UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21339 |

|

MORGAN STANLEY INSTITUTIONAL LIQUIDITY FUNDS |

(Exact name of registrant as specified in charter) |

|

522 FIFTH AVENUE, NEW YORK, NY | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

RONALD E. ROBISON

522 FIFTH AVENUE, NEW YORK, NY, 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-888-378-1630 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 10/31/07 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Fund’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| 2007 Annual Report |

|

October 31, 2007 |

Morgan Stanley Institutional Liquidity Funds

Money Market Portfolio

Prime Portfolio

Government Portfolio

Treasury Portfolio

Tax-Exempt Portfolio

| 2007 Annual Report |

|

October 31, 2007 |

Table of Contents | | |

| | |

Shareholder’s Letter | | 3 |

Performance Summary | | 5 |

| | |

Investment Overviews and Portfolio of Investments | | |

| | |

Money Market Portfolio | | 6 |

Prime Portfolio | | 14 |

Government Portfolio | | 24 |

Treasury Portfolio | | 31 |

Tax-Exempt Portfolio | | 36 |

| | |

Statements of Assets and Liabilities | | 45 |

Statements of Operations | | 47 |

Statements of Changes in Net Assets | | 48 |

Financial Highlights | | 52 |

Notes to Financial Statements | | 58 |

Report of Independent Registered Public Accounting Firm | | 62 |

Federal Income Tax Information | | 63 |

U.S. Privacy Policy | | 64 |

Trustee and Officer Information | | 66 |

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Liquidity Funds. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio’s investment policies to the prospective investor, please call 1 (888) 378-1630. Please read the prospectus carefully before you invest or send money. Additionally, you can access portfolio information including performance, yields, characteristics, and investment team commentary through Morgan Stanley Investment Management’s website: www.morganstanley.com/msim. Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

1

(This page has been left blank intentionally.)

2

| 2007 Annual Report |

| |

| October 31, 2007 |

Shareholder’s Letter

Dear Shareholders:

Overview

We are pleased to present the Morgan Stanley Institutional Liquidity Funds (“MSILF”) Annual Report for the year ended October 31, 2007. MSILF currently offers five portfolios (Money Market, Prime, Government, Treasury and Tax-Exempt), which together are designed to provide flexible cash management options. MSILF’s portfolios provide investors with a means to help them meet specific cash investment needs, whether they need a rated fund, capital preservation, or tax-efficient returns.

Sincerely, |

|

| |

| |

Ronald E. Robison |

President & Principal Executive Officer |

November 2007 |

3

(This page has been left blank intentionally.)

4

| 2007 Annual Report |

| |

| October 31, 2007 |

Performance Summary (unaudited)

The seven-day current and seven-day effective yields (effective yield assumes an annualization of the current yield with all dividends reinvested) as of October 31, 2007, were as follows:

| | Institutional | | Service | | Investor | | Administrative | | Advisory | | Participant | | Cash Management | |

| | Class | | Class | | Class | | Class | | Class | | Class | | Class | |

| | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | |

Portfolio: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market | | 5.15 | % | 5.28 | % | 5.10 | % | 5.23 | % | 5.05 | % | 5.18 | % | 5.00 | % | 5.12 | % | 4.90 | % | 5.02 | % | 4.65 | % | 4.76 | % | 4.85 | % | 4.97 | % |

Prime | | 5.11 | % | 5.25 | % | 5.06 | % | 5.19 | % | 5.01 | % | 5.14 | % | 4.96 | % | 5.09 | % | 4.86 | % | 4.98 | % | 4.61 | % | 4.72 | % | — | | — | |

Government | | 4.82 | % | 4.94 | % | 4.77 | % | 4.89 | % | 4.72 | % | 4.84 | % | 4.67 | % | 4.78 | % | 4.57 | % | 4.68 | % | 4.32 | % | 4.42 | % | — | | — | |

Treasury | | 4.58 | % | 4.69 | % | 4.53 | % | 4.64 | % | 4.48 | % | 4.59 | % | 4.43 | % | 4.53 | % | 4.33 | % | 4.43 | % | 4.08 | % | 4.17 | % | 4.28 | % | 4.38 | % |

Tax-Exempt | | 3.37 | % | 3.43 | % | 3.32 | % | 3.38 | % | 3.27 | % | 3.33 | % | 3.22 | % | 3.28 | % | 3.12 | % | 3.17 | % | 2.87 | % | 2.91 | % | 3.07 | % | 3.12 | % |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance information for the 7-day effective yield assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/msim. Investment return and principal value will fluctuate causing portfolio shares, when redeemed, to be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares.

Investments in the Money Market, Prime, Government, Treasury and Tax-Exempt Portfolios (the “Portfolios”) are neither insured nor guaranteed by the Federal Deposit Insurance Corporation. Although the Portfolios seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these Portfolios. Please read MSILF’s prospectuses carefully before you invest or send money.

Yield quotation more closely reflects the current earnings of the Portfolios than the total return. As with all money market portfolios, yields will fluctuate as market conditions change and the seven-day yields are not necessarily indicative of future performance.

5

2007 Annual Report | |

| |

October 31, 2007 | |

Investment Overview (unaudited)

Money Market Portfolio

The Money Market Portfolio seeks preservation of capital, daily liquidity and maximum current income. The Portfolio seeks to maintain a stable net asset value of $1.00 per share by investing in liquid, high quality U.S. dollar denominated money market instruments of U.S. and foreign financial and non-financial corporations. The Portfolio also invests in obligations of foreign governments and in obligations of the U.S. government and its agencies and instrumentalities.

Performance

For the fiscal year ended October 31, 2007, the Portfolio’s Institutional Share Class had a total return of 5.35%. For the seven-day period ended October 31, 2007, the Portfolio’s Institutional Share Class provided an annualized current yield of 5.15%, while its 30-day moving average annualized yield was 5.17%.

Factors Affecting Performance

From November 2006 through July 2007, the Federal Open Market Committee (the “Fed”) left monetary policy unchanged. On August 17, 2007 citing deteriorating financial market conditions and the potential impact that tighter credit conditions could have in restraining economic growth, the Fed announced a cut in the discount rate of 50 basis points and adjustments in usual discount window practices to facilitate the provision of term financing. On September 18, 2007 the Fed lowered its target federal funds rate by a higher than anticipated 50 basis points, citing risks to growth and the potential for further deterioration in housing activity caused by tightening financial conditions, while also cutting the discount rate a further 50 basis points. Easing continued in October, when on the last day of the month the Fed reduced both the discount rate and the target rates by 25 basis points, to 5.0% and 4.5%, respectively. At that time, the Fed stated that the pace of economic expansion would likely slow. However, it also stated that the upside risks to inflation roughly balanced the downside risks to growth, which the market interpreted as an indication that further rate cuts were unlikely.

Throughout most of the fiscal period under review, the majority of home sales and housing-related statistics released were worse than anticipated. U.S. gross domestic product (GDP) expanded an estimated 3.9% in the third quarter of 2007, about flat with 3.8% in the second quarter but up significantly from the anemic 0.6% rate of growth in the first quarter. Manufacturing activity was sluggish in the first quarter but rebounded in the second quarter as both the Institute for Supply Management manufacturing and non-manufacturing indices rose sharply to levels well above those that indicate expansion. Starting in late July, credit market concerns began to take center stage as highly publicized troubles at two large mortgage-related hedge funds and associated subprime mortgage concerns spread across the broader fixed income market. From mid-August through mid-September, LIBOR rates rose as credit exposures were questioned and fears of ballooning balance sheets and the creditworthiness of those holdings caused inter-bank lending to all but cease. In the last weeks of the fiscal year, high energy costs, volatile financial markets and a weak housing market all contributed to a decline in consumer confidence.

Management Strategies

As of October 31, 2007, the Portfolio had net assets of slightly more than $10.8 billion and a weighted average maturity of 40 days. As of the end of October, 40% of the Portfolio was invested in commercial paper, 29% in corporate bonds, 16% in repurchase agreements, 15% in certificates of deposit (CDs) and 1% in asset backed securities.

Our strategy of managing the Portfolio was really a tale of several distinct periods. During the early months of the review period, when the Fed held monetary policy steady, the market began to price in significant easing. At that time, however, we were not convinced this would occur, and shortly thereafter the money market yield curve inverted with LIBOR rates moving lower from six months on out. Therefore, we chose to emphasize the three-to-six month part of the curve, which effectively increased the weighted average maturity of the Portfolio and allowed it to pick up yield over one-month paper. We favored this part of the curve over the one-year sector as we continued to believe the Fed would not quickly shift to an easing mode, which would be necessary in order for the longer part of the curve to outperform three-to-six month securities.

As we progressed into the second quarter of 2007, we began to look to increase the Portfolio’s weighted average maturity. In the latter part of the quarter there was a pronounced market selloff and the one-year LIBOR setting steepened out to 25 basis points over the current funds rate, at which point we selectively added some one-year fixed rate bonds to the Portfolio. When the credit market crisis hit during the August-September period, we focused on maximizing the Portfolio’s liquidity, favoring investments very short in tenor, from overnight to two weeks maturity, building our overnight liquidity exposure to over 20% of assets. We also selectively purchased four-to-six month paper in order to keep some longer-maturity assets on the books as the Fed was poised to begin easing monetary policy.

