecture

We believe these changes at 400G and above data rates represent a sea change in high-speed network which is resulting in significantly lower costs per bit for network operators. We believe our lasers, coherent techniques and photonic integrated circuits, or PICs, are a significant factor enabling this change in network architecture. Today, the majority of communications between data centers is still done through an equipment rack which contains complex and self-contained elements as the key parts of chassis-based systems. These circuit boards or line cards are usually supplied by a separate network equipment manufacturer, or NEM, to provide the fiber optic link. However, this results in a complex and costly architecture.

Our advanced system-level coherent modules for the highest speeds and longest distances provide a core communications link solution for interconnecting data centers separated by 80 kilometers or more. As such, they carry stringent performance and reliability requirements that are higher than traditional short reach data center modules.

Our integration technologies make it possible for long distance transmission by coherent pluggable transceiver modules that connect directly into switches and routers inside data centers that have previously been used only for short reach connections within data centers. Such dis-aggregated Open Line Systems can manage optical signals between data centers, sometimes called IP over DWDM, with all needed channel management, amplification, traffic planning and monitoring functions. Connections between data centers are now becoming as simple as connections within data centers which provides a major breakthrough to reduce network costs and cost per bit.

To illustrate, a 400G connection between two routers in different data centers 80 kilometers apart can be made by plugging our 400ZR DD-QSFP pluggable transceiver into each router and connecting the fibers through an Open Line System. Similarly, a distance of 400 kilometers or more can be accommodated using our 400ZR+ modules.

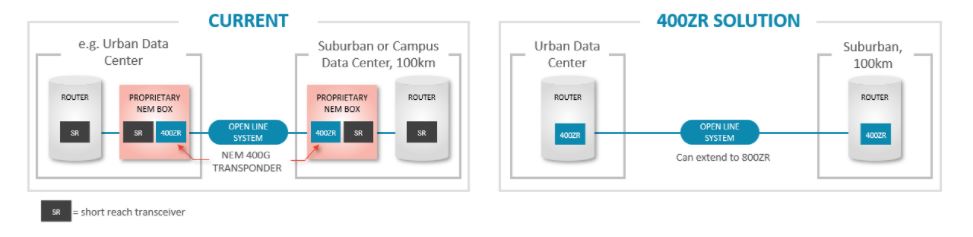

400ZR/ZR+ ARCHITECTURE FOR DATA CENTER INTERCONNECT

Architecture Supported by 400ZR Interconnects for direct connection to Routers or Switches

This architecture eliminates two complex network equipment boxes and four short reach data center transceivers and consequently reduces the cost per bit of the optical link by as much as 80 percent. The architecture is possible because coherent technology, driven by our ultra-pure light lasers and coupled with our highly integrated photonic chips, packages the long distance transmission capability of the NEM line card into a small form factor pluggable transceiver that is plug-compatible with standard short reach data center transceivers. For example, a NeoPhotonics 400ZR QSFP-DD or OSFP module capable of 80 kilometer transmission plugs into the same slot on a router that also accommodates a 400G DR4 QSFP-DD or OSFP data center transceiver capable of only 500 meters transmission. Being able to utilize the same plug receptacle for both short reach connections and long reach connections is a major cost-saving breakthrough for network operators.

We believe that this network architecture is becoming the mainstay of new installations and will move a significant portion of the capital expenditures from network equipment supplier DWDM proprietary boxes to new, disaggregated direct 400ZR interconnections. This approach of IP over DWDM moves Internet Protocol traffic from switches and routers directly over an optical channel in an Open Line System to its destination without passing through a proprietary network equipment transmission chassis.

Broad adoption of 400ZR architectures for DCI applications also portends changes in future metro architectures. For example, 5G wireless applications require an ultra-flexible network that can be dynamically provisioned to implement a range of functions. The most efficient way to implement such a network is through a Cloud architecture which enables traffic to be managed at the packet level. A transport grade 400ZR+ coherent pluggable module allows a metro-level connection to be plugged directly into a switch or router. The traffic then goes directly to a ROADM-based Open Line System, creating a very flexible optical network with a lower total cost of deployment. We believe this new metro architecture will result in a similar magnitude of cost savings as is anticipated in 400ZR DCI networks.

Our Solutions

We use our optical integration technologies to develop and produce integrated optical products that deliver the highest speed over distance. Our products work together as solutions to achieve the highest speeds over the longest distances with the highest performance. To maximize total capacity, we provide additional Line System solutions that leverage our coherent products together with our passive products to maximize total fiber capacity.

