UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark one)

[ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b)3 OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ X ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2006

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from ___________ to ___________

Commission file number 333-107199

PACIFIC GOLD ENTERTAINMENT INC. |

| (Exact name of Registrant specified in its charter) |

| |

N/A |

| (Translation of Registrant’s name into English) |

| |

British Columbia |

| (Jurisdiction of incorporation or organization) |

| |

Suite # 7, 536 Cambie Street, Vancouver, British Columbia, V6B 2N7, Canada |

| (Address of principal executive offices) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| | |

None | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| Shares of Common Stock |

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Class | Outstanding at April 30, 2006 |

| Shares of Common Stock | 2,000,000 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [ X ] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. [ ] Yes [ X ] No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 from their obligation under those Sections.

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ X ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and larger accelerated filer in Rule 12b-2 of the Exchange Act. (Check one):

Larger accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ X ]

Indicate by check mark which financial statement item the registrant has elected to follow.

[ ] Item 17 [ X ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [ X ] No

PACIFIC GOLD ENTERTAINMENT INC.

Form 20-F

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

The information required for this Item is not required for an annual report.

Item 2. Offer Statistics and Expected Timetable.

The information required for this Item is not required for an annual report.

Item 3. Key Information.

A. Selected financial data.

The selected financial and other data set forth below should be read in conjunction with the audited financial statements of Pacific Gold Entertainment Inc. (“PGE Inc.”) as of April 30, 2006 and 2005 including the notes thereto, and “Item 5 - Operating and Financial Review and Prospects” included in this annual report. The selected financial data set forth below for the last four fiscal years are derived from the audited financial statements of PGE Inc., which have been audited by Pannell Kerr Forster, registered independent chartered accountants. PGE Inc.’s financial statements are maintained in Canadian dollars, expressed in US dollars, and presented in accordance with accounting principles generally accepted in the United States of America. PGE Inc. has commenced doing business as a film producer.

(US$) | April 30 |

Statement of Operations Data | 2006 | 2005 | 2004 | 2003 |

| | $ | $ | $ | $ |

| Revenue - Sales | 0 | 8,464 | 0 | 0 |

| Costs of sales | 0 | 5,120 | 0 | 0 |

| Website development and maintenance | 4,218 | 10,000 | 0 | 0 |

| Operating expenses | 5,521 | 9,513 | 0 | 0 |

| Total expenses | 9,739 | 24,663 | 6,189 | 2,379 |

| Net loss | (9,739) | (16,169) | (6,189) | (2,379) |

| Other comprehensive income (loss) | (2,307) | 0 | 87 | (42) |

| Comprehensive loss | (12,046) | (16,169) | (6,102) | (2,421) |

| | | | | |

| Weighted average number of shares | 2,000,000 | 2,000,000 | 2,000,000 | 219,178 |

| Basic and diluted loss per shares | $(0.01) | $(0.01) | $(0.01) | $(0.01) |

| | | | | |

(US$) | April 30 |

Statement of Operations Data | 2006 | 2005 | 2004 | 2003 |

| | $ | $ | $ | $ |

| Cash and cash equivalents | 4,294 | 0 | 13 | 1,389 |

| | | | | |

| Total current assets | 9,234 | 3,344 | 13 | 1,389 |

| | | | | |

| Total Assets | 9,234 | 3,344 | 13 | 1,389 |

| | | | | |

| Accounts payable and accrued liabilities | 15,988 | 17,144 | 3,644 | 2,093 |

| Due to related party | 28,589 | 9,497 | 3,497 | 322 |

| Total Liabilities | 44,577 | 26,641 | 7,141 | 2,415 |

| | | | | |

| Shareholders’ equity (deficiency) | (35,343) | (23,297) | (7,128) | (1,026) |

| | | | | |

| Total Liabilities and Shareholders’ Equity | 9,234 | 3,344 | 13 | 1,389 |

Exchange Rates

PGE Inc. records its finances in Canadian (CDN) dollars and reports its operations in US dollars. Fluctuation in the exchange rate between the CDN dollar and the US dollar will affect the amount of dollars reported in its financial statements and paid out in respect of cash dividends or other distributions paid in CDN dollars by PGE Inc. The following table sets forth, for the periods and dates indicated, certain information concerning the noon buying rate of one US dollar in CDN funds. No representation is made that the CDN dollar amounts referred to herein could have been or could be converted into US dollars at any particular rate, or at all. On October 31, 2006 the noon buying rate was CDN$1.1227 to US$1.00 [Source: Bank of Canada].

High and Low Exchange Rates for Previous Six Months |

| | High | Low |

| October 2006 | 1.1385 | 1.1153 |

| September 2006 | 1.1273 | 1.1056 |

| August 2006 | 1.1315 | 1.1066 |

| July 2006 | 1.1416 | 1.1061 |

| June 2006 | 1.1245 | 1.1004 |

| May 2006 | 1.1233 | 1.0990 |

Annual Average Exchange Rates |

| | CDN$ per US$1.00 |

| 2006 | 1.1779 |

| 2005 | 1,2637 |

| 2004 | 1.3015 |

| 2003 | 1.3916 |

B. Capitalization and indebtedness.

The information required for this Item is not required for an annual report.

C. Reason for offer and use of proceeds.

The information required for this Item is not required for an annual report.

D. Risk factors.

There are significant risks associated with an investment in PGE Inc.’s common stock. Before making a decision concerning the purchase of PGE Inc.’s common stock, you should consider each of the following risk factors and the other information in this annual report, including PGE Inc.’s financial statements and the related notes, in evaluating PGE Inc.’s business and prospects. The risks and uncertainties described below are not the only ones that impact on PGE Inc.’s business. Additional risks and uncertainties not presently known to PGE Inc. or that PGE Inc. currently considers immaterial may also impair its business operations. If any of the following risks actually occur, PGE Inc.’s business and financial results could be harmed.

Risks associated with PGE Inc.’s business.

| 1. | PGE Inc. may not be able to continue as a going concern as a result of its history of operating losses and PGE Inc. not being able to raise additional financing. |

A note provided by PGE Inc.’s independent auditors in PGE Inc.’s financial statements for the period from inception, March 21, 2003 through April 30, 2006 states there is a substantial doubt about PGE Inc.’s ability to continue as a going concern, which is due to PGE Inc.’s history of operating losses and its working capital deficiency. PGE Inc.’s ability to continue as a going concern is dependent on continued financial support from its shareholders, raising additional capital to fund future operations, and ultimately attaining profitable operations. This note may make it more difficult for PGE Inc. to raise additional equity or debt financing needed to run its business, and is not viewed favorably by analysts or investors. PGE Inc. urges potential investors to review this report before making a decision to invest in PGE Inc.

| 2. | PGE Inc. has a limited history of operations and has losses that it expects to continue into the future. If the losses continue PGE Inc. will have to suspend operations or cease operations. |

PGE Inc. was incorporated on March 21, 2003 and PGE Inc. has no significant operating history upon which an evaluation of its future success or failure can be made. PGE Inc.’s net loss since inception is $34,476. PGE Inc. has a limited history of operations that has been characterized by ongoing operating losses, which management believes will continue for at least the next 8 to 12 months. PGE Inc.’s ability to achieve and maintain profitability and positive cash flow is dependent upon its ability to generate revenues from its planned business operations and to reduce development costs. PGE Inc. cannot guaranty that it will operate profitably, and if it cannot, PGE Inc. may not be able to meet its working capital requirements, capital expenditure plans, anticipated production slate, or other cash needs. PGE Inc.’s inability to meet those needs could have a material adverse effect on its business, results of operations and financial conditions.

| 3. | PGE Inc. is relatively new to the film production industry with a limited history of operations and, as a result, PGE Inc.’s ability to operate and compete effectively may be affected negatively. |

In deciding whether to purchase PGE Inc.’s shares of common stock, and the likelihood PGE Inc.’s success, you should consider that PGE Inc. is relatively new to the film production industry and has a limited operating history upon which to judge its current operations. As a result, you will be unable to assess PGE Inc.’s future operating performance or its future financial results or condition by comparing these criteria against its past or present equivalents.

| 4. | PGE Inc. faces substantial capital requirements and financial risks. |

The production, acquisition and distribution of films requires a substantial amount of investment capital. A significant amount of time may elapse between PGE Inc.’s expenditure of funds and the receipt of commercial revenues from or government contributions to its films. This time lapse requires PGE Inc. to fund a significant portion of its capital requirements from other sources. Although PGE Inc. intends to continue to reduce the risks of its production exposure through financial contributions from distributors, tax shelters, government and industry programs, and studios, management cannot assure you that PGE Inc. will continue to implement successfully these arrangements or that PGE Inc. will not be subject to substantial financial risks relating to the production, acquisition, completion and release of future films. If PGE Inc. increases (through internal growth or acquisition) its production slate or its production budgets, PGE Inc. may be required to increase overhead, make larger up-front payments to talent and consequently bear greater financial risks. Any of the foregoing could have a material adverse effect on its business, results of operations or financial condition.

