UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

LITTLE SIOUX CORN PROCESSORS, L.L.C. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

4808 F Avenue

Marcus, IA 51035

NOTICE OF 2006 ANNUAL MEETING OF MEMBERS

To be Held Thursday, March 23, 2006

TO OUR MEMBERS:

The 2006 Annual Meeting of Members (the “Annual Meeting”) of Little Sioux Corn Processors, L.L.C. (the “Company”) will be held at Western Iowa Tech Community College, which is located at 200 Victory Drive in Cherokee, Iowa and will commence on Thursday, March 23, 2006 at 7:00 p.m., local time for the following purposes:

· To elect three (3) Class A Directors to serve until the 2009 Annual Meetings of Members and until their successors are elected.

· To transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. If you have any questions regarding the information in the Proxy Statement or regarding completion of the enclosed Form of Proxy, please call the Company at (712) 376-2800.

Only members of record at the close of business on February 1, 2006, will be entitled to notice of the Annual Meeting and to vote at the Annual Meeting and any adjournments thereof.

All members are cordially invited to attend the Annual Meeting in person. However, to assure the presence of a quorum, you are requested to promptly sign, date and return the enclosed form of proxy, which is solicited by the board of directors, by fax or in the enclosed envelope whether or not you plan to attend the Annual Meeting. The proxy will not be used if you attend and vote at the Annual Meeting in person.

| BY ORDER OF THE BOARD OF DIRECTORS, |

| /s/ | RON WETHERELL |

| Ron Wetherell, Chairman of the Board |

Marcus, Iowa | |

February 1, 2006 | |

Little Sioux Corn Processors, L.L.C.

4808 F Avenue

Marcus, IA 51035

Proxy Statement

2006 Annual Meeting of Members

Thursday, March 23, 2006

SOLICITATION AND VOTING INFORMATION

The enclosed proxy is solicited by the board of directors of Little Sioux Corn Processors, L.L.C. (the “Company”) for use at the annual meeting of members of the Company to be held on Thursday, March 23, 2006, and at any adjournment thereof. Such meeting is to be held at the Western Iowa Tech Community College, 200 Victory Drive, Cherokee, Iowa, and will commence at 7:00 p.m. Such solicitation is being made by mail and the Company may also use its officers, directors and employees to solicit proxies from members either in person or by telephone, facsimile or letter without extra compensation.

Voting Rights and Outstanding Membership Units

Holders of membership units of the Company (the “Membership Units”) of record at the close of business on February 1, 2006 (the “Record Date”) are entitled to vote at the annual meeting. As of February 1, 2006, there were 10,941 Membership Units issued and outstanding. Each member entitled to vote will have one vote for each Membership Unit owned of record by such member as of the close of business on the Record Date on any matter which may properly come before the meeting. This Proxy Statement and the enclosed form of proxy are being mailed to members on or about February 1, 2006. The Company’s annual report on Form 10-K for fiscal year ended September 30, 2005 is being mailed to members along with this Proxy Statement.

ATTENDANCE AT THE ANNUAL MEETING IS LIMITED TO HOLDERS OF MEMBERSHIP UNITS AS OF THE RECORD DATE AND THEIR SPOUSES.

The presence of 25% of the outstanding Membership Units of the Company entitled to vote, represented in person or by proxy, will constitute a quorum at the Annual Meeting. Members who neither submit a proxy nor attend the meeting will not be included as present for the purposes of determining a quorum.

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes and abstentions. Abstentions on any of the proposals or votes withheld for all director nominees will be treated as present at the meeting for purposes of determining a quorum. However, votes withheld for director nominees will not be tabulated as cast in the election of directors.

Proxy Voting

Membership Units cannot be voted at the Annual Meeting unless the holder of record is present in person or by proxy. The enclosed form of proxy is a means by which a member may authorize the voting of his, her or its Membership Units at the Annual Meeting. The Membership Units represented by each properly executed proxy will be voted at the Annual Meeting in accordance with the member’s directions. Members are urged to specify their choices by marking the appropriate boxes on the enclosed proxy. If no

1

choice has been specified and the enclosed proxy is properly executed and returned, the Membership Units will be voted FOR the persons nominated by the Board for election as directors and in favor of each of the proposals described in this proxy statement. If any other matters are properly presented to the Annual Meeting for action, the proxy holders will vote the proxies (which confer discretionary authority to vote on such matters) in accordance with their best judgment.

Execution of the enclosed proxy will not affect a member’s right to attend the Annual Meeting and vote in person. Any member giving a proxy has the right to revoke it by voting at the meeting or by giving either personal or written notice of such revocation to Ron Wetherell, Chairman of the Board and President of Little Sioux Corn Processors, L.L.C., at the Company’s offices at 4808 F Avenue, Marcus, Iowa 51035, or to the Company’s Secretary, Tim Ohlson, at the commencement of the Annual Meeting.

Attendance and Voting at the Annual Meeting

If you own a Membership Unit of record as of February 1, 2006, you may attend the Annual Meeting and vote in person, regardless of whether you have previously voted on a proxy. We encourage you to vote your Membership Unit in advance of the Annual Meeting date by returning the enclosed proxy, even if you plan on attending the Annual Meeting. You may change or revoke your proxy at the Annual Meeting as described above even if you have already voted.

Solicitation

This solicitation is being made by the Company’s board of directors. The entire cost of such solicitation will be borne by the Company. Such cost will include the cost of supplying necessary additional copies of the solicitation material and the Company’s 2005 Annual Report on Form 10-K, for beneficial owners of Membership Units held of record by brokers, dealers, banks and voting trustees and their nominees and, upon request, the reasonable expenses of such record holders for completing the mailing of such material and report to such beneficial owners.

