UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the fiscal year ended September 30, 2005

OR

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

COMMISSION FILE NUMBER 0001229899

LITTLE SIOUX CORN PROCESSORS, L.L.C.

(Exact name of small business issuer as specified in its charter)

Iowa | | 42-1510421 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

4808 F Avenue, Marcus, Iowa 51035 |

(Address of principal executive offices) |

| | |

(712) 376-2800 |

(Issuer’s telephone number, including area code) |

| | |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

None |

| | |

Securities registered pursuant to Section 12(g) of the Exchange Act: |

Membership Units |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

o Yes ý No

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yes ý No

The aggregate market value of the registrant’s membership units held by non-affiliates of the registrant was $32,823,000 computed by reference to the price at which membership units were last sold.

As of the date of this filing, there are 10,941 membership units of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant has incorporated by reference into Part III of this Annual Report on Form 10-K portions of its definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year covered by this Annual Report.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to future events, our future financial performance, or our expected future operations and actions. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “future,” “intend,” “could,” “hope,” “predict,” “target,” “potential,” or “continue” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions based upon current information and involve numerous assumptions, risks and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the reasons described in this report. While it is impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include:

• Overcapacity within the ethanol industry;

• Actual ethanol, distillers grains and corn oil production varying from expectations;

• Availability and costs of products and raw materials, particularly corn and natural gas;

• Changes in the price and market for ethanol, distillers grains and corn oil;

• Our ability to market and our reliance on third parties to market our products;

• Changes in or elimination of governmental laws, tariffs, trade or other controls or enforcement practices such as:

– national, state or local energy policy;

– federal ethanol tax incentives;

– legislation establishing a renewable fuel standard or other legislation mandating the use of ethanol or other oxygenate additives;

– state and federal regulation restricting or banning the use of MTBE; or

– environmental laws and regulations that apply to our plant operations and their enforcement;

• Changes in the weather or general economic conditions impacting the availability and price of corn and natural gas;

• Total U.S. consumption of gasoline;

• Fluctuations in petroleum prices;

• Changes in plant production capacity or technical difficulties in operating the plant;

• Costs of construction and equipment;

• Changes in our business strategy, capital improvements or development plans;

• Results of our hedging strategies;

• Changes in interest rates or the availability of credit;

• Our ability to generate free cash flow to invest in our business and service our debt;

• Our liability resulting from litigation;

• Our ability to retain key employees and maintain labor relations;

• Changes and advances in ethanol production technology;

• Competition from alternative fuels and alternative fuel additives.

• Other factors described elsewhere in this report.

3

The cautionary statements referred to in this section also should be considered in connection with any subsequent written or oral forward-looking statements that may be issued by us or persons acting on our behalf. We undertake no duty to update these forward-looking statements, even though our situation may change in the future. Furthermore, we cannot guarantee future results, events, levels of activity, performance, or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits, completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements.

AVAILABLE INFORMATION

Information about us is also available at our website at www.littlesiouxcornprocessors.com, under “SEC Compliance,” which includes links to reports we have filed with the Securities and Exchange Commission. The contents of our website are not incorporated by reference in this Annual Report on Form 10-K.

PART I.

ITEM 1. BUSINESS.

Overview

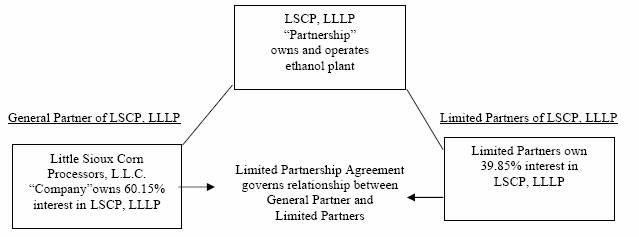

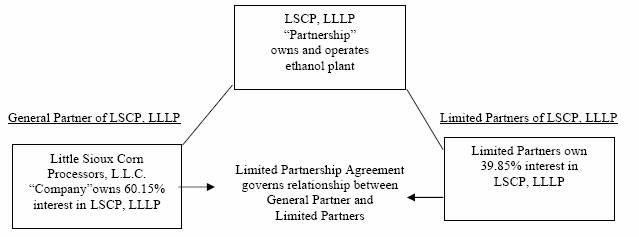

Little Sioux Corn Processors, L.L.C. (the “Company”) is an Iowa limited liability company that owns the sole general partnership interest of LSCP, LLLP, (the “Partnership”) an Iowa limited liability limited partnership. As general partner, we manage the business and day-to-day operations of the Partnership’s 52 million gallon per year ethanol plant which produces ethanol, distillers grains and corn oil. The Company and its subsidiary, LSCP, LLLP, are collectively referred to in this report as “LSCP,” “we,” or “us.”

Since April 2003, we have been engaged in the production of ethanol and distillers grains at our ethanol plant. During fiscal year 2005, we completed the expansion of our plant from an ethanol production capacity of 40 million gallons per year to 52 million gallons per year and installed additional drier controls and maintenance system software. Subsequent to our fiscal year end on September 30, 2005, we installed a corn oil segregation unit.

Fuel grade ethanol is our primary product accounting for the majority of our revenue. We also sell distillers grains, a principal co-product of the ethanol production process, which may be sold as distillers dried grains and distillers modified wet grains. In 2005, we processed approximately 17.6 million bushels of corn into approximately 49 million gallons of ethanol. We also processed approximately 247,000 tons of distillers grains in 2005. In addition in October 2005, we began selling corn oil. In 2006, we anticipate producing approximately 52 million gallons of ethanol, 248,000 tons of distillers grains, and 12 million pounds of corn oil from approximately 18.3 million bushels of corn. However, there is no assurance that we will be able to operate at these anticipated levels.

General Development of Business since October 1, 2004

We were formed as an Iowa limited liability company on September 28, 2000. On March 6, 2002, we purchased the sole general partnership interest in an Iowa limited partnership, LSCP, LP. On June 26, 2003, LSCP, LP elected to become a limited liability limited partnership and is referred to as LSCP, LLLP.

Our general partnership interest in the Partnership represents substantially all of our assets. The Partnership owns and operates a 52 million-gallon per year ethanol plant near Marcus, Iowa. The plant commenced operations in April 2003. In July 2005, the Partnership completed an expansion, from a 40 million gallon per year plant to a 52 million gallon per year plant.

The Partnership consists of the Company, which is the sole general partner, and various limited partners, which own the limited partnership interests. There are six classes of limited partnership interests of which only three classes are currently outstanding. Limited partnership interests are designated in units. The following diagram illustrates the relationship between the Company and the Partnership:

4

DIAGRAM OF THE REGISTRANT’S RELATIONSHIP TO LSCP, LLLP

As general partner of LSCP, LLLP, we have the complete and exclusive power to manage and control the affairs of the Partnership including the day-to-day business and operations of the ethanol plant. As general partner of a limited liability limited partnership, we have limited liability for the payment of debts and liabilities of the Partnership. Under the limited partnership agreement, we can only be removed as general partner if a court has determined that we have been grossly negligent in performing our duties as general partner and the holders of at least 66 2/3% of the outstanding limited partnership units vote to remove us.

The limited partnership agreement allows each class of limited partnership interests the right to appoint one director to our board of directors. This means that the three classes of limited partnership interests can elect three of the thirteen directors on our board. Our board of directors is divided into two classes known as Class A and Class B. Class A directors are elected by the Company’s members. Class B directors are elected by the limited partners of the limited partnership. Both Class A and Class B directors can take action with respect to any matters relating to the ownership and operation of the ethanol plant. However, only Class A directors can take action with respect to any matters relating to the Company and not also directly relating to the ethanol plant. For example, Class B directors may not vote on a motion regarding any distributions we may make to our members. No limited partner or class of limited partnership interests has the right to appoint a majority of the Company’s directors or control the business of the limited partnership.

