Exhibit 99.2 COMPANY PRESENTATION NASDAQ: STIM November 2024 Now FDA-Cleared as an Adjunct Therapy for Ages 15 to 21!

Forward Looking Statements This presentation contains estimates and other statistical data prepared by independent parties and by Neuronetics, Inc. (“Neuronetics” or the “Company”) relating to market size and growth and other data about the industry in which the Company operates. These estimates and data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates and data. Certain statements in this presentation, including the documents incorporated by reference herein, include “forward-looking statements” within the meaning of U.S. federal securities laws. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words or expressions such as “expect”, “anticipate”, “intend”, “plan”, “believe”, “estimate”, “may”, “will”, “project”, “could”, “should”, “would”, “seek”, “forecast”, “expect”, “anticipate”, “predict”, “outlook”, “potential”, or other similar expressions, including without limitation the negative of these terms. Forward-looking statements represent current judgments about possible future events, including, but not limited to statements regarding expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs relating to the proposed transaction between Greenbrook TMS Inc. (“Greenbrook” or “Greenbrook TMS”) and Neuronetics, such as statements regarding the combined operations and prospects of Greenbrook and Neuronetics, estimates of pro forma financial information of the combined company, the current and projected market, growth opportunities and synergies for the combined company, federal and state regulatory tailwinds, the expected cash balance of Greenbrook at the time of the closing of the proposed Arrangement (as such term is defined in the Neuronetics definitive proxy statement), expectations regarding Neuronetics’ ability to leverage Greenbrook’s assets, the expected composition of the management and the board of directors of the combined company, gross margin and future profitability expectations, and the timing and completion of the Arrangement, including the satisfaction or waiver of all the required conditions thereto. These forward-looking statements are based upon the current beliefs and expectations of the management of Neuronetics and are subject to known and unknown risks and uncertainties. Factors that could cause actual events to differ include, but are not limited to: • the inherent uncertainty associated with financial or other projections or outlooks, including due to the unpredictability of the underlying assumptions, adjustments and estimates; • Neuronetics’ ability to maintain the listing requirements of Nasdaq; • the total addressable market of Neuronetics’ and Greenbrook’s businesses; • general economic conditions in the markets where Neuronetics and Greenbrook operate; • the expected timing of any regulatory approvals relating to the Arrangement, the businesses of Greenbrook and Neuronetics and of the combined company and product launches of such businesses and companies; • the non-performance of third-party vendors and contractors; • the risks related to the combined company’s ability to successfully sell its products and the market reception to and performance of its products; • Greenbrook’s, Neuronetics’, and the combined company’s compliance with, and changes to, applicable laws and regulations; • the combined company’s limited operating history; • the combined company’s ability to manage growth; • the combined company’s ability to obtain additional or suitable financing; • the combined company’s ability to expand product offerings; • the combined company’s ability to compete with others in its industry; • the combined company’s ability to protect its intellectual property; • the retention of employees of Greenbrook and Neuronetics following the announcement of the Arrangement; 2

Forward Looking Statements (continued) • Greenbrook’s, Neuronetics’, and the combined company’s ability to defend against legal proceedings; • the combined company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; • the combined company’s ability to achieve the expected benefits from the Arrangement within the expected time frames or at all; • the incurrence of unexpected costs, liabilities or delays relating to the proposed Arrangement; • the satisfaction (or waiver) of closing conditions to the consummation of the Arrangement; • the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Arrangement Agreement (as such term is defined in the Neuronetics definitive proxy statement); • the disruption of the attention of management of Greenbrook and Neuronetics from ongoing business operations due to the Arrangement Agreement; • the outcome of any legal proceedings related to the Arrangement Agreement; • the fact that the trading price of the Greenbrook Shares or the Neuronetics Shares may decline significantly if the Arrangement is not completed; • the effect of the announcement or pendency of the transaction on the combined company’s business relationships, operating results and business generally; and • other economic, business, competitive, and regulatory factors affecting the businesses of the companies generally, including, but not limited to, those set forth in Greenbrook’s filings with the SEC and the Canadian Securities Administrators, including in the “Risk Factors” section of the Greenbrook 10-K and any subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”) and the Canadian Securities Administrators, and those set forth in Neuronetics’ filings with the SEC, including in the “Risk Factors” section of Neuronetics’ Annual Report on Form 10-K filed with the SEC on March 8, 2024 and any subsequent SEC filings. These documents with respect to Greenbrook can be accessed on Greenbrook’s website at https://www.greenbrooktms.com/investor-relations, on Greenbrook’s SEDAR+ profile at www.sedarplus.ca or on Greenbrook’s EDGAR profile at www.sec.gov and these documents with respect to Neuronetics can be accessed on Neuronetics’ website at https://ir.neuronetics.com/ or on Neuronetics’ EDGAR profile at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or, if any of them do, what impact they will have on the results of operations and financial condition of Greenbrook, Neuronetics or the combined company. Forward-looking statements speak only as of the date they are made, and Greenbrook, Neuronetics and the combined company undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors that affect the subject of these statements, except where they are expressly required to do so by law. Projections and estimates used in this presentation are considered forward looking statements. See cautionary statement above regarding forward-looking statements. Forward-looking information representing post-closing expectations is inherently uncertain. Estimates such as expected accretion, expected future production, internal rate of return, financial flexibility and balance sheet strength are preliminary in nature. There can be no assurance that the proposed Arrangement will close or that the forward-looking information will prove to be accurate. 3

n e u r o s t a r . c o m Presenters 38+ years of experience 37+ years of experience Keith Sullivan Steve Furlong President & Executive Vice President, Chief Executive Officer Chief Financial Officer & Treasurer 4

NeuroStar is Renewing Lives by Transforming Neurohealth We’re inspired every day by the opportunity to help people live more fulfilling lives 1 Market Leader in TMS Dedicated to Practice Success #1 Physician recommended Largest direct sales and with over 6.9 million treatment customer support team in the sessions performed in over industry to support over 1,100 1 188,000 patients U.S. offices Robust R&D Pipeline Widely Reimbursed rd 3 generation system. Largest Dedicated to driving health policy clinical dataset in the world to to ensure broad US reimbursement drive new indications among commercial and government payors 5 1 Data on file, Neuronetics, Inc.

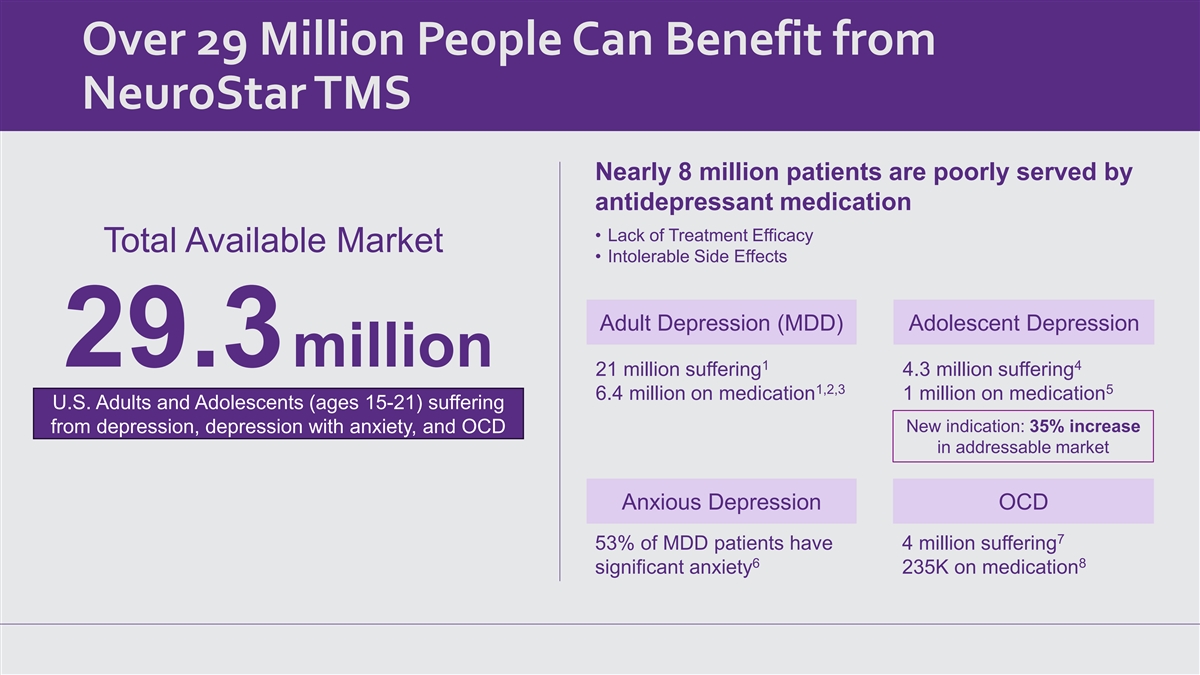

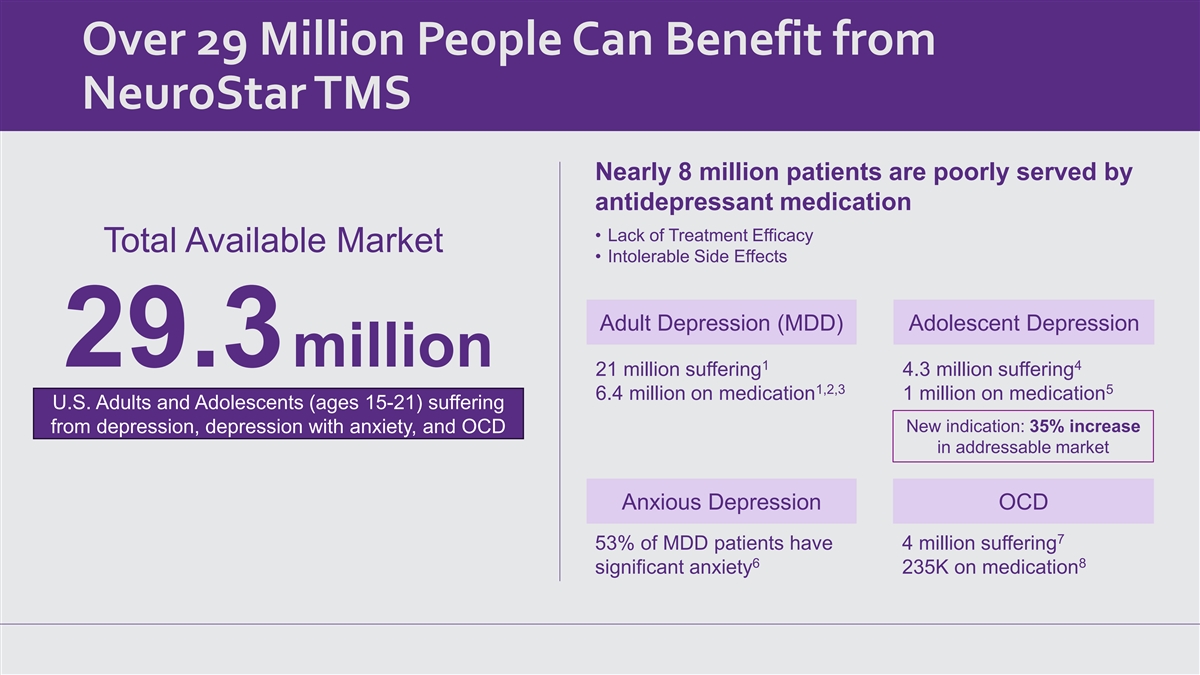

Over 29 Million People Can Benefit from NeuroStar TMS Nearly 8 million patients are poorly served by antidepressant medication • Lack of Treatment Efficacy Total Available Market • Intolerable Side Effects Adult Depression (MDD) Adolescent Depression 29.3million 1 4 21 million suffering 4.3 million suffering 1,2,3 5 6.4 million on medication 1 million on medication U.S. Adults and Adolescents (ages 15-21) suffering New indication: 35% increase from depression, depression with anxiety, and OCD in addressable market Anxious Depression OCD 7 53% of MDD patients have 4 million suffering 6 8 significant anxiety 235K on medication

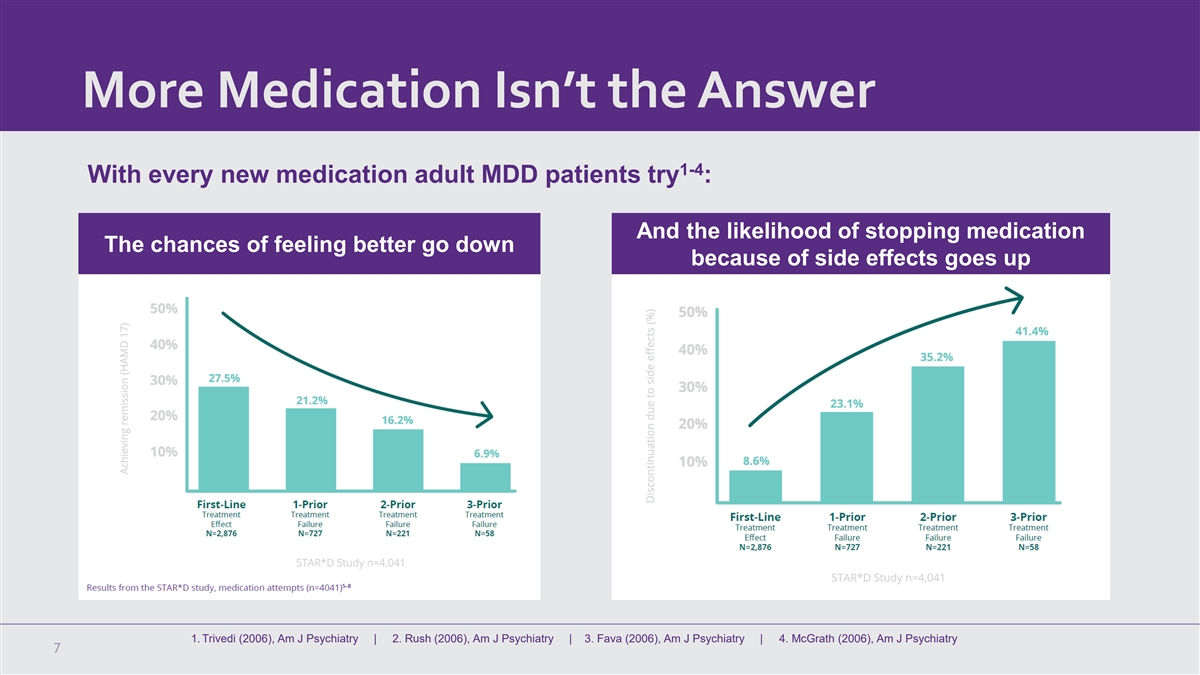

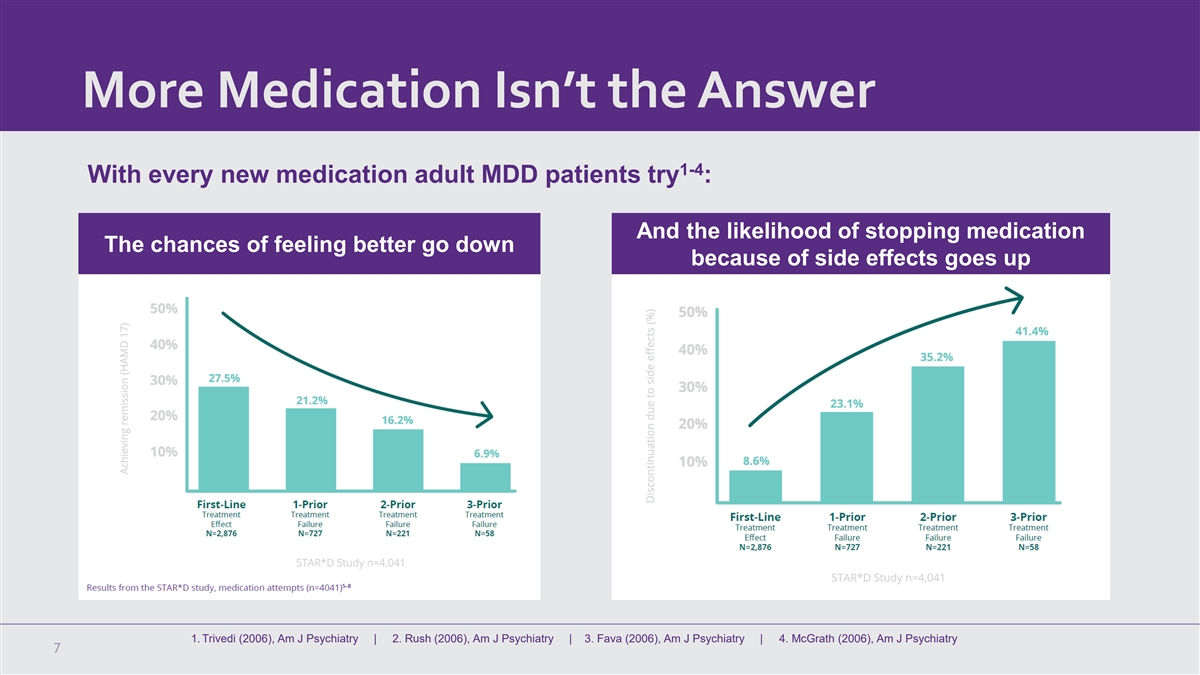

More Medication Isn’t the Answer 1-4 With every new medication adult MDD patients try : And the likelihood of stopping medication The chances of feeling better go down because of side effects goes up 1. Trivedi (2006), Am J Psychiatry | 2. Rush (2006), Am J Psychiatry | 3. Fava (2006), Am J Psychiatry | 4. McGrath (2006), Am J Psychiatry 7

