Exhibit A.12

Offers by

Smith & Nephew Group plc

for

Centerpulse AG and InCentive Capital AG

and

Scheme of Arrangement

in relation to

Smith & Nephew plc

Listing Particulars

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take,[5.6 (a)] you are recommended to seek your own independent financial advice immediately from your stockbroker,[5.7] bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000 or,[5.8] if you are resident outside the United Kingdom, another appropriately authorised independent financial adviser.

If you have sold or otherwise transferred all of your Smith & Nephew Ordinary Shares or Smith & Nephew ADSs, subject to the restrictions set out below, please send this document, together with the accompanying documents, at once to the purchaser or transferee, or to the stockbroker, bank or other agent through or to whom the sale or transfer was effected for transmission to the purchaser or transferee.

Applications have been made to the UK Listing Authority for the New Ordinary Shares to be admitted to the Official List and to the London Stock Exchange[6.B.1] for such shares to be admitted to trading on its market for listed securities. It is expected that admission of the[6.B.3] New Ordinary Shares to the Official List will become effective and that dealings on the London Stock Exchange (for normal settlement) will commence at 8:00 a.m. (London time) on 25 June 2003. A copy of this document, which comprises listing particulars relating to Smith & Nephew Group plc prepared in accordance with[6.B.18]the Listing Rules made under section 74 of the Financial Services and Markets Act 2000, has been delivered to the[6.B.3] Registrar of Companies in England and Wales for registration in accordance with section 83 of that Act.

[6.B.5(a)]

[6.B.6]

[6.B.15(b)]

Smith & Nephew Group plc[6.B.16]

Introduction of

up to 1,260,000,000 ordinary shares of12.5 pence each to the Official List

Sponsored by

Lazard & Co., Limited

Lazard & Co., Limited is acting exclusively for Smith & Nephew Group and Smith & Nephew and for no one else in connection with the Offers and the Scheme and will not be responsible to any other persons for providing the protections afforded to clients of Lazard & Co., Limited or for providing advice in relation to the Offers or the Scheme.

In the United States, this document is only for the information of, and is only being distributed to, holders of Smith & Nephew Ordinary Shares and Smith & Nephew ADSs. Accordingly, copies of this document will not and should not be mailed or otherwise distributed or sent in or into the United States, except to holders of Smith & Nephew Ordinary Shares and Smith & Nephew ADSs.

In addition to the restriction set out above, the distribution of this document in jurisdictions other than the United Kingdom and Switzerland may be restricted by law and therefore persons into whose possession this document comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. Smith & Nephew Group does not assume any responsibility for any violation of such restrictions by anyone whosoever.

SMITH & NEPHEW GROUP DIRECTORS, SECRETARY AND ADVISERS

Smith & Nephew Group Directors | | |

Dudley Graham Eustace Christopher John O’Donnell Peter Hooley Pamela Josephine Kirby Warren Decatur Knowlton Brian Paul Larcombe Richard Urbain De Schutter Rolf Wilhelm Heinrich Stomberg | | Non-Executive Chairman [6.A.1]Chief Executive [6.A.8]Finance Director Non-Executive Director[6.F.1] Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Vice Chairman |

|

Retiring Directors | | |

Pierre-André Chapatte Antoine Raphael Vidts | | |

|

Proposed Directors | | |

Max Eugene Link René Simon Braginsky | | Proposed Non-Executive Vice Chairman Proposed Non-Executive Director |

|

Company secretary | | English legal advisers |

Paul Richard Chambers Registered office 15 Adam Street London WC2N 6LA Head office 122 rte du Moulin de la Ratte 1236 Cartigny Geneva Switzerland Sponsor and financial adviser Lazard & Co., Limited 21 Moorfields London EC2P 2HT Joint stockbrokers Cazenove & Co. Ltd 12 Tokenhouse Yard London EC2R 7AN Dresdner Kleinwort Wasserstein Limited 20 Fenchurch Street London EC3P 3DB Swiss exchange agent Lombard Odier Darier Hentsch & Cie 11 rue de la Corraterie [6.B.14]CH-1211 Geneva 11 Switzerland UK registrars[6.B.14] and paying agent Lloyds TSB Registrars The Causeway Worthing West Sussex BN99 6DA | | Ashurst Morris Crisp Broadwalk House 5 Appold Street London EC2A 2HA Swiss legal advisers Niederer Kraft & Frey Bahnhofstrasse 13 CH-8001 Zurich Switzerland US legal advisers[6.A.8] Sidley Austin Brown & Wood Bank One Plaza 10 South Dearborn Street Chicago, IL 60603 USA Auditors and reporting accountants BDO Stoy Hayward 8 Baker Street London W1U 3LL Banks Lloyds TSB Bank plc 25 Gresham Street London EC2V 7HN The Royal Bank of Scotland plc 36 St. Andrew Square Edinburgh EH2 2YB English legal advisers on share schemes Pinsent Curtis Biddle 3 Colmore Circus Birmingham B4 6BH |

i

TABLE OF CONTENTS

| |

|

|

| | | Page

|

Smith & Nephew Group Directors, secretary and advisers | | i |

|

Part I | | General information on the Combined Group | | 1 |

| | | 1. | | Introduction | | 1 |

| | | 2. | | Background to and reasons for the Offers | | 1 |

| | | 3. | | Information on Smith & Nephew | | 4 |

| | | 4. | | Information on Centerpulse | | 4 |

| | | 5. | | Information on InCentive | | 5 |

| | | 6. | | Management of Smith & Nephew Group | | 6 |

| | | 7. | | Current trading and prospects of Smith & Nephew | | 6 |

| | | 8. | | Current trading and prospects of Centerpulse | | 6 |

| | | 9. | | Prospects of the Combined Group | | 6 |

| | | 10. | | Product recall liability | | 6 |

| | | 11. | | Dividends | | 7 |

|

Part II | | The Offers and the Scheme | | 8 |

| | | 1. | | Details of the Centerpulse Offer | | 8 |

| | | 2. | | Details of the InCentive Offer | | 8 |

| | | 3. | | Collective mix and match facility | | 9 |

| | | 4. | | Fractional entitlements under the Offers | | 10 |

| | | 5. | | The Scheme | | 10 |

| | | 6. | | Recommendations | | 11 |

| | | 7. | | Conditions | | 11 |

| | | 8. | | Employees | | 11 |

| | | 9. | | Smith & Nephew Employee Share Schemes | | 11 |

| | | 10. | | Smith & Nephew US shareholders and holders of Smith & Nephew ADSs | | 12 |

| | | 11. | | Listing, settlement and dealings | | 13 |

|

Part III | | Financial information relating to Smith & Nephew | | 15 |

|

Part IV | | Financial information relating to Centerpulse | | 51 |

| | | A. | | IFRS financial information | | 51 |

| | | B. | | Unaudited reconciliations to Smith & Nephew’s accounting policies | | 98 |

| | | C. | | Letter from BDO Stoy Hayward on the unaudited reconciliations to Smith & Nephew’s accounting policies | | 101 |

|

Part V | | Financial information relating to Smith & Nephew Group | | 103 |

|

Part VI | | Unaudited pro forma statement of net assets of the Combined Group | | 111 |

| | | A. | | Unaudited pro forma statement of net assets of the Combined Group | | 111 |

| | | B. | | Report by the reporting accountants on the unaudited pro forma statement of net assets | | 115 |

