Second Quarter 2021 Results Presentation July 19, 2021 Exhibit 99.2

Disclaimers Special Note Concerning Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include COVID-19 related impacts; competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 9, 2021, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, such as COVID-19, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding.

Disclaimers Important Additional Information The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, Equity intends to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 to register the shares of Equity common stock to be issued to ASB stockholders. The registration statement will include a proxy statement/prospectus, which will be sent to the stockholders of ASB seeking their approval of the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT EQUITY, ASB AND THE PROPOSED TRANSACTION. The documents filed by Equity with the SEC may be obtained free of charge at Equity’s investor relations website at investor.equitybank.com or at the SEC’s website at www.sec.gov. Alternatively, these documents, when available, can be obtained free of charge from Equity upon written request to Equity Bancshares, Inc., Attn: Investor Relations, 7701 East Kellogg Drive, Suite 300, Wichita, Kansas 67207 or by calling (316) 612-6000. Participants in the Transaction Equity, ASB and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from ASB’s stockholders in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Equity is set forth in the proxy statement for Equity’s 2021 annual meeting of stockholders filed with the SEC on Schedule 14A on March 18, 2021, and Equity’s annual report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 9, 2021. Free copies of these documents may be obtained free of charge as described in the preceding paragraph. Additional information regarding the interests of these participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

EQBK’s Value Proposition 3

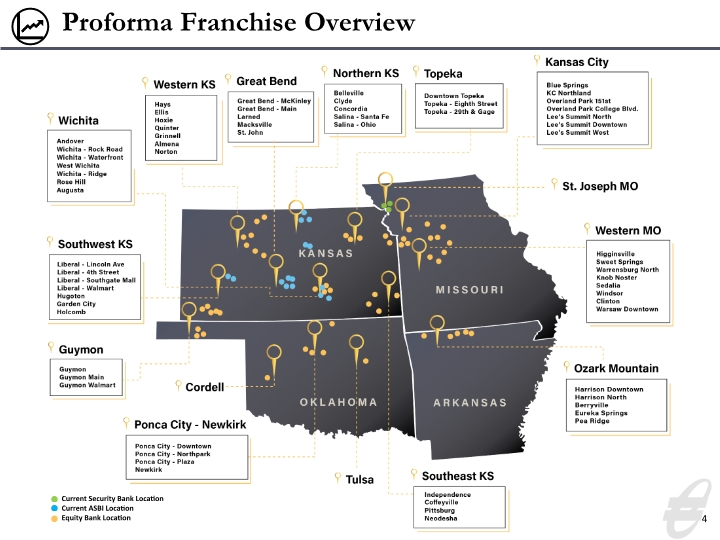

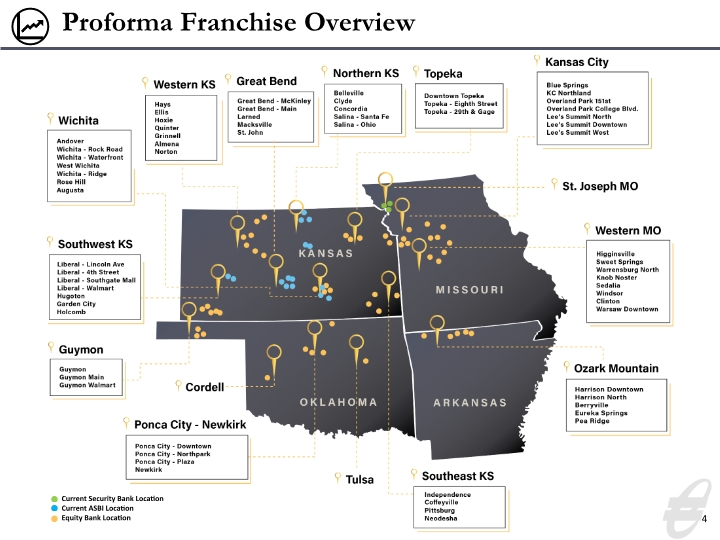

Proforma Franchise Overview 4 Current Security Bank Location Current ASBI Location Equity Bank Location

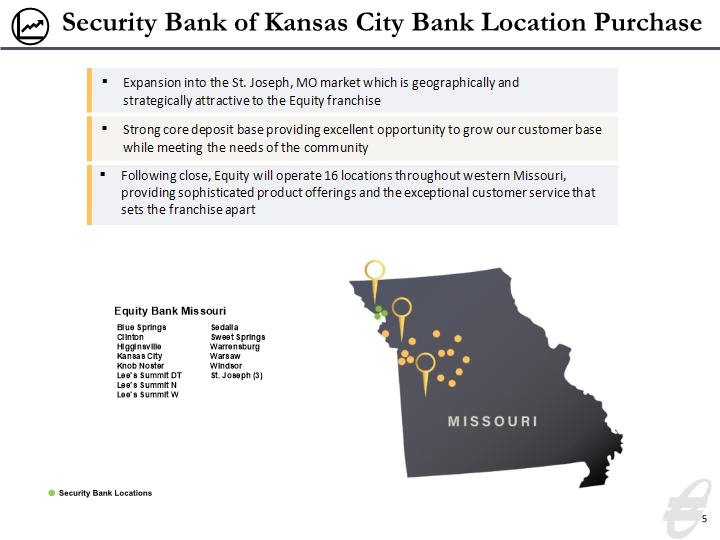

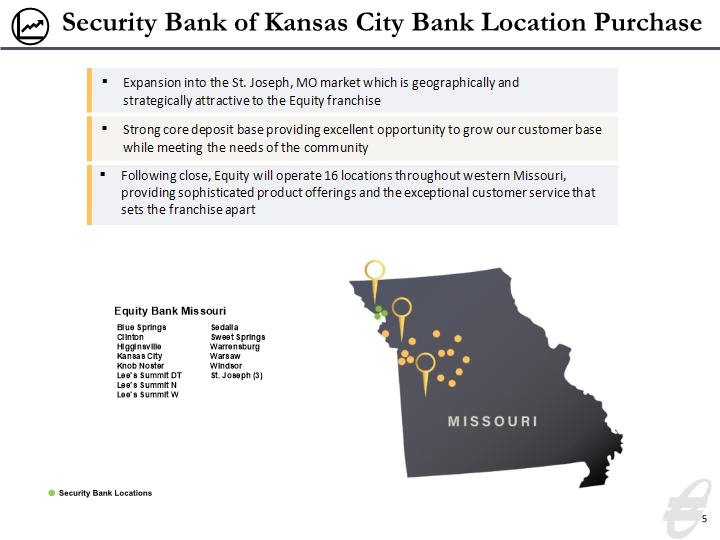

Security Bank of Kansas City Bank Location Purchase 5 Security Bank Locations

Executive Leadership 6 Founded Equity Bank in 2002 2018 EY Entrepreneur of the Year National Finalist 2014 Most Influential CEO, Wichita Business Journal Served as Regional President of Sunflower Bank prior to forming Equity Bank Served as Director of Sales and Marketing for Koch Industries Brad Elliott Chairman & CEO Years at Equity: 19 | Years in Banking: 32 Greg Kossover EVP, COO & CFO Became COO in April 2020 Served as CFO from 2013 to 2020 EQBK Board of Directors, 2011-current Served as president of Physicians Development Group Served as CEO of Value Place, LLC, growing the franchise to more than 150 locations in 25 states Greg Kossover Chief Operating Officer Years at Equity: 8 | Years in Banking: 21 Eric Newell Chief Financial Officer Years at Equity 1 | Years in Banking: 19 Craig Anderson President Years at Equity: 3 | Years in Banking: 39 Became President in April 2020 Served as COO from 2018 to 2020 Joined Equity Bank in March 2018 Served as President of UMBF Commercial Banking More than 38 years of banking experience, concentrated in commercial lending roles Joined Equity Bank in April 2020 Served as CFO at United Bank in Hartford, CT ($7.3B assets) Served as CFO and head of Treasury at Rockville Bank, Glastonbury, Conn. Served as Analyst for AllianceBernstein and Fitch Began career as examiner with FDIC

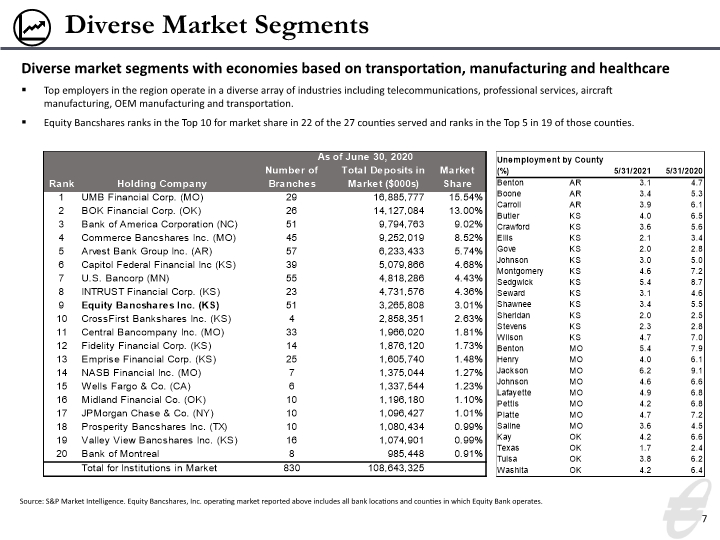

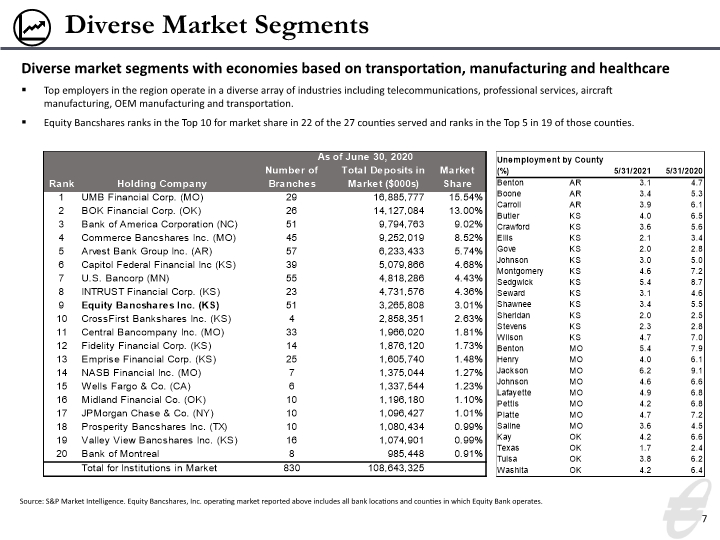

Diverse Market Segments 7 Source: S&P Market Intelligence. Equity Bancshares, Inc. operating market reported above includes all bank locations and counties in which Equity Bank operates. Diverse market segments with economies based on transportation, manufacturing and healthcare Top employers in the region operate in a diverse array of industries including telecommunications, professional services, aircraft manufacturing, OEM manufacturing and transportation. Equity Bancshares ranks in the Top 10 for market share in 22 of the 27 counties served and ranks in the Top 5 in 19 of those counties.

