UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Oncolin Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

____________________________________Nevada____________________________________

(State or other jurisdiction of incorporation or organization)

_____________________________________2834___________________________________

(Primary Standard Industrial Classification Code Number)

____________________________________88-0507007____________________________________

(I. R. S. Employer Identification Number)

6750 West Loop South, Suite 790, Bellaire, Texas 77401, (832) 426-7907

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Steven M. Plumb, Oncolin Therapeutics, Inc.

6750 West Loop South, Suite 790, Bellaire, Texas 77401, (832) 426-7907

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copy to:

THOMAS C. PRITCHARD or SONDRA JURICA, BREWER & PRITCHARD, P.C.,

THREE RIVERWAY, SUITE 1800, HOUSTON, TEXAS 77056, PHONE (713) 209-2950, FAX (713) 659-5302

As soon as practicable after this Registration Statement becomes effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filed, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filed” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company x

| SEC 870 (02-08) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | Amount Being Registered | Proposed Maximum Offering Price Per Share(1) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee(3) |

| Common Stock, par value $.08 | 5,250,000 | $0.43 | $2,257,500 | $88.71 |

| TOTAL | | | | $88.71 |

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457.

(2) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, based upon the last sale of the Registrant’s common stock on February 19, 2008, as reported on the OTC Bulletin Board.

(3)Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion, Dated May 9, 2008

Preliminary Prospectus

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

ONCOLIN THERAPEUTICS, INC.

5,200,000 SHARES

This prospectus relates to the offer and sale of shares of Oncolin Therapeutics, Inc.’s common stock by the selling stockholder, Dutchess Private Equities Fund, Ltd. (“Dutchess”).

This offering is not being underwritten. We have agreed to indemnify Dutchess. Further, we have agreed to pay the expenses related to the registration of the shares being offered, but we will not receive any proceeds from the sale of the shares by the selling stockholder. Dutchess is an underwriter within the meaning of the Securities Act of 1933, as amended.

Our common stock is currently traded on the OTC Bulletin Board under the symbol OCOL. On April 11, 2008, the closing price of our common stock was $0.51 per share.

Investing in our common stock involves risks. You should purchase our shares only if you can afford a complete loss of your investment. WE URGE YOU TO READ THE RISK FACTORS SECTION BEGINNING ON PAGE 5 ALONG WITH THE REST OF THIS PROSPECTUS BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 9, 2008

FORM S-1

TABLE OF CONTENTS

Page

Risk Factors 5

Prospectus Summary 11

The Offering 14

Special Note Regarding Forward-looking Statements 15

Use of Proceeds 15

Market Price Information and Dividend Policy 15

Management's Discussion and Analysis 17

Our Business 19

Selling Stockholder 23

Plan of Distribution 24

Management &# 160; 24

Principal Stockholders 26

Description of Securities 27

Disclosure of Commission Position on Indemnification for Securities Act Liabilities 28

Experts ; 28

Legal Matters 28

Financial Statements F-1

Any investment in our securities involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this prospectus, before you decide to buy our securities.

Our business, financial condition and results of operations could be materially adversely affected if any of these risks materialized, which could result in the trading price of our common stock to decline.

The Company is a development stage company and there can be no assurance the Company will successfully implement its plans.

The Company is in the development stage and its operations are subject to the considerable risks inherent in the establishment of a new business enterprise. As of December 31, 2007, the Company had experienced cumulative losses equal to $4,469,131. The Company’s likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the formation of a new business which seeks to obtain funds to finance its operations in a highly competitive environment. There can be no assurance that the Company will successfully implement any of its plans in a timely or effective manner or that the Company will ever be profitable. In addition, there can be no assurances that we will choose to continue any of our current product candidates because we intend to consider and, as appropriate, divest ourselves of products or businesses that may no longer be a strategic fit to our business strategy.

We have a history of losses and expect to incur substantial losses and negative operating cash flows for the foreseeable future, and we may never achieve or maintain profitability.

We have no revenues and are not currently profitable. We will likely need to raise additional capital as early as six months or sooner. Since our inception, we have incurred significant net losses. As a result of ongoing operating losses, we had an accumulated deficit of $10,896,572 as of December 31, 2007. Even if we succeed in developing and commercializing one or more of our drugs, we expect to incur substantial losses for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and capital expenditures and anticipate that our expenses will increase substantially in the foreseeable future as we:

| § | seek regulatory approvals for our product candidates; |

| § | develop, formulate, manufacture and commercialize our drugs; implement additional internal systems and infrastructure; and hire additional clinical and scientific personnel; and |

| § | expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues to achieve and maintain profitability. We may not be able to commercialize products from which to generate these revenues, and we may never achieve profitability in the future. |

If we cannot raise additional funding, we will be unable to complete development of our product candidates.

We will require additional funding in order to continue our research and product development programs, including preclinical testing and clinical trials of our product candidates, for operating expenses, and to pursue regulatory approvals for product candidates. We also may require additional funding to establish manufacturing and marketing capabilities in the future. We believe that our existing capital resources and the proceeds for this Offering will be sufficient to satisfy our current and projected funding requirements for at least the next six months. However, these resources will be insufficient to conduct research and development programs as planned. If we cannot obtain adequate funds, we may be required to curtail significantly one or more of our research and development programs or obtain funds through arrangements with corporate collaborators or others that may require us to relinquish rights to some of our technologies or product candidates.

Our future capital requirements will depend on many factors, including:

| § | continued scientific progress in our research and development programs; |

| § | the magnitude of our research and development programs; |

| § | progress with preclinical testing and clinical trials; |

| § | the time and costs involved in obtaining regulatory approvals; |

| § | the costs involved in filing and pursuing patent applications and enforcing patent claims; |

| § | competing technological and market developments; |

| § | the establishment of additional strategic alliances; |

| § | the cost of commercialization activities and arrangements; and |

| § | the cost of product licensing and any possible acquisitions. |

Although we intend to seek additional funding through public or private sales of our securities, including equity securities or through strategic alliances, we have no committed sources of additional capital. We cannot assure you that funds will be available to us in the future on favorable terms, if at all. In addition, we may continue to pursue opportunities to obtain additional financing in the future. However, additional equity or debt financing might not be available on reasonable terms, if at all, and any additional equity financings will be dilutive to our stockholders. If adequate funds are not available to us on terms that we find acceptable, or at all, we may be required to delay, reduce the scope of, or eliminate research and development efforts or clinical trials on any or all of our product candidates. We may also be forced to curtail or restructure our operations, obtain funds by entering into arrangements with collaborators on unattractive terms or relinquish rights to certain technologies or product candidates that we would not otherwise relinquish in order to continue independent operations.

The Company’s stock price is highly volatile.

