UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

Or

| x | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from March 31, 2013 to December 31, 2013

Commission file number: 000-50541

BREITLING ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Nevada | | 88-0507007 |

State or other jurisdiction of incorporation or organization | | I.R.S. Employer Identification No. |

1910 Pacific Ave, Suite 12000, Dallas, Texas 75201

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 716-2600

Securities registered pursuant to Section 12(b) of this Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One).

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant at June 30, 2013 was $2,828,454.

Number of shares of the registrant’s common stock outstanding at March 15, 2014 was 498,883,626.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement for the 2014 annual meeting of stockholders, which will be filed within 120 days after December 31, 2013, are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

Cautionary Notice Regarding Forward-Looking Statements

The information in this report includes “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this report, the words “could”, “should”, “will”, “play”, “believe”, “anticipate”, “intend”, “estimate”, “expect”, “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” included in this report. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events.

Forward-looking statements may include statements about:

| | • | | reserve quantities and the present value of our reserves; |

| | • | | financial strategy, liquidity and capital required for our development program; |

| | • | | future oil and natural gas prices; |

| | • | | timing and amount of future production of oil and natural gas; |

| | • | | hedging strategy and results, if applicable; |

| | • | | marketing of oil and natural gas; |

| | • | | leasehold or business acquisitions; |

| | • | | costs of developing our properties; |

| | • | | liquidity and access to capital; |

| | • | | future operating results; and |

| | • | | plans, objectives, expectations and intentions contained in this report that are not historical. |

We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development and production of oil and natural gas. These risks include, but are not limited to, commodity price volatility, low prices for oil and/or natural gas, global economic conditions, inflation, increased operating costs, lack of availability of drilling and production equipment and services, environmental risks, weather risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, reductions in cash flow, access to capital, and the other risks described under “Item 1A. Risk Factors” in this report.

Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reservoir engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered.

Should one or more of the risks or uncertainties described in this report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in this report are expressly qualified in their entirety by these cautionary statements. These cautionary statements should also be considered in connection with any subsequent written or oral forward-looking statements that we may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this report.

4

CERTAIN DEFINITIONS

Unless the context otherwise requires, the terms “we,” “us,” “our,” “ours,” the “Company” or “Breitling” when used in this report refer to Breitling Energy Corporation, together with our consolidated operating subsidiaries. When the context requires, we refer to these entities separately.

We have included below the definitions for certain terms used in this report:

3-D seismic – An advanced technology method of detecting accumulation of hydrocarbons identified through a three-dimensional picture of the subsurface created by the collection and measurement of the intensity and timing of sound waves transmitted into the earth as they reflect back to the surface.

AFE –Authority for expenditure.

After payout – With respect to an oil or natural gas interest in a property, refers to the time period after which the costs to drill and equip a well have been recovered.

AMI–Area of mutual interest.

Bbl – One stock tank barrel, or 42 U.S. gallons liquid volume, used herein in reference to crude oil or other liquid hydrocarbons.

Bbls/d orBOPD – Barrels per day.

Bcf – Billion cubic feet.

Bcfe – Billion cubic feet equivalent, determined using the ratio of six thousand cubic feet (Mcf) of natural gas to one Bbl of crude oil, condensate or natural gas liquids.

Before payout– With respect to an oil and natural gas interest in a property, refers to the time period before which the costs to drill and equip a well have been recovered.

Behind-pipe reserves – Those reserves expected to be recovered from completion interval(s) not yet open but still behind casing in existing wells.

BOE – Barrel of oil equivalent, determined using a ratio of six Mcf of natural gas equal to one barrel of oil equivalent.

Carried interest – A contractual arrangement whereby all or a portion of the working interest cost participation of the project originator is paid for by another party in exchange for earning an interest in such project.

Completion – The installation of permanent equipment for the production of oil or natural gas or, in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Compression – A force that tends to shorten or squeeze, decreasing volume or increasing pressure.

DD&A– Depreciation, depletion and amortization.

Developed acreage – The number of acres which are allotted or assignable to producing wells or wells capable of production.

Development activities – Activities following exploration including the installation of facilities and the drilling and completion of wells for production purposes.

Development well – A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Dry hole or well – A well found to be incapable of producing hydrocarbons economically.

EUR– Expected ultimate recovery from a well, reservoir or field.

Exploitation – The act of making oil and gas property more profitable, productive or useful.

Exploratory well – A well drilled to find and produce oil or natural gas reserves not classified as proved to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir or to extend a known reservoir.

Farm-in orFarmout – An agreement where the owner of a working interest in an oil and natural gas lease assigns the working interest or a portion thereof to another party who desires to drill on the leased acreage. Generally, the assignee is required to drill one or more wells in order to earn its interest in the acreage. The assignor usually retains a royalty and/or reversionary interest in the lease. The interest received by the assignee is a “farm-in” while the interest transferred by the assignor is a “farmout.”

FASB – The Financial Accounting Standards Board.

Field – An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature and/or stratigraphic condition.

GAAP – Generally accepted accounting principles in the United States of America.

Gross acres or gross wells – The total acres or wells, as the case may be, in which a working interest is owned.

Horizontal drilling – A drilling technique that permits the operator to contact and intersect a larger portion of the producing horizon than conventional vertical drilling techniques that may, depending on horizon, result in increased production rates and greater ultimate recoveries of hydrocarbons.

Injection well – A well to inject gas, water, or liquefied petroleum gas under high pressure into a producing formation to maintain sufficient pressure to produce the recoverable reserves.

Mineral rights – Ownership of minerals under a defined surface along with the legal right of access so the minerals can be extracted. Mineral rights can be separated and transferred from land ownership. Also called subsurface rights.

MBbls – One thousand barrels of crude oil or other liquid hydrocarbons.

MBOE – One thousand barrels of oil equivalent, determined using a ratio of six Mcf of natural gas equal to one barrel of oil equivalent.

Mbtu (Mmbtu) – Used as a standard unit of measurement for natural gas and provides a convenient basis for comparing the energy content of various grades of natural gas and other fuels. One cubic foot of natural gas produces approximately 1,000 BTUs, so 1,000 cubic feet of gas is comparable to 1 MBTU. MBTU is often expressed as MMBTU, which is intended to represent a thousand BTUs.

Mcf – One thousand cubic feet.

Mcf/d – One thousand cubic feet per day.