6

Investment Overview (cont’d)

Money Market Portfolio

Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended October 31, 2007 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that “Expenses Paid During Period” are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note E) in the Notes to Financial Statements. Therefore, the annualized net expense ratios may differ from the ratio of the expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,027.00 | | $ | 0.61 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.60 | | 0.61 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.12%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Service Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.80 | | $ | 0.87 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.35 | | 0.87 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.17%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.50 | | $ | 1.12 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.10 | | 1.12 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.22%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Administrative Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.20 | | $ | 1.38 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.84 | | 1.38 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.27%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

7

Investment Overview (cont’d)

Money Market Portfolio

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Advisory Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.70 | | $ | 1.89 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.34 | | 1.89 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.37%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Participant Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,024.40 | | $ | 3.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.13 | | 3.11 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.61%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Cash Management Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.50 | | $ | 2.14 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.09 | | 2.14 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.42%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the period).

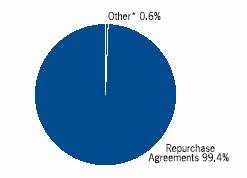

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

* Investment types which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”.

8

| 2007 Annual Report |

| |

| October 31, 2007 |

Portfolio of Investments

Money Market Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed Securities (0.8%) | | | | | |

Asset Backed - CLO (0.8%) | | | | | |

Carlyle Loan Investment Ltd., | | | | | |

5.68%, 6/30/08 | | $ | (a)(b)40,000 | | $ | 40,000 | |

5.76%, 7/14/08 | | (a)(b)12,500 | | 12,500 | |

Shiprock Finance, | | | | | |

5.27%, 8/11/08 | | (a)(b)29,364 | | 29,357 | |

Total Asset Backed Securities (Cost $81,857) | | | | 81,857 | |

Certificates of Deposit (15.1%) | | | | | |

Banking (1.2%) | | | | | |

Citigroup Funding, Inc., | | | | | |

4.73%, 12/28/07 | | 50,000 | | 50,000 | |

Wachovia Corp., | | | | | |

5.32%, 2/4/08 | | 75,000 | | 75,000 | |

| | | | 125,000 | |

International Banks (13.9%) | | | | | |

Banco Bilbao Vizcaya Argentaria, | | | | | |

5.18%, 4/3/08 | | (b)125,000 | | 124,982 | |

Bank of Montreal, | | | | | |

5.09%, 4/18/08 | | 75,000 | | 75,000 | |

Bank of Scotland, | | | | | |

5.32%, 2/22/08 | | 60,000 | | 60,011 | |

5.51%, 12/20/07 | | 75,000 | | 75,036 | |

Barclays Bank plc, | | | | | |

5.18%, 12/21/07 | | 200,000 | | 200,000 | |

Credit Suisse, | | | | | |

5.47%, 2/26/08 | | (b)75,000 | | 75,000 | |

Depfa Bank plc, | | | | | |

5.32%, 11/30/07 | | 100,000 | | 100,000 | |

Deutsche Bank AG, | | | | | |

4.64%, 4/28/08 | | (b)50,000 | | 49,989 | |

Natixis, | | | | | |

5.19%, 2/15/08 | | 30,000 | | 30,004 | |

5.35%, 2/4/08 | | 125,000 | | 125,040 | |

Norinchukin Bank Ltd., | | | | | |

5.35%, 12/21/07 | | 150,000 | | 150,000 | |

5.38%, 12/14/07 | | 125,000 | | 124,999 | |

Societe Generale, | | | | | |

5.15%, 12/19/07 | | 100,000 | | 100,000 | |

UBS AG, | | | | | |

5.46%, 2/19/08 | | 115,000 | | 115,000 | |

5.50%, 3/12/08 | | 100,000 | | 100,000 | |

| | | | 1,505,061 | |

Total Certificates of Deposit (Cost $1,630,061) | | | | 1,630,061 | |

Commercial Paper (39.7%) (e) | | | | | |

Asset Backed - Auto (0.3%) | | | | | |

DaimlerChrysler Revolving Auto Conduit LLC, | | | | | |

5.28%, 11/6/07 | | 31,701 | | 31,678 | |

Asset Backed - Consumer (6.3%) | | | | | |

Corporate Asset Funding Co., Inc, | | | | | |

6.06%, 11/14/07 | | $ | (a)50,000 | | $ | 49,892 | |

Gemini Securitization Corp., | | | | | |

2.57%, 12/14/07 | | (a)50,000 | | 49,706 | |

4.92%, 12/19/07 | | (a)15,000 | | 14,902 | |

4.97%, 11/27/07 | | (a)50,000 | | 49,821 | |

5.42%, 11/6/07 | | (a)25,340 | | 25,321 | |

5.23%, 11/13/07 - 11/16/07 | | (a)60,000 | | 59,885 | |

5.19%, 12/12/07 - 12/17/07 | | (a)60,500 | | 60,116 | |

Old Line Funding LLC, | | | | | |

5.25%, 12/14/07 | | (a)12,500 | | 12,422 | |

Ranger Funding | | | | | |

6.08%, 11/30/07 | | (a)50,659 | | 50,414 | |

Regency Markets No. 1 LLC, | | | | | |

5.00%, 11/23/07 | | (a)30,000 | | 29,909 | |

5.07%, 1/25/08 | | (a)21,311 | | 21,059 | |

Thames Asset Global Securitization, Inc., | | | | | |

5.40%, 11/26/07 - 12/3/07 | | (a)61,465 | | 61,193 | |

6.20%, 11/5/07 | | (a)40,000 | | 39,973 | |

Three Rivers Funding Corp., | | | | | |

5.02%, 11/28/07 | | (a)50,000 | | 49,813 | |

5.21%, 12/21/07 | | (a)35,000 | | 34,749 | |

5.53%, 11/15/07 | | (a)30,000 | | 29,936 | |

Thunder Bay Funding LLC, | | | | | |

5.24%, 11/20/07 | | (a)40,313 | | 40,202 | |

| | | | 679,313 | |

Asset Backed - Corporate (1.7%) | | | | | |

CIESCO LLC, | | | | | |

5.37%, 11/7/07 | | (a)25,000 | | 24,978 | |

5.38%, 11/15/07 | | (a)50,000 | | 49,897 | |

SIMBA Funding Corp., | | | | | |

4.92%, 11/26/07 | | 30,000 | | 29,898 | |

5.35%, 11/2/07 | | 50,000 | | 49,993 | |

Tulip Funding Corp., | | | | | |

6.24%, 11/13/07 | | (a)25,000 | | 24,948 | |

| | | | 179,714 | |

Asset Backed - Diversified (3.5%) | | | | | |

CRC Funding LLC, | | | | | |

5.21%, 1/23/08 | | (a)60,000 | | 59,292 | |

Lexington Parker Capieal Corp., | | | | | |

5.56%, 11/19/07 | | (a)50,000 | | 50,000 | |

Market Street Funding, | | | | | |

5.27%, 11/19/07 | | (a)25,000 | | 24,935 | |

5.37%, 12/3/07 | | (a)30,000 | | 29,858 | |

6.27%, 11/15/07 | | (a)75,000 | | 74,819 | |

Silver Tower U.S. Funding, | | | | | |

5.34%, 11/26/07 | | (a)40,000 | | 39,856 | |

Three Pillars Funding, | | | | | |

5.17%, 11/15/07 | | (a)50,000 | | 49,900 | |

5.27%, 1/16/08 | | (a)20,000 | | 19,780 | |

5.29%, 12/21/07 | | (a)26,271 | | 26,080 | |

| | | | 374,520 | |

The accompanying notes are an integral part of the financial statements.

9

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed - Mortgage (2.3%) | | | | | |

