As filed with the Securities and Exchange Commission on October 16, 2003

Registration No. 333-105499

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

American Seafoods Corporation

(Exact name of registrant as specified in its charter)

| Delaware | | 6719 | | 01-0781250 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Market Place Tower

2025 First Avenue

Suite 1200

Seattle, Washington 98121

(206) 374-1515

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Co-Registrants

See Next Page

Brad Bodenman

Chief Financial Officer

American Seafoods Group LLC

Market Place Tower

2025 First Avenue

Suite 900

Seattle, Washington 98121

(206) 374-1515

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Jeffrey J. Rosen, Esq. Debevoise & Plimpton 919 Third Avenue New York, New York 10022 (212) 909-6000 | | David J. Goldschmidt, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act, check the following box. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee |

|

Income Deposit Securities (IDSs)(2) | | $675,235,361 | | $3,400(3) |

|

Shares of Common Stock, par value 0.01 per share(4) | | 38,918,465 | | |

|

% Notes(5)(6) | | $301,618,101 | | |

|

Guarantees | | * | | None(7) |

|

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes an indeterminate number of IDSs of the same series of the IDSs offered hereby, which may be received by holders of IDSs in the future on one or more occasions in replacement of the IDSs offered hereby in the event of a subsequent issuance of IDSs. The IDS units represent 38,918,465 shares of the common stock and $301.6 million aggregate principal amount of % notes of American Seafoods Corporation, including 4,971,182 IDSs subject to the underwriters’ over-allotment option. Assuming the underwriters’ over-allotment option is exercised, 38,112,392 IDSs will be sold to the public in connection with this initial public offering and 806,073 IDSs will be issued to certain affiliates and members of management in connection with the transactions described in this registration statement under “Detailed Transaction Steps.” |

| (3) | $36,405 and $15,124 were previously paid in connection with the initial filing of this Registration Statement on May 22, 2003 and the filing of Amendment No. 1 on July 9, 2003, respectively. |

| (4) | Including 4,971,182 common shares subject to the underwriters’ over-allotment option, 38,112,392 common shares will be sold to the public in connection with this initial public offering and 806,073 common shares will be issued to certain affiliates and members of management in connection with the transactions. |

| (5) | Including $38.5 million principal amount subject to the underwriters’ over-allotment option. $295.4 million % notes will be sold to the public in connection with this initial public offering and $6.2 million % notes will be issued to certain affiliates and members of management in connection with the transactions. |

| (6) | Includes an indeterminate principal amount of notes of the same series as the notes offered hereby, which will be received by holders of notes offered hereby in the future on one or more occasions in the event of a subsequent issuance of IDSs, upon an automatic exchange of portions of the notes offered hereby for identical portions of such additional notes. |

| (7) | Pursuant to Rule 457(n), no separate filing fee is required for the guarantees. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Exact Name of Co-Registrant as Specified in its Charter

| | State or Other

Jurisdiction of

Incorporation or

Organization

| | Primary Standard

Industrial

Classification

Code Number

| | I.R.S.

Employer

Identification

No.

| | Code, and Telephone Number,

Including Area Code, of Principal

Executive Office

|

American Seafoods Holdings LLC | | Delaware | | 6719 | | 13-4097209 | | Market Place Tower 2025 First Avenue, Suite 1200 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

American Seafoods Group LLC | | Delaware | | 6719 | | 22-3702647 | | Market Place Tower 2025 First Avenue, Suite 1200 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

American Seafoods International LLC | | Delaware | | 2092 | | 22-3702872 | | 40 Herman Melville Blvd. P.O. Box 2087 New Bedford, MA 02741 Phone: (508) 997-0031 |

| | | | |

New Bedford Seafoods LLC | | Delaware | | 2092 | | 22-3702925 | | 40 Herman Melville Blvd. P.O. Box 2087 New Bedford, MA 02741 Phone: (508) 997-0031 |

| | | | |

The Hadley Group LLC | | Delaware | | 2092 | | 04-2918779 | | 40 Herman Melville Blvd. P.O. Box 2087 New Bedford, MA 02741 Phone: (508) 997-0031 |

| | | | |

American Seafoods Processing LLC | | Delaware | | 2092 | | 04-3540757 | | 40 Herman Melville Blvd. P.O. Box 2087 New Bedford, MA 02741 Phone: (508) 997-0031 |

| | | | |

American Seafoods Company LLC | | Delaware | | 2092 | | 22-3702875 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

American Challenger LLC | | Delaware | | 0912 | | 22-3702876 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

American Dynasty LLC | | Delaware | | 0912 | | 22-3702909 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

American Triumph LLC | | Delaware | | 0912 | | 22-3702882 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

Exact Name of Co-Registrant as Specified in its Charter

| | State or Other

Jurisdiction of

Incorporation or

Organization

| | Primary Standard

Industrial

Classification

Code Number

| | I.R.S.

Employer

Identification

No.

| | Code, and Telephone Number,

Including Area Code, of Principal

Executive Office

|

| | | | |

Ocean Rover LLC | | Delaware | | 0912 | | 22-3702880 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

Northern Eagle LLC | | Delaware | | 0912 | | 22-3702900 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

Northern Hawk LLC | | Delaware | | 0912 | | 22-3702905 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

Northern Jaeger LLC | | Delaware | | 0912 | | 22-3702901 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

Katie Ann LLC | | Delaware | | 0912 | | 22-3702906 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

Southern Pride Catfish LLC | | Delaware | | 0912 | | 42-1563059 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

| | | | |

Southern Pride Catfish Trucking, Inc. | | Delaware | | 0912 | | 42-1563057 | | Market Place Tower 2025 First Avenue, Suite 900 Seattle, WA 98121 Phone: (206) 374-1515 |

Subject to Completion, Dated October 16, 2003

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

33,141,210

Income Deposit Securities (IDSs)

We are selling 33,141,210 IDSs in respect of 33,141,210 shares of our common stock and $256.8 million aggregate principal amount of our % notes. Each IDS represents:

| | Ÿ | one share of our common stock; and |

| | Ÿ | $7.75 aggregate principal amount of our % notes. |

Assuming we make our scheduled interest payments and pay dividends in the amount contemplated by our current dividend policy, you will receive in the aggregate approximately $1.80 per year in dividends and interest on the common stock and notes represented by each IDS.

This is the initial public offering of our common stock and notes. We anticipate that the public offering price will be between $16.70 and $18.00 per IDS. We have applied to list our IDSs on the American Stock Exchange under the trading symbol “SEA”. We do not anticipate that the notes will be separately listed on any exchange.

Holders of IDSs will have the right to separate IDSs into the shares of common stock and notes represented thereby at any time after the earlier of 90 days from the closing of this offering or the occurrence of a change of control. Separation of IDSs will occur automatically upon a repurchase, redemption or maturity of the notes. Similarly, holders of our common stock and notes may, at any time, unless the IDSs have automatically separated, combine the applicable number of shares of common stock and principal amount of notes to form IDSs.

Under specified circumstances, we will be permitted to defer interest payments on our notes initially represented by the IDSs. Interest payments will not be deferred for more than 24 months in the aggregate or at any time after , 2008. We will also have the ability to defer interest payments on our notes on one occasion for not more than 10 months between , 2008 and , 2013. Deferred interest on our notes will bear interest at an annual rate of %. Our notes mature on , 2013, subject to our right to extend their maturity for two additional successive five-year terms under specified circumstances.

Upon a subsequent issuance by us of IDSs, a portion of your notes may be automatically exchanged for an identical principal amount of the notes issued in such subsequent issuance and, in such event, your IDSs will be replaced with new IDSs. For more information regarding these automatic exchanges and the effect they may have on your investment, see “Risk Factors—Subsequent issuances of notes pursuant to an offering by us or following an exercise of exchange rights by partners of ASLP may cause you to recognize original issue discount and other adverse consequences” and “Description of Notes—Additional Notes” on page 123 and “Material U.S. Federal Tax Considerations—Exchange Rights and Additional Issuances” on page 177.

We are subject to foreign ownership provisions of the American Fisheries Act as a result of which each owner of 5% or more of our common stock (including purchasers in this offering) must certify to us that such person is a U.S. citizen, and at least 95% of all of our beneficial owners will be required to have U.S. addresses. These requirements, and the remedies we may need to invoke to satisfy them, may have an adverse effect on the market for and trading price of IDSs or shares of our common stock.

Investing in the shares of our common stock and our notes represented by IDSs involves risks. See “Risk Factors” beginning on page 24.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per IDS

| | Total

|

Public offering price | | $ | | | $ | |

Underwriting discount | | $ | | | $ | |

Proceeds to American Seafoods Corporation (before expenses)(1) | | $ | | | $ | |

| (1) | Approximately $155.0 million of those proceeds will be paid to the current owners of our business before this offering and approximately $33.8 million will be paid to a related party to repay indebtedness and redeem preferred stock. |

We have granted the underwriters an option to purchase up to 4,971,182 additional IDSs at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments. We will use all of the proceeds from the sale of any additional IDSs under the underwriters’ over-allotment option indirectly to redeem additional equity from the persons who owned our affiliate, American Seafoods, L.P., before this offering, which will increase our percentage ownership in Holdings. This prospectus also relates to 1,265,464 IDSs being issued concurrently with this offering to certain indirect holders of equity interests in Holdings in exchange for a portion of those interests.

