SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to __________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: ______

Commission file number: 333-104670

STRATA OIL & GAS INC.

(formerly Stratabase Inc.)

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

717 - 7th Avenue SW, Suite 1750, Calgary, Alberta, Canada, T2P 0Z3

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, Fully Paid and Non-Assessable Common Shares, Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: The registrant has one class of Common Stock with 59,861,088 shares outstanding at December 31, 2007 and 61,881,088 shares outstanding as of May 22, 2008. No preferred shares issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes [ ] No [X]

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ X ] | International Financial Reporting Standards as issued by the International Accounting Standards Board [ ] | Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [ ] Item 18 [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [X]

STRATA OIL & GAS INC.

FORM 20-F ANNUAL REPORT 2007

TABLE OF CONTENTS

| Oil and Gas Glossary | 4 |

| Introduction | 5 |

| | | |

| Part I | |

| | | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 6 |

| Item 2. | Offer Statistics and Expected Timetable | 6 |

| Item 3. | Key Information | 6 |

| Item 4. | Information on the Company | 16 |

| Item 4A. | Unresolved Staff Comments | 31 |

| Item 5. | Operating and Financial Review and Prospects | 31 |

| Item 6. | Directors, Senior Management and Employees | 41 |

| Item 7. | Major Shareholders and Related Party Transactions | 47 |

| Item 8. | Financial Information | 48 |

| Item 9. | The Offer and Listing | 49 |

| Item 10. | Additional Information | 50 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 55 |

| Item 12. | Description of Other Securities Other Than Equity Securities | 56 |

| | | |

| Part II | |

| | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 57 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 57 |

| Item 15. | Controls and Procedures | 57 |

| Item 16. | Reserved | 58 |

| | | |

| Part III | |

| | | |

| Item 17. | Not Applicable | 60 |

| Item 18. | Financial Statements | 60 |

| Item 19. | Exhibits | 61 |

| | | |

| Financial Statements | 86 |

| | | |

| Signature Page | 87 |

OIL AND GAS GLOSSARY

| Term | Definition | |

| | | |

| Basin | A depressed area where sediments have accumulated during geologic time and considered to be prospective for oil and gas deposits. | |

| Bitumen | Heavy, viscous crude oil | |

| Bluesky Formation | The Bluesky is fine to medium grained, usually glauconitic, partly calcareous or sideritic, salt and pepper sandstone with fair porosity. Chert granules and pebbles occur near the top, with thin shale interbedded throughout. The thickness is 0-46 meters in the Peace River plains subsurface. It thins to the south and southeast | |

| CHOPS | Cold Heavy Oil Production with Sand | |

| Carboniferous | The period of geological time between 360 and 286 million years ago. A series of stratified rocks and associated volcanic rocks which occur above the Devonian or Old Sandstone and below the Permian or Triassic systems belonging to the Carboniferous period. | |

| Cretaceous Period | A period 144 to 65 million years ago | |

| Debolt Formation | Lies above the Elkton Formation and ranges from mid- to upper Visean in age (345.3 to 326.4 million years ago) | |

| Development | The phase in which a proven oil or gas field is brought into production by drilling production (development) wells. | |

| Drilling | The using of a rig and crew for the drilling, suspension, production testing, capping, plugging and abandoning, deepening, plugging back, sidetracking, re-drilling or reconditioning of a well. | |

| Drilling logs | Recorded observations made of rock chips cut from the formation by the drill bit, and brought to the surface with the mud, as well as rate of penetration of the drill bit through rock formations. Used by geologists to obtain formation data. | |

| Exploration | The phase of operations which covers the search for oil or gas by carrying out detailed geological and geophysical surveys followed up where appropriate by exploratory drilling. Compare to "Development" phase. | |

| Jurassic Period | Between 206 and 144 million years ago | |

| Mineral Lease | A legal instrument executed by a mineral owner granting exclusive right to another to explore, drill, and produce oil and gas from a piece of land | |

| Oil Sands | Sand, clay and rock material containing bitumen | |

| Porosity | The ratio of the volume of void spaces in a rock or sediment to the total volume of the rock or sediment. | |

| Reserves | Generally the amount of oil or gas in a particular reservoir that is available for production. | |

| Reservoir | The underground rock formation where oil and gas has accumulated. It consists of a porous rock to hold the oil or gas, and a cap rock that prevents its escape | |

INTRODUCTION

Strata Oil & Gas Inc. (formerly Stratabase Inc.) was incorporated under the laws of the State of Nevada on November 18, 1998 and commenced operations in January 1999. We completed our initial public offering in February 2000. In January 2003, the Company filed a proposal to effect a continuation of the corporate jurisdiction from the State of Nevada to Canada on Form S-4 with the United States Securities and Exchange Commission (SEC). The Form S-4 was declared effective on or about July 7, 2004 and submitted to the shareholders of the Company. The special meeting of stockholders to vote on the adoption of the plan of conversion was held on August 17, 2004 and a majority of the shareholders approved the plan of conversion. Accordingly, the Company changed its name to "Stratabase Inc.," and continued to operate under the Canada Business Corporations Act.

On June 29, 2005 at an annual general and special meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration. Our headquarters are located at 717 - 7th Avenue SW, Suite 1750, Calgary, Alberta, Canada, T2P 0Z3. The telephone number is (403) 668-6539. The Company’s web address is strataoil.com.

On May 9, 2006, at a Special Meeting of the Company’s stockholders, a majority of the Company’s stockholders approved a 2:1 forward stock split. The record and payment dates of the forward split were May 10 and May 11, 2006 respectively. In addition, on July 13, 2007, at a Special Meeting of the Company’s stockholders, a majority of the Company’s stockholders approved a 2:1 forward stock split. The record and payment dates of the forward split were October 8 and October 9, 2007 respectively. All references to share and per share amounts have been restated in this 20-F to reflect these splits.

In this Annual Report, the “Company”, “Strata Oil & Gas Inc.”, “Strata”, "we", "our", and "us", refer to Strata Oil & Gas Inc. (unless the context otherwise requires). Summary discussions of documents referred to in this Annual Report may not be complete, and we refer you to the actual documents for more complete information.

BUSINESS OF STRATA OIL & GAS INC.

The Company operates in the oil and gas industry with a focus on Canada’s oil sands and heavy oil deposits. The Company currently has interests in a total of 43 oil sands leases located in Northern Alberta, Canada.

FINANCIAL AND OTHER INFORMATION

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (“USD$” or “$”).

FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements, principally in ITEM #4, “Information on the Company” and ITEM #5, “Operating and Financial Review and Prospects". We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions including, among other things, the factors discussed in this Annual Report under ITEM #3, “Key Information, Risk Factors" and factors described in documents that we may furnish from time to time to the Securities and Exchange Commission.

The words "believe", "may", "estimate", "continue", "anticipate", "intend", "expect", and similar words are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking information, events and circumstances discussed in this Annual Report might not occur. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise.

Item 1. Identity of Directors, Senior Management and Advisors

Item 2. Offer Statistics and Expected Timetable

Item 3. Key Information

A. Selected Financial Data

The following sets forth selected financial information of Strata prepared in accordance with accounting principles generally accepted in the United States for the fiscal years ended December 31, 2007, 2006, 2005, 2004 and 2003. On June 29, 2005 at an annual general and special meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration. Subsequent to entering the oil and gas exploration business, we have entered into 43 oil sands leases in Alberta, Canada. These leases have not previously generated revenue nor did we earn any revenue during the year ended December, 31 2007. As a result, the selected financial information may not be indicative of Strata’s future performance and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this annual report.

(in U.S. dollars)

| | | Strata | |

| | | Years Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Revenue | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Expenses | | | 468,031 | | | | 7,059,245 | | | | 2,003,105 | | | | 347,052 | | | | 491,562 | |

| Other income (expense), net | | | 13,306 | | | | 181,840 | | | | (16,589 | ) | | | 2,489 | | | | (169,175 | ) |

| Loss from continuing operations | | | (454,725 | ) | | | (6,877,405 | ) | | | (2,019,694 | ) | | | (344,563 | ) | | | (660,737 | ) |

| Income (loss) from discontinued operations | | $ | - | | | $ | 130,000 | | | $ | (64,916 | ) | | $ | (350,296 | ) | | $ | (366,539 | ) |

| Net income (loss) | | $ | (454,725 | ) | | $ | (6,747,405 | ) | | $ | (2,084,610 | ) | | $ | (694,859 | ) | | $ | (1,027,276 | ) |

| Basic and diluted income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| From continuing operations | | $ | (0.01 | ) | | $ | (0.13 | ) | | $ | (0.05 | ) | | $ | (0.01 | ) | | $ | (0.02 | ) |

| From discontinued operations | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

| After discontinued operations | | $ | (0.01 | ) | | $ | (0.13 | ) | | $ | (0.05 | ) | | $ | (0.02 | ) | | $ | (0.03 | ) |

| Basic weighted average number of common shares outstanding (in millions) | | | 57.4 | | | | 51.8 | | | | 43.2 | | | | 39.6 | | | | 32.2 | |

| Diluted weighted average number of common shares outstanding (in millions) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Item 3. Key Information - continued

A. Selected Financial Data - continued

BALANCE SHEET DATA

| (in U.S. Dollars) | | Strata | |

| | | December 31, | |

| | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 27,963 | | | $ | 3,779,527 | | | $ | 74,436 | | | $ | 52,187 | | | $ | 509,180 | |

| Other current assets | | | 40,045 | | | | 81,893 | | | | 6,638 | | | | 5,329 | | | | 14,674 | |

| Property and equipment, net | | | 8,712 | | | | - | | | | - | | | | 14,520 | | | | 37,001 | |

| Other assets, net | | | - | | | | - | | | | - | | | | - | | | | 243,701 | |

| Oil and gas property interests | | | 7,717,683 | | | | 2,786,842 | | | | 128,733 | | | | - | | | | - | |

| Total assets | | | 7,794,403 | | | | 6,648,262 | | | | 209,807 | | | | 72,036 | | | | 804,556 | |

| Current liabilities | | | 364,528 | | | | 164,213 | | | | 57,229 | | | | 34,729 | | | | 64,933 | |

| Asset retirement obligations | | | 68,563 | | | | - | | | | - | | | | - | | | | - | |

| Common stock | | | 7,712,278 | | | | 7,210,518 | | | | 549,668 | | | | 39,668 | | | | 39,668 | |

| Other capital accounts | | | 11,466,472 | | | | 10,636,244 | | | | 4,218,218 | | | | 2,528,337 | | | | 2,535,794 | |

| (Accumulated deficit) retained earnings | | | (11,817,438 | ) | | | (11,362,713 | ) | | | (4,615,308 | ) | | | (2,530,698 | ) | | | (1,835,839 | ) |

| Total liabilities and stockholders’ equity | | | 7,361,312 | | | | 6,648,262 | | | $ | 209,807 | | | $ | 72,036 | | | $ | 804,556 | |

Dividends

We have never paid or declared dividends on our shares of Common Stock.

Exchange Rates

Our Financial Statements, as provided under Items 8 and 18 and all dollar amounts presented in this Registration Statement, are presented in US dollars, unless otherwise expressly stated. For comparison purposes, exchange rates into U.S. dollars are provided. The following tables set forth the exchange rate as of the latest practicable date, high and low exchange rates for the months indicated and the average exchange rates for the reporting periods indicated, based on the noon U.S. dollar buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York (Canadian Dollar = U.S. $1.00).

Exchange Rates for Canadian Versus U.S. Dollars

The exchange rate as of May 21, 2008 was CDN $0.9841 per U.S. $1.00.

| Exchange Rates for Canadian Versus U.S. Dollars | | |

| (High/low rates for latest six months) | High | Low |

| | | |

| April, 2008 | 1.00 | 1.03 |

| March, 2008 | 0.98 | 1.03 |

| February, 2008 | 0.98 | 1.02 |

| January, 2008 | 0.98 | 1.03 |

| December, 2007 | 0.98 | 1.02 |

| November, 2007 | 0.91 | 0.99 |

| Exchange Rates for Canadian Versus U.S. Dollars | Average ($) |

| For the twelve months ended December 31, 2007 | 1.07 |

| 1.13 |

| For the twelve months ended December 31, 2005 | 1.21 |

| For the twelve months ended December 31, 2004 | 1.30 |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATING TO OUR COMPANY

1. | We are an exploration stage company, with limited operating history, which raises substantial doubt as to our ability to successfully develop profitable business operations and makes an investment in our common shares very risky. |

On June 29, 2005 at an annual general and special meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets to a private company controlled by Trevor Newton, our former president. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration. As a result we have only recently commenced oil and gas exploration operations. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the oil and natural gas industries. We have yet to generate any revenues from operations. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Our future operating results will depend on many factors, including:

| | • our ability to raise adequate working capital; |

| | • success of our development and exploration; |

| | • demand for natural gas and oil; |

| | • the level of our competition; |

| | • our ability to attract and maintain key management and employees; and |

| | • our ability to efficiently explore, develop and produce sufficient quantities of marketable natural gas or oil in a highly competitive and speculative environment while maintaining quality and controlling costs. |

To achieve profitable operations, we must, alone or with others, successfully execute on the factors stated above. If we are not successful in executing any of the above stated factors, our business will not be profitable and may never even generate any revenue, which make our common shares a less attractive investment and may harm the trading of our common shares trading on the OTC Bulletin Board.

| 2. | At this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their investment. |

Because the nature of our business is expected to change as a result of shifts in the market price of oil and natural gas, competition, and the development of new and improved technology, management forecasts are not necessarily indicative of future operations and should not be relied upon as an indication of future performance.