|

Part VII | | Further details of the transaction | | 116 |

| | | 1. | | Introduction | | 116 |

| | | 2. | | Centerpulse Transaction Agreement | | 116 |

| | | 3. | | InCentive Transaction Agreement | | 117 |

| | | 4. | | InCentive Tender Agreement | | 118 |

| | | 5. | | Conditions | | 119 |

| | | 6. | | Implementation of the Scheme | | 121 |

|

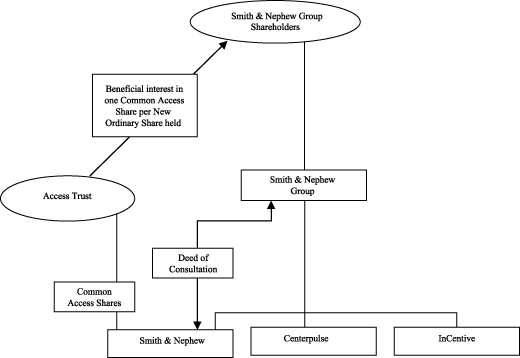

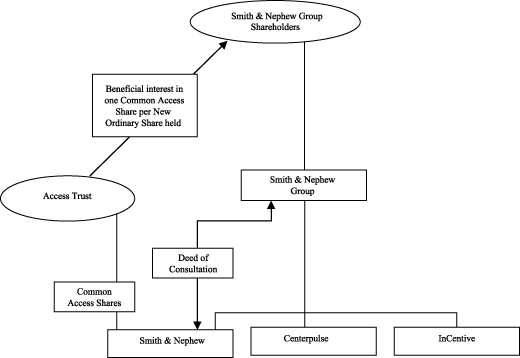

Part VIII | | Common Access Share structure | | 122 |

| | | 1. | | Introduction | | 122 |

| | | 2. | | Key features of the Common Access Share structure | | 123 |

| | | 3. | | Smith & Nephew Group Shareholders | | 123 |

| | | 4. | | Definitions relating to Common Access Shares | | 124 |

| | | 5. | | New Ordinary Shares | | 125 |

| | | 6. | | Rights attaching to the Common Access Shares | | 126 |

| | | 7. | | Access Trust | | 127 |

| | | 8. | | Deed of Consultation | | 128 |

ii

| |

|

|

| | | Page

|

Part IX | | Description of Smith & Nephew Group ADSs | | 129 |

|

Part X | | Additional information | | 135 |

| | | 1. | | Responsibility | | 135 |

| | | 2. | | Corporate details | | 135 |

| | | 3. | | Share capital | | 135 |

| | | 4. | | Memorandum of association | | 141 |

| | | 5. | | Articles of association | | 141 |

| | | 6. | | Proposed Smith & Nephew Group Share Schemes and the Smith & Nephew Share Schemes | | 150 |

| | | 7. | | Smith & Nephew Group Directors’, Proposed Directors’ and other interests | | 166 |

| | | 8. | | Taxation | | 175 |

| | | 9. | | Material contracts | | 181 |

| | | 10. | | Litigation | | 185 |

| | | 11. | | Subsidiaries | | 189 |

| | | 12. | | Summary of main investments | | 189 |

| | | 13. | | Principal establishments | | 190 |

| | | 14. | | Miscellaneous | | 190 |

| | | 15. | | Documents available for inspection | | 196 |

|

Part XI | | Definitions | | 198 |

HELPLINE

Lloyds TSB Registrars are providing a telephone helpline to answer questions which Smith & Nephew Shareholders may have prior to deciding what action to take. The number for callers dialling from within the UK is 0870 600 2027, and for callers dialling from outside the UK the number is +44 1903 702 767. Helpline operators cannot provide financial or legal advice and will only be able to answer questions on the effect of the proposals.

iii

Forward-looking statements

These listing particulars contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Statements that are not strictly historical statements, including statements about Smith & Nephew Group’s, Smith & Nephew’s and Centerpulse’s beliefs and expectations, constitute forward-looking statements. By their nature, forward-looking statements are subject to risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. The forward-looking statements in this document include, but are not limited to, statements addressing the following subjects: expected timing of the Transaction; future financial and operating results; actions to be taken by the Combined Group following the Transaction; and the timing and benefits of the Transaction. The following factors, among others, could cause results to differ materially from those described in the forward-looking statements: inability to obtain, or meet the conditions imposed for, regulatory approvals for the Transaction; the failure of the Smith & Nephew Ordinary Shareholders to pass the resolutions necessary to implement the Transaction, the failure of the minimum tender condition or the failure of other conditions to the Offers; the risk that the businesses will not be integrated successfully and other economic, business, competitive and/or regulatory factors affecting the businesses of Smith & Nephew Group, Smith & Nephew and Centerpulse generally. More detailed information about such economic, business, competitive and/or regulatory factors is set forth in Smith & Nephew Group’s and Centerpulse’s respective filings with the SEC. Subject to any requirement under the Listing Rules to update the forward-looking statements, Smith & Nephew Group, Smith & Nephew and Centerpulse are under no obligation, and expressly disclaim any obligation, to update or alter their forward-looking statements, whether as a result of new information, future events or otherwise.

Additional information

Any offer in the United States will only be made through a prospectus, which is part of a registration statement on Form F-4 to be filed with the SEC. Centerpulse Shareholders and Incentive Shareholders who are US persons or are resident in the United States are urged to review carefully the registration statement on Form F-4 and the prospectus included therein, the Schedule TO and other documents relating to the Offers that have been filed by Smith & Nephew Group with the SEC because these documents contain important information relating to the Offers. Shareholders are also urged to read the related solicitation/recommendation statement on Schedule 14D-9 that has been filed with the SEC by Centerpulse relating to the Centerpulse Offer. You may obtain a free copy of these documents after they have been filed with the SEC, and other documents filed by Smith & Nephew Group and Centerpulse with the SEC, at the SEC’s website at www.sec.gov. The registration statement on Form F-4, as well as any documents incorporated by reference therein, the Schedule TO and the Schedule 14D-9 may also be inspected and copied at the public reference room maintained by the SEC at 450 Fifth Street, NW, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. YOU SHOULD READ THE PROSPECTUS AND THE SCHEDULE 14D-9 CAREFULLY BEFORE MAKING A DECISION CONCERNING THE CENTERPULSE OFFER.

Projections

During the course of discussions between Smith & Nephew and Centerpulse that led to the entering into of the Centerpulse Transaction Agreement and the Offers, Centerpulse provided Smith & Nephew with certain financial projections which have been summarised in the Form F-4 filed with the SEC.

These projections were neither seen nor commented upon by Smith & Nephew Group, Smith & Nephew or its advisers in advance of their preparation and no reliance should be placed on them. The financial projections do not necessarily reflect the Smith & Nephew Group Directors’ view of Centerpulse’s prospects and financial performance nor Centerpulse’s contribution to the prospects and financial performance of the Combined Group. The financial projections should not be regarded as a reliable indicator of Centerpulse’s future operating results nor the operating results of the Combined Group and they should not be relied upon as such.

These projections were prepared prior to the announcement of the Transaction. Not all of the estimates and assumptions upon which they were based are stated and the facts supporting the estimates and assumptions upon which they were stated to have been based may have since changed. In addition, the base data underlying them may now be out of date.

None of Smith & Nephew Group, Smith & Nephew nor their financial advisers nor any other party accepts responsibility for the accuracy, reasonableness, validity or completeness of the financial projections or the estimates and assumptions that underlie them.

iv

None of the financial projections was intended for publication by Smith & Nephew Group or Smith & Nephew and they should not be regarded as a forecast of profits by Smith & Nephew Group, Smith & Nephew, Centerpulse or any of their respective directors and accordingly the financial projections have not been prepared or reviewed to a standard to which published projections would be prepared and reviewed. Shareholders should not rely upon any of the financial projections in making any decision about accepting or not accepting either of the Offers or in deciding whether or not to vote in favour of the resolutions to be proposed at the Extraordinary General Meeting, the Preference Shareholders’ Meeting or the Court Meeting.

v

PART I

GENERAL INFORMATION ON THE COMBINED GROUP

On 20 March 2003, the boards of Smith & Nephew and Centerpulse announced that they had agreed to combine their businesses to create a leading global orthopaedics company. At the same time the Smith & Nephew Board announced that it would create a new holding company by means of a scheme of arrangement under the Act.

The Transaction will be implemented by the acquisition of Smith & Nephew by Smith & Nephew Group pursuant to a scheme of arrangement of Smith & Nephew under section 425 of the Companies Act, and by a public tender offer by Smith & Nephew Group for all the Centerpulse Shares, as a result of which Centerpulse will become a subsidiary of Smith & Nephew Group. InCentive is the largest shareholder of Centerpulse and holds approximately 18.9 per cent. of the share capital of Centerpulse. Smith & Nephew Group is also making a public tender offer for all the InCentive Shares.