The underwriters expect to deliver the IDSs to purchasers on or about , 2003.

CIBC World Markets

Credit Suisse First Boston

UBS Investment Bank

RBC Capital Markets

Legg Mason Wood Walker

Incorporated

McDonald Investments Inc.

SunTrust Robinson Humphrey

U.S. Bancorp Piper Jaffray

Wells Fargo Securities, LLC

Morgan Joseph & Co. Inc.

Scotia Capital

, 2003

Table Of Contents

i

Summary

The following is a summary of the principal features of this offering of IDSs and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus.

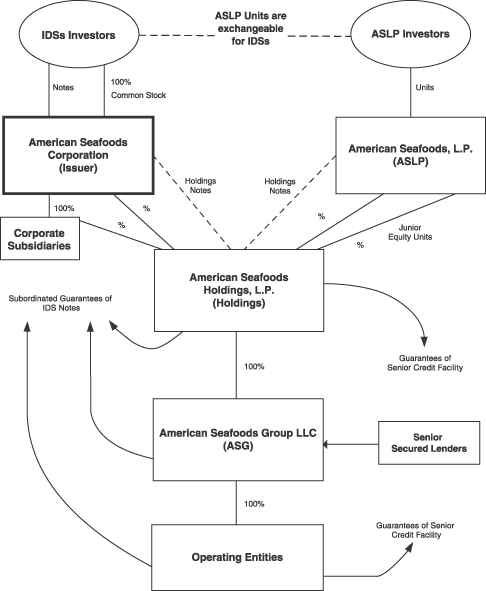

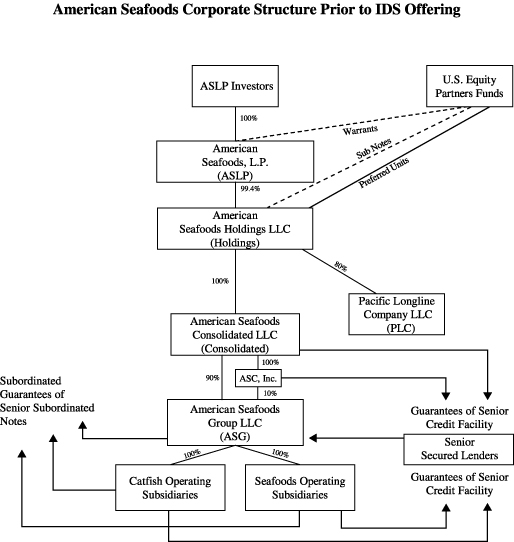

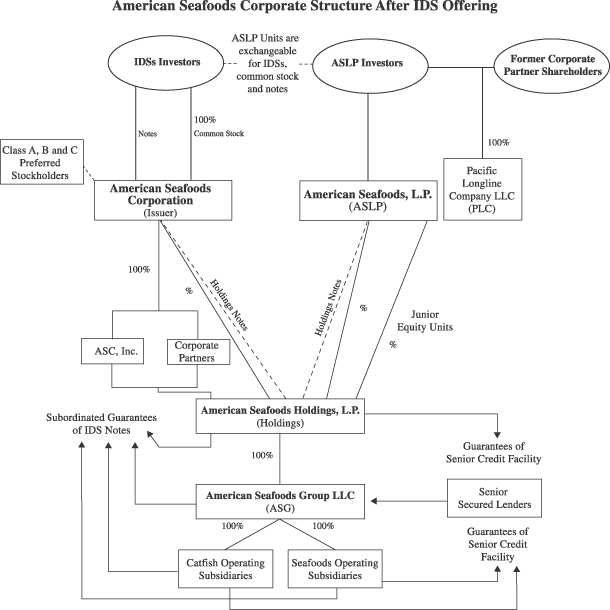

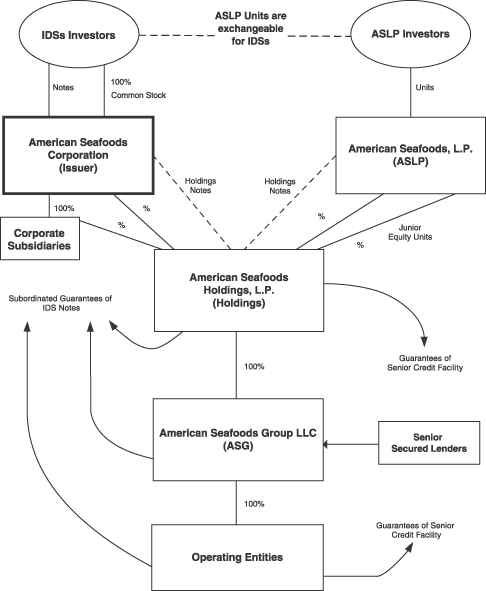

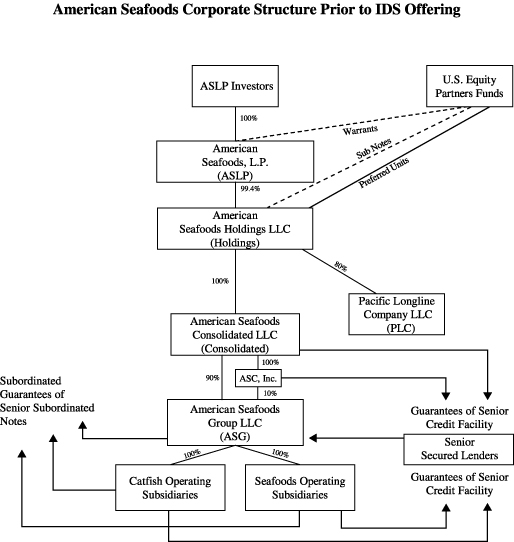

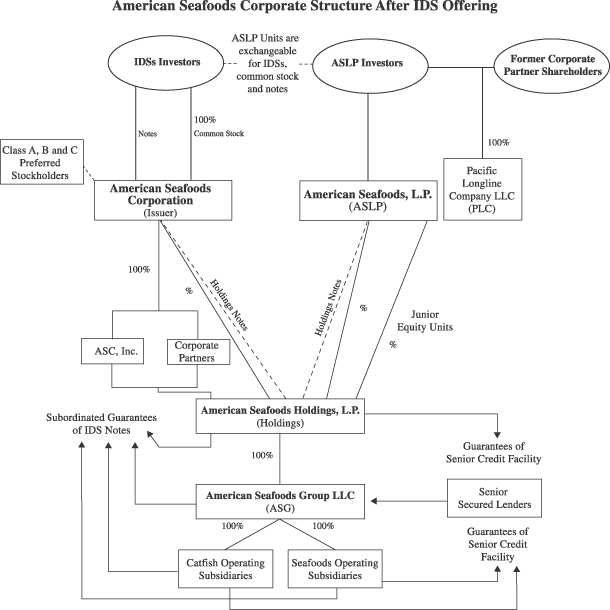

Throughout this prospectus, we refer to American Seafoods Corporation, a Delaware corporation, as the “Issuer.” The Issuer will be the sole general partner of American Seafoods Holdings, L.P., a Delaware limited partnership (together with its predecessor, American Seafoods Holdings LLC, “Holdings”), which owns the operating entities described below, including American Seafoods Group LLC, a Delaware limited liability company (“ASG”). References in this prospectus to “we,” “our” and “us” refer to the Issuer, Holdings and its direct and indirect subsidiaries and their predecessors, unless the context otherwise requires. The current owner of our business is American Seafoods, L.P., a Delaware limited partnership (“ASLP”), which is controlled by its general partner, ASC Management, Inc.