Our Management may incorrectly estimate projected occurrences and events within the timetable of its business plan, which would have an adverse effect on our results of operations and, consequently, make our common shares a less attractive investment and harm the trading of our common shares trading on the OTC Bulletin Board. Investors may find it difficult to sell their shares on the OTC Bulletin Board.

| 3. | If capital is not available to us to fund future operations, we will not be able to pursue our business plan and operations would come to a halt and our common shares would be nearly worthless. |

Cash on hand is not sufficient to fund our anticipated operating needs of approximately $5,800,000 for the next twelve months. We will require substantial additional capital to participate in the development of our properties which have not had any production of oil or natural gas as well as for acquisition and/or development of other producing properties. Because we currently do not have any cash flow from operations we need to raise additional capital, which may be in the form of loans from current shareholders and/or from public and private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for and producing oil and gas at profitable prices. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

| 4. | We are heavily dependent on Manny Dhinsa, our CEO, President and Chairman. The loss of Mr. Dhinsa, whose knowledge, leadership and technical expertise upon which we rely, would harm our ability to execute our business plan. |

Our success depends heavily upon the continued contributions of Manny Dhinsa, whose knowledge, leadership and technical expertise would be difficult to replace. Our success is also dependent on our ability to retain and attract experienced engineers, geoscientists and other technical and professional staff. Effective May 15, 2006 we entered into a consulting agreement with Mr. Dhinsa under which Mr. Dhinsa will dedicate all of his time to the operations of the Company. We do not maintain any key person insurance on Mr. Dhinsa. If we were to lose his services, our ability to execute our business plan would be harmed and we may be forced to cease operations until such time as we could hire a suitable replacement for Mr. Dhinsa.

| 5. | Volatility of oil and gas prices and markets could make it difficult for us to achieve profitability and less likely investors in our common shares will receive a return on their investment. |

Our ability to achieve profitability is substantially dependent on prevailing prices for natural gas and oil. The amounts of and price obtainable for any oil and gas production that we achieve will be affected by market factors beyond our control. If these factors are not favorable over time to our financial interests, it is likely that owners of our common shares will lose their investments. Such factors include:

| | • worldwide or regional demand for energy, which is affected by economic conditions; |

| | • the domestic and foreign supply of natural gas and oil; |

| | • domestic and foreign governmental regulations; |

| | • political conditions in natural gas and oil producing regions; |

| | • the ability of members of the Organization of Petroleum Exporting Countries to agree upon and maintain oil prices and production levels; and |

| | • the price and availability of other fuels. |

| 6. | Drilling wells is speculative, often involving significant costs that may be more than our estimates. Any material inaccuracies in drilling costs, estimates or underlying assumptions will reduce the profitability of our business and will negatively affect our results of operations. |

Developing and exploring for natural gas and oil involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic such as:

| | • blow-outs and surface cratering; |

| | • uncontrollable flows of oil, natural gas, and formation water; |

| | • natural disasters, such as hurricanes and other adverse weather conditions; |

| | • pipe, cement, or pipeline failures; |

| | • embedded oil field drilling and service tools; |

| | • abnormally pressured formations; and |

| | • environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases. |

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

| | • injury or loss of life; |

| | • severe damage to and destruction of property, natural resources and equipment; |

| | • pollution and other environmental damage; |

| | • clean-up responsibilities; |

| | • regulatory investigation and penalties; |

| | • suspension of our operations; and |

| | • repairs to resume operations. |

| 7. | The unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget. |

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

| 8. | We are subject to complex laws and regulations, including environmental regulations, which can adversely affect the cost, manner or feasibility of doing business. |

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

| | • location and density of wells; |

| | • the handling of drilling fluids and obtaining discharge permits for drilling operations; |

| | • accounting for and payment of royalties on production from state, federal and Indian lands; |

| | • bonds for ownership, development and production of natural gas and oil properties; |

| | • transportation of natural gas and oil by pipelines; |

| | • operation of wells and reports concerning operations; and |

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

| 9. | Our oil and gas operations may expose us to environmental liabilities. |

If we experience any leakage of crude oil and/or gas from the subsurface portions of a well, our gathering system could cause degradation of fresh groundwater resources, as well as surface damage, potentially resulting in suspension of operation of a well, fines and penalties from governmental agencies, expenditures for remediation of the affected resource, and liabilities to third parties for property damages and personal injuries. In addition, any sale of residual crude oil collected as part of the drilling and recovery process could impose liability on us if the entity to which the oil was transferred fails to manage the material in accordance with applicable environmental health and safety laws.

| 10. | Exploratory drilling involves many risks and we may become liable for pollution or other liabilities which may have an adverse effect on our financial position. |

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labour, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

| 11. | The potential profitability of oil and gas ventures depends upon factors beyond the control of our company. |

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

| 12. | Our auditors’ opinion on our December 31, 2007 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern. |

We have incurred net losses of $9,068,648 from July 1, 2005 (the date we commenced our oil and gas operations) to December 31, 2007. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern. We will need to obtain additional funds in the future. Our plans to deal with this cash requirement include loans from existing shareholders, raising additional capital from the public or private sale of equity or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

| 13. | If we do not maintain the property lease payments on our properties, we will lose our interest in the properties as well as losing all monies incurred in connection with the properties. |

We have two land packages in Alberta, Canada that were acquired through auction directly from the government of Alberta. The land packages are made up of a number of underlying individual leases. All of our leases require annual lease payments to the Alberta provincial government. See Item 4.D of the 20-F for a more detailed description of the property obligations. If we do not continue to make the annual lease payments, we will lose our ability to explore and develop the properties and we will not retain any kind of interest in the properties.

| 14. | We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves. |

The natural gas and oil market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

| 15. | We expect losses to continue in the future because we have no oil or gas reserves and, consequently, no revenue to offset losses. |

