UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

TRANS1 INC.

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ Fee | paid previously with preliminary materials. |

| ¨ Check | box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 5, 2012

TO OUR STOCKHOLDERS:

You are cordially invited to the 2012 Annual Meeting of Stockholders of TranS1 Inc., a Delaware corporation. The 2012 Annual Meeting of Stockholders will be held on Tuesday, June 5, 2012 at 10:00 a.m., local time, at 200 Horizon Drive, Suite 115, Raleigh, North Carolina 27615 for the following purposes (as more fully described in the Proxy Statement accompanying this Notice):

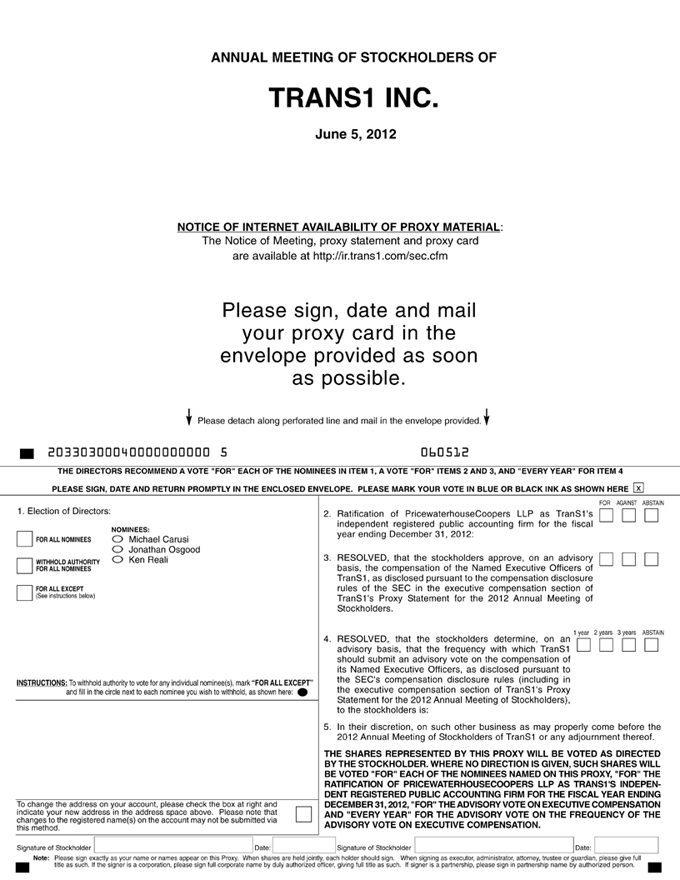

1. To elect three Class II directors to serve for a term of three years expiring upon the 2015 annual meeting of stockholders or until the election of their successors are elected and duly qualified;

2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012;

3. To approve, on a non-binding advisory basis, the compensation paid to the Company’s named executive officers;

4. To approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation paid to the Company’s named executive officers; and

5. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

Only our stockholders of record at the close of business on April 20, 2012 are entitled to notice of, and to vote at, the 2012 Annual Meeting of Stockholders.

Important Notice Regarding the Availability of Proxy Materials for the 2012 Annual Meeting of Stockholders To Be Held on Tuesday, June 5, 2012:

This Notice, along with our Proxy Statement and our annual report on Form 10-K for the fiscal year ended December 31, 2011, is available on the Internet athttp://ir.trans1.com/sec.cfm. Information included on our Website, other than these materials, is not part of the proxy soliciting materials.

All stockholders are cordially invited to attend the 2012 Annual Meeting of Stockholders in person. However, whether or not you plan to attend the 2012 Annual Meeting of Stockholders we encourage you to read this Proxy Statement and promptly vote your shares. In order to vote your shares by proxy please complete, sign and date the proxy and return it in the envelope provided. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

| ON BEHALF OF THE BOARD OF DIRECTORS | ||

| /s/ Ken Reali | ||

| Ken Reali | ||

| President and Chief Executive Officer | ||

Wilmington, North Carolina

April 30, 2012

2

PROXY STATEMENT FOR THE 2012

ANNUAL MEETING OF STOCKHOLDERS

JUNE 5, 2012

ABOUT THE 2012 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

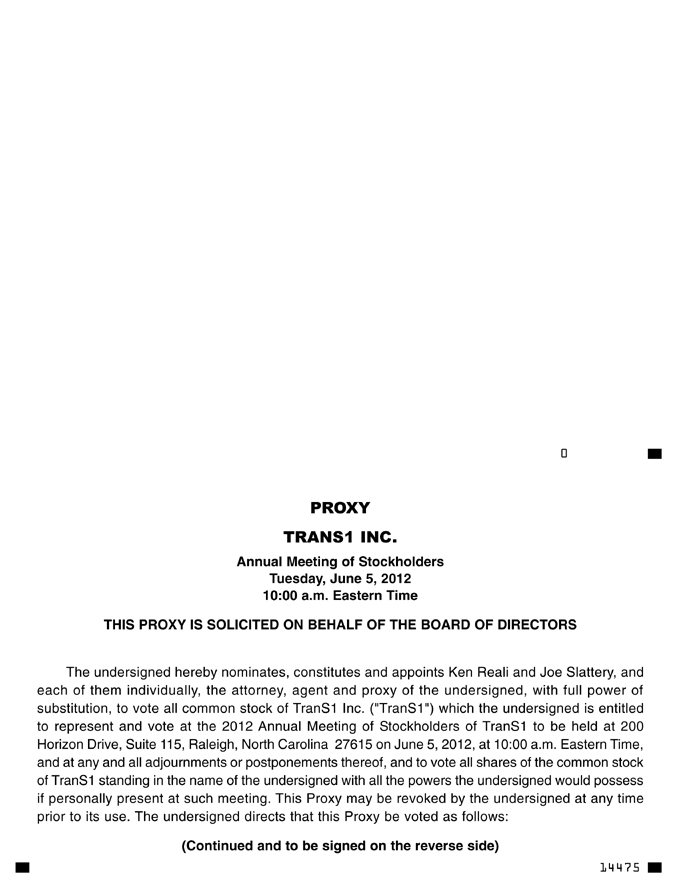

The enclosed proxy statement, which we refer to as the “Proxy Statement,” is solicited on behalf of the Board of Directors of TranS1, Inc., which we refer to as “the Company,” “we,” “us,” or “our,” for use at the Company’s 2012 Annual Meeting of Stockholders to be held on June 5, 2012 at 10:00 a.m., local time, or the “Annual Meeting,” or at any postponements or adjournments thereof, at 200 Horizon Drive, Suite 115, Raleigh, North Carolina 27615.

QUESTIONS AND ANSWERS ABOUT

THE 2012 ANNUAL MEETING AND VOTING

The following questions and answers are intended to briefly address potential questions regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the rules and regulations of the Securities and Exchange Commission, or the SEC. These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about the Proxy Statement or the Annual Meeting, please contact our Corporate Secretary using the contact information provided herein.

| Q: | What is the purpose of the Annual Meeting? |

| A: | At the Annual Meeting, our stockholders will be asked to consider and vote upon the matters described in this Proxy Statement and any other matters that properly come before the Annual Meeting. |

| Q: | When and where will the Annual Meeting be held? |

| A: | You are invited to attend the Annual Meeting on June 5, 2012, beginning at 10:00 a.m., local time. The Annual Meeting will be held at 200 Horizon Drive, Suite 115, Raleigh, North Carolina 27615. |

| Q: | Why did I receive these proxy materials? |

| A: | We are providing these proxy materials in connection with the solicitation by the Board of Directors of the Company of proxies to be voted at the Annual Meeting, and at any adjournment or postponement thereof. This Proxy Statement, the accompanying proxy card and our annual report on Form 10-K for the fiscal year ended December 31, 2011, or the “Annual Report,” are being mailed to all stockholders entitled to vote at the Annual Meeting on or about April 30, 2012. These materials and directions to attend the Annual Meeting, where you may vote in person, are available on the Internet athttp://ir.trans1.com/sec.cfm. |

This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. You are invited to attend the Annual Meeting in person to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares using one of the other voting methods described in this Proxy Statement. Whether or not you expect to attend the Annual Meeting, please vote your shares as soon as possible in order to ensure your representation at the Annual Meeting and to minimize the cost of proxy solicitation.