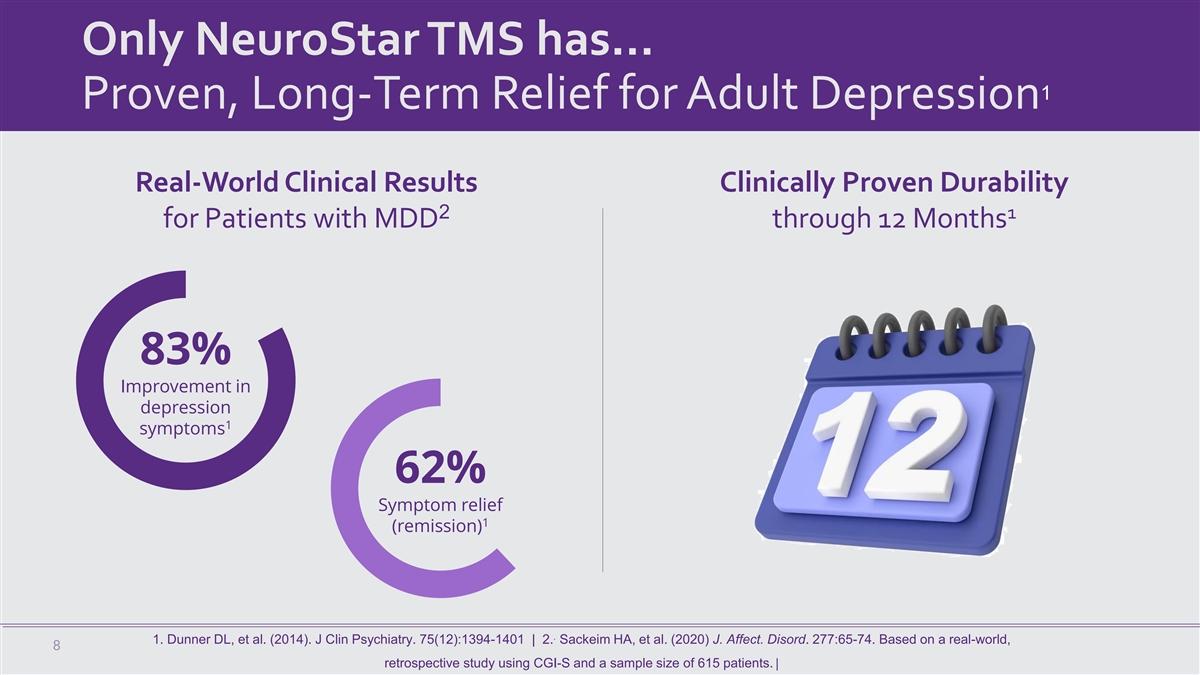

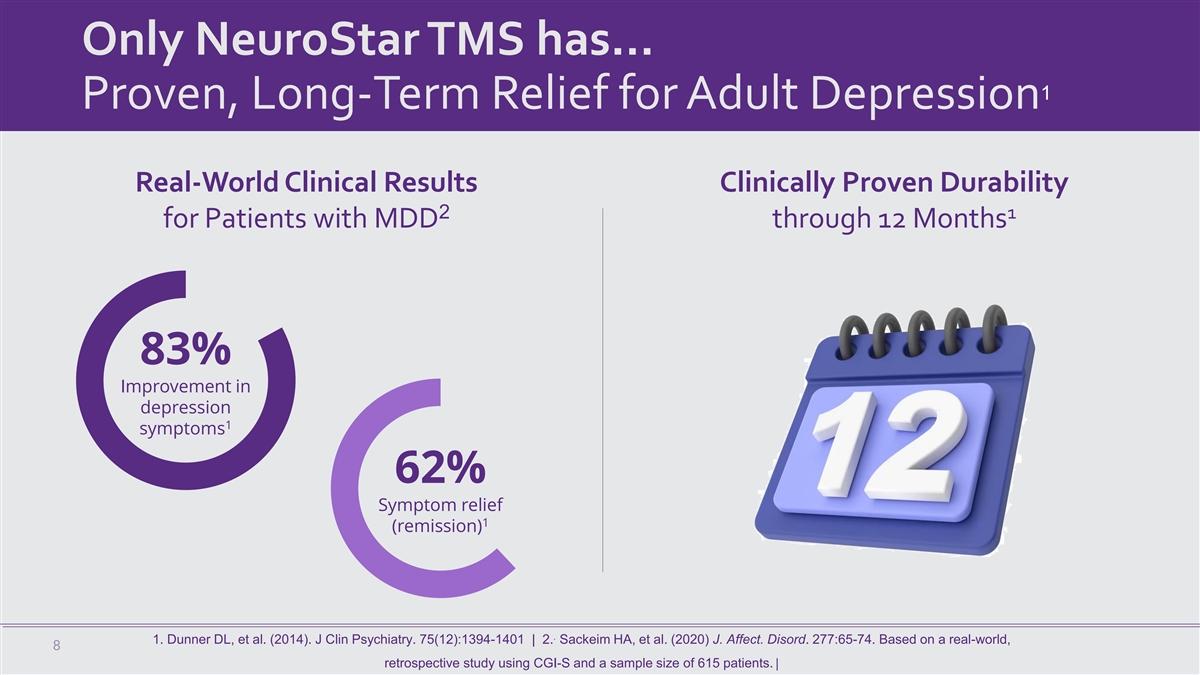

Only NeuroStar TMS has… 1 Proven, Long-Term Relief for Adult Depression Real-World Clinical Results Clinically Proven Durability 2 1 for Patients with MDD through 12 Months 83% Improvement in depression 1 symptoms 62% Symptom relief 1 (remission) . 1. Dunner DL, et al. (2014). J Clin Psychiatry. 75(12):1394-1401 | 2. Sackeim HA, et al. (2020) J. Affect. Disord. 277:65-74. Based on a real-world, 8 retrospective study using CGI-S and a sample size of 615 patients. |

NeuroStar Clinical Excellence Validated by Extensive Research and Publications Investigator Initiated Studies Largest Real-World Sample Sizes in TMS 1 Research Expands understanding of TMS and its potential clinical applications 1 6 High Impact NeuroStar Registry 65+ studies with 1,900+ patients 2-7 Publications 9

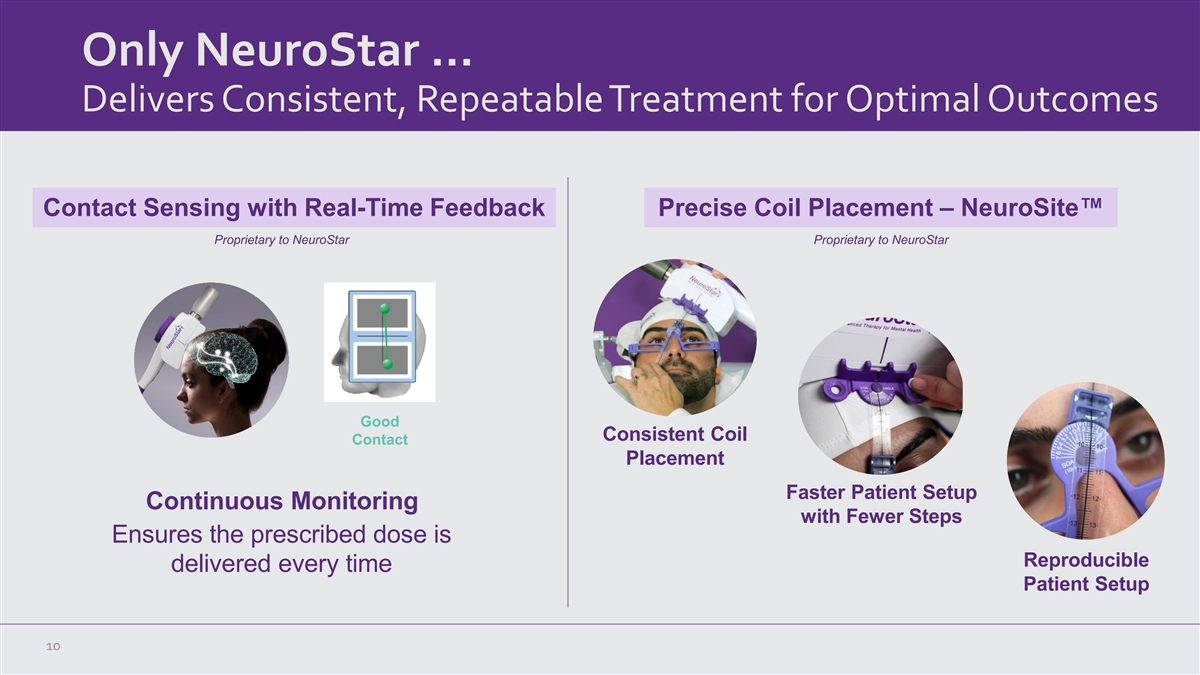

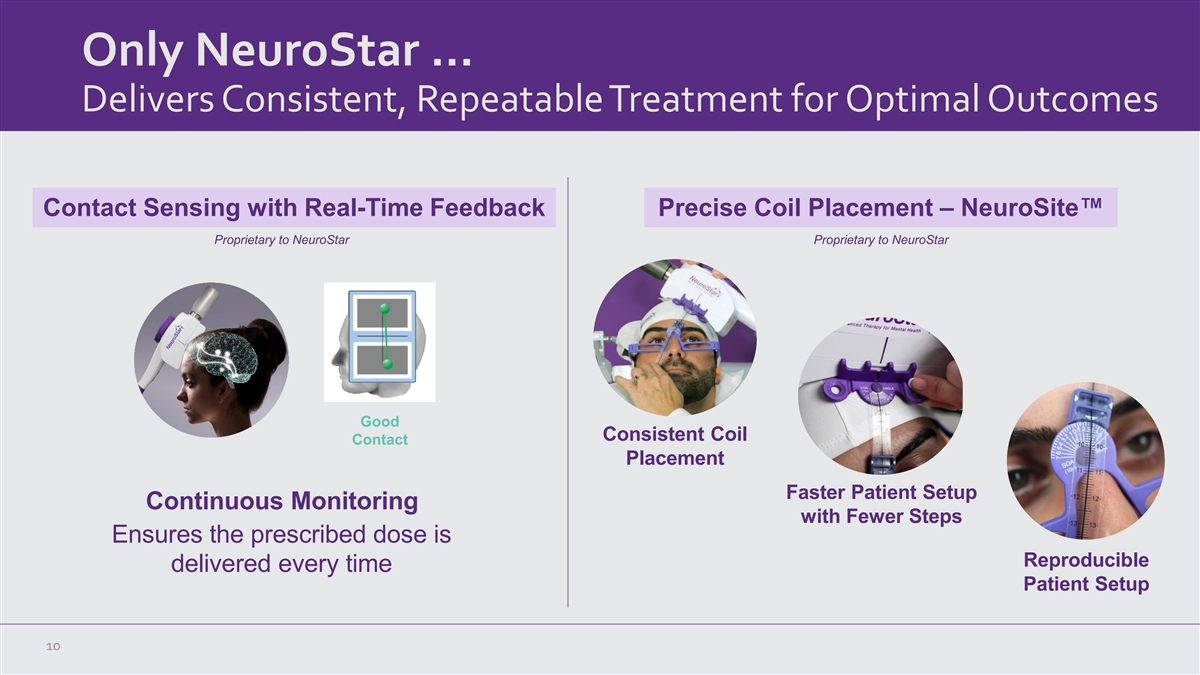

Only NeuroStar … Delivers Consistent, Repeatable Treatment for Optimal Outcomes Contact Sensing with Real-Time Feedback Precise Coil Placement – NeuroSite™ Proprietary to NeuroStar Proprietary to NeuroStar Good Consistent Coil Contact Placement Faster Patient Setup Continuous Monitoring with Fewer Steps Ensures the prescribed dose is Reproducible delivered every time Patient Setup 10

Proprietary TrakStar Platform Provides Actionable Insights for NeuroStar and its Practices World’s Largest Depression Outcomes Patient Management Database 1 Registry Contributes to Future and Reporting System Indications and Publications Tools to identify more patient 188,000+ candidates (PHQ-10, Benefits Total NeuroStar Investigations) 1 patients treated worldwide Automated tools to efficiently 18,294+ manage the patient journey Total Outcomes Registry 1 patients 11

NeuroStar Has one of the Largest Issued Patent Portfolio of All TMS Companies… Patent Portfolio Contact Sensing MT Assist Iron Core Magnet U.S. patent U.S. patent U.S. patent • 33 US / 53 OUS Issued or allowed patents • 10 US / 6 OUS Pending patent applications …protecting our technical advantage and ensuring freedom to operate globally 12

