- EQBK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Equity Bancshares (EQBK) 425Business combination disclosure

Filed: 13 Oct 17, 12:00am

FILED BY EQUITY BANCSHARES, INC. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: CACHE HOLDINGS, INC COMMISSION FILE NO. FOR REGISTRATION STATEMENT ON FORM S-4 FILED BY EQUITY BANCSHARES, INC.: 333-219975 The following are the portions of a letter sent to the customers of Patriot Bank, the banking subsidiary of Cache Holdings, Inc. (“Cache”), on or about October 13, 2017, that relate to the proposed merger of Cache into Equity Bancshares, Inc. (“Equity”).

October 13, 2017 We’re excited to welcome you to Equity Bank! Thank you for your business, and your continued support of Patriot Bank. We’ve proudly served as your community bank in Tulsa, dedicated to providing you the best in banking for your business, your family, and your home. We’re just as proud to begin our next chapter as Equity Bank. Beginning November 13, all Patriot Bank accounts and services will become Equity Bank accounts and services, and you’ll find details included in this booklet to help you begin enjoying your relationship with Equity Bank. At Equity Bank, we live by our motto, We never forget it’s your money. We’re a community bank that offers business solutions customized just for you. We’ll continue to offer a full range of financial solutions that help your company and your family, including commercial banking, mortgage loans, treasury management, consumer banking, and more. Our focus remains on Tulsa and our surrounding community. We’re proud to be in Oklahoma. Your local leaders will remain with Equity Bank, and you’ll see the same faces you’ve counted on locally for several years. In addition, beginning November 13, you’ll have access to the best of Equity Bank! This includes our mobile app with remote check deposit, online banking with bill pay, and when you travel near or far, you will never again pay an ATM fee. We pay all ATM fees as a courtesy for Equity Bank customers. For the past few months, Equity Bank and Patriot Bank teammates have worked hand in hand to ensure a seamless transition for you. This guidebook serves as your handy reference – with calendar, terms, and instructions for using your Equity Bank products and services. The descriptions of your accounts may change, but top-level customer service will continue. Please don’t hesitate to contact us locally at Patriot Bank, or by using Equity Bank’s toll free number. You can also find this guidebook at EquityBank.com and PatriotBankOK.com. Thank you for your patience, your business, and your trust. We’re excited to serve you. Sincerely, Michael E. Bezanson CEO Equity Bank - Tulsa equitybank.com/patriot 3