Mcfe – One thousand cubic feet equivalent determined by using the ratio of six Mcf of natural gas to one Bbl of crude oil, condensate or natural gas liquids, which approximates the relative energy content of crude oil, condensate and natural gas liquids as compared to natural gas. Prices have historically been higher or substantially higher for crude oil than natural gas on an energy equivalent basis although there have been periods in which they have been lower or substantially lower.

MMcf – One million cubic feet.

MMcf/d – One million cubic feet per day.

MMcfe – One million cubic feet equivalent.

6

Net acres or net wells – The product of the fractional working interests owned by gross acres or gross wells.

NGL’s – Natural gas liquids measured in barrels.

NRI orNet Revenue Interests – The share of production after satisfaction of all royalty, oil payments and other non-operating interests.

Normally pressured reservoirs – Reservoirs with a formation-fluid pressure equivalent to 0.465 per square inch per foot of depth from the surface. For example, if the formation pressure is 4,650 per square inch at a depth of 10,000 feet, the pressure is considered to be normal.

Over-riding royalty interest – A royalty interest derived from the working interest, in excess of the royalty provided in the oil and gas lease.

Over-pressured reservoirs – Reservoirs with a formation fluid pressure greater than 0.465 per square inch per foot of depth from the surface.

Plant products – Liquids generated by a plant facility; including propane, iso-butane, normal butane, pentane and ethane.

Plugging and abandonment orP&A – Refers to the sealing off of fluids in the strata penetrated by a well so that the fluids from one stratum will not escape into another or to the surface. Regulations of many states require plugging of abandoned wells.

PV-10 – The present value of estimated future revenues to be generated from the production of proved reserves calculated in accordance with SEC guidelines, net of estimated lease operating expense, production taxes and future development costs, using prices, as prescribed in the SEC rules, and costs as of the date of estimation without future escalation, without giving effect to non-property related expenses such as general and administrative expenses, debt service, depreciation, depletion and amortization, or Federal income taxes and discounted using and annual discount rate of 10%. PV-10 is considered a non-GAAP financial measure as defined by the SEC.

Possible reserves – Additional reserves that are less certain to be recovered than probable reserves. When deterministic methods are used, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates. Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project. Possible reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for probable reserves. Possible reserves may be assigned where geoscience and engineering data identify directly adjacent portions of a reservoir within the same accumulation that may be separated from proved areas by faults with displacement less than formation thickness or other geological discontinuities and that have not been penetrated by a wellbore, and the Company believes that such adjacent portions are in communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are structurally higher or lower than the proved area if these areas are in communication with the proved reservoir. Where direct observation has defined a highest known oil (“HKO”) elevation and the potential exists for an associated gas cap, proved oil reserves should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher contact can be established with reasonable certainty through reliable technology. Portions of the reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible oil or gas based on reservoir fluid properties and pressure gradient interpretations.

Primary recovery – The first stage of hydrocarbon production in which natural reservoir drives are used to recover hydrocarbons, although some form of artificial lift may be required to exploit declining reservoir drives.

Probable reserves –Additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. When deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates. Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir. Probable reserves estimates also include potential incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than assumed for proved reserves.

7

Productive well – A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

Proved developed nonproducing reserves orPDNP – Proved developed nonproducing reserves are proved reserves that are either shut-in or are behind-pipe reserves.

Proved developed producing reservesor PDP – Proved developed reserves that are expected to be recovered from completion intervals currently open in existing wells and able to produce to market.

Proved developed reserves – Proved reserves that are expected to be recovered from existing wells with existing equipment and operating methods.

Proved oil and gas reserves – Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. (i) The area of the reservoir considered as proved includes: (A) the area identified by drilling and limited by fluid contacts, if any, and (B) adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data. (ii) In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. (iii) Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. (iv) Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: (A) successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and (B) the project has been approved for development by all necessary parties and entities, including governmental entities. (v) Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

Proved undeveloped location – A site on which a development well can be drilled consistent with spacing rules for purposes of recovering proved undeveloped reserves.

Proved undeveloped reserves orPUD – Proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

Recompletion – The completion for production of an existing wellbore in another formation from that in which the well has been previously completed.

Re-engineering– A process involving a comprehensive review of the mechanical conditions associated with wells and equipment in producing fields. Our re-engineering practices typically result in a capital expenditure plan, which is implemented over time, to workover (see below) and re-complete wells and modify down-hole artificial lift equipment and surface equipment and facilities. The programs are designed specifically for individual fields to increase and maintain production, reduce down-time and mechanical failures, lower per-unit operating expenses, and therefore, improve field economics.

Reprocessing – Taking older seismic data and performing new mathematical techniques to refine subsurface images or to provide additional ways of interpreting the subsurface environment.

8

Reservoir – A porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

Royalty – The portion of oil, gas, and minerals retained by the lessor on execution of a lease or their cash value paid by the lessee to the lessor or to one who has acquired possession of the royalty rights, based on a percentage of the gross production from the property free and clear of all costs except taxes.

Royalty interest – An interest in an oil and natural gas property entitling the owner to a share of oil or natural gas production free of costs of production.

Secondary recovery – The use of water-flooding or gas injection to maintain formation pressure during primary production and to reduce the rate of decline of the original reservoir drive.

Shut-in reserves – Those reserves expected to be recovered from completion intervals that were open at the time the reserve was estimated but were not producing due to market conditions, mechanical difficulties or because production equipment or pipelines were not yet installed.

Standardized Measure of Discounted Future Net Cash Flows – Present value of proved reserves, as adjusted to give effect to estimated future abandonment costs, net of estimated salvage value of related equipment, and estimated future income taxes.

Undeveloped acreage – Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

Working interest orWI – The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and share of production, subject to all royalties, overriding royalties and other burdens and to share in all costs of exploration, development operations and all risks in connection therewith.

Workover – Operations on a producing well to restore or increase production.

9

PART I

ITEM 1 – BUSINESS

Overview of Our Business

History

Breitling Energy Corporation (formerly, Bering Exploration Inc., formerly, Oncolin Therapeutics, Inc., formerly, Edgeline Holdings, Inc., formerly, Dragon Gold Resources, Inc., formerly Folix Technologies, Inc.) (“we”, “our” or the “Company”) was incorporated in the State of Nevada on December 13, 2000 under the name “Folix Technologies, Inc.” On August 18, 2004, the Company changed its name to Dragon Gold Resources, Inc. On June 22, 2007, the Company changed its name to Edgeline Holdings, Inc. and on March 11, 2008 to Oncolin Therapeutics, Inc. On September 7, 2010, the Company changed its name to Bering Exploration, Inc. and on January 20, 2014 to Breitling Energy Corporation.