YOUR PROXY VOTE IS IMPORTANT. PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY BY NO LATER THAN WEDNESDAY, MARCH 22, 2006 (5:00 P.M.) WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

THE ENCLOSED PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY and delegates discretionary authority with respect to any additional matters which may properly come before the Annual Meeting. Although the Board is not currently aware of any additional matter, if other matters do properly come before the Annual Meeting, proxies will vote thereon in accordance with their best judgment.

If you have any questions regarding the information in the Proxy Statement or regarding completion of the enclosed form of proxy, please call the Company at (712) 376-2800.

2

PROPOSALS TO BE VOTED UPON

PROPOSAL 1

Election of Directors and Voting

Our current board of directors consists of nine (9) Class A directors appointed by the Members and serving staggered terms and three (3) Class B directors appointed and serving at the discretion of the limited partners of LSCP, LLLP. At this year’s Annual Meeting, the Members will be electing three Class A directors following the expiration of the terms of three (3) Class A directors. All three Class A Directors have served since their election in 2004. The following individuals have been recommended by the nominating committee of the board of directors: Vince Davis, Darrell Downs, and Doug Lansink. Detailed information on each nominee is provided in the “Information About Current Directors and Nominees” section of this Proxy Statement.

Required Vote and Board Recommendation

As indicated in the proxy, where no direction is given, the proxies solicited by the board of directors will be voted in favor of the election of the nominees listed in this Proxy Statement. If any such nominees shall withdraw or otherwise become unavailable, which is not expected, the proxies will be voted for a substitute nominee who will be designated by the board of directors. Members who neither submit a proxy nor attend the meeting will not be counted as either a vote for or against the election of a director. Votes withheld for all director nominees will be treated as present at the meeting for purposes of determining a quorum, but will not be counted as votes cast in the director election.

By marking the appropriate box on the form of proxy, a member may withhold authority to vote for all of the nominees listed below or, by writing in individual names on the form of proxy, may withhold the authority to vote for any one or more of such nominees. Neither Membership Units nor proxies may be voted for a greater number of persons than the number of nominees shown below. Each holder of Membership Units may vote for three (3) nominees and is prohibited from cumulating votes for a specific nominee. The three (3) nominees receiving the highest vote totals will be elected as directors of the Company at the Annual Meeting; provided a quorum is present.

YOUR BOARD RECOMMENDS A VOTE FOR THE ELECTION OF ITS NOMINEES FOR CLASS A DIRECTORS

Information about Current Directors and Nominees

At the Company’s 2004 Annual Meeting, the Members elected nine (9) Class A directors to serve in staggered terms until the 2005, 2006 or 2007 Annual Meetings of Members and until their successors are elected and qualified. The Members elected Daryl Haack, Roland Schmidt and Ron Wetherell as Class A directors to serve a one year term until the 2005 Annual Meeting. The Members elected Vince Davis, Darrell Downs and Doug Lansink as Class A directors to serve until the 2006 Annual Meeting. The Members elected Verdell Johnson, Timothy Ohlson, and Myron Pingel to serve until the 2007 Annual Meeting. Due to the death of Roland Schmidt in 2004, a vacancy occurred in a Class A Director position. The board of directors appointed Dale Arends to fill this vacancy until a successor was duly nominated and elected at the 2005 Annual Meeting. Starting with the 2005 Annual Meeting, the Members vote for three directors to serve three-year terms. Dale Arends, Daryl Haack, and Ron Wetherell were re-elected for a three year term at the 2005 Annual Meeting and will serve until the 2008 Annual Meeting. The directors elected at this year’s Annual Meeting will serve until the 2009 Annual Meetings of Members or until their successors are duly elected and qualified.

The Class A directors also represent the Company as general partner of LSCP, LLLP, an Iowa limited liability limited partnership of which the Company is the general partner. The Class B directors of the

3

Company are appointed by and serve at the discretion of the limited partners. The Class B directors only participate in the actions concerning LSCP, LLLP.

All of the nominees have been directors since the formation of the Company.

The following table contains certain information with respect to the persons currently serving as directors and nominees for reelection at the 2006 Annual Meeting of Members:

Class A Nominees for the board of directors

Name and Principal Occupation | | | | Age | | Year First

Became

Director | | Term

Expires | |

Vince Davis | | | 54 | | | | 2000 | | | | 2006 | | |

Iowa Farm Bureau Federation Regional Manager | | | | | | | | | | | | | |

Darrell Downs | | | 68 | | | | 2000 | | | | 2006 | | |

Marketing Manager | | | | | | | | | | | | | |

Doug Lansink | | | 48 | | | | 2000 | | | | 2006 | | |

Farmer | | | | | | | | | | | | | |

Biographical Information on Class A Nominees

Vince Davis has served on the board of the Company since its inception and served on its predecessor steering committee. He currently serves as Iowa Farm Bureau Federation (“IFBF”) regional manager in region 10, which encompasses five counties in west central Iowa. Prior to serving as the IFBF regional manager, he served as Iowa Soybean Association field representative for over 10 years.

Darrell Downs has served on the board of the Company since its inception. From June 1995 through June 2005, Mr. Downs was employed as a marketing manager by a regional seed company. Mr. Downs is also on the board of directors for Siouxland Ethanol, LLC, a public reporting company. He currently serves as the mayor of Marcus, Iowa.

Doug Lansink has served on the board of the Company since its inception. For the past five years, Mr. Lansink has operated a livestock and grain farm in Ida County. Mr. Lansink previously held the office of treasurer for the Company.

