UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ý |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ý | Soliciting Material Pursuant to §240.14a-12 |

TRANS1 INC.

(Name of Registrant as Specified In Its Charter)

________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Conference Call to Discuss Acquisition of Baxano, Inc. Fourth Quarter and Full Year Earnings March 4, 2013

TranS1 Inc. Investor Presentation, March 4, 2013 Forward - Looking Statements Statements in this presentation regarding the proposed merger transaction between the Company and Baxano, and the related financing transaction; the expected timetable for completing the transactions; benefits and synergies of the acquisition; fut ure opportunities for the combined company; the strategy, future operations, financial position, future revenues and projected co sts ; prospects, plans and objectives of management; and any other statements about the Company’s management team’s future expectations, beliefs, goals, plans or prospects constitute "forward looking statements" within the meaning of Section 27A of th e Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and are intended to qualify for the safe harbo r f rom liability established by the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and unce rta inties that are often difficult to predict, are beyond our control, and which may cause results to differ materially from expectations. Fac tors that could cause our results to differ materially from those described include, but are not limited to, the ability to consummate the transactions, the ability to successfully integrate our operations and employees, the ability to realize anticipated synergie s a nd cost savings, the ability to develop and maintain the necessary sales, marketing, distribution and manufacturing capabilities to commercialize our products, the pace of adoption of our product technology by spine surgeons, the outcome of coverage and reimbursement decisions by the government and third party payors, the success of our continuing product development efforts, the effect on our business of existing and new regulatory requirements, uncertainty surrounding the outcome of the matters relati ng to the subpoena issued to the Company by the Department of Health and Human Services, Office of Inspector General, stockholder class action lawsuits, and other economic and competitive factors, and the other factors described in the Company’s filings with th e Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10 - K for the year ended December 31, 2011 and subsequent reports. You are cautioned not to place undue reliance on these forward looking statements, which are based on TranS1's expectations as of the date of this press release and speak only as of the date of this press release. We undertake no oblig ati on to publicly update or revise any forward looking statement, whether as a result of new information, future events or otherwise . 2

TranS1 Inc. Investor Presentation, March 4, 2013 Cautionary Statement / Pro Forma Information CAUTIONARY STATEMENT The merger transaction and financing transaction discussed in this presentation involve the sale of securities in a private trans act ion that will not be registered under the Securities Act of 1933, as amended, and will be subject to the resale restrictions unde r t hat act. Such securities may not be offered or sold absent registration or an applicable exemption from registration requirements. Thi s document does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sal e o f securities in any state or jurisdiction in which such an offer, solicitation, or sale would be unlawful prior to registration or qualificat ion under the securities laws of any such state or jurisdiction. PRO FORMA INFORMATION * All pro forma measures in this presentation combine certain historical financial data of TranS1 and Baxano without adjustment and are not necessarily indicative of what these entities’ actual results of operations or financial position would have been on a c ombined basis, nor are they indicative of their future results of operations or financial position on a standalone or a combined basi s . 3

TranS1 Inc. Investor Presentation, March 4, 2013 Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the merger transaction and financing transaction. The Company will file a proxy statement and other documents regarding the merger transaction and financing transaction described in this press release with the SEC. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE COMPANY’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER TRANSACTION AND FINANCING TRANSACTION. Investors and securityholders will be able to obtain the proxy statement and other relevant documents free of charge at the SEC’s website, http://www.sec.gov, and the Company’s stockholders will receive infor mat ion at an appropriate time on how to obtain the proxy statement and other transaction - related documents for free from the Company. Such documents are not currently available. The Company and its directors, executive officers, certain members of management, and employees may have interests in the mer ger transaction and financing transaction or be deemed to be participants in the solicitation of proxies of the Company’s stockho lde rs to approve the issuance of the Company’s stock in connection with each of the merger transaction and the financing transaction. Cer tain information regarding the participants and their interest in the solicitation is set forth in the proxy statement for the Com pan y’s 2012 Annual Meeting of Stockholders filed with the SEC on April 30, 2012. Stockholders may obtain additional information regarding th e interests of such participants by reading the proxy statement relating to the merger transaction and financing transaction wh en it becomes available. 4

Agenda Acquisition of Baxano, Inc. Fourth Quarter and Full Year Earnings

Acquisition of Baxano, Inc.

