MAG SILVER CORP.

Suite 328, 550 Burrard Street

Vancouver, British Columbia V6C 2B5

INFORMATION CIRCULAR

Dated as of April 4, 2008

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| PROXIES AND VOTING RIGHTS | 1 |

| Management Solicitation and Appointment of Proxies | 1 |

| Revocation of Proxies | 3 |

| Voting of Shares and Proxies and Exercise of Discretion by Proxyholders | 4 |

| Solicitation of Proxies | 5 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 5 |

| RECEIPT OF DIRECTORS’ REPORT AND FINANCIAL STATEMENTS | 5 |

| ELECTION OF DIRECTORS | 5 |

| Corporate Cease Trade Orders or Bankruptcies | 8 |

| Individual Bankruptcies | 9 |

| Audit Committee | 9 |

| Disclosure of Corporate Governance Practices | 9 |

| APPOINTMENT OF AUDITOR | 9 |

| PARTICULARS OF OTHER MATTERS TO BE ACTED UPON | 9 |

| Amendment and Restatement of the Stock Option Plan (2007) | 9 |

| STATEMENT OF EXECUTIVE COMPENSATION | 14 |

| Executive Officers | 14 |

| Summary Compensation Table | 14 |

| Options and Stock Appreciation Rights | 15 |

| Termination of Employment, Change in Responsibilities and Employment Contracts | 16 |

| Compensation of Directors | 18 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 19 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 19 |

| MANAGEMENT CONTRACTS | 20 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 20 |

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 20 |

| ADDITIONAL INFORMATION | 20 |

| APPROVAL OF THE BOARD OF DIRECTORS | 21 |

| Schedule “A” | A-1 |

| Schedule “B” | B-1 |

MAG SILVER CORP.

INFORMATION CIRCULAR

DATED AS OF APRIL 4, 2008

INTRODUCTION

This Information Circular accompanies the Notice of Annual and Special Meeting (the “Meeting”) of the shareholders of MAG Silver Corp. (the “Company”) to be held on Friday, May 9, 2008 at the time and place set out in the accompanying Notice of Meeting. This Information Circular is furnished in connection with the solicitation of proxies by management of the Company for use at the Meeting and at any adjournment of the Meeting.

PROXIES AND VOTING RIGHTS

Management Solicitation and Appointment of Proxies

Registered Shareholders

The persons named in the accompanying form of proxy are nominees of the Company’s management. A shareholder has the right to appoint a person (who need not be a shareholder) to attend and act for and on the shareholder’s behalf at the Meeting other than the persons designated as proxyholders in the accompanying form of proxy. To exercise this right, the shareholder must either:

| (a) | on the accompanying form of proxy, strike out the printed names of the individuals specified as proxyholders and insert the name of the shareholder’s nominee in the blank space provided; or |

| (b) | complete another proper form of proxy. |

To be valid, a proxy must be dated and signed by the shareholder or by the shareholder’s attorney authorized in writing. In the case of a corporation, the proxy must be signed by a duly authorized officer of or attorney for the corporation.

The completed proxy, together with the power of attorney or other authority, if any, under which the proxy was signed or a notarially certified copy of the power of attorney or other authority, must be delivered to Computershare Investor Services Inc. (“Computershare”), 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, Canada V6C 3B9, by 2:00 p.m. (Pacific time) on Wednesday, May 7, 2008 or at least 48 hours (excluding Saturdays, Sundays and holidays) before the time that the Meeting is to be reconvened after any adjournment of the Meeting.

Non-Registered Shareholders

Only registered shareholders or duly appointed proxyholders for registered shareholders are permitted to vote at the Meeting. Shareholders who do not hold their shares in their own names (referred to herein as “Non-Registered Shareholders”) are advised that only proxies from shareholders of record can be recognized and voted at the Meeting.

If shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered in such shareholder’s name on the records of the Company. Such shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. Accordingly, most shareholders of the Company are “Non-Registered Shareholders” because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. More particularly, a person is a Non-Registered Shareholder in respect of shares which are held on behalf of that person, but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant. In Canada, the vast majority of such shares are registered under the name of CDS, which company acts as nominee for many Canadian brokerage firms. Shares so held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Non-Registered Shareholder. Without specific instructions, brokers/nominees are prohibited from voting shares held for Non-Registered Shareholders.

In accordance with National Instrument 54-101 of the Canadian Securities Administrators, the Company has distributed copies of the Notice of Meeting, this Information Circular and the form of proxy (the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Shareholders with a request for voting instructions. Applicable regulatory policy requires Intermediaries/brokers to seek voting instructions from Non-Registered Shareholders in advance of shareholders’ meetings unless the Non-Registered Shareholders have waived the right to receive meeting materials. Every Intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Non-Registered Shareholders in order to ensure that their shares are voted at the Meeting. Often the request for voting instructions supplied to a Non-Registered Shareholder by its broker is identical to the form of proxy provided by the Company to the registered shareholders. However, it is not a valid proxy; rather it is to be used as a means of instructing the registered shareholder how to vote on behalf of the Non-Registered Shareholder. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it to the Company’s registrar and transfer agent, Computershare Investor Services Inc., as provided above; or |

| (b) | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions, which contains a removable label containing a bar code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

The majority of brokers now delegate responsibility for obtaining voting instructions from Non-Registered Shareholders to Broadridge Financial Solutions Inc. (“Broadridge”). Broadridge typically supplies a special sticker to be attached to the proxy forms and asks Non-Registered Shareholders to return the completed proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Non-Registered Shareholder receiving such a proxy from Broadridge cannot use that proxy to vote shares directly at the Meeting – the proxy must be returned to Broadridge well in advance of the Meeting in order to instruct Broadridge how to vote the shares.

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the shares of the Company which they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the names of the Management Proxyholders and insert the name of the Non-Registered Shareholder (or such other person voting on behalf of the Non-Registered Shareholder) in the blank space provided or follow such other instructions as may be provided by their brokers/nominees. In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered.

In addition, there are two kinds of Non-Registered Shareholders - those who object to their names being made known to the issuers of securities which they own called Objecting Beneficial Owners (“OBOs”) and those who do not object to the issuers of the securities they own knowing who they are called Non-Objecting Beneficial Owners (“NOBOs”). The Company has decided to take advantage of those provisions of National Instrument 54-101 that permit it to directly deliver proxy-related materials to its NOBOs. If you are a Non-Registered Shareholder, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of common shares have been obtained in accordance with applicable securities legislation from the intermediary holding the common shares on your behalf. By choosing to send these materials to you directly, the Company has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. As a result, NOBOs can expect to receive a scannable Voting Instruction Form (“VIF”) from our transfer agent, Computershare. These VIFs are to be completed and returned to Computershare in the envelope provided. In addition, Computershare provides both telephone voting and internet voting as described on the VIF itself which contains complete instructions. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the shares represented by the VIFs they receive.

All references to shareholders in this Information Circular and the accompanying Notice of Meeting and form of proxy are to registered shareholders of record unless specifically stated otherwise.