The following table contains certain information with respect to the persons currently serving as directors whose terms of office will continue after this year’s Annual Meeting:

Other Class A Directors

Name and Principal Occupation | | | | Age | | Year First

Became

Director | | Term

Expires | |

Dale Arends | | | 51 | | | | 2005 | | | | 2008 | | |

Farmer | | | | | | | | | | | | | |

Daryl Haack | | | 62 | | | | 2000 | | | | 2008 | | |

Farmer | | | | | | | | | | | | | |

Verdell Johnson | | | 69 | | | | 2000 | | | | 2007 | | |

Farmer | | | | | | | | | | | | | |

Timothy Ohlson | | | 55 | | | | 2000 | | | | 2007 | | |

Farmer | | | | | | | | | | | | | |

Myron Pingel | | | 66 | | | | 2000 | | | | 2007 | | |

Farmer | | | | | | | | | | | | | |

Ron Wetherell | | | 61 | | | | 2000 | | | | 2008 | | |

Small Business Owner | | | | | | | | | | | | | |

4

Biographical Information on Other Class A Directors

Dale Arends has served on the board since January 18, 2005. For the past five years, Mr. Arends has been engaged in farming. In addition, Mr. Arends is president and a director of the Newell Improvement Corporation. As president, he actively manages 16 subsidized income housing units. Mr. Arends also serves as president of the Raccoon Valley Bio Diesel Group.

At our annual meeting of members in March 2005, Mr. Arends was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Arends will serve as a Class A Director of the Company until the annual meeting of members in 2008, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

Daryl Haack has served on the board of the Company since its inception. For the past five years, Mr. Haack has farmed approximately nine hundred crop acres in O’Brien County generally dedicated to corn and soybeans. In addition, Mr. Haack is president of the board of directors of Granpa Pork, a small swine-finishing corporation. The swine-finishing corporation is not a publicly reporting company. Mr. Haack also serves as a director for the National Corn Growers Association. Mr. Haack previously held the offices of president, vice-president, chairman and vice-chairman of the Company.

At our annual meeting of members in March 2005, Mr. Haack was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Haack will serve as a Class A Director of the Company until the annual meeting of members in 2008, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

Verdell Johnson has served on the board of the Company since its inception. He previously served as secretary of the Company. For the past five years, Mr. Johnson has owned and operated a livestock and grain farm in Cherokee County.

At our annual meeting of members in March 2004, Mr. Johnson was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Johnson will serve as a Class A Director of the Company until the annual meeting of members in 2007, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

Tim Ohlson, Secretary, has served on the board of the Company since its inception. For the past five years, Mr. Ohlson has operated a grain and livestock farm north of Meriden. He currently is active in the Cherokee County Farm Bureau and has been a board member of CML Telephone for thirteen years.

On July 20, 2004, our board re-elected Mr. Ohlson as Secretary for the Company. At our annual meeting of members in March 2004, Mr. Ohlson was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Ohlson will serve as a Class A Director of the Company until the annual meeting of members in 2007, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

Myron Pingel, Vice Chairman, has served on the board of the Company since its inception. For the past five years, Mr. Pingel has farmed north of Aurelia and operated a grain and livestock farm. He currently serves as a director for Twin Valley Producers Network farrowing group, a non-public reporting company.

On July 20, 2004, our board elected Mr. Pingel as Vice Chairman for the Company. At our annual meeting of members in March 2004, Mr. Pingel was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Pingel will serve as a Class A Director of the Company until the annual meeting of members in 2007, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

5

Ron Wetherell, Chairman, has served on the board of the Company since its inception. For the past five years, Mr. Wetherell has owned and operated a number of Cherokee County businesses including a repair shop that has grown into Wetherell Manufacturing Co., a designer and manufacturer of farm implements, hydraulic cylinders, and truck utility bodies, and Wetherell Cable TV which services seven separate communities in northwest Iowa. In 1992, he was elected to the Cherokee County Board of Supervisors and was recently elected to his fourth term. He is currently serving his second year as chairman of the board of supervisors. Mr. Wetherell also serves on the board of directors for Siouxland Ethanol, LLC, a public reporting company. Mr. Wetherell previously held the offices of vice chairman and vice president of the Company.

On July 20, 2004, our board elected Mr. Wetherell as Chairman for the Company. At our annual meeting of members in March 2005, Mr. Wetherell was re-elected to our board for a three-year term. Pursuant to our operating agreement, Mr. Wetherell will serve as a Class A Director of the Company until the annual meeting of members in 2008, and until a successor is elected and qualified, or until the earlier death, resignation, removal or disqualification of such director.

Board of Directors’ Meetings and Committees

The board of directors generally meets once a month. The board of directors held 12 regularly scheduled meetings and 2 special meetings during the fiscal year ended September 30, 2005. Except for Dale Arends who was not appointed to the board of directors until February 2005, after the death of Roland Schmidt, each director attended at least 75% of the meetings of the board of directors during the fiscal year ended September 30, 2005. Mr. Arends did attend more than 75% of the meetings of the Nominating Committee, of which he is a member.

The board of directors does not have a formalized process for holders of Membership Units to send communications to the board of directors. The board of directors feels this is reasonable given the close proximity of our members. Members desiring to communicate with the board of directors are free to do so via the Company’s website, fax, phone, or in writing.

The board of directors does not have a policy with regard to board members’ attendance at the annual meetings. Last year all nine (9) directors attended the Company’s annual meeting. Due to this high attendance record, it is the view of the board of directors that such a policy is unnecessary.