Our power to manage LSCP, LLLP is restricted in three cases. First, we cannot dispose of or encumber substantially all of the assets of the limited partnership without first obtaining the consent of the holders of a majority of the limited partnership interests. Second, we cannot remove or appoint a general manager responsible for managing the limited partnership’s business without first obtaining the consent of the holders of a majority of the limited partnership interests and our primary lending institution. Finally, we cannot admit additional general or limited partners without first obtaining the approval of the holders of at least 75% of the limited partnership units.

Under the limited partnership agreement, distributions of the limited partnership’s revenues (as defined below) are made to the general and limited partners in proportion to the units held, however, distributions are also limited by loan covenants contained in our loan agreements executed with our lenders. For example, our loan agreements require us to maintain various financial ratios and make additional loan payments based on excess cash flow, including payments received from the USDA’s Commodity Credit Corporation Bioenergy Program, as discussed below in “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources.”

The Partnership’s revenues are defined by the limited partnership agreement as “net cash flow” meaning the gross cash proceeds of the limited partnership less the amount of proceeds used for expenses, debt payments, capital improvements, replacements, contingencies and reserves, all as reasonably determined by the Company, as

5

general partner. Distributions are made in proportion to the units held by the general and limited partners, which means that a partner’s distribution is calculated based on the number of units such partner owns in proportion to the number of total units outstanding. For example, the Company currently owns 2,189 limited partnership units of the 3,639 limited partnership units outstanding. Therefore, the Company is entitled to distributions equaling 60.15% of the limited partnership’s net cash flow (2,189 units divided by 3,639 units). No partner is entitled to a minimum distribution amount. However, the limited partnership agreement provides that the Company, as general partner, will endeavor to provide for cash distributions at the times and amounts necessary to allow the partners to make timely payment of income taxes. Distributions are not prioritized among the partners.

After giving effect to certain special allocations, such as adjustments for partners who bear the risk of economic loss for certain partnership debts, profits and losses are generally allocated in the same manner as distributions of the limited partnership’s net cash flow. Therefore, the Company, as general partner, is generally allocated 60.15% of the limited partnership’s profits and losses and the limited partners are generally allocated 39.85% of the limited partnership’s profits and losses.

The limited partnership agreement can only be amended if the amendment is approved by our board of directors and is approved by holders of a majority of the limited partnership interests.

Financial Information

The financial statements of the Partnership have been consolidated with the Company since the Partnership was formed on October 16, 2001. The Partnership did not have any assets until the partners of the Partnership contributed assets in March 2002. The net assets contributed by the Company were less than the proportional limited partnership interest received in return as compared to the net assets contributed by the other partners in the Partnership. The other limited partners contributed a total of $7,750,000 in return for 1,550 units in the limited partnership ($5,000 per unit). The Company contributed all of its net assets, approximately $10,198,000, in return for 2,189 units in the limited partnership ($4,658 per unit). Due to the Company’s previous efforts to begin the ethanol plant, the Company was given credit for value in addition to the net assets transferred. Please refer to “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” for information about our revenues, profit and loss measurements and total assets and “Item 8 - Financial Statements and Supplementary Data” for our consolidated financial statements.

Principal Products and Their Markets

The principal products we produce at our plant are fuel grade ethanol and distillers grains. Subsequent to our fiscal year end on September 30, 2005, we began producing corn oil at our plant.

Ethanol

Ethanol is ethyl alcohol, a fuel component made primarily from corn and various other grains. According to the Renewable Fuels Association, approximately 85 percent of ethanol in the United States today is produced from corn, and approximately 90 percent of ethanol is produced from a corn and other input mix. Corn produces large quantities of carbohydrates, which convert into glucose more easily than most other kinds of biomass. The Renewable Fuels Association estimates current domestic ethanol production at approximately 4.28 billion gallons as of December 2005.

An ethanol plant is essentially a fermentation plant. Ground corn and water are mixed with enzymes and yeast to produce a substance called “beer,” which contains about 10% alcohol and 90% water. The “beer” is boiled to separate the water, resulting in ethyl alcohol, which is then dehydrated to increase the alcohol content. This product is then mixed with a certified denaturant to make the product unfit for human consumption and commercially saleable.

Ethanol can be used as: (i) an octane enhancer in fuels; (ii) an oxygenated fuel additive for the purpose of reducing ozone and carbon monoxide vehicle emissions; and (iii) a non-petroleum-based gasoline substitute. Approximately 95% of all ethanol is used in its primary form for blending with unleaded gasoline and other fuel products. The implementation of the Federal Clean Air act has made ethanol fuels an important domestic renewable

6

fuel additive. Used as a fuel oxygenate, ethanol provides a means to control carbon monoxide emissions in large metropolitan areas. The principal purchasers of ethanol are generally the wholesale gasoline marketer or blender. The principal markets for our ethanol are petroleum terminals in the continental United States.

For our fiscal year ended September 30, 2005, revenues from sales of ethanol were approximately 86.1% of total revenues. For our fiscal year ended September 30, 2004, revenues from sales of ethanol were approximately 85.7% of total revenues. For our fiscal year ended September 30, 2003, revenues from sales of ethanol were approximately 82.7% of total revenues. We began operations in April 2003.

Distillers Grains

A principal co-product of the ethanol production process is distillers grains, a high protein, high-energy animal feed supplement primarily marketed to the dairy and beef industry. Distillers grains contain by-pass protein that is superior to other protein supplements such as cottonseed meal and soybean meal. By-pass proteins are more digestible to the animal, thus generating greater lactation in milk cows and greater weight gain in beef cattle. Dry mill ethanol processing creates three forms of distiller grains: Distillers Wet Grains (“DWS”), Modified Wet Distillers Grains with Solubles (“MWDGS”) and Distillers Dried Grains with Solubles (“DDGS”). DWS is processed corn mash that contains approximately 70% moisture. DWS has a shelf life of approximately three days and can be sold only to farms within the immediate vicinity of an ethanol plant. DMWS is DWS that has been dried to approximately 50% moisture. DMWS have a slightly longer shelf life of approximately ten days and are often sold to nearby markets. DDGS is DWS that has been dried to 10% to 12% moisture. DDGS has an almost indefinite shelf life and may be sold and shipped to any market regardless of its vicinity to an ethanol plant. At our plant, the composition of the distillers grains we produce is approximately 31.1% DDGS and 68.9% MWDGS.

For our fiscal year ended September 30, 2005, revenues from sales of distillers grains were approximately 12.0% of total revenues. For our fiscal year ended September 30, 2004, revenues from sales of distillers grains were approximately 14.1% of total revenues. For our fiscal year ended September 30, 2003, revenues from sales of distillers grains were approximately 17.2% of total revenues. We began operations in April 2003.

New Product of the Company - Corn Oil

Corn oil can be produced as a co-product of ethanol production by installing equipment to separate the oil from the distillers grains during the production process. On March 15, 2005, the Board of Directors approved a $1,850,000 capital expenditure to install a corn oil segregation unit. In October 2005, installation of the equipment was completed and we began producing corn oil. Prior to installation of the corn oil segregation unit, the corn oil had been sold as an energy component of our distillers grains. We project this investment will increase our revenues by approximately $1,200,000 million annually, but the actual impact on our revenues could vary due to a variety of factors such as production problems, decline in the demand and price for corn oil.

Corn oil in its raw form can be used as livestock feed, as a fuel under certain operating conditions, refined into bio-diesel fuel, or refined for human consumption. We intend to initially market the unrefined corn oil to the animal feed and bio-diesel markets to assure that quality specifications can be maintained. In the long term, the corn oil co-product could be marketed for human consumption. Specific details regarding market penetration into human food are unknown at this time since corn oil extraction in a dry mill situation such as ours has not yet been proven, nor has its suitability for human consumption been determined.

Distribution of Principal Products

Our ethanol plant is located near Marcus, Iowa in Cherokee County, in the northwestern section of Iowa. We selected the Marcus site because of its location to existing grain production, accessibility to road and rail transportation and its proximity to major population centers. It is also served by the Canadian National Railroad Company. It is in close proximity to major highways that connect to major population centers such as Minneapolis, Minnesota; Omaha, Nebraska; and Chicago, Illinois.