The market price of the Company's common stock has fluctuated and may continue to fluctuate. These fluctuations may be exaggerated since the trading volume of its common stock is volatile. These fluctuations may or may not be based upon any business or operating results. Its common stock may experience similar or even more dramatic price and volume fluctuations in the future.

Other than option agreements with UTMDACC and RDI, we have no intellectual property in which our current drugs are being developed.

If we fail to negotiate a royalty paying license agreement with UTMDACC by August 2008, unless extended until November 2008, or PRI by December 15, 2008, we will not be able to continue our research and development of our four potential drug candidates. We do not know if we will be able to enter into a license agreement with UTMDACC or PRI on terms favorable to us. Therefore, the failure to negotiate a license agreement with UTMDACC or PRI would have a material adverse effect on our business.

Our option agreement relating to the research and investigational use of certain patents with UTMDACC may be terminated if we commit a material breach, the result of which would significantly harm our business prospects.

Our license agreement with UTMDACC is subject to termination upon 10 days written notice if fail to perform our obligation.

The Company’s management is currently unproven.

The Company has a limited history of operations under the management and control of the new officers and directors of the Company. The Company believes that the combined skill, education and experience of the new management team will be successful in its endeavors; however, there is no guarantee that the new management team will be successful.

We have a limited operating history upon which to base an investment decision.

To date, we have no products and we have not demonstrated an ability to perform the functions necessary for the successful commercialization of any of our product candidates. The successful commercialization of our product candidates will require us to perform a variety of functions, including:

| · | outsourcing the formulation and manufacture of our products; |

| · | undertaking lengthy clinical trials; |

| · | participating in regulatory approval processes; and |

| · | conducting sales and marketing activities. |

Our operations have been limited to organizing and staffing our company, acquiring, developing and securing our proprietary technologies and undertaking, through third parties, pre-clinical trials of our product candidates. These operations provide a limited basis for you to assess our ability to commercialize our product candidates and the advisability of investing in our securities.

The Company’s stock price is highly volatile.

The market price of the Company's common stock has fluctuated and may continue to fluctuate. These fluctuations may be exaggerated since the trading volume of its common stock is volatile. These fluctuations may or may not be based upon any business or operating results. Its common stock may experience similar or even more dramatic price and volume fluctuations in the future.

We may not have sufficient shares available to fully access the equity line with Dutchess and may need to seek additional capital to meet our working capital needs.

We may only issue a put to Dutchess if we have registered the shares of common stock. This prospectus is registering 5,250,000 shares of common stock that we may issue pursuant to the equity line if the Registration Statement is declared effective by the Securities and Exchange Commission. On April 11, 2008, the closing price of our common stock was $0.51. Assuming we issue puts only at $0.51, we would be able to access approximately $2,677,500 of our equity line pursuant to the Investment Agreement. If we were to exercise the put right in manner, that would utilize all 5,250,000 shares, we would be required to file a subsequent registration statement with the Securities and Exchange Commission and for that registration statement to be deemed effective prior to the issuance of any such additional shares.

If we can not raise sufficient funds pursuant to our Investment Agreement with Dutchess, for our capital requirements, we will need to seek additional funding which may not be available on terms acceptable to us or at all.

Assuming the Company utilizes the maximum amount available under the equity line of credit with Dutchess existing shareholders could experience substantial dilution upon the issuance of the shares.

The Company’s equity line of credit with Dutchess contemplates the potential future issuance and sale of up to $10,000,000 of its common stock to Dutchess subject to certain restrictions and obligations. The following is an example of the number of shares that could be issued at various prices assuming the Company utilizes the maximum amount remaining available under the equity line of credit. These examples assume issuance at a market price of $0.45 per share and at 10%, 25% and 50% below $0.43 per share.

The following table should be read in conjunction with the footnotes immediately following the table.

| Percent Below Current Market Price | | Price Per Share (1) | | Number of Shares Issuable (2) | | Shares Outstanding After Issuance (3) | | Percent of Outstanding Shares (4) |

| 0% | | $0.49 | | 20,424,837 | | 68,555,569 | | 29.79% |

| 10% | | $0.44 | | 22,694,263 | | 70,824,995 | | 32.04% |

| 25% | | $0.37 | | 27,233,115 | | 75,363,847 | | 36.14% |

| 50% | | $0.24 | | 40,849,673 | | 88,980,405 | | 45.91% |

(1) Represents purchase prices equal to 96% of $0.51, the closing bid price of the Company’s common stock on April 11, 2008, and potential reductions thereof of 10%, 25% and 50%.

(2) Represents the number of shares issuable if the entire $10,000,000 commitment under the equity line of credit was drawn down at the indicated purchase prices.

(3) Based on 48,130,732 common shares issued and outstanding on April 11, 2008.

(4) Percentage of the total outstanding shares of common stock after the issuance of the shares indicated which would be owned by Dutchess, without considering any contractual restriction on the number of shares the selling stockholder may own at any point in time, other restrictions on the number of shares the Company may issue or issuance of shares under any of its other convertible or exchanges securities.

The lower the stock price, the greater the number of shares issuable under the Dutchess transaction, which could contribute to the future decline of the Company’s stock price and dilute existing shareholders’ equity and voting rights.

The number of shares that Dutchess may receive under Dutchess’ transaction with the Company is calculated based upon the market price of the Company’s common stock prevailing at the time of each conversion. The lower the market price, the greater the number of shares issuable under the agreement. Upon issuance of the shares, to the extent that investors will attempt to sell the shares into the market, these sales could further reduce the market price of the Company’s common stock. This in turn will increase the number of shares issuable under the agreements. This could lead to lower market prices and a greater number of shares to be issued. A larger number of shares issuable at a discount in a declining market could expose the Company’s shareholders to greater dilution and a reduction in the value of their investment.

The investor in the Dutchess Transaction will pay less than the then-prevailing market price of the Company’s common stock, which could cause the price of its common stock to decline.

The Company’s common stock to be issued under the investment agreement with Dutchess will be purchased at a discount to the market price. Each issuance of shares of its common stock will dilute the value of each share of common stock due to the increase in the number of outstanding shares. Dutchess has a financial incentive to sell the Company’s shares immediately upon receiving the shares to realize the profit between the discounted price and the market price, which could result in the price of the Company’s common stock decreasing and an increased likelihood that further sales will be imminent. Accordingly, the structure of the Dutchess agreement may result in the price of the Company’s common stock declining.

Additional capital may dilute current stockholders.

In order to provide capital for the operation of the Company’s business, it may enter into additional financing arrangements. These arrangements may involve the issuance of new common stock, preferred stock that is convertible into common stock, debt securities that are convertible into common stock or warrants for the purchase of common stock. Any of these items could result in a material increase in the number of shares of common stock outstanding which would in turn result in a dilution of the ownership interest of existing common shareholders. In addition, these new securities could contain provisions, such as priorities on distributions and voting rights, which could affect the value of the Company’s existing common stock.