3

| Q: | What am I being asked to vote upon at the Annual Meeting? |

| A: | At the Annual Meeting, you will be asked to: |

| • | Elect three Class II directors to serve for a term of three years expiring upon the 2015 annual meeting of stockholders or until their successors are elected and duly qualified (Proposal No. 1); |

| • | Ratify the appointment of PricewaterhouseCoopers LLP, who we refer to as PricewaterhouseCoopers, as our independent registered public accounting firm for the fiscal year ending December 31, 2012 (Proposal No. 2); |

| • | Vote, on a non-binding advisory basis, upon a proposal to approve the compensation of our named executive officers, as disclosed in the “Executive Compensation” section of this Proxy Statement (Proposal No. 3); |

| • | Vote, on a non-binding advisory basis, upon the frequency of future advisory votes on the compensation paid to our named executive officers (Proposal No. 4); and |

| • | Act upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

| Q: | How does the Board of Directors recommend that I vote on the proposals? |

| A: | The Board of Directors unanimously recommends that you vote each of your shares “FOR” each of the three Class II director nominees, “FOR” the ratification of the selection of PricewaterhouseCoopers as our independent registered public accounting firm for the fiscal year ending December 31, 2012, “FOR” the approval, on a non-binding advisory basis, of the compensation paid to our named executive officers, and for “EVERY YEAR” for the frequency of future advisory votes on the compensation paid to our named executive officers. |

| Q: | What are the voting requirements to approve the proposals? |

| A: | The voting requirements to approve each of the proposals to be voted upon at the Annual Meeting are as follows: |

| • | Election of Directors (Proposal No. 1) — Directors are elected by a plurality of votes cast, so the three director nominees who receive the most votes will be elected, assuming that a quorum is present. Abstentions and broker non-votes will not be taken into account in determining the election of directors. Under the rules applicable to brokers, they do not possess discretionary authority to vote shares with respect to the election of directors. Accordingly, to the extent brokers do not receive voting instructions from beneficial owners, broker non-votes will result for this item. Please see “What happens if I do not vote?” below for a discussion of “broker non-votes.” |

| • | Ratification of Selection of Accounting Firm (Proposal No. 2) — Ratification of our appointment of PricewaterhouseCoopers will require the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter, assuming that a quorum is present. Abstentions will have the same effect as votes against the proposal. Because the ratification of the independent registered public accounting firm is a discretionary matter on which brokers have the discretion to vote, broker non-votes will not result for this item. |

| • | Advisory Vote on Executive Compensation (Proposal No. 3) — Approval of the non-binding advisory resolution regarding the compensation of our named executive officers will require the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter, assuming that a quorum is present. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be counted for any purpose in determining whether this proposal has been approved. |

| • | Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation (Proposal No. 4) — Approval of the non-binding advisory resolution regarding the frequency of future advisory votes on the compensation of our named executive offers will require the affirmative vote of a majority of |

4

the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter, assuming that a quorum is present. Abstentions will have the same effect as votes against the proposal. Broker non-votes will not be counted for any purpose in determining whether this proposal has been approved. |

| Q: | What happens if I do not vote? |

| A: | The following is a brief explanation of the effect that a decision not to vote shares will have on the proposals at the Annual Meeting: |

| • | Abstentions: You may withhold authority to vote for one or more nominees for director and may abstain from voting on one or more of the other matters to be voted on at the Annual Meeting. Shares for which authority is withheld or that a stockholder abstains from voting will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Shares for which authority is withheld will have no effect on the voting for the election of directors (which requires a plurality of the votes cast). Shares that a stockholder abstains from voting will be included in the total number of votes cast on the particular matter, and will have the same effect as a vote “AGAINST” Proposal No. 2, Proposal No. 3 and Proposal No. 4 (each of which require the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting). |

| • | Broker Non-Votes: “Broker non-votes” are shares held by a broker, dealer, bank or other nominee (each, a “nominee”) that are represented at the Annual Meeting, but with respect to which the nominee holding those shares (i) has not received instructions from the beneficial owner of the shares to vote on the particular proposal, and (ii) does not have discretionary voting power with respect to the particular proposal. Whether a nominee has authority to vote shares that it holds is determined by stock exchange rules. Nominees holding shares of record for beneficial owners generally are entitled to exercise their discretion to vote on Proposal No. 2, but do not have the discretion to vote on Proposal No. 1, Proposal No. 3, or Proposal No. 4 unless they receive other instructions from the beneficial owners of the shares. Please see “Who can vote at the Annual Meeting?” below for a discussion of beneficial ownership. |

Broker non-votes will be counted for purposes of determining the presence or absence of a quorum at the Annual Meeting, but will not be counted for purposes of determining the number of shares represented and voting with respect to a proposal.

| Q: | Who can vote at the Annual Meeting? |

| A: | Only our stockholders of record at the close of business on April 20, 2012, which we refer to as the Record Date, will be entitled to vote at the Annual Meeting. As of the Record Date, approximately 27,246,975 shares of our common stock were issued and outstanding and held of record by approximately 27 stockholders. Each share of common stock issued and outstanding on the Record Date is entitled to one (1) vote on any matter presented for consideration and action by our stockholders at the Annual Meeting. Stockholders will not be entitled to cumulate their votes in the election of directors. |

| • | Holders of Record: If, on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a “holder of record.” As a “holder of record,” you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares using one of the voting methods described in this Proxy Statement. |

| • | Beneficial Owners: If, on the Record Date, your shares were held in an account with a nominee, then you are the “beneficial owner” of shares held in “street name” and this Proxy Statement is being forwarded to you by that nominee. The nominee holding your account is considered the “holder of record” for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the “holder of record,” you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your nominee. Please contact your nominee directly for additional information. |

5

| Q: | What is the quorum requirement for the Annual Meeting? |

| A: | The presence at the Annual Meeting, in person or represented by proxy, of holders of a majority of the outstanding shares of our common stock outstanding as of the Record Date, will constitute a quorum at the Annual Meeting. We will treat shares of common stock represented by a properly voted proxy, including abstentions and broker non-votes, as present at the Annual Meeting for the purposes of determining the existence of a quorum. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. |

| Q: | How can I vote my shares? |

| A: | If you are a holder of record, you may vote by mail or in person at the Annual Meeting. If you are a beneficial owner of shares held in “street name”, you may vote by mail, in person at the Annual Meeting, or by over the Internet. The voting methods available for holders of record and beneficial owners are described in greater detail below. Stockholders who execute proxies retain the right to revoke them at any time before they are voted. Ken Reali and Joseph Slattery, the designated proxyholders, are members of the Company’s management. |

| • | Vote by Mail. You can vote by mail pursuant to the instructions provided on the proxy card. In order to be effective, completed proxy cards must be received by 12:00 p.m. Eastern Time on June 4, 2012. If you choose to vote by mail, simply mark your proxy, date and sign it, and return it in the business reply envelope provided with this Proxy Statement. |

| • | Vote at the Annual Meeting. The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend in person. If you hold shares beneficially in “street name,” you must obtain a proxy, executed in your favor by your nominee to be able to vote at the Annual Meeting. All shares that have been properly voted and not revoked will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors. |

| • | Vote by Internet. If you hold shares beneficially in “street name,” you may vote by proxy over the Internet by following the instructions provided in the voting instruction card provided to you by your nominee. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 4, 2012 by visiting www.proxyvote.com and following the instructions. Our Internet voting procedures are designed to authenticate stockholders by using individual control numbers, which are located on the voting instruction card. If you vote by Internet, you do not need to return your proxy card. |

| Q: | How may I attend the Annual Meeting? |

| A: | You are entitled to attend the Annual Meeting only if you were a stockholder as of the Record Date or hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. You should be prepared to present government-issued photo identification for admittance, such as a passport or driver’s license. If your shares are held in “street name,” you also will need proof of ownership as of the Record Date to be admitted to the Annual Meeting, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your nominee, or similar evidence of ownership. Please note that for security reasons, you and your bags may be subject to search prior to your admittance to the Annual Meeting. If you do not comply with each of the foregoing requirements, you will not be admitted to the Annual Meeting. Please let us know if you plan to attend the Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone, by indicating your plans when prompted. |

| Q: | What can I do if I change my mind after I vote my shares? |

| A: | You may change your vote at any time before your proxy is voted at the Annual Meeting. You may change your vote by (i) providing written notice of revocation to the Corporate Secretary of the Company at our corporate headquarters located at 301 Government Center Drive, Wilmington, North Carolina 28403, (ii) by executing a subsequent proxy using any of the voting methods discussed above, or (iii) by attending the Annual Meeting and voting in person. However, simply attending the Annual Meeting will not, by itself, |