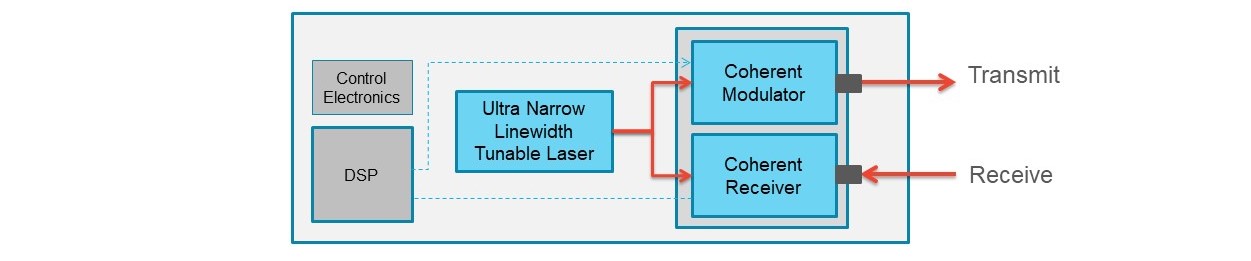

Three critical optical components are required to make a coherent transceiver: (1) a laser with a very narrow linewidth and very pure light; (2) a coherent modulator capable of changing both the intensity and phase of the optical signal to code data onto it; and (3) a coherent receiver capable of detecting both the intensity and phase of the received optical signal to “interpret” its content, plus an electronic DSP IC.

We have been a leading volume supplier of these optical components since coherent systems were first deployed in volume for the telecommunications networks of a decade ago. We are now the primary supplier of ultra-pure light lasers along with other coherent components for 400G, 600G and 800G applications.

These high performance coherent optical components and ultra-pure light tunable lasers require very specialized materials platforms and assembly capabilities. We believe that we have a unique set of materials, design, assembly and test capabilities for ultra-pure light tunable lasers, coherent modulators and receivers as well as optical ICs that form the basis of our competitive position.

In parallel, commercial DSP development has followed Moore’s Law to achieve the performance and low power necessary for 400ZR and 400ZR+ coherent modules. The latest generation of DSPs incorporate forward error correction software standardized by the Optical Internetworking Forum (OIF) so that they can interoperate. This means that the data traffic can remain in IP format and be directly communicated between switches and routers without passing through a proprietary network equipment chassis, thereby accelerating adoption of IP over DWDM adoption.

As these DSPs are based on standard commercial CMOS IC processes and design tools, the number suppliers of DSPs has grown. There are multiple large scale merchant suppliers of DSPs, and at least three captive DSP suppliers within system companies. Other start-up companies are making efforts to enter the DSP market.

We combine our unique high performance ultra-pure light tunable lasers with a coherent modulator and receiver, or with a combined silicon photonics coherent optical sub-assembly, or COSA, together with a commercially available DSP to manufacture 400ZR modules. These are available in multiple form factors including 400G DD-QSFP, OSFP and CFP2 digital coherent optical (“DCO”) transceivers. Our QSFP-DD and OSFP modules are designed to be extendable to 800ZR and 800ZR+ applications, and we believe that such 800G pluggable modules will enter the market within the next few years as next generation DSPs become available.

Increasing the Data-carrying Capacity of Optical Fibers

There are two principal approaches to optimizing the data carrying capacity of an optical fiber. The first approach addresses capacity by increasing the data rate in a given channel using higher baud rate and higher order modulation. Once this limit is reached, the second approach is to expand the wavelength range available, which is achieved by increasing the wavelength tuning range to accommodate more channels. This maximizes the data carrying capacity in any given fiber, thereby lowering overall cost per bit.

The first approach addresses capacity as speed per channel and uses our 64 Gbaud and 96 Gbaud modulators and receivers and our ultra-pure light tunable lasers. As baud rates increase, however, the channels must be made “wider” to accommodate the signal spread, thereby reducing the number of channels that can be “fit” in a given fiber’s bandwidth using standard optics.

The second approach addresses the number of channels, where we combine coherent transmission technologies to maximize interconnect bandwidth capacity. For example, our C++ LASERTM ITLA, C++ CDMTM Modulator and C++ ICRTM Receiver are uniquely capable of increasing fiber capacity up to 50 percent and to deliver up to 32 Terabits per second of capacity over a single fiber. The number of channels is further optimized by our precision 75 to 100GHz-spaced PLC multiplexers for Open Line Systems.

The capabilities of coherent optics continue to grow with increasing photonic integration for higher performance and smaller size, and open further opportunities for us in adjacent markets. Outside of communications, coherent technology improves sensitivity and performance for a variety of applications including inter-satellite communication links for low earth orbit ("LEO") satellites, plus industrial applications, 3D sensing for autonomous vehicle navigation, and medical imaging.

