- IRD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Opus Genetics (IRD) DEF 14ADefinitive proxy

Filed: 29 Apr 24, 4:28pm

| Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: | |||

| ☐ | | | Preliminary Proxy Statement |

| ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

| ☐ | | | Definitive Additional Materials |

| ☐ | | | Soliciting Material Under §240.14a-12 |

| Payment of Filing Fee (Check all boxes that apply): | |||

| ☒ | | | No fee required. |

| ☐ | | | Fee paid previously with preliminary materials. |

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | Elect the seven director nominees named in the Proxy Statement; |

| | | Ratify the appointment of Ernst & Young, LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2024; |

| | | Approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement; |

| | | Approve, pursuant to the Nasdaq Listing Rules, the potential issuance of shares of common stock to Lincoln Park Capital Fund, LLC in excess of 19.99% of our outstanding common stock; |

| | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to provide for the exculpation of officers; and |

| | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock from 75 million shares to 125 million shares. |

| | | Elect the seven director nominees named in the Proxy Statement; |

| | | Ratify the appointment of Ernst & Young, LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2024; |

| | | Approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement; |

| | | Approve, pursuant to the Nasdaq Listing Rules, the potential issuance of shares of common stock to Lincoln Park Capital Fund, LLC in excess of 19.99% of our outstanding common stock; |

| | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to provide for the exculpation of officers; and |

| | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock from 75 million shares to 125 million shares. |

| Ocuphire Pharma, Inc. | | | 1 | | | 2024 Proxy Statement |

| 1. | Elect the seven director nominees named in the Proxy Statement; |

| 2. | Ratify the appointment of Ernst & Young, LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | Approve, on an advisory basis, the compensation of the Company’s named executive officers; |

| 4. | Approve, pursuant to the Nasdaq Listing Rules, the potential issuance of shares of Common Stock to Lincoln Park Capital Fund, LLC in excess of 19.99% of our outstanding Common Stock; |

| 5. | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Charter”) to provide for the exculpation of officers; and |

| 6. | Approve an amendment to the Charter to increase the number of authorized shares of the Company’s Common Stock from 75 million shares to 125 million shares. |

| Ocuphire Pharma, Inc. | | | 2 | | | 2024 Proxy Statement |

| Proposal | | | Vote Required for Approval | | | Effect of Abstentions, Withhold Votes and Broker Non-Votes |

Proposal No. 1 Election of Directors | | | Directors will be elected by a plurality of the votes of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The individuals nominated for election to the Board at the Annual Meeting receiving the highest number of “FOR” votes will be elected. | | | A withhold vote will have no effect on the outcome of the election of directors. Broker discretionary voting is not permitted. Broker non-votes will have no effect on the outcome of this proposal. Votes may not be cumulated. |

Proposal No. 2 Ratification of Ernst & Young, LLP | | | The affirmative vote of the holders of the majority of voting power of the shares virtually present or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required to approve the proposal. | | | An abstention has the same effect as a vote “against” this proposal. Broker discretionary voting is permitted. Because broker discretionary voting is permitted, there will be no broker non-votes on this proposal. |

Proposal No. 3 Approval of Compensation for Named Executive Officers | | | The affirmative vote of the holders of the majority of voting power of the shares virtually present or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required to approve the proposal. | | | An abstention has the same effect as a vote “against” this proposal. Broker discretionary voting is not permitted. Broker non-votes will have no effect on the outcome of this proposal. |

Proposal No. 4 Approval of Potential Issuance of Shares in Excess of 19.99% of Common Stock | | | The affirmative vote of the holders of the majority of voting power of the shares virtually present or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required to approve the proposal. | | | An abstention has the same effect as a vote “against” this proposal. Broker discretionary voting is not permitted. Broker non-votes will have no effect on the outcome of this proposal. |

Proposal No. 5 Approval of Charter Amendment (Officer Exculpation) | | | The affirmative vote of the holders of the majority of voting power of all of the outstanding shares of our Common Stock entitled to vote is required to approve this proposal. | | | An abstention has the same effect as a vote “against” this proposal. Broker discretionary voting is not permitted. Broker non-votes will have the same effect as a vote “against” this proposal. |

Proposal No. 6 Approval of Charter Amendment (Increase Amount of Authorized Shares of Common Stock to 125 Million Shares) | | | The affirmative vote of the holders of the majority of voting power of all of the outstanding shares of our Common Stock entitled to vote is required to approve this proposal. | | | An abstention has the same effect as a vote “against” this proposal. Broker discretionary voting is permitted. Because broker discretionary voting is permitted, there will be no broker non-votes on this proposal. |

| Ocuphire Pharma, Inc. | | | 3 | | | 2024 Proxy Statement |

| • | Vote through the Internet: To vote by Internet, you will need to use a control number provided to you in the materials with this Proxy Statement and follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. |

| • | Vote by Telephone: To vote by telephone, you will need to use a control number provided to you in the materials included with this Proxy Statement and follow the voting instructions as indicated on the enclosed proxy card or voting instruction card. |

| • | Vote by Mail: To vote by mail, you will need to complete, sign and date the accompanying proxy card and return it as soon as possible before the Annual Meeting in the envelope provided. |

| Ocuphire Pharma, Inc. | | | 4 | | | 2024 Proxy Statement |

| • | delivering to our Secretary (by any means, including facsimile) a written notice stating that the proxy is revoked; |

| • | signing and delivering a proxy bearing a later date; |

| • | voting again through the Internet or by telephone; or |

| • | attending and voting at the Annual Meeting (although attendance at the meeting will not, by itself, revoke a proxy). |

| Ocuphire Pharma, Inc. | | | 5 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 6 | | | 2024 Proxy Statement |

| Knowledge, Skills, and Experience | | | Sean Ainsworth | | | Susan K. Benton | | | Cam Gallagher | | | Dr. George Magrath | | | James Manuso | | | Dr. Jay Pepose | | | Richard Rodgers |

| Other Public Company Board | | | | | | | • | | | | | • | | | | | • | ||||

| Senior Leadership and Operations | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| Life Science / Biotech | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| Intellectual Property | | | • | | | | | | | • | | | | | • | | | ||||

| Academic / Research | | | • | | | | | | | • | | | • | | | • | | | |||

| Finance / Capital Management | | | • | | | • | | | • | | | • | | | • | | | | | • | |

| Accounting | | | | | | | | | | | | | | | • | ||||||

| M&A / Strategic Transactions | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| Ophthalmology | | | • | | | • | | | | | • | | | | | • | | | |||

| Clinical Development | | | • | | | • | | | • | | | • | | | • | | | • | | | • |

| Technology / Cybersecurity | | | | | | | | | • | | | | | | |

| Ocuphire Pharma, Inc. | | | 7 | | | 2024 Proxy Statement |

Sean Ainsworth INDEPENDENT DIRECTOR SINCE: November 2020 AGE: 56 COMMITTEES: • Audit • Compensation SKILLS: ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Intellectual Property ✔ Academic / Research ✔ Finance / Capital Management ✔ M&A / Strategic Transactions ✔ Ophthalmology ✔ Clinical Development | | | Experience and Expertise Since 2018, Mr. Ainsworth has been Chief Executive Officer and Chairman of the board at Immusoft Corporation, a cell therapy company. In this role, Mr. Ainsworth established a strategic alliance between Immusoft Corporation and Takeda Pharmaceuticals. In 2021, Mr. Ainsworth co-founded Ray Therapeutics, an ocular gene therapy company, for which he is chairman of its board. Previously, in 2009, he founded RetroSense Therapeutics LLC, an ocular gene therapeutic company for which Mr. Ainsworth served as Chief Executive Officer and Chairman, which was acquired by Allergan in 2016. From 2004 to 2012, Mr. Ainsworth served as Principal at Ainsworth BioConsulting. In 2006, Mr. Ainsworth co-founded Compendia BioScience, Inc., which was subsequently acquired by Life Technologies. From 2004 to 2012, Mr. Ainsworth served as an advisor to clients in the life sciences and entrepreneurial community on matters related to licensing, strategy and business planning. His other professional experience includes research at Medical Biology Institute, corporate development consulting at Kantar Health, intellectual property roles at Koyama and Associates in Tokyo and international corporate development consulting at the Mattson Jack Group, and CEO at GeneVivo, LLC. Mr. Ainsworth holds a B.S. in Microbiology from University of California, San Diego, in 1996 and an M.B.A. from Washington University in St. Louis in 2002. |