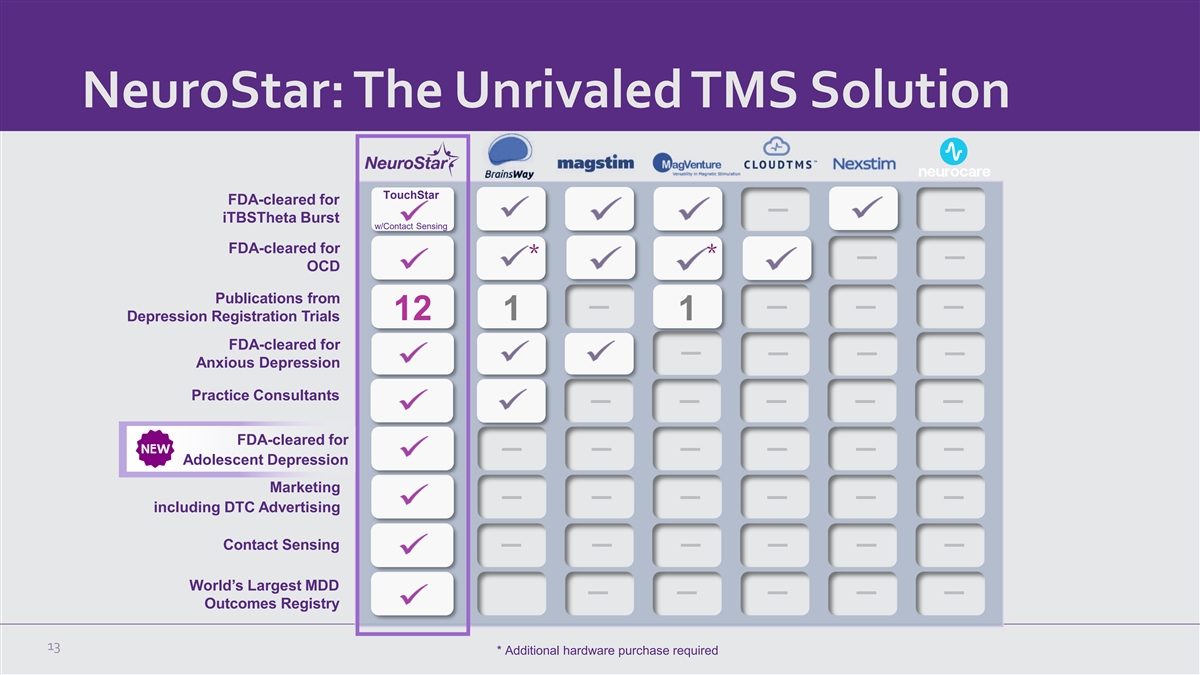

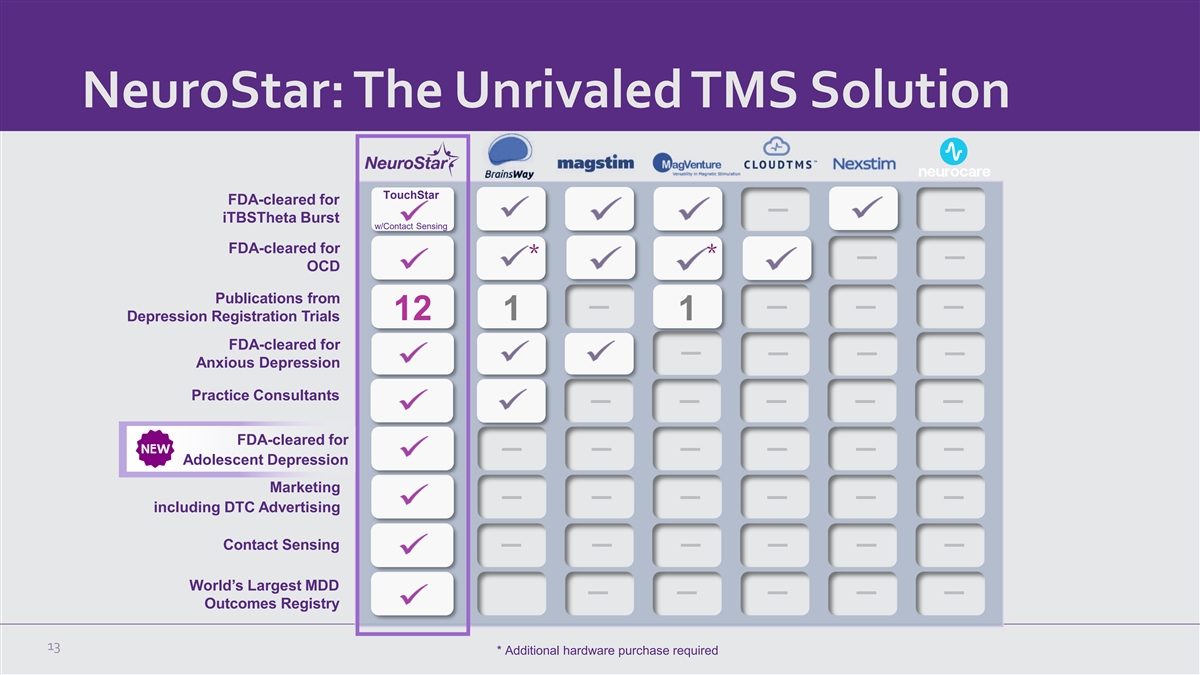

NeuroStar: The Unrivaled TMS Solution TouchStar FDA-cleared for iTBSTheta Burst w/Contact Sensing FDA-cleared for * * OCD Publications from 12 1 1 Depression Registration Trials FDA-cleared for Anxious Depression Practice Consultants FDA-cleared for Adolescent Depression Marketing including DTC Advertising Contact Sensing World’s Largest MDD Outcomes Registry 13 * Additional hardware purchase required

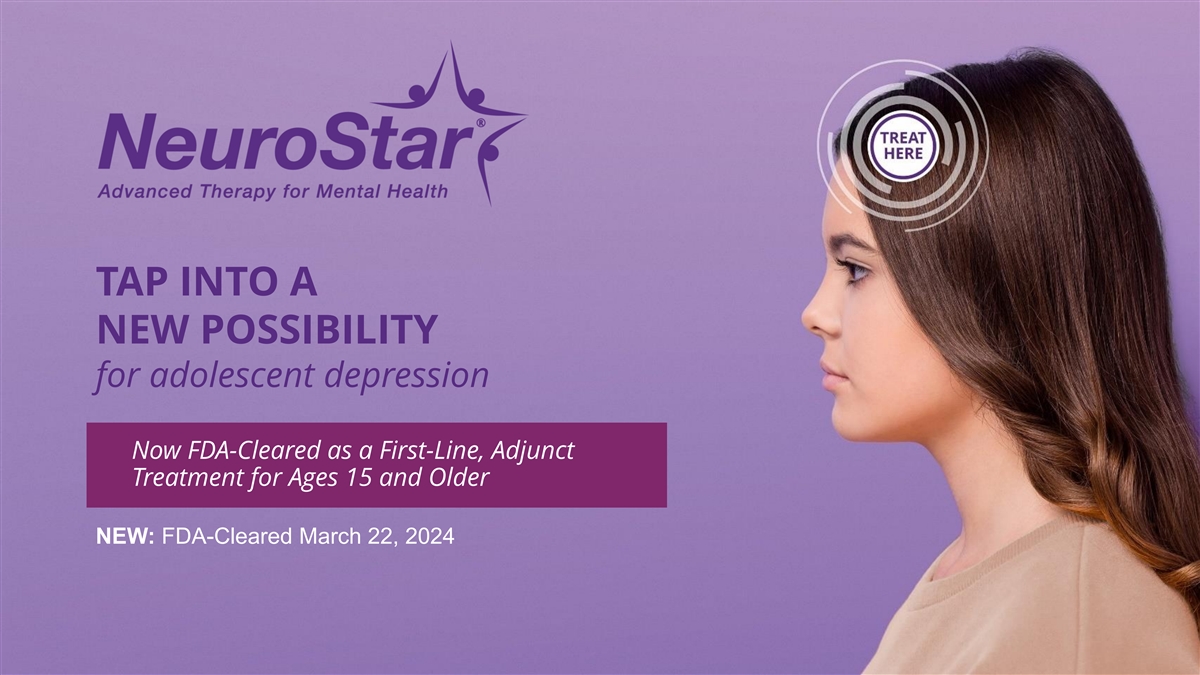

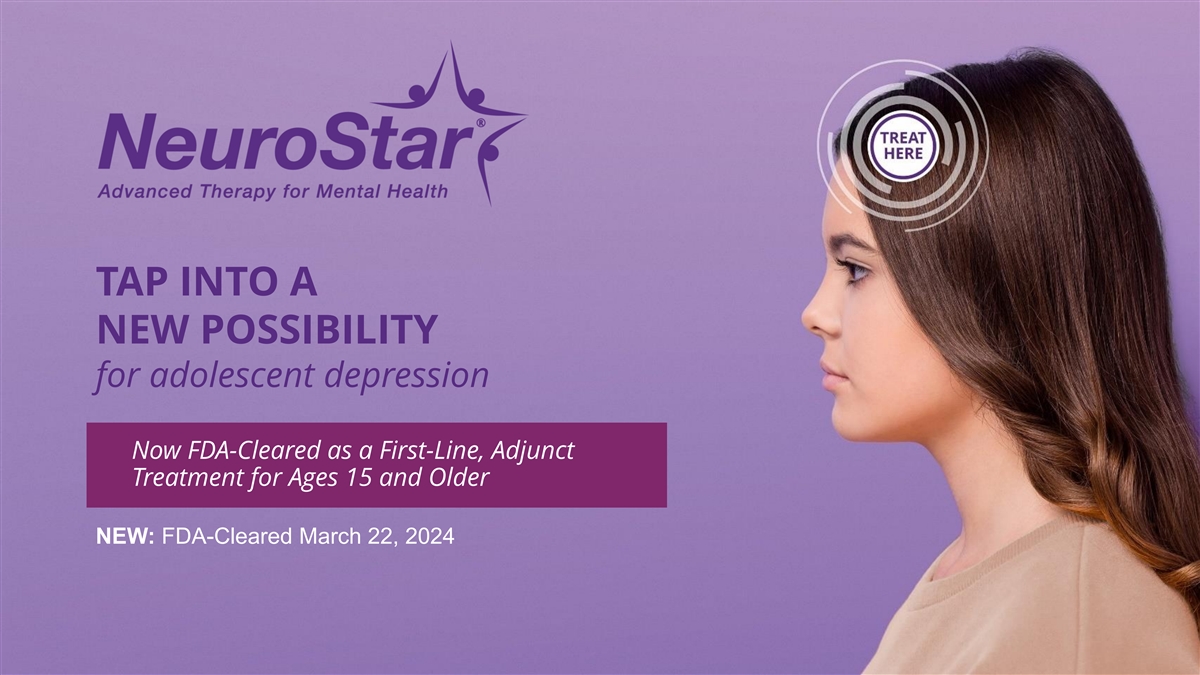

TAP INTO A NEW POSSIBILITY for adolescent depression Now FDA-Cleared as a First-Line, Adjunct Treatment for Ages 15 and Older NEW: FDA-Cleared March 22, 2024

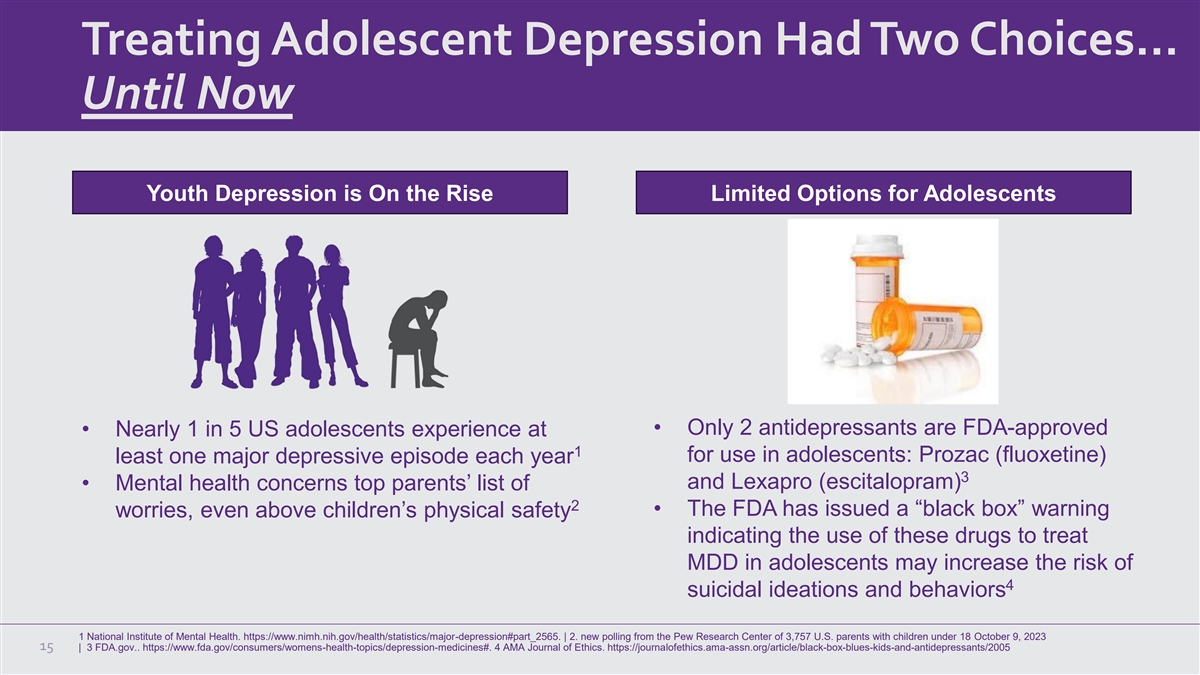

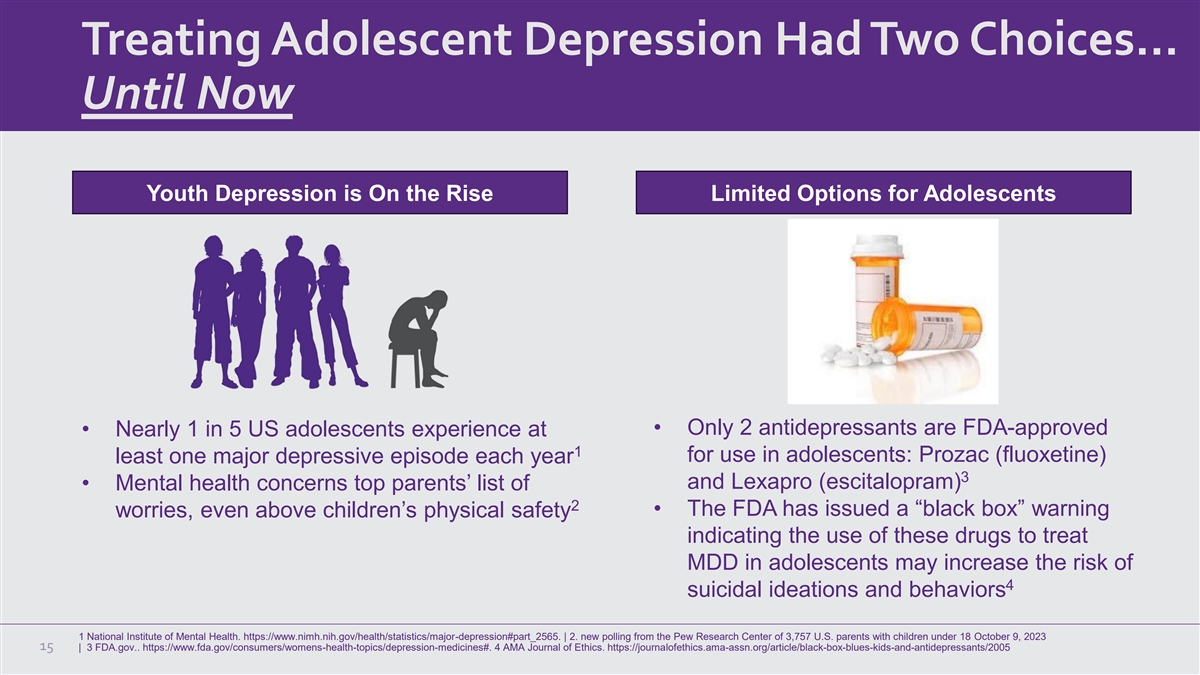

Treating Adolescent Depression Had Two Choices… Until Now Youth Depression is On the Rise Limited Options for Adolescents • Only 2 antidepressants are FDA-approved • Nearly 1 in 5 US adolescents experience at 1 for use in adolescents: Prozac (fluoxetine) least one major depressive episode each year 3 and Lexapro (escitalopram) • Mental health concerns top parents’ list of 2 • The FDA has issued a “black box” warning worries, even above children’s physical safety indicating the use of these drugs to treat MDD in adolescents may increase the risk of 4 suicidal ideations and behaviors 1 National Institute of Mental Health. https://www.nimh.nih.gov/health/statistics/major-depression#part_2565. | 2. new polling from the Pew Research Center of 3,757 U.S. parents with children under 18 October 9, 2023 15 | 3 FDA.gov.. https://www.fda.gov/consumers/womens-health-topics/depression-medicines#. 4 AMA Journal of Ethics. https://journalofethics.ama-assn.org/article/black-box-blues-kids-and-antidepressants/2005