Our Core Technologies in Silicon Photonics and Hybrid Photonic Integration

We believe we have all the capabilities required for producing the highest performance Advanced Hybrid Photonic Integrated optoelectronic and silicon photonics devices for the highest speeds and highest speed over distance and meeting the most stringent performance requirements. Our core technologies are a unique multi-material platform that includes:

Advanced Hybrid Photonic Integration: Provides our core technology and drives our ability to design, develop and produce industry leading, unique and differentiated high-speed optoelectronics products. We utilize proprietary integration platforms that provide optoelectronic functionality on Silicon and compound semiconductor substrates including Indium Phosphide, Gallium Arsenide and Silicon Germanium. Complete advanced photonics integration capability requires integrated combinations of these platforms to achieve optimal performance and cost.

High Performance Optics and Ultra-Pure Light Lasers: Reduces the need for electronic algorithms from digital signal processors, to correct less pure optical signals, thereby improving performance, cost and power consumption.

Silicon Photonics Integration: Silicon is versatile for photonic integration. Silicon Photonics integrated circuits must be designed to be integrated with lasers fabricated from Indium Phosphide, detectors based on germanium-doped silicon, or other functions and materials through Hybrid Photonic Integration. We design Silicon Photonics modulators, receivers, coherent optical subassemblies and laser subassemblies and fabricate the Silicon wafers in commercial Silicon foundries.

Indium Phosphide ("InP"): Indium Phosphide is used to produce efficient lasers, sensitive photodetectors and modulators in the wavelength window typically used for telecommunications. As a compound semiconductor bandgap material, InP is the most important material for the generation of laser signals and the detection and conversion of those signals back to electronic form. We design and manufacture laser and detector chips in our own and outsourced fabs and integrate them with silicon photonics circuits using Advanced Hybrid Photonic Integration.

Silicon Planar Lightwave Circuits: Silicon is a multi-attribute semiconductor material and waveguides of Silicon or doped Silicon Dioxide (silica) have very low optical loss and are ideal for switching, filtering or interferometric applications. We design and manufacture doped silica photonic chips and integrate them with photonic circuits using Advanced Hybrid Photonic Integration.

Gallium Arsenide ("GaAs"): Gallium Arsenide is a compound semiconductor material that operates at very high speeds due to its high electron mobility and is used to make analog integrated circuit drivers for high-speed lasers and modulators. We design and manufacture GaAs ICs and integrate them with our lasers and modulators or into co-packaged optoelectronics devises, or CPO.

Silicon Germanium ("SiGe"): Silicon Germanium is a compound semiconductor material used to manufacture mixed signal and analog integrated circuits for high-speed drivers and trans-impedance amplifiers used in 400G and beyond systems. We design SiGe ICs and fabricate wafers in commercial SiGe foundries.

Laser Technologies: We specialize in the design, manufacture and control of lasers. Our principle products include ultra-pure light tunable lasers, electro-absorptively modulated lasers ("EMLs") and distributed feedback lasers ("DFB").

Optoelectronic engineering and integration: As we create complex integrated optoelectronic devices, we design and build electronic control algorithms and devices, signal processing methodologies, hardware and software routines and protocols, and device level ASICs that function to control and manage the highest performance features and capabilities of these integrated optoelectronic devices and systems.

Hardware and firmware integration: We sell our products as modules and subsystems which contain electronic hardware and firmware controls that interface directly with our customers’ systems.

Devices, Components, Modules and Subsystems: We design and manufacture modules and subsystems that combine our products with other elements to offer customers a complete solution.

Our Strategy

Key elements of our multi-year strategy include:

•Continue to lead in the most advanced ultra-pure light laser technology, and state-of-the-art integrated coherent receivers, modulators and modules. We continue to invest in and develop highest speed and highest speed over distance products in each of the components required for coherent transmission and related applications.

•Continue innovating to develop industry-leading comprehensive technology for Silicon Photonics and Advanced Hybrid Photonic Integration. We have strengthened and expanded our technology platforms for comprehensive advanced photonic integration to design and produce the highest performance optical signal processing solutions.

•Capture major customer share for the most advanced modules and components serving the leading operators and users of state-of-the-art communications networks and solutions. We intend to deepen our relationships with customers by increasing design wins for their systems, including major Cloud and hyperscale data center operators.

•Offer complete optoelectronic solutions for 100G to 800G and beyond for the highest speed Cloud, data center and Telecom market segments. We produce coherent transmitter, modulator and receiver components and transceiver Modules optimized for the highest speeds that are aligned with leading trends in Open Line System architectures.