| | Qualifications • Mr. Ainsworth has 25 years of experience in life sciences industry and experience in and managing companies in the life sciences industry. • Mr. Ainsworth has financial and business expertise and experience on boards of multiple biotech companies. |

| Ocuphire Pharma, Inc. | | | 8 | | | 2024 Proxy Statement |

Susan K. Benton INDEPENDENT DIRECTOR SINCE: November 2020 AGE: 59 COMMITTEES: • Compensation • Nominating and Corporate Governance SKILLS: ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Finance / Capital Management ✔ M&A / Strategic Transactions ✔ Ophthalmology ✔ Clinical Development | | | Experience and Expertise Ms. Benton serves as the President for Thea Pharma, Inc. (Thea), a wholly-owned subsidiary of Thea Laboratories, a leading independent ophthalmic pharmaceutical company, a position she has held since August 2019. Ms. Benton also serves on the boards of two privately held ophthalmic companies: Tarsius Pharma Ltd. (since March 2019) and Ripple Therapeutics (since March 2022). From April 2015 through July 2019, she served in a number of key leadership positions at Shire, Inc. (Shire), including Head of M&A for Ophthalmology, and played an instrumental role in the expansion of its ophthalmic pipeline. As the Head of New Products at Shire, she led the Ophthalmic Innovation Committee that shaped and executed the growth strategy for the franchise. Before joining Shire, Ms. Benton served in a leadership capacity in Global Business Development for Bausch + Lomb Pharmaceuticals (B+L) from September 2011 through September 2013, where she and the Corporate Development team transacted over ten deals in three years. She was a co-Founder and Chief Commercial Officer for an ophthalmic start-up, Sirion Therapeutics, Inc., and she launched and oversaw the commercialization of Durezol® and Zirgan® before they were sold to Alcon and B+L, respectively. Ms. Benton began her ophthalmic career at B+L in March 1995, where she assumed leadership roles as the Head of Diversified Products and the VP of Professional Sales. During her tenure, she built and staffed a team of 75 sales professionals and she launched B+L’s first ever branded products, Lotemax® and Alrex®, in addition to Optivar® through a co-promote with Muro Pharmaceutical. She has also served as a strategic consultant for more than a dozen start-up ophthalmic companies. Her experience outside of ophthalmology includes roles as the VP of Consumer and Professional Sales for Johnson & Johnson’s diabetes franchise, LifeScan, and senior manager roles in Sanofi Pasteur’s vaccine business. Ms. Benton earned her M.B.A from the University of South Florida and a B.S. in Biology from Muhlenberg College. |

| | Qualifications • Ms. Benton has nearly 40 years of experience in the life sciences industry, with 30 years focused in ophthalmology. • Ms. Benton has significant experience with respect to capital raising and business development, raising $120 million of capital at Sirion Therapeutics (Sirion), and commercializing over 20 products at B+L, Sirion, Shire, J&J, and Thea. |

| Ocuphire Pharma, Inc. | | | 9 | | | 2024 Proxy Statement |

Cam Gallagher INDEPENDENT CHAIRMAN OF THE BOARD DIRECTOR SINCE: November 2020 AGE: 54 OTHER PUBLIC BOARDS: • Zentalis Pharmaceuticals COMMITTEES: • Compensation (Chair) • Nominating and Corporate Governance SKILLS: ✔ Other Public Company Board ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Finance / Capital Management ✔ M&A / Strategic Transactions ✔ Clinical Development | | | Experience and Expertise Mr. Gallagher currently serves as Chair of the Board and has served as member of the Board since November 2020. Prior to that, he served on the Board of Ocuphire Pharma, Inc. prior to its merger with Rexahn Pharmaceutics, Inc. (Private Ocuphire) from January 2019 until November 2020. He serves as Chair of the Company’s compensation committee and as a member of the Company’s nominating and corporate governance committee and audit committee. He co-founded and is currently the President of Zentalis Pharmaceuticals (Nasdaq: ZNTL) and has served as a member of its board of directors since December 2014. He also serves on the board of directors of SelectION (since June 2018), Ray Therapeutics (since March 2021), Healios (since March 2022) and Immusoft Corporation (since December 2022). He previously served as a founding board member of Velos Bio Inc., from October 2017 to December 2020, when the company was acquired by Merck. In addition to his board roles, which included several board committee positions, Mr. Gallagher has served as Chief Business Officer at Immusoft Corporation from March 2019 to December 2022 and at jCyte, Inc. from December 2019 to December 2020. From 2014 to 2016, he was a board member and the Chief Business Officer at RetroSense Therapeutics, LLC, which was acquired by Allergan in 2016. In June 2007, Mr. Gallagher co-founded Nerveda, LLC, a life sciences seed fund, and served as its managing director. Prior to these roles, from 1992 to 2007, he held management positions at Verus Pharma B.V., CV Therapeutics, Inc. and Dura Pharmaceuticals, Inc. Mr. Gallagher holds an M.B.A. from the University of San Diego in 1997 and a B.S. in Business Administration from Ohio University in 1992. |

| | Qualifications • Mr. Gallagher has more than 30 years of experience in the life sciences and biotech industries with a focus on corporate development, finance, marketing, business development and early-stage investing. • Mr. Gallagher has experience serving on the boards of various U.S. public and private companies. |

| Ocuphire Pharma, Inc. | | | 10 | | | 2024 Proxy Statement |

Dr. George Magrath CHIEF EXECUTIVE OFFICER DIRECTOR SINCE: November 2023 AGE: 40 SKILLS: ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Intellectual Property ✔ Academic / Research ✔ Finance / Capital Management ✔ M&A / Strategic Transactions ✔ Ophthalmology ✔ Clinical Development ✔ Technology / Cybersecurity | | | Experience and Expertise Dr. George Magrath has served as our Chief Executive Officer since November 2023. Dr. Magrath was previously Chief Executive Officer of Lexitas Pharmaceutical Services, Inc. (Lexitas), a position he served in from February 2021 through September 2023, leading the company’s growth from 35 to over 200 employees and overseeing the sale of the company. Dr. Magrath then served as a consultant to Lexitas from September 2023 through October 2023. Prior to serving in these roles, he served with Lexitas as its Chief Medical Officer from August 2020 to January 2021. Dr. Magrath has also previously served as medical director at Hovione Pharmaceuticals, LLC from August 2015 to August 2020. Dr. Magrath served on the board of directors of Lexitas from August 2021 through September 2023 and as a scientific advisory board member of Line 6 Biotechnology, Inc. from March 2022 to October 2023 and ONO Pharmaceutical Co., Ltd. from November 2019 to January 2023. He is a board observer of Implicit Bioscience (since 2022) and on the advisory board of Foundation Fighting Blindness Translational Research Acceleration Program (since 2022). Dr. Magrath has completed the requirements for the CERT Certificate in Cybersecurity Oversight from Carnegie Mellon University and the National Association of Corporate Directors. Dr. Magrath earned his M.B.A. from The Citadel, his M.D. from Medical University of South Carolina, his M.S. in Applied Economics from Johns Hopkins University and his B.S. in Biological Chemistry from Clemson University. Dr. Magrath is also a co-inventor on two granted patents and has authored over 25 peer-reviewed articles. Dr. Magrath also worked as an equity analyst at Edison Investment Research from 2016 to 2017. |

