QuickLinks -- Click here to rapidly navigate through this document The attached Prospectus dated January 23, 2004 (the "Prospectus") relating to the US$725,000,000 Class A-1(a) Mortgage Backed Floating Rate Bonds, €425,000,000 Class A-1(b) Mortgage Backed Floating Rate Bonds, US$25,000,000 Class B-1(a) Mortgage Backed Floating Rate Bonds and €16,900,00 Class B-1(b) Mortgage Backed Floating Rate Bonds (collectively, the "Securities") issued by ARMS II Global Fund 3 (the "Issuer") was originally filed on January 26, 2004 by Australian Securitisation Management Pty Limited (the "Registrant"), pursuant to Rule 424(b)(4) under the Securities Act of 1933. It is being re-filed for the sole purpose of including an optional "serial tag" in the header of the electronic submission to indicate that a reporting entity separate from the Registrant issued the Securities. No modifications or updates to the Prospectus have been made for purposes of this filing. The Prospectus speaks only as of the date it was originally filed.

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-110126

ARMS II GLOBAL FUND 3

US$725,000,000 CLASS A-1(a) MORTGAGE BACKED FLOATING RATE BONDS

€425,000,000 CLASS A-1(b) MORTGAGE BACKED FLOATING RATE BONDS

US$25,000,000 CLASS B-1(a) MORTGAGE BACKED FLOATING RATE BONDS

€16,900,000 CLASS B-1(b) MORTGAGE BACKED FLOATING RATE BONDS

AUSTRALIAN SECURITISATION MANAGEMENT PTY LIMITED

(ABN 32 103 852 428)

Trust Manager

PERMANENT CUSTODIANS LIMITED

(ACN 001 426 384)

Issuer Trustee

The Class A-1(a) bonds, the Class A-1(b) bonds, the Class B-1(a) bonds and the Class B-1(b) bonds, collectively the Offshore bonds, which are being offered hereby will be collateralized by a pool of housing loans secured by properties located in Australia. ARMS II Global Fund 3 will be governed by the laws of New South Wales, Australia.

The Offshore bonds are not deposits and neither the Offshore bonds nor the underlying housing loans are insured or guaranteed by any governmental agency or instrumentality. The Offshore bonds represent obligations of Permanent Custodians Limited solely in its capacity as trustee of ARMS II Global Fund 3 and do not represent obligations of, or interests in, Australian Securitisation Management Pty Limited or Permanent Custodians Limited in any other capacity and are not guaranteed by Australian Securitisation Management Pty Limited or Permanent Custodians Limited or any of their associates.

Application will be made to the Irish Stock Exchange for each class of Offshore bonds to be admitted to the Daily Official List. There can be no assurance that any such listing will be obtained. The issuance and settlement of each class of Offshore bonds on the initial issue date is not conditioned on the listing of such Offshore bonds on the Irish Stock Exchange.

INVESTING IN THE BONDS INVOLVES RISKS—SEE "RISK FACTORS" ON PAGE 20.

|

| | Initial

Principal

Balance

| | Initial

Interest Rate

| | Price to

Public

| | Underwriting

Discounts and

Commissions**

| | Proceeds to

Issuer Trustee**

|

|---|

|

| Class A-1(a) bonds | | US$725,000,000 | | LIBOR + 0.21% | | US$725,000,000

or 100% | | US$1,087,500

or 0.15% | | US$725,000,000

or 100% |

|

| Class A-1(b) bonds | | €425,000,000 | | EURIBOR + 0.21% | | €425,000,000

or 100% | | €637,500

or 0.15% | | €425,000,000

or 100% |

|

| Class B-1(a) bonds | | US$25,000,000 | | LIBOR + 0.65% | | US$25,000,000

or 100% | | US$37,500

or 0.15% | | US$25,000,000

or 100% |

|

| Class B-1(b) bonds | | €16,900,000 | | EURIBOR + 0.65% | | €16,900,000

or 100% | | €25,350

or 0.15% | | €16,900,000

or 100% |

|

Delivery of the Offshore bonds in book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear System will be made on or about January 29, 2004.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| ABN AMRO INCORPORATED | | DEUTSCHE BANK SECURITIES |

Joint Lead Managers and Joint Bookrunners |

The date of this prospectus is January 23, 2004

- **

- The underwriting discounts and commissions will be paid separately by Australian Mortgage Securities Ltd and not from the proceeds to the issuer trustee.

TABLE OF CONTENTS

| | Page

|

|---|

| DISCLAIMERS WITH RESPECT TO SALES TO NON-U.S. INVESTORS | | 1 |

| AUSTRALIAN DISCLAIMERS | | 3 |

| SUMMARY | | 5 |

| | Parties to the Transaction | | 5 |

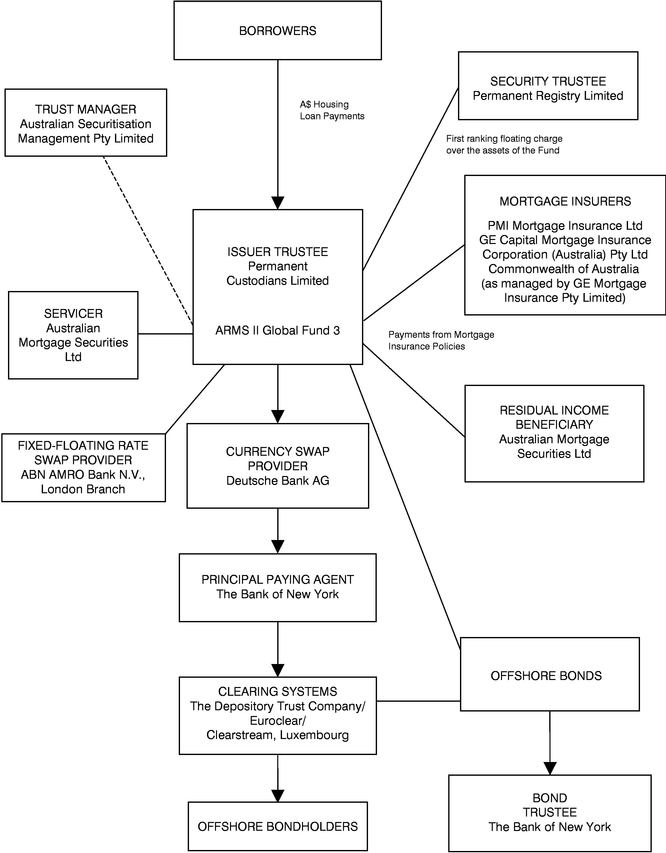

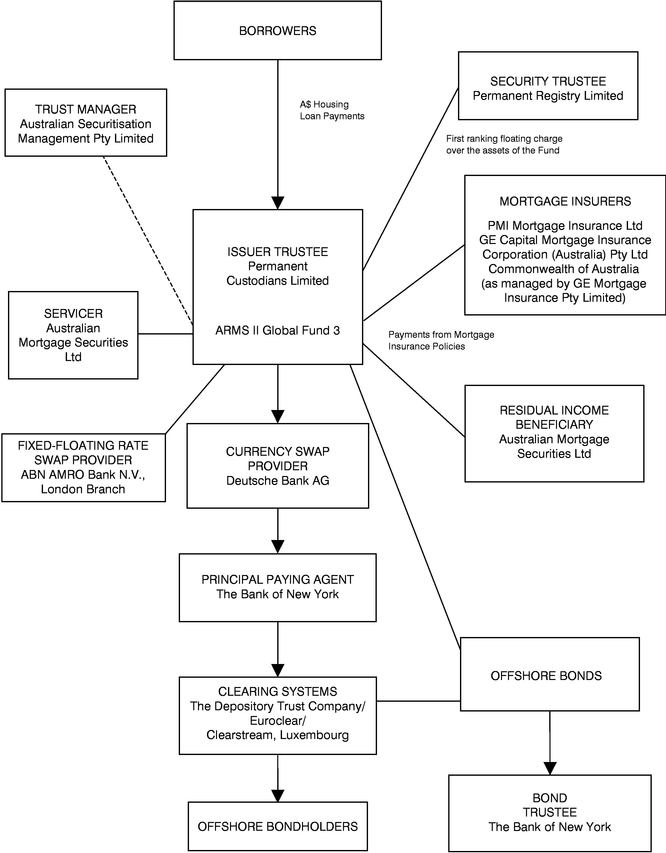

| | Structural Diagram | | 6 |

| SUMMARY OF THE BONDS | | 7 |

| | Structural Overview | | 8 |

| | Credit Enhancements | | 8 |

| | Liquidity Enhancement | | 9 |

| | Redraw Advances, Further Advances, Line of Credit Advances and Fast Prepayment Bonds | | 9 |