7

Ethanol Distribution

As general partner of the Partnership, we entered into a marketing agreement with Minnesota Corn Processors, L.L.C., (“MCP”) in 2003 for the purposes of marketing and distributing all of the ethanol we produce at the plant. This marketing agreement was subsequently assigned by MCP to Archer Daniels Midland Company (“ADM”) following ADM’s acquisition of MCP. Pursuant to our ethanol marketing agreement with ADM, the price ADM pays us for our ethanol is calculated by averaging the price ADM receives for all the ethanol it sells originating from (i) our plant, (ii) ADM’s plant in Marshall, Minnesota and (iii) ADM’s plant in Columbus, Nebraska. In exchange for ADM’s marketing, sales, storage and transportation services, we pay ADM a fixed price per gallon of ethanol sold. The initial term of the marketing agreement with ADM expires in 2007 but the agreement is automatically renewed for successive one-year periods at the end of the initial term unless the parties agree otherwise.

Distillers Grains Distribution

As general partner of the Partnership, we entered into a marketing agreement with Commodity Specialist Company (“CSC”), a Delaware corporation, in 2003 for the purpose of marketing and selling all the distillers grains we produce, except distillers grains we produce and sell directly to local farmers. Approximately, 15% of the distillers grains produced at the plant are marketed and sold by CSC all over the continental United States. For our distillers grains, we receive a percentage of the selling price actually received by CSC in marketing the distillers grains to its customers. The balance of our distillers grains are locally marketed primarily to nearby livestock producers. As additional ethanol plants begin production excess capacity could result in the local markets. If excess capacity in the local markets occurs, we may be forced to dry more of our distillers grains for marketing by CSC rather than directly selling in the local markets. As a result, our natural gas costs will likely increase due to increased drying and our profits may decrease.

Corn Oil Marketing and Distribution

As general partner of the Partnership, we entered into a marketing agreement with United Bio Energy, LLC in October 2005 for the purpose of marketing and selling all the corn oil we produce. In exchange for United Bio Energy’s marketing services, we pay United Bio Energy a fixed price per pound of corn oil sold. Either party may terminate the agreement at any time with one month written notice.

Seasonal Factors in Business

In an effort to improve air quality in regions where carbon monoxide and ozone are a problem, the Federal Oxygen Program of the Clean Air Act requires the sale of oxygenated motor fuels during the winter months in certain major metropolitan areas to reduce carbon monoxide pollution. Gasoline that is blended with ethanol has a higher oxygen content than gasoline that does not contain ethanol. As a result, we expect fairly light seasonality with respect to our gross profit margins on our ethanol allowing us to, potentially, be able to sell our ethanol at a slight premium during the mandated oxygenate period. Conversely, we expect our average sales price for fuel grade ethanol during the summer, when fuel grade ethanol is primarily used as an octane enhancer or a fuel supply extender, to be a little lower.

Sources and Availability of Raw Materials

Corn Feedstock Supply

The major raw material required for our ethanol plant to produce ethanol, distiller’s grain and corn oil is corn. To operate at a name-plate capacity of 52 million gallons, the plant requires a supply of approximately 18 to 19 million bushels million bushels of corn annually. The plant’s location in Marcus, Iowa in Cherokee County currently provides an ample supply of corn to meet and exceed the name-plate production capacity of the plant. Iowa’s calendar year 2004 final corn for grain production was estimated in January 2005 at 2.24 billion bushels. The 2004 corn crop was the largest corn crop on record with national production at approximately 11.8 billion bushels and Iowa production at approximately 2.4 billion bushels. The 2005 national corn crop is projected to be the second largest on record exceeded only the 2004 crop which is the largest ever recorded.

8

We have obtained a grain dealers license and have established our own grain sourcing staff to acquire the corn we need. We have also identified a number of grain dealers as potential sources of grain in northwestern Iowa for additional corn delivery. The grain required for operation of the ethanol plant is readily available through our own grain sourcing staff, which purchases the corn directly from local producers or from secondary markets. During the fiscal year ending September 30, 2005, we purchased approximately $4,416,000 in corn from some of the Company’s members who are local grain producers.

Natural Gas

Natural gas is also an important input to our manufacturing process. We estimate that our natural gas usage is approximately 110,000 million British thermal units (“MMBTU”) per month. We use natural gas to dry our distillers grains products to moisture contents at which they can be stored for long periods and transported greater distances, so that we can market them to broader livestock markets, including poultry and swine markets in the continental United States. We contract with various natural gas vendors to supply the natural gas necessary to operate the plant. U.S. Energy Services, Inc. assists us with sourcing natural gas through various vendors. We determined that sourcing our natural gas from a variety of vendors may prove more cost-efficient than using an exclusive supplier.

Federal Ethanol Supports

The ethanol industry is heavily dependent on several economic incentives to produce ethanol, including federal ethanol supports. The most recent ethanol supports are contained in the Energy Policy Act of 2005. Most notably, the Act creates a 7.5 billion gallon Renewable Fuels Standard (RFS). The RFS requires refiners to use 4 billion gallons of renewable fuels in 2006, increasing to 7.5 billion gallons by 2012.

Historically, ethanol sales have also been favorably affected by the Clean Air Act amendments of 1990, particularly the Federal Oxygen Program which became effective November 1, 1992. The Federal Oxygen Program requires the sale of oxygenated motor fuels during the winter months in certain major metropolitan areas to reduce carbon monoxide pollution. Ethanol use has increased due to a second Clean Air Act program, the Reformulated Gasoline Program. This program became effective January 1, 1995, and requires the sale of reformulated gasoline in nine major urban areas to reduce pollutants, including those that contribute to ground level ozone, better known as smog. The two major oxygenates added to reformulated gasoline pursuant to these programs are MTBE and ethanol, however MTBE has caused groundwater contamination and has been banned from use by many states. Although the Energy Policy Act of 2005 did not impose a national ban of MTBE, its failure to include liability protection for manufacturers of MTBE is expected to result in refiners and blenders using ethanol as an oxygenate rather than MTBE to satisfy the reformulated gasoline oxygenate requirement. While this may create increased demand in the short-term, we do not expect this to have a long term impact on the demand for ethanol as the Act repeals the Clean Air Act’s 2% oxygenate requirement for reformulated gasoline immediately in California and 270 days after enactment elsewhere. However, the Act did not repeal the 2.7% oxygenate requirement for carbon monoxide non-attainment areas which are required to use oxygenated fuels in the winter months. While we expect ethanol to be the oxygenate of choice in these areas, there is no assurance that ethanol will in fact be used.

The use of ethanol as an alternative fuel source has been aided by federal tax policy. On October 22, 2004, President Bush signed H.R. 4520, which contained the Volumetric Ethanol Excise Tax Credit (“VEETC”) and amended the federal excise tax structure effective as of January 1, 2005. Prior to VEETC, ethanol-blended fuel was taxed at a lower rate than regular gasoline (13.2 cents on a 10% blend). Under VEETC, the ethanol excise tax exemption has been eliminated, thereby allowing the full federal excise tax of 18.4 cents per gallon of gasoline to be collected on all gasoline and allocated to the highway trust fund. This is expected to add approximately $1.4 billion to the highway trust fund revenue annually. In place of the exemption, the bill creates a new volumetric ethanol excise tax credit of 5.1 cents per gallon of ethanol blended at 10%. Refiners and gasoline blenders apply for this credit on the same tax form as before only it is a credit from general revenue, not the highway trust fund. Based on volume, the VEETC is expected to allow much greater refinery flexibility in blending ethanol since it makes the tax credit available on all ethanol blended with all gasoline, diesel and ethyl tertiary butyl ether (“ETBE”), including ethanol in E-85 and the E-20 in Minnesota. The VEETC is scheduled to expire on December 31, 2010.

The Energy Policy Act of 2005 expands who qualifies for the small ethanol producer tax credit. Historically, small ethanol producers were allowed a 10-cents-per-gallon production income tax credit on up to 15

9

million gallons of production annually. The size of the plant eligible for the tax credit was limited to 30 million gallons. Under the Energy Policy Act of 2005 the size limitation on the production capacity for small ethanol producers increases from 30 million to 60 million gallons. The credit can be taken on the first 15 million gallons of production. The tax credit is capped at $1.5 million per year per producer. The credit is effective for taxable years ending after the date of enactment.