| | Qualifications • As Chief Executive Officer, Dr. Magrath has key insights and knowledge of the Company’s operations and is a direct connection between senior management and Board. |

| Ocuphire Pharma, Inc. | | | 11 | | | 2024 Proxy Statement |

James S. Manuso INDEPENDENT DIRECTOR SINCE: November 2020 AGE: 75 COMMITTEES: • Audit • Nominating and Corporate Governance (Chair) SKILLS: ✔ Other Public Company Board ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Academic / Research ✔ Finance / Capital Management ✔ M&A / Strategic Transactions ✔ Clinical Development | | | Experience and Expertise From July 2011 until October 2013, Dr. Manuso served as Chairman and Chief Executive Officer of Astex Pharmaceuticals, Inc. (Astex), a commercial-stage, international company, before leading the sale of Astex to Otsuka Pharmaceuticals. While at Astex, Dr. Manuso oversaw multiple domestic and international acquisitions. In 2013, he was a Senior Mergers and Acquisitions Advisor to Otsuka Pharmaceuticals executive management. Since 2015, Dr. Manuso has served as chairman and Chief Executive Officer of Talfinium Investments, Inc., an investment entity and financial consultancy. From 2015 until 2018, Dr. Manuso served as President, Chief Executive Officer and Vice Chairman of RespireRx Pharmaceuticals Inc., a Phase 3-ready, clinical-stage respiratory and neurological pharmaceutical company. Since 2018, Dr. Manuso has served as Managing Member of Laurelside LLC, a family office, which he founded. Dr. Manuso has served on the boards of multiple public companies, including, Novelos Therapeutics, Inc. (now Cellectar Biosciences (Nasdaq: CLRB)), Merrion Pharmaceuticals Ltd., Inflazyme Pharmaceuticals, Inc., and Symbiontics, Inc., (sold to BioMarin Pharmaceutical Inc. (Nasdaq: BMRN)). He also served on the boards Quark Pharmaceuticals, Inc. and Montigen Pharmaceuticals, Inc., which he co-founded, Galenica Pharmaceuticals, Inc., Supratek Pharma, Inc., and EuroGen, Ltd. (London, UK), where he served as Chairman. Dr. Manuso was also on the boards of BIO (Biotechnology Innovation Organization) and the Greater San Francisco Bay Area Leukemia & Lymphoma Society, where he also served as Vice President. Dr. Manuso previously served as Vice Chair and Head of M&A at H.C. Wainwright & Co. He currently serves on the board of directors of TuHura Biosciences, Inc., a private immunotherapeutic developer that is reverse-merging into Kintara (Nasdaq: KTRA). Dr. Manuso holds a B.A. with honors in Economics and Chemistry from New York University, a Ph.D. in Experimental Psychology and Genetics from the New School University, and an Executive M.B.A. from Columbia Business School. Dr. Manuso is the author of a pharmaceutical patent and over 30 articles, chapters, and books. He has served on the adjunct faculties of the business schools of Columbia University and New York University. |

| | Qualifications • Dr. Manuso has over 25 years of experience in the biopharmaceutical industry in finance, business development, mergers & acquisitions and executive management. • Dr. Manuso has experience as a member of the boards of directors of multiple private and public pharmaceutical companies, both domestic and foreign. |

| Ocuphire Pharma, Inc. | | | 12 | | | 2024 Proxy Statement |

Dr. Jay Pepose DIRECTOR SINCE: June 2021 AGE: 69 SKILLS: ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Intellectual Property ✔ Academic Research ✔ M&A / Strategic Transactions ✔ Ophthalmology ✔ Clinical Development | | | Experience and Expertise Dr. Pepose is a board-certified ophthalmologist, trained at the Wilmer Institute of the Johns Hopkins Hospital with subspeciality training at Georgetown University, specializing in cataract, corneal, and refractive surgery. He is Medical Director of the Pepose Vision Institute, MidAmerica Surgery Center and Midwest Laser Center, all three of which he founded in 1999. In October 2019, these entities were acquired by the Firmament PE group, along with a number of other regional and national ophthalmology practices. Since the acquisition, Dr. Pepose has served as a board member and President of Midwest Vision Partners, the midwest division of Vision Integrated Partners (VIP). VIP is Firmament’s management company, servicing a national consortium of practices and ambulatory surgery centers located in Missouri, Illinois, Ohio, Florida and California. Dr. Pepose is also President of Midwest Vision Research Foundation, a non-profit clinical research organization that conducts ophthalmic clinical trials. He also is a co-founder and board member of 911 Vision Foundation, a non-profit charity that provides free LASIK surgery for first responders in the greater St. Louis area. Dr. Pepose has served as Chief Medical Advisor and Scientific Advisor of numerous companies, including Acufocus, BRIM Biotech, Mimetogen, OKYO Pharma, and Stuart Therapeutics, and has presented on behalf of many ophthalmic and pharmaceutical companies for FDA panel reviews, resulting in device approvals and new drug applications. Dr. Pepose holds multiple patents related to ophthalmic pharmaceuticals and devices and has worked with numerous companies in developing their intellectual property assets and strategy. Dr. Pepose holds an M.D. and a Ph.D. in Immunology and Virology from UCLA School of Medicine, where he graduated Alpha Omega Alpha. Dr. Pepose has published over 250 peer reviewed articles as well as book chapters and a textbook. He has been awarded several prestigious awards, including the Cogan Award from the Association for Research in Vision and Ophthalmology (ARVO), the Lifetime Achievement Award from the American Academy of Ophthalmology, and the Distinguished Alumnus Award from the Wilmer Institute at the Johns Hopkins Hospital. Additionally, Dr. Pepose has been elected to membership in the American Ophthalmological Society. He is currently a Professor of Clinical Ophthalmology and Visual Sciences at Washington University School of Medicine, where he formerly held the Bernard Becker Chair. |

| | Qualifications • Dr. Pepose is a leading consultant for the ophthalmic pharmaceutical and device industry, with more than 30 years of consulting experience with global companies, Including Bausch + Lomb Pharmaceuticals, Johnson & Johnson Vision, Sun Pharma, and Thea Pharma. • Dr. Pepose has vast experience in the life sciences industry, including a deep focus in ophthalmology. Dr. Pepose has been recognized in Castle Connelly Top Doctors and Best Doctors in America for the past 30 consecutive years. |

