| Table 24-1 Key Scheduling Parameters | 24-1 |

| Table 24-2 Total Mine Development Quantities | 24-2 |

| Table 24-3 Project Development Milestones | 24-2 |

| Table 24-4 Mill Feed Schedule | 24-3 |

| Table 24-5 Development Waste Production | 24-4 |

| Table 26-1 Proposed Budget (100% Basis) | 26-1 |

LIST OF FIGURES

PAGE

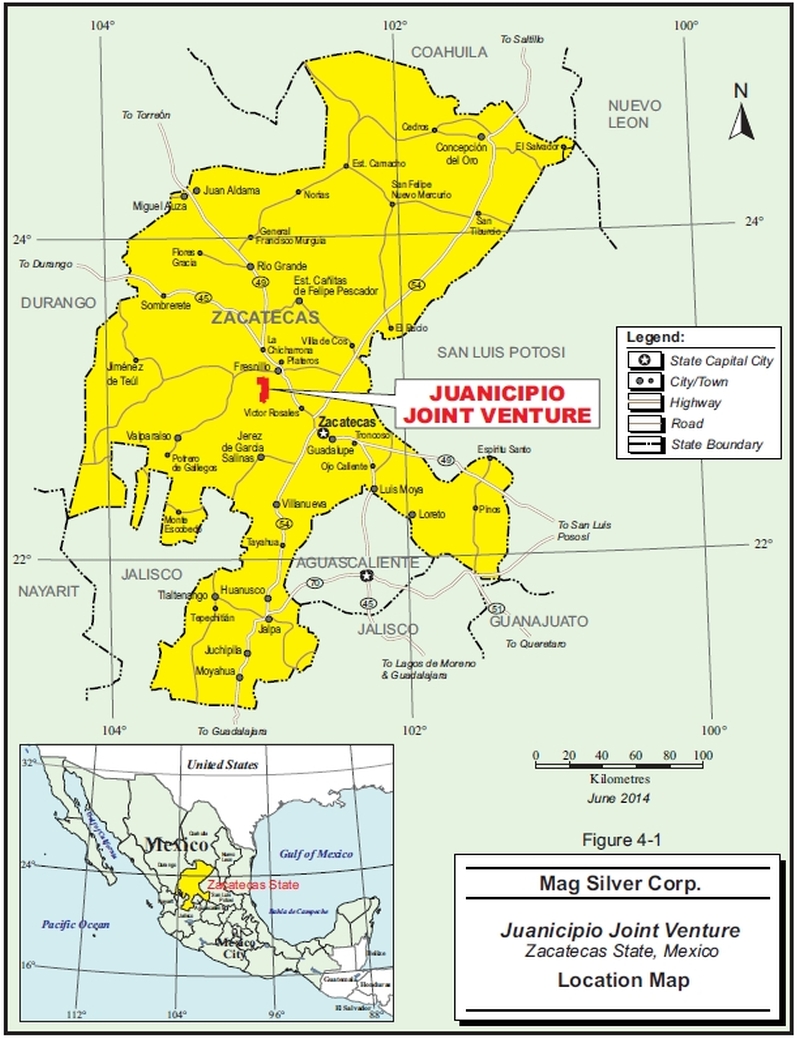

| Figure 4-1 Location Map | 4-3 |

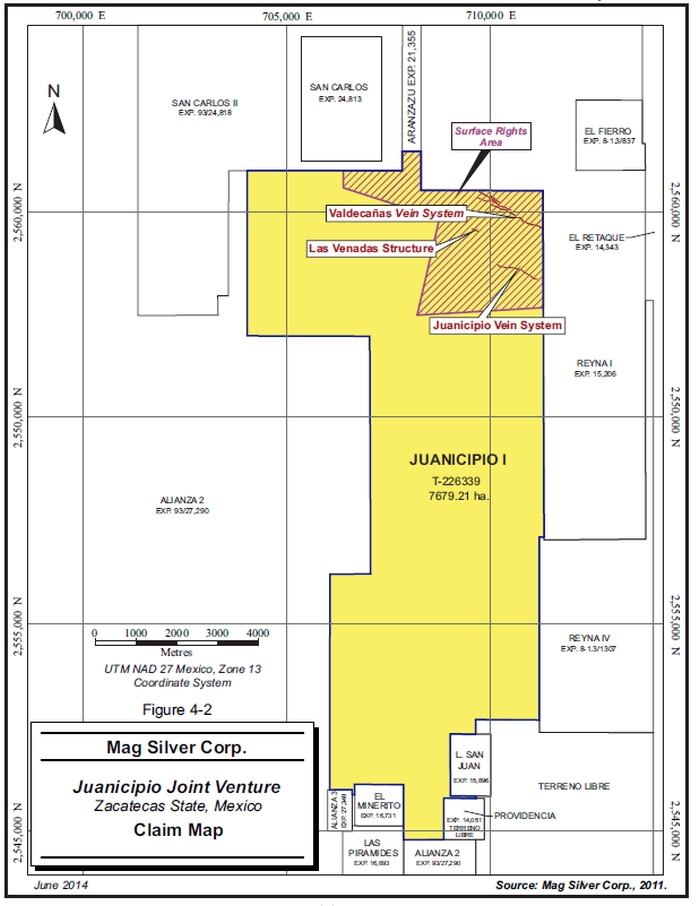

| Figure 4-2 Claim Map | 4-4 |

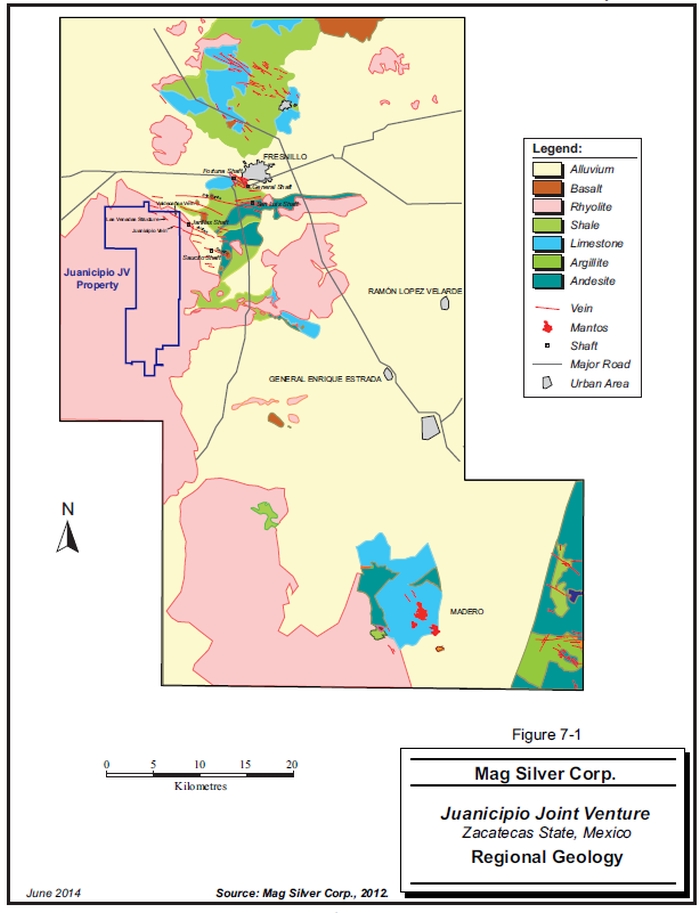

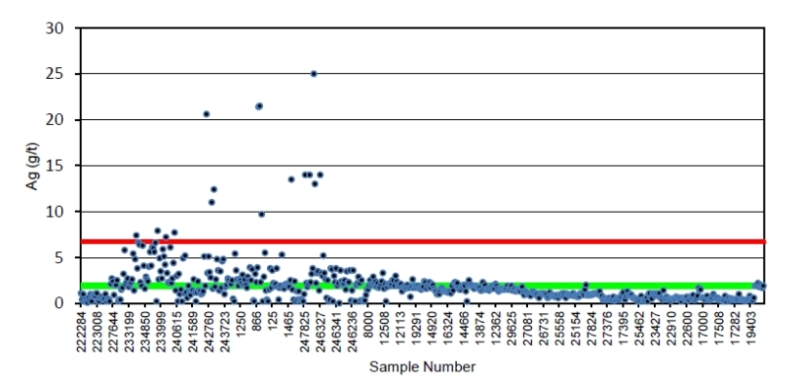

| Figure 7-1 Regional Geology | 7-2 |

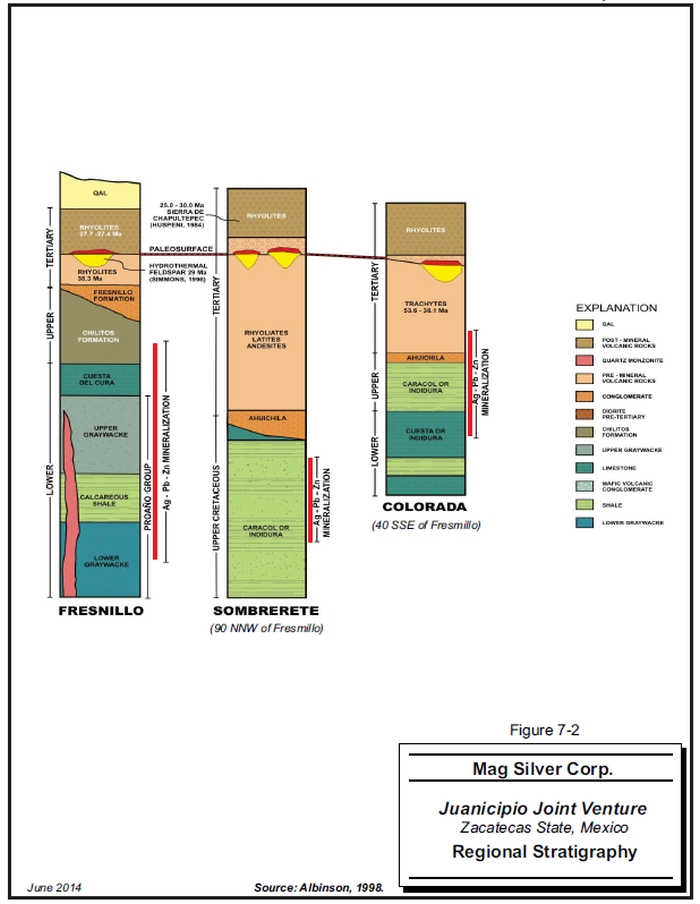

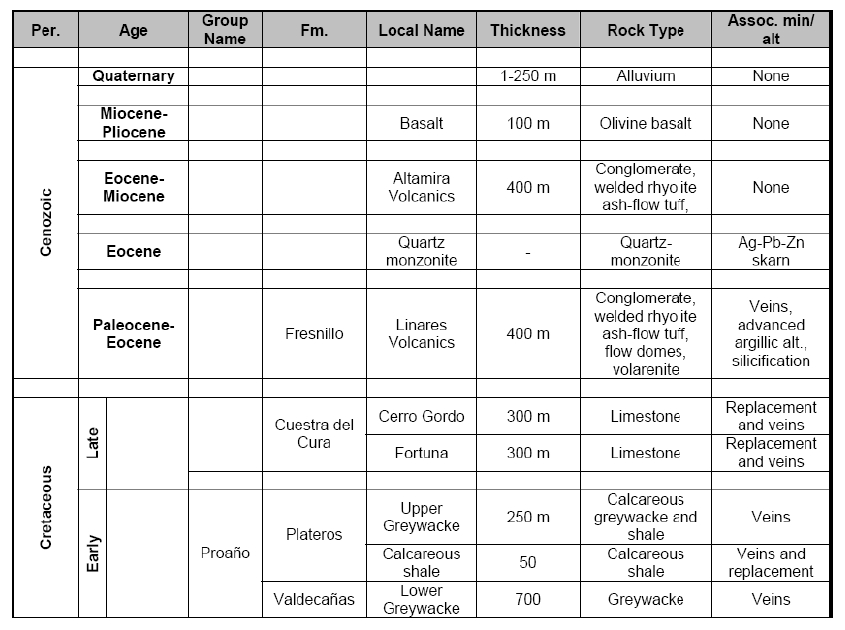

| Figure 7-2 Regional Stratigraphy | 7-3 |

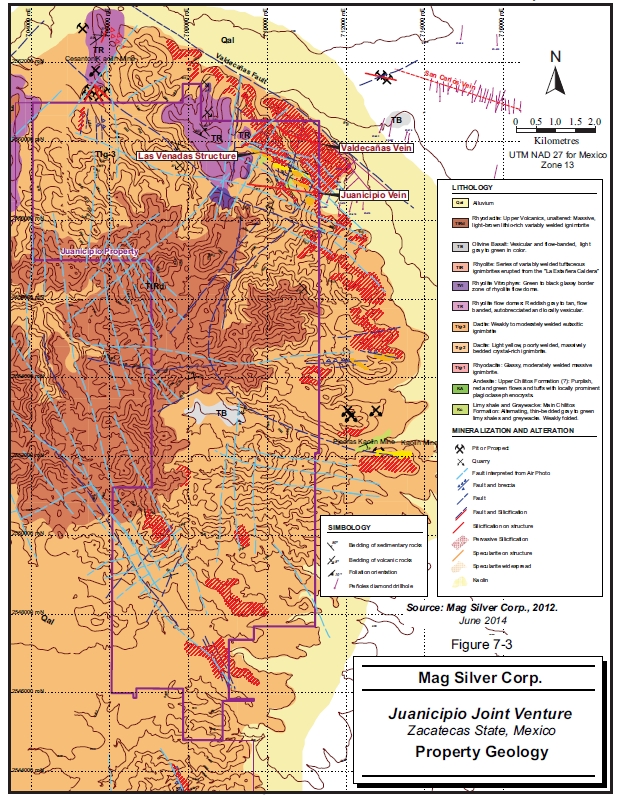

| Figure 7-3 Property Geology | 7-8 |

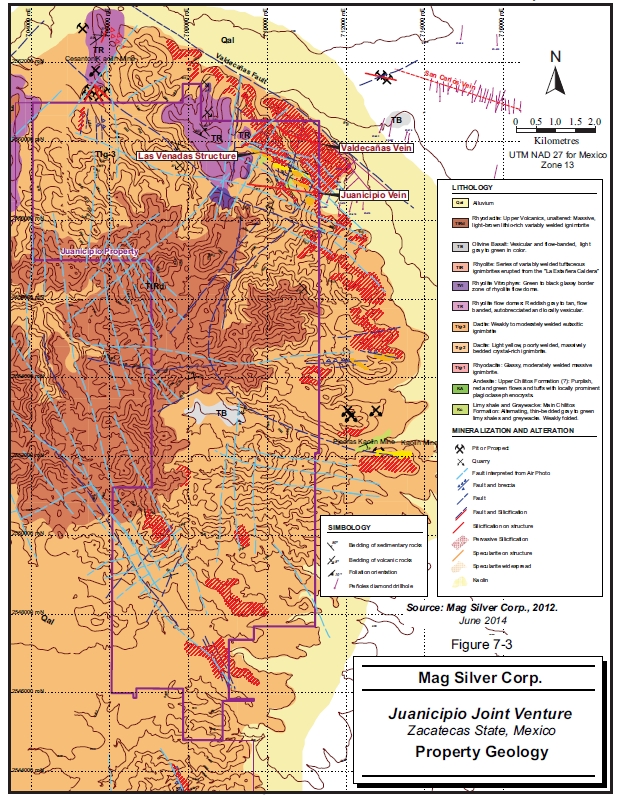

| Figure 10-1 Drill Hole Plan Map | 10-2 |

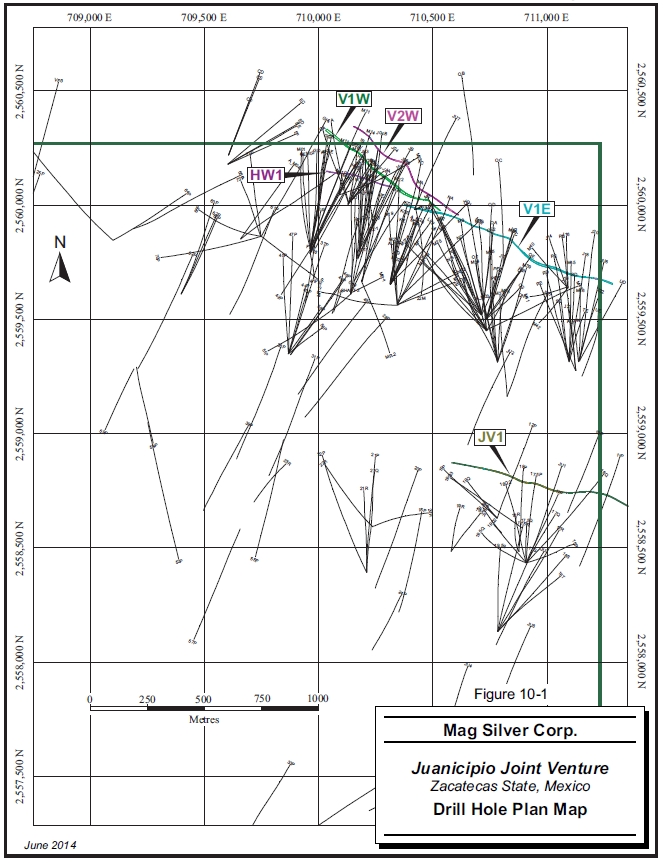

