UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21331

Allspring Multi-Sector Income Fund

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

|

| Date of fiscal year end: October 31 |

| Date of reporting period: October 31, 2021 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

October 31, 2021

Allspring

Multi-Sector Income Fund (ERC)

The views expressed and any forward-looking statements are as of October 31, 2021, unless otherwise noted, and are those of the Fund's portfolio managers and/or Allspring Global Investments. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Allspring Global Investments disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Allspring Multi-Sector Income Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Allspring Funds

Dear Shareholder:

We are pleased to offer you this annual report for the Allspring Multi-Sector Income Fund for the 12-month period that ended October 31, 2021. Global stocks continued to rally as the global economy continued to emerge from the haze of COVID-19. Tailwinds were provided by global stimulus programs, a rapid vaccination rollout, and recovering consumer and corporate sentiment. The bond market had mostly positive returns during the period.

For the 12-month period, equities had robust returns, as policymakers continued to fight the effects of COVID-19. U.S. stocks led both non-U.S. developed market equities and emerging market stocks. Gains by fixed-income securities were varied, though mostly positive. For the period, U.S. stocks, based on the S&P 500 Index,1 gained 42.91%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned 29.66%, while the MSCI EM Index (Net) (USD),3 had a weaker performance, with a 16.96% gain. Among bond indexes, the Bloomberg U.S. Aggregate Bond Index,4 returned -0.48%, the Bloomberg Global Aggregate ex-USD Index (unhedged),5 returned -1.99%, and the Bloomberg Municipal Bond Index,6 gained 2.64%, and the ICE BofA U.S. High Yield Index,7 returned 10.74%.

Efforts to contain COVID-19 drove market performance.

Global stocks rallied in November 2020, propelled by optimism over three promising COVID-19 vaccines. Reversing trends recent to November 2020, value stocks outperformed growth stocks and cyclical stocks outpaced information technology (IT) stocks. However, U.S. unemployment remained elevated, with a net job loss of 10 million since February 2020. The eurozone services Purchasing Managers' Index, a monthly survey of purchasing managers, contracted sharply while the region’s manufacturing activity grew. The U.S. election results added to the upbeat mood as investors anticipated more consistent policies in the new administration.

Financial markets ended 2020 with strength on high expectations for a rapid rollout of the COVID-19 vaccines, the successful passage of a $900 billion stimulus package, and rising expectations of additional economic support from a Democratic-led Congress. U.S. economic data were mixed with still-elevated unemployment and weak retail sales but growth in manufacturing output. In contrast, China’s economic expansion continued in both manufacturing and nonmanufacturing. U.S. COVID-19 infection rates continued to rise even as new state and local lockdown measures were implemented.

The year 2021 began with emerging market stocks leading all major asset classes in January, driven by China’s strong economic growth and a broad recovery in corporate earnings, which propelled China’s stock market higher. In the U.S., positive news on vaccine trials and January expansion in both the manufacturing and services sectors were offset by a weak December monthly jobs report. This was compounded by technical factors as some hedge funds were forced to sell stocks to protect themselves against a well-publicized short squeeze coordinated by a group of retail investors. Eurozone sentiment and economic growth were particularly weak, reflecting the impact of a new lockdown with stricter social distancing along with a slow vaccine rollout.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

2 | Allspring Multi-Sector Income Fund

Letter to shareholders (unaudited)

February saw major domestic equity indexes driven higher on the hope of a new stimulus bill, improving COVID-19 vaccination numbers, and the gradual reopening of the economy. Most S&P 500 companies reported better-than-expected earnings, with positive surprises coming from the financials, IT, health care, and materials sectors. Japan saw its economy strengthen as a result of strong export numbers. Meanwhile, crude oil prices continued their climb, rising more than 25% for the year. Domestic government bonds experienced a sharp sell-off in late February as markets priced in a more robust economic recovery and higher future growth and inflation expectations.

The passage of the massive domestic stimulus bill highlighted March activity, leading to increased forecasts for U.S. growth in 2021. Domestic employment surged as COVID-19 vaccinations and an increasingly open economy spurred hiring. A majority of U.S. small companies reported they were operating at pre-pandemic capacity or higher. Value stocks continued their outperformance of growth stocks in the month, continuing the trend that started in late 2020. Meanwhile, most major developed global equity indexes are up month to date on the back of rising optimism regarding the outlook for global growth. While the U.S. and the U.K. have been the most successful in terms of the vaccine rollout, even in markets where the vaccine has lagged, such as in the eurozone and Japan, equity indexes in many of those countries have also been in positive territory for the year through March 2021.

Equity markets produced another strong showing in April. Domestically, the continued reopening of the economy had a strong impact on positive equity performance, as people started leaving their households and jobless claims continued to fall. Domestic corporate bonds performed well and the U.S. dollar weakened. Meanwhile, the U.S. government continued to seek to invest in the recovery, this time by outlining a package of over $2 trillion to improve infrastructure. The primary headwind in April was inflation, as investors tried to determine the breadth and longevity of recent price increases. Developed Europe has been supported by a meaningful increase in the pace of vaccinations. Unfortunately many emerging market countries have not been as successful. India in particular saw COVID-19 cases surge, serving as an example of the need to get vaccinations rolled out to less developed nations.

Vaccine rollouts continued in May, leading to loosened restrictions globally. As a result, equity markets in general saw a minor increase in returns. Concerns that the continued economic rebound could result in inflation increases becoming more than transitory were supported by the higher input costs businesses were experiencing. Meanwhile, those inflation concerns were tempered by the U.S. Federal Reserve (Fed), which stayed steady on its view of the economy and eased fears of a sudden and substantial policy change. Positive performance in the emerging market equity space was supported this month by steady consumer demand and strong commodity prices. Fixed-income markets were also slightly positive for the month, driven by inflation uncertainty and a softer U.S. dollar.

June witnessed the S&P 500 Index reach a new all-time high. 2021 economic growth and inflation forecasts were revised higher to reflect a strong economic recovery and some supply and demand imbalances. Late June saw a deal reached on a U.S. infrastructure package of approximately $1 trillion for road, bridge, and broadband network upgrades over the next eight years. The Fed’s June meeting yielded no change to policy, but its projections pointed to a possible interest rate rise in 2023. This, combined with a rebound in economic activity and investors searching for yield, led to U.S. Treasury yields being down for the month. Many European and Asian countries saw vaccination momentum increase, while the U.K. dealt with a rise in COVID-19 infections, specifically the Delta variant. Meanwhile, crude oil jumped over 10% in June on the back of the pickup in global economic activity and Organization of the Petroleum Exporting Countries’ (OPEC) slow pace of supply growth.