Audit Committee

The audit committee of the board of directors operates under a charter adopted by the board of directors on July 20, 2005, a copy of which was filed with the Company’s Proxy Statement in 2005. Under the charter, the audit committee must have at least four members. The board of directors appointed Doug Lansink, Ron Wetherell, Daryl Haack, and Vince Davis to the audit committee on May 7, 2003. The chairperson of the audit committee is Doug Lansink. The audit committee is exempt from the independence listing standards because the Company’s securities are not listed on a national securities exchange or listed in an automated inter-dealer quotation system of a national securities association or to issuers of such securities. Nevertheless, each member of our audit committee is independent within the definition of independence provided by NASDAQ rules 4200 and 4350. Our board of directors has determined that we do not currently have an audit committee financial expert serving on our audit committee. We do not have an audit committee financial expert serving on our audit committee because no member of our board of directors has the requisite experience and education to qualify as an audit committee financial expert as defined in Item 401 of Regulation S-K and the board has not yet created a new director position expressly for this purpose. Our board of directors intends to consider such qualifications in future nominations to our board and appointments to the audit committee. The audit committee held four (4) meetings during the fiscal year ended September 30, 2005.

6

There is no change by which security holders recommend nominees.

Audit Committee Report

The audit committee delivered the following report to the board of directors of the Company on December 20, 2005. The following report of the audit committee shall not be deemed to be incorporated by reference in any previous or future documents filed by the Company with the Securities and Exchange Commission under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates the report by reference in any such document.

The audit committee reviews the Company’s financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process. The Company’s independent auditors are responsible for expressing an opinion on the conformity of the audited financial statements to generally accepted accounting principles. The committee reviewed and discussed with management the Company’s audited financial statements as of and for the fiscal year ended September 30, 2005. The committee has discussed with Boulay, Heutmaker, Zibell & Co. P.L.L.P., its independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61 Communication with audit committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. The committee has received and reviewed the written disclosures and the letter to management from Boulay, Heutmaker, Zibell & Co. P.L.L.P., and has discussed with the auditors the auditors’ independence. The committee has considered whether the provision of services by Boulay, Heutmaker, Zibell & Co. P.L.L.P. not related to the audit of the financial statements referred to above and to the reviews of the interim financial statements included in the Company’s Forms 10-Q are compatible with maintaining Boulay, Heutmaker, Zibell & Co. P.L.L.P.’s independence.

Based on the reviews and discussions referred to above, the audit committee recommended to the board of directors that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2005.

| Audit Committee |

| Doug Lansink, Chair |

| Daryl Haack |

| Vince Davis |

| Ron Wetherell |

7

Independent Registered Public Accounting Firm

The audit committee selected Boulay, Heutmaker, Zibell & Co. P.L.L.P. as independent registered public accountants for the fiscal year October 1, 2005 to September 30, 2006. A representative of Boulay, Heutmaker, Zibell & Co. P.L.L.P. is expected to be present at the annual meeting of members and will have an opportunity to make a statement if so desired. The representative is also expected to be available for questions from the members.

Audit Fees

The aggregate fees billed by the principal independent registered public accountants (Boulay, Heutmaker, Zibell & Co. P.L.L.P.) to the Company for the fiscal year ended September 30, 2005, and the fiscal year ended September 30, 2004 are as follows:

Category | | | | Year | | Fees | |

Audit Fees | | 2005 | | $ | 100,044 | |

| | 2004 | | $ | 124,272 | |

Audit-Related Fees(1) | | 2005 | | $ | 684 | (1) |

| | 2004 | | $ | 8,507 | (1) |

Tax Fees | | 2005 | | $ | 0 | (2) |

| | 2004 | | $ | 48,000 | (2) |

All Other Fees | | 2005 | | $ | 0 | |

| | 2004 | | $ | 0 | |

(1) Audit-related fees include consultation on loan covenant compliance report and waiver violation, and consultation on Iowa grain dealers’ license.

(2) Tax fees include consultation on cost segregation study.

Prior to engagement of the principal independent registered public accountants to perform audit services for the Company, the principal accountant was pre-approved by our Audit Committee pursuant to Company policy requiring such approval.

100% of all audit services, audit-related services and tax-related services were pre-approved by our Audit Committee.

Nominating Committee

The board of directors appointed Myron Pingel, and Verdell Johnson to the nominating committee of the board of directors on January 20, 2004. Dale Arends was appointed in 2005. Based upon the size of the Company and the board’s familiarity with the Company since inception, the Board also has determined that each of the Class A Directors is qualified to suggest nominees for consideration to the nominating committee.

The nominating committee oversees the identification and evaluation of individuals qualified to become Class A Directors and recommends to the board of directors the Class A Director nominees for each annual meeting of the Members. The major responsibilities of the nominating committee are to:

· Develop a nomination process for candidates to the board of directors;

· Establish criteria and qualifications for membership to the board of directors;

· Identify and evaluate potential director nominees.

· Fill vacancies on the board of directors;

8

· Recommend nominees to the board of directors for election or reelection.

The following list represents the types of criteria the nominating committee takes into account when identifying and evaluating potential nominees:

· Agricultural, business and financial background

· Accounting experience

· Community or civic involvement

· Independence from the Company (i.e. free from any family, material business or professional relationship with the Company)

· Lack of potential conflicts with the Company

· Examples or references that demonstrate a candidates integrity, good judgment, commitment and willingness to consider matters with objectivity and impartiality

· Specific needs of the existing board relative to any particular candidate so that the overall board compensation reflects a mix of talents, experience, expertise and perspectives appropriate to the Company’s circumstances.