On February 12, 2012, the Board of Directors of the Company (the “Board of Directors”) approved a 1-for-10 reverse stock split, which became effective on February 27, 2012. The Company has retroactively applied this reverse stock split to its financial reporting for the years ended March 31, 2012 and 2011. On December 23, 2013, the stockholders of the Company voted to approve a resolution authorizing the Board of Directors to effect a reverse stock split of the Company’s common stock at a ratio of not less than 1-for-2 and not greater than 1-for-100, with the exact ratio to be set within such a range at the discretion of the Board of Directors. The Board of Directors has not yet effected this reverse stock split.

On December 9, 2013, we completed an Asset Purchase Agreement (the “Purchase Agreement”) with Breitling Oil and Gas Corporation, a Texas corporation (“O&G”) and Breitling Royalties Corporation, a Texas corporation (“Royalties,” and collectively with O&G, the “Predecessors”). Pursuant to the Purchase Agreement, the Company issued to the Predecessors 461,863,084 shares of common stock, in exchange for substantially all of the oil and gas assets owned by the Predecessors (the “Transaction”). In connection with the closing of the Transaction (the “Closing”), all of the Company’s outstanding convertible notes were converted into common stock. The shares of common stock issued to the Predecessors represent approximately 92.5% of the shares of common stock outstanding following the Closing. The Closing did not affect the number of shares of common stock held by our existing public stockholders. O&G was founded in October 2004 in Dallas, Texas.

Business Strategy

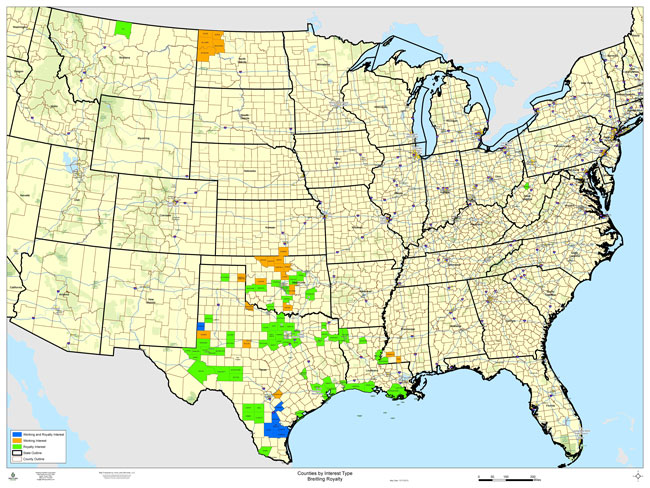

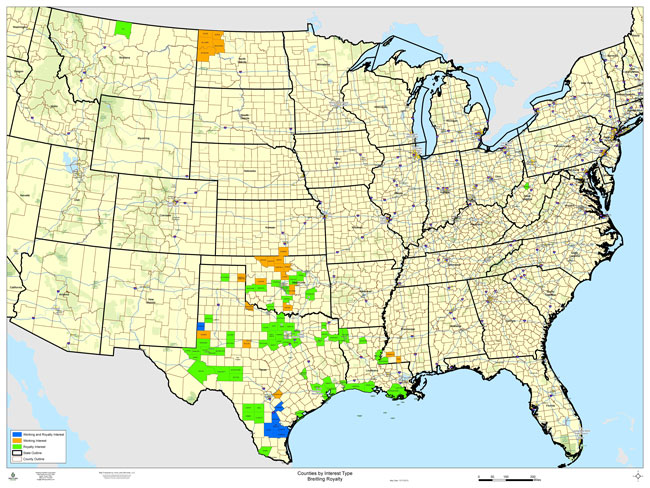

We are an oil and gas exploration and production company that acquires and develops lower risk onshore oil and gas working interests and royalty interests in proven basins in the United States, such as the Permian Basin in Texas, the Bakken / Three Forks formations located in North Dakota and the Mississippi Lime and Hunton / Woodford / Cleveland formations located in Oklahoma. We operate wells in the Permian Basin in Texas and Mississippi Lime in Kansas and plan to expand our operations in the Permian Basin. As of December 31, 2013, the vast majority of our oil and gas interests were acquired as royalty interests or non-operated working interests. Our asset base is primarily comprised of rights to the revenue interests. We are developing infrastructure and expertise to acquire and develop our own properties after December 31, 2013.

Exploration and Production Activities

Our exploration activities are focused on adding profit generating production to existing core areas and increasing our current operated and non-operation positions.

Our primary goal is to increase stockholder value by increasing the value of acquired properties through a combination of exploitation, drilling and proven engineering extraction practices.

As part of our corporate strategy, we believe in the following fundamental principles:

| | • | | Expand our direct operations through the acquisition of operated working interests. |

| | • | | Maximize the value of our properties by increasing production and reserves while controlling cost. |

| | • | | Maintain a highly competitive team of experienced and incentivized personnel. |

| | • | | Acquire properties where we believe additional value can be created through secondary and tertiary recovery operations and a combination of other exploitation, development, exploration and marketing techniques. |

Our goal is to build long-term stockholder value by growing reserves and production revenues in a cost-efficient manner. To accomplish our goal, we plan to carry out a balanced program of (1) developing our properties and expanding into other areas, (2) operating as a low-cost producer, (3) pursuing strategic, complementary acquisitions and (4) maintaining financial flexibility. The following are key elements of our strategy:

| | • | | Develop our properties. Operations and investment opportunities are focused on exploratory and developmental drilling onshore in the U.S. in major plays such as the Permian Basin, Eagle Ford, Marcellus, Utica, Granite Wash, Cleveland, Hunton, Mississippi Lime, Bakken, Lower Hope Lime and Three Forks unconventional liquids plays. |

| | • | | Operate our properties as a low-cost producer. We strive to minimize our operating costs by concentrating our assets within geographic areas where we can consolidate operating control and, thus, create operating efficiencies. We continue to develop our operations in Texas, Oklahoma and Kansas. |

| | • | | Acquire strategic, complementary assets. We target the acquisition of assets in oil and gas fields which display long-lived, high-quality production, heavily weighted in oil and/or liquids rich natural gas production. We evaluate acquisitions based on decline profiles, reserve life and seek to take advantage of any operational in-efficiencies of the target operator. We predominantly value the target’s discounted cash flows from its proved developed producing category. |

Oil and Gas Leases and Wells

As of December 31, 2013, our approximately 1,426 oil and gas properties located in seven states and 84 counties consist of approximately 6,000 oil and gas wells, 999 proved locations, 291 probable locations and 136 possible locations, which are primarily held by production. Our asset base is primarily comprised of rights to receive revenue interest.

