UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| [ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ____________ to __________ |

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report: ______ |

Commission file number: 333-104670

STRATA OIL & GAS INC.

(Exact name of Registrant as specified in its charter)

Alberta, Canada

(Jurisdiction of incorporation or organization)

918 16th Avenue NW, Suite 408, Calgary, Alberta, Canada, T2M 0K3

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, Fully Paid and Non-Assessable Common Shares, Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: The registrant has one class of Common Stock with 69,412,043 shares outstanding at December 31, 2011 and 69,412,043, shares outstanding as of May 12, 2012. No preferred shares issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes [ ] No [ ]

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ X ] | International Financial Reporting Standards as issued by the International Accounting Standards Board [ ] | Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [ ] Item 18 [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes [ ] No [ ]

STRATA OIL & GAS INC.

FORM 20-F ANNUAL REPORT 2011

TABLE OF CONTENTS

| Oil and Gas Glossary |

| Introduction |

| |

| Part I |

| | | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 6 |

| Item 2. | Offer Statistics and Expected Timetable | 6 |

| Item 3. | Key Information | 6 |

| Item 4. | Information on the Company | 14 |

| Item 4A. | Unresolved Staff Comments | 30 |

| Item 5. | Operating and Financial Review and Prospects | 30 |

| Item 6. | Directors, Senior Management and Employees | 37 |

| Item 7. | Major Shareholders and Related Party Transactions | 40 |

| Item 8. | Financial Information | 41 |

| Item 9. | The Offer and Listing | 42 |

| Item 10. | Additional Information | 43 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 49 |

| Item 12. | Description of Other Securities Other Than Equity Securities | 49 |

| |

| Part II |

| | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 50 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 50 |

| Item 15. | Controls and Procedures | 50 |

| Item 16. | Reserved | |

| A | Audit Committee Financial Expert | 51 |

| B | Code of Ethics | 51 |

| C | Principle Accountant Fees and Services | 52 |

| D | Exemptions from the Listing Standards for Audit Committees | 52 |

| E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 52 |

| F | Change in Registrants Certifying Accountant | 52 |

| G | Corporate Governance | 53 |

| |

| Part III |

| | | |

| Item 17. | Financial Statements | 53 |

| Item 18. | Financial Statements | 53 |

| Item 19. | Exhibits | 77 |

| | | |

| Financial Statements | |

| | | |

| Signature Page | | |

| | | |

| Certifications | | |

OIL AND GAS GLOSSARY

| Term | Definition | |

| | | |

| Basin | A depressed area where sediments have accumulated during geologic time and considered to be prospective for oil and gas deposits. | |

| Bitumen | Heavy, viscous crude oil | |

| Bluesky Formation | The Bluesky is fine to medium grained, usually glauconitic, partly calcareous or sideritic, salt and pepper sandstone with fair porosity. Chert granules and pebbles occur near the top, with thin shale interbedded throughout. The thickness is 0-46 meters in the Peace River plains subsurface. It thins to the south and southeast | |

| CHOPS | Cold Heavy Oil Production with Sand | |

| Carboniferous | The period of geological time between 360 and 286 million years ago. A series of stratified rocks and associated volcanic rocks which occur above the Devonian or Old Sandstone and below the Permian or Triassic systems belonging to the Carboniferous period. | |

| Cretaceous Period | A period 144 to 65 million years ago | |

| Debolt Formation | Lies above the Elkton Formation and ranges from mid- to upper Visean in age (345.3 to 326.4 million years ago) | |

| Development | The phase in which a proven oil or gas field is brought into production by drilling production (development) wells. | |

| Drilling | The using of a rig and crew for the drilling, suspension, production testing, capping, plugging and abandoning, deepening, plugging back, sidetracking, re-drilling or reconditioning of a well. | |

| Drilling logs | Recorded observations made of rock chips cut from the formation by the drill bit, and brought to the surface with the mud, as well as rate of penetration of the drill bit through rock formations. Used by geologists to obtain formation data. | |

| Exploration | The phase of operations which covers the search for oil or gas by carrying out detailed geological and geophysical surveys followed up where appropriate by exploratory drilling. Compare to "Development" phase. | |

| Jurassic Period | Between 206 and 144 million years ago | |

| Mineral Lease | A legal instrument executed by a mineral owner granting exclusive right to another to explore, drill, and produce oil and gas from a piece of land | |

| Oil Sands | Sand, clay and rock material containing bitumen | |

| Porosity | The ratio of the volume of void spaces in a rock or sediment to the total volume of the rock or sediment. | |

| Reserves | Generally the amount of oil or gas in a particular reservoir that is available for production. | |

| Reservoir | The underground rock formation where oil and gas has accumulated. It consists of a porous rock to hold the oil or gas, and a cap rock that prevents its escape | |

INTRODUCTION

Strata Oil & Gas Inc. was incorporated under the laws of the State of Nevada on November 18, 1998 and commenced operations in January 1999. We completed our initial public offering in February 2000. In January, 2003, the Company filed a proposal to effect a continuation of the corporate jurisdiction from the State of Nevada to Canada on Form S-4 with the United States Securities and Exchange Commission (SEC). The Form S-4 was declared effective on or about July 7, 2004 and submitted to the shareholders of the Company. The special meeting of stockholders to vote on the adoption of the plan of conversion was held on August 17, 2004 and a majority of the shareholders approved the plan of conversion. Accordingly, the Company changed its name to "Stratabase Inc.," and continued to operate under the Canada Business Corporations Act.

On June 29, 2005 at the Annual General and Special Meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration. Our headquarters are located at 918 16th Avenue NW, Suite 408, Calgary, Alberta, Canada, T2M 0K3. The telephone number is (403) 237-5443. The Company’s web address is strataoil.com.

On May 9, 2006, at a Special Meeting of the Company’s stockholders, a majority of the Company’s stockholders approved a 2:1 forward stock split. The record and payment dates of the forward split were May 10 and May 11, 2006 respectively. In addition, on July 13, 2007, at a Special Meeting of the Company’s stockholders, a majority of the Company’s stockholders approved a 2:1 forward stock split. The record and payment dates of the forward split were October 8 and October 9, 2007 respectively. All references to share and per share amounts have been restated in this 20-F to reflect these splits.