Revocation of Proxies

A shareholder who has given a proxy may revoke it at any time before the proxy is exercised:

| (a) | by an instrument in writing that is: |

| (i) | signed by the shareholder, the shareholder’s legal personal representative or trustee in bankruptcy or, where the shareholder is a corporation, a duly authorized representative of the corporation; and |

| (ii) | delivered to Computershare Investor Services Inc., 3rd Floor, 510 Burrard Street, Vancouver, British Columbia, Canada V6C 0A3 or to the registered office of the Company located at Suite 2900, 550 Burrard Street, Vancouver, British Columbia, Canada V6E 0A3 at any time up to and including the last business day preceding the day of the Meeting or any adjournment of the Meeting, or delivered to the Chair of the Meeting on the day of the Meeting or any adjournment of the Meeting before any vote on a matter in respect of which the proxy is to be used has been taken; or |

| (b) | in any other manner provided by law. |

A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

Voting of Shares and Proxies and Exercise of Discretion by Proxyholders

Voting By Show of Hands

Voting at the Meeting generally will be by a show of hands, where every person present who is a shareholder or proxy holder and entitled to vote on the matter has one vote.

Voting By Poll

Voting at the Meeting will be by poll only if a poll is:

| (a) | requested by a shareholder present at the Meeting in person or by proxy; |

| (b) | directed by the Chair; or |

| (c) | required by law because the number of shares represented by proxy that are to be voted against the motion is greater than 5% of the Company’s issued and outstanding shares. |

On a poll, every shareholder entitled to vote on the matter has one vote for each share entitled to be voted on the matter and held by that shareholder and may exercise that vote either in person or by proxy.

Approval of Resolutions

To approve a motion for an ordinary resolution, a simple majority of the votes cast in person or by proxy will be required; to approve a motion for a special resolution, a majority of not less than two-thirds of the votes cast on the resolution will be required.

Voting of Proxies and Exercise of Discretion By Proxyholders

A shareholder may indicate the manner in which the persons named in the accompanying form of proxy are to vote with respect to a matter to be acted upon at the Meeting by marking the appropriate space. If the instructions as to voting indicated in the proxy are certain, the shares represented by the proxy will be voted or withheld from voting in accordance with the instructions given in the proxy on any ballot that may be called for.

If the shareholder specifies a choice in the proxy with respect to a matter to be acted upon, then the shares represented will be voted or withheld from the vote on that matter accordingly. If no choice is specified in the proxy with respect to a matter to be acted upon, it is intended that the proxyholder named by management in the accompanying form of proxy will vote the shares represented by the proxy in favour of each matter identified in the proxy and for the nominees of the Company’s board of directors for directors and auditor.

The accompanying form of proxy also confers discretionary authority upon the named proxyholder with respect to amendments or variations to the matters identified in the accompanying Notice of Meeting and with respect to any other matters which may properly come before the Meeting. As of the date of this Information Circular, management of the Company is not aware of any such amendments or variations, or any other matters that will be presented for action at the Meeting other than those referred to in the accompanying Notice of Meeting. If, however, other matters that are not now known to management properly come before the Meeting, then the persons named in the accompanying form of proxy intend to vote on them in accordance with their best judgment.

Solicitation of Proxies

It is expected that solicitations of proxies will be made primarily by mail and possibly supplemented by telephone or other personal contact by directors, officers and employees of the Company without special compensation. The Company may reimburse shareholders’ nominees or agents (including brokers holding shares on behalf of clients) for the costs incurred in obtaining authorization to execute forms of proxies from their principals. The costs of solicitation will be borne by the Company.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Only shareholders of the Company who are listed on its Register of Shareholders on the record date of April 4, 2008 are entitled to receive notice of and to attend and vote at the Meeting or any adjournment of the Meeting (see “Voting of Shares and Proxies and Exercise of Discretion by Proxyholders” above).

As of April 4, 2008, the Company had 48,545,566 common shares issued and outstanding.

To the knowledge of the directors and executive officers of the Company, the following persons or companies beneficially own, or exercise control or direction over, directly or indirectly, shares carrying more than 10% of the voting rights attached to all outstanding shares of the Company:

| Name | Number of Shares | Percentage of Outstanding Shares |

Acuity Investment Management Inc.(1) | 8,700,000 | 17.9% |

(1) Investment purposes only. Information obtained from Acuity Investment Management Inc. as at April 4, 2008

RECEIPT OF DIRECTORS’ REPORT AND FINANCIAL STATEMENTS

The Directors’ Report and the financial statements of the Company for the financial year ended December 31, 2007 and accompanying auditor’s report will be presented at the Meeting.

ELECTION OF DIRECTORS

The Company’s board of directors proposes to nominate the persons named in the table below for election as directors of the Company. Each director elected will hold office until the next annual general meeting of the Company or until his or her successor is duly elected or appointed, unless the office is earlier vacated in accordance with the Articles of the Company or the Business Corporations Act (British Columbia) or he or she becomes disqualified to act as a director.

The following table sets out the names of management’s nominees for election as directors, the place in which each is ordinarily resident, all offices of the Company now held by each of them, their principal occupations, the period of time during which each has been a director of the Company, and the number of common shares of the Company beneficially owned by each of them, directly or indirectly, or over which control or direction is exercised, as of the date of this Information Circular.

Name, Place of Residence and Offices Held with the Company(1) | Principal Occupation or Employment (1) | Periods during which has served as a Director | Number of Common Shares Owned(1) |

Daniel T. MacInnis (6) British Columbia, Canada President, CEO and Director | President and CEO of the Company since February 1, 2005; October 2003 to February 2005, VP Exploration, Sargold Resources Corp. Sardinia, Italy, a gold exploration company; from July 2004 to February 2005, Mr. MacInnis ran D. MacInnis Exploration and Consulting in Reno, Nevada. | February 1/05 to present | 81,100 |

Eric H. Carlson (2) (3)(4) British Columbia, Canada Director | July 1994 to present, President and CEO, Anthem Properties (1993) Ltd. (formerly Anthem Properties Corp.), a property development company; 1992 to present, President of Kruger Capital Corp. | June 11/99 to present | 1,009,800 |

R. Michael Jones (2) (3)(4) (6) British Columbia, Canada Director | President of Platinum Group Metals Ltd. from February 2000 to present, a platinum focused company with a deposit interest in South Africa and exploration properties in Canada; director and advisor to West Timmins Mining Inc. from 2006 to present; previously Vice President of Corporate Development for Aber Resources Ltd. from September 1997 to September 1999. | March 31/03 to present | 8,102 |

Dr. Peter K. Megaw Arizona, USA Director | President of IMDEX/Cascabel and co-founder of Minera Cascabel S.A. de C.V. since 1988, a geological consulting company; Consulting geologist for the Company since 2003. | February 6/06 to present | 696,621(5) |

Jonathan A. Rubenstein (3) (4) British Columbia, Canada Chairman and Director | Mr. Rubenstein practiced law until 1993 and has been a mining executive since that time; from September 2006 to present, a director of Aurelian Resources, a TSX listed mining company with a gold discovery in Ecuador; from 1983 to 2007, a director of Cumberland Resources Ltd.; from 2000 to 2007, a director of Redcorp Ventures Ltd. From 2002 to 2005, Mr. Rubenstein was also director, Vice President and Corporate Secretary of Canico Resources Corp. | February 26/07 to present | Nil |