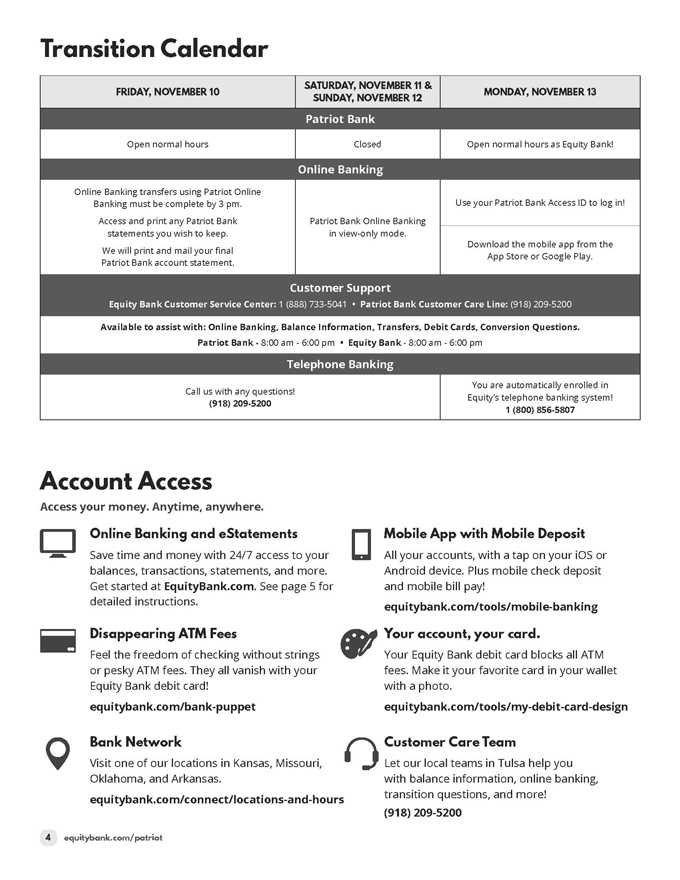

Transition Calendar SATURDAY, NOVEMBER 11 & FRIDAY, NOVEMBER 10 MONDAY, NOVEMBER 13 SUNDAY, NOVEMBER 12 Patriot Bank Open normal hours Closed Open normal hours as Equity Bank! Online Banking Online Banking transfers using Patriot Online Banking must be complete by 3 pm. Use your Patriot Bank Access ID to log in! Access and print any Patriot Bank Patriot Bank Online Banking statements you wish to keep. in view-only mode. Download the mobile app from the We will print and mail your final App Store or Google Play. Patriot Bank account statement. Customer Support Equity Bank Customer Service Center: 1 (888) 733-5041 Patriot Bank Customer Care Line: (918) 209-5200 Available to assist with: Online Banking, Balance Information, Transfers, Debit Cards, Conversion Questions. Patriot Bank - 8:00 am - 6:00 pm Equity Bank - 8:00 am - 6:00 pm Telephone Banking You are automatically enrolled in Call us with any questions! Equity’s telephone banking system! (918) 209-5200 1 (800) 856-5807 Account Access Access your money. Anytime, anywhere. Online Banking and eStatements Save time and money with 24/7 access to your balances, transactions, statements, and more. Get started at EquityBank.com. See page 5 for detailed instructions. Disappearing ATM Fees Feel the freedom of checking without strings or pesky ATM fees. They all vanish with your Equity Bank debit card! equitybank.com/bank-puppet Bank Network Visit one of our locations in Kansas, Missouri, Oklahoma, and Arkansas. equitybank.com/connect/locations-and-hours Mobile App with Mobile Deposit All your accounts, with a tap on your iOS or Android device. Plus mobile check deposit and mobile bill pay! equitybank.com/tools/mobile-banking Your account, your card. Your Equity Bank debit card blocks all ATM fees. Make it your favorite card in your wallet with a photo. equitybank.com/tools/my-debit-card-design Customer Care Team Let our local teams in Tulsa help you with balance information, online banking, transition questions, and more! (918) 209-5200 4 equitybank.com/patriot