In addition, the Energy Policy Act of 2005 creates a new tax credit that permits taxpayers to claim a 30% credit (up to $30,000) for the cost of installing clean-fuel vehicle refueling equipment, such as an E85 fuel pump, to be used in a trade or business of the taxpayer or installed at the principal residence of the taxpayer. Under the provision, clean fuels are any fuel of at least 85% of the volume of which consists of ethanol, natural gas, compressed natural gas, liquefied natural gas, liquefied petroleum gas, and hydrogen and any mixture of diesel fuel and biodiesel containing at least 20% biodiesel. The provision is effective for equipment placed in service December 31, 2005 and before January 1, 2010. While it is unclear how this credit will affect the demand for ethanol in the short term, we expect it will help raise consumer awareness of alternative sources of fuel and could positively impact future demand for ethanol.

Additionally, Congress provides an ethanol production incentive to ethanol producers through the United States Department of Agriculture Commodity Credit Corporation’s Bioenergy Program. Under the program, incentive payments are allocated to ethanol producers based primarily on an increase in gallons of ethanol produced compared to the prior year’s production. These payments are based upon increases in ethanol production relative to previous years. Since we increased our production capacity through our plant expansion from 40 to 52 million gallons per year, we will be eligible to receive additional Bioenergy Program payments. However, due to the size of the expansion, any program payments we receive in the future will be significantly less than our original payments. The receipt of these additional program payments is subject to the continued availability of program funds, which may be reduced as a result of increased participation in the program by new and expanding plants as well as decreased federal funding. The Bioenergy Program is scheduled to expire at the end of the federal government’s 2006 fiscal year.

The ethanol industry and our business depend upon continuation of the federal ethanol supports discussed above. These incentives have supported a market for ethanol that might disappear without the incentives. Alternatively, the incentives may be continued at lower levels than at which they currently exist. The elimination or reduction of such federal ethanol supports would make it more costly for us to sell our ethanol and would likely reduce our net income.

Our Competition

We will be in direct competition with numerous other ethanol producers, many of whom have greater resources than we do. We also expect that additional ethanol producers will enter the market if the demand for ethanol continues to increase. Ethanol is a commodity product, like corn, which means our ethanol plant competes with other ethanol producers on the basis of price and, to a lesser extent, delivery service. We believe we compete favorably with other ethanol producers due to our proximity to ample grain supplies and multiple modes of transportation. In addition, we believe our plant’s location offers an advantage over other ethanol producers in that it has ready access by rail to growing ethanol markets, which reduces our cost of sales.

The ethanol industry has grown to over 90 production facilities in the United States. There are also numerous other producer and privately owned ethanol plants planned and operating throughout the Midwest and elsewhere in the United States. The largest ethanol producers include Abengoa Bioenergy Corp., ADM, Aventine Renewable Energy, Inc., Cargill, Inc., New Energy Corp. and VeraSun Energy Corporation, all of which are each capable of producing more ethanol than we expect to produce. ADM, one of our limited partners and our sole ethanol marketer, recently announced its plan to add approximately 500 million gallons per year of additional ethanol production capacity in the United States. ADM is currently the largest ethanol producer in the U.S. and controls a significant portion of the ethanol market. ADM’s plan to produce an additional 500 million gallons of ethanol per year will strengthen its position in the ethanol industry and cause a significant increase in domestic ethanol supply.

10

Excluding our facility, Iowa currently has 27 ethanol plants in various stages of development or operation. Plants near Galva and Sioux Center produce or will produce approximately 26 million gallons per year per facility. A plant near Steamboat Rock produces 20 million gallons per year per year. A Plant near Fort Dodge produces 100 million gallons per year and plants near Fairbank and Albert City will each produce 100 million gallons per year when they become operational. Plants near Lakota and Iowa Falls currently produce approximately 50 million gallons per year and have begun construction on a 50 million gallon expansion for total capacity of 100 million gallons per year each. The remaining plants will produce or are producing approximately 50 million gallons per year. Total annual ethanol production capacity in Iowa currently exceeds 1 billion gallons. In addition, a nearby plant in Hudson, South Dakota, produces approximately 45 million gallons per year and a 40 million gallons per year plant is being developed near South Sioux City, Nebraska. If organizational efforts are successful, this plant would add an additional 40 million gallons per year of production in close proximity to our facility.

The following table identifies most of the ethanol producers in the United States along with their production capacities.

U.S. FUEL ETHANOL PRODUCTION CAPACITY

million gallons per year (mmgy)

Company | | Location | | Feedstock | | Current Capacity | | Under Construction/

Expansions | |

| | | | | | (mmgy) | | (mmgy) | |

Abingdon Bioenergy Corp. | | York, NE | | Corn/milo | | 55 | | | |

| | Colwich, KS | | | | 25 | | | |

| | Portales, NM | | | | 30 | | | |

| | Ravenna, NE | | | | | | 88 | |

ACE Ethanol, LLC | | Stanley, WI | | Corn | | 39 | | | |

Adkins Energy, LLC* | | Lena, IL | | Corn | | 40 | | | |

Advanced Bioenergy | | Fairmont, NE | | Corn | | | | 100 | |

AGP* | | Hastings, NE | | Corn | | 52 | | | |

Agra Resources Coop. d.b.a. EXOL* | | Albert Lea, MN | �� | Corn | | 40 | | 8 | |

Agri-Energy, LLC* | | Luverne, MN | | Corn | | 21 | | | |

Alchem Ltd. LLLP | | Grafton, ND | | Corn | | 10.5 | | | |

Al-Corn Clean Fuel* | | Claremont, MN | | Corn | | 35 | | | |

Amaizing Energy, LLC* | | Denison, IA | | Corn | | 40 | | | |

Archer Daniels Midland | | Decatur, IL | | Corn | | 1,070 | | | |

| | Cedar Rapids, IA | | Corn | | | | | |

| | Clinton, IA | | Corn | | | | | |

| | Columbus, NE | | Corn | | | | | |

| | Marshall, MN | | Corn | | | | | |

| | Peoria, IL | | Corn | | | | | |

| | Wallhalla, ND | | Corn/barley | | | | | |

Aventine Renewable Energy, LLC | | Pekin, IL | | Corn | | 100 | | 57 | |

| | Aurora, NE | | Corn | | 50 | | | |

Badger State Ethanol, LLC* | | Monroe, WI | | Corn | | 48 | | | |

Big River Resources, LLC* | | West Burlington, IA | | Corn | | 40 | | | |

11

Broin Enterprises, Inc. | | Scotland, SD | | Corn | | 9 | | | |

Bushmills Ethanol, Inc.* | | Atwater, MN | | Corn | | | | 40 | |

Cargill, Inc. | | Blair, NE | | Corn | | 85 | | | |

| | Eddyville, IA | | Corn | | 35 | | | |

Central Indiana Ethanol, LLC | | Marion, IN | | Corn | | | | 40 | |

Central MN Ethanol Coop* | | Little Falls, MN | | Corn | | 21.5 | | | |

Central Wisconsin Alcohol | | Plover, WI | | Seed corn | | 4 | | | |

Chief Ethanol | | Hastings, NE | | Corn | | 62 | | | |

Chippewa Valley Ethanol Co.* | | Benson, MN | | Corn | | 45 | | | |

Commonwealth Agri-Energy, LLC* | | Hopkinsville, KY | | Corn | | 24 | | 9 | |

Corn, LP* | | Goldfield, IA | | Corn | | | | 50 | |

Cornhusker Energy Lexington, LLC | | Lexington, NE | | Corn | | | | 40 | |

Corn Plus, LLP* | | Winnebago, MN | | Corn | | 44 | | | |

Dakota Ethanol, LLC* | | Wentworth, SD | | Corn | | 50 | | | |

DENCO, LLC* | | Morris, MN | | Corn | | 21.5 | | | |

E3 Biofuels | | Mead, NE | | Corn | | | | 24 | |

East Kansas Agri-Energy, LLC* | | Garnett, KS | | Corn | | 35 | | | |

ESE Alcohol Inc. | | Leoti, KS | | Seed corn | | 1.5 | | | |

Ethanol2000, LLP* | | Bingham Lake, MN | | Corn | | 32 | | | |

Frontier Ethanol, LLC | | Gowrie, IA | | Corn | | | | 60 | |

Front Range Energy, LLC | | Windsor, CO | | Corn | | | | 40 | |

Glacial Lakes Energy, LLC* | | Watertown, SD | | Corn | | 50 | | | |

Golden Cheese Company of California* | | Corona, CA | | Cheese whey | | 5 | | | |