In this Annual Report, the “Company”, “Strata Oil & Gas Inc.”, “Strata”, "we", "our", and "us", refer to Strata Oil & Gas Inc. (unless the context otherwise requires). Summary discussions of documents referred to in this Annual Report may not be complete, and we refer you to the actual documents for more complete information.

BUSINESS OF STRATA OIL & GAS INC.

The Company operates in the oil and gas industry with a focus on Canada’s carbonate-hosted bitumen deposits. The Company currently has interests in a total of 18 oil sands leases located in Northern Alberta, Canada.

FINANCIAL AND OTHER INFORMATION

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (“USD$” or “$”).

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Strata Oil & Gas Inc. (hereinafter referred to as the “Company,” “Strata” or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 20-F or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 20-F or in documents incorporated by reference in this Annual Report on Form 20-F. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

Item 1. Identity of Directors, Senior Management and Advisors

Item 2. Offer Statistics and Expected Timetable

Item 3. Key Information

A. Selected Financial Data

The following sets forth selected financial information of Strata prepared in accordance with accounting principles generally accepted in the United States for the fiscal years ended December 31, 2011, 2010, 2009, 2008 and 2007.

The selected financial information and operating information may not be indicative of Strata’s future performance and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The selected financial data as at and for these periods have been extracted from, and are qualified by reference to the audited consolidated financial statements included herein at Item 18.

(in U.S. dollars)

| | | Strata Oil & Gas Inc. | |

| | | Years Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Revenue | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Expenses | | | 172,252 | | | | 972,357 | | | | 331,369 | | | | 654,240 | | | | 468,031 | |

| Other income (expense), net | | | 1,806,507 | | | | 4,474,395 | | | | (6,209,807 | ) | | | 12,497 | | | | 13,306 | |

| Net income (loss) | | $ | 1,629,255 | | | $ | 3,502,038 | | | $ | (6,541,176 | ) | | $ | (641,743 | ) | | $ | (454,725 | ) |

| Basic and income (loss) per share: | | | | | | | | | | | | | |

| From continuing operations | | $ | 0.02 | | | $ | 0.05 | | | $ | (0.10 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

| Basic weighted average number of common shares outstanding (in millions) | | | 68.8 | | | | 66.4 | | | | 62.9 | | | | 61.7 | | | | 57.4 | |

| Diluted weighted average number of common shares outstanding (in millions) | | | 69.2 | | | | 73.2 | | | | N/A | | | | N/A | | | | N/A | |

BALANCE SHEET DATA

| (in U.S. Dollars) | | Strata Oil & Gas Inc. | |

| | | December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 217,504 | | | $ | 151,283 | | | $ | 79,447 | | | $ | 121,776 | | | $ | 27,963 | |

| Other current assets | | | 23,827 | | | | 51,157 | | | | 43,822 | | | | 47,504 | | | | 23,449 | |

| Deposits | | | 116,172 | | | | 114,139 | | | | 94,533 | | | | 94,533 | | | | 16,596 | |

| Property and equipment, net | | | 1,361 | | | | 2,244 | | | | 4,467 | | | | 6,692 | | | | 8,712 | |

| Oil and gas property interests | | | 7,901,703 | | | | 7,967,915 | | | | 8,398,439 | | | | 7,039,208 | | | | 7,717,683 | |

| Total assets | | | 8,260,567 | | | | 8,286,738 | | | | 8,620,708 | | | | 7,309,713 | | | | 7,794,403 | |

| Current liabilities | | | 541,947 | | | | 2,097,438 | | | | 7,284,197 | | | | 120,350 | | | | 364,528 | |

| Asset retirement obligations | | | 127,688 | | | | 119,041 | | | | 104,653 | | | | 88,606 | | | | 68,563 | |

| Additional paid-in capital | | | 21,028,596 | | | | 21,025,596 | | | | 20,371,947 | | | | 19,559,938 | | | | 19,178,750 | |

| (Accumulated deficit) retained earnings | | | (14,008,796 | ) | | | (15,638,051 | ) | | | (19,140,089 | ) | | | (12,459,181 | ) | | | (11,817,438 | ) |

| Total liabilities and stockholders’ equity | | | 8,260,567 | | | | 8,286,738 | | | | 8,620,708 | | | | 7,309,713 | | | | 7,794,403 | |

Dividends

We have never paid or declared dividends on our shares of common stock.

Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (USD$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$), therefore, this annual report may contain conversions of certain amounts in United States dollars into the Company’s functional currency, Canadian dollars, based upon the exchange rate in effect at the end of the month or of the fiscal year to which the amount relates, or the exchange rate on the date specified. For such purposes, the exchange rate means the noon buying rate for United States dollars from the Bank of Canada. These translations should not be construed as representations that the Canadian dollar amounts actually represent such United States dollar amounts or that Canadian dollars could be converted into United States dollars at the rate indicated or at any other rate.

Table No. 2 sets forth the exchange rates for the Canadian Dollar at the end of each of the three fiscal years ended December 31, 2011, 2010, and 2009, and the average rates for the period and the range of high and low rates for the period. The data for April, 2012 and for each month during the most recent six months is also provided.

Exchange Rates for Canadian Versus U.S. Dollars

The exchange rate as of December 31, 2011 was CDN $1.02 per U.S. $1.00.

The exchange rate as of May 12, 2012 was CDN $1.01 per U.S. $1.00.

| Exchange Rates for Canadian Versus U.S. Dollars | | |

(High/low rates for latest six months) | High | Low |

| April, 2012 | 1.00 | 1.00 |

| March, 2012 | 1.01 | 1.00 |

| February, 2012 | 1.00 | 1.00 |

| January, 2012 | 1.00 | 0.97 |

| December, 2011 | 1.02 | 0.99 |

| November, 2011 | .98 | 0.95 |

Exchange Rates for Canadian Versus U.S. Dollars | Average ($) |

| For the twelve months ended December 31, 2011 | 1.02 |

| For the twelve months ended December 31, 2010 | 1.00 |

For the twelve months ended December 31, 2009 | 1.14 |

| For the twelve months ended December 31, 2008 | 1.07 |

| For the twelve months ended December 31, 2007 | 1.07 |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATING TO OUR COMPANY

1. We are an exploration stage company, with limited operating history, which raises substantial doubt as to our ability to successfully develop profitable business operations and makes an investment in our common shares very risky.