•Address additional segments of the network and similar or related applications that leverage our core technology and state-of-the-art products and that will benefit from high speed or high sensitivity optical performance.

Our Products

Our ultra-pure light tunable lasers are core to our coherent communications strategy, and our other coherent components and modules provide industry leading performance and are forward integrations of our lasers. As data rates increase by increasing baud rate and modulation order, it is essential to have the purest possible laser light source. Our ultra-pure light tunable lasers deliver to this essential requirement by having the narrowest linewidth in the industry, meaning the purest color, without noise or other distortion.

We produce transmitter and receiver components and coherent modules, as well as switching products, for 400G and beyond transmission over distances of 2 to 2,000 kilometers. We integrate transmitter and receiver components into next generation pluggable transceiver modules.

All of our high-speed 400G and beyond products are based on our Silicon Photonics technology and our Advanced Hybrid Photonic Integration technology. Our coherent technologies support encoding 400 Gigabits or more per second of information for transmitting over a single channel and decoding the information at the receiver, and enable smaller, more compact and more highly integrated designs for the individual elements and integrated COSAs.

Coherent transmission can only be accomplished in practice using advanced photonic integration to intimately couple functional elements. Coherent systems manipulate light to encode orders of magnitude more information on the same wavelength channel than is possible with traditional methods.

Our coherent optoelectronic modules, which integrate our tunable laser, modulator and receiver components, provide complete transmit and receive functions including variable modulation capability to adjust data rates. Compact integration of our coherent “transceiver” modules allows them to be pluggable and to reduce costs by replacing traditional much larger and more complex chassis.

Each of our module products incorporates one each of our component lasers, integrated coherent receivers and modulators. Further, to minimize size, we often integrate the receiver and modulator into a single component, or a COSA. In addition, each transceiver module has a DSP as an Application Specific Integrated Circuit ("ASIC"). These four elements, three optical components and the DSP, comprise most of the bill of materials for a module, and are roughly comparable in value.

DIGITAL COHERENT TRANSCEIVER

Elements of a Digital Coherent Transceiver Module

We develop and manufacture transmitter products, receiver products and switching products that are used in ultra-high speed digital optical communications, high speed switching and provisioning. We combine our transmitter and receiver products into transceiver modules. Our switching products, such as Multi-Cast Switches, are used primarily in ROADM nodes that dynamically and efficiently allocate bandwidth to adjust for fast changing traffic patterns and for provisioning software defined optical networks. Our products can be categorized into groups, including High-speed Products for 100G, 400G, 600G, 800G and beyond applications, including in coherent networks, including the switches for these applications; and Network Products and Solutions for lower speed networks, plus wavelength management solutions for telecom and DCI networks.

Our High Performance Coherent Module Products

400G Pluggable Coherent Transceivers: We produce pluggable coherent transceivers operating at speeds from 100G to 400G. These high speed and high performance pluggable coherent modules combine our ultra-narrow linewidth laser with our coherent receiver and with our high performance coherent modulator or integrated COSA.

Our 400ZR QSFP-DD and OSFP transceiver modules both provide 400G connections over a DCI reach of up to 120 kilometers in a standard client side pluggable form factor. These modules support OIF standard error correction software and can interoperate with other transceivers using the same standardized software, enabling direct IP over DWDM.

Our 400ZR+ transceiver modules provide 400G connections over longer distances than our standard 400ZR transceivers modules.

Our 400G capable CFP2-DCO transceiver can deliver as much as 32 Terabits per second of capacity per fiber. Our internal optics support 85 channels of 64 Gbaud data at 75 GHz wavelength channel spacing. These CFP2-DCO modules support long haul, metro and DCI network applications.

Our Ultra-Pure Light Laser Products

Ultra-Narrow Linewidth Tunable Laser Products: We produce industry-leading tunable laser products based on an external cavity ("ECL") design. Due to their longer cavity length, ECLs generate a much purer “color,” or narrower “linewidth,” which is critical with new higher order modulation techniques and higher baud rates, thereby carrying significantly more information. We produce standard Micro-ITLA form factor products and a smaller Nano-ITLA that achieves comparable ultra-narrow linewidth, low frequency phase noise and the low power consumption in a more compact package that is approximately one half the size of our Micro-ITLA.