Under the terms of the Scheme and the[6.B.16] Centerpulse Offer, Smith & Nephew Ordinary Shareholders and Centerpulse Shareholders will receive, respectively:[3.18]

for each Smith & Nephew Ordinary Share | | 1 New Ordinary Share[3.19] |

for each Centerpulse Share | | 25.15 New Ordinary Shares and CHF 73.42 in cash[3.22(a)] |

Pursuant to the terms of the InCentive Offer, InCentive Shareholders will receive New Ordinary Shares and cash according to a formula set out in paragraph 2 of Part II of this document.[3.22(b)]

Accepting Shareholders (being Centerpulse Shareholders and InCentive Shareholders who validly accept, respectively, the Centerpulse Offer and the InCentive Offer in accordance with the terms of the Offer Documents) may, pursuant to a mix and match facility, elect to take fewer New Ordinary Shares or more New Ordinary Shares than their basic entitlement under the relevant Offer, but elections under both Offers (taken together) to receive more New Ordinary Shares will only be satisfied to the extent that elections have been made under both Offers overall by Accepting Shareholders to receive fewer New Ordinary Shares.

On the basis of the assumptions set out in paragraph 14.6 of Part X of this document, upon completion of the Transaction, 929.6 million New Ordinary Shares will be issued to[6.B.6] Smith & Nephew Ordinary Shareholders and 298.5 million New Ordinary Shares will be issued to Accepting Shareholders representing approximately 76 per cent. and 24 per cent. respectively of the issued ordinary share capital of Smith & Nephew Group.

Following completion of the Transaction, Smith & Nephew Group Shareholders will be able to elect to receive dividends from Smith & Nephew rather than from Smith & Nephew Group. Further details are set out in Part VIII of this document.

Further details of the Transaction are set out in Parts II and VII of this document.

Financial information on each of Smith & Nephew, Centerpulse and Smith & Nephew Group is set out in Parts III, IV and V respectively of this document. Shareholders should read the whole of this document and not rely only on the summarised information set out below.

| 2. | Background to and reasons for the Offers |

The combination of Smith & Nephew and Centerpulse will create a global leader in the $14 billion orthopaedics market, with the Combined Group rising to a No. 3 market share position. It also offers an enhanced platform for growth in spinal implants, the fastest growing segment within the orthopaedics sector and an opportunity to participate in the dental implant sector. In bringing together two complementary businesses and transforming their scale, the Transaction offers significant strategic and value creation opportunities and is expected to better serve the current and future needs of patients, surgeons and their hospital communities.

1

Market dynamics

The orthopaedic implant market continues to be one of the fastest growing medical technology sectors, with estimated global growth of 15 per cent. in 2002. In most developed countries there are some common drivers including:

| · | demographics of an aging population, with the population aged 50-69 projected to increase by nearly 3 per cent. per annum for the foreseeable future; |

| · | improved quality of life expectations, with patients better informed of the benefits of orthopaedic surgery due to the internet, media and word-of-mouth; |

| · | an expanding patient pool, due to an increase in active lifestyles and new longer-lasting materials such as improved bearing surfaces in orthopaedics and bioresorbables in arthroscopy that are encouraging surgeons to treat younger and more active patients; |

| · | an increasing incidence of osteoarthritis, combined with less invasive surgery trends and continued growth in surgeon familiarity with implant surgery; and |

| · | an increasing need for revision surgeries, as patients from the first orthopaedic boom in the late 80s require revision procedures. |

Global scale and increased geographic reach in reconstructive implants

Building on Centerpulse’s market leading position in Europe and Smith & Nephew’s significant presence in the US, the Combined Group will become the fourth largest global reconstructive implant company with a market share of approximately 18 per cent. In Europe, the Combined Group will be a market leader in reconstructive implants with a market share of approximately 26 per cent. It will become No. 4 overall in reconstructive implants in the US with a market share of 14 per cent. and have an enhanced position in Japan.

Centerpulse’s particular geographic strength is in Europe, based on strong surgeon relationships developed over many years and an outstanding reputation for service. Centerpulse also has significant manufacturing and research and development facilities, located in Winterthur, Switzerland. This provides a major European facility, which will continue as a key centre for the long-term benefit of the Combined Group.

In addition, the two businesses fit together well in the US. Centerpulse, which has a smaller share of the US market, is particularly well established in the southern states of the US, complementing the strong presence of Smith & Nephew across other regions of the US.

The combination will also double the scale of the Combined Group’s business in the important Japanese market, where Smith & Nephew has a strong position in trauma, and Centerpulse is well positioned in reconstructive implants.

Complementary product lines

The fit between the two companies’ product lines is excellent. Centerpulse is strong in hips, with pioneering positions in metal-on-metal and highly cross-linked polyethylene, as well as extensive developments under way in less invasive procedures and in larger heads giving greater range of motion. Whilst Smith & Nephew is also strong in hips, it has particular strength in knees, with the revolutionary OXINIUM® product setting new standards for innovation and longevity. Leveraging the specific strengths of each company’s sales relationships into new and existing accounts with this expanded product range is anticipated to lead to significant cross-selling opportunities.

Both companies have a strong tradition of technological innovation and, when combined, they will possess one of the most innovative product line-ups in global orthopaedics, including:

| · | the broadest range of wear reducing joint implant bearing surfaces (OXINIUM®, DURASUL®, METASUL®); |

| · | unique minimally invasive knee surgery products (UNISPACER™, ACCURIS™); |

| · | proven total joint brands (GENESIS® II, Natural Knee™, CLS™, Alloclassic®, SPECTRON®, REFLECTION®, SYNERGY™); |

| · | computer assisted surgery technology (Navitrack®, ACHIEVE™); and |

| · | advanced trauma devices (TRIGEN™, TAYLOR SPATIAL FRAME™, ORTHOGUARD AB™, EXOGEN®). |

2

Expansion in the fast-growing spinal segment

Centerpulse’s global No. 5 position in spinal implants provides the Combined Group with an enhanced platform for growth in the fastest growing segment of the orthopaedics market. In 2001, the US and European spine market was estimated to be worth $1.7 billion. Centerpulse entered the spinal marketplace in 1998 through the acquisition of Spine-Tech Inc. (“Spine-Tech”), which brought with it the market leading lumbar fusion cage. Spine-Tech now offers a full range of products in the spinal implant market with devices for lumbar and cervical fixation, allografts and stabilisation devices. The spine business is well placed for growth in a rapidly expanding market.

Dental

Centerpulse’s dental division occupies the No. 4 position globally in the dental implant market with a market share of approximately 12 per cent. It primarily serves the US market and had sales of CHF 131 million in 2002, an underlying increase of 18 per cent. The global market for dental implants is currently growing at 15 per cent. per annum and the dental division is well positioned for further growth.

Value creation opportunities

Significant value is expected to be created for the Combined Group’s shareholders in three key areas: integration cost savings, sales and marketing opportunities and the longer term scale advantages of being a leading orthopaedics company.

At the Combined Group level, integration cost savings are expected to amount to £45 million per annum by 2005, requiring exceptional cash costs of £130 million to implement. These will enable the Combined Group to target an improvement of its pre-goodwill operating margin to 23 per cent. by 2005/6, up from Smith & Nephew’s previous guidance of 21 per cent., and with stronger cash generation. This is expected to enhance earnings per share of the Combined Group (before amortisation of goodwill and exceptional integration costs) by mid single digits in 2004 and approaching double digits in 2005 when the post-tax return on investment is expected to meet Smith & Nephew Group’s weighted average cost of capital. Based on current tax rates the Smith & Nephew Group Directors believe that, going forward, the Combined Group’s tax rate will be 29 per cent. (based on profits before tax, goodwill amortisation and exceptional items).

Opportunities to combine the organisations to present a significant force in orthopaedics in each of the key markets, the US, Europe and Japan, have been identified. The combination of each company’s sales relationships in existing accounts with the expanded product range is expected to lead to an increase in sales force productivity and opportunities to launch innovative products through an expanded sales force. Extending proprietary technologies such as OXINIUM®, DURASUL® and METASUL® throughout the product range is expected to develop improved demand for the Combined Group’s products. These, together with related cost savings, will enable the orthopaedics division to target a pre-goodwill operating margin of 27 per cent. by 2005/6.

Longer term, the opportunity to develop and manufacture a unified range of next generation products will lead to further benefits. The enhanced scale of the Combined Group’s strategic research and development will enable it to invest at the forefront of orthopaedic product development and its increased market presence will enable a stronger profile to be built with major customer groups.