TranS1 Inc. Investor Presentation, March 4, 2013 TranS1 Acquisition of Baxano, Inc. Terms of Acquisition Agreement – TranS1 to acquire 100% of Baxano outstanding capital stock in exchange for 10.4M shares and $550K in cash, subject to adjustment – Transaction value $23.6M – Pro forma ownership prior to financing transaction • TranS1 shareholders 72.4% • Baxano shareholders 27.6% – Refinance $3.0 million of Baxano debt – Approved by both Boards of Directors – Expected to close early Q2 Key Management Team – Ken Reali – CEO – Joe Slattery – CFO 7

TranS1 Inc. Investor Presentation, March 4, 2013 Concurrent Financing Transaction Raising $17.2 million in PIPE Transaction – Existing Baxano shareholders have committed $15.3 million • In addition to those issued in the acquisition transaction – Additional PIPE participants have committed $1.9 million – Price per share - $2.28 – Closing concurrent with acquisition Pro Forma Shares Outstanding* – 45.2 million weighted average shares after acquisition and financing transactions Estimated Cash at Closing – $30 million *Please refer to pro forma disclosure in beginning of presentation 8

TranS1 Inc. Investor Presentation, March 4, 2013 Baxano Acquisition - Strategic Rationale Expands focus on minimally invasive spine (MIS) – creates “pure play” MIS company Expands market opportunity Complements existing product portfolio with differentiated, proprietary products Strong early clinical data Broadens sales force and access to MIS customer base – significant cross - selling opportunities Enhances financial profile – Revenue and cost synergies – Shortens time to cash - flow breakeven – Strengthens balance sheet Pro - forma 2012 Revenues of $24M* * Please refer to pro forma disclosure in beginning of presentation 9

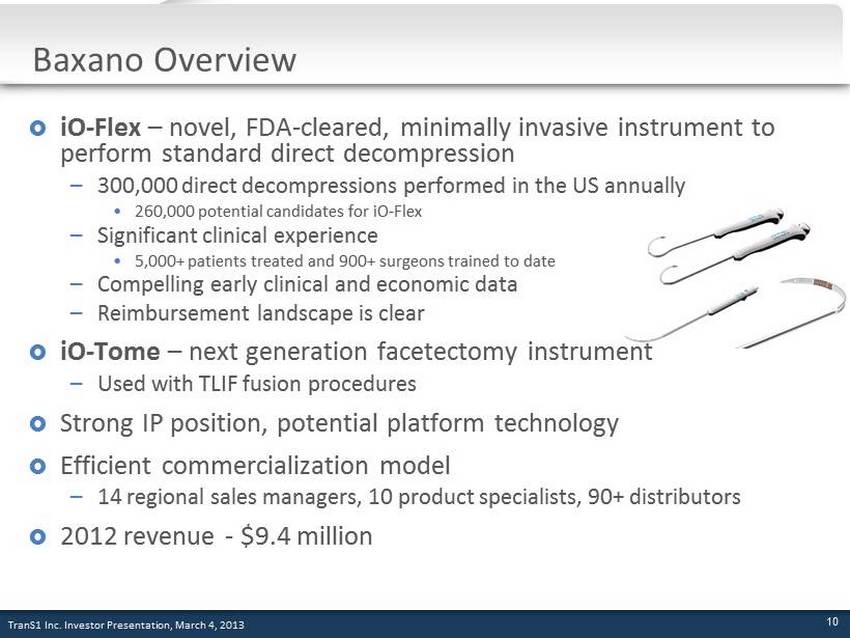

TranS1 Inc. Investor Presentation, March 4, 2013 Baxano Overview iO - Flex – novel, FDA - cleared, minimally invasive instrument to perform standard direct decompression – 300,000 direct decompressions performed in the US annually • 260,000 potential candidates for iO - Flex – Significant clinical experience • 5,000+ patients treated and 900+ surgeons trained to date – Compelling early clinical and economic data – Reimbursement landscape is clear iO - Tome – next generation facetectomy instrument – U sed with TLIF fusion procedures Strong IP position, potential platform technology Efficient commercialization model – 14 regional sales managers, 10 product specialists, 90+ distributors 2012 revenue - $9.4 million 10

TranS1 Inc. Investor Presentation, March 4, 2013 Baxano’s iO - Flex: Complete Decompression with Facet Preservation iO - Flex Traditional Decompression Spacers Complete Direct Decompression Facet Joint Sparing Muscle Sparing Multi - Level (>2) Mild, Moderate and Severe Stenosis = Partly Meets Requirement = Fails Requirement = Fully Meets Requirement 11