6

| revoke your proxy.If you have instructed your nominee to vote your shares, you must follow directions received from your nominee to change those instructions. Subject to any such revocation, all shares represented by properly executed proxies will be voted in accordance with the specifications on the enclosed proxy. |

| Q: | Could other matters be decided at the Annual Meeting? |

| A: | As of the date this Proxy Statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. However, if any other matters are presented for consideration at the Annual Meeting including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place in order to solicit additional proxies in favor of one or more of the proposals, the persons named as proxyholders and acting thereunder will have discretion to vote on these matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. |

| Q: | Who is paying for the cost of this proxy solicitation? |

| A: | The cost of soliciting proxies will be borne by us. We expect to reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers and regular employees, without additional compensation, personally or by telephone or facsimile. The total estimated cost of the solicitation of proxies is approximately $10,000. |

| Q: | How can stockholders nominate a candidate for election as a director or propose other actions for consideration at an annual meeting of stockholders? |

| A: | SEC rules and our Bylaws require that a stockholder provide us with timely advance written notice when seeking to nominate a candidate for election as a director or to propose other actions for consideration at an annual meeting of stockholders. To be timely, a stockholder’s notice must comply with the following: |

| • | Inclusion of Proposals in our Proxy Statement and Proxy Card under the SEC’s Rules. In order to include information with respect to a stockholder proposal in our proxy statement and form of proxy for a stockholders’ meeting, stockholders must comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, and any other applicable rules established by the SEC. Under Rule 14a-8, a stockholder’s proposal must be received at our principal executive offices not less than 120 calendar days prior to the first anniversary of the date our proxy statement was released to stockholders in connection with the preceding year’s annual meeting. Thus, in order for a stockholder’s proposal to be considered for inclusion in our proxy statement and proxy card for the 2013 annual meeting, the proposal must be received at our corporate offices on or before December 31, 2012, unless the date of our 2013 annual meeting is more than 30 days before or after June 5, 2013, in which case the proposal must be received a reasonable time before we begin to print and mail our proxy materials. |

| • | Bylaw Requirements for Stockholder Submission of Nominations and Proposals. A stockholder recommendation for nomination of a person for election to our Board of Directors or a proposal for consideration at our 2013 annual meeting must be submitted in accordance with the advance notice procedures and other requirements set forth in Article II of our bylaws. These requirements are separate from, and in addition to, the requirements discussed above to have the stockholder nomination or other proposal included in our proxy statement and form of proxy/voting instruction card pursuant to the SEC’s rules. Compliance with our bylaw requirements will entitle the proposing stockholder only to present such nominations or proposals before the stockholder meeting, not to have the nominations or proposals included in our proxy statement or proxy card. Any such nomination or proposal may be made only by persons who are stockholders of record on the date on which such notice is given and on the record date for determination of stockholders entitled to vote at that meeting. In addition, no such nomination or proposal may be brought before an annual meeting by a stockholder unless that stockholder has given timely written notice in proper form of such nomination or proposal to our Corporate Secretary, as more particularly set forth in Article II of our bylaws. Any stockholder desiring to submit a nomination or |

7

proposal for action at our 2013 annual meeting of stockholders should deliver the proposal to our Corporate Secretary at our corporate office at TranS1 Inc., 301 Government Center Drive, Wilmington, North Carolina 28403 no earlier than February 5, 2013 and no later than March 7, 2013, in order to be presented at the 2013 annual meeting of stockholders. The full text of the bylaw provisions referred to above (which also set forth requirements and limitations as to stockholder nominations or proposals to be considered at any special meeting) may be obtained by contacting our Corporate Secretary at the address set forth above. |

| Q: | I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

| A: | We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we are delivering a single copy of this Proxy Statement and the Annual Report to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs and other fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of this Proxy Statement and the Annual Report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Proxy Statement or the Annual Report, please write or call us at the following address and telephone number: |

TranS1 Inc.

Attn: Corporate Secretary

301 Government Center Dr.

Wilmington, NC 28403

(910) 332-1700 (telephone)

In addition, if you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact us using the contact information set forth above. Stockholders who hold shares in “street name” may contact their nominee to request information about householding. This Proxy Statement for the Annual Meeting and the Annual Report to Stockholders for the fiscal year ended December 31, 2011, are available athttp://ir.trans1.com/sec.cfm.

| Q: | Where can I find voting results of the Annual Meeting? |

| A: | We will announce preliminary voting results with respect to each proposal at the Annual Meeting. In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that time in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once they are known by the Company. |

| Q: | Whom should I contact with other questions? |

| A: | If you have additional questions about this Proxy Statement or the Annual Meeting or would like additional copies of this Proxy Statement, please contact us by either writing to TranS1 Inc. at our principle executive offices located at 301 Government Center Dr. Wilmington, NC 28403, Attention: Corporate Secretary, by calling us at (910) 332-1700, or by sending a facsimile transmission to (910) 332-1701. |

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of March 30, 2012, by (i) each person or entity who is known by us to own beneficially more than 5% of the outstanding shares of common stock, (ii) each of our directors, (iii) each of the named executive officers, and (iv) all of our directors and executive officers as a group.

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Approximate Percentage of Shares Beneficially Owned(2) | ||||||

5% Stockholders | ||||||||

Delphi Ventures and Affiliated Entities(3) | 4,692,695 | 17.2 | % | |||||

Advanced Technology Ventures and Affiliated Entities(4) | 3,127,906 | 11.5 | % | |||||

Cutlass Capital and Affiliated Entities(5) | 2,036,360 | 7.5 | % | |||||

Sapient Capital, L.P.(6) | 1,613,090 | 5.9 | % | |||||

Thomas Weisel Healthcare Venture Partners, L.P. and Affiliated Entities(7) | 1,149,845 | 4.2 | % | |||||