| Figure 11-1 Blank Results for Silver | 11-4 |

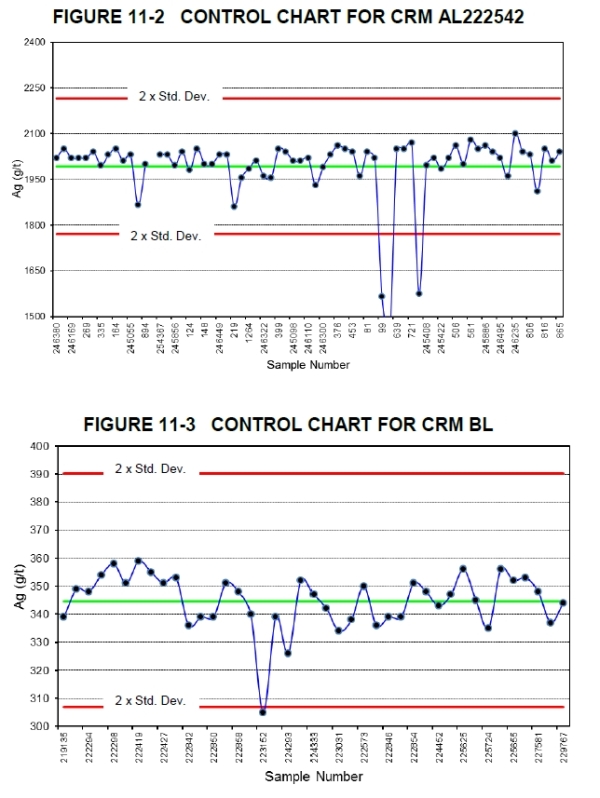

| Figure 11-2 Control Chart for CRM AL222542 | 11-5 |

| Figure 11-3 Control Chart for CRM BL | 11-5 |

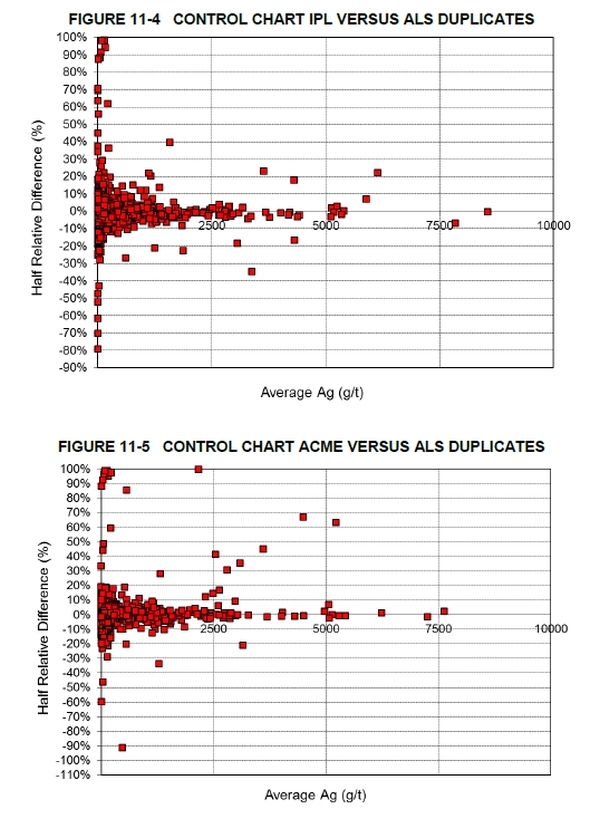

| Figure 11-4 Control Chart IPL Versus ALS Duplicates | 11-6 |

| Figure 11-5 Control Chart ACME Versus ALS Duplicates | 11-6 |

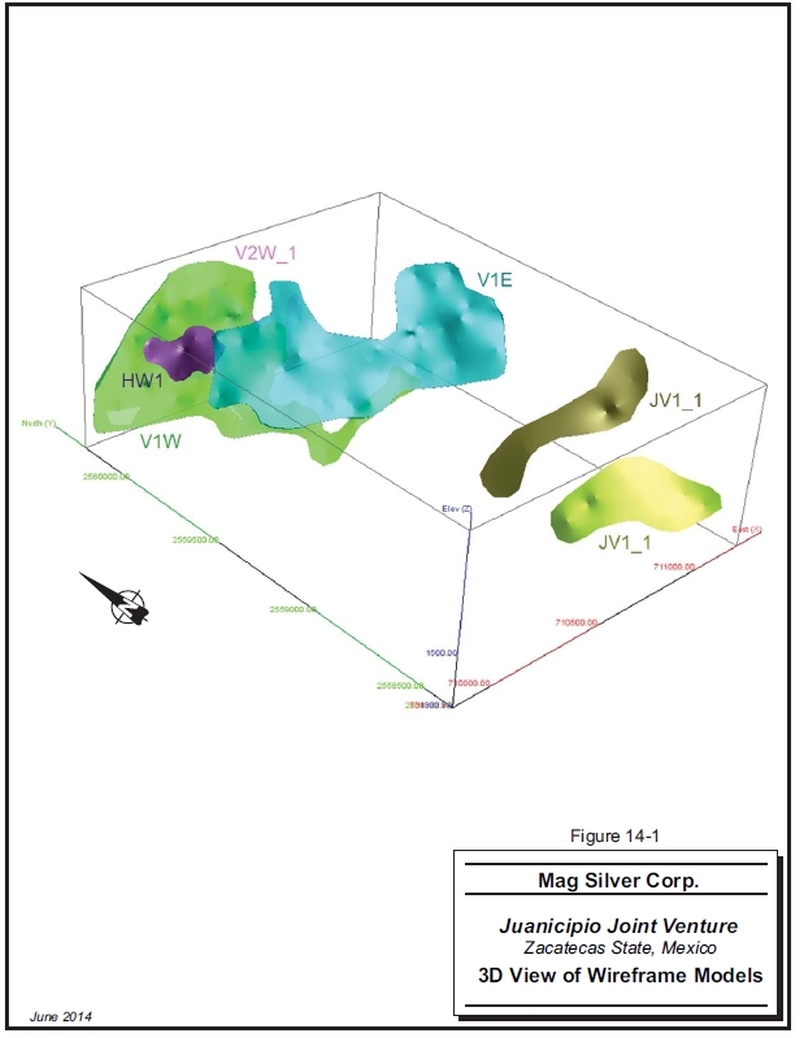

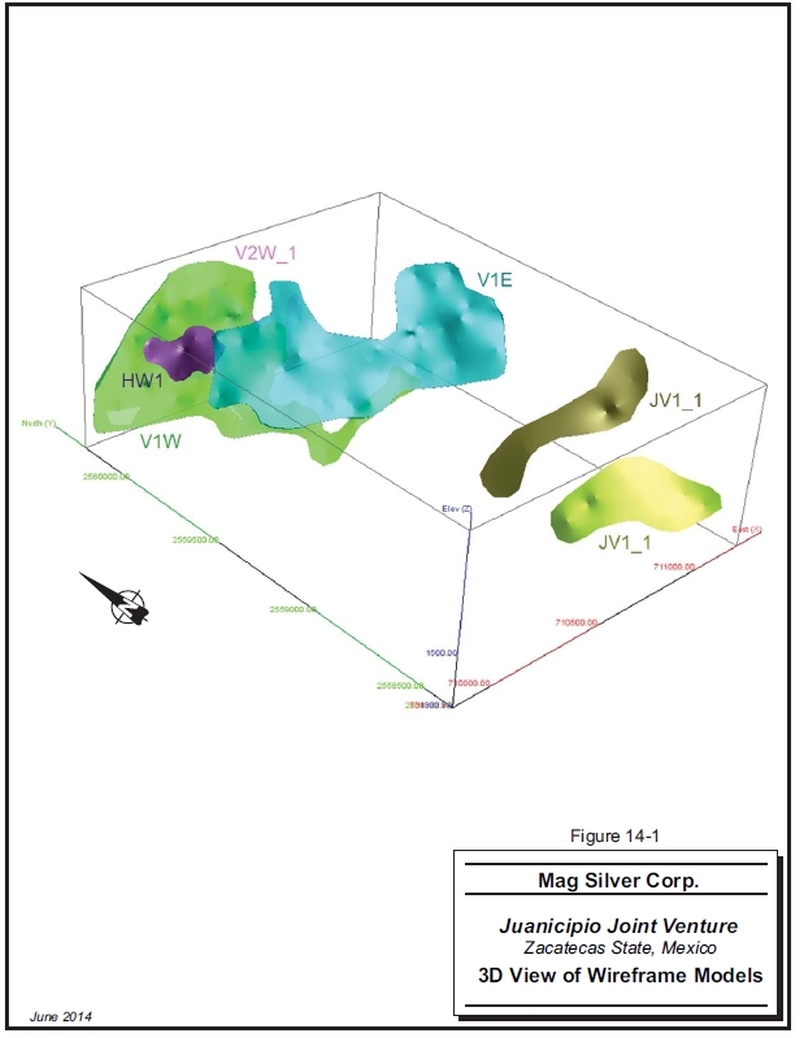

| Figure 14-1 3D View of Wireframe Models | 14-4 |

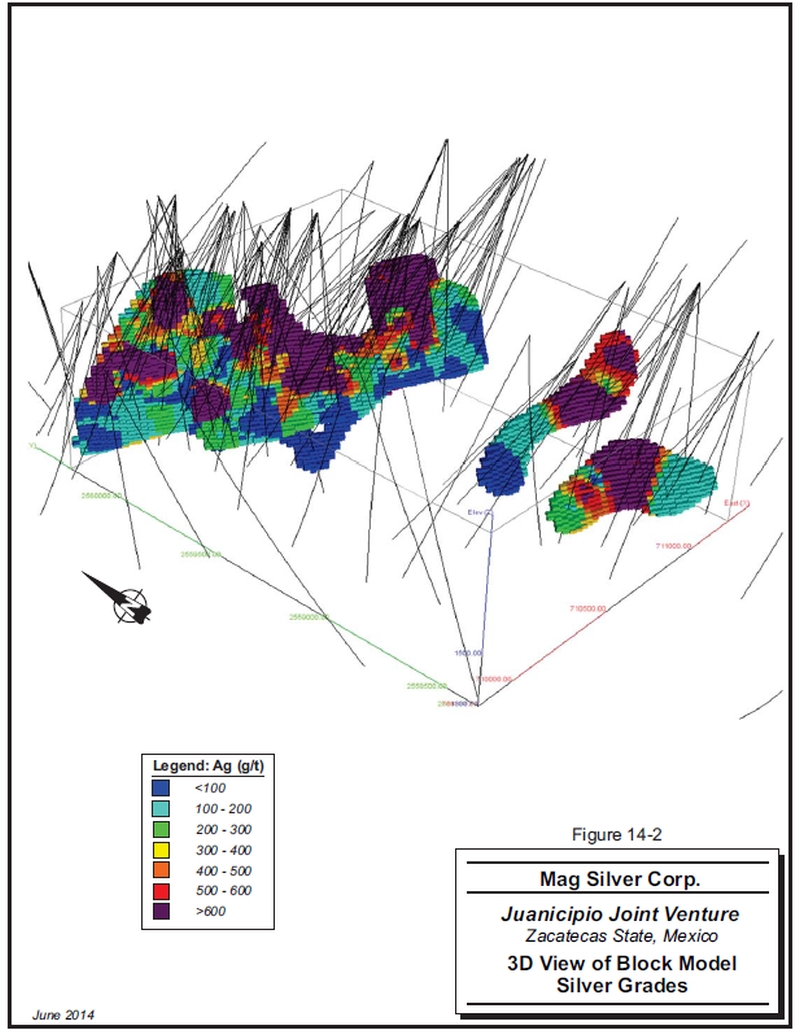

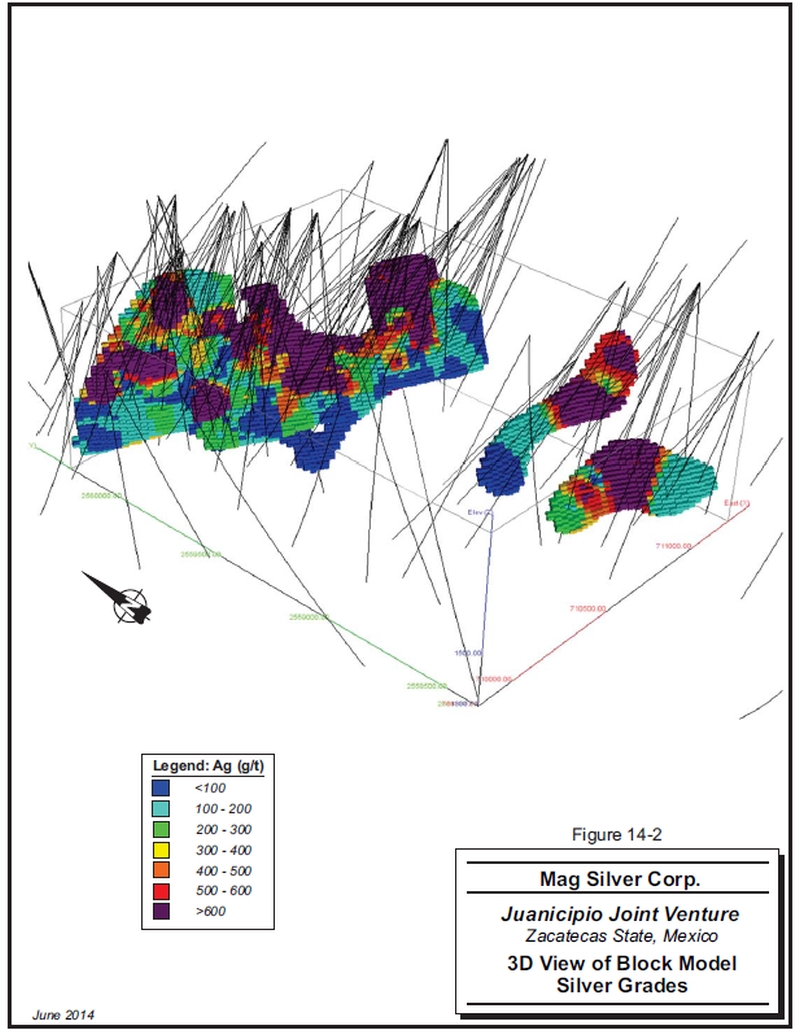

| Figure 14-2 3D View of Block Model Silver Grades | 14-5 |

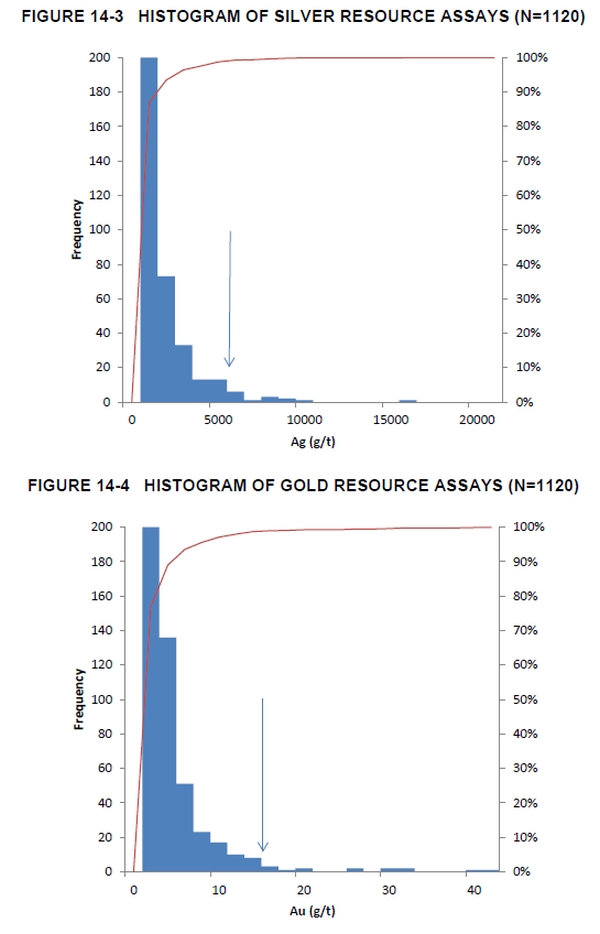

| Figure 14-3 Histogram of Silver Resource Assays (n=1120) | 14-8 |

| Figure 14-4 Histogram of Gold Resource Assays (n=1120) | 14-8 |

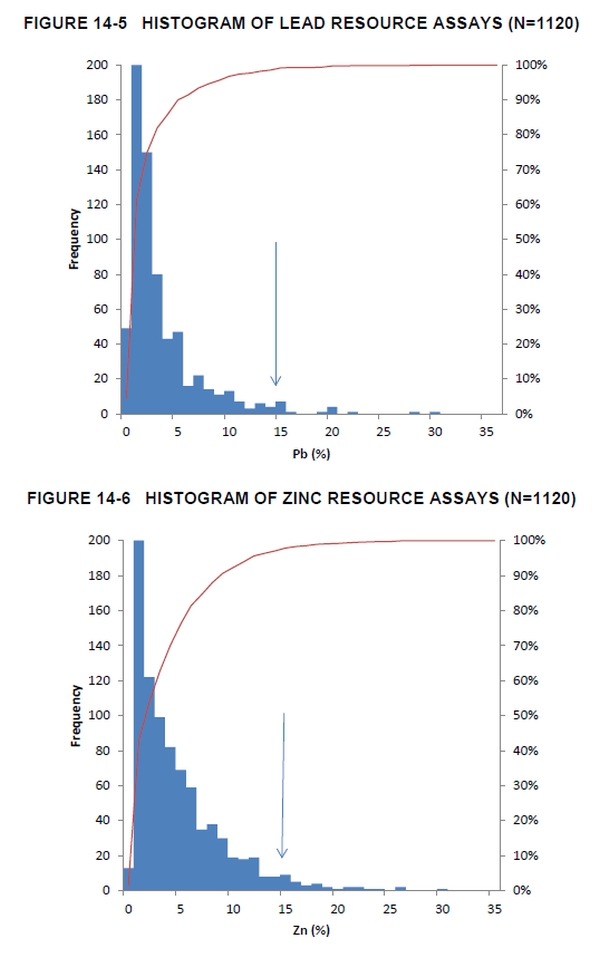

| Figure 14-5 Histogram of Lead Resource Assays (n=1120) | 14-9 |