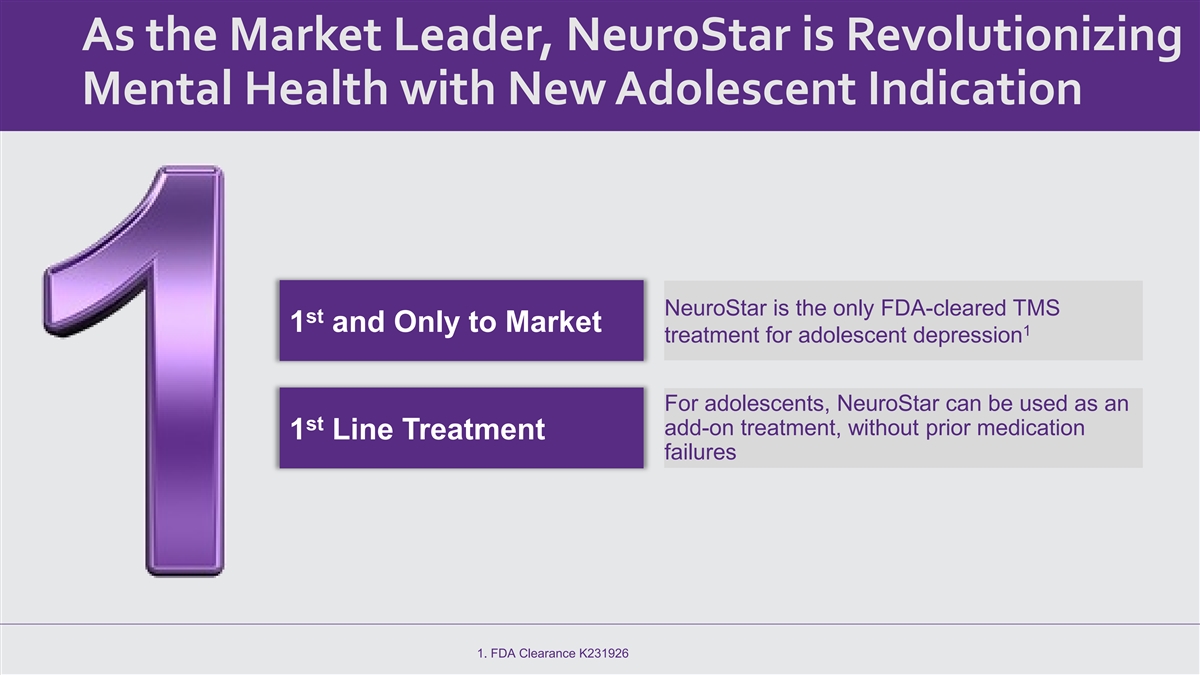

As the Market Leader, NeuroStar is Revolutionizing Mental Health with New Adolescent Indication NeuroStar is the only FDA-cleared TMS st 1 and Only to Market 1 treatment for adolescent depression For adolescents, NeuroStar can be used as an st add-on treatment, without prior medication 1 Line Treatment failures 1. FDA Clearance K231926

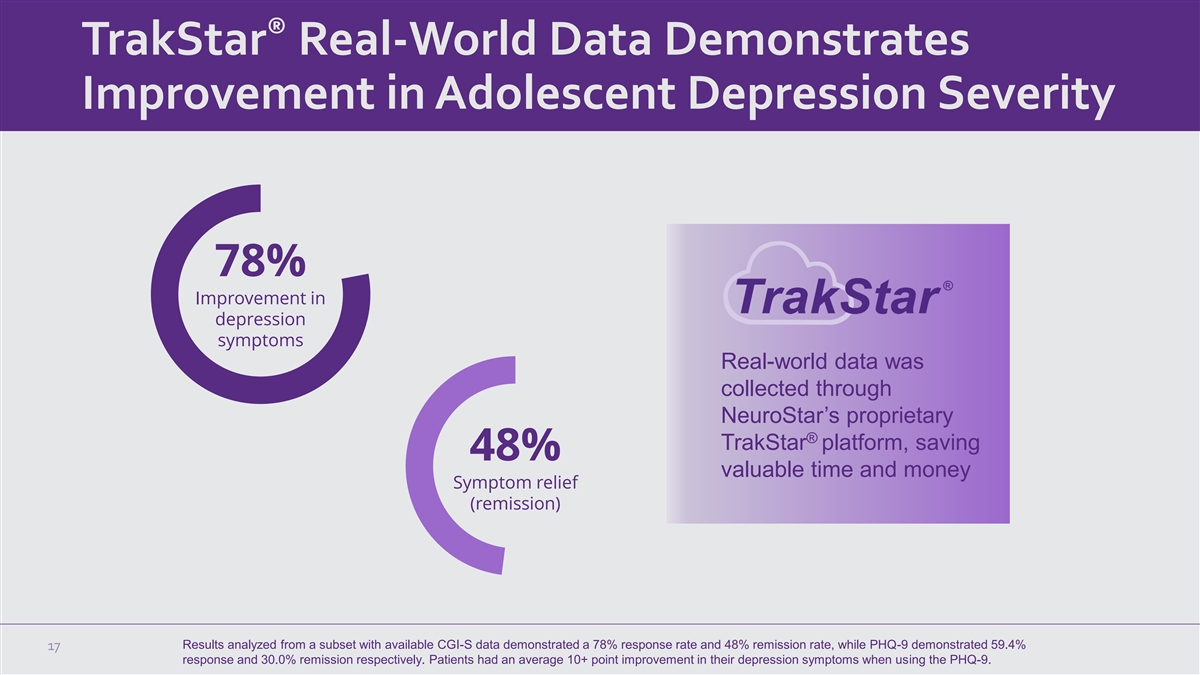

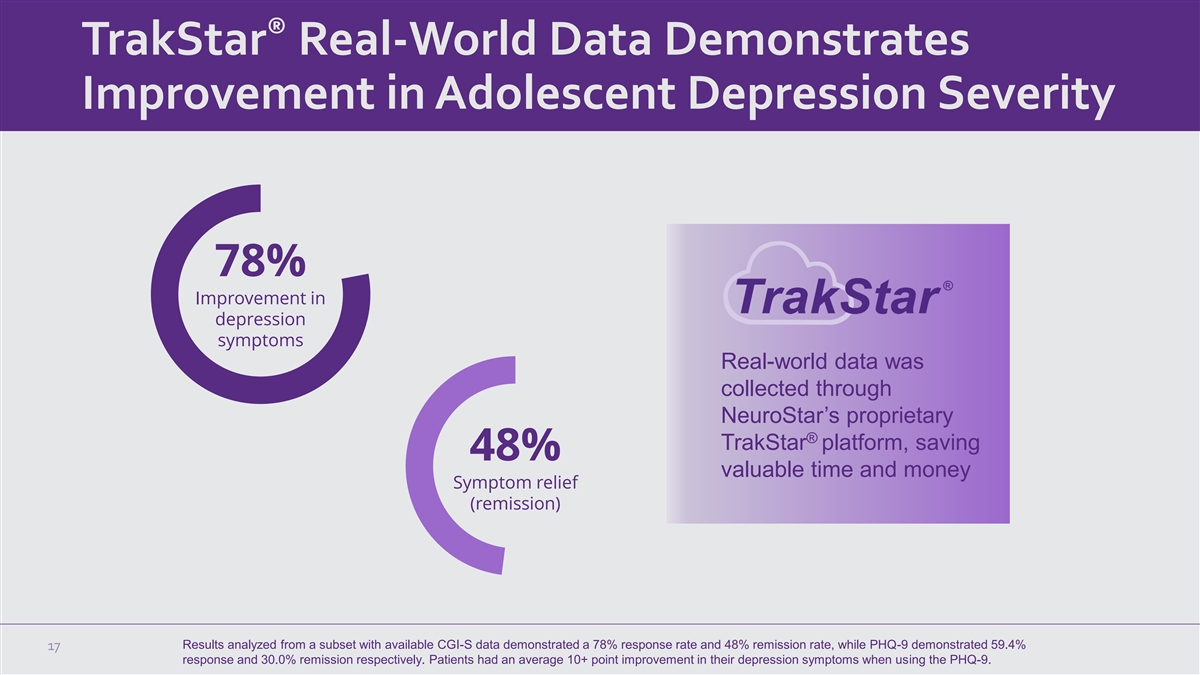

® TrakStar Real-World Data Demonstrates Improvement in Adolescent Depression Severity 78% Improvement in depression symptoms Real-world data was collected through NeuroStar’s proprietary ® TrakStar platform, saving 48% valuable time and money Symptom relief (remission) Results analyzed from a subset with available CGI-S data demonstrated a 78% response rate and 48% remission rate, while PHQ-9 demonstrated 59.4% 17 response and 30.0% remission respectively. Patients had an average 10+ point improvement in their depression symptoms when using the PHQ-9.

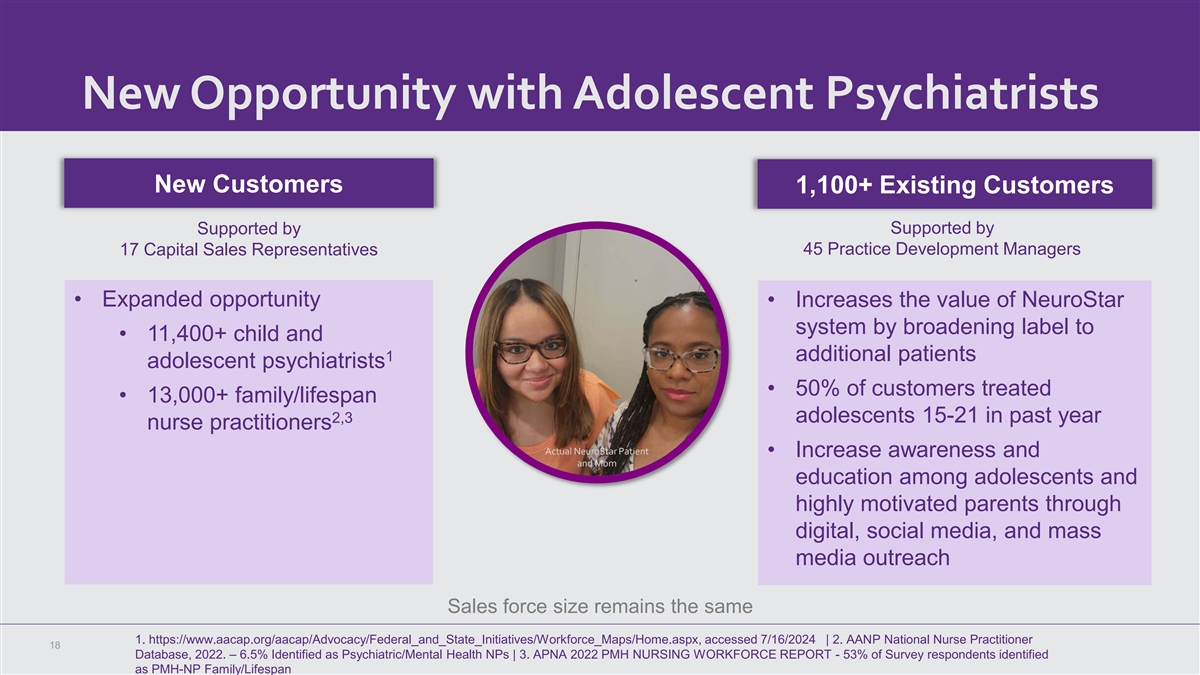

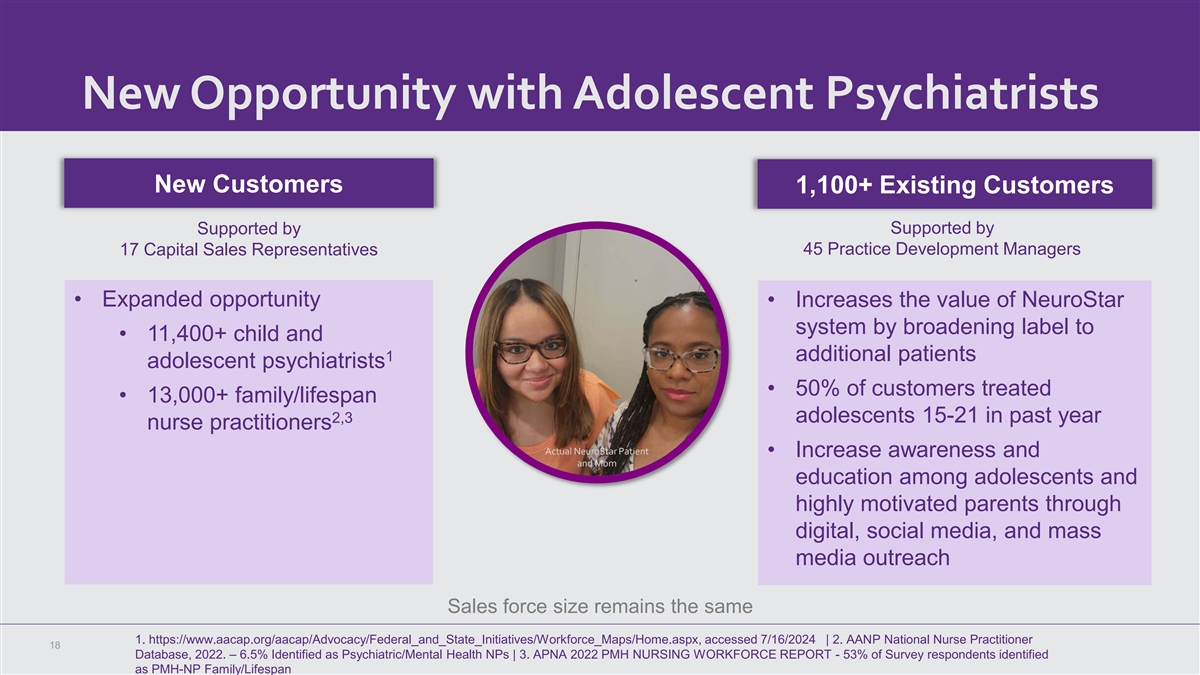

New Opportunity with Adolescent Psychiatrists New Customers 1,100+ Existing Customers Supported by Supported by 17 Capital Sales Representatives 45 Practice Development Managers • Expanded opportunity • Increases the value of NeuroStar system by broadening label to • 11,400+ child and 1 additional patients adolescent psychiatrists • 50% of customers treated • 13,000+ family/lifespan 2,3 adolescents 15-21 in past year nurse practitioners Actual NeuroStar Patient • Increase awareness and and Mom education among adolescents and highly motivated parents through digital, social media, and mass media outreach Sales force size remains the same 1. https://www.aacap.org/aacap/Advocacy/Federal_and_State_Initiatives/Workforce_Maps/Home.aspx, accessed 7/16/2024 | 2. AANP National Nurse Practitioner 18 Database, 2022. – 6.5% Identified as Psychiatric/Mental Health NPs | 3. APNA 2022 PMH NURSING WORKFORCE REPORT - 53% of Survey respondents identified as PMH-NP Family/Lifespan

2024 Adolescent Marketing Strategy Focused on Parents and Practices Key Messages Treats depression at the source | Non-drug, non-invasive | Proven safe and effective Outside the Practice Inside the Practice Parent Awareness & Education Practice Tools & Education Patient Advocate Collaborations

1 The Largest Direct Sales & Customer Support Team 10 16 Experienced team 48 2 dedicated to consistent growth and practice success 18 07 14 1. Neuronetics, Inc. internal data on file 2024. 20

NeuroStar Proven Program for Ongoing Practice Success Reach Source Start Train Awareness Your Patients New Patients • REIMBURSEMENT • FRONT DESK • PRACTICE BRANDING • PATIENT EMAIL • DIGITAL MARKETING CONSULTING TRAINING • WEBSITE BRANDING OUTREACH • HCP EDUCATIONAL • TRAKSTAR 1.0 • CONSULTATION • PATIENT EDUCATION EVENTS • PHQ-10 TRAINING EVENTS • NEUROSTAR • CLINICAL TRAINING TREATMENT • TRAKSTAR 2.0 ROOM SET UP 21