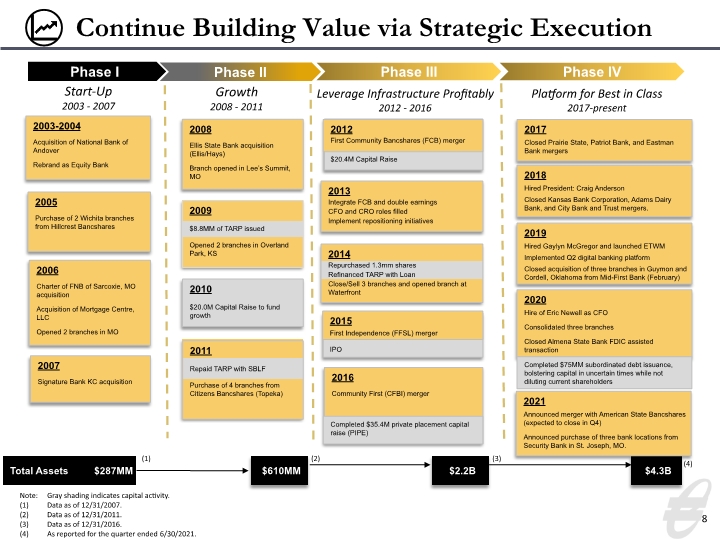

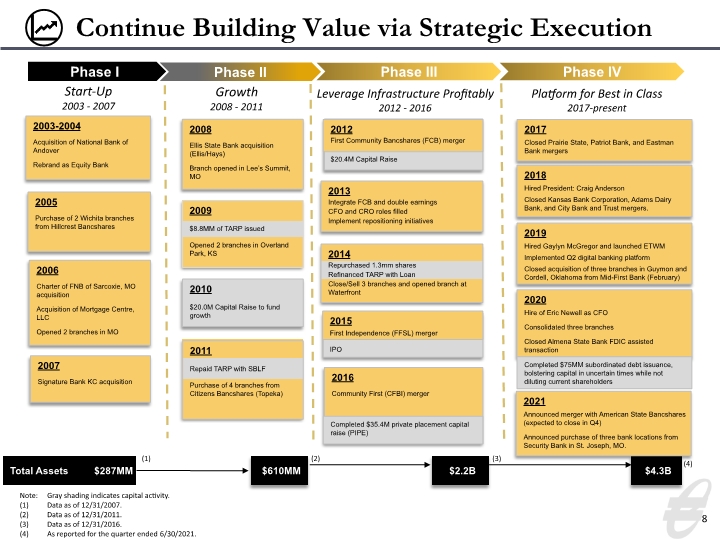

Continue Building Value via Strategic Execution 8 2009 $8.8MM of TARP issued Opened 2 branches in Overland Park, KS 2014 Repurchased 1.3mm shares Refinanced TARP with Loan Close/Sell 3 branches and opened branch at Waterfront 2012 First Community Bancshares (FCB) merger $20.4M Capital Raise 2011 Repaid TARP with SBLF Purchase of 4 branches from Citizens Bancshares (Topeka) 2003-2004 Acquisition of National Bank of Andover Rebrand as Equity Bank 2005 Purchase of 2 Wichita branches from Hillcrest Bancshares 2006 Charter of FNB of Sarcoxie, MO acquisition Acquisition of Mortgage Centre, LLC Opened 2 branches in MO 2008 Ellis State Bank acquisition (Ellis/Hays) Branch opened in Lee’s Summit, MO 2010 $20.0M Capital Raise to fund growth 2013 Integrate FCB and double earnings CFO and CRO roles filled Implement repositioning initiatives 2007 Signature Bank KC acquisition Phase I Phase II Phase III Start-Up 2003 - 2007 Growth 2008 - 2011 Leverage Infrastructure Profitably 2012 - 2016 2015 First Independence (FFSL) merger IPO 2016 Community First (CFBI) merger Completed $35.4M private placement capital raise (PIPE) Phase IV Platform for Best in Class 2017-present 2017 Closed Prairie State, Patriot Bank, and Eastman Bank mergers $2.2B $610MM (1) (2) (3) $4.3B (4) 2018 Hired President: Craig Anderson Closed Kansas Bank Corporation, Adams Dairy Bank, and City Bank and Trust mergers. 2019 Hired Gaylyn McGregor and launched ETWM Implemented Q2 digital banking platform Closed acquisition of three branches in Guymon and Cordell, Oklahoma from Mid-First Bank (February) 2020 Hire of Eric Newell as CFO Consolidated three branches Closed Almena State Bank FDIC assisted transaction Note: Gray shading indicates capital activity. (1) Data as of 12/31/2007. (2) Data as of 12/31/2011. (3) Data as of 12/31/2016. (4) As reported for the quarter ended 6/30/2021. Completed $75MM subordinated debt issuance, bolstering capital in uncertain times while not diluting current shareholders 2021 Announced merger with American State Bancshares (expected to close in Q4) Announced purchase of three bank locations from Security Bank in St. Joseph, MO.

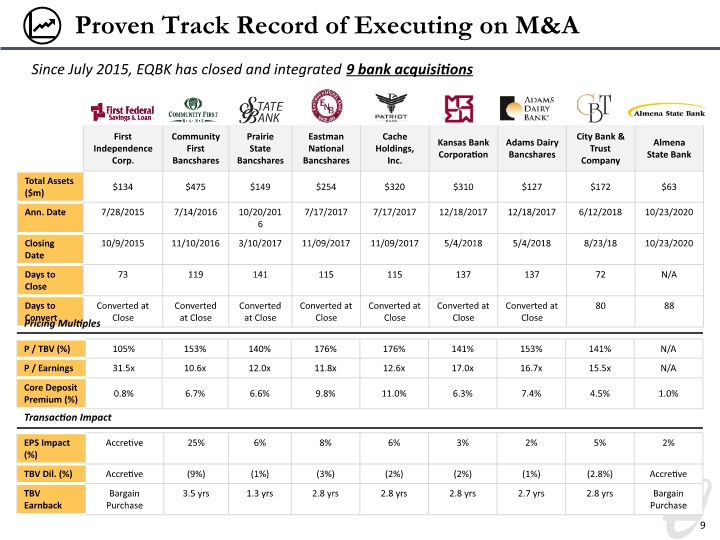

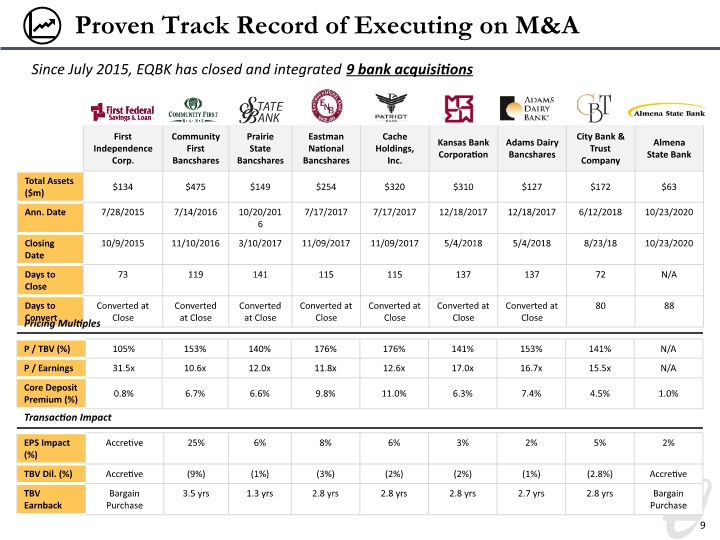

9 Proven Track Record of Executing on M&A Since July 2015, EQBK has closed and integrated 9 bank acquisitions Pricing Multiples Transaction Impact

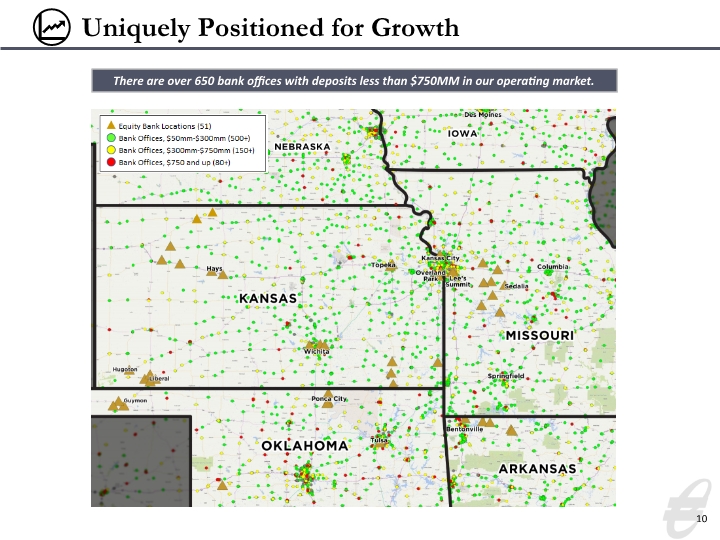

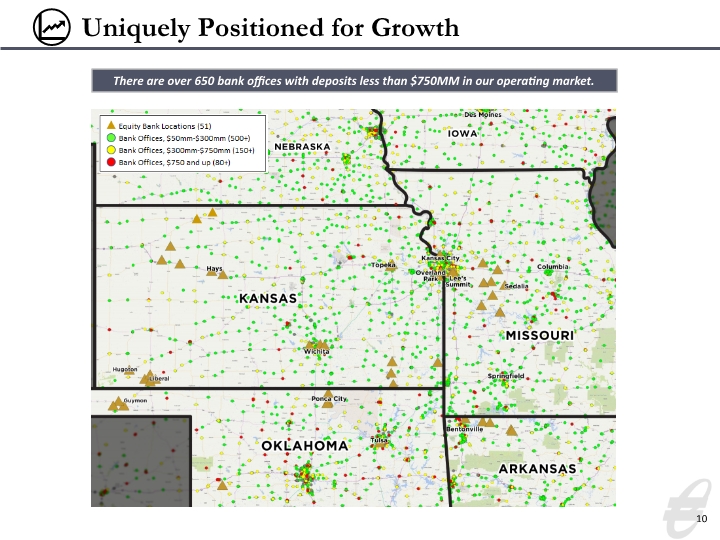

10 Uniquely Positioned for Growth There are over 650 bank offices with deposits less than $750MM in our operating market.

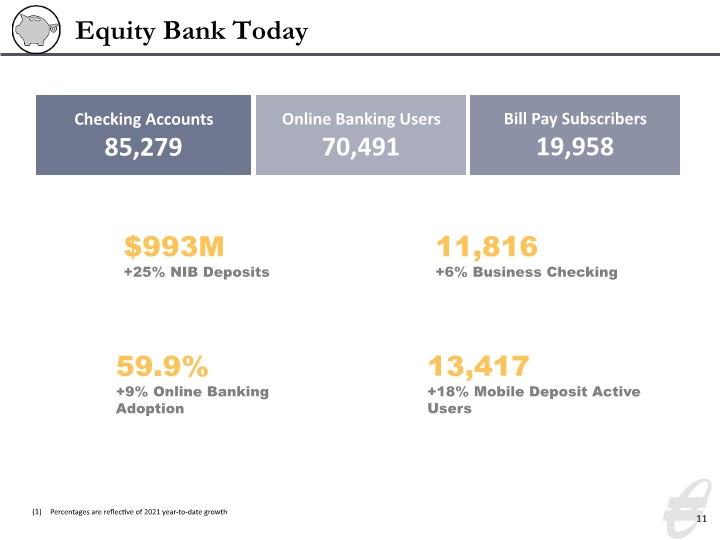

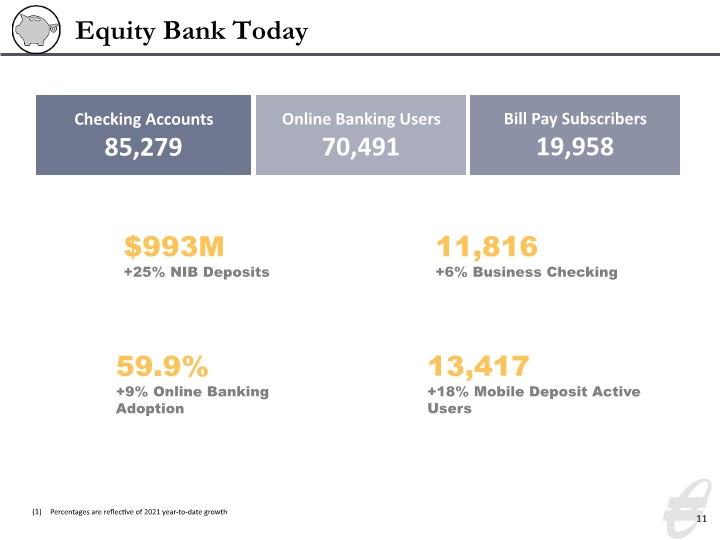

11 Equity Bank Today Percentages are reflective of 2021 year-to-date growth Checking Accounts 85,279 Online Banking Users 70,491 Bill Pay Subscribers 19,958 $993M +25% NIB Deposits 11,816 +6% Business Checking 59.9% +9% Online Banking Adoption 13,417 +18% Mobile Deposit Active Users