Benefits for all stakeholders

The Smith & Nephew Group Directors and the Centerpulse Directors believe that, in addition to creating value for shareholders of the Combined Group, the Transaction will deliver significant benefits for patients, surgeons, hospitals and employees:

| · | patients will benefit from the pooling of research and development activities, resulting in better targeted and more optimised product development which will deliver enhanced product performance; |

| · | surgeons and hospitals will benefit from a wider product offering, broader infrastructure and enhanced delivery of services and solutions; and |

| · | employees will benefit from being part of one of the world’s leading orthopaedic groups, operating in a dynamic and fast-growing industry and with the resources and depth to compete with other market leaders in the sector. |

3

| 3. | Information on Smith & Nephew |

Smith & Nephew is a global advanced medical devices company[6.D.1] employing over 7,300 people with operations in 32 countries. Underlying sales growth in 2002 was 14 per cent., with acquisitions adding a further 4 per cent. Operating margins of continuing operations (before amortisation of goodwill and exceptional items) were 18 per cent. It is structured in three divisions, “Orthopaedics”, “Endoscopy” and “Wound Management”, with principal manufacturing facilities in Tennessee and Massachusetts in the US, and Hull in the UK.

Orthopaedics is a global provider of reconstructive implant systems for knees, hips and shoulder joints, as well as trauma and clinical therapy products to help repair broken bones and damaged joints. This business strives to combine industry-leading technology with clinically proven products to deliver simpler, less invasive and more cost effective procedures to the orthopaedic community. Smith & Nephew has 8 per cent. of the orthopaedic reconstructive implant and trauma markets and holds the No. 6 worldwide position. In 2002, sales for the Orthopaedics division were £470 million, an underlying sales increase of 20 per cent. from the previous financial year, and EBITA before exceptional items was £98 million.

Endoscopy is a world leader in the development and commercialisation of minimally invasive endoscopic surgery. This business is committed to reducing trauma and pain to the patient, reducing cost to healthcare systems, and providing better outcomes for surgeons and patients with its broad range of techniques and instruments for minimally invasive surgery, particularly of the joint. Smith & Nephew has 35 per cent. of the arthroscopy (joint) market and holds the leading worldwide position. In 2002, sales for the Endoscopy division were £292 million, an underlying sales increase of 10 per cent. from the previous financial year, and EBITA before exceptional items was £54 million.

Wound Management provides an advanced range of treatments for difficult to heal wounds. It develops innovative new solutions to chronic and acute wound management problems. Smith & Nephew has 21 per cent. of the wound management market and has the leading worldwide position. In 2002, sales for the Wound Management division were £322 million, an underlying increase of 11 per cent. from the previous financial year, and EBITA before exceptional items was £44 million.

Smith & Nephew also has investments in BSN Medical, a joint venture with Beiersdorf AG, and in AbilityOne Corporation, a rehabilitation business in which it holds a 21.5 per cent. interest. The share of operating profit before exceptional items attributable to Smith & Nephew in 2002 from these two investments was £25 million.

The following table shows Smith & Nephew’s group turnover (continuing operations); EBITA before exceptional items (continuing operations including investments); basic earnings per share before goodwill amortisation and exceptional items; shareholders’ funds; and net debt for each of the financial years ended 31 December 2001 and 31 December 2002 (as extracted from Smith & Nephew’s 2002 financial statements):

| |

|

|

| | | Year to 31 December 2002

| | Year to 31 December 2001

|

Group turnover (continuing operations) | | £ | 1,084m | | £ | 978m |

EBITA before exceptional items (continuing operations including investments) | | £ | 221m | | £ | 187m |

Basic earnings per share before goodwill amortisation and exceptional items | | | 16.02p | | | 13.96p |

Shareholders’ funds | | £ | 517m | | £ | 405m |

Net debt | | £ | 277m | | £ | 244m |

Further information, including financial information relating to Smith & Nephew, is set out in Part III of this document. You should read the whole of this document and not just rely on the summarised information above. In particular this table should be read in conjunction with Note 1 (in relation to group turnover); Note 10 (in relation to earnings per share); Notes 22 and 24 (in relation to shareholders’ funds) and Note 18 (in relation to net debt) in the financial information relating to Smith & Nephew set out in Part III of this document.

| 4. | Information on Centerpulse |

Centerpulse, formerly Sulzer Medica AG, is a leading medical technology group employing over 2,800 employees globally, which serves the reconstructive joint, spinal and dental implant markets. Following the divestiture of its cardiovascular division, which was concluded in January 2003, the group is now organised into three divisions: “Orthopaedics”, “Spine-Tech” and “Dental”. Centerpulse, which is headquartered in Switzerland

4

and has a history of technological leadership in its principal areas of activity, has five production facilities situated in Switzerland, the US and France.

Centerpulse’s largest division is Orthopaedics, which focuses on joint care and includes the traditionally strong hip and knee implant businesses. Centerpulse estimates that it has a leading share of the European implant market, with a 22 per cent. market share. In 2002, the Orthopaedics division reported total sales of CHF 923 million, of which CHF 542 million was in Europe. The underlying sales growth of the Orthopaedics division for 2002 was 14 per cent.

The Spine-Tech division offers a full range of spinal implant systems primarily in the US, and has an estimated global market share of 7 per cent. In 2002, the Spine-Tech division had sales of CHF 179 million, an underlying sales growth of 10 per cent.

The Dental division, producing mainly dental implants, serves primarily the US and European markets and occupies the No. 4 position globally, with a market share of approximately 13 per cent. In 2002, the Dental division had sales of CHF 131 million, an underlying sales increase of 18 per cent.

The following table shows Centerpulse’s group turnover (continuing operations); EBITA before exceptional items (continuing operations); profit/(loss) before tax; basic earnings per share; net assets; and net debt (cash) for each of the financial years ended 31 December 2001 and 31 December 2002 (as extracted from Centerpulse’s 2002 financial statements):

| |

|

|

| | | Year to 31 December 2002

| | Year to 31 December 2001

|

Group turnover (continuing operations) | | CHF 1,241m | | CHF 1,158m |

EBITA before exceptional items (continuing operations) | | CHF 228m | | CHF 107m |

Profit/(loss) before tax | | CHF 376m | | CHF (1,645)m |

Basic earnings per share | | CHF 33.10 | | CHF (119.62) |

Net assets | | CHF 1,278m | | CHF 791m |

Net debt (cash) | | CHF 358m | | CHF (61)m |

As described in paragraph 10 of Part X of this document, Centerpulse is subject to litigation in respect of a major product recall. At the time the 2001 audit was concluded the situation with regard to the ultimate liabilities under this litigation and the financing available to Centerpulse to meet those liabilities was uncertain. Accordingly, the auditors’ report on Centerpulse’s consolidated financial statements for the financial year ended 31 December 2001 contained the following emphasis of matter paragraph and qualification:

“Without qualifying our opinion we draw your attention in accordance with the International Standards on Auditing (ISA) to the following: as described in Note 9 to the consolidated financial statements, on 13 March 2002 Sulzer Medica has reached a tentative settlement agreement with the patients in the USA affected by defective hip and knee implants. The Group’s estimate of costs directly related to this tentative settlement agreement amount to $873 million and is recognized in the 2001 consolidated financial statements. As a result of the uncertainties existing in connection with this pending litigation, the ultimate outcome of this matter cannot presently be determined. This emphasis of matter represents, in contrast to the ISA, a qualification in accordance with the auditing standards promulgated by the Swiss profession.”

The auditors’ report on Centerpulse’s consolidated financial statements for the year ended 31 December 2002 contained no such qualification or emphasis of matter. The current position in relation to this litigation is described below in paragraph 10 below, and also in paragraph 10.3 of Part X of this document.

Further information including financial information relating to Centerpulse is set out in Part IV of this document. You should read the whole of this document and not just rely on the summarised information above. In particular this table should be read in conjunction with Note 11 (in relation to the impact of discontinuing operations) and Note 14 (in relation to earnings per share) in the financial information relating to Centerpulse set out in Part IV of this document.

5. Information on InCentive

InCentive, an investment company listed on the SWX Swiss Exchange, holds approximately 18.9 per cent. of the registered issued share capital of Centerpulse. In its full year 2002 results, InCentive reported profit before tax of CHF 178 million. As of 17 April 2003, InCentive’s unaudited net asset value amounted to CHF 774.2 million.

5

| 6. | Management of Smith & Nephew Group |

On completion of the Transaction the Chairman of the Combined Group will be Dudley Eustace, the Chief Executive will be Chris O’Donnell and the Finance Director will be Peter Hooley. The Combined Group will consist of five divisions, in order of sales revenue, Orthopaedics, Wound Management, Endoscopy, Spine-Tech and Dental and will operate from major manufacturing and market support facilities in the UK, Switzerland and the US.