PGE Inc.’s business model requires that it be efficient in production of its films, but budget overruns may adversely affect PGE Inc.’s business. Actual film costs often exceed their budget, sometimes significantly. The production, completion and distribution of films are subject to a number of uncertainties, including delays and increased expenditures due to creative differences among key cast members and other key creative personnel or other disruptions or events beyond PGE Inc.’s control. Risks such as death or disability of star performers, technical complications with special effects or other aspects of production, shortages of necessary equipment, damage to film negatives, master tapes and recordings or adverse weather conditions may cause cost overruns and delay or frustrate completion of a production. If a film incurs substantial budget overruns, PGE Inc. may have to seek additional financing from outside sources to complete production. PGE Inc. cannot make assurances regarding the availability of such financing on terms acceptable to PGE Inc., and the lack of such financing could have a material adverse effect on its business, results of operations and financial condition.

In addition, if a film incurs substantial budget overruns, PGE Inc. cannot assure you that PGE Inc. will recoup these costs, which could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition. Increased costs incurred with respect to a particular film may result in any such film not being ready for release at the intended time and the postponement to a potentially less favorable time, all of which could cause a decline in box office performance, and thus the overall financial success of such film. Budget overruns could also prevent a picture from being completed or released. Any of the foregoing could have a material adverse effect on PGE Inc.’s business, results of operations and financial condition.

| 5. | PGE Inc.’s revenues and results of operations are difficult to predict and are influenced by a variety of factors, which may cause revenues and results of operations to fluctuate significantly. |

Revenues and results of operations are difficult to predict and depend on a variety of factors. PGE Inc.’s revenues and results of operations depend significantly upon the commercial success of the films that it distributes, which cannot be predicted with certainty. Accordingly, PGE Inc.’s revenues and results of operations may fluctuate significantly from period to period, and the results of any one period may not be indicative of the results for any future periods.

PGE Inc. relies on a few major distributors for the distribution of its film projects. A single distributor accounts for approximately 50% of PGE Inc.’s film project distribution. PGE Inc. does have long-term agreements with most of its distributors, but PGE Inc. cannot assure you that it will continue to maintain favorable relationships with these distributors or that they will not be adversely affected by economic conditions. If any of these distributors reduces or cancels a significant order, it could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

| 6. | PGE Inc.’s profits, if any, may be negatively impacted by currency exchange fluctuations. |

PGE Inc.’s revenues and results of operations are vulnerable to currency fluctuations. PGE Inc. reports its revenues and results of operations in U.S. dollars, but a significant portion of its revenues is earned outside of the United States. PGE Inc.’s principal currency exposure is between Canadian and U.S. dollars. PGE Inc. cannot accurately predict the impact of future exchange rate fluctuations between the Canadian dollar and the U.S. dollar or other foreign currencies on revenues and operating margins, and fluctuations could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

From time to time PGE Inc. may experience currency exposure on distribution and production revenues and expenses from foreign countries, which could have a material adverse effect on its business, results of operations and financial condition.

| 7. | Failure to manage future growth may adversely affect PGE Inc.’s business. |

PGE Inc.’s ability to grow through acquisitions, business combinations and joint ventures, to maintain and expand its development, production and distribution of films and to fund its operating expenses depends upon PGE Inc.’s ability to obtain funds through equity financing, debt financing (including credit facilities) or the sale or syndication of some or all of its interests in certain projects or other assets. If PGE Inc. does not have access to such financing arrangements, and if other funding does not become available on terms acceptable to it, there could be a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

Also, PGE Inc. may enter into, and will continue to pursue, various acquisitions, business combinations and joint ventures intended to complement or expand its business. Given that discussions or activities relating to possible acquisitions range from private negotiations to participation in open bid processes, the timing of any such acquisition is uncertain. Although from time to time management actively engages in discussions and activities with respect to possible acquisitions and investments, PGE Inc. has no present agreements or understandings to enter into any such material transaction. Any indebtedness incurred or assumed in any such transaction may or may not increase its leverage relative to its earnings before interest, provisions for income taxes, amortization, minority interests, gain on dilution of investment in subsidiary and discounted operation, or EBIDTA, or relative to PGE Inc.’s equity capitalization, and any equity issued may or may not be at prices dilutive to PGE Inc.’s then existing shareholders. PGE Inc. may encounter difficulties in integrating acquired assets with its operations. Furthermore, PGE Inc. may not realize the benefits it anticipated when it entered into these transactions. In addition, the negotiation of potential acquisitions, business combinations or joint ventures as well as the integration of an acquired business could require PGE Inc. to incur significant costs and cause diversion of management’s time and resources. Future acquisitions by PGE Inc. could also result in impairment of goodwill and other intangibles, development write-offs, and other acquisition-related expenses.

Any of the foregoing could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

| 8. | Since PGE Inc.’s success depends on its arrangement with Pathway Films Inc. for the use of the studio and equipment, any alternation to or the termination of that arrangement may negatively effect PGE Inc.’s operations. |

PGE Inc is partnered with Pathway Films Inc., a fully functioning film and game production studio and equipment, which allows it to keep every aspect of film and video game production in-house. Pursuant to the arrangement with Pathway Films Inc., PGE Inc. is allowed access to the studio and the equipment for a reduced rate for overhead and equipment. However, there is no written agreement for the arrangement and the arrangement can be terminated without cause or notice. If the arrangement is modified in any way or terminated, and PGE Inc. is unable to use Pathway’s studio and equipment, PGE Inc. will need to find another studio and other equipment to produce its films and video games. Any change in the arrangement could negatively effect the business operations and financial condition of PGE Inc.

Risks associated with PGE Inc.’s industry.

| 9. | PGE Inc.’s business operations could be adversely affected by strikes or other union job actions. |

The films produced by PGE Inc. generally employ actors, writers and directors who are members of the Screen Actors Guild, Writers Guild of America and Directors Guild of America, respectively, pursuant to industry-wide collective bargaining agreements. Many productions also employ members of a number of other unions, including, without limitation, the International Alliance of Theatrical and Stage Employees, the Teamsters and the Alliance of Canadian Cinema, Television and Radio Artists. A strike by one or more of the unions that provide personnel essential to the production of films could delay or halt PGE Inc.’s ongoing production activities. Such a halt or delay, depending on the length of time, could cause a delay or interruption in PGE Inc.’s production, marking and distribution of its films, which could have a material adverse effect on its business, results of operations or financial condition.

| 10. | PGE Inc. faces substantial competition in all aspects of PGE Inc.’s business. |

PGE Inc. is smaller and less diversified than many of its competitors. Although PGE Inc. is an independent distributor and producer, it constantly competes with major U.S. and international studios. Most of the major U.S. studios are part of large diversified corporate groups with a variety of other operations, including television networks and cable channels that can provide both means of distributing their products and stable sources of earnings that may allow them better to offset fluctuations in the financial performance of their motion picture and television operations. In addition, the major studios have more resources with which to compete for ideas, storylines and scripts created by third parties as well as for actors, directors and other personnel required for production. The resources of the major studios may also give them an advantage in acquiring other businesses or assets, including film libraries, that PGE Inc. might also be interested in acquiring. The foregoing could have a material adverse effect on PGE Inc.’s business, results of operations and financial condition.