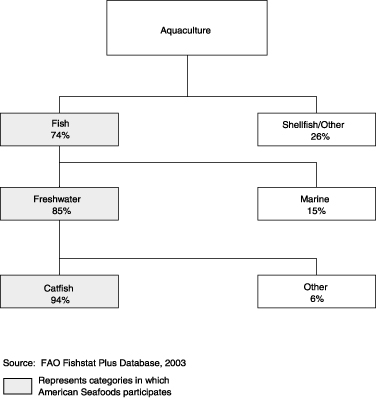

Our Company

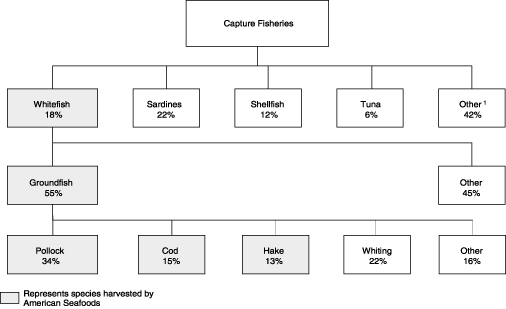

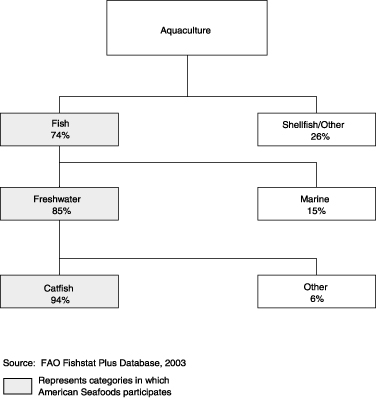

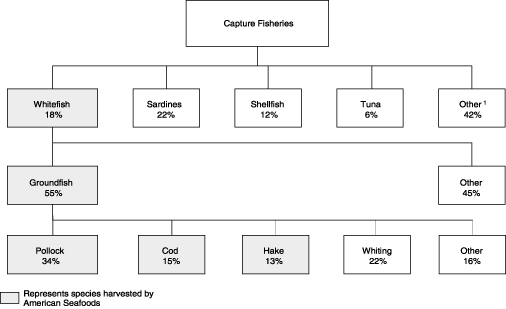

We are one of the largest integrated seafood companies in the U.S. in terms of revenues. We harvest and process a variety of fish, either on board our sophisticated catcher-processor vessels or at our land-based processing facilities, and market our products to a diverse group of customers in North America, Asia and Europe. We are the largest harvester and at-sea processor of pollock and the largest processor of catfish in the U.S. Pollock is the world’s highest-volume whitefish harvested for human consumption and accounts for a majority of our revenues. According to the Food and Agriculture Organization of the United Nations, catfish accounted for approximately 50% of the value of all aquaculture in the U.S. in 2001. In addition, we harvest and/or process other seafood, including scallops, hake and cod. We maintain an international marketing network through our U.S., Japanese and European offices and have developed long-term relationships with a U.S. and international customer base.

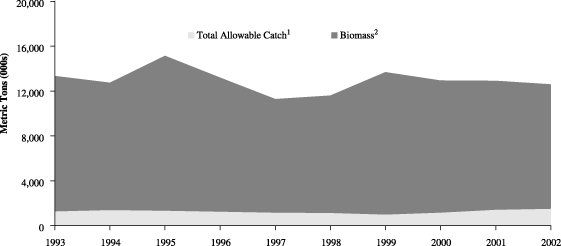

We own and operate a premier modern fleet of seven catcher-processor vessels, which average over 300 feet in length and carry crews of 90 to 125 persons. We produce a variety of products at sea, such as pollock roe (fish eggs), surimi (a fish protein paste used in products such as imitation lobster and crabmeat), fillet blocks, headed and gutted fish and fishmeal. We harvest pollock primarily in the U.S. Bering Sea pollock fishery. According to the Marine Conservation Alliance, this fishery is among the largest and most conservatively managed in the world.

We own and operate two catfish processing facilities in Alabama. We have strong relationships with catfish farmers and we distribute fresh and frozen catfish products to both retailers and foodservice customers throughout several regions in the U.S. In addition, we conduct other seafood processing operations at our facility in Massachusetts, where we manufacture products such as breaded seafood portions, fillets and scallops.

We operate in two principal business segments, ocean harvested whitefish and other seafood products. The ocean harvested whitefish segment includes the harvesting and processing of pollock, cod and hake. Processing of ocean harvested whitefish occurs on our vessels while at sea and at our facilities in Massachusetts. The other seafood products segment includes the processing of catfish and scallops at our facilities in Alabama and Massachusetts.

Industry Overview

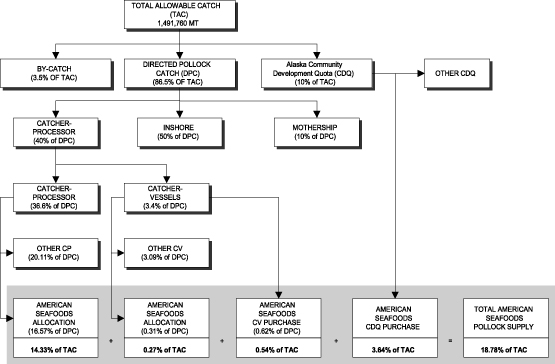

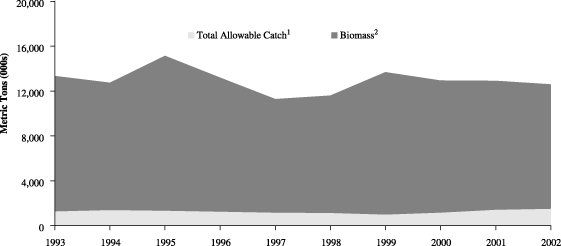

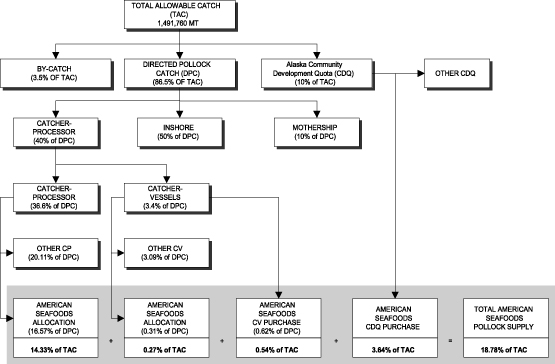

Our pollock harvesting and at-sea processing operations benefit from a favorable statutory and regulatory environment. The American Fisheries Act specifically identifies the catcher-processor vessels that are eligible to participate in the U.S. Bering Sea pollock fishery, prohibits the entry of additional vessels and prohibits any

1

single entity from harvesting more than 17.5% of the annual directed pollock catch. We own and operate seven of the 19 catcher-processor vessels permitted to participate in the catcher-processor sector of the U.S. Bering Sea pollock fishery. Under the American Fisheries Act, this sector is allocated 40% of the annual directed pollock catch. Within the catcher-processor sector, our allocation for pollock under the Pollock Conservation Cooperative agreement, a contractual arrangement among the seven companies that own the catcher-processors named in the statute, is nearly 2.5 times larger than that of the second largest Pollock Conservation Cooperative member. In addition to harvesting and processing pollock, we also participate in the catcher-processor sector of U.S. fisheries for hake and cod.

Catcher-processors, such as the vessels we own, harvest and process fish into frozen products, such as roe, fillets and surimi, within hours of catching them.

As part of our other seafood products processing operations, we process approximately 100 million pounds of catfish per year, making us the largest catfish processor by volume in the U.S. We do not own any of the farms from which we source catfish, reducing our exposure to catfish price volatility. In the U.S., the catfish market has evolved over the last decade from being a regional commodity, locally produced and consumed predominantly in the southern U.S., to a large, commercial aquaculture industry serving major U.S. markets.

Competitive Strengths

| | Ÿ | Abundant, Stable Pollock Fishery. Our pollock harvesting operations target the U.S. Bering Sea pollock fishery, which, according to the Marine Conservation Alliance, is one of the healthiest and most responsibly managed fisheries in the world. |

| | Ÿ | Attractive Regulatory Environment; Barriers to Entry. The American Fisheries Act provides us with key competitive benefits, among other things limiting participation in the catcher-processor sector of the U.S. Bering Sea pollock fishery to 19 specifically named catcher-processor vessels, of which we own and operate seven. |

| | Ÿ | Efficient Large-Scale Operator. We own and operate the largest fleet of catcher-processors in the U.S. Bering Sea pollock fishery. In 2002, our fleet included the industry’s top five catcher-processors in terms of metric tons harvested. Each of our catcher-processors is a floating factory equipped with flexible manufacturing platforms and an integrated computer system, enabling constant communication among vessels, the corporate office and our sales representatives, and the ability to shift production based on current market demand. |

| | Ÿ | Catfish Processor Leader. We are the largest catfish processor in the U.S., processing approximately 100 million pounds of catfish per year in our two Alabama facilities, which represents a leading market share in the catfish processing sector of over 15%. |

| | Ÿ | Strong Customer Relationships and Distribution Network. We have established long-standing relationships with a diverse base of customers worldwide, including industrial importers, foodservice distributors, food retailers, restaurant chains and reprocessing companies. |

| | Ÿ | Experienced Management Team. Our senior management team members average more than 20 years of industry experience. |

Business Strategy

Over the past decade, we have become one of the largest integrated seafood companies in the U.S. Today we are committed to building on our existing harvesting, processing and marketing platforms.