Dr. Max Link, chairman and chief executive of Centerpulse, will be invited to join the Smith & Nephew Group Board as a non-executive director and one of two Vice Chairmen on completion of the Transaction. René Braginsky, a Centerpulse board member, will also be invited to join the Smith & Nephew Group Board as a non-executive director. Dr. Rolf Stomberg, a current Smith & Nephew Director, will become the other Vice Chairman of Smith & Nephew Group.

| 7. | Current trading and prospects of Smith & Nephew |

Sales at Smith & Nephew’s Orthopaedics and Wound Management divisions have seen a solid start to 2003. Orthopaedics’ move to two divisions – reconstructive implant and trauma – is progressing well and the introduction of specialised sales forces in the US is proceeding according to plan. Endoscopy has experienced some pressure from the increased re-use of disposable blades in the United States. Smith & Nephew’s margin in the first half of the year will be impacted by the assumption of the full costs of the Dermagraft launch. Smith & Nephew remains confident of meeting its margin expansion target and its mid-teens pre-goodwill amortisation earnings per share growth target going forward.

| 8. | Current trading and prospects of Centerpulse |

The following outlook statement was included in an announcement of Centerpulse on 20 March 2003:

“Trading since year end has been in line with management expectations. Centerpulse remains confident that it will be able to grow in its core markets at least in line with the market. In Orthopaedics, the Company believes that it can maintain a leading role in its primary markets in Europe and generate solid growth in the US and Japan by continuing to deliver first-class products and building long-term trusting relationships. The Spine-Tech division intends to launch several new products in the US market, with the introduction of the Dynesys stabilisation system and the radiolucent cages in 2003 expected to positively impact sales growth. The Dental division has reinforced its market position by enhancing its product offerings with innovative solutions for aesthetics as well as leading educational programs.”

9. Prospects of the Combined Group

The Smith & Nephew Group Board is confident that Smith & Nephew and Centerpulse can be successfully combined to realise the value creation opportunities discussed earlier and, in particular, to enable the Combined Group to target a pre-goodwill amortisation operating margin of 23 per cent. by 2005/6 and material earnings per share enhancement in 2005.

| 10. | Product recall liability |

Last year the Centerpulse Board put in place measures to deal with claims arising from a major recall of reconstructive implants dating back to 5 December 2000. This involved Centerpulse entering into a district court approved class action settlement for US residents on 13 March 2002, and establishing a settlement trust (the“Settlement Trust”) to pay claims to class members in the US who undergo surgery to replace an affected hip implant prior to 5 June 2003 or an affected tibial base plate prior to 17 November 2003. The Settlement Trust was funded with approximately $1.1 billion, of which Centerpulse contributed $725 million in cash on 4 November 2002. Centerpulse’s insurers and former parent company funded the balance. The settlement agreement (further details of which are set out in paragraph 10.3(a) of Part X of this document), provides for the Settlement Trust to pay for the first 4,000 valid claims. Centerpulse remains liable for 50 per cent. of the cost of settled claims in excess of that number. The Settlement Trust will also fund the first 64 settled claims for reprocessed hip shells replaced before 8 September 2004, with Centerpulse remaining liable in full for settled claims beyond this number.

As at 11 April 2003, the administrator of the Settlement Trust had received 4,362 claim forms in relation to hip implants and tibial base plates and 150 claim forms for reprocessed hip implants. The administrator has determined that of these classes of claims, 3,795 and 119 respectively are likely to be valid. It is not known at present how many more claims will be made or whether the remaining and future claims are or will be valid and hence how many will qualify for settlement.

6

The Smith & Nephew Board has examined this issue in detail. Although the Centerpulse Board believes that the remaining provision in its year end audited accounts will be adequate to provide for the liabilities that may arise from the product recall, the Smith & Nephew Board is mindful that there is a possibility that the eventual number of revisions and cost of settling claims from the product recall issue may exceed the level of provision made by Centerpulse. The Smith & Nephew Board has taken into account this possibility in agreeing the terms and structure of the Offers. Further details of this litigation are set out in paragraph 10.3 of Part X of this document.

In respect of the final dividend of 3.00 pence per Smith & Nephew Ordinary Share recommended for the year ended 31 December 2002, existing Smith & Nephew Ordinary Shareholders[6.B.8] will receive their entitlement in full. The New Ordinary Shares being issued as consideration under the Offers will not qualify for this final dividend. Centerpulse does not intend to pay a dividend in respect of 2002. Smith & Nephew Group will declare dividends in sterling and its dividend policy is expected to continue in line with the current Smith & Nephew policy. All Smith & Nephew dividends will be paid in sterling and all Smith & Nephew Group dividends will be paid in Swiss francs at the prevailing exchange rate at the date of payment.

Following completion of the Transaction, Smith & Nephew Group Shareholders will be able to receive dividends from Smith & Nephew (which is and will be tax resident in the UK) rather than from Smith & Nephew Group (which is and will be tax resident in Switzerland). Were Smith & Nephew Group Shareholders (other than those resident in Switzerland) to receive dividends from Smith & Nephew Group they would, under current tax laws in Switzerland, incur a withholding tax charge at 35 per cent. However, under domestic law, Swiss residents may obtain a refund or tax credit in the full amount of the withholding tax. For non-residents, some relief may be granted under the terms of double tax treaties.

Smith & Nephew Group Shareholders with an address on the Register outside Switzerland (other than those who hold their New Ordinary Shares through a Swiss Clearing System) will be deemed to have made an election to receive dividends from Smith & Nephew and therefore they will not need to take any action in order to receive dividends from Smith & Nephew. Those Smith & Nephew Group Shareholders with an address on the Register outside Switzerland who wish to receive dividends from Smith & Nephew Group rather than from Smith & Nephew, will need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

Smith & Nephew Group Shareholders with an address on the Register in Switzerland or who hold their New Ordinary Shares through a Swiss Clearing System will, in order to receive dividends from Smith & Nephew as opposed to dividends from Smith & Nephew Group, need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

7

PART II

THE OFFERS AND THE SCHEME

| 1. | Details of the Centerpulse Offer |

Smith & Nephew Group is offering 25.15 New Ordinary Shares and CHF 73.42 in cash in respect of each Centerpulse Share so that, on the basis of the assumptions set out in paragraph 14.6 of Part X, Centerpulse Shareholders and InCentive Shareholders will collectively own approximately 24 per cent. of the Combined Group. Holders of Centerpulse ADSs will be offered 0.2515 Smith & Nephew Group ADSs per Centerpulse ADS and CHF 7.342 in cash and may participate in the collective mix and match facility.

On the basis of Smith & Nephew’s closing share price of 419.5 pence on 17 April 2003, the Centerpulse Offer values each Centerpulse Share at CHF 302.12 and the total issued share capital of[6.C.22(a)]Centerpulse at CHF 3,585.4 million (£1,654.0 million). The Offers will together result in the issue of 298.5 million New Ordinary Shares and a net payment of CHF 871.3 million (£402.0 million) in cash, taking account of InCentive’s expected cash balances.

Each accepting Centerpulse Shareholder will also be entitled to a beneficial interest in one Common Access Share for each New Ordinary Share received by that accepting Centerpulse Shareholder. Each Common Access Share will be allotted and issued to the Trustee to be held on bare trust for the relevant accepting Centerpulse Shareholder. The Common Access Shares will enable Smith & Nephew Group Shareholders to receive dividends from Smith & Nephew rather than from Smith & Nephew Group in respect of their New Ordinary Shares.

Smith & Nephew Group Shareholders with an address on the Register outside Switzerland (other than those who hold their New Ordinary Shares through a Swiss Clearing System) will be deemed to have made an election to receive dividends from Smith & Nephew and therefore they will not need to take any action in order to receive dividends from Smith & Nephew. Those Smith & Nephew Group shareholders with an address on the Register outside Switzerland who wish to receive dividends from Smith & Nephew Group rather than from Smith & Nephew, will need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

Smith & Nephew Group Shareholders with an address on the Register in Switzerland or who hold their New Ordinary Shares through a Swiss Clearing System will, in order to receive dividends from Smith & Nephew as opposed to dividends from Smith & Nephew Group, need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

If the Centerpulse Offer becomes or is declared wholly unconditional, Smith & Nephew Group will assume Centerpulse’s outstanding net debt which stood at CHF 358 million (£165 million) as at 31 December 2002. Smith & Nephew Group, Smith & Nephew and certain of its subsidiaries have entered into a new underwritten debt facility of $2.1 billion, inter alia, to refinance the existing net debt of both Smith & Nephew and Centerpulse, to finance the cash element of the Offers and to provide working capital headroom for the Combined Group.

| 2. | Details of the InCentive Offer |

Under the terms of the InCentive Transaction Agreement, InCentive is obliged to dispose of its investments (other than Centerpulse Shares) so that on the Settlement Date its investments will comprise only Centerpulse Shares and cash. The terms of the InCentive Offer will be such that in respect of InCentive’s holding in Centerpulse they will precisely reflect the terms of the Centerpulse Offer.