July began the month seeing vaccinations making progress, as several major developed countries eased restrictions, only to be threatened again by the spread of COVID-19’s Delta variant. Inflation continued to climb, aided by the continued supply bottleneck in the face of high demand. As it pertains to the equity area of the market, U.S. equities led the way in positive return territory followed by international developed markets. In contrast, emerging markets were well in negative territory for the month, hindered by China’s plans for new regulations on a number of sectors, specifically education and technology. The U.S. 10-year Treasury bond yield continued to decline, as strong demand swallowed up supply. After hitting a multiyear high earlier in the month, oil prices leveled off following an agreement by OPEC to raise oil production starting in August.

“ 2021 economic growth and inflation forecasts were revised higher to reflect a strong economic recovery and some supply and demand imbalances.”

Allspring Multi-Sector Income Fund | 3

Letter to shareholders (unaudited)

“ Municipal debt experienced its first monthly performance drop since February of this year, slowing a rally that made it one of the best-performing sectors of the bond market.” |

The Delta variant of COVID-19 produced outbreaks globally in August, increasing the potential for increased market volatility and bringing into question the ongoing economic recovery. Domestically, the U.S. economy continued to stay strong in the face of the Delta variant, continued inflationary pressures, and worries over Hurricane Ida. Emerging market equities experienced elevated volatility, largely influenced by China’s regulatory stance. Emerging market equities started the month with poor performance but rebounded to end the month in positive territory. Municipal debt experienced its first monthly performance drop since February of this year, slowing a rally that made it one of the best-performing sectors of the bond market. In the commodity segment of the market, crude oil fell sharply during the month on the back of dampened expectations as a result of the Delta variant but was still a leading asset-class performer for the year.

Global markets suffered their broadest retreat in a year during September, with the exception of commodities. Concerns over inflation and the interest rate outlook depressed investor confidence and hurt performance. Emerging markets declined on concerns over the continued supply chain disruptions and worries over higher energy and food prices. Meanwhile, the Fed indicated it would slow the pace of asset purchases in the near future. All eyes domestically were fixed on the raising of the debt ceiling, the 2022 budget plan, and the ongoing debate over the infrastructure package. Contrary to most asset classes, commodities thrived in September, driven by sharply higher energy prices.

October’s key themes continued to be elevated inflation pressures and a supply bottleneck, but strong earnings provided a bright spot in the markets. Earnings releases in the U.S. were generally strong and consumer confidence was high. The Fed reaffirmed its plans to taper quantitative easing to a stop by mid-2022. Meanwhile, elevated inflation figures are still being considered transitory by the Fed. Similar to the U.S., the eurozone and many Asian countries saw positive earnings but were facing inflation pressures caused by supply bottlenecks while also experiencing energy price increases amid natural gas shortages. Globally, government bond yields rose as central banks prepared to lower monetary policy accommodation in the face of rising inflationary pressures. As previously referenced, positive commodity performance was driven by sharply higher energy costs.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Information on transaction closing.

On November 1, 2021, GTCR LLC and Reverence Capital Partners, L.P., announced the beginning of Allspring Global Investments™, with the close of the transaction to acquire Wells Fargo Funds Management, LLC; Wells Capital Management, LLC; Galliard Capital Management, LLC.; Wells Fargo Asset Management (International) Ltd.; Wells Fargo Asset Management Luxembourg S.A.; and Wells Fargo Funds Distributor, LLC, as well as Wells Fargo Bank, N.A.’s business of acting as trustee to its collective investment trusts and all related Wells Fargo Asset Management legal entities. The transaction closed on November 1, 2021, forming Allspring Global Investments, a privately held asset management firm with $587 billion in AUM1 as of September 30, 2021.

Allspring Global Investments™ is a leading independent asset management firm with a full breadth of investment capabilities across diverse asset classes, serving the needs of its institutional and wealth management clients around the world. Allspring operates across 18 offices globally supported by more than 480 investment professionals. Allspring and its investment teams provide a broad range of differentiated investment products and solutions to help its diverse range of clients meet their investment objectives.

As part of this transition, all mutual funds and closed-end funds within the Wells Fargo Funds family were rebranded as Allspring Funds. Each individual fund had “Wells Fargo” removed from its fund name and replaced with “Allspring.” The fund name changes went into effect on December 6, 2021.

| 1 | As of September 30, 2021, assets under management (AUM) includes $93 billion from Galliard Capital Management, LLC, an investment advisor that is not part of the Allspring trade name/GIPS firm. |

4 | Allspring Multi-Sector Income Fund

Letter to shareholders (unaudited)

Allspring Global Investments is the trade name for the asset management firms of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P.

Thank you for choosing to invest with Allspring Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Allspring Funds

For further information about your Fund, contact your investment professional, visit our website at allspringglobal.com, or call us directly at 1-800-222-8222.

Allspring Multi-Sector Income Fund | 5

Letter to shareholders (unaudited)

Notice to Shareholders

| ■ | On November 12, 2021, the Fund announced a renewal of its open-market share repurchase program (the “Buyback Program”). Under the renewed Buyback Program, the Fund may repurchase up to 10% of its outstanding shares in open market transactions during the period beginning on January 1, 2022 and ending on December 31, 2022. The Fund’s Board of Trustees has delegated to Allspring Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program, including the determination of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations. |

| ■ | The Fund’s managed distribution plan provides for the declaration of monthly distributions to common shareholders of the Fund at an annual minimum fixed rate of 9% based on the Fund’s average monthly net asset value per share over the prior 12 months. Under the managed distribution plan, monthly distributions may be sourced from income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a monthly basis, the Fund may distribute paid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report. |

6 | Allspring Multi-Sector Income Fund

This page is intentionally left blank.

Performance highlights (unaudited)

| Investment objective | The Fund seeks a high level of current income consistent with limiting its overall exposure to domestic interest rate risk. |

| Strategy summary | The Fund allocates its assets between three separate investment strategies, or sleeves. Under normal market conditions, the Fund allocates approximately 30%-70% of its total assets to a sleeve consisting of below investment-grade (high yield) debt; approximately 10%-40% to a sleeve of foreign debt securities, including emerging market debt; and approximately 10%-30% to a sleeve of adjustable-rate and fixed-rate mortgage backed securities, and investment-grade corporate bonds. |

| Adviser | Allspring Funds Management, LLC |

| Subadvisers | Allspring Global Investments, LLC |

| | Allspring Global Investments (UK) Limited |

| Portfolio managers | Christopher Y. Kauffman, CFA®‡, Chris Lee, CFA®‡, Michael Lee, Alex Perrin, Michael J. Schueller, CFA®‡, Lauren van Biljon, CFA®‡, Peter Wilson, Noah Wise, CFA®‡ |

| Average annual total returns (%) as of October 31, 20211 |

| | 1 year | 5 year | 10 year |

| Based on market value | 34.28 | 11.31 | 8.21 |

| Based on net asset value (NAV) | 13.09 | 7.28 | 6.75 |

| Multi-Sector Income Blended Index2 | 6.32 | 4.79 | 4.71 |

| Bloomberg U.S. Credit Bond Index3 | 1.90 | 4.60 | 4.47 |

| Bloomberg U.S. Securitized Index4 | (0.48) | 2.27 | 2.47 |

| ICE BofA U.S. High Yield Constrained Index5 | 10.75 | 6.23 | 6.65 |

| J.P. Morgan GBI-EM Global Diversified Composite Index6 | 0.84 | 1.96 | 0.37 |

| J.P. Morgan Global Government Bond Index (ex U.S.)7 | (4.41) | 1.50 | 0.30 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Performance figures of the Fund do not reflect brokerage commissions that a shareholder would pay on the purchase and sale of shares. If taxes and such brokerage commissions had been reflected, performance would have been lower. To obtain performance information current to the most recent month-end, please call 1-800-222-8222.