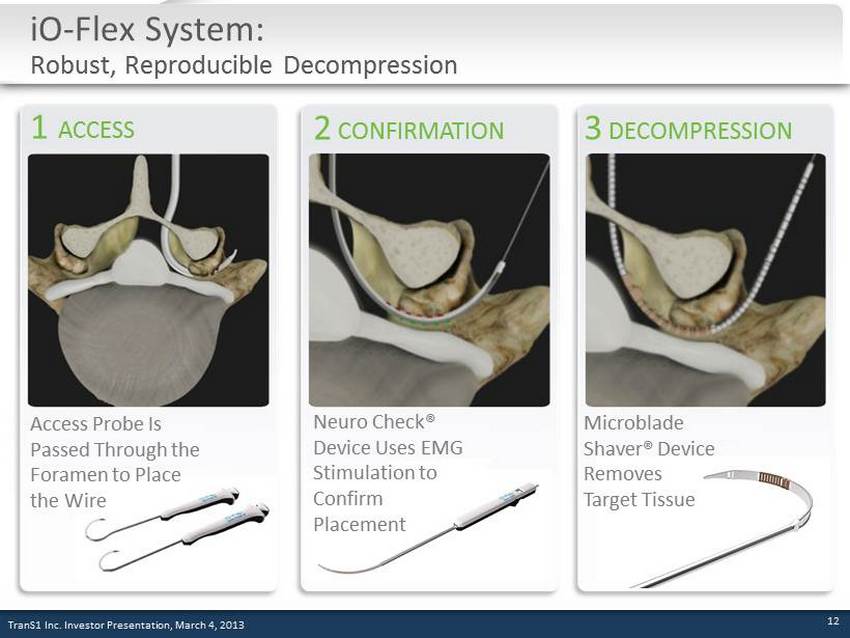

TranS1 Inc. Investor Presentation, March 4, 2013 iO - Flex System: Robust, Reproducible Decompression 3 DECOMPRESSION Microblade Shaver® Device Removes Target Tissue 1 ACCESS Access Probe Is Passed Through the Foramen to Place the Wire 2 CONFIRMATION Neuro Check® Device Uses EMG Stimulation to Confirm Placement 12

TranS1 Inc. Investor Presentation, March 4, 2013 Decompression Market is Large and Growing 300,000 US Annual Procedures $850M Market Opportunity Decompression market drivers - Demographics - Payor pressure on fusion procedures - Favorable reimbursement - L ess invasive procedure 13

TranS1 Inc. Investor Presentation, March 4, 2013 Strong Early Trial Results Safety and Efficacy In Lumbar Spinal Stenosis (vs. SPORT) Prospective observational study of 59 patients with lumbar spinal stenosis Conclusions - “…thorough decompression with few intraoperative complications.” - “Operative variables were favorable compared to the literature…” - “…while allowing for the preservation of the facet joints and midline structures.” iO - Flex Study* (Submitted) Safety and E fficacy in stable Spondylolisthesis Prospective, Non - Randomized, Single Arm Up to 150 Patients at up to 30 Sites Patient Derived C linical D ata , Operative Characteristics, Surgical Success, Time to Retreatment Economic Assessment STRIDE Study (Ongoing) 14 "Facet - sparing Decompression with a Minimally Invasive Flexible Microblade Shaver: A Prospective Operative Analysis", Dickenson, et al.