Cancara Asset Securitisation LLC, | | | | | |

5.13%, 1/25/08 | | $ | (a)50,000 | | $ | 49,403 | |

5.21%, 1/24/08 | | (a)100,000 | | 98,805 | |

5.27%, 12/20/07 | | (a)50,000 | | 49,646 | |

Sydney Capital Corp., | | | | | |

5.16%, 11/13/07 | | (a)25,000 | | 24,957 | |

5.42%, 11/15/07 | | (a)25,000 | | 24,948 | |

| | | | 247,759 | |

Asset Backed - Securities (8.5%) | | | | | |

Amstel Funding Corp., | | | | | |

5.01%, 1/22/08 | | (a)40,000 | | 39,549 | |

6.32%, 11/14/07 | | (a)29,993 | | 29,925 | |

5.30%, 12/3/07 | | (a)30,000 | | 29,860 | |

5.32%, 12/28/07 | | (a)52,500 | | 52,063 | |

Curzon Funding Ltd., | | | | | |

5.31%, 11/16/07 | | (a)40,000 | | 39,914 | |

Galaxy Funding | | | | | |

5.25%, 12/19/07 | | (a)50,000 | | 49,655 | |

Grampian Funding LLC, | | | | | |

5.06%, 2/26/08 | | (a)50,000 | | 49,192 | |

5.10%, 2/1/08 | | (a)50,000 | | 49,357 | |

5.24%, 2/19/08 | | (a)60,000 | | 59,057 | |

5.25%, 2/4/08 | | (a)25,000 | | 24,660 | |

5.32, 11/14/07 | | (a)60,000 | | 59,888 | |

North Sea Funding LLC, | | | | | |

5.19%, 12/21/07 | | (a)25,000 | | 24,821 | |

5.33%, 11/19/07 | | (a)15,000 | | 14,961 | |

5.35%, 12/26/07 | | (a)30,668 | | 30,423 | |

5.45%, 11/27/07 - 12/14/07 | | (a)115,000 | | 114,462 | |

Polonius, Inc., | | | | | |

5.27%, 11/15/07 | | (a)15,000 | | 14,969 | |

5.29%, 11/13/07 | | (a)25,000 | | 24,956 | |

Scaldis Capital LLC, | | | | | |

4.92%, 11/27/07 | | (a)65,000 | | 64,770 | |

5.11%, 1/25/08 | | (a)50,000 | | 49,405 | |

5.27%, 12/17/07 | | (a)75,000 | | 74,502 | |

Zero Coupon, 11/15/07 | | (a)25,000 | | 24,953 | |

| | | | 921,342 | |

Asset Backed - SIV (2.1%) | | | | | |

Asscher Finance Corp., | | | | | |

5.36%, 11/13/07 | | (a)(b)30,000 | | 29,947 | |

5.37%, 12/10/07 | | (a)25,000 | | 24,859 | |

Atlas Capital Funding Corp., | | | | | |

5.34%, 11/26/07 | | (a)(b)18,000 | | 17,935 | |

5.36%, 12/12/07 | | (a)(b)50,000 | | 49,702 | |

5.40%, 3/10/08 | | (a)(b)40,000 | | 39,247 | |

5.42%, 3/7/08 | | (a)(b)10,000 | | 9,816 | |

5.57%, 11/20/07 | | (a)(b)32,000 | | 32,000 | |

Harrier Finance Funding, | | | | | |

5.36%, 12/5/07 | | (a)25,000 | | 24,877 | |

| | | | 228,383 | |

Banking (4.3%) | | | | | |

Bank of America Corp., | | | | | |

4.99%, 3/25/08 | | $ | 64,000 | | $ | 62,742 | |

5.31%, 12/21/07 | | 50,000 | | 49,639 | |

Citigroup Funding, Inc., | | | | | |

5.34%, 12/21/07 | | 20,000 | | 19,855 | |

5.50%, 3/18/08 | | 100,000 | | 97,949 | |

5.73%, 12/10/07 - 12/12/07 | | 210,000 | | 208,683 | |

HSBC Bank USA, | | | | | |

5.29%, 12/14/07 | | 25,000 | | 24,845 | |

| | | | 463,713 | |

Finance - Automotive (1.1%) | | | | | |

Toyota Motor Credit Corp., | | | | | |

5.32%, 2/11/08 | | 50,000 | | 49,263 | |

5.36%, 12/21/07 | | 75,000 | | 74,450 | |

| | | | 123,713 | |

International Banks (7.8%) | | | | | |

Barclays U.S. Funding Corp., | | | | | |

4.79%, 3/31/08 | | 50,000 | | 49,015 | |

4.86%, 3/25/08 | | 125,000 | | 122,601 | |

5.00%, 3/24/08 | | 50,000 | | 49,021 | |

5.15%, 2/15/08 | | 70,000 | | 68,957 | |

5.20%, 2/4/08 | | 25,000 | | 24,663 | |

Deutsche Bank Securities, | | | | | |

5.10%, 7/10/37 | | 250,000 | | 250,000 | |

Kommunalkredit International Bank Ltd., | | | | | |

5.35%, 12/10/07 | | (b)50,000 | | 49,716 | |

Santander Central Hispano Finance Delaware, Inc., | | | | | |

4.94%, 12/18/07 | | 55,925 | | 55,567 | |

5.14%, 3/28/08 | | (a)26,000 | | 25,465 | |

Unicredito Italiano Bank, | | | | | |

5.32%, 11/19/07 | | 80,000 | | 79,793 | |

5.33%, 11/26/07 | | 75,000 | | 74,730 | |

| | | | 849,528 | |

Investment Bankers/Brokers/Services (1.8%) | | | | | |

Bear Stearns Cos., Inc., | | | | | |

5.00%, 11/1/07 | | 100,000 | | 100,000 | |

Lehman Brothers Holdings, Inc., | | | | | |

5.06%, 11/5/07 | | 100,000 | | 100,000 | |

| | | | 200,000 | |

Total Commercial Paper (Cost $4,299,663) | | | | 4,299,663 | |

Corporate Notes (5.2%) | | | | | |

Asset Backed - SIV (2.3%) | | | | | |

Asscher Finance Corp., | | | | | |

5.67%, 6/13/08 | | (a)50,000 | | 49,997 | |

5.45%, 6/25/08 | | (a)20,000 | | 20,000 | |

CC USA, Inc., | | | | | |

5.37%, 6/5/08 | | (a)25,000 | | 25,000 | |

Cullinan Finance Corp., | | | | | |

5.39%, 6/16/08 | | (a)40,000 | | 40,000 | |

5.40%, 4/25/08 | | (a)65,000 | | 65,000 | |

5.45%, 2/1/08 | | (a)20,000 | | 20,000 | |

The accompanying notes are an integral part of the financial statements.

10

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Dorada Finance, Inc. | | | | | |