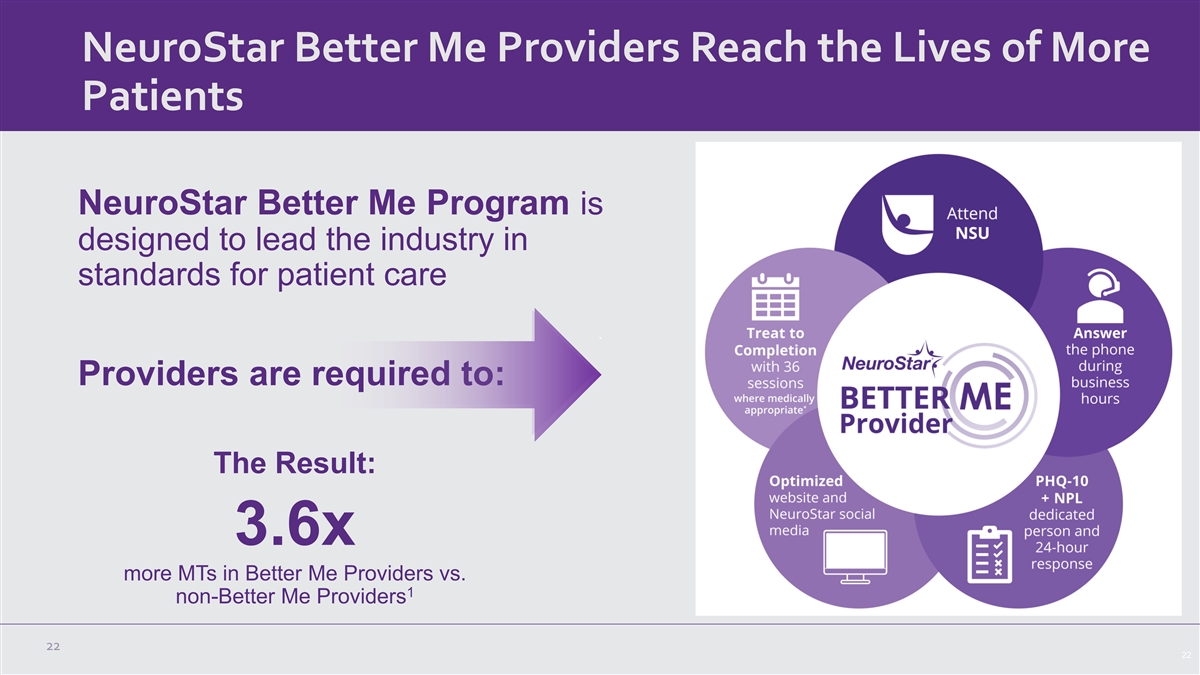

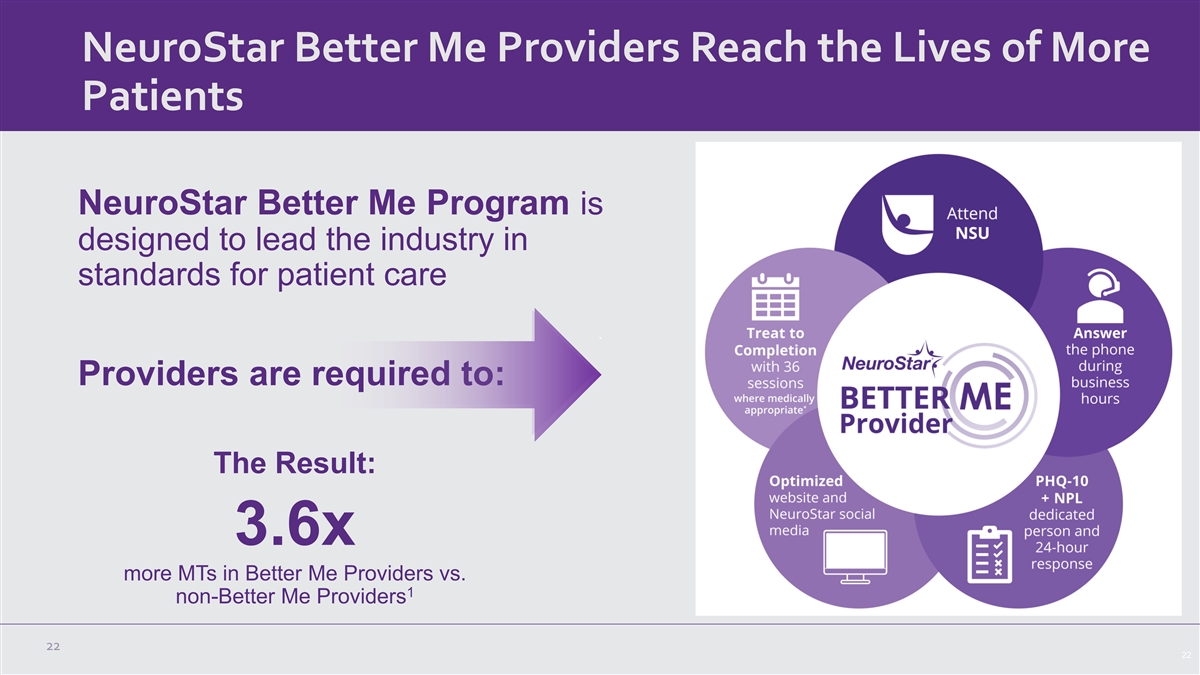

NeuroStar Better Me Providers Reach the Lives of More Patients NeuroStar Better Me Program is designed to lead the industry in standards for patient care Providers are required to: The Result: 3.6x more MTs in Better Me Providers vs. 1 non-Better Me Providers 22 22

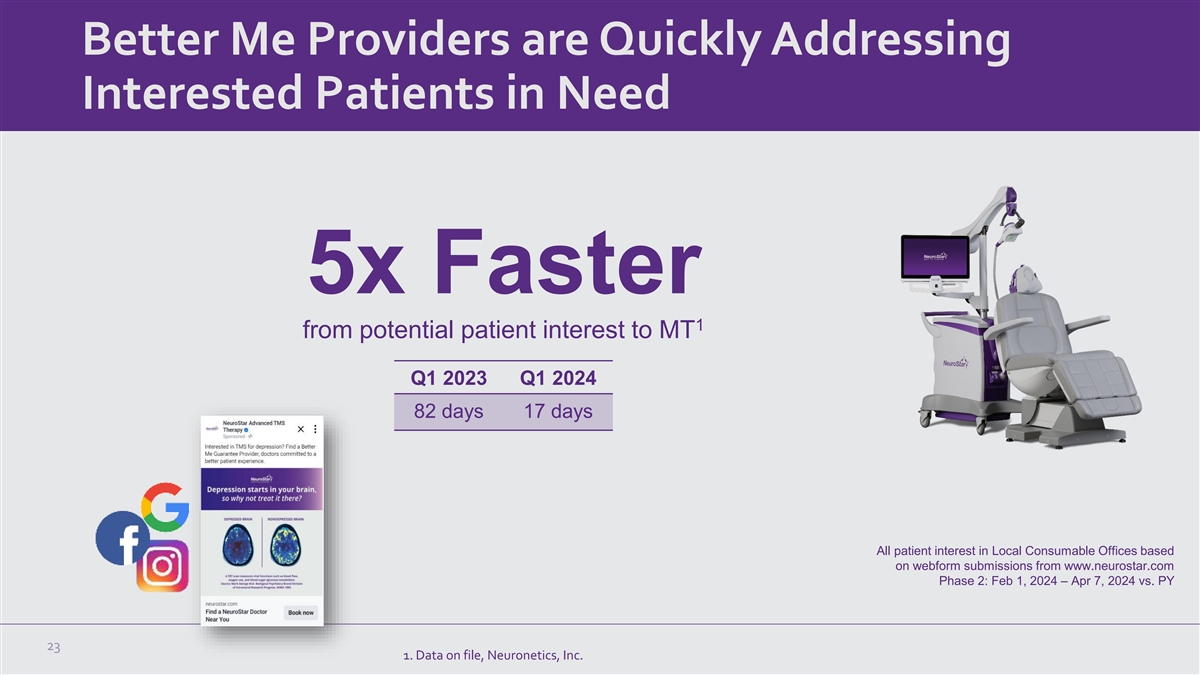

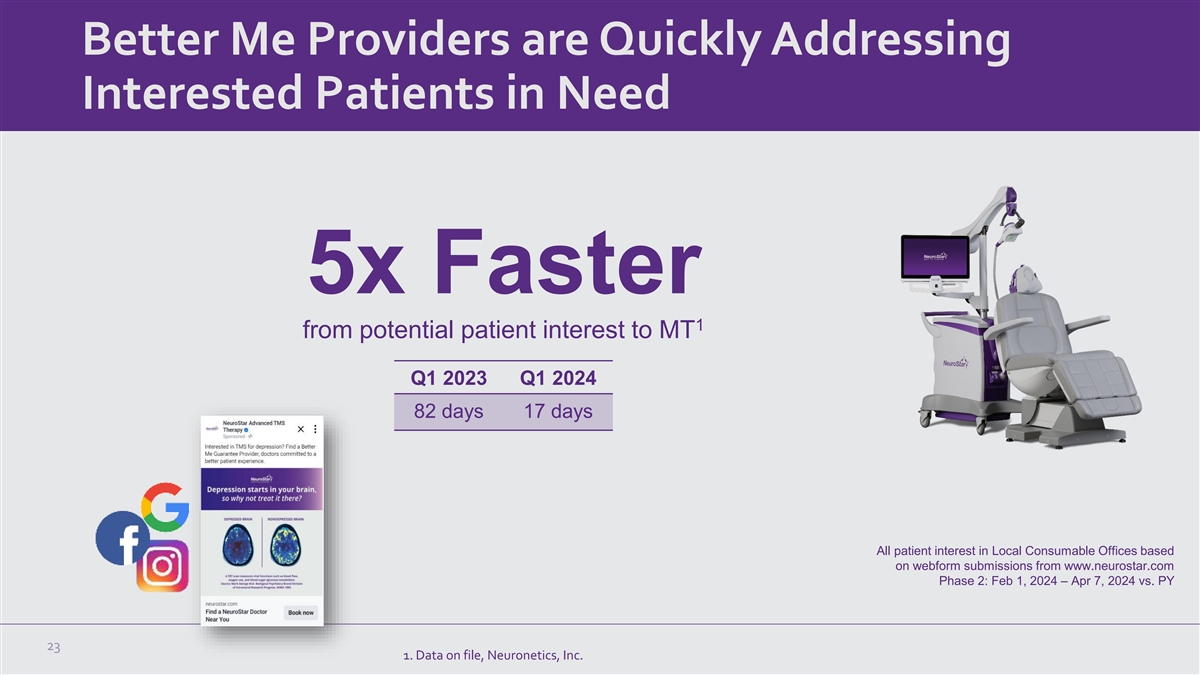

Better Me Providers are Quickly Addressing Interested Patients in Need 5x Faster 1 from potential patient interest to MT Q1 2023 Q1 2024 82 days 17 days All patient interest in Local Consumable Offices based on webform submissions from www.neurostar.com Phase 2: Feb 1, 2024 – Apr 7, 2024 vs. PY 23 1. Data on file, Neuronetics, Inc.

NeuroStar University By September 2024, attendees to NSU increased patient treatment 62% more than accounts that did not attend.* NSU Utilization Performance Index Baseline index values are based on January 2022 utilization. Excludes new sites from Classes 2022-2024. Attended NSU +49% vs. Jan 2022 Aug 2022 NSU Opens Have Not Attended NSU -13% vs. Jan 2022 A 2-DAY COURSE HELD AT OUR STATE-OF-THE-ART TRAINING CENTER Practices learn how to achieve the best clinical outcomes and market their NeuroStar Practices that attend NSU consistently outperform practices that do not on a month-to-month basis. business, through a combination of instruction In the month of September 2024, NSU practices performed 62% better than sites that have not attended NSU vs. January 2022. and peer to peer learning. *As of 9/30/2024 24

Only NeuroStar Invests in Co-Op Marketing to 1 Build Local Consumer Awareness Co-Op Marketing: collaborative effort with practices to increase local patient awareness while sharing advertising costs +15% +16% treatment session utilization* in new MTs* 25

NeuroStar is Available at the Largest National Mental Health Centers 26

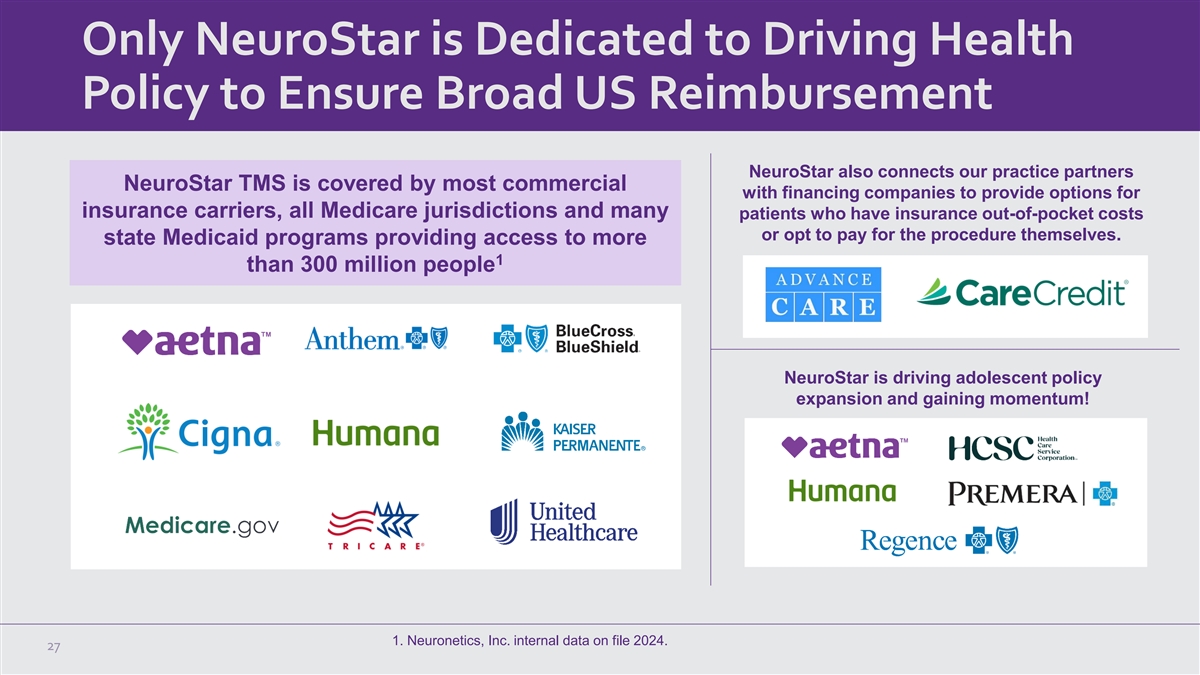

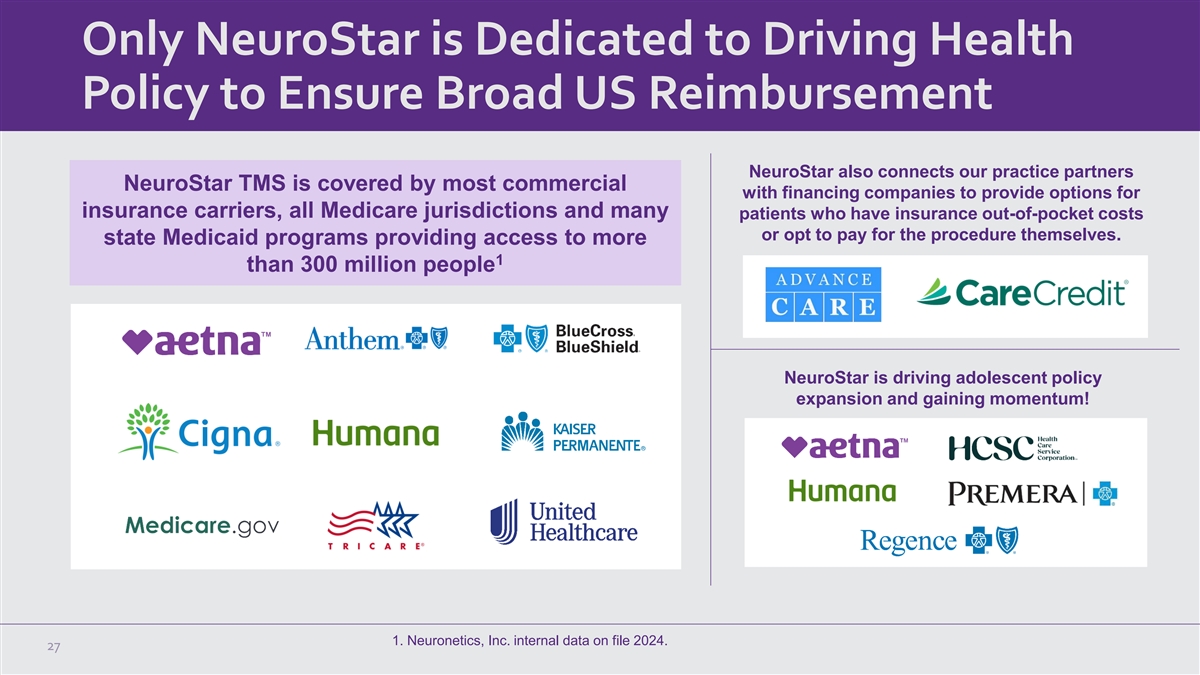

Only NeuroStar is Dedicated to Driving Health Policy to Ensure Broad US Reimbursement NeuroStar also connects our practice partners NeuroStar TMS is covered by most commercial with financing companies to provide options for insurance carriers, all Medicare jurisdictions and many patients who have insurance out-of-pocket costs or opt to pay for the procedure themselves. state Medicaid programs providing access to more 1 than 300 million people NeuroStar is driving adolescent policy expansion and gaining momentum! 1. Neuronetics, Inc. internal data on file 2024. 27