Based upon the fact that we currently do not have any oil or gas reserves, we expect to incur operating losses in next 12 months. The operating losses will occur because there are expenses associated with the acquisition and exploration of natural gas and oil properties which do not have any income-producing reserves. Failure to generate revenues may cause us to go out of business. We will require additional funds to achieve our current business strategy and our inability to obtain additional financing will interfere with our ability to expand our current business operations.

| 16. | Because we are in the exploration stage of operations of our business our securities are considered highly speculative. |

We are in the exploration stage of our business. As a result, our securities must be considered highly speculative. We are engaged in the business of exploring and, if warranted and feasible, developing natural gas and oil properties. Our current properties are without known reserves of natural gas or oil. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural gas and oil, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through loans from existing shareholders, the sale of our equity securities or strategic arrangement with a third party in order to continue our business operations.

| 17. | Since our directors work for other natural resource exploration companies, their other activities for those other companies could slow down our operations or negatively affect our profitability. |

Our officers and directors are not required to work exclusively for us and do not devote all of their time to our operations. In fact, our directors work for other natural resource exploration companies. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by such other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slow down in operations. It is expected that each of our directors will devote approximately 1 hour per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed.

RISKS RELATING TO OUR COMMON SHARES

| 18. | We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value. |

Our Articles of Incorporation authorize the issuance of an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. The future issuance of our unlimited authorized common shares may result in substantial dilution in the percentage of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common shares.

| 19. | Our common shares are subject to the "Penny Stock" Rules of the SEC and we have no established market for our securities, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock. |

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than USD $5.00 per share or with an exercise price of less than USD $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| | · | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| | · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| | · | obtain financial information and investment experience objectives of the person; and |

| | · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| | · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| | · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 20. | We are a “foreign private issuer”, and you may not have access to the information you could obtain about us if we were not a “foreign private issuer”. |

We are considered a "foreign private issuer" under the Securities Act of 1933, as amended. As a foreign private issuer we will not have to file quarterly reports with the SEC nor will our directors, officers and 10% stockholders be subject to Section 16(b) of the Exchange Act. As a foreign private issuer we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-U.S. companies and will not apply to us. Accordingly, you may not be able to obtain information about us as you could obtain if we were not a “foreign private issuer”.

| 21. | Because we do not intend to pay any cash dividends on our Common shares, our stockholders will not be able to receive a return on their shares unless they sell them. |

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

| 22. | We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors. |

If we are a “passive foreign investment company” or “PFIC” as defined in Section 1297 of the Code, U.S. Holders will be subject to U.S. federal income taxation under one of two alternative tax regimes at the election of each such U.S. Holder. Section 1297 of the Code defines a PFIC as a corporation that is not formed in the United States and either (i) 75% or more of its gross income for the taxable year is “passive income”, which generally includes interest, dividends and certain rents and royalties or (ii) the average percentage, by fair market value (or, if we elect, adjusted tax basis), of its assets that produce or are held for the production of “passive income” is 50% or more. Whether we are a PFIC in any year and the tax consequences relating to PFIC status will depend on the composition of our income and assets, including cash. U.S. Holders should be aware, however, that if we become a PFIC, we may not be able or willing to satisfy record-keeping requirements that would enable U.S. Holders to make an election to treat us as a “qualified electing fund” for purposes of one of the two alternative tax regimes applicable to a PFIC, which would result in adverse tax consequences to our shareholders who are U.S. citizens.

| 23. | Because we are organized under the Canada Business Corporations Act and all of our assets and all of our officers and directors are located outside the United States, it may be difficult for an investor to enforce within the United States any judgments obtained against us or any of our officers and directors. |

All of our assets are located outside of the United States and we do not currently maintain a permanent place of business within the United States. In addition, our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for an investor to effect service of process or enforce within the United States any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Canada would recognize or enforce judgments of United States courts obtained against us or our directors and officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. There is even uncertainty as to whether the Canadian courts would have jurisdiction to hear original actions brought in Canada against us or our directors and officers predicated upon the securities laws of the United States or any state thereof.

RISKS RELATING TO THE CONTINUANCE

| 24. | Due to the Company changing its domicile on August 17, 2004 from the United States to Canada we may owe additional U.S. taxes as a result of the conversion if our conclusions relating to the value of our assets are incorrect. |

For U.S. tax purposes, when we continued the company in Canada in the third quarter of 2004, it was treated as though we sold all of our property and received the fair market value for those properties. We were taxed on any income or gains realized on that "sale." The fair market value of our assets was greater than our tax basis of our assets and as a result we had a taxable gain on the deemed "sale".

In connection with the continuation, we reviewed our assets, liabilities and paid-up capital and the extent of our losses carried forward and believe that we do not owe any U.S. federal income taxes as a result of the conversion/continuance. Accordingly, we believe that no U.S. taxes are owing as a result of the proposed conversion. It is possible that the facts on which we based our assumptions and conclusions may be challenged by the Internal Revenue Service. In particular, our determination of fair market value was based upon a valuation of our assets and liabilities as of September 30, 2002. The value was determined based upon the cash flows projected to be generated by our intangible assets, discounted at a rate representative of an appropriate rate of return for an alternative investment of equivalent risk. This discount rate was estimated to be 25%. Underlying the valuation were key estimates of management's projections of revenue and expenses for a six-year period which were based upon on further estimates and assumptions surrounding our cost structure, development of technology and continued market acceptance of our database products and pricing.

There are other valuation methodologies which, if employed, may have yielded a higher fair market value for our assets which would have resulted in a larger taxable gain. One such method is the "market capitalization method" where the implied value of our net assets is equal to the number of our common shares outstanding multiplied by the quoted market price of our common stock on the OTC Bulletin Board on the transaction date. Had the market capitalization method been applied, the valuation of our assets would have been substantially higher (as much as $9.6 million higher as of the September 30, 2002 valuation date) than the value determined using the discounted cash flow method and would have yielded significant taxable capital gains and taxes owing as a result of the continuance. Management assessed the two methods, but did not consider the "market capitalization method" an appropriate reflection of the value of our company as a whole. Our Company's common stock is quoted on the OTC Bulletin Board, had a small public float and was relatively thinly traded. Because of these factors, we considered the quoted market price of our stock to be an unreliable measure of the fair value of our net assets and accordingly sought a more appropriate measure of value.