The Fund’s expense ratio for the year ended October 31, 2021, was 1.19% which includes 0.32% of interest expense.

| 1 | Total returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the end of the period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. |

| 2 | Source: Allspring Funds Management, LLC. The Multi-Sector Income Blended Index is composed of 60% ICE BofA U.S. High Yield Constrained Index, 18% J.P. Morgan GBI-EM Global Diversified Composite Index, 7.5% Bloomberg U.S. Credit Bond Index, 7.5% Bloomberg U.S. Securitized Index, and 7% J.P. Morgan Global Government Bond Index (ex U.S.). You cannot invest directly in an index. |

| 3 | The Bloomberg U.S. Credit Bond Index is an unmanaged index of fixed income securities composed of securities from the Bloomberg Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Securitized Index is an unmanaged composite of asset-backed securities, collateralized mortgage-backed securities (ERISA eligible), and fixed-rate mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The ICE BofA U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3 but are not in default. The ICE BofA U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

| 6 | The J.P. Morgan GBI-EM Global Diversified Composite Index is an unmanaged index of debt instruments of 31 emerging countries. You cannot invest directly in an index. |

| 7 | The J.P. Morgan Global Government Bond Index (ex U.S.) measures the total return from investing in 12 developed government bond markets: Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, the Netherlands, Spain, Sweden, and the U.K. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

8 | Allspring Multi-Sector Income Fund

Performance highlights (unaudited)

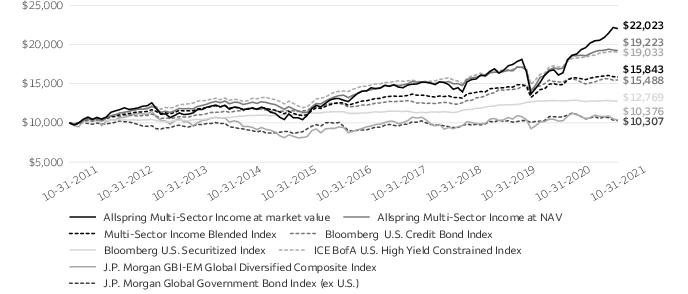

| Growth of $10,000 investment as of October 31, 20211 |

| 1 | The chart compares the performance of the Fund for the most recent ten years with the Multi-Sector Income Blended Index, Bloomberg U.S. Credit Bond Index, Bloomberg U.S. Securitized Index, ICE BofA U.S. High Yield Constrained Index, J.P. Morgan GBI-EM Global Diversified Composite Index and J.P. Morgan Global Government Bond Index (ex U.S.). The chart assumes a hypothetical investment of $10,000 investment and reflects all operating expenses of the Fund. |

| Comparison of NAV vs. market value1 |

| 1 | This chart does not reflect any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s NAV. |

More detailed information about the Fund’s investment objective, principal investment strategies and the principal risks associated with investing in the Fund can be found on page 14.

Allspring Multi-Sector Income Fund | 9

Performance highlights (unaudited)

Risk summary

This closed-end fund is no longer available as an initial public offering and is only offered through broker-dealers on the secondary market. A closed-end fund is not required to buy its shares back from investors upon request. Shares of the Fund may trade at either a premium or discount relative to the Fund’s net asset value, and there can be no assurance that any discount will decrease. The values of, and/or the income generated by, securities held by the Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Debt securities are subject to credit risk and interest rate risk, and high yield securities and unrated securities of similar credit quality have a much greater risk of default and their values tend to be more volatile than higher-rated securities with similar maturities. Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability, and foreign currency fluctuations. Risks of foreign investing are magnified in emerging or developing markets. The Fund is exposed to mortgage- and asset-backed securities risk. The Fund is leveraged through a revolving credit facility and also may incur leverage by issuing preferred shares in the future. The use of leverage results in certain risks, including, among others, the likelihood of greater volatility of the net asset value and the market value of common shares. Derivatives involve additional risks, including interest rate risk, credit risk, the risk of improper valuation, and the risk of non-correlation to the relevant instruments that they are designed to hedge or closely track.

10 | Allspring Multi-Sector Income Fund

Performance highlights (unaudited)

MANAGERS' DISCUSSION

Overview

The Fund’s return based on market value was 34.28% for the 12-month period that ended October 31, 2021. During the same period, the Fund’s return based on its net asset value (NAV) was 13.09%. Based on both its market value and its NAV return, the Fund outperformed the Multi-Sector Income Blended Index, which return 6.32% for the 12-month period that ended October 31, 2021.

Strategy

For the 12-month period that ended October 31, 2021, risk assets continued to rally in response to improving economic conditions, with spreads in investment-grade corporate and securitized sectors tightening on average 37 basis points (bps; 100 bps equal 1.00%) and 29 bps, respectively. Lower-rated and more credit-sensitive bonds significantly outperformed higher-rated securities. Similarly, BBB-rated commercial mortgage-backed securities (CMBS) spreads compressed 586 bps while AAA-rated CMBS tightened only 33 bps. Improving fundamentals, especially in the retail and hospitality sectors, benefited sectors that had materially underperformed early last year as a result of the pandemic.

Reflation and reopening has been a key investment theme over the past 12 months. Broad economic reflation affected the high-yield market in 3 main ways: rising U.S. Treasury yields, a 134% increase in the price of oil, and the recovery in valuations in COVID-19-affected sectors. To capitalize, we increased the average spread in our floating-rate loans, reduced rate-sensitive bonds, optimized our energy overweight, and applied a bottom-up approach to selecting COVID-19-affected securities.

| Ten largest holdings (%) as of October 31, 20211 |

| Mexico, 8.50%, 5-31-2029 | 3.04 |

| India, 7.32%, 1-28-2024 | 2.82 |

| Indonesia, 7.00%, 9-15-2030 | 2.42 |

| Colombia, 7.50%, 8-26-2026 | 1.73 |

| Romania, 3.25%, 4-29-2024 | 1.53 |

| Russia, 6.50%, 2-28-2024 | 1.50 |

| Russia, 6.90%, 5-23-2029 | 1.49 |

| Romania, 5.00%, 2-12-2029 | 1.33 |

| Russia, 7.65%, 4-10-2030 | 1.27 |

| Malaysia, 4.23%, 6-30-2031 | 1.21 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

Growth, inflation, and political risk have been the key drivers of emerging-market bonds and currencies over the reporting period. Investors have oscillated between worrying about inflation and worrying about growth, prompting yields to rise and fall depending on which narrative had the upper hand at the time. The marked sovereign underperformers have been those struggling with domestic political upheaval—Chile, Peru, and Turkey—but it’s worth noting that overall geopolitical risk remains elevated. In general, bond yields are higher and yield curves are steeper than they were a year ago.