NeuroStar is the U.S. Market Leader, Opportunity to Continue Expanding Worldwide Japan Roadmap th 1 • 11 largest healthcare spend globally nd 2 • 2 highest suicide rate after Korea • Single payor healthcare system • Shonin approval since 2017 • Exclusive distribution agreement 3 with Teijin Pharma 4 • Secured national reimbursement listing Estimated TAM in Japan 2 for Treatment Sessions • Adults Suffering from MDD 2.4 million • Active Drug Treatment Population 1.0 million • Treatment Resistant Population 600,000 • ~$750 Million Addressable Market 1. Munira Z. Gunja, Evan D. Gumas, and Reginald D. Williams II, U.S. Health Care from a Global Perspective, 2022: Accelerating Spending, Worsening Outcomes (Commonwealth Fund, Jan. 2023). 28 https://doi.org/10.26099/8ejy-yc74 2. Depression- Pharma Intelligence Disease Analysis, www.datamonitorhealthcare.com, Publication Date: June 2021 3.Distribution agreement signed in 2017 4. Reimbursement granted from July 2019 by MHLW

Keith Sullivan Cory Anderson Steve Furlong Rick Grubbs Sheryl Conley Rob Cascella Glenn Muir President & CEO SVP, R&D and Clinical EVP, CFO & Treasurer SVP, National Board Chairman Accounts Megan Andrew Macan Rusty Page Lisa Rosas Sara Grubbs Keith Sullivan EVP, GC & Chief SVP, Chief Rosengarten SVP, Operations SVP, Chief Revenue Officer Compliance Officer & Quality Marketing Officer 29

Financial Overview NeuroStar Advanced Therapy for Mental Health 30

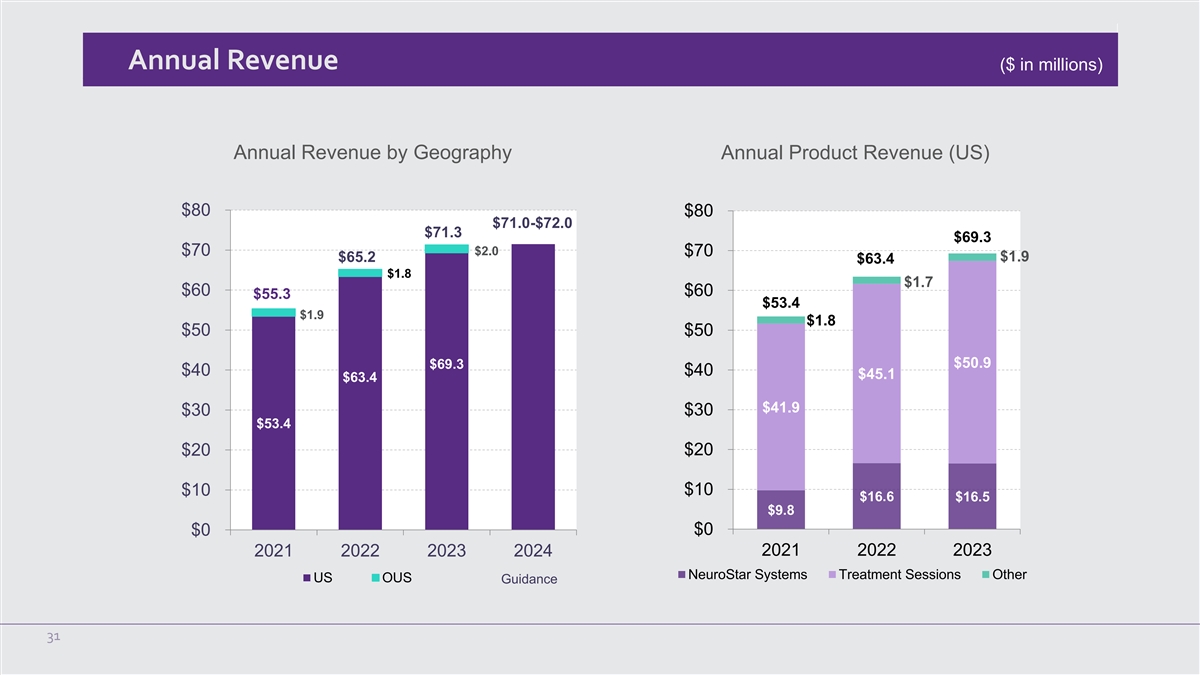

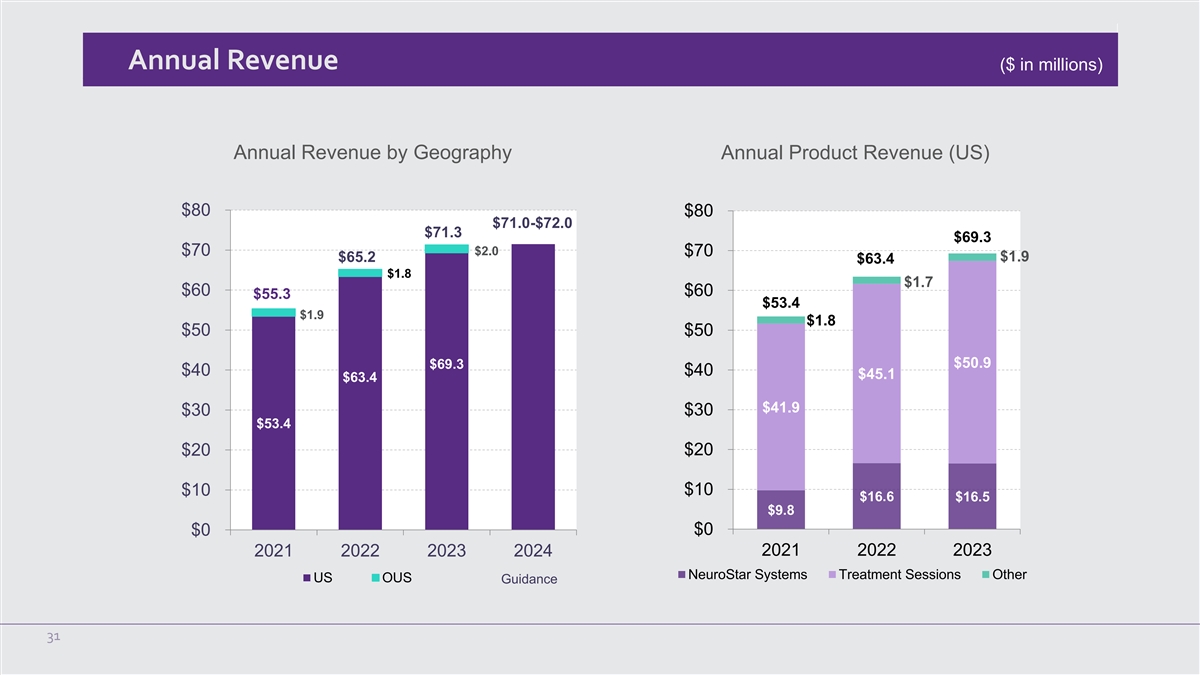

Annual Revenue ($ in millions) Annual Revenue by Geography Annual Product Revenue (US) $80 $80 $71.0-$72.0 $71.3 $69.3 $2.0 $70 $70 $1.9 $65.2 $63.4 $1.8 $1.7 $60 $60 $55.3 $53.4 $1.9 $1.8 $50 $50 $50.9 $69.3 $40 $40 $45.1 $63.4 $41.9 $30 $30 $53.4 $20 $20 $10 $10 $16.6 $16.5 $9.8 $0 $0 2021 2022 2023 2024 2021 2022 2023 NeuroStar Systems Treatment Sessions Other US OUS Guidance 31

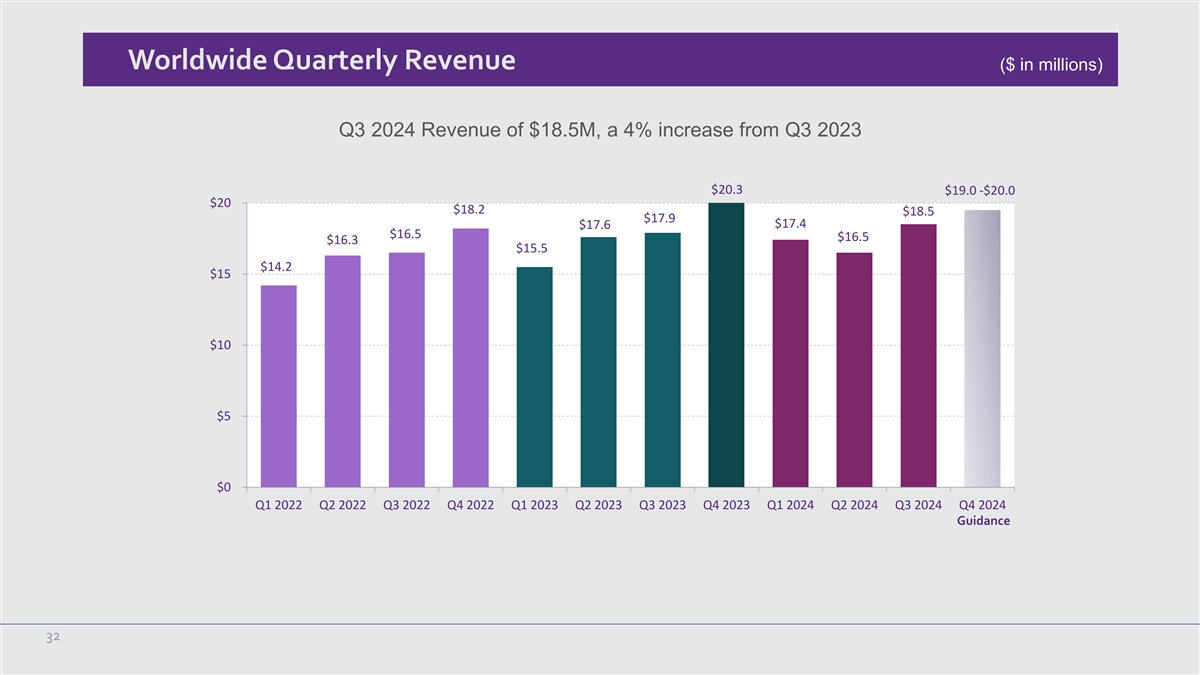

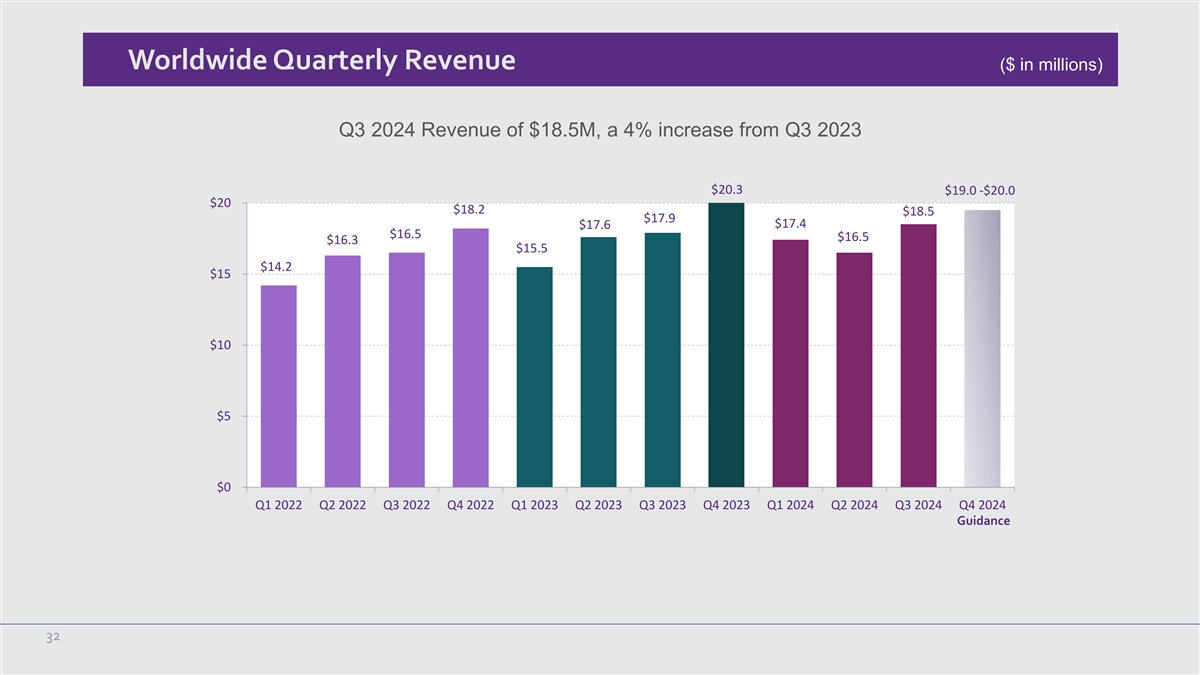

Worldwide Quarterly Revenue ($ in millions) Q3 2024 Revenue of $18.5M, a 4% increase from Q3 2023 $20.3 $19.0 -$20.0 $20 $18.2 $18.5 $17.9 $17.4 $17.6 $16.5 $16.5 $16.3 $15.5 $14.2 $15 $10 $5 $0 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Guidance 32