| | Hedging Arrangements | | 10 |

| | Optional Redemption | | 10 |

| | The Housing Loan Pool | | 12 |

| | U.S. Tax Status | | 14 |

| | Australian Tax Status | | 14 |

| | Australian Withholding Tax | | 14 |

| | Legal Investment | | 14 |

| | ERISA Considerations | | 14 |

| | Book-Entry Registration | | 14 |

| | Listing on Irish Stock Exchange | | 15 |

| | Interest and Principal Collections | | 15 |

| | Interest on the Bonds | | 15 |

| | Principal on the Bonds | | 16 |

| | Allocation of Cash Flows | | 16 |

| DISTRIBUTION OF INTEREST COLLECTIONS ON EACH PAYMENT DATE PRIOR TO THE ENFORCEMENT OF THE CHARGE IN THE SECURITY TRUST DEED | | 17 |

| DISTRIBUTION OF THE AVAILABLE AMORTISATION AMOUNT ON EACH PAYMENT DATE PRIOR TO THE ENFORCEMENT OF THE CHARGE IN THE SECURITY TRUST DEED | | 19 |

| RISK FACTORS | | 20 |

| CAPITALIZED TERMS | | 30 |

| U.S. DOLLAR AND EURO PRESENTATION | | 30 |

| THE ISSUER TRUSTEE, THE TRUST MANAGER AND THE SERVICER | | 31 |

| | The Issuer Trustee | | 31 |

| | The Trust Manager | | 31 |

| | The Servicer | | 32 |

| | | |

i

| DESCRIPTION OF THE FUND | | 35 |

| | ARMS II Securitization Program | | 35 |

| | ARMS II Global Fund 3 | | 35 |

| DESCRIPTION OF THE ASSETS OF THE FUND | | 36 |

| | Assets of the Fund | | 36 |

| | The Housing Loans | | 36 |

| | Transfer and Assignment of the Housing Loans | | 36 |

| | Representations and Warranties | | 37 |

| | Breach of Representations and Warranties | | 38 |

| | Details of the Housing Loan Pool | | 38 |

| HOUSING LOAN INFORMATION | | 39 |

| | Summary Statistics | | 39 |

| | Housing Loans by Current LVR (Loan to Value Ratio) | | 40 |

| | Housing Loans by Current LVR (Loan to Value Ratio) (Owner Occupied) | | 41 |

| | Housing Loans by Current LVR (Loan to Value Ratio) (Investment) | | 42 |

| | Housing Loans by Geographic Distribution[1] | | 43 |

| | Housing Loans by Geographic Distribution[1] (Owner Occupied) | | 44 |

| | Housing Loans by Geographic Distribution[1] (Investment) | | 45 |

| | Housing Loans by Geographic Distribution[2] | | 46 |

| | Housing Loans by Geographic Distribution[2] (Owner Occupied) | | 46 |

| | Housing Loans by Geographic Distribution[2] (Investment) | | 46 |

| | Housing Loans by Loan Size | | 47 |

| | Housing Loans by Loan Size (Owner Occupied) | | 48 |

| | Housing Loans by Loan Size (Investment) | | 49 |

| | Housing Loans by Loan Seasoning | | 50 |

| | Housing Loans by Loan Seasoning (Owner Occupied) | | 51 |

| | Housing Loans by Loan Seasoning (Investment) | | 52 |

| | Housing Loans by Maturity | | 53 |

| | Housing Loans by Maturity (Owner Occupied) | | 54 |

| | Housing Loans by Maturity (Investment) | | 55 |

| | Housing Loans by Mortgage Insurer | | 56 |

| | Housing Loans by Mortgage Insurer (Owner Occupied) | | 56 |

| | Housing Loans by Mortgage Insurer (Investment) | | 56 |

| | Housing Loans by Current Coupon Rates | | 57 |

| | Housing Loans by Current Coupon Rates (Owner Occupied) | | 57 |

| | Housing Loans by Current Coupon Rates (Investment) | | 57 |

| | | |

ii

| | Housing Loans by Interest Only Distribution | | 58 |

| | Housing Loans by Interest Only Distribution (Owner Occupied) | | 58 |

| | Housing Loans by Interest Only Distribution (Investment) | | 59 |

| | Housing Loans by Fixed Rate Distribution | | 60 |

| | Housing Rates by Fixed Rate Distribution (Owner Occupied) | | 60 |

| | Housing Rates by Fixed Rate Distribution (Investment) | | 60 |

| ARMS II RESIDENTIAL LOAN PROGRAM | | 61 |

| | Origination | | 61 |

| | Credit Policy and Procedures | | 61 |

| | Features of the Housing Loans | | 64 |

| | Redraw Advances, Further Advances and Line of Credit Advances | | 66 |

| | Advances Reserve and Fast Prepayment Bonds | | 67 |

| | Governing Law | | 67 |

| THE MORTGAGE INSURANCE POLICIES | | 68 |

| | General | | 68 |

| | Certain Provisions of Mortgage Insurance Policies | | 68 |

| | Description of the Mortgage Insurers | | 70 |

| DESCRIPTION OF THE OFFSHORE BONDS | | 72 |

| | General | | 72 |

| | Form of the Offshore bonds | | 72 |

| | Distributions on the Bonds | | 75 |

| | Key Dates and Periods | | 76 |

| | Example Calendar | | 77 |

| | Interest Collections | | 78 |

| | Distribution of Interest Collections | | 78 |

| | Use of Cash Reserve and Advances Reserve | | 79 |

| | Application of Currency Swap Receipts | | 80 |

| | Interest on the Bonds | | 80 |

| | Available Amortisation Amount | | 81 |

| | Distribution of the Available Amortisation Amount | | 82 |

| | Payments of Principal Amounts to Offshore bondholders | | 82 |

| | Charge-offs | | 82 |

| | Application of the Cash Reserve and Advances Reserve as Available Amortisation Amount | | 83 |

| | Notices | | 84 |

| | The Fixed-Floating Rate Swaps | | 84 |

| | The Currency Swaps | | 87 |

| | | |

iii

| | Fixed-Floating Rate Swap Provider | | 90 |

| | Currency Swap Provider | | 91 |

| | Withholding or Tax Deductions | | 92 |

| | Redemption of the Bonds Upon an Event of Default | | 92 |

| | Redemption of the Bonds Upon Issuer Call Option Event | | 92 |

| | Maturity Date | | 93 |

| | Final Redemption of the Bonds | | 93 |

| | Termination of the Fund | | 93 |

| | Prescription | | 93 |

| | Reports to Bondholders | | 93 |

| | Action of Bond Trustee | | 95 |

| DESCRIPTION OF THE TRANSACTION DOCUMENTS | | 96 |

| | Trust Accounts | | 96 |

| | Modifications | | 96 |

| | The Issuer Trustee | | 97 |

| | The Trust Manager | | 99 |

| | The Bond Trustee | | 101 |

| | Bond Trustee's Annual Report | | 102 |

| | List of Bondholders | | 102 |

| | Reports | | 102 |

| | Limitation of Liability | | 102 |

| | The Security Trust Deed | | 103 |

| | The Master Origination and Servicing Agreement | | 108 |

| THE SERVICER | | 111 |

| | Servicer Delinquency Experience | | 112 |

| PREPAYMENT AND YIELD CONSIDERATIONS | | 113 |

| | General | | 113 |

| | Prepayments | | 113 |

| | Weighted Average Lives | | 114 |

| PERCENTAGE OF INITIAL PRINCIPAL OUTSTANDING AT THE FOLLOWING PERCENTAGES OF THE PREPAYMENT ASSUMPTION—CLASS A BONDS | | 117 |

| PERCENTAGE OF INITIAL PRINCIPAL OUTSTANDING AT THE FOLLOWING PERCENTAGES OF THE PREPAYMENT ASSUMPTION—CLASS B BONDS | | 118 |