The valuation may be challenged by the Internal Revenue Service ("IRS"). Should the IRS disagree with the valuation methodology we used or any of our assumptions, they could reassess the deemed proceeds on the continuance to a higher amount. We may not have tax losses carried forward from prior years sufficient to cover any adjustments to the taxable gain required upon assessment by federal tax authorities. Should our losses be insufficient, the tax liability to our company could be significant and we may not have the available cash at that time to settle the liability owing. Should we be unable to settle any such liability, we may have to cease operations in which case our stockholders would likely loose their investment in our company.

Management believes the methodology, estimates and assumptions are not only reasonable but the most appropriate in these circumstances. Hence, we did not apply to the federal tax authorities (the Internal Revenue Service in the United States and the Canada Revenue Agency in Canada) for a ruling on this matter and do not intend to do so. We have also made certain other assumptions regarding the tax treatment of this transaction in order to reach our conclusions and it may be possible for some of these assumptions to be interpreted in a different manner which would be less favorable to us. You should understand that it is possible that the federal tax authorities will not accept our valuations or positions and claim that we owe taxes as a result of this transaction.

A. History and Development of Strata Oil & Gas Inc.

Strata Oil & Gas Inc. (formerly Stratabase) was incorporated under the laws of the State of Nevada on November 18, 1998 and commenced operations in January 1999. We completed our initial public offering in February 2000. Our headquarters are located at 717 7th Avenue SW, Suite 1750, Calgary, Alberta, Canada, T2P 0Z3. The telephone number is (403) 668-6539. The Company’s web address is strataoil.com. The Company operates in the oil and gas industry with a focus on Canada’s oil sands and heavy oil deposits. The Company has interests in a total of 43 oil sands leases located in Northern Alberta, Canada.

Continuance to Canada

We are presently incorporated under the Canada Business Corporations Act. In January 2003, the Company filed a proposal to effect a continuation of the corporate jurisdiction from the State of Nevada to Canada on Form S-4 with the United States Securities and Exchange Commission (SEC). The Form S-4 was declared effective on or about July 7, 2004 and submitted to the shareholders of the Company. The special meeting of stockholders to vote on the adoption of the plan of conversion was held on August 17, 2004 and a majority of the shareholders approved the plan of conversion. Accordingly, the Company changed its name to "Stratabase Inc.," and continued to operate under the Canada Business Corporations Act. "Continuance" is a process by which a corporation which is not incorporated under the laws of Canada may change its jurisdiction of incorporation to Canada. Under the Canada Business Corporations Act, if the laws of its home jurisdiction allow for it and a resolution authorizing the continuance is approved by 66 2/3% of the company's shareholders, the company may be "continued" as a Canadian corporation by filing of Articles of Continuance with the Director under the Canada Business Corporations Act. Under the corporate law of Nevada, this process is treated as a conversion of the outstanding shares of a Nevada company to shares of a Canadian company. The business and operations of Strata following the conversion were identical in most respects to our current business, except that we will no longer be subject to the corporate laws of the State of Nevada but are subject to the Canada Business Corporations Act. The Canadian company is liable for all the debts and obligations of the Nevada company, and the officers and directors of the company are the officers and directors of Strata. On August 17, 2004, Strata filed a Form 8-A with the SEC registering its securities under Section 12(g) of the Securities Act of 1933.

Discontinued Operations

Until the end of June, 2005 we had developed software which was designed to allow users to interface with and manage databases and customer relationships. On June 29, 2005 at an annual general and special meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets to a private company controlled by our former president. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration.

On June 29, 2005 pursuant to approval by a majority of the shareholders of the Company, the Company entered into a letter of intent to dispose of all of its interest in its proprietary software to a company (the “Purchaser”) controlled by its former president for $130,000. On July 11, 2005 a definitive agreement was completed and in exchange for the rights to all of its software, the Company received a non-interest bearing promissory note (the “Note”) which was due July 11, 2006. The entire amount of the promissory note was received on June 30, 2006 and has been recorded as income from discontinued operations in the Statement of Operations and Comprehensive Loss at December 31, 2006. The Company had a lien and security interest in all of the assets that were acquired by the Purchaser.

The assets acquired by the Purchaser include all rights and use to the “Strata”, “Relata”, and “Resync” names, all rights and use of the trademarks, web pages, and domain names for “Strata”, “Relata”, and “Resync”, and all rights to the source code and related documentation for the “Relata” and “Resync” software. The value of the assets disposed of was based on the results of an evaluation prepared for the Company by an independent evaluator.

The entire outstanding principal amount of the Note could have been converted, at the sole discretion of the Purchaser into the Purchaser’s no par value common shares (“Common Shares”), at any time prior to the maturity. The Purchaser could not have converted less than the entire principal amount of the Note. The Purchaser would not have been permitted to convert this Note into Common Shares if there had been an event of default which had not been cured and or was continuing.

The Purchaser had at his sole discretion, the right to convert the promissory note to equity in his private company. If the Purchaser had chosen to convert the promissory note to equity, it would have been converted into shares of his company at market value. The promissory note was secured by all of the assets acquired by the Purchaser. The Purchaser could have assigned his rights under the purchase agreement, provided that the terms of sale of the software assets to such alternate buyer or assignee would have been substantially the same as described above.

The results of operations of the software operations have been segregated in the financial statements as discontinued operations for the current and prior periods.

Settlement of Loan Receivable

In May 2002, the Company loaned $150,000 to Advanced Cell Technology ("ACT"), a private biotechnology company, in exchange for a convertible promissory note receivable. The note was unsecured, bore interest at 20% per annum, matured on April 30, 2003, and was to be converted into stock of ACT should ACT have proceeded with a preferred stock financing prior to the note's maturity date. The Company accrued a receivable for interest income, due under the terms of the promissory note, in the amount of $21,206 at December 31, 2002. At April 30, 2003, the note receivable was in default. The Company received notice from ACT of their intention to settle the note receivable in full out of future financing. With the uncertainty regarding the recoverability of the note receivable, in 2003 the Company reserved the principal amount of the note receivable and accrued interest outstanding at December 31, 2002 and fully reserved all additional accruals of interest.

On May 8, 2006 the Company completed an agreement with the current parent company of ACT, Advanced Cell Technology, Inc. (“ACTC”) for settlement of the loan. The Company received 109,557 common shares of ACTC, a public company, for settlement of the principal and interest of the loan. As part of the settlement, the Company had agreed to pay its legal counsel a contingent fee based on the loan settlement amount. As a result, of the total 109,557 common shares of ACTC received by the Company, 14,232 were assigned to the Company’s counsel for payment of legal fees. At December 31, 2006 the Company owned 95,325 shares of ACTC at a cost of $115,343 and a market value of $55,288 at December 31, 2006. The gross unrealized holding loss for the twelve month period ended December 31, 2006 was $60,055. The cost and market values of the ACTC shares were determined by reference to their closing prices on May 8 and December 31, 2006 respectively as quoted on the OTC:BB. As a result of the settlement of the loan with ACTC, the Company has recognized a gain of $115,343 at December 31, 2006.