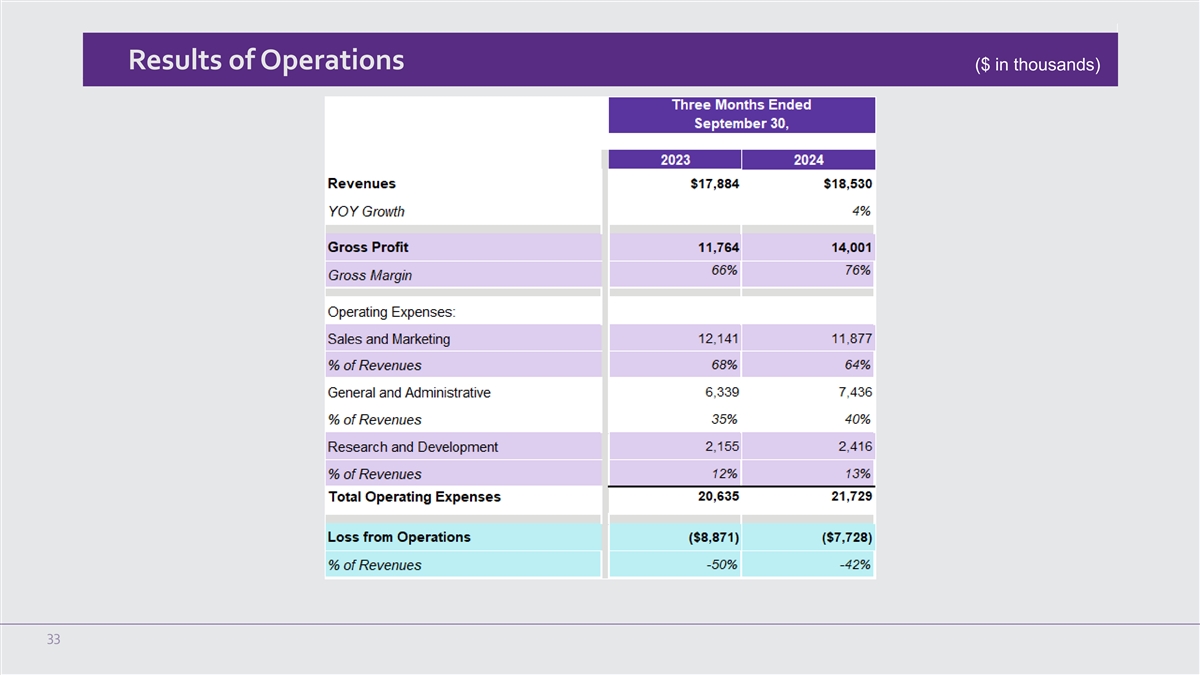

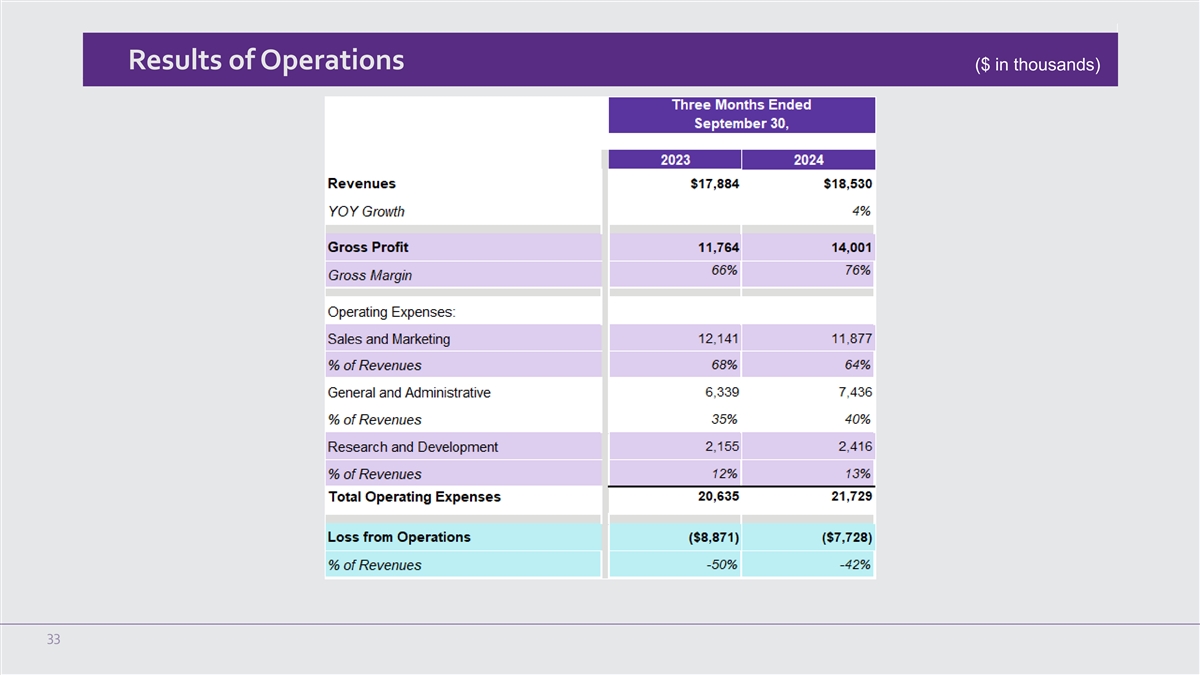

Results of Operations ($ in thousands) 33

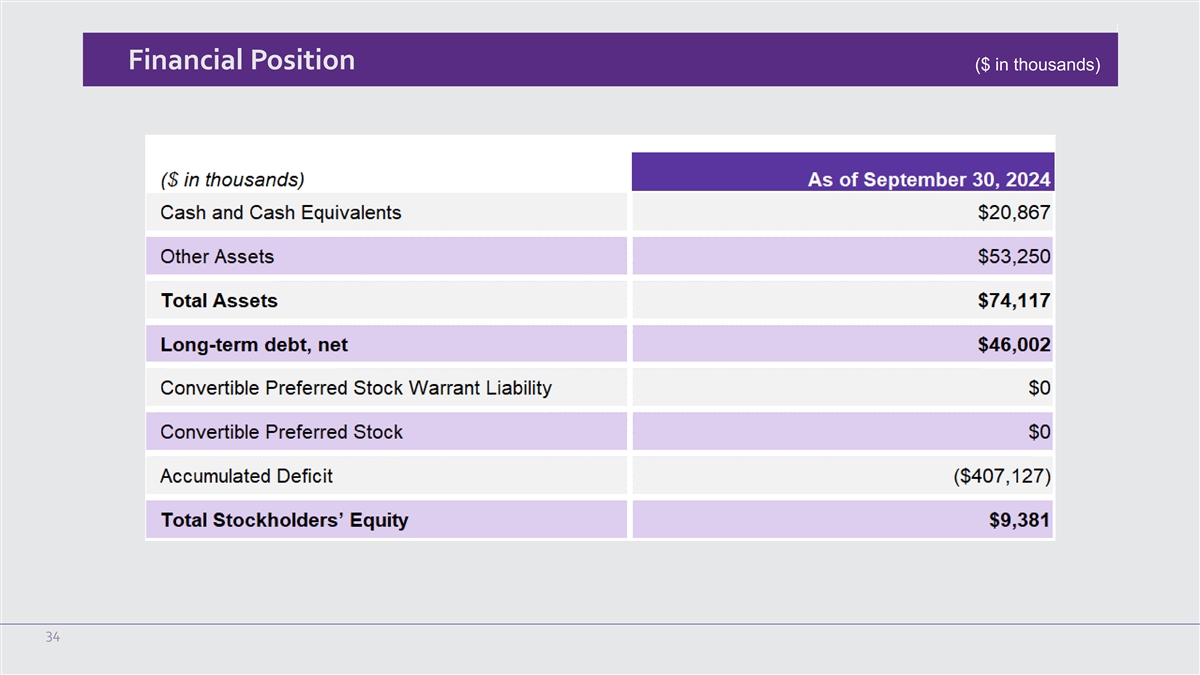

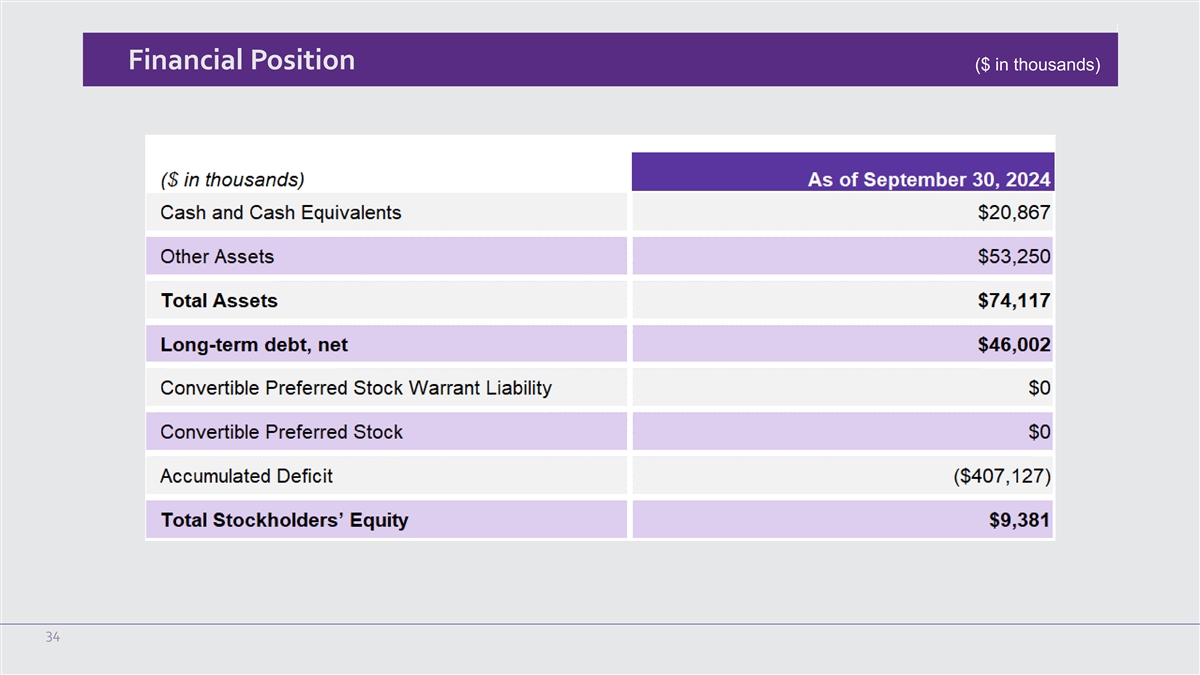

Financial Position ($ in thousands) 34

Supplemental Information NeuroStar Advanced Therapy for Mental Health 35

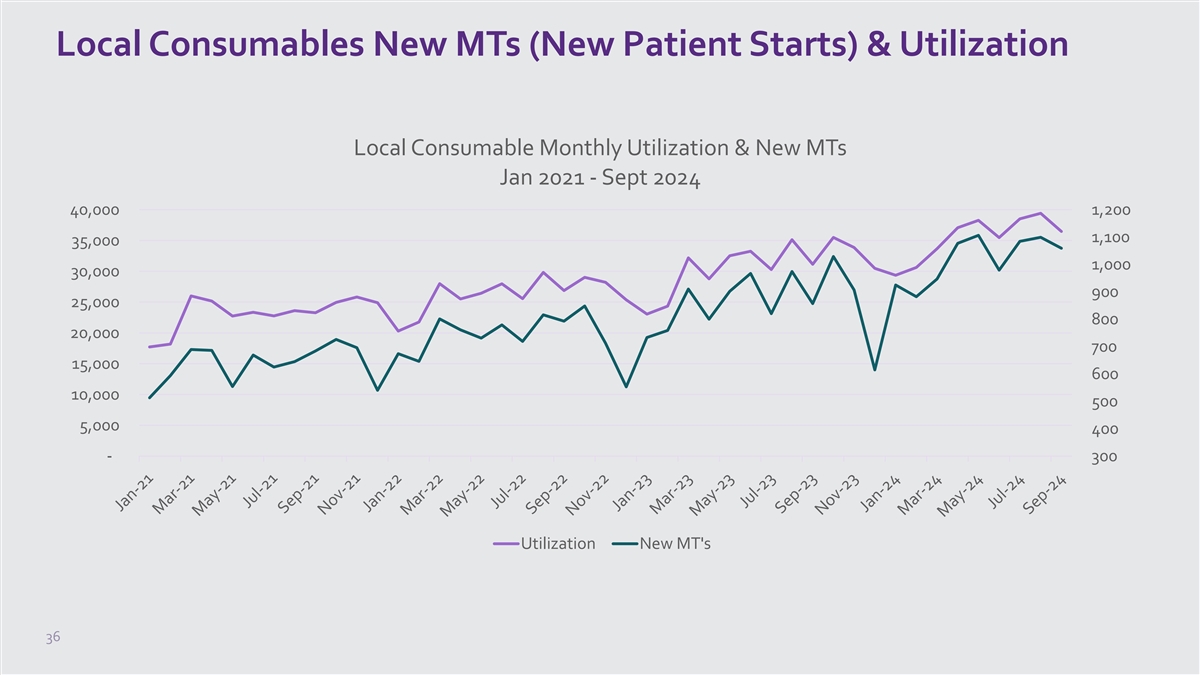

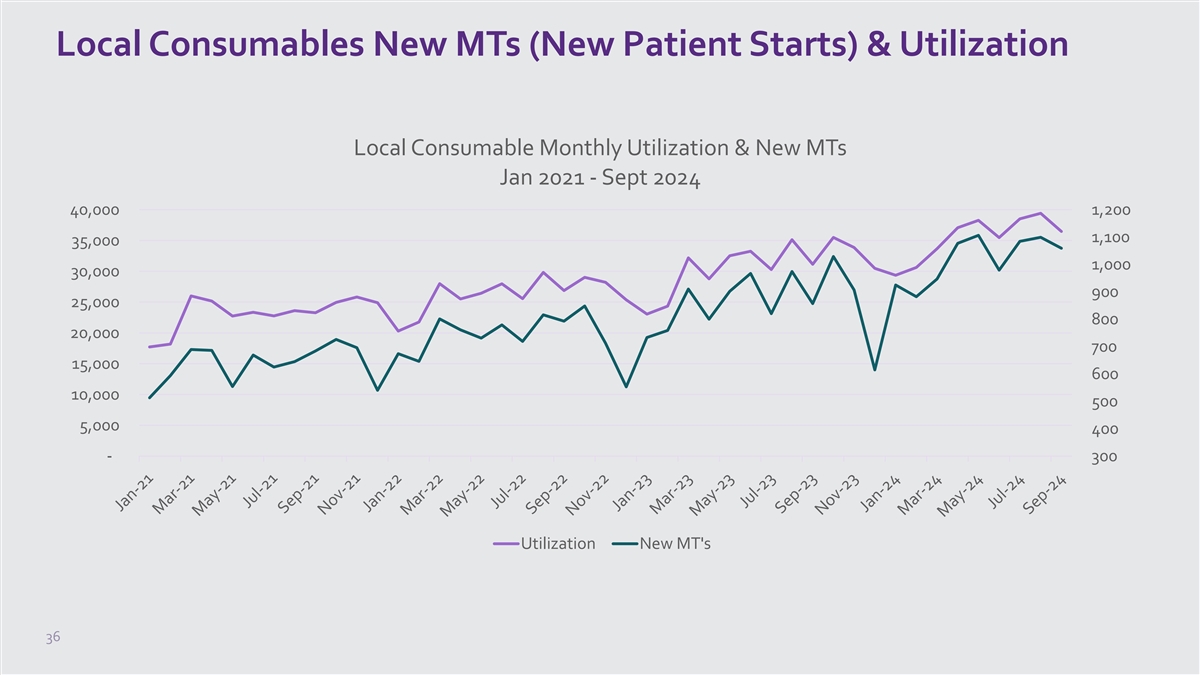

Local Consumables New MTs (New Patient Starts) & Utilization Local Consumable Monthly Utilization & New MTs Jan 2021 - Sept 2024 40,000 1,200 1,100 35,000 1,000 30,000 900 25,000 800 20,000 700 15,000 600 10,000 500 5,000 400 - 300 Utilization New MT's 36