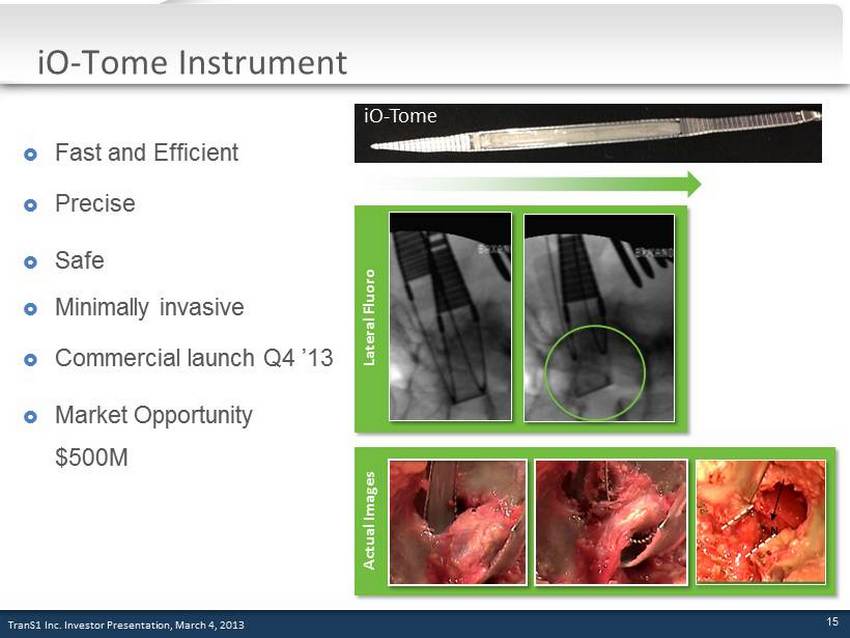

TranS1 Inc. Investor Presentation, March 4, 2013 iO - Tome Instrument Fast and Efficient Precise Safe Minimally invasive Commercial launch Q4 ’13 Market Opportunity $500M Lateral Fluoro Actual Images iO - Tome N 15

TranS1 Inc. Investor Presentation, March 4, 2013 Robust Quarterly Sales Growth ASP $2,860 $2,857 $2,908 $2,884 $3,061 $3,102 $3,383 $3,442 $3,408 $3,374 $3,463 $3,568 $0.1 $0.1 $0.2 $0.3 $0.5 $0.9 $1.1 $1.5 $1.7 $2.2 $2.4 $3.0 - 100 200 300 400 500 600 700 800 900 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Procedures Revenue - Millions Limited Launch Commercial Execution 16

Combined Company Overview

Five Year Vision A Leader in Minimally Invasive Spine Leveraging Our Unique Technologies and Differentiation to Build a Broader Spine Business Based on Technologies That Improve Outcomes and Have a Superior Value Proposition to Current Standards of Care 18

Investment Highlights 19 Focus on minimally invasive technologies Differentiated and synergistic product portfolio Focused sales strategy around MIS surgeons, payors , hospitals Excellent peer - to - peer training programs Strong peer reviewed clinical data Cost effectiveness models demonstrating advantages over standard of care Enhanced financial profile

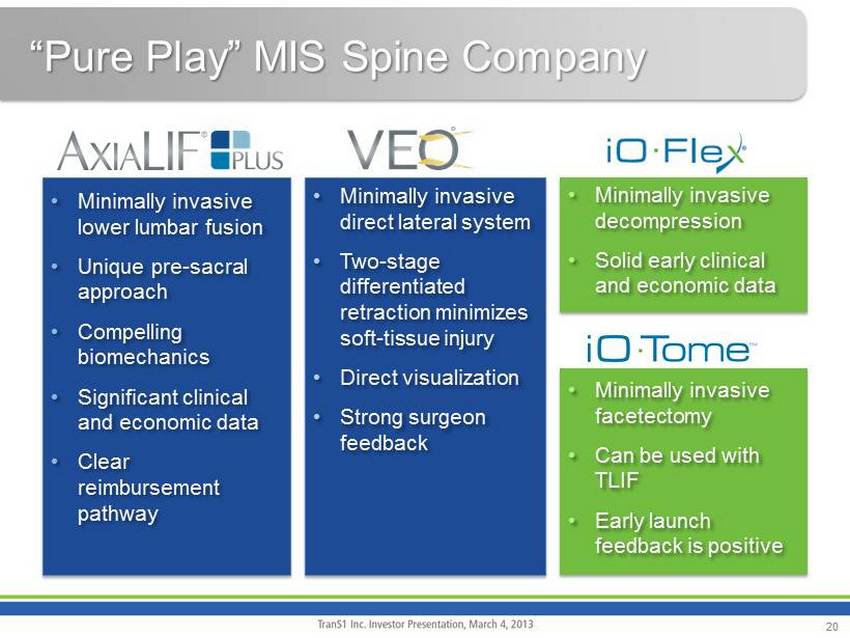

“Pure Play” MIS Spine Company • Minimally invasive lower lumbar fusion • Unique pre - sacral approach • Compelling biomechanics • Significant clinical and economic data • Clear reimbursement pathway • Minimally invasive direct lateral system • Two - stage differentiated retraction minimizes soft - tissue injury • Direct visualization • Strong surgeon feedback • Minimally invasive decompression • Solid early clinical and economic data • Minimally invasive facetectomy • Can be used with TLIF • Early launch feedback is positive 20

