First Quarter Earnings Presentation April 20, 2022 Exhibit 99.2

Forward Looking Statements This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include COVID-19 related impacts; competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 9, 2022, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, such as COVID-19, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. 2

Our Company 3 Committed to our Entrepreneurial Spirit Equity Bancshares, Inc. NASDAQ: EQBK Start-Up: 2002 - 2007 Brad Elliott, current Chairman and CEO, founded Equity Bancshares, Inc. in 2002. Closed 5 branch or whole bank acquisitions Opened 2 branches in Missouri Growth: 2008 - 2016 Opened branches in Lee’s Summit & Overland Park, Kansas Acquired Ellis State Bank $8.8MM of TARP issued and repaid with SBLF $20.0MM Capital Raise Purchased 4 branches from Citizens Bancshares (Topeka) Scale: 2017-2021 $20.4MM Capital Raise Acquired First Community Bancshares Rationalized branch map, 3 closures, 1 opening Acquired First Independence and Community First $35.4MM private placement capital raise Acquired Prairie State, Patriot Bank, and Eastman Acquired Kansas Bank Corporation, Adams Dairy Bank, and City Bank & Trust Launched ETWM Completed $75MM subordinated debt issuance Acquired Almena State Bank, 3 branches from Security Bank, and American State Bancshares For the quarter ended March 31, 2022.

Our Leadership Team 4 Brad Elliott Chairman & CEO Years at Equity: 20 | Years in Banking: 33 Eric Newell Chief Financial Officer Years at Equity: 2 | Years in Banking: 20 Craig Anderson President Years at Equity: 4 | Years in Banking: 40 Greg Kossover Chief Operating Officer Years at Equity: 9 | Years in Banking: 22 Founded Equity Bank in 2002 2018 EY Entrepreneur of the Year National Finalist 2014 Most Influential CEO, Wichita Business Journal Served as Regional President of Sunflower Bank prior to forming Equity Bank Served as Director of Sales and Marketing for Koch Industries Became COO in April 2020 Served as CFO from 2013 to 2020 EQBK Board of Directors, 2011-current Served as president of Physicians Development Group Served as CEO of Value Place, LLC, growing the franchise to more than 150 locations in 25 states Became President in April 2020 Served as COO from 2018 to 2020 Joined Equity Bank in March 2018 Served as President of UMBF Commercial Banking More than 38 years of banking experience, concentrated in commercial lending roles Joined Equity Bank in April 2020 Served as CFO at United Bank in Hartford, CT ($7.3B assets) Served as CFO and head of Treasury at Rockville Bank, Glastonbury, Conn. Served as Analyst for AllianceBernstein and Fitch Began career as examiner with FDIC

Our Value Proposition 5 Market Diversification and Strategy for Growth Experienced and Invested Management Team Conservative Credit Culture and Effective Risk Management and Mitigation Robust Funding Capacity, Anchored by a Diverse, Low-Cost Deposit Base Focus on Efficient Performance Throughout our Diversified Business Lines

Our Core Values embody everything we do at Equity Bank, including teamwork with colleagues, conduct within our communities, and especially our respect for our customers. Our core values are: Integrity Community Focus Accountability Respect Entrepreneurial Spirit Core Values & ESG Impact 6 For the year ended December 31, 2021

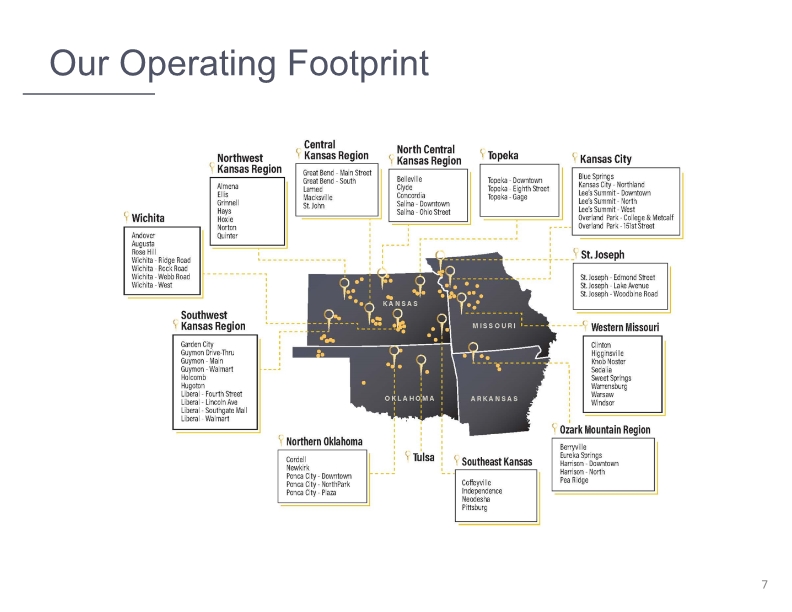

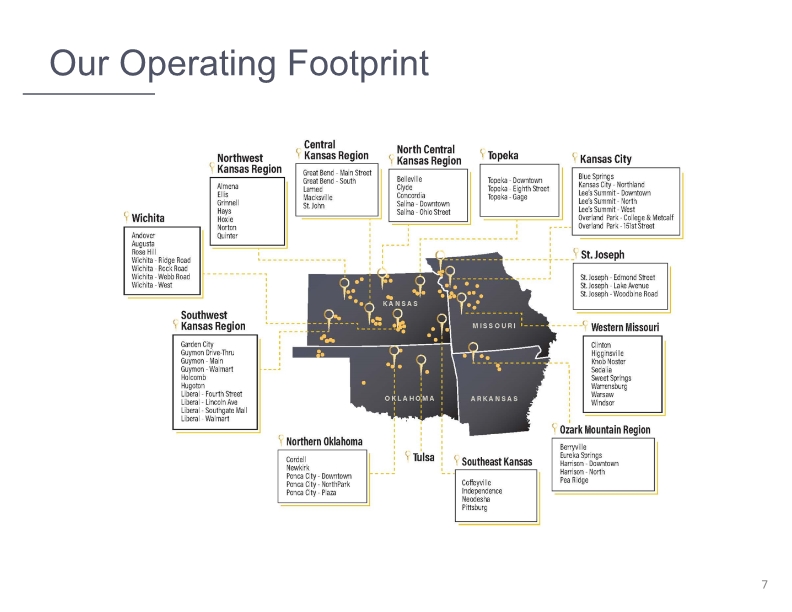

Our Operating Footprint 7

Proven record of M&A execution 8 Pricing Multiples Transaction Impact

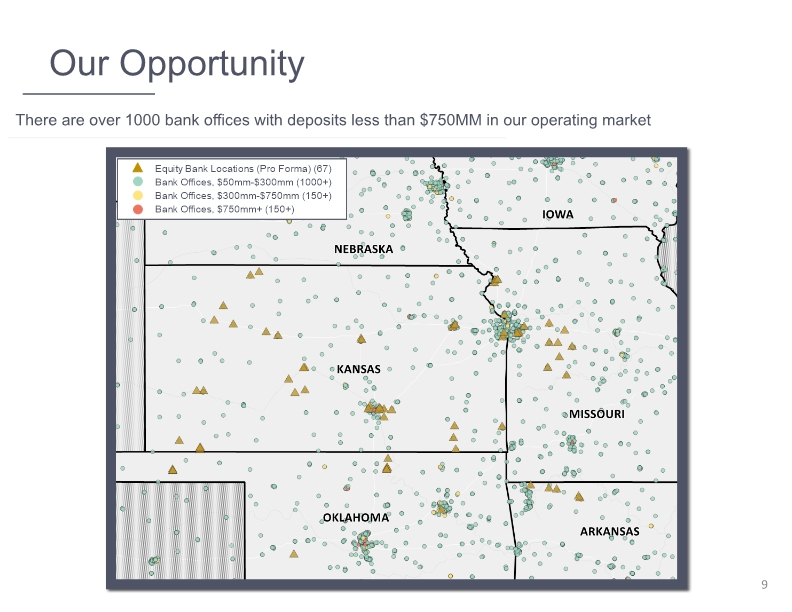

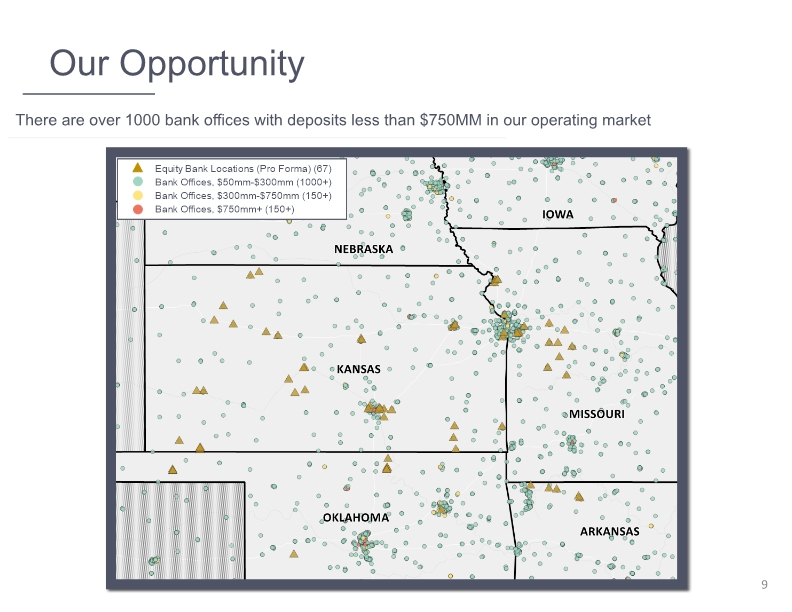

Our Opportunity 9 There are over 1000 bank offices with deposits less than $750MM in our operating market

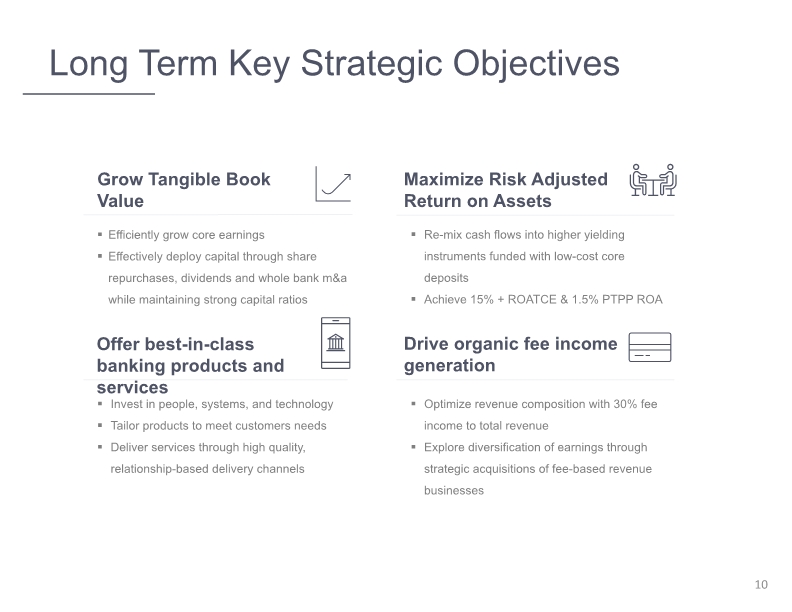

Long Term Key Strategic Objectives 10 Grow Tangible Book Value Maximize Risk Adjusted Return on Assets Offer best-in-class banking products and services Drive organic fee income generation Efficiently grow core earnings Effectively deploy capital through share repurchases, dividends and whole bank m&a while maintaining strong capital ratios Re-mix cash flows into higher yielding instruments funded with low-cost core deposits Achieve 15% + ROATCE & 1.5% PTPP ROA Optimize revenue composition with 30% fee income to total revenue Explore diversification of earnings through strategic acquisitions of fee-based revenue businesses Invest in people, systems, and technology Tailor products to meet customers needs Deliver services through high quality, relationship-based delivery channels