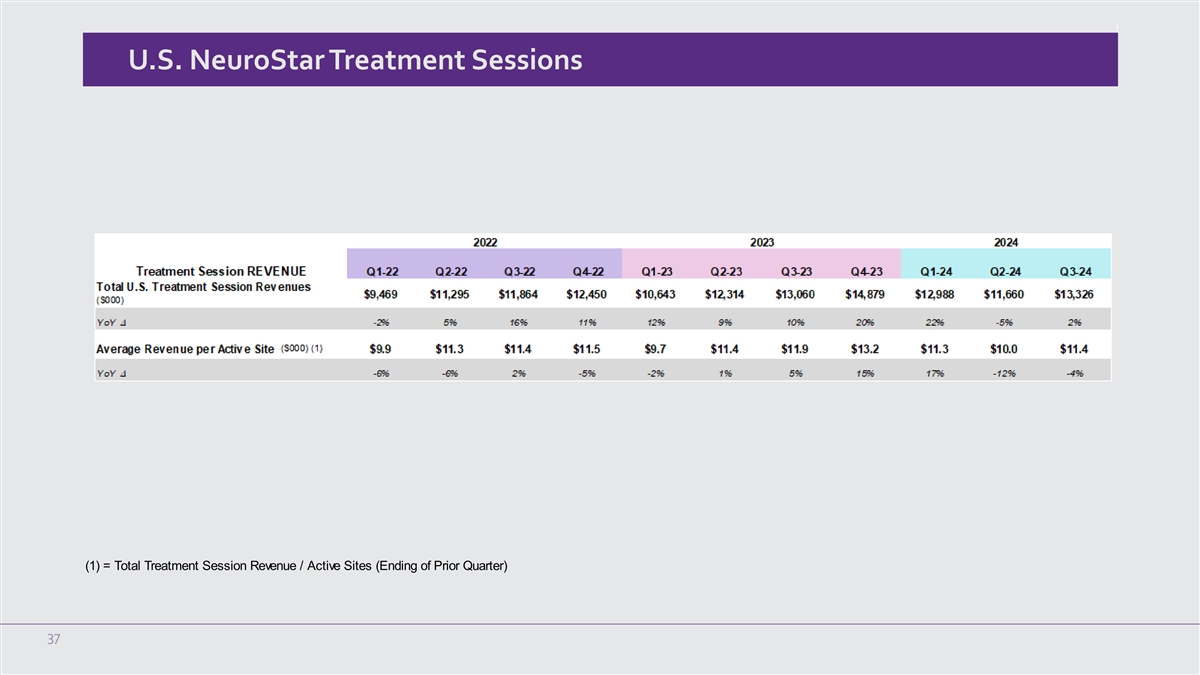

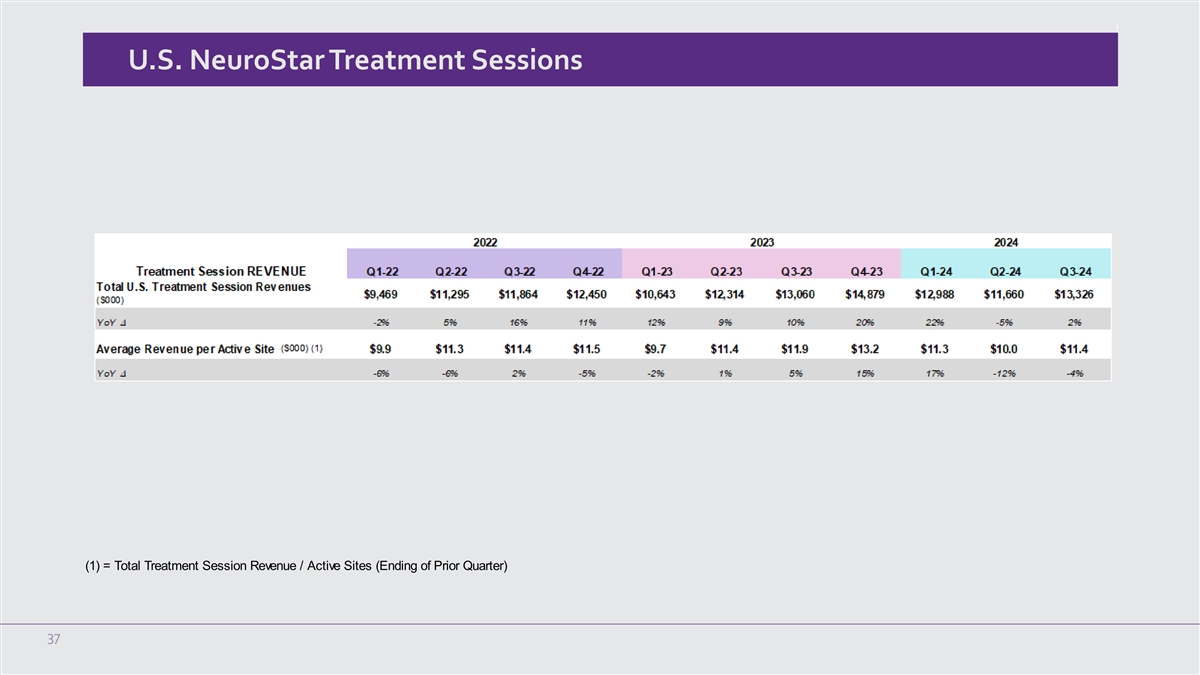

U.S. NeuroStar Treatment Sessions (1) = Total Treatment Session Revenue / Active Sites (Ending of Prior Quarter) 37

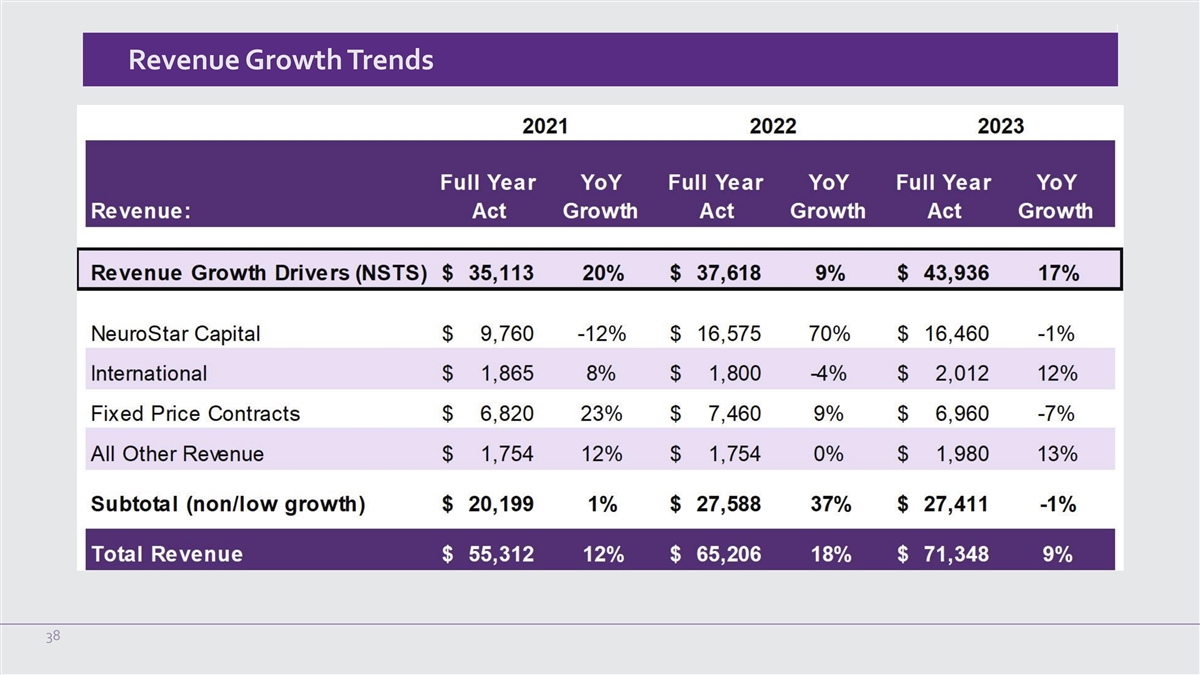

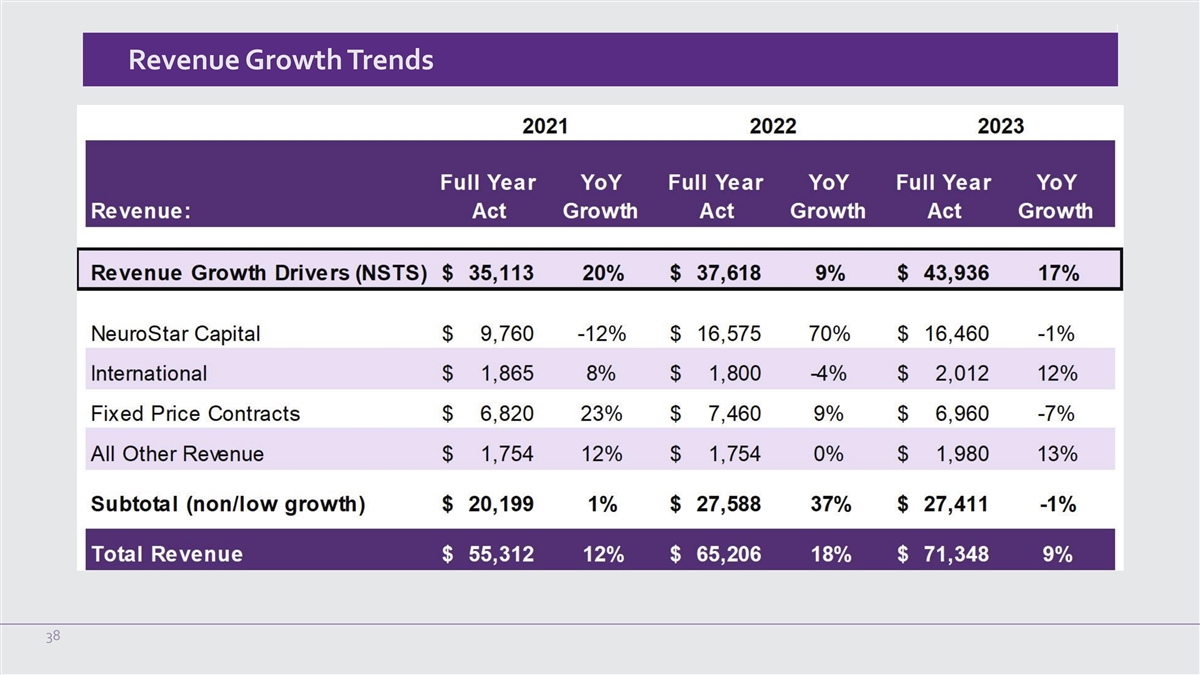

Revenue Growth Trends 38

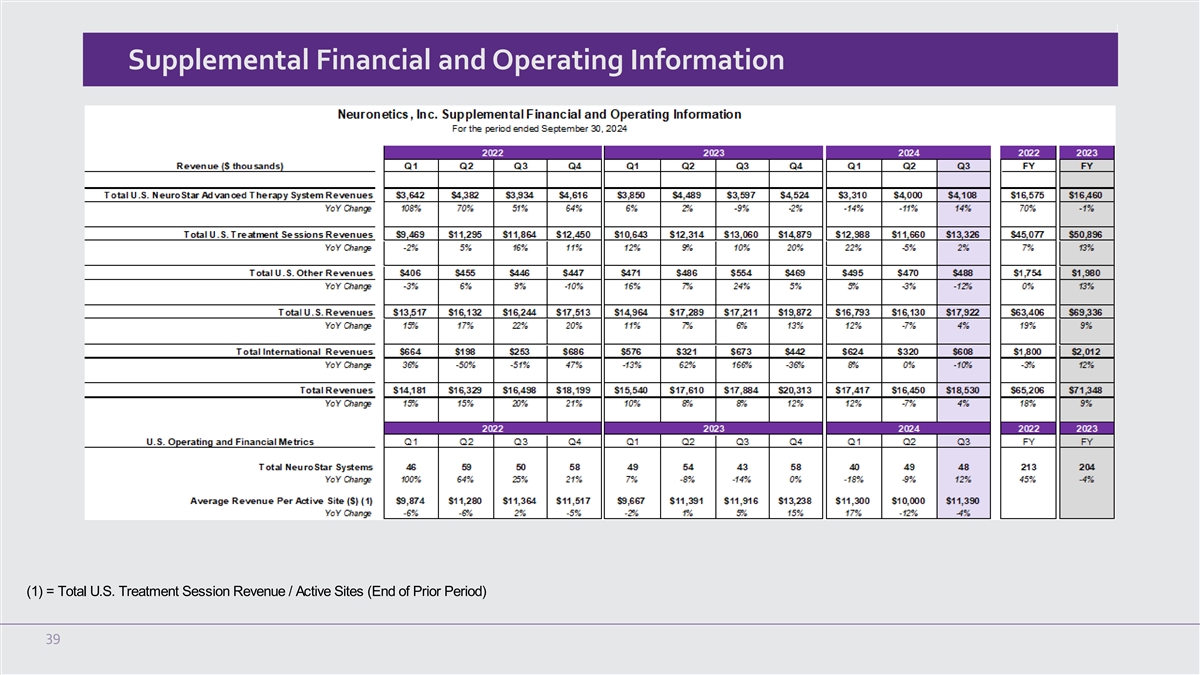

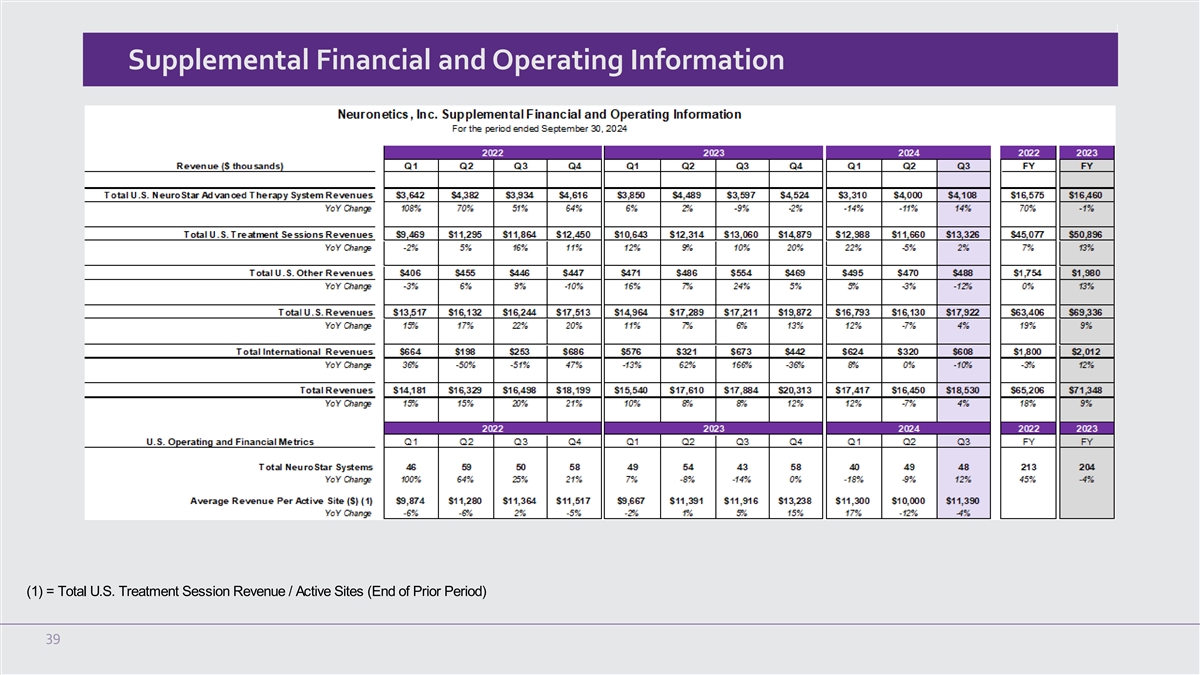

Supplemental Financial and Operating Information (1) = Total U.S. Treatment Session Revenue / Active Sites (End of Prior Period) 39