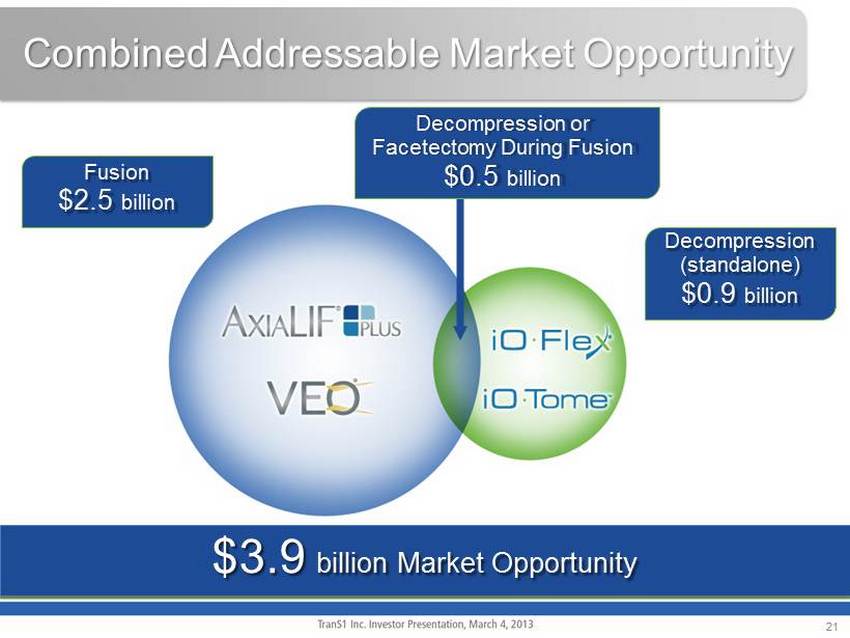

Combined Addressable Market Opportunity $3.9 billion Market Opportunity Fusion $2.5 billion Decompression or Facetectomy During Fusion $0.5 billion Decompression (standalone) $0.9 billion 21

Cross Selling Opportunities • Large historical customer count • Balanced customer overlap • iO - Flex provides low barrier to adoption • Ability to develop surgeon relationships and cross sell other products • Facilitates customer acquisition strategy 22

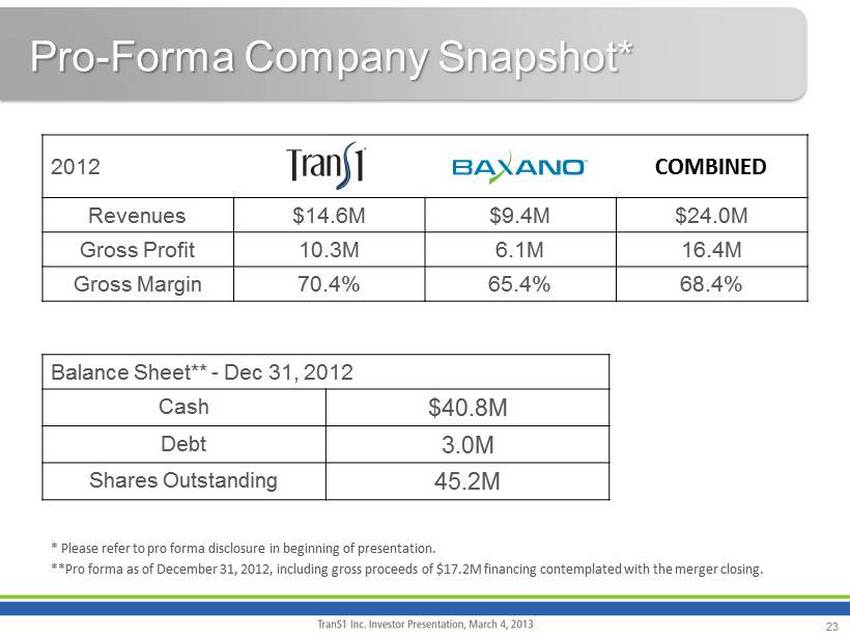

Pro - Forma Company Snapshot* COMBINED * Please refer to pro forma disclosure in beginning of presentation. **Pro forma as of December 31, 2012, including gross proceeds of $17.2M financing contemplated with the merger closing . 2012 Revenues $14.6M $9.4M $24.0M Gross Profit 10.3M 6.1M 16.4M Gross Margin 70.4% 65.4% 68.4% Balance Sheet** - Dec 31, 2012 Cash $40.8M Debt 3.0M Shares Outstanding 45.2M 23