2

The primary components of our business strategy include the following:

| | Ÿ | Maximize Pollock Revenues. Our pollock harvesting and at-sea processing operations provide a majority of our revenues. Our strategy to maximize pollock revenues includes continuing to increase our share of the total allowable catch in the U.S. Bering Sea pollock fishery by purchasing community development quota from Alaska Community Development Groups and optimizing our product mix based on global demand and pricing. |

| | Ÿ | Continue to Diversify Sources of Revenues. We participate in a number of other fisheries besides pollock, such as those for hake and cod. With the recent acquisition of Southern Pride, we became the largest catfish processor in the U.S. and therefore have significant market positions in pollock, catfish and cod, the top three whitefish species in terms of U.S. human consumption. |

| | Ÿ | Leverage International Marketing Network. We are currently expanding our presence in worldwide seafood markets, with a particular focus on the Asian and European markets, to increase and diversify our customer base and global seafood market share. |

| | Ÿ | Continually Improve Operating Efficiencies. We believe that there may be significant synergies created by integrating Southern Pride, our recently acquired Alabama catfish processing operations, with our secondary processing operations in Massachusetts, leading to improved profitability for both businesses. |

| | Ÿ | Pursue Strategic Acquisitions. We intend to evaluate and selectively pursue accretive opportunities that we believe are strategically important based on their potential to diversify our product and customer base, broaden our distribution network and increase cash flow. |

New Credit Facility

Simultaneously with consummating this offering, our subsidiary ASG will enter into $300.0 million of senior secured debt facilities with a syndicate of financial institutions, which we refer to as the “new credit facility.” We expect that the new credit facility will include an $80.0 million senior secured revolving credit facility, which we refer to as the “new revolver,” a term loan in a total principal amount of $80.0 million, which we refer to as the “new term loan,” and $140.0 million of senior secured notes, which we refer to as the “new senior notes.” The Issuer will not be a party to the new credit facility. The new credit facility will contain restrictions on ASG’s ability to make distributions to Holdings and the Issuer. Such distributions are the projected sources of cash to allow the Issuer to make interest and dividend payments to IDS holders. We expect that the new credit facility will have a 5-year maturity. CIBC World Markets Corp., the lead underwriter of this offering, is also the sole placement agent, lead arranger and bookrunner of the new credit facility. The closing of the IDSs offering is conditioned upon the closing of the proposed new credit facility. See “Use of Proceeds” and “Description of Certain Indebtedness—New Credit Facility.”

Existing Senior Subordinated Notes

In conjunction with this offering, ASG commenced a consent solicitation with respect to its outstanding $175.0 million 10.125% senior subordinated notes due 2010, which we refer to as our “existing senior subordinated notes” and a tender offer for such notes. As of October 10, 2003, all of our existing senior subordinated notes had been validly and irrevocably tendered. The tender offer will expire on October 24, 2003, unless we extend it. ASG intends to use a portion of the net proceeds from this offering and borrowings under the new credit facility (1) to acquire our existing senior subordinated notes in the tender offer and (2) to pay fees, expenses and premiums associated with the consent solicitation and tender offer. The closing of the consent solicitation and tender offer is conditioned on the consummation of this offering. Credit Suisse First Boston is the dealer manager of the tender offer and the solicitation agent in the consent solicitation.

The Transactions and Use of Proceeds

Prior to and in connection with this offering, we will consummate various internal restructuring and realignment transactions, the principal effects of which will be to rationalize the existing structure and recapitalize ASLP’s

3

equity interest in Holdings into an interest consisting of part equity and part notes issued by Holdings. In this offering, we expect that the Issuer will sell 33,141,210 IDSs and receive approximately $546.3 million in net proceeds after underwriting discounts, assuming an initial public offering price of $17.35 per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus. In addition, the Issuer will issue 1,265,464 IDSs, and pay approximately $14.3 million of the net proceeds it receives from the offering, to certain indirect holders of equity interests in Holdings in exchange for those interests.

The remaining net proceeds will be invested, directly or indirectly, in equity interests in Holdings and in the notes to be issued by Holdings. The Issuer will become the managing general partner of Holdings (which will convert to a limited partnership).

Holdings will use the proceeds it receives from the Issuer, as well as proceeds from the repayment of a management loan: to repay related party indebtedness and to redeem preferred equity interests (a total of approximately $33.8 million); to make a distribution to ASLP in redemption of Holdings equity held by ASLP (approximately $140.7 million); and to make an investment of approximately $357.5 million in equity of ASG.

ASLP will use the funds it receives from Holdings as well as amounts it receives in repayment of management loans and from the exercise of various options to make a distribution to the existing owners of our business. ASG will use the funds it receives from Holdings, as well as the proceeds from the new credit facility, to repay its outstanding indebtedness as well as expenses associated with such repayment and these transactions. In addition, ASG will escrow approximately $25.0 million to pre-fund the first four monthly interest payments on the notes, the first four monthly distributions on the junior preferred units and the first three monthly distributions on the Holdings regular and junior common equity units. The escrow account will be pledged to secure the new credit facility.

Holdings will guarantee on a subordinated basis the Issuer’s notes represented by the IDSs. ASG and its principal operating subsidiaries will also guarantee, on a subordinated basis, the Issuer’s notes represented by the IDSs, as well as the notes issued by Holdings and held by the Issuer and ASLP. For a more detailed outline of these steps and transactions, see “Detailed Transaction Steps.”

After giving effect to these transactions, the Issuer will own directly or indirectly approximately 73.5% of the economic interests in Holdings and, indirectly, in ASG, and ASLP will own the remaining 26.5%. In addition, members of management will have unvested options to acquire equity interests in ASLP, a portion of which will vest based either on the option holders’ continued employment or on a combination of such continued employment and the achievement by Holdings of performance targets. The options that vest in this compensatory manner will be structured so that the resulting dilution is shared ratably by the Issuer and ASLP. Other management options to acquire equity interests in ASLP will dilute only the owners of ASLP.

Following the completion of these transactions, approximately 34.3% of ASLP’s retained economic interest in Holdings will initially be in the form of junior equity units, consisting of $33.0 million stated amount of % junior preferred units and a number of junior common equity units. Unless and until certain performance and dividend targets are met or certain time periods have elapsed, the distributions otherwise allocable to the junior equity units will be subordinated to the distributions on the regular Holdings equity units held by the Issuer and ASLP. For more information about the subordination of distributions on ASLP’s junior equity units, see “Summary of the Capital Stock—Subordination of Distributions on ASLP’s Junior Equity Units” and “Related Party Transactions—Agreements Relating to ASLP and Holdings—Holdings Partnership Agreement.”

In connection with the offering, the Issuer will issue to all ASLP partners and option holders exchange warrants permitting such holders to exchange their regular ASLP limited partnership units for IDSs representing the Issuer’s common stock and notes. Upon any such exchange, the Issuer would then have the right to exchange the ASLP units received by it for equity interests in Holdings and Holdings notes. See “Related Party Transactions—ASLP Exchange and Registration Rights Agreement.” If all such exchange warrants, other than those associated with compensatory options, were exercised in full (assuming that all ASLP junior units were converted into

4

regular ASLP units), the ASLP partners and option holders would receive an aggregate of 12,428,426 IDSs (or 26.5% of the total IDSs that would be outstanding following such exercise) and the Issuer would own 100% of the economic interests in Holdings.

The Issuer will also issue, for nominal consideration, preferred stock to three partners of ASLP—Centre Partners Management LLC, or Centre Partners, Bernt O. Bodal, our chairman and chief executive officer, and Coastal Villages Pollock LLC. The preferred stock will entitle each such holder to elect one member of the Issuer’s board of directors for so long as such holder meets minimum indirect ownership levels in Holdings. Following this offering, our board will consist of five members, which will be increased to at least seven members shortly thereafter, a majority of whom will be independent. See “American Seafoods Corporate Structure after IDS Offering” in the “Detailed Transaction Steps” section.

The following chart reflects our capital structure immediately following this offering:

5

The Issuer was formed as a holding company under Delaware law in May 2003 and has not conducted any independent operations. Following this offering, Holdings will own 100% of the economic interests in ASG. The Issuer will not have direct operations but, as the sole general partner of Holdings, it will have management responsibility for Holdings and its subsidiaries, including ASG.

Our principal executive office is located at Market Place Tower, 2025 First Avenue, Suite 1200, Seattle, Washington 98121, and our telephone number is (206) 374-1515. Our internet address is www.americanseafoods.com. www.americanseafoods.com is a textual reference only, meaning that the information contained on the website is not part of this prospectus and is not incorporated in this prospectus by reference.

6

The Offering

Summary of the IDSs

What are IDSs?

We are offering 33,141,210 IDSs at an initial public offering price of $17.35 per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus. As described below, assuming we make our scheduled interest payments and pay dividends in the amount contemplated by our current dividend policy, you will receive in the aggregate approximately $1.80 per year in dividends and interest on the common stock and notes represented by each IDS.