Golden Grain Energy, LLC* | | Mason City, IA | | Corn | | 40 | | | |

Golden Triangle Energy, LLC* | | Craig, MO | | Corn | | 20 | | | |

Grain Processing Corp. | | Muscatine, IA | | Corn | | 20 | | | |

Granite Falls Energy, LLC | | Granite Falls, MN | | Corn | | 45 | | | |

Great Plains Ethanol, LLC* | | Chancellor, SD | | Corn | | 50 | | | |

Green Plains Renewable Energy | | Shenandoah, IA | | Corn | | | | 50 | |

Hawkeye Renewables, LLC | | Iowa Falls, IA | | Corn | | 50 | | 50 | |

| | Fairbank, IA | | Corn | | | | 100 | |

Heartland Corn Products* | | Winthrop, MN | | Corn | | 36 | | | |

Heartland Grain Fuels, LP* | | Aberdeen, SD | | Corn | | 9 | | | |

| | Huron, SD | | Corn | | 12 | | 18 | |

Heron Lake BioEnergy, LLC | | Heron Lake, MN | | Corn | | | | 50 | |

Horizon Ethanol, LLC | | Jewell, IA | | Corn | | | | 60 | |

Husker Ag, LLC* | | Plainview, NE | | Corn | | 26.5 | | | |

Illinois River Energy, LLC | | Rochelle, IL | | Corn | | | | 50 | |

Iowa Ethanol, LLC* | | Hanlontown, IA | | Corn | | 50 | | | |

Iroquois Bio-Energy Company, LLC | | Rensselaer, IN | | Corn | | | | 40 | |

James Valley Ethanol, LLC | | Groton, SD | | Corn | | 50 | | | |

12

KAAPA Ethanol, LLC* | | Minden, NE | | Corn | | 40 | | | |

Land O’ Lakes* | | Melrose, MN | | Cheese whey | | 2.6 | | | |

Lincolnland Agri-Energy, LLC* | | Palestine, IL | | Corn | | 48 | | | |

Lincolnway Energy, LLC* | | Nevada, IA | | Corn | | | | 50 | |

Liquid Resources of Ohio | | Medina, OH | | Waste Beverage | | 3 | | | |

Little Sioux Corn Processors, LP* | | Marcus, IA | | Corn | | 52 | | | |

Merrick/Coors | | Golden, CO | | Waste beer | | 1.5 | | 1.5 | |

MGP Ingredients, Inc. | | Pekin, IL | | Corn/wheat starch | | 78 | | | |

| | Atchison, KS | | | | | | | |

Michigan Ethanol, LLC | | Caro, MI | | Corn | | 50 | | | |

Mid-Missouri Energy, Inc.* | | Malta Bend, MO | | Corn | | 45 | | | |

Midwest Grain Processors* | | Lakota, IA | | Corn | | 50 | | 45 | |

| | Riga, MI | | Corn | | | | 57 | |

Midwest Renewable Energy, LLC | | Sutherland, NE | | Corn | | 17.5 | | 4.5 | |

Minnesota Energy* | | Buffalo Lake, MN | | Corn | | 18 | | | |

Missouri Ethanol | | Laddonia, MO | | Corn | | | | 45 | |

New Energy Corp. | | South Bend, IN | | Corn | | 102 | | | |

North Country Ethanol, LLC* | | Rosholt, SD | | Corn | | 20 | | | |

Northeast Missouri Grain, LLC* | | Macon, MO | | Corn | | 45 | | | |

Northern Lights Ethanol, LLC* | | Big Stone City, SD | | Corn | | 50 | | | |

Northstar Ethanol, LLC | | Lake Crystal, MN | | Corn | | 52 | | | |

Otter Creek Ethanol, LLC* | | Ashton, IA | | Corn | | 55 | | | |

Panhandle Energies of Dumas, LP | | Dumas, TX | | Corn/Grain Sorghum | | | | 30 | |

Parallel Products | | Louisville, KY | | Beverage waste | | 5.4 | | | |

| | R. Cucamonga, CA | | | | | | | |

Permeate Refining | | Hopkinton, IA | | Sugars & starches | | 1.5 | | | |

Phoenix Biofuels | | Goshen, CA | | Corn | | 25 | | | |

Pine Lake Corn Processors, LLC* | | Steamboat Rock, IA | | Corn | | 20 | | | |

Platte Valley Fuel Ethanol, LLC | | Central City, NE | | Corn | | 40 | | | |

Prairie Ethanol, LLC | | Loomis, SD | | Corn | | | | 60 | |

Prairie Horizon Agri-Energy, LLC | | Phillipsburg, KS | | Corn | | | | 40 | |

Pro-Corn, LLC* | | Preston, MN | | Corn | | 42 | | | |

Quad-County Corn Processors* | | Galva, IA | | Corn | | 27 | | | |

Red Trail Energy, LLC | | Richardton, ND | | Corn | | | | 50 | |

Redfield Energy, LLC | | Redfield, SD | | Corn | | | | 50 | |

Reeve Agri-Energy | | Garden City, KS | | Corn/milo | | 12 | | | |

Siouxland Energy & Livestock Coop* | | Sioux Center, IA | | Corn | | 25 | | | |

13

Siouxland Ethanol, LLC | | Jackson, NE | | Corn | | | | 50 | |

Sioux River Ethanol, LLC* | | Hudson, SD | | Corn | | 55 | | | |

Sterling Ethanol, LLC | | Sterling, CO | | Corn | | 42 | | | |

Tall Corn Ethanol, LLC* | | Coon Rapids, IA | | Corn | | 49 | | | |

Tate & Lyle | | Loudon, TN | | Corn | | 67 | | | |

The Andersons Albion Ethanol LLC | | Albion, MI | | Corn | | | | 55 | |

Trenton Agri Products, LLC | | Trenton, NE | | Corn | | 35 | | 10 | |

United WI Grain Producers, LLC* | | Friesland, WI | | Corn | | 49 | | | |

US BioEnergy Corp. | | Albert City, IA | | Corn | | | | 100 | |

| | Lake Odessa, MI | | Corn | | | | 45 | |

U.S. Energy Partners, LLC | | Russell, KS | | Milo/wheat starch | | 48 | | | |

Utica Energy, LLC | | Oshkosh, WI | | Corn | | 48 | | | |

Val-E Ethanol, LLC | | Ord, NE | | Corn | | | | 45 | |

VeraSun Energy Corporation | | Aurora, SD | | Corn | | 230 | | | |

| | Ft. Dodge, IA | | Corn | | | | | |

Voyager Ethanol, LLC* | | Emmetsburg, IA | | Corn | | 52 | | | |

Western Plains Energy, LLC* | | Campus, KS | | Corn | | 45 | | | |

Western Wisconsin Renewable Energy, LLC* | | Boyceville, WI | | Corn | | | | 40 | |

Wind Gap Farms | | Baconton, GA | | Brewery waste | | 0.4 | | | |

Wyoming Ethanol | | Torrington, WY | | Corn | | 5 | | | |

Xethanol BioFuels, LLC | | Blairstown, IA | | Corn | | 5 | | | |

Total Current Capacity | | | | | | 4286.4 | | | |

Total Under Construction/Expansions | | | | | | | | 1752 | |

Total Capacity | | | | | | 6038.4 | | | |

* farmer-owned | | | | Source: Renewable Fuels Association

Last Updated: December 2005 |

Competition from Alternative Fuels

Our ethanol plant also competes with producers of other gasoline additives having similar octane and oxygenate values as ethanol, such as producers of MTBE, a petrochemical derived from methanol that costs less to produce than ethanol. Although currently the subject of several state bans, many major oil companies can produce MTBE and because it is petroleum-based, its use is strongly supported by major oil companies.