A low market price may severely limit the potential market for the Company’s common stock.

The Company’s common stock is currently trading at a price below $5.00 per share, subjecting trading in the stock to certain SEC rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer.

Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in the Company’s common stock.

The Company is unlikely to pay dividends on its common stock.

The Company does not anticipate paying any cash dividends on its common stock in the foreseeable future. While its dividend policy will be based on its operating results and capital needs, the Company anticipates that all earnings, if any, will be retained to finance its future operations.

Our business is at an early stage of development.

Our business is at an early stage of development. We do not have any products in clinical trials or on the market. We are still in the early stages of identifying and conducting research on potential products. Our potential products will require regulatory approval prior to marketing in the United States and other countries. Obtaining such approval will require significant research and development and preclinical and clinical testing. We may not be able to develop any products, to obtain regulatory approvals, to enter clinical trials for any of our product candidates, or to commercialize any products. Our product candidates may prove to have undesirable and unintended side effects or other characteristics adversely affecting their safety, efficacy or cost-effectiveness that could prevent or limit their use. Any product using any of our technology may fail to provide the intended therapeutic benefits, or achieve therapeutic benefits equal to or better than the standard of treatment at the time of testing or production.

We will need additional capital to conduct our operations and develop our products and our ability to obtain the necessary funding is uncertain.

We need to obtain significant amounts of additional capital to develop our products and continue our business. We estimate that it will take an additional $1,200,000 to file one investigational new drug application with the United States Food and Drug Administration (“FDA”), $2,000,000 for Phase I clinical trials and $5,000,000 for Phase II clinical trials. The capital may come from many sources, including equity and/or debt financings, license arrangements, grants and/or collaborative research arrangements.

The timing and degree of any future capital requirements will depend on many factors, including:

| | | | § the accuracy of the assumptions underlying our estimates for capital needs in 2008 and beyond; § scientific progress in our research and development programs; § the magnitude and scope of our research and development programs; § our ability to establish, enforce and maintain strategic arrangements for research, development, clinical testing, manufacturing and marketing; § our progress with preclinical development and clinical trials; § the time and costs involved in obtaining regulatory approvals; § the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims; and § the number and type of product candidates that we pursue. |

Additional financing through strategic collaborations, public or private equity financings, capital lease transactions or other financing sources may not be available on acceptable terms, or at all. Additional equity financings could result in significant dilution to our stockholders. Further, if additional funds are obtained through arrangements with collaborative partners, these arrangements may require us to relinquish rights to some of our technologies, product candidates or products that we would otherwise seek to develop and commercialize ourselves. If sufficient capital is not available, we may be required to delay, reduce the scope of or eliminate one or more of our programs, any of which could have a material adverse effect on our financial condition or business prospects.

Clinical trials are subject to extensive regulatory requirements, very expensive, time-consuming and difficult to design and implement. Our anticipated products may fail to achieve necessary safety and efficacy endpoints during clinical trials.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous FDA requirements, and must otherwise comply with federal, state and local requirements and policies of the medical institutions where they are conducted. The clinical trial process is also time-consuming. We estimate that clinical trials of our product candidates will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| | | | § FDA or Institutional Review Board (IRB) objection to proposed protocols; § discussions or disagreement with FDA over the adequacy of trial design to potentially demonstrate effectiveness, and subsequent design modifications; § unforeseen safety issues; § determination of dosing issues and related adjustments; § lack of effectiveness during clinical trials; § slower than expected rates of patient recruitment; § product quality problems (e.g., sterility or purity) § challenges to patient monitoring and data collection during or after treatment (for example, patients’ failure to return for follow-up visits); and § failure of medical investigators to follow our clinical protocols. |

In addition we or the FDA (based on its authority over clinical studies) may delay a proposed investigation or suspend clinical trials in progress at any time if it appears that the study may pose significant risks to the study participants or other serious deficiencies are identified. Prior to approval of our product, FDA must determine that the data demonstrate safety and effectiveness.

Our anticipated product candidates must undergo rigorous clinical testing, the results of which are uncertain and could substantially delay or prevent us from bringing them to market.

Before we can obtain regulatory approval for a product candidate, we must undertake extensive clinical testing in humans to demonstrate safety and efficacy to the satisfaction of the FDA or other regulatory agencies. Clinical trials of new drug candidates sufficient to obtain regulatory marketing approval are expensive and take years to complete.

We cannot be certain of successfully completing clinical testing within the time frame we have planned, or at all. We may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent us from receiving regulatory approval or commercializing our product candidates, including the following:

| | | | § our clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical and/or preclinical testing or to abandon programs; § the results obtained in earlier stage testing may not be indicative of results in future trials; § trial results may not meet the level of statistical significance required by the FDA or other regulatory agencies; § enrollment in our clinical trials for our product candidates may be slower than we anticipate, resulting in significant delays; § we, or regulators, may suspend or terminate our clinical trials if the participating patients are being exposed to unacceptable health risks; and § the effects of our product candidates on patients may not be the desired effects or may include undesirable side effects or other characteristics that may delay or preclude regulatory approval or limit their commercial use, if approved. |

Completion of clinical trials depends, among other things, on our ability to enroll a sufficient number of patients, which is a function of many factors, including:

| | | | § the therapeutic endpoints chosen for evaluation; § the eligibility criteria defined in the protocol; § the size of the patient population required for analysis of the trial’s therapeutic endpoints; § our ability to recruit clinical trial investigators and sites with the appropriate competencies and experience; § our ability to obtain and maintain patient consents; and § competition for patients by clinical trial programs for other treatments. |

We may experience difficulties in enrolling patients in our clinical trials, which could increase the costs or affect the timing or outcome of these trials.

We are subject to significant regulatory approval requirements, which could delay, prevent or limit our ability to market our any product.

Our research and development activities, anticipated preclinical studies, clinical trials and the manufacturing and marketing of our product candidates are subject to extensive regulation by the FDA and other regulatory agencies in the United States and by comparable authorities in Europe and elsewhere. We require the approval of the relevant regulatory authorities before we may commence commercial sales of our product candidates in a given market. The regulatory approval process is expensive and time-consuming, and the timing of receipt of regulatory approval is difficult to predict. Our product candidates could require a significantly longer time to gain regulatory approval than expected, or may never gain approval. We cannot be certain that, even after expending substantial time and financial resources, we will obtain regulatory approval for any of our product candidates. A delay or denial of regulatory approval could delay or prevent our ability to generate product revenues and to achieve profitability.