Exposure to Eastern Europe was reduced over the reporting period through the sale of part of the position in Romania. The lowest-yielding of the emerging market regions, Eastern Europe, has been screening as expensive given underlying inflation dynamics and central bank reluctance to take action. Exposure to Malaysia was reduced after a period of good performance. These sales allowed additional exposure to higher-yielding Brazil and a new position in Chinese government bonds. We have adjusted duration in individual markets as opportunities presented themselves, but we have been careful to keep overall Fund duration fairly modest.

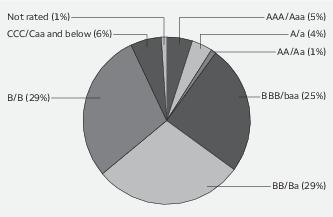

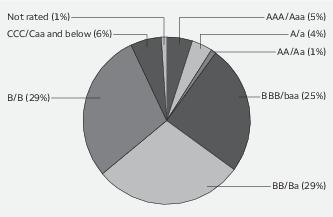

| Credit quality as of October 31, 20211 |

| 1 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the portfolio with the ratings depicted in the chart are calculated based on the market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of the three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

Allspring Multi-Sector Income Fund | 11

Performance highlights (unaudited)

Contributors

Within securitized sectors, out-of-benchmark positioning in mezzanine CMBS was the largest contributor, followed by holdings in subordinate non-agency mortgage-backed securities (MBS). In corporate sectors, the primary contributor was an overweight to BBB-rated bonds.

Reorganized energy equities with depressed valuations and low dollar-price fallen angel bonds were the best ways to capitalize on broad economic reflation within the high-yield market. The portfolio’s top-performing investment was an equity position in Denbury Resources, Incorporated, a long-time high-yield issuer whose set of conventional oil-producing assets positions it to capture carbon that’s a by-product of industrial production and use that carbon to enhance oil recoveries from generations-old wells, thus producing carbon-neutral oil. Bond positions in Baytex Energy, Occidental Petroleum Corp., and EnLink Midstream and equity positions in Bristow Group Incorporated and Whiting Petroleum Corporation were also top performers.

The vaccine rollout led to the normalization of inverted credit curves (near-term maturities trading at higher yields than longer ones). The portfolio built an overweight position in the leisure, airlines, and transportation sectors to take advantage. The Fund's use of leverage had a positive impact on total return performance during this reporting period.

Detractors

Within securitized sectors, the Fund’s allocation to agency MBS was a small detractor. Within corporate sectors, security selection in the industrials sector was a modest detractor.

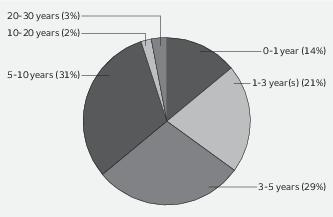

| Effective maturity distribution as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund’s fixed-income securities. These amounts are subject to change and may have changed since the date specified. |

Lack of positions in Transocean Limited, AMC Entertainment Holdings, The Kraft Heinz Company, and PBF Holding Company LLC also dampened performance relative to the ICE BofA U.S. High Yield Constrained Index.

The positions in Romania—bonds and currency—detracted. The Brazilian bond market struggled in the latter stages of the reporting period as inflation quickened, while the Indian rupee was modestly weaker versus the U.S. dollar.

Outlook

We continuously review market conditions, relative valuations, and technical factors over a six-month time frame, asking ourselves whether we think conditions will improve or deteriorate over the next few quarters. Ultimately, the goal of this focus is to foster an unbiased approach in evaluating the conditions we expect over the coming months and to inform our decisions. We believe that a process built to stay closely attuned to changing market conditions will benefit investors over the economic cycle.

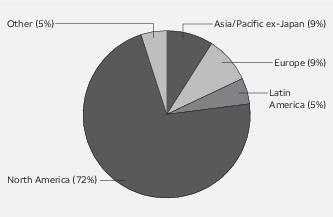

| Geographic allocation as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

We are neutral on corporate credit given current valuations. We continue to favor financials over industrials given the former’s favorable fundamentals and the latter’s higher leverage levels. Lower event risk in the financial space is also preferred. While we continue to like BBB-rated bonds, we are looking for opportunities to implement a more barbelled strategy (where approximately half of the fixed-income holdings are short-term instruments while the other half are long-term instruments), holding A-rated and BB-rated bonds where possible.

Approximately 57% of the mortgage/corporate sleeve’s exposure is in corporate credit and around 41% is in fixed-rate and floating-rate mortgage securities. The largest industry exposures in the credit sector include insurance, energy, banking, and technology companies.

Just as the height of monetary policy support is behind us, so, too, is the majority of systemic spread compression. Looking forward, we expect tight spreads, more aggressive issuance, and the expectation for rate increases to be potential sources of volatility in high yield. Ultimately, we believe that generating attractive risk-adjusted carry and successfully navigating idiosyncratic credit risk will be paramount to generating outperformance.

12 | Allspring Multi-Sector Income Fund

Performance highlights (unaudited)

Emerging markets are in an interesting place, with higher inflation and the pivot to tighter monetary policy contrasting with the continued rebound in economic growth and commodity prices. Duration is not yet attractive, but 2022 could present an opportunity for longer-dated emerging market securities to outperform. There is some anxiety around what the end of quantitative easing in core developed markets means for emerging markets, but we’re encouraged by the proactive measures taken by central banks (particularly central banks of higher-yielders).

Allspring Multi-Sector Income Fund | 13

Objective, strategies and risks (unaudited)

Investment objective

The Fund seeks to provide a high level of current income consistent with limiting its overall exposure to domestic interest rate risk. The Fund’s investment objective is a fundamental policy and may not be changed without the approval of a majority of the outstanding voting securities (as defined in the Investment Company Act of 1940, as amended, (the “1940 Act”) of the Fund.

Principal investment strategies

The Fund allocates its assets between three separate investment strategies, or sleeves.