| Figure 14-6 Histogram of Zinc Resource Assays (n=1120) | 14-9 |

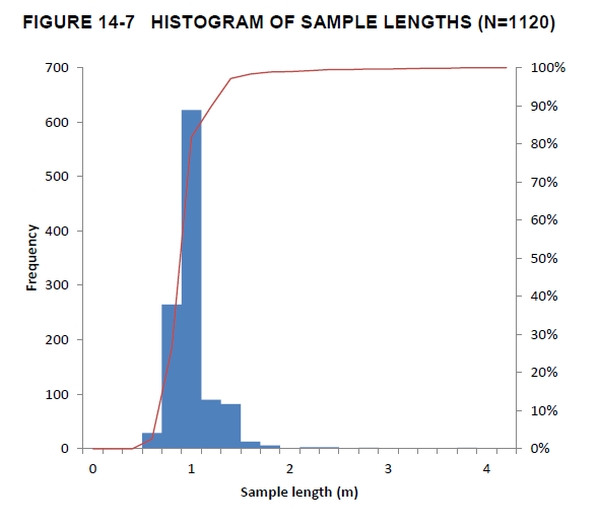

| Figure 14-7 Histogram of Sample Lengths (n=1120) | 14-11 |

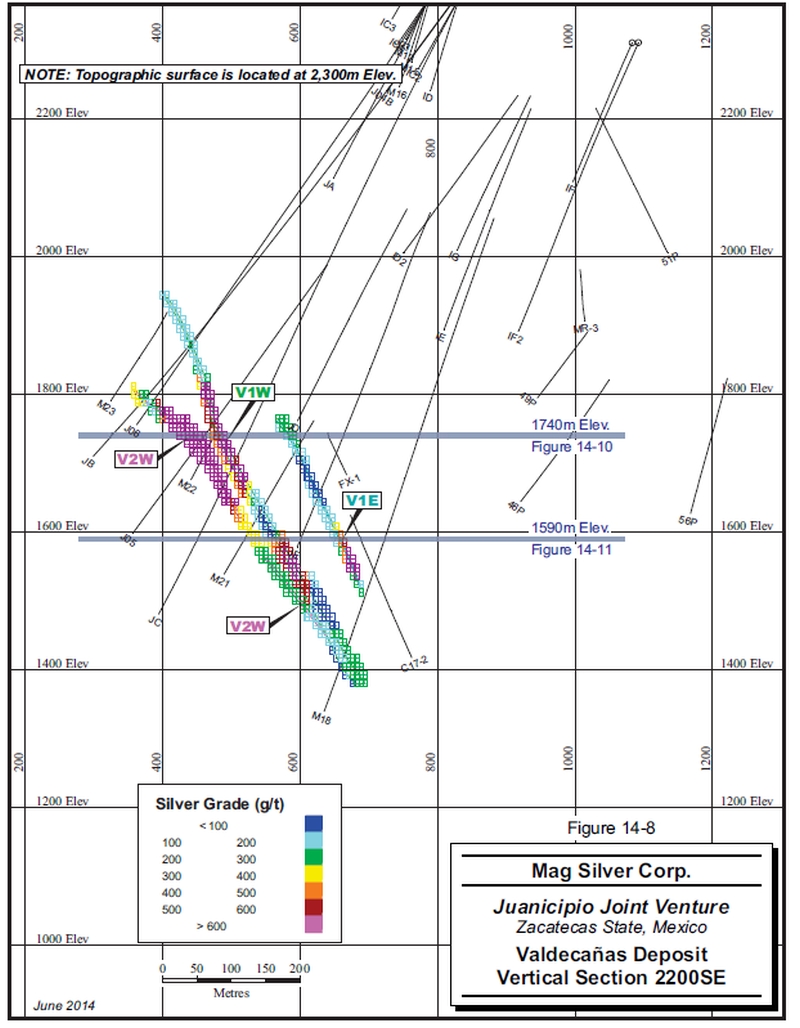

| Figure 14-8 Vertical Section 2200SE | 14-14 |

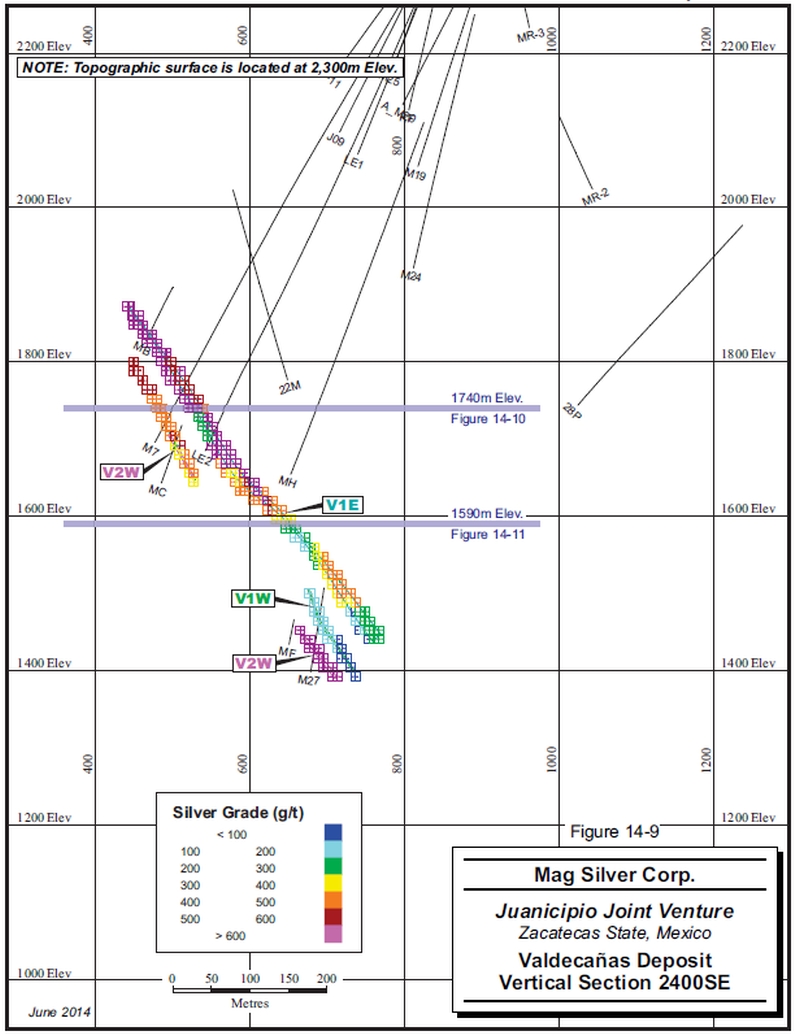

| Figure 14-9 Vertical Section 2400SE | 14-15 |

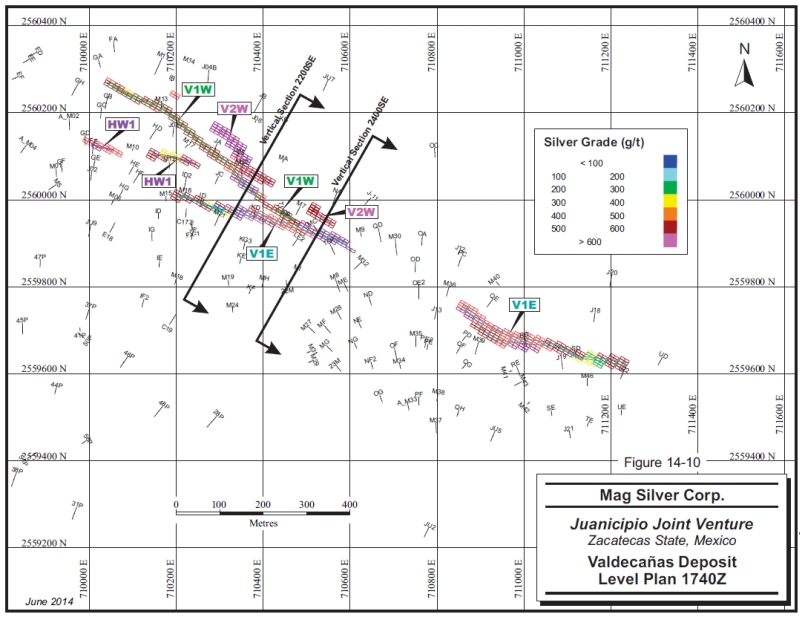

| Figure 14-10 Level Plan 1740Z | 14-16 |

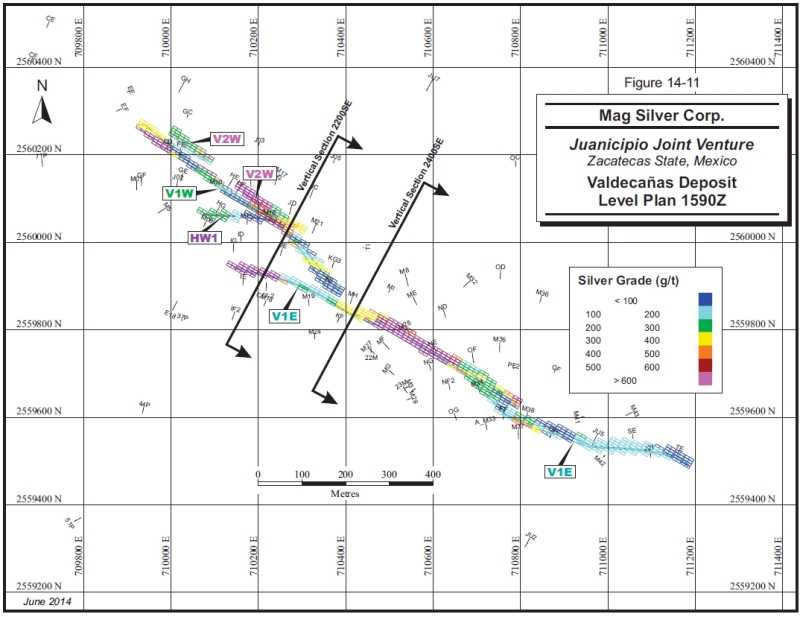

| Figure 14-11 Level Plan 1590Z | 14-17 |

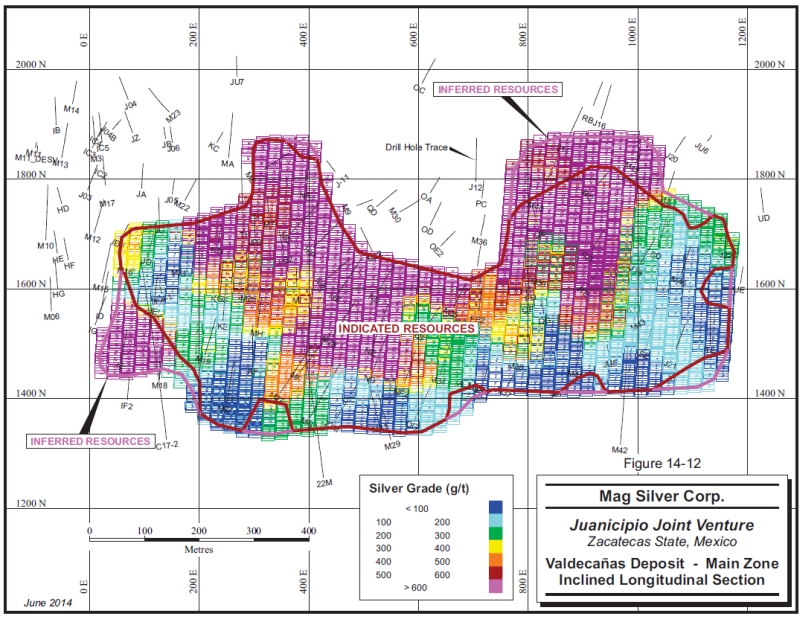

| Figure 14-12 Inclined Longitudinal Section | 14-18 |

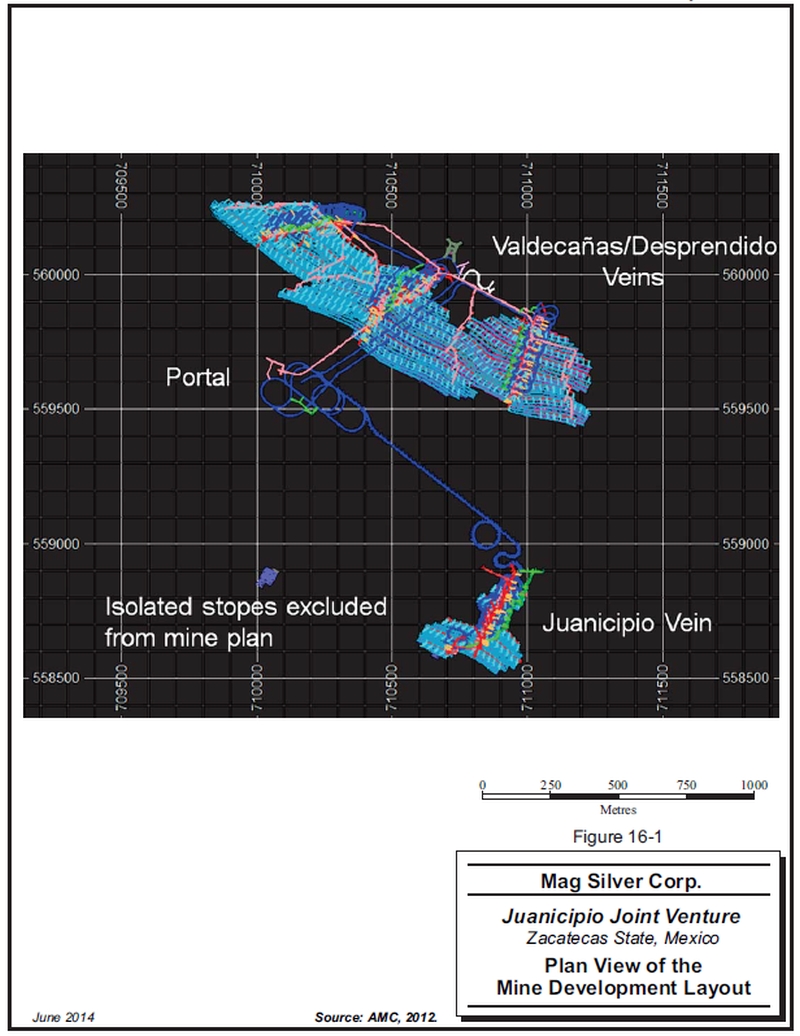

| Figure 16-1 Plan of the Mine Development Layout | 16-8 |

| Figure 16-2 Sectional View of the Mine Development | 16-9 |

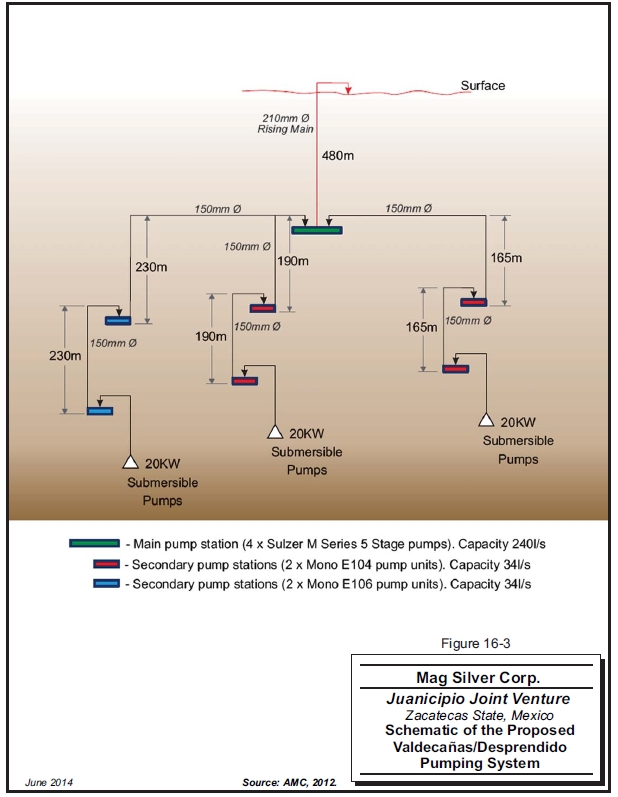

| Figure 16-3 Schematic of the Proposed Valdecañas/Desprendido Pumping System | 16-13 |