5.37%, 6/6/08 | | $ | (a)10,000 | | $ | 10,000 | |

Kestrel Funding U.S. LLC, | | | | | |

4.58%, 6/24/08 | | (a)25,000 | | 25,000 | |

| | | | 254,997 | |

Banking (2.2%) | | | | | |

American Immigration Lawyers Association, | | | | | |

4.93%, 6/1/38 | | 3,600 | | 3,600 | |

Bank of America NT&SA, | | | | | |

5.30%, 12/27/07 | | 25,000 | | 25,000 | |

Capital Markets Access Co. LCC, | | | | | |

4.93%, 3/1/32 | | 8,350 | | 8,350 | |

4.93%, 10/1/31 | | 4,045 | | 4,045 | |

Charter Lakes Capital LLC, | | | | | |

4.86%, 10/1/46 | | 8,150 | | 8,150 | |

Conestoga Wood Specialties Corp., | | | | | |

4.86%, 3/1/14 | | 9,210 | | 9,210 | |

Counts Trust, | | | | | |

5.38%, 2/6/08 | | (a)95,000 | | 95,000 | |

Floridean Realty LLC, | | | | | |

4.93%, 11/1/31 | | 4,000 | | 4,000 | |

Frank Parsons Paper Co., Inc., | | | | | |

4.86%, 6/1/27 | | 10,000 | | 10,000 | |

Helmholdt Capital LLC, | | | | | |

4.96%, 4/1/47 | | 14,000 | | 14,000 | |

Union Hamilton Special Funding LLC, | | | | | |

5.69%, 12/17/07 | | (a)30,000 | | 30,000 | |

Washington Road Properties & WR Partners LLC, | | | | | |

4.93%, 12/1/26 | | 7,000 | | 7,000 | |

Woerner Holdings, Inc., | | | | | |

4.98%, 6/1/33 | | 17,840 | | 17,840 | |

| | | | 236,195 | |

International Banks (0.7%) | | | | | |

Societe Generale, | | | | | |

5.11%, 2/29/08 | | (a)45,000 | | 45,000 | |

5.11%, 11/2/10 | | (a)30,000 | | 30,000 | |

| | | | 75,000 | |

Total Corporate Notes (Cost $566,192) | | | | 566,192 | |

Extendible Floating Rate Notes (12.2%) | | | | | |

International Banks (12.2%) | | | | | |

Australia & New Zealand Banking Group Ltd., | | | | | |

4.97%, 8/22/08 | | (b)25,000 | | 25,000 | |

Banque Federative Credit Mutuel, | | | | | |

5.10%, 8/13/08 | | (a)(b)305,130 | | 305,130 | |

BNP Paribas, | | | | | |

5.33%, 5/7/08 | | (b)150,000 | | 150,000 | |

Caixa d’Estalvis de Catalunya, | | | | | |

5.75%, 3/7/12 | | (a)(b)180,000 | | 179,999 | |

Caja de Ahorros y Monte de Piedad de Madrid, | | | | | |

5.35%, 8/12/08 | | (b)120,000 | | 120,000 | |

Commonwealth Bank of Australia, | | | | | |

4.91%, 9/23/08 | | (a)(b)50,000 | | 50,000 | |

Depfa Bank plc, | | | | | |

5.75%, 6/15/09 | | $ | (a)(b)59,000 | | $ | 59,000 | |

Kommunalkredit Austria AG, | | | | | |

5.02%, 8/22/08 | | (a)(b)150,000 | | 150,000 | |

Kommunalkredit International Bank Ltd., | | | | | |

5.26%, 8/13/08 | | (a)(b)150,000 | | 150,000 | |

Royal Bank of Scotland plc, | | | | | |

5.01%, 8/20/08 | | (a)(b)135,000 | | 135,000 | |

Total Extendible Floating Rate Notes (Cost $1,324,129) | | | | 1,324,129 | |

Floating Rate Notes (8.0%) | | | | | |

Asset Backed - SIV (5.6%) | | | | | |

Atlas Capital Funding Corp., | | | | | |

4.86%, 4/25/08 | | (a)(b)50,000 | | 50,000 | |

CC USA, Inc., | | | | | |

4.62%, 1/25/08 | | (a)(b)44,000 | | 44,004 | |

Cullinan Finance Corp., | | | | | |

4.57%, 1/18/08 | | (a)(b)25,000 | | 24,999 | |

4.82%, 1/23/08 | | (a)(b)50,000 | | 49,999 | |

4.97%, 4/28/08 | | (a)(b)32,000 | | 31,998 | |

4.57%, 7/10/08 | | (a)(b)50,000 | | 49,997 | |

Dorada Finance, Inc. | | | | | |

4.62%, 1/25/08 | | (a)(b)41,000 | | 41,004 | |

Links Finance LLC, | | | | | |

4.57%, 3/25/08 | | (a)(b)25,000 | | 24,998 | |

4.57%, 12/20/07 | | (a)(b)40,000 | | 39,999 | |

5.05%, 4/24/08 | | (a)(b)50,000 | | 49,998 | |

Sigma Finance, Inc., | | | | | |

4.99%, 7/21/08 | | (a)(b)100,000 | | 99,987 | |

Stanfield Victoria Funding LLC, | | | | | |

4.57%, 7/7/08 | | (a)(b)75,000 | | 74,985 | |

5.00%, 7/15/08 | | (a)(b)25,000 | | 24,996 | |

| | | | 606,964 | |

Finance - Automotive (0.2%) | | | | | |

American Honda Finance Corp., | | | | | |

5.36%, 8/6/08 | | (a)26,000 | | 26,000 | |

Investment Bankers/Brokers/Services (2.1%) | | | | | |

Merrill Lynch & Co, Inc., | | | | | |

4.84%, 5/27/08 | | 40,000 | | 40,011 | |

5.23%, 8/14/08 | | 185,000 | | 185,025 | |

| | | | 225,036 | |

U.S. Government & Agency Security (0.1%) | | | | | |

Kamps Capital LLC, | | | | | |

4.91%, 9/1/33 | | 6,080 | | 6,080 | |

Total Floating Rate Notes (Cost $864,080) | | | | 864,080 | |

Municipal Bond (0.3%) | | | | | |

Banking (0.3%) | | | | | |

Urban Campus Environments LLC, | | | | | |

4.86%, 10/1/25 (Cost $34,250) | | (b)34,250 | | 34,250 | |

The accompanying notes are an integral part of the financial statements.

11

2007 Annual Report | |

| |

October 31, 2007 | |

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Promissory Notes (3.6%) | | | | | |

Investment Bankers/Brokers/Services (3.6%) | | | | | |

Bank of America Corp., | | | | | |

5.04%, 12/31/49 | | $ | 75,000 | | $ | 75,000 | |

Goldman Sachs Group, Inc., | | | | | |

5.78%, 12/14/07 | | 35,000 | | 35,000 | |

5.04%, 11/30/07 | | 100,000 | | 100,000 | |

5.26%, 4/10/08 | | 50,000 | | 50,000 | |

Merrill Lynch & Co, Inc., | | | | | |

5.24%, 12/28/07 | | 59,000 | | 59,000 | |

5.52%, 2/19/08 | | 70,000 | | 70,000 | |

Total Promissory Notes (Cost $389,000) | | | | 389,000 | |

Repurchase Agreements (16.1%) | | | | | |

Banc of America Securities LLC, 5.03%, dated 10/31/07, due 11/1/07, repurchase price $325,045; fully collateralized by commercial paper at the date of this Portfolio of Investments as follows: Cedar Spring Capital, due 1/11/08; DNB NOR BANK ASA, due 2/25/08; Freedom PK, due 11/15/07; Societe Generale North America, Inc., due 2/1/08, valued at $331,500. | | 325,000 | | 325,000 | |

Credit Suisse First Boston, 4.96%, dated 10/31/07, due 11/1/07, repurchase price $52,002; fully collateralized by a U.S. goverment agency security at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, due 8/1/36, valued at $53,038. | | 51,995 | | 51,995 | |

Deutsche Bank Securities, 5.10%, dated 10/31/07, due 11/1/07, repurchase price $190,027; fully collateralized by asset backed securities and corporate bonds at the date of this Portfolio of Investments as follows: ACE Securities Corp., due 12/25/34; Argent Securities, Inc., due 3/25/34; Arrow Electronics, Inc., due 6/1/18; Asset Backed Securities Corp. Home Equity, due 1/15/34; Capmark Financial Group, Inc., due 5/10/17; CDC Mortgage Capital Trust, due 3/25/34, Countrywide Financial Corp., due 5/8/12; CVS/Caremark Corp., due 6/1/62; Darden Restaurants, Inc., due 10/15/17; GSAMP Trust; due 3/25/34; Halcyon Structured Asset Management CLO, due 5/21/18; Hearst-Argyle Television, Inc., due 11/15/07; International Paper Co., due 1/15/09; JPMorgan Mortgage Acquisition Corp., due 4/25/37; Kroger Co. (The), due 9/15/29; Nantucket CLO Ltd., due 11/24/20; New Century Home Loan Trust, due 10/25/33; Residential Asset Securities Corp., due 2/25/34 - 11/25/36; Sharps CDO, due 9/8/46; Sharp SP I LLC Net Interest Margin Trust, due 10/25/46; Yum! Brands, Inc., due 3/15/18, valued at $192,359. | | $ | 190,000 | | $ | 190,000 | |

Goldman Sachs, 5.03%, dated 10/31/07, due 11/1/07, repurchase price $350,049; fully collateralized by commercial paper at the date of this Portfolio of Investments as follows; Amstel Funding Corp., due 12/28/07; Chariot Funding LLC, due 11/5/07, valued at 357,000. | | 350,000 | | 350,000 | |

Lehman Brothers, Inc., 5.06%, dated 10/31/07, due 11/1/07, repurchase price $385,054; fully collateralized by commercial paper at the date of this Portfolio of Invesments as follows; Aegis Finance LLC, due 11/1/07, valued at 392,705. | | 385,000 | | 385,000 | |

Merrill Lynch & Co., Inc, 5.04%, dated 10/31/07, due 11/1/07, repurchase price $50,007; fully collateralized by corporate bonds at the date of this Portfolio of Investments as follows: Colorado Interstate Gas Co., due 11/15/15; Cytec Industries, Inc., due 10/1/15; PPL Capital Funding, Inc., due 3/30/67; Tennessee Gas Pipeline Co., due 6/15/32, valued at 51,005. | | 50,000 | | 50,000 | |

Merrill Lynch & Co., Inc., 5.10%, dated 10/31/07, due 11/1/07, repurchase price $145,021; fully collateralized by corporate bonds at the date of this Portfolio of Investments as follows: Avnet, Inc., due 3/15/14; Colorado Interstate Gas Co., due 11/15/15; El Paso Natural Gas Co., due 11/15/26; Highwoods, due 4/15/18; Limited Brands Inc., due 11/1/14; Limited Brands, due 7/15/17; Nevada Power Co., 4/15/12; Nevada Power Co., due 4/1/36; Oncor Electric Delivery Co., due 5/1/12; The Limited Corp., due 3/1/33; Tyson Fresh Meats, Inc., due 2/1/10, valued at 147,904. | | 145,000 | | 145,000 | |

The accompanying notes are an integral part of the financial statements.

12

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Wachovia Capital Markets LLC, 5.14%, dated 10/31/07, due 11/1/07, repurchase price $250,036; fully collateralized by commercial paper and asset backed securities at the date of this Portfolio of Investments as follows: ACE Securities Corp., due 11/25/35; Andina Development Corp., due 11/19/07; Asset Backed Funding Certificates, due 9/25/35; Asset Backed Securities Corp. Home Equity, due 6/25/35, Asset Backed Securities Corp. Home Equity, due 4/25/35; Asset Backed Securities Corp. Home Equity, due 4/25/35; Atlas Funding Corp., due 11/15/07; Aviation Capital Group Trust, due 11/15/25; Cadbury Schweppes, due 11/29/07; Citigroup Mortgage Loan Trust, Inc., due 12/25/35; Citigroup Mortgage Loan Trust, Inc., due 9/25/35; Copper River CLO Ltd., due 1/20/21; Countrywide Asset Backed Certificates, due 12/25/36; Countrywide Asset Backed Certificates, due 11/25/34; Duane Street CLO, due 8/20/18; Embarcadero Aircraft Securitization Trust, due 8/15/25; GE-WMC Mortgage Securities LLC, due 8/25/36; Greenpoint Mortgage Funding Trust, due 9/15/30; Greenpoint Mortgage Funding Trust, due 9/15/30, Kraft Foods, Inc., due 11/9/07; Madison Park Funding I Ltd., due 3/25/20, Neptune Funding Corp., due 11/9/07; Octagon Investment Partners X Ltd., due 10/18/20; Phoenix 2002-1 Ltd., due 7/26/10; Rio Tinto Ltd., due 11/15/07; Rio Tinto Ltd., due 11/9/07; Specialty Underwriting & Residential Finance, due 3/25/36; Structured Asset Investment Loan Trust, due 6/25/36; Structured Asset Securities Corp., due 1/25/35; Toyota Motor Credit Corp., due 10/20/08; United Airlines, Inc., 1/1/14, valued at 254,356. | | $ | 250,000 | | $ | 250,000 | |

Total Repurchase Agreements (Cost $1,746,995) | | | | 1,746,995 | |

Total Investments (101.0%) (Cost $10,936,227) | | | | 10,936,227 | |

Liabilities in Excess of Other Assets (-1.0%) | | | | (110,596 | ) |

Net Assets (100%) | | | | $ | 10,825,631 | |

| | | | | | | |

(a) | 144A Security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid. |

(b) | Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on October 31, 2007. |

(e) | The rates shown are the effective yields at the date of purchase. |

CLO | Collateralized Loan Obligation |

SIV | Structured Investment Vehicle |

The accompanying notes are an integral part of the financial statements.