| Ocuphire Pharma, Inc. | | | 13 | | | 2024 Proxy Statement |

Richard Rodgers INDEPENDENT DIRECTOR SINCE: November 2020 AGE: 57 OTHER PUBLIC BOARDS: • Ardelyx, Inc. • Novavax, Inc. • Sagimet Biosciences, Inc. COMMITTEES: • Audit (Chair) • Compensation SKILLS: ✔ Other Public Company Board ✔ Senior Leadership and Operations ✔ Life Science / Biotech ✔ Finance / Capital Management ✔ Accounting ✔ M&A / Strategic Transactions ✔ Clinical Development | | | Experience and Expertise Richard Rodgers previously served as Interim Chief Executive Officer and President of the Company from April 2023 to November 2023. Mr. Rodgers previously served as a member of the board of directors of Rexahn from 2014 until November 2020. Mr. Rodgers currently serves on the boards of directors of Ardelyx, Inc., Novavax, Inc., and Sagimet Biosciences, Inc., including as the Chair of the audit committee and member of the compensation committee for Ardelyx and Novavax. Mr. Rodgers was previously Executive Vice President, Chief Financial Officer, Secretary and Treasurer of TESARO, Inc., an oncology-focused biopharmaceutical company that he co-founded, from March 2010 until August 2013. He served as the Senior Vice President and Chief Financial Officer from June 2009 to February 2010 of Abraxis BioScience, Inc. which was subsequently acquired by Celgene Corporation. Prior to that, Mr. Rodgers served as Senior Vice President, Controller and Chief Accounting Officer of MGI PHARMA, INC., from 2004 until its acquisition by Eisai Co., Ltd. in January 2008. He has held finance and accounting positions at several private and public companies, including Arthur Andersen. Mr. Rodgers holds a Bachelor of Science degree in Financial Accounting from St. Cloud State University and a Master of Business Administration in Finance from the University of Minnesota, Carlson School of Business. |

| | Qualifications • Mr. Rodgers has an extensive financial background and life sciences industry experience. • Mr. Rodgers has experience serving on other boards of directors of publicly traded companies. |

| Ocuphire Pharma, Inc. | | | 14 | | | 2024 Proxy Statement |

| Board Diversity Matrix | ||||||

| Total Number of Directors: 7 | ||||||

| Director Race / Ethnicity | | | Female | | | Male |

| White | | | 1 | | | 6 |

| Ocuphire Pharma, Inc. | | | 15 | | | 2024 Proxy Statement |

| Director Name | | | Audit Committee | | | Compensation Committee | | | Nominating and Corporate Governance Committee |

| Independent Directors | |||||||||

Cam Gallagher, Chair of the Board | | | | | Chair | | | Member | |

| Sean Ainsworth | | | Member | | | Member | | | |

| Susan Benton | | | | | Member | | | Member | |

| James Manuso | | | Member | | | | | Chair | |

| Dr. Jay Pepose | | | | | | | |||

| Richard Rodgers | | | Chair | | | Member | | | |

| Executive Directors | |||||||||

Dr. George Magrath, Chief Executive Officer | | | | | | | |||

| Meetings Held During 2023 | | | 4 | | | 6 | | | 5 |

| Ocuphire Pharma, Inc. | | | 16 | | | 2024 Proxy Statement |

| • | appointing or replacing and overseeing the Company’s independent auditors and approving all audit engagement fees and terms; |

| • | preapproving all audit (including audit-related) services, internal control-related services and permitted non-audit services (including fees and terms thereof) to be performed for the Company by its independent auditors; |

| • | reviewing and discussing with management and independent auditors’ significant issues regarding accounting and auditing principles and practices and financial statement presentations; |

| • | reviewing and approving procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters; and |

| • | reviewing and overseeing compliance with legal and regulatory requirements. |

| • | reviewing and recommending the compensation and other terms of employment of the Company’s Chief Executive Officer and of other executive officers and senior management positions; |

| • | reviewing and making recommendations with respect to the compensation and benefits for the Company’s non-employee directors, including through equity-based plans; |

| • | evaluating the performance of the Company’s chief executive officer and other senior executives and assisting the Board in developing and evaluating potential candidates for executive positions; and |

| • | administering the incentive compensation, deferred compensation and equity-based plans pursuant to the terms of the respective plans. |

| Ocuphire Pharma, Inc. | | | 17 | | | 2024 Proxy Statement |

| • | reviewing, evaluating and seeking out candidates qualified to become members of the Board; |

| • | reviewing committee structure and recommending directors for appointment to committees; |

| • | developing, reevaluating (not less frequently than every three years) and recommending the selection criteria for board and committee membership; |

| • | establishing procedures to oversee evaluation of the board, its committees, individual directors and management; and |

| • | developing and recommending guidelines on corporate governance. |

| Ocuphire Pharma, Inc. | | | 18 | | | 2024 Proxy Statement |

| • | reviews and approves the Company’s annual business plan; |

| • | reviews business developments, business plan implementation updates and financial results; and |

| • | reviews a summary of significant risks and opportunities at regular meetings of the Board with management, including cybersecurity risk, human capital management risk, risks with the development and use of new technologies, and risks relating to environmental and social issues. |

| Ocuphire Pharma, Inc. | | | 19 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 20 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 21 | | | 2024 Proxy Statement |

| | | Member Annual Service Stipend(1) | | | Chair Annual Service Stipend(1) | |

| Board of directors | | | $42,000 | | | $36,750 |

| Audit committee | | | 10,000 | | | 20,000 |

| Compensation committee | | | 7,500 | | | 15,000 |

| Nominating and corporate governance committee | | | 5,000 | | | 10,000 |

| Lead Independent Director | | | 20,000 | | | — |

| (1) | Chairs of each committee do not receive a stipend for being a member of the applicable committee. |

| Ocuphire Pharma, Inc. | | | 22 | | | 2024 Proxy Statement |

| Name | | | Fees Earned or Paid in Cash ($)(1) | | | Stock Awards ($)(2) | | | Option Awards ($)(3) | | | All Other Compensation ($)(4) | | | Total ($) |

| Cam Gallagher | | | 104,558 | | | 42,038 | | | 28,024 | | | — | | | 174,620 |

| Sean Ainsworth | | | 79,500 | | | 42,038 | | | 28,024 | | | — | | | 149,562 |

| James Manuso | | | 69,041 | | | 57,741 | | | 28,024 | | | — | | | 154,806 |

| Susan Benton | | | 54,500 | | | 52,817 | | | 28,024 | | | — | | | 135,341 |

| Dr. Jay Pepose | | | 92,000 | | | 150,321 | | | 119,779 | | | 300,000 | | | 662,100 |

| (1) | The amounts in this column represent the fees earned or paid in cash for services as a director, including annual retainer, committee chairmanship, non-executive chair fees and transition committee fees for Dr. Pepose. For 2023, Mr. Manuso received 21,363 shares of Common Stock in lieu of $69,041 of cash fees earned, Ms. Benton received 17,320 shares of Common Stock in lieu of $54,500 of cash fees earned, and Dr. Pepose received 13,481 shares of Common Stock in lieu of $42,000 of cash fees earned. |

| (2) | The amounts reported reflect the aggregate grant date fair value of restricted stock units granted to Ocuphire’s non-employee directors during 2023, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“ASC 718”) based on the Company’s stock price on the date of grant. The amounts reported for Mr. Manuso, Ms. Benton and Dr. Pepose also include $15,703, $10,779 and $7,833, respectively, representing the difference between the grant date fair value of the shares of Common Stock they received in lieu of foregone cash fees and the amount of such cash fees. As of December 31, 2023, our non-employee directors held restricted stock units with respect to the following number of shares of Common Stock: Mr. Gallagher, 10,976; Mr. Ainsworth, 10,976; Mr. Manuso, 10,976; Ms. Benton, 10,976; and Dr. Pepose, 45,976. |