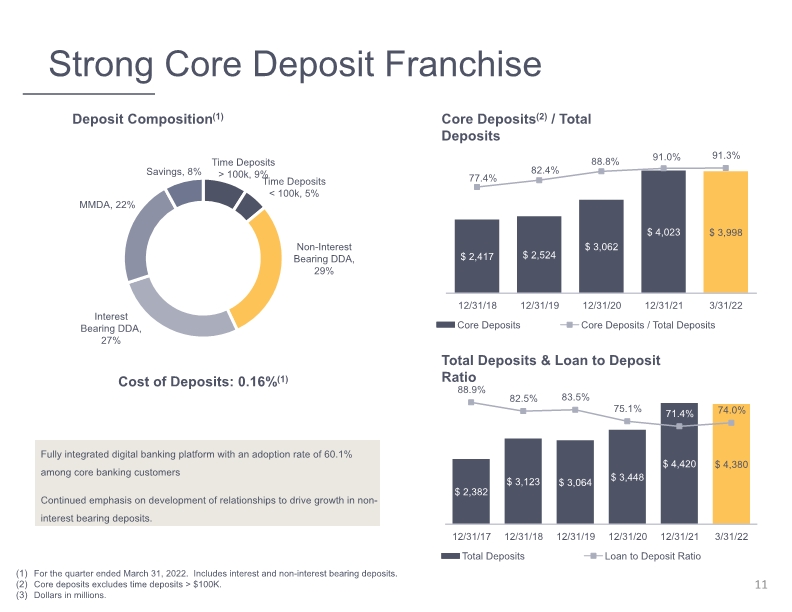

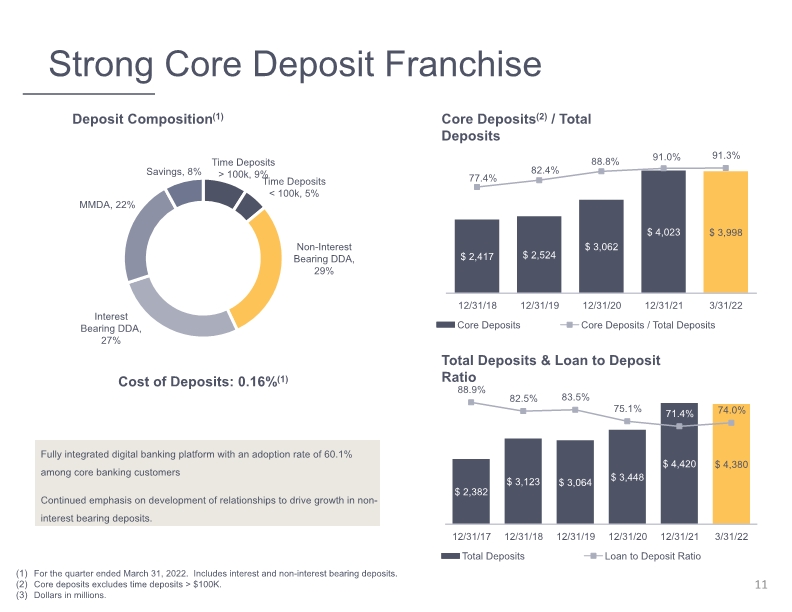

Strong Core Deposit Franchise 11 Deposit Composition(1) Fully integrated digital banking platform with an adoption rate of 60.1% among core banking customers Continued emphasis on development of relationships to drive growth in non-interest bearing deposits. Cost of Deposits: 0.16%(1) Core Deposits(2) / Total Deposits Total Deposits & Loan to Deposit Ratio For the quarter ended March 31, 2022. Includes interest and non-interest bearing deposits. Core deposits excludes time deposits > $100K. Dollars in millions.

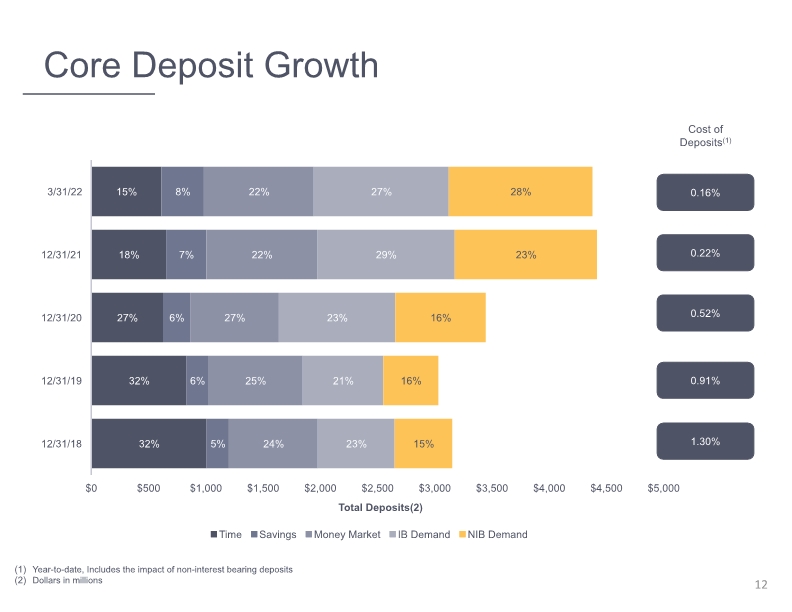

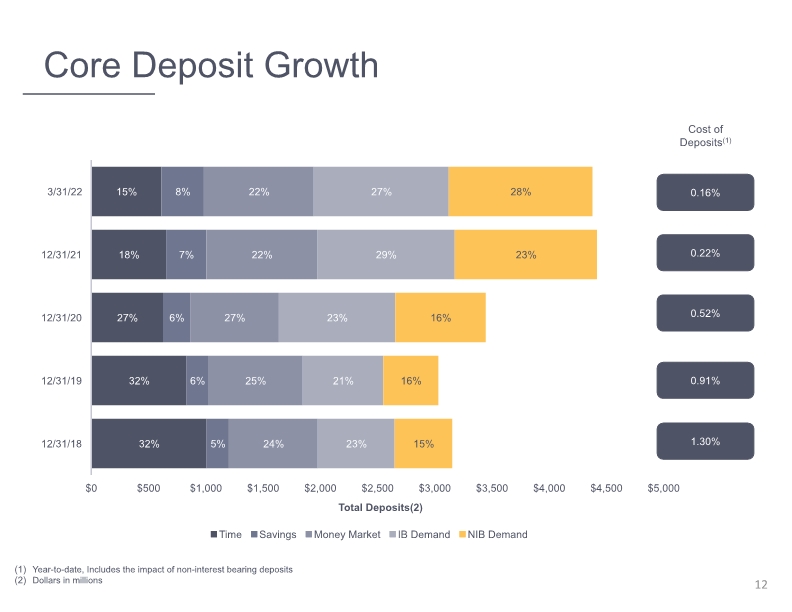

Core Deposit Growth 12 Cost of Deposits(1) 0.16% 0.22% 0.52% 0.91% 1.30% Year-to-date, Includes the impact of non-interest bearing deposits Dollars in millions

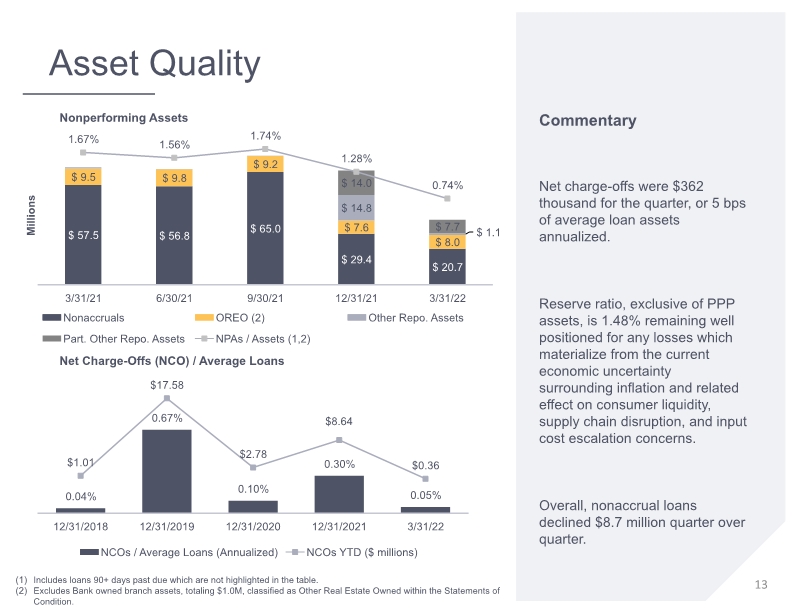

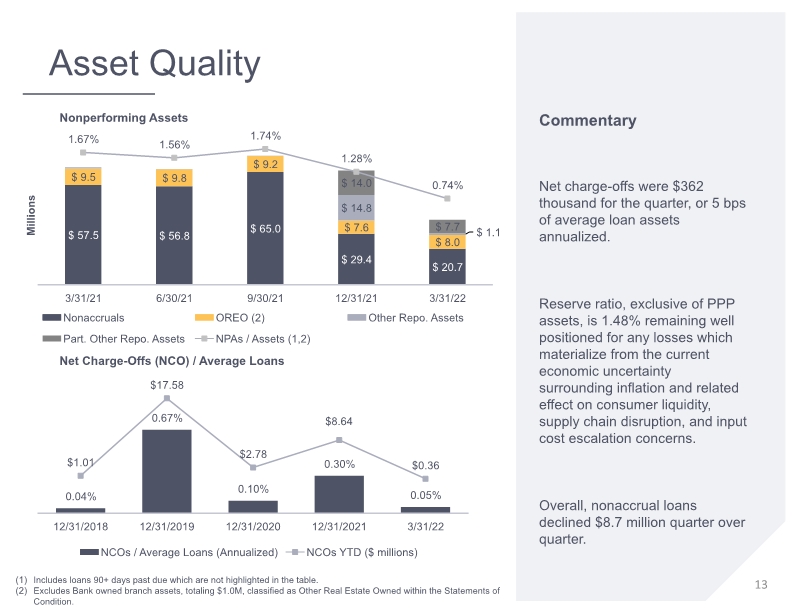

Asset Quality 13 Commentary Net charge-offs were $362 thousand for the quarter, or 5 bps of average loan assets annualized. Reserve ratio, exclusive of PPP assets, is 1.48% remaining well positioned for any losses which materialize from the current economic uncertainty surrounding inflation and related effect on consumer liquidity, supply chain disruption, and input cost escalation concerns. Overall, nonaccrual loans declined $8.7 million quarter over quarter. Nonperforming Assets Net Charge-Offs (NCO) / Average Loans Includes loans 90+ days past due which are not highlighted in the table. Excludes Bank owned branch assets, totaling $1.0M, classified as Other Real Estate Owned within the Statements of Condition.

Credit Quality 14 Total Reserve Ratio Classified Assets Nonaccrual Detail

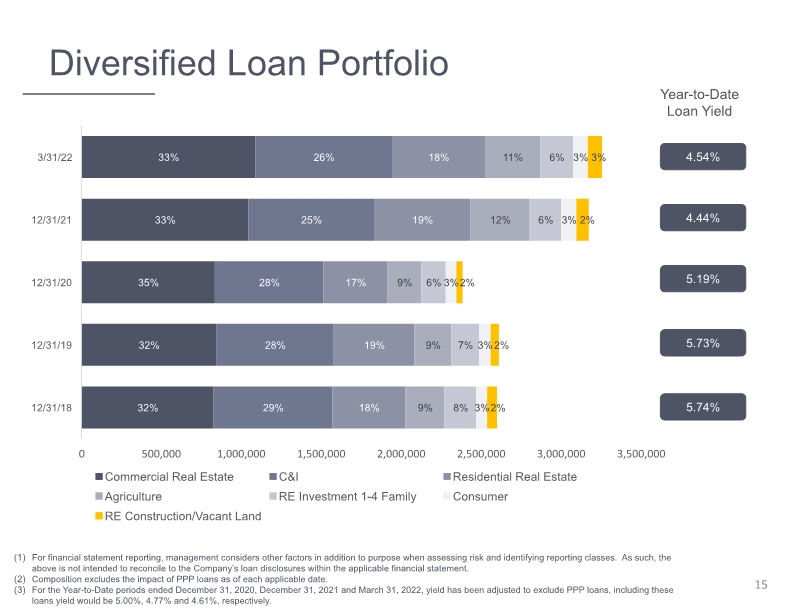

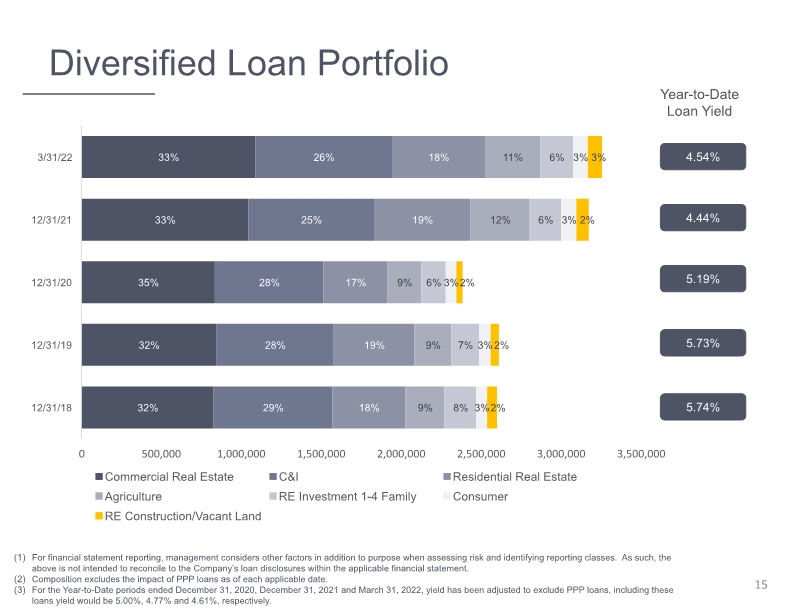

Diversified Loan Portfolio 15 Year-to-Date Loan Yield 4.44% 5.19% 5.73% 5.74% For financial statement reporting, management considers other factors in addition to purpose when assessing risk and identifying reporting classes. As such, the above is not intended to reconcile to the Company’s loan disclosures within the applicable financial statement. Composition excludes the impact of PPP loans as of each applicable date. For the Year-to-Date periods ended December 31, 2020, December 31, 2021 and March 31, 2022, yield has been adjusted to exclude PPP loans, including these loans yield would be 5.00%, 4.77% and 4.61%, respectively. 4.54%