Operated Acreage

On February 19, 2014, the Company entered into an agreement (the “Farmout Agreement”) with Steller Energy and Investment Corporation (“Steller”). Steller had previously entered into an agreement with Clayton Williams Energy, Inc. for the exploration and development of approximately 3,680 acres located in Sterling County, Texas and the Farmout Agreement provides for the Company to perform the obligations of Steller under that existing agreement. Under the Farmout Agreement, the Company will earn a 100% working interest in each well that the Company drills, along with surrounding acreage. If the Company elects to drill at least eight wells, the Company will retain the interest in the entire acreage. The acreage is located in northwestern Sterling County in an area with multiple pay zones. Wells drilled on or adjacent to this block have produced from the Lower Wolfcamp Lime, the Canyon Sand, the Mississippian Chert and Lime, the Fusselman Lime, the Montoya Lime, and the Ellenburger Dolomite. Using improved exploration and exploitation methods, the farmout offers the opportunity to develop significant oil and gas reserves with low to moderate risk.

Acquisitions of Carried Interests

The Predecessors acquired their oil and gas assets in connection with their business model that differs substantially from that of the Company or an ordinary oil and exploration and production company. The Predecessors acquired either working interests in oil and gas properties or royalty interests in oil and gas properties. Following these acquisitions, the Predecessors offered interests in those properties to accredited investors through a series of private placements. The interests offered in those properties were subject to certain carried interests, and those carried interests constitute the bulk of the oil and gas assets acquired from the Predecessors.

The Predecessors have also entered into turnkey drilling contracts with outside working interest owners to develop leasehold acreage acquired. In these arrangements, the Predecessors acquired a working interest in a prospect pursuant to an oil and gas lease, and then sold a portion of a well’s working interest on the acquired lease to third parties with a turnkey drilling agreement. In each case, the working interest holders are obligated to bear the cost of drilling, testing, completing, equipping and operating the well. The Predecessors typically sold a substantial portion of the working interests, had a third-party operate the projects and were granted a carried interest.

In a turnkey drilling agreement, the Predecessors agreed to pay for all costs of identifying, acquiring mineral rights to, drilling, testing, completing and equipping the well for initial production at a fixed price. If the actual costs of these activities exceed the turnkey price, the Predecessors were obligated to pay the excess cost. If the actual costs were less than the turnkey price, the Predecessors were entitled to retain the excess of the turnkey price over actual costs. Following completion of each producing well, the Predecessors and the third-party working interest owners would bear the cost of operating the well according to each party’s proportionate working interest percentage.

11

We intend to continue the acquisition of working interests and royalty interests in oil and gas properties through our subsidiaries and special purpose entities and retain carried interests relating to such properties. The Company through its subsidiaries and special purpose entities plans to develop and operate private placement funds to various institutions (the “Funds”) pursuant to which investors (who are not the same as the stockholders of the Company) will be offered the opportunity to invest in certain oil and gas interests or royalties interests sourced by the Company. These Funds will generate management fees and other fees payable to subsidiaries of the Company as well as generate the retained carried interests.

Acquisition of Other Assets and Leveraging of Assets Acquired

The Company intends to acquire additional assets of a similar type and nature as the assets it currently has including new and existing hydrocarbon wells and oil and gas leases. In the event the Company is unable to acquire the additional assets it plans to acquire it will take the Company significantly longer to implement profitable revenue producing activities. If the Company should successfully acquire additional assets, the assets may or may not be in the same geographical location as the assets we currently own as the Company reserves the right to acquire assets or operate in any geographic locations management believes, in their sole judgment, to be in the best interest of the Company.

Once the Company acquires the oil and gas assets, the Company may leverage those assets by borrowing from a financial source and using the assets as collateral. While this strategy will increase the available funds for Company use, it will require the Company to pay debt service from its cash flow.

There can be no assurance that the Company will be able to achieve its objectives as its plans are dependent upon a number of factors, including but not limited to, the availability of debt and equity capital, the performance of the economy, the availability of adequate raw materials, skilled employees and managers and the activities of our competition.

Development and Exploration Activities

Economic factors prevailing in the oil and gas industry change from time to time. The uncertain nature and trend of economic conditions and energy policy in the oil and gas business generally make flexibility of operating policies important in achieving desired profitability. We intend to evaluate continuously all conditions affecting our potential activities and to react to those conditions, as we deem appropriate from time to time by engaging in businesses we believe will be the most profitable for us. With the continued increase in oil and gas prices and the disparity of US natural gas prices compared to other places in the world, we believe there will be continued growth for the foreseeable future.

Governmental Regulations

Both state and federal authorities regulate the extraction, production, transportation and sale of oil, gas, and minerals. The executive and legislative branches of government at both the state and federal levels have periodically proposed and considered proposals for establishment of controls on alternative fuels, energy conservation, environmental protection, taxation of crude oil imports, limitation of crude oil imports, as well as various other related programs. If any proposals relating to the above subjects were to be enacted, we cannot predict what effect, if any, implementation of such proposals would have upon our operations. A listing of the more significant current state and federal statutory authority for regulation of our current operations and business are provided below.

Federal Regulatory Controls

Recently a new wave of legislation and regulation at the federal level has been initiated. Our operations are subject to numerous laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Without limiting the generality of the foregoing, these laws and regulations may:

| | • | | require the acquisition of a permit before drilling commences; |

| | • | | restrict the types, quantities and concentration of various substances that can be released into the environment from drilling and production activities; |

12

| | • | | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas; |

| | • | | require remedial measures to mitigate pollution from former operations, such as plugging abandoned wells; and |

| | • | | impose substantial liabilities for pollution resulting from our operations. |

Our operations use hydraulic fracturing to drill new oil and gas wells. Hydraulic fracturing is a process that is used to release hydrocarbons from certain geological formations. The process involves the injection of water (typically mixed with significant quantities of sand and small quantities of chemical additives) under pressure into the formation to fracture the surrounding rock and stimulate movement of hydrocarbons through the formation. The process is typically regulated by state oil and gas commissions and has been exempt (except when the fracturing fluids or propping agents contain diesel fuels) since 2005 from United States federal regulation pursuant to the Safe Drinking Water Act.