Further extending our leadership in lasers for the highest speed and highest capacity communications links, we also provide ultra-pure light tunable lasers with wider tuning ranges which support more channels or higher speeds. For high baud rate, high capacity per wavelength systems, our ultra-narrow linewidth tunable lasers are available in a C++ LASERTM configuration, which has a tuning range of 6 THz, covering the full “Super C-band”. This is 50 percent more spectrum than a standard 80 channel, 50 GHz spaced laser. The C++ LASERTM ITLA can tune over 120 channels with 50 GHz per channel spacing or 80 channels with 75 GHz per channel spacing. This fully captures the increase in fiber capacity generated by these newer modulation approaches when combined with our C++ ICRTM receivers and C++ CDMTM modulators.

High Performance Laser and Optical Products: For applications inside data centers and in connecting antennas for 5G wireless networks, we design and manufacture electro-absorptively modulated lasers ("EML") and high power distributed feedback lasers ("DFB") as well as driver ICs for these lasers.

We manufacture and sell 100G products for data center applications, including 28 Gbaud and 53 Gbaud EMLs, laser drivers, modulator drivers and photodiode receivers used for single wavelength PAM4 100G applications and four wavelength 400G intra-data center transmission.

For hyperscale data center applications, we have introduced high power laser diode array products for short reach Silicon Photonics based 100G intra-data center interconnections which use parallel single-mode architectures, or PSM4, as well as coarse wavelength division multiplexing, or CWDM architectures.

Our High Speed Coherent Component Products

High Speed Products including products for 400G and beyond applications: We produce high speed and high performance transmitter and receiver products for maximum data rates of 400Gbps to 800 Gbps and beyond optical transmission applications over distances of up to 2,000 kilometers. Most coherent transceivers are flexible and can be programmed to run at many different rates. Customers use our 400Gbps maximum data rate and above high speed and high performance transmitter and receiver products at data dates below 400Gbps, in order to achieve much longer transmission distances. These products include our integrated coherent receiver ("ICR") and coherent driver modulator ("CDM"), which support baud rates of up to 96 Gbaud and can operate over the C++ wavelength band covering 6 THz.

We have integrated transmitter and receiver functions into a single integrated coherent optical sub assembly, or COSA, which has an ultra-small form factor designed to fit into the next generation pluggable transceivers such as QSFP-DD and OSFP. Our technologies support encoding 400, 600 to 800 Gigabits or more per second of information for transmitting over a single channel and decoding the information at the receiver, as well as enabling smaller, more compact and more highly integrated designs for the individual elements and integrated COSAs.

Our High Performance Wavelength Management Products

We are an industry leading supplier of low-loss, high-capacity wavelength management products that are used in rapidly expanding ROADM nodes for high speed telecom carrier networks, in Open Line Systems for new 400ZR architectures and in 5G wireless backhaul applications. These products utilize our PIC integration technologies to expand and extend the transport of optical signals, lowering total network cost and power consumption. We believe we are one of the highest volume manufacturers of PICs in the industry.

Multi-Cast Switches: Our Multi-Cast Switches ("MCS") are used in ROADM nodes to allocate bandwidth dynamically and efficiently, adjusting for fast changing traffic patterns and provisioning and supporting software defined optical networks. We provide Multi-Cast switching solutions for 100G and above coherent systems. Our 4x16, 8x16 and 12x16 Multi-Cast switch modules for colorless, directionless and contentionless, or CDC, ROADMs efficiently allocate bandwidth and route signals in 100G and higher data rate coherent networks to provide scalable contentionless operation and achieve the highest traffic management efficiency, optimizing traffic flows in coherent transmission systems. Our MCSs products use our planar lightwave circuit photonic integration platform and consists of a complex array of switches, waveguides, taps, crossings and other functional elements.

Arrayed Waveguide Gratings: We design and manufacture arrayed waveguide gratings ("AWGs"), multiplexers and filters used in Dense Wavelength Division Multiplexing ("DWDM") open and proprietary line systems. We design and manufacture wavelength management products that are customized for the highest speed and highest capacity coherent systems operating at 400G, 600G, 800G or higher data rates. We have introduced new AWGs for advanced coherent systems that offer channel spacing from 75 GHz to 150 GHz and channel counts from 40 to 85 channels, covering the widest spectral bands used today and supporting data rates that will extend to 1 Tbps and beyond.

Our Infrastructure, Intellectual Properties and Our Employees

We have product development and product sustaining engineering teams in Silicon Valley, California, Ottawa, Canada, Tokyo, Japan and Shenzhen and Wuhan, China. In our Silicon Valley and Tokyo facilities we conduct research, new product development and product roadmap definitions, including for our Silicon Photonics and Advanced Hybrid Photonic Integration PIC products. In our Shenzhen area facilities, we conduct product development, manufacturing and process engineering, quality control, continuous improvement and cost reduction relating to product manufacturing, assembly and test. In our Wuhan, China and Ottawa, Canada facilities we conduct new device, component and product development.