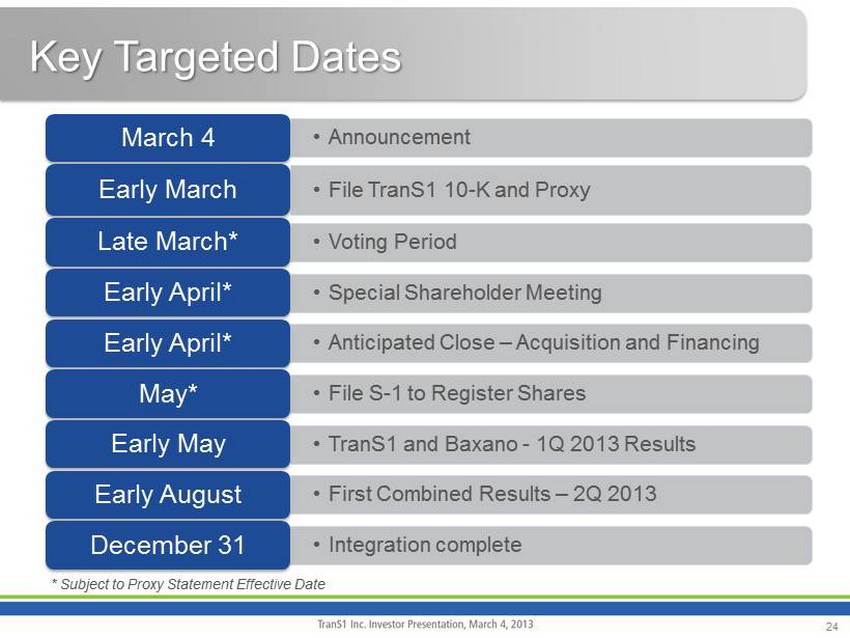

Key Targeted Dates • Announcement March 4 • File TranS1 10 - K and Proxy Early March • Voting Period Late March* • Special Shareholder Meeting Early April* • Anticipated Close – Acquisition and Financing Early April* • File S - 1 to Register Shares May* • TranS1 and Baxano - 1Q 2013 Results Early May • First Combined Results – 2Q 2013 Early August • Integration complete December 31 * Subject to Proxy Statement Effective Date 24

TranS1 Fourth Quarter and Full Year Results

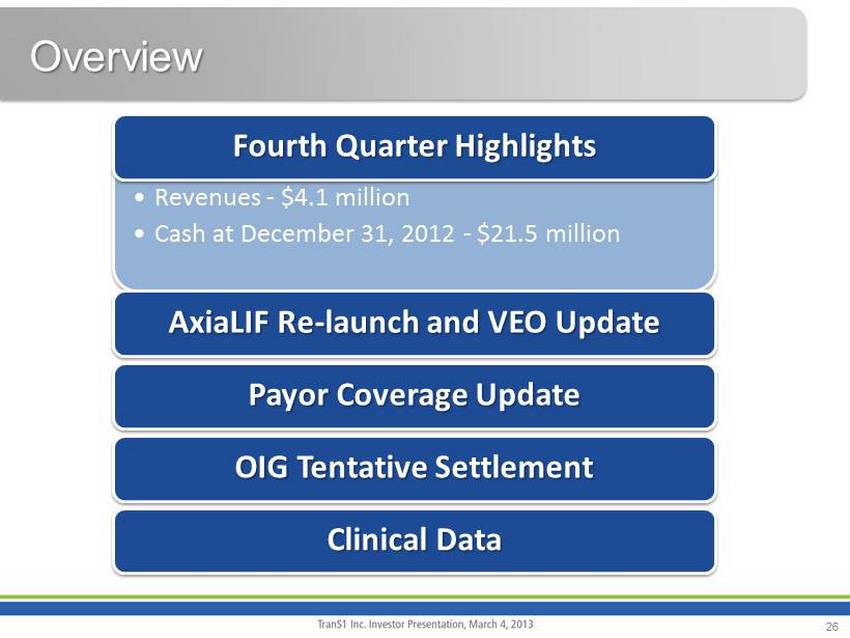

Overview 26 Fourth Quarter Highlights • Revenues - $4.1 million • Cash at December 31, 2012 - $21.5 million AxiaLIF Re - launch and VEO Update Payor Coverage Update OIG Tentative Settlement Clinical Data