The EPA is conducting a comprehensive study of the potential environmental impacts of hydraulic fracturing activities, and a committee of the United States House of Representatives is also conducting an investigation of hydraulic fracturing practices. The results of the EPA study and House investigation could lead to restrictions on hydraulic fracturing. The EPA is currently working on new guidance for application of the Safe Drinking Water Act permits for drilling or completing processes that use fracturing fluids or propping agents containing diesel fuels. In addition, the EPA proposed regulations under the federal Clean Air Act in July 2011 regarding certain criteria and hazardous air pollutant emissions from hydraulic fracturing wells and, in October 2011, announced its intention to propose regulations by 2014 under the federal Clean Water Act to regulate wastewater discharges from hydraulic fracturing and other gas production.

Legislation has been introduced before Congress to provide for federal regulation of hydraulic fracturing, including, for example, requiring disclosure of chemicals used in the fracturing process or seeking to repeal the exemption from the Safe Drinking Water Act. If adopted, such legislation would add an additional level of regulation and necessary permitting at the federal level and could make it more difficult to complete wells using hydraulic fracturing. Similar laws and regulations with respect to chemical disclosure also exist or are being considered by the United States Department of Interior and in several states that could restrict hydraulic fracturing.

Future United States federal, state or local laws or regulations could significantly restrict, or increase costs associated with hydraulic fracturing and make it more difficult or costly for producers to conduct hydraulic fracturing operations, which could result in a decline of our exploration and production. New laws and regulations, and new enforcement policies by regulatory agencies, could also expressly restrict the quantities, sources and methods of water use and disposal in hydraulic fracturing and otherwise increase our costs and our customers’ cost of compliance, which could minimize water use and disposal needs even if other limits on drilling and completing new wells were not imposed. Any decline in exploration and production or any restrictions on water use and disposal could result in a decline in our drilling and rework activity and have a material adverse effect on our business, financial condition, results of operations and cash flows.

The recent trend toward stricter standards in environmental legislation and regulation is likely to continue. The enactment of stricter legislation or the adoption of stricter regulation could have a significant impact on our operating costs, as well as on the oil and gas industry in general.

State Regulatory Controls

In each state where we conduct or contemplate oil and gas activities, these activities are subject to various regulations. The regulations relate to the extraction, production, transportation and sale of oil and natural gas, the issuance of drilling permits, the methods of developing new production, the spacing and operation of wells, the conservation of oil and natural gas reservoirs and other similar aspects of oil and gas operations. In particular, the State of Texas (where we plan to conduct a large part of our oil and gas operations to date) regulates the rate of daily production allowable from both oil and gas wells on a market demand or conservation basis. At the present time, no significant portion of our production has been curtailed due to reduced allowable production. We know of no proposed regulation that will significantly impede our operations.

State Environmental Regulations

Our extraction, production and drilling operations are subject to environmental protection regulations established by federal, state, and local agencies. To the best of our knowledge, we believe that we are in compliance with the applicable environmental regulations established by the agencies with jurisdiction over our operations. We are acutely aware that the applicable environmental regulations currently in effect could have a material detrimental effect upon our earnings, capital expenditures, or prospects for profitability.

13

Our competitors are subject to the same regulations and therefore, the existence of such regulations does not appear to have any material effect upon our position with respect to our competitors. The Texas Legislature has mandated a regulatory program for the management of hazardous wastes generated during crude oil and natural gas exploration and production, gas processing, oil and gas waste reclamation and transportation operations. The disposal of these wastes, as governed by the Railroad Commission of Texas, is becoming an increasing burden on the industry.

As discussed above the likelihood of increased level of regulations at the federal level will also have a corresponding regulatory action at the state level.

Revenues from oil and gas production are subject to taxation by the state in which the production occurred. In Texas, the state receives a severance tax of 4.6% for oil production and 7.5% for gas production. These high percentage state taxes can have a significant impact upon the economic viability of marginal wells that we may produce and require plugging of wells sooner than would be necessary in a less arduous taxing environment.

Marketing and Transportation Regulations

Sales of natural gas are affected by the availability, terms and cost of transportation. The price and terms for access to pipeline transportation are subject to extensive federal and state regulation. From 1985 to the present, several major regulatory changes have been implemented by Congress and the Federal Energy Regulatory Commission (“FERC”) that affect the economics of natural gas production, transportation and sales. In addition, FERC is continually proposing and implementing new rules affecting segments of the natural gas industry, most notably interstate natural gas transmission companies, which remain subject to FERC’s jurisdiction. These initiatives may also affect the intrastate transportation of gas under certain circumstances. The stated purpose of many of these regulatory changes is to promote competition among the various sectors of the natural gas industry and these initiatives generally reflect more light-handed regulation.

Our sales of crude oil and condensate are currently not regulated and are made at market prices. In a number of instances, however, the ability to transport and sell such products are dependent on pipelines whose rates, terms and conditions of service are subject to FERC jurisdiction under the Interstate Commerce Act. However, we do not believe that these regulations affect us any differently than other crude oil producers.

Marketing

Our ability to market oil and natural gas often depends on factors beyond our control. The potential effects of governmental regulation and market factors, including alternative domestic and imported energy sources, available pipeline capacity, and general market conditions, are not entirely predictable.

Natural gas is generally sold pursuant to individually negotiated gas purchase contracts, which vary in length from spot market sales of a single day to term agreements that may extend several years. Customers who purchase natural gas include marketing affiliates of the major oil and gas companies, pipeline companies, natural gas marketing companies, and a variety of commercial and public authorities, industrial, and institutional end-users who ultimately consume the gas. Gas purchase contracts define the terms and conditions unique to each of these sales. The price received for natural gas sold on the spot market may vary daily reflecting changing market conditions. The deliverability and price of natural gas are subject to both governmental regulation and supply and demand forces.

We sell natural gas to many customers. All customers are well capitalized and regulated. We do not anticipate any customer becoming unable to perform under their agreement.