The Nominating Committee does not operate under a charter. The nominating committee is exempt from the independence listing standards because the Company’s securities are not listed on a national securities exchange or listed in an automated inter-dealer quotation system of a national securities association or to issuers of such securities. Each member of the nominating committee is an independent director of the nominating committee under the NASDAQ definition of independence. The nominating committee held one (1) meeting during the fiscal year ended September 30, 2005.

Nominations for the election of Class A Directors may also be made by any member entitled to vote generally in the election of Class A Directors. In accordance with the Company’s Operating Agreement, a member desiring to nominate one or more persons for election as a Class A Director must submit written notice of such intent either by personal delivery or regular mail to the Secretary of the Company, Tim Ohlson, at least 30 days, but not more than 90 days, prior to the annual meeting. This notice must contain: (i) the name and address of record of the member who intends to make the nomination; (ii) a representation that the member is holder of units of the Company entitled to vote at the annual meeting and intends to appear personally or by proxy at the meeting to nominate the person or persons specified in the notice; (iii) the name, age, business and residence addresses, and principal occupation or employment of each nominee; (iv) a description of all arrangements or understandings between the member and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the member; (v) such other information regarding each nominee proposed by the member as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission; (vi) the consent of each nominee to serve as a Class A Director of the Company if so elected; and (vii) a nominating petition signed and dated by the holders of at least five percent (5%) of the Company’s outstanding units that clearly sets forth the proposed candidate as a nominee of the Class A Director’s seat to be filled at the next election of Class A Directors. If a presiding officer at a meeting of the members determines that a nomination is not made in accordance with this procedure, the officer must declare that the nomination was defective and therefore must be disregarded.

Compensation Committee

The board of directors appointed Myron Pingel (chairman), Marty Lyons, and Doug Lansink to the compensation committee on June 15, 2004. Vince Davis was appointed in 2005. Mr. Pingel currently serves

9

as Vice Chairman of the board of directors and Mr. Lansink served as treasurer from 2002 through 2004. Marty Lyons was employed by Archer Daniels Midland, Inc. during the 2005 fiscal year as a marketer. The compensation committee has direct responsibility with respect to the compensation of the Company’s chief executive officer and oversees the compensation of the Company’s other executive officers. The compensation committee has the overall responsibility for approving and evaluating the Company’s director and executive compensation plans, policies and programs. The compensation committee held one (1) meeting during the fiscal year ended September 30, 2005.

Compensation Committee Interlocks and Insider Participation

Marty Lyons, a director and member of the Company’s Compensation Committee is employed by Archer Daniels Midland, Inc. as a marketer. Mr. Lyons is Archer Daniels Midland, Inc.’s appointed Class B director. No other member of the Compensation Committee is employed by or serving as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Compensation Committee.

None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Compensation Committee. In addition, none of our executive officers serves as a member of the compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors.

Compensation Committee Report of Executive Compensation

The general philosophy of the Company is to provide competitive levels of compensation that are influenced by the Company’s performance, that reward individual achievements, and that enable the Company to retain qualified executives. Compensation consists primarily of annual compensation, which includes base salary intended to provide a stable annual salary at a level consistent with individual contributions, and annual performance bonuses intended to link officers’ compensation to the Company’s performance. Bonuses are awarded when, in the compensation committee’s judgment, the Company or a particular executive had a meritorious performance during the year.

On April 19, 2005, the Compensation Committee recommended and our board of directors, acting as general partner of LSCP, LLLP, approved a deferred compensation plan for the partnership’s eligible executive employees. The amount of the cash deferral will be 0-20% of each of the eligible executive employee’s base salary. The cash deferrals will be awarded on an annual basis and will be immediately funded upon deferral through the use of a “Rabbi trust.” The cash award will vest in accordance with the following schedule:

· Year 1—0% vested

· Year 2—0% vested

· Year 3—0% vested

· Year 4—0% vested

· Year 5—0% vested

· Year 6—100% vested

Any vested amounts will be paid out in a lump sum on the first business day following the day in which vesting is complete. The amount of the award will be deductible by LSCP, LLLP when paid to the employee.

10

In determining the compensation of Steve Roe, the Company’s Chief Executive Officer, the compensation committee considers the Company’s overall performance and Mr. Roe’s responsibilities and contributions to such performance. In light of the Company’s strong performance under Mr. Roe’s leadership, the compensation committee approved a salary increase in fiscal year ended September 30, 2005 from $105, 000 to $108,500.

The compensation of the Company’s other executive officers is principally based on the recommendations of the Chief Executive Officer and reflects his assessment of the nature of each officer’s position, individual performance, contribution to the Company’s overall performance, experience and tenure with the Company. The compensation committee also considers various other factors to include the level of each officer’s responsibilities within the Company, the Company’s financial performance and the level of compensation increases in the Company’s industry.

| Compensation Committee |

| Myron Pingel, Chair |

| Marty Lyons |

| Vince Davis |

| Doug Lansink |

11

MANAGEMENT

The Company’s key management consists of the following:

Name | | | | Age | | Current Position |

Steve Roe | | | 52 | | | Chief Executive Officer and President |

Gary Grotjohn | | | 55 | | | Chief Financial Officer |

Mr. Roe was hired as general manager of our ethanol plant on May 20, 2002. Pursuant to our operating agreement, the office of president of the Company is responsible for day-to-day plant management. Until the appointment of a president, the Chairman of our board held this office. Effective May 18, 2004, and in accordance with our operating agreement, the board of directors appointed our general manager, Steve Roe, to the positions of President and Chief Executive Officer. Prior to joining the Company, Mr. Roe was a manager for Cargill, Inc. Mr. Roe will serve in such capacity until he resigns or is removed by the board of directors with the consent of a majority of the holders of limited partnership units of the limited partnership and the approval of our primary lender.