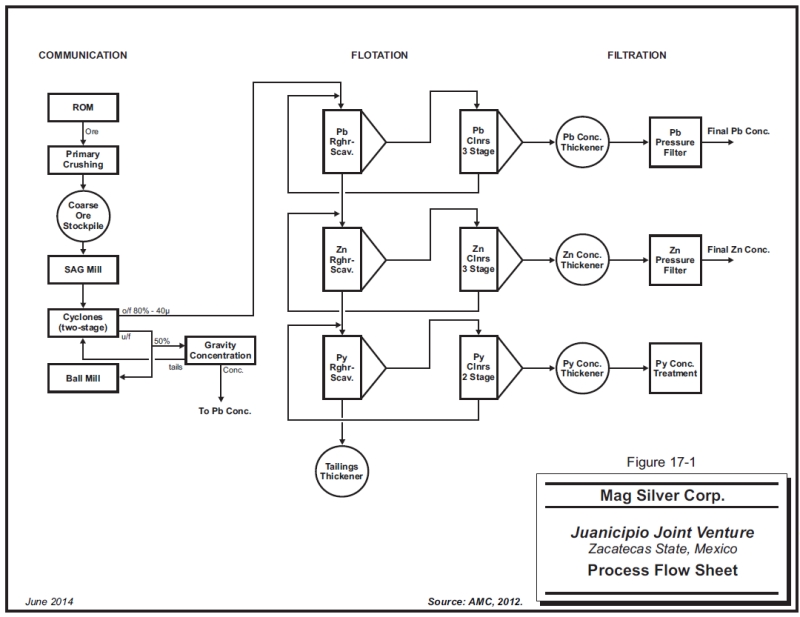

| Figure 17-1 Process Flow Sheet | 17-2 |

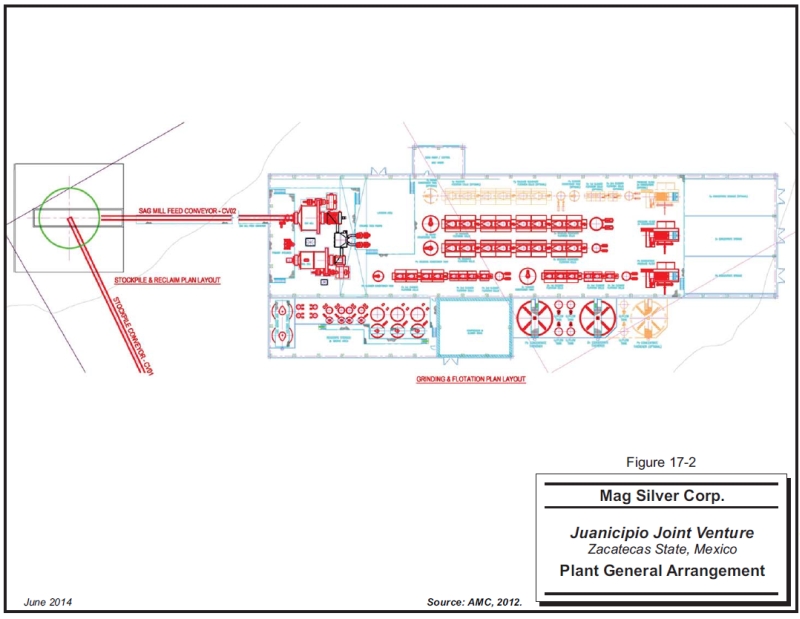

| Figure 17-2 Plant General Arrangement | 17-3 |

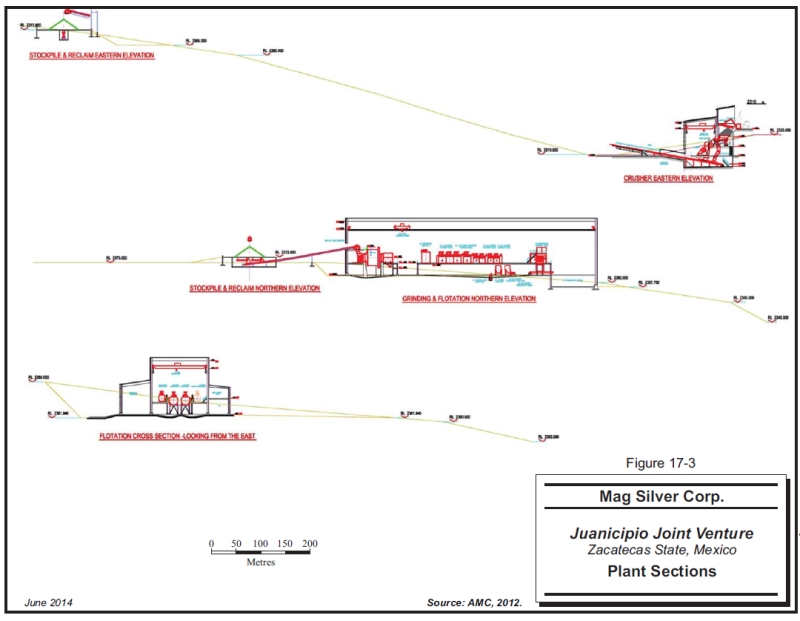

| Figure 17-3 Plant Sections | 17-4 |

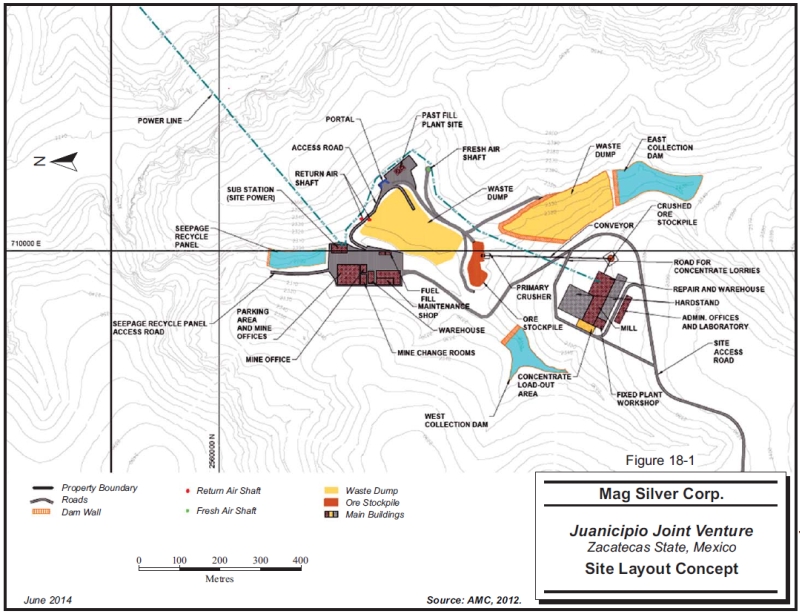

| Figure 18-1 Site Layout Concept | 18-2 |

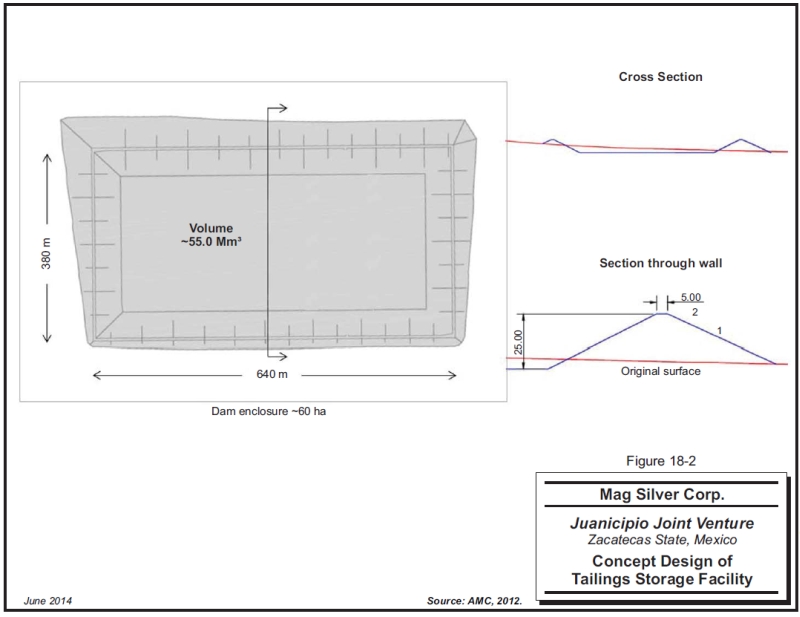

| Figure 18-2 Concept Design of Tailings Storage Facility | 18-6 |

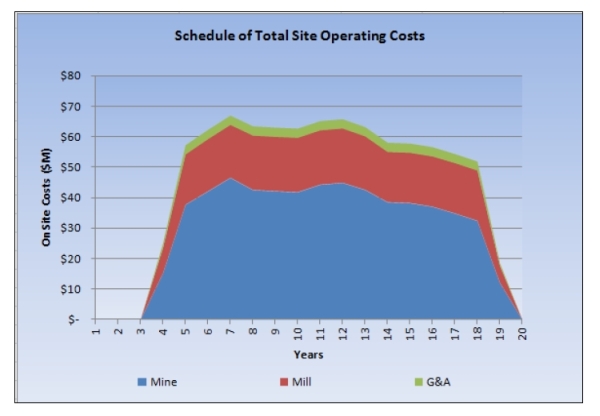

| Figure 21-1 Schedule of Site Operating Costs | 21-7 |

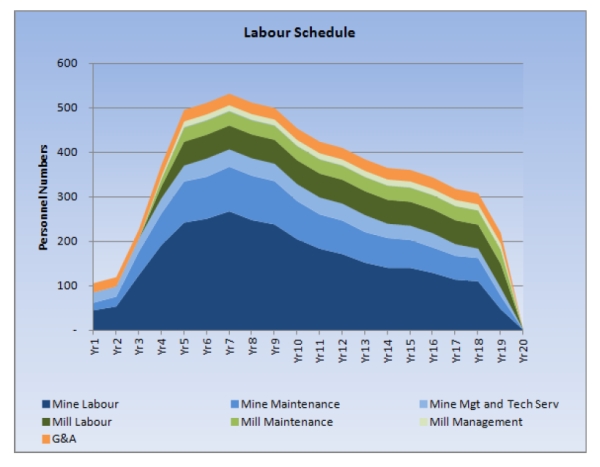

| Figure 21-2 Schedule of Estimated Employee Numbers | 21-12 |

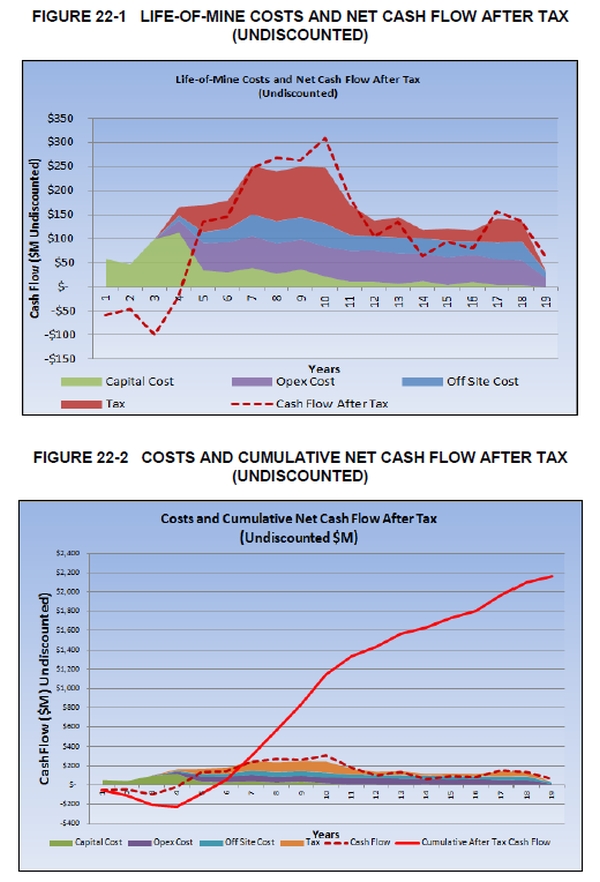

| Figure 22-1 Life-of-Mine Costs and Net Cash Flow after Tax (Undiscounted) | 22-6 |

| Figure 22-2 Costs and Cumulative Net Cash Flow after Tax (Undiscounted) | 22-6 |

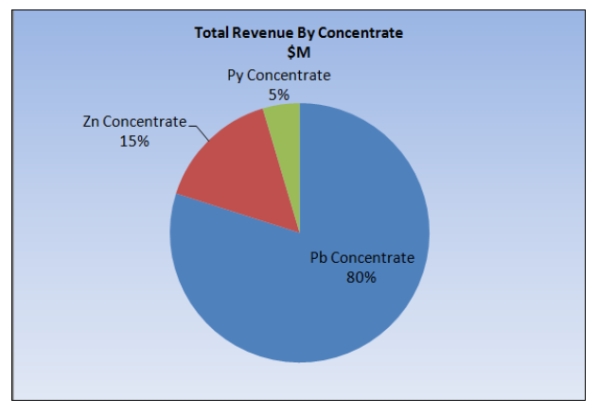

| Figure 22-3 Revenue by Concentrate Type | 22-7 |

| Figure 22-4 Total Revenue by Metal | 22-8 |

| Figure 22-5 Life-of-Mine Revenue by Metal | 22-8 |

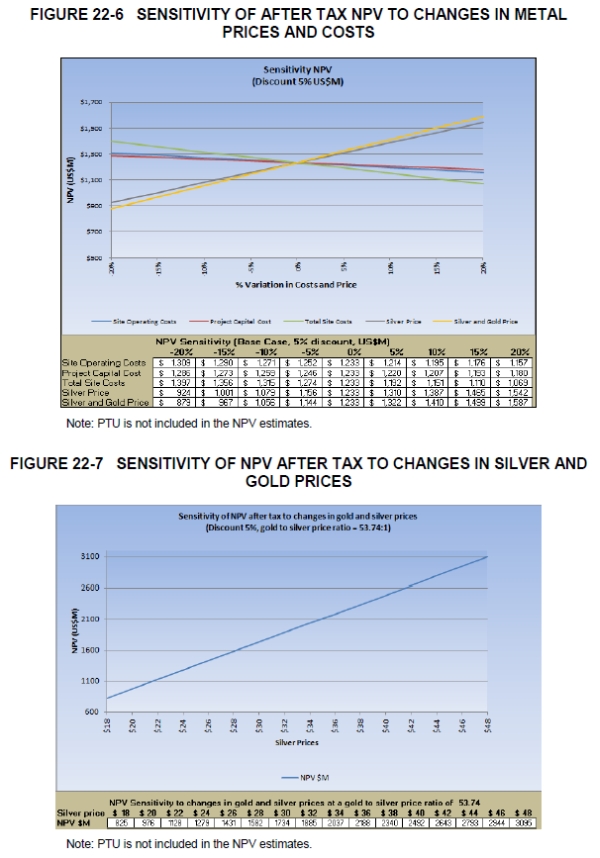

| Figure 22-6 Sensitivity of after Tax NPV to Changes in Metal Prices and Costs | 22-10 |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page v |

| www.rpacan.com |

| Figure 22-7 Sensitivity of NPV after Tax to Changes in Silver and Gold Prices | 22-10 |

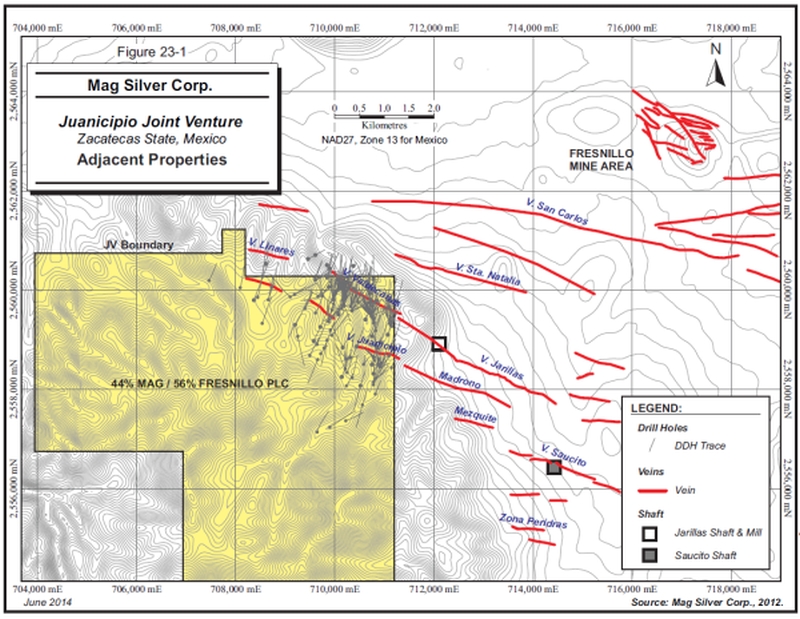

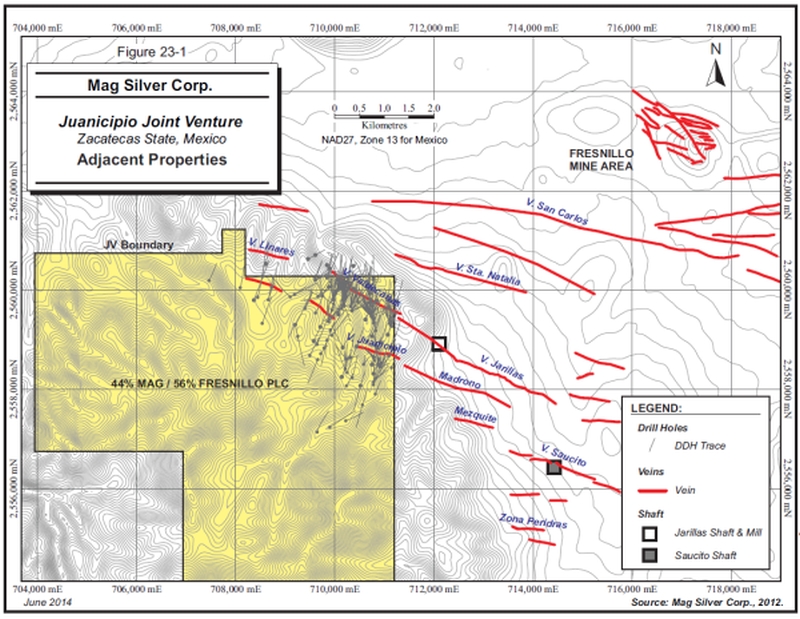

| Figure 23-1 Adjacent Properties | 23-2 |

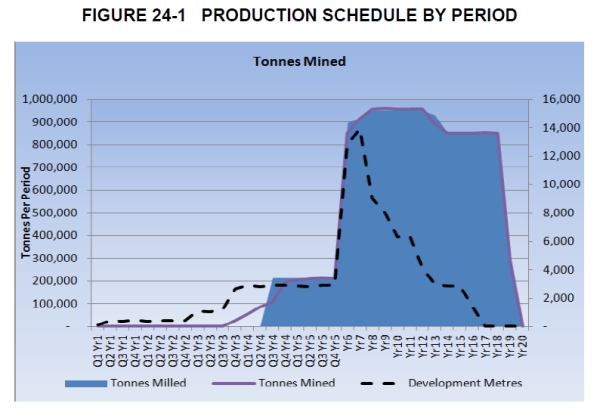

| Figure 24-1 Production Schedule by Period | 24-3 |

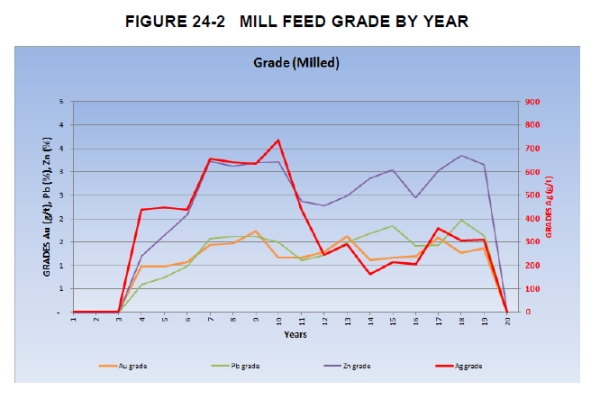

| Figure 24-2 Mill Feed Grade by Year | 24-4 |

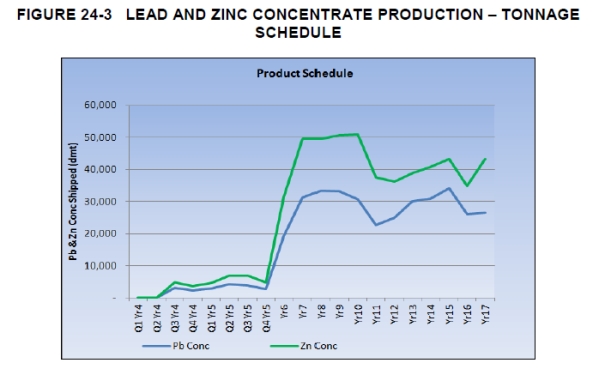

| Figure 24-3 Lead and Zinc Concentrate Production – Tonnage Schedule | 24-6 |

LIST OF APPENDIX FIGURES & TABLES

PAGE

| Table 30-1 Summary of Drilling | 30-2 |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page vi |