Alternative fuels, gasoline oxygenates and alternative ethanol production methods are also continually under development by ethanol and oil companies with far greater resources. The major oil companies have significantly greater resources than we have to develop alternative products and to influence legislation and public perception of MTBE and ethanol. New ethanol products or methods of ethanol production developed by larger and better-financed competitors could provide them competitive advantages and harm our business.

Distillers Grains Competition

Our plant primarily competes with other ethanol producers in the production and sales of distillers grains. According to the University of Minnesota’s DDGS—General Information website (November 28, 2005)

14

approximately 3,200,000 to 3,500,000 tons of distillers grains are produced annually in North America, approximately 98% of which are produced by ethanol plants. The remaining 1 to 2% of DDGS is produced by the alcohol beverage industry. Ethanol plants in South Dakota and Minnesota produce about 25% of this amount. The amount of distillers grains produced is expected to increase significantly as the number of ethanol plants increase. In addition, our distillers grains compete with other livestock feed products such as soybean meal, corn gluten feed, dry brewers grain and mill feeds.

General Ethanol Demand and Supply

Ethanol has important applications, primarily as a high-quality octane enhancer and an oxygenate capable of reducing air pollution and improving automobile performance. Ethanol contains 35% oxygen by weight. When combined with gasoline, ethanol acts as an oxygenate. As a result, the gasoline burns cleaner, and releases less carbon monoxide and other exhaust emissions into the atmosphere.

According to the Renewable Fuels Association, demand for fuel ethanol in the United States reached a new high in 2004 of 3.57 billion gallons per year. In its report titled, “Ethanol Industry Outlook 2005,” the Renewable Fuels Association anticipates demand for ethanol to remain strong. The passage of the Volumetric Ethanol Excise Tax Credit (“VEETC”), is expected to provide the flexibility necessary to expand ethanol blending into higher blends of ethanol such as E85, E diesel and fuel cell markets. In addition, the recent implementation of a Renewable Fuels Standard contained in the Energy Policy Act of 2005, which was signed into law on August 8, 2005 is expected to favorably impact the ethanol industry by enhancing both the production and use of ethanol.

The provision of the Energy Policy Act of 2005 likely to have the greatest impact on the ethanol industry is the creation of a 7.5 billion gallon Renewable Fuels Standard (RFS). The RFS will begin at 4 billion gallons in 2006, increasing to 7.5 billion gallons by 2012. The RFS is a national flexible program that does not require that any renewable fuels be used in any particular area or state, allowing refiners to use renewable fuel blends in those areas where it is most cost-effective. According to the Renewable Fuels Association, the bill is expected to lead to about $6 billion in new investment in ethanol plants across the country. An increase in the number of new plants will bring an increase in the supply of ethanol. Thus, while this bill may cause ethanol prices to increase in the short term due to additional demand, future supply could outweigh the demand for ethanol in the future. This would have a negative impact on our earnings. Alternatively, since the RFS begins at 4 billion gallons in 2006 and national production is expected to exceed this amount, there could be a short-term oversupply until the RFS requirements exceed national production. This would have an immediate adverse effect on our earnings.

In addition, demand for ethanol may also increase as a result of increased consumption of E85 fuel. E85 fuel is a blend of 70% to 85% ethanol and gasoline. According to the Energy Information Administration, E85 consumption is projected to increase from a national total of 11 million gallons in 2003 to 47 million gallons in 2025. E85 is used as an aviation fuel and as a hydrogen source for fuel cells. According to the National Ethanol Vehicle Coalition, there are currently about 4.5 million flexible fuel vehicles capable of operating on E85 in the U.S. and 400 retail stations supplying it. Automakers have indicated plans to produce an estimated 2 million more flexible fuel vehicles per year.

The supply of domestically produced ethanol is at an all-time high. In 2004, 81 ethanol plants located in 20 states produce a record 3.41 billion gallons, a 21% increase from 2003 and 109% increase from 2000. At the end of 2004, 16 plants and 2 major expansions were under construction, representing an additional 750 million gallons of production capacity. The following table shows 2005 U.S. ethanol production capacity by state as of December 2005:

15

Ethanol Production Capacity Ranked by State

(Largest to Smallest Production Capacity as of December 2005)

Rank | | State | | Ethanol Production Capacity | |

| | | | (Million Gallons Per Year) | |

| | | | | |

1 | | Iowa | | 1,699.5 | |

2 | | Illinois | | 881.0 | |

3 | | Nebraska | | 771.5 | |

4 | | South Dakota | | 603.0 | |

5 | | Minnesota | | 593.6 | |

6 | | Wisconsin | | 228.0 | |

7 | | Kansas | | 212.5 | |

8 | | Michigan | | 207.0 | |

9 | | Indiana | | 182.0 | |

10 | | Missouri | | 155.0 | |

11 | | Colorado | | 85.0 | |

11 | | North Dakota | | 83.5 | |

12 | | Tennessee | | 67.0 | |

13 | | Kentucky | | 35.4 | |

14 | | California | | 33.0 | |

15 | | New Mexico | | 30.0 | |

15 | | Texas | | 30.0 | |

16 | | Wyoming | | 5.0 | |

17 | | Ohio | | 3.0 | |

18 | | Georgia | | 0.4 | |

| | United States Total | | 5,905.4 | |

Sources: Renewable Fuels Association, Washington, DC.

Nebraska Energy Office, Lincoln, NE

Ethanol supply is also affected by ethanol produced or processed in certain countries in Central America and the Caribbean region. Ethanol produced in these countries is eligible for tariff reduction or elimination upon importation to the United States under a program known as the Caribbean Basin Initiative (“CBI”). Large ethanol producers, such as Cargill, have expressed interest in building dehydration plants in participating Caribbean Basin countries, such as El Salvador, which would convert ethanol into fuel-grade ethanol for shipment to the United States. Ethanol imported from Caribbean Basin countries may be a less expensive alternative to domestically produced ethanol. The International Trade Commission recently announced the 2005 CBI import quota of 240.4 million gallons of ethanol. Last year, legislation was introduced in the Senate that would limit the transshipment of ethanol through the CBI. No similar legislation has been introduced this year, however, there is no assurance or guarantee that such legislation will be introduced or that it will be successfully passed during 2006.

Research and Development

We do not conduct any research and development activities associated with the development of new technologies for use in producing ethanol and distillers grains.

Dependence on One or a Few Major Customers

As discussed above, we have entered into marketing agreements with ADM and CSC for the purposes of marketing and distributing our principal products, ethanol and distillers grains, respectively. We rely on ADM and CSC for the sale and distribution of almost all of our products, except for those distillers grains that we market locally. Therefore, we are highly dependent on ADM and CSC for the successful marketing of our products. As a large ethanol producer, ADM is also a source of competition. Any loss of ADM or CSC as our marketing agent for our ethanol and distillers grains could have a significant negative impact on our revenues.

16

Costs and Effects of Compliance with Environmental Laws

We are subject to extensive air, water and other environmental regulations and we have been required to obtain a number of environmental permits to construct and operate the plant. We have obtained all of the necessary permits to operate the plant including, air pollution construction permits, a pollutant discharge elimination system general permit, storm water discharge permits, a water withdrawal permit, and an alcohol fuel producer’s permit. In addition, we have completed a spill prevention control and countermeasures plan. Although we have been successful in obtaining all of the permits currently required, any retroactive change in environmental regulations, either at the federal or state level, could require us to obtain additional or new permits or spend considerable resources on complying with such regulations.