Named Executive Officers and Directors | ||||||||

Michael Carusi(8) | 3,127,906 | 11.5 | % | |||||

Jonathan Osgood(9) | 2,036,360 | 7.5 | % | |||||

James Shapiro(10) | 1,149,845 | 4.2 | % | |||||

Richard Randall(11) | 680,835 | 2.5 | % | |||||

Joseph Slattery(12) | 354,866 | 1.3 | % | |||||

Paul LaViolette(13) | 206,346 | * | ||||||

Jeffrey Fischgrund(14) | — | * | ||||||

Ken Reali(15) | 190,460 | * | ||||||

Dwayne Montgomery(16) | 89,508 | * | ||||||

David Simpson(17) | 77,500 | * | ||||||

Rick Feiler(18) | 66,113 | * | ||||||

Steve Ainsworth(19) | 44,959 | * | ||||||

Mukesh Ramchandani(20) | 44,750 | * | ||||||

All Executive Officers and Directors as a Group (13 persons)(21) | 8,069,448 | 29.6 | % | |||||

| * | Less than 1% |

| (1) | Unless otherwise indicated, the business address of each stockholder is c/o TranS1 Inc., 301 Government Center Drive, Wilmington, North Carolina 28403. |

| (2) | This table is based upon information supplied by our officers and directors, and with respect to principal stockholders, Schedules 13G and 13G/A, as well as Forms 4, filed with the SEC. Beneficial ownership is determined in accordance with the rules of the SEC. Applicable percentage ownership is based on 27,246,975 shares of common stock outstanding as of March 30, 2012. Shares of common stock subject to options currently exercisable or exercisable within 60 days of March 30, 2012, are deemed outstanding for computing the ownership percentage of the person holding such options, but are not deemed outstanding for computing the ownership percentage of any other person. Except as otherwise noted, we believe that each of the stockholders named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to applicable community property laws. |

| (3) | Based on information set forth in a Schedule 13G/A filed with the SEC on February 12, 2010. Consists of (i) 2,236,272 shares held by Delphi Ventures VI, L.P. (“DV VI”), (ii) 22,362 shares held by Delphi BioInvestments VI, L.P. (“DBI VI”), (iii) 2,410,523 shares held by Delphi Ventures VIII, L.P. (“DV VIII”), and (iv) 23,538 shares held by Delphi BioInvestments VIII, L.P. (“DBI VIII”). Delphi Management Partners VI, L.L.C. is the general partner of each of DV VI and DBI VI and may be deemed to have sole |

9

| voting and dispositive power with respect to the shares owned by DV VI and DBI VI. Delphi Management Partners VIII, L.L.C. is the general partner of each of DV VIII and DBI VIII and may be deemed to have sole voting and dispositive power with respect to the shares owned by DV VIII and DBI VIII. The managing members of each of Delphi Management Partners VI, L.L.C. and Delphi Management Partners VIII, L.L.C. are James J. Bochnowski, David L. Douglass, Douglas A. Roeder, John F. Maroney and Deepika R. Pakianathan (collectively, the “Delphi Managing Members”). The Delphi Managing Members may be deemed to have shared voting and dispositive power with respect to each of the shares listed above. Delphi Management Partners VI, L.L.C., Delphi Management Partners VIII, L.L.C. and each of the Delphi Managing Members disclaims beneficial ownership of the shares except to the extent of their indirect pecuniary interest therein. In addition, Mr. Douglass has sole voting and dispositive power with respect to 30,000 shares not disclosed in the first sentence of this footnote 3, Mr. Roeder has sole voting and dispositive power with respect to 22,000 shares not disclosed in the first sentence of this footnote 3 and Mr. Pakianathan has sole voting and dispositive power with respect to 500 shares not disclosed in the first sentence of this footnote 3. The address for all entities and individuals affiliated with Delphi Ventures is 3000 Sand Hill Road, Building 1, Suite 135, Menlo Park, CA 94025. |

| (4) | Based on information set forth in a Schedule 13G/A filed with the SEC on February 13, 2009. Consists of (i) 2,894,702 shares held by Advanced Technology Ventures VII, L.P. (“ATV VII”), (ii) 116,163 shares held by Advanced Technology Ventures VII (B), L.P. (“ATV VII-B”), (iii) 55,836 shares held by Advanced Technology Ventures VII (C), L.P. (“ATV VII-C”), (iv) 17,249 shares held by ATV Entrepreneurs VII, L.P. (“ATV VII-E” and together with ATV VII, ATV VII-B, and ATV VII-C, collectively referred to as the “ATV VII Entities”), and (v) 3,956 shares held by ATV Alliance 2002, L.P. (“ATV A 2002” and together with the ATV VII Entities, the “ATV Entities”). ATV Associates VII, L.L.C. (“ATV A VII”) is the general partner of each of the ATV VII Entities and exercises voting and dispositive power over the shares held by the ATV VII Entities. ATV Alliance Associates, L.L.C. (“ATV Alliance”) is the general partner of ATV A 2002 and exercises voting and dispositive power over the shares held by ATV A 2002. Voting and dispositive decisions of ATV A VII are made by a board of five managing directors (the “ATV Managing Directors”), including Michael Carusi, one of our directors. Each of the ATV Managing Directors disclaims beneficial ownership of the shares held by the ATV VII Entities except to the extent of their respective indirect pecuniary interest therein. Voting and dispositive decisions of ATV Alliance are made by its sole manager, Jean George, who disclaims beneficial ownership of the shares held by ATV A 2002. Each of ATV A VII and ATV Alliance disclaims beneficial ownership of any shares held by any of the ATV Entities. The address for all entities and individuals affiliated with Advanced Technology Ventures is 500 Boylston Street, Suite 1380, Boston, Massachusetts 02116. |

| (5) | Based on information set forth in a Schedule 13G filed with the SEC on February 9, 2011. Consists of (i) 1,755,752 shares held by Cutlass Capital, L.P., (ii) 126,133 shares held by Cutlass Capital Principals Fund, L.L.C., and (iii) 114,475 shares held by Cutlass Capital Affiliates Fund, L.P. Jonathan Osgood, one of our directors, is one of two managing members of Cutlass Capital Management, L.L.C., which is the general partner of each of Cutlass Capital, L.P. and Cutlass Capital Affiliates Fund, L.P. Mr. Osgood is also one of two managing members of Cutlass Capital Principals Fund, L.L.C. Mr. Osgood has shared voting and investment power over the shares held by each of Cutlass Capital, L.P., Cutlass Capital Principals Fund, L.L.C. and Cutlass Capital Affiliates Fund, L.P. Mr. Osgood disclaims beneficial ownership of the shares held by Cutlass Capital, L.P., Cutlass Capital Principals Fund, L.L.C. and Cutlass Capital Affiliates Fund, L.P., except to the extent of his proportionate pecuniary interest in them. The address for all entities and individuals affiliated with Cutlass Capital is 322 Dunbarton Drive, St. Simons Island, GA 31522. |

| (6) | Based on information set forth in a Schedule 13G filed with the SEC on November 20, 2007. Mitchell Dann, one of our former directors, is the managing member of Sapient Capital Management, L.L.C., which is the general partner of Sapient Capital Management L.P., which is the general partner of Sapient Capital, L.P. Each of Sapient Capital Management, L.L.C., Sapient Capital Management L.P. and Mr. Dann disclaims beneficial ownership of the shares held by Sapient Capital, L.P., except to the extent of their respective proportionate pecuniary interest therein. The address for Sapient Capital is 4020 Lake Creek Drive, P.O. Box 1590, Wilson, WY 83014. |

10

| (7) | Based on information set forth in a Schedule 13G/A filed with the SEC on February 14, 2011. Consists of (i) 1,029,545 shares held directly by Thomas Weisel Healthcare Venture Partners, L.P. (“TWHVP”), (ii) 78,695 shares held directly by Kearny Venture Partners, L.P. (“KVP”), and (iii) 1,605 shares held directly by Kearny Venture Partners Entrepreneurs’ Fund, L.P. (“KVPEF”). Thomas Weisel Healthcare Venture Partners L.L.C. (“TWHVP LLC”) is the general partner of TWHVP and has shared voting and dispositive power with respect to the shares held by TWHVP. Kearny Venture Associates, L.L.C. (“KVA”) is the general partner of both KVP and KVPEF and has shared voting and dispositive power with respect to the shares held by KVP and KVPEF. Each of James M. Shapiro (“Shapiro”) and Richard Spalding (“Spalding”) is (i) an affiliate of TWHVP LLC, and (ii) a Managing Member of KVA. Each of Spalding and Shapiro may be deemed to have shared voting power with respect to the shares held directly by TWHVP, KVP and KVPEF. The address for each of the foregoing entities is 88 Kearny Street, 2nd Floor, San Francisco, California 94108. |

| (8) | Consists of the shares identified in footnote 4 and 40,000 shares subject to options exercisable within 60 days of March 30, 2012, which options are held directly by Mr. Carusi. Mr. Carusi is one of our directors and is a managing director of ATV Associates VII, LLC. Mr. Carusi disclaims beneficial ownership of the shares held by the ATV Entities except to the extent of his proportionate pecuniary interest therein. |