Changes in regulatory approval policies during the development period of any of our product candidates, changes in, or the enactment of, additional regulations or statutes, or changes in regulatory review practices for a submitted product application may cause a delay in obtaining approval or result in the rejection of an application for regulatory approval.

Regulatory approval, if obtained, may be made subject to limitations on the indicated uses for which we may market a product. These limitations could adversely affect our potential product revenues. Regulatory approval may also require costly post-marketing follow-up studies. In addition, the labeling, packaging, adverse event reporting, storage, advertising, promotion and record-keeping related to the product will be subject to extensive ongoing regulatory requirements. Furthermore, for any marketed product, its manufacturer and its manufacturing facilities will be subject to continual review and periodic inspections by the FDA or other regulatory authorities. Failure to comply with applicable regulatory requirements may, among other things, result in fines, suspensions of regulatory approvals, product recalls, product seizures, operating restrictions and criminal prosecution.

The FDA and foreign regulatory authorities may impose significant restrictions on the indicated uses and marketing of pharmaceutical products.

FDA rules for pharmaceutical promotion require that a company not promote an unapproved drug or an approved drug for an unapproved use. In addition to FDA requirements, regulatory and law enforcement agencies, such as the United States Department of Health and Human Services’ Office of Inspector General and the United States Department of Justice, monitor and investigate pharmaceutical sales, marketing and other practices. For example, sales, marketing and scientific/educational grant programs must comply with the Medicare-Medicaid Anti-Fraud and Abuse Act, as amended, the False Claims Act, as amended, and similar state laws. In recent years, actions by companies’ sales forces and marketing departments have been scrutinized intensely to ensure, among other things, that actions by such groups do not qualify as “kickbacks” to healthcare professionals. A “kickback” refers to the provision of any item of value to a healthcare professional or other person in exchange for purchasing, recommending, or referring an individual for an item or service reimbursable by a federal healthcare program. These kickbacks increase the expenses of the federal healthcare program and may result in civil penalties, criminal prosecutions, and exclusion from participation in government programs, any of which would adversely affect our financial condition and business operations. In addition, even if we are not determined to have violated these laws, government investigations into these issues typically require the expenditure of significant resources and generate negative publicity, which would also harm our financial condition. Comparable laws also exist at the state level.

We are, and in the future may be, subject to new federal and state requirements to submit information on our open and completed clinical trials to public registries and databases.

In 1997, a public registry of open clinical trials involving drugs intended to treat serious or life-threatening diseases or conditions was established under the Food and Drug Administration Modernization Act, or FDMA, in order to promote public awareness of and access to these clinical trials. Under FDMA, pharmaceutical manufacturers and other trial sponsors are required to post the general purpose of these trials, as well as the eligibility criteria, location and contact information of the trials. Since the establishment of this registry, there has been significant public debate focused on broadening the types of trials included in this or other registries, as well as providing for public access to clinical trial results. A voluntary coalition of medical journal editors has adopted a resolution to publish results only from those trials that have been registered with a no-cost, publicly accessible database, such as www.clinicaltrials.gov. The Pharmaceuticals and Research Manufacturers of America has also issued voluntary principles for its members to make results from certain clinical studies publicly available and has established a website for this purpose. Other groups have adopted or are considering similar proposals for clinical trial registration and the posting of clinical trial results. The state of Maine has enacted legislation, with penalty provisions, requiring the disclosure of results from clinical trials involving drugs marketed in the state, and similar legislation has been introduced in other states. Federal legislation was introduced in the fall of 2004 to expand www.clinicaltrials.gov and to require the inclusion of study results in this registry. In some states, such as New York, prosecutors have alleged that a lack of disclosure of clinical trial information constitutes fraud, and these allegations have resulted in settlements with pharmaceutical companies that include agreements to post clinical trial results. Our failure to comply with any clinical trial posting requirements could expose us to negative publicity, fines, and other penalties, all of which could materially harm our business.

Because we are dependant on clinical research institutions and other contractors for clinical testing and for research and development activities, the results of our clinical trials and such research activities are, to a certain extent, beyond our control.

We depend upon independent investigators and collaborators, such as universities and medical institutions, to conduct our pre-clinical and clinical trials under agreements with us. These collaborators are not our employees and we cannot control the amount or timing of resources that they devote to our programs. These investigators may not assign as great a priority to our programs or pursue them as diligently as we would if we were undertaking such programs ourselves. If outside collaborators fail to devote sufficient time and resources to our drug development programs, or if their performance is substandard, the approval of our FDA applications, if any, and our introduction of new drugs, if any, will be delayed. These collaborators may also have relationships with other commercial entities, some of whom may compete with us. If our collaborators assist our competitors at our expense, our competitive position would be harmed.

If our third-party clinical trial vendors fail to comply with strict regulations, the clinical trials for our product candidates may be delayed or unsuccessful.

We do not have the personnel capacity to conduct or manage the clinical trials that we intend for our product candidates. We rely on third parties to assist us in managing, monitoring and conducting most of our clinical trials. If these third parties fail to comply with applicable regulations or do not adequately fulfill their obligations under the terms of our agreements with them, we may not be able to enter into alternative arrangements without undue delay or additional expenditures, and therefore the clinical trials for our product candidates may be delayed or unsuccessful.

Furthermore, the FDA can be expected to inspect some or all of the clinical sites participating in our clinical trials, or our third-party vendors’ sites, to determine if our clinical trials are being conducted according to current good clinical practices. If the FDA determines that our third-party vendors are not in compliance with applicable regulations, we may be required to delay, repeat or terminate the clinical trials. Any delay, repetition or termination of our clinical trials could materially harm our business.

If we are unable to retain and recruit qualified scientists or if any of our key senior executives discontinue their employment with us, it will delay our development efforts.

We are highly dependent on the principal members of our management and we intend to hire scientific staff. The loss of any of these people could impede the achievement of our development objectives. Furthermore, recruiting and retaining qualified scientific personnel to perform research and development work in the future will also be critical to our success. We may be unable to attract and retain personnel on acceptable terms given the competition among biotechnology, pharmaceutical and health care companies, universities and non-profit research institutions for experienced scientists. In addition, we rely on a significant number of consultants to assist us in formulating our research and development strategy. All of our consultants are employed by employers other than us. They may have commitments to, or advisory or consulting agreements with, other entities that may limit their availability to us.

We may be subject to claims that we or our employees have wrongfully used or disclosed alleged trade secrets of their former employers.

As is commonplace in the biotechnology industry, we employ or may employ in the future individuals who were previously employed at other biotechnology or pharmaceutical companies, including our competitors or potential competitors. Although no claims against us are currently pending, we may be subject to claims that these employees or we have inadvertently or otherwise used or disclosed trade secrets or other proprietary information of their former employers. Litigation may be necessary to defend against these claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to management.