8

The offer price for each InCentive Share is calculated by reference to the formula (a+b)/c where:

a | | = | | | | the total amount of New Ordinary Shares and amount of cash that would be payable under the Centerpulse Offer for the Centerpulse Shares held by InCentive (the “Centerpulse Holding”); |

b | | = | | | | the adjusted net asset value (positive or negative) of InCentive (the “Adjusted NAV”) calculated as at the last day of the InCentive Offer period but excluding the Centerpulse Holding and attributing no value to any InCentive Shares held by InCentive or its subsidiaries (the “Treasury Shares”), as confirmed by InCentive’s auditors; and |

c | | = | | | | the total number of InCentive Shares in issue on the last day of the InCentive Offer period less the number of Treasury Shares on that date. |

As a result, the consideration for each InCentive Share will consist of (i) an element of New Ordinary Shares and cash which will mirror InCentive’s holding of Centerpulse Shares; plus or minus (ii) the cash attributable to the Adjusted NAV of InCentive excluding the Centerpulse Holding. If the Adjusted NAV is negative, then the cash element attributable to the Centerpulse Holding shall be reduced, pro rata, and if after such reduction there is still a negative balance, the number of New Ordinary Shares to be issued shall be reduced by a corresponding amount.

InCentive is not permitted to sell its shares in Centerpulse (or to assent them to any other offer) without Smith & Nephew Group’s consent, unless Smith & Nephew Group declares that the InCentive Offer has failed. Smith & Nephew Group can require InCentive to assent its shares in Centerpulse to the Centerpulse Offer in certain limited circumstances.

Under the InCentive Tender Agreement the Major InCentive Shareholders holding approximately 77 per cent. of InCentive’s issued share capital have irrevocably undertaken to accept the InCentive Offer. The Major InCentive Shareholders have no right to withdraw their acceptances of the InCentive Offer in the event of a third party offer for InCentive unless Smith & Nephew Group announces that the InCentive Offer has failed or a higher third party offer is also made for Centerpulse and that offer becomes unconditional as to acceptances. In that event the Major InCentive Shareholders may not withdraw their acceptances if Smith & Nephew Group declares the InCentive Offer unconditional. Further details of the InCentive Offer, the InCentive Transaction Agreement and the InCentive Tender Agreement are set out in Part VII of this document.

Each accepting InCentive Shareholder will also be entitled to a beneficial interest in one Common Access Share for each New Ordinary Share received by that accepting InCentive Shareholder. Each Common Access Share will be allotted and issued to the Trustee to be held on bare trust for the relevant accepting InCentive Shareholder. The Common Access Shares will enable Smith & Nephew Group Shareholders to elect to receive dividends from Smith & Nephew rather than from Smith & Nephew Group in respect of their New Ordinary Shares.

Smith & Nephew Group Shareholders with an address on the Register outside Switzerland (other than those who hold their New Ordinary Shares through a Swiss Clearing System) will be deemed to have made an election to receive dividends from Smith & Nephew and therefore they will not need to take any action in order to receive dividends from Smith & Nephew. Those Smith & Nephew Group shareholders with an address on the Register outside Switzerland who wish to receive dividends from Smith & Nephew Group rather than from Smith & Nephew, will need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

Smith & Nephew Group Shareholders with an address on the Register in Switzerland or who hold their New Ordinary Shares through a Swiss Clearing System will, in order to receive dividends from Smith & Nephew as opposed to dividends from Smith & Nephew Group, need to give Smith & Nephew Group written notice thereof. A form pursuant to which shareholders can give such written notice to Smith & Nephew Group will be available from Smith & Nephew Group. Shareholders are advised to seek independent financial and taxation advice before deciding whether or not to give any such written notice to Smith & Nephew Group. Further details are set out in Part VIII of this document.

| 3. | Collective mix and match facility |

Accepting Centerpulse Shareholders under the Centerpulse Offer and accepting InCentive Shareholders under the InCentive Offer (the latter in respect of InCentive’s holding in Centerpulse) (together the “Accepting Shareholders”) may elect to take fewer New Ordinary Shares or more New Ordinary Shares than their basic

9

entitlement under the relevant Offer, but elections under both Offers (taken together) to receive more New Ordinary Shares (together the “Excess Shares”) will only be satisfied to the extent that elections have been made under both Offers (taken together) by Accepting Shareholders to receive fewer New Ordinary Shares (together referred to as the “Available Shares”). The Available Shares and cash will be allocated to the applicants for Excess Shares in proportion to the number of Excess Shares or amount of cash (above the standard entitlement) applied for. If the total number of Available Shares exceeds the total number of Excess Shares applied for, the Available Shares shall be limited to an amount equal to the Excess Shares applied for and vice versa. Once the share allocations have been determined, the cash element of the consideration will be reduced or increased (as the case may be) for each Accepting Shareholder who has been allocated an increased or reduced number of New Ordinary Shares. All calculations will be made by reference to the number of acceptances and elections as of the last day of the additional acceptance period and, for the purposes of these calculations, the value per New Ordinary Share will be CHF 8.29, the same as the closing middle market price (381.25 pence) of a Smith & Nephew Ordinary Share on the date immediately prior to the pre-announcement of the Offers converted into Swiss francs at the prevailing exchange rate on that date. Accepting Shareholders can elect from the following mix and match alternatives: (a) basic entitlement, (b) as many New Ordinary Shares as possible and (c) as much cash as possible. Accepting Shareholders can submit their mix and match election until the end of the additional acceptance period which is expected to be on or about 11 July 2003. Accepting Shareholders not having submitted a mix and match election are deemed to have elected their basic entitlement of New Ordinary Shares and cash.

| 4. | Fractional entitlements under the Offers |

No fractions of New Ordinary Shares will arise under the Scheme. Pursuant to the Offers fractions of New Ordinary Shares will not be allotted or issued to Accepting Shareholders but will be aggregated and sold in the market and the net proceeds of sales distributed on a pro rata basis to such of the Accepting Shareholders entitled to them.

Smith & Nephew is to be acquired by Smith & Nephew Group pursuant to a scheme of arrangement of Smith & Nephew under section 425 of the Companies Act, as a result of which Smith & Nephew Group will become the new holding company of the Combined Group. Pursuant to the Scheme, all existing Smith & Nephew Ordinary Shares will be cancelled and replaced with the same number of New Ordinary Shares. Provision will be made in the Access Trust (details of which are set out in Part VIII of this document) for Smith & Nephew Group Shareholders to receive dividends paid from either Switzerland or the UK. As a result of the Scheme, Smith & Nephew Group Shareholders will hold New Ordinary Shares with a nominal value of 12.5 pence each instead of the Smith & Nephew Ordinary Shares which have a nominal value of 12 2/9 pence each. This change in nominal value does not adversely affect Smith & Nephew Ordinary Shareholders and will simplify the capital structure of Smith & Nephew Group going forward. As a result of the Scheme, Smith & Nephew Ordinary Shareholders will receive the same number of New Ordinary Shares as they currently hold, which, together with the rights attaching to the Common Access Shares but subject as described in paragraph 3.6(g) of Part X of this document, will confer on Smith & Nephew Ordinary Shareholders equivalent economic and voting rights. Holders of Smith & Nephew ADSs will continue to hold the same number of ADSs which, as a result of the Scheme, but subject to the rights attaching to the Common Access Shares and subject as described in paragraph 3.6(g) of Part X of this document, will enjoy equivalent economic rights in Smith & Nephew Group. The other rights attaching to the New Ordinary Shares are substantially the same as those attaching to the existing Smith & Nephew Ordinary Shares save for minor modifications which have been made to the Smith & Nephew Group articles of association to reflect current practice and the fact that Smith & Nephew Group is resident in Switzerland. Similarly, the other rights attaching to the Smith & Nephew Group ADSs are the same as those attaching to the existing Smith & Nephew ADSs. A summary of the principal terms of the Smith & Nephew Group articles of association is set out in paragraph 5 of Part X of this document.