Also, technological advances may reduce PGE Inc.’s ability to exploit its films. The entertainment industry in general and the motion picture industry in particular continue to undergo significant technological developments, including video-on-demand. This rapid growth of technology combined with shifting consumer tastes could change how consumers view PGE Inc.’s films. For example, an increase in video-on-demand could decrease home video rentals. Other larger entertainment distribution companies will have larger budgets to exploit these growing trends. PGE Inc. cannot predict how it will financially participate in the exploitation of its films through these emerging technologies or whether it has the right to do so for certain of its library titles. If PGE Inc. cannot successfully exploit these and other emerging technologies, it could have a material adverse effect on its business, results of operations or financial condition.

| 11. | PGE Inc. faces risks from doing business internationally. |

PGE Inc. will distribute its films outside the United States and Canada through third party licensees and derive revenues from these sources. As a result, PGE Inc.’s business is subject to certain risks inherent in international business, many of which are beyond its control. These risks include:

● changes in local regulatory requirements, including restrictions on content;

● changes in the laws and policies affecting trade, investment and taxes (including laws and policies relating to the repatriation of funds and to withholding taxes);

● differing degrees of protection for intellectual property;

● instability of foreign economies and governments; and

● cultural barriers.

Any of these factors could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

| 12. | PGE Inc. may lose certain benefits by failing to meet certain Canadian regulatory requirements. |

PGE Inc. may lose investment funds, tax credits and other benefits if it fails to meet Canadian regulatory requirements. The Canadian federal government and a number of its provincial counterparts have established refundable tax credit programs based on eligible labor expenditures of qualifying production entities. PGE Inc. expects that certain of its films will incorporate these refundable tax credits as elements of production financing. If such productions do not ultimately qualify for anticipated refundable tax credits, the relevant production may require additional funds for completion, which may not be available from other sources.

For PGE Inc.’s films to continue to qualify for several refundable tax credits, PGE Inc. must remain Canadian-controlled pursuant to the Investment Canada Act (Canada), or ICA, among other statutory requirements. The ICA contains rules, the application of which determines whether an entity (as the term is defined in the ICA) is Canadian-controlled. Under these rules, an entity is presumed to be a non-Canadian in certain circumstances, including where Canadians own less than a majority of voting interests of an entity. This presumption may be rebutted, for example, if the entity establishes that it is not controlled in fact through the ownership of its voting interests and that two-thirds of the members of its board of directors are Canadians.

Although management believes PGE Inc. is currently a Canadian-controlled entity under the ICA, there can be no assurance that the Minister of Canadian Heritage will not determine PGE Inc. is out of compliance with the ICA, or that events beyond its control will not result in PGE Inc. ceasing to be Canadian-controlled pursuant to the ICA. The ICA provides the Minister of Canadian Heritage with discretion to make a determination that a business activity prescribed under the ICA as relating to Canada’s cultural heritage or national identity (which includes a business engaged in the production, distribution, sale or exhibition of film or video products, hereinafter referred to as a “cultural business”) is not a Canadian-controlled entity, if the Minister is satisfied, after considering any information or evidence submitted by the entity or otherwise made available to the Minister or the Director of Investments, that the entity is controlled in fact by one or more non-Canadians. If PGE Inc. ceases to be Canadian-controlled under the ICA, it would no longer qualify or be entitled to access these refundable tax credits and other Canadian government and private motion picture industry incentives that are restricted to Canadian-controlled corporations, including the ability to produce under Canada’s official co-production treaties with other countries.

Such a change in status would require PGE Inc. to return tax credits previously received, reducing its cash balance. In addition, because under Canadian GAAP tax credits are included in revenues, PGE Inc. would take a charge to earnings in the amount of the lost tax credits. In addition, certain provincial refundable tax credits require that the applicant be provincially controlled. If PGE Inc. ceases to be provincially controlled, it would no longer be entitled to access the applicable provincial refundable tax credits.

For all of the foregoing reasons, the loss of PGE Inc.’s Canadian status could have a material adverse effect on its business, results of operations or financial condition.

PGE Inc. faces other risks in obtaining production financing from private and other international sources. For some productions, PGE Inc.’s finances a portion of its production budgets from incentive programs from such agencies as Telefilm Canada, as well as international sources in the case of its international treaty co-productions. There can be no assurance that local cultural incentive programs that PGE Inc. may access in Canada and internationally, as a result of its Canadian-controlled status, will not be reduced, amended or eliminated. Any change in policies in connection with incentive programs may have an adverse impact on PGE Inc. In addition, PGE Inc. could lose its ability to exploit such incentive programs in Canada if it ceases to qualify as “Canadian.”

Certain films produced by PGE Inc. will be contractually required to be certified as “Canadian Film and Video Production.” If a program does not qualify for such certification, PGE Inc. would be in default on commitments made in connection with government incentive programs and licenses to broadcasters/ distributors. In addition, to the extent PGE Inc. does not qualify as “Canadian” as a result of a merger, an acquisition or an unconstrained share transfer to one or more non-Canadians, it would no longer qualify for such incentives/tax credits and may be liable to repay certain benefits to the applicable authorities. The foregoing could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

| 13. | An investment by non-Canadians in PGE Inc.’s business may constitute an acquisition of control. |

Under the ICA, the Minister of Canadian Heritage has discretion to determine, after considering any information or evidence submitted by the entity or otherwise made available to the Minister or the Director of Investments, that an investment in PGE Inc. by a non-Canadian in a cultural business may constitute an acquisition of control by that non-Canadian, notwithstanding the provisions in the ICA that state that certain investments do not or may not constitute an acquisition of control that would require notification or review under the ICA. If the Minister of Canadian Heritage exercises its discretion and deems an investment by a non-Canadian in a cultural business to be an acquisition of control, the investment is potentially subject to notification and/or review. If the investment is subject to review, the Minister must be satisfied that the investment is likely to be of net benefit to Canada. Such a determination is often accompanied by requests that the non-Canadian provide undertakings supportive of Canadian cultural policy. These undertakings may, in some circumstances, include a request for financial support of certain initiatives. The determination by the Minister of whether a proposed investment is of net benefit to Canada also includes consideration of sector specific policies of the Canadian federal government. One such policy prohibits takeovers of Canadian owned and controlled film distribution businesses by non-Canadians. This prohibition is not contained in the ICA nor in the regulations made under the ICA, but is a separate foreign investment policy relating to the Canadian film distribution sector. If an investment by a non-Canadian in PGE Inc.’s business is deemed by the Minister to be an acquisition of control and ultimately subject to review, the current policy of the Canadian federal government prohibiting the takeover of a Canadian owned and controlled film distribution business would be applied in the context of the Minister’s determination of whether the proposed investment would be of net benefit to Canada, with the result that PGE Inc.’s film distribution business in Canada may have to be divested to a Canadian purchaser, which could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition.

| 14. | Protecting and defending against intellectual property claims may have a material adverse effect on PGE Inc.’s business. |

PGE Inc.’s ability to compete depends, in part, upon successful protection of its intellectual property. PGE Inc. does not have the financial resources to protect its rights to the same extent as major studios. PGE Inc. will attempt to protect proprietary and intellectual property rights to its film productions through available copyright and trademark laws and licensing and distribution arrangements with reputable international companies in specific territories and media for limited durations. Despite these precautions, existing copyright and trademark laws afford only limited practical protection in certain countries. PGE Inc. also distributes its products in other countries in which there is no copyright and trademark protection. As a result, it may be possible for unauthorized third parties to copy and distribute PGE Inc.’s film productions or certain portions or applications of its intended film productions, which could have a material adverse effect on its business, results of operations or financial condition.

Litigation may also be necessary in the future to enforce PGE Inc.’s intellectual property rights, to protect its trade secrets, or to determine the validity and scope of the proprietary rights of others or to defend against claims of infringement or invalidity.

Any such litigation could result in substantial costs and the diversion of resources and could have a material adverse effect on PGE Inc.’s business, results of operations or financial condition. Management cannot assure you that infringement or invalidity claims will not materially adversely affect PGE Inc.’s business, results of operations or financial condition. Regardless of the validity or the success of the assertion of these claims, PGE Inc. could incur significant costs and diversion of resources in enforcing its intellectual property rights or in defending against such claims, which could have a material adverse effect on its business, results of operations or financial condition.

| 15. | Piracy of motion pictures, including digital and internet piracy, may reduce the gross receipts from the exploitation of PGE Inc.’s films. |

Motion picture piracy is extensive in many parts of the world, including South America, Asia, the countries of the former Soviet Union and other former Eastern bloc countries. Additionally, as films begin to be digitally distributed using emerging technologies such as the internet and online services, piracy could become more prevalent, including in the U.S., because digital formats are easier to copy. As a result, users can download and distribute unauthorized copies of copyrighted motion pictures over the internet. In addition, there could be increased use of devices capable of making unauthorized copies of films. As long as pirated content is available to download digitally, many consumers may choose to download such pirated motion pictures rather than pay for motion pictures. Piracy of PGE Inc.’s films may adversely impact the gross receipts received from the exploitation of these films, which could have a material adverse effect on its business, results of operations or financial condition.