We have no marketing experience, sales force or distribution capabilities and, if our product candidates are approved, we may not be able to commercialize them successfully.

Although we do not currently have any products which have been approved for commercial sale, our ability to produce revenues ultimately depends on our ability to sell our products if and when they are approved by the FDA. We currently have no experience in marketing or selling pharmaceutical products and we do not have a marketing and sales staff or distribution capabilities. Our long-term strategy involves establishing alliances with third parties to assist in marking and distribution of our product candidates. There is intense competition for collaborative arrangement with pharmaceutical and biotechnology companies for establishing relationships with academic research institutions, for attracting investigators and sites capable of conducting our clinical trials and for licenses of proprietary technology. Moreover, these arrangements are complex to negotiate and time-consuming to document. Our future profitability will depend in large part on our ability to enter into effective marketing arrangements and our product revenues will depend on those marketers’ efforts, which may not be successful.

If we create a product for sale, governmental and third-party payors may subject our potential products to sales and pharmaceutical pricing controls that could limit our potential product revenues and delay profitability.

The continuing efforts of government and third-party payors to contain or reduce the costs of health care through various means may reduce our potential revenues, if we ever create a product that could be sold to the public. These payors’ efforts could decrease the price that we receive for any potential products we may develop and sell in the future. In addition, third-party insurance coverage may not be available to patients for any potential products we develop. If government and third-party payors do not provide adequate coverage and reimbursement levels for our products, or if price controls are enacted, our product revenues will suffer.

If physicians and patients do not accept our potential products, we may not recover our investment.

The commercial success of our potential products, if they are approved for marketing, will depend upon the medical community and patients accepting our products as being safe and effective. The market acceptance of our products could be affected by a number of factors, including:

| § | the timing of receipt of marketing approvals; |

| § | the safety and efficacy of the potential products; |

| § | the emergence of equivalent or superior products; and |

| § | the cost-effectiveness of the potential products. |

If the medical community and patients do not ultimately accept our products as being safe and effective, we may not recover our investment.

If we are unable to prevent third parties from using our intellectual property, our ability to compete in the market will be harmed.

We believe that the proprietary technology embodied in our product candidates and methods gives us a competitive advantage or at the very least, a pathway to the market place. Maintaining this competitive advantage is important to our future success. We rely on patent protection, as well as on a combination of copyright, trade secret and trademark laws, to protect our proprietary technology. However, these legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep any competitive advantage. For example, our patents may be challenged, invalidated or circumvented by third parties. Our patent applications may not issue as patents at all or in a form that will be advantageous to us. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge or other trade secrets by consultants, vendors, former employees and current employees, despite the existence of nondisclosure and confidentiality agreements and other contractual restrictions. Furthermore, the laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States. If our intellectual property rights are not adequately protected, we may be unable to keep other companies from competing directly with us, which could result in a decrease in our market share. Enforcement of our intellectual property rights to prevent or inhibit appropriation of our technology by competitors can be expensive and time consuming to litigate or otherwise dispose of and can divert management’s attention from carrying on with our core business.

Our product candidates could infringe on the intellectual property rights of others, which may lead to costly litigation, payment of substantial damages or royalties and/or our inability to use essential technologies.

The biopharmaceutical industry has been characterized by extensive litigation and administrative proceedings regarding patents and other intellectual property rights. Whether a drug infringes a patent involves complex legal and factual issues, the determination of which is often uncertain. Our competitors may assert that our product candidates and methods infringe their patents. In addition, they may claim that their patents have priority over ours because their patents issued first. Because patent applications can take many years to issue, there may be applications now pending of which we are unaware, which could later result in issued patents that our instruments or methods may infringe. There could also be existing patents that one or more of our instruments or methods may inadvertently be infringing of which we are unaware. As the number of competitors in the market grows, the possibility of a patent infringement claim against us increases.

Infringement and other intellectual property claims, with or without merit, can be expensive and time-consuming to litigate or otherwise dispose of and can divert management’s attention from carrying on with our core business. In addition, if we lose an intellectual property litigation matter, a court could require us to pay substantial damages and/or royalties and/or prohibit us from using essential technologies. Also, although we may seek to obtain a license under a third party’s intellectual property rights to bring an end to any claims or actions asserted or threatened against us, we may not be able to obtain a license on reasonable terms or at all.

If we fail to adequately protect our intellectual property rights, our competitors may be able to take advantage of our research and development efforts to develop competing drugs.

Our commercial success will depend in part on obtaining patent protection for our products and other technologies and successfully defending these patents against third party challenges. Our patent position, like that of other biotechnology and pharmaceutical companies, is highly uncertain. One uncertainty is that the United States Patent and Trademark Office (“PTO”), or the courts, may deny or significantly narrow claims made under patents or patent applications. This is particularly true for patent applications or patents that concern biotechnology and pharmaceutical technologies, such as ours, since the PTO and the courts often consider these technologies to involve unpredictable sciences. Another uncertainty is that any patents that may be issued or licensed to us may not provide any competitive advantage to us and they may be successfully challenged, invalidated or circumvented in the future. In addition, our competitors, many of which have substantial resources and have made significant investments in competing technologies, may seek to apply for and obtain patents that will prevent, limit or interfere with our ability to make, use and sell our potential products either in the U.S. or in international markets.

Competition and technological change may make our product candidates and technologies less attractive or obsolete.

As noted in “The Company’s Business”, we compete with several pharmaceutical and biotechnology companies on similar types of technologies for the medical indications we are attempting to treat. We also may face competition from companies that may develop or acquire competing technology from universities and other research institutions. As these companies develop their technologies, they may develop competitive positions which may prevent or limit our product commercialization efforts.

Our competitors are established companies with greater financial and other resources than we have. Other companies may succeed in developing products earlier than we do, obtaining FDA approval for products more rapidly than we do or developing products that are more effective than our product candidates. While we will seek to expand our technological capabilities to remain competitive, research and development by others may render our technology or product candidates obsolete or noncompetitive or result in treatments or cures superior to any therapy developed by us.

If product liability lawsuits are successfully brought against us, we may incur substantial damages and demand for the products may be reduced.

The testing and marketing of medical products is subject to an inherent risk of product liability claims. Regardless of their merit or eventual outcome, product liability claims may result in:

| § | decreased demand for our products; |

| § | injury to our reputation and significant media attention; |

| § | withdrawal of clinical trial volunteers; |

| § | costs of litigation; and |

| § | substantial monetary awards to plaintiffs. |

We currently maintain product liability insurance with coverage of $3 million. This coverage may not be sufficient to protect us fully against product liability claims. We intend to expand our product liability insurance coverage to include the sale of commercial products if we obtain marketing approval for any of our product candidates. Our inability to obtain sufficient product liability insurance at an acceptable cost to protect against product liability claims could prevent or limit the commercialization of our products.