We seek to establish and maintain proprietary rights in our technology and products through the use of patents, copyrights and trade secret laws in each of the locations in which we do business. We have filed applications for patents to protect certain of our intellectual property in the U.S. and in other countries, including Australia, Canada, Japan, Korea, Hong Kong, China, Russia, India, Taiwan and several European Union countries. As of December 31, 2021, we had approximately 376 issued patents, expiring between 2022 and 2039.

We have manufacturing operations in the U.S., Japan, China and Thailand. Our wafer fabrication operations are located in our Silicon Valley, California and Japan facilities, and include chip design, clean room fabrication, integration and related facilities for chip-level devices and PICs. Our manufacturing, assembly and test operations are located in our Shenzhen area facilities, in Thailand and in Silicon Valley.

Our Customers

For 2021, we had four customers who constituted 10% or more of our revenue, comprising of Cisco Systems at 27%, Ciena Corporation at 18%, Nokia at 12% and Huawei at 11% of revenue. In 2020, customers of 10% or more revenue were Huawei at 40%, Ciena Corporation at 17% and Acacia Communications at 10%. In 2019, customers of 10% or more revenue were Huawei and Ciena, which accounted for 41% and 29% of our total revenue, respectively.

The U.S. Department of Commerce Bureau of Industry and Security ("BIS") added Huawei and certain affiliates to the BIS Entity List (“Entity List”) with an effective date of May 21, 2019. On August 17, 2020, BIS increased restrictions on Huawei and its affiliates on the Entity List related to items produced domestically and abroad that use U.S. technology or software and imposed additional requirements on items subject to Commerce export control. As Huawei had been our largest customer in recent periods, such action had a material impact on our revenue in 2020 and 2021. Huawei is expected to continue to decline as a percentage of our revenue into 2022.

Our Sales and Marketing

Our sales model aligns with customers through coordination of our sales, product application engineering and manufacturing teams. Our sales cycles typically require significant time and expenditure of resources to realize revenue from the sale of products. The length of our sales cycle is typically 6 to 12 months for an existing product and 12 to 18 months or longer for a new product.

We use a global direct sales force based in North America, Europe and Asia, including China, Japan, Korea and Taiwan. We have very deep technical relationships with our customers' design teams. We believe that these collaborative engineering activities provide us insight into our customers’ broader and longer-term needs and are an important part of our value delivery to our customers.

Our marketing teams focus on product strategy, product development, roadmap development, new product introduction processes, program management, product demand stimulation and assessment, and competitive analysis. Our marketing team also seeks to educate the market about our products by communicating our value proposition and product differentiation in direct customer interactions and presentations, at industry trade shows, at technical conferences, through digital and online content such as webinars and blogs, and in industry forums such as Multi-Source agreement ("MSA") committees.

Our Research and Development

Our research and development activities continue to advance the performance leadership boundaries in high speed lasers and digital optics, silicon photonics and hybrid photonic integration, optoelectronics control and in signal processing.

We have invested and expect to continue to invest significant time and capital into our research and development operations. Research and development expenses were $56.5 million, $56.1 million and $57.6 million in 2021, 2020 and 2019, respectively.

We have research and development and wafer fabrication facilities in Silicon Valley, California and in Tokyo, Japan that coordinate with our research and development and manufacturing facilities in Dongguan, Shenzhen and Wuhan, China and Ottawa, Canada. We use proprietary design tools and design-for-manufacturing techniques to align our design process with our precision nanoscale, vertically integrated manufacturing and testing.

Human Capital Resources

We are committed to attracting and retaining the brightest and best talent. Investing, developing, and maintaining human capital is critical to our success. As of December 31, 2021, we had approximately 1,157 full-time employees, of which approximately 20% are in the Americas, 10% in Japan and 70% in China. As a global manufacturer of products for DCI and telecom networks, a large number of our employees are engineers or trained technical workers focusing on advanced manufacturing, and many of them hold masters', doctorate, or equivalent or higher degrees.

We emphasize a number of measures and objectives in managing our human capital assets, including, among others, employee safety and wellness, talent acquisition and retention, employee engagement, development, and training, diversity and inclusion, and compensation and pay equity. We have not experienced any employee-generated work stoppages or disruptions, and we consider our employee relations to be satisfactory.

Our U.S. and Canadian employees are not represented by a labor union. Under Chinese law, all employees in our China subsidiaries are members of a union that is overseen by the Chinese government. The majority of the employees in our Japanese subsidiary are also members of a union.