13

2007 Annual Report | |

| |

October 31, 2007 | |

Investment Overview (unaudited)

Prime Portfolio

The Prime Portfolio seeks preservation of capital, daily liquidity and maximum current income. The Portfolio seeks to maintain a stable net asset value of $1.00 per share by investing in liquid, high quality money market instruments of domestic financial and non-financial corporations, as well as obligations of the U.S. government and its agencies and instrumentalities.

Performance

For the fiscal year ended October 31, 2007, the Portfolio’s Institutional Share Class had a total return of 5.24%. For the seven-day period ended October 31, 2007, the Portfolio’s Institutional Share Class provided an annualized current yield of 5.11%, while its 30-day moving average annualized yield was 5.13%.

Factors Affecting Performance

From November 2006 through July 2007, the Federal Open Market Committee (the “Fed”) left monetary policy unchanged. On August 17, 2007 citing deteriorating financial market conditions and the potential impact that tighter credit conditions could have in restraining economic growth, the Fed announced a cut in the discount rate of 50 basis points and adjustments in usual discount window practices to facilitate the provision of term financing. On September 18, 2007 the Fed lowered its target federal funds rate by a higher than anticipated 50 basis points, citing risks to growth and the potential for further deterioration in housing activity caused by tightening financial conditions, while also cutting the discount rate a further 50 basis points. Easing continued in October, when on the last day of the month the Fed reduced both the discount and the target rates by 25 basis points, to 5.0% and 4.5%, respectively. At that time, the Fed stated that the pace of economic expansion would likely slow. However, it also stated that the upside risks to inflation roughly balanced the downside risks to growth, which the market interpreted as an indication that further rate cuts were unlikely.

Throughout most of the fiscal period under review, the majority of home sales and housing-related statistics released were worse than anticipated. U.S. gross domestic product (GDP) expanded an estimated 3.9% in the third quarter of 2007, about flat with 3.8% in the second quarter but up significantly from the anemic 0.6% rate of growth in the first quarter. Manufacturing activity was sluggish in the first quarter but rebounded in the second quarter as both the Institute for Supply Management manufacturing and non-manufacturing indices rose sharply to levels well above those that indicate expansion. Starting in late July credit market concerns began to take center stage as highly publicized troubles at two large mortgage-related hedge funds and associated subprime mortgage concerns spread across the broader fixed income market. From mid-August through mid-September, LIBOR-based rates rose as credit exposures were questioned and fears of ballooning balance sheets and the creditworthiness of those holdings caused inter-bank lending to all but cease. In the last weeks of the fiscal year, high energy costs, volatile financial markets and a weak housing market all contributed to a decline in consumer confidence.

Management Strategies

As of October 31, 2007, the Portfolio had net assets of slightly more than $25.3 billion, and a weighted average maturity of 35 days. As of the end of October, 48% of the Portfolio was invested in commercial paper, 18% in floating rate notes, 19% in repurchase agreements, 4% in certificates of deposit (CDs), 10% in corporate notes, and 1% in a master note.

Our strategy of managing the Prime Portfolio was really a tale of several distinct periods. During the early months of the review period, when the Fed held monetary policy steady, the market began to price in significant easing. At that time however, we were not convinced this would occur, and shortly thereafter the money market yield curve inverted with LIBOR rates moving lower from six months on out. Therefore, we chose to extend in the three-to-six month part of the curve, which effectively increased the weighted average maturity of the Portfolio and allowed it to pick up yield over one-month paper. We favored this part of the curve over the one-year sector as we continued to believe the Fed would not quickly shift to an easing mode, which would be necessary in order for the longer part of the curve to outperform three-to-six month securities.

As we progressed into the second quarter of 2007, we began to look to increase the Portfolio’s weighted average maturity. In the latter part of the quarter there was a pronounced market selloff and the one-year LIBOR setting steepened out to 25 basis points over the current funds rate, at which point we selectively added some one-year fixed rate bonds to the Portfolio. When the credit market crisis hit during the August-September period, we focused on maximizing the Portfolio’s liquidity, favoring investments that were very short in tenor, from overnight to two weeks maturity, building our overnight liquidity exposure to over 20% of assets. We also selectively purchased four-to-six month paper in order to keep some longer-maturity assets on the books as the Fed was poised to begin easing monetary policy.

Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare

14

Investment Overview (cont’d)

Prime Portfolio

these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended October 31, 2007 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that “Expenses Paid During Period” are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note E) in the Notes to Financial Statements. Therefore, the annualized net expense ratios may differ from the ratio of the expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.80 | | $ | 0.61 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.60 | | 0.61 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.12%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Service Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.60 | | $ | 0.87 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.35 | | 0.87 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.17%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.30 | | $ | 1.12 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.10 | | 1.12 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.22%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Administrative Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.10 | | $ | 1.38 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.84 | | 1.38 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.27%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Advisory Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.50 | | $ | 1.89 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.34 | | 1.89 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.37%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

15

Investment Overview (cont’d)

Prime Portfolio

| | | | | | Expenses Paid | |

| | | | Ending Account | | During Period* | |

| | Beginning | | Value | | May 1, 2007 — | |

| | Account Value | | October 31, | | October 31, | |

| | May 1, 2007 | | 2007 | | 2007 | |

| | | | | | | |

Participant Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,024.20 | | $ | 3.16 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.08 | | 3.16 | |

| | | | | | | | | | |

* Expenses are equal to the Portfolio’s annualized net expense ratio of 0.62%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

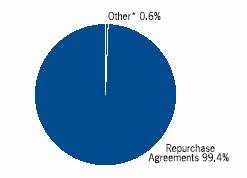

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

* Investment types which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”.

16

| 2007 Annual Report |

| |

| October 31, 2007 |

Portfolio of Investments

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed Securities (0.5%) | | | | | |