| (9) | Consists of the shares identified in footnote 5, and 40,000 shares subject to options exercisable within 60 days of March 30, 2012, which options are held directly by Mr. Osgood. Mr. Osgood is one of our directors and is one of two managing members of Cutlass Capital Management, L.L.C., which is the general partner of each of Cutlass Capital, L.P. and Cutlass Capital Affiliates Fund, L.P. Mr. Osgood is also one of two managing members of Cutlass Capital Principals Fund, L.L.C. Mr. Osgood has shared voting and dispositive power over the shares held by each of Cutlass Capital, L.P., Cutlass Capital Principals Fund, L.L.C. and Cutlass Capital Affiliates Fund, L.P. Mr. Osgood disclaims beneficial ownership of the shares held by Cutlass Capital, L.P., Cutlass Capital Principals Fund, L.L.C. and Cutlass Capital Affiliates Fund, L.P., except to the extent of his proportionate pecuniary interest therein. |

| (10) | Consists of the shares identified in footnote 7, and 40,000 shares subject to options exercisable within 60 days of March 30, 2012, which options are held directly by Mr. Shapiro. Mr. Shapiro is one of our directors and is an affiliate of TWHVP LLC, the general partner of TWHVP, and has shared voting and dispositive power over the shares held by TWHVP. Mr. Shapiro is also a managing member of KVA, which is the general partner of both KVP and KVPEF, and has shared voting and dispositive power with respect to the shares held by KVP and KVPEF. Mr. Shapiro disclaims beneficial ownership of these shares except to the extent of his proportionate pecuniary interest therein. |

| (11) | Includes 136,500 shares subject to options exercisable within 60 days of March 30, 2012. |

| (12) | Includes 163,452 shares subject to options exercisable within 60 days of March 30, 2012. |

| (13) | Includes 52,500 shares subject to options exercisable within 60 days of March 30, 2012. |

| (14) | The Board appointed Dr. Fischgrund to serve on the Board effective as of April 4, 2012. |

| (15) | Includes 190,460 shares subject to options exercisable within 60 days of March 30, 2012. |

| (16) | Includes 89,508 shares subject to options exercisable within 60 days of March 30, 2012. |

| (17) | Includes 17,500 shares subject to options exercisable within 60 days of March 30, 2012. |

| (18) | Includes 65,064 shares subject to options exercisable within 60 days of March 30, 2012. |

| (19) | Includes 44,959 shares subject to options exercisable within 60 days of March 30, 2012. |

| (20) | Includes 44,750 shares subject to options exercisable within 60 days of March 30, 2012. |

| (21) | Includes 924,693 shares subject to options exercisable within 60 days of March 30, 2012. |

11

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We describe below transactions and series of similar transactions that have occurred since January 1, 2010 to which we were a party or will be a party in which:

| • | the amounts involved exceeded or will exceed $120,000; and |

| • | a director, executive officer, nominee for director, holder of more than 5% of our common stock or any member of their immediate family had or will have a direct or indirect material interest. |

Indemnification of Directors and Executive Officers

We have entered into an indemnification agreement with each of our directors and certain of our executive officers. These indemnification agreements and our amended and restated certificate of incorporation and bylaws indemnify each of our directors and certain of our officers to the fullest extent permitted by the Delaware General Corporation Law.

Review, Approval or Ratification of Transactions with Related Persons

As provided in our Audit Committee charter, all related party transactions are to be reviewed and pre-approved by our Audit Committee. A “related party transaction” is defined to include any transaction or series of transactions exceeding $120,000 in which we are or stand to be a participant and any related person has or will have a material interest. Related persons would include our directors, executive officers, nominees for director (and immediate family members of our directors and executive officers), and persons controlling over five percent of our outstanding common stock (and immediate family members of such persons). In determining whether to approve a related party transaction, the Audit Committee will generally evaluate the transaction in terms of: (i) the benefits to us; (ii) the impact on a director’s independence in the event the related person is a director, an immediate family member of a director or an entity in which a director is a partner, shareholder or executive officer; (iii) the availability of other sources for comparable products or services; (iv) the terms and conditions of the transaction; and (v) the terms available to unrelated third parties or to employees generally. The Audit Committee will then document its findings and conclusions in written minutes. In the event a transaction relates to a member of our Audit Committee, that member will not participate in the Audit Committee’s deliberations.

12

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Directors and Nominees for Director

Pursuant to our amended and restated certificate of incorporation and amended and restated bylaws, our Board currently consists of eight persons. Our Board is divided into three classes serving staggered terms of three years. The Class II directors, which now consist of Michael Carusi, Jonathan Osgood, and Ken Reali, are scheduled to serve until the Annual Meeting. The Class III directors, which now consist of Richard Randall, David Simpson, and Jeffrey Fischgrund, are scheduled to serve until the annual meeting of stockholders in 2013. The Class I directors, which now consist of James Shapiro and Paul LaViolette, are scheduled to serve until the annual meeting of stockholders in 2014.

The Board appointed Ken Reali to serve as a director, effective January 4, 2011, in connection with his appointment as the Company’s President and Chief Executive Officer. On June 23, 2011, Mitchell Dann tendered his resignation as a member of the Board of Directors, which resignation was effective as of June 23, 2011. Mr. Dann resigned for personal reasons and not as a result of any disagreement with the Company on any matters relating to the Company’s operations, policies or practices. On April 4, 2012, the Board appointed Jeffrey Fischgrund, M.D. to serve on the Board, effective as of April 4, 2012.

In the event that any person nominated as a Class II director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies in their discretion for any nominee who is designated by the current Board to fill the vacancy. It is not expected that any of the nominees will be unavailable to serve.

The names of the Class II nominees for election to our Board at the Annual Meeting, their ages as of the Record Date, and certain information about them are set forth below. The names of the current Class I and Class III directors with unexpired terms, their ages as of the Record Date, and certain information about them are also stated below.

Name | Age | Principal Occupation | Director Since | |||||||

Nominees for Class II Directors | ||||||||||

Michael Carusi | 47 | General Partner, Advanced Technology Ventures | 2003 | |||||||

Jonathan Osgood | 62 | Managing Member, Cutlass Capital, L.L.C. | 2002 | |||||||

Ken Reali | 46 | President and Chief Executive Officer of TranS1 Inc. | 2011 | |||||||

Continuing Class I Directors | ||||||||||

Paul LaViolette | 54 | Partner, SV Life Sciences | 2008 | |||||||

James Shapiro | 53 | General Partner, Kearny Venture Partners | 2005 | |||||||

Continuing Class III Directors | ||||||||||

Jeffrey Fischgrund | 51 | Orthopedic Spine Surgeon | 2012 | |||||||

Richard Randall | 60 | Chief Executive Officer of Avantis, Inc. | 2002 | |||||||

David Simpson | 65 | Former Executive Vice President of Stryker Corporation | 2010 | |||||||

Nominees for Terms Expiring at the Annual Meeting

Class II Directors

Michael Carusihas served as a member of our Board since April 2003. He has served as a General Partner at Advanced Technology Ventures, a venture capital firm, since October 1998. Mr. Carusi serves on the board of directors of GI Dynamics, which is listed on the Australian Securities Exchange. Mr. Carusi has also served on the board of XTENT, Inc., which was a public company until 2009. In addition, he serves on the boards, audit committees and compensation committees of several other privately-held life sciences and medical device companies. Mr. Carusi received a B.S. degree in Mechanical Engineering from Lehigh University and an M.B.A. degree from the Amos Tuck School of Business at Dartmouth College.

13

Mr. Carusi’s experience and attributes qualify him to serve on our Board for several reasons. As a result of serving on the boards of another public and several privately-held life science and medical device companies, Mr. Carusi has gained vast experience in analyzing and evaluating such companies’ financial statements and operations. Mr. Carusi has also been involved in the management of, or invested in over sixteen separate medical device and biopharmaceutical companies.