We have only recently commenced oil and gas exploration operations. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the oil and natural gas industries. We have yet to generate any revenues from operations. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Our future operating results will depend on many factors, including:

| • | our ability to raise adequate working capital; |

| • | success of our development and exploration; |

| • | demand for natural gas and oil; |

| • | the level of our competition; |

| • | our ability to attract and maintain key management and employees; and |

| • | our ability to efficiently explore, develop and produce sufficient quantities of marketable natural gas or oil in a highly competitive and speculative environment while maintaining quality and controlling costs. |

To achieve profitable operations, we must, alone or with others, successfully execute on the factors stated above. If we are not successful in executing any of the above stated factors, our business will not be profitable and may never even generate any revenue, which make our common shares a less attractive investment and may harm the trading of our common shares trading on the OTC Markets.

2. At this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their investment.

Because the nature of our business is expected to change as a result of shifts in the market price of oil and natural gas, competition, and the development of new and improved technology, management forecasts are not necessarily indicative of future operations and should not be relied upon as an indication of future performance.

Our Management may incorrectly estimate projected occurrences and events within the timetable of its business plan, which would have an adverse effect on our results of operations and, consequently, make our common shares a less attractive investment and harm the trading of our common shares trading on the OTC Markets. Investors may find it difficult to sell their shares on the OTC Markets.

3. If capital is not available to fund future operations, we will not be able to pursue our business plan and operations would come to a halt and our common shares would be nearly worthless.

Cash on hand is not sufficient to fund our anticipated operating needs for the next twelve months. We will require substantial additional capital to participate in the development of our properties which have not had any production of oil or natural gas as well as for acquisition and/or development of other producing properties. Because we currently do not have any cash flow from operations we need to raise additional capital, which may be in the form of loans from current shareholders and/or from private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for and producing oil and gas at profitable prices. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

4. We are heavily dependent on Ron Daems, our CEO, President and Chairman. The loss of Mr. Daems, whose knowledge, leadership and technical expertise upon which we rely, would harm our ability to execute our business plan.

Our success depends heavily upon the continued contributions of Ron Daems, whose knowledge, leadership and technical expertise would be difficult to replace. Our success is also dependent on our ability to retain and attract experienced engineers, geoscientists and other technical and professional staff. We do not maintain any key person insurance on Mr. Daems. If we were to lose his services, our ability to execute our business plan would be harmed and we may be forced to cease operations until such time as we could hire a suitable replacement for Mr. Daems.

5. Volatility of oil and gas prices and markets could make it difficult for us to achieve profitability and less likely investors in our common shares will receive a return on their investment.

Our ability to achieve profitability is substantially dependent on prevailing prices for natural gas and oil. The amounts of and price obtainable for any oil and gas production that we achieve will be affected by market factors beyond our control. If these factors are not favorable over time to our financial interests, it is likely that owners of our common shares will lose their investments. Such factors include:

| • | worldwide or regional demand for energy, which is affected by economic conditions; |

| • | the domestic and foreign supply of natural gas and oil; |

| • | domestic and foreign governmental regulations; |

| • | political conditions in natural gas and oil producing regions; |

| • | the ability of members of the Organization of Petroleum Exporting Countries to agree upon and maintain oil prices and production levels; and |

| • | the price and availability of other fuels. |

6. Drilling wells is speculative, often involving significant costs that may be more than our estimates. Any material inaccuracies in drilling costs, estimates or underlying assumptions will reduce the profitability of our business and will negatively affect our results of operations.

Developing and exploring for natural gas and oil involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic such as:

| • | blow-outs and surface cratering; |

| • | uncontrollable flows of oil, natural gas, and formation water; |

| • | natural disasters, such as hurricanes and other adverse weather conditions; |

| • | pipe, cement, or pipeline failures; |

| • | embedded oil field drilling and service tools; |

| • | abnormally pressured formations; and |

| • | environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases. |

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

| • | injury or loss of life; |

| • | severe damage to and destruction of property, natural resources and equipment; |

| • | pollution and other environmental damage; |

| • | clean-up responsibilities; |

| • | regulatory investigation and penalties; |

| • | suspension of our operations; and |

| • | repairs to resume operations. |

7. The unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

8. We are subject to complex laws and regulations, including environmental regulations, which can adversely affect the cost, manner or feasibility of doing business.

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

| • | location and density of wells; |

| • | the handling of drilling fluids and obtaining discharge permits for drilling operations; |

| • | accounting for and payment of royalties on production from state, federal and Indian lands; |

| • | bonds for ownership, development and production of natural gas and oil properties; |

| • | transportation of natural gas and oil by pipelines; |

| • | operation of wells and reports concerning operations; and |

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

9. Our oil and gas operations may expose us to environmental liabilities.

If we experience any leakage of crude oil and/or gas from the subsurface portions of a well, our gathering system could cause degradation of fresh groundwater resources, as well as surface damage, potentially resulting in suspension of operation of a well, fines and penalties from governmental agencies, expenditures for remediation of the affected resource, and liabilities to third parties for property damages and personal injuries. In addition, any sale of residual crude oil collected as part of the drilling and recovery process could impose liability on us if the entity to which the oil was transferred fails to manage the material in accordance with applicable environmental health and safety laws.

10. Exploratory drilling involves many risks and we may become liable for pollution or other liabilities which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

11. The potential profitability of oil and gas ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

12. Our auditors’ opinion on our December 31, 2011 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern.

We have incurred net losses of $11,260,006 from July 1, 2005 (the date we commenced our oil and gas operations) to December 31, 2011. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern. We will need to obtain additional funds in the future. Our plans to deal with this cash requirement include loans from existing shareholders, raising additional capital from the private sale of our equity securities or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

13. If we do not maintain the property lease payments on our properties, we will lose our interest in the properties as well as losing all monies incurred in connection with the properties.

We have two land packages in Alberta, Canada that were acquired through auction directly from the government of Alberta. The land packages are made up of a number of underlying individual leases. All of our leases require annual lease payments to the Alberta provincial government. See Item 4.D for a more detailed description of the property obligations. If we do not continue to make the annual lease payments, we will lose our ability to explore and develop the properties and we will not retain any kind of interest in the properties.

14. We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves.

The natural gas and oil market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

15. We expect losses to continue in the future because we have no oil or gas reserves and, consequently, no revenue to offset losses.

Based upon the fact that we currently do not have any oil or gas reserves, we expect to incur operating losses in next 12 months. The operating losses will occur because there are expenses associated with the acquisition, exploration, and development of natural gas and oil properties which do not have any income-producing reserves. Failure to generate revenues may cause us to go out of business. We will require additional funds to achieve our current business strategy and our inability to obtain additional financing will interfere with our ability to expand our current business operations.