Asset Backed — CLO (0.5%) | | | | | |

Carlyle Loan Investment Ltd., | | | | | |

5.68%, 6/30/08 | | $ | (a)45,000 | | $ | 45,000 | |

5.76%, 7/14/08 | | (a)37,500 | | 37,500 | |

Shiprock Finance SF2, | | | | | |

5.27%, 8/11/08 | | (a)48,939 | | 48,929 | |

Total Asset Backed Securities (Cost $131,429) | | | | 131,429 | |

Certificates of Deposit (3.9%) | | | | | |

Banking (3.9%) | | | | | |

Citigroup Funding, Inc., | | | | | |

4.73%, 12/28/07 | | 69,000 | | 69,000 | |

Union Bank Of California, | | | | | |

5.15%, 12/21/07 | | 250,000 | | 250,000 | |

5.33%, 12/26/07 | | 300,000 | | 300,000 | |

Wachovia Corp., | | | | | |

5.32%, 2/4/08 | | 375,000 | | 375,000 | |

Total Certificates of Deposit (Cost $994,000) | | | | 994,000 | |

Commercial Paper (48.7%) (e) | | | | | |

Asset Backed — Auto (0.7%) | | | | | |

DaimlerChrysler Revolving Auto Conduit LLC, | | | | | |

5.28%, 11/2/07 | | 75,000 | | 74,989 | |

5.68%, 11/13/07 | | 100,000 | | 99,813 | |

| | | | 174,802 | |

Asset Backed — Consumer (4.8%) | | | | | |

Barton Capital Corp., | | | | | |

4.87%, 11/5/07 | | (a)211,158 | | 211,044 | |

Gemini Securitization Corp., | | | | | |

4.75%, 12/14/07 | | (a)25,000 | | 24,858 | |

4.92%, 12/19/07 | | (a)35,000 | | 34,772 | |

4.97%, 11/27/07 | | (a)50,000 | | 49,821 | |

5.15%, 12/17/07 | | (a)50,000 | | 49,674 | |

5.19%, 12/20/07 | | (a)75,000 | | 74,475 | |

5.23%, 11/13/07 | | (a)65,000 | | 64,887 | |

5.23%, 11/16/07 | | (a)50,000 | | 49,892 | |

5.42%, 11/7/07 | | (a)40,550 | | 40,514 | |

Mont Blanc Capital Corp., | | | | | |

5.14%, 12/17/07 | | (a)30,000 | | 29,805 | |

5.24%, 12/7/07 | | (a)20,000 | | 19,896 | |

Old Line Funding Corp., | | | | | |

5.25%, 12/14/07 | | (a)23,786 | | 23,638 | |

Regency Markets No. 1 LLC, | | | | | |

5.00%, 11/23/07 | | (a)39,444 | | 39,324 | |

5.07%, 1/25/08 | | (a)40,000 | | 39,527 | |

Sheffield Receivables Corp., | | | | | |

4.97%, 11/1/07 | | (a)78,480 | | 78,480 | |

Thames Asset Global Securitization, Inc., | | | | | |

5.35%, 11/14/07 | | (a)25,000 | | 24,953 | |

6.20%, 11/5/07 | | (a)41,883 | | 41,854 | |

Three Rivers Funding LLC, | | | | | |

5.02%, 11/28/07 | | (a)110,000 | | 109,588 | |

5.21%, 12/21/07 | | (a)65,000 | | 64,533 | |

5.53%, 11/15/07 | | (a)50,000 | | 49,893 | |

Thunder Bay Funding LLC, | | | | | |

4.80%, 11/1/07 | | $ | (a)53,246 | | $ | 53,246 | |

5.24%, 11/20/07 | | (a)50,027 | | 49,890 | |

| | | | 1,224,564 | |

Asset Backed — Corporate (4.3%) | | | | | |

CIESCO LLC, | | | | | |

4.88%, 11/1/07 | | (a)147,000 | | 147,000 | |

5.37%, 11/7/07 | | (a)75,000 | | 74,934 | |

5.38%, 11/15/07 | | (a)100,000 | | 99,794 | |

Corporate Asset Funding Co., Inc., | | | | | |

6.07%, 11/19/07 | | (a)75,000 | | 74,775 | |

Eureka Securitization, Inc., | | | | | |

4.90%, 11/1/07 | | (a)101,000 | | 101,000 | |

Nieuw Amsterdam Receivables Corp., | | | | | |

4.90%, 11/1/07 | | (a)147,993 | | 147,993 | |

5.31%, 11/9/07 | | (a)20,543 | | 20,519 | |

Simba Funding Corp., | | | | | |

4.92%, 11/26/07 | | 70,000 | | 69,762 | |

5.31%, 11/14/07 | | 133,510 | | 133,261 | |

5.35%, 11/2/07 | | 101,409 | | 101,394 | |

Tulip Funding Corp., | | | | | |

6.24%, 11/13/07 | | (a)125,000 | | 124,743 | |

| | | | 1,095,175 | |

Asset Backed — Diversified (5.1%) | | | | | |

Alpine Securitization Corp., | | | | | |

4.80%, 11/2/07 | | (a)10,000 | | 9,999 | |

4.90%, 11/1/07 | | (a)22,250 | | 22,250 | |

CRC Funding LLC, | | | | | |

5.21%, 1/23/08 | | (a)80,000 | | 79,056 | |

Fairway Finance Co. LLC, | | | | | |

4.98%, 12/3/07 - 12/7/07 | | (a)100,000 | | 99,532 | |

Hannover Funding Co. LLC, | | | | | |

5.35%, 12/10/07 - 12/11/07 | | (a)79,144 | | 78,690 | |

5.36%, 12/14/07 | | (a)40,923 | | 40,667 | |

Lexington Parker Capital Corp., | | | | | |

5.31%, 11/8/07 | | (a)102,736 | | 102,633 | |

5.56%, 11/19/07 | | (a)200,000 | | 199,998 | |

Market Street Funding LLC, | | | | | |

5.27%, 11/19/07 | | (a)75,000 | | 74,804 | |

5.37%, 12/3/07 | | (a)75,000 | | 74,645 | |

6.27%, 11/15/07 | | (a)102,212 | | 101,965 | |

Silver Tower U.S. Funding LLC, | | | | | |

5.34%, 11/26/07 | | (a)113,000 | | 112,592 | |

Three Pillars Funding LLC, | | | | | |

5.17%, 11/15/07 | | (a)150,000 | | 149,700 | |

5.27%, 1/16/08 | | (a)20,893 | | 20,664 | |

Yorktown Capital LLC, | | | | | |

6.07%, 11/20/07 | | (a)121,388 | | 121,004 | |

| | | | 1,288,199 | |

The accompanying notes are an integral part of the financial statements.

17

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed — Mortgage (0.6%) | | | | | |