PROSPECTUS SUMMARY

To understand this offering fully, you should read the entire prospectus carefully, including the Risk Factors section beginning on page 11 and the financial statements.

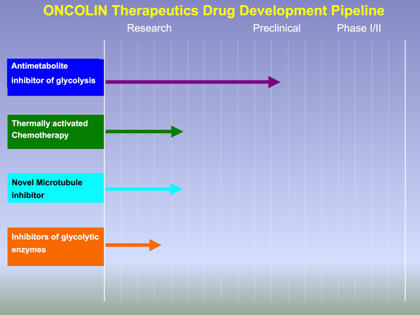

The Company

In January 2008, the Board of Directors Oncolin Therapeutics, Inc. (the “Company”) determined to primarily focus the Company on developing products to treat cancer, infectious diseases and other medical conditions associated with compromised immune systems. As a developmental stage company, substantially all efforts of the Company will be devoted to performing research and experimentation, conducting clinical trials, developing and acquiring intellectual properties, raising capital and recruiting and training personnel.

Overview of Cancer and Treatment Methods

Cancer is the second leading cause of death in the United States, exceeded only by heart disease. It is a devastating disease with tremendous unmet medical needs. The American Cancer Society estimated that 1.4 million new cases of cancer will be diagnosed in 2004 in the United States and 563,700 Americans are expected to die from cancer in 2004.

Cancer is a group of diseases characterized by uncontrolled cell division resulting in the development of a mass of cells, commonly known as a tumor, as well as the invasion and spreading of these cells. Cancerous tumors can arise in any tissue or organ within the human body. Cancer is believed to occur as a result of a number of factors, such as genetic predisposition, chemical agents, viruses and irradiation. These factors result in genetic changes affecting the ability of cells to regulate their growth and differentiation normally. When a normal cell becomes cancerous, it can spread to various sites in the body.

The most common methods of treating patients with cancer are surgery, radiation and drug therapy. A cancer patient often receives treatment with a combination of methods. Surgery and radiation therapy are particularly effective in patients where the disease is localized and has not spread to other tissues or organs. The most common method of treating patients with cancer that has spread beyond the primary site is to administer anticancer drugs by mouth or intravenously. In general, drugs used to treat cancer are classified as chemotherapy. Chemotherapy seeks to damage and kill cancer cells or to interfere with the molecular and cellular processes that control the development, growth and survival of malignant tumor cells. In many cases, chemotherapy consists of the administration of several different drugs in combination. Chemotherapy can cause patient weakness, loss of appetite, nausea and vomiting, and damage to various organs that can result in loss of normal body functions. Current treatment for most kinds of cancer is inadequate. Therefore, a significant need exists for new therapies which are more effective and/or have reduced side effects.

Dutchess Transaction

On December 20, 2007, we entered into an Investment Agreement with Dutchess Private Equities Fund, Ltd. (“Dutchess”). Pursuant to this investment agreement, Dutchess shall commit to purchase up to $10,000,000 of our common stock over the course of thirty-six (36) months. This registration statement is only registering a portion of the shares underlying the Investment Agreement. The maximum amount we may raise under the Investment Agreement is $10,000,000, provided we register enough shares to raise this amount, although we are not obligated to request the entire $10,000,000. Over a period of 36 months, we may periodically deliver new issue shares of our common stock to Dutchess, which then delivers cash to us based on a price per share tied to the current market price of our common stock. The actual number of shares that we may issue subject to the investment agreement is not determinable as it is based on the market price of our common stock from time to time.

The amount that we shall be entitled to request from each purchase (“Puts”) shall be equal to, at our election, either (i) up to $250,000 or (ii) 200% of the average daily volume (U.S. market only) (“ADV”) multiplied by the average of the 3 daily closing bid prices immediately preceding the Put Date. The ADV shall be computed using the three (3) trading days prior to the Put Date. The put date shall be the date that Dutchess receives a put notice of a draw down by the company of a portion of the line. The purchase price shall be set at ninety-six percent (96%) of the lowest closing bid price of the common stock during the pricing period. The pricing period shall be the five (5) consecutive trading days immediately after the put notice date. There are put restrictions applied on days between the put date and the closing date with respect to that particular Put. During this time, we shall not be entitled to deliver another put notice. Further, we shall reserve the right to withdraw the Put if the purchase price is less than seventy-five percent (75%) of the lowest closing bid prices for the 10-trading day period immediately preceding each put notice.

Sample Put Amount Calculation and Purchase Price Calculation

The calculation below assumes a put notice date of April 4, 2008. Set forth below is a trading summary of our common stock for the period April 1, 2008 through April 11, 2008, the 3 trading days immediately prior to April 4, 2008, and the five trading days immediately following April 4, 2008.

| | | |

| Date | Closing Bid Price | Volume |

| April 11, 2008 | $0.51 | 18,600 |

| April 10, 2008 | $0.51 | 17,600 |

| April 9, 2008 | $0.49 | 22,000 |

| April 8, 2008 | $0.46 | 1,000 |

| April 7, 2008 | $0.40 | 11,600 |

| April 4, 2008 | $0.40 | 7,200 |

| April 3, 2008 | $0.45 | 22,100 |

| April 2, 2008 | $0.45 | 13,200 |

| April 1, 2008 | $0.45 | 53,100 |

The average daily volume for the 3 trading days prior to April 4, 2008, is 29,467 shares, 200% of this average is 58,933 shares. The average of the three daily closing bid prices immediately prior to April 4, 2008, is $0.45, resulting in a put amount of $26,520. Thus, on April 4, 2008, we could have requested a put amount of either $26,520 or $250,000.

The purchase price Dutchess would pay for the shares would be equal to 96% of the lowest closing bid price during the five trading day period following April 14, 2008, which in this example is $0.40, resulting in a purchase price of $0.38 per share and the issuance of 651,042 shares.

In addition to the conditions set forth below, Dutchess is precluded from owning more than 4.99% of our common stock (approximately 2,401,723 shares of common stock based on the shares outstanding as of April 11, 2008). Therefore, we would be precluded from submitting a Put Notice, if such notice would result in Dutchess acquiring more than 4.99% of our issued and outstanding common stock. Therefore, prior to each Put Notice, the Company will have to evaluate the current ownership of Dutchess to ensure Dutchess will not own more than 4.99% of our shares of common stock.