Each IDS represents:

| | Ÿ | one share of our common stock; and |

| | Ÿ | $7.75 aggregate principal amount of our % notes. |

The ratio of common stock to principal amount of notes represented by an IDS is subject to change in the event of a stock split, recombination or reclassification of our common stock. For example, if we elect to effect a two-for-one stock split, from and after the effective date of the stock split, each IDS will represent two shares of common stock and the same principal amount of notes as it previously represented. Likewise, if we effect a recombination or reclassification of our common stock, each IDS will thereafter represent the appropriate number of shares of common stock on a recombined or reclassified basis, as applicable, and the same principal amount of notes as it previously represented.

What payments can I expect to receive as a holder of IDSs?

You will be entitled to receive monthly interest payments at an annual rate of % of the aggregate principal amount of notes represented by your IDSs or approximately $1.01 per IDS per year, subject to our right, under specified circumstances, to defer interest payments on the Issuer’s notes for no more than 24 months in the aggregate and no later than , 2008; and subject further to our right, on one occasion for not more than 10 months between , 2008 and , 2013, to defer interest payments on the Issuer’s notes; in each case, so long as the Issuer is not in default under such notes and (if the default is not a payment default) the notes have not been accelerated as a result of such default at the time or during the pendency of such deferral.

You will also receive monthly dividends on the shares of our common stock represented by your IDSs, if and to the extent dividends are declared by our board of directors and permitted by applicable law and the terms of our then existing indebtedness. The indenture governing the notes contains restrictions on our ability to declare and pay dividends on our common stock. We have adopted a dividend policy which contemplates that initial annual dividends will be approximately $0.79 per share of our common stock. However, our board of directors may, in its discretion, modify or repeal our dividend policy. We cannot assure you that we will pay dividends at this level in the future or at all.

ASG will use a portion of the proceeds from this offering to escrow approximately $25.0 million to pre-fund the first four monthly interest payments on the notes, the first four monthly distributions on the junior preferred units and the first three monthly dividend payments on our common stock. The escrow account will be pledged to secure the new credit facility.

We expect to make interest and dividend payments on or about the last day of each month to holders of record on the 25th day of such month. The cash used to make such interest and dividend payments is expected to come from interest payments and distributions by Holdings, and those are expected to be funded out of distributions made to Holdings by ASG. The new credit facility will contain provisions limiting ASG’s ability to make distributions to Holdings in the event various financial tests are not met. See “Description of Certain Indebtedness—New Credit Facility—Limitations on Distributions to Holdings and the Issuer.”

7

Will my rights as a holder of IDSs be any different than the rights of a direct holder of the common stock and notes?

No. As a holder of IDSs you are the beneficial owner of the common stock and notes represented by your IDSs. As such, you will have exactly the same rights, privileges and preferences, including voting rights, rights to receive distributions, rights and preferences in the event of a default under the notes indenture, ranking upon bankruptcy and rights to receive communications and notices as a direct holder of the common stock and notes, as applicable.

Will the IDSs be listed on an exchange?

We have applied to list the IDSs on the American Stock Exchange under the trading symbol “SEA”.

Will the notes and shares of our common stock represented by the IDSs be listed on an exchange?

The notes represented by the IDSs will not be listed on any exchange. Our shares of common stock will not be listed for separate trading on the American Stock Exchange until a required number of shares is held separately and not in the form of IDSs. If more than such required number of our outstanding shares of common stock is no longer held in the form of IDSs for a period of 30 consecutive trading days, we will apply to list the shares of our common stock for separate trading on the American Stock Exchange. The notes and shares of our common stock represented by the IDSs will be freely tradable without restriction or further registration under the Securities Act, unless they are purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act of 1933.

In what form will IDSs and the securities represented by the IDSs be issued?

The IDSs and the securities represented by the IDSs will be issued in book-entry form only. This means that you will not be a registered holder of IDSs or the securities represented by the IDSs, and you will not be entitled to receive a certificate for your IDSs or the securities represented by your IDSs. You must rely on your broker or other financial institution that will maintain your book-entry position to receive the benefits and exercise the rights of a holder of IDSs.

How can I separate my IDSs into shares of common stock and notes or combine shares of common stock and notes to form IDSs?

Holders of IDSs, whether purchased in this offering or in subsequent offerings of IDSs of the same series, may, at any time after the earlier of 90 days from the closing of this offering or the occurrence of a change of control, through a broker or other financial institution, separate each of their IDSs into the shares of common stock and notes represented thereby. Similarly, any holder of shares of our common stock and notes may, at any time, through a broker or other financial institution, combine the applicable number of shares of common stock and principal amount of notes to form IDSs. Separation and recombination of IDSs may involve transaction fees charged by your broker and/or other financial intermediaries. See “Description of IDSs—Book Entry, Settlement and Clearance—Separation and Recombination.”

What will happen if we issue additional IDSs of the same series in the future?

We may conduct future financings by selling additional IDSs of the same series. Additional IDSs will have terms that are identical to those of the IDSs being sold in this offering, except that if they are issued 90 days or more from the closing of this offering, they will be immediately separable, and if they are issued less than 90 days from the closing of this offering, they will be separable on the same date as the IDSs issued hereunder may separate. Additional IDSs will also represent the same proportions of common stock and notes as are represented by the then outstanding IDSs. In addition, we will be required to issue additional IDSs in the future upon the

8

exercise of exchange rights by our existing owners. Although the notes represented by such IDSs will have terms that are substantially identical (except for the issuance date) to the notes being sold in this offering and will be part of the same series of notes for all purposes under the indenture, it is possible that the new notes will be sold with original issue discount (referred to as OID) for U.S. federal income tax purposes. If such notes are issued with OID, all holders of IDSs of the same series (including the IDSs being offered hereby) and of outstanding notes not held in IDSs will automatically exchange a ratable portion of their outstanding notes for a portion of the new notes, whether held directly or in the form of IDSs, and will thereafter hold a unit consisting of new notes and old notes with a new CUSIP number or a new IDS (consisting of such note unit and common stock) with a new CUSIP number. As a result of such exchanges, we intend to allocate and report the OID associated with the sale of the new notes among all holders of notes on a pro rata basis, which may adversely affect your tax treatment. See “What will be the U.S. federal income tax considerations in connection with a subsequent issuance of notes?” In addition, if such notes are issued with OID, holders of such notes may not be able to recover the portion of their principal amount treated as unaccrued OID in the event of an acceleration of the notes or a bankruptcy of the Issuer prior to the maturity of the notes. See “Risk Factors—Subsequent issuances of notes pursuant to an offering by us or following an exercise of exchange rights by partners of ASLP may cause you to recognize original issue discount and other adverse consequences.”

We will file as soon as practicable a Current Report on Form 8-K (or any other applicable form) to announce and quantify any changes in the ratio of IDS components or changes in OID attributed to the notes.

What will be the U.S. federal income tax considerations in connection with an investment in the IDSs?

Certain aspects of the U.S. federal income tax consequences of the purchase, ownership and disposition of IDSs in this offering are not entirely clear. We intend to treat the purchase of IDSs in this offering as the purchase of shares of our common stock and notes and, by purchasing IDSs, you will agree to such treatment. You must allocate the purchase price of the IDSs between those shares of common stock and notes in proportion to their respective initial fair market values, which will establish your initial tax basis. We expect to report the initial fair market value of each share of common stock as $9.60 and the initial fair market value of each $7.75 aggregate principal amount of our notes as $7.75 and, by purchasing IDSs, you will agree to and be bound by such allocation, assuming an initial public offering price of $17.35 per IDS, which represents the mid-point of the range set forth on the cover page of this prospectus.

We believe that the notes should be treated as debt for U.S. federal income tax purposes. However, this conclusion is not free from doubt. If the notes were treated as equity rather than debt for U.S. federal income tax purposes, then the stated interest on the notes would generally be treated as a dividend, and interest on the notes would not be deductible by us for U.S. federal income tax purposes, which could materially increase our taxable income and significantly reduce our future cash flow. In addition, payments on the notes to foreign holders would be subject to U.S. federal withholding taxes at rates of up to 30%. Payments to foreign holders would not be grossed-up on account of any such taxes.

Dividends paid by us, to the extent paid out of our tax “earnings and profits,” will generally be taxable to you at long-term capital gains rates under recently-enacted legislation, which is scheduled to sunset in 2008. Interest income on the notes will generally be taxable to you at ordinary income rates. See “Material U.S. Federal Income Tax Considerations.”

What will be the U.S. federal income tax considerations in connection with a subsequent issuance of notes?