Oil produced is sold at the prevailing field price to one or more of a number of unaffiliated purchasers in the area. Generally, purchase contracts for the sale of oil are cancelable on 30 days’ notice. The price paid by these purchasers is an established market or “posted” price that is offered to all producers.

14

Competition

We compete with major integrated oil and natural gas companies and independent oil and natural gas companies in all areas of our operation. In particular, we compete for property acquisitions and for the equipment and labor required to operate and develop these properties. Many of our competitors have substantially greater financial and other resources than we have. Larger competitors may be able to absorb the burden of any changes in federal, state and local laws and regulations more easily than we can, which could adversely affect our competitive position. Our competitors also may be able to pay more for exploratory prospects and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than we can. Further, our competitors may have technological advantages and may be able to implement new technologies more rapidly than we can. Our ability to explore for oil andnatural gas prospects and to acquire additional properties in the future will depend on our ability to conduct operations, to evaluate and select suitable properties and to consummate transactions in this highly competitive environment. In addition, most of our competitors have operated for a much longer time than we have and have demonstrated the ability to operate through industry cycles.

At various times, we may experience occasional or prolonged shortages or unavailability of drilling rigs, drill pipe and other material used in oil and natural gas drilling. Such unavailability could result in increased costs, delays in timing of anticipated development or cause interests in undeveloped oil and natural gas leases to lapse.

Insurance

In accordance with customary industry practices, we maintain insurance coverage against some, but not all, potential losses in order to protect against the risks we face. We do not carry business interruption insurance. We may elect not to carry insurance if our management believes that the cost of available insurance is excessive relative to the risks presented. In addition, we cannot insure fully against pollution and environmental risks. The occurrence of an event not fully covered by insurance could have a material adverse effect on our financial condition and results of operations.

Employees

We employ ten full-time employees. The employees are assigned to the following departments: administrative, accounting, legal and operations. We retain the services of a significant number of individuals through contract services. These services provide operational and administrative support.

ITEM 1A - RISK FACTORS

Described below are certain risks that we believe are applicable to our business and the oil and gas industry in which we operate. There may be additional risks that are not presently material or known. You should carefully consider each of the following risks and all other information set forth in this annual report.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, other than those we describe below, that are not presently known to us or that we currently believe are immaterial, may also impair our business operations. If any of the following risks occur, our business, financial condition and results of operations could be harmed.

We have had operating losses and limited revenues to date.

We have operated at a loss in each of the last two years. Net losses applicable to stockholders for the fiscal years ended December 31, 2012 and 2013 were $5.7 million and $2.5 million, respectively. Our revenues for the fiscal years ended December 31, 2012 and 2013 were $13.4 million and $26.6 million, respectively. We may not be able to generate significant revenues in the future. In addition, we expect to incur substantial operating expenses in connection with our natural gas and oil exploration and development activities. As a result, we may continue to experience negative cash flow for at least the foreseeable future and cannot predict if or when we might become profitable.

We do not have a long history of operations.

Until the Company establishes centralized accounting and other administrative systems, it will rely primarily on the separate systems developed by the Predecessors. The success of the Company will depend, in part, on the extent to which it is able to centralize these functions and otherwise integrate the systems developed by the Predecessor and such additional businesses as it may hereafter acquire into a cohesive, efficient enterprise. The Company’s executive officers have only limited experience working together, and no assurance can be given they will be able to manage the Company effectively or successfully execute the Company’s acquisition and operating strategies.

15

Our exploration appraisal and development activities are subject to many risks which may affect our ability to profitably extract oil reserves or achieve targeted returns. In addition, continued growth requires that we acquire and successfully develop additional oil reserves.

Oil and gas exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure a profit on the investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental damage could greatly increase the cost of operations, and various field operating conditions may negatively affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions. While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time, production delays and declines from normal field operating conditions cannot be eliminated and can be expected to negatively affect revenue and cash flow levels to varying degrees.

Our future success depends upon our ability to find, develop and acquire additional oil and gas reserves that are economically recoverable.

The rate of production from oil and natural gas properties declines as reserves are depleted. As a result, we must continually locate and develop or acquire new oil and gas reserves to replace those being depleted by production. We must do this even during periods of low oil and gas prices when it is difficult to raise the capital necessary to finance activities. Without successful exploration or acquisition activities, our reserves and revenues will decline. A future increase in our reserves will depend not only on our ability to explore and develop any properties we may have from time to time, but also on our ability to select and acquire suitable producing properties or prospects. We cannot guaranty that we will be able to continue to locate satisfactory properties for acquisition or participation. Moreover, if such acquisitions or participations are identified, we may determine that current markets, terms of acquisition and participation or pricing conditions make such acquisitions or participations economically disadvantageous. We cannot guaranty that commercial quantities of oil will be discovered or acquired by us.

The marketability of our production depends in part upon the availability, proximity and capacity of pipelines and other factors that are beyond our control.

Our ability to market oil and gas from our wells depends upon numerous factors beyond our control. These factors include, but are not limited to, the following:

| | • | | the level of domestic production and imports of oil and gas; |

| | • | | the proximity of gas production to gas pipelines; |

| | • | | the availability of pipeline capacity; |

| | • | | the demand for oil and gas by utilities and other end users; |

| | • | | the availability of alternate fuel sources; |

| | • | | the effect of inclement weather; |

| | • | | state and federal regulation of oil and gas marketing; and |

| | • | | federal regulation of gas sold or transported in interstate commerce. |

If these factors were to change dramatically, our ability to market oil and gas or obtain favorable prices for our oil and gas could be adversely affected.

16

The marketability of our production may be dependent upon transportation facilities over which we have no control.

The marketability of our production depends in part upon the availability, proximity and capacity of pipelines, natural gas gathering systems and processing facilities. Any significant change in market factors affecting these infrastructure facilities could harm our business. We deliver oil and natural gas through gathering systems and pipelines that we do not own. These facilities may not be available to us in the future.

The nature of our business may lead to conflicts of interest.

Conflicts of interest exist and may arise in the future as a result of the relationships between the Company and its affiliates. Approximately 92.5% of our common stock is owned by the Predecessors, which in turn are owned by our President, CEO and Chairman, Parker Hallam and Michael Miller. Pursuant to an Administrative Services Agreement entered into between Crude Energy, LLC and Crude Royalties, LLC (collectively, “Crude”), the Company may, from time to time, offer working interests and royalty interests to Crude. Crude is controlled by Parker Hallam and Michael Miller.