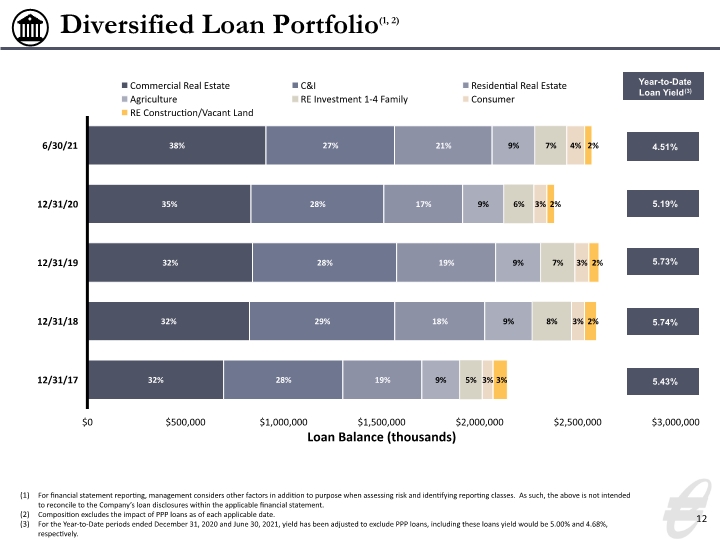

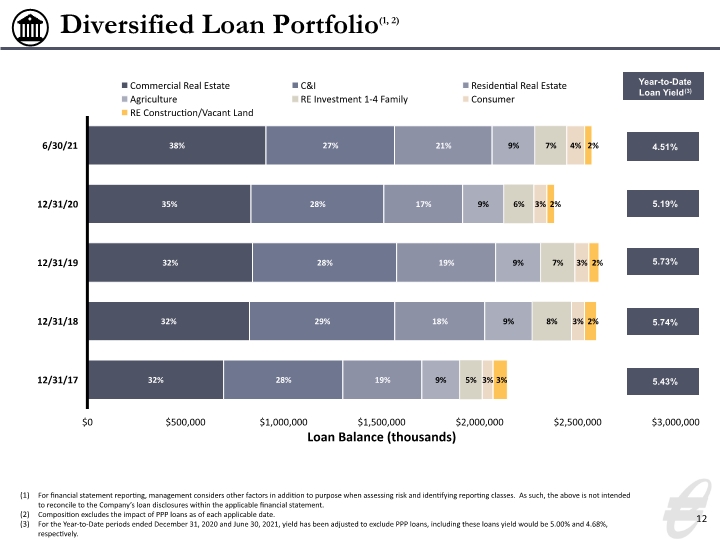

Diversified Loan Portfolio(1, 2) 12 Year-to-Date Loan Yield(3) 4.51% 5.43% 5.74% 5.73% For financial statement reporting, management considers other factors in addition to purpose when assessing risk and identifying reporting classes. As such, the above is not intended to reconcile to the Company’s loan disclosures within the applicable financial statement. Composition excludes the impact of PPP loans as of each applicable date. For the Year-to-Date periods ended December 31, 2020 and June 30, 2021, yield has been adjusted to exclude PPP loans, including these loans yield would be 5.00% and 4.68%, respectively. 5.19%

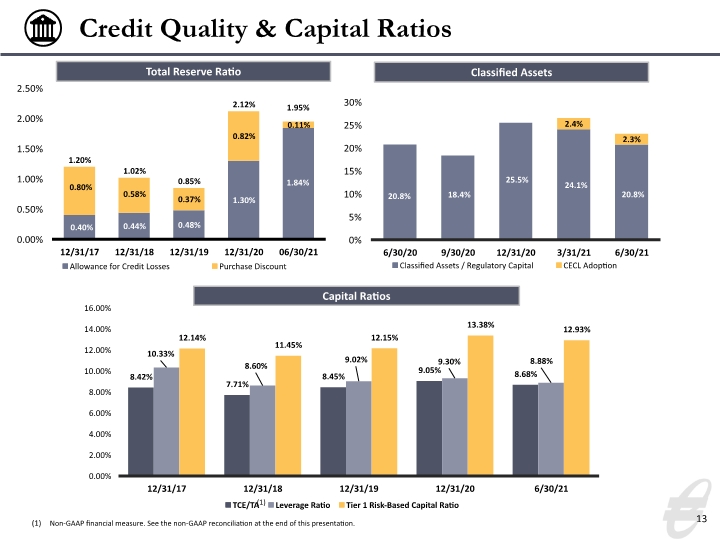

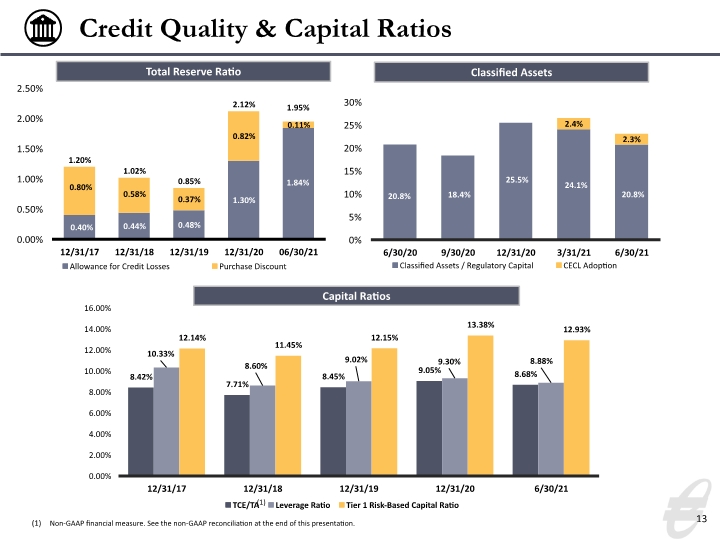

Credit Quality & Capital Ratios 13 Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. (1) Capital Ratios Total Reserve Ratio Classified Assets

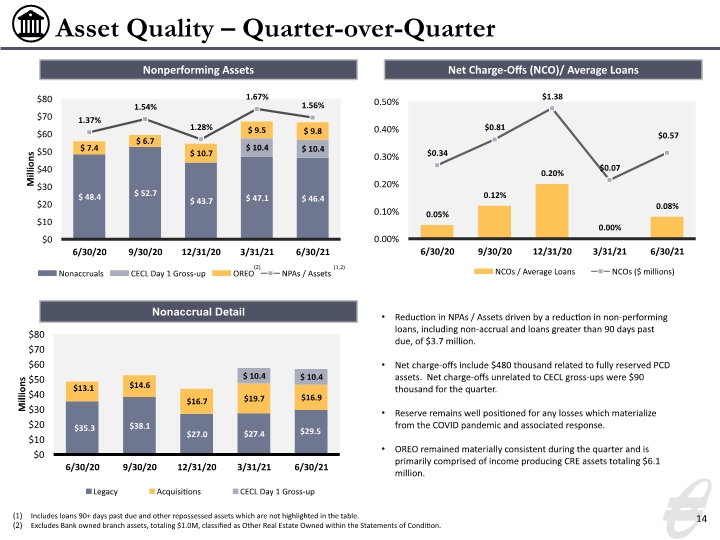

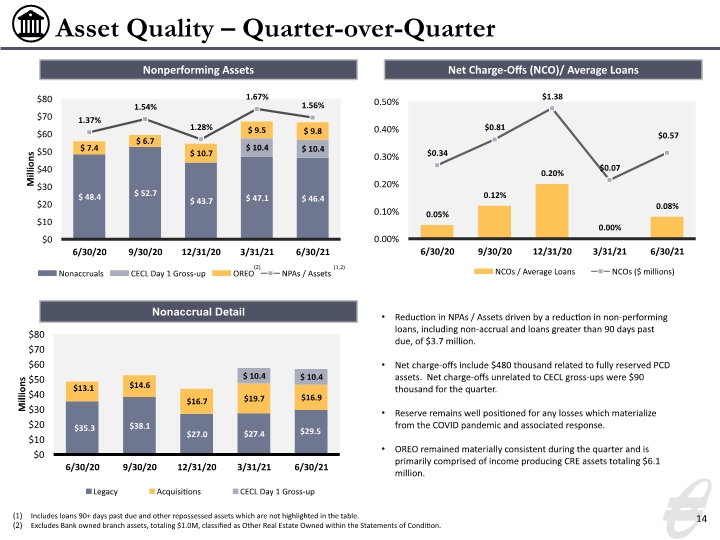

Asset Quality – Quarter-over-Quarter 14 Nonperforming Assets Net Charge-Offs (NCO)/ Average Loans Nonaccrual Detail Includes loans 90+ days past due and other repossessed assets which are not highlighted in the table. Excludes Bank owned branch assets, totaling $1.0M, classified as Other Real Estate Owned within the Statements of Condition. (1,2) Reduction in NPAs / Assets driven by a reduction in non-performing loans, including non-accrual and loans greater than 90 days past due, of $3.7 million. Net charge-offs include $480 thousand related to fully reserved PCD assets. Net charge-offs unrelated to CECL gross-ups were $90 thousand for the quarter. Reserve remains well positioned for any losses which materialize from the COVID pandemic and associated response. OREO remained materially consistent during the quarter and is primarily comprised of income producing CRE assets totaling $6.1 million. (2)

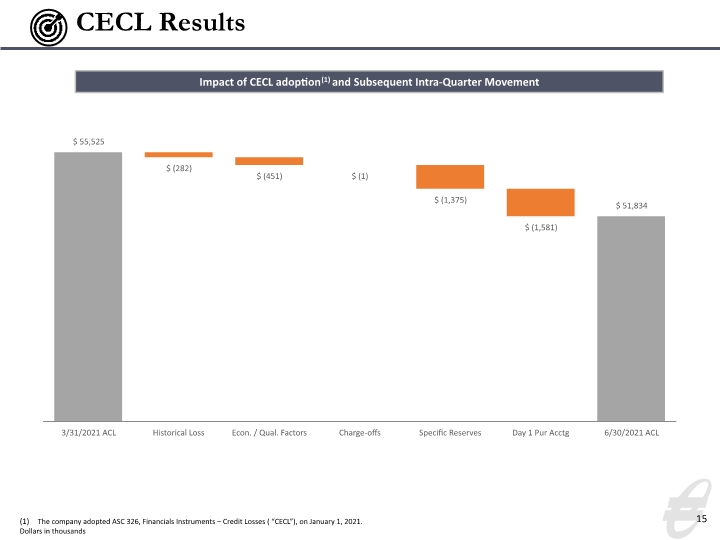

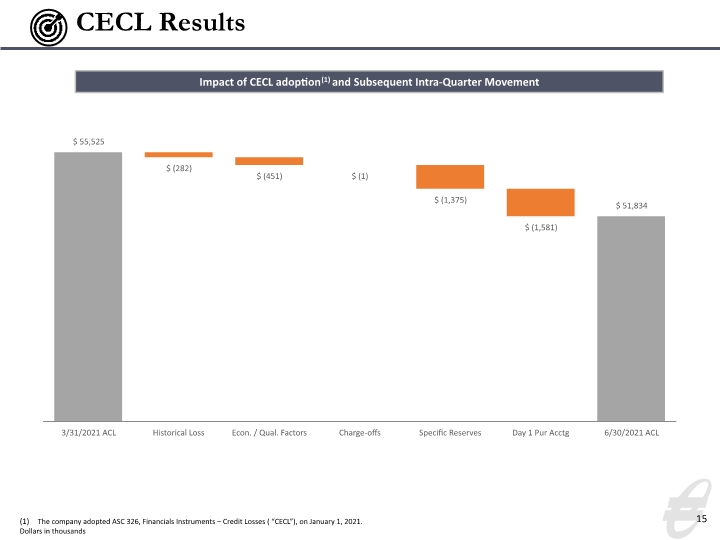

CECL Results 15 The company adopted ASC 326, Financials Instruments – Credit Losses ( “CECL”), on January 1, 2021. Dollars in thousands Impact of CECL adoption(1) and Subsequent Intra-Quarter Movement