During 2007, the Company disposed of all of its ACTC shares for gross proceeds of $77,607 resulting in a loss of $37,736 at December 31, 2007.

B. Business Overview

HISTORICAL CORPORATE DEVELOPMENT

The Company was originally a United States incorporated software development company. In August 2004 the Company formally completed the process of becoming a Canadian-based company and on June 29, 2005 the Company sold all of its interests in its software assets and became a business engaged in oil and gas exploration.

The Company currently has interests in oil sands properties located in the Wabasca and Peace River areas of Northern Alberta, Canada. A description of the Company’s properties is set out below.

The Company is an exploration stage company and there is no assurance that a commercially viable oil or gas deposit exists on any of its properties. Further evaluation will be required on each property before a final evaluation as to the economics and legal feasibility of the property is determined.

The Company currently has an interest in 43 oil sands leases in northern Alberta, Canada. Forty-two of the leases are in the Peace River Oil Sands area and one is located in the Wabasca (a.k.a. Wabiskaw) Oil Sands region.

MATERIAL EFFECTS OF GOVERNMENT REGULATION

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. The oil and gas leases currently leased by the Company are owned by the Province of Alberta and are managed by the Department of Energy. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

| | • location and density of wells; |

| | • the handling of drilling fluids and obtaining discharge permits for drilling operations; |

| | • accounting for and payment of royalties on production from state, federal and Indian lands; |

| | • bonds for ownership, development and production of natural gas and oil properties; |

| | • transportation of natural gas and oil by pipelines; |

| | • operation of wells and reports concerning operations; and |

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

ANTICIPATED CHANGES TO FACILITIES AND EMPLOYEES

Management of the Company anticipates no changes to either facilities or employees in the near future.

SEASONALITY, DEPENDENCY UPON PATENTS, LICENSES, CONTRACTS, PROCESSES, SOURCES AND AVAILIBILTY OF RAW MATERIALS

Certain of the Company’s properties are in remote locations and subject to significant temperature variations and changes in working conditions. It may not be possible to actively explore the Company’s properties in Alberta throughout the year because seasonal changes in the weather. If exploration is pursued at the wrong time of year, the Company may incur additional costs to address issues relating to the weather.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

COMPETITION

The natural gas and oil exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

C. Organizational Structure

The Company is not part of a group and has no subsidiaries.

D. Property Plant and Equipment

CORPORATE OFFICES

We do not own any real property. Our offices are located at 717 7th Avenue SW, Suite 1750, Calgary, Alberta, Canada, T2P 0Z3. The office is leased on a 24.5 month lease expiring October 30, 2009. The Company has the option to renew the lease for an additional one year term. We believe that the facilities will be adequate for the foreseeable future. All costs described in this section are stated in U.S. dollars as converted from Canadian dollars. Accordingly, the costs may vary to some degree with the currency exchange rate.

OIL SANDS LEASES

The Company has an interest in 43 oil sands leases in northern Alberta, Canada. Forty-two of the leases are in the Peace River Oil Sands area and one is located in the Wabasca (a.k.a. Wabiskaw) Oil Sands region.

Oil Sands Background

Oil Sands refer to unconsolidated, bitumen-saturated sands containing varying amounts of clay and rock material. The bitumen content refers to a heavy, viscous crude oil that generally does not flow under natural reservoir conditions. As a result, it cannot be recovered from a conventional well the way lighter oil is most often produced. The oil sands are contained in three major areas beneath an approximate 140,800 square kilometres (54,363 square miles) of north-eastern Alberta - an area larger than the state of Florida. As of December 2002, according to the Alberta Department of Energy, these three areas, Athabasca/Wabasca, Peace River, and Cold Lake, contained 1.6 trillion barrels of bitumen in-place, of which 174 billion barrels are proven reserves that can be recovered using current technology.

These deposits contain a significant amount of oil but until recently the cost of extraction has created a barrier to economic development. Extraction of oil from oil sands requires technologically intensive activity and the input of significant amounts of energy to exploit the oil sands deposits. There are two main types of oil sands production methods: mining and in-situ. Oil sands mining is accomplished using an open pit operation whereby the oil sands are dug up and trucked to a processing facility. For oil sands reservoirs too deep to support economic surface mining, some form of in-situ recovery is required to produce bitumen. In-situ production is similar to that of conventional oil production where oil is recovered through a well. The Alberta Energy and Utilities Board estimates that 80 percent of the total bitumen ultimately recovered will be with in-situ techniques. Numerous in-situ technologies have been developed that apply thermal energy to heat the bitumen and allow it to flow to the well bore.

There are some oil sands reservoirs where primary or “cold” production is possible. The lighter bitumen in these areas can flow towards a well and bitumen production can be enhanced by the co-production of sand, thereby creating a downhole cavity around the well bore which facilitates the flow of oil towards the well. This type of production technology is commonly called cold heavy oil production with sand (“CHOPS”). While this type of bitumen is marginally lighter and less viscous than the conventional bitumen found in mineable and other in-situ reserves, it is also slightly heavier than the conventional “Heavy Oil” reservoirs produced in the “heavy oil belt” region, located around the central Alberta - Saskatchewan border. Another production technology, which may be suitable for some of the lighter oil sands reservoirs is the use of horizontal well bores. Horizontal production wells, which have been drilled up to more than 2 kilometers away from their surface locations, have been successfully applied to cold in-situ bitumen production, where it is suitable. In general, open pit oil sands mines are found in central Athabasca deposits, while in-situ bitumen production technology is used in the Cold Lake, south Athabasca, and Peace River deposits, where the overburden thickness exceeds 50 meters.

Oil in oil sands is found mainly in high porosity quartz arenites to arkosic sands that cover large areas and lie up-dip from the purported source rocks to the southwest. There are also vast amounts of heavy oil as well in fractured carbonate rocks of 10-14% porosity underlying a large triangular region of north central Alberta. In addition, there is a large amount of heavy oil in a series of thinner blanket sands and channel sands extending all the way from Suffield Alberta to zones overlying the Cold Lake Oil Sands near Bonnyville, and extending well into Saskatchewan. The latter deposits called the ‘heavy oil belt” are the sites of the most development attention because the oil is less viscous and it can be produced using either CHOPS or horizontal well technology.