| USE OF PROCEEDS | | 119 |

| LEGAL ASPECTS OF THE HOUSING LOANS | | 119 |

| | General | | 119 |

| | | |

iv

| | Nature of Housing Loans as Security | | 119 |

| | Strata Title | | 120 |

| | Urban Leasehold | | 120 |

| | Taking Security Over Land | | 120 |

| | Enforcement of Registered Mortgages | | 121 |

| | Penalties and Prohibited Fees | | 122 |

| | Bankruptcy | | 122 |

| | Environmental | | 123 |

| | Insolvency Considerations | | 123 |

| | Tax Treatment of Interest on Australian Housing Loans | | 123 |

| | Consumer Credit Legislation | | 123 |

| UNITED STATES FEDERAL INCOME TAX MATTERS | | 124 |

| | Overview | | 124 |

| | Interest Income on the Offshore bonds | | 125 |

| | Sale, Retirement or Other Disposition of Bonds | | 126 |

| | Market Discount | | 127 |

| | Premium | | 128 |

| | Transactions in Euros | | 128 |

| | Backup Withholding | | 128 |

| AUSTRALIAN TAX MATTERS | | 129 |

| | Payments of Principal, Premiums and Interest | | 129 |

| | Profit on Sale | | 130 |

| | Goods and Services Tax | | 130 |

| | Other Taxes | | 132 |

| | Consolidation | | 132 |

| | Thin Capitalization | | 132 |

| | Debt/Equity Rules | | 133 |

| | Tax Reform Proposals—Taxation of Trusts as Companies | | 133 |

| ENFORCEMENT OF FOREIGN JUDGMENTS IN AUSTRALIA | | 134 |

| EXCHANGE CONTROLS AND LIMITATIONS | | 134 |

| | Anti-terrorism restrictions | | 134 |

| | Prohibited transactions | | 135 |

| | Transactions which may be approved by the Reserve Bank of Australia | | 135 |

| ERISA CONSIDERATIONS | | 135 |

| LEGAL INVESTMENT CONSIDERATIONS | | 137 |

| AVAILABLE INFORMATION | | 137 |

| | | |

v

| RATINGS OF THE BONDS | | 137 |

| PLAN OF DISTRIBUTION | | 138 |

| | Underwriting | | 138 |

| | Offering Restrictions | | 139 |

| GENERAL INFORMATION | | 141 |

| | Authorization | | 141 |

| | DTC, Euroclear and Clearstream, Luxembourg | | 141 |

| | Listing on Irish Stock Exchange | | 141 |

| ANNOUNCEMENT | | 141 |

| LEGAL MATTERS | | 142 |

| GLOSSARY | | 143 |

vi

DISCLAIMERS WITH RESPECT TO SALES TO NON-U.S. INVESTORS

This section applies only to the offering of the Offshore bonds in countries other than the United States of America. In this section, references to Permanent Custodians Limited are to that company only in its capacity as trustee of ARMS II Global Fund 3, and not its personal capacity or as trustee of any other trust. Permanent Custodians Limited is not responsible or liable for this prospectus in any capacity. Australian Securitisation Management Pty Limited is solely responsible for this prospectus. Australian Securitisation Management Pty Limited, as trust manager, has taken all reasonable care to ensure that the information contained in this prospectus is true and accurate in all material respects and that in relation to this prospectus there are no material facts the omission of which would make misleading any statement herein, whether fact or opinion.

Other than in the United States of America, no person has taken or will take any action that would permit a public offer of the Offshore bonds in any country or jurisdiction. The Offshore bonds may be offered non-publicly in other jurisdictions. The Offshore bonds may not be offered or sold, directly or indirectly, and neither this prospectus nor any form of application, advertisement or other offering material may be issued, distributed or published in any country or jurisdiction, unless permitted under all applicable laws and regulations. The underwriters have represented that all offers and sales by them have been in compliance, and will comply, with all applicable restrictions on offers and sales of the Offshore bonds. You should inform yourself about and observe any of these restrictions. For a description of further restrictions on offers and sales of the Offshore bonds, see "Plan of Distribution".

This prospectus does not and is not intended to constitute an offer to sell or a solicitation of any offer to buy any of the Offshore bonds by or on behalf of Permanent Custodians Limited in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make an offer or solicitation in such jurisdiction.

Except and unless otherwise explicitly provided in this prospectus if at all, none of Permanent Custodians Limited, in its personal capacity and as issuer trustee, Permanent Registry Limited, as security trustee, Australian Mortgage Securities Ltd, as servicer, The Bank of New York, as bond trustee, principal paying agent, calculation agent, US$ registrar and € registrar, the underwriters, ABN AMRO Bank N.V., London Branch, as fixed-floating rate swap provider, Deutsche Bank AG, as the currency swap provider or PMI Mortgage Insurance Ltd, GE Capital Mortgage Insurance Corporation (Australia) Pty Ltd and the Commonwealth of Australia (as managed by GE Mortgage Insurance Pty Limited) as mortgage insurers accept any responsibility for any information contained in this prospectus and none of them has separately verified the information contained in this prospectus or makes any representation, warranty or undertaking, express or implied, as to the accuracy or completeness of any information contained in this prospectus or any other information supplied in connection with the bonds.

Permanent Custodians Limited, in its personal capacity and as issuer trustee, Australian Securitisation Management Pty Limited, as trust manager, Australian Mortgage Securities Ltd as servicer, Permanent Registry Limited, as security trustee, The Bank of New York, as bond trustee, principal paying agent, calculation agent, US$ registrar and € registrar, ABN AMRO Bank N.V., London Branch, as fixed-floating rate swap provider and Deutsche Bank AG as the currency swap provider, PMI Mortgage Insurance Ltd, GE Capital Mortgage Insurance Corporation (Australia) Pty Ltd and the Commonwealth of Australia (as managed by GE Mortgage Insurance Pty Limited), as mortgage insurers and the underwriters do not recommend that any person should purchase any of the Offshore bonds and do not accept any responsibility or make any representation as to the tax consequences of investing in the Offshore bonds.

Each person receiving this prospectus acknowledges that he or she has not relied on the entities listed in the preceding paragraph nor on any person affiliated with any of them in connection with his or her investigation of the accuracy of the information in this prospectus or his or her investment decisions; acknowledges that this prospectus and any other information supplied in connection with the Offshore bonds is not intended to provide the basis of any credit or other evaluation; acknowledges

that the underwriters have expressly not undertaken to review the financial condition or affairs of the Fund or any party named in the prospectus during the life of the Offshore bonds; should make his or her own independent investigation of the Fund and the Offshore bonds; and should seek its own tax, accounting and legal advice as to the consequences of investing in any of the Offshore bonds.

No person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the issue or sale of the Offshore bonds. If such information or representation is given or received, it must not be relied upon as having been authorized by Permanent Custodians Limited, the trust manager, the servicer, the bond trustee, the underwriters or any of their respective affiliates.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that:

- •

- there has been no material change in the affairs of the Fund or any party named in this prospectus since the date of this prospectus; or

- •

- any other information supplied in connection with the Offshore bonds is correct as of any time subsequent to the date on which it is supplied or, if different, the date indicated in the document containing the same.

Permanent Custodians Limited's liability to make payments of interest and principal on the bonds is limited to its right of indemnity from the assets of the Fund. All claims against Permanent Custodians Limited in relation to the bonds may only be satisfied out of the assets of the Fund and are limited in recourse to the assets of the Fund.

None of the rating agencies, being Standard & Poor's (Australia) Pty Limited (S&P) and Moody's Investors Service Inc. (Moody's) have been involved in the preparation of this prospectus.

Application will be made to the Irish Stock Exchange for the Offshore bonds to be admitted to the Daily Official List. There can be no assurance that any such listing will be obtained. The issuance and settlement of the Offshore bonds is not conditioned on the listing of such Offshore bonds on the Irish Stock Exchange. So long as the Offshore bonds are listed on the Irish Stock Exchange, listed Offshore bonds will be freely transferable and negotiable in accordance with the rules of the Irish Stock Exchange.

Any projections, forecasts and estimates contained herein are forward looking statements and are based upon certain assumptions that the trust manager considers reasonable. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual results. Accordingly, the projections are only an estimate. Actual results may vary from the projections, and the variations may be material.

Some important factors that could cause actual results to differ materially from those in any forward looking statements include changes in interest rates, market, financial or legal uncertainties, timing and frequency of defaults on the housing loans, mismatches between the timing of accrual and receipt of interest collections and principal collections, defaults under housing loans and the effectiveness of the swap agreements, among others. Consequently, the inclusion of projections herein should not be regarded as a representation by the issuer trustee, the trust manager, the security trustee, the bond trustee, the underwriters or any of their respective affiliates or any other person or entity of the results that will actually be achieved by the Fund.

None of the issuer trustee, the trust manager, the bond trustee, the security trustee, the underwriters or their respective affiliates has any obligation to update or otherwise revise any projections, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of unanticipated events, even if the underlying assumptions do not come to fruition.

2

AUSTRALIAN DISCLAIMERS

- •

- The bonds do not represent deposits or other liabilities of Australian Securitisation Management Pty Limited or associates of Australian Securitisation Management Pty Limited.

- •

- The holding of the bonds is subject to investment risk, including possible delays in repayment and loss of income and principal invested.