In addition, the Company through its subsidiaries and special purpose entities plans to develop and operate private placement funds to various institutions (the “Funds”) pursuant to which investors (who are not the same as the stockholders of the Company) will be offered the opportunity to invest in certain oil and gas interests or royalty interests sourced by the Company. In addition, many of the officers of the Company serve in similar capacities with the Funds, which may lead to additional conflicts of interest. The directors and officers of the Funds have fiduciary duties to manage the Funds in a manner beneficial to its owners. At the same time, our directors and officers have a fiduciary duty to manage the Company in a manner beneficial to us and our stockholders.

Whenever a conflict arises between the Funds, the Predecessors and their affiliates, on the one hand, and the Company or its stockholders on the other hand, our board of directors will resolve that conflict. We cannot assure you that the conflicts will always be resolved in the Company’s favor.

We may be subject to liabilities arising out of the Predecessors’ business.

The Predecessors operated a business of acquiring interests in oil and gas properties, selling those interests and retaining carried interests therein. In connection with that business, the Predecessors conducted private placements of securities. Consequently, if the oil and gas interests sold by the Predecessors do not perform as expected by the investors therein, the Predecessors may be subject to future claims arising out of allegations that those securities were issued in violation of the Securities Act or State Blue Sky Laws. Any such claims, if made, could result in attorneys’ fees and other defense costs, including any settlements or judgments rendered, that may adversely affect the financial condition of the Company.

Counterparty credit risk may negatively impact the conversion of our accounts receivables to cash.

The Company is or may be exposed to third party credit risk through its contractual arrangements with its current or future marketers of its oil and natural gas production and other parties. In the event such entities fail to meet their contractual obligations to the Company, such failures could have a material adverse effect on our cash flow from operations.

Recent economic conditions in the credit markets may adversely affect our financial condition.

The disruption experienced in U.S. and global credit markets since the latter half of 2008 has resulted in instability in demand for oil and natural gas, resulting in volatile energy prices, and has affected the availability and cost of capital. In addition, capital and credit markets have experienced unprecedented volatility and disruption and continue to be unpredictable. Given the current levels of market volatility and disruption, the availability of funds from those markets has diminished substantially. Prolonged negative changes in domestic and global economic conditions or disruptions of the financial or credit markets may have a material adverse effect on our results from operations, financial condition and liquidity. At this time, it is unclear whether and to what extent the actions taken by the U.S. government will mitigate the effects of the financial market turmoil. The impact of the current difficult conditions on our ability to obtain, and the cost and terms of, any financing in the future is equally unclear. Any inability to obtain adequate financing or to fund on acceptable terms could deter or prevent us from meeting our future capital needs to finance our development program and result in a deterioration of our financial condition.

17

Oil and natural gas prices are volatile. A substantial decrease in oil and natural gas prices could adversely affect our financial results.

Our future financial condition, results of operations and the carrying value of our oil and natural gas properties depend primarily upon the prices we receive for our oil and natural gas production. Oil and natural gas prices historically have been volatile and likely will continue to be volatile in the future, especially given world geopolitical conditions. Our cash flow from operations is highly dependent on the prices that we receive for oil and natural gas. This price volatility also affects the amount of our cash flow available for capital expenditures and our ability to borrow money or raise additional capital. Oil prices are likely to affect us more than natural gas prices because approximately 81% of our proved reserve value, or 63% of our PV-10 based on our reserve report, is oil. The prices for oil and natural gas are subject to a variety of additional factors that are beyond our control. These factors include:

| | • | | the level of consumer demand for oil and natural gas; |

| | • | | the domestic and foreign supply of oil and natural gas; |

| | • | | the ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls; |

| | • | | the price of foreign oil and natural gas; |

| | • | | domestic governmental regulations and taxes; |

| | • | | the price and availability of alternative fuel sources; |

| | • | | weather conditions, including hurricanes and tropical storms in and around the Gulf of Mexico; |

| | • | | political conditions in oil and natural gas producing regions, including the Middle East; and |

| | • | | worldwide economic conditions. |

These factors and the volatility of the energy markets generally make it extremely difficult to predict future oil and natural gas price movements with any certainty. Also, oil and natural gas prices do not necessarily move in tandem. Declines in oil and natural gas prices would not only reduce revenue, but could reduce the amount of oil and natural gas that we can produce economically and, as a result, could have a material adverse effect upon our financial condition, results of operations, oil and natural gas reserves and the carrying values of our oil and natural gas properties. If the oil and natural gas industry experiences significant price declines, we may, among other things, be unable to meet our financial obligations or make planned expenditures.

Competitive industry conditions may negatively affect our ability to conduct operations.

We encounter competition from other natural gas and oil companies in all areas of our operations, including the acquisition of exploratory prospects and proved properties. There is also competition for contracting for drilling equipment and the hiring of experienced personnel. Factors that affect our ability to compete in the marketplace include:

| | • | | our access to the capital necessary to drill wells and acquire properties; |

| | • | | our ability to acquire and analyze seismic, geological and other information relating to a property; |

| | • | | our ability to retain and hire the personnel necessary to properly evaluate seismic and other information relating to a property; |

| | • | | our ability to hire experienced personnel, especially for our accounting, financial reporting, tax and land departments; |

| | • | | the location of, and our ability to access, platforms, pipelines and other facilities used to produce and transport oil and gas production; and |

| | • | | the standards we establish for the minimum projected return on an investment of our capital. |

Our competitors include major integrated natural gas and oil companies and substantial independent energy companies, many of which possess greater financial, technological, personnel and other resources than we do. Many of our competitors are large, well-established companies that have been engaged in the natural gas and oil business much longer than we have and possess substantially larger operating staffs and greater capital resources than we do. These companies may be able to pay more for exploratory projects and productive natural gas and oil properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may be able to expend greater resources on the existing and changing technologies that we believe are and will be increasingly important to attaining success in the industry. We may not be able to conduct our operations, evaluate and select suitable properties and consummate transactions successfully in this highly competitive environment.

18

We rely on our senior management team and the loss of a single member could adversely affect our operations.