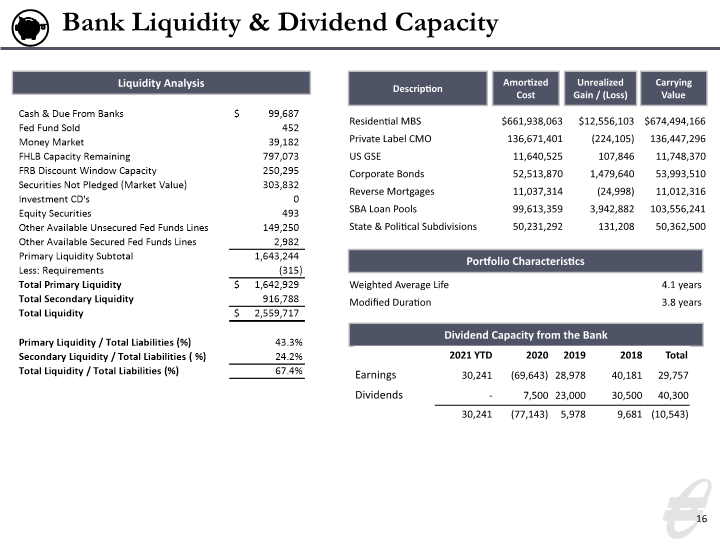

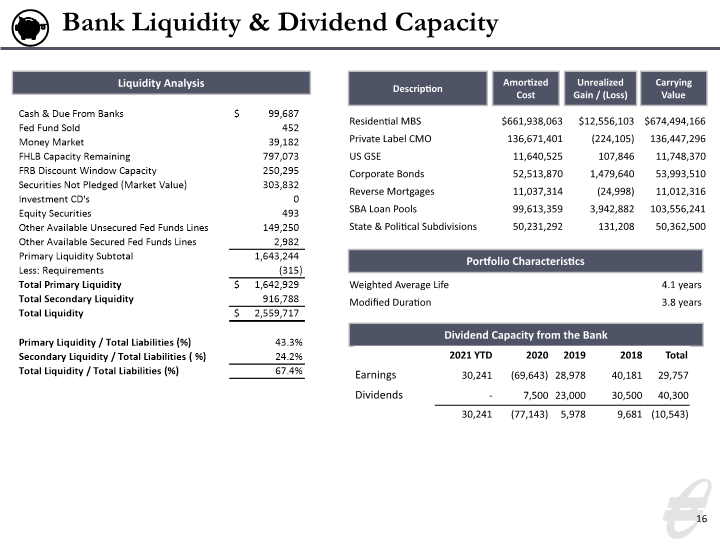

Bank Liquidity & Dividend Capacity 16 Dividend Capacity from the Bank Liquidity Analysis Amortized Cost Carrying Value Unrealized Gain / (Loss) Description Portfolio Characteristics

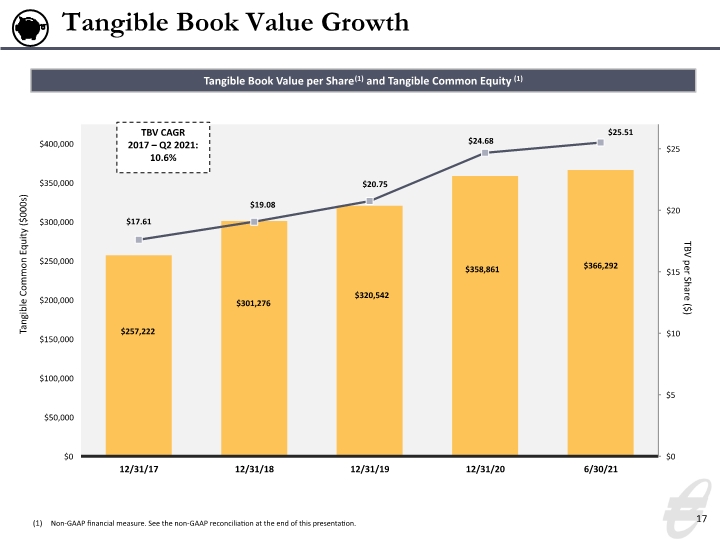

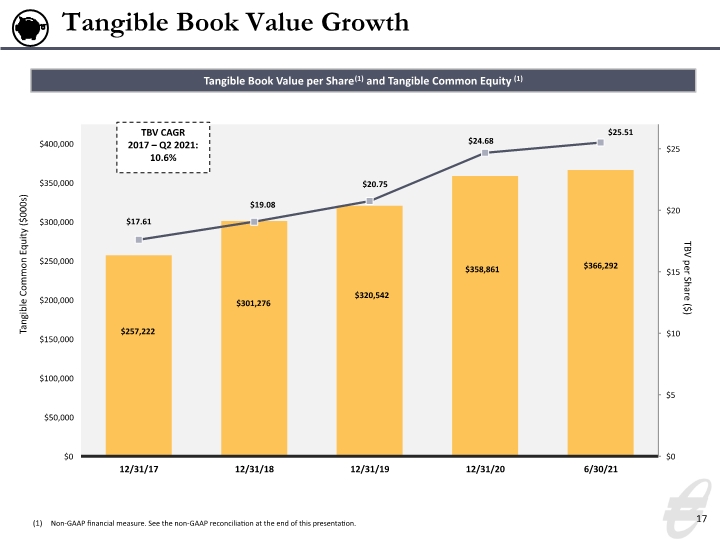

Tangible Book Value Growth 17 Tangible Book Value per Share(1) and Tangible Common Equity (1) TBV CAGR 2017 – Q2 2021: 10.6% Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

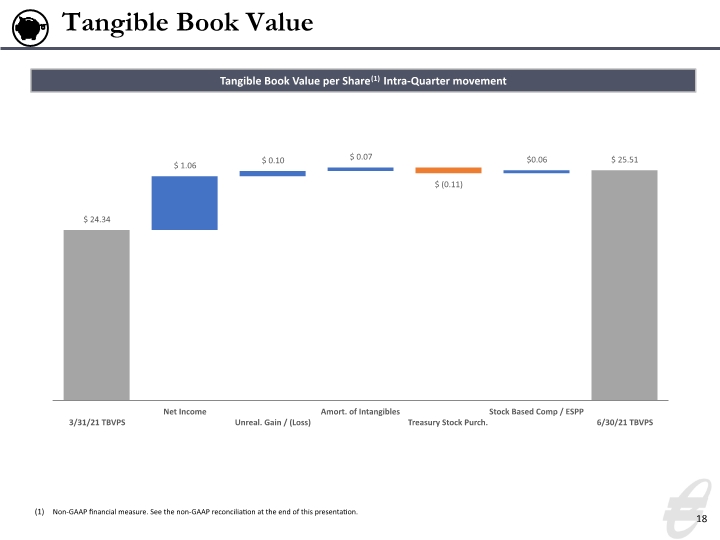

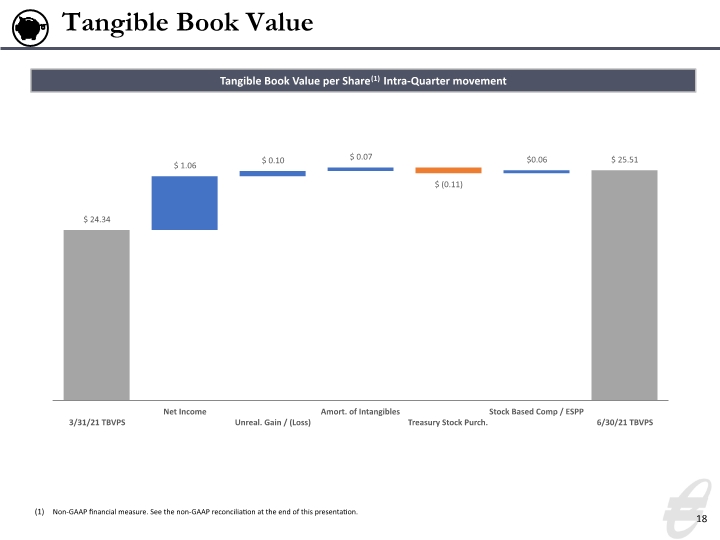

Tangible Book Value 18 Tangible Book Value per Share(1) Intra-Quarter movement Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

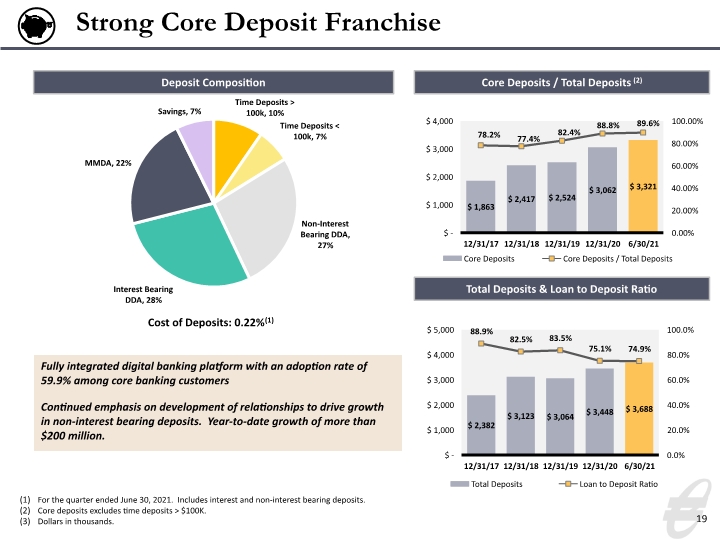

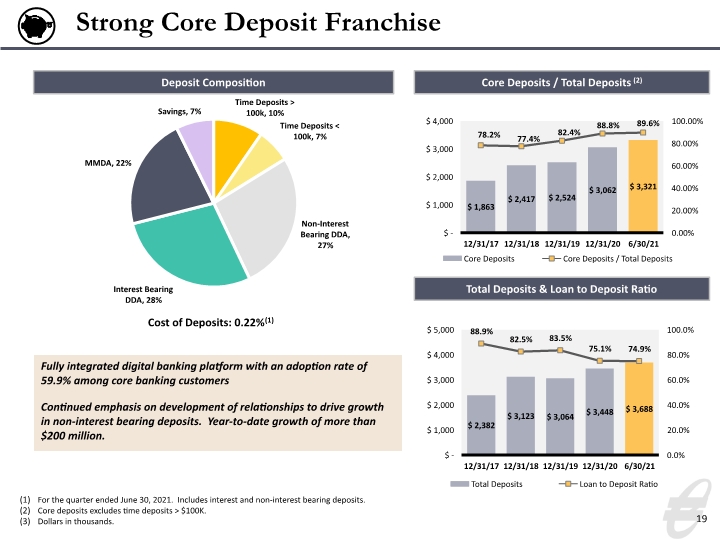

Fully integrated digital banking platform with an adoption rate of 59.9% among core banking customers Continued emphasis on development of relationships to drive growth in non-interest bearing deposits. Year-to-date growth of more than $200 million. 19 Strong Core Deposit Franchise For the quarter ended June 30, 2021. Includes interest and non-interest bearing deposits. Core deposits excludes time deposits > $100K. Dollars in thousands. Cost of Deposits: 0.22%(1) Deposit Composition Core Deposits / Total Deposits (2) Total Deposits & Loan to Deposit Ratio