Jonathan Osgoodhas served as a member of our Board since March 2002. In 2001, Mr. Osgood co-founded, and is a managing member of, Cutlass Capital, L.L.C., a venture capital firm that invests exclusively in the healthcare industry. Mr. Osgood has served as a member of the board of directors of several privately-held medical device companies and as a member of the audit committee and compensation committee of several of such companies. Mr. Osgood is a Certified Financial Analyst and received a B.A. degree in Economics from Dartmouth College and an M.B.A. degree from the Amos Tuck School of Business at Dartmouth College.

Mr. Osgood’s experience and attributes qualify him to serve on our Board for several reasons. Virtually his entire 38 year business career has been spent in and around the health care industry. From 1984 until 2000, Mr. Osgood led Alex. Brown & Sons’ and Deutsche Bank’s Health Care Research practice, where he advised clients in their health care investing strategy. From 2001 to the present, as a managing member of Cutlass Capital, L.L.C., Mr. Osgood has been investing in privately owned health care companies, primarily in the medical device space. As a result of this experience, Mr. Osgood has broad and deep experience in working with and analyzing health care companies, and has developed a large network of health care company executives, entrepreneurs, physicians, investment bankers and venture capitalists.

Ken Realihas been our Chief Executive Officer and a member of our Board since January 4, 2011 and our President since January 2010. Mr. Reali was initially hired by us as our President and Chief Operating Officer in January 2010. He joined us from Smith & Nephew where he spent five years in various general management roles, including most recently as Senior Vice President and General Manager of the Biologics and Clinical Therapies Business. Prior to joining Smith & Nephew, Mr. Reali held senior marketing, sales and product development positions of increasing responsibility at Stryker for seven years. Prior to joining Stryker, Mr. Reali worked as a sales representative and marketing product manager at Biomet for eight years. Mr. Reali received a B.S. degree in Business from Valparaiso University.

Mr. Reali has extensive experience and attributes that qualify him to serve on our Board beyond serving as our President and Chief Executive Officer. He has over 22 years of general management, sales, product development, reimbursement and marketing experience with leading medical device and orthopedic companies. His broad experience in management, product development, marketing and international markets has given him valuable insight in assessing overall business strategies and risks and will enable him to expand our business globally.

Directors Whose Terms Extend Beyond the Annual Meeting

Class I Directors — Terms Expiring at the 2014 Annual Meeting of Stockholders

Paul LaViolettehas served as a member of our Board since August 2008. Mr. LaViolette became a partner at SV Life Sciences in January 2011 and brings over 29 years of global medical technology marketing and general management experience. He was most recently Chief Operating Officer at Boston Scientific Corporation, or BSC, a medical device leader with over $8 billion in revenues. During his 15 years at BSC, he served as Chief Operating Officer, Group President, President-Cardiology and President-International as the company grew its revenues by over 20 times. Mr. LaViolette integrated two dozen acquisitions and led extensive product development, operations and worldwide commercial organizations. He previously held marketing and general management positions at CR Bard, and various marketing roles at Kendall (Covidien). Mr. LaViolette currently serves on the boards of Cameron Health, CardioFocus, CardioKinetix, Conceptus, CSA Medical, DC Devices, Direct Flow Medical, DJO Global, Thoratec, TransEnterix and ValenTx. He currently serves as the chairman of the board of CardioFocus and TransEnterix. He also currently serves as the chairman of the compensation committees of Thoratec and DC Devices, as a member of the compensation committees of ValenTx and Direct Flow Medical, and as a member of the audit committee of Conceptus. He previously served on the board of Urologix, Percutaneous Valve Technologies and the Advanced Medical Technology Association, the largest medical device trade organization in the world. Mr. LaViolette received a B.A degree in Psychology from Fairfield University and an M.B.A. degree from Boston College.

14

Mr. LaViolette’s experience and attributes qualify him to serve on our Board for several reasons. Mr. LaViolette’s vast medical technology operating experience makes him knowledgeable in the areas of product launches, new product development, clinical and regulatory affairs, plant management, quality systems, international sales and marketing, acquisitions and integrations, and income statement management.

James Shapirohas served as a member of our Board since September 2005. Mr. Shapiro has served as a General Partner of Kearny Venture Partners, a venture capital firm, and its predecessor, Thomas Weisel Healthcare Venture Partners, since March 2003. Since January 2000, Mr. Shapiro has also been a General Partner of ABS Healthcare Ventures. Mr. Shapiro serves on the board and audit committee of Hansen Medical, Inc., a publicly traded medical device company, as well as on the boards and committees of several privately-held medical device companies. Mr. Shapiro received an A.B. degree in Molecular Biology from Princeton University and an M.B.A degree from the Stanford University Graduate School of Business.

Mr. Shapiro’s experience and attributes qualify him to serve on our Board for several reasons. From 1985 to 1999, Mr. Shapiro led Alex. Brown & Sons healthcare investment banking practice on the West Coast, providing financing and M&A advisory services to both emerging growth and established healthcare companies. Mr. Shapiro also brings experience as a medical technology investor, serving on several boards of emerging growth companies in that sector.

Class III Directors — Terms Expiring at the 2013 Annual Meeting of Stockholders

Jeffrey Fischgrund joined as a member of our Board on April 4, 2012. Dr. Fischgrund, is a board certified orthopedic spine surgeon with over 20 years of experience. Dr. Fischgrund is a Professor of Orthopedic Surgery at The Oakland University School of Medicine, at William Beaumont Hospital in Royal Oak, Michigan. In addition, Dr. Fischgrund has served as the Editor in Chief of the Journal of the American Academy of Orthopedic Surgeons since 2009, and has been the Spine Fellowship Director at Beaumont Hospital since 2008. Dr. Fischgrund is a graduate of George Washington University School of Medicine in Washington, D.C., has completed an orthopedic surgery residency at the University of Maryland Medical Center in Baltimore, Maryland, and has completed a spine surgery fellowship at William Beaumont Hospital in Royal Oak, Michigan.

Dr. Fischgrund’s experience and attributes qualify him to serve on our Board for several reasons. His 20 years of experience as a board certified orthopedic spine surgeon makes him extraordinarily knowledgeable in the area of spinal implant products. Additionally, Dr. Fischgrund has extensive experience working with spinal implant companies and regulatory agencies in the design and implementation of clinical studies that demonstrate the safety and efficacy of spinal therapies. His expertise and experience in the orthopedic spine field will enable him to make valuable contributions to our Board.

Richard Randallhas been a member of our Board since June 2002, Executive Chairperson of our Board from January 2011 through March 2011, and Chairperson of our Board since April 2011. He was appointed the Chief Executive Officer of Avantis, Inc., a privately-held medical device company, in April 2011 and also serves as the chairman of the board of Avantis. He served as our Chief Executive Officer from June 2002 until January 2011 and as our President from June 2002 until January 2010. From June 2000 to June 2002, Mr. Randall served as President and Chief Executive Officer of Incumed, Inc., a privately-held medical device incubator company. He was President, Chief Executive Officer and a director of Innovasive Devices, Inc., a developer, manufacturer and marketer of arthroscopic surgical products which was acquired by the Ethicon Division of Johnson & Johnson in 2000, from January 1994 to February 2000. Mr. Randall served as President and Chief Executive Officer of Conceptus, Inc. from December 1992 to July 1993 and Chief Financial Officer from December 1992 to January 1995. He served as President and Chief Executive Officer of Target Therapeutics, Inc., an interventional neurovascular medical device company which was acquired by Boston Scientific Corporation in 1997, from June 1989 to May 1993, and was a director of Target Therapeutics from June 1989 to April 1997. Mr. Randall received a B.S. degree in Biology and Science Education from State University College of New York at Buffalo.

Mr. Randall has substantial experience and attributes that qualify him to serve as the Executive Chairperson of the Board. He has been in the medical device industry for over 30 years and has served as the chief executive

15

officer of both private and public medical device companies for over 20 years, including as our Chief Executive Officer for over 8 years. He has broad experience in management, sales, sales management and he has contacts in the medical device industry throughout the world.