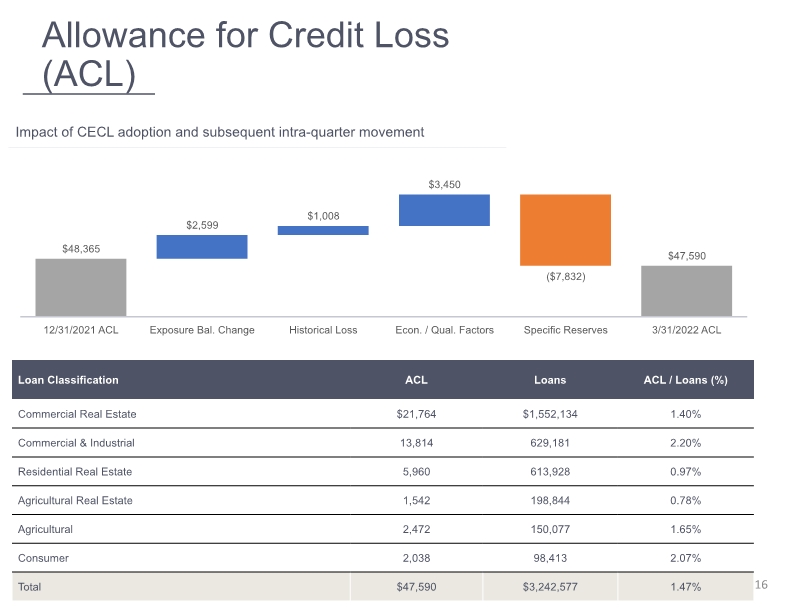

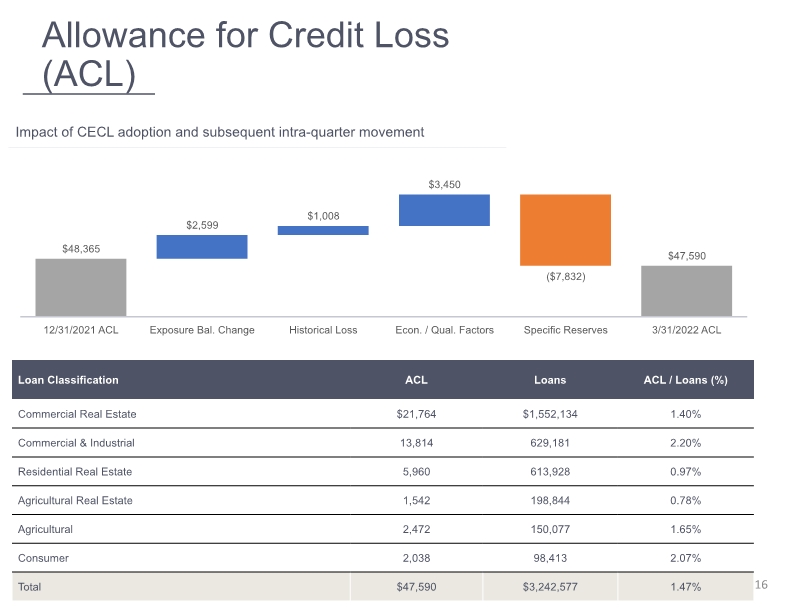

Allowance for Credit Loss (ACL) 16 Impact of CECL adoption and subsequent intra-quarter movement

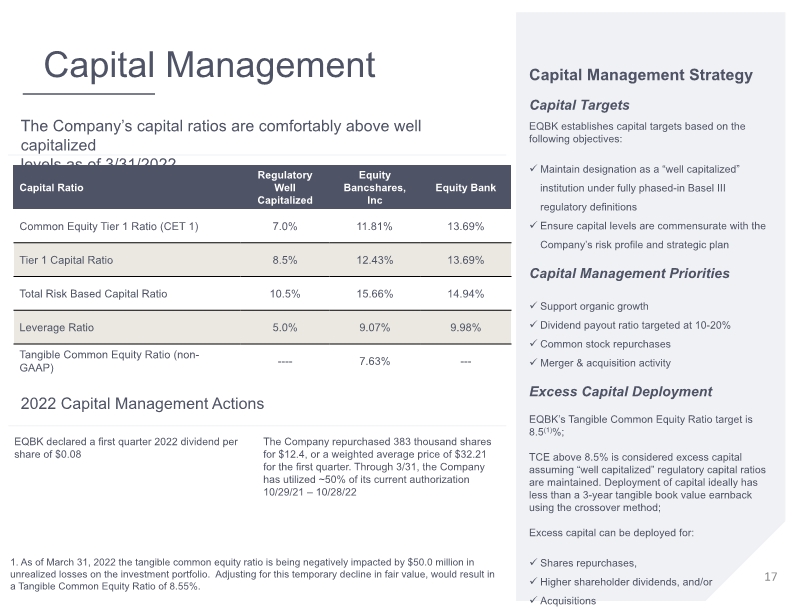

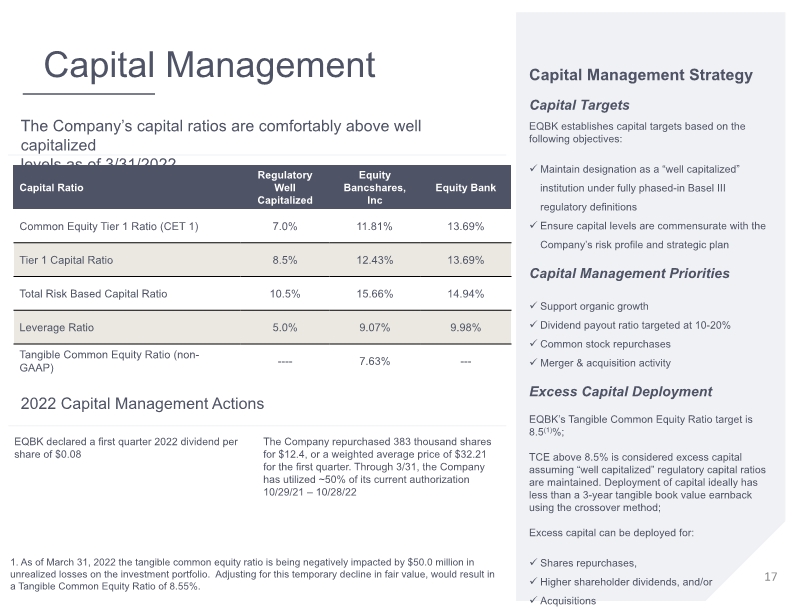

Capital Management 17 Capital Management Strategy Capital Targets EQBK establishes capital targets based on the following objectives: Maintain designation as a “well capitalized” institution under fully phased-in Basel III regulatory definitions Ensure capital levels are commensurate with the Company’s risk profile and strategic plan Capital Management Priorities Support organic growth Dividend payout ratio targeted at 10-20% Common stock repurchases Merger & acquisition activity Excess Capital Deployment EQBK’s Tangible Common Equity Ratio target is 8.5(1)%; TCE above 8.5% is considered excess capital assuming “well capitalized” regulatory capital ratios are maintained. Deployment of capital ideally has less than a 3-year tangible book value earnback using the crossover method; Excess capital can be deployed for: Shares repurchases, Higher shareholder dividends, and/or Acquisitions The Company’s capital ratios are comfortably above well capitalized levels as of 3/31/2022 2022 Capital Management Actions 1. As of March 31, 2022 the tangible common equity ratio is being negatively impacted by $50.0 million in unrealized losses on the investment portfolio. Adjusting for this temporary decline in fair value, would result in a Tangible Common Equity Ratio of 8.55%.

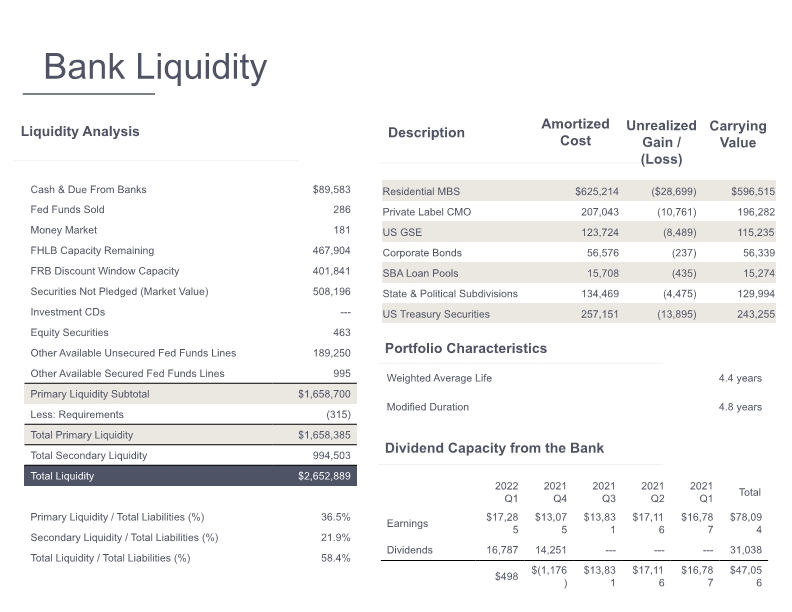

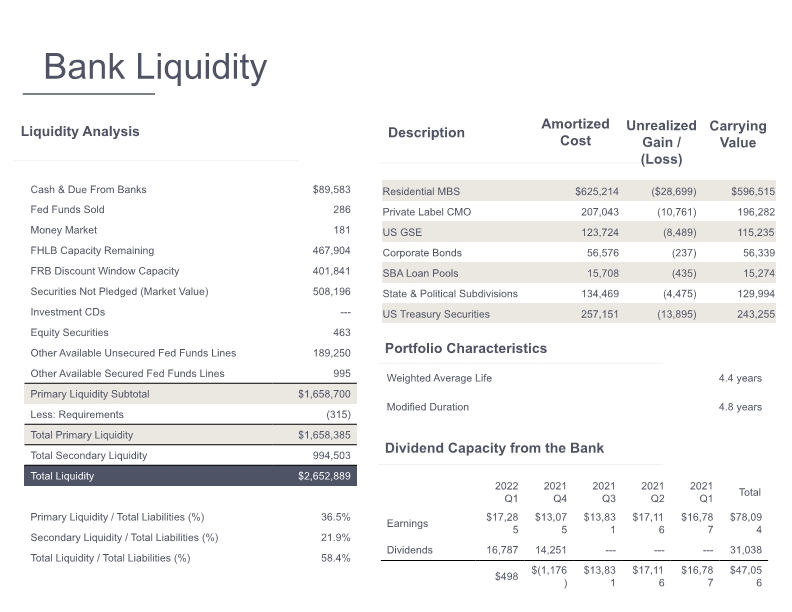

Bank Liquidity 18 Liquidity Analysis Portfolio Characteristics Dividend Capacity from the Bank Description Amortized Cost Unrealized Gain / (Loss) Carrying Value