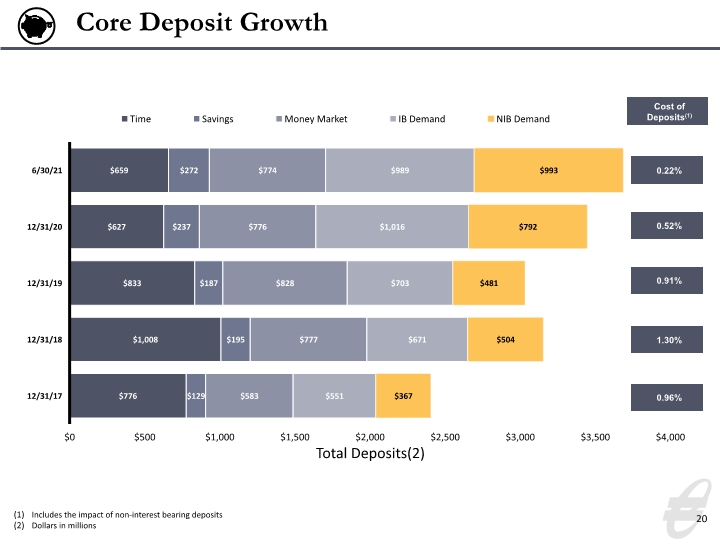

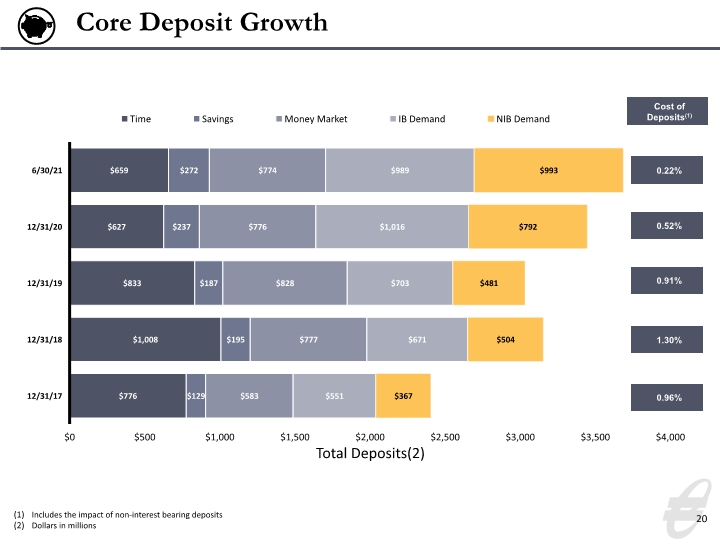

20 Core Deposit Growth Includes the impact of non-interest bearing deposits Dollars in millions Cost of Deposits(1) 0.22% 0.96% 1.30% 0.91% 0.52%

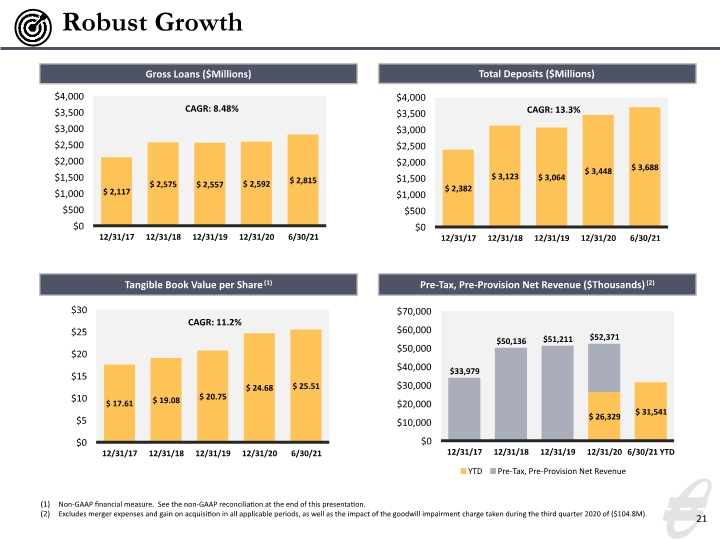

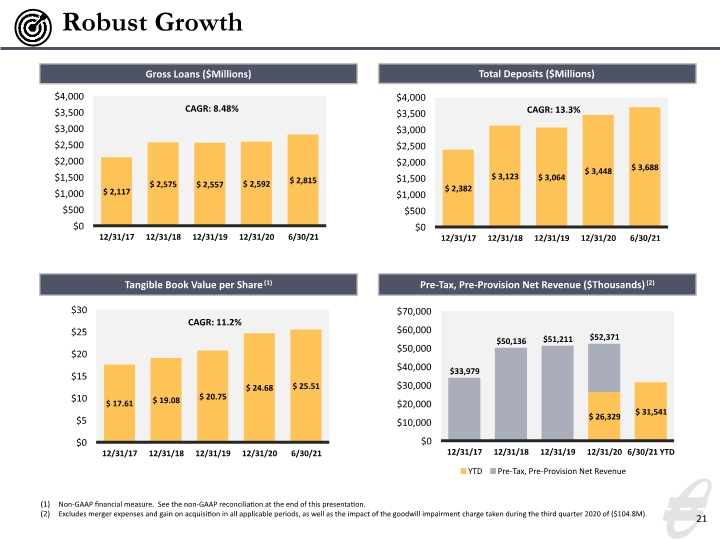

Robust Growth 21 Gross Loans ($Millions) Total Deposits ($Millions) Tangible Book Value per Share(1) Pre-Tax, Pre-Provision Net Revenue ($Thousands)(2) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Excludes merger expenses and gain on acquisition in all applicable periods, as well as the impact of the goodwill impairment charge taken during the third quarter 2020 of ($104.8M).

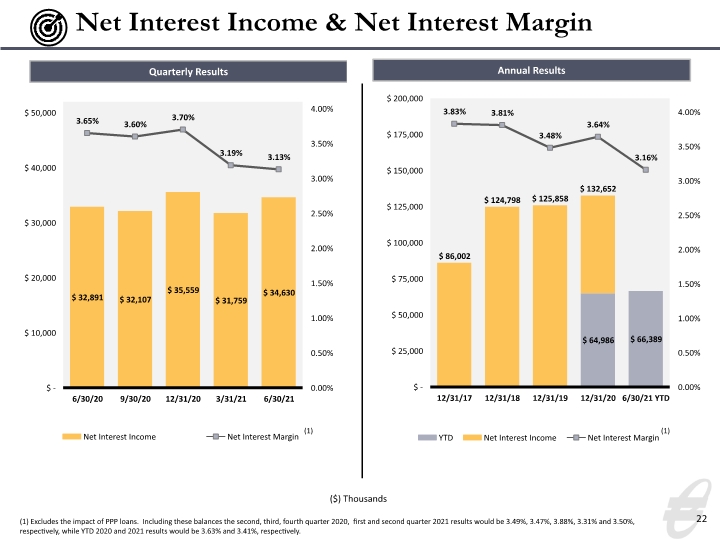

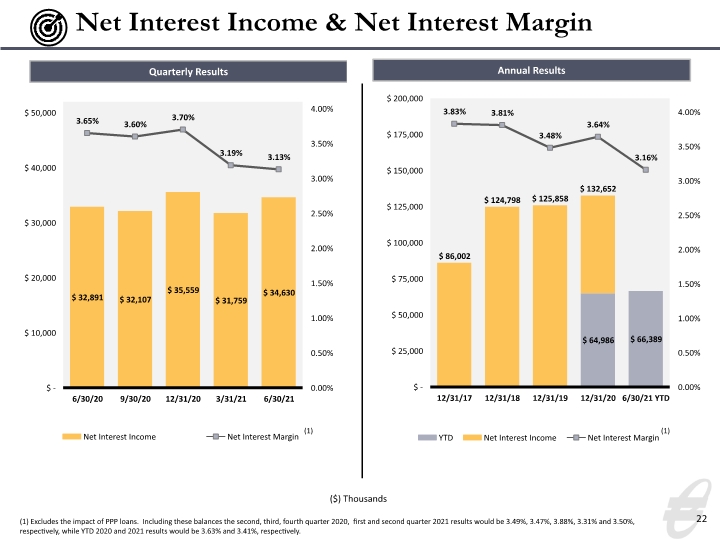

Net Interest Income & Net Interest Margin 22 ($) Thousands (1) (1) (1) Excludes the impact of PPP loans. Including these balances the second, third, fourth quarter 2020, first and second quarter 2021 results would be 3.49%, 3.47%, 3.88%, 3.31% and 3.50%, respectively, while YTD 2020 and 2021 results would be 3.63% and 3.41%, respectively. Annual Results

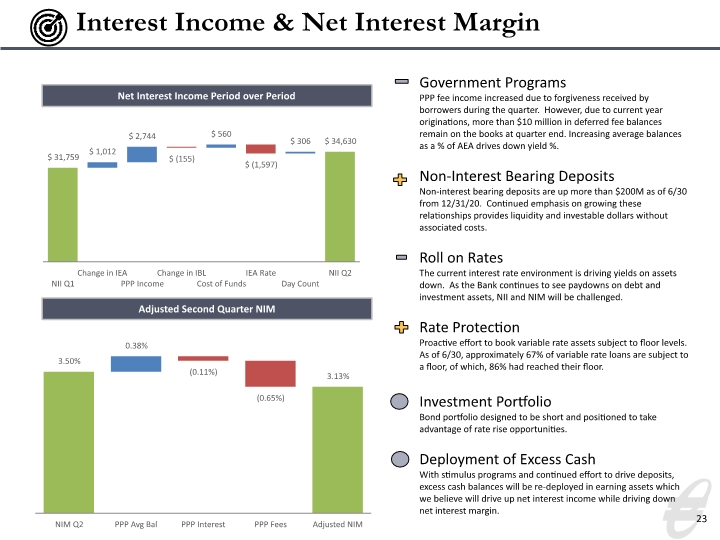

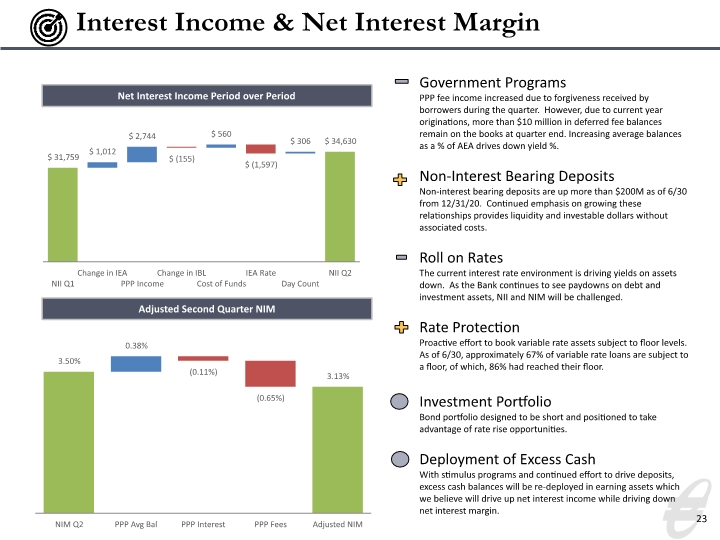

Interest Income & Net Interest Margin 23 Government Programs PPP fee income increased due to forgiveness received by borrowers during the quarter. However, due to current year originations, more than $10 million in deferred fee balances remain on the books at quarter end. Increasing average balances as a % of AEA drives down yield %. Non-Interest Bearing Deposits Non-interest bearing deposits are up more than $200M as of 6/30 from 12/31/20. Continued emphasis on growing these relationships provides liquidity and investable dollars without associated costs. Roll on Rates The current interest rate environment is driving yields on assets down. As the Bank continues to see paydowns on debt and investment assets, NII and NIM will be challenged. Rate Protection Proactive effort to book variable rate assets subject to floor levels. As of 6/30, approximately 67% of variable rate loans are subject to a floor, of which, 86% had reached their floor. Investment Portfolio Bond portfolio designed to be short and positioned to take advantage of rate rise opportunities. Deployment of Excess Cash With stimulus programs and continued effort to drive deposits, excess cash balances will be re-deployed in earning assets which we believe will drive up net interest income while driving down net interest margin. Adjusted Second Quarter NIM Net Interest Income Period over Period