The U.S. federal income tax consequences to you of the subsequent issuance of notes with OID upon a subsequent sale of IDSs pursuant to an offering by us or upon an exercise of exchange rights by partners of ASLP are not entirely clear. The indenture governing the notes and the agreements with the Depository Trust Company, or DTC, will provide that, in the event there is a subsequent issuance of notes by the Issuer having substantially identical terms as the notes, each holder of notes or IDSs (as the case may be) agrees that a portion of such holder’s notes will be automatically exchanged for a portion of the notes acquired by the holders of such

9

subsequently issued notes, and the records of any record holders of notes will be revised to reflect such exchanges. Consequently, following each such subsequent issuance and exchange, without any further action by such holder, each holder of notes or IDSs (as the case may be) will own an indivisible unit composed of notes of each separate issuance in the same proportion as each other holder (and, for any such holder of IDSs, such indivisible unit composed of notes will be included in such holder’s IDSs). However, the aggregate stated principal amount of notes owned by each holder will not change as a result of such subsequent issuance and exchange. It is unclear whether the exchange of notes for subsequently issued notes results in a taxable exchange for U.S. federal income tax purposes, and it is possible that the IRS might successfully assert that such an exchange should be treated as a taxable exchange. Even if the exchange is not treated as a taxable event, such exchange may result in holders having to include OID in taxable income prior to the receipt of cash and other potentially adverse U.S. federal income tax consequences to holders. Because a subsequent issuance will affect the notes in the same manner regardless of whether the notes are held as part of IDSs or directly, the recombination of notes and shares of common stock to form IDSs or the separation of IDSs should not affect your tax treatment. See “Material U.S. Federal Income Tax Considerations.”

Following the subsequent issuance and exchange, we (and our agents) will report any OID on the subsequently issued notes ratably among all holders of notes and IDSs, and each holder of notes and IDSs will, by purchasing IDSs, agree to report OID in a manner consistent with this approach. However, the IRS may assert that any OID should be reported only to the persons that initially acquired such subsequently issued notes (and their transferees) and thus may challenge the holders’ reporting of OID on their tax returns. Such a challenge could create significant uncertainties in the pricing of IDSs and notes and could adversely affect the market for IDSs and notes.

Because there is no statutory, judicial or administrative authority directly addressing the tax treatment of the IDSs or instruments similar to the IDSs, we urge you to consult your own tax advisor concerning the tax consequences of an investment in the IDSs. For additional information, see “Material U.S. Federal Income Tax Considerations.”

10

Summary of the Notes

Issuer | American Seafoods Corporation. |

Notes to be outstanding following the offering |

$266.7 million aggregate principal amount of % notes (or $301.6 million aggregate principal amount assuming the underwriters’ over-allotment option is exercised in full), which includes $9.8 million aggregate principal amount of notes issued to certain of our existing direct and indirect equity investors upon consummation of this offering in connection with our internal restructuring and realignment transactions.

|

Interest rate | % per year. |

Interest payment dates | Interest will be paid monthly in arrears on the last day of each month, commencing , 2003 to holders of record on the twenty fifth day of such month. |

Interest deferral | We will be permitted to defer interest payments on the notes if and for so long as the most recently calculated (i) fixed charge coverage ratio of Holdings for the twelve-month period ended on any June 30, September 30 or December 31, or (ii) adjusted fixed charge coverage ratio of Holdings for the twelve-month period ended on any March 31, in each case, is less than the applicable interest deferral threshold described under “Description of Notes – Certain Definitions,” unless, in each case, a default in payment of interest, principal or premium, if any, on the notes has occurred and is continuing, or any other event of default with respect to the notes has occurred and is continuing and the notes have been accelerated as a result of the occurrence of such event of default. Interest payments will not be deferred under this provision for more than 24 months in the aggregate or at any time after , 2008. In addition, on one occasion for not more than 10 months between , 2008 and , 2013, interest payments may again be deferred, at our option, on the notes, unless a default in payment of interest, principal or premium, if any, has occurred and is continuing, or any other event of default with respect to the notes has occurred and is continuing and the notes have been accelerated as a result of the occurrence of such event of default. Deferred interest on the notes will bear interest at an annual rate of %. After the end of any deferral period occurring before , 2008, we will repay deferred interest (together with accrued interest thereon) in one or more equal quarterly installments payable through , 2008. We may prepay deferred interest at any time, except when an interest deferral period is in effect. At the end of any interest deferral period occurring between 2008 and 2013, we must pay all deferred interest and accrued interest on deferred interest in full. |

| | In the event that interest payments on the notes are deferred, you would be required to include interest in your income for U.S. federal |

11

| | income tax purposes on an economic accrual basis even if you do not receive any cash interest payments. |

Maturity date | The notes will mature on , 2013. We may extend the maturity of the notes for two additional successive five-year terms if the fixed charge coverage ratio or the adjusted fixed charge coverage ratio, as applicable, of Holdings for the most recent twelve-month period ended on the last day of the fiscal quarter ended at least 45 days before the end of the then current term is equal to or greater than and so long as we are not in default under our notes or any of our other outstanding indebtedness and there are no overdue payments of interest on our notes or any of our other outstanding indebtedness for borrowed money in excess of $1 million. |

Ranking | The notes will be senior secured indebtedness of the Issuer and will rankpari passu in right of payment with all existing and future unsubordinated obligations of the Issuer. As of June 30, 2003, after giving pro forma effect to the IDSs offering and the use of proceeds as contemplated in this prospectus, the Issuer had no indebtedness other than the notes. Because the Issuer is a holding company, the notes will be structurally subordinated to all indebtedness of the Issuer’s subsidiaries, including indebtedness under the new credit facility. However, to the extent the holders of the notes are able to exercise their rights and remedies under the note guarantees and the pledge, and indirectly under the guarantees of the Holdings notes, they should be effectively in the same position as if the notes rankedpari passu with all indebtedness of Holdings, ASG and its subsidiariesthat is not senior or subordinate to the note guarantees, other than indebtedness of foreign subsidiaries. |

| | As a holding company, we will rely entirely on payments of interest and principal on the notes issued by Holdings to us and dividends, distributions and other payments from our subsidiaries to make payments on the notes. In addition, Holdings is also a holding company and must rely entirely on equity distributions from ASG to make such payments to us. The new credit facility contains limitations on the ability of our subsidiaries to make distributions to us. See “Description of Certain Indebtedness.” |

Acceleration Forbearance Periods | So long as the notes are guaranteed by at least one of the guarantors and until the earlier of , 2008 and the time when no designated senior indebtedness of any guarantors is outstanding, without in any way limiting the right of holders to exercise any other remedies they may have (including the right to bring suit against the Issuer or any guarantor for payment of all amounts of principal, premium and interest due and payable), upon the occurrence of an event of default (other than bankruptcy defaults), the principal of the notes may not be accelerated for a period of up to 90 days (subject to earlier termination in certain circumstances). See “Description of Notes—Acceleration Forbearance Periods.” |

12

Note guarantees | The notes will be guaranteed by Holdings, ASG and its subsidiaries on an unsecured subordinated basis on the terms set forth in the indenture. The note guarantees will be subordinated in right of payment to all existing and future senior indebtedness of the guarantors that does not expressly provide that it rankspari passu with or subordinate to the guarantees, including indebtedness and guarantees of Holdings, ASG and its subsidiaries under our new credit facility. The note guarantees issued by ASG and its subsidiaries will ranksenior to ASG’s 10 1/8% senior subordinated notes due 2010, if any, outstanding after the consummation of this offering, and related guarantees of such notes by ASG’s subsidiaries, and to all existing and future debt of our subsidiaries that expressly provides that it is subordinated to the guarantees. See “Description of Notes—Guarantees and Pledge.” |

| | As of June 30, 2003, after giving pro forma effect to the IDSs offering and the other transactions contemplated in this prospectus, including the tender offer and consent solicitation and the new credit facility, and the use of proceeds as contemplated in this prospectus, the guarantors had approximately $585.0 million of indebtedness, excluding trade payables, of which $255.0 million is indebtedness under our new credit facility and other senior indebtedness of the guarantors. |

Collateral | The Issuer will pledge all of its interest in the Holdings notes and related guarantees as security for the notes. We will be required to provide additional collateral of the same type if we issue additional notes in the future. |

Optional redemption | On and after , 2008, we may redeem for cash all or part of the notes upon not less than 30 or more than 60 days’ notice by mail to the owners of notes, at redemption prices described under “Description of Notes—Optional Redemption.” If the notes are redeemed in part on a pro rata basis, the notes and stock represented by each IDS will be automatically separated. |

| | In addition, at any time before , 2008, we may redeem all or part of the notes at a redemption price equal to the sum of the present values of the redemption price of the notes at the first optional redemption date pursuant to the preceding paragraph and all required interest payments on the notes through the first optional redemption date, discounted at the treasury rate plus 50 basis points, plus accrued and unpaid interest. See “Description of Notes—Optional Redemption.” |

Change of control | Upon the occurrence of a change of control, as defined under “Description of Notes—Change of Control,” unless we have exercised our right to redeem all notes as described above, each holder of the notes will have the right to require us to repurchase that holder’s notes at a price equal to 101% of the principal amount of the notes being repurchased, plus any accrued but unpaid interest to the |

13

| | date of repurchase. In order to exercise this right, a holder must separate the notes and common stock represented by such holder’s IDSs. |