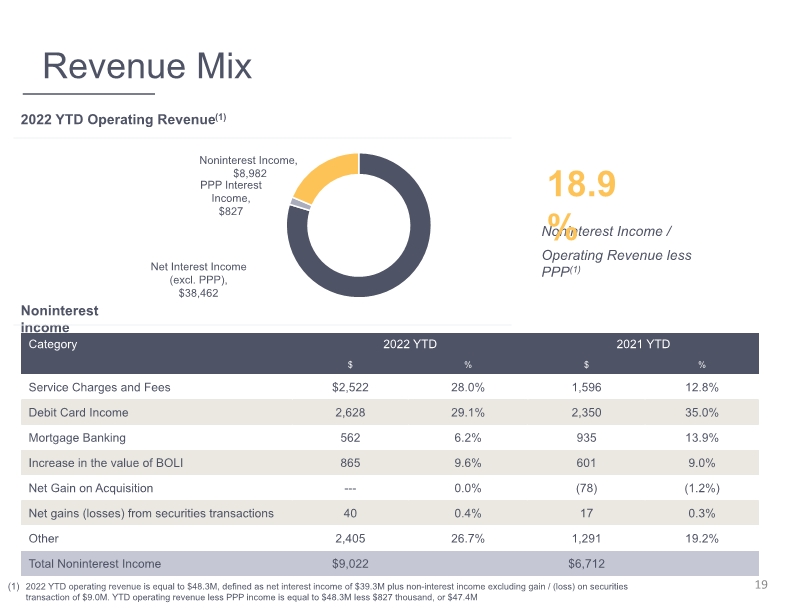

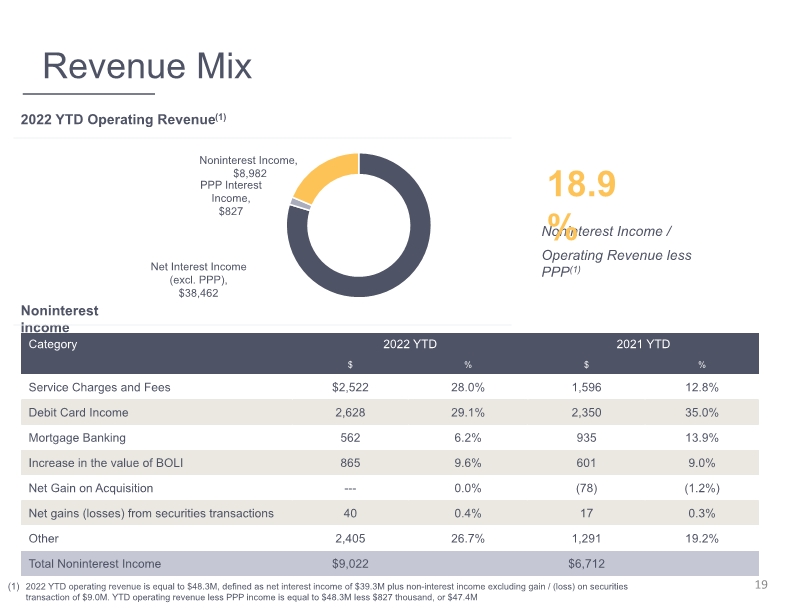

Revenue Mix 19 2022 YTD Operating Revenue(1) Noninterest Income 18.9% 2022 YTD operating revenue is equal to $48.3M, defined as net interest income of $39.3M plus non-interest income excluding gain / (loss) on securities transaction of $9.0M. YTD operating revenue less PPP income is equal to $48.3M less $827 thousand, or $47.4M

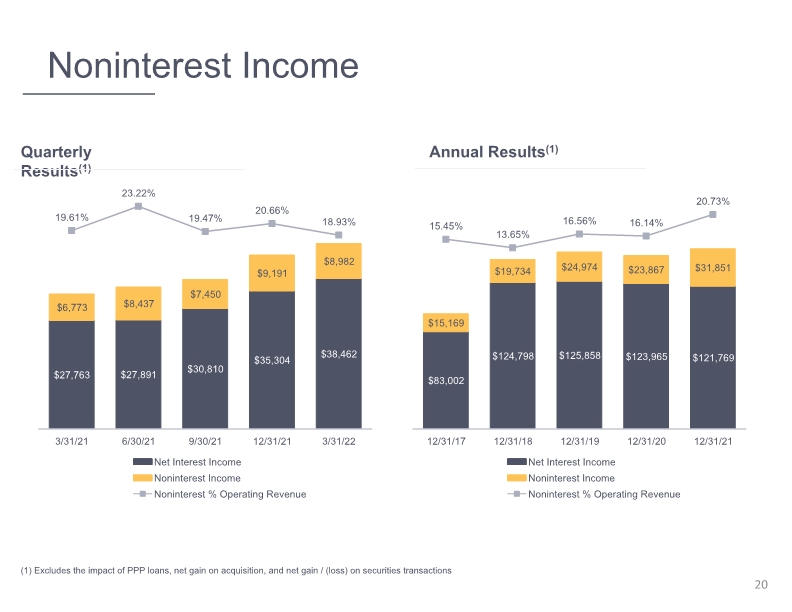

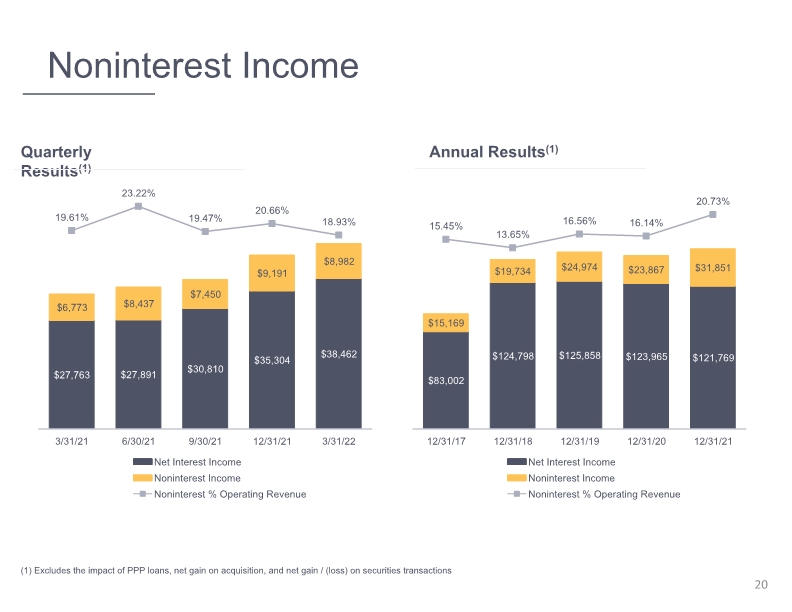

Noninterest Income 20 Quarterly Results(1) (1) Excludes the impact of PPP loans, net gain on acquisition, and net gain / (loss) on securities transactions Annual Results(1)

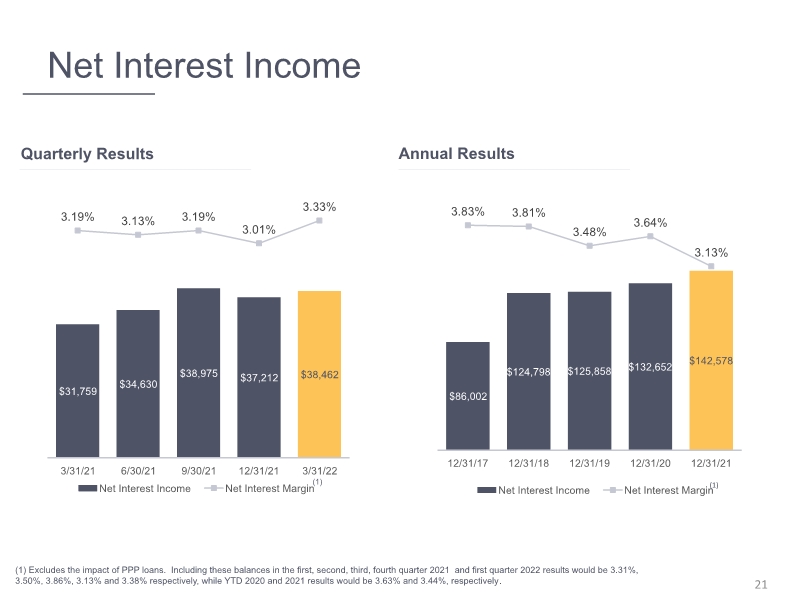

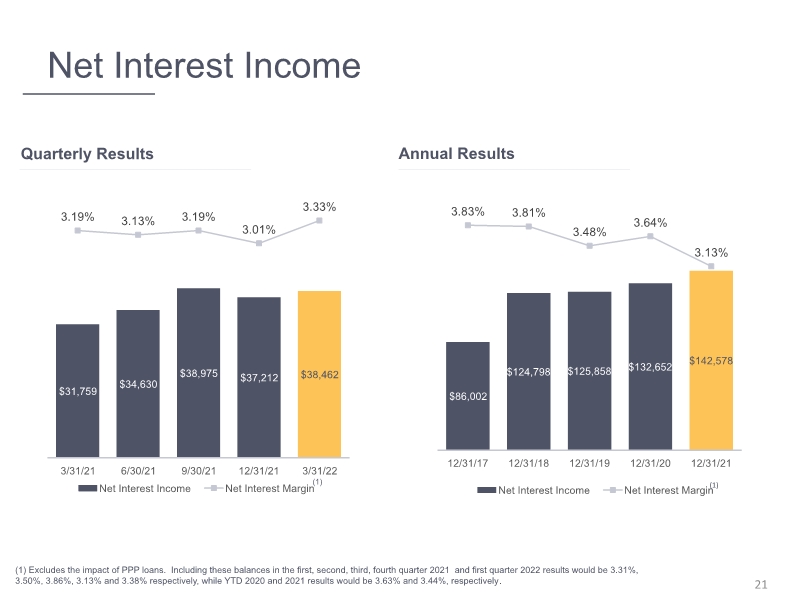

Net Interest Income 21 Quarterly Results Annual Results (1) Excludes the impact of PPP loans. Including these balances in the first, second, third, fourth quarter 2021 and first quarter 2022 results would be 3.31%, 3.50%, 3.86%, 3.13% and 3.38% respectively, while YTD 2020 and 2021 results would be 3.63% and 3.44%, respectively. (1) (1)