16. Because we are in the exploration stage of operations of our business our securities are considered highly speculative.

We are in the exploration stage of our business. As a result, our securities must be considered highly speculative. We are engaged in the business of exploring and, if warranted and feasible, developing natural gas and oil properties. Our current properties are without known reserves of natural gas or oil. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural gas and oil, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional funds through loans from existing shareholders, the sale of our equity securities or strategic arrangement with a third party in order to continue our business operations.

17. Since our Directors work for other natural resource exploration companies, their other activities for those other companies could slow down our operations or negatively affect our profitability.

Our Officer and Directors are not required to work exclusively for us and they do not devote all of their time to our operations. In fact, our Directors work for other natural resource exploration companies. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their consulting or employment by such other companies. Their other activities could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our Directors will devote approximately 1 hour per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed.

RISKS RELATING TO OUR COMMON SHARES

18. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. The future issuance of our unlimited authorized common shares may result in substantial dilution in the percentage of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common shares.

19. Our common shares are subject to the "Penny Stock" Rules of the SEC and we have no established market for our securities, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated there under by the Commission require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor's account. These rules may have the effect of reducing the level of trading activity in the secondary market, if and when one develops. Potential investors in the Company’s common stock are urged to obtain and read such disclosures carefully before purchasing any shares that are deemed to be "penny stock." Moreover, the Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than USD $5.00 per share or with an exercise price of less than USD $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| • | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| • | the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| • | obtain financial information and investment experience objectives of the person; and |

| • | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| • | sets forth the basis on which the broker or dealer made the suitability determination; and |

| • | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock.

Pursuant to the Penny Stock Reform Act of 1990, broker-dealers are further obligated to provide customers with monthly account statements. Compliance with the foregoing requirements may make it more difficult for investors in the Company's stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

20. We are a “foreign private issuer”, and you may not have access to the information you could obtain about us if we were not a “foreign private issuer”.

We are considered a "foreign private issuer" under the Securities Act of 1933, as amended. As a foreign private issuer we will not have to file quarterly reports with the SEC nor will our Directors, Officer and 10% stockholders be subject to Section 16(b) of the Exchange Act. As a foreign private issuer we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-U.S. companies and will not apply to us. Accordingly, you may not be able to obtain information about us as you could obtain if we were not a “foreign private issuer”.

21. Because we do not intend to pay any cash dividends on our Common shares, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

22. We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors.

If we are a “passive foreign investment company” or “PFIC” as defined in Section 1297 of the Code, U.S. Holders will be subject to U.S. federal income taxation under one of two alternative tax regimes at the election of each such U.S. Holder. Section 1297 of the Code defines a PFIC as a corporation that is not formed in the United States and either (i) 75% or more of its gross income for the taxable year is “passive income”, which generally includes interest, dividends and certain rents and royalties or (ii) the average percentage, by fair market value (or, if we elect, adjusted tax basis), of its assets that produce or are held for the production of “passive income” is 50% or more. Whether we are a PFIC in any year and the tax consequences relating to PFIC status will depend on the composition of our income and assets, including cash. U.S. Holders should be aware, however, that if we become a PFIC, we may not be able or willing to satisfy record-keeping requirements that would enable U.S. Holders to make an election to treat us as a “qualified electing fund” for purposes of one of the two alternative tax regimes applicable to a PFIC, which would result in adverse tax consequences to our shareholders who are U.S. citizens.

23. Because we are organized under the Canada Business Corporations Act and all of our assets and our Officers and Directors are located outside the United States, it may be difficult for an investor to enforce within the United States any judgments obtained against us or our Officers and Directors.

All of our assets are located outside of the United States and we do not currently maintain a permanent place of business within the United States. In addition, our Directors and Officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for an investor to effect service of process or enforce within the United States any judgments obtained against us or our Officers or Directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Canada would recognize or enforce judgments of United States courts obtained against us or our Directors and Officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. There is even uncertainty as to whether the Canadian courts would have jurisdiction to hear original actions brought in Canada against us or our Directors and Officers predicated upon the securities laws of the United States or any state thereof.

Item 4. Information on Strata Oil & Gas Inc.

A. History and Development of Strata Oil & Gas Inc.

Strata Oil & Gas Inc. (formerly Stratabase) was incorporated under the laws of the State of Nevada on November 18, 1998 and commenced operations in January 1999. We completed our initial public offering in February 2000. The Company operates in the oil and gas industry with a focus on Canada’s carbonate-hosted bitumen deposits. The Company has interests in a total of 18 oil sands leases located in Northern Alberta, Canada.

Continuance to Canada

We are presently incorporated under the Canada Business Corporations Act. In January 2003, the Company filed a proposal to effect a continuation of the corporate jurisdiction from the State of Nevada to Canada on Form S-4 with the United States Securities and Exchange Commission (SEC). The Form S-4 was declared effective on or about July 7, 2004 and submitted to the shareholders of the Company. The special meeting of stockholders to vote on the adoption of the plan of conversion was held on August 17, 2004 and a majority of the shareholders approved the plan of conversion. Accordingly, the Company changed its name to "Stratabase Inc.," and continued to operate under the Canada Business Corporations Act. "Continuance" is a process by which a corporation which is not incorporated under the laws of Canada may change its jurisdiction of incorporation to Canada. Under the Canada Business Corporations Act, if the laws of its home jurisdiction allow for it and a resolution authorizing the continuance is approved by 66 2/3% of the company's shareholders, the company may be "continued" as a Canadian corporation by filing of Articles of Continuance with the Director under the Canada Business Corporations Act. Under the corporate law of Nevada, this process is treated as a conversion of the outstanding shares of a Nevada company to shares of a Canadian company. The business and operations of Strata following the conversion were identical in most respects to our previous business, except that we were no longer subject to the corporate laws of the State of Nevada but became subject to the Canada Business Corporations Act. The Canadian company is liable for all the debts and obligations of the Nevada company, and the officers and directors of the company are the officers and directors of Strata. On August 17, 2004, Strata filed a Form 8-A with the SEC registering its class of common shares under Section 12(g) of the Exchange Act.