| www.rpacan.com |

1 SUMMARY

EXECUTIVE SUMMARY

Roscoe Postle Associates Inc. (RPA) was retained by MAG Silver Corp. (MAG) to update the Mineral Resource estimate and prepare an independent Technical Report on the Juanicipio Joint Venture in Zacatecas State, Mexico. This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). MAG requires this report to support the updated Mineral Resource estimate for the property prepared by RPA and disclosed in a press release. RPA has visited the property several times, most recently on May 27, 2014.

The Juanicipio property is owned by Minera Juanicipio S.A. de C.V. (Minera Juanicipio), a joint venture between Fresnillo plc (Fresnillo, 56%) and MAG (44%), with Fresnillo acting as the operator. The major asset associated with the Juanicipio Joint Venture is a silver-gold-lead-zinc epithermal vein deposit.

An updated Preliminary Economic Assessment (PEA) was carried out by AMC Mining Consultants (Canada) Ltd. (AMC) in 2012 (2012 PEA). The study defined Juanicipio as an economically robust, high-grade underground silver project exhibiting minimal financial or development risks that will produce an average of 15.1 million payable ounces of silver over the first full six years of commercial production and 10.3 million payable ounces per year over a 14.8 year total mine life. The 2012 PEA does not take into account any potential mining, processing, or infrastructure synergies from any association with the adjoining property owned by Fresnillo. The 2012 PEA was based on the resource estimate and model developed by Strathcona Mineral Services (Strathcona) dated November 2011.

On October 28, 2013, MAG announced that the Joint Venture had commenced underground development. The ramp advancement work is being conducted by a contractor using a conventional drill and blast method and a continuous miner where possible.

CONCLUSIONS

MAG and joint venture partner Fresnillo have made a major discovery of low-sulphidation epithermal vein mineralization, located in the southwest part of the world-class Fresnillo silver mining district. The discovery is located in the northeast corner of the property and consists of two silver-gold-lead-zinc epithermal structures known as the Valdecañas and Juanicipio vein systems. Most exploration on the property has focused on these two vein systems. There is good exploration potential remaining at the Juanicipio Vein and elsewhere on the property, which remains largely underexplored. A significant exploration budget is warranted.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-1 |

| www.rpacan.com |

The updated Mineral Resource estimate reflects the drill results available as of December 31, 2013 including 40 new infill diamond drill holes completed since the previous resource estimate. The new estimate demonstrates a conversion of previously classified Inferred Resources into the Indicated category and reports a deep lower grade resource separately. The Mineral Resources on the Juanicipio Property are contained within the Valdecañas Vein system and the Juanicipio Vein. The updated resource estimate uses a cut-off of US$70/tonne Net Smelter Return (NSR), which includes values for silver, gold and base metals.

The Valdecañas and Juanicipio Veins display the vertical grade transition from upper silver rich zones to deep gold and base metal dominant areas that is typical of Fresnillo District veins, and epithermal silver veins in general. Previous resource estimates were largely based on the upper silver rich zones with limited influence from the deep base metal dominant zone. The recent infill drilling has greatly improved discrimination of the vertical compositional zonations, allowing the updated Mineral Resource estimate reported here to be manually divided into the upper Bonanza Grade Silver Zone (BGS Zone) and the Deep Zone (Tables 1-1 and 1-2). This division highlights both the improved confidence in the BGS Zone, through conversion of previously categorized Inferred Resources into Indicated Resources, and the initial definition of the Deep Zone.

The increased drill density provides a better understanding of the vein geometry and indicates that that the Valdecañas Vein comprises two overlapping “en-echelon” veins rather than a single vein offset by a fault. This reveals an area of overlap, with incrementally increased tonnage, especially in the BGS Zone. A number of new holes, targeted below the limits of the previous resource estimate, intersected significant widths (10.5 m to 25.8 m true thickness) of lower grade mineralization, which combined with previous deep intercepts led to the definition of the new Deep Zone resource.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-2 |

| www.rpacan.com |

TABLE 1-1 MINERAL RESOURCES BY METAL ZONE (100% BASIS)

MAG Silver Corp. - Juanicipio Joint Venture

| | | Grade | Contained Metal |

| Zone/Classification | Tonnage | Ag | Au | Pb | Zn | Ag | Au | Pb | Zn |

| | (Mt) | (g/t) | (g/t) | (%) | (%) | (M oz) | (k oz) | (M lb) | (M lb) |

| Bonanza Grade Silver Zone | | | | | | | | | |

| Indicated | 8.3 | 601 | 1.7 | 2.0 | 3.7 | 160 | 448 | 365 | 676 |

| Inferred | 2.4 | 626 | 1.9 | 1.4 | 2.2 | 48 | 146 | 74 | 114 |

| Deep Zone | | | | | | | | | |

| Indicated | 1.8 | 93 | 1.7 | 1.4 | 2.6 | 5 | 97 | 54 | 102 |

| Inferred | 2.7 | 146 | 2.0 | 2.1 | 3.4 | 13 | 173 | 128 | 203 |

Notes:

| | 1. | CIM definitions were followed for the classification of Mineral Resources. |

| | 2. | Mineral Resources are estimated at an incremental NSR cut-off value of US$70/tonne |

| | 3. | NSR values are calculated in US$ using factors of $0.57 per g/t Ag, $30.11 per g/t Au, $9.07 per % Pb, and $12.21 per % Zn. These factors are based on metal prices of US$21.50/oz Ag, US$1,250/oz Au, $0.91/lb Pb, and $0.99/lb Zn and estimated recoveries and smelter terms. |

| | 4. | The Mineral Resource estimate uses drill hole data available as of December 31, 2013. |

| | 5. | Totals may not add correctly due to rounding. |

Combining the BSG Zone and the Deep Zone into a total resource by category, results in an overall increase in tonnage and a lower overall silver grade (Table 1-2).

| TABLE 1-2 JUANICIPIO JOINT VENTURE MINERAL RESOURCES (100% BASIS) |

| MAG Silver Corp. - Juanicipio Joint Venture | |

| | | Grade | Contained Metal |

| Classification | Tonnage | Ag | Au | Pb | Zn | Ag | Au | Pb | Zn |

| | (Mt) | (g/t) | (g/t) | (%) | (%) | (M oz) | (k oz) | (M lb) | (M lb) |

| Indicated | 10.1 | 511 | 1.7 | 1.9 | 3.5 | 166 | 544 | 419 | 778 |

| Inferred | 5.1 | 372 | 2.0 | 1.8 | 2.8 | 61 | 319 | 202 | 317 |

Notes:

| | 1. | CIM definitions were followed for the classification of Mineral Resources. |

| | 2. | Mineral Resources are estimated at an incremental NSR cut-off value of US$70 per tonne. |

| | 3. | NSR values are calculated in US$ using factors of $0.57 per g/t Ag, $30.11 per g/t Au, $9.07 per % Pb, and $12.21 per % Zn. These factors are based on metal prices of $21.50/oz Ag, $1,250/oz Au, $0.91/lb Pb, and $0.99/lb Zn and estimated recoveries and smelter terms. |

| | 4. | The Mineral Resource estimate uses drill hole data available as of December 31, 2013. |

| | 5. | Totals may not add correctly due to rounding. |

In RPA’s opinion the Juanicipio project has the potential to be developed into an economically robust, high-grade underground silver project. Further drilling and investigation work aimed at upgrading Inferred Mineral Resources and increasing the geotechnical and hydrogeological understanding of the deposit is required to form a firm base for the next stage of project design and evaluation.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-3 |

| www.rpacan.com |

RPA notes several changes since the 2012 PEA that would have an insignificant impact on the overall economic results:

| | · | Updated Mineral Resource as described in this report |

| | · | Payment Terms for concentrate |

| | · | New Gold and Silver Tax (0.5% Gross Revenue) |

| | · | New Mining Tax (7.5% on EBITDA) |

| | · | Increased Corporate Tax rate (30% from 28%) |

| | · | Increase in cut-off grade used to report Mineral Resources |

RPA would expect an updated PEA to have similar economic results as the 2012 PEA, and believes that the 2012 PEA remains a reasonable representation of the property’s economic potential.

RECOMMENDATIONS

The Juanicipio property hosts a significant silver-gold-lead-zinc deposit and merits considerable additional exploration and development work. RPA recommends a budget of US$22.6 million (Table 1-3) for 2014 to advance the access ramp to the Valdecañas vein system and to explore elsewhere on the property. Work should include:

| | · | Continuing to advance the underground access ramp. The budget in the 2012 PEA estimates this work to be $11.4 million with MAG’s 44% share being $5 million. |

| | · | 10,000 m of drilling at the Valdecañas vein system to obtain a drill hole spacing no greater than 100 m in both the along-strike and up- and down-dip directions. |

| | · | 10,000 m of drilling for a property-wide exploration program including mapping, and drilling of new targets. Key criteria should be known mineralization, lineaments, and alteration. |

In addition to the ramp advancement and continued drilling, RPA recommends the continuation of the environmental, engineering, and metallurgical studies as recommended in the 2012 PEA.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-4 |

| www.rpacan.com |

| TABLE 1-3 PROPOSED BUDGET (100% BASIS) |

| MAG Silver Corp. - Juanicipio Joint Venture |

| Item | US$ M |

| Ramp advancement | 11.4 |

| Drilling (~20,000 m) | 3.6 |

| Interpretation, resource update, etc. | 0.1 |

| Geotechnical and Engineering Studies | 1.2 |

| Metallurgical and Mill Design Studies | 1.1 |

| Permitting and Environmental Work | 0.9 |

| Operating Costs / Office | 1.2 |

| Infrastructure Studies | 1.0 |

| Sub-total | 20.5 |

| Contingency (10%) | 2.1 |

| Total | 22.6 |

TECHNICAL SUMMARY

PROPERTY DESCRIPTION AND LOCATION

The Juanicipio Joint Venture consists of a single concession covering 7,679.21 ha in central Zacatecas State, Mexico. It is centred at approximately 102° 58’ east longitude and 23° 05’ north latitude.

LAND TENURE

The Juanicipio 1 exploitation concession has a 50 year life from the date it was issued and will expire on December 12, 2055. The Juanicipio Joint Venture holds the surface ownership over the area of interest in the northeast portion of the property which encompasses the Valdecañas Vein system, Juanicipio Vein, and the proposed tailings storage site north of the Juanicipio 1 mining concession.

SITE INFRASTRUCTURE

Site infrastructure consists of the following items:

| | · | a series of roads used to access drill sites, the decline and the mill site, |

| | · | an underground access portal, and the start of an underground access ramp, |

| | · | a surface explosive magazine, and |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-5 |

| www.rpacan.com |

HISTORY

Silver mineralization in the Fresnillo area was discovered in 1554. Although no records exist prior to the 1970s, the Juanicipio property was likely prospected sporadically over the years because of its proximity to the Fresnillo mining area.

Industrias Peñoles S.A. de C.V. (Peñoles) drilled several holes to the northeast of the property in the 1970s and 1980s. Detailed exploration of the areas adjoining the Juanicipio property was initiated by Fresnillo in 2006 based on results from the Valdecañas Vein discovery.

From 1998 to 2001, Minera Sunshine S.A. de C.V. (Minera Sunshine) completed an exploration program consisting of property-wide geological mapping, preliminary rock chip sampling, and Landsat image and air photo analysis. This was followed by more detailed geological mapping in areas of interest, additional Landsat image analysis, detailed geochemical sampling, and a limited Natural Source Audio Magnetotelluric (NSAMT) geophysical survey. Drilling targets were identified, prioritized and fully permitted but never drilled due to Minera Sunshine’s bankruptcy.

In July 2002, Minera Lagartos S.A. de C.V. (Minera Lagartos) optioned the Juanicipio 1 concession. On August 8, 2002, MAG entered into an agreement whereby it could acquire 98% of the issued and outstanding shares of Minera Lagartos. This agreement was later amended such that MAG could acquire a 99% interest in Minera Lagartos and a beneficial ownership of the remaining 1% interest.

From May 2003 to June 2004, MAG completed 10 drill holes for a total of 7,595 m and during this exploration program, discovered the Juanicipio Vein and cut what would later be discovered to be the upper and deep parts of the Valdecañas Vein outside of the thick and high grade Bonanza Zone.

On April 4, 2005, MAG announced that it had entered into a joint venture agreement with Peñoles whereby Peñoles could earn a 56% interest in the property. Fresnillo, then Peñoles’ wholly-owned operating division, and MAG formed a new company, Minera Juanicipio, to operate the joint venture.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-6 |

| www.rpacan.com |

On July 25, 2008, MAG filed a Technical Report on the Juanicipio Project which included an initial Mineral Resource estimate. That report covered work on the property to December 31, 2007. The Mineral Resource estimate was then updated by RPA (then Scott Wilson RPA) in early 2009 based on drill hole results available to January 29, 2009. On September 14, 2009, MAG announced the results of the independent preliminary assessment by Tetra Tech WEI Inc. for development of the Valdecañas Vein as a potential stand-alone silver mine. On December 1, 2010, MAG announced a Juanicipio resource estimation and update prepared by RPA (then Scott Wilson RPA). A NI 43-101 Technical Report to support the resource update was filed on SEDAR on January 14, 2011. On November 10, 2011, MAG announced an updated Juanicipio resource estimate prepared by Strathcona on behalf of Minera Juanicipio. On December 19, 2011, MAG announced an updated resource estimate by RPA. On June 14, 2012, MAG announced an updated PEA study prepared by AMC on behalf of Minera Juanicipio. The 2012 PEA was based on the resource model prepared by Strathcona.

GEOLOGY

The Juanicipio property lies on the western flank of the Central Altiplano, just east of the Sierra Madre Occidental range. Basement rocks underlying the western Altiplano are a late Palaeozoic to Mesozoic assemblage of marine sedimentary and submarine volcanic rocks belonging to the Guerrero Terrane that were obducted onto older Palaeozoic and Precambrian continental rocks during the early Jurassic. These were then overlapped by a Jurassic-Cretaceous epi-continental marine and volcanic arc sequence that in the Fresnillo area is represented by the Proaño and Chilitos formations. The late Cretaceous to early Tertiary Laramide Orogeny folded and thrust faulted the basement rocks in the entire area and preceded the emplacement of mid-Tertiary plutons and related dykes and stocks.

On the Juanicipio property, the dominant structural features are: (i) 340° to 020°, or north-south structures; (ii) 290° to 310° trending, steeply dipping faults; and (iii) lesser 040° to 050° structures. From field observations, the north-south structures appear to be steeply dipping normal faults that cut and down-drop blocks of silicified tuff, especially in the vicinity of Linares Canyon. More important to the silicification appears to be the 290° to 310° trending, steeply to moderately dipping faults. These faults occur where silicification and advanced argillic alteration are most intense and may have served as major hydrothermal fluid pathways.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-7 |

| www.rpacan.com |

The two significant silver-gold epithermal structures discovered to date on the Juanicipio property are known as the Valdecañas and Juanicipio vein systems. Both veins strike east-southeast and dip 35o to 55o southwest. The Valdecañas structure hosts the majority of the Mineral Resources currently estimated on the property.