Mr. Grotjohn was hired as Controller for the Company on February 24, 2003. In accordance with our operating agreement, the treasurer of the Company performed the duties of the Chief Financial Officer until the creation of a separate office for this purpose. Effective May 18, 2004, and in accordance with our operating agreement, the board of directors eliminated the office of treasurer and appointed our controller, Gary Grotjohn, to the position of Chief Financial Officer. Prior to joining the Company, Mr. Grotjohn worked as a financial analyst for Lank O’Lakes, Inc. for over twenty years. Mr. Grotjohn will serve as Chief Financial Officer of the Company until he resigns or is removed by the board of directors.

COMPENSATION OF DIRECTORS

Our directors receive a $100 per diem fee for attending each meeting of the Company’s board of directors and reimbursement for reasonable out of pocket expenses.

SUMMARY COMPENSATION TABLE FOR EXECUTIVE OFFICERS

The following table set forth all compensation paid or payable by the Company during the last three fiscal years to our Chairman, President and Chief Executive Officer. We do not have any compensatory security option plan for our executive officers and directors. None of our directors or officers has any options, warrants, or other similar rights to purchase securities of the Company.

Name and Principal Position | | | | | Year | | | Salary | | Bonus | | All Other

Compensation | |

Stephen Roe, | | Fiscal Year 2005 | | $ | 107,154 | | $ | 26,048 | (1) | | $ | 0 | | |

President and Chief Executive Officer | | Fiscal Year 2004 | | $ | 100,962 | | $ | 0 | | | $ | 0 | | |

| | Fiscal Year 2003 | | $ | 0 | | $ | 0 | | | $ | 0 | | |

Daryl Haack, | | Fiscal Year 2005 | | $ | 0 | | $ | 0 | | | $ | 1,596 | (2) | |

Chairman of the Board and President | | Fiscal Year 2004 | | $ | 0 | | $ | 0 | | | $ | 1,745 | (2) | |

(offices held October 2003 through July 2004) | | Fiscal Year 2003 | | $ | 0 | | $ | 0 | | | $ | 2,725 | (2) | |

Ron Wetherell, | | Fiscal Year 2005 | | $ | 0 | | $ | 0 | | | $ | 1,428 | (2) | |

Chairman of the Board | | Fiscal Year 2004 | | $ | 0 | | $ | 0 | | | $ | 1,638 | (2) | |

(office held July 2004 to present) | | Fiscal Year 2003 | | $ | 0 | | $ | 0 | | | $ | 825 | | |

(1) Includes deferred compensation award monies which vest and are payable after six (6) years.

(2) Consists of fees, expenses, and per diem for serving on the board of directors.

12

OWNERSHIP OF SECURITIES BY DIRECTORS AND NOMINEES AND OFFICERS

None of our officers, directors or unit holders, directly or beneficially, owns more than five percent of our issued and outstanding units.

The following table sets forth the Membership Unit ownership for each of the directors and nominees for director as of January 1, 2006:

Title of Class(1) | | Name of

Beneficial Owner(2) | | Amount and

Nature of

Beneficial Ownership(3) | | Percent

of Class(4) | |

Class A Membership Units | | Dale Arends,

Class A Director | | | 29 Units | (1) | | | 0.27 | % | |

Class A Membership Units | | Vince Davis,

Class A Director | | | 24 Units | (2) | | | 0.22 | % | |

Class A Membership Units | | Darrell Downs,

Class A Director | | | 32 Units | (1) | | | 0.29 | % | |

Class A Membership Units | | Daryl Haack,

Class A Director | | | 20 Units | (1) | | | 0.18 | % | |

Class A Membership Units | | Verdell Johnson,

Class A Director | | | 100 Units | (3) | | | 0.91 | % | |

Class A Membership Units | | Doug Lansink,

Class A Director | | | 28 Units | (1) | | | 0.26 | % | |

Class A Membership Units | | Tim Ohlson,

Secretary & Class A Director | | | 52 Units | | | | 0.48 | % | |

Class A Membership Units | | Myron Pingel,

Vice Chairman & Class A Director | | | 84 Units | (4) | | | 0.77 | % | |

Class A Membership Units | | Ron Wetherell,

Chairman & Class��A Director | | | 100 Units | | | | 0.91 | % | |

Total Membership Units Held by Current Directors, Nominees and Officers of the Company: | | | 469 Units | | | | 4.29 | % | |

(1) All Class A Membership Units held in joint tenancy with spouse.

(2) Includes 4 Class A Membership Units held in joint tenancy with spouse.

(3) Includes 80 Class A Membership Units held in joint tenancy with spouse.

(4) Includes 60 Class A Membership Units held in joint tenancy with spouse.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

No family relationships exist between any of the directors of the board, officers, or key employees of the Company.

Since the beginning of the Company’s last fiscal year, we have engaged in several transactions with related parties.

Fagen, Inc. and Fagen Energy, Inc.