Conditions to Dutchess’ Obligation to Purchase Shares

We are not entitled to request a drawdown unless each of the following conditions is satisfied:

| 1. | a registration statement is and remains effective for the resale of securities in connection with the equity line of credit; |

| 2. | at all times during the period between our request for a drawdown and its subsequent funding, our common stock is listed on its principal market and shall not have been suspended from trading thereon for a period of two consecutive trading days; |

| 3. | we have complied with our obligations and are otherwise not in breach or default of any agreement related to the equity line of credit; |

| 4. | no injunction shall have been issued and remain in force, or action commenced by a governmental authority which has not been stayed or abandoned, prohibiting the purchase or the issuance of securities in connection with the equity line of credit; or |

| 5. | the issuance of the securities in connection with the equity line of credit will not violate any shareholder approval requirements of the principal market. |

If we fail to issue shares to Dutchess pursuant to the Investment Agreement, we have agreed to pay Dutchess a late fee for each $10,000 worth of common stock not issued of $100 for each day late for up to 10 days. If we are more than 10 days late issuing the common stock then we shall pay $200 for each additional day after the 10th late day. The late fee does not limit Dutchess’ right to pursue any actual damages caused by the Company’s failure to timely issue stock to Dutchess, except the late fees and the Open Market Adjustment Amount (defined below) will offset any actual damages incurred by Dutchess.

We are only registering a portion of the shares underlying the Dutchess Investment Agreement at this time. We believe that if we raise $2,677,500 under this offering (based upon puts at $0.51 per share), that we will have sufficient cash through December 31, 2008. However, the actual number of shares of common stock issuable upon the exercise of the Dutchess Investment Agreement is subject to adjustment depending on the future market price of our common stock, the amount we draw down and other factors. The actual number of shares issuable pursuant to the Dutchess Investment Agreement could be materially less or more than the number registered in this Registration Statement. Therefore, the 5,250,000 shares being registered in this registration statement may not be enough shares to access the full $10,000,000 million equity line, depending upon the price of our common stock. This will require us to file another registration statement that would need to be declared effective by the Securities and Exchange Commission in order to utilize the full $10,000,000 equity line.

We believe in order to fulfill our current business plan we will need to utilize the entire $10,000,000, of which $1,000,000 for research, $2,000,000 for Phase I clinical trials, $5,000,000 for Phase II clinical trials and $2,000,000 for general and administrative expenses. On April 11, 2008, the closing price of our common stock was $0.51. Assuming we issue puts only at $0.51, we would be able to access approximately $2,677,500 of our equity line pursuant to the Investment Agreement. If we want to use the entire $10,000,000 available under the Investment Agreement, we would be required to file a subsequent registration statement with the Securities and Exchange Commission and for that registration statement to be deemed effective prior to the issuance of any such additional shares.

If, by the third business day after the closing date of a put, the Company fails to deliver any portion of the shares subject to the put and Dutchess purchases, in an open market transaction or otherwise, shares of common stock necessary to make delivery of shares which would have been delivered if the full amount of the shares to be delivered to Dutchess by the Company, then the Company will be obligated to pay Dutchess, in addition to the amounts described above, and not in lieu thereof, the Open Market Adjustment Amount. The “Open Market Adjustment Amount” is the amount equal to the excess, if any, of (x) the Dutchess’ total purchase price (including brokerage commissions, if any) for the open market share purchase minus (y) the net proceeds (after brokerage commissions, if any) received by Dutchess from the sale of the put shares due. The Company shall pay the Open Market Adjustment Amount to Dutchess in immediately available funds within five (5) business days of written demand by Dutchess. By way of illustration and not in limitation of the foregoing, if Dutchess purchases shares of common stock having a total purchase price (including brokerage commissions) of $11,000 to cover an Open Market Purchase with respect to shares of common stock it sold for net proceeds of $10,000, the Open Market Purchase Adjustment Amount which the Company will be required to pay to the Investor will be $1,000.

Neither Dutchess nor the Company may assign its obligations under the Investment Agreement and therefore, this registration statement only covers shares held by Dutchess.

Registration Rights Agreement

The Company has the obligation to use its reasonable best efforts to cause this Registration Statement to become effective, remain effective until the shares registered herein are sold or Dutchess no longer has an obligation to purchase shares under the Investment Agreement, file and prepare any amendments, make any necessary blue sky filings and respond to SEC comments. The Company must provide Dutchess with a copy of this Registration Statement and upon effectiveness copies of the prospectus. If the Company becomes aware that the registration statement contains an untrue statement of material fact or omission, the Company must promptly use all diligent efforts to prepare a supplement or amendment to cure the misstatement. In April 2008, the Company entered into an amendment to the registration rights agreement, whereby the Company deleted the liquidated damage provision. Therefore, there are no liquidated damages or penalties in connection with the registration rights agreement.

Under the terms of the Registration Rights Agreement, we agreed to indemnify, hold harmless and defend Dutchess to the fullest extent permitted by law, against all costs and fees incurred in relation to any claim arising out of any misstatement or material omission in this Registration Statement, any post-effective amendment thereto, any Blue Sky Filings or the final prospectus, or any other violation by us relating to the offer of sale of securities under the Registration Rights Agreement. The indemnification clause will not apply if the claim is due to misinformation furnished to us by Dutchess expressly for use in connection with this Registration Statement, failure of Dutchess to deliver the prospectus, Dutchess’ use of an incorrect prospectus, Dutchess’ failure to register as a dealer under applicable securities laws, failure of Dutchess to notify us of a material fact that should be included in this Registration Statement or any amounts paid in settlement not approved by us.

Further, under the Registration Rights Agreement, Dutchess agreed to severally and jointly indemnify, hold harmless and defend us and our directors and officers to the same extent as above against any claim arising due to the inclusions in this Registration Statement of any written information provided to us by Dutchess expressly for use in this Registration Statement.

We believe the Dutchess transaction is compliant with Rule 415 because the 5,250,000 shares, the resale of which is being registered hereunder, is an amount less than one-third of our non-affiliated outstanding common stock outstanding as of the date hereof, and we believe that the 5,250,000 shares being registered is sufficient to meet our capital needs for the balance of this fiscal year.

Corporate History

We were originally incorporated in the State of Nevada in December 2000 as Folix Technologies Inc. In June 2004, we changed our name to Dragon Gold Resources, Inc. In June 2007, we changed our name to Edgeline Holdings, Inc. In March 2008, we changed our name to Oncolin Therapeutics, Inc. In May 2007, we entered into and closed on an Exchange Agreement with Secure Voice Communications, Inc., a Texas corporation, (“Secure Voice”) and the stockholders of Secure Voice (the “Stock Transaction”). As a result of the Stock Transaction, Secure Voice became our wholly-owned subsidiary and Secure Voice became the surviving entity for accounting purposes. Pursuant to the Stock Transaction we agreed to issue an aggregate of 40,098,000 shares of our common stock to the former shareholders of Secure Voice (in exchange for all the outstanding capital stock of Secure Voice), resulting in the former shareholders of Secure Voice owning approximately 98.5% of our issued and outstanding common stock. As a result of the Stock Transaction, Secure Voice became our wholly-owned subsidiary and Secure Voice became the surviving entity for accounting purposes.