Risks associated with PGE Inc.

| 16. | The loss of key personnel could adversely affect PGE Inc.’s business. |

PGE Inc.’s success depends on its ability to attract, retain and motivate qualified personnel and to a significant degree upon the efforts, contributions and abilities of its key personnel. PGE Inc.’s limited financial resources seriously inhibit its ability to attract qualified personnel. Key personnel represent a significant asset, and the competition for these personnel is intense in the film production industry. PGE Inc. has no employment agreements with any of its personnel and does not maintain key person life insurance on any of its personnel. Management cannot assure you that the services of PGE Inc.’s key personnel will continue to be available to it or that PGE Inc. will be able to successfully retain such key personnel. The loss of one or more of its key personnel or PGE Inc’s inability to attract, retain and motivate qualified personnel could negatively impact its ability to implement its plan of operations and to complete its films.

| 17. | PGE Inc.’s officers, directors and principal shareholders own more than 50% of the outstanding shares of common stock in the capital of PGE Inc., and as a result, they are able to decide who will be directors and you are not able to elect any directors, which may lead to the entrenchment of management. |

Management and the principal shareholders currently own an aggregate 8,332,500 shares of common stock, which represent 83.3% of the 10,000,000 issued and outstanding shares of common stock of PGE Inc. Holders of PGE Inc.’s shares of common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares of common stock, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of PGE Inc.’s directors. As a result, if neither management nor the principal shareholders sell any of their shares, and regardless of the number of shares you may acquire, management and the principal shareholders, as a group, will be able to elect all of PGE Inc.’s directors, control PGE Inc.’s business operations, and entrench management.

| 18. | PGE Inc. does not expect to pay cash dividends in the foreseeable future. |

PGE Inc. has never paid cash dividends on its shares of common stock and has no plans to do so in the foreseeable future. PGE Inc. intends to retain earnings, if any, to develop and expand its business operations.

| 19. | If and when PGE Inc.’s shares of common stock are listed for quotation on the NASD’s OTC Bulletin Board, any sale of a significant amount of PGE Inc.’s shares of common stock into the public market may depress PGE Inc.’s stock price. |

Management and the principal shareholders currently own an aggregate 8,332,500 shares of common stock, which represent 83.3% of the 10,000,000 issued and outstanding shares of common stock of PGE Inc. None of these shares have been registered for resale under a registration statement. Currently, there are 1,000,000 shares of common stock in the capital of PGE Inc. that are freely tradeable and there are 6,000,000 shares of common stock that are subject to Rule 144 and there are 3,000,000 shares of common stock that are restricted from trading. If PGE Inc.’s shares of common stock are listed for quotation on the NASD’s OTC Bulletin Board, management and the principal shareholders may sell in the future, large amounts of shares of common stock into the public market over relatively short periods of time subject to Rule 144. Any sale of a substantial amount of PGE Inc.’s shares of common stock in the public market may adversely affect the market price of PGE Inc.’s shares of common stock. Such sales could create public perception of difficulties or problems with PGE Inc.’s business and may depress PGE Inc.’s stock price.

| 20. | “Penny Stock” rules may make buying or selling PGE Inc.’s shares of common stock difficult, and severely limit the market and liquidity of the shares of common stock. |

Trading in PGE Inc.’s shares of commons tock is subject to certain regulations adopted by the SEC commonly known as the “penny stock” rules. If and when PGE Inc.’s shares of common stock are quoted for trading on the NASD’s OTC Bulletin Board, management expects that the shares of common stock will trigger and be subject to the “penny stock” rules. These rules govern how broker-dealers can deal with their clients and “penny stocks”. The additional burdens imposed upon broker-dealers by the “penny stock” rules may discourage broker-dealers from effecting transactions in PGE Inc.’s securities, which could severely limit their market price and liquidity of PGE Inc.’s securities.

Item 4. Information on Pacific Gold Entertainment Inc.

Pacific Gold Entertainment Inc. (“PGE Inc.”) is a British Columbia corporation that is reporting with the United States Securities Exchange and Commission. PGE Inc. is a Canadian multi-media studio that intends to produce and market genre related, independent films. Each film will be marked with spin-off merchandise, such as soundtracks, graphic novels, tee-shirts and video games on franchise titles.