Procedures relating to subsequent Issuances | The indenture governing the notes will provide that, in the event there is a subsequent issuance of notes by the Issuer having substantially identical terms as the notes but a different CUSIP number, each holder of notes or IDSs (as the case may be) agrees that a portion of such holder’s notes (whether held directly in book-entry form or held as part of IDSs) will be automatically exchanged for a portion of the notes purchased by the holders of such subsequently issued notes, and the records of any record holders of notes will be revised to reflect such exchanges. Consequently, following each such subsequent issuance and automatic exchange, without any action by such holder, each holder of notes or IDSs (as the case may be) will own an indivisible unit composed of notes of each separate issuance in the same proportion as each other holder. However, the aggregate stated principal amount of notes owned by each holder will not change as a result of such subsequent issuance and exchange. The indenture governing the notes will permit issuances of additional notes upon exercise of exchange warrants by holders of ASLP units for notes and common stock and, subject to compliance with restrictive covenants contained in the indenture, for other permitted purposes in connection with issuances of the Issuer’s IDSs or common stock. However, we may not issue additional notes if and for so long as an event of default with respect to the notes has occurred and is continuing. Any subsequent issuance of notes by the Issuer may adversely affect the tax and non-tax treatment of the holders of notes and IDSs. See “Risk Factors—Subsequent issuances of notes pursuant to an offering by us or following an exercise of exchange rights by partners of ASLP may cause you to recognize original issue discount and other adverse consequences” and “Material U.S. Federal Income Tax Considerations—Exchange Rights and Additional Issuances.” |

Restrictive covenants | The indenture governing the notes will contain covenants with respect to us and our restricted subsidiaries that will restrict: |

| | Ÿ | the incurrence of additional indebtedness and the issuance of preferred stock and certain redeemable capital stock; |

| | Ÿ | dividends or distributions on or redemptions of capital stock; |

| | Ÿ | a number of other restricted payments, including investments; |

| | Ÿ | specified sales of assets; |

| | Ÿ | specified transactions with affiliates; |

| | Ÿ | the creation of a number of liens; |

| | Ÿ | consolidations, mergers and transfers of all or substantially all of our assets; and |

14

| | Ÿ | certain restrictions on distributions from our restricted subsidiaries. |

| | The limitations and prohibitions described above are subject to a number of other important qualifications and exceptions described under “Description of Notes—Certain Covenants.” |

Use of Proceeds; Intercompany Notes | The aggregate gross cash proceeds from the issuance of the notes will be approximately $256.8 million (or $295.4 million if the underwriters’ overallotment option is exercised in full). The Issuer will lend these proceeds and a portion of the proceeds from the issuance of the common stock to Holdings pursuant to intercompany notes, such that the aggregate principal amount of Holdings notes issued to the Issuer will be the same as the principal amount of the notes. Holdings will also issue identical notes to ASLP in redemption of a portion of the Holdings’ equity interests held by ASLP and may issue notes to ASLP in the future in redemption of ASLP’s junior preferred equity units in Holdings. The notes issued by Holdings will be unsecured subordinated indebtedness of Holdings and will have the same payment and interest terms and substantially similar other provisions as the notes and will contain cross-default provisions such that an event of default under the notes will trigger an event of default under the Holdings notes. The Holdings notes will be guaranteed by ASG and its subsidiaries on the same basis as the notes. The Issuer will pledge all of its interest in the Holdings notes to secure the notes as described above. See “Description of Certain Indebtedness —Holdings Intercompany Notes.” |

15

Summary of the Capital Stock

Issuer | American Seafoods Corporation. |

Shares of common stock to be outstanding following the offering | 34,406,674 shares (or 38,918,465 shares assuming the underwriters’ over-allotment option is exercised in full), which include 1,265,464 shares to be issued to certain of our existing direct or indirect equity investors upon consummation of this offering in connection with our internal restructuring and realignment transactions. |

Voting rights | Subject to applicable law, each outstanding share of our common stock will carry one vote per share and the common stock will vote as a class on all matters presented to the shareholders for a vote. |

Listing | The shares of our common stock will be freely tradable without restriction or further registration under the Securities Act, unless they are purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act of 1933. Our shares of common stock will not be listed for separate trading on the American Stock Exchange until a required number of shares is held separately and not in the form of IDSs. If such required number of our outstanding shares of common stock is no longer held in the form of IDSs for a period of 30 consecutive trading days, we will apply to list the shares of our common stock for separate trading on the American Stock Exchange. |

Foreign ownership provisions | We are subject to complex foreign ownership limitations applicable to companies that participate in U.S. fisheries. We will put in place governance provisions (i) requiring each owner of 5% or more of the Issuer’s capital stock (including purchasers in this offering) to certify to us that such person is a U.S. citizen, (ii) limiting to 20% the aggregate percentage ownership of the Issuer’s capital stock by non-U.S. citizens, (iii) requiring that at least 95% of all of the Issuer’s capital stock be held by beneficial owners with U.S. addresses, and (iv) declaring any holding in violation of the foregoing null and void, or voidable, and providing the Issuer with various remedies including mandatory redemptions and sales. See “Business—Government Regulation.” |

Equity interest in Holdings | The Issuer will be the sole general partner of Holdings and, through Holdings, will have management control of all of its subsidiaries. Three wholly-owned subsidiaries of the Issuer will hold limited partnership interests in Holdings. The Issuer’s direct and indirect interests in Holdings at the closing will constitute 73.5% of the equity of Holdings (assuming conversion of ASLP’s junior equity into regular equity and Holdings notes). The balance of the equity of Holdings will be held by ASLP. |

16

Subordination of Distributions on ASLP’s Junior Equity Units | Under the limited partnership agreement of Holdings, a portion of ASLP’s retained economic interest in Holdings (approximately 34.3% of its total retained economic interest in the debt and equity of Holdings) will initially be in the form of junior equity units, consisting of $33.0 million of % junior preferred units and a number of junior common equity units. The junior equity units will not be entitled to monthly distributions, and all amounts otherwise distributable on the junior equity units will be distributed in respect of the regular Holdings equity units held by the Issuer and ASLP, if and to the extent necessary to permit the Issuer to pay dividends on its common stock at a rate of $0.79 per year per share. The junior equity units will be entitled to quarterly distributions if the Issuer is paying dividends on its common stock at a rate of $0.79 per year per share. The junior common equity units will be recapitalized into regular Holdings equity units, and the junior preferred units will be redeemed for an equivalent amount of Holdings notes, if certain performance and dividend targets are met or certain time periods have elapsed. See “Related Party Transactions—Agreements Relating to ASLP and Holdings—Holdings Partnership Agreement.” |

Preferred Stock | The Issuer will issue 100 shares of each of its Class A, Class B and Class C preferred stock directly or indirectly by Coastal Villages Pollock LLC, Bernt O. Bodal and Centre Partners Management LLC respectively for nominal consideration. Each class of preferred shares will entitle the holder thereof to elect one member of our board of directors, which will be increased to at least seven members shortly after this offering, a majority of whom will be independent. Our organizational documents will limit the size of our board to not more than 13 members. The shares of preferred stock will not entitle the holders thereof to any voting rights other than the right to block any increase in the size of the board to more than 13 members and other changes to our organizational documents that would be detrimental to the specific rights, privileges and preferences of the preferred holders and as required by applicable law. The shares of preferred stock will not be transferable except to a limited class of affiliates of the original owners. The preferred shares of each class will be redeemable by us for nominal consideration (i) if the holders thereof sell shares of our common stock or equity in ASLP such that their indirect equity interest in Holdings is reduced below 5% (or, following any sale, their indirect equity interest in Holdings has otherwise been reduced below 5%) or (ii) at such time as, for any reason, the indirect equity interest in Holdings of the holders of such class falls below 2%. The preferred shares will not entitle the holders thereof to receive dividends or distributions of any kind, other than nominal redemption consideration. |

17

Risk Factors

You should carefully consider the information under the heading “Risk Factors” and all other information in this prospectus before investing in the shares of our common stock and notes represented by IDSs.

General Information About This Prospectus

Unless we specifically state otherwise, the information in this prospectus does not take into account the exercise by the underwriters of their over-allotment option with respect to IDSs.

Throughout this prospectus, we have assumed (i) the purchase of all of the existing senior subordinated notes pursuant to the consent solicitation and tender offer for aggregate consideration of $210.2 million, (ii) a % interest rate on the notes, which is subject to change depending on market conditions and (iii) an initial public offering price of $17.35 per IDS (comprised of $7.75 allocated to each note and $9.60 allocated to each share of common stock).

Unless we specifically state otherwise, the information and computations in this prospectus do not take into account the exercise by members of our management of compensatory options to acquire interests in ASLP that, if exercised, would cause ASLP to receive additional interests in Holdings, resulting in dilution for all holders of IDSs and ASLP units. If all of such options and mirror options were exercised immediately following the offering, the Issuer’s percentage ownership in Holdings would decline from 73.5% to 69.1%.