Sydney Capital Corp., | | | | | |

5.16%, 11/13/07 | | $ | (a)100,000 | | $ | 99,828 | |

5.42%, 11/15/07 | | (a)50,000 | | 49,895 | |

| | | | 149,723 | |

Asset Backed — Securities (13.1%) | | | | | |

Amstel Funding Corp., | | | | | |

5.01%, 1/22/08 | | (a)105,000 | | 103,816 | |

5.30%, 12/3/07 | | (a)65,000 | | 64,697 | |

5.33%, 12/28/07 | | (a)110,000 | | 109,084 | |

Cancara Asset Securitisation LLC, | | | | | |

5.13%, 1/25/08 | | (a)110,000 | | 108,686 | |

5.21%, 1/24/08 | | (a)200,000 | | 197,611 | |

5.27%, 12/20/07 | | (a)200,000 | | 198,584 | |

Clipper Receivables Corp., | | | | | |

4.88%, 11/1/07 | | (a)119,274 | | 119,274 | |

Curzon Funding LLC, | | | | | |

5.31%, 11/9/07 - 11/16/07 | | (a)415,000 | | 414,253 | |

Galaxy Funding, Inc., | | | | | |

4.92%, 11/1/07 | | (a)53,000 | | 53,000 | |

5.25%, 12/19/07 | | (a)50,000 | | 49,655 | |

Galleon Capital Corp., | | | | | |

4.96%, 11/1/07 | | (a)448,132 | | 448,132 | |

Grampian Funding LLC, | | | | | |

5.06%, 2/26/08 | | (a)110,000 | | 108,223 | |

5.10%, 2/1/08 | | (a)25,000 | | 24,679 | |

5.11%, 1/24/08 | | (a)97,400 | | 96,255 | |

5.24%, 2/19/08 | | (a)190,000 | | 187,013 | |

5.25%, 2/4/08 | | (a)55,000 | | 54,251 | |

5.32%, 11/14/07 | | (a)200,000 | | 199,626 | |

Lake Constance Funding LLC, | | | | | |

5.35%, 12/7/07 - 12/11/07 | | (a)92,000 | | 91,495 | |

North Sea Funding LLC, | | | | | |

5.19%, 12/21/07 | | (a)25,000 | | 24,821 | |

5.33%, 11/19/07 | | (a)42,503 | | 42,393 | |

5.45%, 11/27/07 - 12/14/07 | | (a)150,000 | | 149,287 | |

Polonius, Inc., | | | | | |

5.27%, 11/15/07 | | (a)29,000 | | 28,941 | |

5.29%, 11/13/07 | | (a)50,000 | | 49,912 | |

Scaldis Capital LLC, | | | | | |

4.80%, 11/15/07 | | (a)57,050 | | 56,943 | |

4.92%, 11/27/07 | | (a)135,000 | | 134,522 | |

5.11%, 1/25/08 | | (a)110,000 | | 108,691 | |

5.27%, 12/17/07 | | (a)100,000 | | 99,335 | |

| | | | 3,323,179 | |

Asset Backed — SIV (4.1%) | | | | | |

Asscher Finance Corp., | | | | | |

5.36%, 11/13/07 | | (a)120,000 | | 119,790 | |

5.37%, 11/26/07 - 12/10/07 | | (a)150,000 | | 149,303 | |

Atlas Capital Funding Corp., | | | | | |

5.31%, 11/7/07 | | (a)60,000 | | 59,948 | |

5.33%, 11/26/07 | | (a)200,000 | | 199,279 | |

5.36%, 12/12/07 | | (a)200,000 | | 198,806 | |

5.40%, 3/10/08 | | (a)120,000 | | 117,742 | |

5.42%, 3/7/08 | | $ | (a)30,000 | | $ | 29,449 | |

Harrier Finance Funding US. LLC/ Harrier Finance Funding Ltd., | | | | | |

5.36%, 12/5/07 - 12/6/07 | | (a)150,000 | | 149,247 | |

| | | | 1,023,564 | |

Banking (7.0%) | | | | | |

Bank of America Corp., | | | | | |

4.99%, 3/25/08 | | 64,000 | | 62,742 | |

5.31%, 12/21/07 | | 300,000 | | 297,833 | |

Citigroup Funding, Inc., | | | | | |

5.23%, 12/20/07 | | 100,000 | | 99,296 | |

5.34%, 12/14/07 - 12/21/07 | | 331,000 | | 328,712 | |

5.50%, 3/19/08 | | 250,000 | | 244,836 | |

5.73%, 12/12/07 | | 115,000 | | 114,260 | |

5.74%, 12/11/07 | | 250,000 | | 248,431 | |

HSBC Bank USA, | | | | | |

4.93%, 12/24/07 | | 100,000 | | 99,280 | |

5.12%, 12/21/07 | | 100,000 | | 99,297 | |

5.29%, 12/14/07 | | 75,000 | | 74,535 | |

5.58%, 12/13/07 | | 100,000 | | 99,358 | |

| | | | 1,768,580 | |

Finance — Automotive (1.4%) | | | | | |

BMW U.S. Capital LLC, | | | | | |

4.83%, 11/1/07 | | (a)17,000 | | 17,000 | |

Toyota Motor Credit Corp., | | | | | |

4.74%, 3/24/08 | | 20,000 | | 19,628 | |

5.32%, 2/11/08 | | 100,000 | | 98,527 | |

5.36%, 12/21/07 | | 225,000 | | 223,350 | |

| | | | 358,505 | |

International Banks (6.2%) | | | | | |

Barclays U.S. Funding Corp., | | | | | |

4.79%, 3/31/08 | | 150,000 | | 147,046 | |

4.86%, 3/25/08 | | 260,000 | | 255,010 | |

5.00%, 3/24/08 | | 170,000 | | 166,671 | |

5.13%, 2/19/08 | | 335,000 | | 329,839 | |

5.15%, 2/15/08 | | 130,000 | | 128,063 | |

5.20%, 2/4/08 | | 50,000 | | 49,326 | |

ING (U.S.) Funding LLC, | | | | | |

5.00%, 2/20/08 | | 44,550 | | 43,875 | |

UBS Finance Delaware LLC, | | | | | |

5.07%, 2/19/08 | | 100,200 | | 98,682 | |

5.31%, 11/15/07 - 11/16/07 | | 350,000 | | 349,275 | |

| | | | 1,567,787 | |

Investment Bankers/Brokers/Services (1.4%) | | | | | |

Bear Stearns Cos., Inc., | | | | | |

5.00%, 11/1/07 | | 200,000 | | 200,000 | |

Lehman Brothers Holdings, Inc., | | | | | |

5.06%, 11/7/07 | | 150,000 | | 150,000 | |

| | | | 350,000 | |

Total Commercial Paper (Cost $12,324,078) | | | | 12,324,078 | |

The accompanying notes are an integral part of the financial statements.

18

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Corporate Notes (3.2%) | | | | | |

Asset Backed — SIV (2.6%) | | | | | |

Asscher Finance Corp., | | | | | |

5.45%, 6/25/08 | | $ | (a)85,000 | | $ | 85,000 | |

Beta Finance, Inc., | | | | | |

5.37%, 6/6/08 | | (a)55,000 | | 55,000 | |

CC USA, Inc., | | | | | |

5.37%, 6/5/08 | | (a)85,000 | | 85,000 | |

Cullinan Finance Corp., | | | | | |

5.39%, 6/16/08 | | (a)160,000 | | 160,000 | |

5.40%, 4/25/08 | | (a)185,000 | | 185,000 | |

5.45%, 2/1/08 | | (a)79,000 | | 79,000 | |

| | | | 649,000 | |

Banking (0.6%) | | | | | |

Bank of America N.A., | | | | | |

5.30%, 12/27/07 | | 150,000 | | 150,000 | |

Total Corporate Notes (Cost $799,000) | | | | 799,000 | |

Extendible Floating Rate Notes (0.9%) | | | | | |

Banking (0.9%) | | | | | |

Fifth Third Bancorp., | | | | | |

4.95%, 8/22/08 | | (a)150,000 | | 150,000 | |

Wells Fargo & Co., | | | | | |

5.17%, 7/15/09 | | (a)87,565 | | 87,565 | |

Total Extendible Floating Rate Notes (Cost $237,565) | | | | 237,565 | |

Floating Rate Notes (17.3%) | | | | | |

Asset Backed — SIV (7.2%) | | | | | |

Asscher Finance Corp., | | | | | |

5.67%, 6/13/08 | | (a)(b)200,000 | | 199,988 | |

Beta Finance, Inc., | | | | | |

5.24%, 4/11/08 | | (a)(b)50,000 | | 50,004 | |

Cullinan Finance Corp., | | | | | |

4.57%, 1/18/08 - 7/10/08 | | (a)(b)250,000 | | 249,988 | |

4.82%, 1/23/08 | | (a)(b)150,000 | | 149,997 | |

Kestrel Funding US LLC, | | | | | |

4.58%, 6/24/08 | | (a)(b)125,000 | | 124,999 | |

Links Finance LLC, | | | | | |

4.57%, 12/20/07 - 3/25/08 | | (a)(b)235,000 | | 234,993 | |

5.05%, 4/24/08 | | (a)(b)50,000 | | 49,998 | |

5.16%, 3/31/08 | | (a)(b)150,000 | | 149,994 | |

5.47%, 5/19/08 | | (a)(b)100,000 | | 99,994 | |

Sigma Finance, Inc., | | | | | |

4.58%, 12/14/07 | | (a)(b)85,000 | | 84,998 | |

4.99%, 7/22/08 | | (a)(b)150,000 | | 149,981 | |

Stanfield Victoria Funding, | | | | | |

4.57%, 7/7/08 | | (a)(b)225,000 | | 224,954 | |

5.00%, 7/15/08 | | (a)(b)50,000 | | 49,993 | |

| | | | 1,819,881 | |

Banking (5.3%) | | | | | |

Bank of America N.A., | | | | | |

4.99%, 2/8/08 | | 300,000 | | 300,000 | |

HSBC USA, Inc., | | | | | |

5.09%, 8/15/08 | | 130,000 | | 130,000 | |

JPMorgan Chase & Co., | | | | | |

5.10%, 4/11/12 | | $ | 75,000 | | $ | 75,000 | |

Union Hamilton Special Funding LLC, | | | | | |

5.24%, 12/21/07 | | (a)25,000 | | 25,000 | |

5.69%, 12/17/07 | | (a)170,000 | | 170,000 | |

Wachovia Bank N.A., | | | | | |

4.78%, 11/30/07 | | 27,000 | | 27,000 | |

5.02%, 6/27/08 | | 315,000 | | 315,061 | |

5.03%, 11/30/07 | | 225,000 | | 225,008 | |

5.19%, 6/27/08 | | 70,000 | | 70,006 | |

| | | | 1,337,075 | |

Finance - Automotive (2.0%) | | | | | |

American Honda Finance Corp., | | | | | |

5.21%, 4/14/08 | | (a)140,000 | | 140,000 | |

5.33%, 5/9/08 | | (a)50,000 | | 50,000 | |

5.47%, 5/12/08 | | (a)40,000 | | 40,000 | |

5.70%, 6/11/08 | | (a)187,500 | | 187,500 | |

Toyota Motor Credit Corp., | | | | | |

4.57%, 5/12/08 | | 100,000 | | 100,003 | |

| | | | 517,503 | |

Financial Conglomerates (0.6%) | | | | | |

General Electric Capital Corp., | | | | | |

5.30%, 4/15/08 | | (b)50,000 | | 50,013 | |

5.70%, 1/15/08 | | (b)100,000 | | 100,016 | |

| | | | 150,029 | |

Insurance (1.2%) | | | | | |

AIG Matched Funding Corp., | | | | | |

4.57%, 1/9/08 | | (a)(b)200,000 | | 200,000 | |

5.03%, 12/17/07 | | (a)(b)93,000 | | 93,002 | |

| | | | 293,002 | |

Investment Bankers/Brokers/Services (1.0%) | | | | | |

Merrill Lynch & Co., Inc., | | | | | |

4.85%, 5/27/08 | | 50,000 | | 50,014 | |

5.23%, 8/14/08 | | 215,000 | | 215,000 | |

| | | | 265,014 | |

Total Floating Rate Notes (Cost $4,382,504) | | | | 4,382,504 | |

Mortgage Bond (0.6%) | | | | | |

Asset Backed — Mortgage (0.6%) | | | | | |

Wachovia Corp., | | | | | |

5.09%, 7/17/08 (Cost $150,000) | | 150,000 | | 150,000 | |

Promissory Notes (6.8%) | | | | | |

Investment Bankers/Brokers/Services (6.8%) | | | | | |

Bank of America Securities LLC, | | | | | |

5.04%, | | (g)273,500 | | 273,500 | |

Goldman Sachs Group, Inc., | | | | | |

5.04%, 11/30/07 | | 275,000 | | 275,000 | |

5.26%, 4/10/08 | | 175,000 | | 175,000 | |

5.56%, 12/17/07 | | 250,000 | | 250,000 | |

5.64%, 2/29/08 | | 200,000 | | 200,000 | |

5.78%, 12/14/07 | | 165,000 | | 165,000 | |

The accompanying notes are an integral part of the financial statements.