A. History and development of Pacific Gold Entertainment Inc.

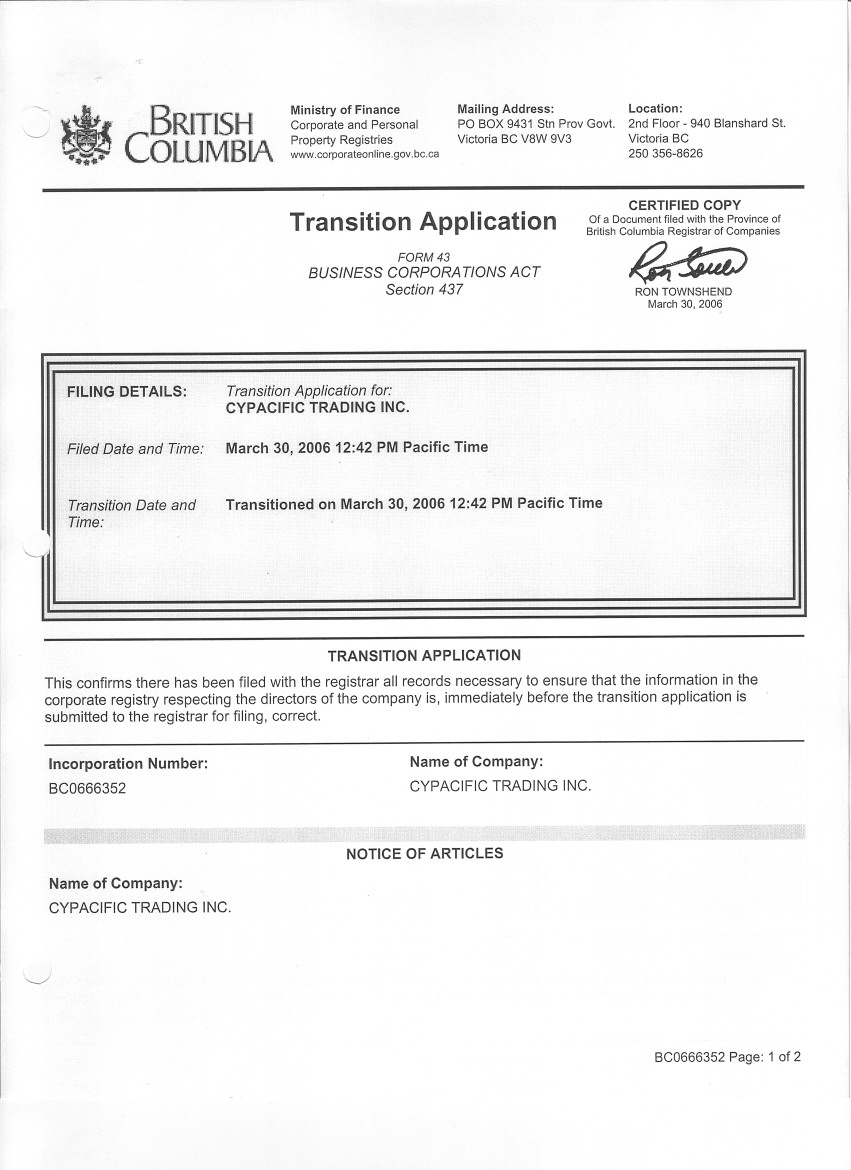

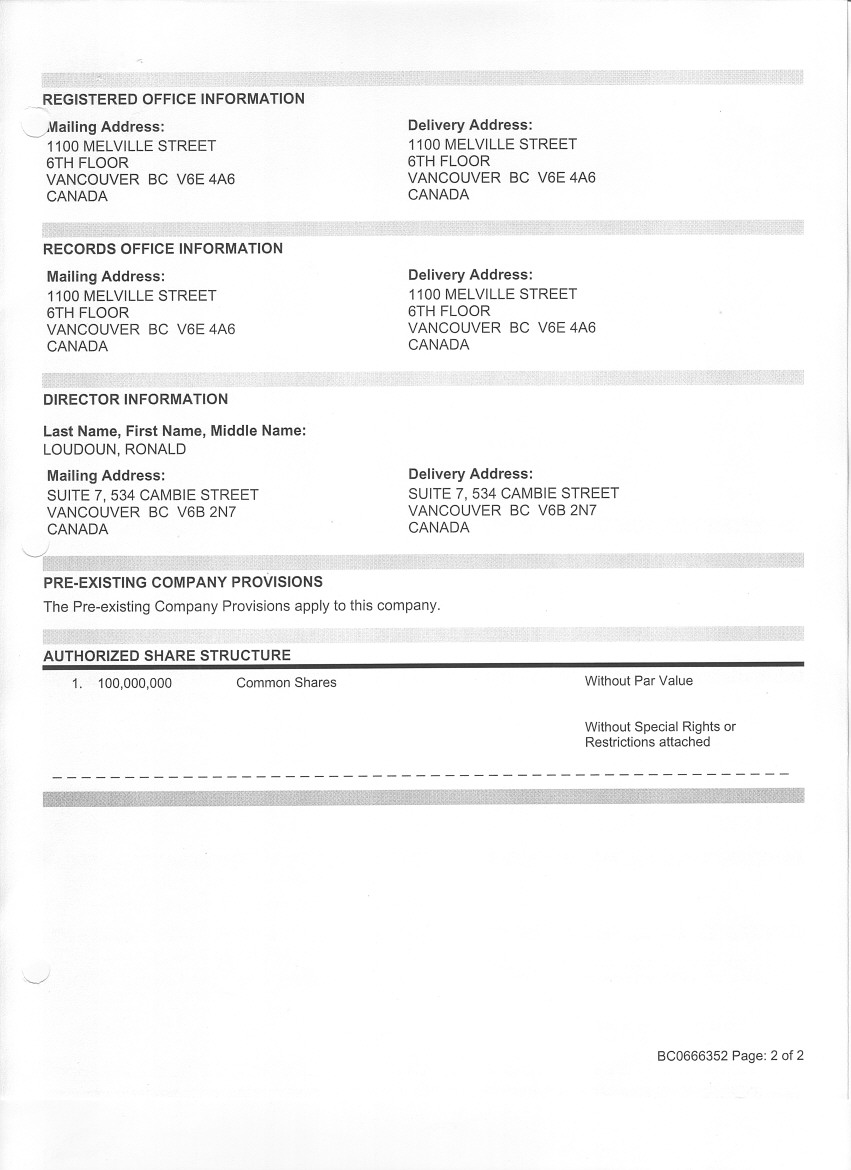

PGE Inc. was incorporated in British Columbia on March 12, 2003 under the name “CyPacific Trading Inc.” On June 27, 2006, PGE Inc. changed its name to its current name “Pacific Gold Entertainment Inc.”

PGE Inc.’s principal place of business is located at Suite # 7, 536 Cambie Street, Vancouver, British Columbia, V6B 2N7, Canada and the telephone number is 604-633-2753. PGE Inc.’s registered office is located at 1100 Melville Street, 6th Floor, Vancouver, British Columbia, V6E 4A6, Canada and the telephone number is 604-648-0527.

PGE Inc.’s original business concept involved Internet-based electronic retail sales with an on-line store. PGE Inc. intended to specialize in selling products obtained from North American manufacturers, which products may be difficult to find in Asian countries, to individuals and businesses first in Korea, and later in other parts of Asia. Subsequently, in 2005, PGE Inc. had a contract to manage Internet-based electronic retail sales via an on-line store for Daval Productions Ltd. Daval Productions Ltd. produced and distributed travel and sites of interest video products in DVD format to the travel and tourist industry. However, in 2006, the contract with Daval Productions Inc. was cancelled and PGE Inc. changed its focus and business to film production.

B. Business overview.

PGE Inc. is a multi media studio, specializing in popular, genre branded films. With each film project, PGE Inc. will bundle the project with ancillary merchandise, including video games, graphic novels, t-shirts, and other related products. PGE Inc. will also coordinate the release of its film projects with the release of the video games and the ancillary merchandise.

PGE Inc.’s mission is to garner worldwide exposure for all of its projects and create franchise potentials that generate long term income returns for its investors. PGE Inc. will enhance the value and exposure of its projects by releasing film affiliated merchandises to other lucrative markets, thus creating familiarity in the licensed products. PGE Inc.’s model is to make a quantity of lower budget independent films for the growing DVD market. Where the average Canadian film costs about $1 million and takes about two years to complete, PGE Inc’s average budget is $250K, with a six month turn around. Most Canadian films fail to reach the international market. PGE Inc.’s primary focus is the international markets, via its distributor. PGE Inc. intends to also diversify its licences so it can create more revenue potentials within a brand. The Disney Company employs this model, so rather then spending $12 million on a film, they will produce four films for $3 million, for greater revenue potential.

Products

PGE Inc.’s products will include genre related, independent films, which will be produced and marketed by PGE Inc. Also, each film project will be marked with spin-off merchandise, such as soundtracks, graphic novels, tee-shirts and video games based on the applicable film project. PGE Inc. has commenced production of the first film project. PGE Inc. wants to (1) create a non-stop work flow of back to back film projects for the first two years; (2) achieve complete delivery of the first film project within six months; (3) complete four film projects and three video games to add to the ancillary merchandise within the first two years.

On July 10, 2006, 2006, PGE Inc. acquired the following film projects:

Blood

This horror feature follows a heart-broken butcher, who exacts revenge on a clan of vampires who turn his fiancé into a minion of evil. The film will be released in conjunction with the video game, a soundtrack, and graphic novel. PGE Inc. has budgeted US$125,000 for this film project. The film project is currently in the pre-production, which includes casting and financing.

Beneath

This claustrophobic thriller plants the audience in the middle of a cat and mouse game between a lawyer buried alive in a coffin and a serial killer. A young female lawyer wakes up to find herself buried in a coffin. With only a cell phone she finds out that she is a pawn of a serial killer who plans to murder her past clients, who were technically found innocent of their crimes. The film will be released in conjunction with the video game, a soundtrack and graphic novel. PGE Inc. has budgeted US$3 million for this film project. The film project is currently in the pre-production, which includes casting and financing.

Crimson

A state of the art horror reveals the deadly world of stem cell research that is tested on vampires. Four university students kidnap a woman who they believe is a vampire, and begin horrific experiments to extract the gene that presumably gives her immortality. PGE Inc. intends to release the film in conjunction with a soundtrack and graphic novel. PGE Inc. has budgeted US$250,000 for this film project. The film project is currently in development, which includes commitments for financing and attaching actors.

SUBhuman 2 - The Crimson Palace

This is the second feature in the SUBhuman series. A female FBI profiler investigates a series of brutal and bloody murders, which leads her to Martin the destroyer. Martin reveals the terrifying truth; human existence is headed towards extinction. The film will be released in conjunction with the video game, a soundtrack, graphic novel and video game. PGE Inc. has budgeted US$500,000 for this film project. The film project is currently in development, which includes commitments for financing and attaching actors.

SUBhuman Extreme Edition

PGE Inc. intends to re-release this first film in the franchise. This will include an uncut version of the original film, a graphic novel, a half hour documentary, and a soundtrack. PGE Inc. has budgeted US$125,000 for this film project. PGE Inc. plans to re-release this film project along with the release of SUBhuman 2 and the video game SUBhuman Destroyer.

The film projects were acquired from Mark Tuit’s company, SomnamBulist Imagery Inc., for a purchase price of CDN$32,000 per film project. See “Item 7.B. - Related party transactions” below, “Item 10. C. - Material contracts” below, and Exhibits 4.1 to 4.5 inclusive for more details.

All DVD’s of the film projects will be released in two versions. The first one will be a general version for the initial release. The second version will be an extreme version, which will include an uncut version of the film and additional supplementary material.

Also, PGE Inc. intends to develop and market the following video games in conjunction with the film projects:

Butchers Block

This video game will pick up immediately where the film, Blood, ends, with contaminated ground meat being consumed by innocent people. Those who consume the meat die, to rise soon after as vampires themselves. In a time sensitive reality, the player must escape a gated urban community, with several blocks of idyllic suburban homes contained within perimeter walls, where the residences are slowly turning into blood thirsty ghouls. PGE Inc. has budgeted US$250,000 for this video game. The video game is currently in development.