Richard M. Colterjohn British Columbia, Canada Director | Mr. Colterjohn is the President and Chief Executive Officer of Centenario Copper, a position he has held since March 2004. Since 2002, he has also served as Managing Partner at Glencoban Capital Management Inc., a merchant banking firm. From April 1992 to April 2002, he was Managing Director, Corporate Finance Dept. of UBS Bunting Warburg Inc., an investment dealer. Since 2002, Mr. Colterjohn has also served as a director of three Canadian public mining companies: Canico Resource Corp. (2002 – 2006), Cumberland Resources Ltd. (2003 – 2007) and Viceroy Exploration Ltd. (2004 – 2006). | October 16/07 to present | Nil |

Derek C. White(2) British Columbia, Canada Director | Mr. White is presently the Executive Vice President - Corporate Development of Quadra Mining Limited and previously held the position of Quadra’s CFO commencing in April 2004. From January 2003 to February 2004, he held the position of CFO of International Vision Direct Ltd. Mr. White holds an undergraduate degree in Geological Engineering and is a Chartered Accountant. | October 16/07 to present | Nil |

| Notes: |

| (1) | Information as to the place of residence, principal occupation and shares beneficially owned, directly or indirectly, or controlled or directed, has been furnished by the respective directors. |

| (2) | Member of the Company’s Audit Committee. |

| (3) | Member of the Company’s Compensation Committee. |

| (4) | Member of the Company’s Governance and Nomination Committee. |

| (5) | Of these holdings, 11,685 shares are held by Minera Cascabel S.A. de C.V. of which Dr. Megaw is a 33.33% owner. |

| (6) | Member of the Company’s Disclosure Committee which also includes Frank Hallam, the Company’s CFO. |

The Company does not have an Executive Committee.

The Company’s board of directors does not contemplate that any of its nominees will be unable to serve as a director. If any vacancies occur in the slate of nominees listed above before the Meeting, then the proxyholders named in the accompanying form of proxy intend to exercise discretionary authority to vote the shares represented by proxy for the election of any other persons as directors.

Attendance of Directors at Board and Committee Meetings

The following tables set out the number of meetings held by the board of directors and committees of the directors for the period commencing January 1, 2007 and expiring December 31, 2007.

| Summary of Board and Committee Meetings Held | |

| Board of Directors | 10(1) |

| Audit Committee | 2 |

| Compensation Committee | 4 |

| Governance and Nomination Committee | 4 |

(1) The board of directors meet on a regular basis and when appropriate, non-independent directors are asked to step out of the meeting.

| Summary of Attendance of Directors at Meetings | ||||

| Directors | Board Meetings | Audit Committee Meetings | Compensation Committee Meetings | Governance & Nomination Committee Meetings |

| Daniel T. MacInnis | 10 | n/a | n/a | n/a |

| Peter Megaw | 9 | n/a | n/a | n/a |

| Richard Colterjohn | 3(1) | n/a | n/a | n/a |

| Derek White | 3(1) | 1 | n/a | n/a |

| Eric Carlson | 10 | 2 | 3 | 4 |

| R. Michael Jones | 10 | 2 | 4 | 4 |

| Jonathan Rubenstein | 8(2) | 2 | 3 | 4 |

| Dave Pearce | 7(3) | 1 | 1 | n/a |

(1) Mr. Colterjohn and Mr. White joined the board of directors on October 16, 2007.

(2) Mr. Rubenstein joined the board of directors on February 26, 2007.

(3) Mr. Pearce resigned as a director on October 16, 2007.

Corporate Cease Trade Orders or Bankruptcies

Jonathan Rubenstein was a director of Primero Industries Inc. (“Primero”) in 1998 when it made a voluntary assignment into bankruptcy as a result of events which occurred prior to Mr. Rubenstein becoming a director of Primero.

Other than as described above, during the ten years preceding the date of this Information Circular, no proposed director of the Company has, to the knowledge of the Company, been:

| (a) | a director, chief executive officer or chief financial officer of any issuer that: |

| (i) | was the subject of a cease trade or similar order or an order that denied such issuer access to any exemption under securities legislation that was in effect for a period of more than thirty consecutive days (an “Order”) while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to such an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer in the company that is the subject of the Order and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (b) | a director or executive officer of any issuer that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that issuer. |

Individual Bankruptcies

During the ten years preceding the date of this Information Circular, no proposed director of the Company has, to the knowledge of the Company, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

Penalties and Sanctions

None of the proposed nominees for election as a director of the Company has been subject to any penalties or sanctions imposed by a court or regulatory body or entered into a settlement agreement with any securities regulatory authority.

Audit Committee

The Audit Committee is comprised of three independent directors – Eric Carlson, R. Michael Jones and Derek White. The Audit Committee is responsible for assisting the board in the discharge of its responsibilities relating to the Company’s accounting principles, reporting practices, internal controls and its approval of the Company’s annual and quarterly financial statements.

Audit committee information, as required under National Instrument 52-110 – Audit Committee, is contained in the Company’s Annual Information Form dated March 26, 2008 under the heading “Audit Committee”. Audit Committee information includes the charter, committee composition, relevant education and experience, audit committee oversight, pre-approval policies and procedures, and fees paid to the external auditor. The Annual Information Form is available on SEDAR at www.sedar.com. A copy of the Company’s Annual Information Form will be provided to any shareholder of the Company without charge by request to the Corporate Secretary of the Company at Suite 328, 550 Burrard Street, Vancouver, British Columbia, V6C 2B5.

Disclosure of Corporate Governance Practices

National Instrument 58-101 Disclosure of Corporate Governance Practices (“NI 58-101”) requires issuers to disclose the corporate governance practices that they have adopted. The corporate governance practices adopted by the Company are set out in the attached Schedule “A”.

APPOINTMENT OF AUDITOR

The shareholders will be asked to vote for the appointment of Deloitte & Touche LLP, Chartered Accountants, as the auditor of the Company to hold office until the next annual general meeting of shareholders of the Company at a remuneration to be fixed by the directors.

Amendment and Restatement of the Stock Option Plan (2007)

The shareholders will be asked to vote for the amendment and restatement of the Company’s stock option plan (2007) at the Meeting, as described below.

On March 26, 2008, the board of directors of the Company (the “Board”) approved, subject to the receipt of shareholder and regulatory approvals, the amended and restated stock option plan of the Company (the “Amended Plan”). The full text of the Amended Plan is attached to this Circular as Schedule “B”. The summary of the Amended Plan set forth herein is subject to and qualified in its entirety by the provisions of such plan. Reference should be made to the provisions of the Amended Plan with respect to any particular provision described below.

If the Amended Plan is approved by the shareholders, such plan would effect certain changes to the existing stock option plan of the Company (the “Existing Plan”) of a general administrative or housekeeping nature, including certain changes to reflect the fact that the Company has become listed on the Toronto Stock Exchange (the “TSX”). The Amended Plan would also amend the Existing Plan in certain other respects, including the following:

| · | the Compensation Committee of the Board (the “Committee”) would be entitled to extend the expiry date of any outstanding option (the “Options”) to purchase common shares (the “Shares”) of the Company in the event the Option would otherwise expire during or within 10 business days following a blackout period (during which trading of securities of the Company by the holder of Options (the “Option Holder”) is restricted by the Company), to the tenth business day following the date of expiry of such period; |

| · | the Committee would be entitled to issue Options during a black-out period at an exercise price per Share equal to the greater of (i) the Market Price (as defined at “Description of Amended Plan - Determination of Exercise Price”) at the time of the grant, and (ii) the Market Price at the close of trading on the first business day following the expiry of the black-out period; |

| · | the Amended Plan restricts the grant of Options to insiders, as described at “Limitations on Grants” below; and |

| · | the Amended Plan specifies the types of amendments to the provisions of such plan and outstanding Options that would and would not require shareholder approval, as described at “Amendment Procedure” below. |

The purpose of the proposed amendments is to (a) ensure that the procedures set forth in the Company’s option plan are appropriate to assist the Company in providing executives, key employees and consultants with compensation opportunities that will reward the creation of shareholder value over the long-term and enhance the Company’s ability to attract, retain and motivate key personnel, and (b) increase the Company’s flexibility with respect to the administration of the Options, including with respect to the dates during which Options may be granted, vesting and exercise periods and the manner in which Options may be treated.