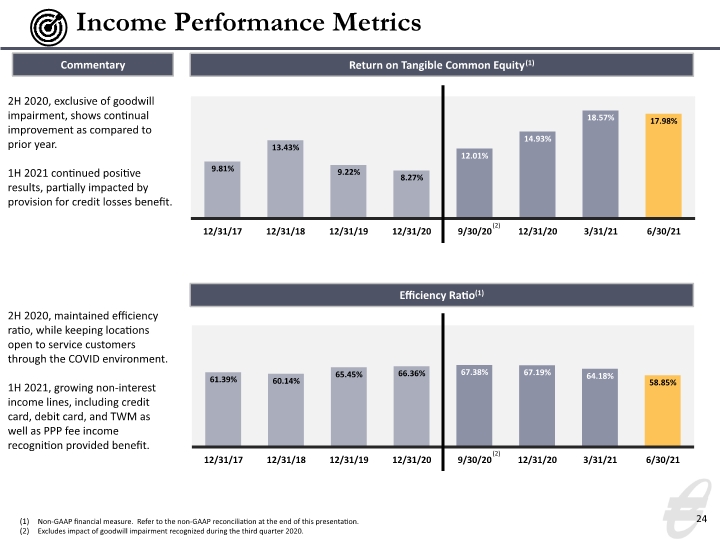

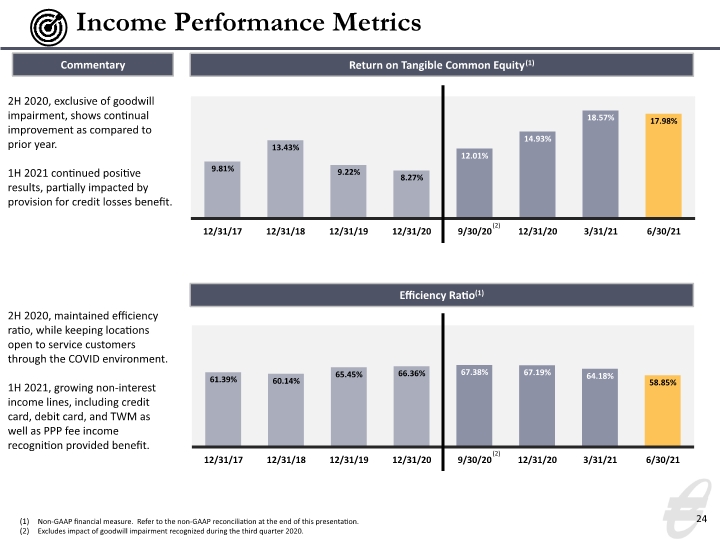

Income Performance Metrics 24 Non-GAAP financial measure. Refer to the non-GAAP reconciliation at the end of this presentation. Excludes impact of goodwill impairment recognized during the third quarter 2020. Return on Tangible Common Equity(1) Efficiency Ratio(1) 2H 2020, exclusive of goodwill impairment, shows continual improvement as compared to prior year. 1H 2021 continued positive results, partially impacted by provision for credit losses benefit. Commentary 2H 2020, maintained efficiency ratio, while keeping locations open to service customers through the COVID environment. 1H 2021, growing non-interest income lines, including credit card, debit card, and TWM as well as PPP fee income recognition provided benefit. (2) (2)

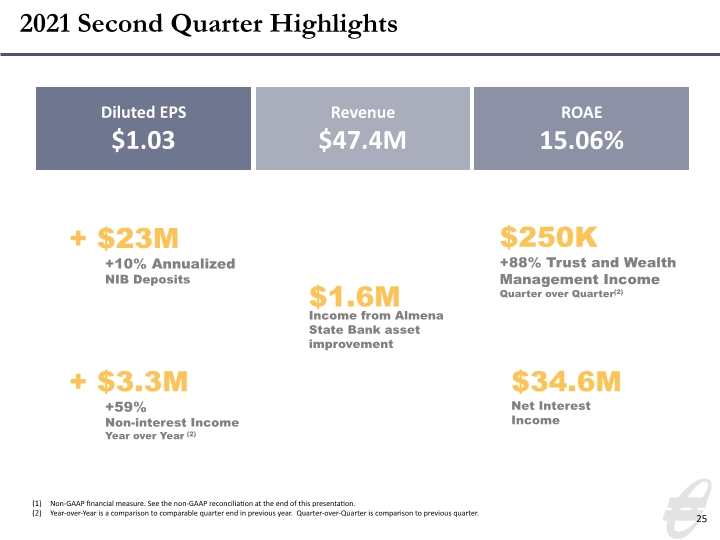

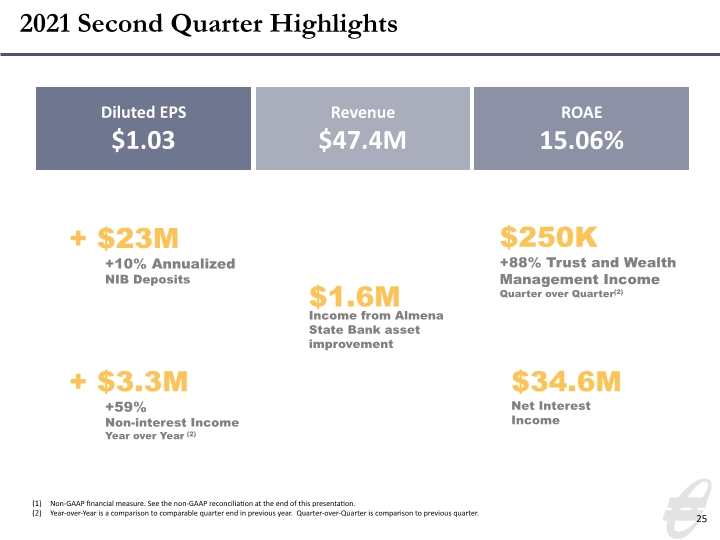

25 2021 Second Quarter Highlights Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Year-over-Year is a comparison to comparable quarter end in previous year. Quarter-over-Quarter is comparison to previous quarter. Diluted EPS $1.03 Revenue $47.4M ROAE 15.06% $34.6M Net Interest Income + $23M +10% Annualized NIB Deposits $1.6M Income from Almena State Bank asset improvement $250K +88% Trust and Wealth Management Income Quarter over Quarter(2) + $3.3M +59% Non-interest Income Year over Year(2)

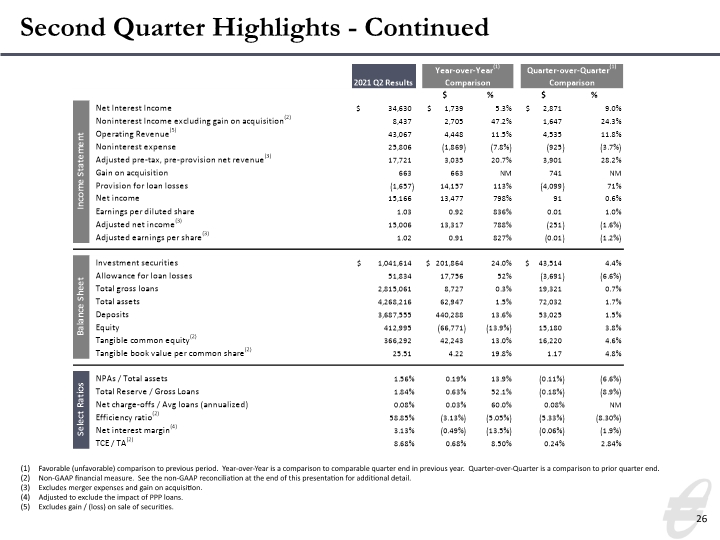

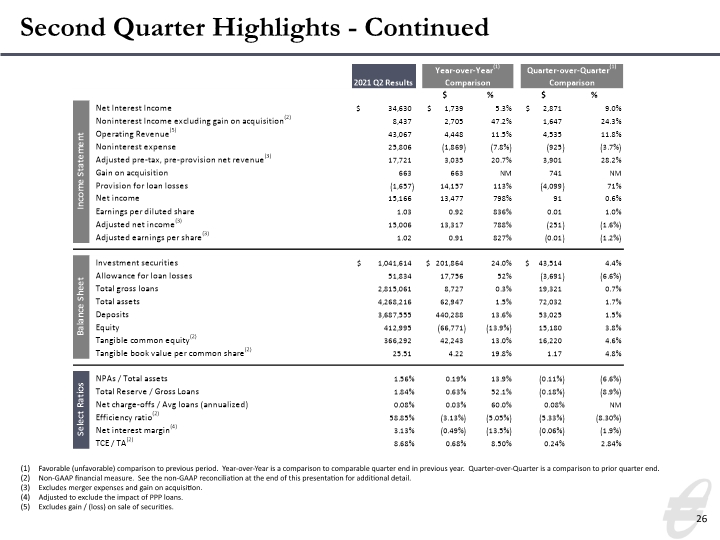

Second Quarter Highlights - Continued 26 Favorable (unfavorable) comparison to previous period. Year-over-Year is a comparison to comparable quarter end in previous year. Quarter-over-Quarter is a comparison to prior quarter end. Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation for additional detail. Excludes merger expenses and gain on acquisition. Adjusted to exclude the impact of PPP loans. Excludes gain / (loss) on sale of securities.

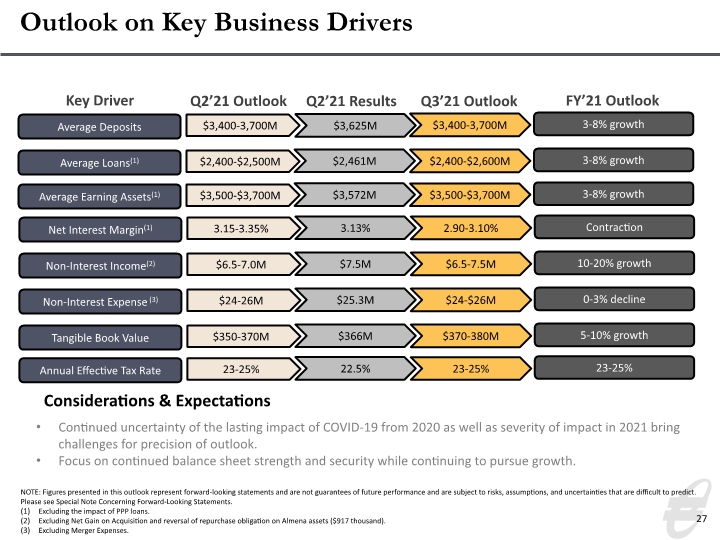

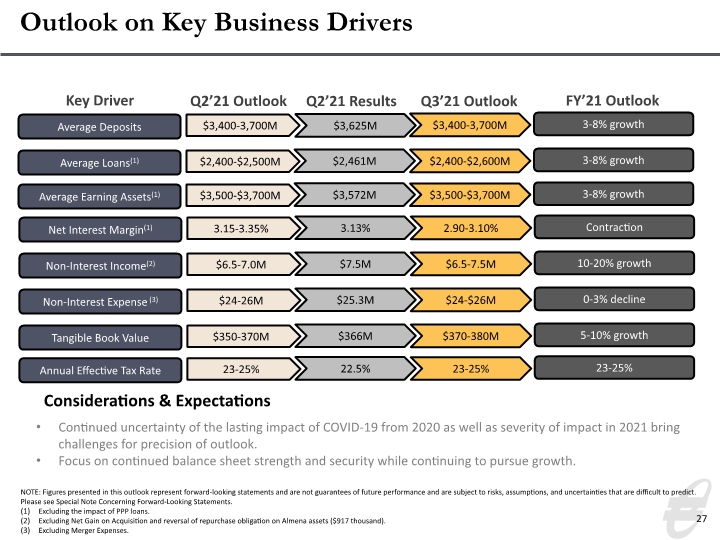

27 Outlook on Key Business Drivers Average Deposits $3,400-3,700M $3,625M 3-8% growth Key Driver Q2’21 Results Q2’21 Outlook Average Loans(1) $2,400-$2,500M $2,461M 3-8% growth Net Interest Margin(1) 3.15-3.35% 3.13% Contraction Non-Interest Income(2) $6.5-7.0M $7.5M 10-20% growth Non-Interest Expense (3) $24-26M $25.3M 0-3% decline Tangible Book Value $350-370M $366M 5-10% growth Considerations & Expectations Continued uncertainty of the lasting impact of COVID-19 from 2020 as well as severity of impact in 2021 bring challenges for precision of outlook. Focus on continued balance sheet strength and security while continuing to pursue growth. FY’21 Outlook NOTE: Figures presented in this outlook represent forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Please see Special Note Concerning Forward-Looking Statements. Excluding the impact of PPP loans. Excluding Net Gain on Acquisition and reversal of repurchase obligation on Almena assets ($917 thousand). Excluding Merger Expenses. Average Earning Assets(1) $3,500-$3,700M $3,572M 3-8% growth Annual Effective Tax Rate 23-25% 22.5% 23-25% Q3’21 Outlook $3,400-3,700M $2,400-$2,600M 2.90-3.10% $6.5-7.5M $24-$26M $370-380M $3,500-$3,700M 23-25%