Beneath: Buried Alive

In this video game, the player will be put in the role as a buried victim. In this point-of-view game, the player will be placed in a coffin by a serial killer. It will be up to the player to negotiate through a labyrinth of tricks and traps in order to survive. The goal is simple, survive and escape. PGE Inc. has budgeted US$250,000 for this video game. The video game is currently in development, which includes negotiations for favorable financing.

SUBhuman Destroyer

This video game will follow the exploits of Martin the Destroyer, who must save a city from being devoured by the bloodthirsty parasites. Based on the film, SUBhuman 2, this game places the player in the terrifying Crimson palace where they have to rescue the imprisoned humans, while searching for the host parasite. PGE Inc. intends to release the video game on a downloadable format for PC and X-Box 360. PGE Inc. has budgeted US$500,000 for this video game. The video game is currently in development.

Finally, PGE Inc. will be further marketing its film projects and video games with the sale and distribution of soundtracks and graphic novels. PGE Inc. has a budget of 5% of the budgets for the film projects for these ancillary products.

Partners in Production

Pathway Films Inc.

Pathway Films Inc. is a British Columbia company formed on September 18, 2001. Ron Loudoun, PGE Inc.’s CFO, is the sole shareholder, officer and director of Pathway. Pathway studios will provide deferred costs of its services and equipment, which include offices for production, HD cameras, grip and lighting, full sound stage, sound recording facilities, picture edit facilities, and DVD authoring.

Somnambulist Imagery Inc.

Somnambulist Imagery Inc. is a British Columbia company formed on November 21, 2004. Mark Tuit, PGE Inc.’s CEO, is the sole shareholder, officer and director of Somnambulist Imagery Inc. Somnambulist Imagery Inc. will defer a percentage of writing and directing fees to keep the initial film costs down.

Sky Works Studio

Sky Works Studio is a visual effects and motion graphics design studio located in Vancouver, British Columbia, Canada, that was founded in 1999. Ashish Mittal is the president of Sky Works. Sky Works has agreed to defer a percentage in visual special effects, and on-line colour correction and delivery elements.

Power Up Studios

Power Up Studios is a video game production company based out of Vancouver, British Columbia. The company’s principal and president is Bren Lynne. Power Up Studios will be responsible for the creation, completion and marketing of all of the video games produced from PGE Inc.

Markets

With PGE Inc.’s current slate of film projects, video games and merchandise, its target demographic ranges from 14 years to 35 years, both male and female. Management also intends to target comic book, video game and horror related franchises.

PGE Inc. will also target the video and DVD market with its film projects. All of PGE Inc.’s film projects have secured worldwide video and DVD distribution in advance, thus eliminating the risk of having to shop a film on the markets without guarantees.

Dependence on Partners

PGE Inc. is not dependent on any patents or licenses, industrial, or commercial or financial contracts, including contracts with customers or suppliers, with the exception of the following:

PGE Inc is partnered with Pathway Films Inc., a fully functioning film and game production studio, which allows it to keep every aspect of film and video game production in-house. Pathway Films Inc. will provide deferred costs of its services and equipment, which include offices for production, HD cameras, grip and lighting, full sound stage, sound recording facilities, picture edit facilities, and DVD authoring. There is currently no agreement for this arrangement. If PGE Inc. is unable to use Pathway’s studio and equipment, it will have to find another studio and other equipment to produce its films and video games. Management cannot be certain at this time, but it is unlikely that PGE Inc. would be able to secure terms for another studio and other equipment on such favorable terms as provided by Pathway Films Inc.

Competition

Film and video game production and distribution are highly competitive businesses. PGE Inc. faces competition from companies within the entertainment business and from alternative forms of leisure entertainment. PGE Inc.’s competitors vary in size from very small companies with limited resources to very large corporations with greater financial, marketing and product development resources than ours. Successful competition in PGE Inc’s target markets is also dependent on price, access to retail shelf space, product quality, product enhancements, brand recognition, marketing support and access to distribution channels. The number of new video game releases for PC’s in a given year is much higher than the number of new video game releases for home consoles and handheld platforms. Management believes PGE Inc.’s strategy of publishing PC titles within established franchises and games developed by studios personnel, well-known within the industry allows PGE Inc. to quickly develop market share with a minimal investment in sales and distribution infrastructure.

Film Projects

PGE Inc. competes with the major studios, numerous independent motion picture and television production companies such as: Focus Features, New Line Cinema, Castle Rock Entertainment, Fine Line Features and Warner Independent Pictures, Tri-Star Pictures, Screen Gems Dimension Films, and Miramax Film Corp.

According to the Motion Picture Association of America, the average cost to produce and distribute a major studio film in 2004 was $98.0 million, including $63.6 million of production costs and $34.4 million of distribution and marketing expenses (typically called “P&A” or “prints and advertising”).

In comparison, films released by smaller independent studios typically cost less than $4.0 million to produce and market in the same period. Despite the limited resources generally available to independent studios, independent films have gained wider market approval and increased share of overall box office receipts in recent years. Past successful independent films such as Open Water, Cabin Fever, Saw, The Blair Witch Project and Crash highlight moviegoers’ willingness to support high quality motion pictures despite limited marketing and production budgets.

Video Games

PGE Inc.’s competitors vary in size from very small companies with limited resources to very large corporations with greater financial, marketing and product development resources than ours. These competitors include Activision, Atari, Capcom, Electronic Arts, Konami, Namco, Sci Entertainment, Sega, Take-Two Interactive Software, THQ, Ubisoft Entertainment, and Vivendi Universal Games, among others. PGE Inc. faces additional competition from the entry of new companies into the market, including large diversified entertainment companies. PGE Inc. will compete with Microsoft, Nintendo and Sony, who publish software for their respective systems. PGE Inc. also competes with numerous companies licensed by the platform manufacturers to develop or publish software products for use with their respective systems.

Government Regulation

While the actual production of PGE Inc.’s movies does not require governmental approval, PGE Inc. is subject to many federal, state, local and foreign regulation with respect to the production and distribution of its movies. Accordingly, PGE Inc. is required to be aware and sensitive to government laws and regulations. PGE Inc. distributes its films to wholesalers and retailers in the United States and abroad. Management has taken steps to ensure compliance with all federal, state, local and foreign regulations regulating the content of motion pictures, by staying abreast of all legal developments in the areas in which motion pictures are distributed. In light of PGE Inc.’s efforts to review, regulate and restrict the distribution of its materials, management believes that the distribution of PGE Inc.’s products does not violate any statutes or regulations.

Distribution rights to films are granted legal protection under the copyright laws of Canada, the United States and most foreign countries, which impose substantial civil and criminal sanctions for unauthorized duplication and exhibition of films. From time to time, various third parties may contest or infringe upon PGE Inc.’s intellectual property rights. Management will take all appropriate and reasonable measures to secure, protect and maintain or obtain agreements from licensees to secure, protect and maintain copyright protection for all of its films and products produced and distributed by PGE Inc. under the laws of all applicable jurisdictions. PGE Inc. can give no assurance that its actions to establish and protect its trade-marks and other proprietary rights will be adequate to prevent imitation or copying of its filmed entertainment by others or to prevent third parties from seeking to block sales of its filmed entertainment as a violation of their trade-marks and proprietary rights. Moreover, PGE Inc. can give no assurance that others will not assert rights in, or ownership of, PGE Inc.’s trade-marks and other proprietary rights, or that PGE Inc. will be able to successfully resolve these conflicts. In addition, the laws of certain foreign countries may not protect proprietary rights to the same extent as do the laws of the United States or Canada. See “Risk Factors” for more details.

Tax Credits

The Canadian federal government and a number of its provincial counterparts have established refundable tax credit programs based on eligible labor expenditures of qualifying production entities. PGE Inc. expects that certain of its films will incorporate these refundable tax credits as elements of production financing. If such productions do not ultimately qualify for anticipated refundable tax credits, the relevant production may require additional funds for completion, which may not be available from other sources.

For PGE Inc.’s films to continue to qualify for several refundable tax credits, PGE Inc. must remain Canadian-controlled pursuant to the Investment Canada Act (Canada), or ICA, among other statutory requirements. The ICA contains rules, the application of which determines whether an entity (as the term is defined in the ICA) is Canadian-controlled. Under these rules, an entity is presumed to be a non-Canadian in certain circumstances, including where Canadians own less than a majority of voting interests of an entity. This presumption may be rebutted, for example, if the entity establishes that it is not controlled in fact through the ownership of its voting interests and that two-thirds of the members of its board of directors are Canadians.