- •

- None of Australian Securitisation Management Pty Limited, any associate of Australian Securitisation Management Pty Limited, Permanent Custodians Limited, in any capacity, any associate of Permanent Custodians Limited, Permanent Registry Limited, in any capacity, any associate of Permanent Registry Limited, The Bank of New York, as bond trustee, principal paying agent, calculation agent, US$ registrar and € registrar, nor the underwriters in any way stands behind the capital value or the performance of the bonds or the assets of the Fund except to the limited extent provided in the transaction documents for the Fund.

- •

- None of Permanent Custodians Limited, in any capacity, Australian Securitisation Management Pty Limited, as trust manager, Australian Mortgage Securities Ltd, as servicer, Permanent Registry Limited, as security trustee, The Bank of New York, as bond trustee, principal paying agent, US$ registrar, € registrar and calculation agent, ABN AMRO Bank N.V., London Branch, as fixed-floating rate swap provider and Deutsche Bank AG, as the currency swap provider, or any underwriter guarantees the payment of interest or the repayment of principal due on the bonds.

- •

- None of the obligations of Permanent Custodians Limited, in its capacity as trustee of the Fund, are guaranteed in any way by Australian Securitisation Management Pty Limited or any associate of Australian Securitisation Management Pty Limited or by any associate of Permanent Custodians Limited, in any capacity. None of Permanent Custodians Limited, in any capacity, or Permanent Registry Limited, in any capacity, guarantees the success or performance of the Fund or the repayment of capital or any particular rate of capital or income return.

3

[This page intentionally left blank.]

4

SUMMARY

This summary highlights selected information from this document and does not contain all of the information that you need to consider in making your investment decision. This summary contains an overview of some of the concepts and other information to aid your understanding. All of the information contained in this summary is qualified by the more detailed explanations in other parts of this prospectus.

Parties to the Transaction

| Fund | | ARMS II Global Fund 3 |

Issuer Trustee |

|

Permanent Custodians Limited (ACN 001 426 384), in its capacity as trustee of the Fund |

Trust Manager |

|

Australian Securitisation Management Pty Limited (ABN 32 103 852 428), of Level 6, 12 Castlereagh Street, Sydney, NSW, 2000, telephone (612) 8236 8800 |

Bond Trustee |

|

The Bank of New York |

Security Trustee |

|

Permanent Registry Limited (ACN 000 334 636) |

Servicer |

|

Australian Mortgage Securities Ltd (ABN 89 003 072 446) |

Principal Paying Agent |

|

The Bank of New York |

Calculation Agent |

|

The Bank of New York |

Irish Listing and Irish Paying Agent |

|

Ernst & Young |

US$ Registrar |

|

The Bank of New York |

€ Registrar |

|

The Bank of New York |

Residual Income Beneficiary |

|

Australian Mortgage Securities Ltd |

Underwriters |

|

ABN AMRO Incorporated and Deutsche Bank Securities Inc. |

Mortgage Insurers |

|

PMI Mortgage Insurance Ltd (PMI Mortgage) (ABN 70 000 511 071), GE Capital Mortgage Insurance Corporation (Australia) Pty Ltd (GEMICO) (ABN 52 081 488 440) and the Commonwealth of Australia (as managed by GE Mortgage Insurance Pty Limited (GEMI) (ACN 071 466 334)) |

Fixed-Floating Rate Swap Provider |

|

ABN AMRO Bank N.V., London Branch |

Currency Swap Provider |

|

Deutsche Bank Aktiengesellschaft (Deutsche Bank AG) |

Rating Agencies. |

|

Moody's and S&P |

5

STRUCTURAL DIAGRAM

6

SUMMARY OF THE BONDS

The issuer trustee may issue fast prepayment bonds which will be collateralized by the same pool of housing loans as the Offshore bonds. The fast prepayment bonds have not been and will not be registered in the United States and are not being offered by this prospectus. When used in this prospectus the term "US$ bonds" will mean the Class A-1(a) bonds and the Class B-1(a) bonds and the term "US$ bondholders" when used in this prospectus will mean the holders of any Class A-1(a) bonds and/or Class B-1(a) bonds. The term "Class A bonds" when used in this prospectus will mean the Class A-1(a) bonds and the Class A-1(b) bonds and the term "Class B bonds" when used in this prospectus will mean the Class B-1(a) bonds and the Class B-1(b) bonds. The term "Offshore bonds" when used in this prospectus will mean the Class A bonds and the Class B bonds. The term "bonds" when used in this prospectus will mean the Offshore bonds and, if issued, the fast prepayment bonds.

| | Class A-1(a)

| | Class A-1(b)

| | Class B-1(a)

| | Class B-1(b)

|

|---|

| Aggregate Initial Principal Amount: | | US$725,000,000 | | €425,000,000 | | US$25,000,000 | | €16,900,000 |

% of Total: |

|

55.75% |

|

40.71% |

|

1.92% |

|

1.62% |

Anticipated Ratings: |

|

|

|

|

|

|

|

|

| |

Moody's |

|

Aaa |

|

Aaa |

|

Aa3 |

|

Aa3 |

| | S&P | | AAA | | AAA | | AA | | AA |

Interest rate from the initial payment date up to but excluding the margin step-up date: |

|

three-month LIBOR + 0.21% |

|

three-month EURIBOR + 0.21% |

|

three-month LIBOR + 0.65% |

|

three-month EURIBOR + 0.65% |

Interest rate from and including the margin step-up date: |

|

three-month LIBOR + 0.42% |

|

three-month EURIBOR + 0.42% |

|

three-month LIBOR + 1.50% |

|

three-month EURIBOR + 1.50% |

Minimum Denominations: |

|

US$100,000 |

|

€100,000 |

|

US$100,000 |

|

€100,000 |

Interest Accrual Method: |

|

actual/360 |

|

actual/360 |

|

actual/360 |

|

actual/360 |

Payment Dates: |

|

The 10th day or, if the 10th day is not a Business Day, then the next Business Day of each January, April, July and October. The first payment date will be April 13, 2004. |

|

The 10th day or, if the 10th day is not a Business Day, then the next Business Day of each January, April, July and October. The first payment date will be April 13, 2004. |

|

The 10th day or, if the 10th day is not a Business Day, then the next Business Day of each January, April, July and October. The first payment date will be April 13, 2004. |

|

The 10th day or, if the 10th day is not a Business Day, then the next Business Day of each January, April, July and October. The first payment date will be April 13, 2004. |

Clearance/Settlement: |

|

DTC/Euroclear/Clearstream, Luxembourg |

|

Euroclear/Clearstream, Luxembourg |

|

DTC/Euroclear/Clearstream, Luxembourg |

|

Euroclear/Clearstream, Luxembourg |

Pool cut-off date: |

|

Close of Business on January 19, 2004 |

Pricing Date: |

|

January 21, 2004 |

Initial Issue Date: |

|

January 29, 2004 |

Margin Step-Up Date: |

|

The first date on which an event referred to in "Description of the Offshore Bonds—Interest on the Bonds—Calculation of Interest Payable on the Bonds" occurs |

Maturity Date: |

|

The payment date falling in January 2035 |

7

Structural Overview

The ARMS II securitization program was established pursuant to a master trust deed dated March 7, 1995 among Permanent Custodians Limited and Australian Mortgage Securities Ltd, as amended and restated from time to time. The master trust deed provides the general terms and structure for securitizations under the program. Supplementary bond terms will set out the specific details of ARMS II Global Fund 3 and the bonds, which may vary from the terms set forth in the master trust deed. Each securitization under the program is a separate transaction with a separate trust—known as a "fund". The assets of ARMS II Global Fund 3 will not be available to pay the obligations of any other fund under the program, and the assets of other funds under the program will not be available to pay the obligations of Permanent Custodians Limited as trustee of ARMS II Global Fund 3. See "Description of the Fund".

ARMS II Global Fund 3 involves the securitization of housing loans originated by Australian Mortgage Securities Ltd in the name of Permanent Custodians Limited, as trustee of a number of warehouse funds, and secured by mortgages over residential property located in Australia. Permanent Custodians Limited will issue the bonds to fund the acquisition of the housing loans. Upon receipt of the issue proceeds of the bonds, in accordance with the master trust deed, Permanent Custodians Limited will hold the issue proceeds as trustee of the relevant warehouse funds and the housing loans as trustee of ARMS II Global Fund 3.

The issuer trustee will grant a first ranking floating charge over all assets which are subject to the Fund under the security trust deed in favor of Permanent Registry Limited, as security trustee, to secure the issuer trustee's payment obligations to the bondholders and its other creditors. A first ranking floating charge is a first priority security interest over a class of assets, but does not attach to specific assets unless or until it crystalizes, which means it becomes a fixed charge. The charge will crystalize if, among other events, an event of default occurs under the security trust deed. Once the floating charge crystalizes, the issuer trustee will no longer be able to dispose of or create interests in the assets of the Fund without the consent of the security trustee. For a description of floating charges and crystallization see "Description of the Transaction Documents—The Security Trust Deed—Nature of the Charge".