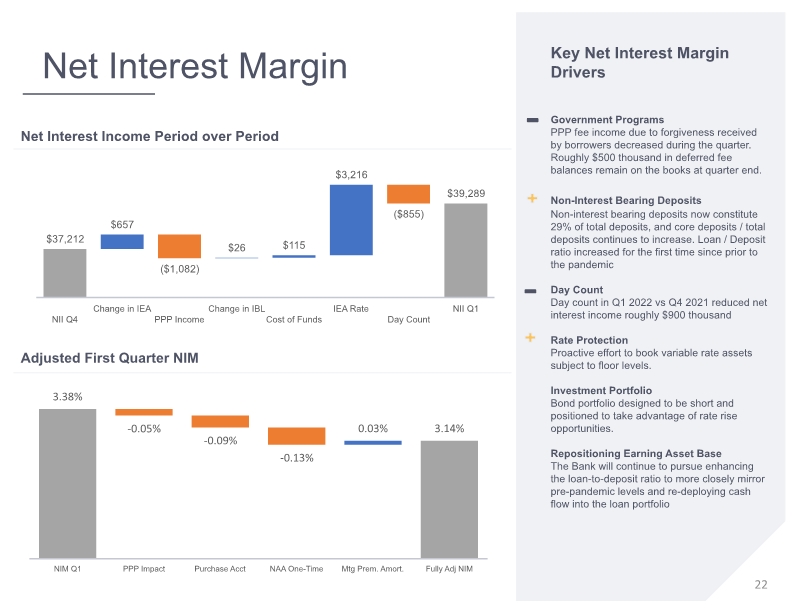

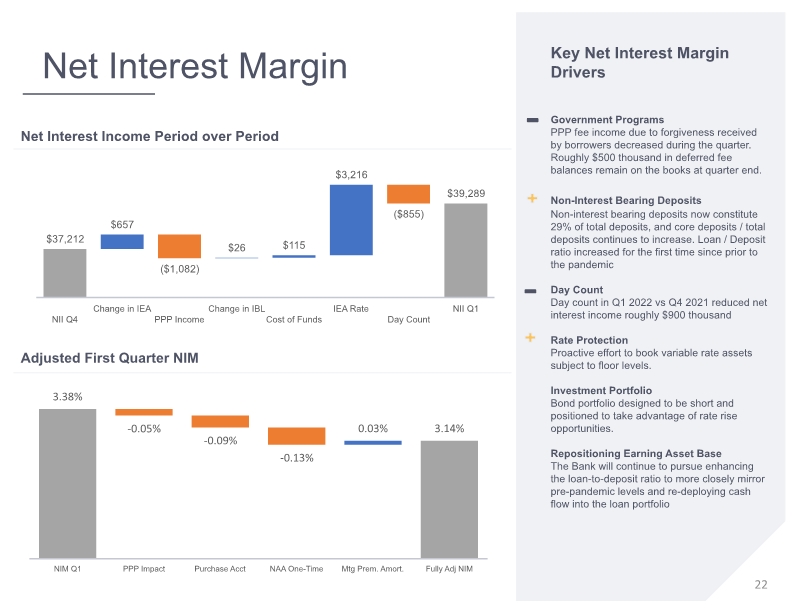

Net Interest Margin 22 Key Net Interest Margin Drivers Government Programs PPP fee income due to forgiveness received by borrowers decreased during the quarter. Roughly $500 thousand in deferred fee balances remain on the books at quarter end. Non-Interest Bearing Deposits Non-interest bearing deposits now constitute 29% of total deposits, and core deposits / total deposits continues to increase. Loan / Deposit ratio increased for the first time since prior to the pandemic Day Count Day count in Q1 2022 vs Q4 2021 reduced net interest income roughly $900 thousand Rate Protection Proactive effort to book variable rate assets subject to floor levels. Investment Portfolio Bond portfolio designed to be short and positioned to take advantage of rate rise opportunities. Repositioning Earning Asset Base The Bank will continue to pursue enhancing the loan-to-deposit ratio to more closely mirror pre-pandemic levels and re-deploying cash flow into the loan portfolio Net Interest Income Period over Period Adjusted First Quarter NIM

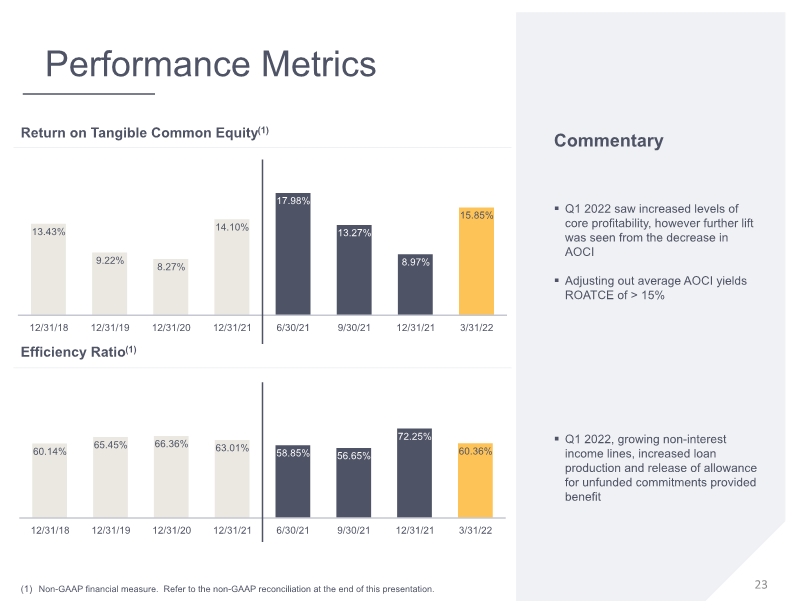

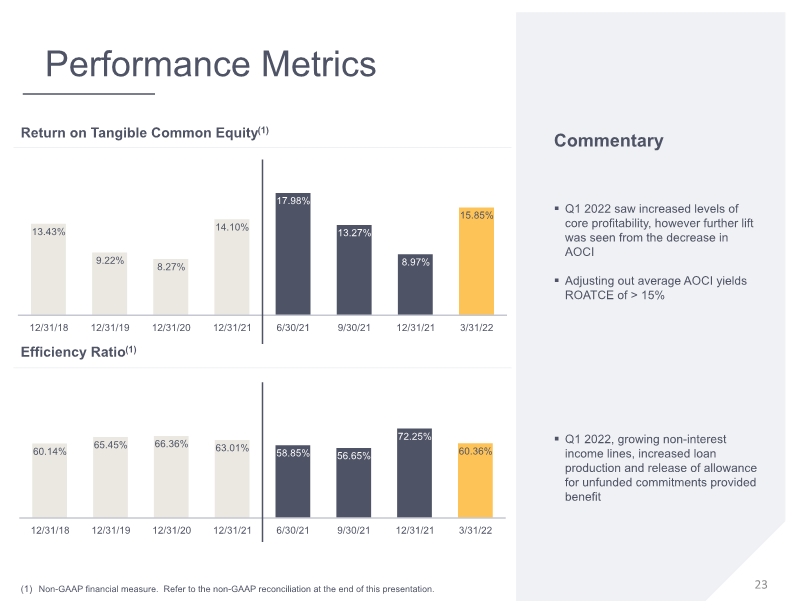

Performance Metrics 23 Commentary Q1 2022 saw increased levels of core profitability, however further lift was seen from the decrease in AOCI Adjusting out average AOCI yields ROATCE of > 15% Q1 2022, growing non-interest income lines, increased loan production and release of allowance for unfunded commitments provided benefit Return on Tangible Common Equity(1) Efficiency Ratio(1) Non-GAAP financial measure. Refer to the non-GAAP reconciliation at the end of this presentation.

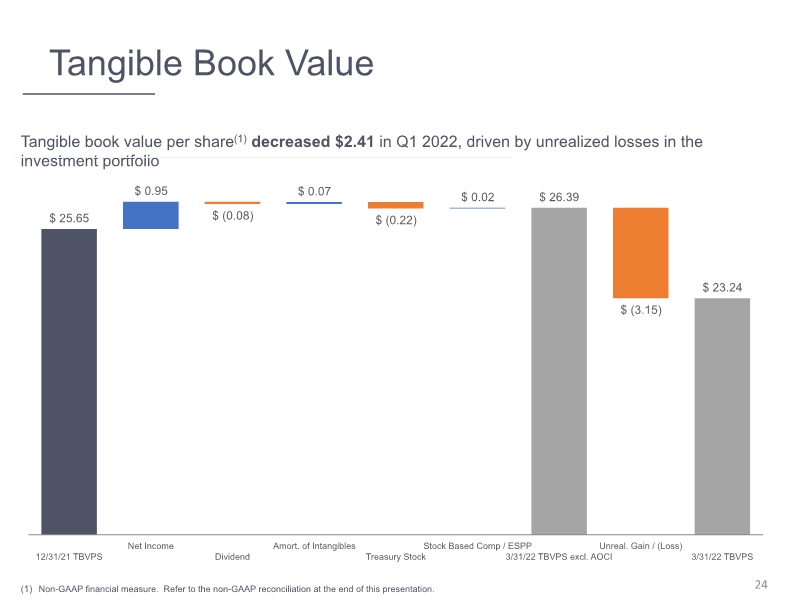

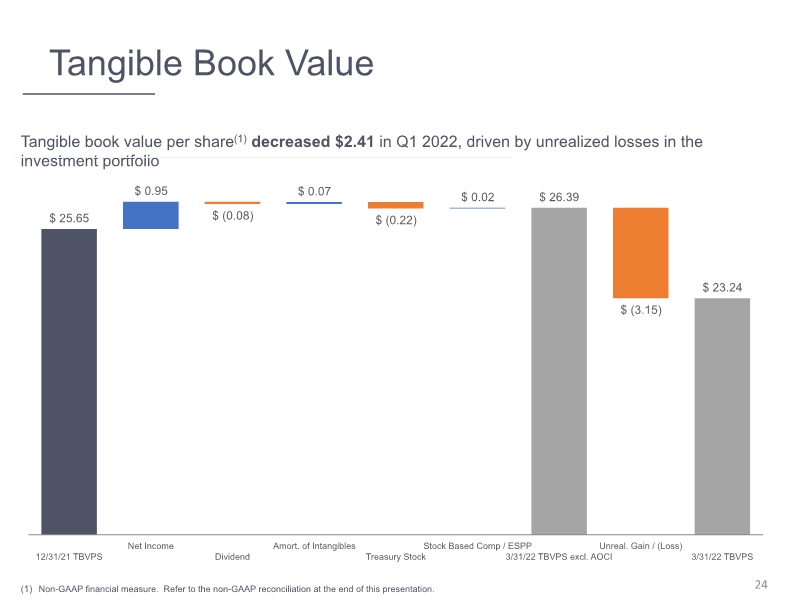

Tangible Book Value 24 Tangible book value per share(1) decreased $2.41 in Q1 2022, driven by unrealized losses in the investment portfolio Non-GAAP financial measure. Refer to the non-GAAP reconciliation at the end of this presentation.