Although management believes PGE Inc. is currently a Canadian-controlled entity under the ICA, there can be no assurance that the Minister of Canadian Heritage will not determine PGE Inc. is out of compliance with the ICA, or that events beyond its control will not result in PGE Inc. ceasing to be Canadian-controlled pursuant to the ICA. The ICA provides the Minister of Canadian Heritage with discretion to make a determination that a business activity prescribed under the ICA as relating to Canada’s cultural heritage or national identity (which includes a business engaged in the production, distribution, sale or exhibition of film or video products, hereinafter referred to as a “cultural business”) is not a Canadian-controlled entity, if the Minister is satisfied, after considering any information or evidence submitted by the entity or otherwise made available to the Minister or the Director of Investments, that the entity is controlled in fact by one or more non-Canadians. If PGE Inc. ceases to be Canadian-controlled under the ICA, it would no longer qualify or be entitled to access these refundable tax credits and other Canadian government and private motion picture industry incentives that are restricted to Canadian-controlled corporations, including the ability to produce under Canada’s official co-production treaties with other countries.

In addition, certain provincial refundable tax credits require that the applicant be provincially controlled. If PGE Inc. ceases to be provincially controlled, it would no longer be entitled to access the applicable provincial refundable tax credits.

Investment by Non-Canadians

Under the ICA, the Minister of Canadian Heritage has discretion to determine, after considering any information or evidence submitted by the entity or otherwise made available to the Minister or the Director of Investments, that an investment by a non-Canadian in a cultural business may constitute an acquisition of control by that non-Canadian, notwithstanding the provisions in the ICA that state that certain investments do not or may not constitute an acquisition of control that would require notification or review under the ICA. If the Minister of Canadian Heritage exercises its discretion and deems an investment by a non-Canadian in a cultural business to be an acquisition of control, the investment is potentially subject to notification and/or review. If the investment is subject to review, the Minister must be satisfied that the investment is likely to be of net benefit to Canada. Such a determination is often accompanied by requests that the non-Canadian provide undertakings supportive of Canadian cultural policy. These undertakings may, in some circumstances, include a request for financial support of certain initiatives. The determination by the Minister of whether a proposed investment is of net benefit to Canada also includes consideration of sector specific policies of the Canadian federal government. One such policy prohibits takeovers of Canadian owned and controlled film distribution businesses by non-Canadians. This prohibition is not contained in the ICA nor in the regulations made under the ICA, but is a separate foreign investment policy relating to the Canadian film distribution sector. If an investment by a non-Canadian in PGE Inc.’s business is deemed by the Minister to be an acquisition of control and ultimately subject to review, the current policy of the Canadian federal government prohibiting the takeover of a Canadian owned and controlled film distribution business would be applied in the context of the Minister’s determination of whether the proposed investment would be of net benefit to Canada, with the result that PGE Inc.’s film distribution business in Canada may have to be divested to a Canadian purchaser, which could have a material adverse effect on PGE Inc.’s business, results of

C. Organizational structure.

PGE is not part of a group and PGE does not have any subsidiaries.

D. Property, plants and equipment.

As of April 30, 2006, and as of the date of this annual report, PGE has no material tangible fixed assets. Also, PGE has no plans to construct, expand or improve any facilities.

Item 4A. Unresolved Staff Comments.

There are no unresolved Staff comments at this time.

Item 5. Operating and Financial Review and Prospects.

A. Operating results.

Year Comparisons between 2006 and 2005

For the year ended April 30, 2006, PGE Inc. achieved sales revenues of $nil compared with sales revenues of $8,464 for the period ended April 30, 2005. PGE Inc.’s operating loss decreased to $9,739 in 2006 from a loss of $16,169 in 2005. Such decrease in the operating loss was due primarily to a decrease of $5,782 in website construction and maintenance and a decrease of $5,373 in consulting fees, which was offset by an increase of $850 in professional fees, an increase of $337 in internet costs, and an increase of $207 in interest and bank charges. In the same period, the working capital deficiency increased to $(35,343) in 2006 from a deficiency of $(23,297) in 2005. As of the year ended April 30, 2006, PGE Inc. had an accumulated stockholders’ deficiency of $(35,343). The current year’s contribution to the deficit was financed in part by a $6,601 advance from Pathway Films Inc.

B. Liquidity and capital resources.

PGE Inc. estimates that funding of CDN$1,900,000 will be required to implement its business plan over the next 12 months. The funding is anticipated to be required for film equipment expenses of CDN$50,000, inventory and raw stock items of CDN$30,000, wage and salaries of CDN$700,000, marketing expenses of CDN$100,000, administrative costs of CDN$450,000, professional fees of CDN$380,000, and film production expenses of CDN$190,000.

PGE Inc. had $4,294 on hand as at April 30, 2006.

PGE Inc. intends to finance its administrative, start up and initial operating costs by the sale of its shares, other shareholder financings, and standard business trade financing. No commitments to provide additional funds have been made by management, stockholders or anyone else.

PGE Inc. intends to raise the required funds to implement its business plan through equity or debt financing or a combination of both. To the extent that additional capital is raised through the sale of equity or equity-related securities, the issuance of such securities is likely to result in dilution to PGE Inc.’s shareholders. There can be no assurance that sources of capital will be available to PGE Inc. on acceptable terms, or at all. The absence of funding would make the successful completion of PGE Inc.’s business plan doubtful.

C. Research and development, patents and licenses, etc.

PGE Inc. has not spent any funds on research and development activities in the last three fiscal years except for funds spent for the development of its website.

PGE Inc. is not currently conducting any research and development activities.

Currently, PGE Inc. has not patents or licenses or registered trademarks or any other intellectual property, with the exception of the copyright to its film projects. PGE Inc. will attempt to protect proprietary and intellectual property rights to its film projects through available copyright and trademark laws and licensing and distribution arrangements with reputable international companies in specific territories and media for limited durations.

D. Trend information.

PGE Inc. does not have a significant history with respect to its financial operations in order to identify any recent trends in its business operations.

E. Off-balance sheet arrangements.

PGE Inc. does do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

F. Tabular disclosure of contractual obligations.

As at April 30, 2006, PGE Inc. had no contractual obligations and commitments as set out in the following table.

| | Payments due (by period) |

| | | less than | | | more than |

Contractual Obligations | Total | one year | 1-3 years | 3-5 years | 5 years |

| Long-term debt obligations | $nil | $nil | $nil | $nil | $nil |

| Debentures | $nil | $nil | $nil | $nil | $nil |

| Long-term accounts payable | $nil | $nil | $nil | $nil | $nil |

| Contractual commitments | $nil | $nil | $nil | $nil | $nil |

| Retirement and severance indemnities | $nil | $nil | $nil | $nil | $nil |

G. Safe Harbor.

This Form 20-F - Annual Report contains forward-looking statements. PGE Inc. intends to identify forward-looking statements in this report using words such as “anticipates”, “will”, “believes”, “plans”, “expects”, “future”, “intends”, “projects”, “estimates”, “should”, “could”, or similar expressions. These statements are based on management’s beliefs as well as assumptions PGE Inc. made using information currently available to it. You should not place undue reliance on these forward-looking statements. Because these statements reflect PGE Inc.’s current views concerning future events, these statements involve risks, uncertainties and assumptions. Actual future results may differ significantly from the results discussed in the forward-looking statements. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives requires the exercise of judgment. To the extent that the assumed events do not occur, PGE Inc.’s outcome may vary substantially from its anticipated or projected results, and accordingly, PGE Inc. expresses no opinion on the achievability of those forward-looking statements and give no assurance that any of the assumptions relating to the forward-looking statements are accurate. Some, but not all, of the factors that may cause these differences include those discussed in the Risk Factors section.

All forward-looking statements are made as of the date of filing of this Form 20-F and PGE Inc. disclaims any duty to update such statements.

PGE Inc. may, from time to time, make oral forward-looking statements. PGE Inc. strongly advises you to read the foregoing paragraphs and the risk factors described in this Form 20-F - Annual Report and in PGE Inc.’s other exhibits and documents filed with the United States Securities and Exchange Commission for a description of certain factors that could cause actual results to differ materially from those in the oral forward-looking statements. PGE Inc. disclaims any intention or obligation to update or revise any oral or written forward-looking statements whether as a result of new information, future events or otherwise.