We are subject to ongoing environmental regulations and testing. The plant passed emissions testing in December 2003 and we received renewed operating permits in April 2004. The operating permits allow us to operate in excess of 40 million gallons per year. Subsequent to installation of the regenerative thermal oxidizer, we retested critical emissions points in November 2004 to further enhance our ability to operate at peak efficiencies. We are pleased with the results of these tests, and final permitting was granted by the regulatory agency in November 2005. Our capacity to operate at lower temperatures while maintaining compliance is expected to increase efficiency and may reduce costs of operations. We are required by federal regulations to conduct a Relative Accuracy Test Audit (RATA) once per 12-month period. We passed the RATA testing in February 2005. By installing hard surfacing on the plant road, we expect to reduce our dust emissions, which should aid our continued compliance with environmental standards.

On August 9, 2005, the Board of Directors approved plans to proceed with a 40 million gallon per year expansion to our plant. However, before we can begin expansion of our plant, we must obtain numerous regulatory approvals and permits. While we anticipate receiving these approvals and permits, there is no assurance that these requirements can be satisfied in a timely manner or at all. In addition, as a condition of receiving the permits and approvals, we may be required to make significant capital expenditures to install additional pollution control equipment, which could have a material adverse effect on our results of operations and financial condition.

We are subject to oversight activities by the EPA. There is always a risk that the EPA may enforce certain rules and regulations differently than Iowa’s environmental administrators. Iowa or EPA rules are subject to change, and any such changes could result in greater regulatory burdens on plant operations. We could also be subject to environmental or nuisance claims from adjacent property owners or residents in the area arising from possible foul smells or other air or water discharges from the plant. Such claims may result in an adverse result in court if we are deemed to engage in a nuisance that substantially impairs the fair use and enjoyment of real estate.

The government’s regulation of the environment changes constantly. It is possible that more stringent federal or state environmental rules or regulations could be adopted, which could increase our operating costs and expenses. It also is possible that federal or state environmental rules or regulations could be adopted that could have an adverse effect on the use of ethanol. For example, changes in the environmental regulations regarding the required oxygen content of automobile emissions could have an adverse effect on the ethanol industry. Furthermore, plant operations likely will be governed by the Occupational Safety and Health Administration (“OSHA”). OSHA regulations may change such that the costs of the operation of the plant may increase. Any of these regulatory factors may result in higher costs or other materially adverse conditions effecting our operations, cash flows and financial performance.

Employees

As of September 30, 2005, we had a total of 36 full-time employees. We have 29 full-time employees in ethanol production operations and 7 full-time employees in general management and administration. At the current plant size of 52 MGY, we do not expect to hire a significant number of employees in the next 12 months. However, significant expansion of the plant may require us to hire several new employees.

17

ITEM 1A. RISK FACTORS.

You should carefully read and consider the risks and uncertainties below and the other information contained in this report. The risks and uncertainties described below are not the only ones we may face. The following risks, together with additional risks and uncertainties not currently known to us or that we currently deem immaterial could impair our financial condition and results of operation.

Risks Relating to Our Business

We have a limited operating history and our business may not be as successful as we anticipate. We began our business in 2000 and commenced production of ethanol at our plant in April 2003. Accordingly, we have a limited operating history from which you can evaluate our business and prospects. Our operating results could fluctuate significantly in the future as a result of a variety of factors, including those discussed through out these risk factors. Many of these factors are outside our control. As a result of these factors, our operating results may not be indicative of future operating results and you should not rely on them as indications of our future performance. In addition, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company and in rapidly growing industries, such as the ethanol industry, where supply and demand may change substantially in a short amount of time.

Our business is not diversified. Our success depends largely upon our ability to profitably operate our ethanol plant. We do not have any other lines of business or other sources of revenue if we are unable to operate our ethanol plant and manufacture ethanol, distillers grains and corn oil. If economic or political factors adversely affect the market for ethanol, the Company has no other line of business to fall back on if the ethanol business declines. Our business would also be significantly harmed if its ethanol plant could not operate at full capacity for any extended period of time.

Our financial performance is significantly dependent on corn and natural gas prices and generally we cannot pass on increases in input prices to our customers. Our results of operations and financial condition are significantly affected by the cost and supply of corn and natural gas. Changes in the price and supply of corn and natural gas are subject to and determined by market forces over which we have no control

Ethanol production requires substantial amounts of corn. Corn, as with most other crops, is affected by weather, disease and other environmental conditions. The price of corn is also influenced by general economic, market and government factors. These factors include weather conditions, farmer planting decisions, domestic and foreign government farm programs and policies, global demand and supply and quality. Changes in the price of corn can significantly affect our business. Generally, higher corn prices will produce lower profit margins and, therefore, represent unfavorable market conditions. This is especially true if market conditions do not allow us to pass along increased corn costs to our customers. The price of corn has fluctuated significantly in the past and may fluctuate significantly in the future. If a period of high corn prices were to be sustained for some time, such pricing may reduce our ability to generate revenues because of the higher cost of operating and may make ethanol uneconomical to use in fuel markets. We cannot offer any assurance that we will be able to offset any increase in the price of corn by increasing the price of our products. If we cannot offset increases in the price of corn, our financial performance may be materially and adversely affected.

Natural gas has recently been available only at prices exceeding historical averages. These prices are increasing our costs of production. The prices for and availability of natural gas are subject to volatile market conditions. These market conditions often are affected by factors beyond our control such as higher prices as a result of colder than average weather conditions, overall economic conditions and foreign and domestic governmental regulations and relations. Significant disruptions in the supply of natural gas could impair our ability to manufacture ethanol for our customers. Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect our results of operations and financial condition.

We seek to minimize the risks from fluctuations in the prices of corn and natural gas through the use of hedging instruments. However, these hedging transactions also involve risks to our business. See “Risks Relating to Our Business - We engage in hedging transaction which involve risks that can harm our business.”

18

The spread between ethanol and corn prices can vary significantly and we do not expect the spread to remain at recent high levels. Corn costs significantly impact our cost of goods sold. Our gross margins are principally dependent upon the spread between ethanol and corn prices. Recently, the spread between ethanol and corn prices has been at historically high level, due in large part to high oil prices and low corn prices. However, this spread has fluctuated significantly in 2005 and may fluctuate significantly in the future. Any reduction in the spread between ethanol and corn prices, whether as a result of an increase in corn prices or a reduction in ethanol prices, would adversely affect our results of operations and financial condition

Our revenues will be greatly affected by the price at which we can sell our ethanol and distillers grains. These prices can be volatile as a result of a number of factors. These factors include the overall supply and demand, the price of gasoline, level of government support, and the availability and price of competing products. For instance, the price of ethanol tends to increase as the price of gasoline increases, and the price of ethanol tends to decrease as the price of gasoline decreases. Any lowering of gasoline prices will likely also lead to lower prices for ethanol, which may decrease our ethanol sales and reduce revenues.

The price of ethanol has recently been much higher than its 10-year average. We do not expect these prices to be sustainable as supply from new and existing ethanol plants increases to meet increased demand. Increased production of ethanol may lead to lower prices. The increased production of ethanol could have other adverse effects. For example, the increased production could lead to increased supplies of co-products from the production of ethanol, such as distillers grains. Those increased supplies could outpace demand, which would lead to lower prices for those by-products. Also, the increased production of ethanol could result in increased demand for corn. This could result in higher prices for corn and corn production creating lower profits. There can be no assurance as to the price of ethanol or distillers grains in the future. Any downward changes in the price of ethanol and/or distillers grains may result in less income which would decrease our revenues and profitability.

We sell all of the ethanol we produce to ADM in accordance with an ethanol marketing agreement. ADM, a significant competitor of ours, is the sole buyer of all of our ethanol and we rely heavily on its marketing efforts to successfully sell our product. Because ADM sells ethanol for itself and a number of other producers, we have limited control over its sales efforts. Our financial performance is dependent upon the financial health of ADM, as a significant portion of our accounts receivable are attributable to ADM. If ADM breaches the ethanol marketing agreement or is not in the financial position to purchase all of the ethanol we produce, we could experience a material loss and we may not have any readily available means to sell our ethanol and our financial performance will be adversely and materially affected. If our agreement with ADM terminates, we may seek other arrangements to sell our ethanol, including selling our own product, but we give no assurance that our sales efforts would achieve results comparable to those achieved by ADM.