Payments of interest and principal on the bonds will come only from the housing loans and other assets of the Fund. The assets of the parties to the transaction are not available to meet the payments of interest and principal on the bonds. If there are losses on the housing loans, the Fund may not have sufficient assets to repay the bonds.

Credit Enhancements

Payments of interest and principal on the Class A-1(a) bonds and the Class A-1(b) bonds will be supported by the following forms of credit enhancement.

Subordination

The Class B-1(a) bonds and the Class B-1(b) bonds will be subordinated to the Class A-1(a) bonds and the Class A-1(b) bonds in their right to receive interest and principal payments. The Class B-1(a) bonds and the Class B-1(b) bonds will rankpari passu.

The credit support provided by the Class B-1(a) bonds and the Class B-1(b) bonds is intended to enhance the likelihood that the Class A-1(a) bonds and the Class A-1(b) bonds will receive expected quarterly payments of interest and principal. The following chart describes the initial credit support provided to the Class A-1(a) bonds and the Class A-1(b) bonds by the Class B-1(a) bonds and the Class B-1(b) bonds:

Class

| | Credit Support

| | Initial Support

Percentage

| |

|---|

| A | | B | | 3.54 | % |

The initial support percentage in the preceding table is the Australian dollar equivalent of the principal amount of the Class B-1(a) bonds and the Class B-1(b) bonds as a percentage of the Australian dollar

8

equivalent of the principal amount of all of the bonds on the initial issue date.

To the extent there is a loss on a housing loan not covered by a mortgage insurance policy or by the application of excess interest collections, the amount of such loss will be borne by the Class B-1(a) bonds and the Class B-1(b) bonds before it is borne by the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds. See "Description of the Offshore Bonds—Charge-offs".

Mortgage Insurance Policies

Mortgage insurance policies issued by, or transferred to, GE Capital Mortgage Insurance Corporation (Australia) Pty Ltd, PMI Mortgage Insurance Ltd and the Commonwealth of Australia (as managed by GE Mortgage Insurance Pty Limited) will provide full coverage for the balance outstanding on each housing loan irrespective of its original or current LVR. The mortgage insurance policies are subject to some exclusions from coverage and rights of termination which are described in "The Mortgage Insurance Policies".

Excess Interest Collections

Any interest collections on the housing loans remaining after payments of interest on the bonds and the Fund's expenses will be available to cover any losses on the housing loans that are not covered by the mortgage insurance policies.

Liquidity Enhancement

To enable the issuer trustee to make timely payments of interest on the bonds, the trust manager is required to ensure that, at all times while the Australian dollar equivalent of the outstanding principal amount of all Offshore bonds is greater than or equal to 25% of the aggregate Australian dollar equivalent of the principal amount of the Offshore bonds on the initial issue date, the Fund has an amount equal to at least 0.25% of the Australian dollar equivalent of the aggregate principal amount of the bonds on the initial issue date invested in highly-rated, short-term investments. Part of the issue proceeds from the Offshore bonds, after conversion into A$ under the relevant currency swap, will be applied to meet this requirement on the initial issue date. These liquid authorized investments are available to make interest payments on the bonds if there are not enough interest collections from the housing loans available to make those payments.

Each mortgage insurance policy includes timely payment cover for losses as a result of a borrower under a housing loan failing to pay all or part of a payment when due. This timely payment cover comprises at least twenty four months of missed payment installments for each housing loan.

Redraw Advances, Further Advances, Line of Credit Advances and Fast Prepayment Bonds

Redraw Advances, Further Advances and Line of Credit Advances

Under the terms of most variable rate housing loans a borrower may, at the absolute discretion of the issuer trustee, redraw previously prepaid principal. In exercising any such discretion, the issuer trustee acts on proposals given to it by the servicer. A borrower may redraw an amount equal to the difference between the scheduled principal amount of the loan and the current principal amount of the loan. In addition, in certain circumstances the issuer trustee may make a further advance to a borrower where, after that further advance, the principal amount of the loan exceeds the scheduled principal amount of the loan at that time. Under a line of credit loan, the issuer trustee may also permit a borrower to make multiple borrowings up to the credit limit on the loan. The amount that the issuer trustee may advance to a borrower in respect of a particular housing loan from time to time depends on the circumstances described under "ARMS II Residential Loan Program—Redraw Advances, Further Advances and Line of Credit Advances".

Any redraw advances, further advances and line of credit advances will be funded from the advances reserve. In addition, to the extent there are insufficient interest collections from the housing loans available to make interest payments on the bonds, the advances reserve shall be applied, after the cash reserve, towards

9

payment of the deficiency. If, at any time, the advances reserve is insufficient to fund redraw advances, further advances and line of credit advances, then the trust manager may give the issuer trustee a direction to, and the issuer trustee must, issue a series of fast prepayment bonds. The trust manager must not give this direction unless, among other things, it has received confirmation from each rating agency that the issue of the fast prepayment bonds would not result in a downgrade or withdrawal of a rating of any bond then outstanding. See "ARMS II Residential Loan Program—Redraw Advances, Further Advances and Line of Credit Advances".

Fast Prepayment Bonds

In certain circumstances, the issuer trustee may issue fast prepayment bonds in A$. See "ARMS II Residential Loan Program—Advances Reserve and Fast Prepayment Bonds". No fast prepayment bonds are being offered under this prospectus.

If issued, fast prepayment bonds will, prior to the occurrence of an event of default and enforcement of the charge under the security trust deed, rank equally with the Class A-1(a) bonds and the Class A-1(b) bonds in their right to receive interest payments. Fast prepayment bonds in respect of which the fast prepayment period has not expired will rank in priority to the Class A-1(a) bonds and the Class A-1(b) bonds in their right to receive principal payments. Fast prepayment bonds in respect of which the fast prepayment period has expired will rank equally with the Class A-1(a) bonds and the Class A-1(b) bonds in their right to receive principal payments. Following the occurrence of an event of default and enforcement of the charge under the security trust deed, the fast prepayment bonds will rank equally with the Class A-1(a) bonds and the Class A-1(b) bonds in their right to receive both interest and principal payments.

Hedging Arrangements

To hedge its interest rate and currency exposures, the issuer trustee will enter into the following hedging arrangements:

- •

- fixed-floating rate swaps to hedge the basis risk between the interest rates on the housing loans which are subject to a fixed rate of interest and the floating rate obligations of the Fund, which includes the issuer trustee's interest payments to the currency swap provider under each currency swap. At no time will the aggregate of the notional amounts and contract amounts of all fixed-floating rate swaps entered into by the issuer trustee exceed 20% of the aggregate principal amount of all housing loans at that time.

- •

- currency swaps to hedge the currency risk between, on the one hand, the collections on the housing loans and the amounts received by the issuer trustee under the fixed-floating rate swaps, which are denominated in Australian dollars, and, on the other hand, the obligation of the Fund to pay interest and principal on the Offshore bonds, which are denominated in U.S. dollars or Euros, as the case may be, together with the basis risk between, on the one hand, amounts in respect of interest calculated under the fixed-floating rate swaps by reference to the Australian bank bill rate and, on the other hand, amounts in respect of interest calculated under the Offshore bonds by reference to LIBOR or EURIBOR, as the case may be.

Optional Redemption

The trust manager will have the option to direct the issuer trustee to redeem all of the bonds on any payment date occurring on or after the earlier of:

- •

- October 10, 2009;

- •

- the date on which the Australian dollar equivalent of the total principal amount of the Offshore bonds is equal to or less than 10% of the Australian dollar

10

If the trust manager directs the issuer trustee to redeem the bonds, the issuer trustee must so redeem the bonds and the bondholders will receive a payment equal to the outstanding principal amount of the bonds plus any outstanding interest on the bonds. As to the circumstances in which the trust manager may give such a direction, see "Description of the Offshore bonds—Redemption of the Bonds Upon Issuer Call Option Event".