The Company is sole general partner of LSCP, LLLP, the limited liability limited partnership that owns and operates the ethanol plant. Fagen, Inc., the company that provided design, development and construction services for our ethanol plant, previously owned 350 of the 3,639 total outstanding limited partnership units in LSCP, LLLP. During the fiscal year ended September 30, 2004, Fagen, Inc. transferred all of its units in LSCP, LLLP. It transferred 340 units to an affiliated company, Fagen Energy, Inc. and

13

10 units to two of its employees. After the transfer, Fagen Energy, Inc. owns a 9.3% limited partnership interest in the limited partnership. Of the 3,639 limited partnership units, 1,450 of the units are limited partnership units held by the limited partners. Fagen Energy, Inc.’s ownership of 340 units means that it owns 23.5% of the total number of units held by the limited partners. Fagen Energy, Inc.’s ownership of its limited partnership interest entitles it to join with its class of limited partnership interests in appointing one Class B Director to the Company’s board of directors. Fagen Energy, Inc.’s Class B Director appointee is Brian Thome.

The Company is currently in negotiations with Fagen, Inc. to expand the Company’s plant in order to increase production capacity by 40 million gallons per year. The estimated cost of the expansion is $50,000,000. In addition, the Company paid approximately $69,000 for services rendered to Fagen during the fiscal year ended September 30, 2005.

Indeck Energy Services, Inc.

Indeck Energy Services, Inc., owns 300 of the 3,639 total outstanding limited partnership units in LSCP, LLLP. This means that Indeck Energy Services, Inc., owns an 8.2% limited partnership interest in the limited partnership. Of the 1,450 limited partnership units held by the limited partners, Indeck Energy Services, Inc.’s ownership of 300 units means that it owns 20.7% of the total number of units held by the limited partners. Indeck Energy Services, Inc.’s ownership of its limited partnership interest entitles it to join with its class of limited partnership interests in appointing one Class B Director to the Company’s board of directors. Indeck Energy Services, Inc.’s Class B Director appointee is Tom Campone.

Archer Daniels Midland, Inc.

Archer Daniels Midland, Inc. (ADM), formerly MCP Holding Company, L.L.C., owns 800 of the 3,639 total outstanding limited partnership units in LSCP, LLLP. ADM acquired MCP Holding Company, L.L.C. This means that ADM now owns 800 of the 3,639 total outstanding limited partnership units in LSCP, LLLP or a 21.98% limited partnership interest in the limited partnership. Of the 1,450 limited partnership units held by the limited partners, ADM’s ownership of 800 units means that it owns 55.2% of the total number of units held by the limited partners. ADM’s ownership of its limited partnership interest entitles it to join with its class of limited partnership interests in electing one Class B Director to our board of directors. ADM’s Class B Director appointee is Marty Lyons.

ADM provides marketing services to our ethanol plant pursuant to the marketing agreement assigned by MCP to ADM. In the fiscal year ended September 30, 2005, we paid ADM approximately $476,000 as a marketing fee. The amount we pay ADM for marketing services is comparable to that of an arms-length transaction.

The Company was involved in a dispute with ADM involving the ethanol marketing agreement. In October 2005, ADM contacted us and claimed that since the inception of the ethanol marketing agreement, ADM has mistakenly failed to factor in its hedging costs for the ethanol sold, which resulted in an overpayment to us of approximately $3.9 million. In support of its claim, ADM provided us with documentation demonstrating how the hedging costs incurred by ADM would affect the price received by us for ethanol. After engaging independent accountants to review ADM’s claimed overpayment, we orally offered in December 2005 to settle the claim by paying ADM approximately $3,900,000 less actual legal and accounting expenses incurred in connection with investigation and settlement of the claimed overpayment.

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations from our officers and directors, all Section 16(a) filing requirements were complied with during the fiscal year ended September 30, 2005. Subsequent to fiscal year ended September 30, 2005, Dale Arends, Director, inadvertently failed to file one Form 4.

15

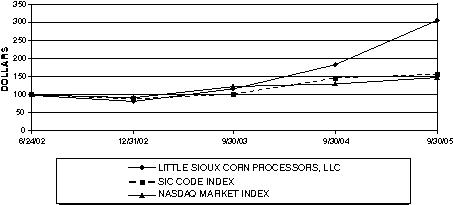

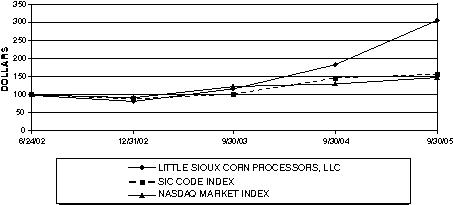

PERFORMANCE GRAPH

The following graph compares the cumulative total return on the Company’s units with the cumulative total return of the NASDAQ Index and the SIC Code Index (SIC Code 2869—Industrial Organic Chemicals, Not Elsewhere Classified). The unit price performance shown on the following graph is not intended to forecast and is not indicative of future unit price performance. The data for this performance graph was compiled for us by Hemscott Data, Inc. (Assumes $100 invested on June 24, 2002 in the Company’s units and the two indices, including reinvestment of dividends).

COMPARE CUMULATIVE TOTAL RETURN

AMONG LITTLE SIOUX CORN PROCESSORS, LLC,

NASDAQ MARKET INDEX AND SIC CODE INDEX

ASSUMES $100 INVESTED ON JUNE 24, 2002

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING SEPT. 30, 2005

| | FISCAL YEAR ENDING | |

COMPANY/INDEX/MARKET | | | | 6/24/2002 | | 12/31/2002 | | 9/30/2003 | | 9/30/2004 | | 9/30/2005 | |

Little Sioux Corn Processors | | | 100.00 | | | | 81.88 | | | | 117.55 | | | | 184.61 | | | | 308.07 | | |

Industrial Org Chemicals, NEC | | | 100.00 | | | | 89.09 | | | | 101.66 | | | | 145.10 | | | | 157.88 | | |

NASDAQ Market Index | | | 100.00 | | | | 91.59 | | | | 123.18 | | | | 130.60 | | | | 148.57 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

16

ANNUAL REPORT AND FINANCIAL STATEMENTS

The Company’s Annual Report to the Securities and Exchange Commission on Form 10-K, including the financial statements and the notes thereto, for the fiscal year ended September 30, 2005, accompanies the mailing of this Proxy Statement.