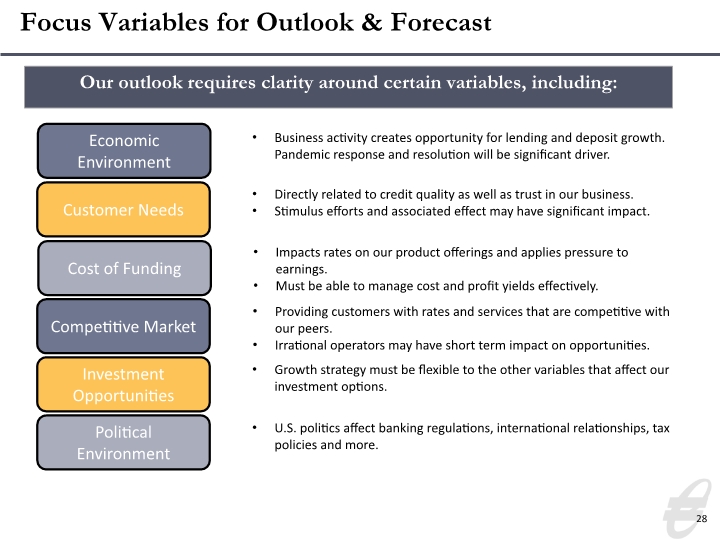

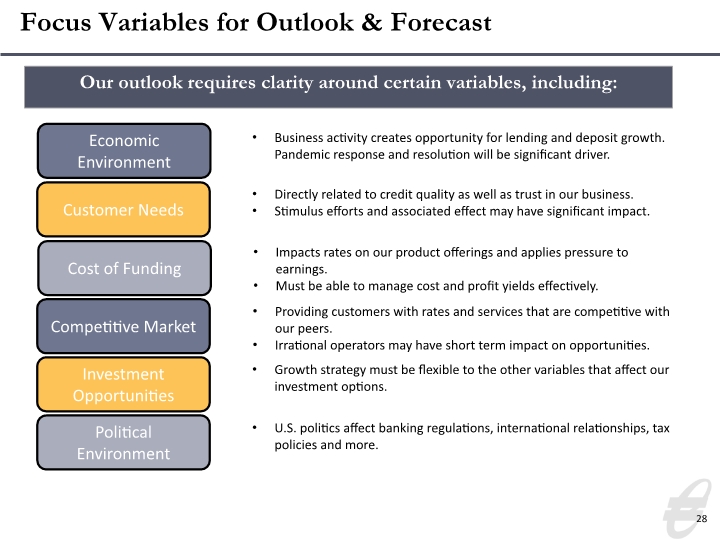

28 Focus Variables for Outlook & Forecast Business activity creates opportunity for lending and deposit growth. Pandemic response and resolution will be significant driver. Directly related to credit quality as well as trust in our business. Stimulus efforts and associated effect may have significant impact. Impacts rates on our product offerings and applies pressure to earnings. Must be able to manage cost and profit yields effectively. Providing customers with rates and services that are competitive with our peers. Irrational operators may have short term impact on opportunities. Growth strategy must be flexible to the other variables that affect our investment options. U.S. politics affect banking regulations, international relationships, tax policies and more. Economic Environment Customer Needs Cost of Funding Competitive Market Investment Opportunities Political Environment Our outlook requires clarity around certain variables, including:

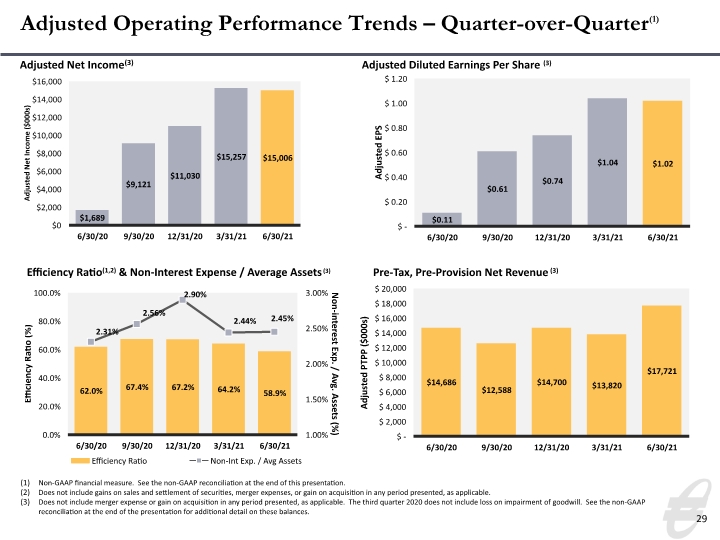

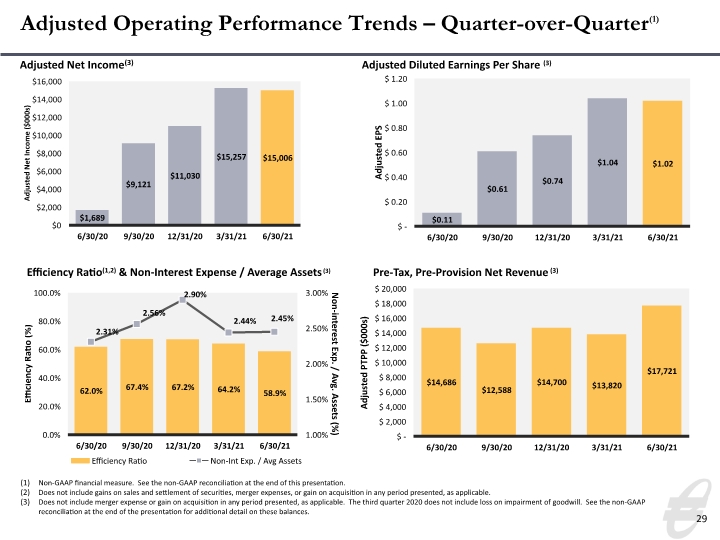

29 Adjusted Operating Performance Trends – Quarter-over-Quarter(1) Adjusted Diluted Earnings Per Share (3) Efficiency Ratio(1,2) & Non-Interest Expense / Average Assets(3) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Does not include gains on sales and settlement of securities, merger expenses, or gain on acquisition in any period presented, as applicable. Does not include merger expense or gain on acquisition in any period presented, as applicable. The third quarter 2020 does not include loss on impairment of goodwill. See the non-GAAP reconciliation at the end of the presentation for additional detail on these balances. Adjusted Net Income(3) Pre-Tax, Pre-Provision Net Revenue(3)

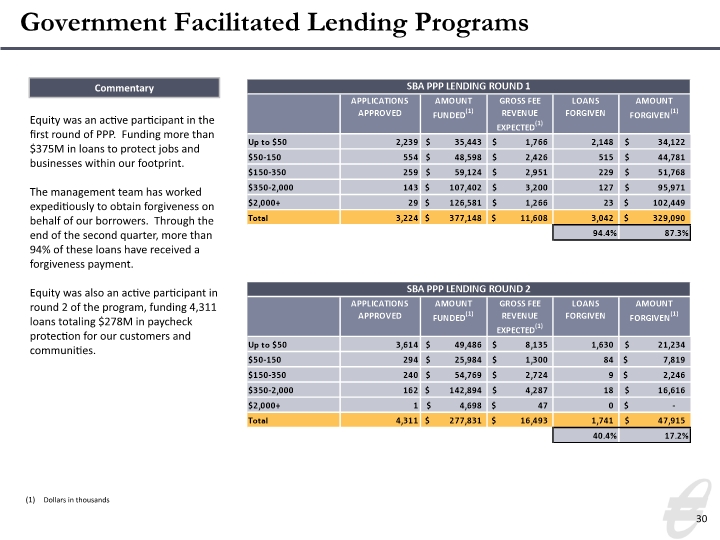

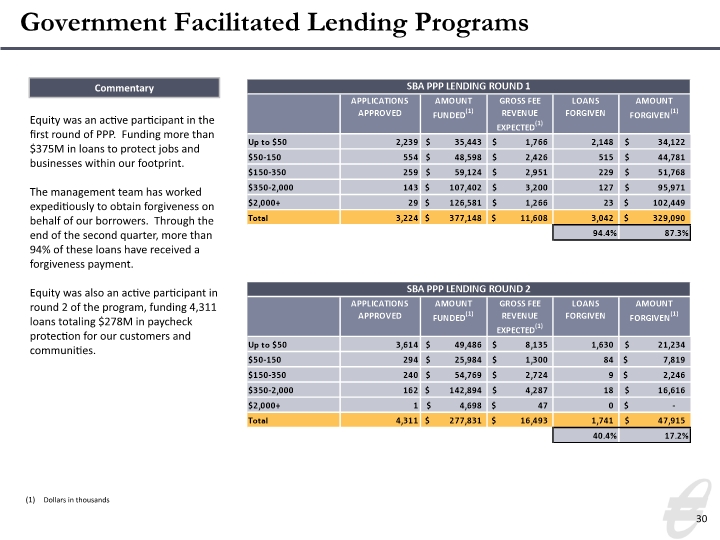

30 Government Facilitated Lending Programs Equity was an active participant in the first round of PPP. Funding more than $375M in loans to protect jobs and businesses within our footprint. The management team has worked expeditiously to obtain forgiveness on behalf of our borrowers. Through the end of the second quarter, more than 94% of these loans have received a forgiveness payment. Equity was also an active participant in round 2 of the program, funding 4,311 loans totaling $278M in paycheck protection for our customers and communities. Commentary Dollars in thousands