11

The Housing Loan Pool

The housing loan pool will consist of residential housing loans bearing either a fixed rate or variable rate of interest, secured by mortgages on owner occupied and non-owner occupied residential properties. The housing loans will have original terms to stated maturity of no more than 30 years. The pool of housing loans has the following characteristics:

Selected Housing Loan Pool Data as of the Close of Business on January 19, 2004

| Housing Loan Pool Size | | A$1,706,793,183.68 | |

| Total Number of Housing Loans | | 6,934 | |

| Average Housing Loan Balance | | A$246,148.43 | |

| Maximum Housing Loan Balance | | A$1,000,000.00 | |

| Total Valuation of the Properties | | A$2,567,445,793.00 | |

| Maximum Remaining Term to Maturity in Months | | 360 | |

| Weighted Average Remaining Term to Maturity in Years | | 29.39 | |

| Weighted Average Seasoning in Months | | 5.89 | |

| Weighted Average Original Loan-to-Value Ratio | | 76.48 | % |

| Weighted Average Current Loan-to-Value Ratio | | 73.89 | % |

| Maximum Current Loan-to-Value Ratio | | 95.00 | % |

The original loan to value ratio of a housing loan is calculated by comparing the initial principal amount of the housing loan or, in the case of a line of credit loan, the initial maximum credit limit applicable to that line of credit loan, to:

- •

- where the principal secured under that housing loan is to be used in whole or in part to purchase the property securing that housing loan, the lower of:

- •

- the most recent valuation of that property; and

- •

- the purchase price paid by the borrower to purchase that property; or

- •

- in any other case, the most recent valuation of the property securing that housing loan.

Thus, if collateral has been released from the mortgage securing a housing loan or if the property securing the housing loan has been revalued, the original loan to value ratio may not reflect the actual loan to value ratio at the date of acquisition of that housing loan by the Fund.

The current loan to value ratio of a housing loan, at any time, is calculated by comparing the actual outstanding principal amount of the housing loan at that time to the current property valuation, which will be determined as follows:

- •

- where a new valuation of the property securing that housing loan has been obtained since the date the housing loan was originated, that valuation; or

- •

- where:

- •

- a new valuation of the property securing that housing loan has not been obtained since the date the housing loan was originated; and

- •

- the principal secured under that loan was not used in whole or in part to purchase that property;

12

- •

- where:

- •

- a new valuation of the property securing that housing loan has not been obtained since the date the housing loan was originated; and

- •

- the principal secured under that loan was used in whole or in part to purchase that property,

the lower of:

- •

- the most recent valuation of the property securing that housing loan as at the date the housing loan was originated; and

- •

- the purchase price paid by the borrower to purchase that property.

In respect of a further advance, as to which see the second bullet point under "ARMS II Residential Loan Program—Redraw Advances, Further Advances and Line of Credit Advances—Further Advances", the adjusted loan to value ratio is calculated by comparing the scheduled principal balance immediately prior to the further advance, together with the amount of the further advance and any undrawn line of credit under the housing loan, to the current property valuation.

Before the issuance of the bonds, housing loans may be added to or removed from the housing loan pool. New housing loans may also be substituted for housing loans that are removed from the housing loan pool. This addition, removal or substitution of housing loans may result in changes in the housing loan pool characteristics shown in the preceding table and could affect the weighted average lives and yields of the bonds. The trust manager will not add, remove or substitute any housing loans prior to the initial issue date if this would result in a change of more than 5% in any of the characteristics of the pool of housing loans described in the above table other than a change in the Housing Loan Pool Size, Total Number of Housing Loans or Total Valuation of the Properties where the change is due to adding or removing loans due to a fluctuation in the A$/US$ exchange rate or the A$/€ exchange rate, unless a revised prospectus is delivered to prospective investors.

13

U.S. Tax Status

In the opinion of Mayer, Brown, Rowe & Maw LLP, special U.S. tax counsel to the trust manager, the Offshore bonds will be characterized as debt for U.S. federal income tax purposes and the issuer trustee and the Fund will not be subject to United States federal income tax. Each Offshore bondholder, by acceptance of an Offshore bond, agrees to treat the bonds as indebtedness. See "United States Federal Income Tax Matters".

Australian Tax Status

The Offshore bonds should be characterized as debt for Australian tax purposes. See "Australian Tax Matters".

Australian Withholding Tax

Payments of principal and interest on the Offshore bonds will be reduced by any applicable withholding taxes assessed on the issuer trustee or any paying agent and could be reduced if any withholding taxes are assessed in respect of payments under the housing loans. Neither the issuer trustee nor the bond trustee nor any paying agent nor any borrower is obliged to pay any additional amounts to the Offshore bondholders to cover any withholding taxes.

If an Australian government body requires the withholding of amounts:

- •

- from payments of principal or interest to the bondholders; or

- •

- from interest payments by borrowers under the housing loans with the effect that those interest payments cease to be receivable by the issuer trustee,

due to taxes, duties, assessments or other governmental charges, the issuer trustee must, when so directed by the trust manager and provided the issuer trustee will be in a position to discharge all of its liabilities in respect of the bonds, redeem all of the bonds. See "Australian Tax Matters".

Legal Investment

The Offshore bonds will not constitute "mortgage-related securities" for the purposes of the Secondary Mortgage Market Enhancement Act of 1984. No representation is made as to whether the bonds constitute legal investments under any applicable statute, law, rule, regulation or order for any entity whose investment activities are subject to investment laws and regulations or to review by regulatory authorities. You are urged to consult with your own legal advisors concerning the status of the Offshore bonds as legal investments for you. See "Legal Investment Considerations".

ERISA Considerations

Subject to considerations discussed herein under "ERISA Considerations", the Offshore bonds will be eligible for purchase by retirement plans subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA) or Section 4975 of the Internal Revenue Code of 1986, as amended (theCode). Investors should consult their counsel with respect to the consequences under ERISA and the Code of the plan's acquisition and ownership of the Offshore bonds. See "ERISA Considerations".

Book-Entry Registration

Persons acquiring beneficial ownership interests in the Offshore bonds will hold their Offshore bonds through The Depository Trust Company in the United States or Clearstream, Luxembourg or Euroclear outside of the United States. Transfers within The Depository Trust Company, Clearstream, Luxembourg or Euroclear will be in accordance with the usual rules and operating procedures of the relevant system. Crossmarket transfers between persons holding directly or indirectly through The Depository Trust Company, on the one hand, and persons holding directly or indirectly through Clearstream, Luxembourg or Euroclear, on the other hand, will take place in The Depository Trust Company through the relevant depositories of Clearstream, Luxembourg or Euroclear.

14

Listing on Irish Stock Exchange

Application will be made to the Irish Stock Exchange for each class of Offshore bonds to be admitted to the Daily Official List. There can be no assurance that any such listing will be obtained. The issuance and settlement of each class of Offshore bonds on the initial issue date is not conditional on the listing of such Offshore bonds on the Irish Stock Exchange. See "General Information—Listing on Irish Stock Exchange".

Interest and Principal Collections

The issuer trustee will receive for each calculation period the following amounts, which are known as interest collections:

- •

- payments of interest and fees under the housing loans;

- •

- amounts received under the fixed-floating rate swaps;

- •

- income derived from authorized investments standing to the credit of the cash reserve, except if, the Australian dollar equivalent of the total principal amount of the Offshore bonds is equal to or less than 10% of the Australian dollar equivalent of the total principal amount of such bonds on the initial issue date, then interest on authorized investments standing to the credit of the cash reserve must be credited to the cash reserve;

- •

- indemnity payments from the trust manager in respect of the expenses of the Fund; and

- •

- payments of all other amounts under or in respect of the assets of the Fund which the trust manager determines to be of an income nature.

The issuer trustee will receive for each calculation period the following amounts, which are known as principal collections:

- •

- payments of principal under the housing loans; and

- •

- payments of all other amounts under or in respect of the assets of the Fund which are not interest collections.

Interest collections are normally used to pay fees and expenses of the issuer trustee in connection with the Fund, together with interest on the bonds. Principal collections are normally used to pay principal on the bonds. However, if there are not enough interest collections to pay interest on the bonds on a payment date, the trust manager must direct the issuer trustee to, and the issuer trustee must, apply liquid authorized investments, if any, first, from the cash reserve, and then, to the extent that there is still a shortfall, from the advances reserve, to meet those interest payments. Any liquid authorized investments used to make interest payments on the bonds will be replenished on future payment dates from excess interest collections, to the extent available.

If there are excess interest collections after the payment of all interest on the bonds and the replenishment of liquid authorized investments from the cash reserve and the advances reserve, such excess will be applied:

- •

- first, to reduce, pro rata, any charge-offs on the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds, if any;

- •

- second, to reinstate, pro rata, the stated amount of the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds, if any;

- •

- third, to reduce, pro rata, any charge-offs on the Class B-1(a) bonds and the B-1(b) bonds; and

- •

- fourth, to reinstate, pro rata, the stated amount of the Class B-1(a) bonds and the B-1(b) bonds.

Any remaining interest collections will be distributed to the residual income beneficiary on each payment date.