High Yield Bond Sleeve. Under normal market conditions, the Fund allocates approximately 30%-70% of its total assets to a sleeve with an investment strategy that focuses on U.S. dollar-denominated below investment-grade bonds, debentures, and other income obligations, including loans and preferred stocks (often called “high yield” securities or “junk bonds”). We may invest in below investment-grade debt securities of any credit quality, however, we may not purchase securities rated CCC or below if 20% of the sleeve’s assets are already held with such a rating. We are not required to sell securities rated CCC or below if the 20% limit is exceeded due to security downgrades. Securities in the Fund’s high yield bond sleeve may be issued by domestic or foreign issuers (including foreign governments).

For purposes of the sleeve’s credit quality policies, if a security receives different ratings from nationally recognized securities rating organizations, the sleeve will use the rating that the portfolio managers believe is most representative of the security’s credit quality. The sleeve’s high yield securities may have fixed or variable principal payments and all types of interest rate and dividend payment and reset terms, including fixed rate, adjustable rate, contingent, deferred, payment in kind and auction rate features. The sleeve may invest in securities with a broad range of maturities.

The Fund’s high yield sleeve is managed following a rigorous investment process that emphasizes both quality and value. The research driven approach includes both a top-down review of macroeconomic factors and intensive, bottom-up scrutiny of individual securities. We consider both broad economic and issuer specific factors in selecting securities for the high yield sleeve. In assessing the appropriate maturity and duration for the Fund’s high yield sleeve and the credit quality parameters and weighting objectives for each sector and industry in this portion of the Fund’s portfolio, we consider a variety of factors that are expected to influence the economic environment and the dynamics of the high yield market. These factors include fundamental economic indicators, such as interest rate trends, the rates of economic growth and inflation, the performance of equity markets, commodities prices, Federal Reserve monetary policy and the relative value of the U.S. dollar compared to other currencies. Once we determine the preferable portfolio characteristics, we conduct further evaluation to determine capacity and inventory levels in each targeted industry. We also identify any circumstances that may lead to improved business conditions, thus increasing the attractiveness of a particular industry. We select individual securities based upon the terms of the securities (such as yields compared to U.S. Treasuries or comparable issues), liquidity and rating, sector and issuer diversification. We also employ due diligence and fundamental research to assess an issuer’s credit quality, taking into account financial condition and profitability, future capital needs, potential for change in rating, industry outlook, the competitive environment and management ability.

The analysis of issuers may include, among other things, historic and current financial conditions, current and anticipated cash flow and borrowing requirements, value of assets in relation to historical costs, strength of management, responsiveness to business conditions, credit standing, the company’s leverage versus industry norms and current and anticipated results of operations. While we consider as one factor in our credit analysis the ratings assigned by the rating services, we perform our own independent credit analysis of issuers.

In making decisions for the high yield sleeve, we rely on the knowledge, experience and judgment of our team who have access to a wide variety of research. We apply a strict sell discipline, which is as important as purchase criteria in determining the performance of this portion of this portfolio. We routinely meet to review profitability outlooks and discuss any deteriorating business fundamentals, as well as consider changes in equity valuations and market perceptions before selling securities.

In other than normal market conditions, when changing economic conditions and other factors cause the yield difference between lower rated and higher rated securities to narrow, the high yield bond sleeve may purchase higher rated U.S. debt instruments if we believe that the risk of loss of income and principal may be reduced substantially with only a relatively small reduction in yield.

We regularly review the investments of the portfolio and may sell a portfolio holding when it has achieved its valuation target, there is deterioration in the underlying fundamental of the business, or we have identified a more attractive investment opportunity.

Material Changes During the Fiscal Year: As of the date of this report, there have been no material changes made to the high yield bond sleeve of the Fund during this fiscal year.

14 | Allspring Multi-Sector Income Fund

Objective, strategies and risks (unaudited)

International/Emerging Markets Bond Sleeve. Under normal market conditions, the Fund allocates approximately 10%-40% of its total assets to an investment strategy that focuses on developed and emerging market debt securities, including obligations of foreign governments or governmental entities, foreign corporations, or supranational agencies denominated in various currencies. Within this sleeve, the Fund invests in at least three countries or supranational agencies.

Up to 10% of the debt securities in the sleeve may be below investment grade. The weighted average credit quality of the sleeve is expected to be investment grade.

Currency is managed as a separate asset class. We may purchase a foreign currency on a spot or forward basis in order to benefit from potential appreciation of such currency relative to the U.S. dollar or to other currencies. The sleeve may enter into foreign currency exchange contracts to gain or hedge currency exposure or control risk.

While we may purchase securities of any maturity or duration, under normal circumstances, we expect this sleeve of the Fund’s portfolio to maintain a dollar-weighted average effective maturity of between 5 and 14 years, and a dollar-weighted average effective duration of between 3 1/2 and 10 years. “Dollar-Weighted Average Effective Maturity” is a measure of the average time until the final payment of principal and interest is due on fixed income securities in this sleeve of the Fund. “Dollar-Weighted Average Effective Duration” is an aggregate measure of the sensitivity of a fund’s fixed income portfolio securities to changes in interest rates. As a general matter, the price of a fixed income security with a longer effective duration will fluctuate more in response to changes in interest rates than the price of a fixed income security with a shorter effective duration.

We use proprietary models and systems to assess and highlight areas of relative value around the world. Model-driven forecasts are created using fundamental economic inputs to generate economic forecasts on the global bond markets. With these forecasts, an optimization process accounts for multiple iteration scenarios to create, what we believe to be, an optimal portfolio strategy. The output of the model process is intended to provide relative valuations for determining an over, or underweight of country-specific bond markets. Similarly, currencies are valued for their potential returns or to hedge currency exposure. These macro ‘top-down’ quantitative models are used in conjunction with our investment expertise and aligned with a ‘bottom-up’ security selection process. Each of our quantitative models and investment expertise are equally important in our security selection process.

Sell decisions with respect to this sleeve are valuation-driven based on our models and our fundamental analysis. We may also sell a security held by this sleeve of the Fund due to changes in portfolio strategy or cash flow needs.

Material Changes During the Fiscal Year: As of the date of this report, there have been no material changes made to the international/emerging markets bond sleeve of the Fund during this fiscal year.

Mortgage/Corporate Bond Sleeve. Under normal market conditions, the Fund allocates approximately 10%-30% of its total assets to an investment strategy that focuses on adjustable-rate and fixed-rate mortgage backed securities (including collateralized mortgage obligations (“CMOs”)) and asset-backed securities) and investment grade corporate bonds. Mortgage backed securities in which the sleeve invests may include both non-agency mortgage securities and securities issued or guaranteed by the U.S. government, its agencies, or its instrumentalities. The sleeve may invest in securities with a broad range of maturities.

Under normal circumstances, we expect to maintain an average weighted credit quality rating for the sleeve of investment-grade (BBB-/Baa3 or better). As part of our mortgage-backed securities investment strategy, we may enter into dollar roll transactions for this sleeve of the Fund.