Discontinued Operations

Until the end of June 2005, the Company had developed software which was designed to allow users to interface with and manage databases and customer relationships. On June 29, 2005 at an annual general and special meeting of shareholders, a majority of the shareholders of the Company approved the sale of all of the rights to the Company’s software assets to a private company controlled by our former president. At the same meeting, a majority of the Company’s shareholders also approved the change in business of the Company from software development to oil and gas exploration.

On June 29, 2005 pursuant to approval by a majority of the shareholders of the Company, the Company entered into a letter of intent to dispose of all of its interest in its proprietary software to a company (the “Purchaser”) controlled by its former president for $130,000. On July 11, 2005 a definitive agreement was completed, and in exchange for the rights to all of its software the Company received a non-interest bearing promissory note (the “Note”) which was due July 11, 2006. The entire amount of the promissory note was received on June 30, 2006 and was recorded as income from discontinued operations in the Statement of Operations and Comprehensive Loss at December 31, 2006. The Company had a lien and security interest in all of the assets that were acquired by the Purchaser.

The assets acquired by the Purchaser included all rights and use to the “Strata”, “Relata”, and “Resync” names, all rights and use of the trademarks, web pages, and domain names for “Strata”, “Relata”, and “Resync”, and all rights to the source code and related documentation for the “Relata” and “Resync” software. The value of the assets disposed of was based on the results of an evaluation prepared for the Company by an independent evaluator.

B. Business Overview

HISTORICAL CORPORATE DEVELOPMENT

The Company was originally a United States incorporated software development company. In August 2004 the Company formally completed the process of becoming a Canadian-based company and on June 29, 2005 the Company sold all of its interests in its software assets and became a business engaged in oil and gas exploration.

The Company currently has interests in oil sands properties located in the Peace River and Wabiskaw areas of Northern Alberta, Canada.

The Company is an exploration stage company and there is no assurance that a commercially viable oil or gas deposit exists on any of its properties. Further evaluation will be required on each property before a final evaluation as to the economics and legal feasibility of the property is determined.

The Company originally had an interest in 43 oil sands leases in northern Alberta, Canada. In December 2010, the Company sold 25 of its oil sands leases to an Alberta Company considered to be a related party by common Director and Officer. As of December 31, 2010 the Company holds 17 leases in the in the Peace River oil sands area and 1 lease in the Athabasca oil sands area.

MATERIAL EFFECTS OF GOVERNMENT REGULATION

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. The oil and gas leases currently leased by the Company are owned by the Province of Alberta and are managed by the Department of Energy. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

| • | location and density of wells; |

| • | the handling of drilling fluids and obtaining discharge permits for drilling operations; |

| • | accounting for and payment of royalties on production from state, federal and Indian lands; |

| • | bonds for ownership, development and production of natural gas and oil properties; |

| • | transportation of natural gas and oil by pipelines; |

| • | operation of wells and reports concerning operations; and |

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

ANTICIPATED CHANGES TO FACILITIES AND EMPLOYEES

The Company utilizes third party consultants and does not have employees. Management of the Company anticipates no changes in connection with the facilities in the near future.

SEASONALITY, DEPENDENCY UPON PATENTS, LICENSES, CONTRACTS, PROCESSES, SOURCES AND AVAILIBILTY OF RAW MATERIALS

Certain of the Company’s properties are in remote locations and subject to significant temperature variations and changes in working conditions. It may not be possible to actively explore the Company’s properties in Alberta throughout the year because of seasonal changes in the weather. If exploration is pursued at the wrong time of year, the Company may incur additional costs to address issues relating to the weather.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

COMPETITION

The natural gas and oil exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

C. Organizational Structure

The Company is not part of a group and has no subsidiaries.

D. Property Plant and Equipment

CORPORATE OFFICES

We do not own any real property. Our corporate offices are located at 918 16th Avenue NW, Suite 408, Calgary, Alberta, Canada, T2M 0K3. The operational offices at 703 - 6th Avenue SW, Suite 410, Calgary, Alberta T2P 0T9 were leased over a 20 month period and expired December 30, 2011. We believe that the facilities will be adequate for the foreseeable future. All costs described in this section are stated in U.S. dollars as converted from Canadian dollars. Accordingly, the costs may vary to some degree with the currency exchange rate.

OIL SANDS LEASES

The Company currently has an interest in 18 oil sands leases in northern Alberta, Canada. 17 of the leases are located in the Peace River oil sands area, and 1 lease is located in the Athabasca oil sands area.

Oil Sands Background

“Oil Sands” refers to unconsolidated, bitumen-saturated sands containing varying amounts of clay and rock material. The bitumen content refers to a heavy, viscous crude oil that generally does not flow under natural reservoir conditions. As a result, it cannot be recovered from a conventional well the way lighter oil is most often produced. The oil sands are contained in three major areas beneath an approximate 140,800 square kilometers (54,363 square miles) of north-eastern Alberta - an area larger than the state of Florida. As of December 2002, according to the Alberta Department of Energy, these three areas, Athabasca/Wabiskaw, Peace River, and Cold Lake, contained 1.6 trillion barrels of bitumen in-place, of which 174 billion barrels are proven reserves that can be recovered using current technology.

These deposits contain a significant amount of oil but until recently the cost of extraction has created a barrier to economic development. Extraction of oil from oil sands requires technologically intensive activity and the input of significant amounts of energy to exploit the oil sands deposits. There are two main types of oil sands production methods: mining and in-situ. Oil sands mining is accomplished using an open pit operation whereby the oil sands are dug up and trucked to a processing facility. For oil sands reservoirs too deep to support economic surface mining, some form of in-situ recovery is required to produce bitumen. In-situ production is similar to that of conventional oil production where oil is recovered through a well. The Alberta Energy and Utilities Board estimates that 80 percent of the total bitumen ultimately recovered will be with in-situ techniques. Numerous in-situ technologies have been developed that apply thermal energy to heat the bitumen and allow it to flow to the well bore.