David Simpson has served as a member of our Board and Chairperson of our Audit Committee since June 2010. Mr. Simpson served as a director of Kinetic Concepts, a public medical technology company, from June 2003 to November 2011. He also served as a director of RTI Biologics, a public medical technology company, from 2002 to 2010. Mr. Simpson served as the chairperson of the board and as a member of the audit committees of both RTI Biologics and Kinetic Concepts. From 2002 until his retirement in 2007, Mr. Simpson served as Executive Vice President of Stryker Corporation, a worldwide medical products and services company. From 1987 to 2002, he served as Vice President, Chief Financial Officer and Secretary of Stryker Corporation. Mr. Simpson has a B.B.A. degree in accounting and finance from Western Michigan University and is a graduate of the Advanced Management Program at Harvard Business School.

Mr. Simpson has substantial experience and attributes that qualify him to serve on our Board and as Chairperson of our Audit Committee. He has over 20 years of experience with public medical device companies and extensive leadership and oversight experience in the healthcare industry. He has recently served as the chairperson of the board and as a member of the audit committees of RTI Biologics and Kinetic Concepts, both of which are public medical technology companies. In addition, Mr. Simpson has extensive finance and accounting experience, having served as a chief financial officer for nearly 20 years and as an accountant at a major accounting firm for over 9 years. His expertise in financial matters and his vast experience in the healthcare industry enable him to make valuable contributions to our Board and our Audit Committee.

Recommendation of the Board of Directors

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE THREE DIRECTOR NOMINEES SET FORTH ABOVE.

Board Meetings and Annual Meeting Attendance

Our Board held ten meetings during the fiscal year ended December 31, 2011. Each of the directors serving at the time attended in person or by teleconference at least 75% of the aggregate of all of the meetings held by the Board and any committees of the Board on which such person served during the last fiscal year. None of our directors attended the 2011 annual meeting of stockholders.

Our securities are listed on The Nasdaq Global Market and are governed by its listing rules and standards. Our Board has affirmatively determined that the following six directors satisfy the current “independent director” standards established by Rule 5605(a)(2) of the Nasdaq Listing Rules: Messrs. Carusi, Fischgrund, LaViolette, Osgood, Shapiro and Simpson. Mr. Dann, who served on our Board until his resignation in June 2011, also satisfied the standards with respect to independence.

Committees of the Board of Directors

Our Board has established three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under a written charter adopted by our Board, copies of which are posted on our Internet website atwww.trans1.com. In addition, we will provide electronic or paper copies of the standing committee charters free of charge, upon request made to our Corporate Secretary at TranS1 Inc., 301 Government Center Drive, Wilmington, North Carolina 28403, by telephone at (910) 332-1700, or by facsimile at (910) 332-1701. Each committee is described in greater detail below.

Audit Committee. The functions of our Audit Committee include appointing and determining the compensation for our independent auditors, establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls and reviewing and overseeing our independent registered public accounting firm. The Chairperson of the Audit Committee is Mr. Simpson and the other current members are Messrs. Osgood and Carusi. All current members of the Audit Committee are non-employee directors and satisfy the current standards with respect to independence, financial expertise and experience established by Nasdaq and SEC rules. Our Board has determined that Mr. Simpson meets the SEC’s current definition of “Audit Committee financial expert” as described above in Mr. Simpson’s biography. The Audit Committee held six meetings during 2011.

16

Compensation Committee. Our Compensation Committee reviews and recommends to our Board the salaries and benefits for our executive officers and recommends overall employee compensation policies. Our Compensation Committee also administers our equity compensation plans. Until his resignation on June 23, 2011, Mr. Dann served as the Chairperson of the Compensation Committee. The current Chairperson of the Compensation Committee is Mr. Shapiro and the other current members are Mr. Simpson and Mr. LaViolette. All current members of our Compensation Committee are non-employee directors and satisfy the current independence standards established by Nasdaq and SEC rules. Mr. Dann, who served on our Compensation Committee until his resignation in June 2011, also satisfied the standards with respect to independence. Our Compensation Committee held six meetings during 2011.

The scope of authority of our Compensation Committee, the role of executive officers in determining or recommending the amount or form of executive and director compensation, and the role of compensation consultants, if any, in determining or recommending the amount or form of executive and director compensation are described below under the heading “Executive Compensation — Role of Compensation Committee.”

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee identifies individuals qualified to serve as members of our Board, recommends to our Board nominees for our annual meetings of stockholders, evaluates our Board’s performance, develops and recommends to our Board corporate governance guidelines and provides oversight with respect to corporate governance and ethical conduct. The Chairperson of the Nominating and Corporate Governance Committee is Mr. Carusi and the other current members are Mr. Osgood and Mr. LaViolette. All current members of the Nominating and Corporate Governance Committee are non-employee directors and satisfy the current independence standards established by Nasdaq and SEC rules. Mr. Dann, who served on the Nominating and Corporate Governance Committee until his resignation in June 2011, also satisfied the standards with respect to independence. The Nominating and Corporate Governance Committee held one meeting during 2011.

The Nominating and Corporate Governance Committee believes that differences in experiences, knowledge, skills and viewpoints enhance the Board’s performance. Thus, the committee considers such diversity in selecting, evaluating and recommending proposed nominees. However, neither the committee nor the Board has implemented a formal policy with respect to the consideration of diversity for the composition of the Board.

The processes and procedures followed by the Nominating and Corporate Governance Committee in identifying and evaluating director candidates are described below under the heading “Director Nomination Process.”

Other Committees. Our Board may establish other committees as it deems necessary or appropriate from time to time. At this time, the only other committees of the Board that have been established are the Legal Committee and the Finance Committee, both of which were formed in 2011. The Legal Committee was formed for the purpose of overseeing the Company’s response to the subpoena issued to the Company by the Office of the Inspector General of the U.S. Department of Health and Human Services. The members of the Legal Committee are Messrs. Carusi, LaViolette, Osgood, Shapiro and Simpson. The scope of the Legal Committee’s duties may be expanded to include oversight of other legal or regulatory matters as our Board determines in its discretion. The Finance Committee was formed for the purpose of overseeing the Company’s 2011 equity financing transaction. The members of the Finance Committee were Messrs. Simpson, LaViolette, and Shapiro.

Director Nomination Process

The process followed by our Nominating and Corporate Governance Committee to identify and evaluate director candidates includes, without limitation, requests to Board members, management and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of the committee and the Board. From time to time, we may also use the services of a third-party search firm to identify and evaluate potential director candidates.

In determining whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, our Nominating and Corporate Governance Committee considers a number of factors, including the candidate’s character and integrity, business acumen, experience in our business and

17

industry, diligence, potential conflicts of interest, and the ability to act in the best interests of all stockholders. The committee does not assign specific weights to particular criteria, and no particular criterion is a prerequisite for each prospective nominee. Our Board believes that the qualifications of its directors, considered as a group, should provide a diverse mix of experiences, knowledge, skills and viewpoints.

Our Nominating and Corporate Governance Committee also considers properly submitted stockholder recommendations of director candidates. Stockholders who wish to recommend a director candidate for consideration by the Nominating and Corporate Governance Committee may do so by submitting the nominee’s comprehensive written resume, including the candidate’s name, home and business contact information, detailed biographical data and relevant qualifications, as well as a consent in writing signed by the recommended nominee that he or she is willing to be considered as a nominee and if nominated and elected, he or she will serve as a director. Stockholders should send their written recommendations of nominees accompanied by the candidate’s resume and consent to: Chairperson of the Nominating and Corporate Governance Committee, c/o TranS1 Inc., 301 Government Center Drive, Wilmington, North Carolina 28403. Assuming that an appropriate resume and consent have been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for other director candidates. If the Board determines to nominate a stockholder-recommended candidate and recommends him or her for election, then his or her name will be included in our proxy materials for the next annual meeting. The foregoing policy is subject to our amended and restated certificate of incorporation, bylaws and applicable law.