Mineralization consists of precious metal rich, banded, or brecciated quartz-pyrargyrite-acanthite-polybasite-galena-sphalerite veins. The veins have undergone multiple mineralizing events as suggested by various stages of brecciation and quartz sealing, local rhythmic microcrystalline quartz-pyrargyrite banding, and open-space cocks-comb textures and vuggy silica. The vein exhibits the characteristic metal zoning of the principal veins in the Fresnillo district, observed as a change from silver and gold rich zones at the top to increased base metals in the deeper intersections.

MINERAL RESOURCES

A set of cross sections and plan views were interpreted to construct three-dimensional wireframe models of the mineralized veins using the descriptive logs, a minimum NSR value of approximately US$70 per tonne, and a minimum thickness of two metres. Prior to compositing to two metre lengths, high grades were cut to 6,000 g/t Ag, 16 g/t Au, and 15% for both lead and zinc. Classification into the Indicated and Inferred categories was guided by the drill hole density and the apparent continuity of the mineralized zones.

The updated Mineral Resource estimate dated December 31, 2013 is listed in Table 1-1.

The following summary sections are summarized from the NI 43-101 Technical Report on the Juanicipio Property prepared by AMC dated July 1, 2012. In RPA’s opinion, these sections remain reasonable for this stage of study.

GEOTECHNICAL CONSIDERATIONS

Cretaceous sedimentary rocks, which host the veins, are overlain by Tertiary volcanic rocks across the majority of the project site, except for two surface outcrops located southwest of the Valdecañas Vein. Rock quality in moderate to slightly weathered Cretaceous sedimentary rocks typically consist of poor to fair quality rocks with localized zones of high fracture frequency. Rock quality within the Tertiary volcanic rocks varies greatly from extremely poor to good. Veins are characterized by typically good rock quality, but geotechnical data relating to the veins is extremely limited.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-8 |

| www.rpacan.com |

Hydrogeological information on the project area has not yet been collected. The study assumes that the rock mass in the project area will be generally dry except in fault zones, which have been assumed to produce medium inflows.

MINING METHODS

AMC considered use of the following stoping methods at the project:

| | · | Down-hole benching with uncemented rockfill (modified Avoca). |

| | · | Long-hole open stoping (LHOS) with cemented backfill. |

| | · | Cut-and-fill with uncemented backfill. |

In AMC’s opinion, LHOS with cemented backfill is the most suitable method for the veins, mainly because of the higher recovery achievable using this method. LHOS with cemented backfill can be used in both steeply dipping and shallow dipping parts of the deposit. It is envisaged that some steeper dipping lower grade parts of the veins will be mined using the lower cost Avoca method.

Truck haulage, shaft hoisting, and conveying were considered for transferring ore and waste from the mine workings to surface. The trucking option was selected on the basis of its lower up-front capital cost and lower overall net present cost. However, there are relatively small cost differences between the options and the trucking option is sensitive to future increases in fuel and labour costs. In AMC’s opinion ongoing consideration is warranted on the option of constructing a hoisting shaft to a depth of about 450 m.

It is envisaged that access to the mine will be via a decline driven at a nominal gradient of 1:7. The access decline will connect to a number of internal declines providing access to stoping levels positioned at either 15 m or 20 m vertical intervals, depending on the dip of the vein. It is envisaged that mining will be carried out using modern trackless mining equipment. The proposed mine ventilation circuit will include a number of ventilation shafts, raise bored from surface.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-9 |

| www.rpacan.com |

MINERAL PROCESSING

Two sets of metallurgical test work were carried out in 2008 and 2009, on metallurgical samples composited from drill holes samples taken from the Valdecañas Vein. No metallurgical test work has yet been carried out relating to the Juanicipio Vein.

The proposed process plant consists of a comminution circuit followed by the sequential flotation of a silver-rich lead concentrate, a zinc concentrate, and a gold-rich pyrite concentrate.

It is envisaged that the process plant will commence operation at a throughput rate of 850,000 tpa, which will be increased to 950,000 tpa when production from the Juanicipio Vein commences.

Estimated mill recoveries and concentrate grades are summarized in Table 1-4.

TABLE 1-4 MILL RECOVERIES AND CONCENTRATE GRADES

MAG Silver Corp. - Juanicipio Joint Venture

| | Gold | Silver | Lead | Zinc |

| Recoveries to lead concentrate | 69% | 81% | 93% | 8% |

| Lead concentrate grades | 30.3 g/t | 10,265 g/t | 43.0% | 6.7% |

| Recoveries to zinc concentrate | 3% | 7% | 1% | 87% |

| Zinc concentrate grades | 0.95 g/t | 637 g/t | 0.33% | 52.0% |

| Recovery to pyrite concentrate | 19% | 6% | – | – |

PROJECT INFRASTRUCTURE

A 9.8 km access road, mostly over hilly terrain, will be required to access the site. A two-lane unsealed road suitable for use by heavy vehicles hauling concentrates is proposed.

Power would be supplied to a main substation at the site via a 115 kV overhead power line from an existing power line and substation located to the north of the property. The line would have a length of approximately 5.2 km. The average power demand for the site is estimated at 11.9 MW.

Three water catchment dams are envisaged for the site. The dams would be used to store water from the mine dewatering system and from rainfall. A hydrogeological study will be carried out during further studies.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-10 |

| www.rpacan.com |

The Joint Venture has purchased 125 ha of relatively flat-lying land suitable and adequate for the proposed five million cubic metres tailings storage facility (TSF). This land lies to the northeast of the proposed mill site along the proposed access road from the JV area to the regional highway. The necessary detailed environmental and geotechnical studies for this TSF site have been outlined but not yet initiated.

PROJECT DEVELOPMENT AND PRODUCTION SCHEDULE

Following satisfactory completion of further studies, and subject to the application for and grant of the necessary permits and licences, it is estimated that it will take approximately three and a half years to develop the project from the start of the box cut and portal to mill start-up.

The estimated tonnage and grade of material mined and processed that forms the basis for the economic assessment is set out in Table 1-5. Mill feed from vein development comprises approximately 19% of total mill feed, with the remainder from stoping operations.

TABLE 1-5 TONNAGE OF MATERIAL MINED AND PROCESSED AS A BASIS FOR THE ECONOMIC ASSESSMENT

MAG Silver Corp. - Juanicipio Joint Venture

| | Grade | Contained Metal |

| Tonnes | Au (g/t) | Ag (g/t) | Pb (%) | Zn (%) | Au (koz) | Ag (Moz) | Pb (Mlb) | Zn (Mlb) |

| 13.3 | 1.30 | 416 | 1.4 | 2.7 | 558 | 178 | 417 | 793 |

The tonnages and grades shown in Table 1-4 have been derived from the Mineral Resource estimate and vein model prepared by Strathcona by applying a $65 NSR cut-off grade to the resource model and then allowing for dilution, and design and mining losses. Metal prices used in the NSR calculation were $1,210 per ounce gold, $22.10 per ounce silver, $0.94 per pound lead, and $0.90 per pound zinc and an exchange rate of 12.50 Mexican pesos to one US dollar. In developing the tonnage and grade estimates, stope blocks that were in contact with the property boundaries were excluded and zero grades have been assumed for the dilution material. Approximately 49% of the tonnage and 36% of the silver content of the material that forms the basis of the 2012 PEA is derived from Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them and to be categorized as Mineral Reserves.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-11 |

| www.rpacan.com |

CAPITAL AND OPERATING COSTS

Project capital is estimated at $302 million, inclusive of capitalized operating costs (costs usually related to the operation of the mine, but incurred prior to first concentrate production). Sustaining capital of $267 million results mainly from the need for ongoing mine development after concentrate production commences, including development of the Juanicipio Vein, and the need for mobile equipment replacements over the mine life.

Total site operating costs have been estimated at approximately $67/t milled. The unit costs are broken down as follows:

| | · | Mining: $43.92/t milled. |

| | · | Milling: $19.18/t milled. |

| | · | General and Administration: $3.46/t milled. |

PROJECT REVENUE

Project economics have been analyzed using the following metal prices (Base Case Prices), which are based on the three year trailing average prices to the year ending December 2011:

| | · | Silver price = $23.39/oz |

It is envisaged that silver rich zinc concentrate will be sold primarily to smelters in the Asian region. Lead concentrate could potentially be sold to a smelter in Mexico or exported to offshore smelters. The gold-rich pyrite concentrate will be sold to a customer able to recover the gold and silver values.

ECONOMIC ANALYSIS

The economic analysis contained in this section is based, in part, on Inferred Resources, and is preliminary in nature. Inferred Resources are considered too geologically speculative to have mining and economic considerations applied to them and to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-12 |

| www.rpacan.com |

Table 1-6 summarizes the results of the economic analysis. Employee profit sharing (PTU) is not included in the financial estimates and the net present value (NPV) and internal rate of return (IRR) of the project may fluctuate depending on how the project is structured once it is in operation.

TABLE 1-6 SUMMARY OF FINANCIAL RESULTS

MAG Silver Corp. - Juanicipio Joint Venture

| Item | Units | Value |

| Revenue | $M | 4,992 |

| Cash flow before tax | $M | 3,013 |

| Tax | $M | 851 |

| Cash flow after tax | $M | 2,162 |

| Discount rate | % | 5% |

| NPV before tax (5% discount rate) | $M | 1,762 |

| IRR before tax | % | 54% |

| NPV after tax (5% discount rate) | $M | 1,233 |

| IRR after tax | % | 43% |

| Peak debt | $M | (302) |

| Payback from Year 1 (approximate) | yrs | 5.6 |

| Payback from mill start-up (approximate) | yrs | 2.1 |

| Project life from Year 1 | yrs | 19 |

Note: PTU is not included in the financial estimates.

SENSITIVITY

The NPV of the project is most sensitive to changes in the silver price and will have similar sensitivity to silver head grade. The NPV is less sensitive to costs. The project maintains a positive NPV over the range of sensitivities tested.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 1-13 |

| www.rpacan.com |

2 INTRODUCTION

Roscoe Postle Associates Inc. (RPA) was retained by MAG Silver Corp. (MAG) to update the Mineral Resource estimate and to prepare an independent Technical Report on the Juanicipio Joint Venture in Zacatecas State, Mexico. This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). MAG requires this report to support the updated Mineral Resource estimate for the property.

MAG is listed on the Toronto Stock Exchange and on the NYSE Amex Equities. MAG’s major assets are the Juanicipio Joint Venture Project, the subject of this report, and the Cinco de Mayo Project located in Chihuahua State, Mexico. The Juanicipio property is owned by Minera Juanicipio S.A. de C.V. (Minera Juanicipio), a joint venture between Fresnillo plc (Fresnillo, 56%) and MAG (44%), with Fresnillo acting as the operator. The major asset associated with the Juanicipio Joint Venture is a silver-gold-lead-zinc epithermal vein deposit.

An updated Preliminary Economic Assessment (PEA) was carried out by AMC in 2012. The study planned production at an average of 15.1 million payable ounces of silver over the first full six years of commercial production and 10.3 million payable ounces per year over a 14.8 year total mine life. The 2012 PEA did not take into account any potential mining, processing, or infrastructure synergies from an association with the adjoining property owned by Fresnillo. The PEA is based on the resource estimate and model developed by Strathcona dated November 2011.

SOURCES OF INFORMATION

The most recent site visit to the property was carried out by David Ross, M.Sc., P.Geo., Principal Geologist with RPA, on May 27, 2014. Other site visits were carried out in 2010 and 2011. Mr. Ross examined core from numerous drill holes (M40, KE, M22, KG3, 18-R, NA, NF2, PD, and JC), visited active drill sites and underground development, and reviewed logging and sampling methods. Discussions have been held with:

| | · | Mr. George Paspalas, President and CEO, MAG |

| | · | Dr. Peter Megaw, C.P.G., President of IMDEX, Director of MAG |

| | · | Lyle Hansen, Geotechnical Director, MAG |

| | · | Mr. Dan MacInnis, former President and CEO, MAG |

| | · | Mike Petrina, P.Eng., former Vice President Business Development, MAG |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 2-1 |

| www.rpacan.com |

| | · | Gabriel Arredondo, Geologist, Minera Cascabel |

| | · | Carlos Altamirano Morales, Fresnillo |

| | · | Jonathan Franco, Project Geologist, Fresnillo |

| | · | Polo Gonzalez, Geologist, Fresnillo |

RPA has visited the property several times since the discovery of Juanicipio and Valdecañas vein systems. In December 2010, drill core from boreholes NA, NF2, PD, and JC was reviewed and compared with assay results and descriptive log records were made by Fresnillo geologists. RPA visited the core shack again in May 2011, and reviewed core from KG3 and again from NA. RPA visited the property and core shack most recently on May 27, 2014 and reviewed core from holes M40, KE, M22, and 18-R. In addition to reviewing core, RPA examined outcrops, drill rigs, sampling procedures, and other general exploration protocols in use by the Joint Venture.

The documentation reviewed, and other sources of information, are listed at the end of this report in Section 27, References.

LIST OF ABBREVIATIONS

Units of measurement used in this report conform to the metric system. All currency in this report is US dollars (US$) unless otherwise noted.

| a | annum | kWh | kilowatt-hour |

| A | ampere | L | litre |

| bbl | barrels | lb | pound |

| btu | British thermal units | L/s | litres per second |

°C | degree Celsius | m | metre |

| C$ | Canadian dollars | M | mega (million); molar |

| cal | calorie | m2 | square metre |

| cfm | cubic feet per minute | m3 | cubic metre |

| cm | centimetre | m | micron |

cm2 | square centimetre | MASL | metres above sea level |

| d | day | mg | microgram |

| dia | diameter | m3/h | cubic metres per hour |

| dmt | dry metric tonne | mi | mile |

| dwt | dead-weight ton | min | minute |

°F | degree Fahrenheit | mm | micrometre |

| ft | foot | mm | millimetre |

ft2 | square foot | mph | miles per hour |

ft3 | cubic foot | MVA | megavolt-amperes |

| ft/s | foot per second | MW | megawatt |

| g | gram | MWh | megawatt-hour |

| G | giga (billion) | oz | Troy ounce (31.1035g) |

| Gal | Imperial gallon | oz/st, opt | ounce per short ton |

| g/L | gram per litre | ppb | part per billion |

| Gpm | Imperial gallons per minute | ppm | part per million |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 2-2 |

| www.rpacan.com |

| g/t | gram per tonne | psia | pound per square inch absolute |

gr/ft3 | grain per cubic foot | psig | pound per square inch gauge |

gr/m3 | grain per cubic metre | RL | relative elevation |

| ha | hectare | s | second |

| hp | horsepower | st | short ton |

| hr | hour | stpa | short ton per year |

| Hz | hertz | stpd | short ton per day |

| in. | inch | t | metric tonne |

in2 | square inch | tpa | metric tonne per year |

| J | joule | tpd | metric tonne per day |

| k | kilo (thousand) | US$ | United States dollar |

| kcal | kilocalorie | USg | United States gallon |

| kg | kilogram | USgpm | US gallon per minute |

| km | kilometre | V | volt |

km2 | square kilometre | W | watt |

| km/h | kilometre per hour | wmt | wet metric tonne |

| kPa | kilopascal | wt% | weight percent |

| kVA | kilovolt-amperes | yd3 | cubic yard |

| kW | kilowatt | yr | year |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 2-3 |

| www.rpacan.com |

3 RELIANCE ON OTHER EXPERTS

This report has been prepared by RPA for MAG. The information, conclusions, opinions, and estimates contained herein are based on:

| | · | Information available to RPA at the time of preparation of this report; |

| | · | Assumptions, conditions, and qualifications as set forth in this report; and |

| | · | Data, reports, and other information supplied by MAG and other third party sources. |

For the purpose of this report, RPA has relied on ownership information provided by MAG, including an independent opinion by Creel, García-Cuéllar, Aiza y Enríquez, of México, Mexico, dated September 5, 2012. RPA has not researched property title or mineral rights for the Juanicipio Joint Venture and expresses no opinion as to the ownership status of the property.

Except for the purposes legislated under provincial securities laws, any use of this report by any third party is at that party’s sole risk.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 3-1 |

| www.rpacan.com |

4 PROPERTY DESCRIPTION AND LOCATION

The Juanicipio Joint Venture property is located in central Zacatecas State, approximately 70 km by road northwest of the state capital of Zacatecas City (Figure 4-1). Zacatecas City has a population of approximately 255,000 and is located about 550 km northwest of Mexico City. Zacatecas City is serviced by daily flights from Mexico City. The property is accessible by Federal Highway 49 northwest from Zacatecas City to Fresnillo, then six kilometres to the southwest along paved and dirt roads. The centre of the property is located at approximately 102° 58’ east longitude and 23° 05’ north latitude.

LAND TENURE

The property consists of a single mining concession measuring 7,679.21 ha (Figure 4-2). Table 4-1 lists the tenure information for the Juanicipio concession. All concessions in Mexico are classified as exploitation concessions and have a 50 year life from the date of issue, renewable for another 50 years if desired.

| TABLE 4-1 TENURE DATA |

| MAG Silver Corp. – Juanicipio Joint Venture |

| |

| Concession | Date Issued | Expiry Date | Area (ha) | Title No. | Owner |

| Juanicipio 1 | 13-Dec-2005 | 12-Dec-2055 | 7,679.21 | Tx 226339 | Minera Juanicipio S.A. |

The property is owned by Minera Juanicipio, a joint venture company 56% held by Fresnillo and 44% held by MAG, with Fresnillo acting as the operator. Industrias Peñoles S.A. de C.V. (Peñoles) holds a 77% interest in Fresnillo and therefore a beneficial 43% interest in the property.