| (3) | The amounts reported in this column represent the aggregate grant date fair values of the stock options granted to Ocuphire’s non-employee directors during 2023, computed in accordance with ASC 718. Assumptions applicable to these valuations can be found in Note 6 of the Notes to Consolidated Financial Statements - Stock-Based Compensation contained in the Ocuphire Pharma, Inc. Annual Report on Form 10-K for the year ended December 31, 2023. As of December 31, 2023, our non-employee directors held options with respect to the following number of shares: Mr. Gallagher, 143,127; Mr. Ainsworth, 143,127; Mr. Manuso, 143,127; Ms. Benton, 99,639; and Dr. Pepose, 197,721. |

| (4) | The amount reported for Dr. Pepose represents consulting fees paid to him for his services as Chief Medical Advisor pursuant to his consulting agreement. |

| Ocuphire Pharma, Inc. | | | 23 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 24 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 25 | | | 2024 Proxy Statement |

| Fee Category | | | Fiscal Year 2023 | | | Fiscal Year 2022 |

Audit fees(1) | | | $463,750 | | | $393,581 |

Audit-related fees(2) | | | — | | | — |

Tax fees(3) | | | — | | | — |

| All other fees | | | — | | | — |

| Total fees | | | $463,750 | | | $393,581 |

| (1) | Audit fees include fees for professional services provided by EY in connection with the annual audit of our consolidated financial statements, review of our quarterly consolidated financial statements, and related services that are typically provided in connection with registration statements and other SEC filings. |

| (2) | Audit-related fees include fees billed for assurance and related services reasonably related to the performance of the audit or reviews of our consolidated financial statements that are not included as audit fees. There were no such fees incurred during the years ended December 31, 2023 or 2022. |

| (3) | Tax fees include fees for tax compliance, advice and planning. There were no such fees incurred during the years ended December 31, 2023 or 2022. |

| Ocuphire Pharma, Inc. | | | 26 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 27 | | | 2024 Proxy Statement |

| Name | | | Age | | | Position(s) |

| Dr. George Magrath | | | 40 | | | Chief Executive Officer |

| Joseph Schachle | | | 59 | | | Chief Operating Officer |

| Nirav Jhaveri | | | 46 | | | Chief Financial Officer |

| Ash Jayagopal | | | 42 | | | Chief Scientific and Development Officer |

| Bernhard Hoffmann | | | 68 | | | Senior Vice President of Corporate Development |

| Amy Rabourn | | | 44 | | | Senior Vice President of Finance |

| Ocuphire Pharma, Inc. | | | 28 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 29 | | | 2024 Proxy Statement |

| • | Dr. George Magrath, Chief Executive Officer;(1) |

| • | Amy Rabourn, Senior Vice President of Finance; |

| • | Bernhard Hoffmann, Senior Vice President of Corporate Development; |

| • | Ronil Patel, Chief Business Officer; |

| • | Mina Sooch, Former Chief Executive Officer and President;(2) and |

| • | Richard Rodgers, Director and Former Interim Chief Executive Officer and President.(3) |

| (1) | Dr. Magrath was appointed as Chief Executive Officer of the Company, effective November 1, 2023. |

| (2) | Ms. Sooch separated from the Company, effective April 19, 2023. |

| (3) | Mr. Rodgers is a member of the Board and served as Interim Chief Executive Officer and President from April 19, 2023 to November 1, 2023. |

| Ocuphire Pharma, Inc. | | | 30 | | | 2024 Proxy Statement |

| Name and Principal Position | | | Year(1) | | | Salary ($)(1) | | | Bonus ($)(2) | | | Stock Awards ($)(3) | | | Option Awards ($)(4) | | | Non-Equity Incentive Plan Compensation ($)(5) | | | All Other Compensation ($)(6) | | | Total ($) |

Dr. George Magrath Chief Executive Officer(7) | | | 2023 | | | 95,833 | | | — | | | 1,148,000 | | | 1,373,447 | | | 50,073 | | | 0 | | | 2,667,353 |

Amy Rabourn Senior Vice President of Finance | | | 2023 | | | 305,000 | | | — | | | 163,128 | | | 192,690 | | | 115,900 | | | 13,200 | | | 789,918 |

| | 2022 | | | 260,000 | | | — | | | — | | | 114,751 | | | 91,000 | | | 33,516 | | | 499,267 | ||

Bernhard Hoffmann Senior Vice President of Corporate Development | | | 2023 | | | 305,000 | | | — | | | 163,128 | | | 192,690 | | | 115,900 | | | 13,200 | | | 789,918 |

| | 2022 | | | 240,000 | | | — | | | — | | | 97,538 | | | 84,000 | | | 24,958 | | | 446,496 | ||

Ronil Patel, Chief Business Officer | | | 2023 | | | 293,243 | | | | | 316,143 | | | 370,914 | | | 108,864 | | | 13,200 | | | 1,102,364 | |

Mina Sooch Former Chief Executive Officer and President(7) | | | 2023 | | | 168,831 | | | — | | | 470,596 | | | 974,086 | | | 0 | | | 1,197,625 | | | 2,811,138 |

| | 2022 | | | 550,000 | | | — | | | — | | | 459,005 | | | 302,500 | | | 30,090 | | | 1,341,595 | ||

Richard Rodgers Director and Former Interim Chief Executive Officer and President(7)(8) | | | 2023 | | | 379,626 | | | 100,000 | | | 419,450 | | | — | | | 0 | | | 0 | | | 899,076 |

| (1) | The amount reported in this column for Mr. Rodgers for 2023 includes $254,667 for services as Interim Chief Executive Officer and President and $50,000, representing fees paid to him for his service as a member of the Board pursuant to the Company’s non-employee director compensation program, including monthly cash retainers paid in respect of his service on the transition committee. On January 11, 2023, Mr. Rodgers was granted 20,822 shares of Common Stock in lieu of $74,959 of cash fees for his service as a member of the Board and which are reflected in this column. |

| (2) | The amount reported in this column for Mr. Rodgers for 2023 reflects a discretionary bonus paid to him in recognition of his performance as Interim Chief Executive Officer in 2023. |

| (3) | The amounts reported reflect the aggregate grant date fair value of restricted stock units granted to Ocuphire’s named executive officers during 2023, computed in accordance with ASC 718 based on the Company’s stock price on the date of grant. The amount reported in this column for Mr. Rodgers for 2023 includes $100,450, representing the grant date fair value of the restricted stock units granted to him for his service as a member of the Board. |

| (4) | The amounts reported reflect the aggregate grant date fair value of the stock options granted to Ocuphire’s named executive officers during 2023 and 2022, computed in accordance with ASC 718. In addition, the amounts reported for Ms. Sooch for 2023 also includes $418,210 representing the incremental fair value associated with the extension of the post-termination exercise period of her stock option awards in connection with her separation, as described below and calculated in accordance with ASC 718. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Assumptions applicable to these valuations can be found in Note 6 of the Notes to Consolidated Financial Statements — Stock-Based Compensation contained in the Ocuphire Pharma, Inc. Annual Report on Form 10-K for the year ended December 31, 2023. |

| (5) | This column represents the amounts of non-equity incentive plan compensation earned for the respective years. |

| (6) | Amounts reflect 401(k) Company matching contributions paid on behalf of the named executive officers. The amount reflected for Ms. Sooch for 2023 also includes the following amounts paid to her in connection with her separation pursuant to her separation and release agreement: (i) $678,756, which includes Ms. Sooch’s $583,000 annual base salary plus a $95,756 pro rata bonus for 2023, (ii) a lump sum payment of $500,000, and (iii) $11,808, representing the cost of premiums for continued health insurance coverage. |