We employ a top-down, macroeconomic outlook to determine the portfolio’s duration, yield curve positioning, credit quality and sector allocation. Macroeconomic factors considered may include, among others, the pace of economic growth, employment conditions, corporate profits, inflation, monetary and fiscal policy, as well as the influence of international economic and financial conditions. In combination with our top-down macroeconomic approach, we employ a bottom-up process of fundamental securities analysis to determine the specific securities for investment. Elements of this evaluation may include credit research, duration measurements, historical yield spread relationships, volatility trends, mortgage refinance rates, as well as other factors. Our credit analysis may consider an issuer’s general financial condition, its competitive position and its management strategies, as well as industry characteristics and other factors. We may sell a security due to changes in credit characteristics or outlook, as well as changes in portfolio strategy or cash flow needs. A security may also be sold and replaced with one that presents a better value or risk/reward profile.

Material Changes During the Fiscal Year: As of the date of this report, there have been no material changes made to the mortgage/corporate bond sleeve of the Fund during this fiscal year.

Allspring Multi-Sector Income Fund | 15

Objective, strategies and risks (unaudited)

The Fund’s Overall Portfolio. We monitor the weighting of each investment strategy within the Fund’s portfolio on an ongoing basis and rebalance the Fund’s assets when we determine that such a rebalancing is necessary to align the portfolio in accordance with the investment strategies described above. From time to time, we may make adjustments to the weighting of each investment strategy. Such adjustments would be based on our review and consideration of the expected returns for each investment strategy and would factor in the stock, bond and money markets, interest rate and corporate earnings growth trends, and economic conditions which support changing investment opportunities.

The Fund may enter into transactions including, among others, options, futures and forward contracts, loans of portfolio securities, swap contracts, and other derivatives, as well as when-issued, delayed delivery, or forward commitment transactions, that may in some circumstances give rise to a form of leverage. The Fund may use some or all of these transactions from time to time in the management of its portfolio, for hedging purposes, to adjust portfolio characteristics, or more generally for purposes of attempting to increase the Fund’s investment return. There can be no assurance that the Fund will enter into any such transactions at any particular time or under any specific circumstances. The Fund reserves the flexibility to issue preferred shares and debt securities, or to borrow money, for leveraging purposes. By using leverage, the Fund would seek to obtain a higher return for holders of common shares than if it did not use leverage. Leveraging is a speculative technique, and there are special risks involved. There can be no assurance that any leveraging strategies, if employed by the Fund, will be successful, and such strategies can result in losses to the Fund.

In contrast to the investment objectives of the Fund, which are fundamental, the investment policies of the Fund described above are non-fundamental and may be changed by the Board of Trustees of the Fund so long as shareholders are provided with at least 60 days prior written notice of any change to the extent required by the rules under the 1940 Act.

Other investment techniques and strategies

As part of or in addition to the principal investment strategies discussed above, the Fund may at times invest a portion of its assets in the investment strategies and may use certain investment techniques as described below.

Convertible and Other Securities. The Fund’s investment in fixed income securities may include bonds and preferred stocks that are convertible into the equity securities of the issuer or a related company. The Fund will not invest more than 10% of its total assets in convertible securities. Depending upon the relationship of the conversion price to the market value of the underlying securities, convertible securities may trade more like equity securities than debt instruments. Consistent with its objective and other investment policies, the Fund may also invest a portion of its assets in equity securities, including common stocks, depositary receipts, warrants, rights and other equity interests.

Loans. The Fund may invest in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. The loans in which the Fund invests primarily consist of direct obligations of a borrower. The Fund may invest in a loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the Fund acquires some or all of the interest of a bank or other lending institution in a loan to a borrower. The participations typically will result in the Fund having a contractual relationship only with the lender, not the borrower. The Fund will have the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may be unsecured. Loans that are fully secured offer the Fund more protection than an unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a risk of insolvency of the lending bank or other financial intermediary. The markets in loans are not regulated by federal securities laws or the U.S. Securities and Exchange Commission.

Preferred Shares. The Fund may invest in preferred shares. Preferred shares are equity securities, but they have many characteristics of fixed income securities, such as a fixed dividend payment rate and/or a liquidity preference over the issuer’s common shares. However, because preferred shares are equity securities, they may be more susceptible to risks traditionally associated with equity investments than the Fund’s fixed income securities.

Foreign Currency Transactions. The Fund may engage in foreign currency transactions for the purpose of hedging against foreign exchange risk arising from the Fund’s investment or anticipated investment in securities denominated in foreign currencies. The Fund also may enter into these contracts for purposes of increasing exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one country to another.

16 | Allspring Multi-Sector Income Fund

Objective, strategies and risks (unaudited)

Structured Securities. The Fund may invest in structured securities. The value of the principal and/or interest on such securities is determined by reference to changes in the value of specific currencies, interest rates, commodities, indices or other financial indicators (“Reference”) or the relative change in two or more References. The interest rate or the principal amount payable upon maturity or redemption may be increased or decreased depending upon changes in the Reference. The terms of the structured securities may provide in certain circumstances that no principal is due at maturity and, therefore, may result in a loss of the Fund’s investment. Changes in the interest rate or principal payable at maturity may be a multiple of the changes in the value of the Reference. Consequently, structured securities may entail a greater degree of market risk than other types of fixed income securities.

Asset-Backed Securities. Asset-backed securities are securities that represent a participation in, or are secured by and payable from, a stream of payments generated by particular assets, most often a pool or pools of similar assets (e.g., trade receivables). The credit quality of these securities depends primarily upon the quality of the underlying assets and the level of credit support and/or enhancement provided.

The underlying assets (e.g., loans) are subject to prepayments which shorten the securities’ weighted average maturity and may lower their return. If the credit support or enhancement is exhausted, losses or delays in payment may result if the required payments of principal and interest are not made. The value of these securities also may change because of changes in the market’s perception of the creditworthiness of the servicing agent for the pool, the originator of the pool, or the financial institution or Fund providing the credit support or enhancement.

Real Estate Investment Trusts. The Fund may invest a portion of its assets in real estate investment trusts (“REITs”). REITs primarily invest in income-producing real estate or real estate related loans or interests. REITs are generally classified as equity REITs, mortgage REITs, or a combination of equity and mortgage REITs. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling properties that have appreciated in value. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. The Fund will indirectly bear its proportionate share of any management and other expenses paid by REITs in which it invests in addition to the expenses paid by the Fund. Distributions received by the Fund from REITs may consist of dividends, capital gains, and/or return of capital.

U.S. Government Securities. The Fund may invest in U.S. government securities, including debt securities issued or guaranteed by the U.S. Treasury, U.S. Government agencies or government-sponsored entities. These securities may have fixed, floating or variable rate and also include mortgage-backed securities.