The Company will provide each member solicited a copy of Exhibits to the 10-K upon written request and payment of specified fees. The written request for such Exhibits should be directed to Ron Wetherell, Chairman of the Board of Little Sioux Corn Processors, L.L.C. at 4808 F Avenue, Marcus, Iowa 51035. Such request must set forth a good faith representation that the requesting party was a holder of record or a beneficial owner of Membership Units in the Company on February 1, 2006. The 2005 Annual Report on Form 10-K with exhibits is also available at no cost through the EDGAR database available from the SEC’s internet site (www.sec.gov).

MEMBERS’ PROPOSALS

Any member proposal intended to be considered for inclusion in the Proxy Statement for presentation at the 2007 Annual Meeting of Members must be received by the Company no later than October 1, 2006 (120 days prior to the one year anniversary of the date of mailing of this proxy statement). The proposal must be in accordance with the provisions of Rule 14a-8 promulgated by the SEC under the Exchange Act. It is suggested that the proposal be submitted by certified mail-return receipt requested.

Members who intend to present a proposal at the 2007 Annual Meeting of members without including such proposal in the Company’s Proxy Statement must provide the Company notice of such proposal no later than December 15, 2006. The Company reserves the right to reject, rule out of order, or take appropriate action with respect to any proposal that does not comply with these and other applicable requirements. If the Company does not receive notice of a member proposal intended to be submitted to the 2007 Annual Meeting by December 15, 2006, the persons named on the proxy card accompanying the notice of meeting may vote on any such proposal in their discretion. However, if the Company does receive notice of a member proposal intended to be submitted to the 2007 Annual Meeting by December 15, 2006, then the persons named on the proxy card may vote on any such proposal in their discretion only if the Company includes in its proxy statement an explanation of its intention with respect to voting on the proposal.

OTHER MATTERS

The board of directors knows of no other matter to be acted upon at the meeting. However, if any other matter is lawfully brought before the meeting, the Membership Units covered by the proxy in the accompanying form will be voted on such matter in accordance with the best judgment of the persons acting under such proxy.

| BY ORDER OF THE BOARD OF DIRECTORS |

| Ron Wetherell, Chairman of the Board |

February 1, 2006 | |

TO BE CERTAIN THAT YOUR MEMBERSHIP UNITS WILL BE REPRESENTED AT THE 2006 ANNUAL MEETING OF MEMBERS, WE URGE YOU TO SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY BY FAX TO (712) 376-2815 OR IN THE ENCLOSED ENVELOPE BY NO LATER THAN WEDNESDAY, MARCH 22, 2006 (5:00 P.M.) WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON.

17

| | MEMBER NAME: ____________________________ |

| | |

| | NUMBER OF CLASS A MEMBERSHIP UNITS: __________ |

| | |

| | Check here to authorize the Company to send you electronic communications in lieu of paper ones.

E-mail address: _______________________________ | o |

PLEASE INDICATE YOUR PROPOSAL SELECTION BY FIRMLY PLACING

AN “X” IN THE APPROPRIATE NUMBERED BOX WITH BLUE OR BLACK INK |

| |

| DIRECTORS | |

ELECTION OF DIRECTORS | RECOMMEND | For | Against | Abstain | |

Vince Davis---------------------------------->>> | FOR --------->>> | o | o | o | | |

| | | | | |

Darrell Downs--------------------------------->>> | FOR --------->>> | o | o | o | | |

| | | | | Signature: | | |

Doug Lansink--------------------------------->>> | FOR --------->>> | o | o | o | Date: | | |

| | | | | | | |

PLACE “X” HERE IF YOU PLAN TO ATTEND AND VOTE YOUR SHARES AT THE MEETING | o |

| | | | | Signature: | | |

| | | | | Date: | | |

| | | | | | | |

| | | | | Please sign exactly as your name appears above. Joint owners must both sign. When signing as attorney executor, administrator, trustee or guardian, please note that fact. |

| | | | | |

LITTLE SIOUX CORN PROCESSORS, L.L.C. |

Annual Meeting – Thursday, March 23, 2006 |

For Unit Holders as of February 1, 2006 |

Proxy Solicited on Behalf of the Board of Directors |

| | |

| | | | | | | | | |

By signing this proxy card, you appoint Tim Ohlson and Ron Weatherell, jointly and severally, each with full power of substitution, as proxies to represent you at the Annual Meeting of the Members to be held on Thursday, March 23, 2006 at 7:00 p.m. and at any adjournment thereof, on any matters coming before the Meeting.

Please specify your choice by marking the appropriate box for each matter above. The Proxies cannot vote your units unless you sign and return this card.

This proxy, when properly executed, will be voted in the manner directed herein and authorizes the Proxies to take action in their discretion upon other matters that may properly come before the Meeting. If no direction is made, this proxy will be voted FOR the Election of Vince Davis, FOR the Election of Darrell Downs, and FOR the Election of Doug Lansink.

Vote by Mail or Facsimile:

1) Read the Proxy Statement

2) Check the appropriate boxes on the proxy card below

3) Sign and date the proxy card

4) Return the proxy card in the envelope provided or via fax to (712) 376-2815