The source rocks for the oil sands are from the Cretaceous and Jurassic shales in the Alberta Syncline. Rapid sedimentation of organic rich argillaceous material caused large flow volumes to be generated as the result of compaction. Deep burial of the kerogeneous source rocks allowed organic diagenesis to occur resulting in the generation of oil and gas from the kerogen. The oil sands are 98% un-cemented (unconsolidated sandstones). The ingress of bitumen has essentially stopped diagenetic processes and the sands do show strong evidence of the early effects of pressure solution and re-crystallization but true cementation is quite rare as are significant calcite cemented zones.

Carboniferous Oil Sands

Strata has focused its efforts on carbonate-hosted oil sands. The carbonates are the next challenge in the Alberta oil sands industry. Like oil sands two decades ago, carbonates represent an enormous and relatively untapped petroleum resource. The means for producing bitumen from carbonates is still being understood. The nature of the carbonate triangle in Alberta tends to vary and there is unlikely to be a single one-size-fits-all strategy for production. Cold production may be possible in some areas although in most cases production requires an in-situ treatment. Various technologies have been tested and others considered, including similar technologies to those employed in oil sands (Cyclic Steam, SAGD, etc). Bitumen carbonates are still being understood, and as yet there are several techniques which may prove to be effective. We are in the process of running tests to determine the most efficient means of producing the bitumen from our Cadotte project.

Carbonate oil sands are an unconventional resource that remains almost untapped. While much of the world now knows about Alberta’s vast oil sands resource, many people are unaware that a bitumen resource of similar magnitude is locked in carbonate rock. According to a report by Petroleum Technology Alliance Canada (PTAC), 26% of Alberta’s bitumen resources are contained in carbonate rather than sand formations. One northern Alberta carbonate formation alone — the Devonian-age Grosmont complex — has bitumen volumes in place comparable to the huge Athabasca oil sands deposit. This comparison is made in the 176-page official history of the Alberta Oil Sands Technology and Research Authority (AOSTRA), the long-since disbanded provincial agency set up in 1974 to promote bitumen recovery technologies. The history devotes four well-illustrated pages to bitumen carbonates. The resource received serious attention during the AOSTRA years with a series of pilot tests running in the Grosmont formation between 1975 and 1987. However, oil prices fell and funding was cut. The remotely located and little known bitumen carbonates were largely forgotten until Royal Dutch Shell plc paid nearly $500 million dollars for leases in 2006.

Contained in a roughly triangular 70,000- square-kilometre area of northern Alberta called the Carbonate Triangle, the deposits may be the most technically challenging of the province’s bitumen resources. The basic difference between oil sands and bitumen carbonates is the former is bitumen mixed with unconsolidated sand, which can be either mined or produced from wells. The latter, as the name implies, is bitumen in carbonate rock — both dense limestone and heavily karsted rock. Grosmont bitumen is even heavier than the Athabasca bitumen and the reservoir is extremely variable, meaning that a single recovery method is unlikely to work throughout the formation. The lack of understanding of the heterogeneous nature of the reservoir is the main hurdle for developing successful bitumen recovery schemes. The bitumen is contained in a dual porosity system — both in the vugs (cavities or fractures) and in the rock matrix itself. The vugs could potentially be good news in that they could conceivably improve permeability once the viscosity of the bitumen is raised by heat or other means, but bad news if they serve as channels for steam to escape from the area of interest. In the karsted areas, these irregular cavities and tunnels are often the diameter of a man’s arm, and sometimes much larger. According to the PTAC review of the pilot results, challenges of drilling through this karsted rock include the potential for loss of drilling fluids into the formation, and problems with the placement of cement to maintain a strong well-to-formation bond.

DROWNED AREA OIL SANDS LEASE

Acquisition of Interest

On September 7, 2005 the Company acquired a 100% interest in Alberta Oil Sands Lease #7400100011 (the ‘Drowned Property’). The rights to the Drowned Property were acquired for a payment of CDN $25,000 (USD $20,635) as well as other closing costs of CDN$9,874 (USD $8,150). The Drowned Property covers 512 hectares of land in the Drowned Area of the Wabasca oil sands in the West Athabasca area of Northern Alberta. The lease gives the Company the right to explore the Drowned Property covered by the lease.

Strata's acquisition of the Drowned Property lease includes an overriding 4% royalty agreement with the vendor. The royalty is to be paid on a well-to-well basis and is payable on all petroleum substances produced by any well on the Property. In addition, the Company must pay the province of Alberta CDN $1,792 (USD $1,808) per year to maintain its right to the lease. The lease is subject to a royalty payable to the government of Alberta. The royalty is calculated using a revenue-less-cost formula. In years prior to the recovery of the project’s capital investment, the royalty is 1% of gross revenue. Once the project costs have been recovered, the royalty is the greater of 1% of gross revenue or 25% of net revenue.

Location

The Drowned Property lies near the southern edge of the Wabasca Heavy Oil/Oil sands field in west Athabasca approximately 45km south of the town of Wabasca or 60km Northeast of Slave Lake.

| Lease Number | Hectares | Townships | Range | Section |

| | | | | |

| 7400100011 | 512 | 75, 76 | 23 | 1 and 36 |

| | | | | |

Drowned Project Lease Information

The Drowned Property is comprised of a single lease with the government of the province of Alberta, Canada. The lease is a fifteen year lease and expires on October 4, 2015.

| Lease Number | Hectares | Rent / Hectare | Annual Minimum Lease Payments |

| | | | |

| 7400100011 | 512 | CDN $3.50 (USD $3.53) per year | CDN $1,792 (USD $1,808) per year |

| | | | |

Regional Geology

Regionally, the Wabiskaw Reservoir consist of three overlapping en-echelon sand bodies interpreted as shoreface sand which coarsen upwards from shale to fine sand. The three bodies are informally referred to as Wabiskaw “A” Sand, Wabiskaw “B” Sand, and Wabiskaw “C” Sand. The three bodies are separated from each other by shales and each has proven to be correlatable and mappable over a wide area. All three bodies contain bitumen but only the bitumen sand of the Wabiskaw “A” is being cold produced at the present time. The “B” and “C” are generally thinner and contain smaller bitumen accumulations.

Gas and water are also significant components of the reservoir fluids in the Wabiskaw sands. Several associated gas fields are currently in production. There may be a distinct basal water leg below the bitumen. This is especially true in the southwestern part of the Wabiskaw reservoirs.

