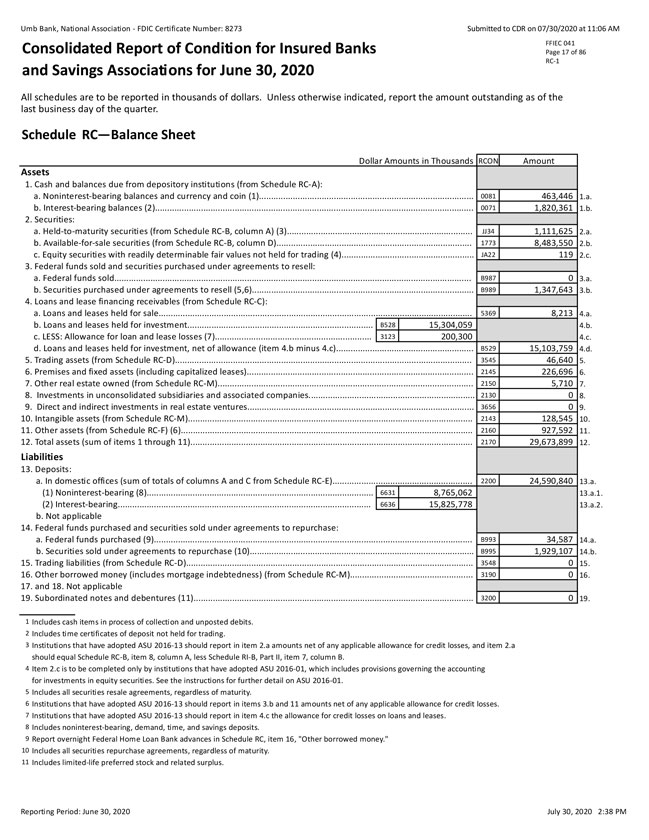

Umb Bank, National Association - FDIC Certificate Number: 8273 Submitted to CDR on 07/30/2020 at 11:06 AM Consolidated Report of Condition for Insured Banks FFIEC 041 Page 17 of 86 and Savings Associations for June 30, 2020 RC-1 All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day of the quarter. Schedule RC—Balance Sheet Dollar Amounts in Thousands RCON Amount Assets 1. Cash and balances due from depository institutions (from Schedule RC-A): a. Noninterest-bearing balances and currency and coin (1). 0081 463,446 1.a. b. Interest-bearing balances (2) 0071 1,820,361 1.b. 2. Securities: a. Held-to-maturity securities (from Schedule RC-B, column A) (3). JJ34 1,111,625 2.a. b. Available-for-sale securities (from Schedule RC-B, column D). 1773 8,483,550 2.b. c. Equity securities with readily determinable fair values not held for trading (4). JA22 119 2.c. 3. Federal funds sold and securities purchased under agreements to resell: a. Federal funds sold B987 0 3.a. b. Securities purchased under agreements to resell (5,6) B989 1,347,643 3.b. 4. Loans and lease financing receivables (from Schedule RC-C): a. Loans and leases held for sale 5369 8,213 4.a. b. Loans and leases held for investment. B528 15,304,059 4.b. c. LESS: Allowance for loan and lease losses (7). 3123 200,300 4.c. d. Loans and leases held for investment, net of allowance (item 4.b minus 4.c). B529 15,103,759 4.d. 5. Trading assets (from Schedule RC-D). 3545 46,640 5. 6. Premises and fixed assets (including capitalized leases) 2145 226,696 6. 7. Other real estate owned (from Schedule RC-M) 2150 5,710 7. 8. Investments in unconsolidated subsidiaries and associated companies. 2130 0 8. 9. Direct and indirect investments in real estate ventures 3656 0 9. 10. Intangible assets (from Schedule RC-M) 2143 128,545 10. 11. Other assets (from Schedule RC-F) (6). 2160 927,592 11. 12. Total assets (sum of items 1 through 11). 2170 29,673,899 12. Liabilities 13. Deposits: a. In domestic offices (sum of totals of columns A and C from Schedule RC-E) 2200 24,590,840 13.a. (1) Noninterest-bearing (8) 6631 8,765,062 13.a.1. (2) Interest-bearing. 6636 15,825,778 13.a.2. b. Not applicable 14. Federal funds purchased and securities sold under agreements to repurchase: a. Federal funds purchased (9) B993 34,587 14.a. b. Securities sold under agreements to repurchase (10). B995 1,929,107 14.b. 15. Trading liabilities (from Schedule RC-D). 3548 0 15. 16. Other borrowed money (includes mortgage indebtedness) (from Schedule RC-M). 3190 0 16. 17. and 18. Not applicable 19. Subordinated notes and debentures (11) 3200 0 19. 1 Includes cash items in process of collection and unposted debits. 2 Includes time certificates of deposit not held for trading. 3 Institutions that have adopted ASU 2016-13 should report in item 2.a amounts net of any applicable allowance for credit losses, and item 2.a should equal Schedule RC-B, item 8, column A, less Schedule RI-B, Part II, item 7, column B. 4 Item 2.c is to be completed only by institutions that have adopted ASU 2016-01, which includes provisions governing the accounting for investments in equity securities. See the instructions for further detail on ASU 2016-01. 5 Includes all securities resale agreements, regardless of maturity. 6 Institutions that have adopted ASU 2016-13 should report in items 3.b and 11 amounts net of any applicable allowance for credit losses. 7 Institutions that have adopted ASU 2016-13 should report in item 4.c the allowance for credit losses on loans and leases. 8 Includes noninterest-bearing, demand, time, and savings deposits. 9 Report overnight Federal Home Loan Bank advances in Schedule RC, item 16, “Other borrowed money.” 10 Includes all securities repurchase agreements, regardless of maturity. 11 Includes limited-life preferred stock and related surplus. Reporting Period: June 30, 2020 July 30, 2020 2:38 PM