Appendix 31

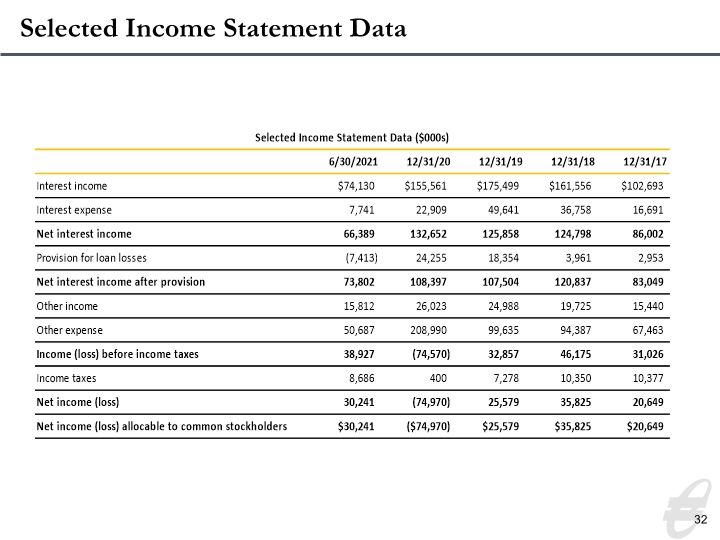

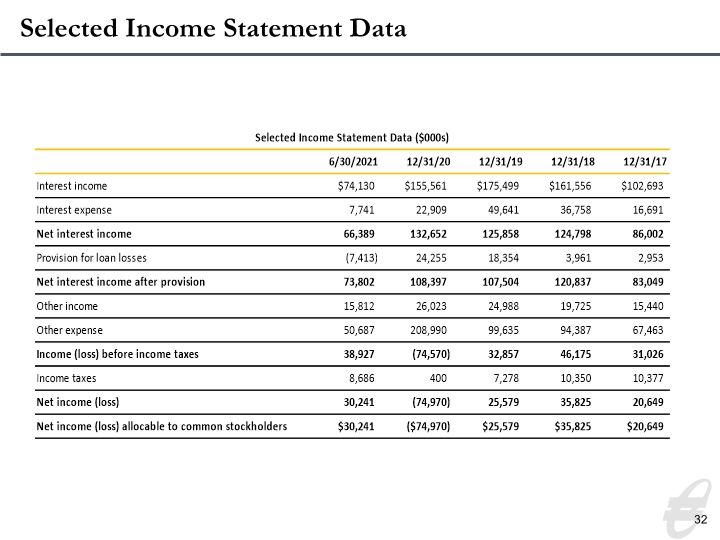

Selected Income Statement Data 32

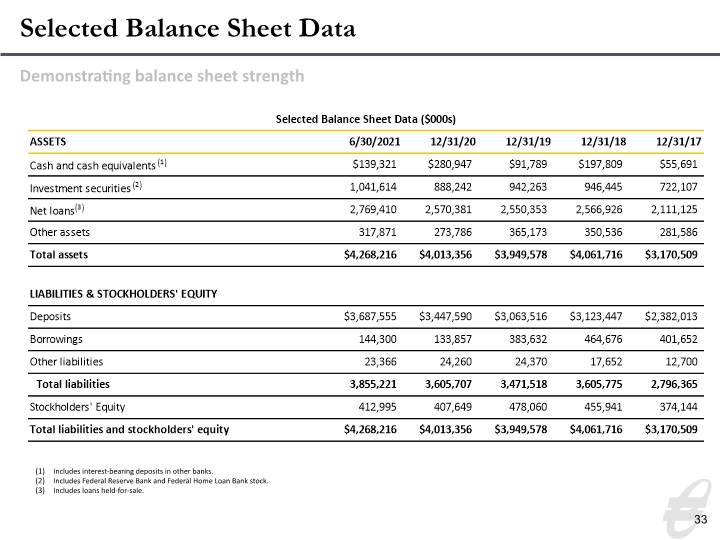

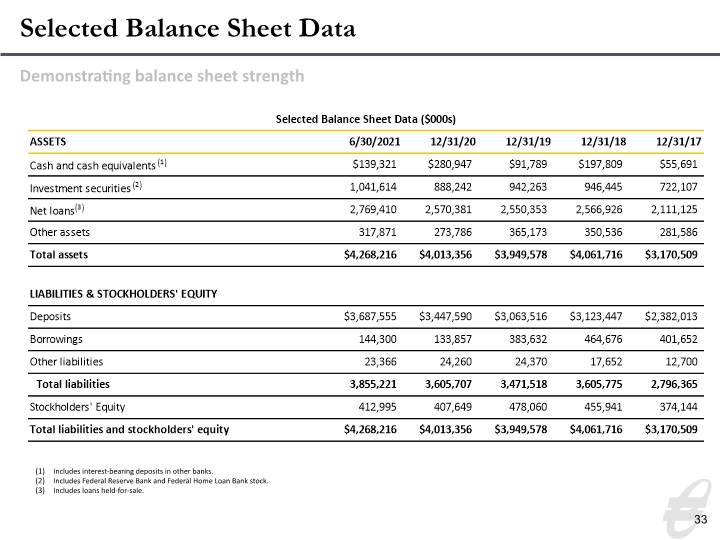

Selected Balance Sheet Data 33 Demonstrating balance sheet strength Includes interest-bearing deposits in other banks. Includes Federal Reserve Bank and Federal Home Loan Bank stock. Includes loans held-for-sale.

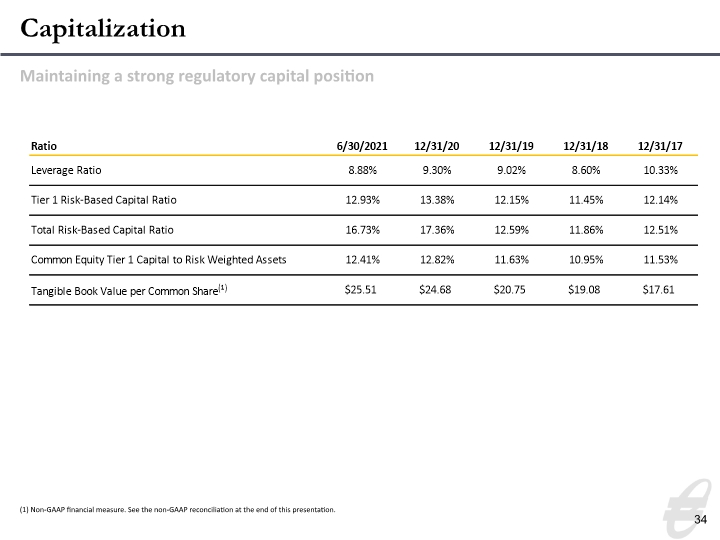

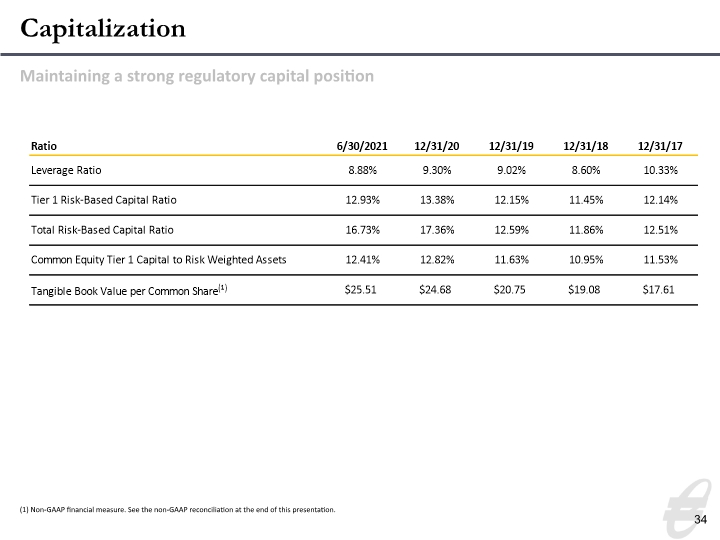

Capitalization 34 (1) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Maintaining a strong regulatory capital position

The subsequent tables present non-GAAP reconciliations of the following calculations: Tangible Common Equity (TCE) to Tangible Assets (TA) Ratio Tangible Book Value per Common Share Return on Average Tangible Common Equity (ROATCE) Efficiency Ratio 35

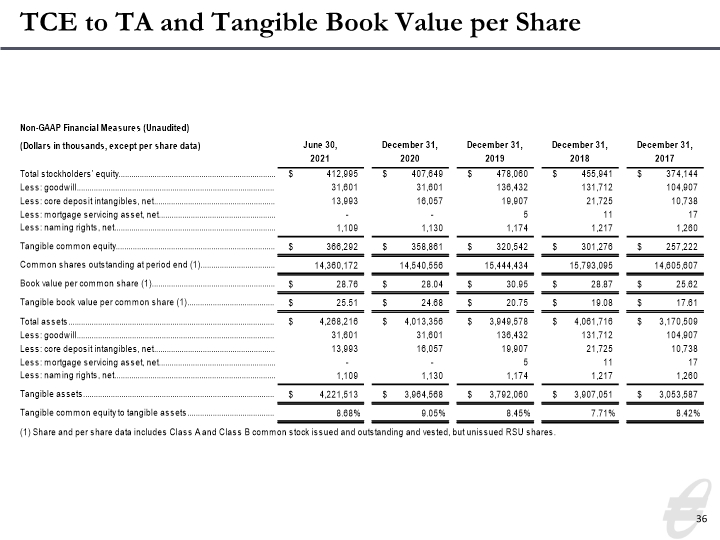

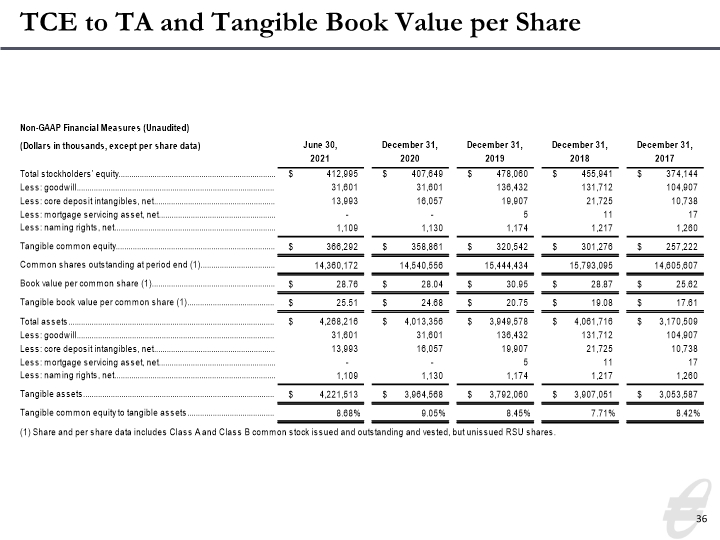

TCE to TA and Tangible Book Value per Share 36

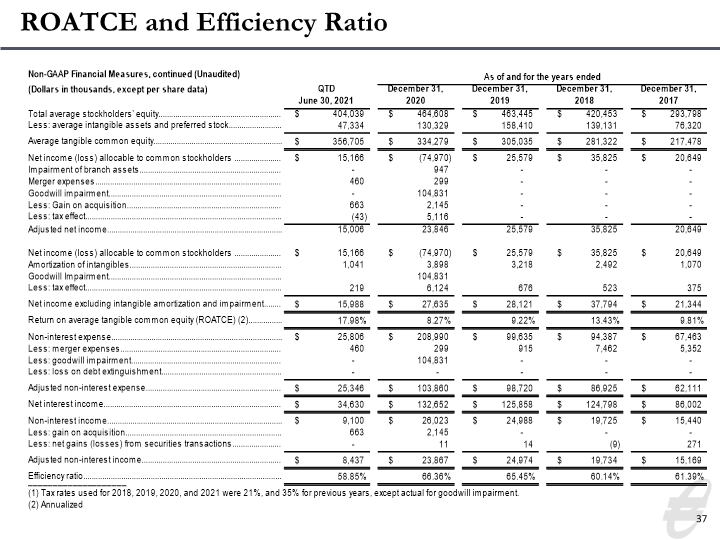

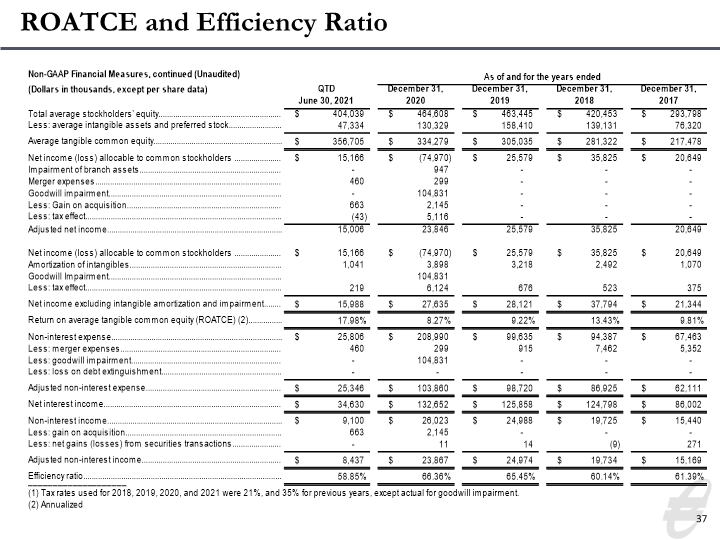

ROATCE and Efficiency Ratio 37

investor.equitybank.com