The Company is required to seek shareholder approval for the amendments to the Existing Plan that are being effected pursuant to the Amended Plan as described below at “Approval Required for Proposed Stock Option Plan Amendments”. The Amended Plan, if approved by shareholders, will govern all outstanding options of the Company. As at April 4, 2008, the Company had 3,635,830 Options outstanding representing approximately 7.48% of the 48,545,566 total shares issued and outstanding at such date.

Description of Amended Plan

If approved by the shareholders of the Company, the effective date (the “Effective Date”) of the Amended Plan will be May 9, 2008. The Amended Plan provides that Options may be granted to any employee, officer, director or consultant of the Company or a subsidiary of the Company (each, an “Eligible Person”). The Committee has the authority to administer the Amended Plan and to determine, among other things, the vesting period and the exercise period (subject to a maximum term of five years from the date of grant and the Committee's discretion in the event that it accelerates vesting for any reason). The Board has the ability to revoke any of the powers conferred on the Committee under the Amended Plan. Any reference to the "Committee" in this section of the Circular refers to the Board and/or such committee of the Board to which all or any of the powers of the Board have been delegated where the Board has revoked any of the powers conferred on the Committee under the Amended Plan as described herein.

Limitations on Grants

Under the Amended Plan, the number of Shares available for purchase pursuant to Options will not exceed 10% of the number of Shares issued and outstanding on the particular grant date. The maximum number of Options which may be granted to U.S. persons in accordance with Section 422 of the U.S. Internal Revenue Code of 1986, as amended, is limited to 700,000.

Because the Amended Plan is a rolling stock option plan, the TSX rules require that all unallocated options be approved by shareholders of the Company every three years after the institution of the Amended Plan.

No Options will be granted under the Amended Plan if, together with any other share compensation arrangement established or maintained by the Company, such grant of Options could result, at any time, in the aggregate number of Shares (i) issued to insiders within any one-year period and (ii) issuable to insiders at any time, exceeding 10% of the issued and outstanding Shares.

Determination of Exercise Price

Options may be granted from time to time by the Committee at an exercise price equal to the “Market Value” of the Shares at the time the Option is granted. “Market Value” means:

| (a) | if the Shares are listed on one organized trading facility, the closing trading price of the Shares on the business day immediately preceding the grant date, |

| (b) | if the Shares are listed on more than one organized trading facility, the market price as determined in accordance with (a) above for the primary organized trading facility on which the Shares are listed, as determined by the Committee, subject to any adjustments as may be required to secure all necessary regulatory approvals, |

| (c) | if the Shares did not trade on the business day prior to the grant date, the average of the bid and ask prices in respect of such Shares at the close of trading on such date on the primary organized trading facility on which the Shares are listed, and |

| (d) | if the Shares are not listed for trading on a stock exchange or over the counter market, a price which is determined by the Committee to be the fair value of the Shares, taking into consideration all factors that the Committee deems appropriate, including, without limitation, recent sale and offer prices of the Shares in private transactions negotiated at arms’ length. The Market Value will in no event be less then the minimum prescribed by each of the organized trading facilities that would apply to the Company on the grant date in question. |

For any Options that are granted during a black-out period (during which trading of securities of the Company by an Option Holder is restricted by the Company), the exercise price for each Option would be equal to the greater of the Market Price at the time of grant and the Market Price at the close of trading on the first business day following the expiry of the black-out period. The Committee believes that this provision, which is not included in the Existing Plan, is necessary to ensure that the Company maintains the flexibility to grant Options to Eligible Persons in accordance with the Company’s regular granting schedule, or as determined by the Committee, while at the same time satisfying the requirements under the TSX rules with respect to the terms of any options that are granted during periods where there is any material undisclosed information about an issuer.

Termination of Options

Each Option will expire and terminate immediately upon the Option Holder ceasing to be an Eligible Person except as otherwise provided in the Amended Plan. The Amended Plan provides that where an employee or executive whose employment terminates for any reason other than for cause (but including termination without cause and voluntary resignation), any exercisable Options held by (a) former executive will continue to be exercisable for a period of 90 days following the termination date, and (b) a former employee will continue to be exercisable for a period of 30 days following the termination date, subject in each case to the discretion of the Committee to extend such period. In the event that the employment of an employee or executive is terminated by reason of death or disability, such Option Holder or his or her estate, as the case may be, is entitled to exercise any Options that were vested and exercisable as of the date of death or the date such Option Holder’s employment was terminated by reason of disability, as the case may be, for a period of six months after the date of death or the termination date, as applicable, subject to the discretion of the Committee to extend such period.

Where an Option Holder’s employment or term of office is terminated for cause, any Options held by the Option Holder, whether or not exercisable as of the date of termination, will expire and be cancelled on the date that is 30 days following the termination date, subject to the discretion of the Committee to extend such period.

The vesting and exercise of options granted to a consultant of the Company or its Subsidiaries will be treated in a similar manner to that described above for employees.

Transferability

Each Option is personal to the Option Holder and is non-assignable and non-transferable. No Option granted under the Amended Plan may be pledged, hypothecated, charged, transferred, assigned or otherwise encumbered or disposed of by the Option Holder, whether voluntarily or by operation of law, other than by testate succession, will or the laws of descent and distribution.

Amendment Procedure

Under the Amended Plan, the Committee will be entitled to make any amendments to the Amended Plan that are not material. Some examples of amendments that would not be considered material, and which could therefore be made without shareholder approval, include the following:

| (a) | ensuring continuing compliance with applicable laws, regulations, requirements, rules or policies of any governmental authority or any stock exchange; |

| (b) | amendments of a “housekeeping” nature, which include amendments to eliminate any ambiguity or correct or supplement any provision contained in the Amended Plan which may be incorrect or incompatible with any other provision thereof; |

| (c) | a change to provisions on transferability of Options for normal estate settlement purposes; |

| (d) | a change in the process by which an Option Holder who wishes to exercise his or her Option can do so, including the required form of payment for the Shares being purchased, the form of exercise notice and the place where such payments and notices must be delivered; |

| (e) | changing the vesting and exercise provisions of the Amended Plan or any Option in a manner which does not entail an extension beyond the originally scheduled expiry date for any applicable Option, including to provide for accelerated vesting and early exercise of any Options deemed necessary or advisable in the Committee's discretion; |

| (f) | changing the termination provisions of the Amended Plan or any Option which does not entail an extension beyond the originally scheduled expiry date for that Option; |

| (g) | adding a cashless exercise feature, payable in cash or securities, which provides for a full deduction of the number of underlying Shares from the Amended Plan reserve; and |

| (h) | adding a conditional exercise feature which would give the Option Holders the ability to conditionally exercise in certain circumstances determined by the Committee, at its discretion, at any time up to a date determined by the Committee, at its discretion, all or a portion of those Options granted to such Option Holders which are then vested and exercisable in accordance with their terms, as well as any unvested Options which the Committee has determined shall be immediately vested and exercisable in such circumstances. |