| (7) | Ms. Sooch served as Chief Executive Officer in 2023 until April 19, 2023, when Mr. Rodgers was appointed as Interim Chief Executive Officer. Effective November 1, 2023, Dr. Magrath was appointed as Chief Executive Officer of the Company and Mr. Rodgers resumed his role as a non-employee director. |

| (8) | Prior to and following his service as Interim Chief Executive Officer, Mr. Rodgers received compensation under the Company’s non-employee director compensation program. |

| Ocuphire Pharma, Inc. | | | 31 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 32 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 33 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 34 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 35 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 36 | | | 2024 Proxy Statement |

| | | | | Option Awards | | | Stock Awards | ||||||||||||||

| Name | | | Grant Date | | | Number of Securities Underlying Unexercised Options Exercisable (#) | | | Number of Securities Underlying Unexercised Options Unexercisable (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock that have not Vested (#) | | | Market Value of Shares or Units of Stock that have not Vested (#)(3) |

| Dr. George Magrath | | | November 1, 2023 | | | — | | | 600,000(1) | | | $2.87 | | | October 31, 2033 | | | — | | | — |

| | November 1, 2023 | | | — | | | — | | | — | | | — | | | 400,000(4) | | | 1,204,000 | ||

| Bernhard Hoffmann | | | October 1, 2018 | | | 42,867 | | | — | | | $0.90 | | | October 1, 2028 | | | — | | | — |

| | December 27, 2019 | | | 30,110 | | | — | | | $1.21 | | | December 27, 2029 | | | — | | | — | ||

| | June 3, 2020 | | | 4,226 | | | — | | | $1.65 | | | June 3, 2030 | | | — | | | — | ||

| | November 11, 2020 | | | 15,808 | | | 4,192(2) | | | $4.05 | | | November 11, 2030 | | | — | | | — | ||

| | January 28, 2022 | | | 20,360 | | | 22,140(1) | | | $2.90 | | | January 27, 2032 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | 69,912(5) | | | $3.50 | | | January 9, 2033 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | — | | | — | | | — | | | 46,608(4) | | | 140,290 | ||

| Amy Rabourn | | | June 3, 2020 | | | 21,130 | | | — | | | $1.65 | | | June 3, 2030 | | | — | | | — |

| | November 11, 2020 | | | 59,356 | | | 15,644(2) | | | $4.05 | | | November 11, 2030 | | | — | | | — | ||

| | January 28, 2022 | | | 23,951 | | | 26,049(1) | | | $2.90 | | | January 7, 2032 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | 69,912(7) | | | $3.50 | | | January 9, 2033 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | — | | | — | | | — | | | 46,608(4) | | | 140,290 | ||

| Ronil Patel | | | March 25, 2021 | | | 18,000 | | | — | | | $6.04 | | | March 24, 2031 | | | — | | | — |

| | July 1, 2021 | | | 12,488 | | | 7,512(1) | | | $5.37 | | | June 30, 2031 | | | — | | | — | ||

| | January 28, 2022 | | | 9,001 | | | 9,799(1) | | | $2.90 | | | January 27, 2032 | | | — | | | — | ||

| | September 1, 2022 | | | 4,998 | | | 10,002(1) | | | $2.24 | | | August 31, 2032 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | 25,956(5) | | | $3.50 | | | January 9, 2033 | | | — | | | — | ||

| | April 24, 2023 | | | — | | | 30,000(5) | | | $5.35 | | | April 23, 2033 | | | — | | | — | ||

| | December 1, 2023 | | | — | | | 74,538(6) | | | $2.99 | | | November 30, 2033 | | | — | | | — | ||

| | January 10, 2023 | | | — | | | — | | | — | | | — | | | 17,304(4) | | | 52,085 | ||

| | April 24, 2023 | | | — | | | — | | | — | | | — | | | 20,000(4) | | | 60,200 | ||

| | December 1, 2023 | | | — | | | — | | | — | | | — | | | 49,692(6) | | | 149,573 | ||

| Mina Sooch | | | October 1, 2018 | | | 89,142 | | | — | | | $0.90 | | | October 1, 2028 | | | — | | | — |

| | December 27, 2019 | | | 90,860 | | | — | | | $1.21 | | | December 27, 2029 | | | — | | | — | ||

| | November 11, 2020 | | | 97,159 | | | — | | | $4.05 | | | April 19, 2026 | | | — | | | — | ||

| | January 28, 2022 | | | 108,324 | | | — | | | $2.90 | | | April 19, 2026 | | | — | | | — | ||

| | January 10, 2023 | | | 63,026 | | | — | | | $3.50 | | | April 19, 2026 | | | — | | | — | ||

| Richard Rodgers | | | November 11, 2020 | | | 50,000 | | | — | | | $4.05 | | | November 10, 2030 | | | — | | | — |

| | June 7, 2021 | | | 20,000 | | | — | | | $5.74 | | | June 6, 2031 | | | — | | | — | ||

| | June 13, 2022 | | | 20,000 | | | — | | | $1.93 | | | June 12, 2032 | | | — | | | — | ||

| | April 19, 2023 | | | — | | | — | | | — | | | — | | | 50,000(7) | | | 150,500 | ||

| | November 1, 2023 | | | — | | | — | | | — | | | — | | | 35,000(7) | | | 105,350 | ||

| (1) | 25% of the shares subject to the option vested or will vest on the first anniversary of the grant date, with the remaining portions vesting on the last day of the month over the following 36 months. |

| (2) | The shares vest in equal monthly installments over four years from the date of grant. |

| (3) | The market value of shares or units of stock that have not vested reflects a stock price of $3.01, our closing stock price on December 29, 2023, the last trading date of 2023. |

| (4) | These restricted stock units vest in equal installments on each of the first four anniversaries of the grant date. |

| (5) | 25% of the shares subject to the option vested or will vest on the first anniversary of grant date, with the balance vesting quarterly in 12 equal installments thereafter. |

| (6) | These options and restricted stock units vest 25% on the six-month anniversary of the grant date, with the remaining portions vesting in equal installments every six months over the two years following the grant date. |

| (7) | These restricted stock units vest on the one-year anniversary of the grant date. |