19

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Investment Bankers/Brokers/Services (cont’d) | | | | | |

Merrill Lynch & Co., Inc., | | | | | |

5.24%, 12/28/07 | | $ | 241,000 | | $ | 241,000 | |

5.52%, 2/19/08 | | 130,000 | | 130,000 | |

Total Promissory Notes (Cost $1,709,500) | | | | 1,709,500 | |

Repurchase Agreements (18.9%) | | | | | |

Banc of America LLC, 5.03%, dated 10/31/07, due 11/1/07, repurchase price $175,024; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: DNB NOR Bank ASA, due 2/1/08, valued at $178,500. | | 175,000 | | 175,000 | |

Bear Stearns Cos., Inc., 4.85%, dated 10/31/07, due 11/1/07, repurchase price $510,069; fully collateralized by U.S. government agency securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pools: 4.00% to 7.50%, due 10/1/21 - 8/1/47; Federal National Mortgage Association, Fixed Rate Mortgages: 4.50% - 9.50%, due 2/1/09 - 10/1/47, FG: Zero Coupon, due 7/20/07, valued at $520,202. | | 510,000 | | 510,000 | |

CS First Boston LLC, 4.96%, dated 10/31/07, due 11/1/07, repurchase price $108,980; fully collateralized by U.S. government agency securities at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Adjustable Rate Mortgages: Zero Coupon, due 12/1/34 - 8/1/36, valued at $111,145. | | 108,965 | | 108,965 | |

Deutsche Bank Securities, Inc., 5.10%, dated 10/31/07, due 11/1/07, repurchase price $450,064; fully collateralized by asset backed securities at the date of this Portfolio of Investments as follows: ACE Securities Corp., 5.97% to 7.87%, due 10/25/32 - 5/25/37; Aegis Asset Backed Securities Trust, Zero Coupon, due 10/25/35; American Airlines, Inc., Zero Coupon, due 1/2/13; Ameriquest Mortgage Securities, Inc., Zero Coupon to 7.14%, due 2/25/33 - 6/25/34; Argent Securities, Inc., 7.31%, due 5/25/36; Asset Backed Funding Certificates, Zero Coupon, due 1/25/37; Asset Backed Securities Corp. Home Equity, 7.37%, due 3/25/36; Avalon Re Ltd., Zero Coupon, due 6/6/08; BNC Mortgage Loan Trust, 7.37%, due 7/25/37; Bruce Mansfield Unit, 6.85%, due 6/1/34; Carrington Mortgage Loan Trust, Zero Coupon to 6.87%, due 5/25/35 - 1/25/37; Citigroup Mortgage Loan Trust, Inc., Zero Coupon to 7.37%, due 9/25/35 - 1/25/37; CNF, Inc., 9.16%, due 6/1/30; Conseco Finance Securitizations Corp., 7.69%, due 2/1/33; Countrywide Alternative Loan Trust NIM, 9.00%, due 10/25/46; Countrywide Asset Backed Certificates, 5.40% to 6.57%, due 2/25/35 - 6/25/37; Counts Trust, 6.08%, due 8/19/30; Deutsche ALT-A Securities, Inc., Alternate Loan Trust, Zero Coupon, due 7/25/47; Deutsche ALT-A Securities NIM Trust, Zero Coupon to 7.50%, due 2/25/47 - 7/25/47; Deutsche Financial Capital Securitization LLC, 7.28%, due 9/15/27; Federal National Mortgage Association Grantor Trust, 7.50%, due 11/25/31; Green Tree Financial Corp., 6.85% to 7.53%, due 10/15/18 - 2/15/29; Green Tree Home Improvement Loan Trust, 7.72% to 8.15%, due 7/15/22 - 10/15/28; Heat Equity Asset Trust NIM, 4.50%, due 4/27/35; Home Equity Asset Trust, 7.29% to 8.87%, due 10/25/33 - 1/25/37; Indymac Manufactured Housing Contract, 6.20%, due 9/25/17; Indymac Residential Asset Backed Trust, 6.87%, due 3/25/36; JPMorgan Mortgage Acquisition Corp., 6.87%, due 8/25/36; Lease Investment Flight Trust, 5.48%, due 7/15/31; Lehman XS Net Interest Margin Notes, 9.00%, due 6/28/46 - 12/28/46; Long Beach Mortgage Loan Trust, Zero Coupon to 7.62%, due 3/25/33 - 12/25/36; Mastr Asset Backed Securities Trust, Zero Coupon, due 3/25/36; Morgan Stanley ABS Capital I, 5.77% to 5.97%, due 4/25/36 - 9/25/36; Mountain View Funding CLO, 8.87%, due 4/16/52; Nantucket CLO Ltd., 9.25%, due 11/24/20; Nationstar Home Equity Loan Trust, 6.92%, due 6/25/37; Nomura Home Equity Loan, Inc., Zero Coupon, due 7/25/36; Novastar Home Equity Loan, 5.40%, due 12/25/33; Orion Ltd., CDO, 6.06% to 9.72%, due 12/10/51; Park Place Securities NIM Trust, 5.19%, due 5/25/35; Residential Accredit Loans, Inc., Zero Coupon to 6.00%, due 2/25/36; Residential Asset Securities Corp., 6.97%, due 4/25/36; Saco, Zero Coupon, due 11/25/32; Sail Net Interest Margin Notes, 5.50%, due 3/27/34; SB Finance Trust, 4.75%, due 7/25/35; Securitized Asset Backed Receivables LLC Trust, Zero Coupon, due 5/25/36; Sharp SP I LLC Net Interest Margin Trust, 5.90% to 12.50%, due 4/25/36 - 3/25/37; Soundview Home Equity Loan Trust, 7.22% to | | | | | |

| | | | | | | |

20

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

7.37%, due 6/25/36 - 12/25/36; Specialty Underwriting & Residential Finance, 7.87%, due 9/25/34; Static Residential Trust, 8.00%, due 9/12/37; Stingray Pass-Through Trust, Zero Coupon, due 1/12/15; Structured Adjustable Rate Mortgage Loan Trust, Zero Coupon, due 4/25/34; Structured Asset Investment Loan Trust, Zero Coupon, due 4/25/34; Terwin Mortgage Trust, 5.39% to 6.79%, due 2/25/37 - 10/25/37; Van Kampen CLO II Ltd., 6.61%, due 7/15/08; Wachovia CRE CDO, 8.45%, due 9/25/26; Washington Mutual Asset Backed Certificates, 6.47%, due 11/25/36; West Penn Funding LLC, 4.46%, due 12/27/10, valued at $459,000. | | $ | 450,000 | | $ | 450,000 | |

Deutsche Bank Securities, Inc., 5.10%, dated 10/31/07, due 11/1/07, repurchase price $810,115; fully collateralized by corporate bonds at the date of this Portfolio of Investments as follows: CBS Corp., 7.88% to 8.63%, due 7/30/30; COX Communications, Inc., 7.63%, due 6/15/25; CSX Corp., 4.88% to 5.50%, due 11/1/09 - 8/1/13; Darden Restaurants, Inc., 5.63% to 6.80%, due 10/15/12 - 10/15/37; DR Horton, Inc., 5.38% to 8.00%, due 2/1/09 -8/15/11; DTE Energy Center LLC, 7.46%, due 4/30/24; DTE Energy Co., 7.05%, due 6/1/11; Embarq Corp., 7.08%, due 6/1/16; Energy Transfer Partners, LP, 6.13%, due 2/15/17; Enogex, Inc., 8.13%, due 1/15/10; Entergy Gulf States, Inc., 4.88%, due 11/1/11; Enterprise Products Operating, LP, 4.63%, due 10/15/09; GRE Co., due 12/15/18; Health Care REIT, Inc., 6.00%, due 11/15/13; International Paper Co., 6.75%, due 9/1/11; Kroger Co. (The), 6.38% to 7.00%, due 3/1/08 - 5/1/18; Legrand France S.A., 8.50%, due 2/15/25; Lehman Brothers Holdings, Inc., 6.20%, due 9/26/14; Liberty Mutual Group, Inc., 7.00%, due 3/7/67; MDC Holdings, Inc., 7.00%, due 12/1/12; Nationwide Health Properties, Inc., 6.25%, due 2/1/13; NIBC Bank N.V., 5.82%, due 12/11/99; Nisource Finance Corp., 5.25% to 5.59%, due 11/23/09 - 9/15/17; Panhandle Eastern Pipe Line, 6.05%, due 8/15/13; Premcor Refining Group, Inc. (The), 6.13%, due 5/1/11; Pyxis, 6.00%, due 11/10/46; Qwest Corp., 6.88% to 7.50%, due 10/1/14 - 9/15/33; Safeway, Inc., 7.50%, due 9/15/09; Sealed Air Corp., 6.88%, due 7/15/33; Sharps SP I LLC, 8.50%, due 4/25/36;Sprint Capital Corp., 6.88% to 6.90%, due 5/1/19 - 11/15/28; Sprint Nextel Corp., 6.00%, due 12/1/16; Starwood Hotels & Resorts Worldwide, Inc., 7.88%, due 5/1/12; Viacom, Inc., 6.75%, due 10/5/37; Waste Management, Inc., 6.38% to 7.75%, due 11/15/12 - 5/15/32; Westvaco Corp., 8.20%, due 1/15/30; Yum! Brands, Inc., 6.88%, due 11/15/37; ZFS Finance USA Trust I, 6.15%, due 12/15/65, valued at $826,200. | | $ | 810,000 | | $ | 810,000 | |

Goldman Sachs Group, Inc., 5.03%, dated 10/31/07, due 11/1/07, repurchase price $200,028; fully collateralized by discount commercial paper and U.S. government agency securities at the date of this Portfolio of Investments as follows: Chariot Funding LLC, due 11/5/07; Federal Nation Mortgage Association, Fixed Rate Mortgages: 5.00%, due 9/1/33 to 1/1/36, valued at $204,000. | | 200,000 | | 200,000 | |