Any material amendments to the Amended Plan will require shareholder approval. Some examples of material amendments that would require shareholder approval include the following:

| (a) | any amendment to the amending provisions of the Amended Plan other than amendments made to ensure compliance with existing laws, regulations, rules or policies or amendments of a “housekeeping” nature; |

| (b) | any increase in the maximum number of Shares available for purchase pursuant to Options other than in accordance with the provision of the Amended Plan that entitles the Committee to make adjustments to give effect to certain adjustments made to the Shares in the event of certain capital reorganizations and other transactions; |

| (c) | any reduction in the exercise price or extension of the period during which an Option granted to an insider may be exercised; |

| (d) | any amendment to permit the repricing of Options; |

| (e) | the cancellation and reissue of any Options; and |

| (f) | any amendment that would permit Options to be transferred or assigned other than for normal estate settlement purposes. |

Approval Required for Proposed Stock Option Plan Amendments

The resolution respecting the proposed amendment and restatement of the Existing Plan (the “Stock Option Plan Resolution”) must be approved by a majority of the votes cast by the holders of Shares present or represented by proxy at the Meeting. The text of the Stock Option Plan Resolution is set out below. The Board of Directors recommends a vote “for” the proposed amendment and restatement of the Existing Plan described above and referred to in the Stock Option Plan Resolution. In the absence of a contrary instruction, the persons designated by management of the Company in the enclosed form of proxy intend to vote FOR the resolution.

Resolution Approving Amendment and Restatement of the Stock Option Plan

The resolution to approve the amendment and restatement of the Existing Plan which will be presented at the Meeting and, if deemed appropriate, adopted with or without variation is as follows:

“IT IS RESOLVED THAT:

1. The proposed amendment and restatement of the existing stock option plan of the Company, as described in, and attached to, the Management Information Circular dated April 4, 2008, are approved, ratified and confirmed;

2. all unallocated options issuable pursuant to the Amended Plan are hereby approved and authorized until May 9, 2011; and

3. any director or officer of the Company is authorized and directed on behalf of the Company to execute all documents and to do all such other acts and things as such director or officer may determine to be necessary or advisable to give effect to the foregoing provisions of this resolution.”

STATEMENT OF EXECUTIVE COMPENSATION

Executive Officers

For the purposes of this Information Circular, “executive officer” of the Company means an individual who at any time during the year was the Chair, a Vice-Chair or the President of the Company; any Vice-President in charge of a principal business unit, division or function including sales, finance or production; and any individual who performed a policy-making function in respect of the Company.

The summary compensation table below discloses compensation paid to the following individuals:

| (a) | each chief executive officer (“CEO”) of the Company; |

| (b) | each chief financial officer (“CFO”) of the Company; |

| (c) | each of the Company’s three most highly compensated executive officers, other than the CEO and CFO, who were serving as executive officers at the end of the most recently completed financial year and whose total salary and bonus exceeds $150,000 per year; and |

| (d) | any additional individuals for whom disclosure would have been provided under (c) except that the individual was not serving as an officer of the Company at the end of the most recently completed financial year, |

(each, a “Named Executive Officer” or “NEO”).

The Company currently has two Named Executive Officers, Daniel MacInnis, its President and Chief Executive Officer and Frank Hallam, its Chief Financial Officer.

Summary Compensation Table

The following table contains a summary of the compensation paid to the Named Executive Officers of the Company during the three most recently completed financial years.

| Annual Compensation | Long Term Compensation | |||||||

| Awards | Payouts | |||||||

NEO Name and Principal Position | Year Ended | Salary ($) | Bonus ($) | Other Annual Compen-sation ($) | Securities Under Options/ SARs(1) Granted (#) | Shares or Units Subject to Resale Restrictions ($) | LTIP(2) Payouts ($) | All Other Compen-sation ($) |

Daniel McInnis (3) President and CEO | 2007/12/31 2006/12/31 2005/12/31 | $154,128 $139,500 $119,900 | $50,000 Nil $30,000 | Nil Nil Nil | Nil 290,000 360,000 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

Frank Hallam CFO | 2007/12/31 2006/12/31 2005/12/31 | Nil Nil Nil | Nil Nil $5,000 | Nil Nil Nil | Nil 175,000 100,000 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| Notes: |

| (1) | “SAR” or “stock appreciation right” means a right, granted by the Company or any of its subsidiaries as compensation for employment services or office to receive cash or an issue or transfer of securities based wholly or in part on changes in the trading price of publicly traded securities of the Company. |

| (2) | “LTIP” or “long term incentive plan” means any plan providing compensation intended to motivate performance over a period greater than one financial year, but does not include option or stock appreciation right plans or plans for compensation through shares or units that are subject to restrictions on resale. |

| (3) | Mr. MacInnis was appointed the Company’s President and CEO on February 1, 2005. |

Long-Term Incentive Plan Awards

The Company has not granted any LTIP’s during the past fiscal year.

Options and Stock Appreciation Rights

No stock options or stock appreciation rights were granted to any Named Executive Officer during the Company’s most recently completed financial year.

The following table sets out the incentive stock options and stock appreciation rights exercised by the Named Executive Officers during the Company’s most recently completed financial year and provides the values of the stock options and stock appreciation rights still held by the Named Executive Officers at year-end.

| NEO Name | Securities Acquired on Exercise (#) | Aggregate Value Realized ($) | Unexercised Options/SARs at Financial YE (#) Exercisable/ Unexercisable | Value of Unexercised in-the-Money Options/SARs at Financial YE ($) Exercisable/ Unexercisable (1) |

| Daniel MacInnis | 50,000 | $626,500 | 600,000/Nil | $7,491,600/Nil |

| Frank Hallam | Nil | Nil | 275,000/Nil | $3,259,250/Nil |

Notes: |

| (1) | “In the money” options are those where the market value of the underlying securities at the fiscal year-end exceeds the exercise price of the option. Value is determined by calculating the difference between the closing price of the Company’s shares ($14.79) on December 31, 2007, and the exercise price of each option, and then multiplying the difference by the number of shares under option at the fiscal year end. |

Options and SAR Repricings

No stock options were repriced during the Company’s most recently completed financial year.

Termination of Employment, Change in Responsibilities and Employment Contracts

The Company has no compensatory plan, contract or arrangement whereby any Named Executive Officer may be compensated in an amount exceeding $100,000 in the event of that officer’s resignation, retirement or other termination of employment, or in the event of a change of control of the Company or a subsidiary or a change in the Named Executive Officer’s responsibilities following such a change of control.

Effective January 25, 2005, the Company entered into an employment agreement (the “Employment Agreement”) with Daniel MacInnis, the President, Chief Executive Officer and a director of the Company, pursuant to which Mr. MacInnis receives stock options and is paid a base salary of $12,844 per month to manage the day-to-day operations of the Company for an indefinite term. The Company may terminate the Employment Agreement on notice without cause upon payment of two months’ salary and provision of benefits for the earlier of two months or until Mr. MacInnis obtains comparable benefits from another source. Mr. MacInnis may terminate the Employment Agreement at any time by providing 90 days’ written notice to the Company.