Equity, Diversity and Inclusion

We are committed to being broadly inclusive to capture the ideas and perspectives that fuel innovation and enable our workforce, customers, and communities to succeed in the digital age. We strive to create an inclusive workplace where people can bring their authentic selves to work. Our commitment to diversity and inclusion starts with our diverse world-wide employee base which represents well over 25 countries. We are also committed to gender diversity in our workforce with women currently holding 38% of executive leadership positions at our company and representing 35% of our employees. We strive to remain a diverse company as we believe it is integral to our success.

Our Suppliers

We build long term relationships with companies that are capable to meet our stringent technical requirements at the same time as being cost competitive, and who can scale with us over time. As a result, we work closely with our suppliers to understand their business as we grow together. We use suppliers from the U.S., China, Japan and other locations.

Although there are multiple sources for most of the component parts of our products, some components are sourced from single or, in some cases, limited sources, which can increase risks of materials availability for production, including with

current semiconductor shortages. We also use contract manufacturers primarily in Thailand and other Asia locations for the back-end manufacturing of certain of our products.

We also work to develop new companies as suppliers for new technologies, innovations and for purposes of managing costs and technology competitiveness over time. We examine our supply chain for their performance, quality, technology and technology roadmaps, service, engineering talent, labor practices and environmental sustainability.

We promote long-term relationships with suppliers that we believe have the elements for long-term success, and whose management exercise good practices for both their long-term success and our long-term success and competitiveness.

Our Customer Relationships and Support for Supply Chains

Our sales process requires design and development in collaboration with customers, working with them through their introduction of new, advanced communications systems, whether for Cloud infrastructure customers or for telecom equipment manufacturers. As a supply philosophy we maintain long term relationships with customers and our business grows with them over time, while simultaneously working to develop new customers. Our maintaining close technical collaboration and commercial working relationships with customers required that we have a technically capable and commercially adept global sales and engineering team facing our customers that can support the totality of their supply chains.

Our direct sales force works with our customers in an integrated approach to understand current and future needs. Because we operate a sales model that focuses on alignment with our customers, we additionally must operate our manufacturing and product delivery functions to accommodate flexible demand.

Sales of our products generally are made pursuant to purchase orders, often with short lead times. Purchase orders are typically made without deposits and quantities actually purchased by our customers are frequently revised to reflect changes in our customers’ needs. In 2021, in part due to global supply chain challenges, sales by purchase orders comprised about 90% of our revenue.

Certain of our customers use vendor managed inventory ("VMI") arrangements under which we manufacture at a customer’s request, then ship to its facility or a designated contract manufacturer for the customer, to be held until it is used by the customer. We maintain title to VMI until the customer uses the inventory. At that time the customer takes title to the products, it reports the consumption to us and we recognize the revenue for the product sale. In 2021, sales by customer VMI arrangements comprised approximately 10% of our revenue.

For larger network equipment companies and for Cloud hyperscalers, additional needs for maintaining inventory arises from their need for supply flexibility in the face of longer lead times for some supply chain components including chip-level components produced in wafer fabs. We anticipate that as our revenue increases from hyperscalers, our proportion of finished goods inventory to sales for those companies will increase, as will our need for maintaining more raw material inventory as a percent of total inventory.

The business cycle, as well as international trade discussion between countries including the U.S. and China, require that we carefully monitor and adjust production levels in line with end user demand to minimize impacts of inventory overstocking.

In 2021, we experienced increasing challenges as a result of the global supply chain being impacted by semiconductor chip shortages and other products. These challenges are expected to continue through 2022.

Our Competitors

The market for optical communications systems is highly competitive. We specialize in products that provide the highest speed over distance for which there are fewer competitors than in the broader market. While no single company competes with us across all of our product areas, our competitors range from large international companies offering a wide range of products to smaller companies specializing in narrow markets. We believe the principal competitive requirements to be successful in this market are:

•ability to provide leading edge technologies for high speed and highest speed over distance communications, including ultra-pure light tunable lasers;

•ability to integrate complex and highly precise chip-based and component product designs into sub-system level solutions;

•ability to produce these complex chip-level products and module products solutions that require precise and high quality manufacturing processes and controls, and;

•ability to consistently produce and deliver the complex products in high volume with high reliability and high quality to customers globally.

We believe we compete favorably with respect to these factors. We believe our principal competitors include:

•In lasers and coherent products Cisco Systems through its acquisition of Acacia Communications, Furukawa Electric Co., Ltd., Fujitsu Optical Components Limited, Molex Incorporated, NTT Electronics Corporation, II-VI Incorporated, Sumitomo Electric Industries, Ltd. and others, and;

•In wavelength management and switching Accelink Technologies Co., Ltd., II-VI, Lumentum Holdings Inc., Molex Incorporated and NTT Electronics.