Stockholders also have the right under our bylaws to directly nominate director candidates, without any action or recommendation on the part of the Nominating and Corporate Governance Committee or the Board, by following the procedures set forth above under “How can stockholders nominate a candidate for election as a director or propose other actions for consideration at an annual meeting of stockholders?” However, candidates directly nominated by stockholders in accordance with the procedures set forth in the bylaws will not be included in our proxy materials for the next annual meeting.

We do not currently pay any fees to any third party to identify or evaluate, or to assist in identifying or evaluating, potential director candidates.

No director nominations by stockholders have been received as of the filing of this Proxy Statement.

Stockholder Communications to the Board of Directors

Stockholders may submit communications to our Board, its committees or the chairperson of any of its committees or any individual members of the Board by addressing a written communication to: Board of Directors, c/o TranS1 Inc., 301 Government Center Drive, Wilmington, North Carolina 28403. Stockholders should identify in their communication the intended addressee. Stockholder communications will be forwarded to our Corporate Secretary. The Corporate Secretary will acknowledge receipt to the sender, unless the sender has submitted the communication anonymously, and forward a copy of the communication to the addressee or, if the communication is addressed generally to our Board, to our Chairperson of the Board.

Board Structure

Chairperson of the Board. Historically, we had chosen not to create a Chairperson of the Board position and, until fiscal year 2011, had never appointed anyone to this position. The Board generally believes that it is in the best interests of the Company’s stockholders not to elect the Chief Executive Officer as the Chairperson of the Board because it may concentrate too much power or influence in the hands of a single executive and because the Chief Executive Officer should have an obligation to report to the entire Board. However, we have consistently disclosed the Board’s intention to routinely assess whether the appointment of a Chairperson of the Board is appropriate in light of changing circumstances.

Effective January 4, 2011, the Board elected to create an Executive Chairperson of the Board position and appointed Richard Randall to that position. Mr. Randall was an existing director at the time of his appointment and was our Chief Executive Officer until his resignation from that position, which was effective on January 1,

18

2011. The Board elected to appoint Mr. Randall as Executive Chairperson of the Board in order to allow him to continue to be involved with the management of the Company following his resignation and to assist with the transition of the Chief Executive Officer role to Ken Reali who was appointed to that position on January 4, 2011.

On March 31, 2011, in light of the significant progress that had been made in the transition of the Chief Executive Officer role to Mr. Reali and the anticipated reduction in the level of responsibility and time commitment required by Mr. Randall, our Compensation Committee determined that Mr. Randall was no longer an executive officer of the Company effective as of that date. However, Mr. Randall is continuing to serve as the Chairperson of the Board of Directors. In connection with that role, Mr. Randall receives compensation in accordance with the Company’s standard Board compensation policies applicable to all directors.

Lead Director. Also effective January 4, 2011, the Board chose to create a Lead Director position and appointed an existing director, Paul LaViolette, as the Lead Director. As Lead Director, Mr. LaViolette is principally charged with creating agendas for each Board meeting with input from management and other Board members, directing the preparation of materials to be distributed in advance of each Board meeting, presiding over executive sessions of the Board, and taking the lead in structuring and managing Board meetings. The Board felt that, in light of the appointment of Mr. Randall as Executive Chairperson of the Board as discussed above, it was important to also appoint a Lead Director to ensure that Board meetings are led and managed by a director who is independent of management. The Board has determined that Mr. LaViolette is an “independent” director for purposes of the Nasdaq Listing Rules.

Role of Board in Risk Oversight Process

The responsibility for the day-to-day management of risk lies with the Company’s management, while the Board is responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. Each year the Company’s management identifies what it believes are the top individual risks facing the Company. These risks are then discussed and analyzed with the Board. This enables the Board to coordinate the risk oversight role. However, in addition to the Board, the committees of the Board consider the risks within their areas of responsibility. The Audit Committee oversees the risks associated with the Company’s financial reporting and internal controls, our Compensation Committee oversees the risks associated with the Company’s compensation practices, including reviewing the Company’s risk assessment of its compensation policies and practices for its employees, and the Nominating and Corporate Governance Committee oversees the risks associated with the Company’s overall corporate governance policies.

Non-Employee Director Compensation for 2011

Each of our non-employee directors, including our Chairperson of the Board, receives an annual cash retainer equal to $18,000 and each non-employee director who serves as a member of our Audit Committee receives an annual retainer equal to $2,000, while non-employee directors who serve as members of our compensation or nominating and governance committees receive an annual retainer equal to $1,000. In addition to the annual retainers, non-employee directors receive $2,500 for each Board meeting attended in person, $750 for each Board meeting attended telephonically and $750 for each committee meeting attended in person or telephonically. Each non-employee director who serves as the chairperson of our Audit Committee, Compensation Committee or Nominating and Corporate Governance Committee receives, for services performed in such capacity, an annual retainer of $12,000, $5,000 and $5,000, respectively, in lieu of the retainer amount provided to members of those committees. We reimburse each non-employee member of our Board for out-of-pocket expenses incurred in connection with attending our Board and committee meetings.

Each non-employee director first appointed to our Board automatically receives an initial option to purchase 30,000 shares of common stock upon such appointment, which will vest over four years. In addition, at each annual meeting, non-employee directors who were non-employee directors for at least six months prior to the annual meeting will automatically receive an option to purchase 10,000 shares of common stock, which will be immediately vested and fully exercisable. Thus, Dr. Fischgrund received an option to purchase 30,000 shares upon his appointment to the Board in April 2012, but will not receive an additional option to purchase 10,000 shares at the Annual Meeting.

19

As discussed above, the Board has created a Lead Director position and has appointed an existing director, Paul LaViolette, as the Lead Director effective as of January 4, 2011. In addition to the amounts paid for service to the Board or any committee as described above, the Lead Director receives an additional $5,000 per meeting for each regularly scheduled quarterly Board meeting attended in person, $2,500 for each Board meeting attended in person during the year that is not a regularly scheduled meeting, and an additional $750 for each Board meeting attended telephonically that is not a regularly scheduled meeting.

The following table summarizes all compensation paid to our non-employee directors in 2011:

Non-Employee Director Compensation Paid for the 2011 Fiscal Year

Name | Fees Earned or Paid in Cash ($)(1) | Option Awards ($)(2) | Total ($) | |||||||||

Michael Carusi | 43,000 | 26,320 | 69,320 | |||||||||

Mitchell Dann(3) | 22,538 | 26,320 | 48,858 | |||||||||

Jeffrey Fischgrund, M.D.(4) | — | — | — | |||||||||

Paul LaViolette | 64,231 | 26,320 | 90,551 | |||||||||

Jonathan Osgood | 40,750 | 26,320 | 67,070 | |||||||||

Richard Randall | 24,000 | 26,320 | 50,320 | |||||||||

James Shapiro | 39,327 | 26,320 | 65,647 | |||||||||

David Simpson | 45,768 | 26,320 | 72,088 | |||||||||

| (1) | Reflects cash compensation earned for fiscal year 2011. |

| (2) | Represents the aggregate grant date fair value of the option awards computed in accordance with FASB ASC Topic 718 and excludes the impact of estimated forfeitures related to service-based vesting conditions. The assumptions used in calculating the fair value of the option awards are set forth in footnote 1 of the Summary Compensation Table below. |

| (3) | Mr. Dann resigned from the Board in June 2011. |

| (4) | Dr. Fischgrund was appointed to the Board of Directors on April 4, 2012 and did not receive any compensation as a director during 2011. |

During fiscal year 2011, our non-employee directors were issued options to purchase shares of our common stock as set forth in the following table:

Name | Date of Option Grant | Options Granted(1) | ||||||

Michael Carusi | 06/02/2011 | 10,000(2) | ||||||

Mitchell Dann(3) | 06/02/2011 | 10,000(2) | ||||||