Surface ownership over the area of interest in the northeast portion of the property was held by the Valdecañas Ejido and Ejido Saucito de Poleo. The joint venture has purchased the surface rights of that area for US$1.40 million (Figure 4-2).

MAG provided an independent opinion by Creel, García-Cuéllar, Aiza y Enríquez, of México, dated September 5, 2012, which is in agreement with the above land tenure information.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 4-1 |

| www.rpacan.com |

Since that time the Joint Venture has purchased 125 hectares of surface rights north of the mining concession for a tailings storage facility and access roads.

With the exception of liabilities related to the reclamation of exploration drill roads and sites, RPA is not aware of any outstanding environmental liabilities. MAG reports that all applicable permits required to conduct mineral exploration, drive the decline, prepare the millsite and improve or construct access roads and powerlines have been granted.

RPA is not aware of any other significant factors and risks that may affect access, title, or the right or ability to perform the proposed work program on the property.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 4-2 |

| www.rpacan.com |

| www.rpacan.com |

| www.rpacan.com |

5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

ACCESSIBILITY

The Juanicipio Joint Venture is located 70 km by road northwest of Zacatecas City in central Zacatecas State. The property is accessible by taking Federal Highway 49 northwest from Zacatecas City to Fresnillo and then six kilometres to the southwest along paved and dirt roads.

CLIMATE

The climate is warm and arid. Temperatures vary from 0°C to 41°C and average 21°C. The average annual precipitation is 290 mm, with the period from June to September being the rainiest. Exploration and development can be carried out twelve months a year.

LOCAL RESOURCES

The closest full service town is Fresnillo, located eight kilometres from the property. Fresnillo has a population of approximately 255,000 and has all the services required to support a mining operation including a trained workforce, hospital, and accommodations.

The closest airport with daily air service to Mexico City is located at Zacatecas City. Both Zacatecas City and Fresnillo are serviced by rail.

There is an electric power substation in Fresnillo.

INFRASTRUCTURE

Site infrastructure consists of the following items:

| | · | a series of roads used to access drill sites, the decline and the mill site, |

| | · | an underground access portal, and the start of an underground access ramp, |

| | · | a surface explosive magazine, and |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 5-1 |

| www.rpacan.com |

Section 23 describes infrastructure located immediately outside the property boundary.

PHYSIOGRAPHY

The Juanicipio property lies within the Mexican Mesa Central or Altiplano. This region is flanked to the west by the Sierra Madre Occidental and to the east by the Sierra Madre Oriental mountain ranges. The Altiplano in this region is dominated by broad alluvium filled valleys between mountain ranges with an average elevation of approximately 1,700 MASL. Local mountain ranges reach 3,000 MASL. Elevations on the Juanicipio property itself range from 2,050 MASL to 2,450 MASL and the terrain is moderate to rugged.

Vegetation is sparse and consists mainly of grasses, low thorny shrubs, and cacti with scattered oak forests at higher elevations. Surface water is rare, but groundwater is available.

At this stage of the project, there are sufficient surface rights and available power, water, and personnel to carry out the exploration.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 5-2 |

| www.rpacan.com |

6 HISTORY

PRIOR OWNERSHIP

The Juanicipio 1 concession was originally staked in 1996, with title eventually granted in 1998. It was held under the name of Juan Antonio Rosales and covered an area of approximately 28,000 ha. The concession was later acquired by Martin Sutti, who optioned it to Minera Sunshine de Mexico S.A. de C.V (Minera Sunshine) until 2001.

In July 2002, Minera Lagartos S.A. de C.V. (Minera Lagartos) optioned the Juanicipio 1 concession from Mr. Sutti. On August 8, 2002, MAG entered into an agreement whereby it could acquire 98% of the issued and outstanding shares of Minera Lagartos. This agreement was later amended such that MAG could acquire a 99% interest in Minera Lagartos and a beneficial ownership of the remaining 1% interest.

On April 4, 2005, MAG announced that it had entered into a joint venture agreement with Peñoles whereby Peñoles could earn a 56% interest in the property by spending US$5 million on or before the end of year four of the agreement. Peñoles committed to a minimum expenditure of US$750,000 including at least 3,000 m of drilling in the first year of the agreement. Peñoles subscribed for US$500,000 in MAG shares at the market price on signing and an additional US$500,000 in MAG shares if the contract continued into the second year. All earn-in requirements have been met.

In 2007, Peñoles’ precious metals assets were assigned to a wholly owned subsidiary, Fresnillo plc.

On December 21, 2007, Fresnillo and MAG announced the formation of a new company incorporated in Mexico, Minera Juanicipio, to operate the joint venture. Minera Juanicipio is 56% held by Fresnillo and 44% held by MAG, with Fresnillo acting as the operator.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 6-1 |

| www.rpacan.com |

EXPLORATION HISTORY

Silver mineralization in the Fresnillo area was discovered in 1554. Although no records exist prior to the 1970s, the Juanicipio property was likely prospected periodically over the years because of its proximity to the Fresnillo mining area.

Peñoles drilled several holes to the northeast of the property in the 1970s and 1980s, prior to the discovery of the nearby San Carlos Vein. Concerted exploration of the areas adjoining the Juanicipio property was begun by Fresnillo in 2006 based on results from the Valdecañas and San Carlos veins.

From 2000 to 2001, Minera Sunshine contracted IMDEX Inc./Cascabel S.A. de C.V. (IMDEX/Cascabel) to complete property-wide (1:50,000 scale) geological mapping, preliminary rock chip sampling, and Landsat image and air photo analysis. This was followed by more detailed (1:5,000 scale) geological mapping in areas of interest, additional Landsat image analysis, detailed geochemical sampling, and a limited amount of Natural Source Audio Magnetotelluric (NSAMT) geophysical surveying. The NSAMT survey was used to define structures, mainly in the northeastern part of the property. Minera Sunshine obtained drill permits to test this area but was not able to undertake drilling before they went bankrupt in 2001 (Megaw and Ramirez, 2001).

PREVIOUS MINERAL RESOURCE ESTIMATES

In April 2008, Fresnillo reported an initial Mineral Resource estimate for the Valdecañas deposit. In June 2008, MAG retained SRK Consulting (Canada) Inc. (SRK) to prepare a NI 43-101 Technical Report documenting the initial Mineral Resource estimate prepared by Fresnillo and audited by SRK (Chartier et al., 2008).

In 2009, RPA, then Scott Wilson RPA, prepared a Mineral Resource estimate based on drill hole results available to January 29, 2009. This work was done independently of the modelling and estimation work by Fresnillo (Ross and Roscoe, 2009).

RPA updated the resource in late 2010 based on data available to September 10, 2010 (Ross, 2011). Fresnillo prepared a parallel estimate using similar drill hole data. The Fresnillo estimate was audited by SRK (Brown et al., 2011). The two estimates differed in

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 6-2 |

| www.rpacan.com |

the silver grade, which led to studies by additional consultants (Srivastava, 2011; Leuangthong et al., 2011).

On November 10, 2011, MAG announced an updated Mineral Resource estimate made by Strathcona on behalf of the Minera Juanicipio Joint Venture. The estimate was based on drill results available as of June 1, 2011, and used a cut-off grade of 100 g/t Ag. Indicated Mineral Resources were estimated to total 5.7 million tonnes at 702 g/t Ag, 1.9 g/t Au, 2.2% Pb, and 4.2% Zn. Total contained metals in the Indicated Resource were 128 million ounces of silver, 346,000 ounces of gold, 268 million pounds of lead, and 521 million pounds of zinc. Inferred Mineral Resources were estimated to total 4.3 million tonnes at 513 g/t Ag, 1.4 g/t Au, 1.6% Pb, and 3.0% Zn. The Inferred Resources contained an additional 71 million ounces of silver, 192,000 ounces of gold, 152 million pounds of lead, and 280 million pounds of zinc.

On December 19, 2011, MAG announced an updated resource estimate by RPA (Ross, 2011). Using drill hole data available as of August 5, 2011 and a net smelter return (NSR) cut-off value of US$55/t, Indicated Mineral Resources were estimated to total 6.2 million tonnes of 728 g/t Ag, 1.9 g/t Au, 1.9% Pb, and 3.9% Zn. Inferred Mineral Resources were estimated to total 7.1 million tonnes of 373 g/t Ag, 1.6 g/t Au, 1.5% Pb, and 2.6% Zn. The contained metals in the Indicated Resource were estimated to total 146 million ounces of silver, 384,000 ounces of gold, 267 million pounds of lead, and 539 million pounds of zinc. The Inferred Resources were estimated to total 85 million ounces of silver, 370,000 ounces of gold, 236 million pounds of lead, and 400 million pounds of zinc.

On June 14, 2012, MAG announced an updated PEA Study prepared by AMC on behalf of Minera Juanicipio (Thomas et al., 2012). The updated PEA was based on the resource model prepared by Strathcona dated November 2011.

All Mineral Resource estimates reported in this section are superseded by the current Mineral Resource estimate contained in Section 14 of this report.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 6-3 |

| www.rpacan.com |

SCOPING STUDY - 2009

In May 2009, Tetra Tech WEI Inc., formerly Wardrop Engineering (Wardrop), was retained by Minera Juanicipio to carry out an initial scoping level study on the Valdecañas deposit. The study (Ghaffari et al., 2009) was filed on SEDAR on November 6, 2009.

The study was completed on the basis that the joint mine/mill project would be conducted on a "stand alone" basis, independent of any other regional mining operations or related infrastructure. It was based on Mineral Resource estimates made by Strathcona. It was also assumed that the most economical and efficient access to the mine would be via a ramp. The estimates were to an accuracy of + 35%. All costs were in US$ and the Wardrop Base Case utilized the Energy and Metals Consensus Forecasts (EMCF) quarterly reports in calculating Wardrop/EMCF prices.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 6-4 |

| www.rpacan.com |

7 GEOLOGICAL SETTING AND MINERALIZATION

The following is modified from Megaw and Ramirez (2001). Figure 7-1 shows the regional geology and Figure 7-2 depicts the regional stratigraphy.

REGIONAL GEOLOGY

The Juanicipio property lies on the western flank of the Central Altiplano, just east of the Sierra Madre Occidental range. Basement rocks underlying the western Altiplano are a late Palaeozoic to Mesozoic assemblage of marine sedimentary and submarine volcanic rocks belonging to the Guerrero Terrane (Simmons, 1991) that were obducted onto older Palaeozoic and Precambrian continental rocks during the early Jurassic. These were then overlapped by a Jurassic-Cretaceous epi-continental marine and volcanic arc sequence that in the Fresnillo area is represented by the Proaño and Chilitos formations (Simmons, 1991; Wendt, 2002). The late Cretaceous to early Tertiary Laramide Orogeny folded and thrust faulted the basement rocks in the entire area and preceded the emplacement of mid-Tertiary plutons and related dykes and stocks (Ruvalcaba-Ruiz and Thompson, 1988). Mesozoic marine rocks are host to the San Nicolas volcanogenic massive sulphide (VMS) deposit and Francisco Madero sedimentary exhalative (Sedex) deposit (Wendt, 2002).

Unconformably overlying the Mesozoic basement rocks in the western Altiplano are units from the late Cretaceous to Tertiary, Sierra Madre Occidental magmatic arc. These rocks consist of a lower assemblage of late Cretaceous to Tertiary volcanic, volcaniclastic, conglomerate and locally limestone rocks, the “lower volcanic complex”, and a Tertiary (~25 to 45 Ma) “upper volcanic supergroup” of caldera related, rhyolite ash flow tuffs and flows. Eocene to Oligocene intrusions occur throughout the Altiplano and are related to the later felsic volcanic event. Locally, these two units are separated by an unconformity (Ruvalcaba-Ruiz and Thompson, 1988; Wendt, 2002).

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-1 |

| www.rpacan.com |

| www.rpacan.com |

| www.rpacan.com |

A late northeast-southwest extensional tectonic event accompanied by major strike-slip fault movement affected the Altiplano starting ca. 35 Ma. This extension was most intense during the Miocene and developed much of the current basin and range topography. Calcrete cemented alluvial material covered the basins within the Fresnillo area.

The Fresnillo district’s lowest stratigraphic unit is the early Cretaceous greywacke and shale units of the Proaño Group (Table 7-1). The Proaño Group is broken into two formations: the “lower greywacke” Valdecañas Formation, comprising thinly bedded greywacke and shale, and the “upper greywacke” Plateros Formation, comprising carbonaceous and calcareous shale at the base grading to immature sandstone units (Ruvalcaba-Ruiz and Thompson, 1988).

TABLE 7-1 STRATIGRAPHY OF THE FRESNILLO DISTRICT

MAG Silver Corp. – Juanicipio Joint Venture

(Modified after Ruvalcaba-Ruiz et al., 1988 and Wendt, 2002)

Laramide thrust faulting complicates the stratigraphy of the overlying limestone units, called the Cerro Gordo and Fortuna units in the Fresnillo district, and the Chilitos Formation

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-4 |

| www.rpacan.com |

volcanic and volcaniclastic rocks. Regionally, the Cerro Gordo and Fortuna limestone units appear to be the stratigraphic equivalents of the Cuesta del Cura Formation and are probably early Cretaceous in age and overlie the Proaño Group clastic sedimentary rocks (Megaw and Ramirez, 2001). In this case, volcanic and volcaniclastic rocks of the Chilitos Formation are likely late Cretaceous in age and represent the earliest phase of volcanism identified in the area, and possibly correlate to the base of the “lower volcanic complex” of the Sierra Madre volcanic arc.

Overlying the Chilitos Formation are Tertiary volcanic rocks of the Fresnillo Formation (> 29 Ma), which consists of conglomerate, welded rhyolitic ash-flow tuff and flow domes, later (< 29 Ma) conglomerate, rhyolitic ash-flow tuff, and finally upper Tertiary olivine basalt flows.

Within this stratigraphy is a quartz-monzonite stock/dyke that intruded the Fresnillo mine area in mid-Tertiary (~32.4 Ma) and is associated with the introduction of silver-lead-zinc mineralized skarn and argillic alteration within surrounding greywacke and calcareous units.

PROPERTY GEOLOGY

Geological mapping on the Juanicipio property was conducted by IMDEX/Cascabel on behalf of Minera Sunshine from 1999 to 2001. The results of this mapping are detailed in a company report by Megaw and Ramirez (2001) and are summarized in the following subsections. Figure 7-3 shows the property geology.

MESOZOIC ROCKS

The oldest rocks observed in the Juanicipio area are fragments of greywacke found in dumps on the Cerro Colorado area south of the property and presumably belong to the Proaño Group. The oldest rocks observed in outcrop are calcareous shale and andesitic volcaniclastic rocks of the Chilitos Formation at the base of Linares Canyon. They are highly deformed and sheared and are locally boudinaged and dip shallowly to moderately northeast.

The upper contact of the Chilitos Formation forms an irregular unconformity to the overlying Tertiary volcanic and volcaniclastic rocks. Drilling in 2002 and 2003 intersected significant

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-5 |

| www.rpacan.com |

sections of the Chilitos and Proaño formations, including polymictic intermediate volcanic breccias with exhalite layers.

TERTIARY IGNEOUS ROCKS

Tertiary igneous rocks are divided into the Linares and Altamira volcanic assemblages that are separated by an unconformity.

The lower assemblage, informally named the Linares volcanic package (Megaw and Ramirez, 2001) consists of volcaniclastic sedimentary units, welded and non-welded crystal lithic tuff, flow breccia, and rhyolite flow domes. The basal unit is composed of 5 m to 20 m of epiclastic volarenites and arkoses overlain by 20 m to 100 m of variably welded, rhyolite to dacite, composite ash-flow tuff that resembles, and may correlate with, Fresnillo Formation volcanic rocks (Megaw and Ramirez, 2001). This unit generally hosts the pervasive silicification “sinter”, advanced argillic alteration (kaolinite-alunite) and iron-oxide alteration found on the Juanicipio property. Textural variation and Landsat interpretation within this unit suggests several eruptive centres (calderas) for these volcanic rocks in the Sierra Valdecañas range.

Overlying the ash-flows is a well bedded volarenite layer and then 100 m to 150 m of welded ash-flow tuff, which are less silicified than the lower unit. Locally, several rhyolite domes occur between Linares Canyon and the Cesantoni Kaolinite Mine.

The Linares volcanic rocks are block-faulted along north-northwest trending faults with shallow to moderate southwest dips. Silicification appears to post-date the faulting as the faults only locally cut or displace silicified units (Megaw and Ramirez, 2001).

Megaw and Ramirez (2001) also describe and informally name the Altamira volcanic package after the tallest peak in the area, Cerro Altamira, where the thickest section of these volcanic rocks outcrop. These volcanic rocks overlie the Linares volcanic package across an angular unconformity overlain by a 20 m to 50 m thick layer of well bedded conglomerate and coarse volarenite. Rounded fragments of silicified Linares volcanic rocks occur within the conglomerate. Overlying these clastic rocks is a 20 m to 350 m thick section of welded rhyolite to rhyodacite ash-flow tuff. Several caldera complexes have been identified within this package. This unit is post-alteration and presumably post-mineralization and does not appear to contain any alteration.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-6 |

| www.rpacan.com |

UPPER TERTIARY ROCKS

These rocks are composed of olivine basalt flows that locally overlie the felsic mid-Tertiary volcanic and volcaniclastic rocks on the property.

STRUCTURAL GEOLOGY

Regional satellite image interpretation suggests that the Sierra Valdecañas range is a topographically high, but structurally down-dropped block that is bounded by several major orthogonal northeast and northwest structures. The most notable of these is the more than 200 km long Fresnillo strike-slip fault and its parallel structure, the San Acacio-Zacatecas fault to the east of the Juanicipio property. Also, it appears that the San Acacio-Zacatecas structure traverses the northeast corner of the Juanicipio property and coincides with the Valdecañas and Juanicipio veins.