We engage in hedging transactions which involve risks that can harm our business. We are exposed to market risk from changes in commodity prices. Exposure to commodity price risk results from our dependence on corn and natural gas in the ethanol production process. We seek to minimize the risks from fluctuations in the prices of corn and natural gas through the use of hedging instruments. The effectiveness of our hedging strategies is dependent upon, the cost of corn and natural gas and our ability to sell sufficient products to use all of the corn and natural gas for which we have futures contracts. There is no assurance that our hedging activities will successfully reduce the risk caused by price fluctuation which may leave us vulnerable to high corn and natural prices. Alternatively, we may choose not to engage in hedging transactions in the future. As a result, our results of operations and financial conditions may also be adversely affected during periods in which corn and/or natural gas prices increase.

Hedging activities themselves can result in costs because price movements in corn and natural gas contracts are highly volatile and are influenced by many factors that are beyond our control. There are several variables that could affect the extent to which our derivative instruments are impacted by price fluctuations in the cost of corn or natural gas. However, it is likely that commodity cash prices will have the greatest impact on the derivatives instruments with delivery dates nearest the current cash price. We may incur such costs and they may be significant.

Changes and advances in ethanol production technology could require us to incur costs to update our plant or could otherwise hinder our ability to compete in the ethanol industry or operate profitably. Advances and changes in the technology of ethanol production are expected to occur. Such advances and changes may make the ethanol production technology installed in our plant less desirable or obsolete. These advances could also allow our competitors to produce ethanol at a lower cost than us. If we are unable to adopt or incorporate technological advances, our ethanol production methods and processes could be less efficient than our competitors, which could cause our plant to become uncompetitive or completely obsolete. If our competitors develop, obtain or license technology that is superior to ours or that makes our technology obsolete, we may be required to incur significant costs to enhance or acquire new technology so that our ethanol production remains competitive. Alternatively, we may be required to seek third-party licenses, which could also result in significant expenditures. We cannot guarantee or assure you that third-party licenses will be available or, once obtained, will continue to be available on commercially reasonable terms, if at all. These costs could negatively impact our financial performance by increasing our operating costs and reducing our net income.

19

Risks Related to Ethanol Industry

New plants under construction or decreases in the demand for ethanol may result in excess production capacity in our industry. The supply of domestically produced ethanol is at an all-time high. In 2004, 81 ethanol plants located in 20 states produce a record 3.41 billion gallons, a 21% increase from 2003 and 109% increase from 2000. At the end of 2004, 16 plants and 2 major expansions were under construction, representing an additional 750 million gallons of production capacity. The ethanol industry has grown to over 90 production facilities in the United States. Excluding our facility, Iowa currently has 27 ethanol plants in various stages of development or operation. Excess capacity in the ethanol industry would have an adverse impact on our results of operations, cash flows and general financial condition. Excess capacity may also result or intensify from increases in production capacity coupled with insufficient demand. If the demand for ethanol does not grow at the same pace as increases in supply, we would expect the price for ethanol to decline. If excess capacity in the ethanol industry occurs, the market price of ethanol may decline to a level that is inadequate to generate sufficient cash flow to cover our costs.

We operate in a competitive industry and compete with larger, better financed entities which could impact our ability to operate profitably. There is significant competition among ethanol producers with numerous producer and privately owned ethanol plants planned and operating throughout the Midwest and elsewhere in the United States. The number of ethanol plants being developed and constructed in the United States continues to increase at a rapid pace. The recent passage of the Energy Policy Act of 2005 included a renewable fuels mandate that we expect will further increase the number of domestic ethanol production facilities. The largest ethanol producers include Abengoa Bioenergy Corp., Archer Daniels Midland, Aventine Renewable Energy, Inc., Cargill, Inc., New Energy Corp. and VeraSun Energy Corporation, all of which are each capable of producing more ethanol than we expect to produce. Archer Daniels Midland, one of our limited partners and our sole ethanol marketer, recently announced its plan to add approximately 500 million gallons per year of additional ethanol production capacity in the United States. ADM is currently the largest ethanol producer in the U.S. and controls a significant portion of the ethanol market. ADM’s plan to produce an additional 500 million gallons of ethanol per year will strengthen its position in the ethanol industry and cause a significant increase in domestic ethanol supply. If the demand for ethanol does not grow at the same pace as increases in supply, we expect that lower prices for ethanol will result which may adversely affect our ability to generate profits and our financial condition.

Our ethanol plant also competes with producers of other gasoline additives made from raw materials other than corn having similar octane and oxygenate values as ethanol, such as producers of methyl tertiary butyl ether (MTBE). MTBE is a petrochemical derived from methanol which generally costs less to produce than ethanol. Many major oil companies produce MTBE and strongly favor its use because it is petroleum-based. Alternative fuels, gasoline oxygenates and alternative ethanol production methods are also continually under development. The major oil companies have significantly greater resources than we have to market MTBE, to develop alternative products, and to influence legislation and public perception of MTBE and ethanol. These companies also have significant resources to begin production of ethanol should they choose to do so.

Competition from the advancement of alternative fuels may lessen the demand for ethanol. Alternative fuels, gasoline oxygenates and ethanol production methods are continually under development. A number of automotive, industrial and power generation manufacturers are developing alternative clean power systems using fuel cells or clean burning gaseous fuels. Like ethanol, the emerging fuel cell industry offers a technological option to address increasing worldwide energy costs, the long-term availability of petroleum reserves and environmental concerns. Fuel cells have emerged as a potential alternative to certain existing power sources because of their higher efficiency, reduced noise and lower emissions. Fuel cell industry participants are currently targeting the

20

transportation, stationary power and portable power markets in order to decrease fuel costs, lessen dependence on crude oil and reduce harmful emissions. If the fuel cell and hydrogen industries continue to expand and gain broad acceptance, and hydrogen becomes readily available to consumers for motor vehicle use, we may not be able to compete effectively. This additional competition could reduce the demand for ethanol, resulting in lower ethanol prices that might adversely affect our results of operations and financial condition.

Corn-based ethanol may compete with cellulose-based ethanol in the future, which could make it more difficult for us to produce ethanol on a cost-effective basis. Most ethanol is currently produced from corn and other raw grains, such as milo or sorghum - especially in the Midwest. The current trend in ethanol production research is to develop an efficient method of producing ethanol from cellulose-based biomass, such as agricultural waste, forest residue, municipal solid waste, and energy crops. This trend is driven by the fact that cellulose-based biomass is generally cheaper than corn, and producing ethanol from cellulose-based biomass would create opportunities to produce ethanol in areas which are unable to grow corn. Although current technology is not sufficiently efficient to be competitive, a recent report by the U.S. Department of Energy entitled “Outlook for Biomass Ethanol Production and Demand” indicates that new conversion technologies may be developed in the future. If an efficient method of producing ethanol from cellulose-based biomass is developed, we may not be able to compete effectively. We do not believe it will be cost-effective to convert the ethanol plant we are proposing into a plant which will use cellulose-based biomass to produce ethanol. If we are unable to produce ethanol as cost-effectively as cellulose-based producers, our ability to generate revenue and financial condition will be negatively impacted.

Competition from ethanol imported from Caribbean basin countries may be a less expensive alternative to our ethanol. Ethanol produced or processed in certain countries in Central America and the Caribbean region is eligible for tariff reduction or elimination upon importation to the United States under a program known as the Caribbean Basin Initiative. Large ethanol producers, such as Cargill, have expressed interest in building dehydration plants in participating Caribbean Basin countries, such as El Salvador, which would convert ethanol into fuel-grade ethanol for shipment to the United States. Ethanol imported from Caribbean Basin countries may be a less expensive alternative to domestically produced ethanol. Competition from ethanol imported from Caribbean Basin countries may affect our ability to sell our ethanol profitably, adversely affect our results of operations and financial condition.