Composition of the Compensation Committee

For the period from May 8, 2007 to present, the Compensation Committee of the Company has been comprised of three independent directors: Jonathan Rubenstein (Chair of the Committee), Eric Carlson and R. Michael Jones.

Prior to May 8, 2007, the Compensation Committee of the Company was comprised of Eric Carlson, Dave Pearce (former President and former Secretary of the Company) and R. Michael Jones.

Report on Executive Compensation

The Company’s executive compensation program is administered by the Compensation Committee on behalf of the board of directors. The Compensation Committee is responsible for ensuring that the Company has in place an appropriate plan for executive compensation. The plan must be competitive and rewarding so as to attract, retain and motivate executives who will provide the leadership required to enhance the growth and profitability of the Company.

This Committee’s overall policy for determining executive compensation is based on the following fundamental principles:

| 1. | Management’s fundamental objective is to maximize long term shareholder value; |

| 2. | Performance is the key determinant of pay for executive officers; and |

| 3. | The executive officers have clear management accountabilities. |

Overall executive compensation is comprised of several components: base salary and annual incentives which relate to specific accomplishments during the year and which are paid in cash and long term equity-based incentives in the form of stock options. To date, no specific formulae have been developed to assign a specific weighting to each of these components. The Company’s compensation philosophy is to foster entrepreneurship at all levels of the organization by making long term equity-based incentives, through the granting of stock options, a significant component of executive compensation assuming the Company’s common share price achieves good long term performance. The Compensation Committee uses third party compensation data to help determine competitiveness. The Compensation Committee reviews each component of executive compensation and, in addition, reviews total compensation for overall competitiveness.

Base Salary

The Compensation Committee and the board of directors approve the salary ranges for senior executives and officers of the Company. Comparative data is accumulated from a number of external sources including independent consultants. The policy for determining salary for executive officers is consistent with the administration of salaries for all other employees. Base salaries for executives are determined by assessment of sustained performance and consideration of competitive compensation levels for the markets in which the Company operates.

Annual Incentives

Annual bonuses are awarded to provide incentive for and reward performance by the Company’s senior executives and officers. The bonuses are based in part on the Company’s success in reaching its objectives and in part on individual performance. The Compensation Committee and the board of directors approve the annual incentives. Comparative data is accumulated from a number of external sources including independent consultants. The Compensation Committee sets certain performance objectives for individual officers during the year. The success of these individuals in achieving their individual objectives and assisting the Company to reach its overall objectives is a factor in the determination of their annual bonus.

Long Term Compensation

The Company has a broadly-based employee stock option plan. The plan is designed to encourage stock ownership and entrepreneurship on the part of the senior staff. The plan aligns the interests of executive officers with shareholders by linking a component of executive compensation to the long term performance of the Company’s common stock. Consideration is given to the amount and terms of outstanding options, SARs and shares and units subject to resale restrictions. Comparative data is accumulated from a number of external sources including independent consultants.

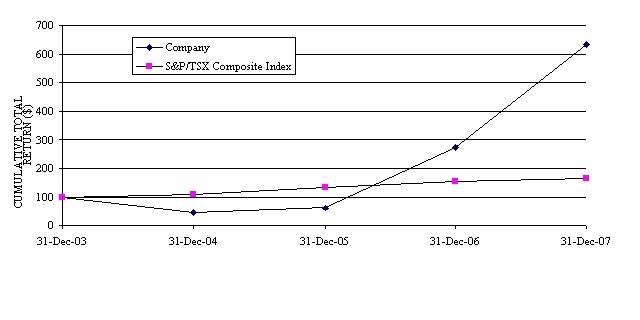

Performance Graph

The chart below compares the cumulative shareholder return on a $100 investment in common shares of the Company to the cumulative shareholder return of the S&P/TSX 300 Index for the period from December 31, 2003 to December 31, 2007.

| Investment | December 31, 2003 | December 31, 2004 | December 31, 2005 | December 31, 2006 | December 31, 2007 | |

| Company | 100.00 | 100.00 | 44.29 | 62.35 | 273.48 | 634.68 |

| S&P/TSX Composite Index | 100.00 | 100.00 | 110.96 | 135.27 | 154.90 | 166 |

Compensation of Directors

Effective February 22, 2007, the board of directors adopted a policy on board compensation to provide an annual retainer of $10,000 to each independent board member with a meeting stipend of $1,000 per meeting or $750 per telephone attendance. Members of board committees will receive an additional $1,000 per committee meeting stipend with a further $5,000/$1,000 annual retainer to the audit committee chairperson/member respectively and $2,500/$1,000 annual retainer to the compensation and governance and nomination committees chair persons/members respectively. See “Termination of Employment, Change in Responsibilities and Employment Contracts” above for details of Dan MacInnis who is compensated as a non-independent director of the company and see “Interest of Informed Persons in Material Transactions” for details of compensation paid to companies with which Peter Megaw is interested.

During the last fiscal year, the following stock options were granted to the Company’s directors who are not NEO’s:

| Name | Date of Grant | # of Options Granted | Exercise Price | Expiration Date |

| Jonathan Rubenstein | Feb 23, 2007 | 200,000 | $8.80 | Feb 23, 2012 |

| Derek White | Oct 16, 2007 | 200,000 | $14.15 | Oct 15, 2012 |

| Richard Colterjohn | Oct 16, 2007 | 200,000 | $14.15 | Oct 15, 2012 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Equity Compensation Plan Information

The following table sets forth details of the Company’s compensation plan under which equity securities of the Company are authorized for issuance at the end of the Company’s most recently completed financial year:

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| Plan Category | (a) | (b) | (c) |

Equity compensation plans approved by securityholders Stock Option Plan (2007) (1) | 3,805,700(1) | $4.44 | 889,719 |

Equity compensation plans not approved by securityholders(1) | N/A | N/A | N/A |

| Total | 3,805,700 | 889,719 |

Note:

(1) Authorizes options to purchase up to 10% of the issued and outstanding shares of the Company. The Company intends, subject to the receipt of required shareholder and regulatory approvals, to amend and restate in its entirety its Stock Option Plan (2007). Shareholders will be asked to approve this amendment and restatement at the 2008 annual and special meeting of the Company, as discussed at “Particulars of Other Matters to be Acted Upon - Amendment and Restatement of the Stock Option Plan (2007)”. If the amendment and restatement to the existing stock option plan of the Company is approved by the shareholders, the effective date of the amended and restated plan will be May 9, 2008.

(2) The Company has 3,635,830 options outstanding representing approximately 7.48% of the 48,545,566 total shares issued and outstanding at April 4, 2008.

Amended Stock Option Plan

The Company proposes to amend and restate the Company’s existing stock option plan to effect certain changes. Accordingly, shareholder approval of amendment and restatement of the Company’s existing stock option plan is being sought at the Meeting. See “Particulars of Other Matters to be Acted Upon - -Amendment and Restatement of the Stock Option Plan (2007)”.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

Other than routine indebtedness, no current or former executive officer, director or employee of the Company or any of its subsidiaries, or any proposed nominee for election as a director of the Company, or any associate or affiliate of any such executive officer, director, employee or proposed nominee, is or has been indebted to the Company or any of its subsidiaries, or to any other entity that was provided a guarantee, support agreement, letter of credit or other similar arrangement by the Company or any of its subsidiaries in connection with the indebtedness, at any time since the beginning of the most recently completed financial year of the Company.