Zero-Coupon, Step-Up Coupon, and Pay-in-Kind Securities. Zero-coupon, step-up coupon, and pay-in-kind securities are types of debt securities that do not make regular cash interest payments. Asset-backed securities, convertible securities, corporate debt securities, foreign securities, high yield securities, mortgage-backed securities, municipal securities, participation interests, stripped securities, U.S. Government and related obligations and other types of debt instruments may be structured as zero-coupon, step-up coupon, and pay-in-kind securities.

Instead of making periodic interest payments, zero-coupon securities are sold at discounts from face value. The interest earned by the investor from holding this security to maturity is the difference between the maturity value and the purchase price. Step-up coupon bonds are debt securities that do not pay interest for a specified period of time and then, after the initial period, pay interest at a series of different rates. Pay-in-kind securities normally give the issuer an option to pay cash at a coupon payment date or to give the holder of the security a similar security with the same coupon rate and a face value equal to the amount of the coupon payment that would have been made. To the extent these securities do not pay current cash income, the market prices of these securities would generally be more volatile and likely to respond to a greater degree to changes in interest rates than the market prices of securities that pay cash interest periodically having similar maturities and credit qualities.

Investments in Equity Securities. The Fund may invest in equity securities. Equity securities, such as common stock, generally represent an ownership interest in a company. While equity securities have historically generated higher average returns than fixed income securities, equity securities have also experienced significantly more volatility in those returns. An adverse event, such as an unfavorable earnings report, may depress the value of a particular equity security held by the Fund. Also, the price of equity securities, particularly common stocks, are sensitive to general movements in the stock market. A drop in the stock market may depress the price of equity securities held by the Fund.

Other Investment Companies. The Fund may invest in other investment companies to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder. The Fund, as a holder of the securities of other investment companies, will bear its pro rata portion of the other investment companies’ expenses, including advisory fees. These expenses are in addition to the direct expenses of the Fund’s own operations.

Allspring Multi-Sector Income Fund | 17

Objective, strategies and risks (unaudited)

Defensive and Temporary Investments. The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments for purposes of maintaining liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective.

Derivatives. The Fund may invest up to 10% of its total assets in futures and options on securities and indices and in other derivatives. In addition, the Fund may enter into interest rate swap transactions with respect to the total amount the Fund is leveraged in order to hedge against adverse changes in interest rates affecting dividends payable on any preferred shares or interest payable on borrowings constituting leverage. In connection with any such swap transaction, the Fund will segregate liquid securities in the amount of its obligations under the transaction. A derivative is a security or instrument whose value is determined by reference to the value or the change in value of one or more securities, currencies, indices or other financial instruments. The Fund does not use derivatives as a primary investment technique and generally does not anticipate using derivatives for non-hedging purposes. In the event the Advisor uses derivatives for non-hedging purposes, no more than 3% of the Fund’s total assets will be committed to initial margin for derivatives for such purposes. The Fund may use derivatives for a variety of purposes, including:

| ■ | As a hedge against adverse changes in securities market prices or interest rates; and |

| ■ | As a substitute for purchasing or selling securities. |

Repurchase Agreements. The Fund may enter into repurchase agreements with broker-dealers, member banks of the Federal Reserve System and other financial institutions. Repurchase agreements are arrangements under which the Fund purchases securities and the seller agrees to repurchase the securities within a specific time and at a specific price. We review and monitor the creditworthiness of any institution which enters into a repurchase agreement with the Fund. The counterparty’s obligations under the repurchase agreement are collateralized with U.S. Treasury and/or agency obligations with a market value of not less than 100% of the obligations, valued daily. Collateral is held by the Fund’s custodian in a segregated, safekeeping account for the benefit of the Fund. Repurchase agreements afford the Fund an opportunity to earn income on temporarily available cash at low risk. In the event that the counterparty to a repurchase agreement is unwilling or unable to fulfill its contractual obligations to repurchase the underlying security, the Fund may lose money, suffer delays, or incur costs arising from holding or selling the underlying security.

Portfolio Turnover. It is the policy of the Fund not to engage in trading for short-term profits although portfolio turnover is not considered a limiting factor in the execution of investment decisions for the Fund.

Principal risks

An investment in the Fund may lose money, is not a deposit of a bank, is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below.

Market Risk. The values of, and/or the income generated by, securities held by the Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Securities markets are volatile and may decline significantly in response to adverse issuer, regulatory, political, or economic developments. Different sectors of the market and different security types may react differently to such developments. Political, geopolitical, natural and other events, including war, terrorism, trade disputes, government shutdowns, market closures, natural and environmental disasters, epidemics, pandemics and other public health crises and related events have led, and in the future may lead, to economic uncertainty, decreased economic activity, increased market volatility and other disruptive effects on U.S. and global economies and markets. Such events may have significant adverse direct or indirect effects on the Fund and its investments. In addition, economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions.

Debt Securities Risk. Debt securities are subject to credit risk and interest rate risk. Credit risk is the possibility that the issuer or guarantor of a debt security may be unable, or perceived to be unable, to pay interest or repay principal when they become due. In these instances, the value of an investment could decline and the Fund could lose money. Credit risk increases as an issuer’s credit quality or financial strength declines. Interest rate risk is the possibility that interest rates will change over time. When interest rates rise, the value of debt securities tends to fall. The longer the terms of the debt securities held by a Fund, the more the Fund is subject to this risk. If interest rates decline, interest that the Fund is able to earn on its investments in debt securities may also decline, which could cause the Fund to reduce the dividends it pays to shareholders, but the value of those securities may increase. Very low or negative interest rates may magnify interest rate risk.

18 | Allspring Multi-Sector Income Fund

Objective, strategies and risks (unaudited)

High Yield Securities Risk. High yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”) have a much greater risk of default (or in the case of bonds currently in default, of not returning principal) and their values tend to be more volatile than higher-rated securities with similar maturities. Additionally, these securities tend to be less liquid and more difficult to value than higher-rated securities.

Foreign Investment Risk. Foreign investments may be subject to lower liquidity, greater price volatility and risks related to adverse political, regulatory, market or economic developments. Foreign companies may be subject to significantly higher levels of taxation than U.S. companies, including potentially confiscatory levels of taxation, thereby reducing the earnings potential of such foreign companies. Foreign investments may involve exposure to changes in foreign currency exchange rates. Such changes may reduce the U.S. dollar value of the investments. Foreign investments may be subject to additional risks such as potentially higher withholding and other taxes, and may also be subject to greater trade settlement, custodial, and other operational risks than domestic investments. Certain foreign markets may also be characterized by less stringent investor protection and disclosure standards.