The Scheme itself will have no immediate impact on the management of the Current Group as all of the existing Smith & Nephew Directors, save for Sir Timothy Lankester, have been appointed to the Smith & Nephew Group Board. In addition, Dr. Max Link and René Braginsky will join the Smith & Nephew Group Board on the Settlement Date. Pierre-André Chapatte and Antoine Vidts will retire from the Smith & Nephew Group Board on the Scheme Effective Date.

The Scheme will not be implemented if the conditions to the Centerpulse Offer are not satisfied or (where permissible) waived. The conditions to the Centerpulse Offer are set out in paragraph 5.2 of Part VII of this document. The Offers are themselves conditional upon the Scheme having become effective and the conditions to the Scheme becoming effective are set out in paragraph 6 of Part VII of this document.

10

To be implemented, the Scheme requires the approval (as summarised below) of Smith & Nephew Ordinary Shareholders. For this purpose an extraordinary general meeting of Smith & Nephew Ordinary Shareholders and a Court convened meeting of Smith & Nephew Ordinary Shareholders have been convened for 10.10 a.m. and 10.20 a.m., respectively, on 19 May 2003 to be held at the offices of Ashurst Morris Crisp, Broadwalk House, 5 Appold Street, London EC2A 2HA. Smith & Nephew Ordinary Shareholders should refer to the accompanying Scheme Document for further details of the Scheme and the action to be taken by them.

The Transaction has the unanimous support and recommendation of the Smith & Nephew Group Board, the Smith & Nephew Board, and the boards of both Centerpulse and InCentive.

The Smith & Nephew Directors, who have been so advised by Lazard, consider the Transaction to be in the best interests of Smith & Nephew and its shareholders as a whole. In giving its advice, Lazard has taken into account the Smith & Nephew Directors’ commercial assessment of the Transaction. The Smith & Nephew Board also considers the resolutions to be proposed at the Extraordinary General Meeting and the Court Meeting to be in the best interests of Smith & Nephew and its shareholders as a whole. Accordingly, the Smith & Nephew Directors have unanimously recommended that Smith & Nephew Ordinary Shareholders vote in favour of the resolutions to be proposed at the Extraordinary General Meeting and the Court Meeting as they intend to do in respect of their own beneficial holdings of, in aggregate, 295,618 Smith & Nephew Ordinary Shares and 21,331 Smith & Nephew ADSs, representing approximately 0.055 per cent. of the current issued ordinary share capital of Smith & Nephew.

The Centerpulse Directors consider the terms of the Centerpulse Offer to be fair and reasonable. The Centerpulse Directors unanimously recommended in the Centerpulse Offer Document that Centerpulse Shareholders should accept the Centerpulse Offer.

The InCentive Directors consider the terms of the InCentive Offer to be fair and reasonable as it is equal to the Centerpulse Offer. The InCentive Directors unanimously recommended in the InCentive Offer Document that InCentive Shareholders accept the InCentive Offer. The Major InCentive Shareholders (which together hold 77 per cent. of all issued InCentive Shares) have irrevocably undertaken to accept the InCentive Offer.

The Transaction can only become effective if all of (i) the conditions to the Scheme, including Smith & Nephew Ordinary Shareholder approvals referred to below and the sanction of the Court in respect of the Scheme, and (ii) the conditions to the Centerpulse Offer, have been satisfied or waived (where capable of waiver). The Scheme will become effective upon the delivery to the Registrar of Companies in England and Wales of a copy of the court order pursuant to the Scheme and registration of such court order which is expected to occur on 24 June 2003.

The conditions which need to be satisfied or waived for the Scheme and the Offers to be implemented, and which are set out in full in paragraph 5 of Part VII of this document, include:

| · | a separate approval of the Scheme, at the Court Meeting, by a majority in number representing three fourths in value of those Smith & Nephew Ordinary Shareholders present and voting, either in person or by proxy, at the meeting; |

| · | the passing of the requisite resolutions to implement the Transaction by Smith & Nephew Ordinary Shareholders at the Extraordinary General Meeting; |

| · | the sanction (with or without modification) of the Scheme by the Court; |

| · | the number of Centerpulse Shares validly tendered for acceptance of the Offers representing at least 75 per cent. of the issued Centerpulse Shares or such lesser percentage as Smith & Nephew Group may decide; and |

| · | Admission and the Smith & Nephew Group ADSs to be issued in connection with the Scheme being authorised for listing on the NYSE (subject to official notice of issuance). |

Existing employment rights, including pension rights, of employees of both the Current Group and the Centerpulse Group will be fully safeguarded.

| 9. | Smith & Nephew Employee Share Schemes |

On the date the Court sanctions the Scheme all options granted under the Smith & Nephew 1985 Share Option Scheme and the Smith & Nephew 1990 International Executive Share Option Scheme will, if not already

11

exercisable, become exercisable in full. Options outstanding under all other Smith & Nephew Share Schemes will then become exercisable (if or insofar as they are not already), if at all, in respect of a proportion only of the Smith & Nephew Ordinary Shares (or Smith & Nephew ADSs) in respect of which such options are outstanding. Subject to the rules of each of the relevant Smith & Nephew Share Schemes, and to obtaining all necessary consents and approvals of overseas tax and other relevant authorities (and, in the case of the Inland Revenue approved schemes, the approval of the board of the Inland Revenue), Smith & Nephew and Smith & Nephew Group will be making proposals to offer optionholders the opportunity to exchange (or“roll-over”) their existing rights to acquire Smith & Nephew Ordinary Shares (or Smith & Nephew ADSs) for equivalent options and rights to acquire New Ordinary Shares (or Smith & Nephew Group ADSs). These proposals will be made to optionholders by way of separate letters. Further details are set out in section 15 of Part II of the Scheme Document.

In relation to options proposed to be granted before 1 June 2003 under the Smith & Nephew 2001 UK Unapproved Plan, the remuneration committee of the Smith & Nephew Board has exercised its power to amend the rules of that plan so as to provide that, if the holders of such options are offered the opportunity to “roll-over” their options as described above, such options may not be exercised early and, if not rolled over, will lapse at the end of the period within which such offer may be accepted.

The Smith & Nephew Long Term Share Incentive Plan (“theLTIP”) will be amended by the plan trustee (acting on the recommendation of the Committee) so as to provide that outstanding awards under the LTIP will not, if the Court sanctions the Scheme (and as presently provided by the rules of the LTIP), become automatically vested in respect of any proportion of the award shares, but that if and insofar as an outstanding award becomes vested in respect of any number of Smith & Nephew Ordinary Shares in consequence of the relevant performance target being met, participants will then become entitled to such number of New Ordinary Shares. After the Scheme has become effective, the target levels of corporate performance set in relation to outstanding awards under the LTIP will remain the same but, in relation to any period thereafter, will relate to future performance of Smith & Nephew Group rather than of Smith & Nephew. Further details regarding the rights of participants under the LTIP are set out in section 15 of Part II of the Scheme Document.

Details of the rights of exercise, if any, under the Centerpulse Share Option Schemes are dealt with under individual option agreements. Irrespective of these rights, (if any), an offer to exchange these options will be made in accordance with the Centerpulse Transaction Agreement. The Centerpulse Transaction Agreement provides that the holders of Centerpulse’s outstanding stock options will receive stock options relating to New Ordinary Shares, at an exchange ratio of 34:1, vesting 30 days after completion of the Centerpulse Offer, with an exercise period of 18 months. The strike price of the new options will be calculated by dividing the existing strike price of the option by 34 and converting this into sterling at the prevailing exchange rate on the Settlement Date.

Conditional upon the Scheme becoming effective, Smith & Nephew Group intends to adopt the Smith & Nephew Group Share Schemes, save for the Smith & Nephew Group 2003 US Share Plan and the Smith & Nephew Group 2003 US Employee Stock Purchase Plan previously adopted by Smith & Nephew which Smith & Nephew Group will assume. Smith & Nephew Group will also establish a new employee share trust for the benefit of employees and directors of Smith & Nephew Group and its subsidiaries. Each of these plans and the trust contain terms which are broadly similar to the terms of the corresponding Smith & Nephew Share Scheme or Smith & Nephew employee share trust. Smith & Nephew Group will obtain approval from the board of the Inland Revenue under Schedules 3 and 4 of the Income Tax (Earnings and Pensions) Act 2003 for the Smith & Nephew Group 2003 UK Approved Plan and the 2003 UK Sharesave Plan prior to the grant of options under those plans. Further details of such new employee share schemes are set out in paragraph 6 of Part X of this document.