Interest on the Bonds

Interest on the bonds will be payable quarterly in arrears on each payment date. This period is referred to as an interest period. Amounts available to make interest payments on the bonds will be allocated pro rata between the Class A-1(a) bonds, the Class A-1(b) bonds and

15

the fast prepayment bonds, if any. Amounts available to make interest payments on the bonds will be allocated to pay interest on the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds, if any, before any allocation is made to pay interest on the Class B-1(a) bonds and the Class B-1(b) bonds. Interest on each class of bonds is calculated for each interest period as follows:

- •

- on a daily basis at the bond's interest rate;

- •

- on the outstanding principal amount of that bond at the beginning of that interest period, after giving effect to any payments of principal with respect to that bond on that day; and

- •

- on the basis of the actual number of days in that interest period and a year of 360 days for the Offshore bonds, or 365 days for the fast prepayment bonds.

Principal on the Bonds

Principal on the Offshore bonds will be payable on each payment date. If any fast prepayment bonds have been issued, principal will be repaid first on the fast prepayment bonds in respect of which the fast prepayment period has not expired and then, pro rata, between the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds in respect of which the fast prepayment period has expired. The Class B-1(a) bonds and the Class B-1(b) bonds will not receive any principal payments unless amounts allocated to pay principal on the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds are sufficient to repay the outstanding principal amount of the Class A-1(a) bonds, the Class A-1(b) bonds and the fast prepayment bonds in full. On each payment date, the outstanding principal amount of each bond will be reduced by the amount of the principal payment made on that date on that bond. If the charge under the security trust deed is enforced after an event of default, the proceeds from the enforcement will be distributed pro rata between the Class A-1(a) bonds, the Class A-1(b) bonds, fast prepayment bonds, the currency swap provider in respect of the Class A US$ currency swap, the currency swap provider in respect of the Class A € currency swap and the fixed-floating rate swap provider prior to any distributions to the Class B-1(a) bonds and the Class B-1(b) bonds.

Allocation of Cash Flows

On each payment date, the issuer trustee will repay principal and interest to each bondholder to the extent that there are collections received for those payments on that date. The charts on the next three pages summarize the flow of payments.

16

DISTRIBUTION OF INTEREST COLLECTIONS ON

EACH PAYMENT DATE PRIOR TO THE ENFORCEMENT OF THE CHARGE IN THE SECURITY TRUST DEED

| | |

| | |

| | | Payment or reimbursement of all taxes in respect of the Fund payable or paid during the corresponding calculation period or which the issuer trustee on the advice of the trust manager considers it necessary, on or before the date which is three Business Days before the payment date relating to that calculation period, to make provision for. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment or reimbursement of all Expenses of the Fund—except for the manager's fee—payable or paid during the corresponding calculation period or which the issuer trustee on the advice of the trust manager considers it necessary, on or before the date which is three Business Days before the payment date relating to that calculation period, to make provision for. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment or reimbursement of the aggregate fixed-floating rate swap payments for that calculation period other than any break costs payable to the fixed-floating rate swap provider. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment of the manager's fee, including any manager's fee remaining unpaid from previous payment dates. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment,pari passu and rateably:

• to the currency swap provider of the Class A US$ Currency Swap Payment Amount for that payment date;

• to the currency swap provider of the Class A € Currency Swap Payment Amount for that payment date; and

• to the bondholders of fast prepayment bonds (if any) of the interest due and payable on those bonds in respect of the interest period ending on that payment date,pari passu and rateably. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment,pari passu and rateably:

• to the currency swap provider of the Class B US$ Currency Swap Payment Amount for that payment date; and

• to the currency swap provider of the Class B € Currency Swap Payment Amount for that payment date. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Crediting to the cash reserve an amount equal to the aggregate of all amounts previously applied from the cash reserve under "Description of the Offshore Bonds—Use of Cash Reserve and Advances Reserve", to the extent not previously credited under this provision. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Crediting to the advances reserve an amount equal to the aggregate of all amounts previously applied from the advances reserve under "Description of the Offshore Bonds—Use of Cash Reserve and Advances Reserve", to the extent not previously credited under this provision. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Reducingpari passu and rateably, any Charge-offs that would otherwise occur on that date in relation to the fast prepayment bonds, if any, and the Class A bonds, and any amount so applied will constitute part of the Available Amortisation Amount. | | |

| | |

| | |

| | |  | | |

17

| | |

| | |

| | | Reinstatingpari passu and rateably, the stated amount of the fast prepayment bonds and the Class A bonds to the extent of the Unreimbursed Charge-offs in relation to the fast prepayment bonds and the Class A bonds and any amount so applied will constitute part of the Available Amortisation Amount. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Reducingpari passu and rateably, any Charge-offs that would otherwise occur on that date in relation to the Class B bonds, and any amount so applied will constitute part of the Available Amortisation Amount. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Reinstatingpari passu and rateably the stated amount of the Class B bonds to the extent of the Unreimbursed Charge-offs in relation to the Class B bonds, and any amount so applied will constitute part of the Available Amortisation Amount. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment to the fixed-floating rate swap provider of all break costs paid or payable during the corresponding calculation period in respect of the termination of the fixed-floating rate swap. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment of the balance (if any) to the residual income beneficiary by way of a distribution of the income of the Fund. | | |

| | |

| | |

18

DISTRIBUTION OF THE AVAILABLE AMORTISATION AMOUNT ON

EACH PAYMENT DATE PRIOR TO THE ENFORCEMENT OF THE CHARGE IN THE SECURITY TRUST DEED

| | |

| | |

| | | Repayment of the principal amount of all fast prepayment bonds (if any) in respect of which the fast prepayment period has not expired,pari passu and rateably among each tranche of fast prepayment bonds in order of issue. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment or repayment,pari passu and rateably:

• to the currency swap provider of an amount equal to the A$ Equivalent of the aggregate principal amount of the Class A-1(a) bonds on that payment date;

• to the currency swap provider of an amount equal to the A$ Equivalent of the aggregate principal amount of the Class A-1(b) bonds on that payment date; and

• of the principal amount of all fast prepayment bonds (if any) in respect of which the fast prepayment period has expired,pari passu and rateably. | | |

| | |

| | |

| | |  | | |

| | |

| | |

| | | Payment,pari passu and rateably:

• to the currency swap provider of an amount equal to the A$ Equivalent of the aggregate principal amount of the Class B-1(a) bonds on that payment date; and

• to the currency swap provider of an amount equal to the A$ Equivalent of the aggregate principal amount of the Class B-1(b) bonds on that payment date. | | |

| | |

| | |

19

RISK FACTORS

The Offshore bonds are complex securities issued by a foreign entity and secured by property located in a foreign jurisdiction. You should consider the following risk factors in deciding whether to purchase any Offshore bonds. There may be other unforeseen reasons why you might not receive principal or interest on your Offshore bonds. You should also read the detailed information set out elsewhere in the prospectus.

| The bonds will be paid only from the assets of the Fund | | • | | The bonds are debt obligations of the issuer trustee only in its capacity as trustee of the Fund. The bonds do not represent an interest in or obligation of any of the other parties to the transaction. The assets of the Fund will be the sole source of payments on the bonds. The issuer trustee's other assets will only be available to make payments on the bonds if the issuer trustee fails to exercise the degree of care, diligence and prudence required of a trustee or because of some other neglect, default or breach of duty by the issuer trustee having regard to the powers and duties conferred on it by the master trust deed. Therefore, if the assets of the Fund are insufficient to pay the interest and principal on your bonds when due, there will be no other source from which to receive these payments and you may not get back your entire investment or the yield you expected to receive. |

There is no way to predict the actual rate and timing of payments on the housing loans |

|

• |

|

The rate of principal and interest payments on pools of housing loans varies among pools, and is influenced by a variety of economic, demographic, social, tax, legal and other factors, including prevailing market interest rates for housing loans and the particular terms of the housing loans. Australian housing loans have features and options that are different from housing loans in the United States, and thus will have different rates and timing of payments from housing loans in the United States. There is no guarantee as to the actual rate of prepayment on the housing loans, or that the actual rate of prepayments will conform to any model described in this prospectus. A majority of the housing loans have floating rates of interest, all of which do not impose prepayment penalties on the borrower. Accordingly, an increase in interest rates may lead to an increase in prepayments. In addition, the rate and timing of principal and interest payments on the housing loans and the ability for further principal drawdowns to be made by way of redraw advances, further advances or line of credit advances on the housing loans will affect the rate and timing of payments of principal and interest on your bonds. |

|

|

|

|

The performance of relevant counterparties under each mortgage insurance policy, each fixed-floating rate swap and each currency swap will also have a key impact on such payments in terms of both the timeliness of such payments and the amount of such payments. Unexpected prepayment rates could have the following negative effects: |

|

|

|

|

• |

|

if you bought your bonds for more than their face amount, the yield on your bonds will drop if principal payments occur at a faster rate than you expect; or |

| | | | | | | |

20

|

|

|

|

• |

|

if you bought your bonds for less than their face amount, the yield on your bonds will drop if principal payments occur at a slower rate than you expect. |