Emerging Markets Risk. Emerging market securities typically present even greater exposure to the risks described under “Foreign Investment Risk” and may be particularly sensitive to global economic conditions. For example, emerging market countries are typically more dependent on exports and are therefore more vulnerable to recessions in other countries. Emerging markets tend to have less developed legal and financial systems and a smaller market capitalization than markets in developed countries. Some emerging markets are subject to greater political instability. Additionally, emerging markets may have more volatile currencies and be more sensitive than developed markets to a variety of economic factors, including inflation. Emerging market securities are also typically less liquid than securities of developed countries and could be difficult to sell, particularly during a market downturn.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities are subject to risk of default on the underlying mortgages or assets, particularly during periods of economic downturn. Defaults on the underlying mortgages or assets may cause such securities to decline in value and become less liquid. Rising interest rates tend to extend the duration of these securities, making them more sensitive to changes in interest rates than instruments with fixed payment schedules. As a result, in a period of rising interest rates, these securities may exhibit additional volatility. When interest rates decline or are low, borrowers may pay off their mortgage or other debts sooner than expected, which can reduce the returns of the Fund. Mortgage dollar roll transactions involve the risk that the market value of the securities that are required to be repurchased in the future may decline below the agreed upon repurchase price. They also involve the risk that the party to whom the securities are sold may become insolvent, limiting the fund’s ability to repurchase securities at the agreed upon price.

Leverage Risk. The use of leverage through the issuance of preferred shares and/or debt securities, or from borrowing money, may result in certain risks to the Fund as described below. Certain transactions, such as derivatives, also may give rise to a form of economic leverage. Leveraging is a speculative technique, and there are special risks involved, including the risk that downside outcomes for common shareholders are magnified as a result of losses and declines in value of portfolio securities purchased with borrowed money. In addition, the costs of the financial leverage may exceed the income from investments made with such leverage, interest rates or dividends payable on the financial leverage may affect the yield and distributions to the common shareholders, and the net asset value and market value of common shares may be more volatile than if the Fund had not been leveraged. The use of leverage may cause the Fund to have to liquidate portfolio positions when it may not be advantageous to do so. There can be no assurance that any leveraging strategies will be successful.

Because many derivatives have a leverage component (i.e., a notional value in excess of the assets needed to establish and/or maintain the derivative position), adverse changes in the value or level of the underlying asset, rate or index may result in a loss substantially greater than the amount invested in the derivative itself.

Anti-takeover Provisions Risk. The Fund’s governing documents include provisions that could limit the ability of other entities or persons to acquire control of the Fund or to change the composition of its Board of Trustees. Such provisions could limit the ability of shareholders to sell their shares at a premium over prevailing market prices by discouraging a third party from seeking to obtain control of the Fund. These provisions include staggered terms of office for the Trustees, advance notice requirements for shareholder proposals, and super majority voting requirements for open-ending the Fund or a merger, liquidation, asset sale or similar transactions.

Closed-end Fund Risk. Closed-end funds involve investment risks different from those associated with other investment companies. Shares of closed-end funds frequently trade at either a premium or discount relative to their net asset value (“NAV”). There can be no assurance that the discount will decrease. It is possible that a market discount may increase and the Fund may suffer realized or unrealized capital losses due to further decline in the market price of the securities held by the

Allspring Multi-Sector Income Fund | 19

Objective, strategies and risks (unaudited)

Fund, thereby adversely affecting the NAV of the Fund’s shares. Similarly, there can be no assurance that the Fund’s shares will trade at a premium, will continue to trade at a premium or that the premium will not decrease over time.

Convertible Securities Risk. A convertible security has characteristics of both equity and debt securities and, as a result, is exposed to risks that are typically associated with both types of securities. The market value of a convertible security tends to decline as interest rates increase but also tends to reflect changes in the market price of the common stock of the issuing company. A convertible security is also exposed to the risk that an issuer is unable to meet its obligation to make dividend or interest and principal payments when due as a result of changing financial or market conditions. In the event of a liquidation of the issuer, holders of a convertible security would generally be paid only after holders of any senior debt obligations. The Fund may be forced to convert a convertible security before it would otherwise choose to do so, which may decrease the Fund’s return.

Derivatives Risk. The use of derivatives, such as futures, options and swap agreements, presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. The use of derivatives can lead to losses because of adverse movements in the price or value of the derivatives’ underlying assets, indexes or rates and the derivatives themselves, which may be magnified by certain features of the derivatives. These risks are heightened when derivatives are used to enhance the Fund’s return or as a substitute for a position or security, rather than solely to hedge (or mitigate) the risk of a position or security held by the Fund. The success of a derivative strategy will be affected by the portfolio manager’s ability to assess and predict market or economic developments and their impact on the derivatives’ underlying assets, indexes or rates and the derivatives themselves. Certain derivative instruments may become illiquid and, as a result, may be difficult to sell when the portfolio manager believes it would be appropriate to do so. Certain derivatives create leverage, which can magnify the impact of a decline in the value of their underlying assets, indexes or rates and increase the volatility of the Fund’s net asset value. Certain derivatives (e.g., over-the-counter swaps) are also subject to the risk that the counterparty to the derivative contract will be unwilling or unable to fulfill its contractual obligations, which may cause the Fund to lose money, suffer delays or incur costs arising from holding or selling an underlying asset. Changes in laws or regulations may make the use of derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect the use, value or performance of derivatives.

Equity Securities Risk. The values of equity securities may experience periods of substantial price volatility and may decline significantly over short time periods. In general, the values of equity securities are more volatile than those of debt securities. Equity securities fluctuate in value and price in response to factors specific to the issuer of the security, such as management performance, financial condition, and market demand for the issuer’s products or services, as well as factors unrelated to the fundamental condition of the issuer, including general market, economic and political conditions. Different parts of a market, industry and sector may react differently to adverse issuer, market, regulatory, political, and economic developments.

Foreign Currency Risk. The Fund may invest in non-dollar-denominated investments. The Fund may be limited in its ability to hedge the value of its non-dollar denominated investments against currency fluctuations. As a result, a decline in the value of currencies in which the Fund’s investments are denominated against the dollar will result in a corresponding decline in the dollar value of the Fund’s assets. These declines will in turn affect the Fund’s income and net asset value.

Futures Contracts Risk. A Fund that uses futures contracts, which are a type of derivative, is subject to the risk of loss caused by unanticipated market movements. In addition, there may at times be an imperfect correlation between the movement in the prices of futures contracts and the value of their underlying instruments or indexes, and there may at times not be a liquid secondary market for certain futures contracts.

Inflation Risk. Inflation risk is the risk that the value of assets or income from the Fund’s investments will be worth less in the future as inflation decreases the value of money. As inflation increases, the real, or inflation-adjusted, value of the common shares and distributions can decline and the dividend payments on the Fund’s preferred shares, if any, or interest payments on Fund borrowings, if any, may increase.

Issuer Risk. The value of corporate income-producing securities may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and services.