Item 6. Directors, Senior Management and Employees.

A. Directors and senior management.

Mark Tuit (40 years old) - Mark has been a director and the CEO and the President of PGE Inc. since June 2006. In 1994, Mark wrote, produced and directed his first feature film CURIOUSLY DEAD, followed up with the semi-biography BARNONE, which went on to sell out at various film festivals and eventually received wide North American distribution on Video and DVD. In the last four years, Mark has directed the feature films LUNCH, SYMPHONY OF GRACE. Mark was a film and screenplay instructor at such schools as V.P.A.C., Gas town Actors’ Studio, and C.D.I.S. Arts School from 1999 to 2003. Mark created Somnambulist Imagery Inc in 2003. SUBHUMAN is the first film produced by this new studio, which is currently being distributed in over 22 countries. In the United States alone, SUBHUMAN sold over 30,000 units in national DVD stores. Mark is currently producing and directing the 3-D animated feature “BUNNY TALES” for Pathway Films Inc.

Ron Loudoun (43) - Ron has been a director and officer of PGE Inc. since March 2004 and has been the CFO of PGE Inc. since March 2004. Ron is also the sole officer, director, and owner of Pathway Films Inc., a British Columbia corporation, which owns and operates the studios that are being leased to PGE Inc. Ron graduated with a diploma of Administrative management from BCIT in 1983. In 2001, Ron graduated from the Vancouver Film School Foundation Program. In 2002, Ron purchased two buildings and renovated them into a fully equipped soundstage, HD postproduction facilities and office buildings, thus creating the studios owned by Pathway Films Inc.

Michael George (33) - Michael has been a director of PGE Inc. since June 2006. In 1998, Michael founded Wandering Buffalo Productions and produced The CBC signature short “Fluffy”, and Kody Zimmerman’s “A Strange Tale”. In 2001, Michael co-formed Sli-Fi media, over seeing several productions such as Neil Gaumens’s “We can get it for Wholesale”, Pale Thomas’s feature “Front Desk” and Himalaya Behl’s top selling yoga DVD’s. Michael has evolved to producing, with the award winning films “Subhuman and “Unwritten’ to his credits. Michael is currently co-producing the upcoming feature films “Crimson”, “Butcher” and “Subhuman II”.

Rene Daignault (40) - Rene has been a director and the corporate secretary of PGE Inc. since June 2006. Since graduating from University of Victoria in 1992, Rene has been a business and securities lawyer in British Columbia and a member in good standing with the Law Society of British Columbia. From November 1993 to June 2002, he has worked for such law firms as Walker & Company, Russell & DuMoulin, and Jeffs & Company Law Corporation. Since July 2002, Rene has been working as a sole practitioner with start-up companies and clients involved with the securities markets in both Canada and the United States.

There are no family relationships among the directors and executive officers of PGE Inc. Also, there are no arrangements or understandings with major shareholders, customers, suppliers or others, by which any director or officer was elected or appointed.

Advisory Board

Bren Lynne - Lead Developer

Game Producer

Bren was Senior Programmer at 3DNA Corp in Toronto, Ontario. Employing direct marketing and digital distribution methods, 3DNA developed and published the 3DNA Desktop. Bren ’s other computer and video game development experience includes Lead Designer at Arc-Media Inc., a developer /publisher Level Designer/Writer at Pseudo Interactive, developer of Full Auto and Cell Damage, and Designer and 3D Programmer at Wagga-world Entertainment, an MMORPG developer. Bren has nine years experience as a Lead Designer, Senior Programmer, Level Designer and Writer. Bren joined EA as a Software Engineer, and later graduated into his current production role to engage more of his creative talents, working on such titles as Need For Speed: Most Wanted 5-1-0, Fight Night: Round 2, and NBA Basketball for the PlayStation Portable (PSP).

Mathew Rose - Video Game Designer

Game Producer

Mr. Rose has over 10 years of Graphic design and 3D animation experience on such titles as NBA Street: Showdown and Marvel Nemesis PSP, and has worked on several additional PSP titles (FIFA, Madden, NCAA, Need for Speed, Tiger Woods Golf etc.) of yet unannounced project as a member of a central art team. Currently working as Assistant Art Lead on an as of yet unannounced project, Mr. Rose designed, purchased and implemented a Linux based network of 22 workstations, including several file servers, a fax server, print server and four line testing workstations. Mr. Rose then evolved to an IT administrator where he was partially responsible for the administration and maintenance of nearly 200 workstations and 90 servers.

Robert Merilees - Industry Advisor

Producer

Over the past six years working with Infinity Features, Mr. Merilees has helped put together over US$160M in financing for feature films and television. In addition to financing, Mr. Merilees has been physically producing feature films for seven years. The most ambitious feature film project in Canadian history recently completed and released THE SNOW WALKER, starring Barry Pepper and James Cromwell. THE SNOW WALKER has smashed its DVD sales records . Working behind the scenes, Mr. Merilees has assisted in the financing and production of films in the Infinity slate such as: SAVED, MR RIPLEY ’S RETURN, EVELYN, the Academy Award winning CAPOTE, the New Line Cinema romantic comedy, and JUST FRIENDS, starring Ryan Reynolds. Recently Mr. Merilees wrapped up production on another New Line film, THE CLEANER.

Charles Martin Smith - Industry Advisor

Producer / Director

Mr. Smith is an American film actor, writer and director. Mr. Smith landed the role of Terry “The Toad” Fields in the George Lucas 1973 film AMERICAN GRAFFITI. The sequel MORE AMERICAN GRAFFITI (1979), did not have the success of the original, but he gained notice in THE BUDDY HOLLY STORY (1978), NEVER CRY WOLF (1983), and the successful STARMAN (1984). Mr. Smith’s career continued to receive good reviews for his work in THE UNTOUCHABLES (1987), SPEECHLESS (1994) and I LOVE TROUBLE (1995). Mr. Smith was also one of the directors on the hit TV series BUFFY THE VAMPIRE SLAYER (1997). Mr. Smith directed the successful feature film AIR BUD (Disney-1997). Mr. Smith also wrote and directed the $12 million dollar feature film THE SNOW WALKER (2003) for Lionsgate Films. Mr. Smith recently completed working with Academy award winning director Curtis Hanson on LUCKY YOU.

B. Compensation.

In the past fiscal year ended April 30, 2006, PGE Inc. did not pay any form of compensation to its directors and officers. Also, for the same time period, the amount of retirement and severance benefits accrued for its executive officers and directors was $nil and there were no pension, retirement or other similar benefits set aside for PGE Inc.’s executive officers and directors.

C. Board practices.

Each director holds their office until the next annual meeting of the shareholders or until he resigns or his successor has been elected or qualified. Each officer holds their office until they resign or are removed from their office.

PGE Inc. does not have any service contracts with any of its directors, which provide for benefits upon the termination of employment.

PGE Inc. does not have a separately-designated standing audit committee. Rather, PGE Inc.’s entire board of directors perform the required functions of an audit committee. However, none of the directors meet the independent requirements for an audit committee member.

PGE Inc.’s audit committee reviews and recommends to the board of directors for approval the annual financial statements and the annual report of PGE Inc. In addition, the audit committee is charged with the responsibility of monitoring the integrity of PGE Inc.’s internal controls and management information systems. For the purposes of performing these duties, the members of the audit committee have the right, at all times, to inspect all of the books and financial records of PGE Inc. and to discuss with management and the auditors of PGE Inc. any accounts, records and matters relating to the financial statements of PGE Inc.

PGE Inc.’s audit committee is responsible for: (1) selection and oversight of PGE Inc.’s independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by PGE Inc.’s employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; (5) funding for the outside auditory and any outside advisors engagement by the audit committee; (6) reviewing the annual financial statements and management discussion and analyses; and (7) reviewing any relevant accounting and financial matters including reviewing PGE Inc.’s public disclosure of information extracted or derived from its financial statements. PGE Inc. has adopted an audit committee charter. See Exhibit 15.1 - Audit Committee Charter for more information. A copy of the Audit Committee Charter can be found on PGE Inc.’s web site at www.pacificgoldentertainment.com or a copy can be requested by calling Rene Daignault at (604) 648-0527.