It is also proposed to amend the Smith & Nephew articles of association to ensure that any Smith & Nephew Ordinary Shares issued on or after the date of adoption of the amendments to the Smith & Nephew articles of association but at or prior to 5.30 p.m. on the last business day prior to the date of the Court Hearing are issued subject to the terms of the Scheme. The amendment to the Smith & Nephew articles of association will provide that any Smith & Nephew Ordinary Shares issued after the Scheme Effective Date, for example upon exercise of options under the Smith & Nephew Share Schemes, will be transferred to Smith & Nephew Group in consideration of the issue or transfer to such holder by Smith & Nephew Group of the relevant New Ordinary Shares on a one for one basis.

| 10. | Smith & Nephew US shareholders and holders of Smith & Nephew ADSs |

The New Ordinary Shares and Smith & Nephew Group ADSs to be issued to Smith & Nephew Group Shareholders and holders of Smith & Nephew ADSs pursuant to the Scheme will not be registered under the US

12

Securities Act, in reliance upon the exemption from the registration requirements thereof provided by Section 3(a)(10) thereof. For the purpose of qualifying for such exemption, Smith & Nephew Group and Smith & Nephew will advise the Court that its sanctioning of the Scheme will be relied upon by Smith & Nephew Group and Smith & Nephew as an approval of the Scheme following a hearing on its fairness to Smith & Nephew Ordinary Shareholders at which hearing all such holders are entitled to attend in person or through counsel to support or oppose the sanctioning of the Scheme and with respect to which notification has been given to all such shareholders.

US Smith & Nephew Ordinary Shareholders and US holders of Smith & Nephew ADSs should refer to paragraph 8.3 of Part X of this document for important additional information, including certain tax consequences of the Scheme.

| 11. | Listing, settlement and dealings |

Smith & Nephew Group

The New Ordinary Shares to be issued pursuant to the Transaction will be issued credited as fully paid and free from all liens, equities, charges, encumbrances and other interests and will rank in full for all dividends and distributions on the ordinary share capital of Smith & Nephew Group declared, made or paid after the Scheme Effective Date.

UK listing[6.B.1]

Applications have been made to the UK Listing Authority for the New Ordinary Shares to be admitted to the Official List and to the London Stock Exchange for admission to trading on its market for listed securities.[6.B.13] It is expected that listing will become effective and that dealings, for normal settlement, will commence on the Scheme Effective Date. The listing on the London Stock Exchange will be the primary listing.

Where a Smith & Nephew Ordinary Shareholder holds his Smith & Nephew Ordinary Shares in certificated form, the New Ordinary Shares to which such Smith & Nephew Ordinary Shareholder is entitled will be issued in certificated form. Temporary documents of title will not be issued in respect of New Ordinary Shares issued in certificated form. Pending the despatch by post of definitive certificates for such New Ordinary Shares, transfers will be certified against the Register. Definitive share certificates are expected to be despatched to shareholders by 9 July 2003.

Where a Smith & Nephew Ordinary Shareholder holds his Smith & Nephew Ordinary Shares in uncertificated form, the New Ordinary Shares to which such Smith & Nephew Ordinary Shareholder is entitled will be issued to such person in uncertificated form through CREST. Smith & Nephew Group will procure that CRESTCo is instructed to credit the appropriate stock account in CREST of such Smith & Nephew Ordinary Shareholder with such person’s entitlement to New Ordinary Shares at the commencement of dealings in the New Ordinary Shares. As from the Scheme Effective Date each holding of Smith & Nephew Ordinary Shares credited to any stock account in CREST will be disabled. All Smith & Nephew Ordinary Shares will be removed from CREST in due course. Smith & Nephew Group will have the right to issue New Ordinary Shares in the manner referred to above for certificated shares if, for any reason, it wishes to do so.

NYSE listing[6.B.13]

It is expected that the Smith & Nephew Group ADSs will be authorised for listing (subject to official notice of issuance) prior to the Scheme Effective Date and that trading of Smith & Nephew Group ADSs on the NYSE will commence on the Scheme Effective Date.

Swiss listing

Smith & Nephew Group intends to obtain a secondary listing of the New Ordinary Shares on SWX Swiss Exchange upon or as soon as reasonably practicable after the Settlement Date.

General

Save as set out above, New Ordinary Shares will not be listed on any other stock exchange.[6.B.13]

All documents and remittances sent by, to or from Smith & Nephew Ordinary Shareholders, Centerpulse Shareholders, InCentive Shareholders or their respective appointed agents will be sent at their own risk.

13

All mandates, instructions and other instruments in force relating to holdings of Smith & Nephew Ordinary Shares, Centerpulse Shares or InCentive Shares will, unless and until amended or revoked, continue in force and be deemed as from the Scheme Effective Date (in the case of Smith & Nephew Ordinary Shareholders) or the Settlement Date (in the case of Centerpulse Shareholders or InCentive Shareholders) to relate to payments and notices by Smith & Nephew Group in respect of the New Ordinary Shares.

Smith & Nephew

On the Scheme Effective Date, the Smith & Nephew Ordinary Shares and the Smith & Nephew ADSs will be delisted from the Official List. The last day of dealings in Smith & Nephew Ordinary Shares on the London Stock Exchange will be the business day prior to the Scheme Effective Date.

Centerpulse and InCentive

The Smith & Nephew Group Board reserves the right at its own discretion to apply for the delisting of the Centerpulse Shares once the Centerpulse Offer has been completed and the delisting of the InCentive Shares once the InCentive Offer has been completed.

If Smith & Nephew Group holds more than 98 per cent. of the votes attaching to Centerpulse Shares after the Centerpulse Offer or to InCentive Shares after the InCentive Offer, Smith & Nephew Group will request the cancellation of the remaining share certificates of either or both of the Centerpulse Shares and the InCentive Shares in accordance with Article 33 of the Swiss Federal Act on Stock Exchanges and Securities Trading.

14

PART III

FINANCIAL INFORMATION RELATING TO SMITH & NEPHEW

| 1. | The financial information contained in this[3.03b] Part III does not constitute Smith & Nephew’s statutory accounts within the meaning of section 240 of the Companies Act. The information for the three years ended 31 December 2002 is extracted without[3.03c] material adjustment from the published audited consolidated financial statements of Smith & Nephew for the years ended 31 December 2001 and 2002.[3.03d] The 31 December 2000 information has been extracted from the comparative information contained within the 2001 financial statements. The comparative 2000 information[6.E.1]within the 2001 audited accounts of Smith & Nephew is based on the 31 December 2000 financial statements,[6.E.2]restated for FRS 19 and to reflect the final outcome of the joint venture agreement whereby Smith & Nephew retained distribution of BSN Medical products in certain countries. In addition the presentation of the 31 December 2001 and 2000 information provided in this document reflects the changes to the segmental analysis introduced in the 2002 financial statements together with the consequences of discontinuing certain operations in 2002. |

Smith & Nephew’s auditors, Ernst & Young LLP, made reports under section 235 of the Companies Act on the financial statements for each of the three financial years ended 31 December 2002, 31 December 2001 and 31 December 2000 (each of which[[3.03e]] received an unqualified audit opinion and did not contain a statement under section 237(2) or (3) of the Companies Act) and the financial statements have been delivered to the Registrar of Companies in England and Wales.[6.A.5]

15

| 2. | Smith & Nephew consolidated profit and loss account |

| |

|

|

| | | Years ended 31 December[3.03a]

| |

| | | 2002 | | | 2001 | | | 2000 | |

| | |

|

| |

|

| |

|

|

| | | (£ million, except for ordinary share amounts) | |

Turnover –(Notes 1, 2) | | | | | | | | | |

Ongoing operations | | 1,083.7 | | | 943.0 | | | 772.9 | |

Operations contributed to the joint venture | | — | | | 35.3 | | | 138.6 | |

| | |

|

| |

|

| |

|

|

Continuing operations | | 1,083.7 | | | 978.3 | | | 911.5 | |

Discontinued operations | | 26.2 | | | 103.4 | | | 223.2 | |

| | |

|

| |

|

| |

|

|