| Ocuphire Pharma, Inc. | | | 37 | | | 2024 Proxy Statement |

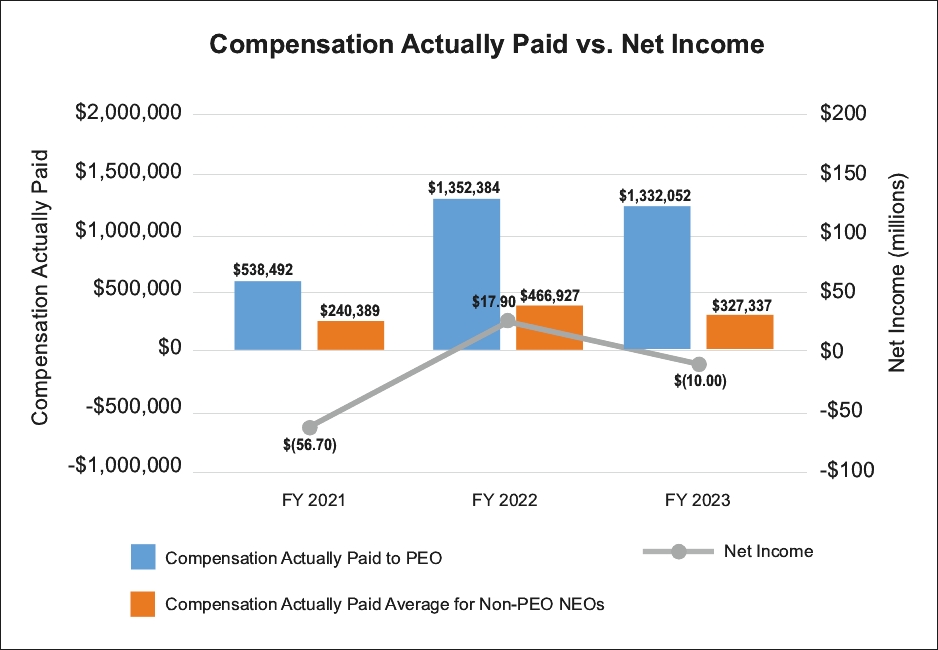

Year(1) | | | Summary Compensation Table Total for Ms. Sooch ($)(1)(2) | | | Compensation Actually Paid to Ms. Sooch ($)(1)(3) | | | Summary Compensation Table Total for Mr. Rodgers ($)(1)(2) | | | Compensation Actually Paid to Mr. Rodgers ($)(1)(3) | | | Summary Compensation Table Total for Dr. Magrath ($)(1)(2) | | | Compensation Actually Paid to Dr. Magrath ($)(1)(3) | | | Average Summary Compensation Table Total for Non-PEO NEOs ($)(4) | | | Average Compensation Actually Paid to Non-PEO NEOs ($)(5) | | | Total Shareholder Return ($) | | | Net Income (loss) ($) (in millions) |

| 2023 | | | 2,811,138 | | | 765,812 | | | 899,076 | | | 309,345 | | | 2,667,353 | | | 256,895 | | | 894,067 | | | 327,337 | | | 46.38 | | | (10.0) |

| 2022 | | | 1,341,595 | | | 1,352,384 | | | — | | | — | | | — | | | — | | | 472,882 | | | 466,927 | | | 54.39 | | | 17.9 |

| 2021 | | | 801,030 | | | 538,492 | | | — | | | — | | | — | | | — | | | 328,594 | | | 240,389 | | | 57.47 | | | (56.7) |

| (1) | Ms. Sooch served as principal executive officer from January 1, 2023 until April 19, 2023, Mr. Rodgers served as principal executive officer from April 19, 2023 to November 1, 2023, and Dr. McGrath served as principal officer beginning on November 1, 2023. Ms. Sooch served as principal executive officer for the entirety of 2021 and 2022. |

| (2) | Reflects the amount reported in the “Total” column of the Summary Compensation Table for the applicable principal executive officer each corresponding year. |

| (3) | Amounts reported reflect CAP for the applicable principal executive officer, as computed in accordance with Item 402(v) of Regulation S-K, for each corresponding year, which amounts do not reflect the actual amount of compensation earned by or paid to such principal executive officer during the applicable year. The adjustments below were made to each principal executive officer’s total compensation for each year to determine the CAP for such fiscal year in accordance with the requirements of Item 402(v) of Regulation S-K. |

| Year | | | Reported Summary Compensation Table Total for Ms. Sooch ($) | | | Less | | | Reported Value of Equity Awards ($)(a) | | | Plus | | | Equity Award Adjustments ($)(b) | | | Equals | | | CAP for Ms. Sooch ($) |

| 2023 | | | 2,811,138 | | | - | | | 1,444,682 | | | + | | | (600,644) | | | = | | | 765,812 |

| 2022 | | | 1,341,595 | | | - | | | 459,005 | | | + | | | 469,794 | | | = | | | 1,352,384 |

| 2021 | | | 801,030 | | | - | | | — | | | + | | | (262,538) | | | = | | | 538,492 |

| Year | | | Reported Summary Compensation Table Total for Mr. Rodgers ($) | | | Less | | | Reported Value of Equity Awards ($)(a) | | | Plus | | | Equity Award Adjustments ($)(b) | | | Equals | | | CAP for Mr. Rodgers ($) |

| 2023 | | | 899,076 | | | - | | | 419,450 | | | + | | | (170,281) | | | = | | | 309,345 |

| Ocuphire Pharma, Inc. | | | 38 | | | 2024 Proxy Statement |

| Year | | | Reported Summary Compensation Table Total for Dr. Magrath ($) | | | Less | | | Reported Value of Equity Awards ($)(a) | | | Plus | | | Equity Award Adjustments ($)(b) | | | Equals | | | CAP for Dr. Magrath ($) |

| 2023 | | | 2,667,353 | | | - | | | 2,521,447 | | | + | | | 110,989 | | | = | | | 256,895 |

| (a) | Amounts reflect the grant date fair value of equity awards as reported in the “Option Awards” and “Stock Awards” columns in the Summary Compensation Table for the applicable year. |

| (b) | The equity award adjustments were calculated in accordance with Item 402(v) of Regulation S-K and include, to the extent applicable: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value, (iv) the fair value as of the vesting date of any awards that were granted and vested in the same fiscal year; and (v) the excess fair value, if any, of modified option awards or stock awards over the fair value of the original awards as of the modification and which is not otherwise reflected in the foregoing adjustments. For 2023, reflects the incremental fair value associated with the modification of Ms. Sooch’s outstanding option awards to extend the post-termination exercise period. The amounts deducted or added in calculating the equity award adjustments for Ms. Sooch are as follows: |

| Year | | | Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) | | | Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) | | | Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | Fair Value as of Vesting Date of Equity Awards Granted and Vested in Fiscal Year ($) | | | Change in Fair Value to Reflect Excess Fair Value Resulting From Modifications to Stock Option Awards ($) | | | Total Equity Award Adjustments ($) |

| 2023 | | | — | | | — | | | (1,016,860) | | | (1,994) | | | 418,210 | | | (600,644) |

| 2022 | | | 532,736 | | | (28,284) | | | (34,658) | | | — | | | — | | | 469,794 |

| 2021 | | | — | | | (203,149) | | | (59,389) | | | — | | | — | | | (262,538) |

| Year | | | Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) | | | Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) | | | Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | Total Equity Award Adjustments ($) |

| 2023 | | | (163,600) | | | — | | | (6,681) | | | (170,281) |

| Ocuphire Pharma, Inc. | | | 39 | | | 2024 Proxy Statement |

| Year | | | Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) | | | Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) | | | Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | Total Equity Award Adjustments ($) |

| 2023 | | | 110,989 | | | — | | | — | | | — |

| (4) | Reflects the average amount reported in the “Total” column of the Summary Compensation Table for our other named executive officers as a group (excluding the principle executive officers) for each corresponding year. The other named executive officers included for purposes of calculating the average amounts were Mr. Bernhard Hoffmann and Ms. Amy Rabourn for 2021 and 2022 and Mr. Bernhard Hoffmann, Ms. Amy Rabourn and Mr. Ronil Patel for 2023. |

| (5) | Amounts reported reflect CAP for the other named executive officers as a group, as computed in accordance with Item 402(v) of Regulation S-K, for each corresponding year, which amounts do not reflect an average of the actual amount of compensation earned by or paid to the other named executive officers as a group during the applicable year. The adjustments below were made to the average total compensation for the named executive officers as a group for each year to determine the CAP for such year in accordance with the requirements of Item 402(v) of Regulation S-K. |

| Year | | | Average Reported Summary Compensation Table Total for Non-PEO NEOs ($) | | | Less | | | Average Reported Value of Equity Awards ($) | | | Plus | | | Average Equity Award Adjustments ($)(a) | | | Equals | | | Average CAP for Non-PEO NEOs ($) |