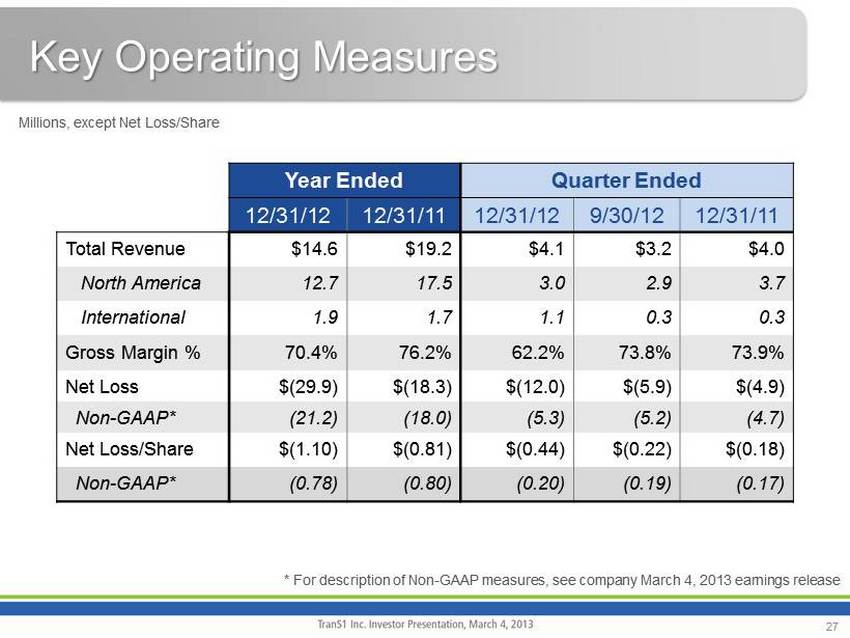

Key Operating Measures Year Ended Quarter Ended 12/31/12 12/31/11 12/31/12 9/30/12 12/31/11 Total Revenue $14.6 $19.2 $4.1 $3.2 $4.0 North America 12.7 17.5 3.0 2.9 3.7 International 1.9 1.7 1.1 0.3 0.3 Gross Margin % 70.4% 76.2% 62.2% 73.8% 73.9% Net Loss $(29.9) $(18.3) $(12.0) $(5.9) $(4.9) Non - GAAP* (21.2) (18.0) (5.3) (5.2) (4.7) Net Loss/Share $(1.10) $(0.81) $(0.44) $(0.22) $(0.18) Non - GAAP* (0.78) (0.80) (0.20) (0.19) (0.17) * For description of Non - GAAP measures, see company March 4, 2013 earnings release 27 Millions, except Net Loss/Share

North America Revenue Details Year Ended Quarter Ended 12/31/12 12/31/11 12/31/12 9/30/12 12/31/11 AxiaLIF Procedures Revenue $8.7 $14.4 $1.9 $1.9 $2.9 % Single - Level 62% 65% 62% 65% 68% % Two - Level 38% 35% 38% 35% 32% Procedures 736 1,300 157 164 257 % Single - Level 70% 74% 69% 72% 76% % Two - Level 30% 26% 31% 28% 24% VEO Procedures Revenue $1.8 $0.4 $0.6 $0.5 $0.2 Procedures 182 50 60 49 21 Avg levels/procedure 1.5 1.4 1.6 1.4 1.2 28 Millions, except procedure information