The deposit lies above the western part of the Athabasca oil sands and extends westward somewhat beyond the McMurray Formation edge. In many regions, the Wabasca is oil rich and it overlies the McMurray forming two stacked reservoirs. Detrital matter arrived mainly from the west but mixed with a small component of sediments from the shield. The bitumen is highly viscous and is at a depth of 100 to 700 meters. The Wabasca is classified as the lowest Member of the Clearwater Formation and therefore overlies the McMurray Formation. The reservoir and the thickness of oil saturated material vary from 0 to 10 meters.

Property Geology

Several pre-existing bore holes indicate that neither the Wabiskaw “A” sand nor the Wabiskaw “B” sand is present on the Company’s Drowned Property, although it appears that 0 to 4 meters of a thin bitumen-bearing Wabiska “C” sand may be present. In addition, the McMurray Formation is present beneath the Wabiskaw and fills a local north-south oriented valley system incised into the older limestone basement. These McMurray valley filled sediments appear to be complex, consisting mainly of water-bearing silts and clays, and hold only minor, discontinuous, bitumen-bearing sands of an unknown quality. The Wabiskaw and McMurray sands lie at a depth of 550 to 600 meters and the Grand Rapids reservoir lies at a depth of 425 to 500 meters.

Previous Work

Historically, the Drowned Project has had four wells drilled on it by companies owning the gas exploration rights. The geophysical well logs demonstrate the presence of bitumen in all four wells, one of which shows the presence of oil sands. The Company did not undertake any exploration work on the Drowned Property in 2007.

Planned Work by the Company for 2008

The Company has focused its exploration efforts on its Peace River Property and as a result, does not have any current plans to undertake an exploration program on the Drowned Property in 2008.

PEACE RIVER OIL SANDS LEASES

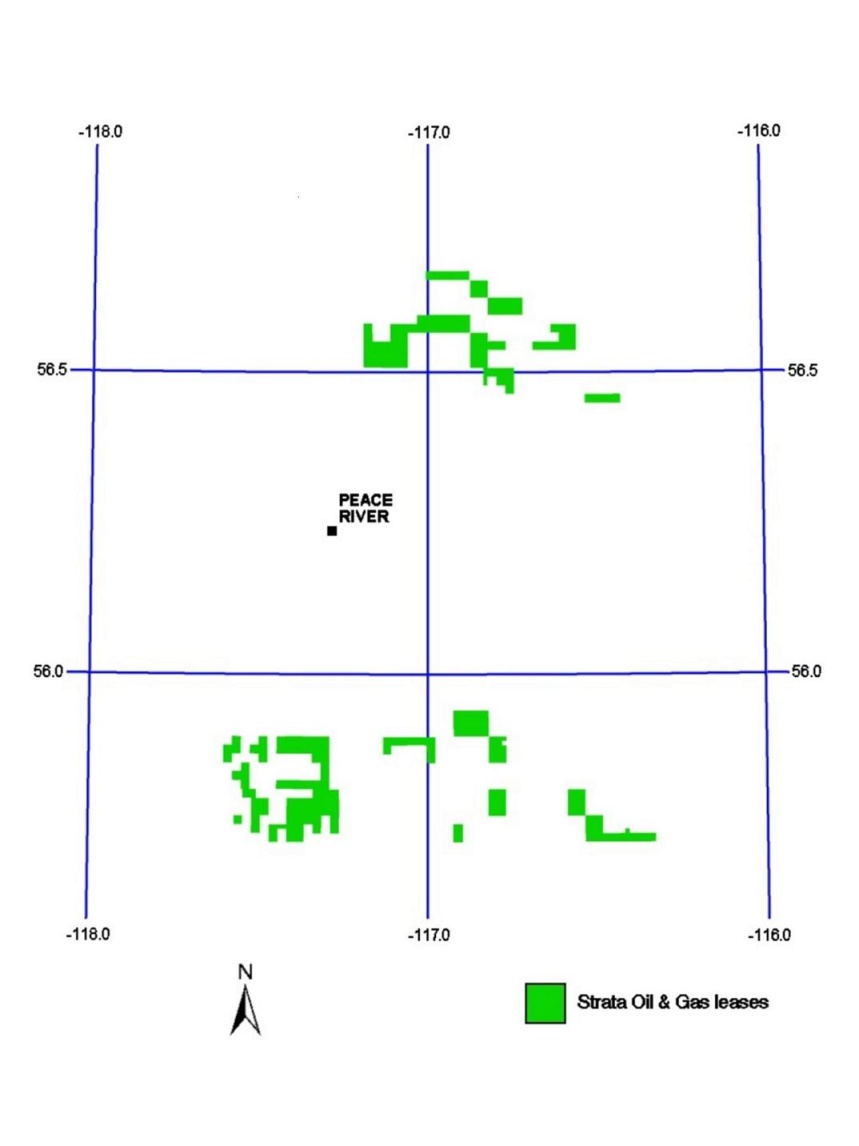

The following are two maps showing the location of the Company’s 42 oil sands leases in the Peace River region of northern Alberta, Canada.

Acquisition of Interest

The Company has entered into a series of leases in multiple transactions with the province of Alberta in the Peace River area of Alberta, Canada (the “Peace River Property”). All of the leases were acquired through a public auction process that requires the Company to submit sealed bids for land packages being auctioned by the provincial government. Upon being notified that it has submitted the highest bid for a specific land parcel the Company immediately pays the government the bid price and enters into a formal lease with the government. The bid price includes the first year’s minimum annual lease payments. The specific transactions entered into by the Company are as noted below.

Date | Number of Leases | Land Area (Hectares) | Annual Minimum Lease Payments |

| | | | |

| December 15, 2005 | 7 | 10,752 | CDN $37,632 / USD $37,962 |

| June 15, 2006 | 3 | 4,864 | CDN $17,024 / USD $17,173 |

| August 10, 2006 | 9 | 7,424 | CDN $25,984 / USD $26,212 |

| August 24, 2006 | 2 | 2,048 | CDN $7,168 / USD $7,231 |

| October 19, 2006 | 4 | 3,584 | CDN $12,544 / USD $12,654 |

| November 2, 2006 | 9 | 14,336 | CDN $50,176 / USD $50,616 |

| January 11, 2007 | 4 | 4,608 | CDN $16,128 / USD $16,270 |

| January 24, 2007 | 2 | 2,304 | CDN $8,064 / USD $8,135 |

| April 2, 2008 | 2 | 512 | CDN $1,792 / USD $1,808 |

| | 42 | 50,432 | CDN $176,512 / USD $178,061 |