On the Juanicipio property, the dominant structural features are: (i) 340° to 020°, or north-south structures; (ii) 290° to 310° trending, steeply dipping faults; and (iii) lesser 040° to 050° structures. From field observations, the north-south structures appear to be steeply dipping normal faults that cut and down-drop blocks of silicified tuff, especially in the vicinity of Linares Canyon. More important to the silicification appears to be the 290° to 310° trending, steeply to moderately dipping faults. These faults occur where silicification and advanced argillic alteration are most intense and may have served as major hydrothermal fluid pathways. NSAMT surveys on the Juanicipio property appear to confirm the presence of these northwest trending structures and they were the primary drill targets for the 2003 and 2004 drilling program.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-7 |

| www.rpacan.com |

| www.rpacan.com |

MINERALIZATION

The two significant silver-gold epithermal structures discovered to date on the Juanicipio property are known as the Valdecañas and Juanicipio veins. Both veins strike east-southeast and dip 35° to 70° with an average of about 58° southwest. Both display the metal zonation typical of the Fresnillo District and epithermal veins in general, of an upper precious metal “Bonanza” zone grading downwards into a deeper base metal zone. Representative assay intervals for both vein structures are listed in Table 7-2. The Valdecañas structure hosts the majority of the Mineral Resources currently estimated on the property.

VALDECAÑAS VEIN

As of December 31 2013, 142 drill holes had tested the lateral and depth extensions of the Valdecañas structure, with 132 holes being used for vein modelling. The vein extends beyond the Juanicipio property boundaries in both the northwest and southeast directions. It varies in true thickness from less than one metre up to 25.8 m, averaging approximately five metres. Generally, the precious metals rich zone is 400 m to 450 m in vertical extent with an additional 50 m vertical extent of base metal dominant zone. The vein structure is made up of one main vein and three parallel to subparallel smaller veins. Descriptions of the geometry, location, and grades are presented in Section 14. The various vein panels making up the overall Valdecañas vein structure are now referred to as: V1E, V1W, V2W and HW1.

The naming convention of the individual veins within the Valdecañas vein structure has evolved over the last few years. The older names used in the 2012 PEA are maintained in this Technical Report for sections derived directly from that study. A summary of changes to the naming convention is listed below:

| | · | V1E is approximately equivalent to the eastern part of the Valdecañas Vein and parts of the eastern Desprendido Vein as defined in the 2012 PEA. V1E was formerly known as the eastern part of the Main Valdecañas Vein in previous RPA reports. |

| | · | V1W is approximately equivalent to the western part of the Valdecañas Vein as defined in the 2012 PEA. V1W was formerly known as the western part of the Main Valdecañas Vein in previous RPA reports. |

| | · | V2W is approximately equivalent to the western part of the Desprendido Vein as defined by the 2012 PEA. V2W was formerly known as the combined Footwall Vein 1 and Footwall Vein 2 in previous RPA reports. |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-9 |

| www.rpacan.com |

| | · | HW1 was not included as part of the 2012 PEA. HW1 was formerly known as Hanging Wall Vein 1 in previous RPA reports. |

Mineralization consists of precious metal rich, banded, or brecciated quartz-pyrargyrite-acanthite-polybasite-galena-sphalerite veins. The Valdecañas veins have undergone multiple mineralizing events as suggested by various stages of brecciation and quartz sealing, local rhythmic microcrystalline quartz-pyrargyrite banding, and open-space cocks-comb textures and vuggy silica. The veins exhibit the characteristic metal zoning of the principal veins in the Fresnillo district, observed as a change from silver and gold rich zones at the top to increased base metals in the deeper intersections. Notably, the gold rich mineralization cuts across the silver rich zones, which in turn cut earlier base-metal dominant stages indicating complex multi-stage mineralization as is seen separately in other parts of the district.

Within 10 m to 20 m of the vein, the wall rocks are progressively and pervasively silicified and cut by quartz veinlets carrying pyrite-sphalerite-galena sulphide minerals. Alteration in the volcaniclastic/sedimentary host rock farther away from the vein is characterized by weak pyritization, moderate clay alteration, and calcite veining.

JUANICIPIO VEIN

The Juanicipio Vein was discovered in 2003 by MAG prior to the discovery of the Valdecañas system, which is located 1,100 m to the north. Discovery hole JI03-01 intersected two metres averaging 630 g/t Ag and 11.4 g/t Au at a vertical depth of approximately 515 m. Thirty-five drill holes contributed to the definition of this vein and the current Mineral Resource estimate includes the Juanicipio Vein. In general, the zone averages greater than 530 g/t Ag, 4.00 g/t Au with low Pb and Zn values. The Juanicipio Vein is referred to as JV1 most statistical and modelling examinations.

| TABLE 7-2 SELECT DRILL HOLE INTERSECTIONS |

| MAG Silver Corp. - Juanicipio Joint Venture |

| Vein | Borehole | From | To | Length | True Thickness | Ag | Au | Pb | Zn |

| | | (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) |

| V1E | IE | 816.35 | 821.65 | 5.30 | 4.11 | 1,843 | 3.70 | 3.54 | 5.96 |

| V1E | NG | 732.25 | 735.25 | 3.00 | 2.17 | 1,703 | 5.78 | 3.47 | 5.50 |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-10 |

| www.rpacan.com |

| Vein | Borehole | From | To | Length | True Thickness | Ag | Au | Pb | Zn |

| | | (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) |

| V1E | 16P | 680.90 | 687.25 | 6.35 | 4.67 | 1,798 | 2.91 | 3.43 | 5.51 |

| V1E | PD | 619.00 | 624.20 | 5.20 | 4.17 | 1,021 | 3.32 | 4.79 | 7.20 |

| V1E | NA | 728.09 | 730.18 | 2.09 | 1.96 | 1,157 | 1.11 | 0.77 | 0.87 |

| V1E | MC | 625.20 | 636.25 | 11.05 | 7.86 | 1,046 | 0.44 | 1.00 | 2.05 |

| V1E | M28 | 731.35 | 741.05 | 9.70 | 6.91 | 768 | 1.90 | 2.59 | 6.60 |

| V1E | M41 | 736.90 | 751.90 | 15.00 | 7.11 | 706 | 2.88 | 2.66 | 4.86 |

| V1E | M45 | 709.00 | 711.06 | 2.06 | 1.82 | 942 | 0.82 | 0.01 | 0.01 |

| V1E | NF2 | 757.60 | 762.80 | 5.20 | 3.91 | 523 | 2.94 | 2.23 | 5.67 |

| V1E | PE2 | 652.10 | 660.95 | 8.85 | 7.08 | 448 | 3.20 | 1.68 | 4.21 |

| V1E | M7 | 686.45 | 696.70 | 10.25 | 9.12 | 580 | 0.98 | 0.71 | 1.33 |

| V1E | M34 | 712.20 | 722.50 | 10.30 | 7.54 | 261 | 0.68 | 3.53 | 9.15 |

| V1E | M19 | 870.25 | 873.45 | 3.20 | 2.46 | 290 | 1.31 | 1.02 | 2.72 |

| V1E | JU5 | 802.47 | 805.37 | 2.90 | 2.73 | 136 | 0.24 | 4.37 | 6.03 |

| V1E | M43 | 687.85 | 694.10 | 6.25 | 5.04 | 178 | 1.45 | 0.69 | 2.55 |

| V1E | JD | 690.85 | 693.00 | 2.15 | 1.87 | 225 | 0.16 | 0.24 | 0.53 |

| V1E | QG | 637.60 | 639.90 | 2.30 | 1.78 | 86 | 0.15 | 2.72 | 3.81 |

| V1W | J04B | 656.45 | 659.90 | 3.45 | 3.23 | 1,905 | 8.50 | 0.21 | 0.21 |

| V1W | GD | 802.80 | 823.90 | 21.10 | 17.57 | 1,032 | 2.97 | 6.21 | 5.77 |

| V1W | JC | 748.80 | 759.80 | 11.00 | 9.52 | 535 | 4.54 | 0.91 | 2.59 |

| V1W | GA | 669.50 | 676.85 | 7.35 | 5.55 | 562 | 0.55 | 0.80 | 1.92 |

| V1W | J05 | 733.10 | 736.45 | 3.35 | 3.15 | 516 | 1.73 | 0.05 | 0.11 |

| V1W | M13 | 649.05 | 655.50 | 6.45 | 5.01 | 420 | 1.89 | 1.24 | 0.81 |

| V1W | M5 | 948.30 | 960.65 | 12.35 | 10.45 | 294 | 2.06 | 2.94 | 4.81 |

| V1W | J02 | 827.60 | 839.75 | 12.15 | 10.52 | 138 | 4.80 | 1.25 | 3.32 |

| V1W | KG3 | 782.55 | 801.70 | 19.15 | 15.59 | 302 | 1.02 | 1.72 | 1.91 |

| V1W | M17 | 700.70 | 706.95 | 6.25 | 4.68 | 196 | 2.30 | 1.35 | 2.54 |

| V1W | M24 | 955.20 | 958.25 | 3.05 | 2.22 | 165 | 0.86 | 2.55 | 4.50 |

| V1W | HE | 774.85 | 778.20 | 3.35 | 2.99 | 145 | 1.64 | 0.92 | 3.68 |

| V1W | M21 | 806.85 | 815.80 | 8.95 | 8.09 | 110 | 1.88 | 0.49 | 1.19 |

| V1W | KC | 647.89 | 650.16 | 2.27 | 2.15 | 184 | 0.10 | 0.01 | 0.06 |

| V2W | GE | 838.05 | 847.20 | 9.15 | 7.95 | 771 | 1.51 | 2.21 | 1.85 |

| V2W | M13 | 690.65 | 693.25 | 2.60 | 2.01 | 730 | 0.46 | 0.49 | 0.83 |

| V2W | JA | 741.80 | 751.25 | 9.45 | 8.34 | 1,182 | 0.25 | 1.02 | 2.30 |

| V2W | ID2 | 864.89 | 866.93 | 2.04 | 1.88 | 773 | 0.56 | 3.39 | 3.38 |

| V2W | NA | 751.75 | 753.50 | 1.75 | 1.62 | 518 | 0.15 | 0.03 | 0.09 |

| V2W | MC | 684.80 | 692.25 | 7.45 | 5.29 | 487 | 0.30 | 0.11 | 0.18 |

| V2W | J06 | 712.06 | 714.00 | 1.94 | 1.82 | 169 | 0.23 | 0.80 | 0.09 |

| HW1 | FE | 652.74 | 655.56 | 2.82 | 2.46 | 1,166 | 0.15 | 1.47 | 0.64 |

| HW1 | GE | 685.20 | 688.15 | 2.95 | 2.48 | 728 | 0.25 | 1.41 | 4.60 |

| HW1 | HG | 751.25 | 754.65 | 3.40 | 2.92 | 210 | 0.08 | 0.30 | 1.08 |

| JV1 | 17.5R | 888.60 | 890.35 | 1.75 | 1.63 | 1,597 | 6.92 | 0.82 | 2.06 |

| JV1 | 19R | 920.00 | 923.20 | 3.20 | 2.27 | 149 | 0.42 | 2.02 | 1.56 |

| JV1 | JU1 | 596.45 | 598.45 | 2.00 | 1.76 | 630 | 11.44 | 0.07 | 0.21 |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-11 |

| www.rpacan.com |

| Vein | Borehole | From | To | Length | True Thickness | Ag | Au | Pb | Zn |

| | | (m) | (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) |

| JV1 | 19P | 656.55 | 660.60 | 4.05 | 2.42 | 133 | 2.66 | 0.03 | 0.10 |

Notes:

| | 1. | Prior to compositing, Ag was cut to 6,000 g/t, Au cut to 16 g/t, and both Pb and Zn were cut to 15%. |

| | 2. | True thickness was calculated using an average strike of 120° and an average dip of -55°. |

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 7-12 |

| www.rpacan.com |

8 DEPOSIT TYPES

The following is taken from Chartier et al. (2008).

The Fresnillo district is a world-class silver mining district located in the centre of the 800 km long Mexican Silver Belt including mining districts Sombrerete (San Martín, Sabinas Mines), Zacatecas, Real de Angeles, Pachuca, and Taxco. Fresnillo owns and operates the Proaño silver mine which has been in production since 1554. From 1554 to 2010, the district had produced more than 850 million ounces of silver at an average grade of approximately 400 g/t Ag, with substantial gold, lead, and zinc credits (Megaw, 2010). According to the Silver Institute (http://www.silverinstitute.org), the Proaño mine produced 26.38 million ounces of silver in 2012, ranking second in the world. Also according to the Silver Institute, the Saucito mine produced 7.5 million ounces of silver.

The deposits in the district consist of low-sulphidation epithermal quartz-carbonate veins forming an extensive array of stacked steeply dipping, west to west-northwest-trending veins, crosscutting Cretaceous and Jurassic age rocks, mostly of sedimentary origin.

The veins are laterally very extensive and, although the structures are quite persistent with depth, the silver-gold rich section of each structure is typically limited to a 300 m to 400 m range of elevation corresponding to the boiling zone of the fossil hydrothermal system. Metal distributions show a subhorizontal zoning, with base metal abundance increasing with depth. The main veins in the district have been mined continuously over lateral distances ranging from one kilometre to eight kilometres.

The epithermal mineralization is characterized by quartz-adularia-carbonate veins, stockworks, and breccias exhibiting classical epithermal textures such as colloform banding, druzy, and vuggy cockade infilling, suggesting repeated episodes of hydrothermal deposition in open structures. Mineralization includes sphalerite, galena, pyrite, pyrrhotite, silver sulphosalts, and gold. The hydrothermal veins are associated with minor clay alteration.

Epithermal deposits comprise a wide range of hydrothermal deposits associated with volcanic and magmatic edifices and formed at shallow crustal levels by the circulation of magmatic-related hydrothermal fluids into fractured rocks. These deposits are typically related with arrays of regional structures developed in extensional tectonic settings.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 8-1 |

| www.rpacan.com |

Low sulphidation epithermal deposits are related with the circulation of reduced, near neutral, dilute fluids developed by mixing of hot magmatic fluids with deep circulating groundwater. Metal deposition typically occurs during fluid ascent along open deep-seated structures through a combination of processes including fluid mixing, cooling, degassing, and transient boiling. The hydrothermal deposits exhibit strong vertical zoning about the transient boiling zone, with precious metals generally enriched above the boiling zone and base metals abundances increasing with depth.

These hydrothermal deposits are important supply of silver, gold, and base metals such as lead, zinc, and occasionally copper.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 8-2 |

| www.rpacan.com |

9 EXPLORATION

Exploration on the Juanicipio property prior to MAG’s involvement is documented in Section 6 of this report. Drilling on the Juanicipio property is documented in Section 10 of this report.

In 2007, MAG completed a helicopter-borne geophysical survey using Aeroquest’s AeroTEM II time domain electromagnetic system employed in conjunction with a high-sensitivity caesium vapour magnetometer. Ancillary equipment included a real-time differential GPS navigation system, radar altimeter, video recorder, and a base station magnetometer. Full-waveform streaming electromagnetic data were recorded at 36,000 samples per second. The total survey coverage presented was 351 line kilometres. The survey was flown at 100 m line spacing in a north-south flight direction.

The survey was successful in mapping the magnetic and conductive properties of the geology throughout the survey area. Additional reprocessing, interpretation, and follow-up work are recommended.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 9-1 |

| www.rpacan.com |

10 DRILLING

Drilling on the property has been contracted to various companies since 2004. All the drilling has been diamond core. Fresnillo currently contracts drilling to Perfoservice S.A. de C.V. (Perfoservice), an agent of Boart Longyear, headquartered in Aguascalientes, Mexico. Perfoservice currently operates two drill rigs on the property. Diamond drill holes are commonly collared using HQ (64 mm core diameter) equipment and reduced to NQ (48 mm core diameter) or BQ (37 mm) as drilling conditions dictate.

Fresnillo uses a Datamine database and 3D model to plan borehole locations and orientations. Spacing varies from 70 m to 100 m along strike and 50 m to 100 m down dip in the plane of mineralization. All drill hole collars are surveyed using differential GPS or a transit system. Downhole deviation is monitored using a Reflex Flexit instrument with readings at intervals ranging from 50 m to 150 m. Drilling by MAG recorded surveys every 15 m. Once a drill hole is completed, casing is pulled and collars are identified with cement monuments with the drill hole number engraved. The site is then revegetated according to local law.

As of December 31, 2013, 262 holes have been completed on the Juanicipio property for a total of 211,040.5 m. Figure 10-1 shows drill hole locations and Appendix Table 30-1 lists the drill holes on the property. From May 2003 to June 2004, MAG completed nine core holes for a total of 7,346 m. From August 2005 to December 31, 2013, Fresnillo completed 253 core holes for a total of 203,694.5 m.

Drill hole UE includes unusual downhole survey records that show the hole turns westerly and steepened abruptly, intersecting the Valdecañas Vein on the Juanicipio property rather than on the Fresnillo property to the east of the property boundary. RPA checked the raw Flexit data and these correspond to the resource database records.

Drill hole 13P was lost due to poor ground conditions and was also removed from resource modelling work.

There are no known drilling, sampling, or recovery factors that could materially affect the accuracy and reliability of the results.

| MAG Silver Corp. – Juanicipio Project, Project #2264 Technical Report NI 43-101 – June 12, 2014 | Page 10-1 |

| www.rpacan.com |

| www.rpacan.com |

11 SAMPLE PREPARATION, ANALYSES AND SECURITY

SAMPLING METHOD AND APPROACH

SAMPLING BY MAG