MANAGEMENT CONTRACTS

Management functions of the Company or any subsidiary of the Company are not, to any substantial degree, performed by a person other than the directors or executive officers of the Company or its subsidiaries.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than as set forth in this Information Circular, no informed person of the Company, no proposed nominee for election as a director of the Company and no associate or affiliate of any such informed person or proposed nominee has had any material interest, direct or indirect, in any transaction since the commencement of the Company’s most recently completed financial year or in any proposed transaction that, in either case, has materially affected or will materially affect the Company or any of its subsidiaries, except as follows:

Dr. Megaw

Dr. Peter Megaw, of Arizona, USA, became a member of the board of directors of the Company on February 6, 2006. Dr. Megaw is also a principal of Minera Bugambilias, S.A. de C.V. (“Bugambilias”) and Minera Coralillo, S.A. de C.V. (“Coralillo”). The Company acquired the mineral claims of the Batopilas property from Bugambilias and Bugambilias has retained a net smelter royalty interest in that property. The Company acquired the mineral claims of the Guigui property from Coralillo and Coralillo has retained a net smelter royalty interest in that property. Dr. Megaw is also a principal of Minera Cascabel, S.A. de C.V. (“Cascabel”). The Company holds an option from Cascabel to earn an interest in the mineral claims of the Cinco de Mayo Property. In 2006 Cascabel was paid US$62,500 and 30,840 common shares of the Company (value $70,932) pursuant to the option agreement for the Adargas Property. In 2006 Cascabel was paid US$62,500 and 30,840 common shares of the Company (value $70,932) pursuant to the option agreement for the Cinco de Mayo property. In 2007 Cascabel was paid US$175,000 pursuant to the option agreement for the Cinco de Mayo Property.

Further, Cascabel has been and will continue to be retained by the Company as a consulting geological firm compensated at industry standard rates. During the year ended December 31, 2007 the Company accrued or paid Cascabel and IMDEX consulting, administration and travel fees totaling $134,720 (2006 - $141,154) and exploration costs totaling $1,312,826 (2006 - $1,049,611) under the Field Services Agreement.

INTEREST OF CERTAIN PERSONS OR COMPANIES

IN MATTERS TO BE ACTED UPON

Other than as set forth in this Information Circular, no director or executive officer of the Company at any time since the beginning of the Company’s most recently completed financial year, no proposed nominee for election as a director of the Company and no associate or affiliate of any of such persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting, except for any interest arising from the ownership of shares of the Company where the shareholder will receive no extra or special benefit or advantage not shared on a pro-rata basis by all holders of shares in the capital of the Company.

ADDITIONAL INFORMATION

Additional information relating to the Company is available on SEDAR at www.sedar.com.

Financial information is provided in the Company’s comparative financial statements and Management Discussion and Analysis for its most recently completed financial year. To request copies of the Company’s financial statements and Management Discussion and Analysis, please contact the Company at Suite 328 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5, telephone (604) 630-1399, facsimile (604) 484-4710, e-mail info@magsilver.com.

APPROVAL OF THE BOARD OF DIRECTORS

The contents of this Information Circular have been approved, and the delivery of it to each shareholder of the Company entitled thereto and to the appropriate regulatory agencies has been authorized by the board of directors of the Company.

BY ORDER OF THE BOARD OF DIRECTORS OF

| MAG Silver Corp. | |||

/s/ “Dan MacInnis” | |||

| Daniel MacInnis | |||

| President and Chief Executive Officer | |||

SCHEDULE “A”

CORPORATE GOVERNANCE PRACTICES

The following table addresses the disclosure requirements set out in Form 58-101F1 Corporate Governance Disclosure:

| Corporate Governance Disclosure Requirement | The Company’s Approach |

1. Board of Directors – (a) Disclose identity of directors who are independent. | (a) The Company’s six independent directors are Messrs. Eric Carlson, R. Michael Jones, Peter Megaw, Jonathan Rubenstein, Richard Colterjohn and Derek White. |

| (b) Disclose identity of directors who are not independent and describe the basis for that determination. | (b) The Company’s only non-independent director is Mr. Daniel MacInnis. Mr. MacInnis is not considered independent as he is the President of the Company. |

(c) Disclose whether or not a majority of directors are independent. If a majority of directors are not independent, describe what the board of directors (the board) does to facilitate its exercise of independent judgment in carrying out its responsibilities. | (c) A majority of the Company’s directors are independent (six out of seven). |

(d) If a director is presently a director of any other issuer that is a reporting issuer (or the equivalent) in a jurisdiction or a foreign jurisdiction, identify both the director and the other issuer. | (d) The following directors are presently also directors of other issuers as listed below: Daniel MacInnis is a director of MAX Resources Corp.; Eric Carlson is a director of Platinum Group Metals Ltd., West Timmins Mining Inc. and Kruger Capital Corp.; R. Michael Jones is a director of Platinum Group Metals Ltd., West Timmins Mining Inc. and Jerico Explorations Inc.; Peter Megaw is a director of Candente Resources Corp.; Jonathan Rubenstein is a director of Aurelian Resources; Richard Colterjohn is a director of Centenario Copper; and Derek White is a director of Oro Silver Resources Limited. |

(e) Disclose whether or not the independent directors hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. If the independent directors hold such meetings, disclose the number of meetings held since the beginning of the issuer’s most recently completed financial year. If the independent directors do not hold such meetings, describe what the board does to facilitate open and candid discussion among its independent directors. | (e) The independent directors of the board do not hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. The Company holds regular quarterly director meetings and other meetings as required, at which the opinion of the independent directors is sought and duly acted upon for all material matters related to the Company. When appropriate, non-independent directors are asked to step out of the meeting. |

(f) Disclose whether or not the chair of the board is an independent director. If the board has a chair or lead director who is an independent director, disclose the identity of the independent chair or lead director, and describe his or her role and responsibilities. If the board has neither a chair that is independent nor a lead director that is independent, describe what the board does to provide leadership for its independent directors. | (f) Jonathan Rubenstein is the independent director appointed as the chair of the board. Mr. Rubenstein facilitates the meetings and actively seeks out the views of the independent directors on all board matters. |

| (g) Disclose the attendance record of each director for all board meetings held since the beginning of the issuer’s most recently completed financial year. | (g) The Company has held 10 board meetings since January 1, 2007, the beginning of its most recently completed financial year. The attendance record for its seven directors is outlined on page 8 of this Information Circular. |