that we withdrew the wrong amount from your account or that we withdrew money from your account more than once for the same check). The losses you may attempt to recover under this procedure may include the amount that was withdrawn from your account and fees that were charged as a result of the withdrawal (for example, bounced check fees). The amount of your refund under this procedure is limited to the amount of your loss or the amount of the substitute check, whichever is less. You also are entitled to interest on the amount of your refund if your account is an interest-bearing account. If your loss exceeds the amount of the substitute check, you may be able to recover additional amounts under other law. If you use this procedure, you may receive up to $2,500.00 of your refund (plus interest if your account earns interest) within 10 Business Days after we received your claim and the remainder of your refund (plus interest if your account earns interest) not later than 45 calendar days after we received your claim. We may reverse the refund (including any interest on the refund) if we later are able to demonstrate that the substitute check was correctly posted to your account. How Do I Make a Claim for a Refund? If you believe that you have suffered a loss relating to a substitute check that you received and that was posted to your account, please call us at: 1-888-733-5041 or write to us at: Equity Bank Attn: Deposit Ops PO Box 730 Andover, KS 67002 You may also email us at: depositops@equitybank.com . You must contact us within 40 calendar days of the date that we mailed (or otherwise delivered by a means to which you agreed) the substitute check in question or the account statement showing that the substitute check was posted to your account, whichever is later. We will extend this time period if you were not able to make a timely claim because of extraordinary circumstances. Your claim must include: A description of why you have suffered a loss (for example, you think the amount withdrawn was incorrect); An estimate of the amount of your loss; An explanation of why the substitute check you received is insufficient to confirm that you suffered a loss; and A copy of the substitute check and/or the following information to help us identify the substitute check such as the check number, the name of the person to whom you wrote the check, the amount of the check. An expedited recredit claim must be submitted in writing. When a claim has been submitted orally, we must receive that written claim within 10 Business Days of the oral claim. Important Information for Investors COMPLETION OF THE MERGER OF EQUITY BANCSHARES INC. AND CACHE HOLDINGS, INC. REMAINS SUBJECT TO CUSTOMARY CLOSING CONDITIONS The merger of Equity Bancshares, Inc. (“Equity”), the parent company of Equity Bank, and Cache Holdings, Inc. (“Patriot”), the parent company of Patriot Bank, remains subject to the satisfaction of customary closing conditions, including, among others, stockholder approval. If these closing conditions are not satisfied on or before November 10, 2017, the closing of the merger will be delayed. For additional information concerning the merger please see the disclosure below under the heading “Important Additional Information.” FORWARD-LOOKING STATEMENTS The information presented herein and in documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public communications, or in oral statements made with the approval of an authorized executive officer contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, the expected benefits of the proposed transaction, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; the possibility that the expected benefits related to the proposed transaction may not materialize as expected; the proposed transaction not being timely completed, if completed at all; prior to the completion of the proposed transaction, Patriot’s business experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities, difficulty retaining key employees; the ability to obtain regulatory approval of the transactions contemplated by the Agreement; and the ability to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2017 and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K and those discussed in the proxy statement/prospectus included in the registration statement on Form S-4 (Reg. No. 333-219975) filed by Equity with the SEC on August 15, 2017, and the amendments thereto. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. IMPORTANT ADDITIONAL INFORMATION This communication is being made in respect of the proposed transaction involving Equity and Patriot. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. Investors and security holders are urged to carefully review and consider Equity’s public filings with the SEC, including but not limited to its Annual Report on Form 10-K, its proxy statement, its Current Reports on Form 8-K and its Quarterly Reports on Form 10-Q. The documents filed by Equity with the SEC may be obtained free of charge at Equity’s investor relations website at investor.equitybank.com or at the SEC’s website at www.sec.gov. Alternatively, these documents can be obtained free of charge from Equity upon written request to Equity Bancshares, Inc., Attn: Investor Relations, 7701 East Kellogg Drive, Suite 300, Wichita, Kansas 67207 or by calling (316) 612-6000. In connection with the proposed transaction, Equity filed a registration statement on Form S-4 (333-219975) with the SEC on August 15, 2017, which includes a proxy statement of Patriot and a prospectus of Equity, and will file other documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF PATRIOT ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A proxy statement/prospectus was sent to the stockholders of Patriot seeking the required stockholder approvals. Investors and security holders may obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website or from Equity by writing to the address provided above. Equity and Patriot and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from their stockholders in connection with the proposed transaction. Information about Equity’s participants may be found in the definitive proxy statement of Equity relating to its 2017 Annual Meeting of Stockholders filed with the SEC on March 22, 2017. The definitive proxy statement can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such participants is included in the proxy statement/prospectus and other relevant documents regarding the proposed merger transaction filed with the SEC, copies of which may also be obtained free of charge from the sources indicated above. equitybank.com/patriot 17

Special Note Concerning Forward-Looking Statements This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 16, 2017 and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this document are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. Additional Information for Investors The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transactions, Equity filed a registration statement on Form S-4 (File No. 333-219975) with the SEC, which includes a proxy statement of Cache and a prospectus of Equity, and will file other documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EQUITY AND CACHE ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus has been sent to the stockholders of Cache seeking the required stockholder approvals. These documents and other documents relating to the transaction filed by Equity can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing Equity’s

investor relations website at investor.equitybank.com or by directing a request to Equity Bancshares, Inc., 7701 East Kellogg, Wichita, Kansas 67207, Attention: John J. Hanley, SVP and Director of Investor Relations, Telephone: (316) 612-6000; or to Cache Holdings Inc., 9292 Delaware Avenue, Tulsa, Oklahoma, Attention: Michael Bezanson, Chairman & CEO, Telephone: (918) 209-5200. Participants in the Transaction Equity, Cache and certain of their respective directors and executive officers may be deemed under the rules of the SEC to be participants in the solicitation of proxies from the respective shareholders of Cache in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about Equity and its directors and officers may be found in the definitive proxy statement of Equity relating to its 2017 Annual Meeting of Stockholders filed with the SEC on March 22, 2017 and Equity’s annual report on Form 10-K for the year ended December 31, 2016 filed with the SEC on March 16, 2017. The definitive proxy statement and annual report can be obtained free of charge from the SEC’s website at www.sec.gov.