There are some oil sands reservoirs where primary or “cold” production is possible. The lighter bitumen in these areas can flow towards a well and bitumen production can be enhanced by the co-production of sand, thereby creating a down hole cavity around the well bore which facilitates the flow of oil towards the well. This type of production technology is commonly referred to as “Cold Heavy Oil Production with Sand” (“CHOPS”). While this type of bitumen is marginally lighter and less viscous than the conventional bitumen found in mineable and other in-situ reserves, it is also slightly heavier than the conventional “Heavy Oil” reservoirs produced in the “heavy oil belt” region, located around the central Alberta - Saskatchewan border. Another production technology, which may be suitable for some of the lighter oil sands reservoirs, is the use of horizontal well bores. Horizontal production wells, which have been drilled up to more than 2 kilometers away from their surface locations, have been successfully applied to cold in-situ bitumen production, where it is suitable. In general, open pit oil sands mines are found in central Athabasca deposits, while in-situ bitumen production technology is used in the Cold Lake, south Athabasca, and Peace River deposits, where the overburden thickness exceeds 50 meters.

Oil in oil sands is found mainly in high porosity quartz arenites to arkosic sands that cover large areas and lie up-dip from the purported source rocks to the southwest. There are also vast amounts of heavy oil as well in fractured carbonate rocks of 10-14% porosity underlying a large triangular region of north central Alberta. In addition, there is a large amount of heavy oil in a series of thinner blanket sands and channel sands extending all the way from Suffield, Alberta to zones overlying the Cold Lake Oil Sands near Bonnyville, and extending well into Saskatchewan. The latter deposits called the ‘heavy oil belt” are the sites of the most development attention because the oil is less viscous and it can be produced using either CHOPS or horizontal well technology.

The source rocks for the oil sands are from the Cretaceous and Jurassic shales in the Alberta Syncline. Rapid sedimentation of organic rich argillaceous material caused large flow volumes to be generated as the result of compaction. Deep burial of the kerogeneous source rocks allowed organic diagenesis to occur resulting in the generation of oil and gas from the kerogen. The oil sands are 98% un-cemented (unconsolidated sandstones). The ingress of bitumen has essentially stopped diagenetic processes and the sands do show strong evidence of the early effects of pressure solution and re-crystallization but true cementation is quite rare as are significant calcite cemented zones.

Carboniferous Oil Sands

Strata has focused its efforts on carbonate-hosted bitumen sands. The carbonates are the next challenge in the Alberta oil sands industry. Like oil sands two decades ago, carbonates represent an enormous and relatively untapped petroleum resource. The means for producing bitumen from carbonates is still being studied. The nature of the carbonate triangle in Alberta tends to vary and there is unlikely to be a single one-size-fits-all strategy for production. Cold production may be possible in some areas although in most cases production requires an in-situ treatment. Various technologies have been tested and others considered, including similar technologies to those employed in oil sands (cyclic steam, SAGD, etc.). Bitumen carbonates are still being studied, and as yet there are several techniques which may prove to be effective. We are in the process of determining the most efficient means of producing the bitumen from our Peace River project.

Carbonate oil sands are an unconventional resource that remains almost untapped. While much of the world now knows about Alberta’s vast oil sands resource, many people are unaware that a bitumen resource of similar magnitude is locked in carbonate rock. According to a report by Petroleum Technology Alliance Canada (PTAC), 26% of Alberta’s bitumen resources are contained in carbonate rather than sand formations. One northern Alberta carbonate formation alone — the Devonian-age Grosmont complex — has bitumen volumes in place comparable to the huge Athabasca oil sands deposit. This comparison is made in the 176-page official history of the Alberta Oil Sands Technology and Research Authority (AOSTRA), the long-since disbanded provincial agency set up in 1974 to promote bitumen recovery technologies. The history devotes four well-illustrated pages to bitumen carbonates. The resource received serious attention during the AOSTRA years with a series of pilot tests running in the Grosmont formation between 1975 and 1987. However, oil prices fell and funding was cut. The remotely located and little known bitumen carbonates were largely forgotten until Royal Dutch Shell plc paid nearly $500 million for leases in 2006.

Contained in a roughly triangular 70,000 square-kilometer area of northern Alberta called the Carbonate Triangle, the deposits may be the most technically challenging of the province’s bitumen resources. The basic difference between oil sands and bitumen carbonates is the former is bitumen mixed with unconsolidated sand, which can be either mined or produced from wells. The latter, as the name implies, is bitumen in carbonate rock — both dense limestone and heavily karsted rock. Grosmont bitumen is even heavier than the Athabasca bitumen and the reservoir is extremely variable, meaning that a single recovery method is unlikely to work throughout the formation. The lack of understanding of the heterogeneous nature of the reservoir is the main hurdle for developing successful bitumen recovery schemes. The bitumen is contained in a dual porosity system — both in the vugs (cavities or fractures) and in the rock matrix itself. The vugs could potentially be good news in that they could conceivably improve permeability once the viscosity of the bitumen is raised by heat or other means, but bad news if they serve as channels for steam to escape from the area of interest. In the karsted areas, these irregular cavities and tunnels are often the diameter of a man’s arm, and sometimes much larger. According to the PTAC review of the pilot results, challenges of drilling through this karsted rock include the potential for loss of drilling fluids into the formation, and problems with the placement of cement to maintain a strong well-to-formation bond.

DROWNED AREA OIL SANDS LEASE

Acquisition of Interest

On September 7, 2005 the Company acquired a 100% interest in Alberta Oil Sands Lease #7400100011 (the “Drowned Property’). The rights to the Drowned Property were acquired for a payment of CDN $25,000 (USD $20,635) as well as other closing costs of CDN$9,874 (USD $8,150). The Drowned Property covers 512 hectares of land in the Drowned Area of the Wabiskaw oil sands in the West Athabasca area of Northern Alberta. The lease gives the Company the right to explore the Drowned Property covered by the lease.

Strata's acquisition of the Drowned Property lease includes an overriding 4% royalty agreement with the vendor. The royalty is to be paid on a well-to-well basis and is payable on all petroleum substances produced by any well on the Property. In addition, the Company must pay the province of Alberta CDN $1,792 (USD $1,471) per year to maintain its right to the lease. The lease is subject to a royalty payable to the government of Alberta.

Alberta's project-based generic oil sands royalty regime operates on the principle of revenue minus cost. Royalty is paid at one of two rates, depending on the project’s financial status. The deciding factor is the project’s payout date. A project has “reached payout” once its cumulative revenues have exceeded its cumulative costs. Before the payout date, the applicable royalty is 1% of the project’s gross revenue. This low rate recognizes the high costs, long lead times and high risks associated with oil sands investment. It prevents undue strain on the developer’s financial resources during the most critical, start-up stages of the project. After the payout date, the applicable royalty is the greater of 1% of the project’s gross revenue or 25% of the net revenue for the period.