We also face competition from some of our customers, including Cisco, Huawei and Ciena, who evaluate our capabilities against the merits of manufacturing products internally. These customers may have the ability to manufacture competitive products at a lower cost than we would charge as a result of their higher levels of integration.

Our Financial Information by Geographic Region

Our geographic sales represent locations of our customers or their respective contract manufacturers rather than the location of final use or deployment. Major contract manufacturer locations for our customers include Mexico, China, Thailand, Malaysia and Singapore. These are our “ship to” destinations. We have historically reported quarterly revenue by geographic territory, i.e. Americas, China, and Rest of World.

We serve virtually all leading network equipment manufacturers globally. Seven of these customers comprise more than 80% of our revenue.

For information regarding our revenue and property, plant and equipment by geographic region, see Note 3 and Note 19 to the Consolidated Financial Statements.

Our Environmental, Health and Safety Matters

We operate our research and development and manufacturing operations globally with a goal of enhancing value and sustainability over time by steadily investing in improvements to our operations. Our facilities and our products are subject to a variety of environmental, health and safety laws and regulations in the jurisdictions in which we operate including employees health and safely, discharges of effluents, hazardous materials and solid waste, energy efficiency and carbon emissions, and the preservation and improvement of air, water and soil resources. We continue to develop and improve our manufacturing operations to comply with environmental, health and safety requirements and improve the overall performance of our operations to create even more sustainable methods of operation.

Operating facilities and procedures support local initiatives for employee health and safety, including Covid-19 prevention and containment measures, risk reduction and disaster preparedness, environmental protections that include liquid and gaseous effluent reduction, carbon reduction, and solid waste reduction and recycling. Moreover, we support multiple initiatives to improve our energy efficiency while reducing our emissions. We are compliant with current requirements in each location in which we have operations, and we similarly pursue best practices in our owned factories and with our subcontractor manufacturing partners. We continue to invest in and develop and adopt new and improved methods and procedures as these requirements evolve.

Export Control

We are subject to export and import control laws, trade regulations and other trade requirements that limit which products we sell and where and to whom we sell our products. Because we are committed to complying with all applicable export laws, regulations, and requirements, we have reviewed and revised our processes and procedures to ensure that our shipments to our customers remain compliant with applicable export laws.

Available Information

We file electronically with the U.S. Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make available free of charge on our website at www.neophotonics.com copies of these reports as soon as reasonably practicable after filing them with the SEC.

Our principal offices are located at 3081 Zanker Road, San Jose, CA 95134, USA and our telephone number is +1 (408) 232-9200. Our website address is www.neophotonics.com. Information accessible through our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

RISKS ASSOCIATED WITH THE MERGER

Our proposed Merger may be delayed or not occur at all for a variety of reasons, some of which are outside of the parties' control, and if these conditions are not satisfied, the Merger Agreement may be terminated and the Merger may not be completed.

On November 3, 2021, we entered into the Merger Agreement, with Lumentum Holdings Inc. and Neptune Merger Sub, Inc., a wholly owned subsidiary of Lumentum Holdings. The Merger Agreement provides for the merger of the Neptune Merger Sub with and into us, which we refer to as the “Merger”, with us surviving the Merger as a wholly owned subsidiary of Lumentum. Completion of the Merger is subject to customary closing conditions, including (i) obtaining Chinese antitrust approvals (ii) the absence of governmental injunctions or other legal restraints prohibiting the Merger or imposing certain antitrust restraints and (iii) the absence of a “Material Adverse Effect,” as defined in the Merger Agreement. In addition, the obligation of each party to consummate the Merger is conditioned upon, among other things, the accuracy of the representations and warranties of the other party (subject to certain materiality exceptions), and material compliance by the other party with its covenants under the Merger Agreement. Therefore, the Merger may not be completed or may not be completed as quickly as expected.

In addition, if the Merger is not completed by August 3, 2022, either we or Lumentum may choose to terminate the Merger Agreement (subject to two automatic extensions if the closing is delayed due to certain conditions to closing relating to antitrust laws not being satisfied but all other conditions to the closing are otherwise satisfied or could be satisfied at the closing). Either party may also elect to terminate the Merger Agreement in certain other circumstances, including by mutual written consent of both parties.

Failure to complete the Merger could adversely affect our business and the market price of our common stock in a number of ways, including:

•The market price of our common stock may decline to the extent that the current market price reflects an assumption that the Merger will be consummated;

•If the Merger Agreement is terminated under certain circumstances specified in the Merger Agreement, we would be required to pay a termination fee of $27,500,000;