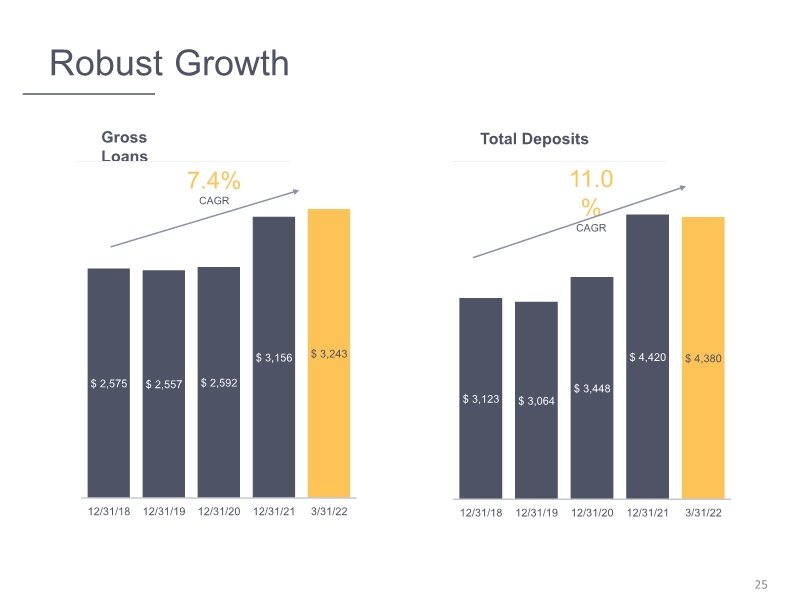

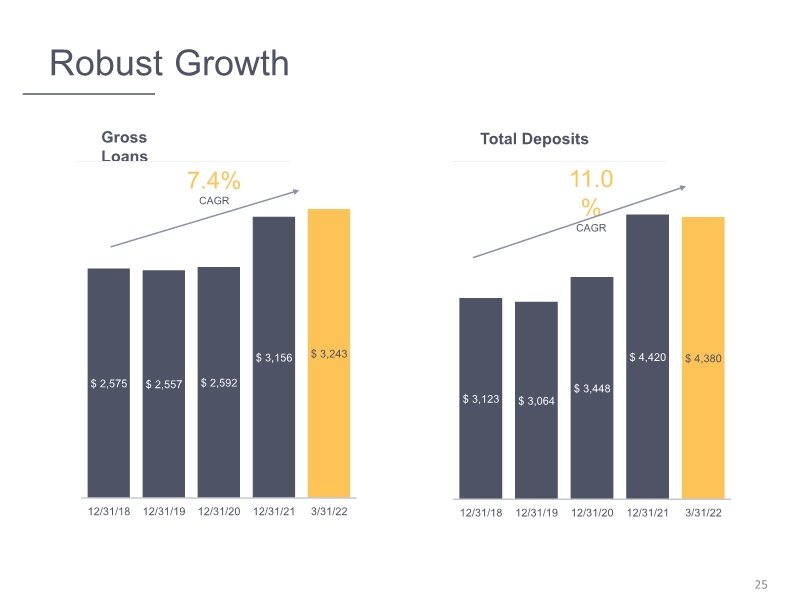

Robust Growth 25 Gross Loans 7.4% CAGR Total Deposits 11.0% CAGR

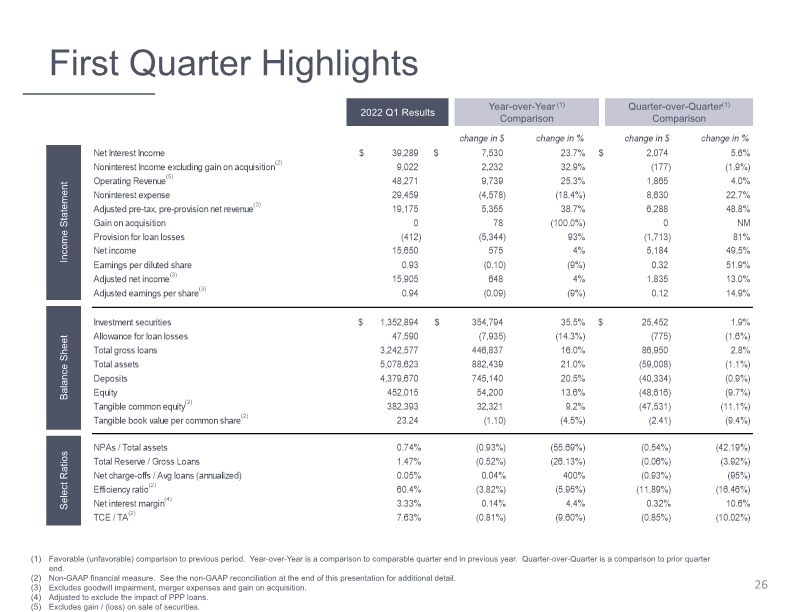

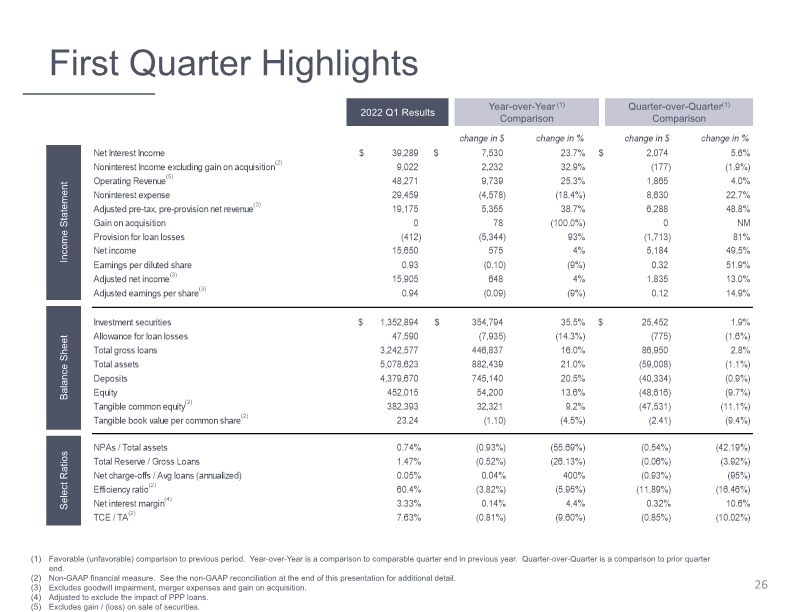

First Quarter Highlights 26 Favorable (unfavorable) comparison to previous period. Year-over-Year is a comparison to comparable quarter end in previous year. Quarter-over-Quarter is a comparison to prior quarter end. Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation for additional detail. Excludes goodwill impairment, merger expenses and gain on acquisition. Adjusted to exclude the impact of PPP loans. Excludes gain / (loss) on sale of securities.

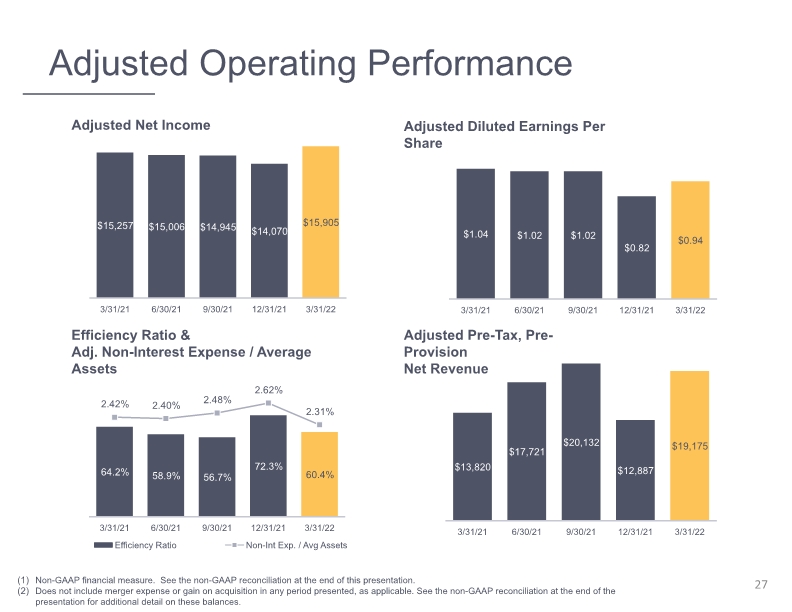

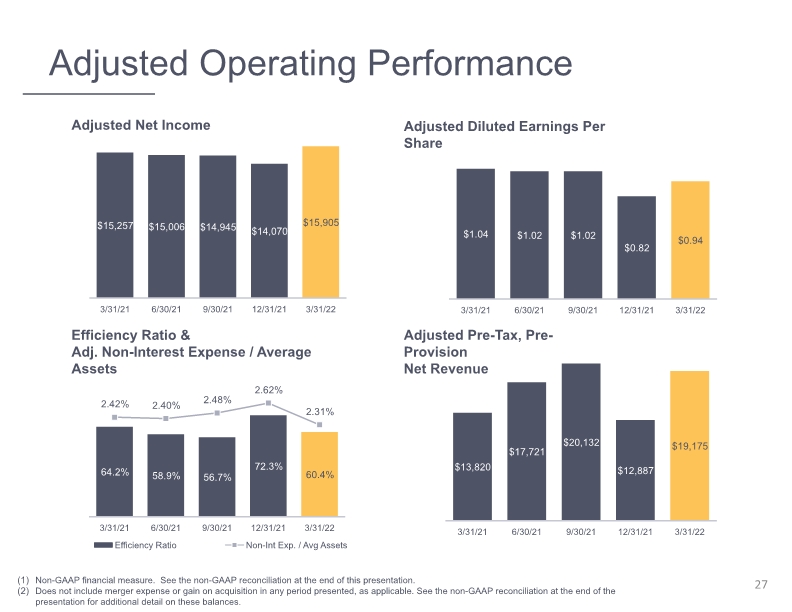

Adjusted Operating Performance 27 Adjusted Net Income Adjusted Diluted Earnings Per Share Efficiency Ratio & Adj. Non-Interest Expense / Average Assets Adjusted Pre-Tax, Pre-Provision Net Revenue Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Does not include merger expense or gain on acquisition in any period presented, as applicable. See the non-GAAP reconciliation at the end of the presentation for additional detail on these balances.

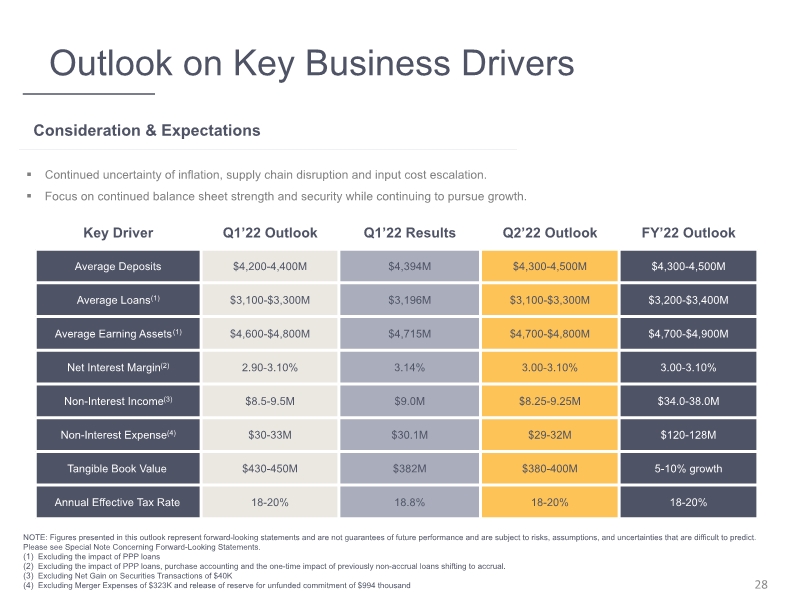

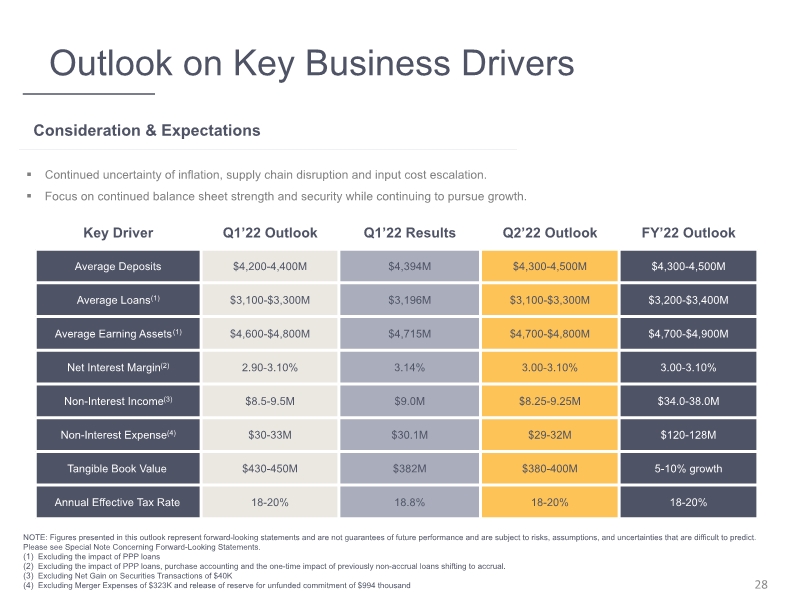

Outlook on Key Business Drivers 28 Consideration & Expectations Continued uncertainty of inflation, supply chain disruption and input cost escalation. Focus on continued balance sheet strength and security while continuing to pursue growth. NOTE: Figures presented in this outlook represent forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Please see Special Note Concerning Forward-Looking Statements. Excluding the impact of PPP loans Excluding the impact of PPP loans, purchase accounting and the one-time impact of previously non-accrual loans shifting to accrual. Excluding Net Gain on Securities Transactions of $40K Excluding Merger Expenses of $323K and release of reserve for unfunded commitment of $994 thousand

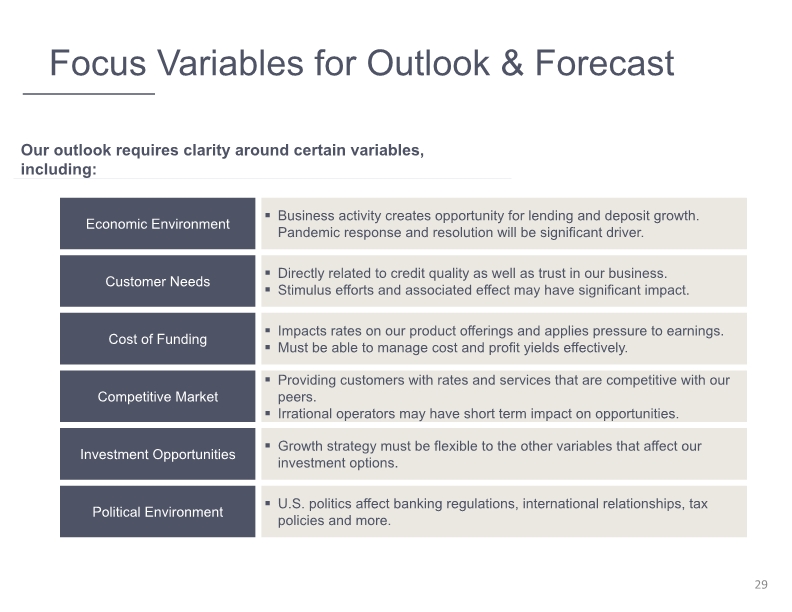

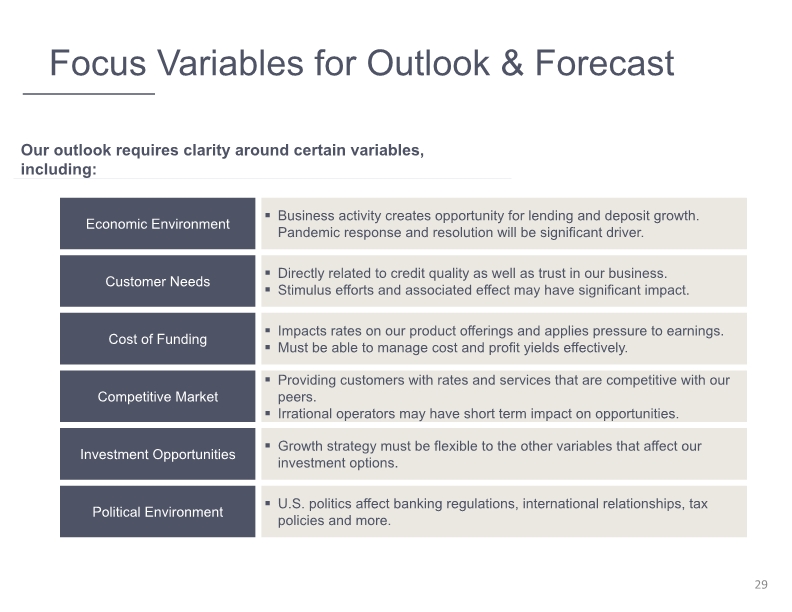

Focus Variables for Outlook & Forecast 29 Our outlook requires clarity around certain variables, including:

30 Appendix

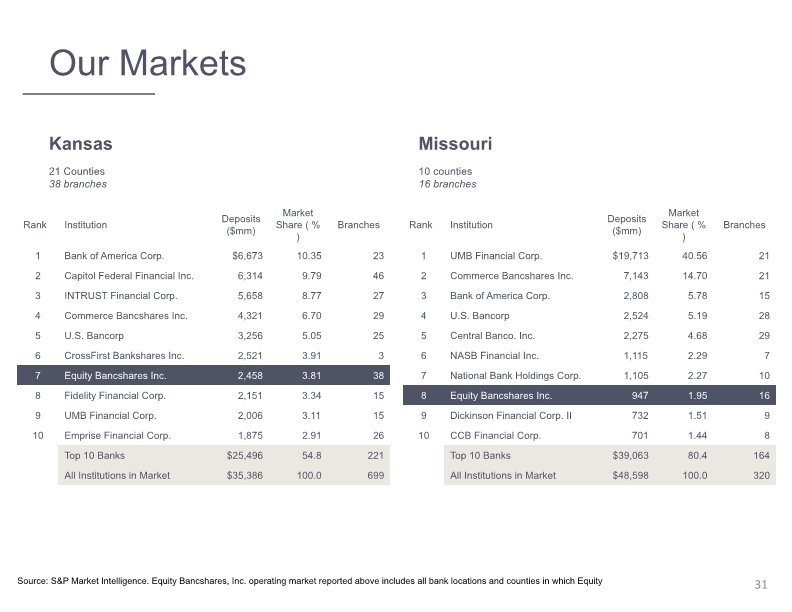

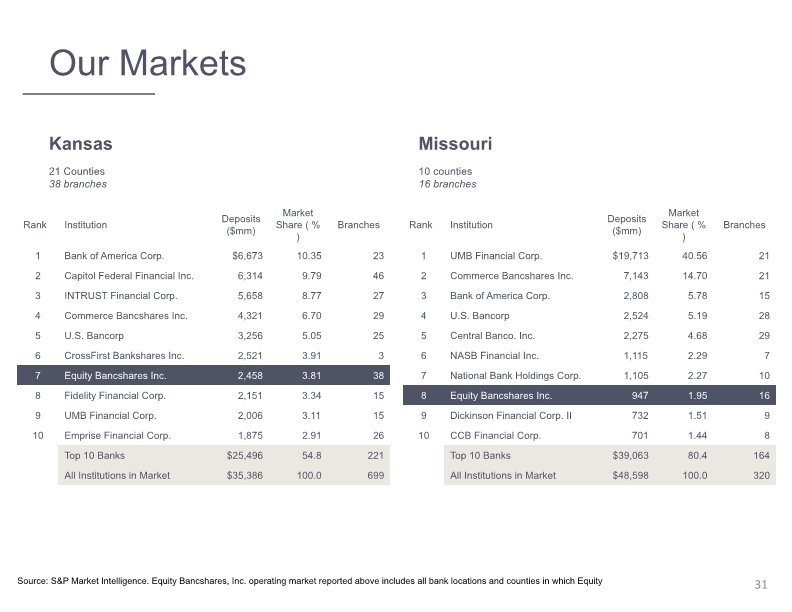

Our Markets 31 Missouri 10 counties 16 branches Kansas 21 Counties 38 branches Source: S&P Market Intelligence. Equity Bancshares, Inc. operating market reported above includes all bank locations and counties in which Equity

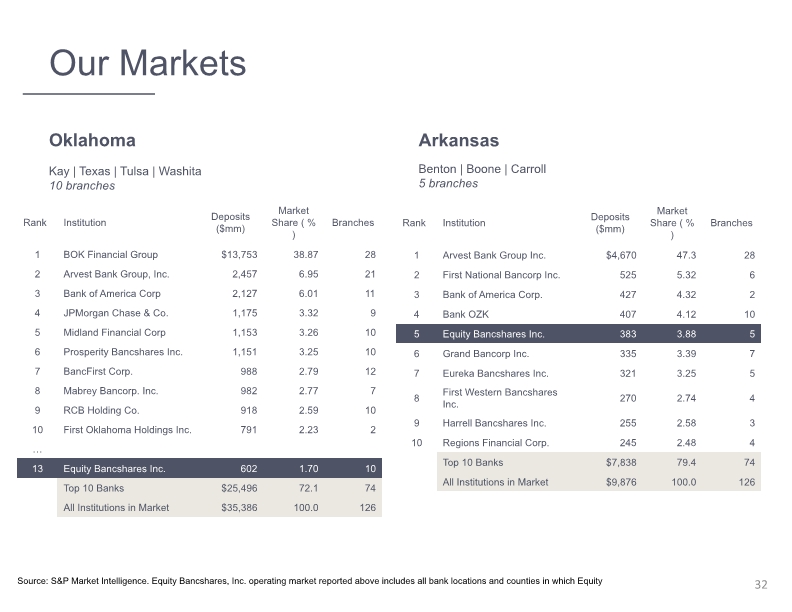

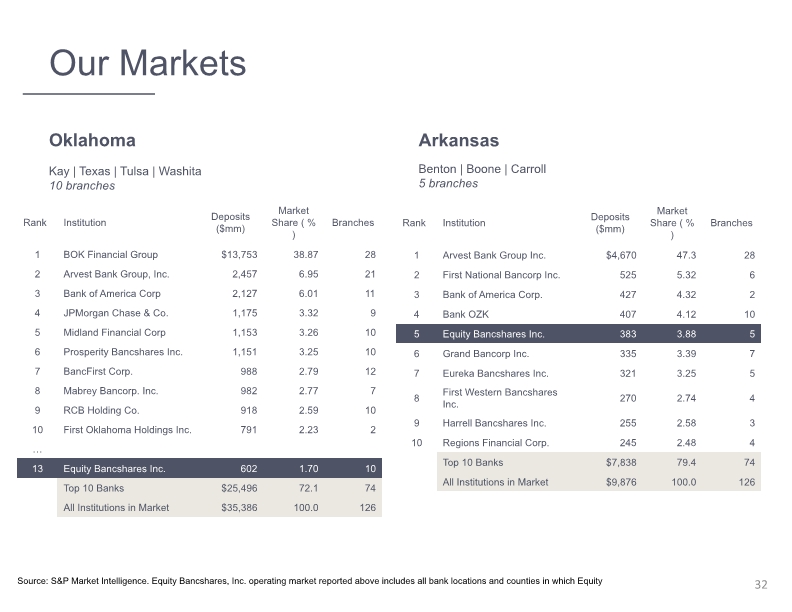

Our Markets 32 Arkansas Benton | Boone | Carroll 5 branches Oklahoma Kay | Texas | Tulsa | Washita 10 branches Source: S&P Market Intelligence. Equity Bancshares, Inc. operating market reported above includes all bank locations and counties in which Equity