Location

The Drowned Property lies near the southern edge of the Wabiskaw Heavy Oil/Oil sands field in west Athabasca approximately 45km south of the town of Wabiskaw or 60km Northeast of Slave Lake.

| Lease Number | Hectares | Townships | Range | Section |

| | | | | |

| 7400100011 | 512 | 75, 76 | 23 | 1 and 36 |

Drowned Project Lease Information

The Drowned Property is comprised of a single lease with the government of the province of Alberta, Canada. The lease is a fifteen year lease and expires on October 4, 2015.

| Lease Number | Hectares | Rent / Hectare | Annual Minimum Lease Payments |

| | | | |

| 7400100011 | 512 | CDN $3.50 (USD $3.52) per year | CDN $1,792 (USD $1,802) per year |

Regional Geology

Regionally, the Wabiskaw Reservoir consists of three overlapping en-echelon sand bodies interpreted as shoreface sand which coarsen upwards from shale to fine sand. The three bodies are informally referred to as Wabiskaw “A” Sand, Wabiskaw “B” Sand, and Wabiskaw “C” Sand. The three bodies are separated from each other by shales and each has proven to be correlatable and mappable over a wide area. All three bodies contain bitumen but only the bitumen sand of the Wabiskaw “A” is being cold produced at the present time. The “B” and “C” are generally thinner and contain smaller bitumen accumulations.

Gas and water are also significant components of the reservoir fluids in the Wabiskaw sands. Several associated gas fields are currently in production. There may be a distinct basal water leg below the bitumen. This is especially true in the southwestern part of the Wabiskaw reservoirs.

The deposit lies above the western part of the Athabasca oil sands and extends westward somewhat beyond the McMurray Formation edge. In many regions, the Wabiskaw is oil rich and it overlies the McMurray forming two stacked reservoirs. Detrital matter arrived mainly from the west but mixed with a small component of sediments from the shield. The bitumen is highly viscous and is at a depth of 100 to 700 meters. The Wabiskaw is classified as the lowest Member of the Clearwater Formation and therefore overlies the McMurray Formation. The reservoir and the thickness of oil saturated material vary from 0 to 10 meters.

Property Geology

Several pre-existing bore holes indicate that neither the Wabiskaw “A” sand nor the Wabiskaw “B” sand is present on the Company’s Drowned Property, although it appears that 0 to 4 meters of a thin bitumen-bearing Wabiskaw “C” sand may be present. In addition, the McMurray Formation is present beneath the Wabiskaw and fills a local north-south oriented valley system incised into the older limestone basement. These McMurray valley filled sediments appear to be complex, consisting mainly of water-bearing silts and clays, and hold only minor, discontinuous, bitumen-bearing sands of an unknown quality. The Wabiskaw and McMurray sands lie at a depth of 550 to 600 meters and the Grand Rapids reservoir lies at a depth of 425 to 500 meters.

Previous Work

Historically, the Drowned Project has had four wells drilled on it by companies owning the gas exploration rights. The geophysical well logs demonstrate the presence of bitumen in all four wells, one of which shows the presence of oil sands. The Company did not undertake any exploration work on the Drowned Property in 2011.

Planned Work by the Company for 2012

The Company has focused its exploration efforts on its Peace River Property and as a result, does not have any current plans to undertake an exploration program on the Drowned Property in 2012 due to our limited funds.

PEACE RIVER OIL SANDS LEASES

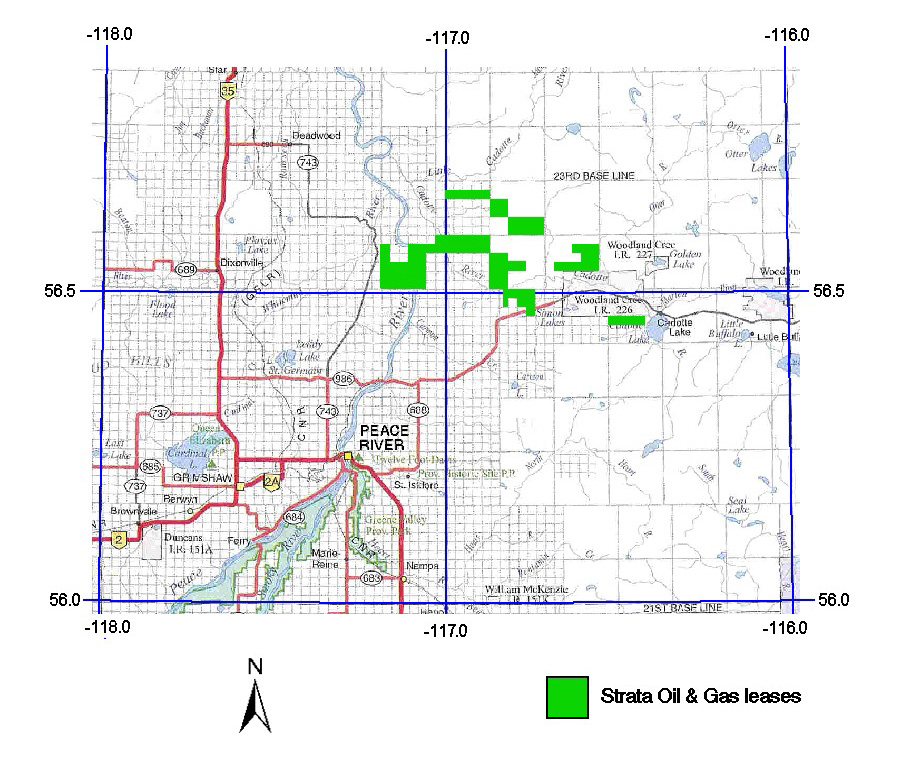

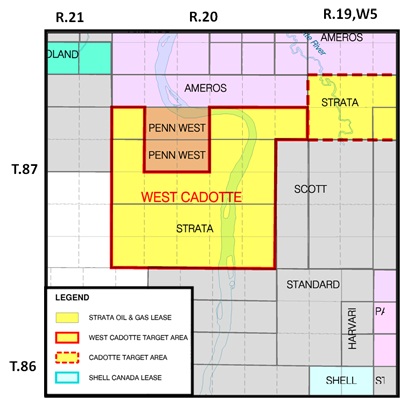

The following are two maps showing the location of the Company’s 17 oil sands leases in the Peace River region of northern Alberta, Canada.