| 2023 | | | 894,067 | | | - | | | 466,231 | | | + | | | (100,499) | | | = | | | 327,337 |

| 2022 | | | 472,882 | | | - | | | 106,145 | | | + | | | 100,190 | | | = | | | 466,927 |

| 2021 | | | 328,594 | | | - | | | 0 | | | + | | | (88,205) | | | = | | | 240,389 |

| (a) | See note (b) to footnote (3) above for an explanation of the equity award adjustments made in accordance with Item 402(v) of Regulation S-K. The amounts deducted or added in calculating the total average equity award adjustments for the other named executive officers as a group are as follows: |

| Year | | | Average Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) | | | Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards ($) | | | Average Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | Total Average Equity Award Adjustments ($) |

| 2023 | | | (84,967) | | | (17,251) | | | 1,719 | | | (100,499) |

| 2022 | | | 123,195 | | | (10,335) | | | (12,670) | | | 100,190 |

| 2021 | | | 0 | | | (74,227) | | | (13,978) | | | (88,205) |

| Ocuphire Pharma, Inc. | | | 40 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 41 | | | 2024 Proxy Statement |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| Plan category | | | (a) | | | (b) | | | (c) |

| Equity compensation plans approved by security holders | | | 3,778,958 | | | $2.63 | | | 635,745(1) |

| Equity compensation plans not approved by security holders | | | 1,433,000 | | | $2.24 | | | 892,258 (2) |

| Total | | | 5,211,958 | | | $2.52 | | | 1,528,003 |

| (1) | Consists of shares available under the 2020 Plan. The number of shares of our Common Stock reserved under the 2020 Plan will automatically increase on January 1 of each calendar year through January 1, 2030 by 5.0% of the total number of shares of our Common Stock outstanding on December 31 of the preceding calendar year. |

| (2) | Consists of shares available under the Ocuphire Pharma, Inc. Inducement Plan (the “Inducement Plan”). The Inducement Plan was adopted in February 2021 and amended on November 1, 2023, pursuant to which the Company reserves shares of its Common Stock to be used exclusively for grants of awards to individuals who were not previously employees or directors of the Company, as an inducement material to the individual’s entry into employment with the Company within the meaning of Rule 5635(c)(4) of the Nasdaq Listing Rules. |

| Ocuphire Pharma, Inc. | | | 42 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 43 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 44 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 45 | | | 2024 Proxy Statement |

| • | the lowest sale price for the Company’s Common Stock on Nasdaq on the purchase date of such shares; and |

| • | the average of the three (3) lowest closing sale prices for the Company’s Common Stock on Nasdaq during the ten (10) consecutive business days prior to the purchase date of such shares. |

| • | three (3) times the number of shares purchased pursuant to such Regular Purchase; and |

| • | 30% of the aggregate shares of the Company’s Common Stock traded on Nasdaq during all or, if certain trading volume or market price thresholds specified in the Purchase Agreement are crossed on the applicable Accelerated Purchase date, the portion of the normal trading hours on the applicable Accelerated Purchase date prior to such time that any one of such thresholds is crossed. |

| • | three (3) times the number of shares purchased pursuant to such Regular Purchase; and |

| • | 30% of the aggregate shares of the Company’s Common Stock traded on Nasdaq during all or, if certain trading volume or market price thresholds specified in the Purchase Agreement are crossed on the applicable Accelerated Purchase date, the portion of the normal trading hours on the applicable Accelerated Purchase date prior to such time that any one of such thresholds is crossed. |

| Ocuphire Pharma, Inc. | | | 46 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 47 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 48 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 49 | | | 2024 Proxy Statement |

| • | Breaches of the fiduciary duty of loyalty (which requires officers to act in good faith for the benefit of the corporation and not for personal gain); |

| • | Intentional misconduct or knowing violations of the law; and |

| • | Derivative claims on behalf of a corporation by a stockholder. |

| Ocuphire Pharma, Inc. | | | 50 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 51 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 52 | | | 2024 Proxy Statement |

| • | each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of our Common Stock; |

| • | each of our named executive officers; |

| • | each of our directors; and |

| • | all of our current executive officers and directors as a group. |

| Ocuphire Pharma, Inc. | | | 53 | | | 2024 Proxy Statement |

| Name of beneficial owner | | | Number of shares of Common Stock beneficially owned(1) | | | Percentage of Common Stock beneficially owned |

| Directors and Named Executive Officers | | | | | ||

| Dr. George Magrath | | | 25,000 | | | * |

Cam Gallagher(2) | | | 192,425 | | | * |

Sean Ainsworth(3) | | | 203,736 | | | * |

James S. Manuso(4) | | | 240,718 | | | * |

Richard Rodgers(5) | | | 279,797 | | | 1.1 |

Susan K. Benton(6) | | | 198,519 | | | * |

Dr. Jay Pepose(7) | | | 229,098 | | | * |

Bernhard Hoffmann(8) | | | 249,465 | | | 1.0 |

Ronil Patel(9) | | | 61,258 | | | * |

Amy Rabourn(10) | | | 147,002 | | | * |

Mina Sooch(11) | | | 786,877 | | | 3.0 |

All Current Directors and Officers as a Group (12 persons)(12) | | | 1,777,760 | | | 6.6 |

| * | Less than 1% |

| (1) | Based on 25,608,506 shares of Common Stock outstanding as of April 15, 2024. |

| (2) | Includes (i) options to purchase 143,127 shares of Common Stock that are exercisable within 60 days of April 15, 2024 and (ii) warrants to purchase 13,394 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (iii) 10,976 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (3) | Includes (i) options to purchase 143,127 shares of Common Stock that are exercisable within 60 days of April 15, 2024; (ii) warrants to purchase 13,394 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (iii) 10,976 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (4) | Includes (i) options to purchase 143,127 shares of Common Stock that are exercisable within 60 days of April 15, 2024; (ii) warrants to purchase 6,697 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (iii) 10,976 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (5) | Includes (i) options to purchase 90,000 shares of Common Stock that are exercisable within 60 days of April 15, 2024; (ii) warrants to purchase 26,789 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (iii) 50,000 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (6) | Includes (i) options to purchase 99,639 shares of Common Stock that are exercisable within 60 days of April 15, 2024 and (ii) 10,976 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (7) | Includes (i) options to purchase 156,783 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (ii) 10,976 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| (8) | Includes options to purchase 141,724 shares of Common Stock that are exercisable within 60 days of April 15, 2024. |

| (9) | Includes options to purchase 53,214 shares of Common Stock that are exercisable within 60 days of April 15, 2024. Mr. Patel, former Chief Business Officer, separated from the Company, effective March 4, 2024. His ownership information is provided as of the date of his departure. |

| (10) | Includes options to purchase 139,300 shares of Common Stock that are exercisable within 60 days of April 15, 2024. |

| (11) | Ms. Sooch, former Chief Executive Officer and President, separated from the Company, effective April 19, 2023. Her ownership information is provided as of the day of her departure. |

| (12) | Includes (i) options to purchase 1,056,827 shares of Common Stock that are exercisable within 60 days of April 15, 2024; (ii) warrants to purchase 60,724 shares of Common Stock that are exercisable within 60 days of April 15, 2024; and (iii) 104,880 unvested restricted stock units that vest within 60 days of April 15, 2024. |

| Ocuphire Pharma, Inc. | | | 54 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 55 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 56 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 57 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | 58 | | | 2024 Proxy Statement |

| Ocuphire Pharma, Inc. | | | A-1 | | | 2024 Proxy Statement |