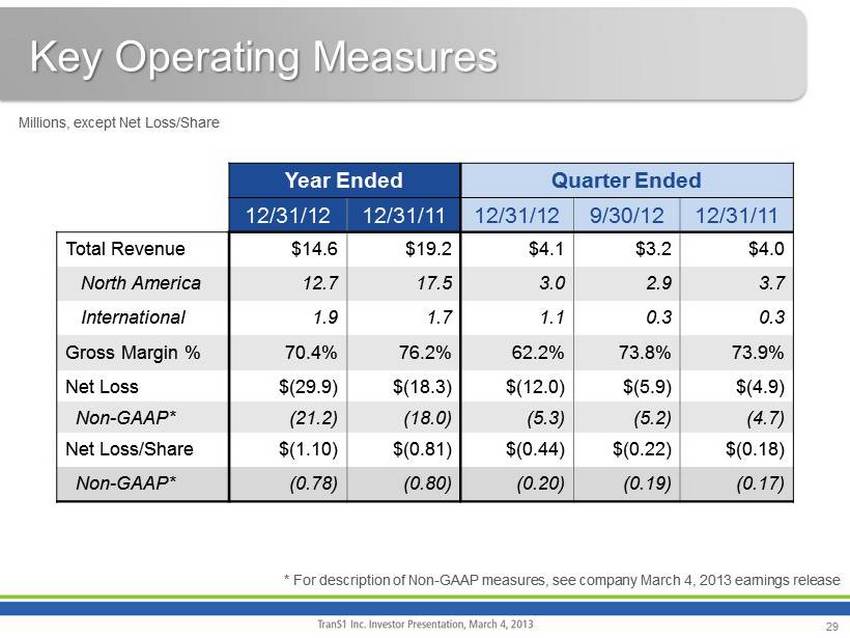

Key Operating Measures Year Ended Quarter Ended 12/31/12 12/31/11 12/31/12 9/30/12 12/31/11 Total Revenue $14.6 $19.2 $4.1 $3.2 $4.0 North America 12.7 17.5 3.0 2.9 3.7 International 1.9 1.7 1.1 0.3 0.3 Gross Margin % 70.4% 76.2% 62.2% 73.8% 73.9% Net Loss $(29.9) $(18.3) $(12.0) $(5.9) $(4.9) Non - GAAP* (21.2) (18.0) (5.3) (5.2) (4.7) Net Loss/Share $(1.10) $(0.81) $(0.44) $(0.22) $(0.18) Non - GAAP* (0.78) (0.80) (0.20) (0.19) (0.17) * For description of Non - GAAP measures, see company March 4, 2013 earnings release 29 Millions, except Net Loss/Share

Balance Sheet Highlights Quarter Ended 12/31/12 9/30/12 12/31/11 Cash $21.5M $27.2M $44.8M A/R DSO 70* 58 57 Inventory Turns 0.86 0.73 0.94 Debt $ - $ - $ - Shares Outstanding 27.3M 27.3M 22.6M * Impacted by $1.0M sales to new China distributor in the quarter 30

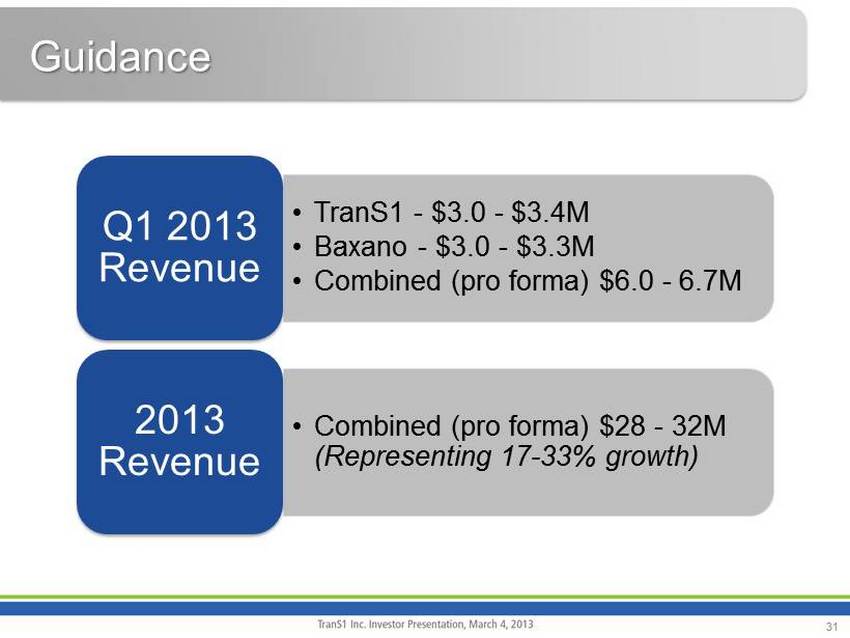

Guidance 31 • TranS1 - $3.0 - $3.4M • Baxano - $3.0 - $3.3M • Combined (pro forma) $6.0 - 6.7M Q1 2013 Revenue • Combined (pro forma) $28 - 32M (Representing 17 - 33% growth) 2013 Revenue

Review of 2012 Operating Priorities • Secure AxiaLIF physician reimbursement – Category I Code, Code Valued – Nearly 100 million covered lives • Drive adoption of VEO direct lateral system – 182 procedures performed by 54 surgeons • Generate further clinical research and data demonstrating the value of AxiaLIF and VEO – 12 peer - reviewed papers published – RAMP trial enrollment started • Position company to grow revenue in 2013 – AxiaLIF re - introduction – Physician training 32

2013 Operating Priorities 33 Integrate TranS1 and Baxano with a focus on revenue and cost synergies Leverage 2012 accomplishments to generate revenue growth Increase payor coverage for AxiaLIF Generate clinical and economic data to differentiate our products from standard of care

Questions and Answers

Thank You