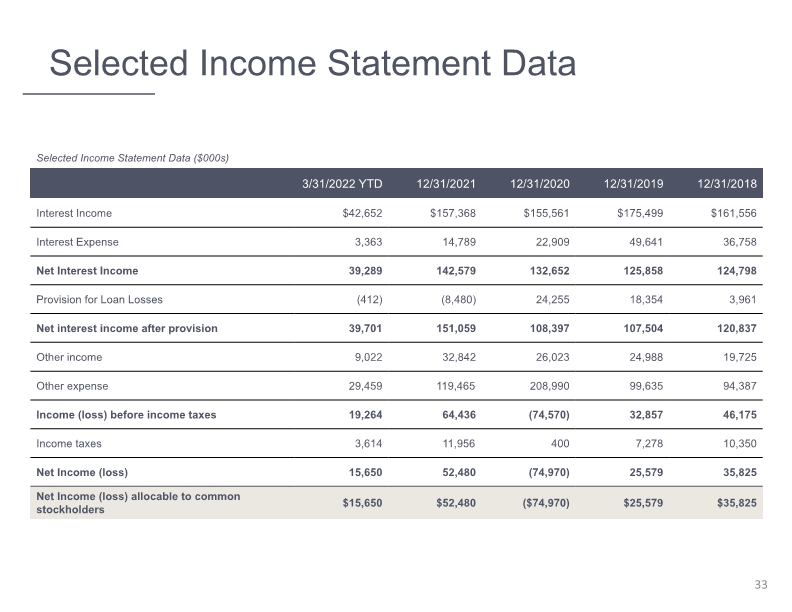

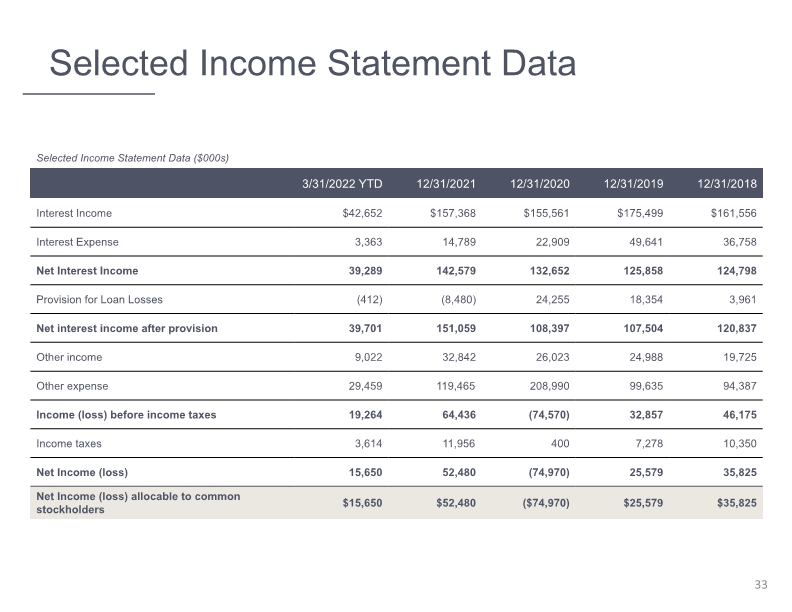

Selected Income Statement Data 33

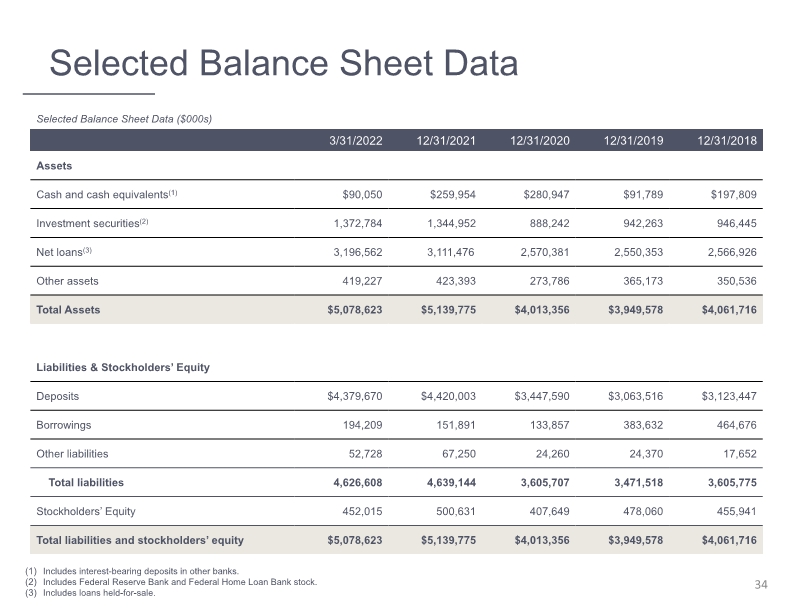

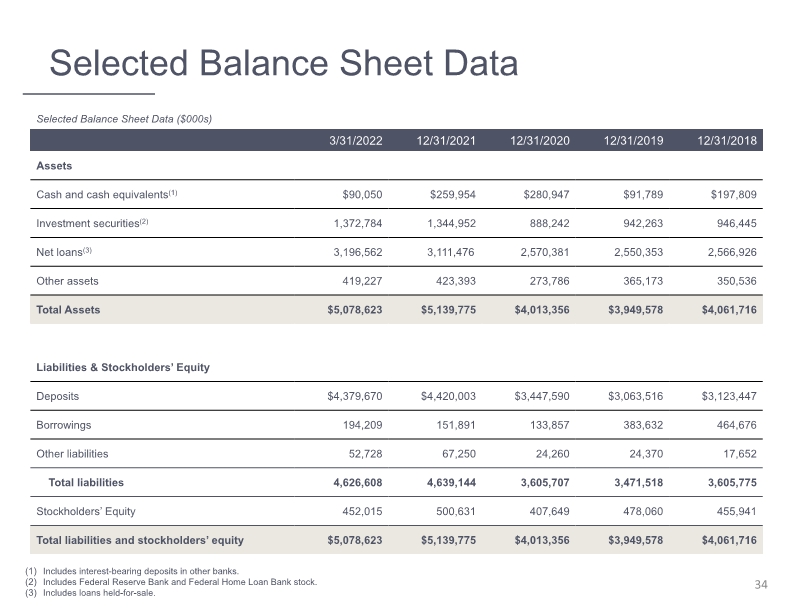

Selected Balance Sheet Data 34 Includes interest-bearing deposits in other banks. Includes Federal Reserve Bank and Federal Home Loan Bank stock. Includes loans held-for-sale.

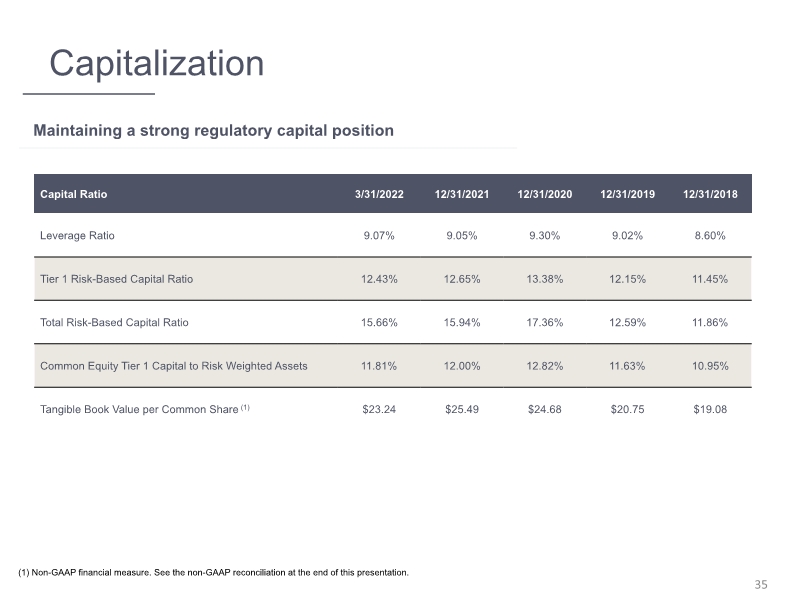

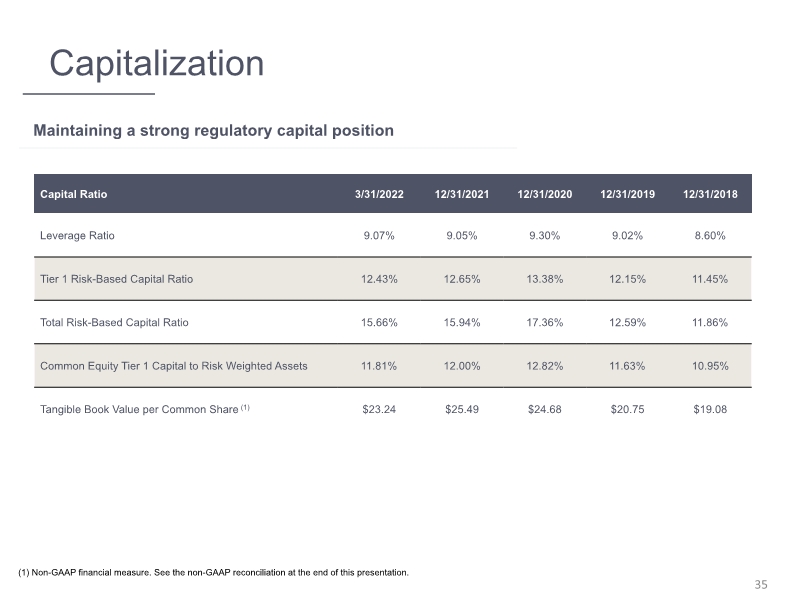

Capitalization 35 (1) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Maintaining a strong regulatory capital position

36 The subsequent tables present non-GAAP reconciliations of the following calculations: Tangible Common Equity (TCE) to Tangible Assets (TA) Ratio Tangible Book Value per Common Share Return on Average Tangible Common Equity (ROATCE) Efficiency Ratio

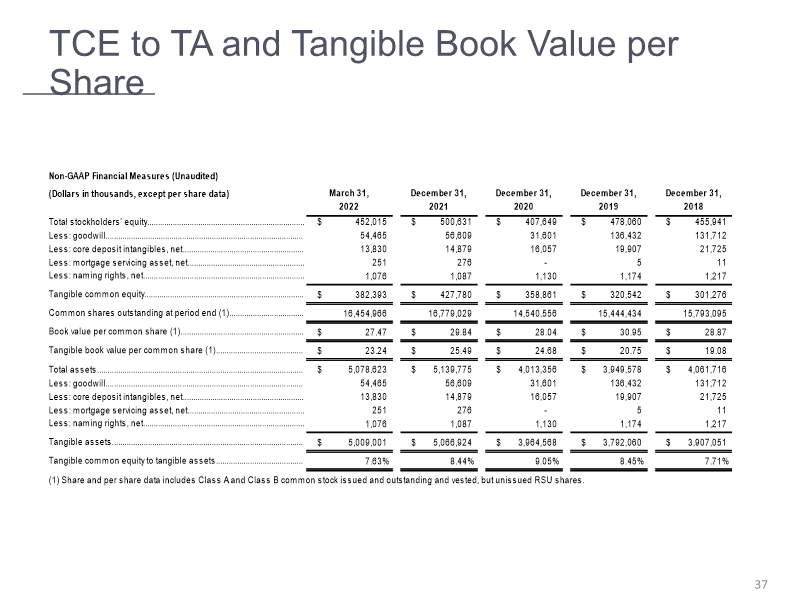

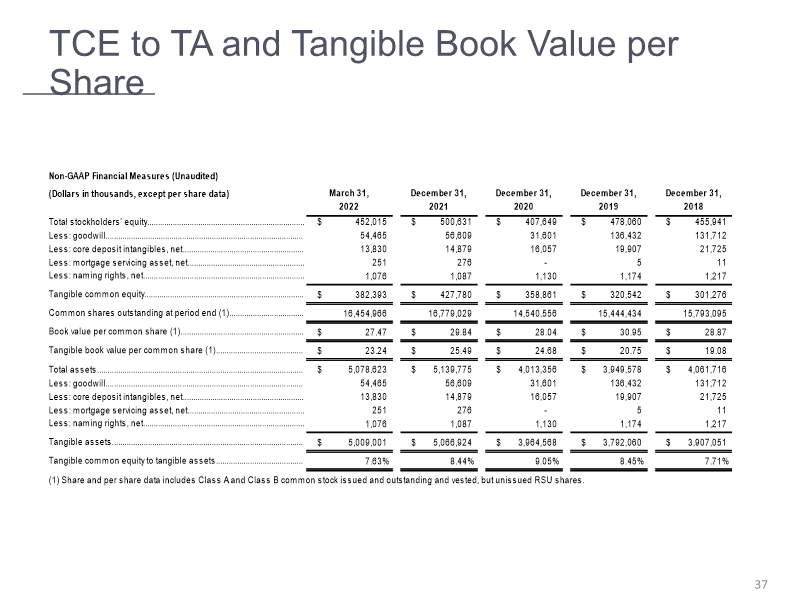

37 TCE to TA and Tangible Book Value per Share

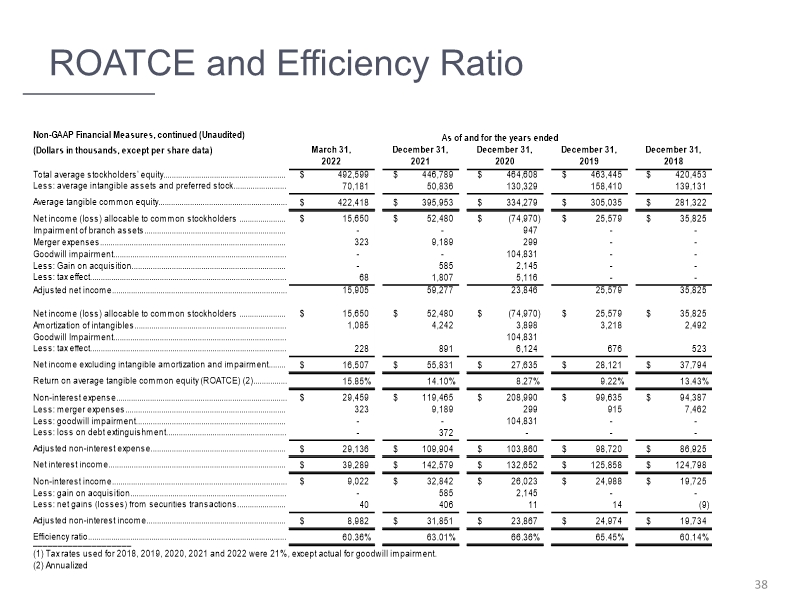

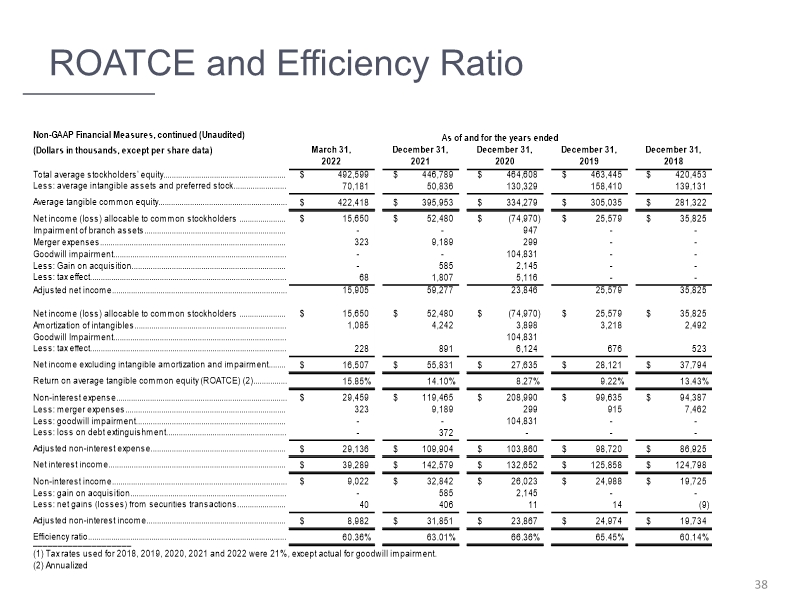

38 ROATCE and Efficiency Ratio

investor.equitybank.com