18

Summary Consolidated Financial Information for Holdings

The following summary historical consolidated financial information for Holdings for the years ended December 31, 2001 and 2002 has been derived from our audited consolidated financial statements included elsewhere in this prospectus and the summary historical consolidated financial information for Holdings as of June 30, 2003 and for the six month periods ended June 30, 2002 and 2003 has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus.

The following summary unaudited pro forma financial information for Holdings has been derived by the application of pro forma adjustments to Holdings’ historical financial statements included elsewhere in this prospectus. The summary pro forma financial information for Holdings gives pro forma effect to (i) the distribution by Holdings to the equityowners of ASLP and the Corporate Partners of Holdings’ 80% interest in PLC and (ii) the acquisition of Southern Pride as if such transactions occurred on January 1, 2002 and, in the case of balance sheet data, as of June 30, 2003. The pro forma financial information for Holdings does not reflect any adjustments that give effect to this offering or any of the other transactions contemplated hereby, which adjustments are reflected in the pro forma financial information for the Issuer appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | Pro Forma

| |

| | | Year Ended

December 31,

| | | Six Months Ended

June 30,

| | | Year Ended

December 31,

| | | Six Months

Ended June 30,

| | | Six Months

Ended

June 30,

| |

| | | 2001

| | | 2002

| | | 2002

| | | 2003

| | | 2002

| | | 2002

| | | 2003

| |

| | | (dollars in thousands) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue | | $ | 336,839 | | | $ | 332,872 | | | | 182,710 | | | | 232,963 | | | $ | 419,293 | | | $ | 228,259 | | | $ | 228,062 | |

Gross profit | | | 127,239 | | | | 126,481 | | | | 78,178 | | | | 88,166 | | | | 146,628 | | | | 88,525 | | | | 87,323 | |

Gross margin | | | 37.8 | % | | | 38.0 | % | | | 42.8 | % | | | 37.8 | % | | | 35.0 | % | | | 38.8 | % | | | 38.3 | % |

Operating profit | | | 35,436 | | | | 58,975 | | | | 47,514 | | | | 51,481 | | | | 63,629 | | | | 49,682 | | | | 51,484 | |

Income before income taxes and minority interest | | | 18,180 | | | | 23,012 | | | | 21,064 | | | | 38,246 | | | | 24,858 | | | | 21,982 | | | | 38,340 | |

Net income | | | 20,078 | | | | 22,253 | | | | 20,541 | | | | 35,800 | | | | 24,099 | | | | 21,355 | | | | 35,927 | |

Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flows from operating activities | | | 84,588 | | | | 96,678 | | | | 75,178 | | | | 39,954 | | | | | | | | | | | | | |

Cash flows from investing activities | | | (13,648 | ) | | | (58,634 | ) | | | (4,840 | ) | | | (7,881 | ) | | | | | | | | | | | | |

Purchases of property, vessels and equipment | | | (9,171 | ) | | | (9,431 | ) | | | (5,069 | ) | | | (6,708 | ) | | | | | | | | | | | | |

Cash flows from financing activities | | | (73,014 | ) | | | (34,736 | ) | | | (53,767 | ) | | | (32,778 | ) | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(1) | | $ | 121,385 | | | $ | 103,150 | | | $ | 57,262 | | | $ | 79,042 | | | $ | 111,614 | | | $ | 61,559 | | | $ | 78,339 | |

Adjusted EBITDA(1) | | | 108,765 | | | | 113,297 | | | | 72,870 | | | | 75,250 | | | | 122,512 | | | | 77,271 | | | | 74,514 | |

Ratio of earnings to fixed charges(2) | | | 1.53 | | | | 1.59 | | | | 2.24 | | | | 2.77 | | | | 1.59 | | | | 2.21 | | | | 2.79 | |

| | | June 30, 2003

| | | Pro Forma

June 30, 2003

| |

| | | (dollars in thousands) | |

Balance Sheet Data: | | | | | | | | |

Current assets | | $ | 110,901 | | | $ | 106,582 | |

Current liabilities | | | 56,434 | | | | 54,653 | |

Property, vessels and equipment, net | | | 240,306 | | | | 230,330 | |

Cooperative rights, net | | | 83,830 | | | | 82,563 | |

Total assets | | | 554,076 | | | | 538,465 | |

Total interest bearing obligations | | | 543,209 | | | | 535,972 | |

Members deficit | | | (83,098 | ) | | | (86,134 | ) |

19

| (1) | EBITDA represents net income from continuing operations before interest expense, income tax provision (benefit) and depreciation and amortization. EBITDA is not a measure of operating income, operating performance or liquidity under GAAP. We include EBITDA because we understand it is used by some investors to determine a company’s historical ability to service indebtedness and fund ongoing capital expenditures, and because certain covenants in our borrowing agreements are tied to similar measures. Nevertheless, this measure should not be considered in isolation or as a substitute for operating income (as determined in accordance with GAAP) as an indicator of our operating performance, or of cash flows from operating activities (as determined in accordance with GAAP), or as a measure of liquidity. The consummation of the transactions contemplated by this offering will not have an impact on EBITDA before minority interest. EBITDA as calculated here differs from Adjusted EBITDA as defined in our note indenture and credit agreements. Adjusted EBITDA as defined in our note indenture and credit agreements means net income from continuing operations before interest expense, income tax provision or benefit, depreciation, amortization, net unrealized foreign exchange gains or losses, net gains and losses from derivatives relating to our equity and debt, minority interest in income or loss of consolidated entities, equity-based compensation, fees and expenses related to acquisition, merger or restructuring transactions, and any loss from debt repayments and related write-offs. If our Adjusted EBITDA were to decline below certain levels, covenants in our indebtedness that are based on Adjusted EBITDA, including our interest coverage ratio and fixed charge coverage ratio covenants could result in, among other things, a default or mandatory prepayment under our senior credit facility, our inability to pay dividends or a requirement that we defer interest payments on the notes. These covenants are summarized under “Description of Certain Indebtedness” and “Description of Notes.” A reconciliation of EBITDA to Adjusted EBITDA is as follows: |

| | | | | | | | | | | | | | | Pro Forma

| |

| | | Year Ended

December 31,

| | | Six Months

Ended

June 30,

| | | Year Ended

December 31,

2002

| | | Six Months

Ended

June 30,

2002

| | | Six Months

Ended

June 30,

2003

| |

| | | 2001

| | | 2002

| | | 2002

| | | 2003

| | | | |

| | | (dollars in thousands) | |

| | | | | | | |

EBITDA | | $ | 121,385 | | | $ | 103,150 | | | $ | 57,262 | | | $ | 79,042 | | | $ | 111,614 | | | $ | 61,559 | | | $ | 78,339 | |

Unrealized foreign exchange gains/losses, net | | | (12,976 | ) | | | (10,763 | ) | | | (1,508 | ) | | | (4,037 | ) | | | (10,763 | ) | | | (1,508 | ) | | | (4,037 | ) |

Equity-based compensation | | | 527 | | | | 5,600 | | | | 1,509 | | | | 212 | | | | 5,600 | | | | 1,509 | | | | 212 | |

Loss from debt repayment and related write-offs | | | — | | | | 15,711 | | | | 15,711 | | | | — | | | | 15,711 | | | | 15,711 | | | | — | |

Transaction costs related to the acquisition of Southern Pride | | | — | | | | — | | | | — | | | | — | | | | 350 | | | | — | | | | — | |

Minority interest in income (loss) of subsidiary | | | (171 | ) | | | (401 | ) | | | (104 | ) | | | 33 | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted EBITDA | | $ | 108,765 | | | $ | 113,297 | | | $ | 72,870 | | | $ | 75,250 | | | $ | 122,512 | | | $ | 77,271 | | | $ | 74,514 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

We consider EBITDA to be a measure of liquidity. Accordingly, EBITDA is reconciled to operating cash flows as follows:

| | | Year Ended December 31,

| | | Six Months

Ended

June 30,

| |

| | | 2001

| | | 2002

| | | 2002

| | | 2003

| |

| | | (dollars in thousands) | |

| | | | |

Cash flows from operating activities | | $ | 84,588 | | | $ | 96,678 | | | $ | 75,178 | | | $ | 39,954 | |

Interest expense, net of non-cash interest | | | 18,715 | | | | 35,051 | | | | 11,203 | | | | 18,938 | |

Net change in operating assets and liabilities | | | 899 | | | | (15,495 | ) | | | (14,138 | ) | | | 12,999 | |

Income tax provision (benefit) | | | (1,898 | ) | | | 759 | | | | 627 | | | | 2,413 | |

Deferred income tax provision (benefit) | | | 6,607 | | | | (3,696 | ) | | | — | | | | — | |

Other | | | 25 | | | | 401 | | | | 104 | | | | 913 | |

Unrealized foreign exchange gains/losses, net | | | 12,976 | | | | 10,763 | | | | 1,508 | | | | 4,037 | |

Equity-based compensation | | | (527 | ) | | | (5,600 | ) | | | (1,509 | ) | | | (212 | ) |