Acquisition of Interest

The Company has entered into a series of leases in multiple transactions with the province of Alberta in the Peace River area of Alberta, Canada (the “Peace River Property”). All of the leases were acquired through a public auction process that requires the Company to submit sealed bids for land packages being auctioned by the provincial government. Upon being notified that it has submitted the highest bid for a specific land parcel the Company immediately pays the government the bid price and enters into a formal lease with the government. The bid price includes the first year’s minimum annual lease payments. The specific transactions entered into by the Company are as noted below.

Date | Number of Leases | Land Area (Hectares) | Annual Minimum Lease Payments |

| | | | |

| June 15, 2006 | 3 | 4,864 | CDN $17,024 / USD $17,116 |

| October 19, 2006 | 4 | 3,584 | CDN $12,544 / USD $12,612 |

| November 2, 2006 | 4 | 5,632 | CDN $19,712 / USD $19,818 |

| January 11, 2007 | 4 | 4,608 | CDN $16,128 / USD $16,216 |

| January 24, 2007 | 2 | 2,304 | CDN $8,064 / USD $8,107 |

| | 17 | 20,992 | CDN $73,472 / USD $73,869 |

On December 20, 2010, the Company entered into an assignment and assumption agreement with an Alberta company, a related party by common Director and Officer, assigning an undivided 100% right and interest in 25 Alberta Crown Oil Sands Lease Agreements, pursuant to respective individual lease agreements with the Province of Alberta for the sale price of CDN $300,000 (USD $303,833). The fair market value of CDN $300,000 was established through third party evidence and recent sales comparables. There was a loss recognized of $731,866 on the disposition of properties due to the combination of all acquisition costs and prior year’s annual lease payments being capitalized.

The Peace River Property consists of a total of 20,992 hectares of land in a region of northern Alberta known as Peace River. The leases are subject to royalties payable to the government of Alberta. Alberta's project-based generic oil sands royalty regime operates on the principle of revenue minus cost. Royalty is paid at one of two rates, depending on the project’s financial status. The deciding factor is the project’s payout date. A project has “reached payout” once its cumulative revenues have exceeded its cumulative costs. Before the payout date, the applicable royalty is 1% of the project’s gross revenue. This low rate recognizes the high costs, long lead times and high risks associated with oil sands investment. It prevents undue strain on the developer’s financial resources during the most critical, start-up stages of the project. After the payout date, the applicable royalty is the greater of 1% of the project’s gross revenue or 25% of the net revenue for the period.

Location

The Peace River Property lies in the Peace River oil sands field in Alberta approximate 40 to 50 kilometers northeast of the town of Peace River. These holdings are situated near Cadotte Lake.

Peace River Project Lease Information

The Peace River Property is comprised of 17 leases with the government of the Province of Alberta, Canada. All of the leases are for a 15 year term, require minimum annual lease payments, and grant the Company the right to explore for potential oil sands opportunities on the respective lease.

Regional Geology

The Peace River Cretaceous clastic reservoir consists of a complex stratigraphy similar in nature to the Athabasca Deposit to the east. These are thought to comprise fossil estuarine systems where the best reservoirs are contained in tidal inlet and barrier sands. Secondary reservoir targets may be tidal delta, bayhead delta, tidal channel, and tidal flat sands. The Peace River Carboniferous reservoir consists of platform sediments with relatively few reef building organisms. Structurally, the Peace River strata dip to the southwest and the elevation of the bitumen-bearing interval lies between 50 and 100 meters below sea level or at a depth of between 680 to 790 meters below the surface.

Property Geology (Cadotte Leases)

Strata has focused its efforts on the bitumen resources contained in the Debolt/Elkton carbonate Carboniferous Formation and the Bluesky/Gething clastic Cretaceous Formation in the Cadotte area. In particular, our exploration programs to date have focused on 29 sections in the Cadotte area located in Townships 86 and 87, Ranges 18 and 19W (the “Target Area”).

The nature of the geology of the carbonate sequence in the Target Area has a significant influence on the distribution of the bitumen resource. The principal reference source for this section is the Alberta Research Council’s publication, “Geological Atlas of the Western Canada Sedimentary Basin”. The sequence that hosts the bitumen deposits is the Rundle Group of Lower Carboniferous age. The Rundle Group in this area includes three stratigraphic units which, in ascending order, are the Pekisko, Shunda and Debolt Formations. From place-to-place the Debolt Formation may also include another distinct unit, the Elkton Member. In the Cadotte Lease area, the Elkton Member is usually present, as long as the overlying unconformity with the Cretaceous sequence has not eroded the entire Debolt Formation sequence. Although there are many intervals that are bitumen enriched in the Rundle sequence in the Cadotte Lease area, the principal enrichment zones occur in the Elkton Member, the upper half of the Debolt but usually not right at the top of the formation and, to a lesser extent, in the Shunda Formation. The high grade zones of enrichment are those that occur in the Elkton Member and the Debolt Formation.

A Cretaceous clastic sequence that includes the Gething and Bluesky Formations at the base, unconformably overlies the Carboniferous rocks in this area. All the beds dip gently to the west with those lying below the unconformity having a somewhat greater dip than those above it. This causes the sequence below the unconformity to be eroded to a greater degree to the east and to be less complete, compared with the west. These westerly dips are the result of post-depositional tectonic events and do not reflect the original orientation of the accumulation of sediment. The Carboniferous sequence of the Rundle assemblage accumulated as a result of a series of prograding events that developed in a southerly to south-westerly direction.

The Carboniferous sequence mainly includes platform sediments that show generally shallower-water characteristics up-section. In a basinward direction the depositional facies proceed from beach and lagoonal environments through shoals of the shelf margin to marine basin muds. The lithologies that result include high energy siliciclastics of the beach environment, through various types of carbonates on the platform and its slope to shale in the deep marine environment. There even appear to be beds present that have the character of unconsolidated coarse sediments. Several transgressive events therefore resulted in the accumulation of clastic sediments interbedded with carbonate units.

The carbonate units included relatively few reef building organisms and thus there was little tendency for irregular geological bodies such as reefs to form in this sequence in this area. From one well to the next the regular nature of the deposition that took place at this time is apparent and it is relatively easy to show the correlation that exists between the same units in adjacent wells in the target area. This feature of regular bed continuity is in strong contrast to the variability of the clastic units of the overlying Cretaceous sequence as seen in the Athabasca region.