2.Board Mandate – | |

| Disclose the text of the board’s written mandate. If the board does not have a written mandate, describe how the board delineates its role and responsibilities. | The board does not have a written mandate. The board assumes responsibility for stewardship of the Company, including overseeing all of the operations of the business, supervising management and setting milestones for the Company. The board reviews the statements of responsibilities for the Company including, but not limited to, the code of ethics and expectations for business conduct. The board approves all significant decisions that affect the Company and its subsidiaries and sets specific milestones towards which management directs their efforts. The strategic planning process is carried out at each board meeting where there are regularly reviewed specific milestones for the Company. The corporate milestones are incorporated into senior management’s bonus scheme where performance bonuses are matched to the corporate objectives and milestones. The board reviews the strategic plan at each meeting, usually at least once quarterly. The strategic planning process incorporates identifying the main risks to the Company’s objectives and ensuring that mitigation plans are in place to manage and minimize these risks. The board appoints senior management. As the Company has grown it has seen that management has also grown, mitigating risk with respect to succession planning. At this time one executive is in place with sufficient experience to assume the CEO role in the case of the loss of the CEO. The board as a whole, given its small size, is involved in developing the Company’s approach to corporate governance; however, the board recently established a Governance and Nomination Committee to review and make recommendations on matters including, but not limited to: corporate governance in general; size and composition of the board in the short and long-term; CEO succession planning; and policies and procedures for directors to carry out their duties with due diligence and in compliance with all legal and regulatory requirements. The board approves all of the Company’s major communications, including annual and quarterly reports and certain press releases with specific review of financial disclosure by the Audit Committee . The board also approved the hiring of a communications manager to oversee all of the Company’s communication and ensure a consistent and well-delivered message of the Company’s objectives, achievements and results. In accordance with its recently adopted Timely Disclosure, Confidentiality and Insider Trading Policy, four (4) corporate spokespersons have been formally designated. The communication policy of the Company is to circulate all press releases to technical staff and all responsible people involved in press release material. This policy ensures that shareholders receive information not only from the senior management point of view but from the viewpoint of the project staff. Shareholder feedback, when significant, is also communicated directly back to the board. The board and the Audit Committee examine the effectiveness of the Company’s internal control processes and information systems. The board, and the Audit Committee, consult with the auditor with respect to these systems. The Company also initiated a process in 2005 to work towards compliance with the new Sarbanes-Oxley regulations in the United States well in advance of the deadline for corporations of the Company’s size. This process involved the work of a full time senior accounting advisor in consultation with the Company’s auditors and was completed in November 16, 2007. In general, transactions over a CDN$50,000 limit or involving mineral properties require the board’s approval. Project budgets are brought before the board on a regular basis. The board’s direction with respect to these budgets are communicated back to project staff. The number of scheduled board meetings varies with circumstances but a minimum of 4 meetings are held annually. In addition, special meetings are called as necessary. The Chairman establishes the agenda before each board meeting and submits a draft to each director for their review and recommendation for items for inclusion on the agenda and each director has the ability to raise subjects that are not on the agenda at any board meeting. Meeting agendas and other materials to be reviewed and/or discussed for action by the board are distributed to directors in time for review prior to each meeting. Board members have full and free access to senior management and employees of the Company. |

| 3.Position Descriptions – | |

| (a) Disclose whether or not the board has developed written position descriptions for the chair and the chair of each board committee. If the board has not developed written position descriptions for the chair and/or the chair of each board committee, briefly describe how the board delineates the role and responsibilities of each such position. | (a) The board has not developed written position descriptions for the chair and the chair of each board committee. The board requires each chair, among other things, to ensure (i) effective functioning of the committee, (ii) responsibilities of the committee are well understood and (iii) that board functions, delegated to the committees are carried out. Each of the Audit Committee, Compensation Committee and Governance and Nomination Committee have a clear written charter from the board which have been filed on SEDAR (www.sedar.com). |

(b) Disclose whether or not the board and CEO have developed a written position description for the CEO. If the board and CEO have not developed such a position description, briefly describe how the board delineates the role and responsibilities of the CEO. | (b) The board and CEO have not developed a written position description for the CEO. The board has delegated to the Compensation Committee to review and approve the corporate objectives that the CEO is responsible for meeting. The Compensation Committee assesses the CEO’s performance against these objectives. Management is responsible for the day-to-day operations of the Company, reviewing and implementing strategies, budgeting and monitoring performance against budget and identifying opportunities and risks. |

| 4.Orientation and Continuing Education – | |

(a) Briefly describe what measures the board takes to orient new directors regarding i.The role of the board, its committees and its directors, and ii.The nature and operation of the issuer’s business. | (a) The Company does not have a formal orientation and education program for new directors. However, new directors are provided with relevant materials with respect to the Company as well as being oriented on relevant corporate issues by the CEO. The Governance and Nomination Committee will review, approve and report to the board on the orientation process for new directors. |

(b) Briefly describe what measures, if any, the board takes to provide continuing education for its directors. If the board does not provide continuing education, describe how the board ensures that its directors maintain the skill and knowledge necessary to meet their obligations as directors. | (b) The board currently does not provide continuing education for its directors. By using a board composed of experienced professionals with a wide range of financial, legal, exploration and mining expertise, the Company ensures that the board operates effectively and efficiently. The Governance and Nomination Committee will review, approve and report to the board on plans for the ongoing development of existing board members including the provision of continuing education opportunities for all directors, so that individuals may maintain or enhance their skills and abilities as directors, as well as to ensure their knowledge and understanding of the Company’s business remains current. Until such time that an official orientation is implemented, if and when a new director is added, they will have the opportunity to become familiar with the Company by meeting with the other directors and with officers and employees of the Company. As each director has a different skill set and professional background, orientation and training activities will be tailored to the particular needs and experience of each director. |

| 5.Ethical Business Conduct – | |

(a) Disclose whether or not the board has adopted a written code for the directors, officers and employees. If the board has adopted a written code: i.Disclose how a person or company may obtain a copy of the code; ii.Describe how the board monitors compliance with its code, or if the board does not monitor compliance, explain whether and how the board satisfies itself regarding compliance with its code; and iii.Provide a cross-reference to any material change report filed since the beginning of the issuer’s most recently completed financial year that pertains to any conduct of a director or executive officer that constitutes a departure from the code. | (a) The board has adopted a written Code of Business Conduct and Ethics for the directors, officers and employees of the Company. The Ethics Policy is available on the Company’s website at www.magsilver.com and filed on SEDAR (www.sedar.com). The Company’s Governance and Nomination Committee monitors compliance with the code. No material change report has been filed since January 1, 2007, or ever, that pertains to any conduct of a director or executive officer that constitutes a departure from the code. |

(b) Describe any steps the board takes to ensure directors exercise independent judgment in considering transactions and agreements in respect of which a director or executive officer has a material interest. | (b) Directors with an interest in a material transaction are required to declare their interest and abstain from voting on such transactions. In addition, the Company’s Code of Business Conduct and Ethics requires all directors to obtain the specific permission of the Governance and Nomination Committee prior to becoming involved in certain activities that create or gives the appearance of a conflict of interest. A thorough discussion of the documentation related to any transaction in which a director or executive officer has a material interest is required for review by the board, particularly independent directors. |

| (c) Describe any other steps the board takes to encourage and promote a culture of ethical business conduct. | (c) The board seeks directors who have solid track records in spheres ranging from legal and financial to exploration and mining in order to ensure a culture of ethical business conduct. The board has also adopted a Code of Business Conduct and Ethics which summarizes the legal, ethical and regulatory standards that the Company must follow to promote integrity and deter wrongdoing. It is a reminder to all directors, officers and employees of the seriousness of the Company’s commitment and compliance with the Code of Business Conduct and Ethics is mandatory for every director, officer and employee of the Company or any of its subsidiaries. |

| 6.Nomination of Directors - | |