Losses and delinquent payments on the housing loans may affect the return on your bonds |

|

• |

|

If borrowers fail to make payments of interest and principal under the housing loans when due and the credit enhancements described in this prospectus are not enough to protect your bonds from the borrowers' failure to pay, then the issuer trustee may not have enough funds to make full payments of interest and principal due on your bonds. Consequently, the yield on your bonds could be lower than you expect and you could suffer losses. |

Enforcement of the housing loans may cause delays in payment and losses |

|

• |

|

Substantial delays could be encountered in connection with the liquidation of a housing loan, which may lead to shortfalls in payments to you to the extent those shortfalls are not covered by a mortgage insurance policy or if the relevant mortgage insurer fails to perform its obligations under the relevant mortgage insurance policy. |

|

|

• |

|

Further, enforcement expenses such as legal fees, real estate taxes and maintenance and preservation expenses, to the extent not covered by a mortgage insurance policy, will reduce the net amounts recoverable by the issuer trustee from an enforced housing loan or mortgage. If the proceeds of the sale of a mortgaged property, net of these expenses, are less than the amount due under the related housing loan, the issuer trustee may not have enough funds to make full payments of interest and principal due to you unless the difference is covered under a mortgage insurance policy. In addition, even if these risks are covered by a mortgage insurance policy, there is no guarantee that the mortgage insurer will promptly make any payment under any mortgage insurance policy or that the mortgage insurer will have the necessary financial capacity to make any such payment at the relevant time. |

Certain provisions of the mortgage insurance policies may affect the return on your bonds |

|

• |

|

The liability of a mortgage insurer is governed by the terms of the relevant mortgage insurance policy, which contains certain exclusions that may allow that mortgage insurer to reduce a claim or terminate mortgage insurance cover in respect of a housing loan in certain circumstances. See "The Mortgage Insurance Policies". Any such reduction or termination may affect the ability of the issuer trustee to pay you principal and interest in full. |

The Class B bonds provide only limited protection to the Class A bonds against losses |

|

• |

|

The amount of credit enhancement provided through the subordination of the Class B-1(a) bonds and the Class B-1(b) bonds to the Class A-1(a) bonds and the Class A-1(b) bonds is limited. If the stated amounts of the Class B-1(a) bonds and Class B-1(b) bonds are reduced to zero due to losses on the housing loans, you may not receive payments of principal in full on the Class A-1(a) bonds and Class A-1(b) bonds. |

| | | | | | | |

21

The Class B bonds are subordinated to the Class A bonds and therefore Class B bondholders may not be paid all principal and interest on the Class B bonds |

|

• |

|

The Class B-1(a) bonds and Class B-1(b) bonds will at all times be subordinated to the Class A-1(a) bonds and Class A-1(b) bonds in their right to receive principal and interest payments. Accordingly, Class B-1(a) bondholders and Class B-1(b) bondholders may not be paid principal and interest in full in respect of the Class B-1(a) bonds and Class B-1(b) bonds. Therefore you may not receive your entire investment or the yield you expected to receive. |

You may not be able to resell your bonds |

|

• |

|

The underwriters are not required to assist you in reselling your bonds. A secondary market for your bonds may not develop. If a secondary market does develop, it might not continue or might not be sufficiently liquid to allow you to resell any of your bonds readily or at the price you desire. The market value of your bonds is likely to fluctuate, which could result in significant losses to you. |

The termination of any of the swaps may subject you to losses from interest rate or currency fluctuations |

|

• |

|

The issuer trustee will exchange fixed rate payments in respect of fixed rate housing loans for variable rate payments based upon the one-month Australian bank bill rate. If a fixed-floating rate swap is terminated or the fixed-floating rate swap provider fails to perform its obligations, you will be exposed to the risk that the floating rate of interest payable with respect to the bonds will be greater than the discretionary fixed rate set by the servicer on the fixed rate housing loans, which may lead to losses to you. See "Description of the Offshore Bonds—The Fixed-Floating Rate Swaps" below. |

|

|

• |

|

The issuer trustee will receive payments from the borrowers on the housing loans and the fixed-floating rate swap provider in Australian dollars, calculated, in the case of payments by the fixed-floating rate swap provider, by reference to the Australian bank bill rate, and make payments to you in U.S. dollars or Euros, as the case may be, calculated, in the case of payments of interest, by reference to LIBOR or EURIBOR, as the case may be. Under each currency swap, the currency swap provider will exchange Australian dollar receipts for U.S. dollar payments or Euro payments, as the case may be, and in the case of interest, amounts calculated by reference to the Australian bank bill rate for amounts calculated by reference to LIBOR or EURIBOR, as the case may be. If the currency swap provider fails to perform its obligations or if a currency swap is terminated, the issuer trustee might have to exchange its Australian dollars for U.S. dollars or Euros, as the case may be, and its Australian bank bill rate obligations for LIBOR obligations or EURIBOR obligations, as the case may be, at a relevant spot exchange rate that does not provide sufficient U.S. dollars or Euros, as the case may be, to make payments to you in full. |

| | | | | | | |

22

Prepayments during a calculation period may result in you not receiving your full interest payments |

|

• |

|

If a prepayment is received on a housing loan during a calculation period, interest on the housing loan will cease to accrue on that portion of the housing loan that has been prepaid, starting on the date of prepayment. The amount prepaid will be invested in investments that may earn a rate of interest lower than that paid on the housing loan. If it is less, the issuer trustee may not have sufficient funds to pay you the full amount of interest due to you on the next payment date. |

The proceeds from the enforcement of the security trust deed may be insufficient to pay amounts due to you |

|

• |

|

If the security trustee enforces the charge over the assets of the Fund after an event of default under the security trust deed, there is no assurance that the market value of the assets of the Fund will be equal to or greater than the outstanding principal and interest due on the bonds, or that the security trustee will be able to realize the full value of the assets of the Fund. The issuer trustee, the security trustee, the bond trustee and other service providers will generally be entitled to receive the proceeds of any sale of the assets of the Fund, to the extent they are owed fees and expenses, before you. Consequently, the proceeds from the sale of the assets of the Fund after an event of default under the security trust deed may be insufficient to pay you principal and interest in full. |

If the trust manager directs the issuer trustee to redeem the bonds early or elects not to do so, the yield on your bonds may be lower than expected |

|

• |

|

The trust manager expects, but does not undertake, to exercise its right to direct the issuer trustee to redeem the bonds early as described in "Description of the Offshore Bonds—Redemption of the Bonds Upon Issuer Call Option Event". If it does so, the early retirement of your bonds will shorten their average lives and potentially lower the yield on your bonds. Conversely, if the trust manager elects not to exercise this right, the average life of your bonds may be longer than you expect and potentially lower the yield on your bonds. |

The imposition of a withholding tax will reduce payments to you and may lead to an early redemption of the bonds |

|

• |

|

If a withholding tax is imposed on payments by the issuer trustee or any paying agent of interest on your bonds, you will not be entitled to receive grossed-up amounts to compensate for such withholding tax. Thus, you will receive less interest than is scheduled to be paid on your bonds. |

|

|

• |

|

In addition, upon the occurrence of such an event, the issuer trustee must, when so directed by the trust manager, provided the issuer trustee will be in a position to discharge all of its liabilities in respect of the bonds and to the other creditors of the Fund, on the next payment date redeem in whole, but not in part, the aggregate outstanding principal amount plus accrued interest on the bonds. If the option to redeem the bonds affected by a withholding tax is exercised, you may not be able to reinvest the redemption payments at a comparable interest rate. |

| | | | | | | |

23

The features of the housing loans may change, which could affect the timing and amount of payments to you |

|

• |

|

The features of the housing loans, including their interest rates, may be changed by the servicer, either on its own initiative or at a borrowers' request. Some of these changes may include the addition of newly developed features which are not described in this prospectus. As a result of these changes and borrowers' payments of principal, the concentration of housing loans with specific characteristics is likely to change over time, which may affect the timing and amount of payments you receive. |

|

|

• |

|

If the servicer changes the features of the housing loans, borrowers may elect to refinance their loan with another lender to obtain more favorable features. The refinancing of housing loans could cause you to experience higher rates of principal prepayment than you expected, which could affect the yield on your bonds. |

There are limits on the amount of available liquidity to ensure payments of interest to you |

|

• |

|