General

Our principal executive offices are located at 6750 West Loop South, Suite 790, Bellaire, Texas 77401, and our telephone number is (832) 426-7907.

Where You Can Find More Information

This prospectus is part of a registration statement on Form S-1 that we have filed registering the common stock to be sold in this offering. We also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may access and read our SEC filings, including this registration statement and all of the exhibits to the registration statement, through the SEC’s web site (http:www.sec.gov). This site contains reports, proxy and information statements and other information regarding registrants, including us, that file electronically with the SEC. This registration statement, including the exhibits and schedules filed as a part of this registration statement, may be inspected at the public reference facility maintained by the SEC at its public reference room at 100 F, Street NE, Washington, DC 20549 and copies of all or any part thereof may be obtained from that office. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room.

All references to “we,” “our,” or “us” refer to Oncolin Therapeutics Inc., a Nevada corporation, and our subsidiaries. All references to our common stock will give effect to our 1 for 80 reverse stock split.

THE OFFERING

| Securities Offered | The selling stockholder is offering a total of 5,250,000 shares of common stock or approximately 10.9% of our current outstanding common stock |

| Common Stock Outstanding Before the Offering | As of April 11, 2008, we had 48,130,732 shares of common stock outstanding |

| Use of Proceeds | We will not receive any of the proceeds from the sale of shares of our common stock offered by our selling stockholder. The proceeds received from any “Puts” tendered to Dutchess pursuant to the investment agreement will be used for payment of general corporate and operating expenses |

| Risk Factors | The securities offered hereby involve a high degree of risk and immediate substantial dilution. See “Risk Factors” |

| Over-the-Counter Bulletin Board Symbol | OCOL |

Summary Financial Information

| | Inception (May 9, 2007) To December 31, 2007 |

| Statement of operations data: | |

| Total revenue | $ -- |

| Total costs and expenses | $ 1,531,644 |

| Interest expense | $ 17,745 |

| Net loss | $ (1,549,389) |

| Net loss per share, basic and diluted | $ (0.04) |

| | December 31, 2007 |

| Balance sheet data: | |

| Cash and Cash Equivalents | $ 7,522 |

| Total assets | $ 108,115 |

| Total liabilities | $ 490,200 |

| Shareholders’ deficit | $ (382,085) |

Included in this prospectus are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements. Important factors that could cause our actual results, performance or achievements to differ from these forward-looking statements include the factors described in the “Risk Factors” section and elsewhere in this prospectus.

All forward-looking statements attributable to us are expressly qualified in their entirety by these and other factors. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

USE OF PROCEEDS

The selling stockholder is selling shares of common stock covered by this prospectus for its own account. We will not receive any of the proceeds from the resale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling security holder. However, whenever Dutchess sells shares issued under the equity line we will have received proceeds when we originally put such shares to Dutchess. The proceeds received from any “Puts” tendered to Dutchess pursuant to the investment agreement will be used for payment of general corporate and operating expenses.

MARKET PRICE INFORMATION AND DIVIDEND POLICY

Our common stock is listed on the over-the-counter electronic bulletin board (“OTCBB”) under the symbol “OCOL.OB”. The following table sets forth the range of high and low bid prices for the last two fiscal years and the first three quarters of the current fiscal year.

| | |

Quarter ended March 31, 2008 | | |

Quarter ended December 31, 2007 | | |

Quarter ended September 30, 2007 | | |

Quarter ended June 30, 2007 | | |

| | |

| Quarter ended March 31, 2007 | $ 4.00 | $ 3.20 |

| Quarter ended December 31, 2006 | $ 5.60 | $ 3.20 |

| Quarter ended September 30, 2006 | $ 7.20 | $ 3.20 |

| Quarter ended June 30, 2006 | $ 9.60 | $ 5.60 |

| | |

| Quarter ended March 31, 2006 | $ 13.60 | $ 4.00 |

| Quarter ended December 31, 2005 | $ 9.60 | $ 4.00 |

| Quarter ended September 30, 2005 | $ 20.80 | $ 8.80 |

| Quarter ended June 30, 2005 | $ 53.60 | $ 16.00 |

The quotations reflect inter-dealer prices without retail mark-up, mark-down or commission and may not represent actual transactions. The quotations give effect to a one for eighty reverse stock split effective July 23, 2007. On April 11, 2008, the closing bid price of the common stock was $0.51.

Stockholders

As of April 11, 2008, we estimate that there were in excess of 1,900 beneficial holders of our common stock.

Dividends

We have never declared or paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and do not anticipate declaring or paying any cash dividends on our common stock in the near future.

DILUTION

As of December 31, 2007, the net tangible book value of our common stock was ($382,085) or ($0.01) per share, based upon 41,849,533. Due to the nature of the Dutchess transaction, the purchase price paid by Dutchess is variable, as is the purchase price paid by the public upon the resale by Dutchess of our common stock. The following tables show the dilution based upon (i) a resale price of our common stock at $0.51 per share and a Dutchess purchase price of $0.38 per share, (ii) twenty five percent (25%) of the resale price and the Dutchess purchase price used in table (i), and (iii) fifty percent (50%) of the resale price and the Dutchess purchase price used in table (i).

Resale price of $0.51 and Dutchess Purchase Price of $0.38 per share

Without taking into account any changes in the pro forma net tangible book value prior to this offering, other than to give effect to the issuance of 5,250,000 shares at an offering price of $0.51 per share (based upon the closing price of our common stock on April 11, 2008) and the application of the net proceeds of $1,995,000 (based upon a put notice on April 4, 2008), the pro forma net tangible book value of the Company’s common stock after this offering will be $1,612,915 or $0.030 per share. Consequently, based on the above assumptions, the purchasers of the common stock offered hereby will sustain an immediate substantial dilution (i.e., the difference between the purchase price of $0.43 per share of common stock and the net tangible book value per share) after the offering of $0.480 per share. The following table illustrates such dilution:

Per Share Price ………………………………………………..…………………………… $ 0.510

Per Share Pro Forma Net Tangible Book Value as of December 31, 2007 …….……….$ (0.009)

Per Share Increase Attributable to New Investors……………………………………… $ 0.039

Per Share Pro Forma Net Tangible Book Value After the Offering……………… …… $ 0.034

Per Share Dilution to New Investors ………………….………………………………… $ 0.476

Resale price of $0.38 and Dutchess Purchase Price of $0.29 per share (25% discount)