We depend to a large extent on the services of certain key management personnel, including Chris A. Faulkner, our President and Chief Executive Officer, Jeremy S. Wagers, our Chief Operating Officer and General Counsel, Judson “Rick” F. Hoover, our Chief Financial Officer, and our other executive officers and key employees. The loss of Mr. Faulkner, Mr. Wagers, Mr. Hoover or other key management personnel could have a material adverse effect on our business, financial condition and results of operations. These individuals have experience and expertise in the oil and natural gas industry. We do not maintain key-man life insurance with respect to any of our employees. Our success will be dependent on our ability to continue to employ and retain skilled technical personnel.

The inability to control associated entities could adversely affect our business.

We do not operate all of the properties in which we have working interests. Accordingly, our success depends in part upon operations on certain properties in which we may have an interest along with other business entities. In the event that an operator experiences financial difficulties, this may negatively impact our ability to receive payments for our share of net production to which we are entitled under our contractual arrangements with such operator. While we seek to minimize such risks, there can be no assurances that we can do so in all situations covering our non-operated properties. Because we have no control over such operators and entities, we are able to neither direct their operations, nor ensure that their operations on our behalf will be completed in a timely and efficient manner. Any delay in such business entities’ operations could adversely affect our operations.

There are risks in acquiring producing properties.

We constantly evaluate opportunities to acquire oil and natural gas properties and frequently engage in bidding and negotiating for these acquisitions. If successful in this process, we may alter or increase our capitalization through the issuance of additional debt or equity securities, the sale of production payments or other measures. Any change in capitalization affects our risk profile.

A change in capitalization, however, is not the only way acquisitions affect our risk profile. Acquisitions may alter the nature of our business. This could occur when the character of acquired properties is substantially different from our existing properties in terms of operating or geologic characteristics.

A substantial percentage of our proved reserves consist of undeveloped reserves.

As of the end of our 2013 fiscal year, approximately 57% of our proved reserves, based on PV-10, were classified as proved undeveloped reserves. These reserves may not ultimately be developed or produced. As a result, we may not find commercially viable quantities of oil and natural gas, which in turn may have a material adverse effect on our results of operations.

Operating hazards may adversely affect our ability to conduct business.

Our operations are subject to risks inherent in the oil and gas industry, including but not limited to the following:

| | • | | uncontrollable flows of oil, gas or well fluids; |

| | • | | other environmental risks. |

19

These risks could result in substantial losses to us from injury and loss of life, damage to and destruction of property and equipment, pollution and other environmental damage and suspension of operations. Governmental regulations may impose liability for pollution damage or result in the interruption or termination of operations.

Losses and liabilities from uninsured or underinsured drilling and operating activities could have a material adverse effect on our financial condition and operations.

In accordance with customary industry practices, we maintain insurance coverage against some, but not all, potential losses in order to protect against the risks we face. We do not carry business interruption insurance. We may elect not to carry insurance if our management believes that the cost of available insurance is excessive relative to the risks presented. In addition, we cannot insure fully against pollution and environmental risks. The occurrence of an event not fully covered by insurance could have a material adverse effect on our financial condition and results of operations.

Oil and natural gas operations are subject to particular hazards incident to the drilling and production of oil and natural gas, such as blowouts, cratering, explosions, uncontrollable flows of oil, natural gas or well fluids, fires and pollution and other environmental risks. These hazards can cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and suspension of operation. We do not operate all of the properties in which we have an interest. In such non-operated properties, the operator for the prospect maintains insurance of various types to cover our operations with policy limits and retention liability customary in the industry. We believe the coverage and types of insurance are adequate. The occurrence of a significant adverse event that is not fully covered by insurance could result in the loss of our total investment in a particular prospect, which could have a material adverse effect on our financial condition and results of operations.

Compliance with environmental and other government regulations could be costly and could negatively impact production.

Our operations are subject to complex and constantly changing laws and regulations adopted by federal, state and local governmental authorities governing the discharge of materials into the environment or otherwise relating to environmental protection. Without limiting the generality of the foregoing, these laws and regulations may:

| | • | | require the acquisition of a permit before drilling commences; |

| | • | | restrict the types, quantities and concentration of various substances that can be released into the environment from drilling and production activities; |

| | • | | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas; |

| | • | | require remedial measures to mitigate pollution from former operations, such as plugging abandoned wells; and |

| | • | | impose substantial liabilities for pollution resulting from our operations. |

The recent trend toward stricter standards in environmental legislation and regulation is likely to continue. The enactment of stricter legislation or the adoption of stricter regulation could have a significant impact on our operating costs, as well as on the oil and gas industry in general. We will continue to be subject to uncertainty associated with new regulatory interpretations and inconsistent interpretations between state and federal agencies. We cannot be sure that existing environmental laws or regulations, as currently interpreted or enforced, or as they may be interpreted, enforced or altered in the future, will not have a material adverse effect on our results of operations and financial condition.

Our operations could result in liability for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. We could also be liable for environmental damages caused by previous property owners. As a result, substantial liabilities to third parties or governmental entities may be incurred which could have a material adverse effect on our financial condition and results of operations. We maintain insurance coverage for our operations, but we do not believe that insurance coverage for environmental damages that occur over time or complete coverage for sudden and accidental environmental damages is available at a reasonable cost. Accordingly, we may be subject to liability or may lose the privilege to continue exploration or production activities upon substantial portions of our properties if certain environmental damages occur.

20

Cyber-attacks targeting systems and infrastructure used by the oil and gas industry may adversely impact our operations.

Our business has become increasingly dependent on digital technologies to conduct certain exploration, development, production and financial activities. We depend on digital technology to estimate quantities of oil and gas reserves, process and record financial and operating data, analyze seismic and drilling information, and communicate with our employees and third party partners. Unauthorized access to our seismic data, reserves information or other proprietary information could lead to data corruption, communication interruption or other operational disruptions in our exploration or production operations. Also, computers control nearly all of the oil and gas distribution systems in the United States and abroad, which are necessary to transport our production to market. A cyber-attack directed at oil and gas distribution systems could damage critical distribution and storage assets or the environment, delay or prevent delivery of production to markets and make it difficult or impossible to accurately account for production and settle transactions. While we have not experienced cyber-attacks, there is no assurance that we will not suffer such attacks and resulting losses in the future. Further, as cyber-attacks continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerability to cyber-attacks.

Our operations are subject to United States federal, state and local laws and regulations relating to health, safety, transportation and protection of natural resources and the environment.